The Daily Shot: 19-Apr-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrencies

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

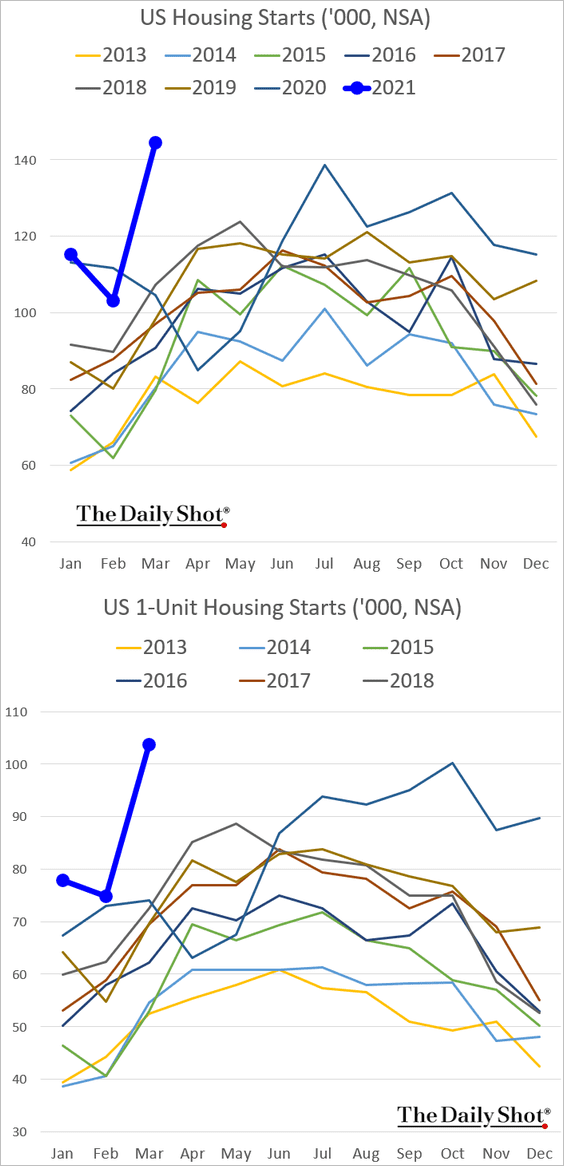

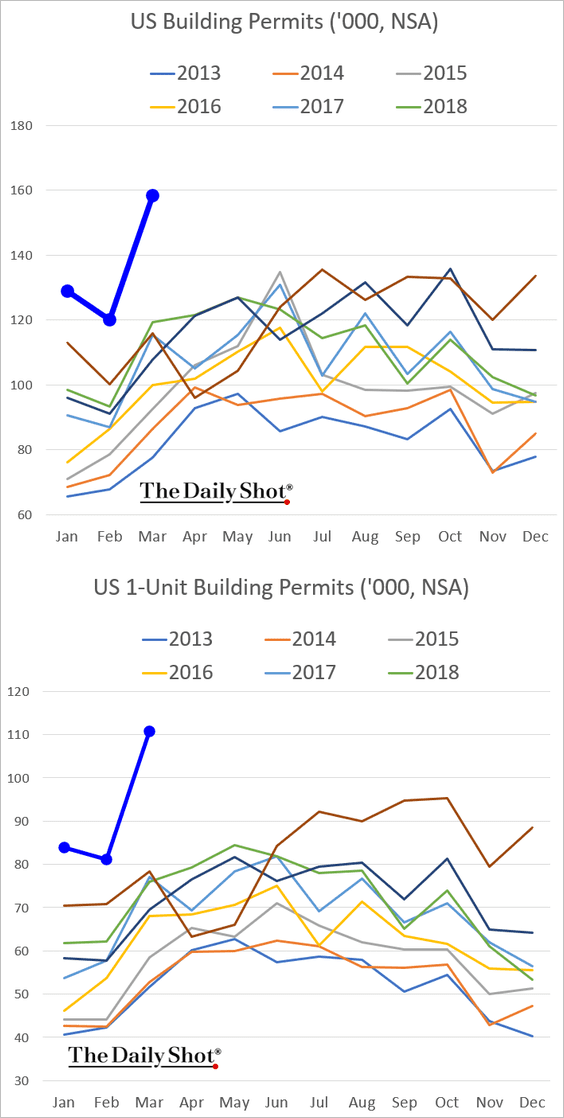

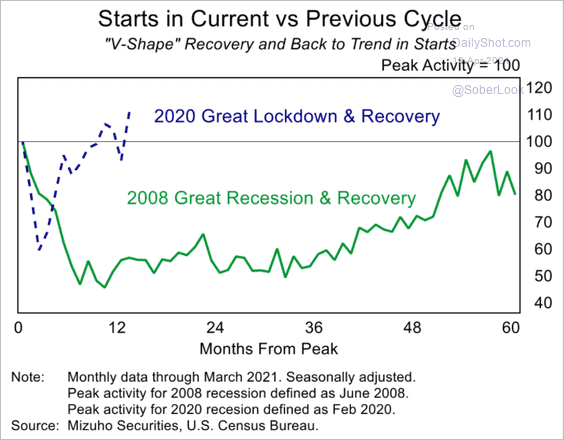

1. US residential construction activity surged last month, rebounding from the February slump.

• Housing starts (total and single-family):

• Building permits:

• Housing starts relative to the post-2008 recovery:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

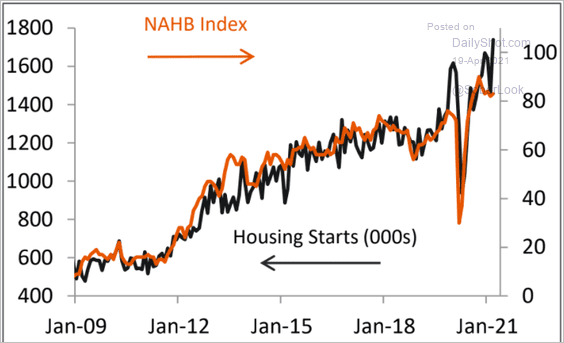

• Housing starts have diverged from the NAHB homebuilder confidence index.

Source: Piper Sandler

Source: Piper Sandler

——————–

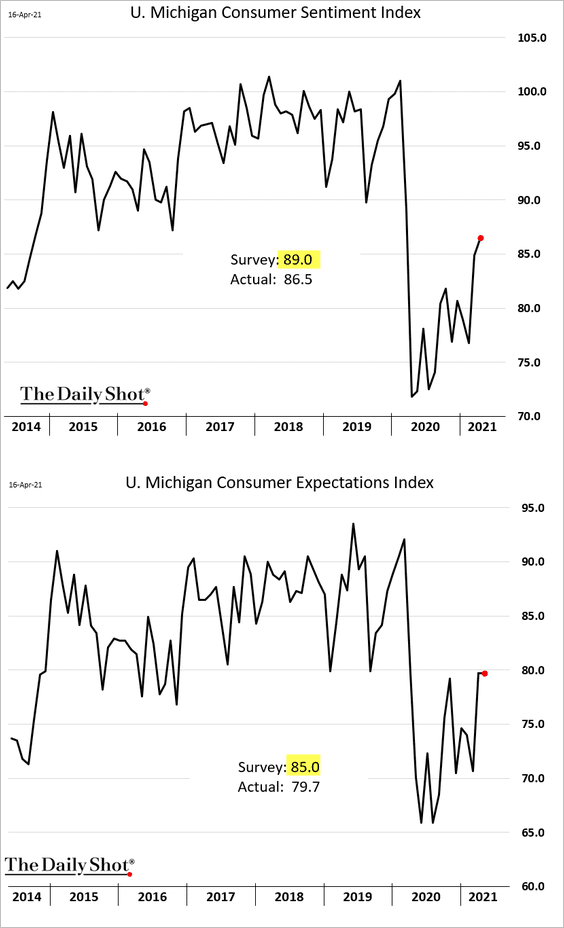

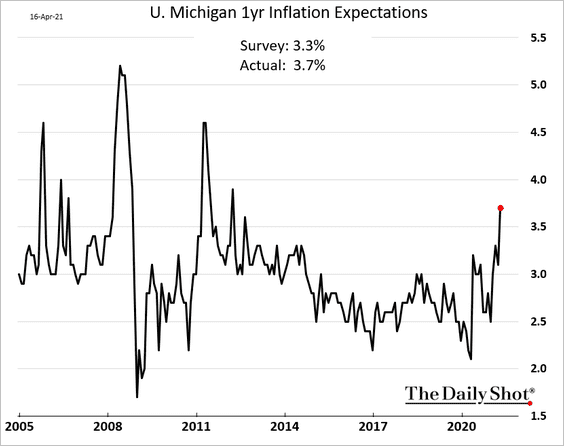

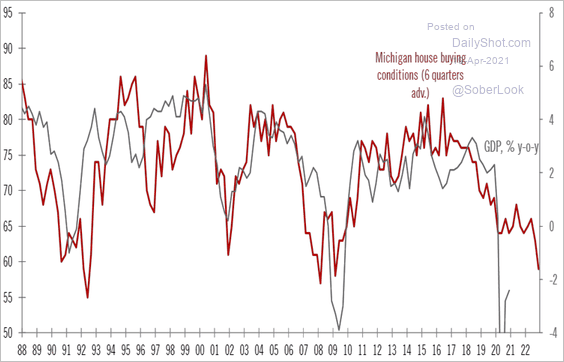

2. The U. Michigan consumer sentiment index was below market forecasts, with the expectations component stalling this month.

Near-term inflation expectations surged.

House buying conditions deteriorated further. Will we see this trend reflected in the housing market?

Source: @TCosterg

Source: @TCosterg

——————–

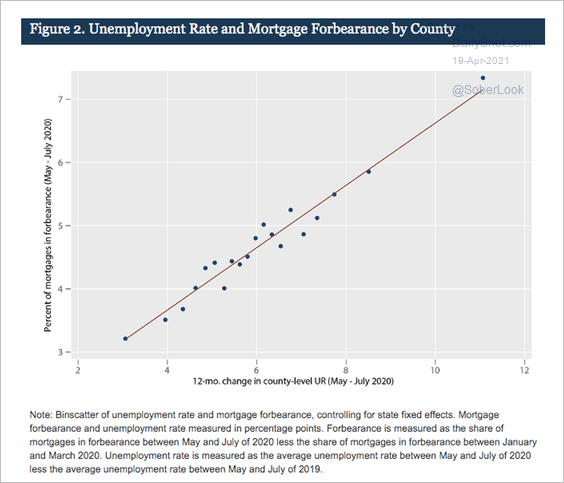

3. Mortgage forbearance should ease as the labor market strengthens.

Source: Federal Reserve Read full article

Source: Federal Reserve Read full article

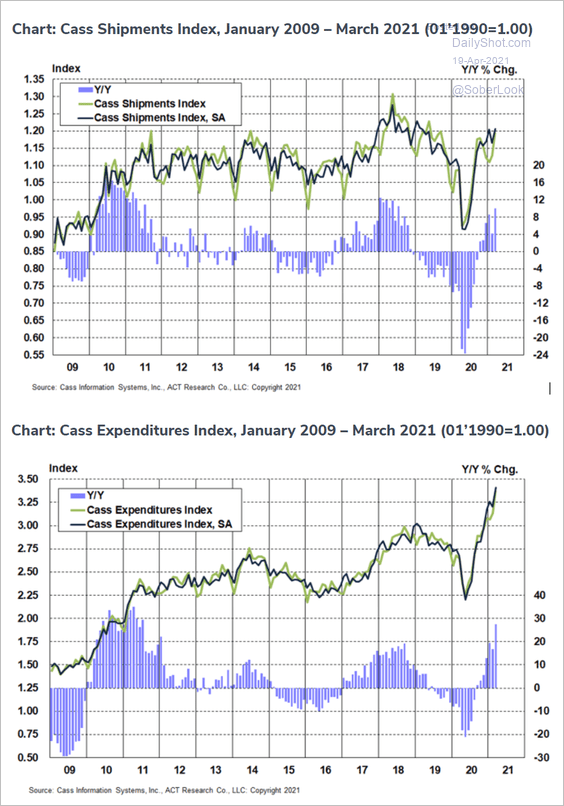

4. Freight activity grew further last month, with freight spending hitting a record high.

Source: Cass Information Systems

Source: Cass Information Systems

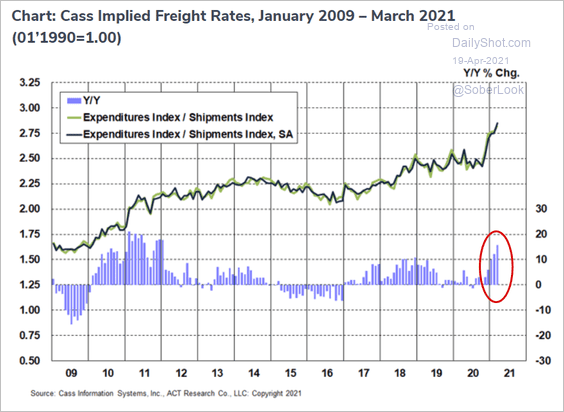

• Freight rates inflation is now the highest in nearly a decade.

Source: Cass Information Systems

Source: Cass Information Systems

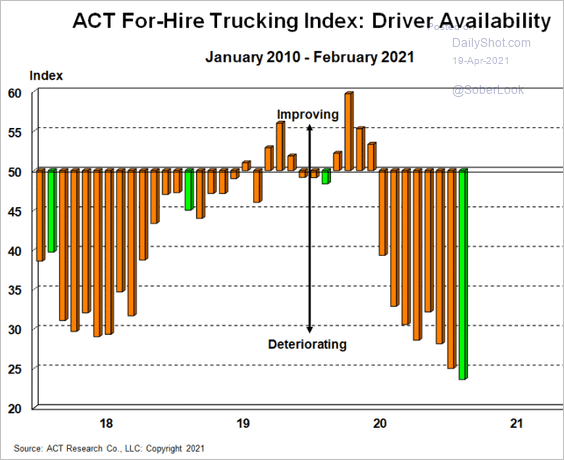

• The US faces a severe shortage of drivers, which is exacerbating the supply-chain bottlenecks.

Source: Cass Information Systems

Source: Cass Information Systems

5. The nation’s labor shortages are not limited to drivers.

Source: @jessefelder; Business Insider Read full article

Source: @jessefelder; Business Insider Read full article

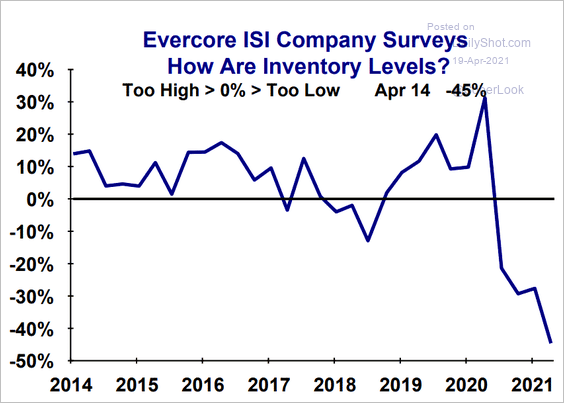

6. The Evercore ISI business survey shows tightening inventories.

Source: Evercore ISI

Source: Evercore ISI

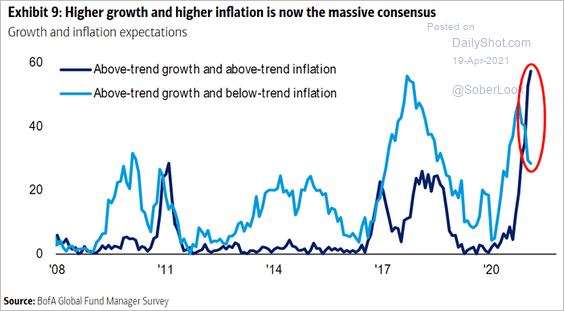

7. BofA’s survey of fund managers shows rising expectations of above-trend growth and inflation.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

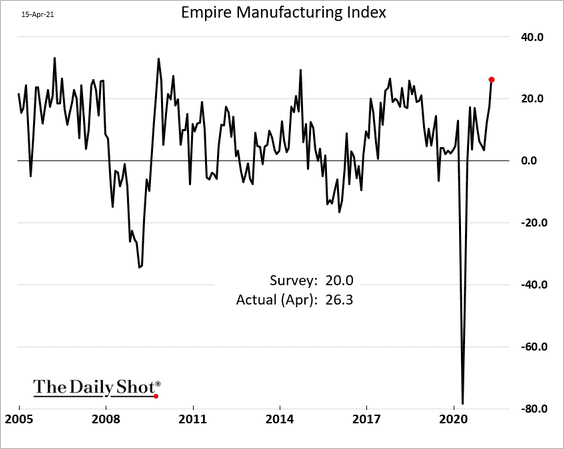

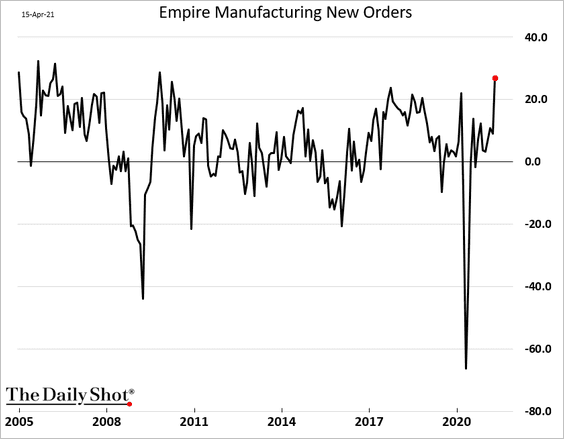

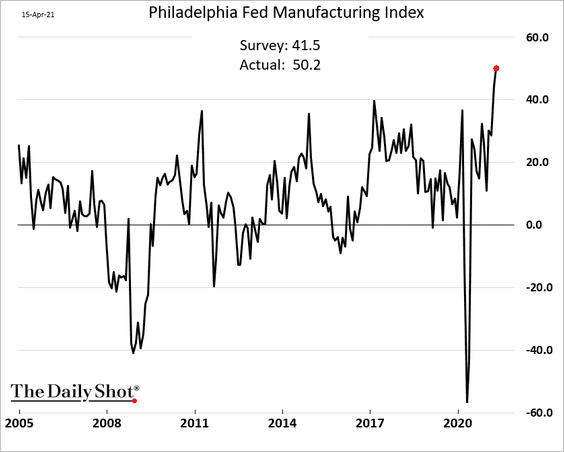

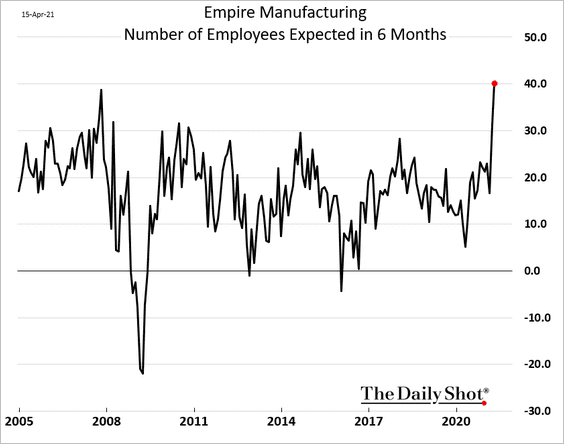

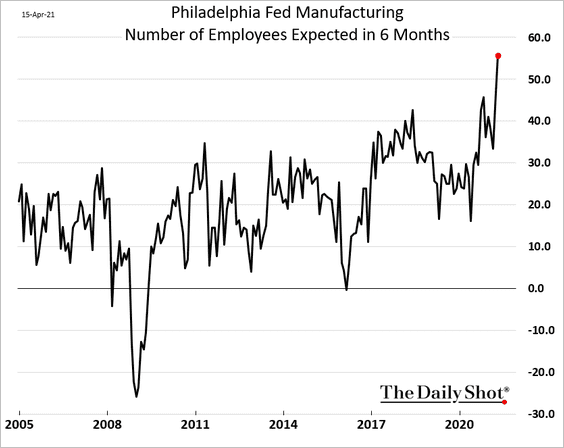

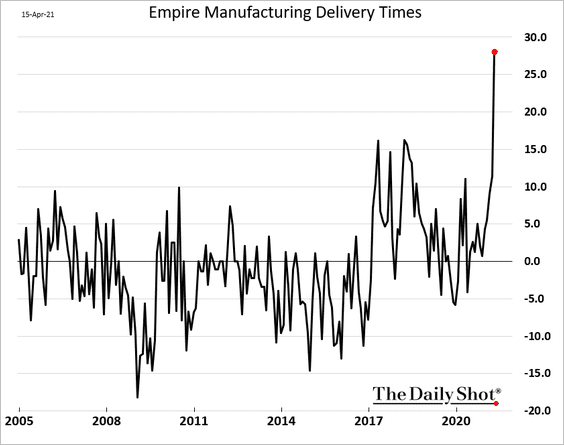

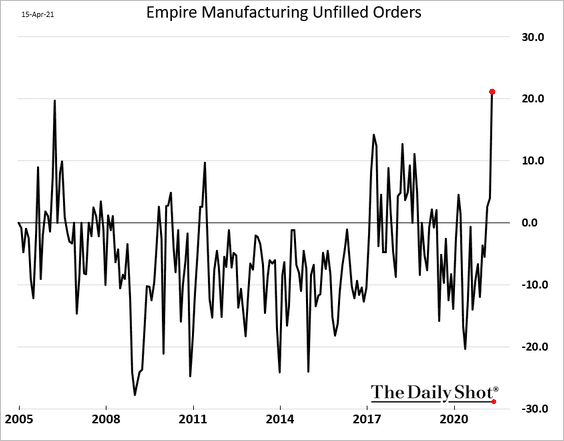

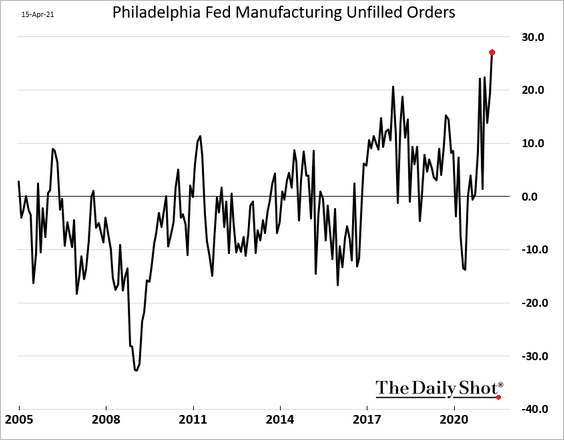

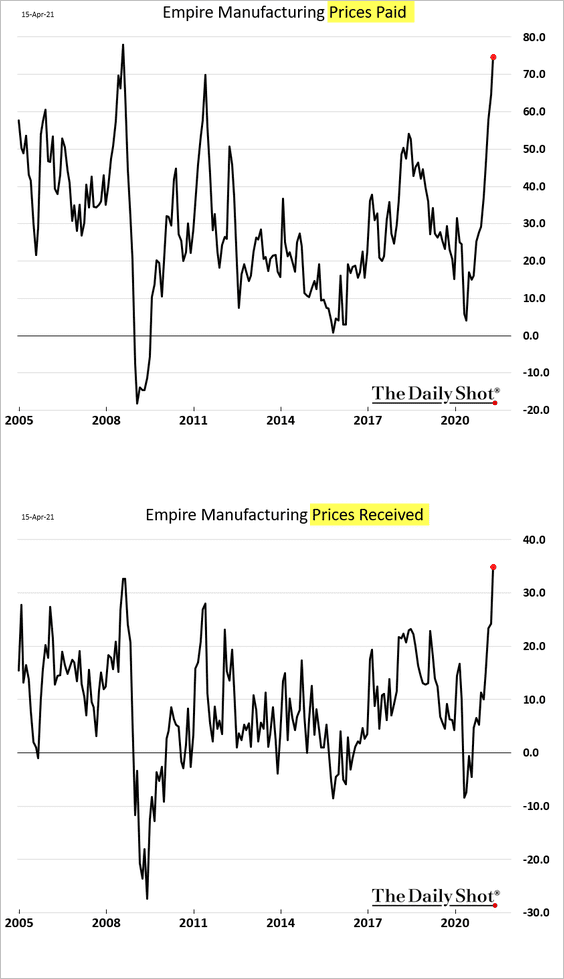

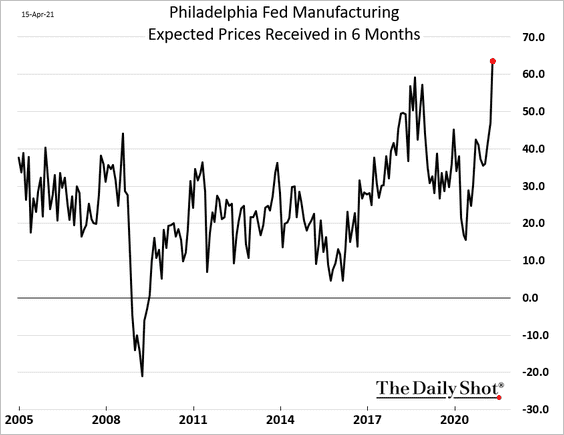

8. The regional manufacturing surveys point to exceptionally strong factory activity this month.

• The NY Fed’s manufacturing indicator:

• The Philly Fed’s manufacturing indicator:

• Manufacturing employment expectations surged, which will further tighten the labor market in the months ahead (2 charts).

• Supply-chain hurdles remain.

• The backlog of orders continues to climb (2 charts).

• Price pressures persist.

——————–

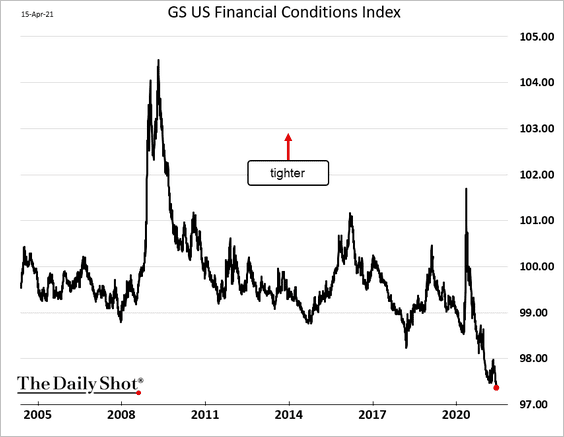

9. According to a widely tracked indicator from Goldman, US financial conditions are now the most accommodative in decades. The stock market’s strength, extraordinarily tight credit spreads, low rates, and a weak US dollar contributed to this trend.

Back to Index

Canada

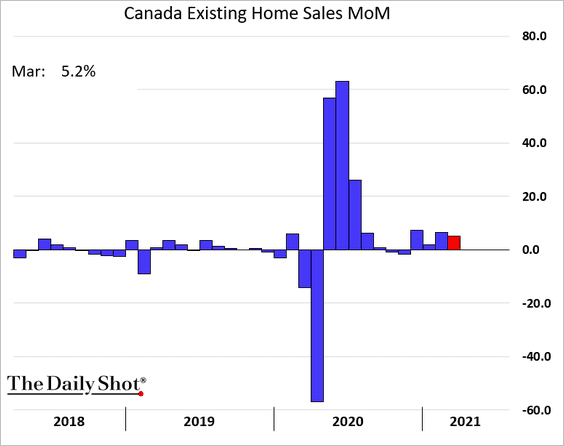

1. Existing home sales remain robust.

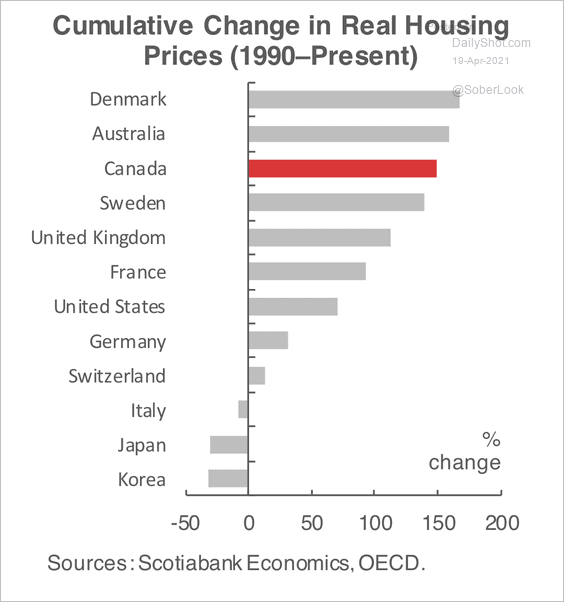

2. Canada experienced one of the largest gains in real housing prices over the past 30 years.

Source: Scotiabank Economics

Source: Scotiabank Economics

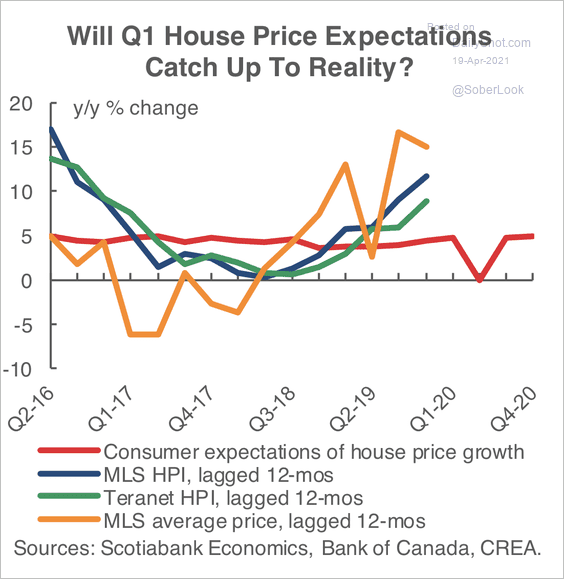

3. Expectations for higher house prices have been relatively weak compared to actual price changes.

Source: Scotiabank Economics

Source: Scotiabank Economics

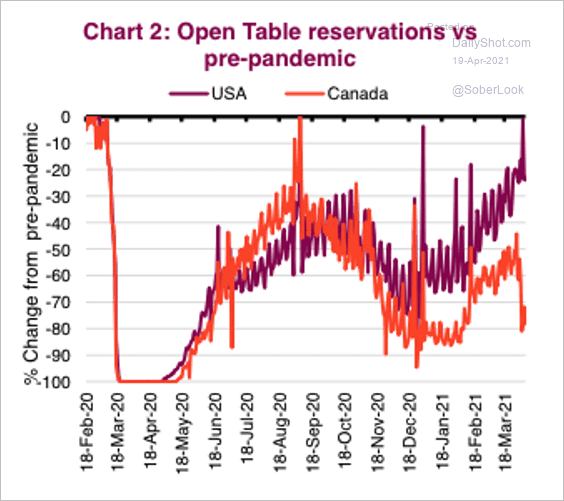

4. Restaurant reservations have declined relative to pre-pandemic levels and have sharply diverged from the US.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

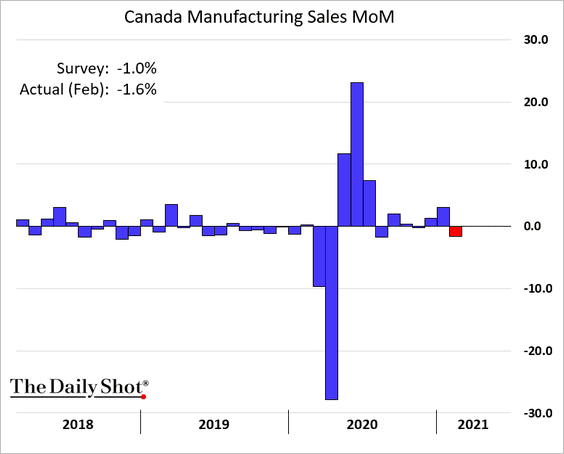

5. Manufacturing sales weakened in February.

Back to Index

The United Kingdom

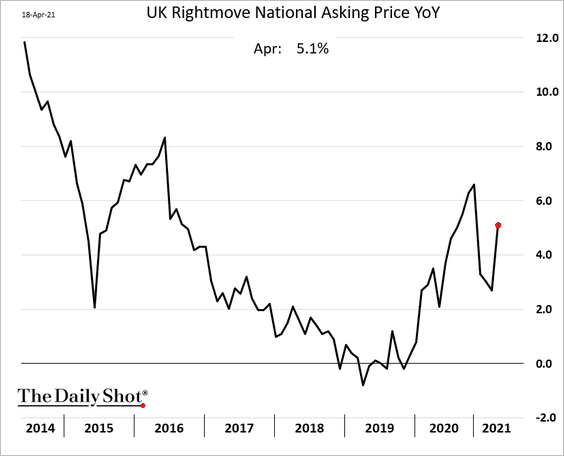

1. Home price appreciation is rebounding this month.

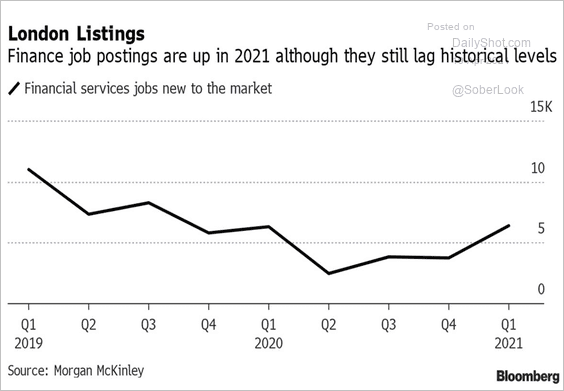

2. Finance job postings are up this year but still lag historical levels.

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

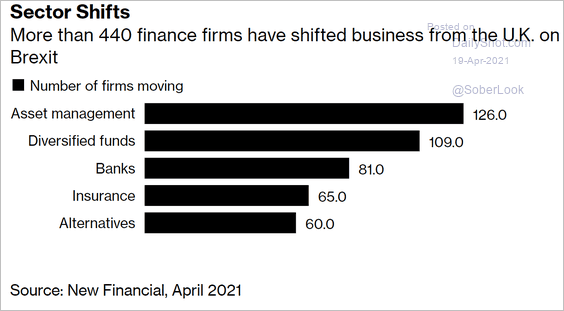

Many financial firms have shifted a portion of their business to the EU.

Source: @business Read full article

Source: @business Read full article

Back to Index

The Eurozone

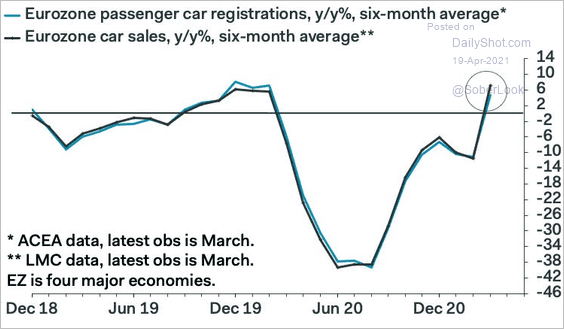

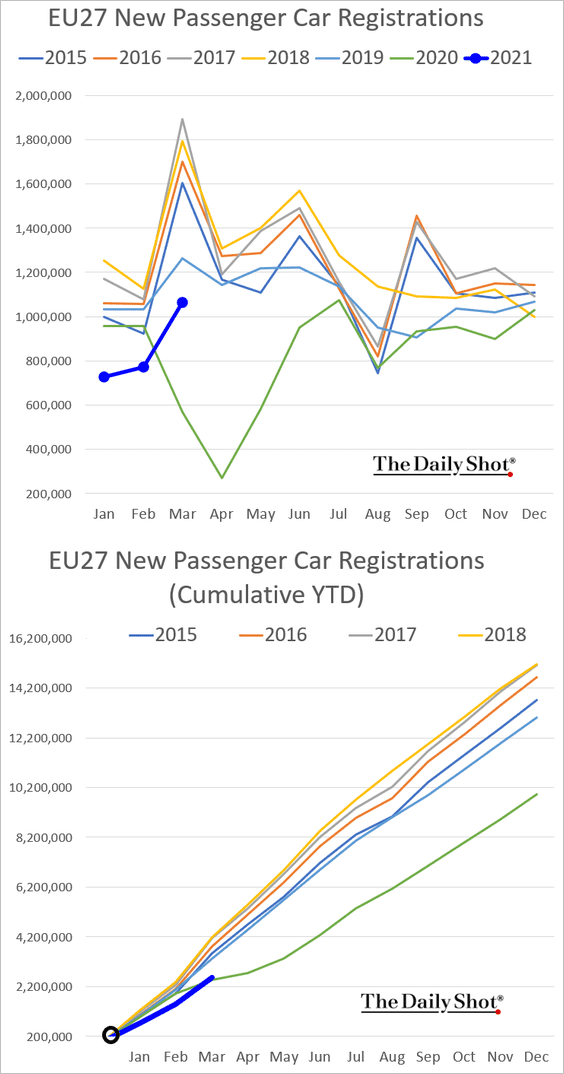

1. Passenger car registrations strengthened last month.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

This chart shows vehicle registrations at the EU level.

——————–

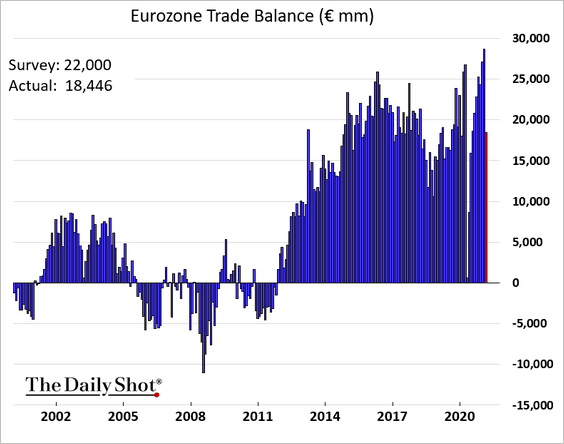

2. Last month’s trade surplus was below expectations.

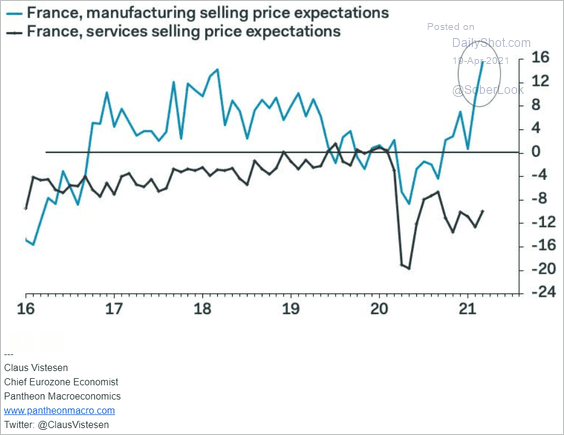

3. French manufacturing and services price expectations have diverged sharply.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

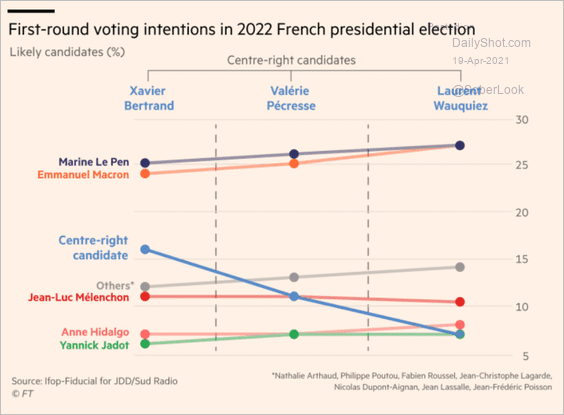

Separately, here are the first-round voting intentions in France.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

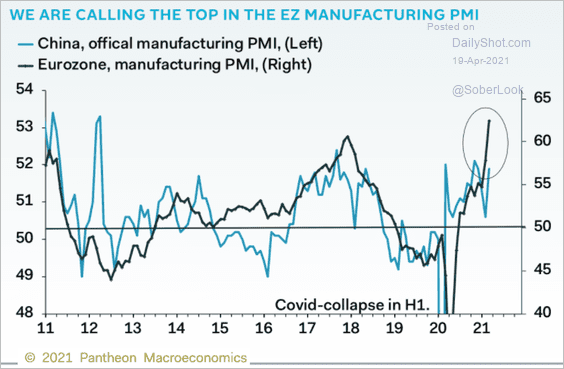

4. Will we see a pullback in the Eurozone manufacturing PMI?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

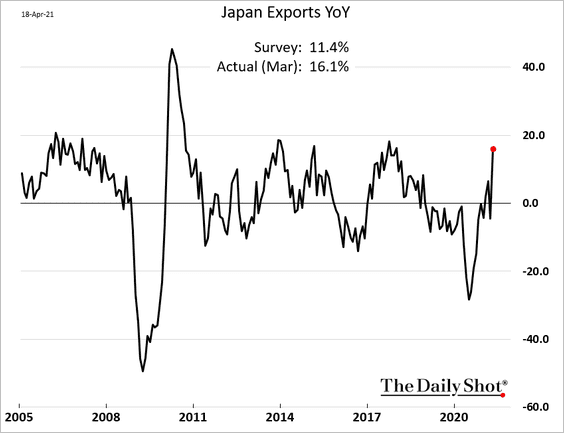

1. Japan’s exports topped expectations.

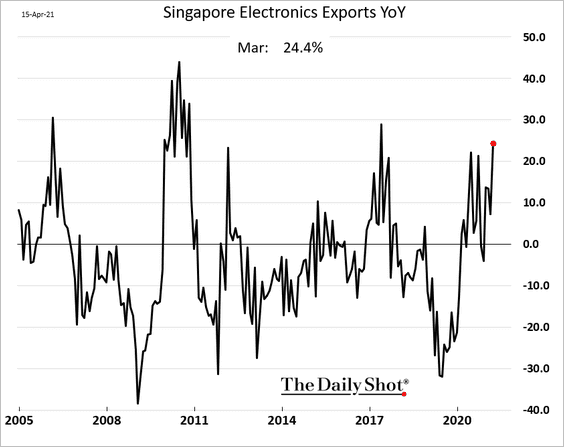

2. Singapore’s exports remain solid.

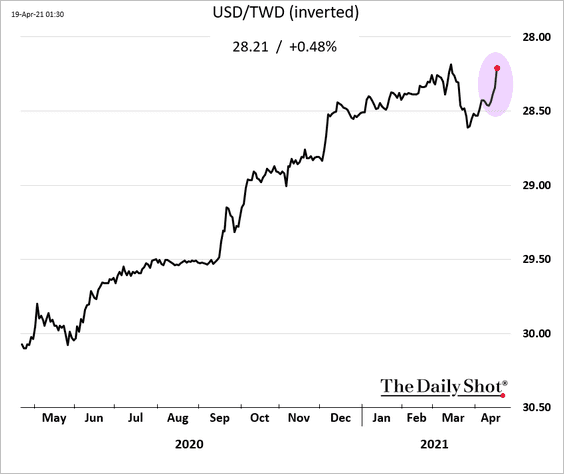

3. The Taiwan dollar is strengthening amid US pressure.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

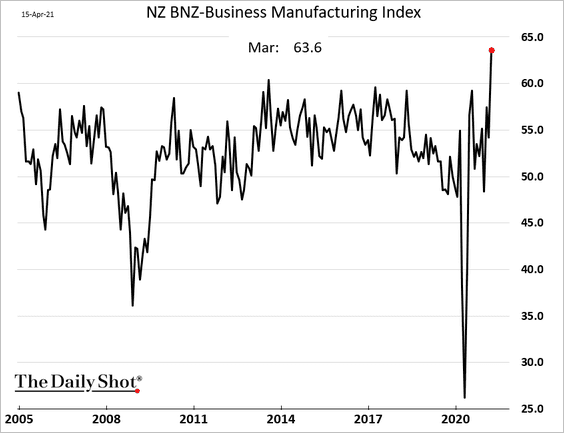

4. New Zealand’s factory activity surged last month.

Back to Index

China

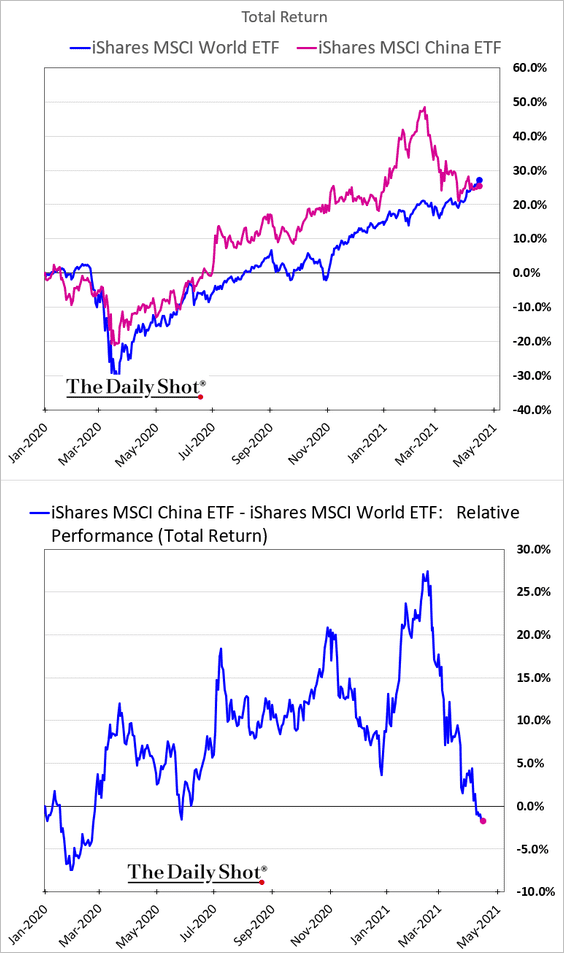

1. Is the stock market underperformance coming to an end?

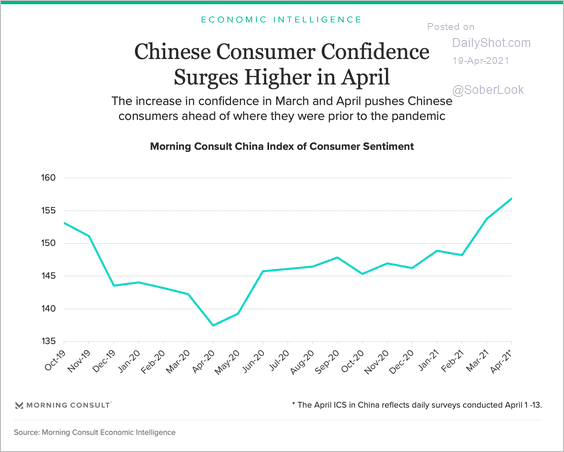

2. Consumer confidence is rebounding.

Source: Morning Consult

Source: Morning Consult

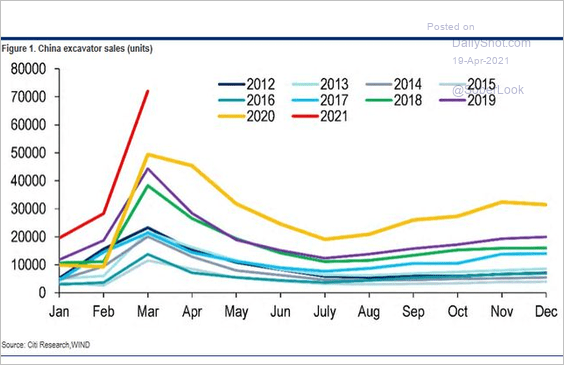

3. This chart shows China’s excavator sales.

Source: Gustavo Fuhr

Source: Gustavo Fuhr

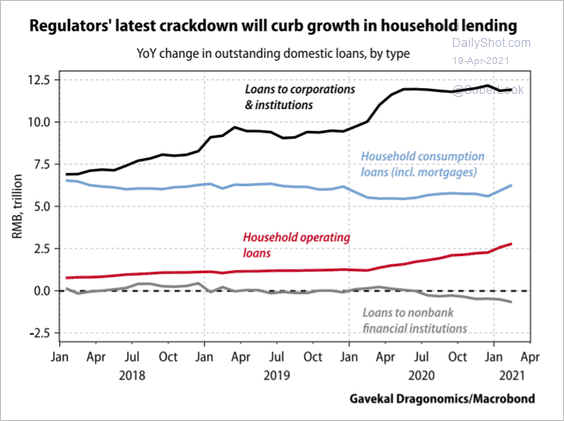

4. Will we see a slowdown in housing finance?

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

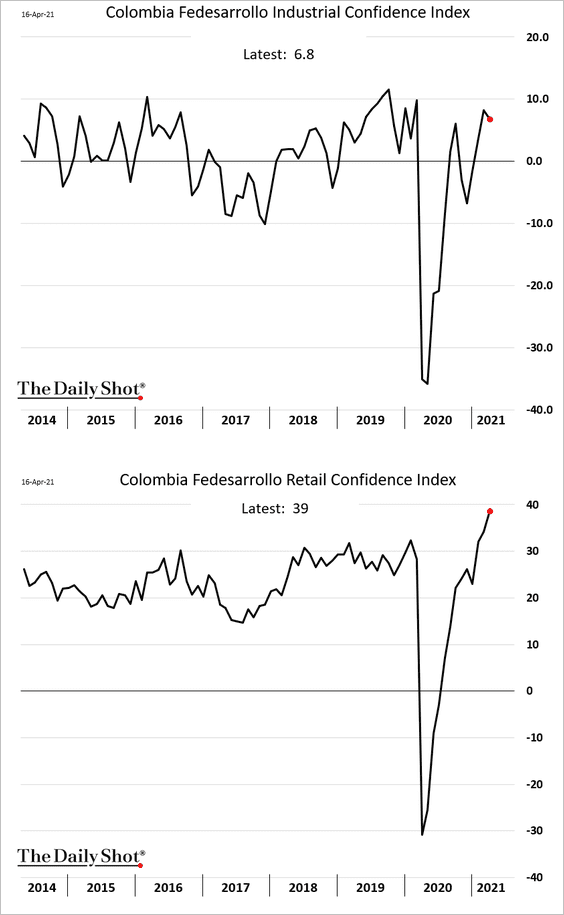

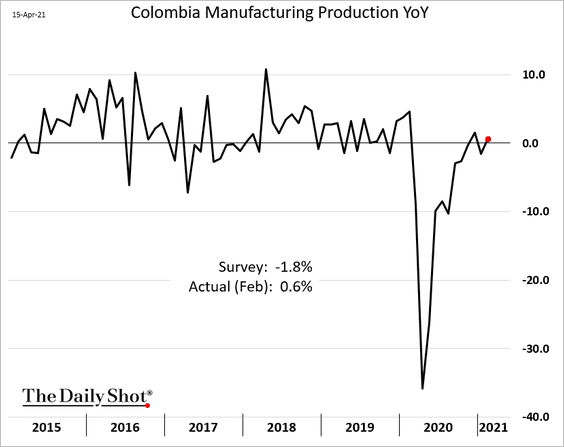

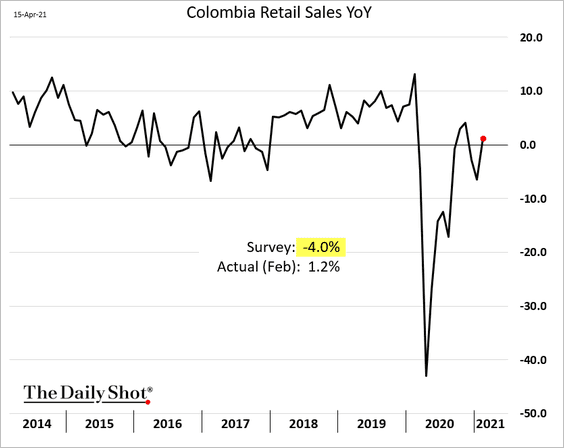

1. Let’s begin with Colombia.

• Business confidence:

• Industrial production:

• Retail sales:

——————–

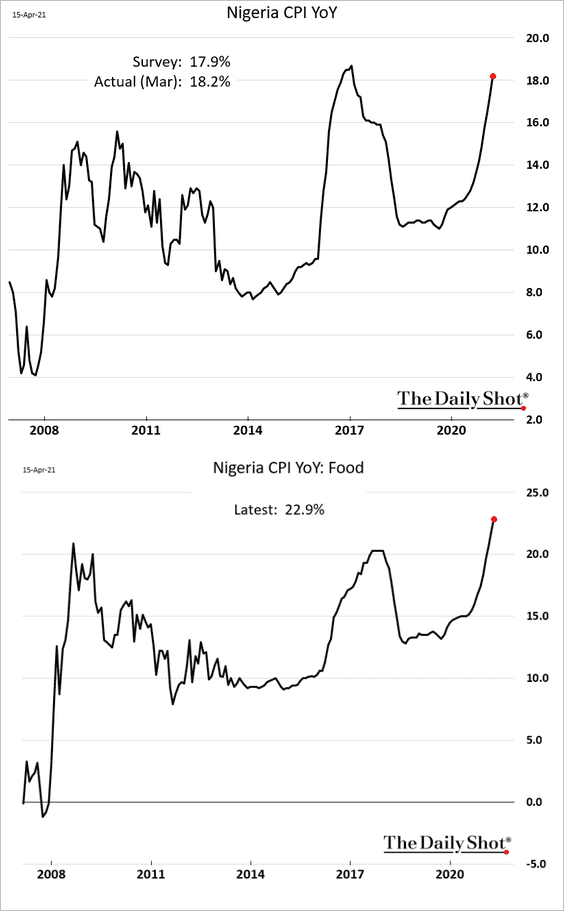

2. Nigeria’s inflation is surging, driven by food prices.

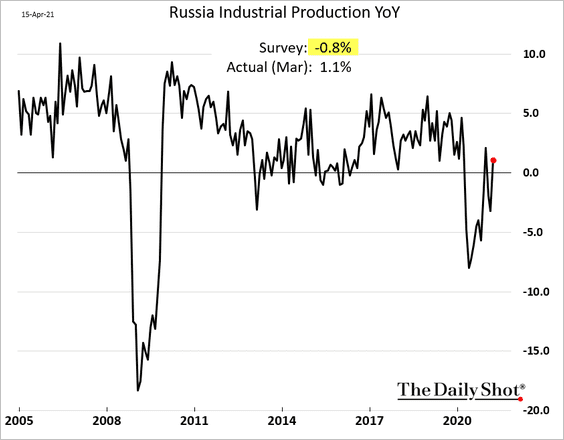

3. Russia’s industrial production improved last month.

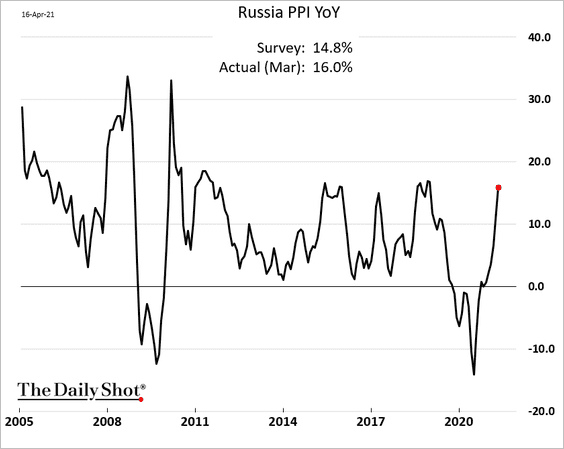

Producer prices rose faster than expected.

——————–

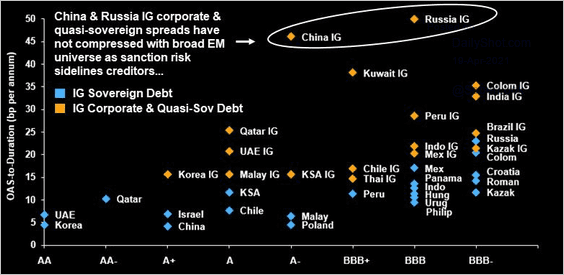

4. China’s and Russia’s investment-grade quasi-sovereign bonds have lagged the broader compression in EM spreads over the past 6-months.

Source: Damian Sassower

Source: Damian Sassower

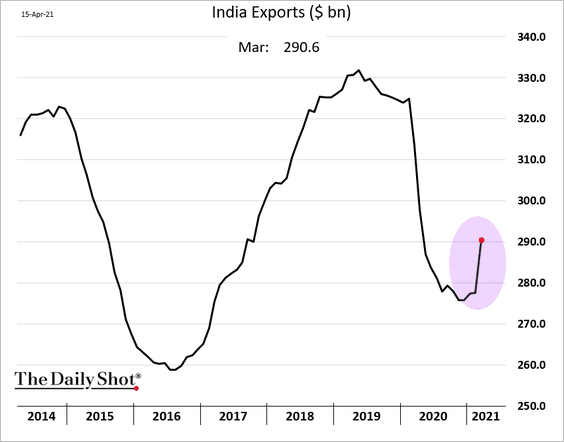

5. India’s exports strengthened in March.

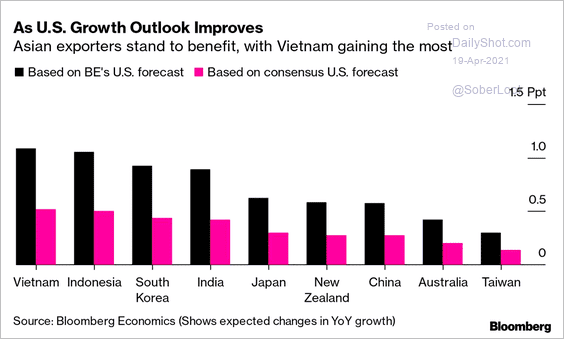

6. Vietnam stands to benefit from strong US growth.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

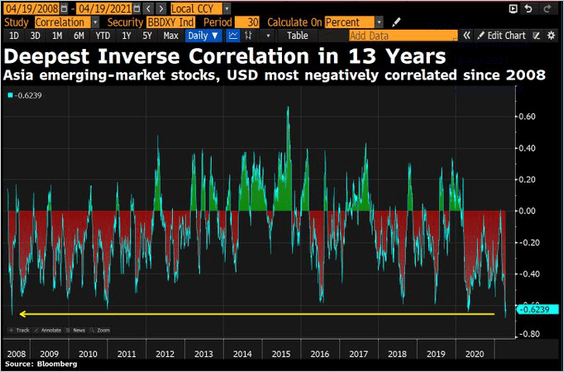

7. Here is the correlation between EM Asia stocks and the US dollar.

Source: @DavidInglesTV

Source: @DavidInglesTV

Back to Index

Cryptocurrencies

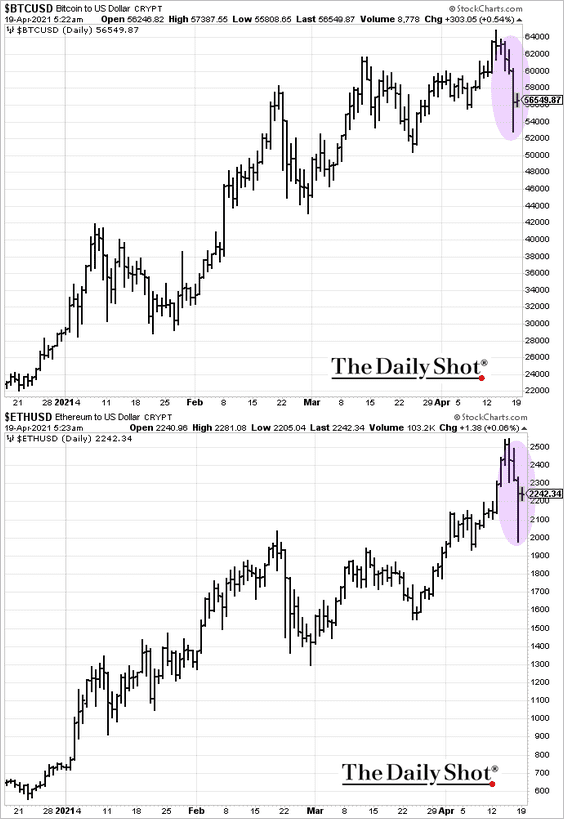

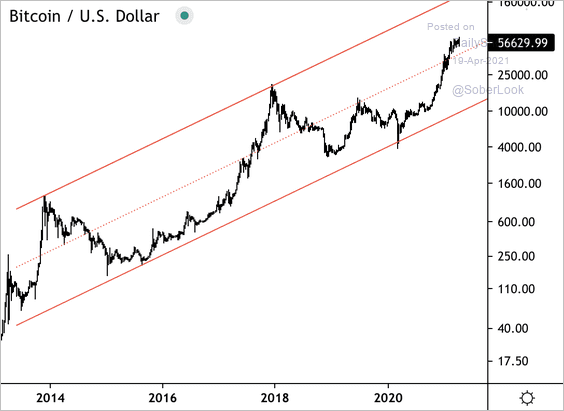

1. The weekend’s crypto selloff wiped out all of bitcoin’s gains over the past month …

Source: FinViz

Source: FinViz

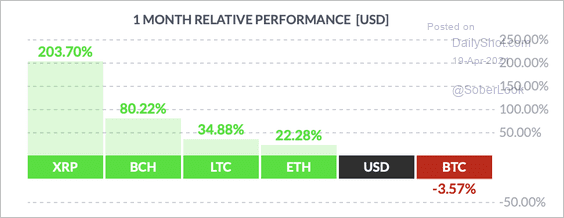

… and triggered mass liquidation (the chart shows changes in open interest).

Source: @skewdotcom

Source: @skewdotcom

——————–

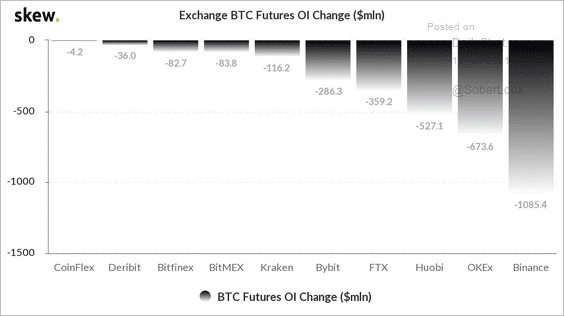

2. Despite short-term swings, BTC/USD remains in a long-term uptrend going back to 2014.

Source: Dantes Outlook

Source: Dantes Outlook

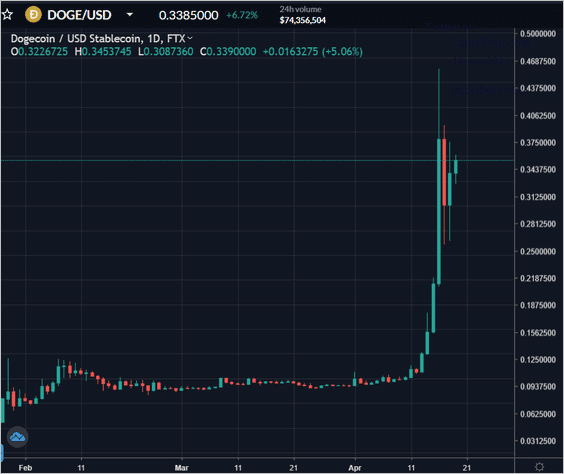

3. Dogecoin is now above 30 cents.

Source: FTX

Source: FTX

Source: Benzinga Read full article

Source: Benzinga Read full article

Source: Cointelegraph.com Read full article

Source: Cointelegraph.com Read full article

——————–

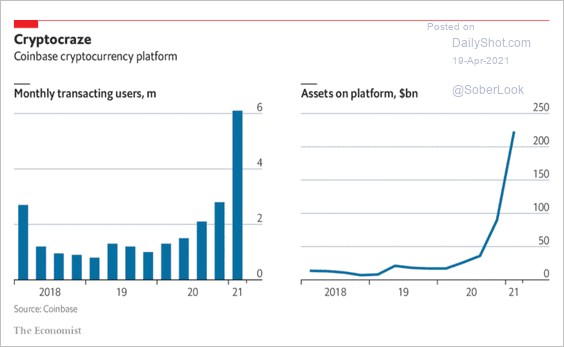

4. Coinbase’s transaction volume gains have been impressive.

Source: The Economist Read full article

Source: The Economist Read full article

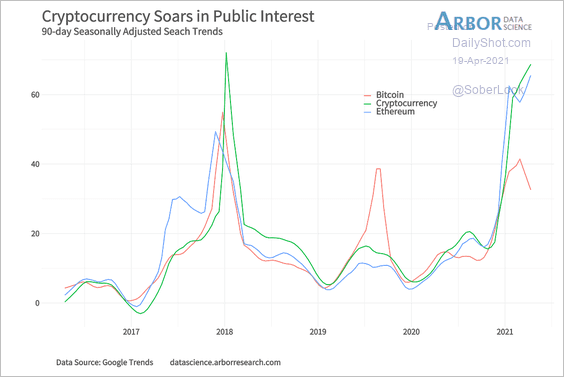

5. Here is the online search activity for cryptos.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Commodities

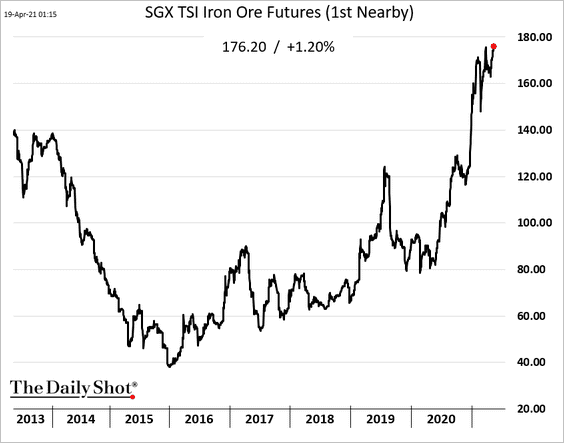

1. Iron ore futures in Singapore hit a multi-year high.

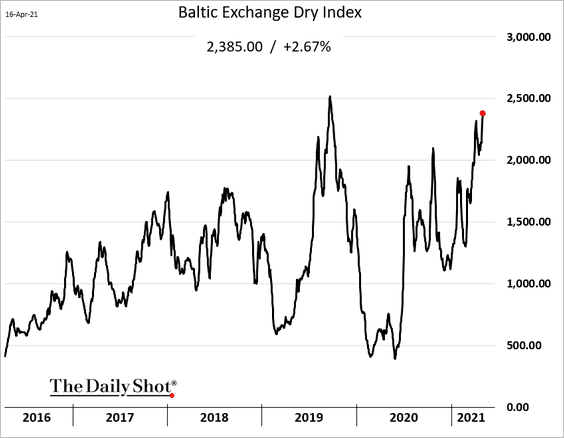

2. Dry bulk shipping costs are moving higher.

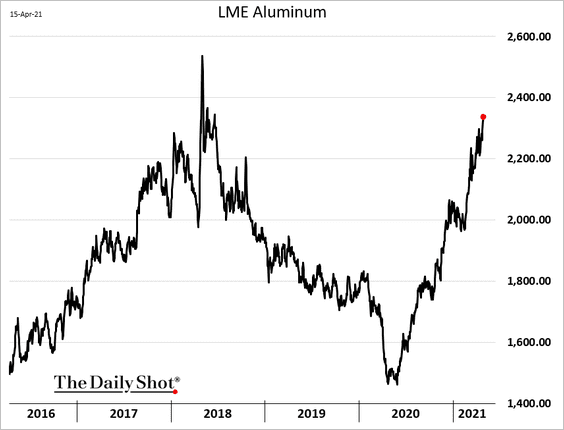

3. Aluminum prices have been rising.

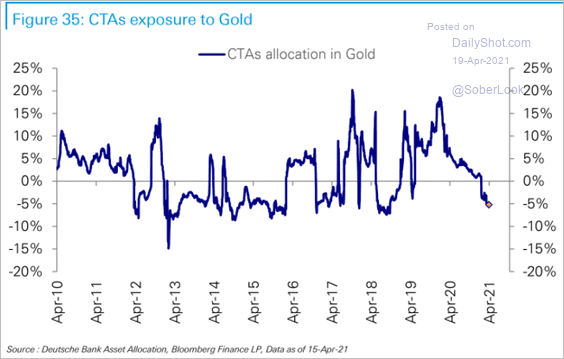

4. CTAs have been reducing their gold positions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

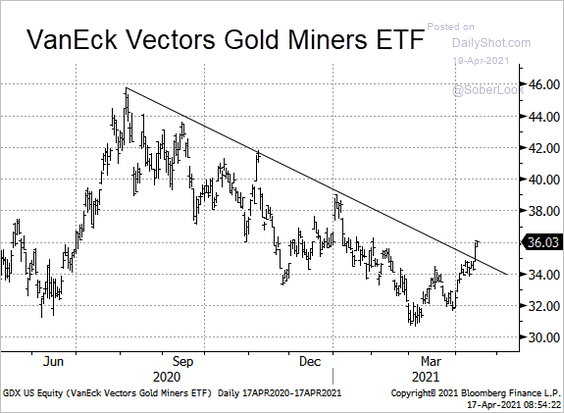

Separately, here is the largest gold miners ETF.

Source: Pain Report; Bloomberg

Source: Pain Report; Bloomberg

——————–

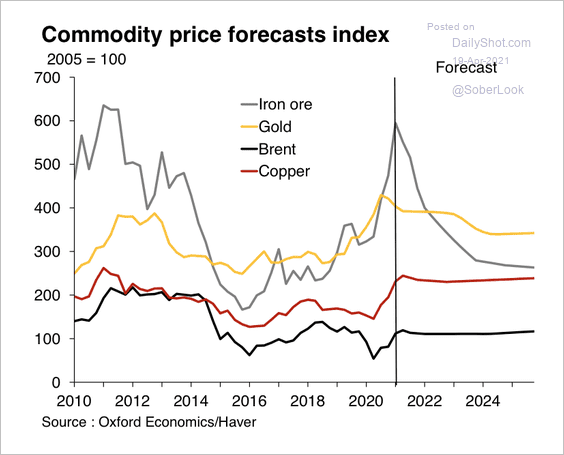

5. Oxford Economics does not expect a commodity supercycle.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

Energy

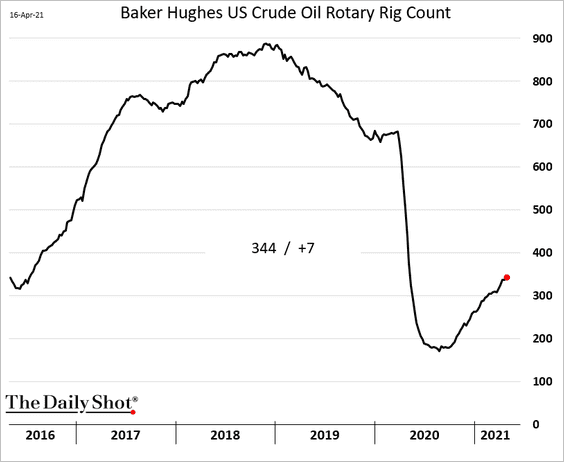

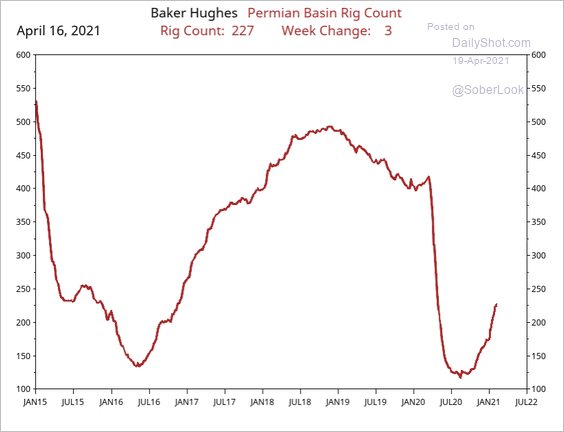

1. The US rig count keeps climbing (2 charts).

Source: Joel Fingerman, Fundamental Analytics

Source: Joel Fingerman, Fundamental Analytics

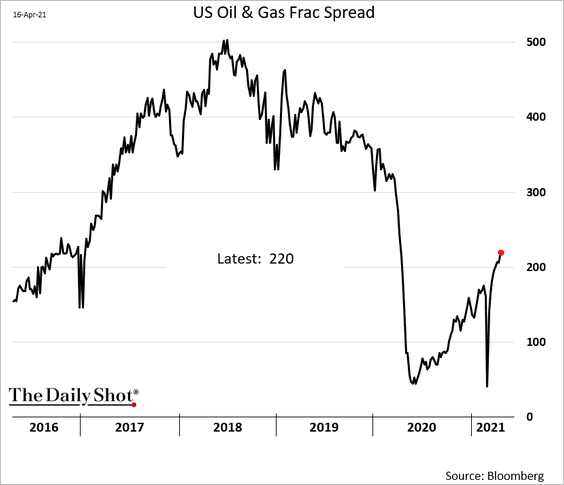

The frac spread continues to rebound.

——————–

2. Global oil stockpiles are normalizing.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

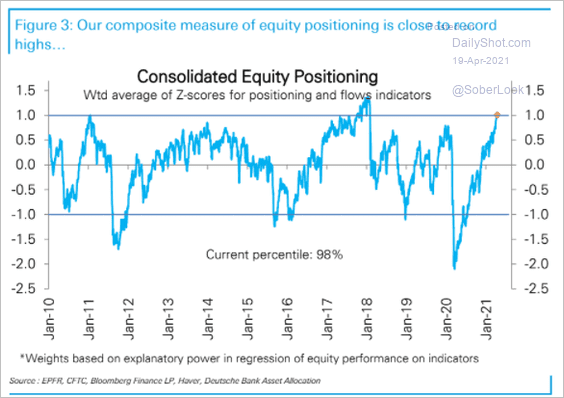

1. Equity positioning is at extreme levels, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

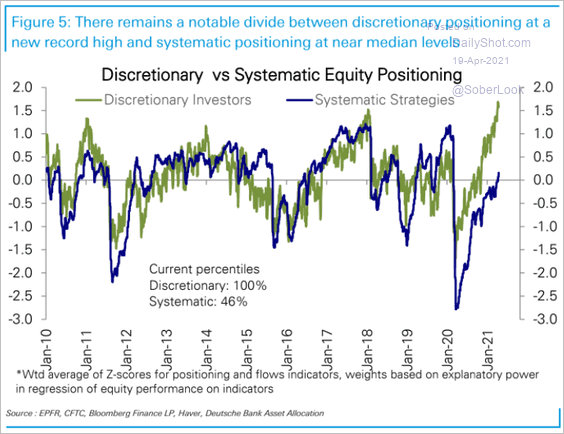

… driven by discretionary accounts.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

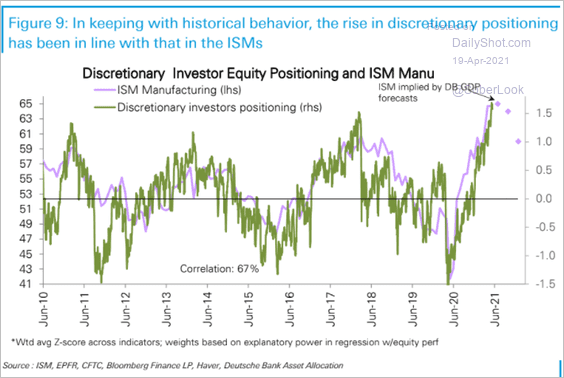

What will happen when the US economic growth starts moderating?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

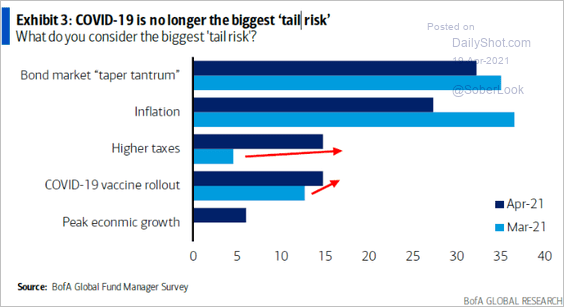

2. What are fund managers’ key concerns?

Source: BofA Global Research

Source: BofA Global Research

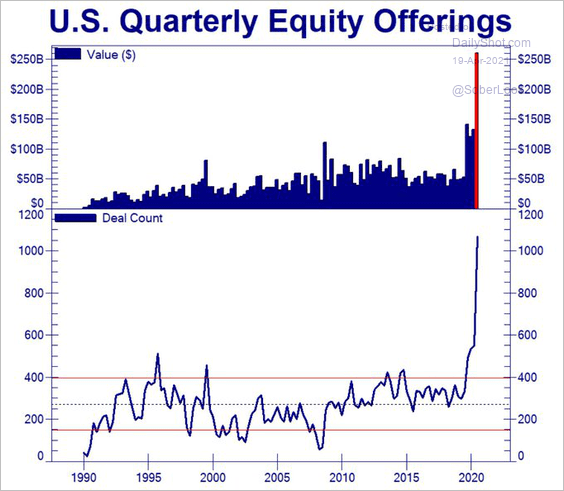

3. The amount of equity capital raised this year has been impressive.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

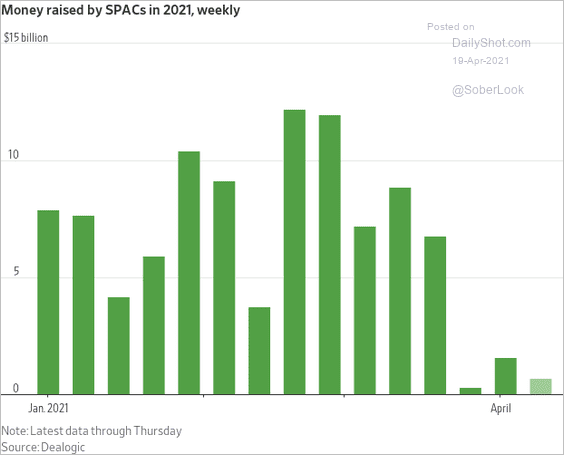

But SPAC fundraising is slowing.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

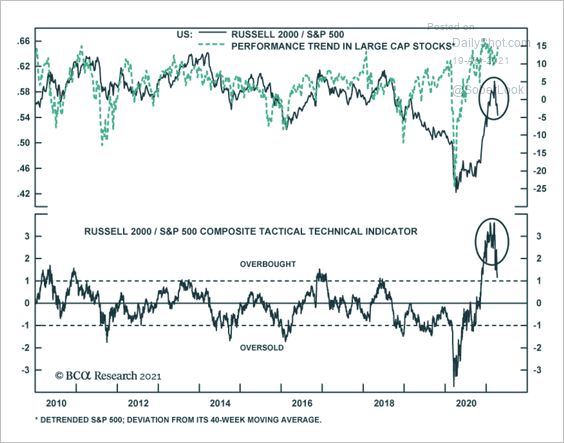

4. Small caps have underperformed over the past month after reaching extreme overbought levels.

Source: BCA Research

Source: BCA Research

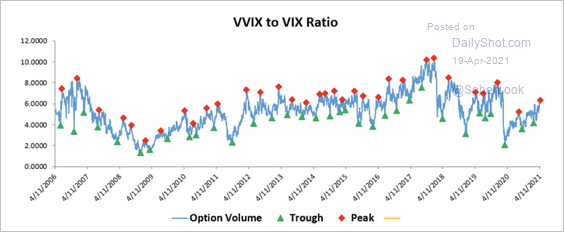

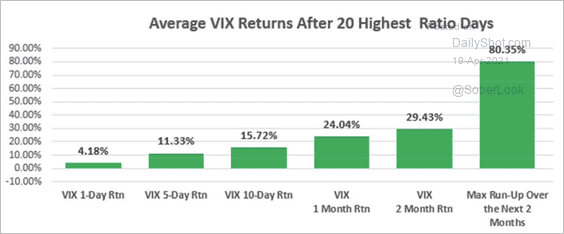

5. The implied volatility of VIX (VVIX) has been ticking higher relative to VIX (demand for VIX options).

Source: Susquehanna Derivative Strategy

Source: Susquehanna Derivative Strategy

Historically, peaks in VVIX/VIX have led to higher equity market volatility.

Source: Susquehanna Derivative Strategy

Source: Susquehanna Derivative Strategy

——————–

6. Here is more evidence of speculative activity in the US equity market.

Source: @jessefelder; CNBC Read full article

Source: @jessefelder; CNBC Read full article

Back to Index

Credit

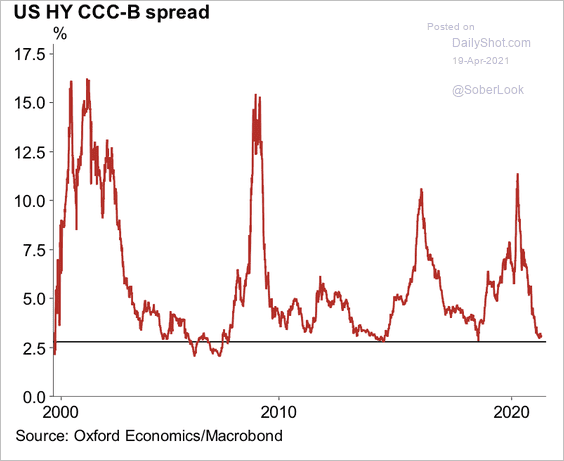

1. The spread between US CCC and B-rated corporate debt is approaching multi-year lows.

Source: Oxford Economics

Source: Oxford Economics

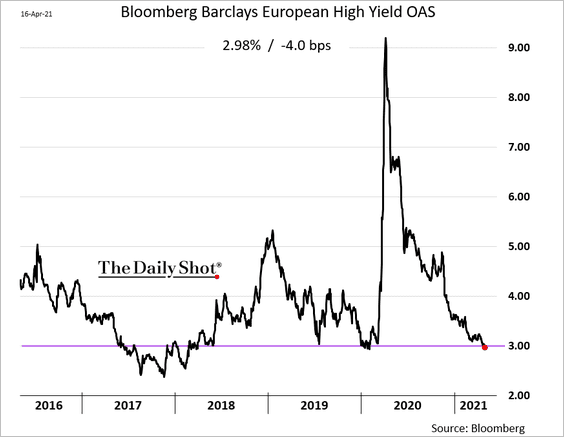

2. European HY spreads continue to tighten.

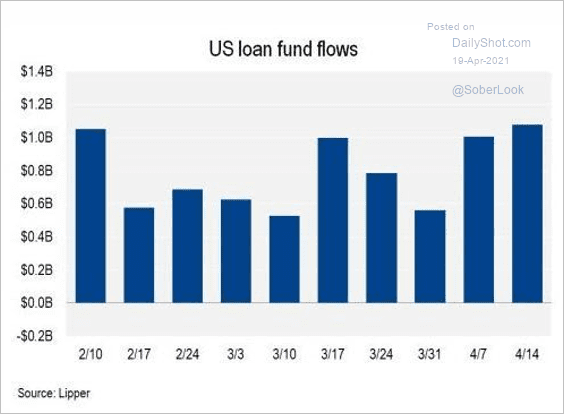

3. Leveraged loan fund flows remain robust.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

Back to Index

Global Developments

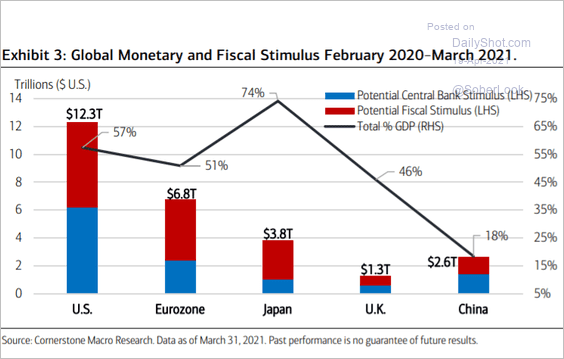

1. Let’s start with pandemic-driven stimulus levels in major economies.

Source: BofA Global Research

Source: BofA Global Research

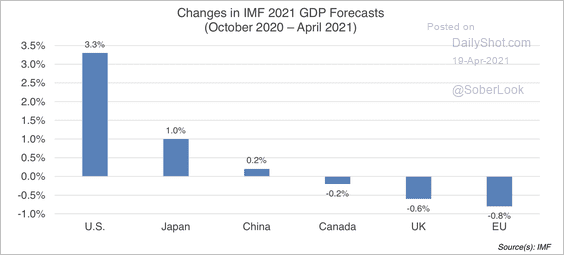

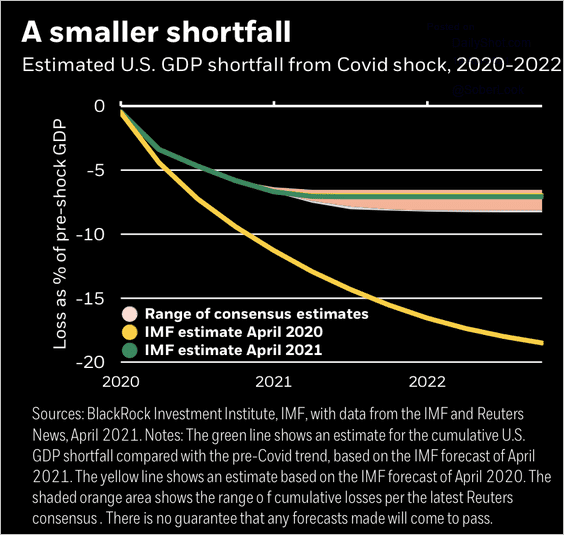

2. The IMF posted a large upward revision to its 2021 US GDP forecast while slashing those for the euro-area and UK (2 charts).

Source: III Capital Management

Source: III Capital Management

Source: BlackRock

Source: BlackRock

——————–

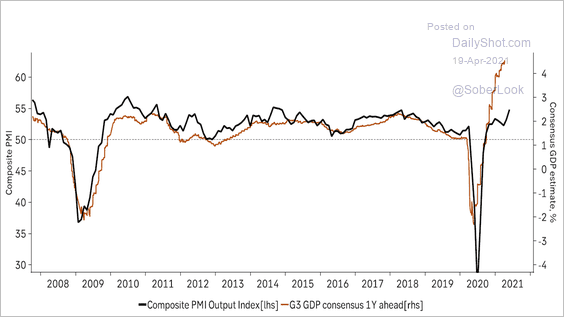

3. There is a divergence between the G3 consensus GDP growth estimates and the output PMI.

Source: @themarketear

Source: @themarketear

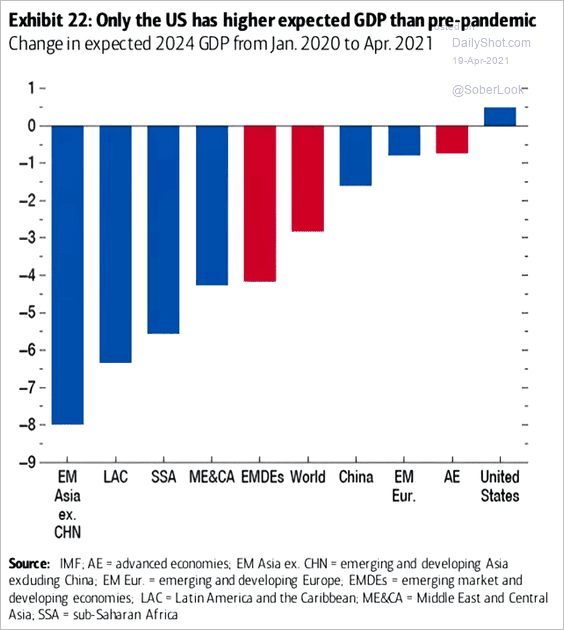

4. This chart shows the expected GDP changes relative to the pandemic-period levels.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

Food for Thought

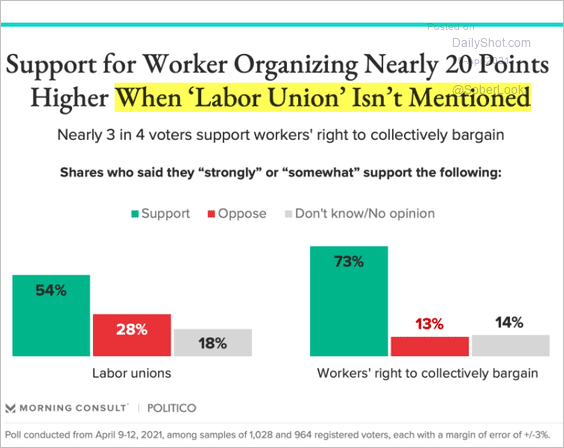

1. Support for workers’ rights to collectively bargain:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

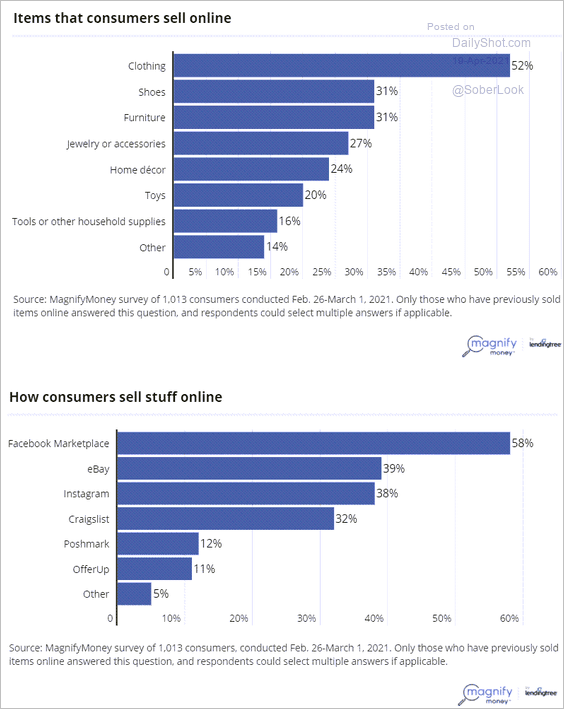

2. What consumers sell online:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

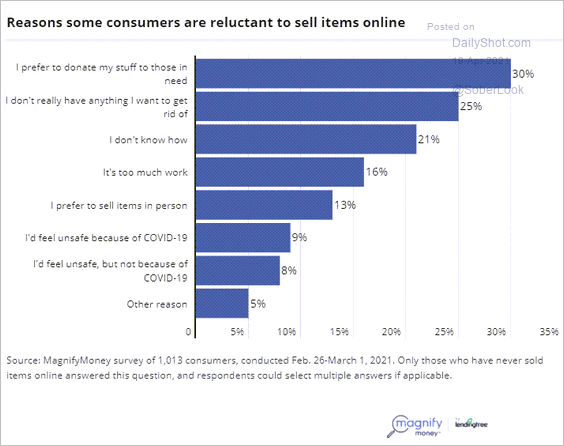

Reasons some are reluctant to sell online:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

——————–

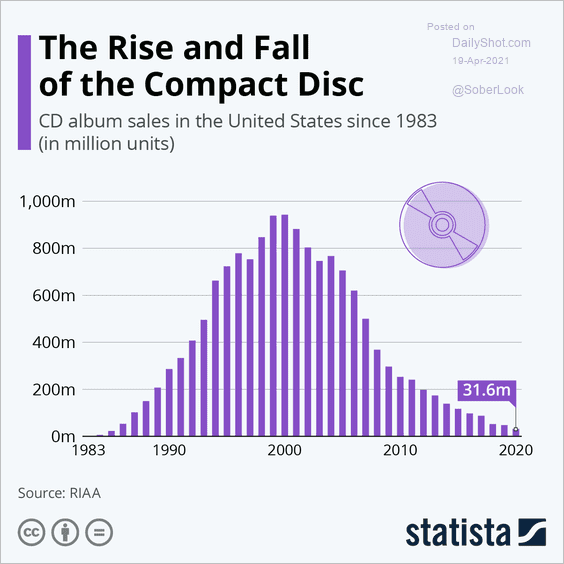

3. The compact disc:

Source: Statista

Source: Statista

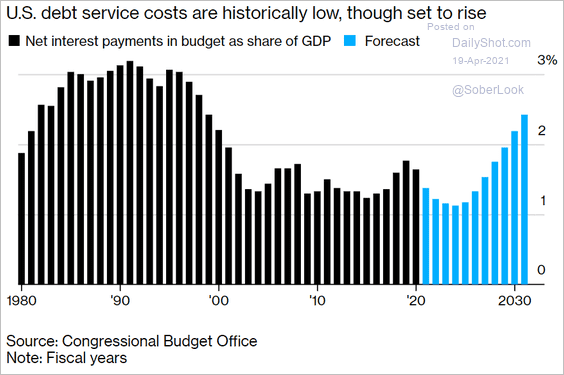

4. US debt service costs:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

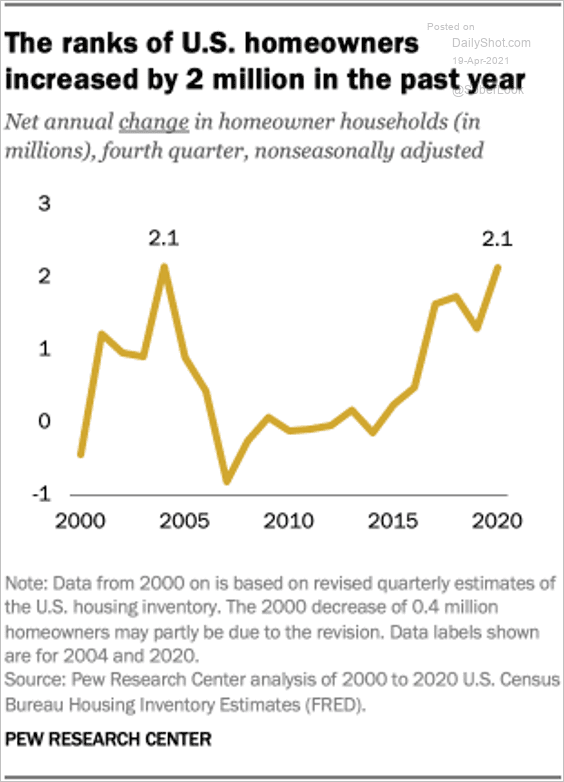

5. Changes in the number of homeowners:

Source: @FactTank Read full article

Source: @FactTank Read full article

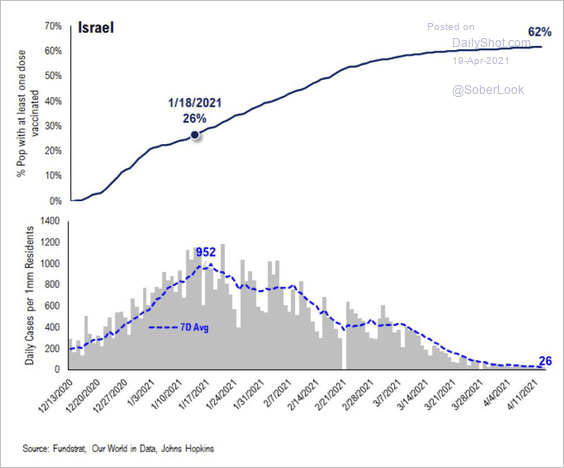

6. The COVID situation in Israel:

Source: @carlquintanilla, @fundstrat

Source: @carlquintanilla, @fundstrat

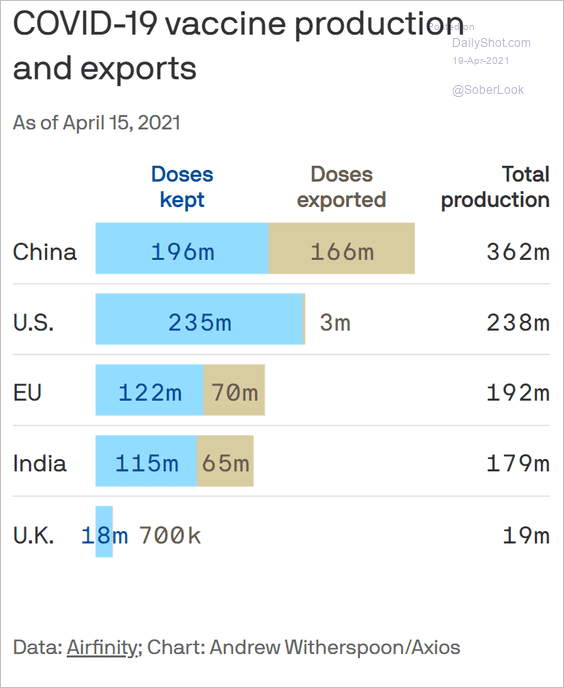

7. Vaccine production and exports:

Source: @axios Read full article

Source: @axios Read full article

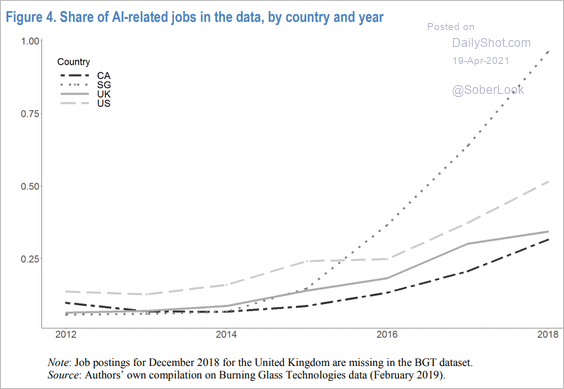

8. AI-related jobs:

Source: OECD Read full article

Source: OECD Read full article

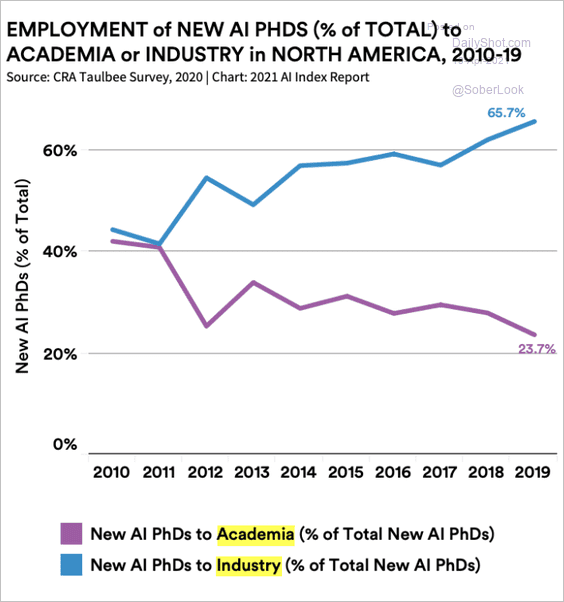

AI Ph.D. employment:

Source: @indexingai

Source: @indexingai

——————–

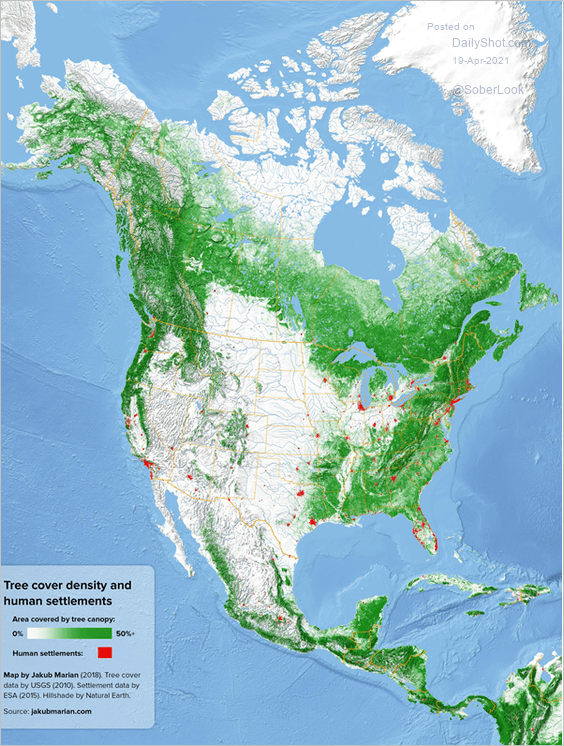

9. North American tree cover:

Source: @JakubMarian

Source: @JakubMarian

——————–

Back to Index