The Daily Shot: 24-May-21

• Administrative Update

• Commodities

• Energy

• Equities

• Credit

• Rates

• Cryptocurrency

• Emerging Markets

• Asia – Pacific

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Food for Thought

Administrative Update

As a reminder, The Daily Shot will not be published from May 27th to May 31st.

We will have a “Food for Thought special” on Thursday.

Back to Index

Commodities

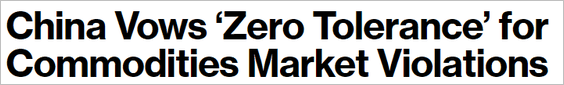

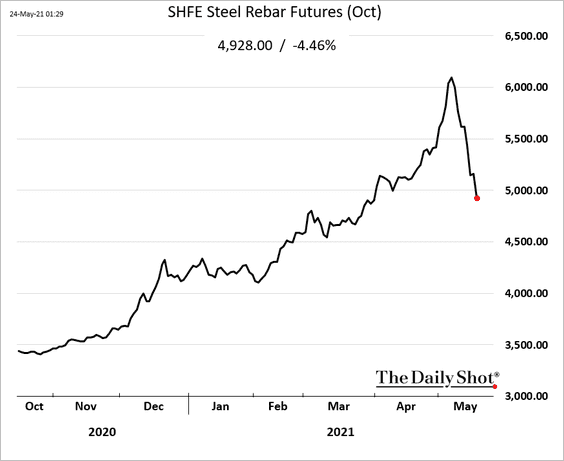

1. Beijing has lost patience with the recent acceleration in commodity costs.

Source: @markets Read full article Further reading

Source: @markets Read full article Further reading

Industrial commodities are under pressure.

• Steel rebar futures in Shanghai:

• Iron ore futures in Singapore:

——————–

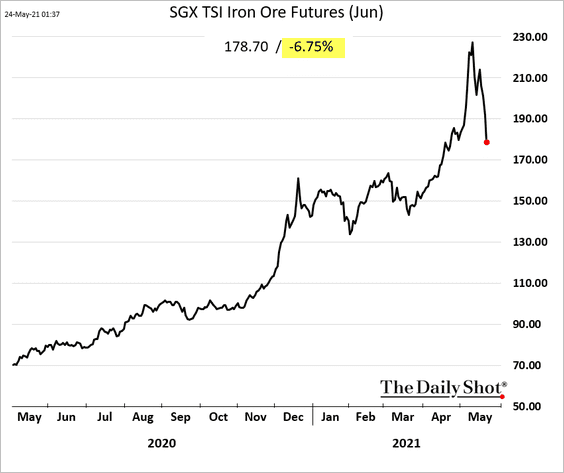

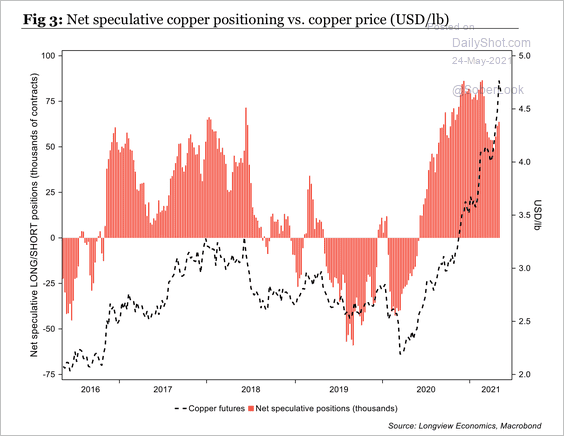

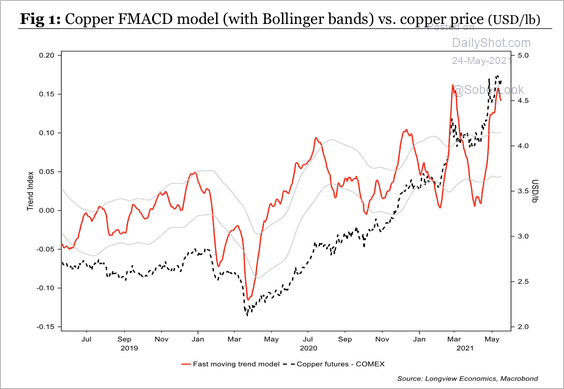

2. Next, we have some updates on copper.

• In recent months, copper prices have surged towards the upper end of their historical range, supported by the rebound in global industrial output.

Source: MRB Partners

Source: MRB Partners

• Speculative net-long copper positioning appears stretched.

Source: Longview Economics

Source: Longview Economics

• Technicals suggest copper is overbought.

Source: Longview Economics

Source: Longview Economics

——————–

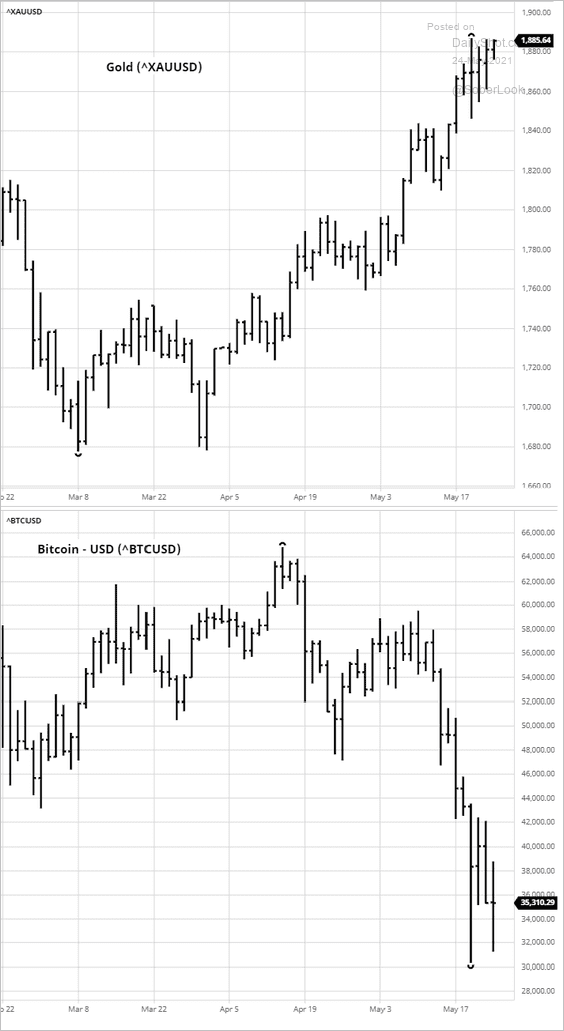

3. Precious metals continue to benefit from the crypto rout.

Source: barchart.com

Source: barchart.com

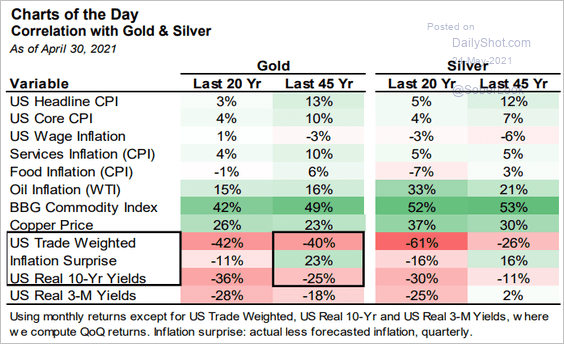

How do gold and silver prices correlate with other markets and economic indicators?

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

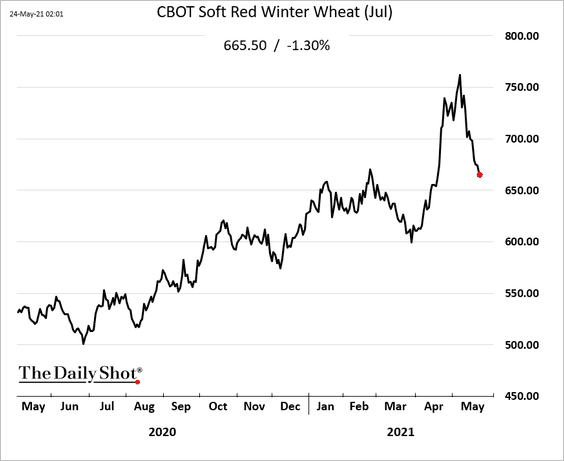

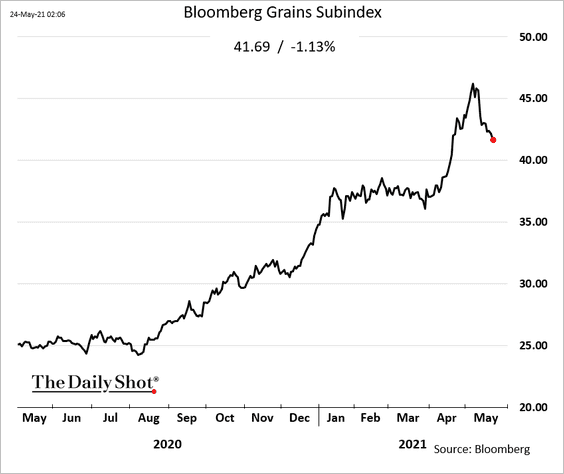

4. US grains have been rolling over.

• Wheat:

• Bloomberg’s grains index.

——————–

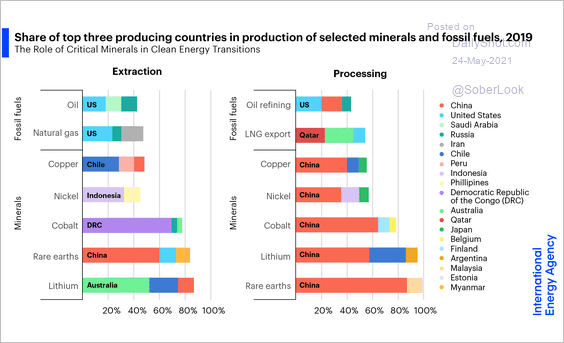

5. This chart shows the share of each country’s production of minerals and fossil fuels.

Source: International Energy Agency

Source: International Energy Agency

Back to Index

Energy

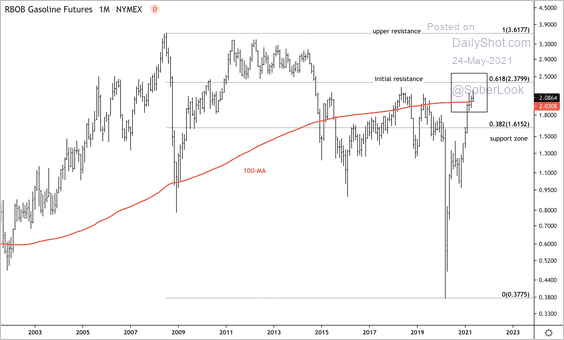

1. The front-month NYMEX RBOB gasoline futures contract is approaching long-term resistance.

Source: Dantes Outlook

Source: Dantes Outlook

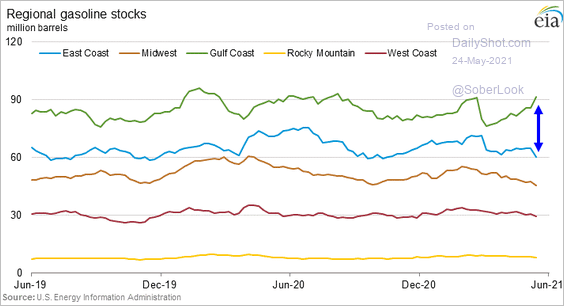

2. Here is the impact of the Colonial Pipeline fiasco on the regional gasoline inventories.

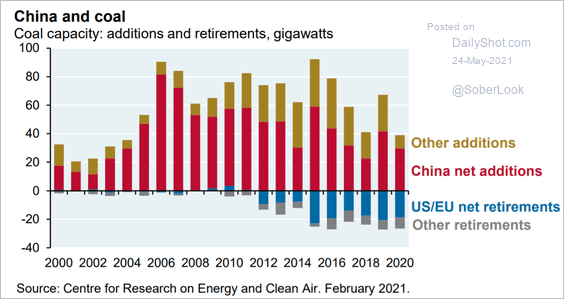

3. The chart below shows additions and retirements of global coal capacity over time.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

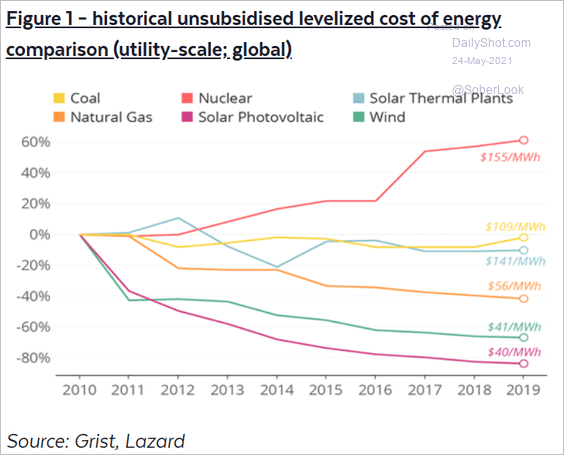

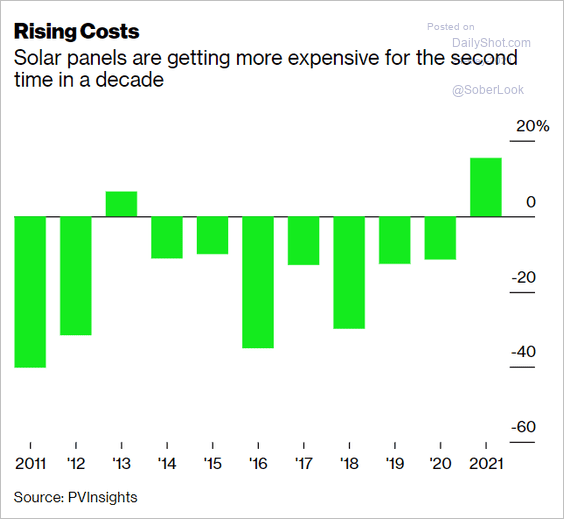

4. Next, we have some updates on renewable energy.

• Energy costs:

Source: Alex Debney Read full article

Source: Alex Debney Read full article

• Solar panel prices:

Source: @business Read full article

Source: @business Read full article

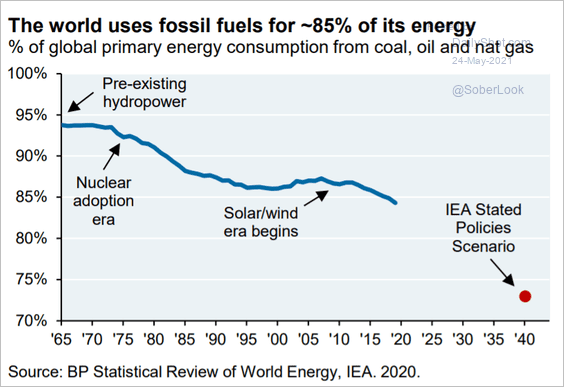

• Fossil fuel use targeted reductions:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

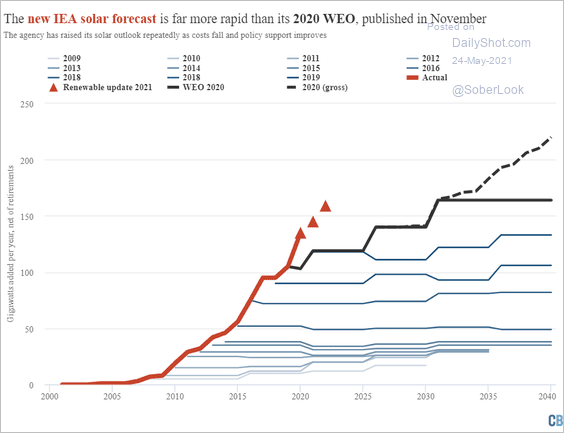

• IEA’s latest forecast for solar capacity growth:

Source: Carbon Brief Read full article

Source: Carbon Brief Read full article

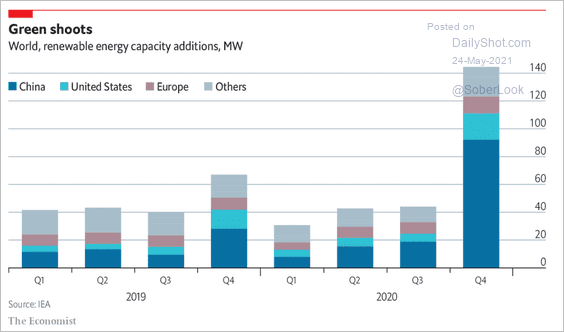

Source: The Economist Read full article

Source: The Economist Read full article

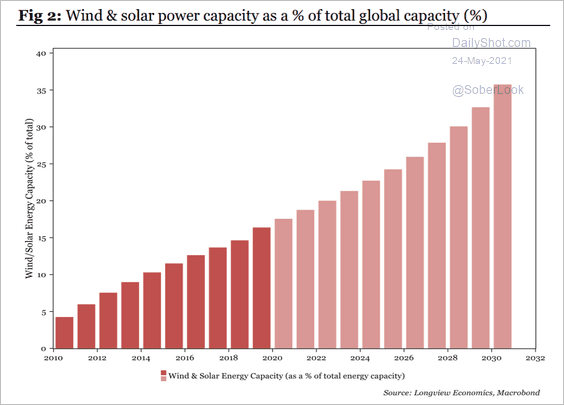

• A forecast from Longview Economics:

Source: Longview Economics

Source: Longview Economics

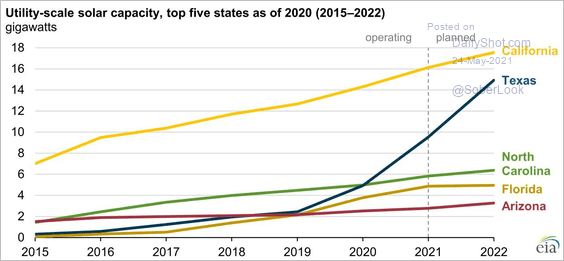

• Solar capacity growth by state:

Source: Yale School of the Environment, h/t Morning Consult Read full article

Source: Yale School of the Environment, h/t Morning Consult Read full article

Back to Index

Equities

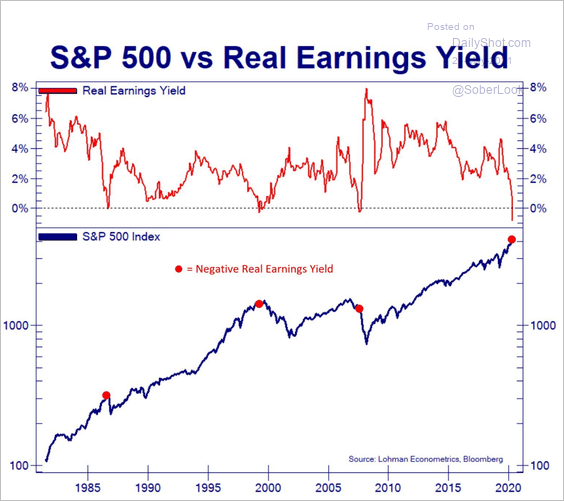

1. Adjusted for inflation, the S&P 500 earnings yield is back in negative territory.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

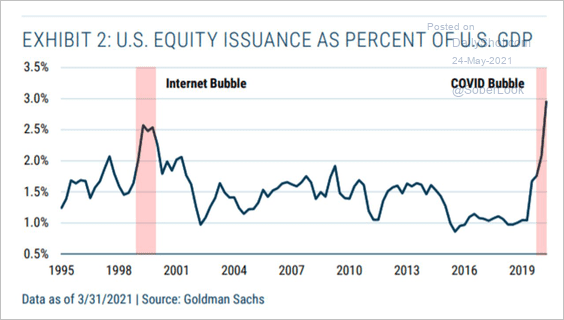

2. There has been quite a bit of new equity supply hitting the market over the past year.

Source: Goldman Sachs, @ercorbeil

Source: Goldman Sachs, @ercorbeil

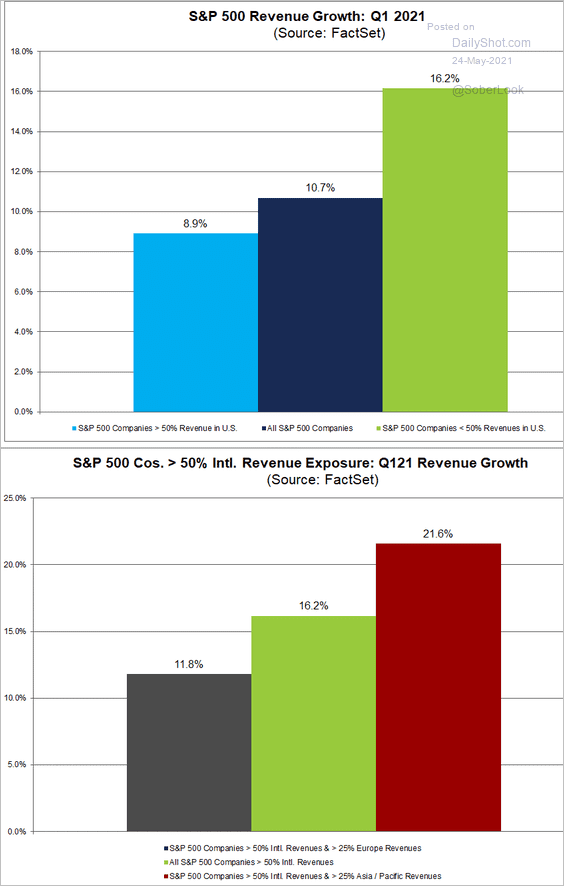

3. US companies with significant international revenue sources have outperformed, driven by Asia.

Source: @FactSet Read full article

Source: @FactSet Read full article

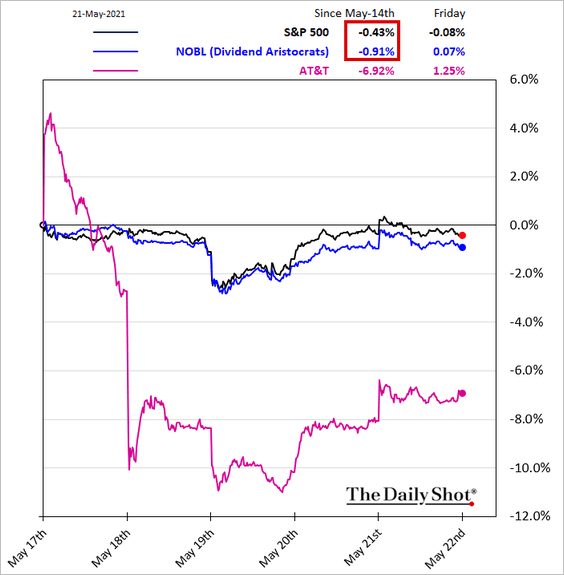

4. The Dividend Aristocrats index has underperformed as AT&T guided its dividend lower.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Credit

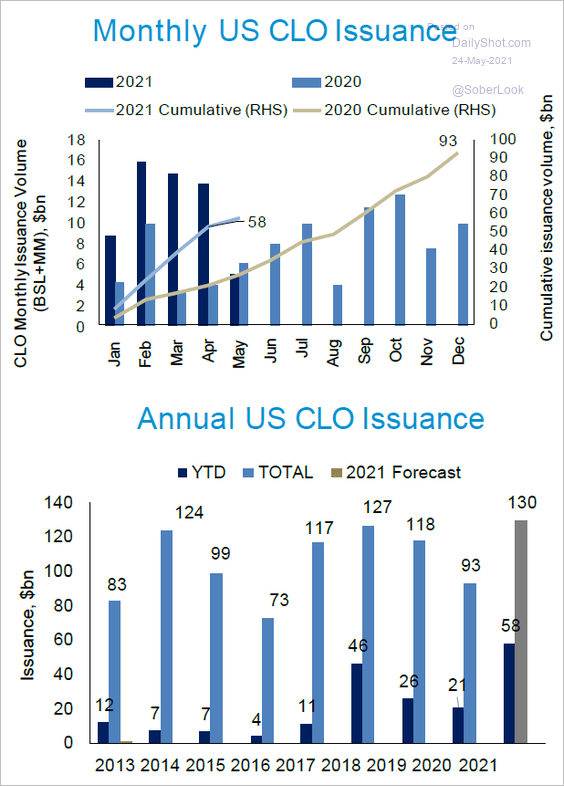

1. US CLO issuance has been strong this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

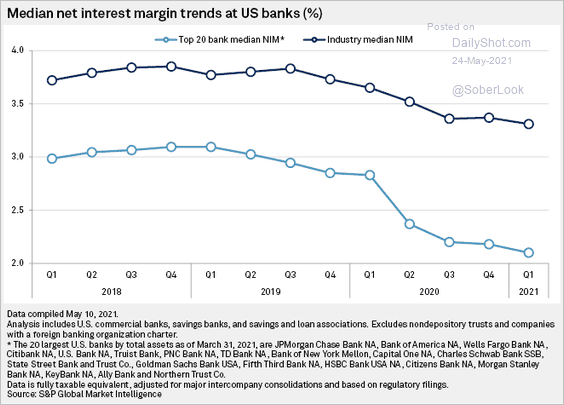

2. This chart shows US banks’ interest margin trends.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

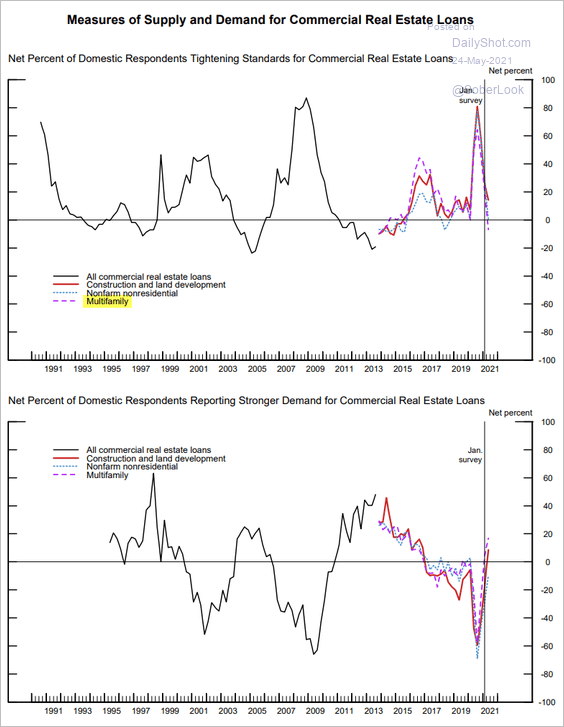

3. Banks have eased their lending standards for multi-family housing as demand strengthens.

Source: Federal Reserve Board

Source: Federal Reserve Board

Back to Index

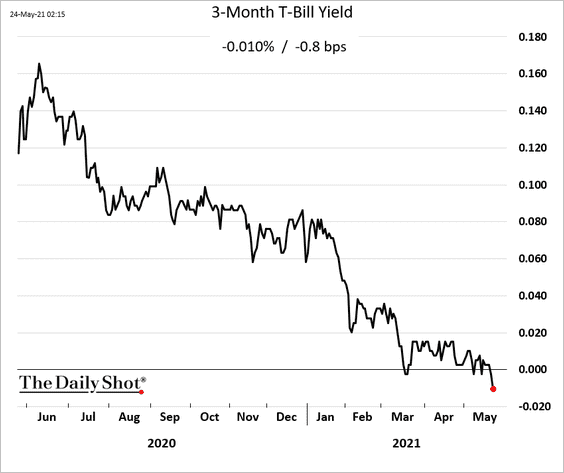

Rates

1. Short-term rates remain near zero or negative.

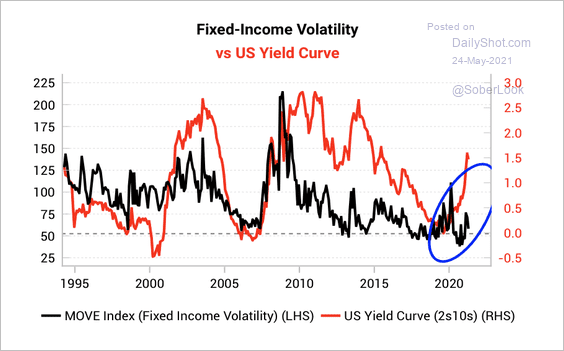

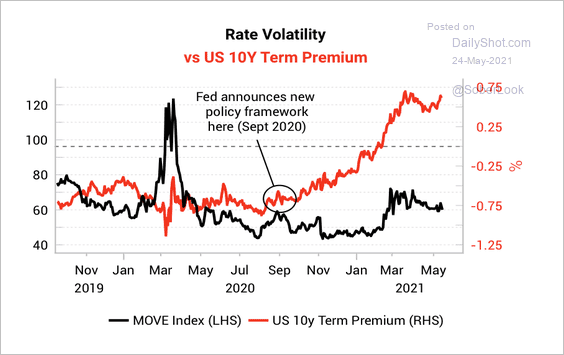

2. A steeper US yield curve points to higher fixed-income volatility.

Source: Variant Perception

Source: Variant Perception

High volatility means more risk to hold duration, which will help support the term premium. That, in turn, will help the yield curve steepen further, according to Variant Perception.

Source: Variant Perception

Source: Variant Perception

Back to Index

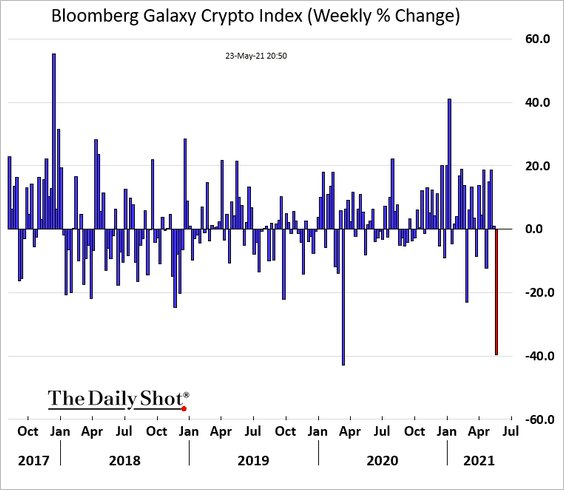

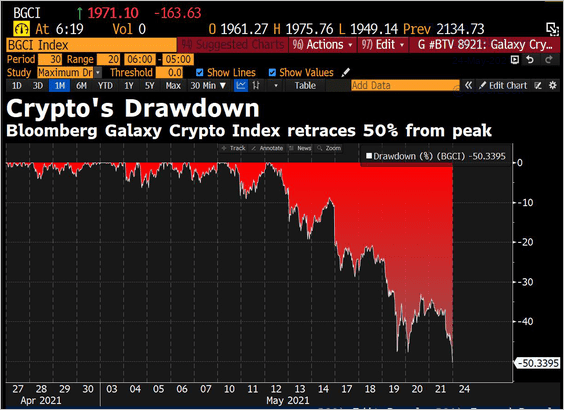

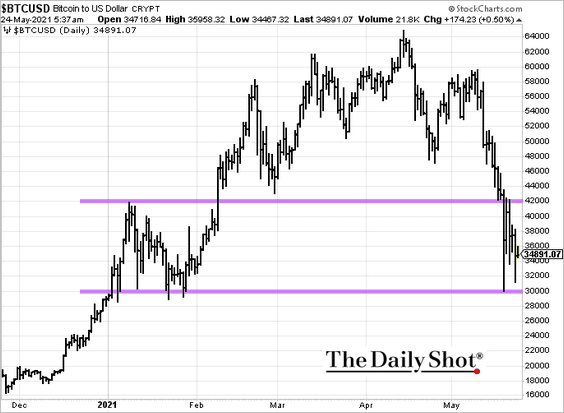

Cryptocurrency

1. It was a rough weekend for cryptos, with some revisiting last week’s lows.

• Here is Bloomberg’s crypto index (2 charts).

Source: @DavidInglesTV

Source: @DavidInglesTV

• Ether dipped below $1800 before rebounding. The $2k support appears to be holding.

• Bitcoin has stabilized after approaching $31k and is moving higher this morning.

——————–

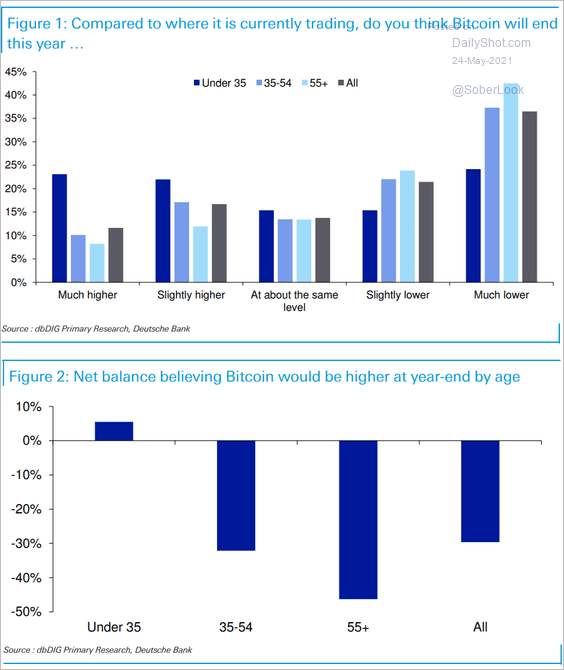

2. Where will bitcoin be by the end of the year? Here is a survey from Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

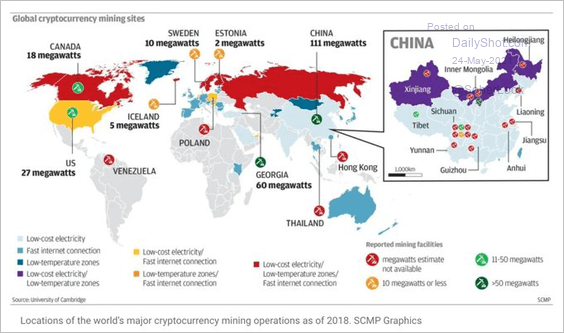

3. Ether could gain a substantial advantage over bitcoin by becoming environmentally more friendly.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Separately, while this map is outdated in terms of absolute power usage levels, the geographic distribution hasn’t changed too much since 2018.

Source: @adam_tooze, The Economist Read full article

Source: @adam_tooze, The Economist Read full article

——————–

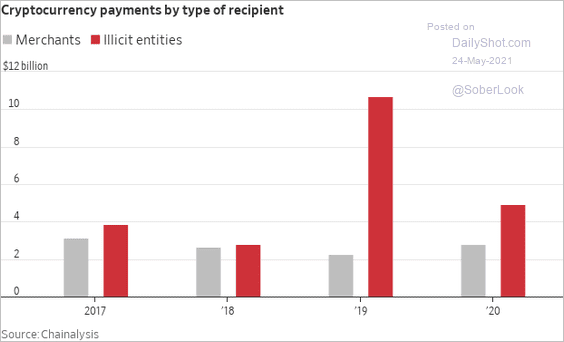

4. Crypto payments to illicit entities have risen sharply.

Source: @WSJ Read full article

Source: @WSJ Read full article

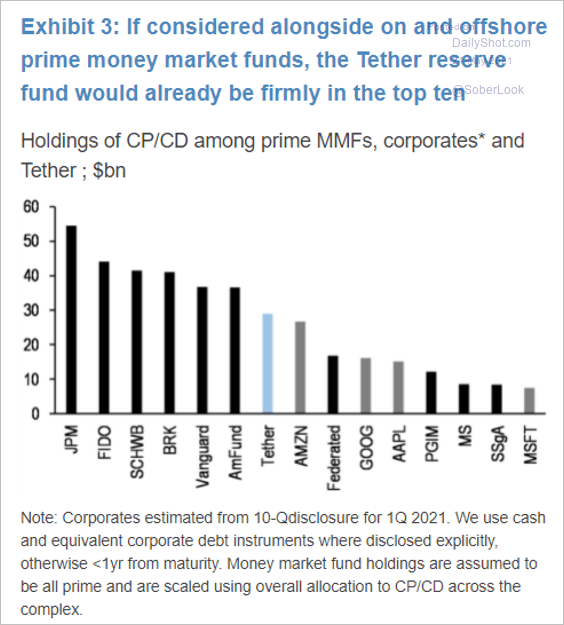

5. How does Tether compare to prime money market funds and corporates in terms of CP and CD holdings?

Source: JP Morgan, @tracyalloway, @TheStalwart Read full article

Source: JP Morgan, @tracyalloway, @TheStalwart Read full article

Back to Index

Emerging Markets

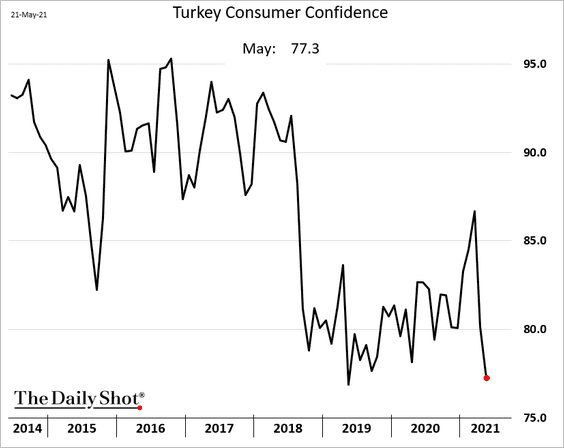

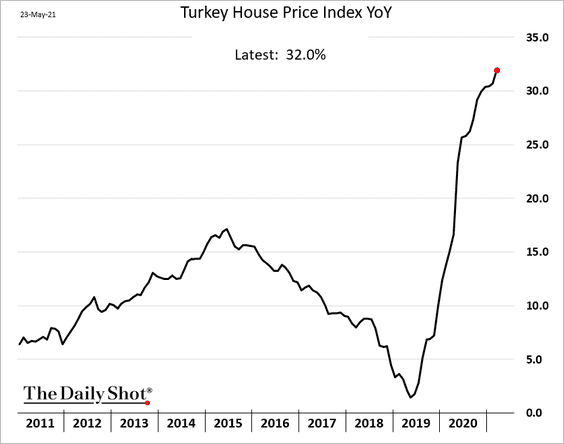

1. Turkey’s consumer confidence plummeted since the lira’s slump.

Home prices are over 30% above last year’s levels.

——————–

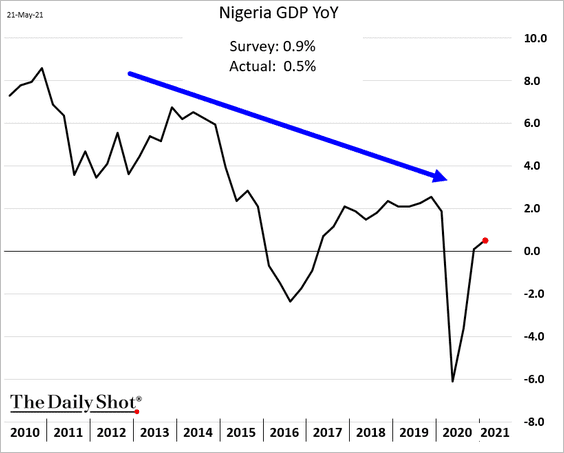

2. Despite the rebound, Nigeria’s GDP growth remains in the doldrums.

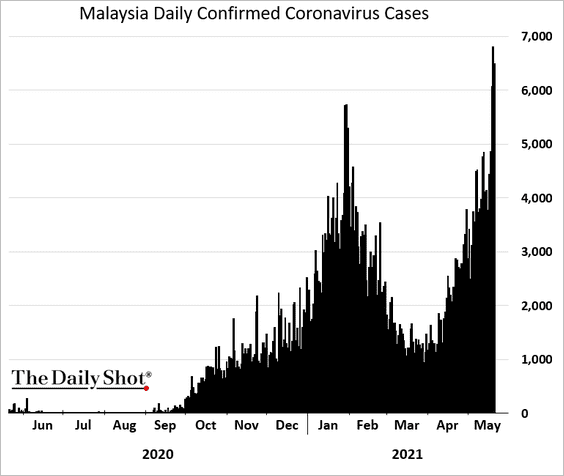

3. Malaysia’s COVID cases hit a new high last week.

h/t Liau Y-Sing

h/t Liau Y-Sing

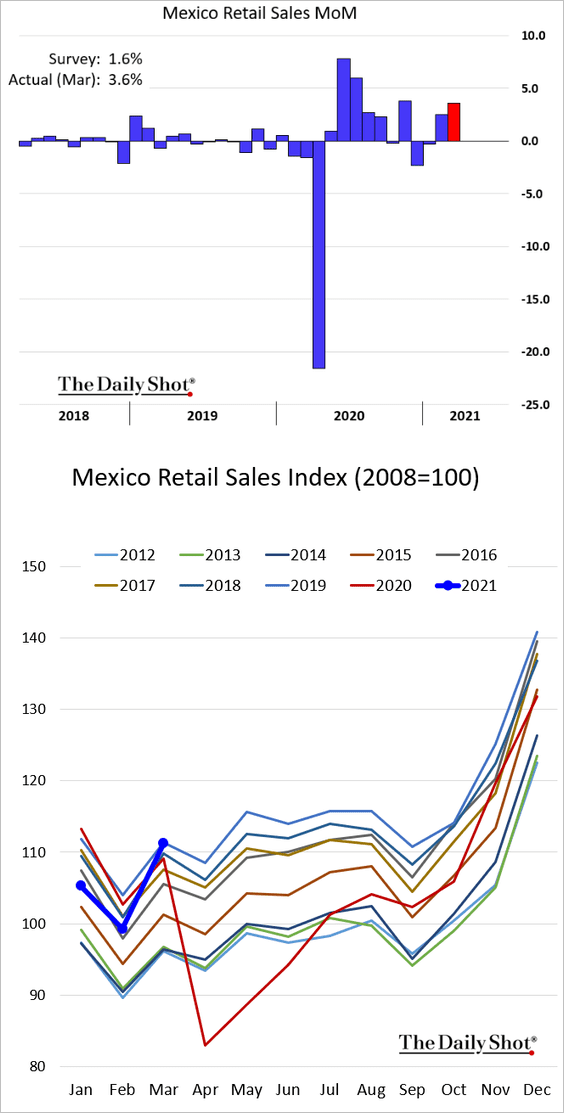

4. Mexico’s March retail sales surprised to the upside.

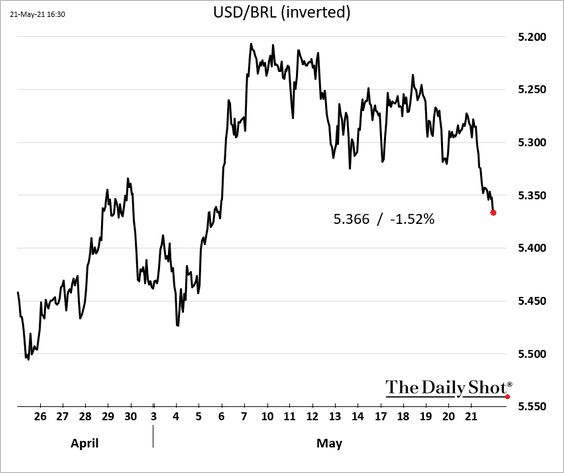

5. The Brazilian real sold off on Friday.

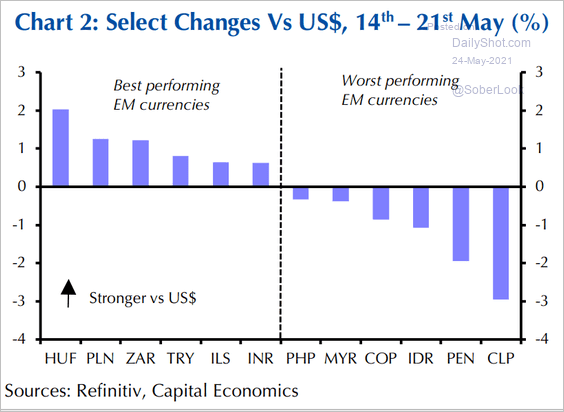

6. Here is last week’s performance for select EM currencies.

Source: Capital Economics

Source: Capital Economics

Back to Index

Asia – Pacific

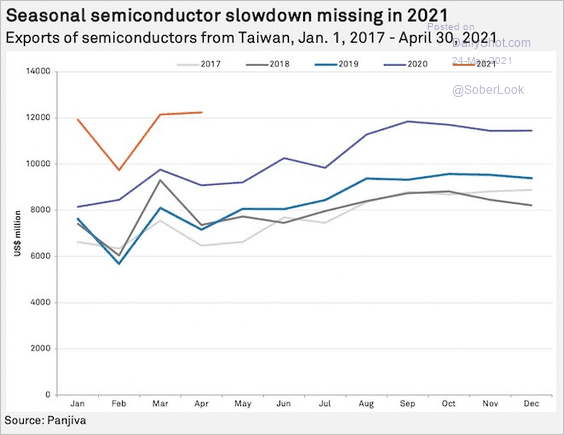

1. Taiwan’s semiconductor exports did not pause last month (that’s not the typical seasonal pattern).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

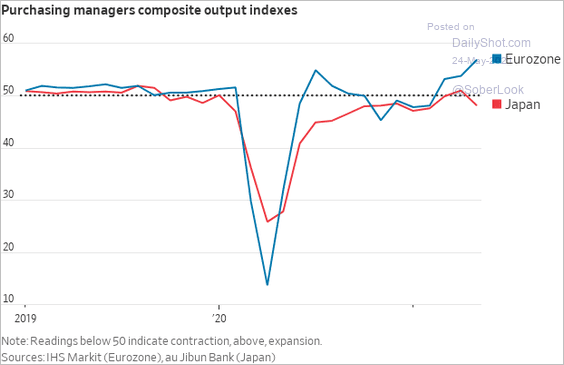

2. Japan’s business recovery is lagging the Eurozone.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

The Eurozone

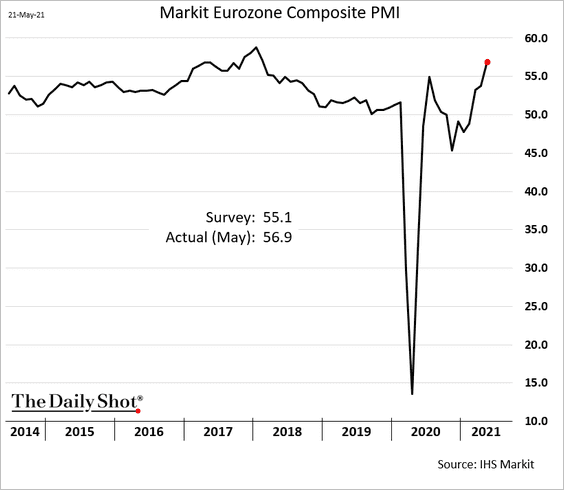

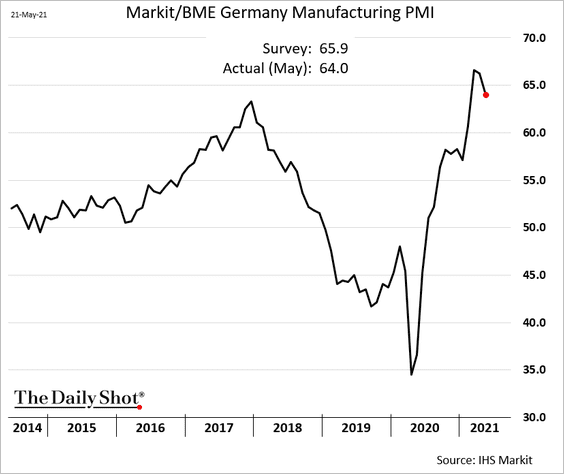

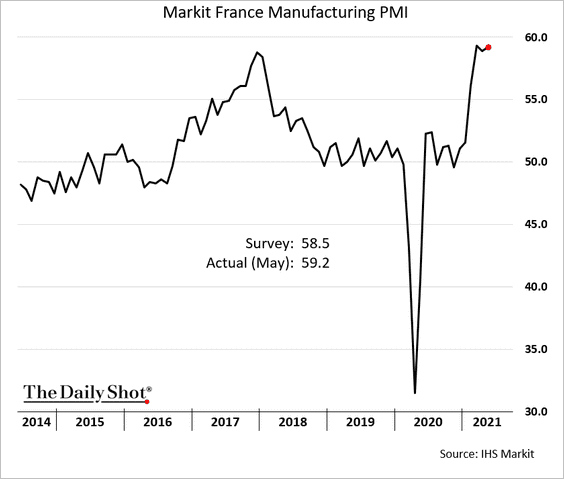

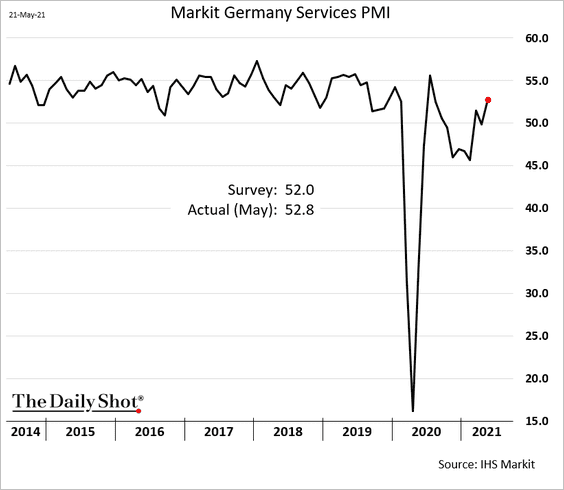

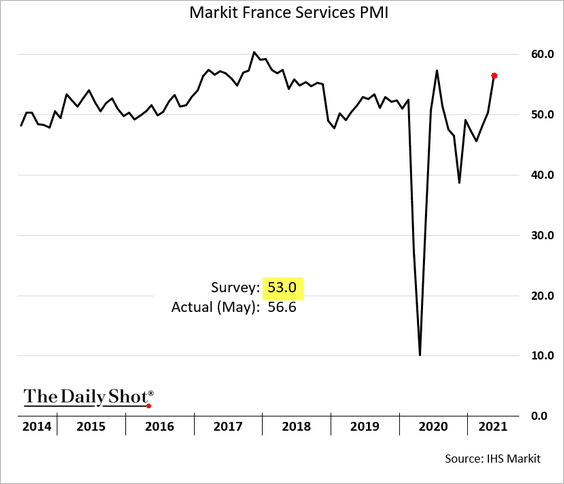

1. Business activity accelerated this month.

• Germany’s manufacturing expansion is off the highs, …

… but French manufacturing growth remains near the peak.

• Service companies’ recovery is picking up momentum.

– Germany:

– France:

——————–

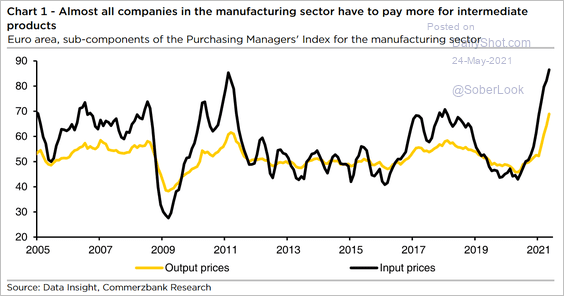

2. Price pressures continue to grow (a global trend).

Source: Commerzbank Research

Source: Commerzbank Research

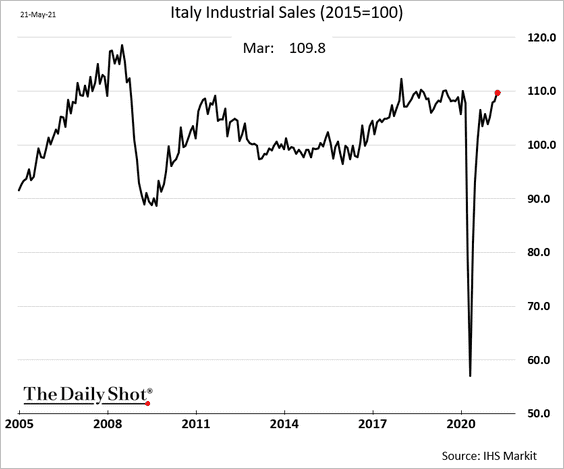

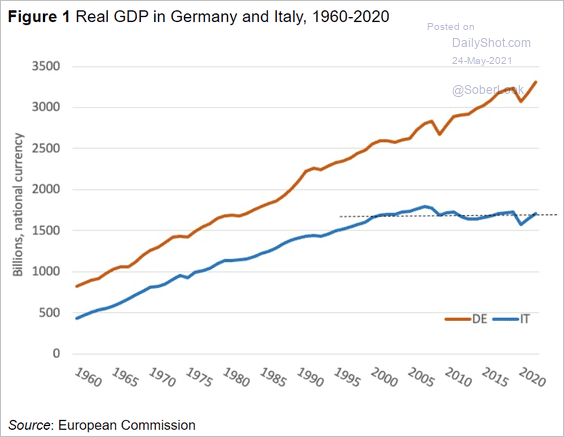

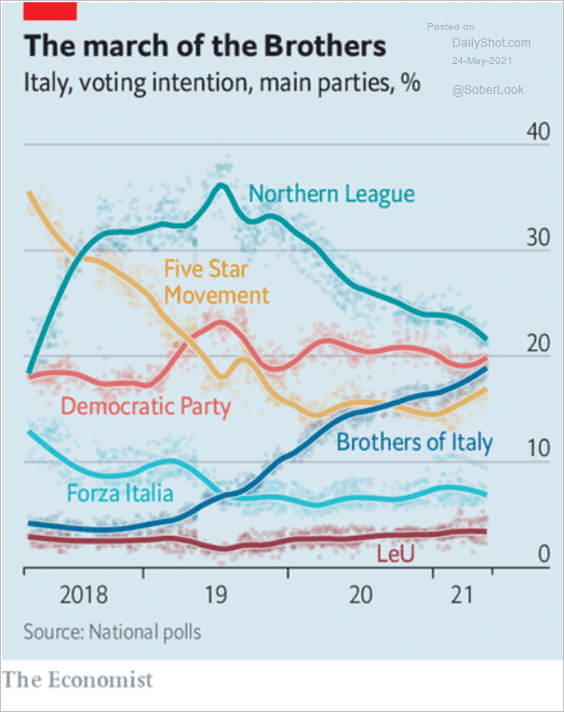

3. Next, we have some updates on Italy.

• Industrial sales were back at pre-COVID levels in March.

• Economic growth has stalled over the past two decades.

Source: VOX EU Read full article

Source: VOX EU Read full article

• Will the Northern League and Brothers of Italy be able to form a far-right populist coalition?

Source: @adam_tooze, The Economist Read full article

Source: @adam_tooze, The Economist Read full article

——————–

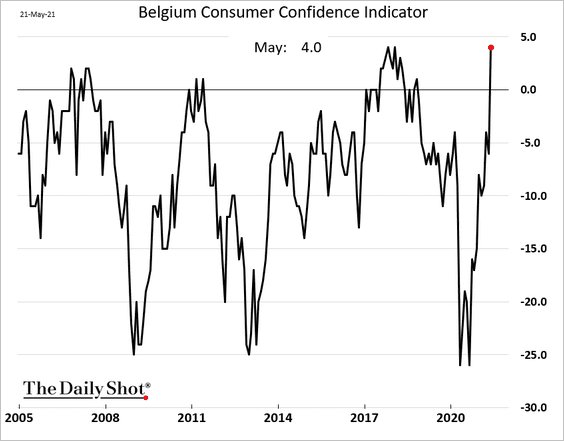

4. Belgian consumer confidence shot up this month.

Back to Index

The United Kingdom

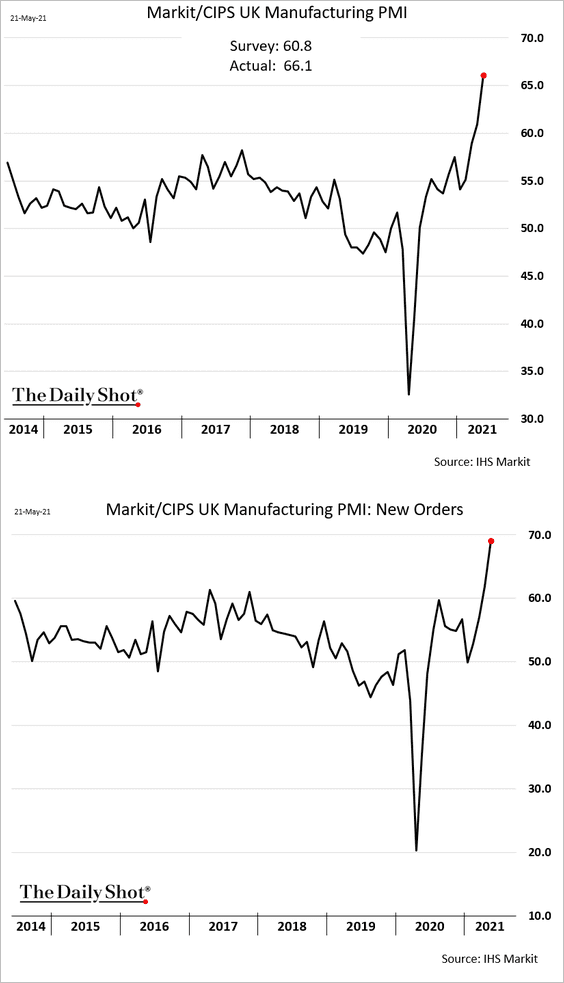

1. Factory activity surged this month.

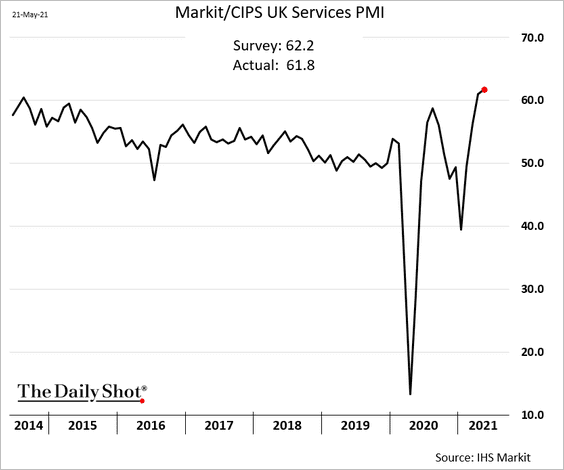

Robust service-sector growth continues.

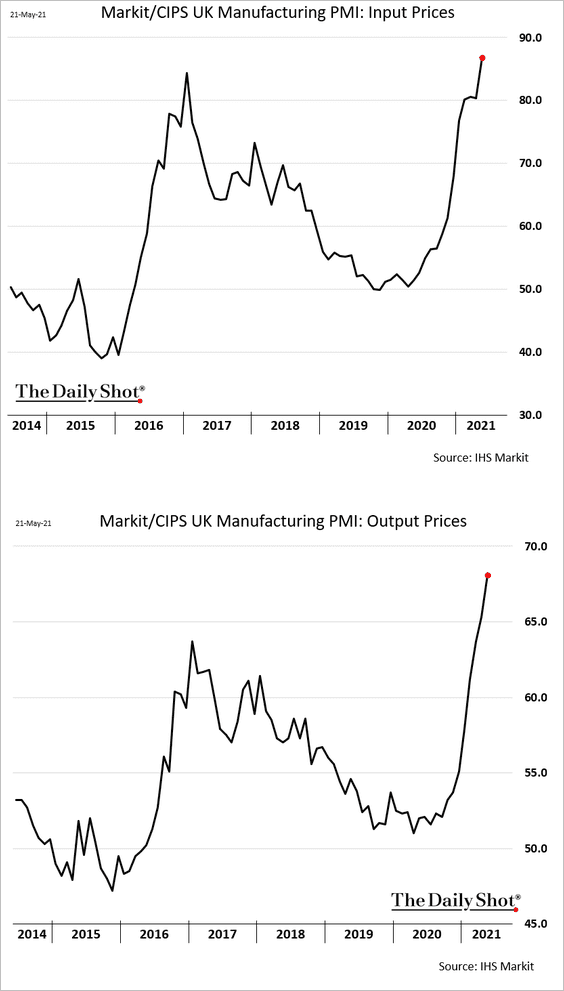

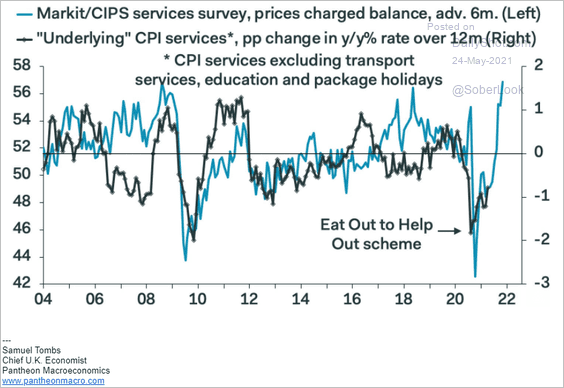

Price pressures are becoming more intense, …

… which will boost inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

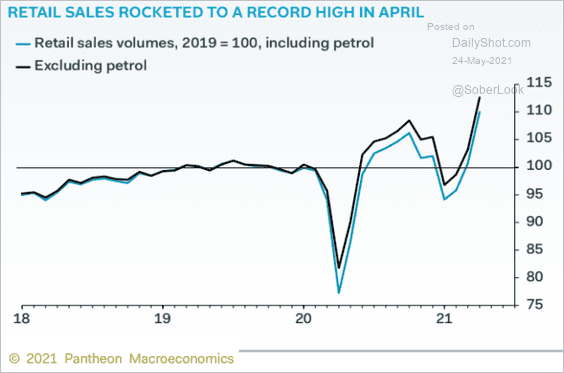

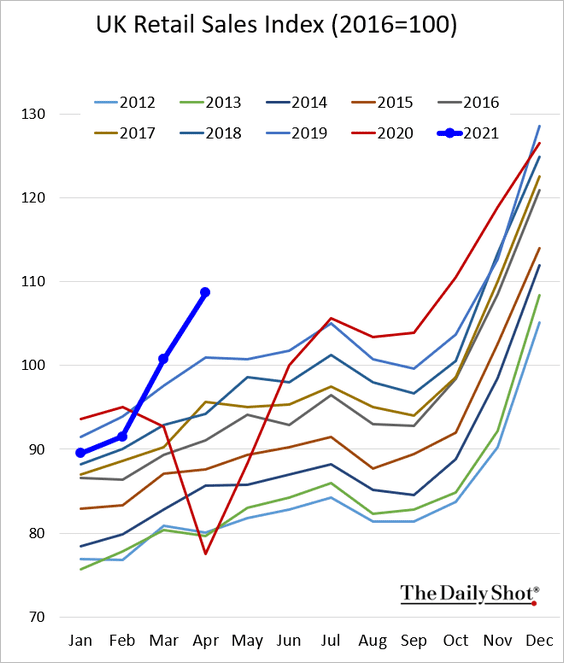

2. Retail sales accelerated in April.

• Seasonally adjusted:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Not seasonally adjusted:

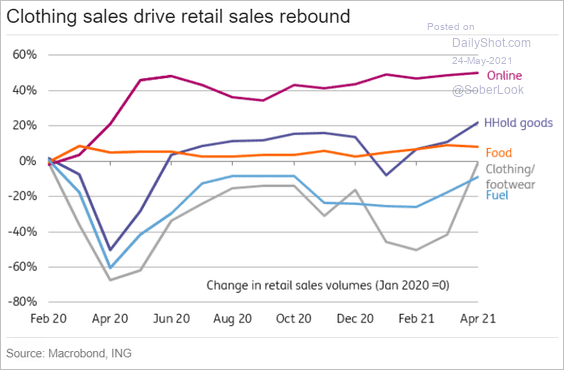

Here is the breakdown by sector.

Source: ING

Source: ING

——————–

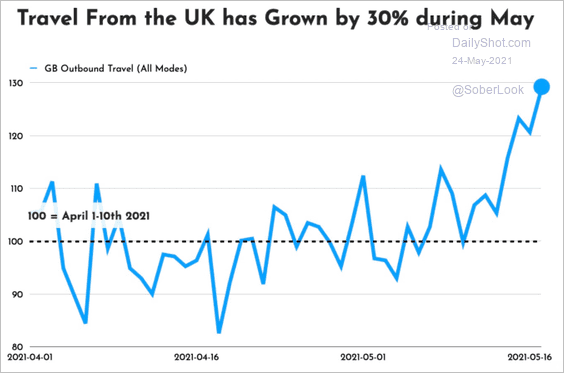

3. Outbound travel is picking up.

Source: huq Read full article

Source: huq Read full article

Back to Index

Canada

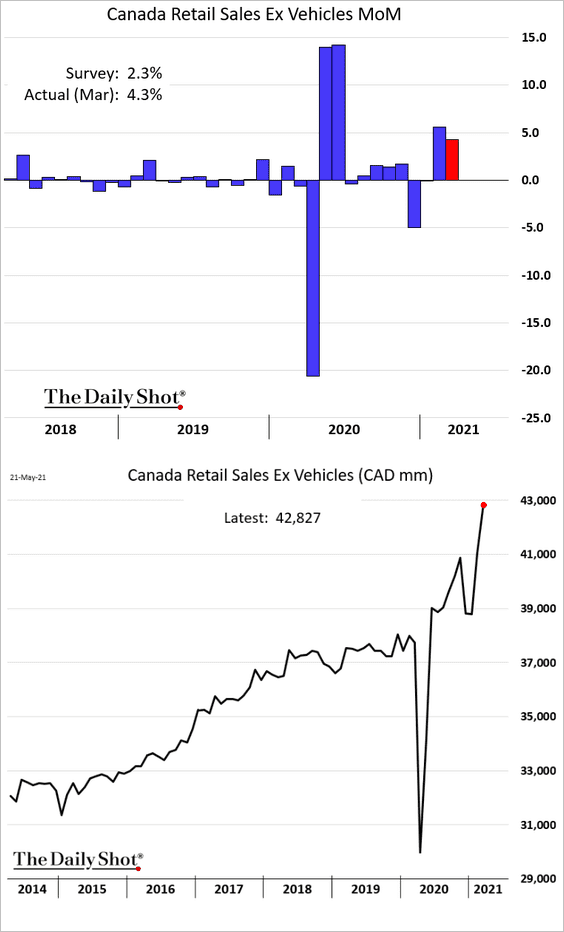

1. March retail sales surprised to the upside and are running well above the pre-COVID trend.

2. The BoC is concerned about household debt and the hot housing market.

Source: @WSJ Read full article

Source: @WSJ Read full article

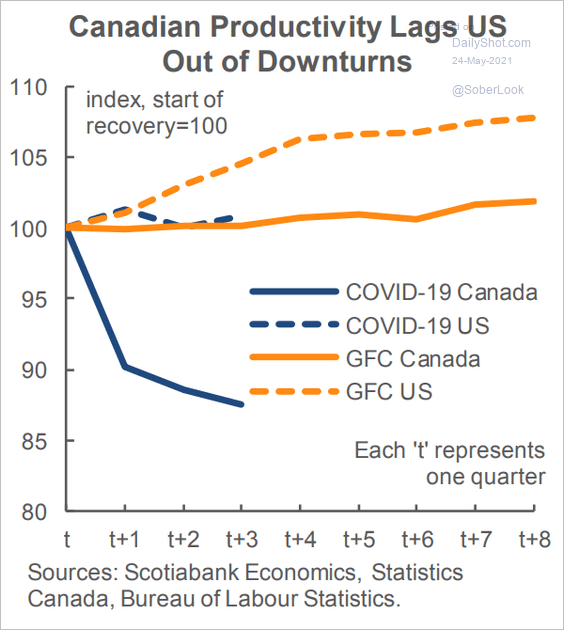

3. Canada’s productivity has been lagging the US.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United States

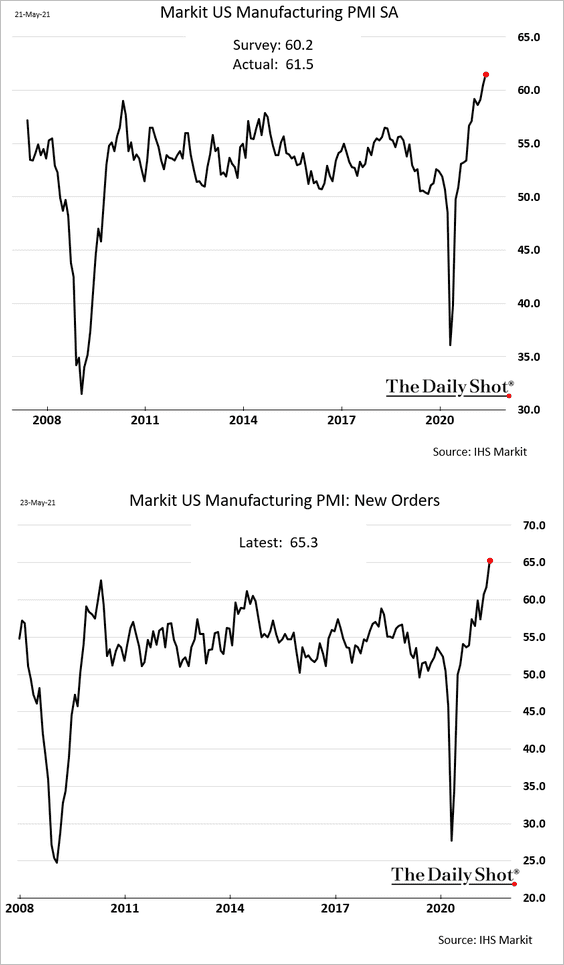

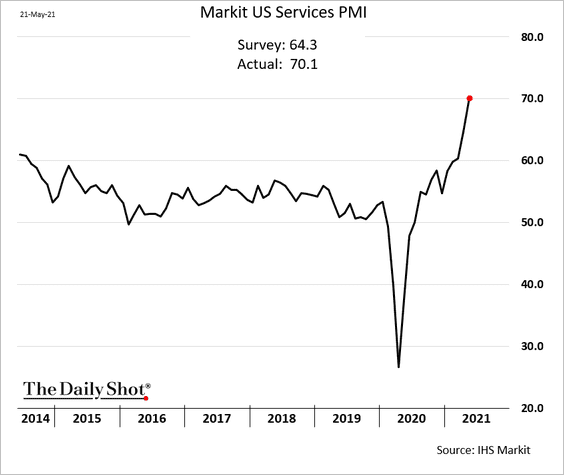

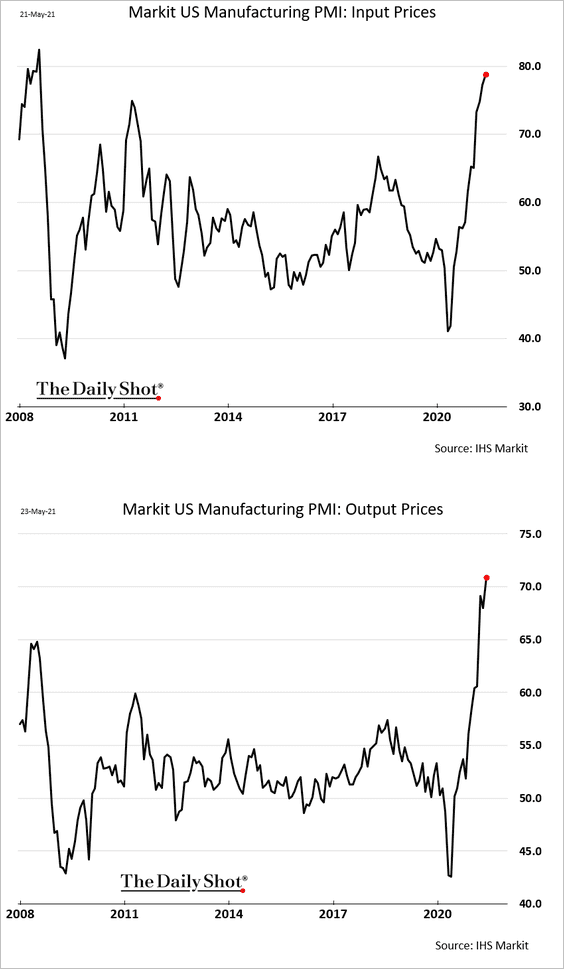

1. The Markit PMI report showed a further acceleration in the nation’s business activity this month.

• Manufacturing:

• Services (well above consensus):

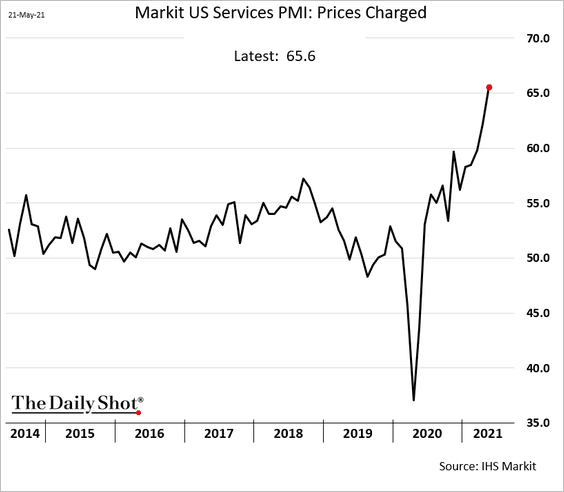

Price pressures are getting worse both in the manufacturing and services sectors.

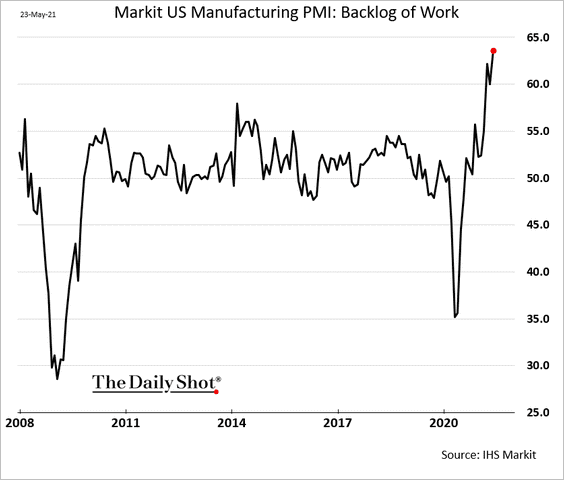

As we mentioned previously, factories are backed up.

——————–

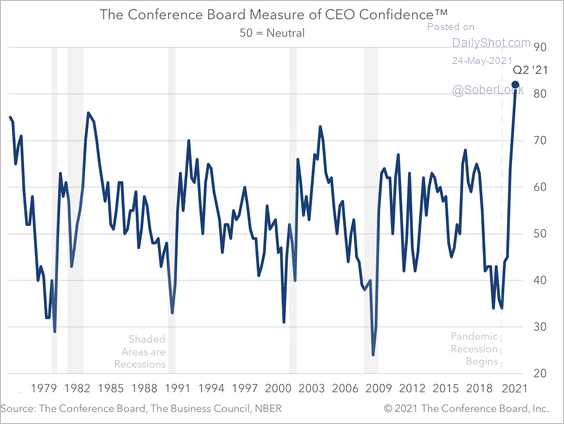

2. CEO confidence is at multi-decade highs.

Source: The Conference Board

Source: The Conference Board

——————–

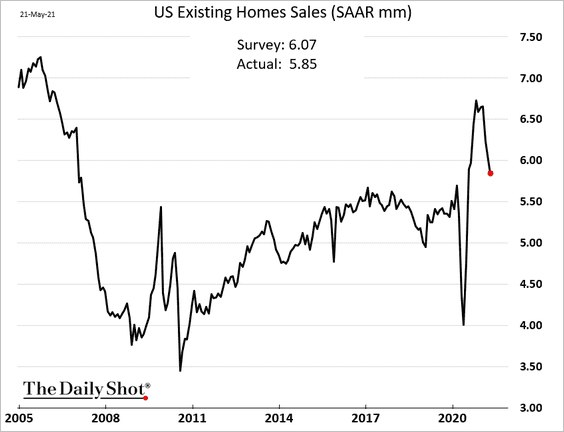

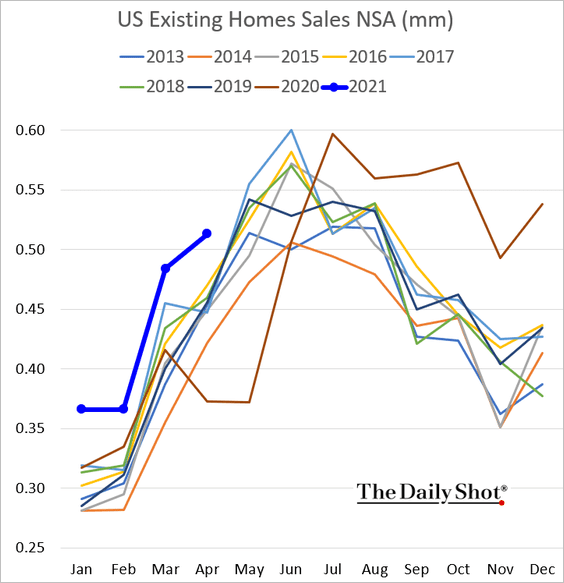

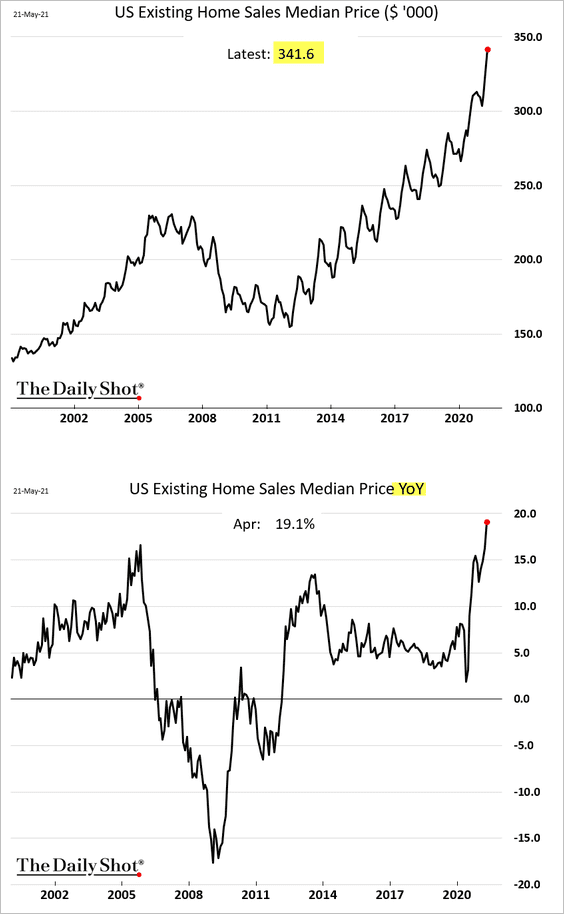

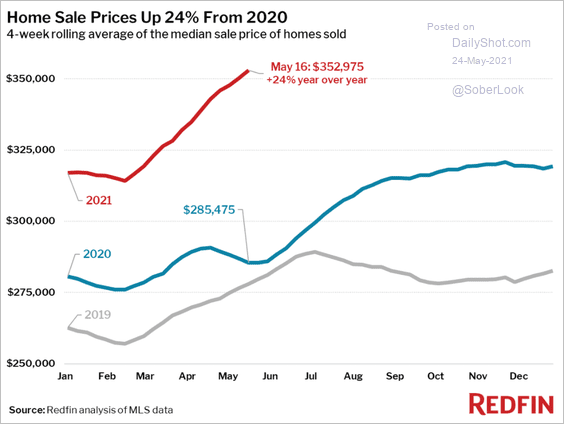

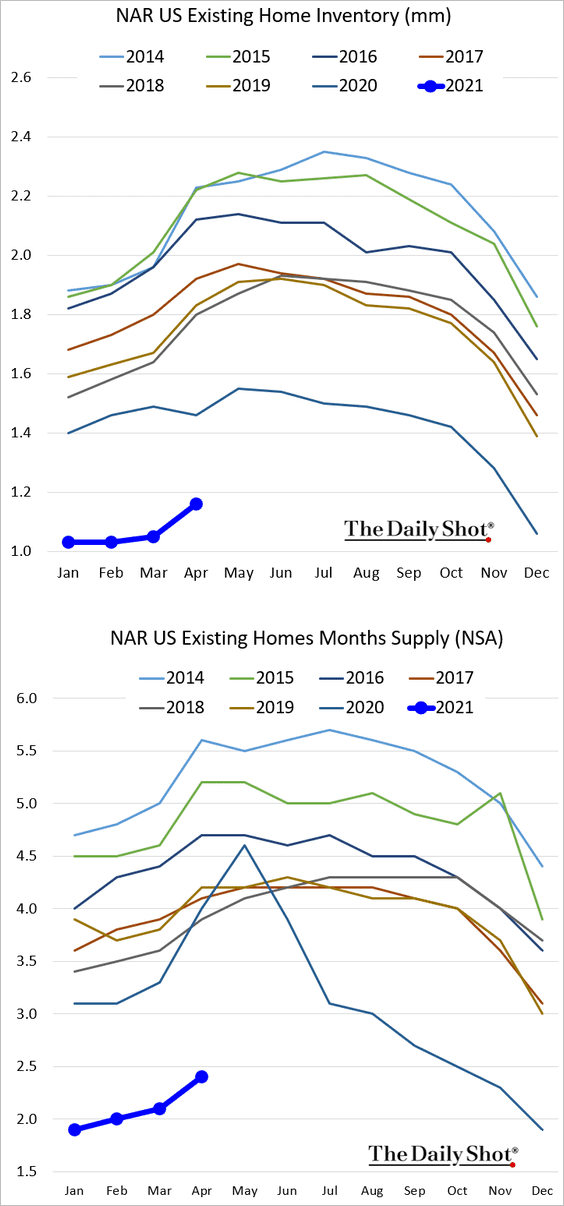

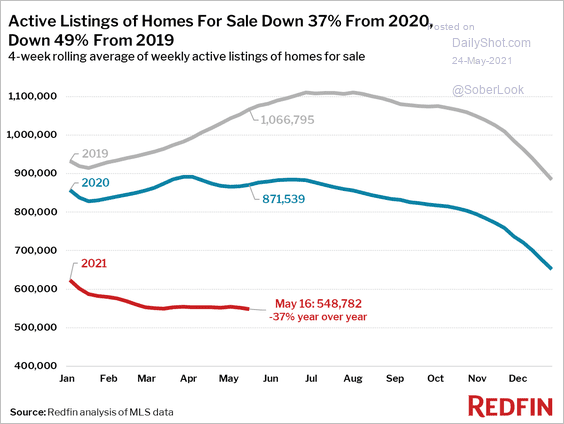

3. Next, we have some updates on the housing market.

• Existing home sales slowed last month.

– Seasonally adjusted (one has to be careful with seasonal adjustments in housing markets, especially in this environment):

– Not seasonally adjusted:

• Prices are surging (2 charts).

Source: Redfin

Source: Redfin

• And inventories remain extremely tight (2 charts).

Source: Redfin

Source: Redfin

——————–

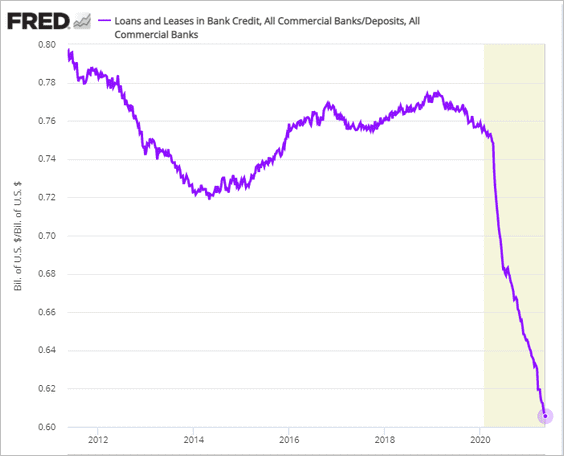

4. The banking sector’s loan-to-deposit ratio continues to fall.

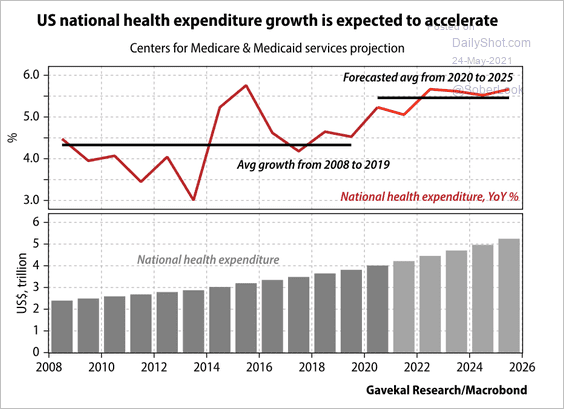

5. Healthcare spending is expected to accelerate over the next few years.

Source: Gavekal Research

Source: Gavekal Research

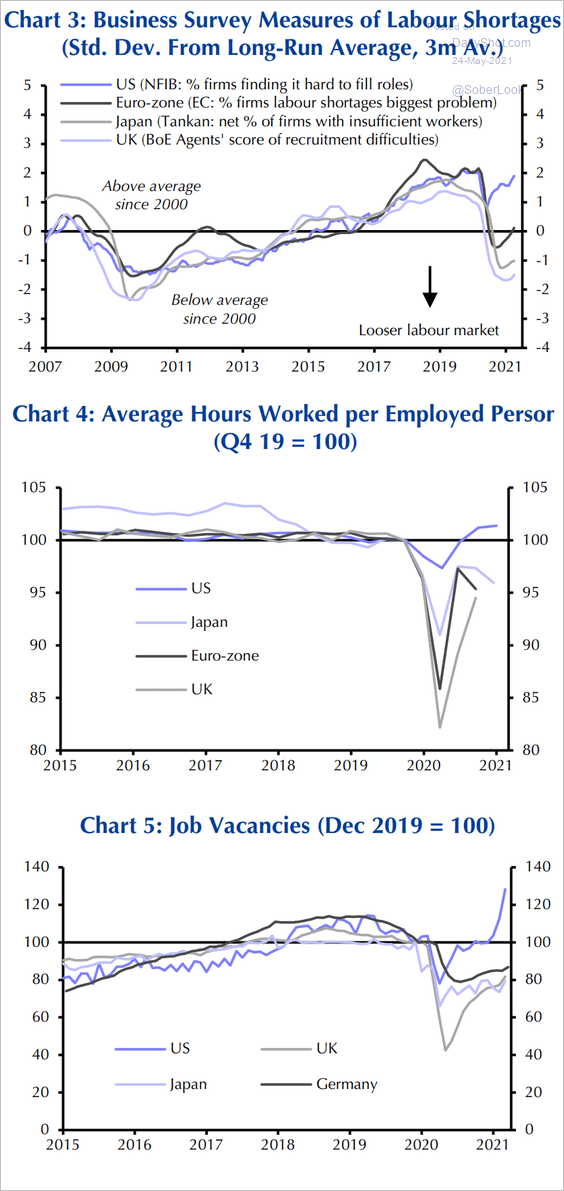

6. The labor market is tighter than in other developed economies.

Source: Capital Economics

Source: Capital Economics

Back to Index

Food for Thought

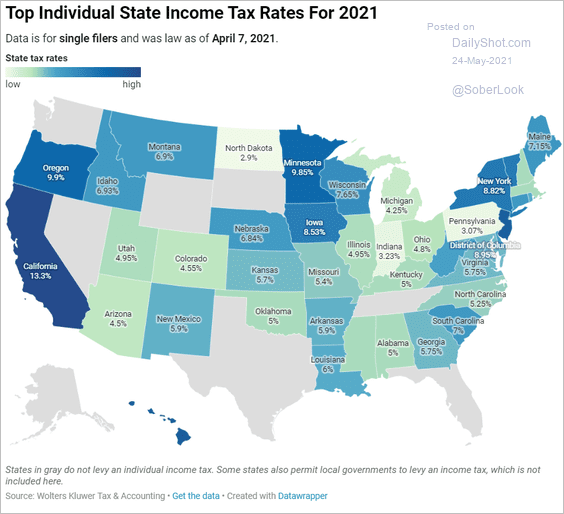

1. Top individual state income tax rates:

Source: Forbes Read full article

Source: Forbes Read full article

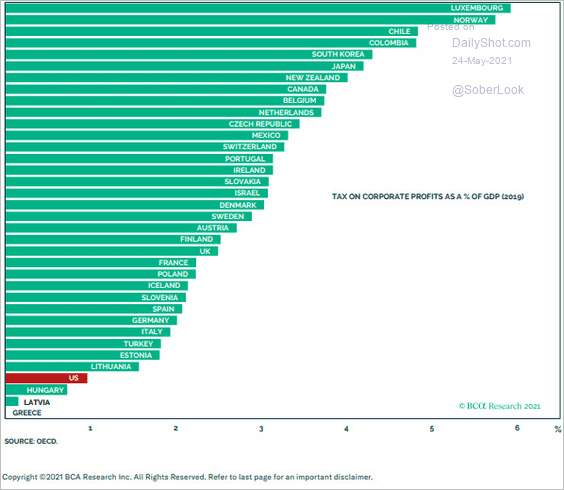

2. Corporate taxes as a percentage of GDP:

Source: BCA Research

Source: BCA Research

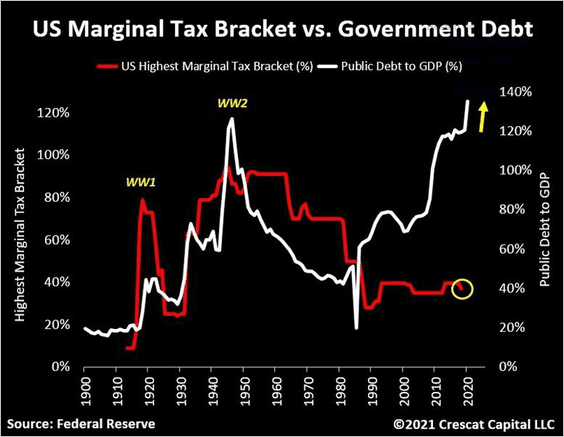

3. US marginal tax bracket vs. government debt:

Source: @TaviCosta

Source: @TaviCosta

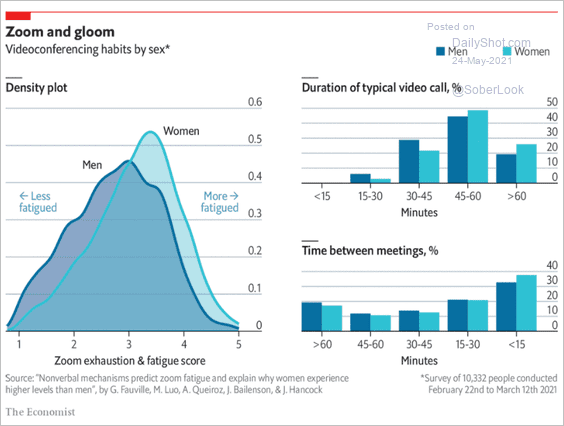

4. Zoom fatigue:

Source: The Economist Read full article

Source: The Economist Read full article

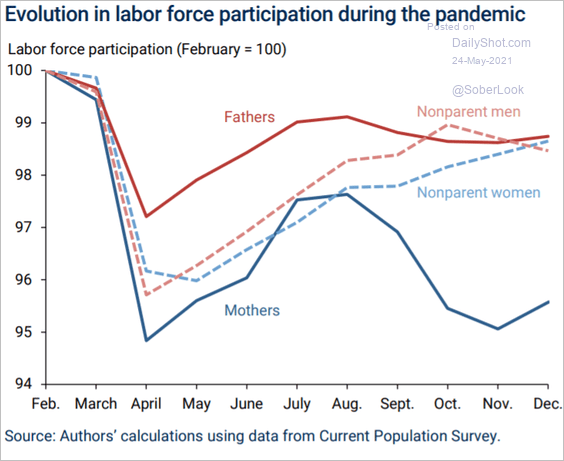

5. Labor force participation during the pandemic:

Source: Federal Reserve Bank of San Francisco

Source: Federal Reserve Bank of San Francisco

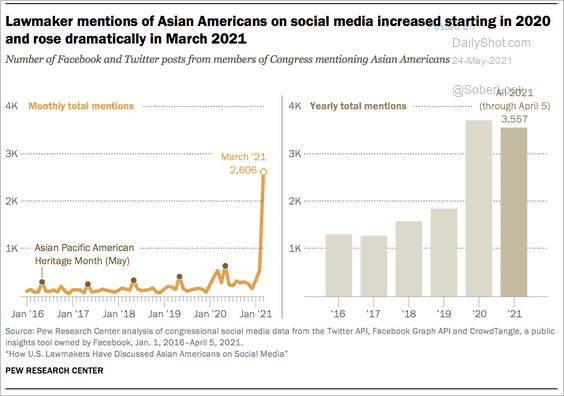

6. Lawmaker mentions of Asian Americans:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

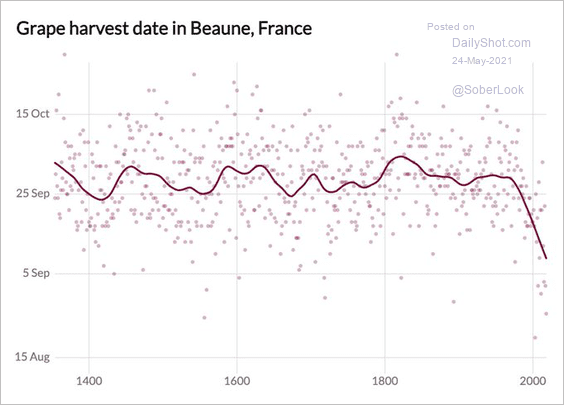

7. Grape harvest date in Beaune, France:

Source: @MunishDatta Read full article

Source: @MunishDatta Read full article

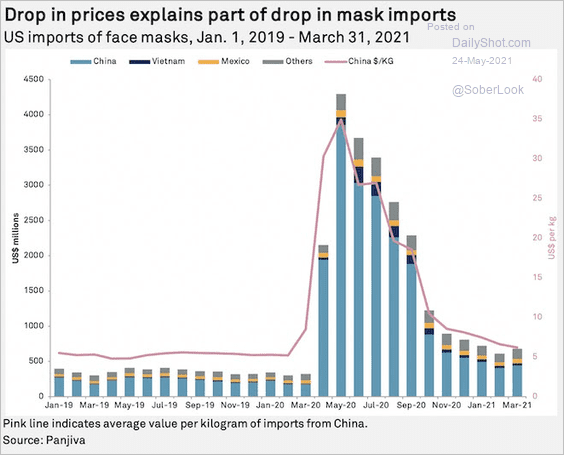

8. Mask prices and imports:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

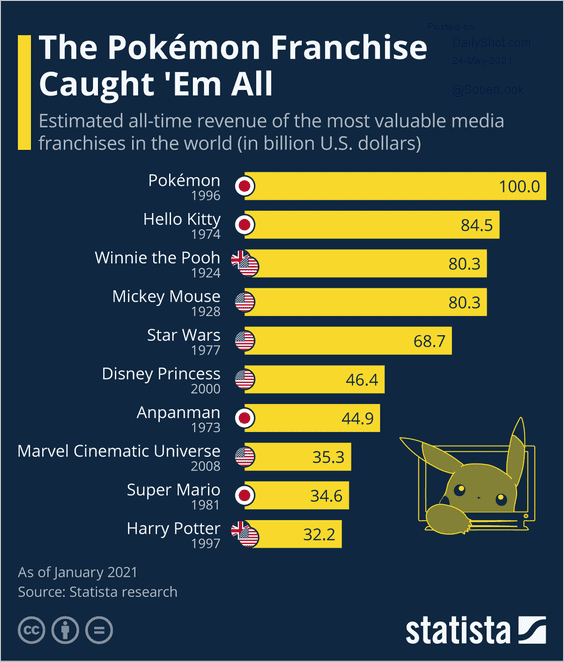

9. Most valuable media franchises:

Source: Statista

Source: Statista

——————–

Back to Index