The Daily Shot: 13-Oct-20

• Equities

• Credit

• Rates

• Energy

• Commodities

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United States

• Food for Thought

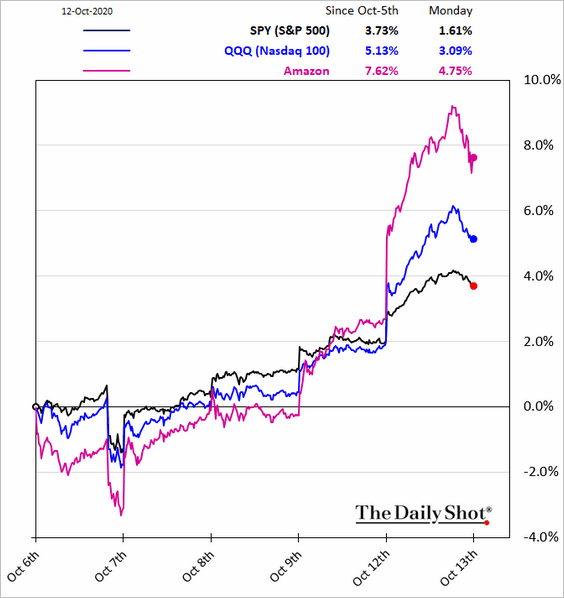

Equities

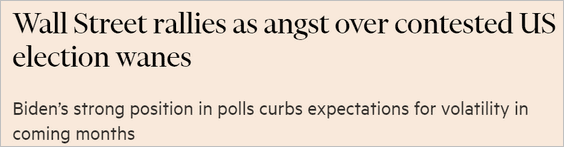

1. With election uncertainty apparently out of the way and stimulus no longer in focus, risk-on sentiment has returned.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

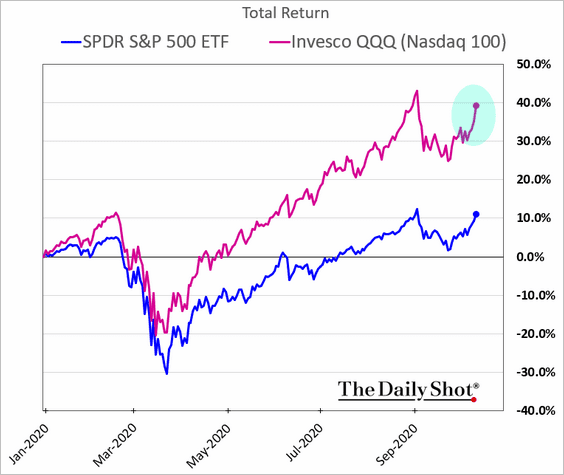

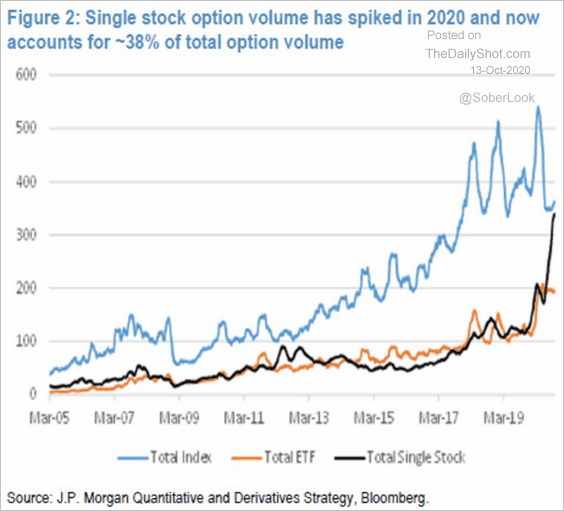

Speculative stock option activity is ramping up again.

• The Nasdaq 100 and its VIX equivalent index both climbed on Monday, which is unusual.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

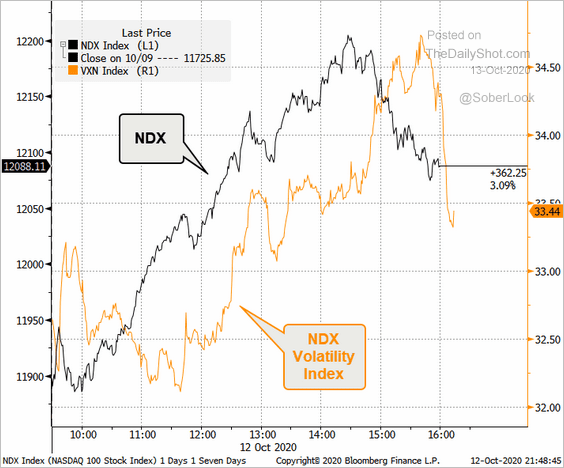

• The put/call ratio declined sharply amid increased demand for call options.

• Single-stock option volume has been elevated.

Source: JPMorgan, @markets Read full article

Source: JPMorgan, @markets Read full article

——————–

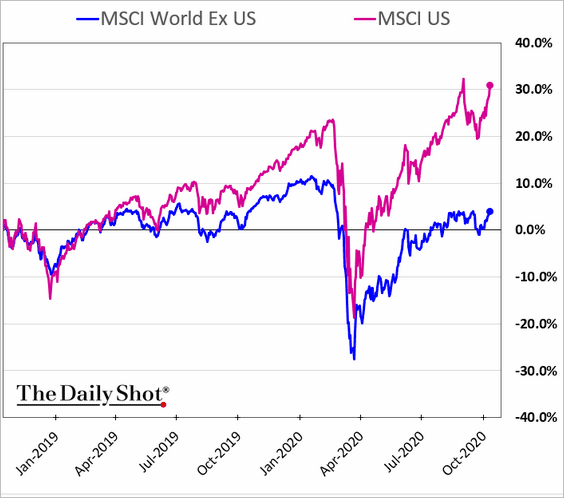

2. The outperformance of US vs. non-US shares is widening again.

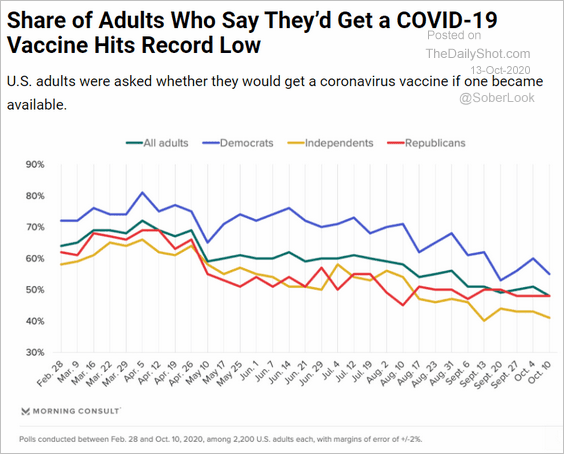

3. The market is behaving as if the coronavirus problem is all but gone. The assumption is that the vaccine will be available soon, will be effective, and most people will be inoculated. There is, however, a substantial risk associated with each of these assumptions.

• Vaccine timing remains uncertain.

Source: STAT Read full article

Source: STAT Read full article

• COVID vaccine effectiveness and the immune response longevity are unknown at this point.

Source: BBC Read full article

Source: BBC Read full article

• Americans are increasingly skeptical about getting vaccinated, which raises questions about herd immunity.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

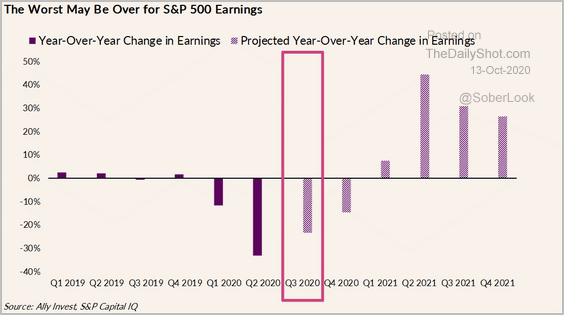

4. Currently, analysts think S&P 500 profits declined 23.3% year-over-year last quarter.

Source: Ally Read full article

Source: Ally Read full article

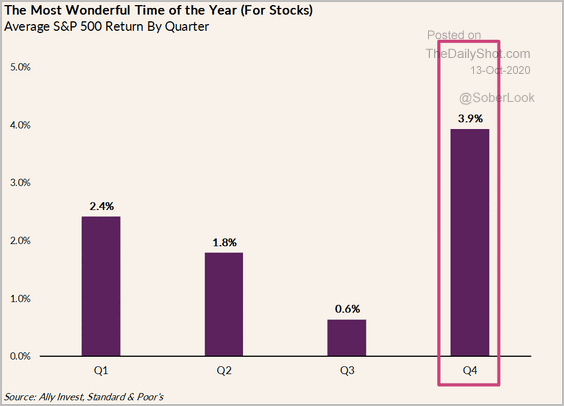

5. Q4 tends to be a strong period for the S&P 500.

Source: Ally Read full article

Source: Ally Read full article

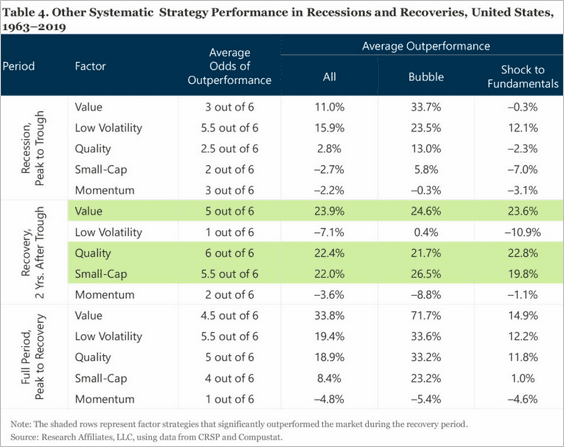

6. Value, quality, and small-cap strategies tend to perform well during economic recoveries, according to Research Affiliates.

Source: Research Affiliates Read full article

Source: Research Affiliates Read full article

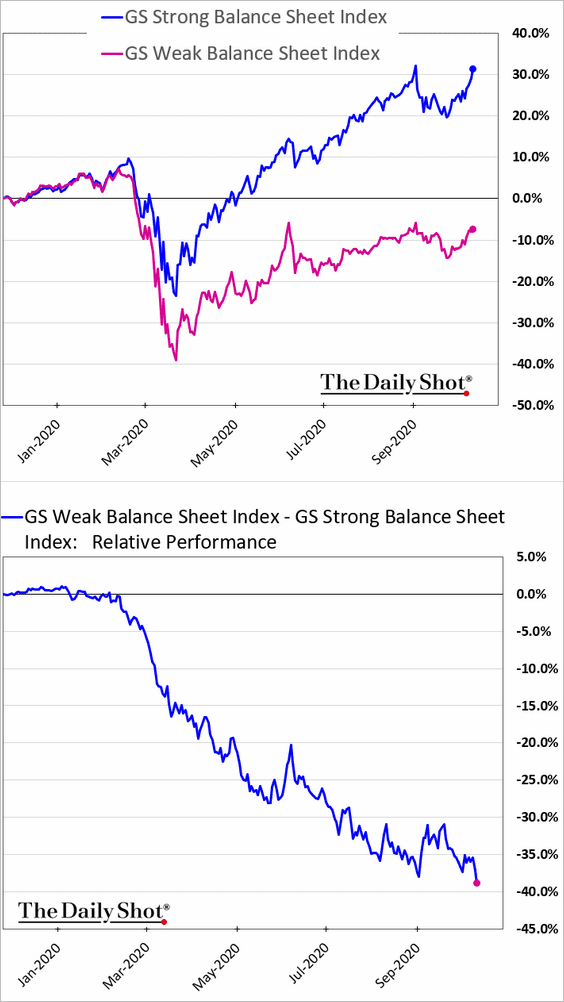

7. Investors continue to favor companies with strong balance sheets.

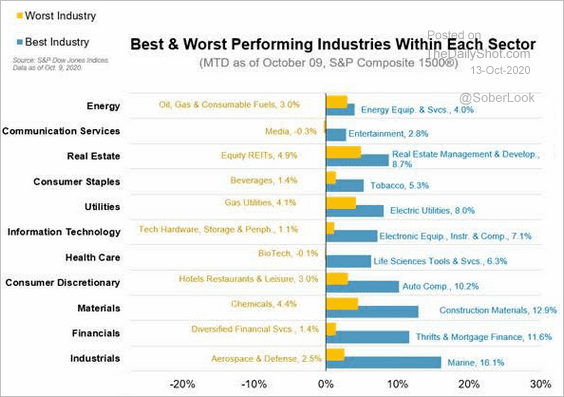

8. Next, we have some sector updates.

• Best- and worst-performing sub-sectors:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

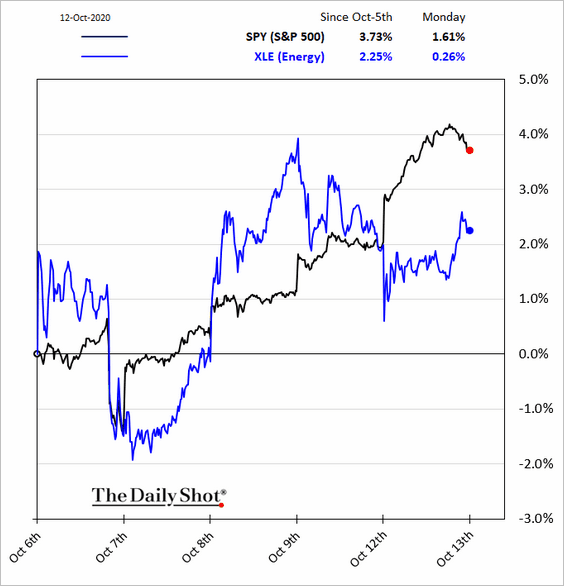

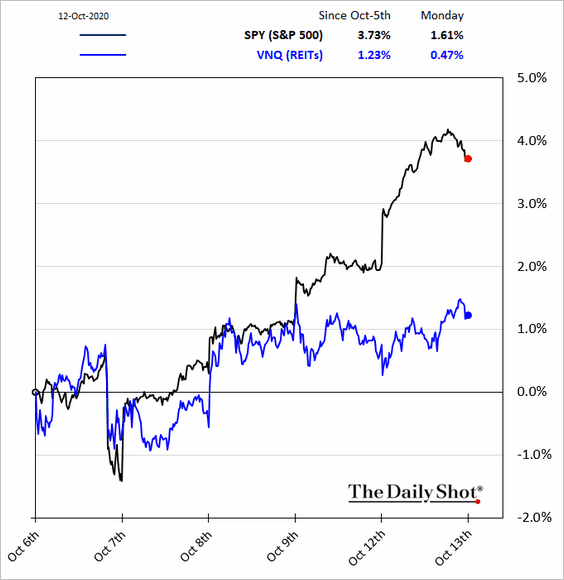

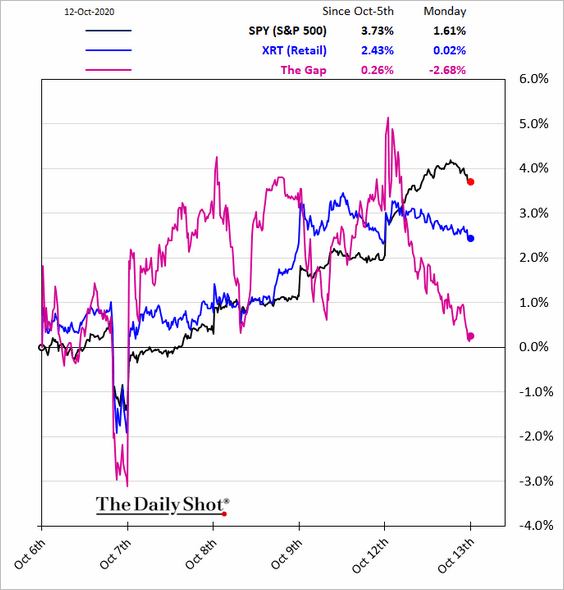

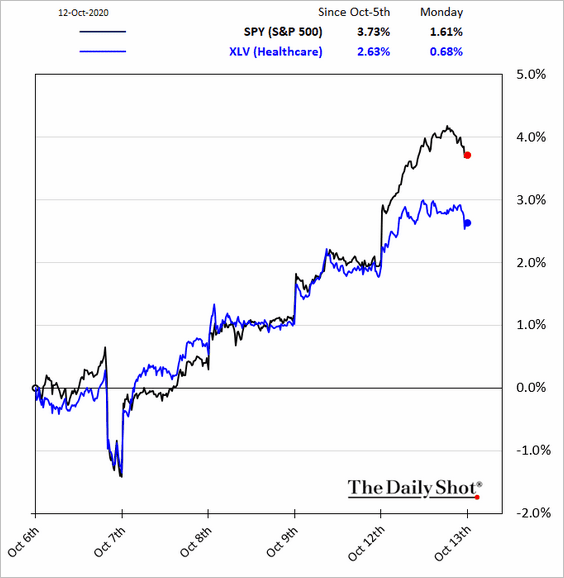

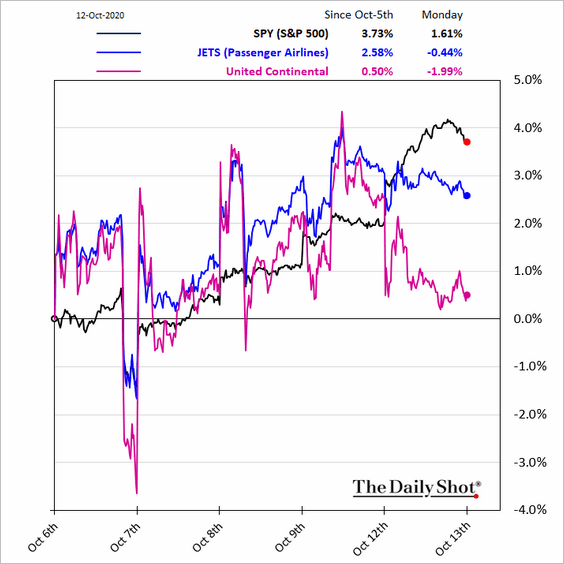

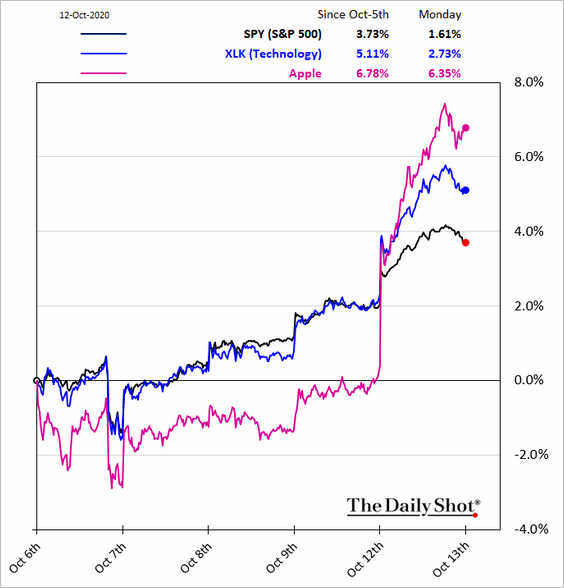

• Relative performance over the past five business days:

– Energy:

– REITs:

– Retail:

– Healthcare:

– Airlines:

– Tech (2 charts):

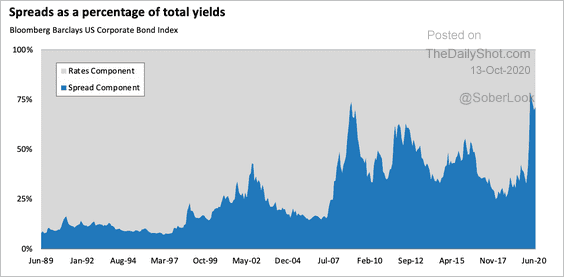

Credit

1. As Treasury rates have fallen, spreads have become a larger component of US corporate bond yields.

Source: BMO Global Asset Management

Source: BMO Global Asset Management

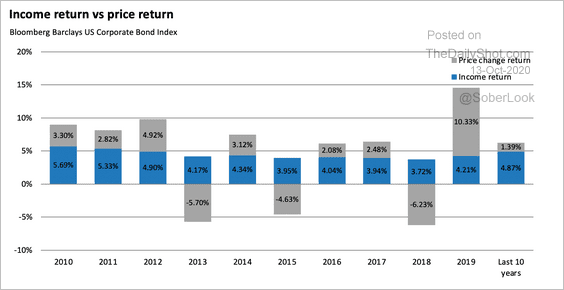

2. Price moves may dominate in a given year, but over time, income has driven the returns of US investment-grade corporate bonds, according to BMO.

Source: BMO Global Asset Management

Source: BMO Global Asset Management

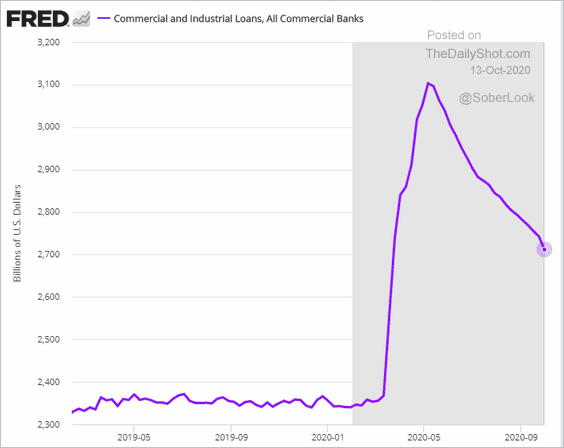

3. Corporate loan balances at US banks continue to shrink as companies pay down their drawn credit lines.

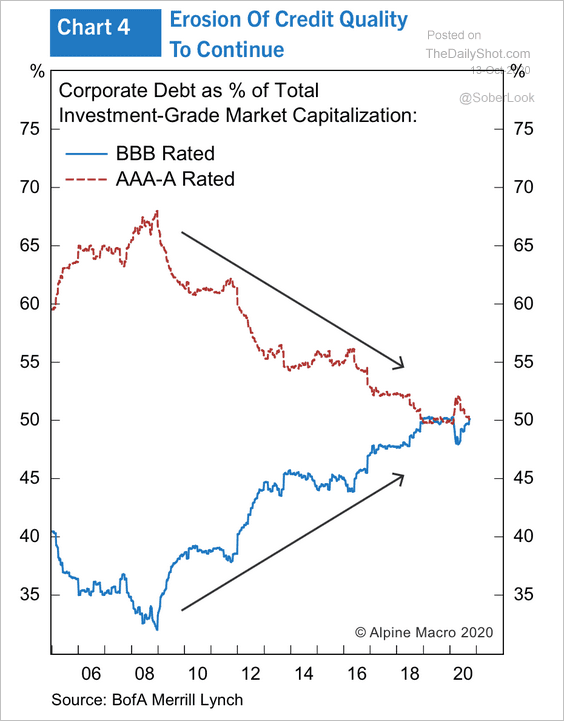

4. About half of all outstanding US investment-grade corporate bonds are now rated BBB, up from 32% in early 2009, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

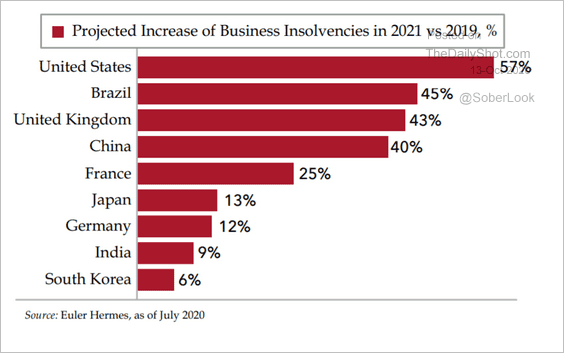

5. How much will business insolvencies increase next year?

Source: Quill Intelligence

Source: Quill Intelligence

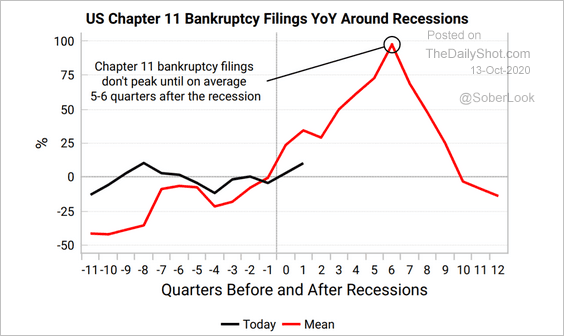

When will bankruptcy filings peak?

Source: Variant Perception

Source: Variant Perception

——————–

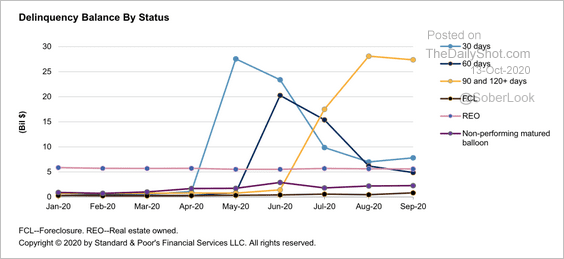

6. Next, we have some updates on commercial real estate.

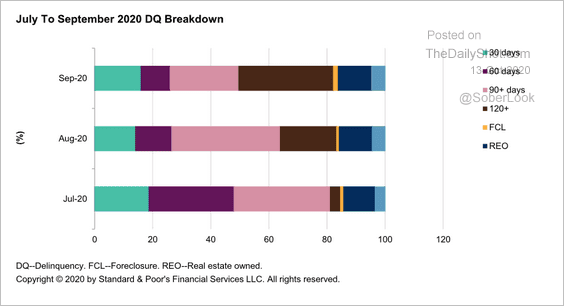

• CMBS loans delinquency status:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

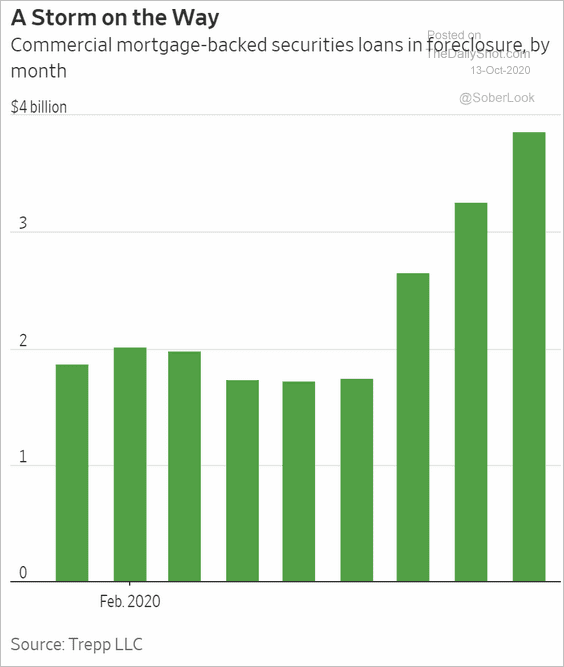

• Loans in foreclosure:

Source: @WSJ Read full article

Source: @WSJ Read full article

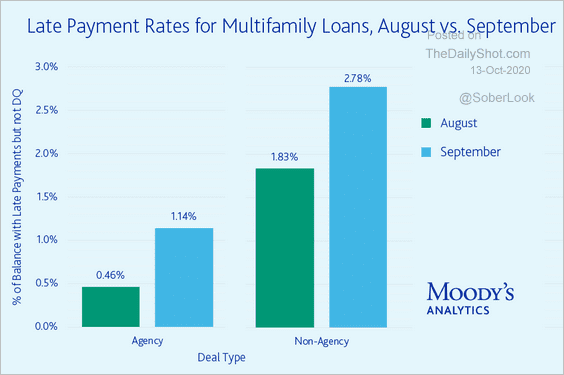

• Multifamily housing loans:

Source: Moody’s Analytics

Source: Moody’s Analytics

Rates

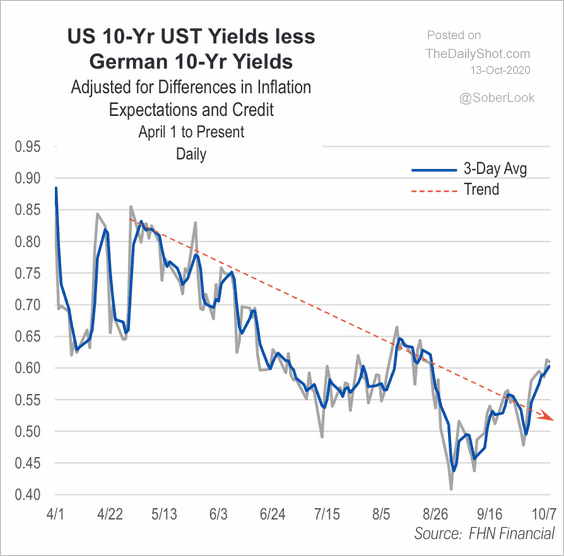

1. The 10-year Treasury yield has risen more than Bund yield.

Source: FHN Financial

Source: FHN Financial

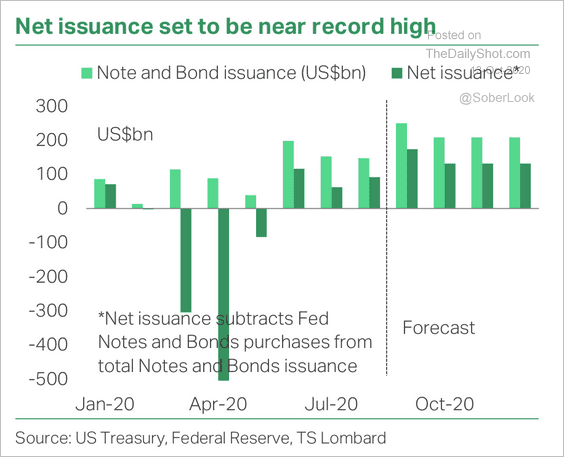

2. New Treasury note and bond issuance is set to remain high.

Source: TS Lombard

Source: TS Lombard

Energy

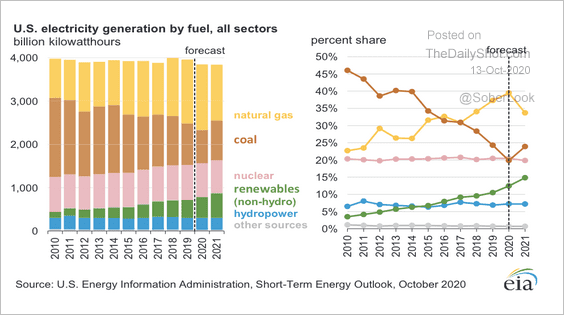

1. Renewables’ share of the US electricity generation market is expected to keep climbing.

Source: @EIAgov

Source: @EIAgov

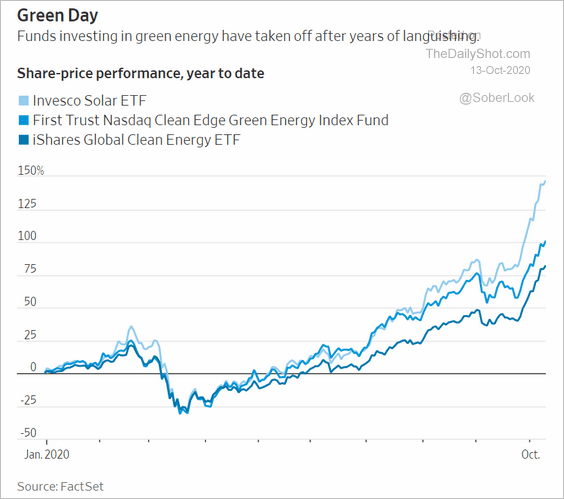

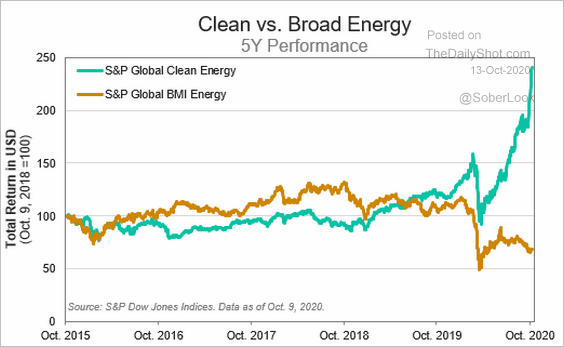

2. Renewable energy stocks are soaring.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

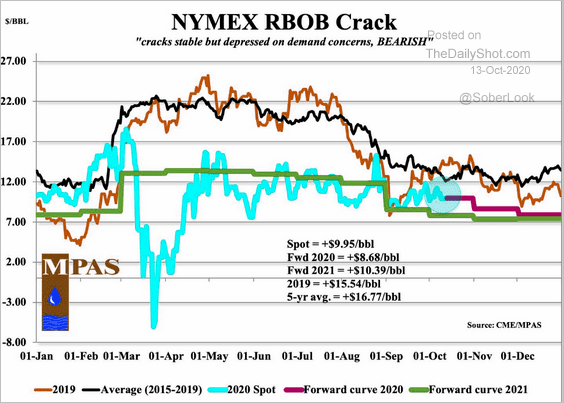

3. NYMEX gasoline refinery margins remain depressed relative to last year (similar to global trends).

Source: MPAS, @TheMarketEar

Source: MPAS, @TheMarketEar

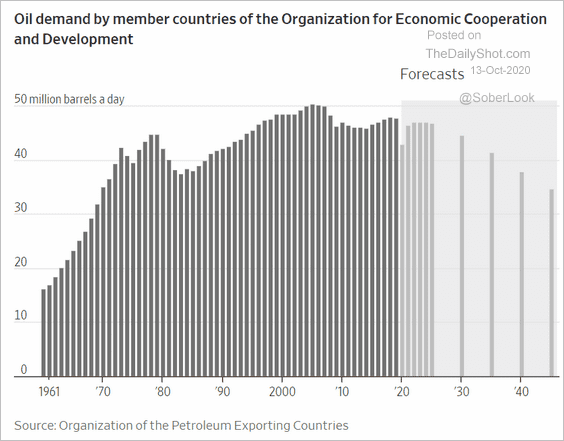

4. OECD oil demand peaked some 15 years ago and is expected to keep falling.

Source: @WSJ Read full article

Source: @WSJ Read full article

Commodities

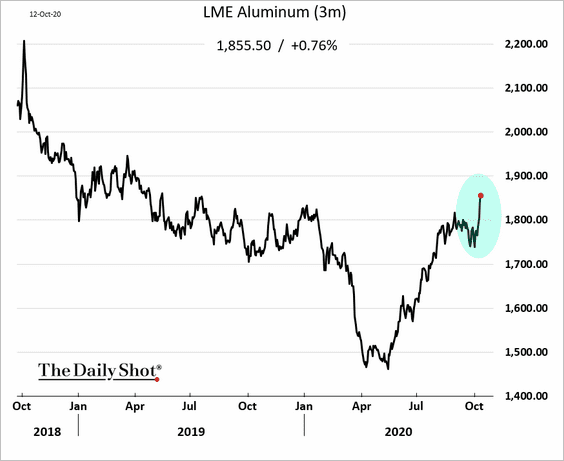

1. Aluminum is having a strong month.

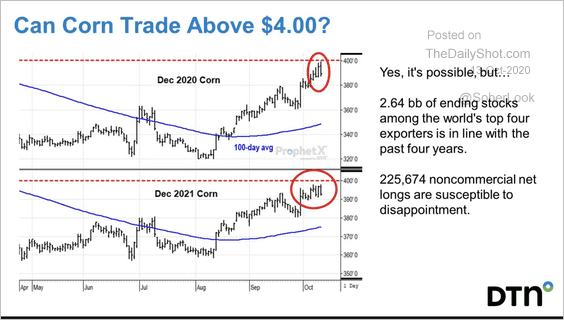

2. December US corn futures are testing resistance at $4.

Source: @ToddHultman1

Source: @ToddHultman1

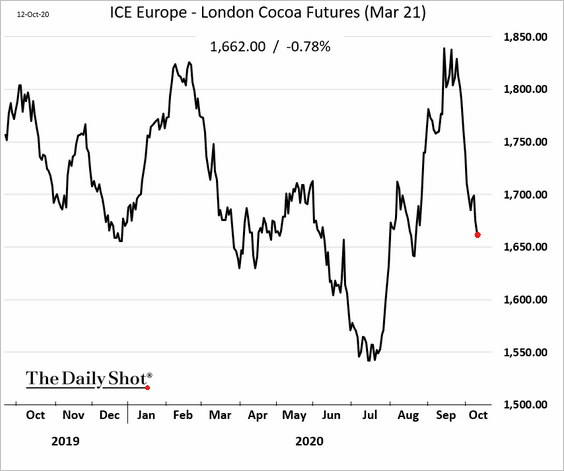

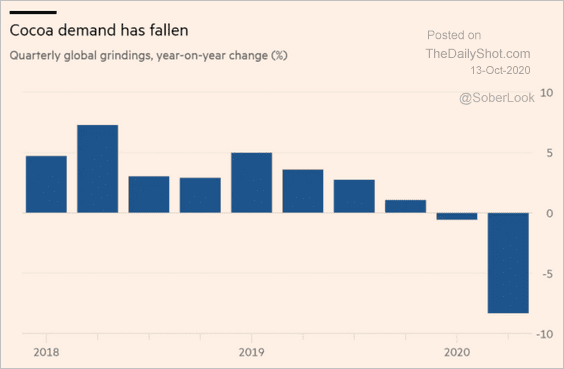

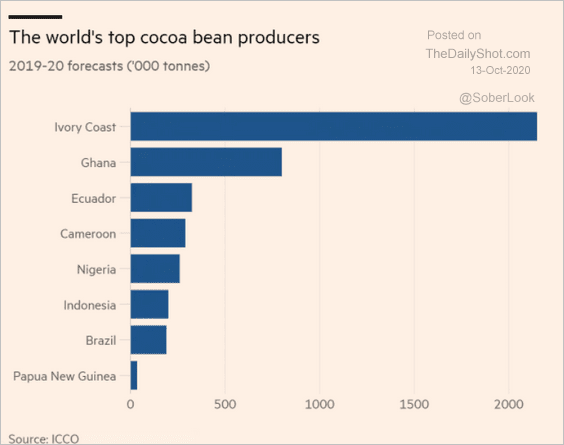

3. Next, we have some updates on the cocoa market.

• Futures price (London):

• Demand:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Top producers:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Cryptocurrency

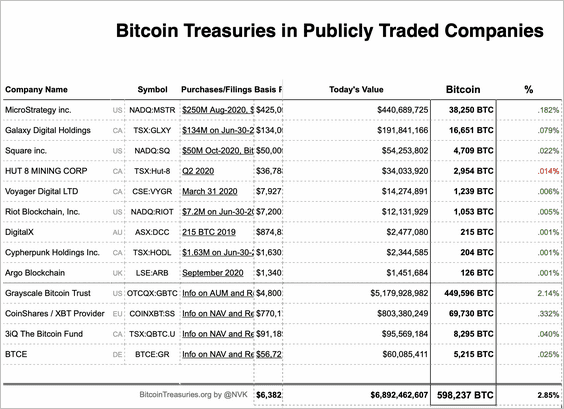

1. This table shows some of the public companies that are active in Bitcoin.

Source: @nvk

Source: @nvk

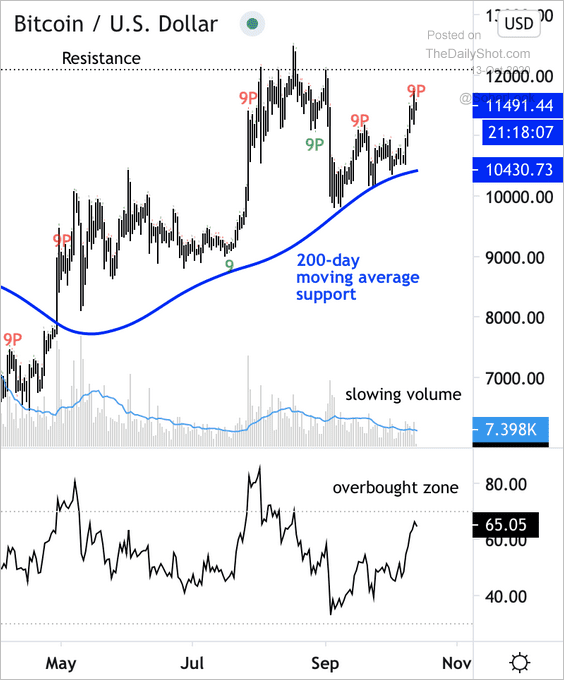

2. Bitcoin is nearing initial resistance but remains above its 200-day moving average.

Source: @DantesOutlook

Source: @DantesOutlook

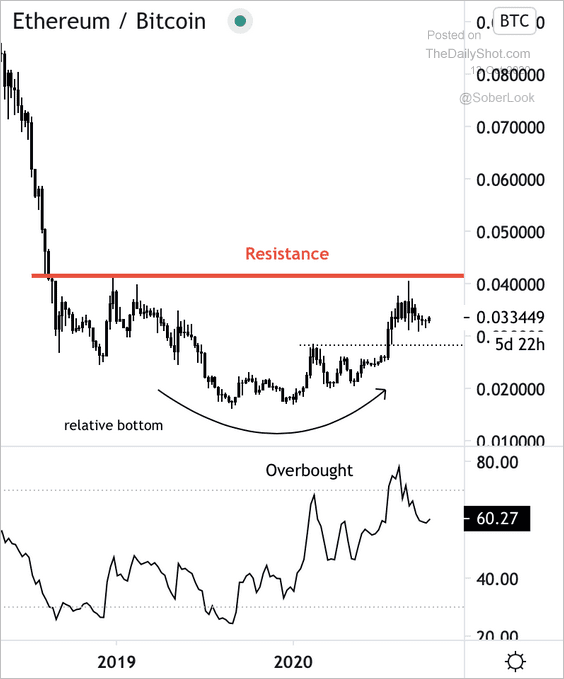

3. Ethereum appears to be overbought vs. Bitcoin.

Source: @DantesOutlook

Source: @DantesOutlook

Emerging Markets

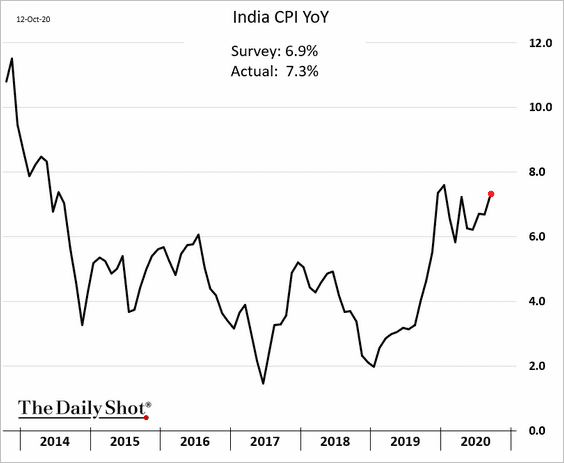

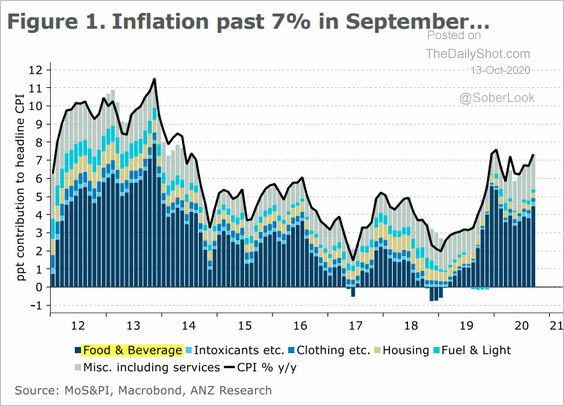

1. India’s inflation surprised to the upside.

Food was one of the main drivers of the increase.

Source: ANZ Research

Source: ANZ Research

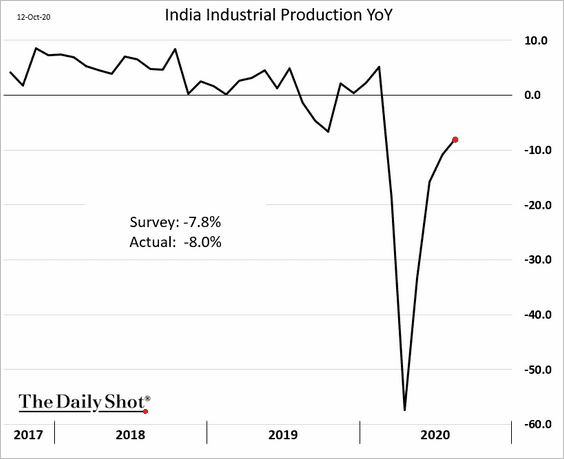

Separately, the rebound in India’s industrial production is slowing.

——————–

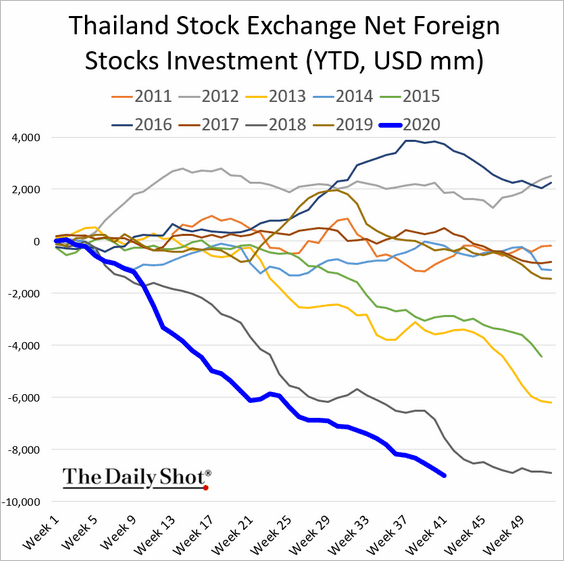

3. Unnerved by political uncertainty, foreign investors have been getting out of Thai stocks.

h/t Anuchit Nguyen

h/t Anuchit Nguyen

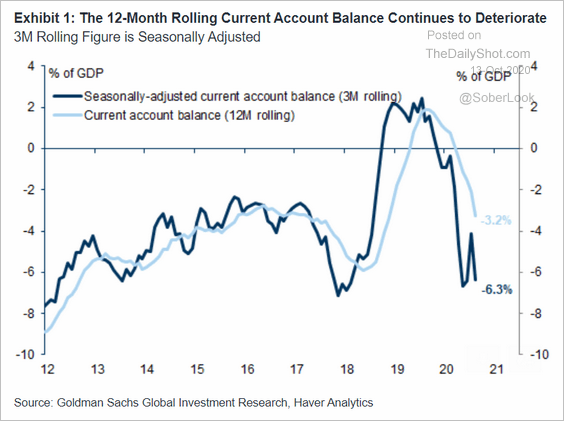

4. Turkey’s current account deficit is widening.

Source: Goldman Sachs

Source: Goldman Sachs

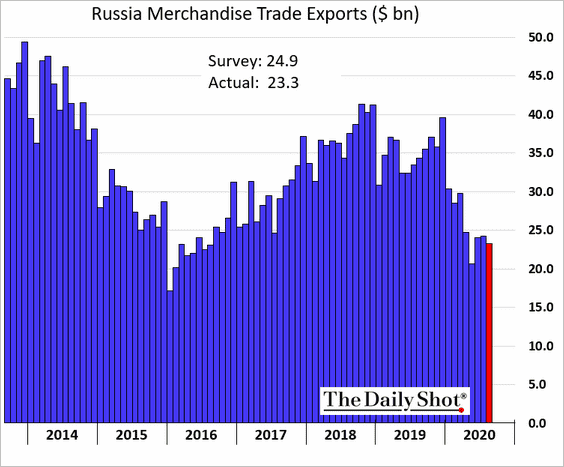

5. Russia’s exports weakened this year (in part due to lower oil prices).

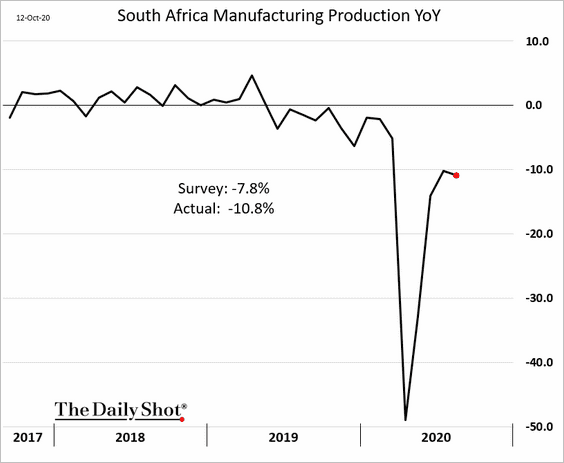

6. The recovery in South Africa’s factory output has stalled.

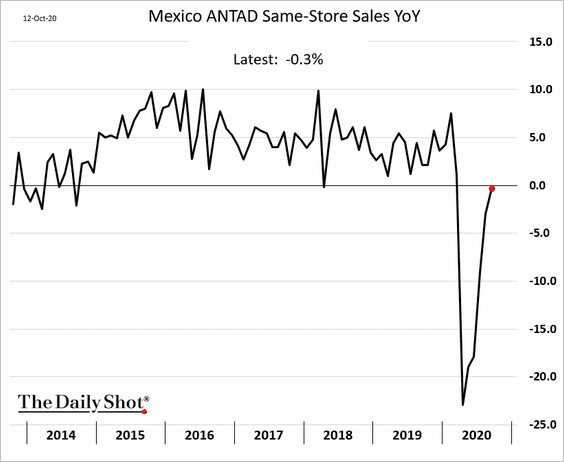

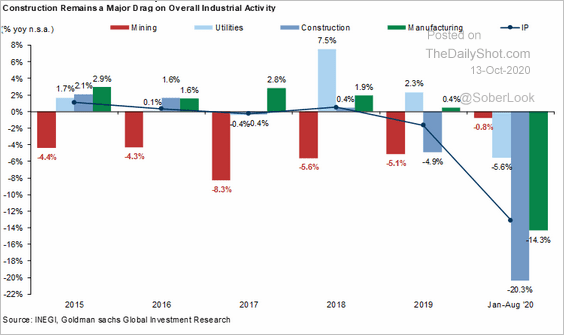

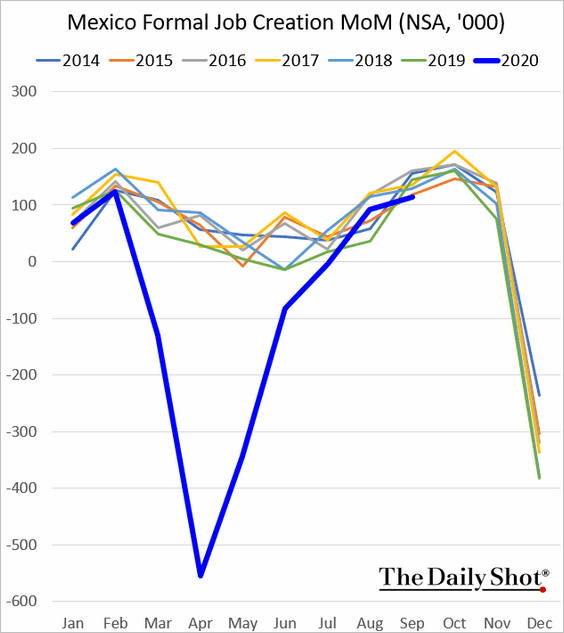

7. Next, we have some updates on Mexico.

• Same-store sales (almost flat vs. last year):

• Industrial output pressured by construction:

Source: Goldman Sachs

Source: Goldman Sachs

• Formal job creation:

——————–

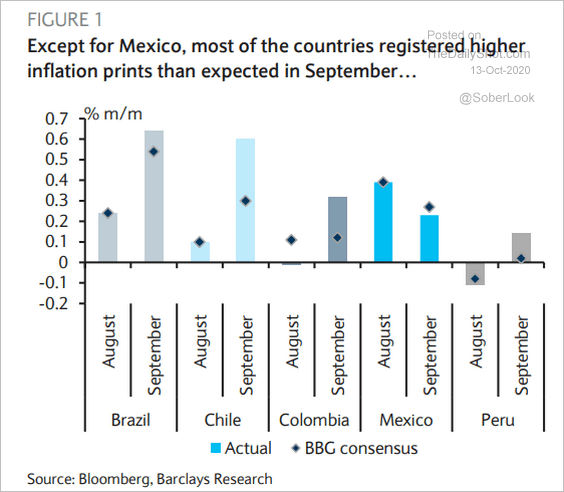

8. LatAm CPI reports surprised to the upside:

Source: Barclays Research

Source: Barclays Research

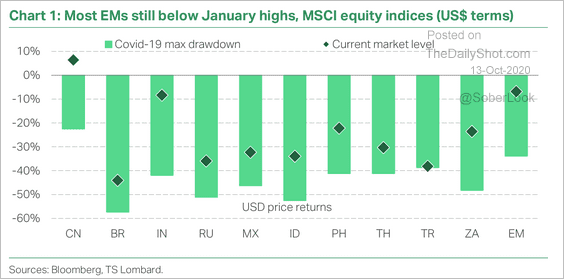

9. Most EM equity markets are trading well below their January highs, suggesting recovery potential.

Source: TS Lombard

Source: TS Lombard

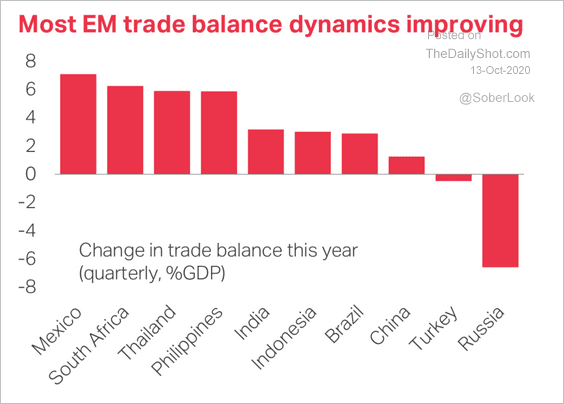

10. EM trade balance dynamics have been improving.

Source: TS Lombard

Source: TS Lombard

China

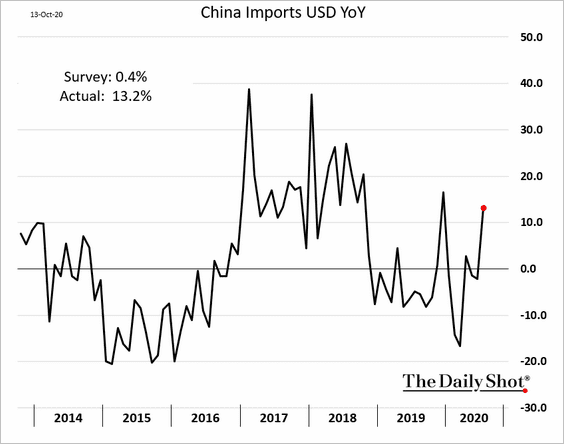

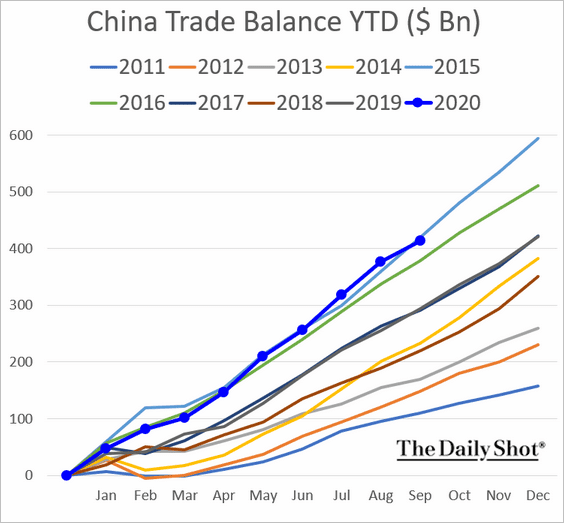

1. Imports rose sharply last month, exceeding estimates.

Below is the year-to-date cumulative trade balance.

——————–

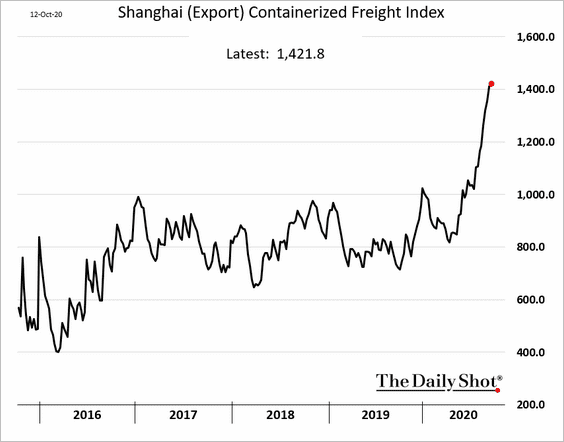

2. The Shanghai freight index soared in recent months, suggesting robust export demand.

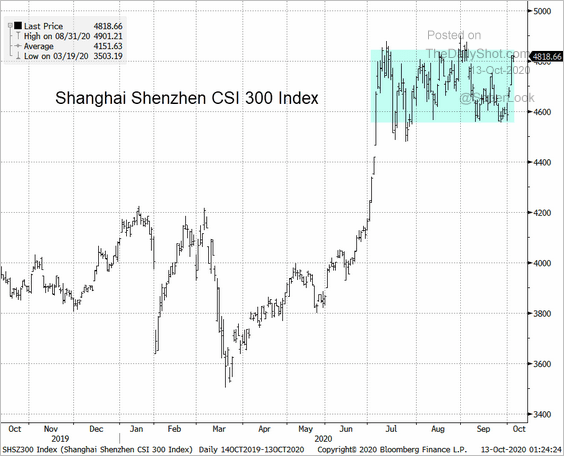

3. The stock market is at the upper end of the recent range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

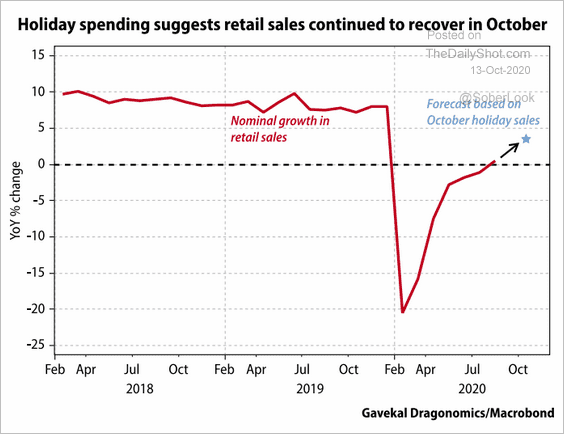

4. Retail sales continue to recover.

Source: Gavekal

Source: Gavekal

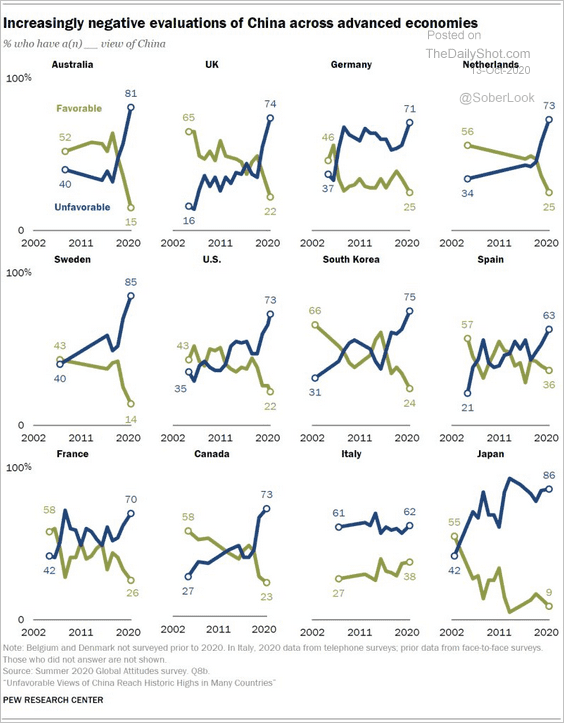

5. China has a PR problem.

Source: @Noahpinion Read full article

Source: @Noahpinion Read full article

Asia – Pacific

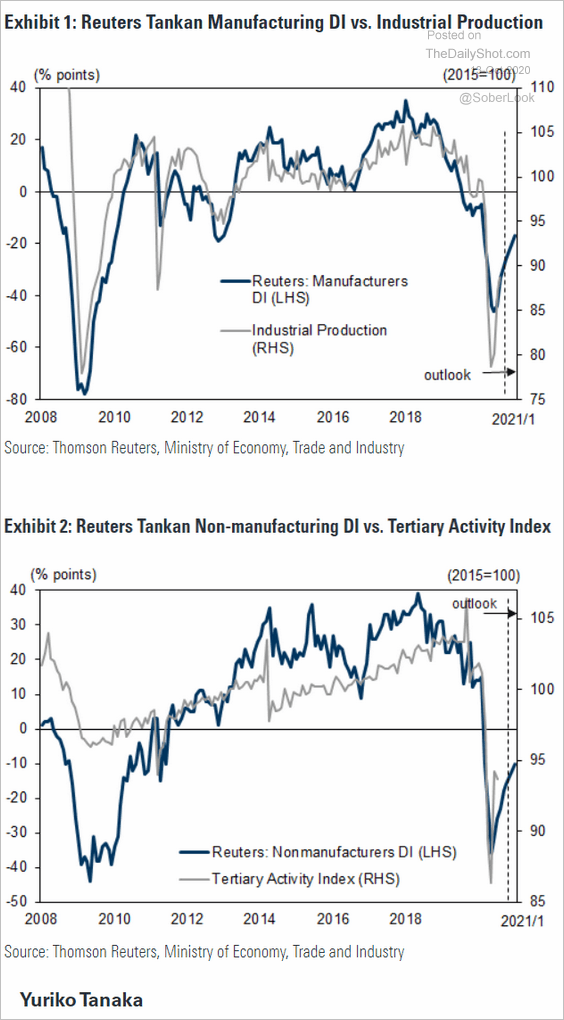

1. Japan’s Reuters Tankan survey points to an ongoing recovery in business activity. But there is a long way to go.

Source: Goldman Sachs

Source: Goldman Sachs

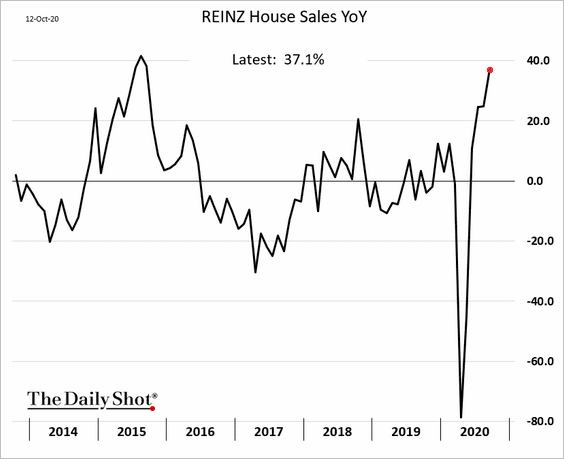

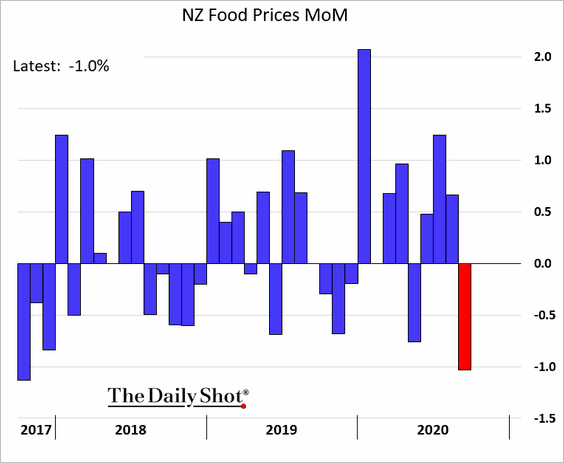

2. New Zealand’s home sales are up 37% from last year.

Separately, New Zealand’s food prices declined sharply last month.

——————–

3. Next, we have some updates on Australia.

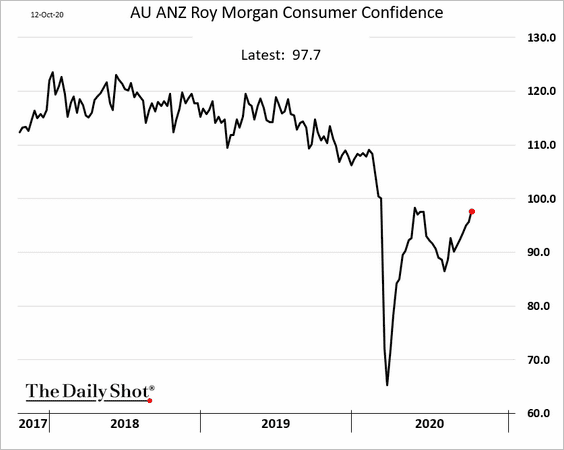

• Consumer confidence is recovering.

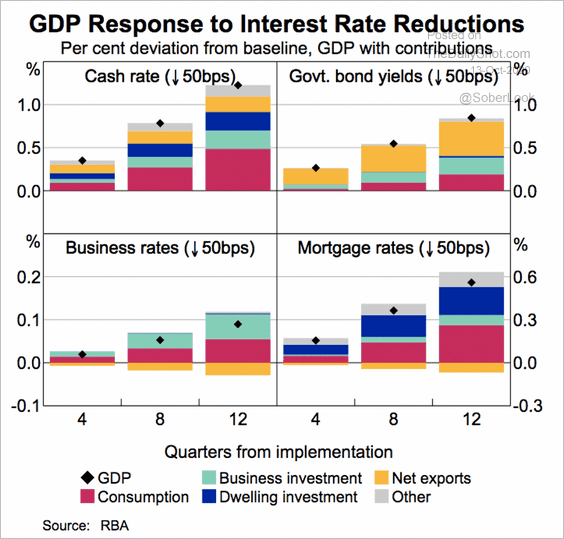

• This chart shows the estimated effect on GDP of a 50 basis point decrease across various rates.

Source: RBA Read full article

Source: RBA Read full article

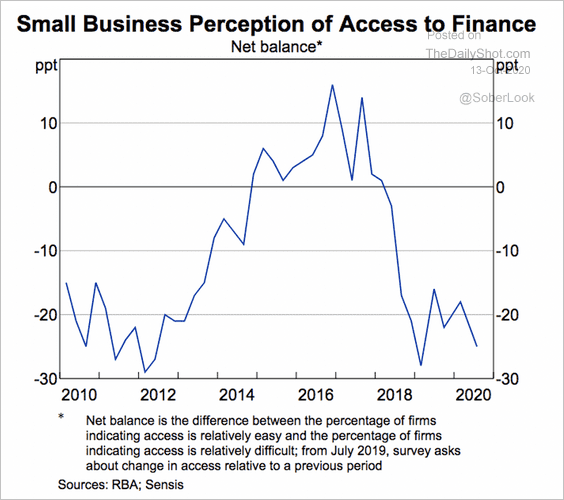

• Small businesses are having a difficult time accessing financing.

Source: RBA Read full article

Source: RBA Read full article

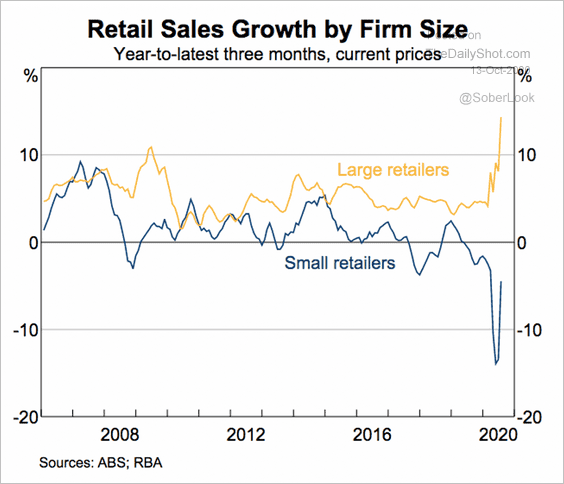

• Smaller retailers have suffered tremendously this year, especially compared to their larger counterparts.

Source: RBA Read full article

Source: RBA Read full article

The Eurozone

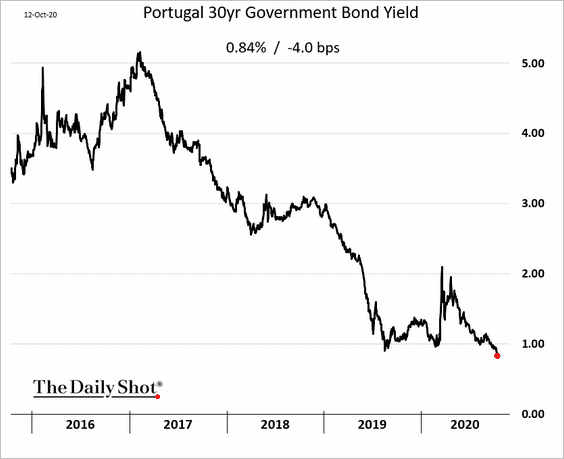

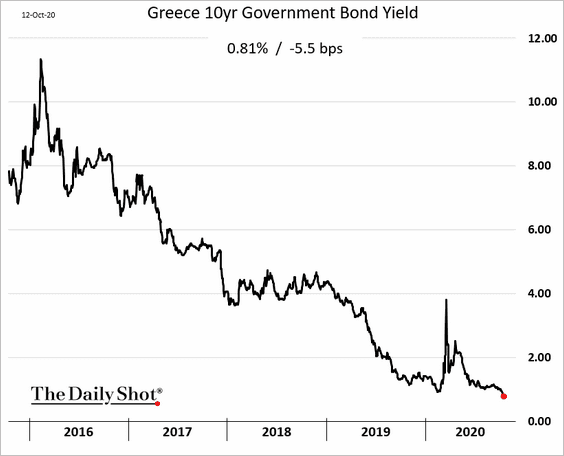

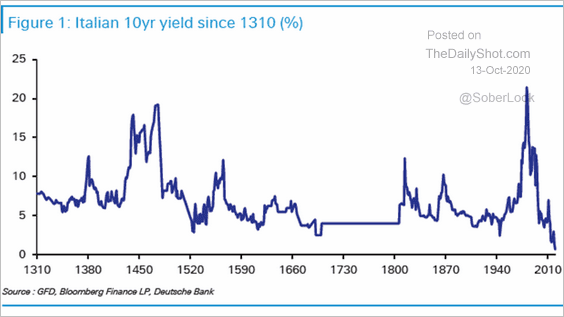

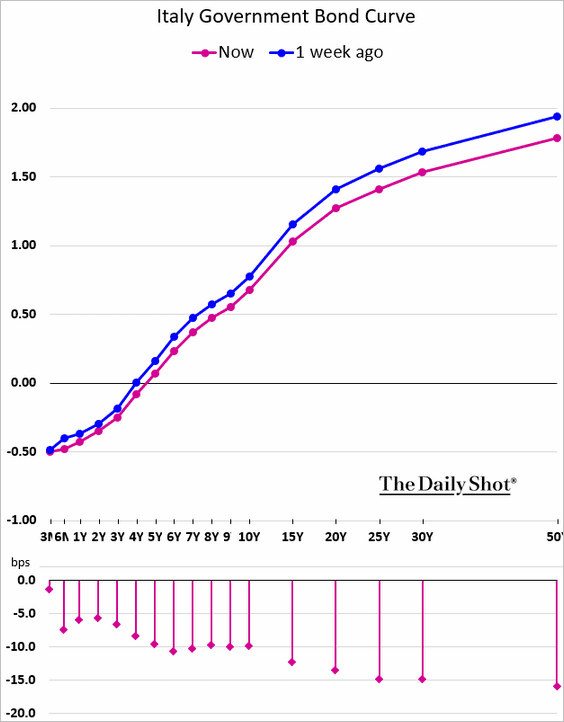

1. Euro-area periphery bond yields continue to hit record lows.

• Portugal (30yr):

• Greece (10yr):

• Italian 10yr yield (since 1310!):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

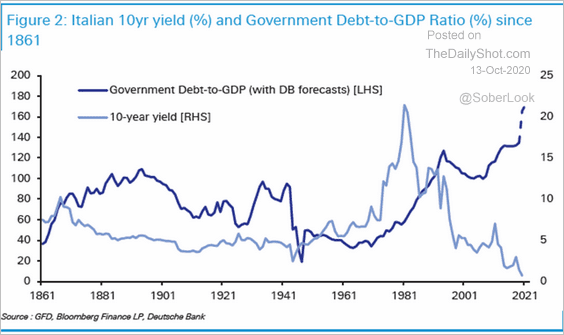

And here is Italy’s 10yr yield vs. the government’s debt-to-GDP ratio.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• Yield curves are flattening.

——————–

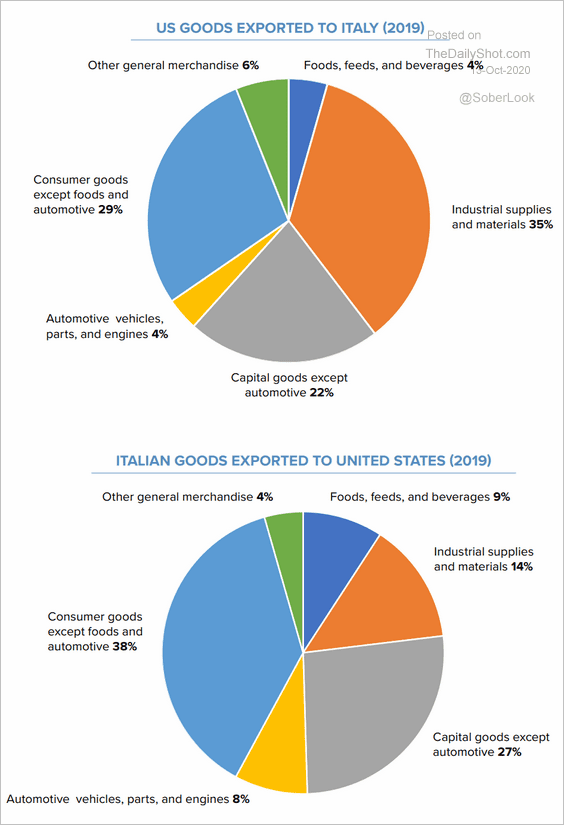

2. Here is the distribution of Italy’s trade with the US.

Source: Atlantic Council Read full article

Source: Atlantic Council Read full article

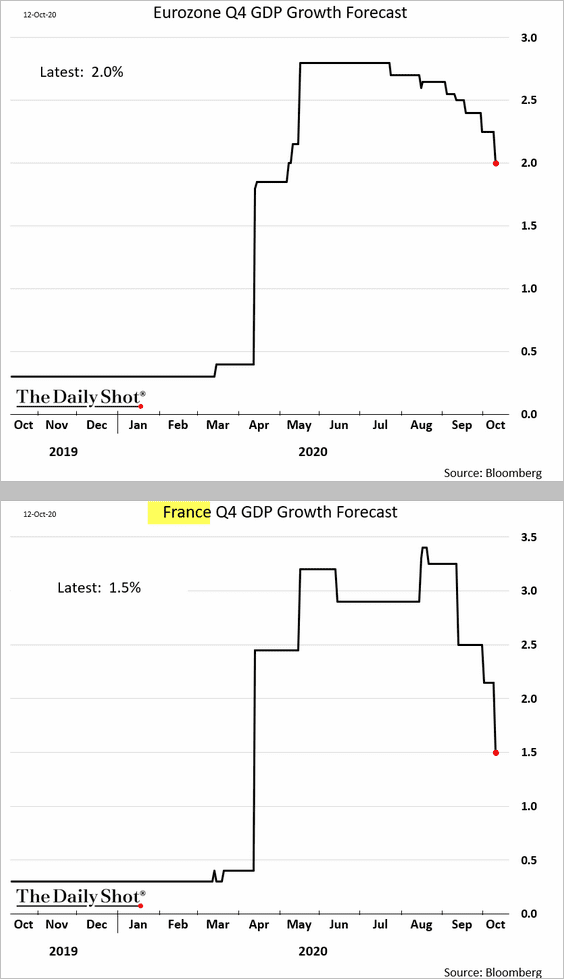

3. Economists are downgrading their Q4 GDP forecasts.

The United States

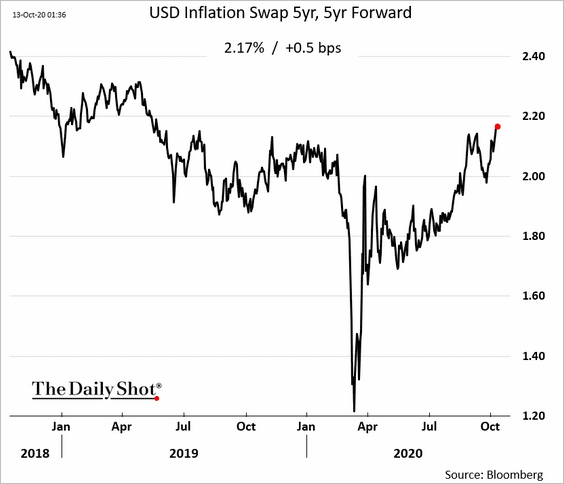

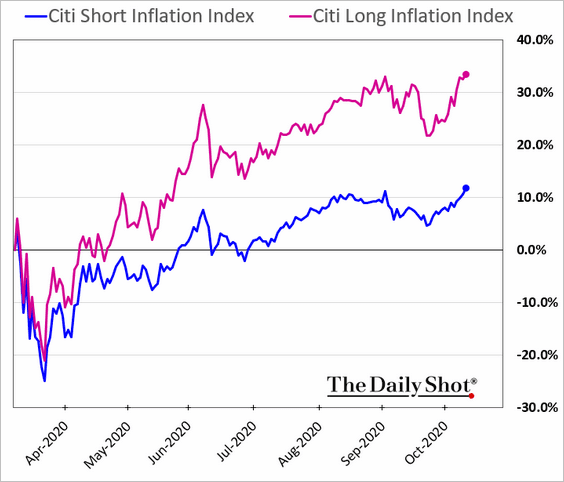

1. Markets continue to signal firmer US inflation ahead.

• Inflation swaps (longer-term expectations):

• The stock market (companies that would benefit from higher inflation are outperforming):

——————–

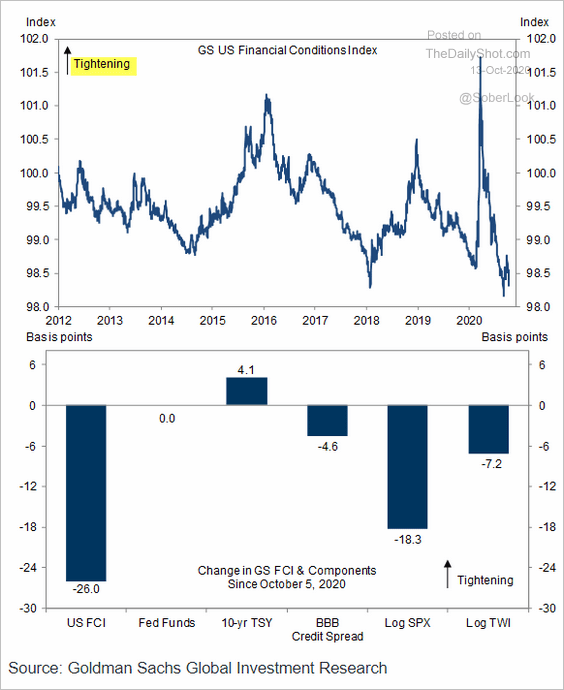

2. A weaker US dollar and the stock market rally have significantly eased US financial conditions.

Source: Goldman Sachs

Source: Goldman Sachs

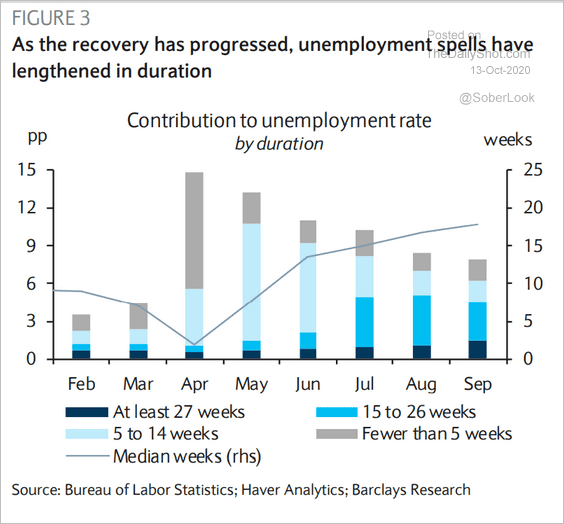

3. Long-term unemployment is a concern.

Source: Barclays Research

Source: Barclays Research

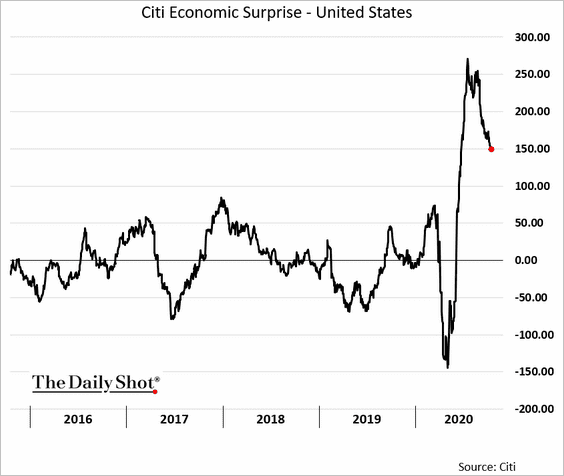

4. The Citi Economic Surprise Index has been declining as the recovery loses momentum.

Food for Thought

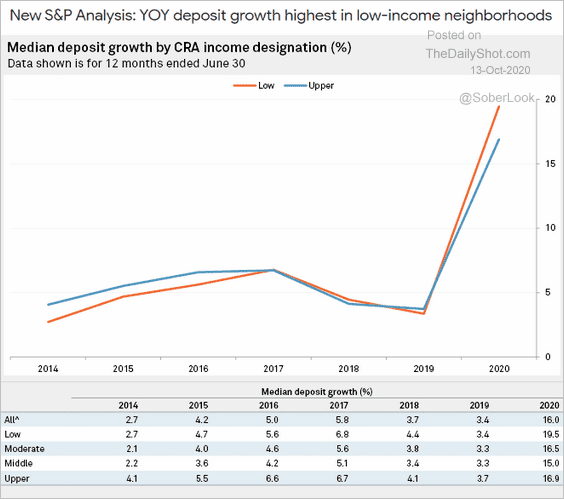

1. US deposit growth by neighborhood type (boosted by government checks):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

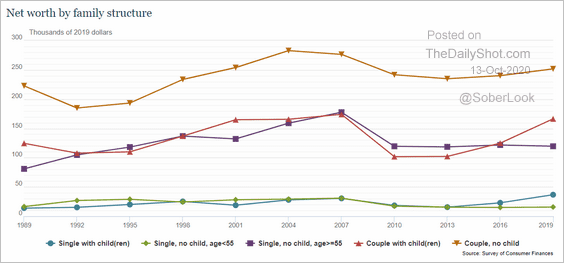

2. Net worth by family structure:

Source: Federal Reserve Board of Governors

Source: Federal Reserve Board of Governors

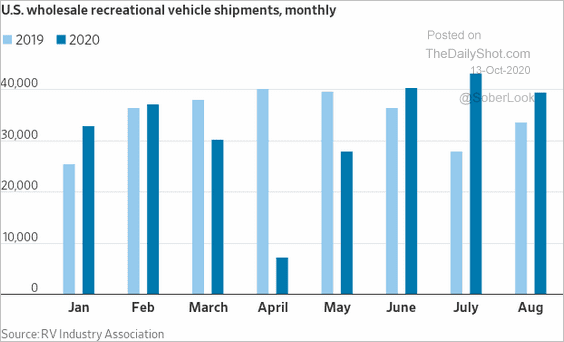

3. RV demand:

Source: @WSJ Read full article

Source: @WSJ Read full article

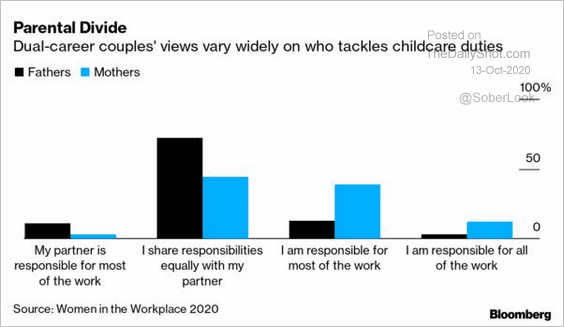

4. Childcare duties:

Source: @business Read full article

Source: @business Read full article

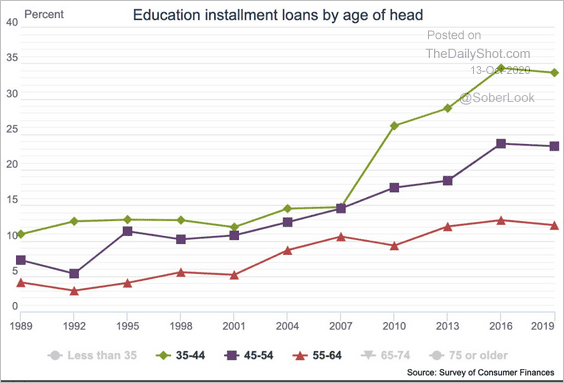

5. Student debt by age:

Source: @rortybomb

Source: @rortybomb

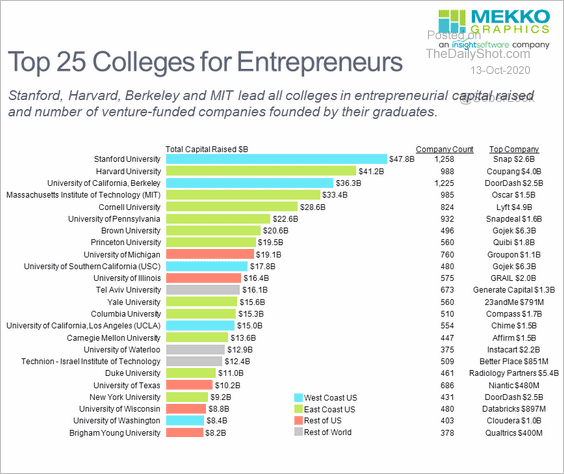

6. Top 25 colleges for entrepreneurs:

Source: Mekko Graphics Read full article

Source: Mekko Graphics Read full article

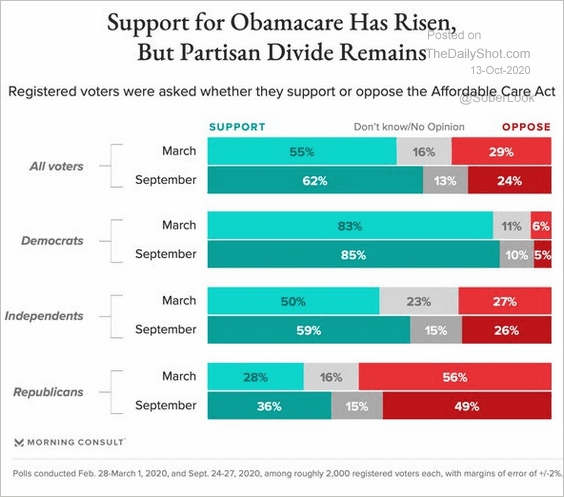

7. Support for Obamacare:

Source: @MorningConsult, @mg_galvin Read full article

Source: @MorningConsult, @mg_galvin Read full article

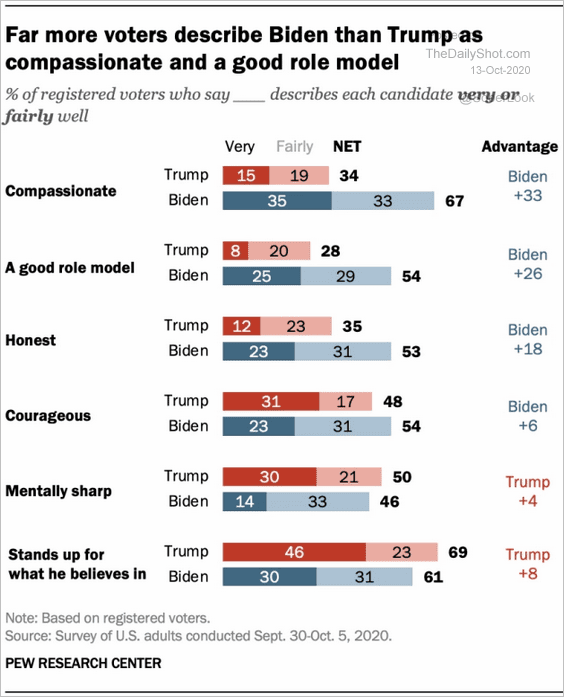

8. A poll on Trump/Biden personal traits:

Source: Pew Research Center

Source: Pew Research Center

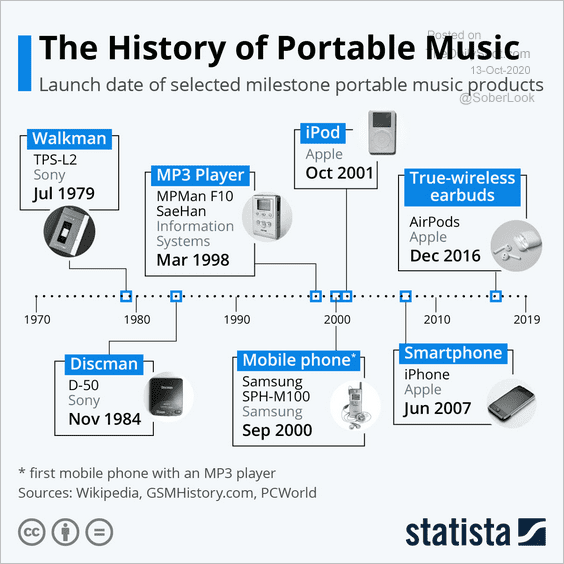

9. The history of portable music:

Source: Statista

Source: Statista

——————–