The Daily Shot: 15-Apr-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

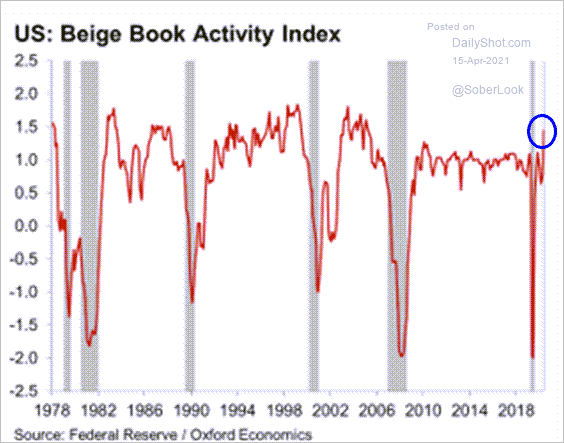

1. The Fed’s Beige Book report was more upbeat than the markets were expecting. The survey also showed an increase in inflation.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

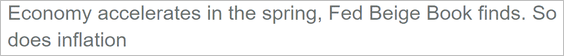

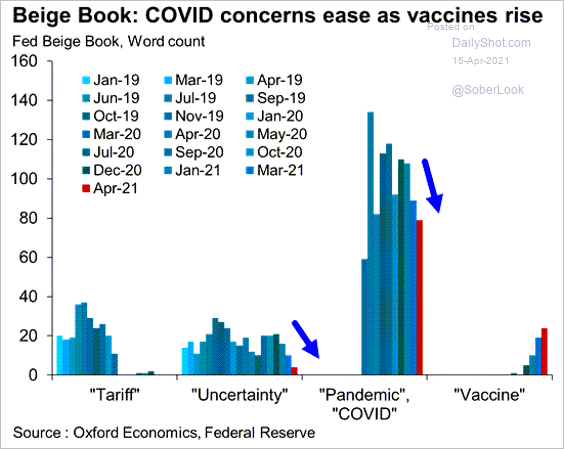

Economic uncertainty and COVID concerns are easing (2 charts).

Source: @GregDaco, @federalreserve, @OxfordEconomics

Source: @GregDaco, @federalreserve, @OxfordEconomics

Source: @zerohedge

Source: @zerohedge

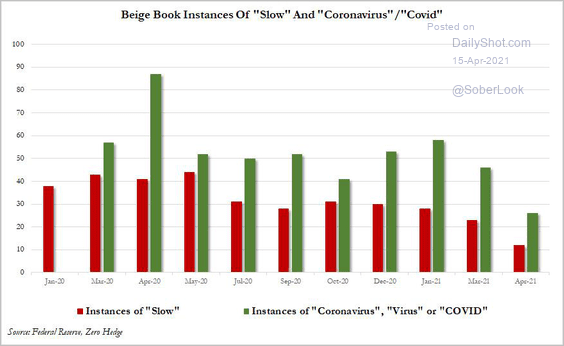

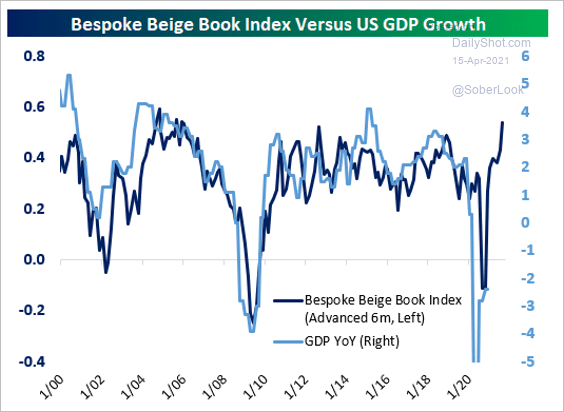

Beige Book activity indicators (based on the language used in the report) are up sharply (2 charts), pointing to an acceleration in growth.

Source: @BostjancicKathy

Source: @BostjancicKathy

Source: Bespoke Investment Group; @pearkes

Source: Bespoke Investment Group; @pearkes

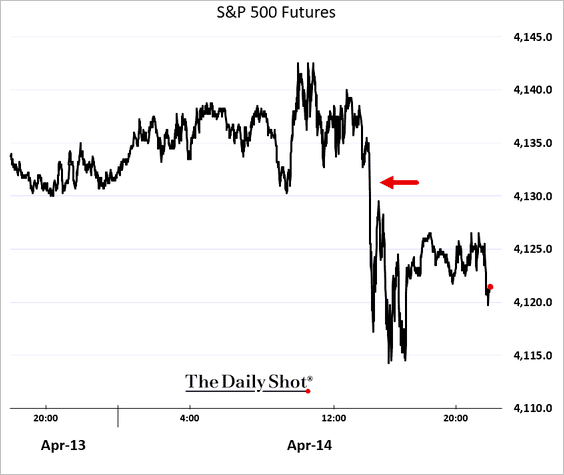

Stocks pulled back from the highs after the Beige Book report was released (due to inflation concerns).

——————–

2. Now, let’s take a look at some inflation trends.

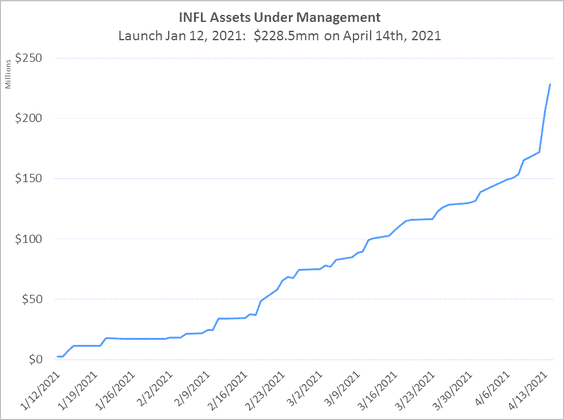

• A recently launched ETF that focuses on inflation-sensitive stocks continues to attract capital.

Source: Horizon Kinetics

Source: Horizon Kinetics

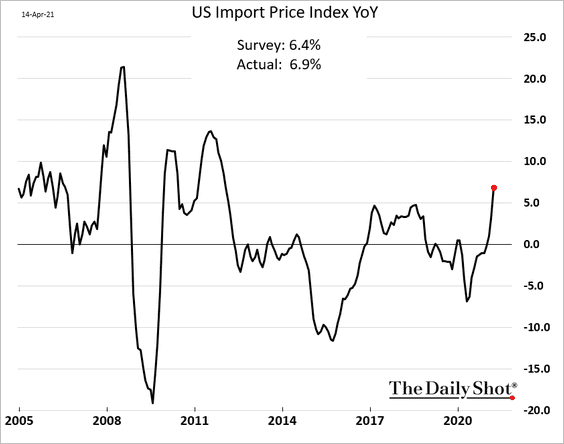

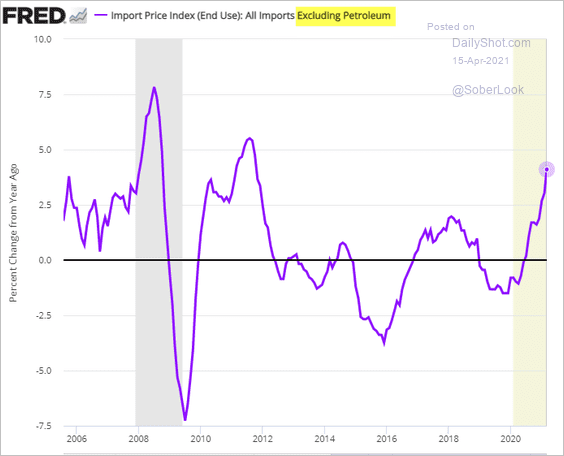

• Import price inflation surprised to the upside.

Below is the same index excluding petroleum imports.

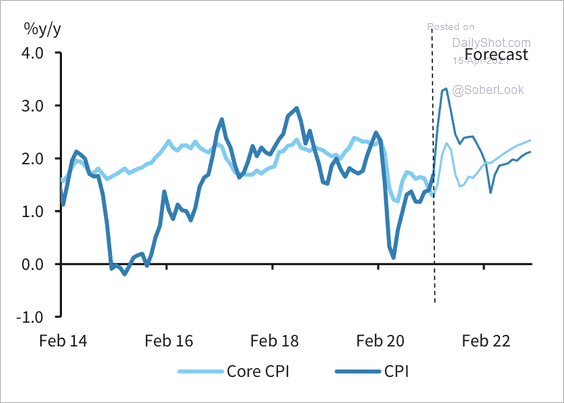

• Here is a CPI forecast from Barclays.

Source: Barclays Research

Source: Barclays Research

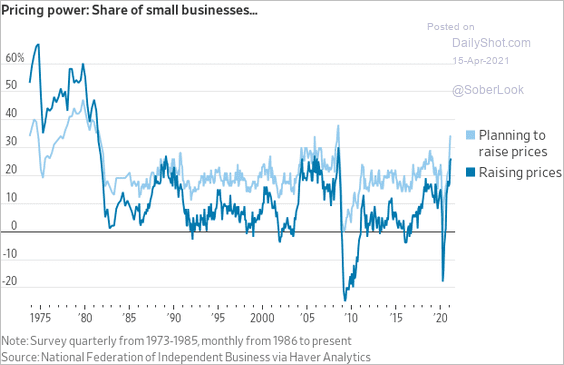

• Small businesses are gaining some pricing power.

Source: @jeffsparshott

Source: @jeffsparshott

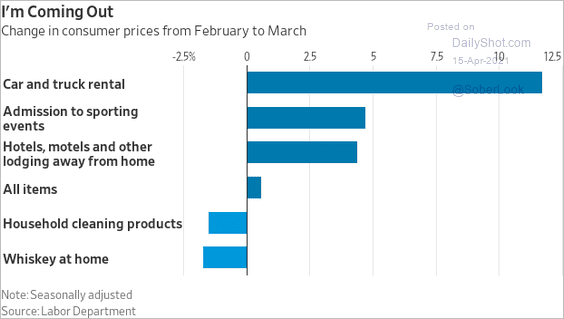

• Below are a few sector CPI trends.

– Going out vs. staying in:

Source: @jeffsparshott

Source: @jeffsparshott

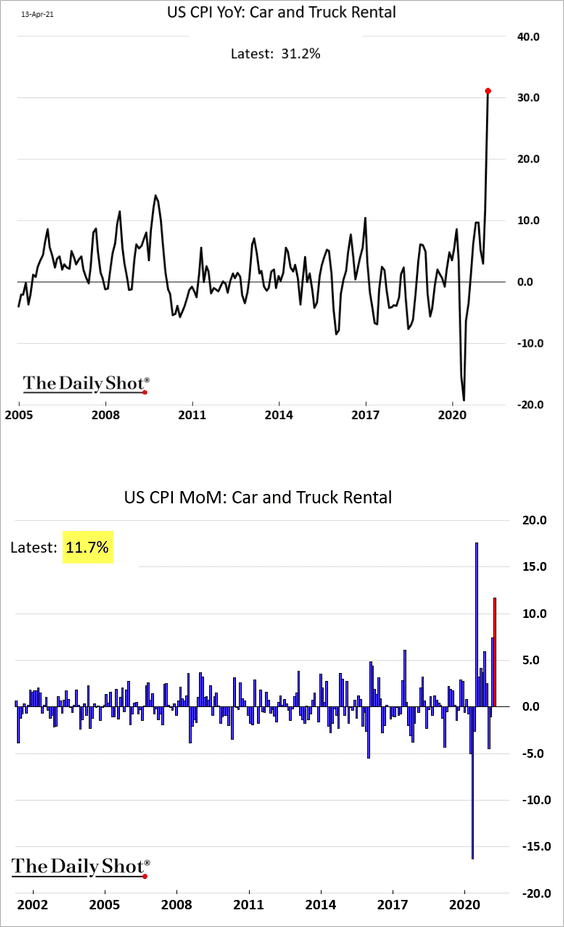

– Car rental CPI (year-over-year and month-over-month):

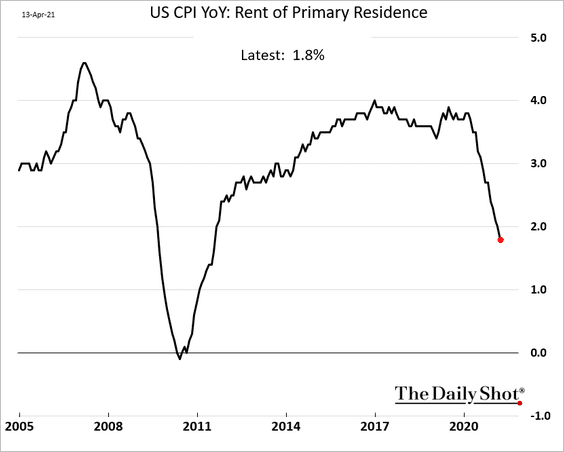

– Rent:

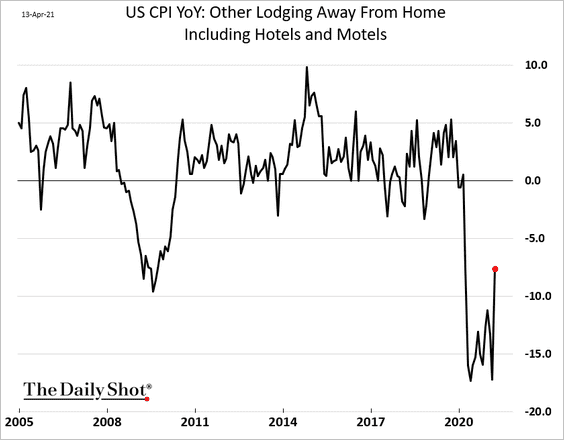

– Hotels:

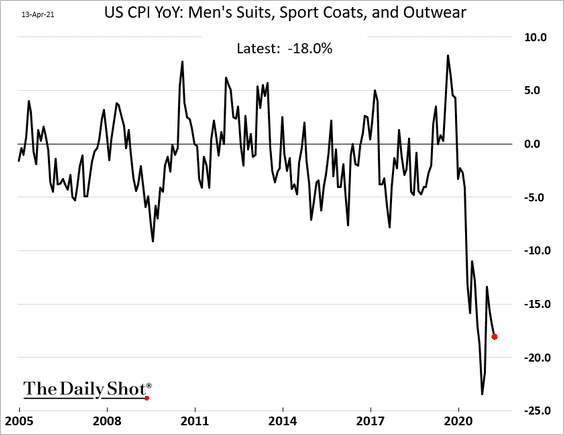

– Men’s suits:

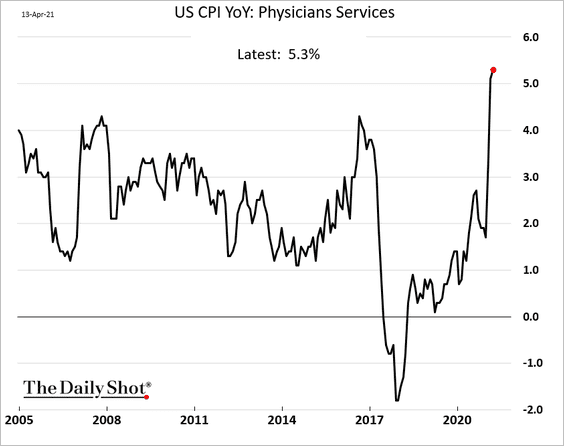

– Physicians’ services:

– Haircuts:

Source: @TCosterg

Source: @TCosterg

——————–

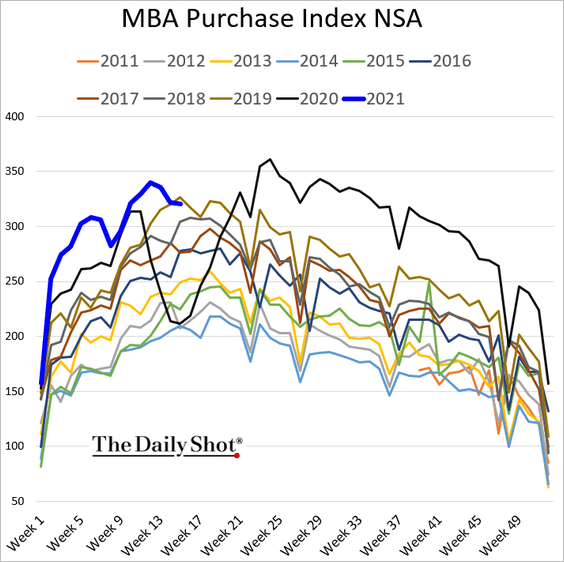

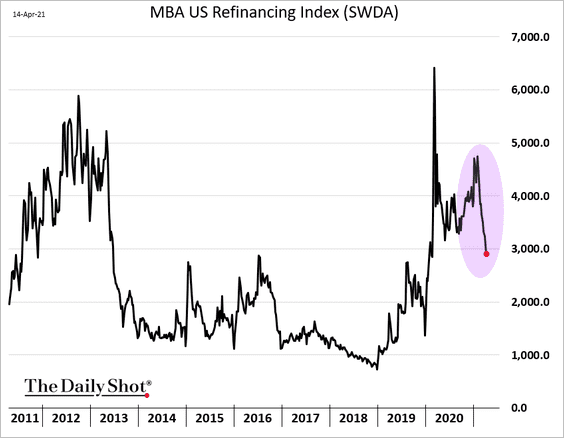

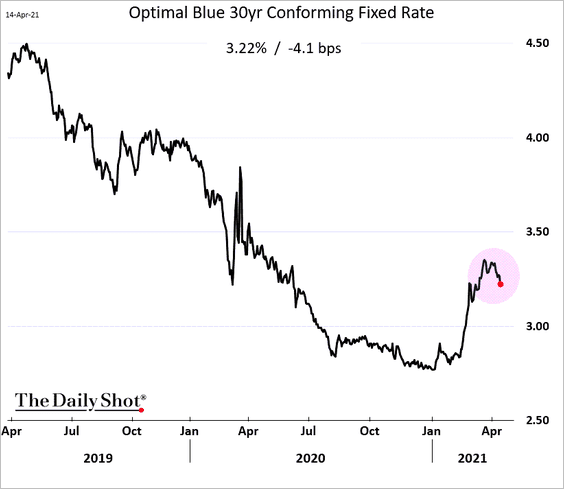

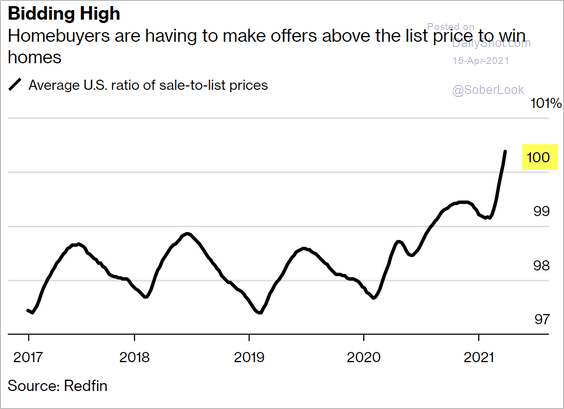

3. Next, we have some updates on the housing market.

• Mortgage applications for house purchase moved lower last week (now below 2019 levels).

Refi activity continues to slow.

• However, mortgage rates are now drifting lower.

• Bidding wars have pushed home sale prices above list prices.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

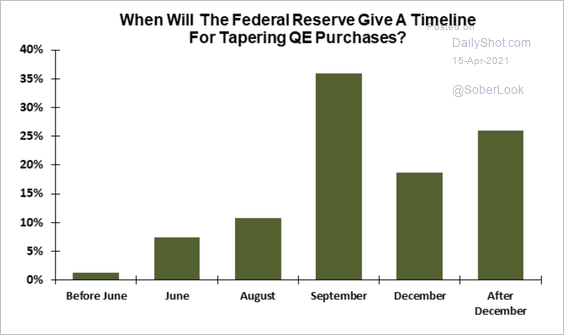

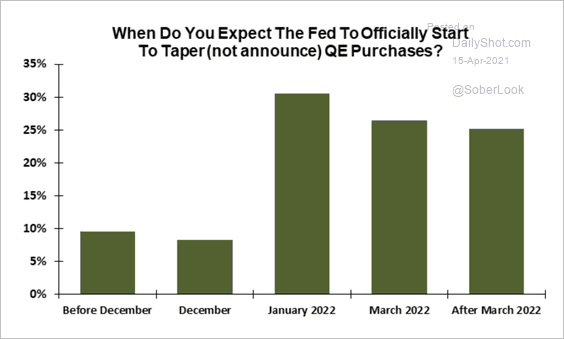

4. Investors expect the Fed to give a timeline of tapering QE purchases by September, aiming for a January start, according to a survey by Evercore ISI (2 charts).

Source: Evercore ISI

Source: Evercore ISI

Source: Evercore ISI

Source: Evercore ISI

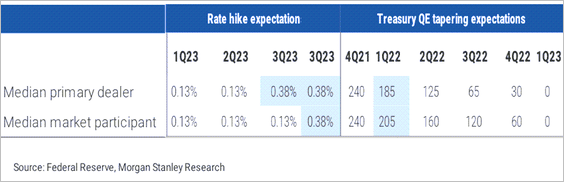

Primary dealers expect a Fed taper by Q1 of next year and a rate hike in late 2023.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

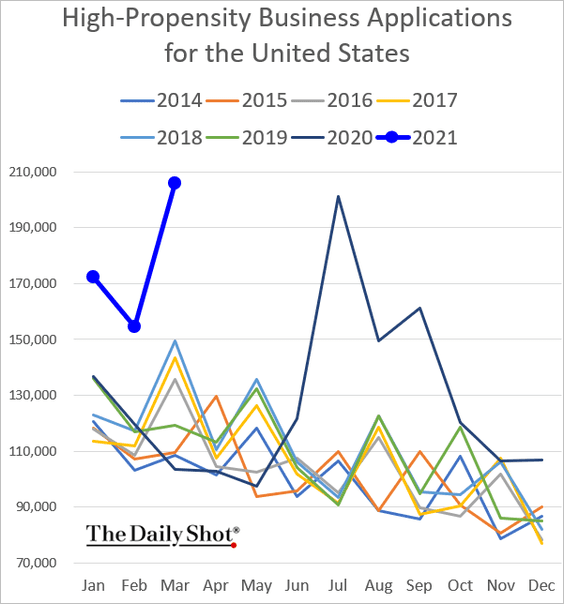

5. Business applications are surging (2 charts).

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

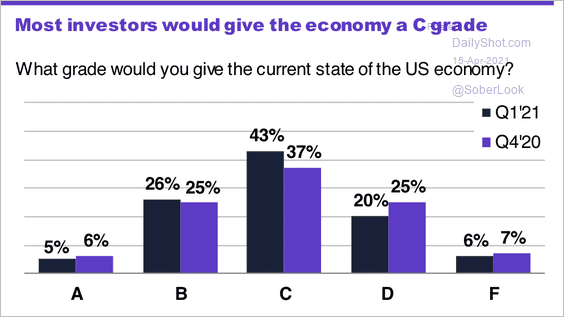

6. Retail traders are more upbeat on the economy, according to an E*Trade survey.

Source: E*Trade Financial

Source: E*Trade Financial

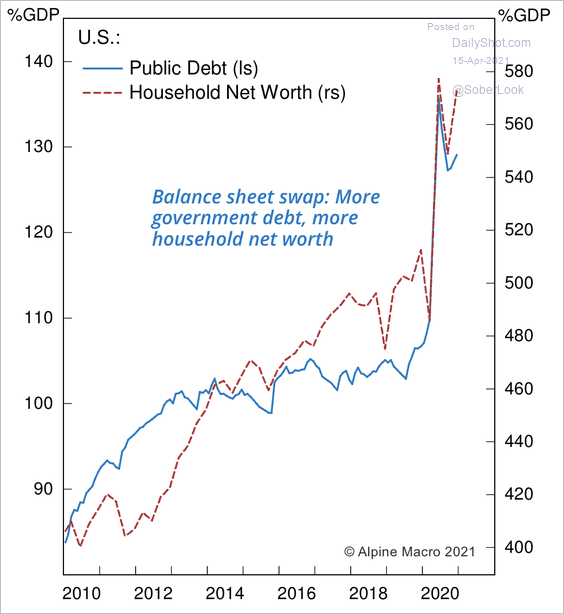

7. Household net worth has risen along with government debt over the past decade.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

The United Kingdom

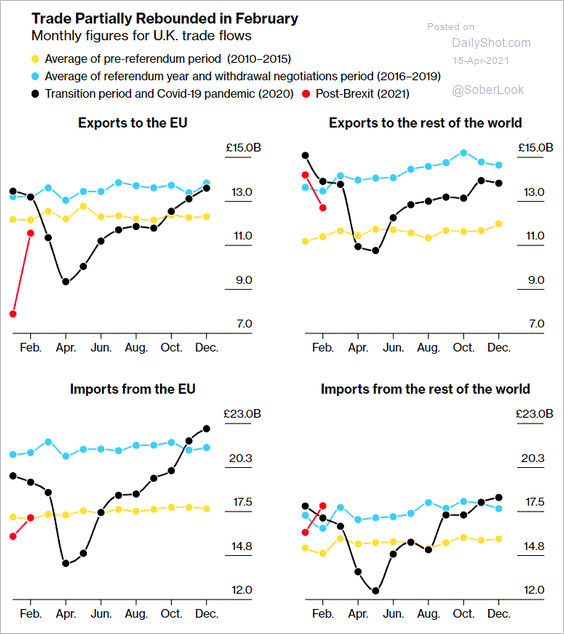

1. Trade with the EU showed some improvement in February.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

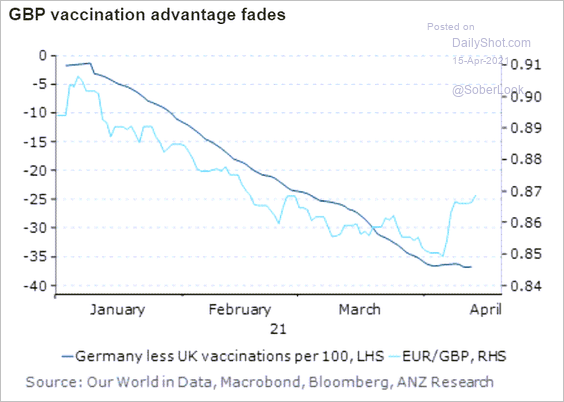

2. The vaccination differential with Germany points to a lower EUR/GBP.

Source: ANZ Research

Source: ANZ Research

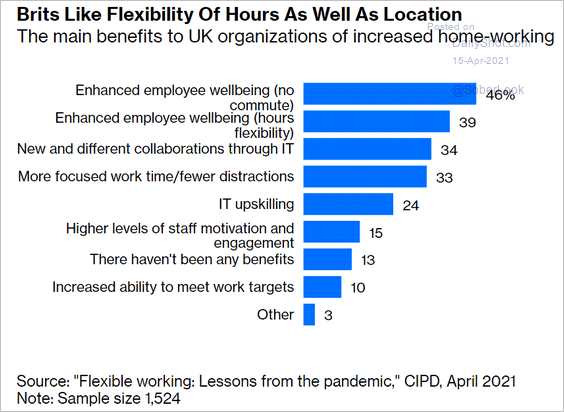

3. What are the benefits of remote work?

Source: Chris Hughes, Bloomberg Read full article

Source: Chris Hughes, Bloomberg Read full article

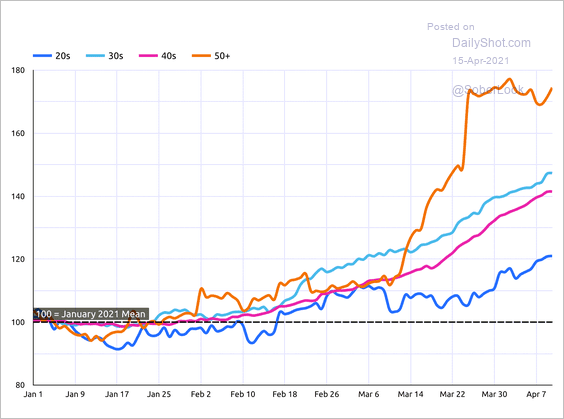

4. This chart shows UK park visits by age.

Source: Huq Read full article

Source: Huq Read full article

Back to Index

The Eurozone

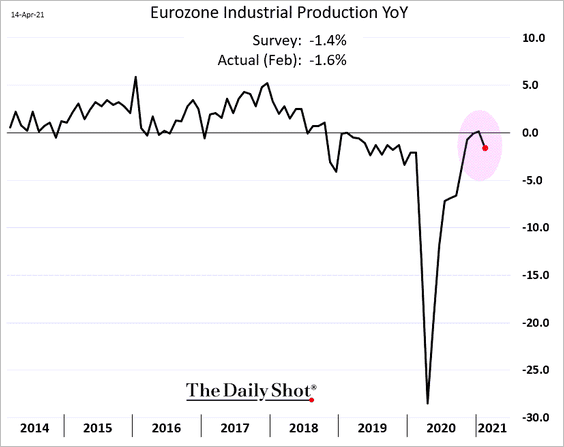

1. Industrial production eased in February.

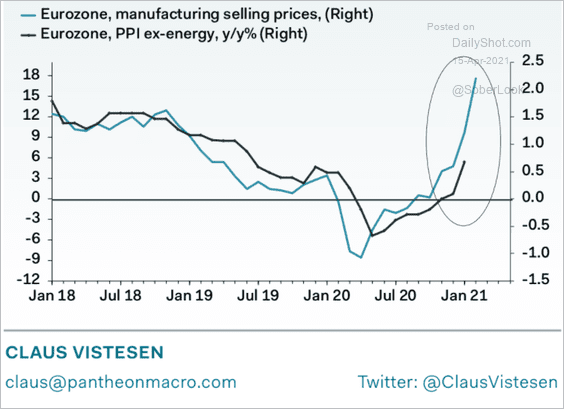

2. More gains for producer price inflation ahead?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

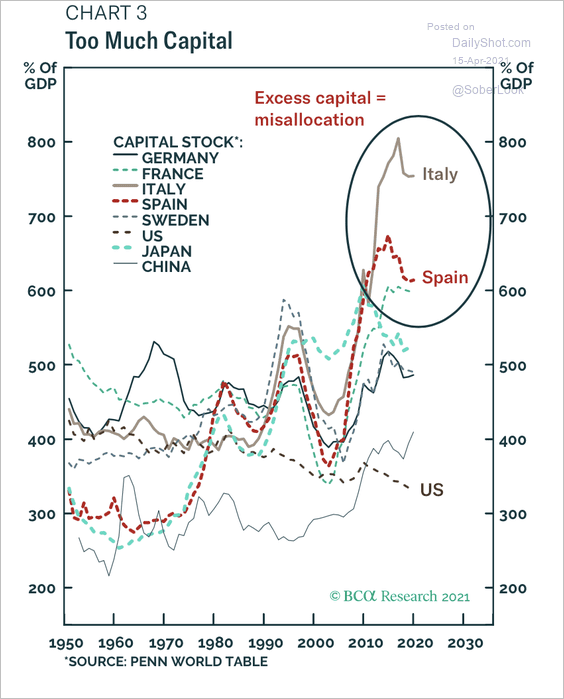

3. Is previously misallocated capital burdening the euro area?

Source: BCA Research

Source: BCA Research

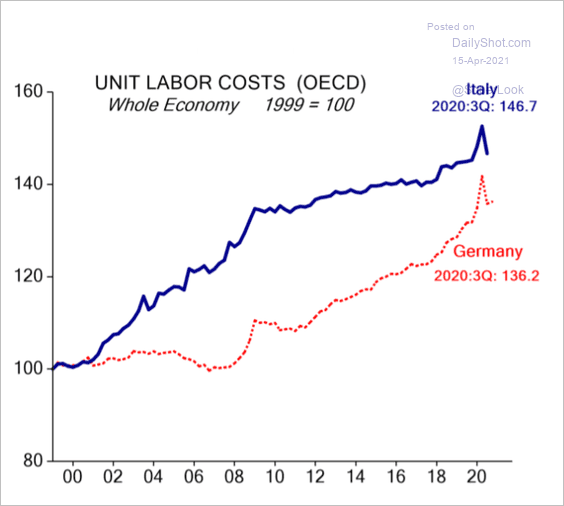

4. This chart shows Italian and German unit labor costs (a measure of competitiveness).

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Asia – Pacific

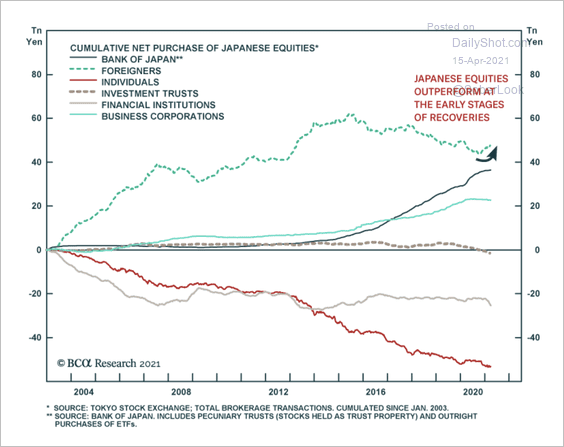

1. The Bank of Japan has increased its purchases of domestic equities as foreigners retreated over the past few years.

Source: BCA Research

Source: BCA Research

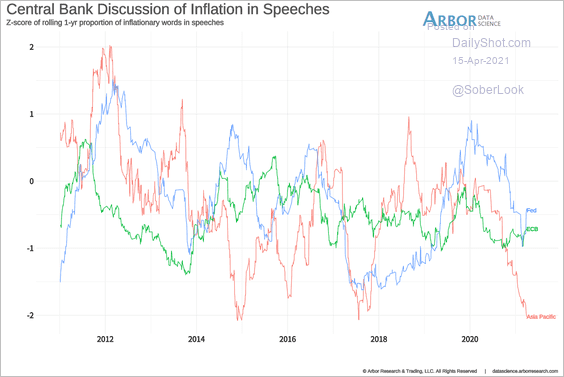

2. Asia’s central banks are not concerned about inflation.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

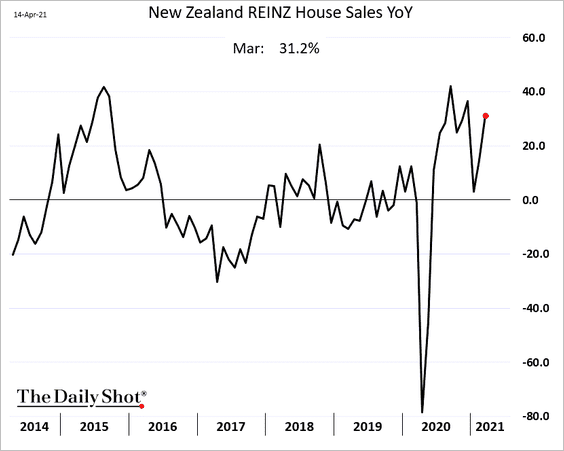

3. New Zealand’s home sales surged again last month.

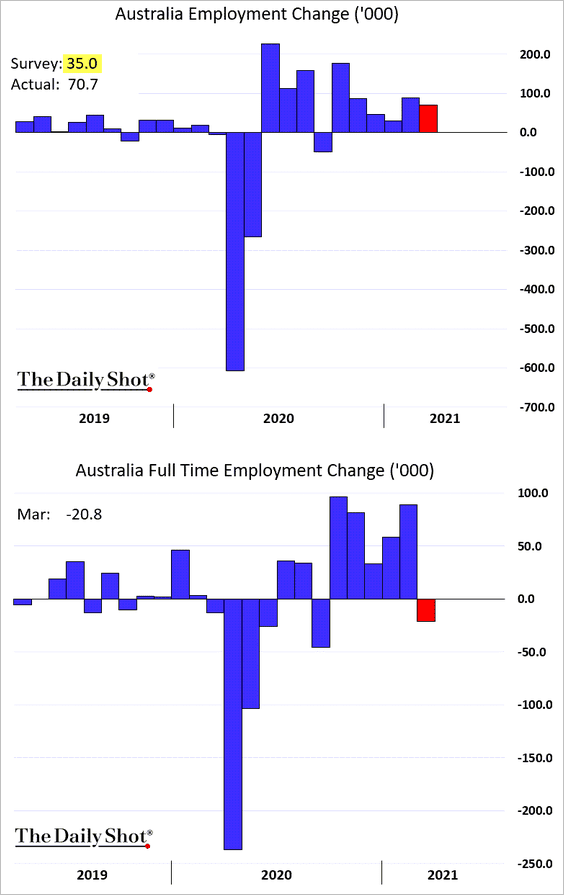

4. Next, we have some updates on Australia.

• The employment report topped economists’ forecasts, although job gains were driven by part-time positions.

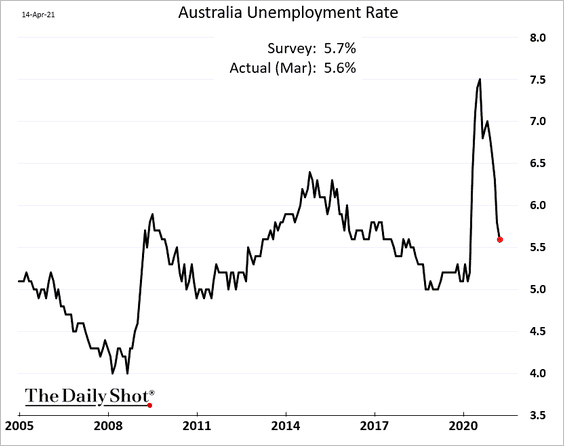

– The unemployment rate continues to fall.

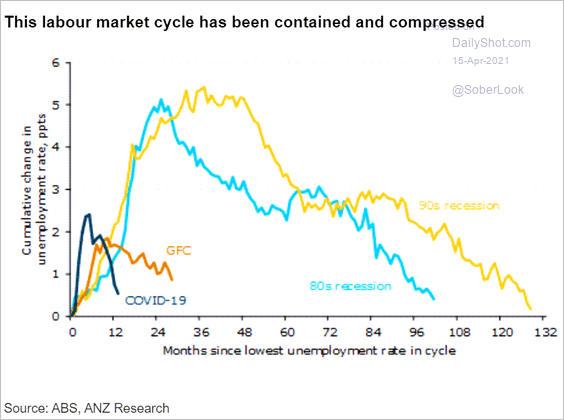

Here is a comparison with previous downturns.

Source: ANZ Research

Source: ANZ Research

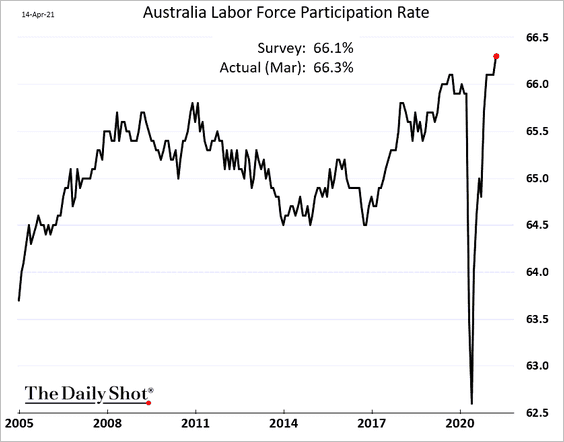

– The labor force participation rate hit a record high.

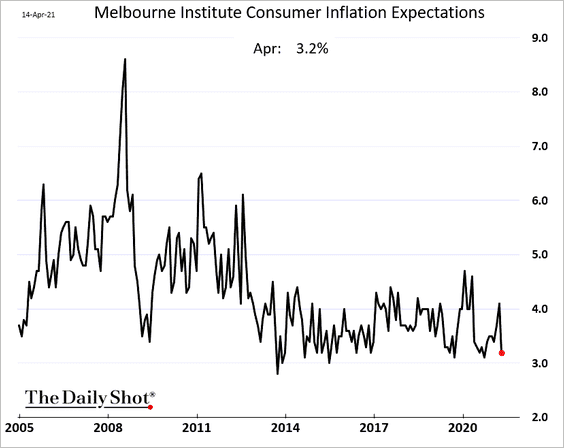

• Consumer inflation expectations are back near the lows.

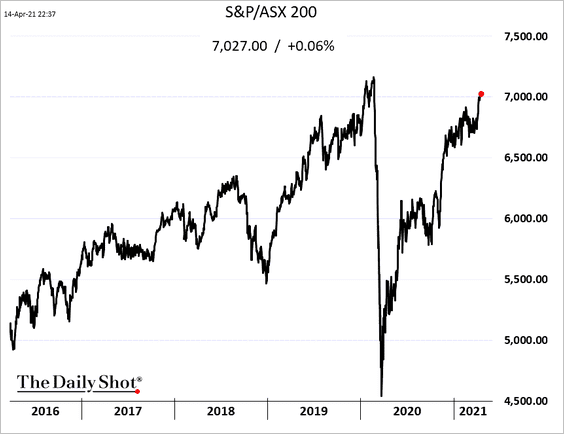

• The stock market is almost back to the pre-COVID peak.

h/t @ThuyOng

h/t @ThuyOng

Back to Index

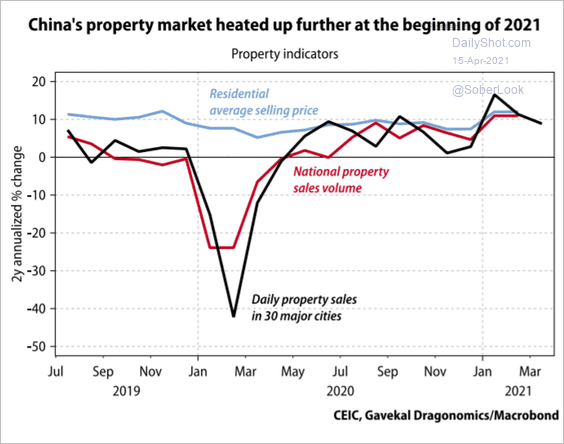

China

1. Housing market metrics have been robust.

Source: Gavekal Research

Source: Gavekal Research

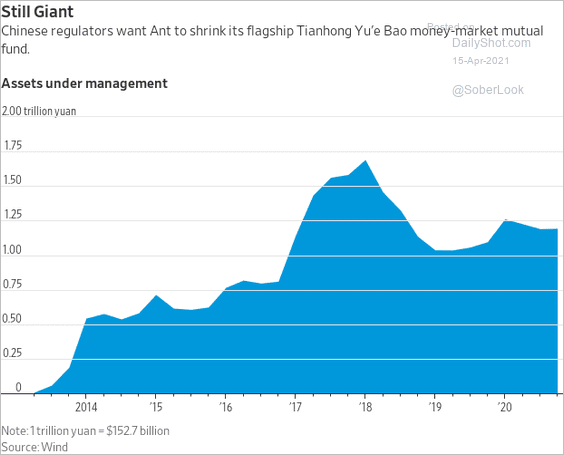

2. Time to shrink the world’s largest money market fund?

Source: @WSJ Read full article

Source: @WSJ Read full article

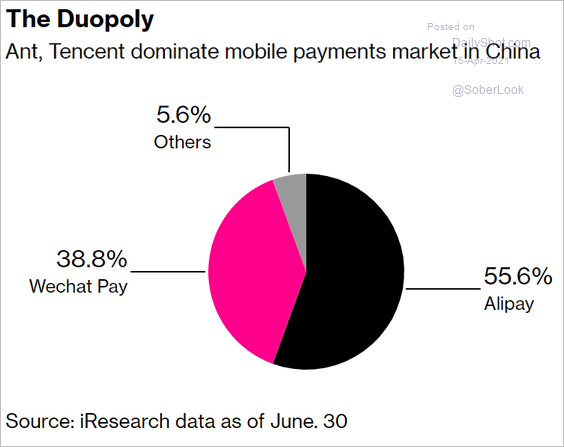

3. Who controls China’s mobile payments market?

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Emerging Markets

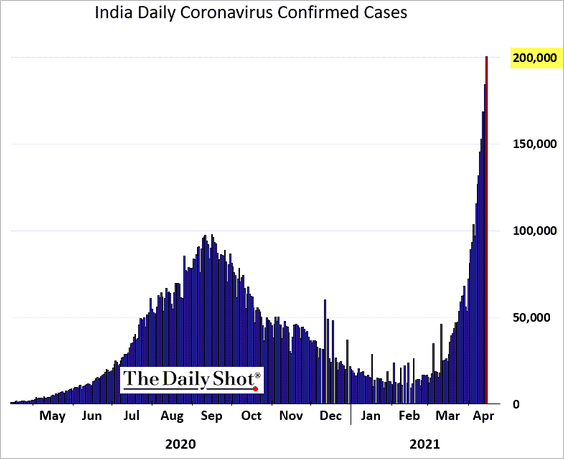

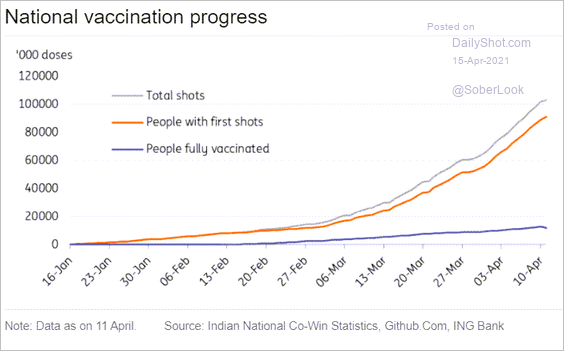

1. India’s pandemic situation is out of control.

This chart shows India’s vaccination trend.

Source: ING

Source: ING

——————–

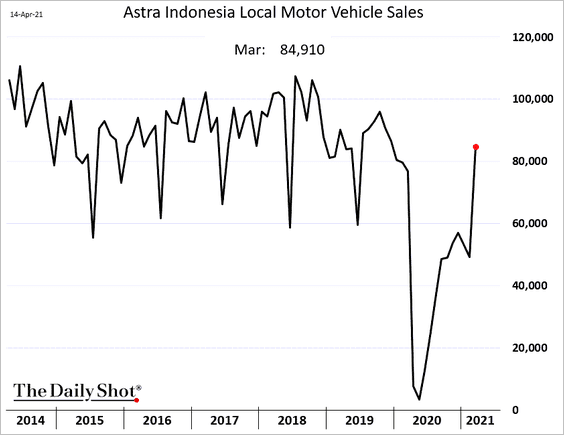

2. Indonesia’s vehicle sales are back at pre-crisis levels.

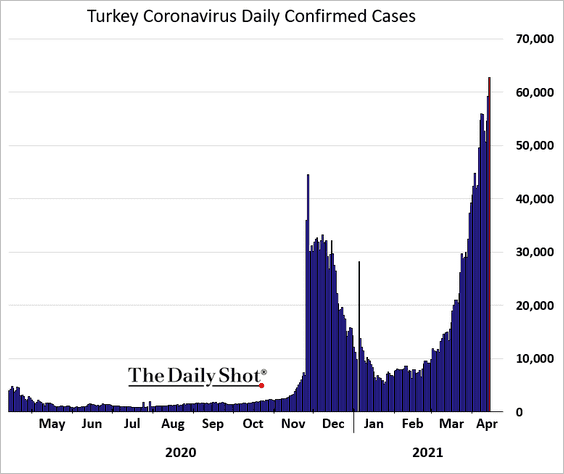

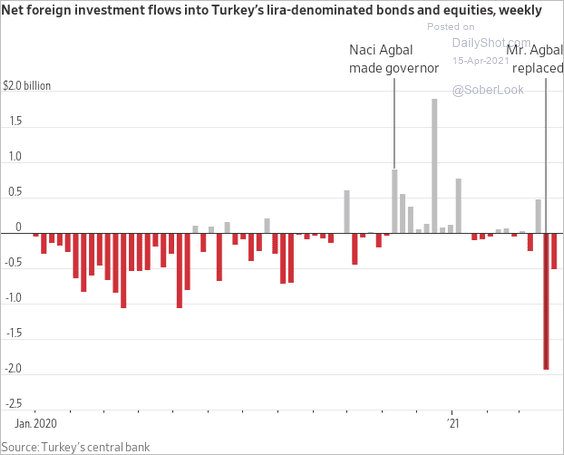

3. COVID cases in Turkey are accelerating.

Investors have been pulling capital out of the country since the central bank chief’s removal.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

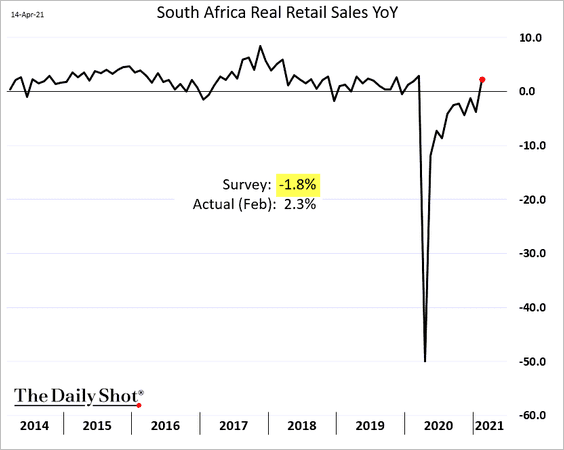

4. South Africa’s retail sales jumped in February.

5. Here are some updates on Russia.

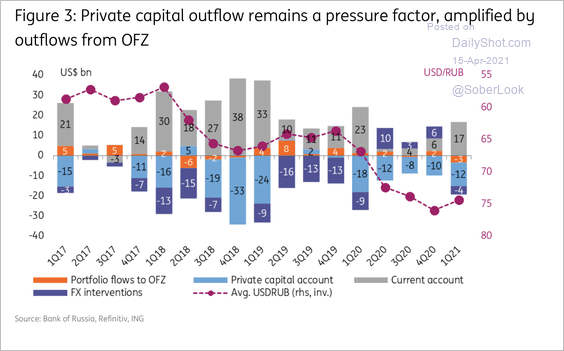

• Capital outflows continue to weigh on the Russian ruble.

Source: ING

Source: ING

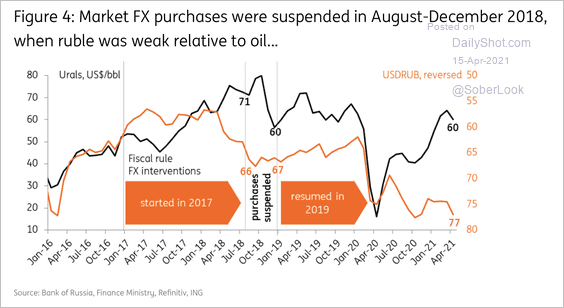

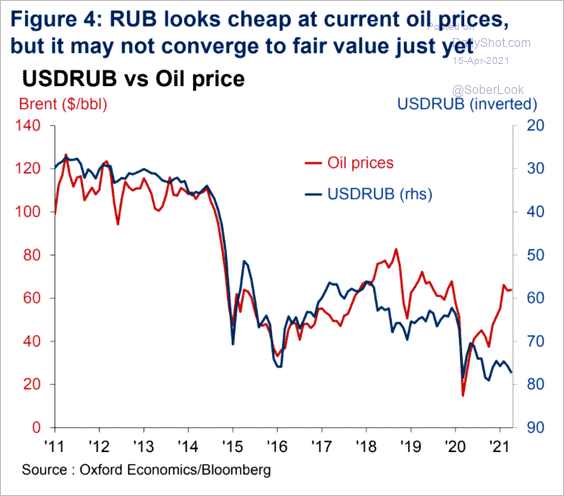

• The current ruble weakness, mainly due to non-oil factors, has led to decoupling from oil prices (2 charts).

Source: ING

Source: ING

Source: Oxford Economics

Source: Oxford Economics

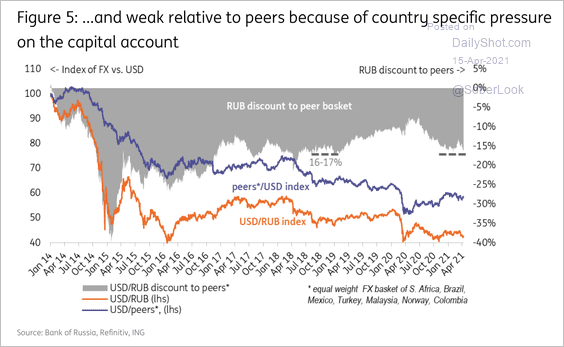

• The ruble’s underperformance versus peers is the most extreme since 2018.

Source: ING

Source: ING

——————–

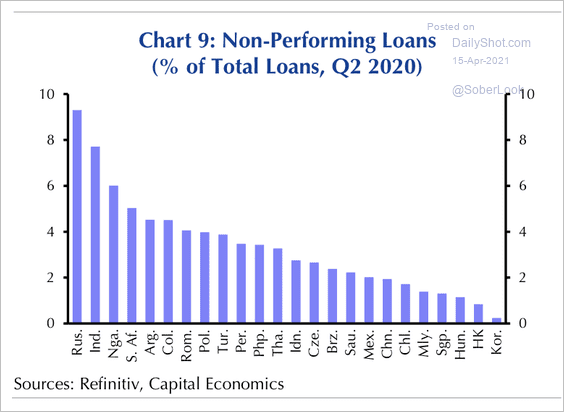

6. Russia, India, and Nigeria have some of the highest levels of non-performing loans relative to EM peers.

Source: Capital Economics

Source: Capital Economics

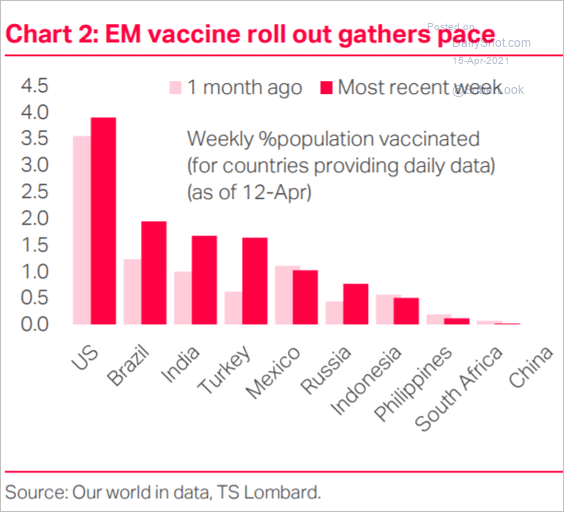

7. This chart illustrates the vaccination progress across EM economies.

Source: TS Lombard

Source: TS Lombard

Back to Index

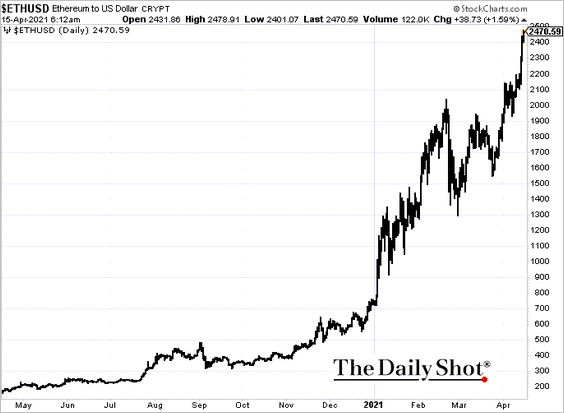

Cryptocurrency

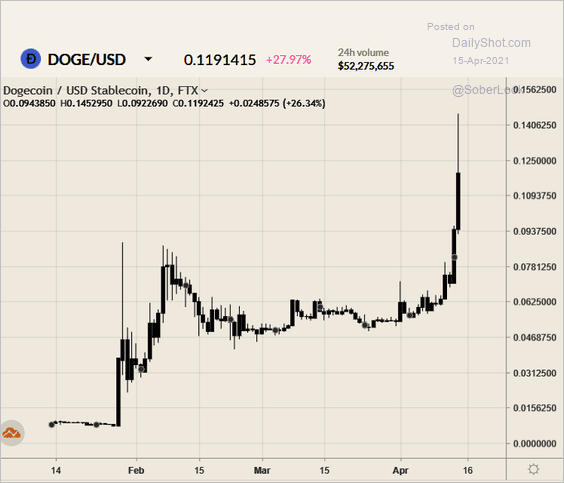

1. Cryptocurrencies continue to rally, with many hitting record highs.

• Ethereum:

• Dogecoin:

Source: FTX

Source: FTX

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

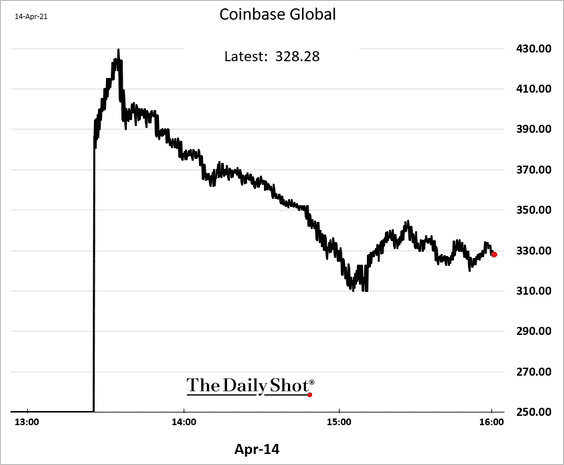

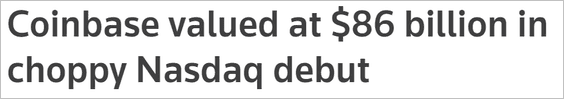

2. Coinbase popped at the open but declined over the next two hours. Some investors were hoping to see a higher valuation.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

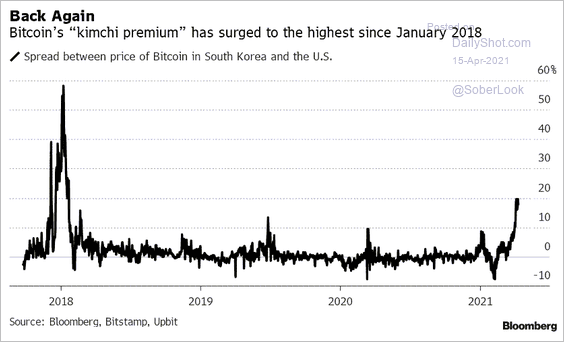

3. The “kimchi premium” is back.

Source: Kyungji Cho, @TheTerminal, Bloomberg Finance L.P. Read full article

Source: Kyungji Cho, @TheTerminal, Bloomberg Finance L.P. Read full article

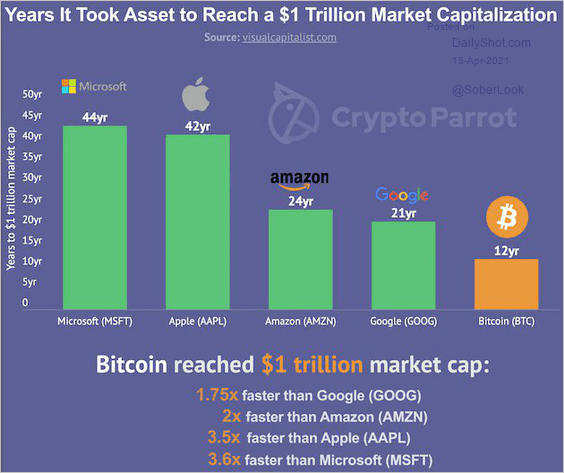

4. How long did it take to reach a $1 trillion valuation?

Source: @Schuldensuehner, Markets Insider Read full article

Source: @Schuldensuehner, Markets Insider Read full article

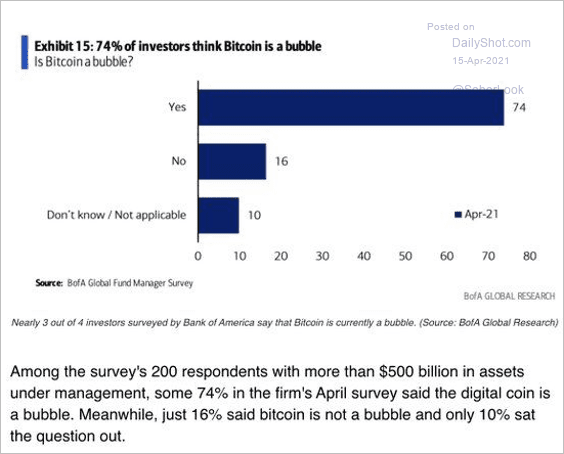

5. Is bitcoin a bubble?

Source: BofA Global Research; Gustavo Fuhr

Source: BofA Global Research; Gustavo Fuhr

Back to Index

Commodities

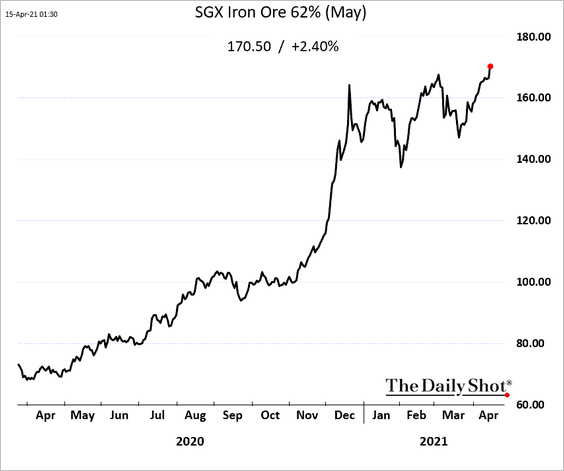

1. Iron ore futures are moving higher.

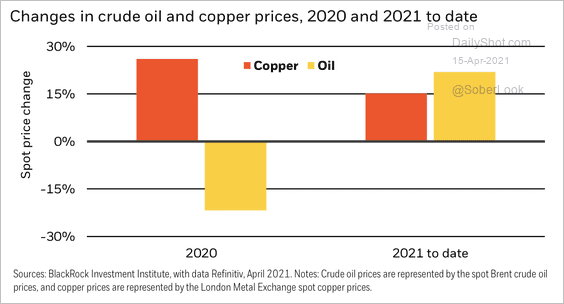

2. Copper prices have given up some of their gains versus oil this year.

Source: BlackRock

Source: BlackRock

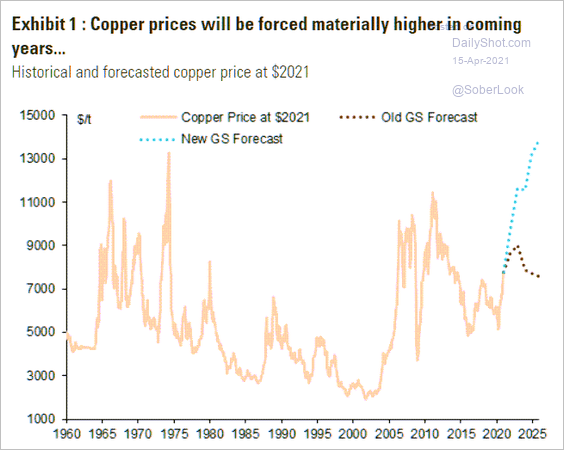

Goldman now expects sharp price gains for copper in the years ahead, …

Source: Goldman Sachs; @themarketear

Source: Goldman Sachs; @themarketear

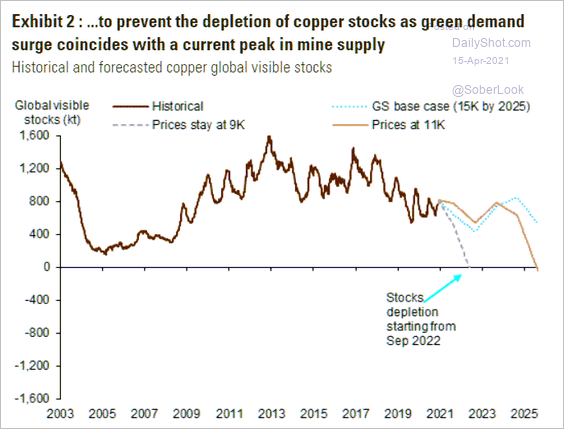

… as supplies shrink.

Source: Goldman Sachs; @themarketear

Source: Goldman Sachs; @themarketear

Back to Index

Energy

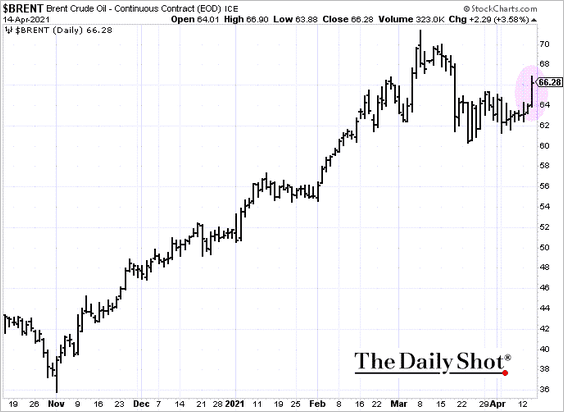

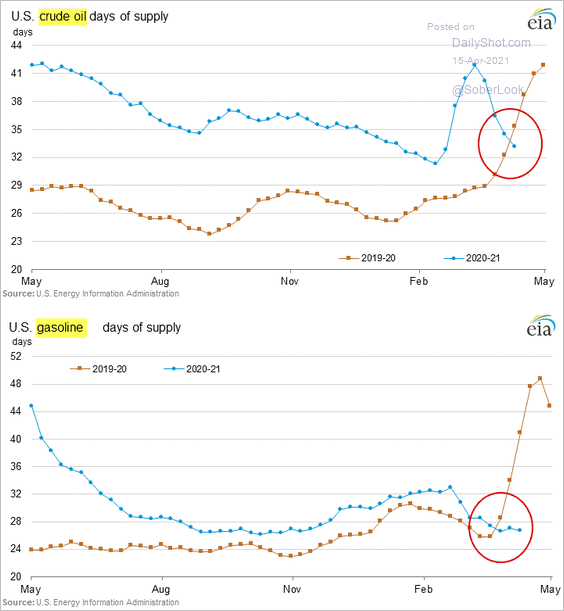

1. Crude oil futures jumped on Wednesday, …

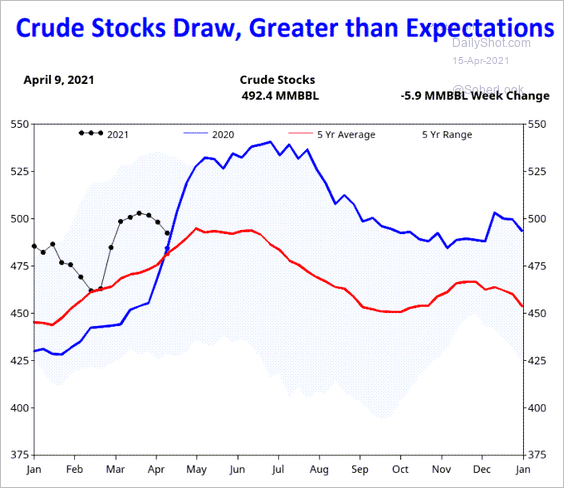

… as US inventories declined more than expected.

Source: Fundamental Analytics

Source: Fundamental Analytics

Here are the crude oil and gasoline inventories measured in days of supply.

——————–

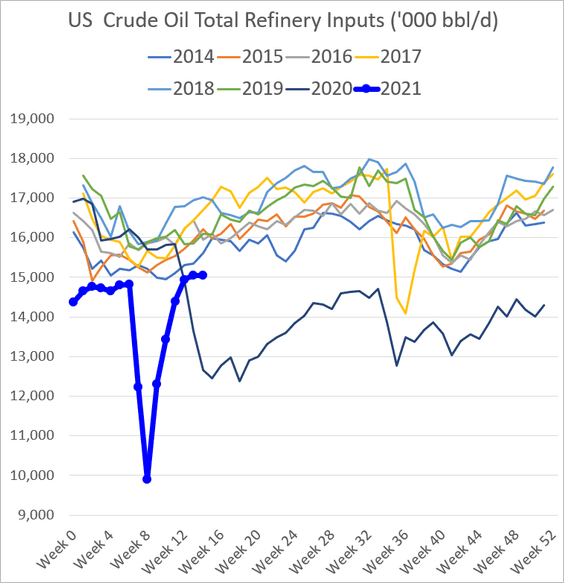

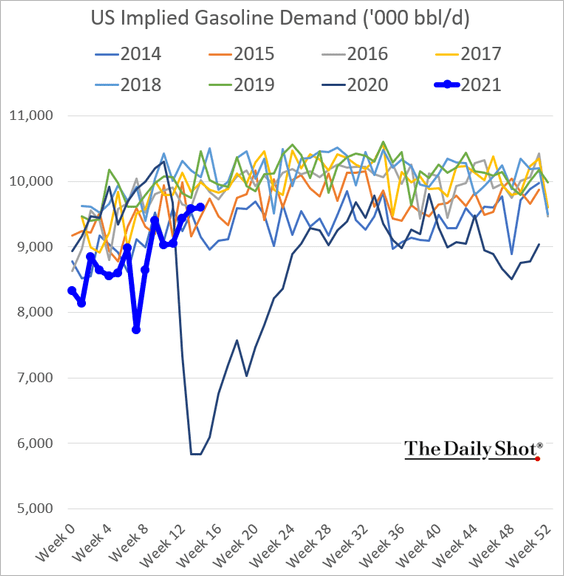

2. Refinery runs have leveled off.

US gasoline demand is trending higher.

——————–

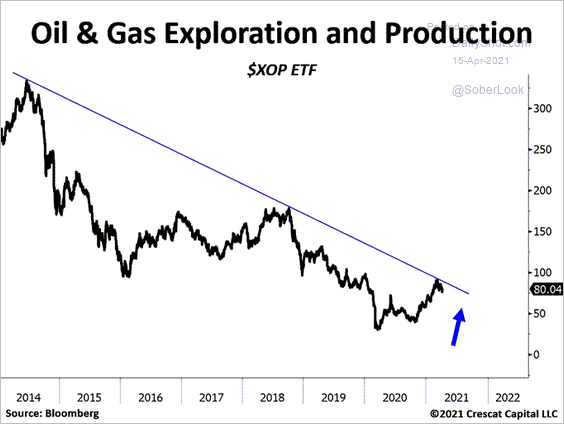

3. The SPDR Oil & Gas Exploration & Production ETF is at long-term resistance.

Source: @TaviCosta

Source: @TaviCosta

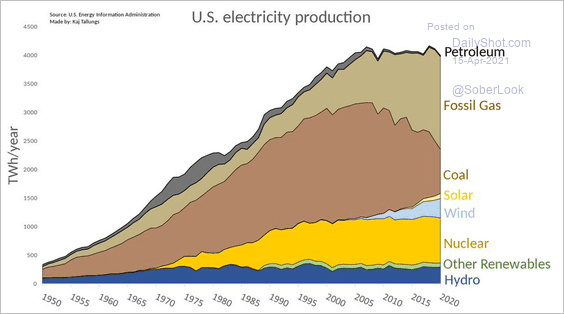

4. This chart shows US electricity production by fuel source.

Source: @TheBigDataStats Read full article

Source: @TheBigDataStats Read full article

Back to Index

Equities

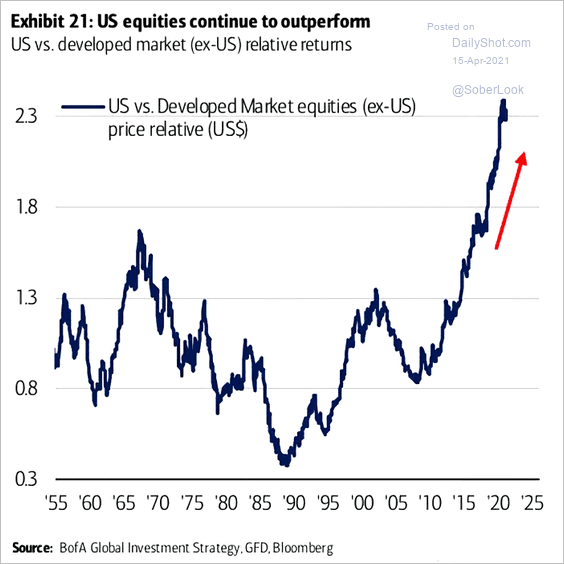

1. US stocks continue to outperform peers in other advanced economies.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

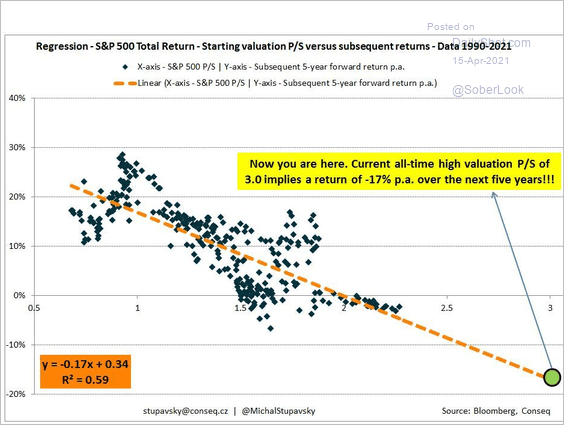

2. What does the S&P 500 price-to-sales ratio tell us about returns over the next five years?

Source: Michal Stupavsky

Source: Michal Stupavsky

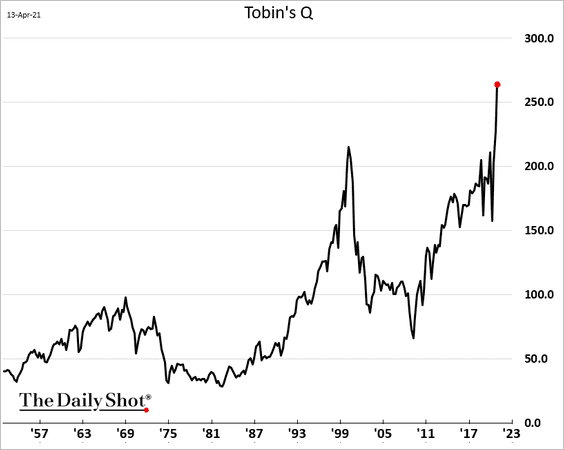

3. Tobin’s Q tells us that it’s much cheaper to build businesses internally than to buy them.

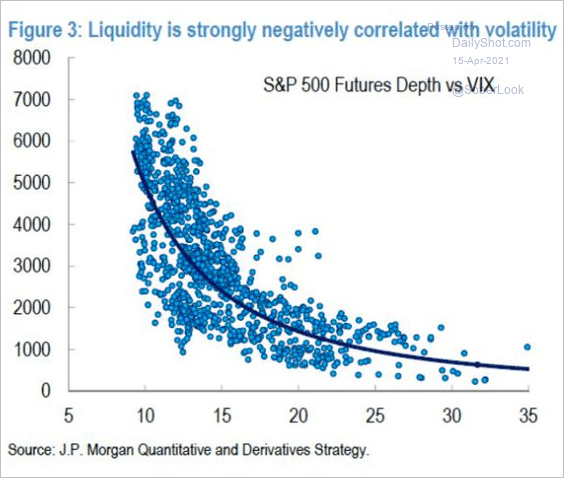

4. Liquidity is negatively correlated with volatility.

Source: JP Morgan; Ahmad Azeem

Source: JP Morgan; Ahmad Azeem

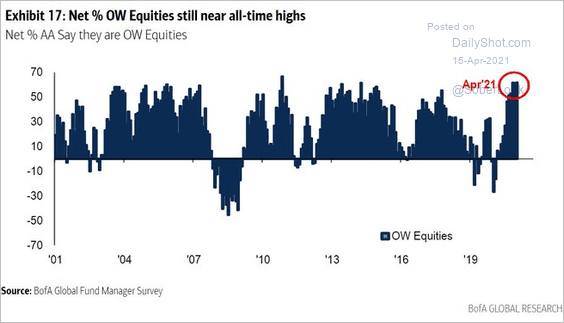

5. Fund managers remain extremely overweight equities.

Source: BofA Global Research

Source: BofA Global Research

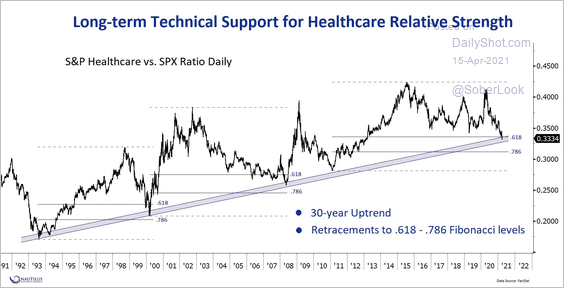

6. The healthcare sector is at support relative to the S&P 500.

Source: Nautilus Investment Research; Tilo Marotz

Source: Nautilus Investment Research; Tilo Marotz

Back to Index

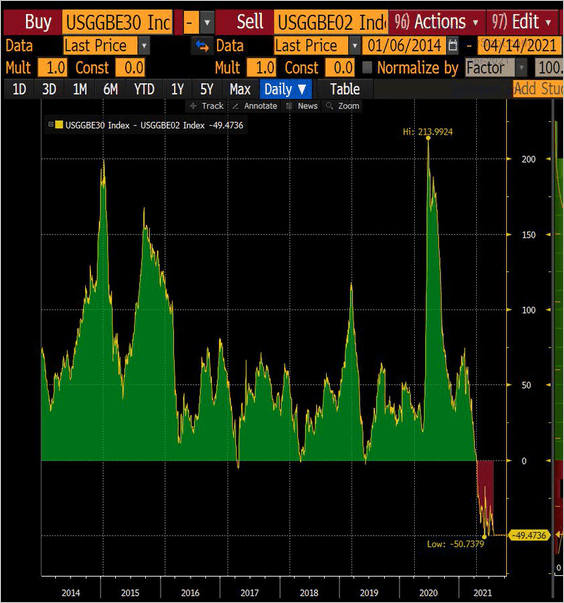

Rates

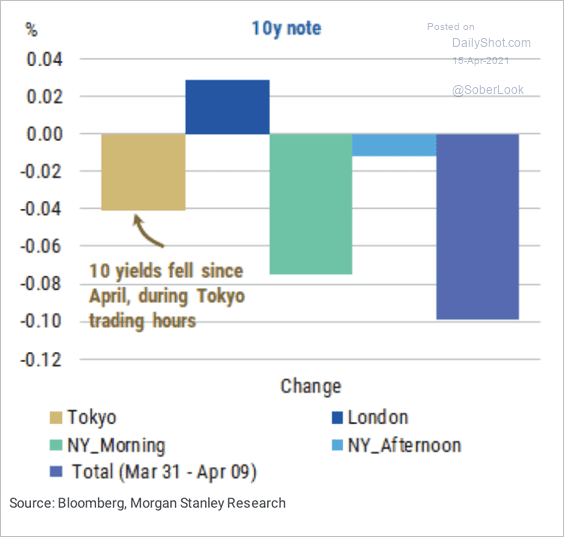

1. Here is a look at 10-year Treasury yield moves across time zones.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

2. The breakeven curve remains inverted (the market expects inflation to moderate over the long run).

Source: @lisaabramowicz1

Source: @lisaabramowicz1

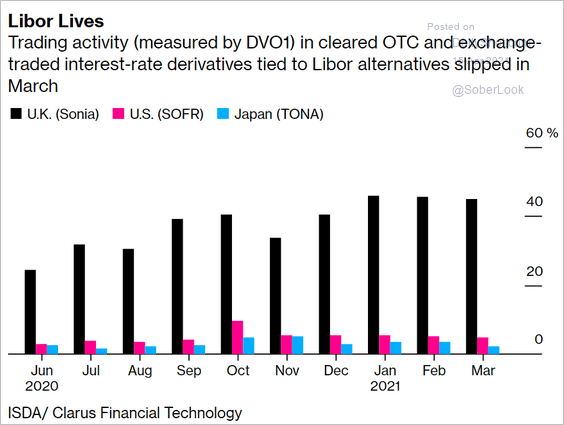

3. LIBOR replacement benchmarks in the US and Japan are not getting much traction.

Source: @markets Read full article

Source: @markets Read full article

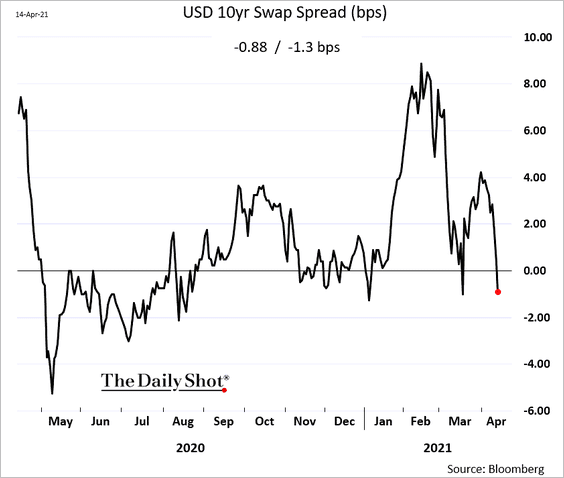

4. The 10yr USD swap spread is negative again (as US mortgage rates move lower).

Back to Index

Global Developments

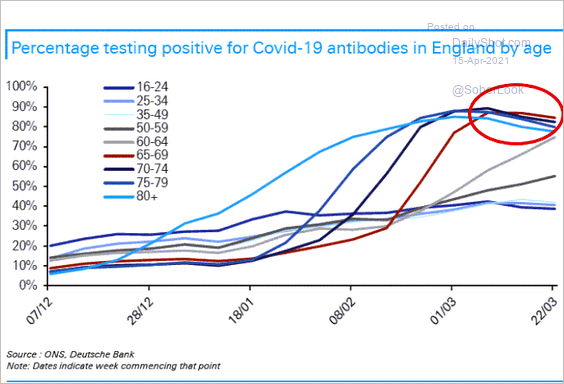

1. The UK COVID testing data suggest that post-vaccine antibodies may be waning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

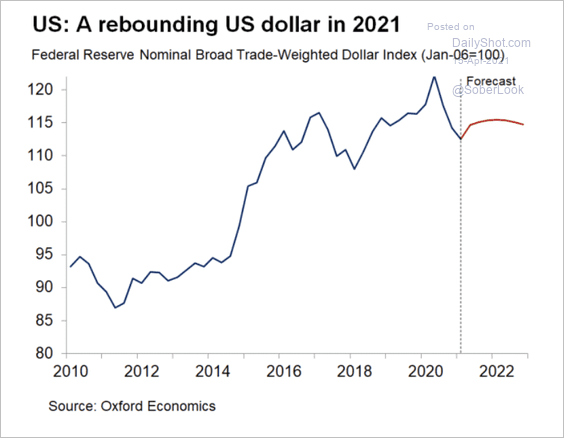

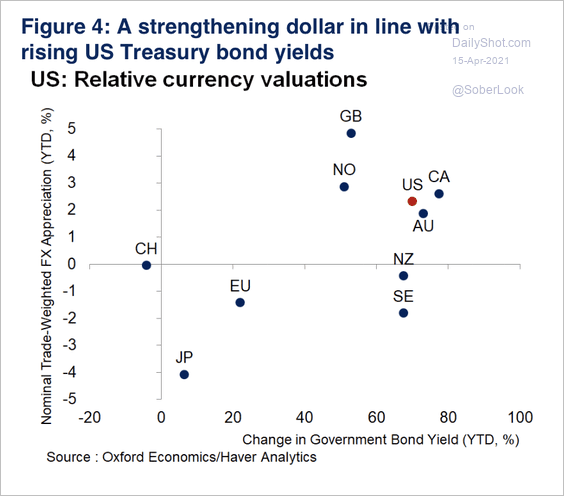

2. Oxford Economics expects a stronger dollar this year, in line with rising yields (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

Source: Oxford Economics

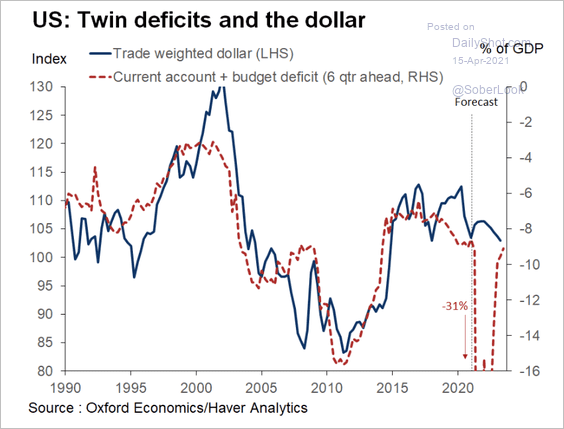

However, the rise in US external funding needs could weigh on the dollar.

Source: Oxford Economics

Source: Oxford Economics

——————–

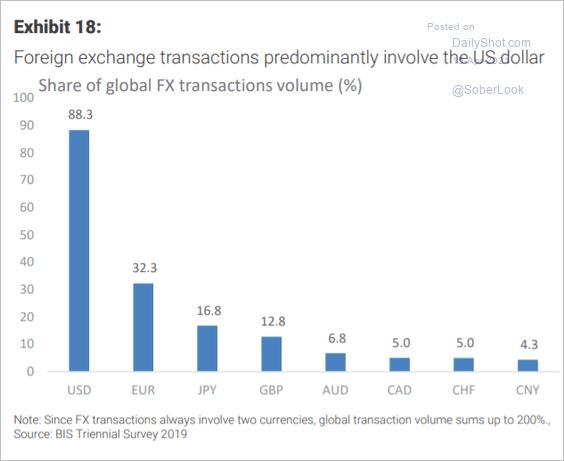

3. The FX market is still dominated by USD.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

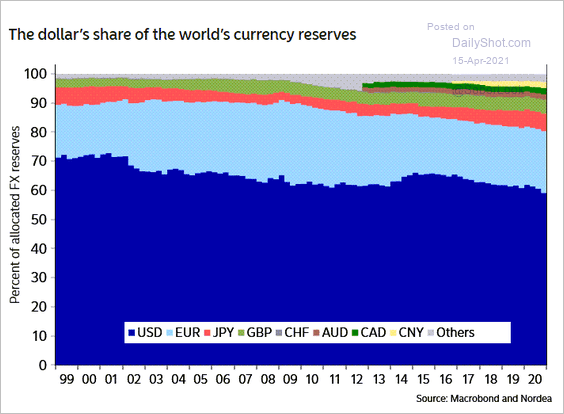

4. The dollar’s share of the world’s currency reserves is drifting lower.

Source: Nordea Markets

Source: Nordea Markets

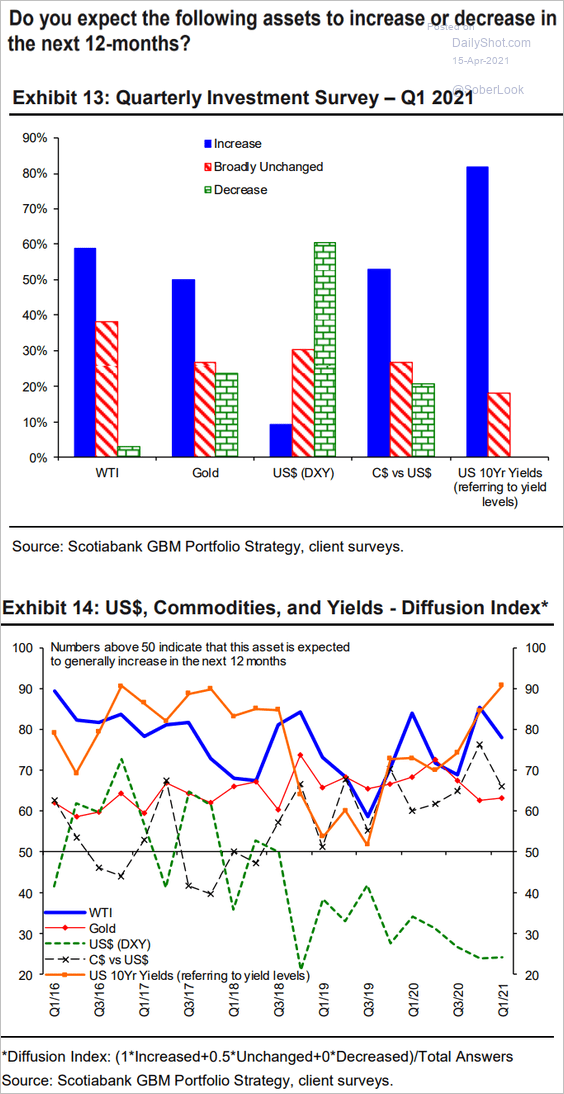

5. How will the following assets perform over the next 12 months?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

Food for Thought

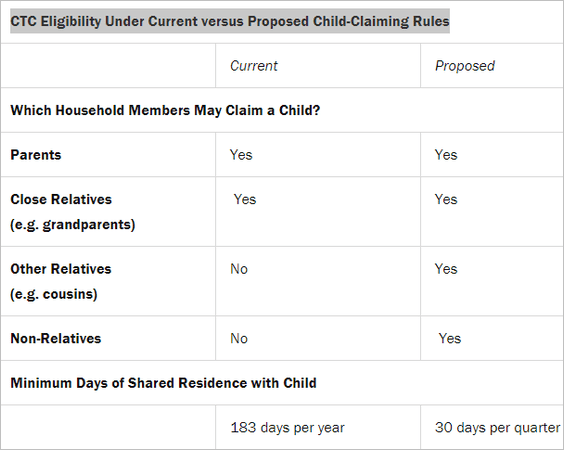

1. US child tax credit proposal:

Source: Brookings Read full article

Source: Brookings Read full article

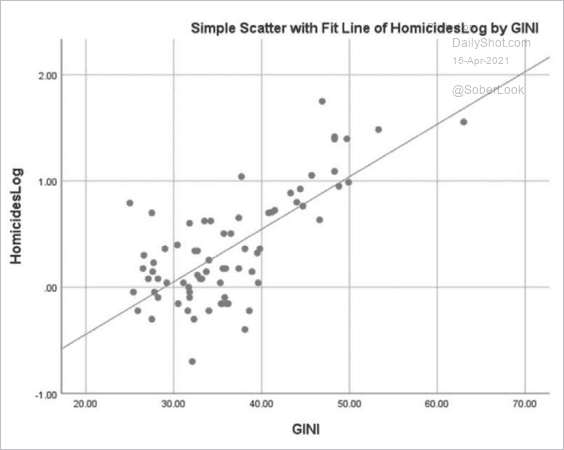

2. Homicides vs. inequality globally:

Source: Christopher J. Ferguson and Sven Smith, Stetson University Read full article

Source: Christopher J. Ferguson and Sven Smith, Stetson University Read full article

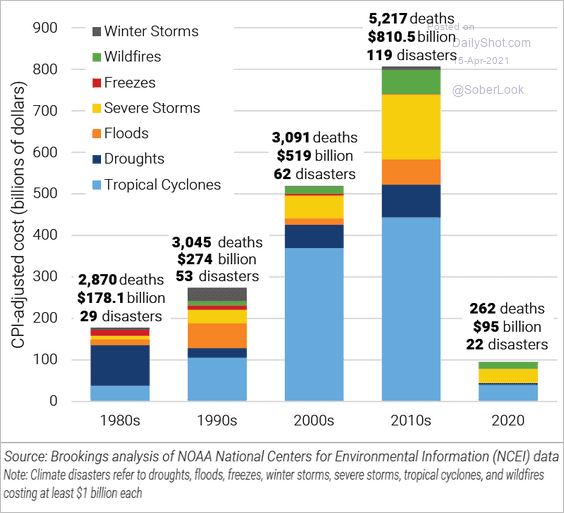

3. US climate-related costs:

Source: Brookings Read full article

Source: Brookings Read full article

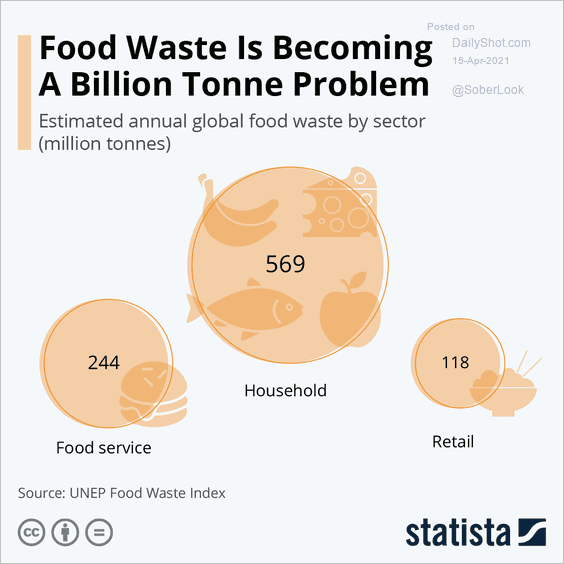

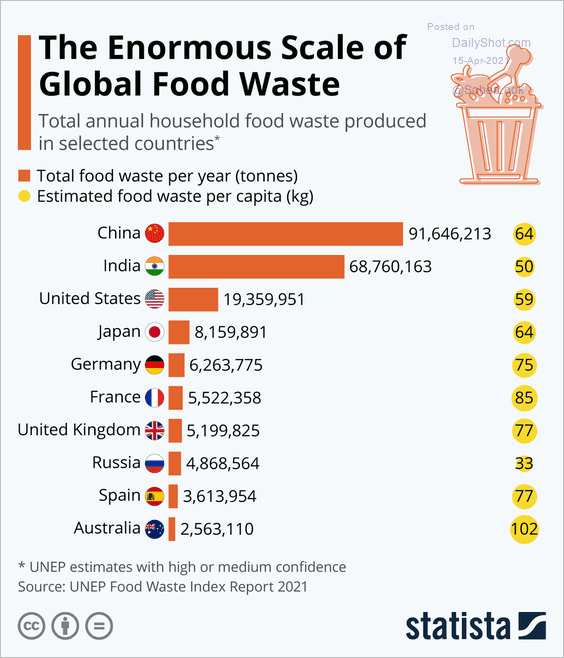

4. Food waste (2 charts):

Source: Statista

Source: Statista

Source: Statista

Source: Statista

——————–

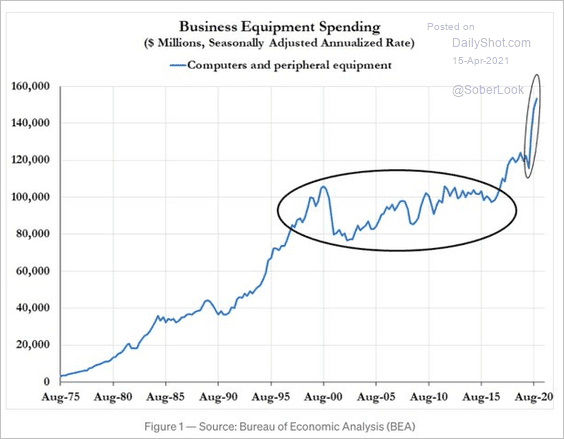

5. US IT spending:

Source: @adam_tooze Read full article

Source: @adam_tooze Read full article

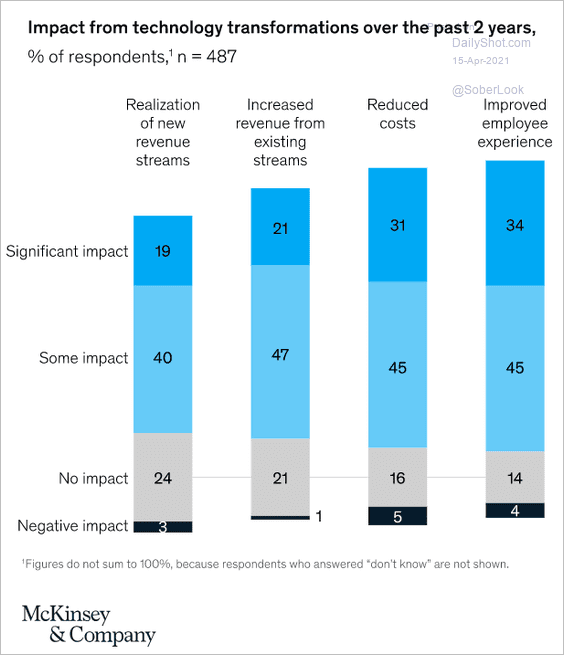

6. Technology’s impact on business:

Source: McKinsey Insights Read full article

Source: McKinsey Insights Read full article

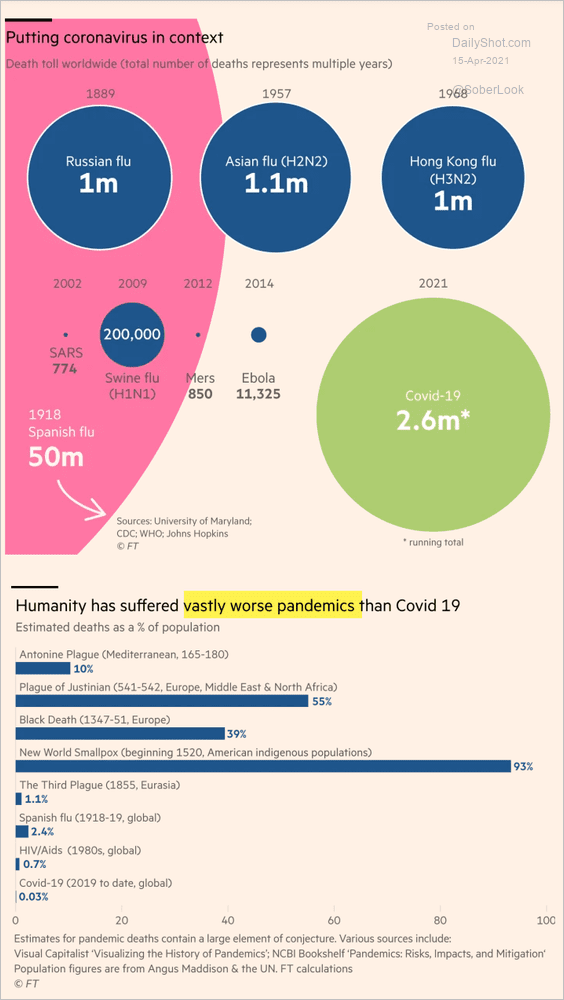

7. COVID in perspective:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

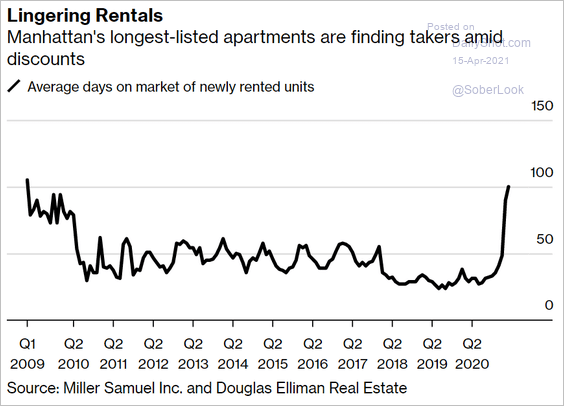

8. Manhattan rentals days on the market:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

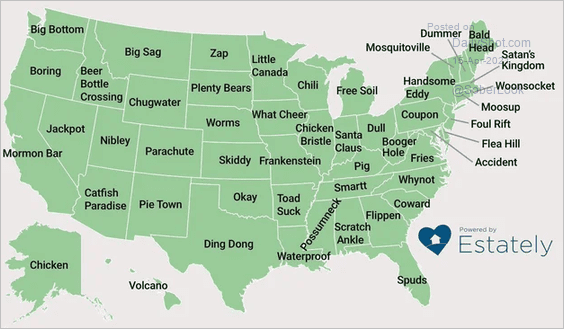

9. Most oddly named towns:

Source: Estately

Source: Estately

——————–

Back to Index