The Daily Shot: 22-Oct-20

• Equities

• Credit

• Rates

• Energy

• Cryptocurrency

• Emerging Markets

• China

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Food for Thought

Equities

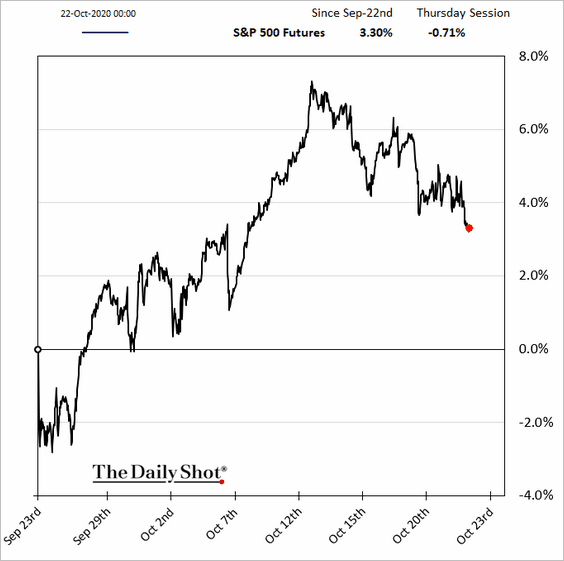

1. US stimulus uncertainty is weighing on stocks again.

Source: The Hill Read full article

Source: The Hill Read full article

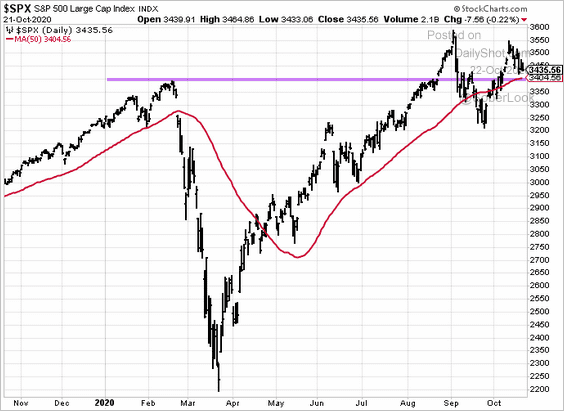

From a technical perspective, 3400 is an important level for the S&P 500.

h/t Andrew Adams (Saut Strategy), Cormac Mullen (Bloomberg)

h/t Andrew Adams (Saut Strategy), Cormac Mullen (Bloomberg)

——————–

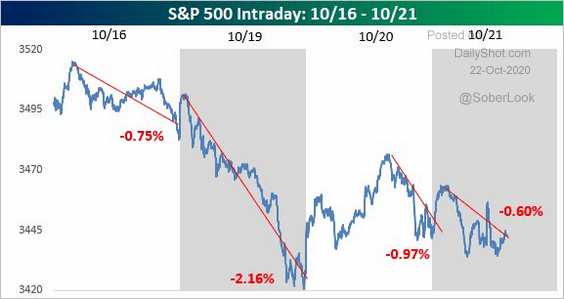

2. Stocks have been selling off going into the close over the past few days. That’s a deviation from what we saw during much of the rally.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

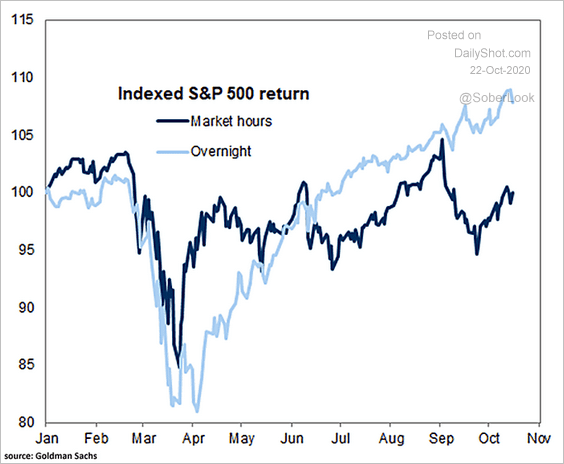

3. This year’s S&P 500 gains have been driven by the after-hours market.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

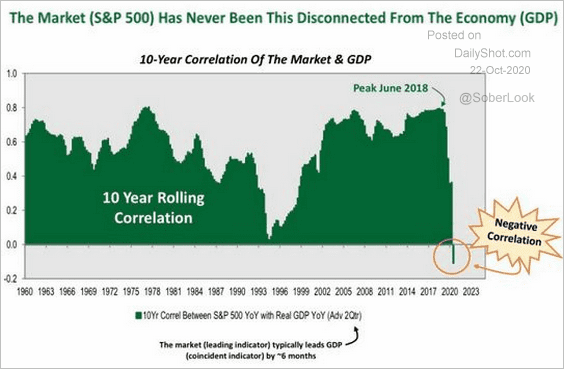

4. Here is the correlation between the S&P 500 and the US GDP.

Source: Cornerstone Macro LLC

Source: Cornerstone Macro LLC

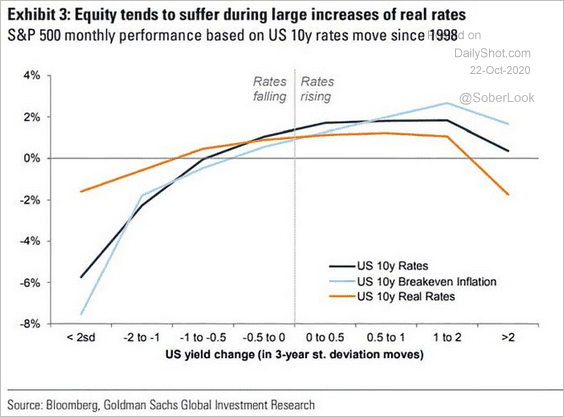

5. How do rate changes impact the S&P 500 performance?

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

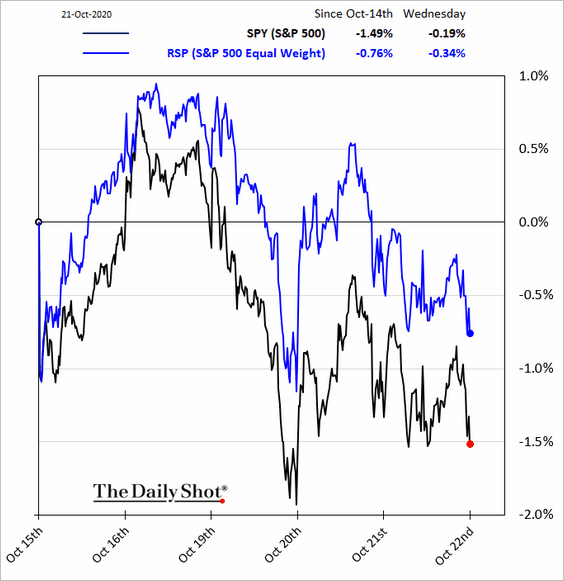

6. Smaller shares have been outperforming recently.

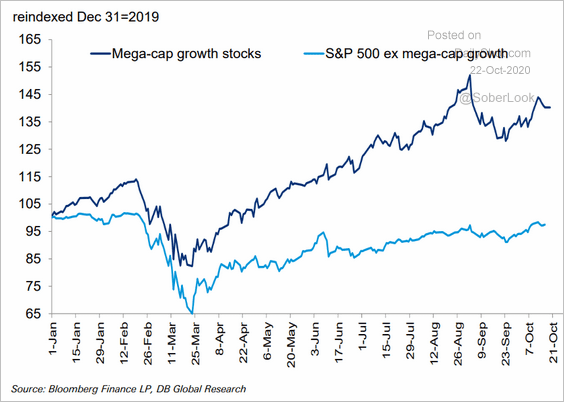

7. Here is the S&P 500 performance with the tech mega-caps excluded.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

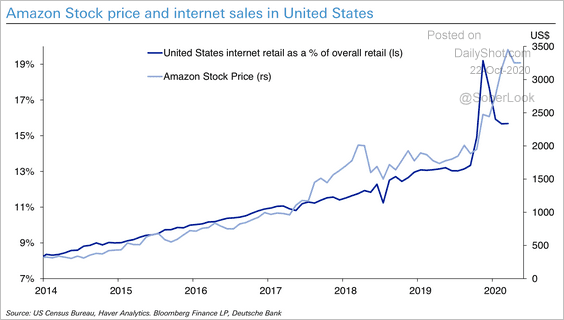

8. Amazon’s rally coincided with growth in online retail sales.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

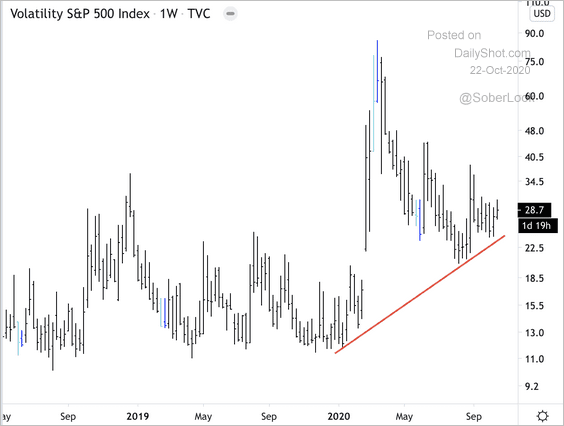

9. VIX remains elevated relative to pre-crisis levels.

Source: @DantesOutlook

Source: @DantesOutlook

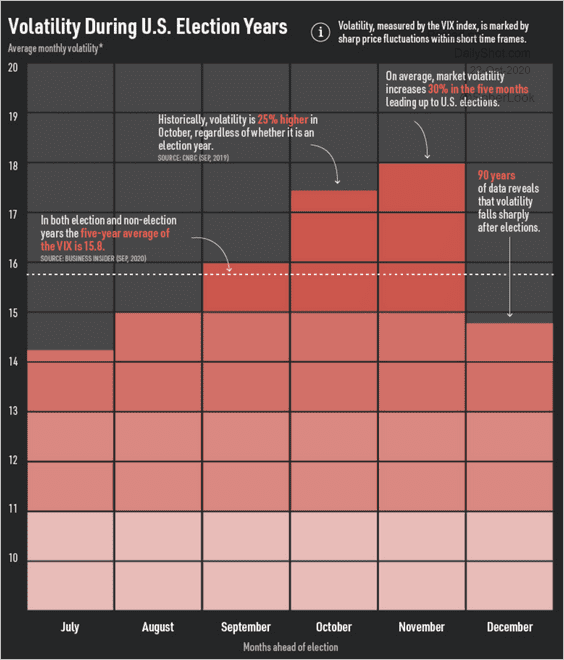

10. How does volatility change during election years?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

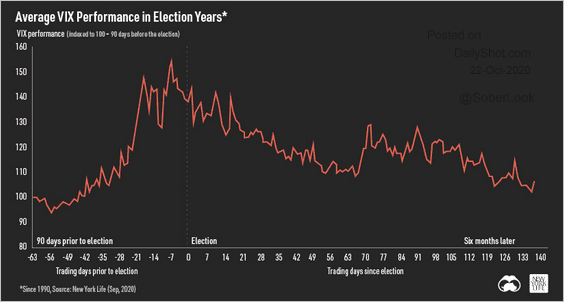

What happens after the elections?

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

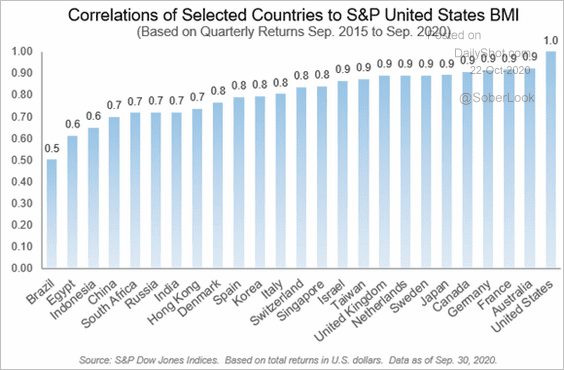

11. How correlated are global markets to the S&P 500?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Credit

1. Despite elevated default risks, US CCC-rated corporate bond spreads are near pre-crisis levels.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

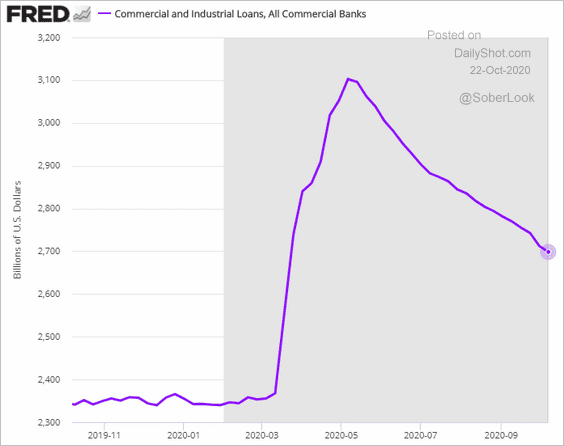

2. Business loan balances in the US banking system continue to shrink.

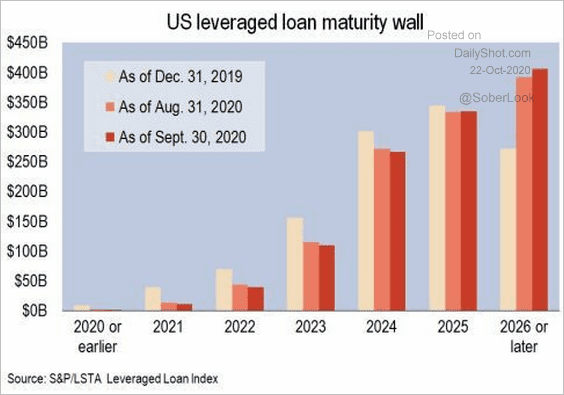

3. Many leveraged companies successfully extended their loan maturities this year.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

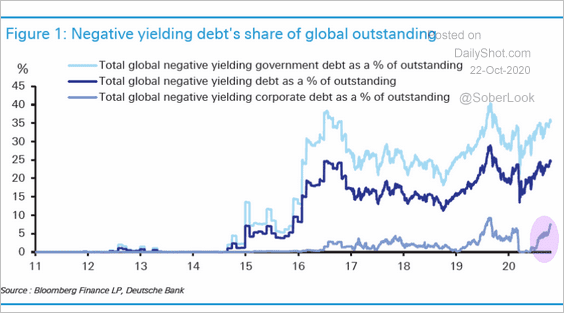

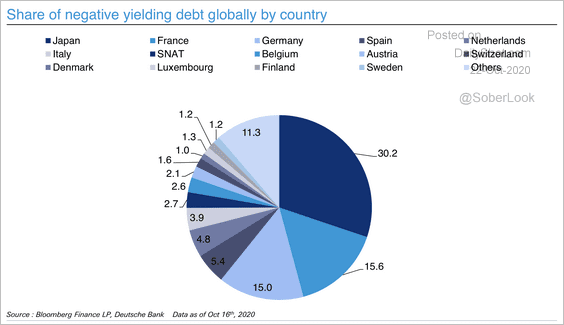

4. The amount of corporate debt with negative yields is climbing again (mostly in Europe).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

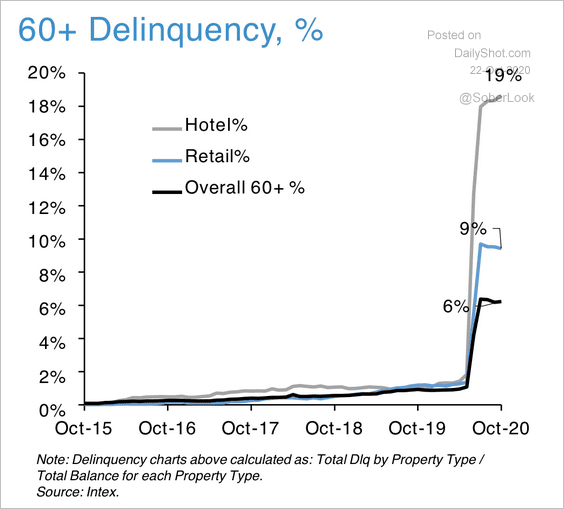

5. US retail and hotel real estate mortgage delinquencies remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

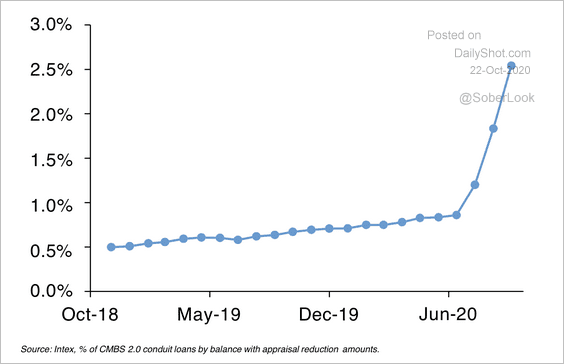

New appraisals are rising for weak US CMBS loans.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Rates

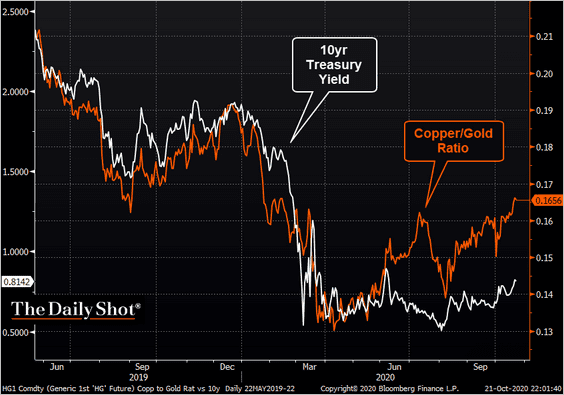

1. Treasury yields and the copper-to-gold ratio have diverged.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

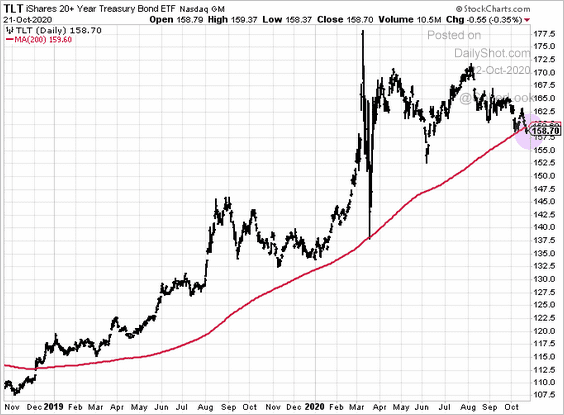

2. The iShares 20+ Treasury ETF (TLT) is testing support at the 200-day moving average.

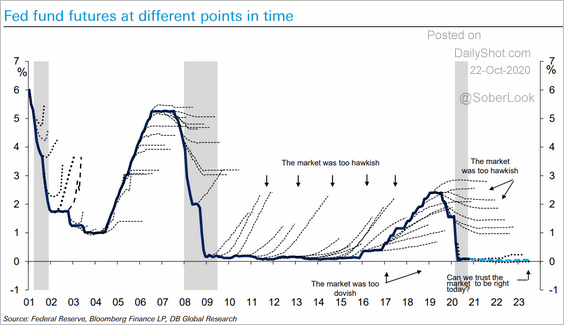

3. Could the futures market be entirely off on the timing of the next Fed rate hike?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

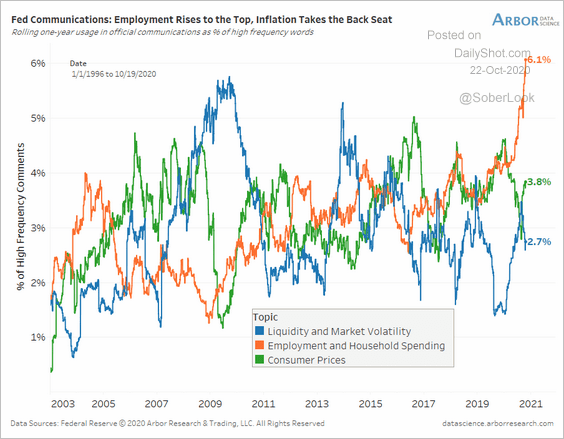

4. Fed officials remain focused on employment and household spending.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

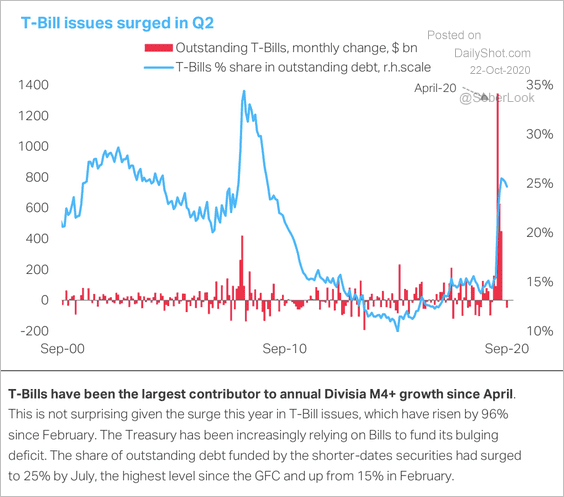

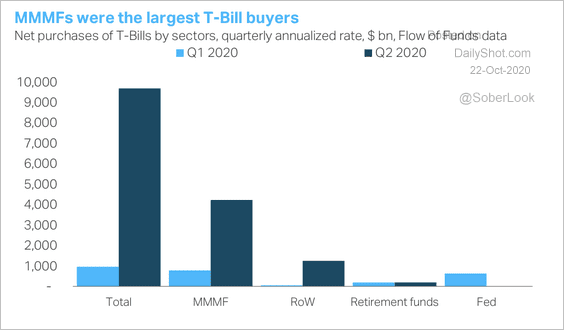

5. Massive T-Bill issuance drove the M4 money supply growth, according to TS Lombard.

Source: TS Lombard

Source: TS Lombard

Money market mutual funds (MMMFs) were the largest buyers of T-Bills in Q2, followed by foreign investors.

Source: TS Lombard

Source: TS Lombard

——————–

6. Japan, France, and Germany lead the way by volume of negative-yielding global debt.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Energy

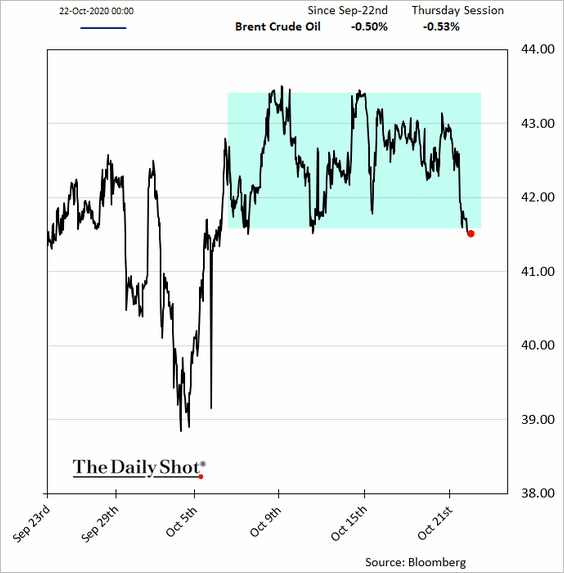

1. Crude oil prices are at the lower end of the recent trading range.

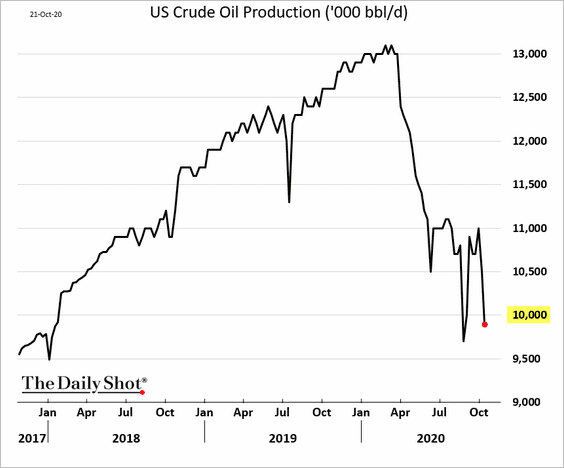

2. US oil production was once again below ten million barrels per day last week.

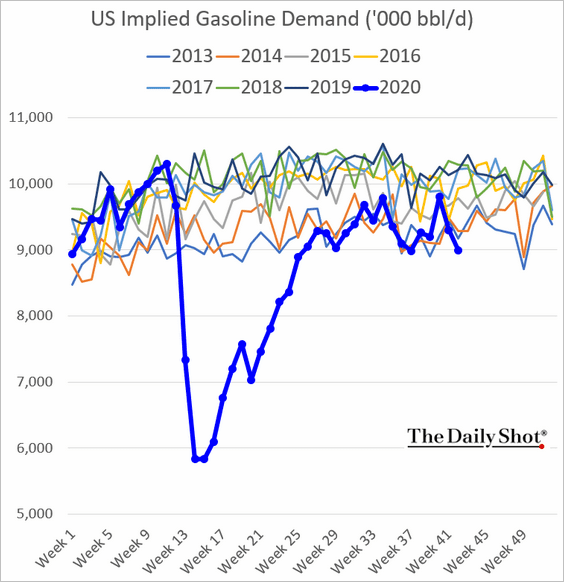

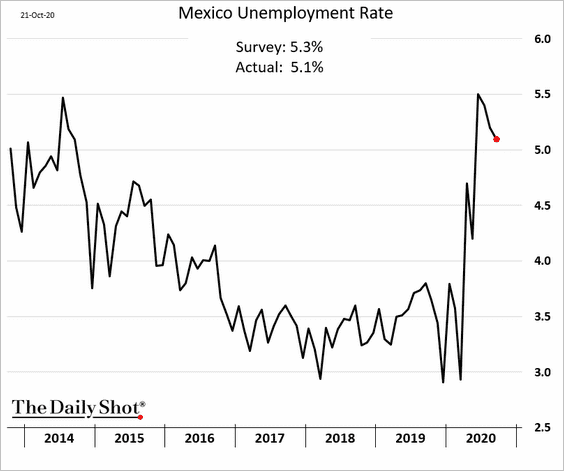

3. Gasoline demand is weakening again.

And US gasoline inventories edged higher last week.

Cryptocurrency

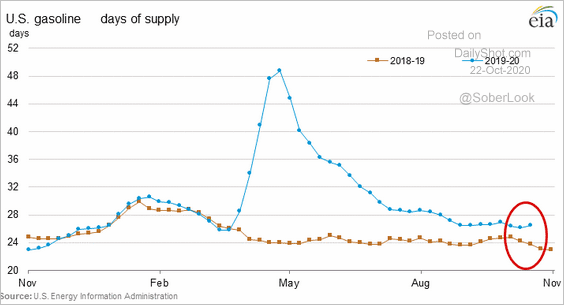

Bitcoin briefly crossed $13k, …

… outperforming other major cryptos.

Emerging Markets

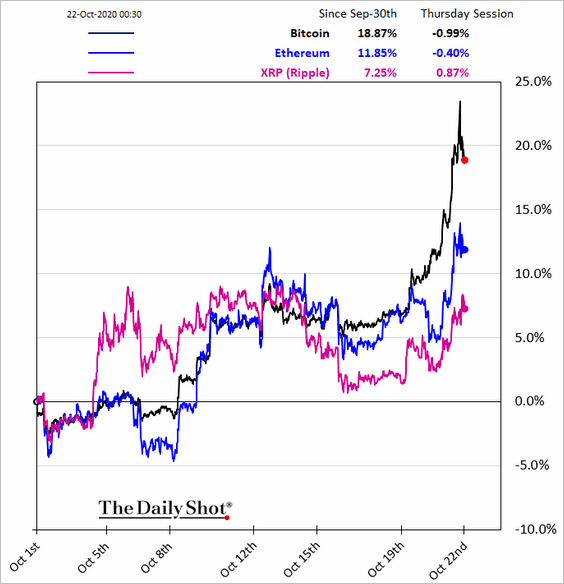

1. Mexico’s labor market is gradually recovering.

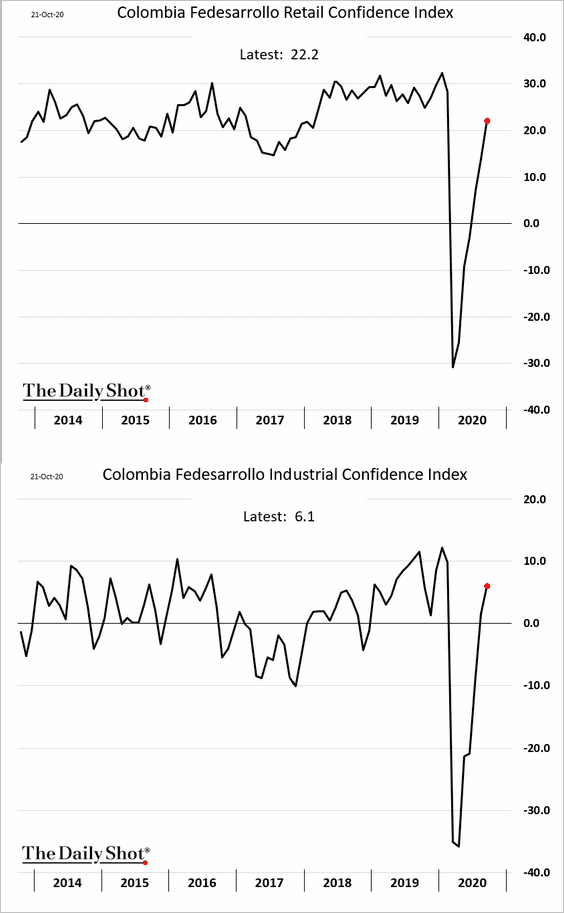

2. Colombia’s sentiment indicators have rebounded.

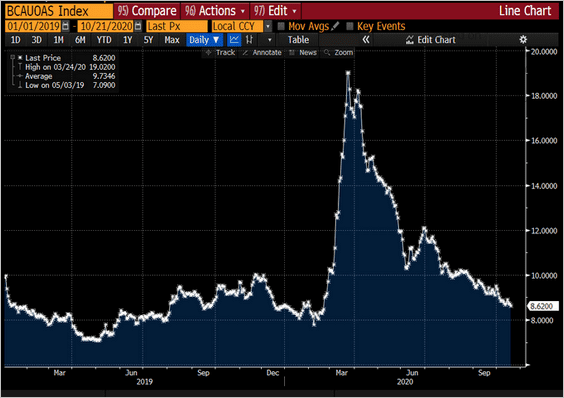

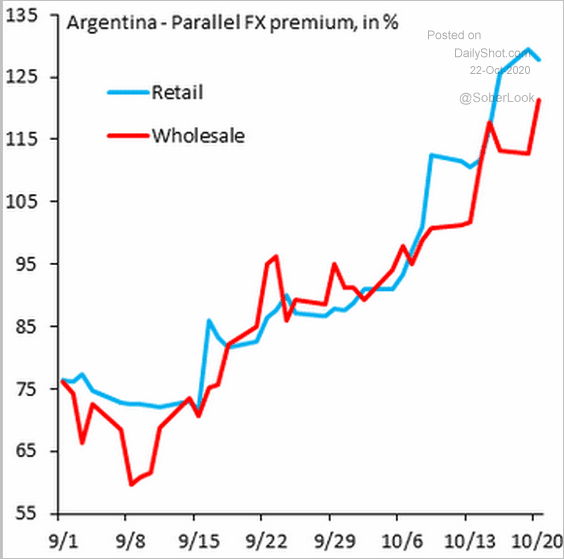

3. Argentina’s black-market premium on US dollars (vs. the official exchange rate) keeps climbing.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

4. Thailand’s shares have been underperforming.

Source: @WSJ Read full article

Source: @WSJ Read full article

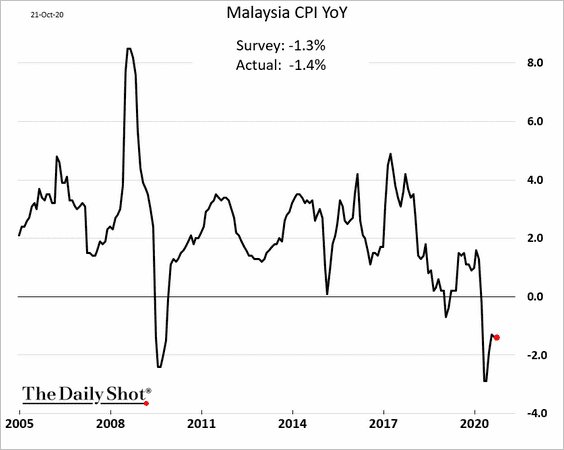

5. Malaysia’s consumer inflation remains depressed.

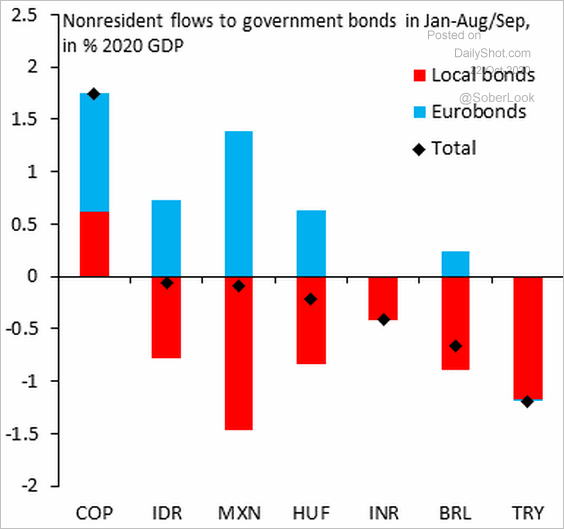

6. Foreign investors have been exiting local-currency bonds.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

China

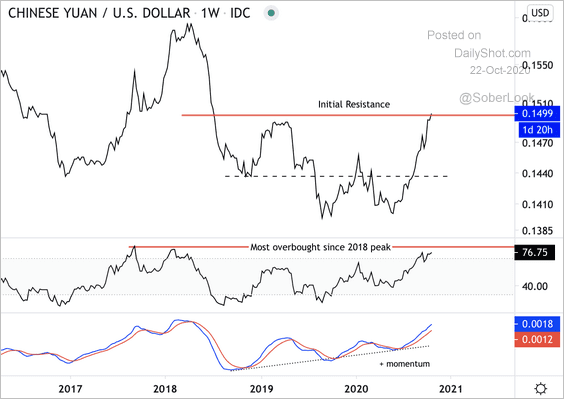

1. Technicals suggest that the yuan is overbought.

Source: @DantesOutlook

Source: @DantesOutlook

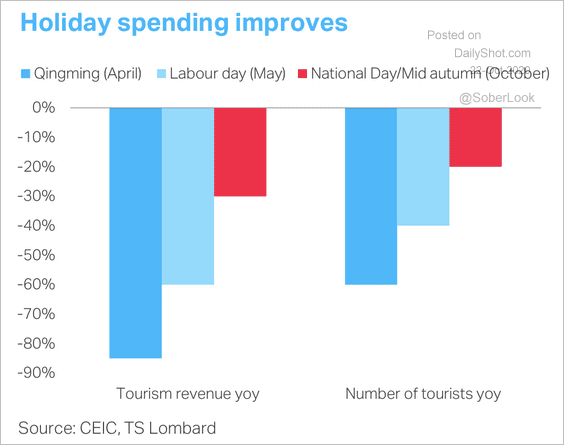

2. The Autumn national holiday in October marked a significant improvement in tourism revenue versus earlier holidays this year.

Source: TS Lombard

Source: TS Lombard

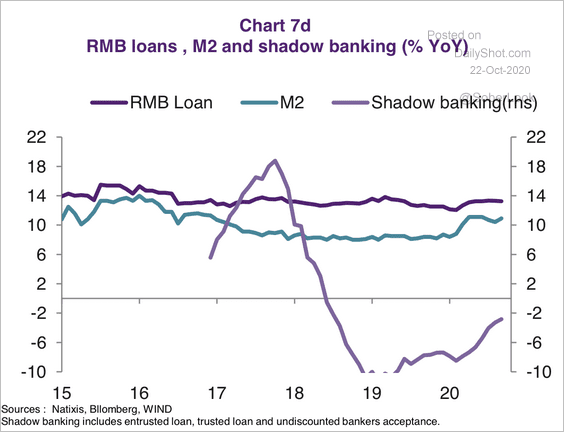

3. Shadow banking is making a return.

Source: Natixis

Source: Natixis

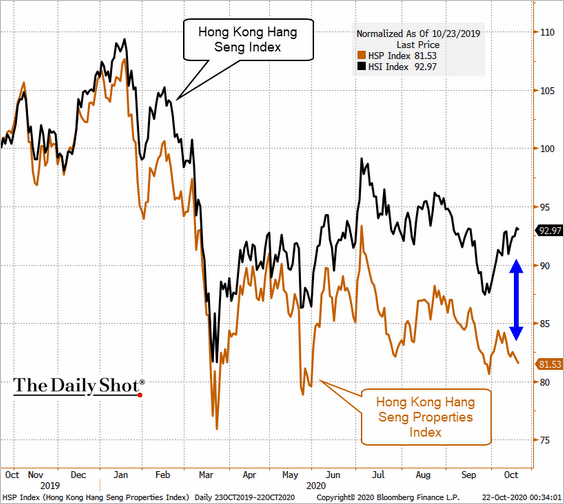

4. Hong Kong-listed property stocks are underperforming.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The Eurozone

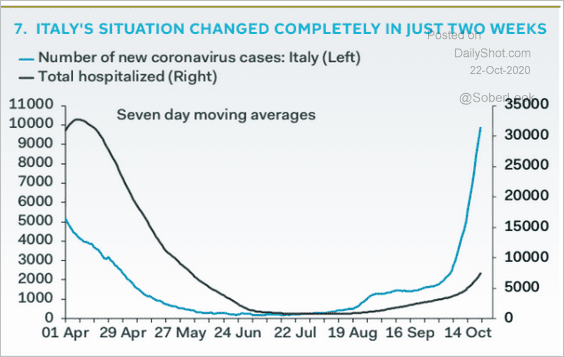

1. Italy’s new COVID cases exploded over the past couple of weeks.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

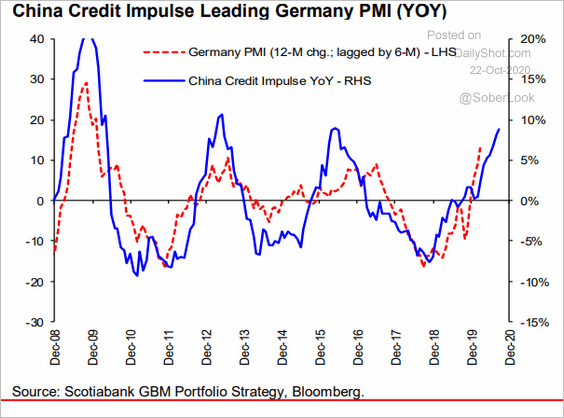

2. China’s credit impulse has been leading Germany’s business activity (PMI).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

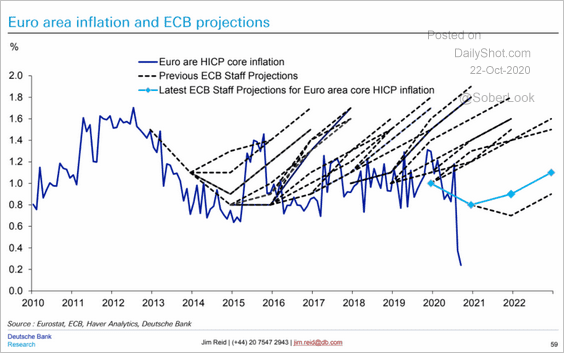

3. This chart shows the ECB’s inflation projections vs. the actual CPI.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

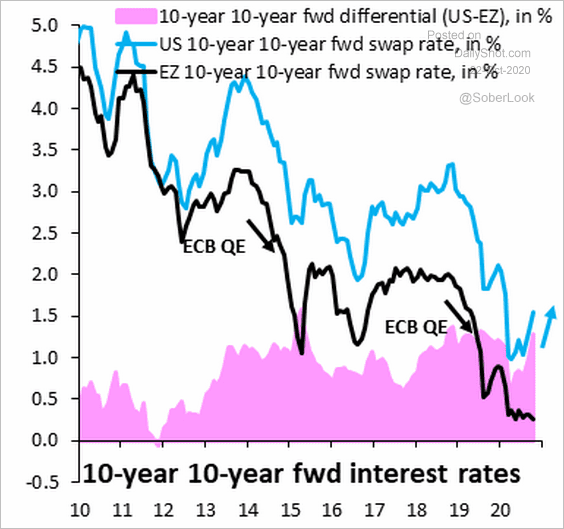

4. The US and Eurozone long-term forward rates have diverged.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

The United Kingdom

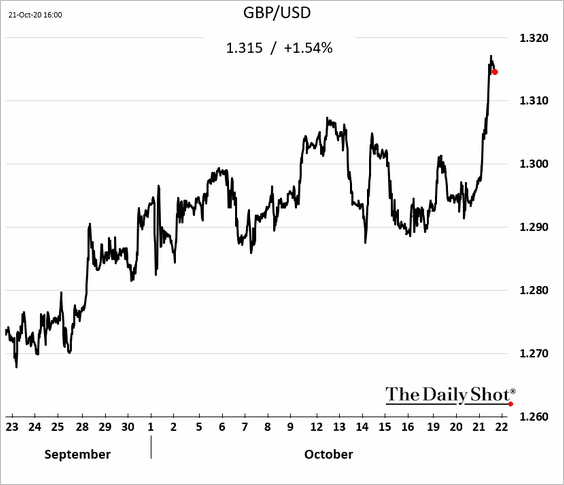

1. The pound jumped amid hopes for a trade deal.

Source: Reuters Read full article

Source: Reuters Read full article

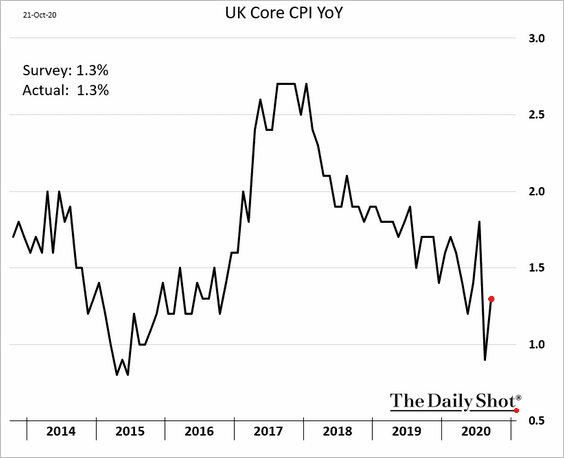

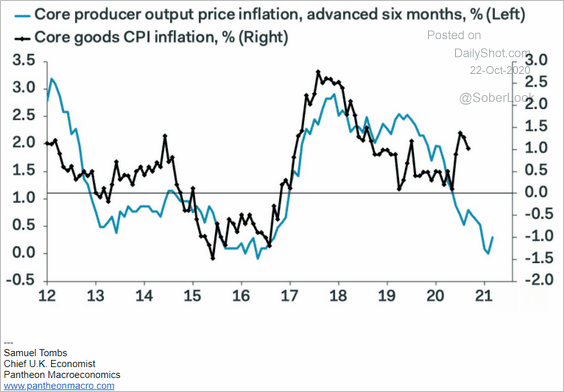

2. The UK CPI edged higher, but further gains should be limited.

The PPI points to downside risks for the core goods CPI.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Canada

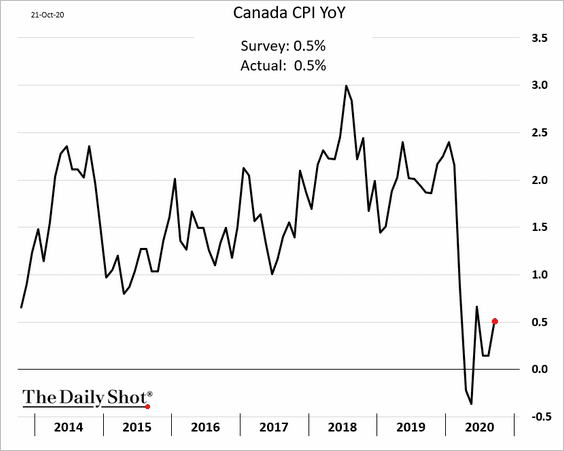

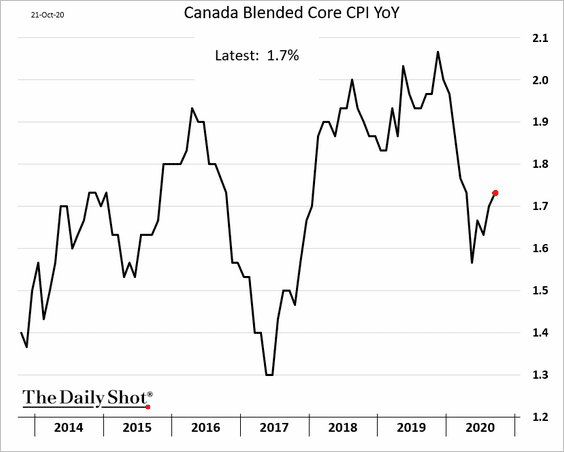

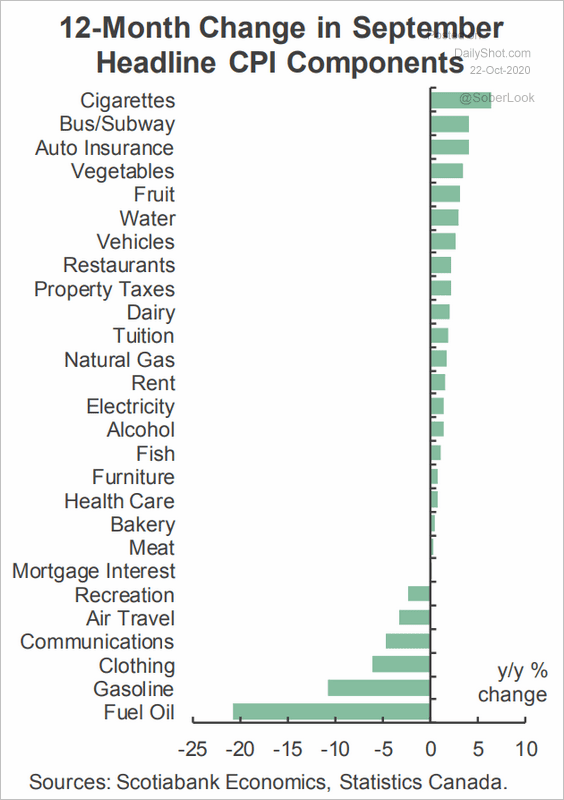

1. Inflation ticked higher last month.

Here are the CPI changes by sector.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

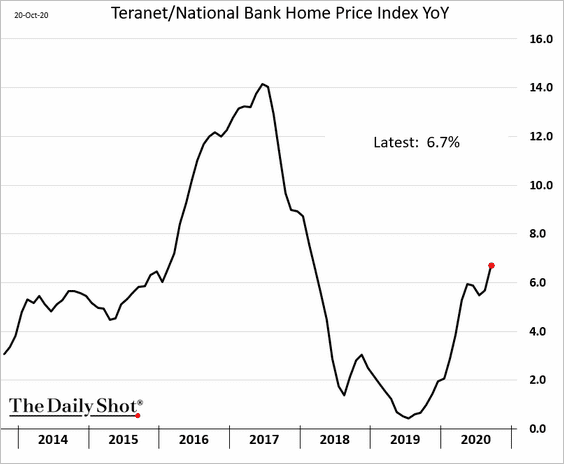

2. Home price gains continue to accelerate.

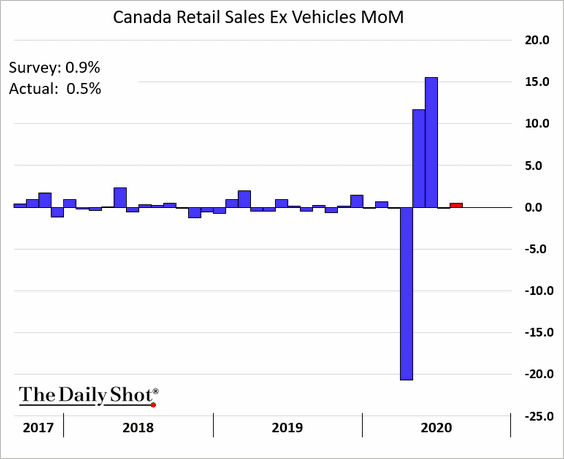

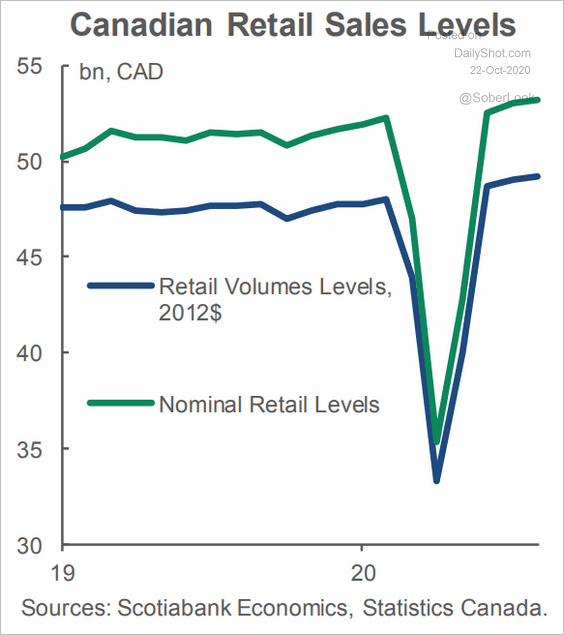

3. August retail sales were softer than expected.

Nonetheless, the absolute level of retail sales is at record highs.

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

4. The Oxford Economics Recovery Tracker showed further deterioration, driven by the second wave of infections.

![]() Source: Oxford Economics

Source: Oxford Economics

The United States

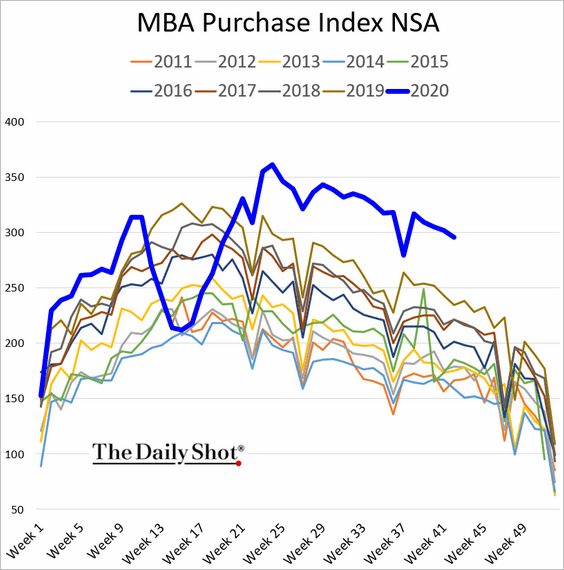

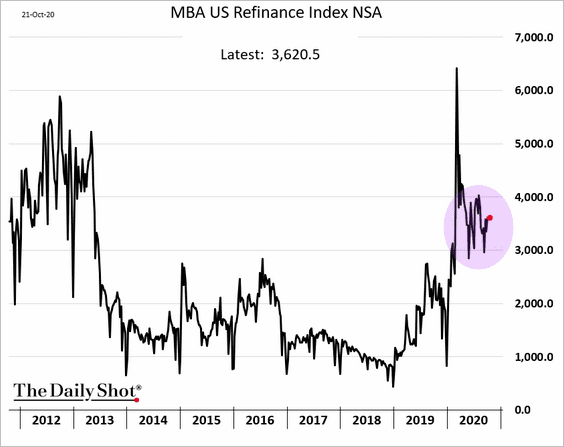

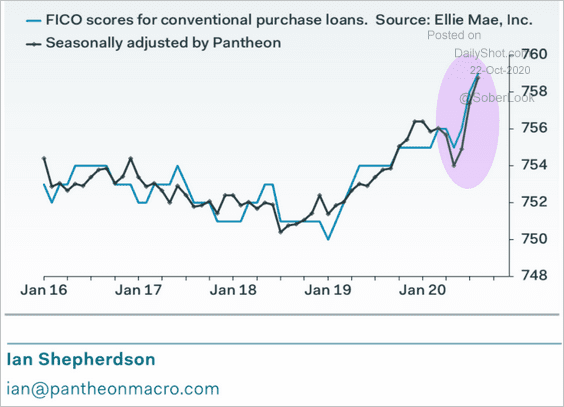

1. Let’s begin with the housing market.

• Mortgage applications remain elevated for this time of the year.

– House purchase loans:

– Refi:

• The housing boom is increasingly driven by borrowers with stronger credits.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

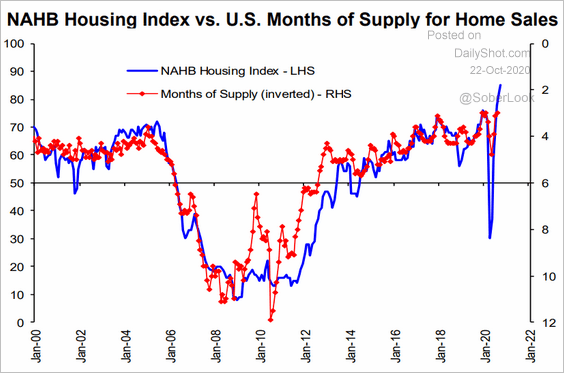

• This chart shows homebuilder optimism vs. the supply of new homes.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

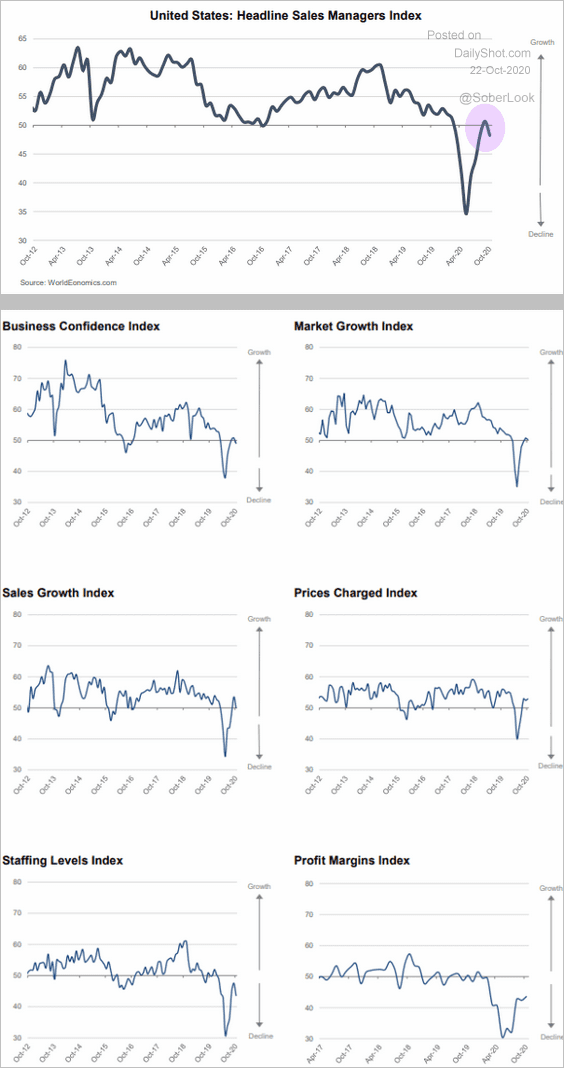

2. The World Economics SMI index, which measures the nation’s business activity, moved back into contraction territory this month.

Source: World Economics

Source: World Economics

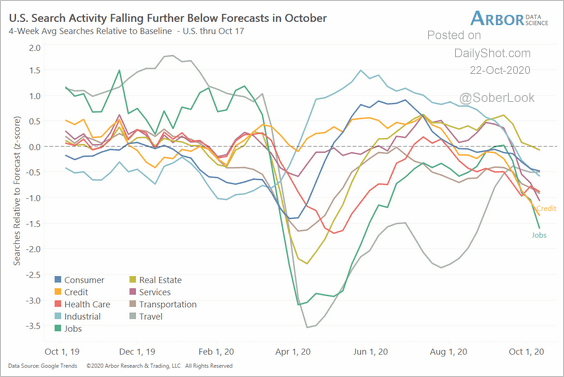

3. Online searches across different sectors point to reduced activity.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

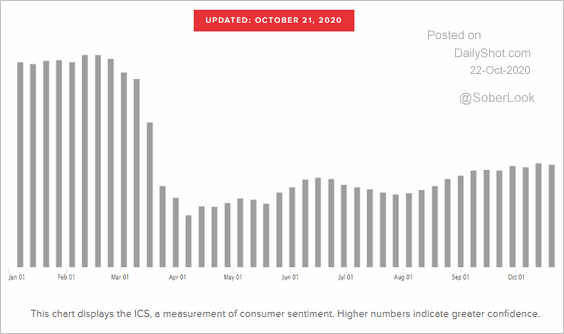

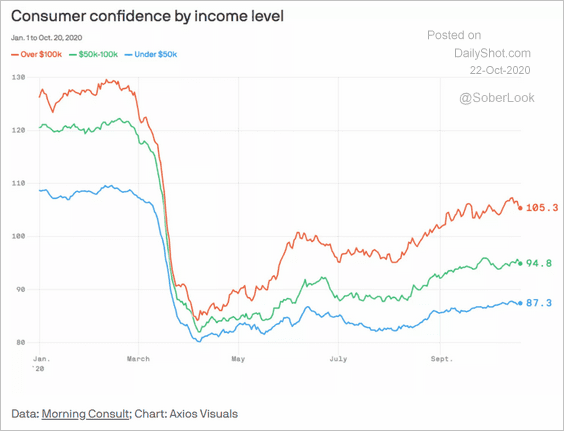

4. Improvements in consumer confidence have been slow, according to Morning Consult’s index (2 charts).

Source: Morning Consult Read full article

Source: Morning Consult Read full article

Source: @axios Read full article

Source: @axios Read full article

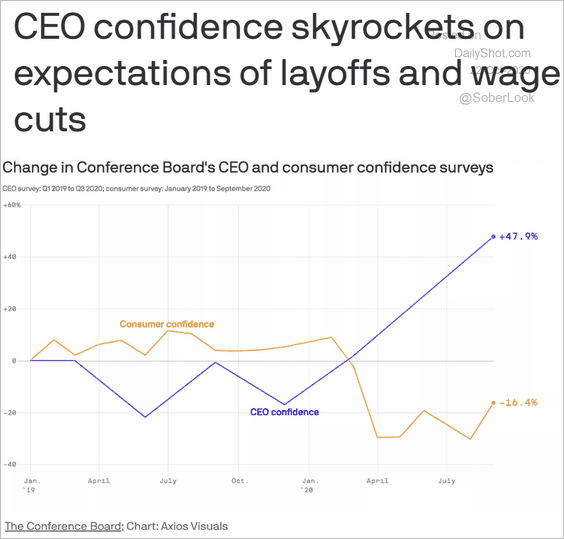

5. On the other hand, CEO confidence soared in recent months.

Source: @axios Read full article

Source: @axios Read full article

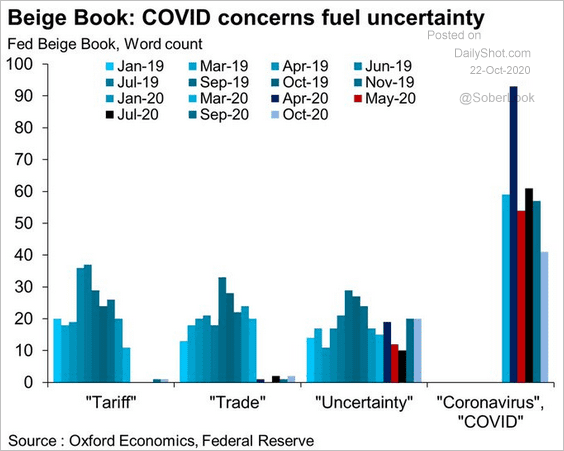

6. The Fed’s Beige Book still shows significant worries about COVID, but these concerns appear to be moderating. Trade-related issues are barely mentioned.

Source: @GregDaco, @OxfordEconomics, @BostjancicKathy

Source: @GregDaco, @OxfordEconomics, @BostjancicKathy

——————–

Food for Thought

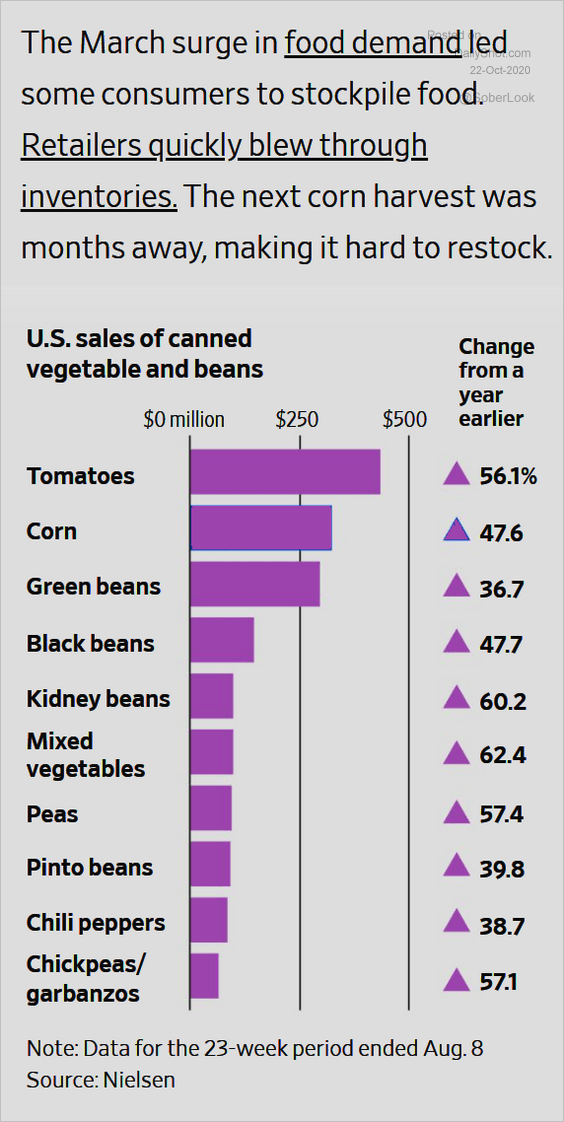

1. Surge in demand for canned vegetables and beans:

Source: @WSJ Read full article

Source: @WSJ Read full article

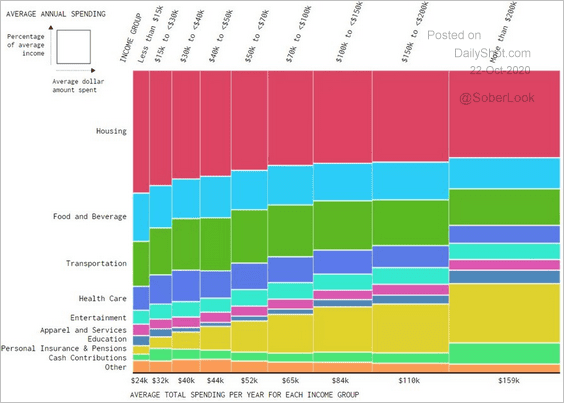

2. Average household spending per year, by income group:

Source: @VisualCap Read full article

Source: @VisualCap Read full article

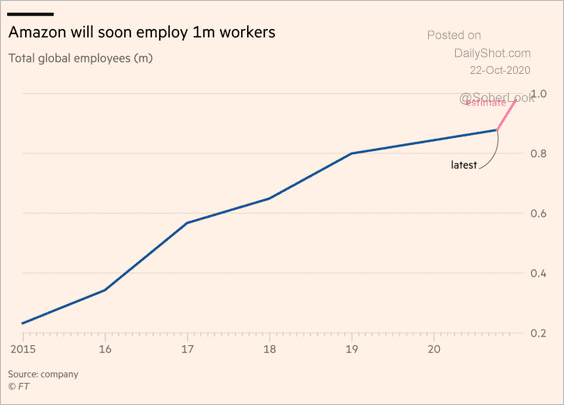

3. Amazon employees:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

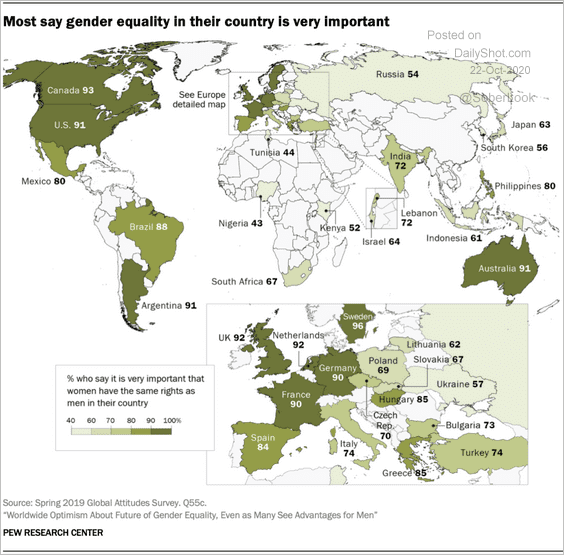

4. Views on gender equality:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

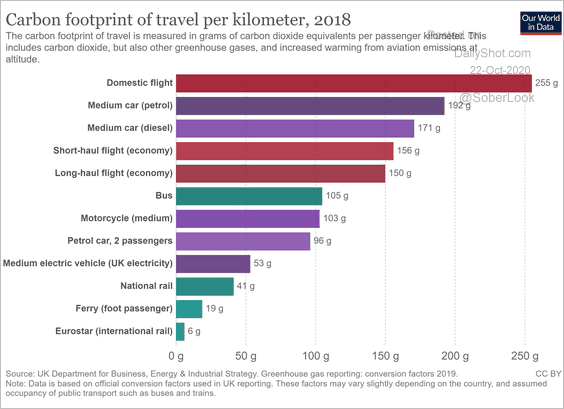

5. Carbon footprint of travel:

Source: @MaxCRoser, @_HannahRitchie Read full article

Source: @MaxCRoser, @_HannahRitchie Read full article

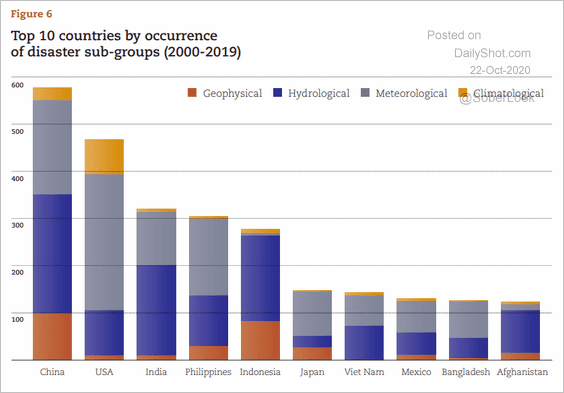

6. Natural disaster sub-groups:

Source: @wef Read full article

Source: @wef Read full article

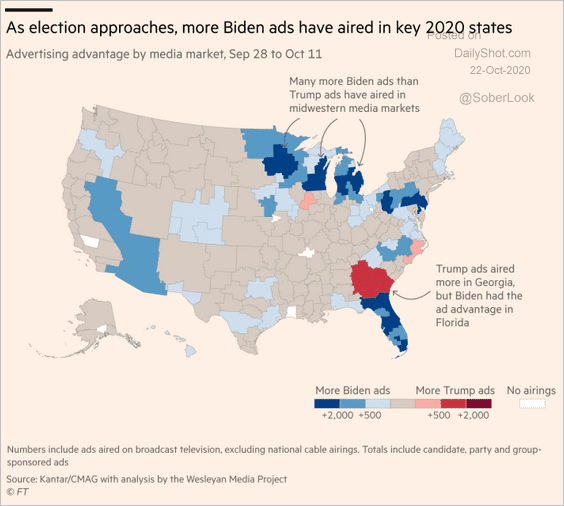

7. Presidential campaign advertising across local media markets:

Source: WEF Read full article

Source: WEF Read full article

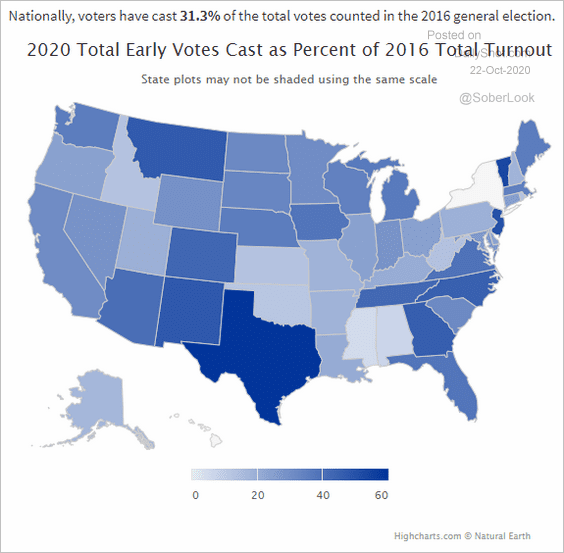

8. Total early votes so far this year:

Source: @ElectProject

Source: @ElectProject

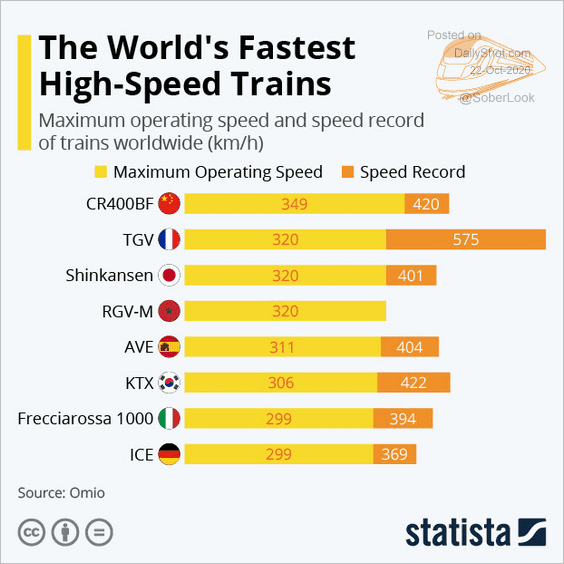

9. Fastest high-speed trains:

Source: Statista

Source: Statista

——————–