The Daily Shot: 26-Jul-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia -Pacific

• China

• Emerging Market

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

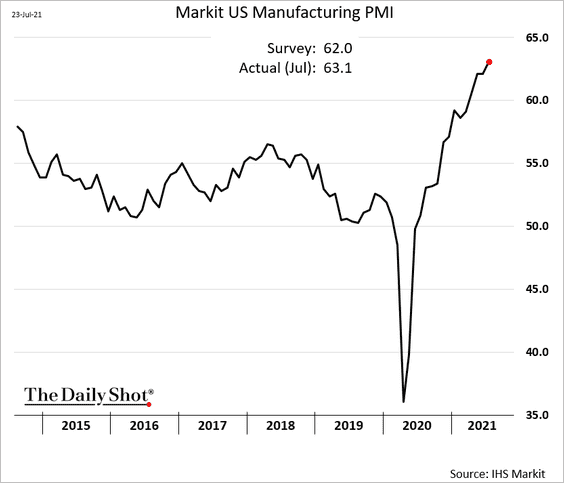

1. The flash Markit PMI report shows factory growth accelerating this month.

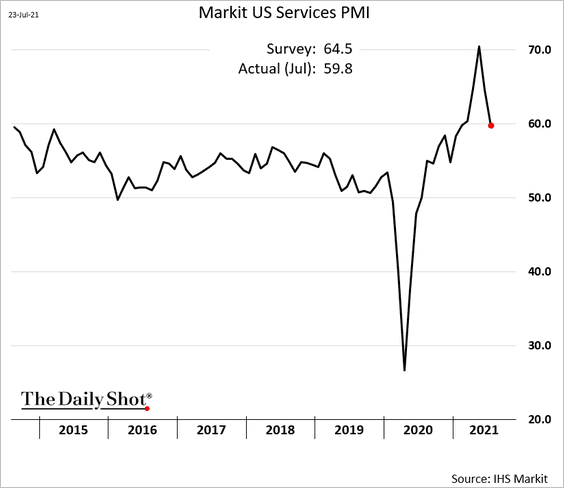

Service-sector growth remains robust but is well off the highs (and below forecasts).

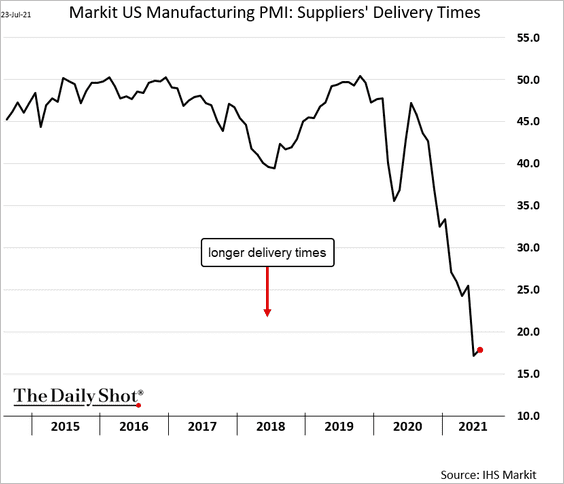

Manufacturing supply constraints remain severe.

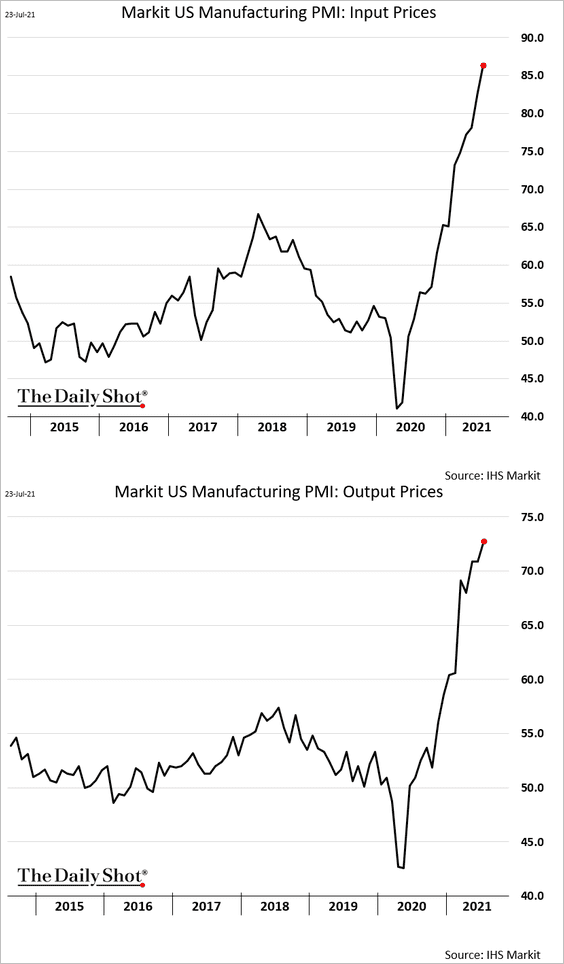

And price pressures worsened further this month.

——————–

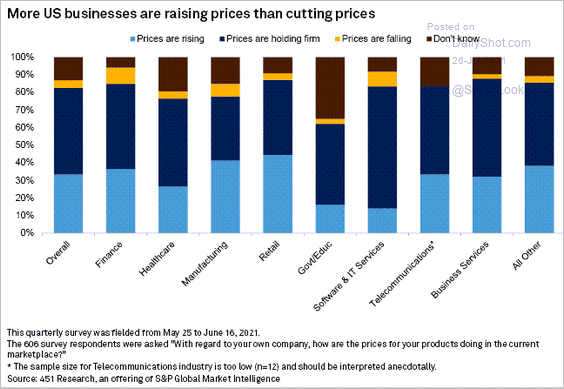

2. Next, we have some updates on inflation.

• Businesses are boosting prices across industries.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

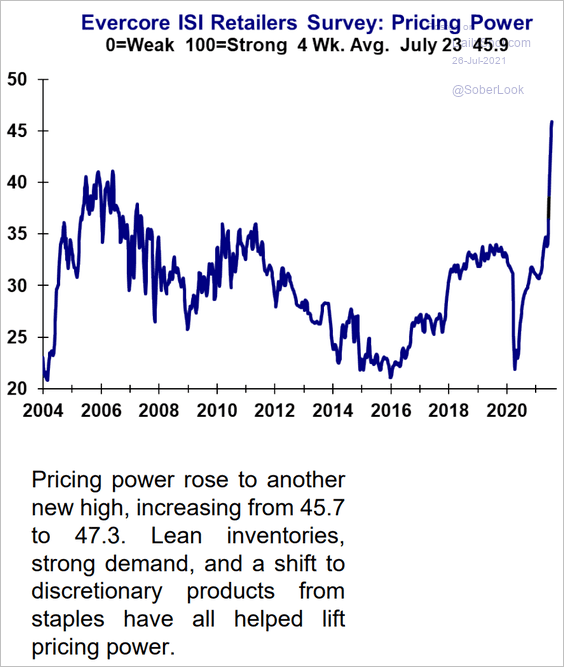

• Retailers’ pricing power has been surging, according to Evercore ISI.

Source: Evercore ISI

Source: Evercore ISI

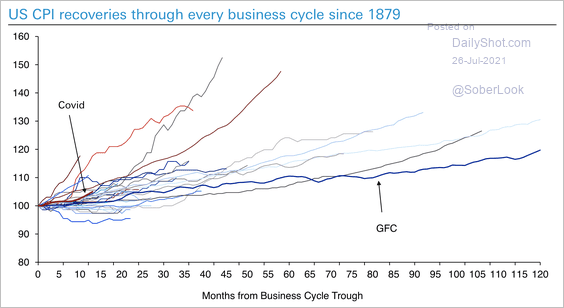

• The current recovery in CPI is not extreme relative to history.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

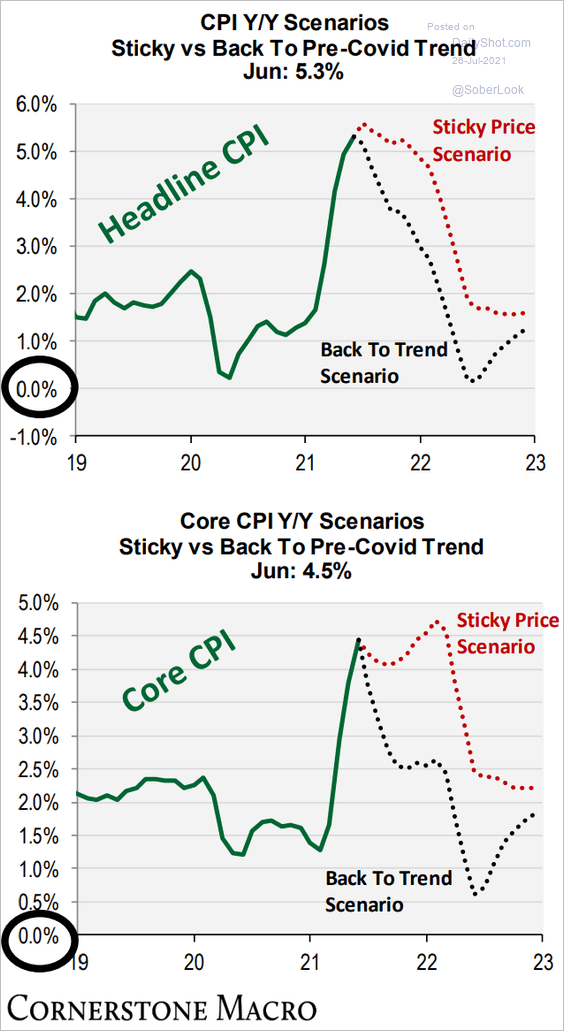

• This chart shows two inflation scenarios from Cornerstone Macro. Will we get the “sticky price” outcome?

Source: Cornerstone Macro

Source: Cornerstone Macro

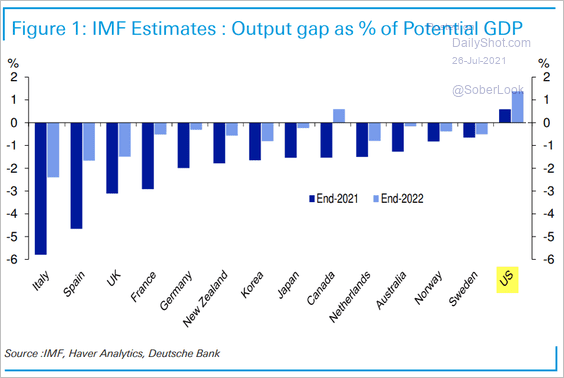

• US economic growth is expected to run above its potential, which tends to be inflationary.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

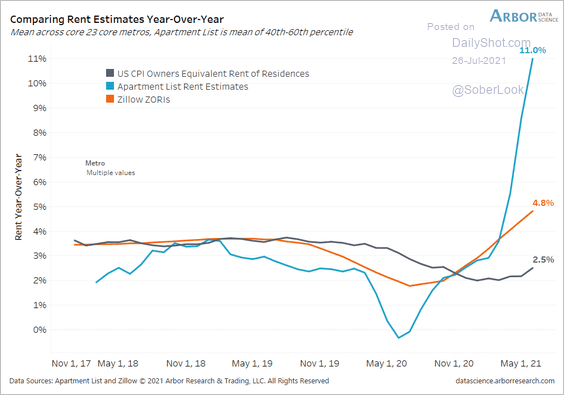

• High-frequency measures show that shelter inflation should accelerate.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

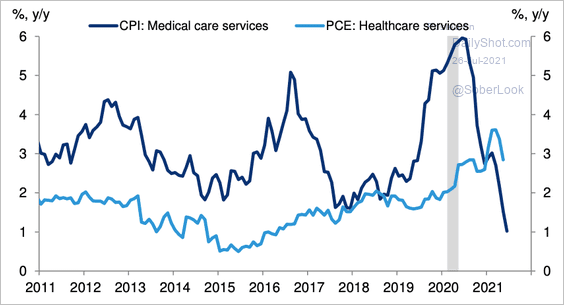

• Medical care CPI has been moderating.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

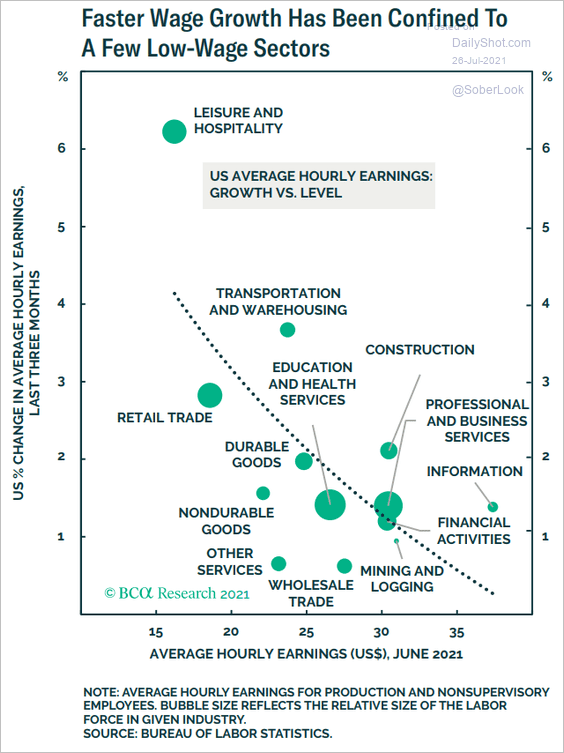

• Faster wage growth has been constrained to several low-wage sectors, according to BCA Research.

Source: BCA Research

Source: BCA Research

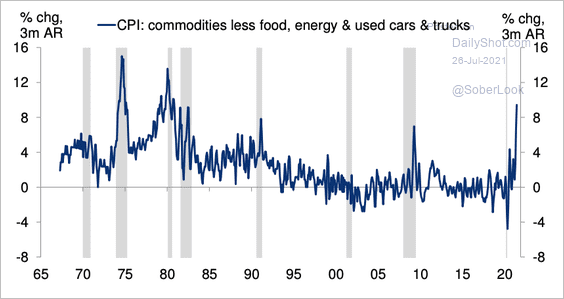

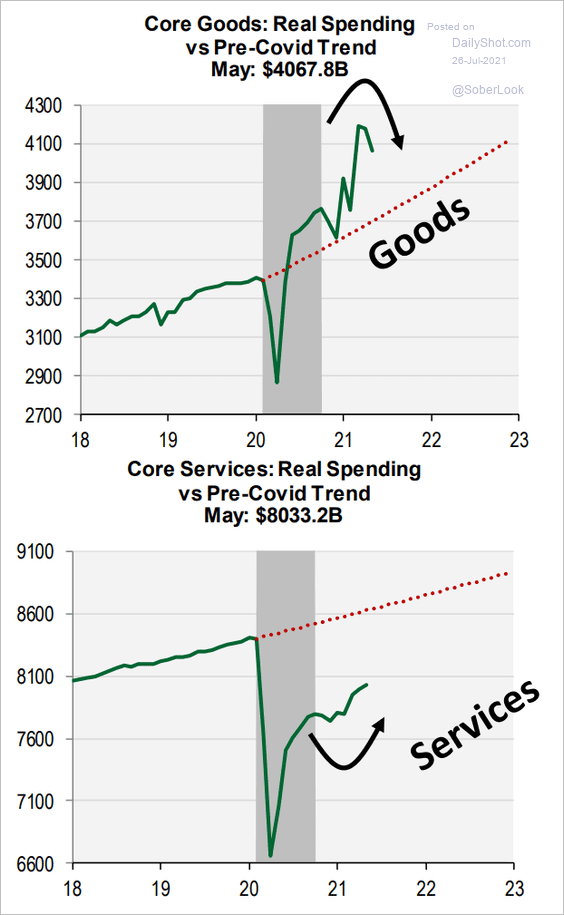

• Core goods prices, excluding used cars, have surged over the past three months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

But they are expected to start moderating. At the same time, services inflation (including shelter) will be rebounding.

Source: Cornerstone Macro

Source: Cornerstone Macro

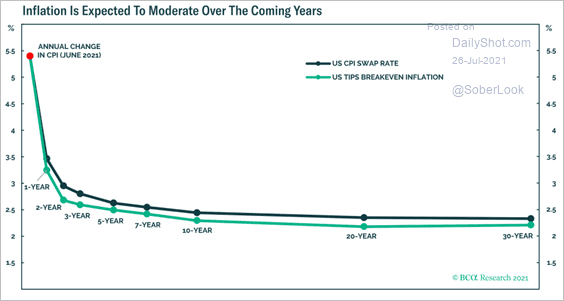

• The market expects inflation to ease going forward.

Source: BCA Research

Source: BCA Research

——————–

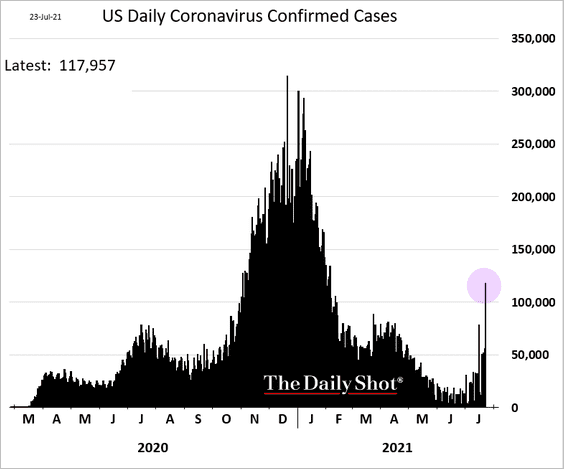

3. Finally, let’s take a look at a couple of COVID metrics.

• New cases:

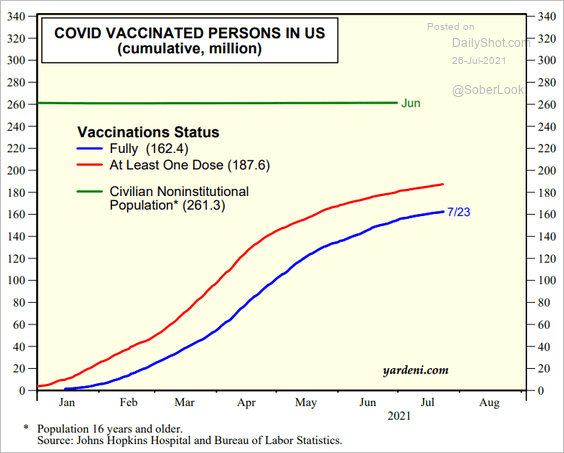

• Vaccinations:

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Canada

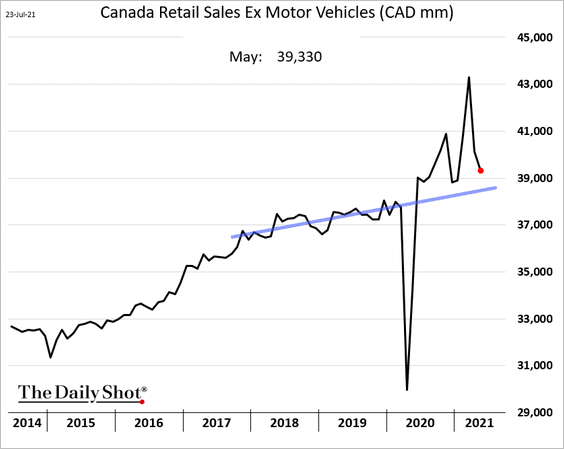

1. Retail sales slowed further in May.

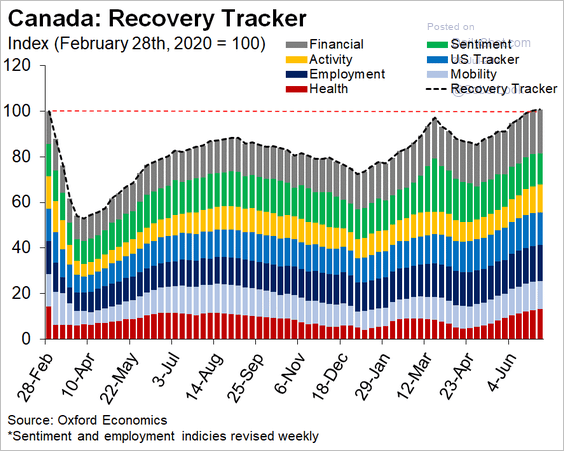

2. The Oxford Economics Recovery Tracker is above pre-COVID levels.

Source: Oxford Economics

Source: Oxford Economics

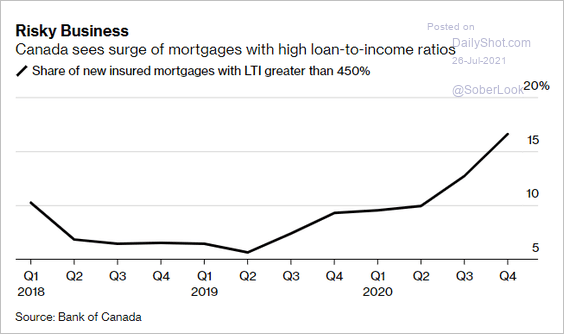

3. “Subprime” mortgages are on the rise in Canada.

Source: @C_Barraud Read full article

Source: @C_Barraud Read full article

Back to Index

The United Kingdom

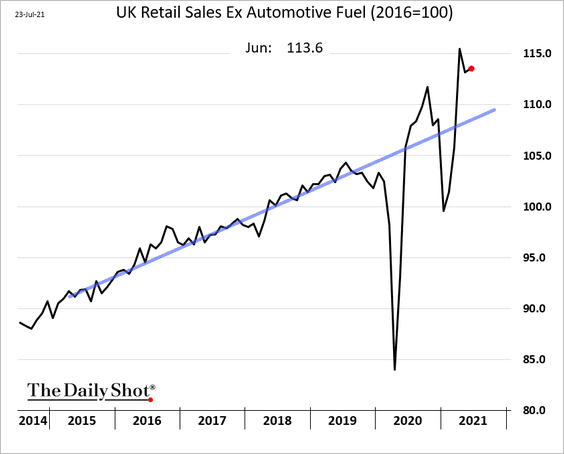

1. Retail sales remain robust.

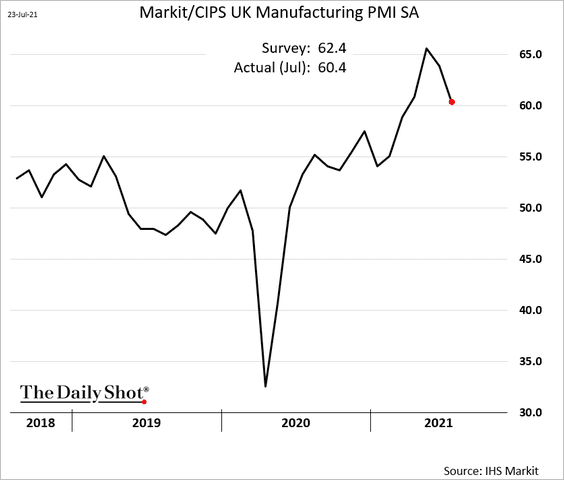

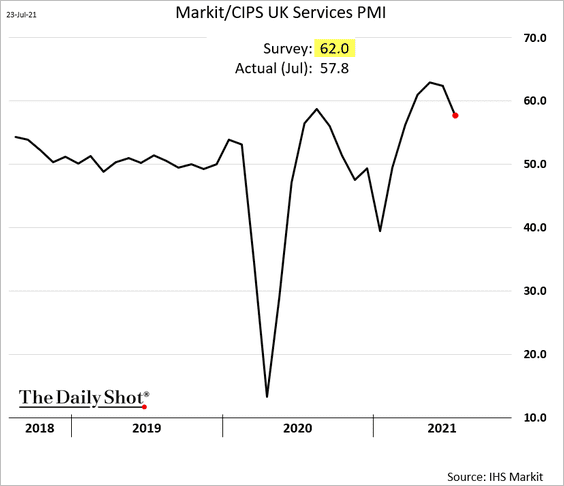

2. The flash PMI report surprised to the downside. To be sure, growth in business activity is strong, but we are off the highs.

• Manufacturing:

• Services:

——————–

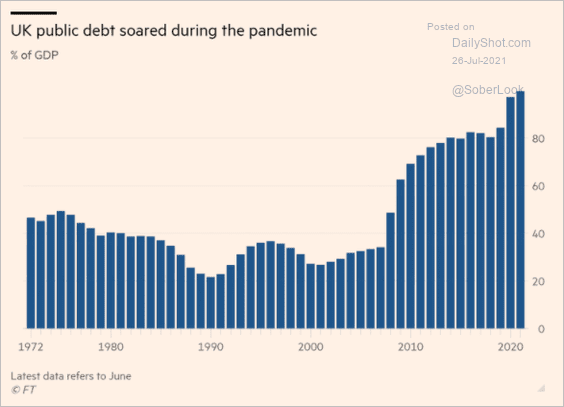

3. Public debt surged since the start of the pandemic.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

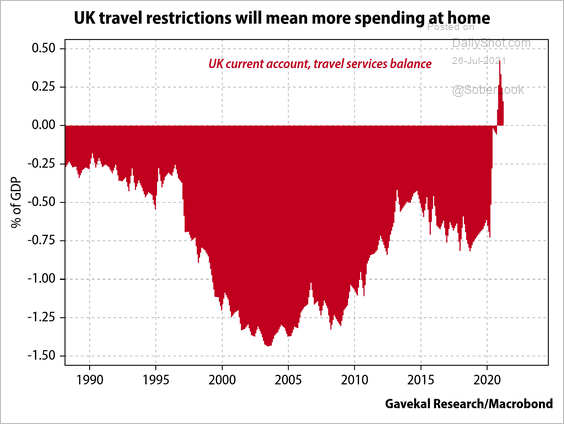

4. The travel sector’s current account has been in surplus as more Britons stay local.

Source: @Gavekal

Source: @Gavekal

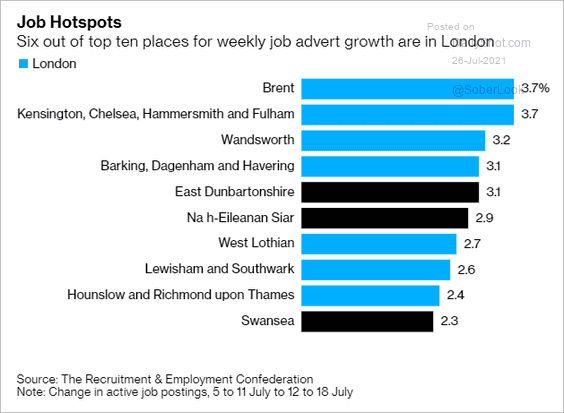

5. Job adverts have been on the rise in London (driven by financial and consulting firms).

Source: @StuartLWallace, @EamonFarhat Read full article

Source: @StuartLWallace, @EamonFarhat Read full article

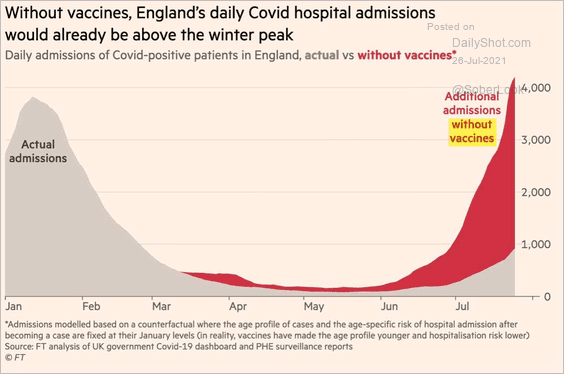

6. Hospital admissions would be surging without the vaccine program.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

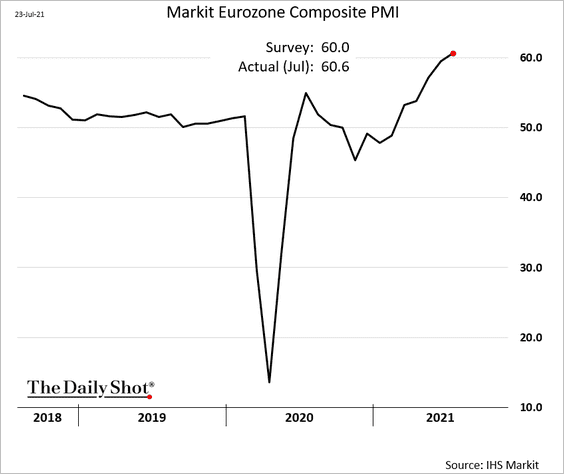

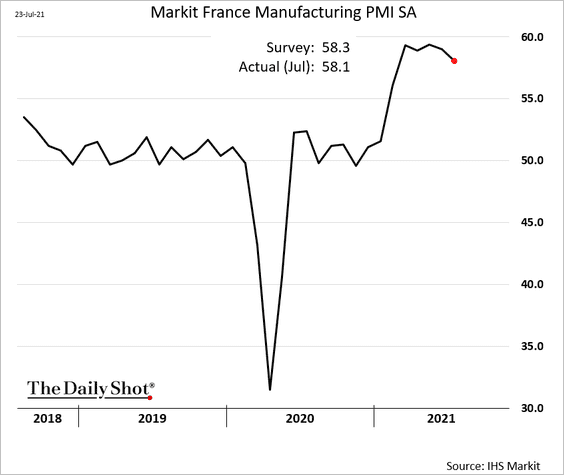

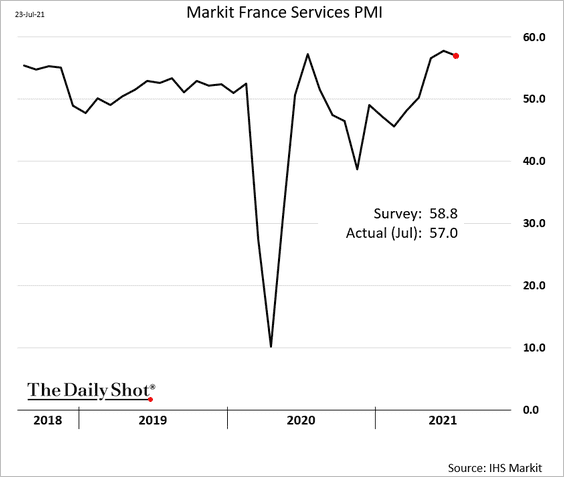

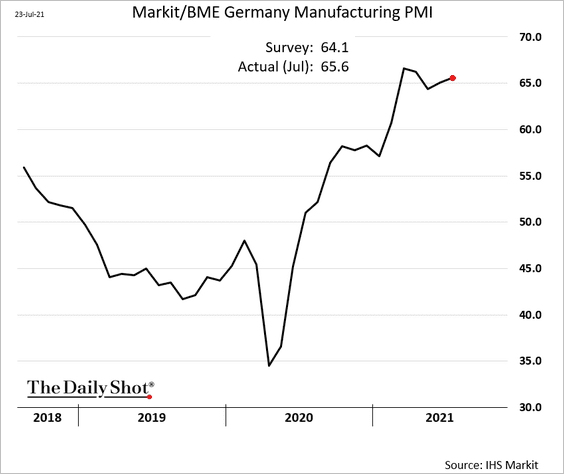

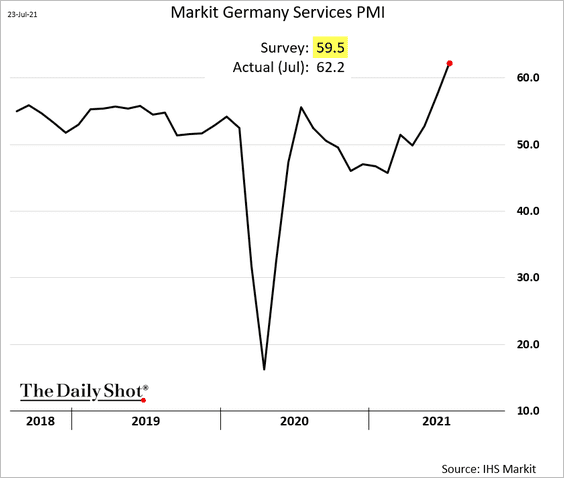

1. The flash PMI report showed stronger growth in July.

• French results were a bit below consensus.

– Manufacturing:

– Services:

• But German PMI indices topped forecasts.

– Manufacturing:

– Services (surging):

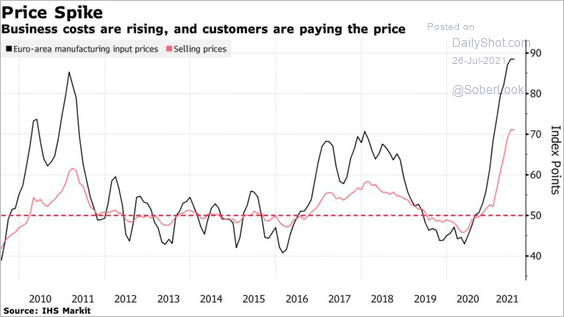

Price pressures persist.

Source: @markets Read full article

Source: @markets Read full article

——————–

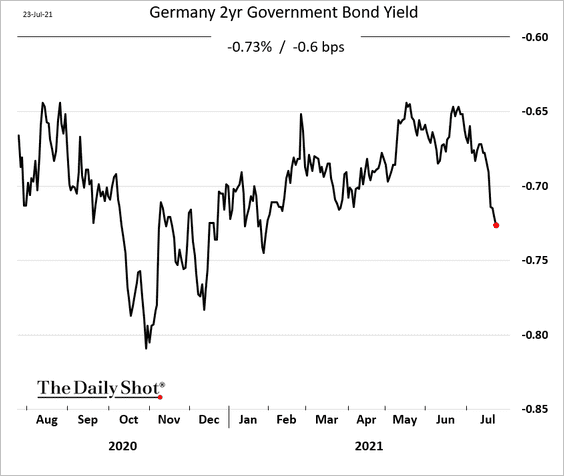

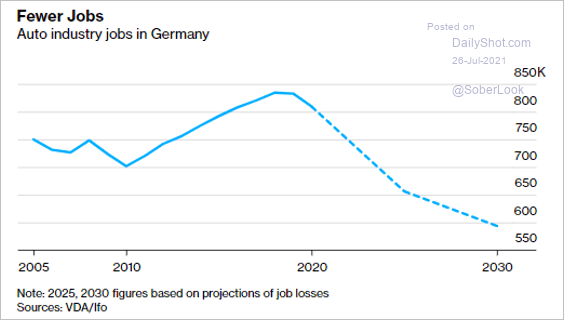

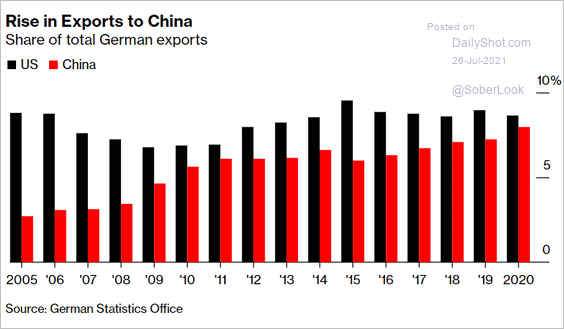

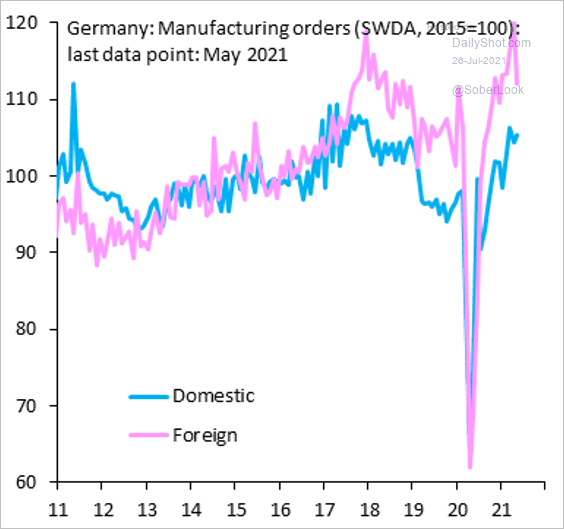

2. Next, we have some additional updates on Germany.

• The 2yr yield:

• Auto industry jobs:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Exports to the US vs. China:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• Manufacturing orders (showing a drop in global demand):

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

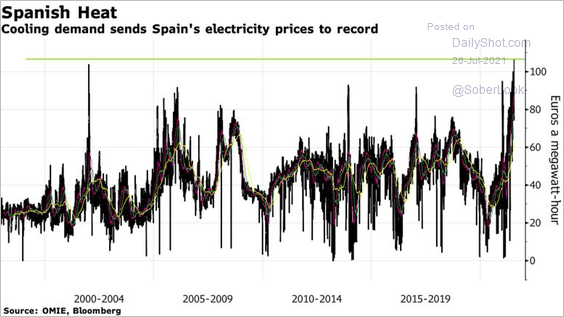

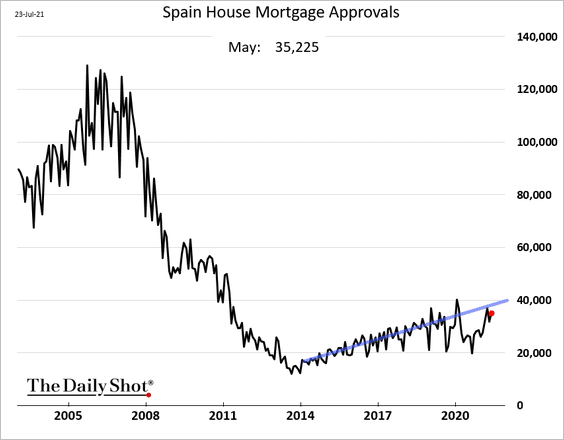

3. Finally, here are a couple of updates on Spain.

• Electricity demand (driven by the heatwave):

Source: @markets Read full article

Source: @markets Read full article

• Mortgage approvals:

Back to Index

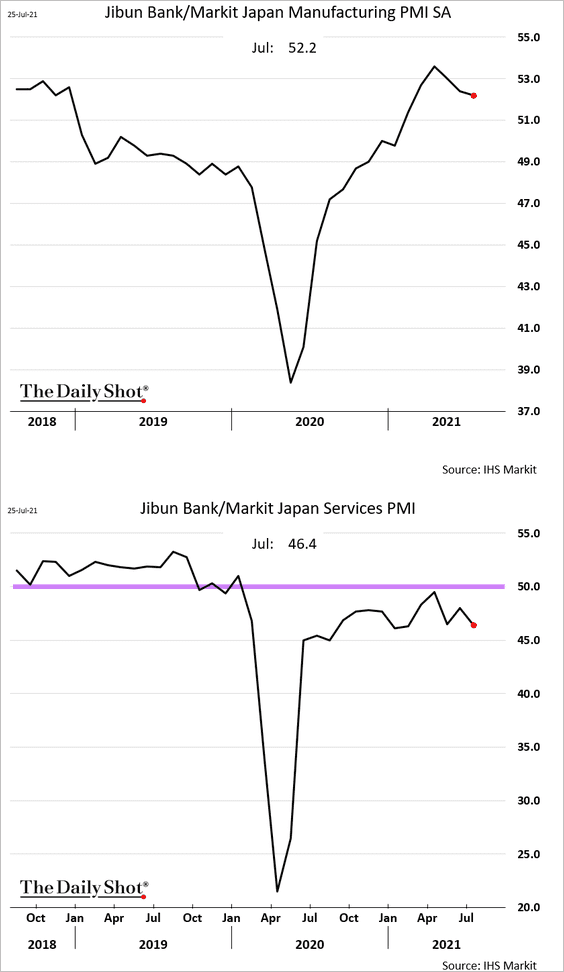

Asia -Pacific

1. Japan’s manufacturing growth eased further this month. Services are still in bad shape (PMI < 50 means contraction).

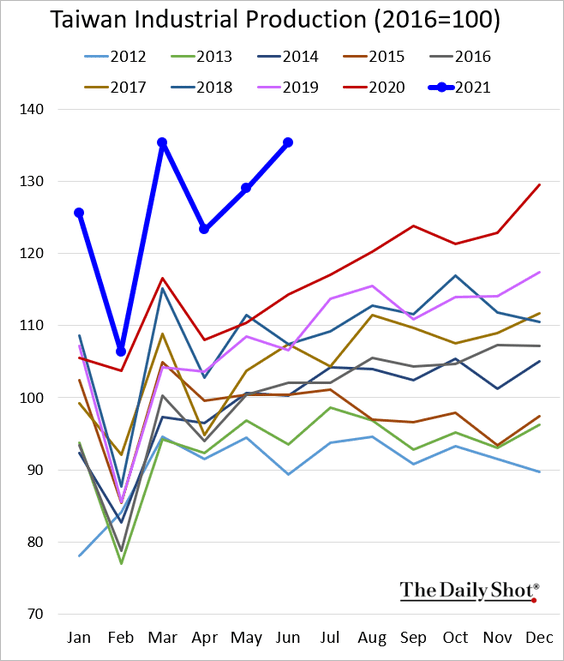

2. Taiwan’s industrial production is surging.

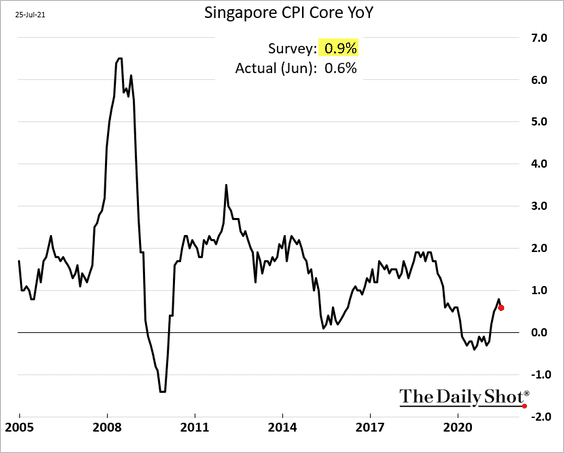

3. Singapore’s inflation remains tepid (below forecasts).

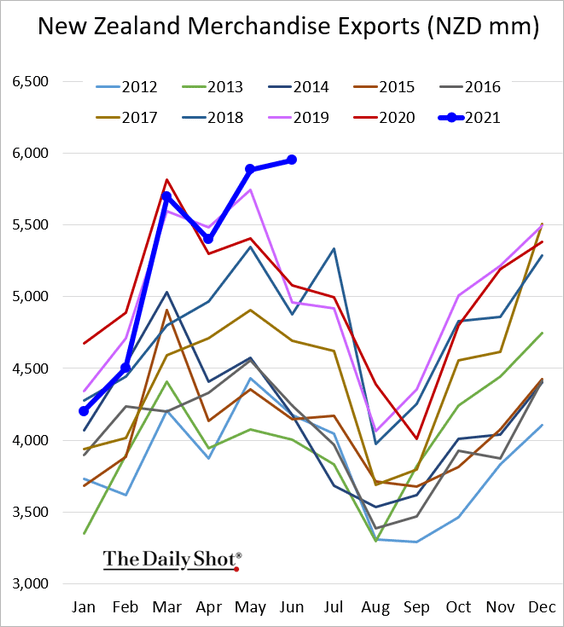

4. New Zealand’s exports are hitting new highs. Exports usually decline in June – but not this year.

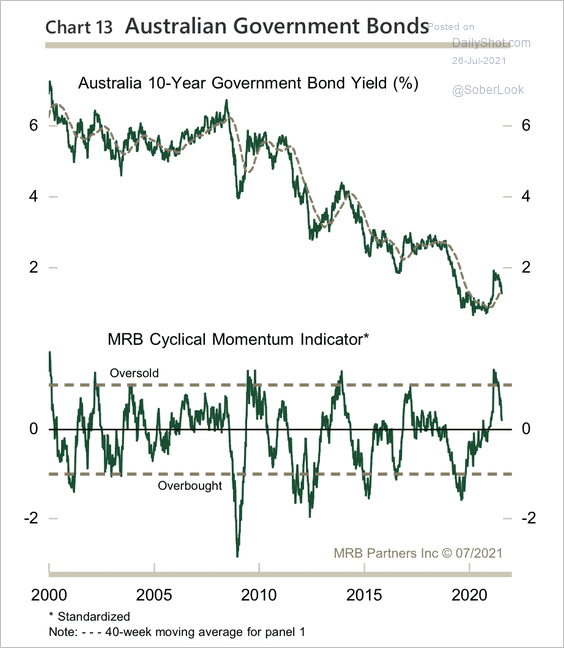

5. Next, we have some updates on Australia.

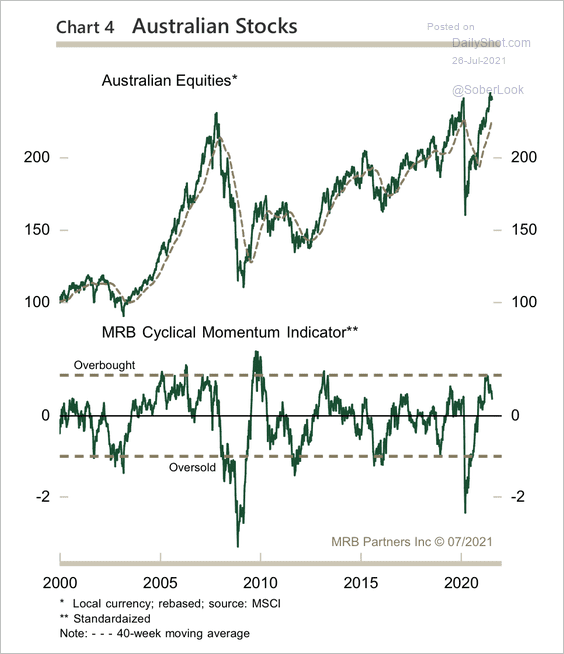

• Australian equities appear stretched based on MRB’s momentum measures …

Source: MRB Partners

Source: MRB Partners

… as government bonds unwind from oversold conditions.

Source: MRB Partners

Source: MRB Partners

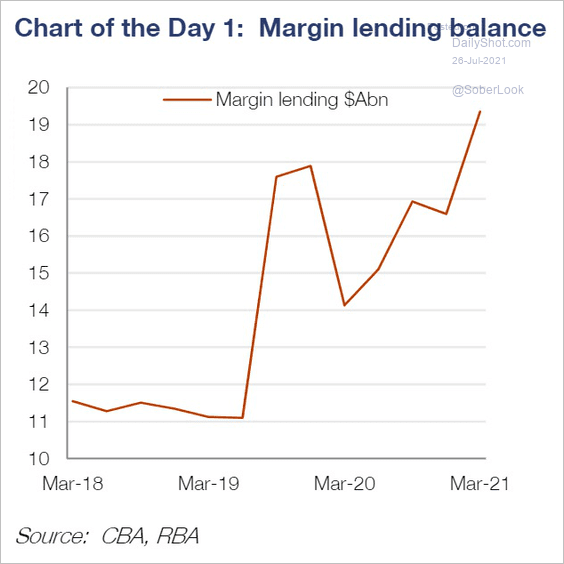

• Margin debt has been rising.

Source: @Scutty, @CommBank, @martin_whetton

Source: @Scutty, @CommBank, @martin_whetton

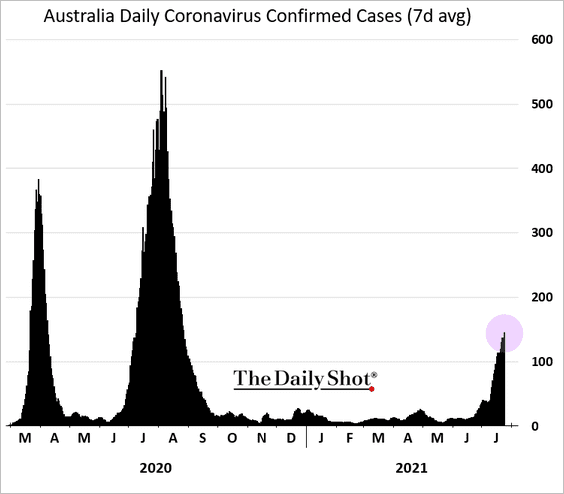

• The COVID situation is getting worse.

Source: Reuters Read full article

Source: Reuters Read full article

• The ANZ activity tracker tumbled to levels not seen since October 2020.

Source: @ANZ_Research, @DimesHayden

Source: @ANZ_Research, @DimesHayden

Back to Index

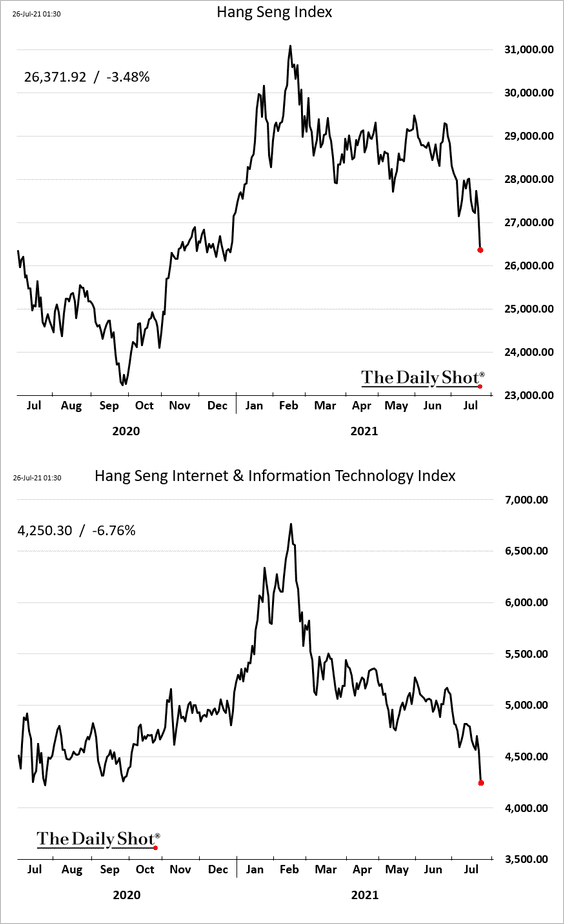

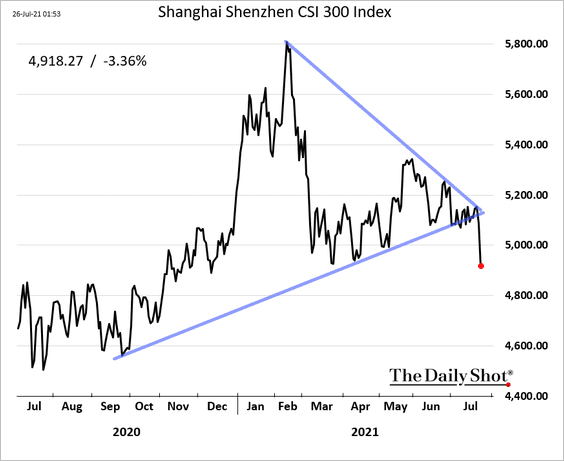

China

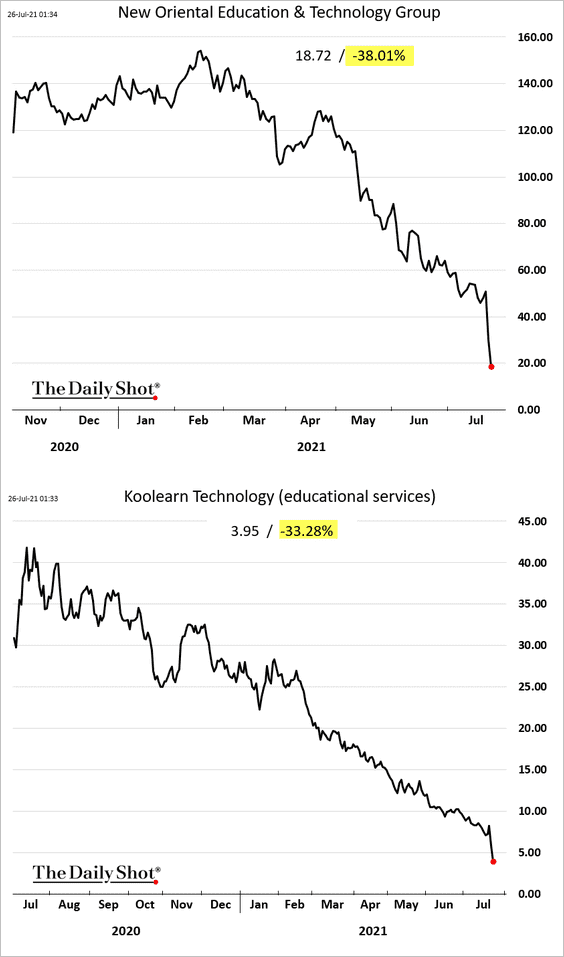

1. Education stocks are tumbling as Beijing cracks down (forcing them to become non-profit organizations).

Source: @WSJ Read full article

Source: @WSJ Read full article

And that’s dragging markets in Hong Kong and the mainland sharply lower.

——————–

2. Bond yields are drifting lower.

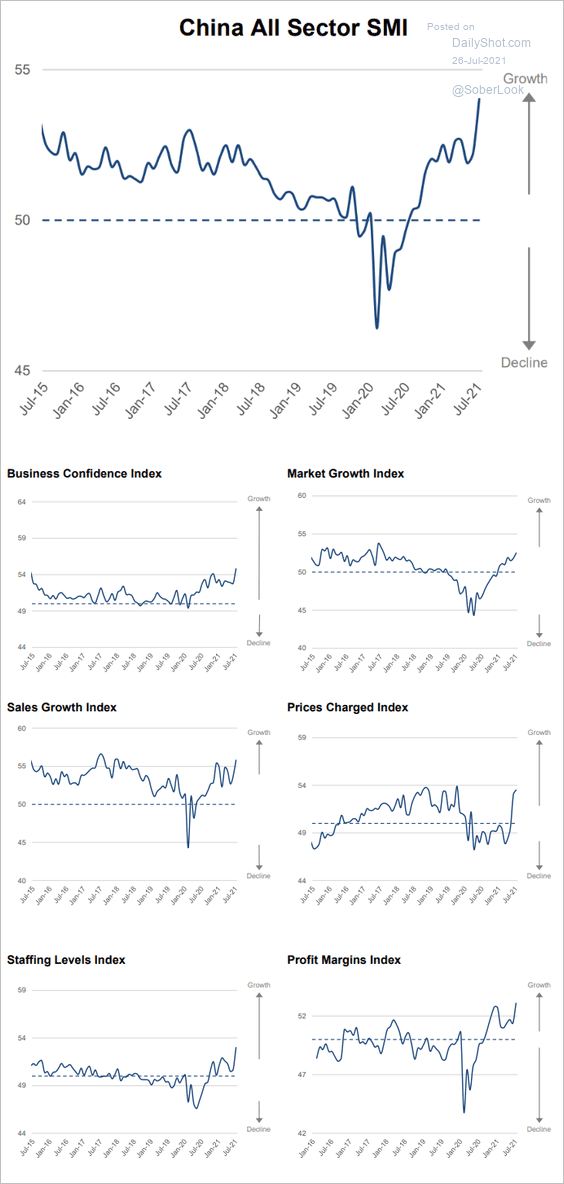

3. The World Economics SMI report shows acceleration in business activity this month. Hiring has strengthened.

Source: World Economics

Source: World Economics

4. China has been using cheap coal power to drive down polysilicon costs and dominate the global solar panel market.

![]() Source: @adam_tooze, @alexbhturnbull Read full article

Source: @adam_tooze, @alexbhturnbull Read full article

Back to Index

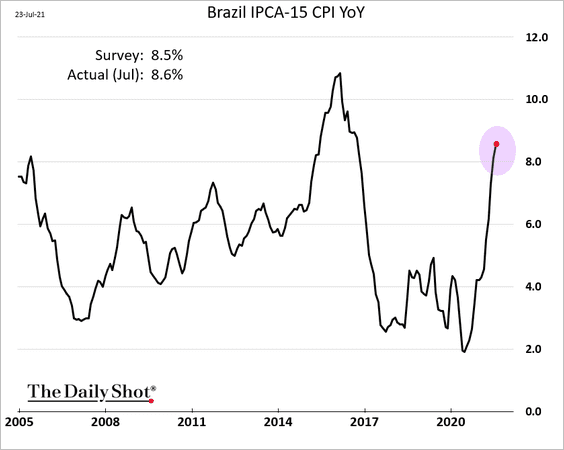

Emerging Market

1. Brazil’s inflation continues to climb.

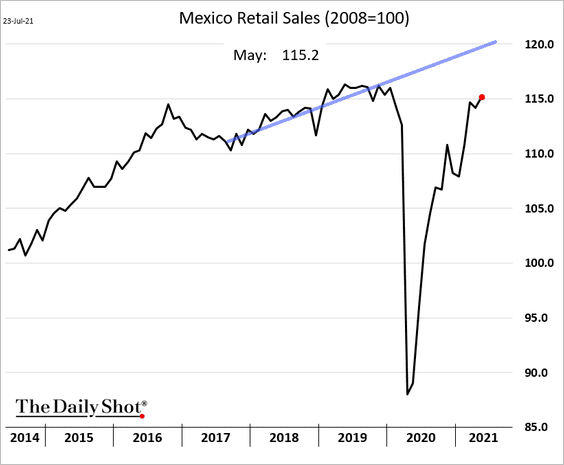

2. Mexican retail sales are near pre-COVID levels (but well below trend).

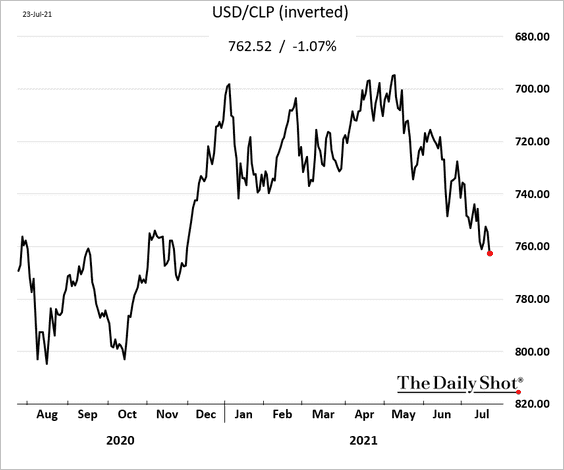

3. The Chilean peso remains under pressure.

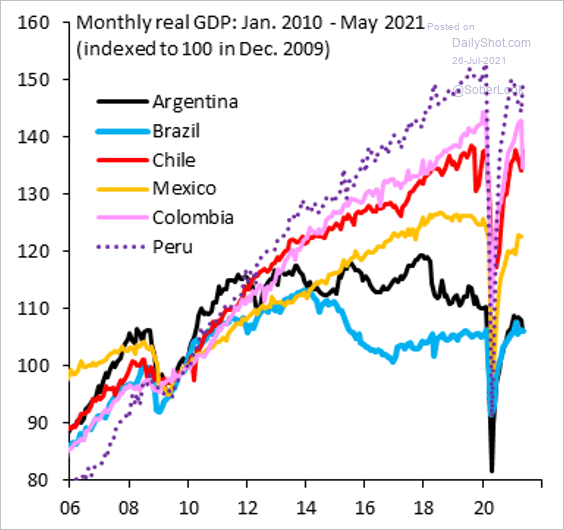

4. This chart shows real GDP growth in LatAm economies since 2009.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

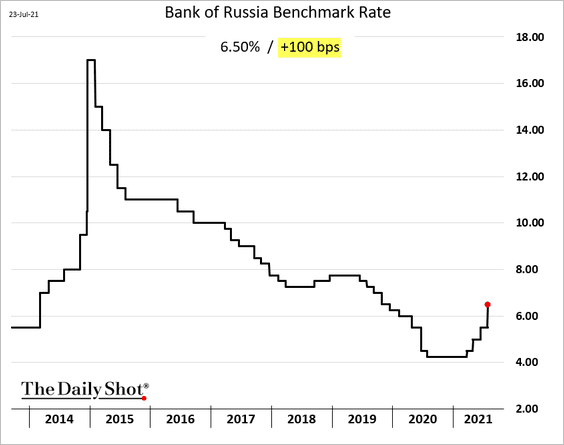

5. Russia’s central bank aggressively hiked rates (as expected) to combat rising inflation.

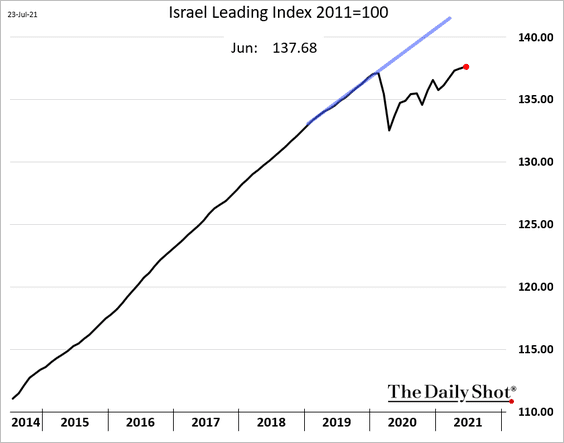

6. Israel’s leading index remains well below its pre-COVID trend.

Back to Index

Cryptocurrency

1. Bitcoin rallied sharply over the weekend and is now approaching $40k.

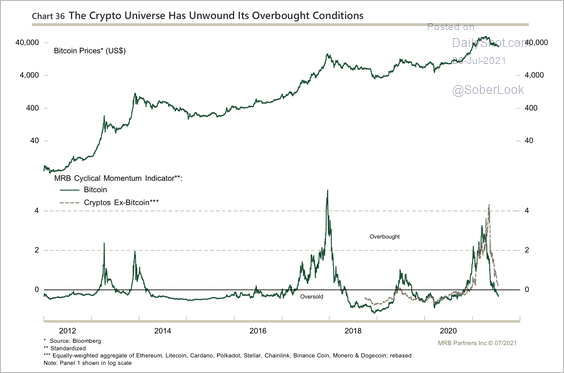

2. Cryptocurrencies appear oversold, although the cyclical trend is still facing downward pressure, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

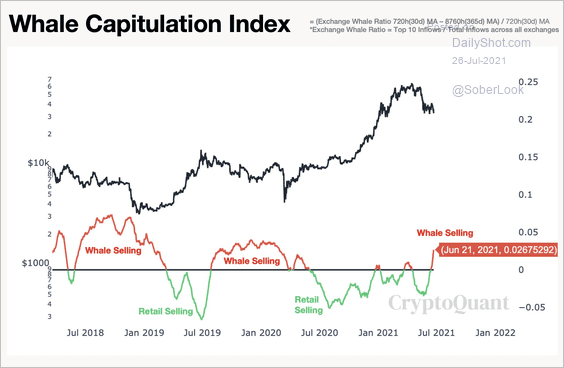

3. A significant number of “whales” (large holders) are sending BTC to exchanges, which typically means an intention to sell rather than hold in digital wallets.

Source: @ki_young_ju

Source: @ki_young_ju

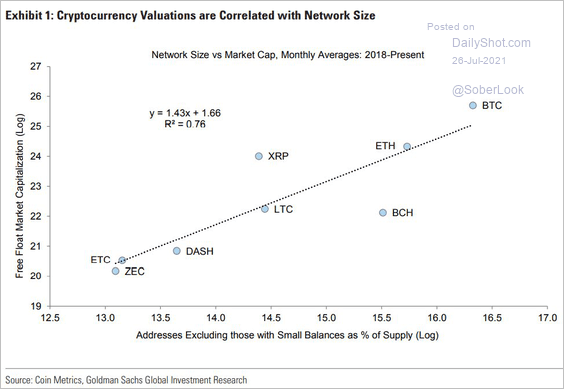

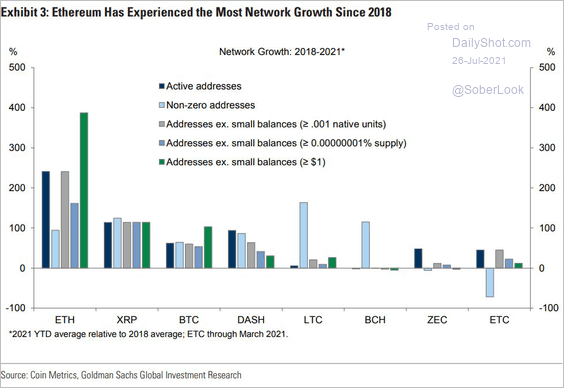

4. Crypto valuations are correlated with network size.

Source: Goldman Sachs; @MichaelRinko

Source: Goldman Sachs; @MichaelRinko

Ethereum has experienced the most network growth.

Source: Goldman Sachs; @MichaelRinko

Source: Goldman Sachs; @MichaelRinko

——————–

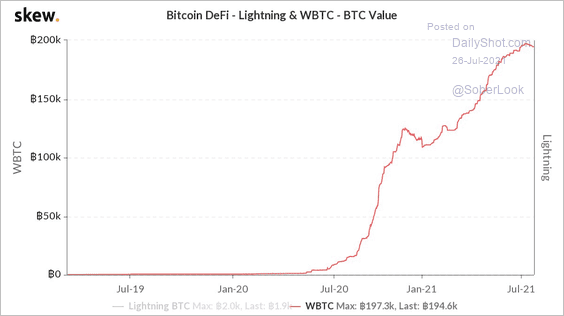

5. Over the past year, nearly BTC 200k has been wrapped on the Ethereum blockchain.

Source: @skew

Source: @skew

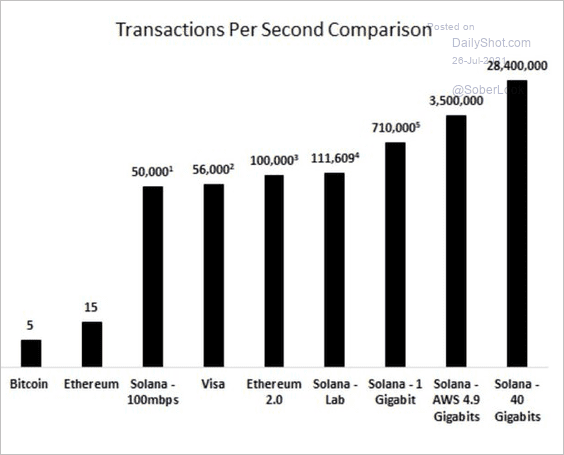

6. Below is a comparison of network transaction speeds.

Source: @TeddyVallee, @MichaelRinko

Source: @TeddyVallee, @MichaelRinko

Back to Index

Commodities

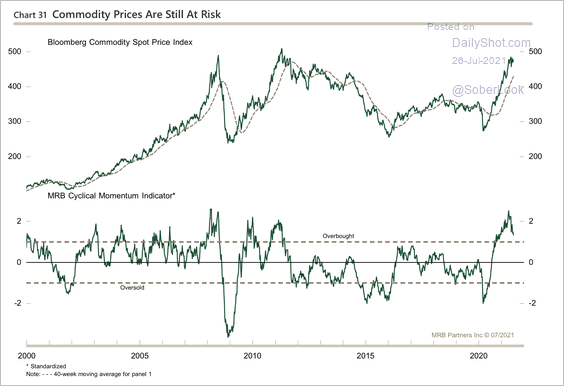

1. Commodities appear extremely overbought.

Source: MRB Partners

Source: MRB Partners

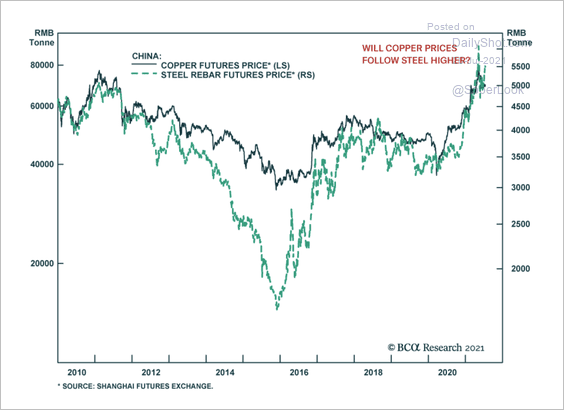

2. Are steel prices pointing to another leg up in metals?

Source: BCA Research

Source: BCA Research

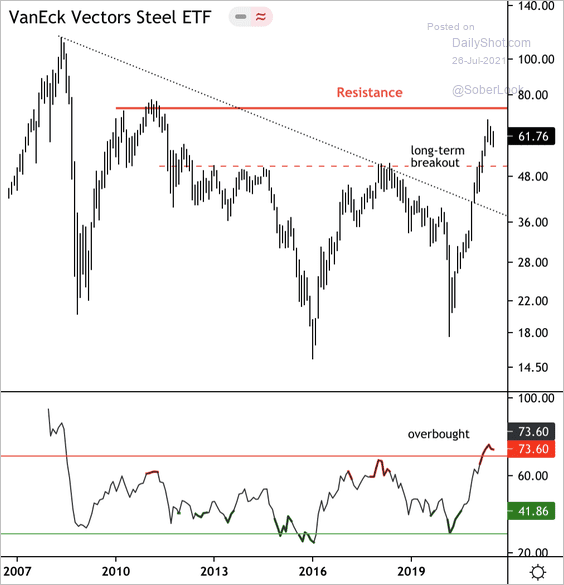

The VanEck Vectors Steel ETF (SLX) is testing resistance.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

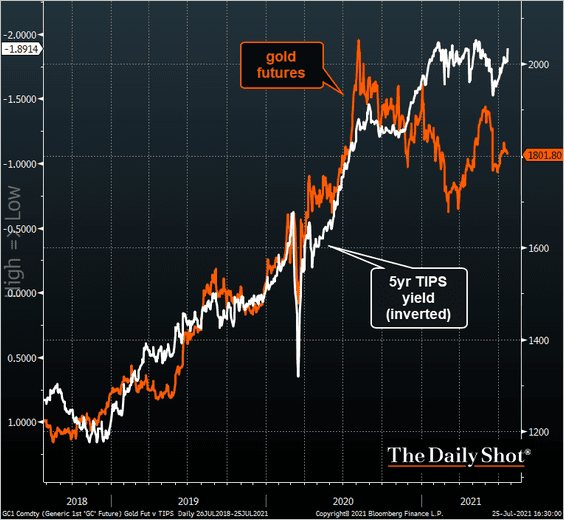

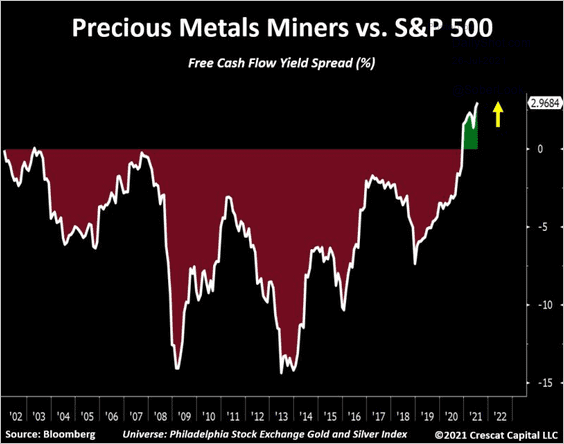

3. Next, we have some updates on precious metals.

• Gold vs. TIPS yield (US implied real rates):

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

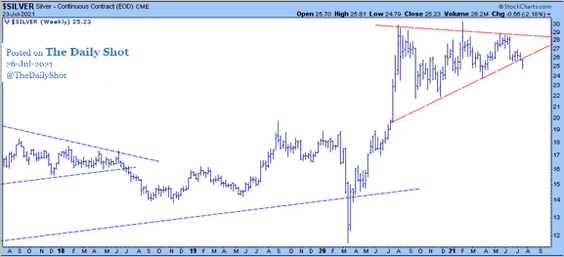

• Silver breakdown?

Source: @sunchartist

Source: @sunchartist

• Precious metals miners’ free cash flow spread to the S&P 500:

Source: @TaviCosta

Source: @TaviCosta

Back to Index

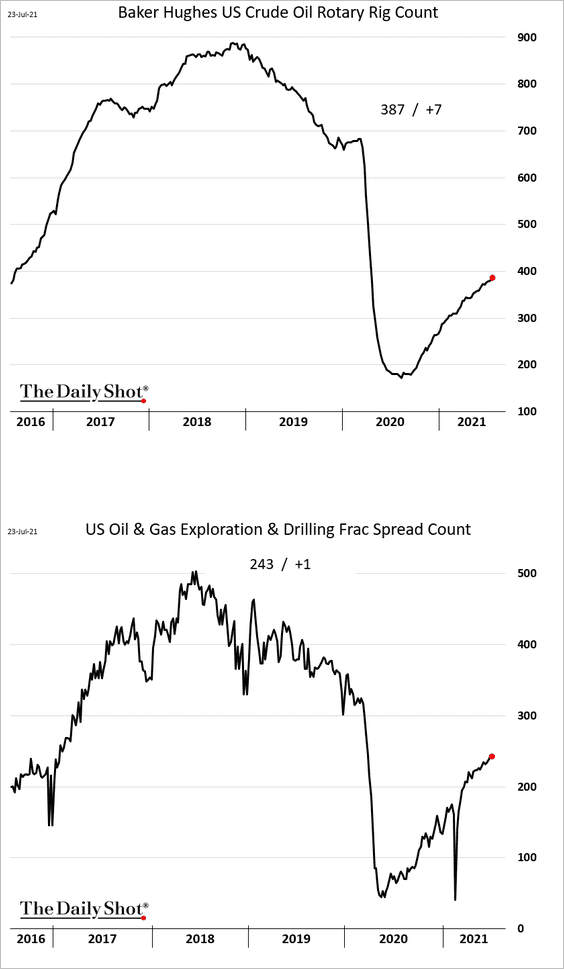

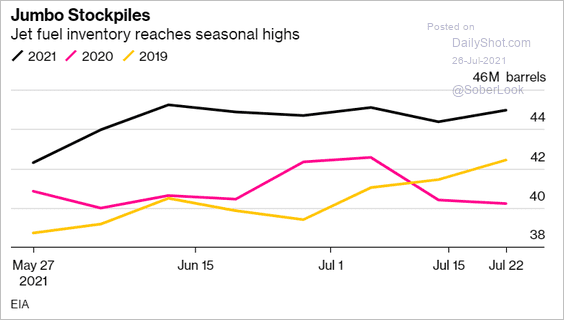

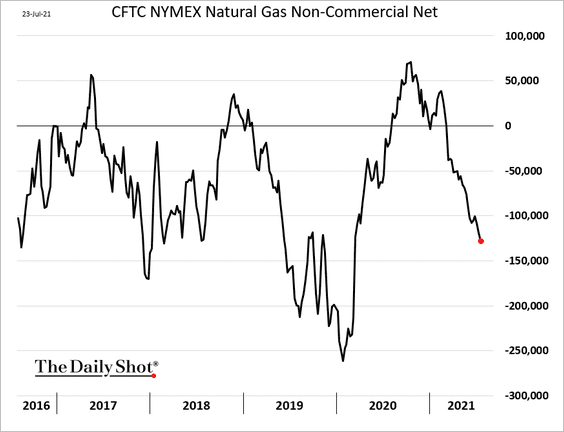

Energy

1. US rig count and frac spreads continue to recover.

2. Jet fuel inventory remains elevated.

Source: @markets Read full article

Source: @markets Read full article

3. Speculative accounts continue to increase their bets against US natural gas.

Back to Index

Equities

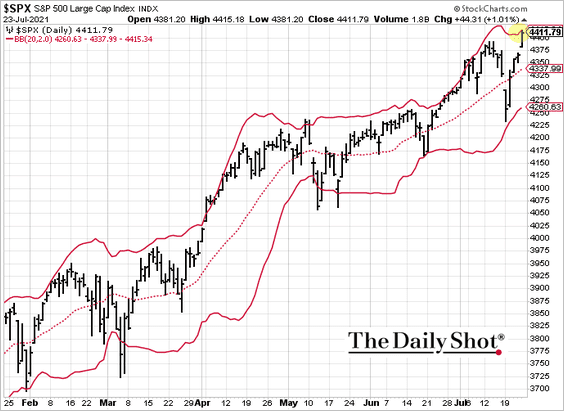

1. The S&P 500 hit another record high and is now back at the upper Bollinger Band.

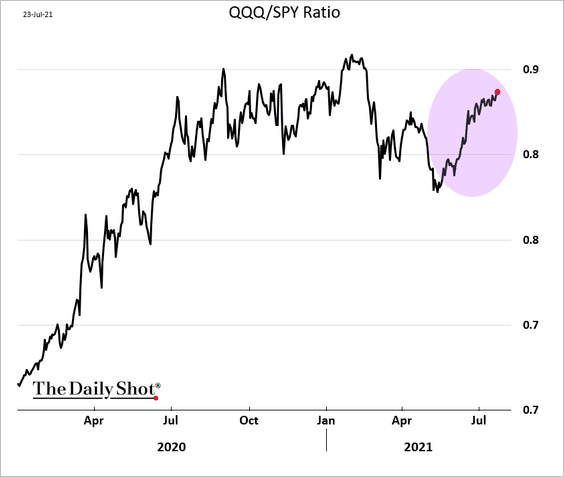

The largest growth stocks continue to lead the rally.

——————–

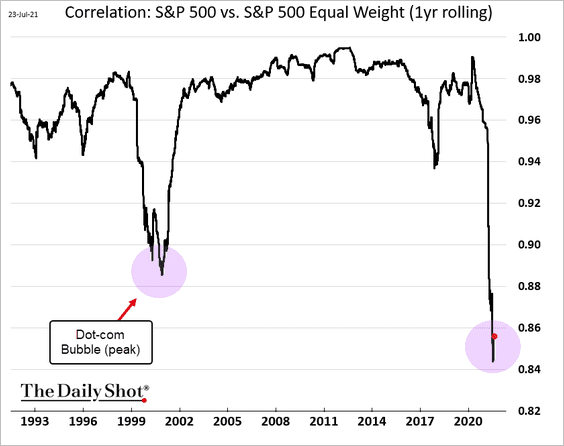

2. The correlation between the S&P 500 and the equal-weight index has been unusually low.

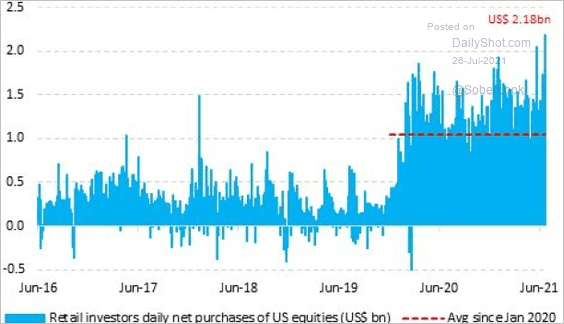

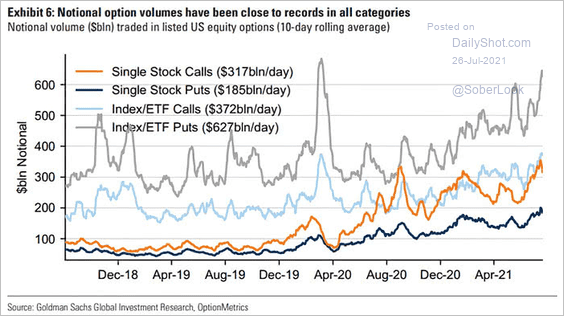

3. Forget the Fed Put – we now have the “retail put.” Retail investors have been consistently buying market dips.

Source: Vanda Research, Bloomberg Read full article

Source: Vanda Research, Bloomberg Read full article

Call options allow retail investors to punch above their weight.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

4. The S&P 500 dividend yield is the lowest in a couple of decades.

Source: @sunchartist

Source: @sunchartist

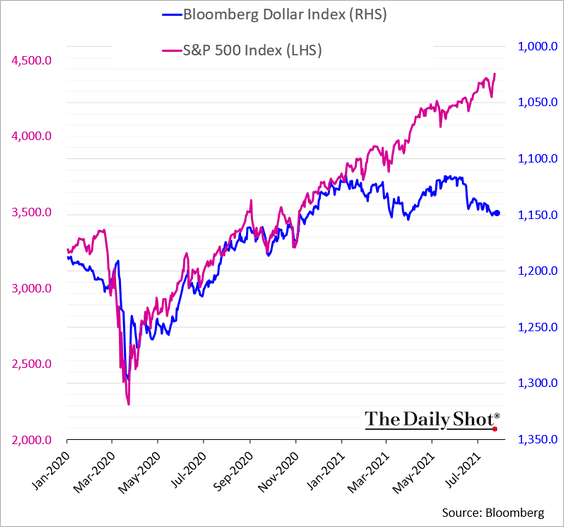

5. The rising US dollar hasn’t been pressuring stocks (for now).

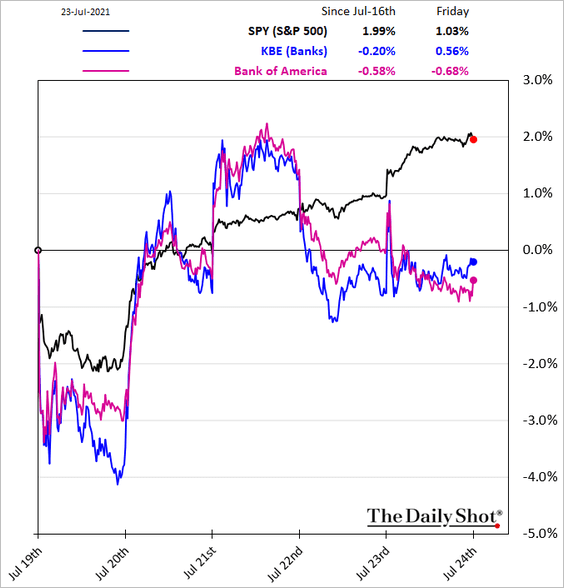

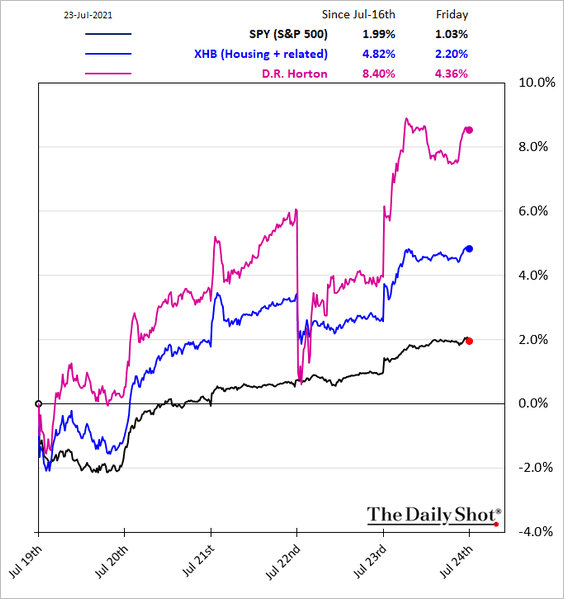

6. Next, we have some sector updates.

• Banks:

• Housing:

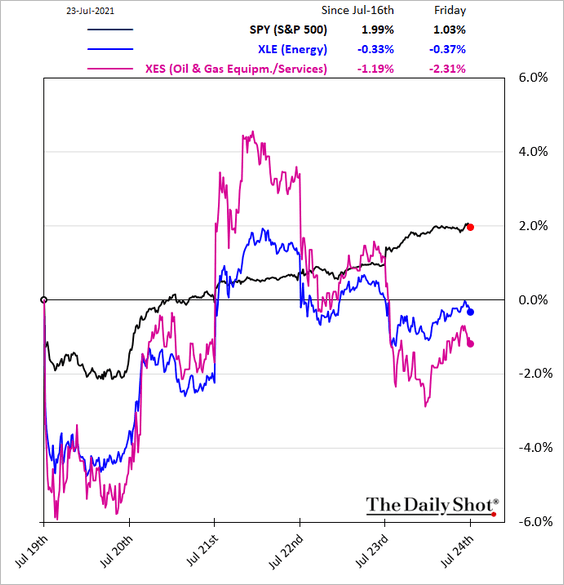

• Energy:

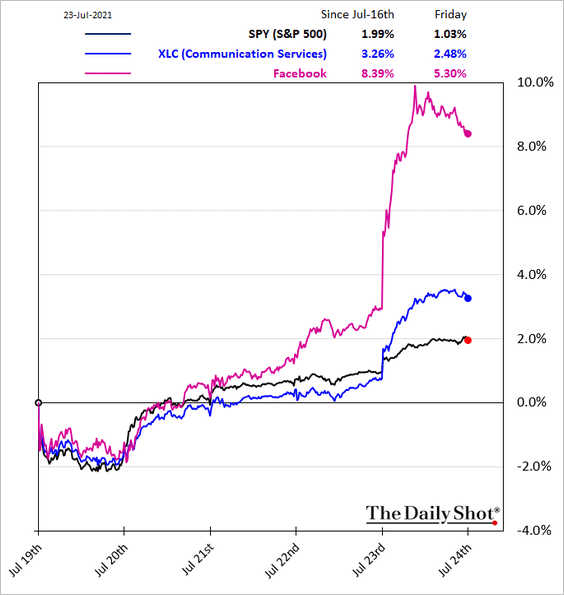

• Communication Services:

——————–

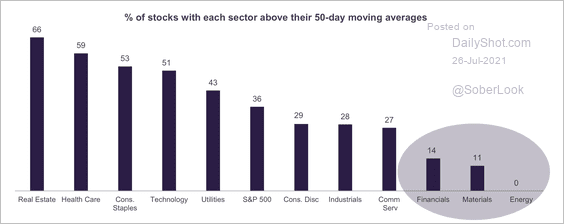

7. Cyclical sectors have not participated in the broader market rise in recent weeks. Typically, sectors become oversold when the percentage of stocks above the 50-day moving average is lower than 20% to 30%, according to Truist.

Source: Truist Advisory Services

Source: Truist Advisory Services

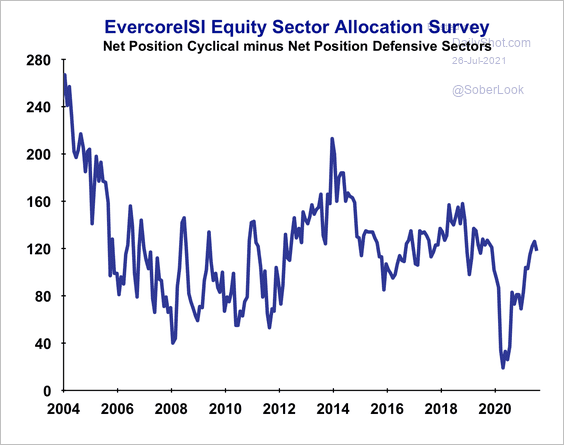

Long-only investors have cut back on cyclicals relative to defensives last month, according to an Evercore ISI survey.

Source: Evercore ISI

Source: Evercore ISI

——————–

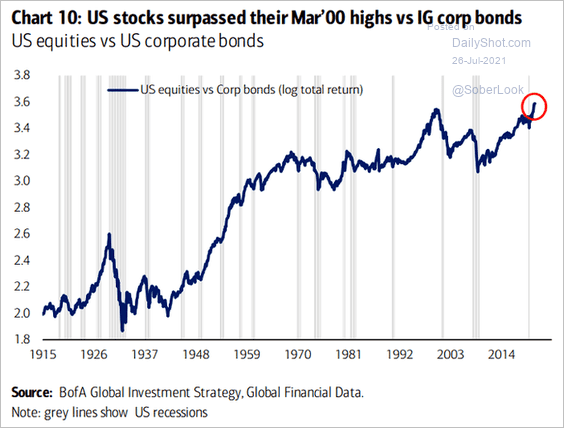

8. This chart shows US equities vs. corporate bonds.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Back to Index

Rates

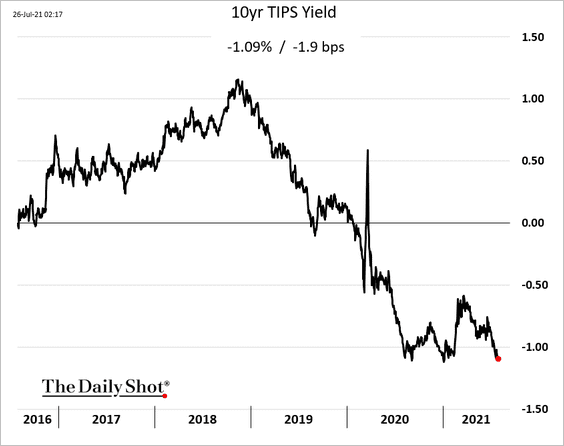

1. The 10yr TIPS yield (US real rate) is near all-time lows.

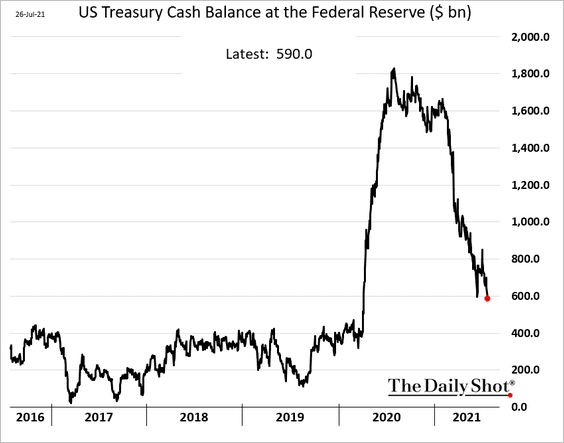

2. The US Treasury’s cash balances at the Fed continue to shrink.

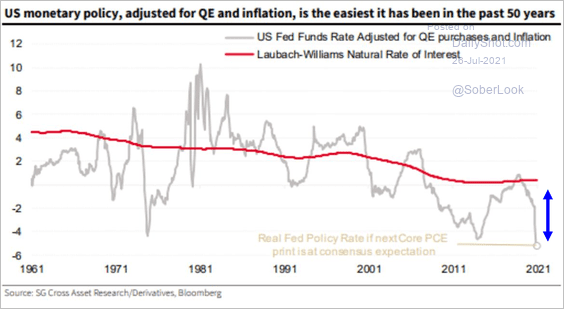

3. The US monetary policy is extraordinarily accommodative.

Source: SG Cross Asset Research; @jessefelder, Bloomberg Read full article

Source: SG Cross Asset Research; @jessefelder, Bloomberg Read full article

Back to Index

Global Developments

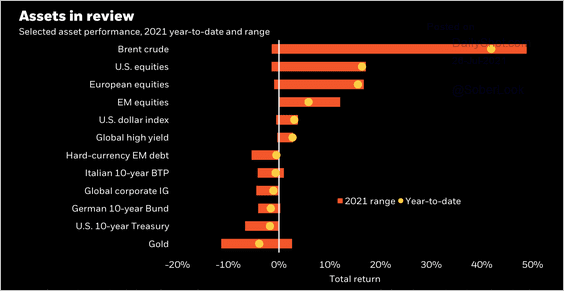

1. Here is a look at asset returns year-to-date relative to their 2021 range so far.

Source: BlackRock

Source: BlackRock

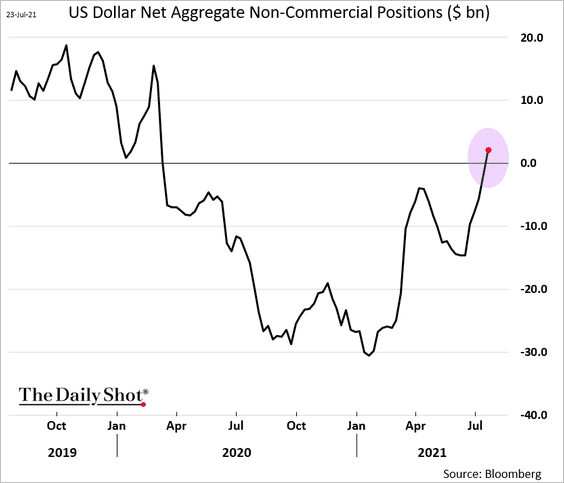

2. Speculative accounts are now net long the US dollar.

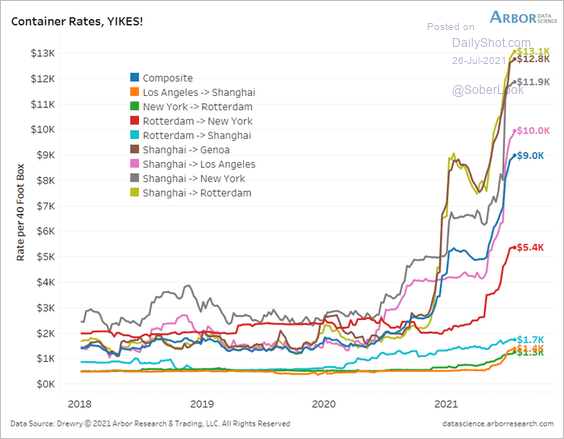

3. Container rates appear to be peaking.

Source: @benbreitholtz

Source: @benbreitholtz

Back to Index

Food for Thought

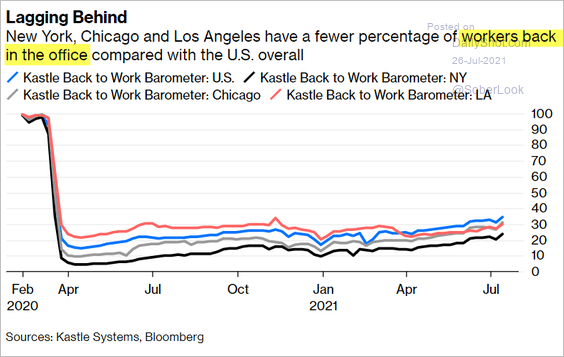

1. Percentage of workers back in the office:

Source: @BobOnMarkets, @bopinion Read full article

Source: @BobOnMarkets, @bopinion Read full article

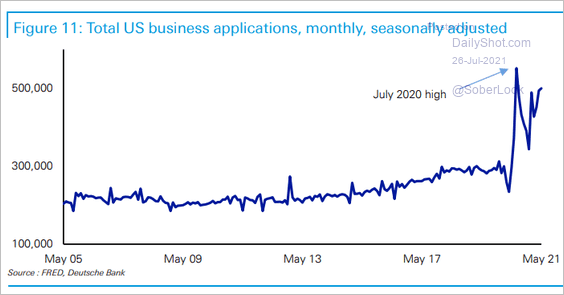

2. US business applications:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

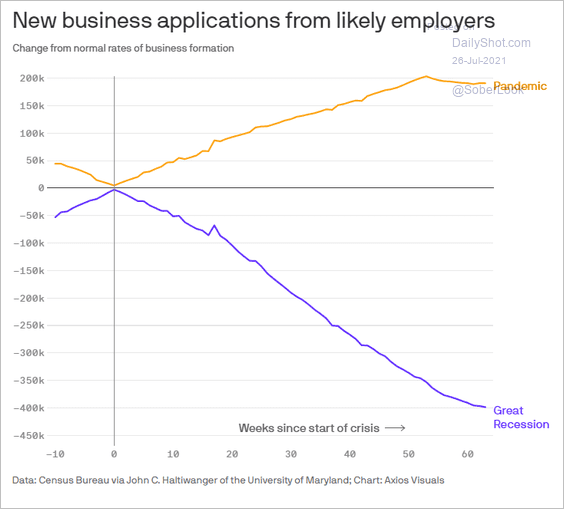

Source: @axios Read full article

Source: @axios Read full article

——————–

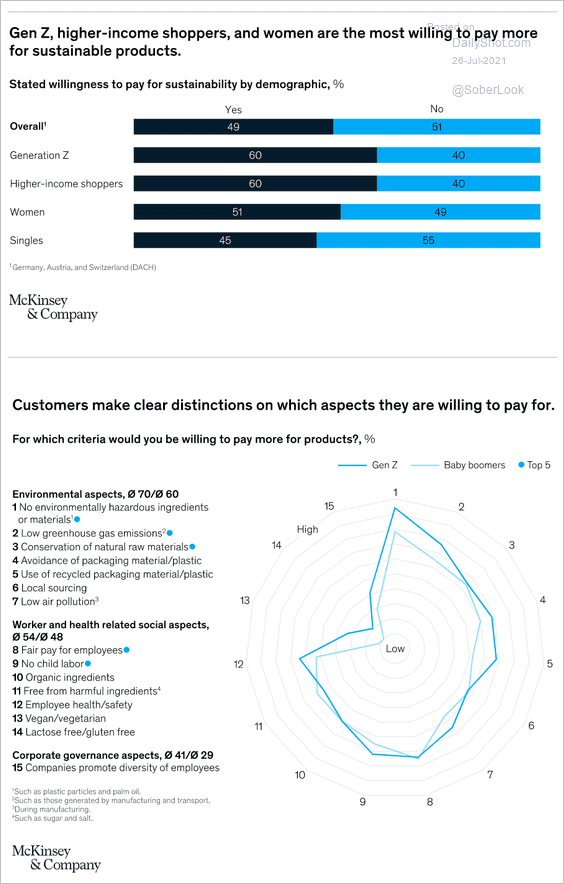

3. Willingness to pay more for sustainable products (in Europe):

Source: McKinsey Read full article

Source: McKinsey Read full article

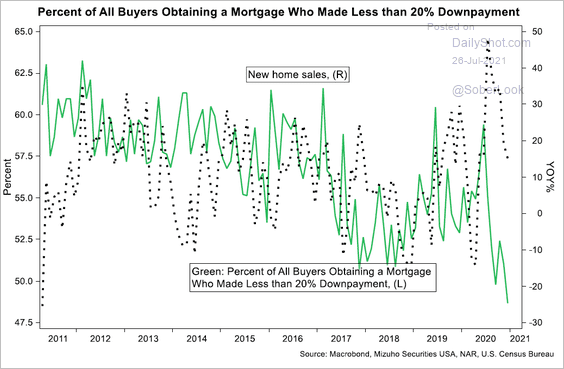

4. US homebuyers with less than a 20% downpayment:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

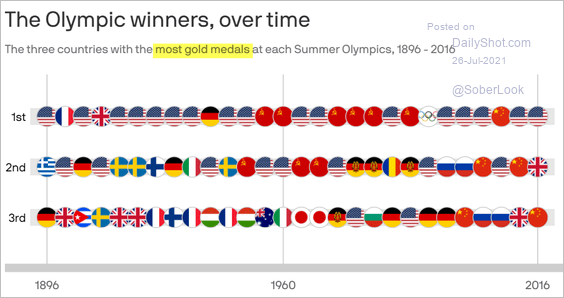

5. Countries with most Olympic gold medals over time:

Source: @axios Read full article

Source: @axios Read full article

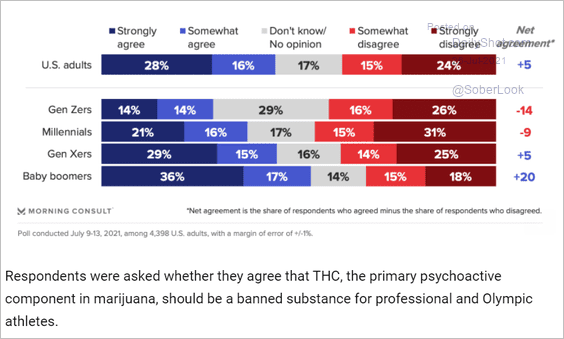

6. Should Olympic athletes be allowed to use marijuana?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

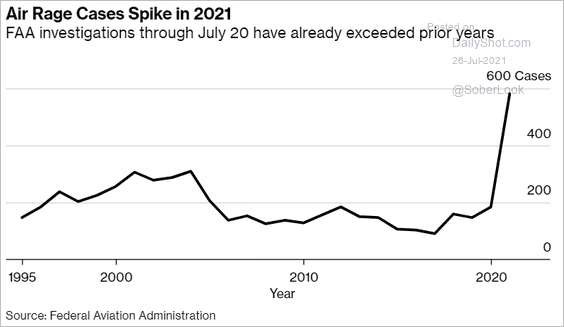

7. US air rage cases:

Source: @business Read full article

Source: @business Read full article

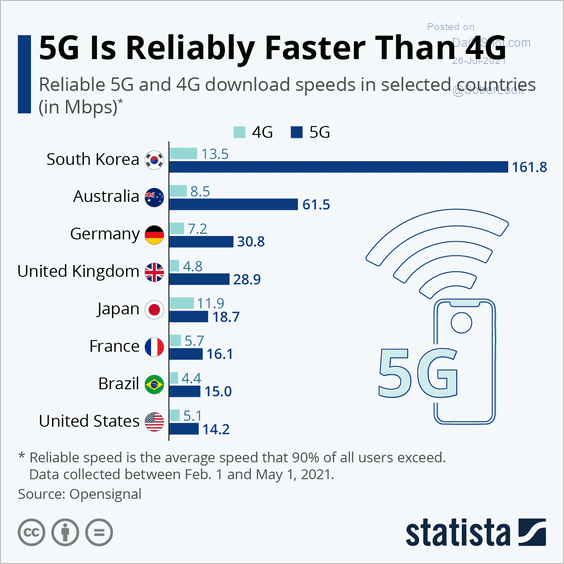

8. 4G vs. 5G download speeds:

Source: Statista

Source: Statista

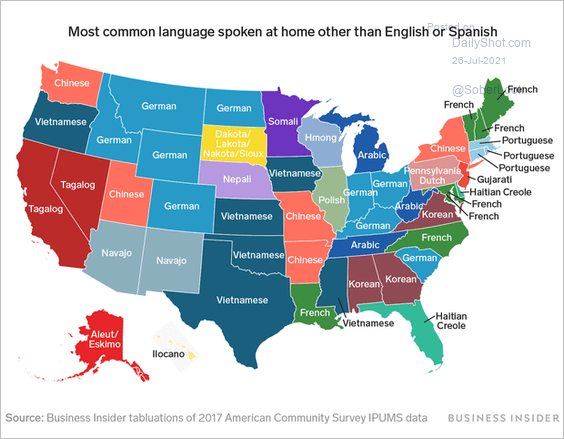

9. The most common language spoken at home other than English or Spanish:

Source: Markets Insider Read full article

Source: Markets Insider Read full article

——————–

Back to Index