The Daily Shot: 31-Aug-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

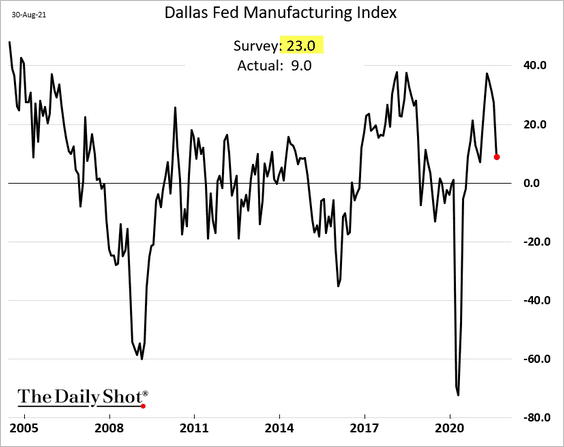

1. The Dallas Fed’s regional manufacturing index tumbled in August, coming in well below market expectations.

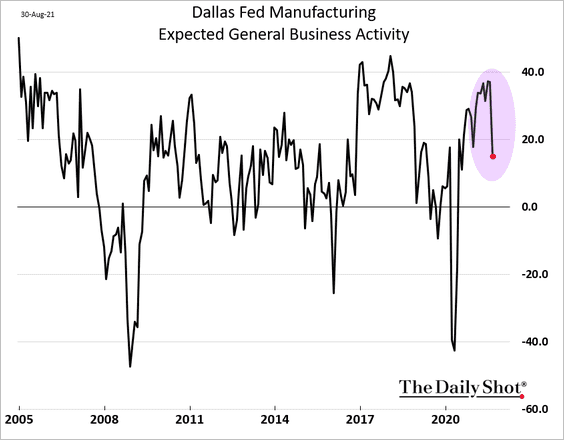

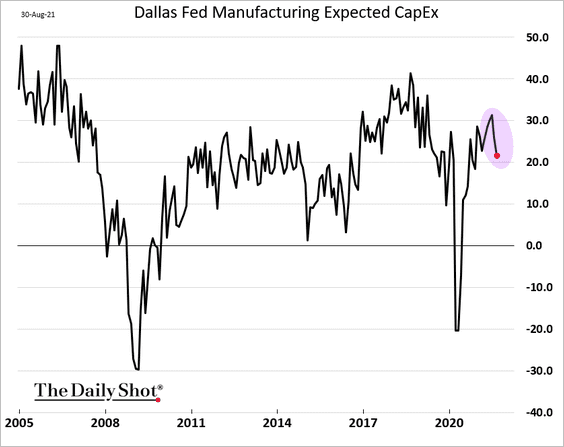

• Manufacturers have become much less upbeat about the future.

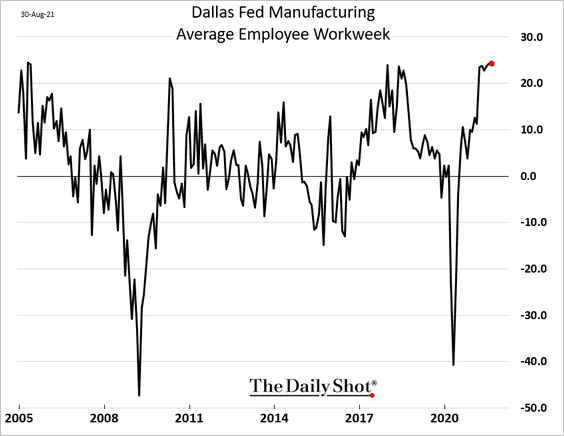

• However, factory workers remain very busy.

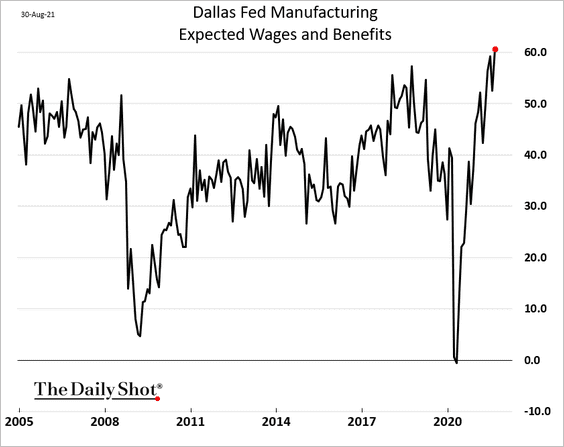

• Businesses increasingly expect to boost employee pay in the near-term.

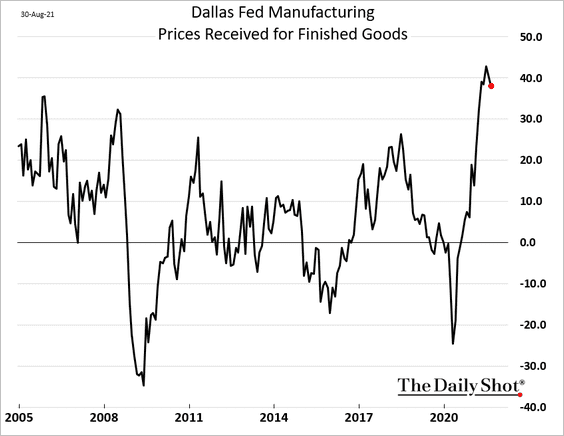

• Price pressures persist, although the “prices received” index appears to have peaked.

——————–

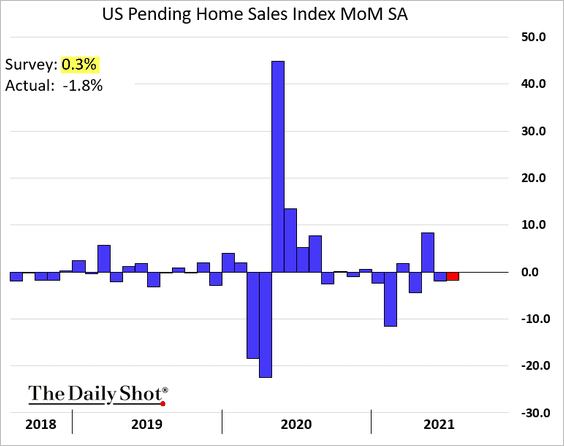

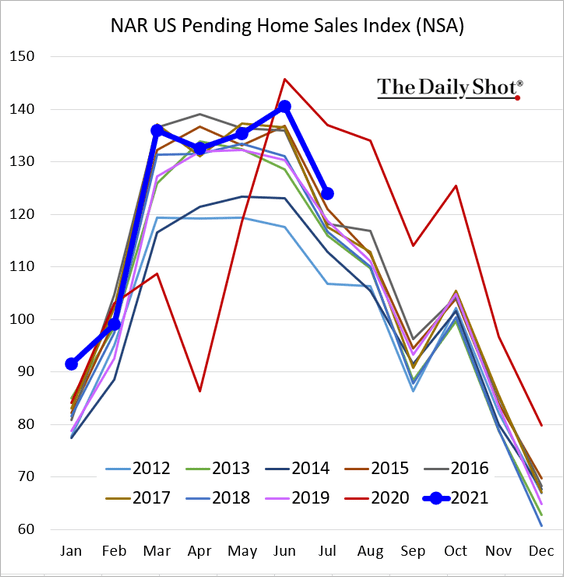

2. Pending home sales unexpectedly declined in July as rapid price gains take their toll on housing activity.

Source: CNBC Read full article

Source: CNBC Read full article

——————–

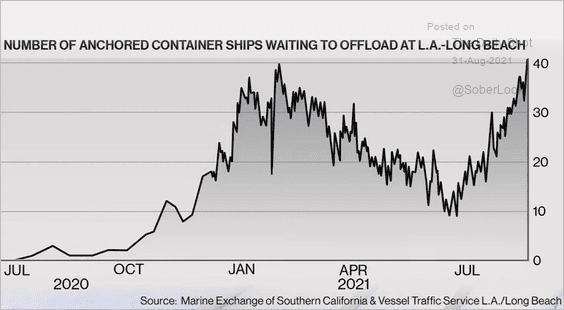

3. Next, we have some updates on supply bottlenecks.

• The number of container ships waiting to offload in West Cost ports hit a multi-year high.

Source: Bloomberg TV; h/t Gustavo Fuhr

Source: Bloomberg TV; h/t Gustavo Fuhr

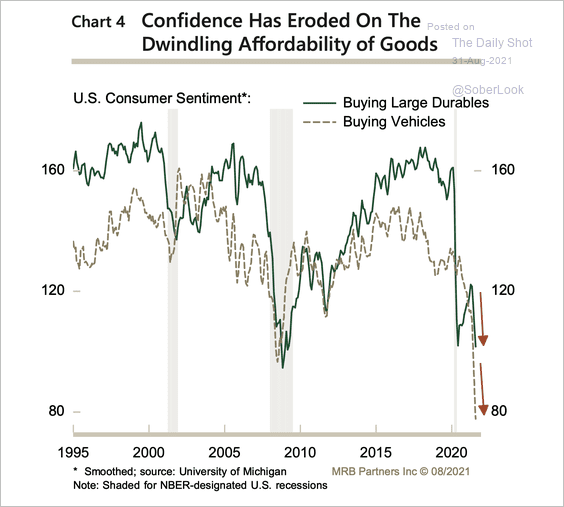

• Supply shortages and rising prices have hit US consumer buying sentiment in durable goods and autos.

Source: MRB Partners

Source: MRB Partners

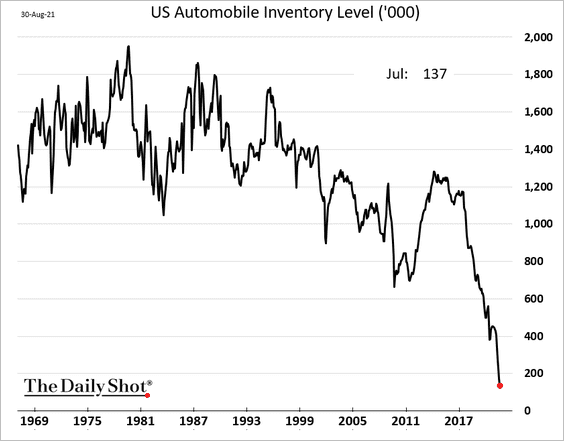

• US automobile inventory is at multi-decade lows.

——————–

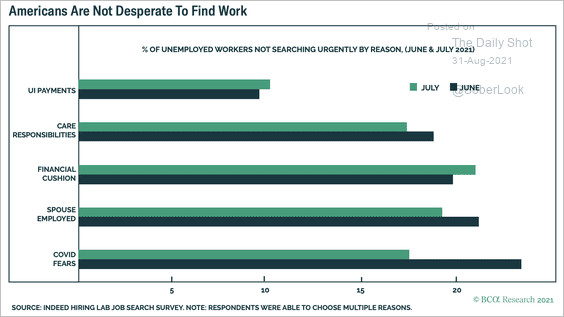

4. Savings glut is having a perverse effect. A financial cushion is now the top reason for not searching for a job urgently.

Source: BCA Research

Source: BCA Research

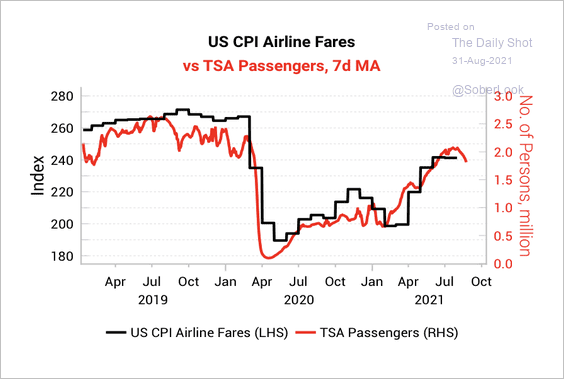

5. Does the recent decline in travel point to lower airline fares? Perhaps.

Source: Variant Perception

Source: Variant Perception

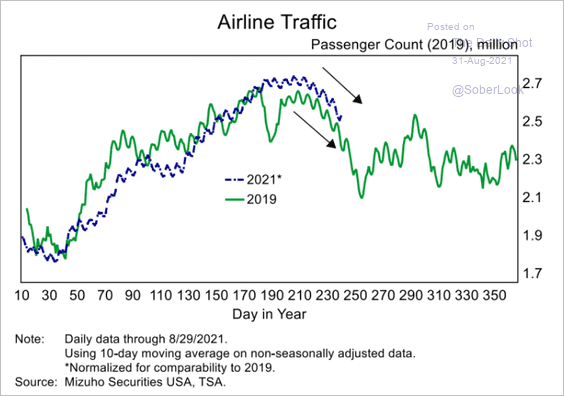

It’s important to consider seasonal effects when looking at US passenger count.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

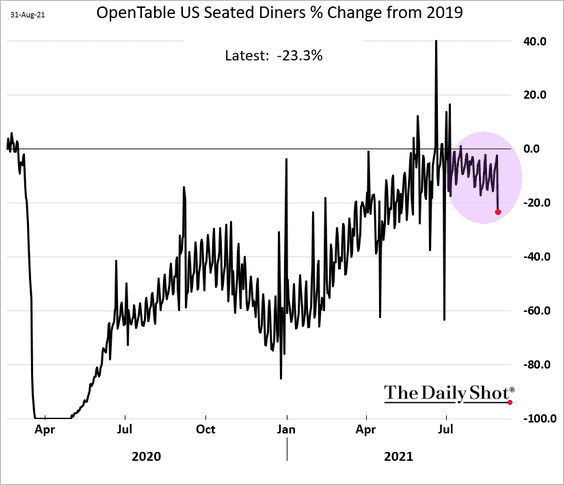

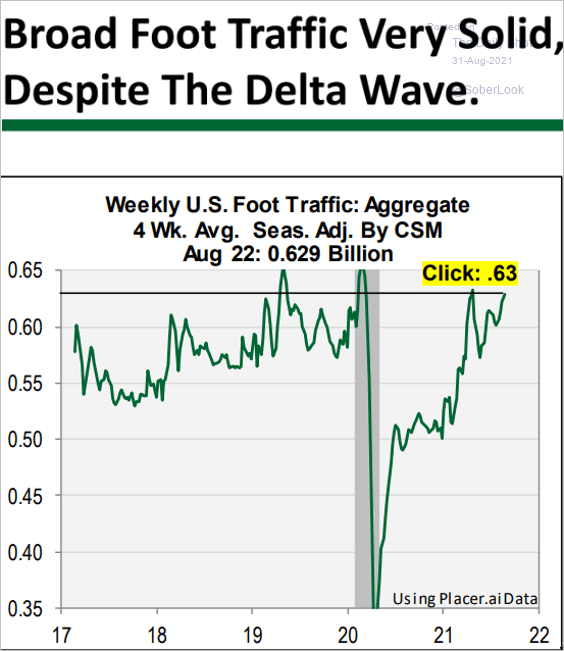

6. Next, we have some high-frequency indicators.

• Seated diners at restaurants:

• The Cornerstone Macro retail foot traffic index:

Source: Cornerstone Macro

Source: Cornerstone Macro

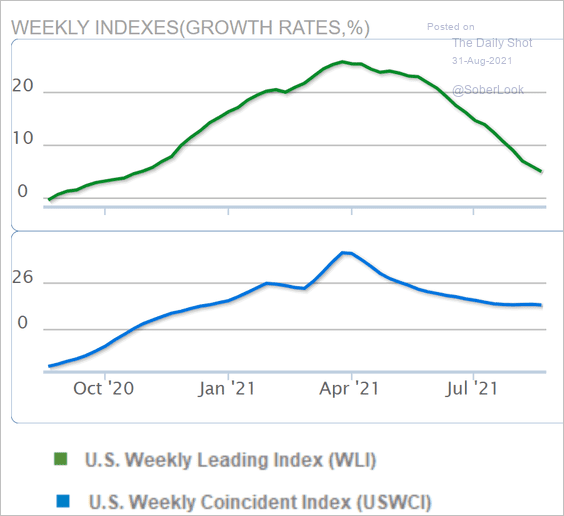

• The ECRI US leading index:

Source: ECRI

Source: ECRI

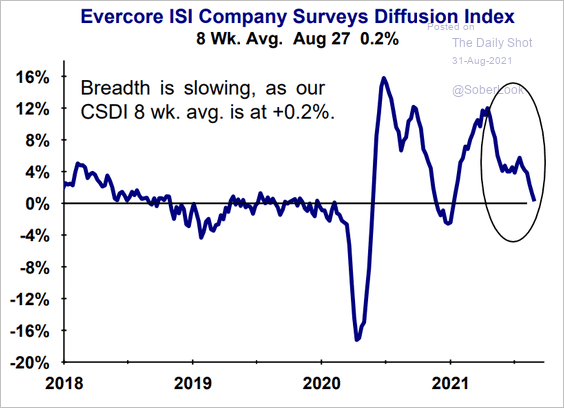

• The Evercore ISI Company Survey Diffusion Index:

Source: Evercore ISI

Source: Evercore ISI

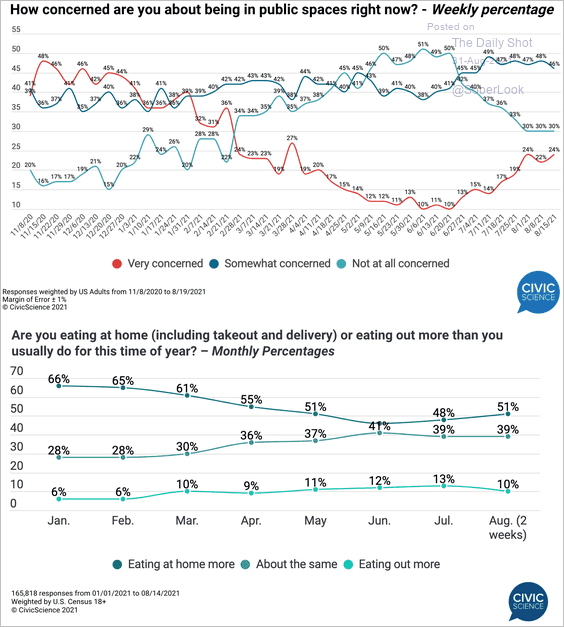

• Concerns about being in public:

Source: @CivicScience

Source: @CivicScience

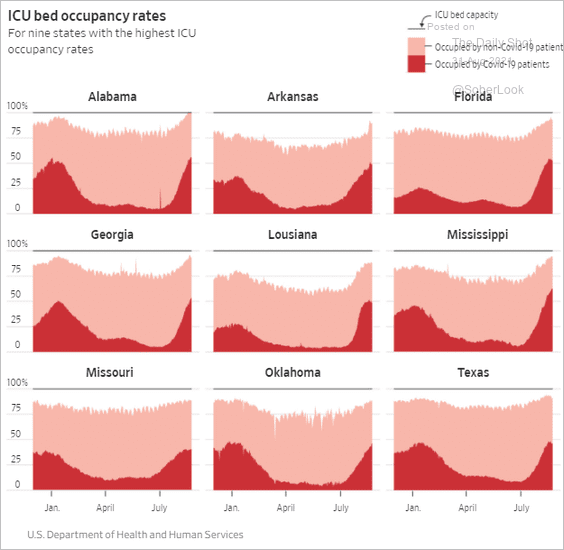

• COVID cases peaking in some states:

Source: @WSJ, h/t @LizAnnSonders Read full article

Source: @WSJ, h/t @LizAnnSonders Read full article

Back to Index

Canada

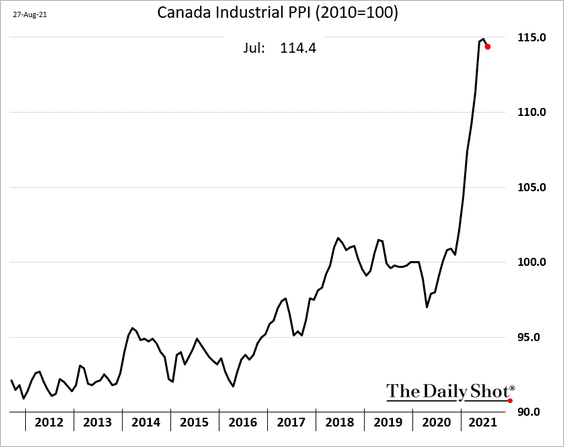

1. Industrial producer prices appear to be peaking (at elevated levels).

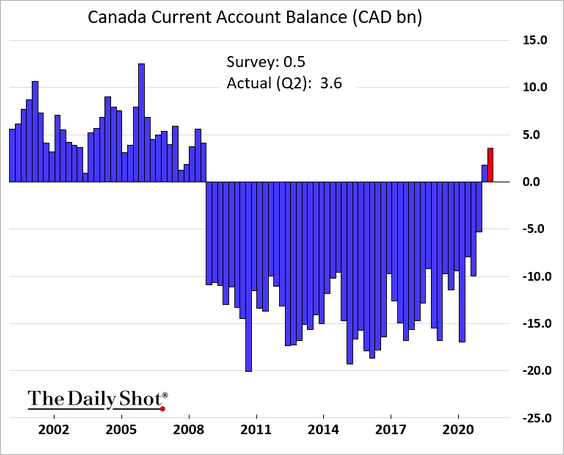

2. The Q2 current account surplus surprised to the upside.

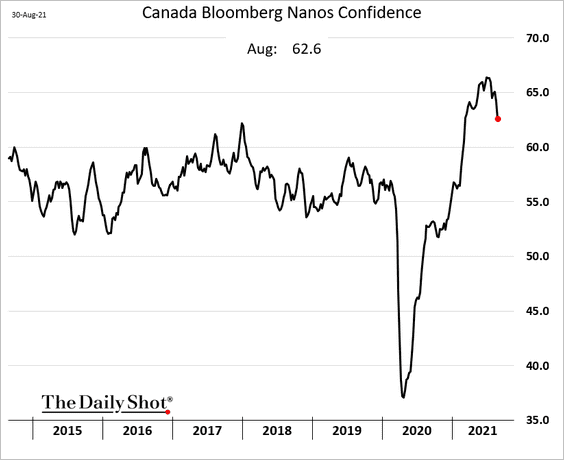

3. Consumer sentiment is rolling over ahead of the election.

Back to Index

The United Kingdom

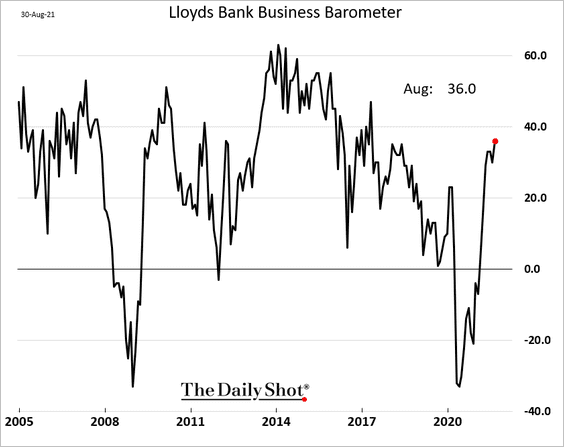

1. Business sentiment continues to improve and is now well above pre-COVID levels.

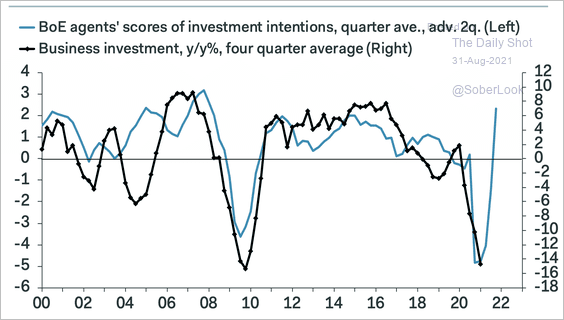

2. UK business investment intentions have recovered fully, suggesting investment should pick up soon.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

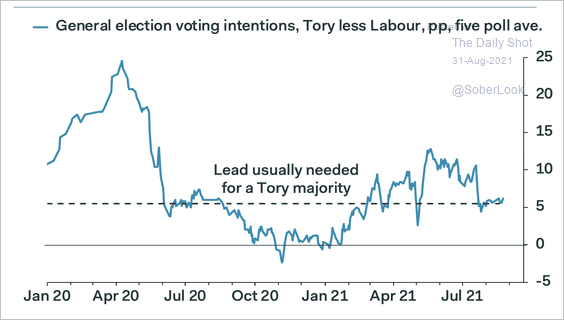

3. Conservative party lead in UK polls no longer signals a majority.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

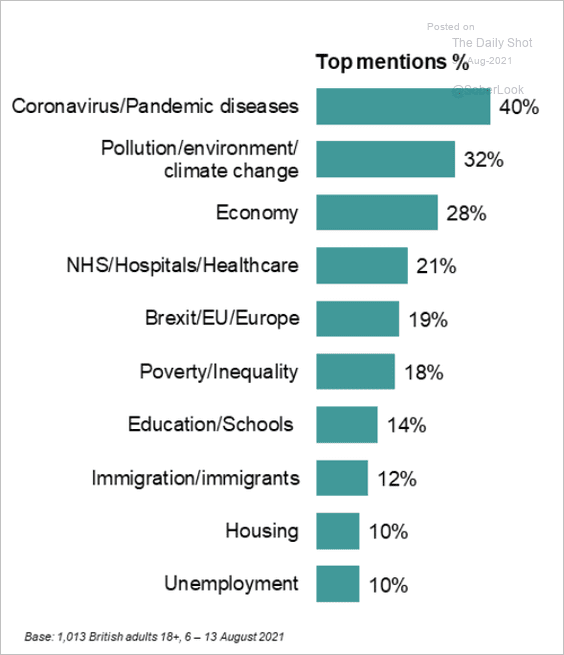

4. What are the most important issues?

Source: Ipsos; @henrymance

Source: Ipsos; @henrymance

Back to Index

The Eurozone

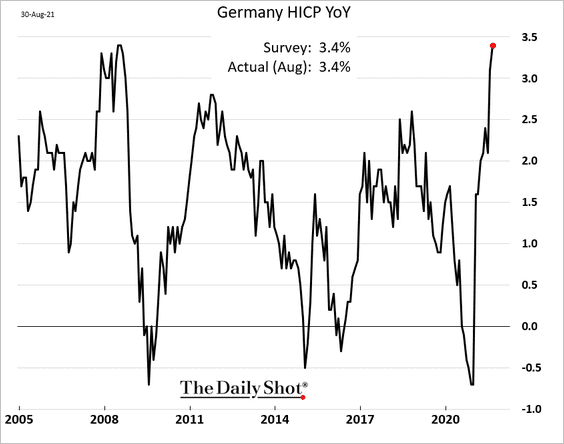

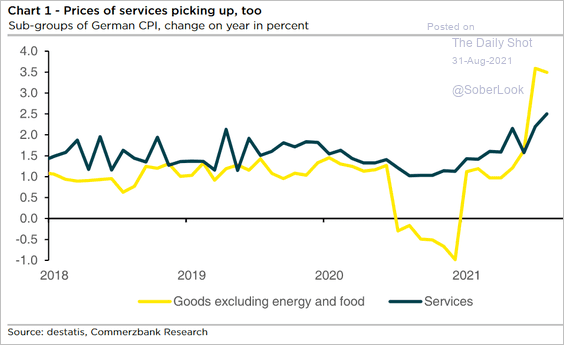

1. Germany’s inflation continues to surge (in line with expectations).

• Services inflation has been picking up.

Source: Commerzbank Research

Source: Commerzbank Research

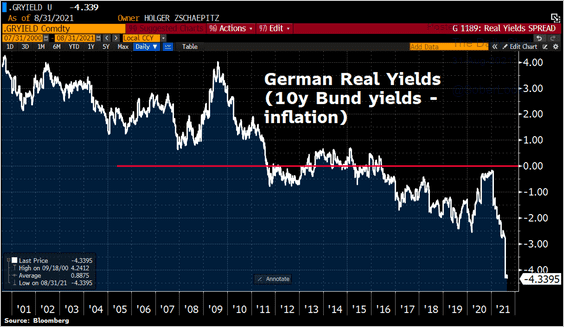

• Here is the 10yr Bund yield adjusted for inflation.

Source: @stlouisfed, @AndreaBeranjais, @djgt123, @mustgoupforever, @Callum_Thomas, @michaelshermer, @markets, @Schuldensuehner Read full article

Source: @stlouisfed, @AndreaBeranjais, @djgt123, @mustgoupforever, @Callum_Thomas, @michaelshermer, @markets, @Schuldensuehner Read full article

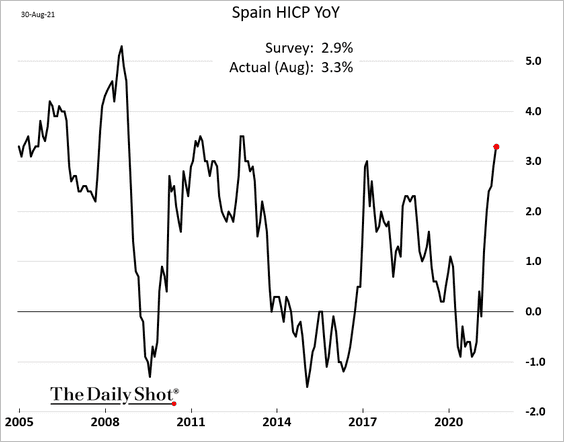

• Spain’s inflation surprised to the upside.

——————–

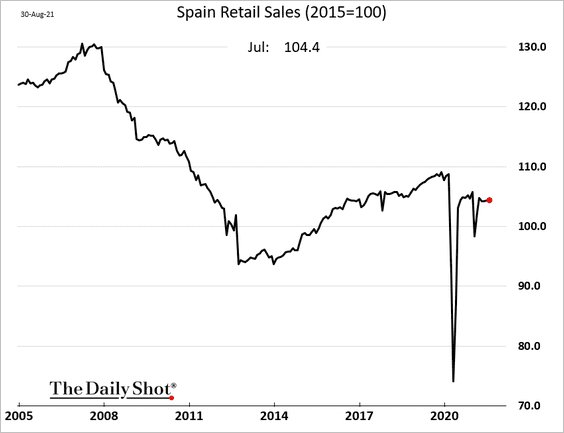

2. Spanish retail sales have been relatively flat in recent months and remain below pre-COVID levels.

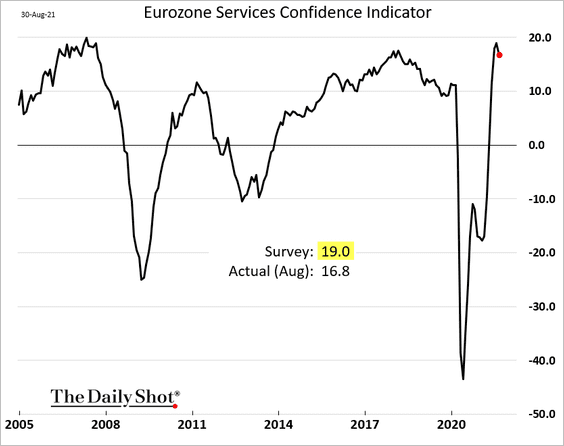

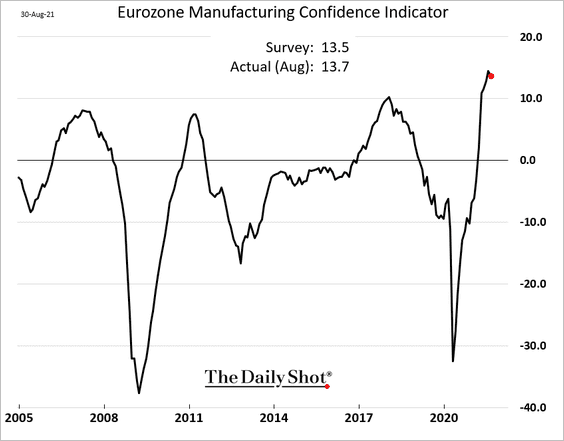

3. Service-sector business confidence unexpectedly declined from the highs.

Manufacturing sentiment also appears to have peaked.

——————–

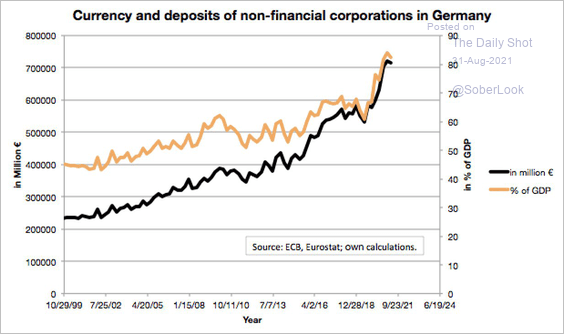

4. German companies are sitting on a pile of cash.

Source: @heimbergecon

Source: @heimbergecon

Back to Index

Europe

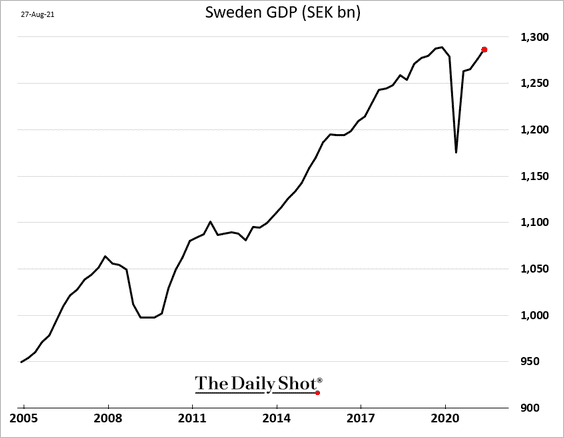

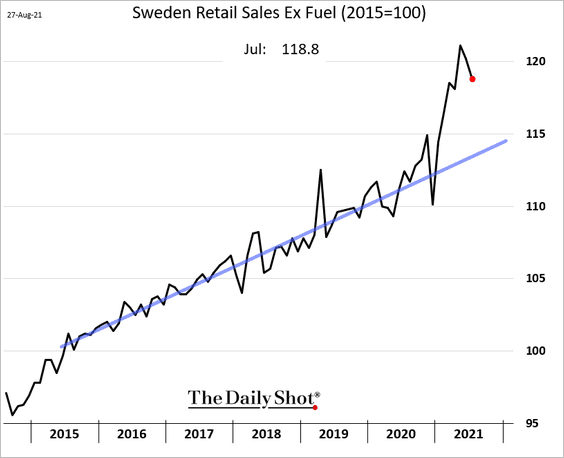

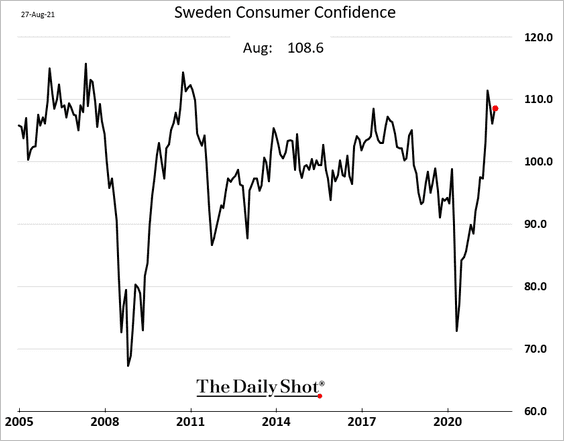

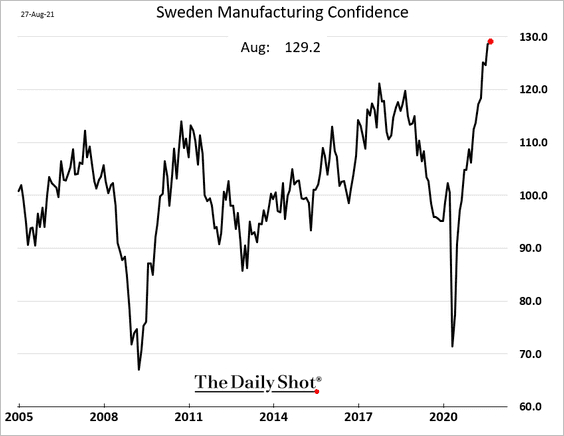

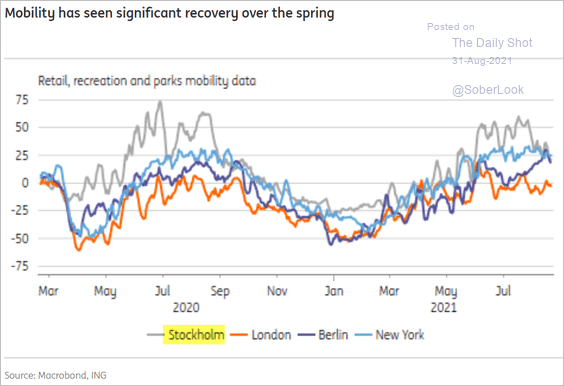

1. Let’s begin with Sweden.

• The GDP:

• Retail sales:

• Consumer confidence:

• Manufacturing confidence:

• Stockholm mobility data relative to other cities:

Source: ING

Source: ING

——————–

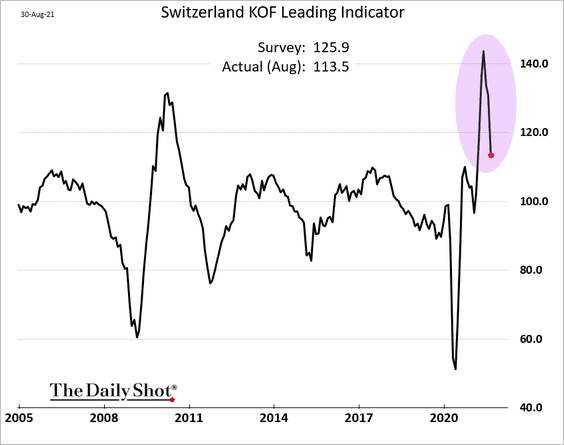

2. The Swiss index of leading indicators tumbled this month.

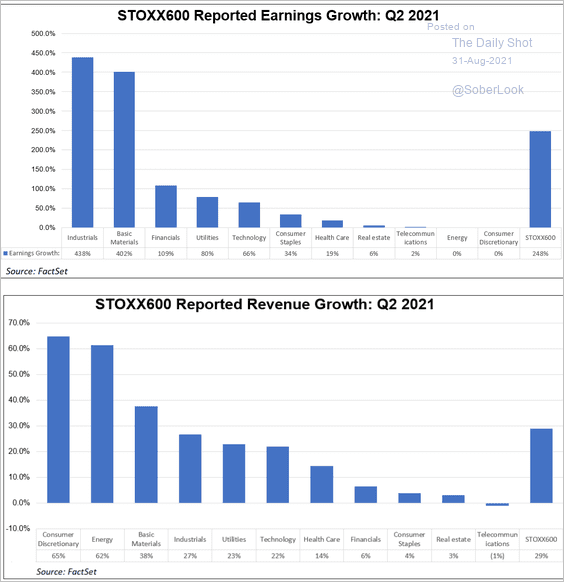

3. Next, we have some data on STOXX 600 corporate earnings.

• Earnings and revenue growth by sector:

Source: @FactSet Read full article

Source: @FactSet Read full article

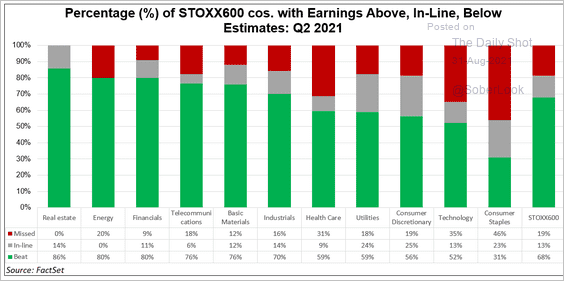

• Earnings vs. expectations:

Source: @FactSet Read full article

Source: @FactSet Read full article

Back to Index

Japan

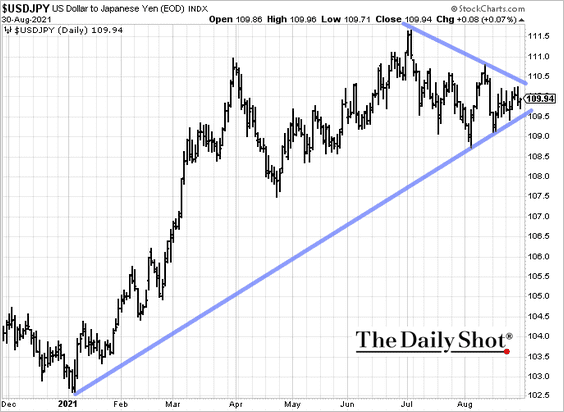

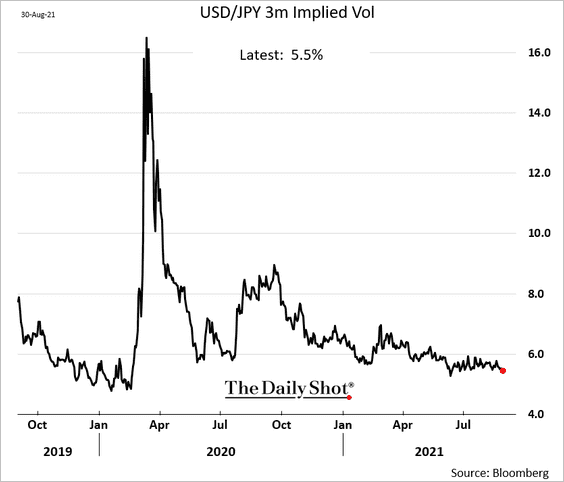

1. Dollar-yen has been consolidating, …

… as the implied volatility drifts lower.

——————–

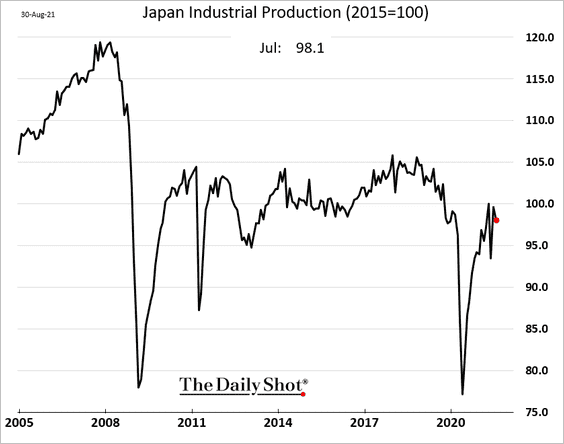

2. Industrial production ticked down last month.

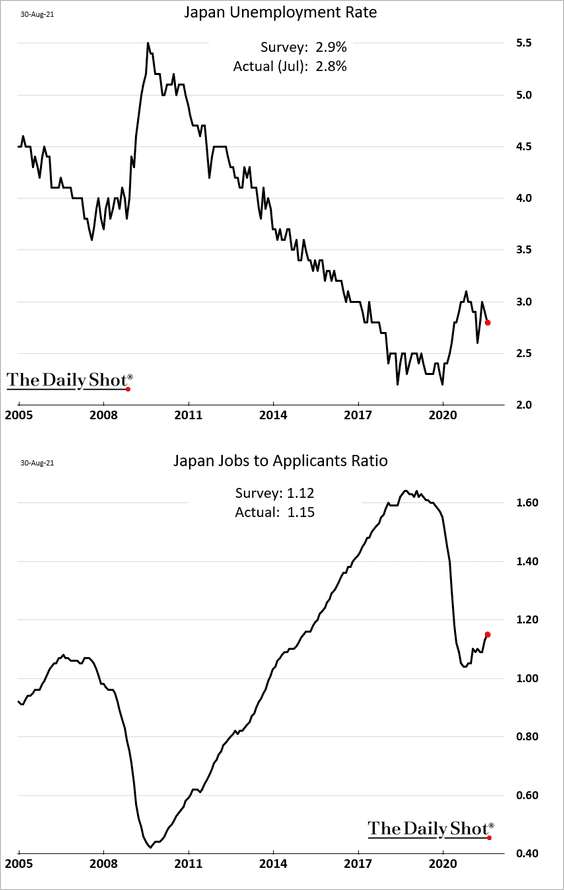

3. The labor market continues to improve.

Back to Index

Asia – Pacific

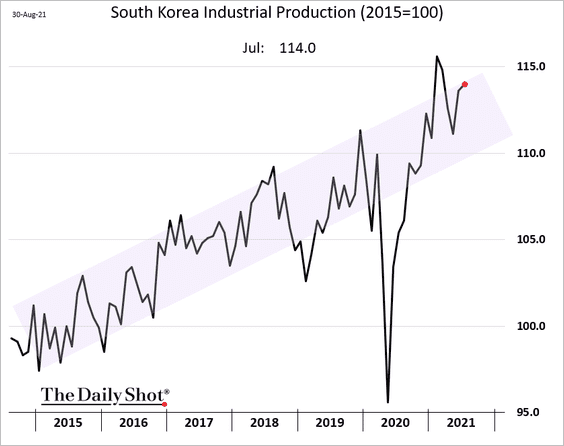

1. South Korea’s industrial production remains in the upward trend.

Exports to China accelerated recently.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

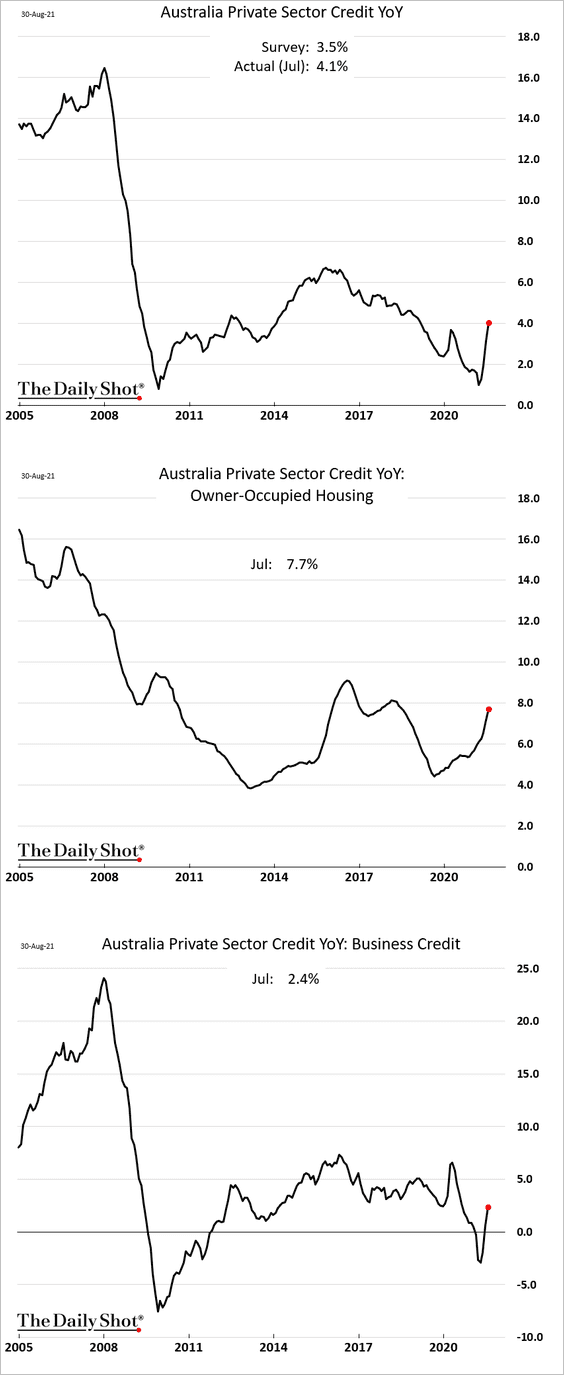

2. Australia’s private-sector credit growth continues to recover.

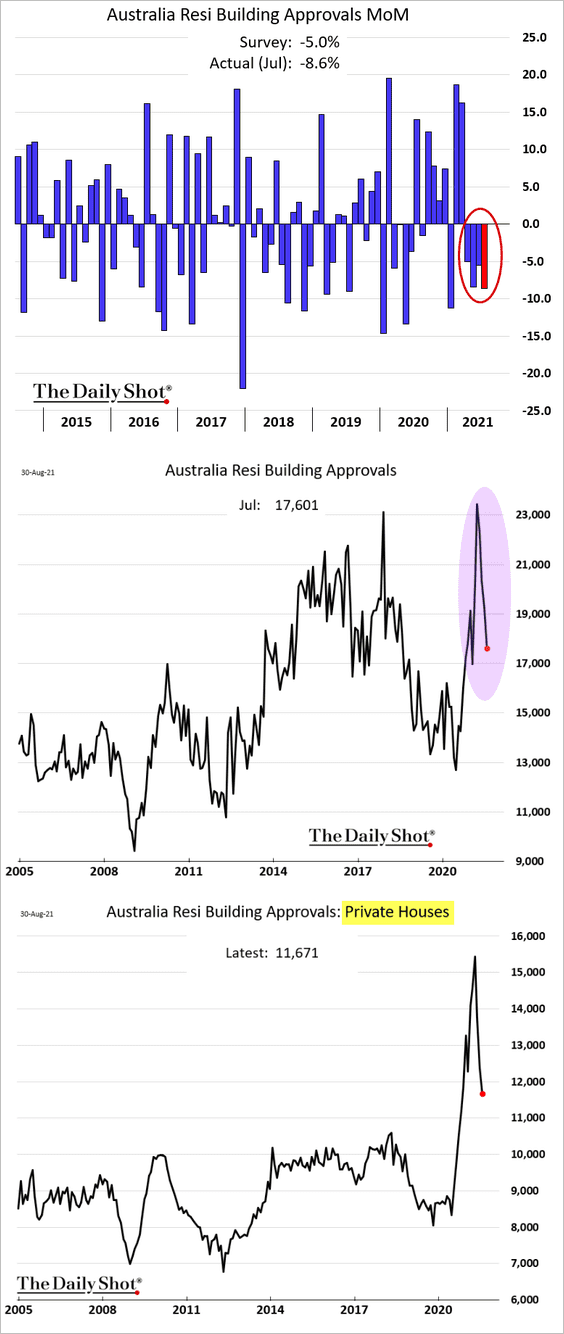

Building permits tumbled again last month.

Back to Index

China

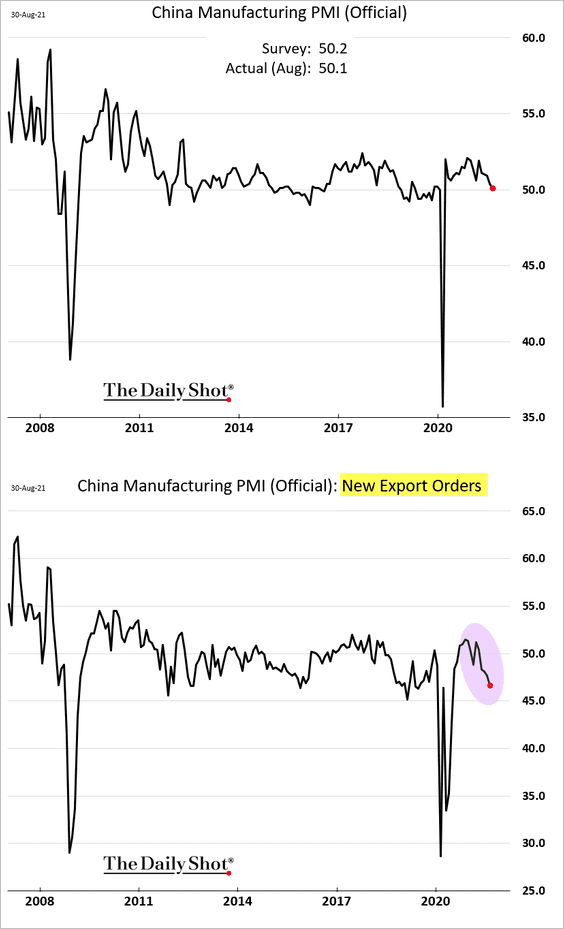

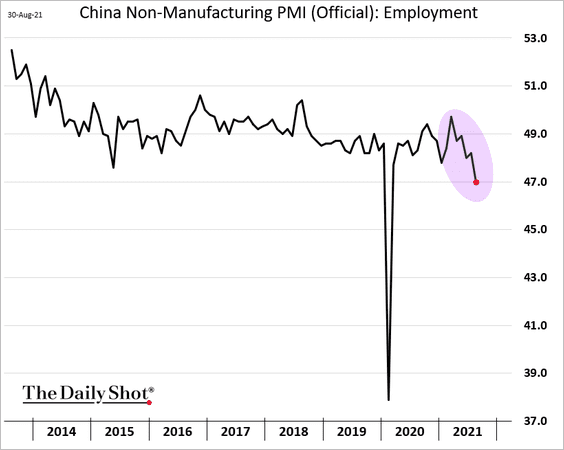

1. We continue to see signs of moderating economic activity. The official PMI report showed almost no manufacturing growth in August (PMI near 50) as export orders slump.

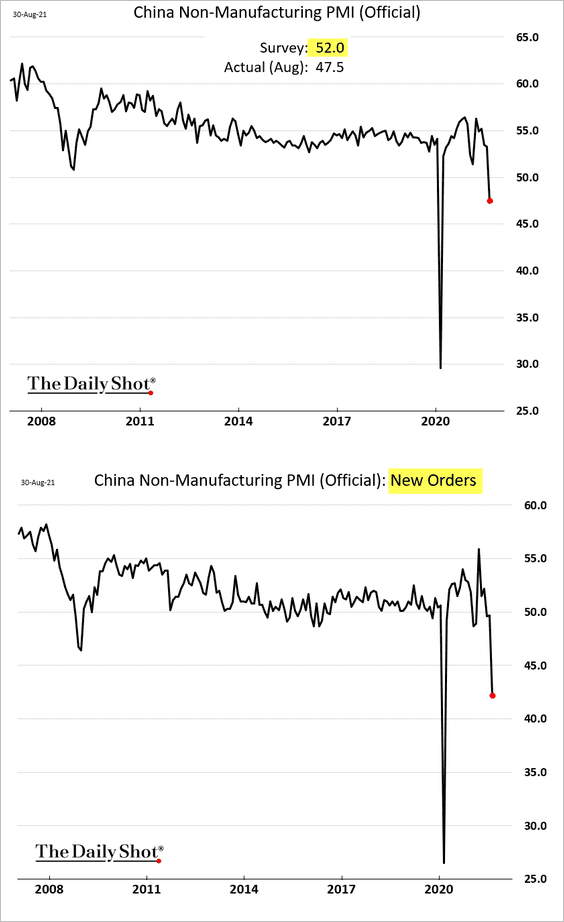

Nonmanufacturing activity tumbled in August.

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

Companies are reducing staff.

——————–

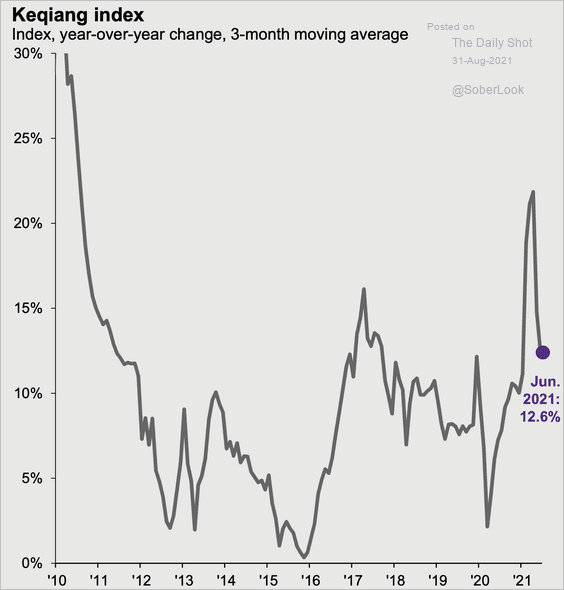

2. The Keqiang index, a key cyclical indicator for China, continues to roll over.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

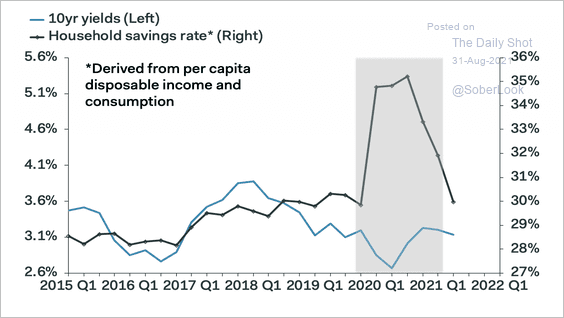

3. China’s savings rate has already normalized, exhausting this source of demand.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

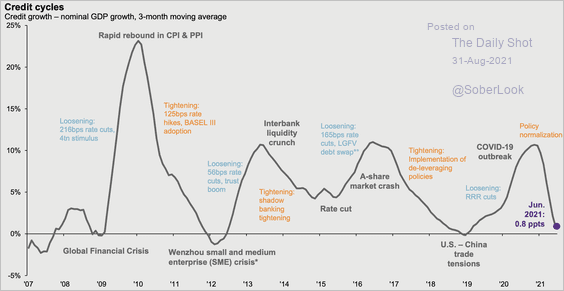

4. China’s credit mini-cycles are a key driver of the economy.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Emerging Markets

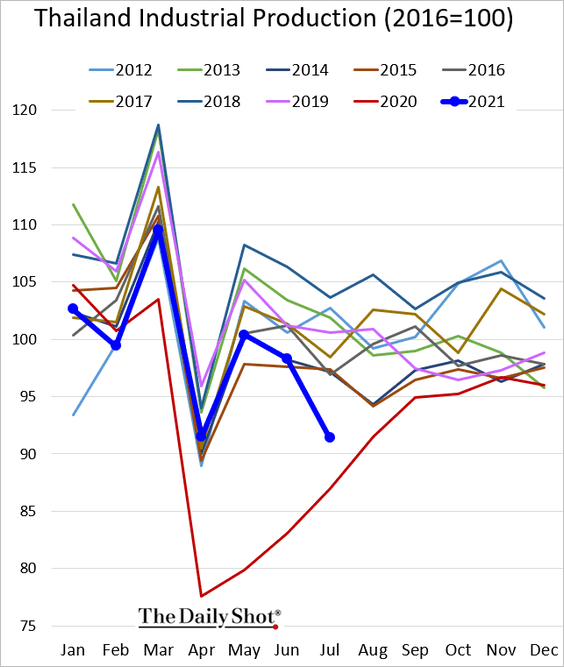

1. Thailand’s industrial production slumped in July.

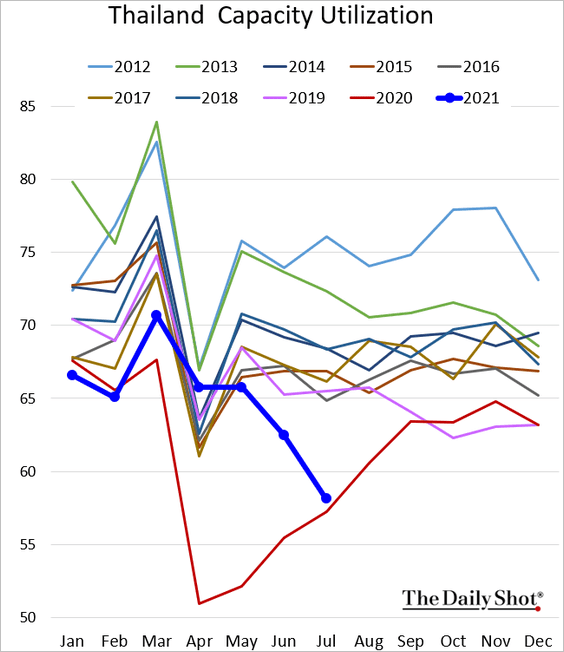

Capacity utilization is approaching 2020 levels.

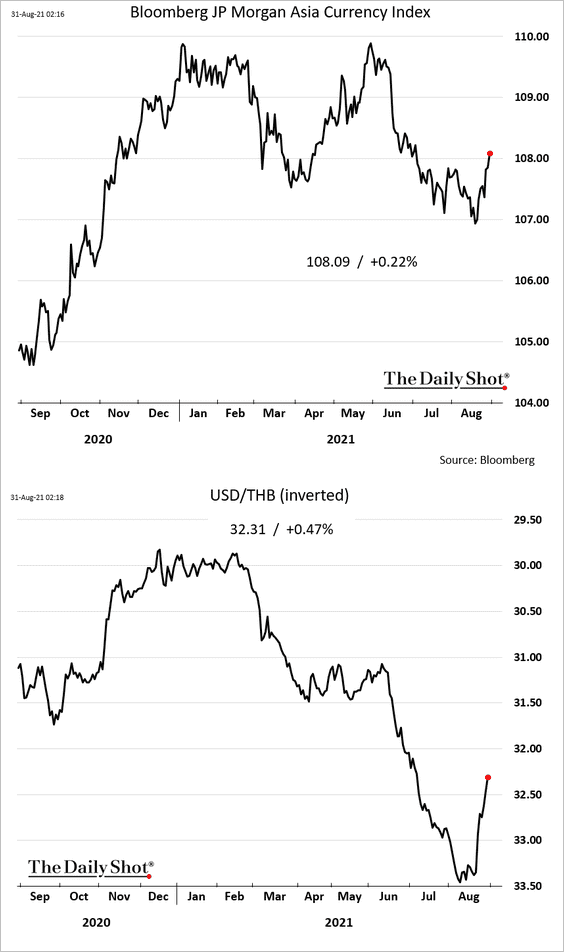

The Thai baht is rising with other Asian currencies, boosted by the dovish Fed.

——————–

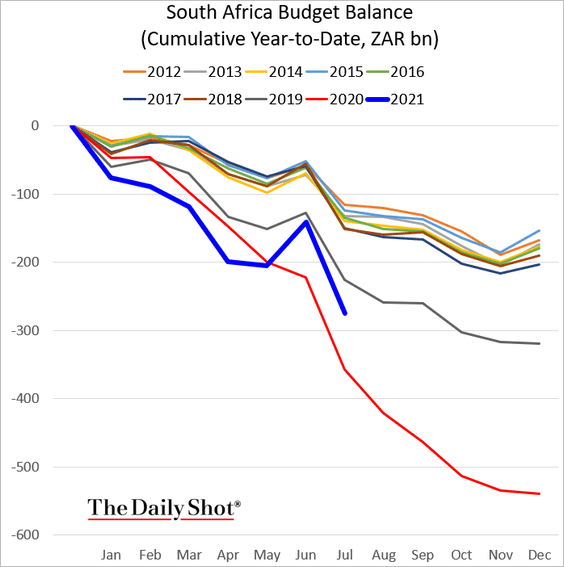

2. This chart shows South Africa’s year-to-date government budget.

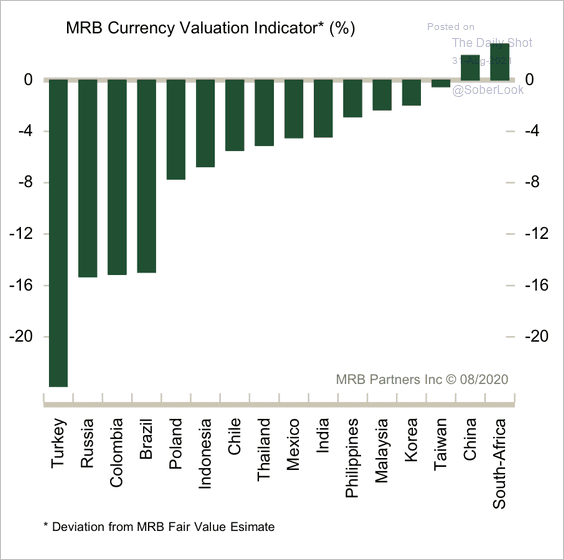

3. Widespread undervaluation persists across EM currencies, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

Back to Index

Cryptocurrency

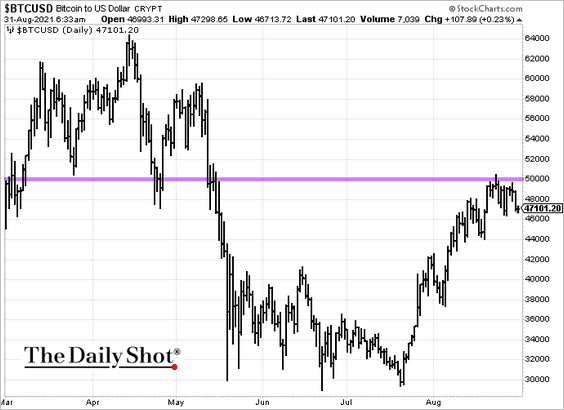

1. Bitcoin is holding resistance at $50k.

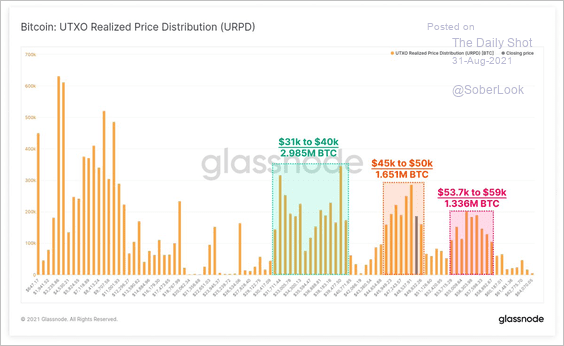

2. Blockchain data shows large accumulation support for bitcoin in the $31K-$40K price range and between $45K and $50K.

Source: Glassnode

Source: Glassnode

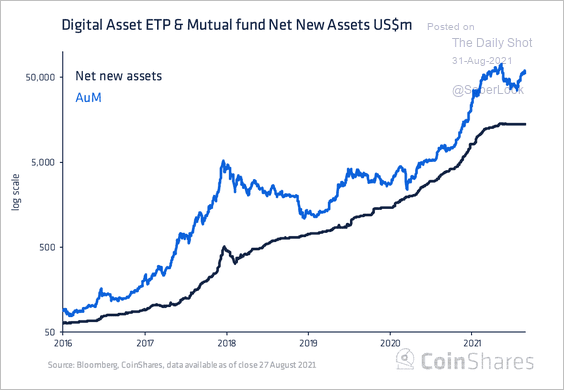

3. Digital asset investment products saw a second consecutive week of inflows totaling $24 million last week, led by altcoin funds. Total assets under management are starting to recover.

Source: CoinShares

Source: CoinShares

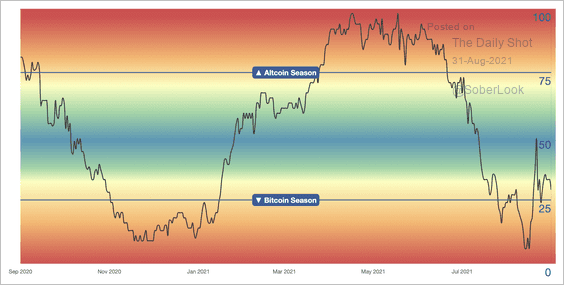

3. Altcoins are starting to outperform bitcoin, which could reflect a greater risk appetite among investors.

Source: BlockchainCenter.net

Source: BlockchainCenter.net

4. Etherium competitors are attracting more investment capital.

Source: Forbes Read full article

Source: Forbes Read full article

Here is Solana.

Source: CoinMarketCap

Source: CoinMarketCap

——————–

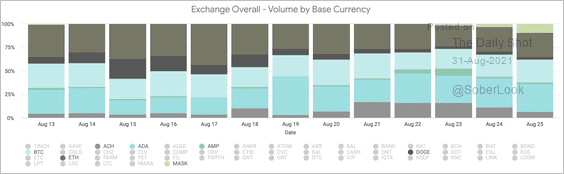

5. Dogecoin (dark gray) trading volume on the Coinbase exchange has been lackluster in August as buyers take a breather.

Source: Coinbase

Source: Coinbase

Back to Index

Commodities

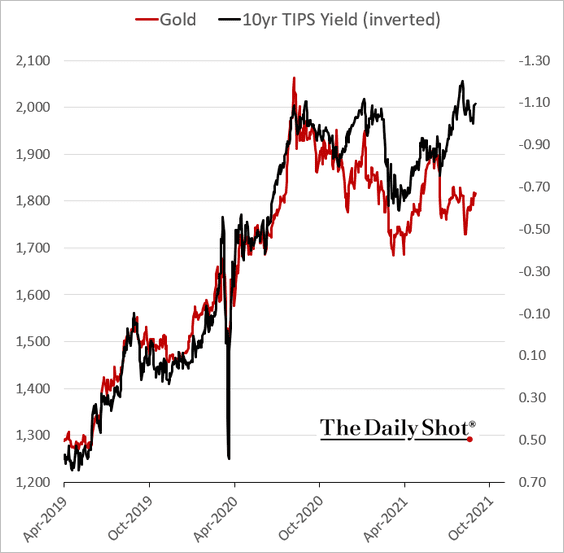

1. The divergence between gold and US real yields persists.

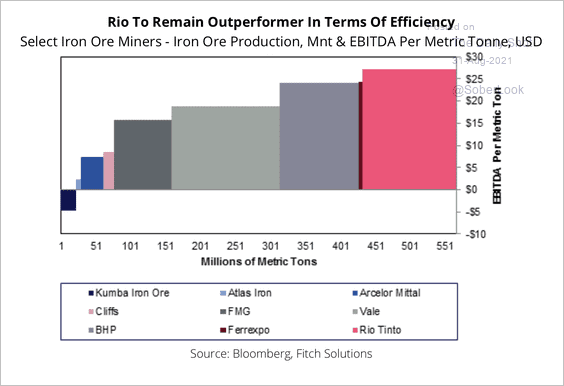

2. Major iron ore producers continue to drive down costs and increase production over the long-term, which could benefit earnings.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

Back to Index

Energy

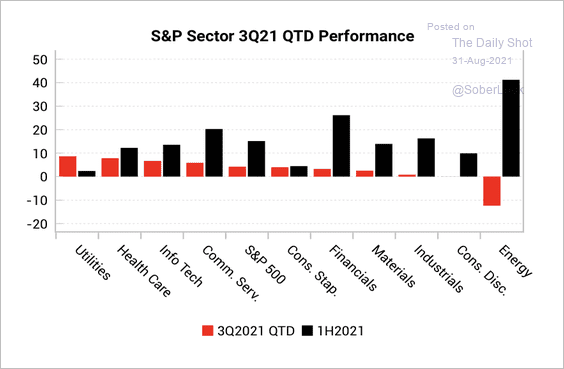

1. So far, energy has been the worst-performing sector in Q3, while being the best performer in the first half of the year.

Source: Variant Perception

Source: Variant Perception

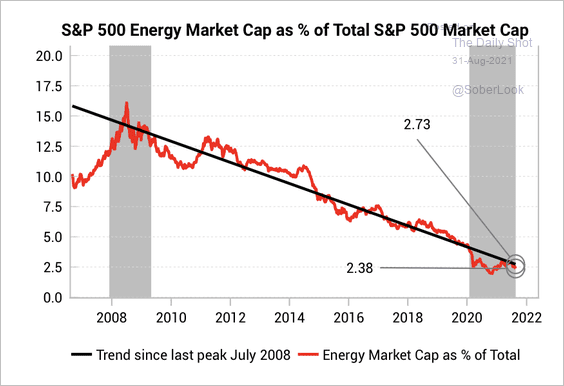

Energy’s share of the S&P 500 market cap has recovered to the long-term downtrend line but remains at historically low levels.

Source: Variant Perception

Source: Variant Perception

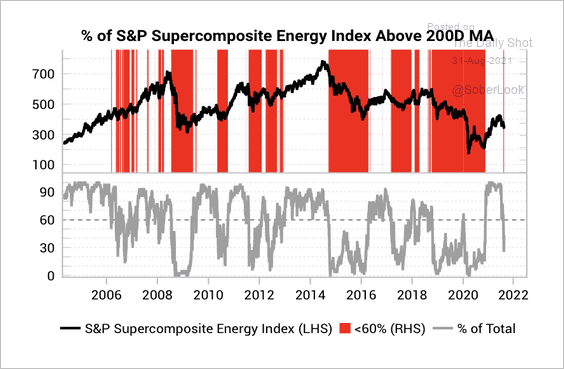

Less than 60% of energy stocks are below their 200-day moving average.

Source: Variant Perception

Source: Variant Perception

——————–

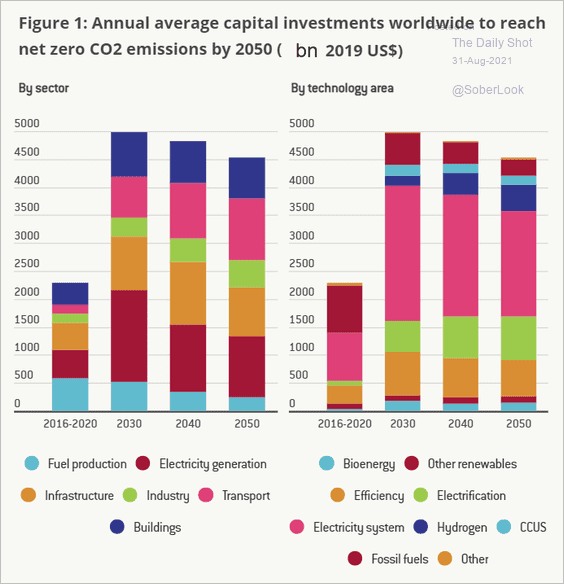

2. Getting to net-zero CO2 emissions by 2050 will be costly.

Source: Bruegel Read full article

Source: Bruegel Read full article

Back to Index

Equities

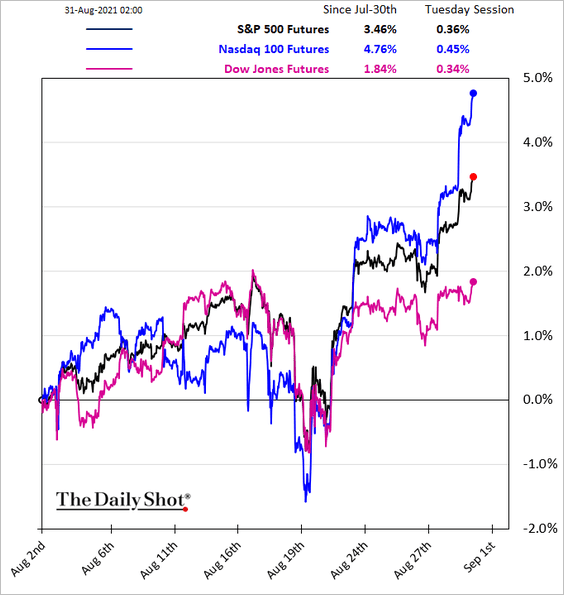

1. Stocks are surging, with records broken daily. This chart shows US stock futures performance over the past month.

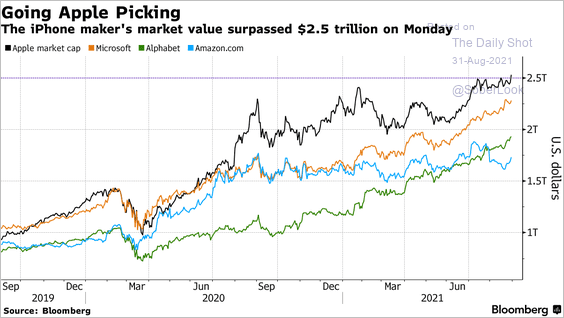

Apple’s valuation has surpassed $2.5 trillion.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

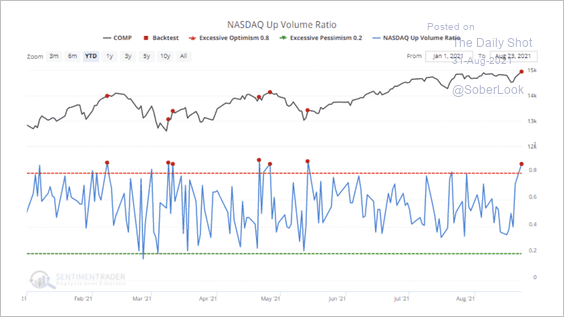

2. More than 87% of the volume on the Nasdaq exchange flowed into advancing stocks, which typically precedes a pullback two weeks later.

Source: SentimenTrader

Source: SentimenTrader

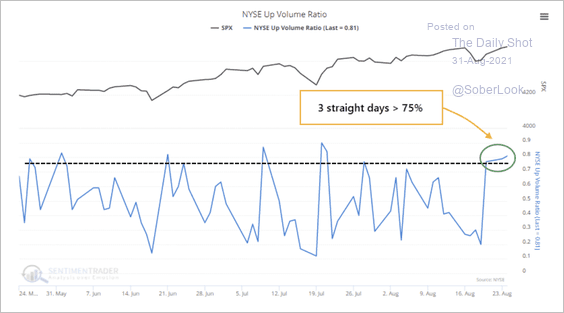

And more than 75% of volume on the NYSE flowed into advancing stocks for three straight days last week.

Source: SentimenTrader

Source: SentimenTrader

——————–

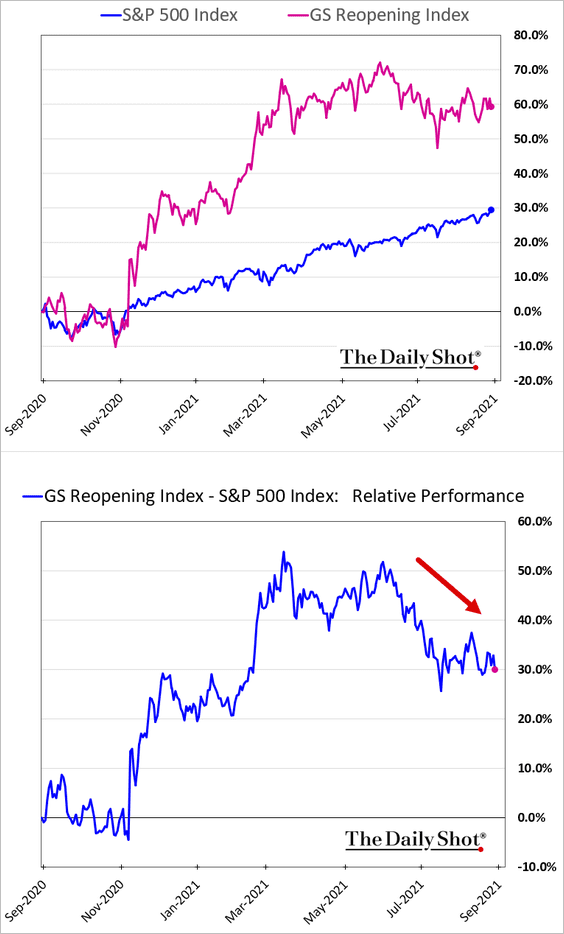

3. “Reopening” stocks have been underperforming since May.

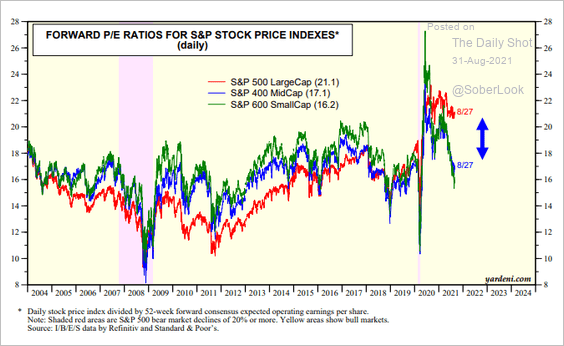

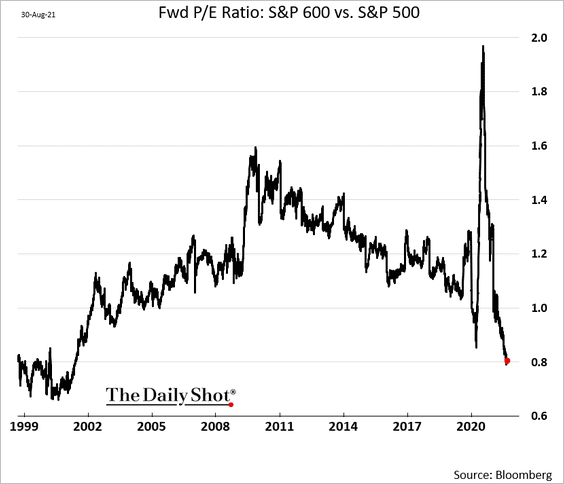

4. The valuation gap between small- and large-cap shares has blown out (2 charts).

Source: Yardeni Research

Source: Yardeni Research

——————–

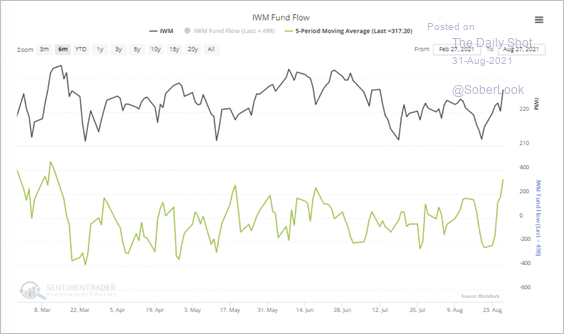

5. The iShares Russell 2,000 ETF (IWM) saw the highest 5-day average inflows since March last week.

Source: SentimenTrader

Source: SentimenTrader

6. The iShares S&P 500 Value ETF (IVE) is approaching support relative to the iShares Growth ETF (IVW).

Source: Dantes Outlook

Source: Dantes Outlook

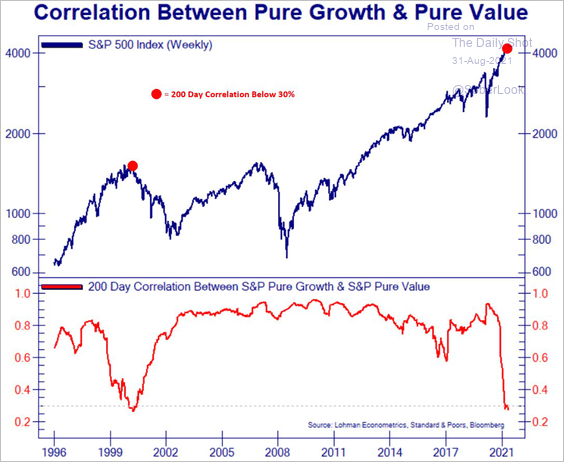

The correlation between value and growth remains near extremes.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

——————–

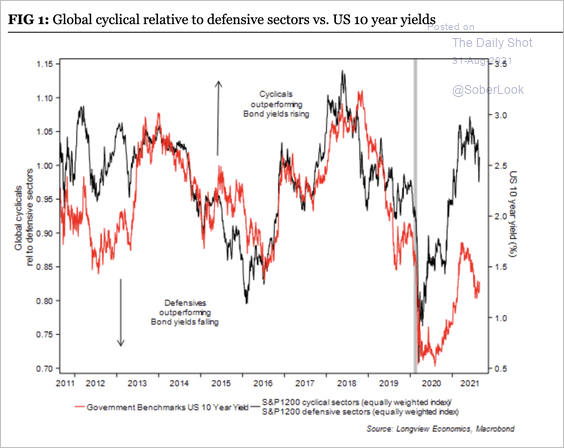

7. Cyclicals have been underperforming defensives as bond yields pull back.

Source: Longview Economics

Source: Longview Economics

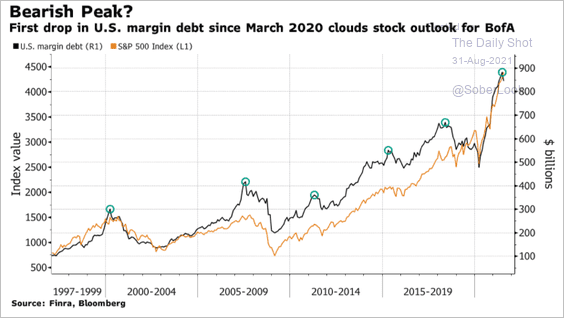

8. Should investors be concerned about a peak in margin debt?

Source: @TheOneDave Read full article

Source: @TheOneDave Read full article

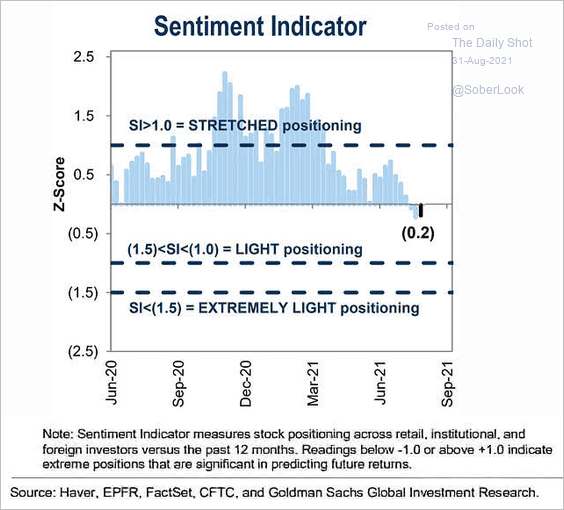

9. Sentiment doesn’t seem to be stretched.

Source: @ISABELNET_SA

Source: @ISABELNET_SA

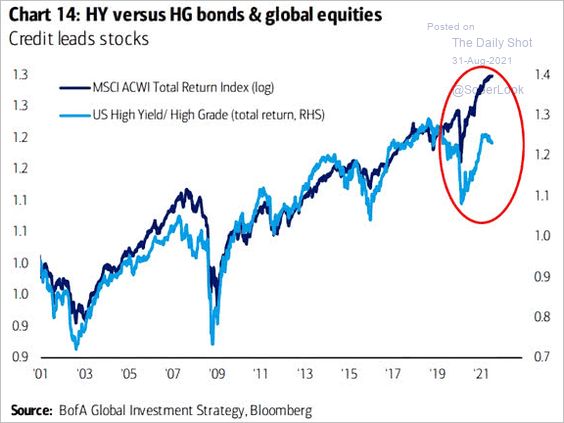

10. Divergence between stocks and credit (HY vs. IG relative return) persists.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

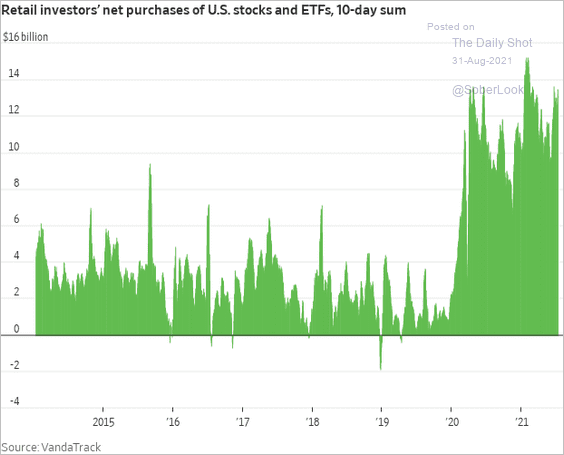

11. Retail investors remain a significant force in the stock market.

Source: @WSJ Read full article

Source: @WSJ Read full article

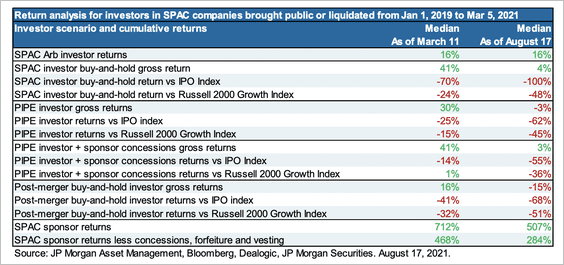

12. Apart from sponsors and “SPAC Arbitrage” investors, everyone else’s SPAC returns have been poor.

Source: J.P. Morgan Asset Management Further reading

Source: J.P. Morgan Asset Management Further reading

Back to Index

Rates

1. The 30-year bond yield is testing support.

Source: Longview Economics

Source: Longview Economics

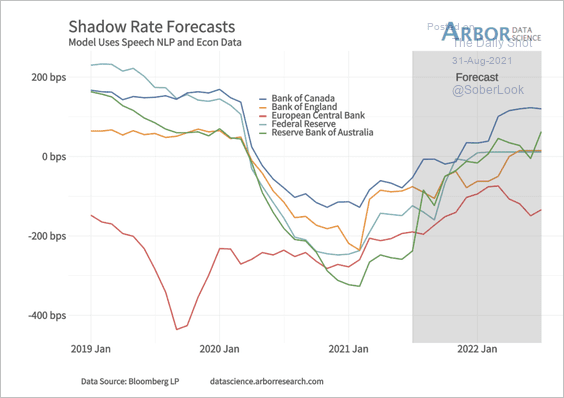

2. Arbor Data Science expects a rise in shadow rates next year based on central bank rhetoric. In this event, real yields could rise along with implied volatility.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Back to Index

Global Developments

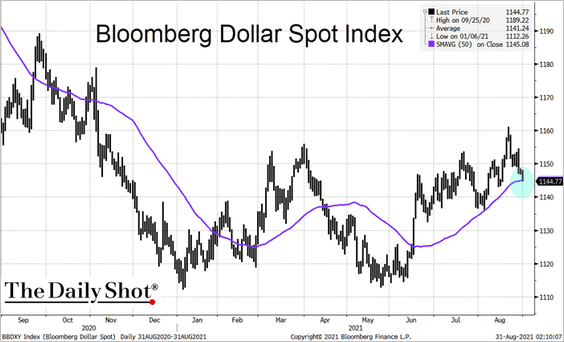

1. The Bloomberg US Dollar Index is testing support at the 50-day moving average.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

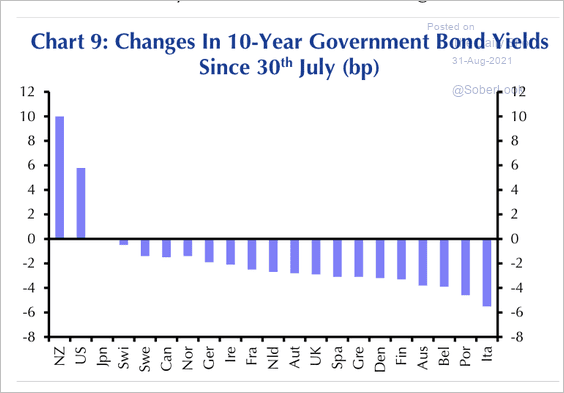

2. 10-year government bond yields have fallen a bit further in most major developed markets recently.

Source: Capital Economics

Source: Capital Economics

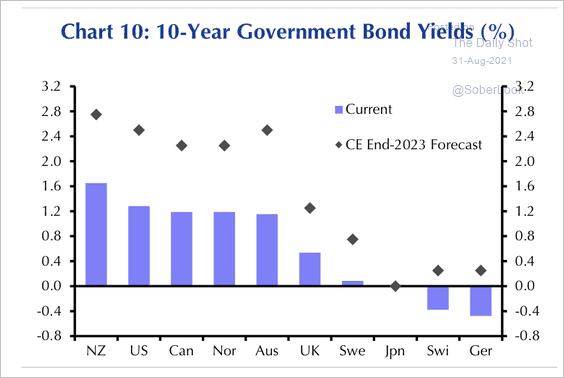

• Capital Economics expects higher yields over the next 1-2 years.

Source: Capital Economics

Source: Capital Economics

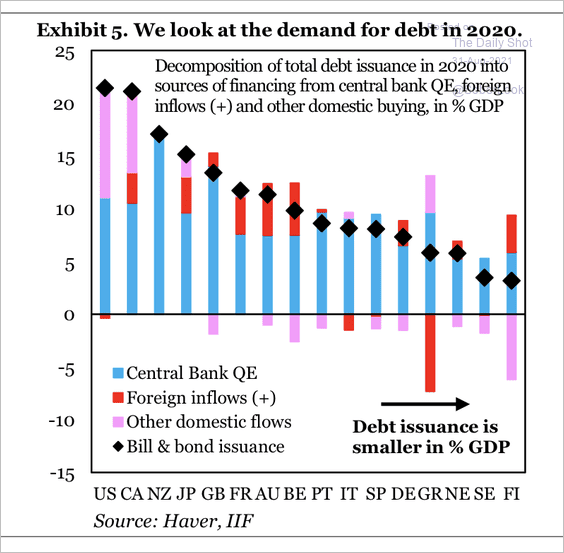

• The US and Canada had the largest debt issuance last year, but only half was absorbed by central bank QE, with the remainder absorbed by the markets.

Source: IIF

Source: IIF

——————–

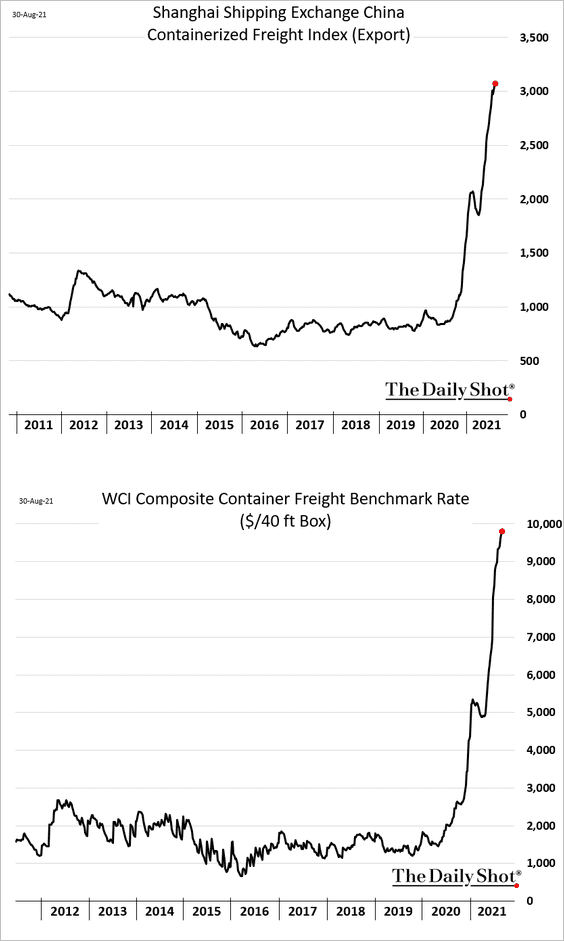

3. Container shipping costs continue to surge.

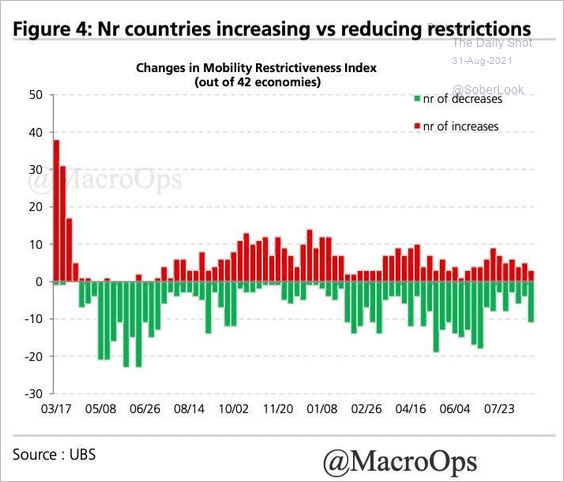

4. More countries have been lifting COVID restrictions than implementing them.

Source: @a_martinoro, @MacroOps

Source: @a_martinoro, @MacroOps

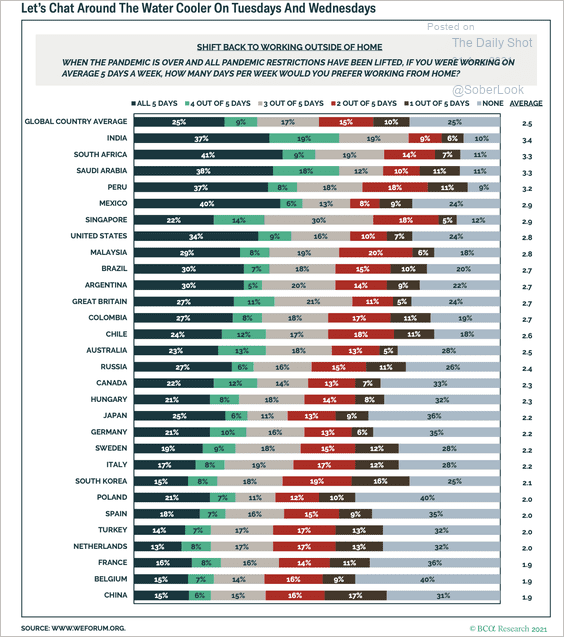

5. Globally, one in four people would rather work from home all the time once the pandemic is over.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

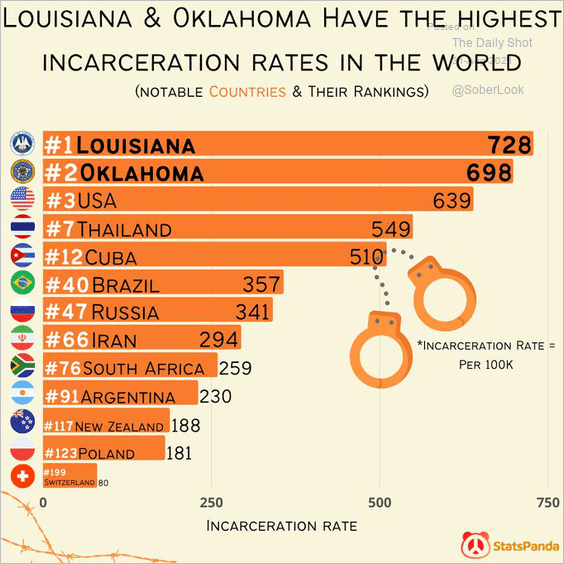

1. Highest incarceration rates in the world:

Source: @statspanda1

Source: @statspanda1

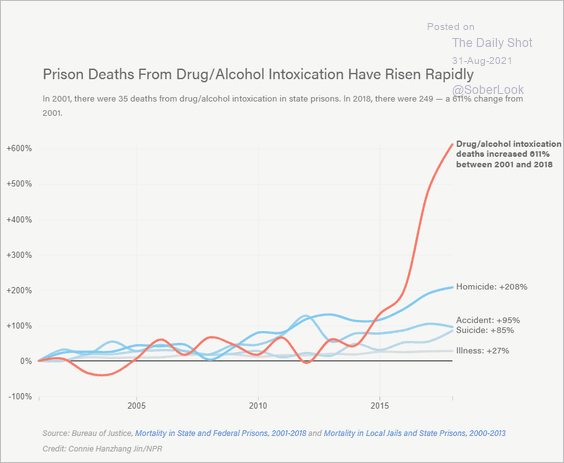

2. US prison deaths:

Source: The Marshall Project Read full article

Source: The Marshall Project Read full article

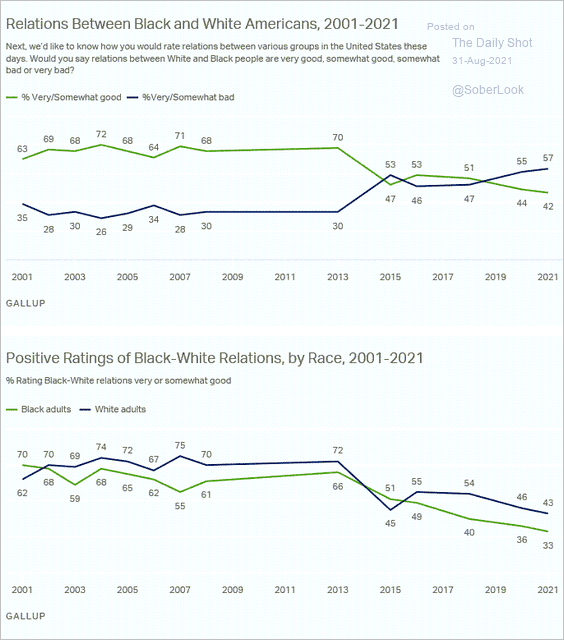

3. Ratings of US Black-White relations:

Source: Gallup Read full article

Source: Gallup Read full article

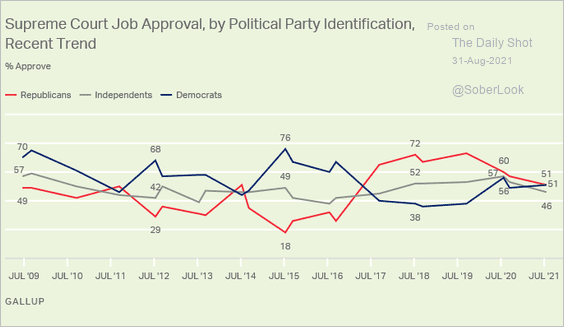

4. US Supreme Court job approval:

Source: Gallup Read full article

Source: Gallup Read full article

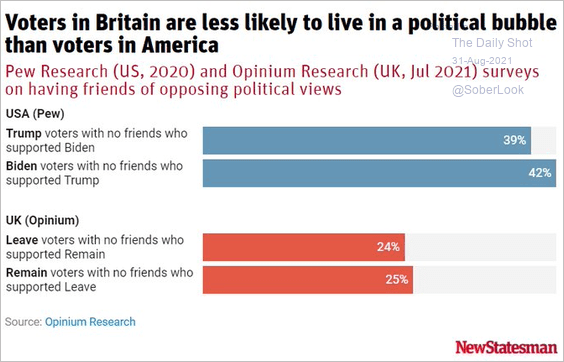

5. Political bubble in the US vs. the UK:

Source: @BritainElects Read full article

Source: @BritainElects Read full article

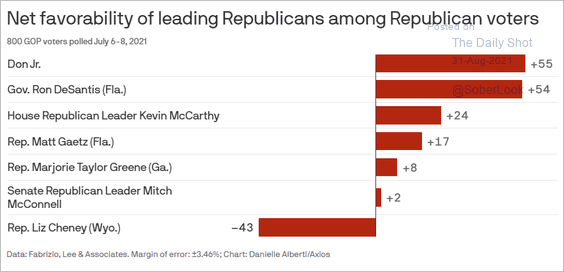

6. GOP net favorability of leading Republicans:

Source: @axios Read full article

Source: @axios Read full article

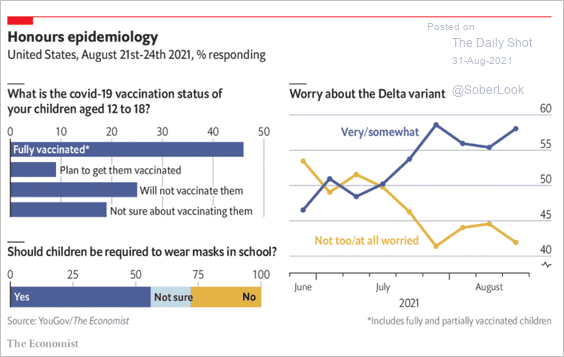

7. Teen vaccinations:

Source: The Economist Read full article

Source: The Economist Read full article

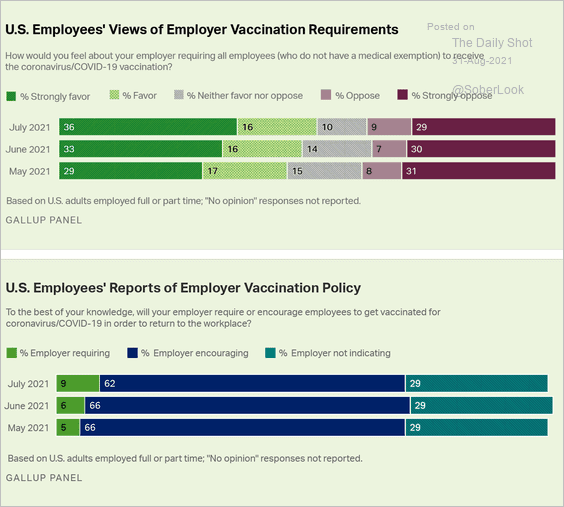

8. Views on employer vaccination policies:

Source: Gallup Read full article

Source: Gallup Read full article

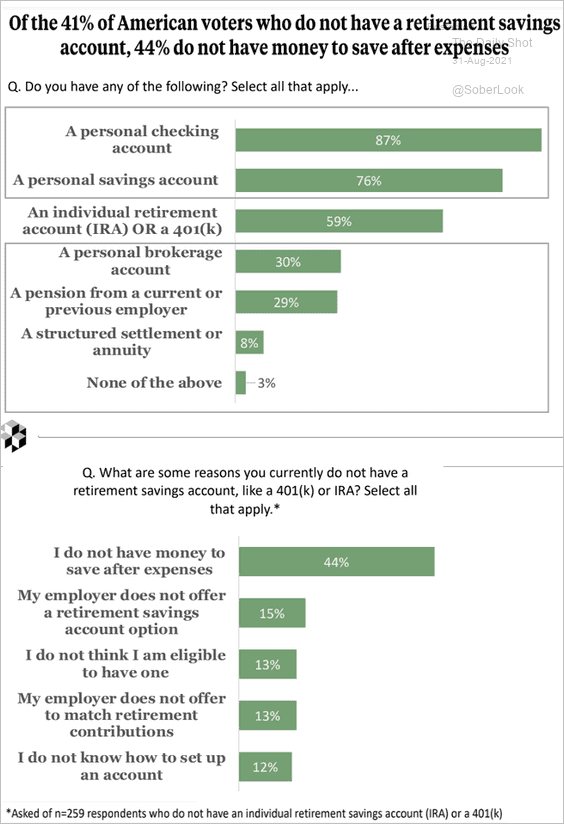

9. US retirement savings:

Source: MarketWatch Read full article

Source: MarketWatch Read full article

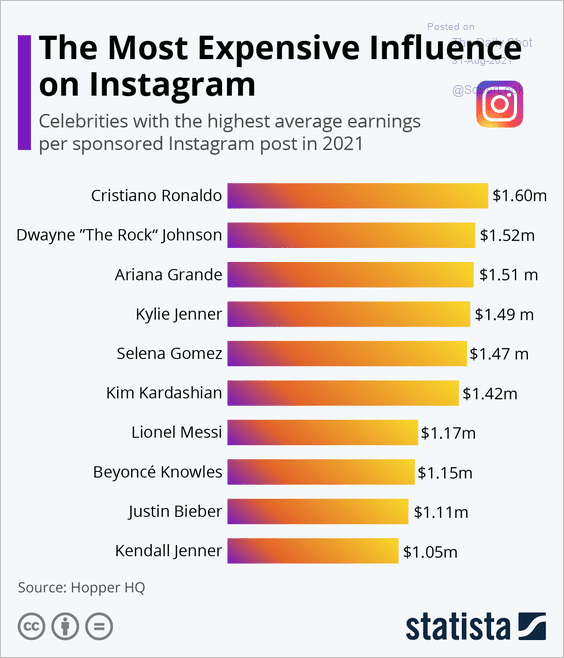

10. Celebrities with highest pay per sponsored post on Instagram:

Source: Statista

Source: Statista

——————–

Back to Index