The Daily Shot: 11-Jun-21

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

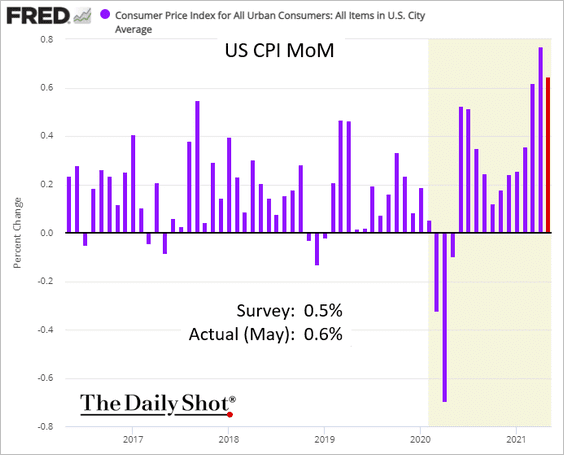

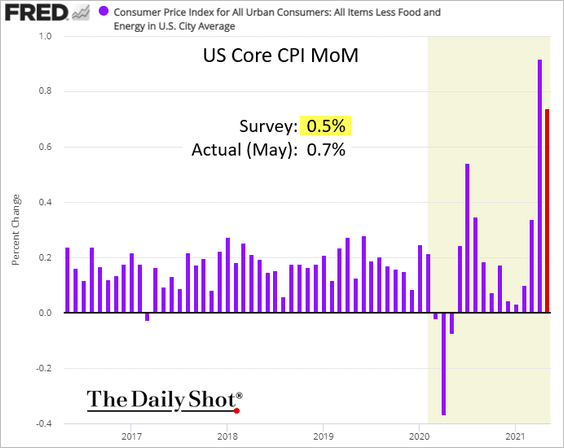

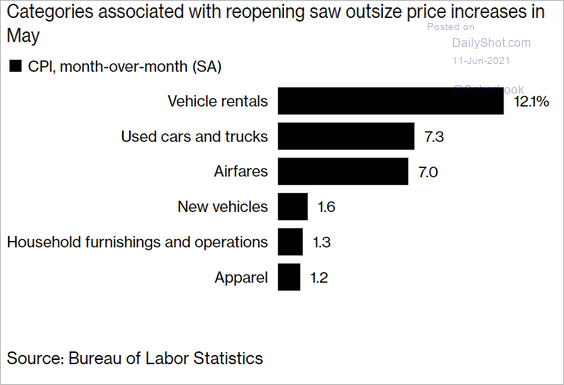

1. The May CPI report topped economists’ forecasts.

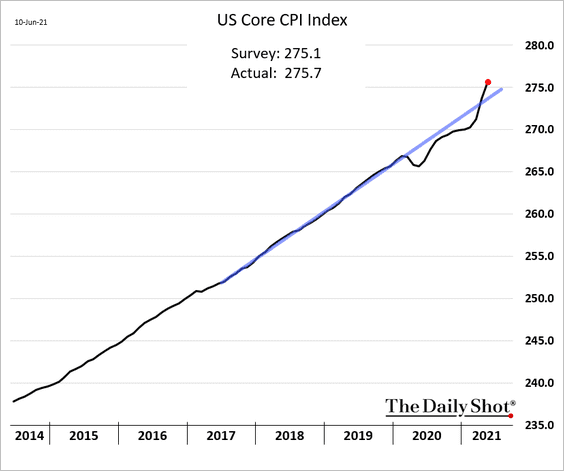

The core CPI price index is now firmly above the pre-COVID trend.

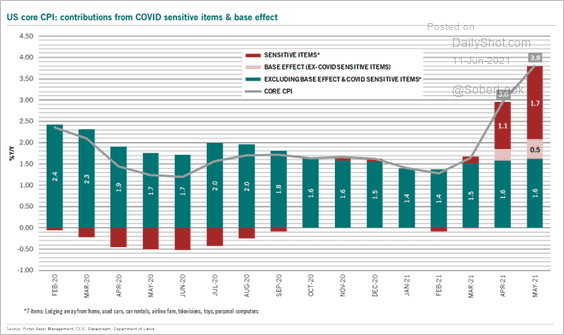

On a year-over-year basis, the core CPI climbed by most in years. However, without the COVID-sensitive items (including the auto manufacturing disruptions) and the base effect, the core inflation remains relatively stable. As far as the markets are concerned, this supports the Fed’s “transient” inflation narrative.

Source: @PkZweifel

Source: @PkZweifel

Here are the “COVID-sensitive” items.

Source: @markets Read full article

Source: @markets Read full article

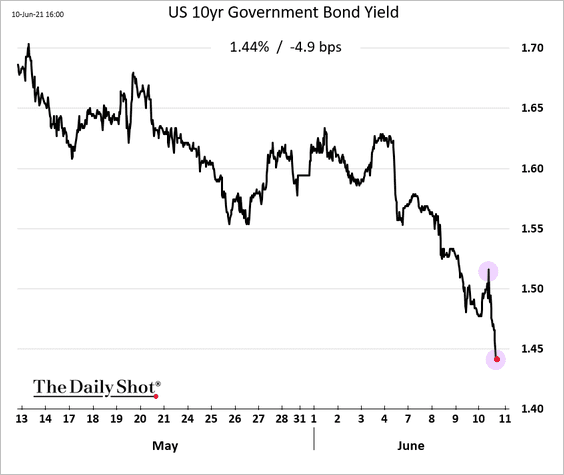

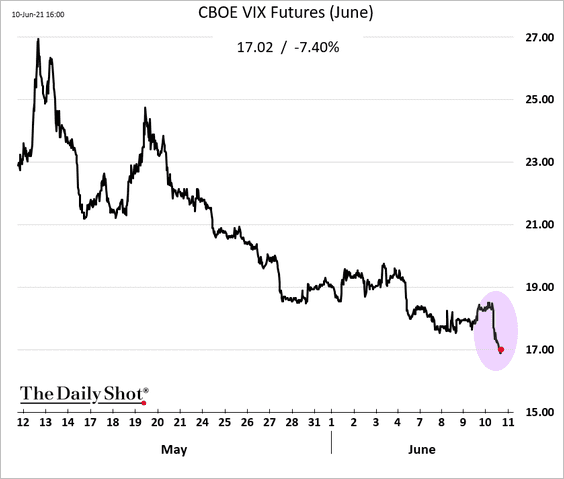

The markets were initially spooked by the upside CPI surprise, but after digesting the news, the trends reversed.

• The 10yr Treasury yield:

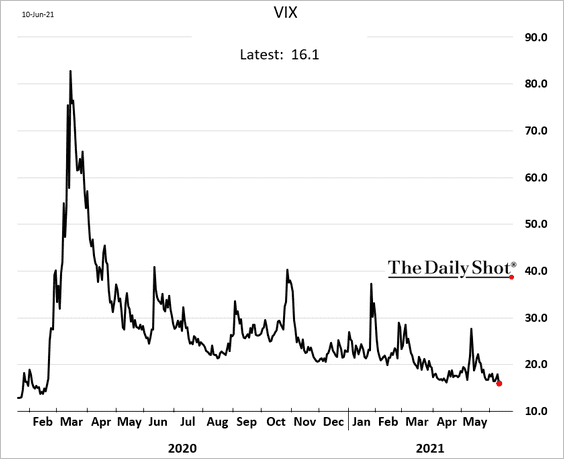

• VIX:

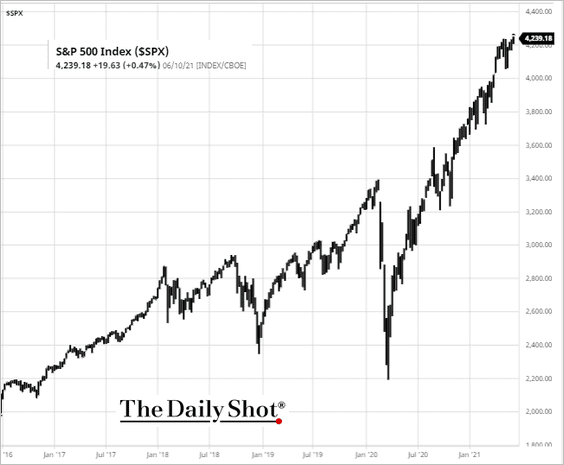

The S&P 500 hit a record high.

Source: barchart.com

Source: barchart.com

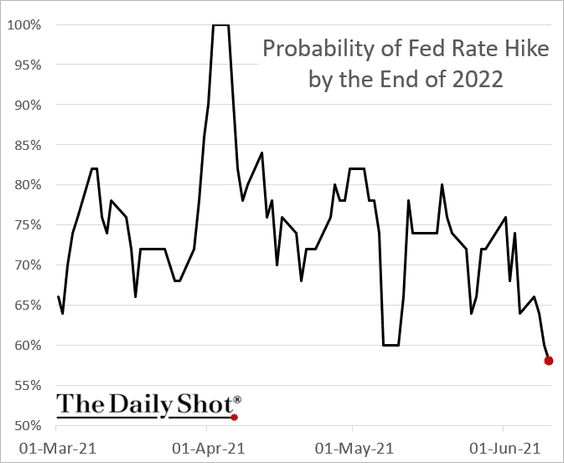

The futures-based probability of a 2022 Fed rate hike declined, with the full 25 bps increase now priced for the first quarter of 2023.

We will have more detail in the CPI report on Monday.

——————–

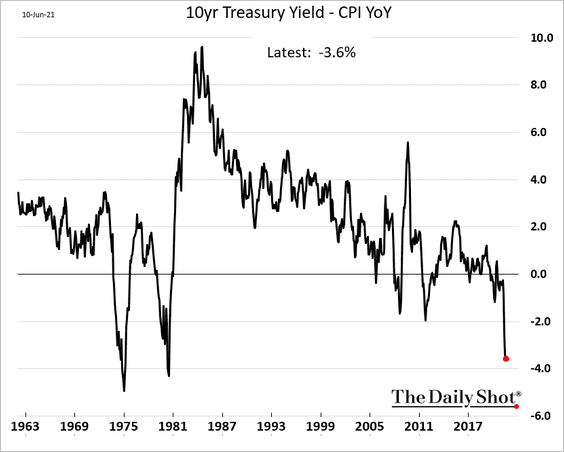

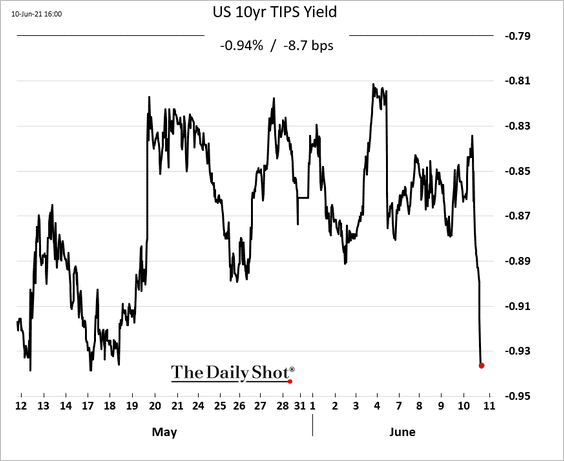

2. The 10-year Treasury yield adjusted for inflation hit the lowest level in decades, pointing to extreme monetary accommodation.

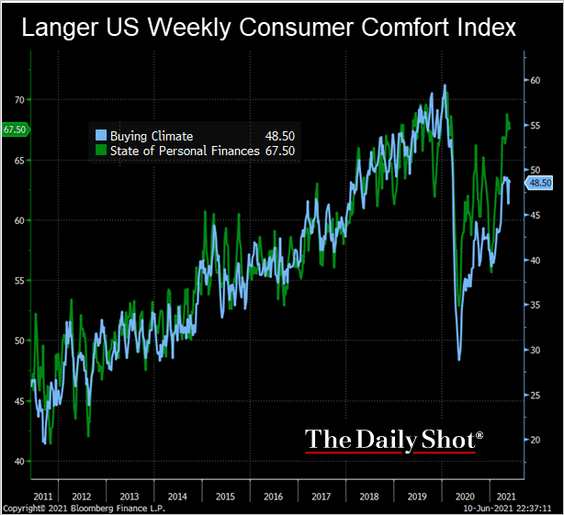

3. Consumers are now nearly as comfortable with their financial situation as they were before the pandemic. However, the “buying climate” index is lagging, partially due to rapid price increases.

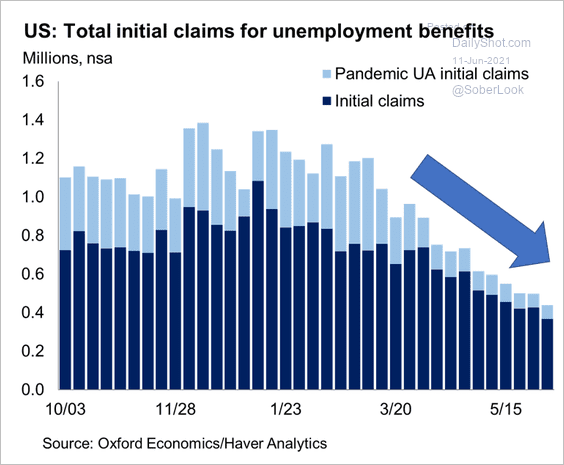

4. Initial jobless claims continue to trend down.

Source: @GregDaco

Source: @GregDaco

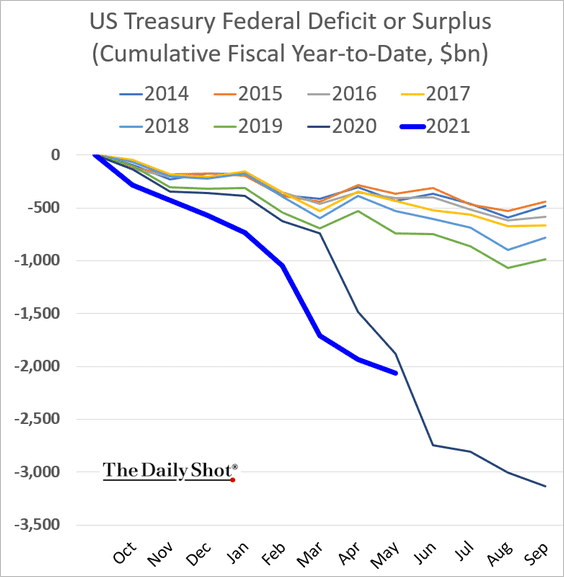

5. The federal budget increased less than expected, …

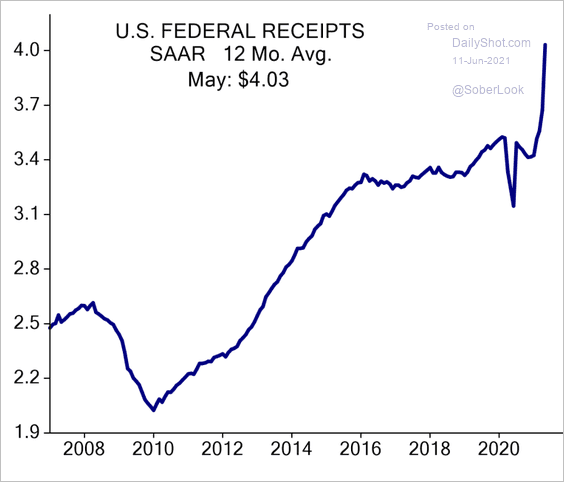

… as federal tax receipts spike.

Source: Evercore ISI

Source: Evercore ISI

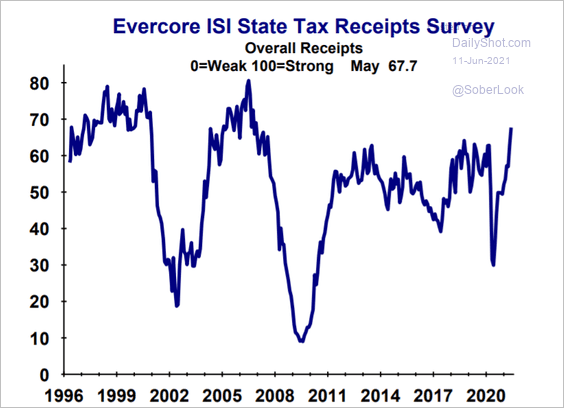

By the way, state tax receipts are also at multi-year highs.

Source: Evercore ISI

Source: Evercore ISI

——————–

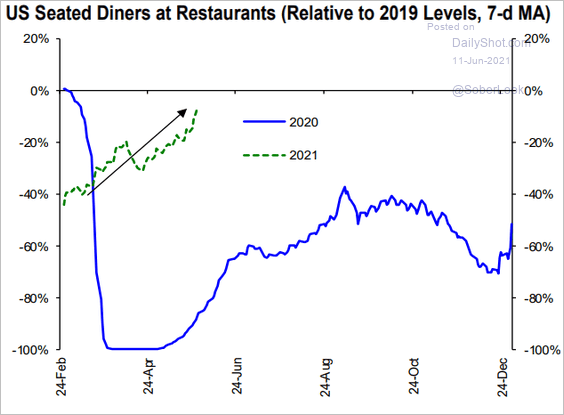

6. Seated diners at restaurants are nearing the pre-COVID level.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

The Oxford Economics Recovery Tracker is also closing in on pre-pandemic levels (another good chart for our friends at the Fed).

![]() Source: Oxford Economics

Source: Oxford Economics

Back to Index

The Eurozone

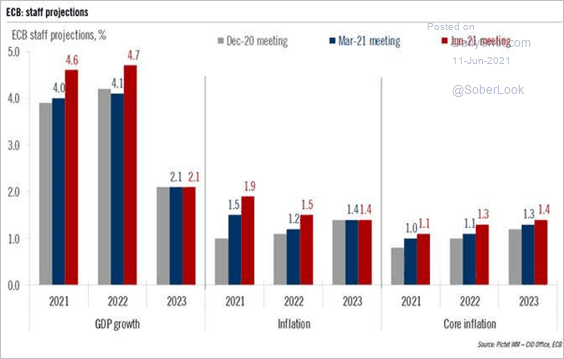

1. The ECB upgraded its GDP and inflation forecasts.

Source: @fwred

Source: @fwred

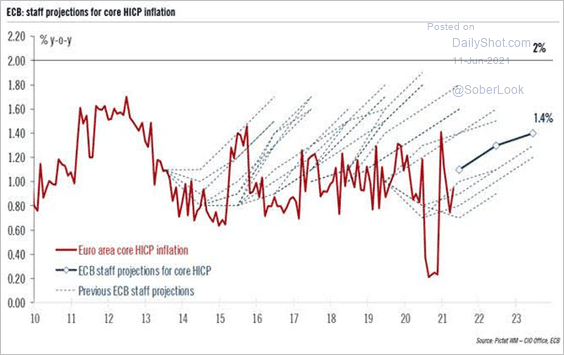

By the way, the ECB staff has been consistently overestimating the core CPI forecasts over the past decade. Part of the reason was their optimistic estimates of the output gap (more slack in the economy than they modeled).

Source: @fwred

Source: @fwred

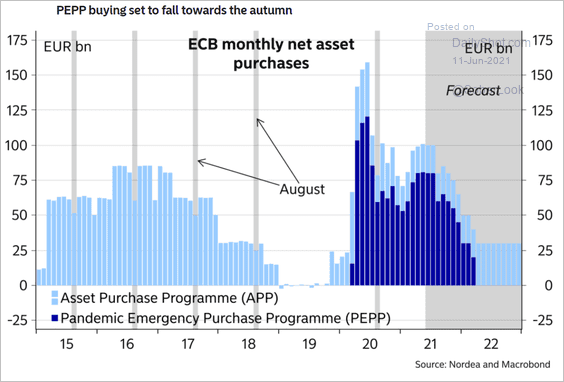

There is some debate around the ECB’s taper timing.

Source: Nordea Markets

Source: Nordea Markets

——————–

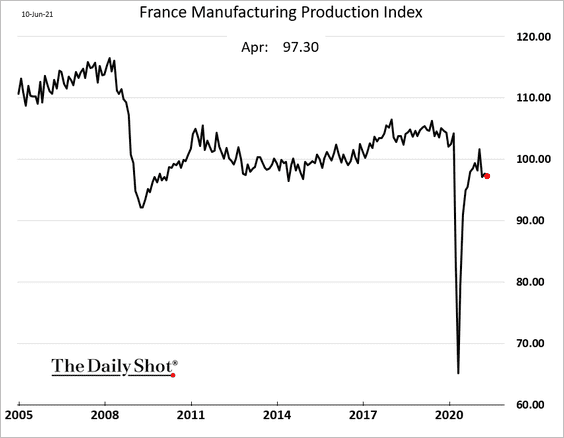

2. French manufacturing output has been disappointing.

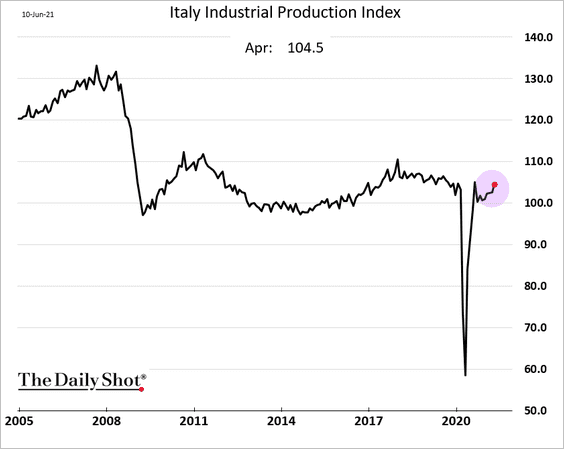

But Italy’s industrial production is back at pre-COVID levels.

Back to Index

Europe

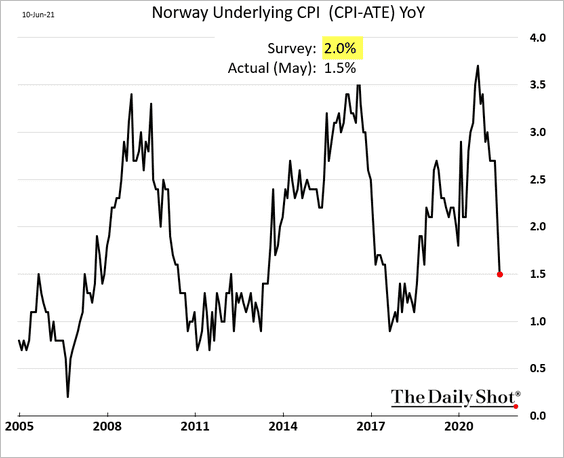

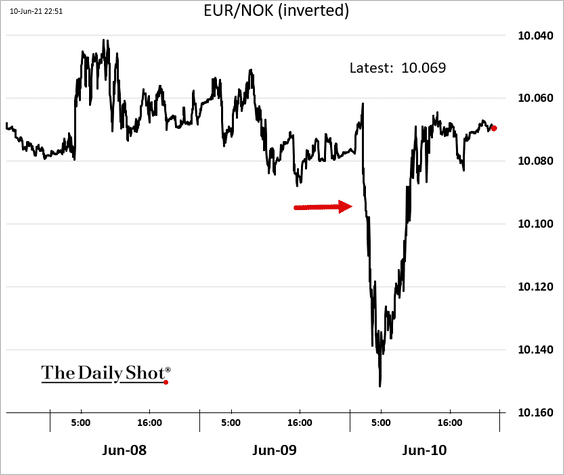

1. Norway’s inflation was remarkably weak in May.

The Norwegian krone tumbled in response but then quickly recovered.

——————–

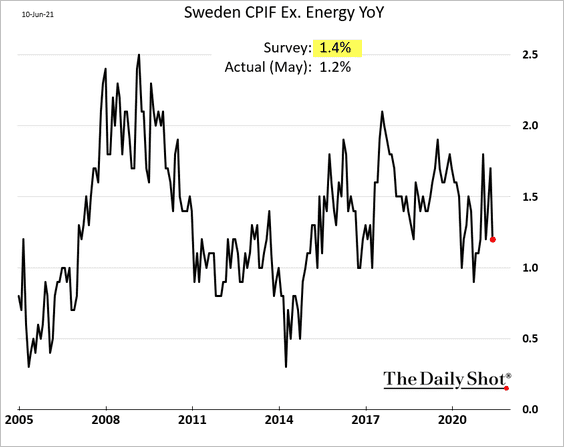

2. Sweden’s CPI also surprised to the downside.

Back to Index

Asia – Pacific

1. Dollar-yen is at support.

Source: @TheTerminal, Bloomberg Finance L.P., h/t Michael G Wilson

Source: @TheTerminal, Bloomberg Finance L.P., h/t Michael G Wilson

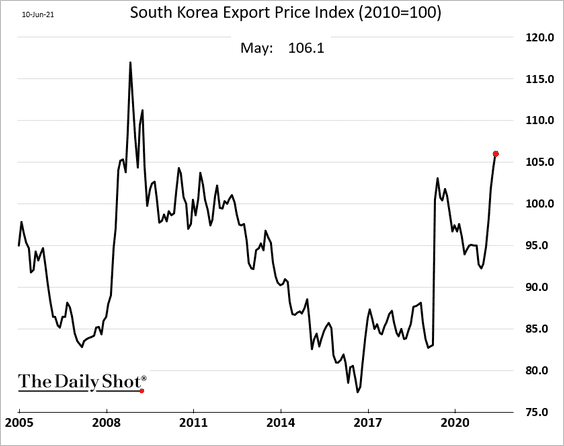

2. South Korea’s export prices have risen sharply this year.

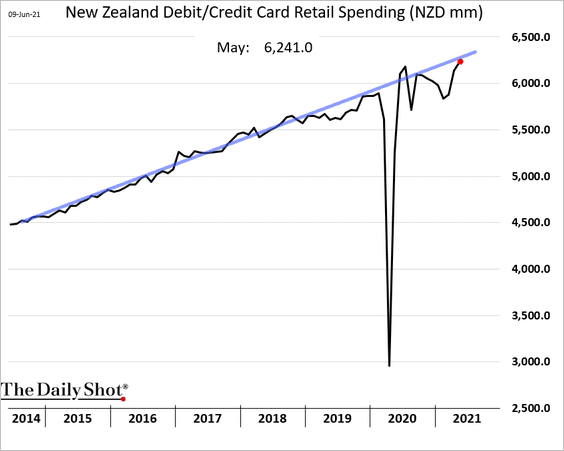

3. New Zealand’s retail card spending is back at the pre-COVID trend.

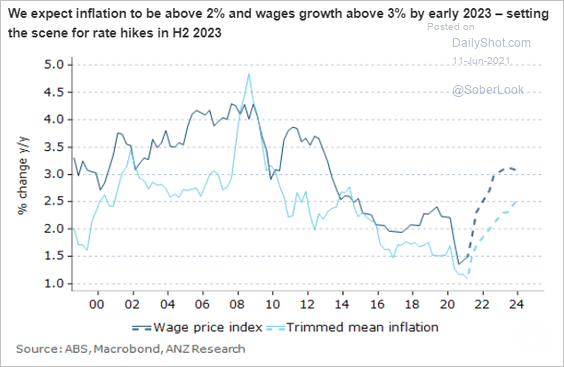

4. ANZ expects the RBA liftoff in the second half of 2023.

Source: ANZ Research

Source: ANZ Research

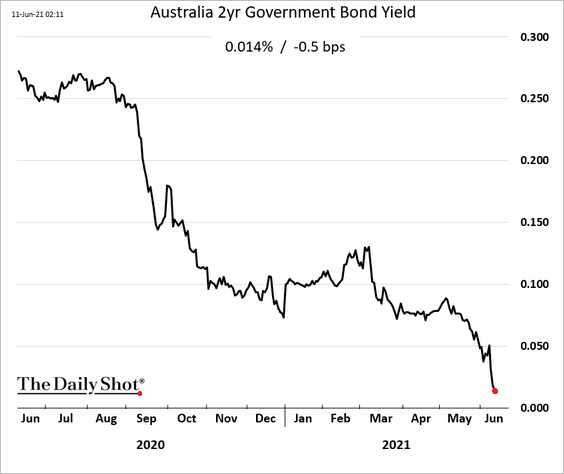

The Australian 2-year yield is rapidly approaching zero.

Back to Index

China

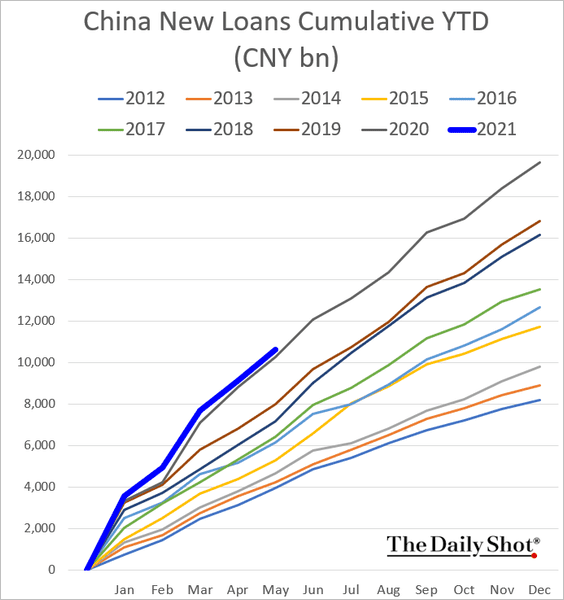

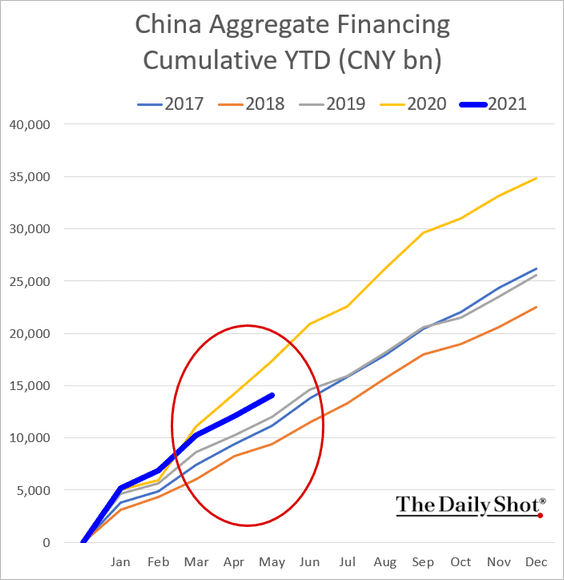

1. Domestic bank lending is hugging last year’s trend.

But aggregate credit has diverged sharply from 2020.

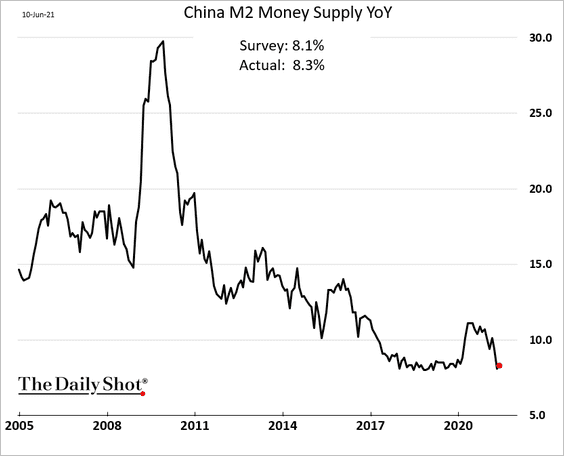

The broad money supply growth ticked higher last month.

——————–

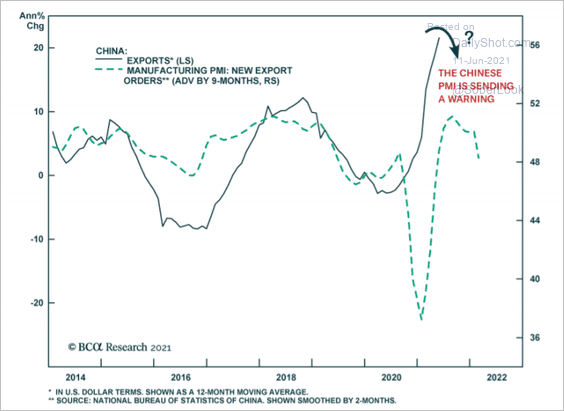

2. PMI data point to China’s exports peaking.

Source: BCA Research

Source: BCA Research

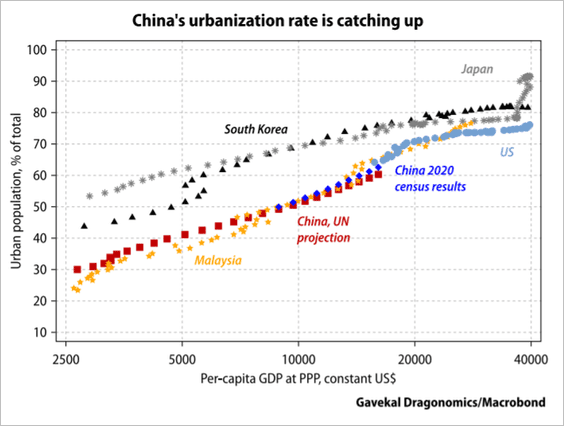

3. China’s urbanization rate has been faster than previous estimates.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Emerging Markets

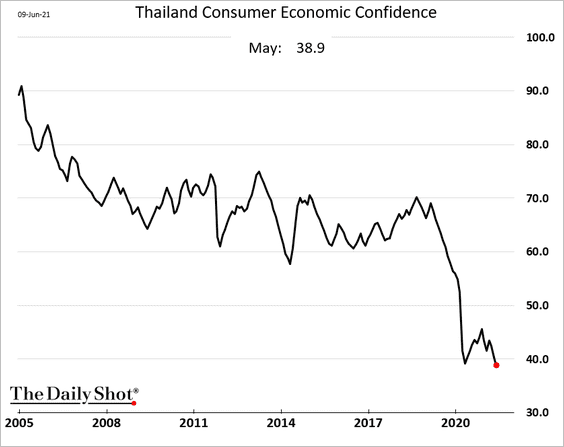

1. Thailand’s consumer confidence deteriorated further last month as the pandemic takes its toll.

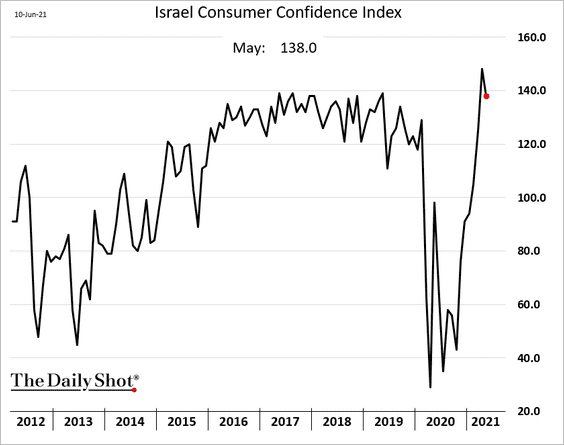

2. Israel’s consumer confidence was off the highs amid political uncertainty.

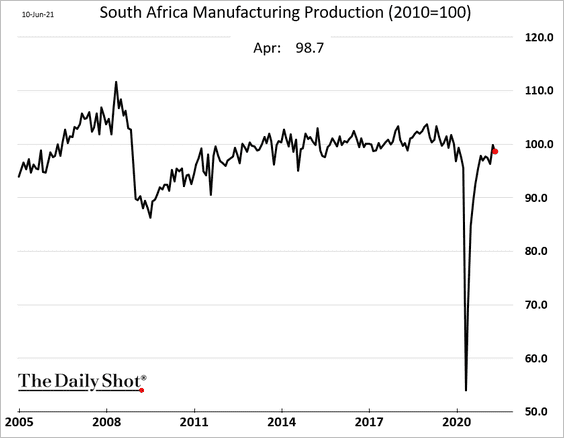

3. South Africa’s factory output declined in April.

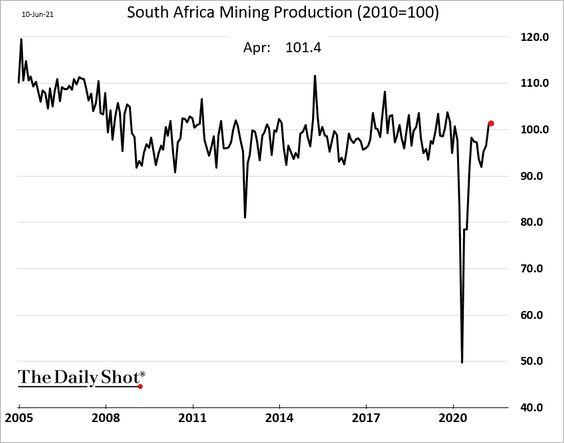

But mining production remains robust.

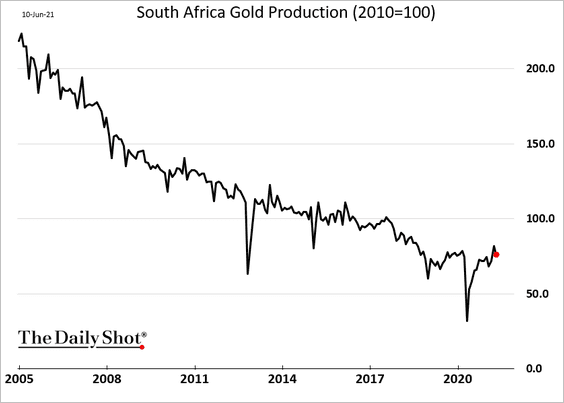

Here is the nation’s gold production.

——————–

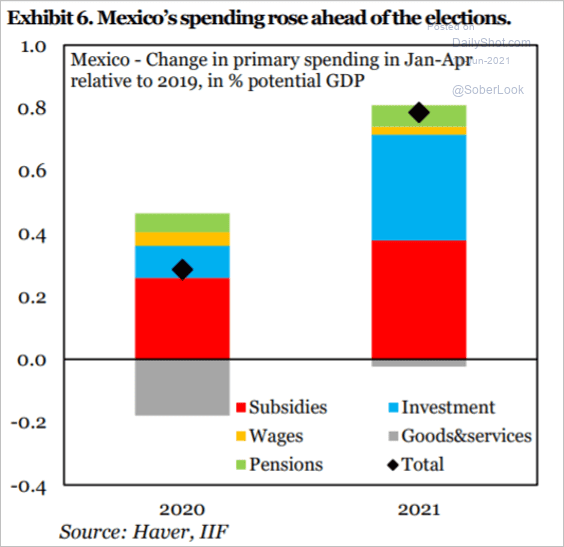

4. Mexican government spending rose ahead of the elections.

Source: IIF

Source: IIF

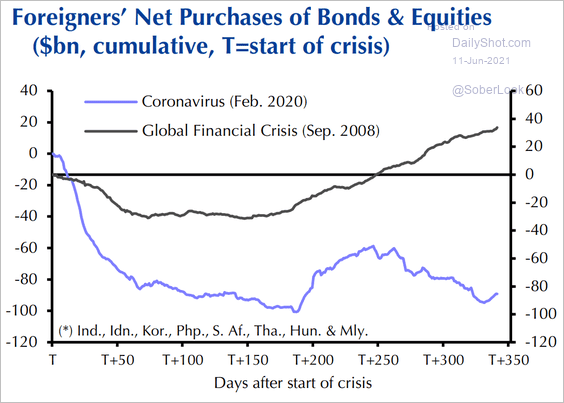

5. EM fund flows have been much weaker during the COVID recession than in 2008.

Source: Capital Economics

Source: Capital Economics

Back to Index

Cryptocurrency

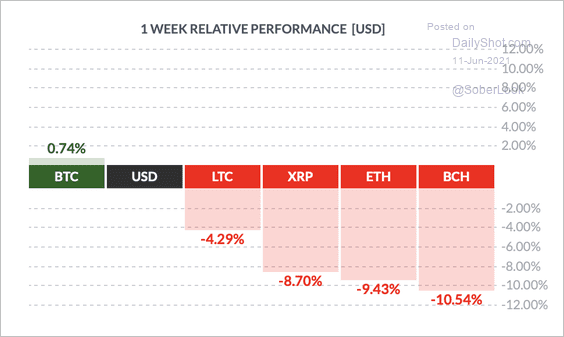

1. Bitcoin has outperformed other large cryptocurrencies over the past week.

Source: FinViz

Source: FinViz

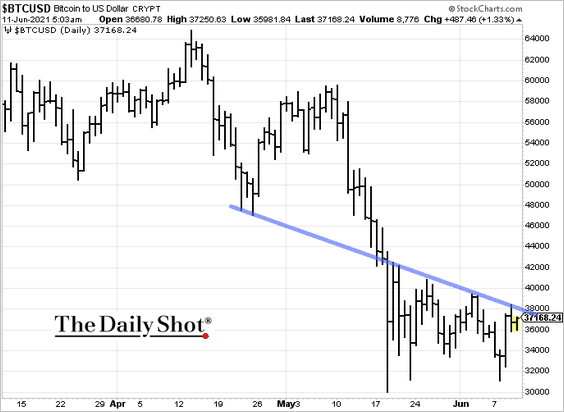

2. Bitcoin held the downtrend resistance over the past couple of days.

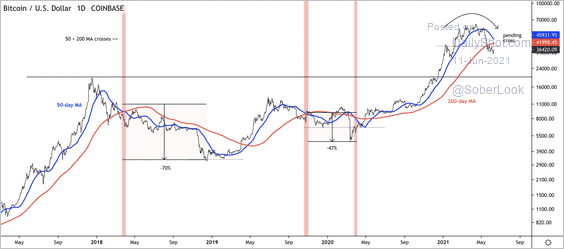

The looming “death cross” could signal a bitcoin bear market.

Source: Dantes Outlook Read full article

Source: Dantes Outlook Read full article

——————–

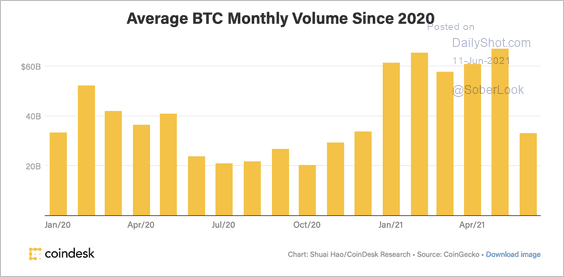

3. Bitcoin’s trading volume is sharply lower this month following record levels in May.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

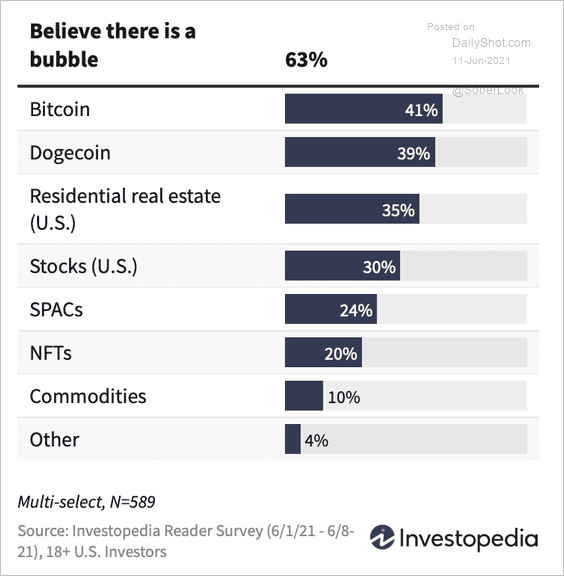

4. A majority of Investopedia readers surveyed believe there is a market bubble led by bitcoin and dogecoin.

Source: Investopedia Read full article

Source: Investopedia Read full article

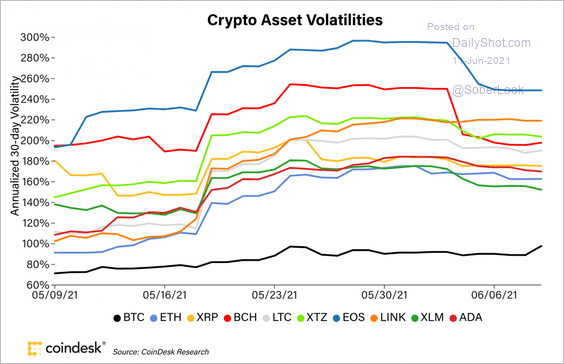

5. Ether tops the list in terms of annualized 30-day volatility.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

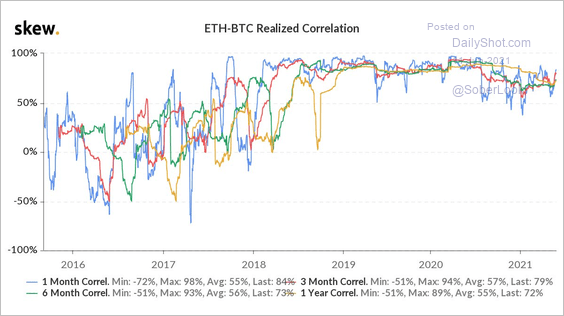

6. The correlation between ether and bitcoin has started to recede over the past year.

Source: @skewdotcom

Source: @skewdotcom

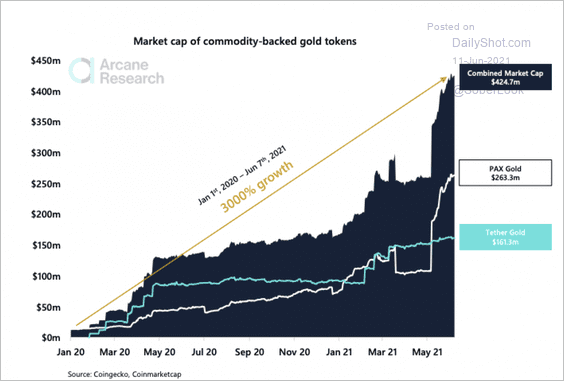

7. The market cap of gold-backed tokens has increased significantly over the past year.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

8. It’s going to be expensive for banks to hold crypto.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Energy

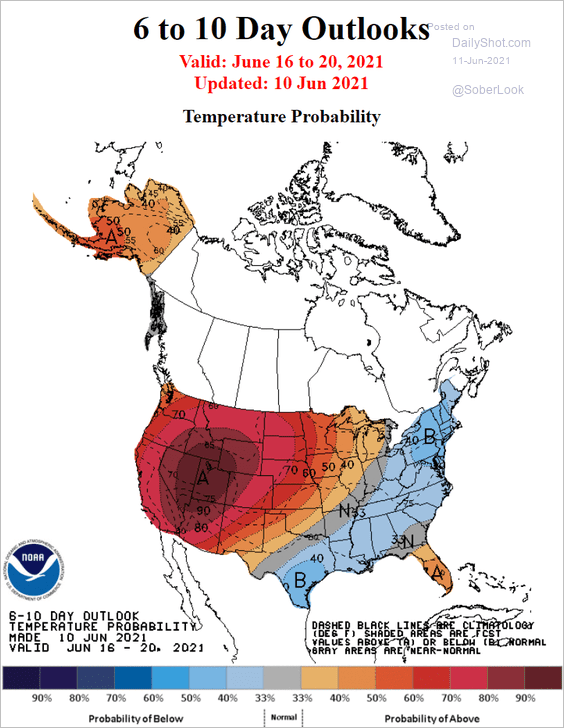

1. Rising temperatures and the ongoing drought sent the Hoover Dam Reservoir to its lowest level since 1937.

Source: NOAA

Source: NOAA

Source: @business Read full article

Source: @business Read full article

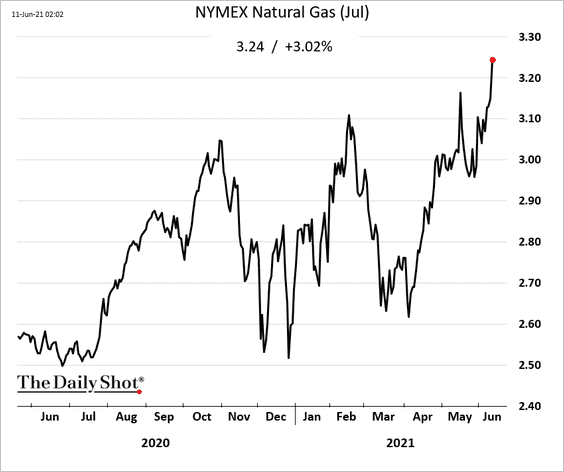

US natural gas futures spiked.

——————–

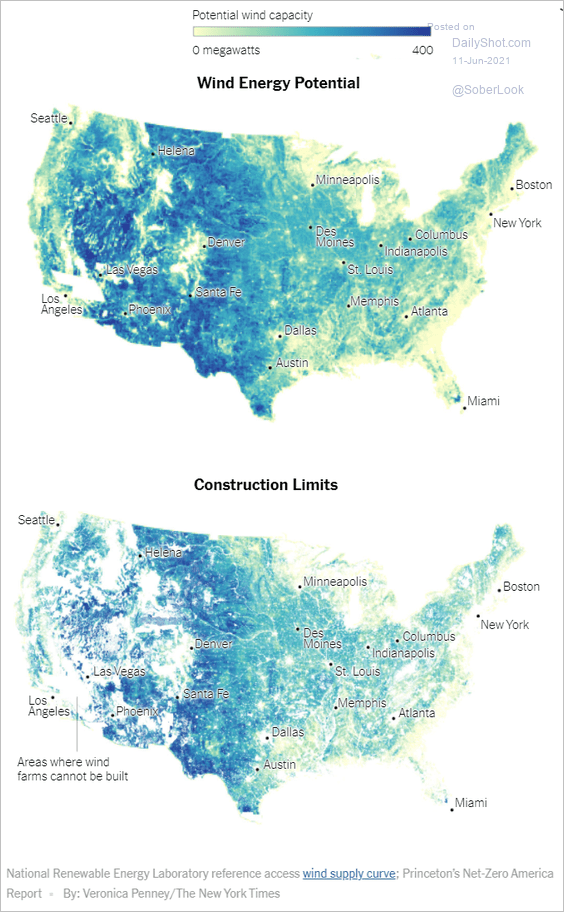

2. The US has massive potential for wind energy, but there are construction limits in many areas.

Source: The New York Times Read full article

Source: The New York Times Read full article

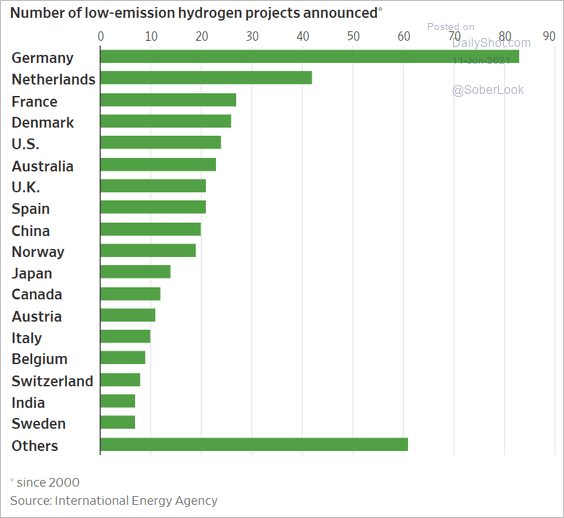

3. Low-emission hydrogen projects are popping up all over the world. The goal is to use hydrogen production to store and transport renewable energy.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Equities

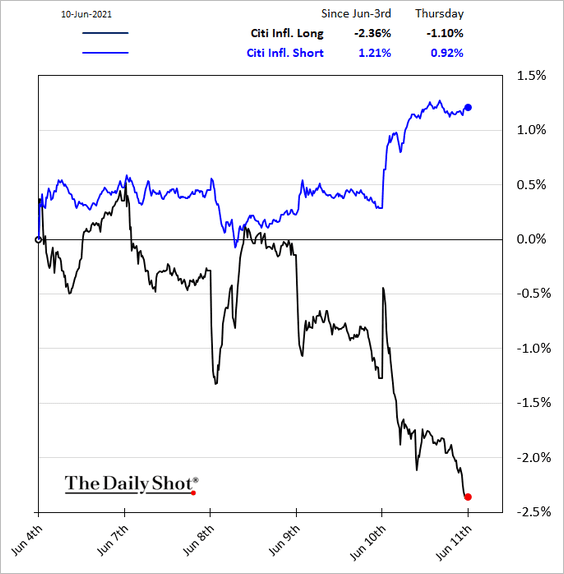

1. It’s been a tough couple of days for inflation-sensitive stocks as the market comes to terms with the Fed’s “transient” inflation narrative.

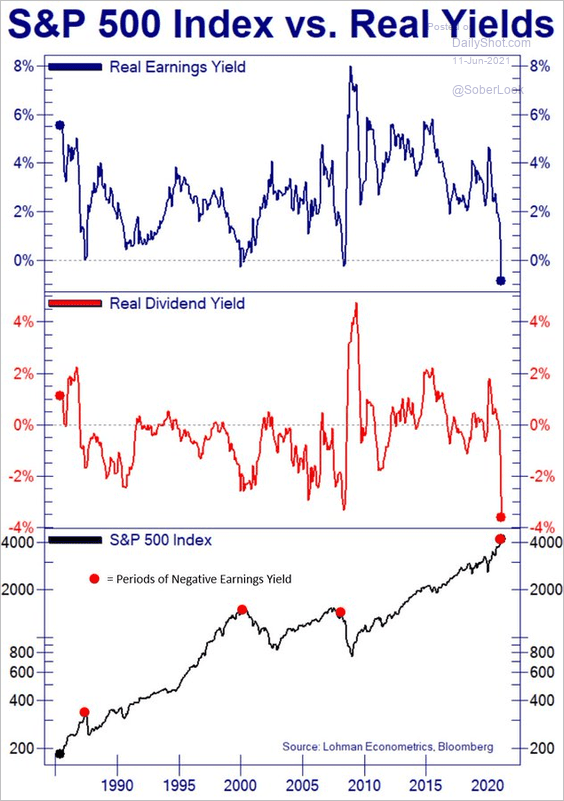

2. Inflation-adjusted earnings and dividend yields are at multi-decade lows.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

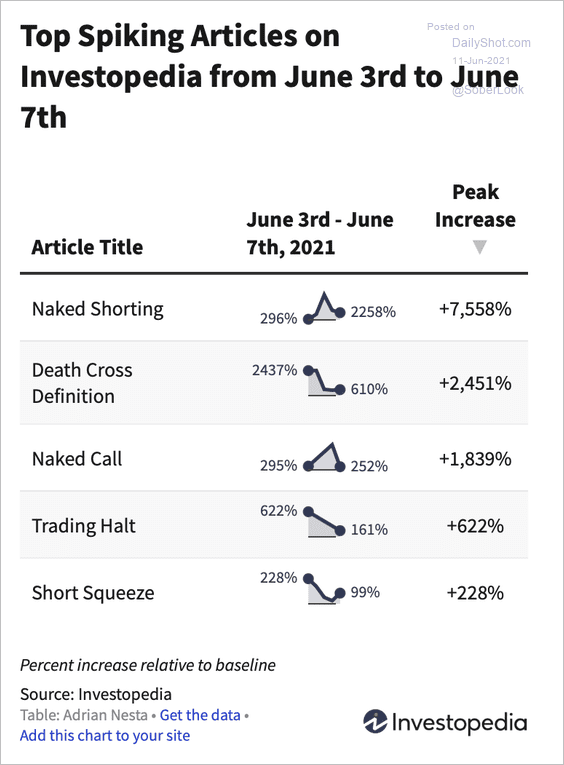

3. The most read articles on Investopedia over the past week reflect some anxiety among retail investors.

Source: Investopedia

Source: Investopedia

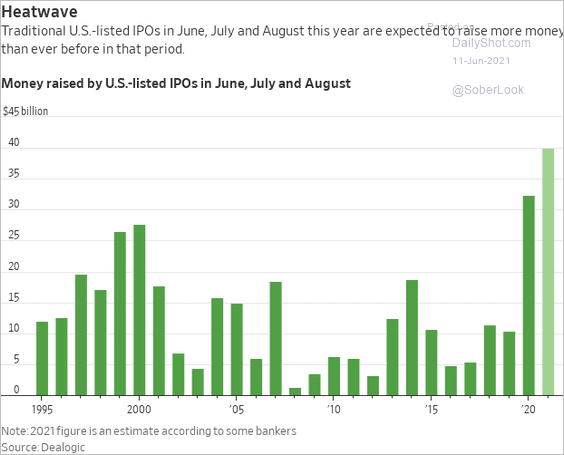

4. It’s expected to be a good summer for IPOs.

Source: @WSJ Read full article

Source: @WSJ Read full article

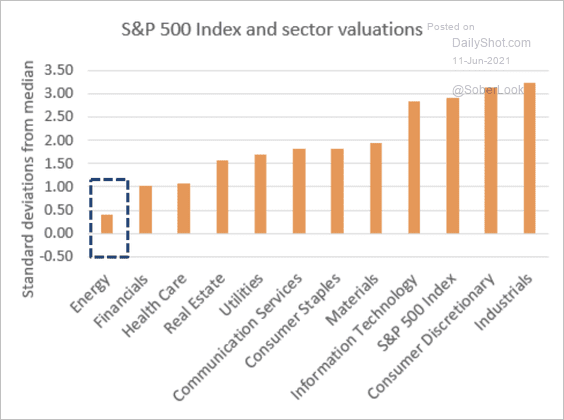

5. The energy sector appears inexpensive relative to its long-term average valuation.

Source: Charles Schwab

Source: Charles Schwab

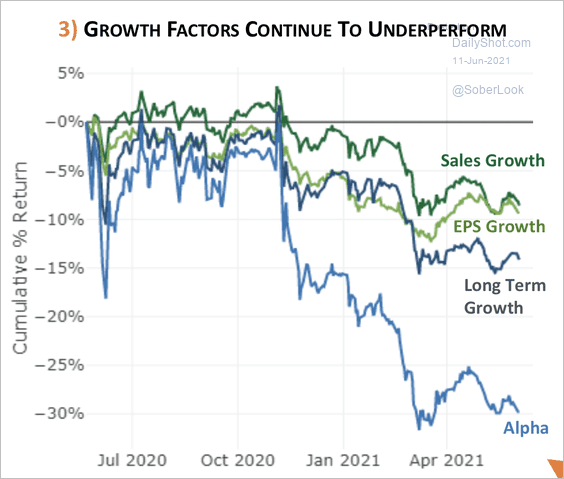

6. Growth factors have underperformed over the past year, which typically occurs when PMIs (business activity) are high, according to Cornerstone Macro.

Source: Cornerstone Macro

Source: Cornerstone Macro

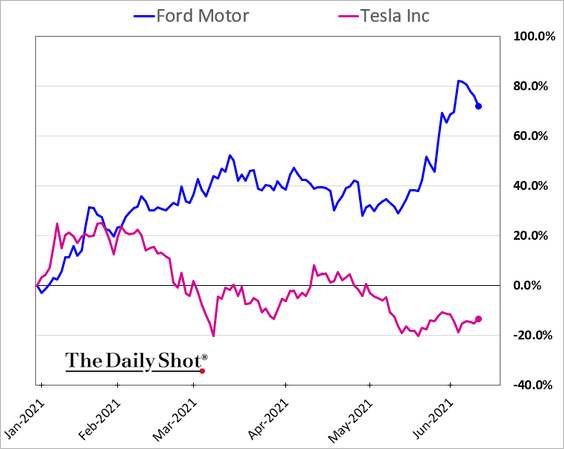

7. Ford has outperformed Tesla year to date.

h/t Cornerstone Macro

h/t Cornerstone Macro

8. VIX hit the lowest level since the start of the pandemic.

Back to Index

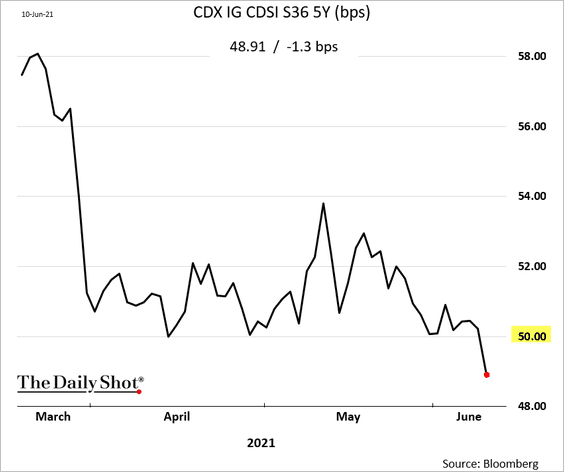

Credit

Looking for a cheap macro hedge? The on-the-run investment-grade CDX dipped below 50 bps after the CPI report.

Back to Index

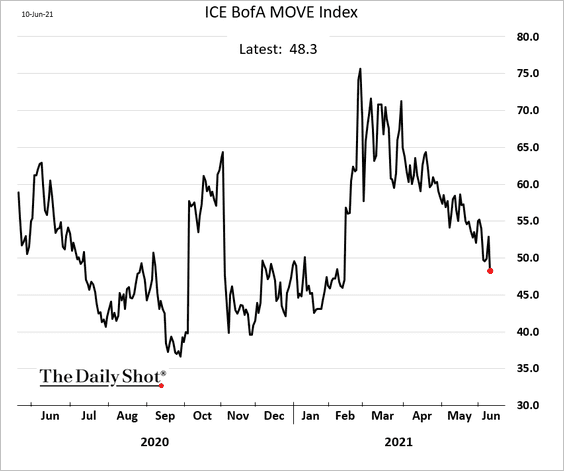

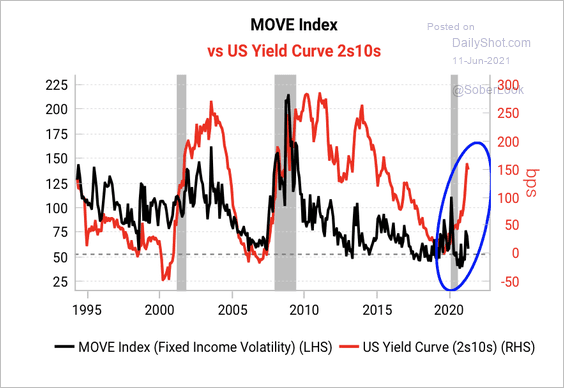

Rates

1. The 10yr inflation-linked Treasury yield (real yield) declined sharply after the CPI report.

2. Treasury implied volatility continues to trend lower.

Fixed income volatility has been low despite a steeper yield curve.

Source: Variant Perception

Source: Variant Perception

——————–

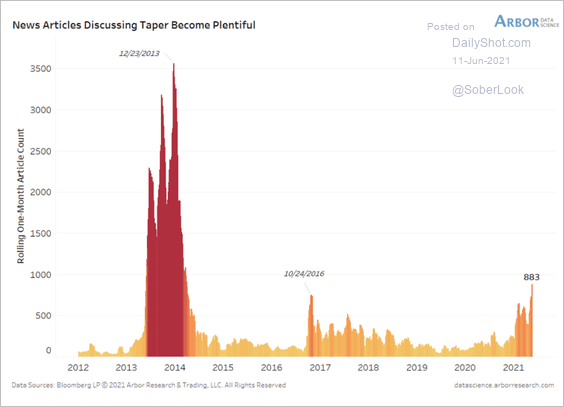

3. The Fed’s potential tapering is dominating the news cycle, but not as much as the 2013 taper tantrum.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

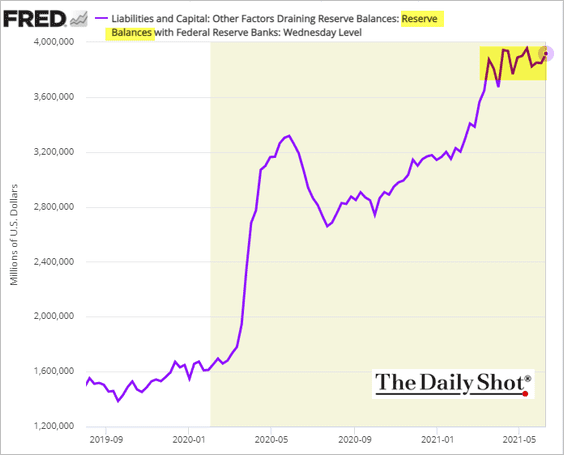

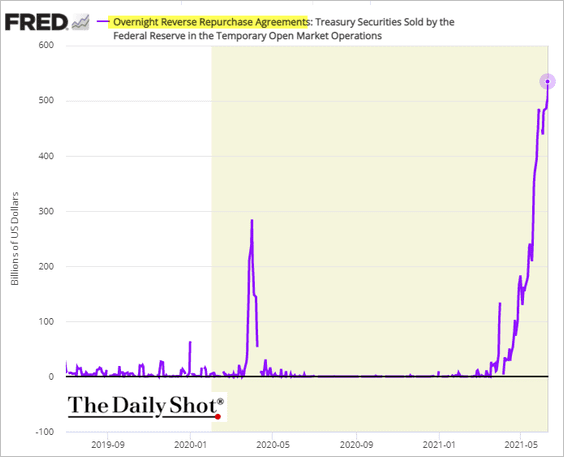

4. The expansion of reserve balances has stalled.

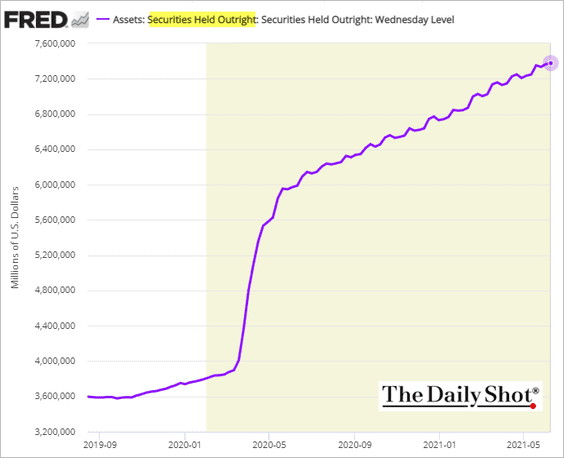

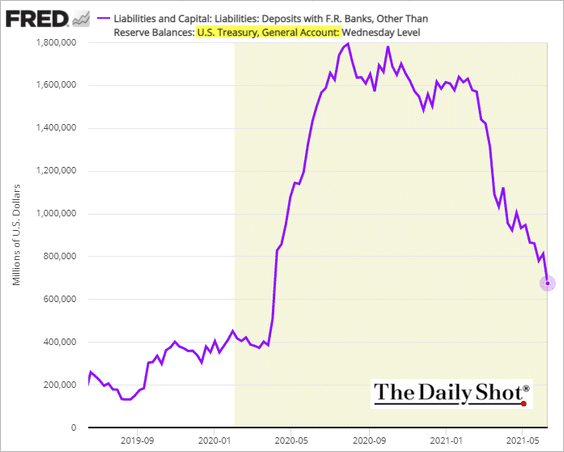

Two key trends have been pushing reserves higher.

• The Fed’s securities purchases:

• The US Treasury reducing its cash holdings at the Fed:

But the RRP program has been soaking up some of that liquidity, limiting the growth in reserves.

Back to Index

Global Developments

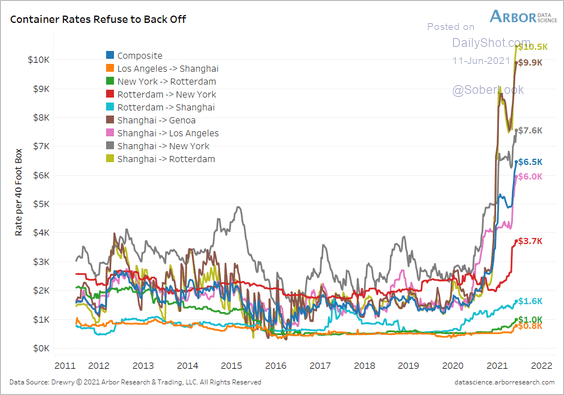

1. Container rates continue to surge.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

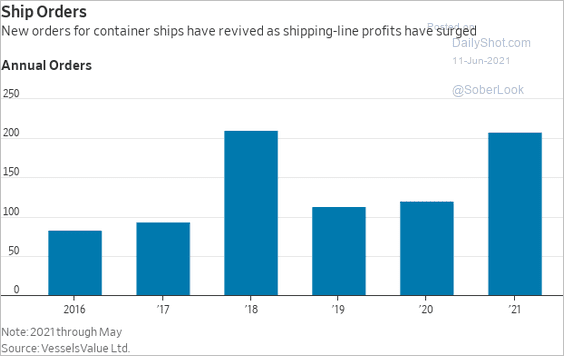

Demand for container ships rose sharply this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

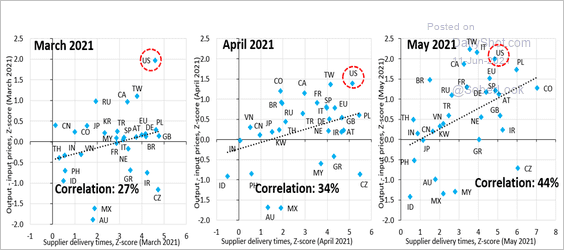

2. Manufacturers are increasingly passing on the supply-chain disruptions to their clients in the form of higher costs.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

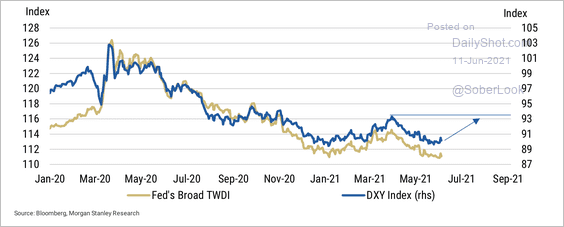

3. Morgan Stanley expects the dollar index (DXY) to rise to 93.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

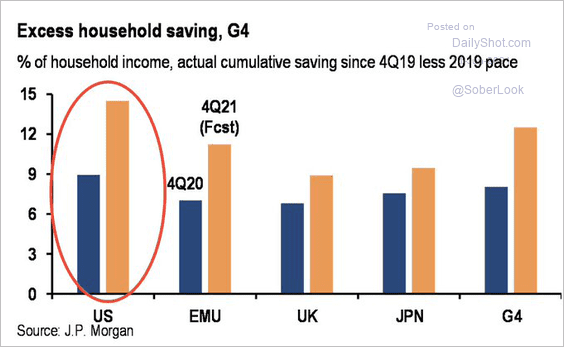

4. Advanced economies’ household excess savings rose sharply in Q1

Source: JP Morgan; @carlquintanilla

Source: JP Morgan; @carlquintanilla

——————–

Food for Thought

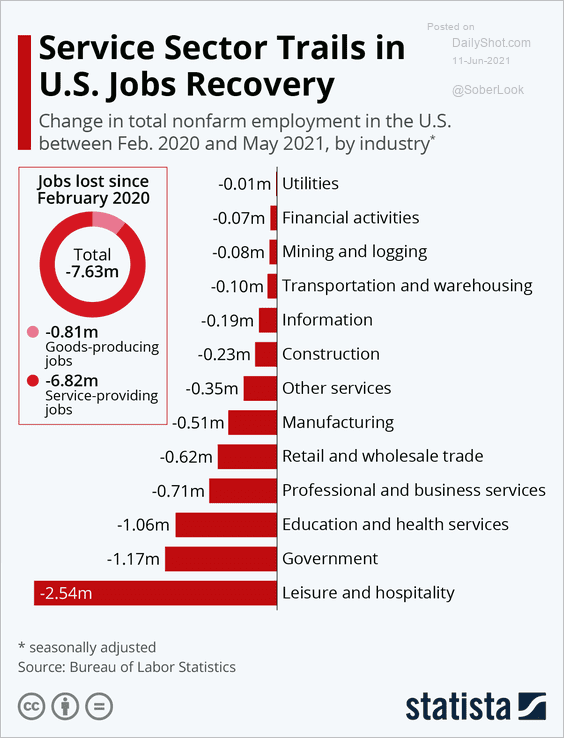

1. US net job losses since February 2020:

Source: Statista

Source: Statista

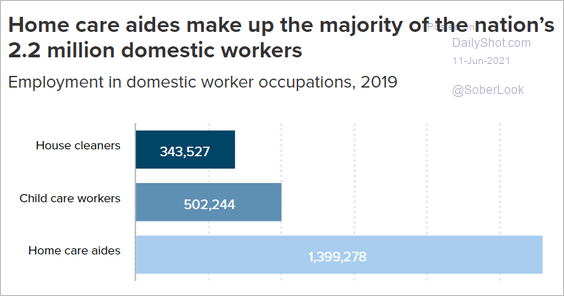

2. Domestic workers:

Source: EPI Read full article

Source: EPI Read full article

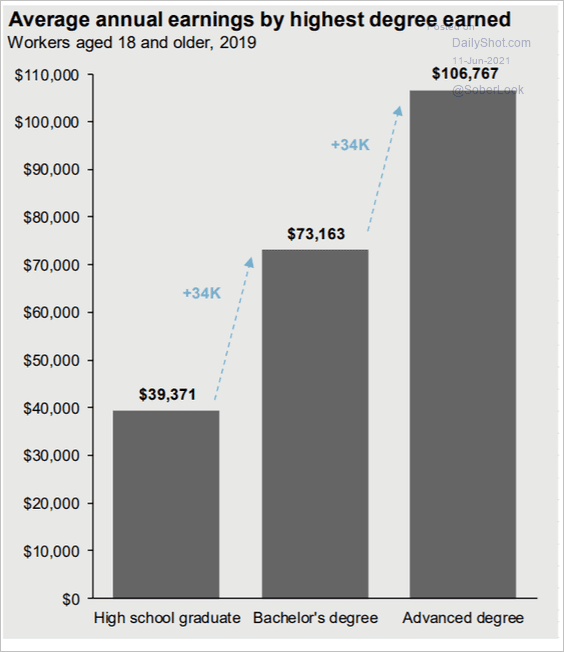

3. US wages by educational attainment:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

4. Wages withheld illegally:

Source: The Center for Public Integrity Read full article

Source: The Center for Public Integrity Read full article

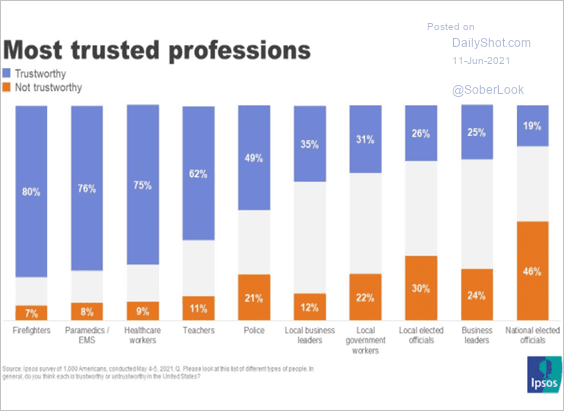

5. Most trusted professions:

Source: IPSOS Read full article

Source: IPSOS Read full article

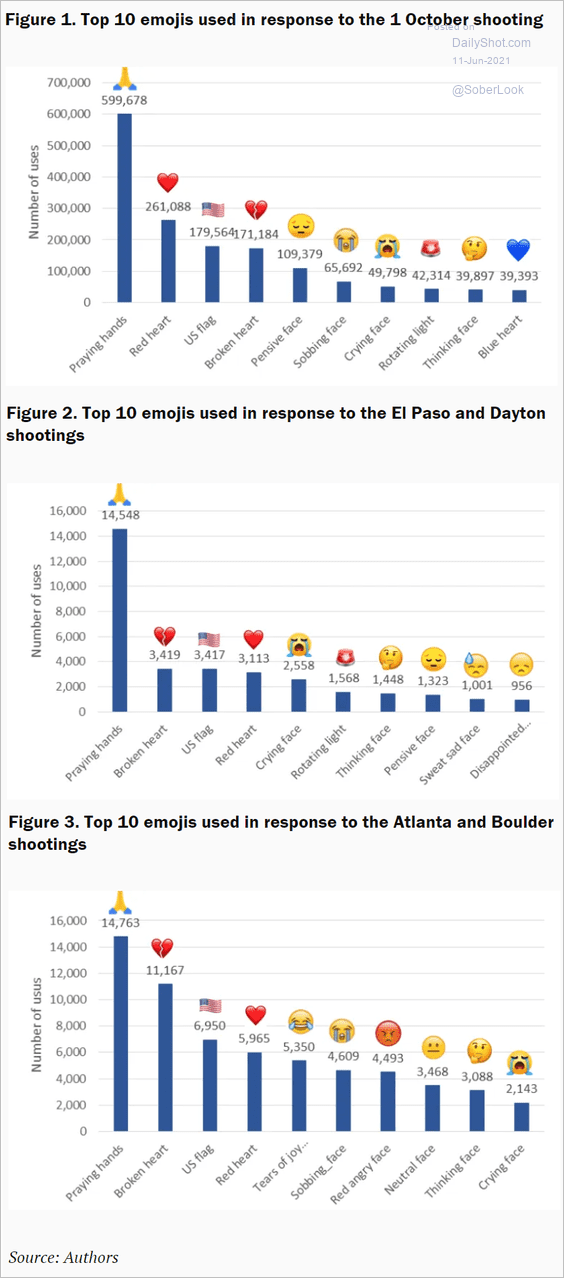

6. Top 10 emojis in response to various US shootings:

Source: Brookings Read full article

Source: Brookings Read full article

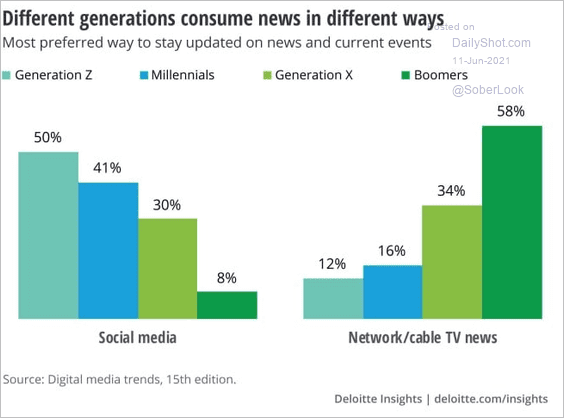

7. News consumption by generation:

Source: Deloitte Read full article

Source: Deloitte Read full article

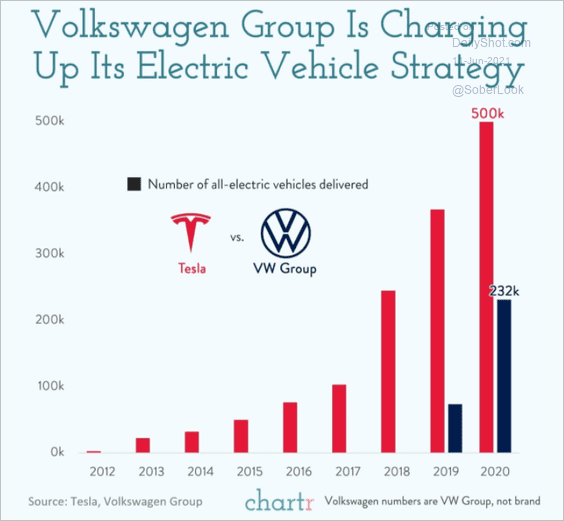

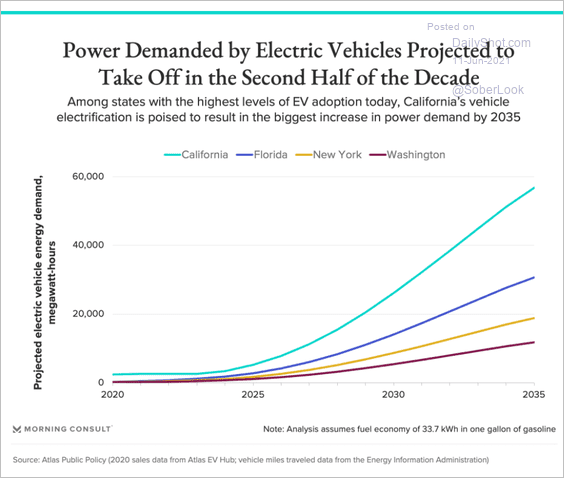

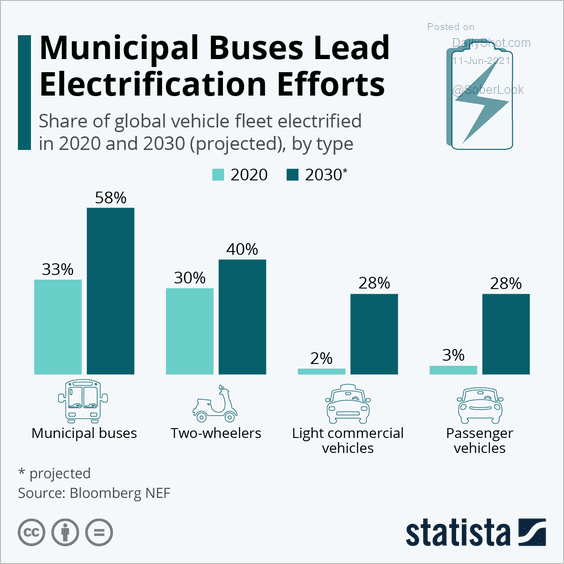

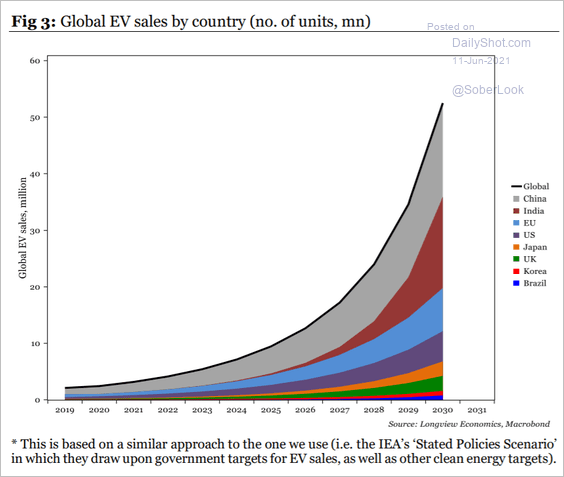

8. Data on electric vehicles (4 charts):

• EV deliveries:

Source: @chartrdaily

Source: @chartrdaily

• EV-related power demand:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

• Projected EV fleet share:

Source: Statista

Source: Statista

• EV sales by country:

Source: Longview Economics

Source: Longview Economics

——————–

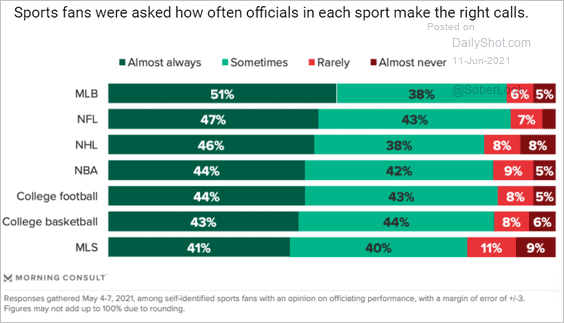

9. Referees making the right calls:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Have a great weekend!

Back to Index