The Daily Shot: 15-Feb-21

• The United States

• Canada

• The United Kingdom

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Food for Thought

The United States

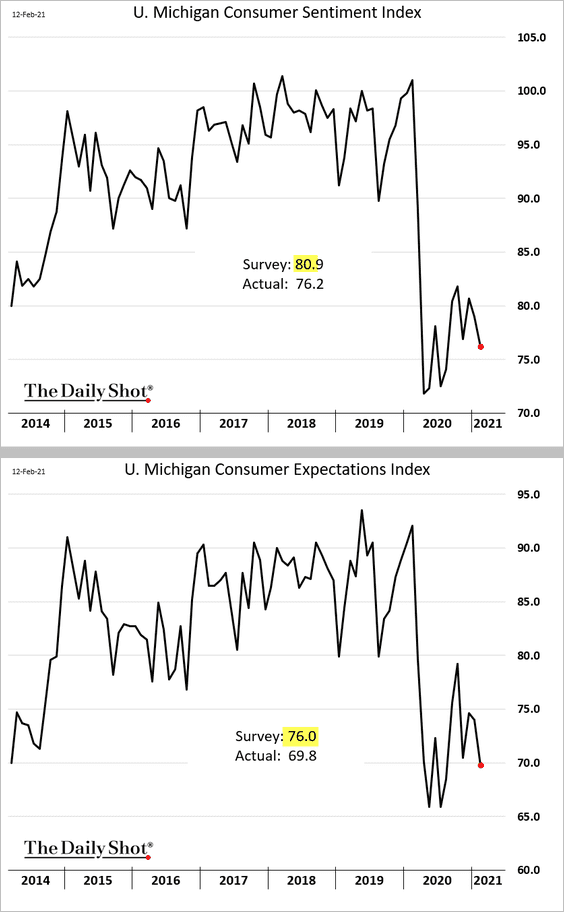

1. The February U. Michigan consumer sentiment report was surprisingly soft (economists were projecting an uptick).

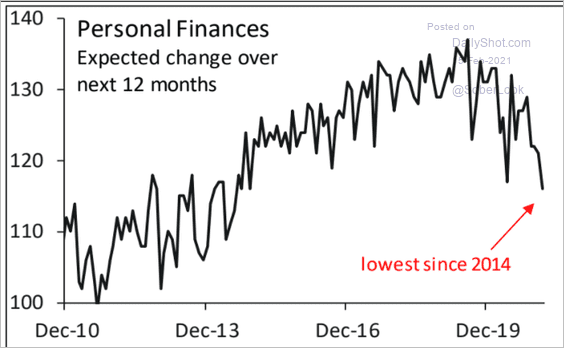

• The index of expected changes in personal finances hit the lowest level since 2014.

Source: Piper Sandler

Source: Piper Sandler

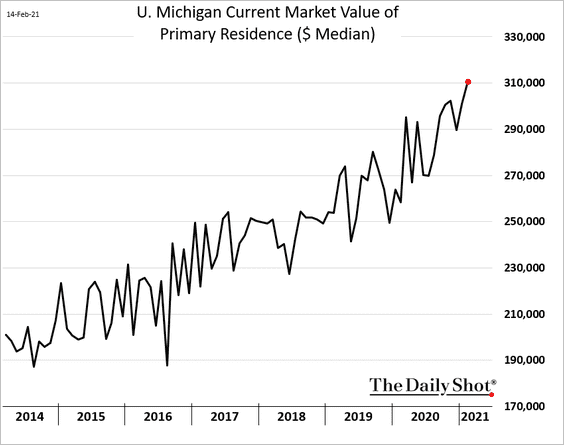

• Survey participants are reporting higher home prices.

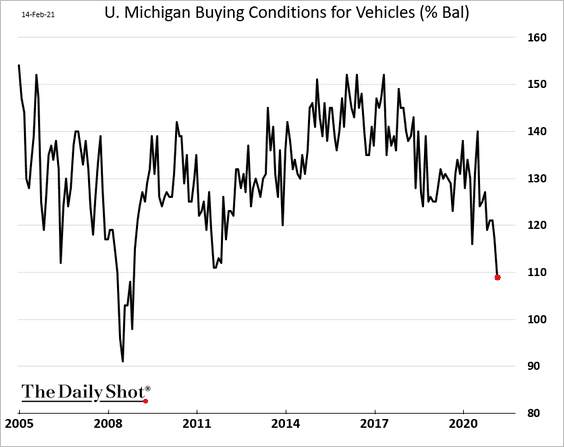

• The indicator of buying conditions for vehicles continues to deteriorate. It’s a bit surprising, given that vehicle sales held up relatively well last year despite the massive job losses.

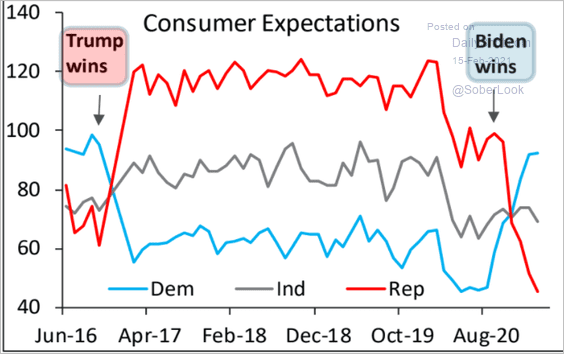

• As with other sentiment indicators, politics plays a significant role in the U. Michigan index.

Source: Piper Sandler

Source: Piper Sandler

——————–

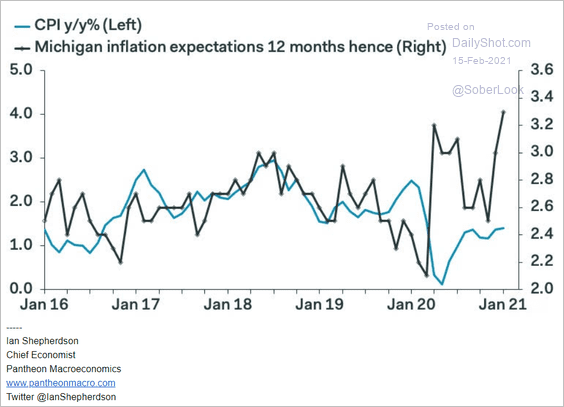

2. Next, we have some updates on inflation.

• The U. Michigan survey (above) points to higher inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

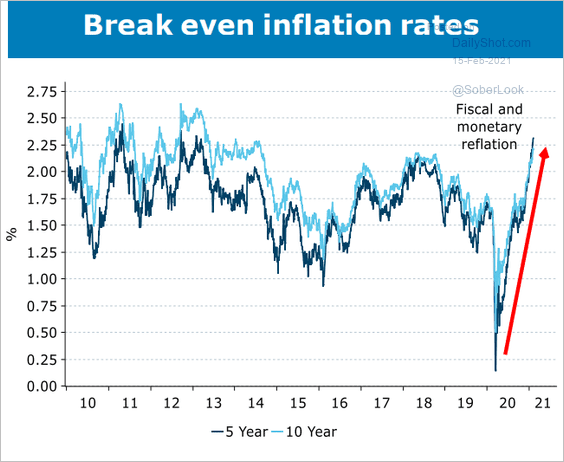

• Market-based inflation expectations also keep climbing.

Source: ANZ Research

Source: ANZ Research

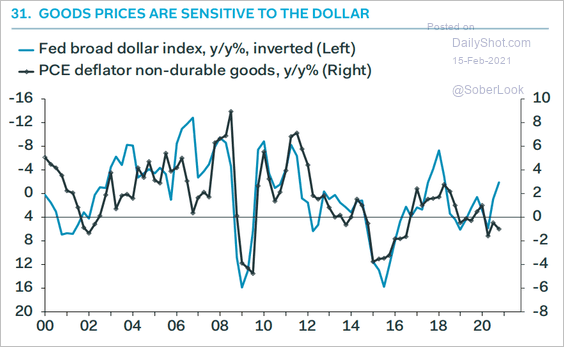

• The US dollar weakness is yet to be fully reflected in inflation figures.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

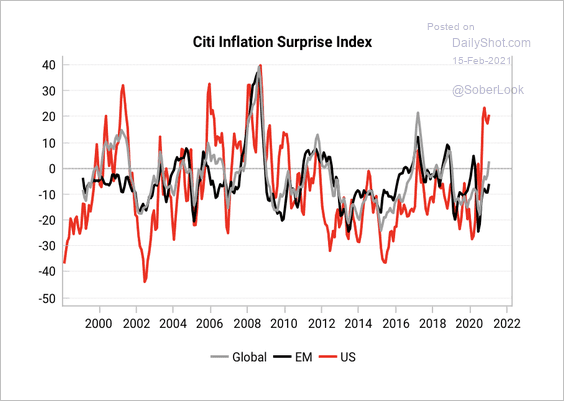

• Inflation surprises have been greater in the US than in the rest of the world.

Source: Variant Perception

Source: Variant Perception

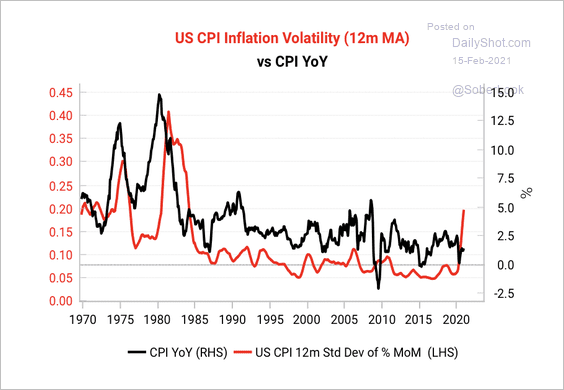

• Inflation volatility has risen sharply.

Source: Variant Perception

Source: Variant Perception

——————–

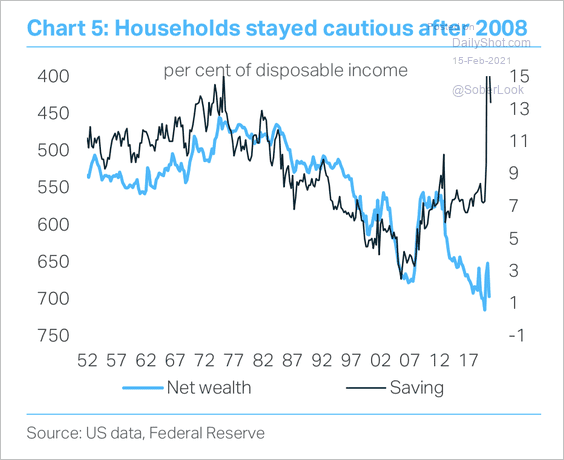

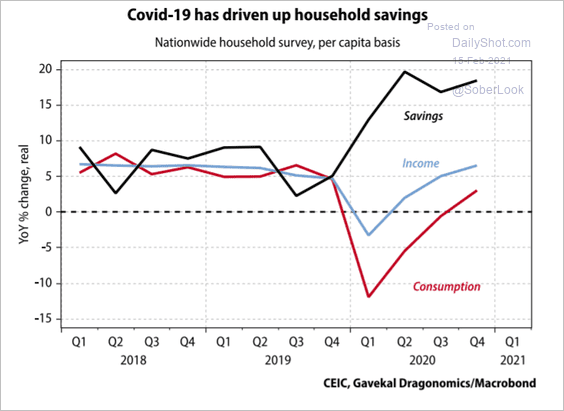

3. Households have been saving more since the financial crisis.

Source: TS Lombard

Source: TS Lombard

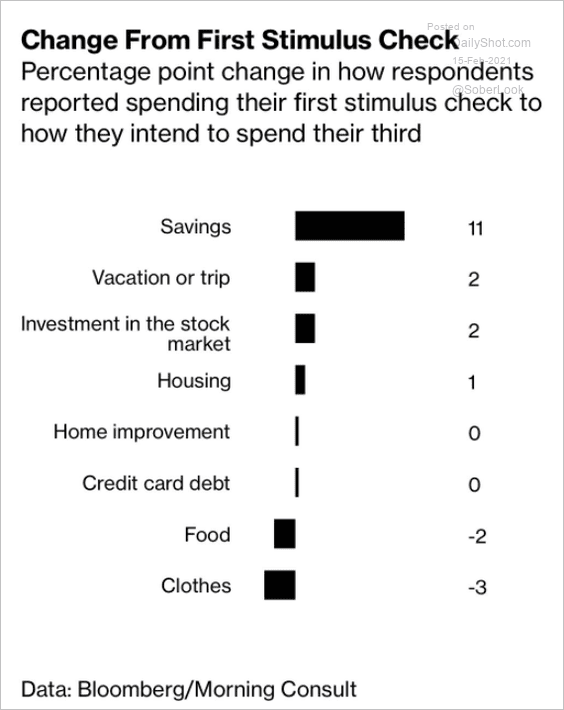

Consumers are more likely to save the third stimulus check vs. how they used funds from the first check.

Source: @business Read full article

Source: @business Read full article

——————–

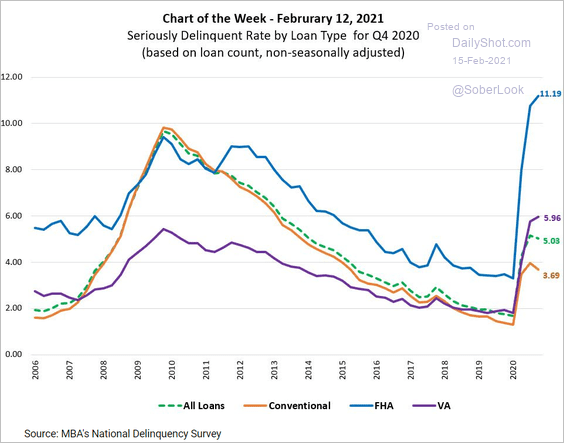

4. This chart shows mortgage delinquencies by loan type.

Source: Mortgage Bankers Association

Source: Mortgage Bankers Association

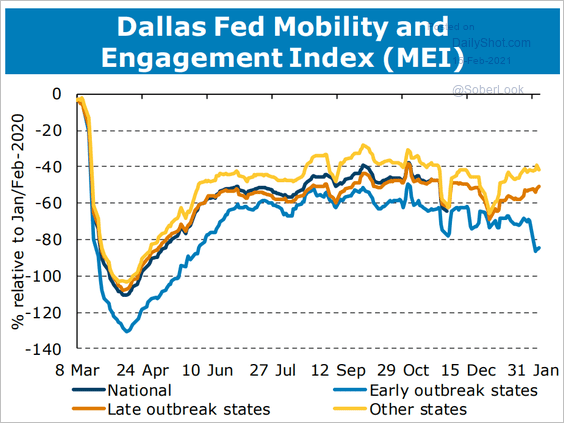

5. US mobility recovery is increasingly uneven.

Source: ANZ Research

Source: ANZ Research

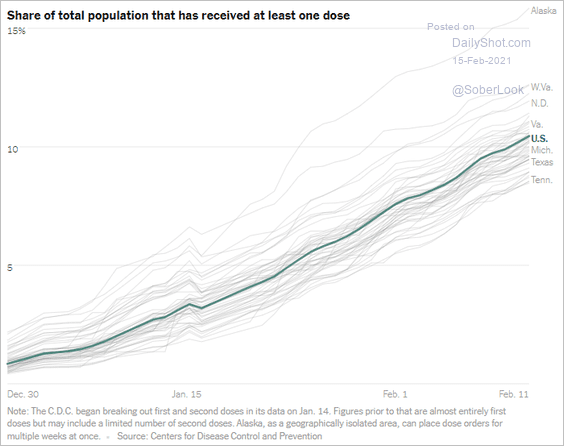

6. Finally, we have the US population share that has received at least one vaccine dose.

Source: The New York Times Read full article

Source: The New York Times Read full article

Back to Index

Canada

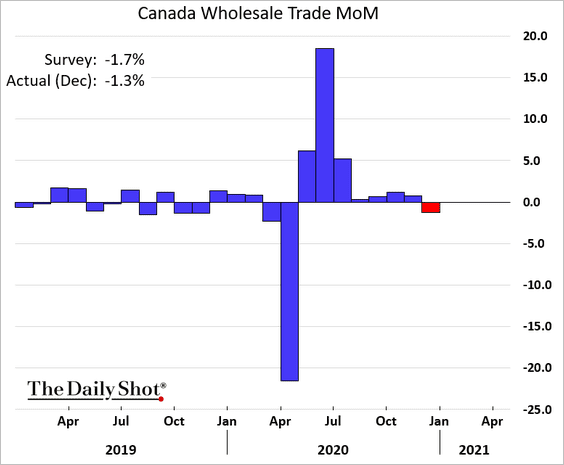

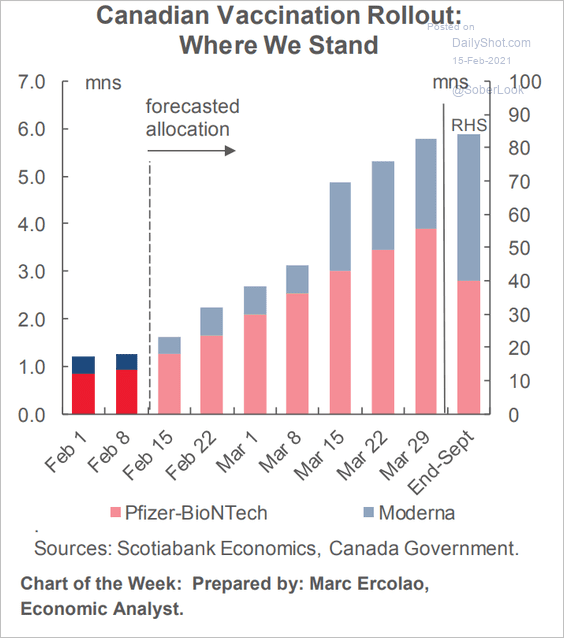

1. After seven consecutive increases, wholesale trade declined in December

2. Here is Scotiabank’s forecast for vaccination rollout.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

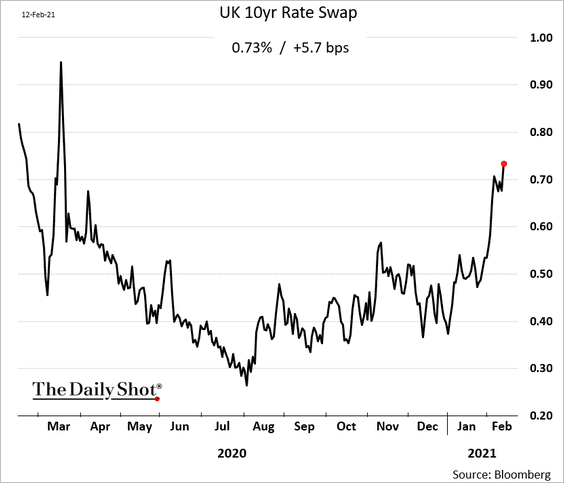

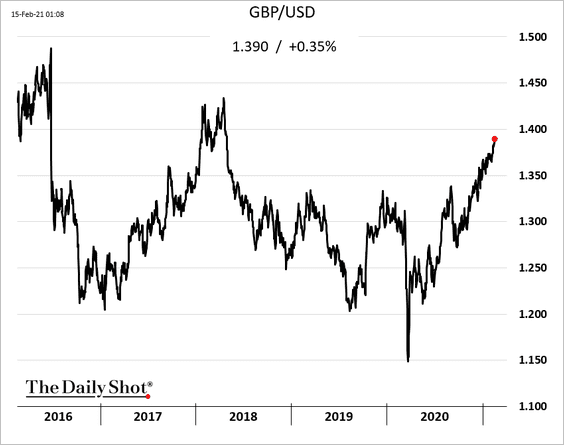

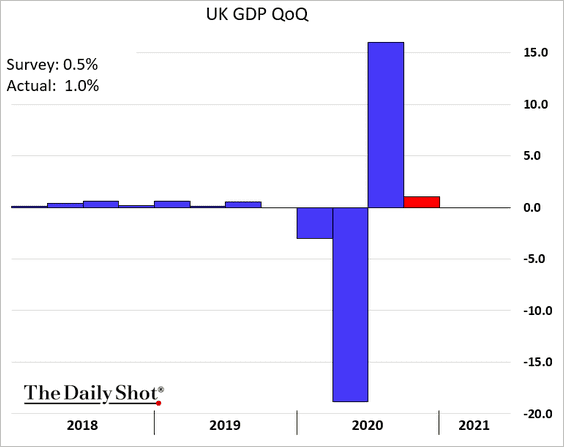

The United Kingdom

1. Longer-term rates are climbing.

2. The pound is approaching $1.40.

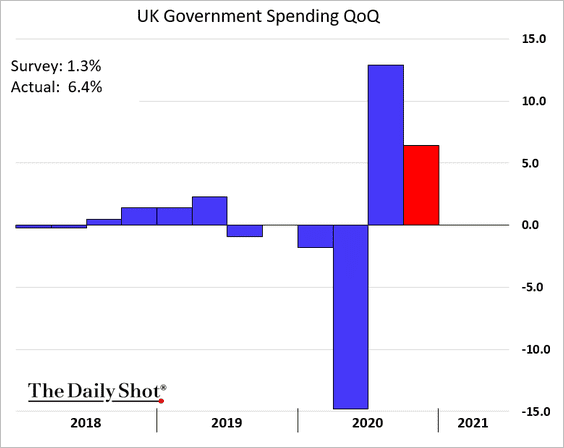

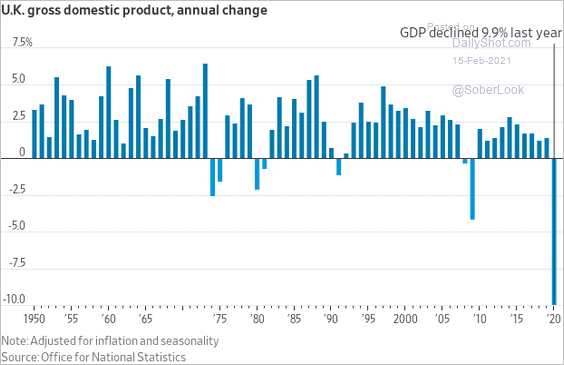

3. The Q3 GDP growth was firmer than expected.

Government spending was particularly strong.

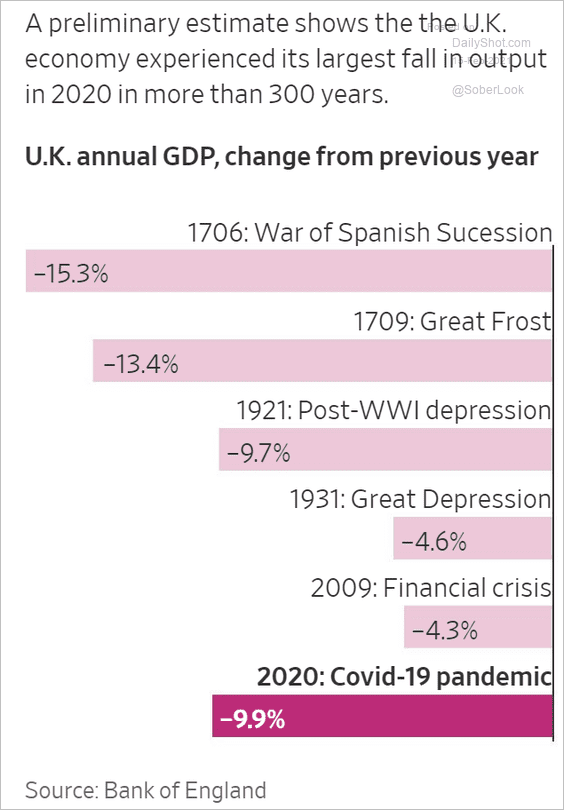

On an annual basis, the GDP decline was the worst in centuries.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

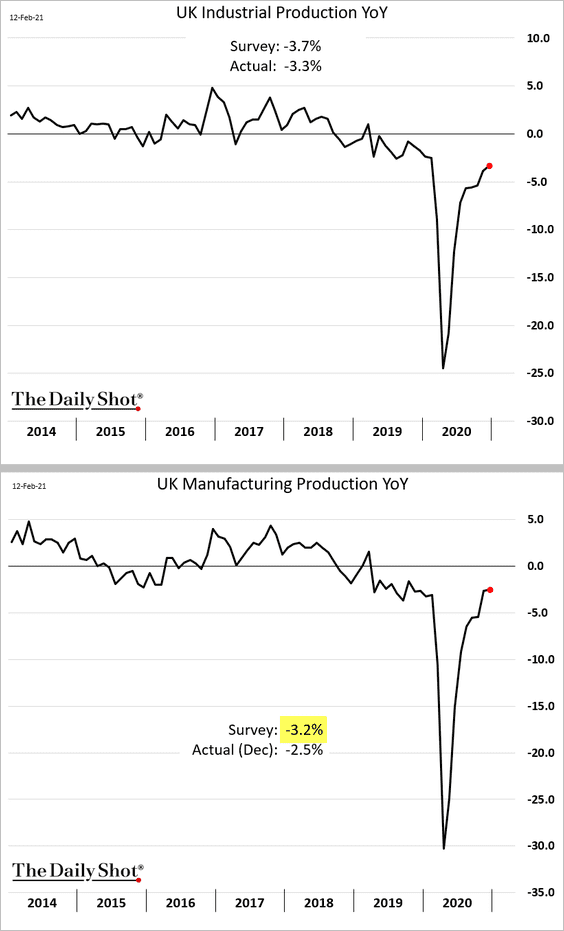

4. December manufacturing output surprised to the upside.

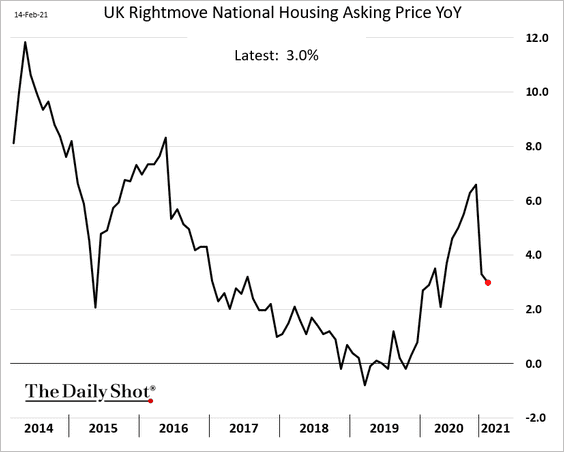

5. Home asking prices have pulled back over the past couple of months.

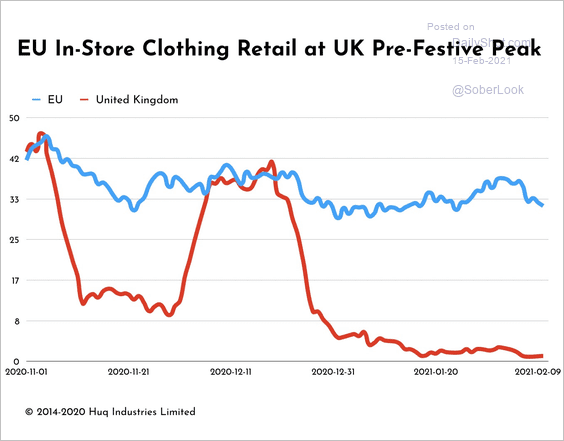

6. This chart shows the divergence between EU and UK in-store clothing retail activity.

Source: Huq Read full article

Source: Huq Read full article

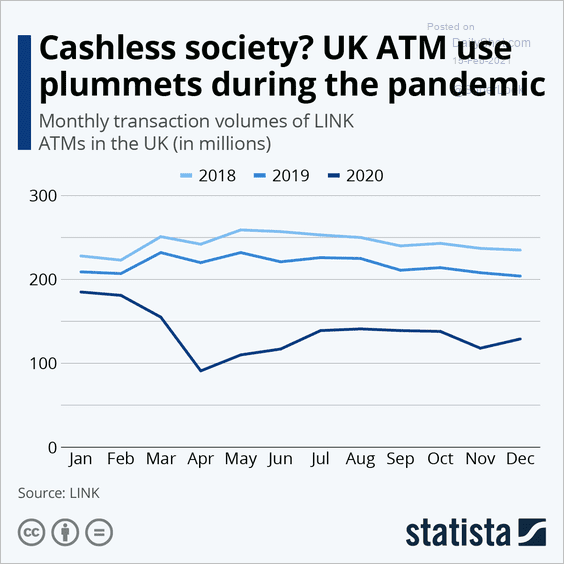

7. ATM usage remains soft relative to previous years.

Source: Statista

Source: Statista

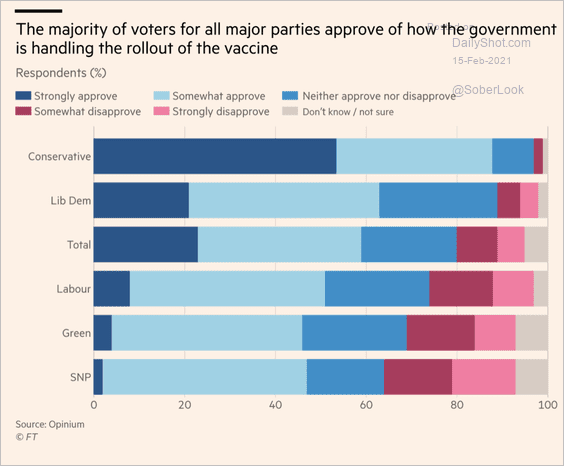

8. The public mostly approves of the government’s vaccine rollout.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

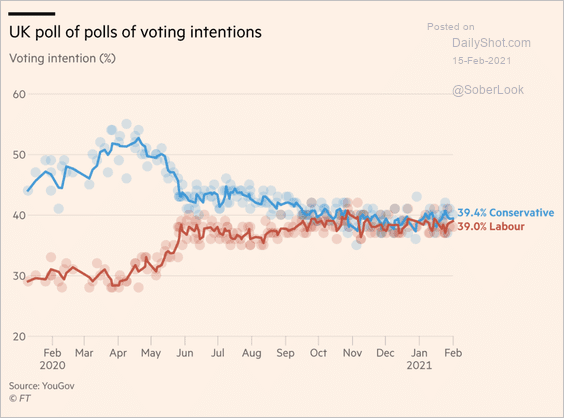

Here are the latest voting intentions poll numbers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

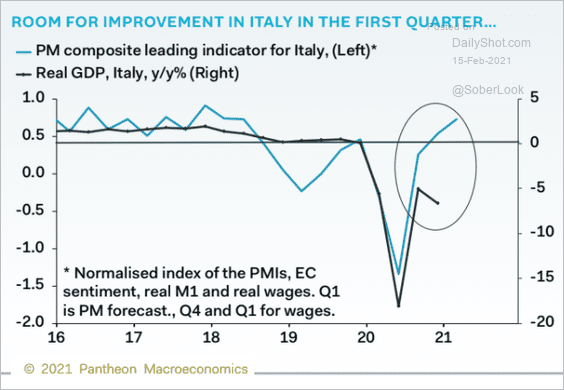

1. Italy may see an economic rebound in Q1.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

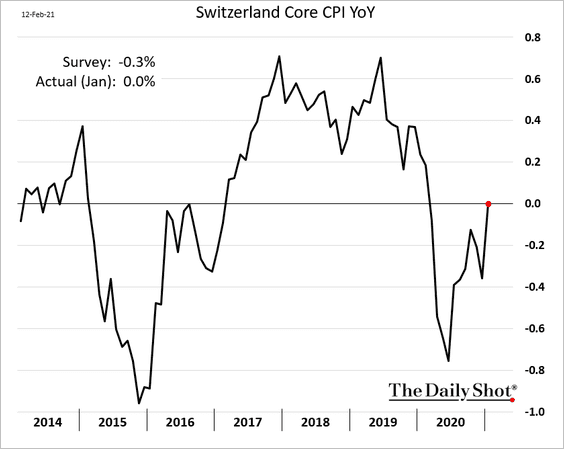

2. Switzerland is pulling out of deflation.

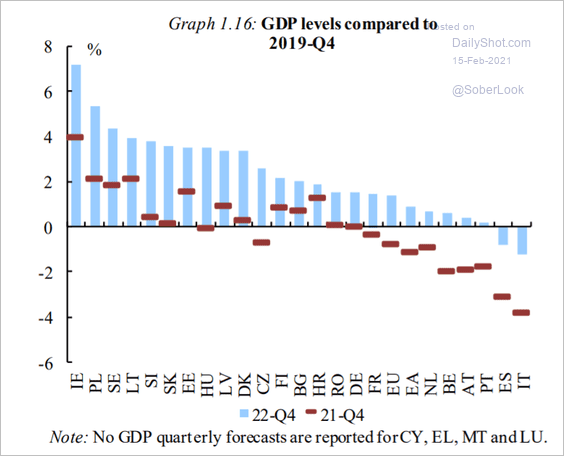

3. This chart shows the expected GDP levels at the end of 2021 and 2022 relative to 2019-Q4.

Source: EC Read full article

Source: EC Read full article

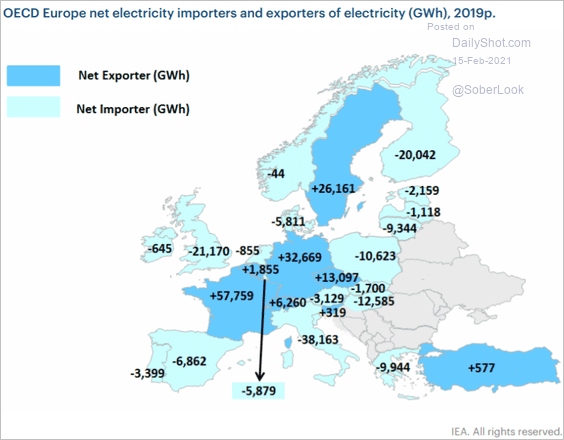

4. Finally, we have European importers and exporters of electricity.

Source: IEA

Source: IEA

Back to Index

Japan

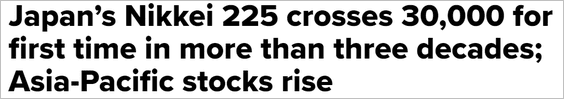

1. The Nikkei breached 30k for the first time in decades.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

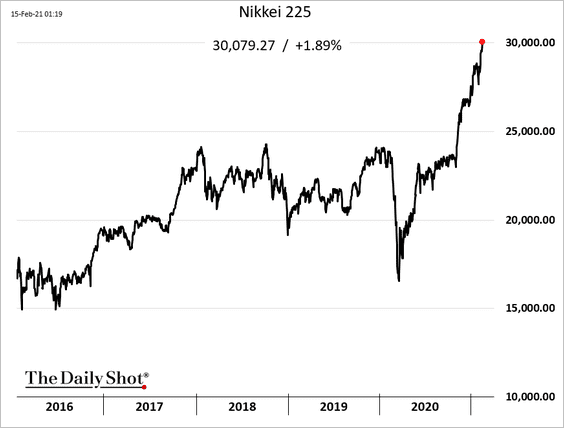

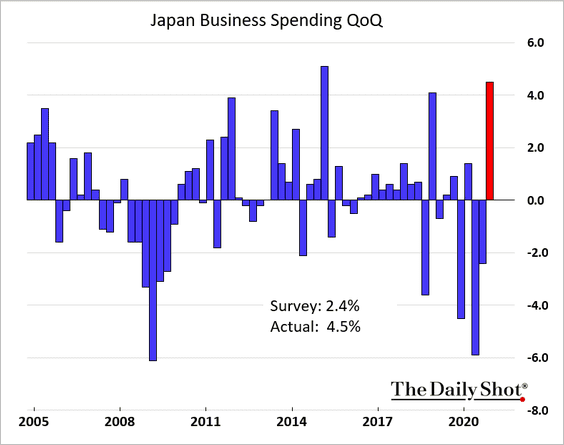

2. The Q4 GDP growth surprised to the upside.

Business spending was particularly strong.

——————–

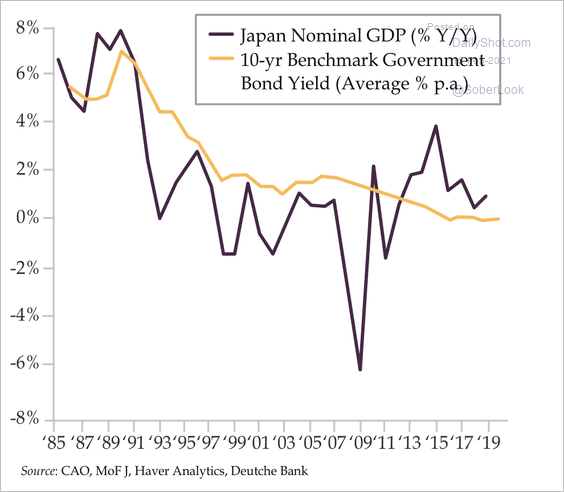

3. Government bond yields have followed nominal GDP lower.

Source: Quill Intelligence

Source: Quill Intelligence

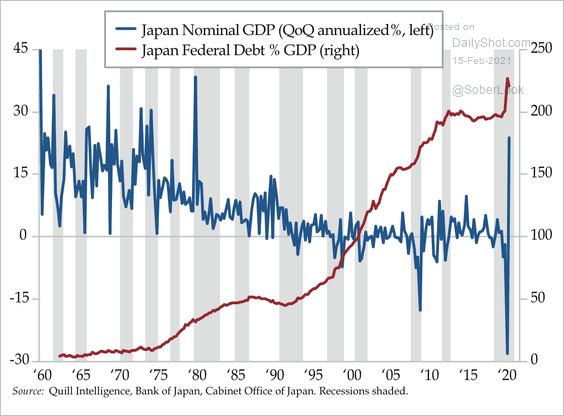

The government has added more debt as the economy faces structural weakness.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Asia – Pacific

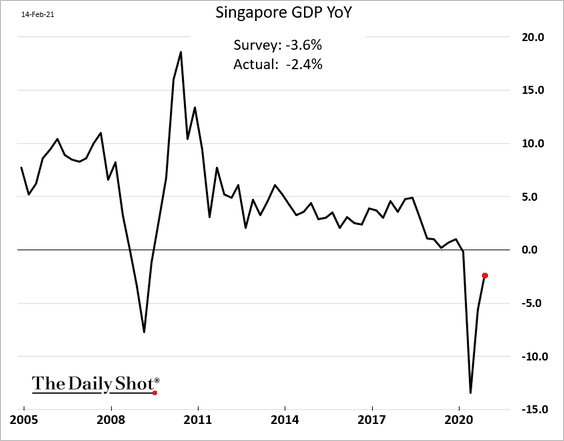

1. Singapore’s Q4 GDP topped economists’ forecasts.

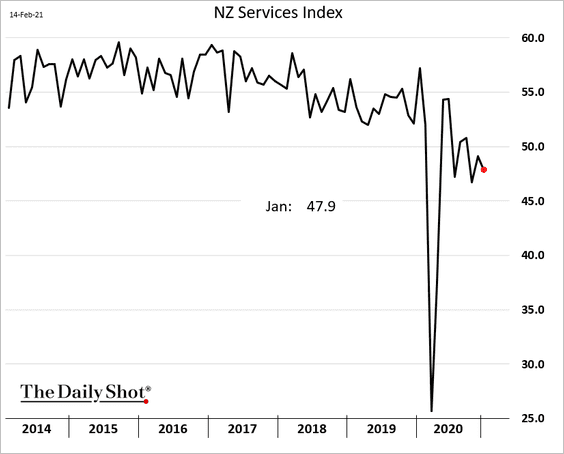

2. New Zealand’s service sector continued to weaken last month.

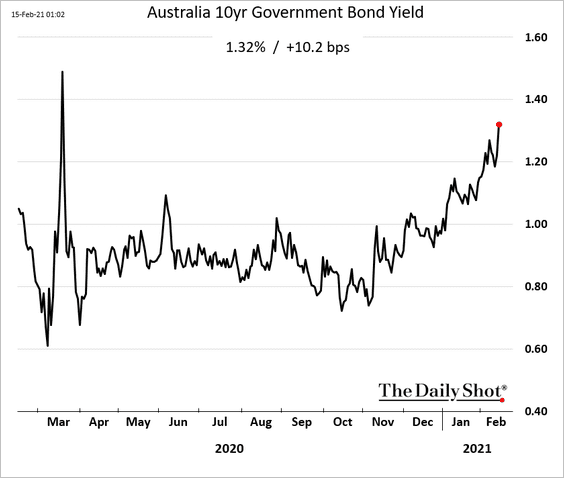

3. Australia’s 10yr yield climbed above 1.3%

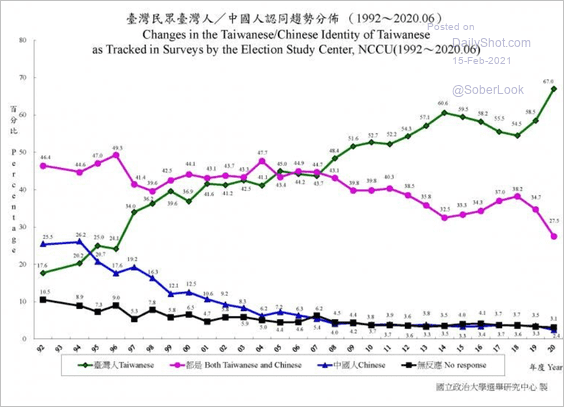

4. Taiwan’s citizens increasingly think of themselves as Taiwanese rather than “Chinese,” which may further heighten tensions with China.

Source: Noah Smith Read full article

Source: Noah Smith Read full article

Back to Index

China

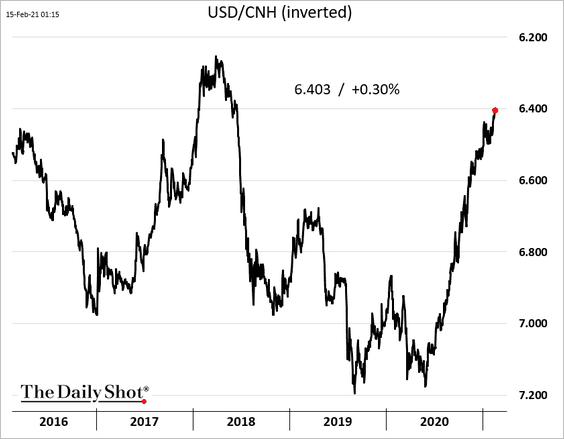

1. The offshore renminbi keeps climbing.

2. Household savings remain elevated.

Source: Gavekal Research

Source: Gavekal Research

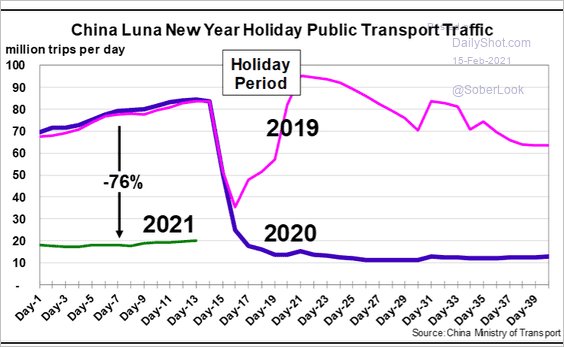

3. Unlike in some other countries, China’s citizens have been mostly avoiding travel during the holidays.

Source: Evercore ISI

Source: Evercore ISI

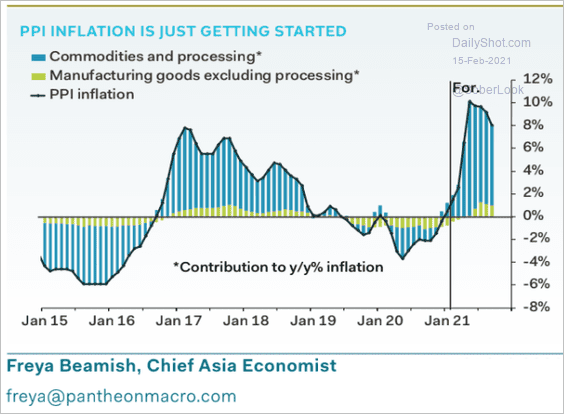

4. Pantheon Macroeconomics expects producer inflation to climb sharply this year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

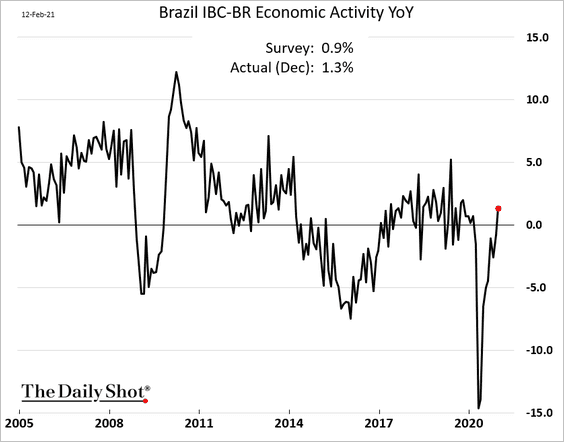

1. Brazil’s economic activity fully recovered in December (topping expectations).

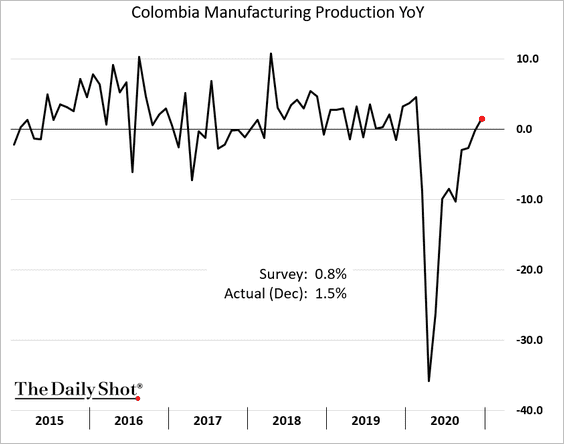

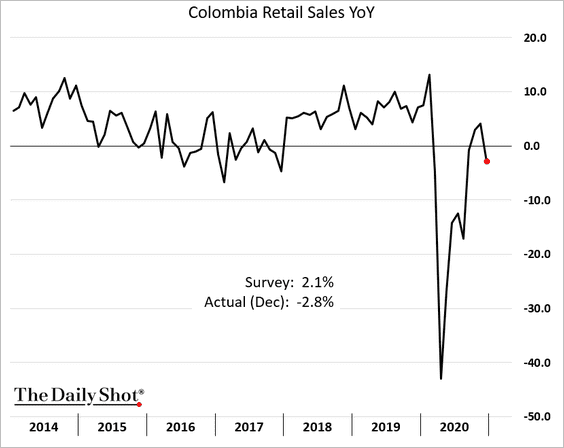

2. Colombia’s factory output has rebounded.

But retail sales deteriorated in December.

——————–

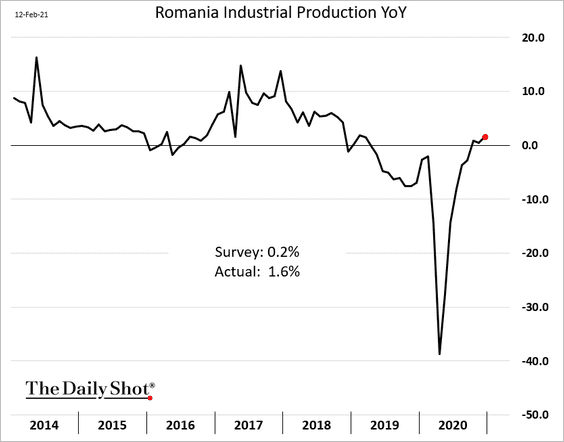

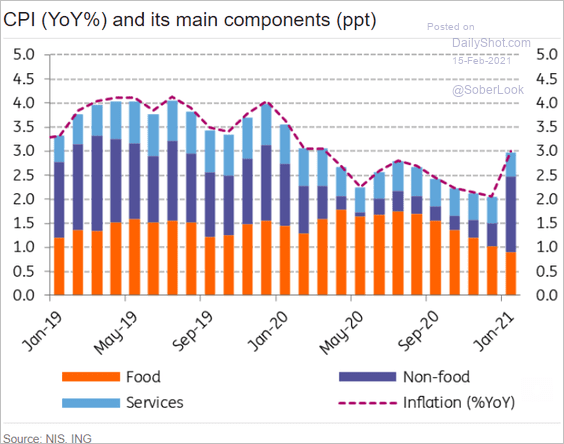

3. Romania’s industrial production surprised to the upside.

Inflation jumped.

Source: ING

Source: ING

——————–

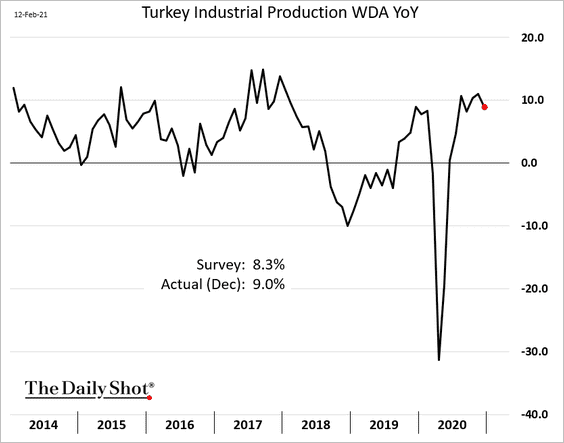

4. Turkey’s industrial production remains robust.

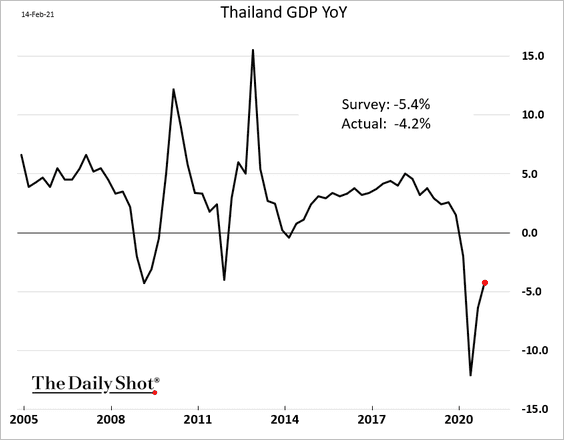

5. Here is Thailand’s year-over-year GDP growth.

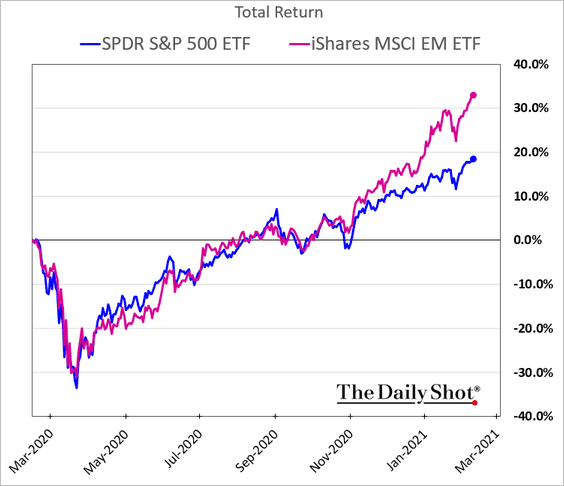

6. EM stocks have been outperforming the S&P 500 in US-dollar terms.

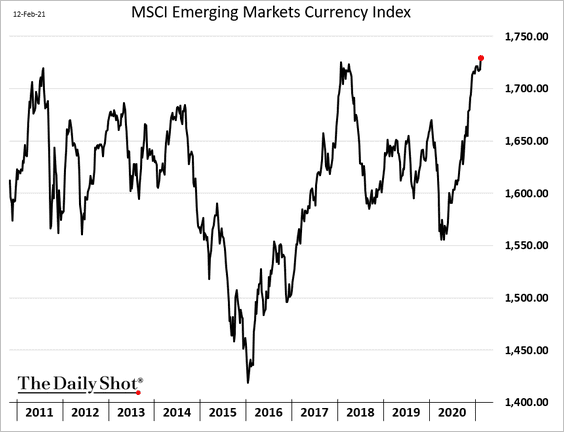

7. EM currencies keep grinding higher.

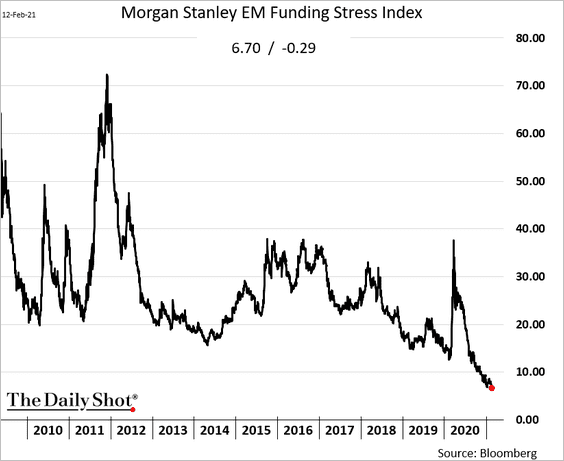

8. EM funding conditions continue to ease amid foreign investors’ search for yield.

Back to Index

Cryptocurrency

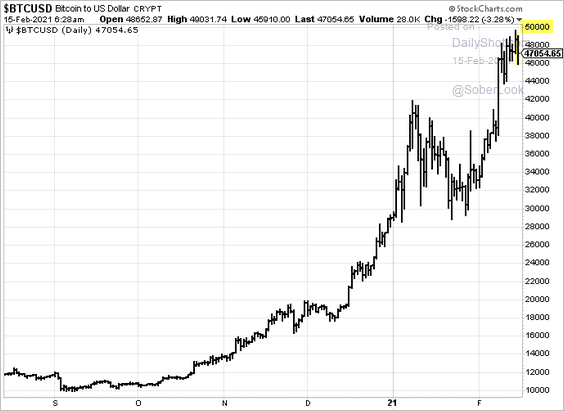

1. News of wider adoption sent Bitcoin toward $50k.

Source: Fox Business Read full article

Source: Fox Business Read full article

Source: @business Read full article

Source: @business Read full article

——————–

2. Bitcoin and cannabis stocks have been correlated.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

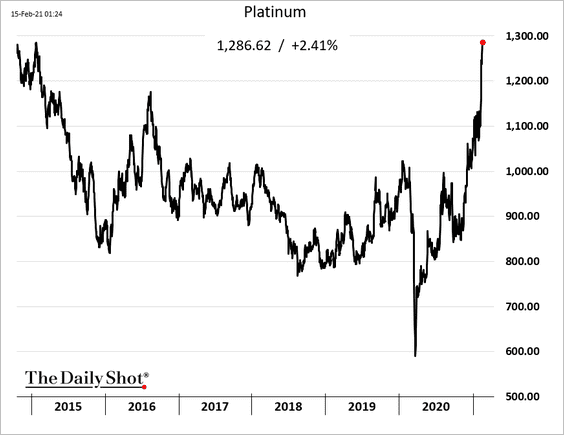

Commodities

1. Platinum is soaring.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

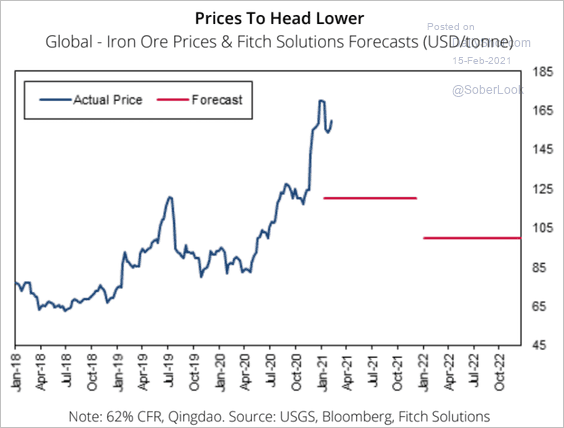

2. Fitch Solutions suggests that iron ore prices have peaked.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

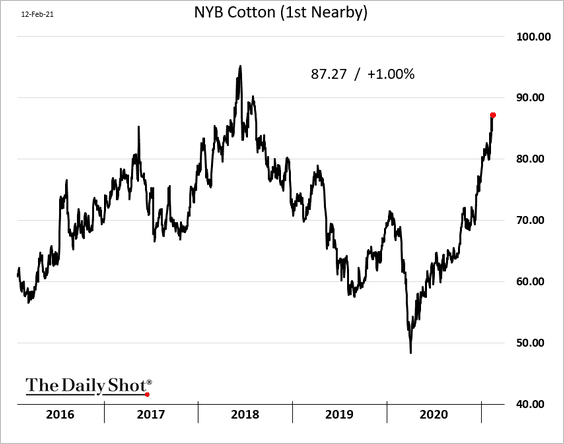

3. US cotton futures keep climbing as analysts expect lower planted acres (as farmers shift to corn and soybeans). Stong exports also help.

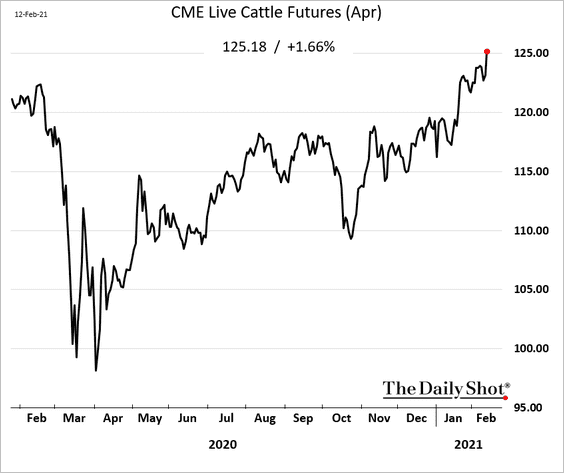

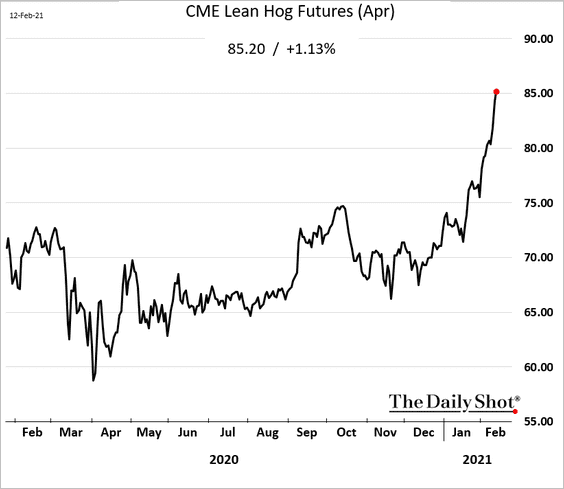

4. US meat futures are surging.

• Cattle:

• Hogs:

——————–

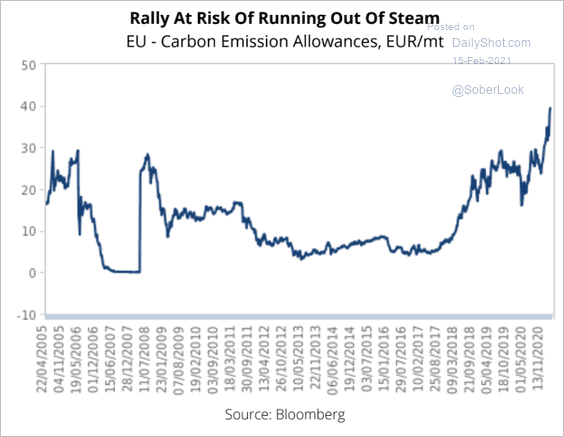

5. European carbon emission allowances have been soaring in response to stricter environmental rules in the EU. Is the rally overdone?

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Energy

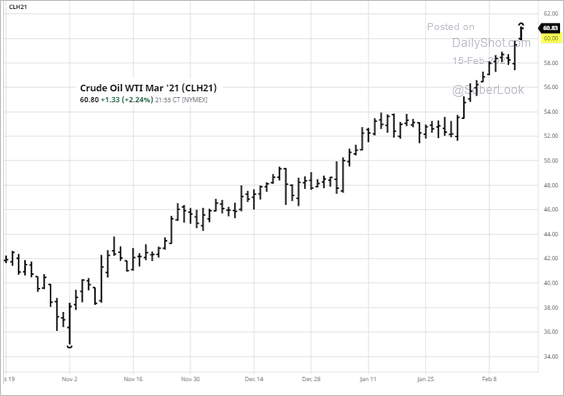

1. WTI crude futures breached $60/bbl.

Source: barchart.com

Source: barchart.com

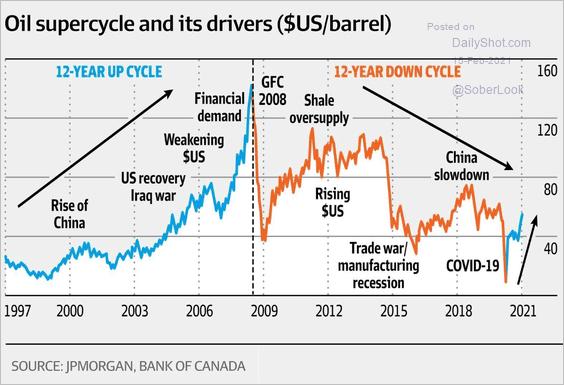

2. Are we entering the next resource supercycle?

Source: The Australian Financial Review Read full article

Source: The Australian Financial Review Read full article

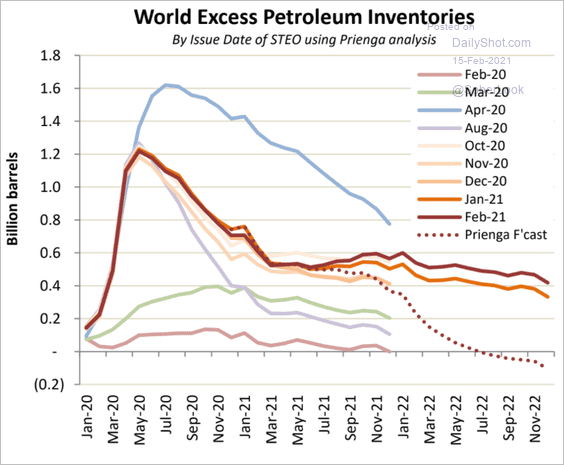

How tight will oil supplies get over the next couple of years?

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

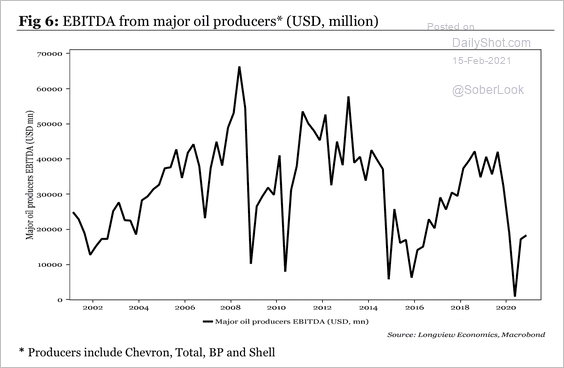

3. Oil producer earnings are starting to recover.

Source: Longview Economics

Source: Longview Economics

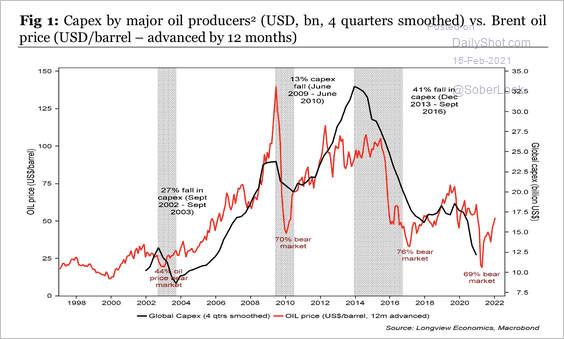

Rising oil prices could encourage greater capital spending by producers.

Source: Longview Economics

Source: Longview Economics

——————–

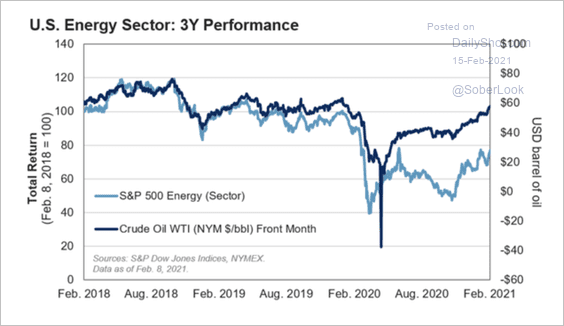

4. US energy stocks continue to lag crude oil futures.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

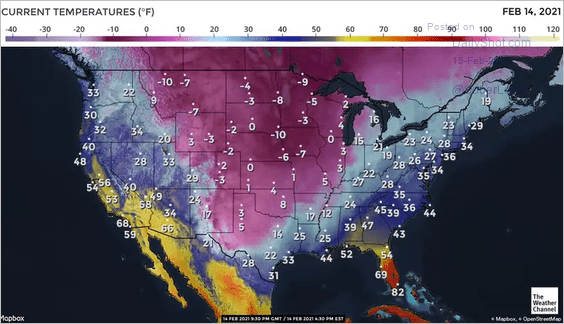

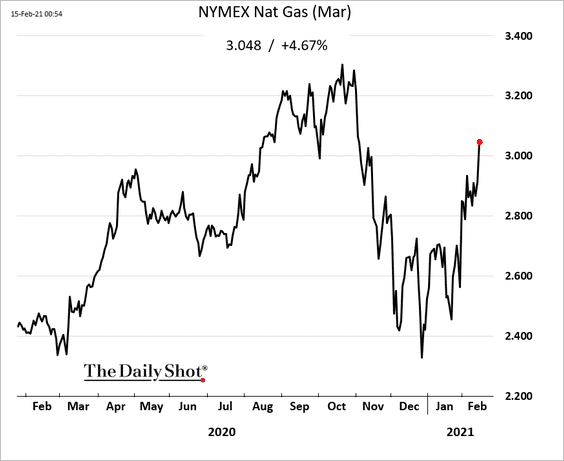

5. US cold weather is sending natural gas prices sharply higher, with Henry Hub futures exceeding $3/mmbtu.

Source: The Weather Channel

Source: The Weather Channel

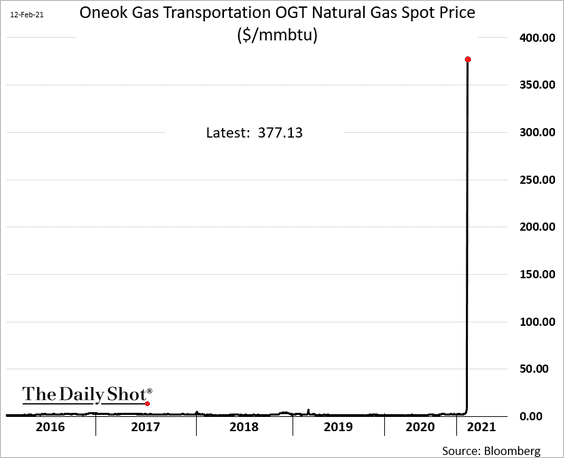

Natural gas prices soared in Texas amid tight supplies.

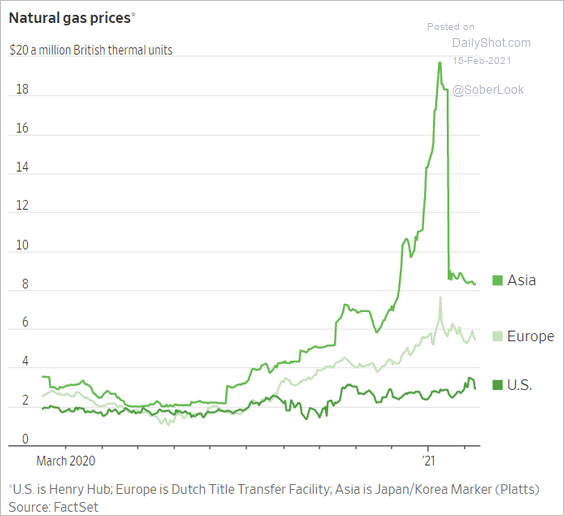

While Asia’s gas prices dropped from the highs, global natural gas prices remain elevated.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

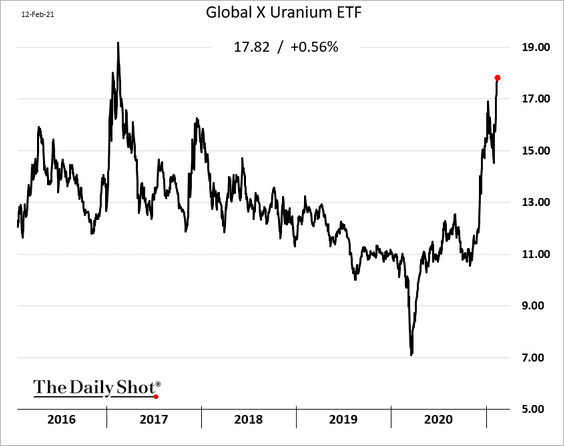

6. Uranium stocks rose sharply in recent months.

Back to Index

Equities

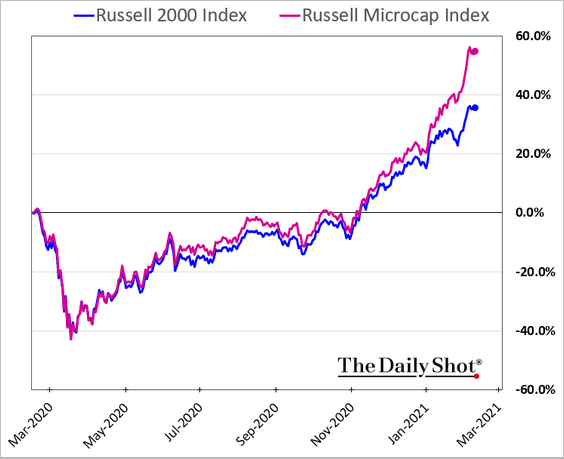

1. Micro-cap stocks have been outperforming small caps.

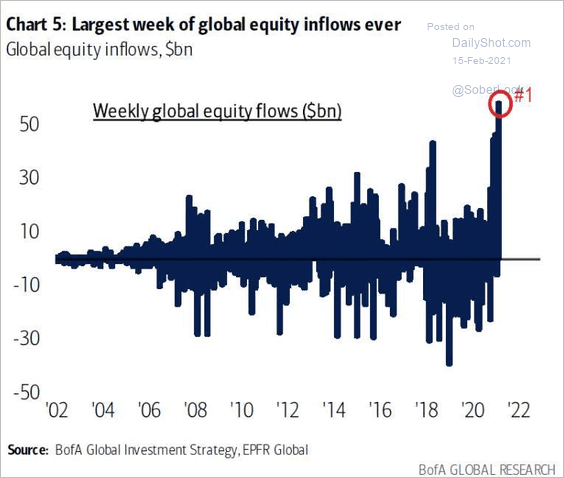

2. Equity fund inflows have accelerated.

Source: BofA Global Research

Source: BofA Global Research

3. According to Google Trends, interest in day trading hit a new high.

Source: Google Trends; h/t @JohnKicklighter Read full article

Source: Google Trends; h/t @JohnKicklighter Read full article

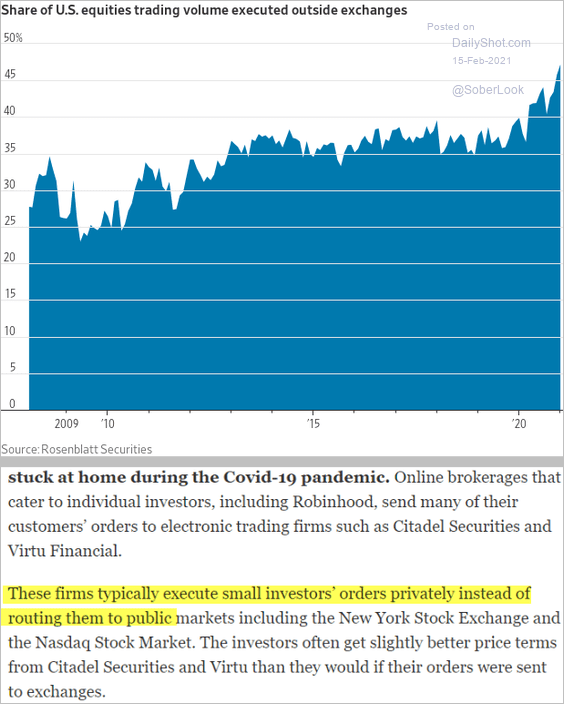

4. Dark trading has exceeded 47% of total volume (see comment below from the Wall Street Journal).

Source: @WSJ Read full article

Source: @WSJ Read full article

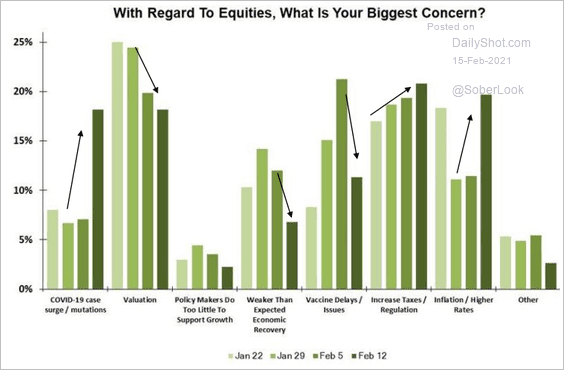

5. What are investors’ concerns?

Source: Evercore ISI

Source: Evercore ISI

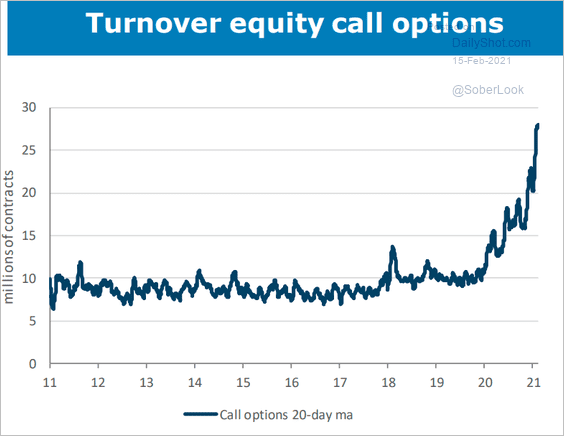

6. Next, we have some updates on volatility.

• Call option volume keeps climbing.

Source: ANZ Research

Source: ANZ Research

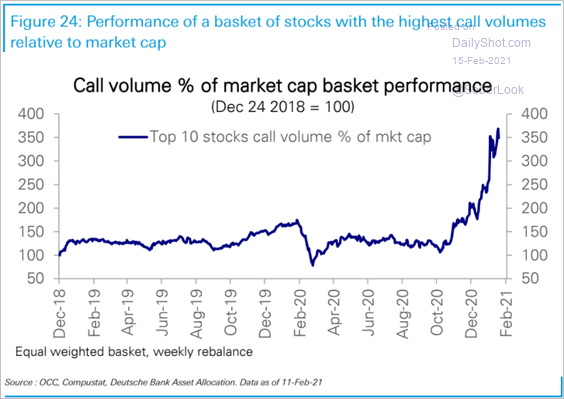

• Stocks with the highest call option volume have outperformed massively.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

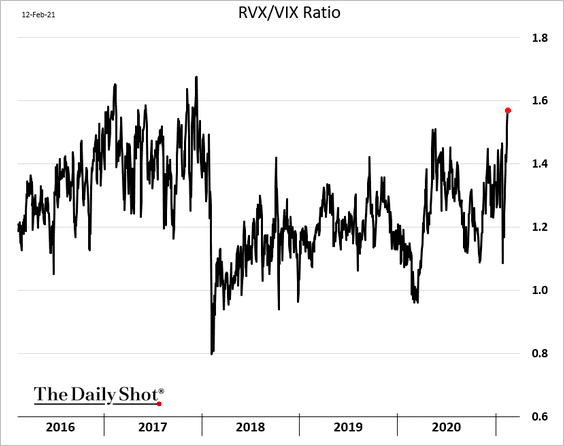

• Small-cap implied volatility (RVX) rose sharply relative to VIX in recent days.

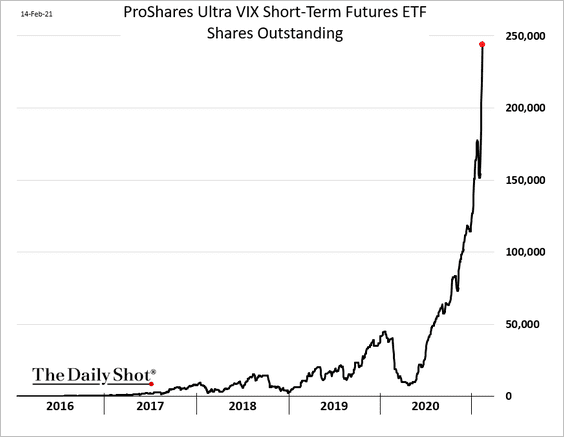

• Shares outstanding in the largest leveraged VIX ETF (UVXY) have gone vertical.

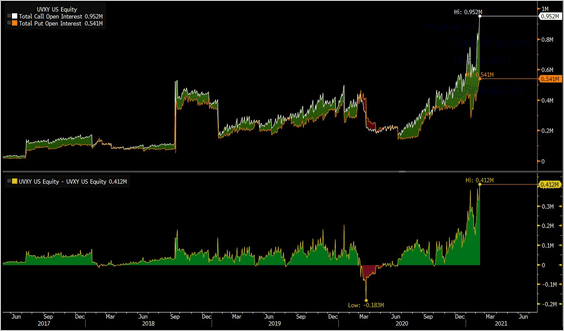

And call option interest on this security has far outpaced put options. Someone is betting on higher volatility ahead.

Source: @iv_technicals

Source: @iv_technicals

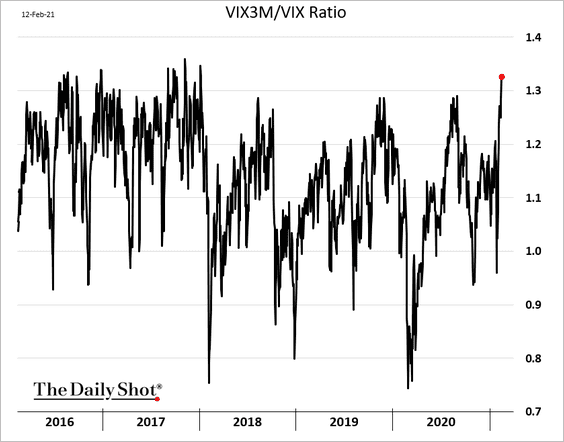

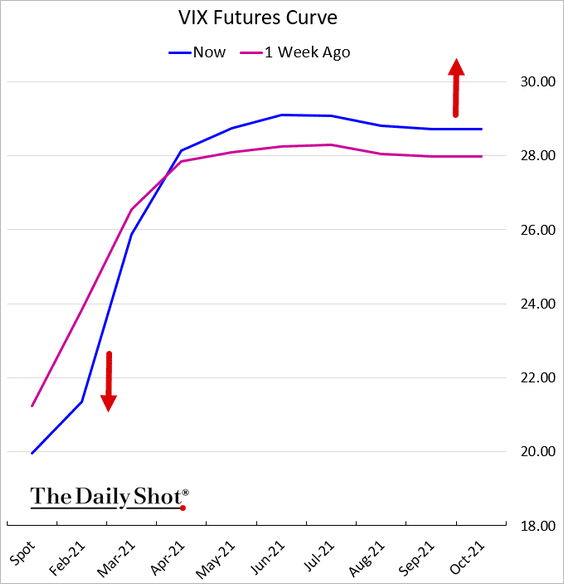

• The VIX curve has steepened further (deep in contango).

– 3-month vol / 1-month vol ratio:

– VIX futures curve:

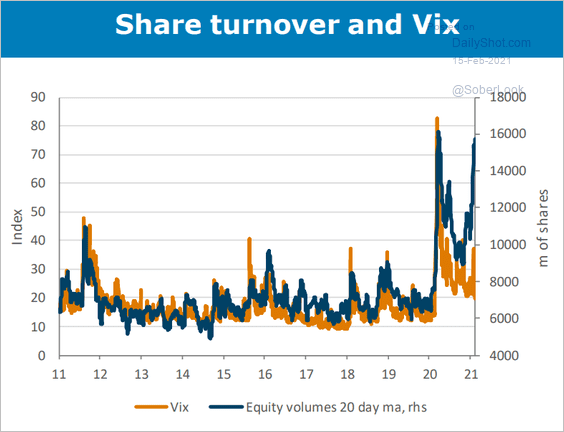

• Trading volume has diverged from VIX.

Source: ANZ Research

Source: ANZ Research

Back to Index

Credit

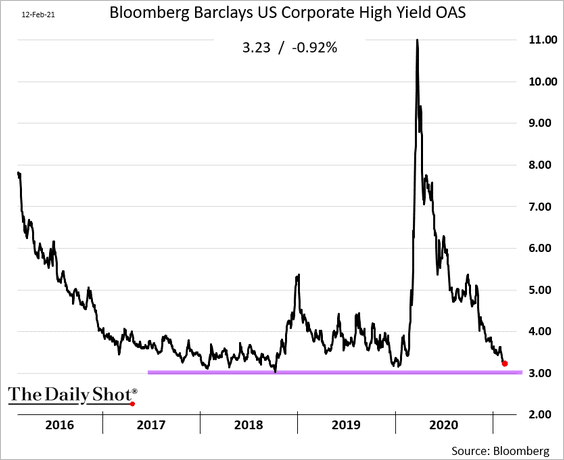

1. US high-yield bond spreads are approaching multi-year lows.

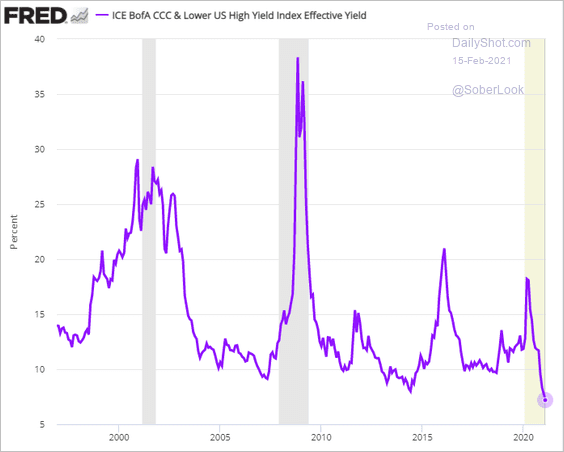

2. CCC bond yields hit a record low.

h/t Anastasios Avgeriou

h/t Anastasios Avgeriou

Back to Index

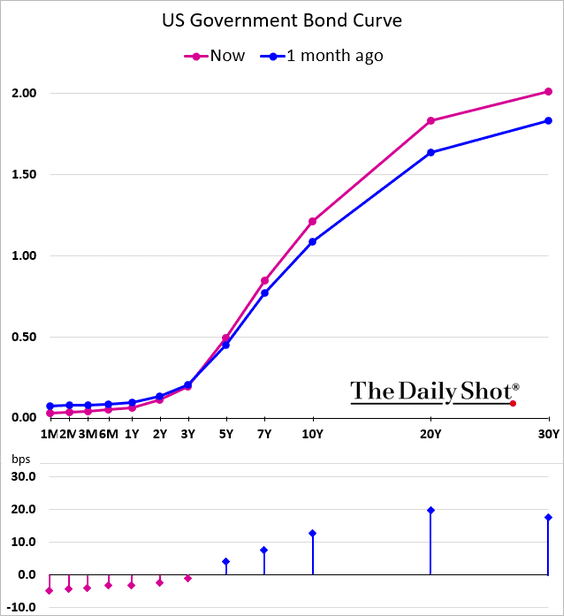

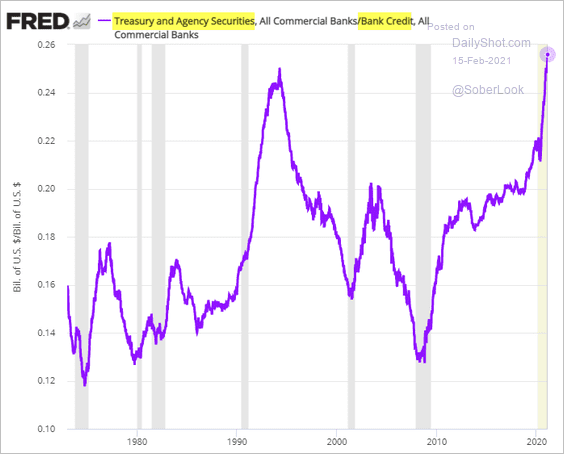

Rates

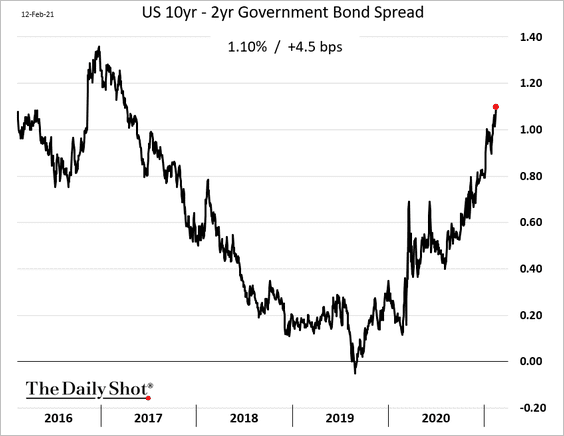

1. The Treasury curve keeps steepening.

——————–

2. US banks’ holdings of Treasury and Agency debt hit a record high as a percentage of bank credit.

——————–

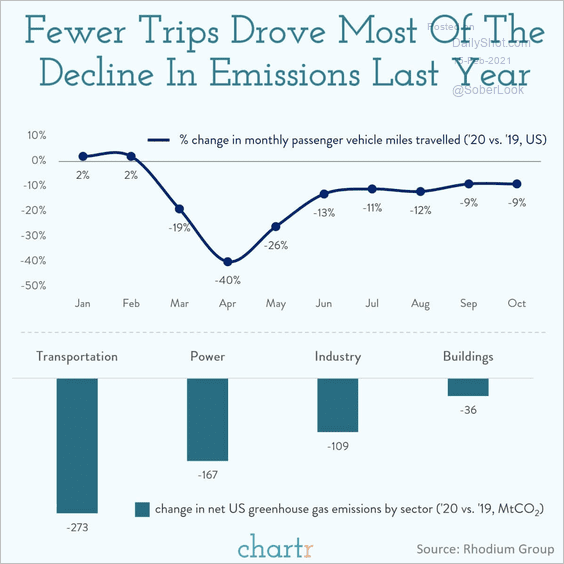

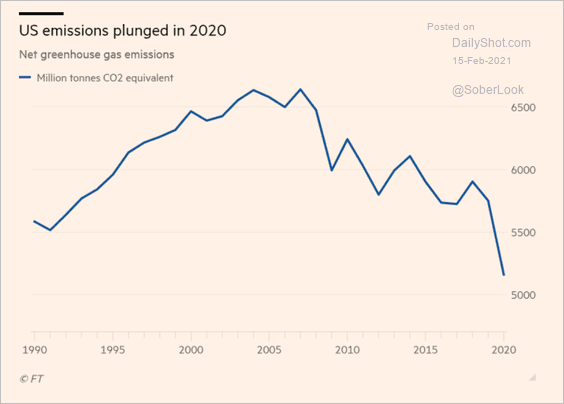

Food for Thought

1. Drivers of lower emissions in 2020:

Source: @chartrdaily

Source: @chartrdaily

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

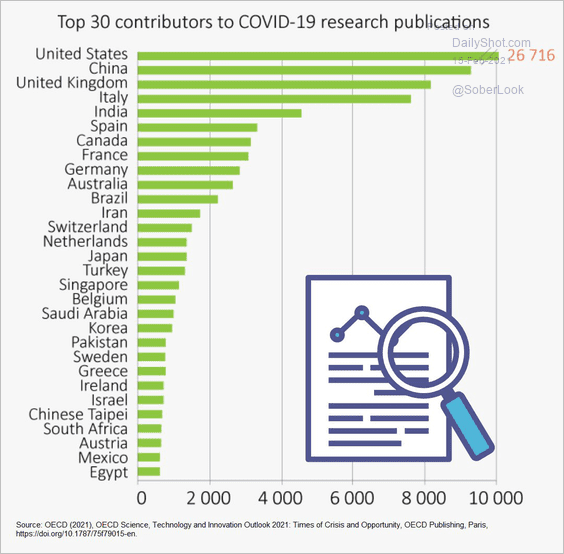

2. COVID research publications:

Source: @OECD Read full article

Source: @OECD Read full article

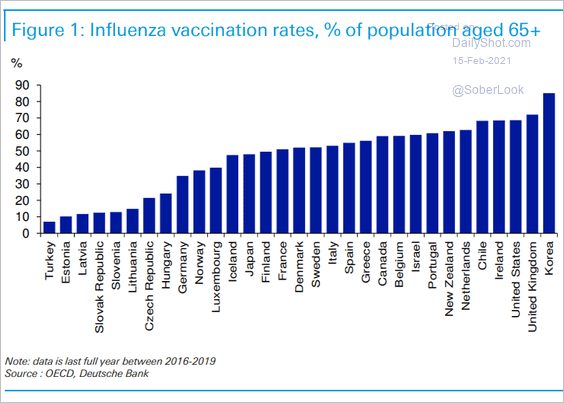

3. Flu vaccination rates:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

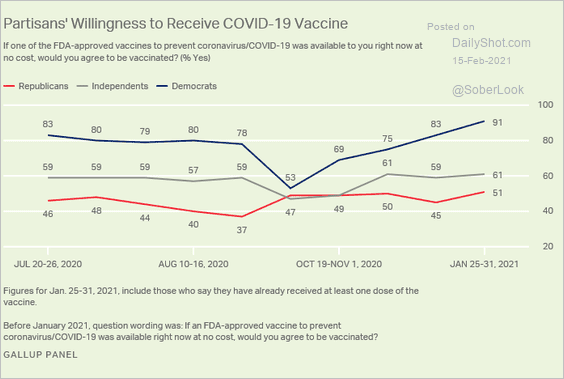

4. Willingness to get the vaccine:

Source: Gallup Read full article

Source: Gallup Read full article

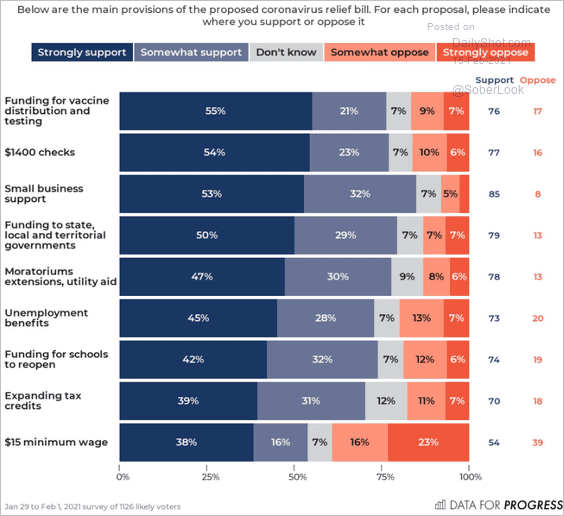

5. Support for provisions in Biden’s stimulus package:

Source: @DataProgress

Source: @DataProgress

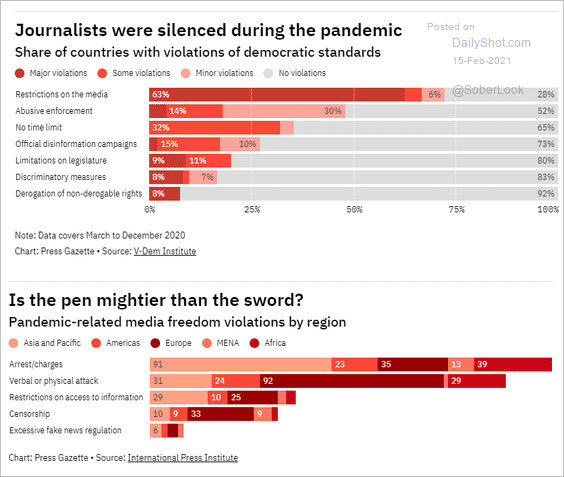

6. Media restrictions globally:

Source: PressGazette Read full article

Source: PressGazette Read full article

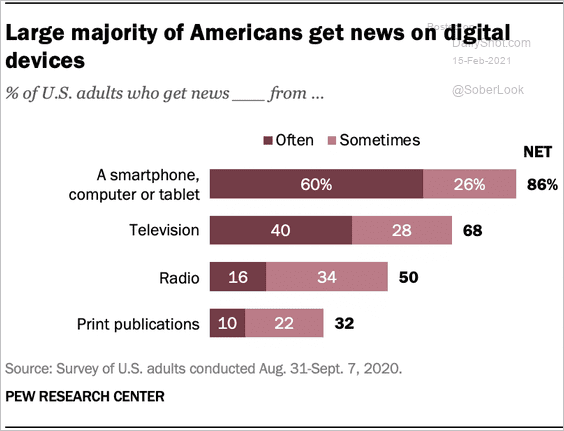

7. News sources in the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

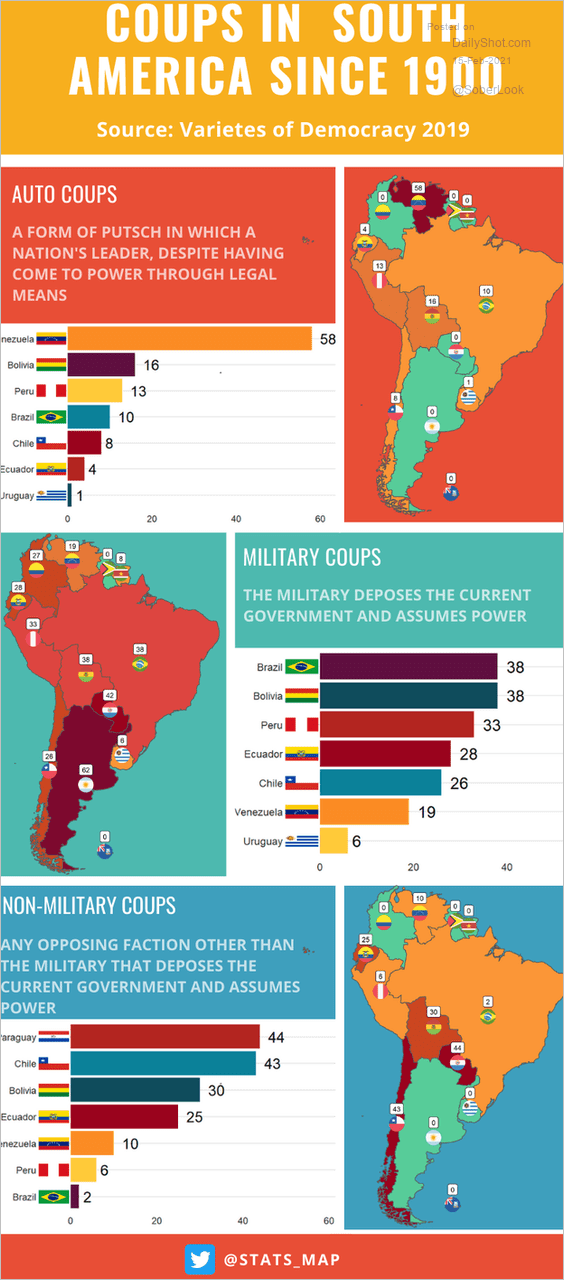

8. Coups in South America:

Source: @stats_map

Source: @stats_map

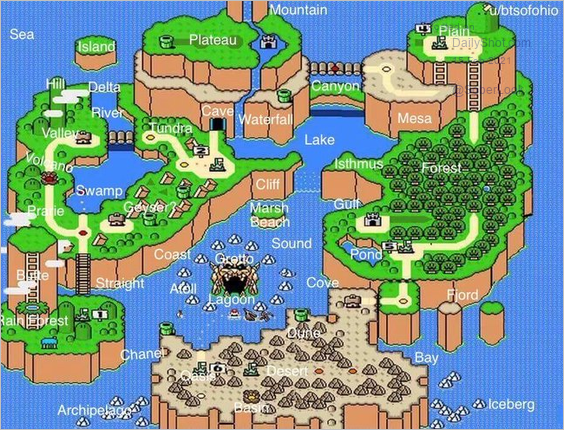

9. Learning geography terms from Super Mario Bros:

Source: @simongerman600

Source: @simongerman600

——————–

Back to Index