The Daily Shot: 06-Nov-20

• Equities

• Credit

• Alternatives

• Energy

• Commodities

• Rates

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• Japan

• The Eurozone

• Europe

• The United Kingdom

• The United States

• Food for Thought

Equities

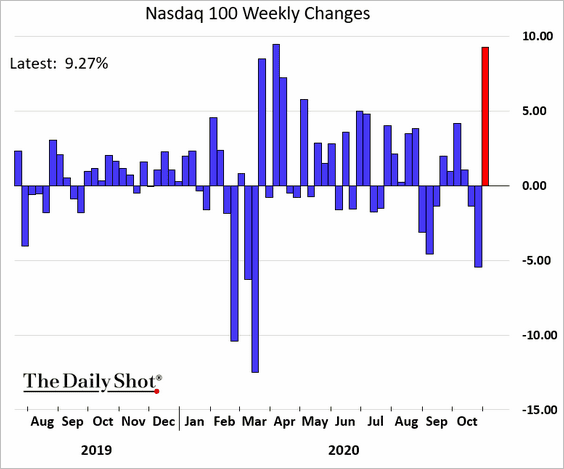

1. It’s been a good week for the mega-cap shares. Here are the weekly changes in the Nasdaq 100 index.

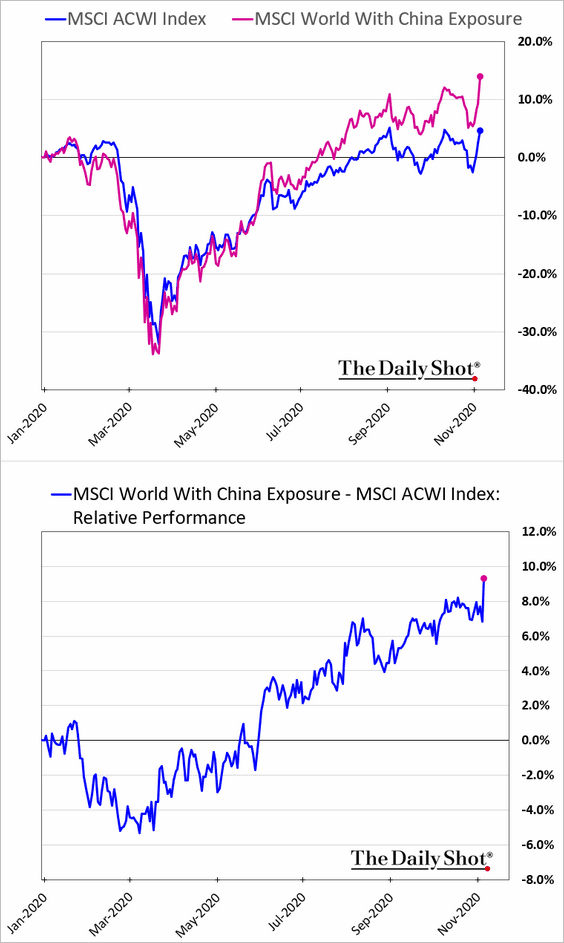

2. Companies with exposure to China were rewarded this week.

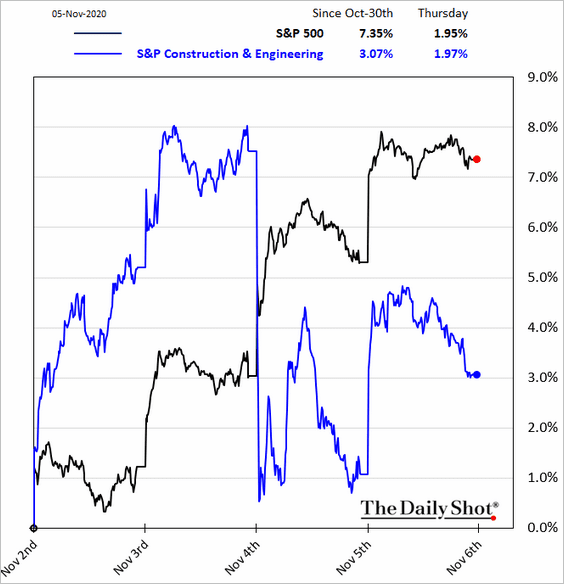

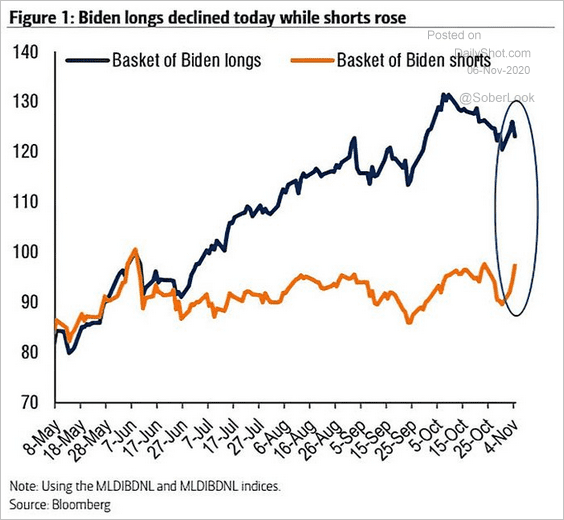

3. The “blue wave” reflation bet soured on the news of a divided US Congress. A big stimulus bill would have expanded construction activity due to a substantial increase in infrastructure spending.

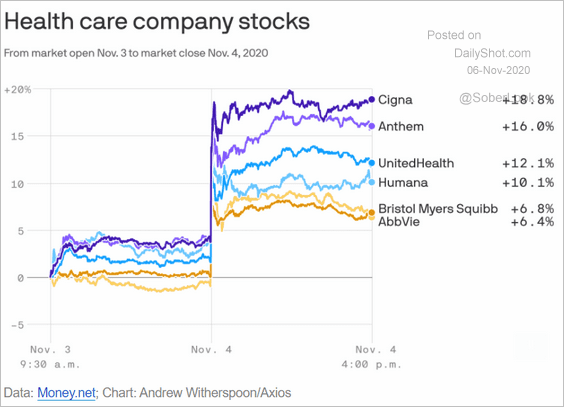

The divided Congress news also boosted managed care stocks since no significant health legislation is expected at this point.

Source: @axios

Source: @axios

That’s why the “Biden short basket” rallied.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

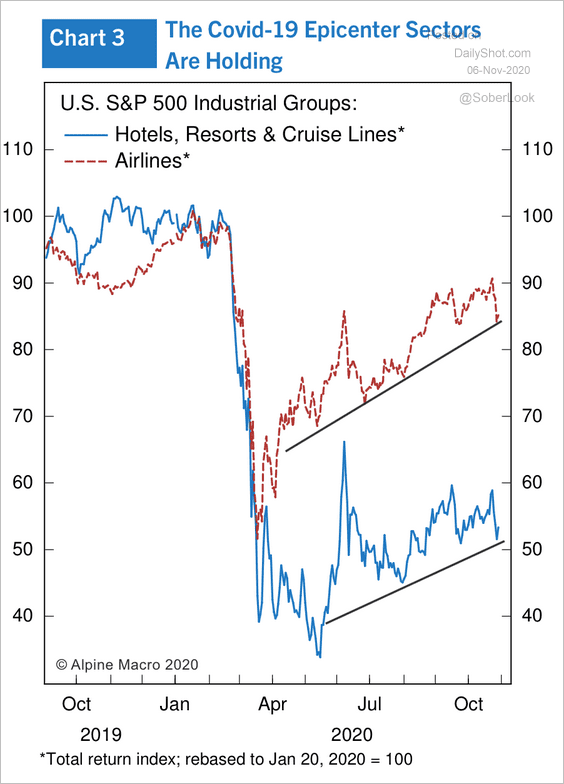

4. Sectors that have been most vulnerable to the pandemic continue to trend higher (gradually).

Source: Alpine Macro

Source: Alpine Macro

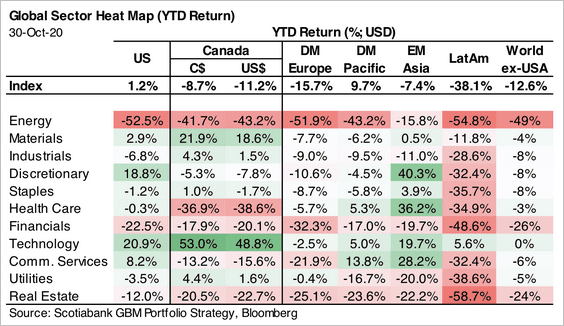

5. Here is a look at global sector performance year-to-date.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

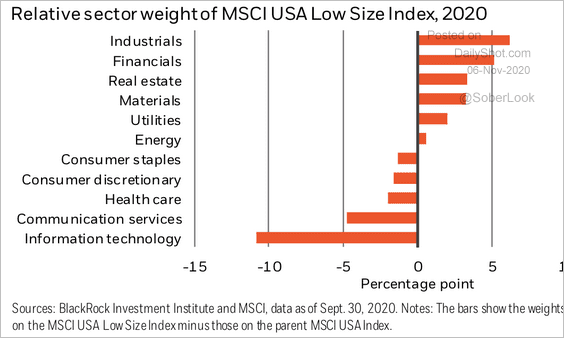

6. This chart shows the sector weights in the MSCI USA Low Size Index (smaller firms).

Source: BlackRock

Source: BlackRock

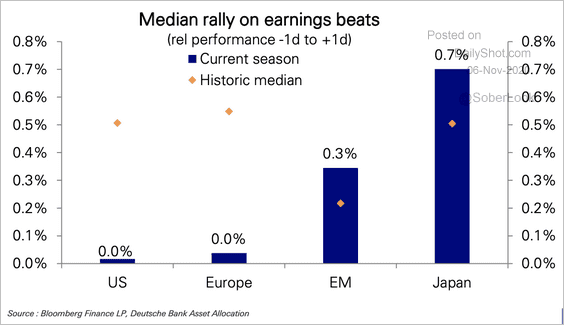

7. Strong earnings beats in the US and Europe haven’t been rewarded.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

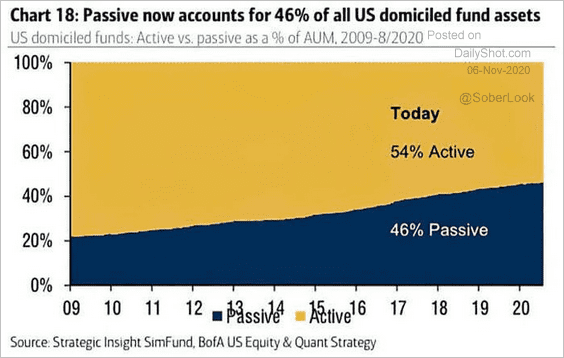

8. Passive funds are approaching 50% of the total US-domiciled funds’ AUM.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

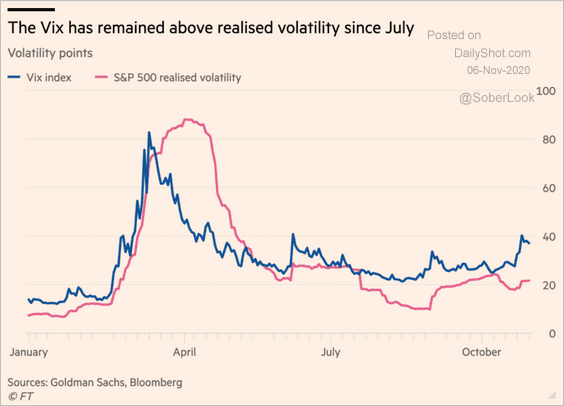

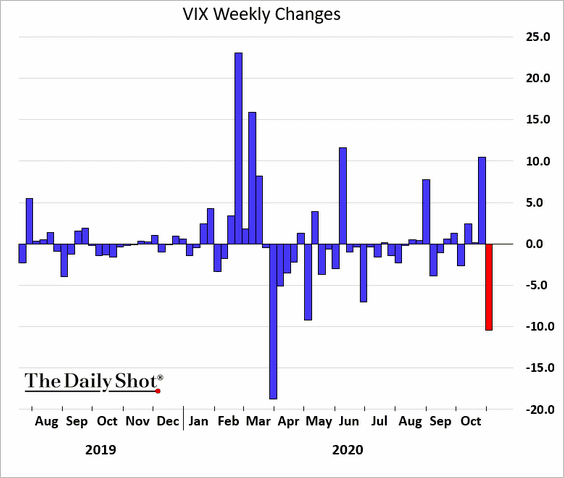

9. VIX has been running well above the S&P 500 realized volatility ahead of the elections.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

But the index tumbled this week.

Credit

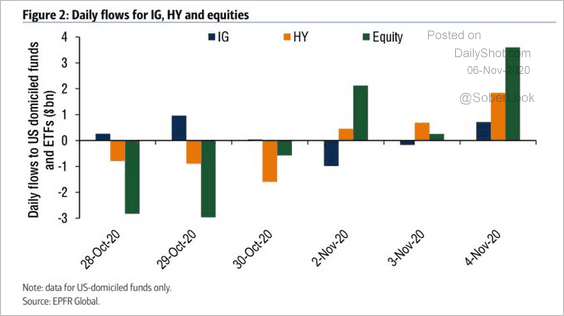

1. Corporate bonds saw substantial inflows this week as Treasury yields tumbled.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

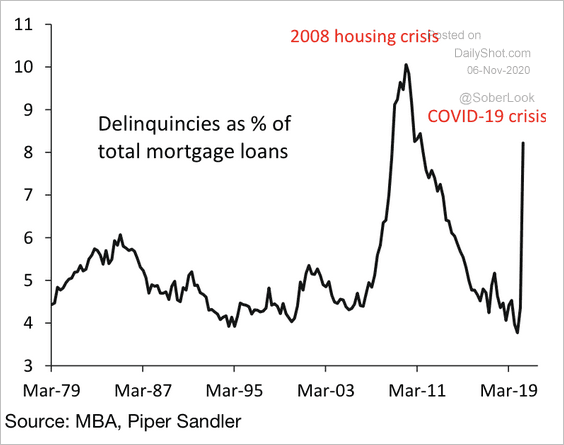

2. The delinquency rate for US residential mortgage loans has spiked to a nine-year high.

Source: Piper Sandler

Source: Piper Sandler

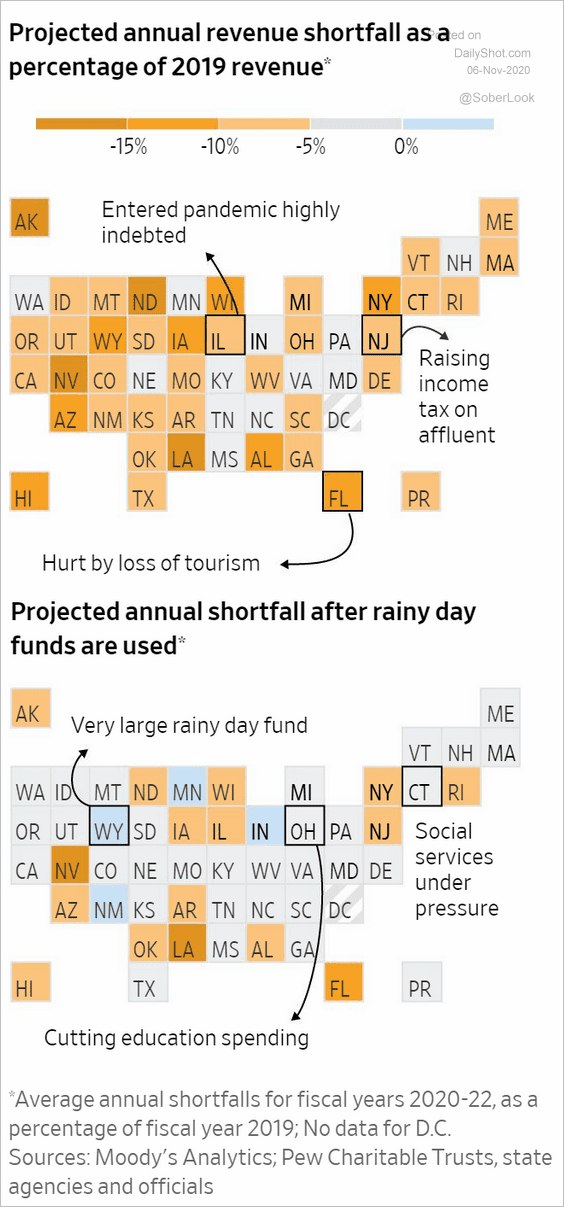

3. This chart shows states’ revenue shortfall this year. Since significant support from the federal government is unlikely at this point, it’s a bit surprising to see further strength in the muni market this week.

Source: @WSJ Read full article

Source: @WSJ Read full article

Alternatives

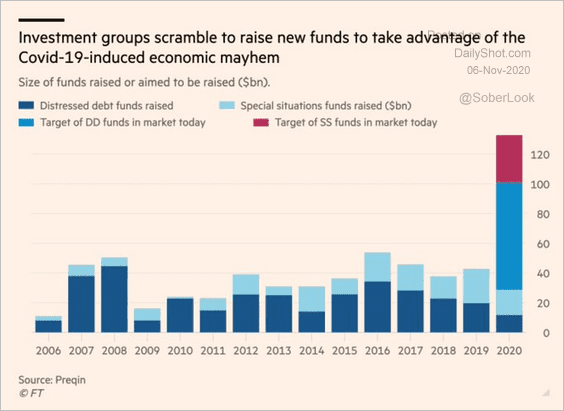

1. Distressed and special situation funds have raised a great deal of capital this year.

Source: @adam_tooze, @RobinWigg Read full article

Source: @adam_tooze, @RobinWigg Read full article

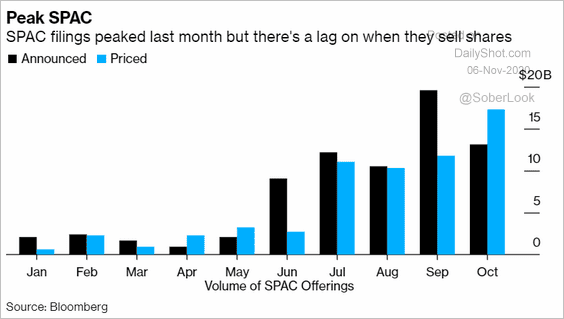

2. Has all the SPAC activity finally peaked?

Source: @markets Read full article

Source: @markets Read full article

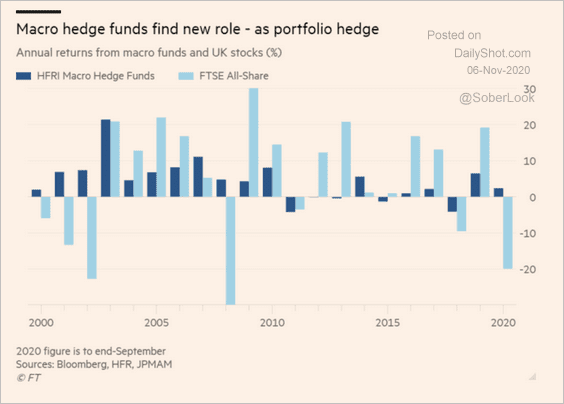

3. Macro hedge funds are now often used as a portfolio hedge.

Source: @FT Read full article

Source: @FT Read full article

Energy

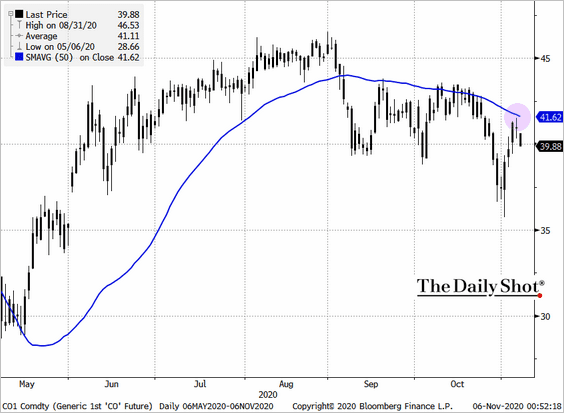

1. Brent crude held resistance at the 50-day moving average and is now back below $40/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

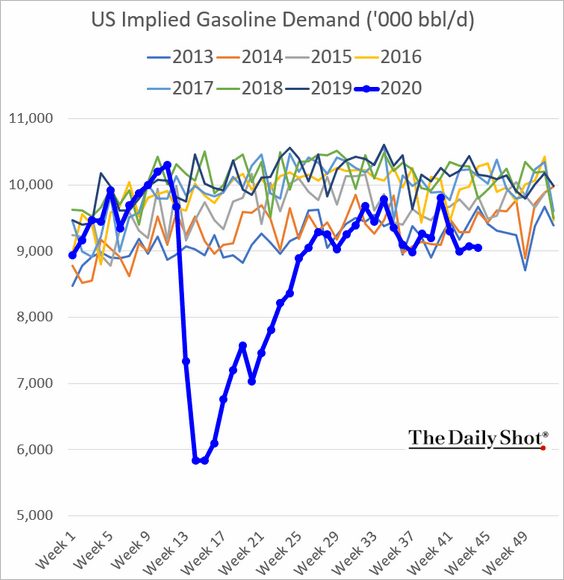

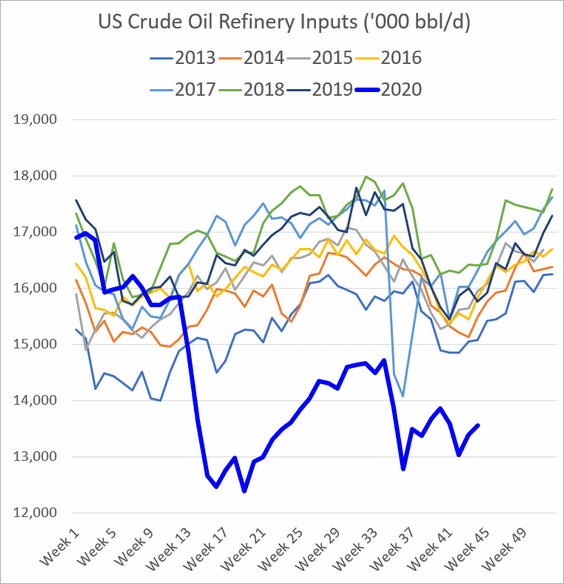

2. US gasoline demand is back below the 7-year range.

Refinery inputs remain depressed.

——————–

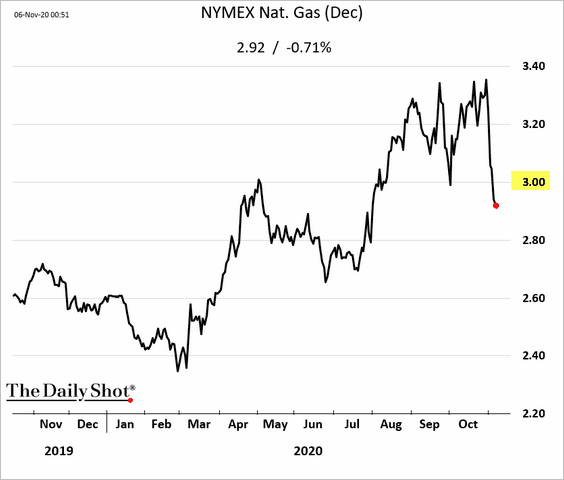

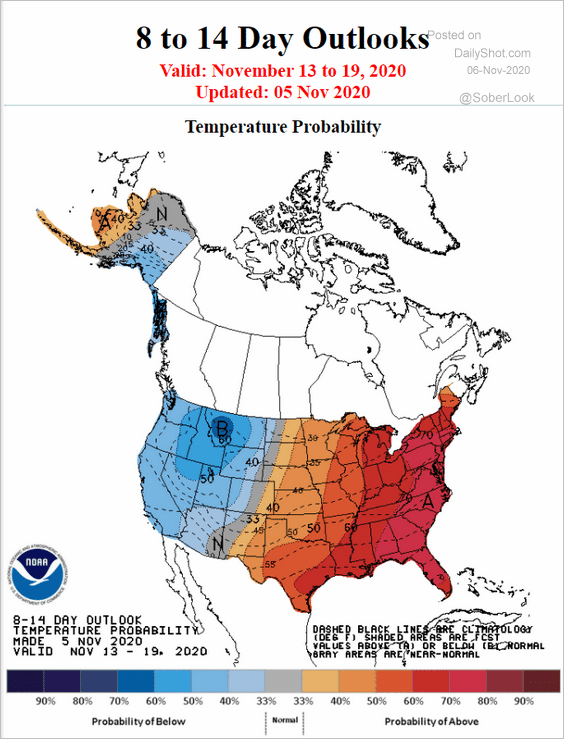

3. US natural gas futures are back below $3/MMBTU amid forecasts for warmer weather.

Source: NOAA

Source: NOAA

Commodities

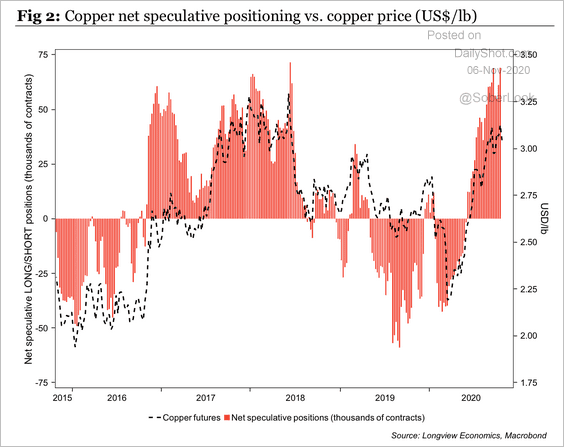

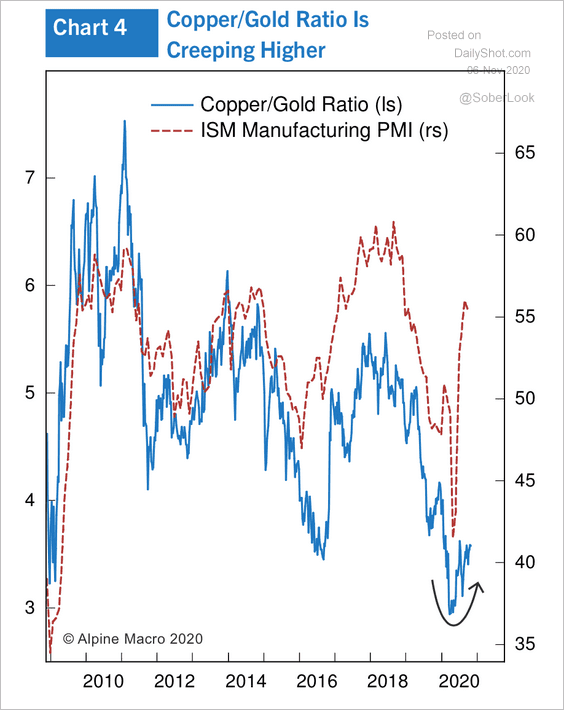

1. Speculative long positioning in copper futures is at the highest level since 2018.

Source: Longview Economics

Source: Longview Economics

Improved US manufacturing activity points to a higher copper-to-gold ratio.

Source: Alpine Macro

Source: Alpine Macro

——————–

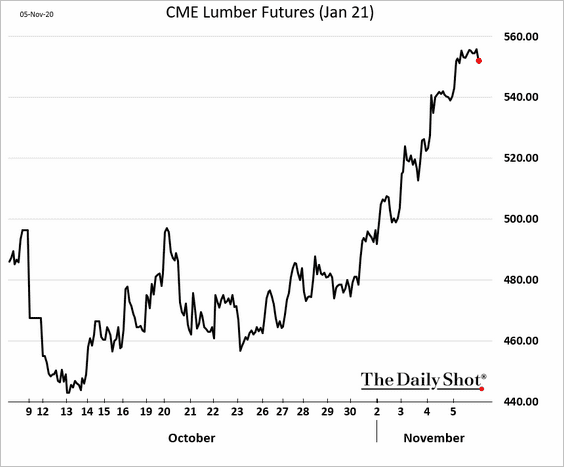

2. US lumber futures started the month on a strong note.

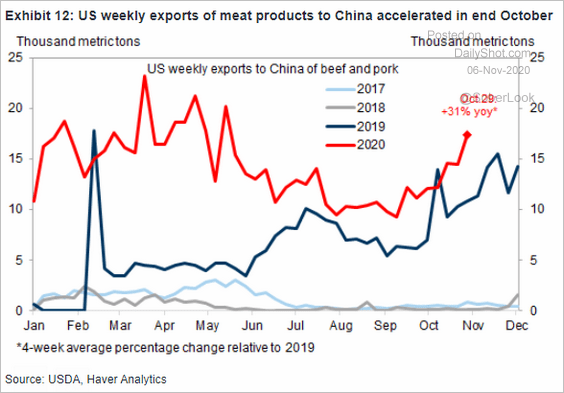

3. US meat exports to China are at multi-year highs for this time of the year.

Source: Goldman Sachs

Source: Goldman Sachs

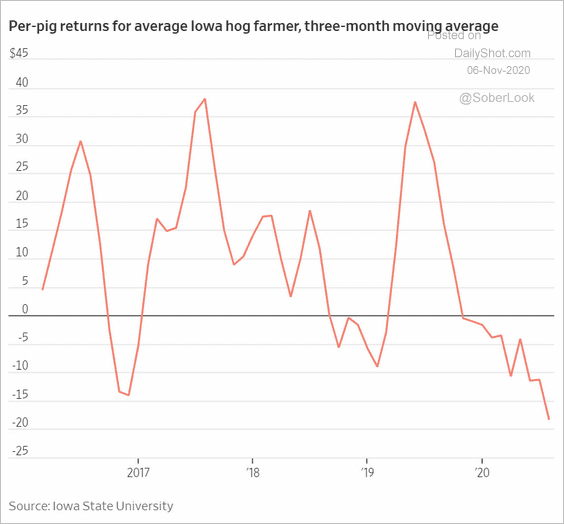

Will increased exports help improve returns for US pig farmers?

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

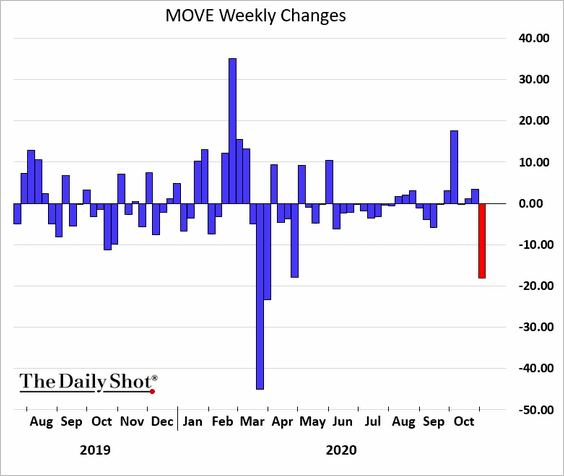

1. Treasury implied volatility tumbled this week.

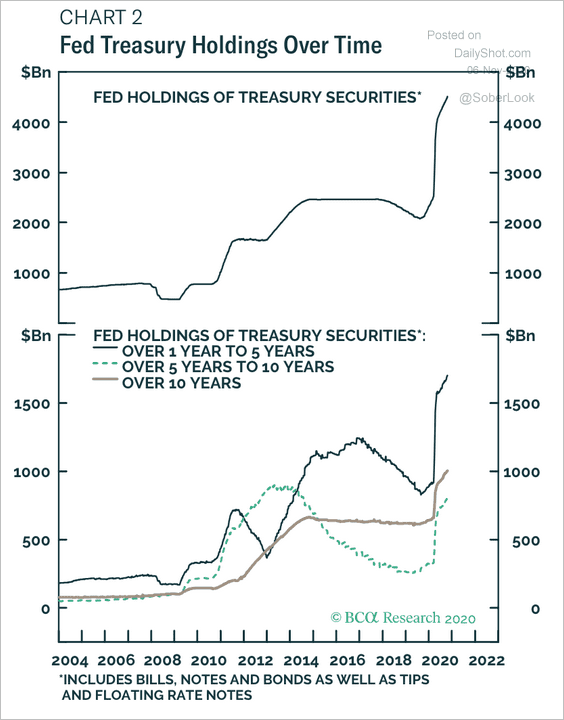

2. Will the Fed focus on longer maturities in the next easing phase?

Source: BCA Research

Source: BCA Research

Cryptocurrency

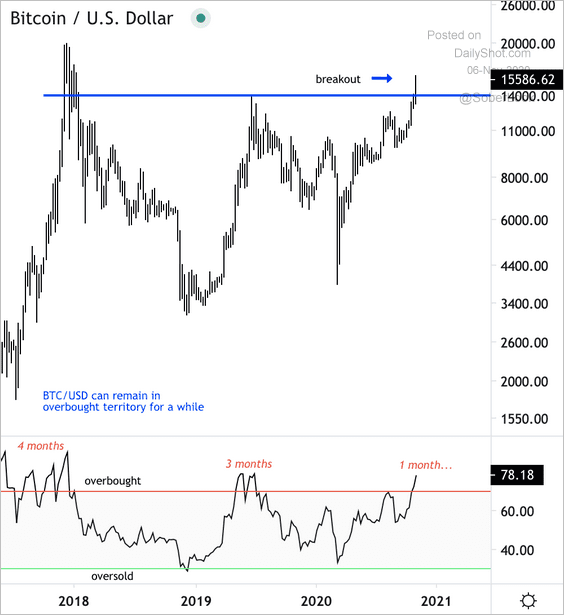

1. Bitcoin is testing the $16k level.

Technicals show that Bitcoin is overbought (2nd panel).

Source: @DantesOutlook

Source: @DantesOutlook

——————–

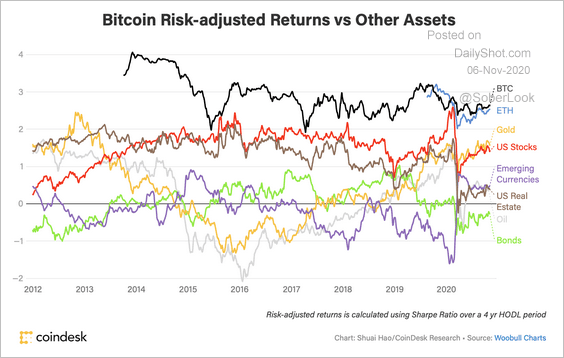

2. Here is Bitcoin vs. other asset classes.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

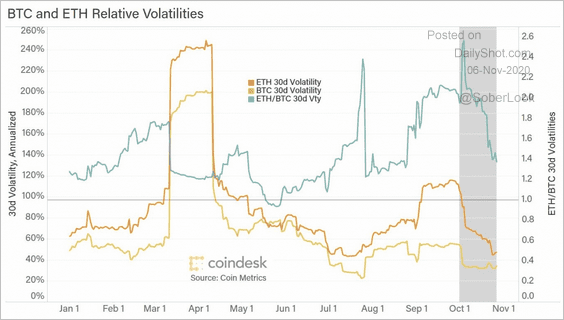

3. Ether’s volatility has declined sharply versus Bitcoin in October.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

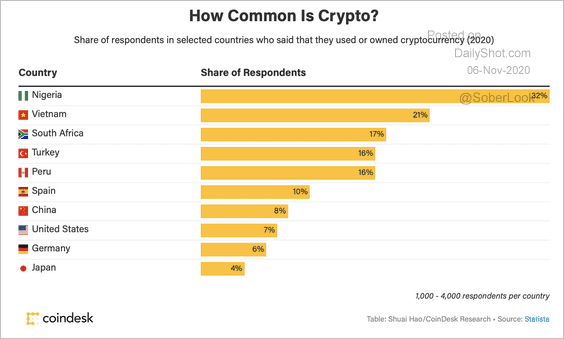

4. Bitcoin is becoming more popular in emerging markets.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Emerging Markets

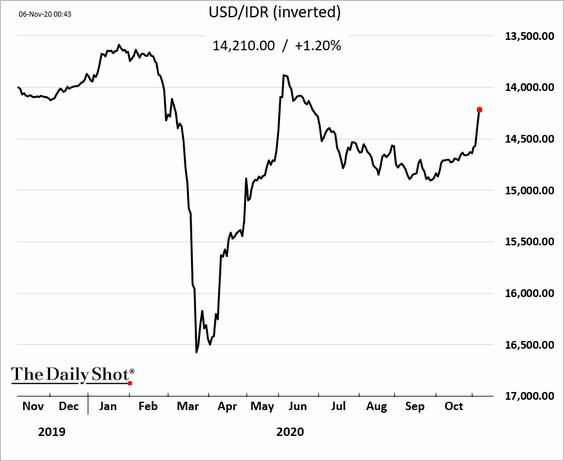

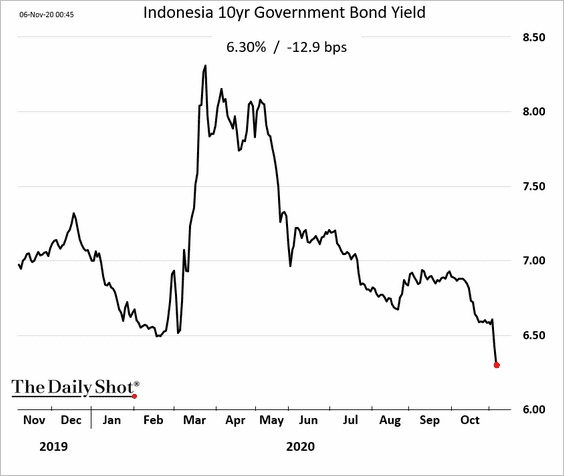

1. Indonesian assets are rallying, boosted by lower Treasury yields.

• The Indonesian rupiah:

• The 10yr yield (local currency):

——————–

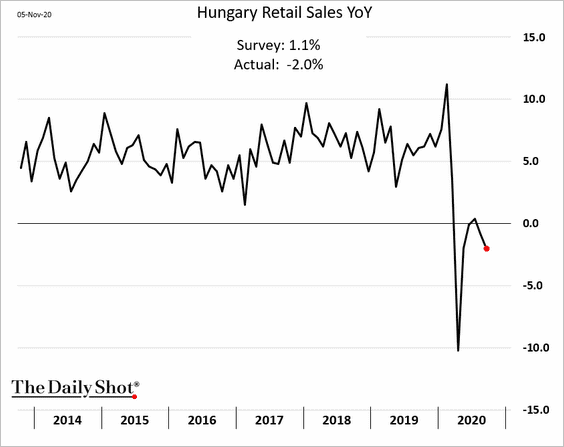

2. Hungarian retail sales slumped in September.

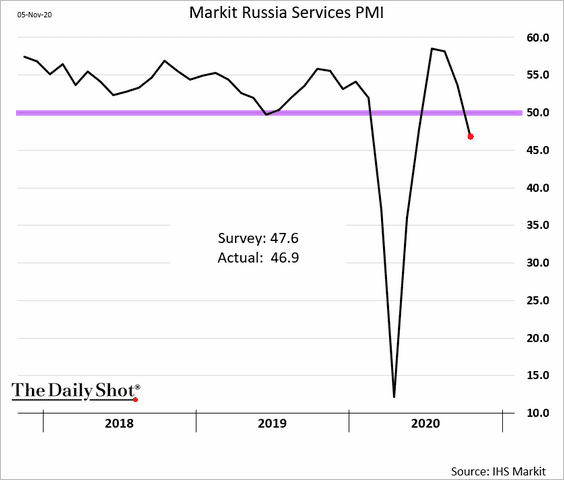

3. Russia’s service sector is contracting again.

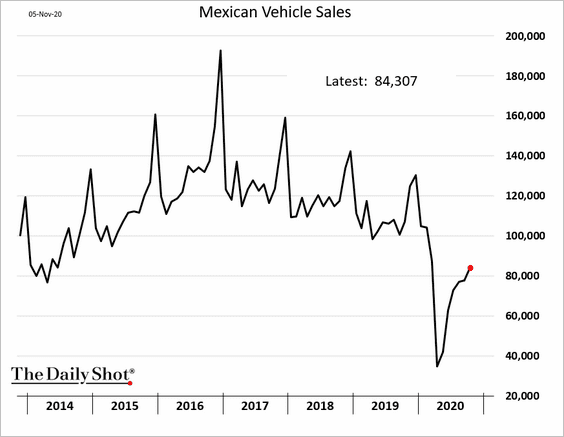

4. Mexico’s vehicle sales are gradually recovering.

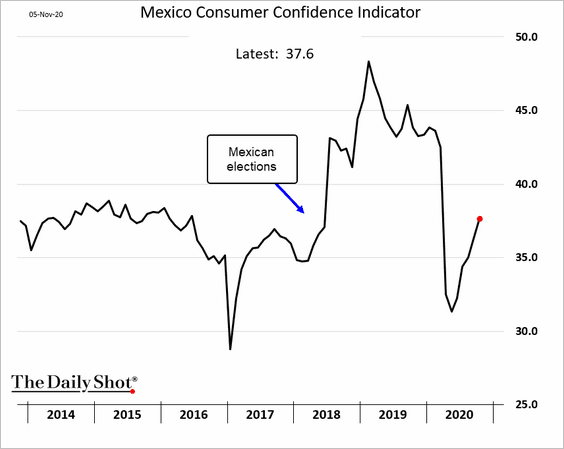

Here is the nation’s consumer confidence index.

——————–

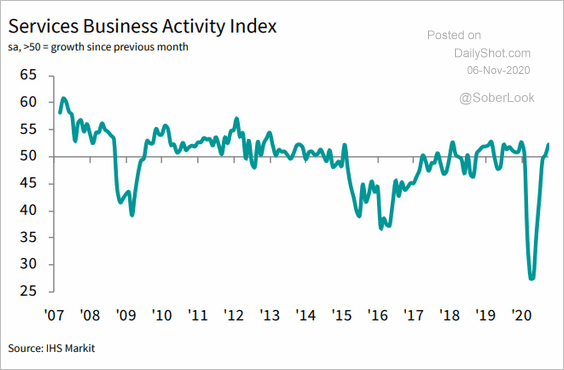

5. Brazil’s service sector activity is now growing.

Source: IHS Markit

Source: IHS Markit

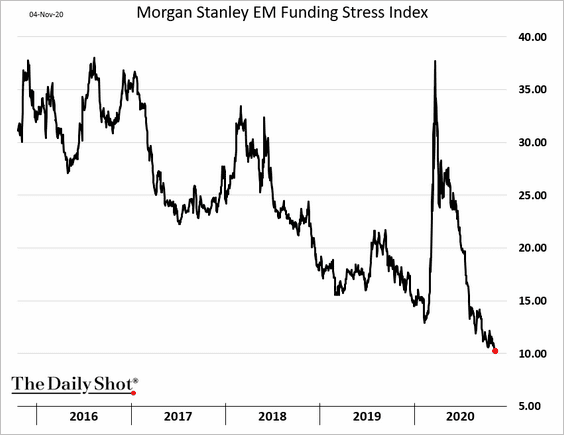

6. Liquidity and access to cheaper funding have been improving across EM economies.

Source: Bloomberg

Source: Bloomberg

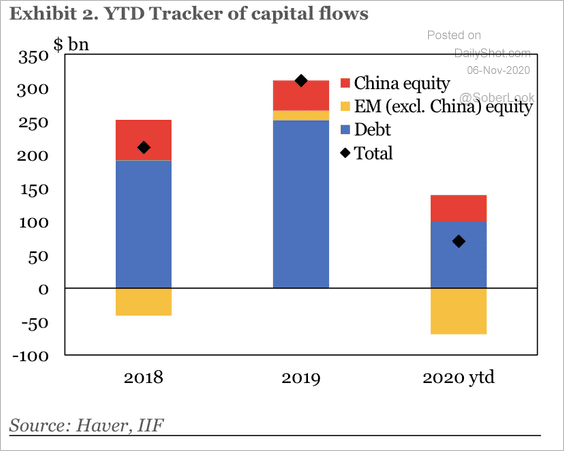

7. EM equities (excluding China) experienced outflows this year.

Source: IIF

Source: IIF

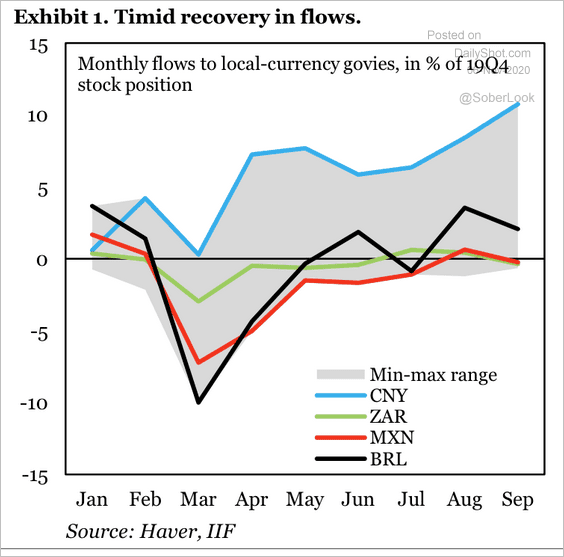

Here are fund flows into local-currency government bonds.

Source: IIF

Source: IIF

China

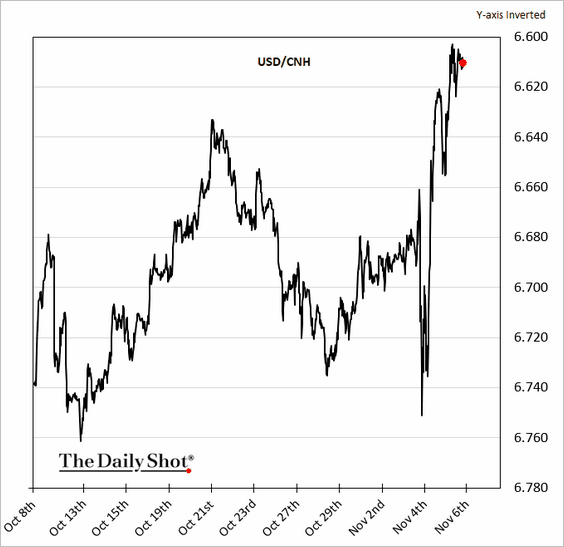

1. The renminbi strengthened further in response to the US election results.

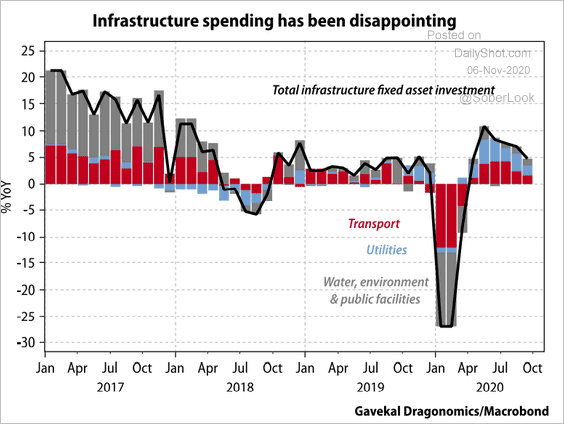

2. Infrastructure spending has been modest compared to the post-2015 stimulus.

Source: Gavekal

Source: Gavekal

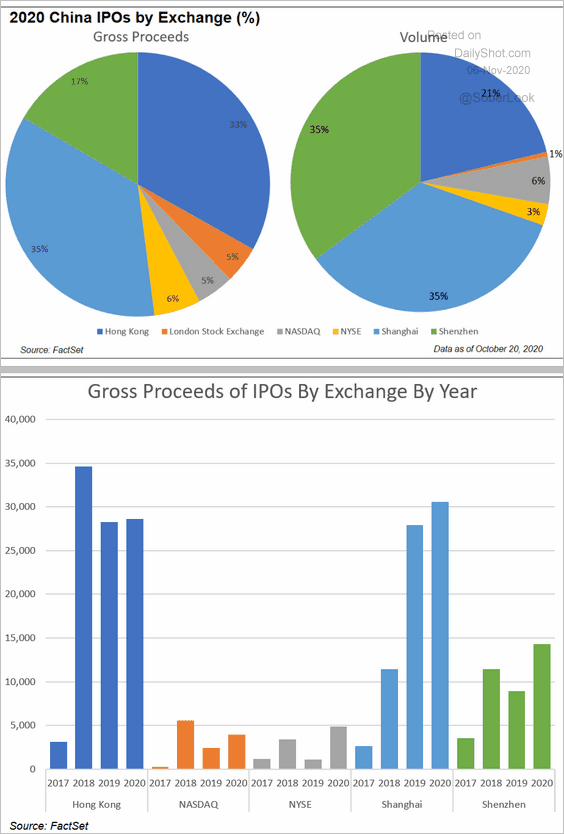

3. Next, we have some data on China’s IPO activity, by exchange.

Source: @FactSet Read full article

Source: @FactSet Read full article

Asia – Pacific

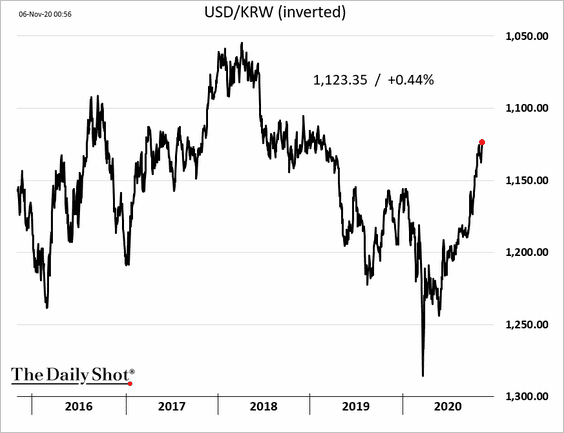

1. The South Korean won continues to rally.

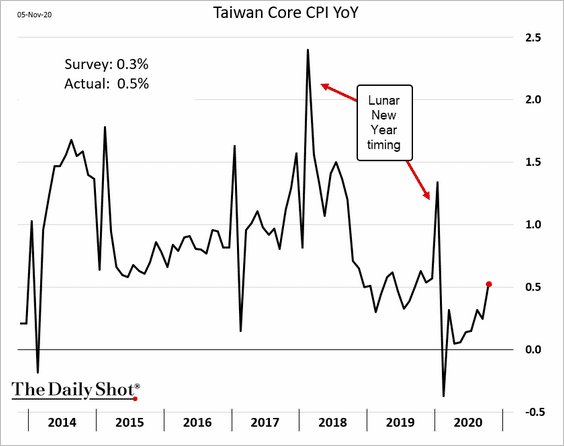

2. Taiwan’s CPI is recovering.

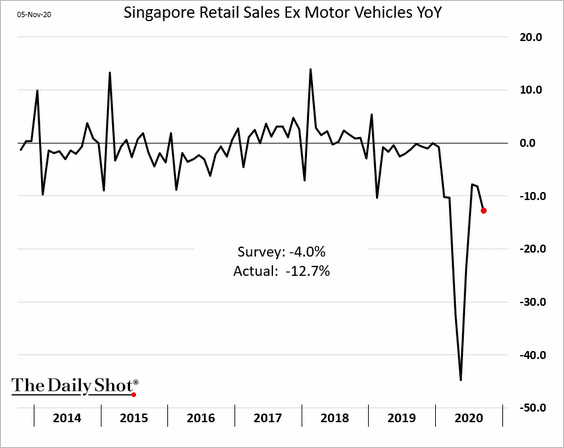

3. Singapore’s September retail sales were disappointing.

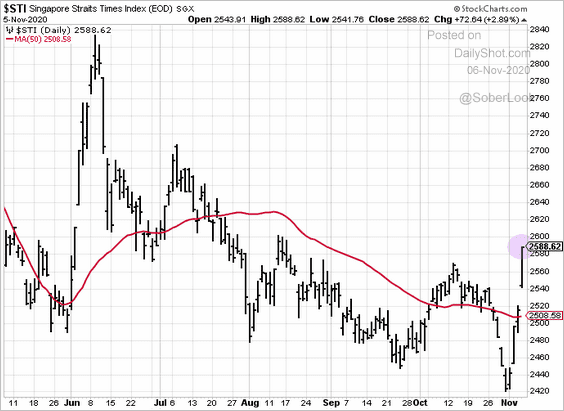

But Singapore’s stock market is rebounding sharply.

——————–

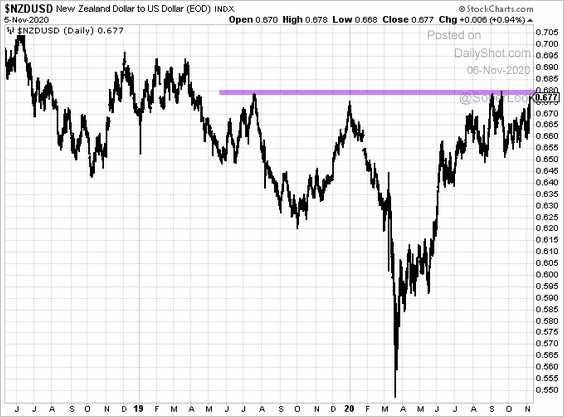

4. The Kiwi dollar is at resistance (0.68).

5. Next, we have some updates on Australia.

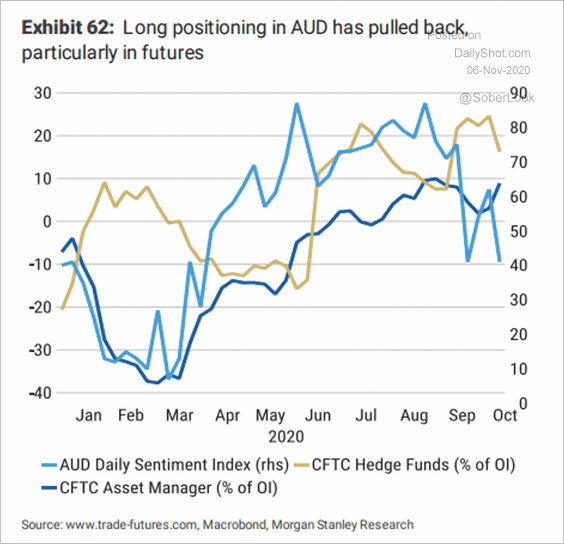

• Bullish sentiment on the Aussie dollar is starting to fade.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

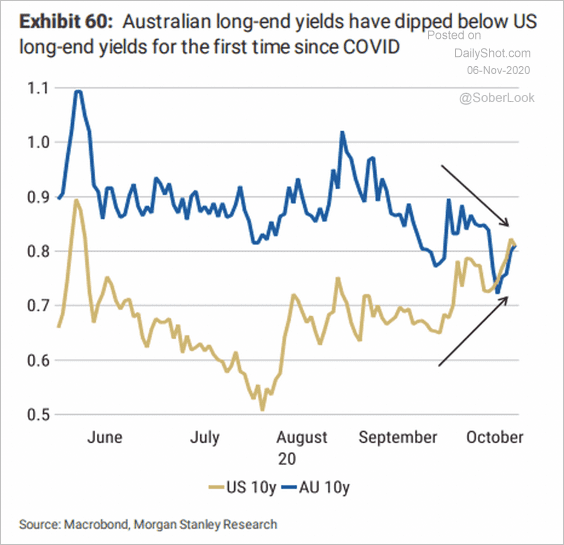

• The Australian 10-year yield has dipped below the 10-year Treasury.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

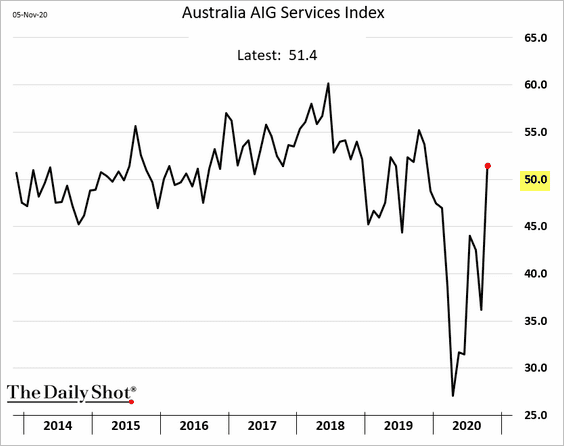

• Australia’s service sector activity is growing again.

Japan

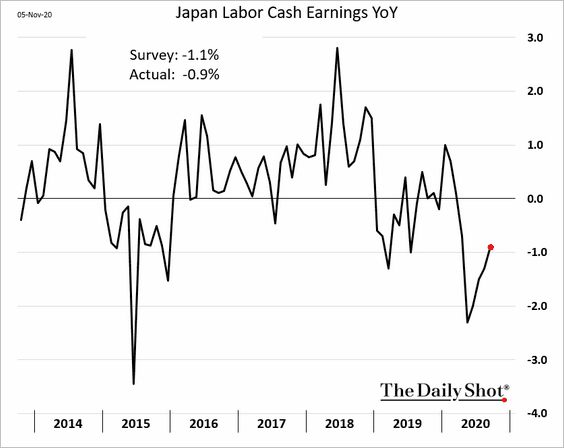

1. Wages are gradually recovering.

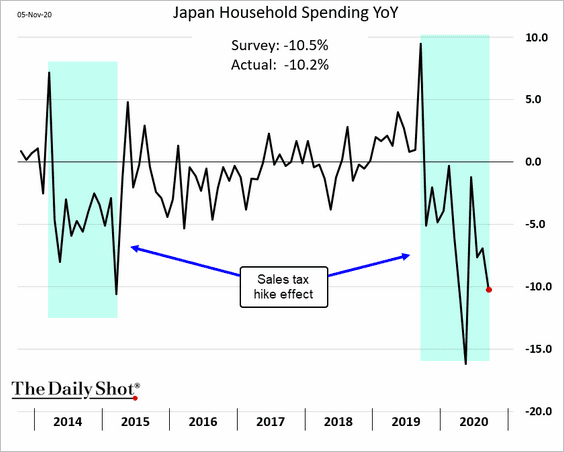

2. Household spending has been soft (but there are some base effects from last year’s sales tax hike).

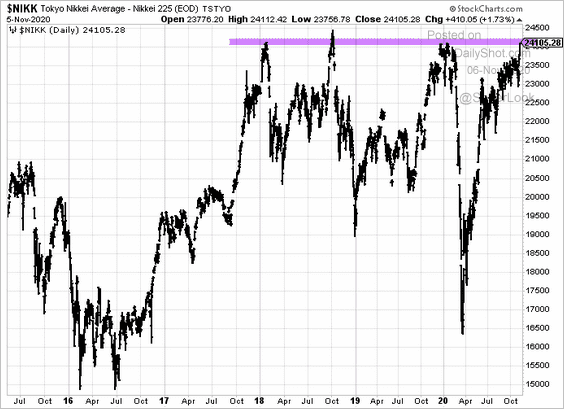

3. The Nikkei 225 is at resistance.

The Eurozone

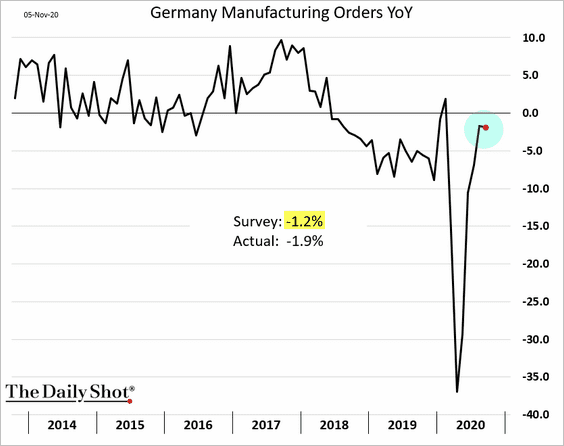

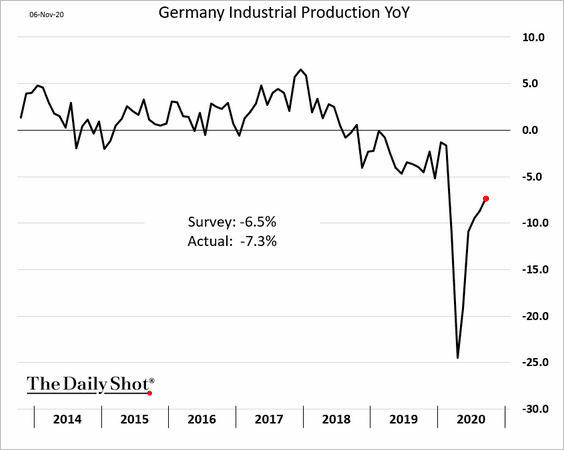

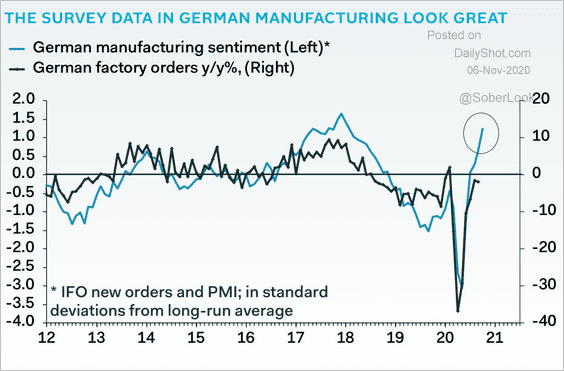

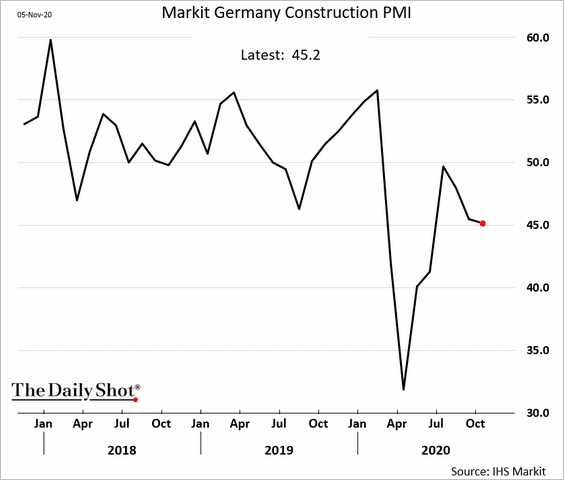

1. The September figures for German factory orders and industrial production were disappointing. The rebound is losing momentum.

However, manufacturing sentiment points to further gains in Germany’s industrial sector.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Construction activity remains sluggish.

——————–

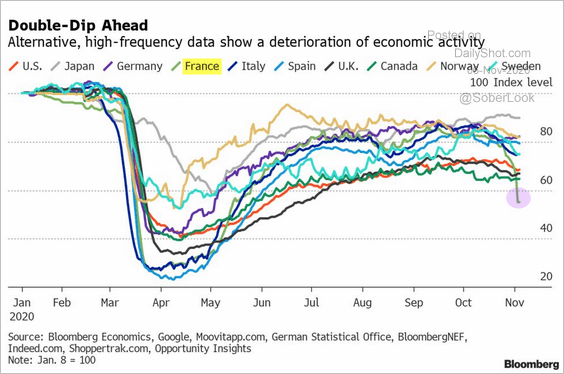

3. High-frequency data show a sharp deterioration in French economic activity.

Source: @markets Read full article

Source: @markets Read full article

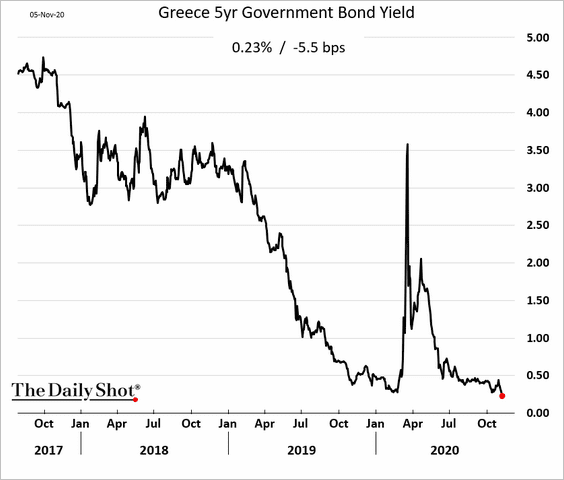

4. The 5yr Greek government bond yield hit a new low.

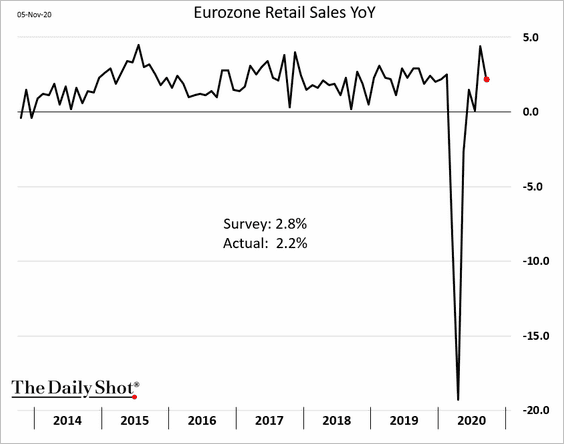

5. Retail sales at the Eurozone level pulled back in September.

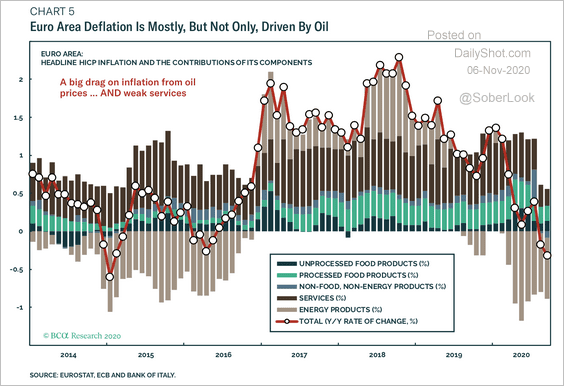

6. Lower oil prices and weakness in the service sector continues to weigh on euro-area headline inflation.

Source: BCA Research

Source: BCA Research

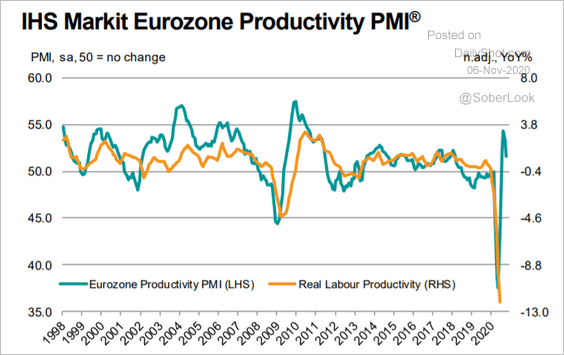

7. Eurozone productivity remains elevated due to reduced worker hours.

Source: IHS Markit Read full article

Source: IHS Markit Read full article

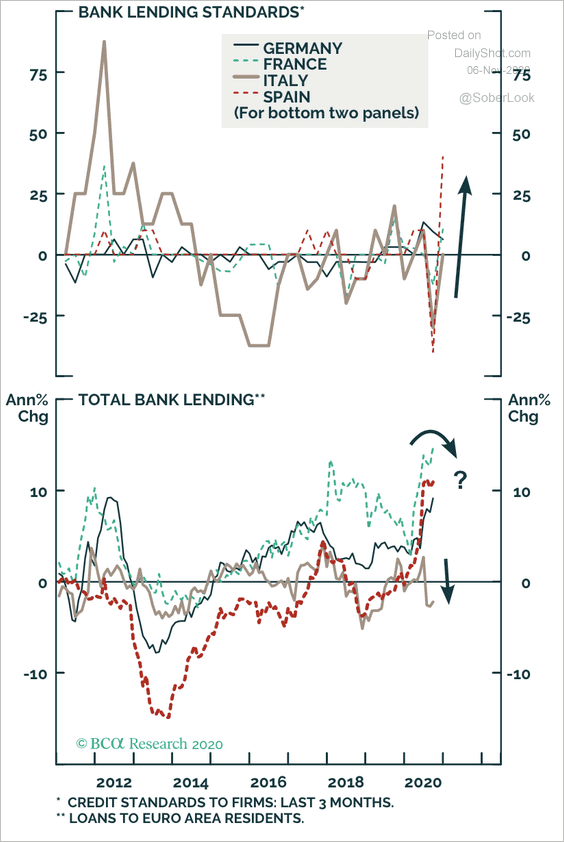

8. European banks have tightened lending standards.

Source: BCA Research

Source: BCA Research

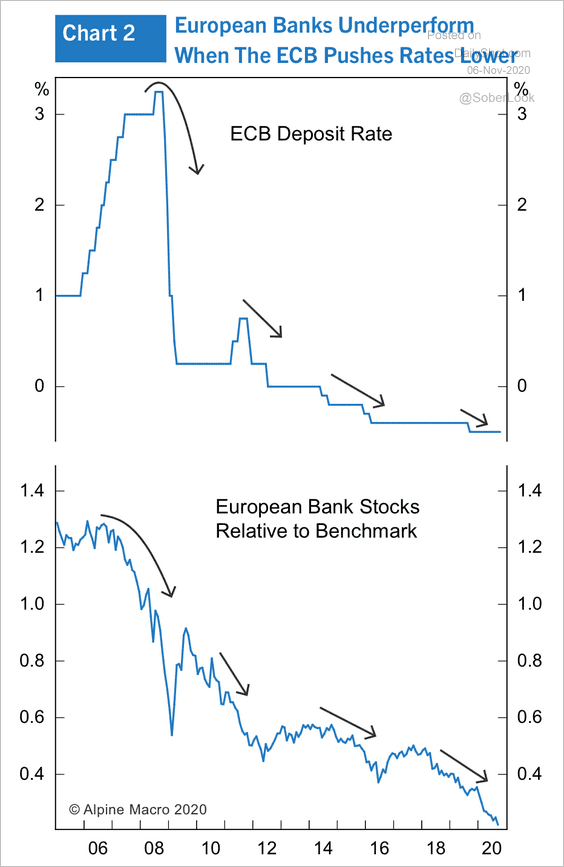

9. Low rates have squeezed bank net-interest margins, contributing to more than a decade of underperformance. Is the bottom in?

Source: Alpine Macro

Source: Alpine Macro

Europe

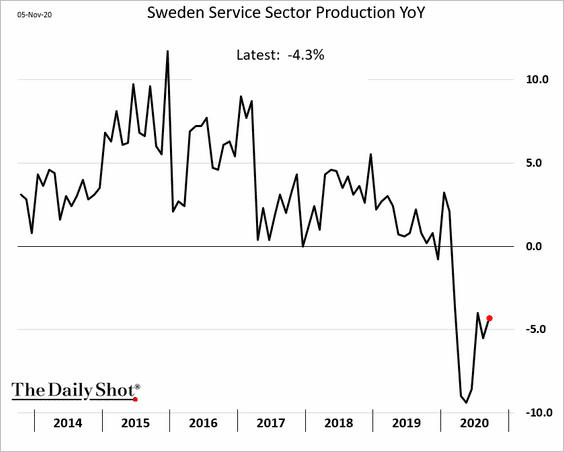

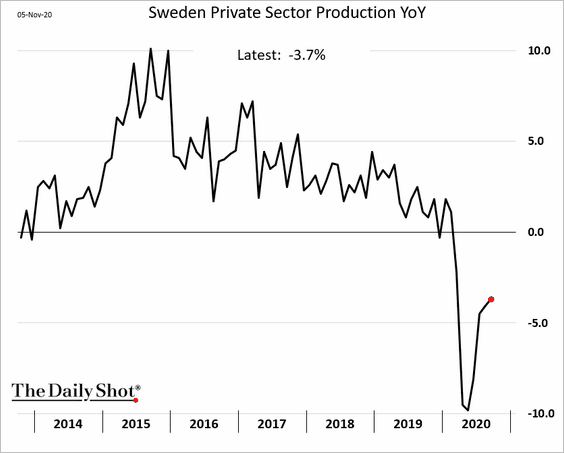

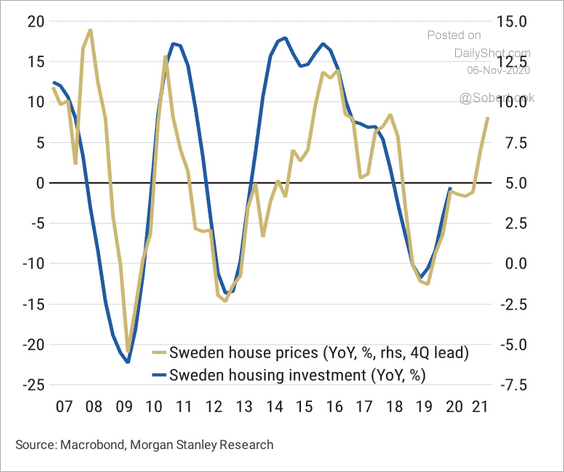

1. Let’s begin with Sweden.

• Service-sector output:

• Industrial production:

• Rising house prices should support continued investment.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

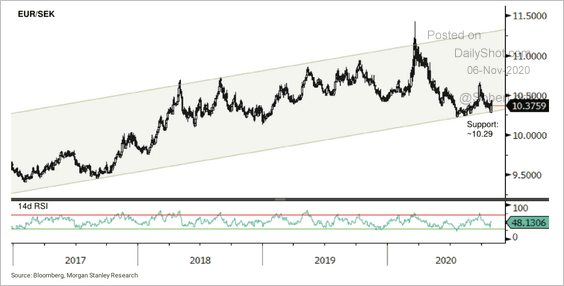

• EUR/SEK is at long-term support.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

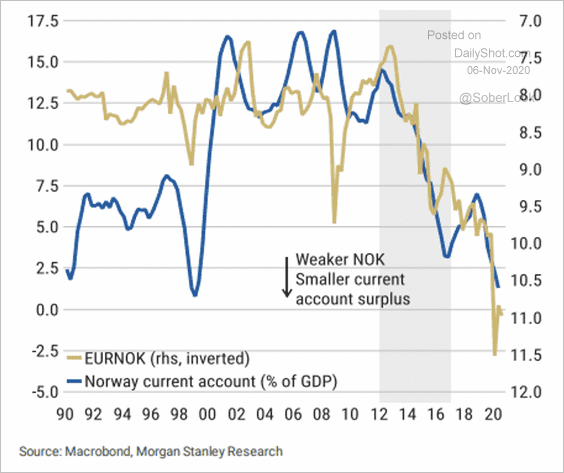

2. Norway’s current account surplus is correlated with the strength of the krone.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

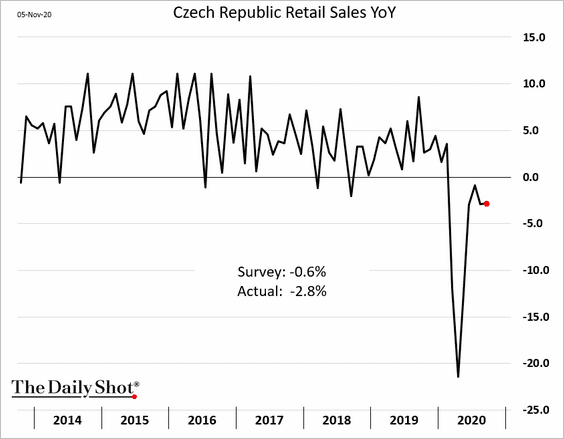

3. Czech September retail sales were disappointing as the rebound stalls.

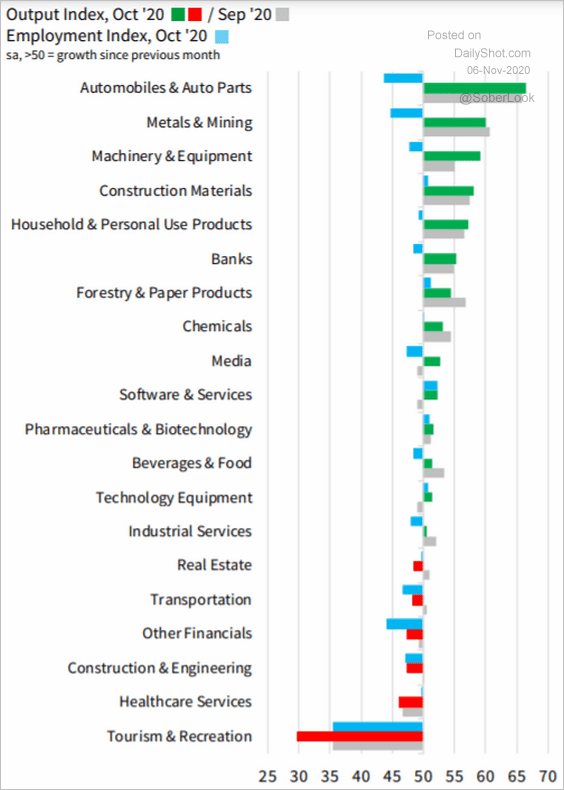

4. This chart shows business activity by sector (October vs. September).

Source: IHS Markit Read full article

Source: IHS Markit Read full article

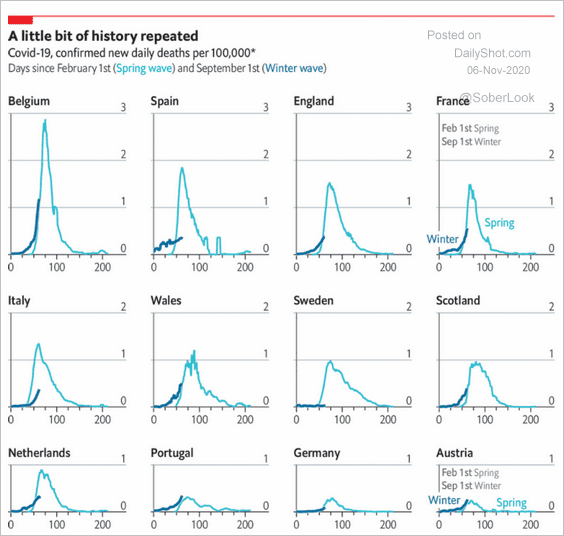

5. Here is a comparison of COVID fatalities relative to the Spring wave.

Source: The Economist Read full article

Source: The Economist Read full article

The United Kingdom

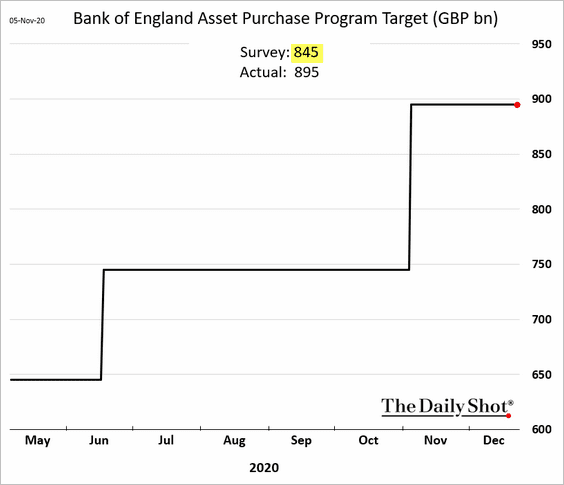

1. The BoE raised its QE target.

Source: CNBC Read full article

Source: CNBC Read full article

The increase was larger than expected.

The central bank is once again struggling with leaks.

Source: @business Read full article

Source: @business Read full article

——————–

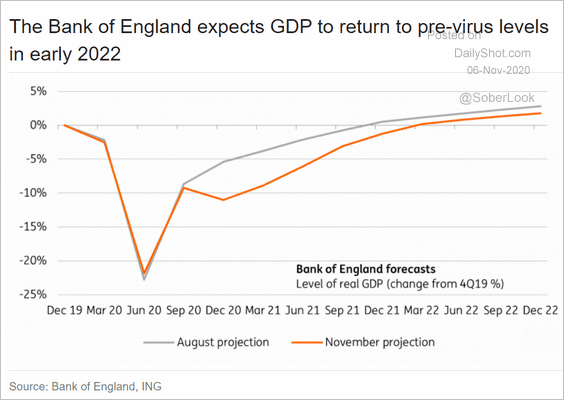

2. The BoE is now projecting a double-dip recession.

Source: ING

Source: ING

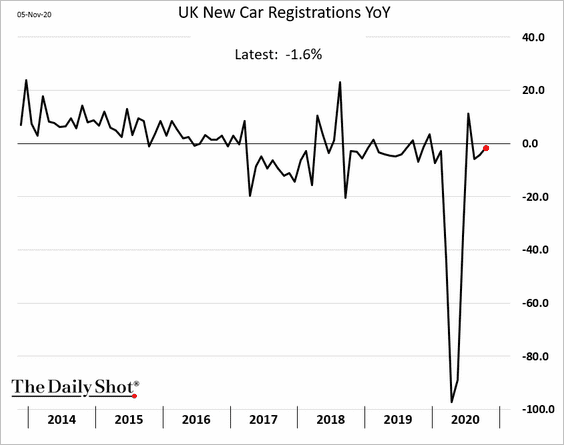

3. New car registrations ticked higher.

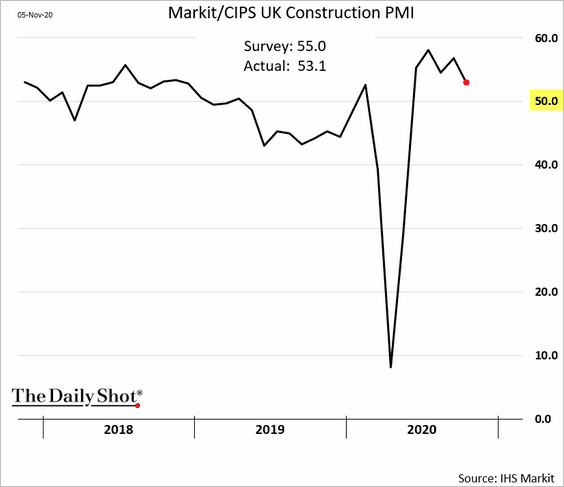

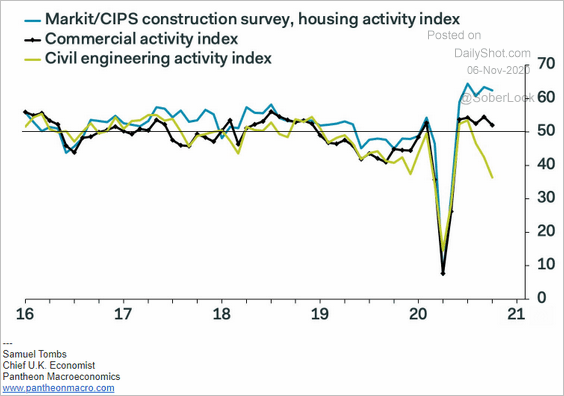

4. Construction activity is losing momentum.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The United States

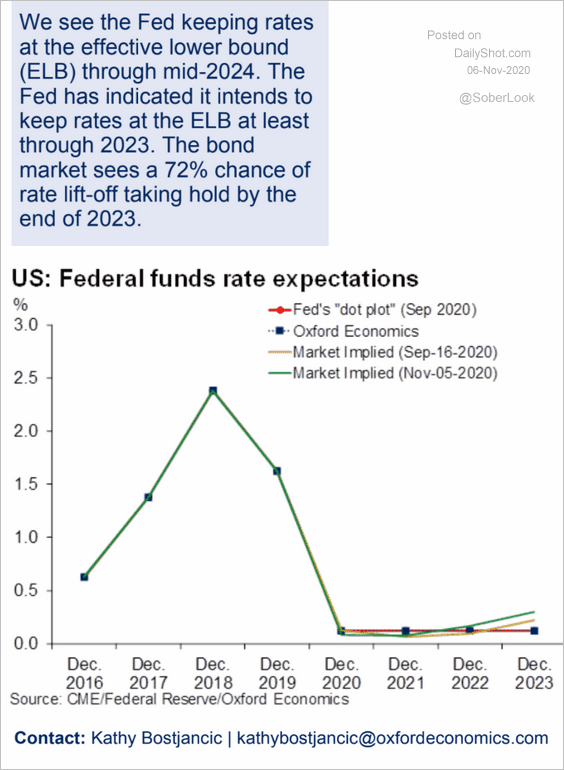

1. The Fed left its policy unchanged for now, but the central bank continues to call for more fiscal stimulus. The year-end income cliff is a key concern.

Source: Newsweek Read full article

Source: Newsweek Read full article

Economists expect the fed funds rate to remain near zero for another three years.

Source: Oxford Economics

Source: Oxford Economics

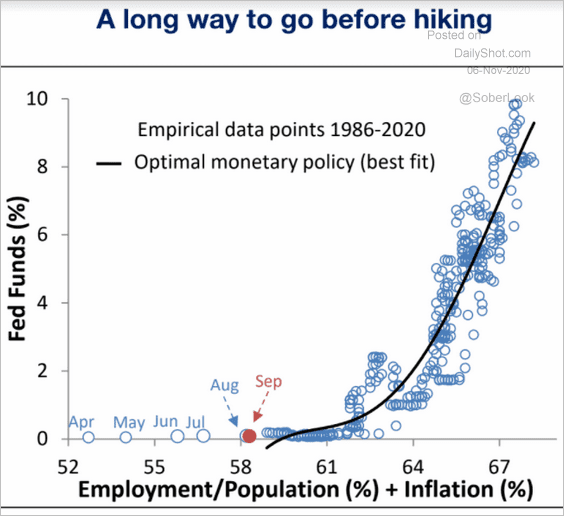

Historical data suggest that zero rates are appropriate in the current environment.

Source: Piper Sandler

Source: Piper Sandler

——————–

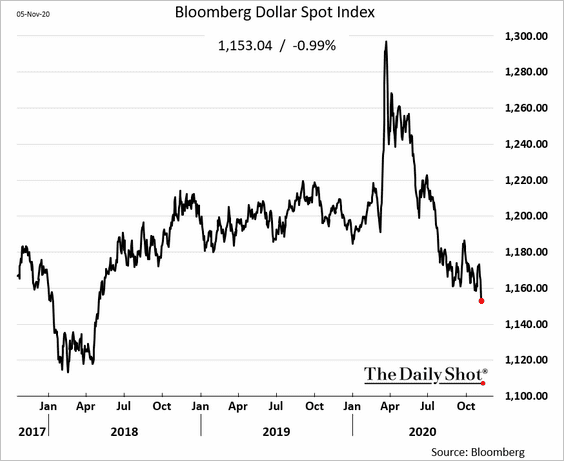

2. The US dollar hit the lowest level since early 2018. The dollar weakness is boosting commodities, stocks, and emerging markets.

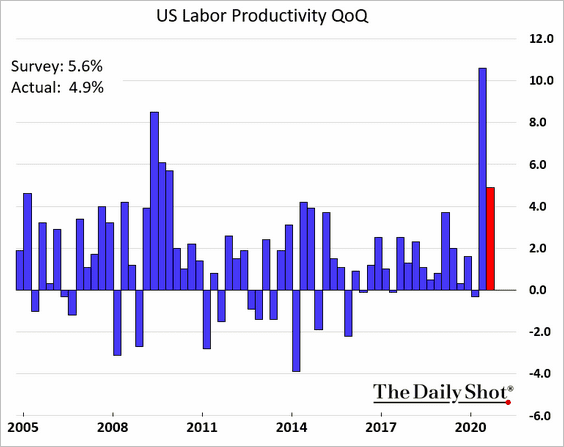

3. Labor productivity growth remains elevated due to reduced employee hours.

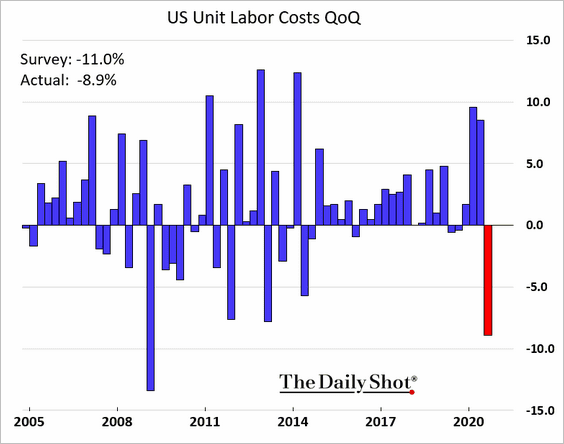

Unit labor costs declined sharply last quarter.

——————–

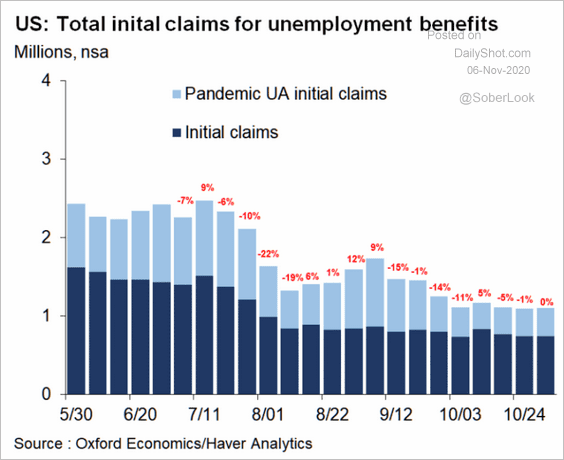

4. Next, we have some updates on the labor market.

• Initial claims are holding above one million per week.

Source: Oxford Economics

Source: Oxford Economics

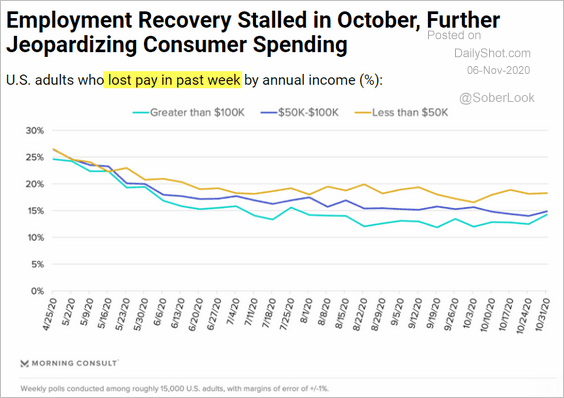

• The percentage of Americans who lost pay in the past week has leveled off at 15-18%

Source: Morning Consult

Source: Morning Consult

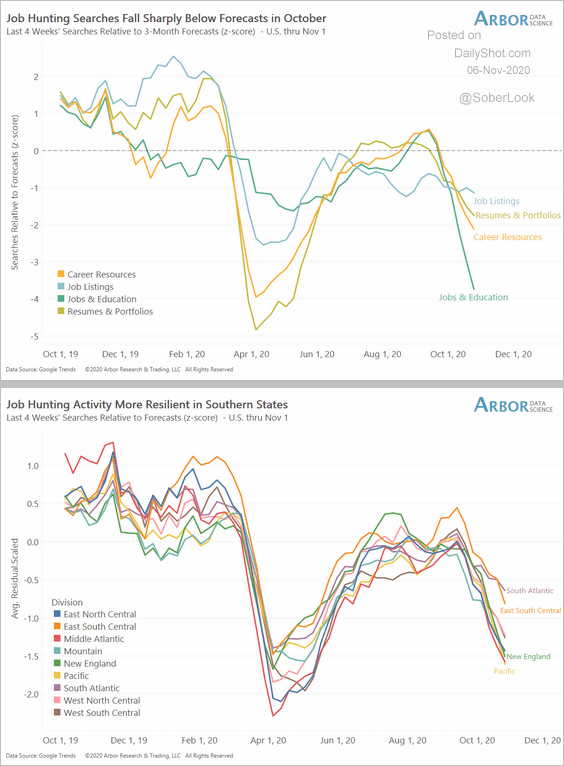

• Job hunting search activity declined sharply last month.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

Food for Thought

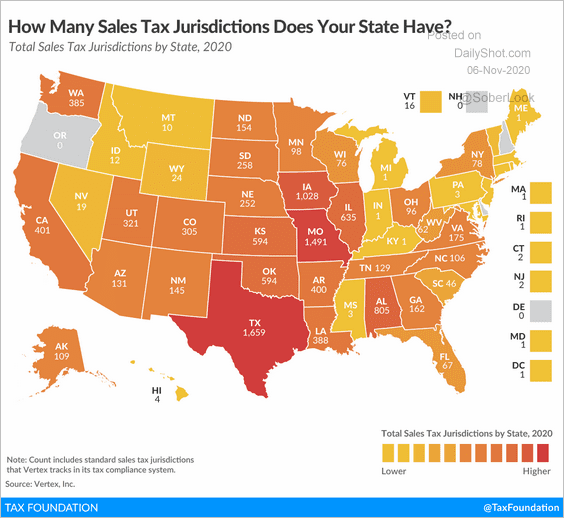

1. The number of sales tax jurisdictions by state:

Source: @TaxFoundation Read full article

Source: @TaxFoundation Read full article

2. The global semiconductor industry:

![]() Source: @bpolitics Read full article

Source: @bpolitics Read full article

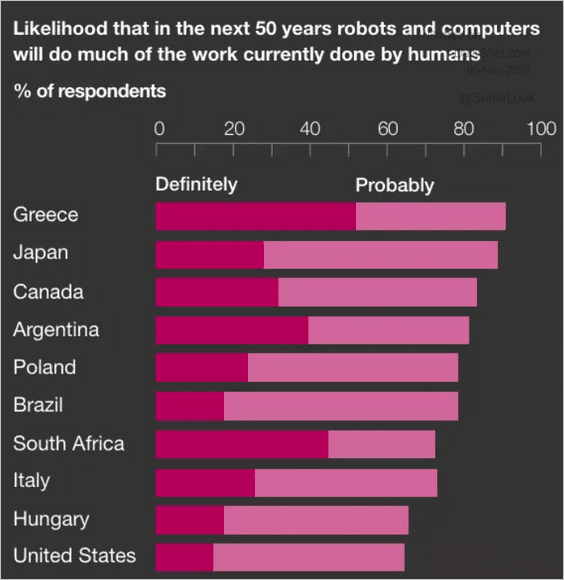

3. Concerns about robots replacing humans:

Source: WEF Read full article

Source: WEF Read full article

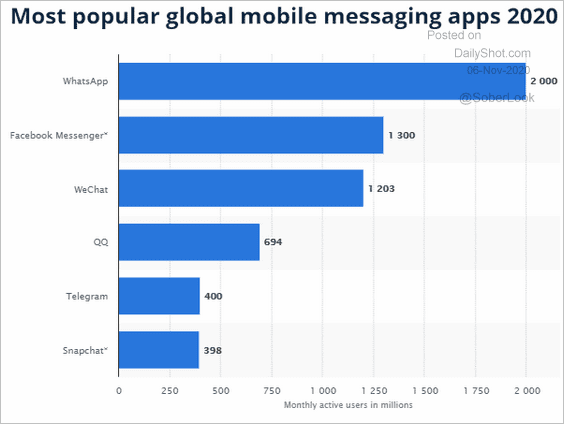

4. Most popular messaging apps:

Source: Statista

Source: Statista

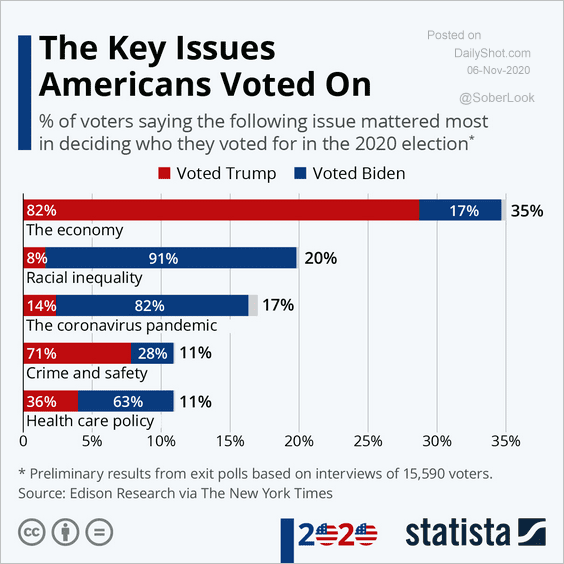

5. Key issues in the 2020 elections:

Source: Statista

Source: Statista

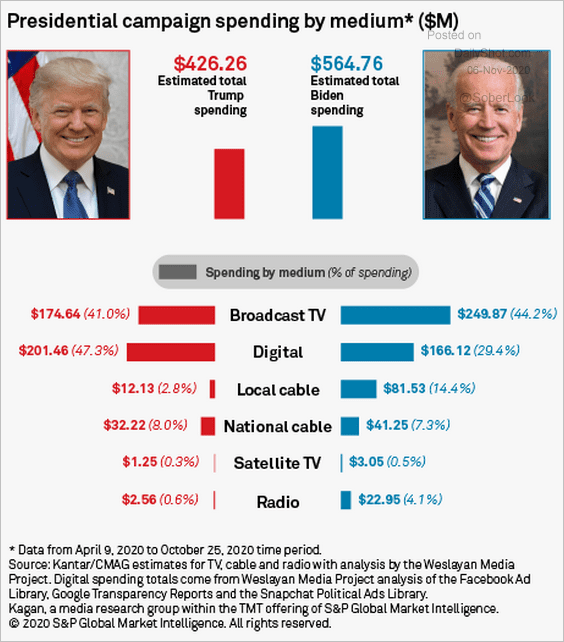

6. Campaign spending data:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

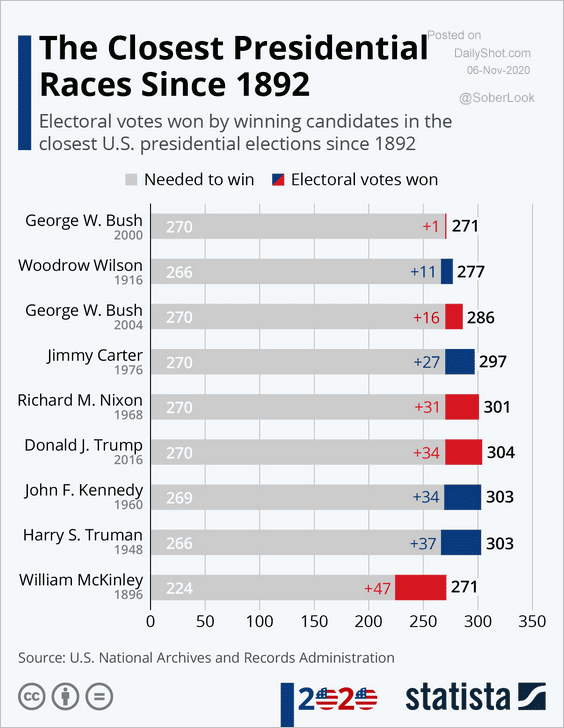

7. Closest presidential elections:

Source: Statista

Source: Statista

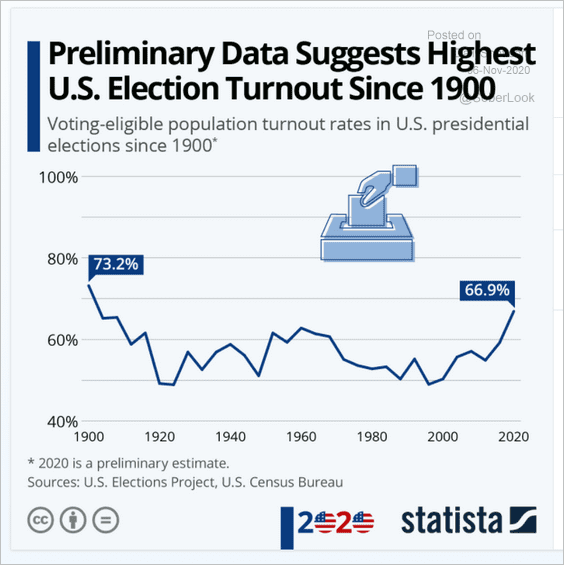

8. US election turnouts since 1900:

Source: Statista

Source: Statista

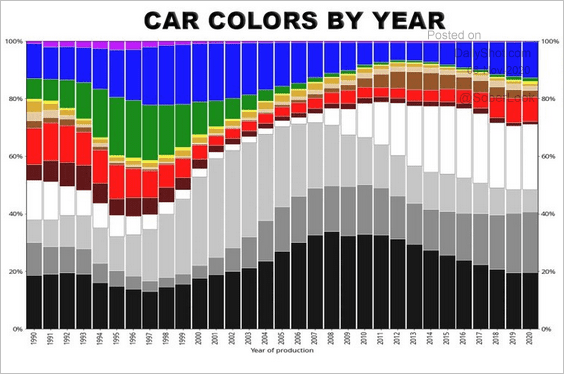

9. The distribution of new car colors by year:

Source: @jokull Read full article

Source: @jokull Read full article

——————–

Have a great weekend!