The Daily Shot: 22-Apr-21

• Canada

• The United States

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

Canada

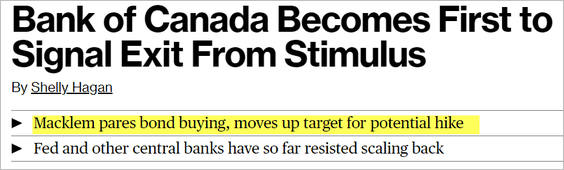

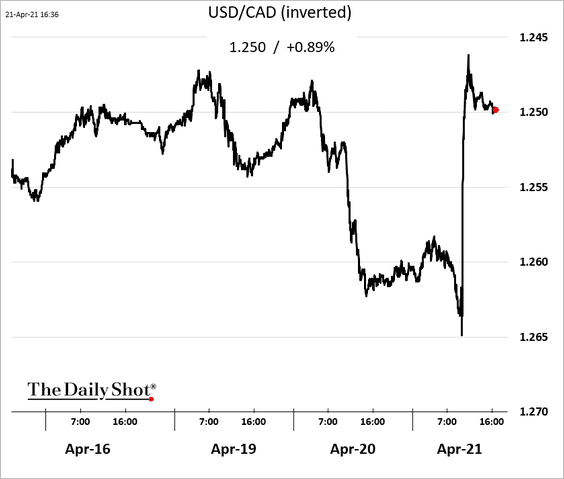

1. The Bank of Canada struck a hawkish tone, diverging from the Fed.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Insider.com Read full article

Source: Insider.com Read full article

The loonie and bond yields climbed.

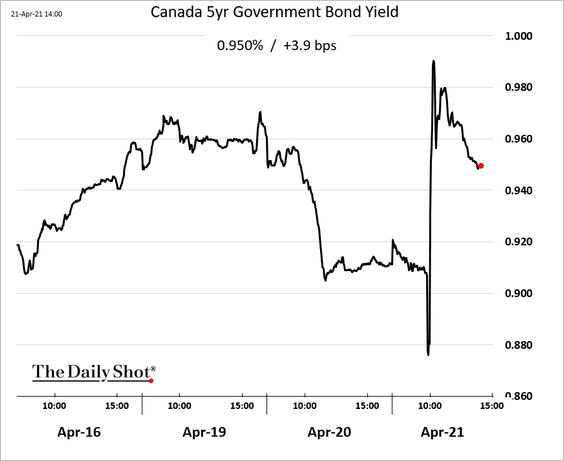

The US-Canada 10yr yield spread continues to tighten.

——————–

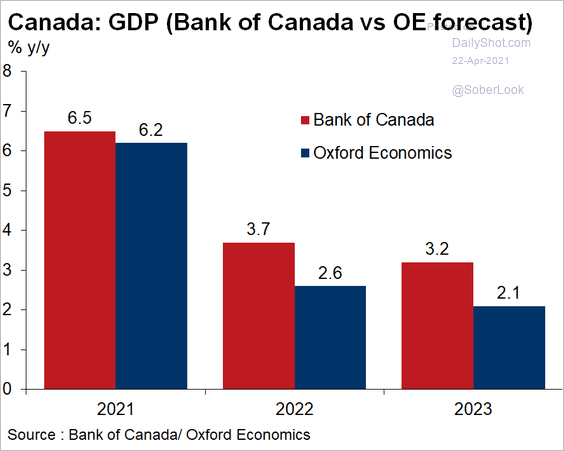

2. Is the central bank too upbeat on economic growth? Here is a forecast from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

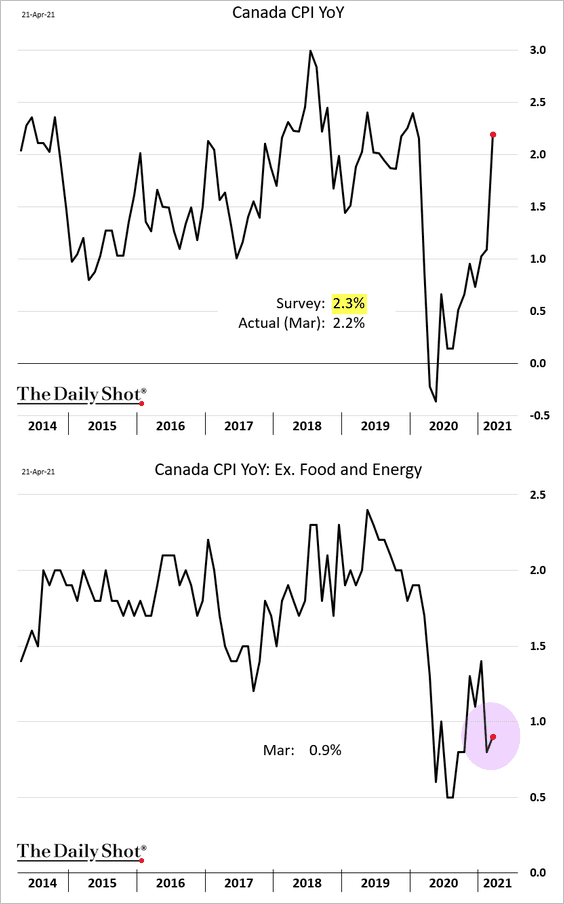

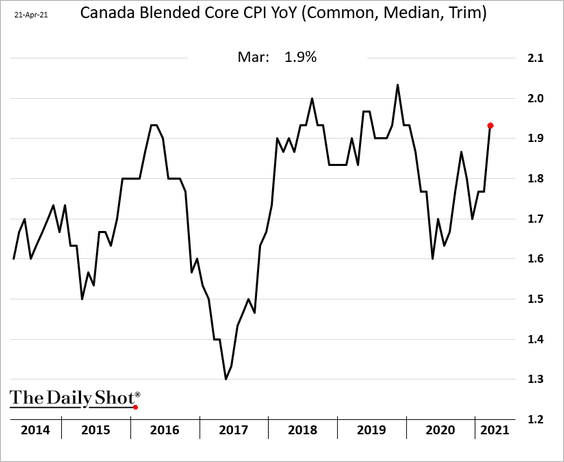

3. The CPI rose above 2% on a year-over-year basis due to base effects. The underlying inflation shows no signs of significant acceleration.

Here is the blended core CPI.

——————–

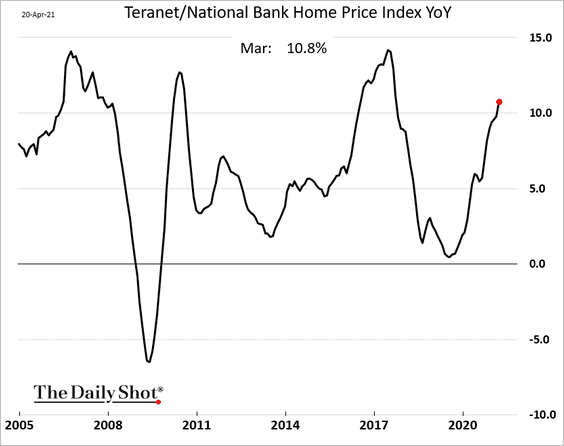

4. Home price appreciation is approaching 11%.

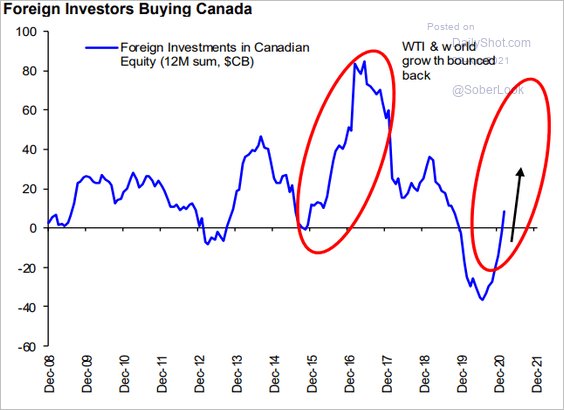

5. Foreign investors are getting back into Canadian stocks.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

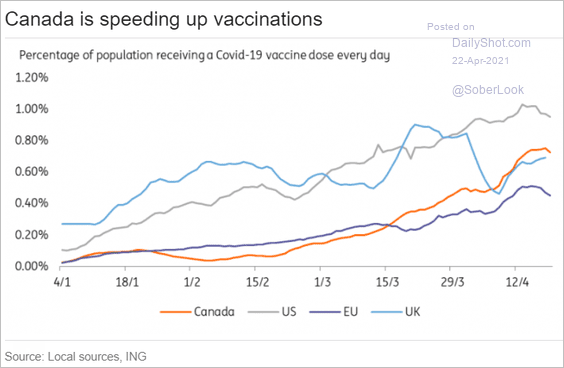

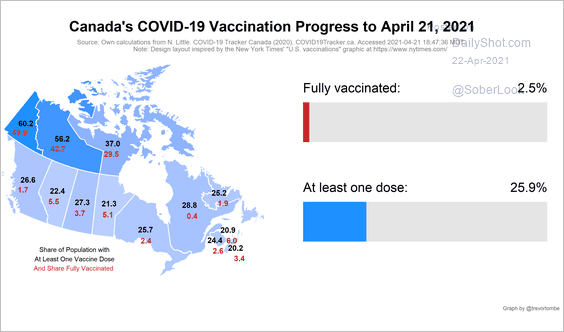

6. The pace of vaccinations is picking up momentum (2 charts).

Source: ING

Source: ING

Source: @trevortombe Read full article

Source: @trevortombe Read full article

Back to Index

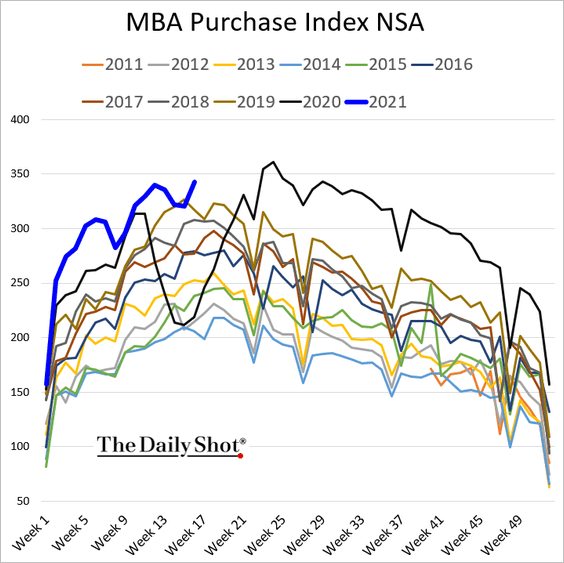

The United States

1. Home purchase loan applications jumped last week.

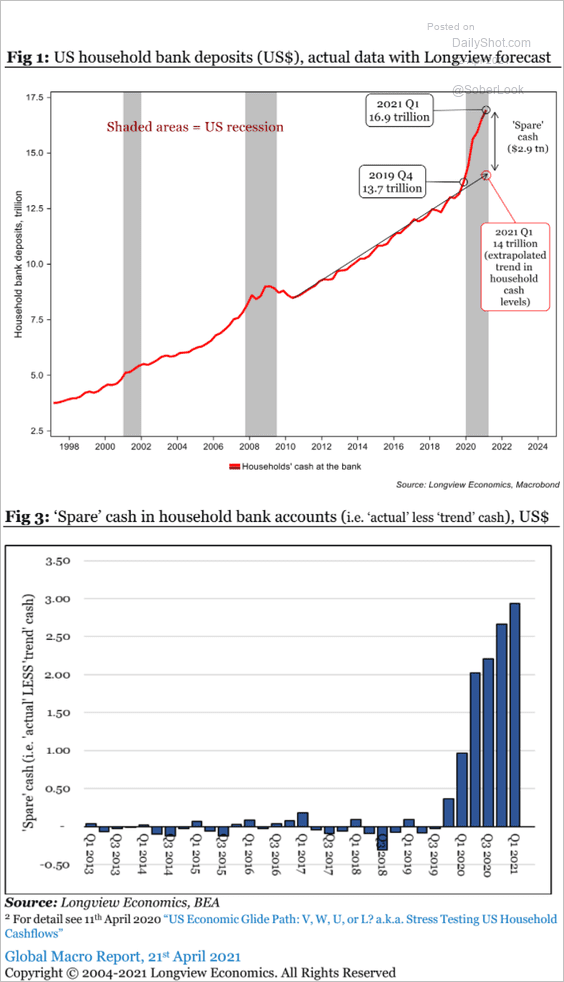

2. US households are sitting on substantial savings, as deposits massively diverge from the pre-pandemic trend.

Source: Longview Economics

Source: Longview Economics

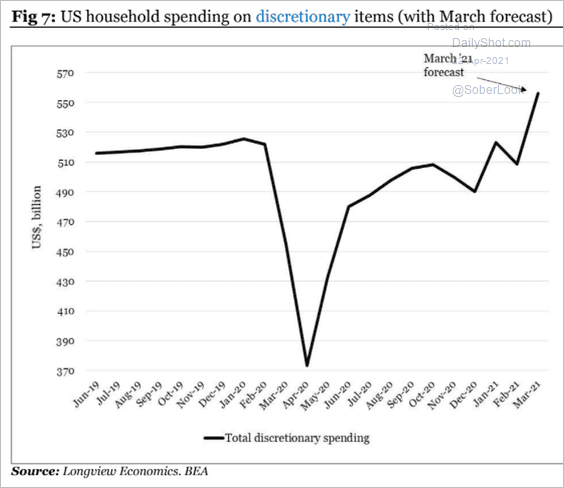

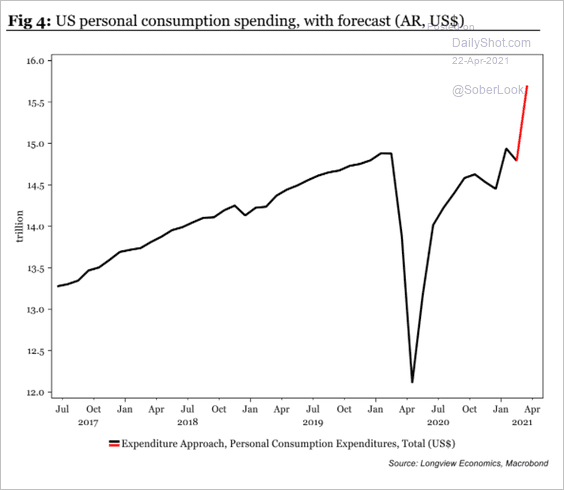

Longview Economics estimates a spike in consumer spending last month, boosting the first-quarter GDP growth.

• Discretionary spending:

Source: Longview Economics

Source: Longview Economics

• Total consumption:

Source: Longview Economics

Source: Longview Economics

——————–

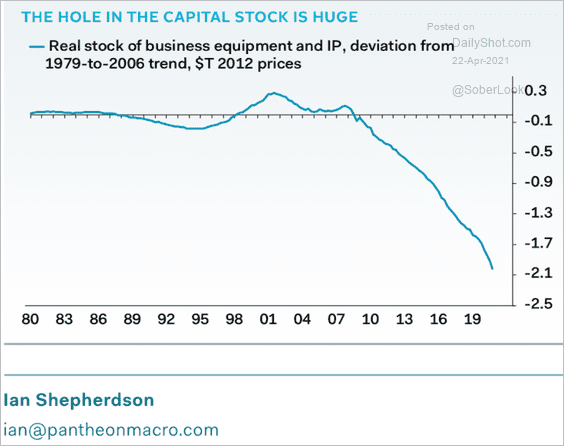

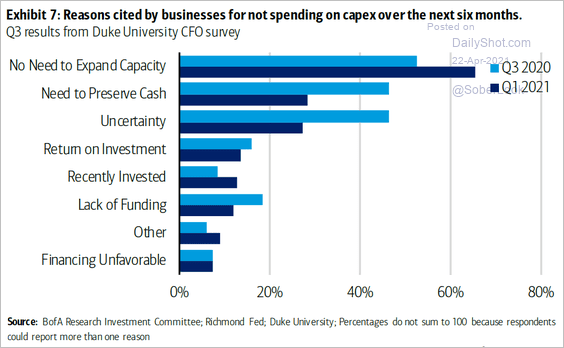

3. Over the past decade, US CapEx has massively deviated from the historical trend, becoming a drag on productivity. Will we see the trend reversing during the current decade?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Here are some of the reasons companies are not spending on CapEx over the next six months.

Source: BofA Global Banking & Markets

Source: BofA Global Banking & Markets

——————–

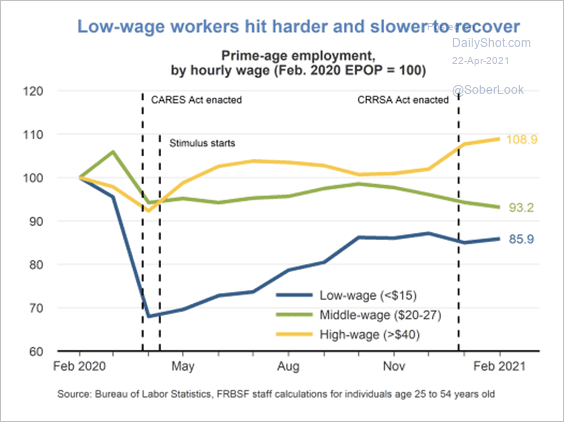

4. Low-wage workers were hit hard by the pandemic and have had a slow recovery so far. It’s the primary reason the Fed remains so dovish.

Source: San Francisco Fed Read full article

Source: San Francisco Fed Read full article

Back to Index

The United Kingdom

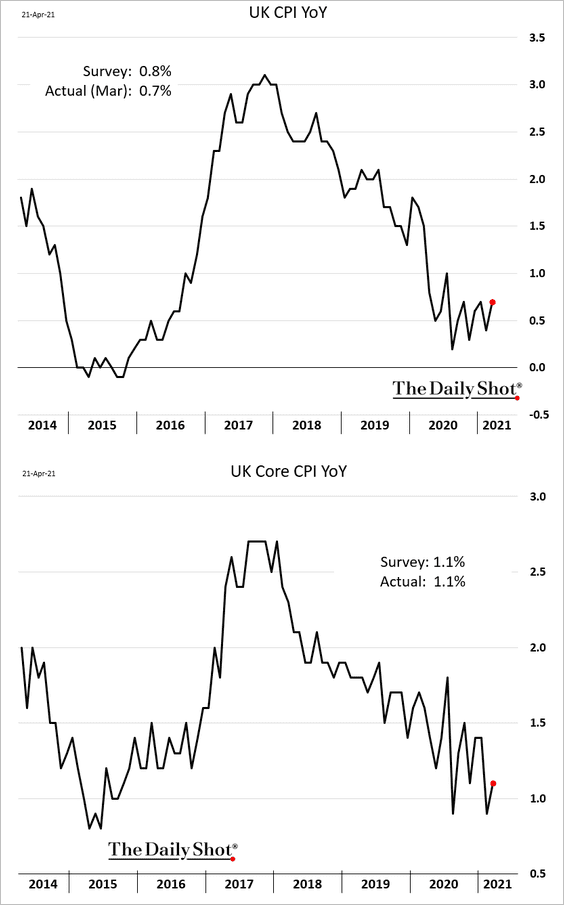

1. Inflation remains subdued.

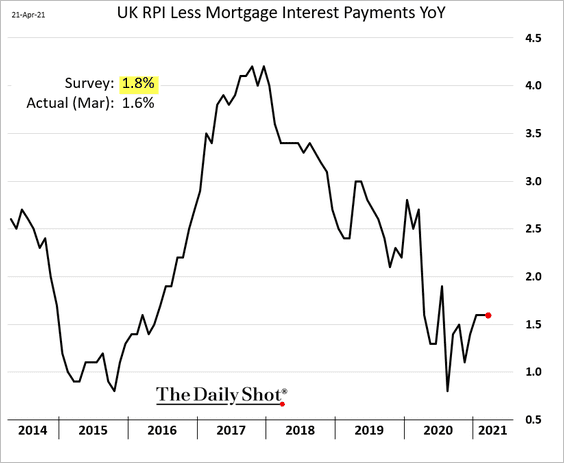

The rebound in retail prices (RPI) has stalled.

——————–

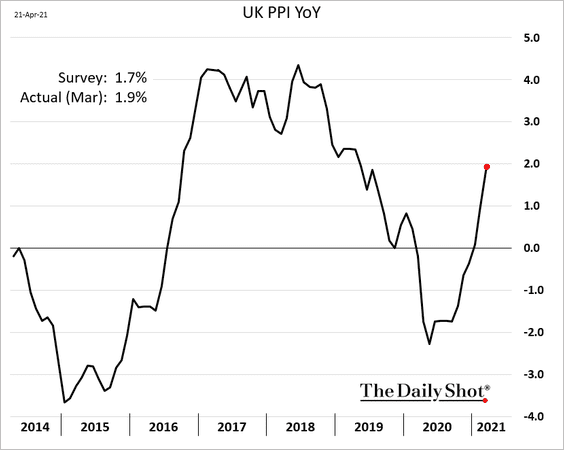

2. Producer price inflation is gaining momentum – a global trend.

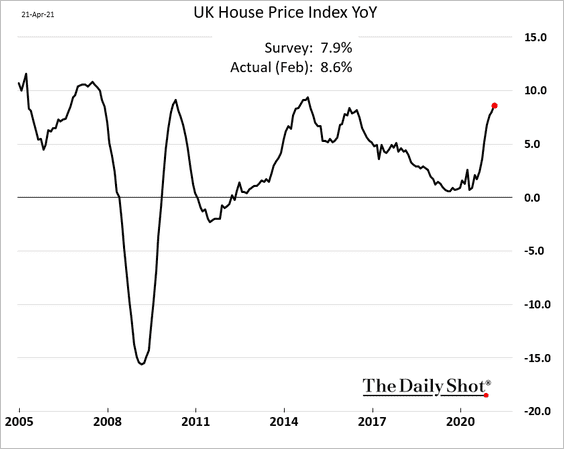

3. The official home price appreciation index was firmer than expected in February.

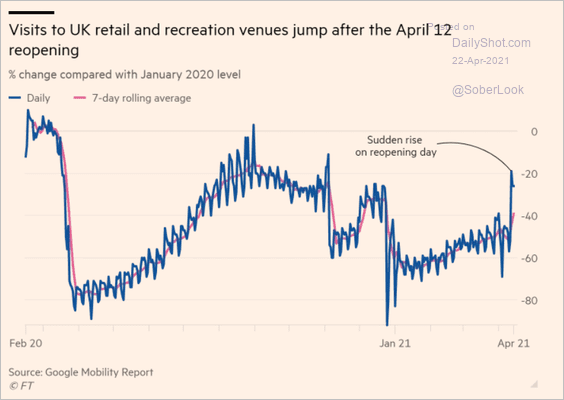

4. Visits to retail and recreation venues are rebounding.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

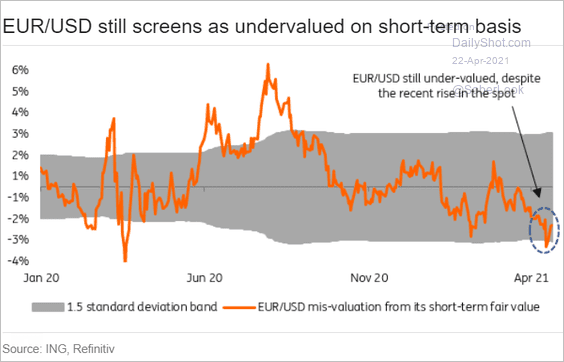

1. ING sees the euro as undervalued relative to USD.

Source: ING

Source: ING

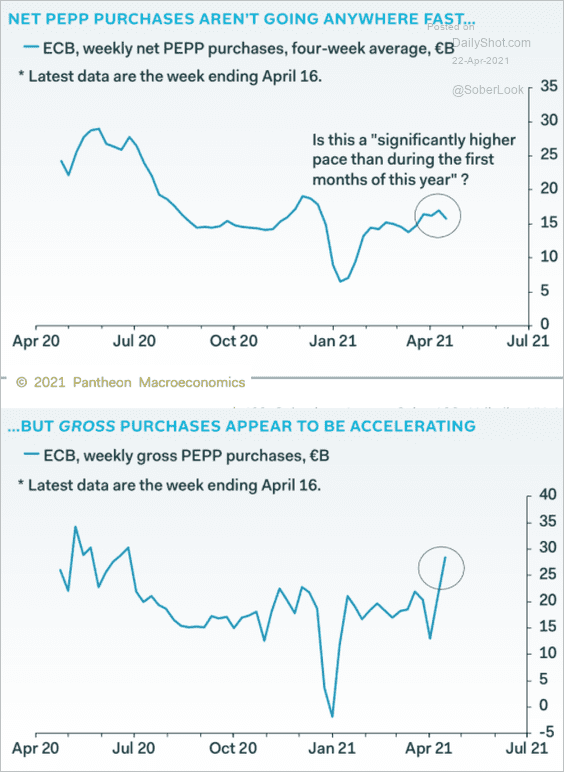

2. The ECB has increased its securities purchases but not enough to offset maturing bonds.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

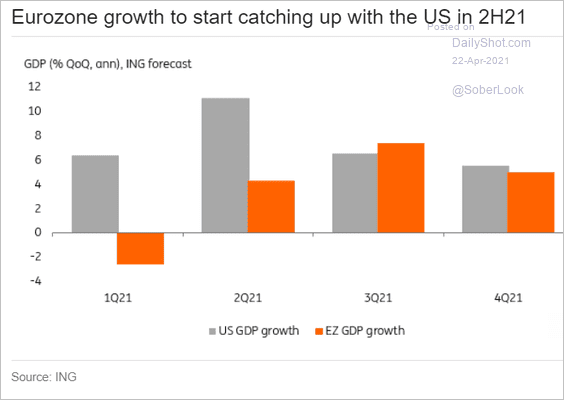

3. Will the Eurozone growth catch up to the US later this year?

Source: ING

Source: ING

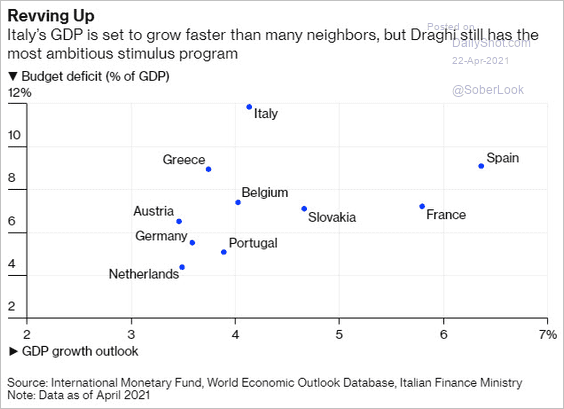

4. This chart shows each country’s budget deficit vs. the GDP growth outlook.

Source: @adam_tooze; @bpolitics Read full article

Source: @adam_tooze; @bpolitics Read full article

Back to Index

Europe

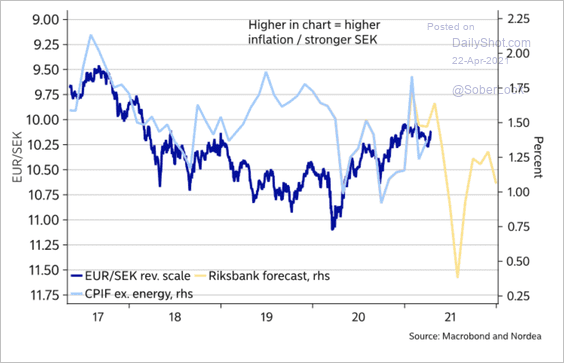

1. A collapse in Sweden’s core inflation could lead to a lower SEK (vs. EUR) this year.

Source: Nordea Markets

Source: Nordea Markets

2. Next, we have some updates on Poland.

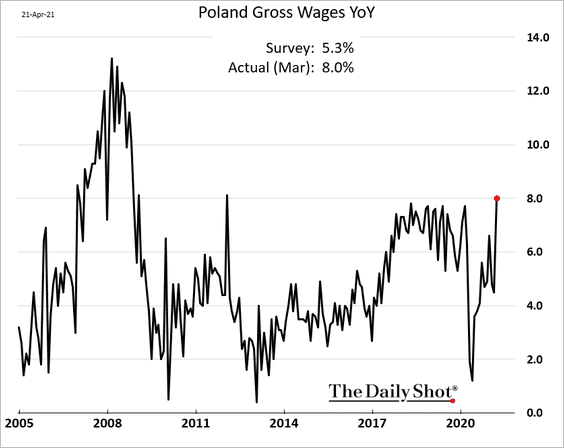

• Wage growth was much stronger than expected. Inflationary pressures ahead?

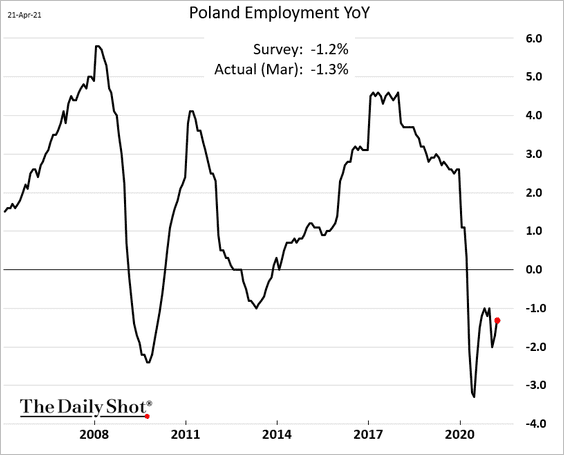

• Employment recovery will take some time.

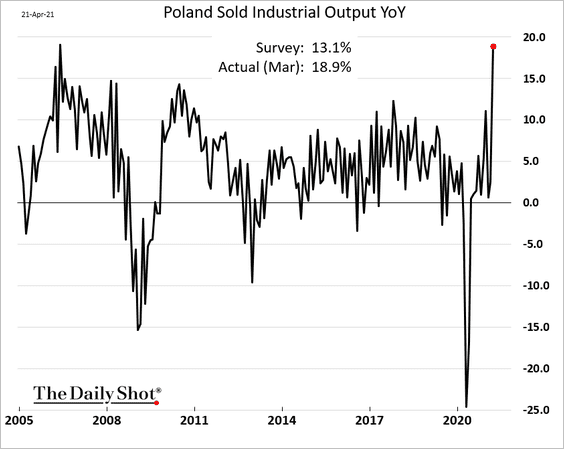

• Industrial output rose more than expected.

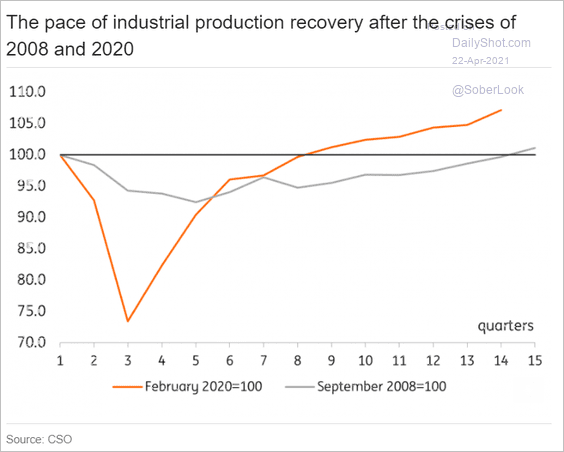

Here is a comparison to 2008.

Source: ING

Source: ING

Back to Index

China

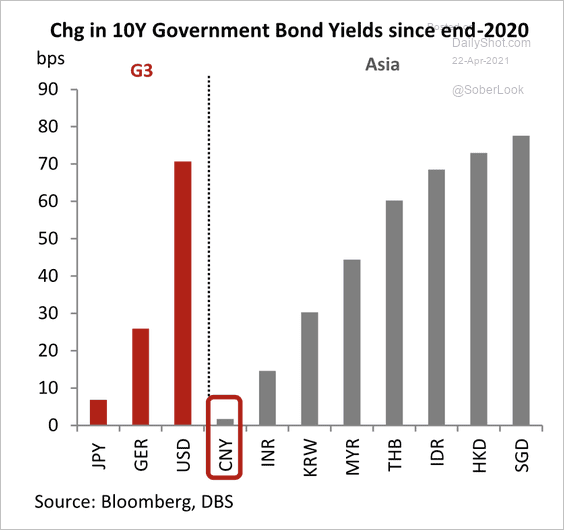

1. Since the end of 2020, the 10-year Chinese government bond registered the smallest yield increase relative to Asian peers.

Source: DBS Group Research

Source: DBS Group Research

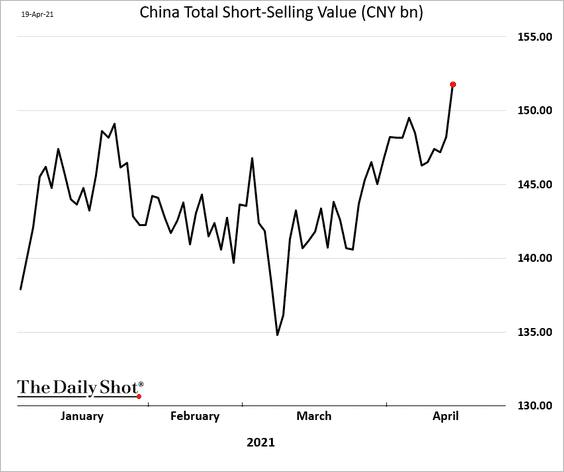

2. Equity short-selling has picked up in recent weeks.

h/t John Liu

h/t John Liu

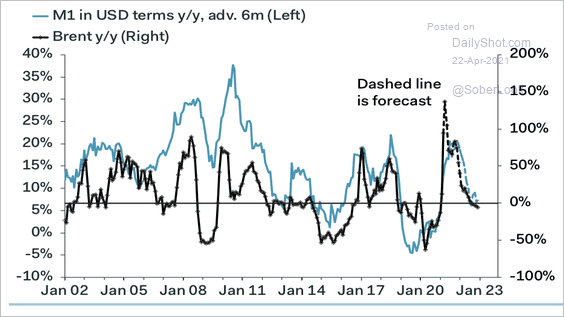

3. Pantheon Macroeconomics expects slowing money supply growth and peak oil prices to weigh on inflation after this year’s rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

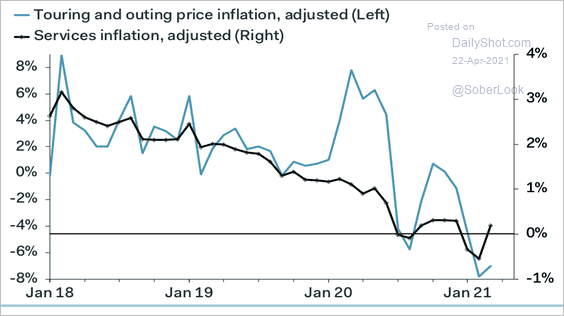

Tourism remains a significant drag on services inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

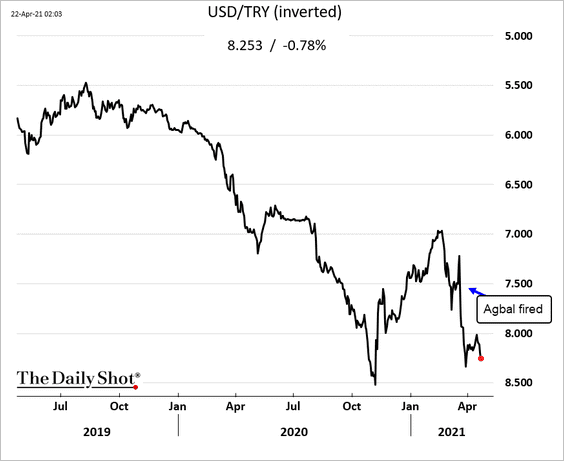

1. The Turkish lira remains vulnerable.

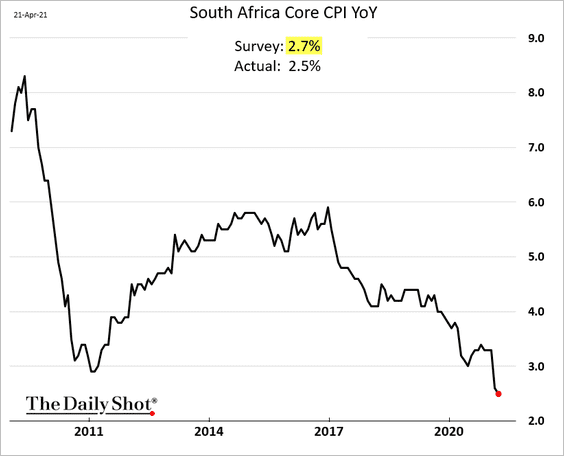

2. South Africa’s core CPI continues to fall.

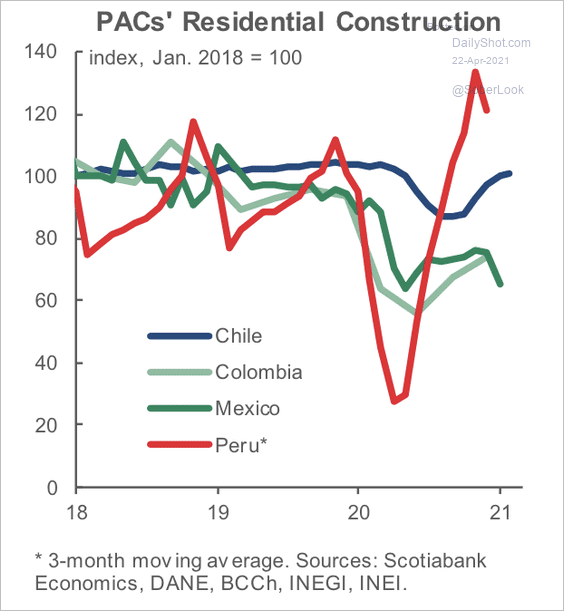

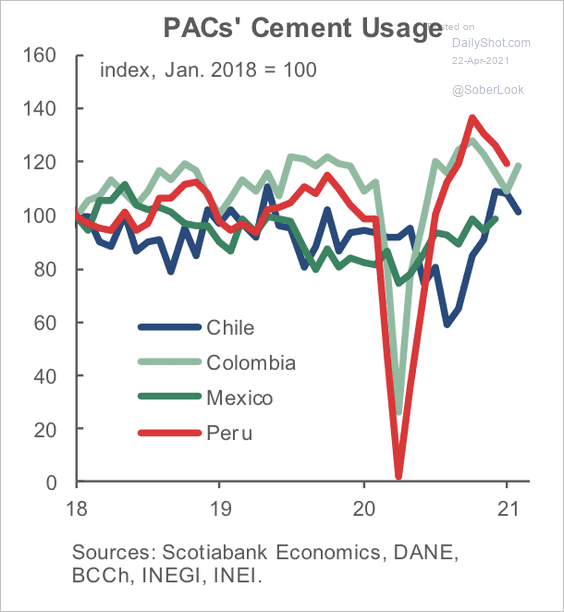

3. Residential transactions in Peru received support from government efforts to boost sales, which spurred a sharp construction recovery, according to Scotiabank. …

Source: Scotiabank Economics

Source: Scotiabank Economics

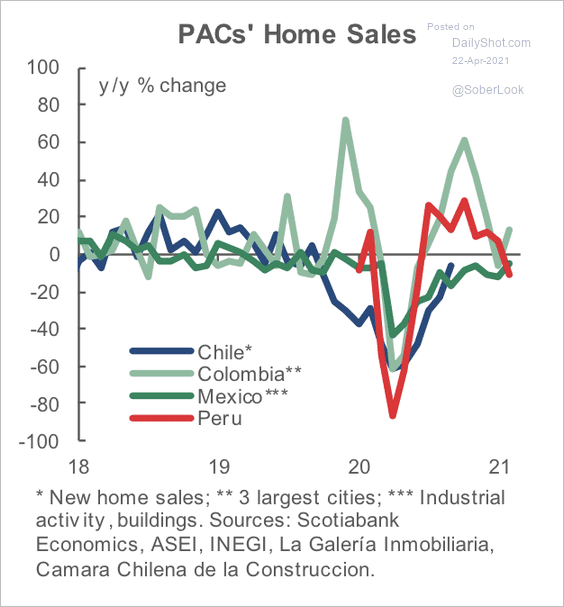

… However, home sales and cement usage are starting to weaken in Peru and other Pacific Alliance countries (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

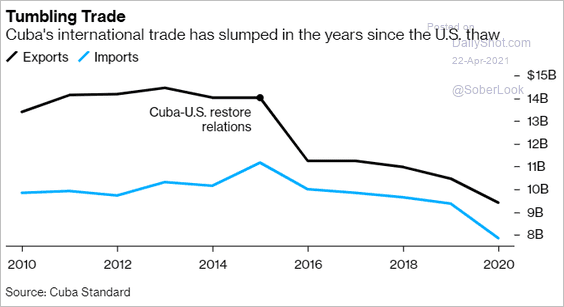

4. Cuba’s trade has been shrinking in recent years as the economy struggles.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

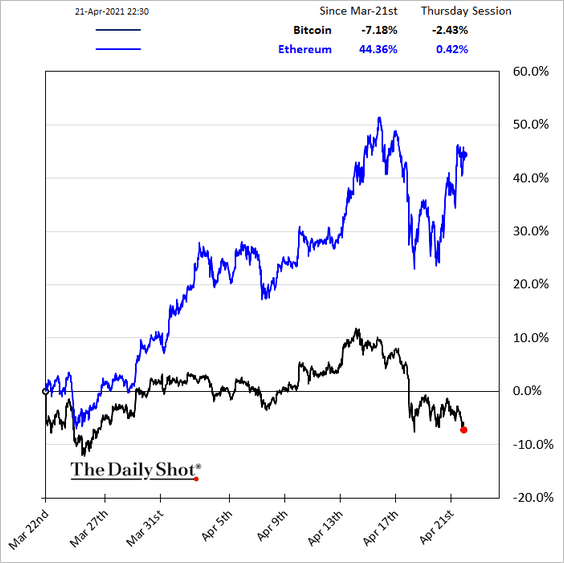

Cryptocurrency

1. Bitcoin is holding below the 50-day moving average.

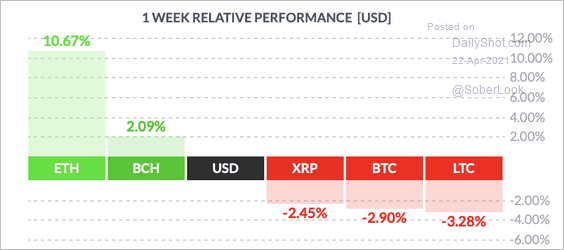

2. Ether (ETH) has outperformed other large cryptocurrencies over the past week.

Source: FinViz

Source: FinViz

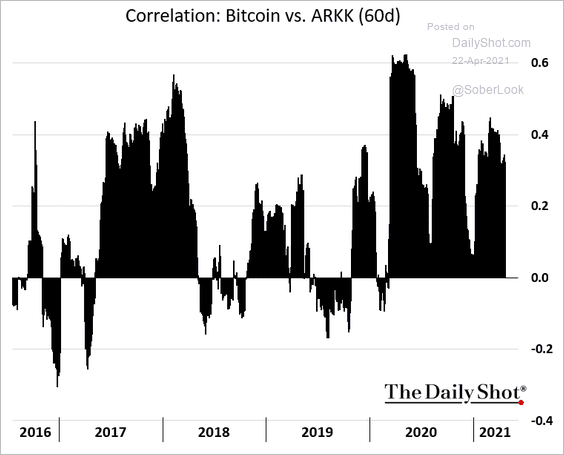

3. Bitcoin remains correlated with the ARK Innovation ETF, suggesting that the crypto market is still dominated by retail investors.

Source: @ossingerj

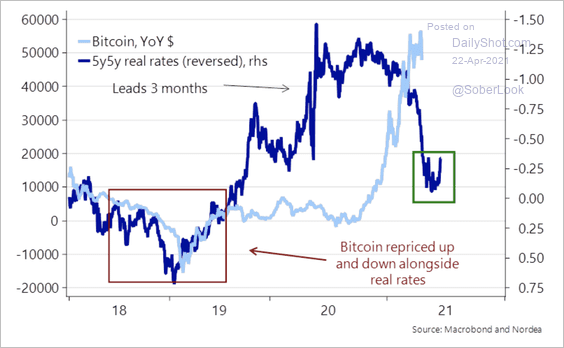

Source: @ossingerj 4. Higher US real rates could put downward pressure on bitcoin.

Source: Nordea Markets

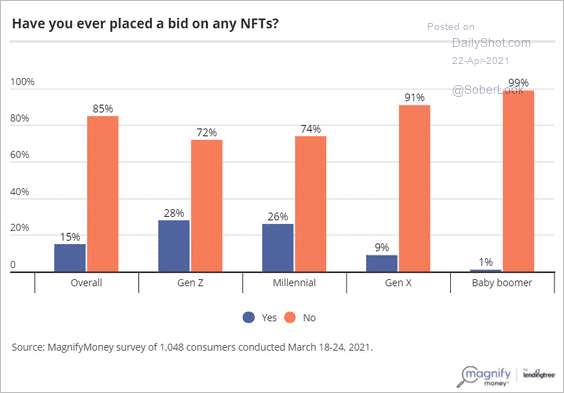

Source: Nordea Markets 5. Have you ever placed a bet on any NFTs?

Source: MagnifyMoney Read full article

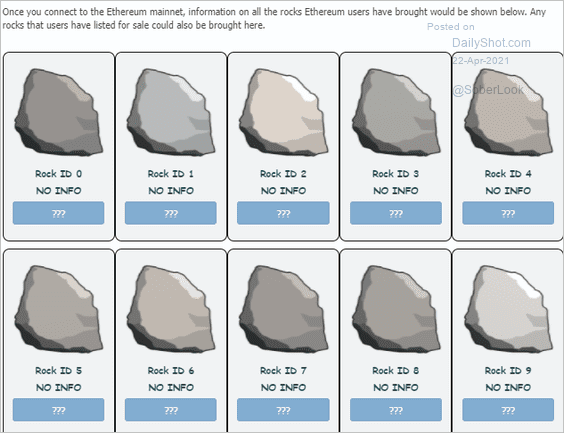

Source: MagnifyMoney Read full article Want to own/trade a virtual (Ethereum) pet rock with different color shadings?

Source: Ether Rock; h/t Katie

Source: Ether Rock; h/t Katie

Back to Index

Commodities

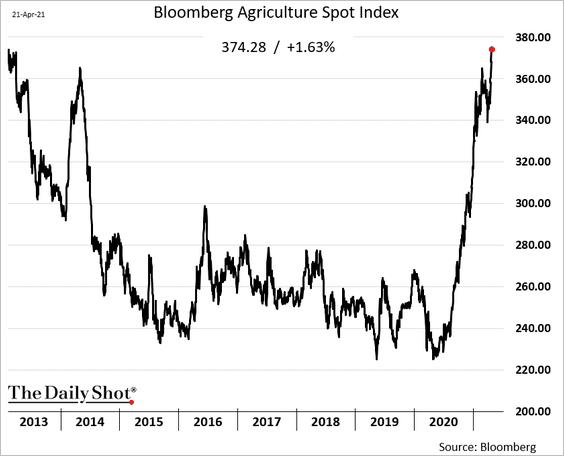

1. Bloomberg’s spot agriculture index hit the highest level since 2013.

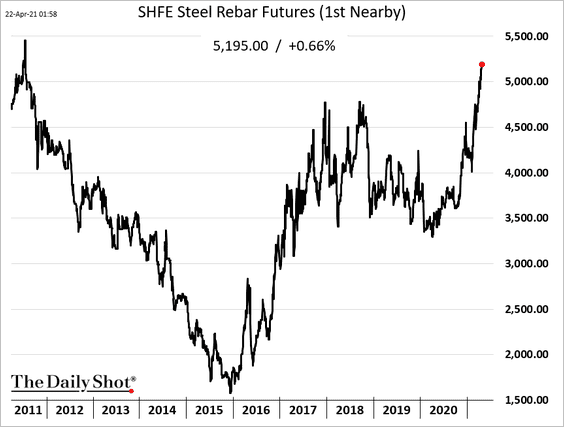

2. China’s steel rebar prices are the highest in a decade.

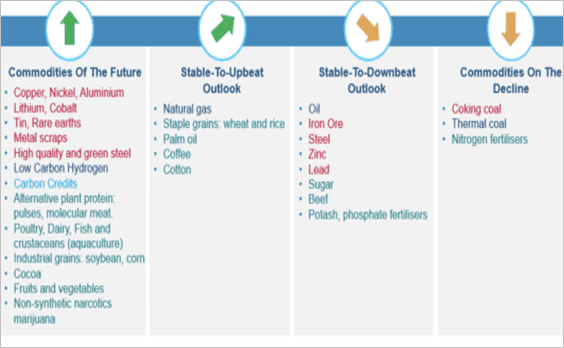

3. Here is the demand outlook for commodities over the next 20-years, according to Fitch Solutions.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

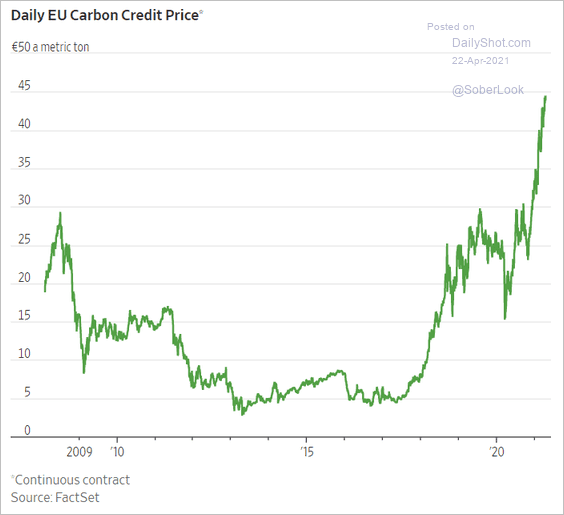

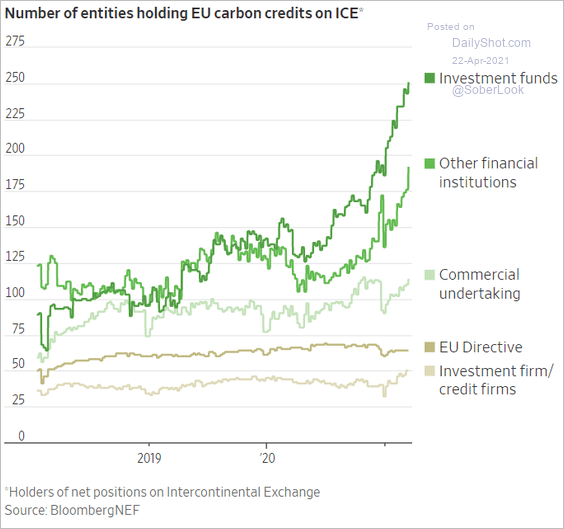

4. EU carbon credit prices keep climbing.

Source: @WSJ Read full article

Source: @WSJ Read full article

Who is holding these contracts?

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

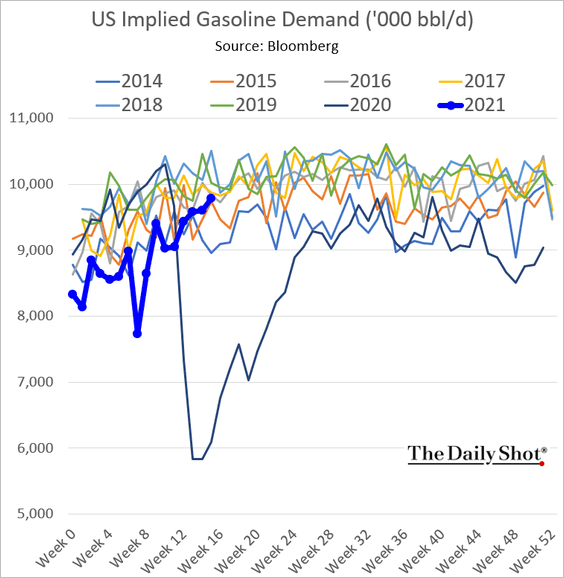

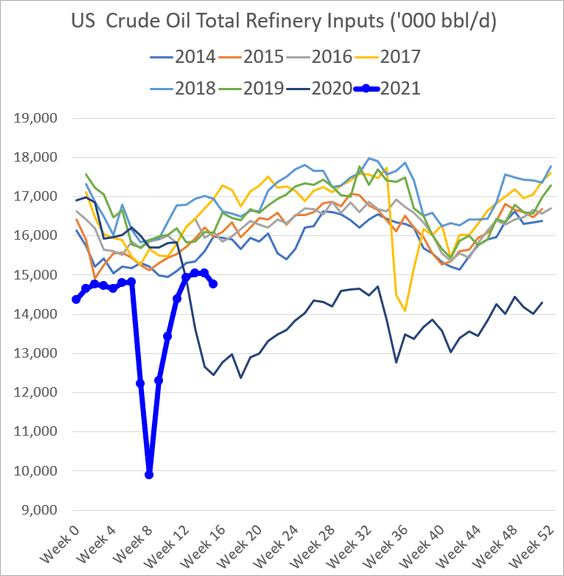

1. US gasoline demand continues to recover.

Refinery runs slowed last week.

——————–

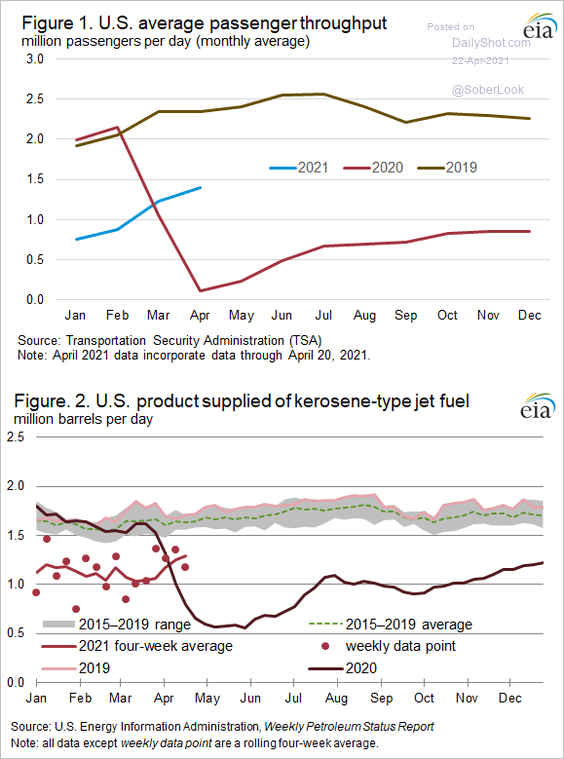

2. Jet fuel demand is picking up.

Source: EIA

Source: EIA

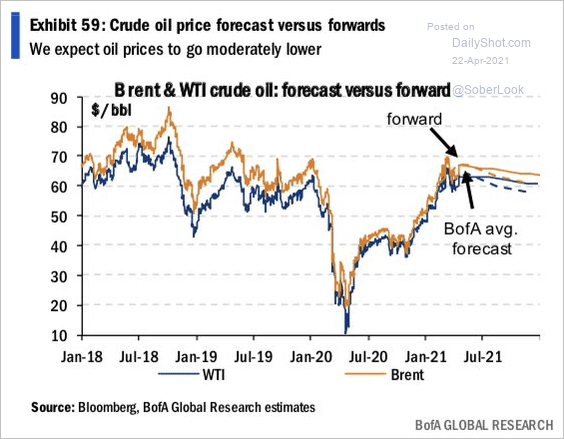

3. BofA expects crude oil prices to drift lower from here.

Source: BofA Global Research; @WallStJesus

Source: BofA Global Research; @WallStJesus

Back to Index

Equities

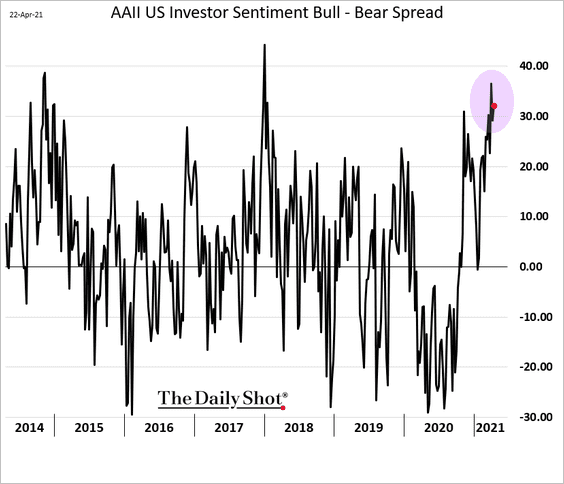

1. Sentiment remains very bullish.

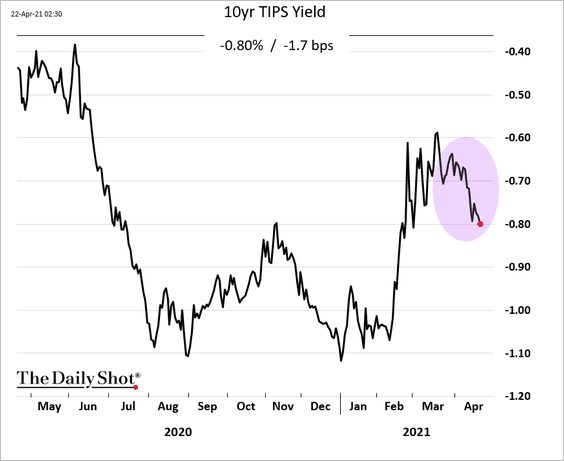

2. Declining US real rates should be a tailwind for the stock market.

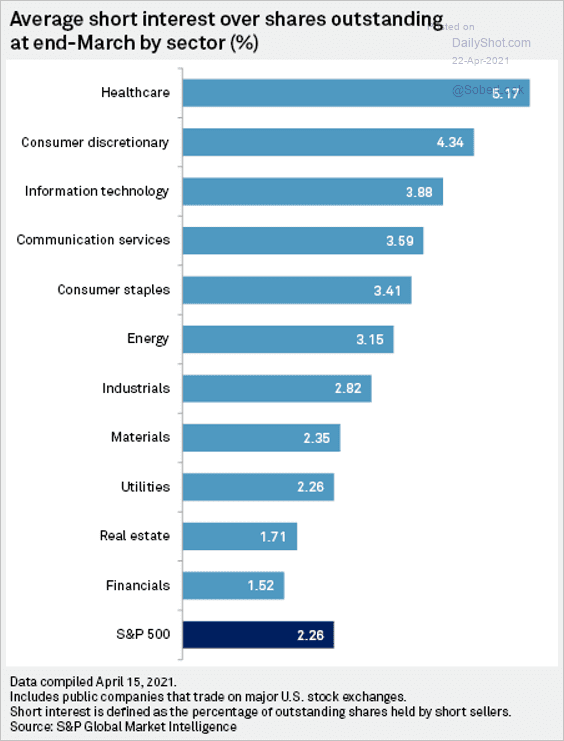

3. Which are the most shorted sectors?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

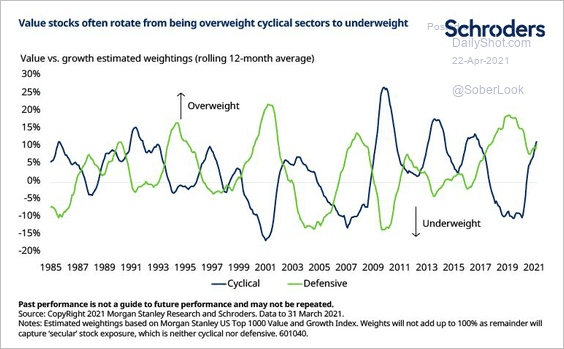

4. This chart shows the value factor’s rotation between cyclical and defensive sectors.

Source: Sean Markowicz, Schroders

Source: Sean Markowicz, Schroders

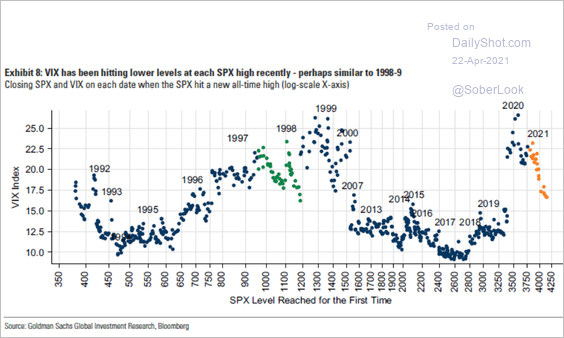

5. VIX has been hitting lower levels as the S&P 500 touched new highs this year.

Source: Goldman Sachs; @lena_popina, @TheTerminal Read full article

Source: Goldman Sachs; @lena_popina, @TheTerminal Read full article

Back to Index

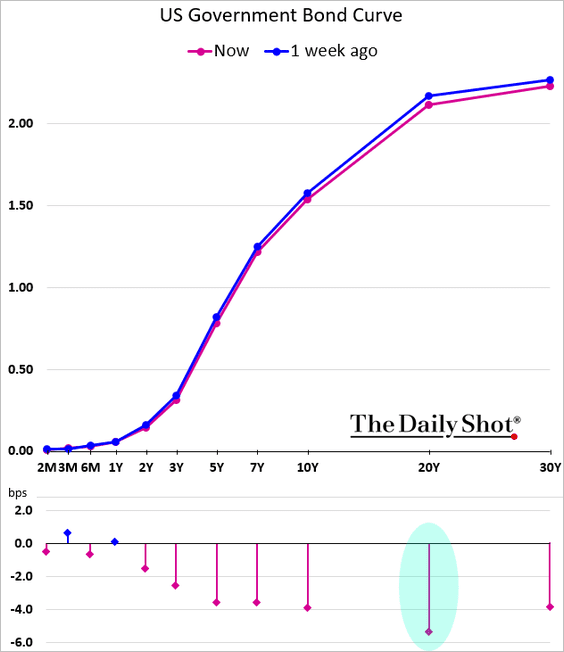

Rates

1. Moderating Treasury supply concerns helped the 20yr security outperform (supported by this week’s auction).

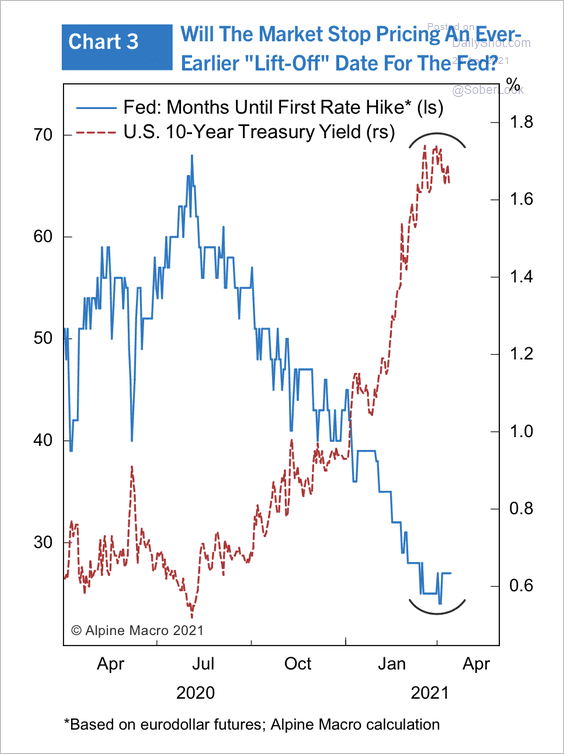

2. There has been a strong inverse correlation between the 10-year Treasury yield and the expected time to the Fed’s liftoff over the past year.

Source: Alpine Macro

Source: Alpine Macro

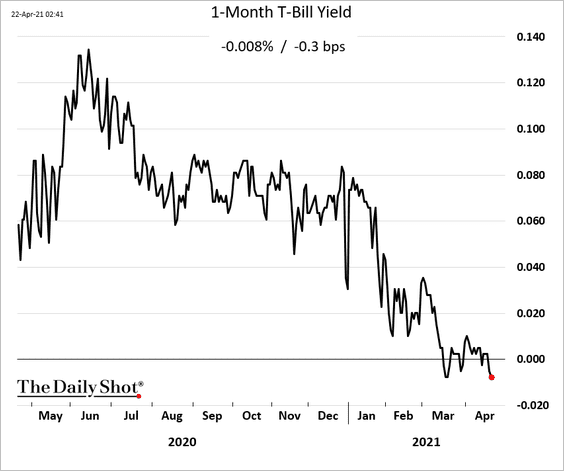

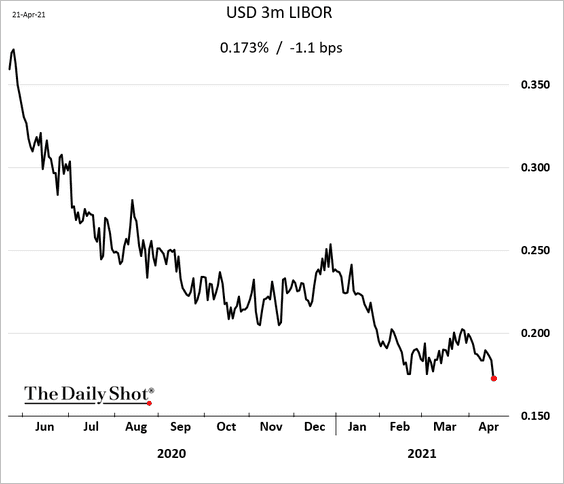

3. Short-term rates continue to see downward pressure.

• The 1-month T-Bill:

• The 3-month LIBOR (record low):

——————–

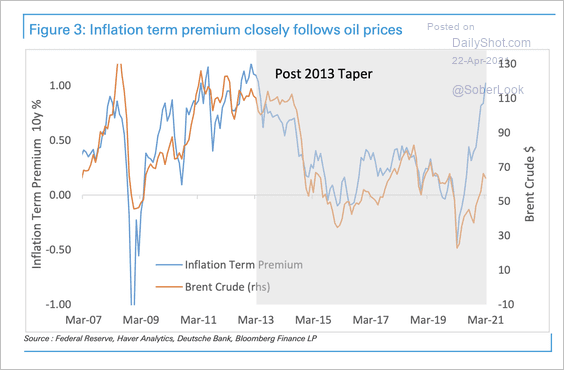

4. The US inflation term premium has risen far ahead of oil prices over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

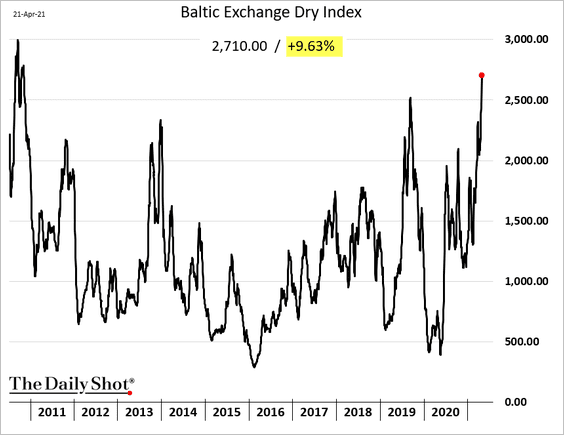

1. Dry bulk shipping prices hit the highest level in a decade.

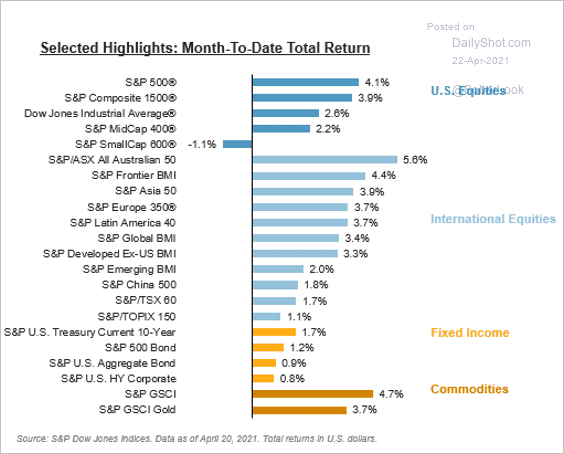

2. Here is a look at month-to-date returns across different asset classes.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

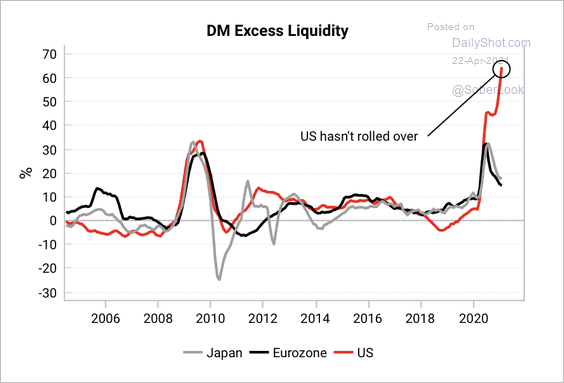

3. Excess liquidity is fading in Europe and Japan but remains high in the US.

Source: Variant Perception

Source: Variant Perception

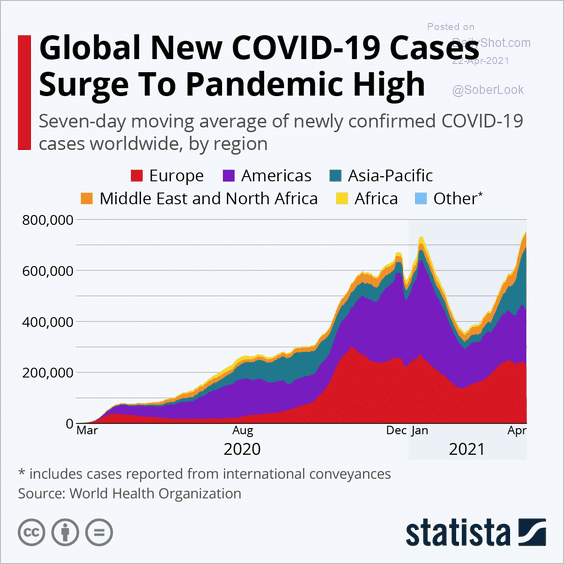

4. Global daily COVID cases hit a new high.

Source: Statista

Source: Statista

——————–

Food for Thought

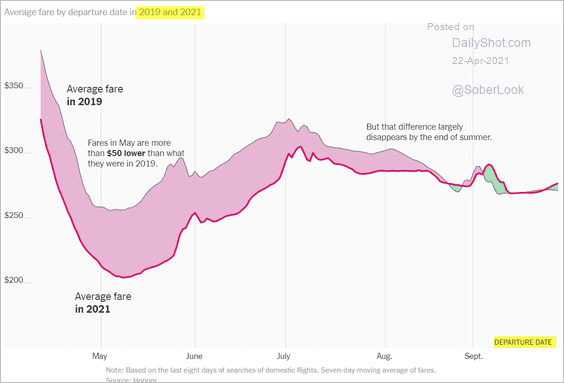

1. Airline fares by departure day (2019 vs. 2021):

Source: The New York Times Read full article

Source: The New York Times Read full article

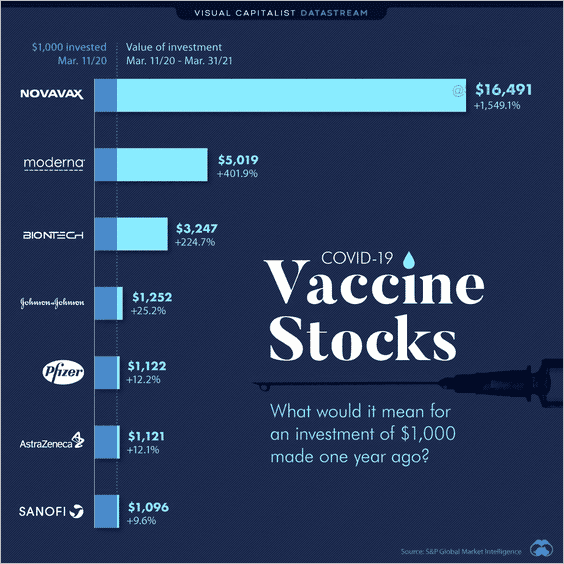

2. Vaccine companies’ stocks:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

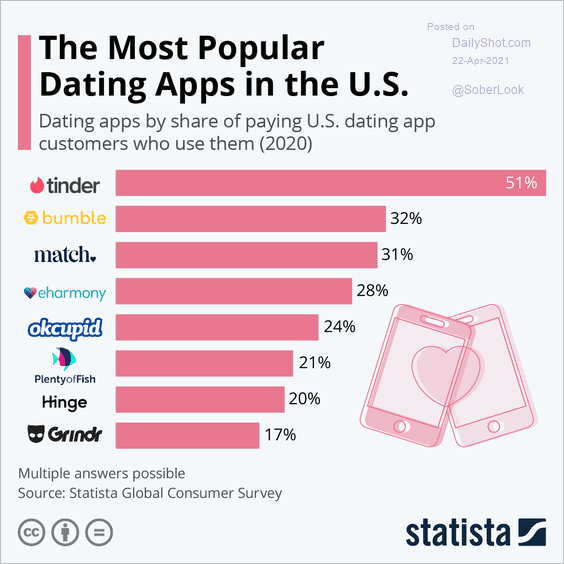

3. Dating apps in the US:

Source: Statista

Source: Statista

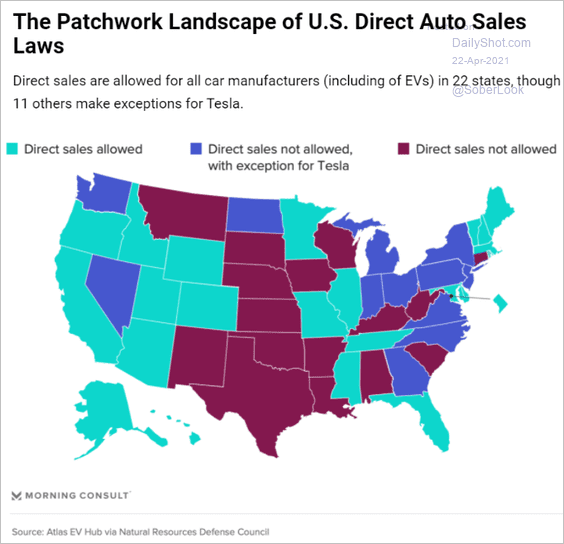

4. Direct car sales:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

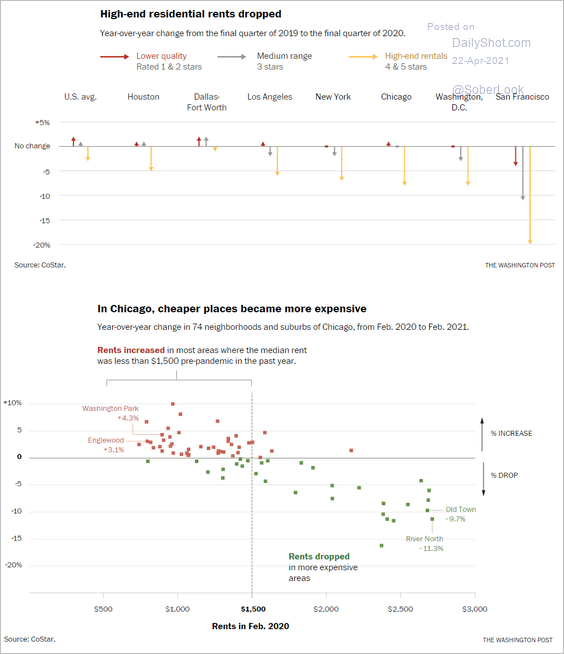

5. High- vs. low-end residential rent changes:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

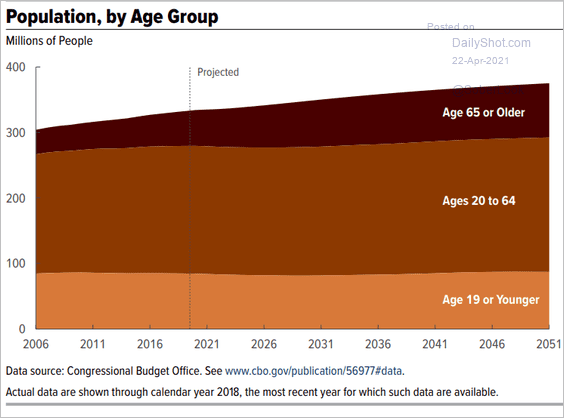

6. CBO’s projections for US age distribution:

Source: CBO

Source: CBO

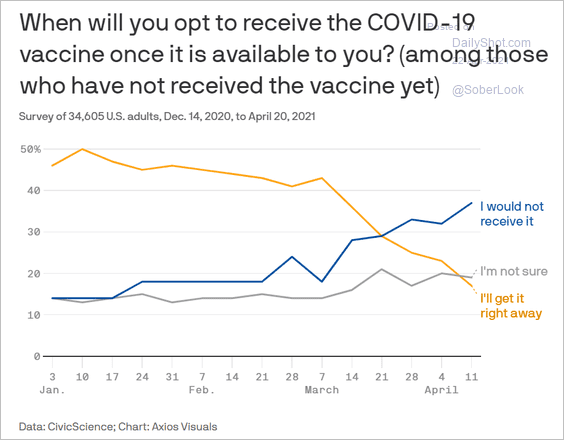

7. Vaccine hesitancy tipping point:

Source: @axios Read full article

Source: @axios Read full article

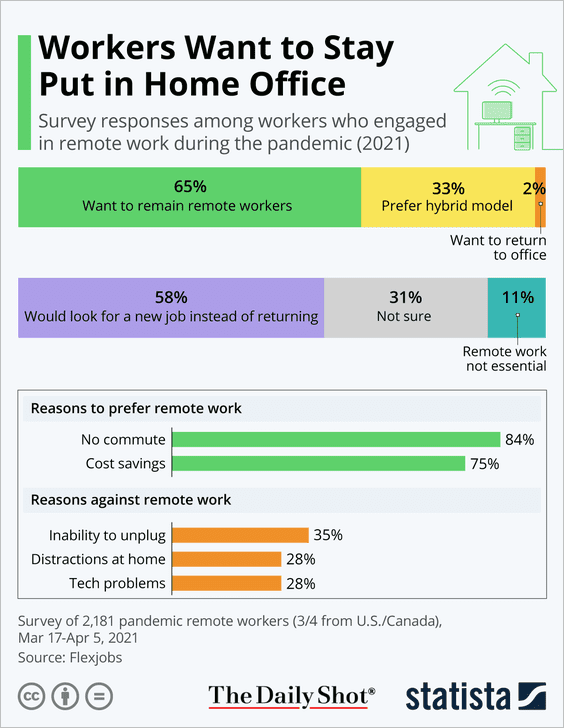

8. Preference for remote work:

Source: Statista

Source: Statista

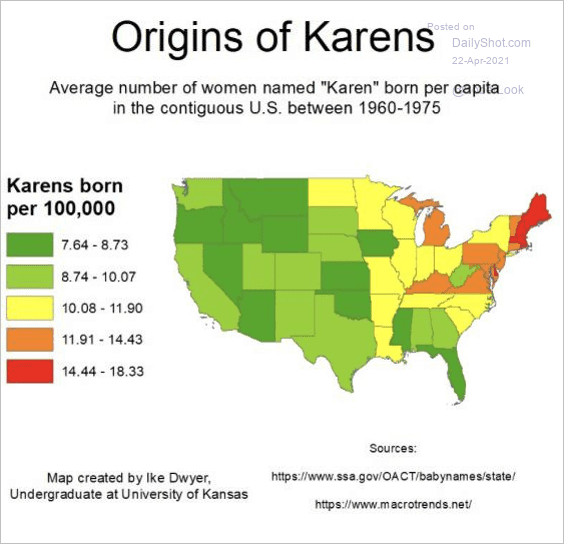

9. The percentage of women named “Karen”:

Source: r/dataisbeautiful

Source: r/dataisbeautiful

——————–

Back to Index