The Daily Shot: 04-Sep-20

• Equities

• Cryptocurrency

• Commodities

• Rates

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United States

• Food for Thought

Equities

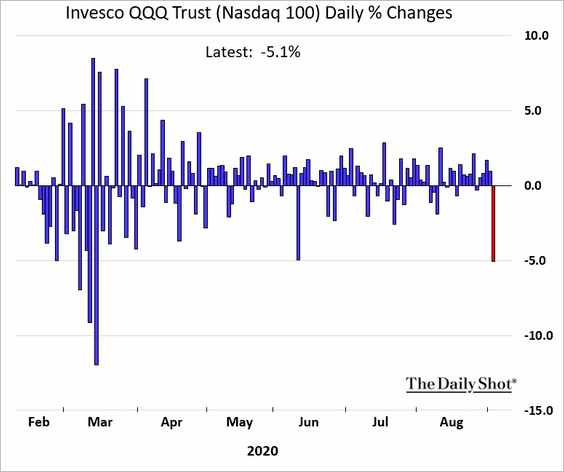

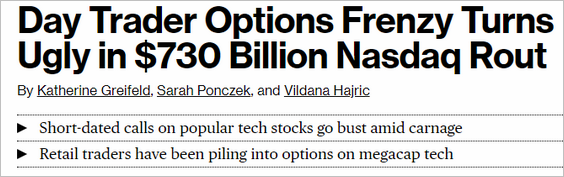

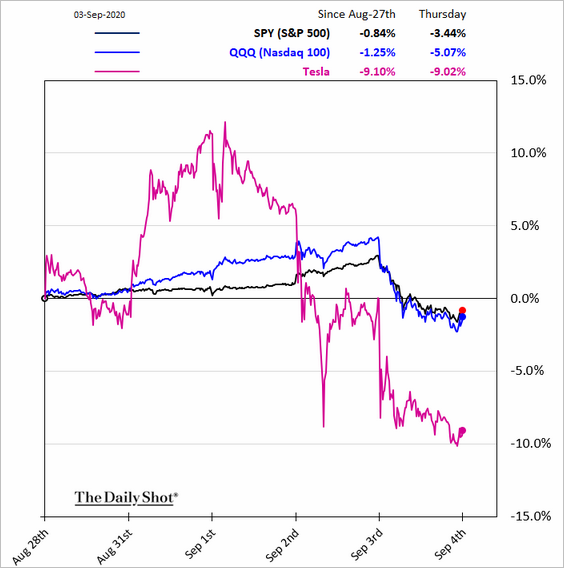

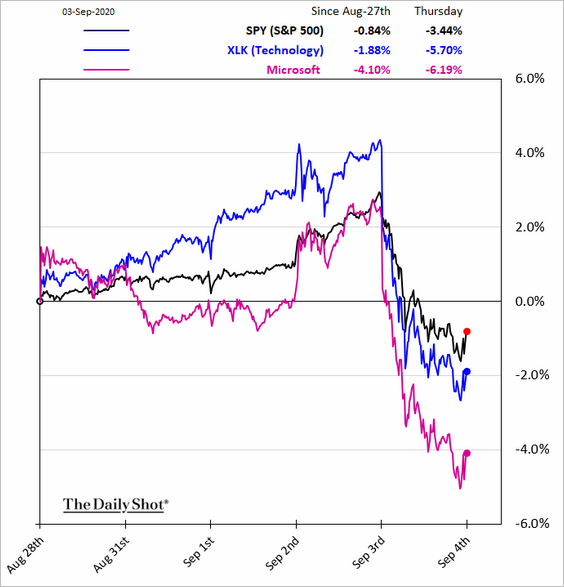

1. The market finally saw a healthy adjustment, as the dealers’ short gamma exposure exacerbated the selloff (the same effect that created the melt-up). The tech mega-cap shares sold off.

Source: @markets Read full article

Source: @markets Read full article

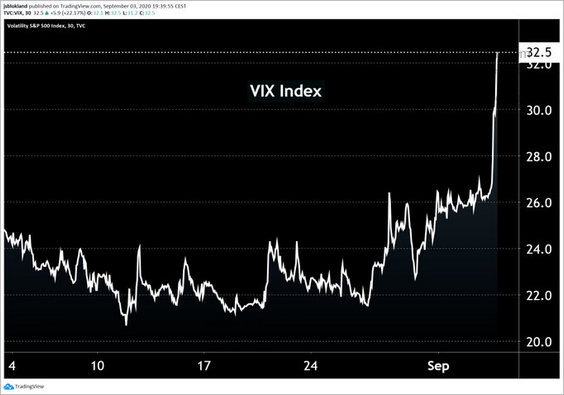

VIX spiked.

Source: @jsblokland

Source: @jsblokland

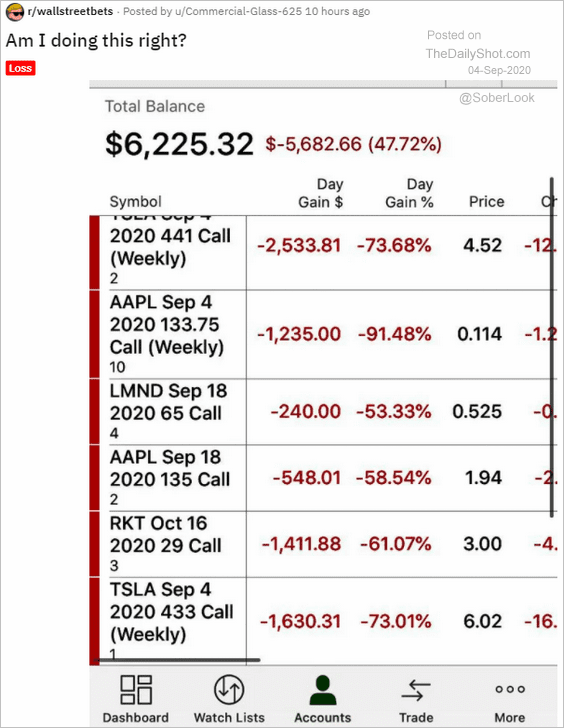

Social media lit up with retail traders discussing their losses.

• Reddit

Source: reddit Read full article

Source: reddit Read full article

• Twitter:

But no worries. Individual traders got a taste for quick gains in the options markets, and many will be back shortly.

——————–

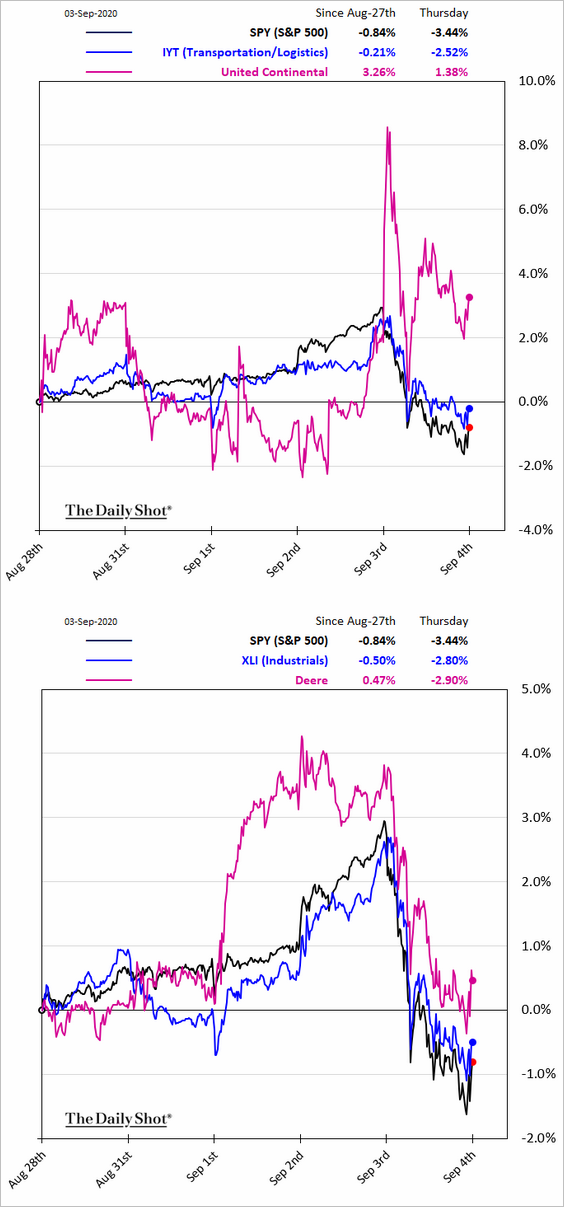

2. Here are some sector moves.

• Nasdaq 100 (QQQ):

• Tech:

• Semiconductors:

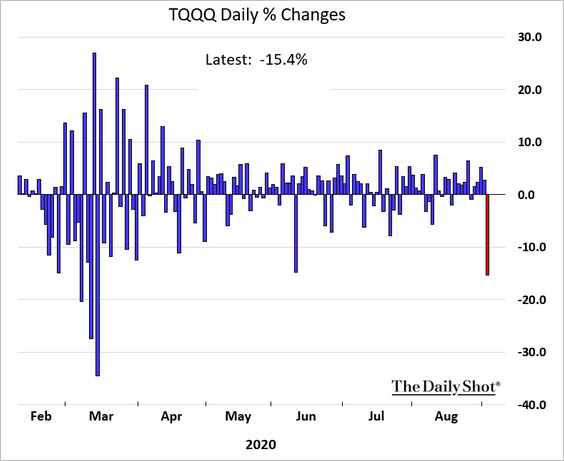

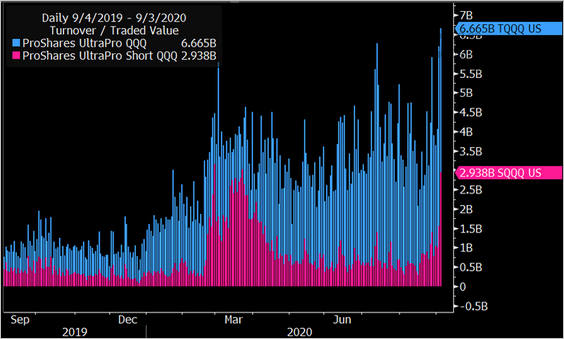

• The leveraged Nasdaq 100 ETF (TQQQ) was down 15%, with trading volumes hitting records. The leveraged short-QQQ (SQQQ) also saw a spike in volume (second chart).

Source: @JSeyff

Source: @JSeyff

• Industrials and transportation shares outperformed.

——————–

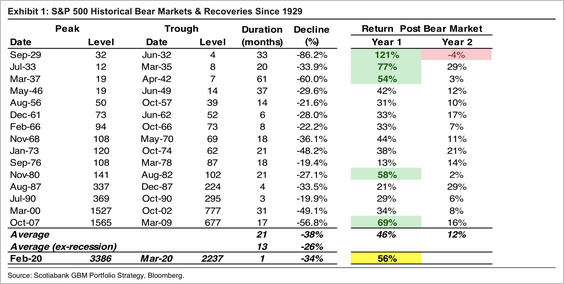

3. Here is a list of bear markets and recoveries since 1929.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

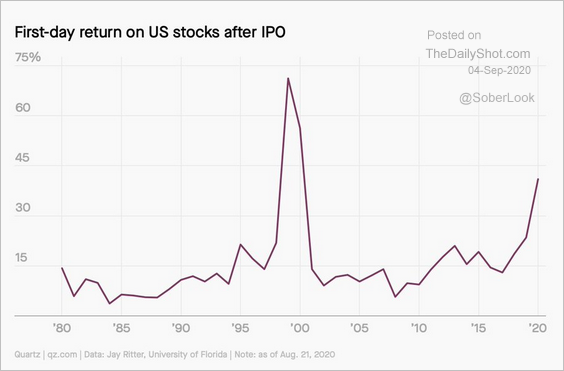

4. First-day IPO performance has been excellent this year. Will the trend continue?

Source: Quartz, @jessefelder Read full article

Source: Quartz, @jessefelder Read full article

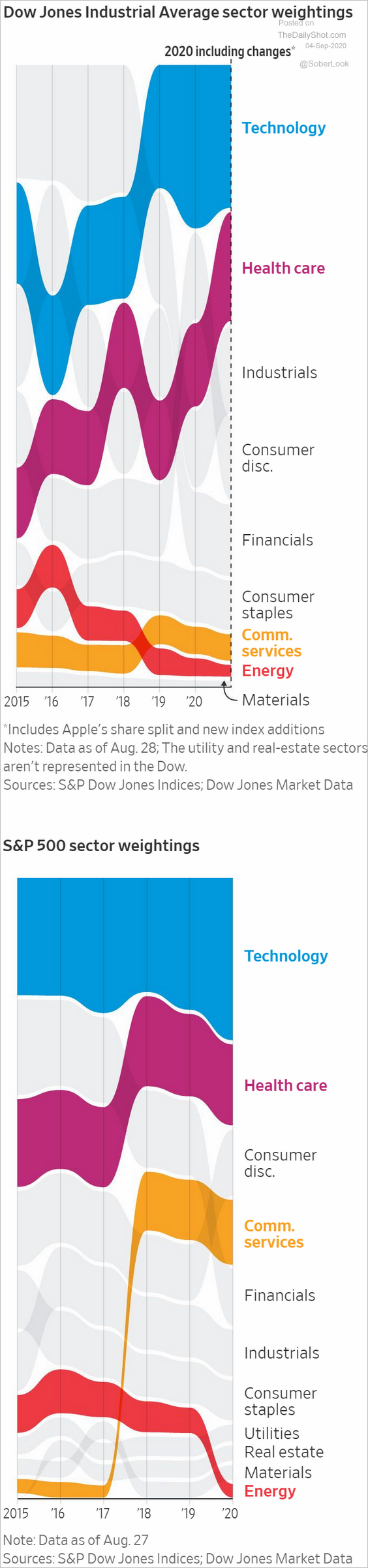

5. These charts compare the Dow and the S&P 500 sector weightings over time.

Source: @WSJ Read full article

Source: @WSJ Read full article

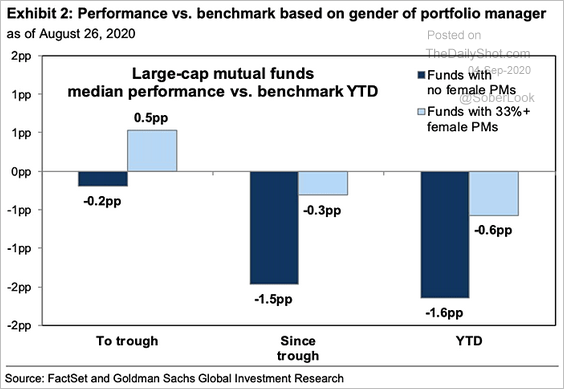

6. Funds with female portfolio managers have been outperforming.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

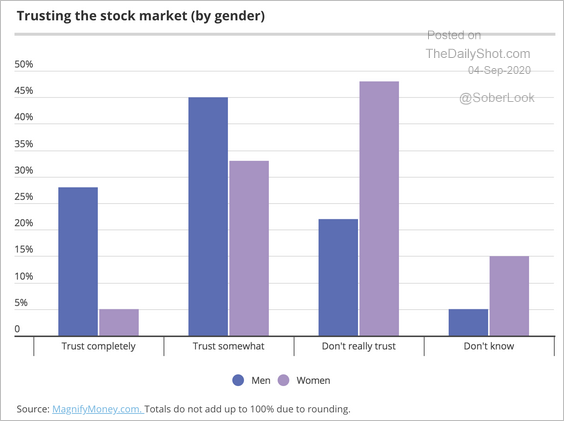

7. Who trusts the stock market?

Source: MagnifyMoney

Source: MagnifyMoney

Cryptocurrency

1. Bitcoin could not break resistance at $12k, tumbling with stocks on Thursday.

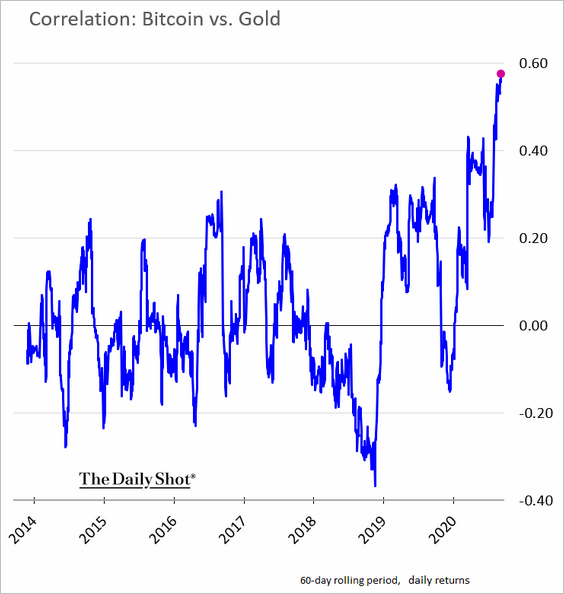

2. The correlation between Bitcoin and gold is hitting new highs.

Commodities

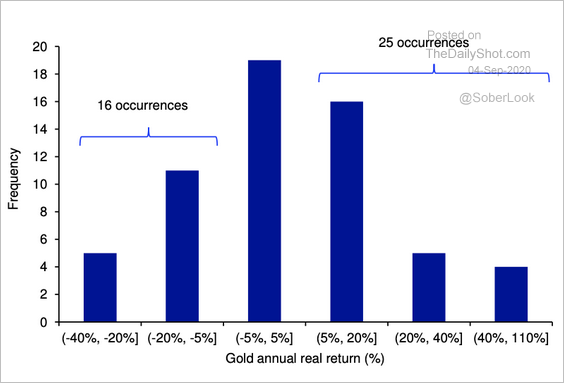

1. This chart shows the distribution of annual real gold returns since 1960.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

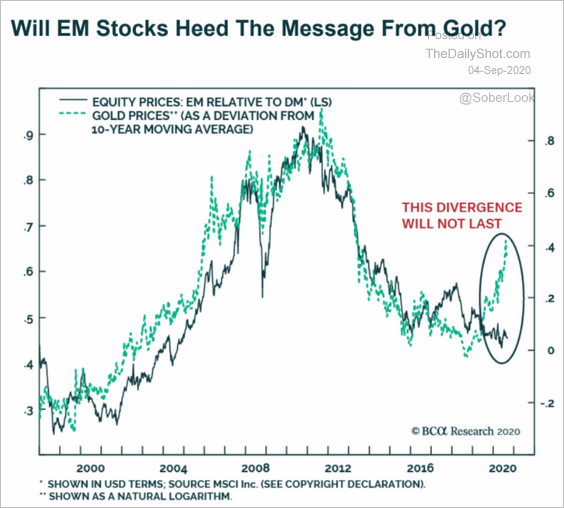

2. Either EM shares should begin outperforming, or gold needs go lower.

Source: BCA Research

Source: BCA Research

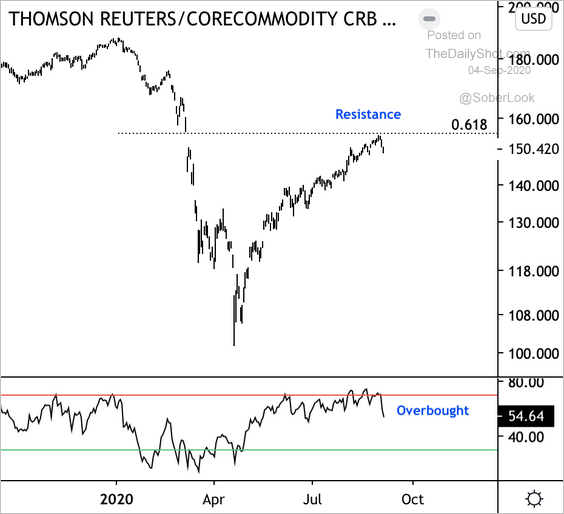

3. The Thomson Reuters Core Commodity CRB Index is overbought.

Source: @DantesOutlook

Source: @DantesOutlook

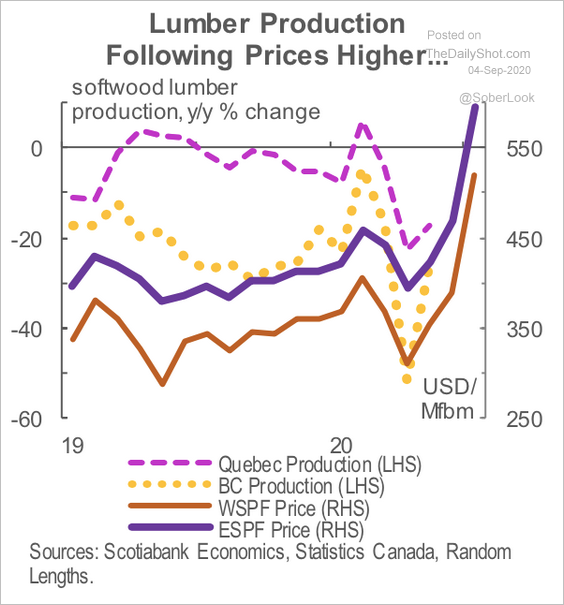

4. Canadian lumber production has been following prices higher …

Source: Scotiabank Economics

Source: Scotiabank Economics

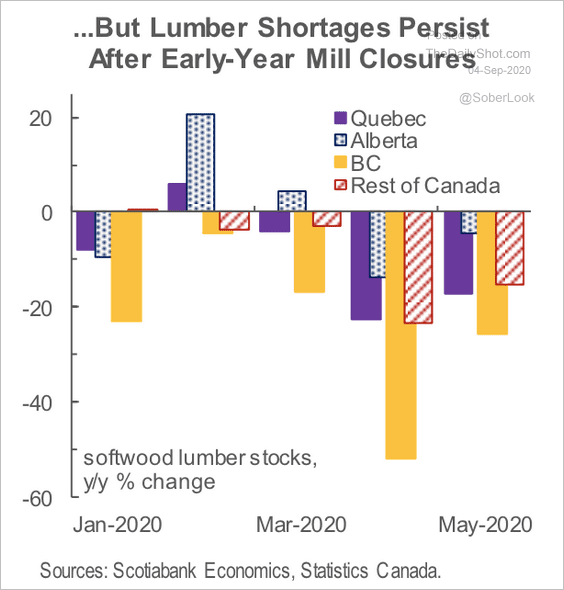

… but supply is still tight.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

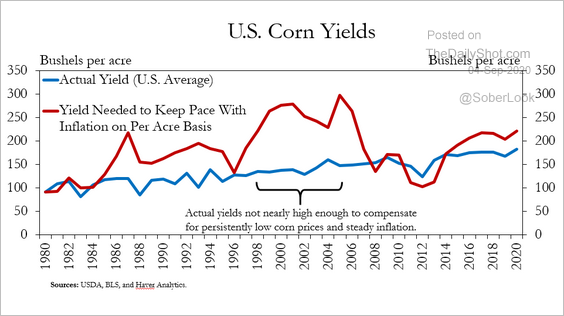

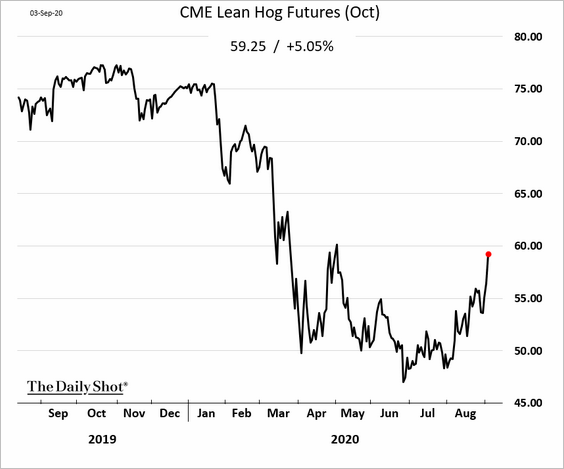

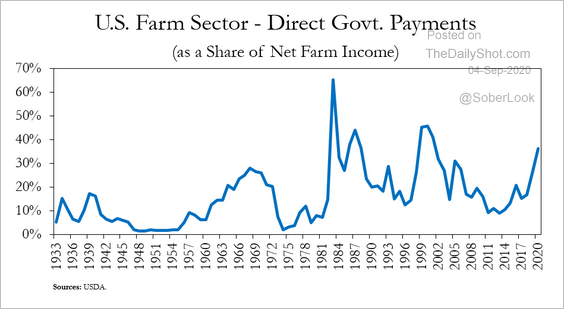

5. Next, we have some updates on agricultural commodities.

• US corn yields are not high enough to compensate for persistently low corn prices.

Source: @N_Kauffman

Source: @N_Kauffman

• The rebound in hog futures is accelerating.

• Direct US government payments could account for almost 40% of net farm income this year.

Source: @N_Kauffman

Source: @N_Kauffman

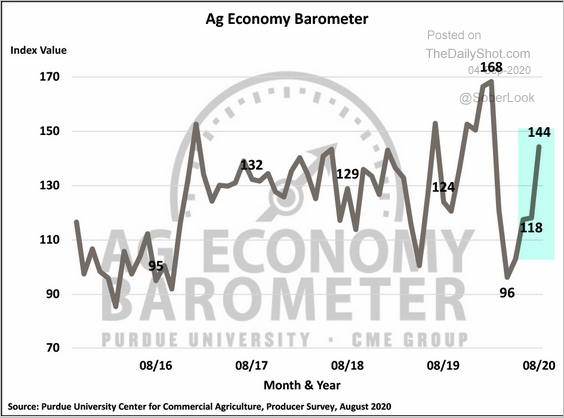

Government support helped boost US farmers’ sentiment.

Source: Purdue/CME Group Ag Economy Barometer

Source: Purdue/CME Group Ag Economy Barometer

Rates

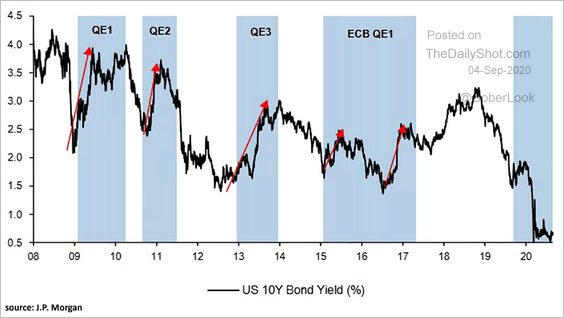

1. Typically, Treasury yields rise during periods of QE.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

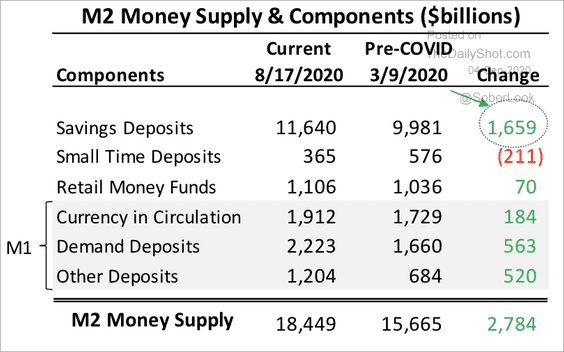

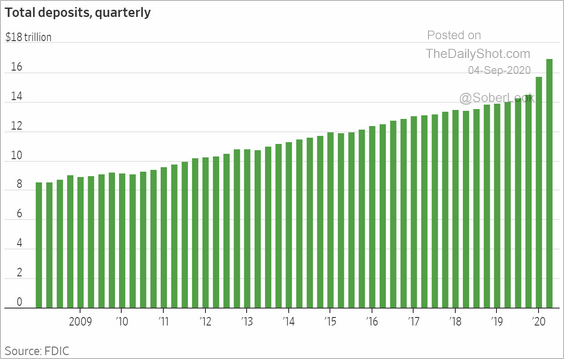

2. Next, we have some updates on liquidity.

• Savings and demand deposits have grown on the back of risk aversion and an aggressive fiscal response as a result of the pandemic, according to Piper Sandler.

Source: Piper Sandler

Source: Piper Sandler

Source: @WSJ Read full article

Source: @WSJ Read full article

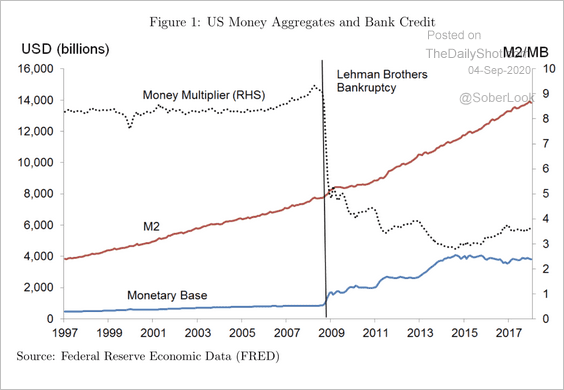

• Over a longer period, growth in US deposits has been driven by the Fed’s QE, which boosted bank reserves since the financial crisis. According to the ECB, “without an increase in bank reserves, the total quantity of bank deposits would have fallen, broadly-speaking in line with commercial bank credit.”

Source: ECB Read full article

Source: ECB Read full article

Emerging Markets

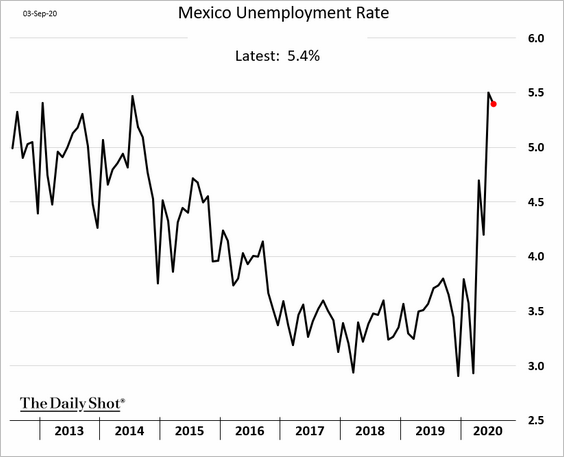

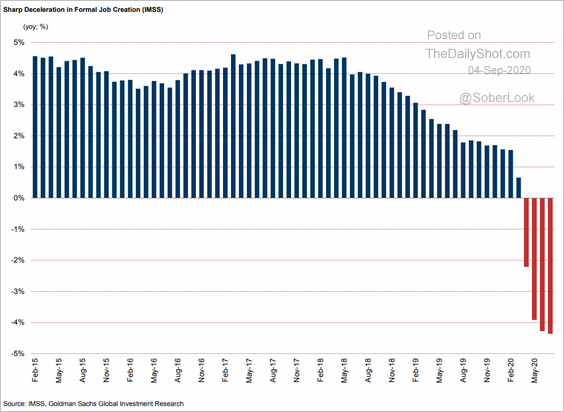

1. Mexico’s unemployment remains elevated.

• The unemployment rate:

• Formal job creation:

Source: Goldman Sachs

Source: Goldman Sachs

——————–

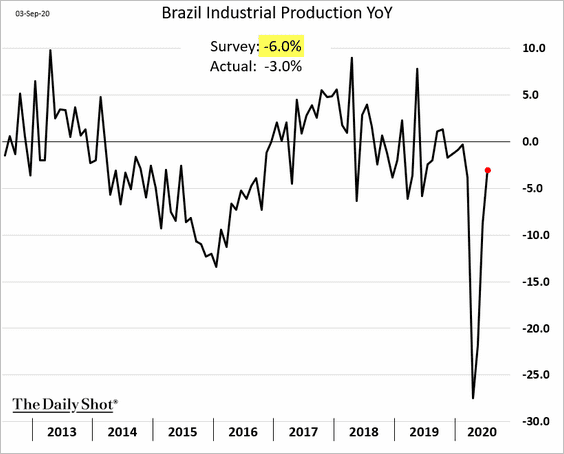

2. Brazil’s industrial production had a v-shaped recovery (as of July).

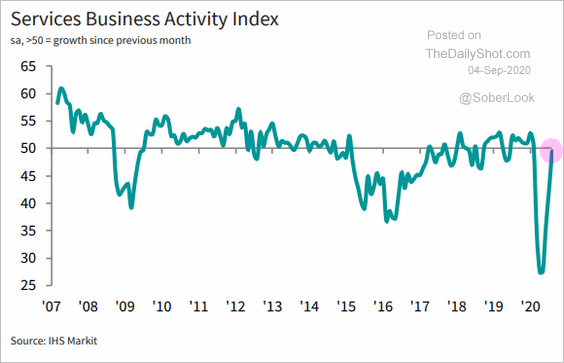

And service-sector activity is stabilizing (as of August).

Source: IHS Markit

Source: IHS Markit

——————–

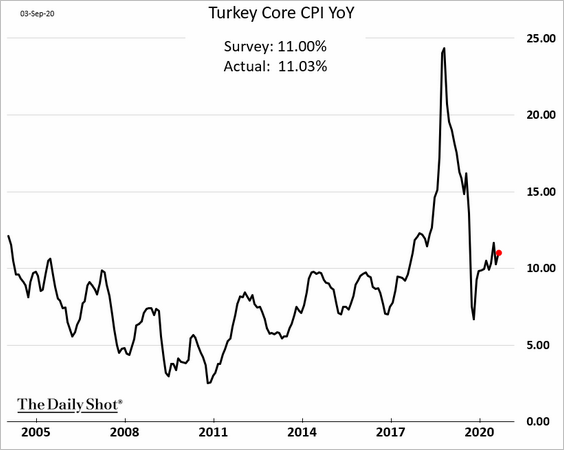

3. Next, we have some updates on Turkey.

• Core inflation is holding above 11%.

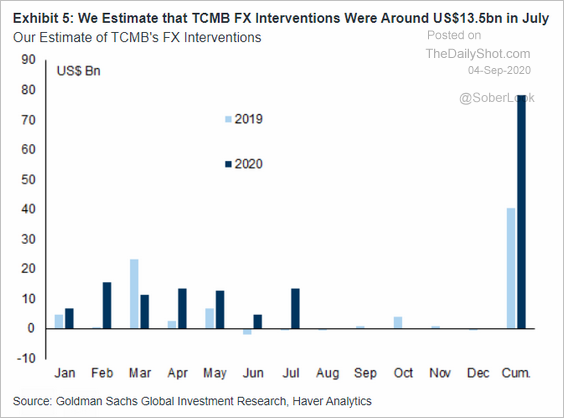

• The central bank spent a great deal of foreign reserves to defend the lira (in part because it’s not “allowed” to hike rates).

Source: Goldman Sachs

Source: Goldman Sachs

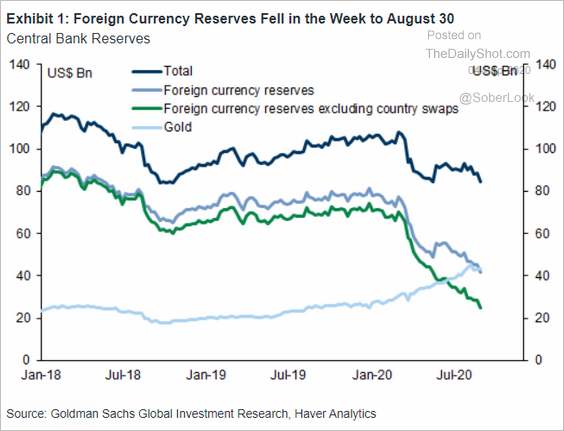

As a result, Turkey’s F/X reserves tumbled this year.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

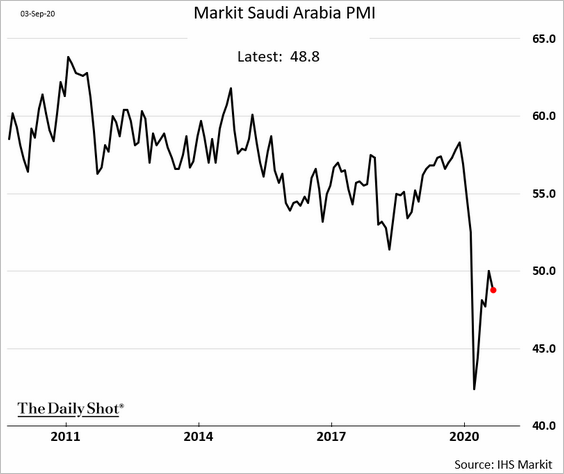

4. Saudi Arabia’s business activity remains soft.

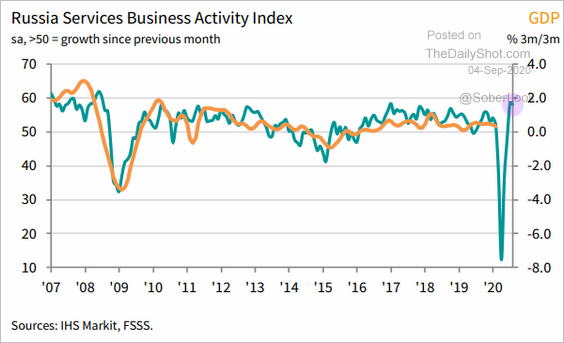

5. Russia’s service sector continues to expand.

Source: IHS Markit

Source: IHS Markit

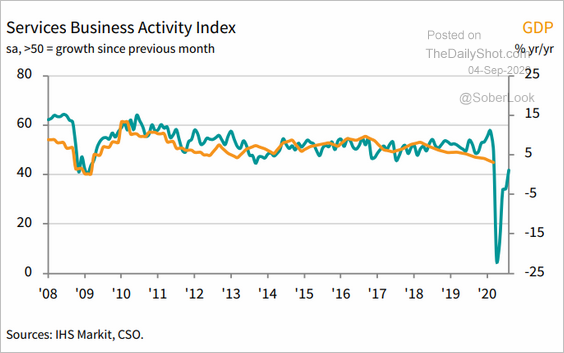

6. Here are some updates on India.

• India’s service businesses are still struggling.

Source: IHS Markit

Source: IHS Markit

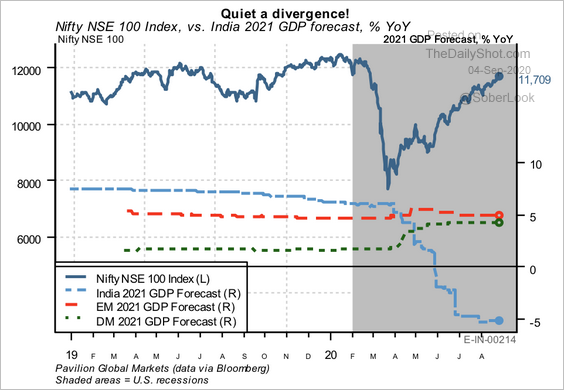

• Indian equities have rallied off March lows despite the deteriorating 2021 GDP forecasts relative to other EMs.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

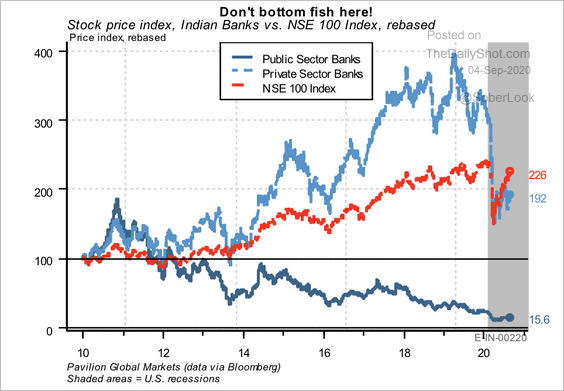

• Public-sector banks have been underperforming the broader market.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

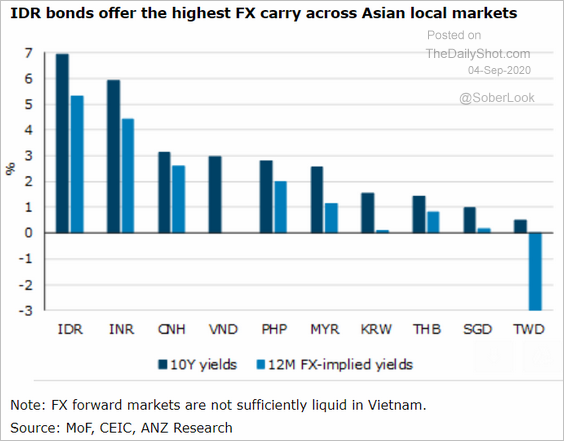

7. Indonesia presents the most attractive carry trade.

Source: ANZ Research

Source: ANZ Research

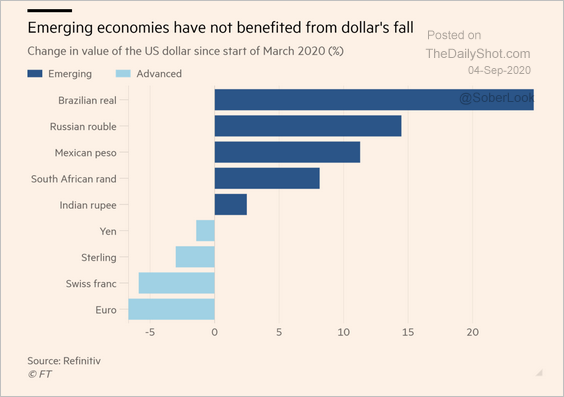

8. EM currencies have not benefitted from the US dollar decline.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

China

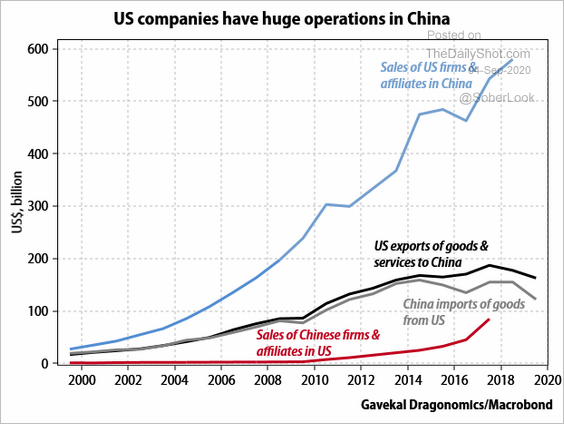

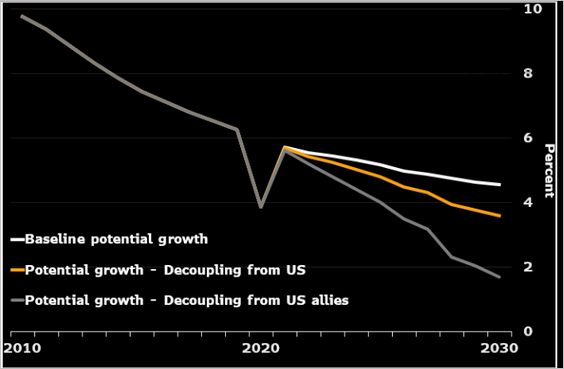

1. Decoupling from the US could be challenging. The second chart shows the decoupling impact on China’s GDP.

Source: Gavekal

Source: Gavekal

Source: @TomOrlik, @RoyeBjorn, @sharonchenhm Read full article

Source: @TomOrlik, @RoyeBjorn, @sharonchenhm Read full article

——————–

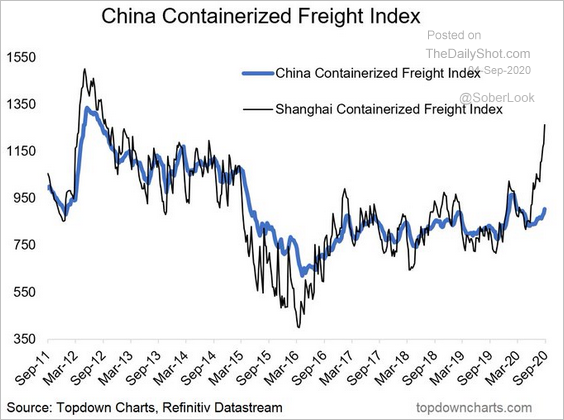

2. The Shanghai Freight Index shows rising export demand.

Source: @topdowncharts

Source: @topdowncharts

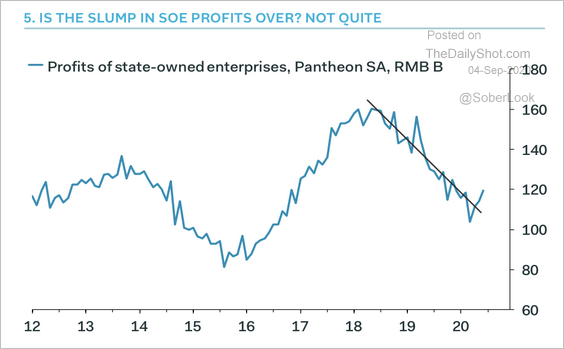

3. Profits at state-owned enterprises have been trending lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

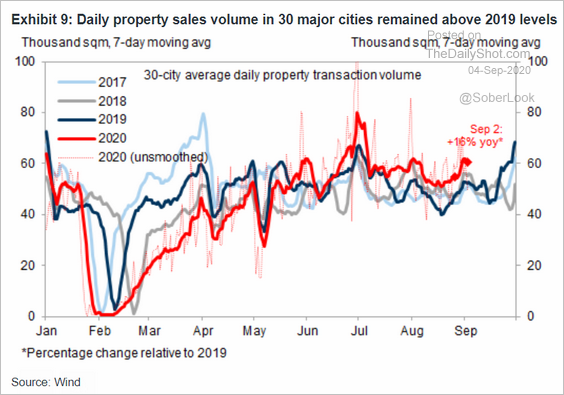

4. Property sales remain robust.

Source: Goldman Sachs

Source: Goldman Sachs

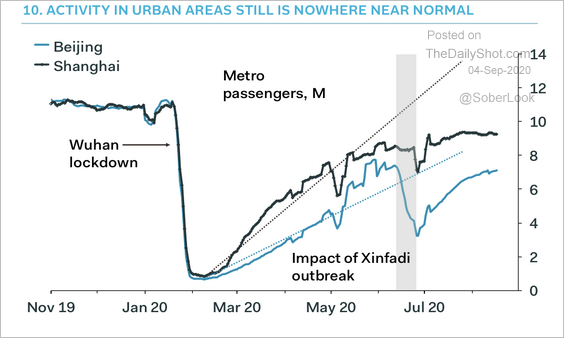

5. The recovery in urban activity is still soft.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

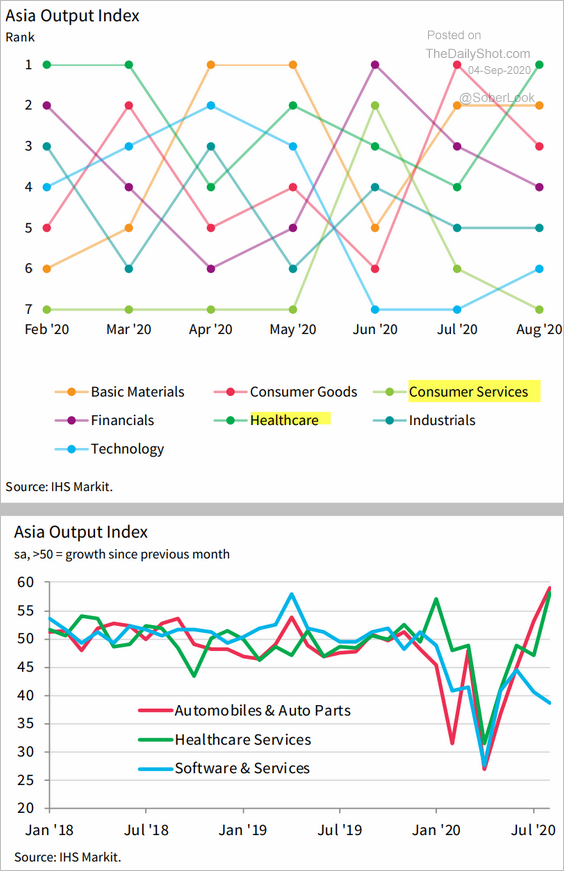

Asia – Pacific

1. Let’s start with relative sector performance (output PMI rankings).

Source: IHS Markit

Source: IHS Markit

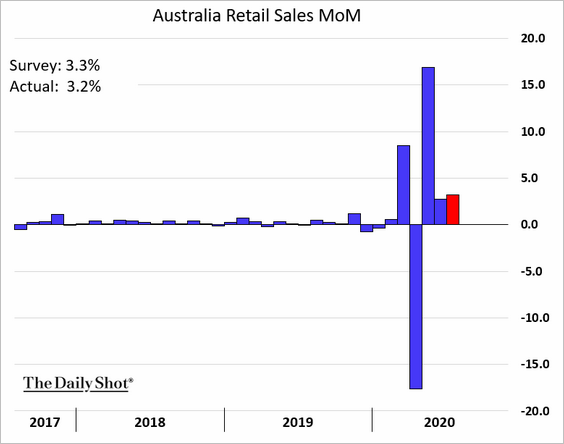

2. Australia’s retail sales remain robust, especially outside of Victoria.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

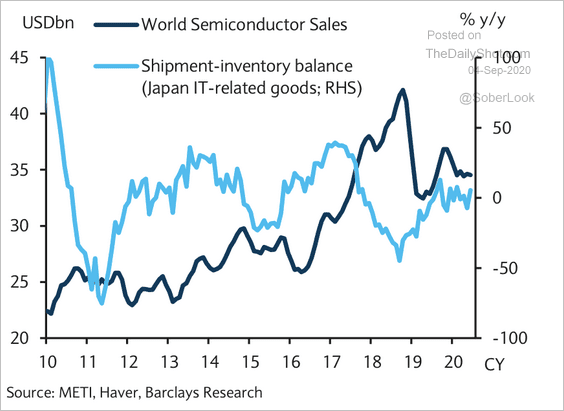

3. A recovery in Japanese IT-related goods shipments could signal higher global semiconductor sales.

Source: Barclays Research

Source: Barclays Research

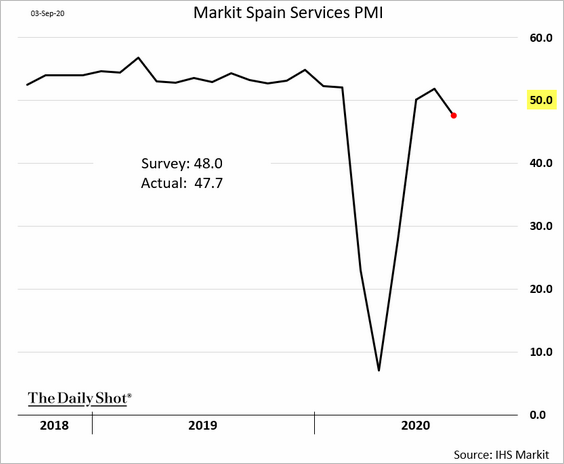

The Eurozone

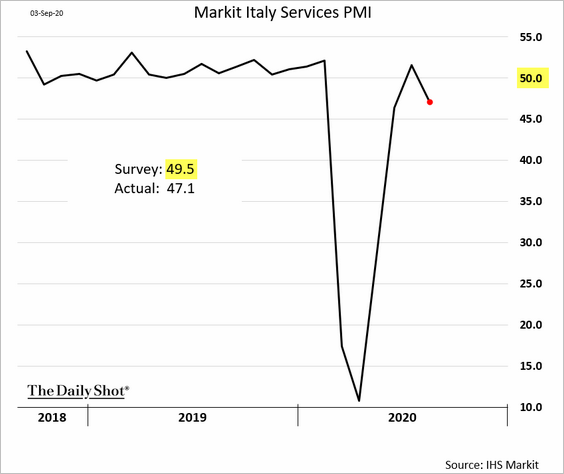

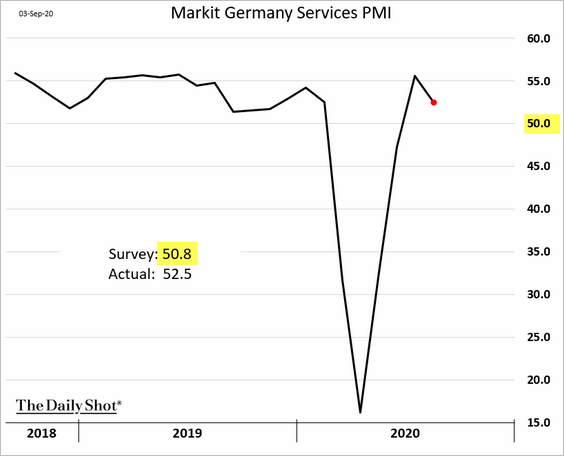

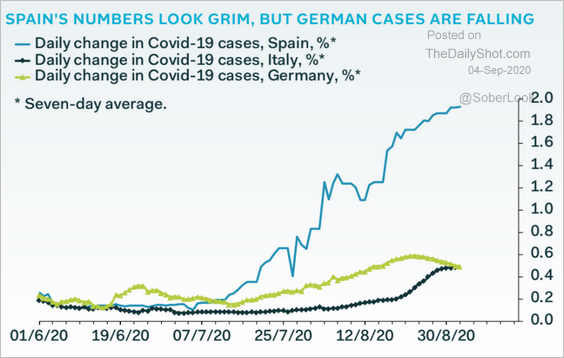

1. Service-sector activity weakened in Spain and Italy last month, …

… but remained stable in Germany.

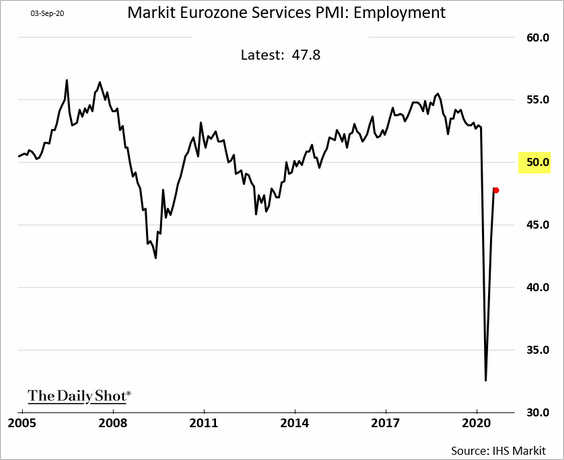

Service-sector employment is still shrinking.

——————–

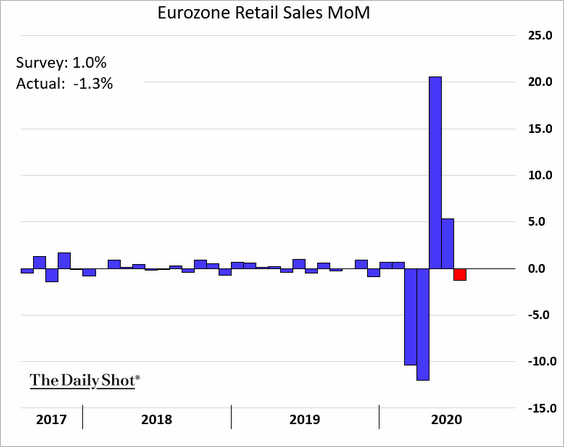

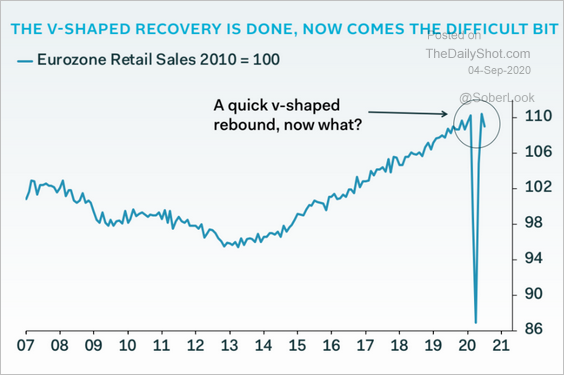

3. Retail sales weakened in July as the second wave hit (3rd chart).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

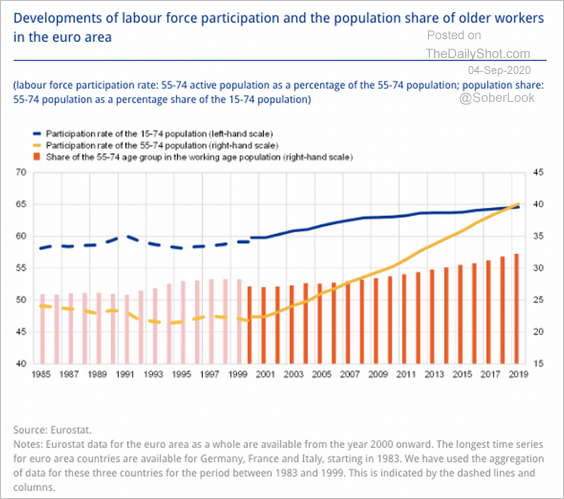

4. The labor force participation rate for people ages 55 to 74 has been steadily rising over the past decade.

Source: ECB

Source: ECB

The United States

1. Let’s begin with the labor market.

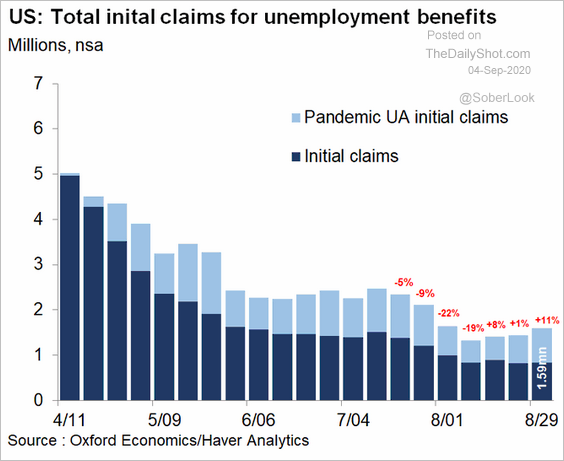

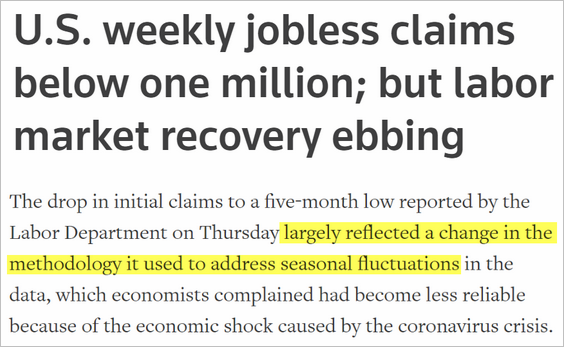

• Unemployment applications increased again last week.

Source: @GregDaco

Source: @GregDaco

By the way, be careful with the headline figures suggesting that claims declined.

Source: Reuters Read full article

Source: Reuters Read full article

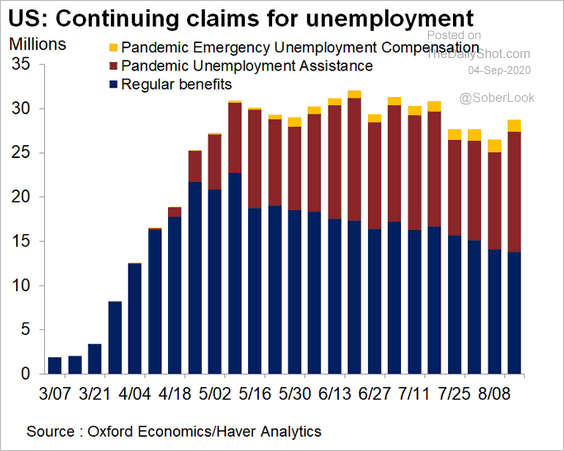

• There is still a massive number of Americans out of work.

Source: @GregDaco

Source: @GregDaco

• According to the National Federation of Independent Business, the share of US small firms who say they plan to add workers in the coming months is at pre-crisis levels.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

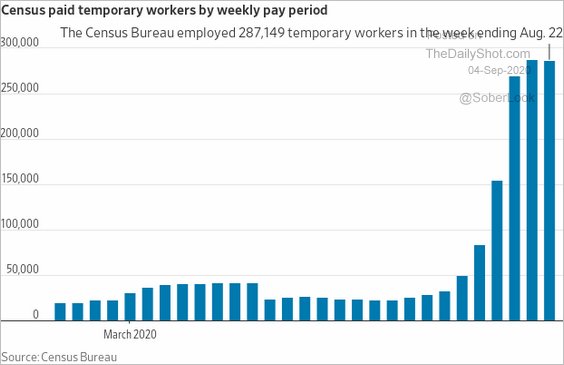

• Census hiring has accelerated.

Source: @WSJ

Source: @WSJ

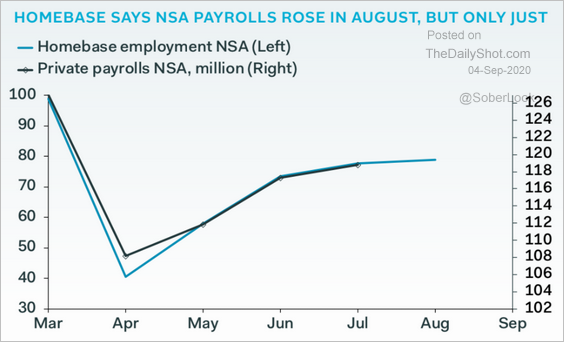

• For now, small business employment (Homebase) points to weak payroll gains in August.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

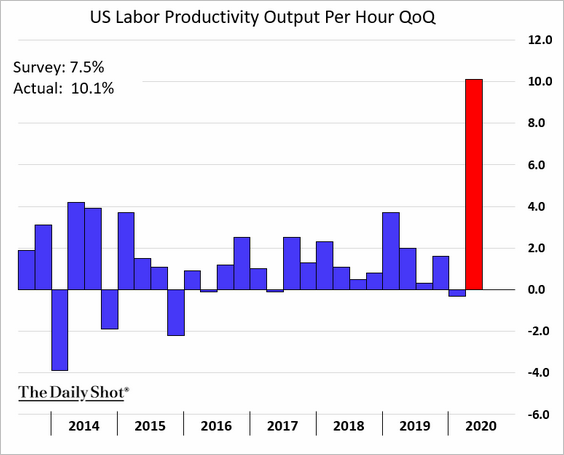

• Labor productivity spiked last quarter as employee hours collapsed. By the way, many firms may decide to maintain lean staff through the recovery, which could keep productivity elevated.

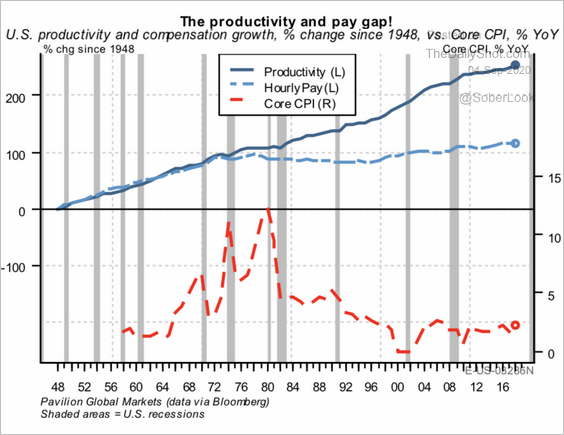

This chart shows the productivity-pay gap.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

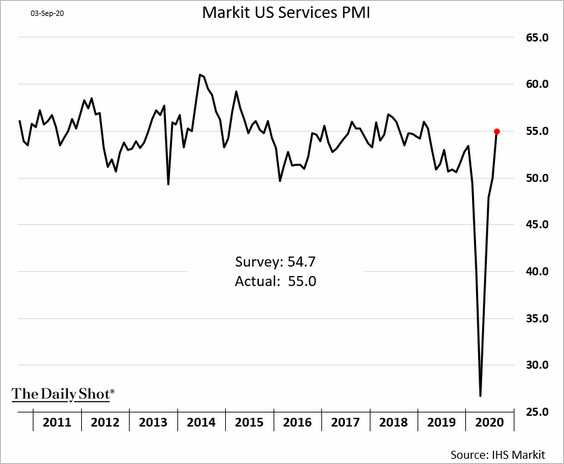

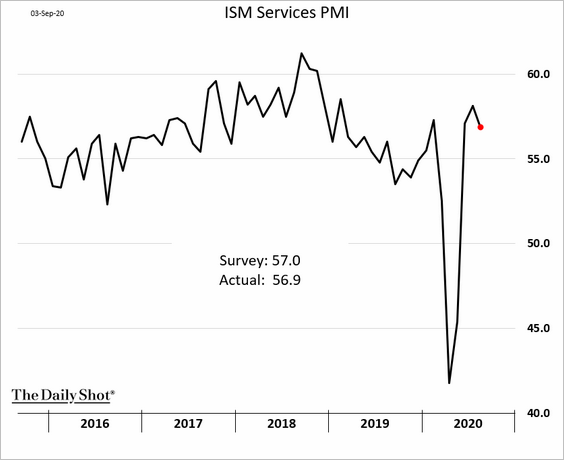

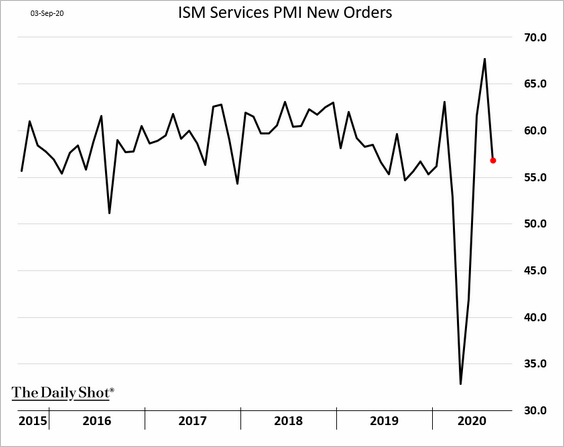

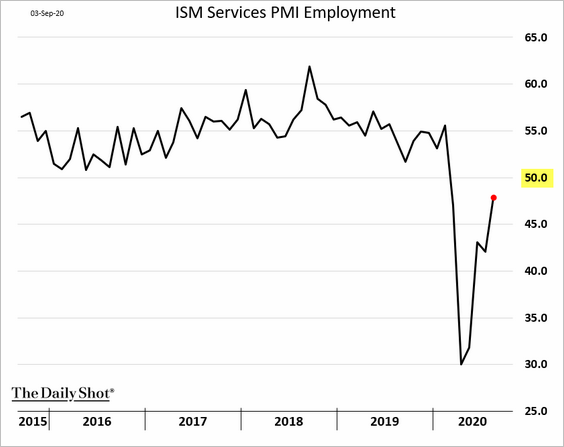

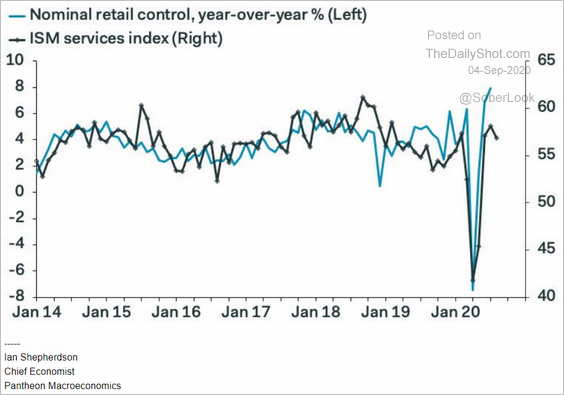

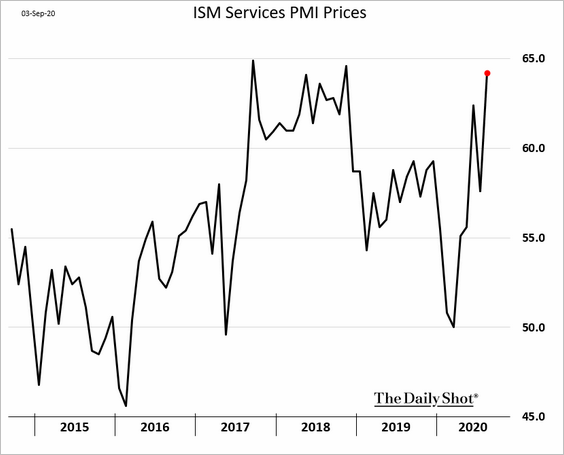

2. Service sector activity remained robust through August, although the strength was mostly in retail.

– Markit PMI:

– ISM PMI:

• Orders slowed.

• Employment is stabilizing.

• This chart shows that retail sales have been boosting service activity. Other sectors may not see the same level of improvement.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Service-sector price increases have accelerated.

——————–

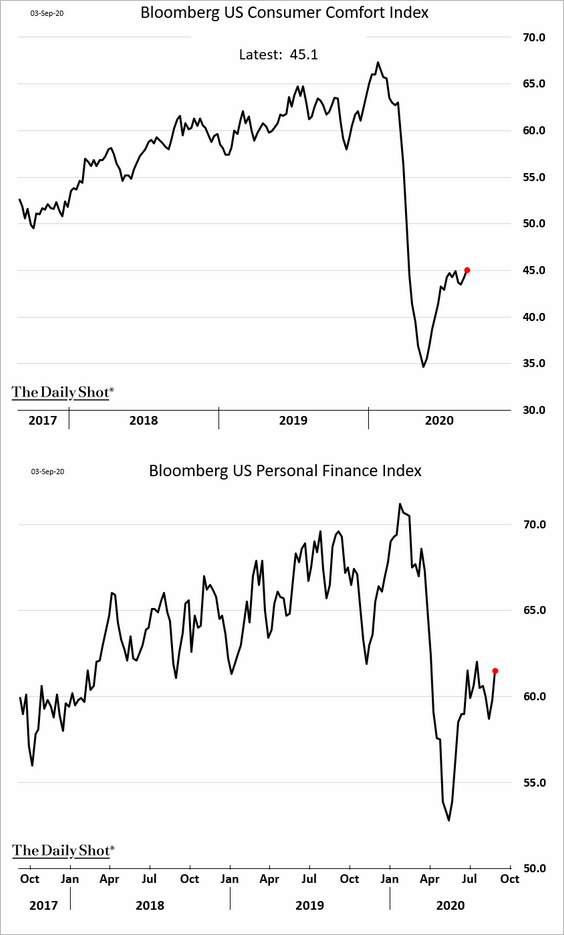

3. Bloomberg’s consumer sentiment index is starting to recover again.

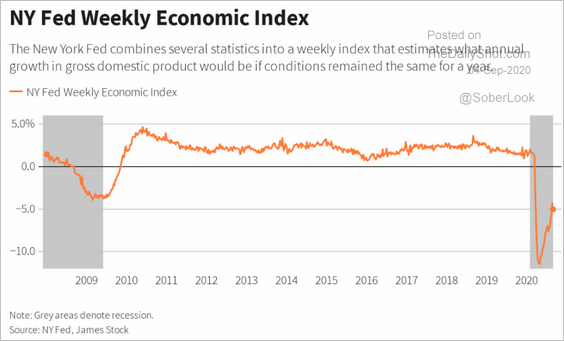

4. The NY Fed’s national economic activity index has stalled.

Source: Reuters Read full article

Source: Reuters Read full article

The Oxford Economics Recovery Tracker is grinding higher.

![]() Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

——————–

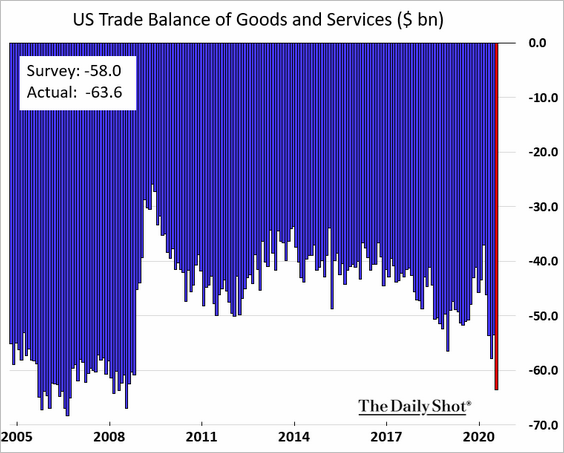

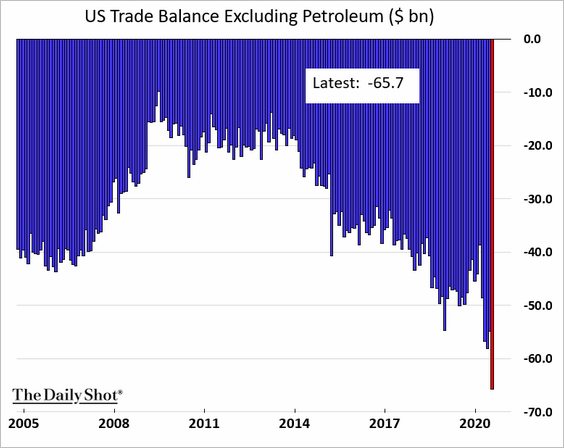

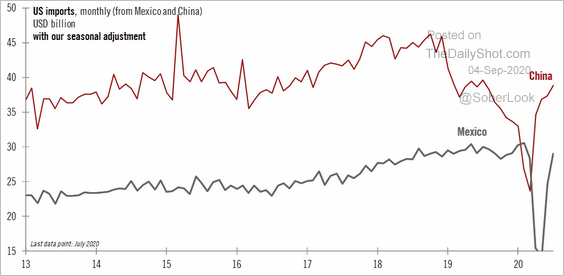

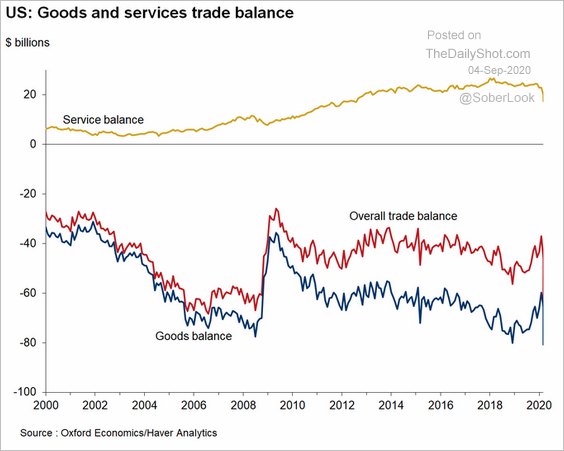

5. The nation’s trade deficit has widened sharply.

• Excluding petroleum, the deficit hit a new record.

• Imports from China and Mexico are rebounding (Mexico’s rebound was from autos).

Source: @TCosterg

Source: @TCosterg

• The surplus in services declined.

Source: @GregDaco

Source: @GregDaco

——————–

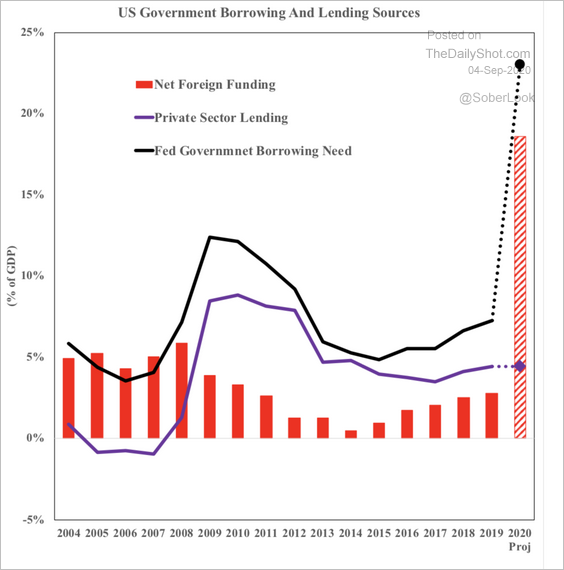

6. The federal government is heavily reliant on foreign capital. Will the Fed have to step up its QE to plug the funding gap?

Source: Alan Brazil; SOM Macro Strategies

Source: Alan Brazil; SOM Macro Strategies

——————–

Food for Thought

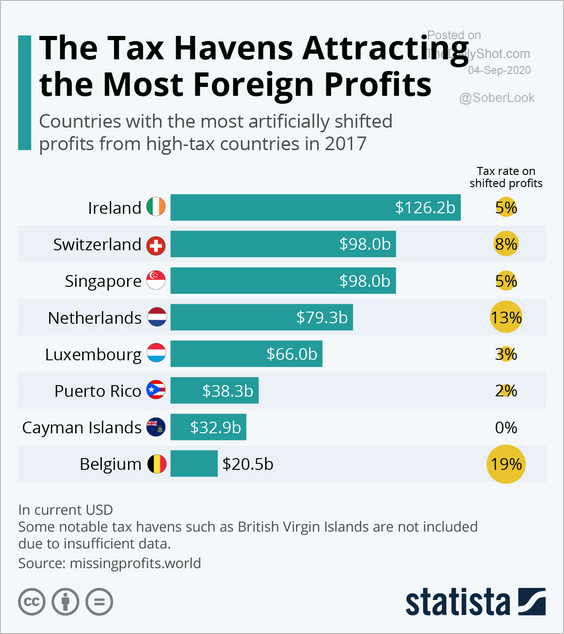

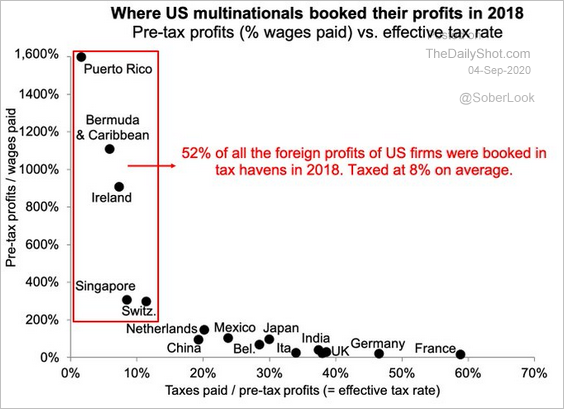

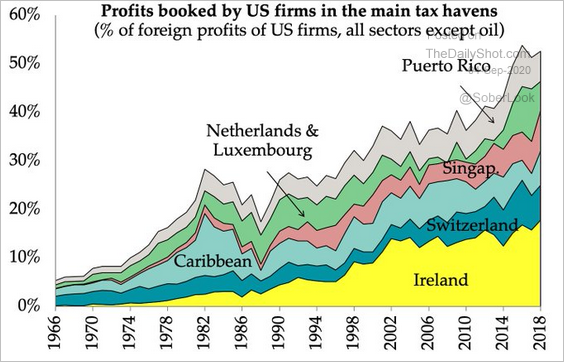

1. Tax havens attracting the most foreign earnings (3 charts):

Source: Statista

Source: Statista

Source: @gabriel_zucman

Source: @gabriel_zucman

Source: @gabriel_zucman

Source: @gabriel_zucman

——————–

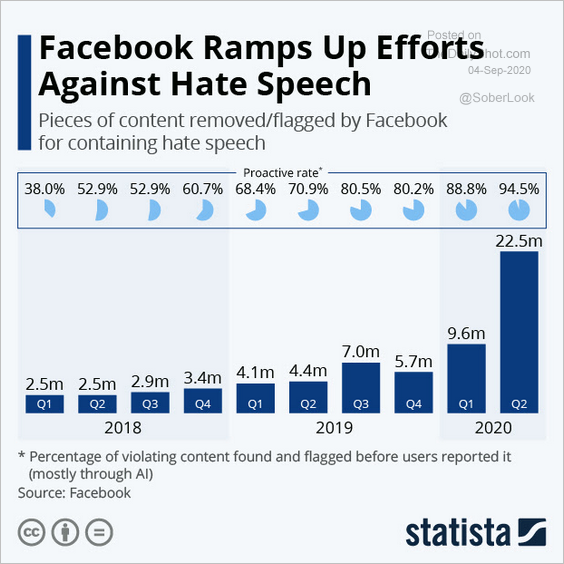

2. Facebook’s hate speech removal:

Source: Statista

Source: Statista

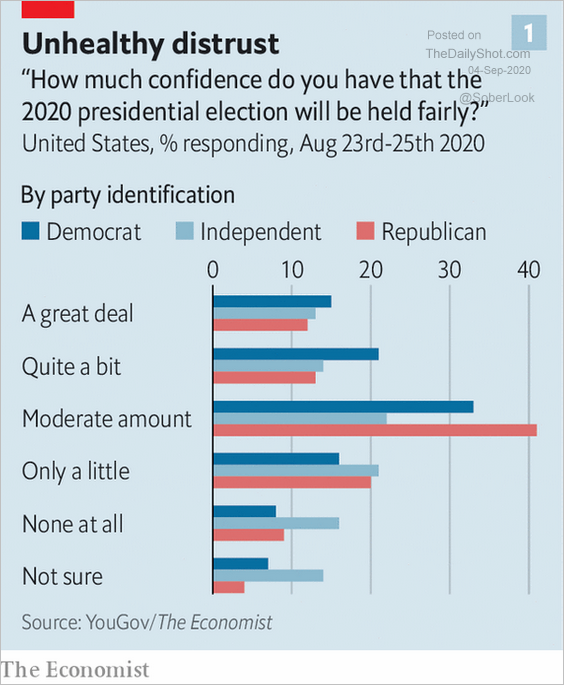

3. Trust in US elections:

Source: The Economist Read full article

Source: The Economist Read full article

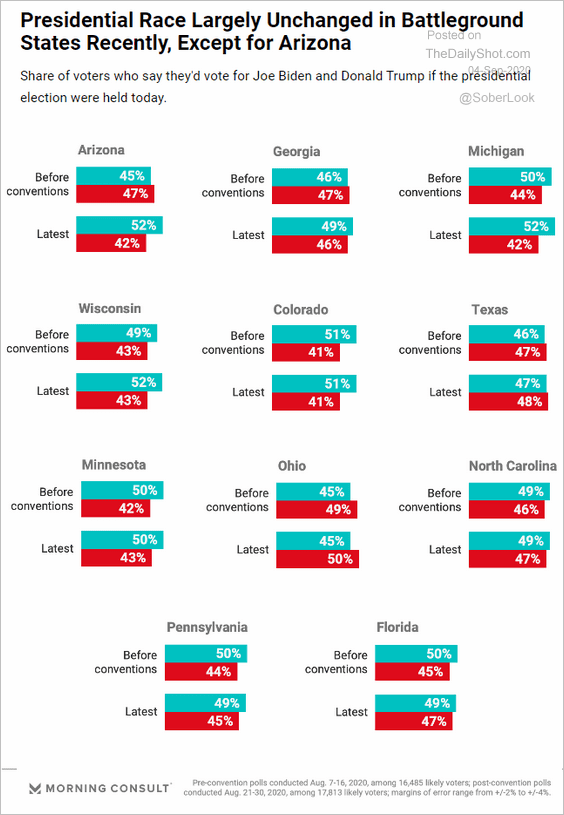

4. Presidential election polls in battleground states:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

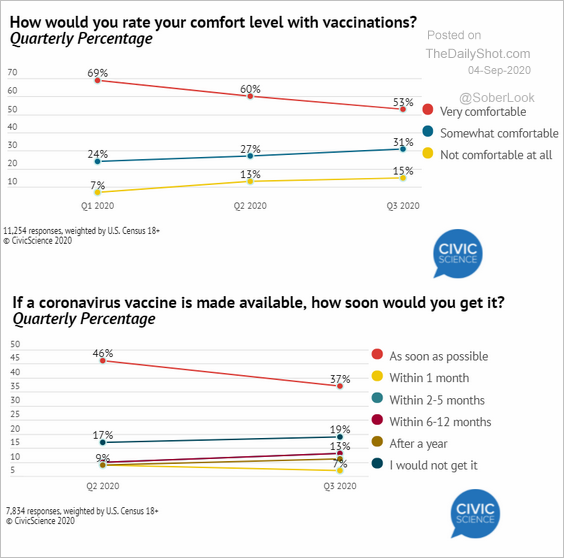

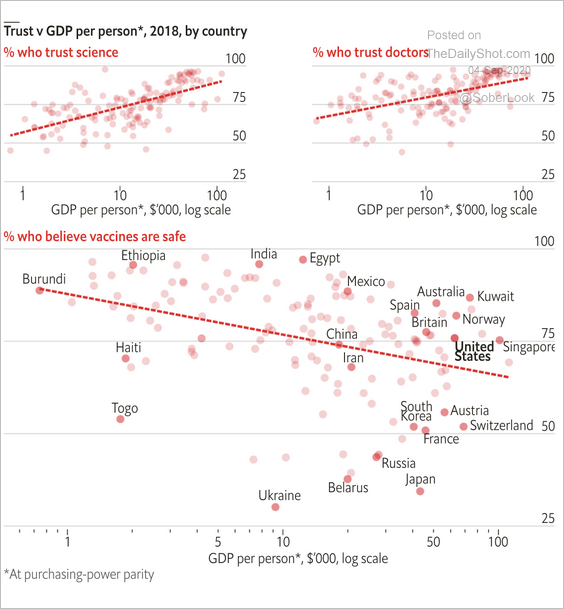

5. Comfort with vaccination:

Source: @CivicScience

Source: @CivicScience

Source: The Economist Read full article

Source: The Economist Read full article

——————–

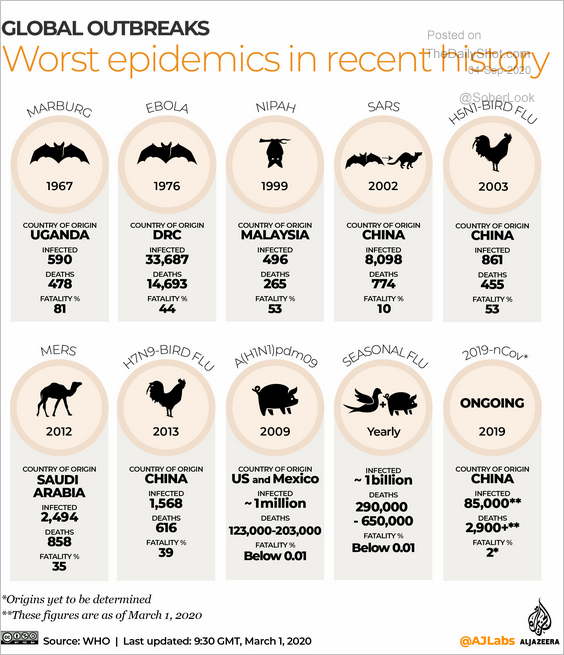

6. Primary drivers of past disease emergence (2 charts):

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Al Jazeera Read full article

Source: Al Jazeera Read full article

——————–

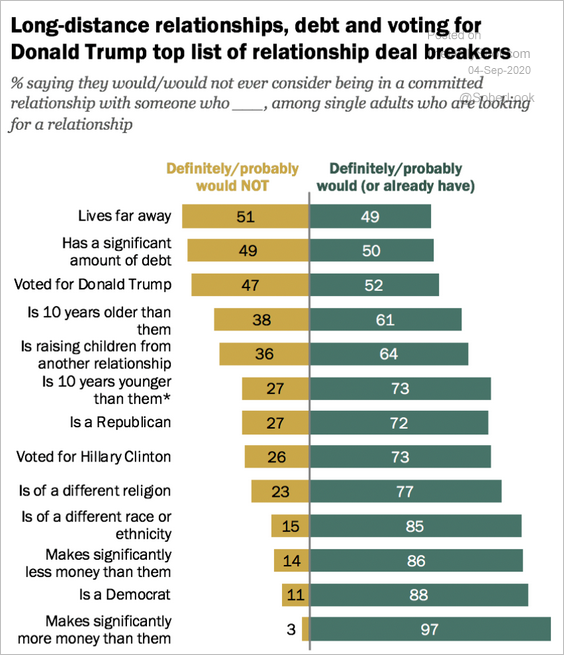

7. Deal breakers for single adults looking for a relationship:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

We are back on Tuesday, the 8th.

Have a great weekend!