The Daily Shot: 04-May-21

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

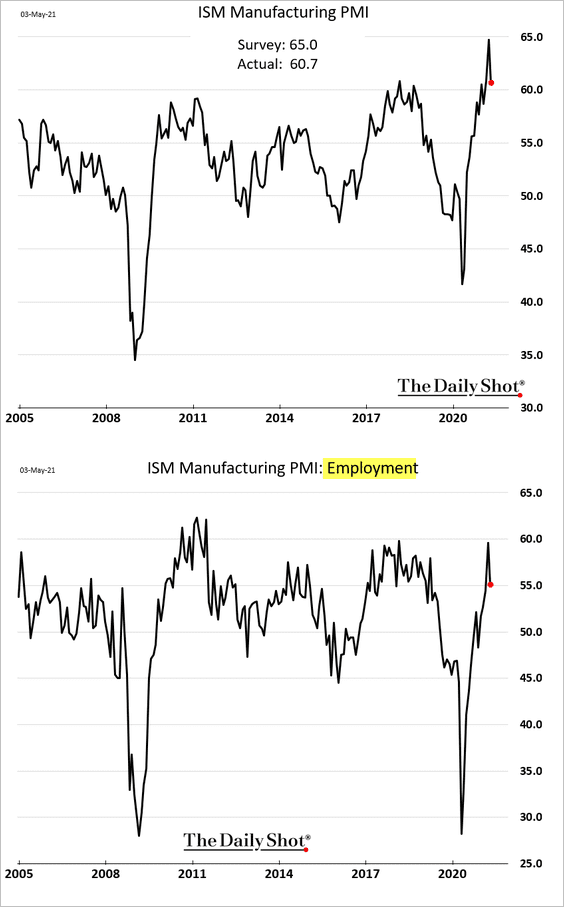

1. The April ISM Manufacturing PMI unexpectedly pulled back from the highs. While factory activity remains exceptionally strong, there are signs that supply-chain bottlenecks are becoming a drag on production and employment.

Source: Reuters Read full article

Source: Reuters Read full article

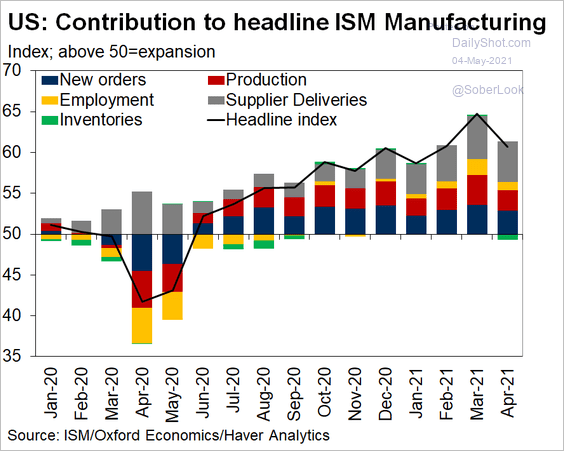

• Here is the breakdown of the ISM index.

Source: @GregDaco

Source: @GregDaco

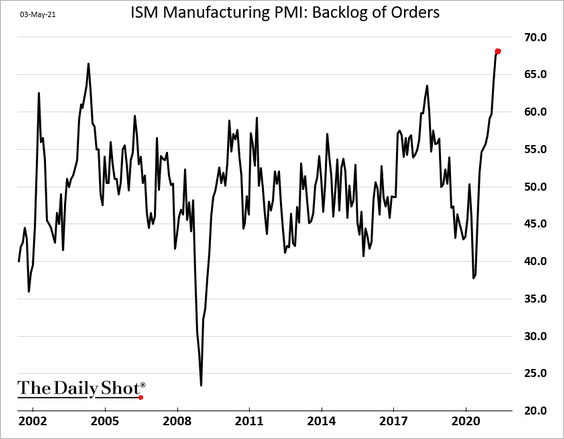

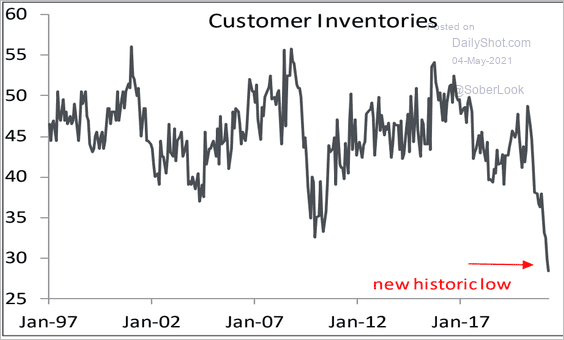

Below are some indicators of supply-chain pressures.

– Order backlog:

– Manufacturers’ estimates of customers’ inventories:

Source: Piper Sandler

Source: Piper Sandler

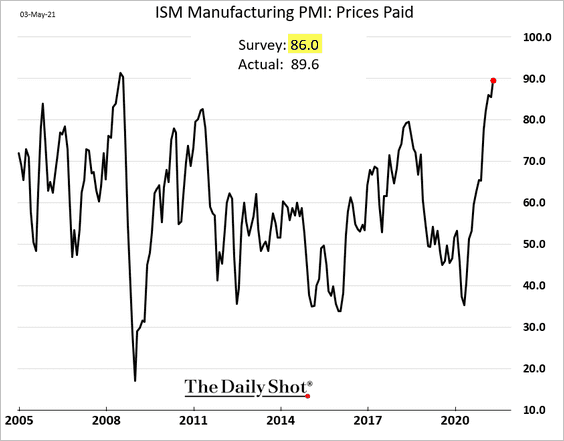

– Prices paid:

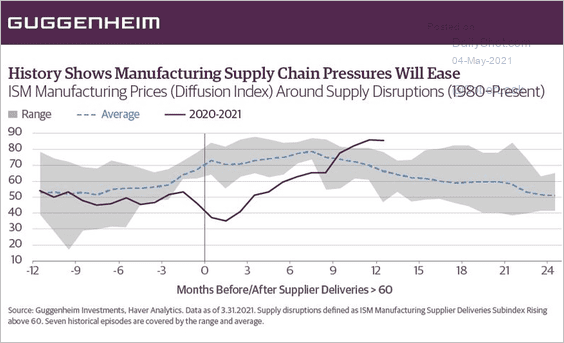

• Economists expect the situation to ease in the months ahead.

Source: @ScottMinerd Read full article

Source: @ScottMinerd Read full article

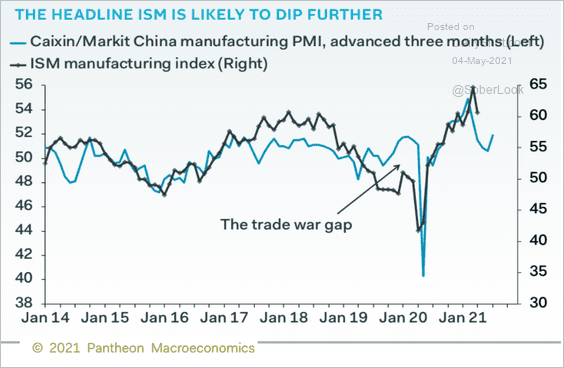

• Has the ISM index peaked?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

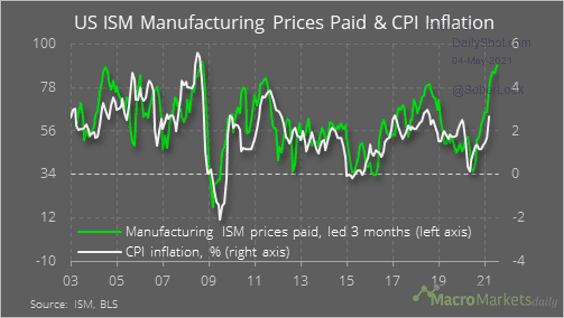

2. Next, we have some updates on inflation.

• This chart compares the ISM prices paid (above) with the CPI inflation.

Source: @macro_daily

Source: @macro_daily

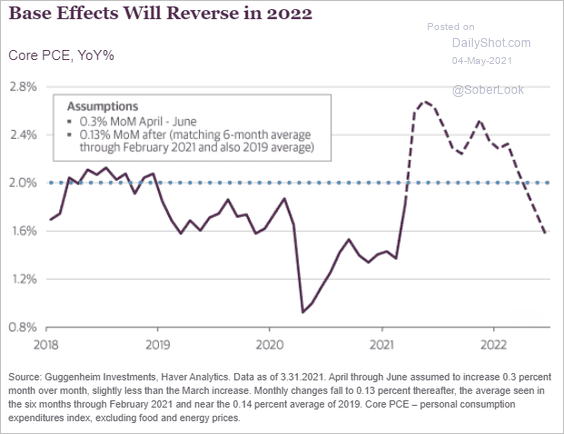

• Base effects in the core PCE inflation will reverse in 2022.

Source: @ScottMinerd Read full article

Source: @ScottMinerd Read full article

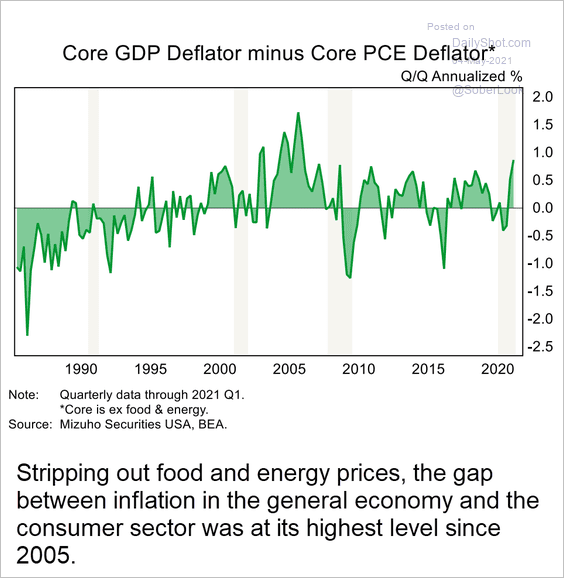

• Price gains in the overall economy (GDP deflator) have been outpacing consumer inflation.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

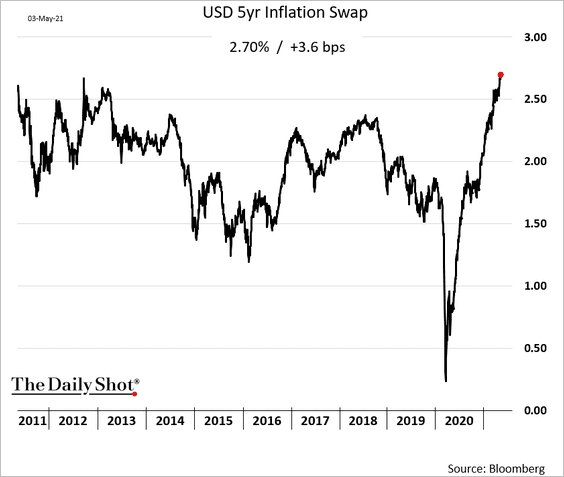

• The 5-year USD inflation swap, an estimate of inflation expectations, is at multi-year highs.

——————–

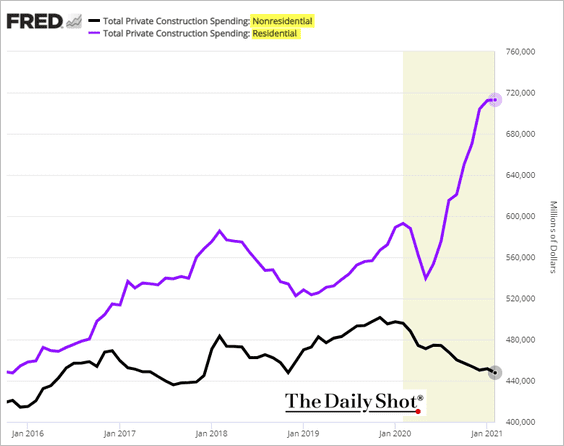

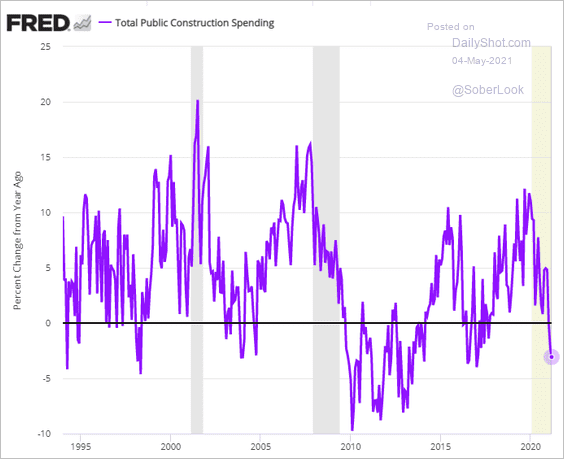

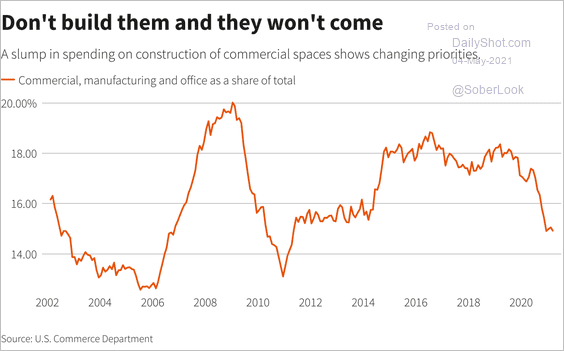

3. Residential and non-residential construction spending trends continue to diverge.

Public construction spending has slowed.

——————–

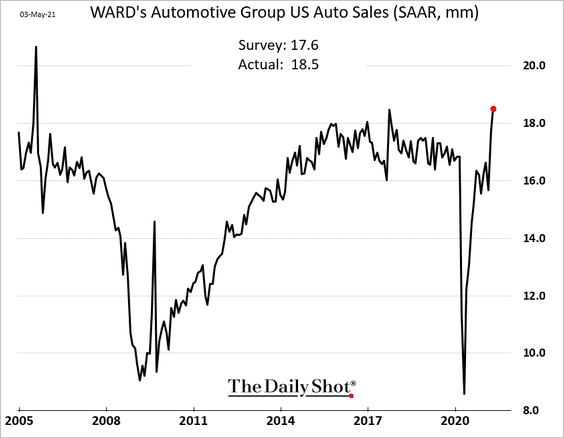

4. US automobile sales hit the highest level in years.

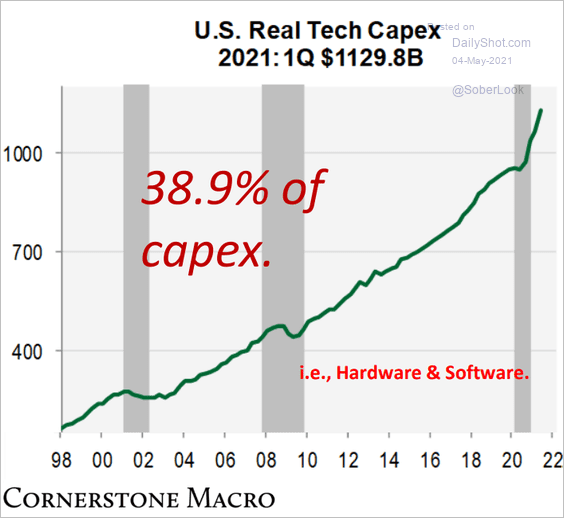

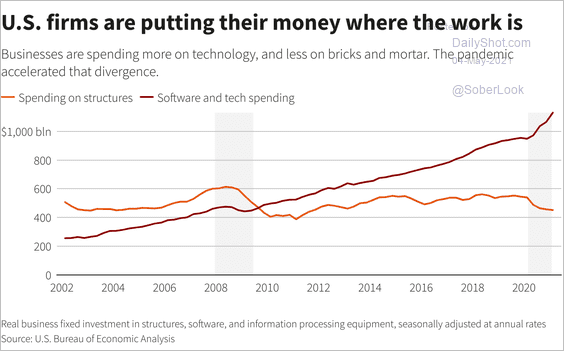

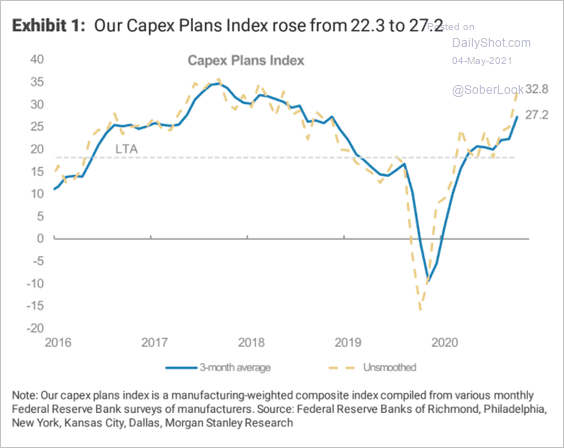

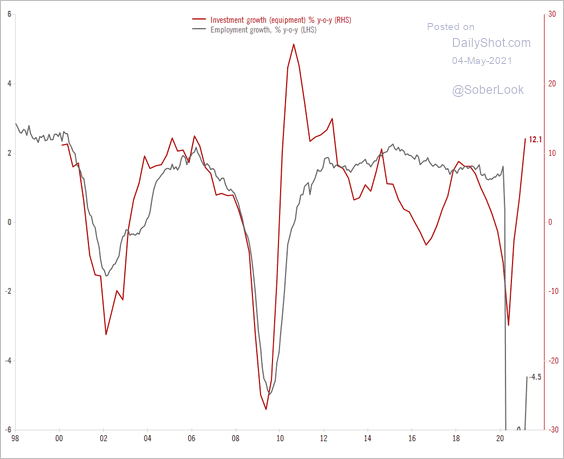

5. Below are some trends in US business investment.

• Tech CapEx:

Source: Cornerstone Macro

Source: Cornerstone Macro

• Investment in tech vs. structures:

Source: Reuters Read full article

Source: Reuters Read full article

• Commercial, manufacturing, and office CapEx as a share of total investment:

Source: Reuters Read full article

Source: Reuters Read full article

• Morgan Stanley’s index of CapEx plans :

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Investment growth vs. employment growth:

Source: @TCosterg

Source: @TCosterg

——————–

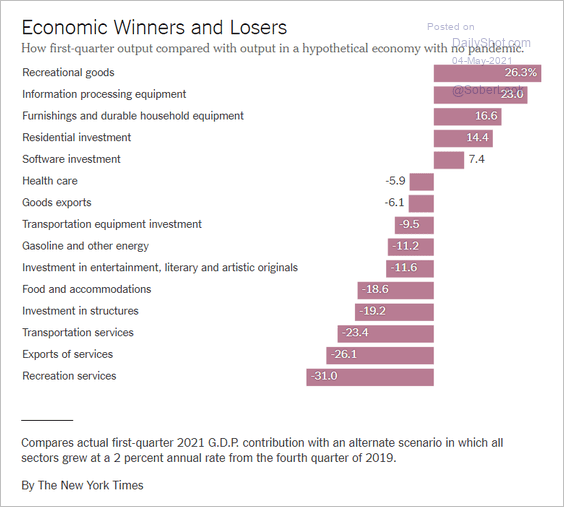

6. How has the pandemic changed output across different sectors?

Source: The New York Times Read full article

Source: The New York Times Read full article

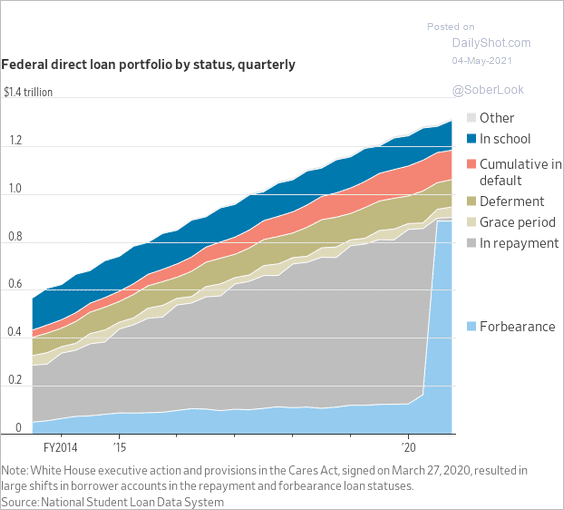

7. What will happen to the federal government’s massive portfolio of student debt? Will borrowers resume payments when the interest holiday ends?

Source: @WSJ Read full article

Source: @WSJ Read full article

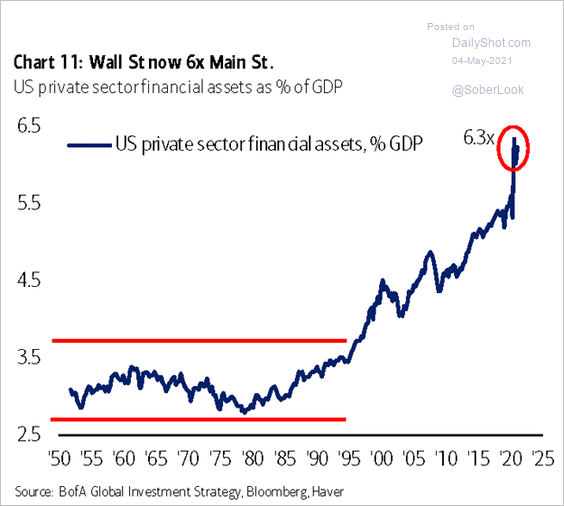

8. Finally, we have private-sector financial assets as a percentage of GDP.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Back to Index

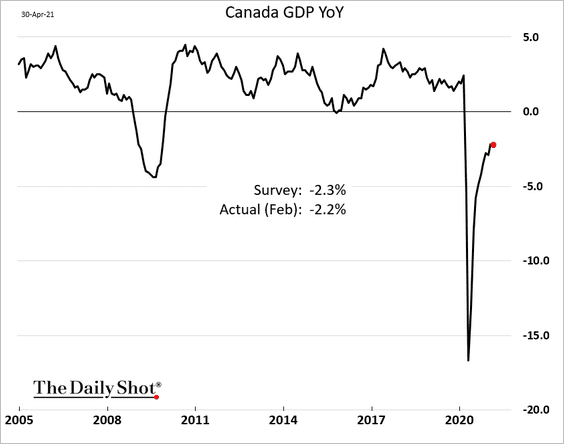

Canada

1. The GDP recovery will take time.

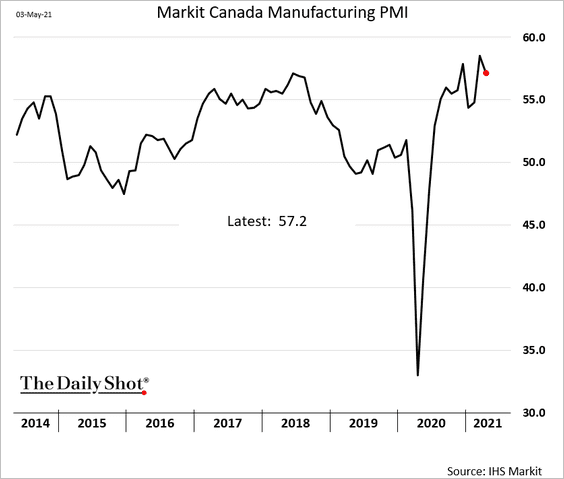

2. The manufacturing PMI came off the highs last month (similar to the US).

Back to Index

The United Kingdom

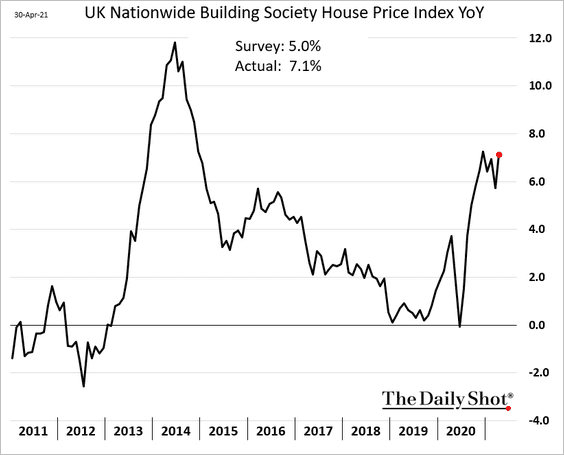

1. Home price appreciation strengthened last month.

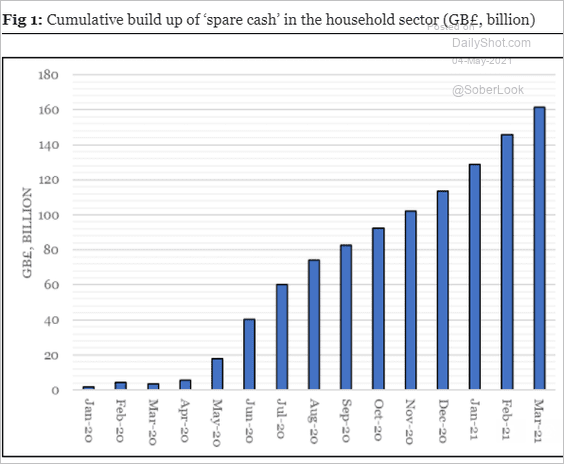

2. UK households are sitting on massive savings.

Source: Longview Economics

Source: Longview Economics

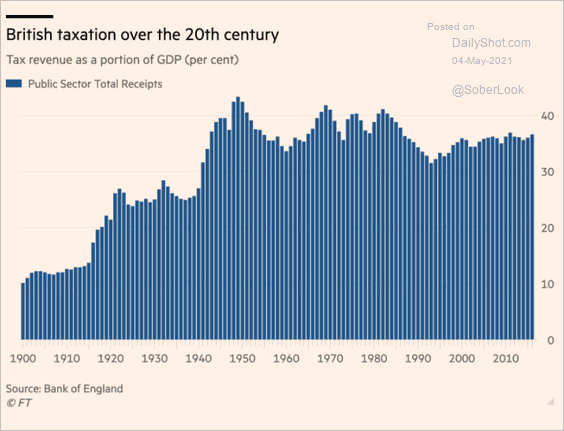

3. Here is the nation’s tax revenue as a share of GDP.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Europe

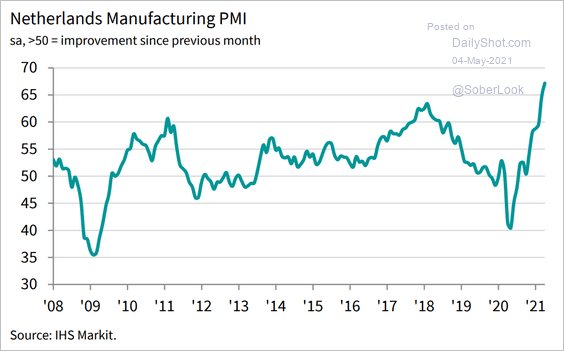

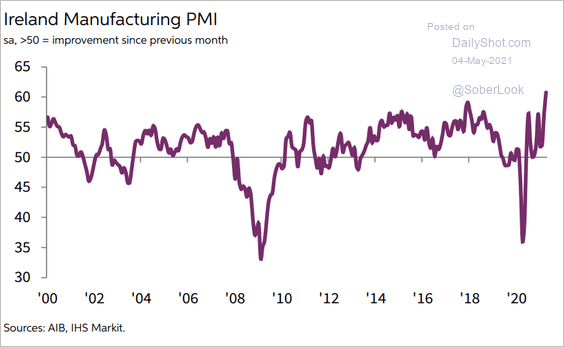

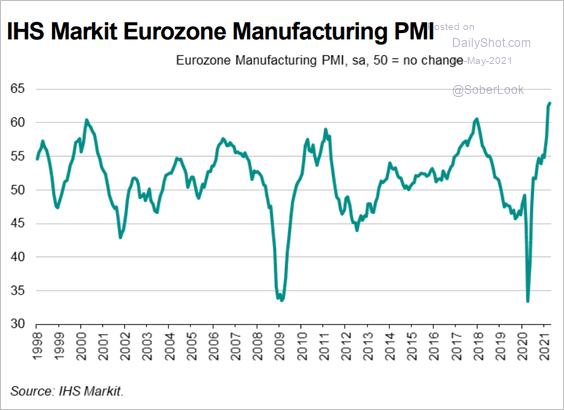

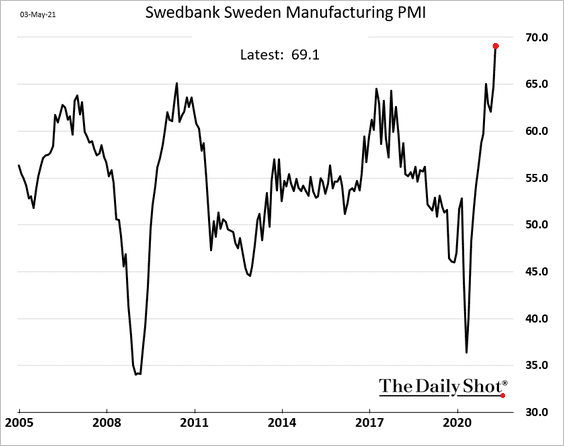

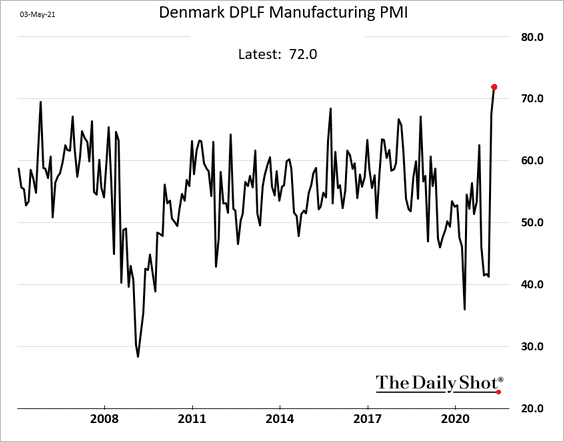

1. Factory activity across Western Europe has been remarkably strong. Here are some manufacturing PMI trends.

• The Netherlands:

Source: IHS Markit

Source: IHS Markit

• Ireland:

Source: IHS Markit

Source: IHS Markit

• The Eurozone:

Source: IHS Markit

Source: IHS Markit

• Sweden:

• Denmark:

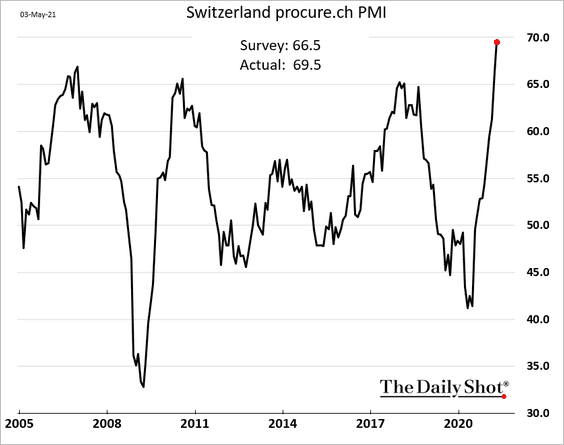

• Switzeland:

——————–

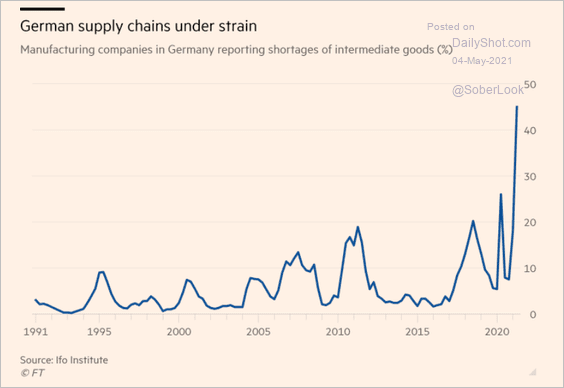

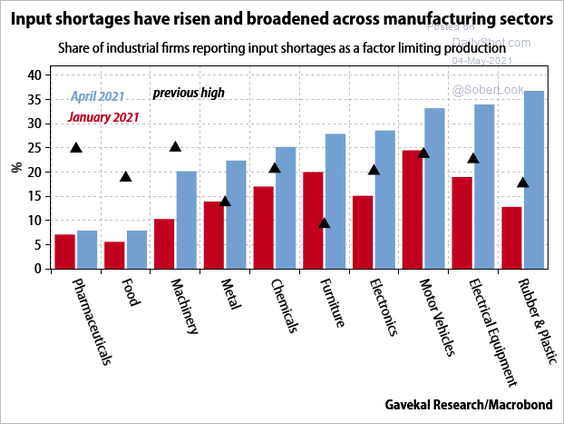

2. Just like in the US, European supply chains are strained (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Gavekal Research

Source: Gavekal Research

——————–

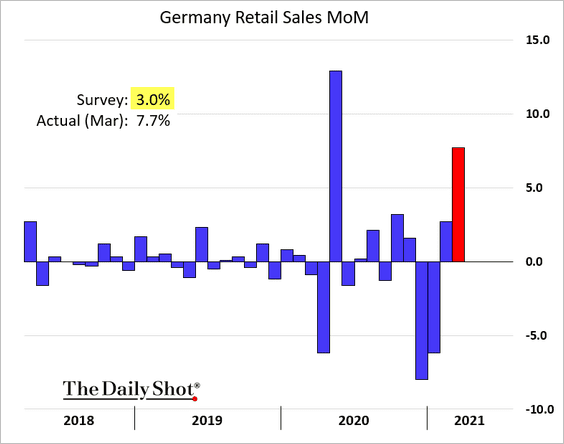

3. German March retail sales topped economists’ forecasts.

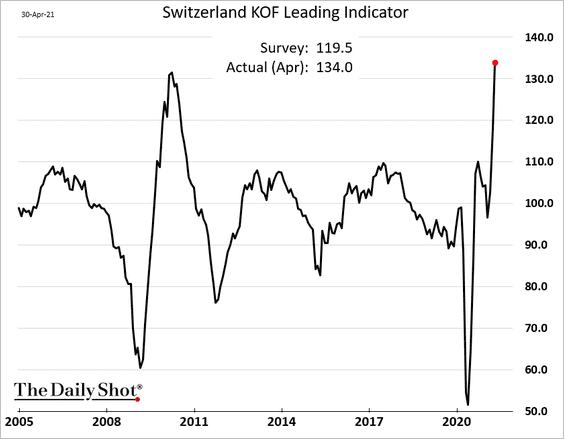

4. The Swiss economy is on fire.

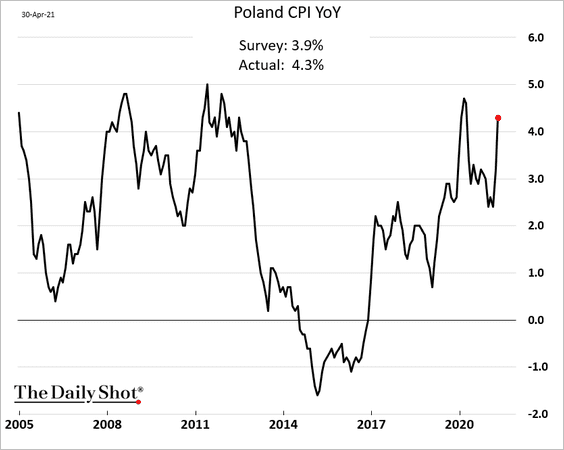

5. Poland’s inflation surprised to the upside.

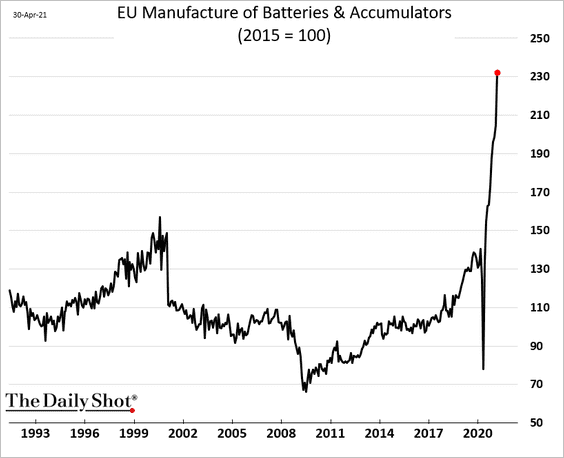

6. EU battery production soared over the past year.

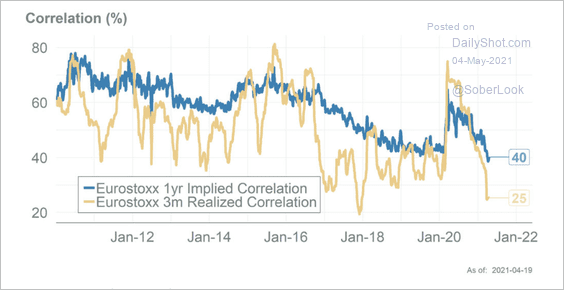

7. EuroStoxx implied and realized correlations are at multi-year lows.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Asia – Pacific

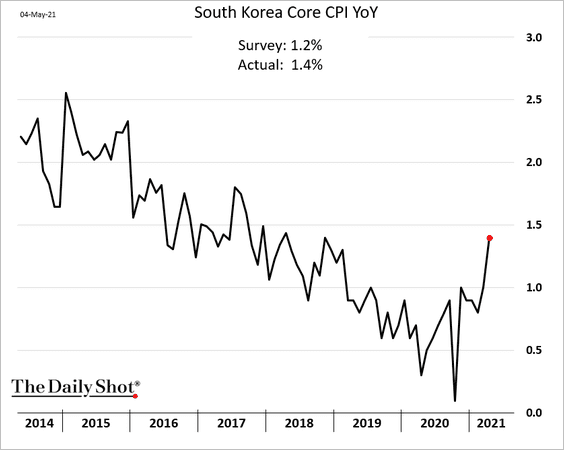

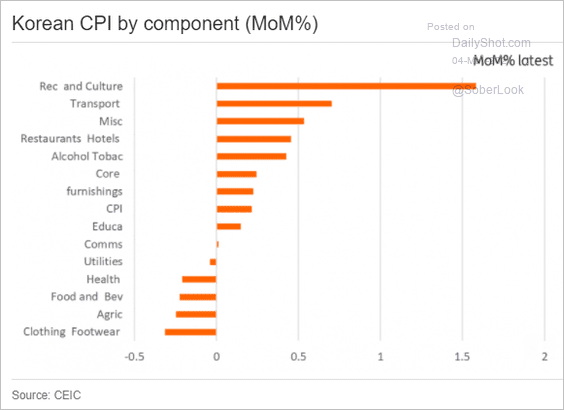

1. South Korea’s CPI surprised to the upside.

Source: ING

Source: ING

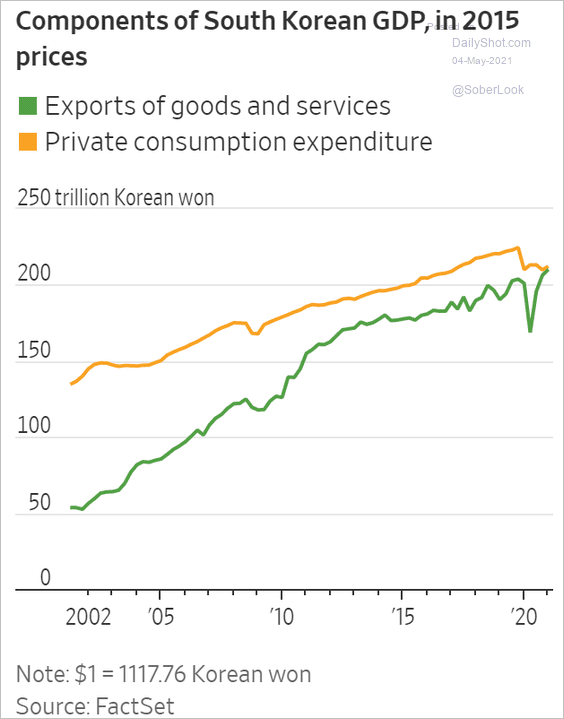

Separately, the South Korean economy remains heavily dependent on exports.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

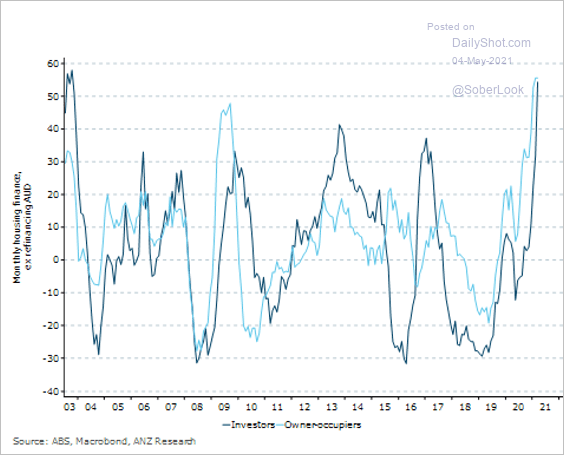

2. Australia’s housing credit is expanding rapidly.

Source: ANZ Research

Source: ANZ Research

Back to Index

China

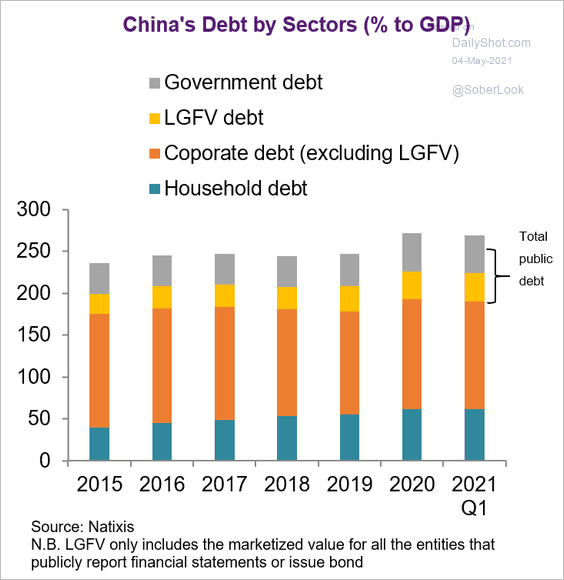

1. Here is China’s debt by sector.

Source: Alicia Garcia-Herrero, Natixis

Source: Alicia Garcia-Herrero, Natixis

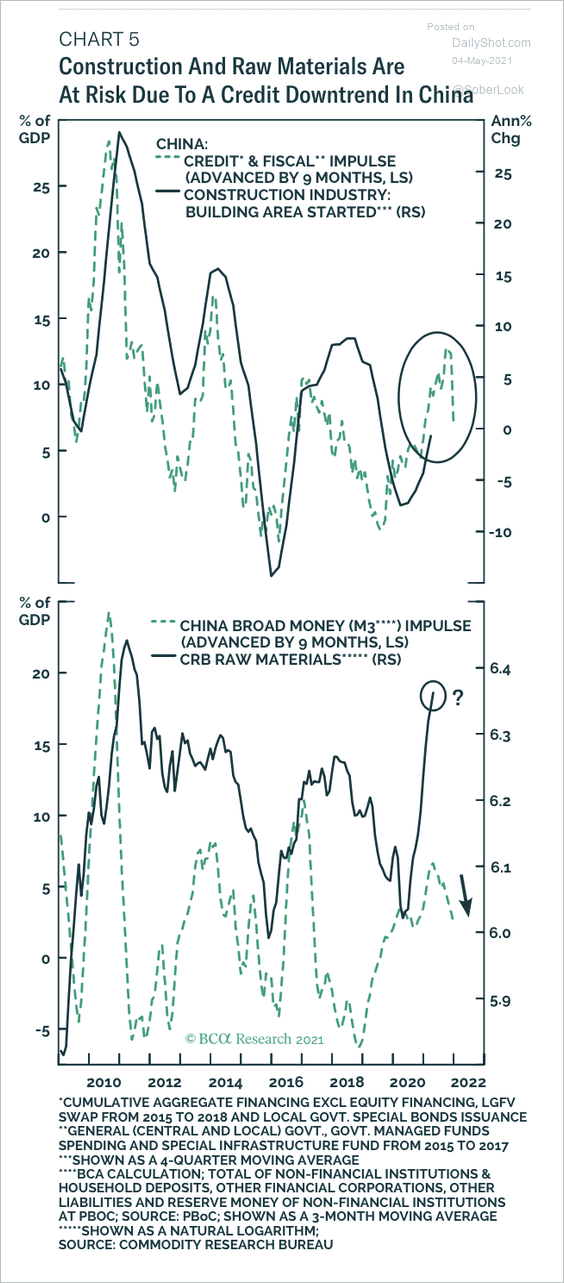

2. The decline in credit impulse and money supply growth points to moderation in construction activity and raw material prices.

Source: BCA Research

Source: BCA Research

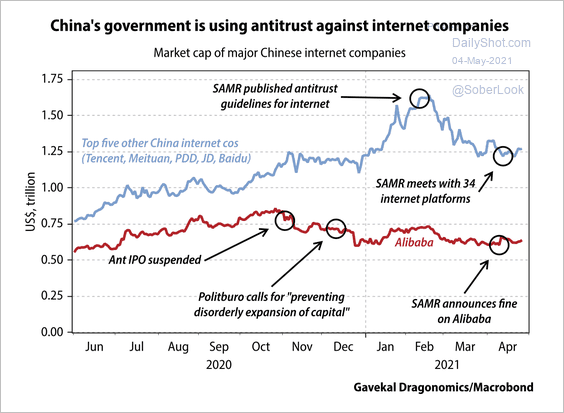

3. The market cap of major Chinese internet companies has declined this year partly due to the government’s antitrust crackdown.

Source: Gavekal Research

Source: Gavekal Research

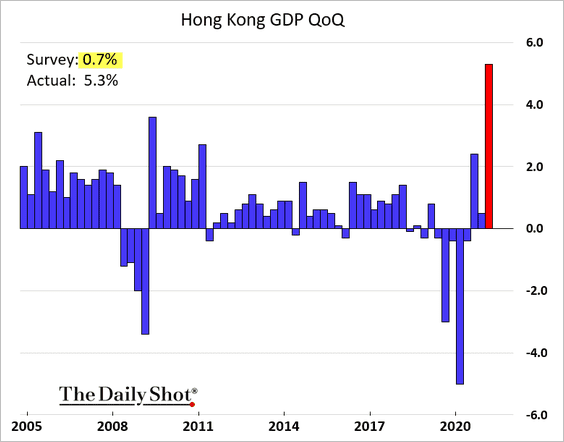

4. Hong Kong’s GDP growth was shockingly strong last quarter.

Back to Index

Emerging Markets

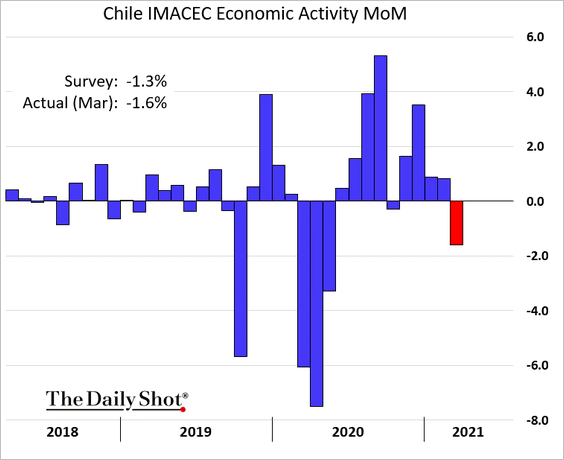

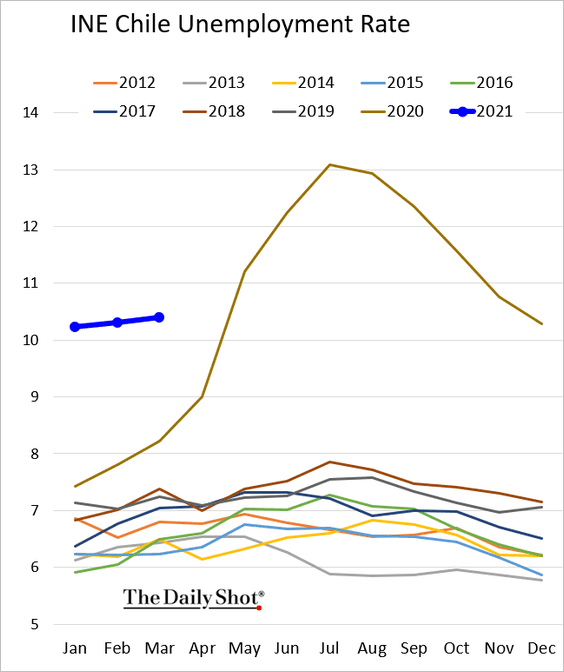

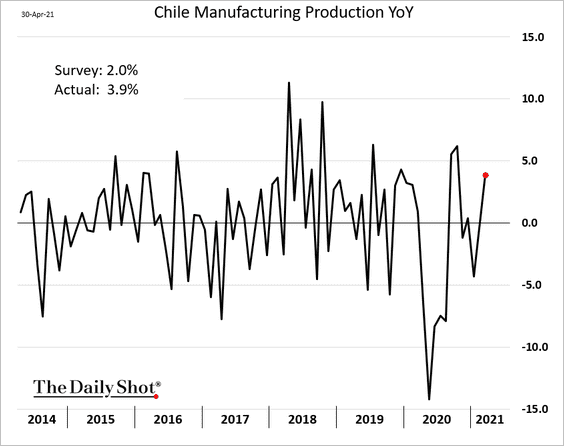

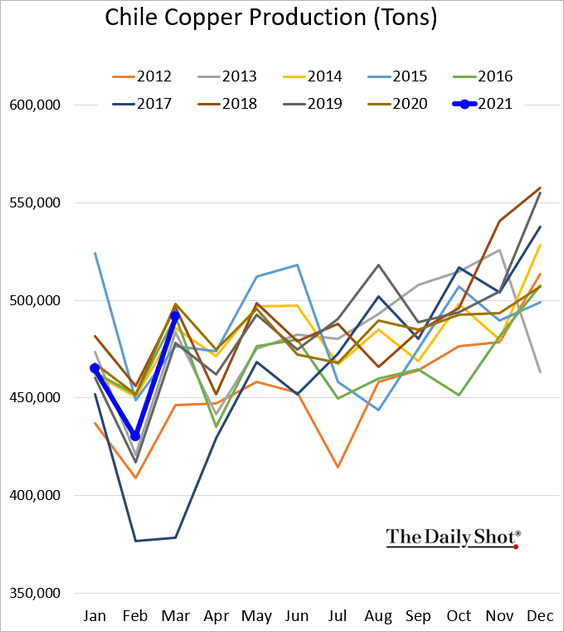

1. Let’s start with Chile.

• Economic activity:

• The unemployment rate:

• Manufacturing output (stronger than expected):

• Copper production:

——————–

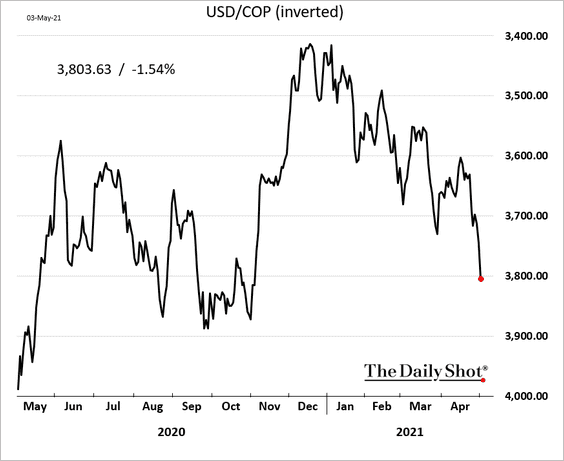

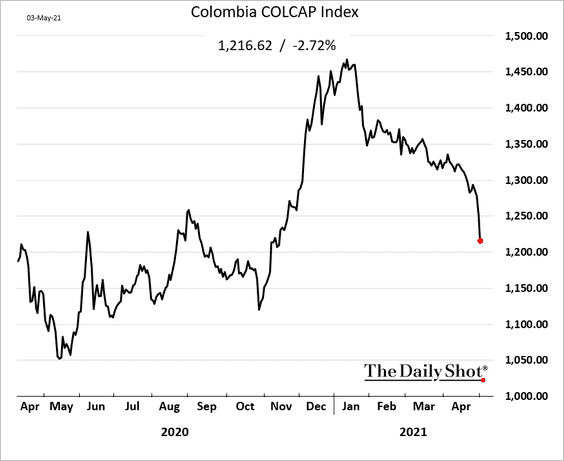

2. Colombia’s finance minister quit, spooking the markets.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• The peso:

• The stock market:

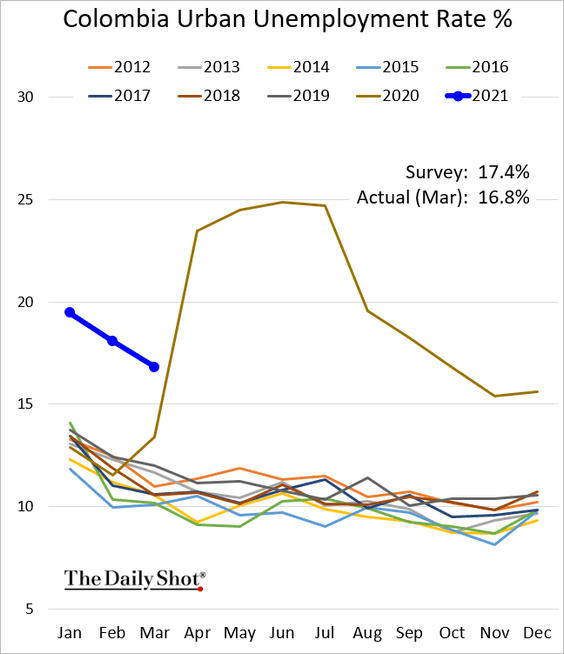

Separately, here is Colombia’s unemployment rate.

——————–

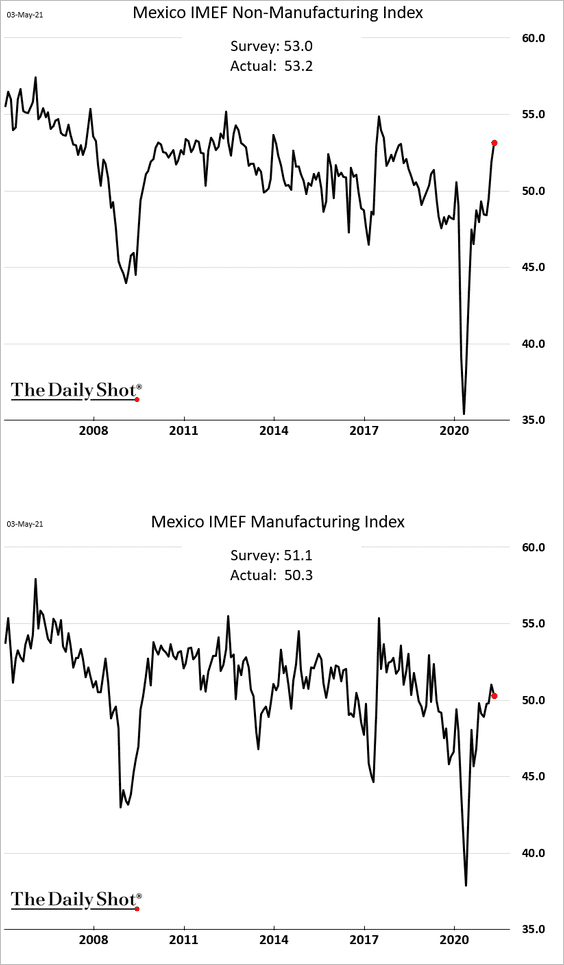

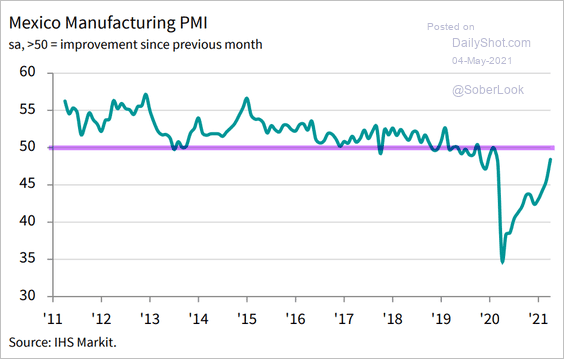

3. Mexico’s business activity is improving.

• IMEF indices:

• Markit PMI:

Source: IHS Markit

Source: IHS Markit

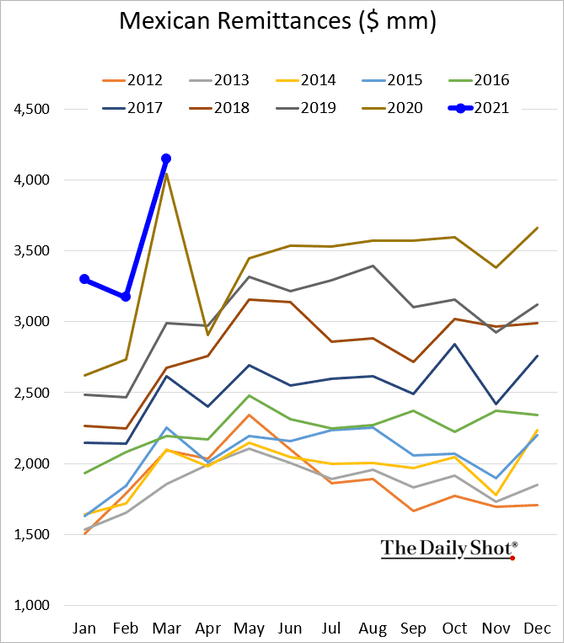

Mexico’s remittances hit a record high.

——————–

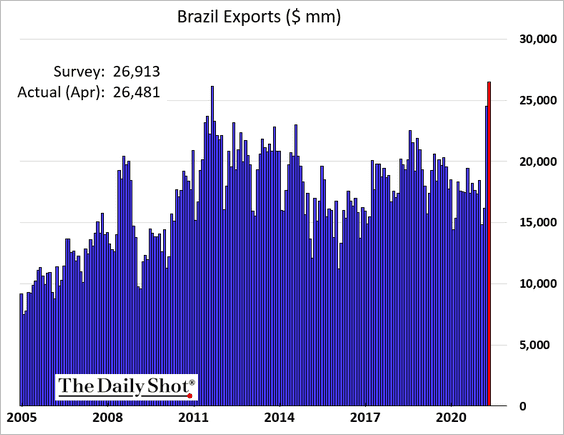

4. Brazil’s exports surged over the past couple of months.

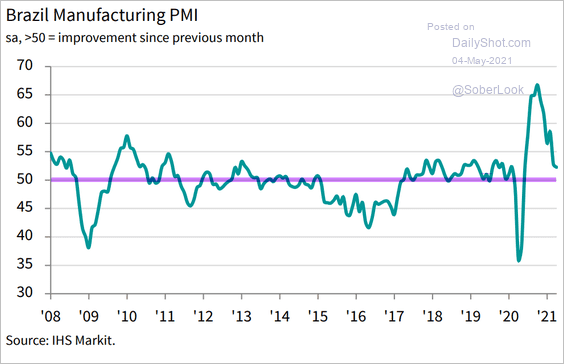

Manufacturing growth has been moderating.

Source: IHS Markit

Source: IHS Markit

——————–

5. Indonesia’s inflation remains subdued.

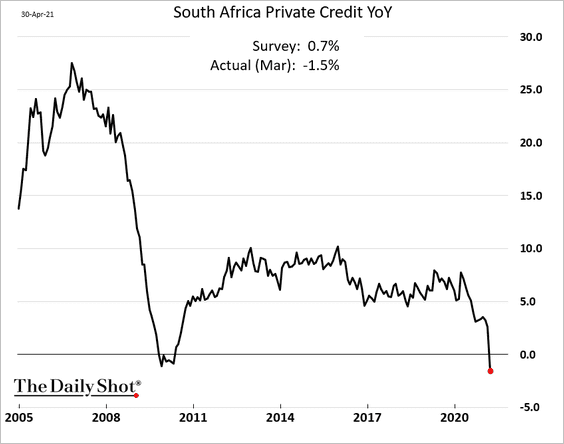

6. South Africa’s private credit has been shrinking (similar to Mexico).

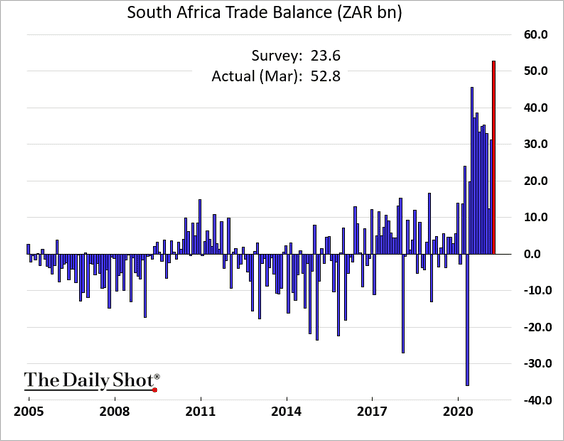

South Africa’s trade surplus hit a record high.

——————–

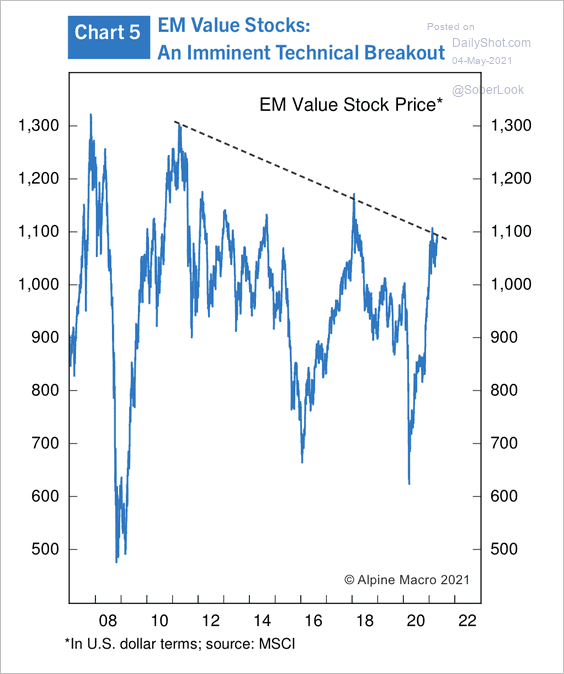

7. EM value stocks are testing long-term resistance.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

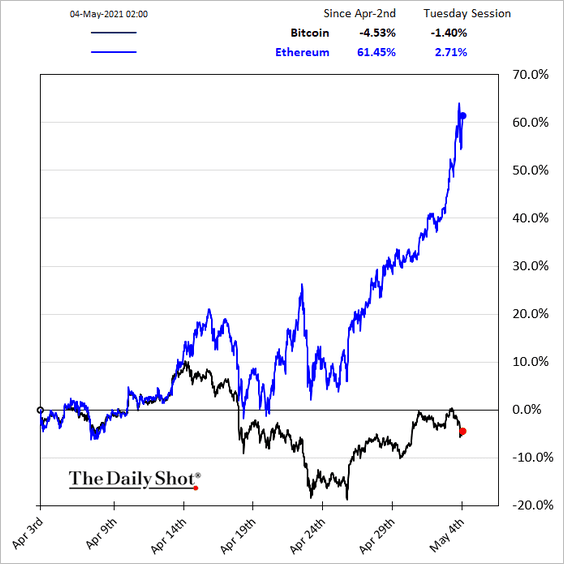

Ether continues to surge.

Back to Index

Commodities

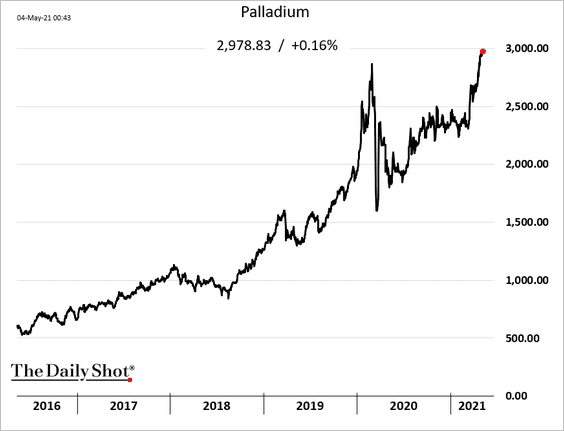

1. Palladium surged to a record high.

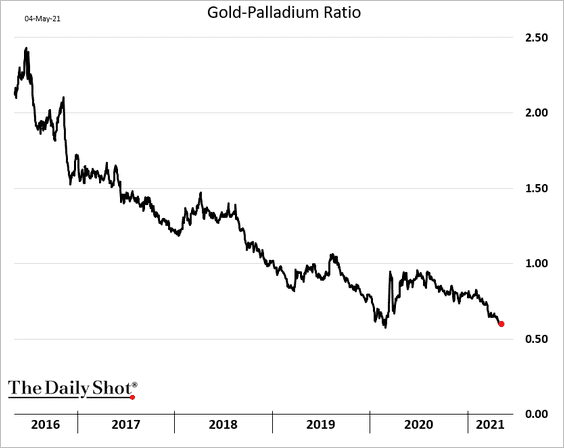

Here is the gold-palladium ratio.

——————–

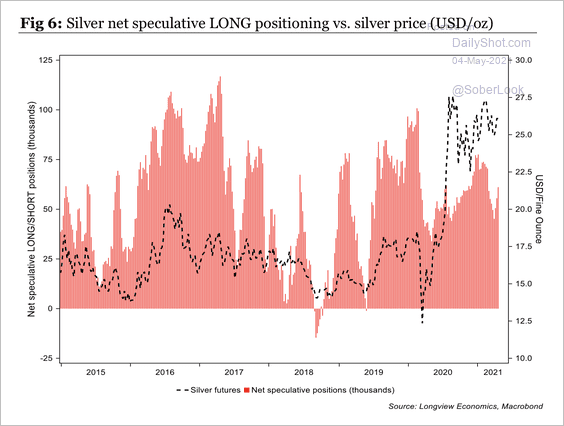

2. Speculative net-long positions in silver futures increased over the past few weeks but remain below peak levels.

Source: Longview Economics

Source: Longview Economics

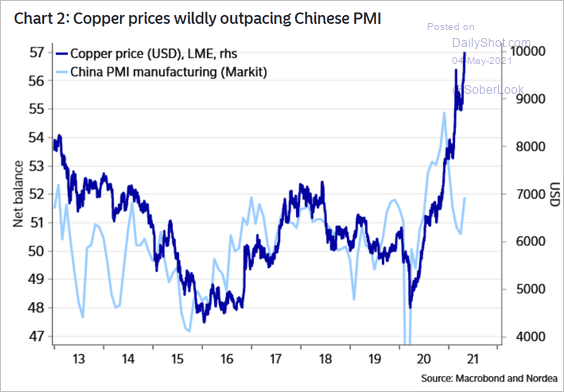

3. Given softer manufacturing growth in China, is copper vulnerable?

Source: Nordea Markets

Source: Nordea Markets

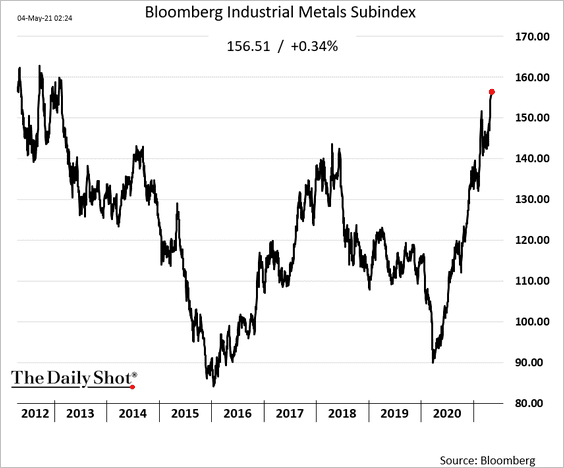

4. Bloomberg’s industrial metals index is at multi-year highs.

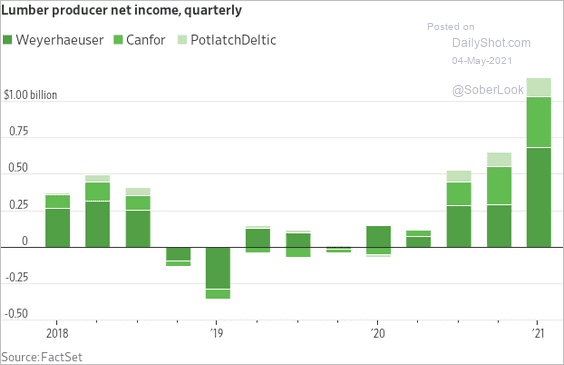

5. It’s a great time to operate a lumber company.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

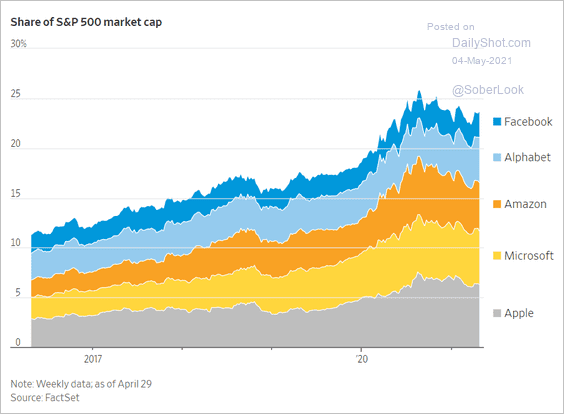

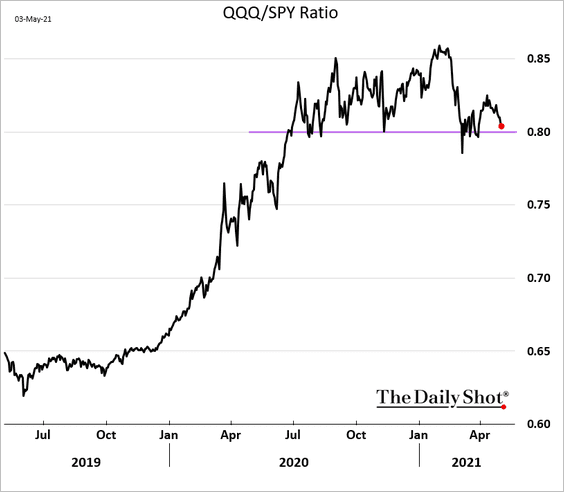

1. Let’s begin with some trends in big tech stocks.

• Revenue growth:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Percent of S&P 500 market cap:

Source: @WSJ Read full article

Source: @WSJ Read full article

• The Nasdaq 100 relative performance:

——————–

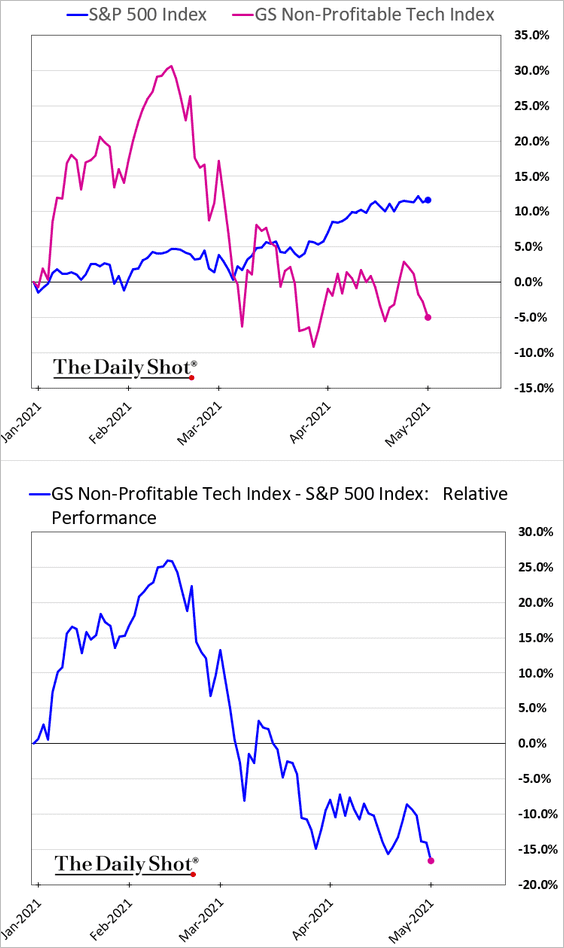

2. Non-profitable tech companies are underperforming.

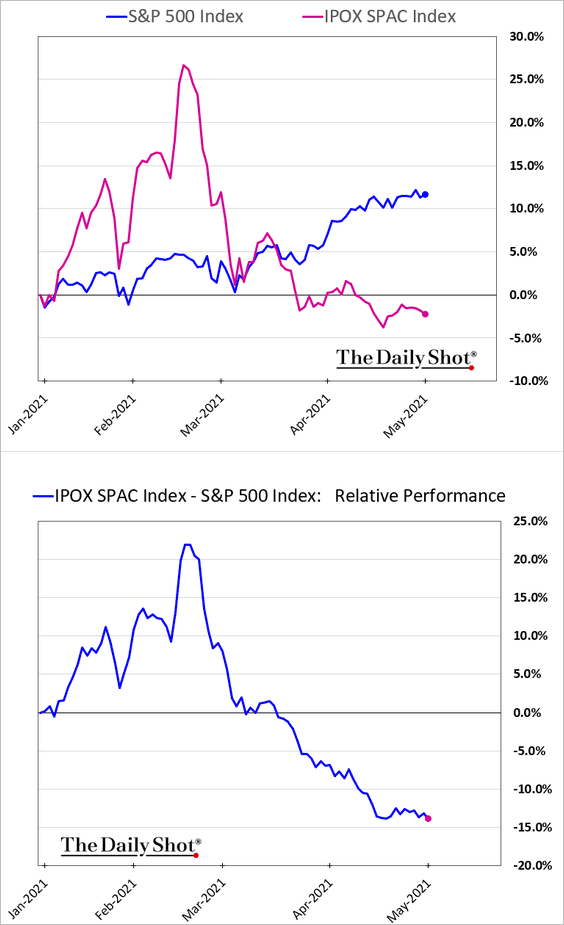

3. SPACs continue to lag.

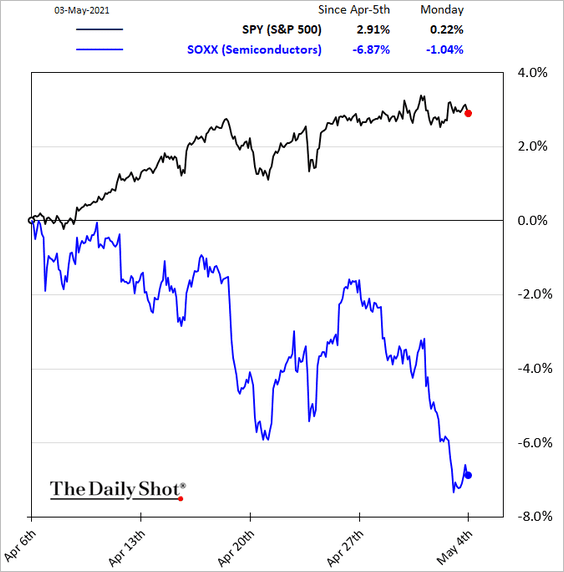

4. It’s been a rough month for semiconductor shares.

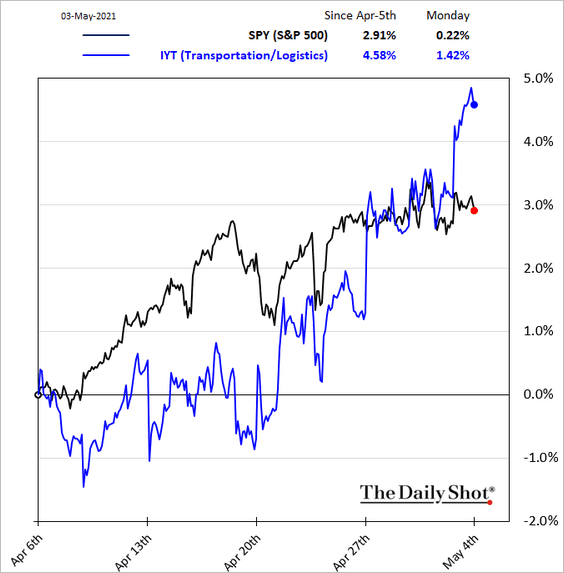

But transportation stocks are outperforming.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

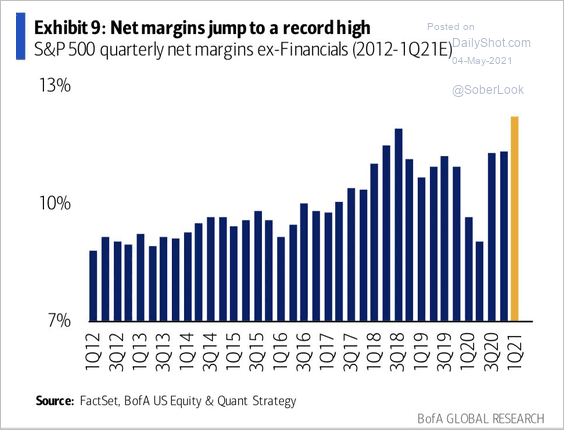

5. S&P 500 margins surged last quarter.

Source: BofA Global Research; @carlquintanilla

Source: BofA Global Research; @carlquintanilla

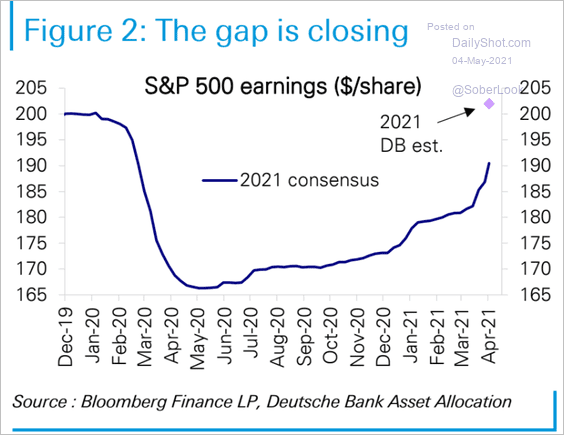

6. Here is Deutsche Bank’s estimate for 2021 earnings per share.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

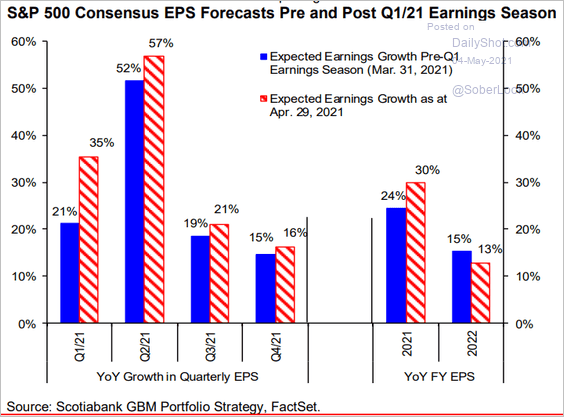

Earnings expectations got pulled forward (from 2022 to 2021).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

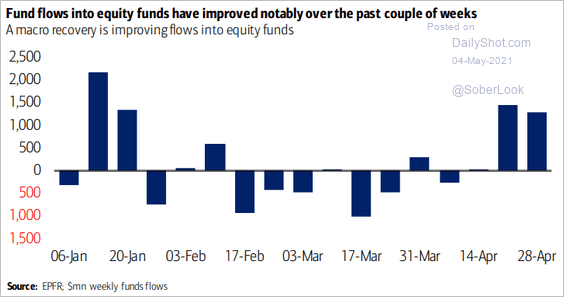

7. Fund flows strengthened over the past couple of weeks.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

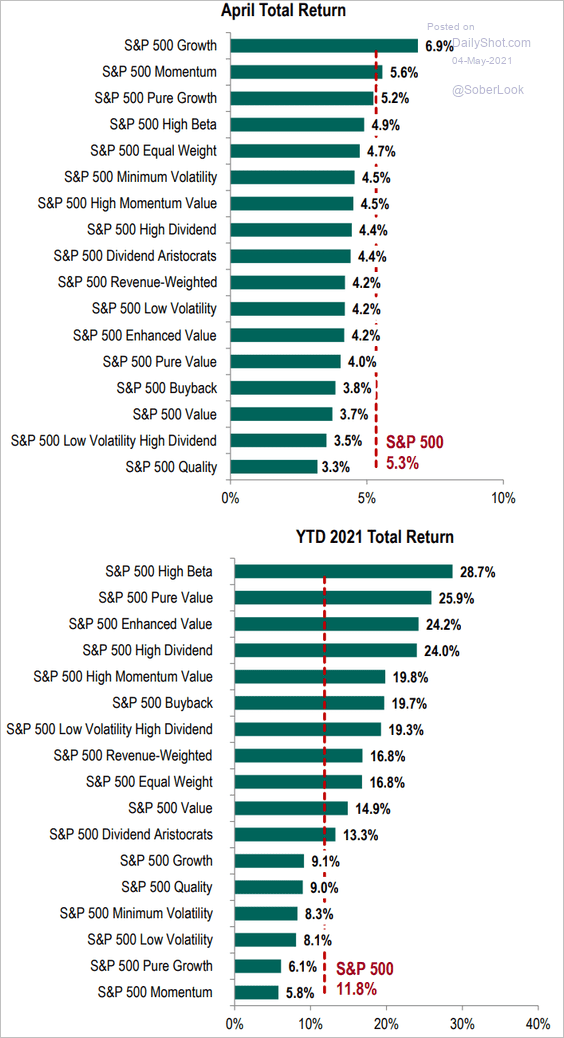

8. Here is a look at equity factor performance.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

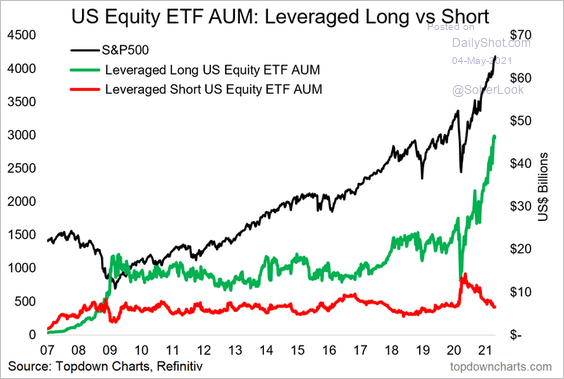

9. Leveraged long equity ETF AUM soared over the past year.

Source: @Callum_Thomas, @topdowncharts

Source: @Callum_Thomas, @topdowncharts

Back to Index

Credit

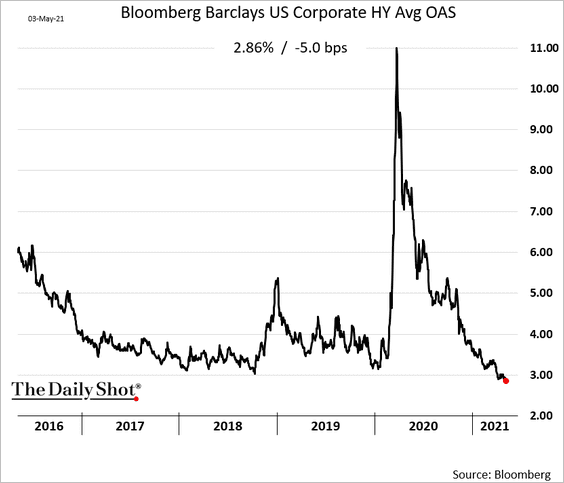

1. US high-yield spreads hit a multi-year low.

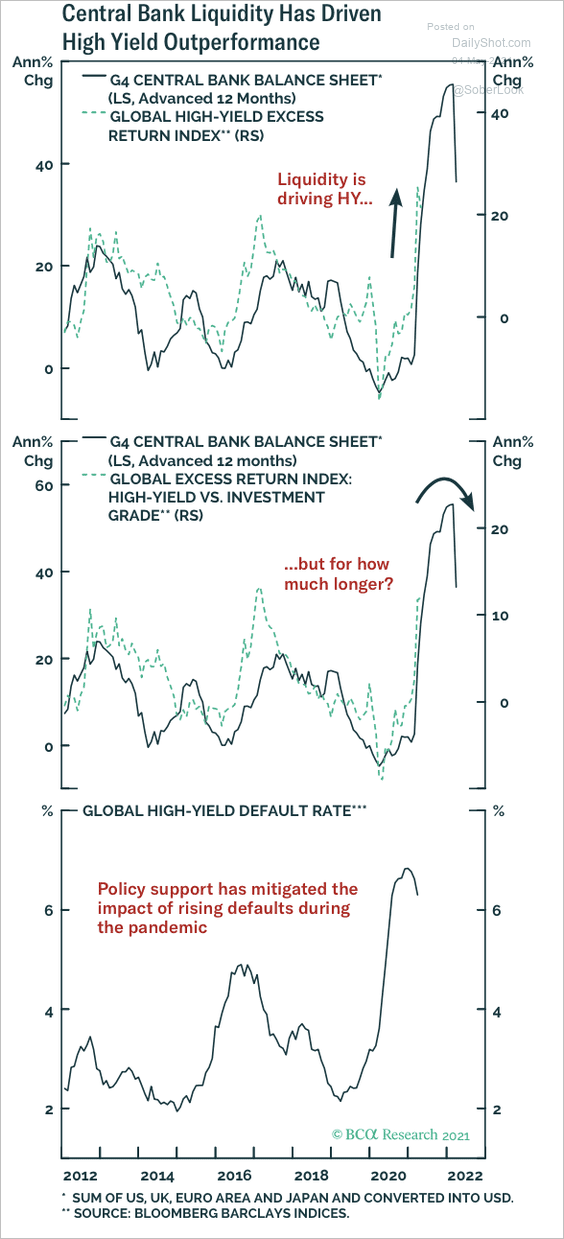

2. Will we see some pressure on high yield as central banks taper QE?

Source: BCA Research

Source: BCA Research

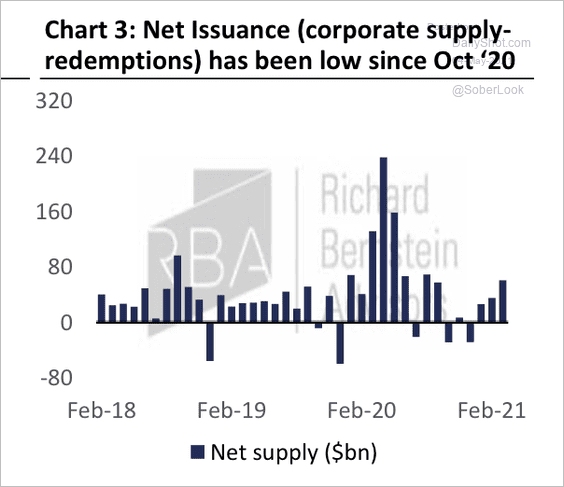

3. US corporate net issuance has receded since October 2020.

Source: Richard Bernstein Advisors

Source: Richard Bernstein Advisors

Back to Index

Rates

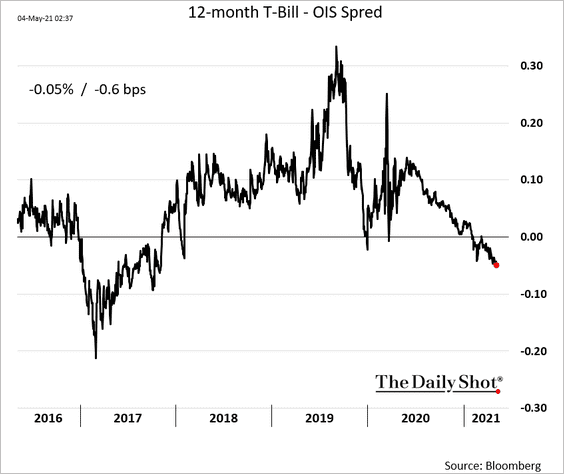

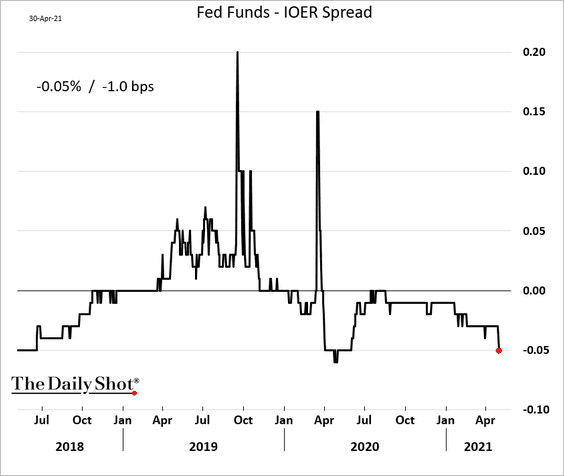

1. Massive liquidity continues to depress money market rates. Here is the 12m T-Bill – OIS spread.

Will the Fed be forced to adjust IOER to bring the fed funds rate toward the middle of the range?

——————–

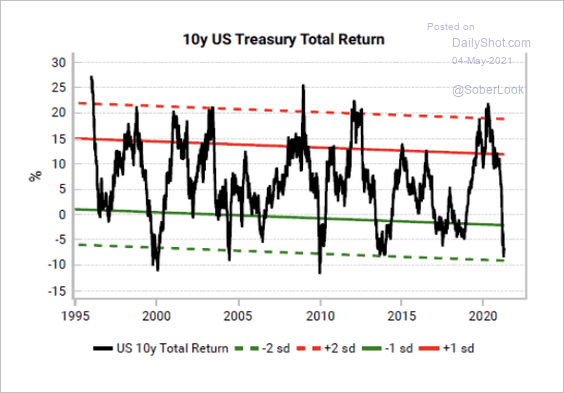

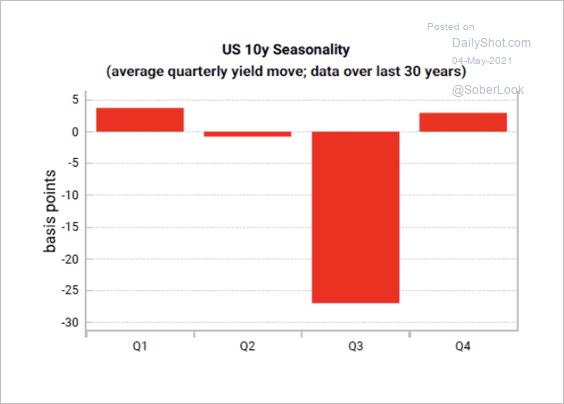

2. The 10-year Treasury note is oversold as yields enter a seasonally weak period (2 charts).

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Source: Variant Perception

Back to Index

Global Developments

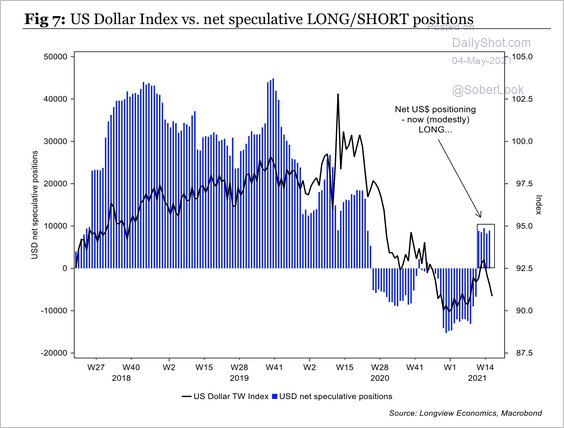

1. Speculators are modestly net-long the dollar.

Source: Longview Economics

Source: Longview Economics

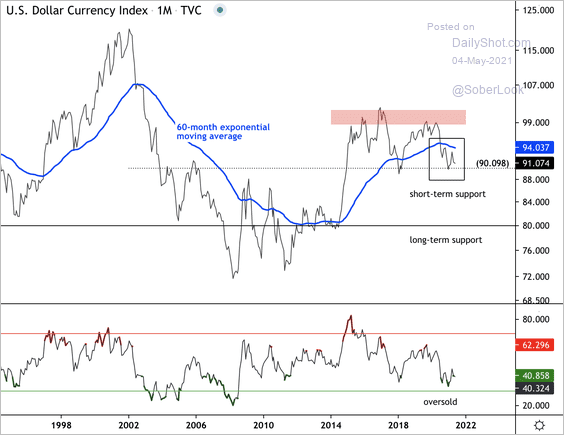

The dollar appears oversold at short-term support.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

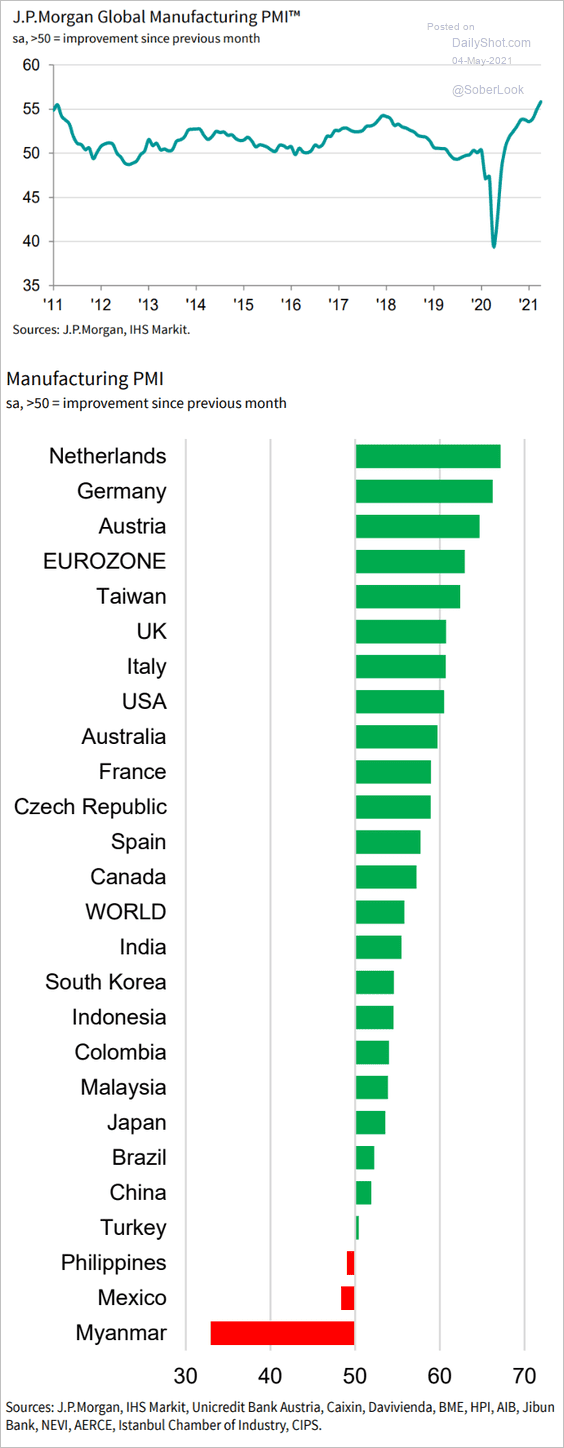

2. Here is a summary of Markit’s manufacturing PMI.

Source: IHS Markit

Source: IHS Markit

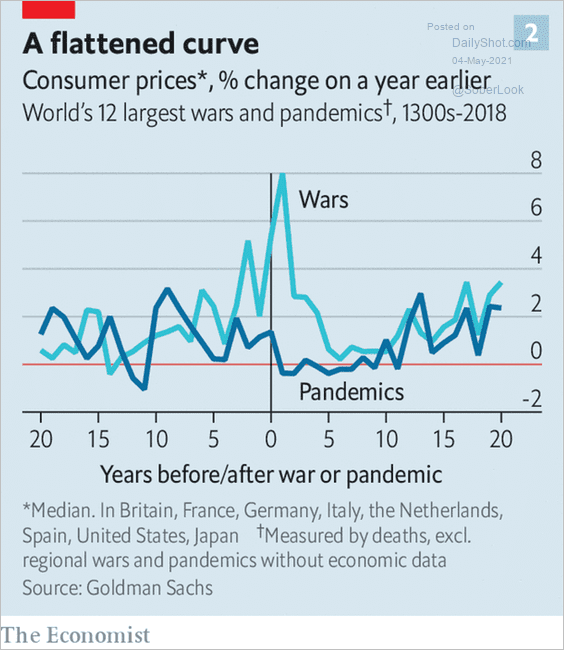

3. Consumer prices did not accelerate after past pandemics.

Source: The Economist

Source: The Economist

——————–

Food for Thought

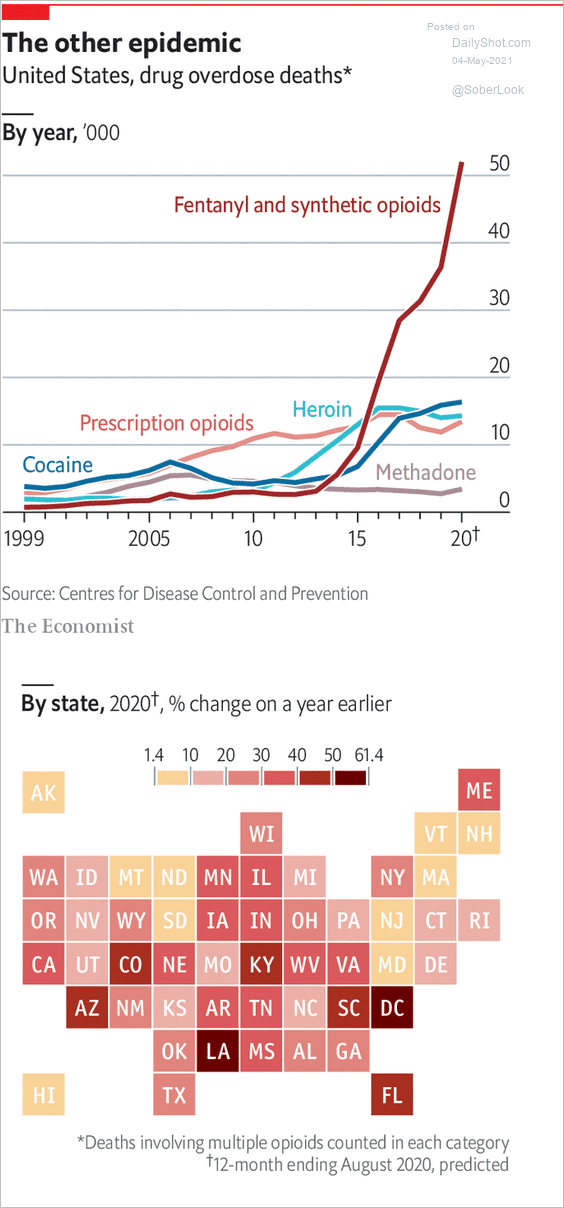

1. US drug overdose deaths:

Source: The Economist Read full article

Source: The Economist Read full article

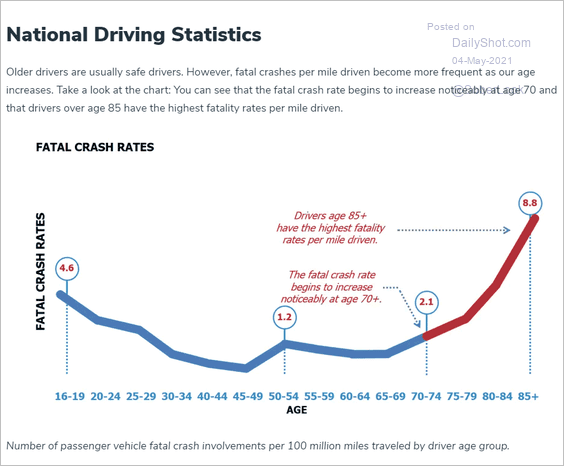

2. Fatal car crashes by age:

Source: AARP Read full article

Source: AARP Read full article

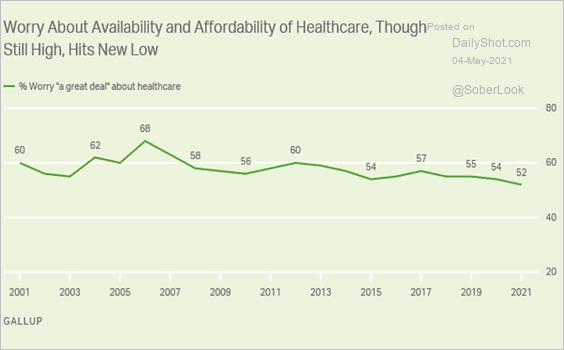

3. US concerns about healthcare affordability:

Source: Gallup Read full article

Source: Gallup Read full article

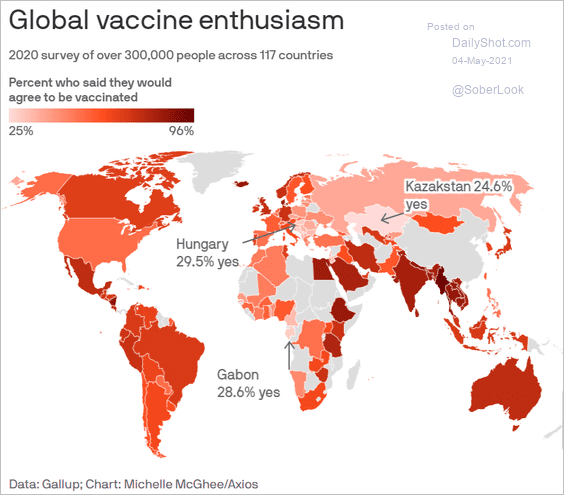

4. Vaccine enthusiasm:

Source: @axios Read full article

Source: @axios Read full article

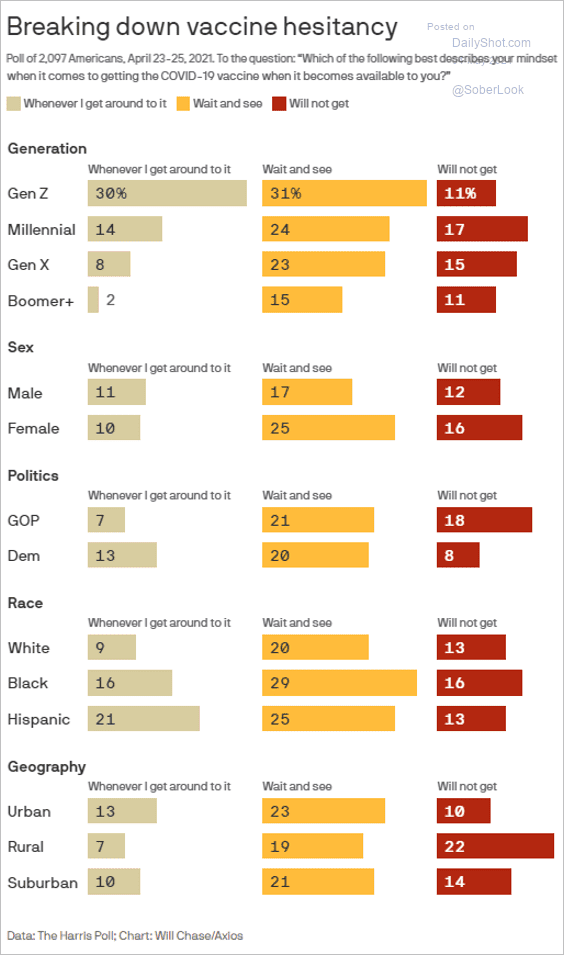

• US vaccine hesitancy:

Source: @axios Read full article

Source: @axios Read full article

——————–

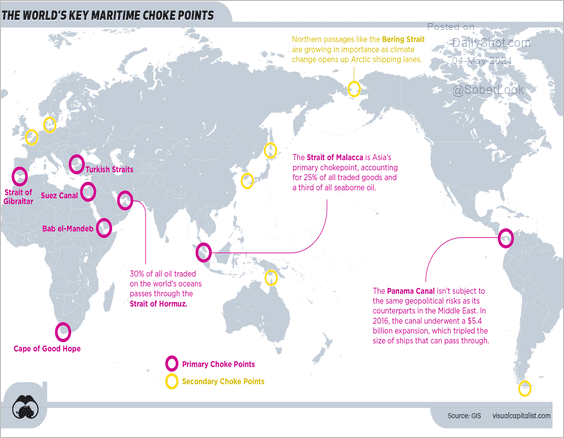

5. Maritime choke points:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

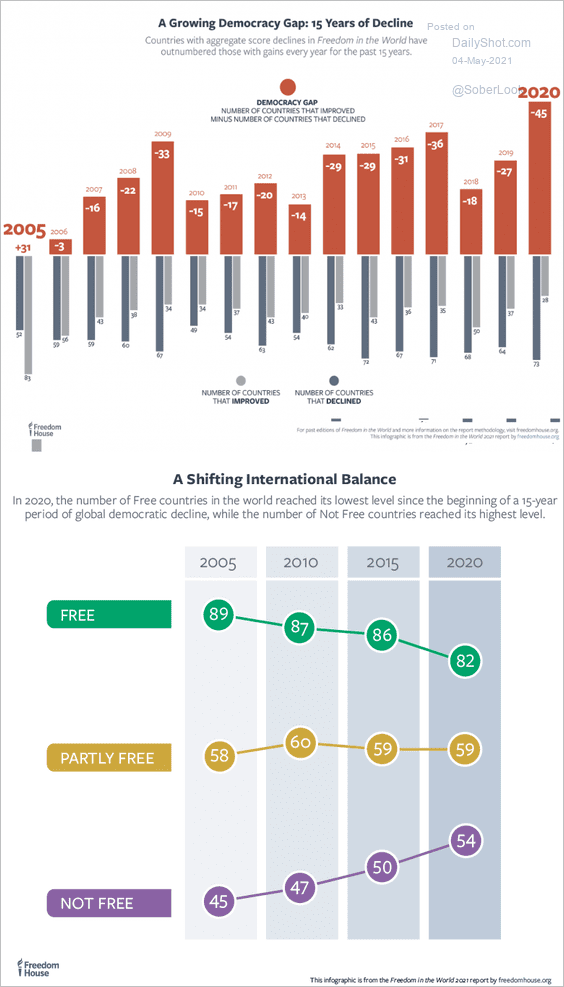

6. Democracy losing ground:

Source: FreedomHouse Read full article

Source: FreedomHouse Read full article

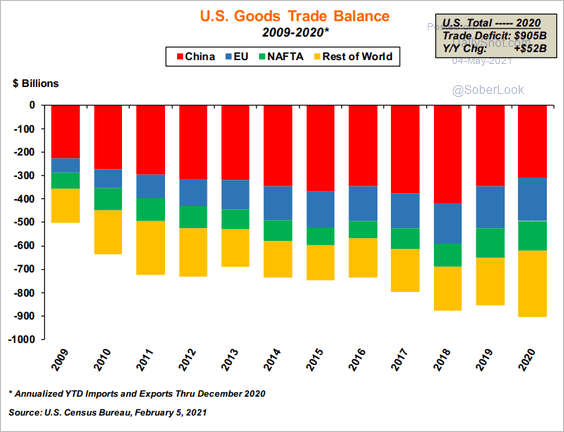

7. US trade deficit by country:

Source: Sam Kyei

Source: Sam Kyei

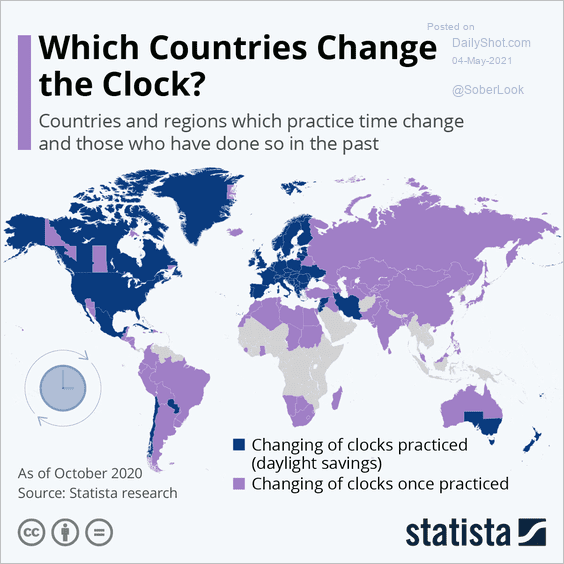

8. Changing of clocks:

Source: Statista

Source: Statista

——————–

Back to Index