The Daily Shot: 11-Jan-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

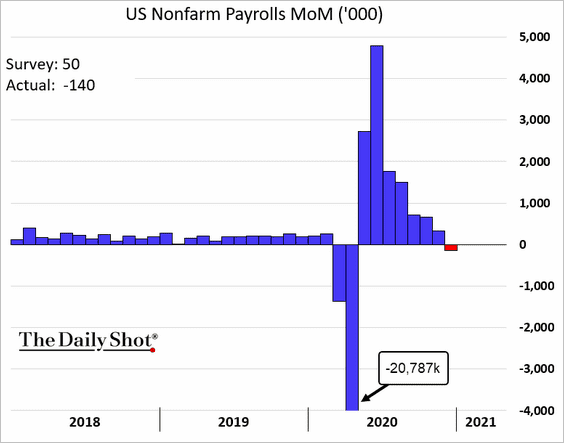

1. The December employment report was substantially stronger than the headline figures would suggest. While the US lost 140k payrolls last month, there was also an upward revision of 135k jobs for October and November.

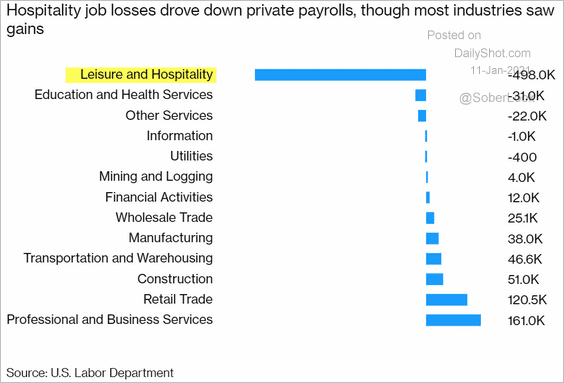

• Most of the losses were in leisure and hospitality.

Source: @markets Read full article

Source: @markets Read full article

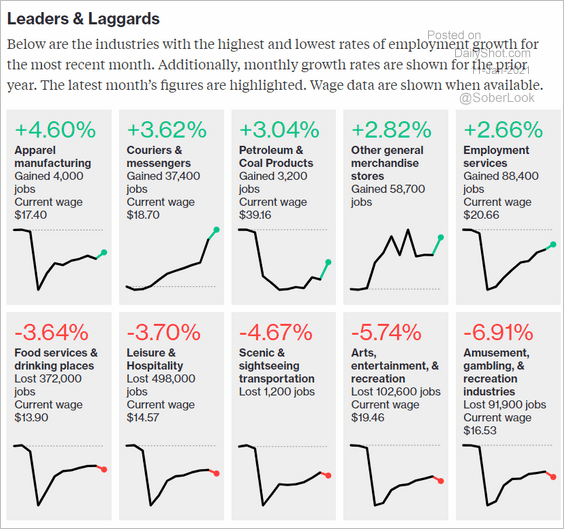

– The bottom panel charts show the impact of the pandemic’s second wave.

Source: @bbgvisualdata Read full article

Source: @bbgvisualdata Read full article

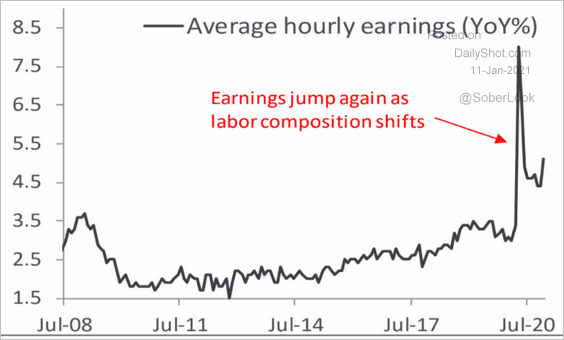

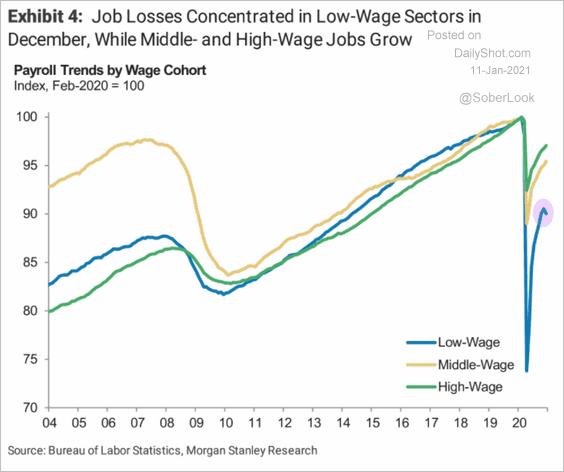

– The layoffs in low-wage sectors changed the labor force’s composition, boosting the average wage.

Source: Piper Sandler

Source: Piper Sandler

– Sectors with higher wages continued to recover.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

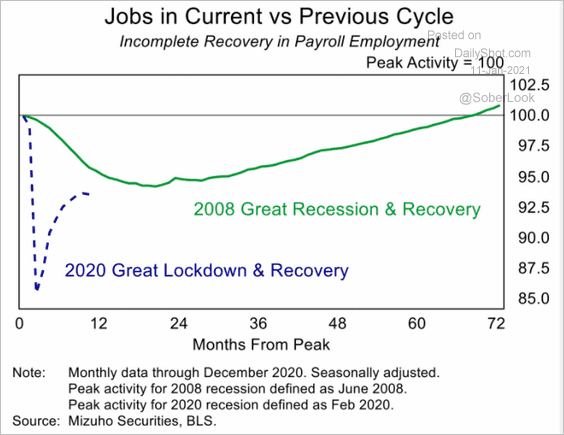

• This chart shows the employment trajectory compared to the 2008 recession.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

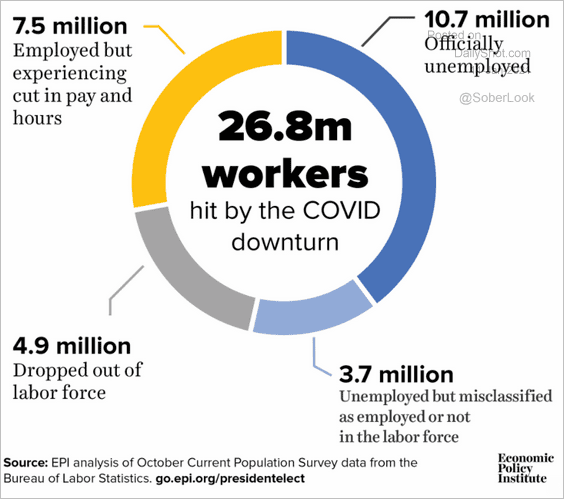

• How many workers have been impacted by the pandemic?

Source: @EconomicPolicy Read full article

Source: @EconomicPolicy Read full article

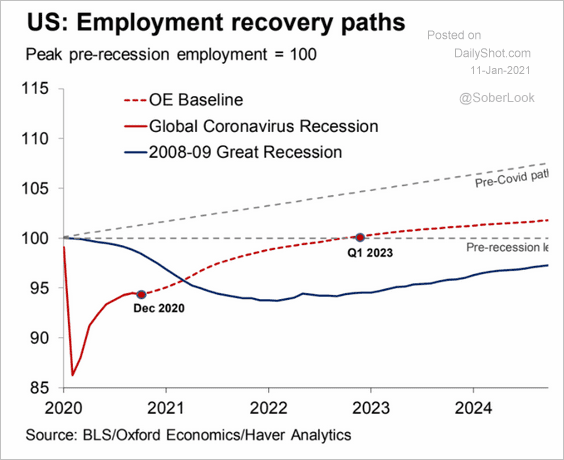

• When will we see employment return to pre-crisis levels? Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

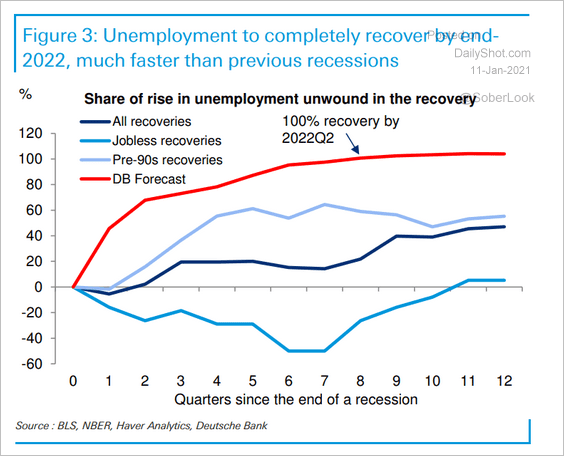

And this is a forecast from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

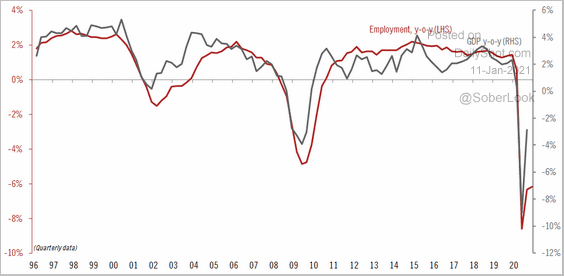

• The job market recovery is lagging the GDP.

Source: @TCosterg

Source: @TCosterg

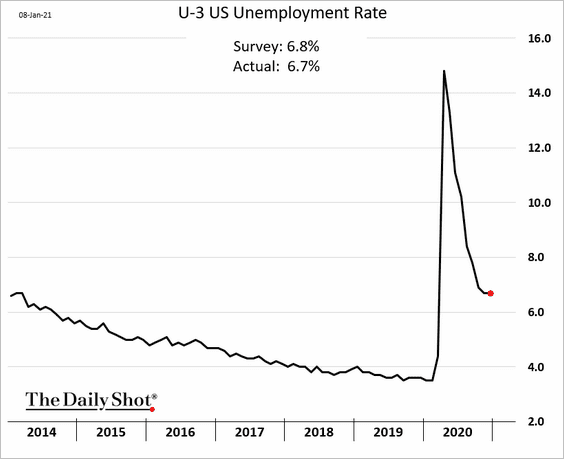

• The unemployment rate held steady (economists were expecting an increase).

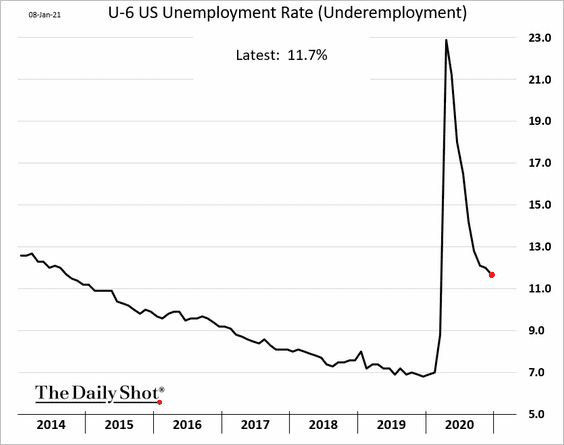

The underemployment rate continued to decline.

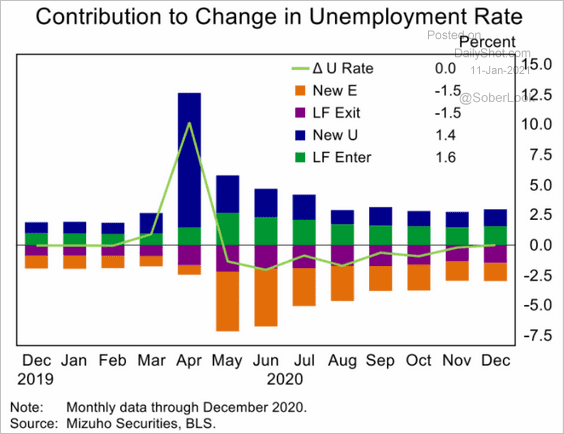

Here are the contributions to unemployment (New E = new employed, LF Exit = leaving the labor force, New U = newly unemployed, LF Enter = entering the labor force.)

Source: Mizuho Securities USA

Source: Mizuho Securities USA

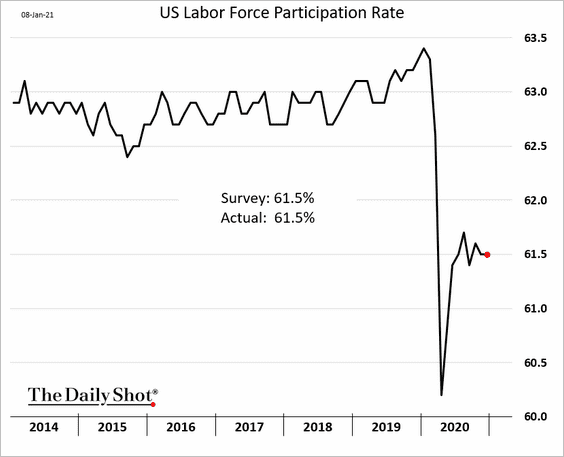

• The participation rate held steady.

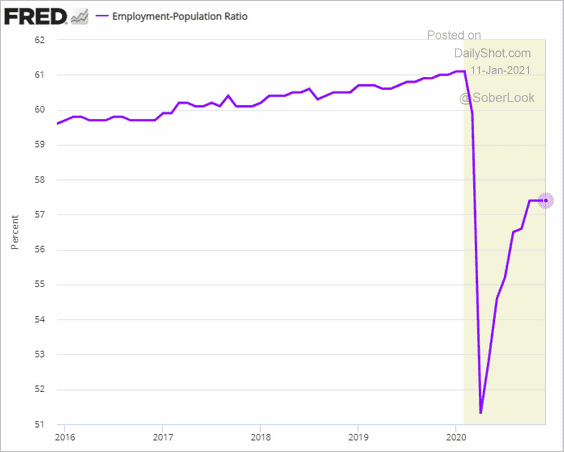

And so did the employment-to-population ratio.

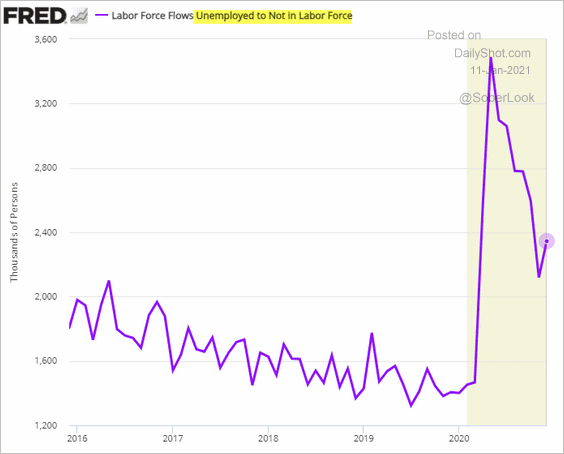

There was an increase in the number of workers leaving the labor force.

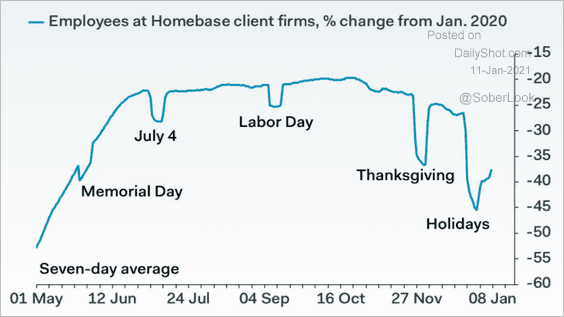

• One troubling trend in the labor market has been small-business employment.

– Homebase small business employment index:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

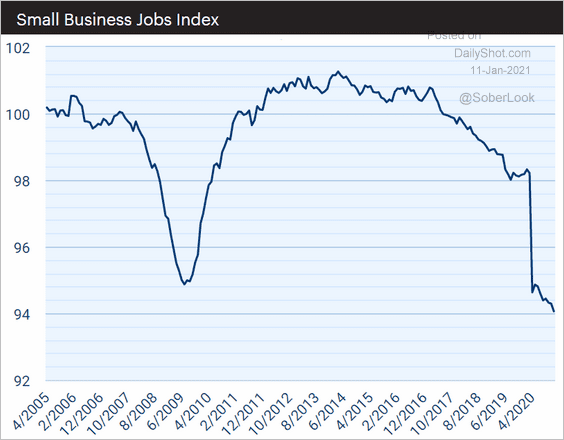

• Paychex/IHS Markit Small Business Employment Watch:

Source: Paychex | IHS Markit Small Business Employment Watch

Source: Paychex | IHS Markit Small Business Employment Watch

——————–

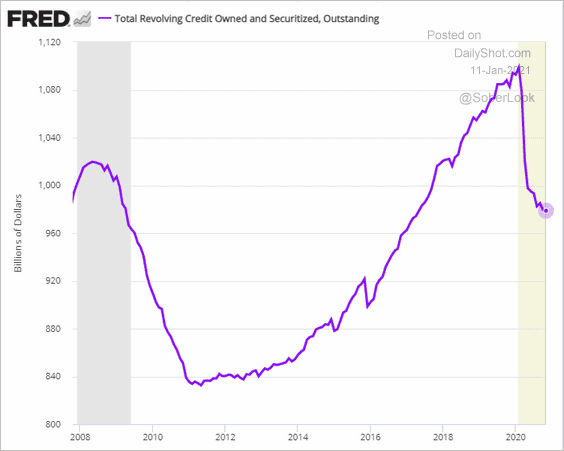

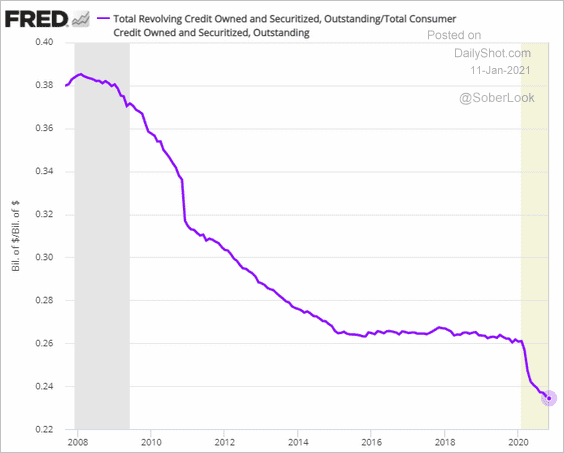

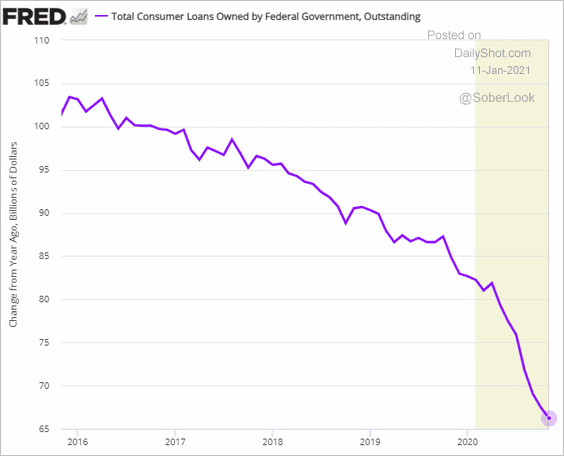

2. Revolving consumer credit (credit cards) continues to shrink.

Here is revolving credit as a share of total consumer credit.

Growth in student loan balances has been slowing.

——————–

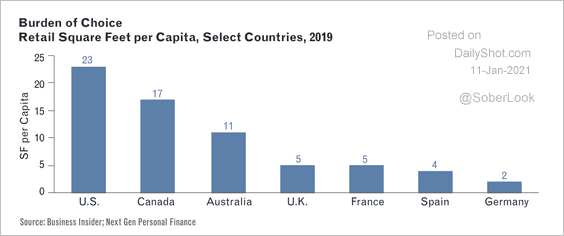

3. The US remains over-retailed compared to other countries.

Source: Park Madison Partners

Source: Park Madison Partners

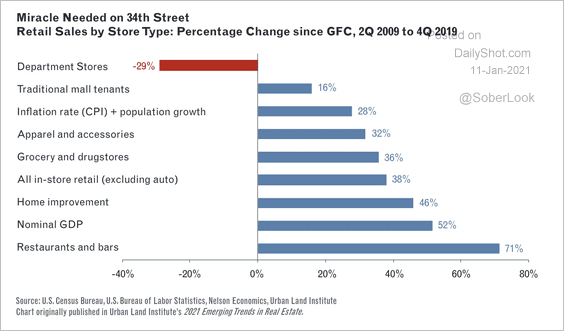

Department store retail sales have declined since the financial crisis.

Source: Park Madison Partners

Source: Park Madison Partners

——————–

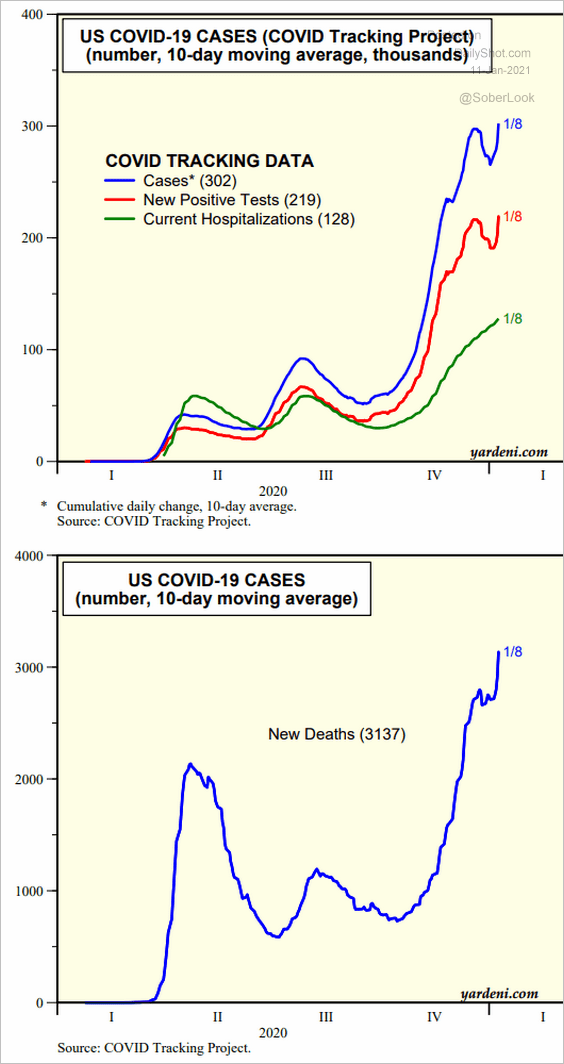

4. The COVID situation remains worrisome.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Canada

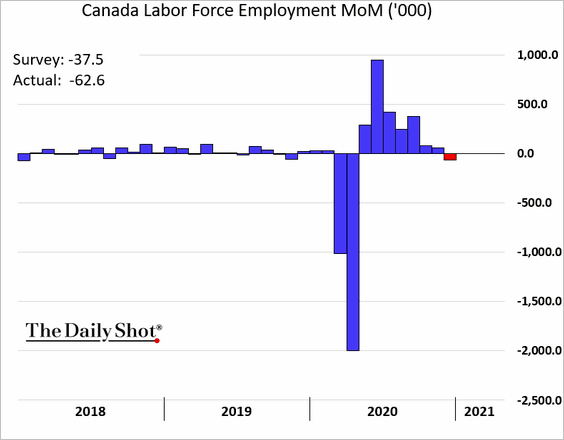

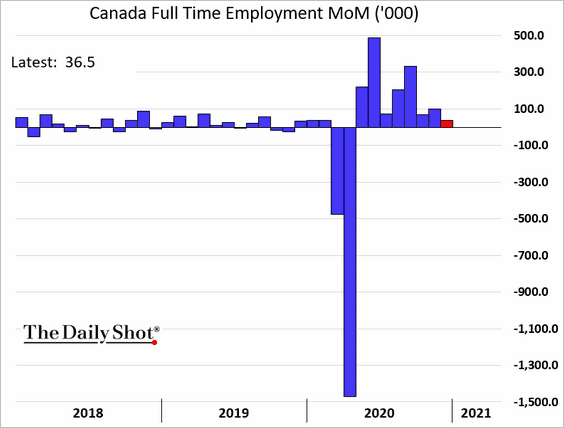

1. December job losses were higher than expected.

However, the layoffs were mostly in part-time positions.

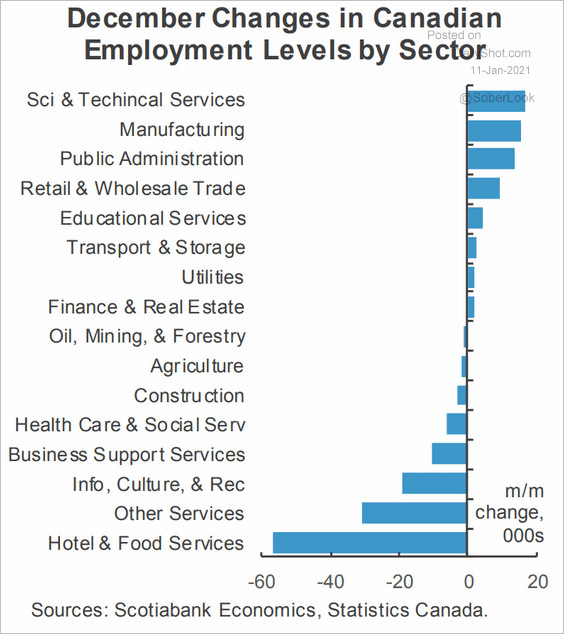

• Just like in the US, the biggest job losses were in sectors most impacted by the latest pandemic wave.

Source: Scotiabank Economics

Source: Scotiabank Economics

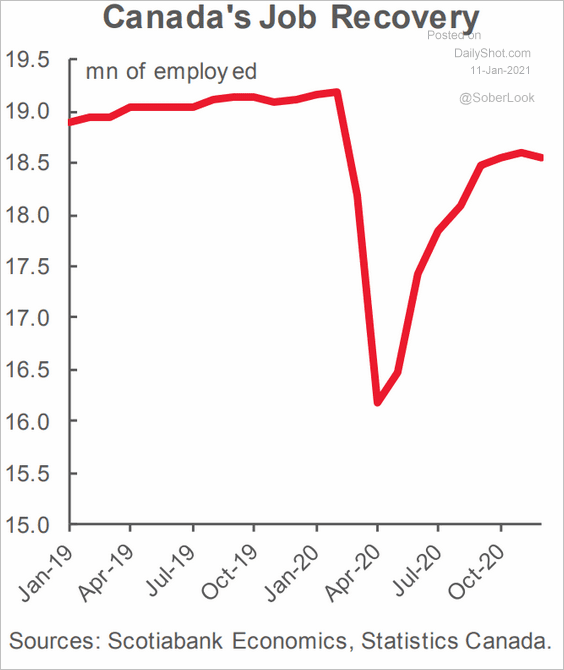

• Here is the employment trajectory.

Source: Scotiabank Economics

Source: Scotiabank Economics

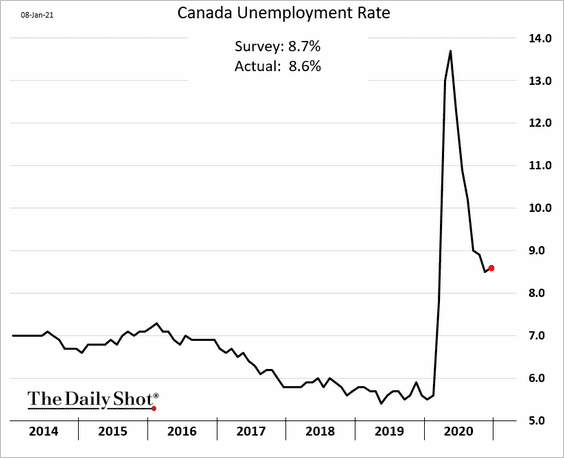

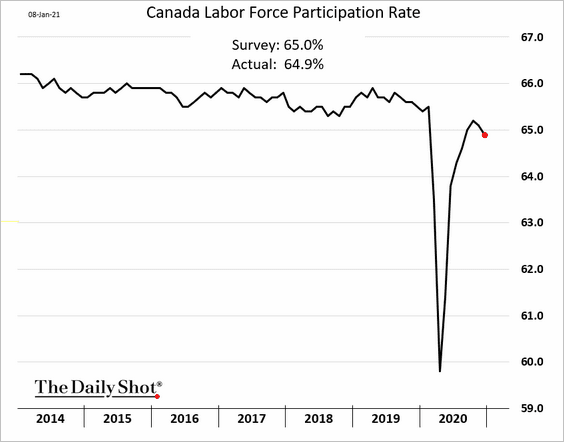

• The unemployment rate ticked higher.

The participation rate declined.

——————–

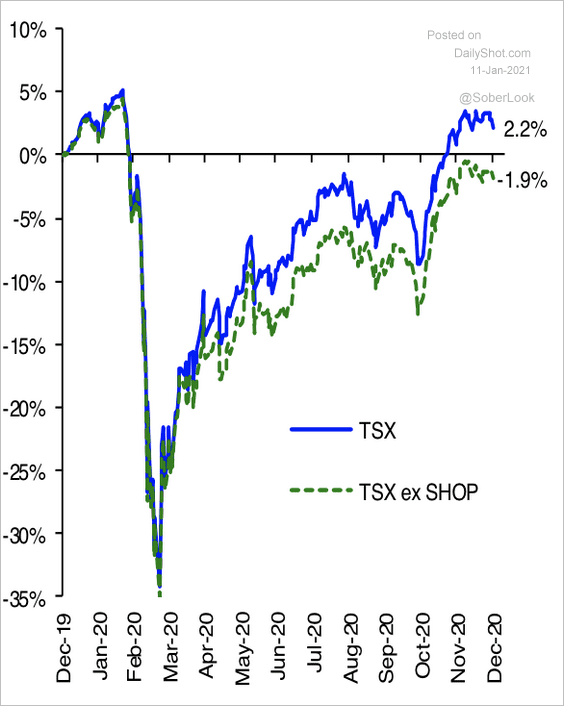

2. Without Shopify, the TSX would have ended last year down 1.9%.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

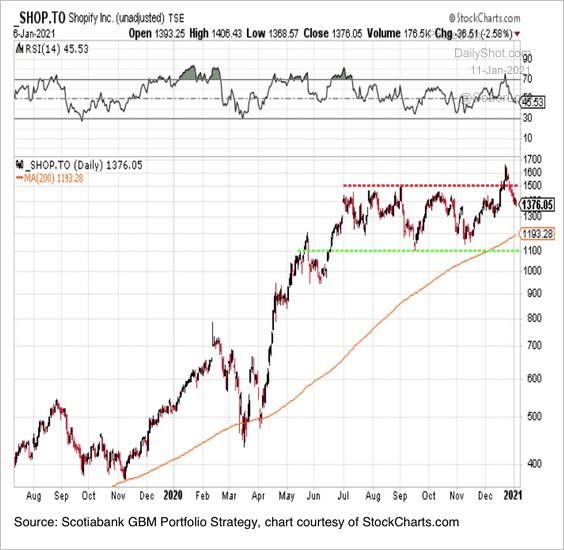

By the way, Shopify has been trading sideways over the past few months.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

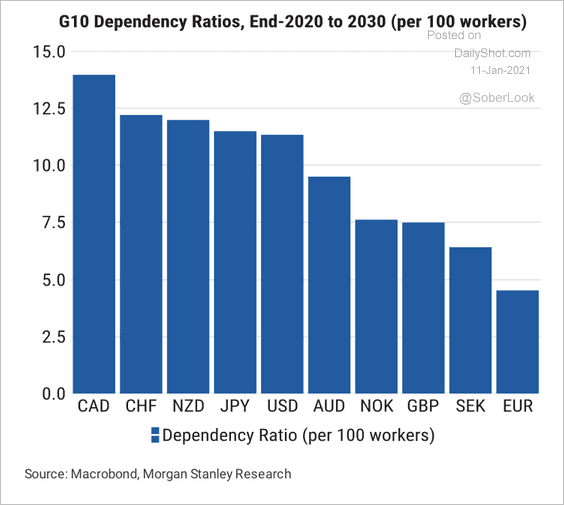

3. The increase in Canada’s dependency ratio is expected to outpace most developed economies (Canada is aging quickly).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

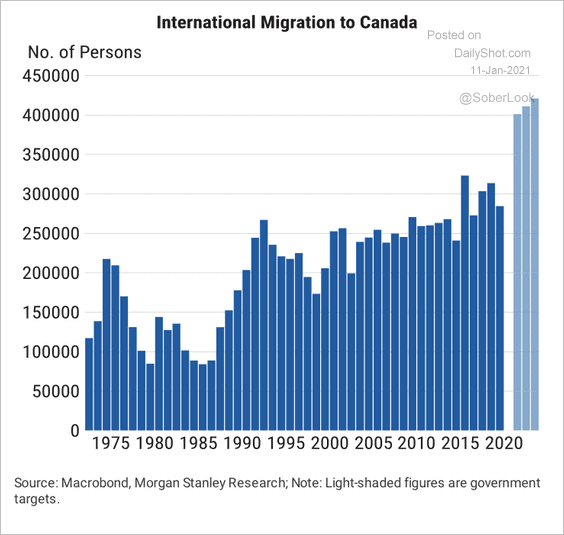

The government forecasts the highest immigration target on record (to mitigate the trend above).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

The United Kingdom

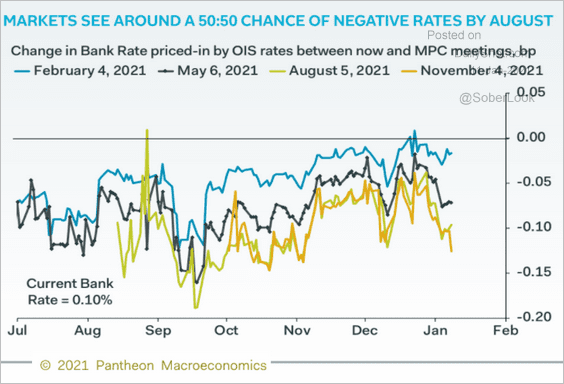

1. The markets see a 50/50 chance of negative rates by August.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

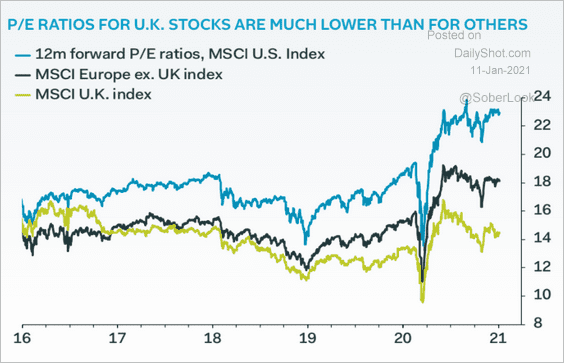

2. UK stocks are significantly undervalued vs. the rest of Europe and the US.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

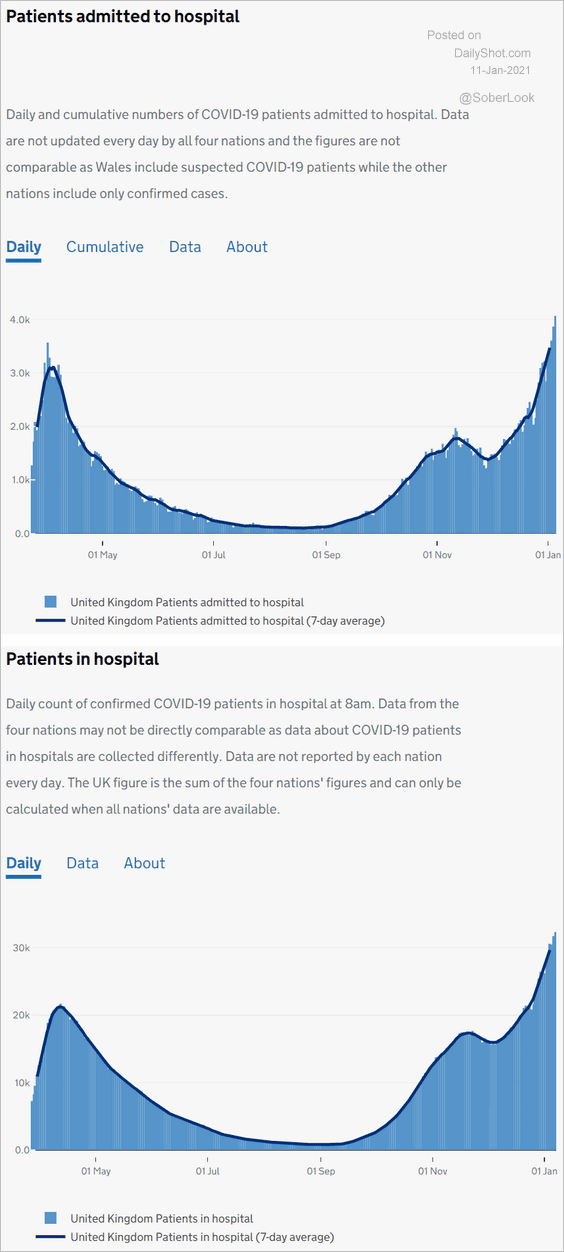

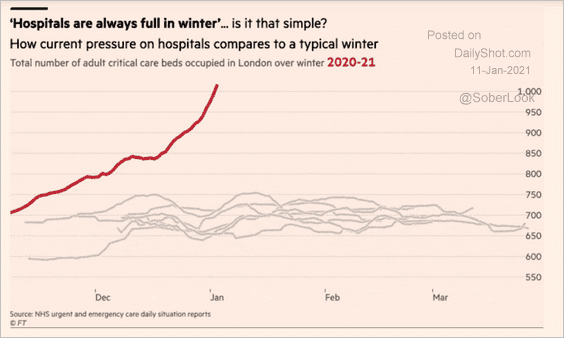

3. UK hospitals are stretched (3 charts).

Source: Public Health England and NHSX

Source: Public Health England and NHSX

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

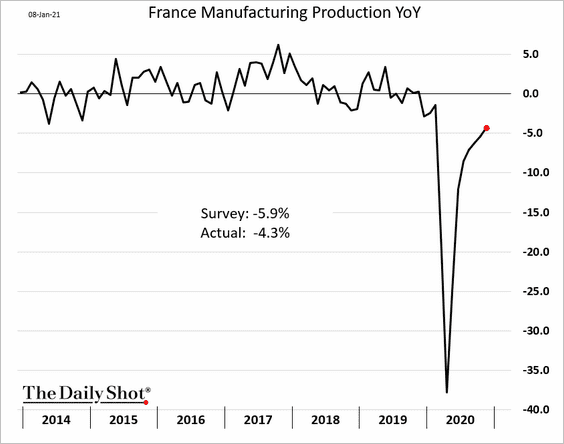

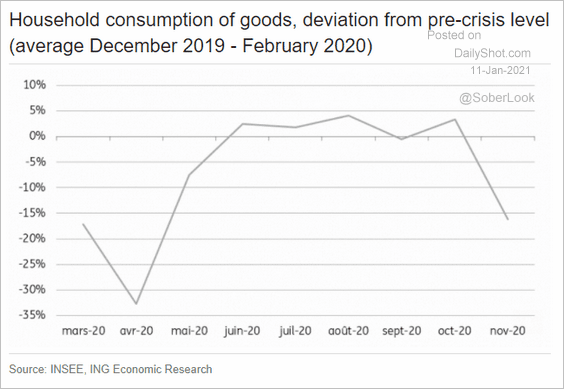

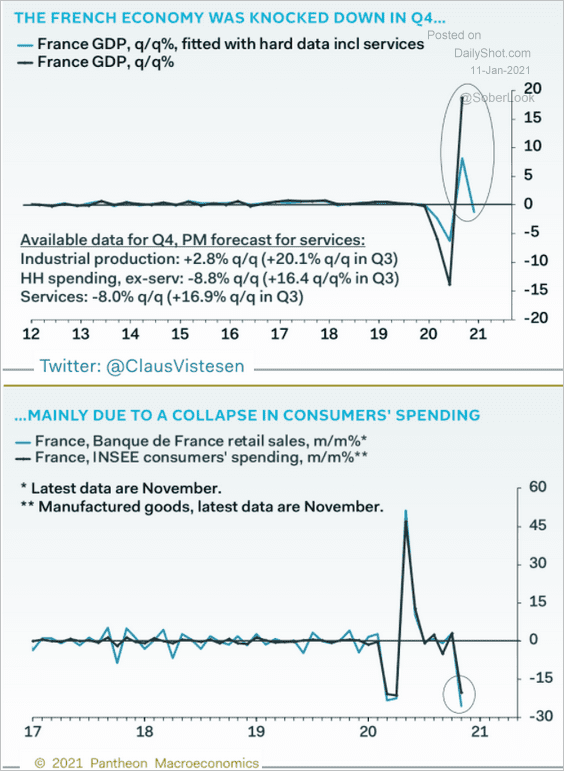

1. Let’s begin with France.

• Industrial production continues to recover.

• Household consumption took a hit in November.

Source: ING

Source: ING

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

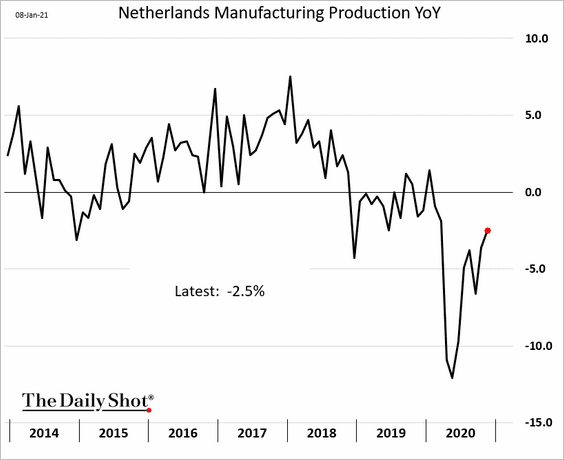

2. The Netherlands’ factory output is rebounding.

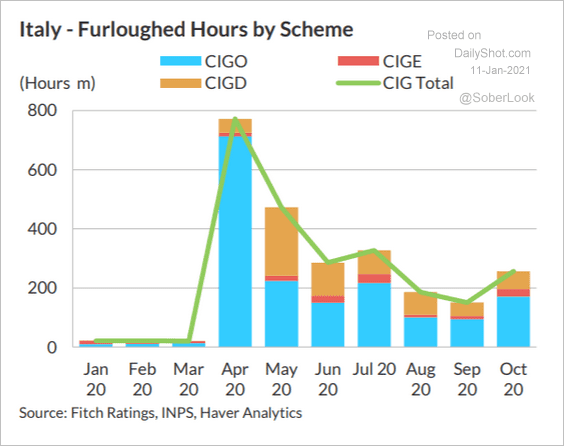

3. This chart shows Italy’s furloughed workers (by program).

Source: Fitch Ratings

Source: Fitch Ratings

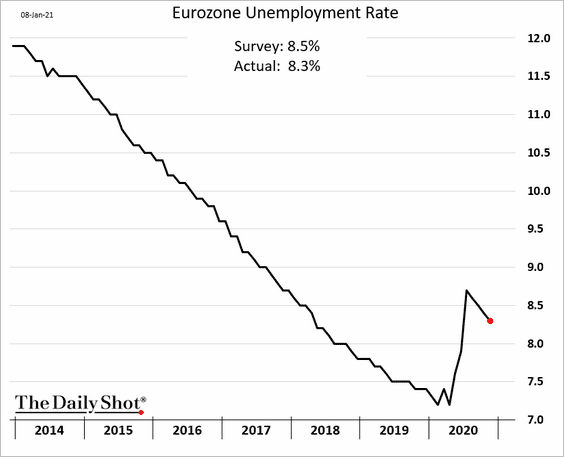

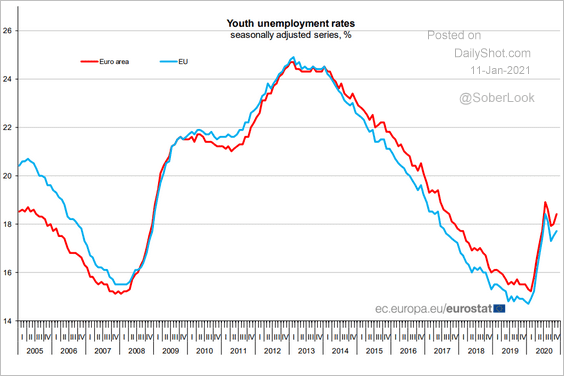

4. The Eurozone unemployment rate was lower than expected in November.

However, youth unemployment worsened.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Europe

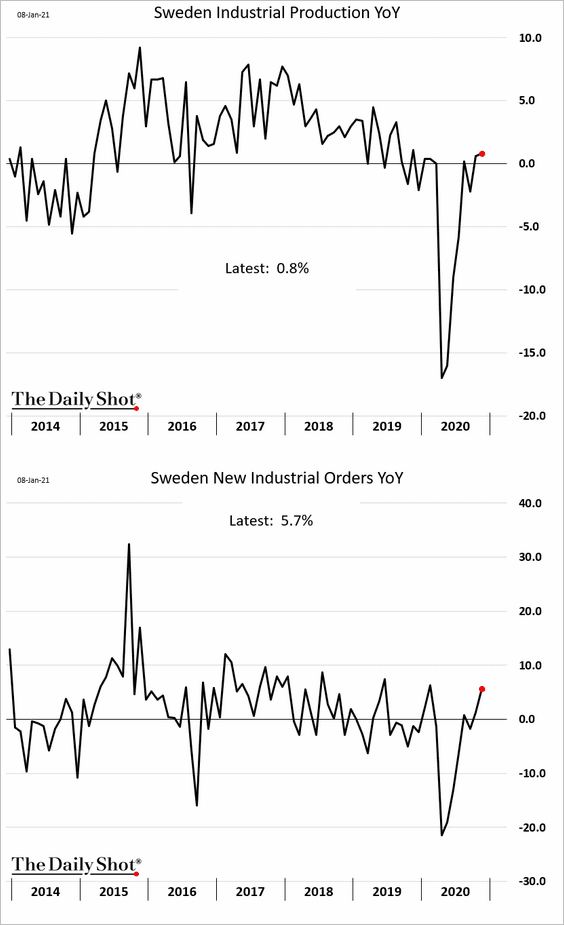

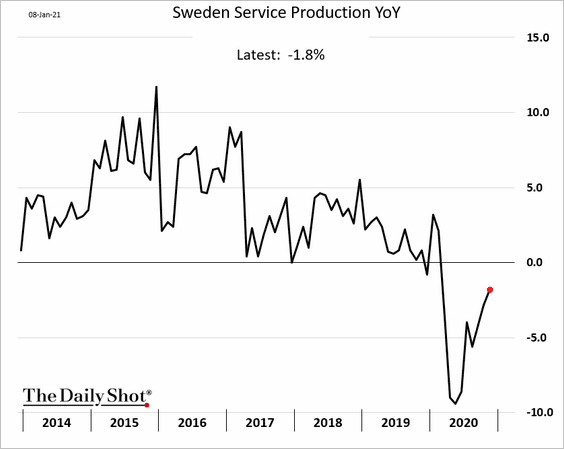

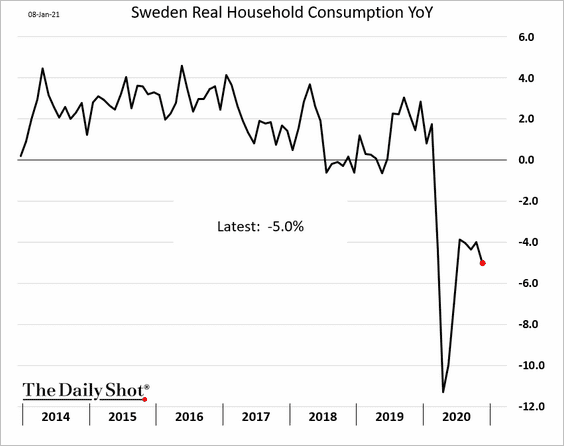

1. Sweden’s industrial activity has fully recovered, with new orders rising sharply in November.

Service-sector output continues to rebound.

However, consumption deteriorated in November.

——————–

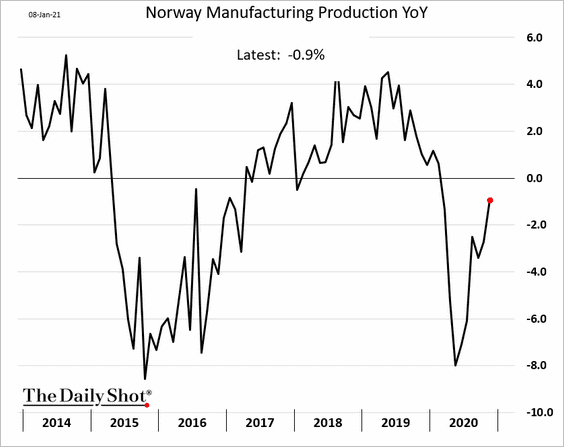

2. Norway’s industrial production has not yet fully recovered.

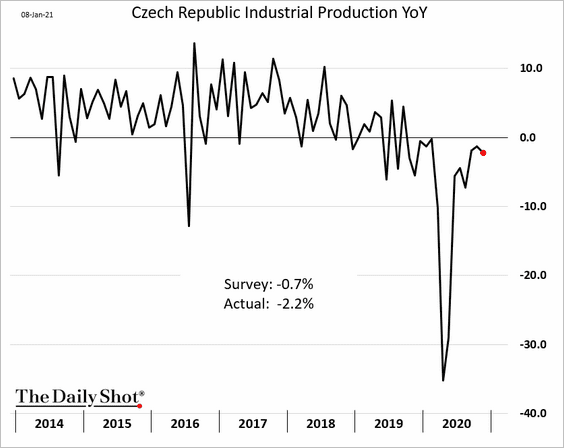

3. Industrial output in the Czech Republic deteriorated in November.

Back to Index

Japan

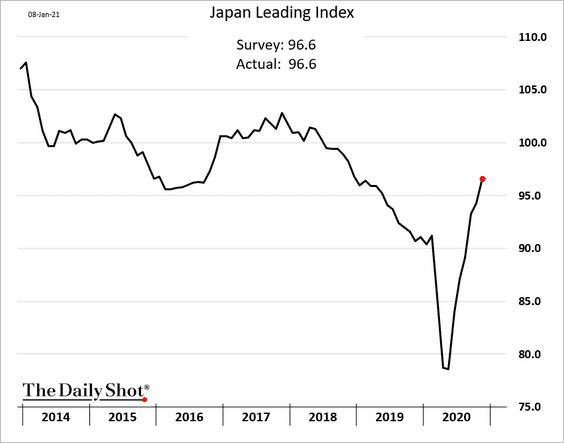

1. The leading index is improving.

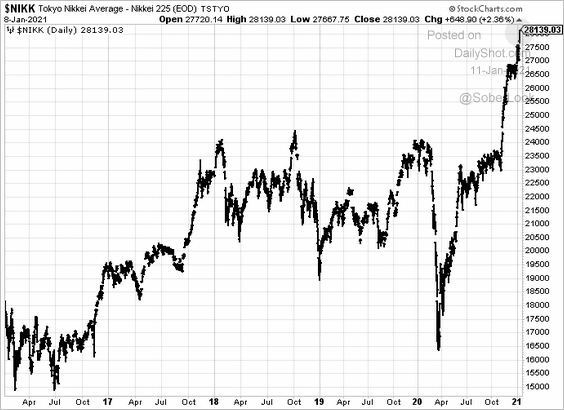

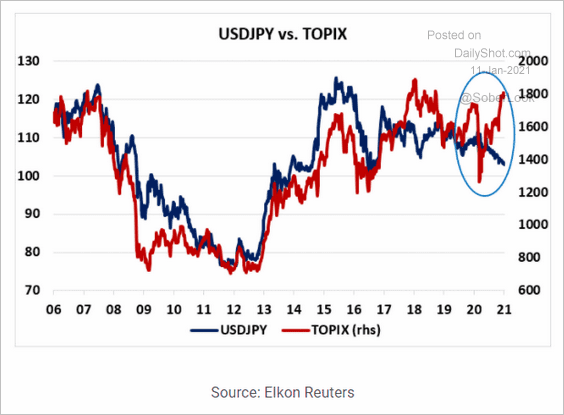

2. The stock market rally accelerated last week.

There is a divergence between the stock market and USD/JPY.

Source: Rothko Research

Source: Rothko Research

——————–

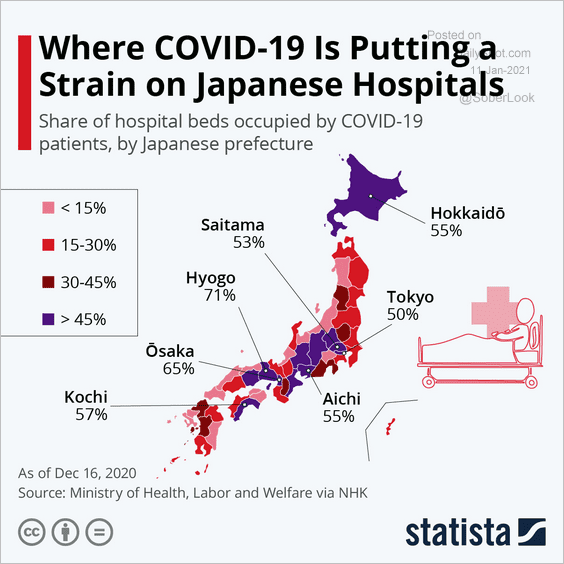

3. Hospitals in some areas are under strain.

Source: Statista

Source: Statista

Back to Index

Asia – Pacific

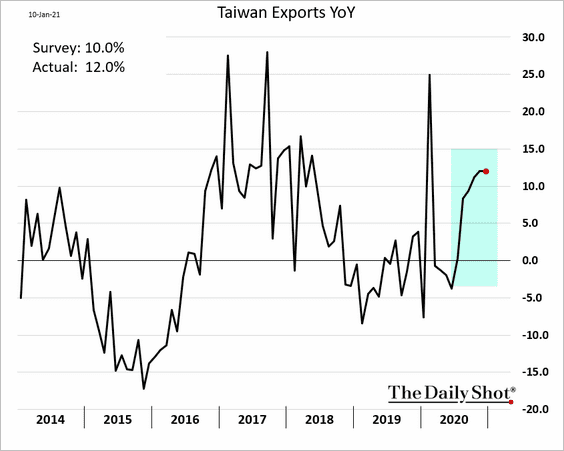

1. Taiwan’s exports remain robust.

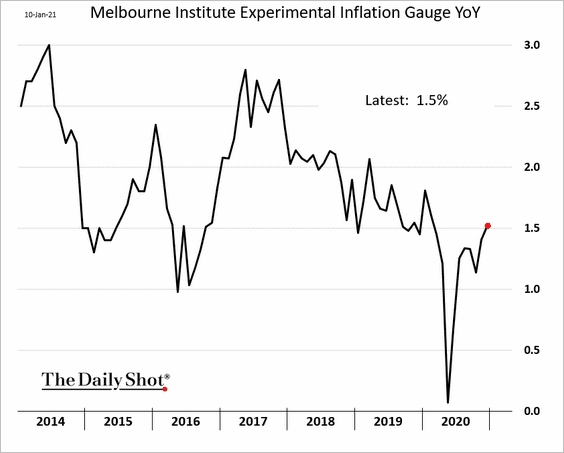

2. Below are some updates on Australia.

• The Melbourne Institute inflation index:

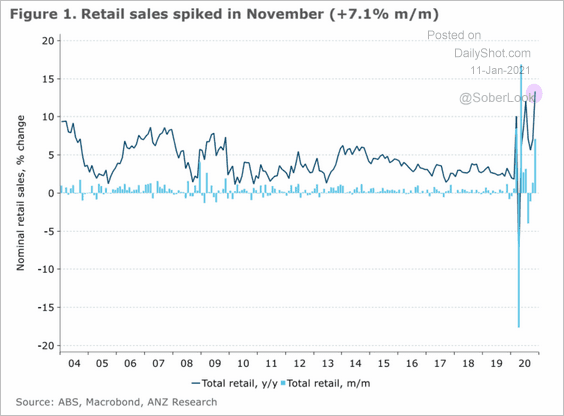

• Retail sales (second-highest year-over-year growth in 31 years, according to ANZ):

Source: ANZ Research

Source: ANZ Research

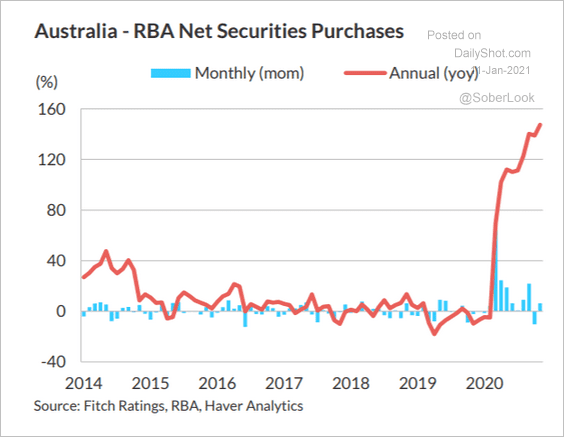

• RBA’s net securities purchases:

Source: Fitch Ratings

Source: Fitch Ratings

——————–

China

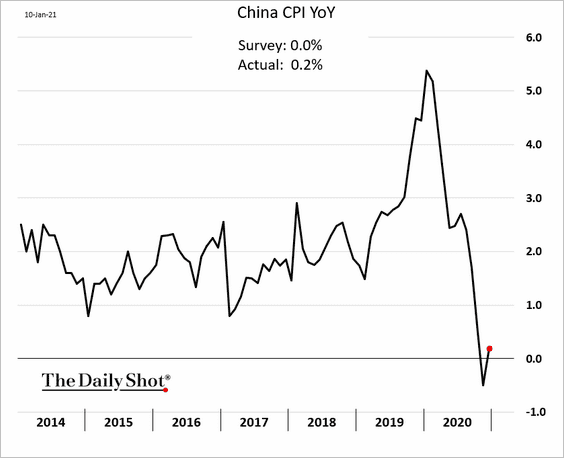

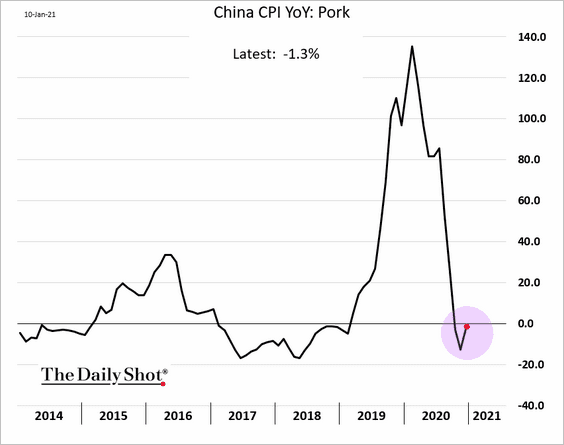

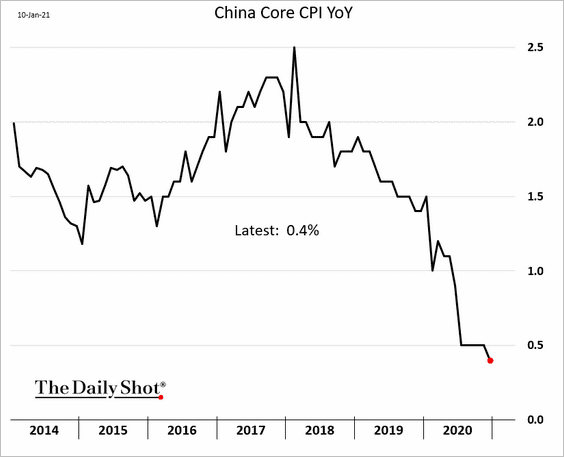

1. The CPI was a bit higher than expected, boosted by stabilization in pork prices (2nd chart).

The core CPI remains soft.

——————–

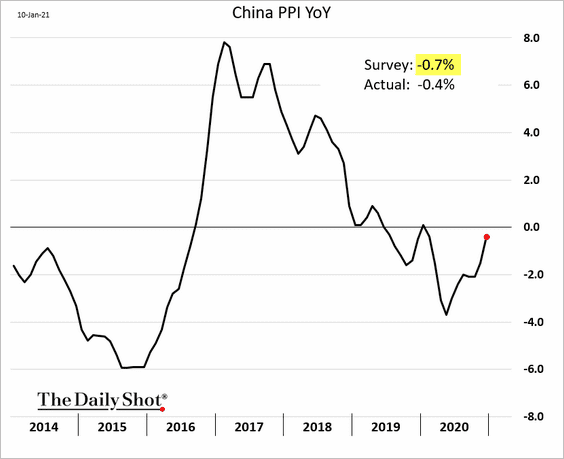

2. The PPI is recovering, with the latest report topping economists’ forecasts.

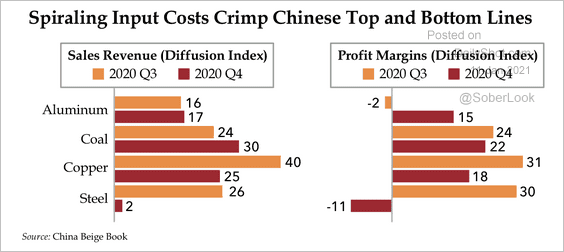

• Input costs have been rising, squeezing margins for industrial companies (the PPI will need to climb much further to boost margins).

Source: Quill Intelligence

Source: Quill Intelligence

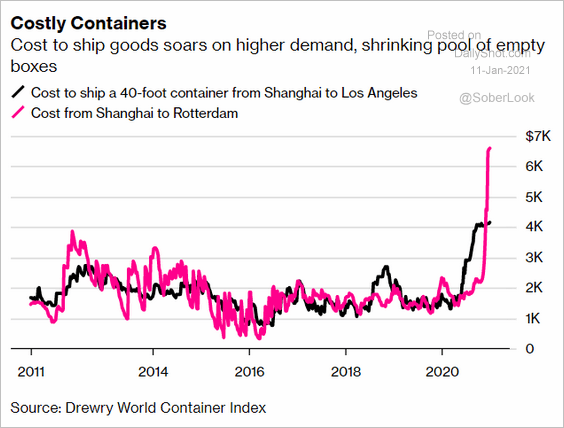

• Shipping costs have spiked.

Source: @markets Read full article

Source: @markets Read full article

——————–

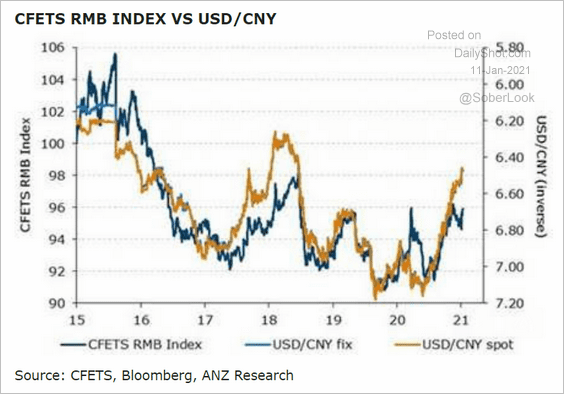

3. The rally in CNY vs. the dollar has outpaced the broader renminbi index.

Source: ANZ Research

Source: ANZ Research

Back to Index

Emerging Markets

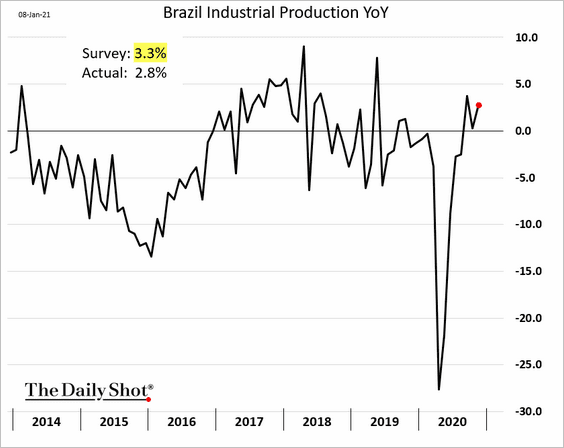

1. Brazil’s November industrial production was a bit disappointing.

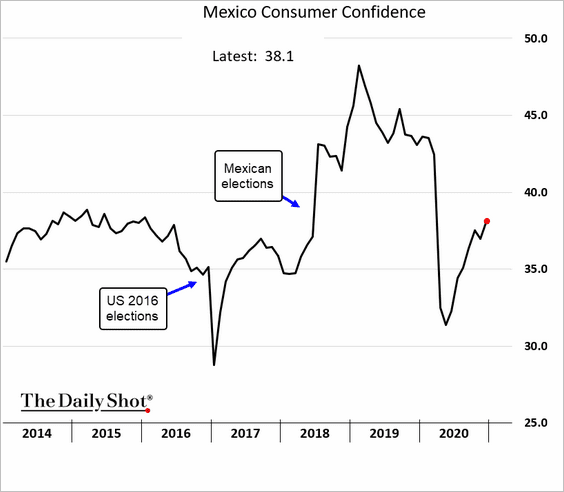

2. Mexico’s consumer confidence is recovering.

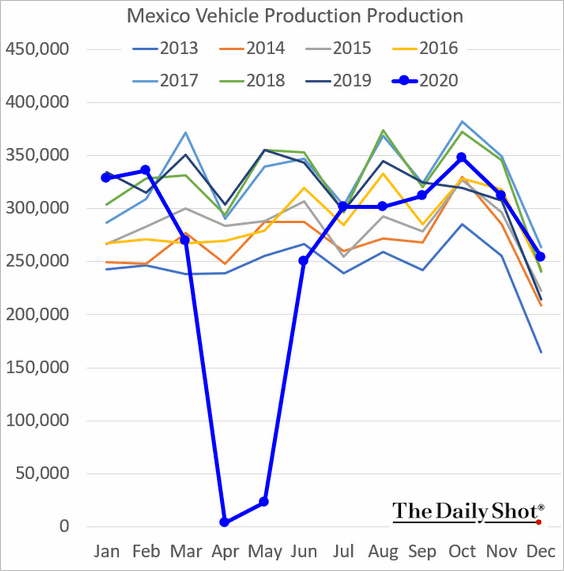

Mexican car production finished the year on a strong note.

——————–

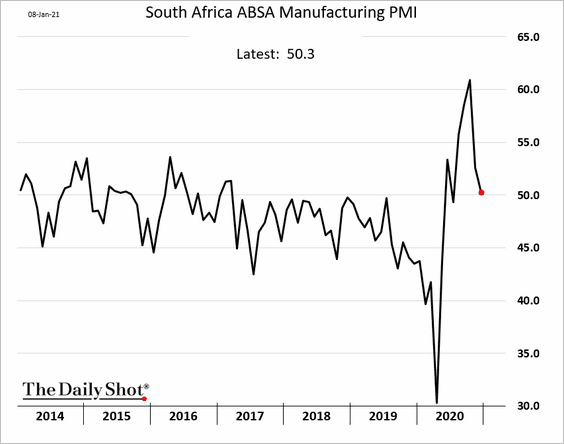

3. Growth in South Africa’s factory activity stalled last month amid new lockdowns.

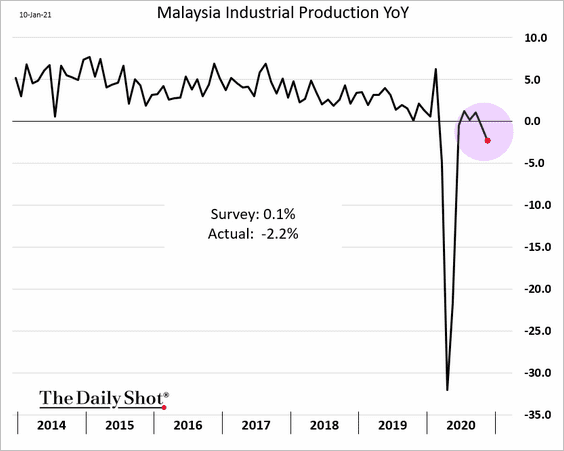

4. Malaysia’s industrial output deteriorated in November.

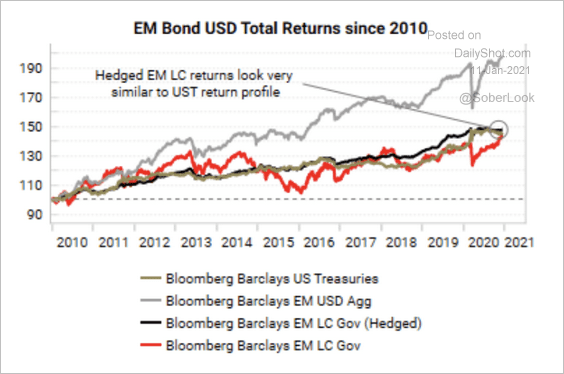

5. FX-hedged EM local currency bonds have a return profile that is similar to US Treasuries.

Source: Variant Perception

Source: Variant Perception

Back to Index

Cryptocurrency

1. Bitcoin is undergoing a correction as global markets shift into risk-off mode on Monday.

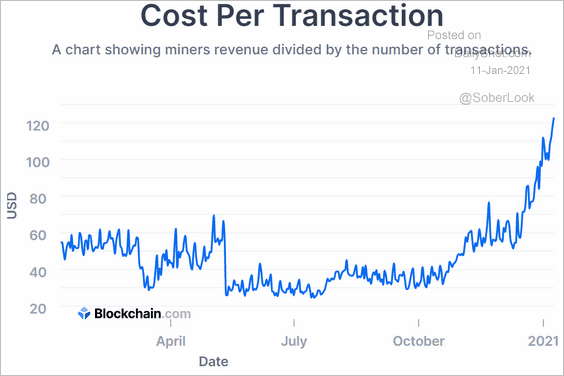

2. This chart shows the implicit cost per transaction for Bitcoin.

Source: Blockchain.com

Source: Blockchain.com

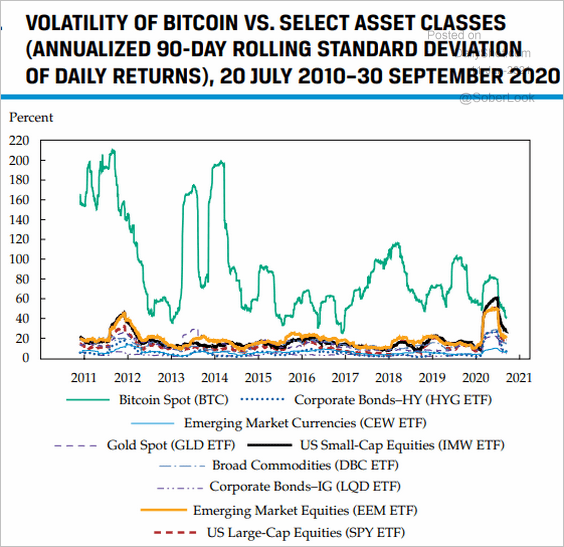

3. How does Bitcoin volatility compare to other markets?

Source: CFA Institute

Source: CFA Institute

Back to Index

Commodities

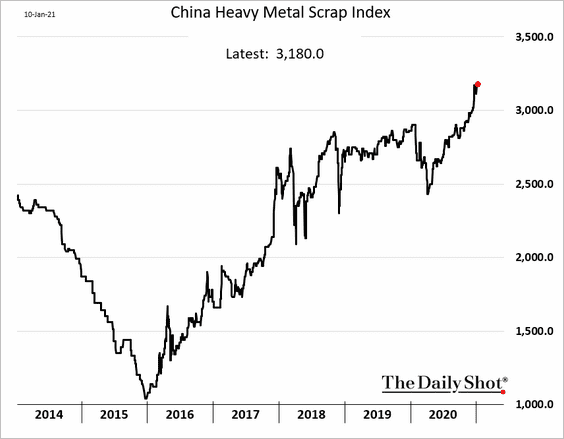

1. China’s scrap metal prices spiked amid shortages.

h/t @krystalchia

h/t @krystalchia

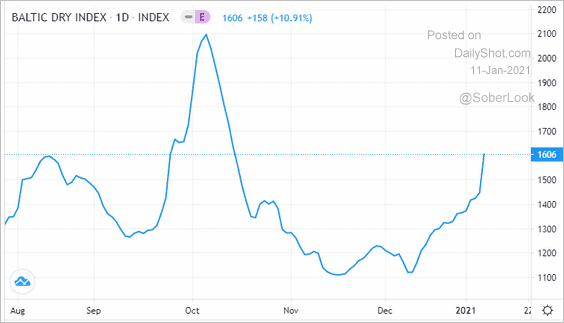

2. Dry bulk shipping costs jumped last week.

Source: Trading Economics

Source: Trading Economics

Source: Seekeing Alpha, h/t Walter Read full article

Source: Seekeing Alpha, h/t Walter Read full article

——————–

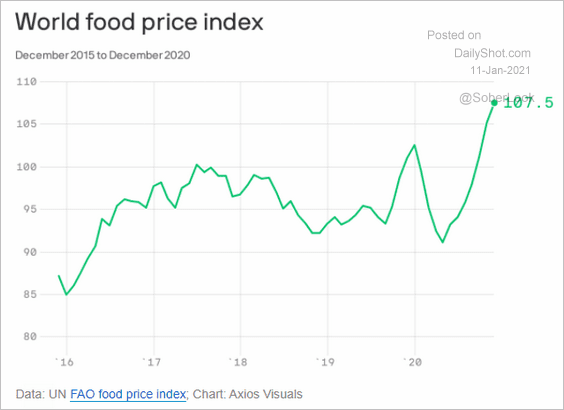

3. Global food prices are climbing.

Source: @axios

Source: @axios

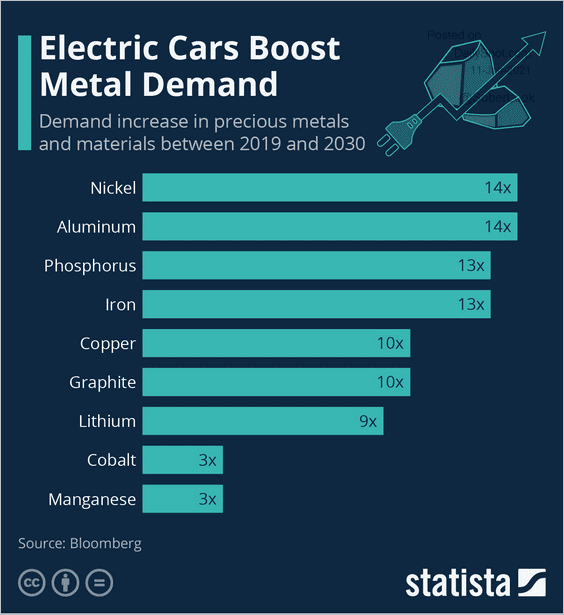

4. Here is the expected demand increase for materials used in electric vehicles.

Source: Statista

Source: Statista

Back to Index

Energy

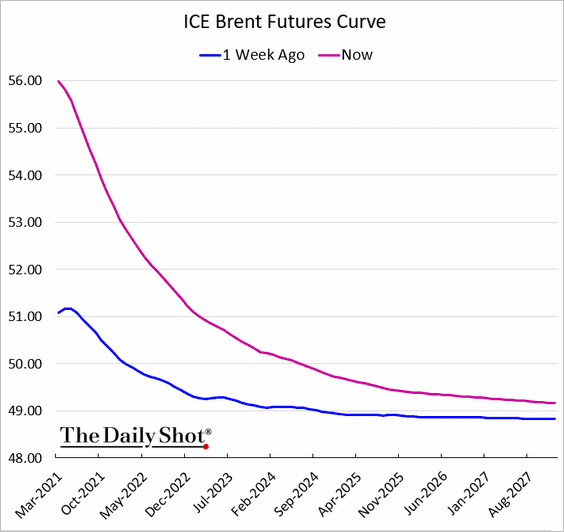

1. The Brent backwardation increased sharply last week.

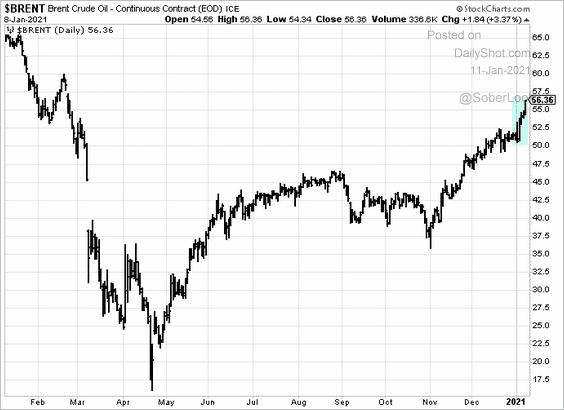

2. It’s been a strong start of the year for oil prices.

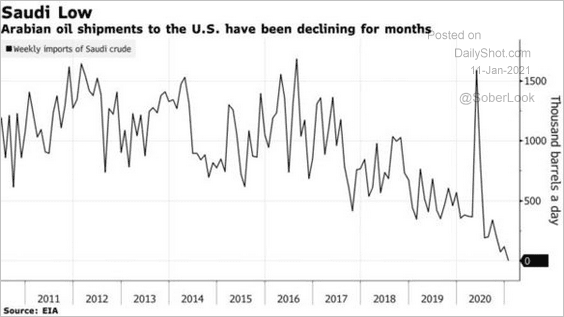

3. This chart shows Saudi oil shipments to the US.

Source: @business Read full article

Source: @business Read full article

Back to Index

Equities

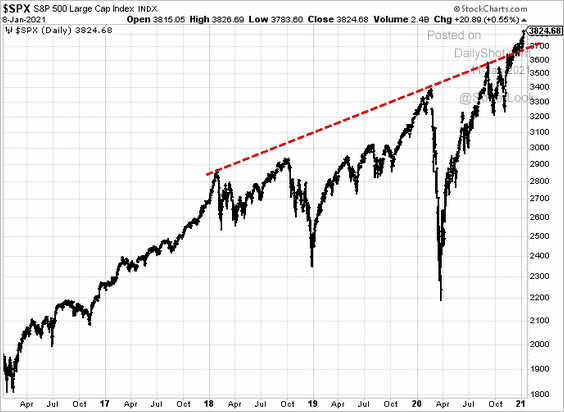

1. The S&P 500 hit a new high last week, but futures are softer this morning amid global risk-off sentiment.

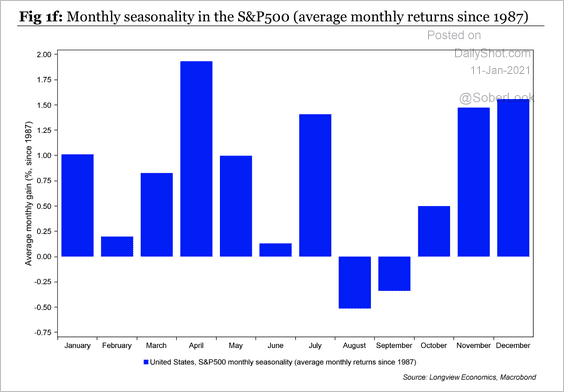

2. The S&P 500 tends to produce lower returns in February.

Source: Longview Economics

Source: Longview Economics

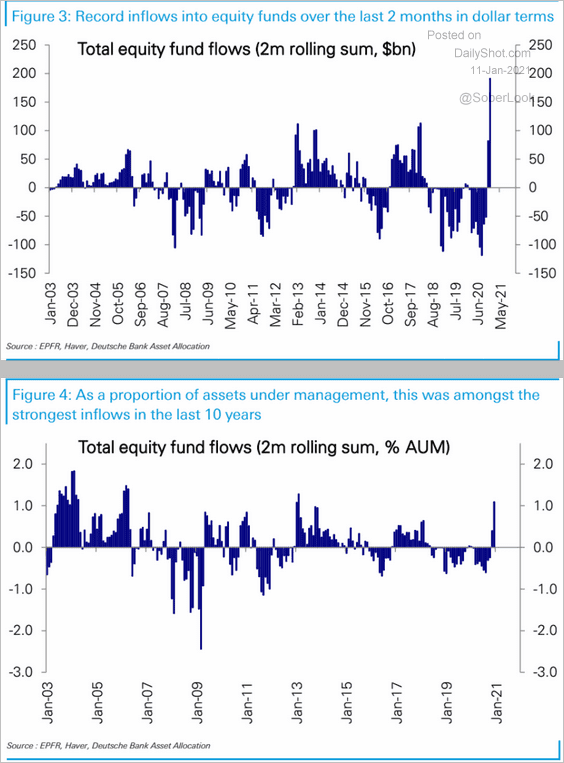

3. It’s been a good couple of months for equity fund inflows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

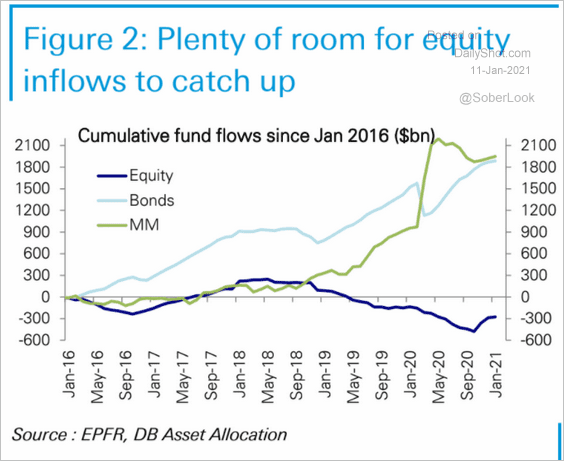

But equity flows have plenty of room to catch up to other asset classes.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

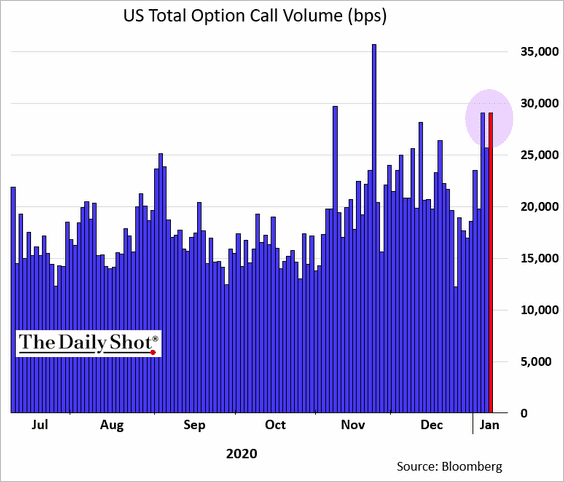

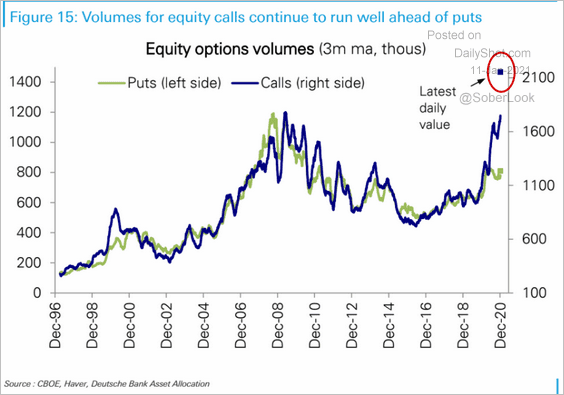

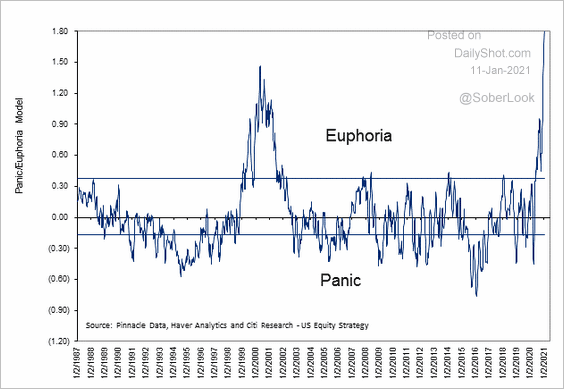

4. Sentiment indicators continue to show market exuberance.

• Equity call option volume (2 charts):

Source: Deutsche Bank Research

Source: Deutsche Bank Research

• The Citi euphoria/panic indicator:

Source: Citi, @AvidCommentator

Source: Citi, @AvidCommentator

——————–

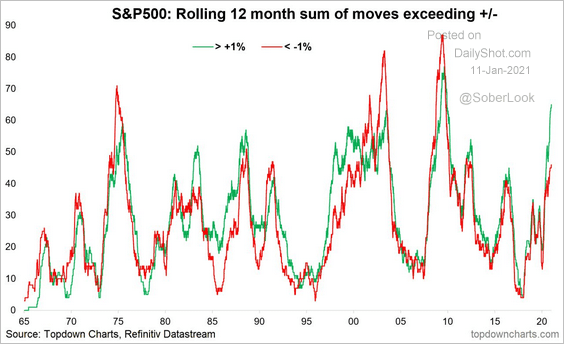

5. The S&P 500 has experienced significant upside volatility over the past year (similar to the late 1980s and 1990s).

Source: Topdown Charts

Source: Topdown Charts

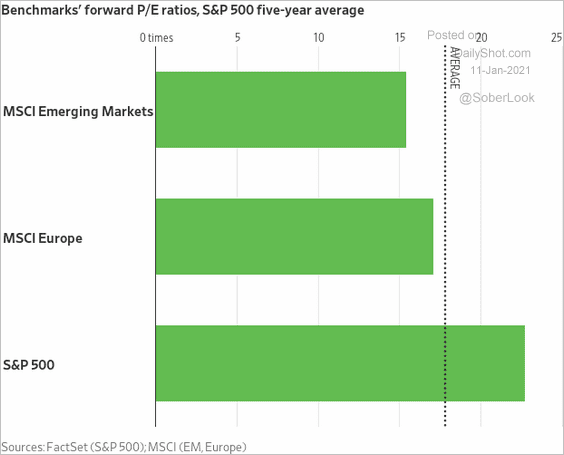

6. Here is a comparison of the S&P 500 forward P/E ratios to other markets (the S&P 500 is more tech-heavy).

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

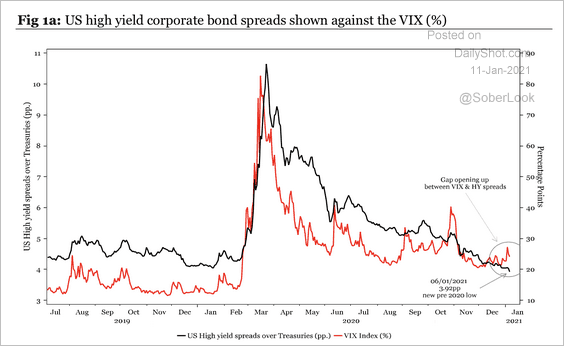

1. US high-yield spreads have tightened to 2018 levels and diverged from VIX (2nd chart).

Source: Longview Economics

Source: Longview Economics

——————–

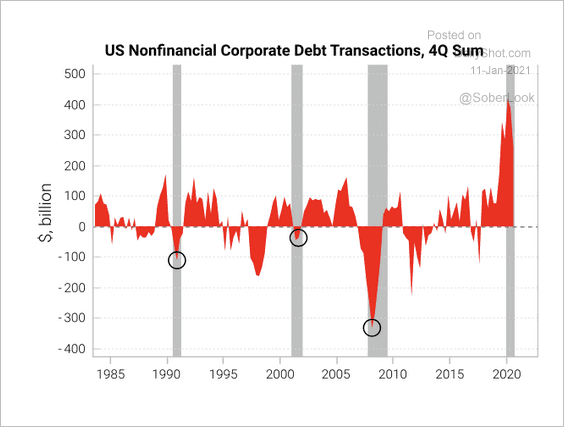

2. US corporate debt transactions accelerated last year.

Source: Variant Perception

Source: Variant Perception

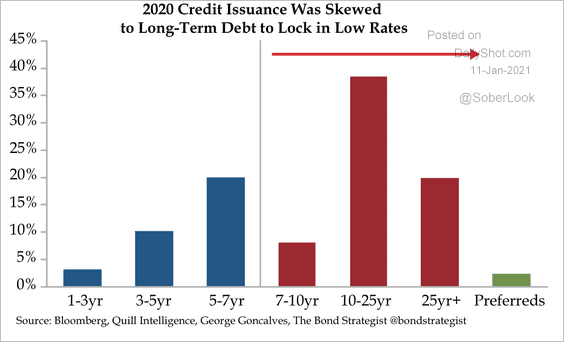

US companies issued longer-duration bonds to lock in low rates.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Rates

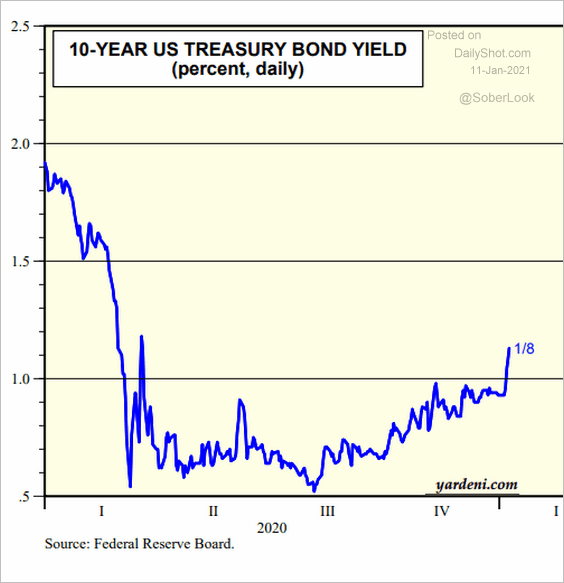

1. Treasury yields rose sharply last week.

Source: Yardeni Research

Source: Yardeni Research

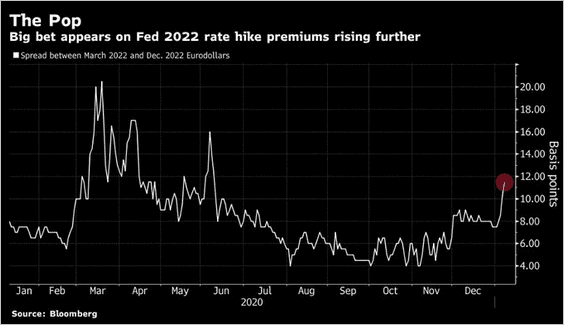

2. Some traders are betting on a Fed rate hike in 2022.

Source: @StephenSpratt, @markets

Source: @StephenSpratt, @markets

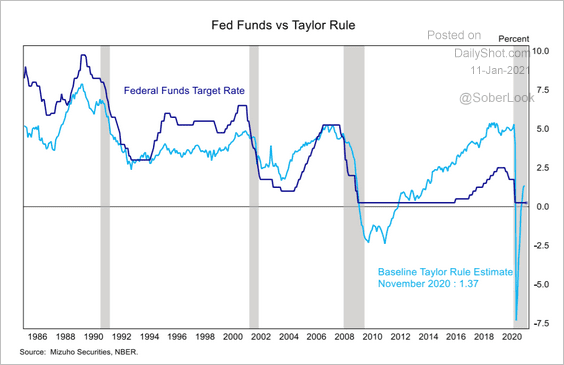

3. This chart shows the fed funds rate vs. the Taylor Rule.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Global Developments

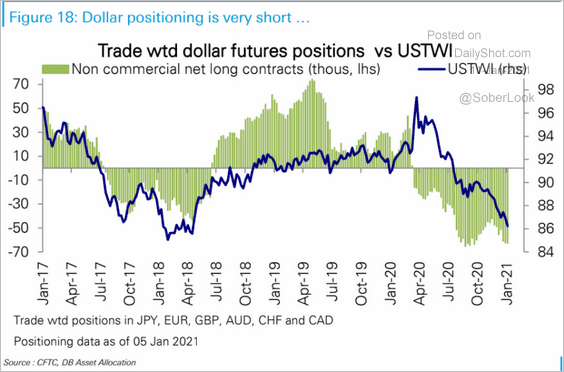

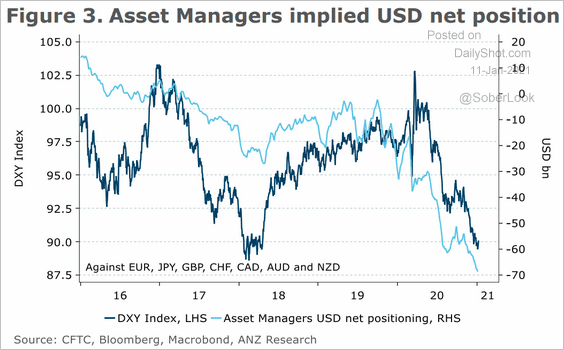

1. Speculative bets against the dollar are quite stretched (2 charts). Will we see a bounce?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: ANZ Research

Source: ANZ Research

——————–

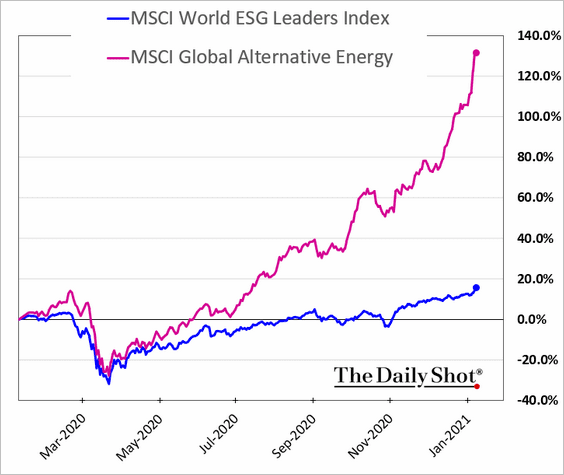

2. The rally in global alternative energy stocks has been impressive.

h/t @mikamsika

h/t @mikamsika

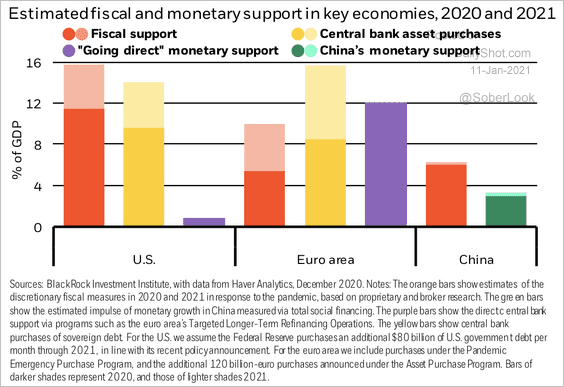

3. BlackRock expects ongoing fiscal and monetary support this year.

Source: BlackRock

Source: BlackRock

Back to Index

Food for Thought

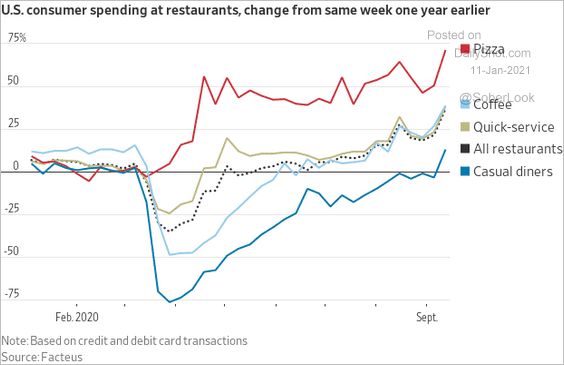

1. US consumer spending at restaurants:

Source: @jeffsparshott

Source: @jeffsparshott

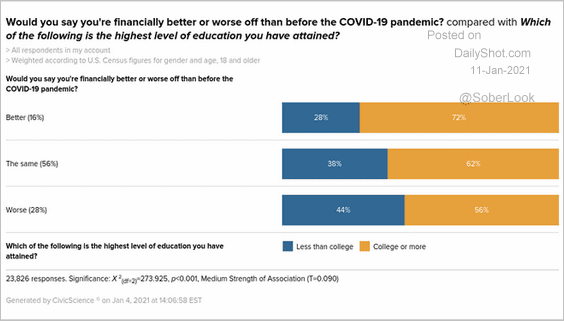

2. Who is better or worse off financially?

Source: @jdcivicscience, @CivicScience

Source: @jdcivicscience, @CivicScience

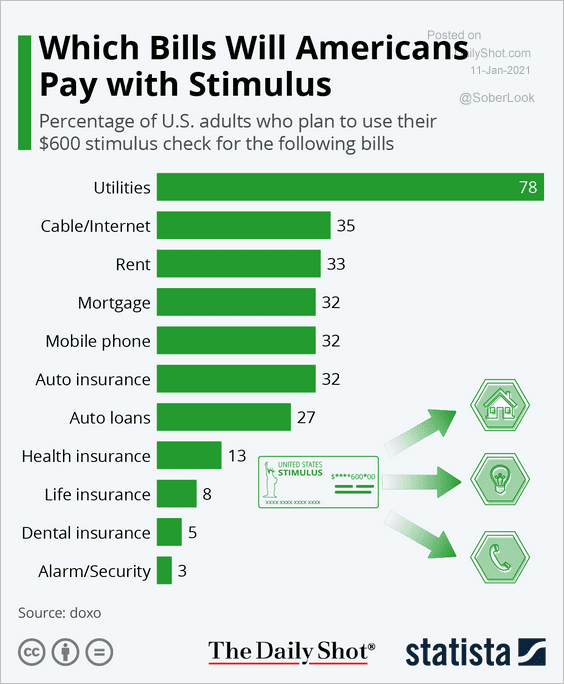

3. Which bills will Americans prioritize as they receive the stimulus checks?

Source: Statista

Source: Statista

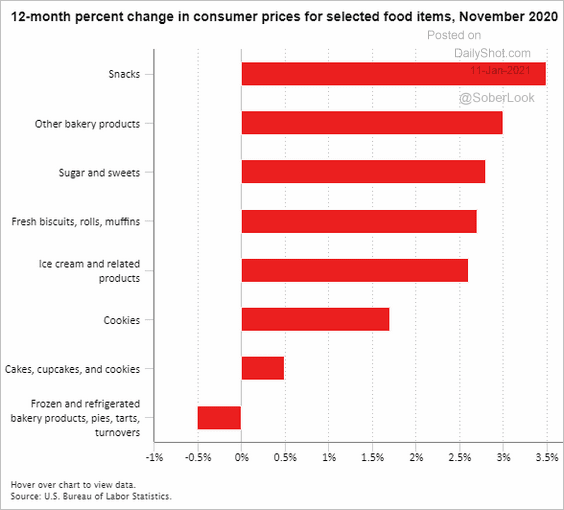

4. Changes in consumer prices for selected food items:

Source: BLS

Source: BLS

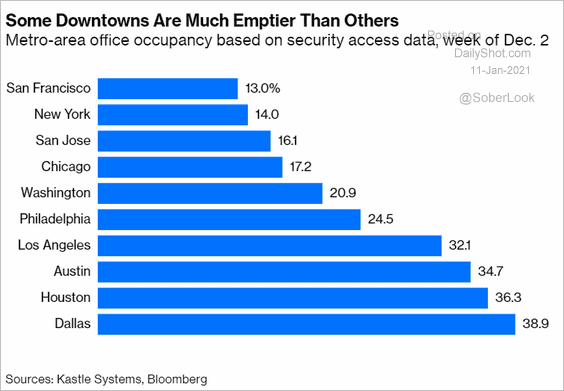

5. Office occupancy rates:

Source: @bopinion Read full article

Source: @bopinion Read full article

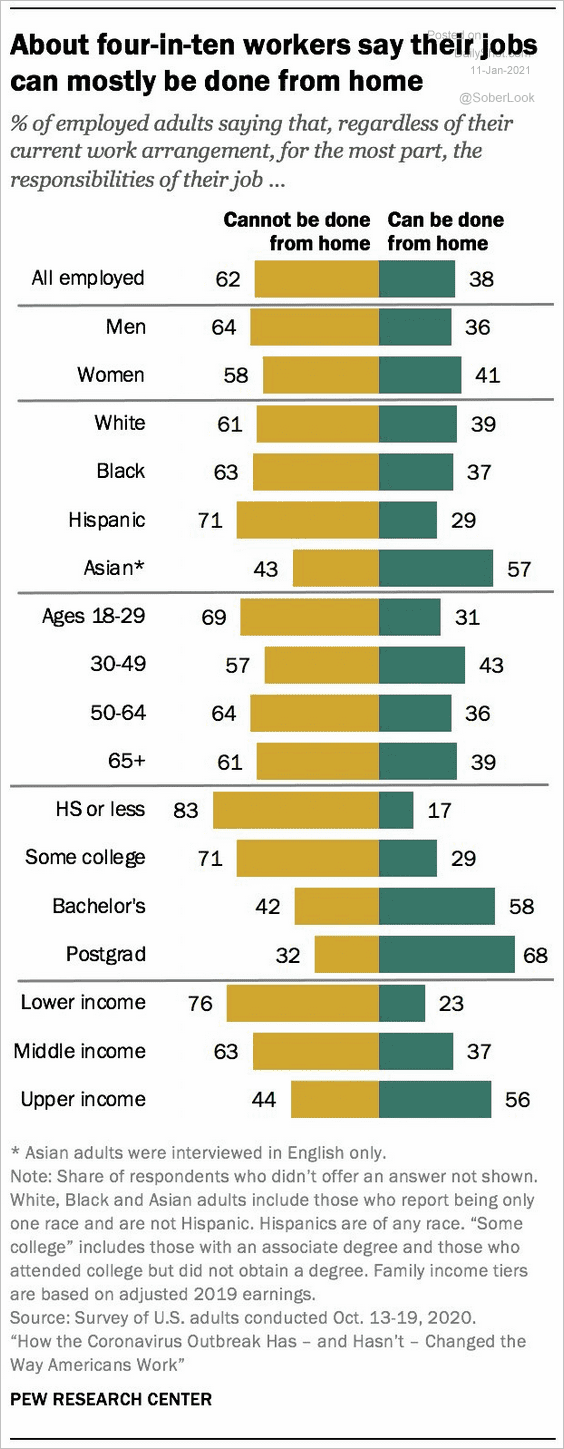

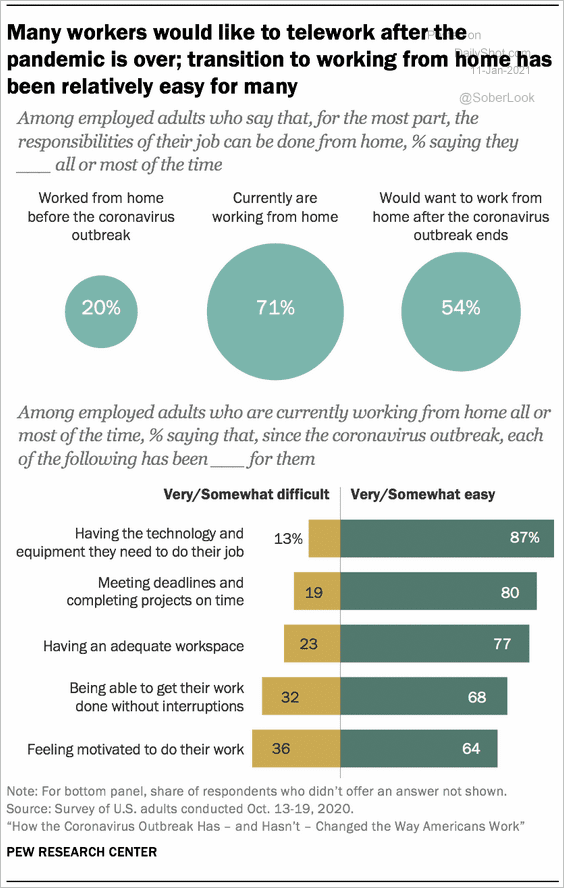

6. Who can work from home?

Source: @pewresearch Read full article

Source: @pewresearch Read full article

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

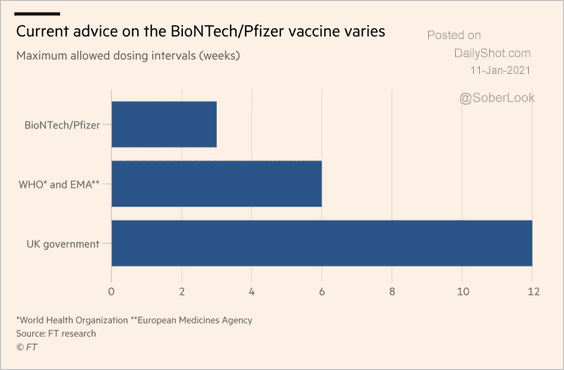

7. Delaying the second dose of the vaccine:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

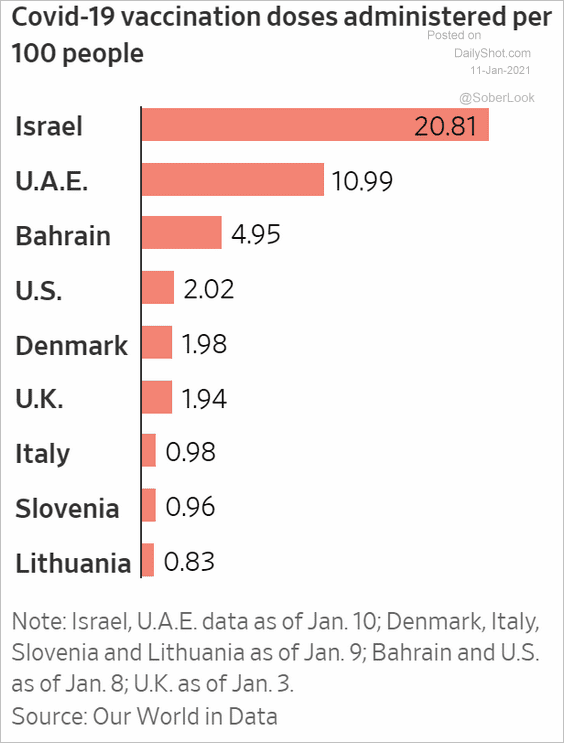

8. Vaccination progress:

Source: @WSJ Read full article

Source: @WSJ Read full article

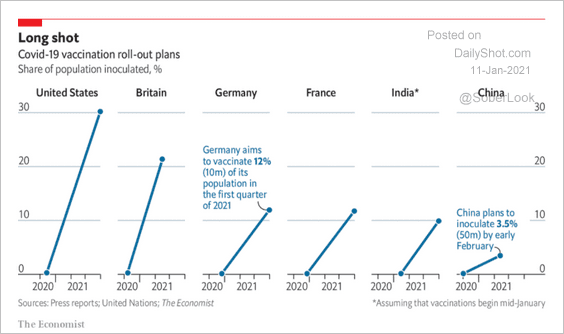

9. Vaccination plans:

Source: The Economist Read full article

Source: The Economist Read full article

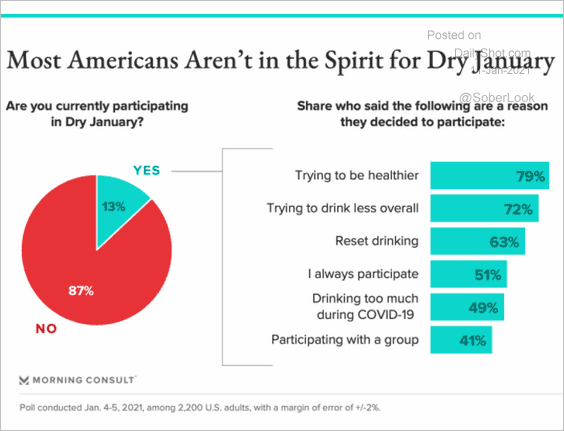

10. Dry January?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Back to Index