The Daily Shot: 10-Mar-21

• The United States

• Canada

• The Eurozone

• Europe

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

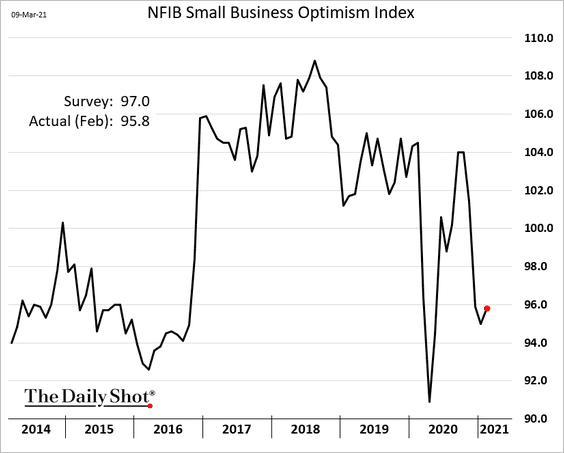

1. The NFIB small business index ticked higher but was below forecasts.

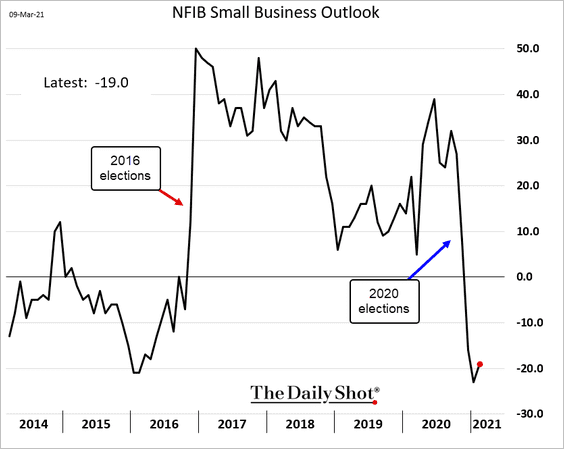

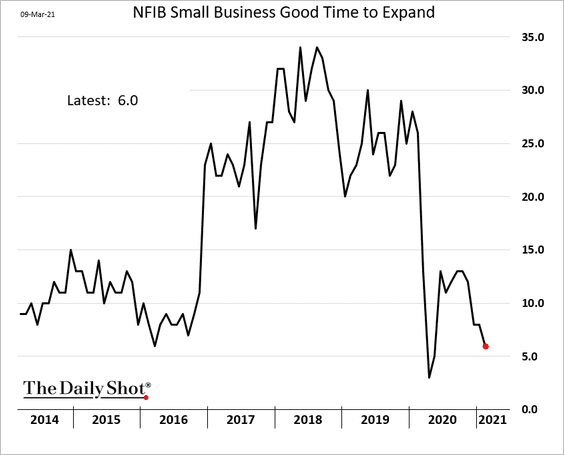

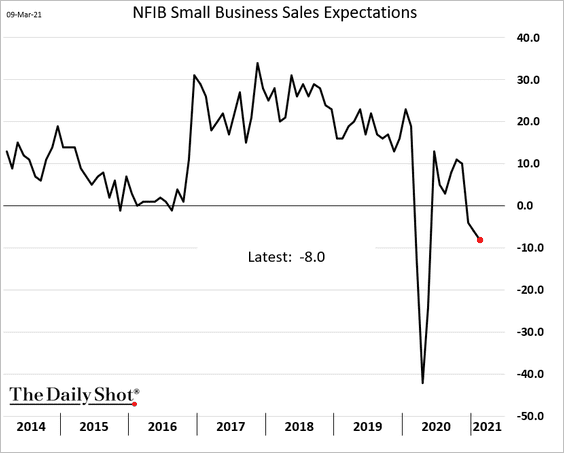

• Recent political developments remain a drag on sentiment.

– Outlook:

– Good time to expand:

– Sales expectations:

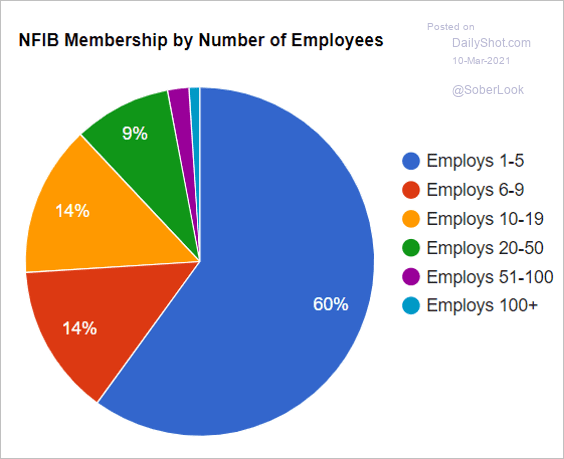

It’s important to note that 60% of the NFIB members are tiny businesses. As a result, this report sometimes resembles a GOP-leaning household survey.

Source: NFIB

Source: NFIB

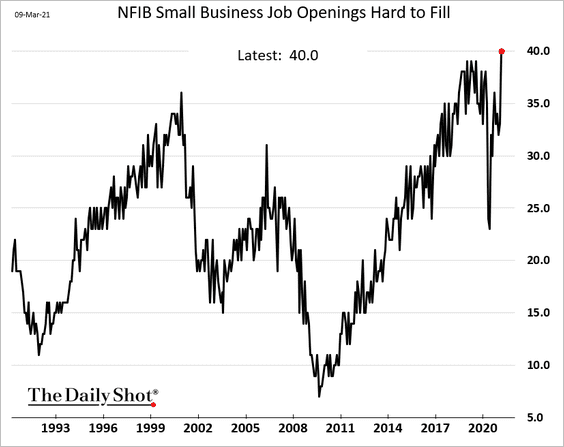

• Businesses are increasingly facing labor shortages. Unemployment benefits have been much higher than normal. Combined with the one-off government payments, it’s been less attractive for many workers to get back into the labor force. Childcare challenges exacerbate the situation. The index of “job openings hard to fill” hit a record high.

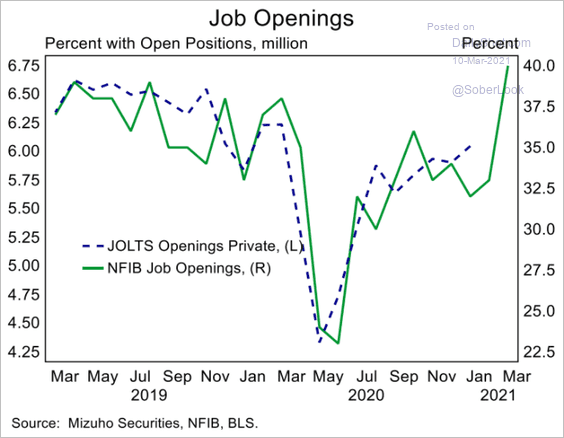

The NFIB job openings index spiked, suggesting that we will see more vacancies at the national level.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

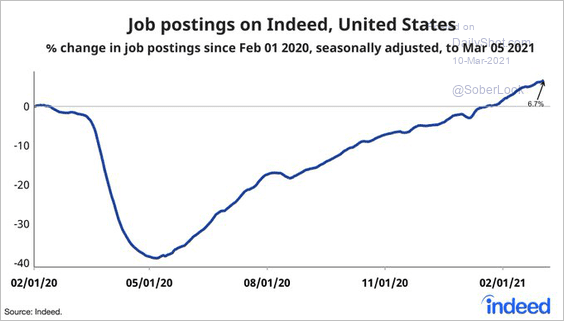

Job postings on Indeed keep climbing.

Source: @JedKolko, @indeed

Source: @JedKolko, @indeed

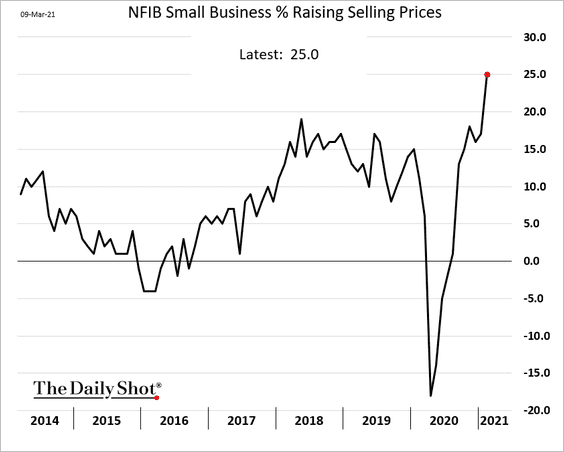

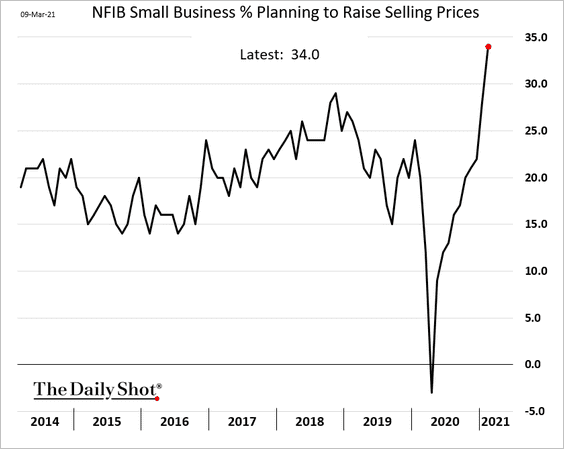

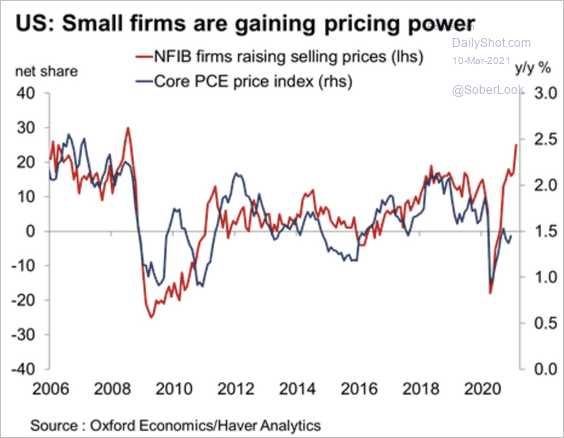

• More firms are boosting prices (2 charts).

It’s a clear indication of rising consumer inflation ahead.

Source: @GregDaco, @OxfordEconomics

Source: @GregDaco, @OxfordEconomics

——————–

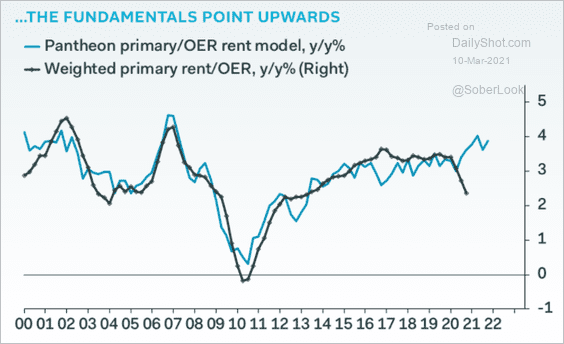

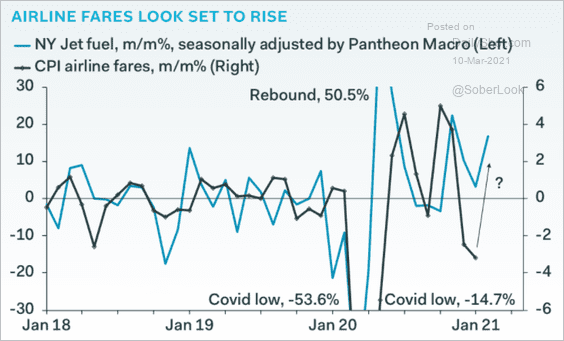

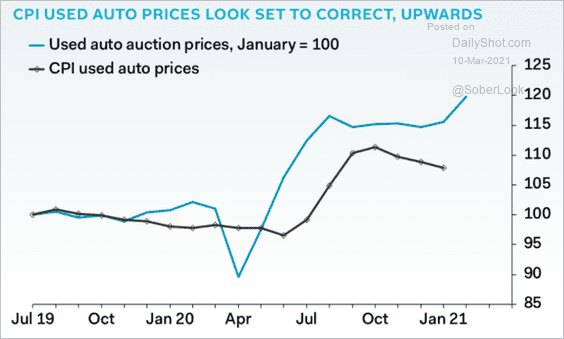

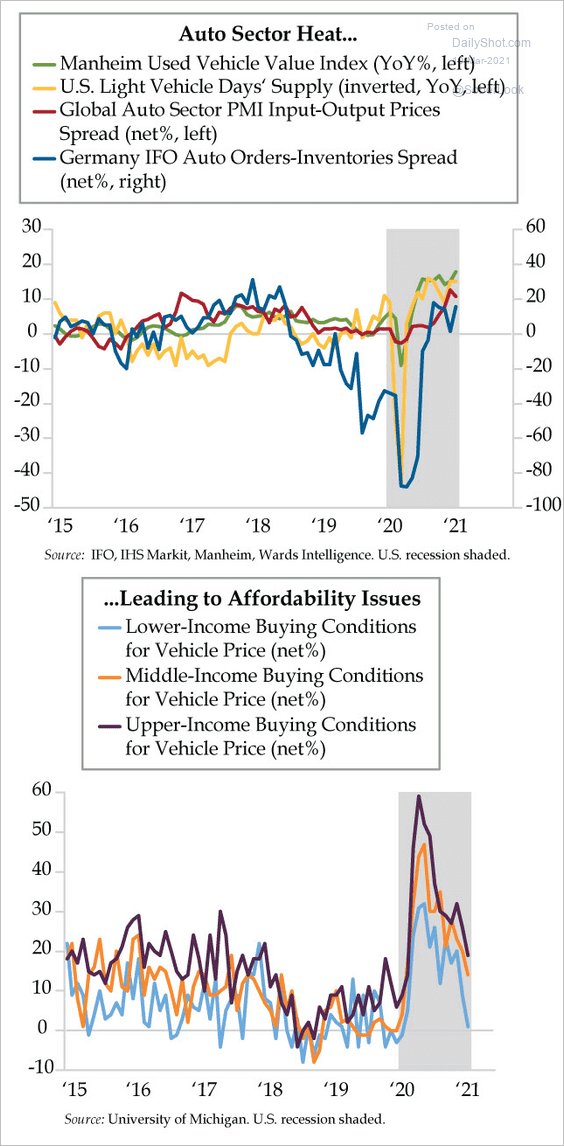

2. High-frequency indicators point to stronger gains in some of the CPI components in the coming months.

• Rent and owners’ equivalent rent:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Airline fares:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Used cars:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

By the way, rising vehicle prices are hurting affordability.

Source: The Daily Feather

Source: The Daily Feather

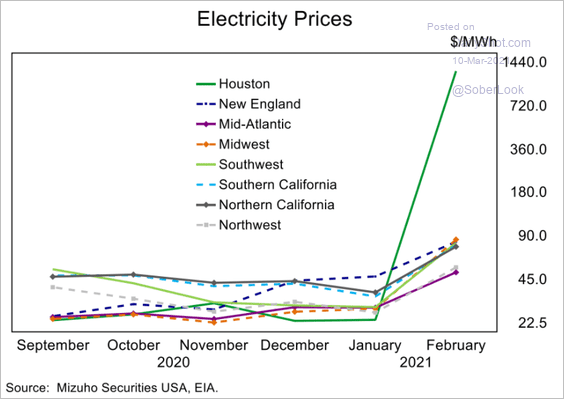

• The Texas electricity price spike will boost the headline CPI.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

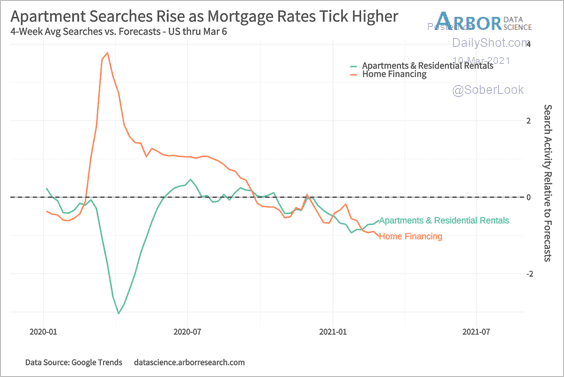

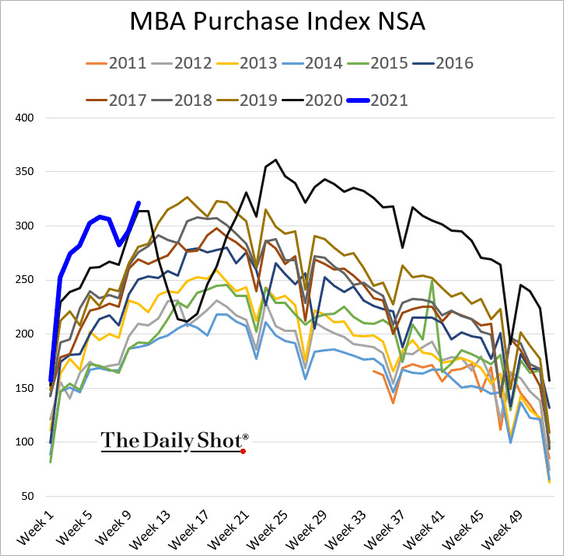

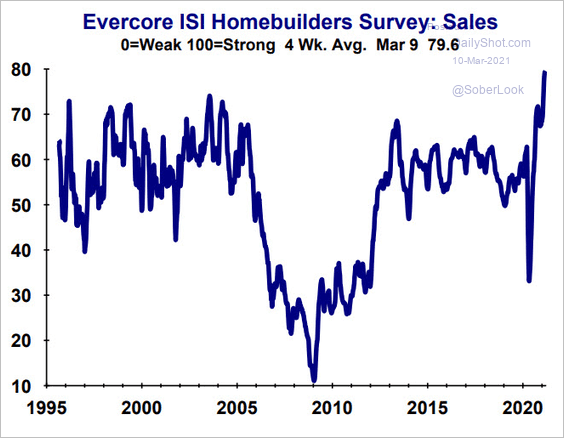

3. Next, we have some updates on the housing market.

• Search activity for home financing has dipped below interest in rentals.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

• For now, there is little evidence that higher mortgage rates are becoming a drag on the housing market.

– Mortgage applications for house purchase:

– Homebuilder survey from Evercore ISI:

Source: Evercore ISI

Source: Evercore ISI

——————–

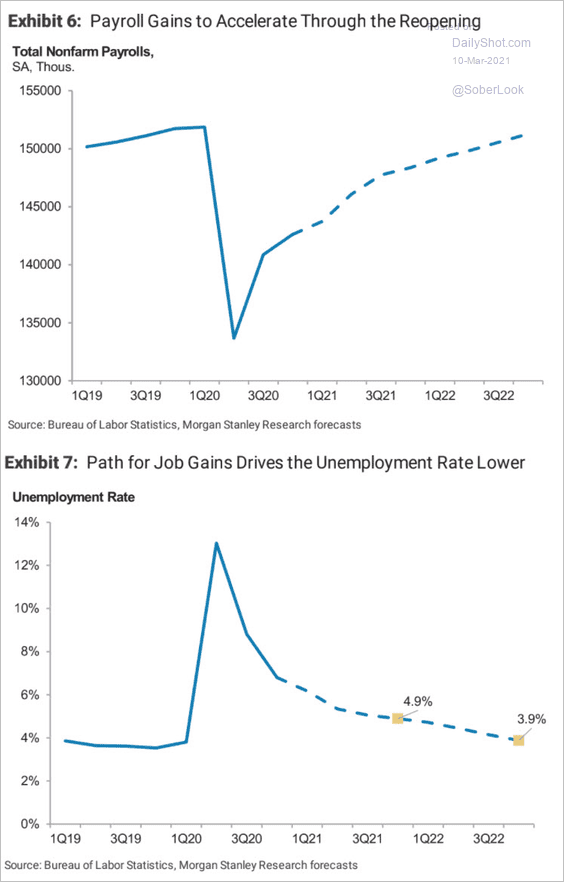

4. Here is a forecast for the US labor market recovery from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

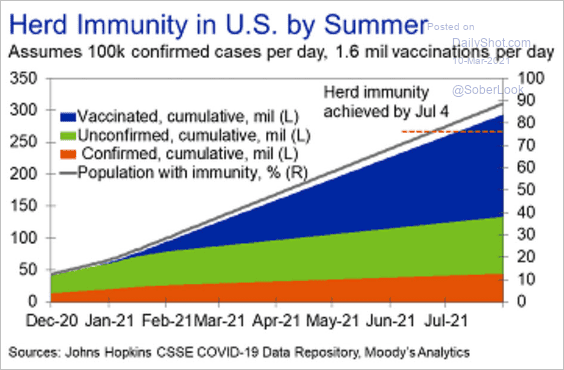

5. Herd immunity by summer?

Source: Moody’s Analytics

Source: Moody’s Analytics

Back to Index

Canada

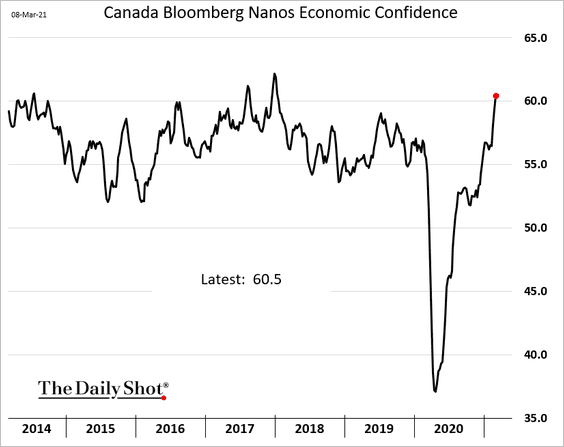

1. Consumer confidence hit a multi-year high.

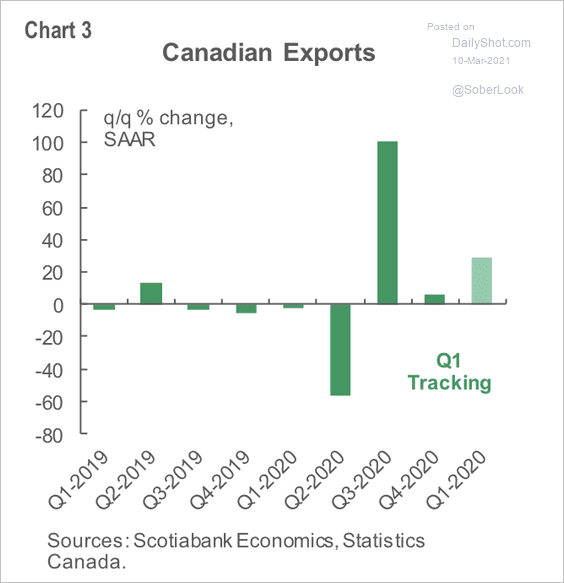

2. Will demand from the US fiscal stimulus leak into Canada through the trade accounts? Export gains in January are already tracking well for the quarter.

Source: Scotiabank Economics

Source: Scotiabank Economics

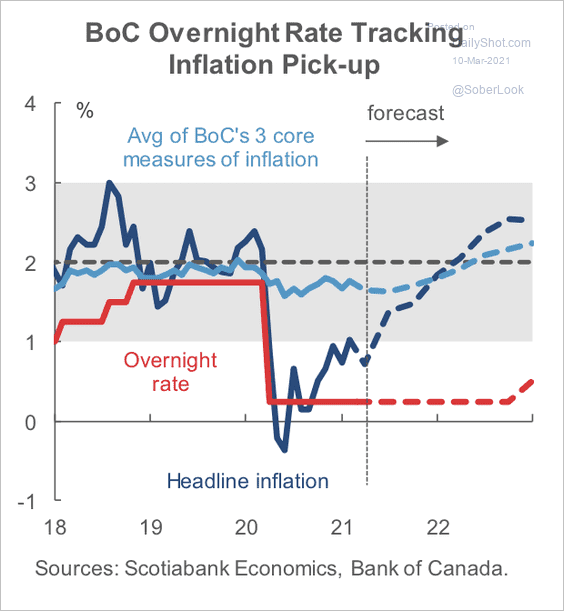

3. Liftoff by late next year?

Source: Scotiabank Economics

Source: Scotiabank Economics

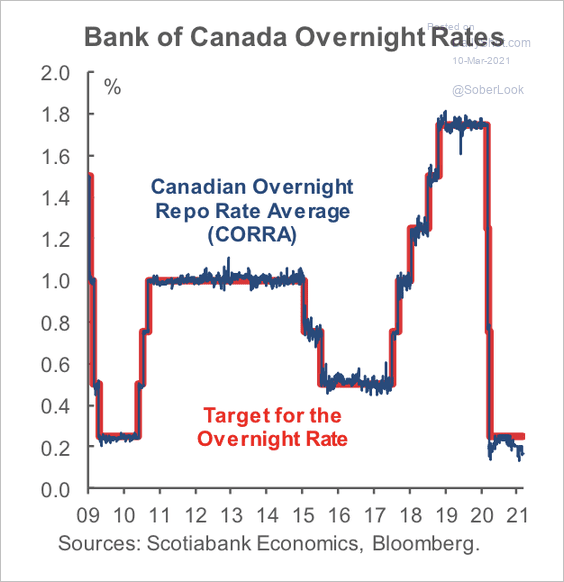

4. Currently, the overnight repo rate average is below the Bank of Canada’s target.

Source: Scotiabank Economics

Source: Scotiabank Economics

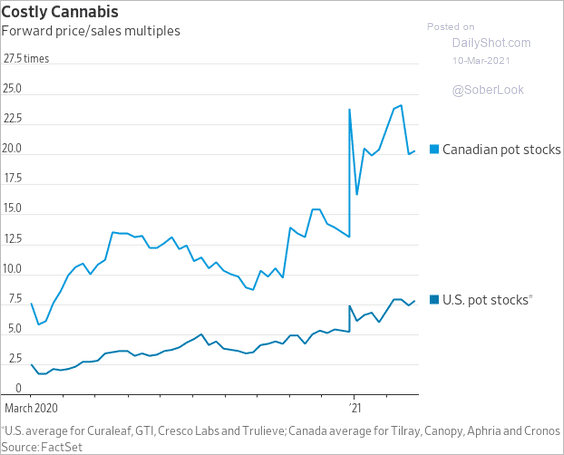

5. Canadian cannabis stocks trade at a substantial premium to US counterparts.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

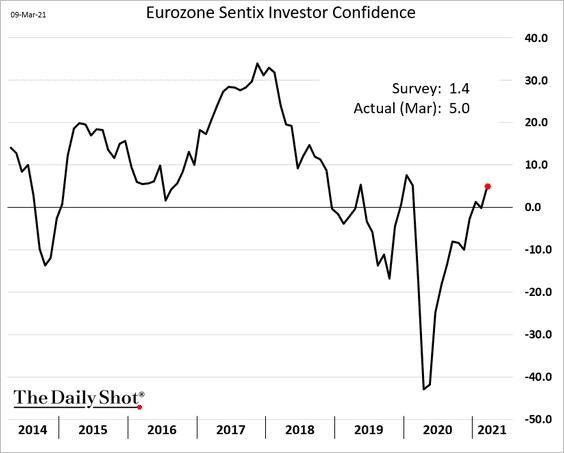

The Eurozone

1. Investor confidence continues to improve.

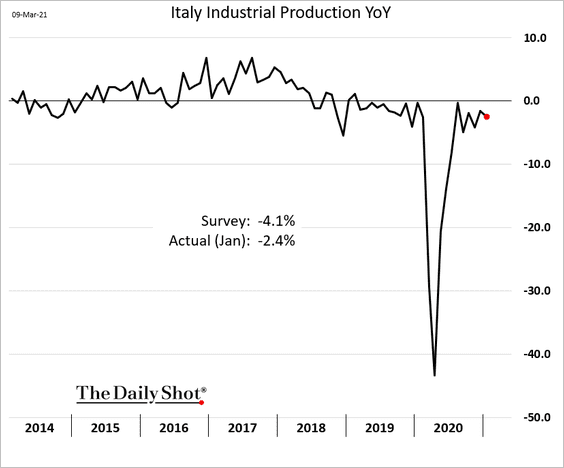

2. Italy’s industrial production held up better than expected at the start of the year.

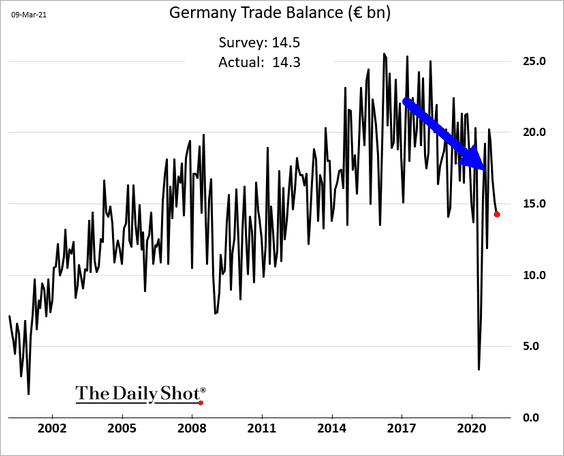

3. Germany’s trade surplus is trending lower.

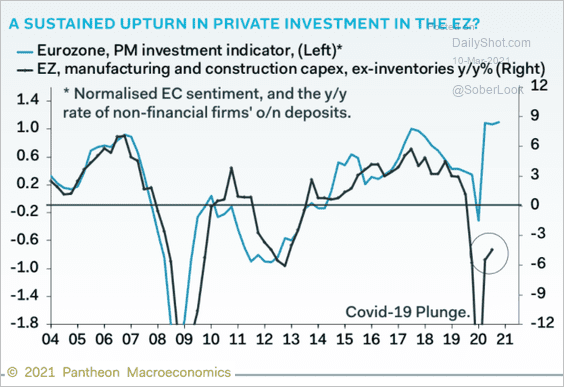

4. According to Pantheon Macroeconomics, business investment is rebounding.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Europe

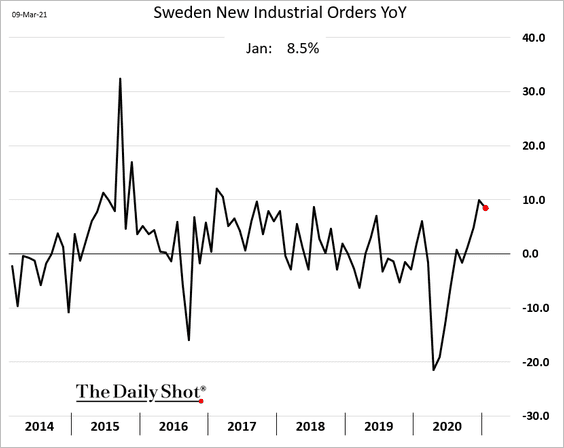

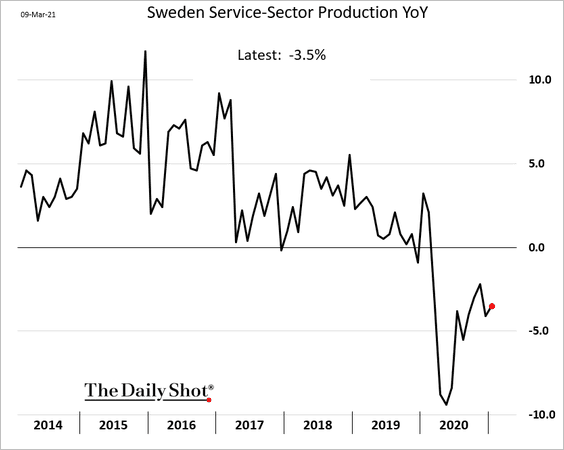

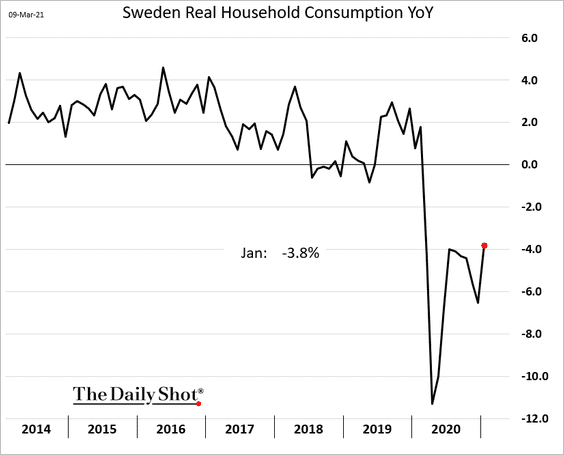

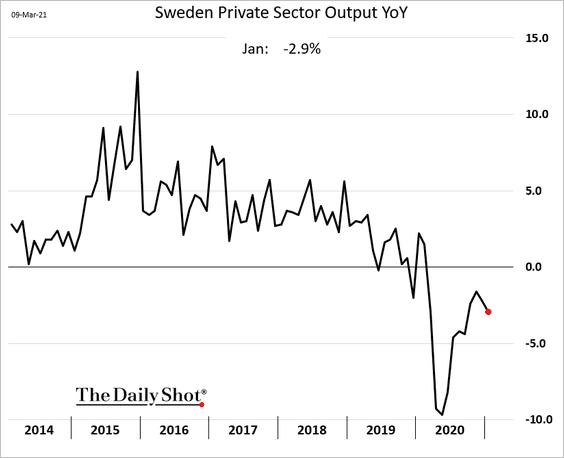

1. Let’s begin with Sweden.

• Industrial activity remains robust.

• Service-sector recovery will take time.

• And so will consumer spending.

• Here is the overall private-sector output.

——————–

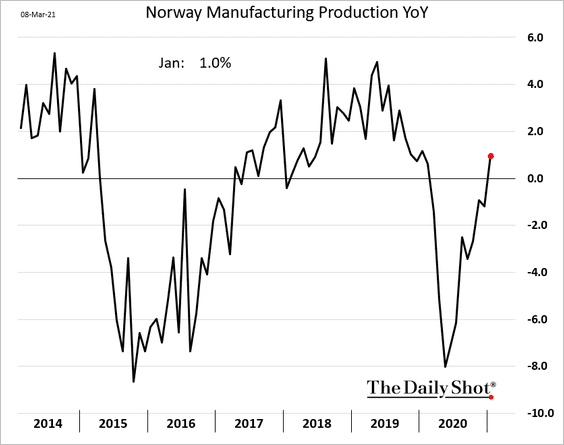

2. Norway’s industrial production is rebounding.

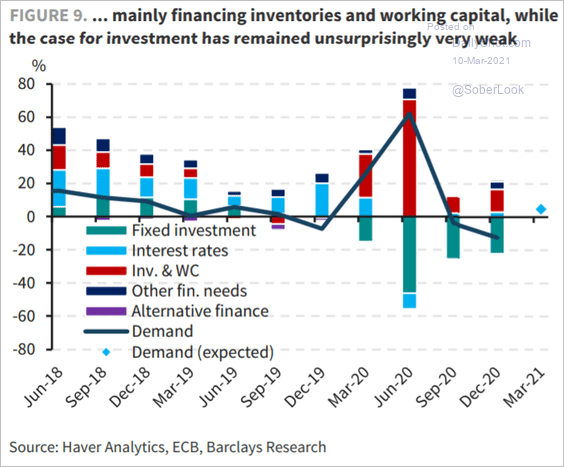

3. EU emergency loans were used to mainly finance inventories and working capital.

Source: Barclays Research

Source: Barclays Research

Back to Index

China

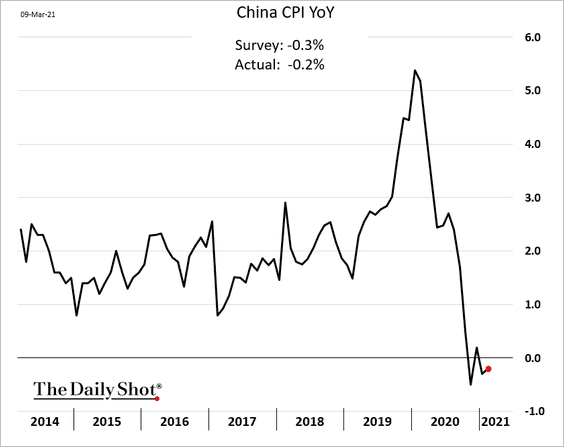

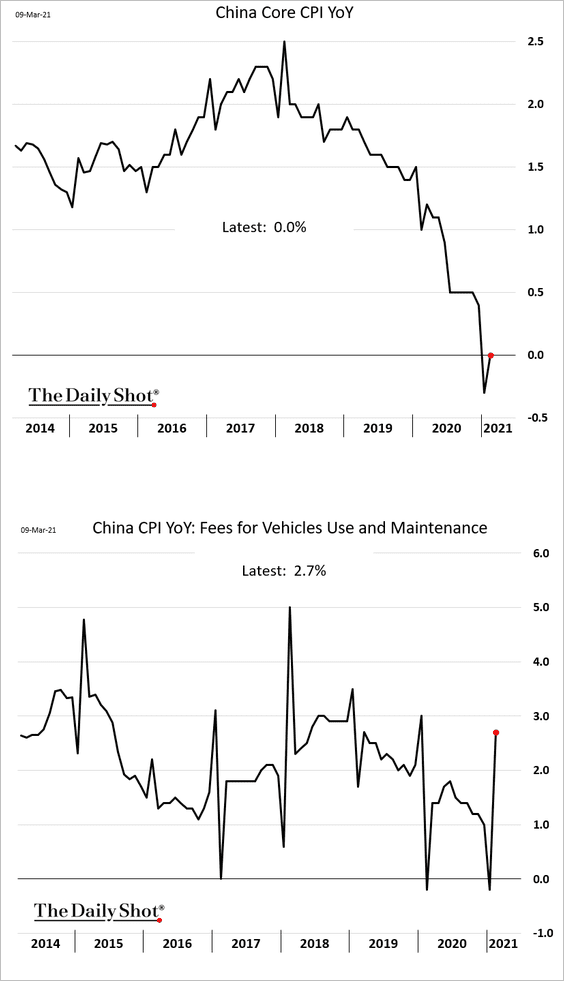

1. The CPI ticked higher last month, …

… driven by core inflation. However, there is a great deal of seasonal noise in the data (2nd chart).

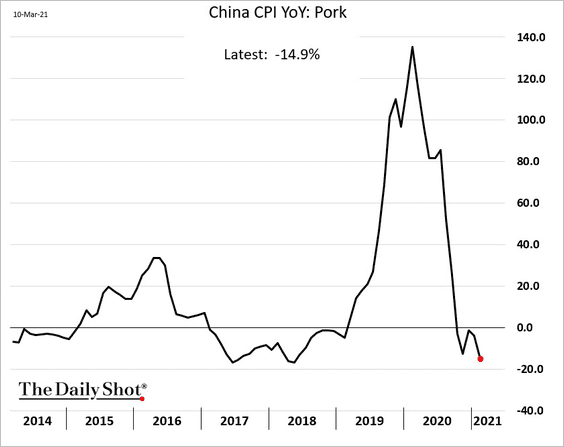

Pork prices are down 15% from a year ago as the pig herd is rebuilt.

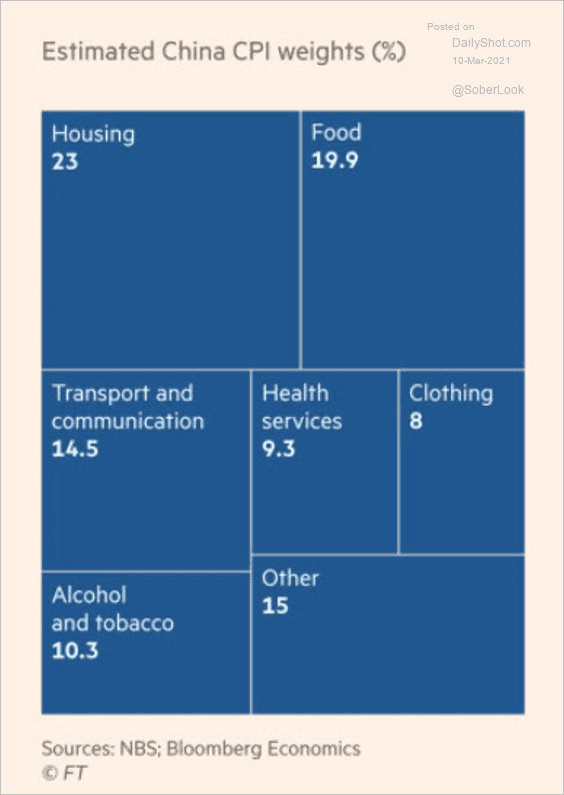

By the way, food is 20% of the CPI.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

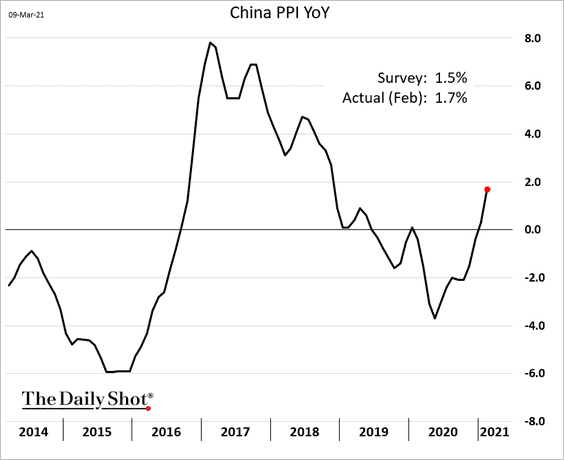

2. Producer prices are rebounding, which is now a global trend.

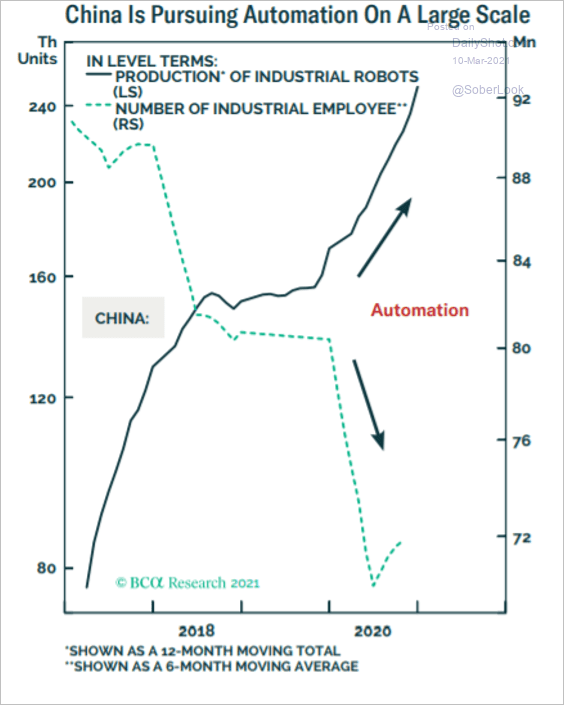

3. Beijing is focused on automation.

Source: BCA Research

Source: BCA Research

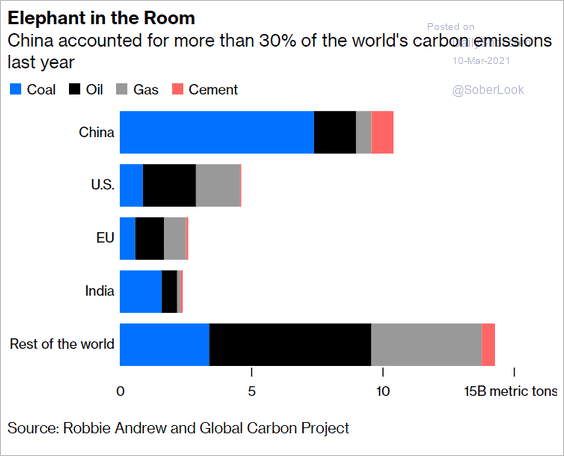

4. China accounts for 30% of the world’s carbon emissions.

Source: @davidfickling, @bopinion Read full article

Source: @davidfickling, @bopinion Read full article

Back to Index

Emerging Markets

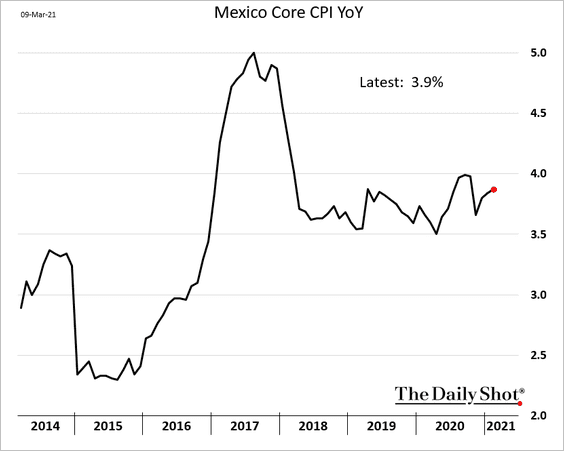

1. Mexico’s core inflation remains relatively benign.

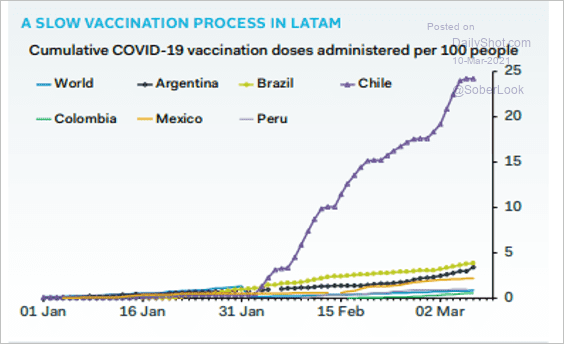

2. Except for Chile, the pace of vaccinations in LatAm nations has been slow.

Source: @PantheonMacro, @andres__abadia Read full article

Source: @PantheonMacro, @andres__abadia Read full article

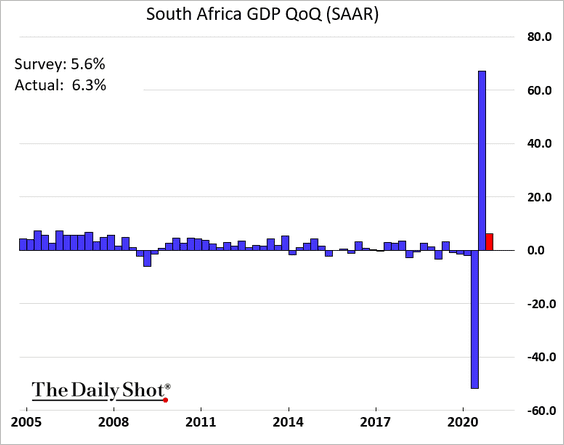

3. South Africa’s Q4 GDP gain was firmer than expected.

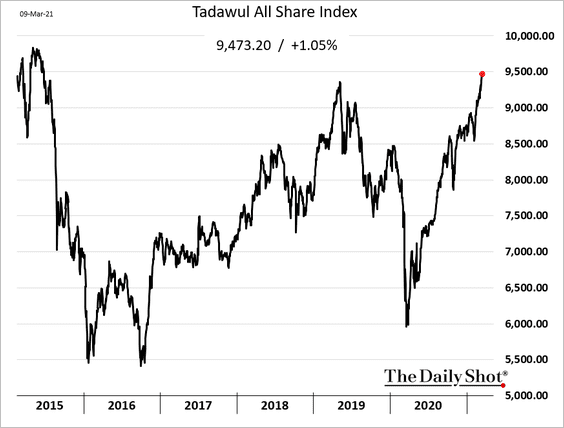

4. Saudi stocks hit the highest level since 2015 on the back of rising oil prices.

h/t @filipepacheco Read full article

h/t @filipepacheco Read full article

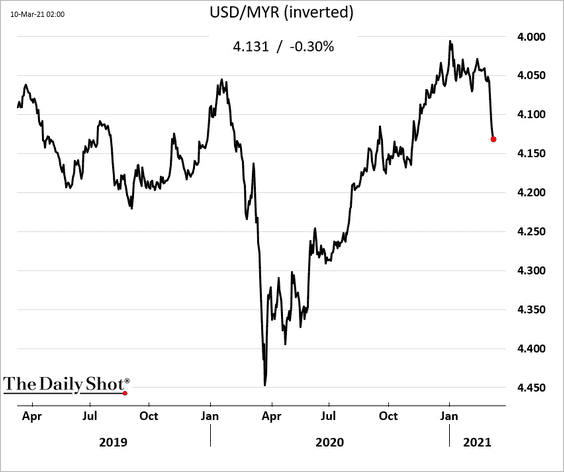

5. Asian currencies have been softer in recent days. Here is the Malaysian ringgit vs. USD.

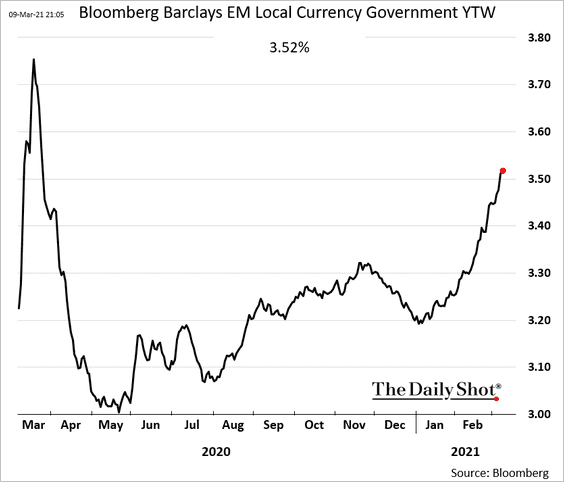

6. Local-currency government bond yields have been climbing this year.

h/t @lisaabramowicz1 Further reading

h/t @lisaabramowicz1 Further reading

Back to Index

Commodities

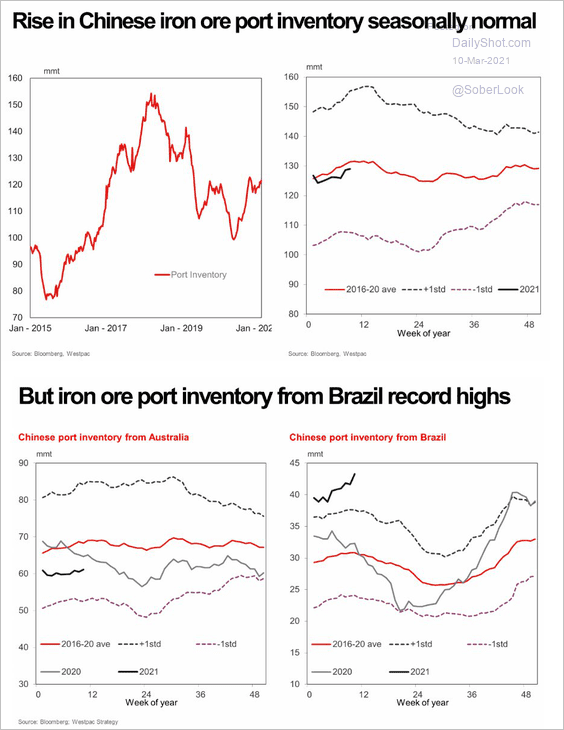

1. While the rise in China’s iron ore inventories is normal for this time of the year, the commodity stockpiles from Brazil hit a record high.

Source: Westpac Strategy, @Robert__Rennie

Source: Westpac Strategy, @Robert__Rennie

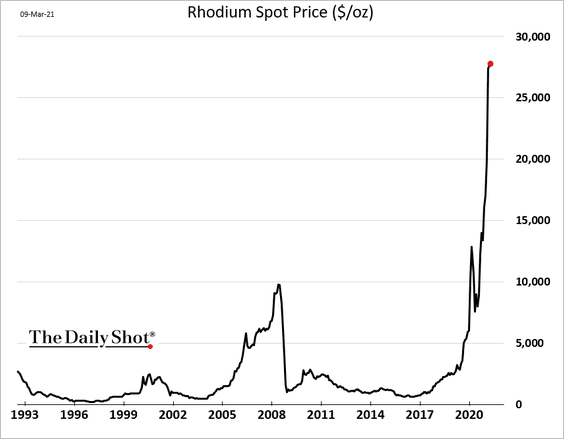

2. The surge in rhodium prices has been spectacular. Rhodium is a byproduct of platinum and nickel mining, and platinum inventories are quite high currently. Since miners are not incentivized to produce platinum, there has been a shortage of rhodium. At the same time, stricter emission standards in Europe increased rhodium demand for catalytic converters.

Source: The Washington Post Read full article

Source: The Washington Post Read full article

Source: Johnson Matthey, h/t Florian

Source: Johnson Matthey, h/t Florian

——————–

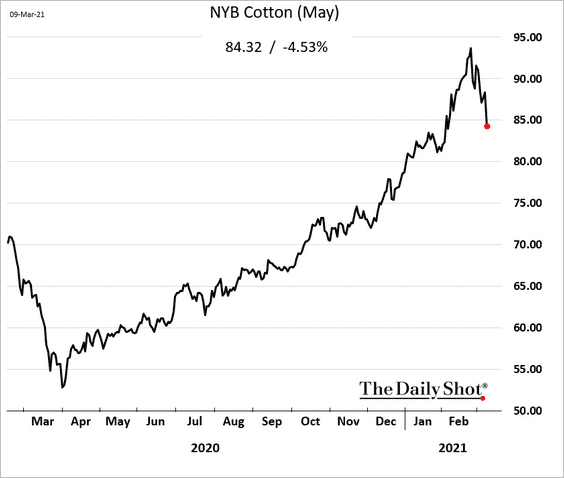

3. Cotton prices dropped in response to a weaker Brazilian real.

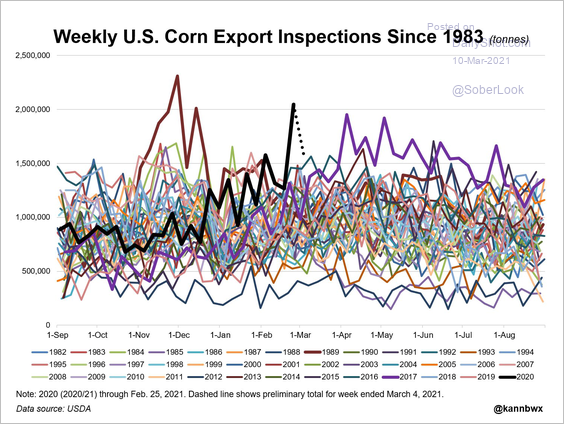

4. US corn exports have been elevated.

Source: @ReutersCommods, @kannbwx Read full article

Source: @ReutersCommods, @kannbwx Read full article

Back to Index

Equities

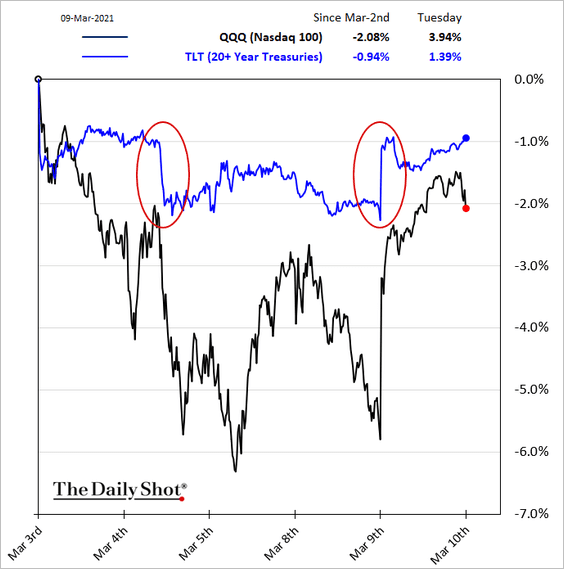

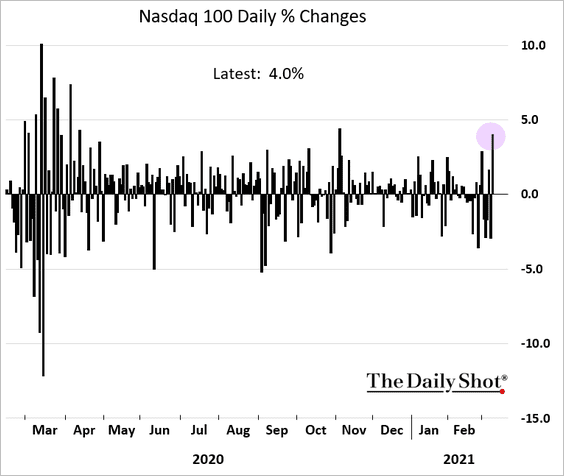

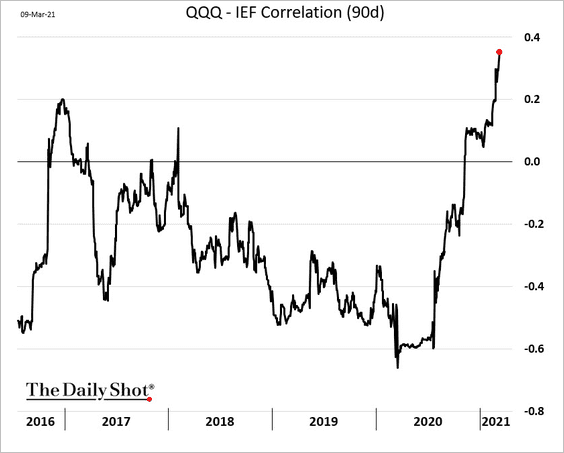

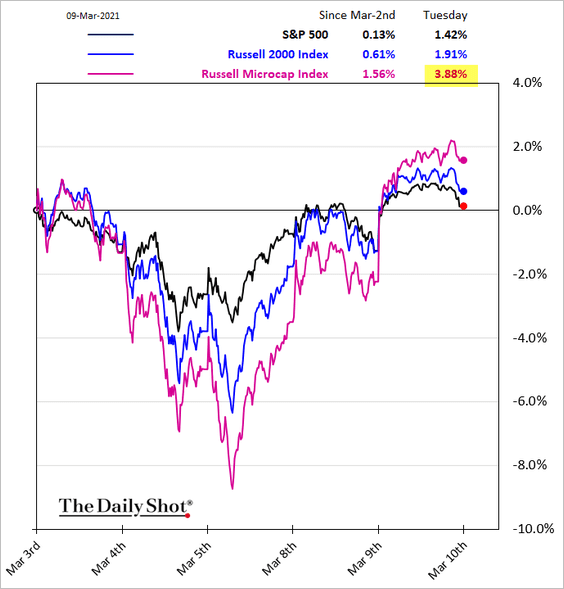

1. Tech stocks popped on Tuesday as bonds caught a bid.

The correlation between tech and Treasuries keeps climbing, making the market increasingly vulnerable to higher Treasury yields.

——————–

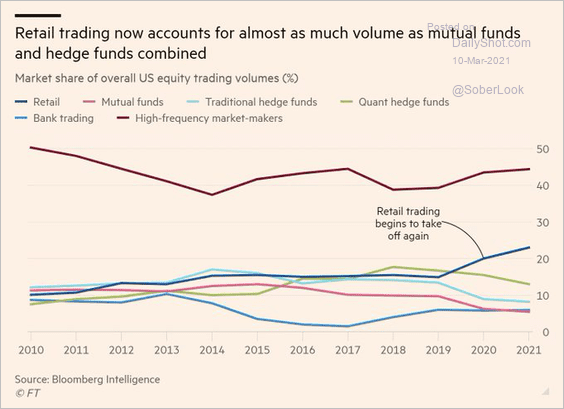

2. Retail investors are chasing microcaps again, boosted by the Reddit pump & dump machine.

Retail trading is now nearly as large as mutual funds and hedge funds combined volumes.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

——————–

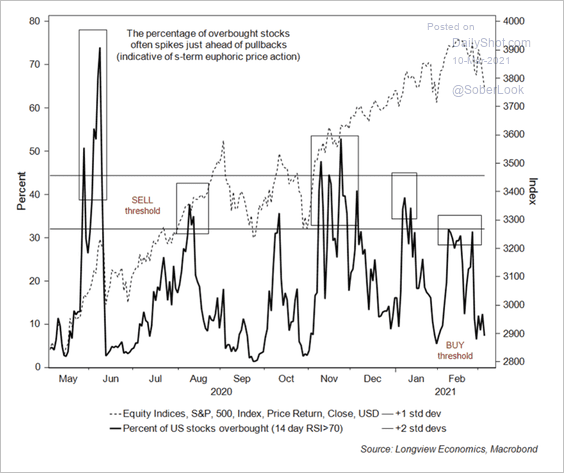

3. Less than 10% of US stocks are overbought based on the RSI indicator.

Source: Longview Economics

Source: Longview Economics

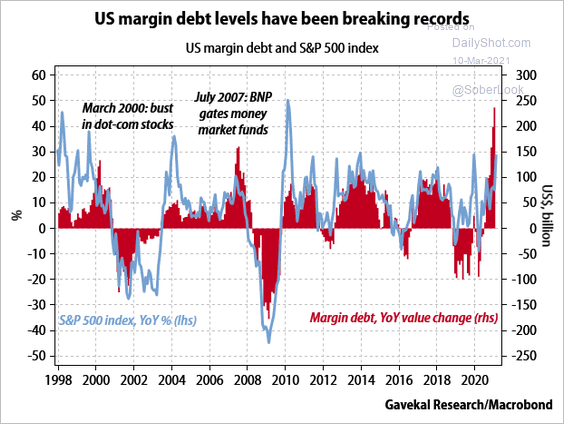

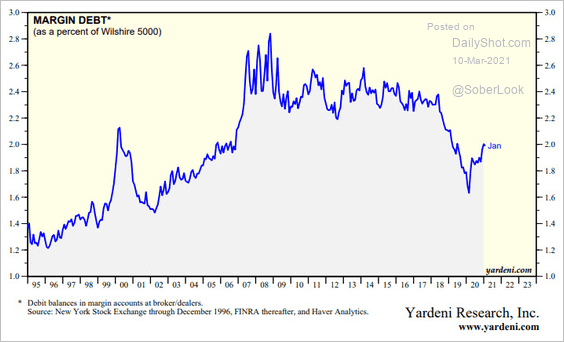

4. While margin debt spiked in recent months, …

Source: Gavekal Research

Source: Gavekal Research

… the increase is not extreme relative to the total market cap.

Source: Yardeni Research

Source: Yardeni Research

——————–

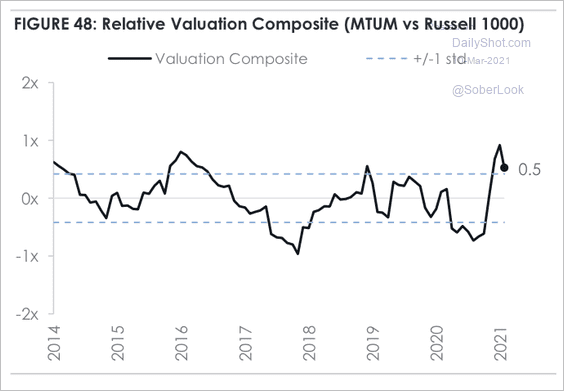

5. Momentum stocks are still very expensive vs. the broader market.

Source: MarketDesk Research

Source: MarketDesk Research

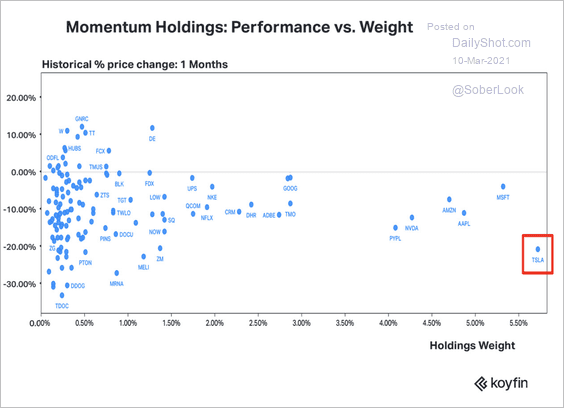

By the way, Tesla is the highest weighted stock in the iShares Momentum Factor ETF (MTUM), which has been a drag on performance over the past month.

Source: Koyfin

Source: Koyfin

——————–

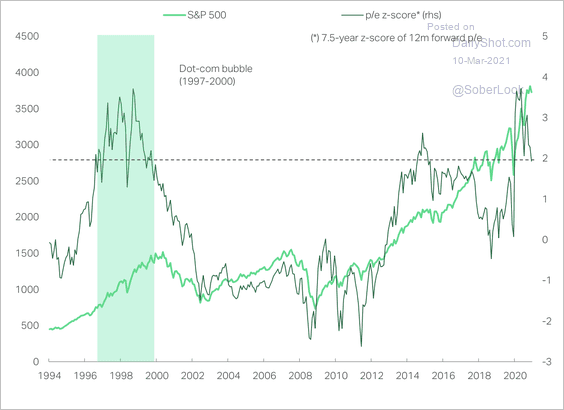

6. The S&P 500’s cyclically adjusted price-to-earnings ratio is declining from its highest level since the dot-com bubble.

Source: TS Lombard

Source: TS Lombard

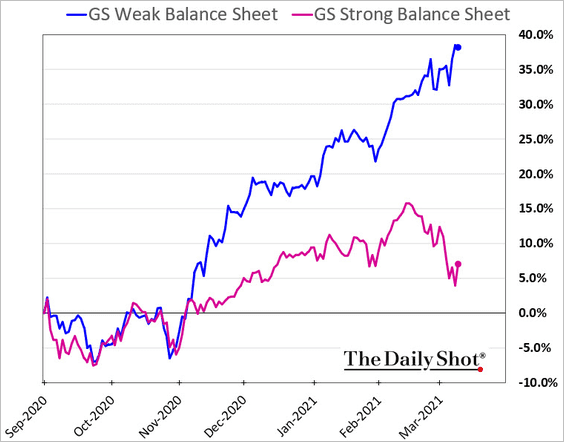

7. Companies with weak balance sheets have outperformed sharply since the vaccine announcement.

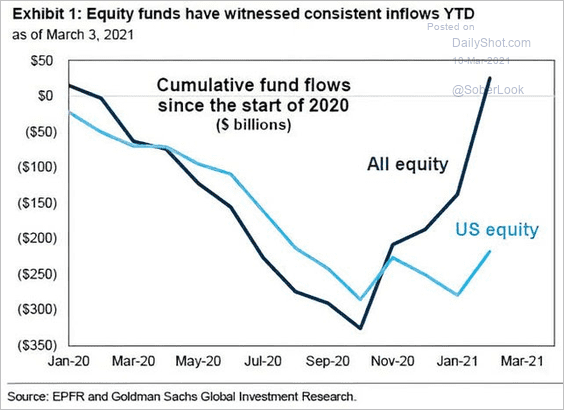

8. Global equity inflows have been stronger than flows into US funds.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

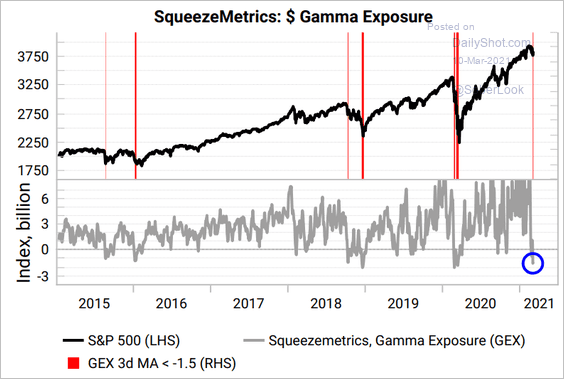

9. Dealers are extremely short gamma.

Source: Variant Perception

Source: Variant Perception

Back to Index

Credit

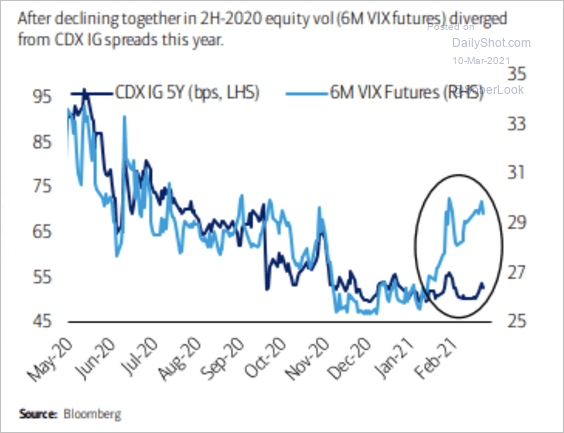

1. The gap between VIX and investment-grade credit default swap spreads remains wide.

Source: III Capital Management

Source: III Capital Management

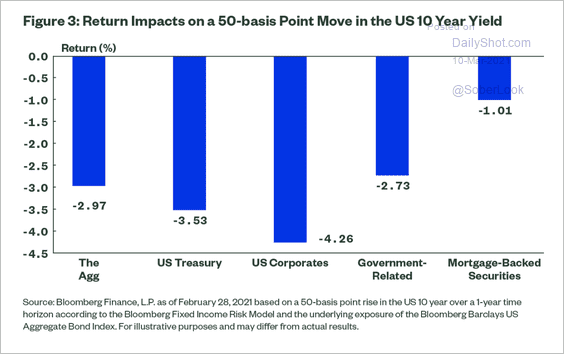

2. This chart shows the return impact of a 50-basis point move in the 10-year Treasury yield.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

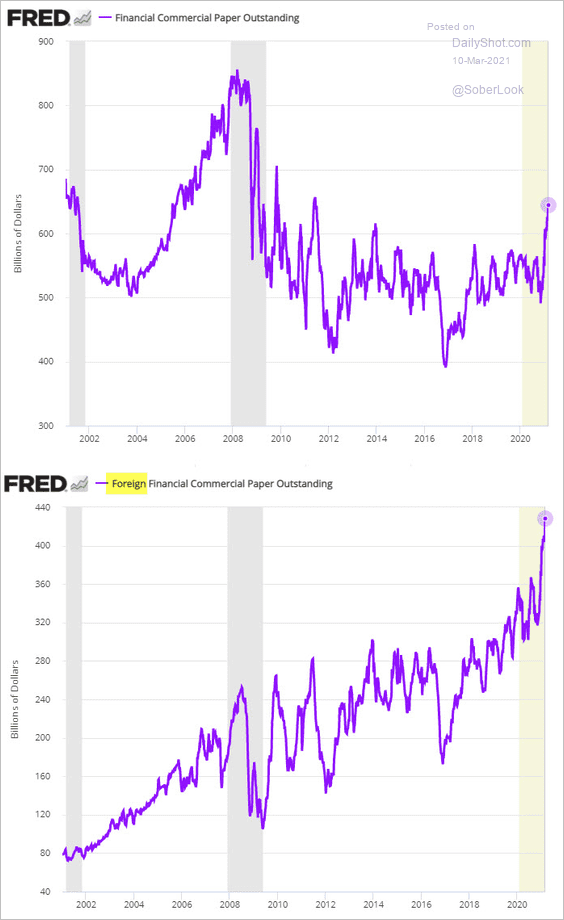

3. Foreign banks continue to dominate USD commercial paper issuance.

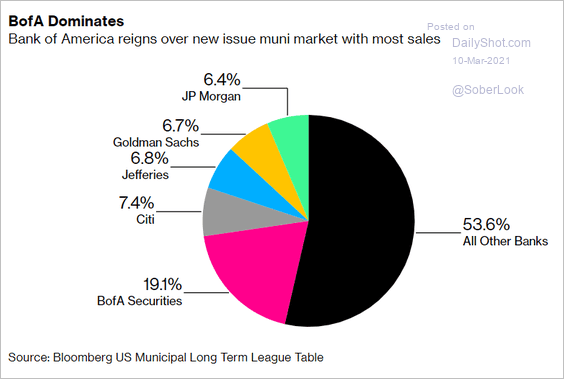

4. BofA controls 19% of the new-issue muni sales.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Rates

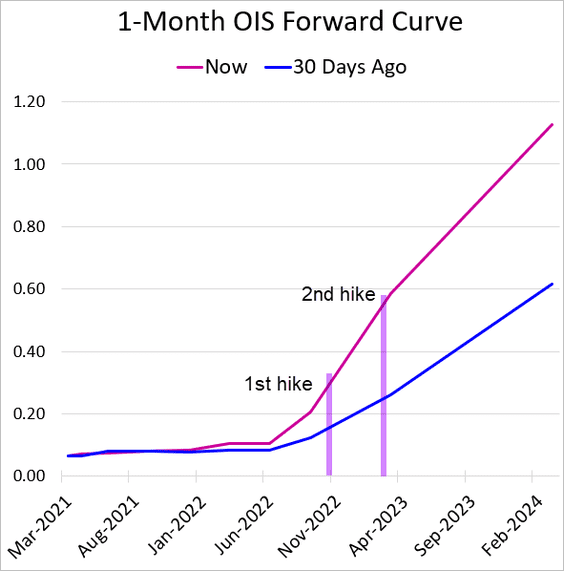

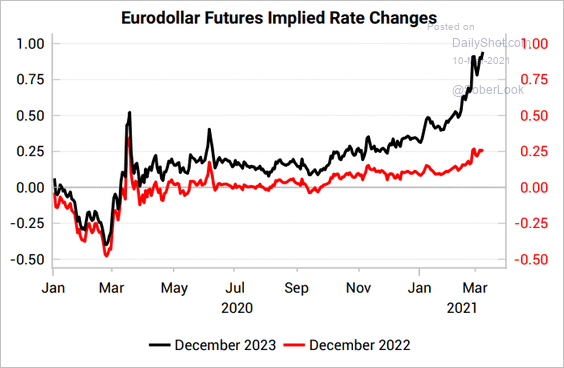

1. The market is pricing in a full 25 bps Fed rate increase by the middle of Q4 of next year. And the market-based probability of liftoff within the next 18 months is now 58%.

Source: Variant Perception

Source: Variant Perception

——————–

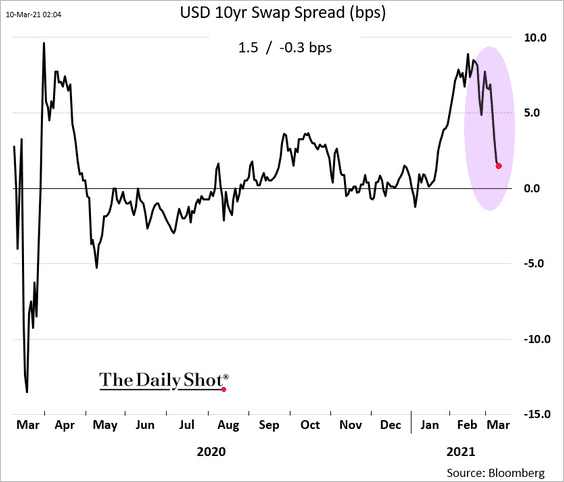

2. Swap spreads have eased as the demand for mortgage portfolio hedging wanes.

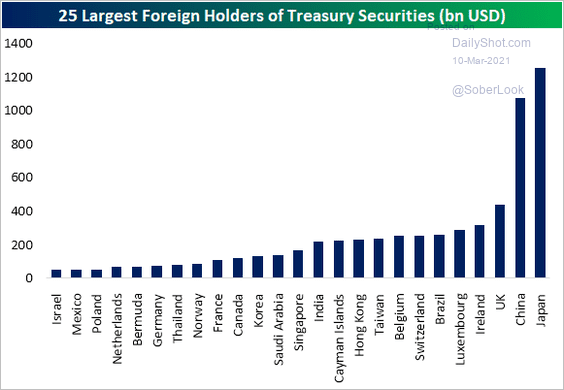

3. Here are the largest foreign holders of Treasury debt.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Back to Index

Global Developments

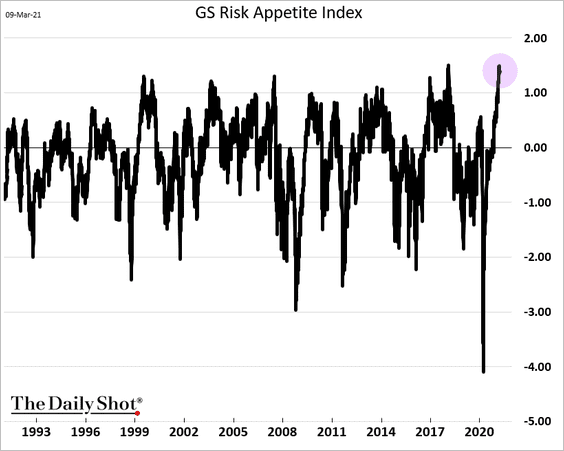

1. Goldman’s risk appetite index is near record highs.

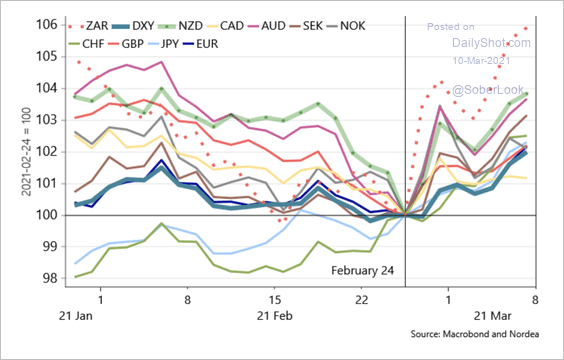

2. The dollar has moved higher versus other major currencies over the past two weeks.

Source: Nordea Markets

Source: Nordea Markets

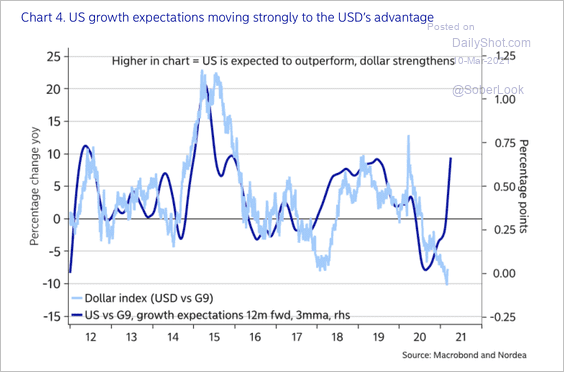

Higher US relative growth expectations could support further upside in the dollar.

Source: Nordea Markets

Source: Nordea Markets

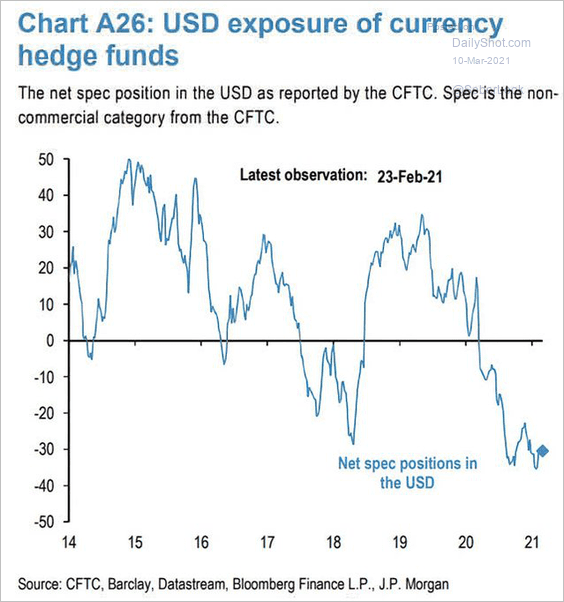

Moreover, speculative accounts are extremely short the US currency.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

——————–

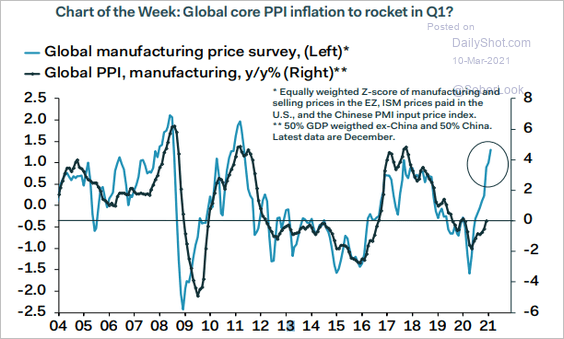

3. Global producer price inflation is about to accelerate.

Source: @PantheonMacro, @IanShepherdson

Source: @PantheonMacro, @IanShepherdson

——————–

Food for Thought

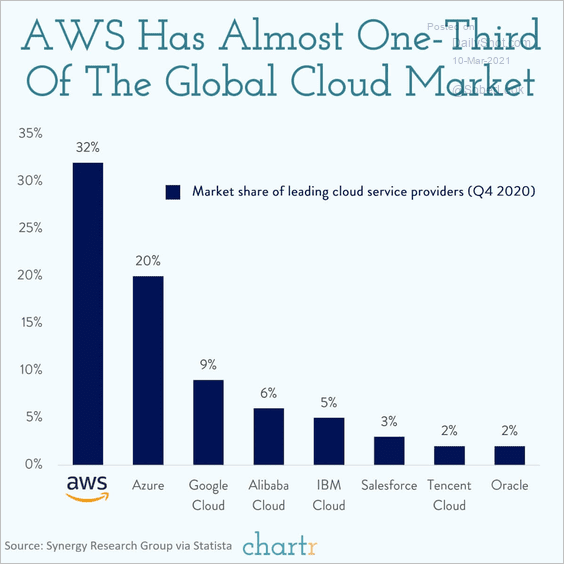

1. The global cloud market:

Source: @chartrdaily

Source: @chartrdaily

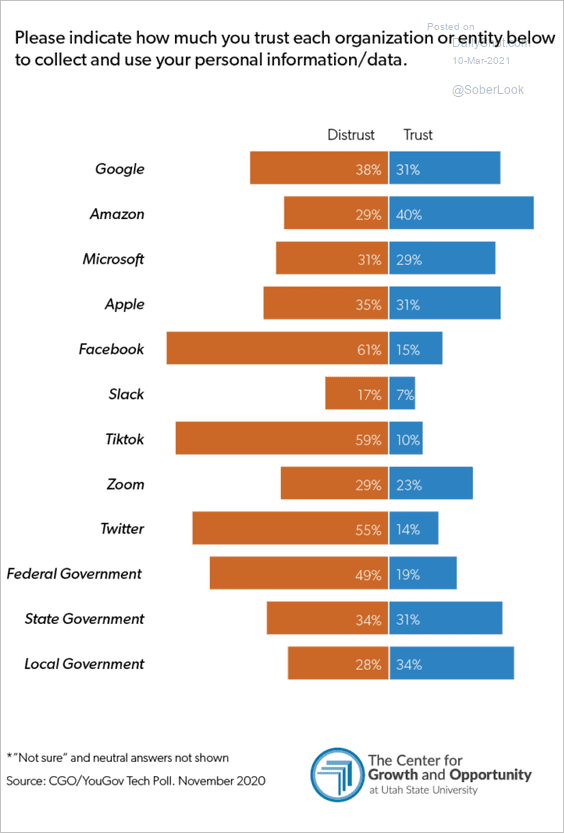

2. Trust in tech companies:

Source: The Center for Growth and Opportunity

Source: The Center for Growth and Opportunity

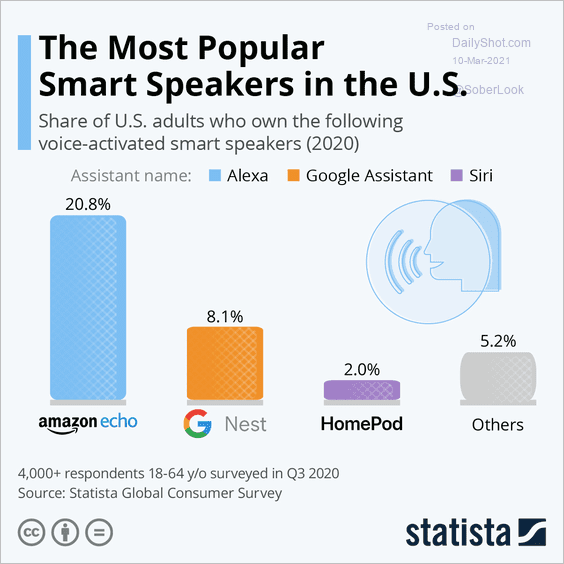

3. Smart speaker popularity:

Source: Statista

Source: Statista

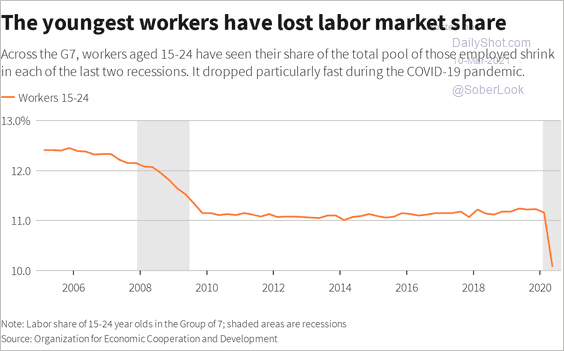

4. Young workers’ labor market share:

Source: Reuters Read full article

Source: Reuters Read full article

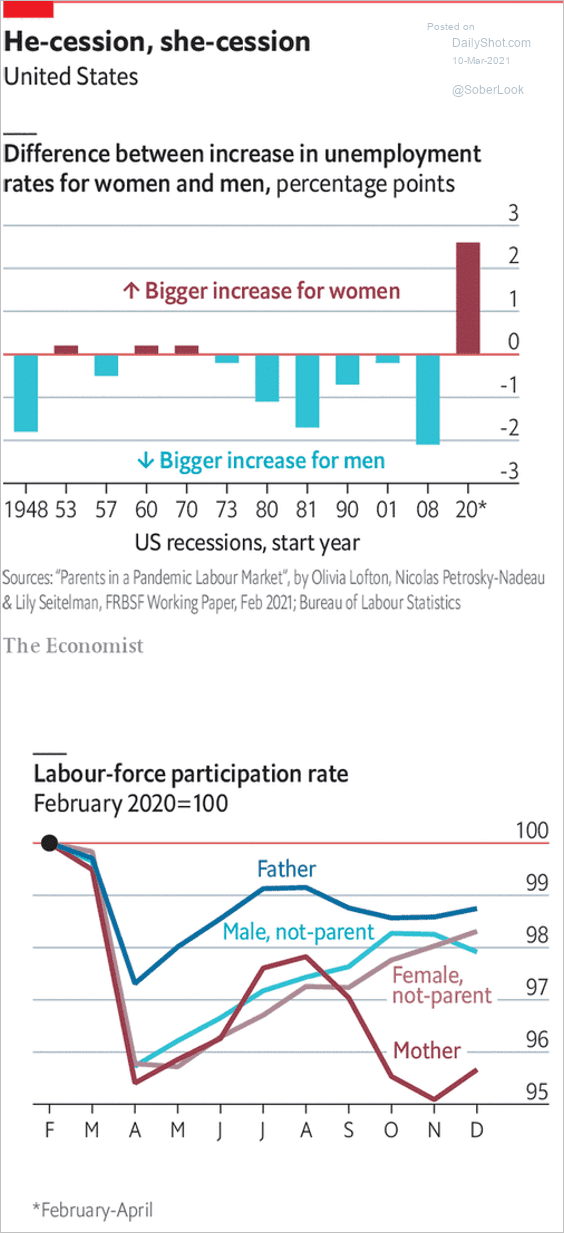

5. The pandemic has been particularly hard on working mothers.

Source: The Economist Read full article

Source: The Economist Read full article

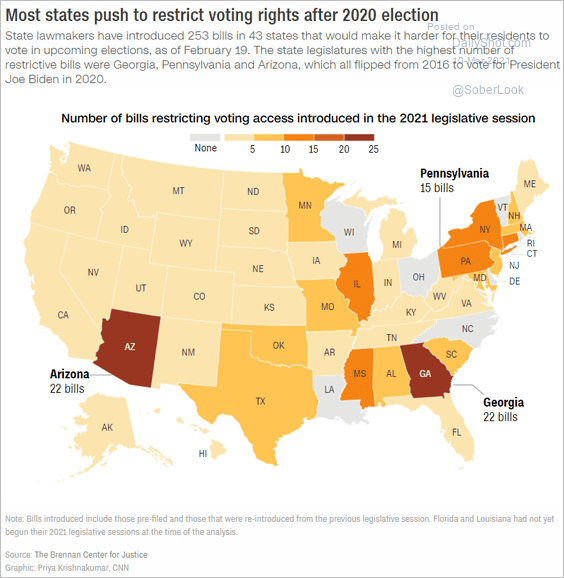

6. Voting restrictions legislation:

Source: CNN Read full article

Source: CNN Read full article

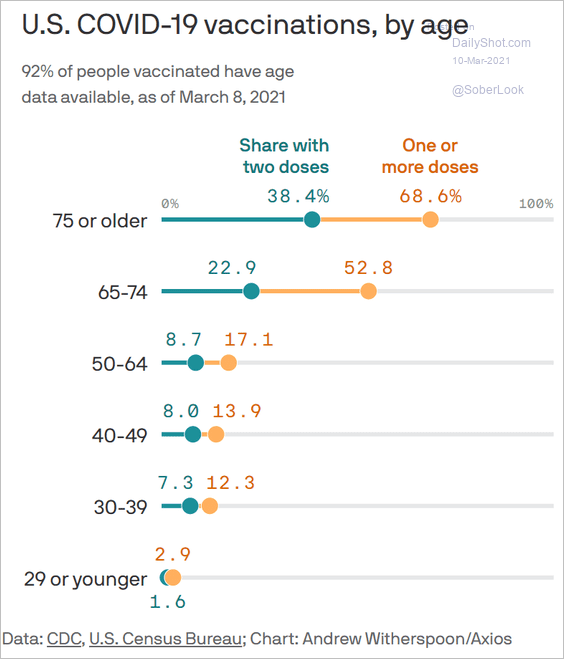

7. US vaccination progress, by age:

Source: @axios Read full article

Source: @axios Read full article

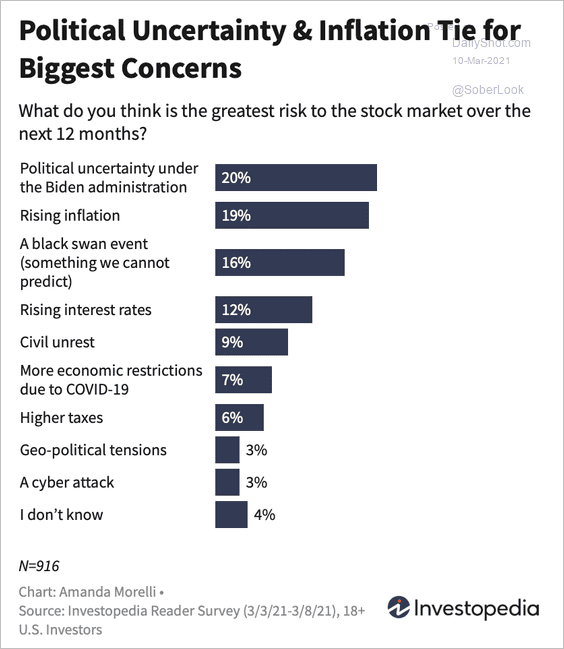

8. Retail investor concerns:

Source: Investopedia

Source: Investopedia

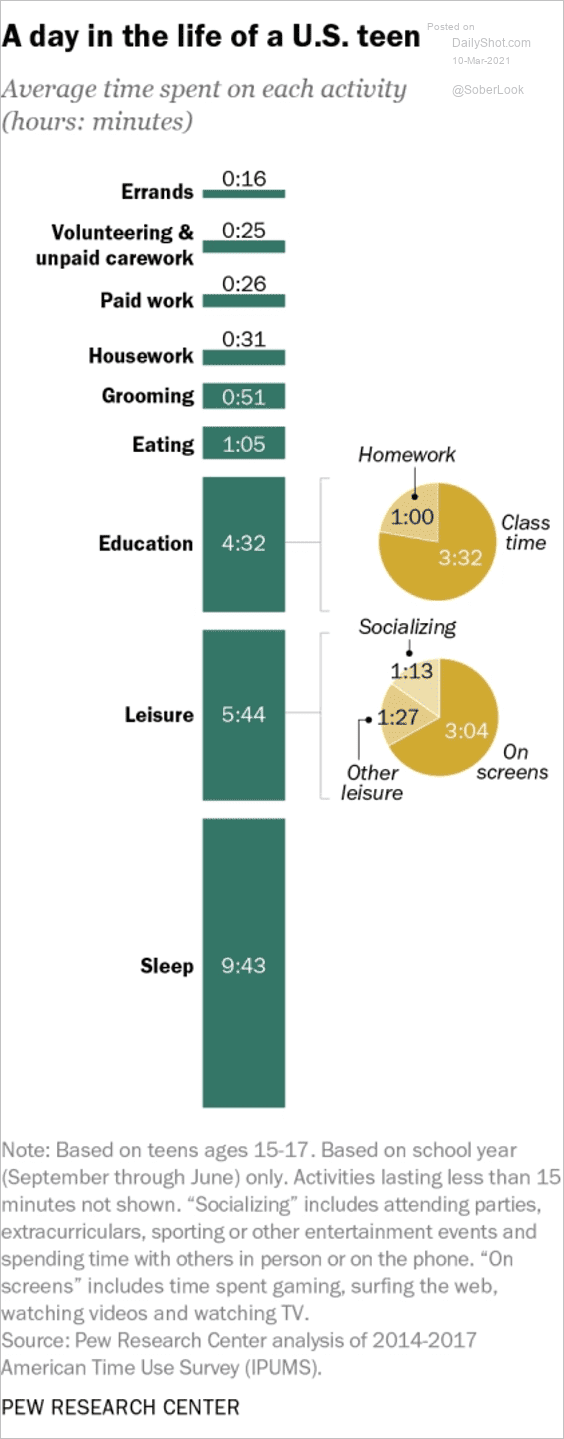

9. A day in the life of a US teen:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Back to Index