The Daily Shot: 28-Jul-21

• The United States

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

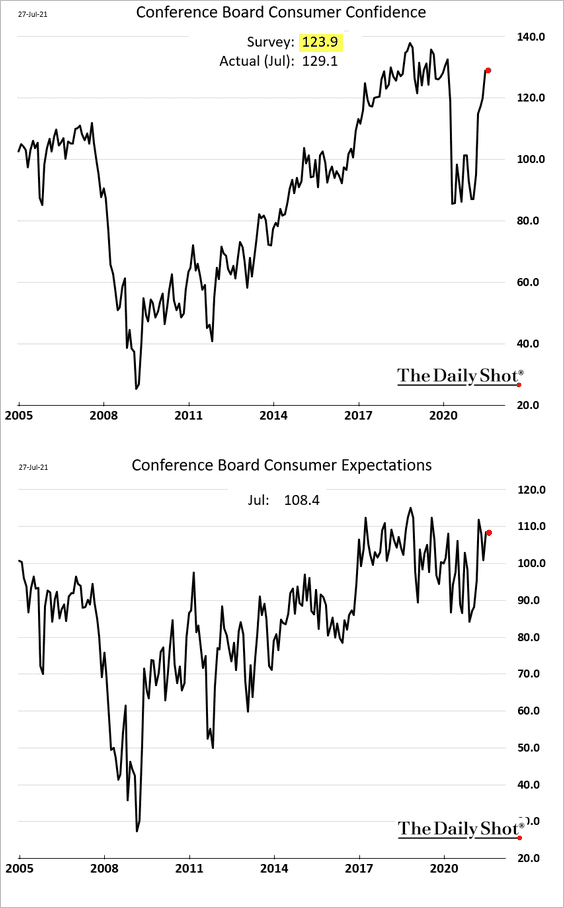

1. Despite increasing COVID cases, the Conference Board’s consumer confidence index is holding near pre-pandemic levels (exceeding forecasts).

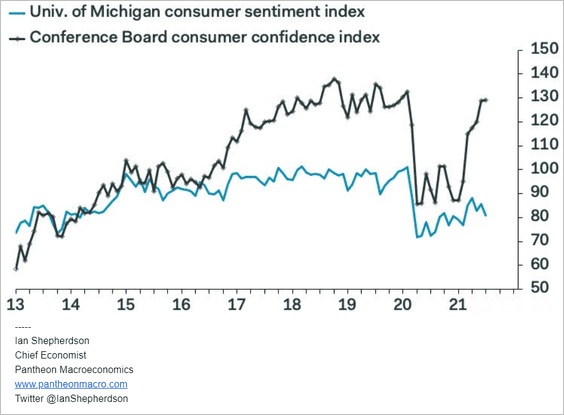

• This indicator continues to diverge from U. Michigan’s measure.

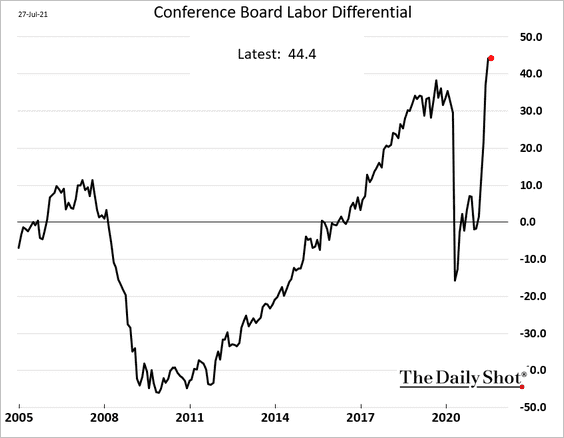

• The labor differential (“jobs plentiful” – “jobs hard to get”) remains elevated.

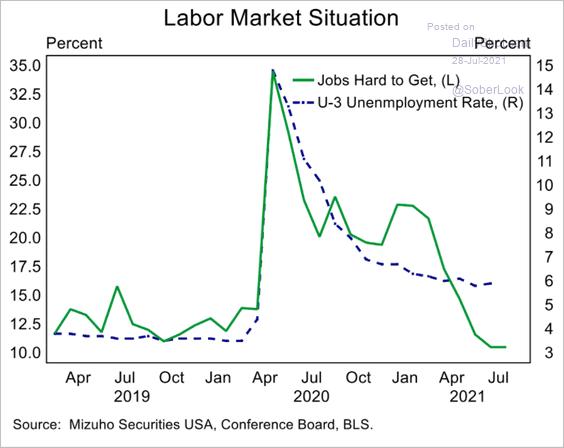

The “jobs hard to get” indicator suggests that the unemployment rate should be significantly lower.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

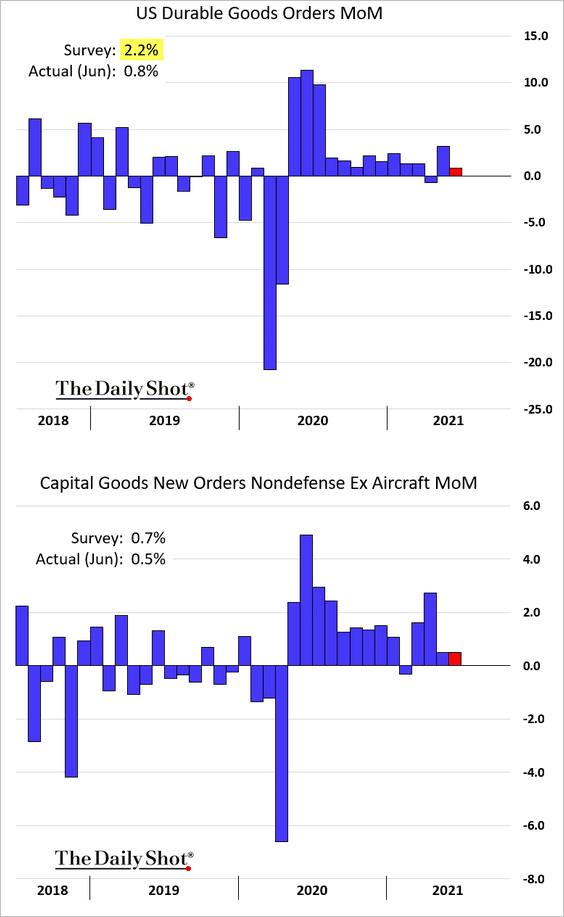

2. Durable goods orders were weaker than expected.

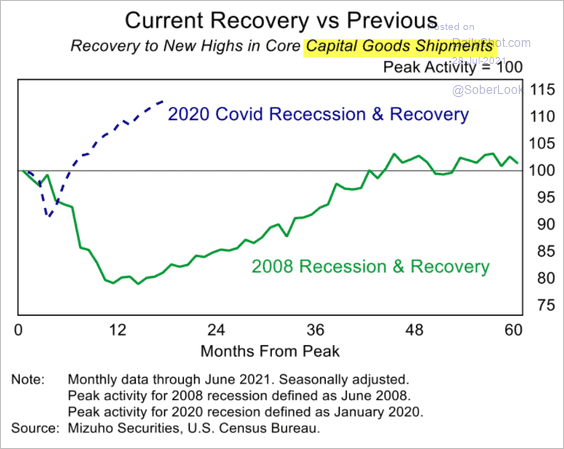

Nonetheless, the rebound in capital goods orders during this recovery has been remarkably strong.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

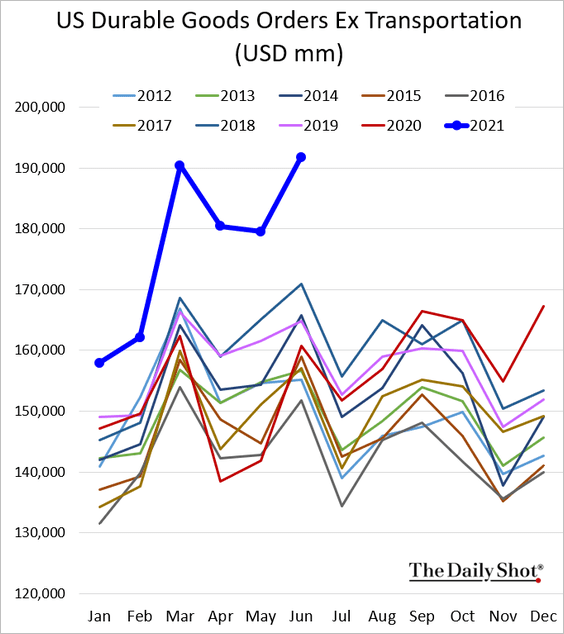

This chart shows durable goods orders without seasonal adjustments.

——————–

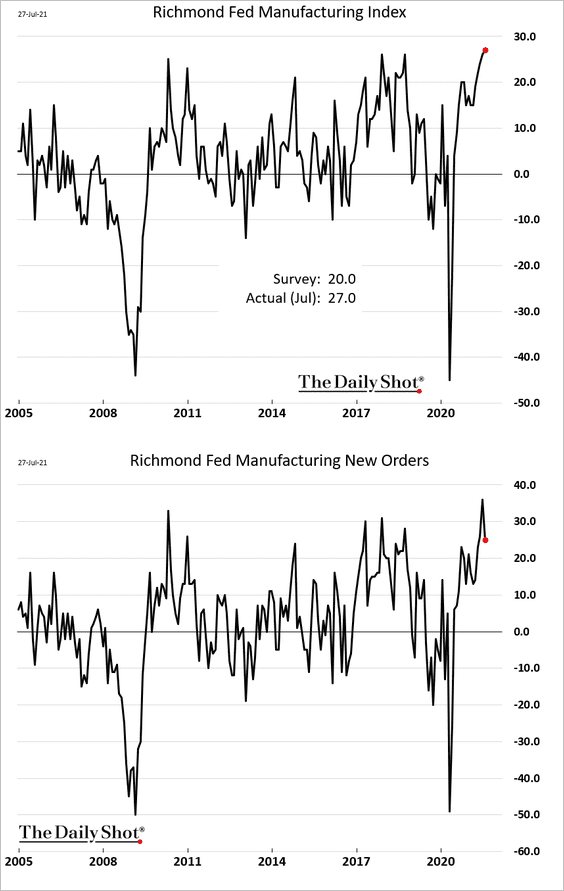

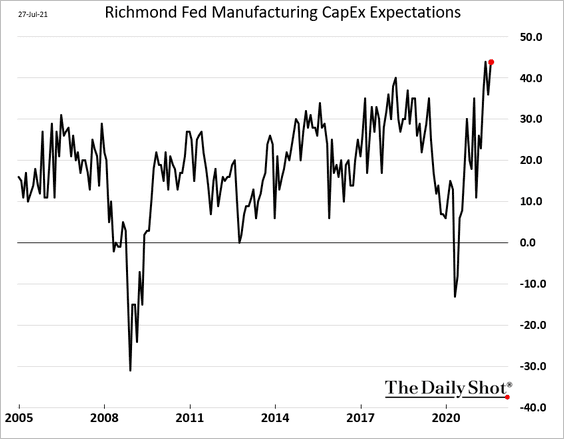

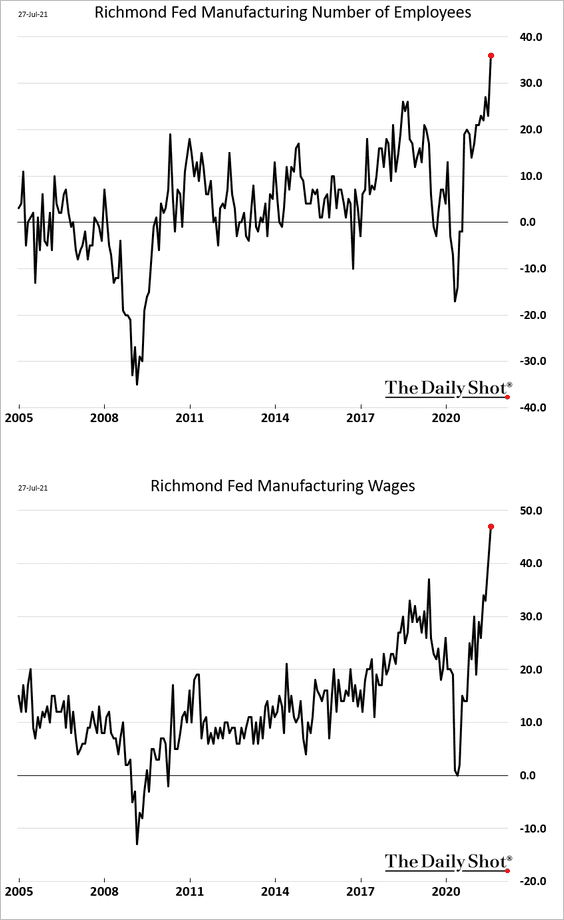

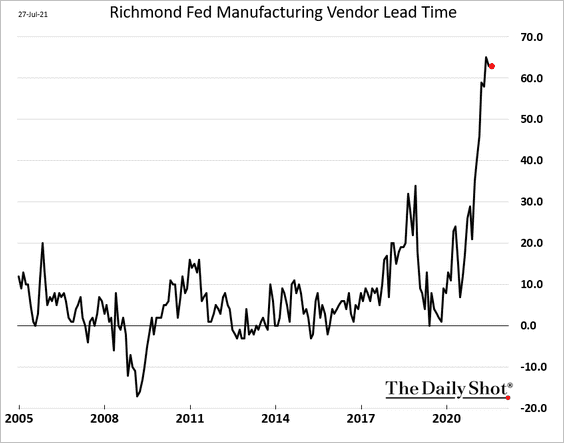

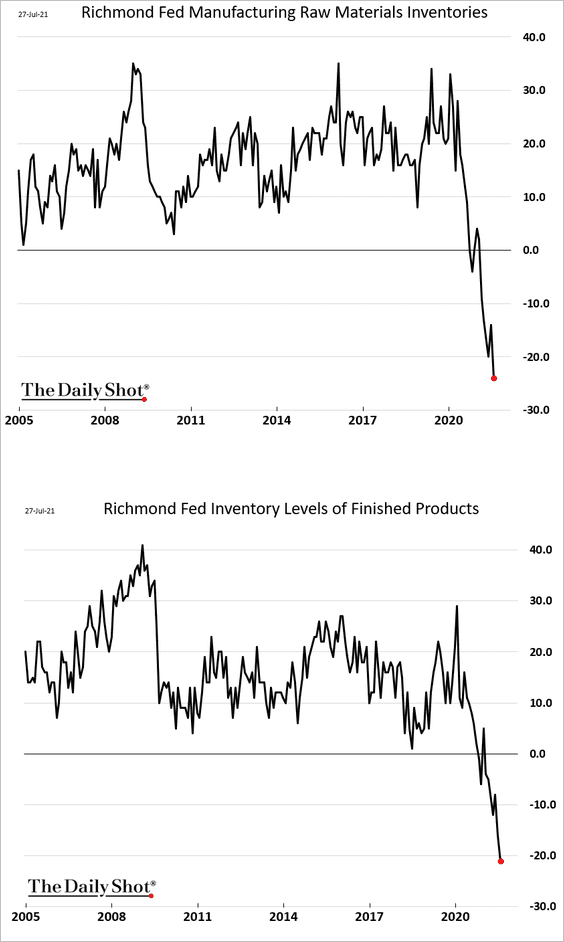

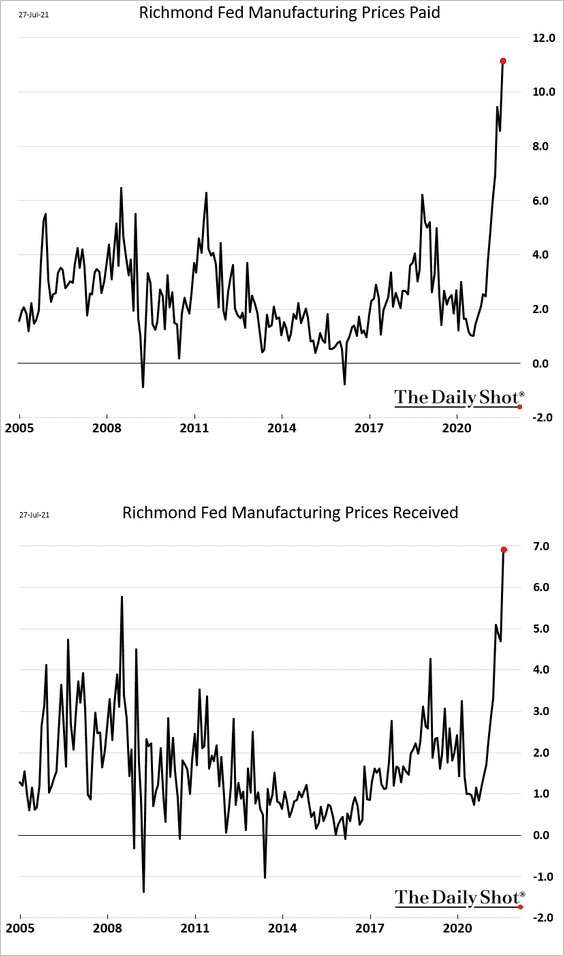

3. The Richmond Fed’s manufacturing index surprised to the upside this month, although new orders growth moderated.

• CapEx expectations remain robust.

• Indicators of hiring and wage increases are soaring.

• Supply bottlenecks continue to plague manufacturers in the region.

– Supplier lead times:

– Inventories:

• Price pressures are hitting extreme levels.

——————–

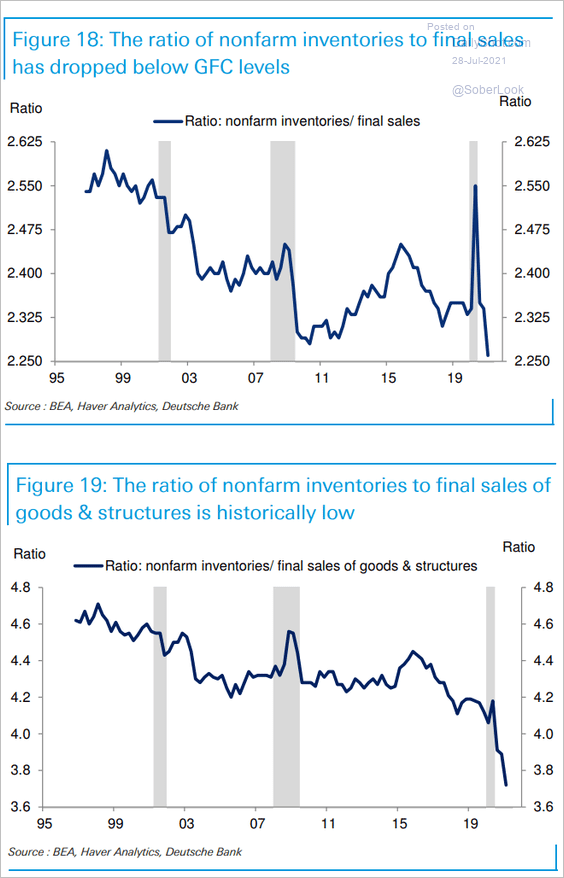

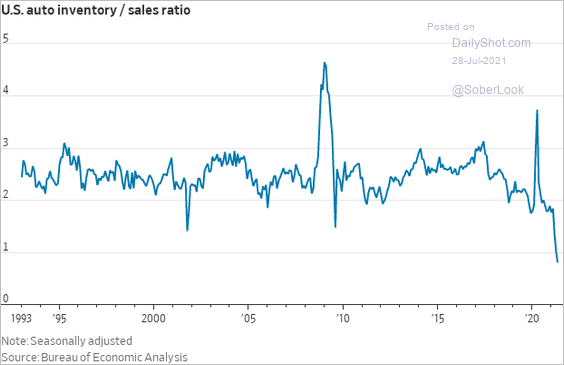

4. At the national level, inventories-to-sales ratios are at record lows.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: @WSJ Read full article

Source: @WSJ Read full article

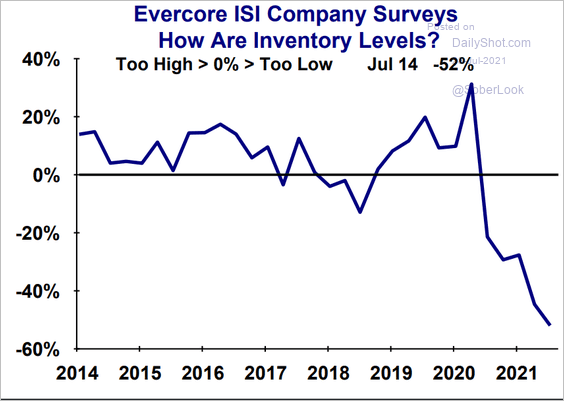

• Here is the Evercore ISI business survey question about inventory levels.

Source: Evercore ISI

Source: Evercore ISI

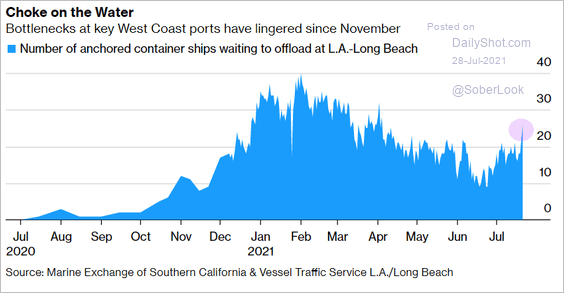

• Bottlenecks at West Coast ports persist.

Source: @markets Read full article

Source: @markets Read full article

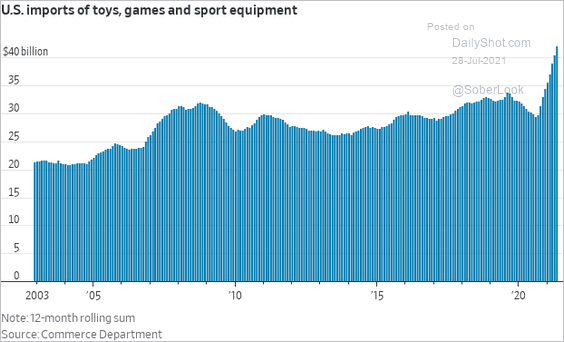

• Some of the tightness is driven by consumer demand for imports. This chart shows US imports of toys, games, and sports equipment.

Source: @WSJ Read full article

Source: @WSJ Read full article

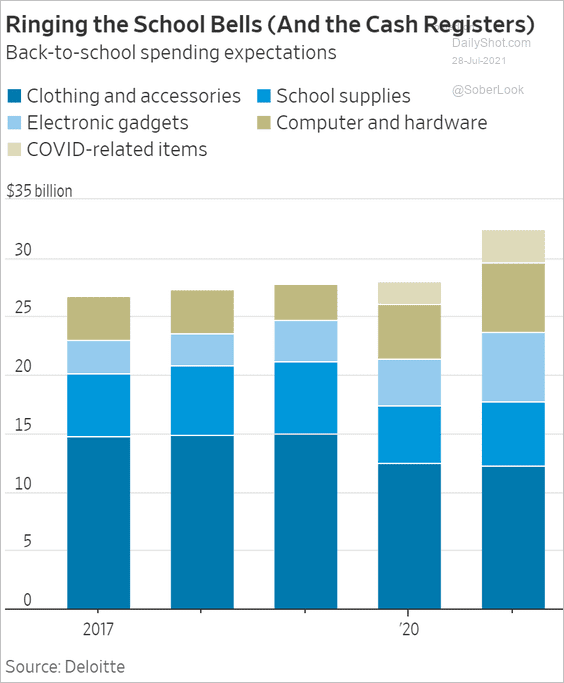

• And increased back-to-school spending expectations are adding to the need to rebuild inventories.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

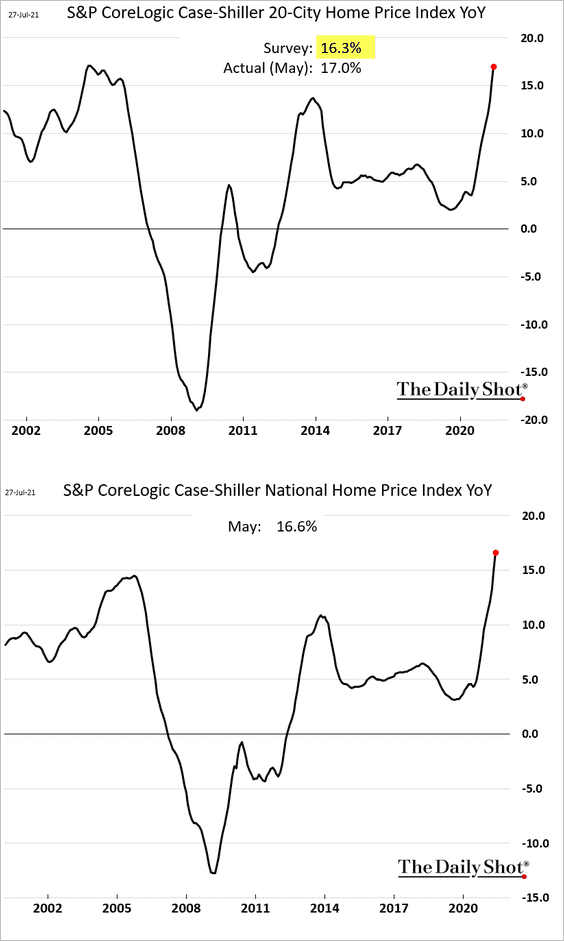

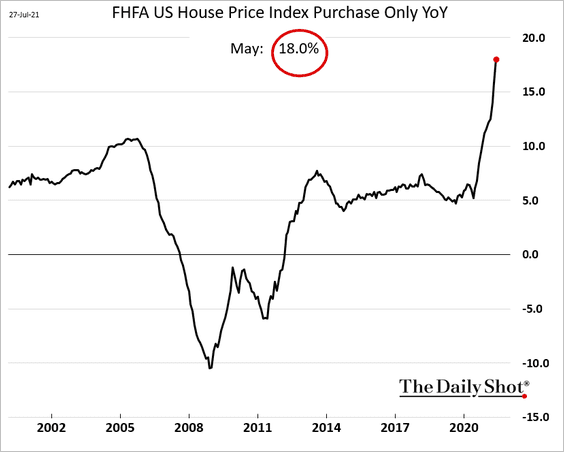

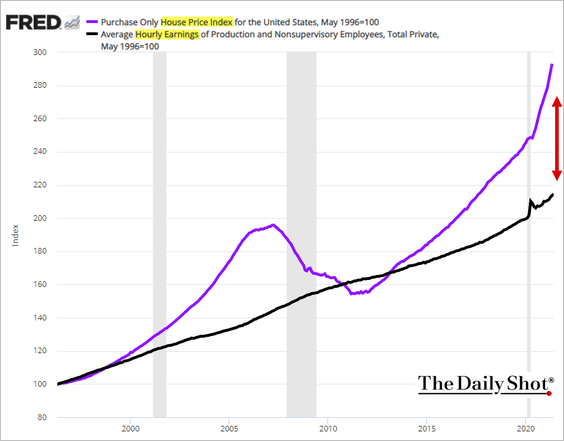

5. Once again, the Case-Shiller home price appreciation report surprised to the upside.

Here is a similar index from the FHFA.

The massive divergence between housing prices and wages is not sustainable. Home price appreciation should begin to moderate shortly.

Back to Index

The United Kingdom

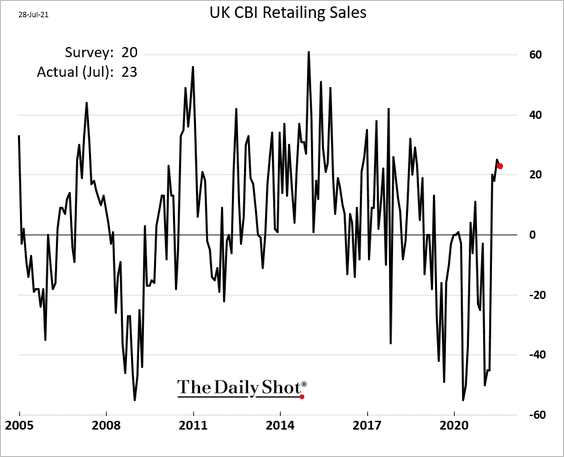

1. UK retail sales remain robust, with the July CBI report exceeding forecasts.

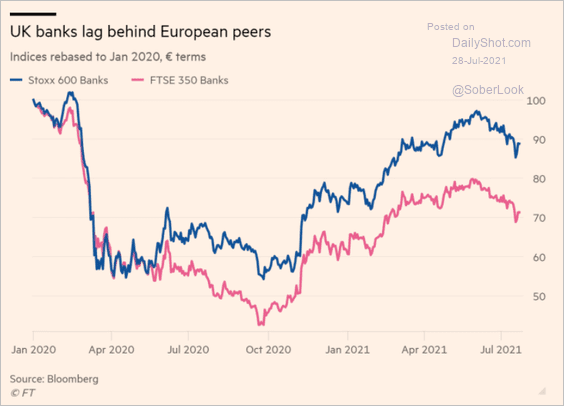

2. Bank shares continue to underperform EU peers.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

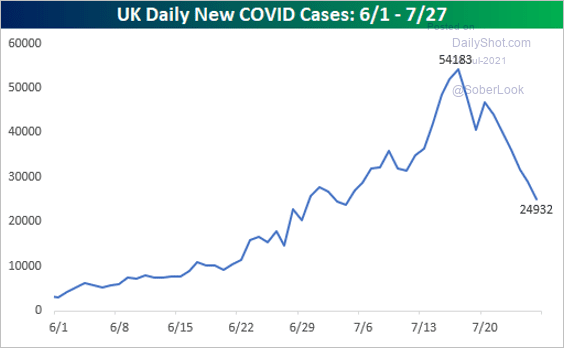

3. COVID cases are rapidly declining.

Source: @bespokeinvest

Source: @bespokeinvest

Back to Index

The Eurozone

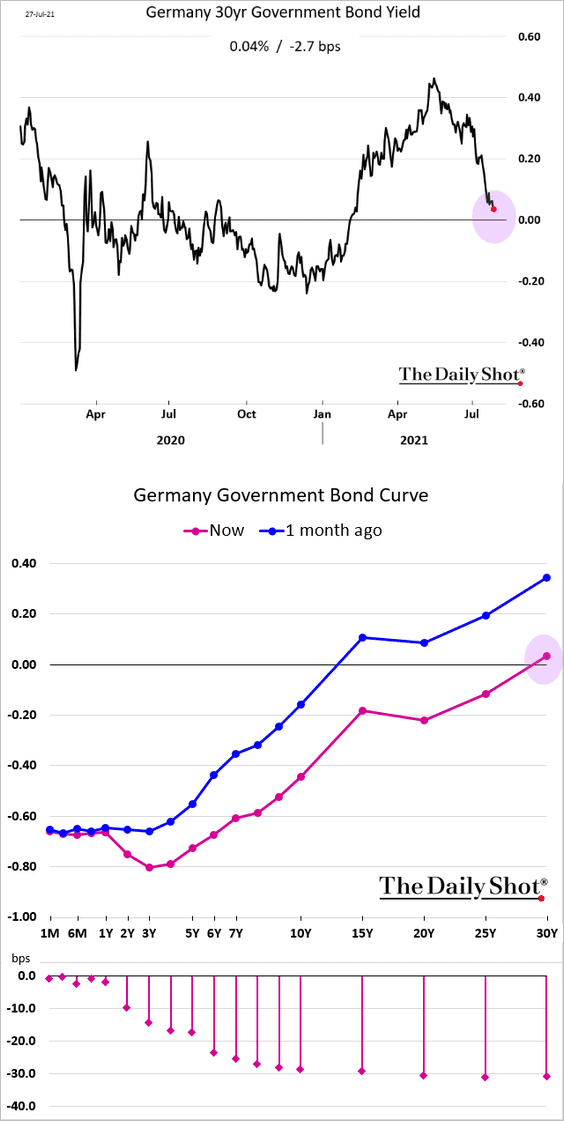

1. The whole Bund curve is about to go negative.

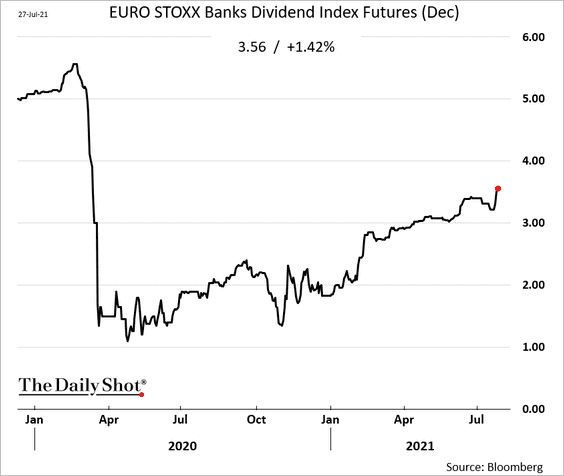

2. The market is becoming more upbeat about bank dividends.

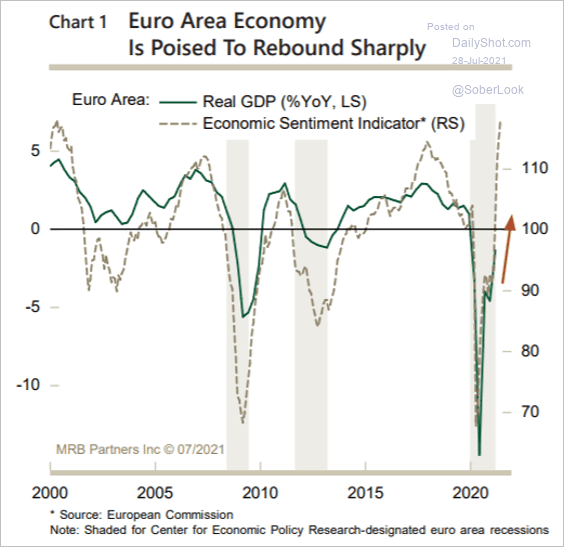

3. The recent spike in positive economic sentiment points to a rebound in GDP growth.

Source: MRB Partners

Source: MRB Partners

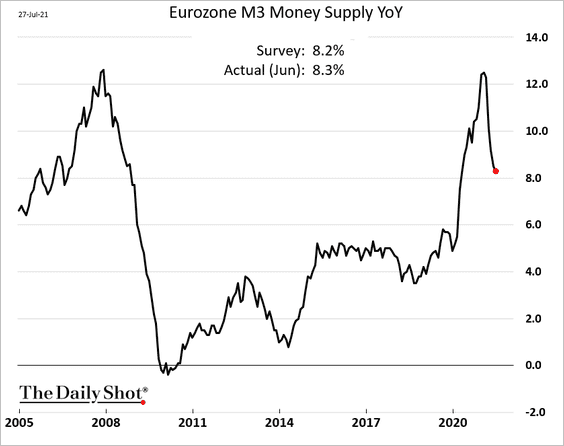

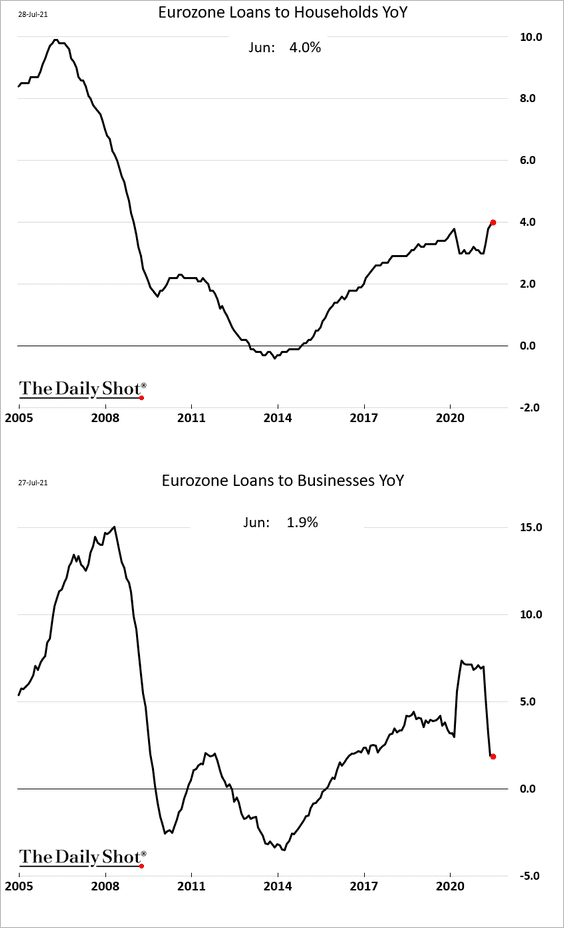

4. The rate of expansion in the euro-area broad money supply has been moderating.

Loan growth trends have diverged.

——————–

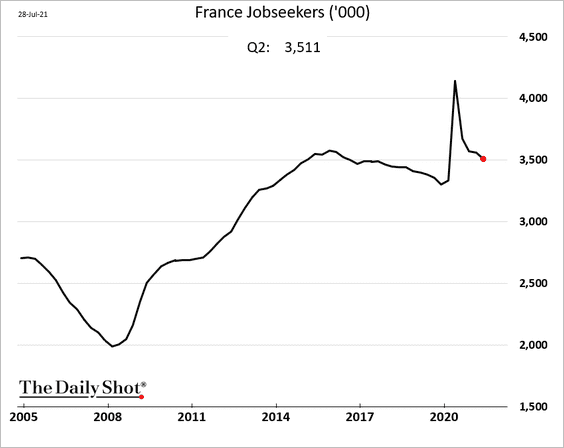

5. The number of job seekers in France is declining but remains above pre-COVID levels.

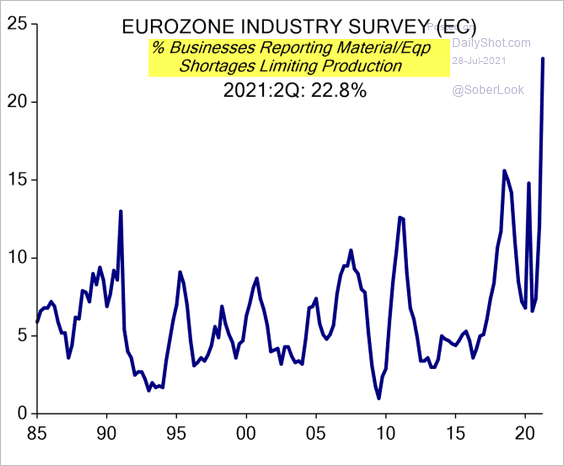

6. Businesses have been reporting materials/equipment shortages limiting production.

Source: Evercore ISI

Source: Evercore ISI

Back to Index

Asia – Pacific

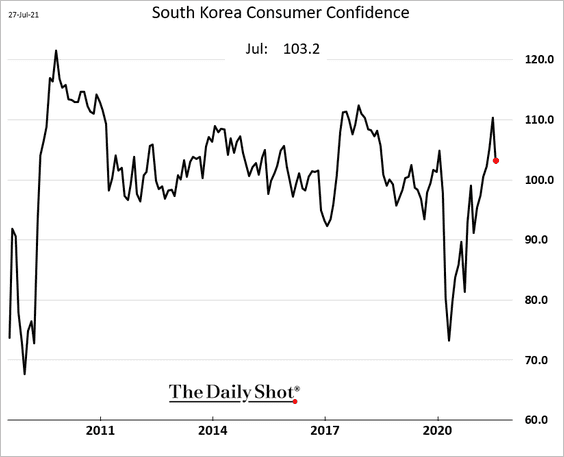

1. South Korea’s consumer confidence pulled back from the recent highs.

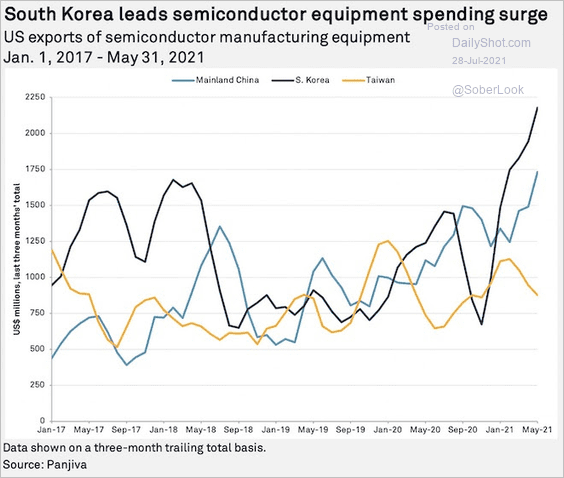

Separately, South Korea has been leading Asia’s semiconductor equipment spending surge.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

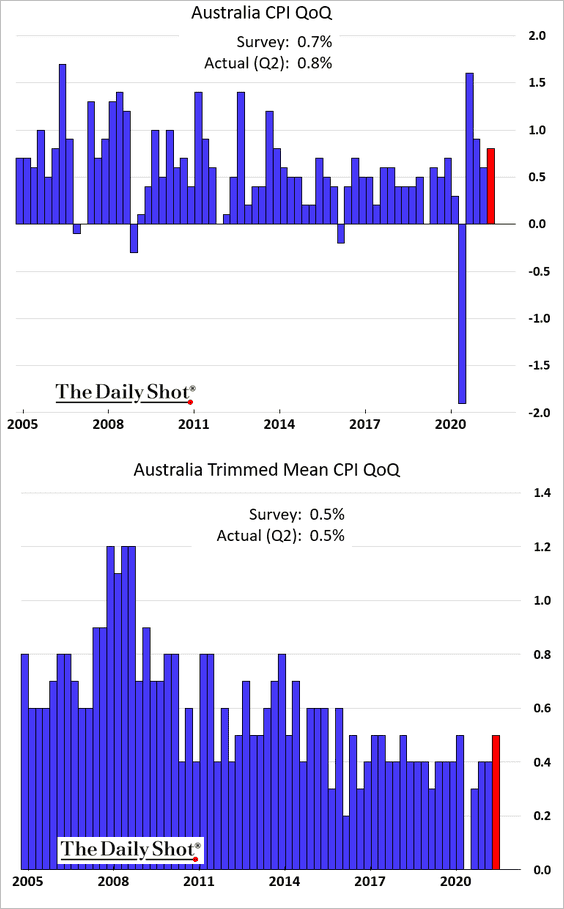

2. Australia’s inflation was firmer in Q2 (roughly in line with expectations).

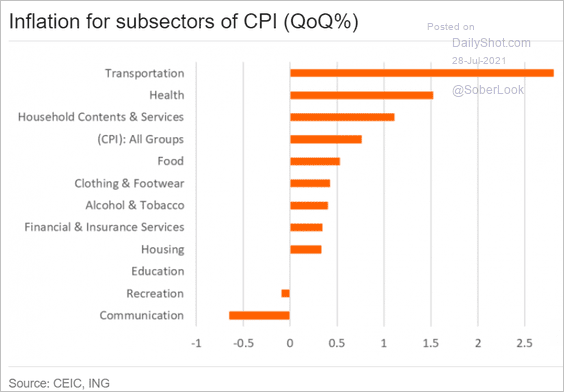

Here is the breakdown by sector.

Source: ING

Source: ING

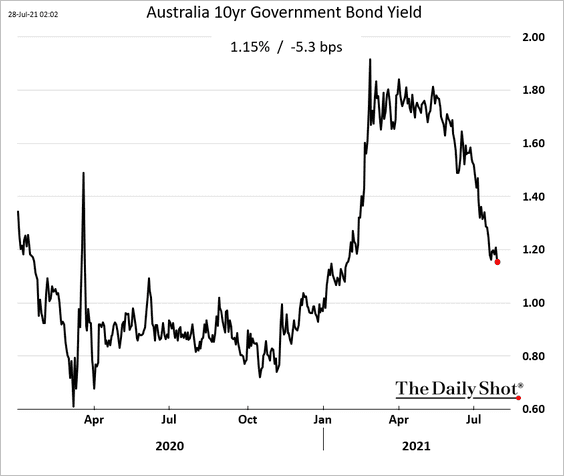

Australia’s bond yields continue to sink.

Back to Index

China

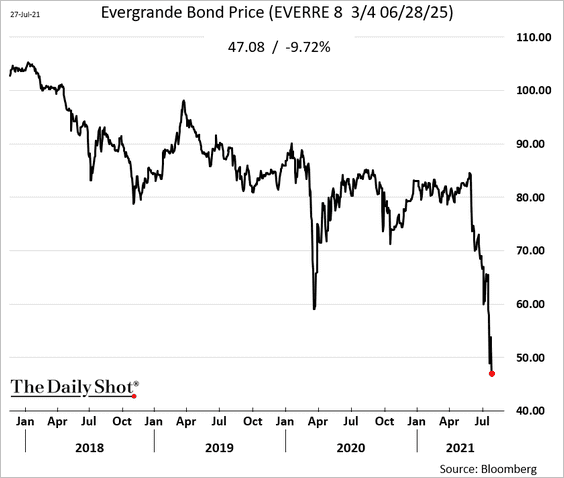

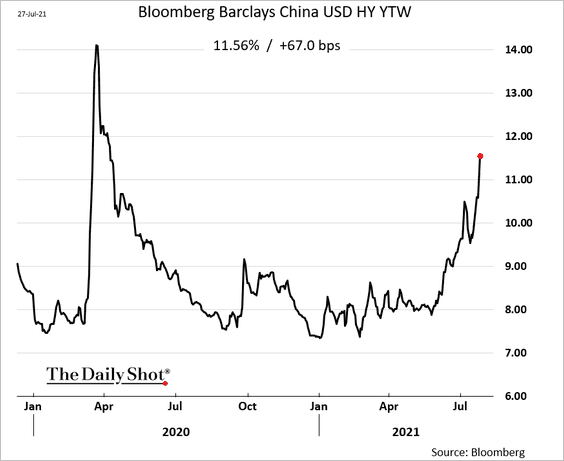

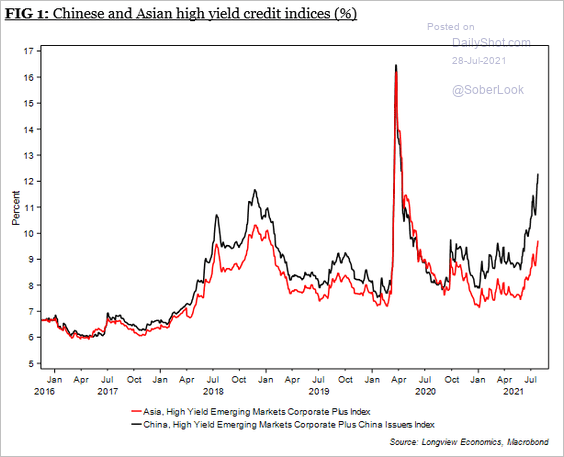

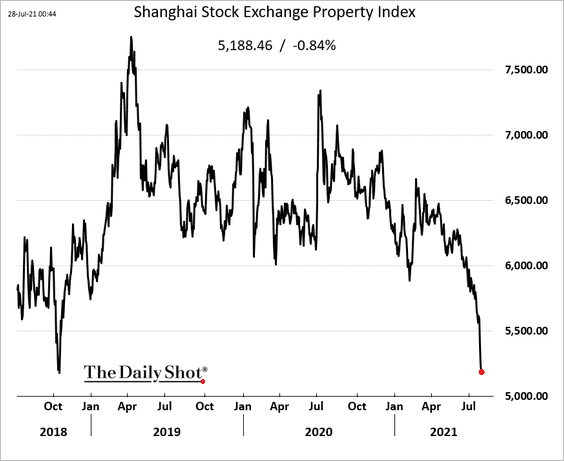

1. Evergrande’s bonds keep plummeting, …

… which is driving up the HY index yield (2 charts) …

Source: @Lvieweconomics

Source: @Lvieweconomics

… and pressuring China’s property stock index.

——————–

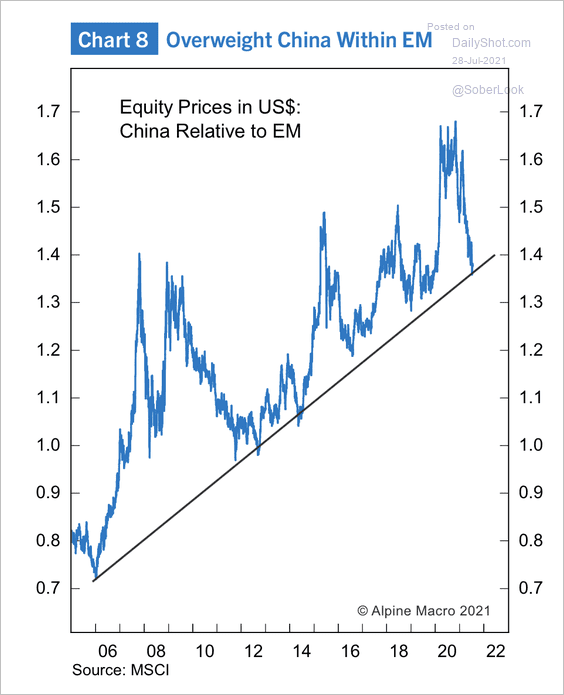

2. In dollar terms, Chinese equities are testing long-term support relative to EM. Is the sell-off overdone?

Source: Alpine Macro

Source: Alpine Macro

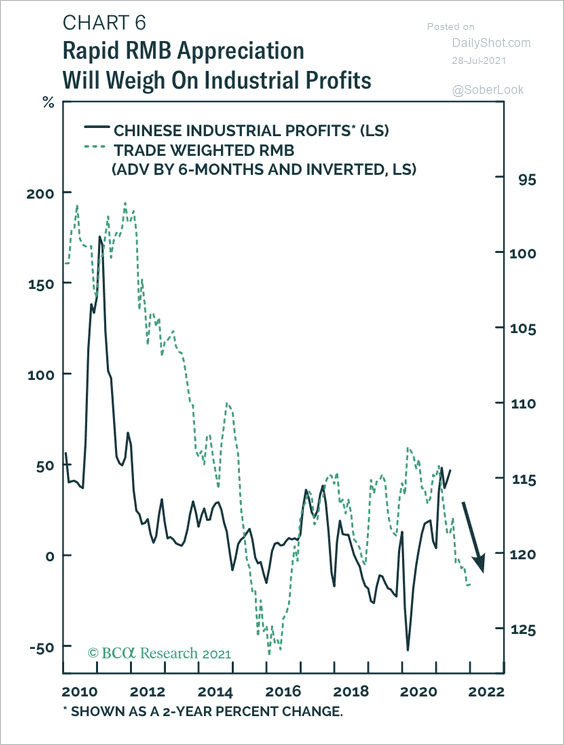

3. A higher renminbi could weigh on industrial profits.

Source: BCA Research

Source: BCA Research

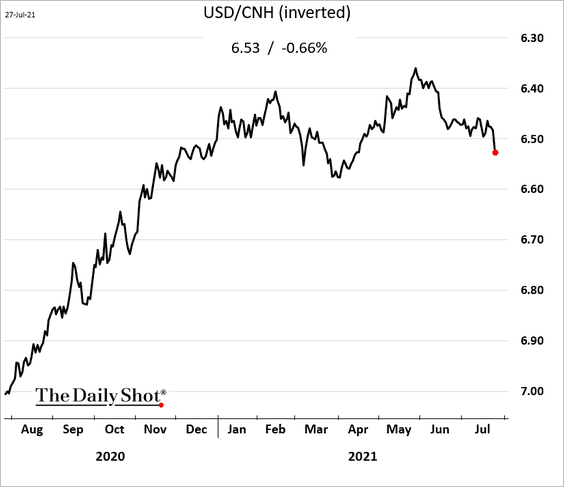

The renminbi softened this week due to the tech selloff.

——————–

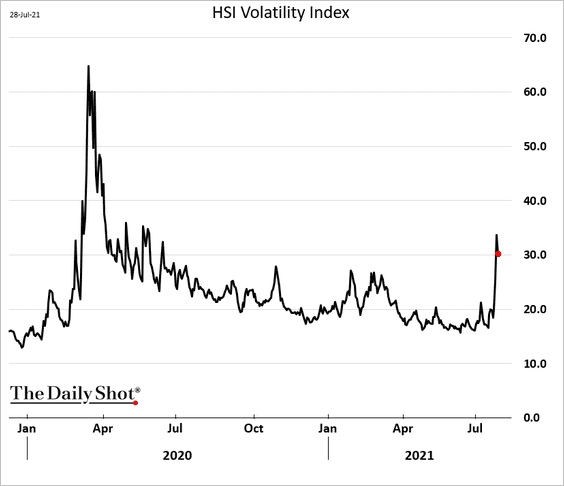

4. Hong Kong equity implied vol jumped this week.

Source: Naoto Hosoda

Source: Naoto Hosoda

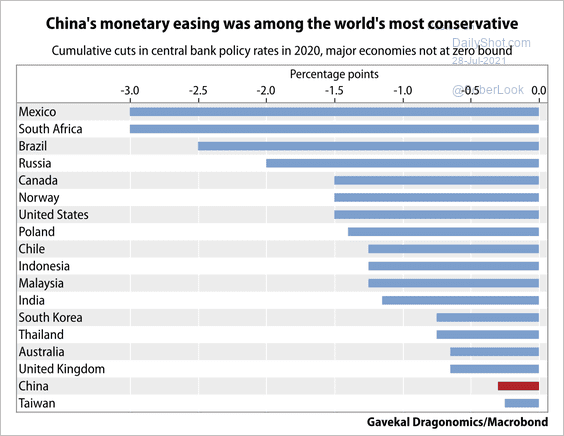

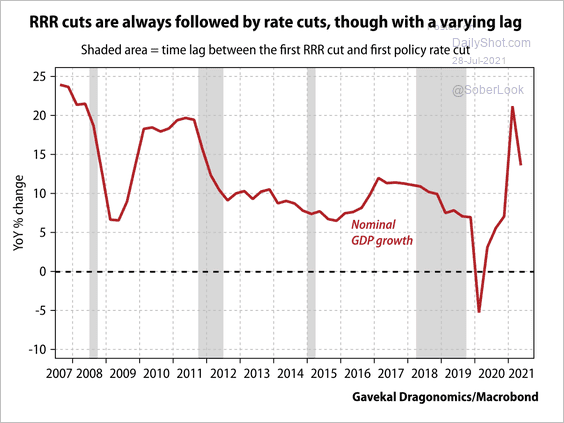

5. The PBoC has been more conservative relative to other central banks over the past year.

Source: Gavekal Research

Source: Gavekal Research

But it’s only a matter of time until the central bank moves to cut policy rates, according to Gavekal.

Source: Gavekal Research

Source: Gavekal Research

——————–

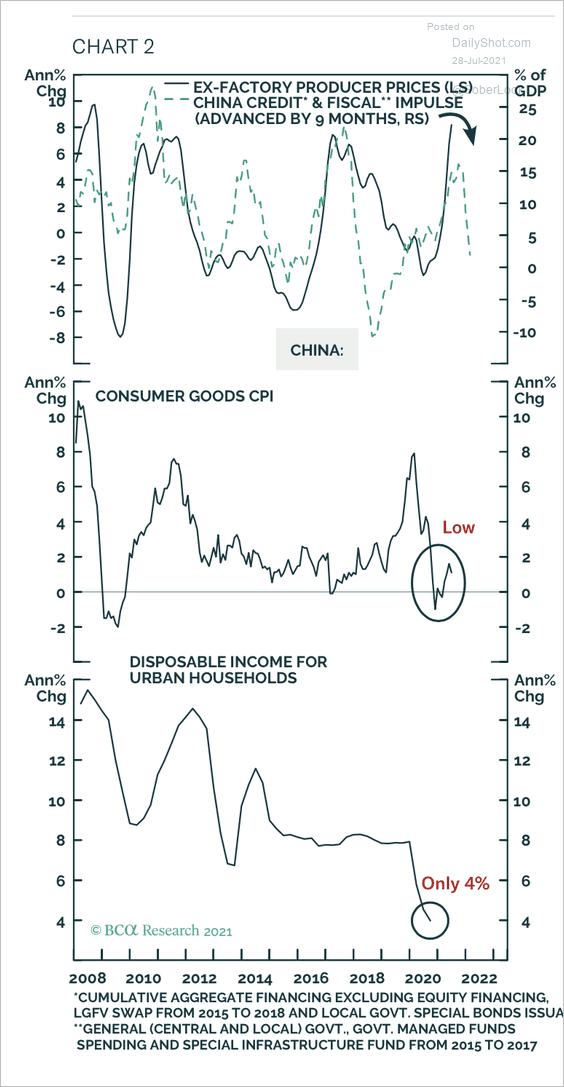

6. The surge in producer price inflation could reverse due to slower economic growth.

Source: BCA Research

Source: BCA Research

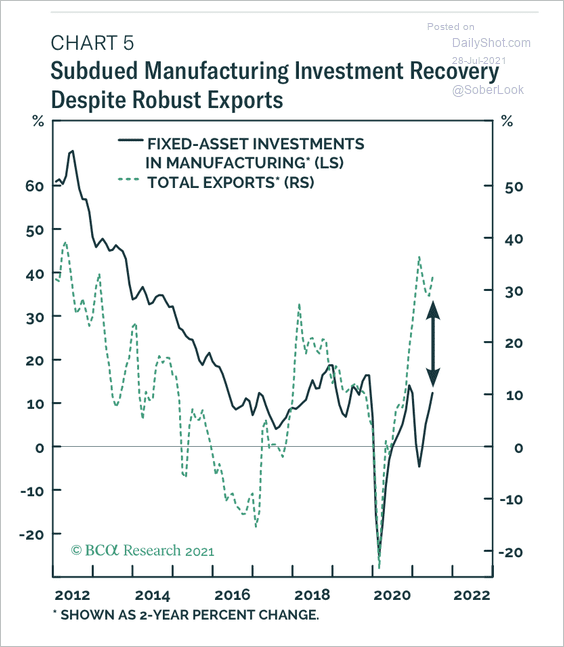

7. Manufacturing investment remains weak despite the recent rise in exports.

Source: BCA Research

Source: BCA Research

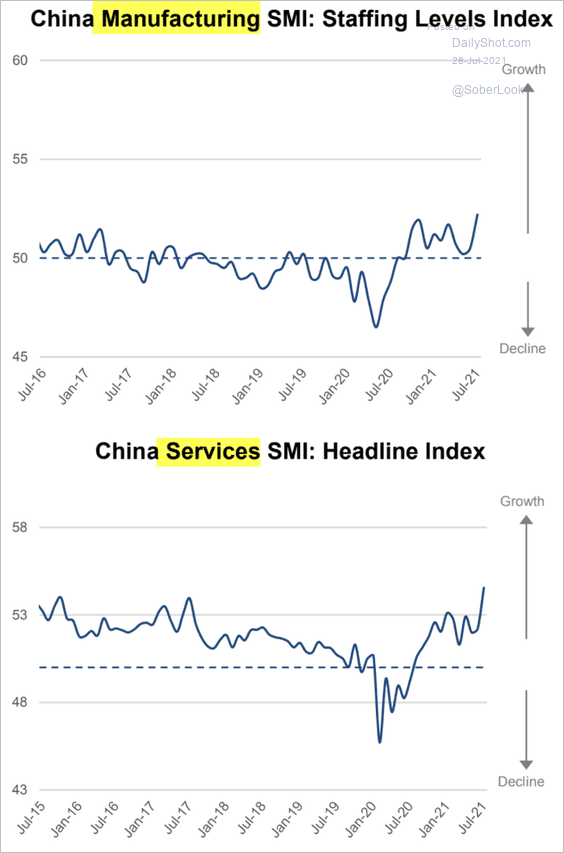

8. As we saw earlier, the World Economics SMI report showed an acceleration in business activity this month. The improvement was particularly strong in services.

Source: World Economics

Source: World Economics

Back to Index

Emerging Markets

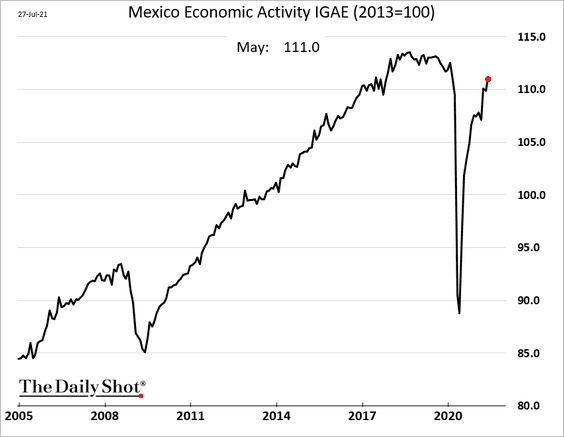

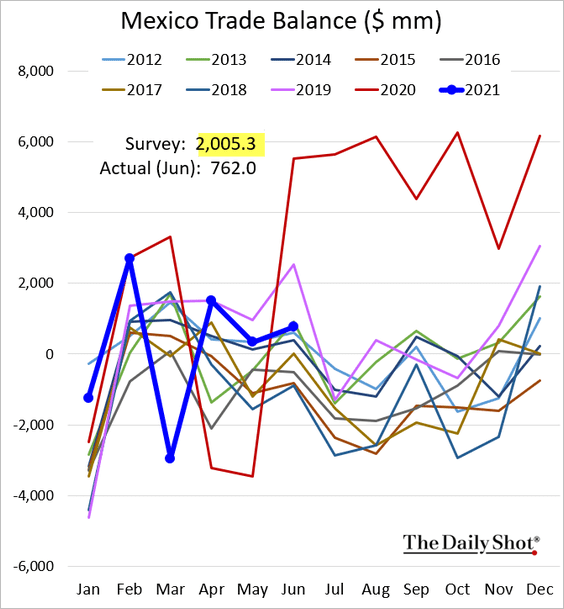

1. Mexico’s economic activity is approaching pre-COVID levels.

The nation’s trade balance surprised to the downside again.

——————–

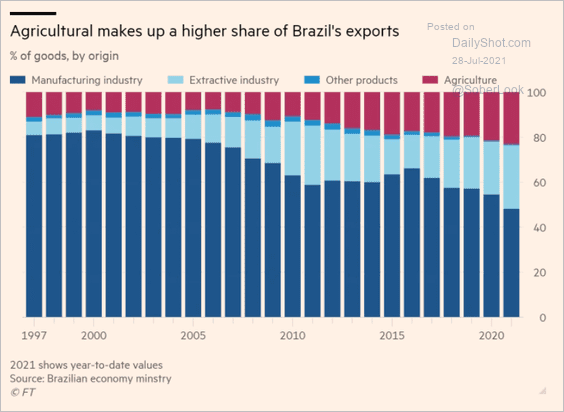

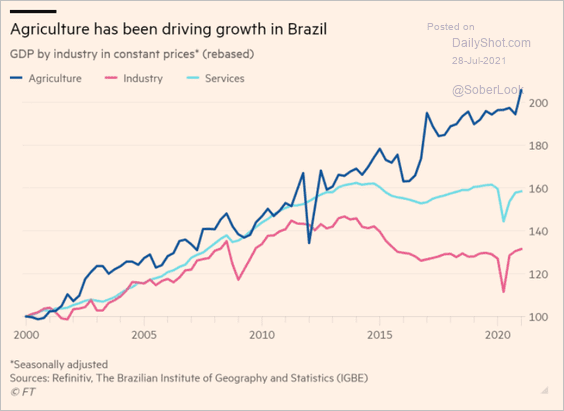

2. Agriculture’s share of Brazil’s exports has been rising (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

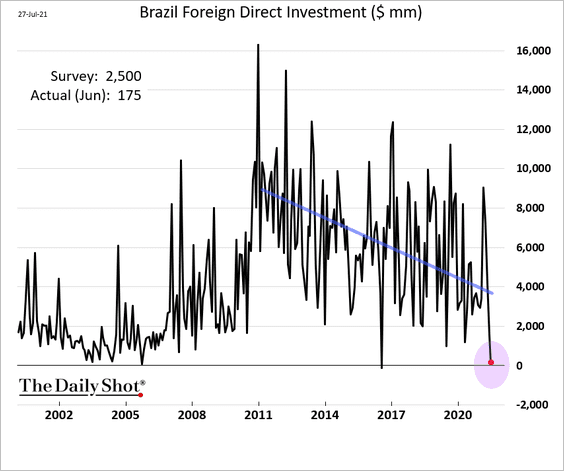

Separately, foreign direct investment has been trending lower (collapsing in June).

——————–

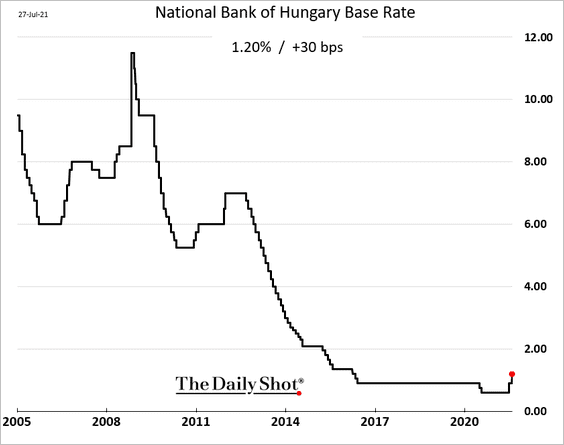

3. Hungary’s central bank hiked rates again.

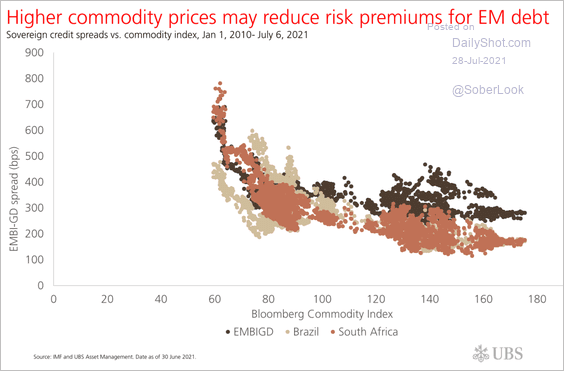

4. Higher commodity prices typically result in tighter EM bond spreads.

Source: UBS Asset Management

Source: UBS Asset Management

Back to Index

Cryptocurrency

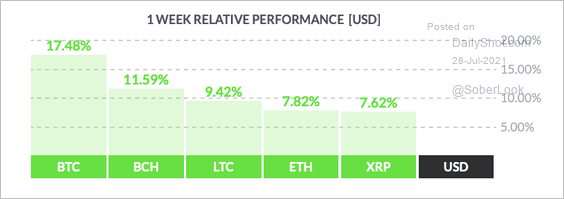

1. Cryptocurrencies have rallied over the past week, led by Bitcoin.

Source: FinViz

Source: FinViz

2. Bitcoin’s drawdown narrowed to around 40% over the past week, which is roughly halfway through previous bear markets.

Source: Koyfin Read full article

Source: Koyfin Read full article

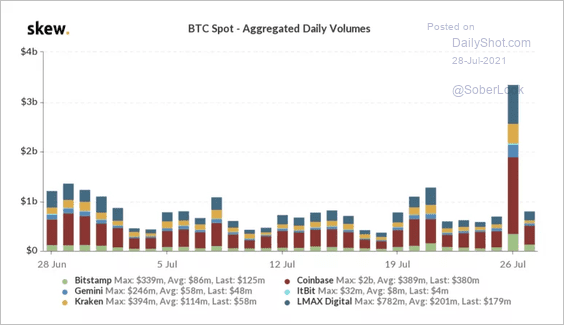

3. Bitcoin’s short-squeeze rally triggered the most active trading session this quarter.

Source: Skew

Source: Skew

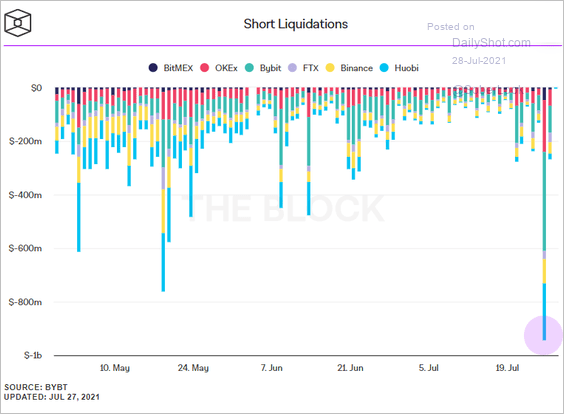

Short liquidations were unusually large.

Source: Valérie Noël, The Block

Source: Valérie Noël, The Block

——————–

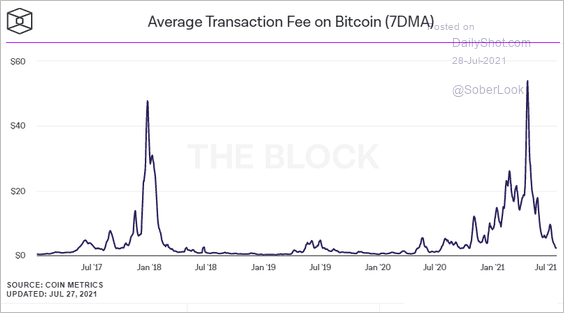

4. Bitcoin’s average transaction fee has been declining in recent months, but we should see a rebound shortly.

Source: The Block

Source: The Block

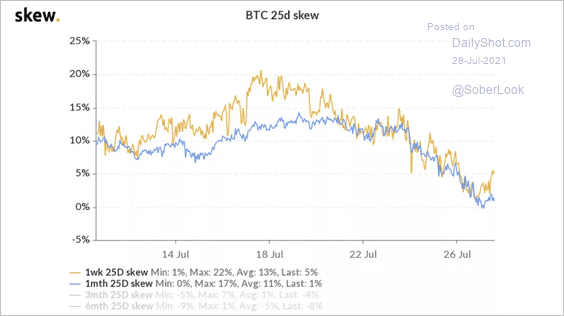

5. Bitcoin’s 1-month put-call options skew has declined sharply over the past week. This could mean investors are no longer seeking downside protection.

Source: Skew Read full article

Source: Skew Read full article

Back to Index

Commodities

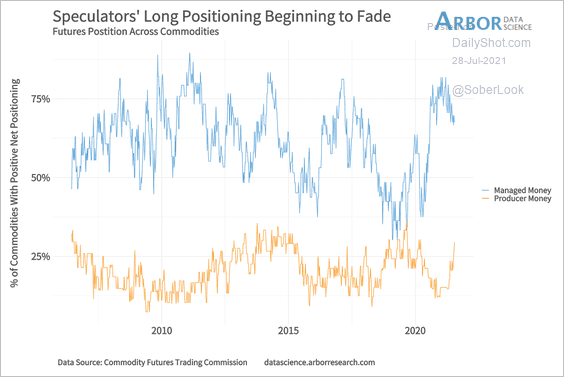

1. Speculative bets on commodities have peaked.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

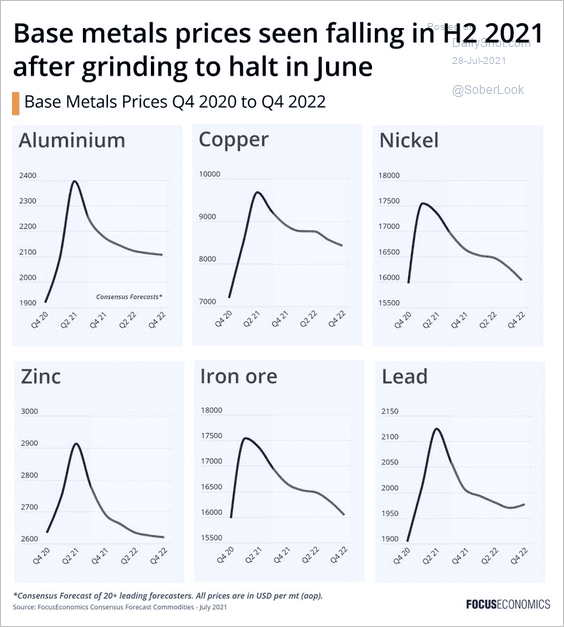

2. Some analysts see base metals prices moderating in the second half of the year.

Source: @FocusEconomics

Source: @FocusEconomics

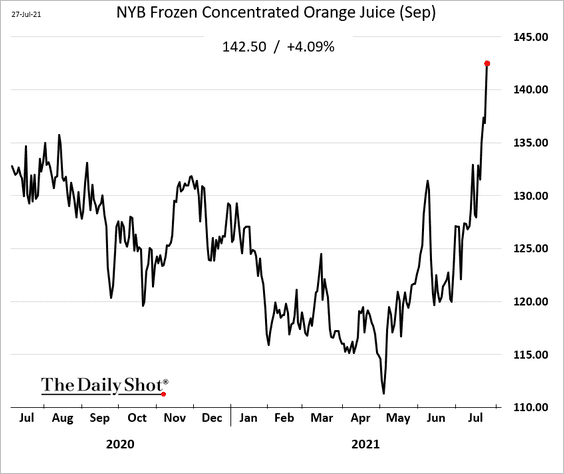

3. US orange juice futures are surging due to the weather situation in Brazil.

Back to Index

Energy

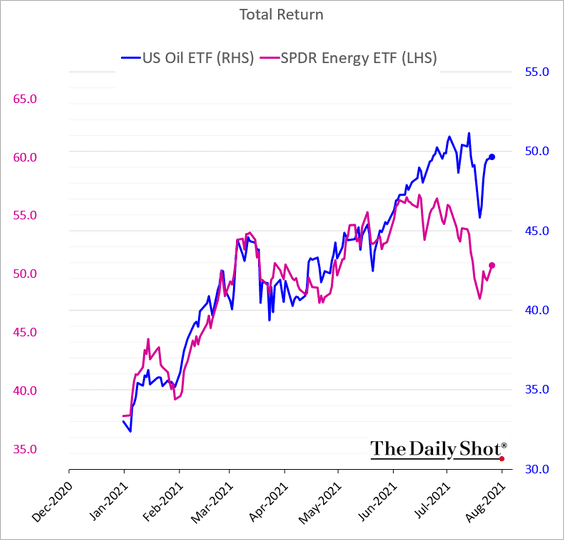

1. US energy shares continue to underperform crude oil.

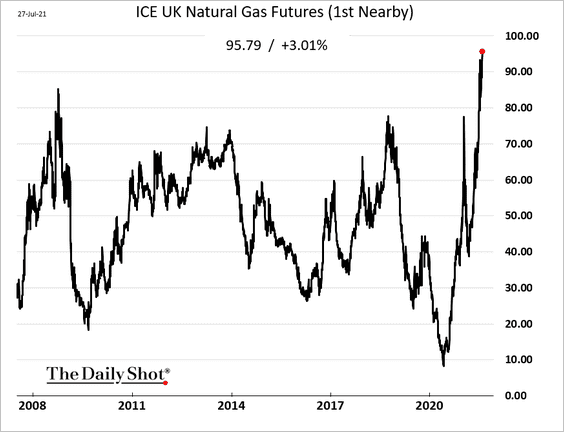

2. European natural gas prices have been surging amid a spike in electricity demand (heatwave).

Back to Index

Equities

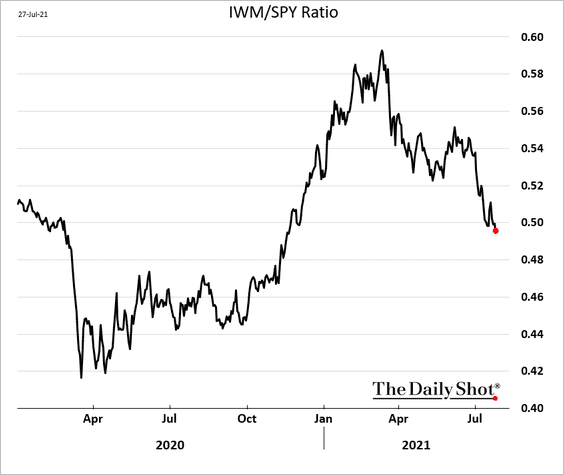

1. Small caps continue to underperform (chart shows the ratio of Russell 2000 ETF to S&P 500 ETF).

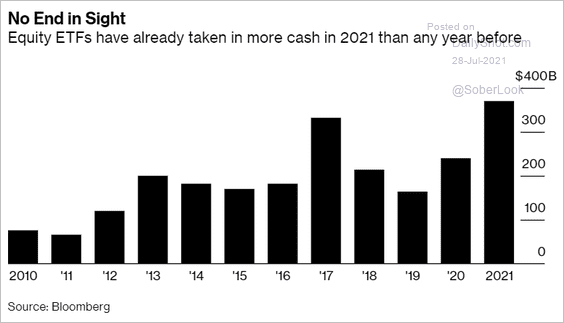

2. Equity ETF inflows have been impressive this year.

Source: @markets, h/t @DiMartinoBooth Read full article

Source: @markets, h/t @DiMartinoBooth Read full article

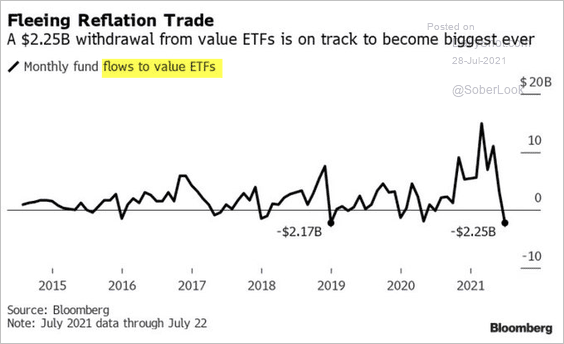

3. Value ETFs saw some outflows recently.

Source: @LizAnnSonders, @Bloomberg

Source: @LizAnnSonders, @Bloomberg

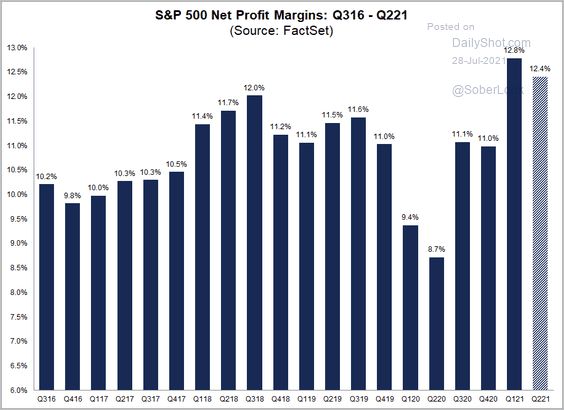

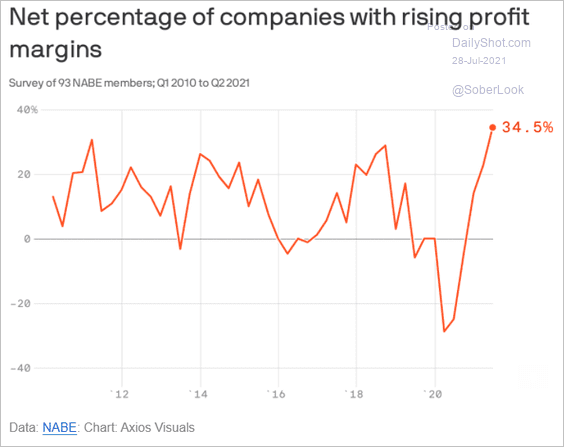

4. Corporate margin growth remains robust.

Source: @FactSet Read full article

Source: @FactSet Read full article

Source: @axios

Source: @axios

——————–

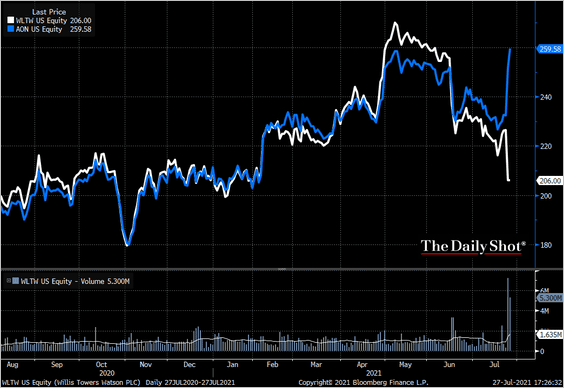

5. M&A is becoming more challenging in the current environment.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

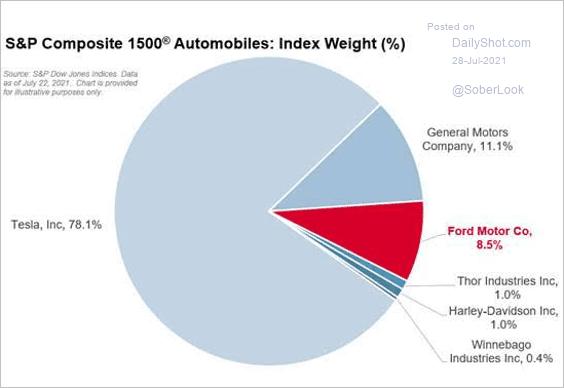

6. Here is the S&P 1500 Automobiles subindex.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

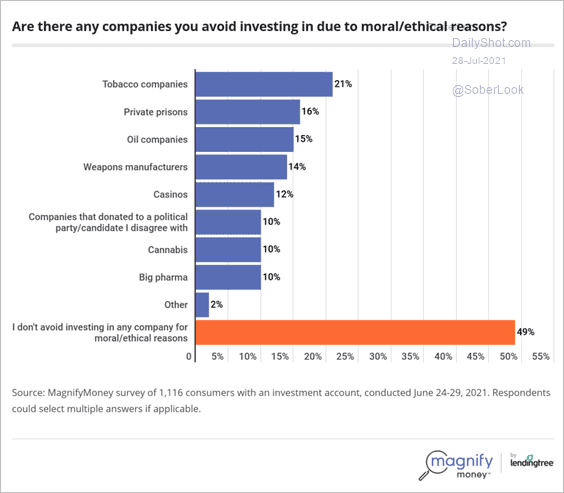

7. Which sectors are investors more likely to avoid due to moral/ethical reasons?

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

Back to Index

Credit

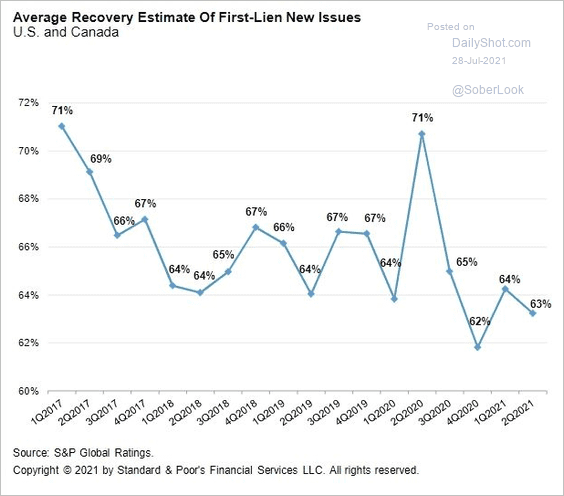

1. 1st-lien recovery expectations continue to trend lower due, in part, to more loan-only structures (lower debt cushion).

Source: @lcdnews Read full article

Source: @lcdnews Read full article

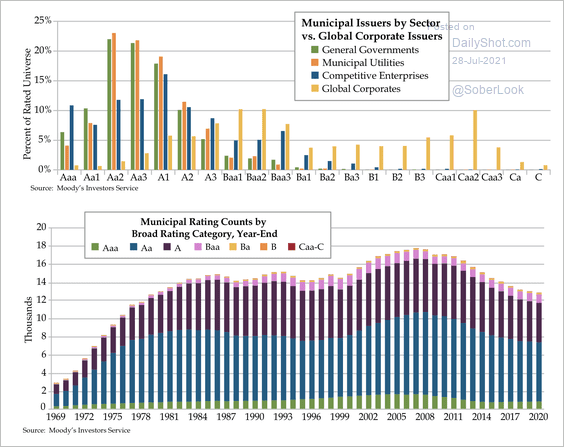

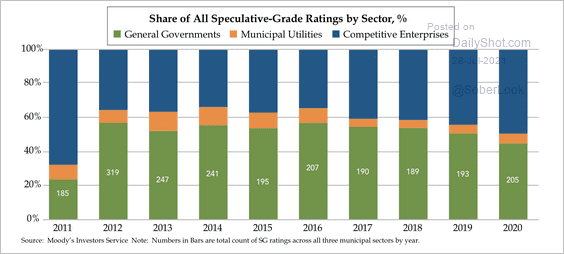

2. Muni bonds tend to be in the higher-rated portion of fixed-income markets.

Source: Quill Intelligence

Source: Quill Intelligence

• General government obligations comprise nearly half of the speculative-grade muni market.

Source: Quill Intelligence

Source: Quill Intelligence

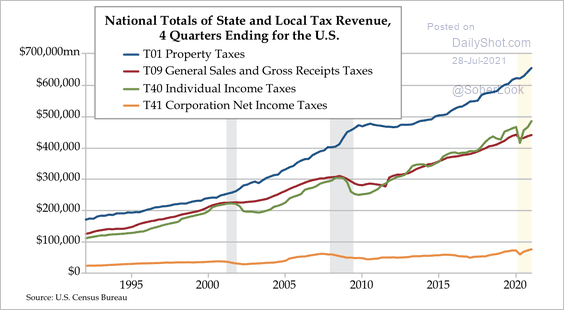

• Higher property tax payments have boosted municipal revenues.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Global Developments

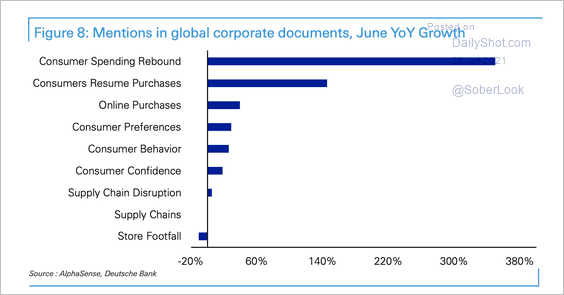

1. More global firms are mentioning rebounding consumer spending.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

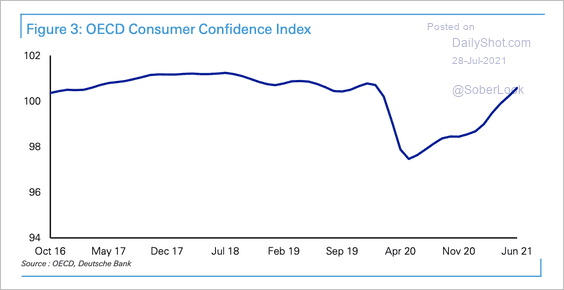

2. OECD consumer confidence is approaching pre-pandemic levels.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

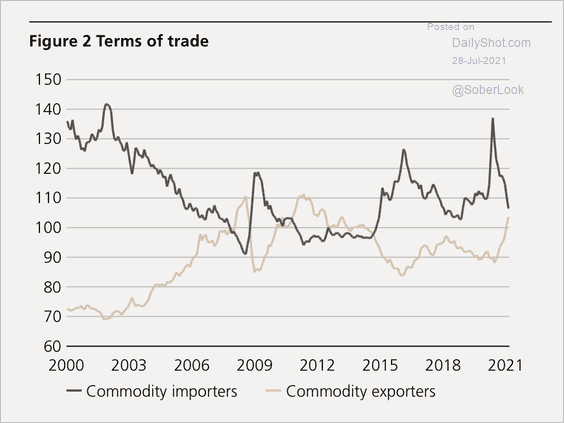

3. Higher commodity prices have benefitted net-export currencies.

Source: UBS

Source: UBS

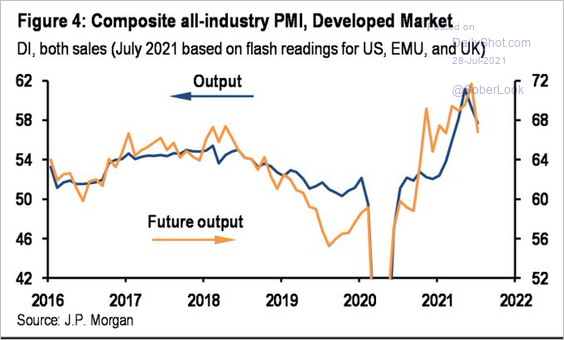

4. Business activity growth in developed economies is peaking.

Source: JP Morgan; @dlacalle_IA

Source: JP Morgan; @dlacalle_IA

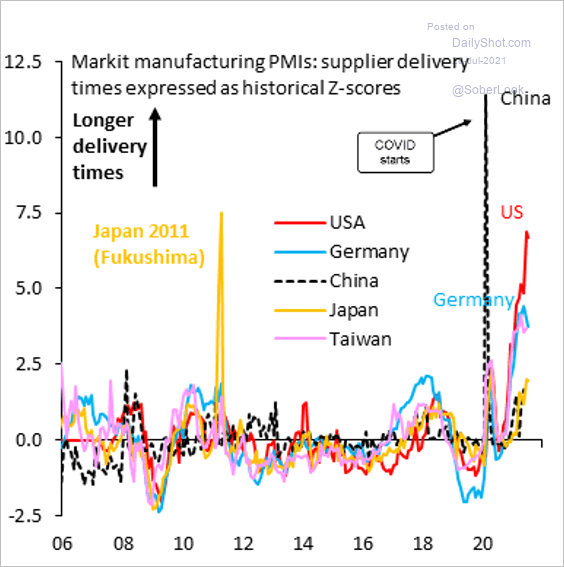

5. Supplier delivery bottlenecks have been severe in major manufacturing hubs.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

——————–

Food for Thought

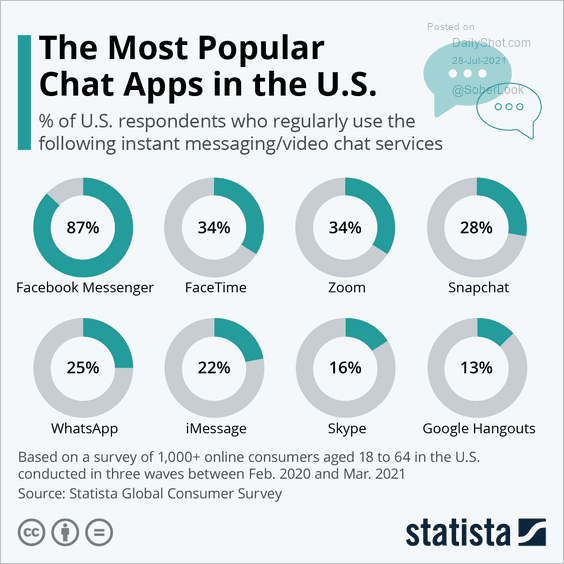

1. The most popular chat apps in the US:

Source: Statista

Source: Statista

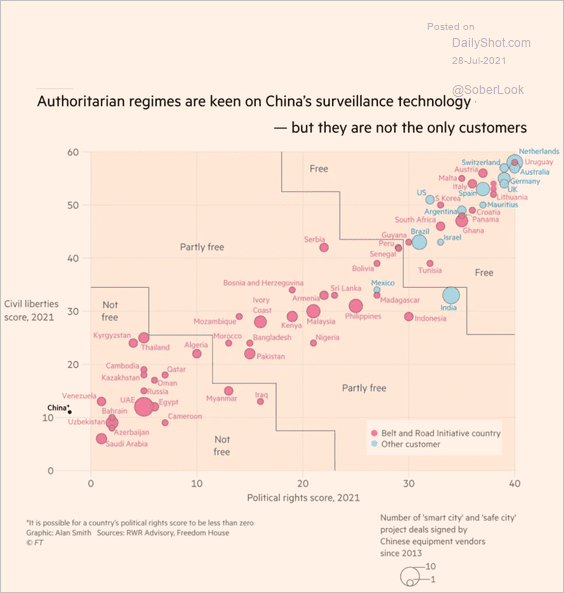

2. Demand for China’s surveillance tech:

Source: @adam_tooze, @FT Read full article

Source: @adam_tooze, @FT Read full article

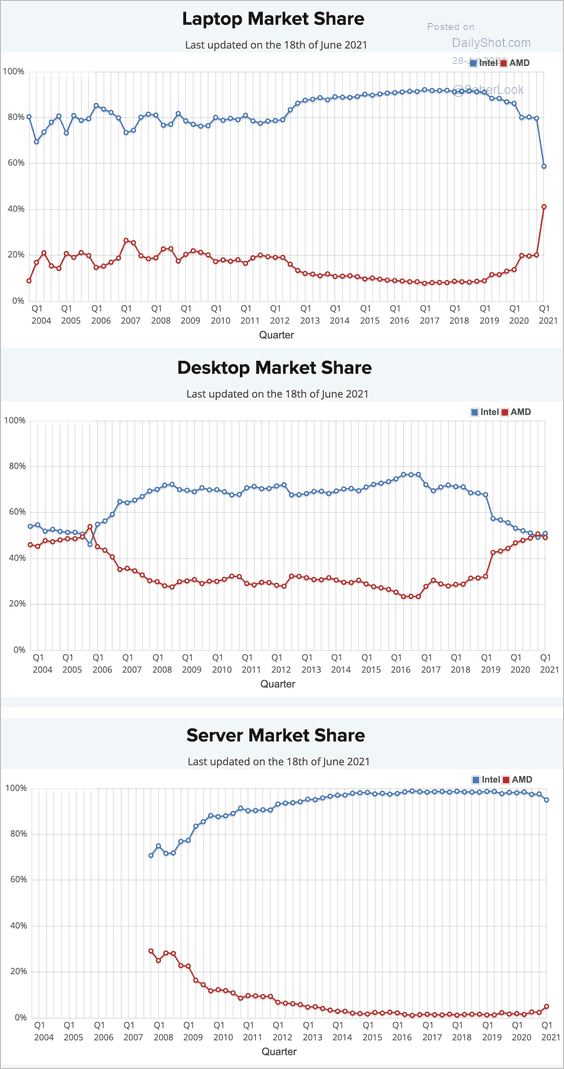

3. Intel’s vs. AMD’s market share:

Source: @Noahpinion, @AlecStapp

Source: @Noahpinion, @AlecStapp

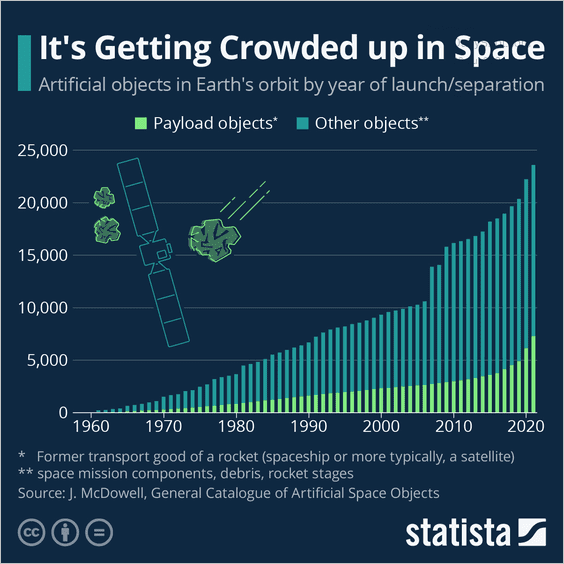

4. Artificial objects in orbit:

Source: Statista

Source: Statista

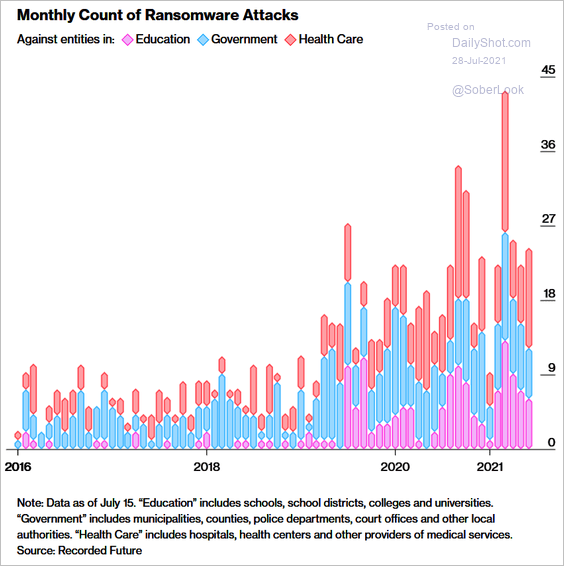

5. Ransomware attacks:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

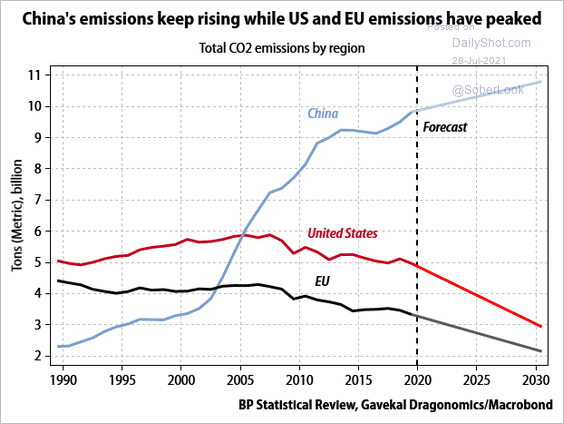

6. Emissions forecasts:

Source: Gavekal Research

Source: Gavekal Research

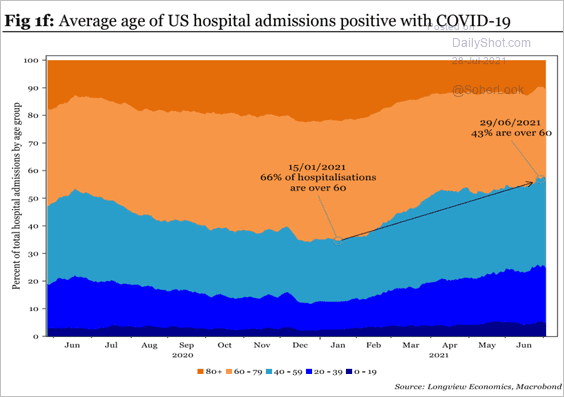

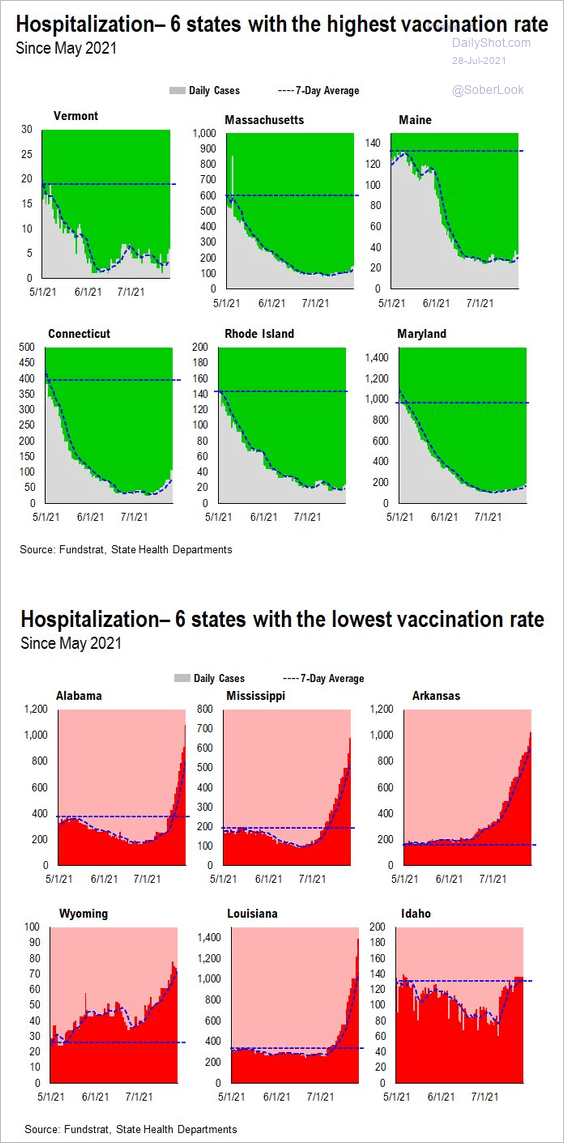

7. US COVID-related hospital admissions (2 charts):

Source: Longview Economics

Source: Longview Economics

Source: @carlquintanilla, @fundstrat

Source: @carlquintanilla, @fundstrat

——————–

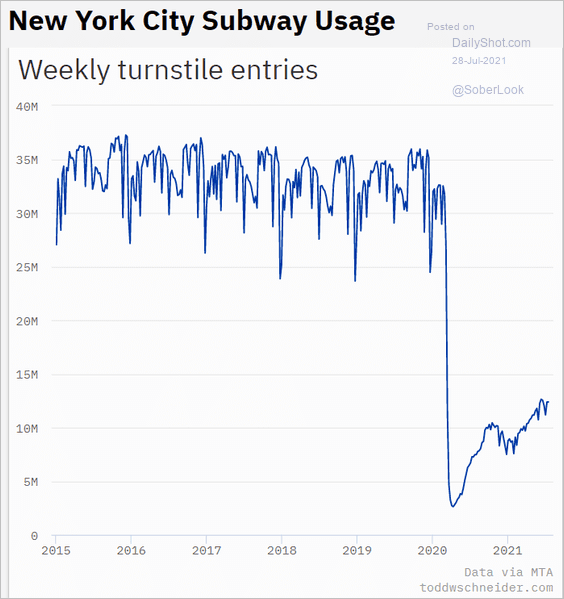

8. New York City subway usage:

Source: Todd Schneider

Source: Todd Schneider

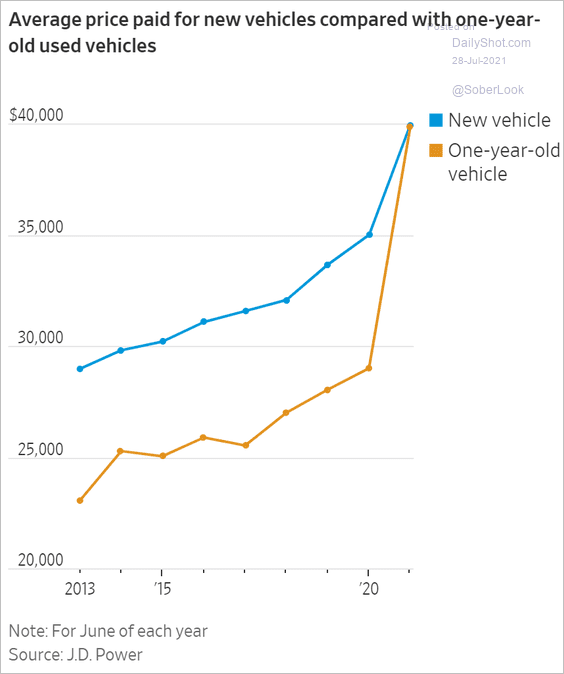

9. Prices paid for new vs. one-year-old used vehicles:

Source: @WSJ Read full article

Source: @WSJ Read full article

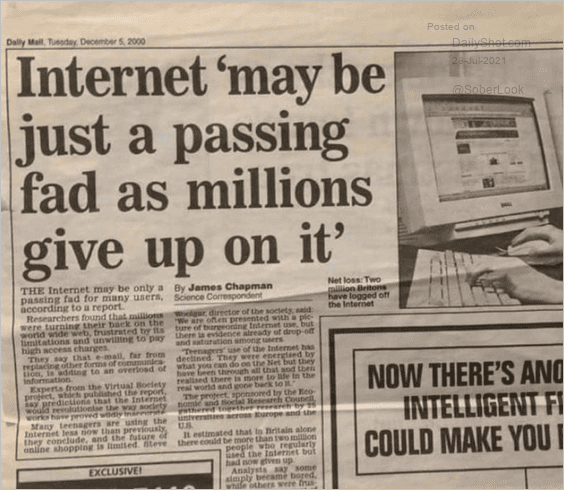

10. Internet “may be a passing fad” (December 2000):

Source: @th3j35t3r

Source: @th3j35t3r

——————–

Back to Index