The Daily Shot: 21-May-21

• The United States

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Global Developments

• Food For Thought

The United States

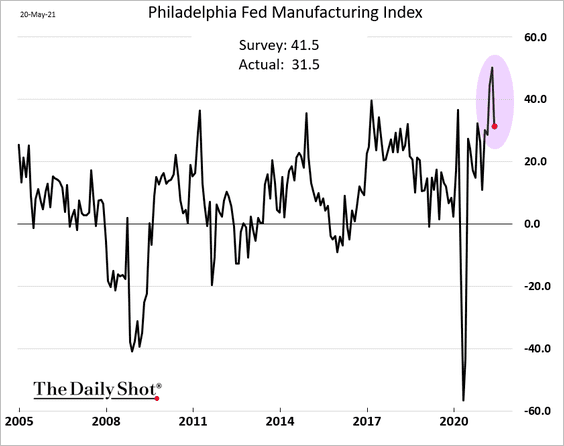

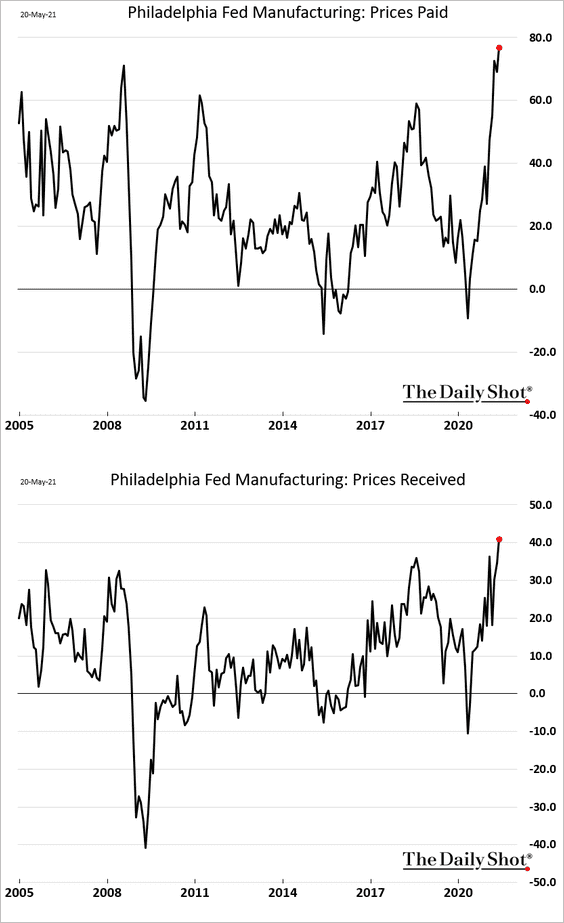

1. The Philly Fed’s manufacturing index weakened more than expected this month.

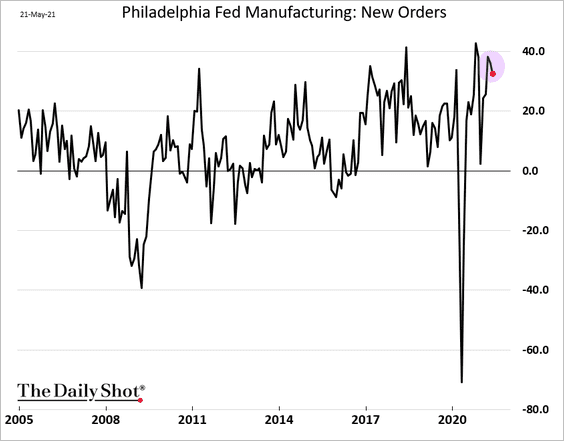

To be sure, the PA/NJ/DE-area factory activity remains strong, but this report shows a loss of momentum. Much of this pullback was due to supply bottlenecks but not all. Demand eased slightly as well (chart below). Are higher output prices to blame?

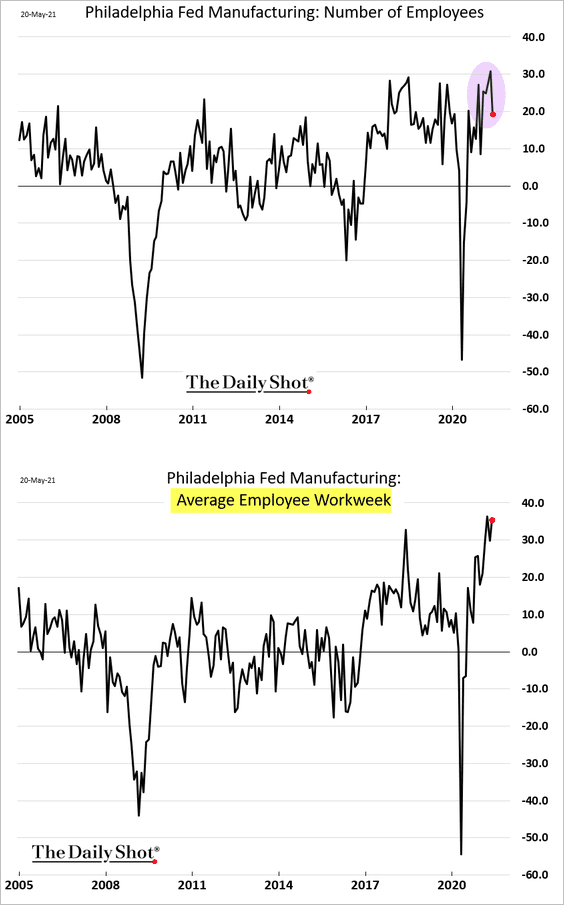

• Hiring slowed, but many manufacturers are boosting workers’ hours.

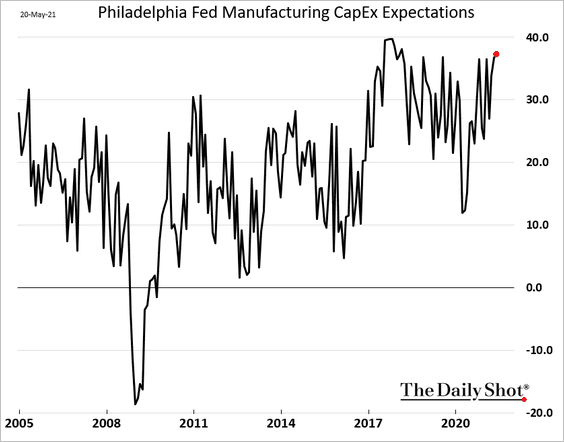

• The CapEx expectations index remains elevated.

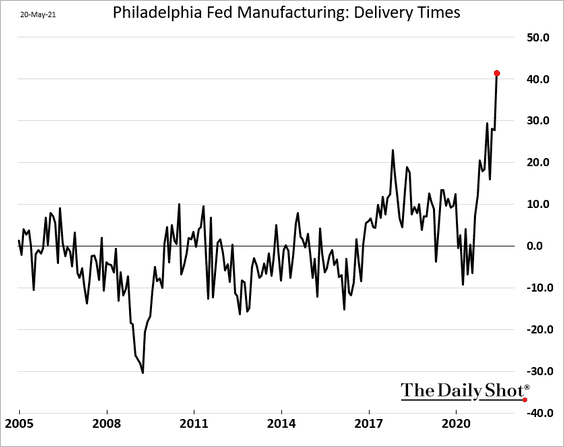

• Supply challenges are hitting extreme levels as delivery times extend further.

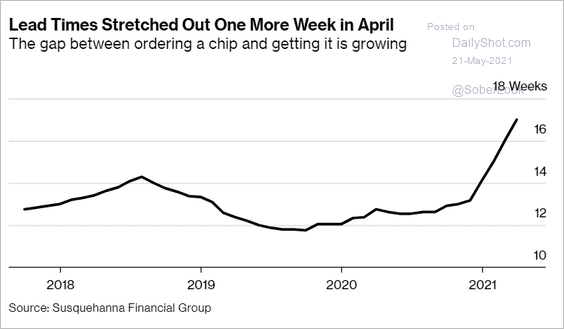

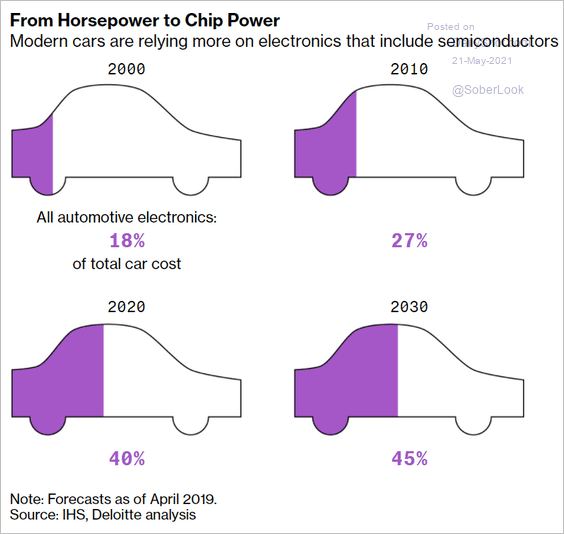

By the way, chip lead times have risen sharply around the world.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

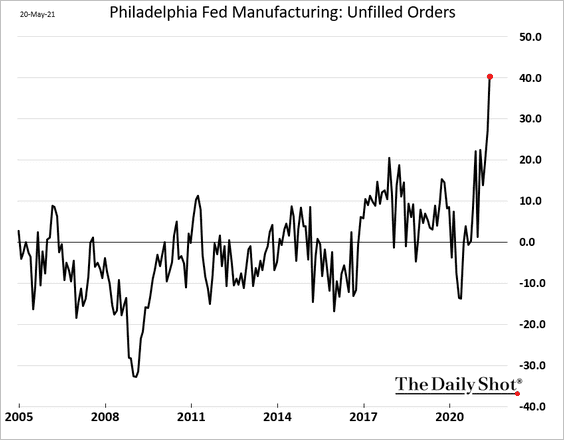

• Factories haven’t been this backed up on orders in decades.

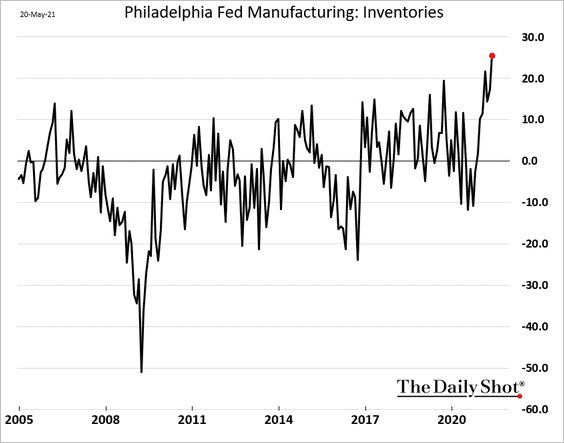

• Manufacturers have been increasing inventories.

• Price pressures continue to surge. While businesses are increasingly passing on a portion of these costs (2nd chart) to clients, at some point, buyers are going to balk.

——————–

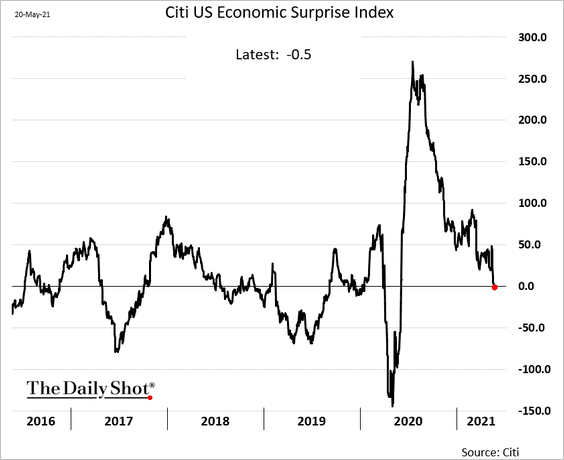

2. The downside surprise in the Philly Fed’s report sent the Citi Economic Surprise Index below zero.

We also saw a pullback in the Oxford Economics Recovery Tracker.

![]() Source: Oxford Economics

Source: Oxford Economics

——————–

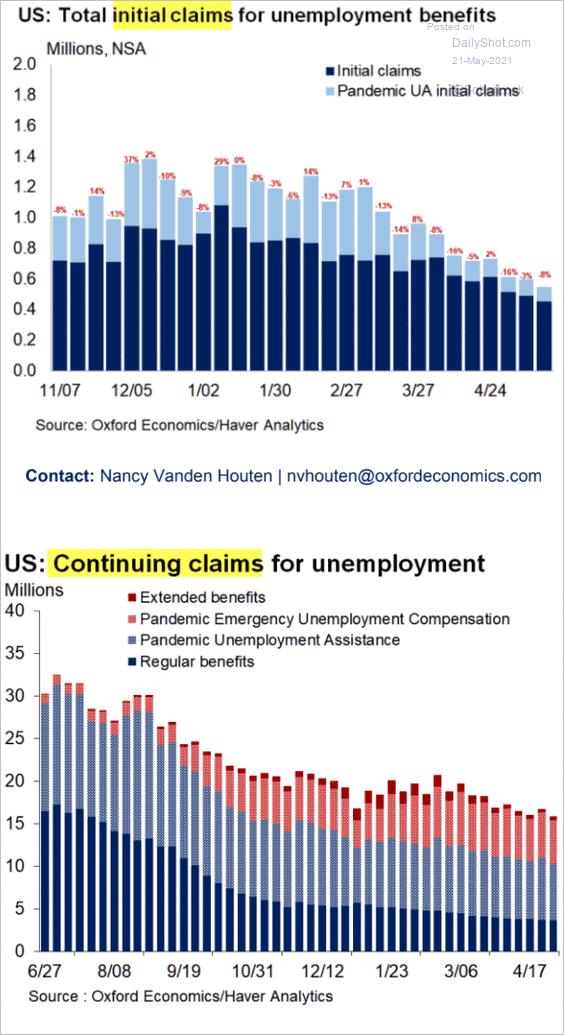

3. Initial jobless claims continue to ease. We should see a substantial drop in continuing claims (2nd chart) next month as several states terminate emergency benefits.

Source: Oxford Economics

Source: Oxford Economics

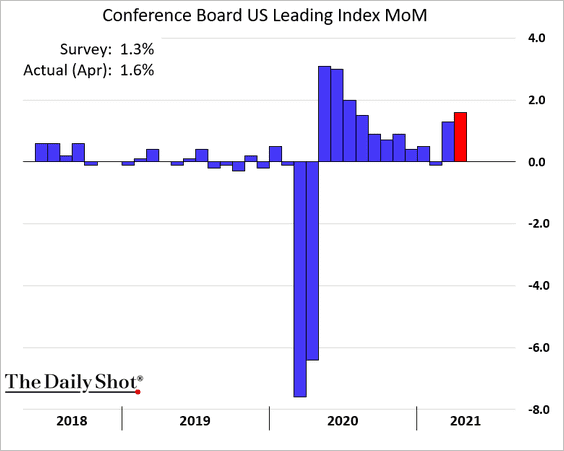

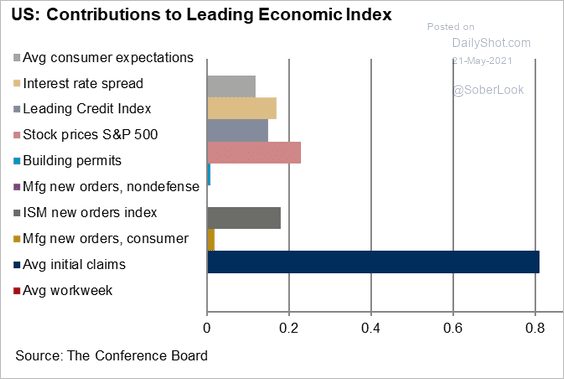

4. The Conference Board’s index of leading indicators rose sharply last month, …

… driven by the decline in initial jobless claims.

Source: @OxfordEconomics, @nanc455

Source: @OxfordEconomics, @nanc455

——————–

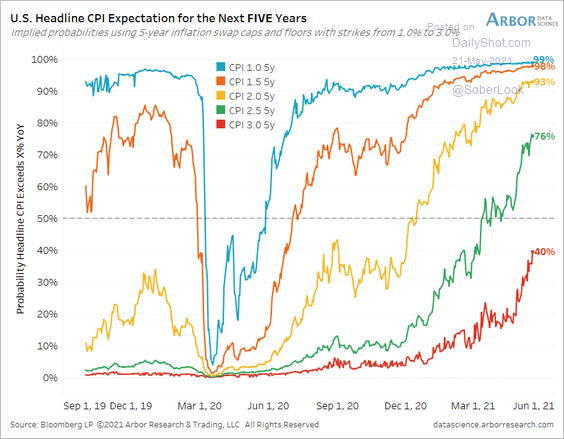

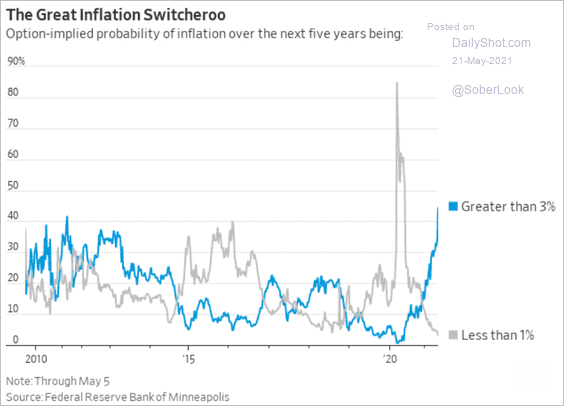

4. Next, we have some updates on inflation.

• Inflation options markets are assigning a 40% probability of inflation running above 3% over the next five years (2 charts).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Source: @WSJ Read full article

Source: @WSJ Read full article

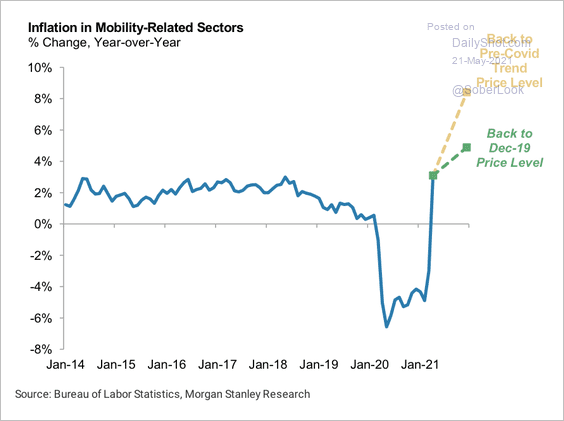

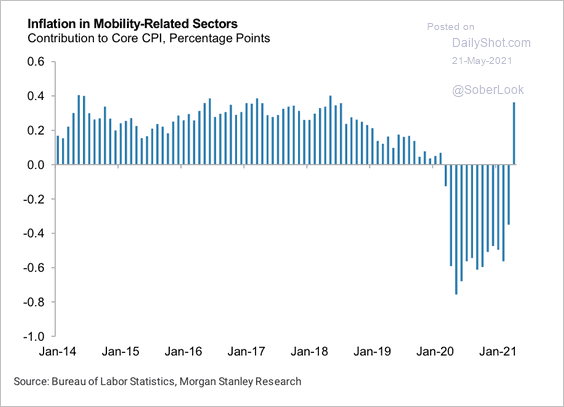

• Morgan Stanley sees scope for mobility-sensitive inflation components to rise (2 charts).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Source: Morgan Stanley Research

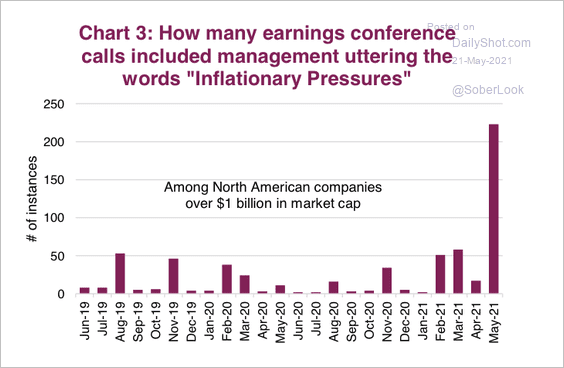

• More US companies are mentioning “inflationary pressures” during earnings calls.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

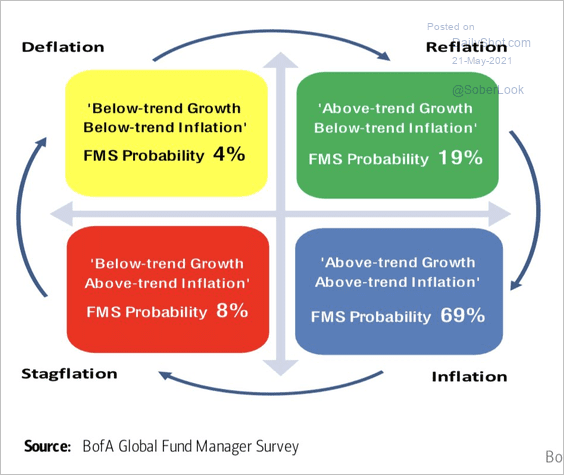

• Most fund managers see above-trend growth and above-trend inflation ahead.

Source: @DiMartinoBooth, @BankofAmerica

Source: @DiMartinoBooth, @BankofAmerica

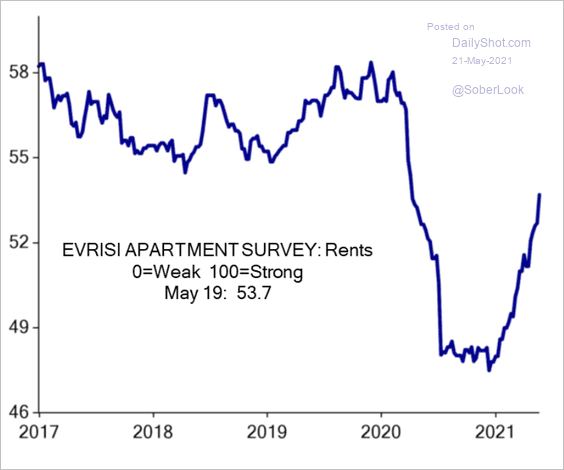

• A survey from Evercore ISI suggests that rent inflation should be rebounding.

Source: Evercore ISI

Source: Evercore ISI

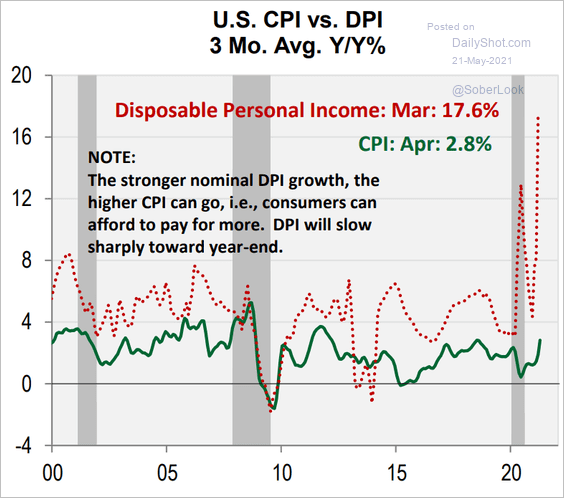

• Will the recent spike in disposable incomes put upward pressure on the CPI?

Source: Cornerstone Macro

Source: Cornerstone Macro

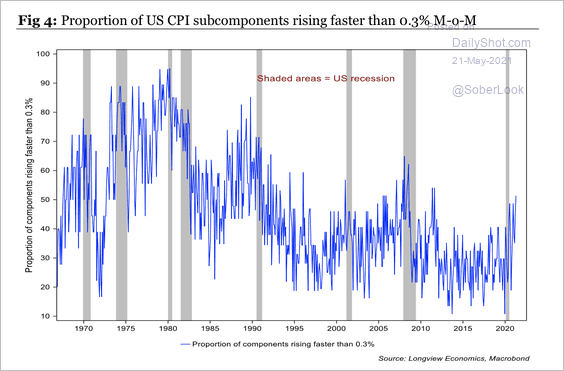

• Nearly half of US CPI components are rising faster than 0.3% per month.

Source: Longview Economics

Source: Longview Economics

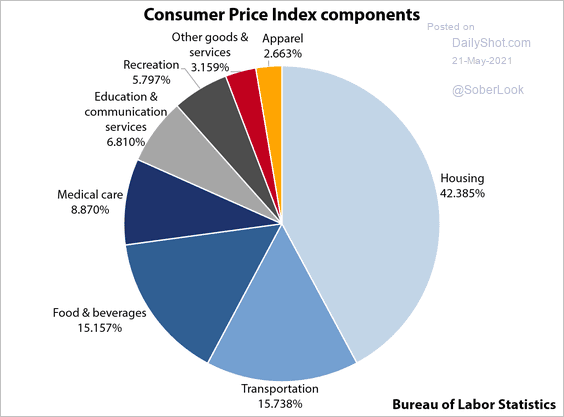

• Here are the components of CPI.

Source: Gavekal Research

Source: Gavekal Research

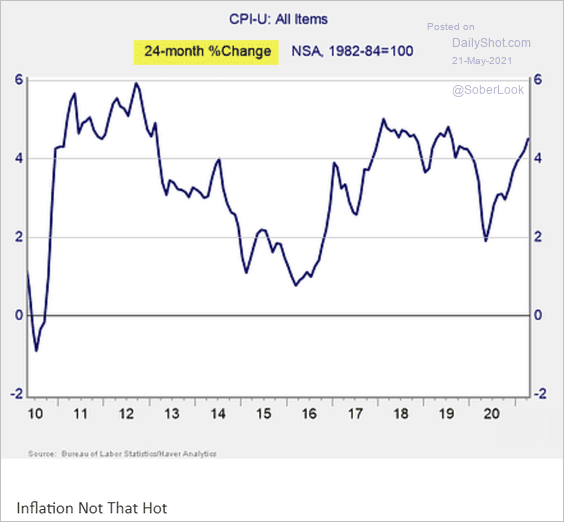

• Inflation is not extreme at this point. The two-year changes in inflation are in line with the levels we saw in 2018 and 2019.

Source: Brad McMillan

Source: Brad McMillan

Back to Index

The United Kingdom

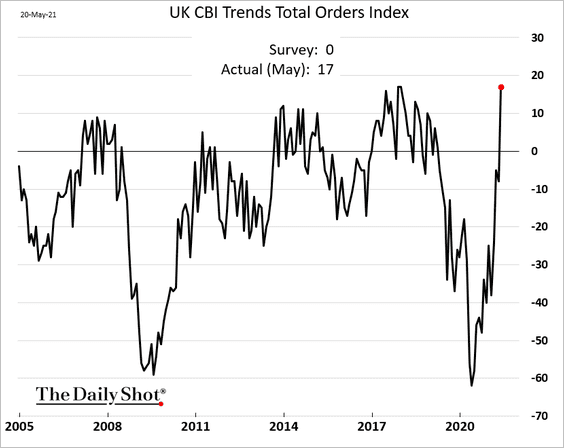

1. Industrial orders surged this month, …

Source: Reuters Read full article

Source: Reuters Read full article

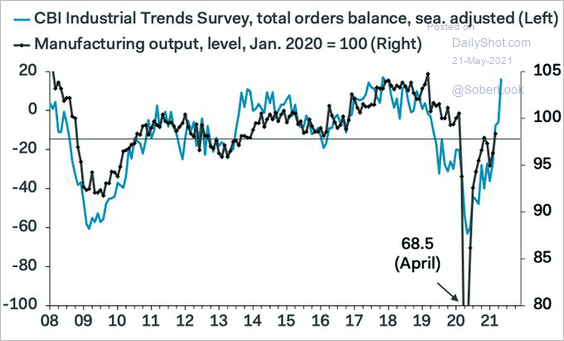

… pointing to gains in factory output.

Source: @samueltombs

Source: @samueltombs

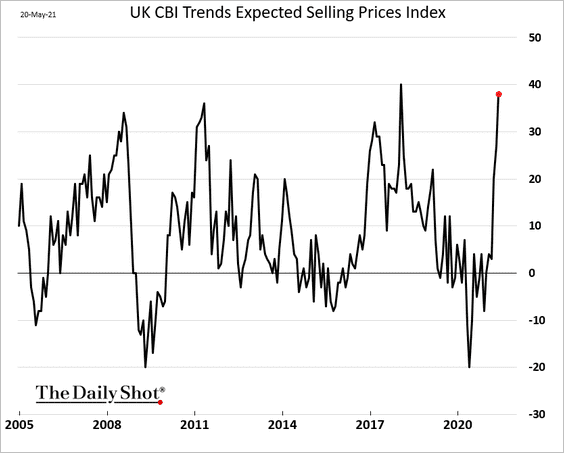

More firms are boosting prices.

——————–

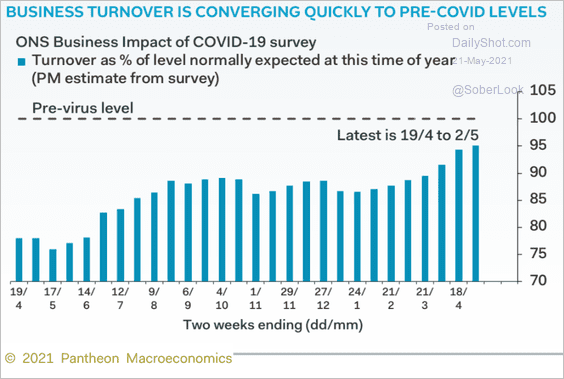

2. Business turnover is rebounding quickly.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

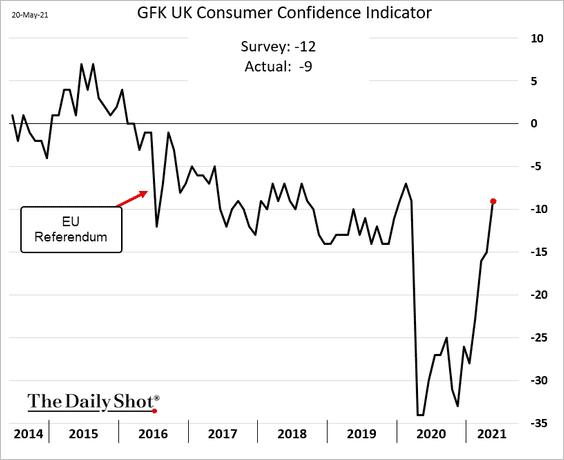

3. Consumer confidence has recovered to pre-COVID levels.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

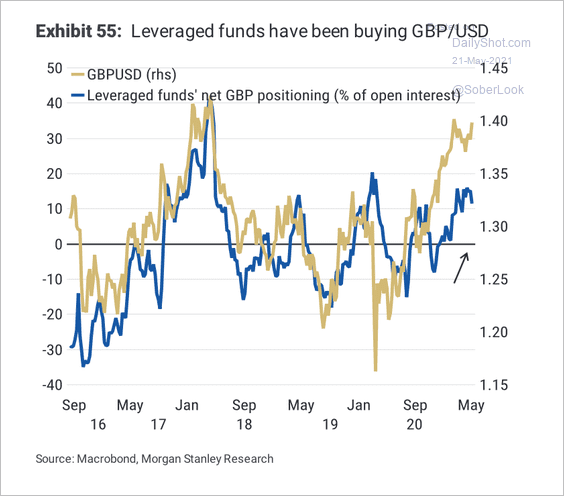

4. Leveraged funds have been net-long the pound over the past year.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

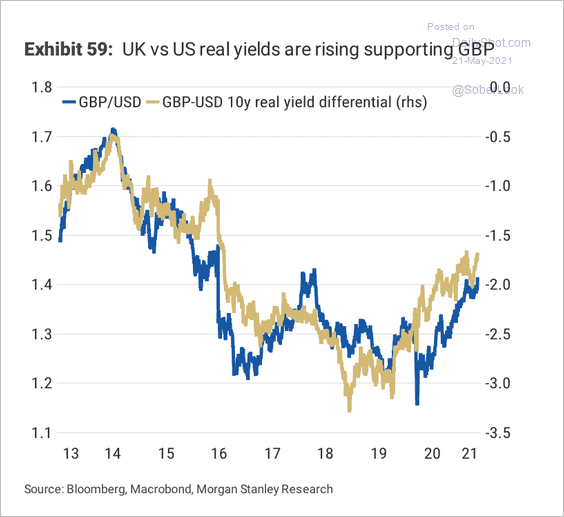

GBP/USD has been supported by real yield differentials.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

The Eurozone

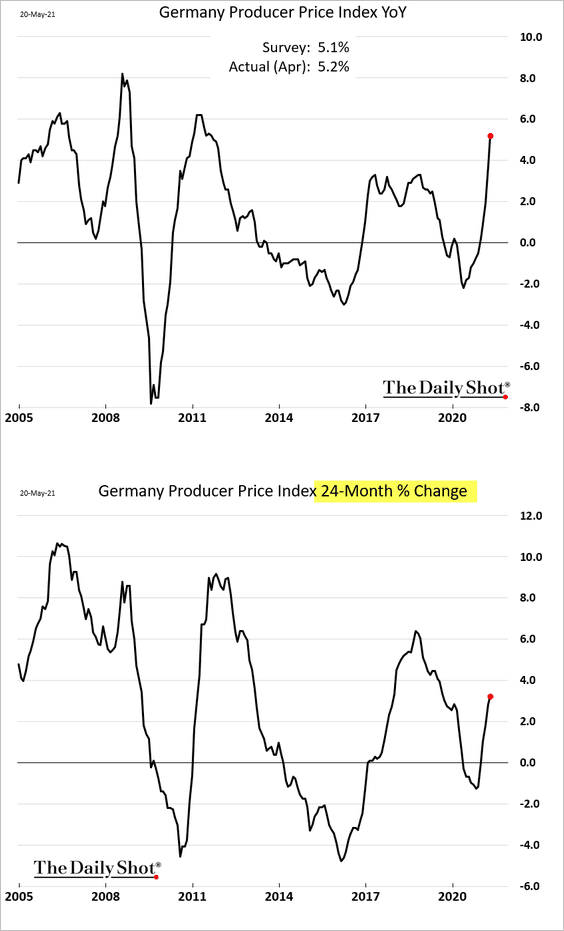

1. Germany’s producer prices have been rising quickly (chart below), but the gains are not very large on a 2-year basis (2nd chart).

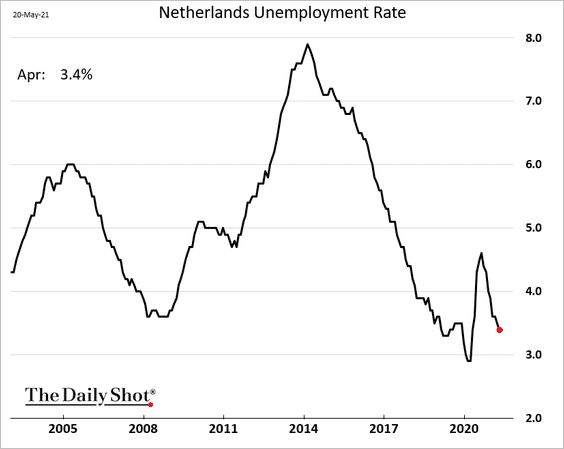

2. Dutch unemployment continues to moderate.

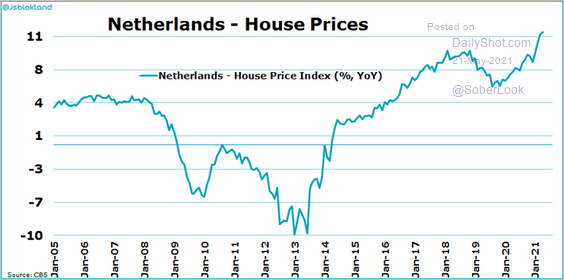

Home price appreciation has accelerated.

Source: @jsblokland

Source: @jsblokland

——————–

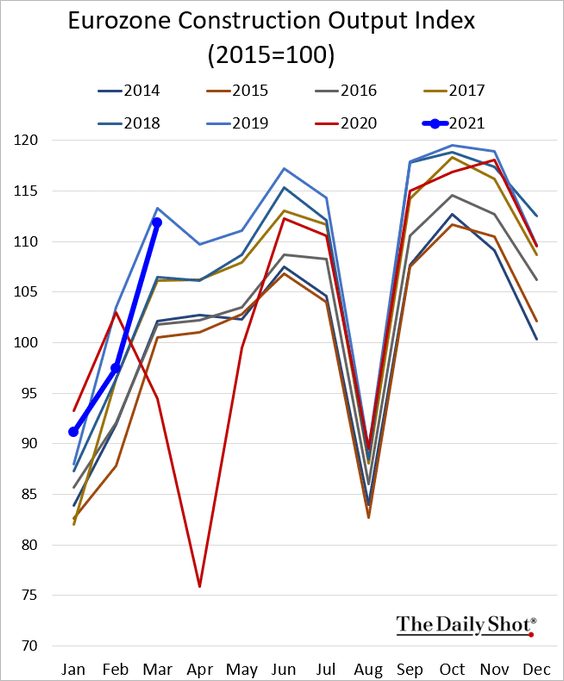

3. Construction output has rebounded but is still running below 2019 levels.

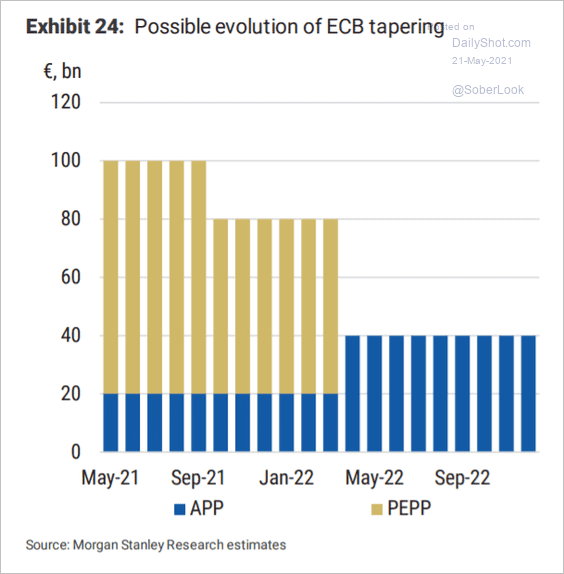

4. Here is Morgan Stanley’s estimate for the ECB tapering.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Japan

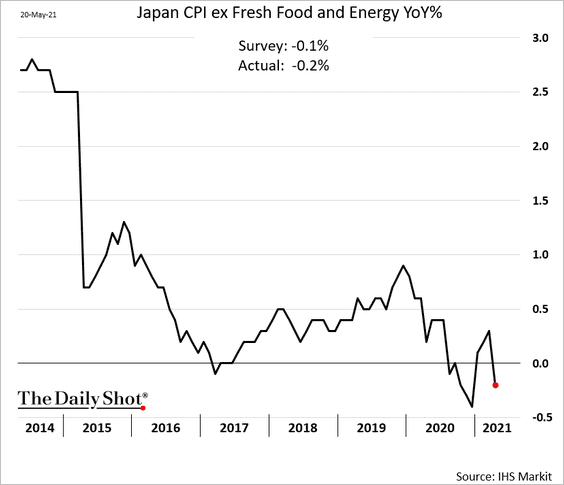

1. Inflation is back in negative territory.

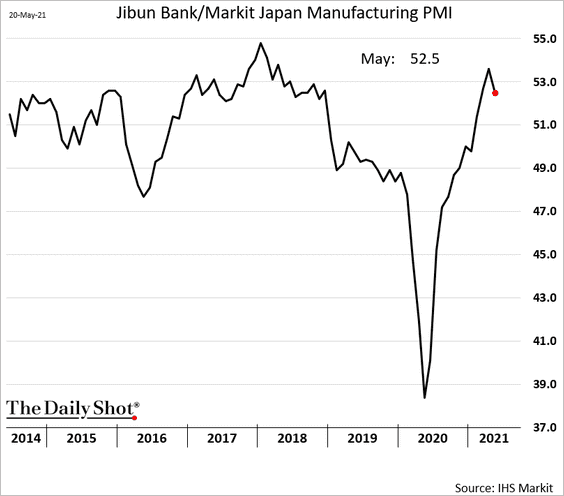

2. Factory activity expanded at a slower pace in May.

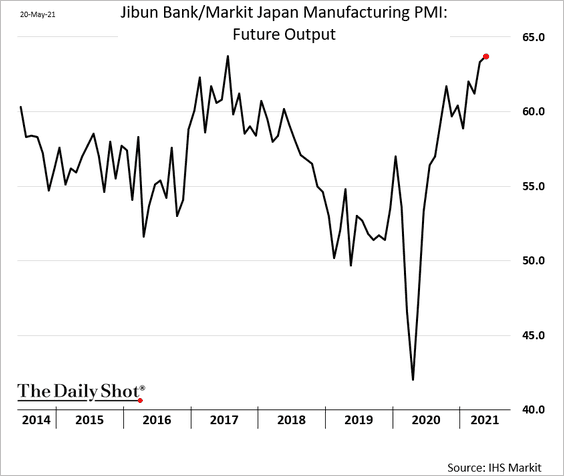

But manufacturers are upbeat about the future.

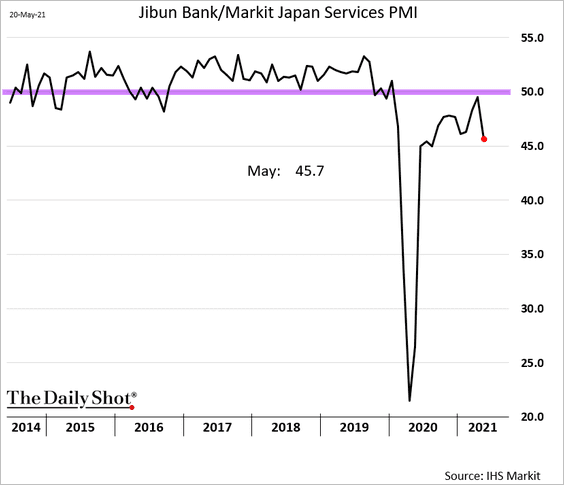

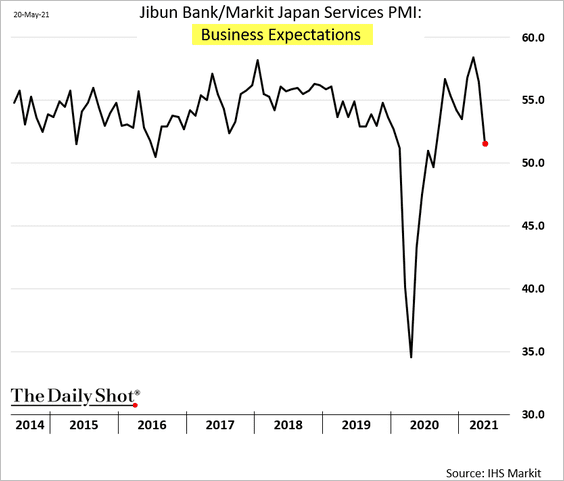

3. Japan’s service firms continue to struggle …

… and are less optimistic about the future.

Back to Index

Asia – Pacific

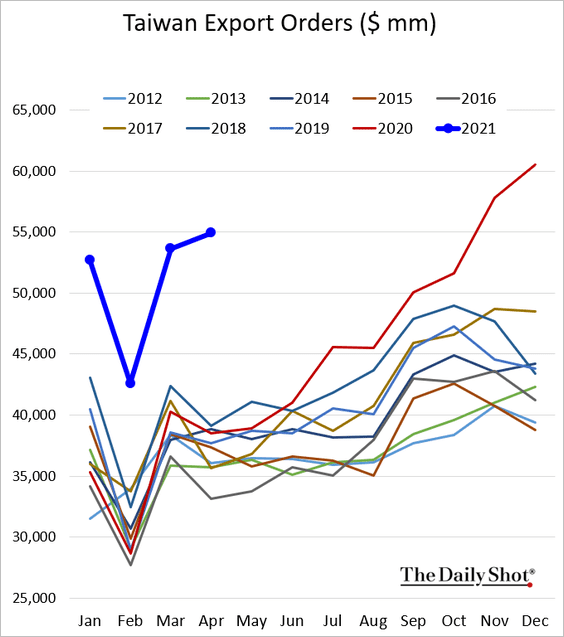

1. Taiwan’s export orders have been remarkably strong this year (boosted by semiconductor demand).

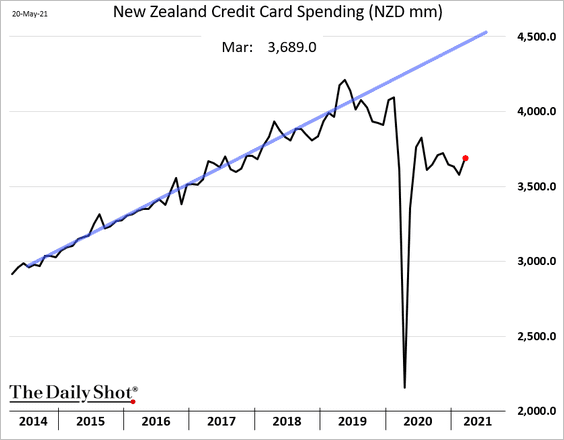

2. New Zealand’s credit card spending is running well below the pre-COVID trend (similar to the US).

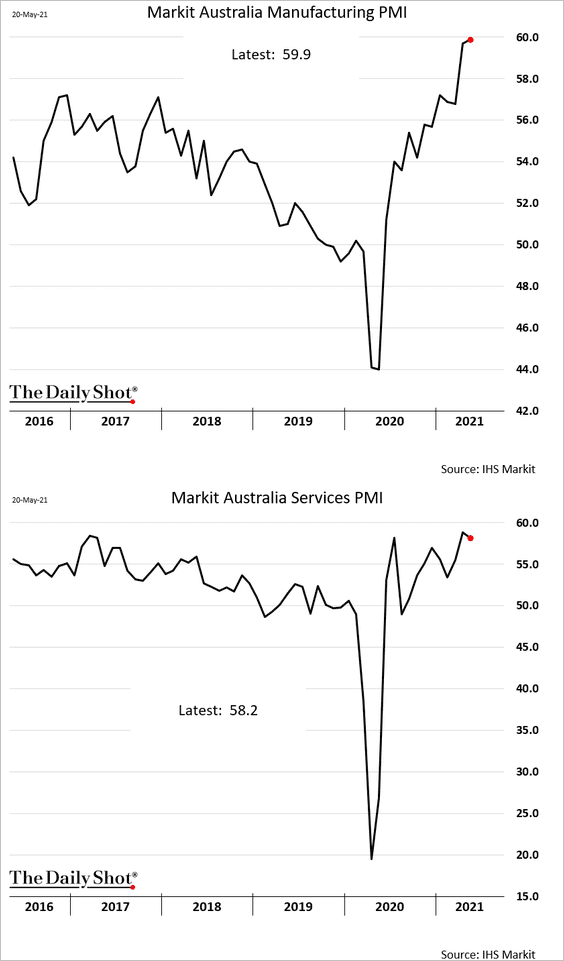

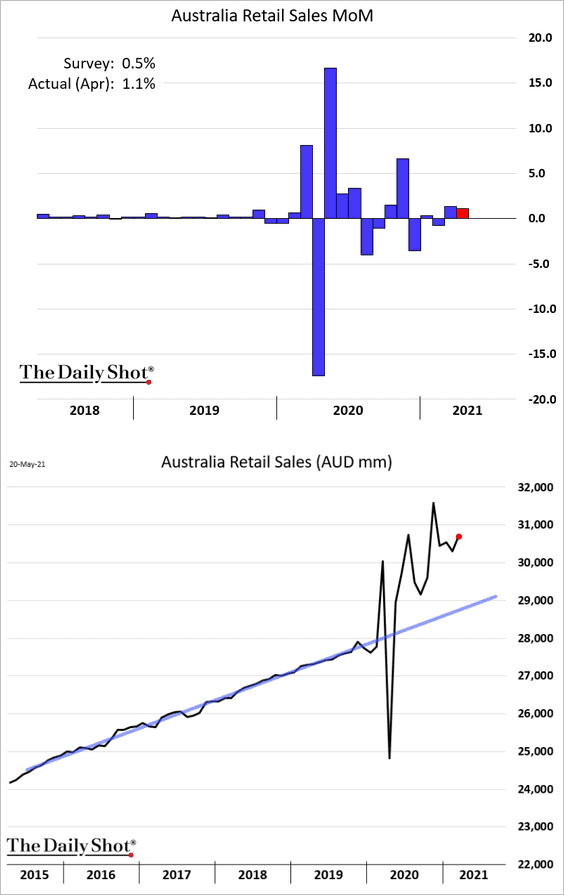

3. Next, we have some updates on Australia.

• Business activity is rapidly expanding, especially in manufacturing.

• April retail sales surprised to the upside and are running well above the pre-COVID trend (2nd chart).

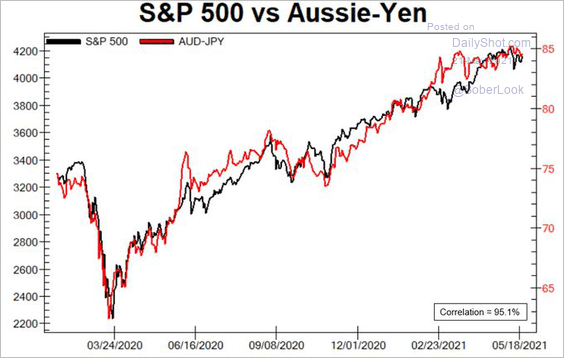

• The Aussie-Yen cross is highly correlated with the S&P 500 (AUD/JPY is an indicator of global risk appetite).

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

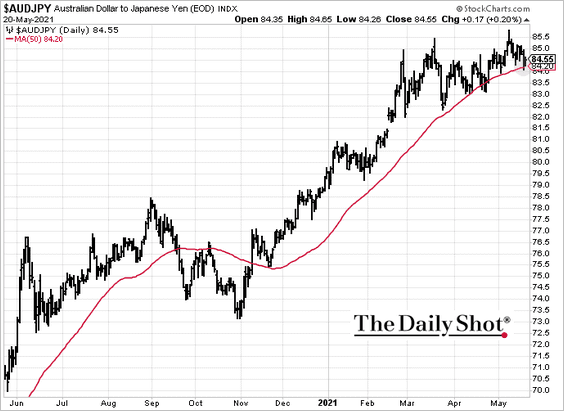

AUD/JPY is at support at the 50-day moving average.

Back to Index

China

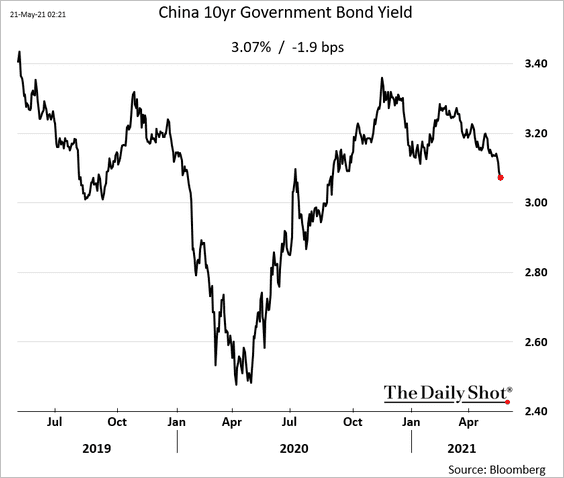

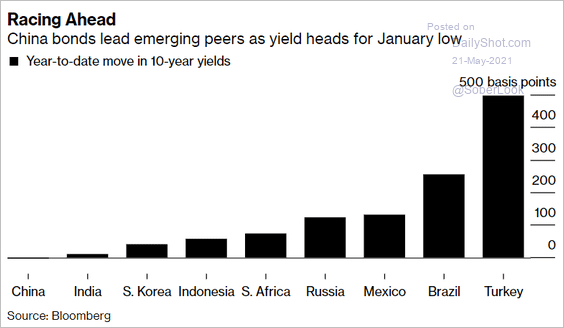

1. Bond yields have been declining, …

… with China’s debt outperforming other EM.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

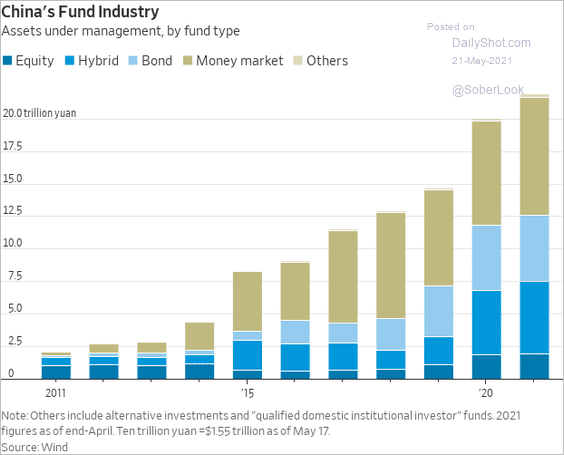

2. Here is the evolution of China’s fund industry.

Source: @WSJ Read full article

Source: @WSJ Read full article

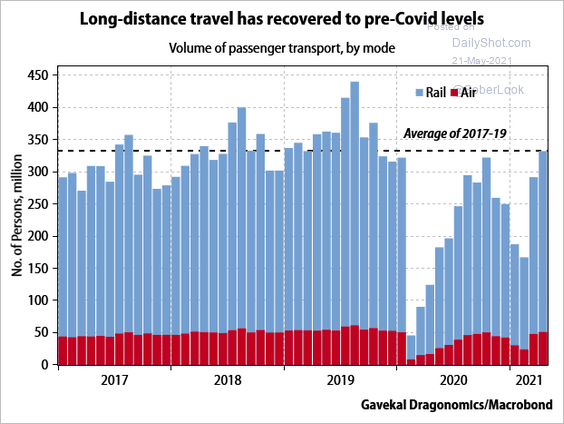

3. Long-distance travel has recovered.

Source: Gavekal Research

Source: Gavekal Research

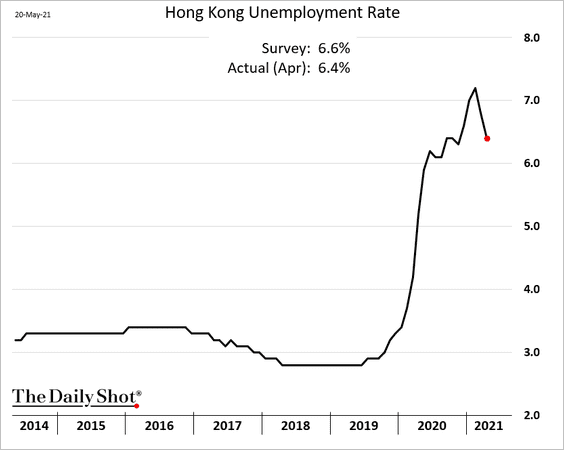

4. Hong Kong’s unemployment is starting to ease.

Back to Index

Emerging Markets

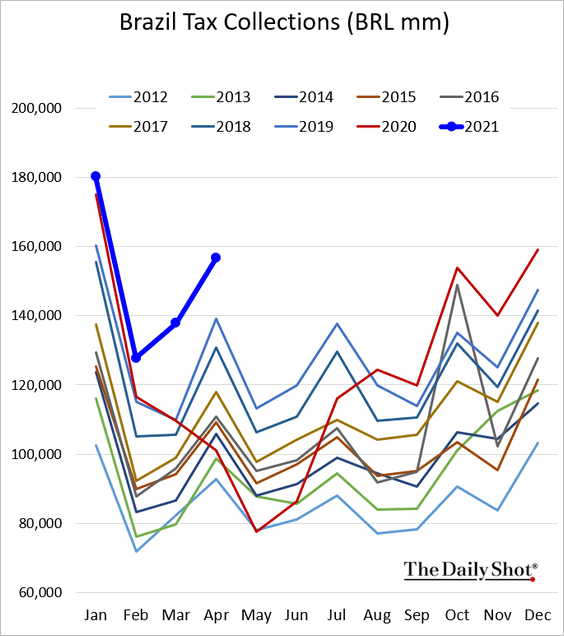

1. Brazil’s tax collections have been strong this year.

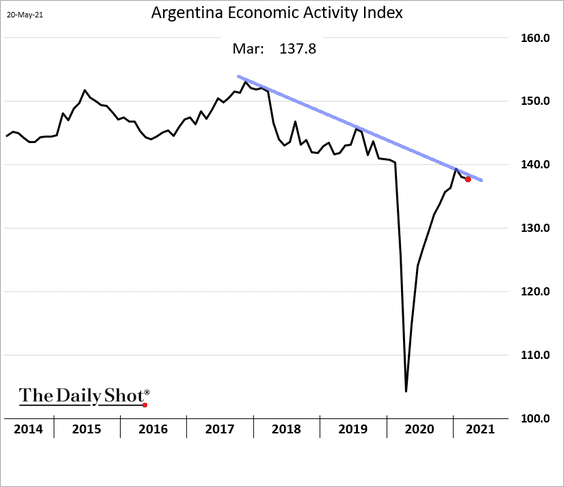

2. Argentina’s economic activity is continuing its pre-COVID downward drift.

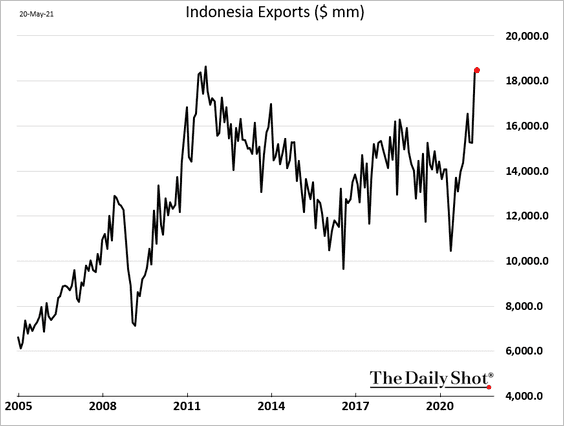

3. Indonesia’s exports are near record highs.

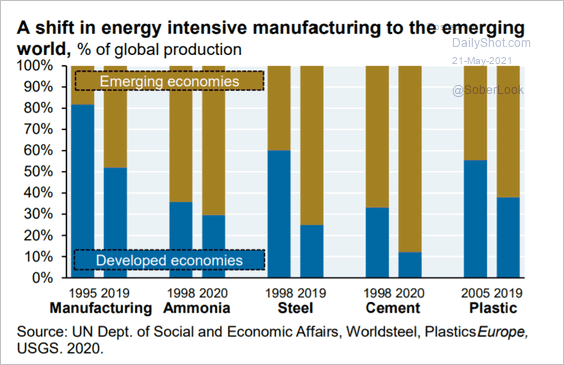

4. Energy-intensive manufacturing has been shifting to EM.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Cryptocurrency

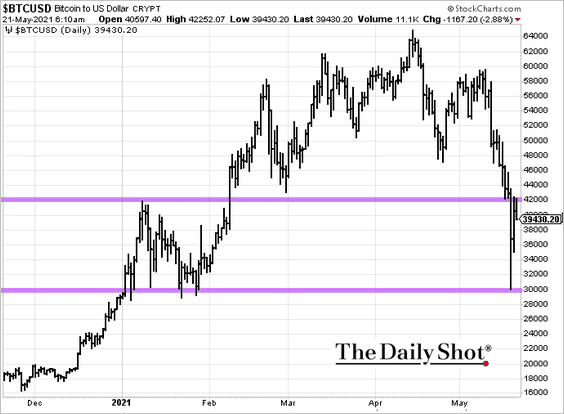

1. Bitcoin hasn’t been able to break resistance at $42k and is now trading below $40k.

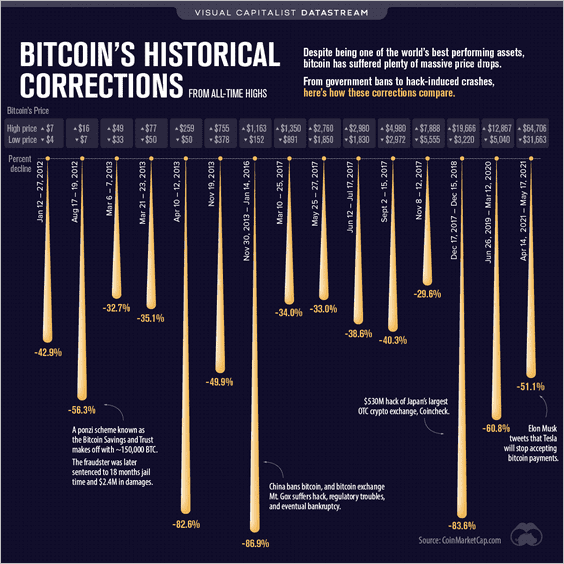

2. Here is the history of bitcoin drawdowns.

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

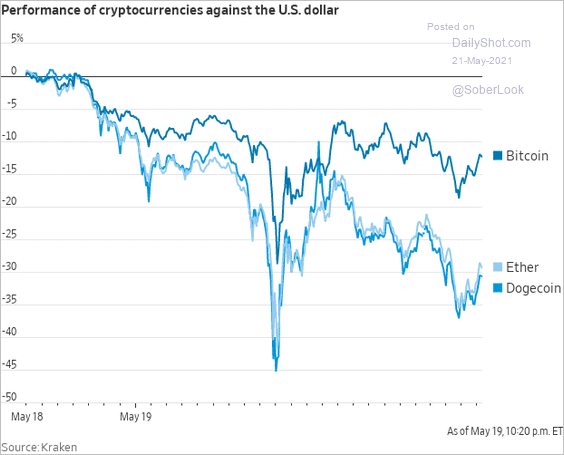

3. Bitcoin has been more resilient than other cryptos.

Source: @WSJ Read full article

Source: @WSJ Read full article

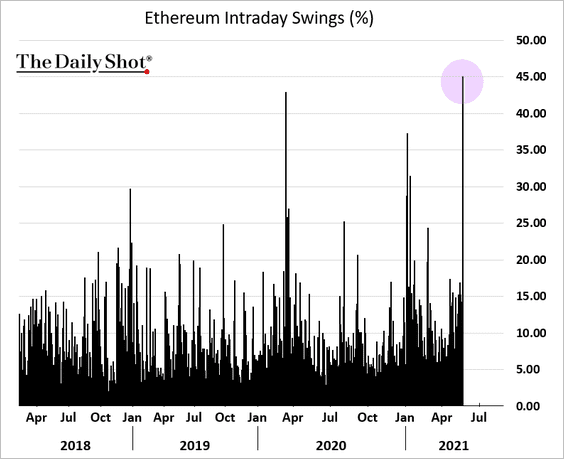

4. Etherium saw a 45% intraday move.

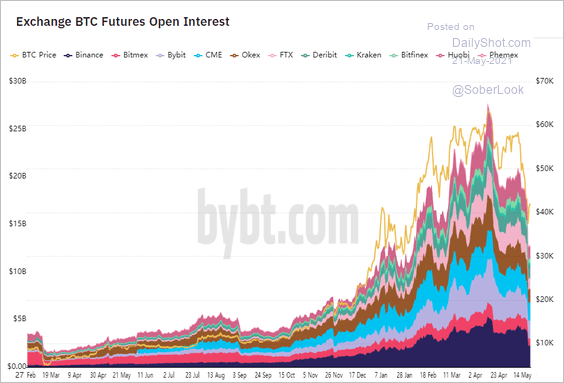

5. This chart shows bitcoin futures’ open interest.

Source: bybt

Source: bybt

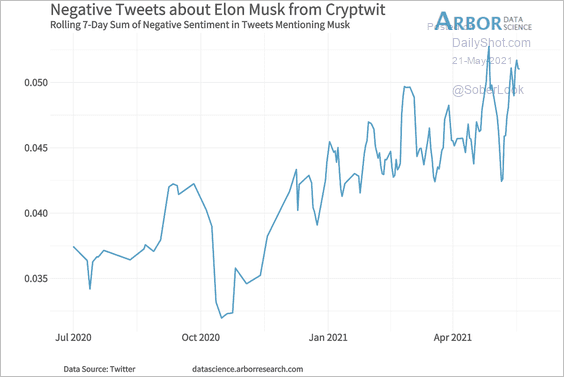

6. Crypto enthusiasts are not very happy with our friend Elon (at least on Twitter).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

7. US authorities are becoming more focused on the crypto market.

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

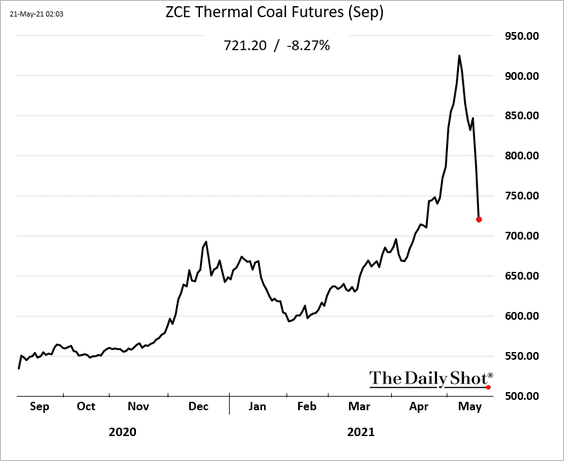

——————–

8. While there are other reasons for the massive selloff in China’s thermal coal futures (chart below), a potential reduction in electricity demand from the nation’s bitcoin mining industry has contributed to this decline.

Source: Forbes Read full article

Source: Forbes Read full article

Back to Index

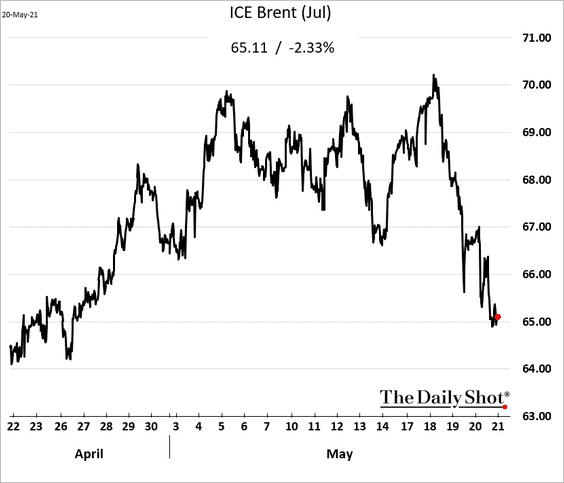

Energy

A deal with Iran could add substantial supplies to the global crude oil market.

Source: The Hill Read full article

Source: The Hill Read full article

Back to Index

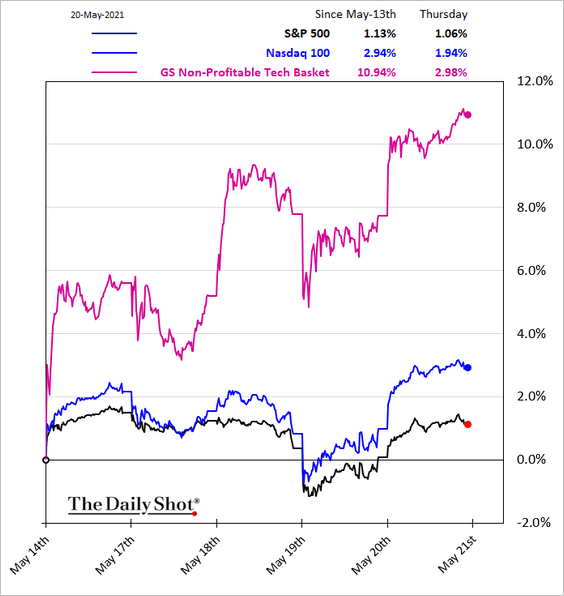

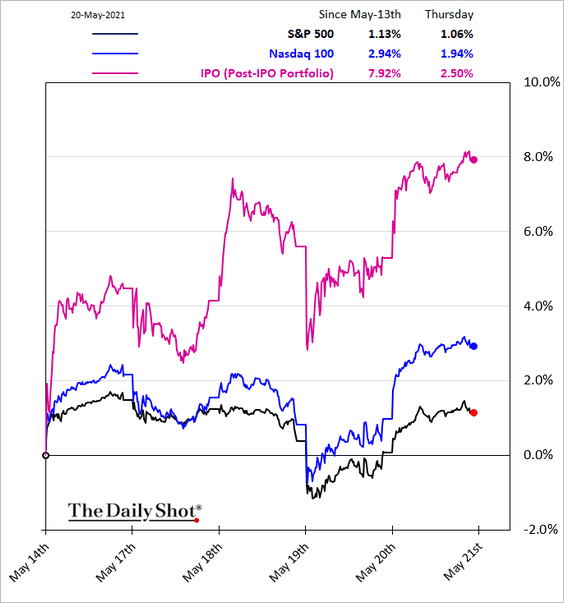

Equities

1. Non-profitable tech continues to outperform as cryptos struggle.

Here is a basket of post-IPO stocks.

——————–

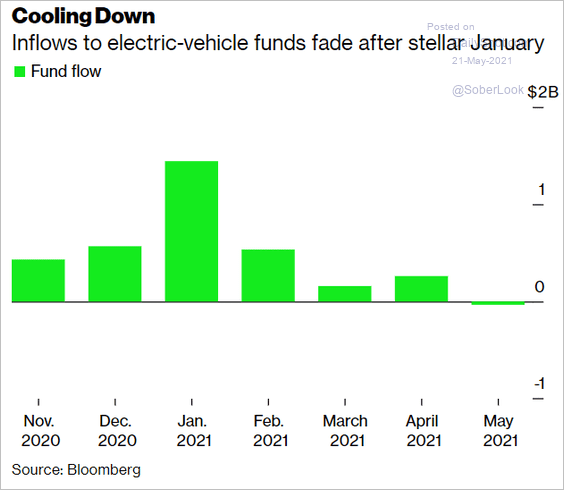

2. Inflows into EV funds have slowed.

Source: @business Read full article

Source: @business Read full article

Back to Index

Rates

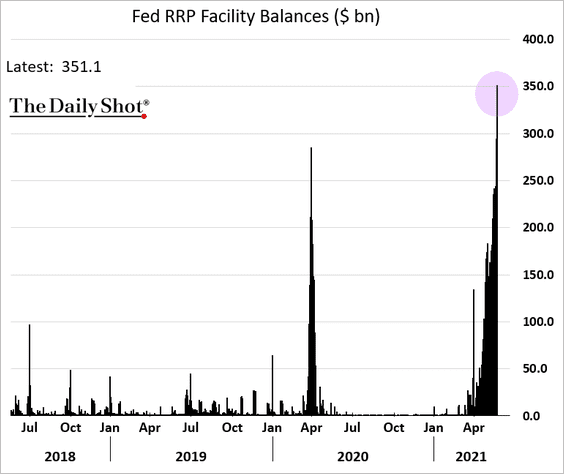

1. Money market mutual funds and other market participants move cash into the Fed’s RRP facility as the market is flooded with liquidity.

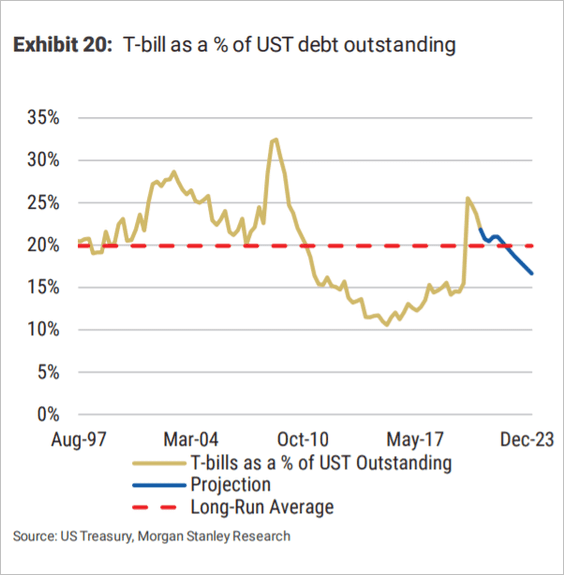

2. Morgan Stanley projects that T-bills as a percentage of Treasury debt outstanding will decline going forward.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

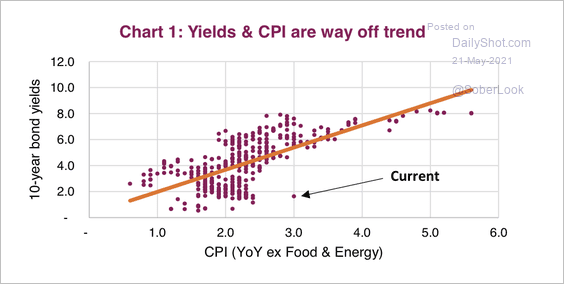

3. US yields are very low given current inflation data (relative to the historical relationship).

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

Back to Index

Global Developments

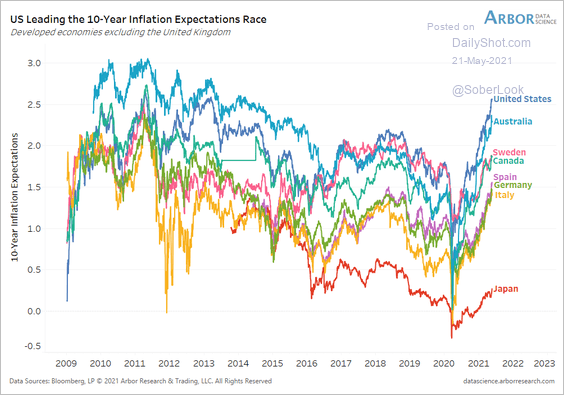

1. Global market-based inflation expectations have been climbing.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

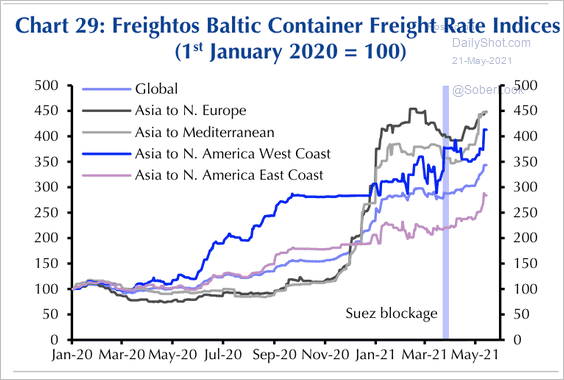

2. Shipping costs have been trending higher before the Suez Canal blockage. This is primarily due to container shortages which have contributed to longer delivery times, according to Capital Economics.

Source: Capital Economics

Source: Capital Economics

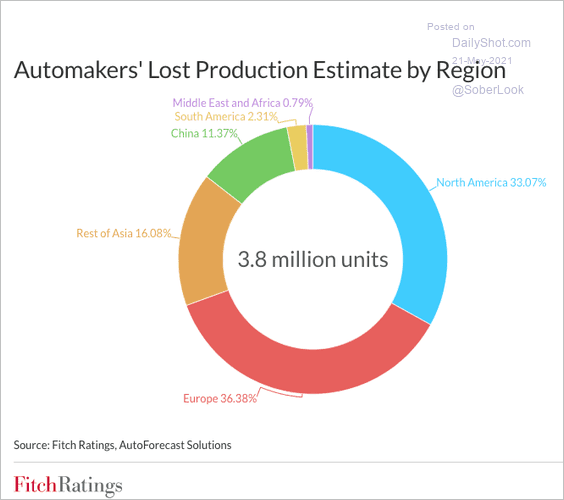

3. How much auto production has been lost due to chip shortages?

Source: Fitch Ratings

Source: Fitch Ratings

——————–

Food For Thought

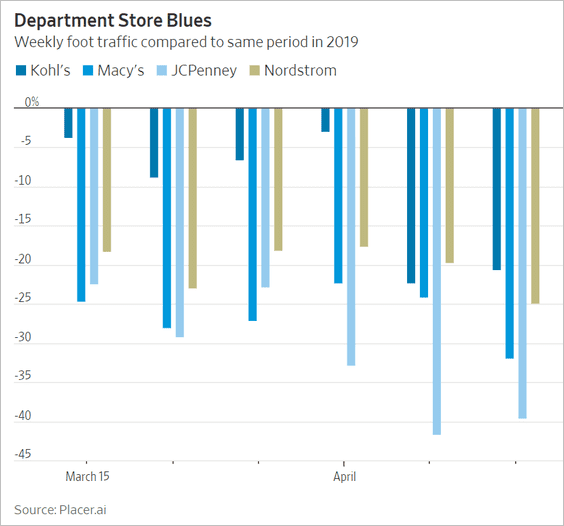

1. US department store foot traffic:

Read full article

Read full article

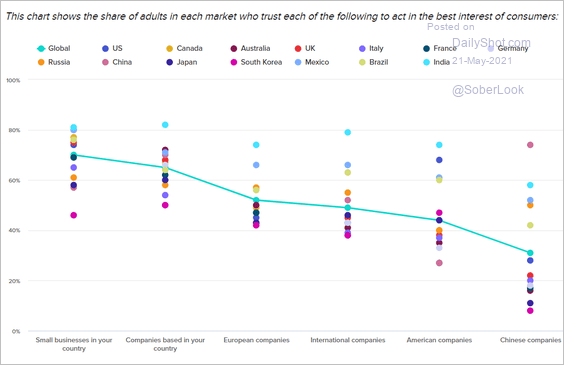

2. Companies acting in the best interest of consumers:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

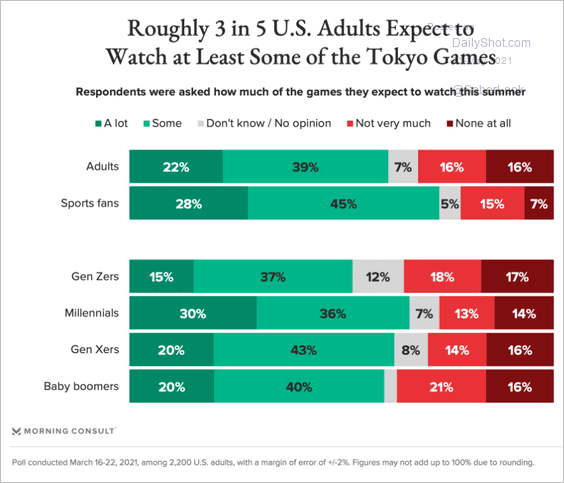

3. Interest in watching the Summer Olympics:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

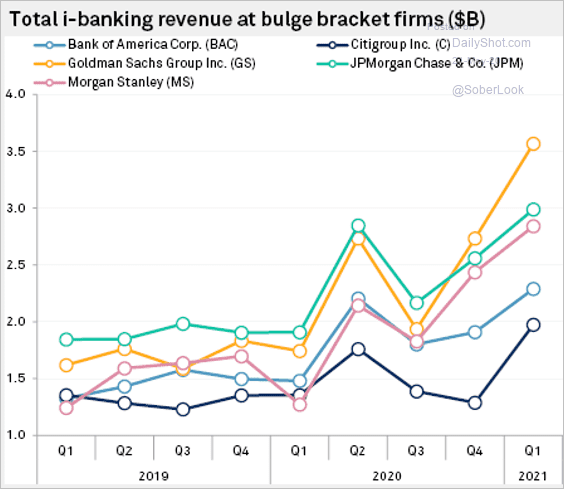

4. Investment banking revenues at the largest US banks:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

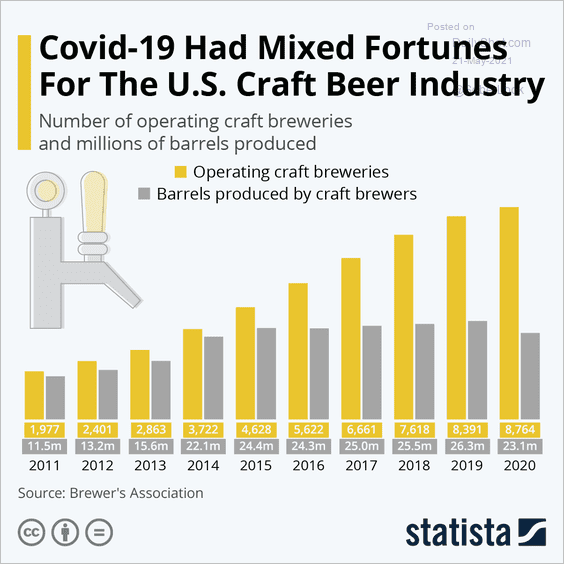

5. The number of craft breweries and their beer production:

Source: Statista

Source: Statista

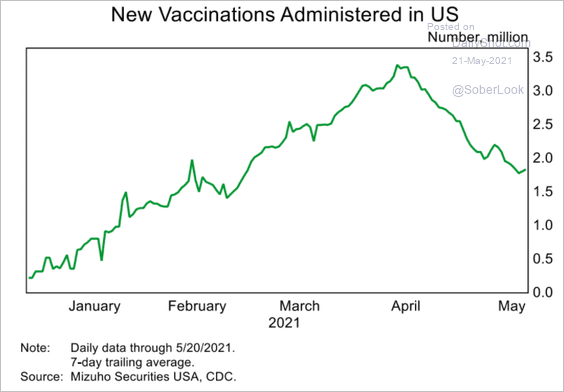

6. New vaccinations in the US:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

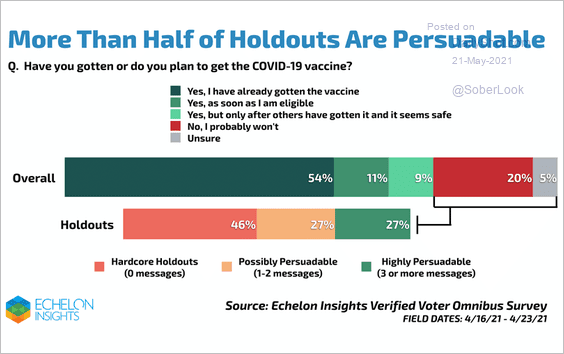

• Vaccine-persuadable holdouts:

Source: Echelon Insights Read full article

Source: Echelon Insights Read full article

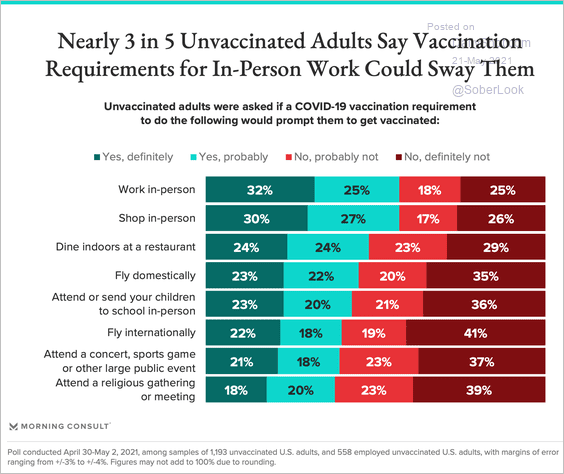

• Potential responses to vaccination requirements:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

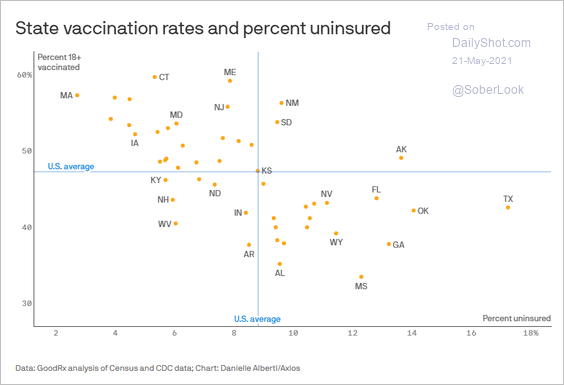

• State vaccination rates vs. percent uninsured:

Source: @axios Read full article

Source: @axios Read full article

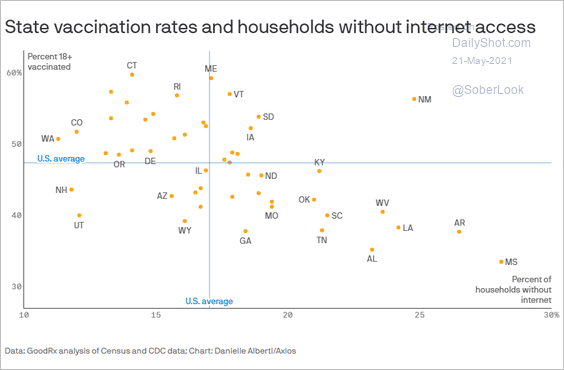

• Vaccination rates vs. percent without internet:

Source: @axios Read full article

Source: @axios Read full article

——————–

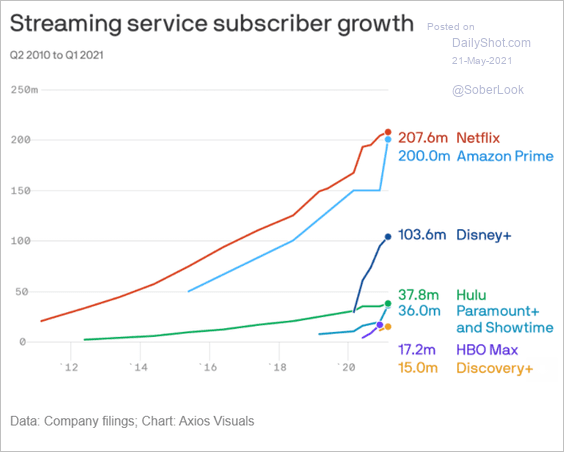

7. Streaming services:

Source: @axios Read full article

Source: @axios Read full article

8. Electronics costs in automobiles:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

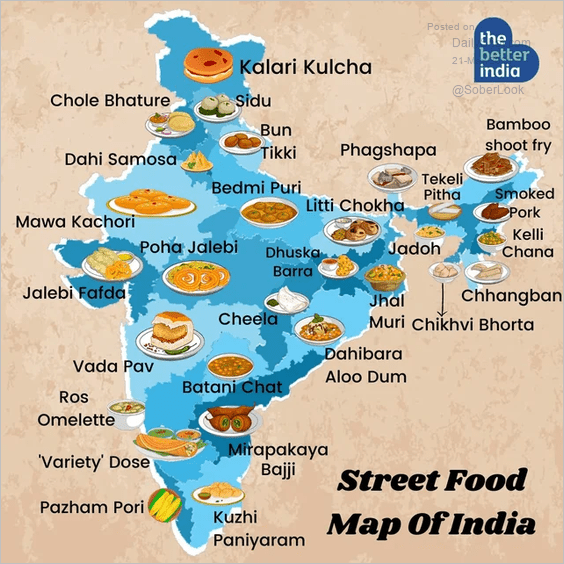

9. Street food in India:

Source: The Better India

Source: The Better India

——————–

Have a great weekend!

Back to Index