The Daily Shot: 29-Jul-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

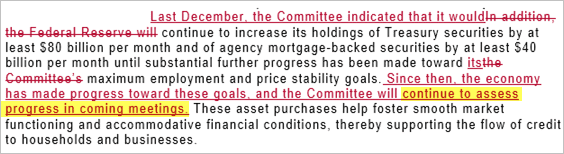

1. The FOMC statement suggests that QE is no longer on “autopilot.” The Fed officials took the “first deep dive” into scaling back purchases. But what does assessing progress in the “coming meetings” mean?

Source: @NickTimiraos

Source: @NickTimiraos

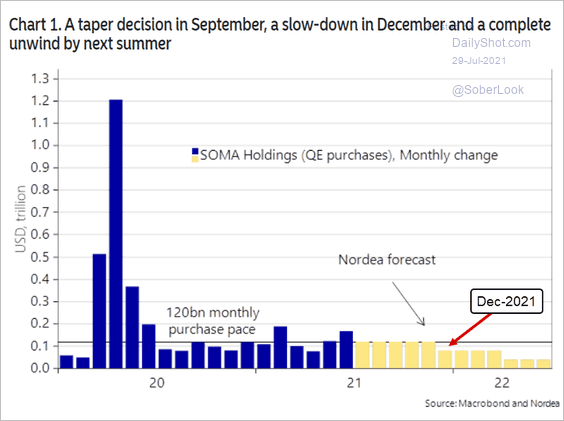

Will we get the taper announcement in September? December? The FOMC wants to see “sufficient further progress” toward the central bank’s “broad labor market recovery” goals.

Nordea Markets expects the taper decision in September and the first QE reduction in December.

Source: Nordea Markets

Source: Nordea Markets

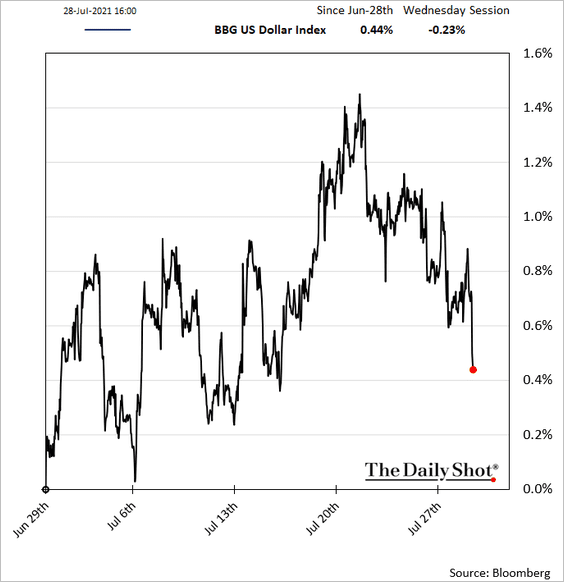

The market reaction was muted. The dollar weakened.

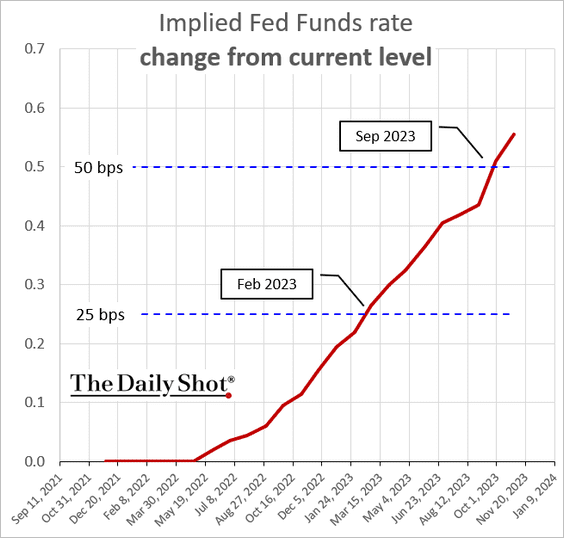

Fed funds futures continue to price in the first hike in early 2023.

——————–

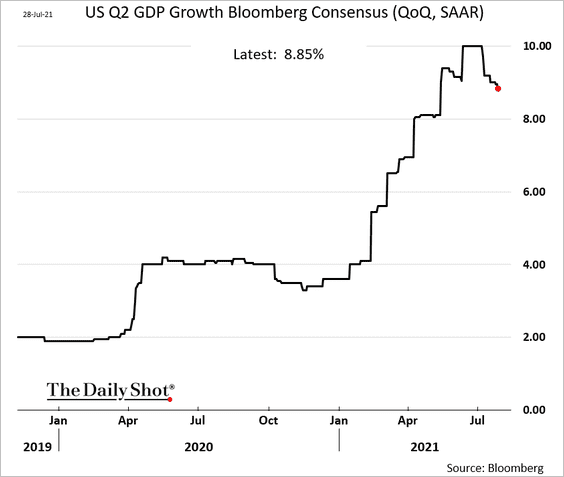

2. Economists’ expectations for the Q2 GDP growth have been moderating in recent weeks.

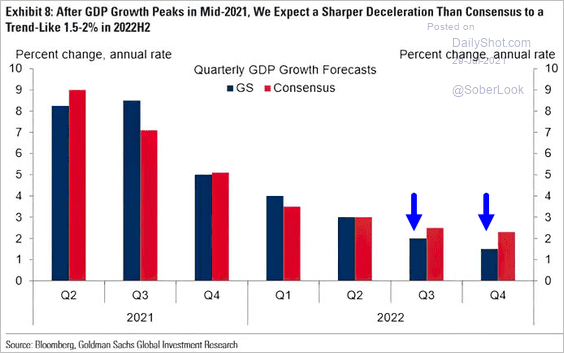

Goldman expects strong growth for the rest of the year but sees a sharp pullback in the second half of next year.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

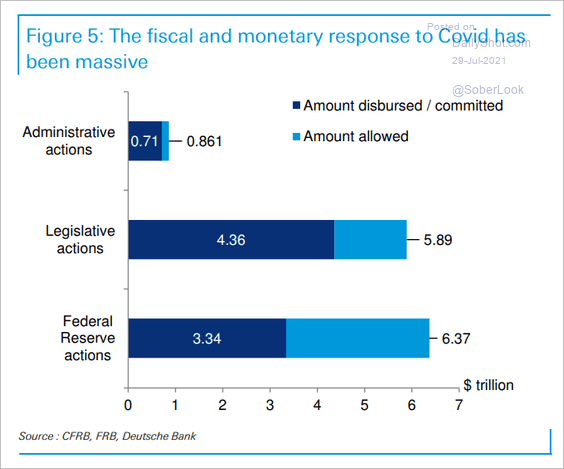

While fiscal and monetary stimulus has been immense, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

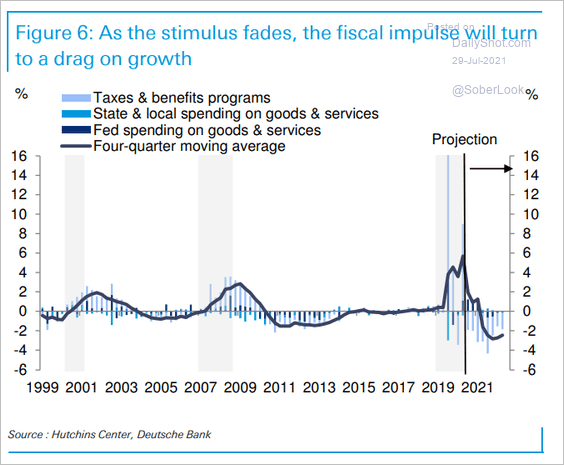

… the fiscal impulse will turn into a drag on growth next year, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

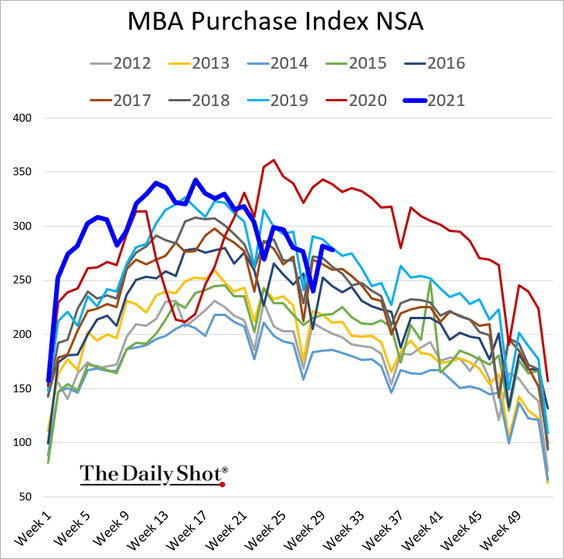

3. Mortgage applications remain in line with 2019 levels.

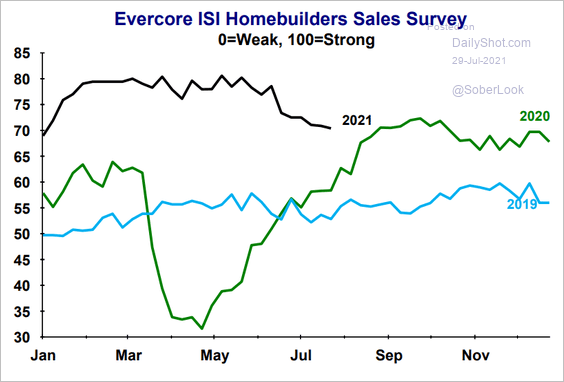

The Evercore ISI Homebuilders Sales index has been moderating.

Source: Evercore ISI

Source: Evercore ISI

——————–

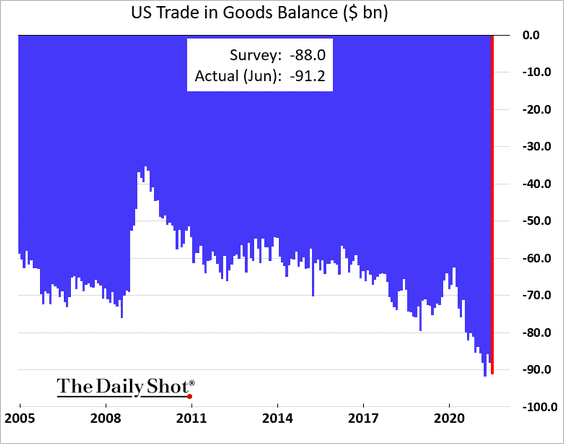

4. US goods trade deficit was larger than expected in June amid robust domestic demand.

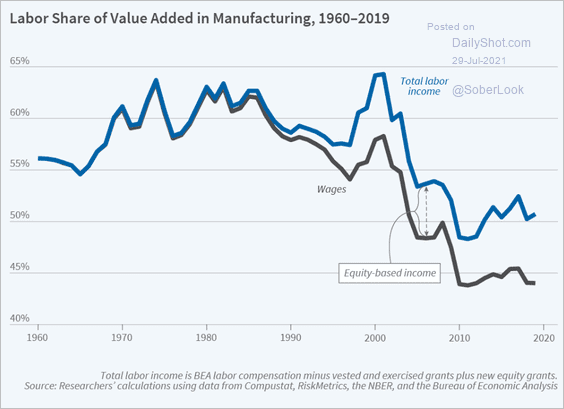

5. Labor’s share of corporate earnings has been trending lower over the past three decades. But when equity-based compensation is included, the decline isn’t nearly as severe (the gap is mostly high-skill workers).

Source: NBER Read full article

Source: NBER Read full article

Back to Index

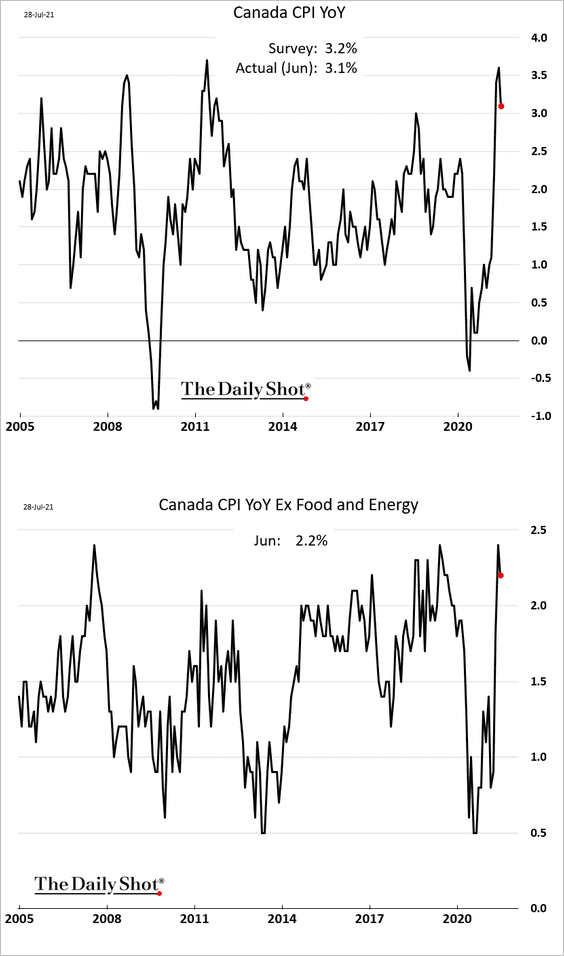

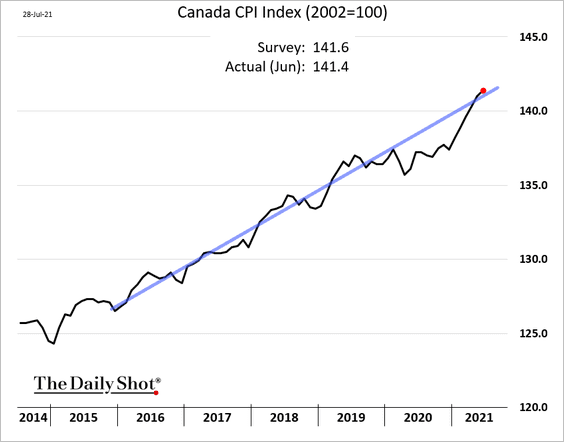

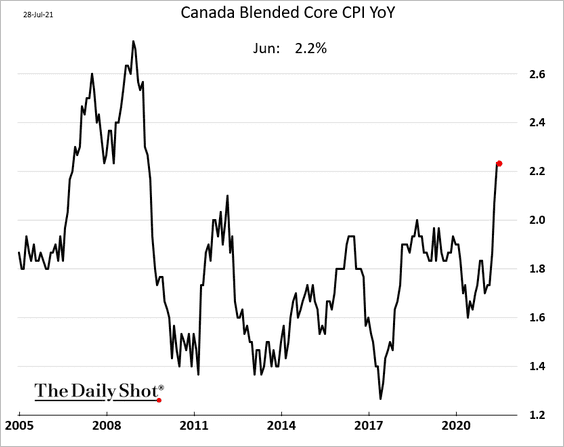

Canada

Headline inflation moderated in June.

• The CPI index is roughly in line with the pre-COVID trend.

• The “blended” core CPI remains at multi-year highs.

Back to Index

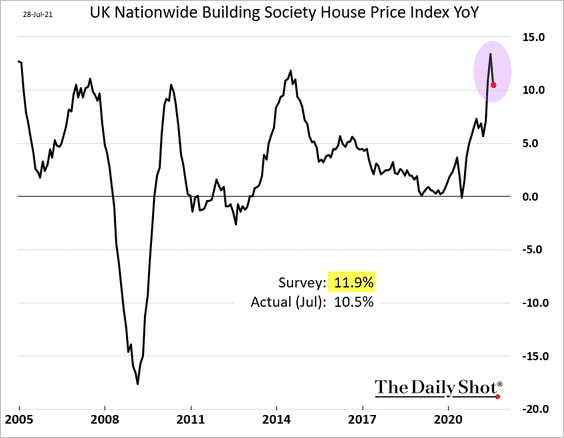

The United Kingdom

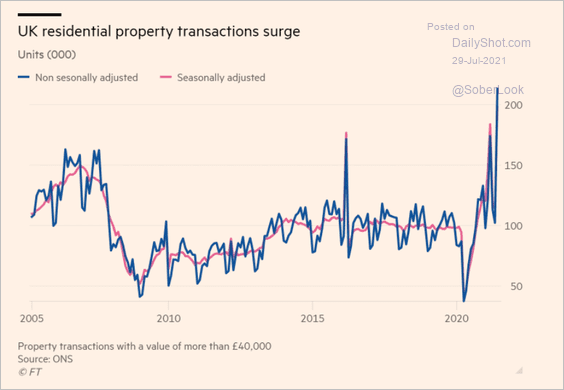

1. Home price appreciation appears to have peaked this month.

But residential property transactions have been surging.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

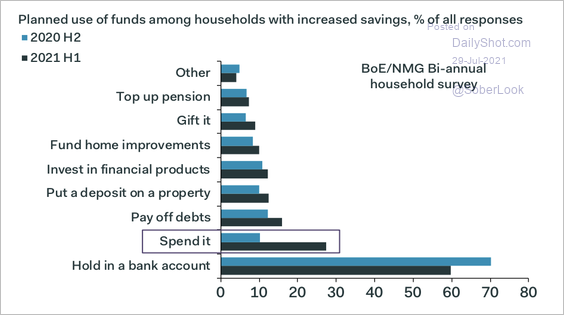

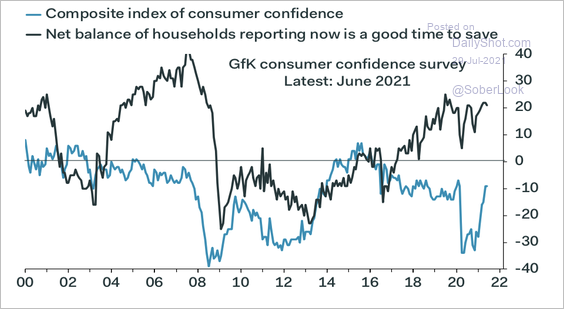

2. Some surveys signal willingness to spend savings.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

But other surveys show that saving intentions remain high.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

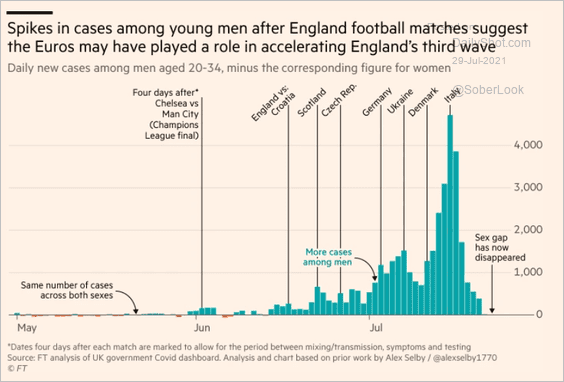

3. Did Euros matches contribute to the recent spike in COVID cases?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

The Eurozone

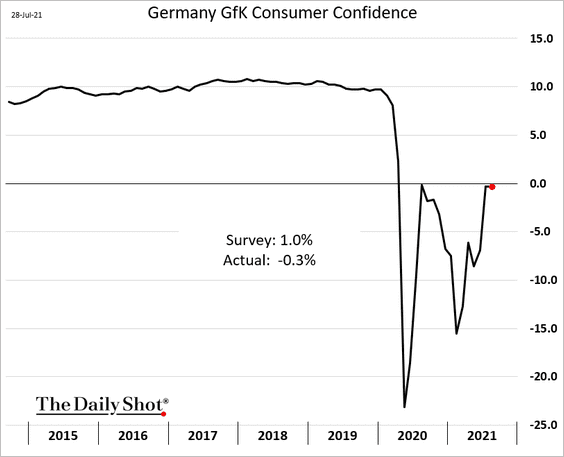

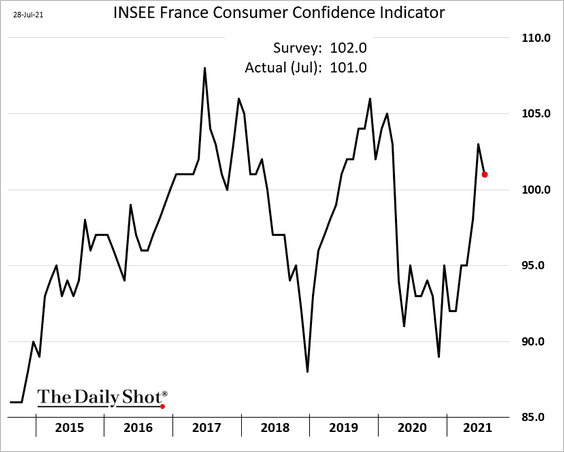

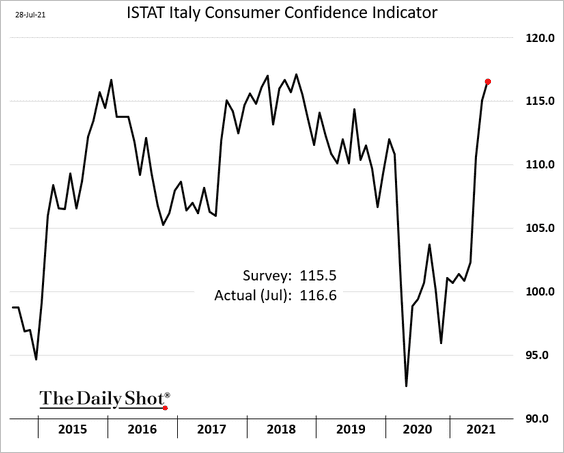

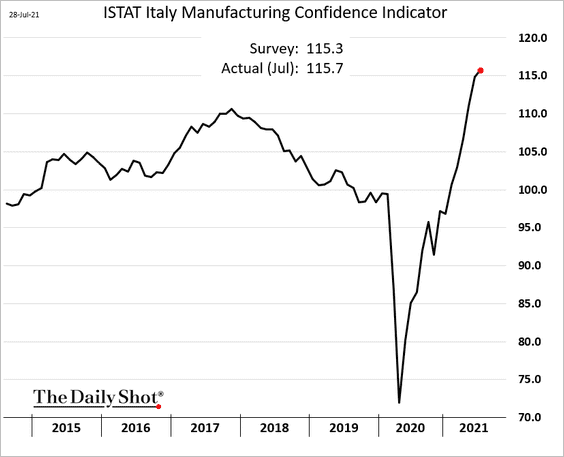

1. Let’s begin with July sentiment indicators.

• The rebound in Germany’s consumer confidence stalled this month.

• French consumer sentiment declined.

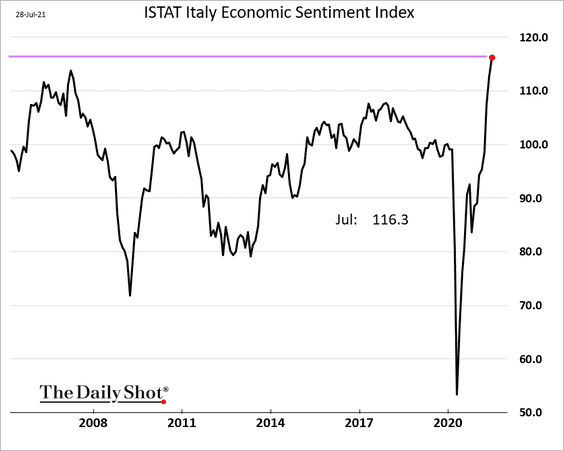

• Italian sentiment indicators continue to surge.

– Consumer confidence:

– Manufacturing confidence:

– The ISTAT Economic Sentiment Index:

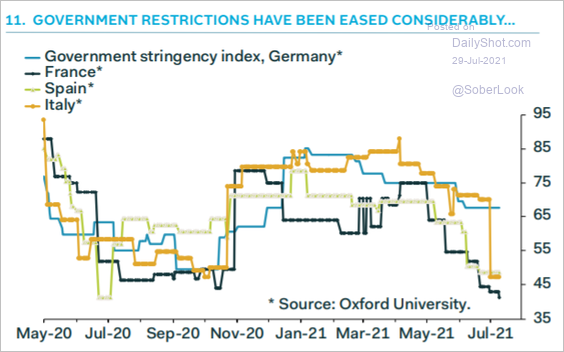

Easing government restrictions helped boost Italian sentiment.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

2. German import prices keep climbing.

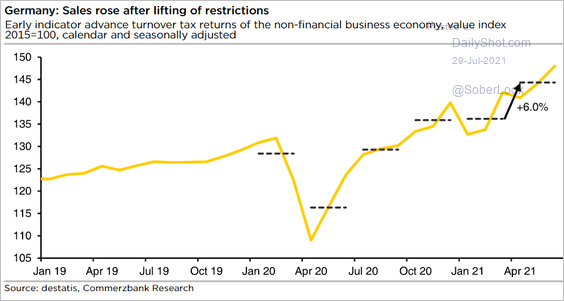

Separately, corporate sales jumped in Q2.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

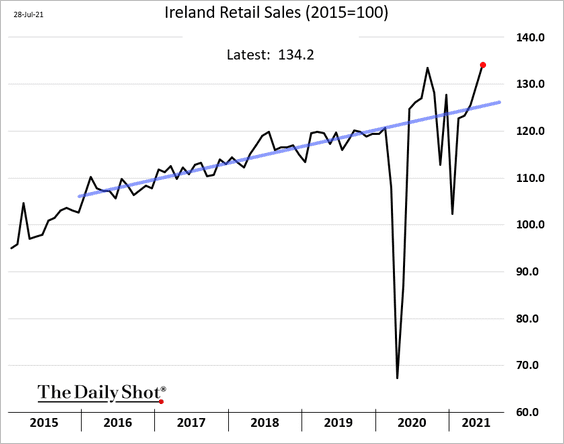

3. Ireland’s retail sales are back above the pre-COVID trend.

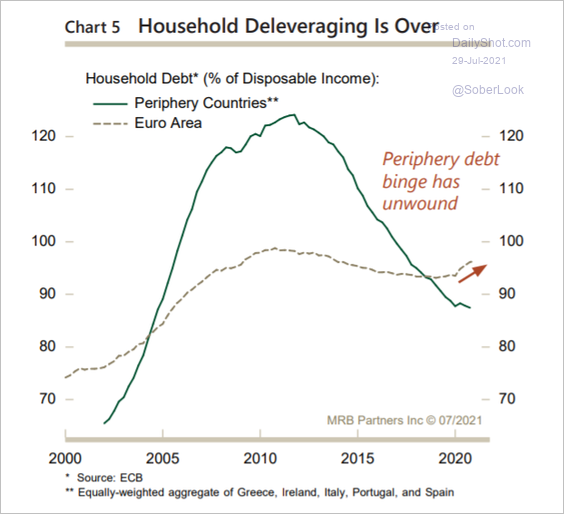

4. The household deleveraging process in periphery economies has largely run its course.

Source: MRB Partners

Source: MRB Partners

Back to Index

Europe

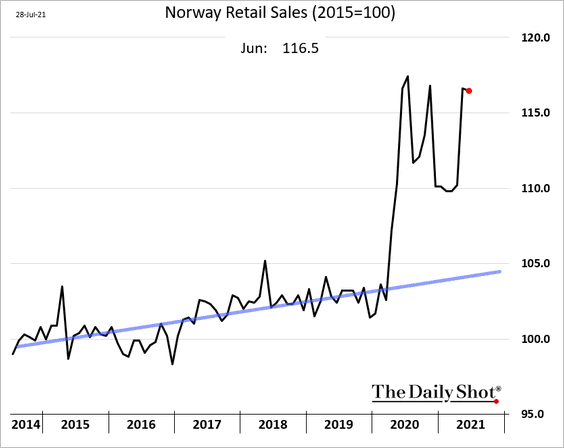

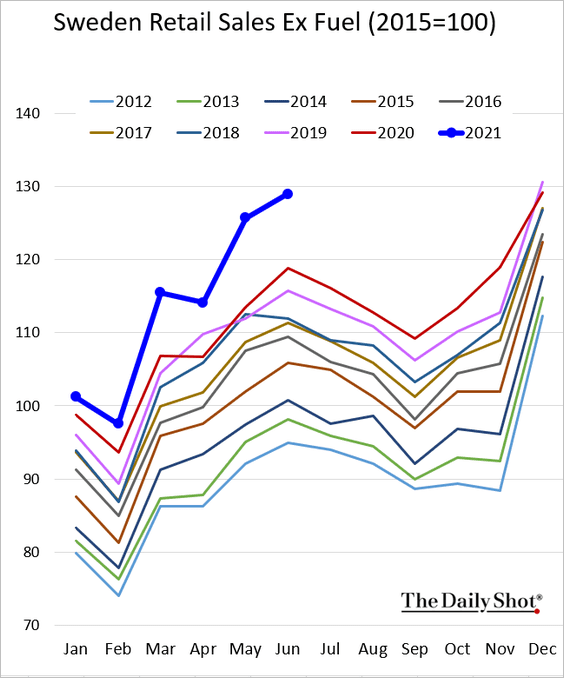

1. Retail sales in Sweden and Norway remain remarkably strong.

• Norway sales relative to pre-COVID trend:

• Sweden retail sales (not seasonally adjusted):

——————–

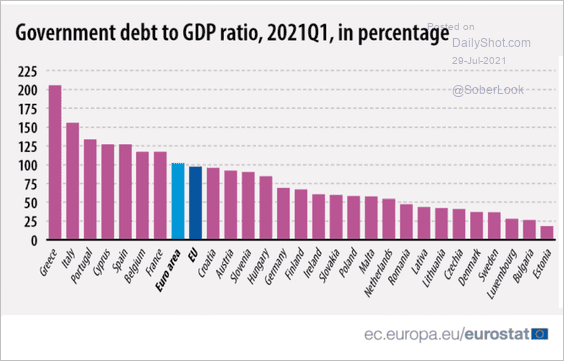

2. This chart shows government debt-to-GDP ratios across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

China

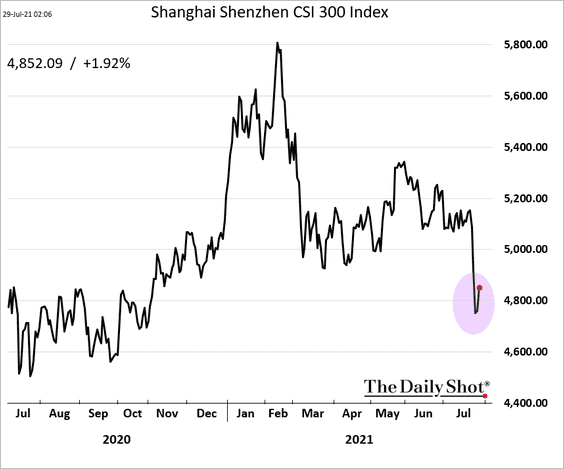

1. The equity market stabilized as Beijing stepped in to calm investors (see story).

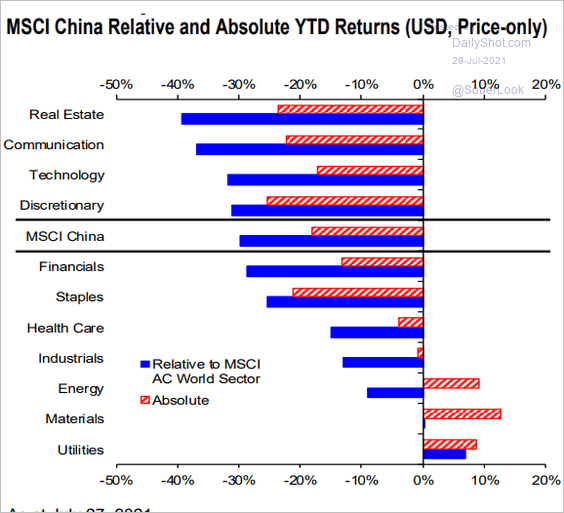

This chart shows stock returns by sector.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

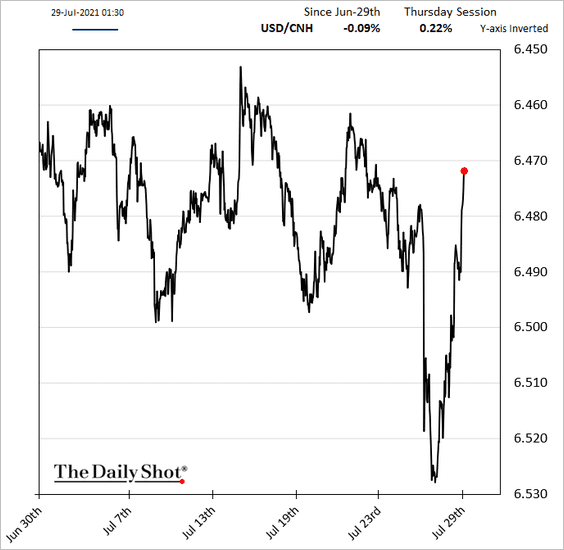

2. The renminbi rebounded (offshore yuan shown below).

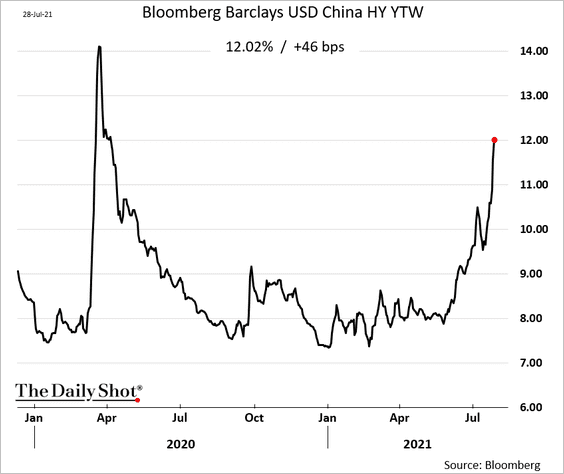

3. The high-yield index remains under pressure.

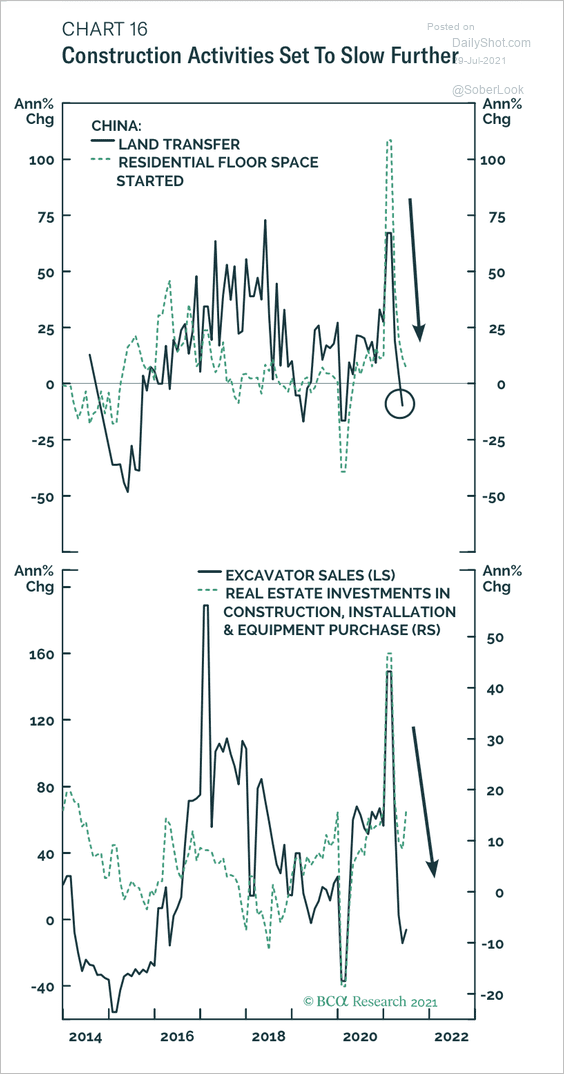

4. Excavator sales and investment in construction equipment have deteriorated sharply.

Source: BCA Research

Source: BCA Research

5. The Evercore ISI business survey on China sales points to a deterioration in manufacturing growth.

Source: Evercore ISI

Source: Evercore ISI

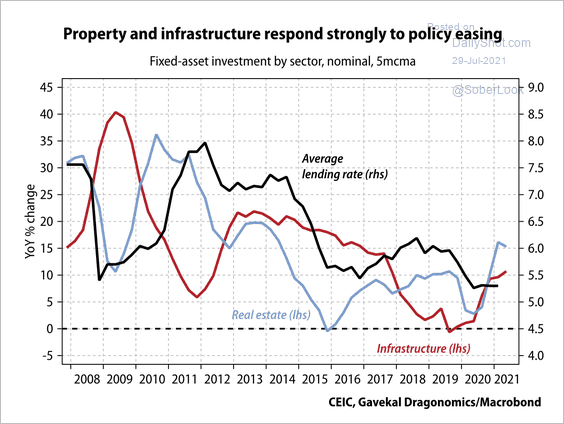

6. Highly leveraged sectors respond quickly and strongly to policy easing.

Source: Gavekal Research

Source: Gavekal Research

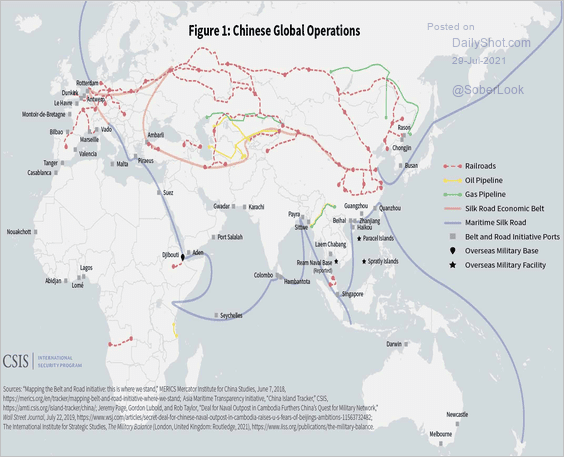

7. This map shows China’s global operations.

Source: CSIS Read full article

Source: CSIS Read full article

Back to Index

Emerging Markets

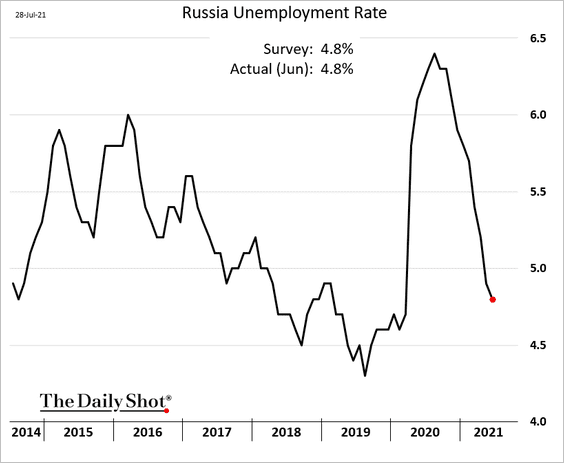

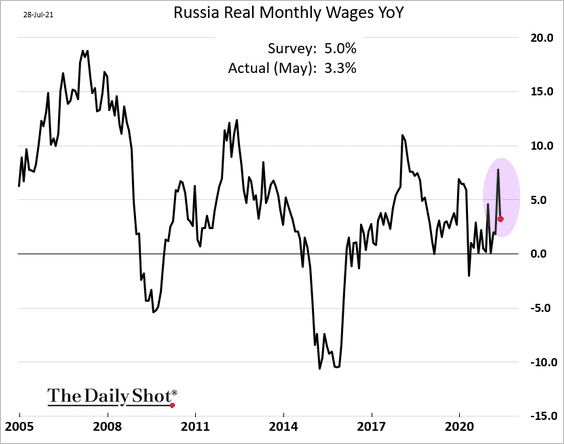

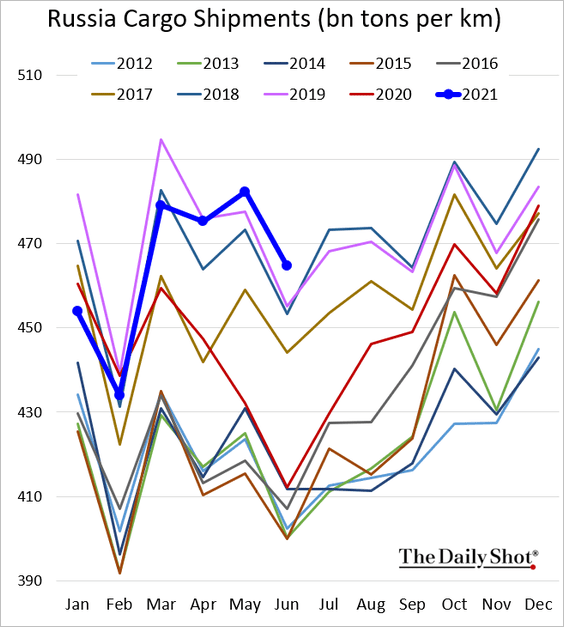

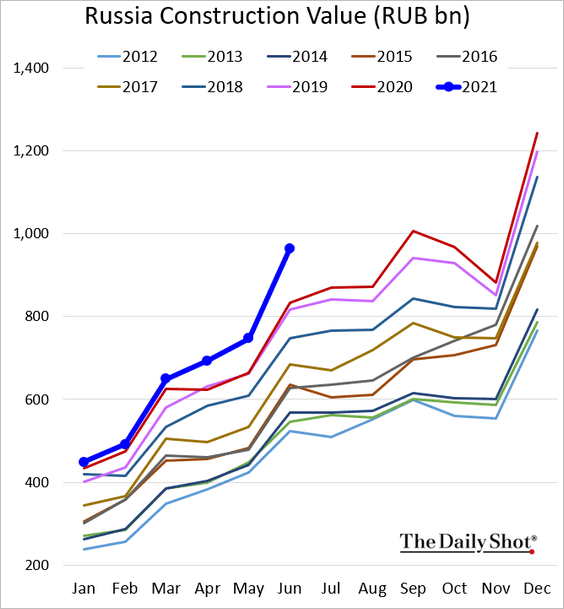

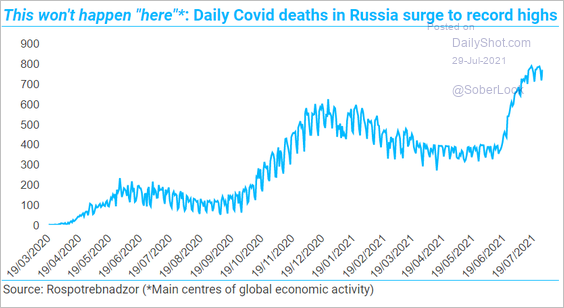

1. Let’s begin with Russia.

• The unemployment rate:

• Wage growth (a drop in May):

• Cargo shipments:

• Construction (very strong):

• COVID-related deaths:

Source: TS Lombard

Source: TS Lombard

——————–

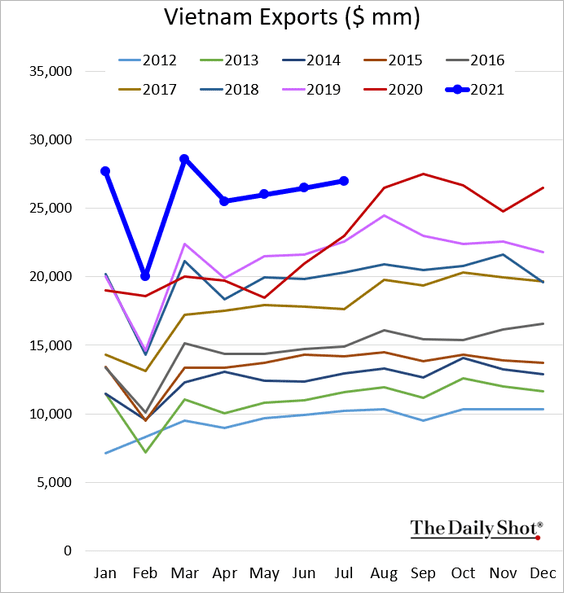

2. Vietnam’s exports remain robust.

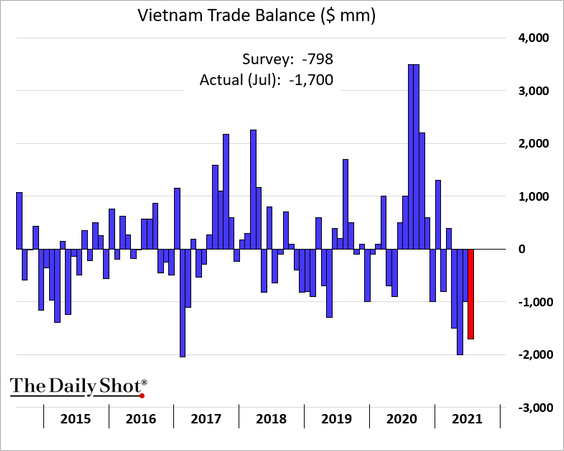

The nation’s trade deficit was higher than expected.

——————–

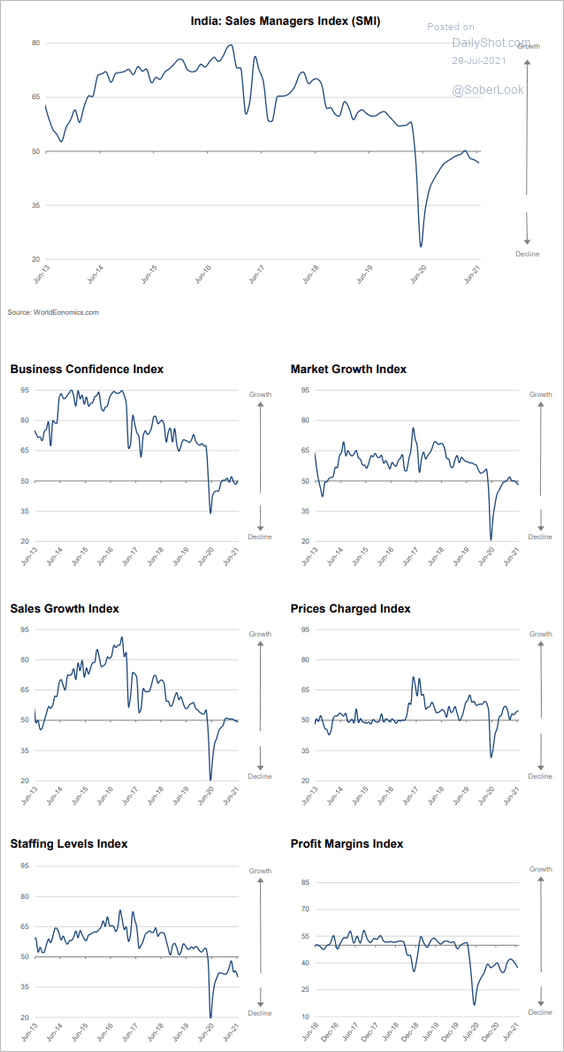

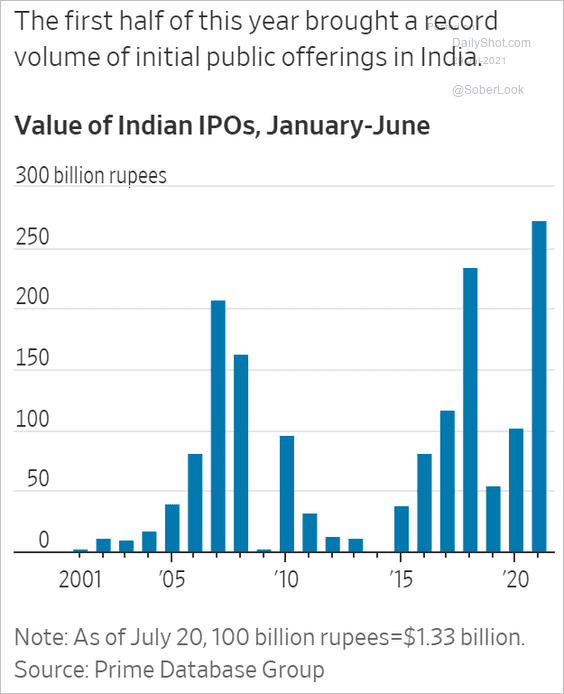

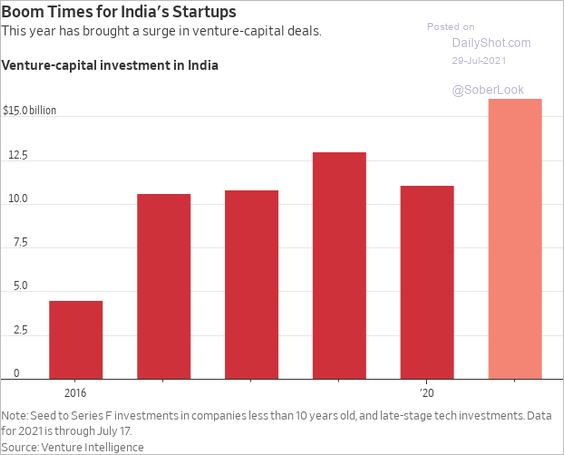

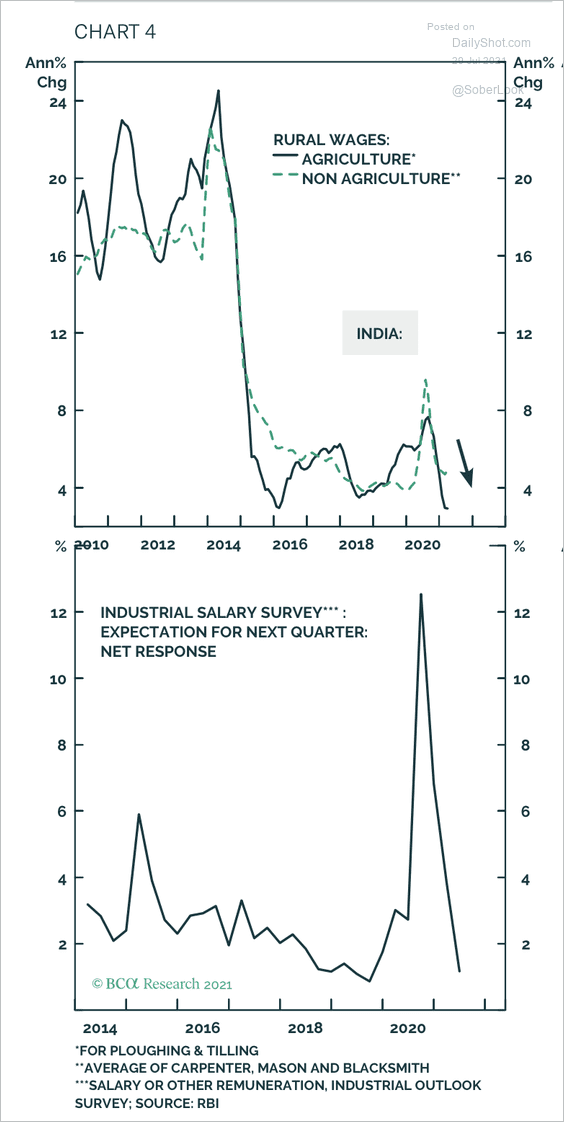

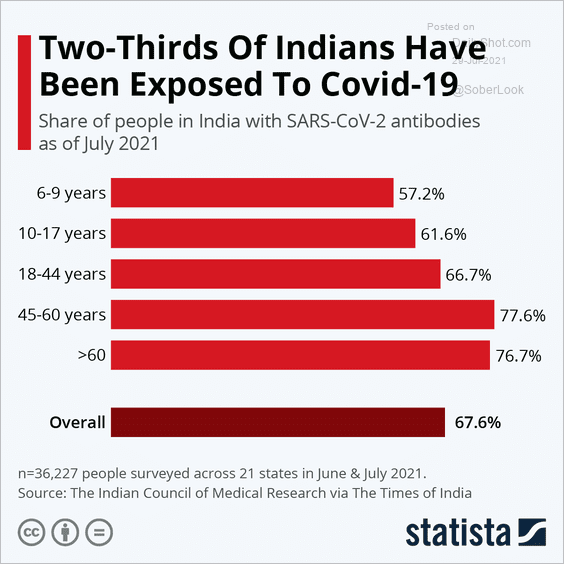

3. Next, we have some updates on India.

• The World Economic SMI (shows ongoing recession):

Source: World Economics

Source: World Economics

• IPO activity:

Source: @WSJ Read full article

Source: @WSJ Read full article

• VC Investments:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Rural and industrial wage growth:

Source: BCA Research

Source: BCA Research

• Exposure to COVID:

Source: Statista

Source: Statista

Back to Index

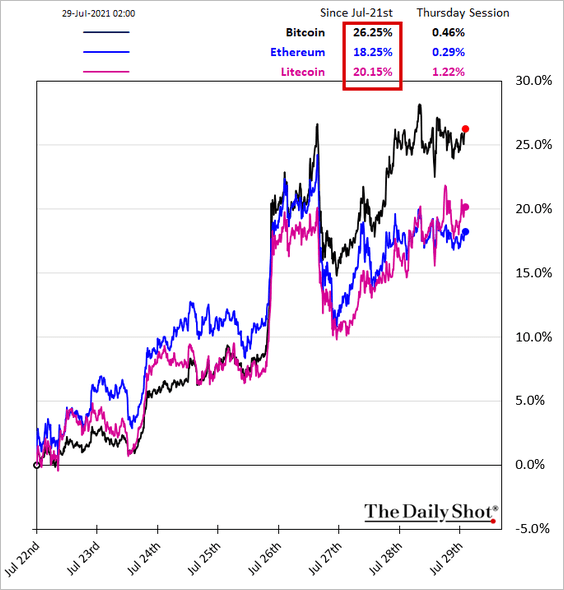

Cryptocurrency

1. It’s been a good week for crypto markets.

Bitcoin is back above $40k.

——————–

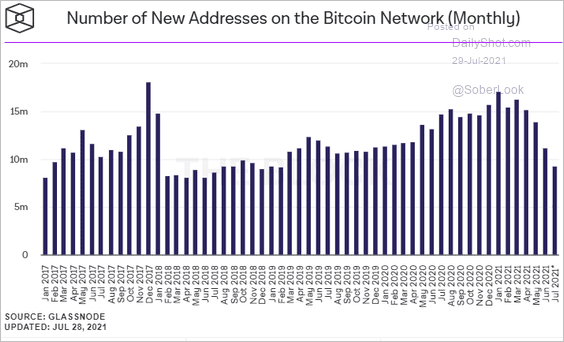

2. Has the number of new addresses on the Bitcoin network bottomed this month?

Source: The Block

Source: The Block

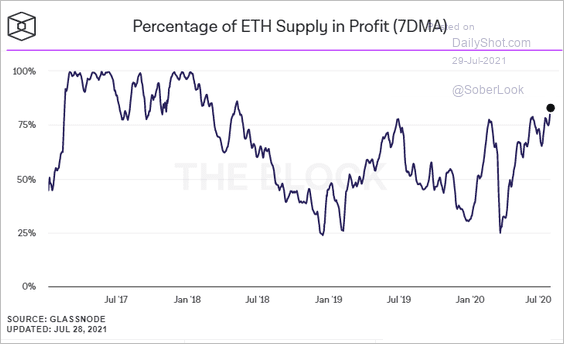

3. This chart shows the percentage of Ethereum supply in profit.

Source: The Block

Source: The Block

Back to Index

Commodities

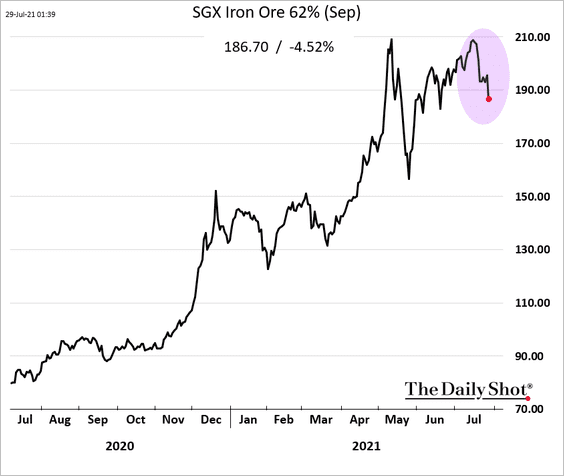

1. The rally in iron ore is fading.

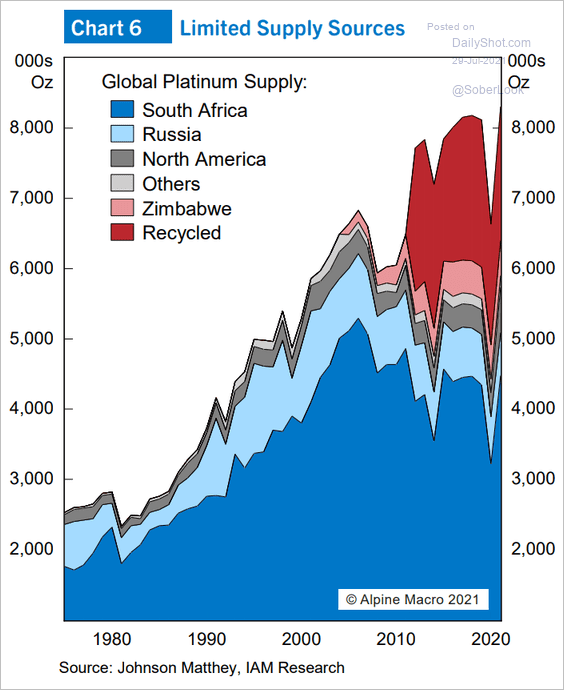

2. Here are the sources of global platinum supply.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Energy

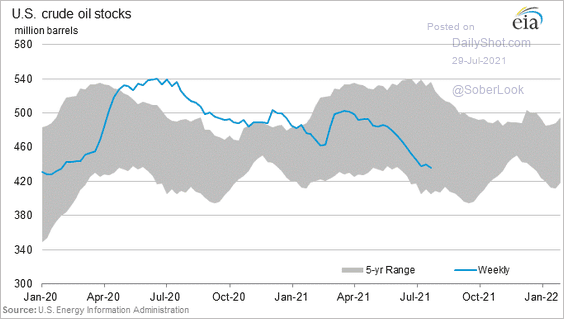

1. US oil inventories continue to trend lower.

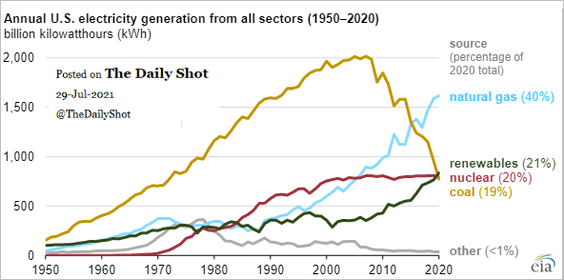

2. This chart shows US electricity generation by fuel type.

Source: EIA Read full article

Source: EIA Read full article

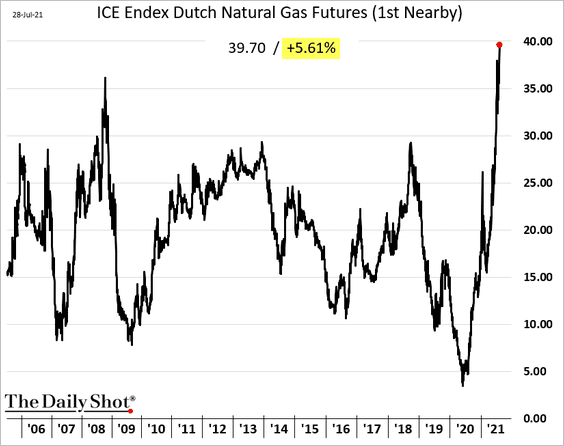

3. European natural gas prices continue to hit record highs.

Back to Index

Equities

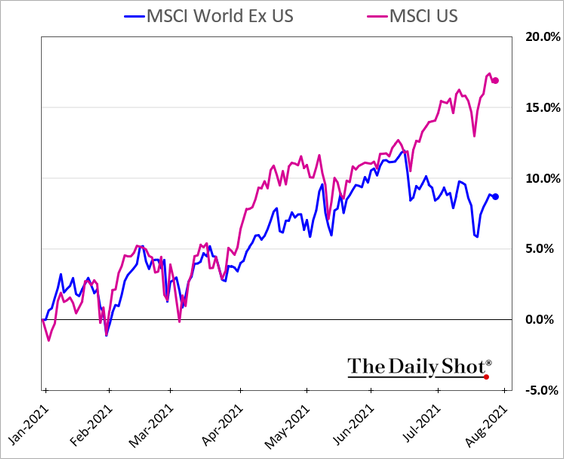

1. The year-to-date performance gap between US and non-US stocks keeps widening.

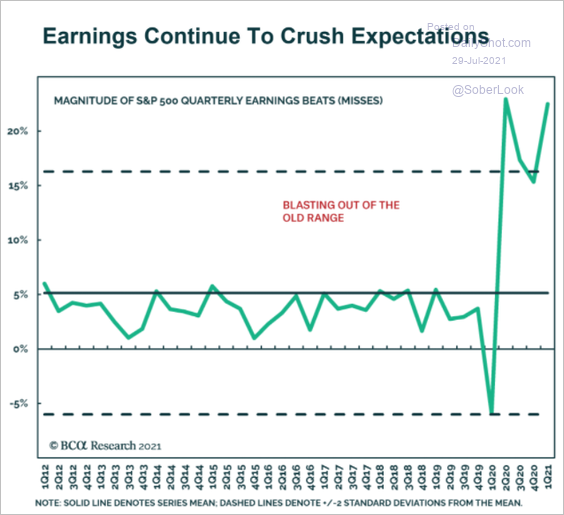

2. Earnings continue to exceed forecasts.

Source: BCA Research

Source: BCA Research

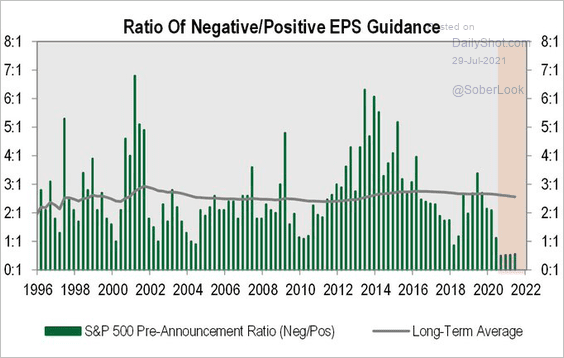

Negative pre-announcements have been rare.

Source: @MichaelKantro

Source: @MichaelKantro

——————–

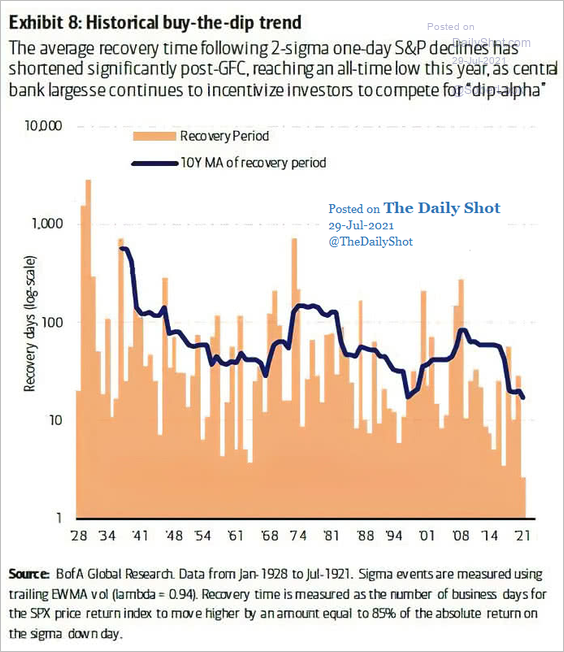

3. The average recovery time from sharp one-day declines continues to shorten as the “buy-the-dip” mentality permeates the market.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

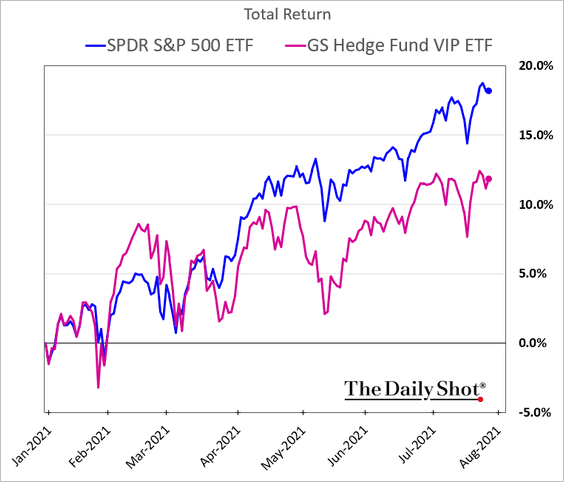

4. Hedge funds’ favorite stocks have underperformed this year.

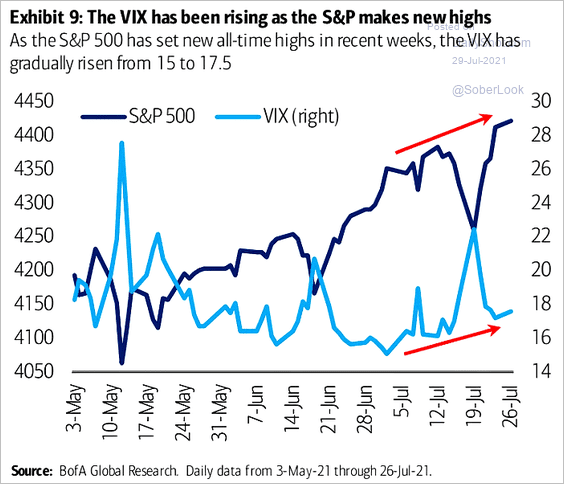

5. VIX has been trending up even as the market makes new highs.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

Back to Index

Credit

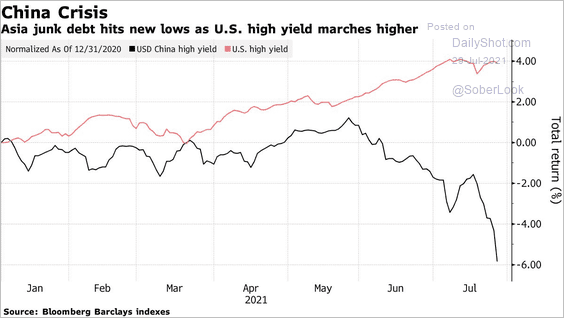

1. Will China’s high-yield market rout put downward pressure on US credit?

Source: @markets Read full article

Source: @markets Read full article

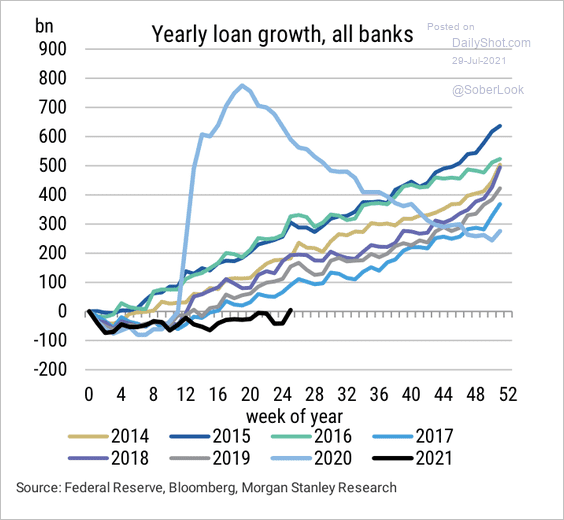

2. US loan growth turned positive year-to-date but remains weak relative to previous years.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

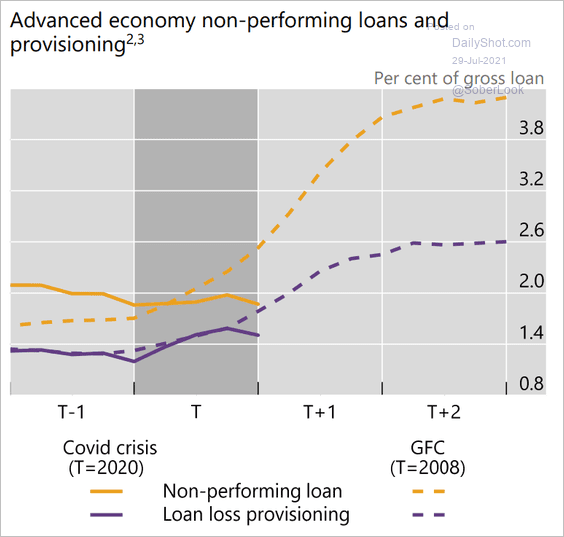

3. Loan performance has been remarkably strong relative to the 2008 downturn.

Source: BIS Read full article

Source: BIS Read full article

Back to Index

Rates

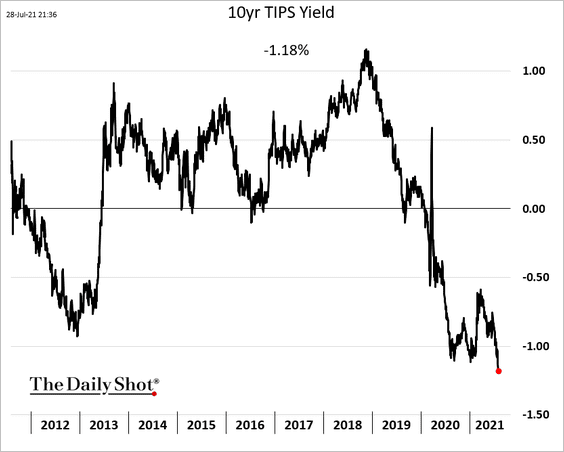

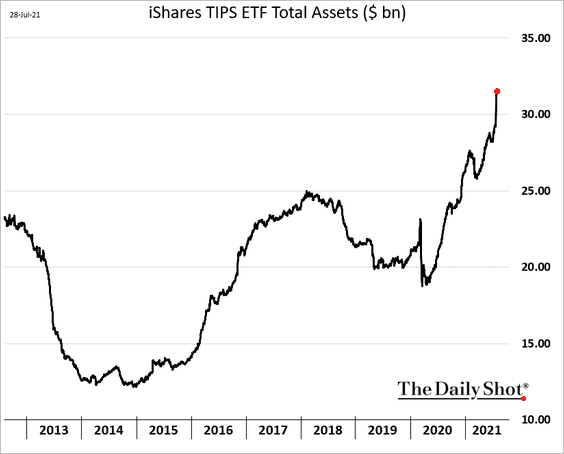

US real rates continue to hit new lows as investors pour money into inflation-linked Treasuries (2nd chart).

Back to Index

Global Developments

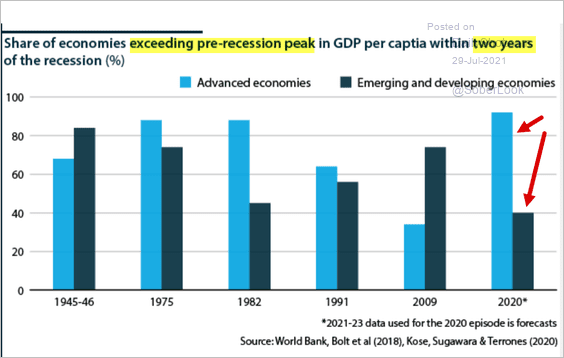

1. Here is the share of economies exceeding pre-recession GDP within two years.

Source: Oxford Analytica Read full article

Source: Oxford Analytica Read full article

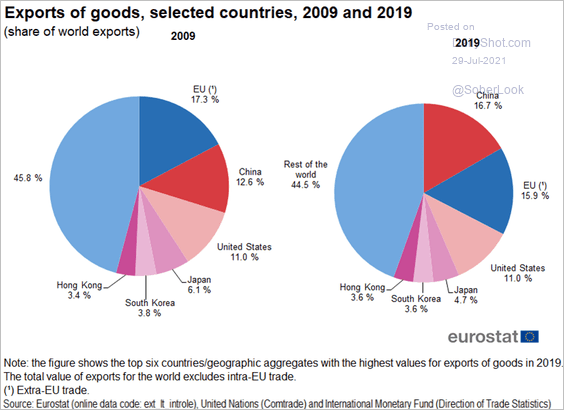

2. Next, we have the distribution of goods exports in 2009 and 2019.

Source: Eurostat Read full article

Source: Eurostat Read full article

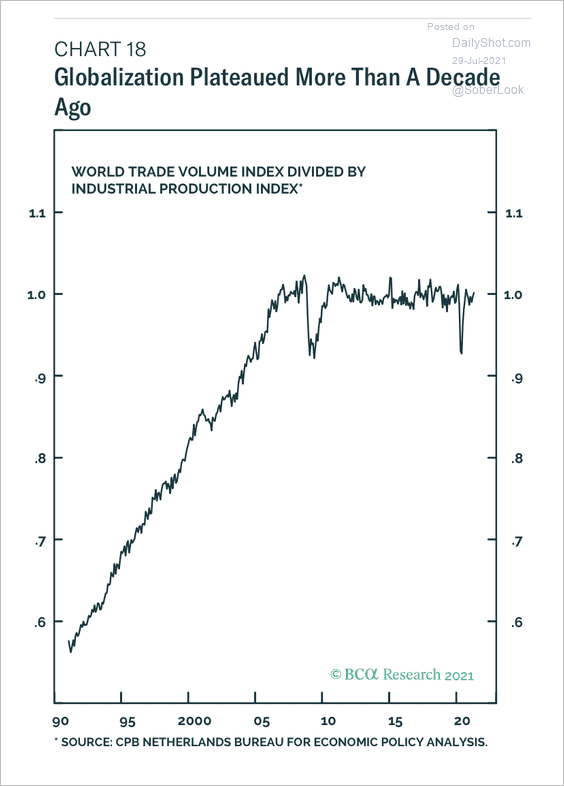

3. The ratio of global trade-to-manufacturing output has been flat for over a decade.

Source: BCA Research

Source: BCA Research

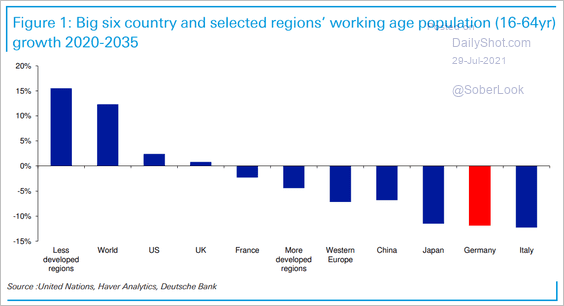

4. This chart shows the expected working-age population growth between 2020 and 2035.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

5. Finally, we have semiconductor capacity growth projections.

![]() Source: SIA Read full article

Source: SIA Read full article

——————–

Food for Thought

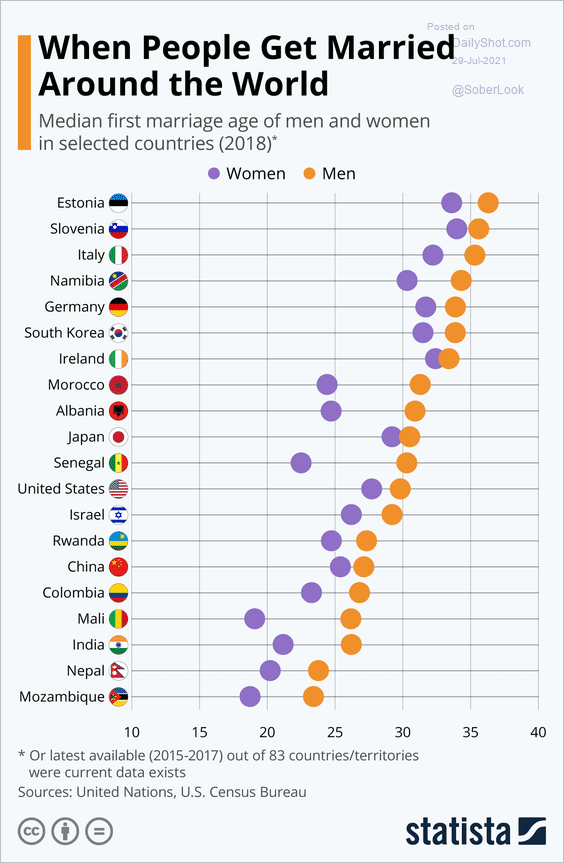

1. The median age of first marriage around the world:

Source: Statista

Source: Statista

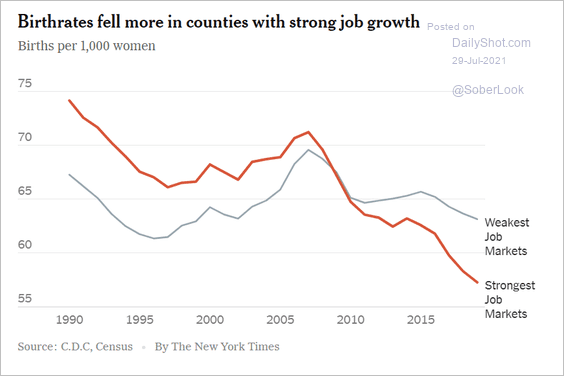

2. US birth rates in counties with strong and weak job markets:

Source: The New York Times Read full article

Source: The New York Times Read full article

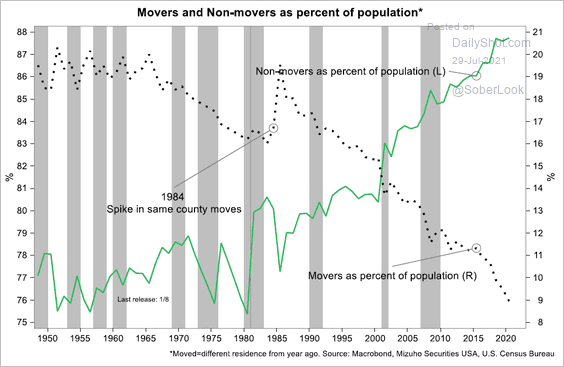

3. Declining mobility in the US:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

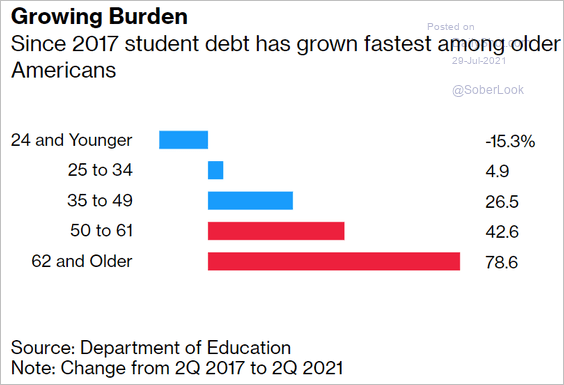

4. Growth in student debt burden:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

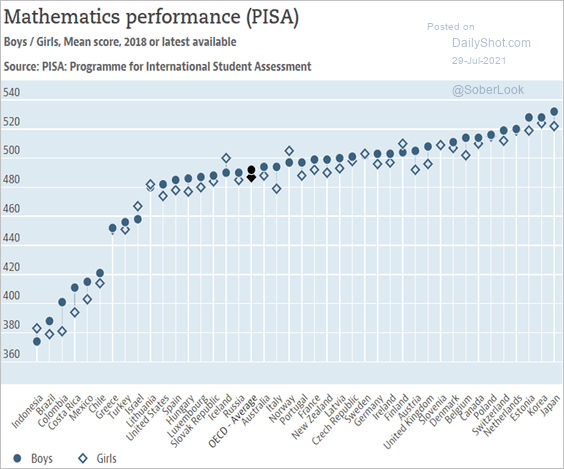

5. Mathematics performance:

Source: OECD

Source: OECD

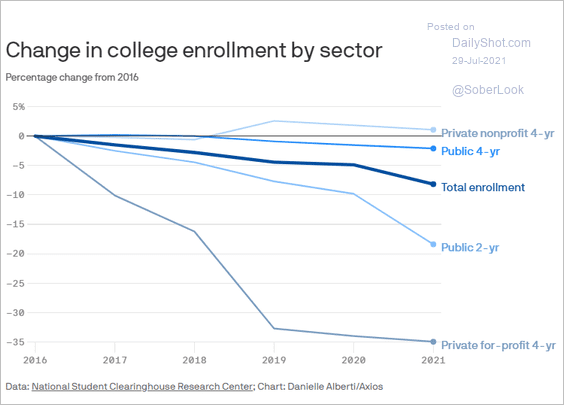

6. Changes in US college enrollment:

Source: @axios Read full article

Source: @axios Read full article

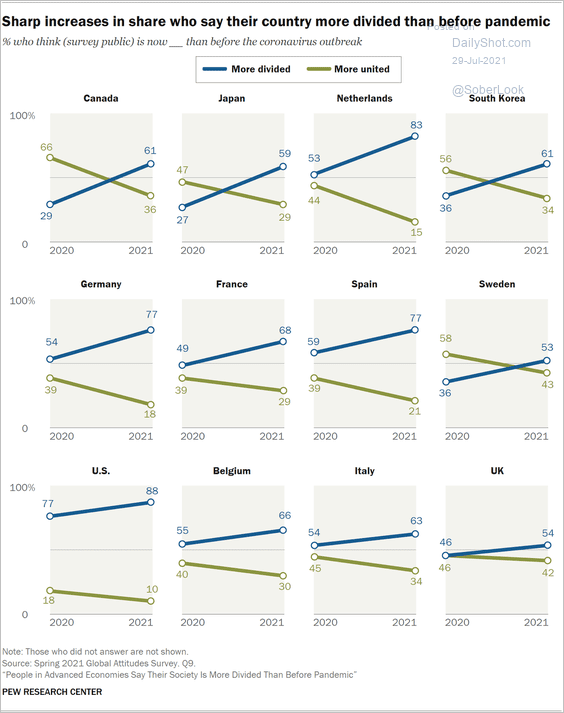

7. Populations more divided than before COVID:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

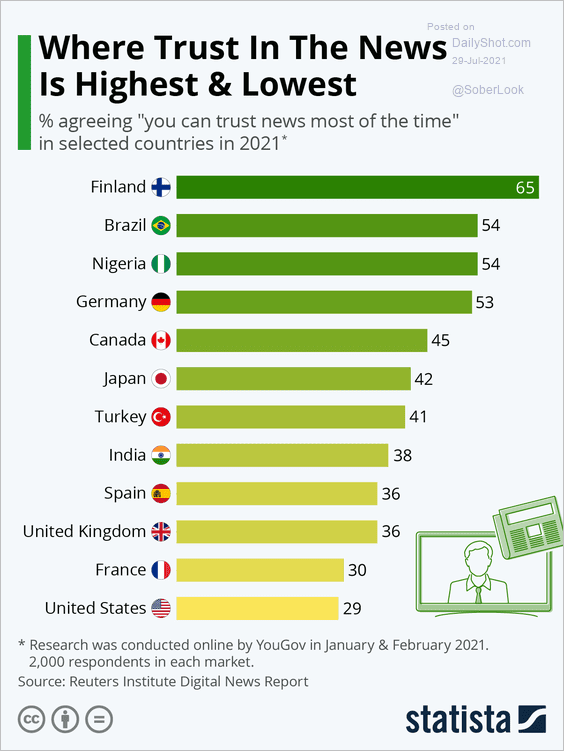

8. Trust in the news:

Source: Statista

Source: Statista

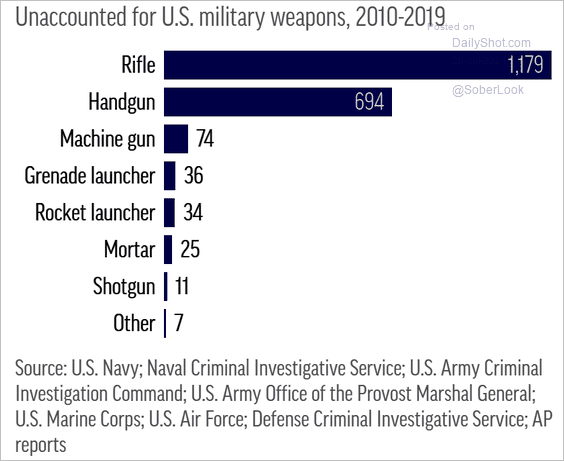

9. Unaccounted for US military weapons:

Source: AP Read full article

Source: AP Read full article

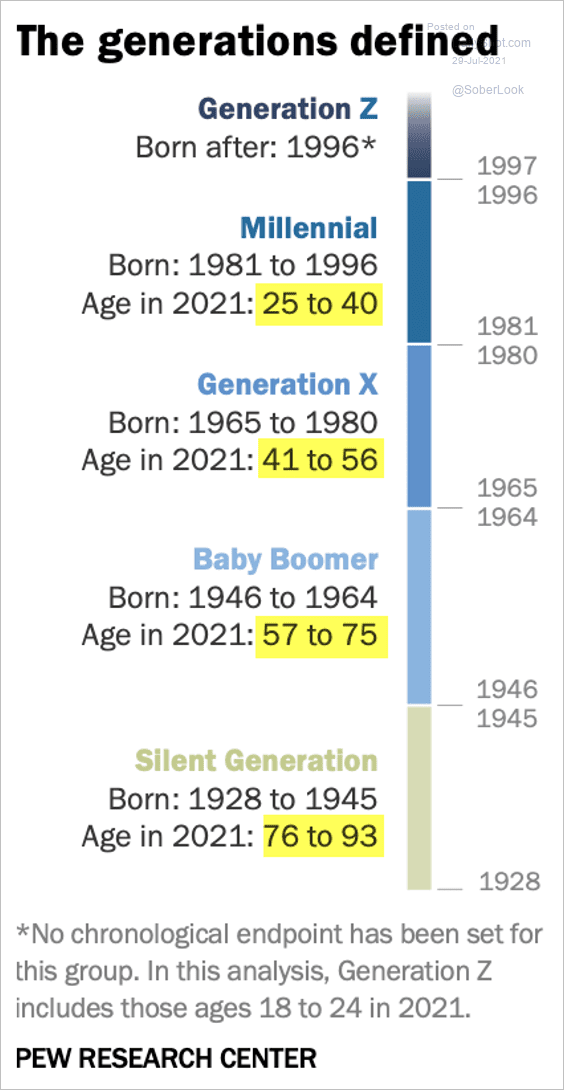

10. Generations defined:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

Back to Index