The Daily Shot: 05-Jan-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

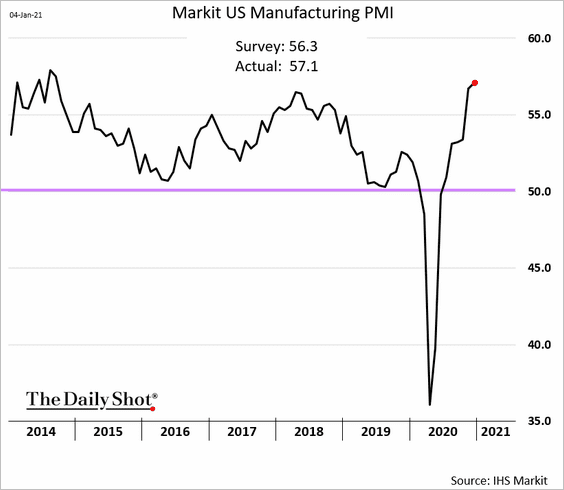

1. The updated December manufacturing PMI (from Markit) shows faster growth in the nation’s factory activity.

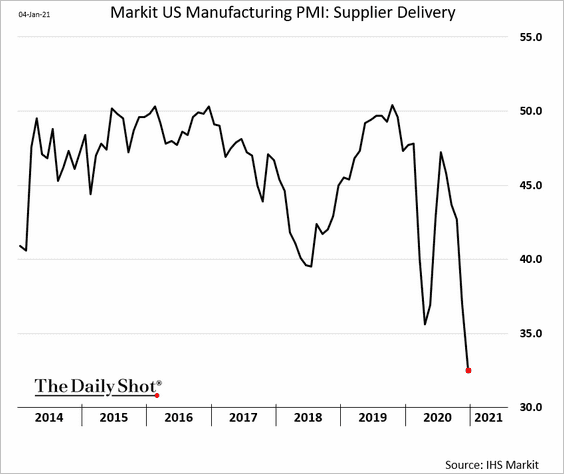

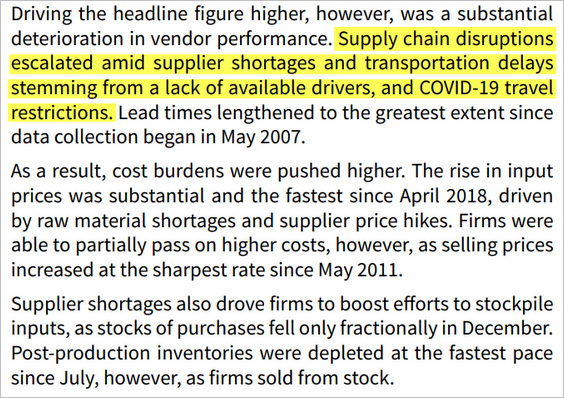

However, the report points to rising supply bottlenecks as the pandemic worsened.

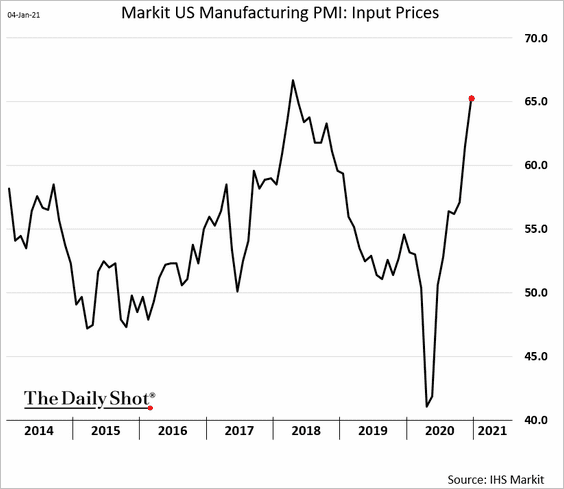

As a result, manufacturers’ cost increases have accelerated.

Here is a comment from Markit.

Source: IHS Markit

Source: IHS Markit

——————–

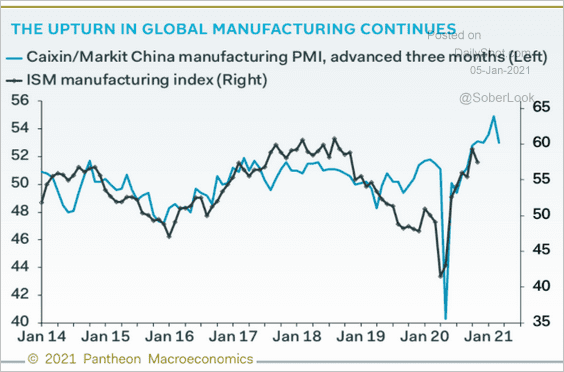

2. China’s manufacturing strength suggests that US factory activity may see further improvements in the months ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

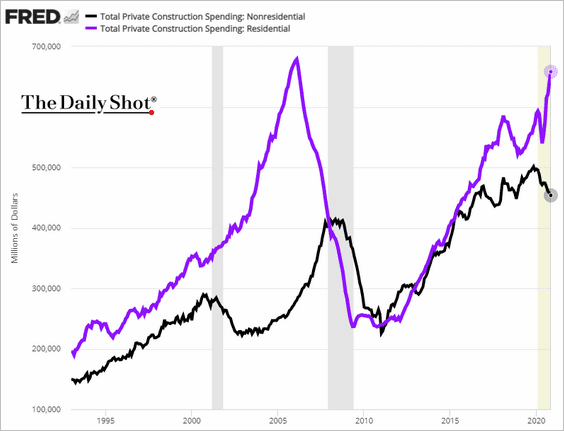

3. The gap between residential and nonresidential construction spending continues to widen (a shift from office buildings and retail establishments to home-offices and online purchasing).

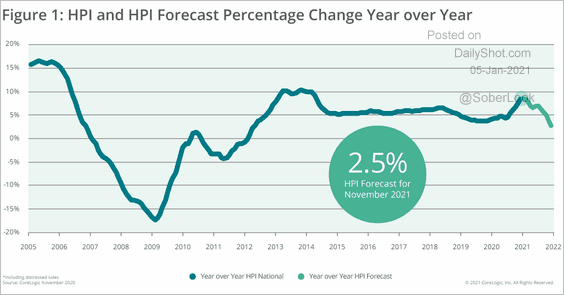

4. CoreLogic expects home price appreciation to slow later this year.

Source: CoreLogic

Source: CoreLogic

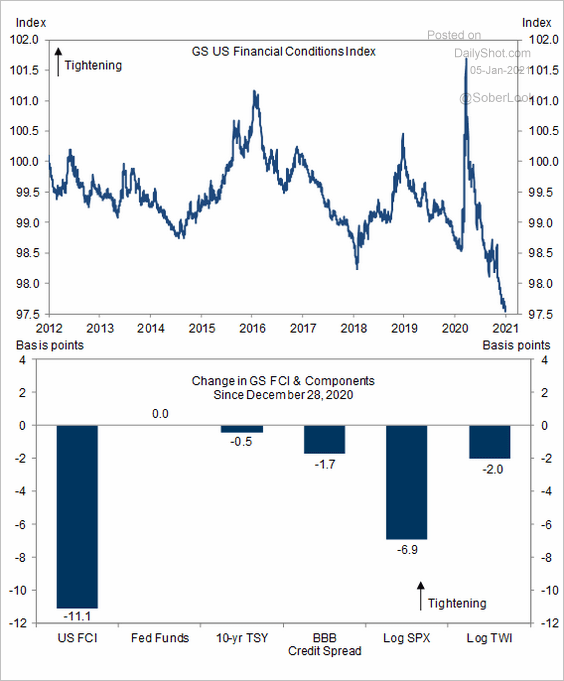

5. Goldman’s financial conditions index hit the lowest (most accommodative) level on record. The stock market, the dollar weakness, and tighter credit spreads have been the key drivers of this easing trend.

Source: Goldman Sachs

Source: Goldman Sachs

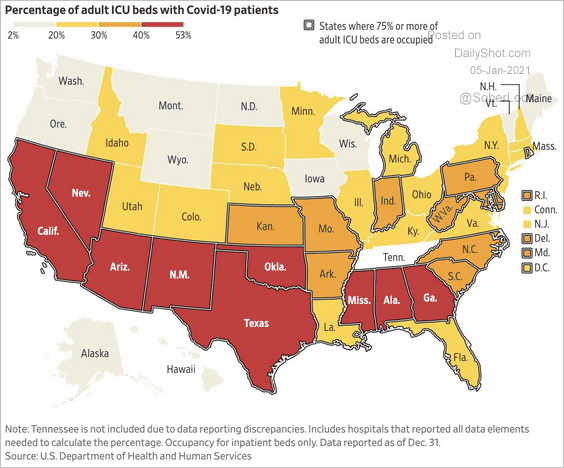

6. The pandemic has overwhelmed ICUs across the Sun Belt region.

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

Back to Index

Canada

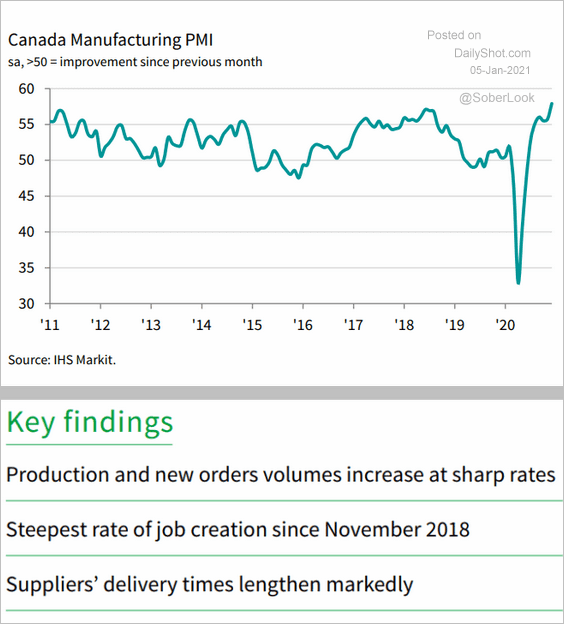

1. The Markit Manufacturing PMI report was exceptionally strong as growth in factory activity accelerates.

Source: IHS Markit

Source: IHS Markit

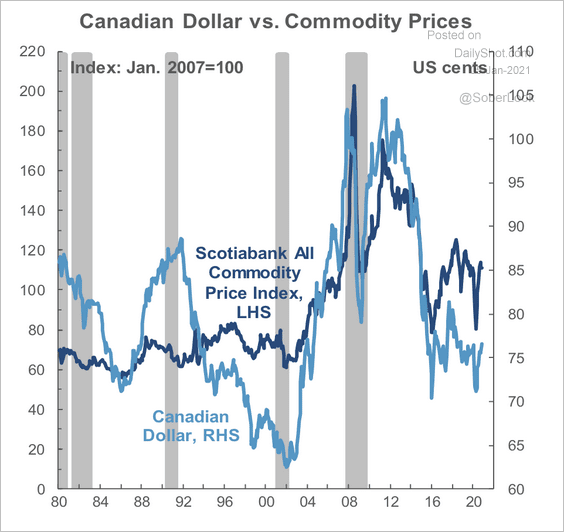

2. The Canadian dollar has lagged the recovery in commodity prices.

Source: Scotiabank Economics

Source: Scotiabank Economics

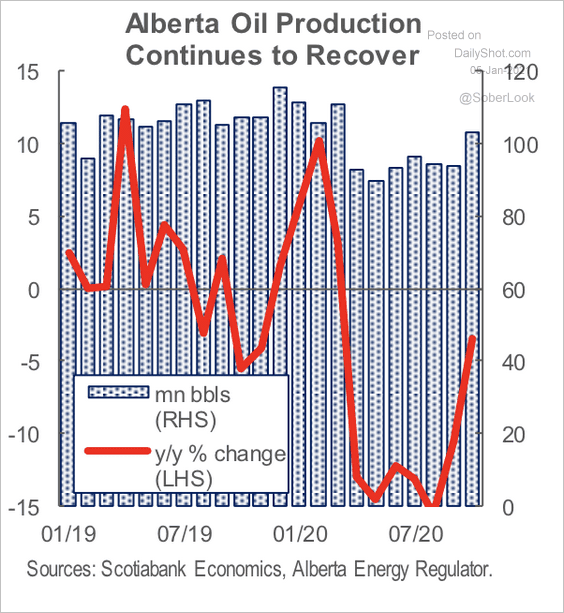

3. Oil production in Alberta is rebounding.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United Kingdom

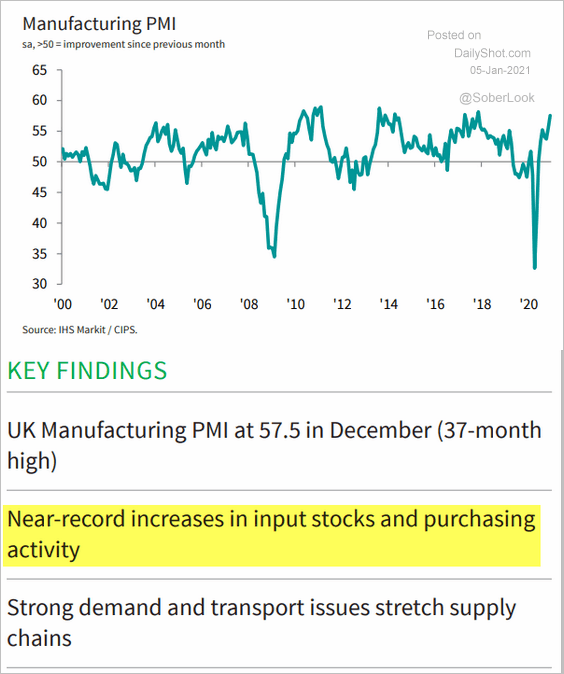

1. The nation’s manufacturing sector got a massive boost from Brexit planning in December.

Source: IHS Markit

Source: IHS Markit

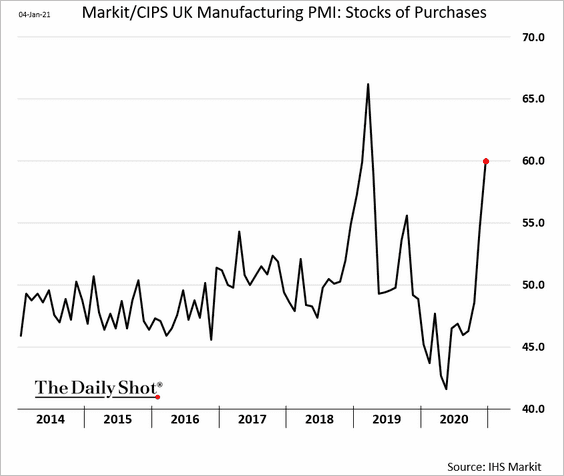

Inventory building accelerated, …

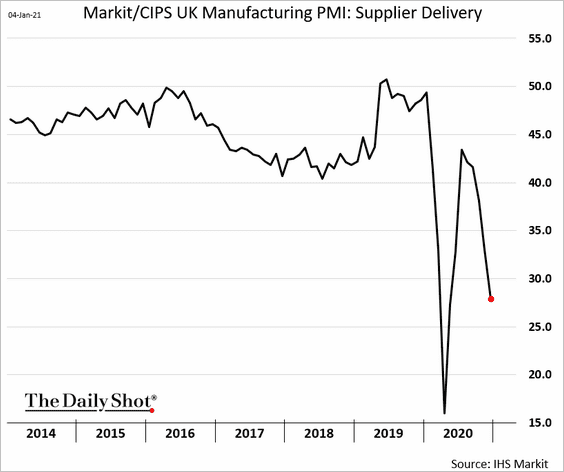

… while supply-chain disruptions worsened …

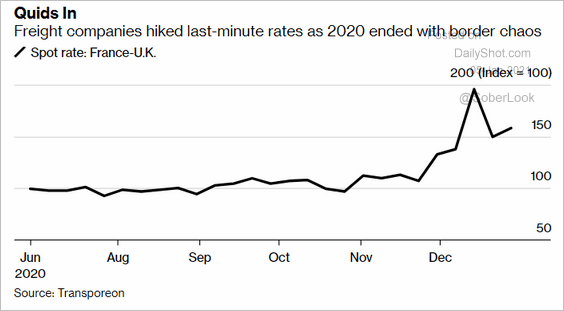

… and shipping costs spiked.

Source: @business Read full article

Source: @business Read full article

——————–

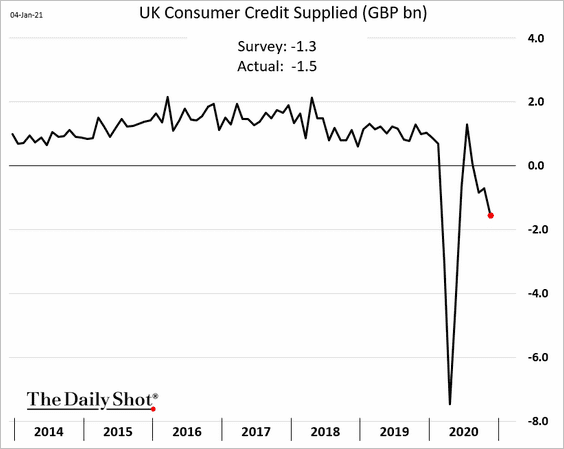

2. Britons are paying down their credit cards …

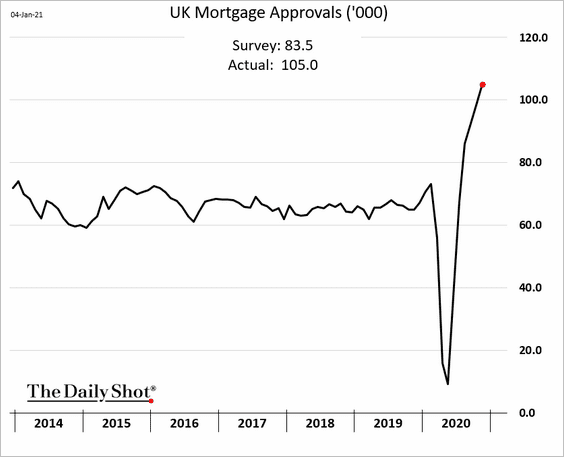

… and buying homes. Mortgage approvals hit the highest level in years.

Back to Index

The Eurozone

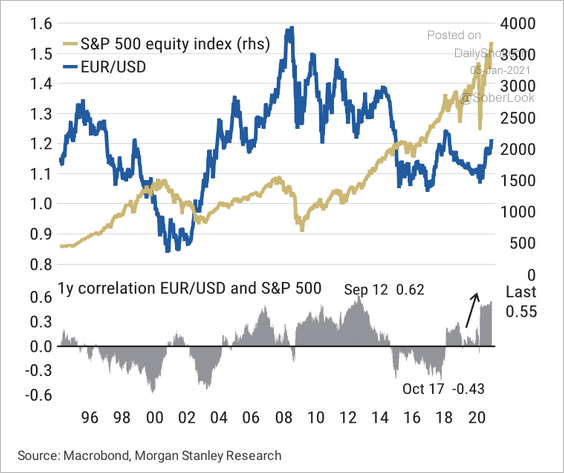

1. The euro’s correlation to the S&P 500 strengthened last year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

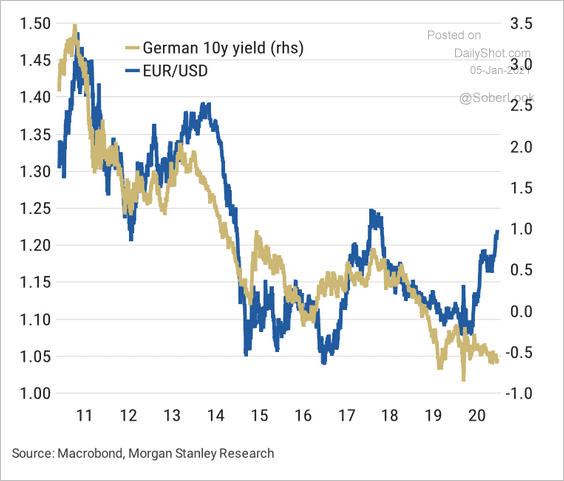

2. EUR/USD is no longer tracking the 10-year Bund yield.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

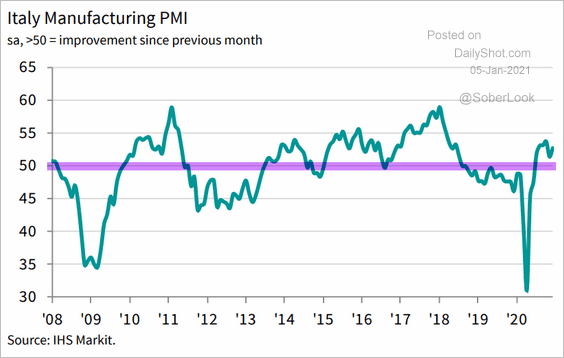

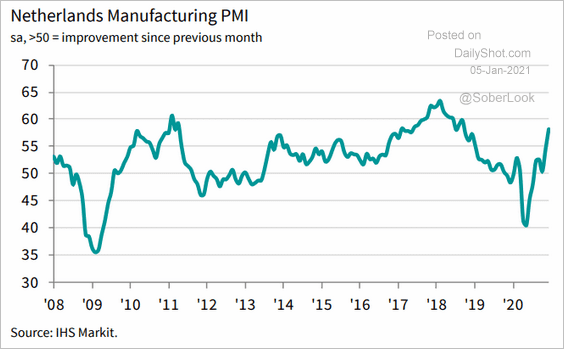

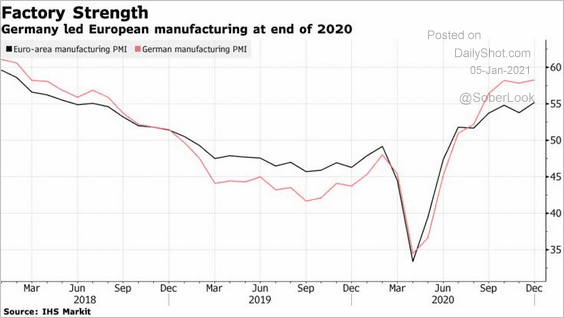

3. Manufacturing growth strengthened in December, led by Germany.

• Italy PMI:

Source: IHS Markit

Source: IHS Markit

• The Netherlands PMI:

Source: IHS Markit

Source: IHS Markit

• Germany vs. the Eurozone:

Source: @business Read full article

Source: @business Read full article

——————–

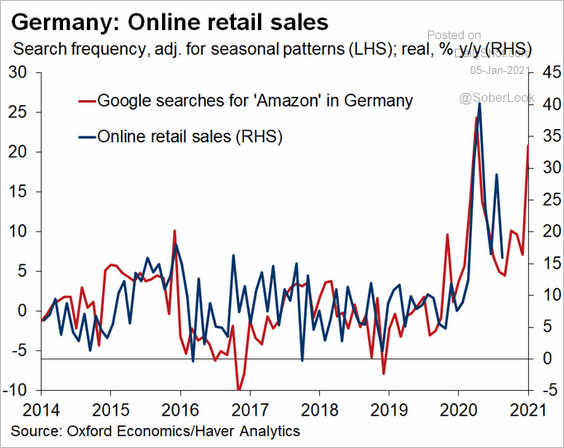

4. German online search activity points to further gains in online retail sales.

Source: @OliverRakau

Source: @OliverRakau

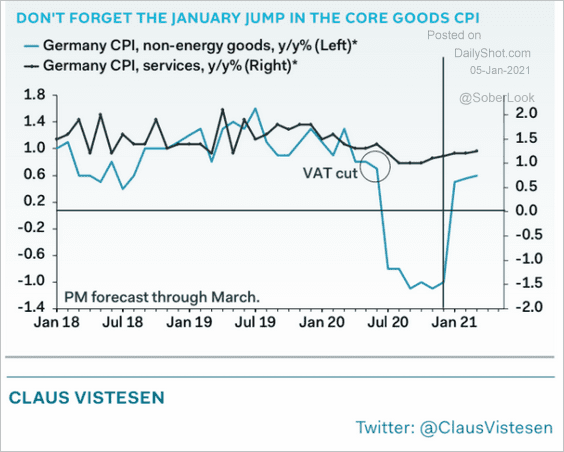

5. Germany’s VAT (sales tax) cut will be rolling off from the year-over-year price data, which will result in a CPI rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

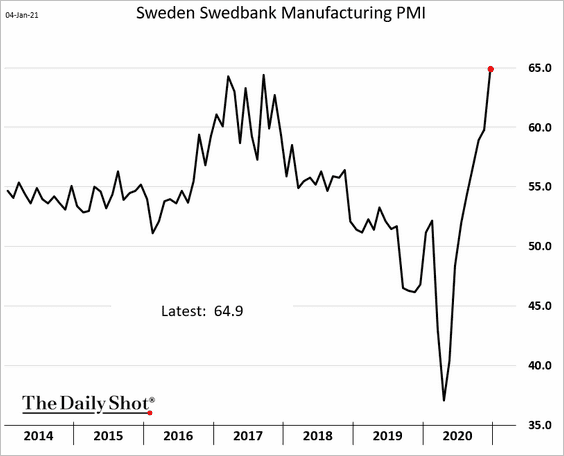

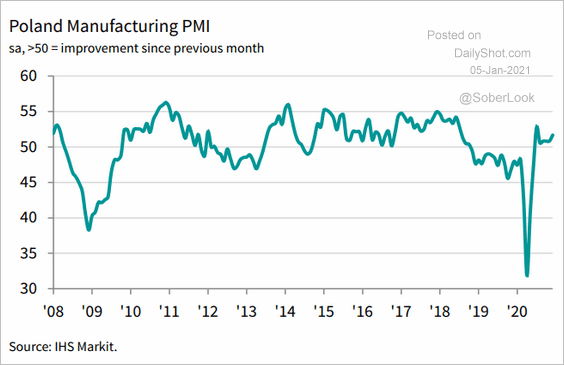

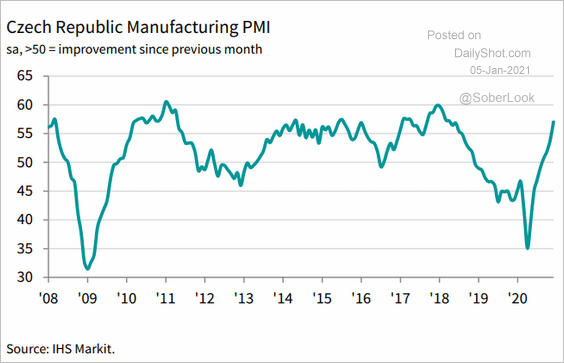

1. Sweden’s factory activity surged in December.

Central Europe also saw substantial improvements in manufacturing last month, especially in the Czech Republic.

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

Source: IHS Markit

——————–

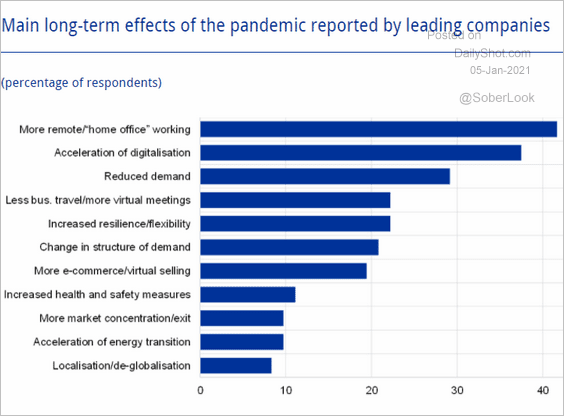

2. A survey of EU leading companies asked about the pandemic’s impact over the long-term.

Source: ECB Read full article

Source: ECB Read full article

The pandemic forced companies to …

Source: ECB Read full article

Source: ECB Read full article

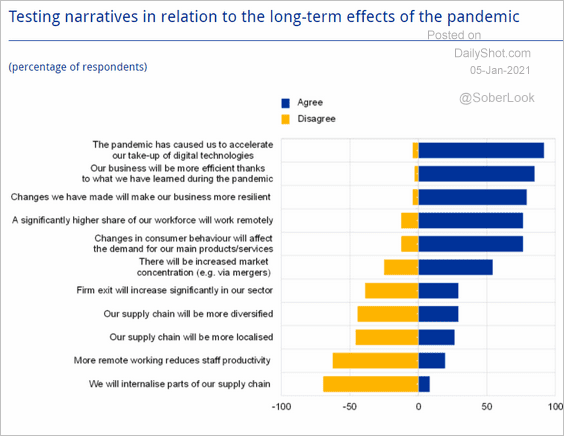

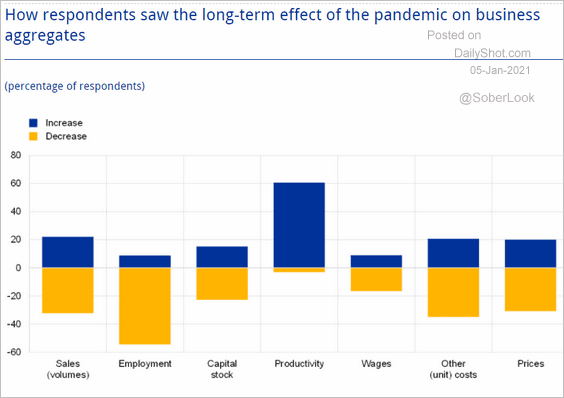

Corporations are betting on productivity improvements.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

Asia – Pacific

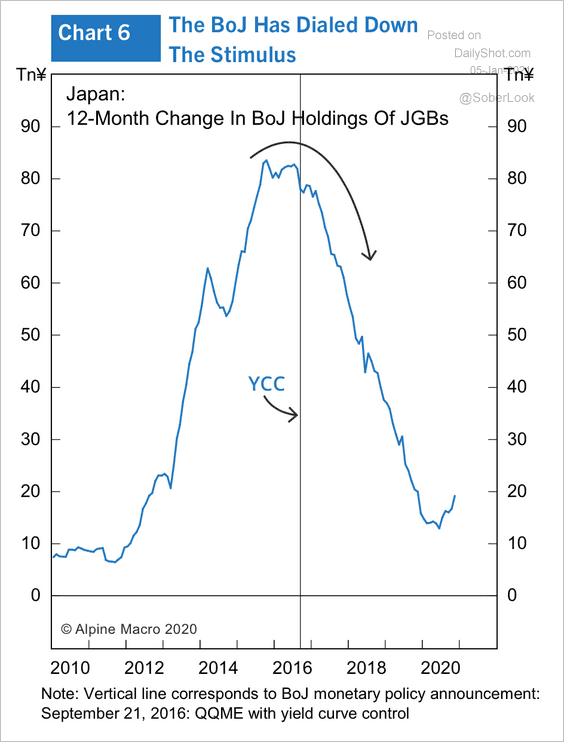

1. With the launch of its yield curve control (YCC) policy in 2016, the Bank of Japan dramatically slowed the pace of government bond purchases.

Source: Alpine Macro

Source: Alpine Macro

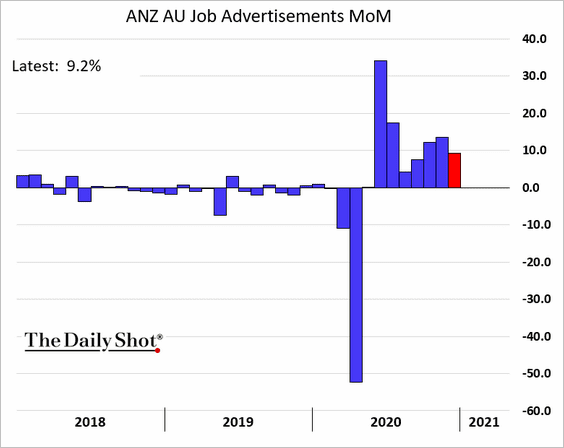

2. Job advertisements in Australia are growing at a rapid pace.

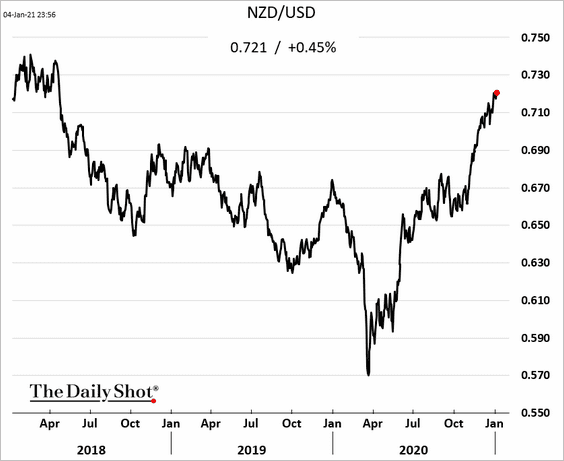

3. The Kiwi dollar hit the highest level since early 2018.

Back to Index

China

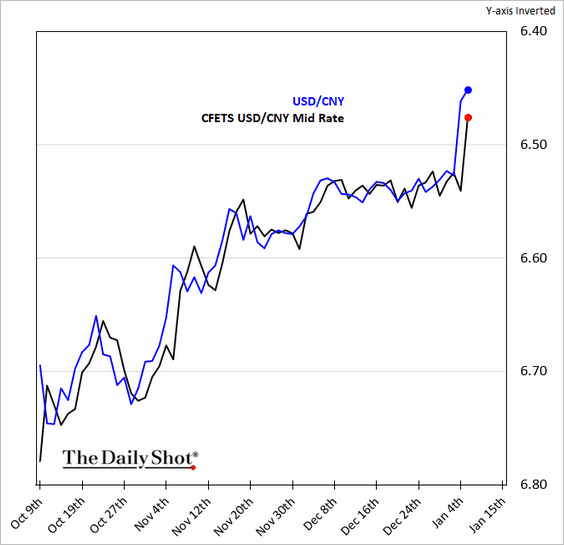

1. The renminbi is trading at a premium to the official mid-rate setting. The market is betting on further gains in China’s currency.

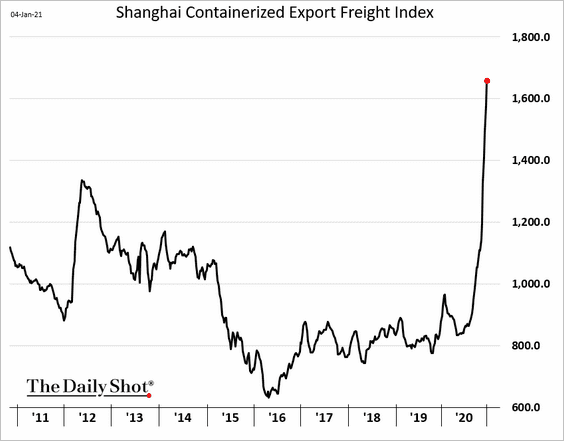

2. The freight index has gone vertical as export demand soars.

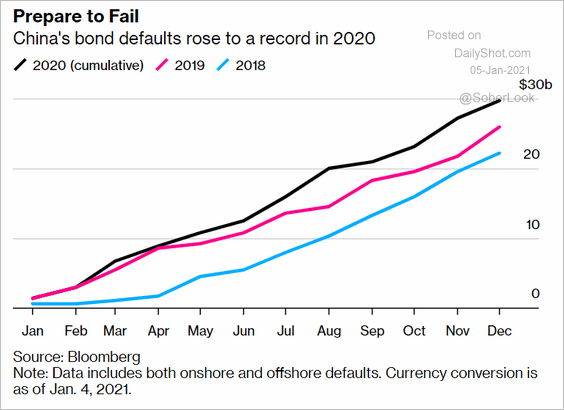

3. Bond defaults hit a record in 2020.

Source: @markets Read full article

Source: @markets Read full article

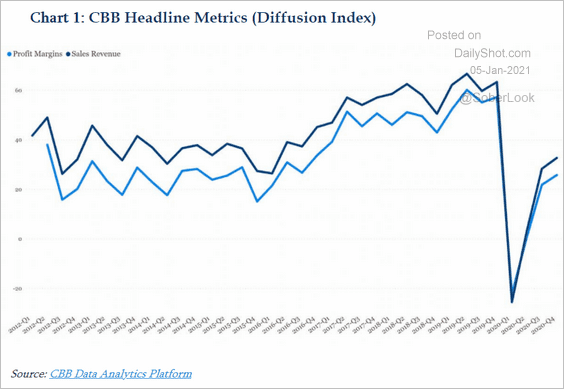

4. The Q4 China Beige Book report shows ongoing improvements in sales revenue and profit margins. However, we are not at pre-COVID levels yet.

Source: @ChinaBeigeBook

Source: @ChinaBeigeBook

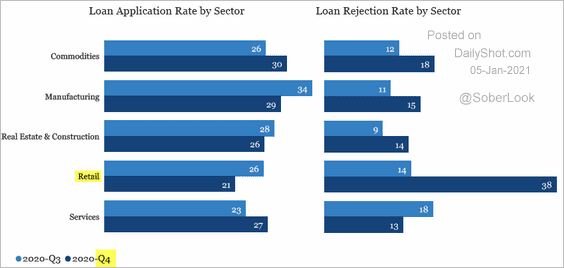

Separately, banks have ramped up their business loan application rejections in the retail sector.

Source: @ChinaBeigeBook

Source: @ChinaBeigeBook

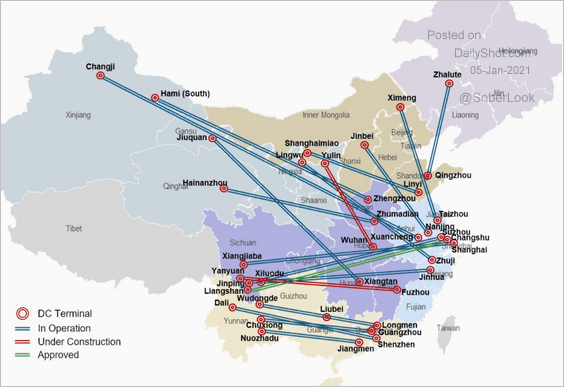

5. China has been building an advanced UHV (ultra-high voltage line) grid.

Source: @pretentiouswhat

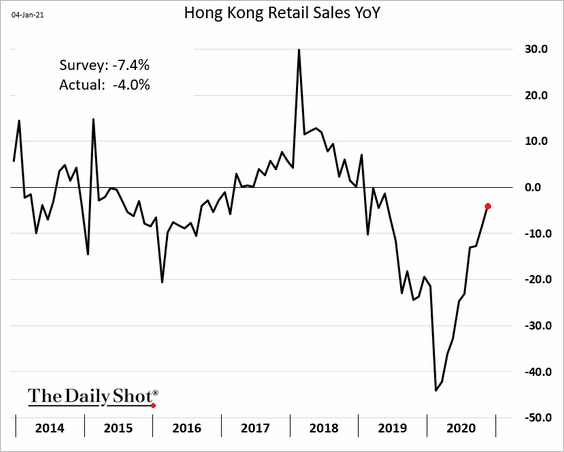

Source: @pretentiouswhat 6. Hong Kong’s retail sales continued to improve in November.

Back to Index

Emerging Markets

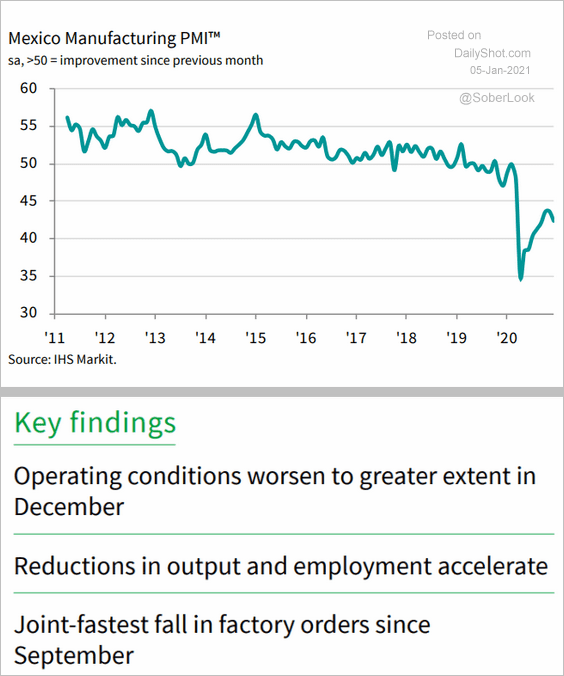

1. Let’s begin with Mexico.

• The nation’s manufacturing slump continues.

Source: IHS Markit

Source: IHS Markit

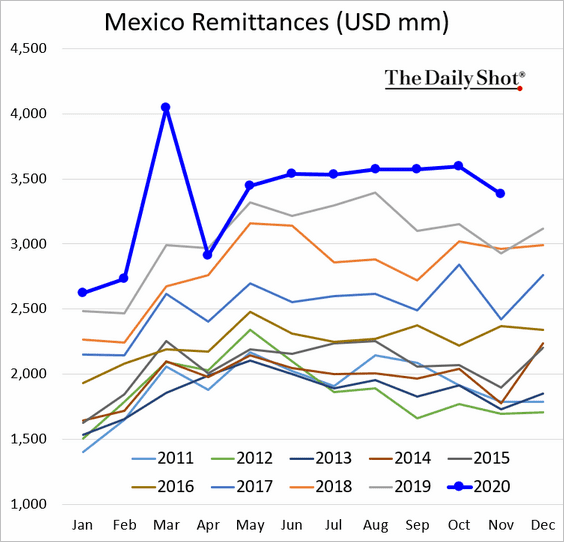

• Remittances remain robust.

——————–

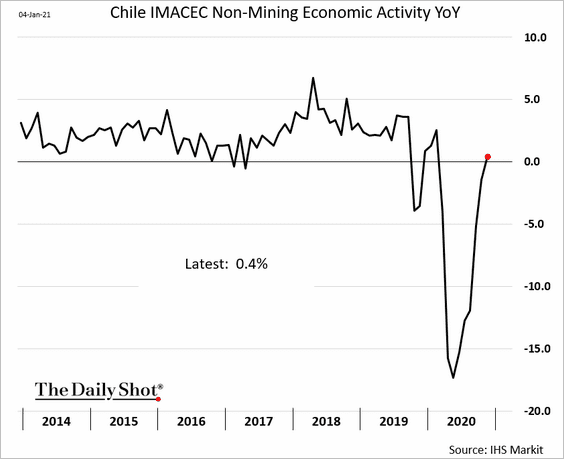

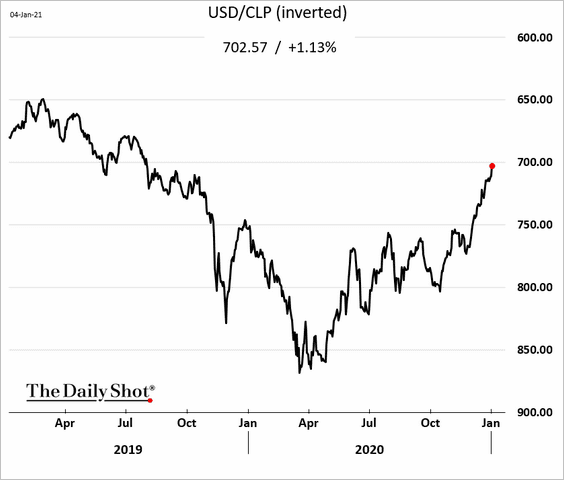

2. Chile’s economic activity has recovered.

The Chilean peso continues to rally.

——————–

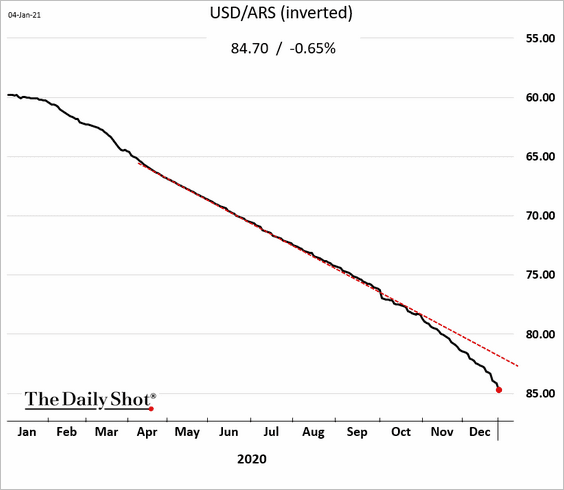

3. Argentina is accelerating the peso’s devaluation.

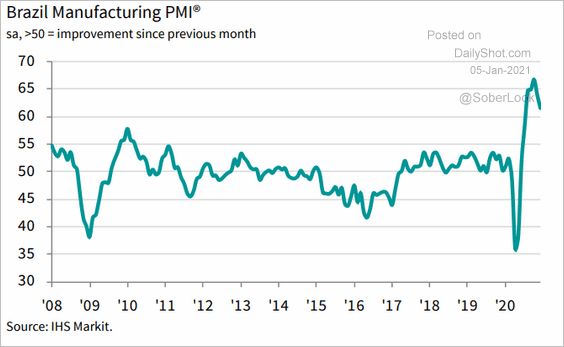

4. Brazil’s factory activity has been expanding at a rapid pace.

Source: IHS Markit

Source: IHS Markit

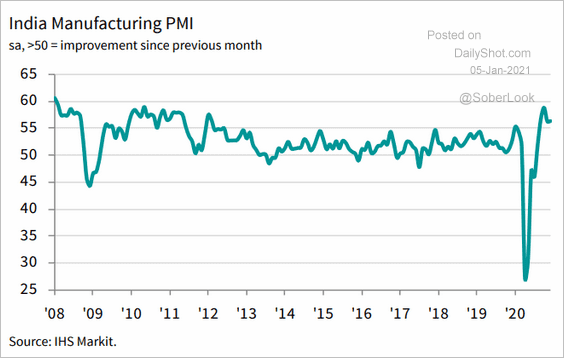

5. India’s manufacturing sector is also in growth mode.

Source: IHS Markit

Source: IHS Markit

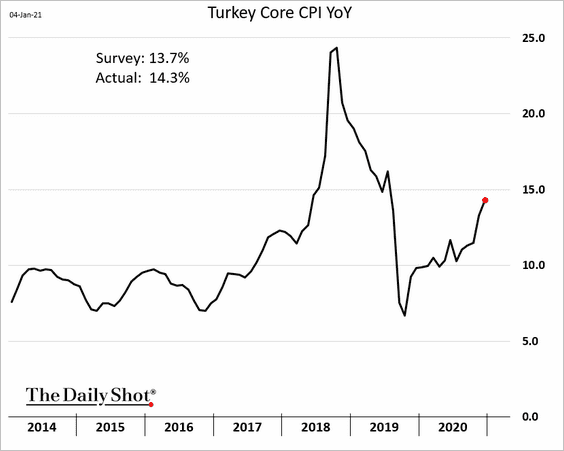

6. Turkey’s inflation is rising as the weak lira pushes prices higher.

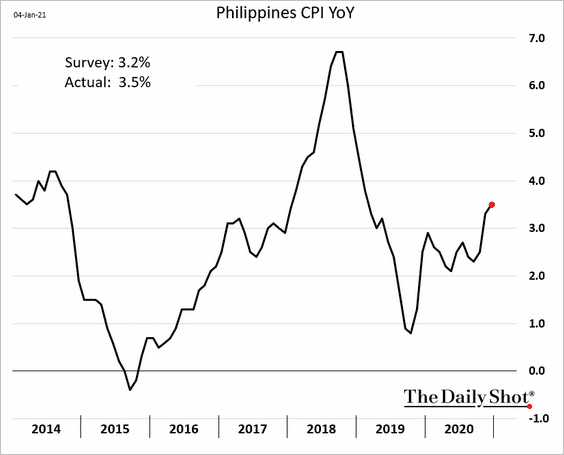

7. Inflation in the Philippines surprised to the upside.

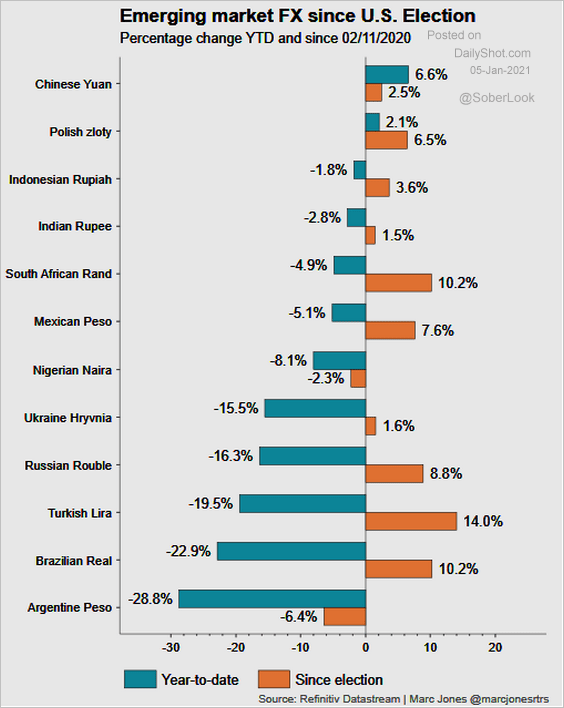

8. How did EM currencies perform since the US 2020 elections?

Source: Reuters Read full article

Source: Reuters Read full article

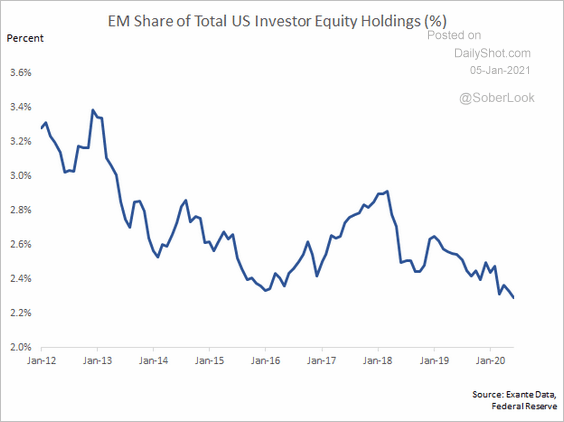

9. Emerging markets are less reliant on US investors.

Source: @adam_tooze, @jnordvig Read full article

Source: @adam_tooze, @jnordvig Read full article

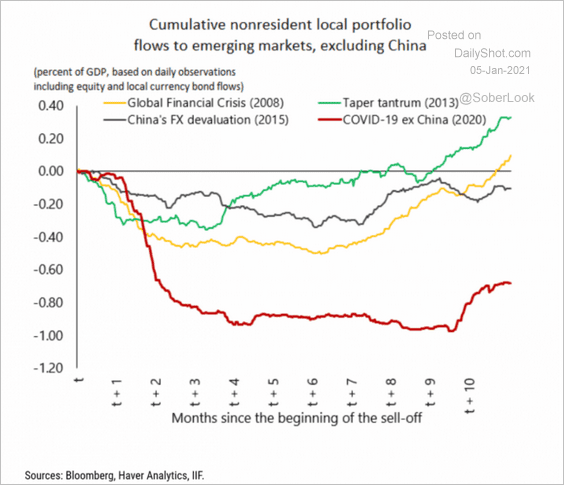

10. Investor retreat from EM has been more severe during the COVID crisis than in past downturns.

Source: IMF Read full article

Source: IMF Read full article

Back to Index

Cryptocurrency

1. Bitcoin’s total market cap has more than doubled in just a couple of months to nearly $900 billion.

Source: CoinMarketCap

Source: CoinMarketCap

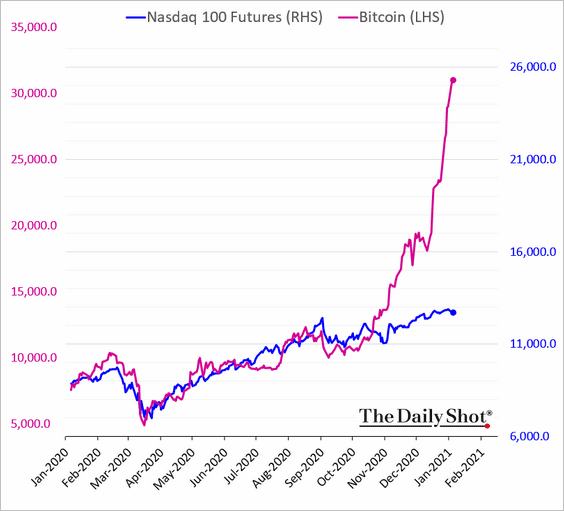

2. Up until November, Bitcoin was correlated with US equities. And then …

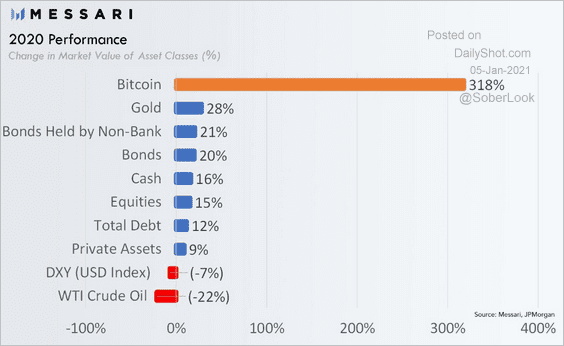

3. Here is Bitcoin’s performance relative to other assets last year.

Source: @asiahodl

Source: @asiahodl

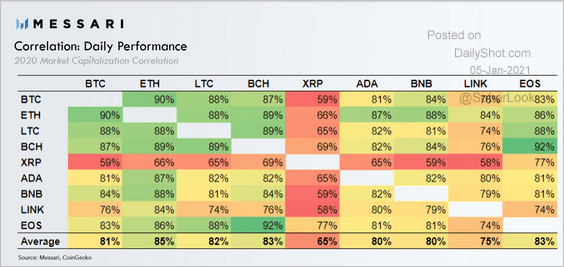

4. With the exception of XRP, daily percent changes across cryptocurrencies were highly correlated last year.

Source: @asiahodl

Source: @asiahodl

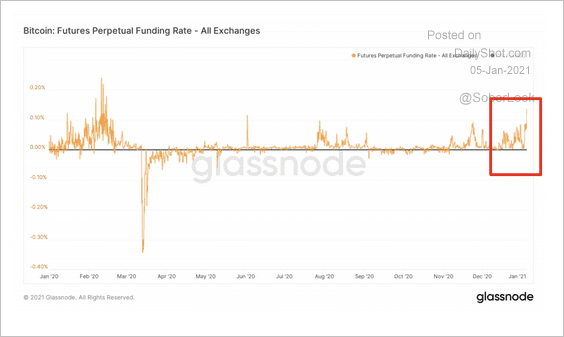

5. Funding rates have climbed on Bitcoin perpetual swaps (a proxy for the cost of maintaining a long position in the derivatives market). This is a sign of elevated demand for long bets, according to CoinDesk.

Source: CoinDesk

Source: CoinDesk

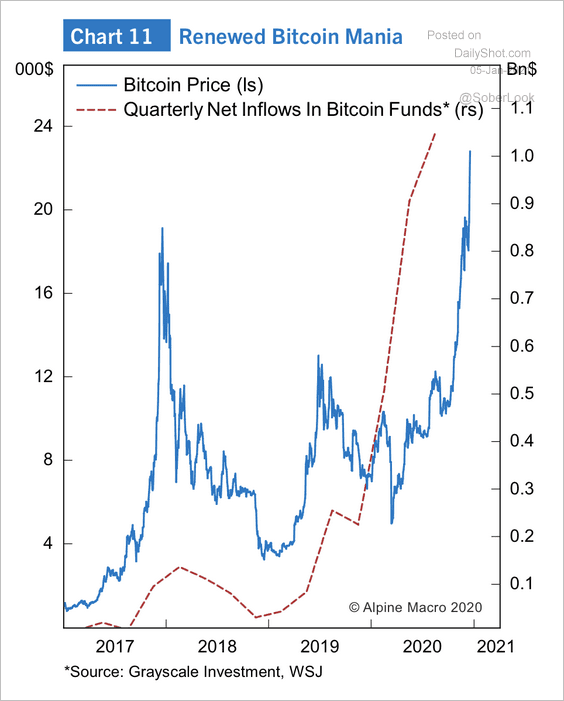

6. Inflows to Bitcoin funds accelerated last year.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Commodities

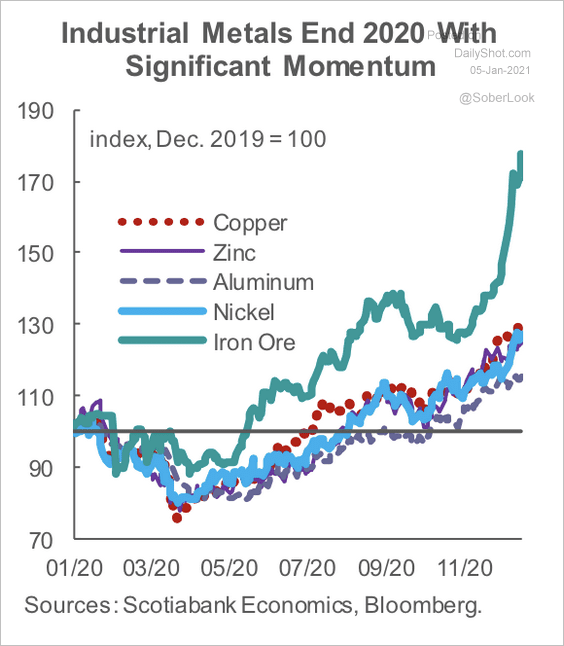

1. Iron ore significantly outperformed industrial metals last year.

Source: Scotiabank Economics

Source: Scotiabank Economics

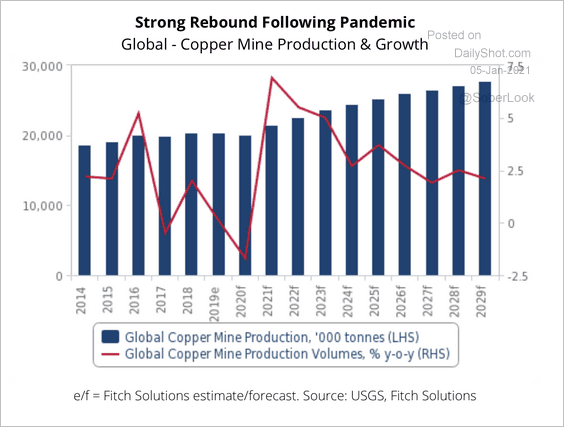

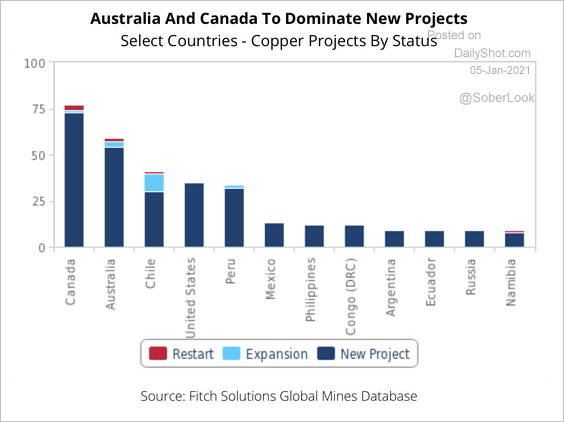

2. Fitch expects copper production to increase over the next few years.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Increased copper production will be driven by new projects in Australia and Canada.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

——————–

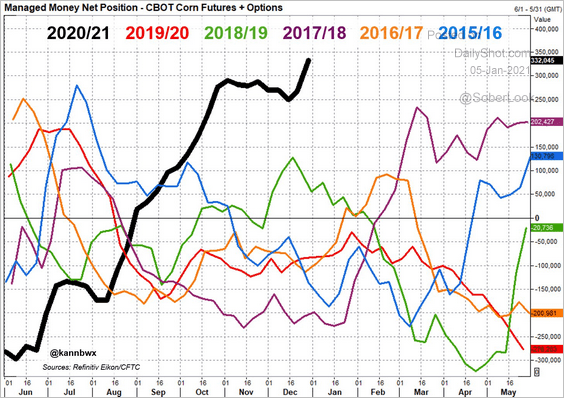

3. Money managers remain extremely net long corn futures relative to previous years. Long positioning accelerated during the final week of 2020.

Source: @kannbwx

Source: @kannbwx

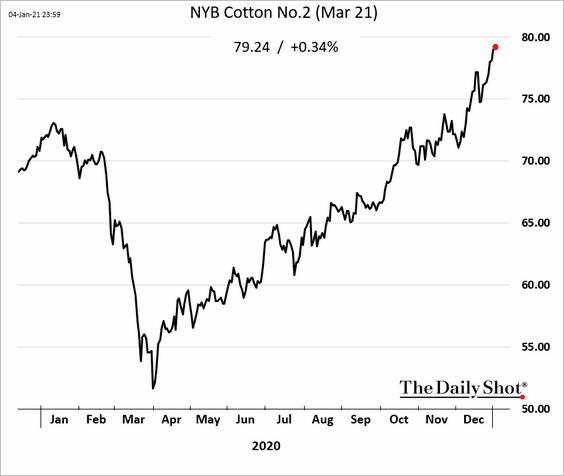

4. Cotton futures continue to rally.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

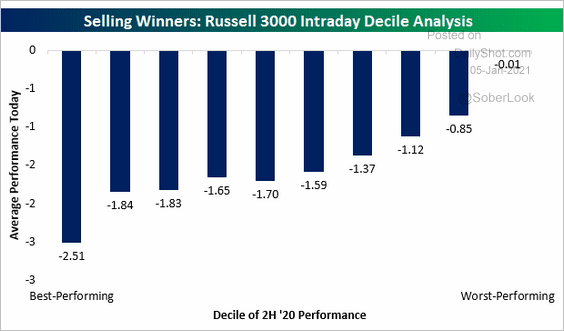

1. Investors took some profits on Monday, selling the best-performing names.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

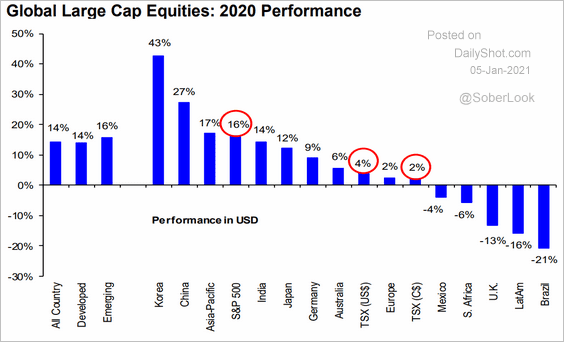

2. Here is the 2020 large-cap equity performance globally.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

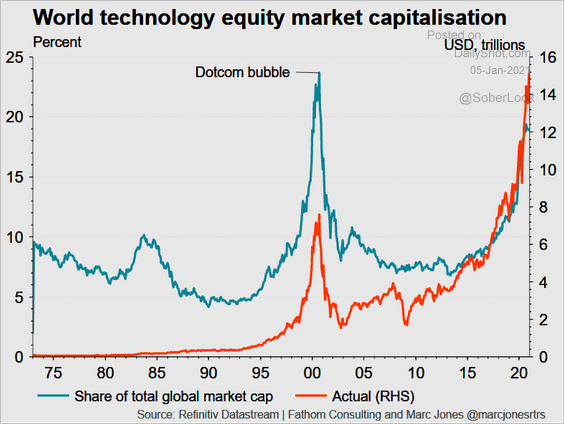

3. This chart shows the global tech equity market capitalization in dollars and as a share of the total market cap.

Source: Reuters Read full article

Source: Reuters Read full article

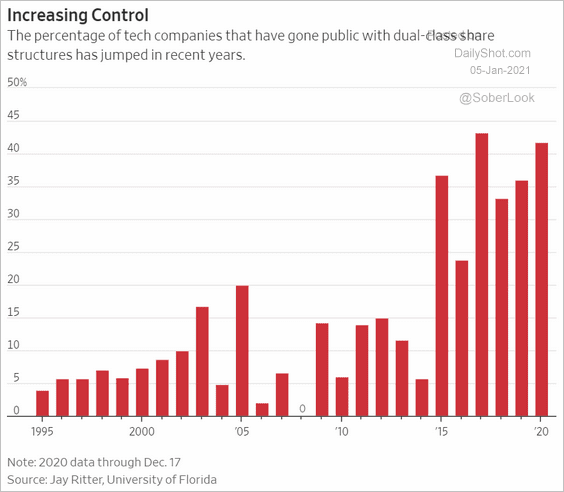

4. Tech companies have increasingly been going public with dual-class share structures (founders retain control).

Source: @WSJ Read full article

Source: @WSJ Read full article

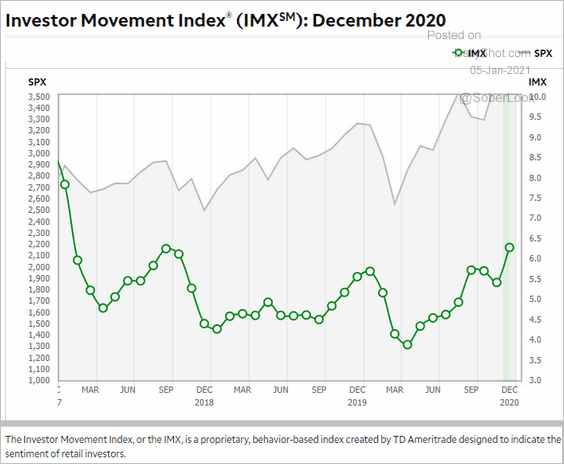

5. The TD Ameritrade positioning index shows that retail investors are most bullish since 2018.

Source: TD Ameritrade

Source: TD Ameritrade

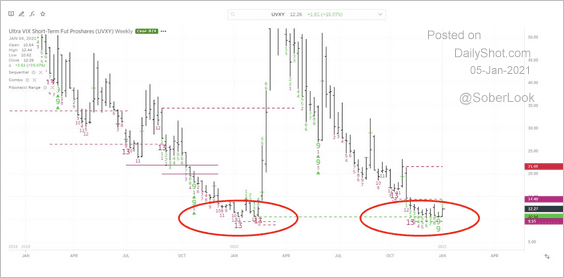

6. The ProShares Ultra VIX Short-Term Futures ETF (UVXY) is at support (the ETF targets 1.5x VIX).

Source: @MarkNewtonCMT

Source: @MarkNewtonCMT

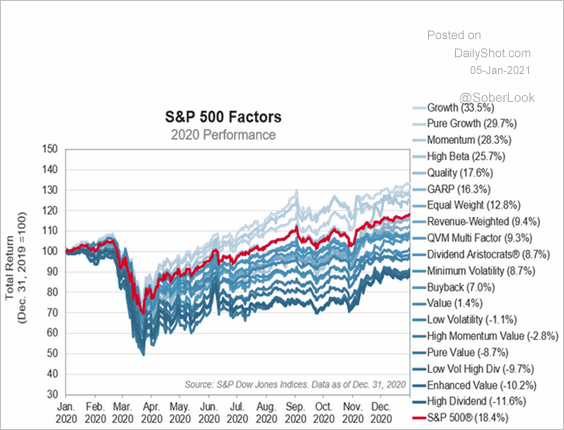

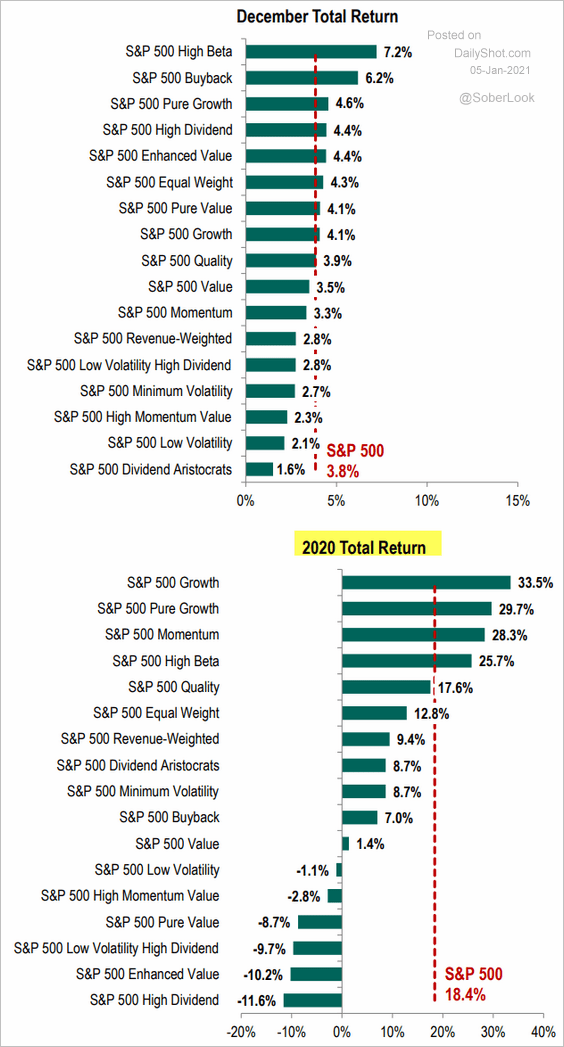

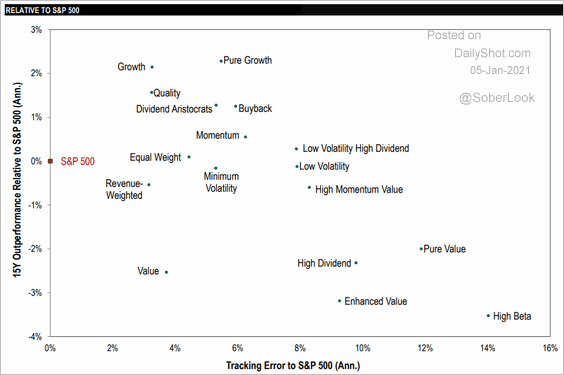

7. Next, we have some equity factor performance charts from S&P Global.

• S&P 500 factors 2020 performance:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

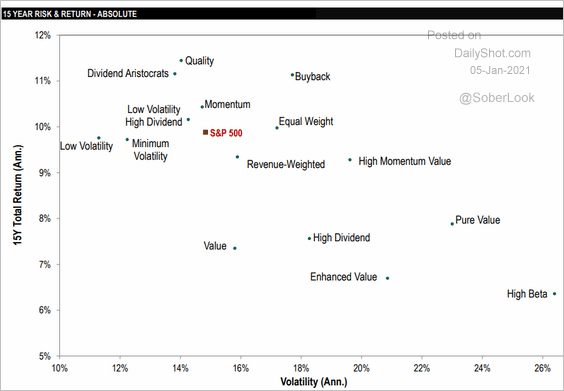

• The risk-return profile over the past 15 years:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Relative returns:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Credit

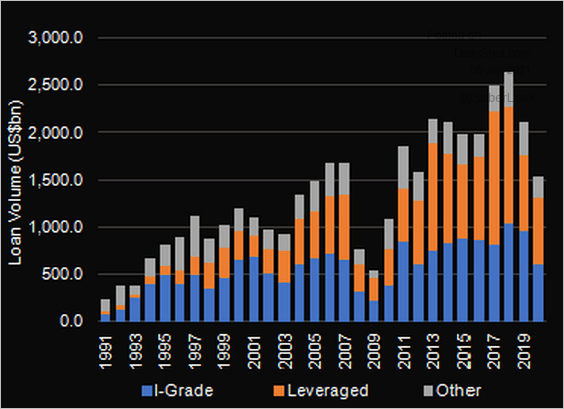

1. US leveraged loan volume declined last year.

Source: @LPCLoans, @refinitiv

Source: @LPCLoans, @refinitiv

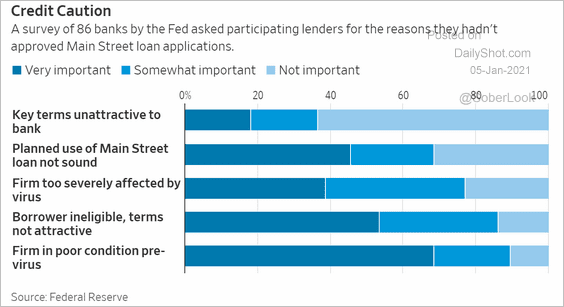

2. Why banks didn’t approve many loan applications in the Main Street program?

Source: @WSJ Read full article

Source: @WSJ Read full article

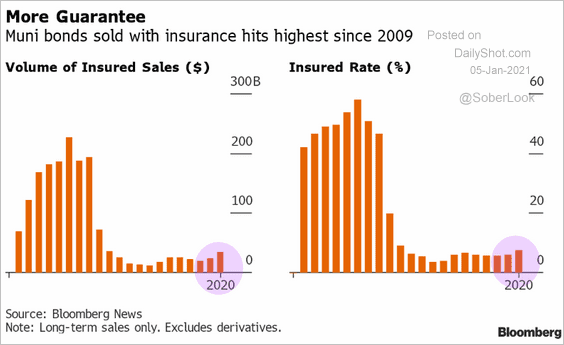

3. Muni bond insurance is on the rise again.

Source: @bloomberglaw Read full article

Source: @bloomberglaw Read full article

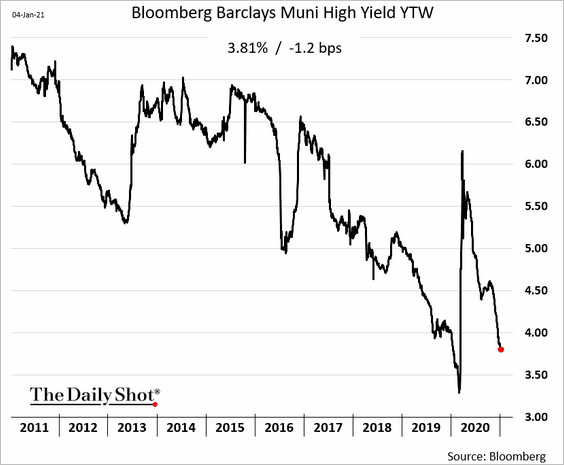

High-yield muni yields are approaching pre-crisis lows.

Back to Index

Rates

1. The 30-year US breakeven rate (inflation expectations) is testing resistance.

Source: @TaviCosta

Source: @TaviCosta

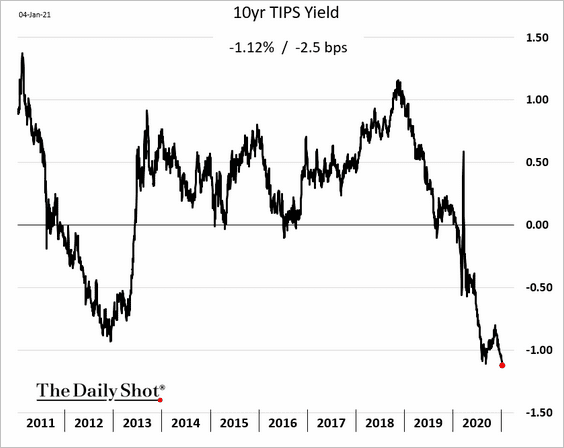

2. The 10yr TIPS yield (real rate) hit a record low (stable nominal yields + rising inflation expectations = falling real rates).

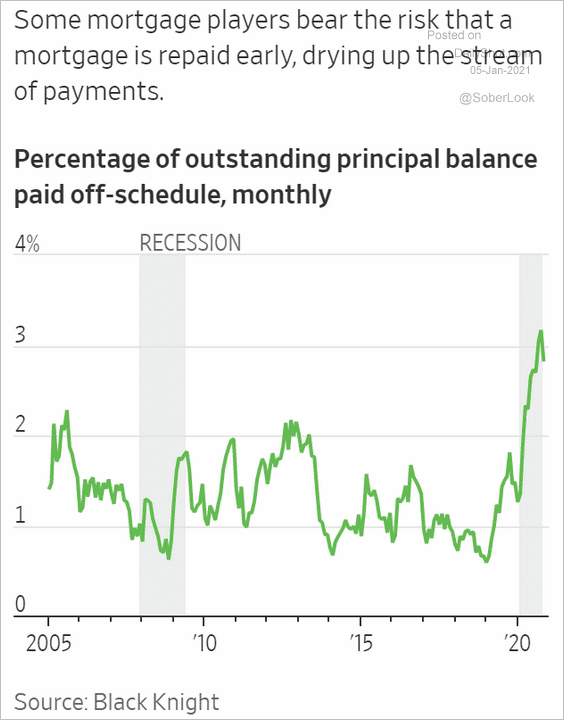

3. Mortgage prepayment speed spiked in 2020 (refinancing).

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

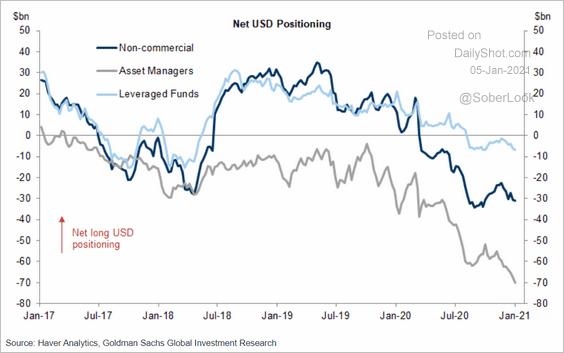

1. Asset managers keep boosting their bets against the US dollar.

Source: Goldman Sachs

Source: Goldman Sachs

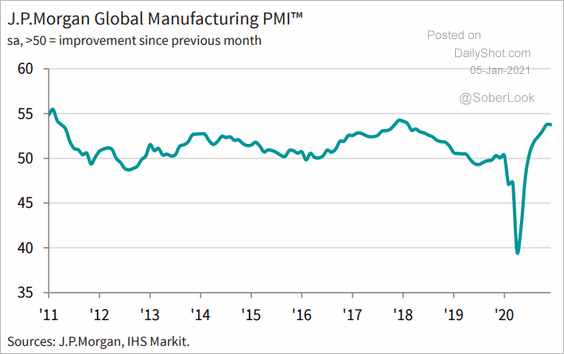

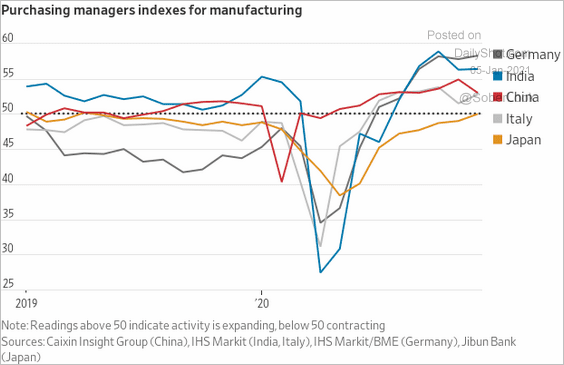

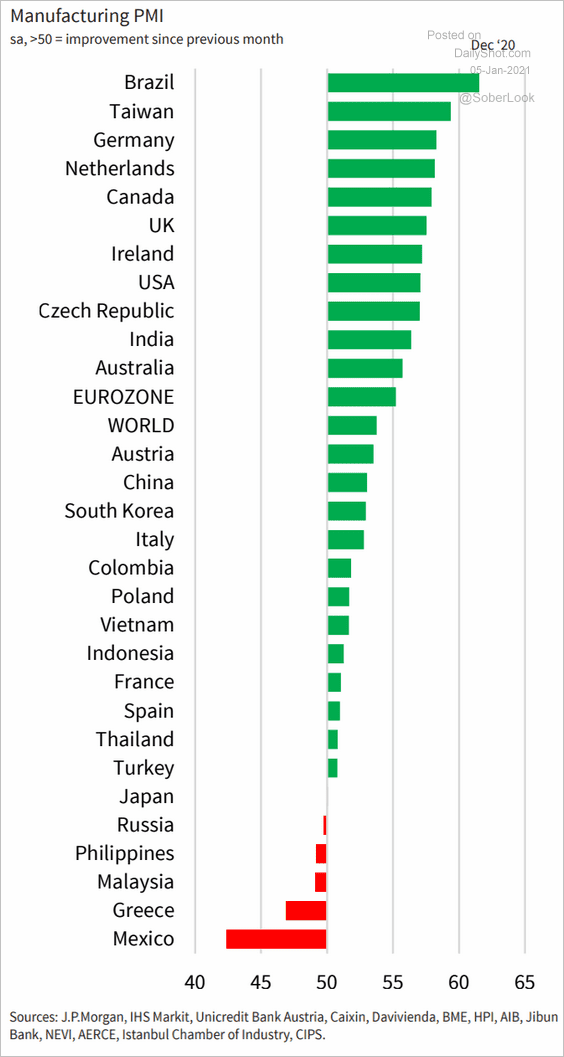

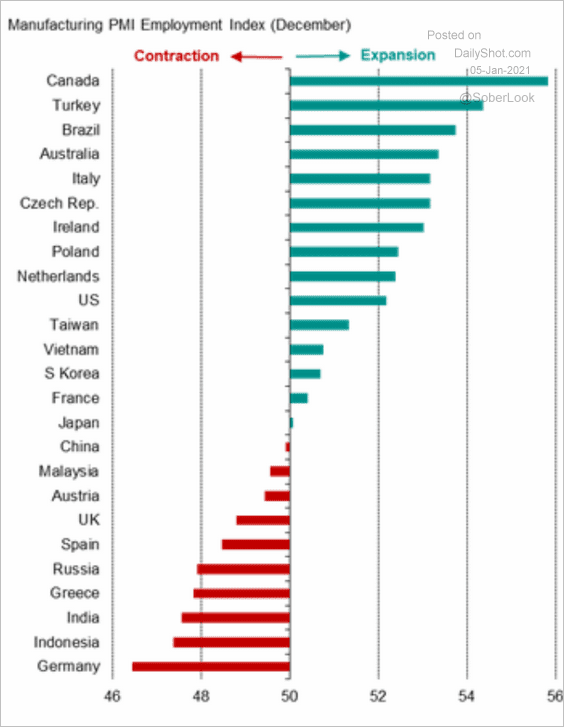

2. Next, we have some updates on factory activity in December.

• Global Markit PMI:

Source: IHS Markit

Source: IHS Markit

• PMI trends for select economies:

Source: @WSJ Read full article

Source: @WSJ Read full article

• December PMI by country:

Source: IHS Markit

Source: IHS Markit

• Employment PMI by country:

Source: IHS Markit

Source: IHS Markit

——————–

Food for Thought

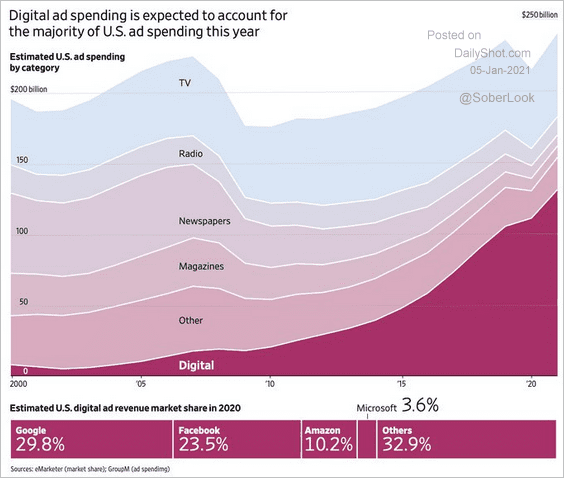

1. US digital ad spending:

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

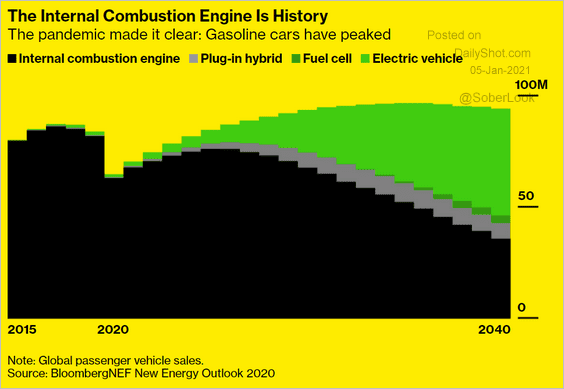

2. The gasoline car peak:

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

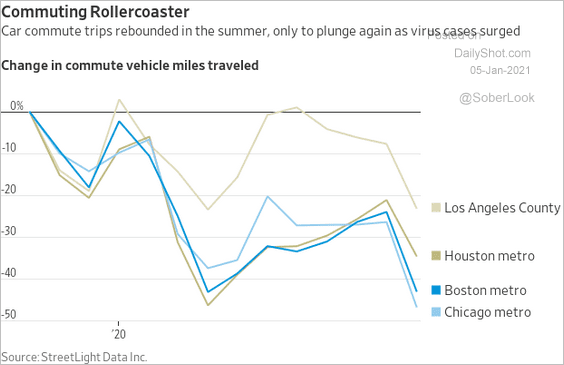

3. US commuters:

Source: @WSJ Read full article

Source: @WSJ Read full article

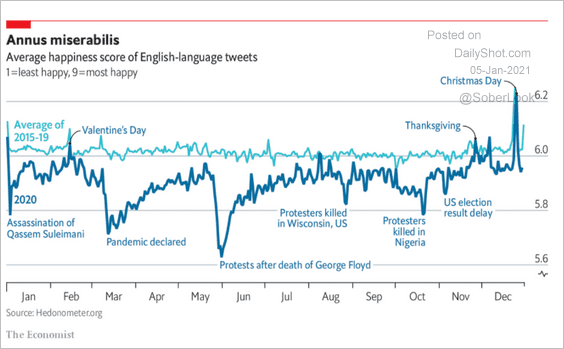

4. The happiness score (based on English-language tweets):

Source: The Economist Read full article

Source: The Economist Read full article

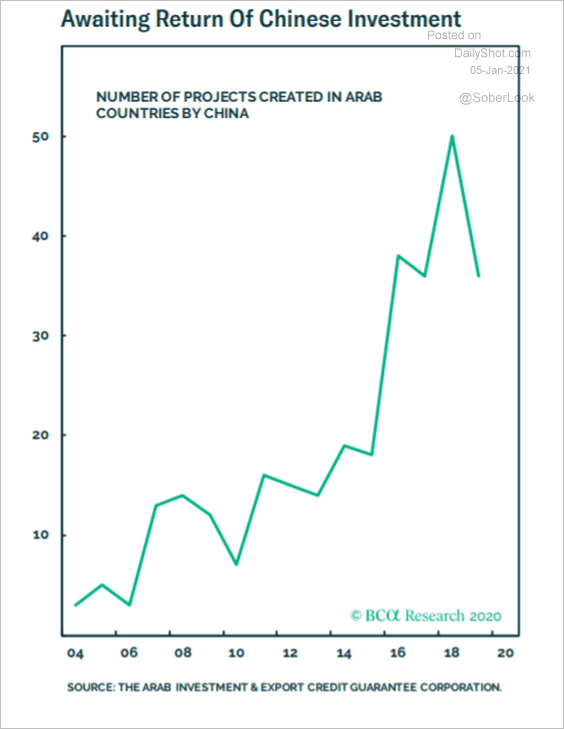

5. China’s investments in Arab countries:

Source: BCA Research

Source: BCA Research

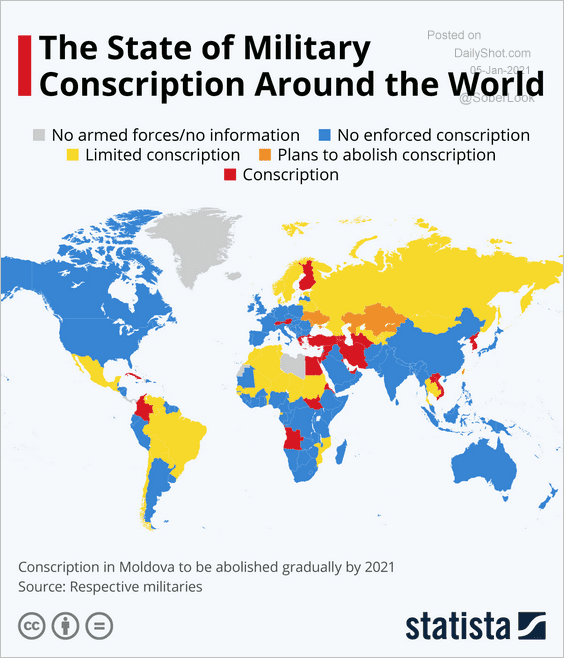

6. Military conscriptions globally:

Source: Statista

Source: Statista

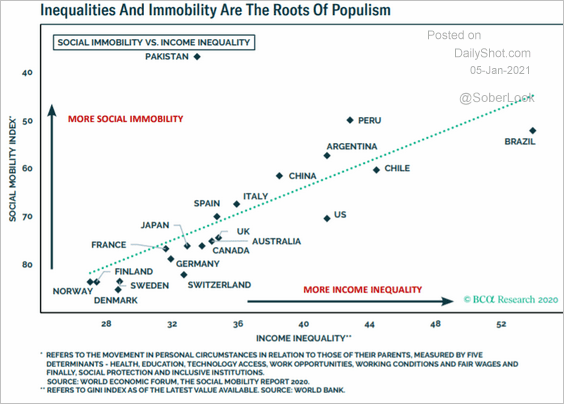

7. Social immobility vs. income inequality:

Source: BCA Research

Source: BCA Research

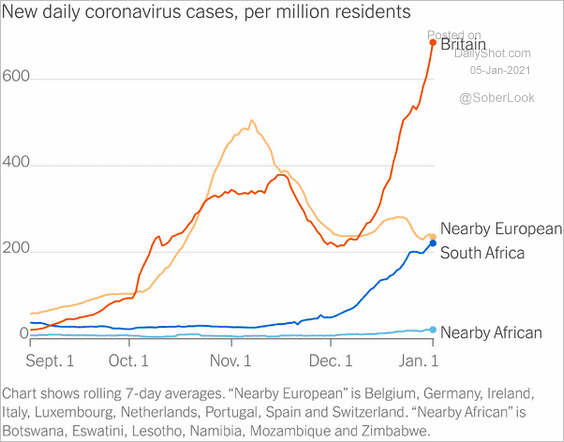

8. Virulent COVID strains in the UK and South Africa:

Source: @WSJ Read full article

Source: @WSJ Read full article

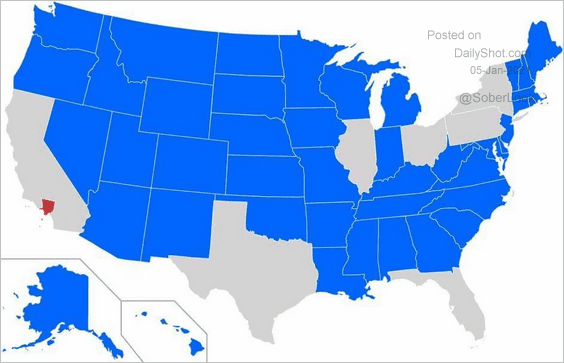

9. States with smaller populations than LA:

Source: The California Sun, h/t Walter Read full article

Source: The California Sun, h/t Walter Read full article

——————–

Back to Index