The Daily Shot: 09-Mar-21

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities:

• Equities

• Rates

• Food for Thought

The United States

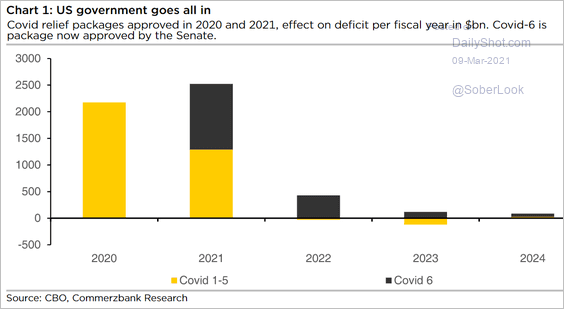

1. The amount of government stimulus this year is expected to exceed the 2020 level.

Source: Commerzbank Research

Source: Commerzbank Research

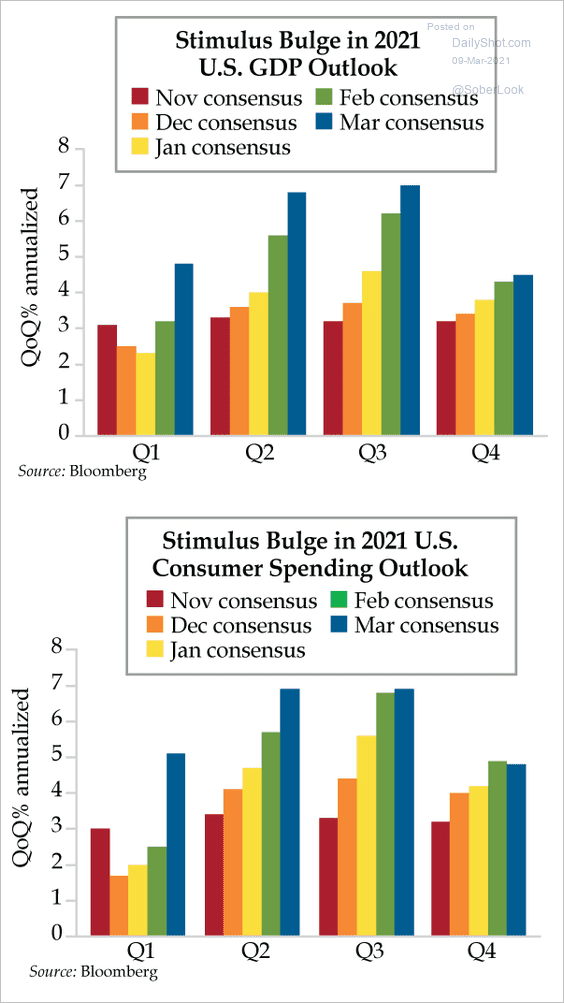

• As a result of the COVID relief package (and the vaccine progress), economists have been upgrading their forecasts for GDP growth and consumer spending.

Source: The Daily Feather

Source: The Daily Feather

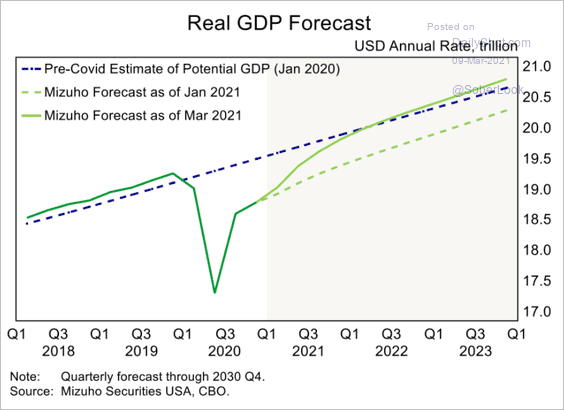

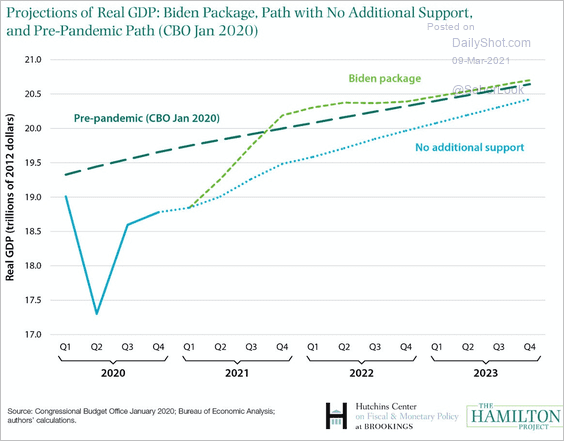

The GDP path is now expected to overtake the pre-COVID trajectory in early 2022 or even late this year.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Source: Brookings Read full article

Source: Brookings Read full article

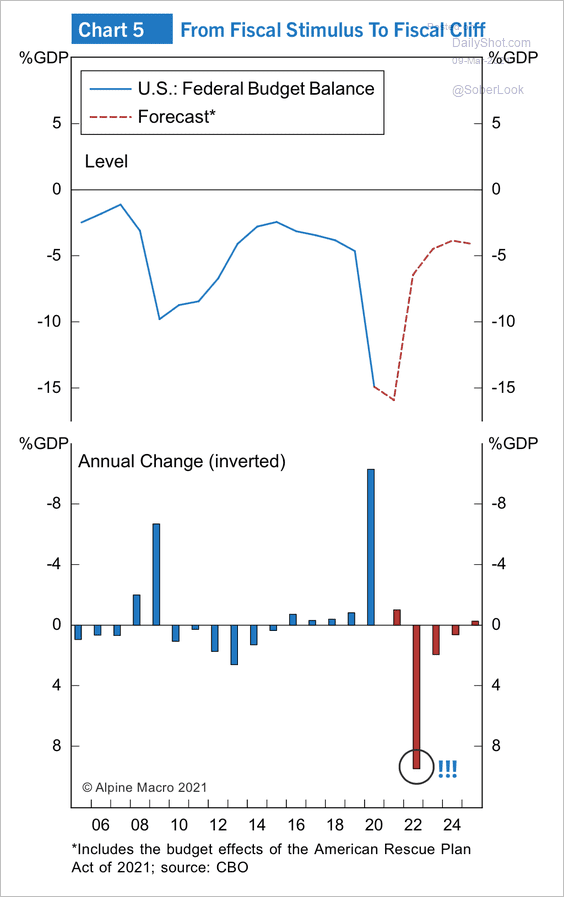

• What happens after the stimulus juice runs out? There will be a large “fiscal cliff” in 2022, according to Alpine Macro.

Source: Alpine Macro

Source: Alpine Macro

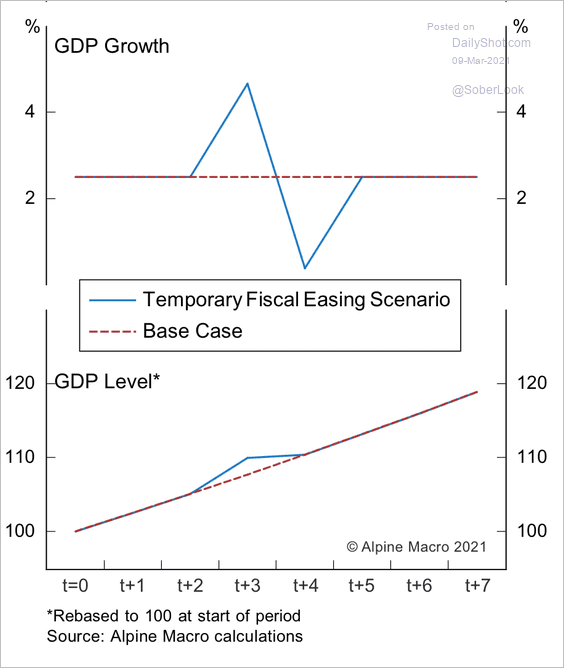

Alpine Macro expects the unwinding of temporary fiscal stimulus to depress economic growth and push GDP back to its pre-stimulus trend.

Source: Alpine Macro

Source: Alpine Macro

——————–

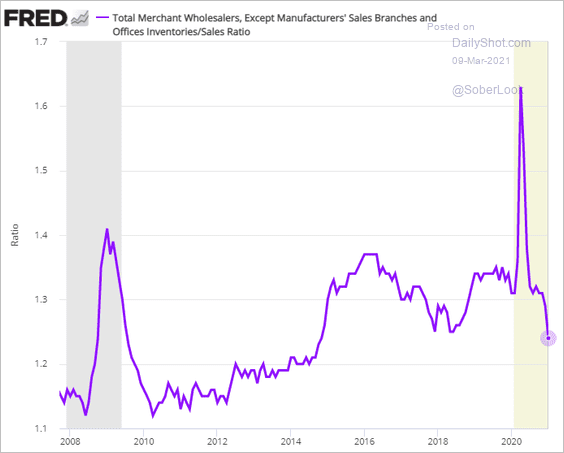

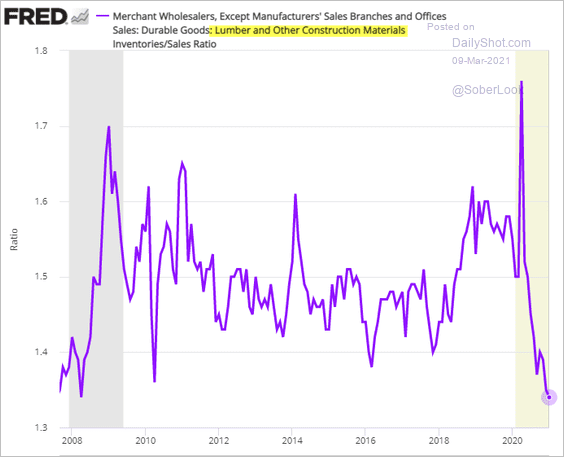

2. The inventory-to-sales ratio tumbled in recent months amid supplier bottlenecks and rising demand.

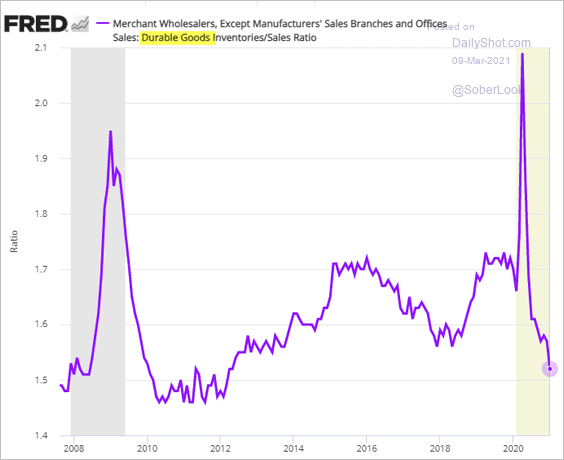

The decline has been especially sharp in durable goods.

For example, the inventory-to-sales ratio for lumber and other construction materials is now the lowest in over a decade.

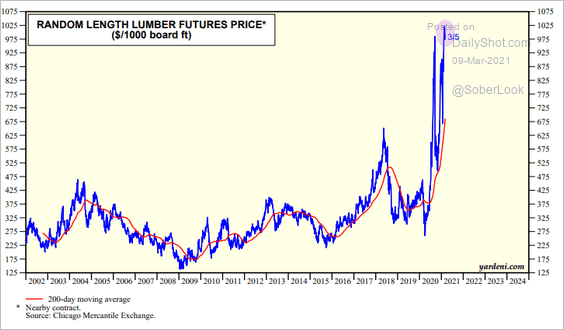

That’s why lumber prices have soared.

Source: Yardeni Research

Source: Yardeni Research

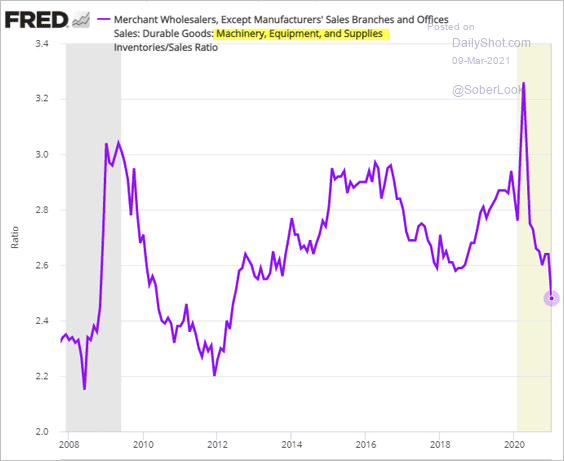

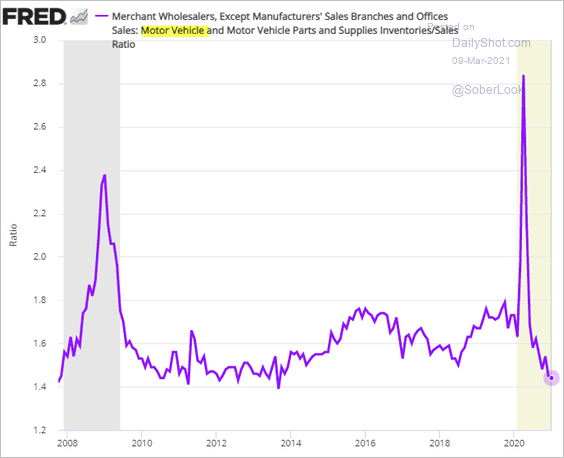

Other sectors also saw substantial declines.

• Machinery:

• Vehicles:

——————–

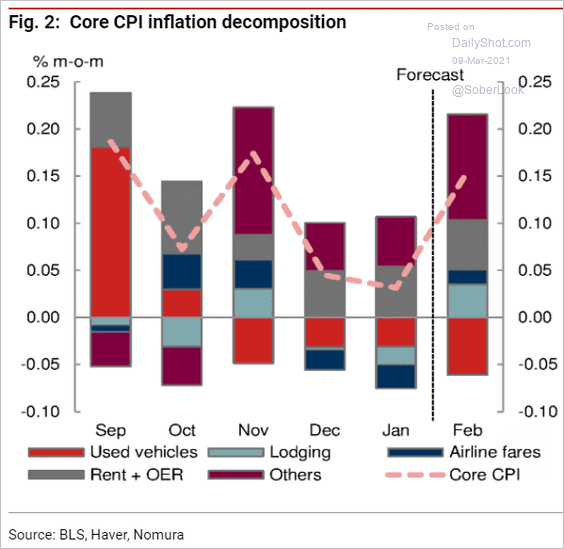

3. Next, we have some updates on inflation.

• Nomura expects a pop in the February core CPI index.

Source: Nomura Securities

Source: Nomura Securities

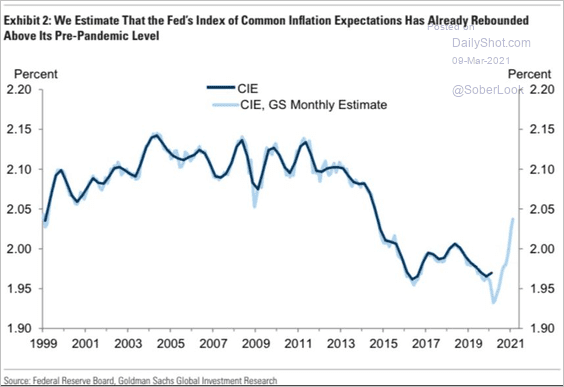

• The Fed’s measure of inflation expectations has rebounded sharply, according to Goldman.

Source: J B; Goldman Sachs

Source: J B; Goldman Sachs

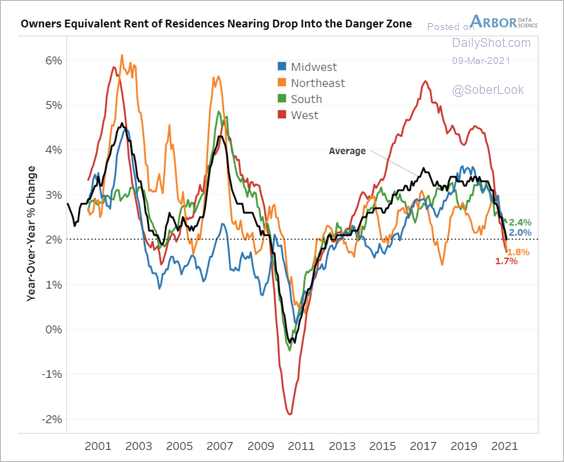

• Owners’ equivalent rent continues to fall, which has been weighing on CPI.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

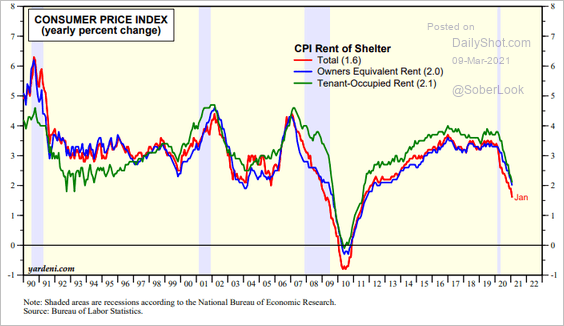

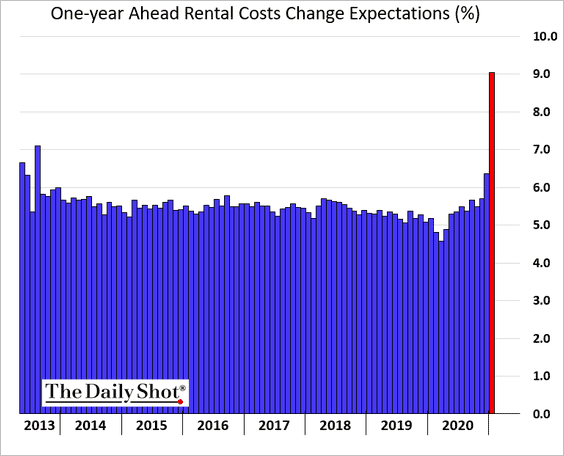

• Gains in rental costs have been slowing.

Source: Yardeni Research

Source: Yardeni Research

However, according to the New York Fed’s latest consumer survey, US households anticipate a sharp increase in rental costs over the next 12 months.

Source: NY Fed; h/t Alex Tanzi

Source: NY Fed; h/t Alex Tanzi

——————–

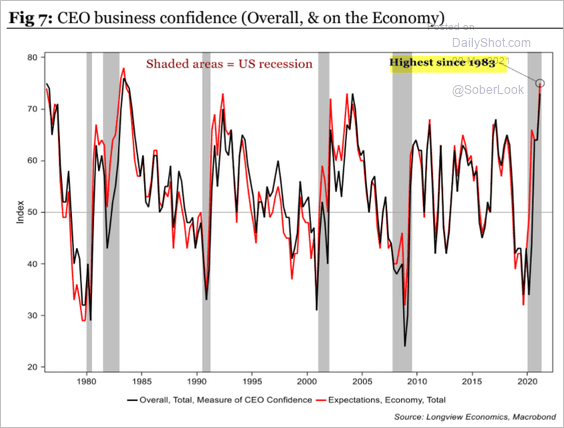

4. CEO confidence hit the highest level since 1983.

Source: Longview Economics

Source: Longview Economics

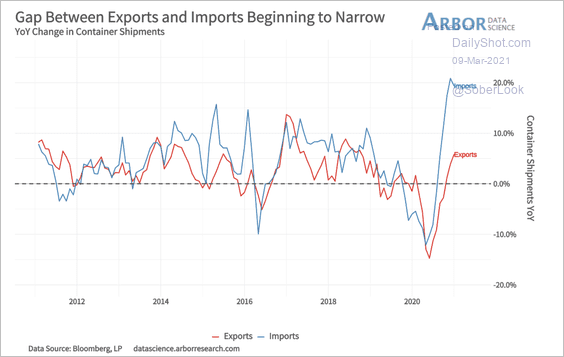

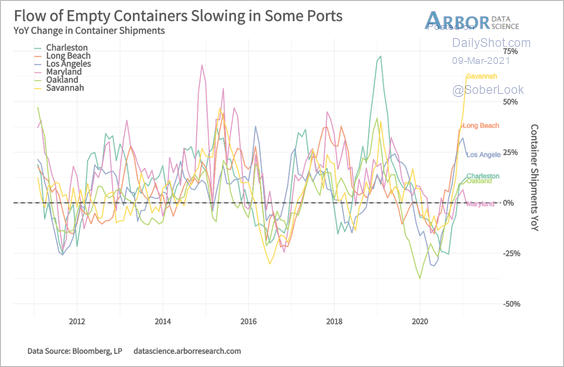

5. The imbalance between imports and exports in container shipments is beginning to resolve.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

More goods making their way out of the US means fewer empty containers. Has the trade deficit (see chart) peaked for now?

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

The United Kingdom

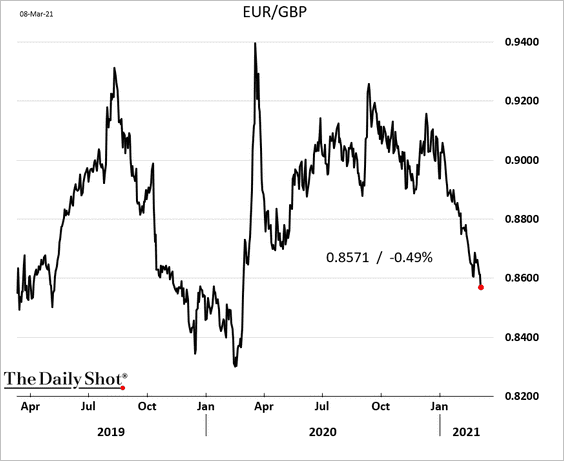

1. The pound continues to gain against the euro.

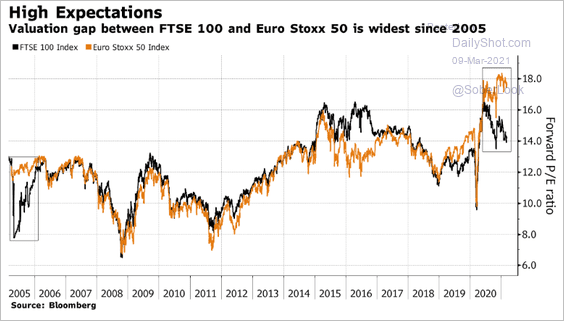

2. The valuation gap between UK and other European shares has widened further.

Source: @mikamsika, @TheTerminal, Bloomberg Finance L.P.

Source: @mikamsika, @TheTerminal, Bloomberg Finance L.P.

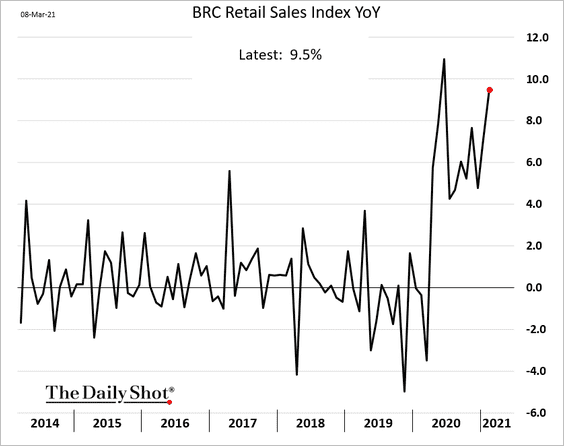

3. Retail sales strengthened last month.

Source: Evening Standard Read full article

Source: Evening Standard Read full article

——————–

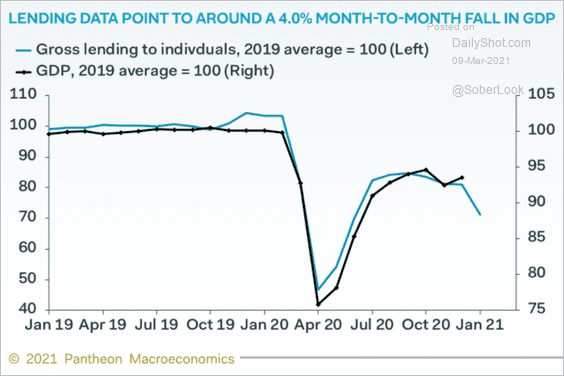

4. Lending data point to a sharp GDP decline in January.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

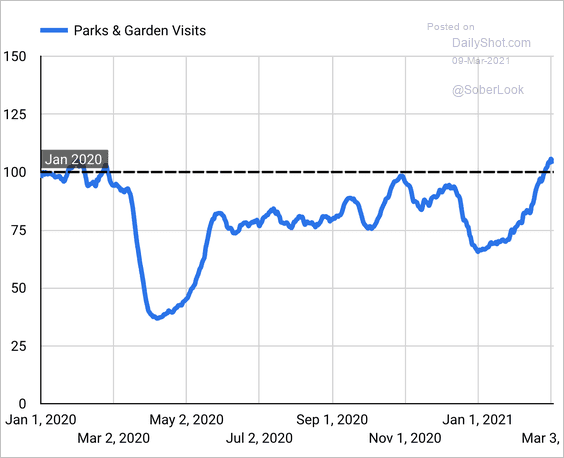

5. Britons are returning to parks and gardens.

Source: huq Read full article

Source: huq Read full article

Back to Index

The Eurozone

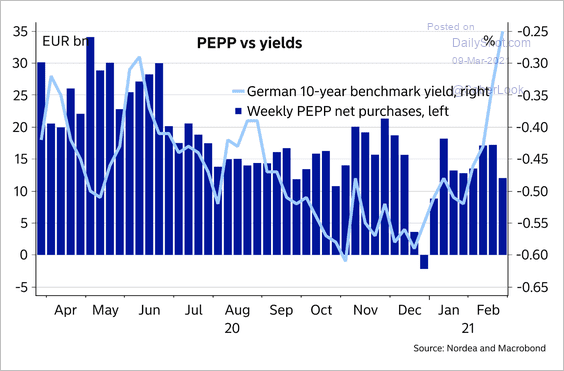

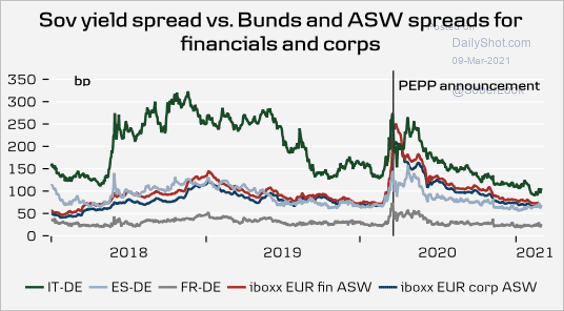

1. Will we see a pickup in PEPP (ECB’s emergency QE) purchases in response to higher yields?

Source: Nordea Markets

Source: Nordea Markets

Despite increased yields, bond spreads remain tight.

Source: Nordea Markets

Source: Nordea Markets

——————–

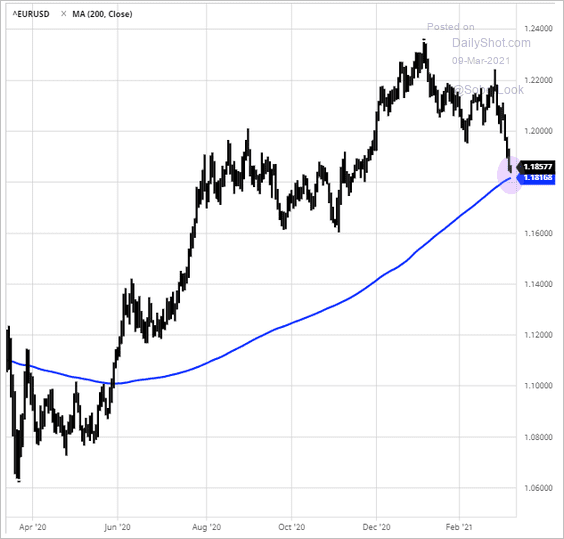

2. The euro may test support at the 200-day moving average.

Source: barchart.com

Source: barchart.com

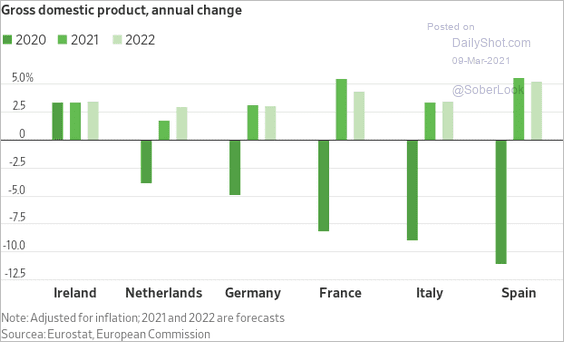

3. Here are the latest GDP forecasts for this and next year.

Source: @WSJ Read full article

Source: @WSJ Read full article

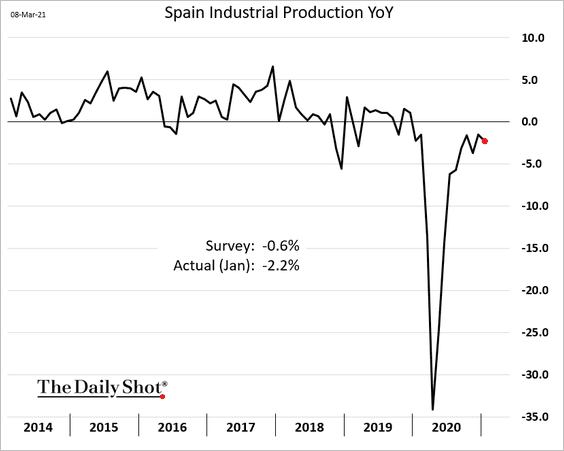

4. Spain’s industrial production weakened in January, missing expectations.

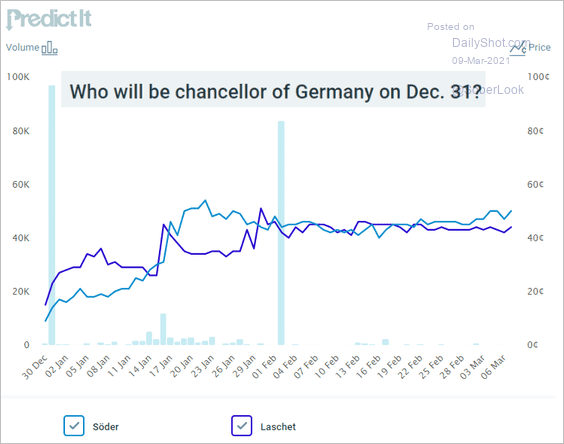

5. Who will be the next chancellor of Germany? Here is what the betting markets are telling us.

Source: @PredictIt

Source: @PredictIt

Back to Index

Japan

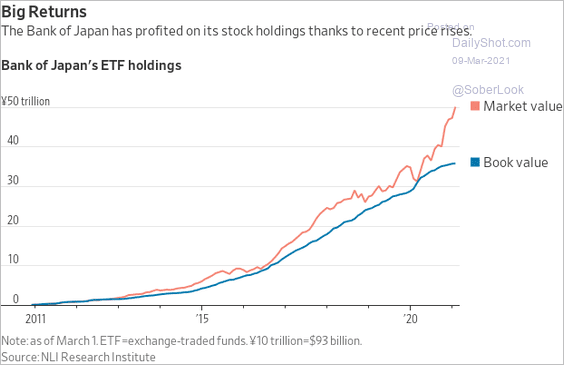

1. The BoJ is making money on its ETF holdings.

Source: @WSJ Read full article

Source: @WSJ Read full article

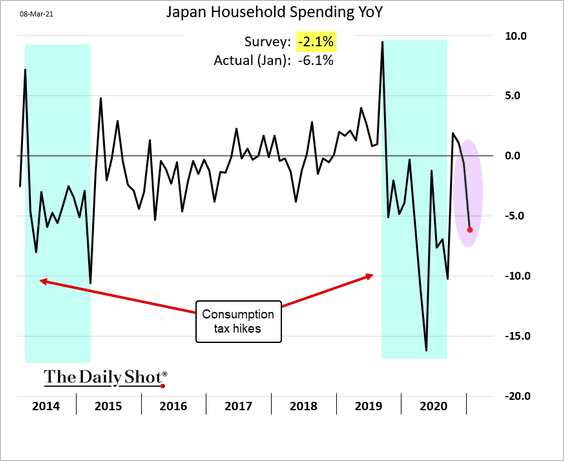

2. Household spending deteriorated in January.

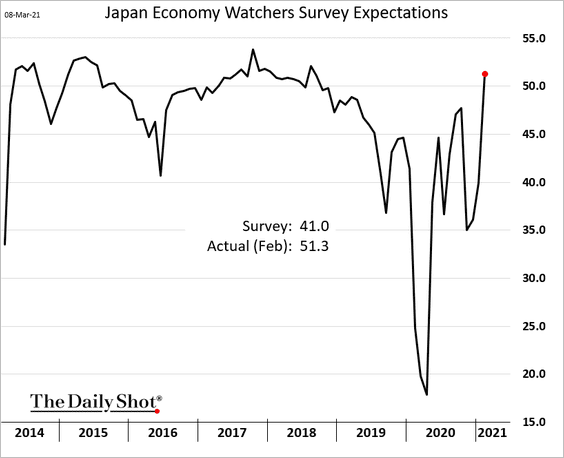

3. The Economy Watchers Survey expectations index climbed to the highest level since 2018 last month.

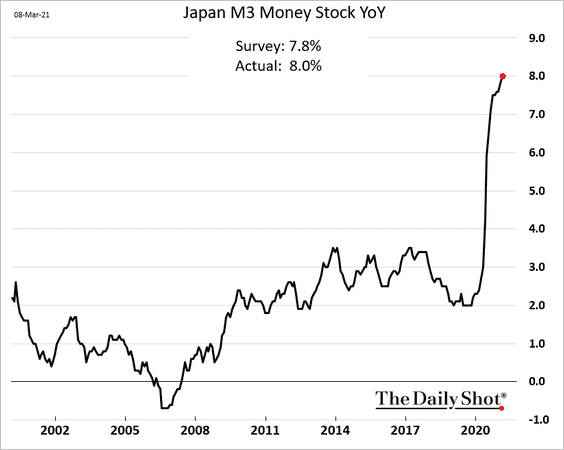

4. Growth in Japan’s broad money supply reached 8% – the highest in recent decades.

Back to Index

Asia – Pacific

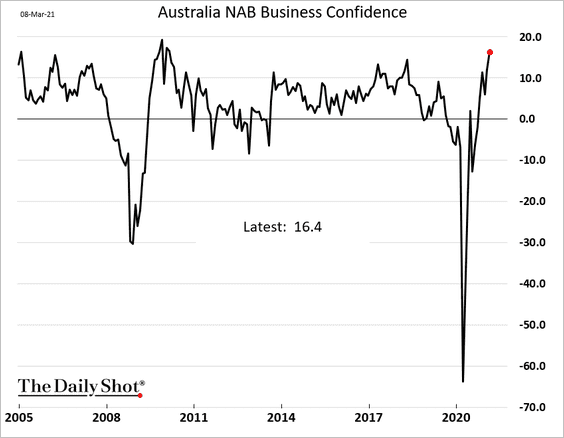

1. Australia’s business confidence hit the highest level in a decade.

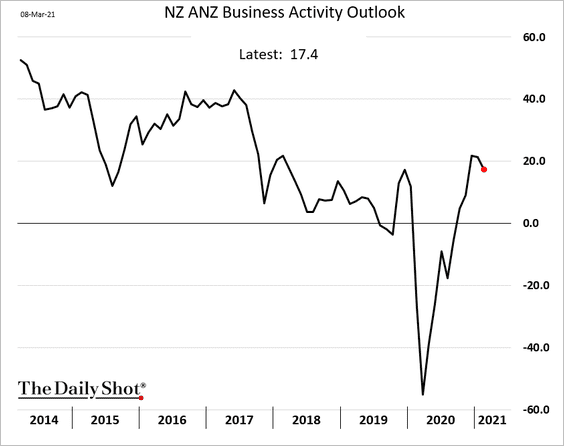

2. New Zealand’s business confidence is off the recent highs.

Back to Index

China

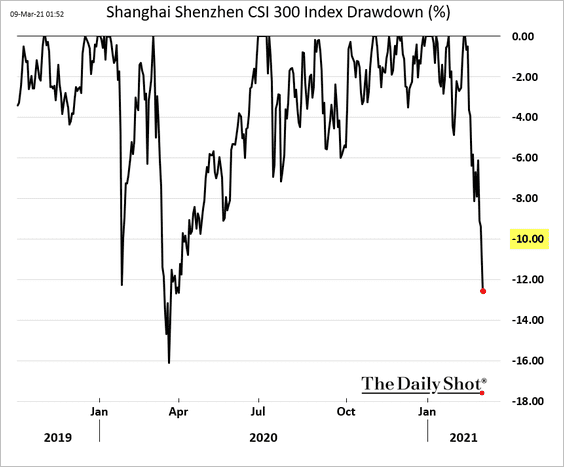

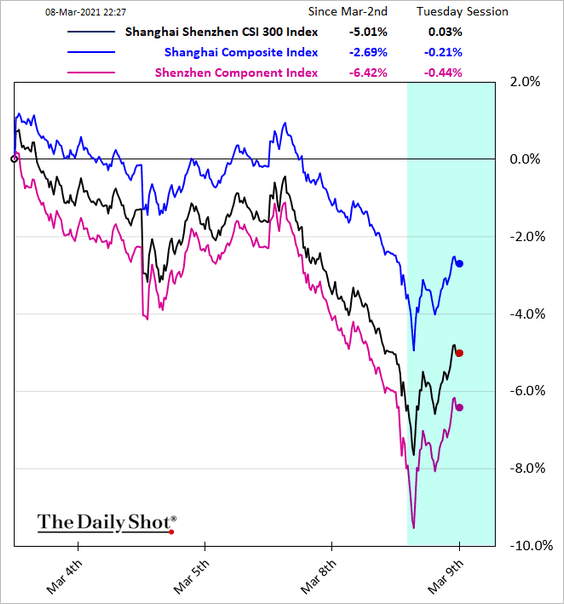

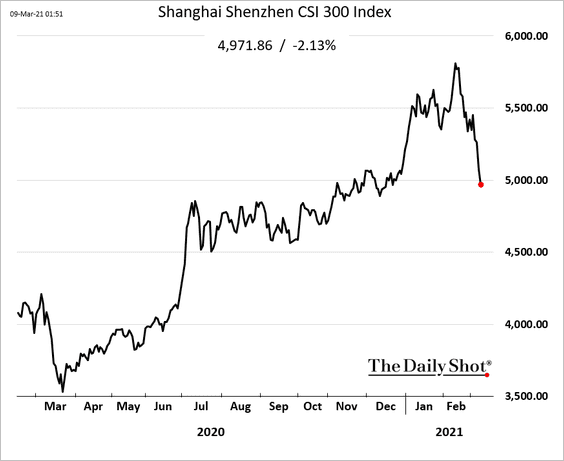

1. China’s stock market is in correction territory.

Beijing started buying stocks to cushion the selloff, …

Source: Bloomberg Read full article

Source: Bloomberg Read full article

… which helped initially.

But the selloff resumed and the market is down some 2% on the day.

——————–

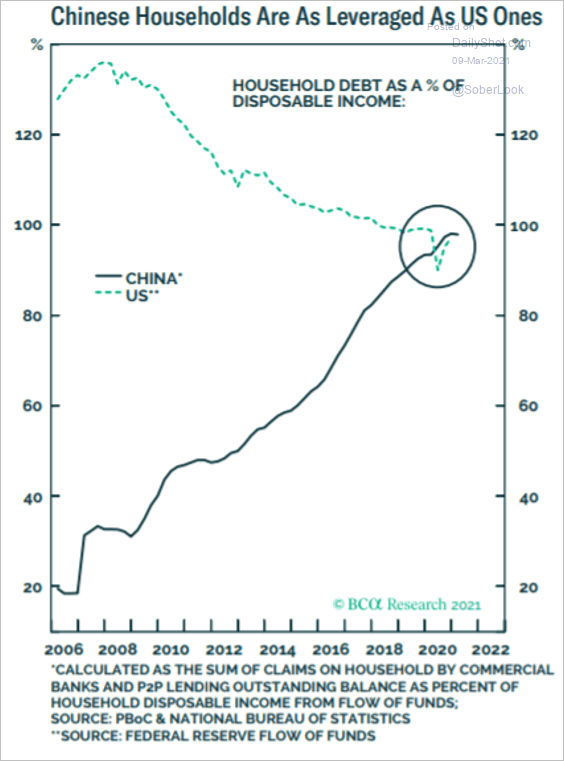

2. China’s households are leveraged.

Source: BCA Research

Source: BCA Research

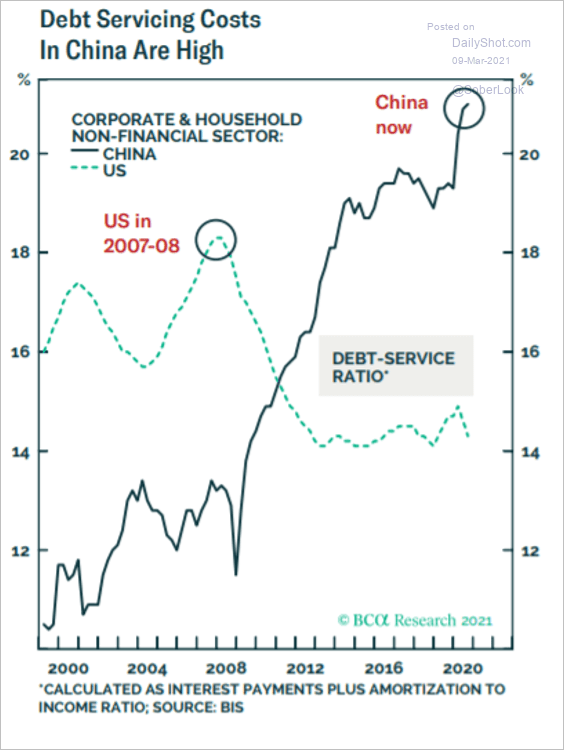

Corporate and household debt servicing costs are high.

Source: BCA Research

Source: BCA Research

——————–

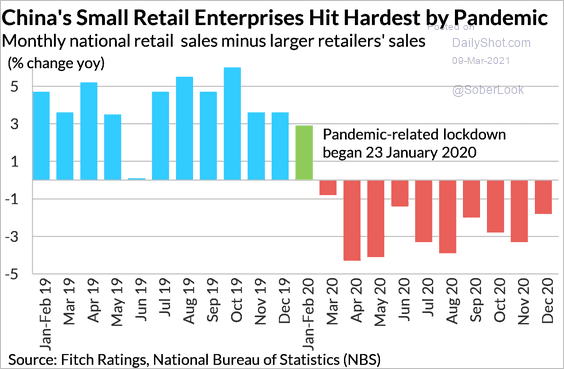

3. Small retailers have been left out of the recovery.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

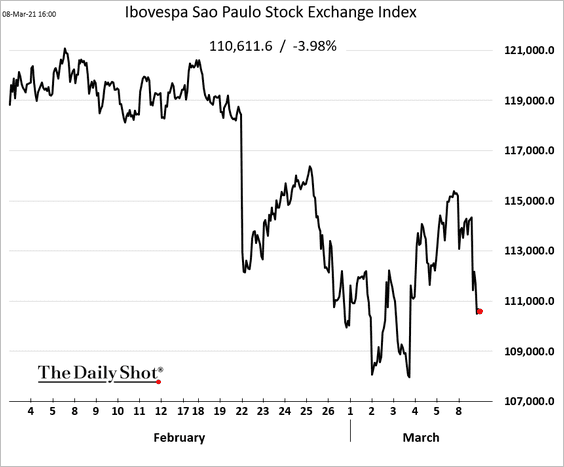

1. A Supreme Court judge in Brazil tossed out several criminal cases against former President Lula. He can now challenge Bolsonaro.

Source: The Guardian Read full article

Source: The Guardian Read full article

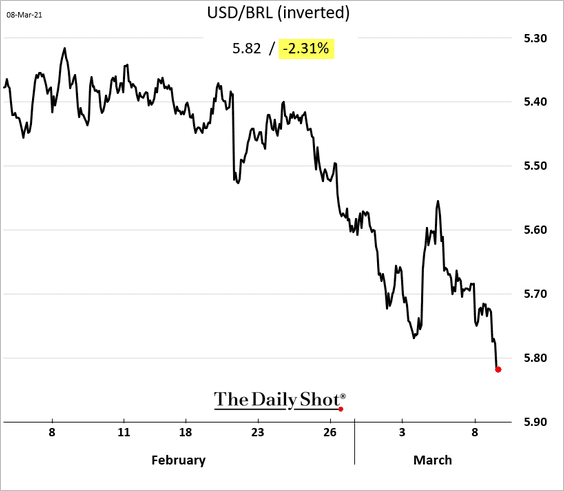

Brazil’s markets tumbled in response to the judge’s decision.

• Stocks (down 4%):

• The real:

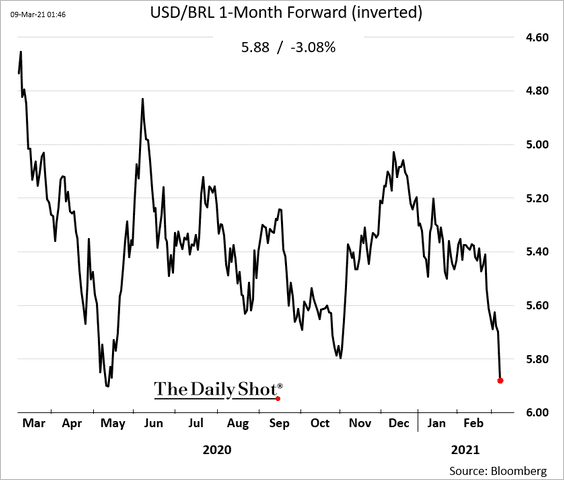

Here is the USD/BRL 1-month F/X forward.

——————–

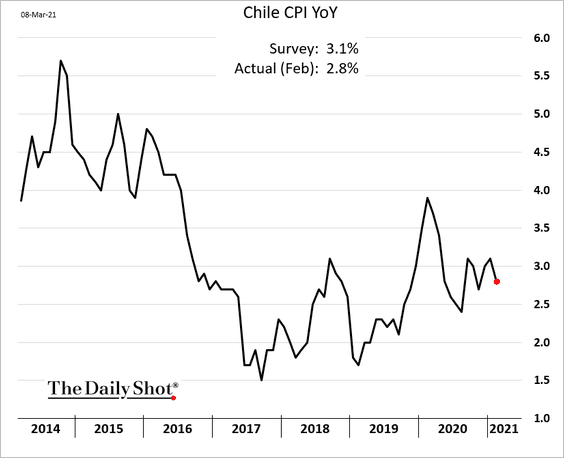

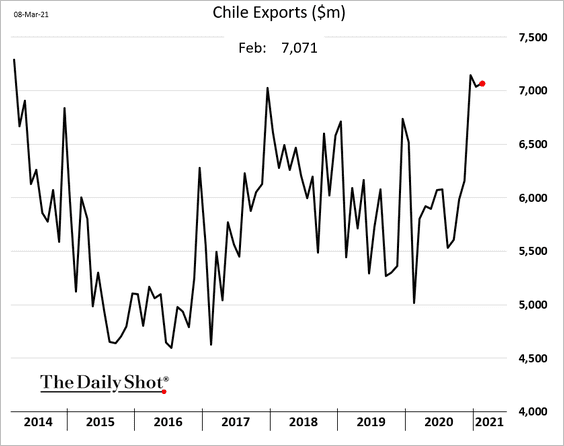

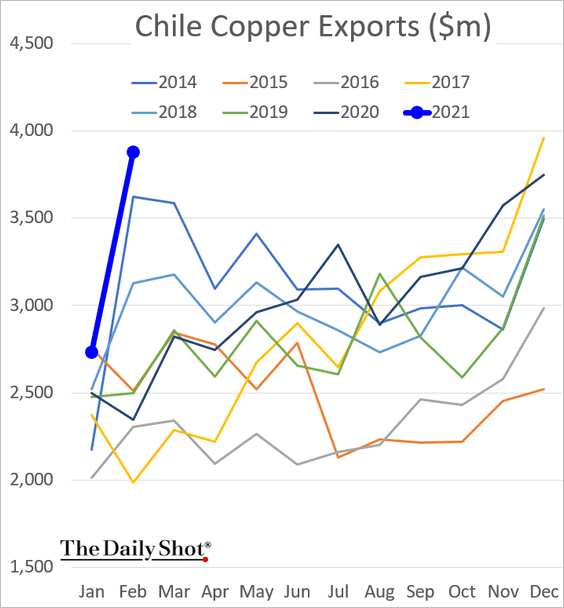

2. Next, we have some updates on Chile.

• Inflation has been relatively benign.

• Exports remain elevated.

Copper exports surged.

——————–

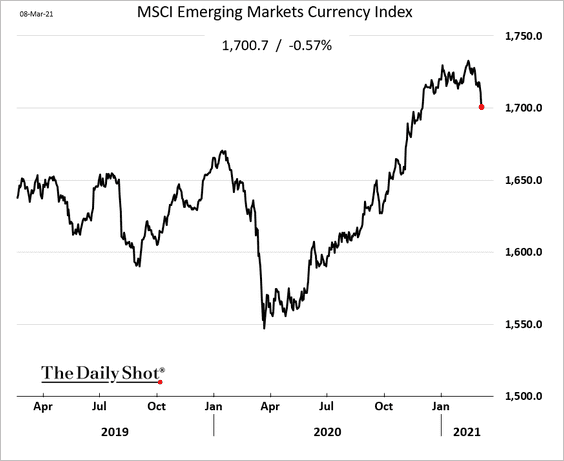

3. The rally in EM currencies has faded for now.

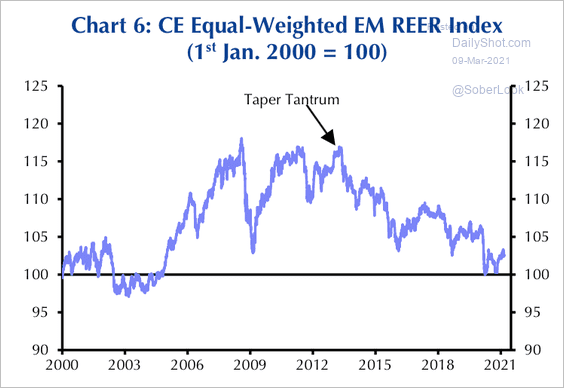

The equal-weighted index of EM real effective exchange rates is well below 2013 levels and generally low by historical standards.

Source: Capital Economics

Source: Capital Economics

——————–

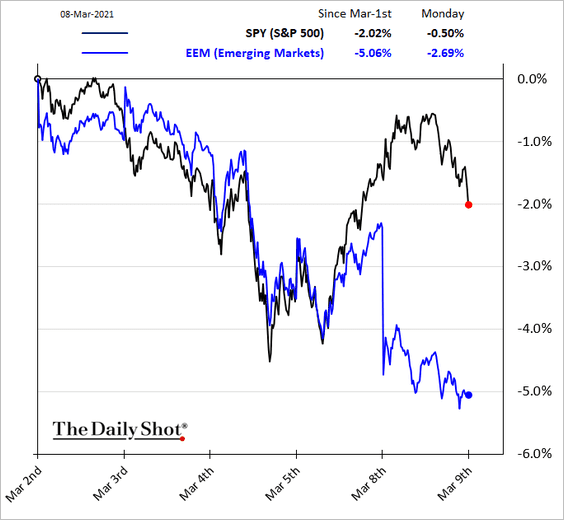

4. EM stocks underperformed the US on Monday.

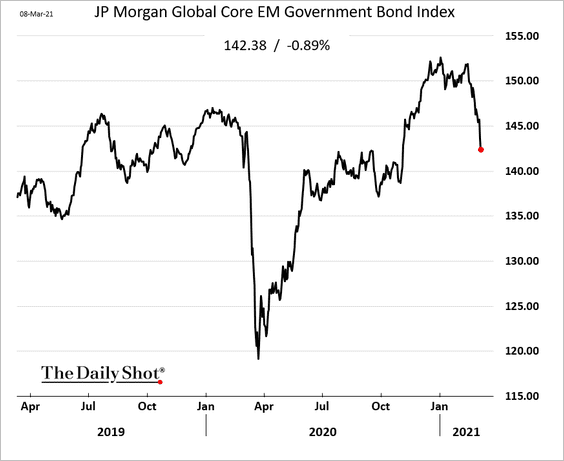

5. Government debt has been selling off with Treasuries.

Back to Index

Cryptocurrency

1. Bitcoin is above $54k. The Reddit crowd isn’t getting enough action in stocks and has shifted to cryptos.

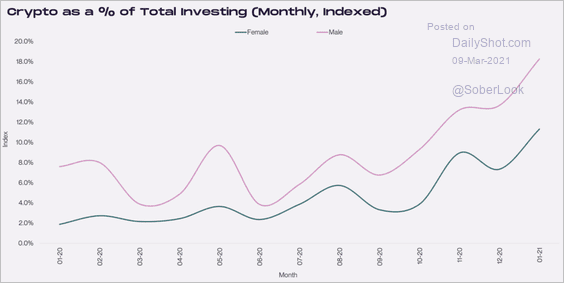

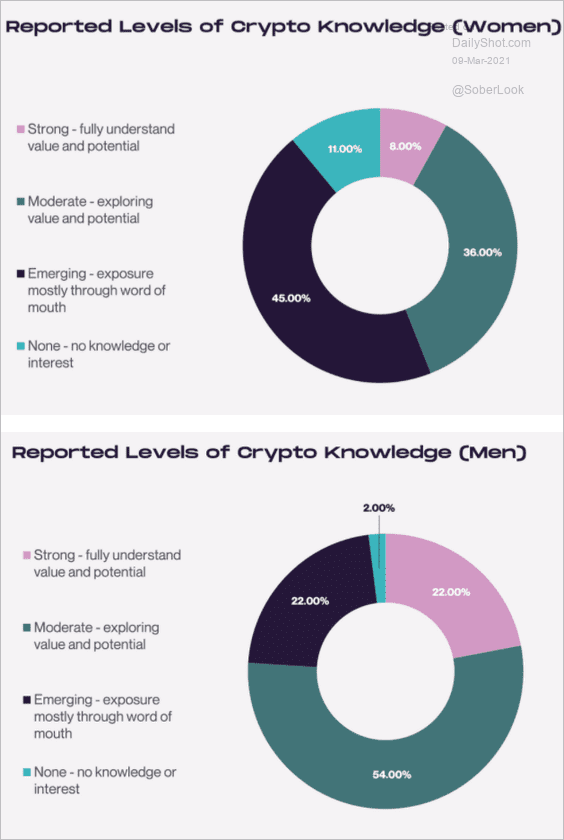

2. Next, we have some data from a survey by Cardify.

• Crypto as % of total investing:

Source: cardify Read full article

Source: cardify Read full article

• Crypto knowledge:

Source: cardify Read full article

Source: cardify Read full article

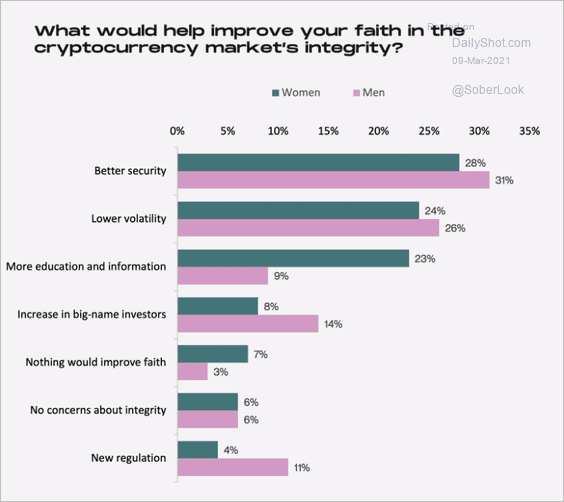

• What could help the market’s integrity?

Source: cardify Read full article

Source: cardify Read full article

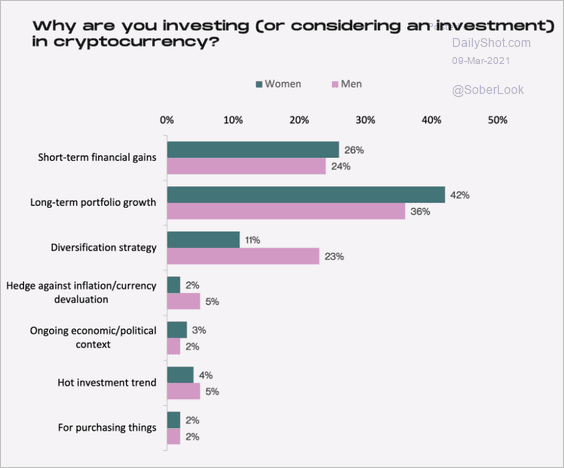

• Why invest?

Source: cardify Read full article

Source: cardify Read full article

Back to Index

Commodities:

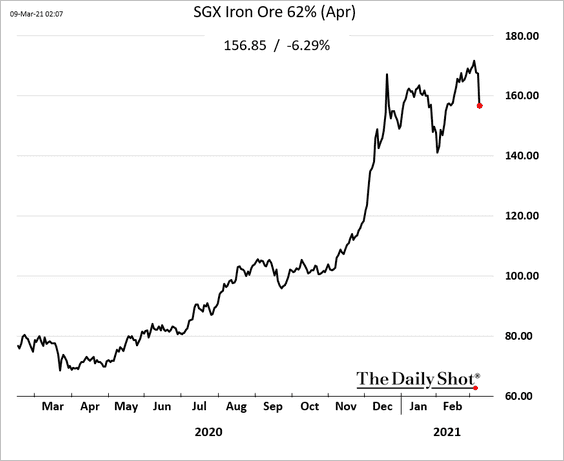

1. Iron ore is down 6%.

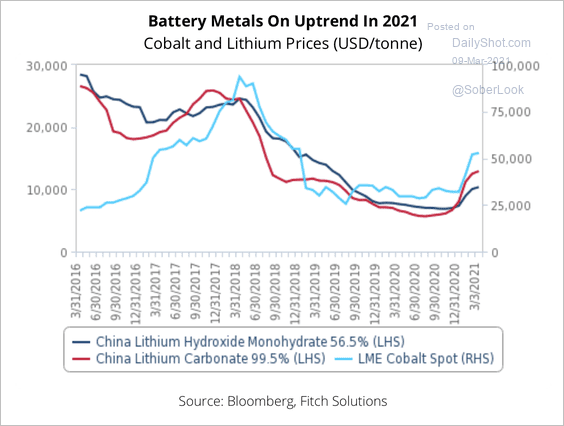

2. Battery metals are trending higher over the past few months.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

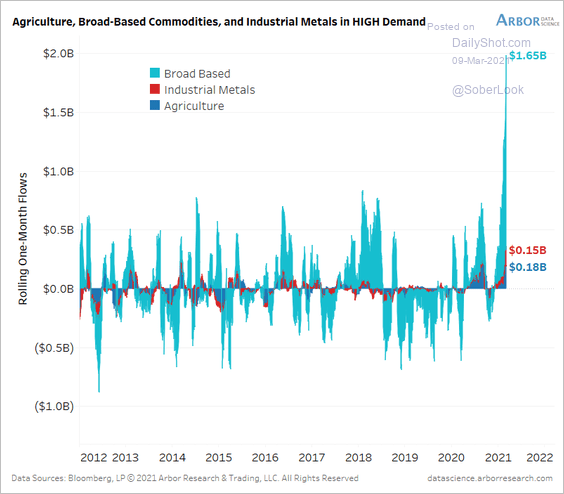

3. Inflows into commodities have accelerated in recent weeks.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Equities

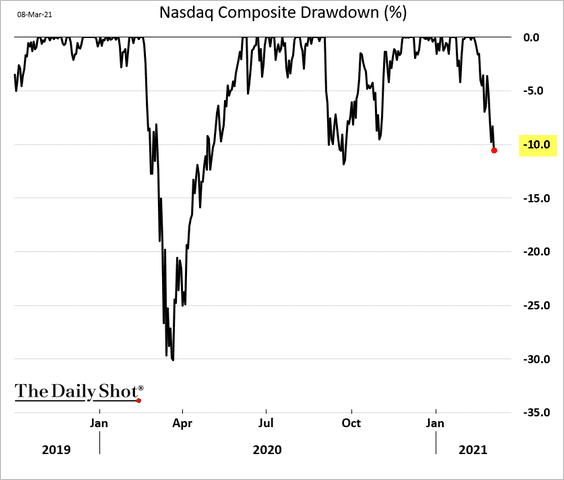

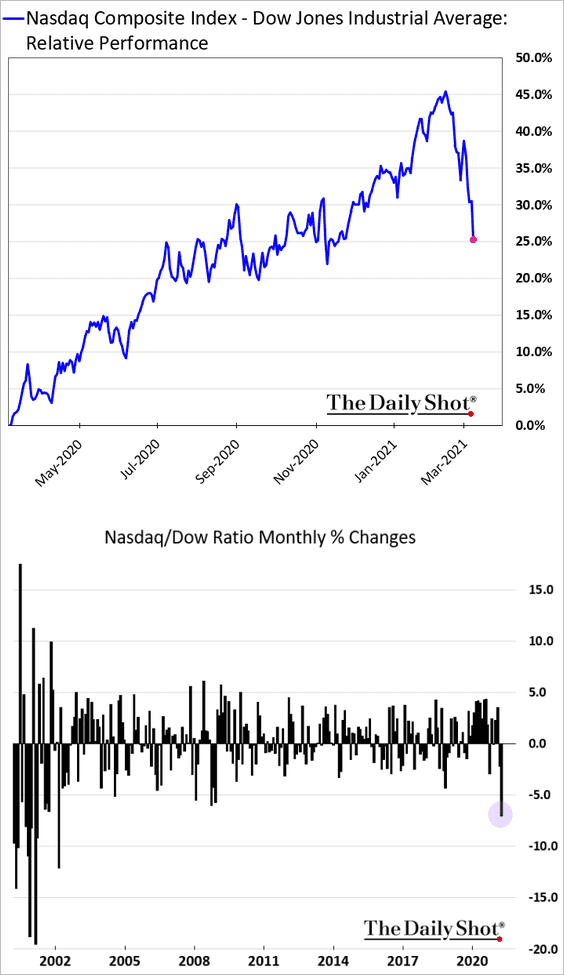

1. The Nasdaq Composite entered correction territory.

This month’s Nasdaq underperformance vs. the Dow has been the sharpest in years.

——————–

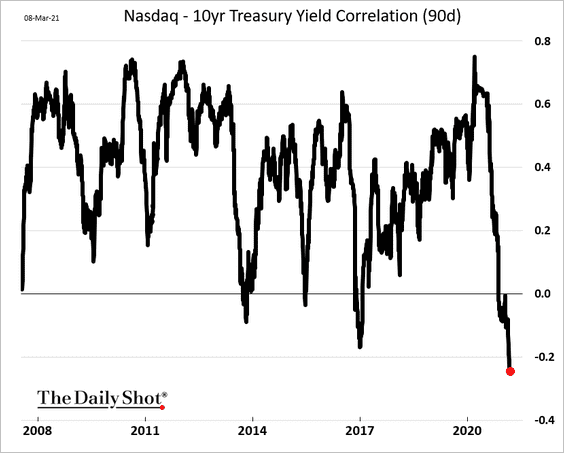

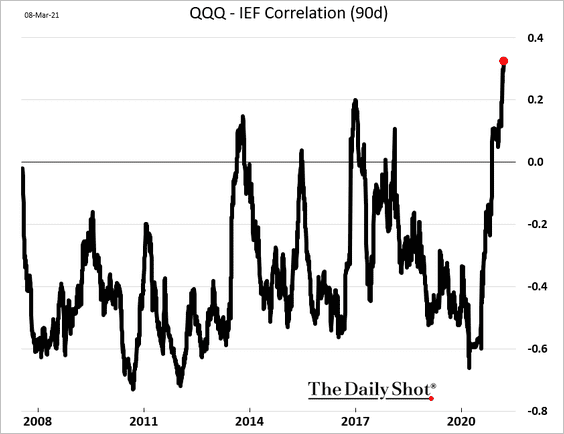

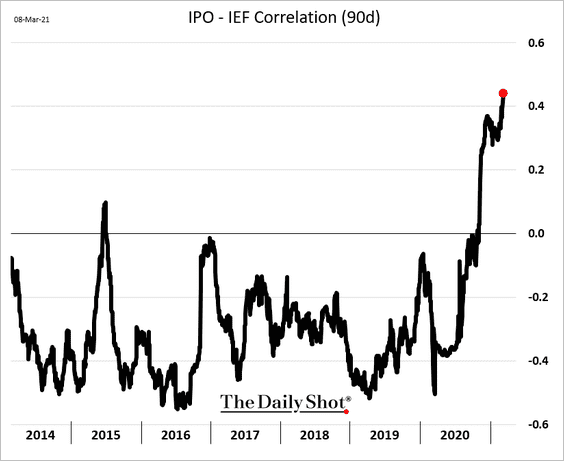

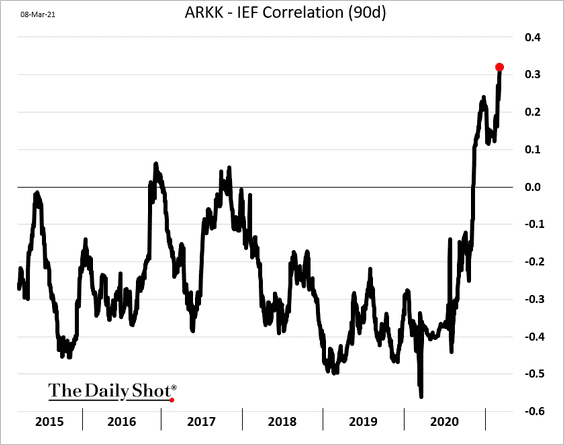

2. The correlation between stocks with high valuation multiples and Treasuries has risen sharply.

• Nasdaq vs. the 10yr Treasury yield:

• Nasdaq 100 vs. the 7-10yr Treasury ETF (IEF):

• Post-IPO stocks vs. IEF:

• Ark Innovation ETF vs. IEF:

——————–

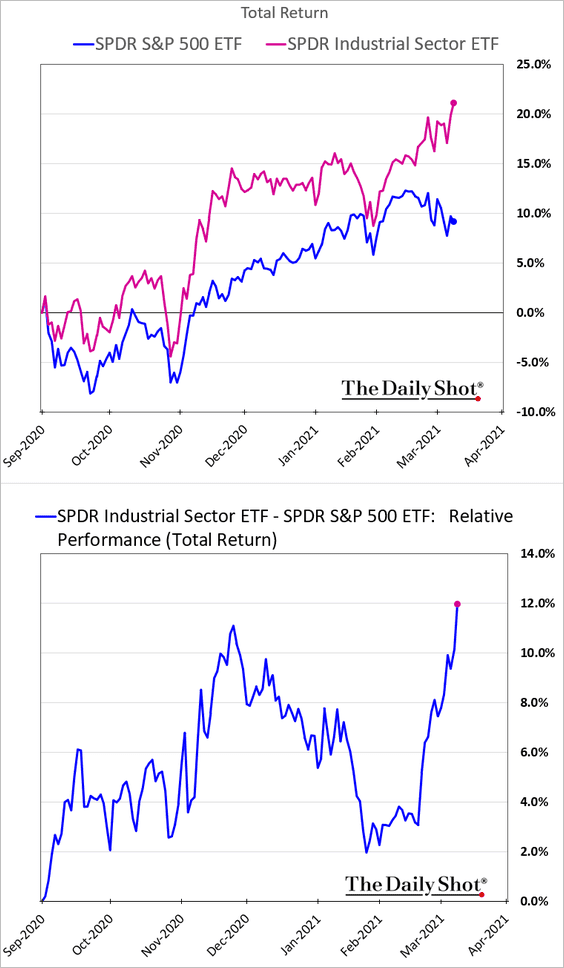

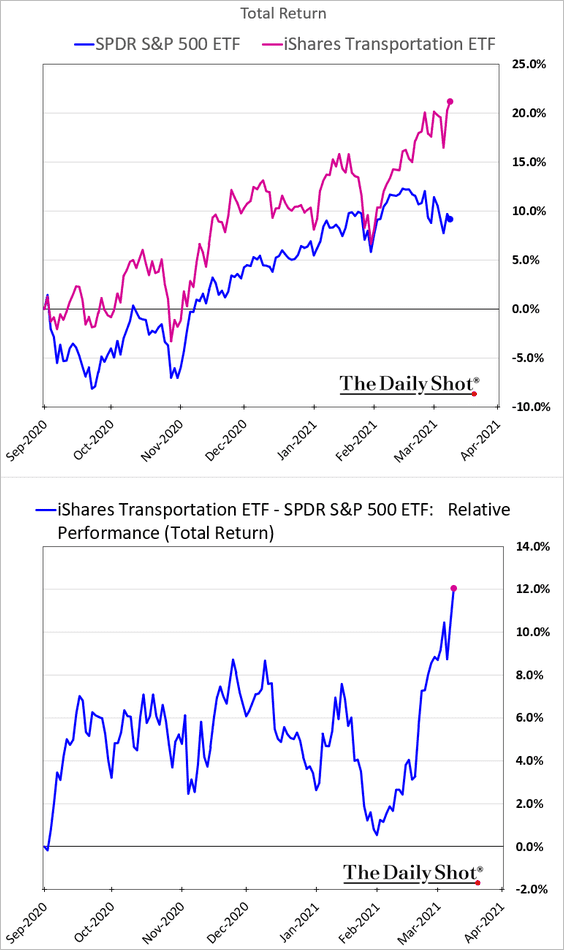

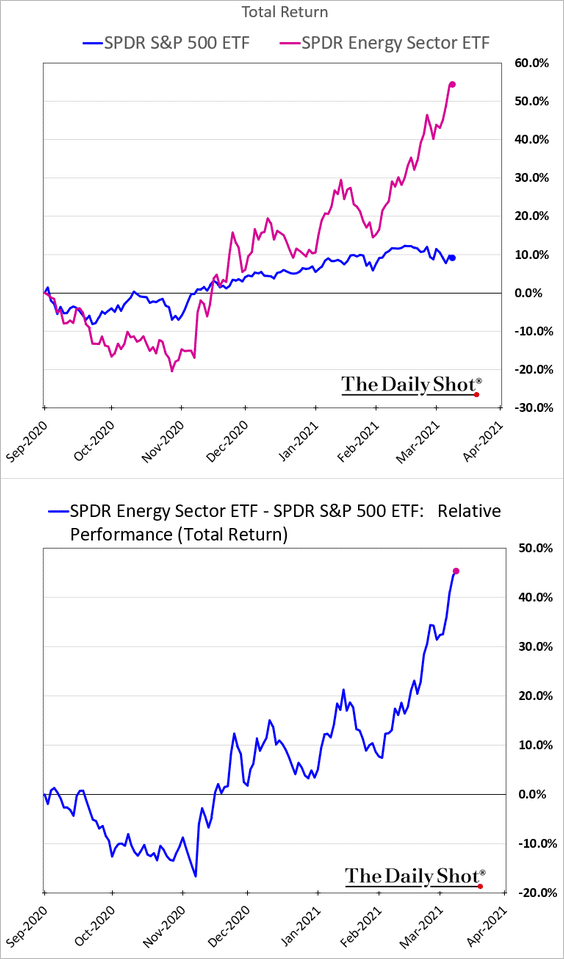

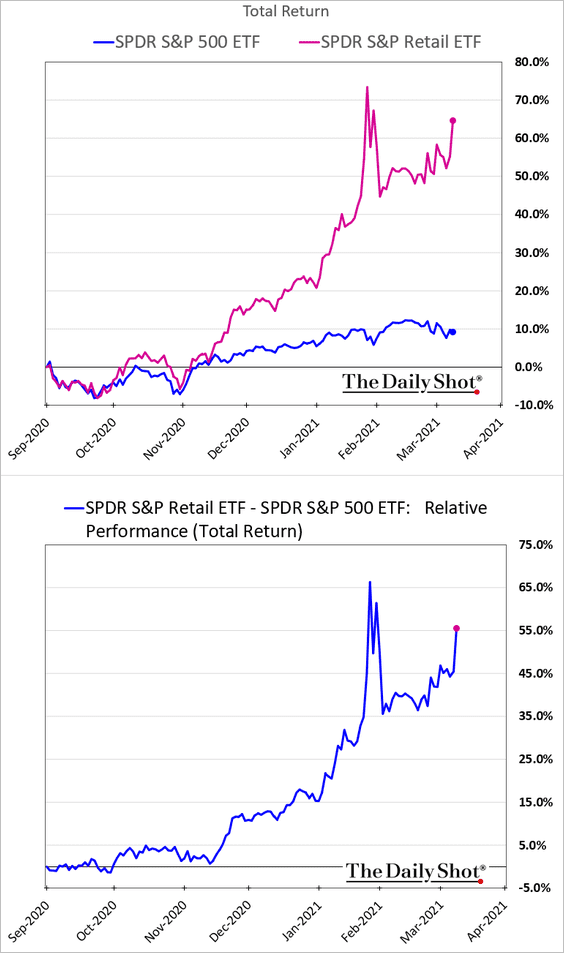

3. Here are some sector performance charts over the past six months.

• Banks:

• Industrials:

• Transportation:

• Energy:

• Retail (XRP ETF boosted by GameStop):

• Semiconductors:

![]()

——————–

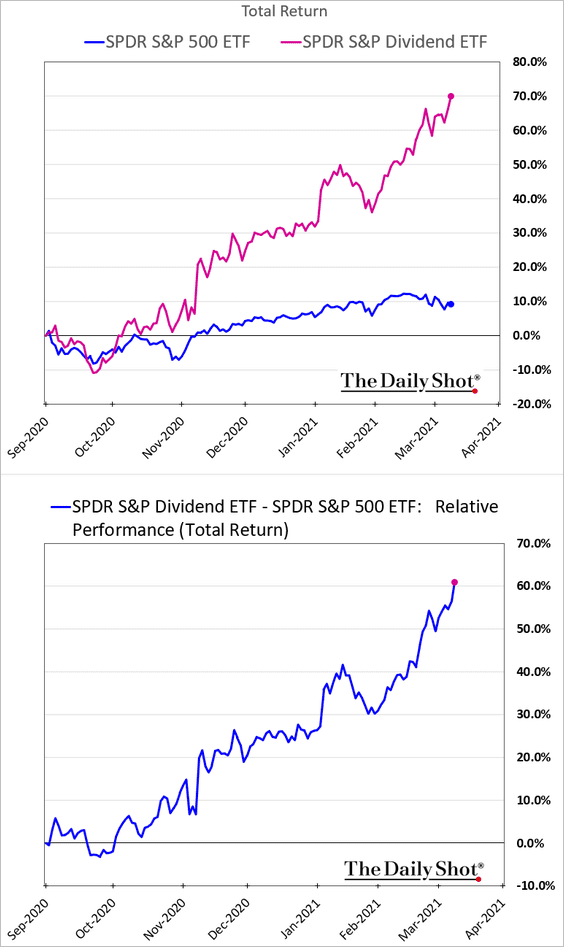

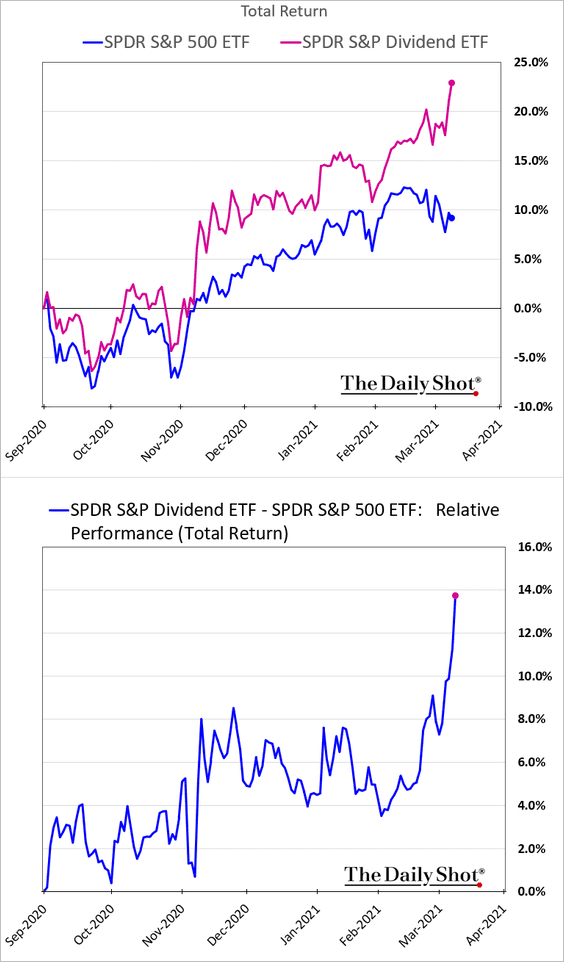

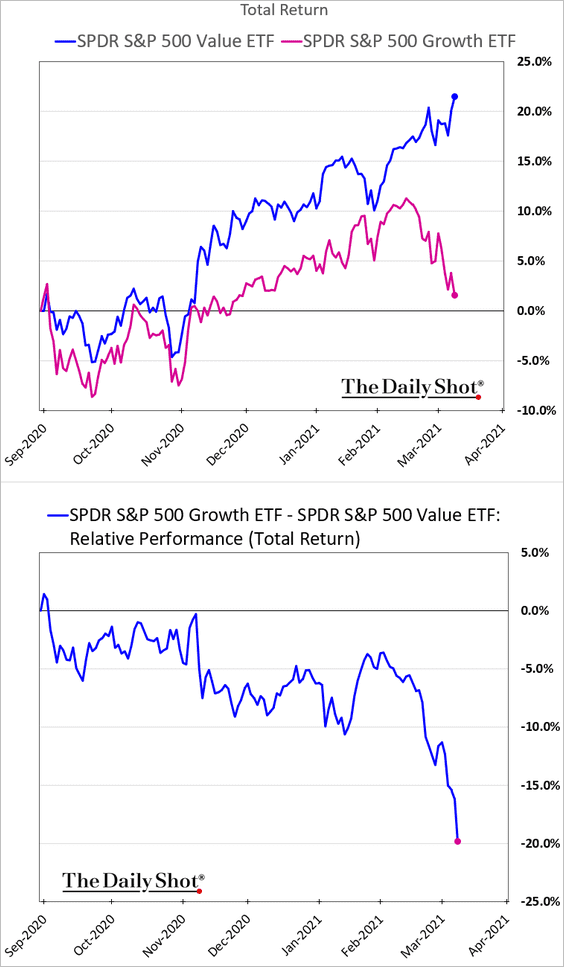

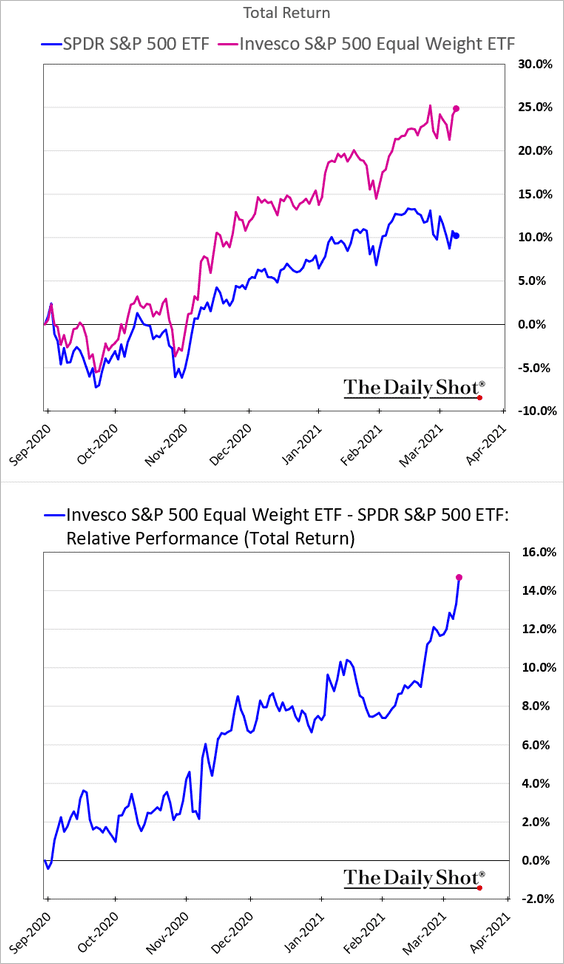

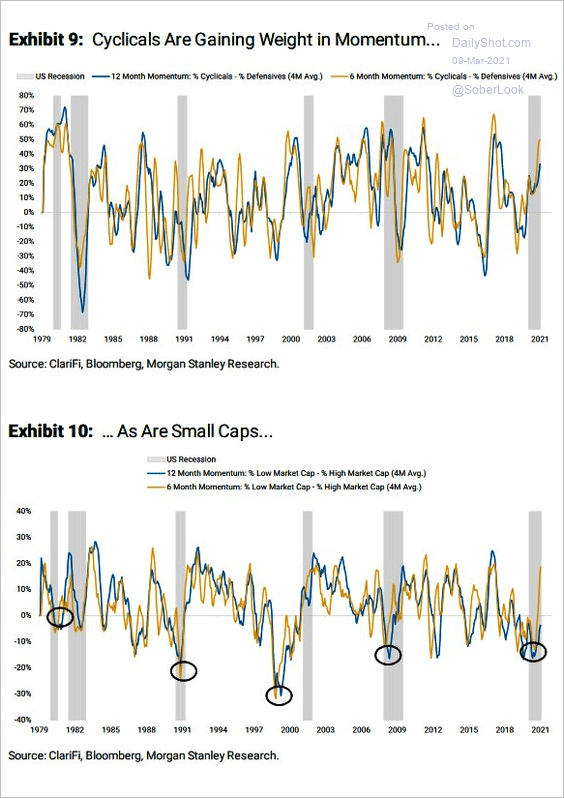

4. Next, we have some equity factor/style trends.

• High-dividend stocks (boosted by banks):

• Value vs. growth:

• Equal-weight S&P 500:

h/t Heather Burke

h/t Heather Burke

Some of the value/cyclical stocks and smaller firms are gaining weight in the momentum factor.

Source: Morgan Stanley Research, @WallStJesus

Source: Morgan Stanley Research, @WallStJesus

——————–

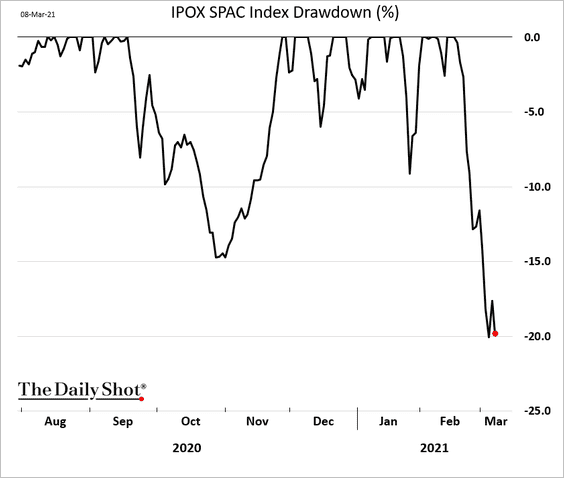

5. SPACs are in bear-market territory.

h/t @chrismbryant Read full article

h/t @chrismbryant Read full article

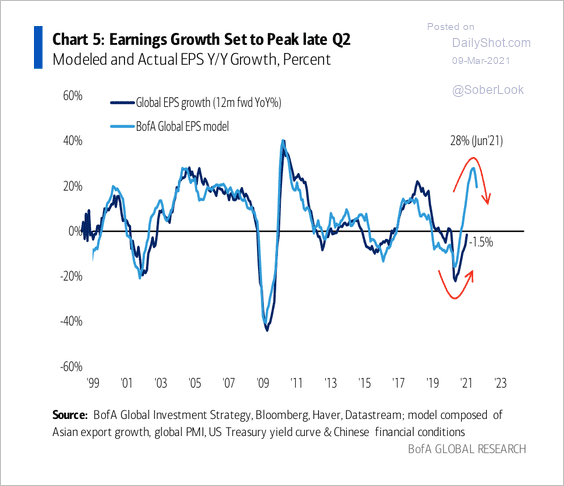

6. BofA expects earnings growth to peak in late Q2.

Source: BofA Global Research

Source: BofA Global Research

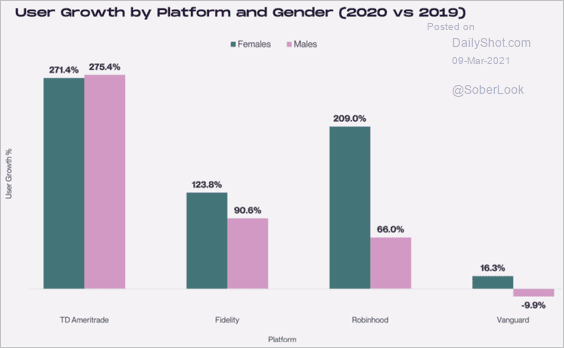

7. Here is the 2020 user growth on retail trading platforms (women outpacing men at most firms).

Source: cardify Read full article

Source: cardify Read full article

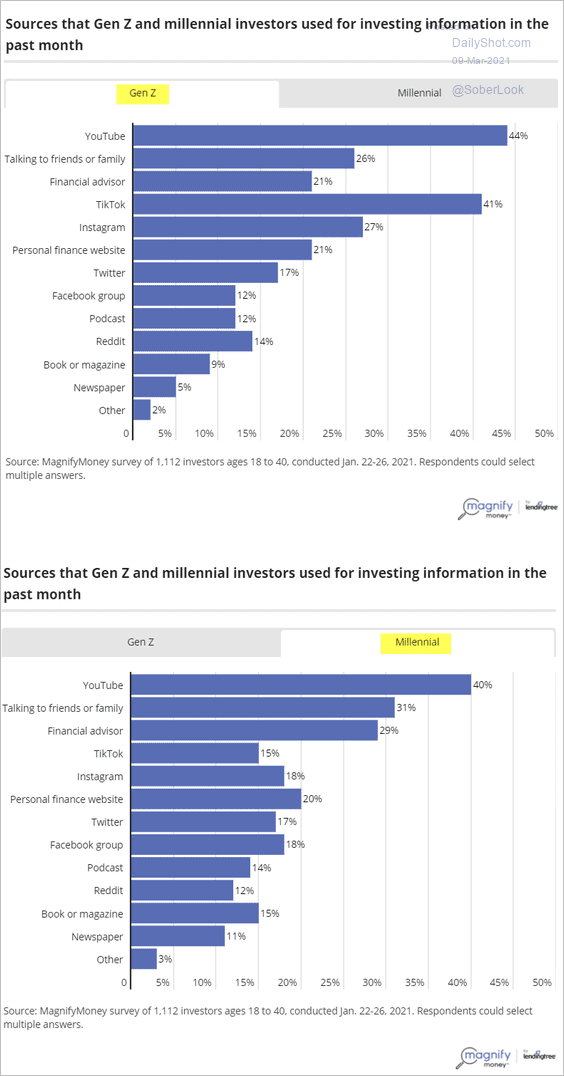

8. YouTube has all the answers.

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

Back to Index

Rates

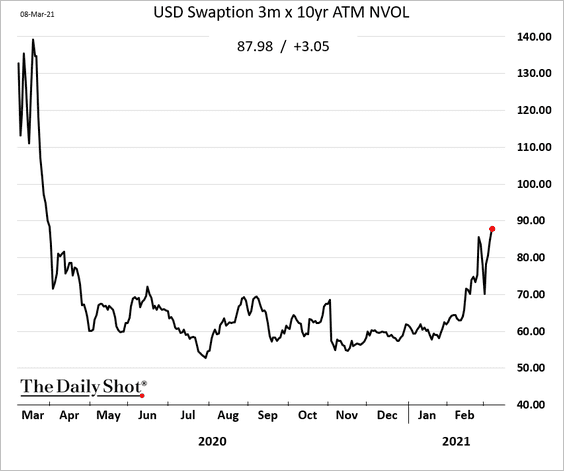

1. Rates implied volatility is rising again.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

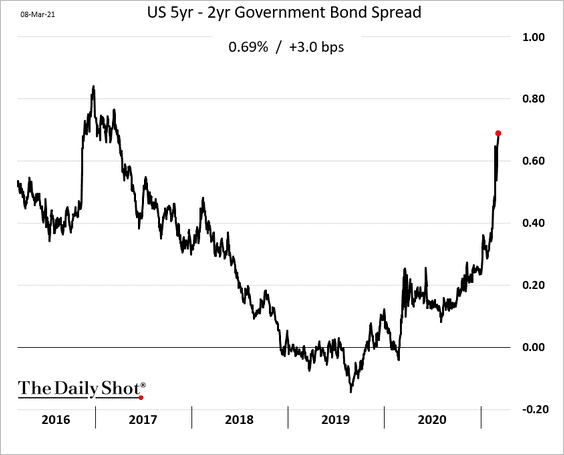

2. The yield curve keeps steepening at the shorter end.

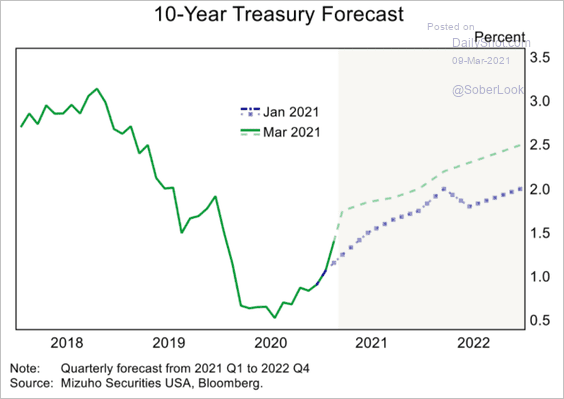

3. How high will the 10yr Treasury yield get? Here is a forecast from Mizuho.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

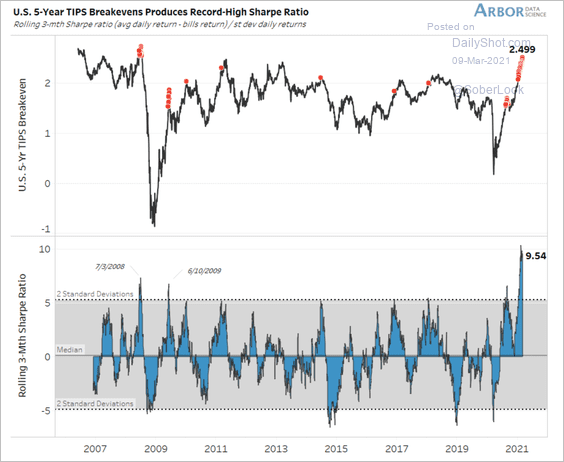

4. The US 5-year TIPS risk-adjusted return is at an extreme.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

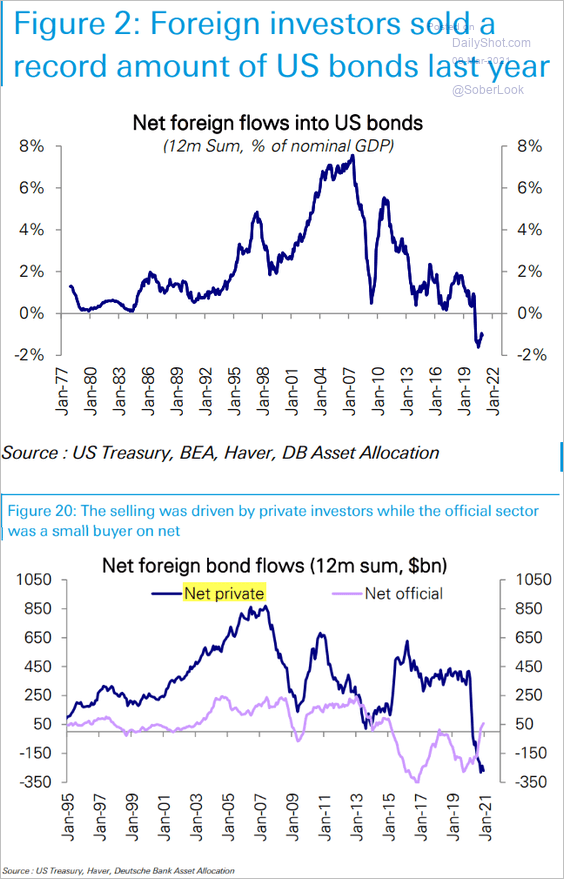

5. Private-sector foreign investors have been selling US bonds.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

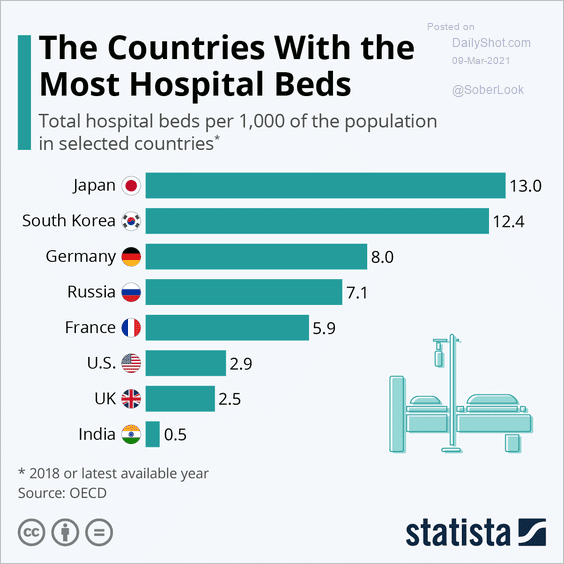

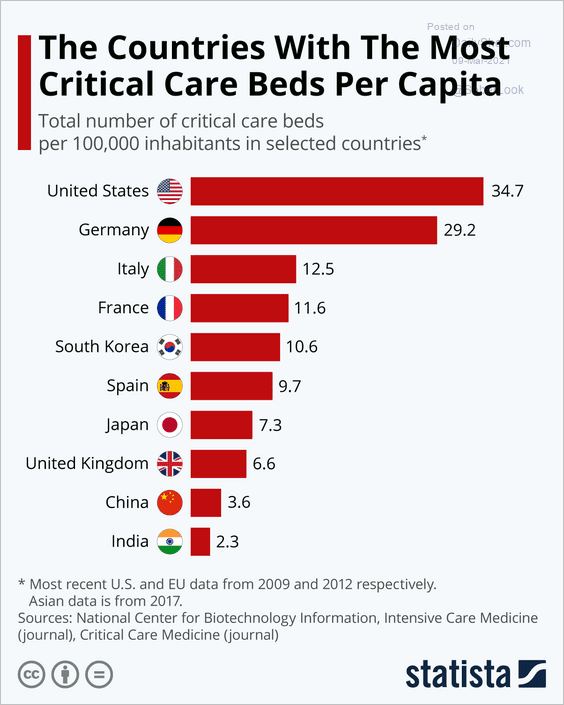

1. Countries with most hospital beds:

Source: Statista

Source: Statista

Source: Statista

Source: Statista

——————–

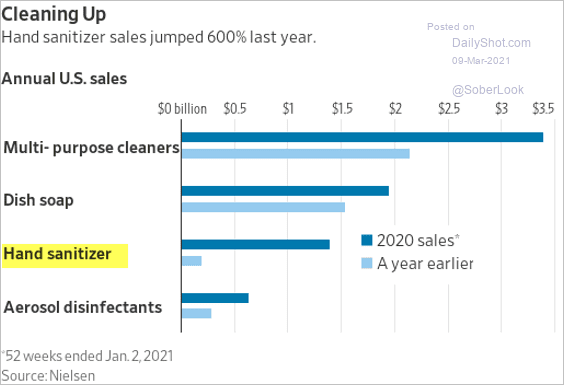

2. Hand sanitizer sales in 2020 vs. 2019:

Source: @WSJ Read full article

Source: @WSJ Read full article

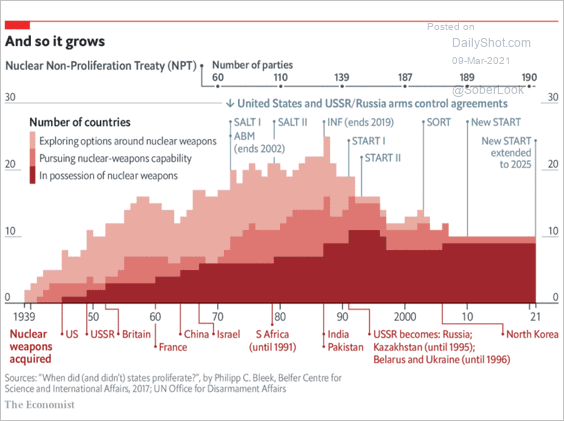

3. The number of countries in possession of nuclear weapons:

Source: The Economist Read full article

Source: The Economist Read full article

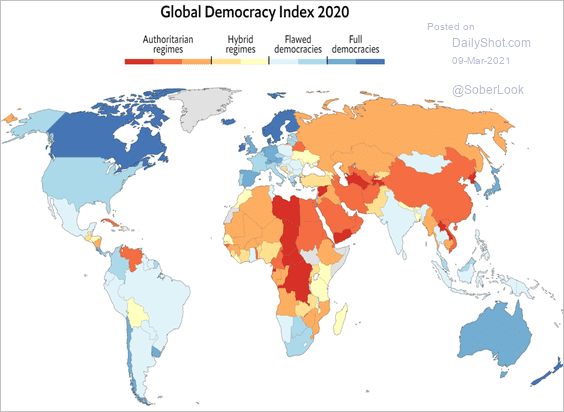

4. The Global Democracy Index:

Source: The Economist Read full article

Source: The Economist Read full article

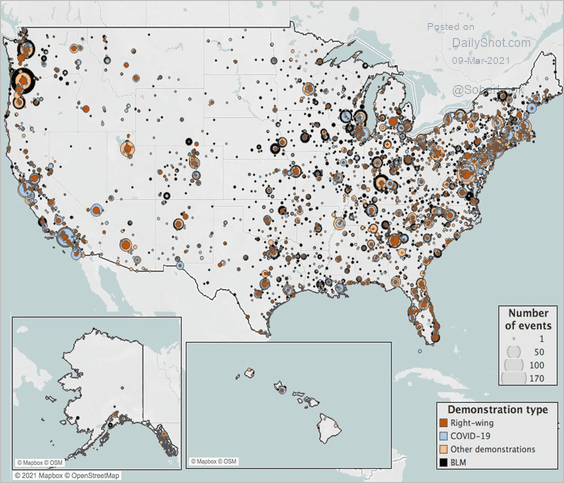

5. Militia activity in right-wing demonstrations (pre-Capitol incident):

Source: @ACLEDINFO Read full article

Source: @ACLEDINFO Read full article

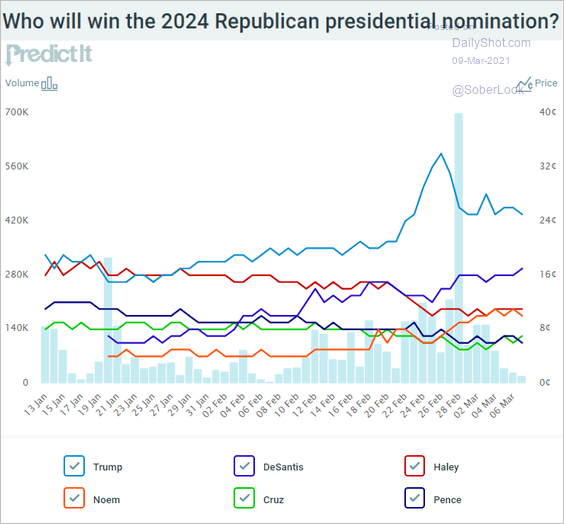

6. GOP 2024 presidential nomination odds in the betting markets:

Source: @PredictIt

Source: @PredictIt

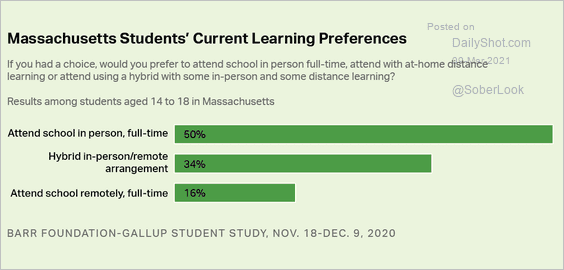

7. Massachusetts students’ learning preferences:

Source: Gallup Read full article

Source: Gallup Read full article

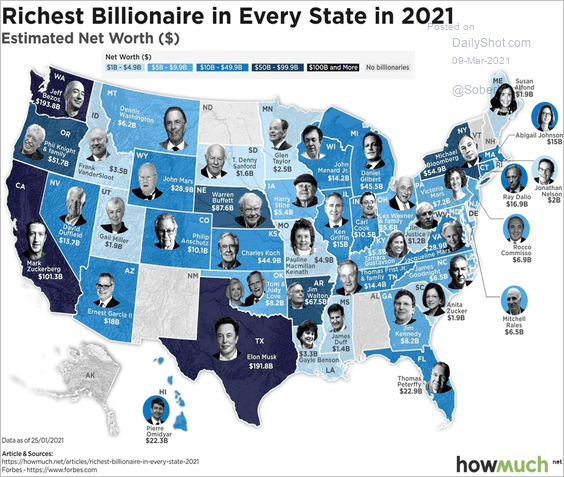

8. The wealthiest billionaire in each state:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

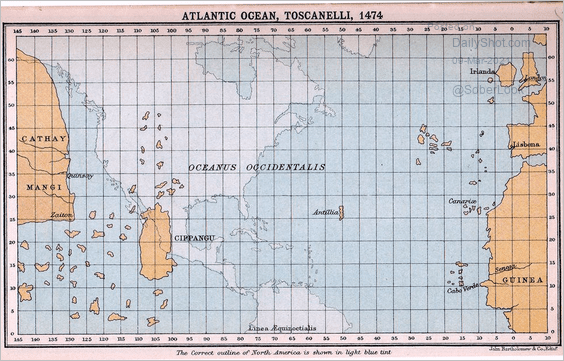

9. This is a world map from the 15th century that influenced Columbus.

Source: @simongerman600 Read full article

Source: @simongerman600 Read full article

——————–

Back to Index