The Daily Shot: 15-Sep-20

• The United States

• Global Developments

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

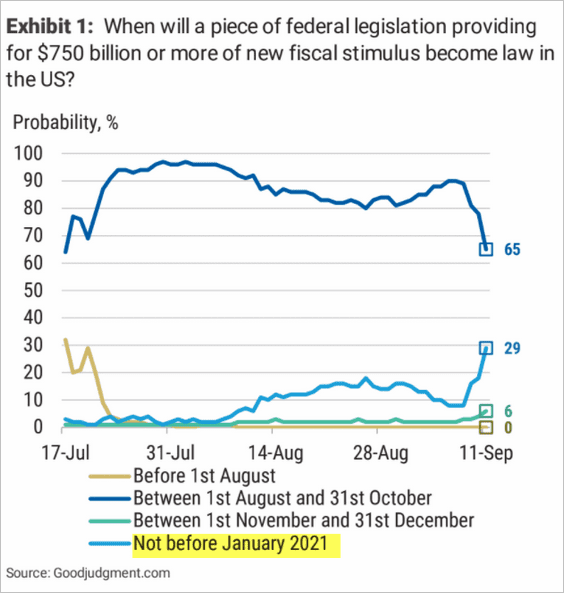

1. Analysts are starting to have doubts about a CARES 2 stimulus package this year. Here are the aggregate probabilities from superforecasters.

Source: Morgan Stanley

Source: Morgan Stanley

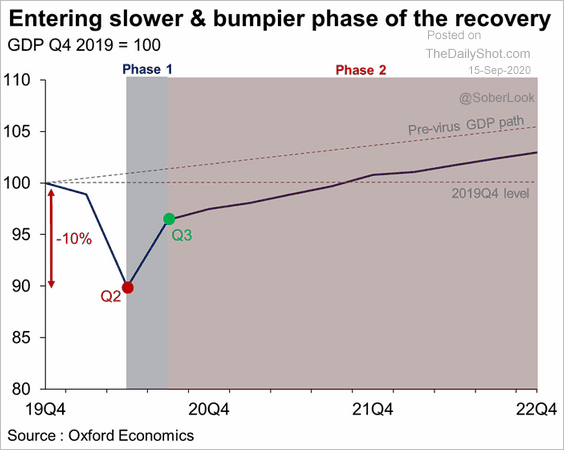

The concern is that cutting off the stimulus checks could reverse the recent economic gains. At this point, the recovery is already slowing, making it vulnerable to a shock.

Source: Oxford Economics

Source: Oxford Economics

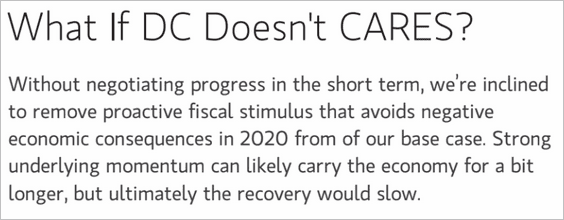

Below is a comment from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

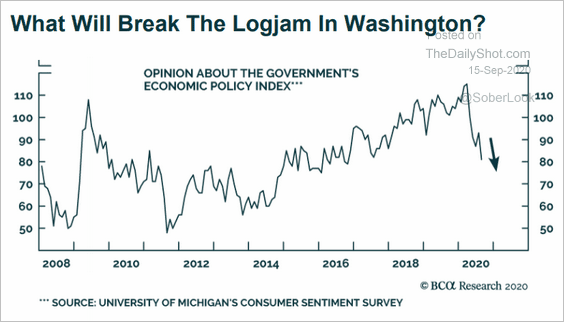

Views on the government’s economic policy are deteriorating.

Source: BCA Research

Source: BCA Research

——————–

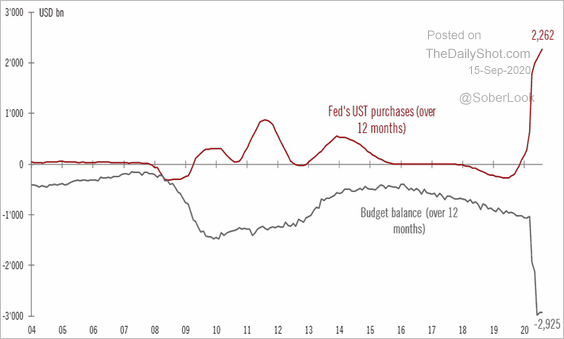

2. Will the Fed boost its QE program to support the US Treasury’s borrowing?

Source: @TCosterg

Source: @TCosterg

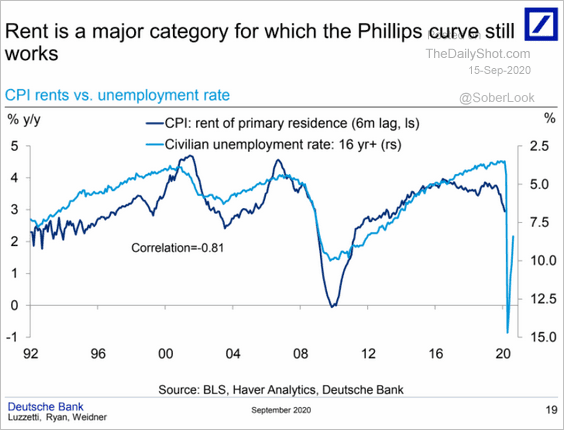

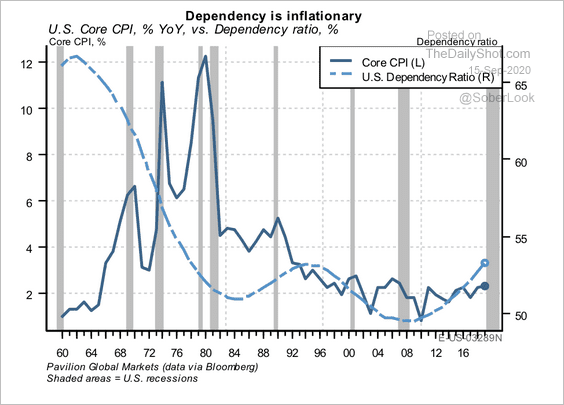

3. Next, we have a couple of updates on inflation.

• PCE inflation forecasts over the next five and ten years:

Source: @markets Read full article

Source: @markets Read full article

• Rent CPI vs. the unemployment rate:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The dependency ratio vs. core CPI.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

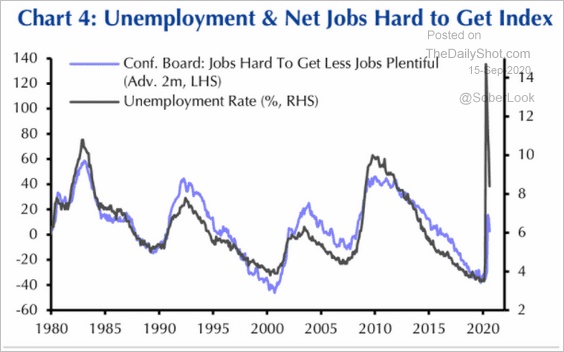

4. The Conference Board’s index of “jobs hard to get” less “jobs plentiful” points to a lower unemployment rate ahead.

Source: Capital Economics

Source: Capital Economics

Global Developments

1. Let’s begin with central banks’ policies.

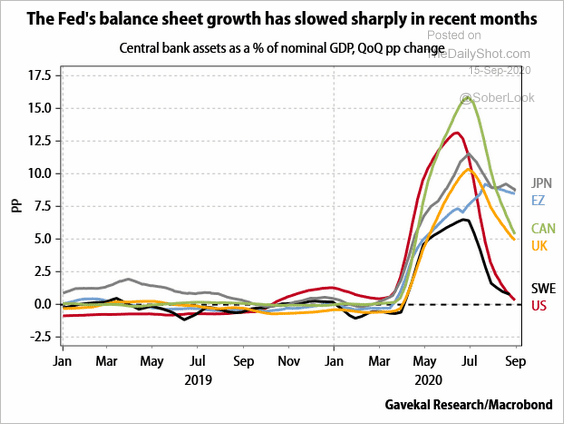

• Asset growth has slowed.

Source: Gavekal

Source: Gavekal

• Are central banks’ balance sheets tracking demographic trends (aging)?

![]() Source: Deutsche Bank Research

Source: Deutsche Bank Research

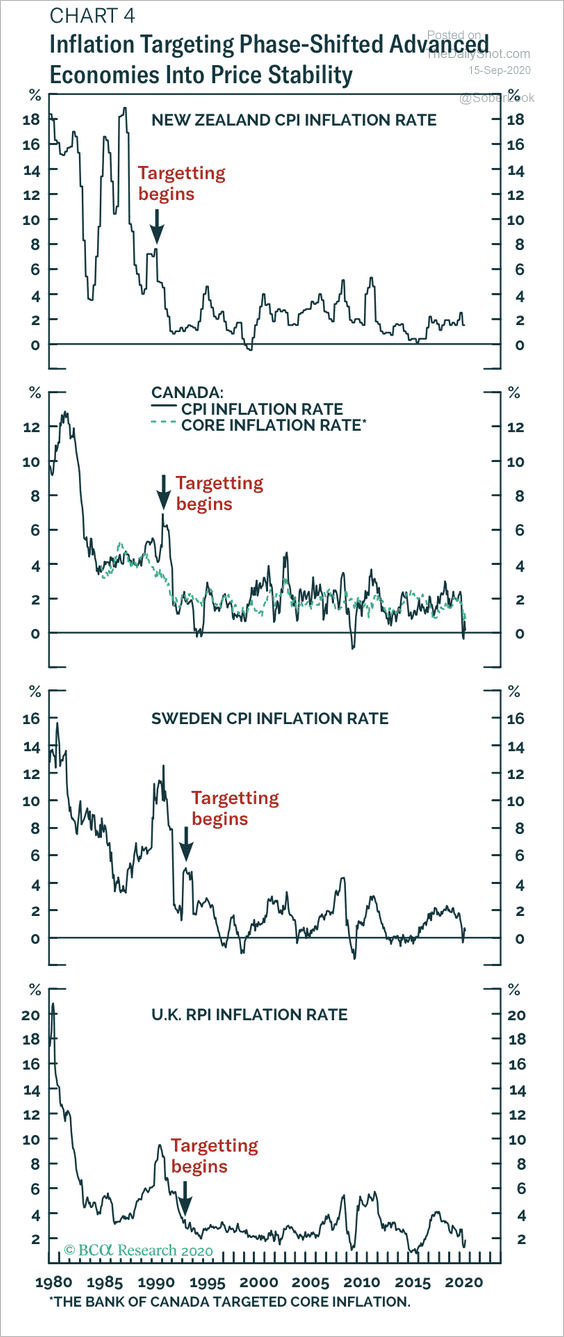

• Inflation targeting helped price stability in advanced economies.

Source: BCA Research

Source: BCA Research

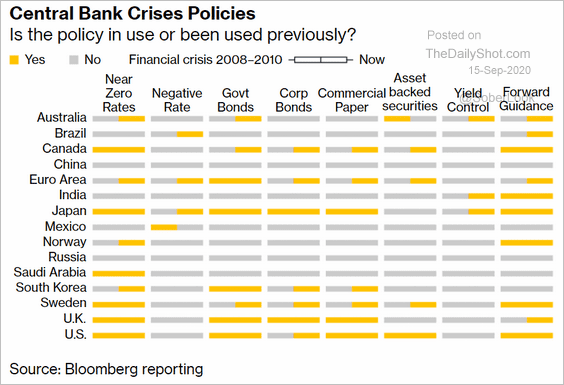

• Unconventional policies are now the norm.

Source: @markets Read full article

Source: @markets Read full article

——————–

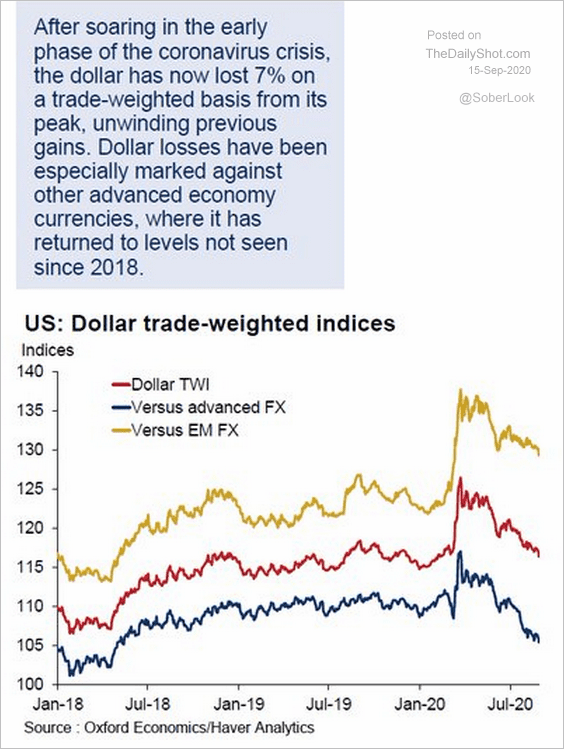

2. Next, we have a couple of updates on the dollar.

• Here is a quote from Oxford Economics.

In our view, the recent 7% fall in the dollar reflects an unwinding of a number of short-term dollar positives and a modest deterioration of longer-term fundamentals. This looks like a correction rather than the beginning of a dramatic collapse

Source: @OxfordEconomics Read full article

Source: @OxfordEconomics Read full article

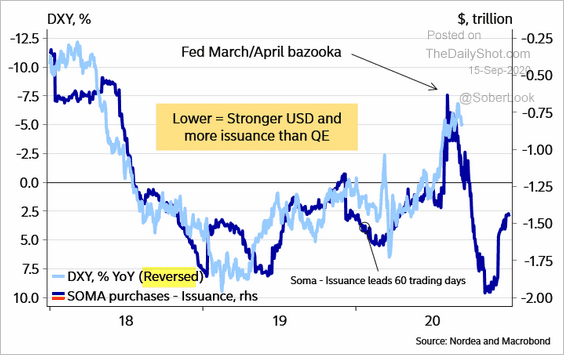

• The Fed’s slower asset growth (first chart above) points to a rebound in the US dollar.

Source: @AndreasSteno Read full article

Source: @AndreasSteno Read full article

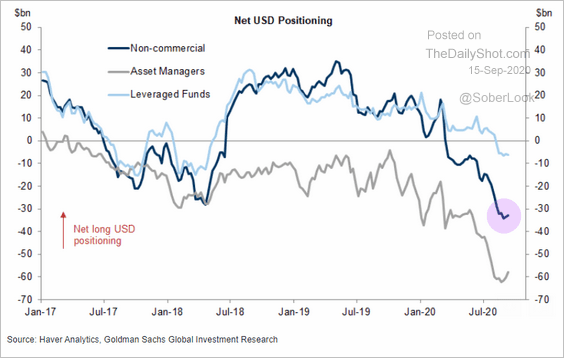

• Shorting the dollar remains a crowded trade.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

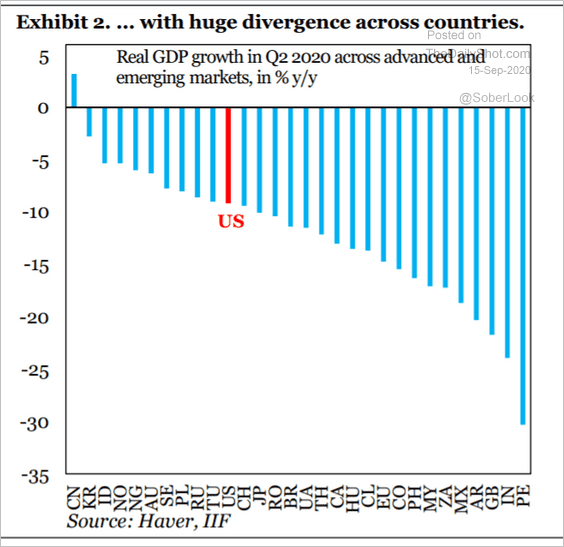

3. Here are some updates on economic growth.

• The Q2 GDP declines:

Source: IIF

Source: IIF

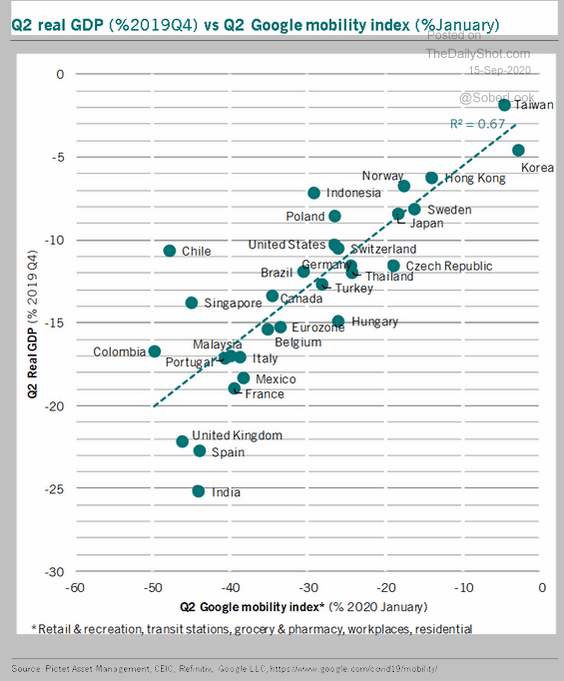

• The Q2 GDP declines vs. the Google mobility index:

Source: @PkZweifel

Source: @PkZweifel

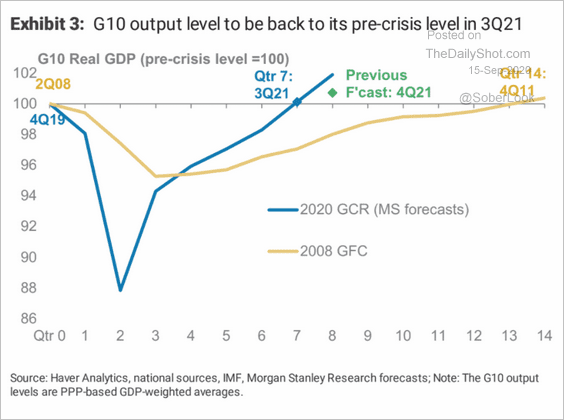

• Morgan Stanley’s G10 GDP forecast:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

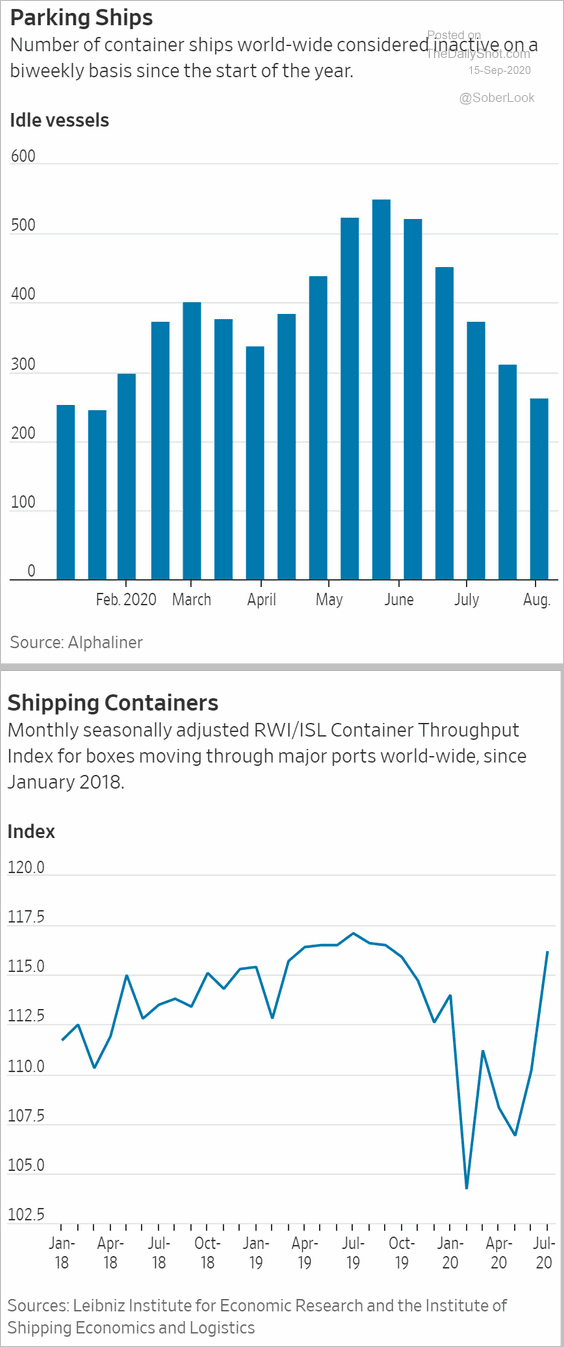

• Shipping activity:

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

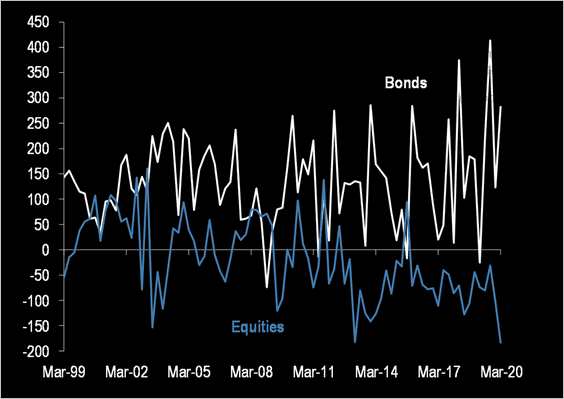

4. G4 pension funds have favored bonds over equities.

Source: @TheMarketEar

Source: @TheMarketEar

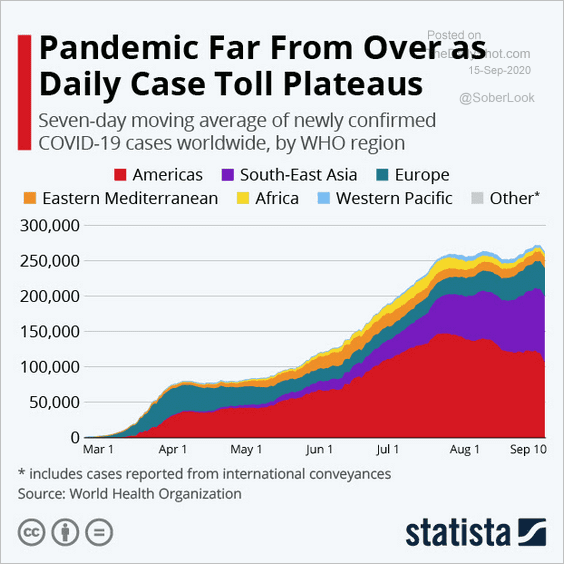

5. Finally, we have the contributions to global COVID cases.

Source: Statista

Source: Statista

The Eurozone

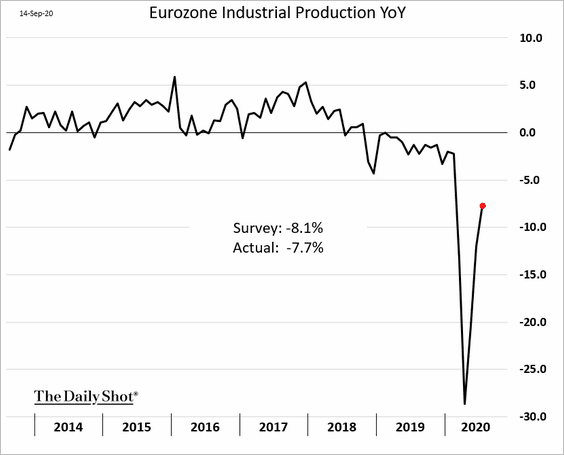

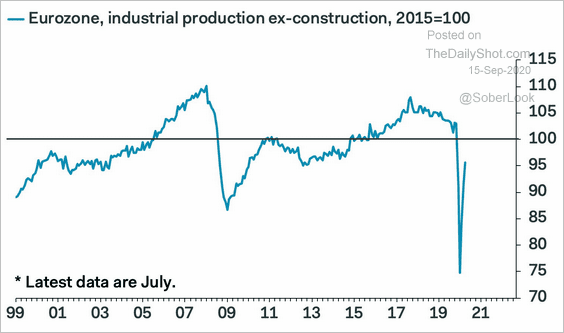

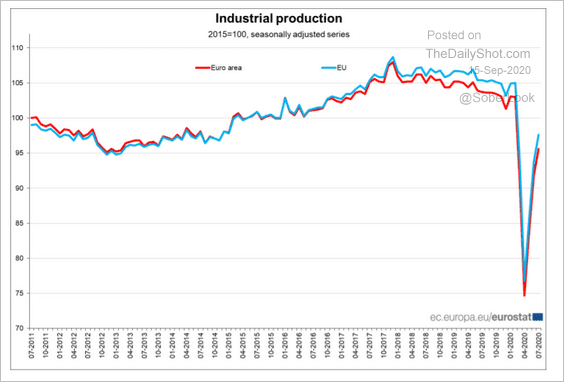

1. Industrial production is recovering.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

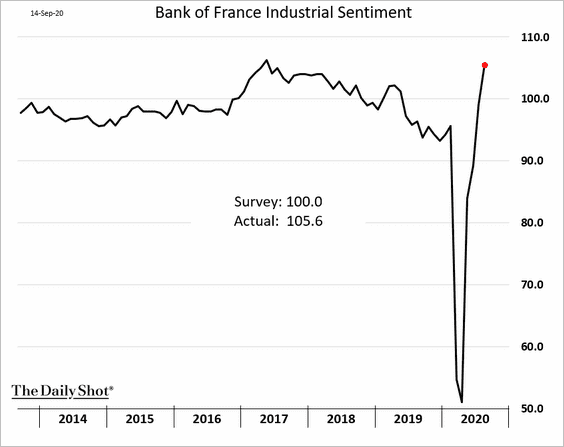

Industrial sentiment in France has been much stronger than expected.

——————–

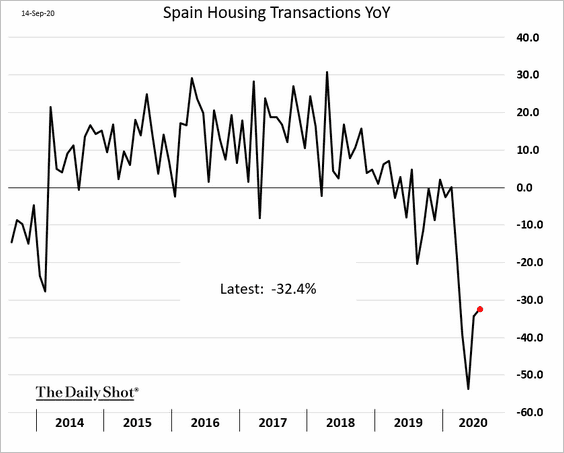

2. Spain’s housing market continues to struggle.

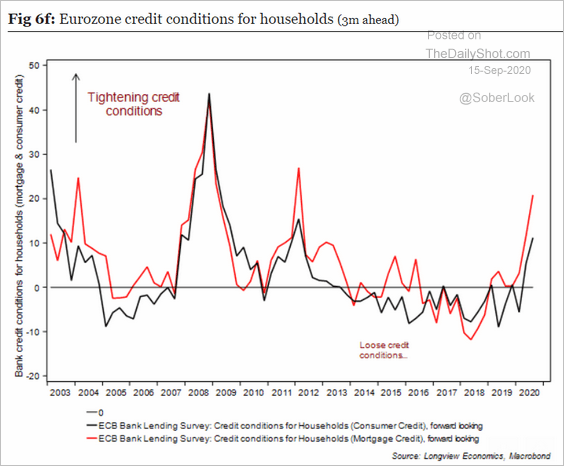

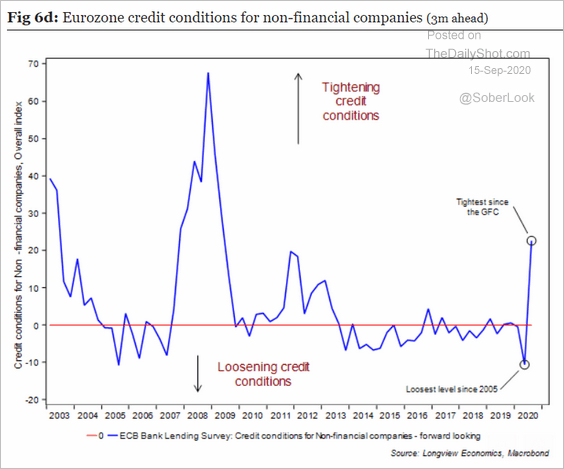

3. Credit conditions have been tight.

• Households:

Source: Longview Economics

Source: Longview Economics

• Businesses:

Source: Longview Economics

Source: Longview Economics

——————–

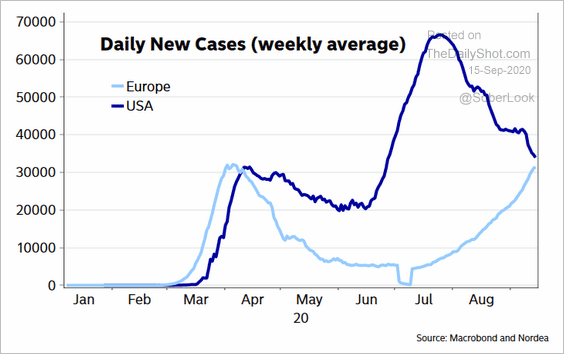

4. This COVID trend doesn’t bode well for the euro.

Source: @AndreasSteno Read full article

Source: @AndreasSteno Read full article

Europe

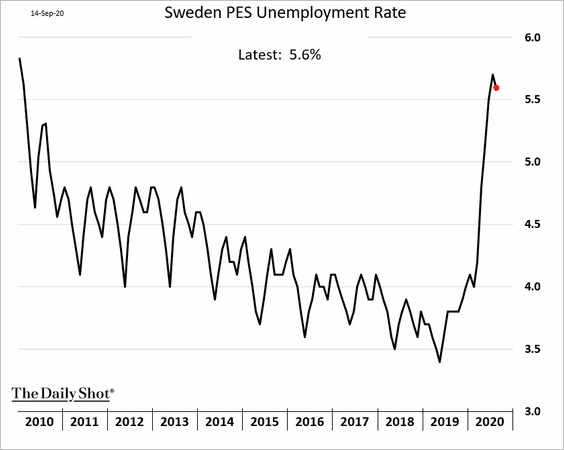

1. Sweden’s unemployment rate appears to have peaked.

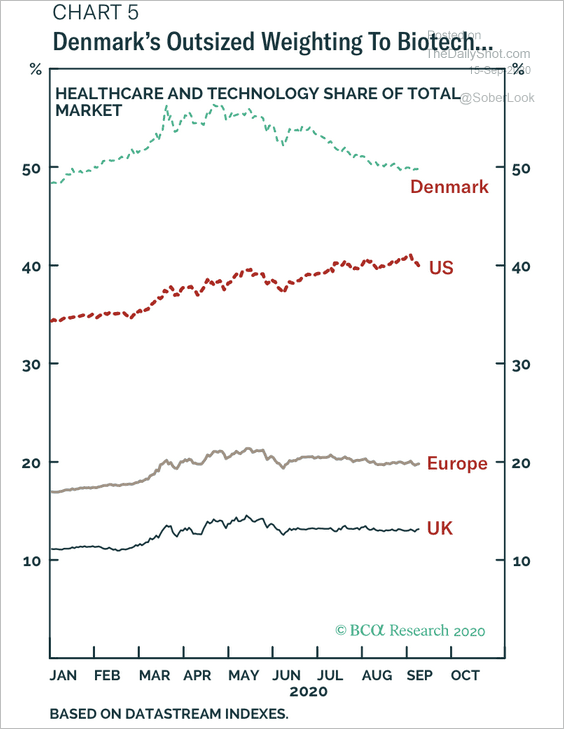

2. Denmark’s stock market has an outsized weighting to biotech shares …

Source: BCA Research

Source: BCA Research

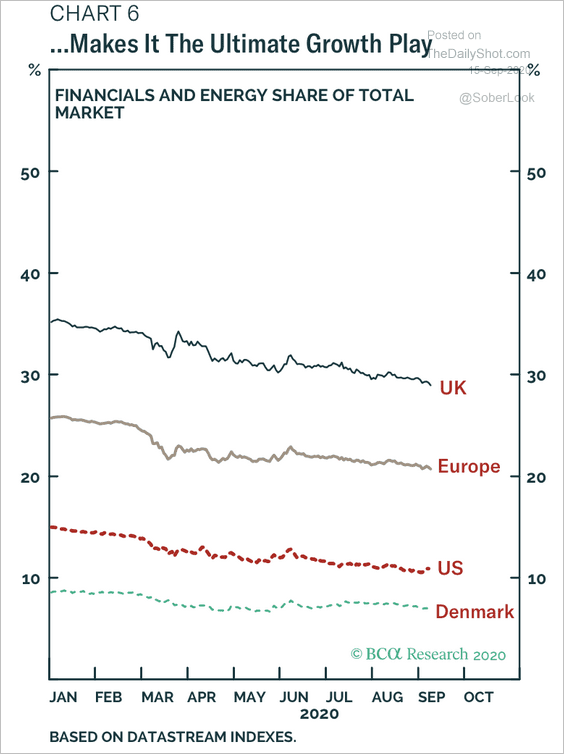

… and is less exposed to financials and energy relative to its developed-market peers.

Source: BCA Research

Source: BCA Research

——————–

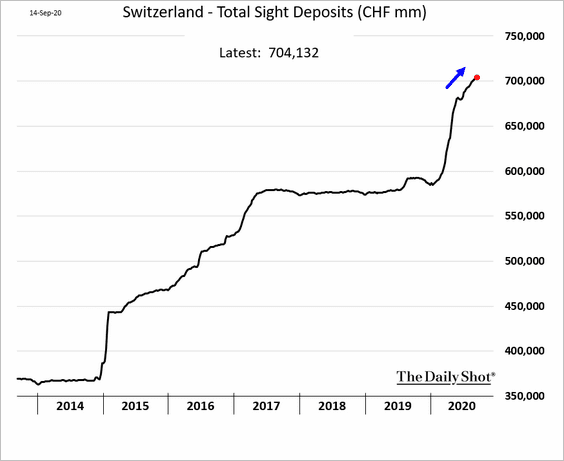

3. Switzerland’s central bank (SNB) continues to intervene in the currency markets (mostly buying euros).

4. The overall EU industrial production keeps outperforming the Eurozone.

Source: Eurostat Read full article

Source: Eurostat Read full article

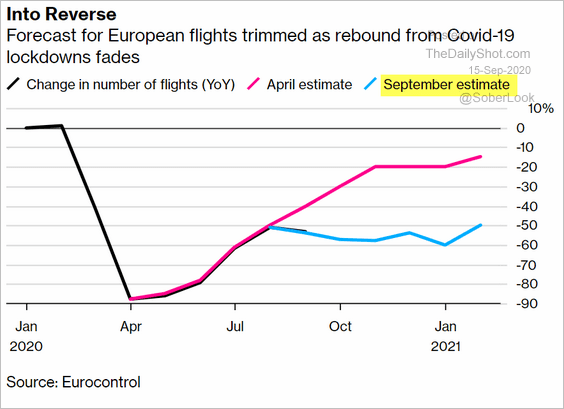

5. The full recovery in European flights is a long way off.

Source: @business Read full article

Source: @business Read full article

Asia – Pacific

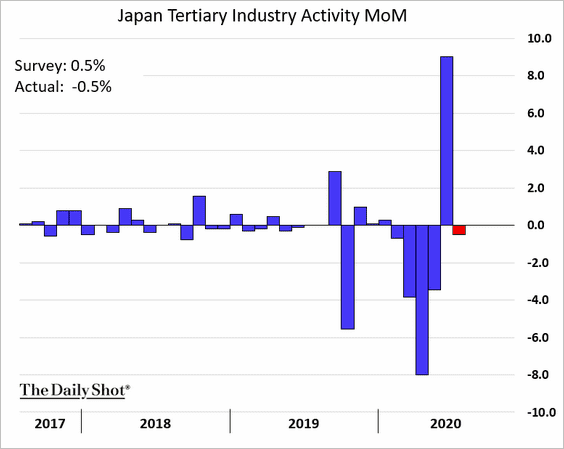

1. Japan’s service sector activity has slowed again.

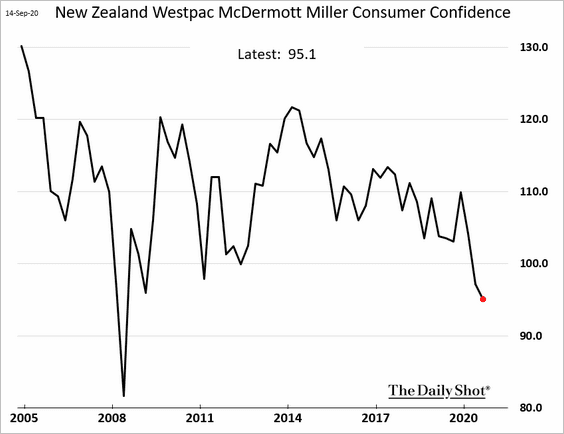

2. New Zealand’s consumer sentiment remains soft.

China

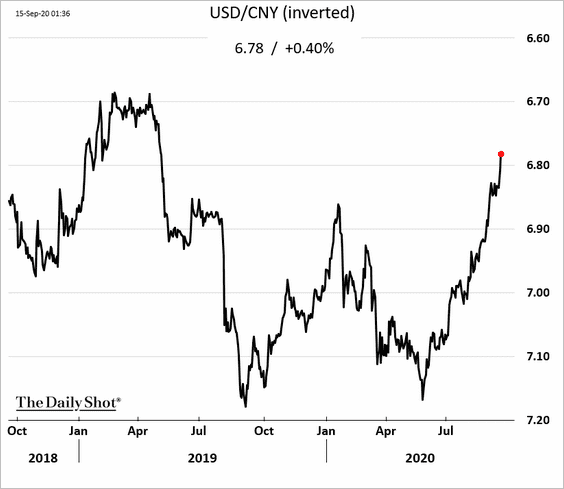

1. The renminbi continues to rally.

2. China’s August economic indicators surprised to the upside.

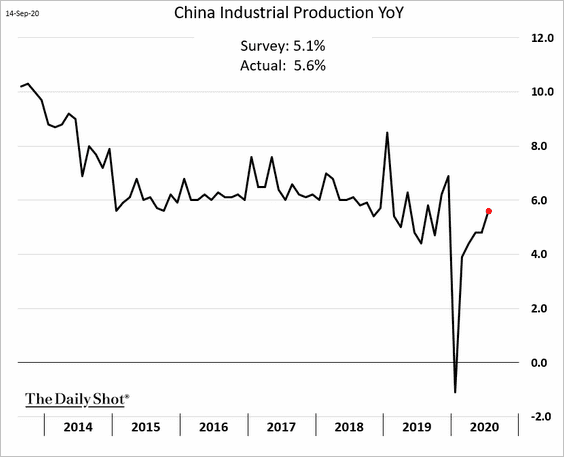

• Industrial production:

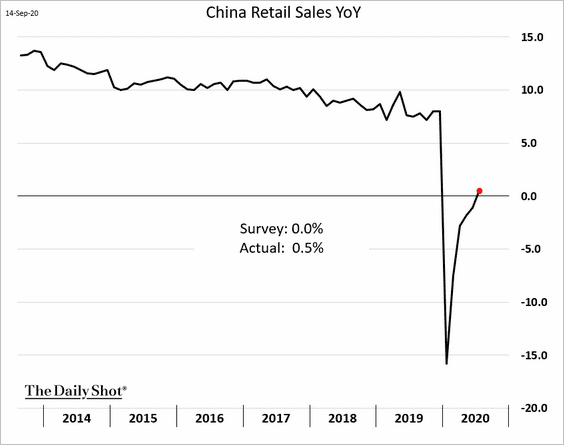

• Retail sales (now up on a year-over-year basis):

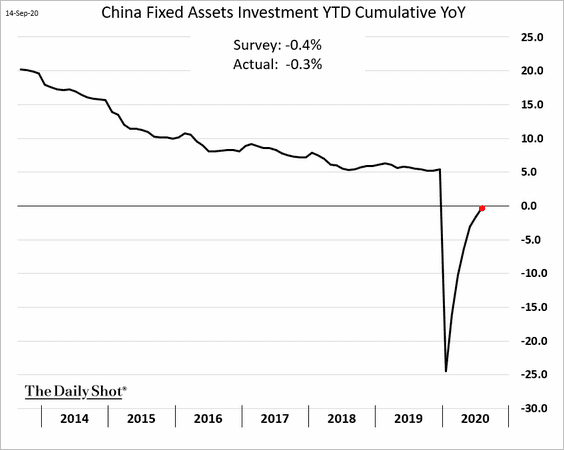

3. Fixed asset investment is near flat vs. last year.

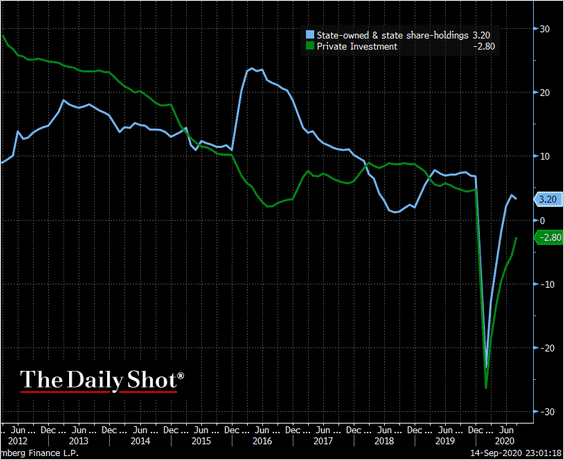

Here are the trends for state-owned vs. private investment.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

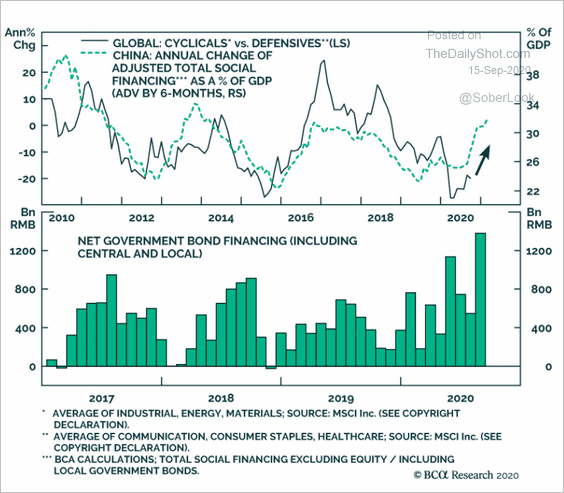

4. Rapid government borrowing (central and local) points to ongoing fiscal stimulus.

Source: BCA Research

Source: BCA Research

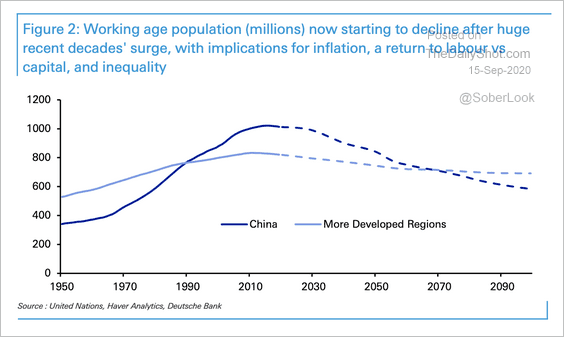

5. The working-age population is set to fall below more developed regions over the next few decades.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Emerging Markets

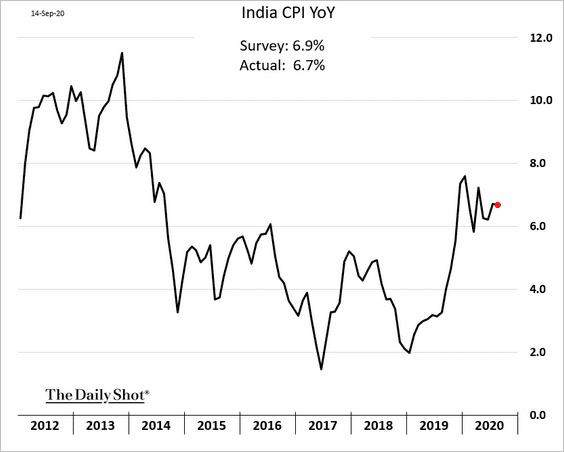

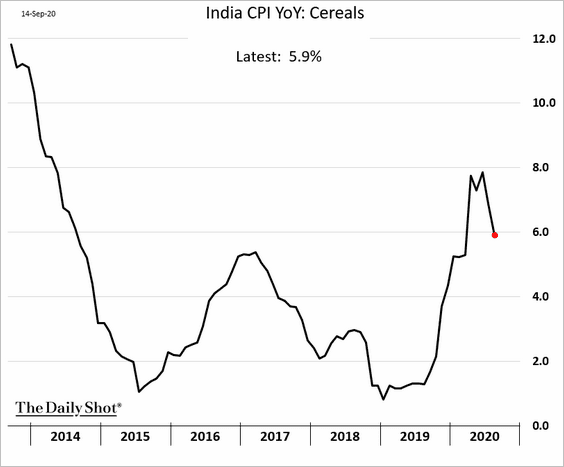

1. India’s CPI remained stable as food inflation eased.

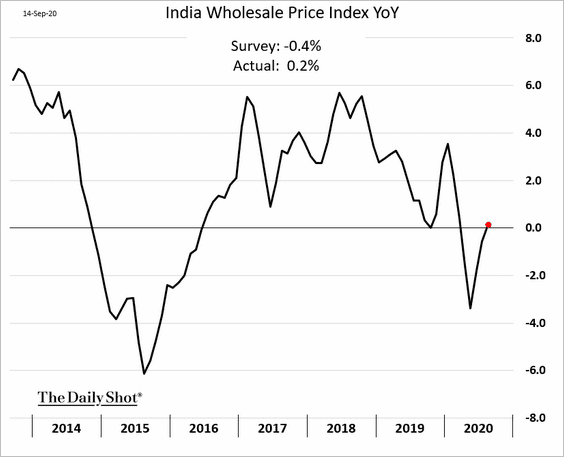

However, wholesale prices surprised to the upside.

——————–

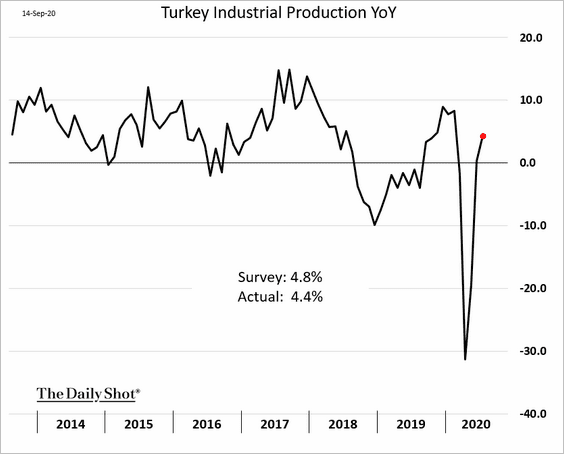

2. Turkey’s industrial production has rebounded.

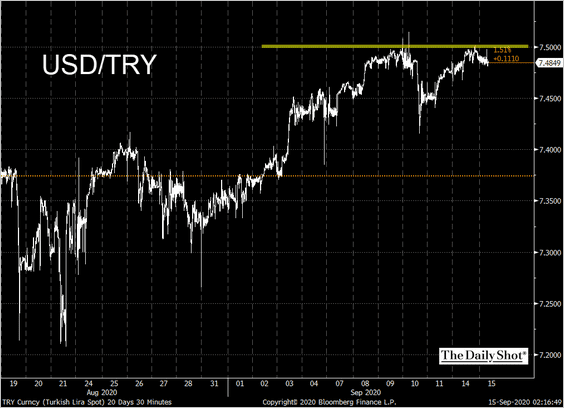

USD/TRY is testing resistance at 7.5. Will the lira hit new lows?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

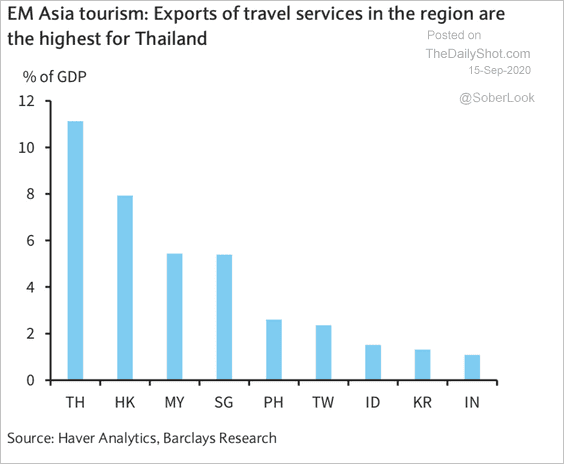

3. Which Asian economies rely most on tourism?

Source: Barclays Research

Source: Barclays Research

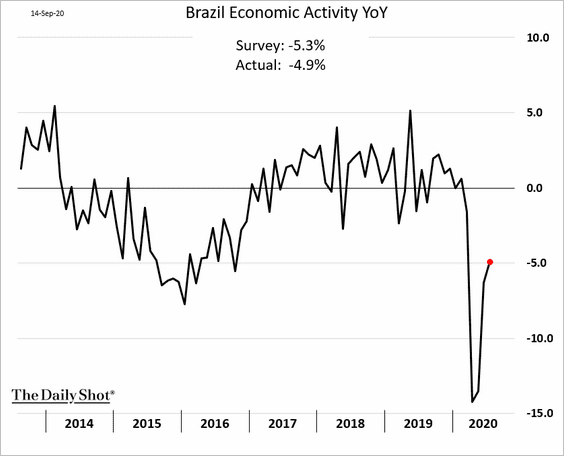

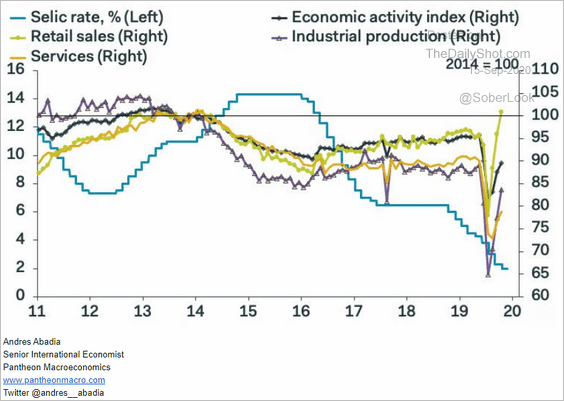

4. Brazil’s economic activity continued to recover in July.

But the rebound has been uneven, with the nation’s service sector lagging.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

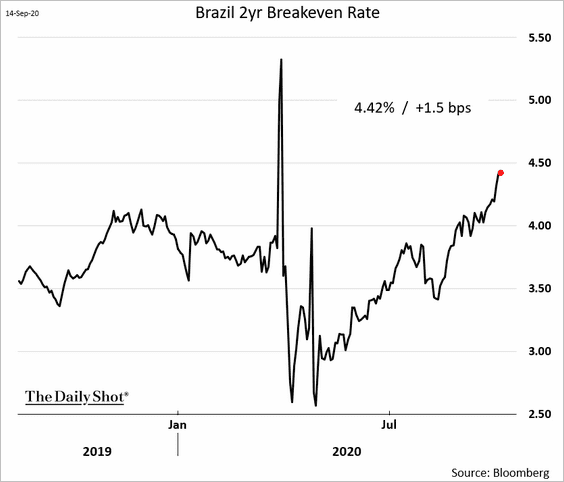

Brazil’s market-based inflation expectations have been rising, suggesting that the central bank is on hold for now.

——————–

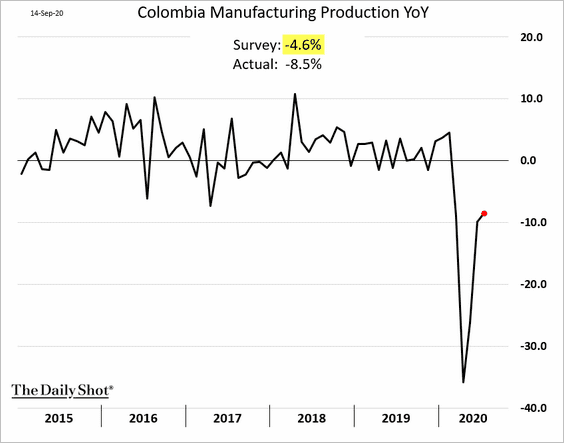

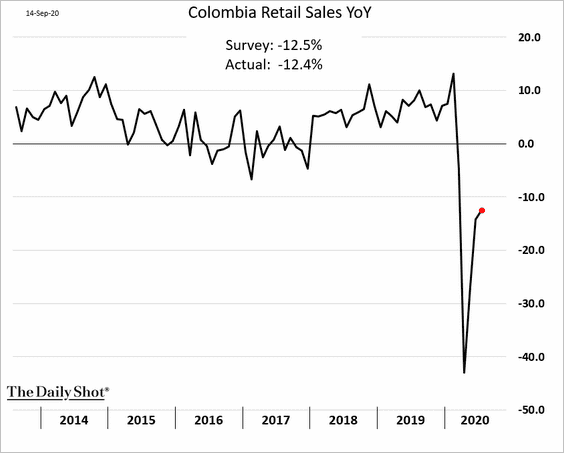

5. Colombia’s economic recovery has been slow.

• Manufacturing output:

• Retail sales:

——————–

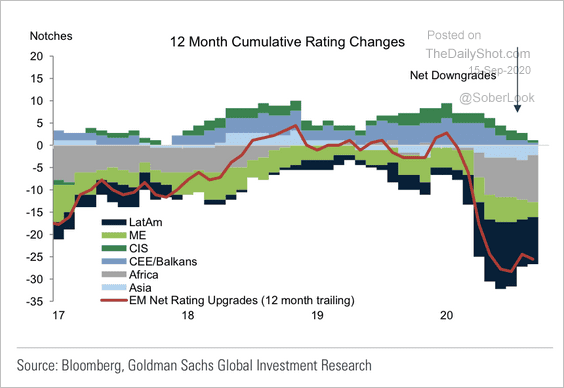

6. The pace of EM sovereign credit rating downgrades has slowed.

Source: Goldman Sachs

Source: Goldman Sachs

Cryptocurrency

Bitcoin found support at $10k.

Commodities

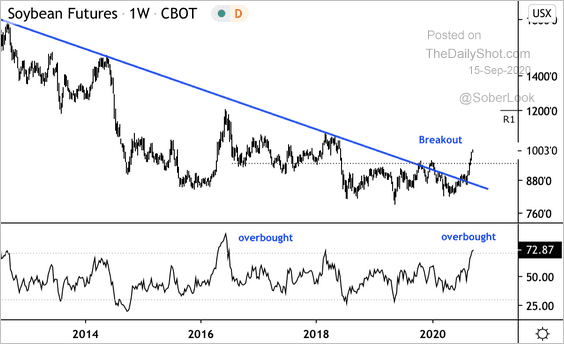

1. Technical indicators suggest that US soybean futures are the most overbought since 2016.

Source: @DantesOutlook

Source: @DantesOutlook

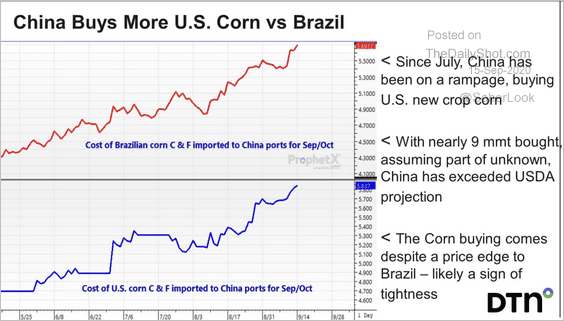

2. China has been buying more US corn (relative to Brazil).

Source: DTN, @Agridome

Source: DTN, @Agridome

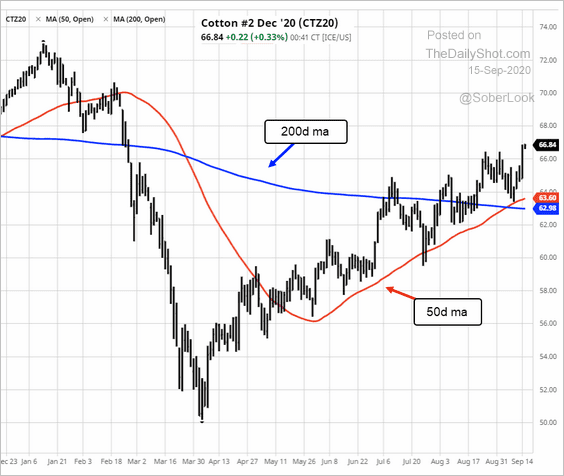

3. US cotton continues to rally.

Source: barchart.com

Source: barchart.com

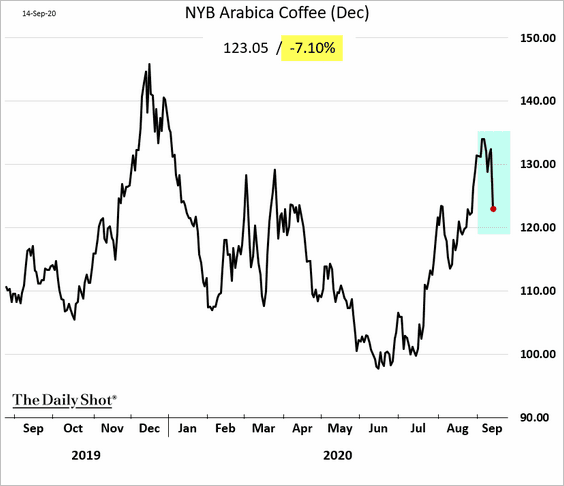

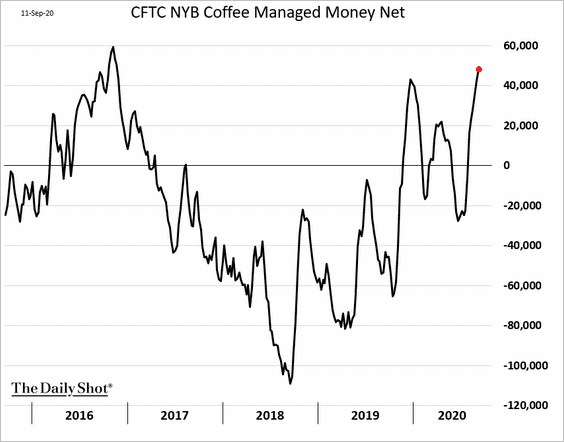

4. New York coffee futures tumbled, as traders were surprised by improved weather conditions for parts of Brazil (rain after a period of drought).

Speculative accounts have been building bets on coffee (chart below), with the weather report forcing a pullback.

Energy

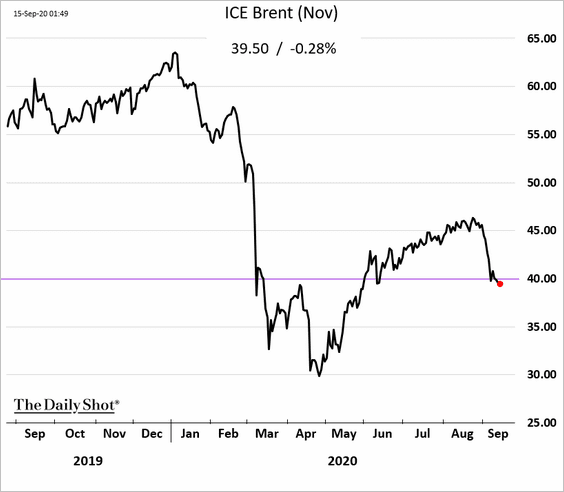

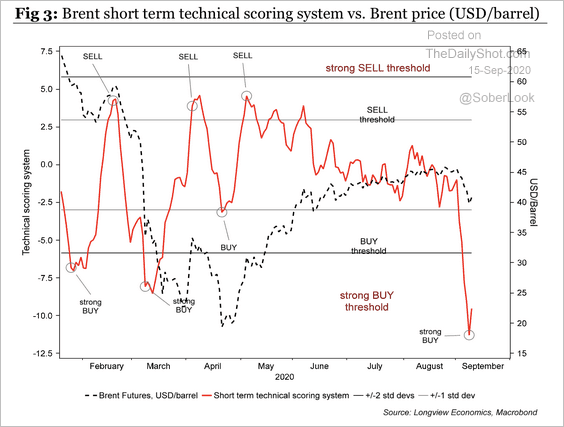

1. Brent is trading below $40/bbl.

Technicals have been indicating that Brent is oversold.

Source: Longview Economics

Source: Longview Economics

——————–

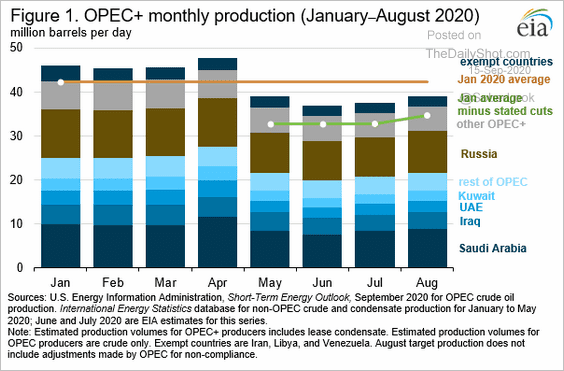

2. Here is the OPEC+ monthly production.

Source: EIA

Source: EIA

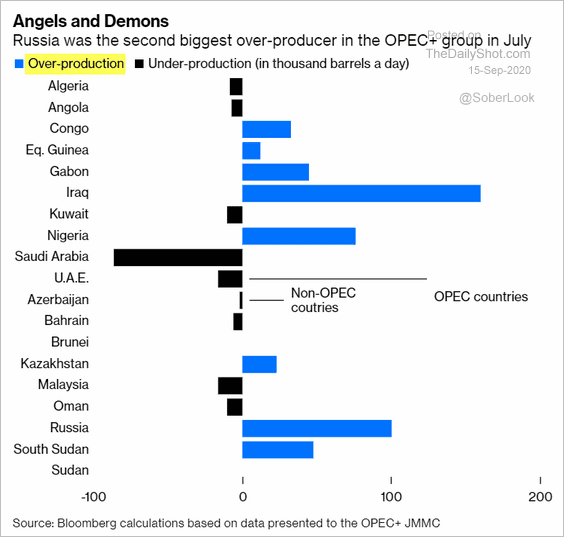

Russia’s output has been well above the OPEC limit.

Source: @bopinion Read full article

Source: @bopinion Read full article

——————–

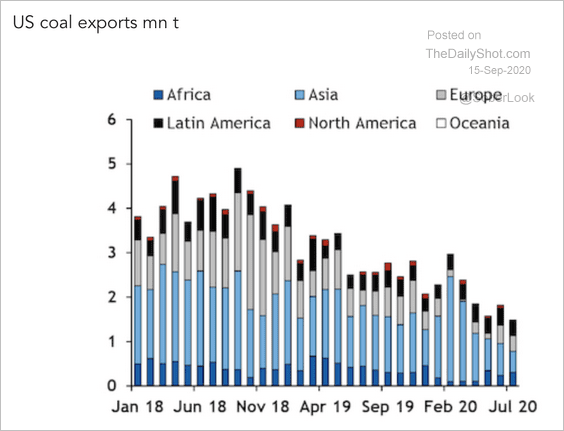

3. Finally, this chart shows US coal exports.

Source: Argus Media Read full article

Source: Argus Media Read full article

Equities

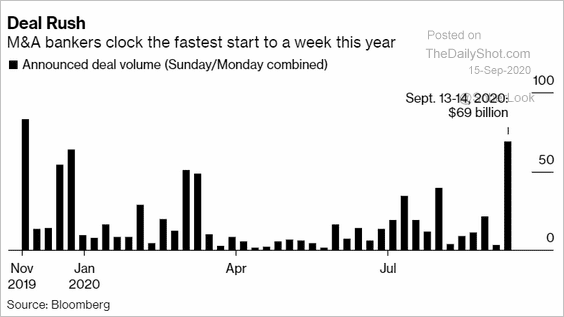

1. M&A activity has picked up, fueling the market rally.

Source: @business Read full article

Source: @business Read full article

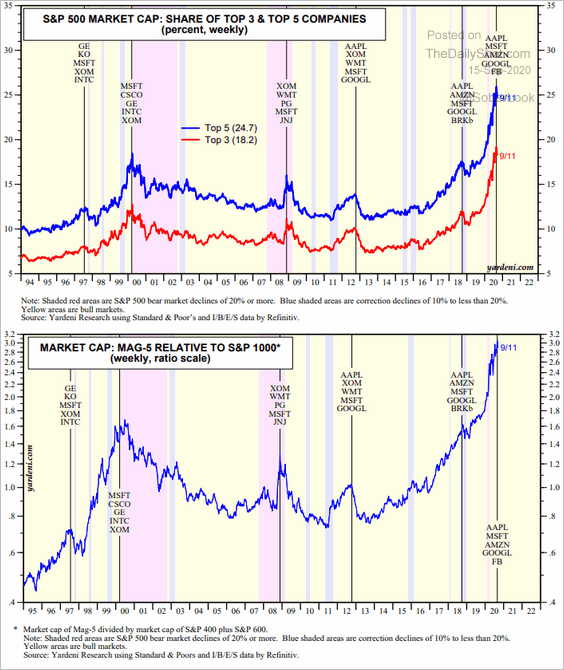

2. The US market remains concentrated.

Source: Yardeni Research

Source: Yardeni Research

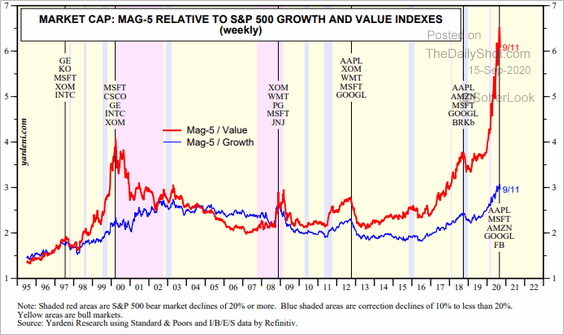

Here are the largest stocks relative to value and growth indices.

Source: Yardeni Research

Source: Yardeni Research

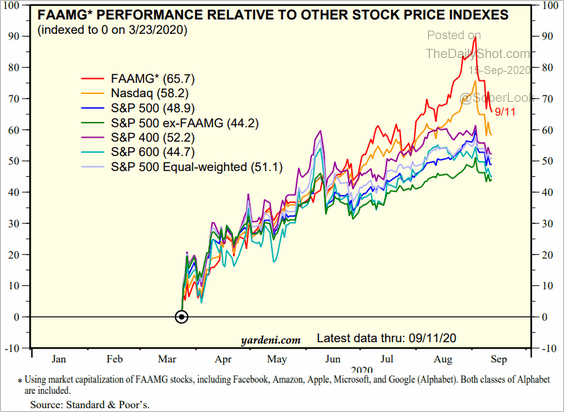

• Despite the recent selloff, the mega-cap shares remain well ahead of other indices since the March lows.

Source: Yardeni Research

Source: Yardeni Research

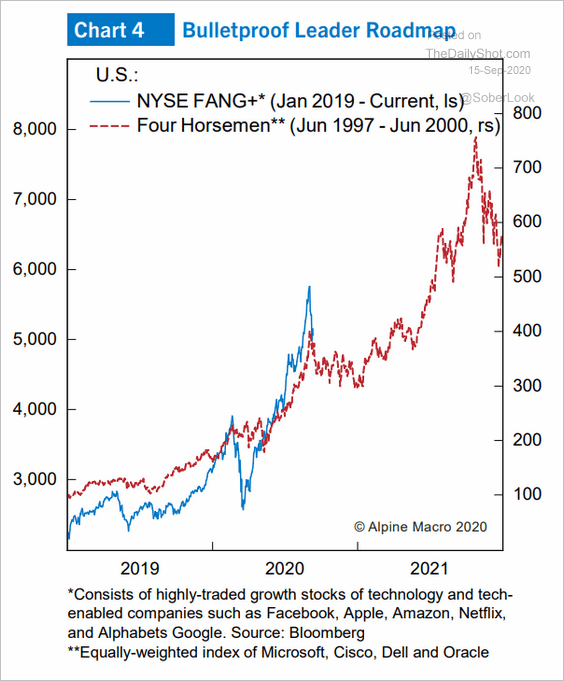

• Is there more upside for the tech giants?

Source: Alpine Macro

Source: Alpine Macro

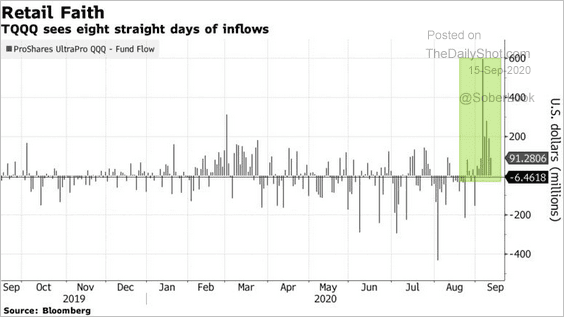

Traders are betting on it. Here are the flows into TQQQ – the Nasdaq 100 index leveraged three times.

Source: @markets Read full article

Source: @markets Read full article

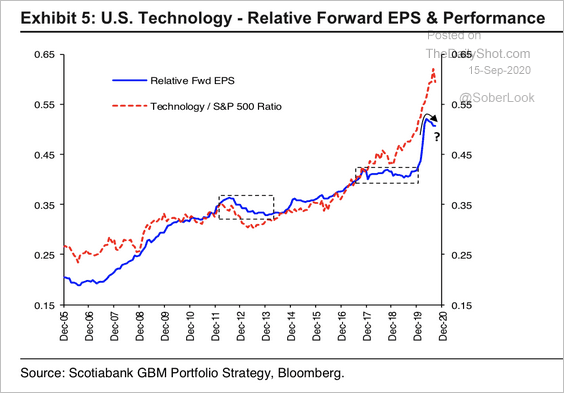

• By the way, the US tech sector’s forward earnings per share are fading relative to the S&P 500.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

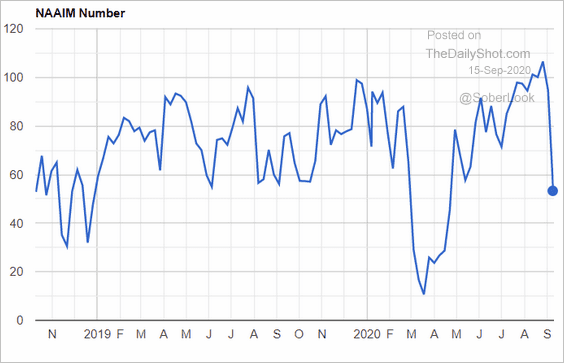

3. Investment managers are less bullish.

Source: NAAIM

Source: NAAIM

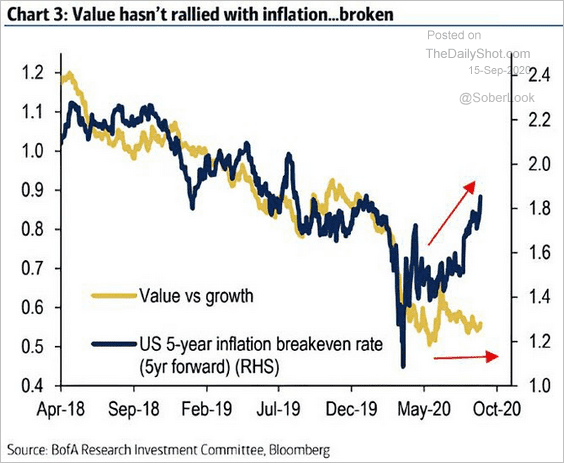

4. Higher inflation expectations haven’t boosted value shares.

Source: BofA Securities

Source: BofA Securities

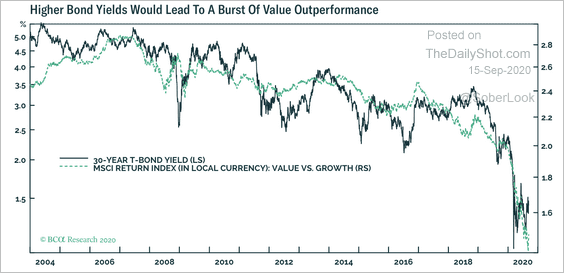

Perhaps higher bond yields are needed.

Source: BCA Research

Source: BCA Research

——————–

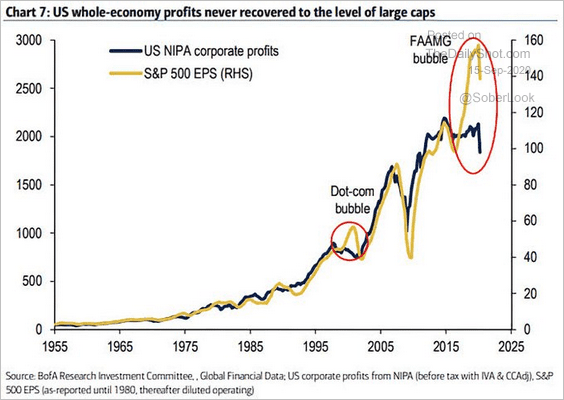

5. US overall corporate profits are lagging large-caps (S&P 500).

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

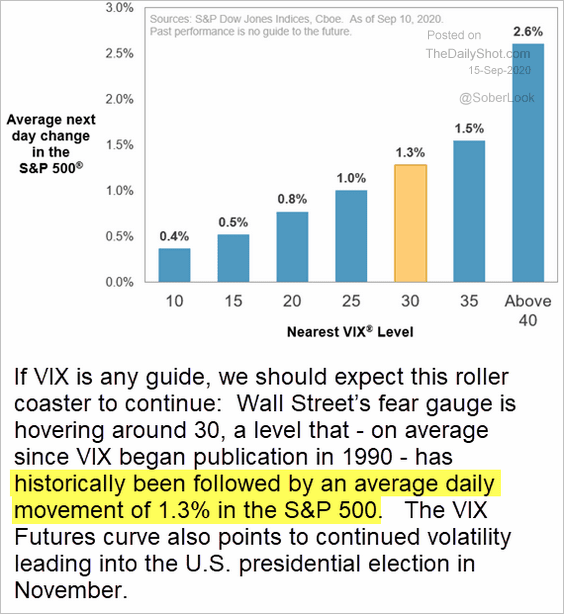

6. Will we see higher volatility ahead?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Rates

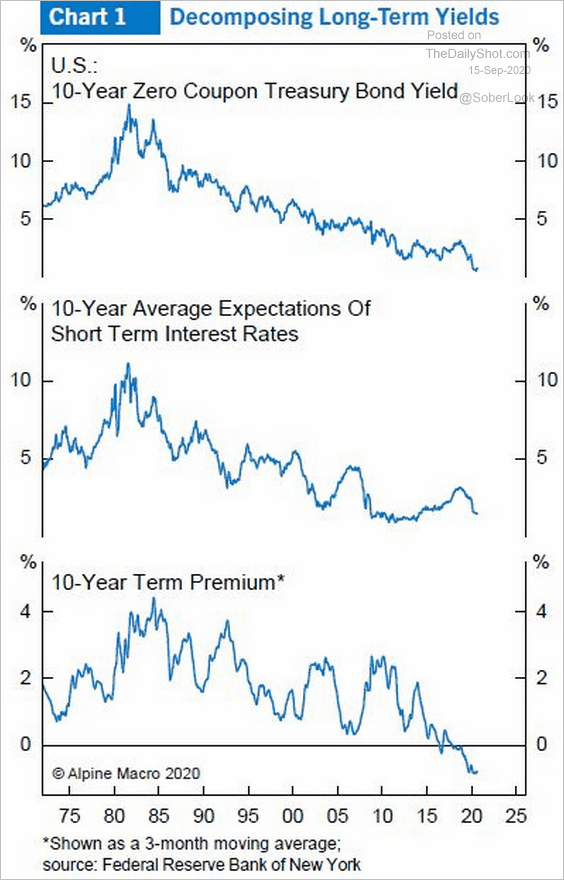

1. Here is a long-term attribution of changes in Treasury yields.

Source: Alpine Macro

Source: Alpine Macro

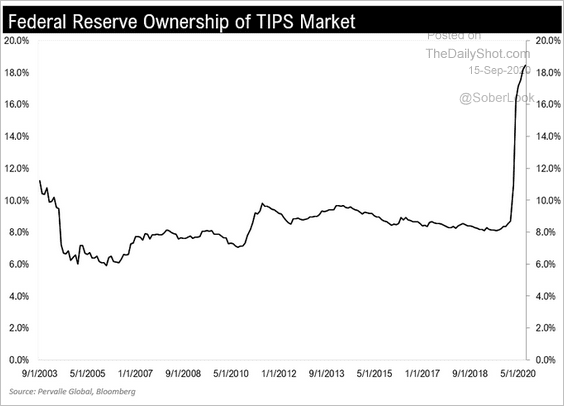

2. The Fed’s TIPS holdings spiked this year, which helped push real yields deep into negative territory.

Source: @TeddyVallee

Source: @TeddyVallee

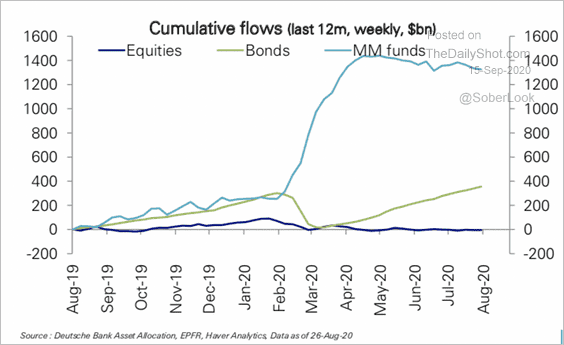

3. Although money market funds have seen record inflows this year, flows have moderated in favor of bonds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

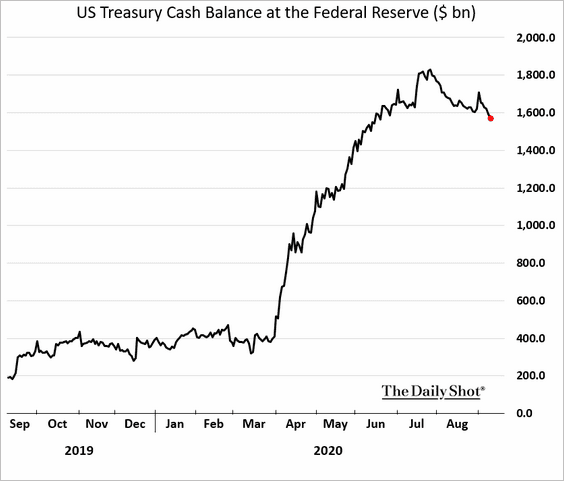

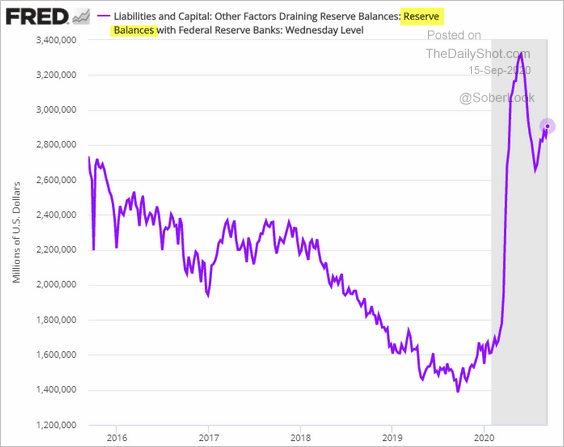

4. The US Treasury’s cash balances at the Fed have declined, …

… boosting reserves.

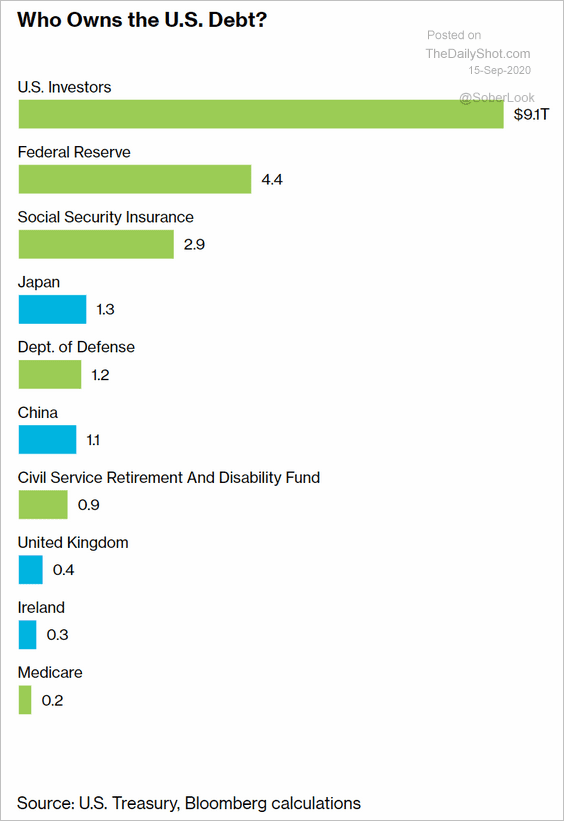

5. Who owns US government debt?

Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

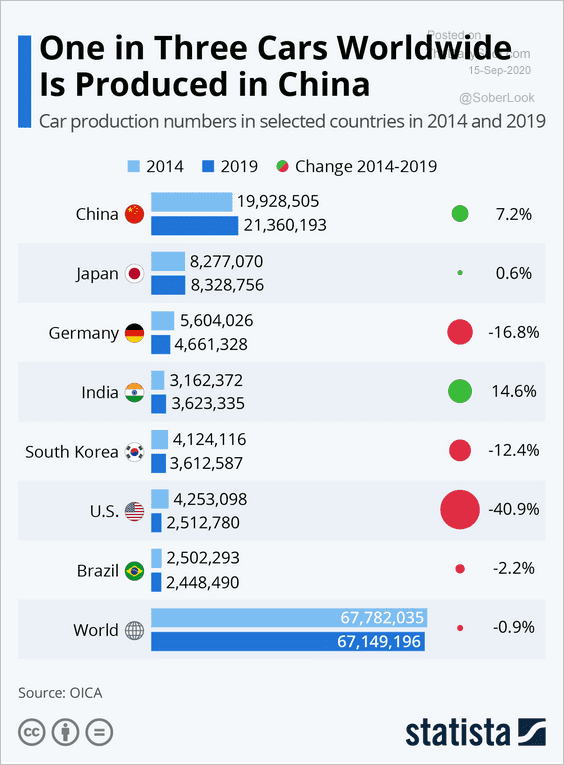

1. Car production by country:

Source: Statista

Source: Statista

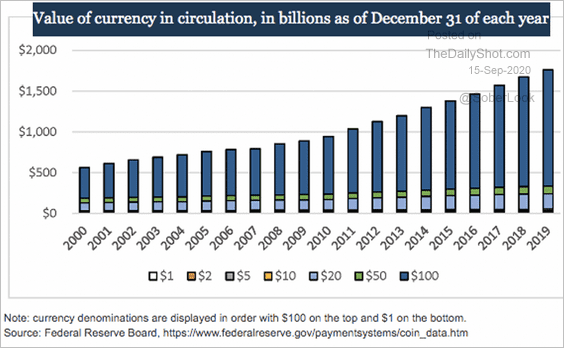

2. US currency (banknotes) in circulation:

Source: Federal Reserve

Source: Federal Reserve

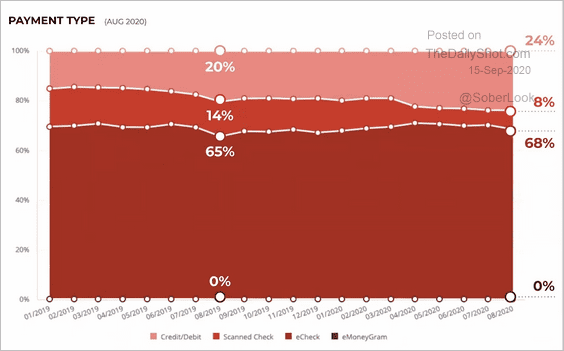

3. US rent payments by type:

Source: NMHC

Source: NMHC

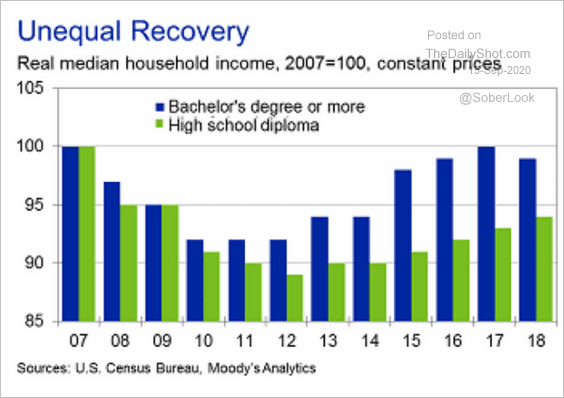

4. Median household income by education:

Source: Moody’s Analytics

Source: Moody’s Analytics

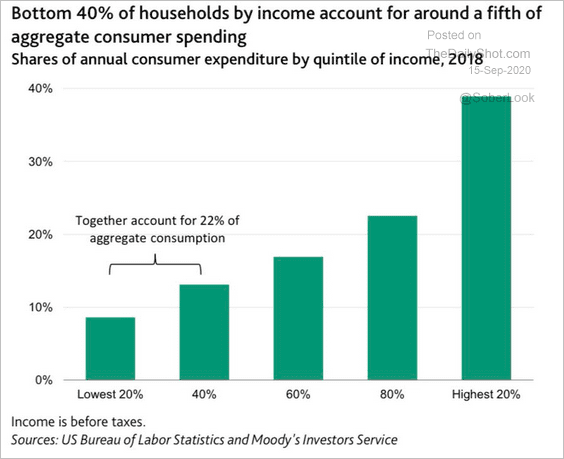

5. Consumption by income:

Source: @LizAnnSonders, @MoodysInvSvc

Source: @LizAnnSonders, @MoodysInvSvc

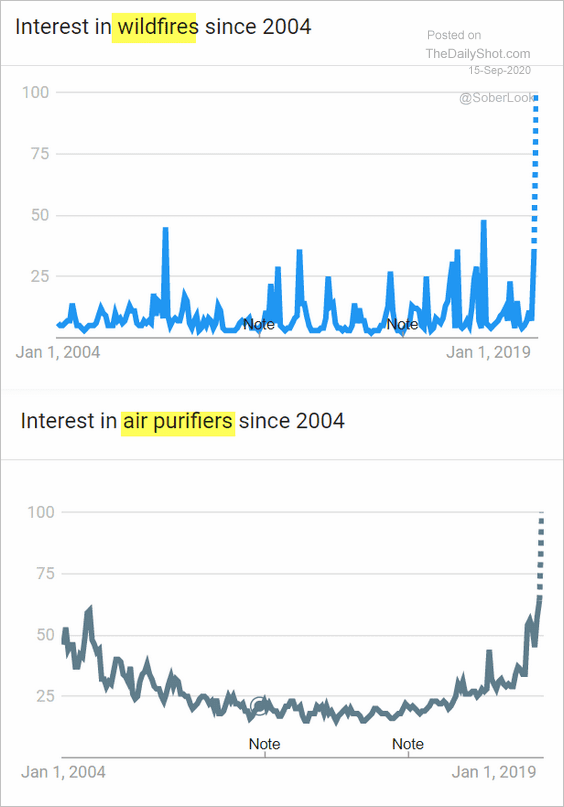

6. Google search activity for air purifiers:

Source: Google Trends

Source: Google Trends

——————–

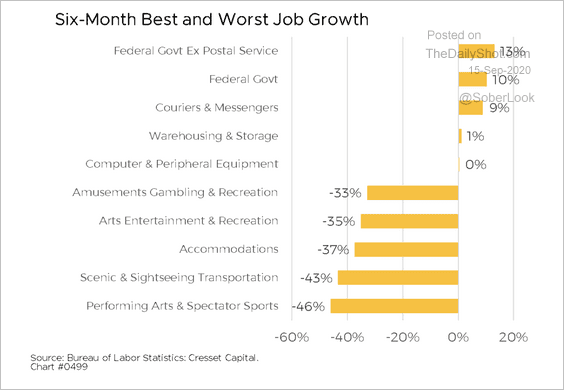

7. Best and worst sectors for job growth:

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

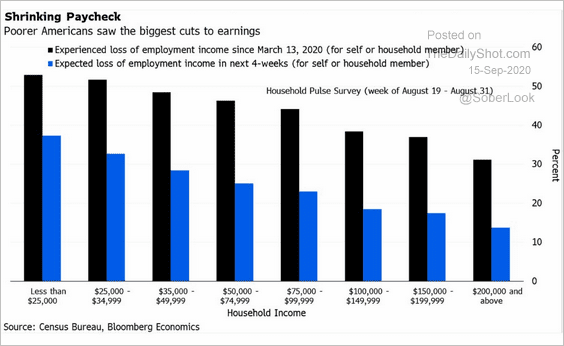

8. Loss of employment income:

Source: @lisaabramowicz1, @markets Read full article

Source: @lisaabramowicz1, @markets Read full article

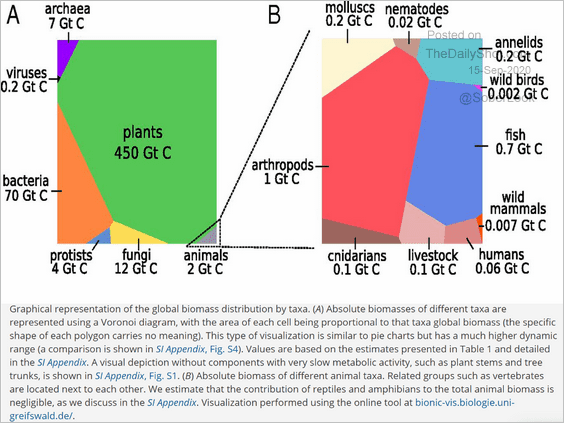

9. The Earth’s biomass:

Source: @adam_tooze, Proceedings of the National Academy of Sciences Further reading

Source: @adam_tooze, Proceedings of the National Academy of Sciences Further reading

——————–