The Daily Shot: 22-Jun-21

• The United States

• Canada

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

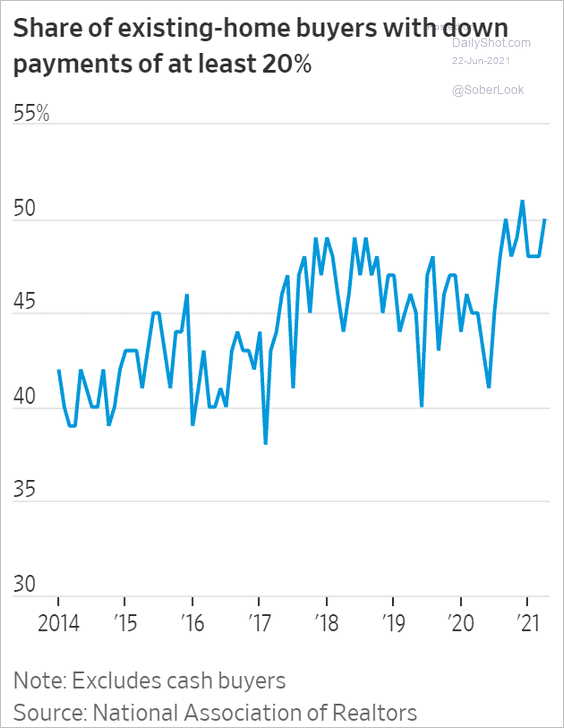

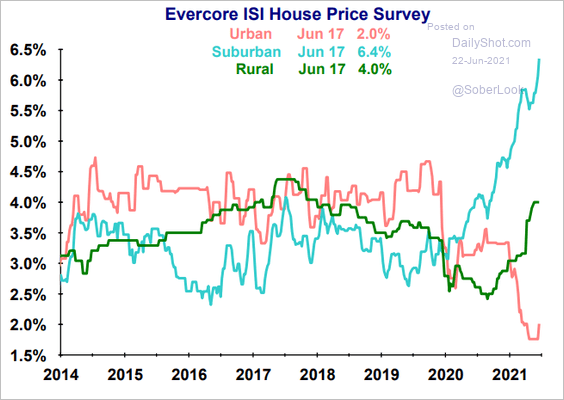

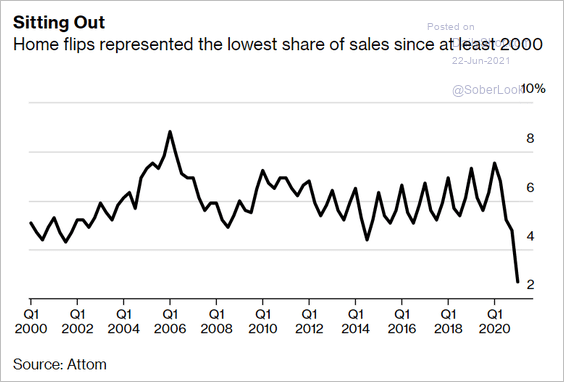

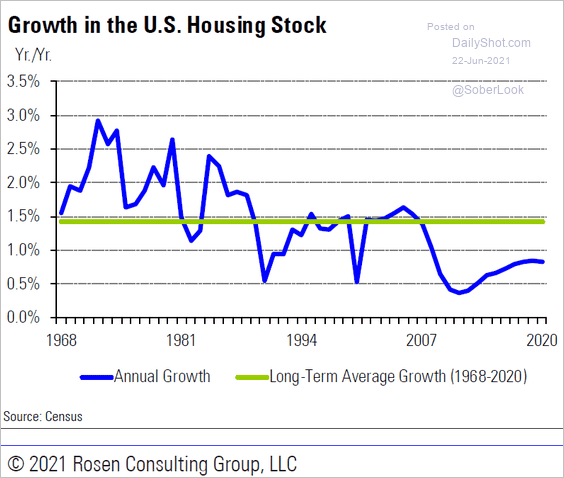

1. Let’s begin with housing.

• Half of the recent homebuyers made a downpayment of at least 20%.

Source: @WSJ Read full article

Source: @WSJ Read full article

• The biggest housing price gains were in suburban communities, according to an Evercore ISI survey.

Source: Evercore ISI

Source: Evercore ISI

• Home flipping hasn’t been popular since the start of the pandemic.

Source: @markets Read full article

Source: @markets Read full article

• The US is increasingly facing housing shortages.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Rosen Consulting Group

Source: Rosen Consulting Group

——————–

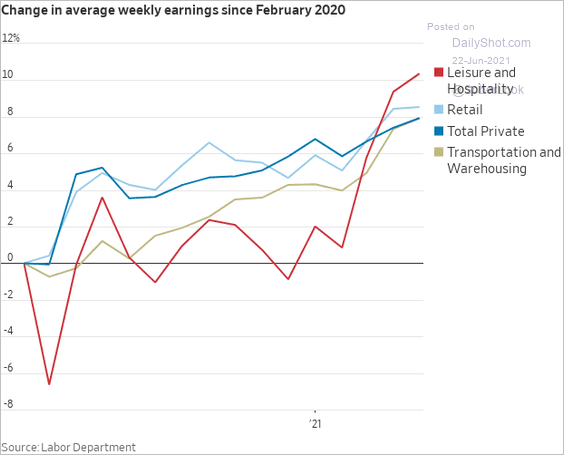

2. Next, we have some updates on the labor market.

• Pay has been rising the fastest in low-wage sectors.

Source: @WSJ Read full article

Source: @WSJ Read full article

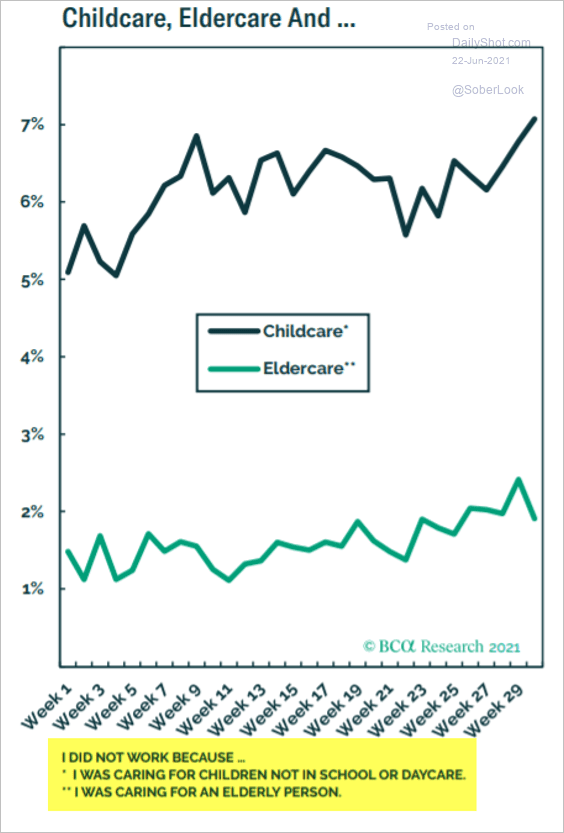

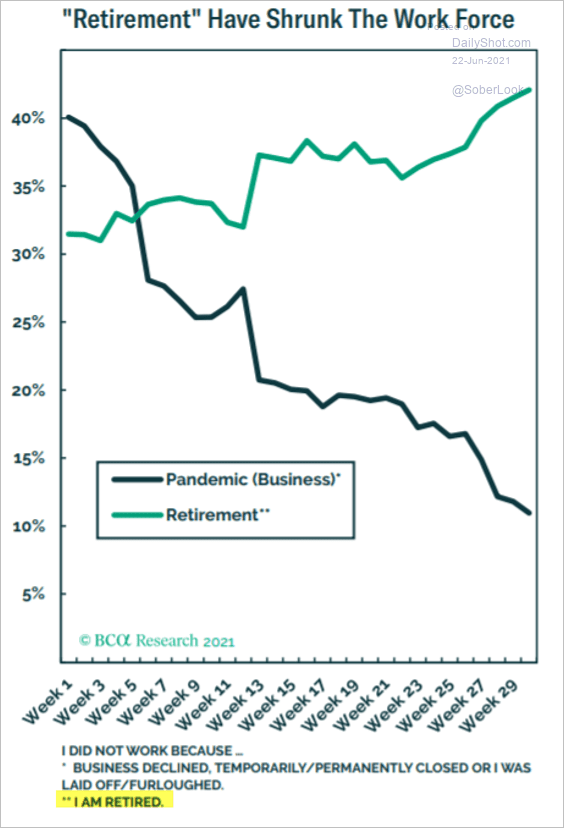

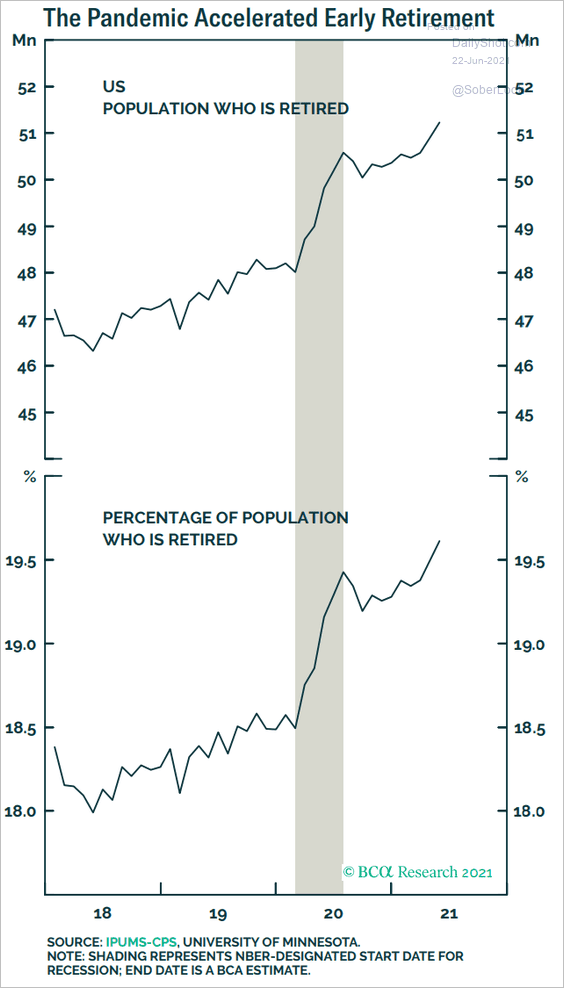

• These are some of the trends that contributed to labor shortages.

– Childcare challenges:

Source: BCA Research

Source: BCA Research

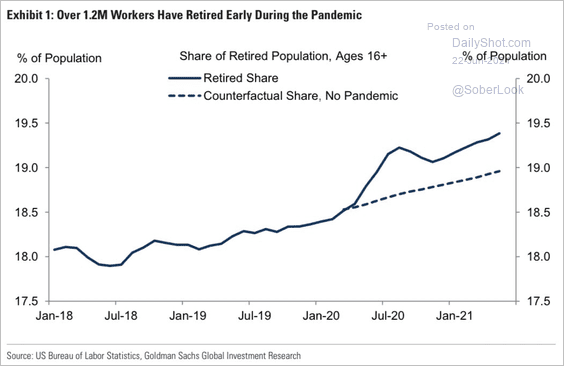

– Accelerated retirements:

Source: BCA Research

Source: BCA Research

Source: BCA Research

Source: BCA Research

This chart shows “excess” retirements vs. the pre-COVID trend.

Source: Goldman Sachs; @carlquintanilla

Source: Goldman Sachs; @carlquintanilla

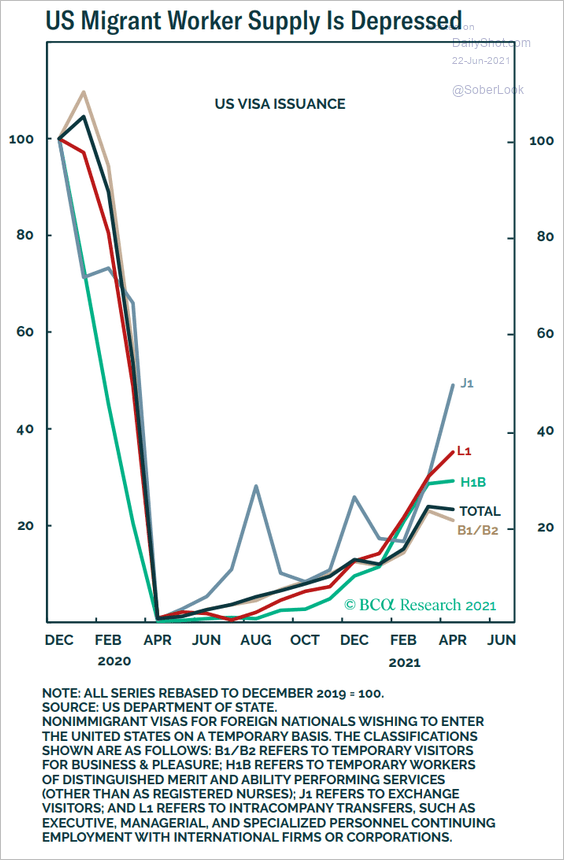

– Depressed immigration:

Source: BCA Research

Source: BCA Research

——————–

3. Now, let’s take a look at a few trends in consumer spending.

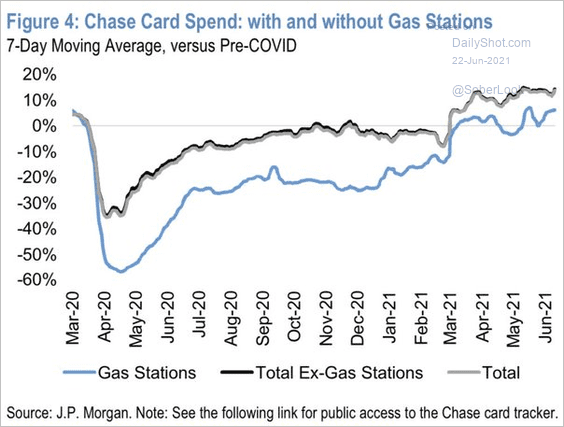

• Card spending has been above pre-COVID levels.

Source: JP Morgan; @carlquintanilla

Source: JP Morgan; @carlquintanilla

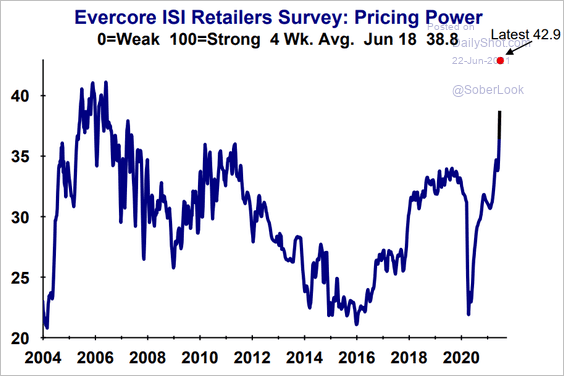

• Retailers now wield more pricing power than they have in years.

Source: Evercore ISI

Source: Evercore ISI

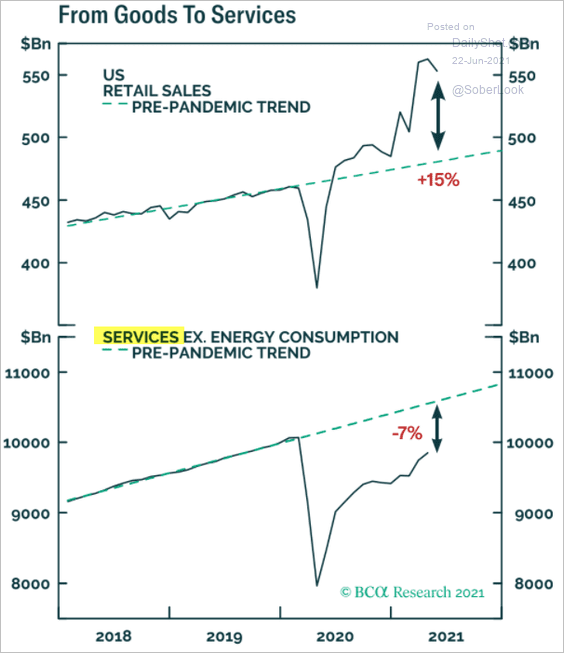

• Spending has been shifting to services.

Source: BCA Research

Source: BCA Research

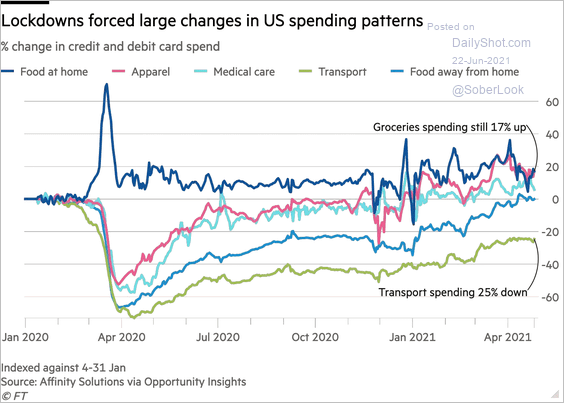

• Spending patterns are not back to “normal.”

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

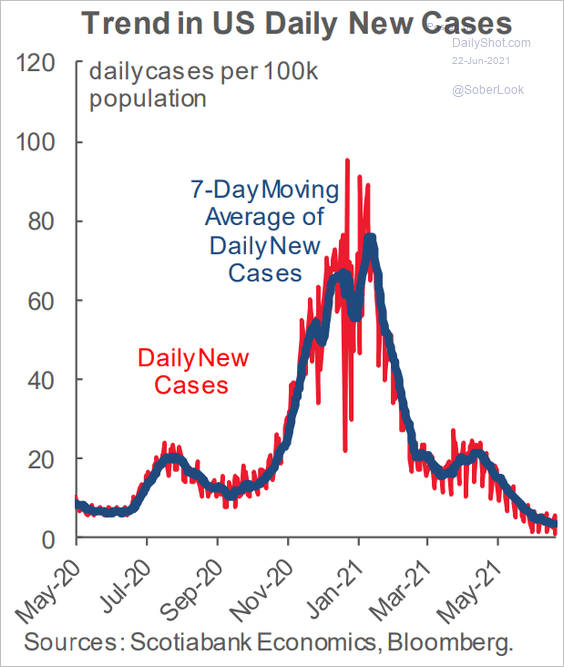

4. Finally, we have some updates on the pandemic.

• New COVID cases continue to trend lower.

Source: Scotiabank Economics

Source: Scotiabank Economics

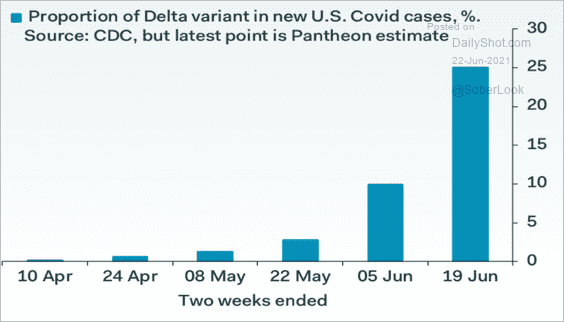

• But the Delta variant, which is more contagious, is becoming a concern.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

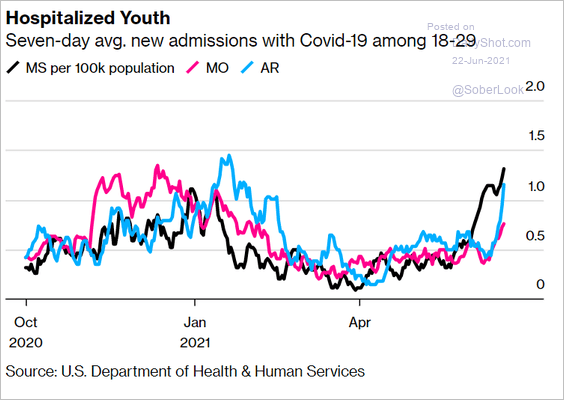

• Some states now see an increase in hospitalizations of young people.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Back to Index

Canada

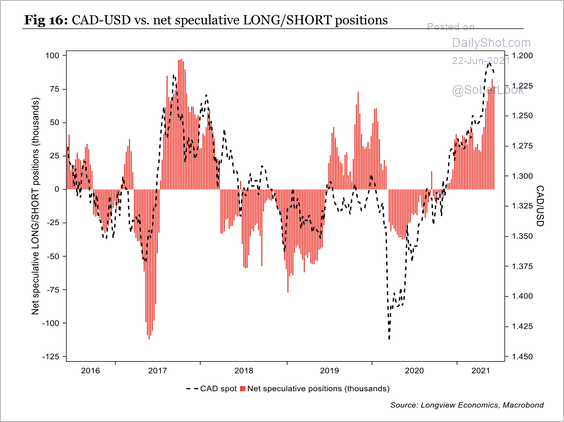

1. Speculative net-long position in the Canadian dollar appears stretched.

Source: Longview Economics

Source: Longview Economics

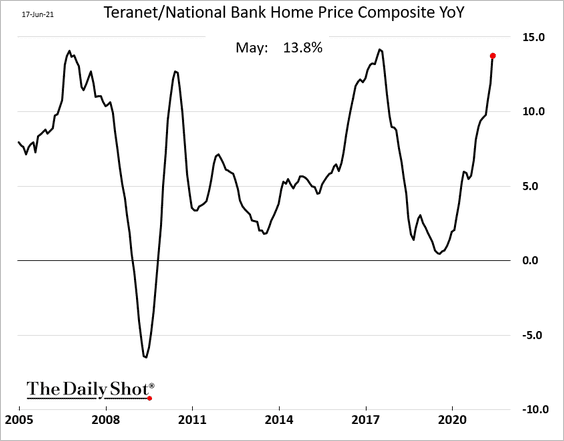

2. Home price appreciation is nearing extreme levels.

Back to Index

The United Kingdom

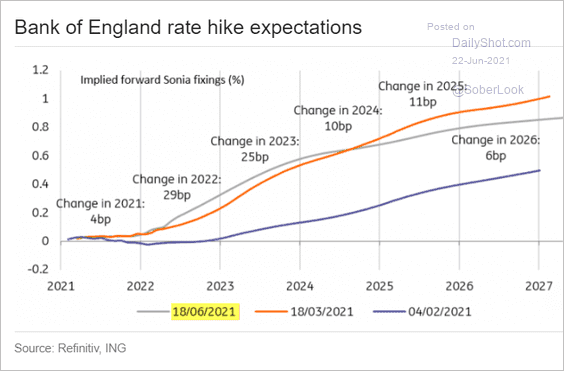

1. Let’s start with market-based BoE rate trajectory expectations.

Source: ING

Source: ING

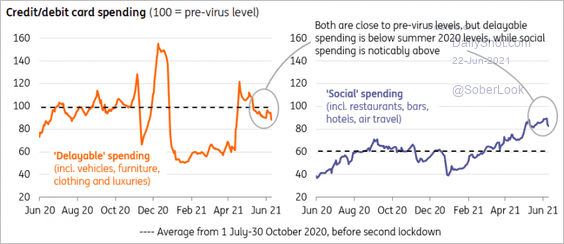

2. Card spending points to some rotation to services.

Source: ING

Source: ING

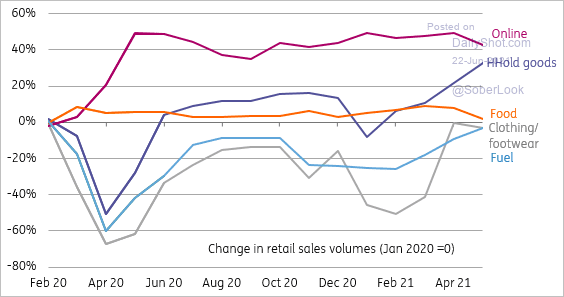

3. Retail sales patterns have not returned to pre-COVID levels.

Source: ING

Source: ING

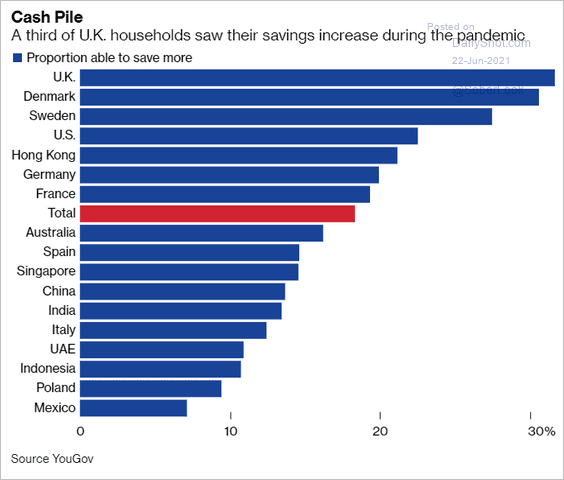

4. UK households boosted their savings more than peers in other economies.

Source: @markets Read full article

Source: @markets Read full article

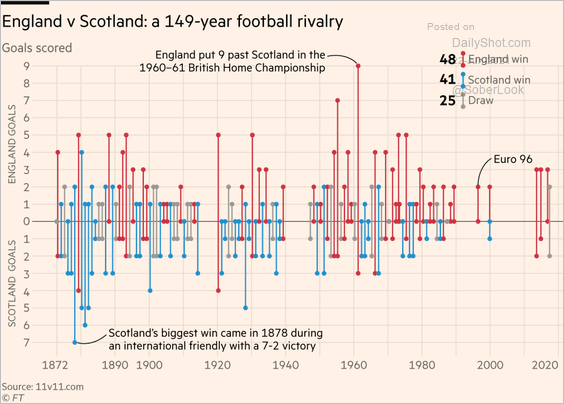

5. The England vs. Scotland football rivalry has existed for a century and a half.

Source: @ftdata Read full article

Source: @ftdata Read full article

Back to Index

Europe

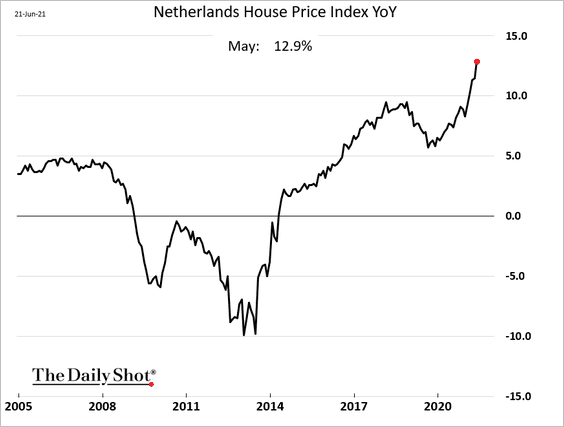

1. Dutch home price gains are accelerating.

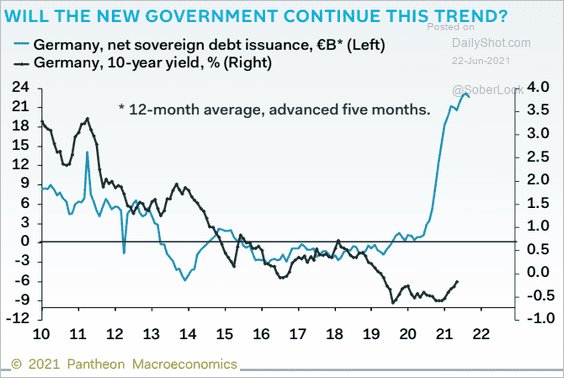

2. Germany’s sovereign debt issuance spiked since the start of the pandemic.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

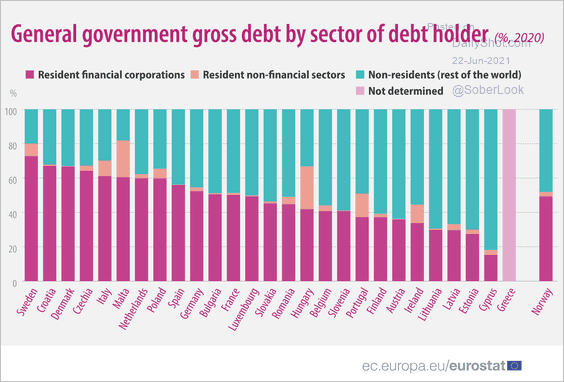

3. This chart shows the distribution of debt by sector in the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

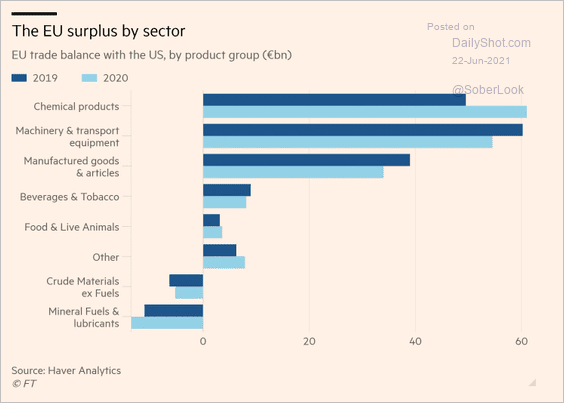

4. Finally, we have the EU’s trade surplus with the US by sector.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Asia – Pacific

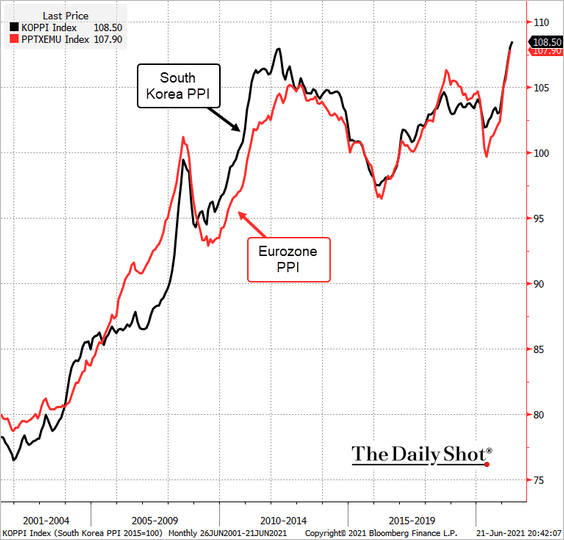

1. South Korea’s and the Eurozone’s producer prices are highly correlated. Several other manufacturing hubs also follow a similar pattern.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

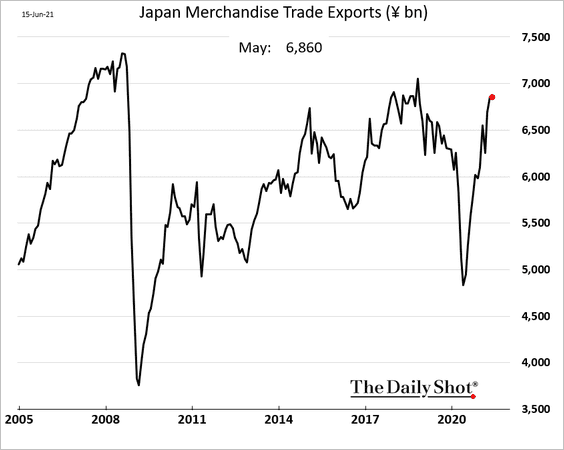

2. Japan’s exports are now well above pre-COVID levels.

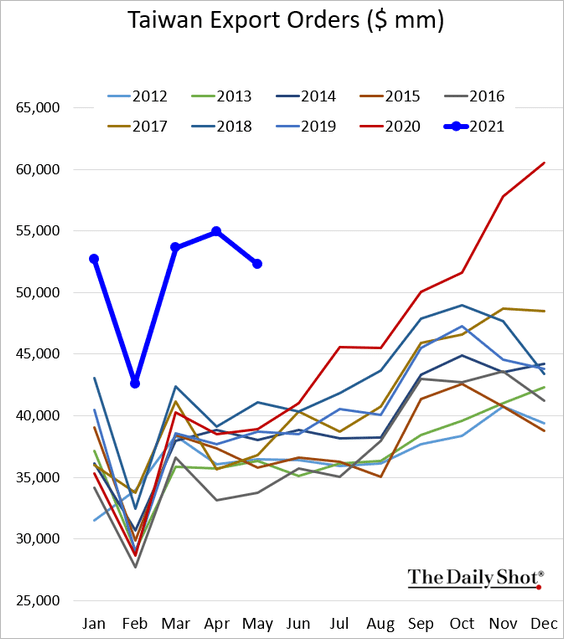

3. Taiwan’s export orders remain robust.

Back to Index

China

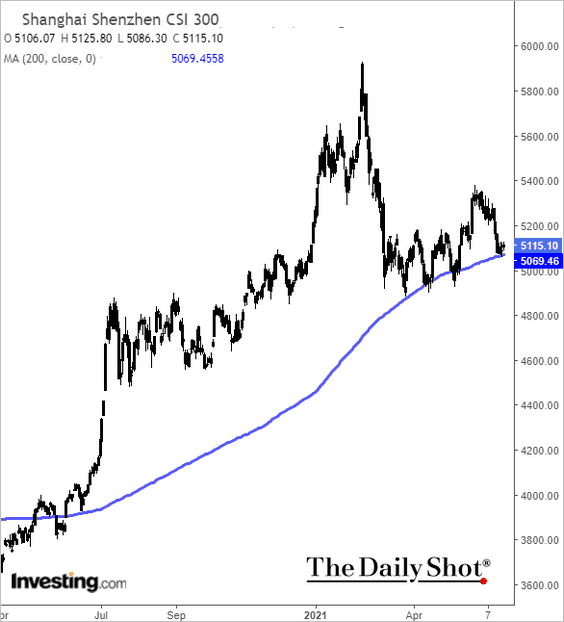

1. The Shanghai Shenzhen CSI 300 Index is holding support at the 200-day moving average.

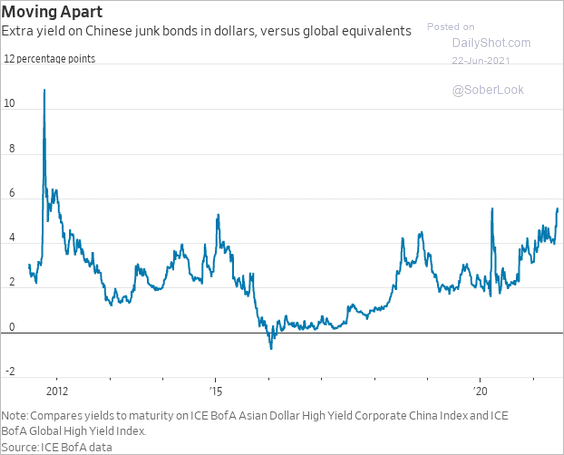

2. High-yield debt spread to global peers has been widening.

Source: @WSJ Read full article

Source: @WSJ Read full article

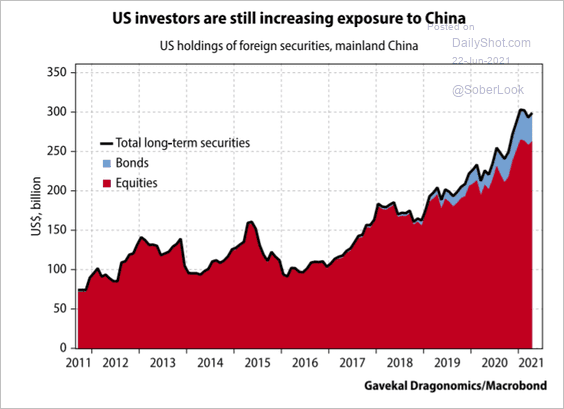

3. US investors continue to increase their exposure to China.

Source: Gavekal Research

Source: Gavekal Research

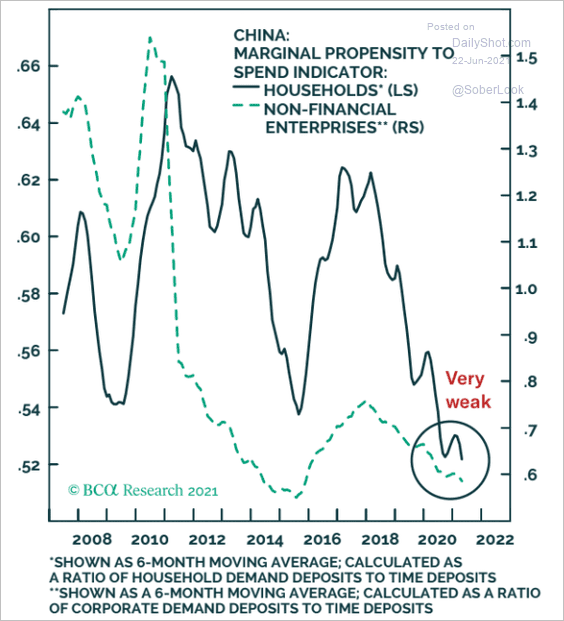

4. Households and businesses are in no rush to spend.

Source: BCA Research

Source: BCA Research

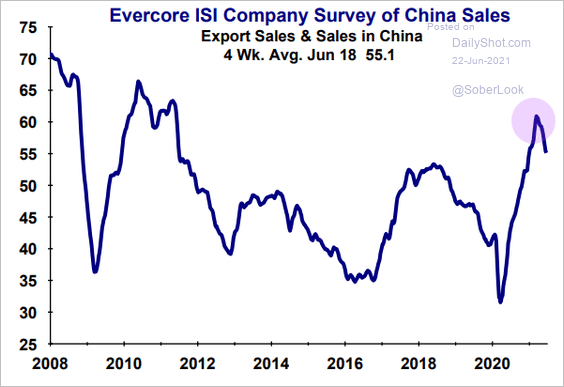

5. According to an Evercore ISI survey, international companies’ sales in China are starting to moderate.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Emerging Markets

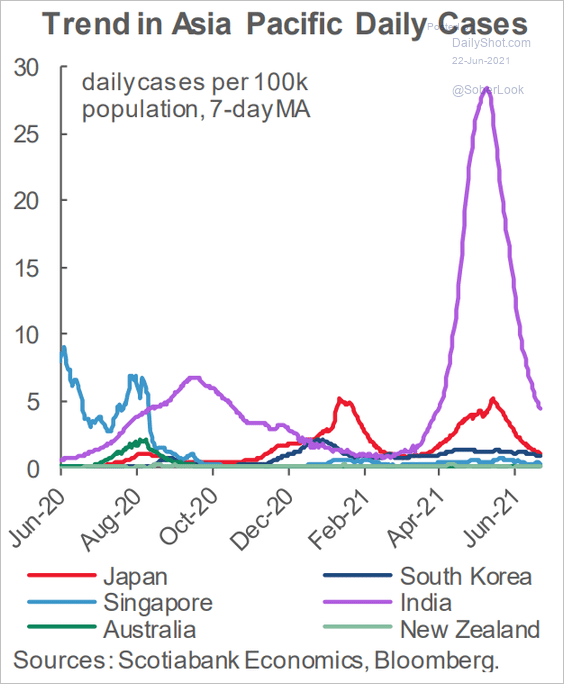

1. New COVID cases in India continue to fall.

Source: Scotiabank Economics

Source: Scotiabank Economics

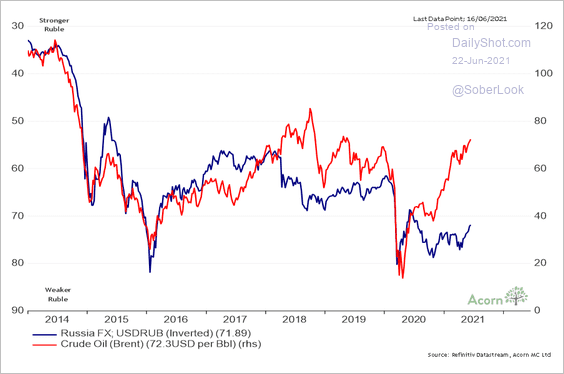

2. The Russian ruble has been lagging oil prices.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

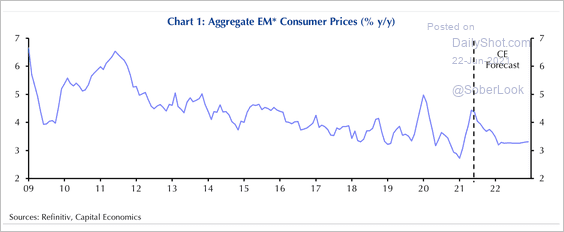

3. Capital Economics expects EM price pressures to ease in the coming months.

Source: Capital Economics

Source: Capital Economics

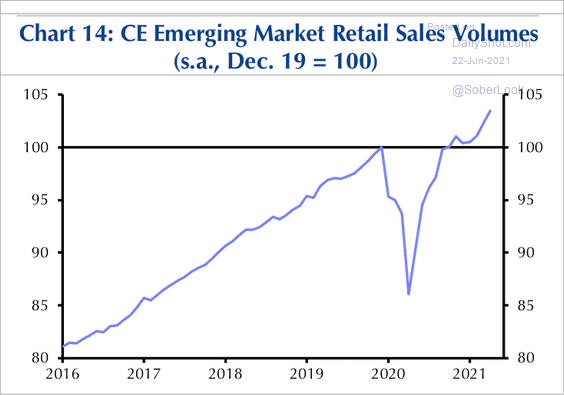

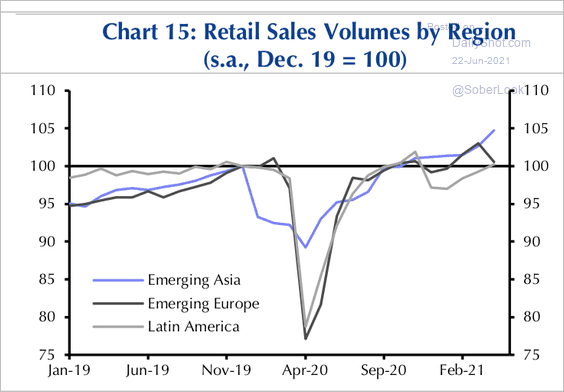

4. EM retail sales volumes are back above pre-crisis levels, led by emerging Asia (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

——————–

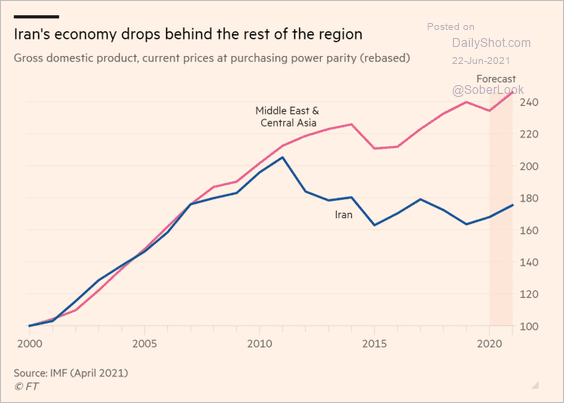

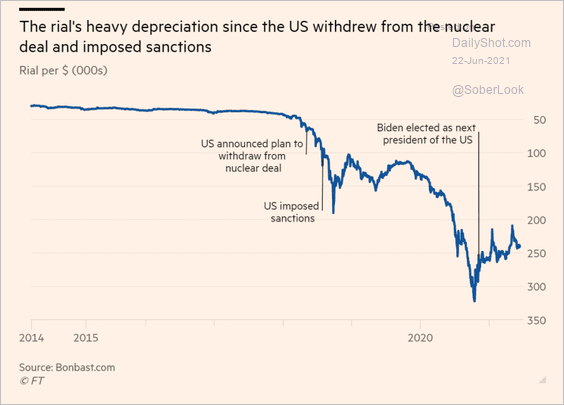

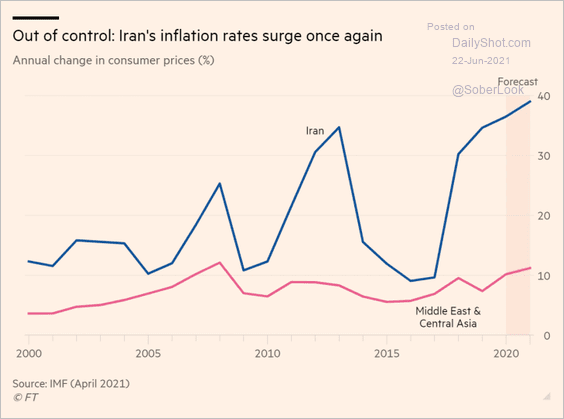

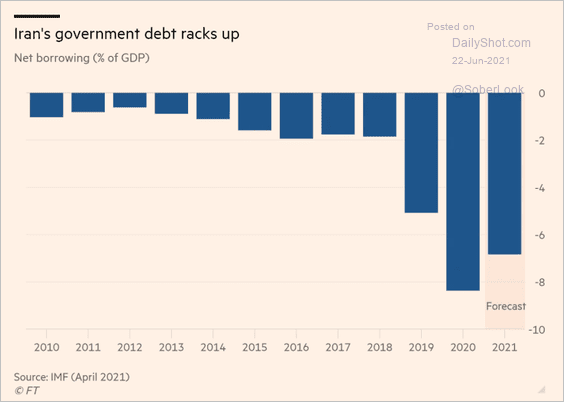

5. Next, we have some updates on Iran.

• Lagging economic growth:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Weakened currency:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Inflation:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

• Government debt:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Cryptocurrency

1. Bitcoin formed a death cross, although, in the fast-moving crypto world, this is old news.

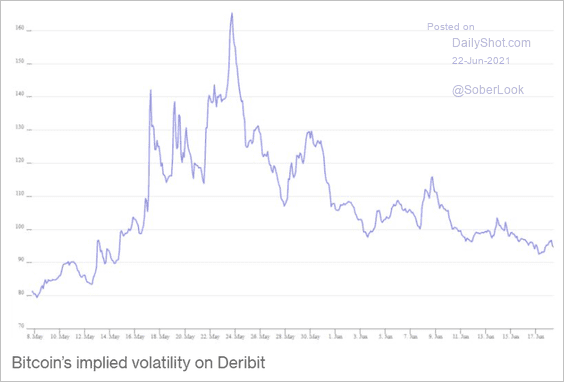

2. Bitcoin implied volatility has been trending lower since the spike in late May.

Source: @technology Read full article

Source: @technology Read full article

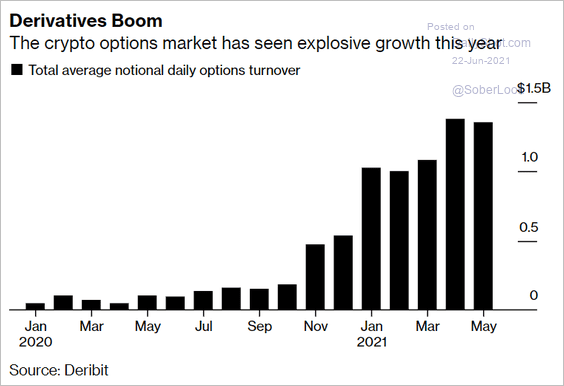

3. Crypto options volume spiked this year.

Source: @technology Read full article

Source: @technology Read full article

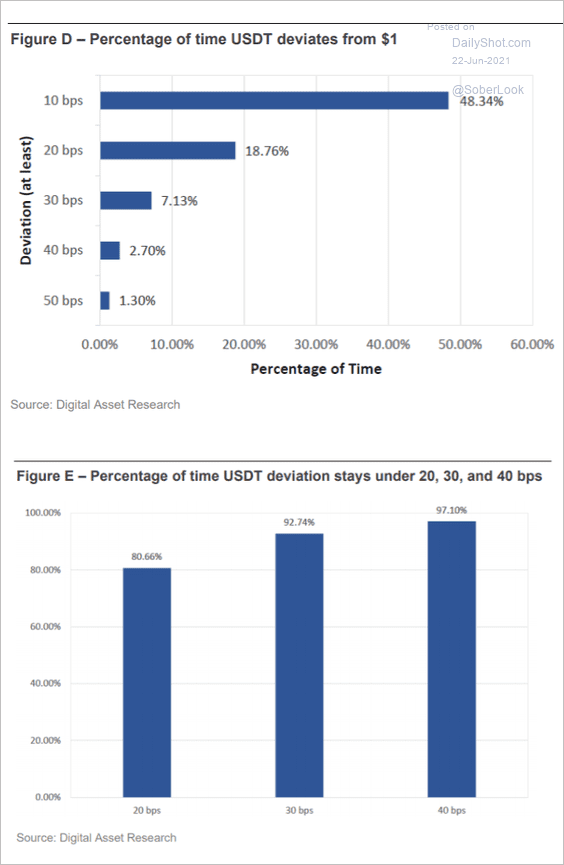

4. How much does Tether deviate from par?

Source: FTSE Russell and Digital Asset Research

Source: FTSE Russell and Digital Asset Research

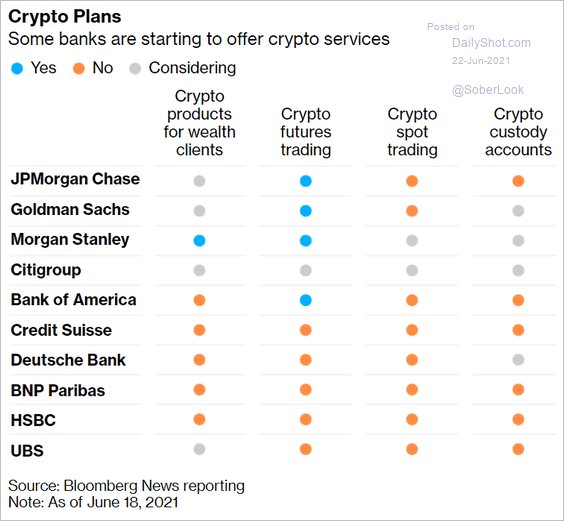

5. Which banks offer crypto services?

Source: @markets Read full article

Source: @markets Read full article

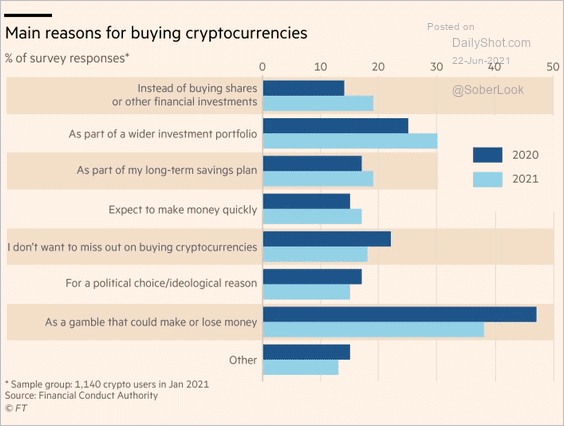

6. What are the main reasons investors buy crypto?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

7. Sotheby’s will accept bitcoin or ether in a high-profile auction.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Commodities

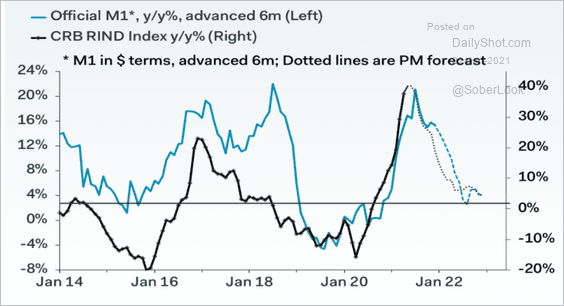

1. China’s weakened money supply growth points to slower gains in industrial commodities.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

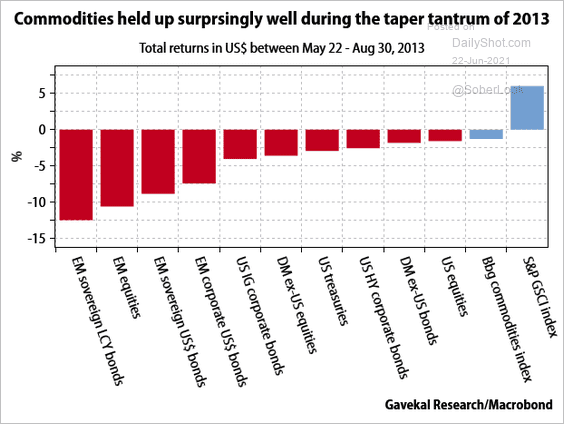

2. Commodities held up well during the 2013 taper tantrum.

Source: Gavekal Research

Source: Gavekal Research

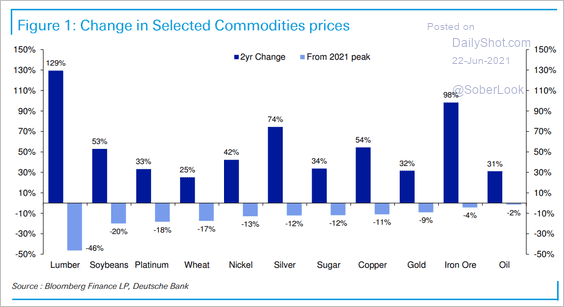

3. How much have commodities declined from their 2021 peaks?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

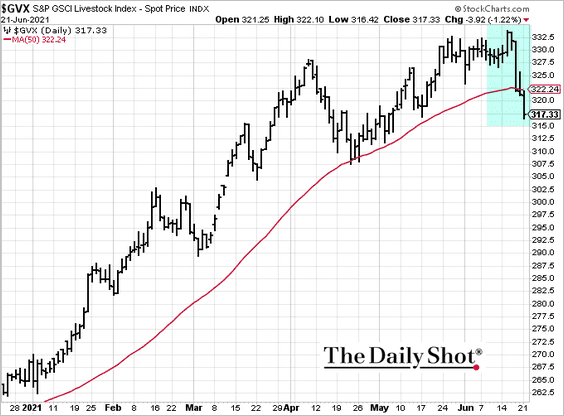

4. US livestock prices have rolled over.

Back to Index

Energy

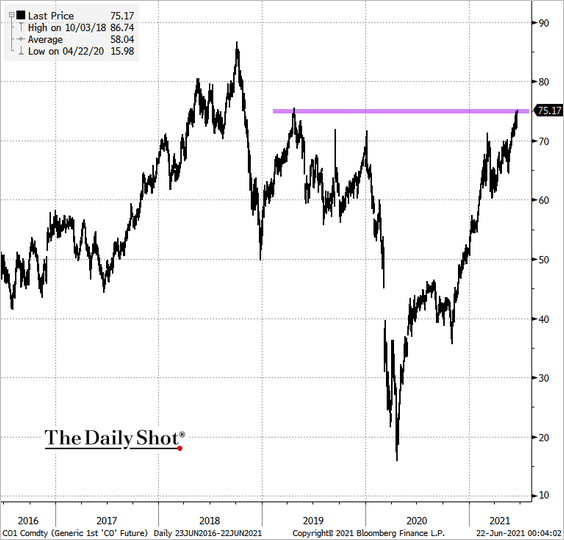

1. Brent is above $75/bbl.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

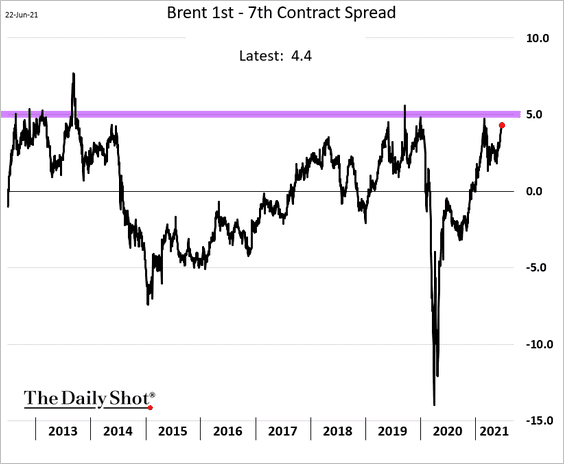

2. The Brent curve backwardation is nearing multi-year highs.

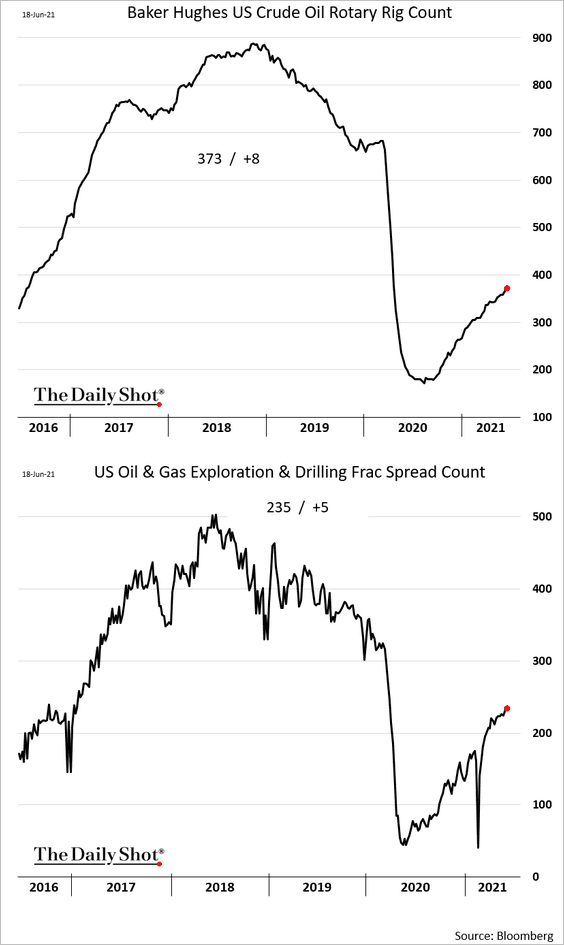

3. The US rig count and frac spread count continue to recover.

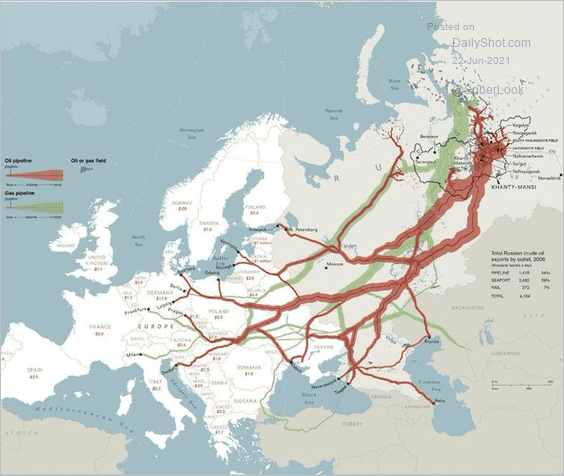

4. This map shows the pipeline infrastructure for Russia’s natural gas.

Source: @simongerman600, @NatGeo Read full article

Source: @simongerman600, @NatGeo Read full article

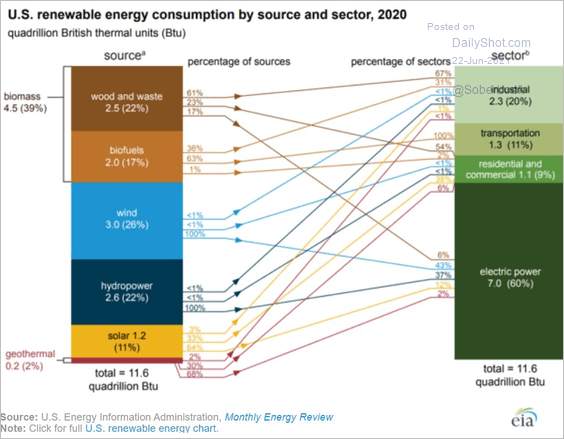

6. Finally, we have US renewables consumption by source and sector.

Source: @EIAgov Read full article

Source: @EIAgov Read full article

Back to Index

Equities

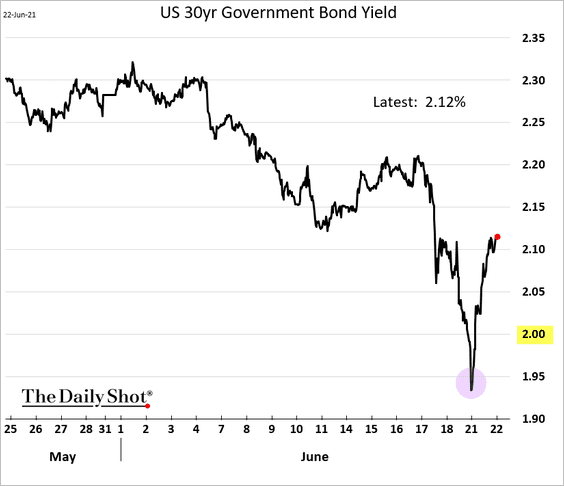

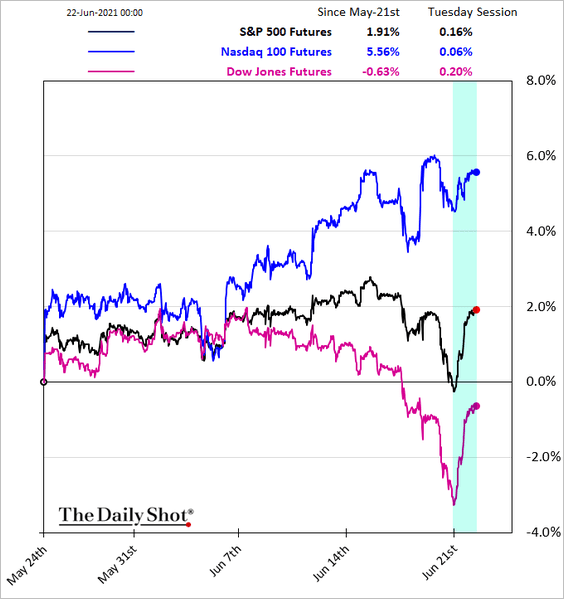

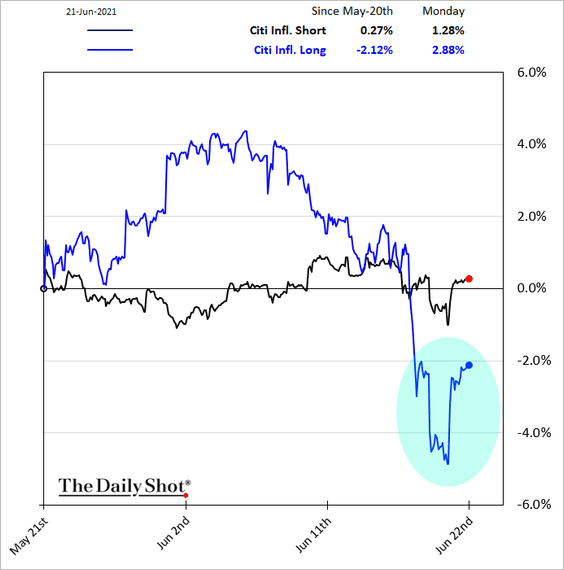

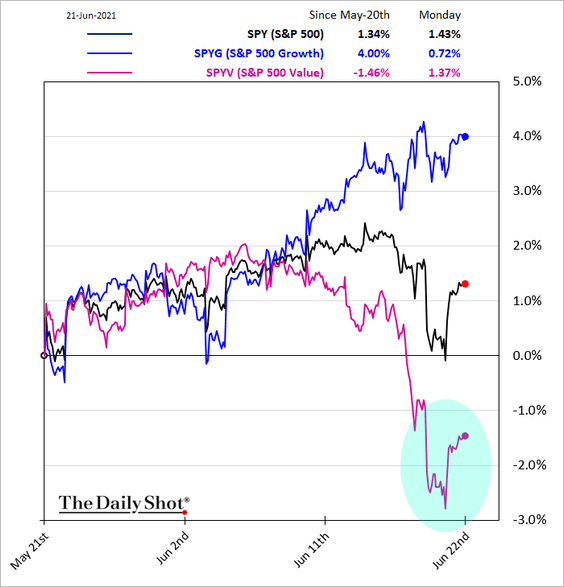

1. The rebound in longer-term yields on Monday …

… reignited the reflation trade, with the “buy the dip” crowd jumping in (3 charts).

——————–

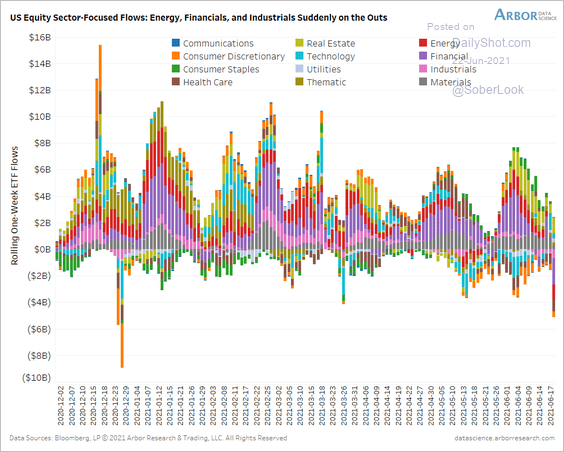

2. Some inflation-friendly sectors saw outflows last week.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

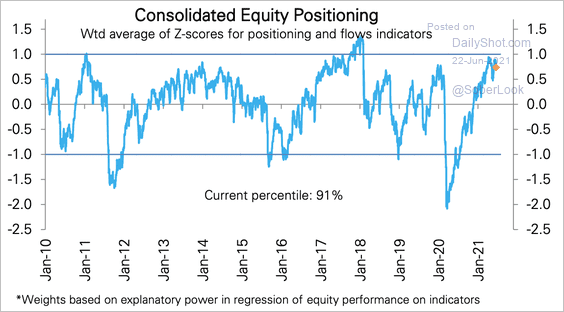

3. Equity positioning is hovering near the top of the historical range for the past two months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

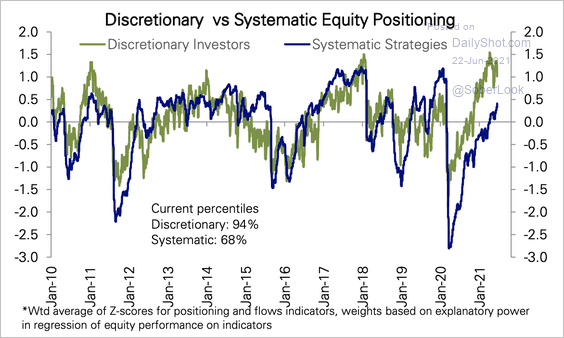

Discretionary investor positioning appears to have peaked while systematic strategy positioning keeps climbing.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

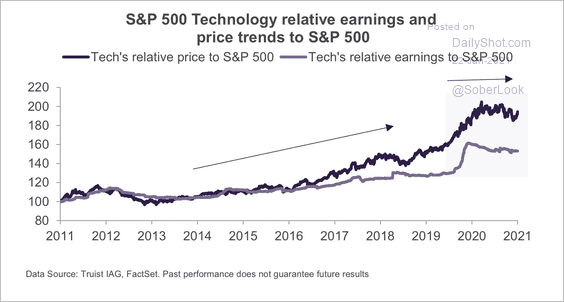

4. Tech’s relative earnings momentum peaked in late May of 2020.

Source: Truist Advisory Services

Source: Truist Advisory Services

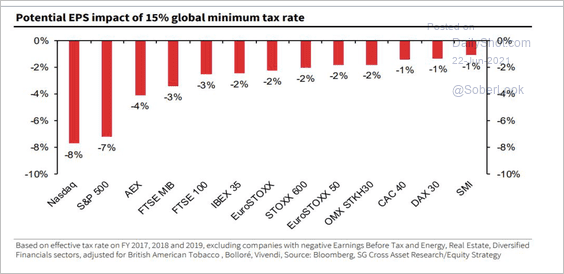

5. This chart shows the potential earnings per share impact from a 15% global minimum tax rate. Much of the hit is already priced in.

Source: III Capital Management

Source: III Capital Management

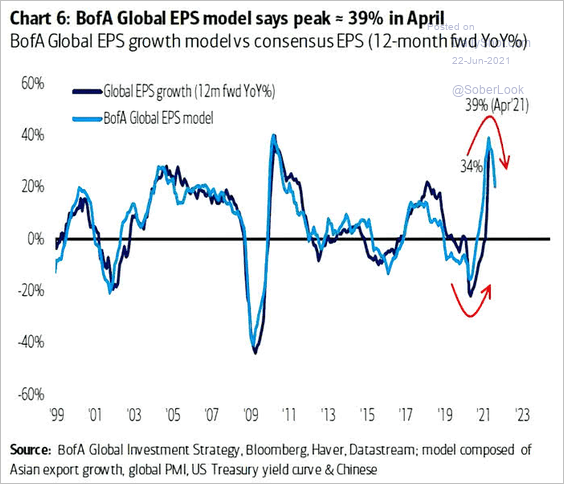

6. The year-over-year global earnings rebound has peaked.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

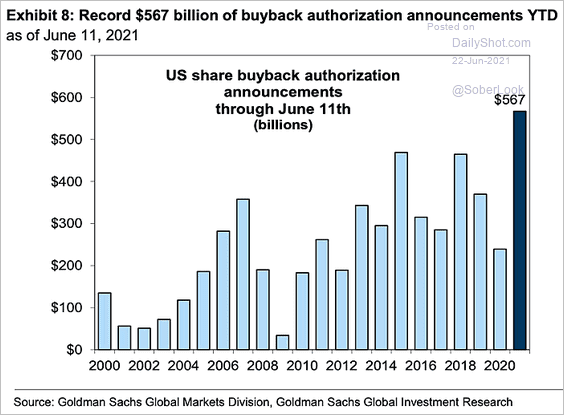

7. Share buyback announcements hit a record this year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

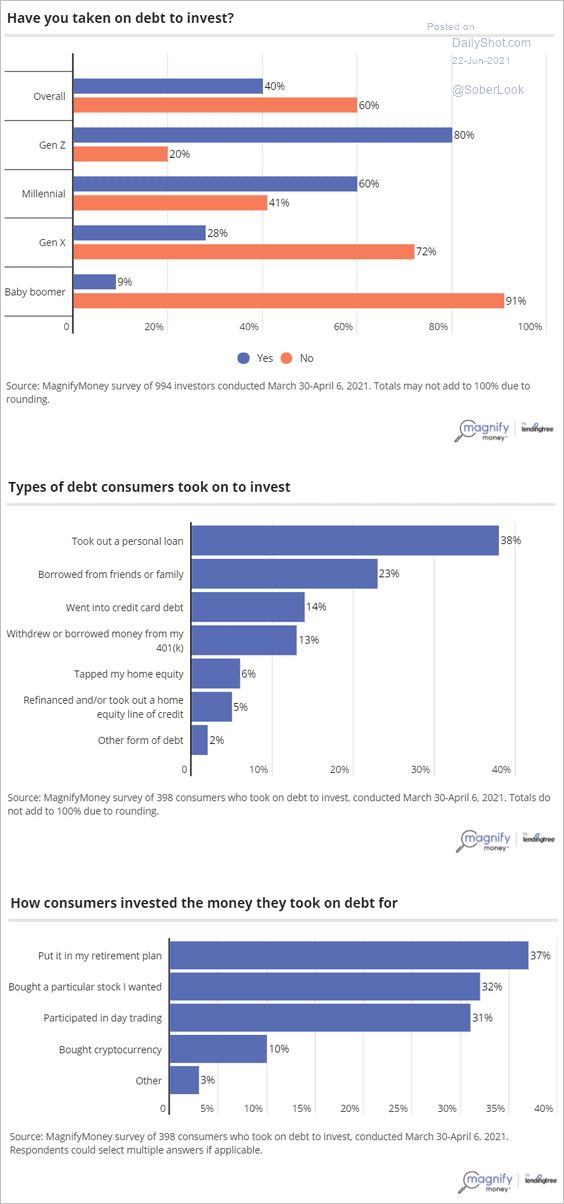

8. Forget margin debt. Retail investors are taking out personal loans to trade stocks. This is not going to end well.

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

Back to Index

Credit

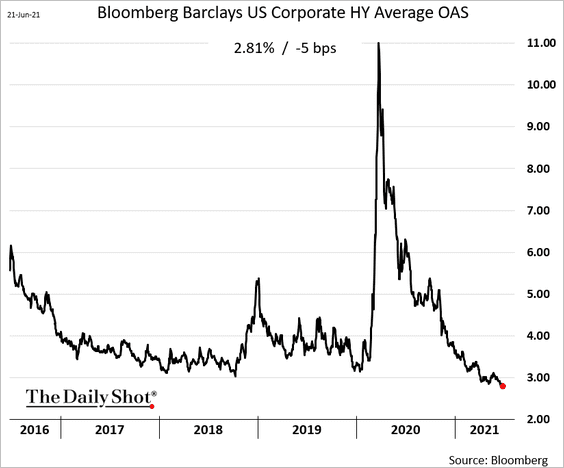

1. US high-yield spreads are near record lows.

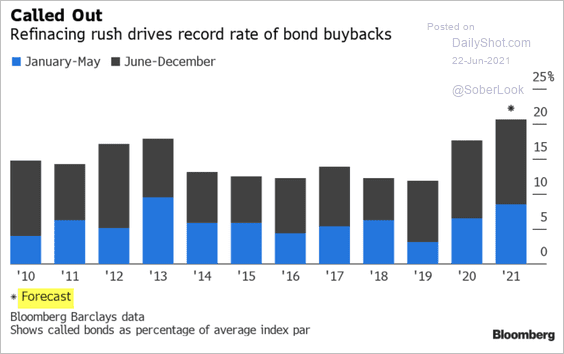

2. 20% of high yield bonds are getting called this year (refinanced).

Source: @AlexWittenberg_ Read full article

Source: @AlexWittenberg_ Read full article

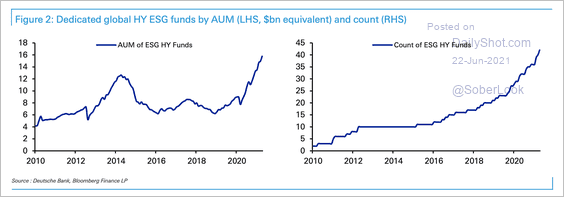

3. There has been a rise in sustainable financing in the global high-yield market over the past few years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

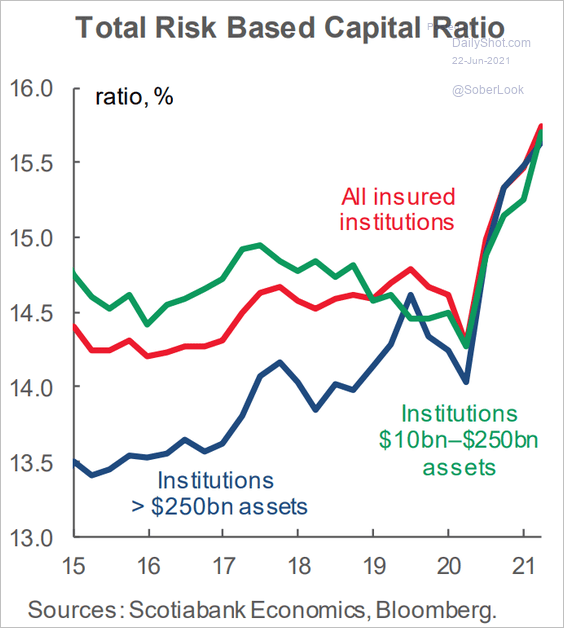

4. US banks are well-capitalized. The Fed should have no concerns about the banking system as it starts to tighten.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

Rates

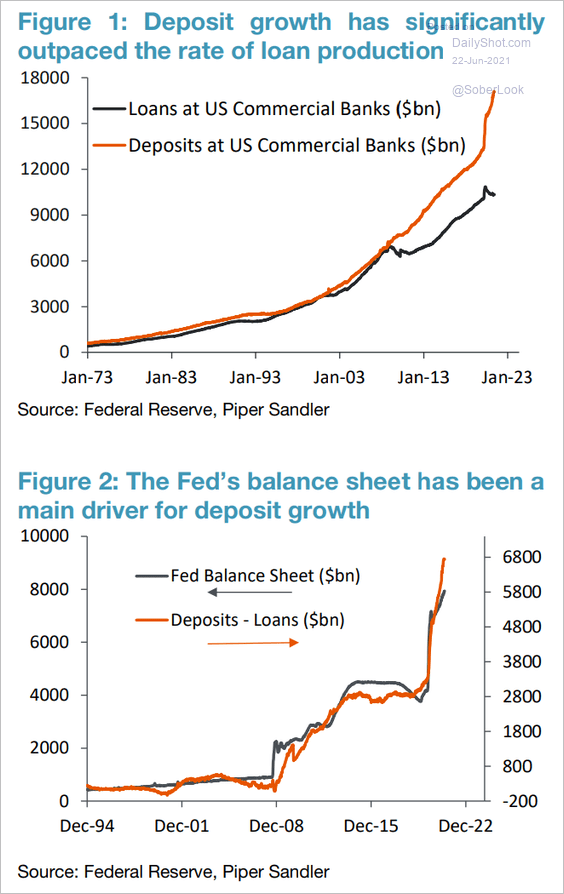

1. Bank deposits have been outpacing loans due to QE.

Source: Piper Sandler

Source: Piper Sandler

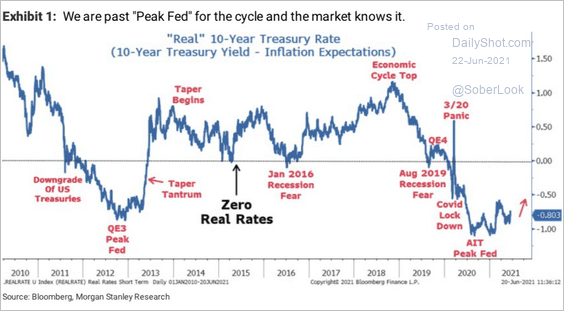

2. We are past “Peak Fed” for this cycle.

Source: Morgan Stanley Research; @carlquintanilla

Source: Morgan Stanley Research; @carlquintanilla

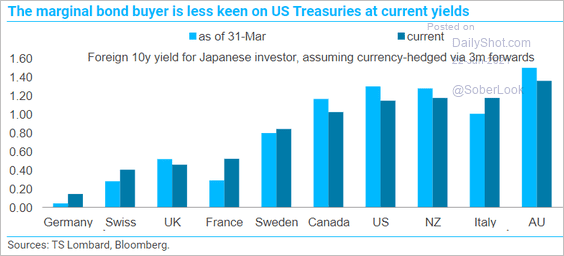

3. Treasuries are now less attractive for Japanese investors than they were earlier this year.

Source: TS Lombard

Source: TS Lombard

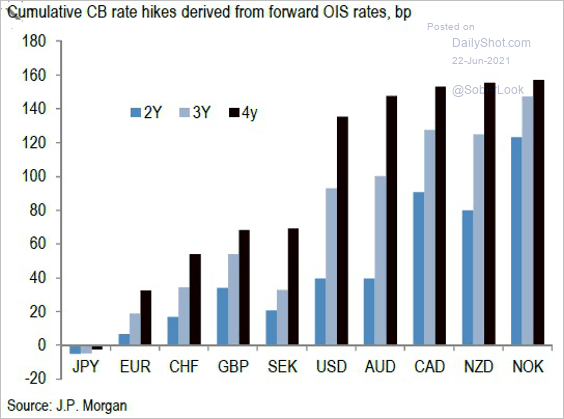

4. How many rate hikes are priced in over the next four years?

Source: JP Morgan; @Scutty

Source: JP Morgan; @Scutty

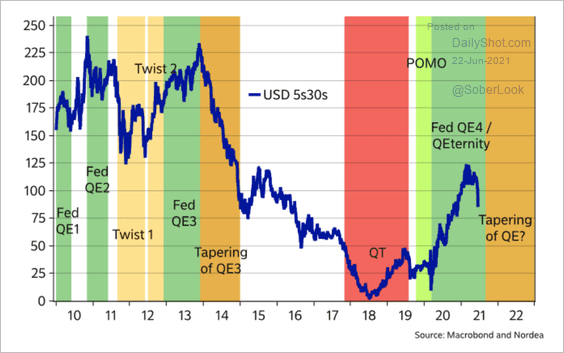

5. The Treasury yield curve tends to flatten when the Fed tapers.

Source: Nordea Markets

Source: Nordea Markets

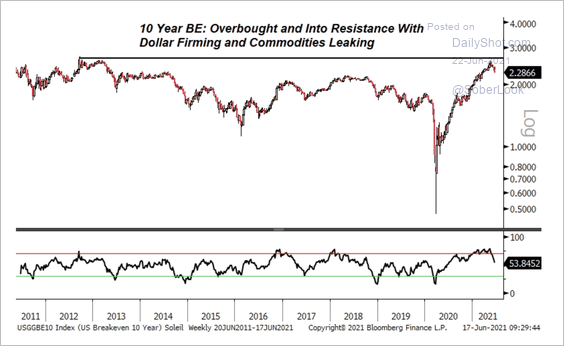

6. The US 10-year breakeven rate held resistance.

Source: Evercore ISI

Source: Evercore ISI

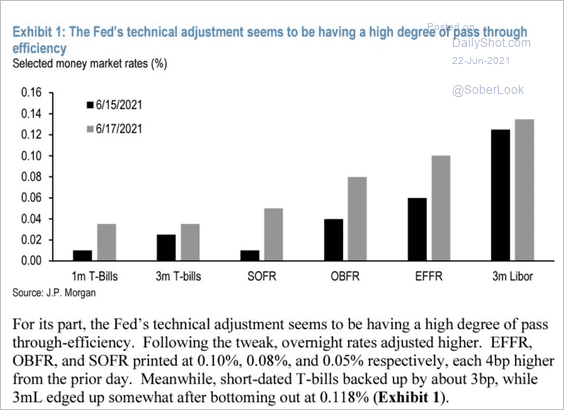

7. Here is how the Fed’s policy “tweak” (#3 here) affected different money market rates.

Source: JP Morgan; A K

Source: JP Morgan; A K

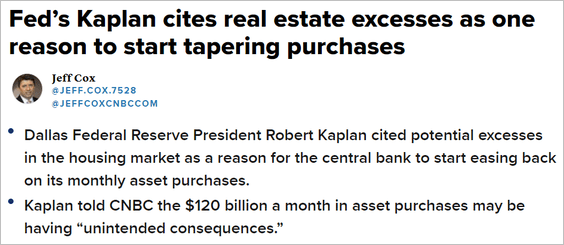

8. The Fed’s Kaplan is concerned about rapidly rising residential property prices.

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

Global Developments

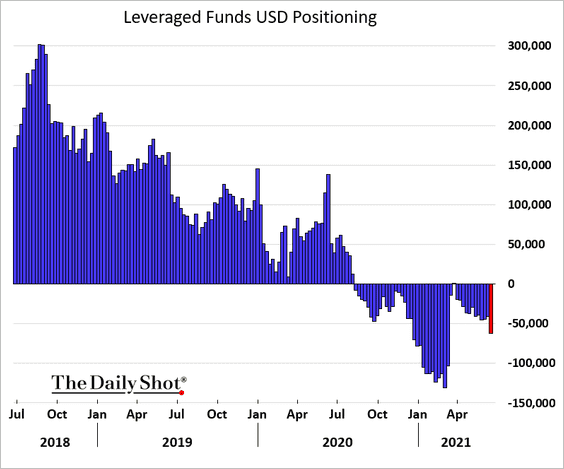

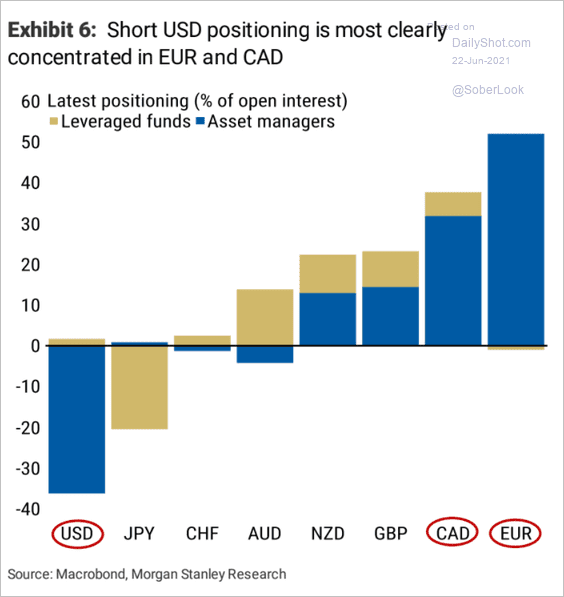

1. Hedge funds increased their bets against the dollar last week – right before the Fed-induced rally.

• Here is the positioning in key currency futures.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

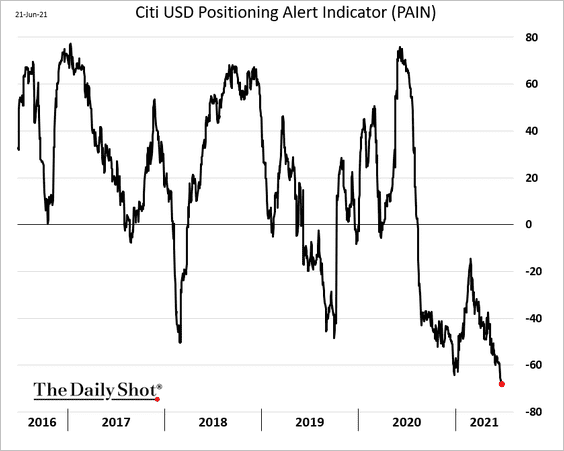

• The Citi PAIN index shows active F/X traders are most bearish on the US dollar in years.

——————–

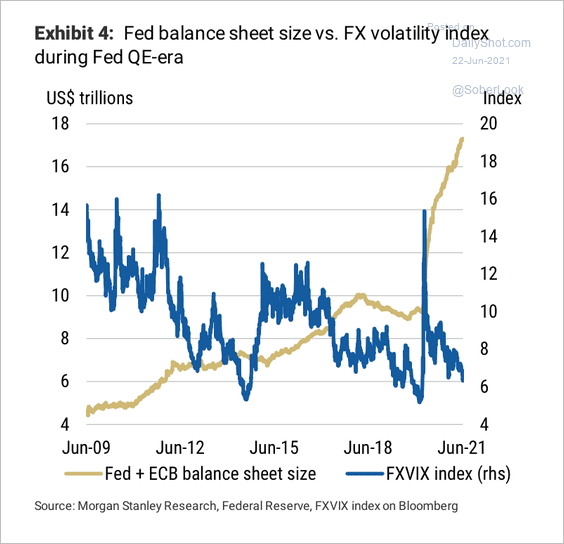

2. FX implied volatility has trended lower as the size of the Fed and ECB’s balance sheet rises.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

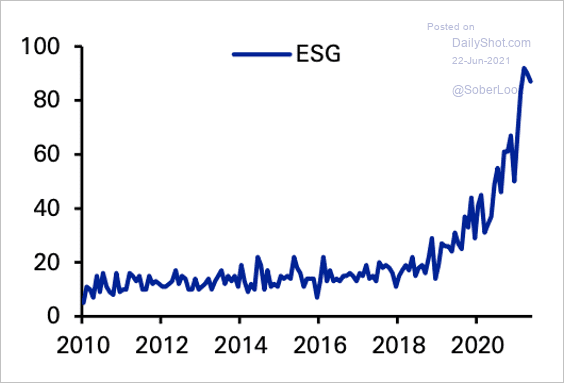

3. Google searches for ESG have risen substantially over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

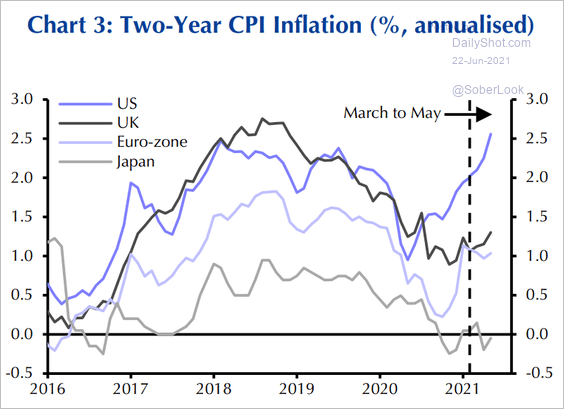

4. This chart shows the CPI in advanced economies using a two-year period to avoid base effects.

Source: Capital Economics

Source: Capital Economics

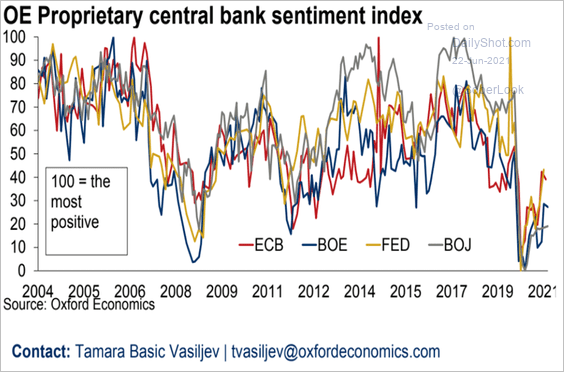

5. Advanced economies’ central banks are still quite dovish.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

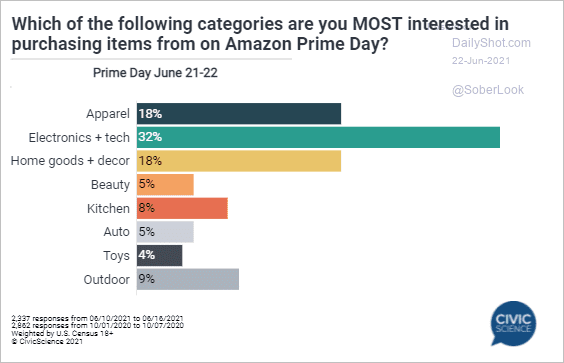

1. Amazon Prime Day’s most popular categories:

Source: @CivicScience

Source: @CivicScience

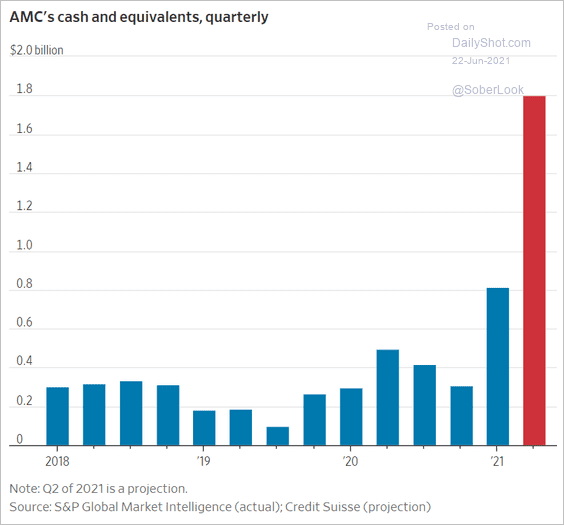

2. AMC Entertainment’s cash holdings:

Source: @WSJ Read full article

Source: @WSJ Read full article

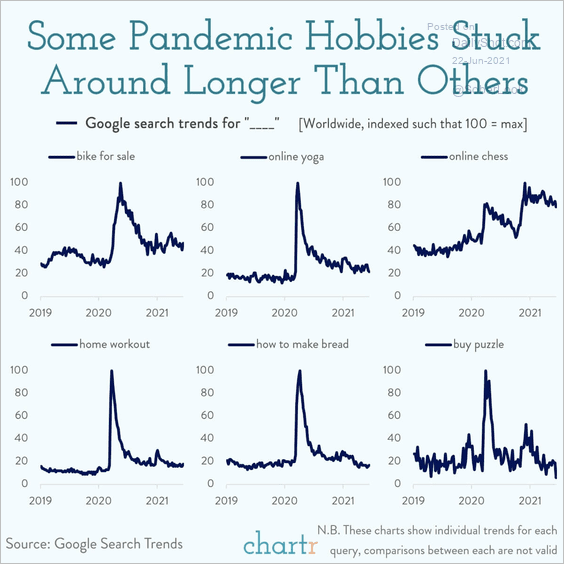

3. Pandemic hobbies:

Source: @chartrdaily

Source: @chartrdaily

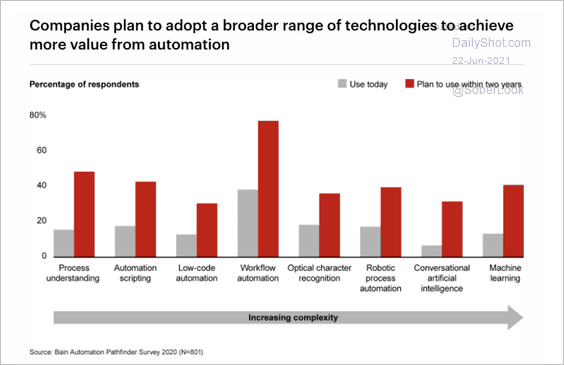

4. Business automation trends:

Source: Bain & Company Read full article

Source: Bain & Company Read full article

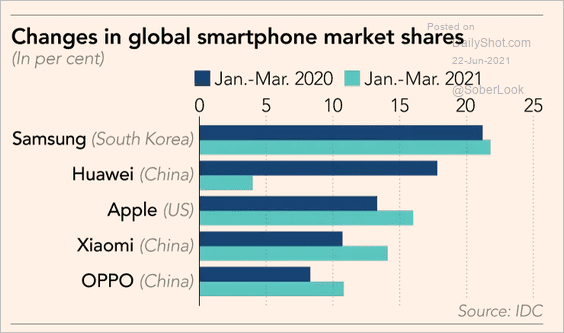

5. Changes in the global smartphone market:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

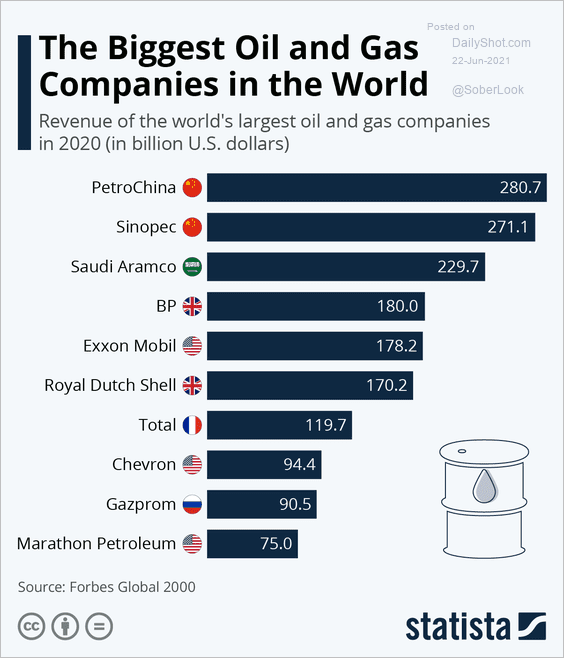

6. Revenues of the largest oil and gas companies:

Source: Statista

Source: Statista

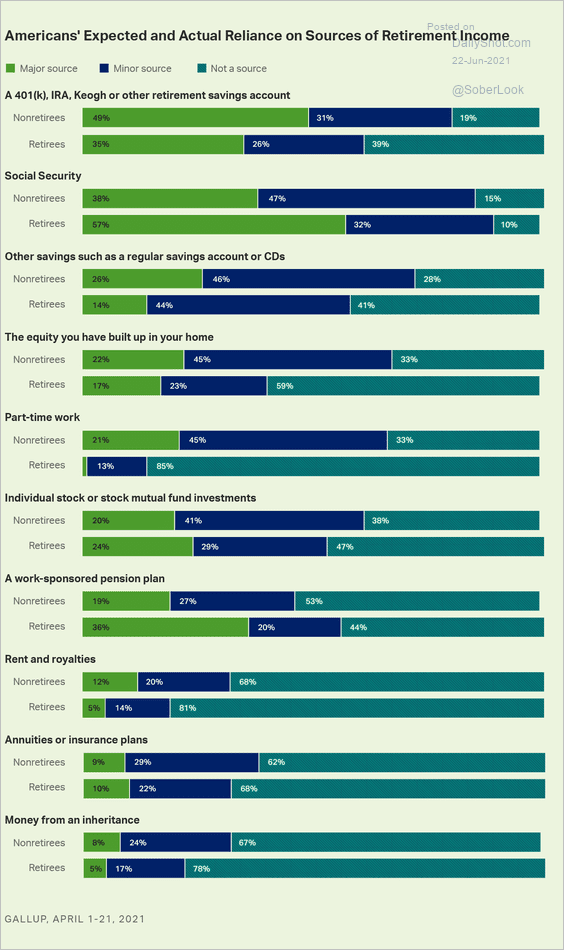

7. Sources of retirement income in the US:

Source: Gallup Read full article

Source: Gallup Read full article

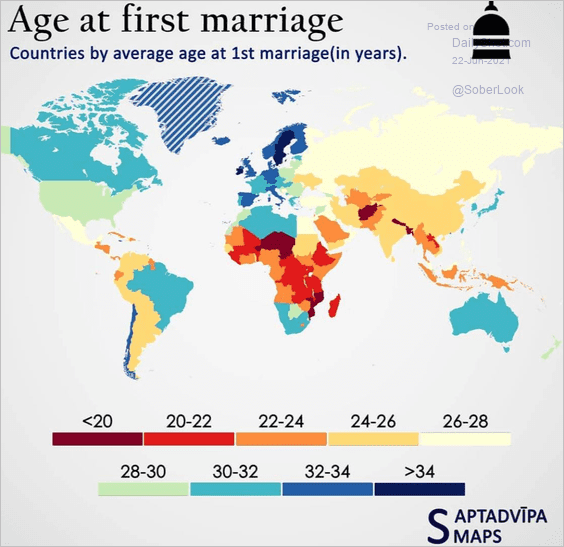

8. Age at first marriage:

Source: @TheBigDataStats

Source: @TheBigDataStats

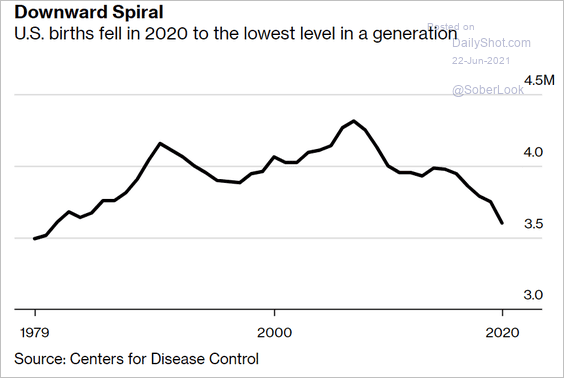

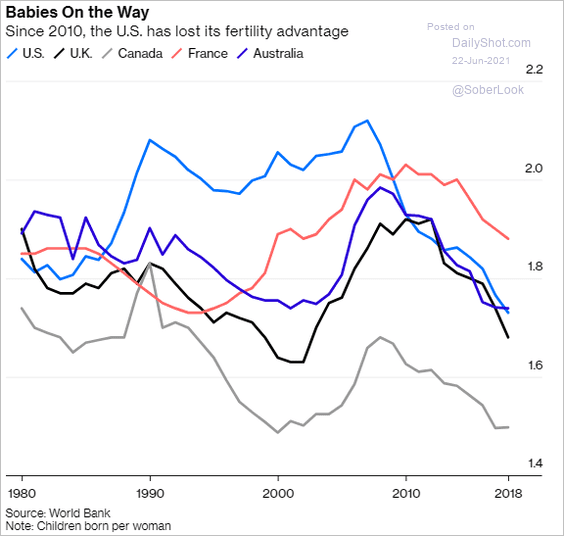

9. US birth rate:

Source: @business Read full article

Source: @business Read full article

• Birth rates in select economies:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

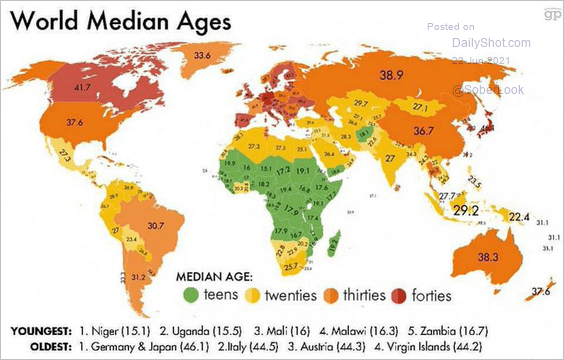

10. The median age around the world:

Source: @331167, @DiMartinoBooth

Source: @331167, @DiMartinoBooth

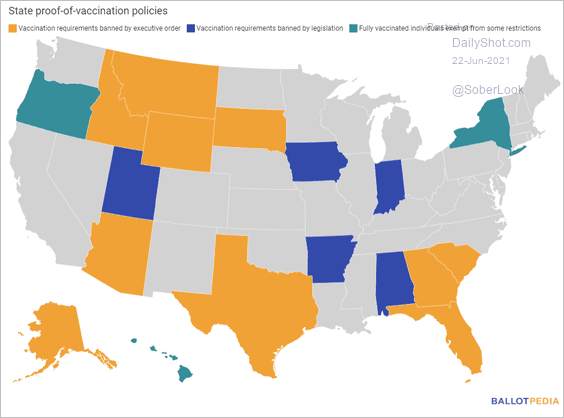

11. Vaccination policies

Source: Ballotpedia Read full article

Source: Ballotpedia Read full article

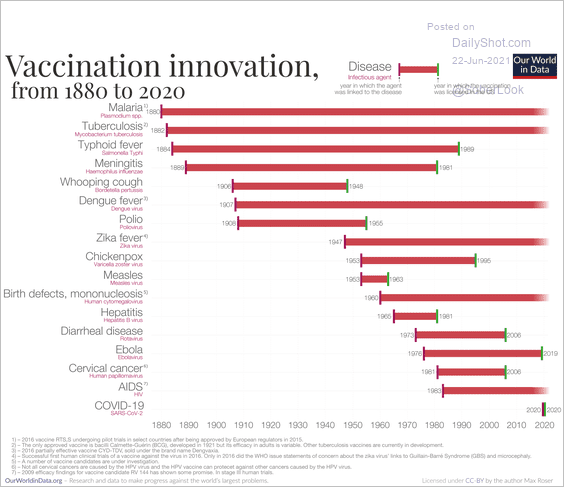

12. The year each disease was identified and a vaccination licensed:

Source: @EricTopol, @NatureHumBehav, @OurWorldInData Read full article

Source: @EricTopol, @NatureHumBehav, @OurWorldInData Read full article

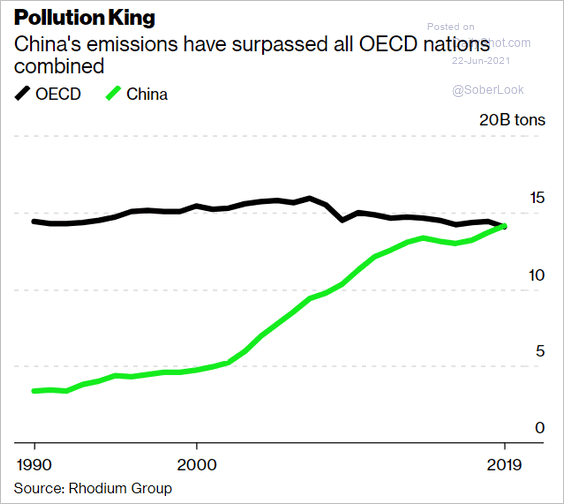

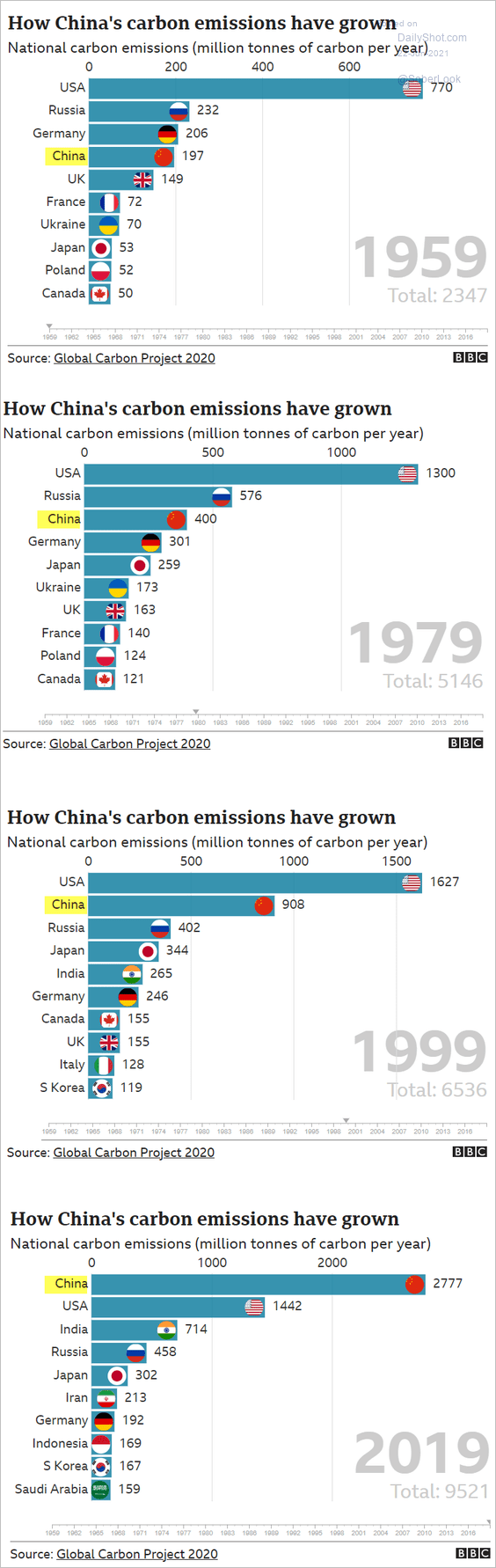

13. China’s CO2 emissions:

Source: @business Read full article

Source: @business Read full article

Source: BBC Read full article

Source: BBC Read full article

——————–

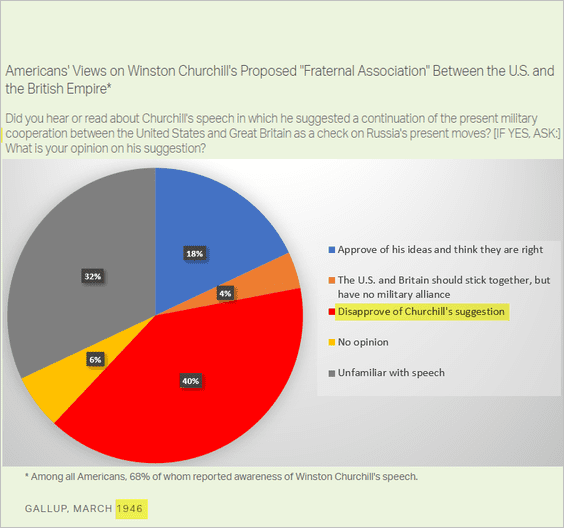

14. Americans’ views in 1946 on Winston Churchill’s proposal for continued military collaboration between the US and Britain:

Source: Gallup Read full article

Source: Gallup Read full article

——————–

Back to Index