The Daily Shot: 06-May-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

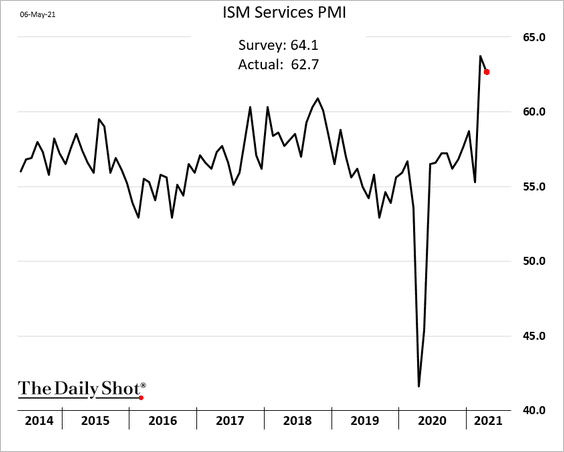

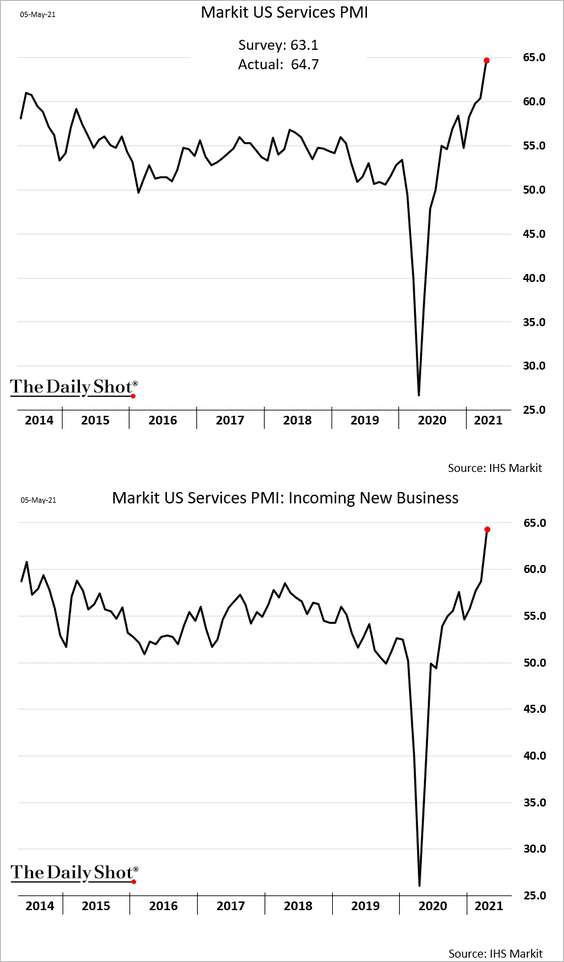

1. Growth in US service-sector industries has been remarkably strong, with both the ISM and Markit PMI measures near the highs.

• ISM:

• Markit:

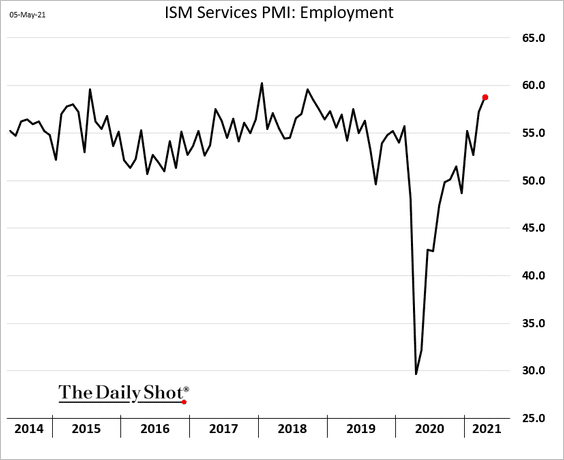

Hiring continues to accelerate.

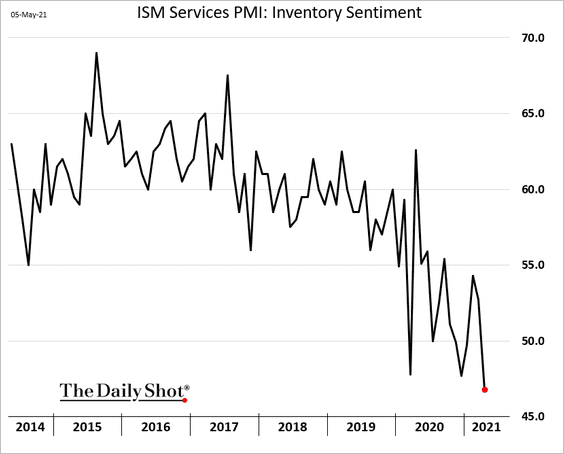

Inventories have been tightening rapidly.

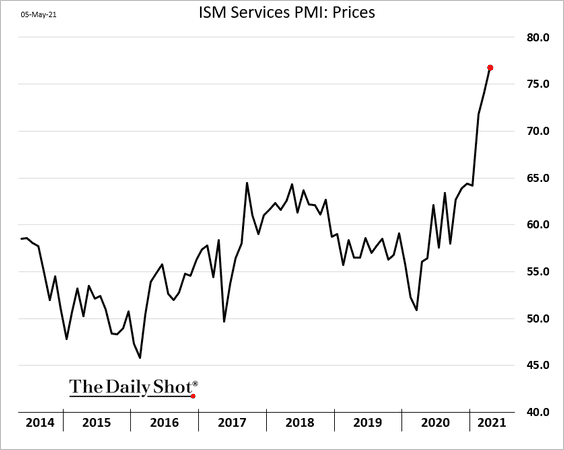

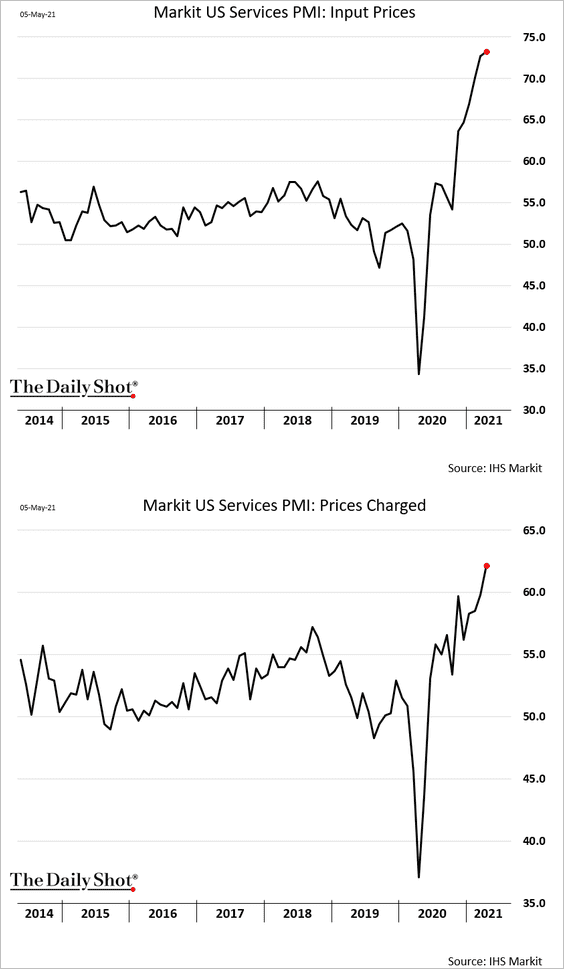

And price pressures continue to increase.

• ISM:

• Markit:

——————–

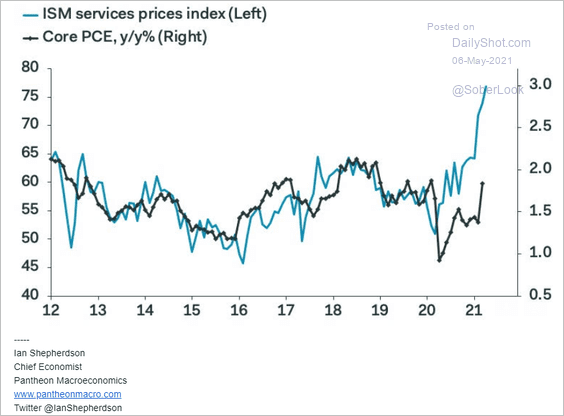

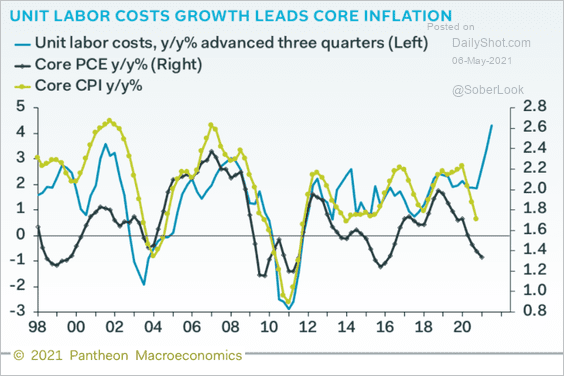

2. Price pressures in the service sector are expected to boost core consumer inflation (the core PCE is the Fed’s preferred metric).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Below are a few additional updates on inflation.

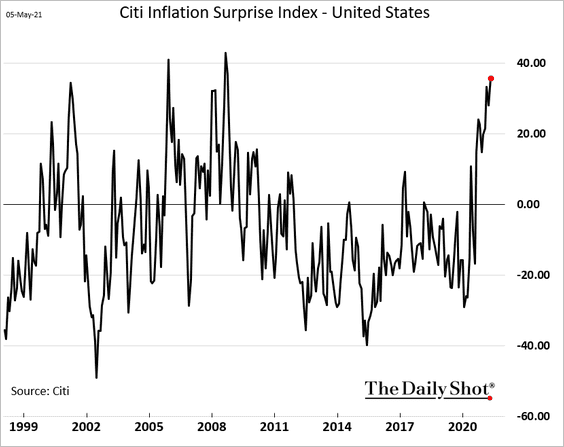

• US inflation reports have been surprising to the upside.

h/t @Callum_Thomas

h/t @Callum_Thomas

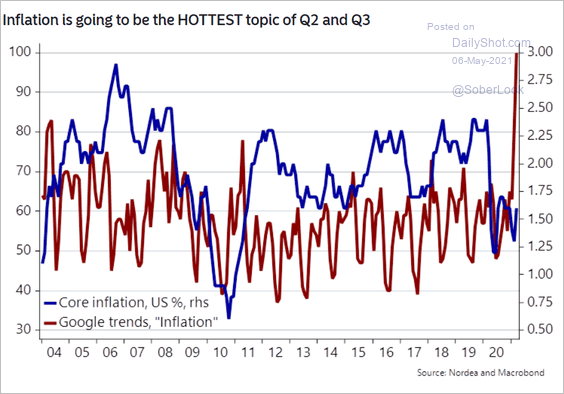

• Online searches for inflation reached a new high.

Source: Nordea Markets

Source: Nordea Markets

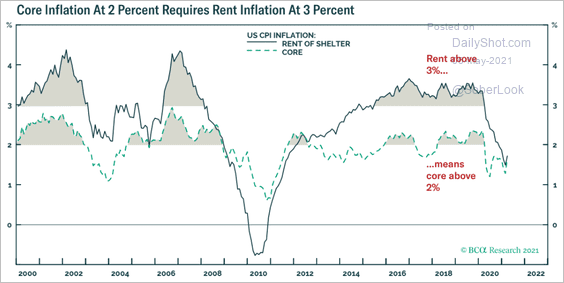

• Rent inflation would need to rise substantially to keep inflation above 2%.

Source: BCA Research

Source: BCA Research

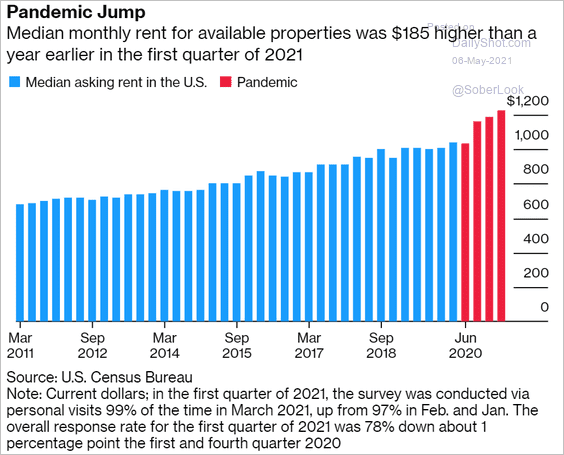

And surveys suggest that rent inflation is picking up.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

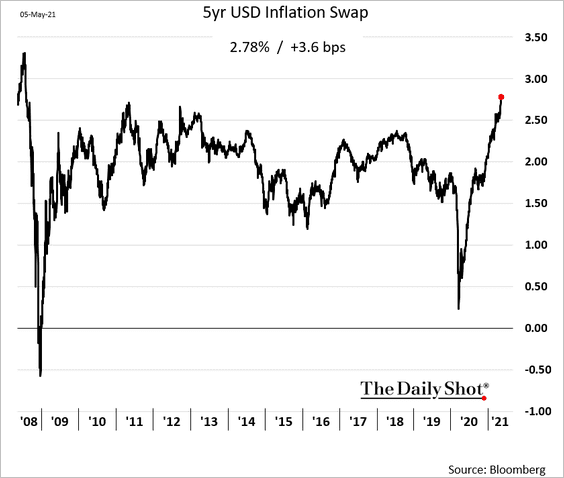

• Market-based inflation expectations keep grinding higher.

• Labor costs point to more inflation ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

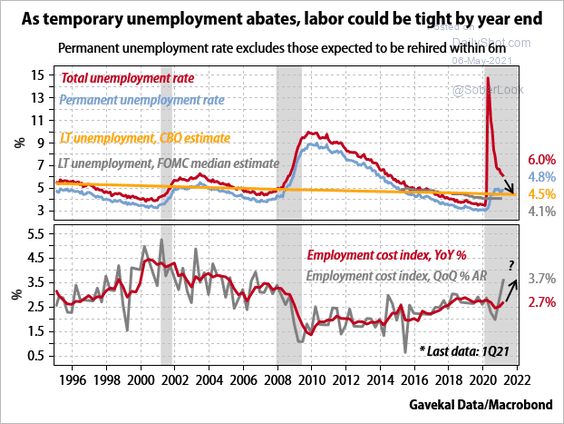

And we could be looking at much tighter labor markets going forward.

Source: Gavekal Research

Source: Gavekal Research

——————–

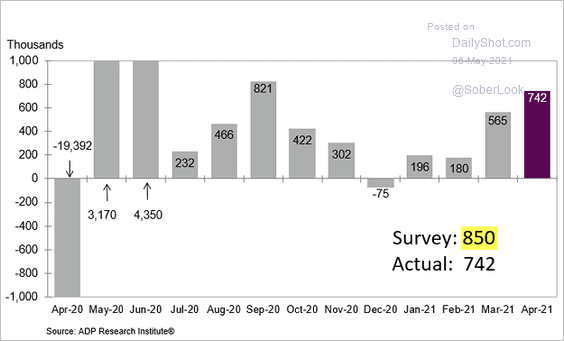

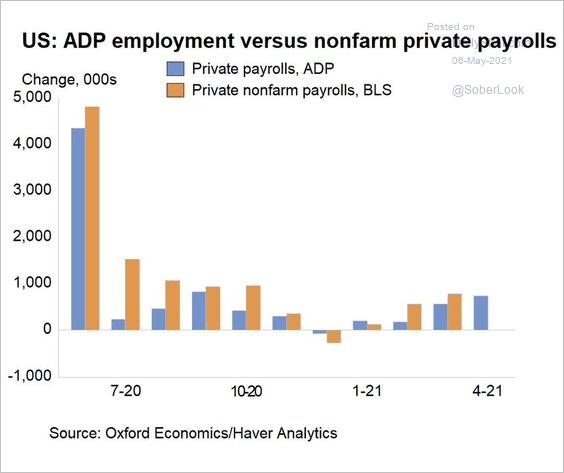

3. The ADP private payrolls report was a bit softer than expected.

Source: ADP Research Institute

Source: ADP Research Institute

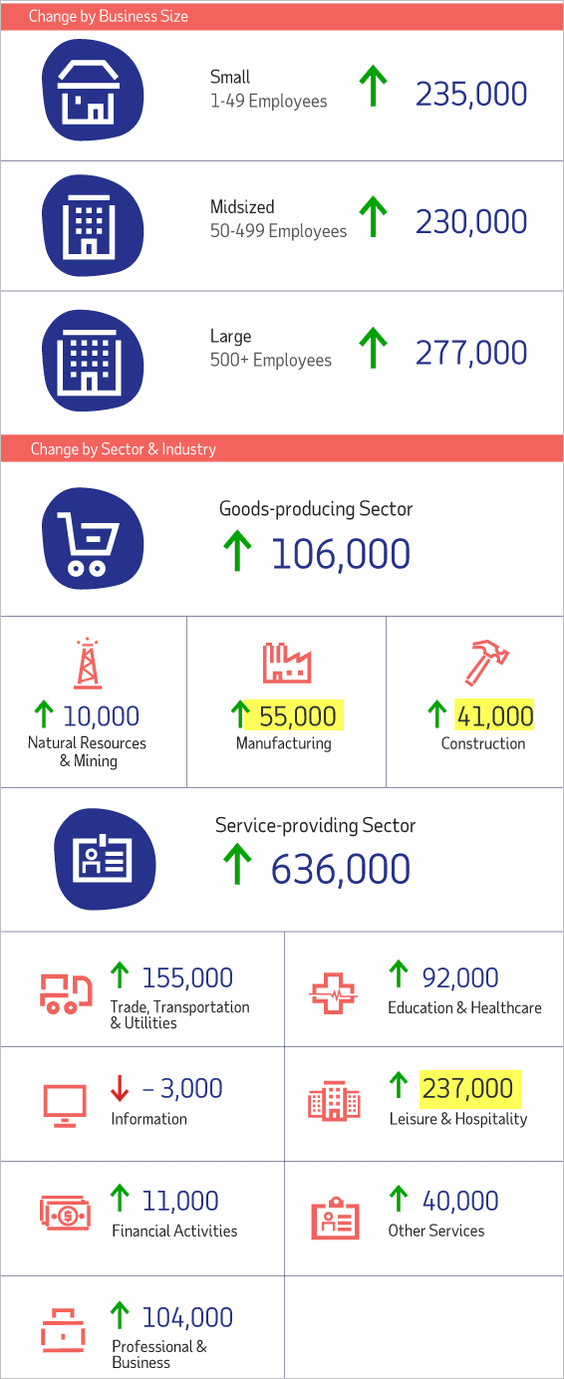

But employment gains were broad.

Source: ADP Research Institute

Source: ADP Research Institute

Moreover, the ADP figures have been undershooting the official employment data.

Source: @GregDaco

Source: @GregDaco

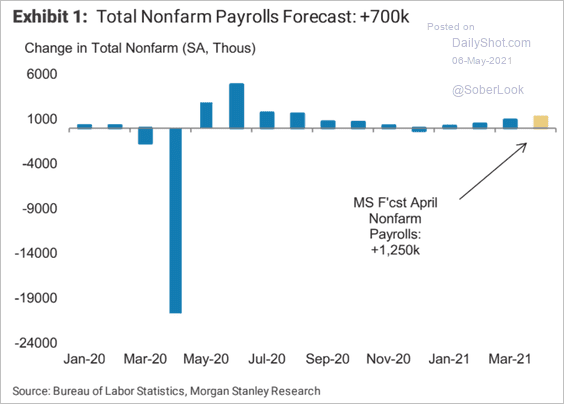

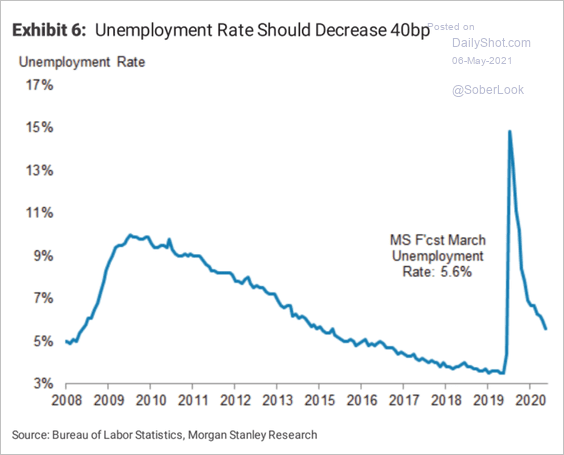

Morgan Stanley expects to see 1.25 million new jobs created in April (consensus is 1 million), with the unemployment rate dropping to 5.6% (2nd chart).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

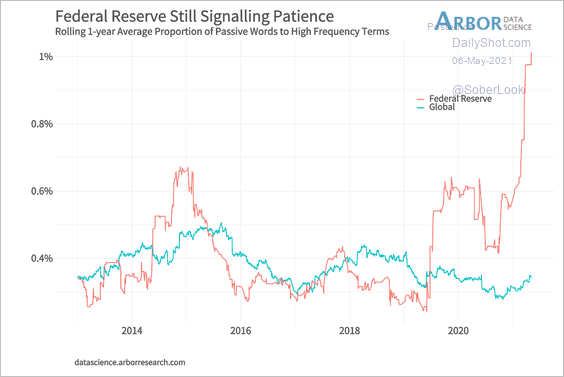

By the way, an exceptionally strong jobs report on Friday could pressure the stock market, potentially putting the Fed’s taper in play earlier than expected. So far, the US central bank has been signaling much more patience than global peers.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

The United Kingdom

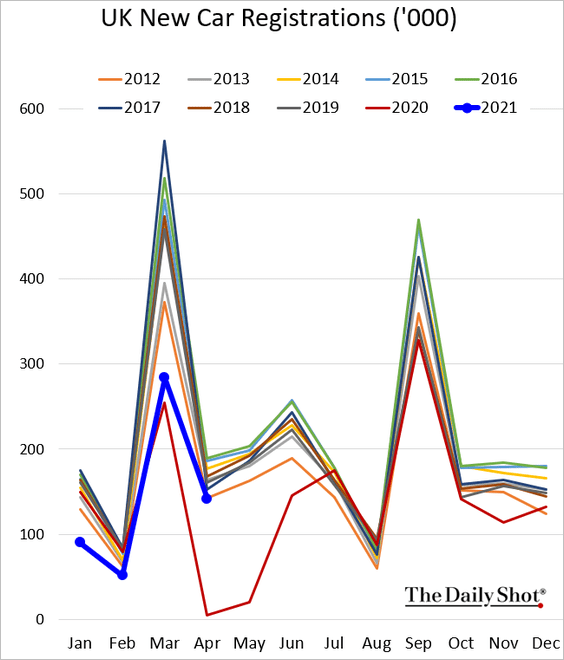

1. Last month’s new car registrations were roughly in line with the 2012 levels (for this time of the year).

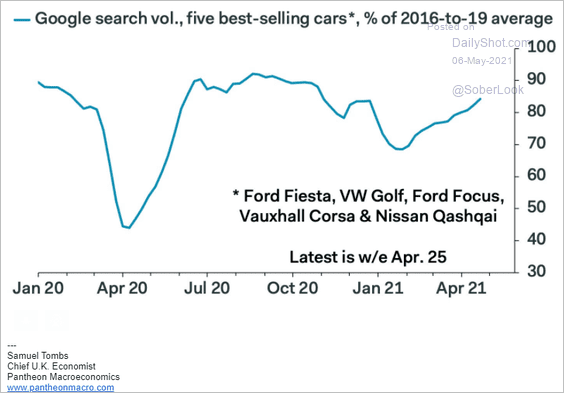

But online search activity suggests improvements in automobile purchases.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

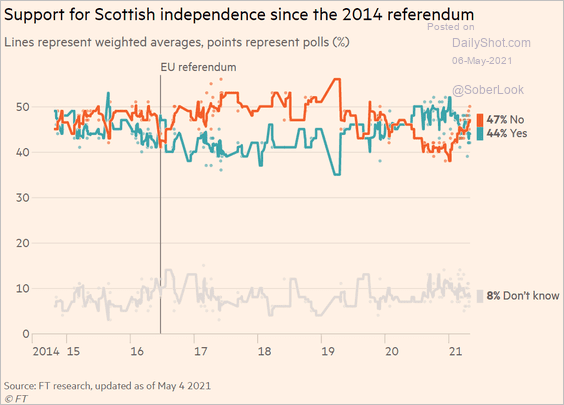

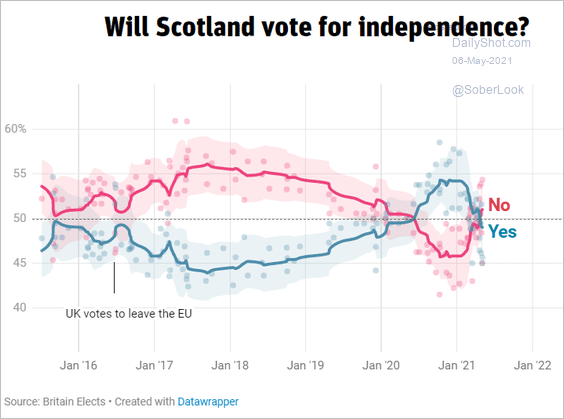

2. Surveys point to less enthusiasm toward Scottish independence (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @NewStatesman Read full article

Source: @NewStatesman Read full article

Back to Index

The Eurozone

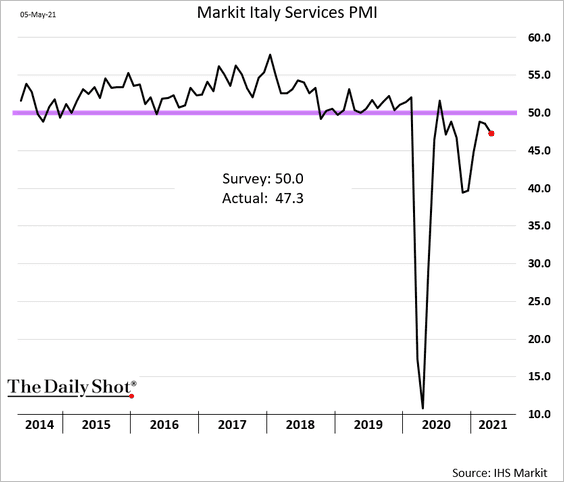

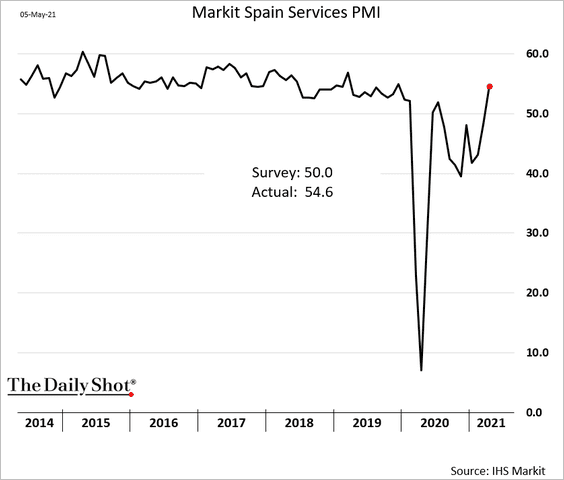

1. Service PMI reports have been mixed.

• Italy (in contraction mode):

• Spain (surprising strength):

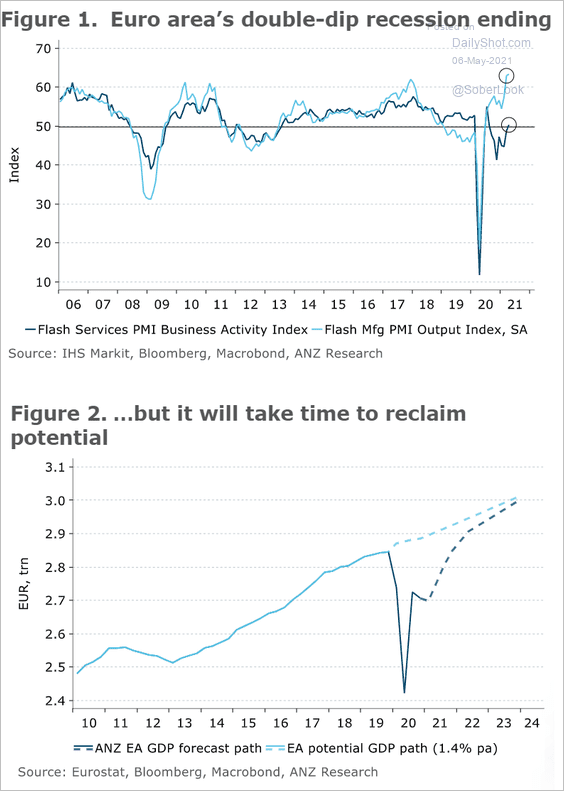

Service sectors continue to lag manufacturing (due to lockdowns). It will take some time for the euro-area GDP growth to return to its pre-COVID trend.

Source: ANZ Research

Source: ANZ Research

——————–

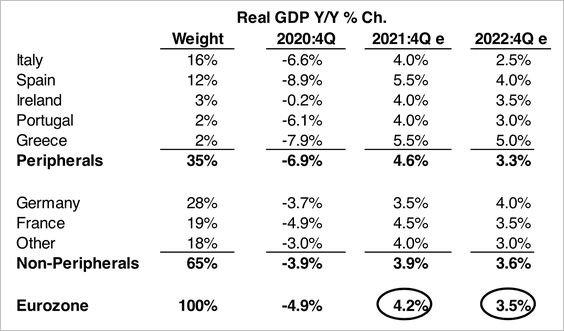

2. Evercore ISI forecasts a rebound in year-over-year real GDP growth of 4.2% in Q4.

Source: Evercore ISI

Source: Evercore ISI

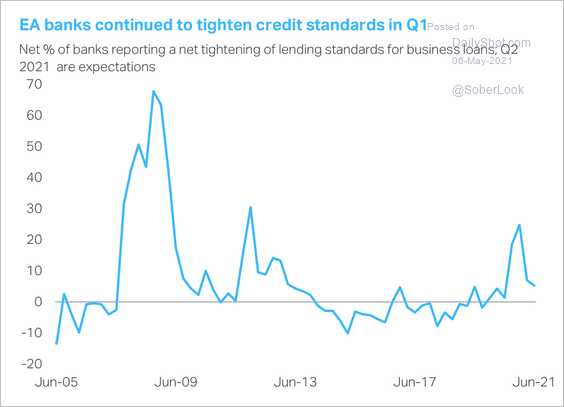

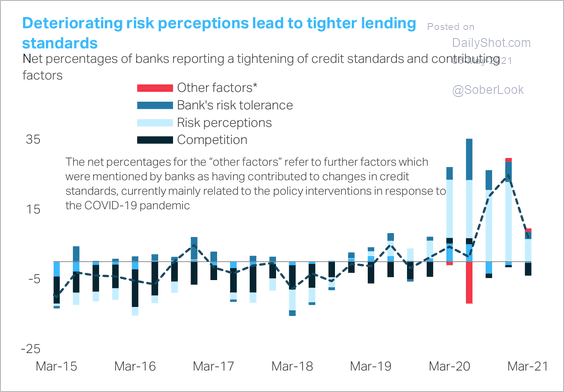

3. European banks continue to tighten credit standards for business loans, although to a lesser extent than the previous quarter (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

Source: TS Lombard

——————–

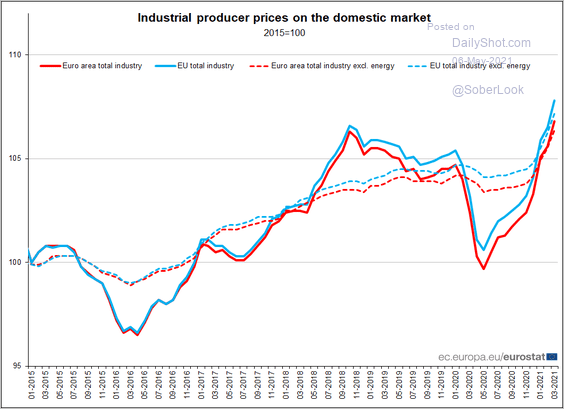

4. Industrial producer prices are surging.

Source: Eurostat Read full article

Source: Eurostat Read full article

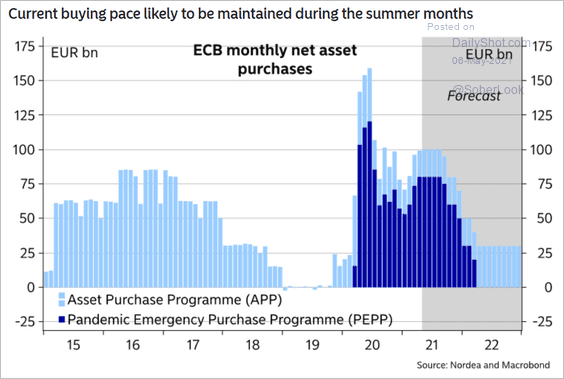

5. The ECB will probably begin tapering this fall.

Source: Nordea Markets

Source: Nordea Markets

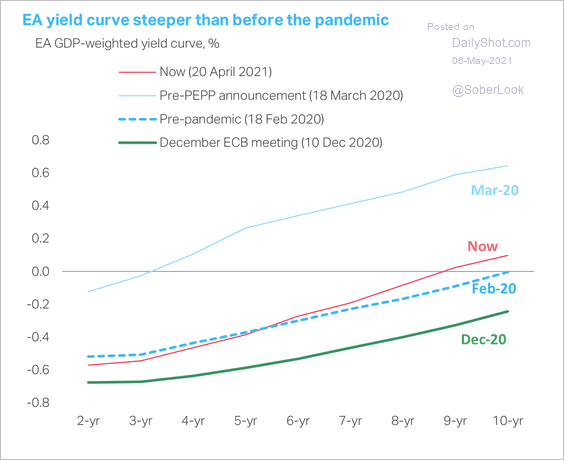

6. The euro-area yield curve has steepened over the past year – and meaningfully so compared to December levels.

Source: TS Lombard

Source: TS Lombard

Back to Index

Asia – Pacific

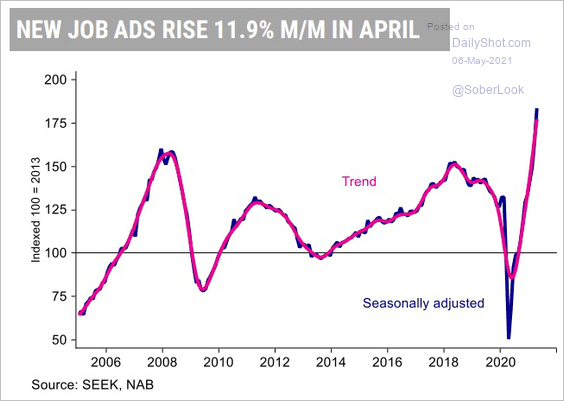

1. Job ads surge in Australia.

Source: SEEK, @Scutty

Source: SEEK, @Scutty

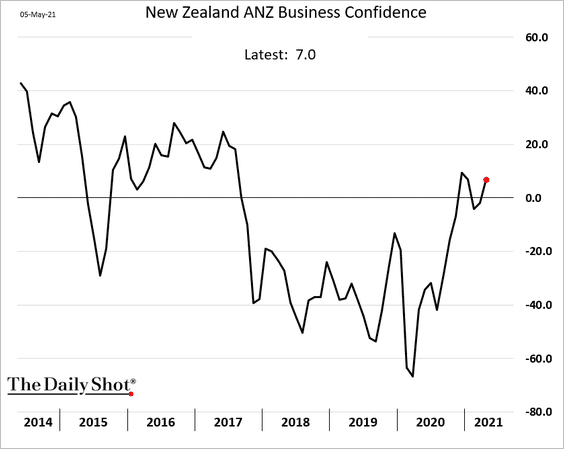

2. New Zealand’s business confidence index shows improvement.

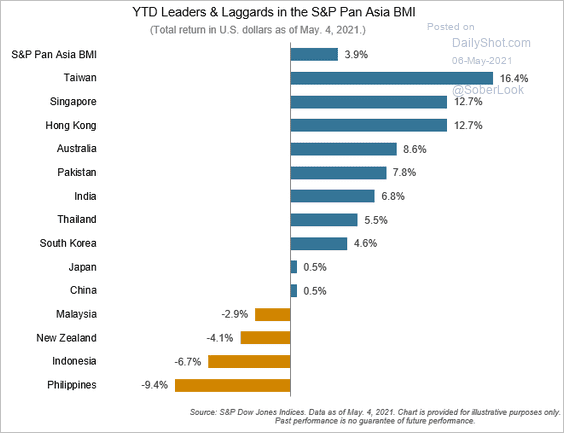

3. Here is a look at the year-to-date equity returns.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

China

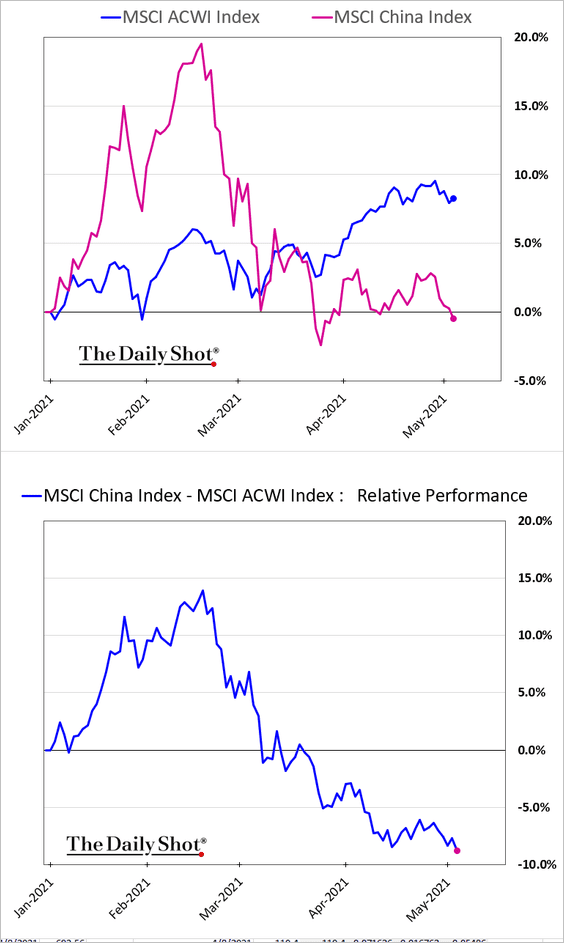

1. The stock market continues to lag global peers.

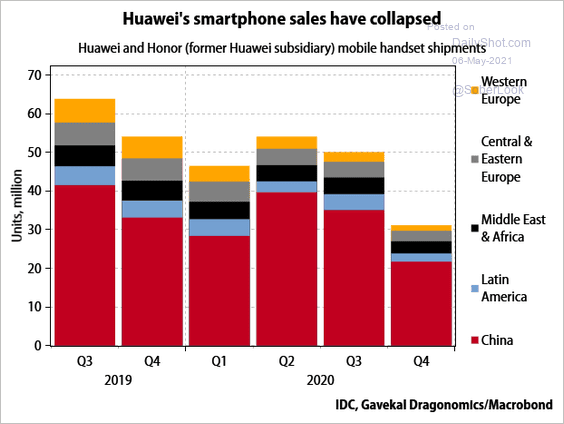

2. Huawei’s smartphone sales have tumbled as the company’s chip inventory shrinks (hurt by US restrictions).

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

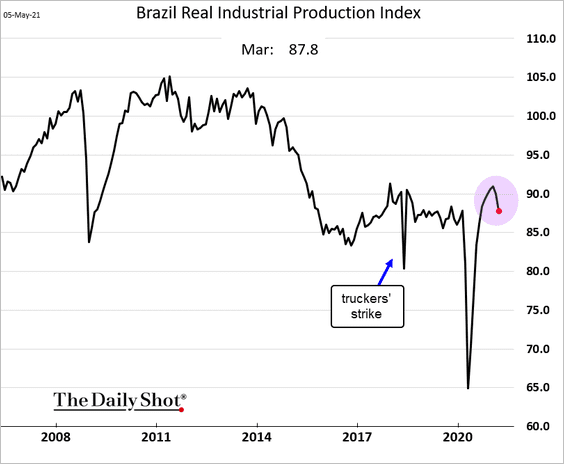

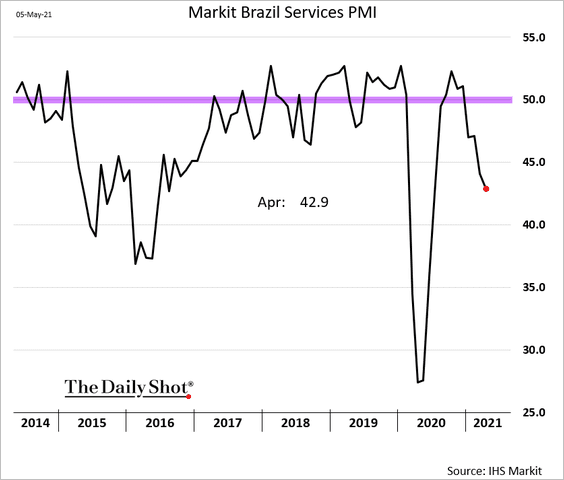

1. Let’s begin with Brazil.

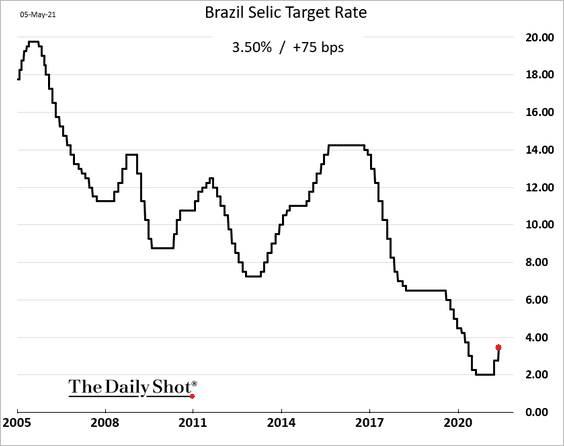

• The central bank hiked rates (as expected).

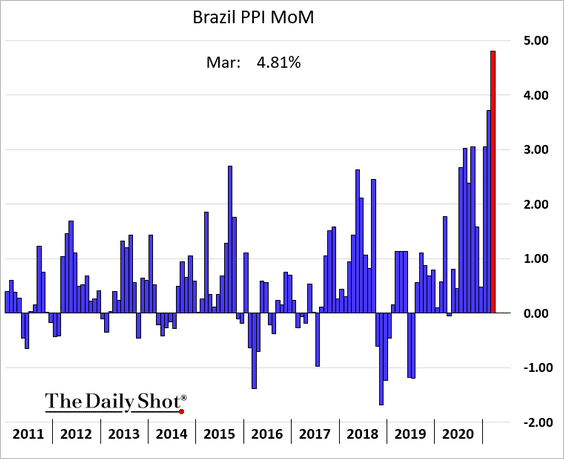

• Producer prices are surging.

• Industrial production has been slowing.

• Service-sector activity has deteriorated sharply.

——————–

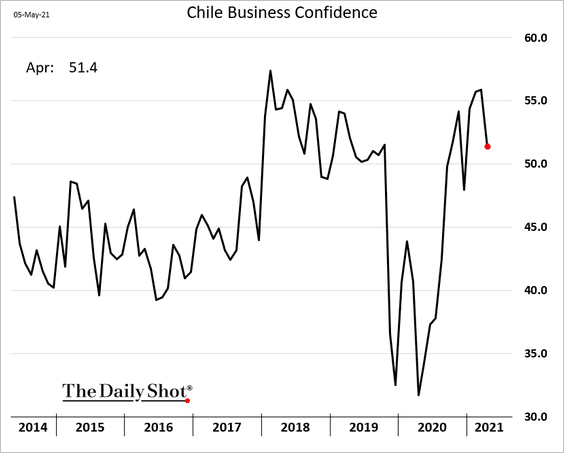

2. Chile’s business confidence is off the highs.

3. Indonesia’s GDP rebound will take time.

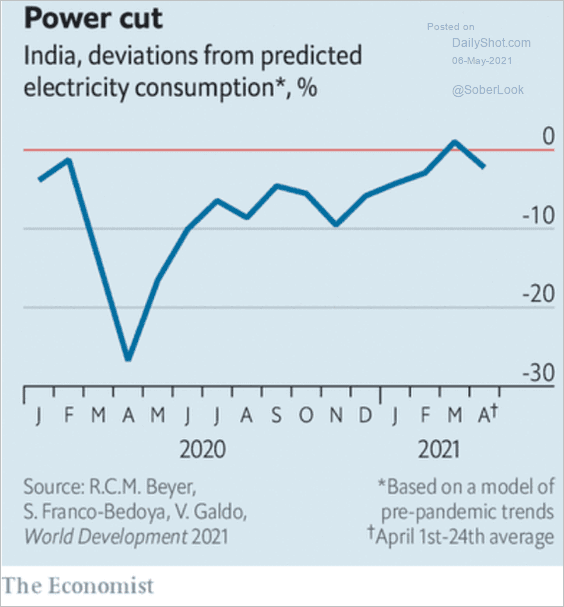

4. India’s electricity usage declined last month.

Source: @adam_tooze; The Economist Read full article

Source: @adam_tooze; The Economist Read full article

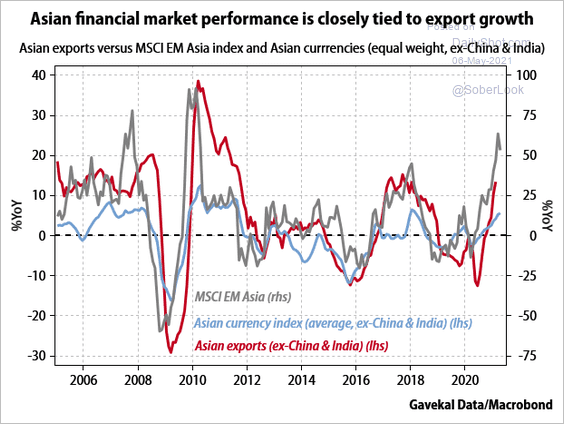

5. EM Asia stock performance is closely linked to exports.

Source: Gavekal Research

Source: Gavekal Research

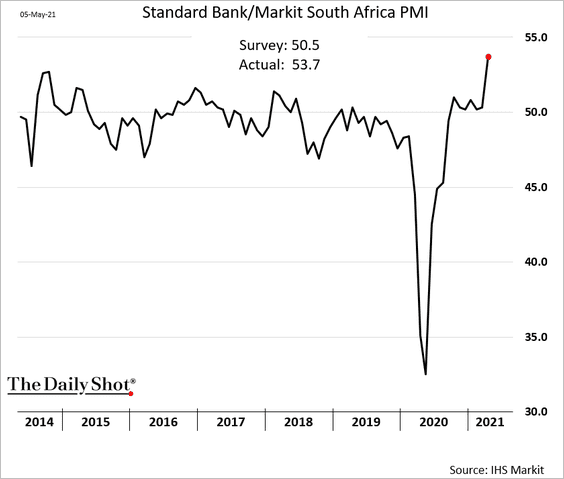

6. South Africa’s business activity has been remarkably strong.

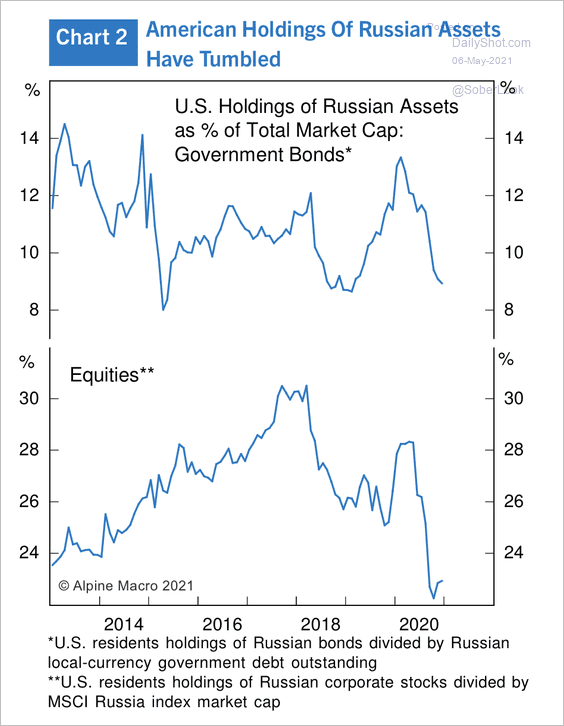

7. US holdings of Russian assets have tumbled to multi-year lows.

Source: Alpine Macro

Source: Alpine Macro

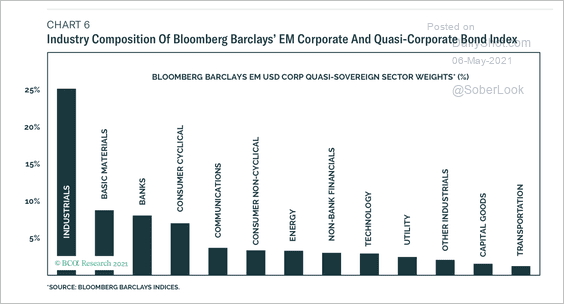

8. Here is a breakdown of industry weights in the EM corporate credit benchmark.

Source: BCA Research

Source: BCA Research

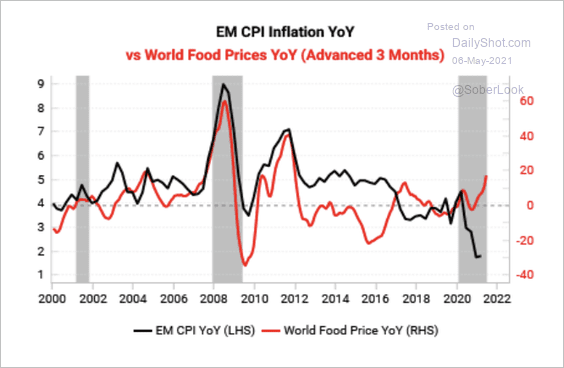

9. Rising food prices could lead to higher EM inflation.

Source: Variant Perception

Source: Variant Perception

Back to Index

Cryptocurrency

As the stock market gains slow, the Reddit crowd floods into crypto – the more speculative, the better. Dogecoin has gone parabolic.

Source: FXT

Source: FXT

So why not have a cat-themed coin now?

Source: CNN Read full article

Source: CNN Read full article

This brings back memories of the Beanie Baby bubble.

Source: wbur Read full article

Source: wbur Read full article

Back to Index

Commodities

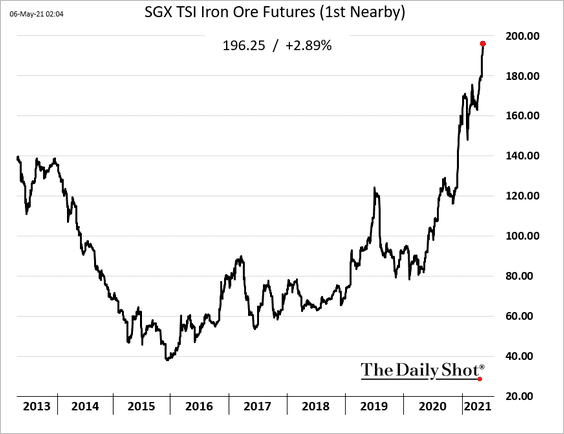

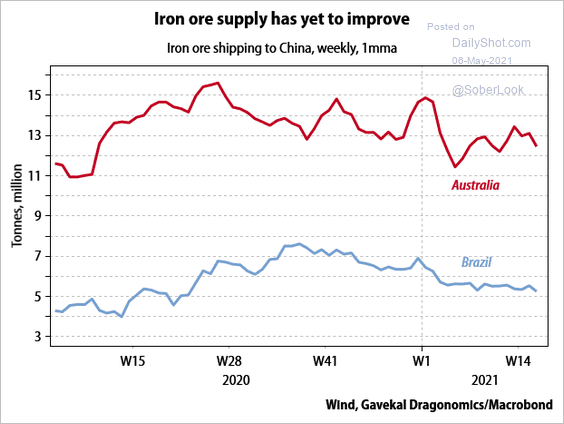

1. Iron ore prices continue to surge, …

… as supply remains limited.

Source: Gavekal Research

Source: Gavekal Research

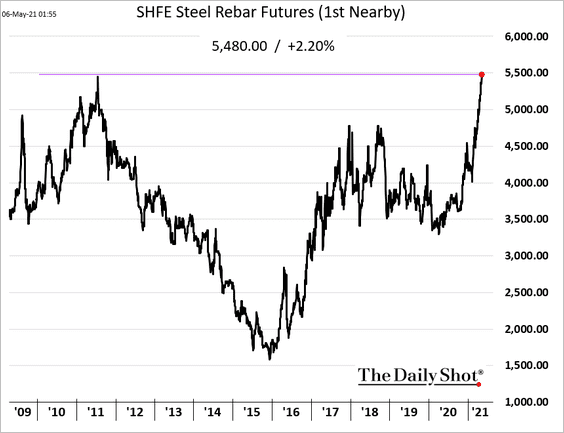

China’s steel rebar futures just cleared the decade-old peak.

——————–

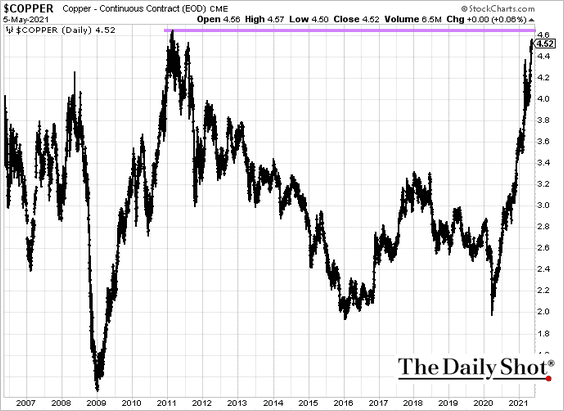

2. Copper is approaching its 2011 peak.

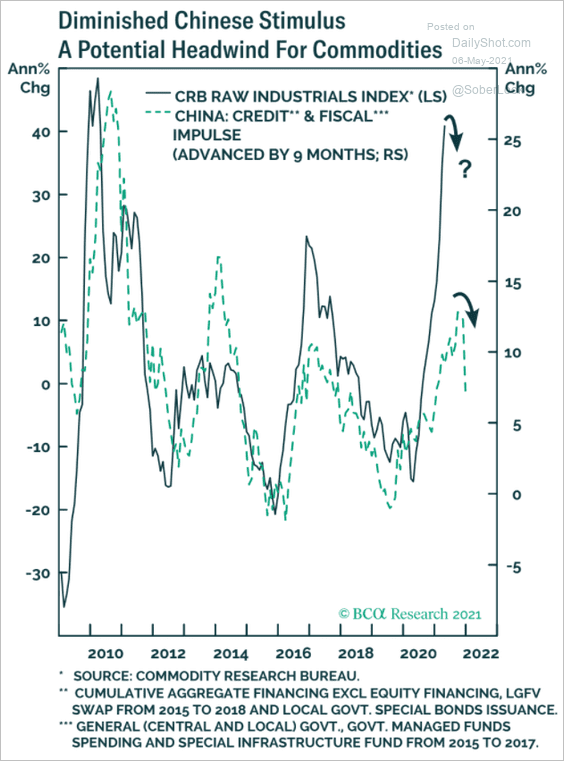

But are these gains in industrial commodities sustainable?

Source: BCA Research

Source: BCA Research

——————–

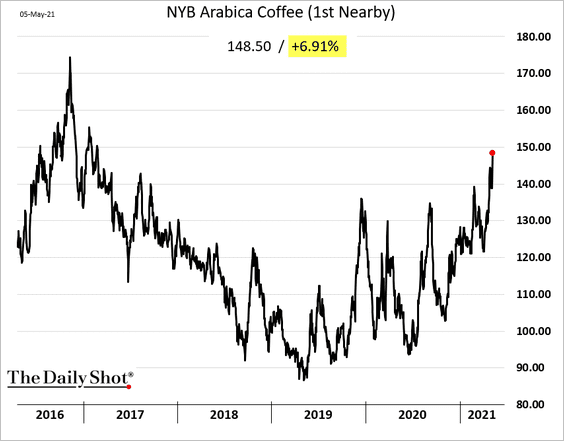

3. Drought has been devastating the coffee crop in Brazil, sending futures soaring.

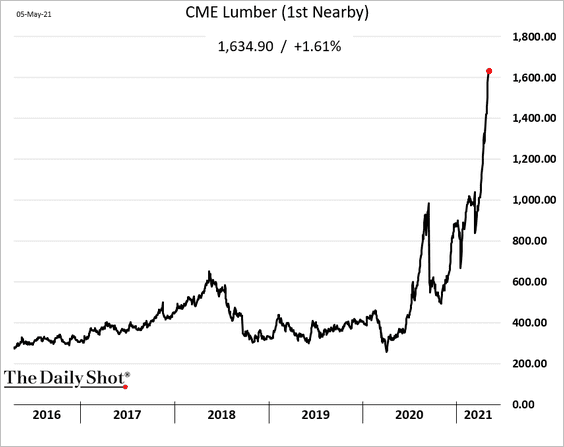

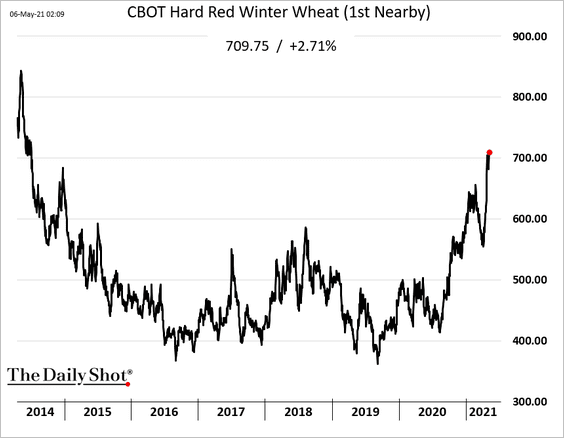

4. We continue to see further strength in the “usual suspects” – lumber and US grains.

Back to Index

Energy

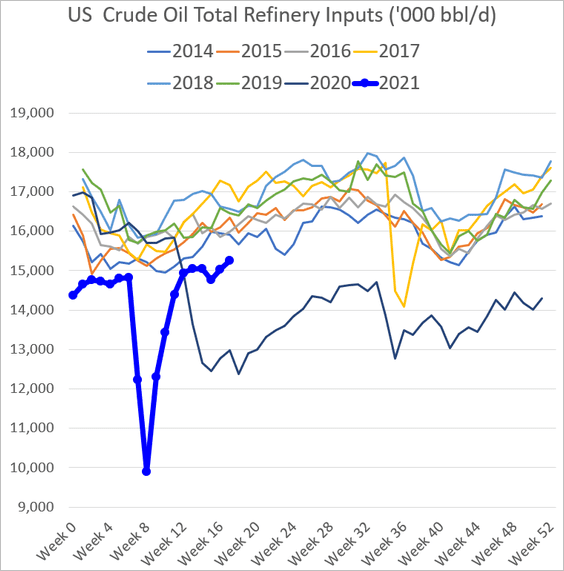

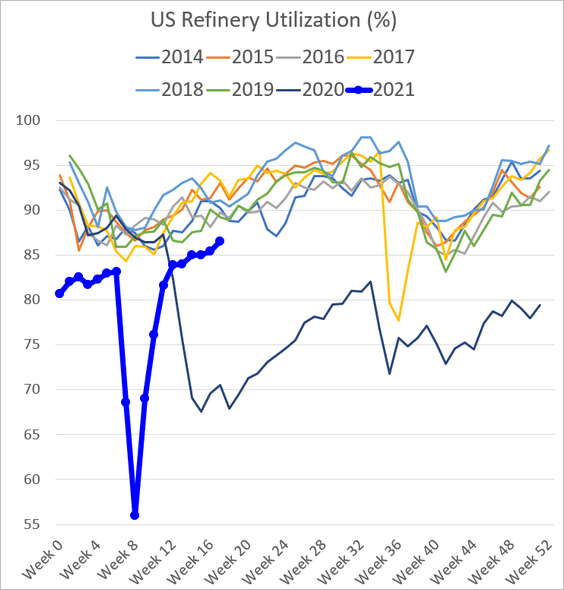

1. US refinery activity continues to improve.

• Refinery inputs:

• Utilization:

h/t @MikeJeffers

h/t @MikeJeffers

——————–

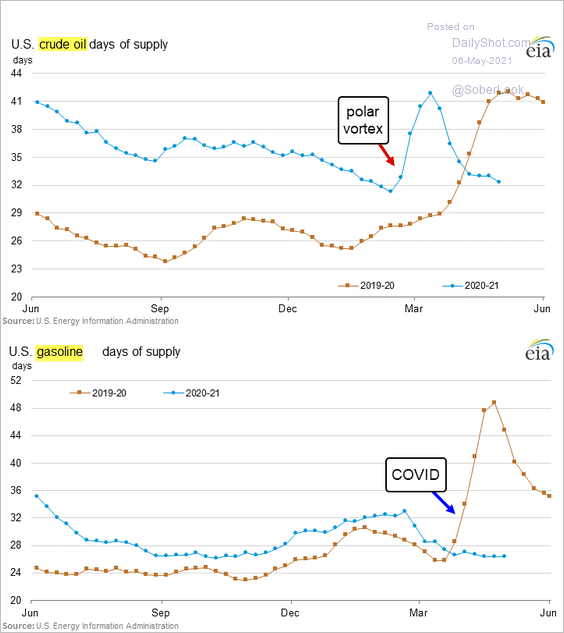

2. Crude oil inventories are back at pre-Texas-freeze levels (measured in days of supply).

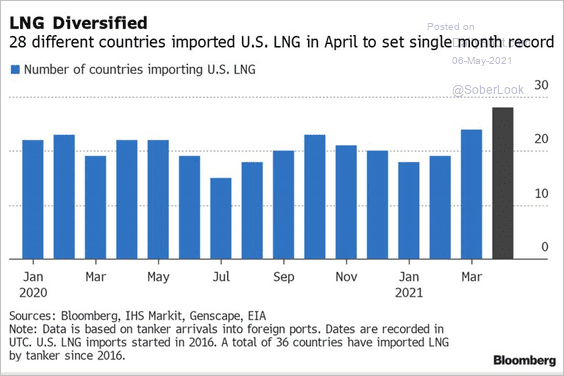

3. Next, we have a couple of updates on LNG.

• US LNG exports have broadened.

Source: @SStapczynski

Source: @SStapczynski

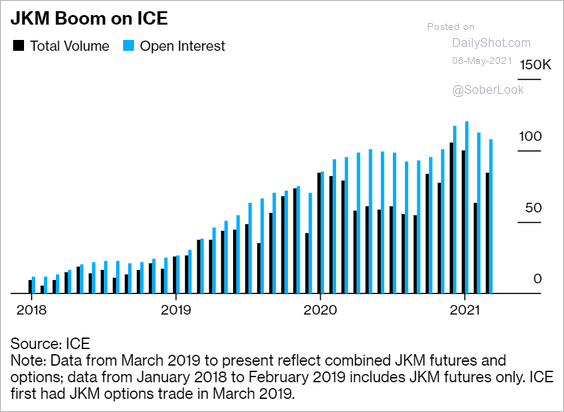

• LNG paper marker (financial as opposed to physical) trading activity has been on the rise.

Source: @markets Read full article

Source: @markets Read full article

Back to Index

Equities

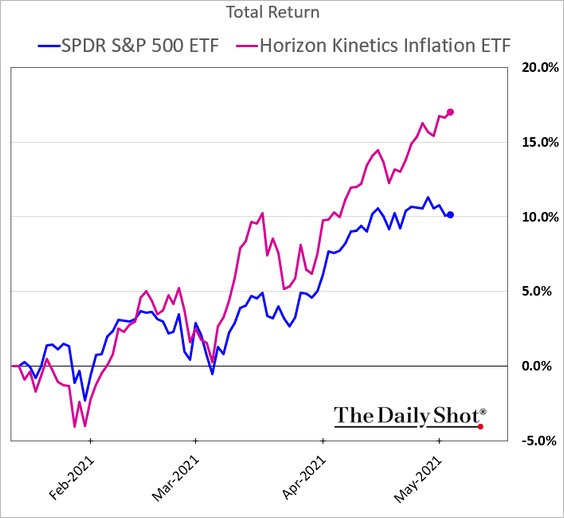

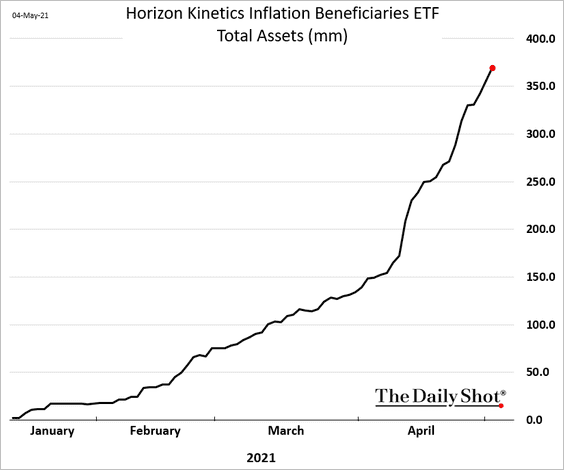

1. Investors are increasingly concerned about inflation. Below is a recently launched inflation-sensitive equity ETF.

And here is this ETF’s AUM.

——————–

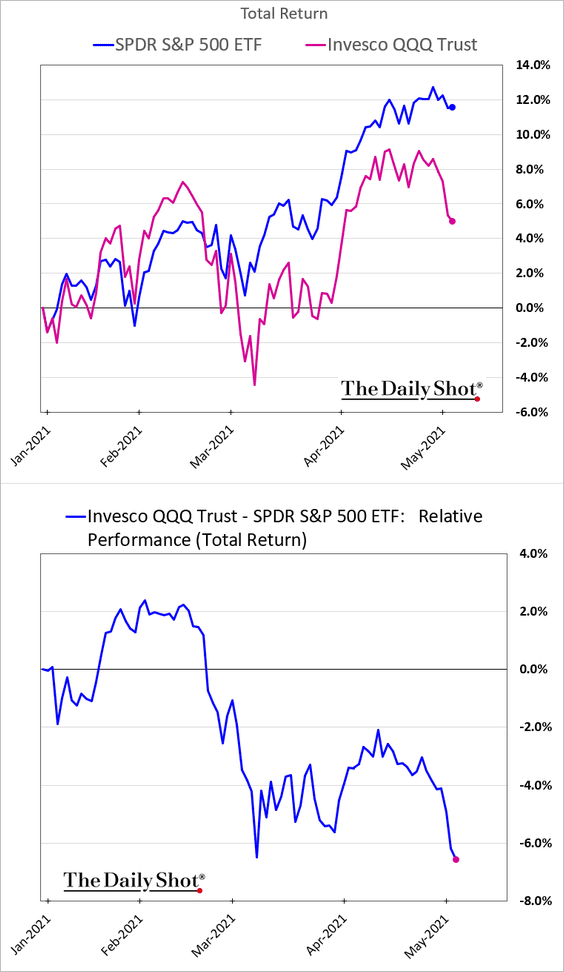

2. The Nasdaq 100 continues to underperform.

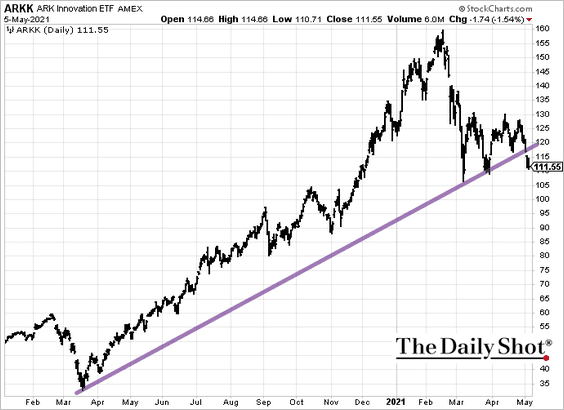

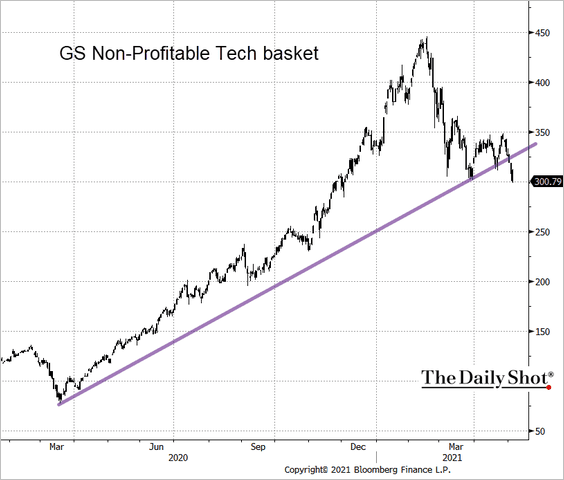

3. Some of the more speculative shares have been struggling lately as the Reddit crowd shifts to cryptocurrencies.

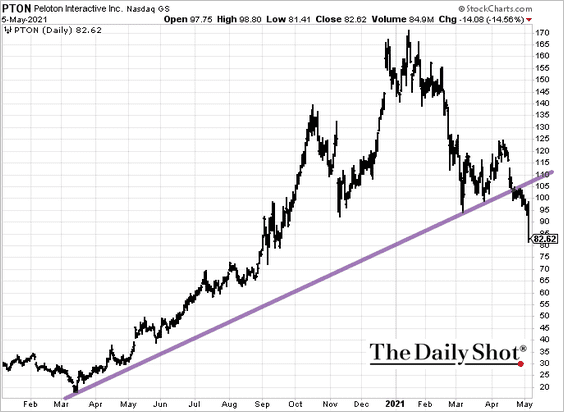

• Ark Innovation:

h/t Cormac Mullen

h/t Cormac Mullen

• Non-profitable tech stocks:

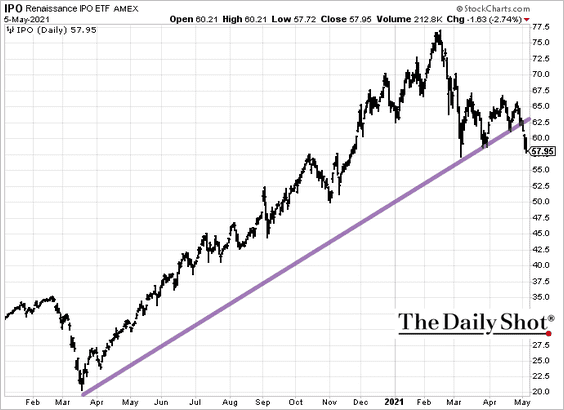

• Post-IPO stocks:

——————–

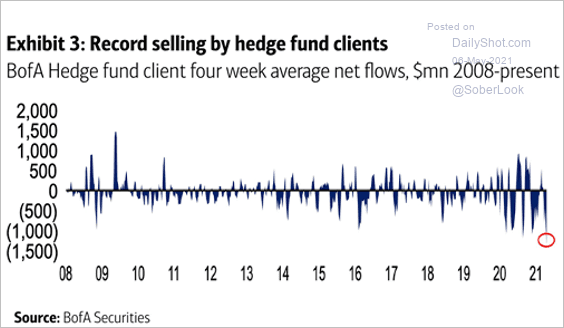

4. Hedge funds have been selling stocks.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

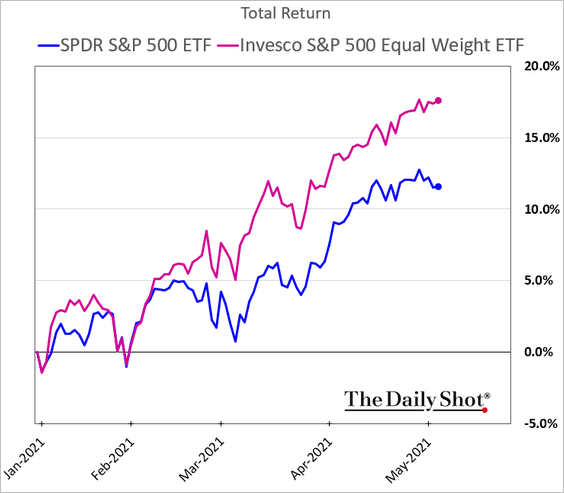

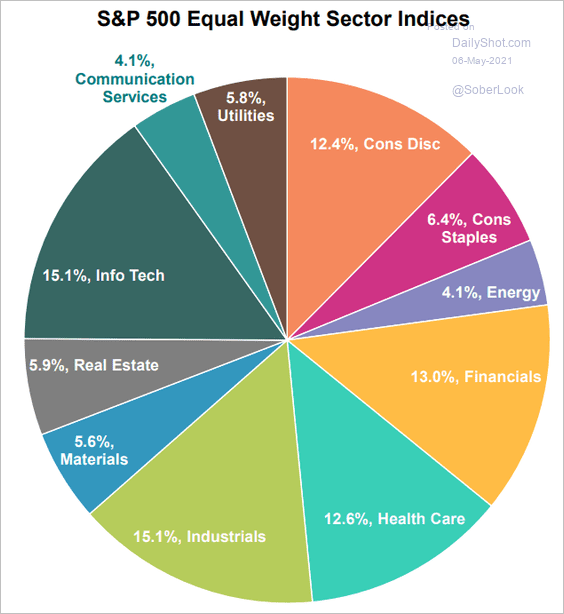

5. The S&P 500 equal-weight index has been outperforming.

Here is the sector distribution of the equal-weight index.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

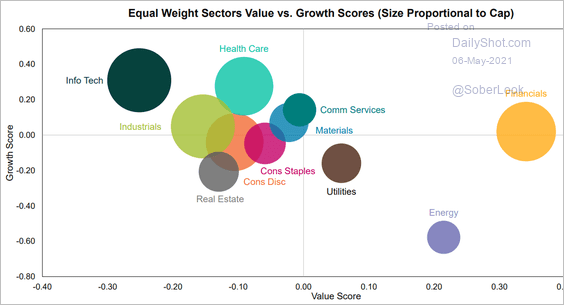

And this is how the equal-weight sectors are distributed in terms of growth and value.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

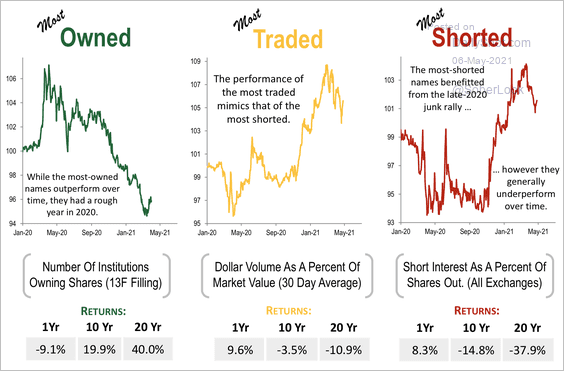

6. Over the long-term, the most owned stocks tend to perform well while the most traded and most shorted stocks tend to underperform.

Source: Cornerstone Macro

Source: Cornerstone Macro

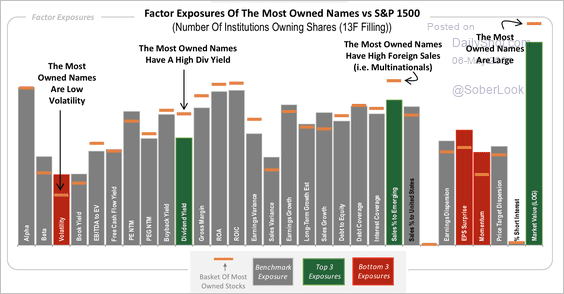

The most owned stocks tend to be large-cap, low volatility, and high dividend payers.

Source: Cornerstone Macro

Source: Cornerstone Macro

——————–

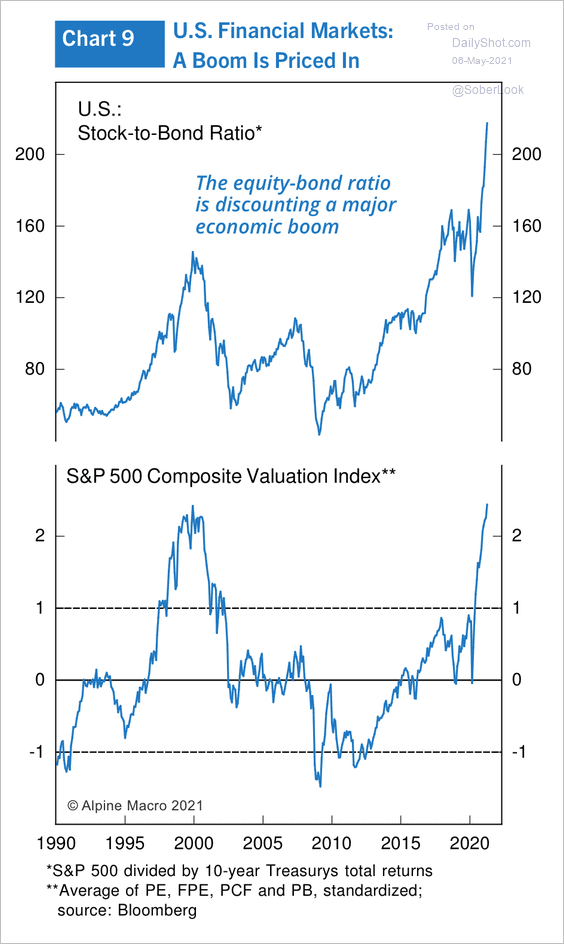

7. Has the stock/bond ratio reached an extreme?

Source: Alpine Macro

Source: Alpine Macro

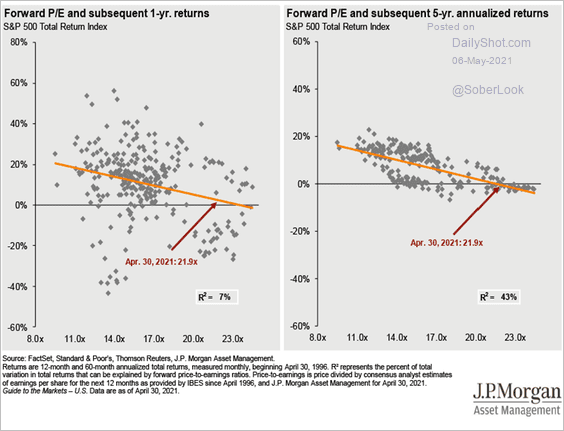

8. Lofty valuations point to lower returns ahead.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

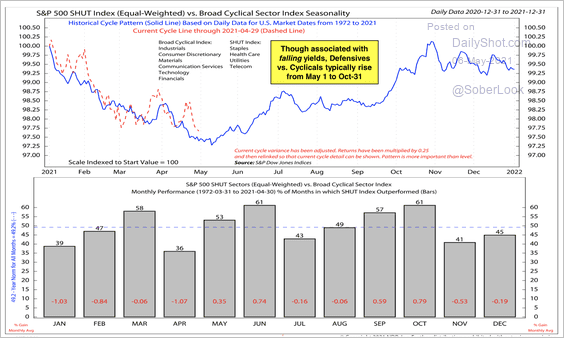

9. A seasonal lull in equities could benefit defensive stocks over cyclicals.

Source: Stifel

Source: Stifel

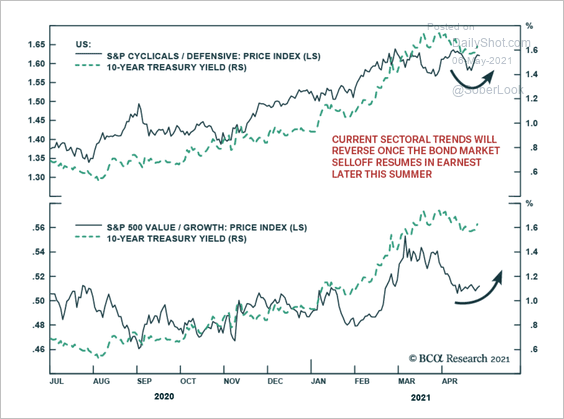

For now, cyclical and value stocks have risen along with the 10-year Treasury yield.

Source: BCA Research

Source: BCA Research

Back to Index

Rates

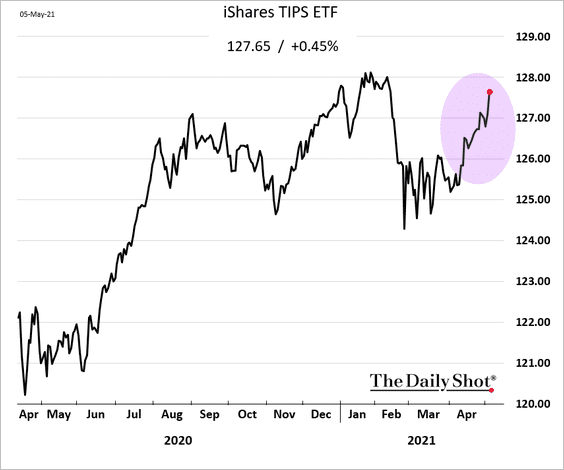

Inflation fears are pushing investors back into TIPS.

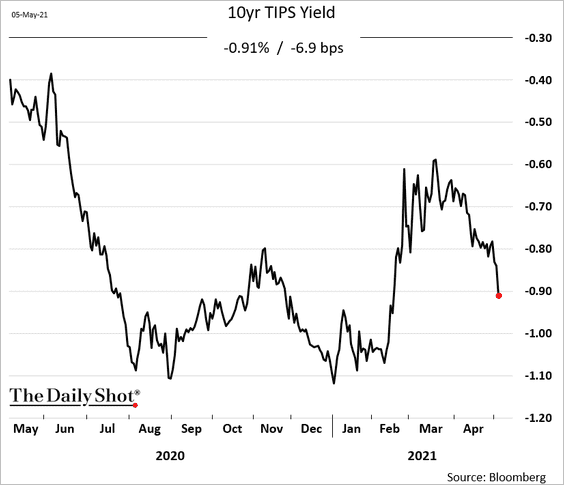

Real yields tumbled in recent days.

——————–

Food for Thought

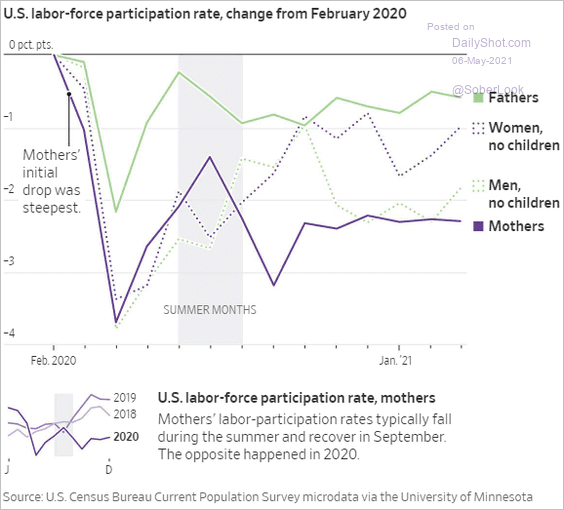

1. Changes in US labor-force participation:

Source: @WSJ Read full article

Source: @WSJ Read full article

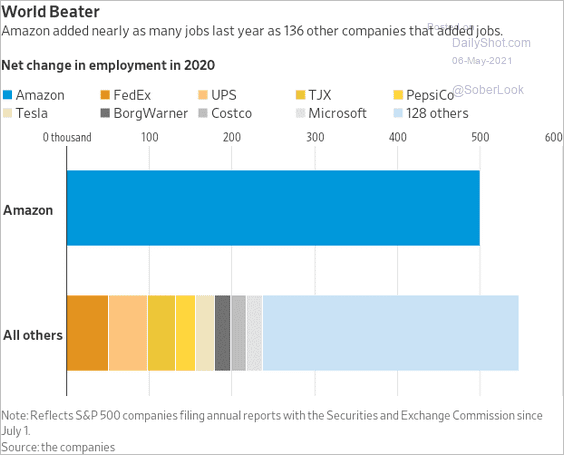

2. Amazon’s hiring in 2020:

Source: @WSJ Read full article

Source: @WSJ Read full article

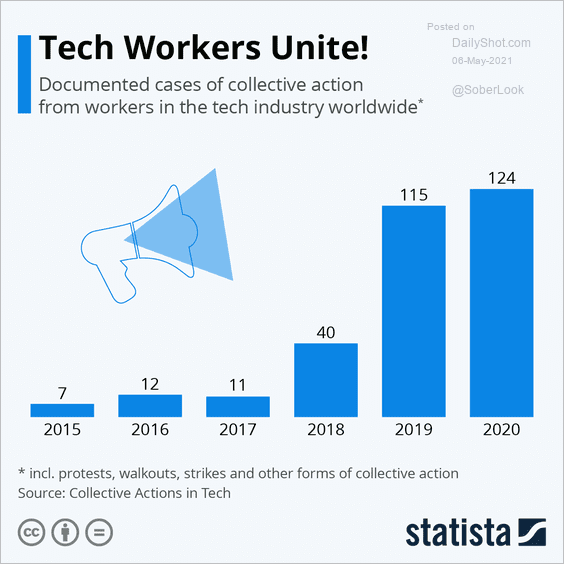

3. Tech industry’s collective action:

Source: @chartrdaily

Source: @chartrdaily

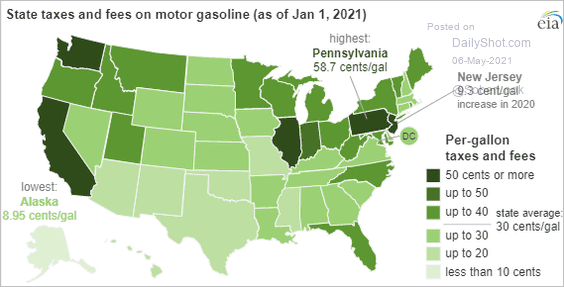

4. US gasoline taxes:

Source: @EIAgov

Source: @EIAgov

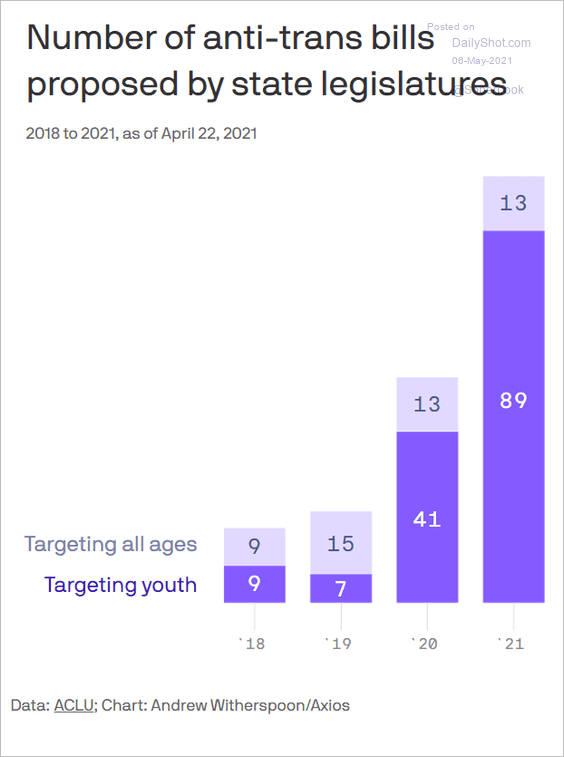

5. Proposed anti-trans legislation:

Source: @axios Read full article

Source: @axios Read full article

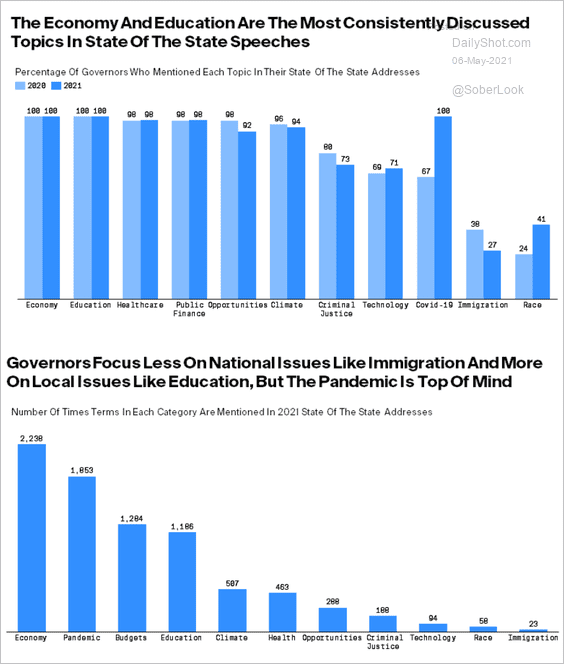

6. State of the State speeches:

Source: Hamilton Place Strategies Read full article

Source: Hamilton Place Strategies Read full article

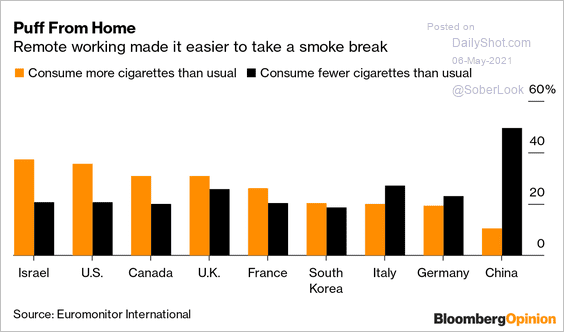

7. Changes in smoking:

Source: @AndreaFelsted, @bopinion Read full article

Source: @AndreaFelsted, @bopinion Read full article

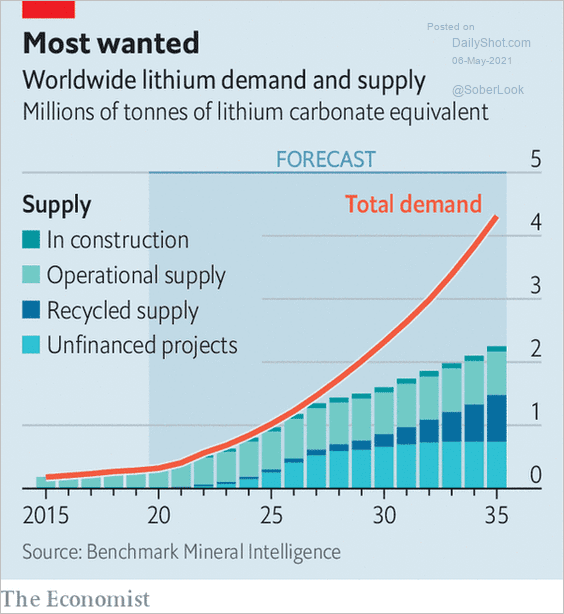

8. Lithium demand:

Source: The Economist Read full article

Source: The Economist Read full article

9. Beer preferences by region:

Source: Ranker Read full article

Source: Ranker Read full article

——————–

Back to Index