The Daily Shot: 08-Oct-21

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

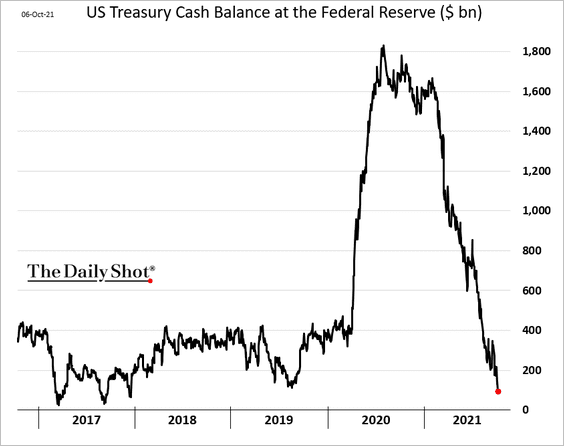

1. The US Senate approved a short-term increase in the debt ceiling, raising the level by $480 billion. The timing was critical because the US Treasury’s cash balances hit the lowest level since 2017.

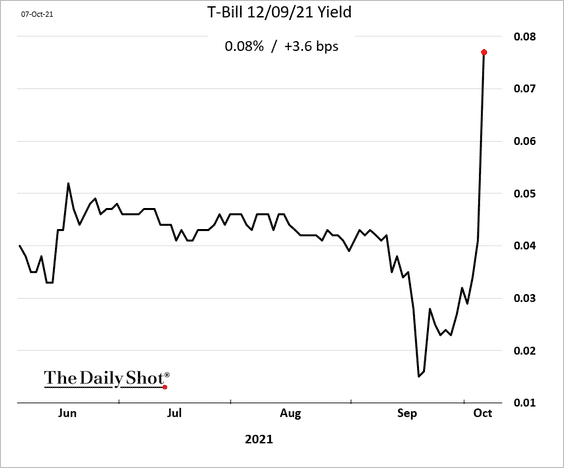

But the 480-billion boost will not last long, and the markets will face the same predicament in early December. Here is the T-bill maturing on December 9th.

——————–

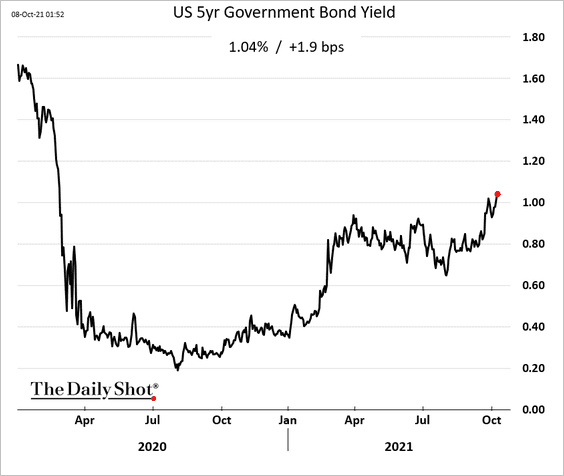

2. Treasury yields keep grinding higher ahead of the employment report.

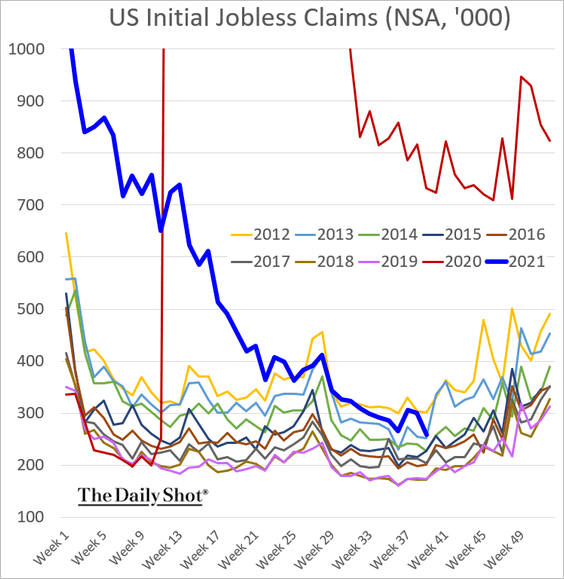

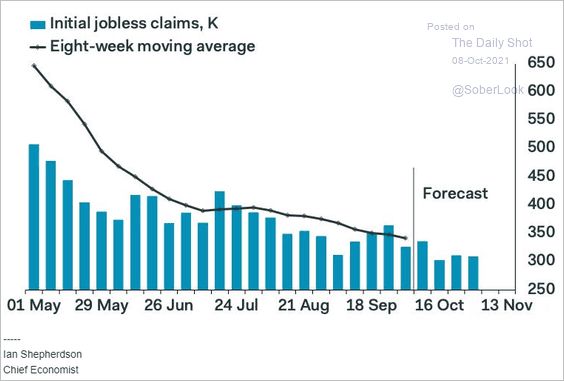

3. Initial jobless claims continue to show improvement in the labor market, with further declines expected (2nd chart).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

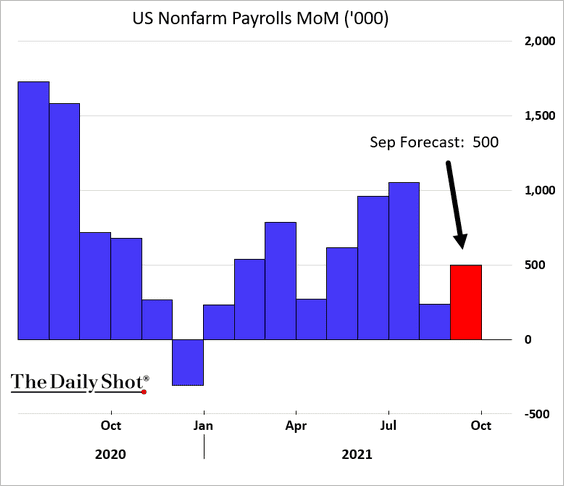

Economists are estimating a 500k increase in employment last month (consensus).

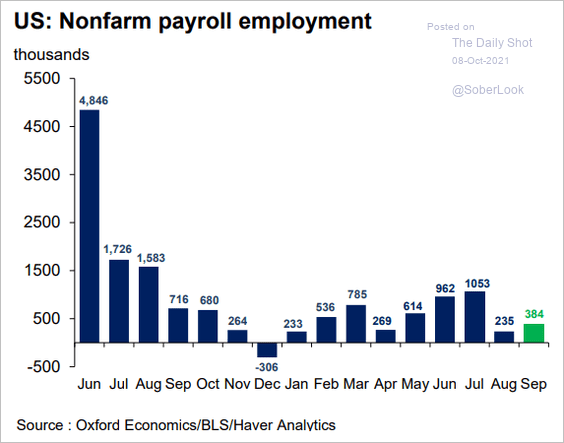

Below is a forecast from Oxford Economics.

Source: @GregDaco

Source: @GregDaco

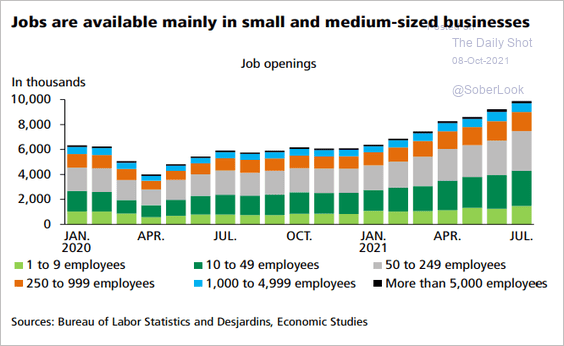

Separately, the bulk of the recent job openings have been in small and medium-sized businesses.

Source: Desjardins

Source: Desjardins

——————–

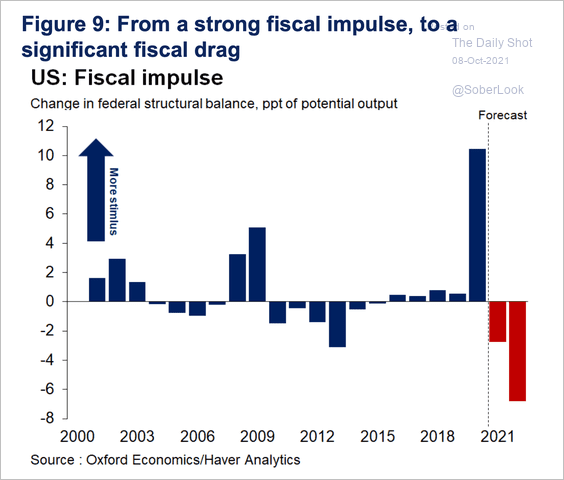

4. The reversal of the pandemic fiscal impulse will be a drag on the GDP next year.

Source: Oxford Economics

Source: Oxford Economics

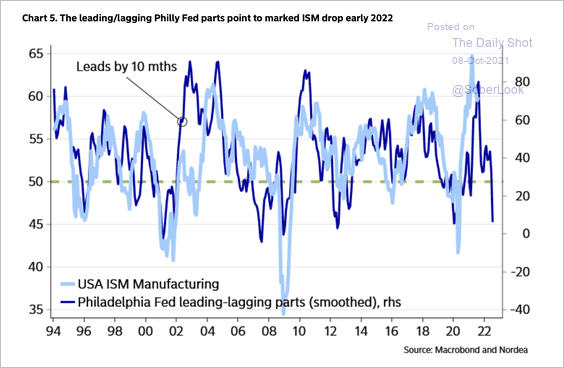

5. The Philly Fed’s regional manufacturing survey (leading vs. lagging components) leads the broader ISM index. And right now, it is flashing a significant drop in early 2022.

Source: Nordea Markets

Source: Nordea Markets

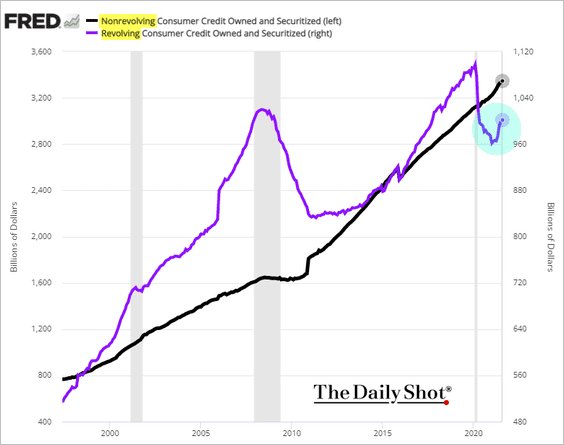

6. Next, we have some updates on consumer credit.

• Credit card debt remains well below pre-COVID levels.

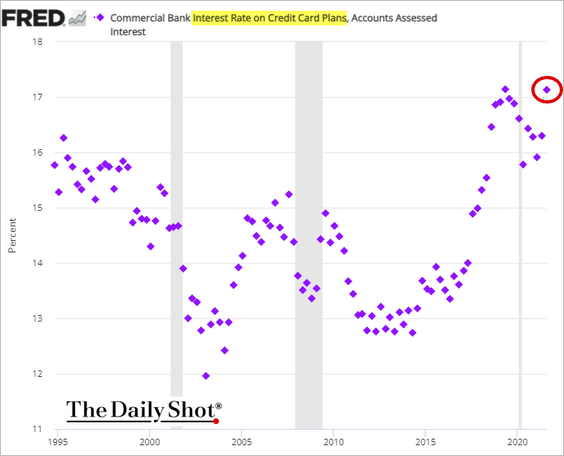

• Credit card rates are back above 17% – near the highs.

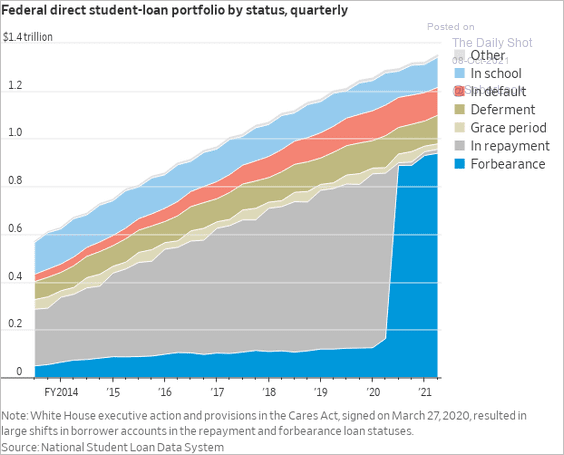

• Here is the status of the US government’s student debt portfolio.

Source: @WSJ Read full article

Source: @WSJ Read full article

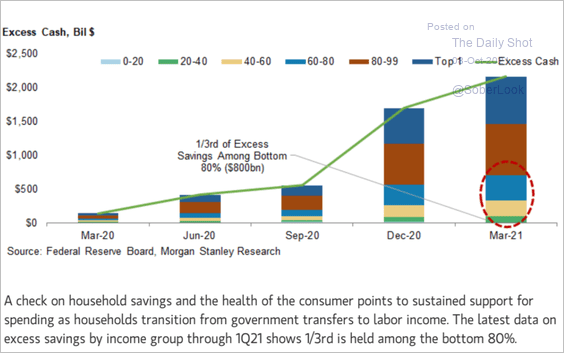

• This chart shows households’ excess savings by income category.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

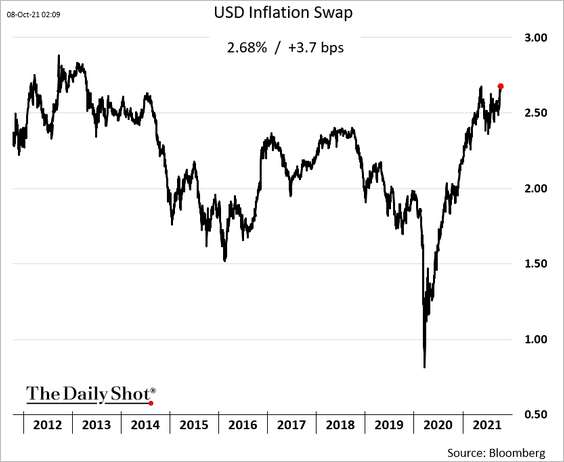

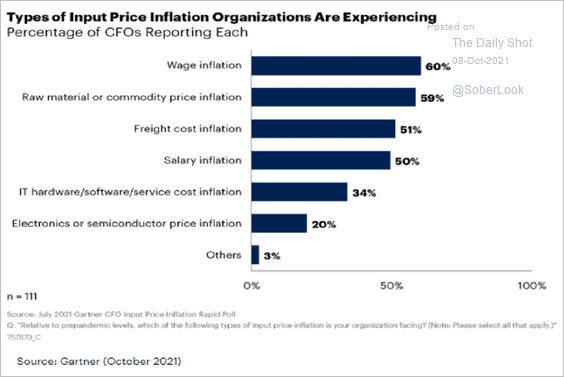

7. Finally, we have some data on inflation.

• Long-term market-based inflation expectations (highest since 2013):

• Businesses experiencing inflation (CFO survey):

Source: Gartner; @JeffWeniger

Source: Gartner; @JeffWeniger

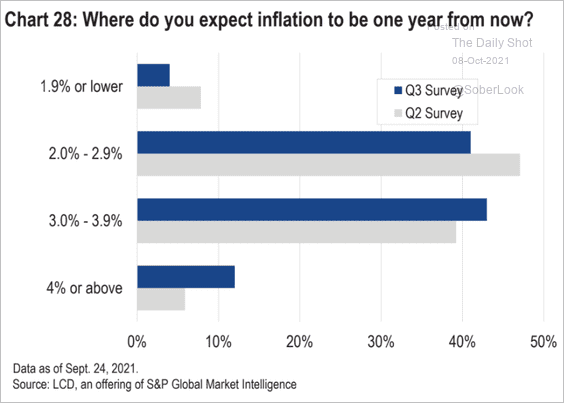

• Inflation in 12 months (a survey of credit investors) :

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

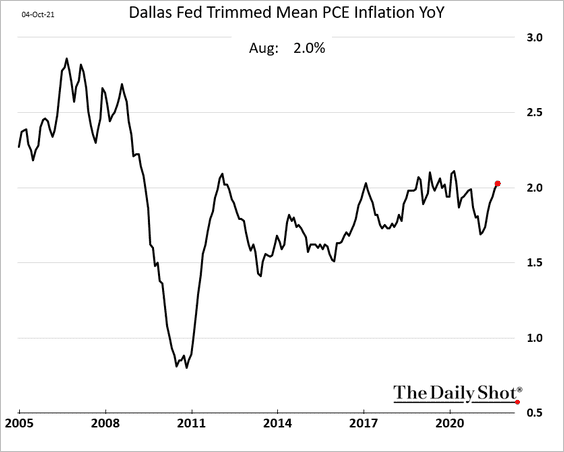

• The Dallas Fed’s trimmed mean PCE inflation (closely watched by the Fed):

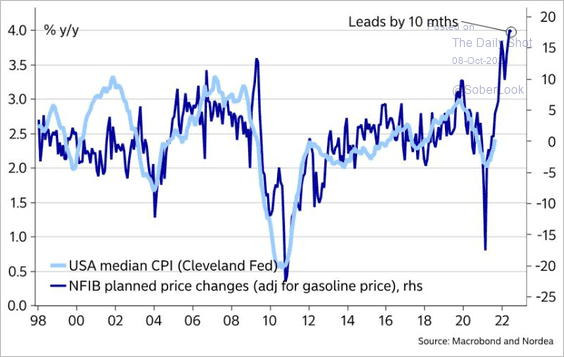

• Small business plans to boost prices vs. the median CPI:

Source: Nordea Markets

Source: Nordea Markets

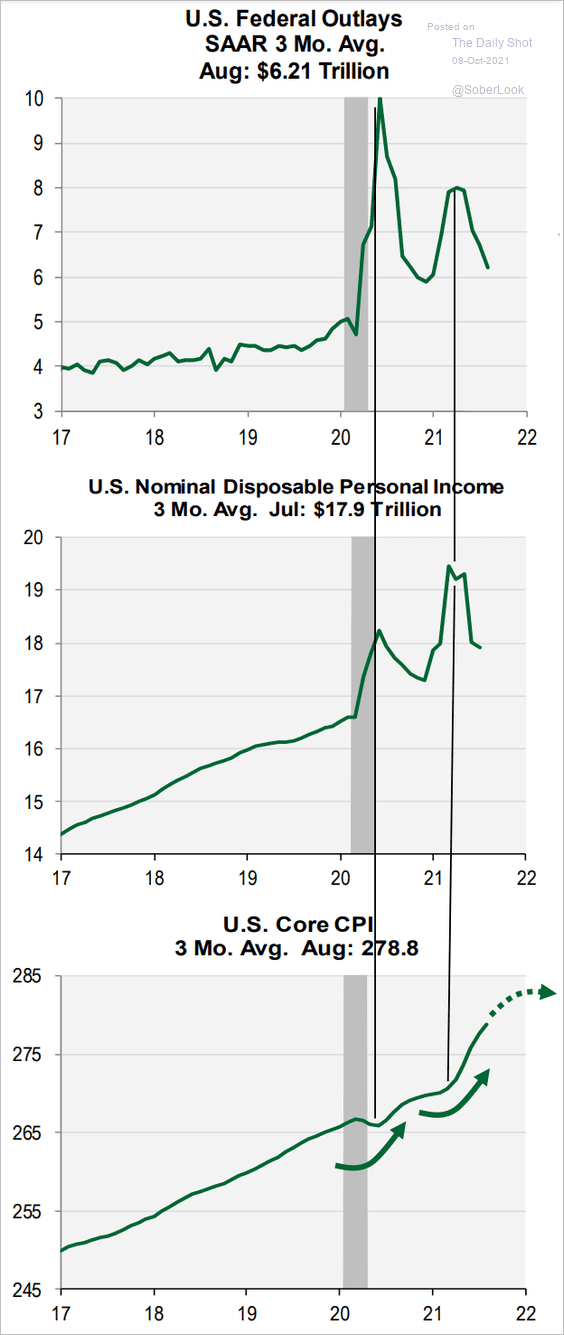

• Incomes feeding into the CPI:

Source: Cornerstone Macro

Source: Cornerstone Macro

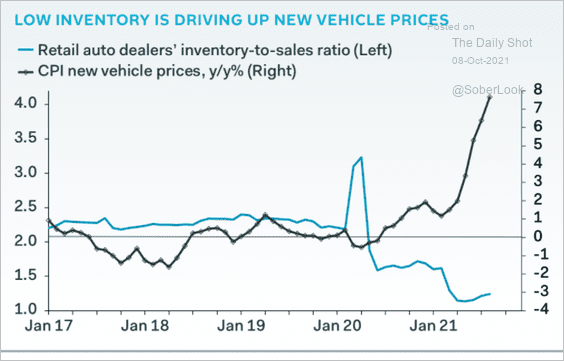

• Low automobile inventories boosting prices:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

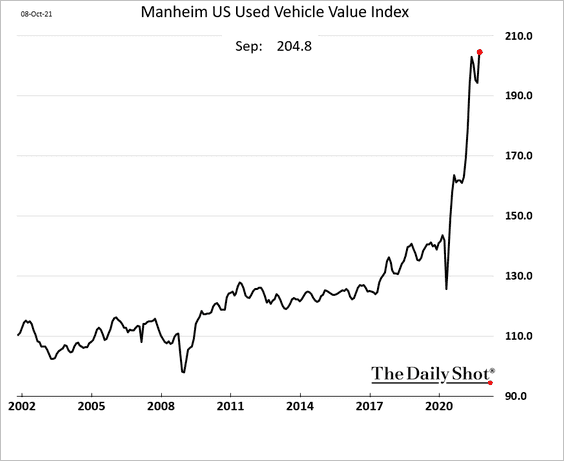

• Wholesale used car prices (updated):

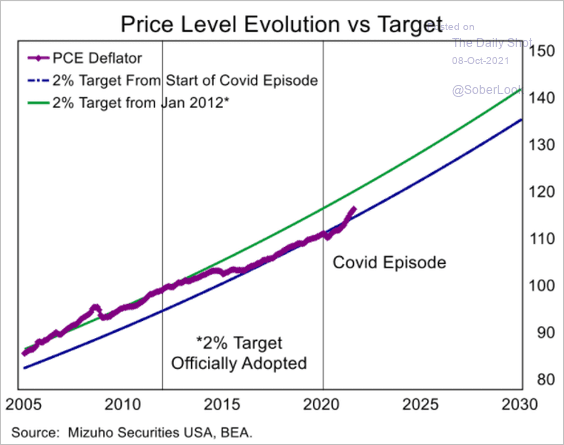

• The 2% price target (as opposed to a rate target) depends on the starting point.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

Back to Index

Canada

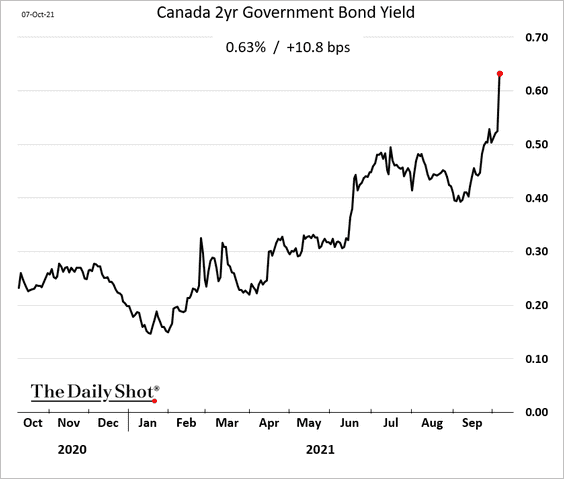

1. Short-term bond yields are surging as more rate hikes get priced in.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

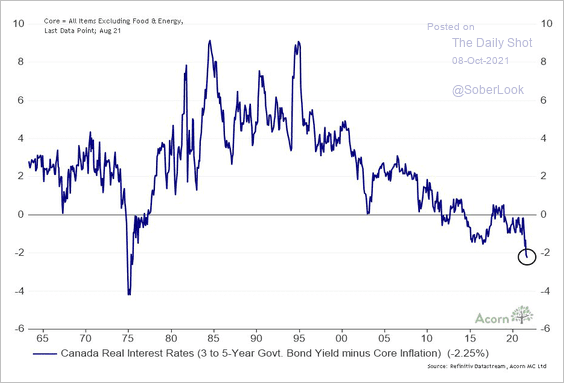

2. Real rates have been exceptionally low.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

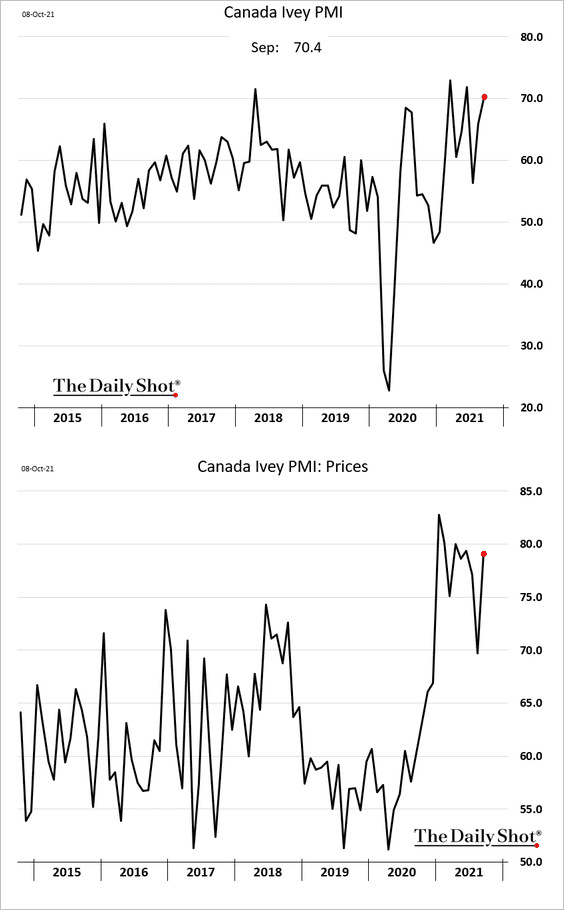

3. The Ivey PMI index showed robust business activity in September, with prices surging.

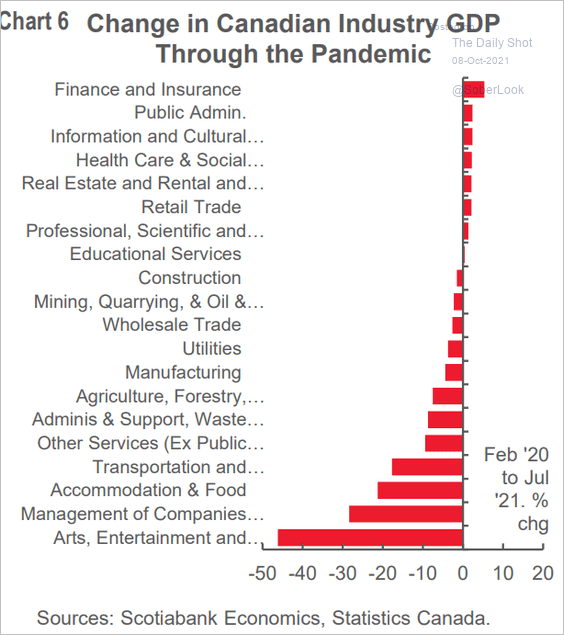

4. Here are the GDP changes by sector since the start of the pandemic.

Source: Scotiabank Economics

Source: Scotiabank Economics

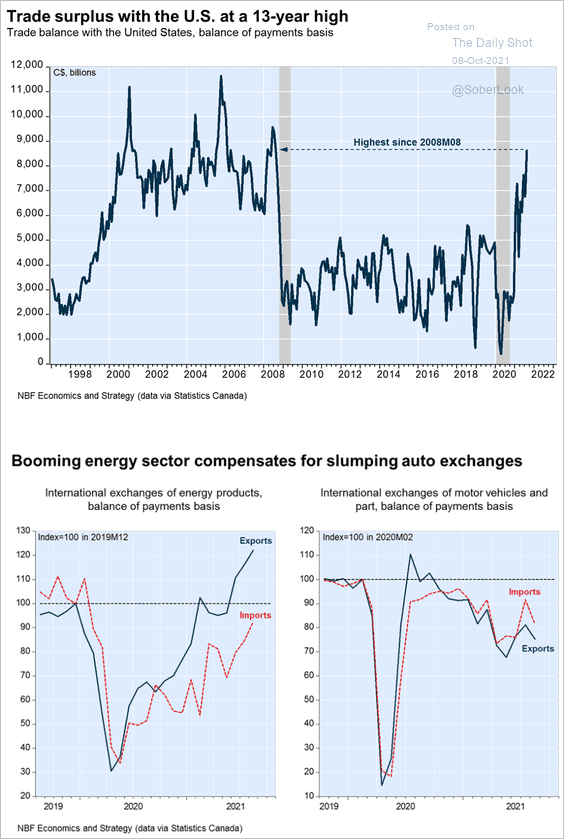

5. The energy sector’s strength offset the softness in autos, boosting Canada’s trade surplus with the US.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

Back to Index

The United Kingdom

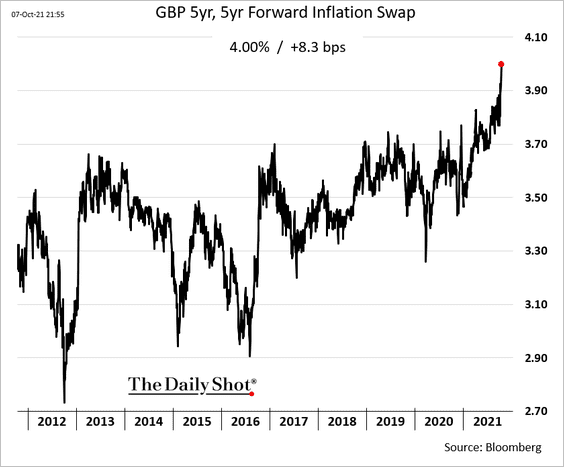

1. Market-based inflation expectations continue to surge.

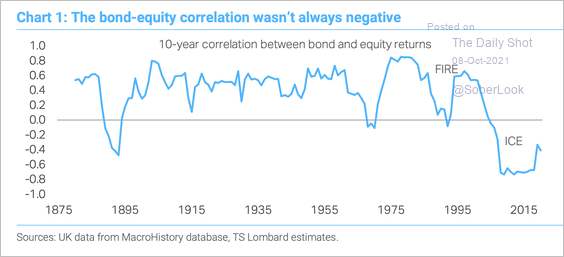

2. This chart shows the UK’s stock-bond correlation since 1875.

Source: TS Lombard

Source: TS Lombard

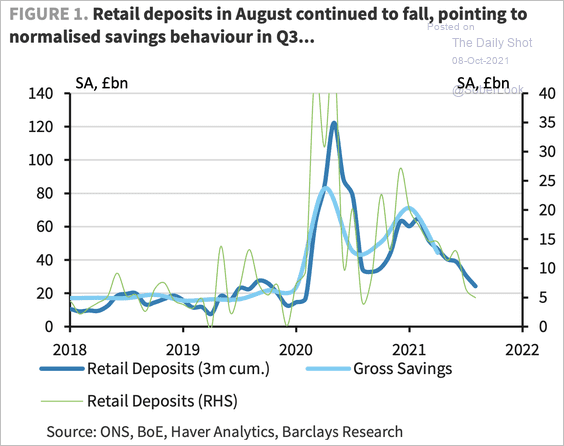

3. UK savings are returning to pre-COVID levels.

Source: Barclays Research

Source: Barclays Research

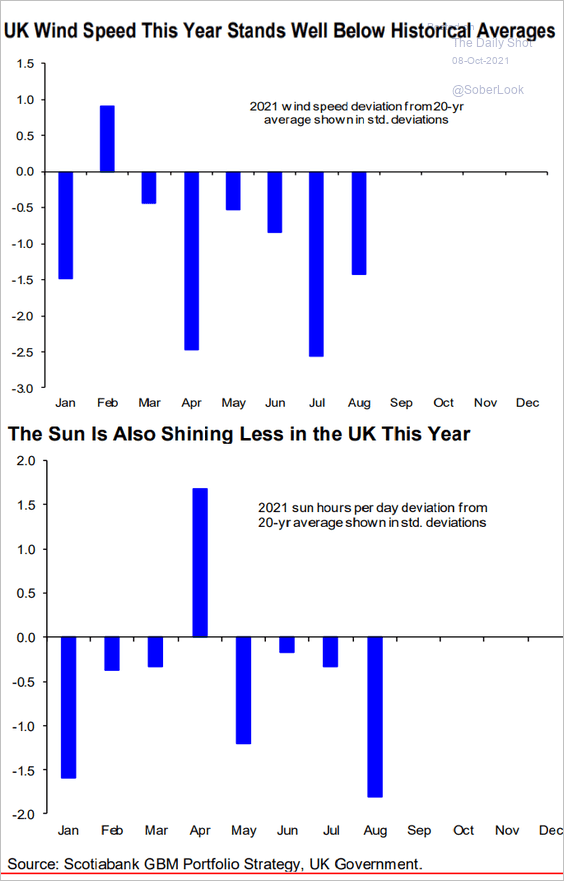

4. As we mentioned earlier, the UK weather has not cooperated this year. Weaker renewables production exacerbated the energy crisis.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

The Eurozone

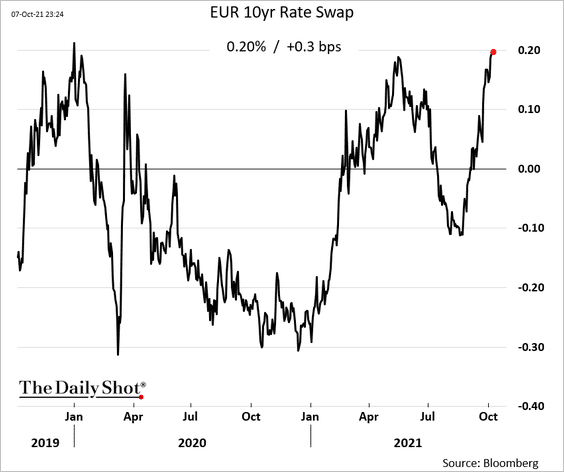

1. Longer-term rates are climbing.

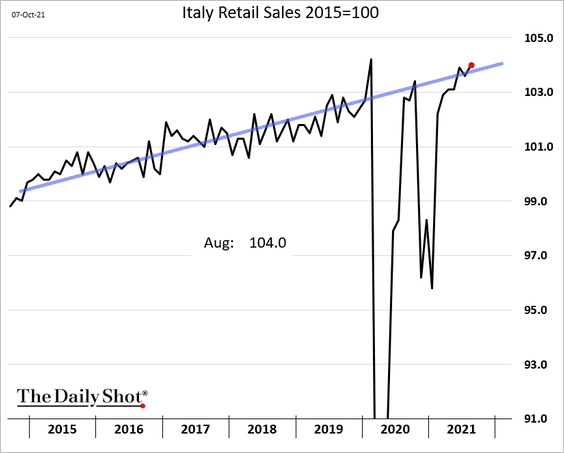

2. Italian retail sales improved in August, continuing on the pre-COVID trend.

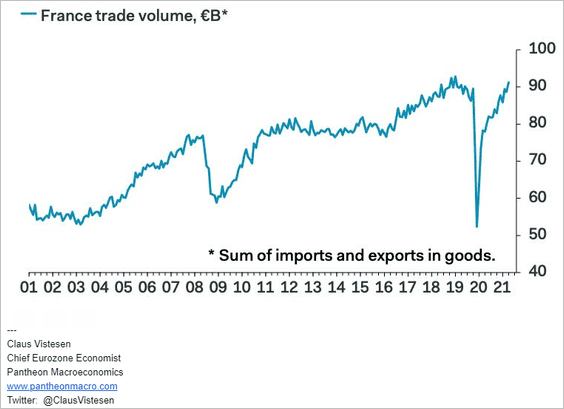

3. France’s trade volume keeps climbing.

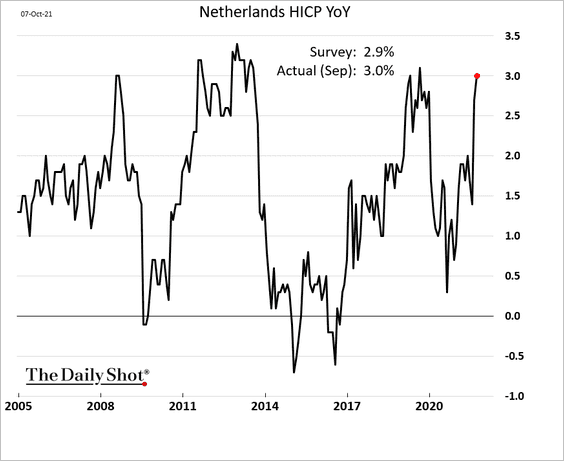

4. The Dutch CPI is back at 3%.

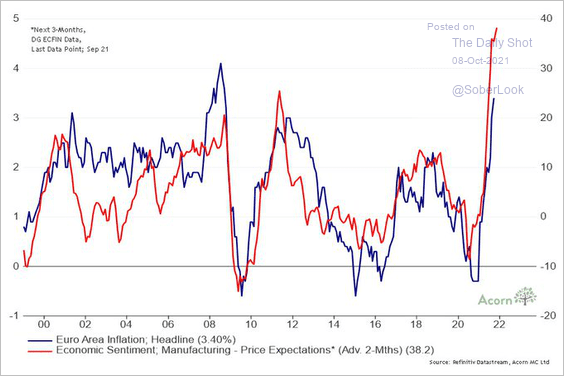

5. Manufacturing price expectations point to higher Eurozone inflation ahead.

Source: @RichardDias_CFA

Source: @RichardDias_CFA

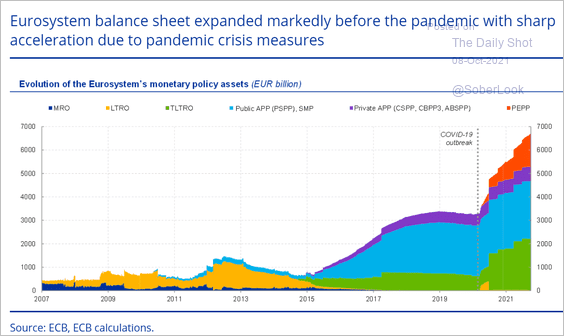

6. Here is the composition of the ECB’s (Eurosystem) balance sheet.

Source: ECB Read full article

Source: ECB Read full article

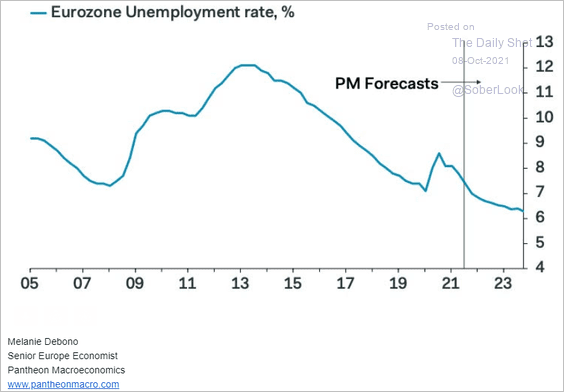

7. Pantheon Macroeconomics expects the unemployment rate to continue on a downward path.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

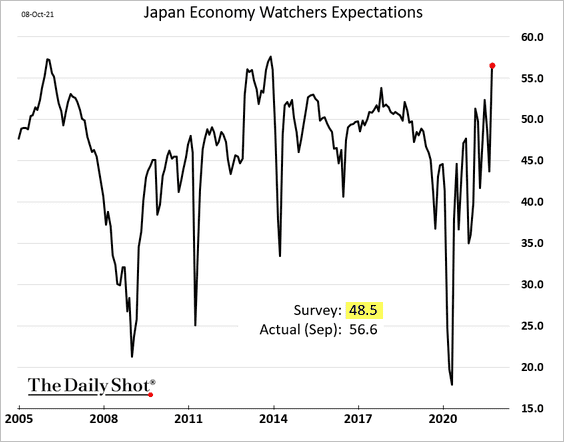

1. Japan’s Economy Watchers Expectations Index surged last month, pointing to a rebound in economic activity.

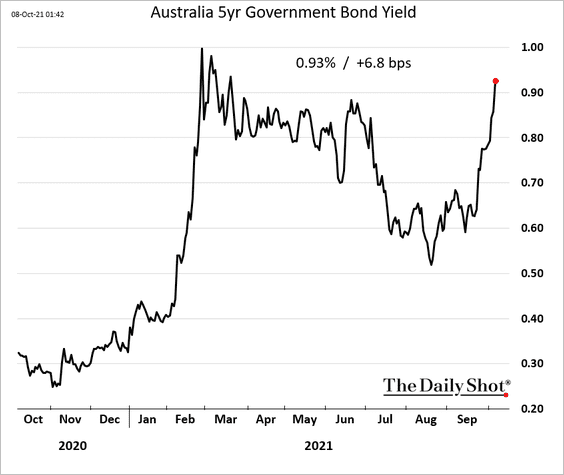

2. Australia’s bond yields continue to climb.

Back to Index

China

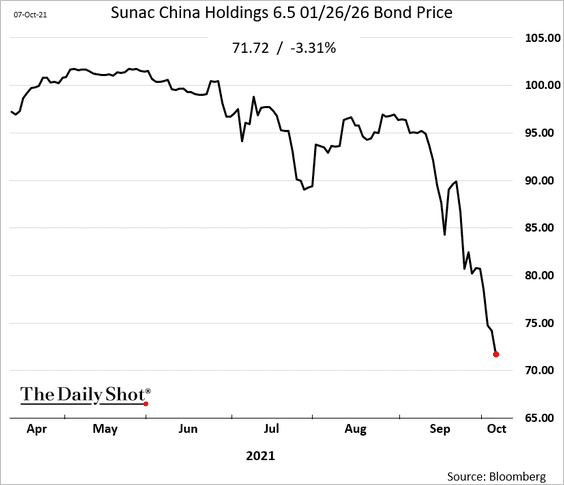

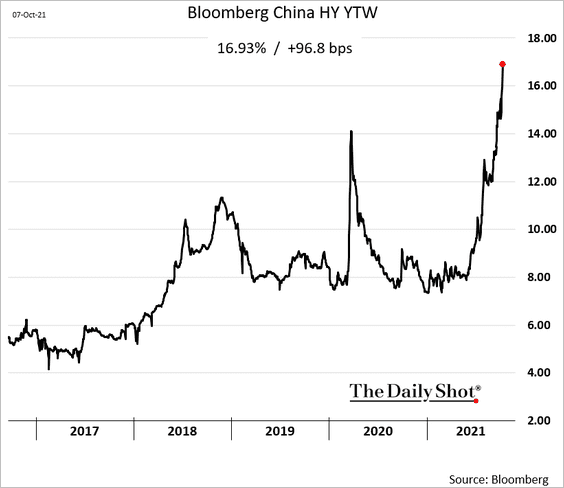

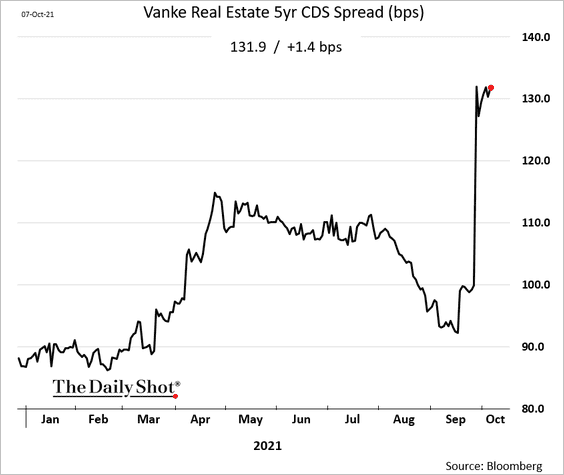

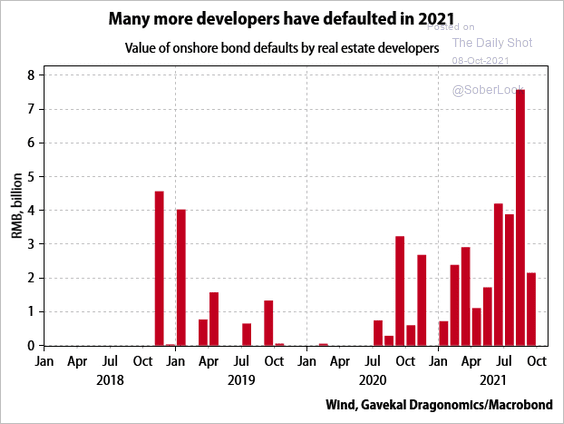

1. The credit crisis in the property sector shows no signs of letting up.

• Sunac’s bond price continues to sink.

• Bloomberg’s leveraged dollar-denominated corporate bond index yield is nearing 17%.

• Venke Real Estate is not highly leveraged, but investors are using its credit default swaps to hedge risks in the sector.

• Many developers already defaulted this year.

Source: Gavekal Research

Source: Gavekal Research

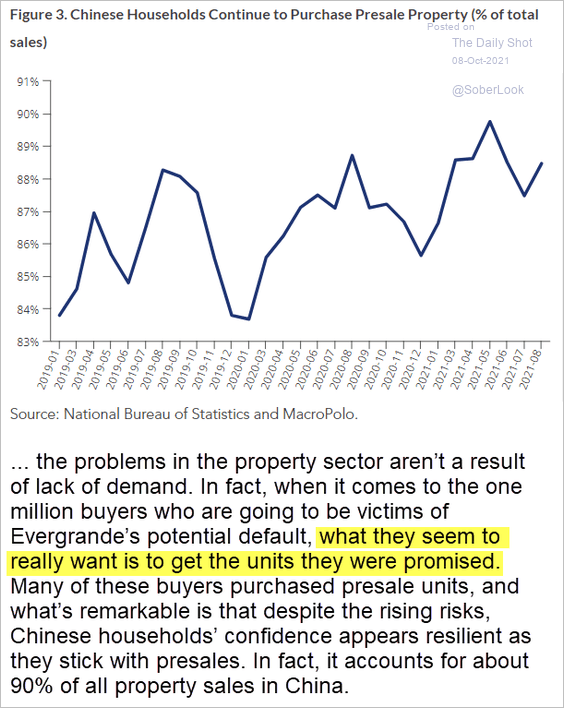

• By the way, the developers’ credit crunch is not about lack of demand.

Source: MacroPolo

Source: MacroPolo

——————–

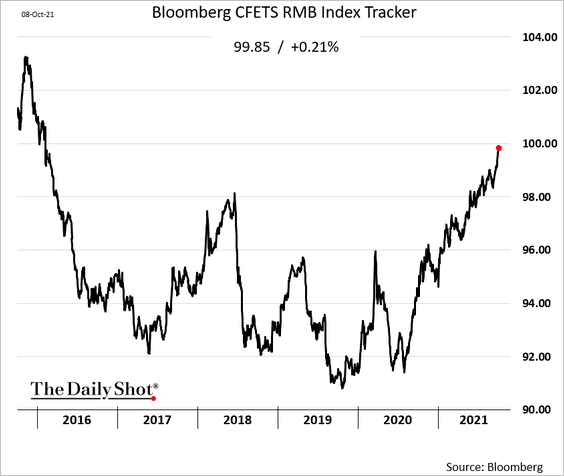

2. The renminbi continues to climb against a basket of currencies, which will further tighten China’s financial conditions and put pressure on exporters.

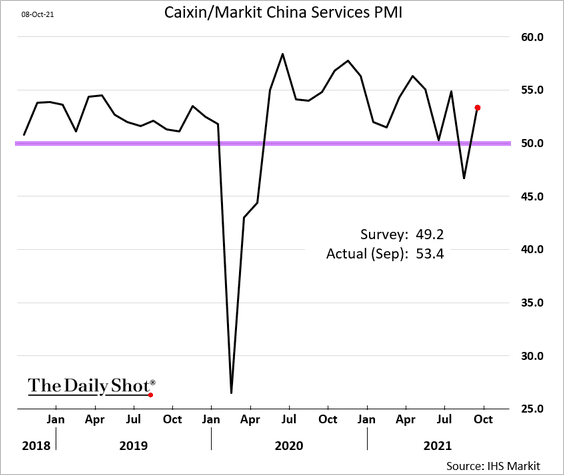

3. Service-sector activity grew last month, with the Markit PMI surprising to the upside.

Back to Index

Emerging Markets

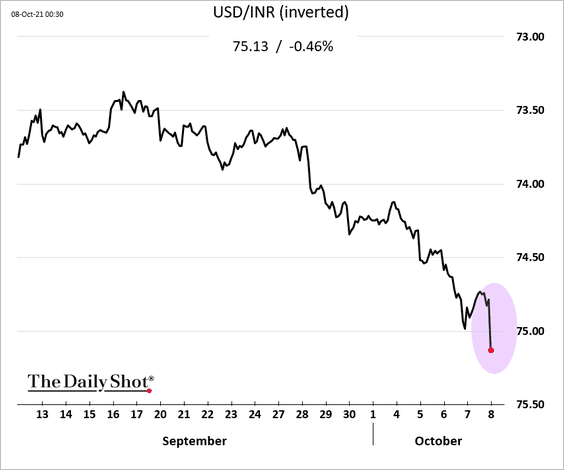

1. The Indian rupee tumbled further after the RBI left rates unchanged.

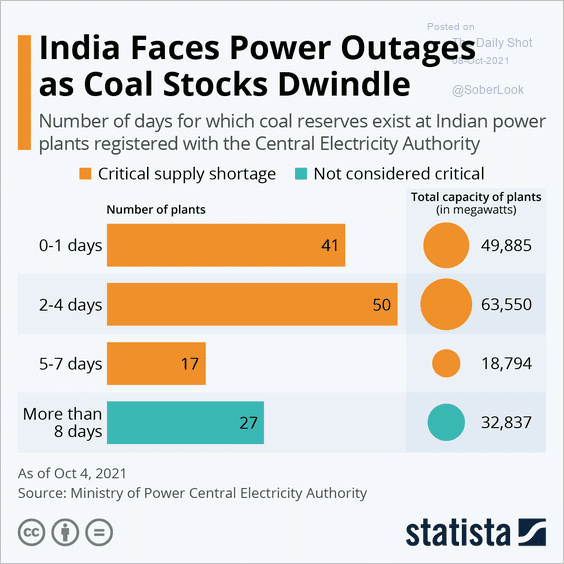

Separately, here is a summary of India’s energy crisis.

Source: Statista

Source: Statista

——————–

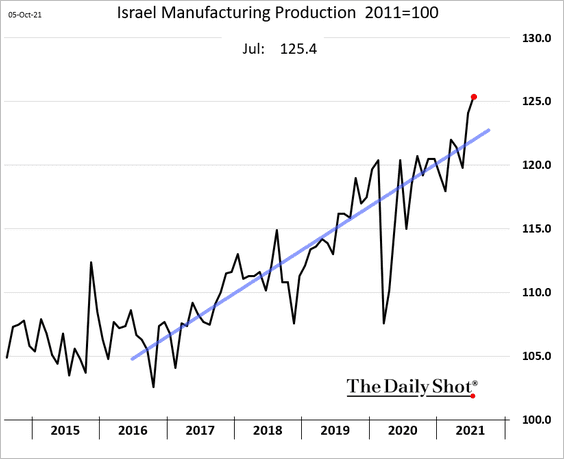

2. Israel’s manufacturing output continues to surge.

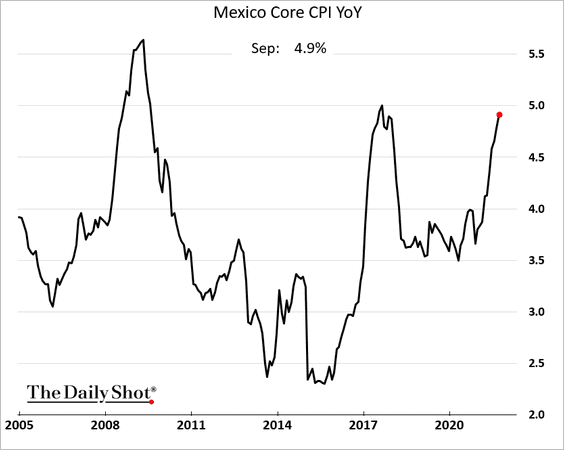

3. Mexican core CPI is approaching 5%.

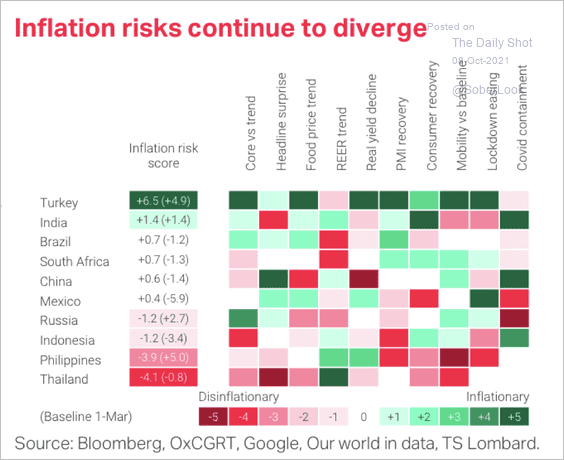

4. Inflation risks have diverged across EM economies.

Source: TS Lombard

Source: TS Lombard

Back to Index

Cryptocurrency

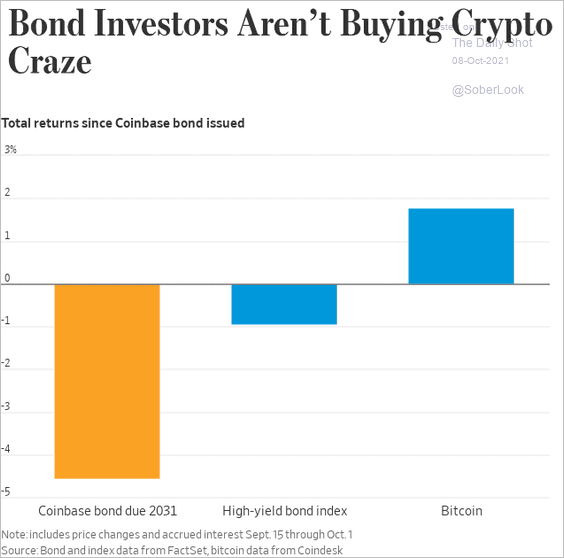

1. Bond investors haven’t been happy in the crypto space.

Source: @WSJ Read full article

Source: @WSJ Read full article

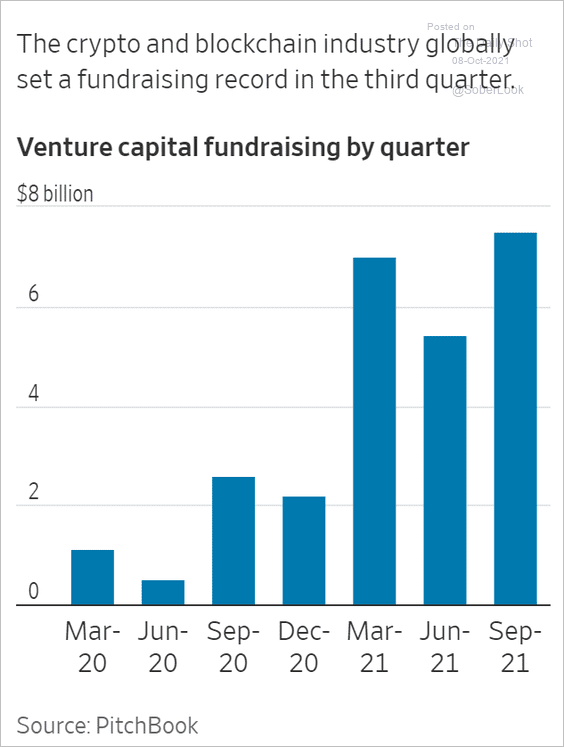

2. Crypto and blockchain VC funding hit a record high last quarter.

Source: @WSJ Read full article

Source: @WSJ Read full article

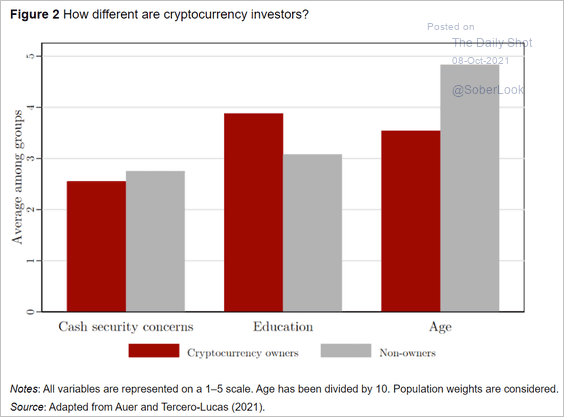

3. How different are crypto investors from the broader population?

Source: VOX EU Read full article

Source: VOX EU Read full article

Back to Index

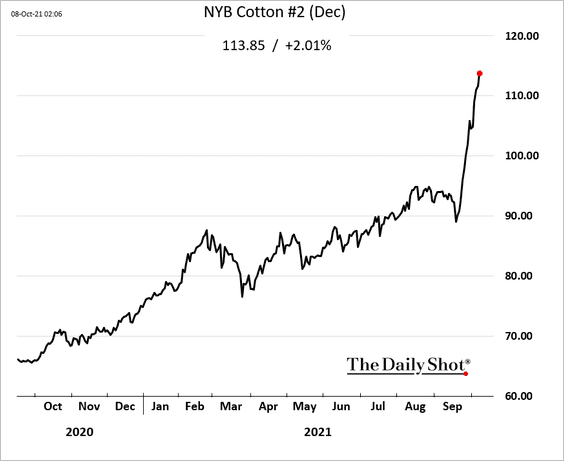

Commodities

1. Cotton futures continue to surge.

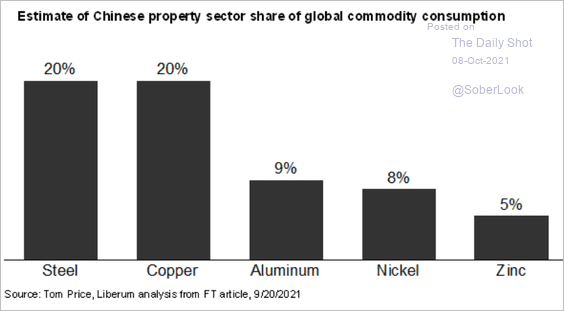

2. China’s property developer credit crisis poses a risk for industrial metals.

Source: Macro Trends Group, Bain Read full article

Source: Macro Trends Group, Bain Read full article

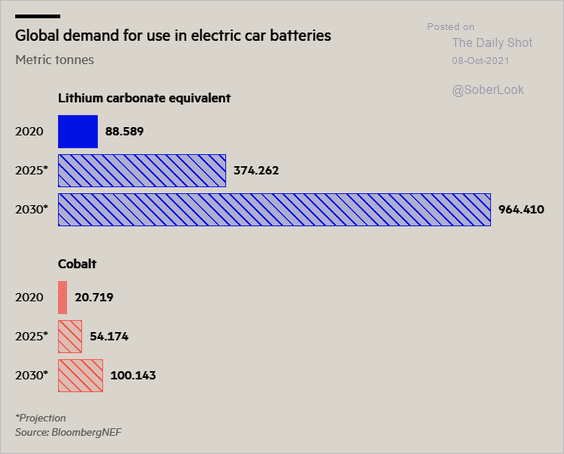

3. Next, we have lithium and cobalt expected demand growth from EV battery production.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

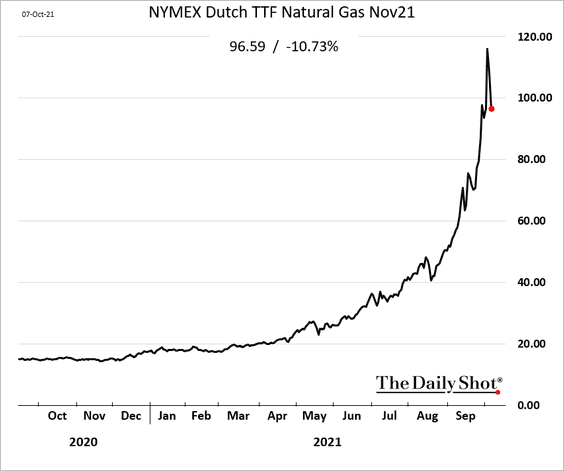

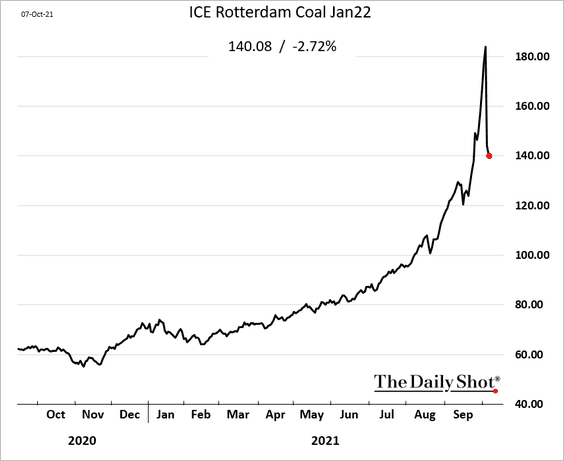

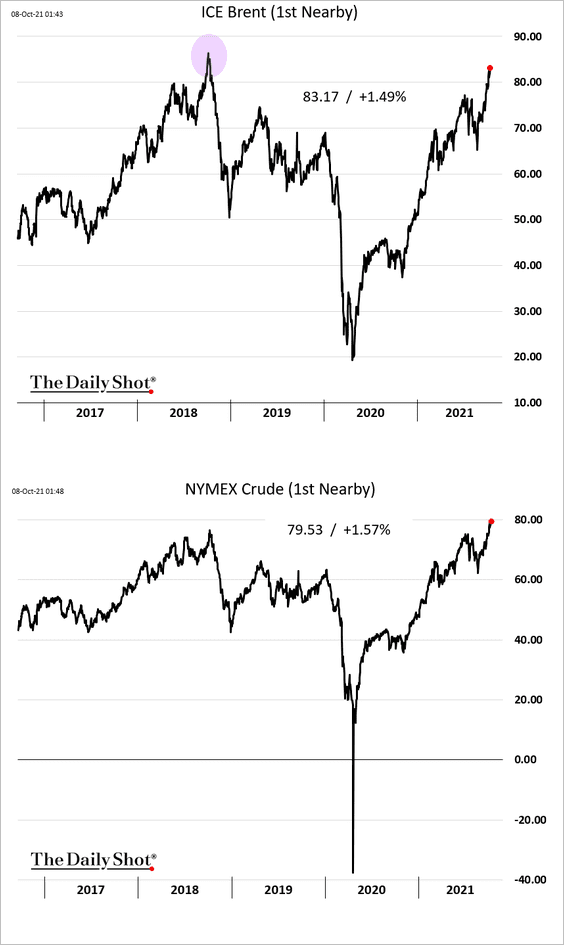

Energy

1. European energy prices are off the highs.

• Gas:

• Coal:

——————–

2. Brent crude is nearing the 2018 high. US oil is approaching $80/bbl.

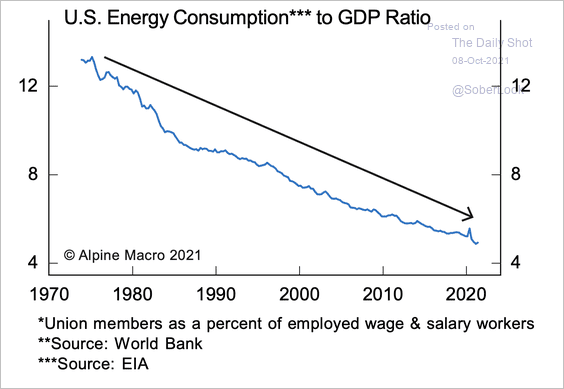

3. US energy consumption, as a share of the GDP, is far lower now than it was in the 1970s. As a result, the spike in prices is not expected to have a substantial impact on growth.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

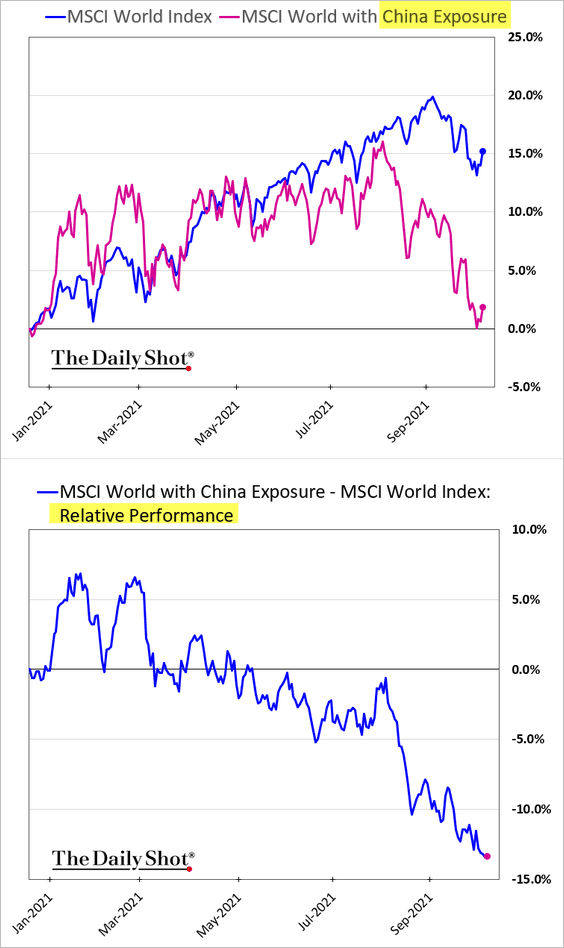

Equities

1. Companies with substantial sales in China are widening their underperformance.

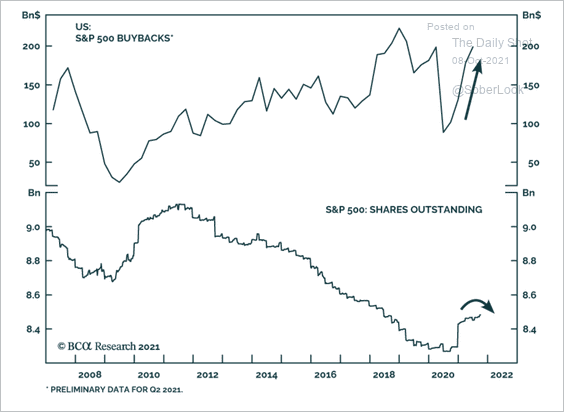

2. Buybacks are making a strong comeback, becoming a tailwind for stocks.

Source: BCA Research

Source: BCA Research

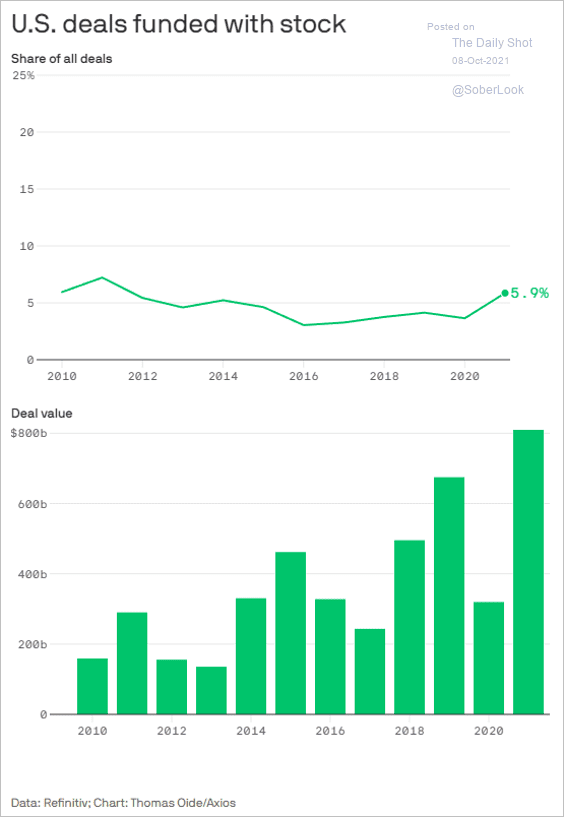

3. Many M&A deals have been funded with stock.

Source: @axios Read full article

Source: @axios Read full article

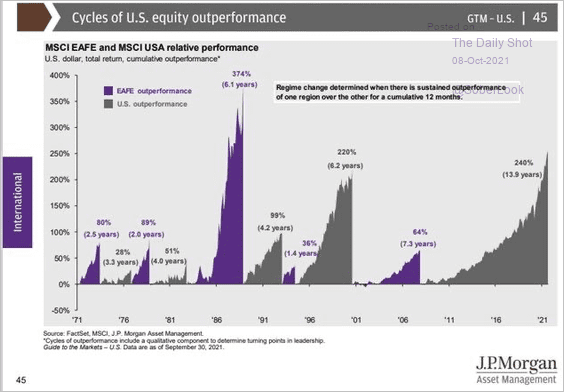

4. US equities have been outperforming EAFE for the longest time since the 1990s.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

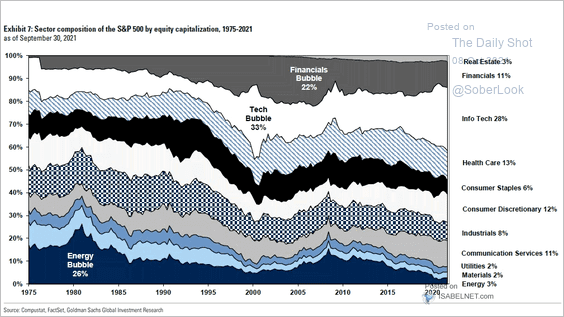

5. This chart shows the S&P 500 sector composition over time.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

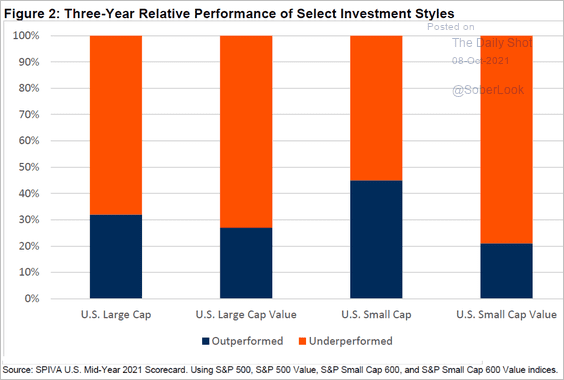

6. What percentage of active funds outperformed their benchmark over the past three years?

Source: @ToddCFRA

Source: @ToddCFRA

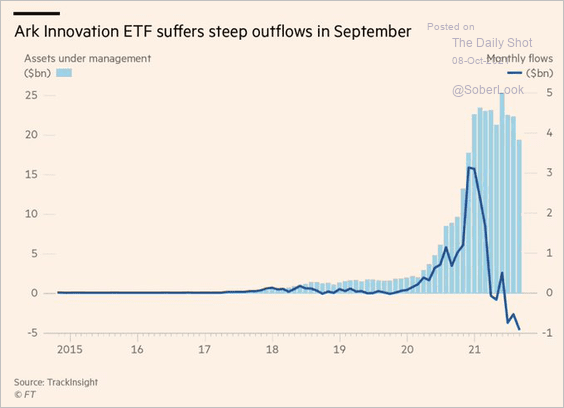

7. ARK Innovation saw some outflows last month.

Source: @jessefelder, @FT Read full article

Source: @jessefelder, @FT Read full article

Back to Index

Credit

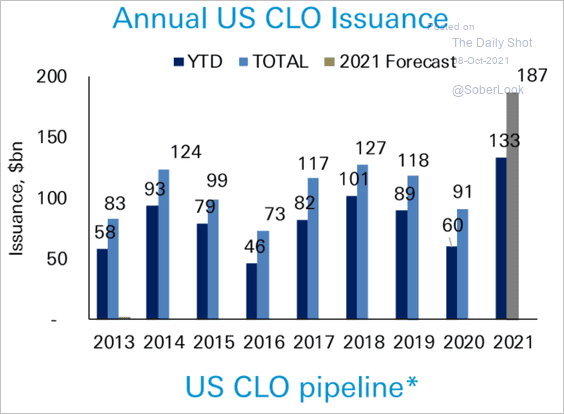

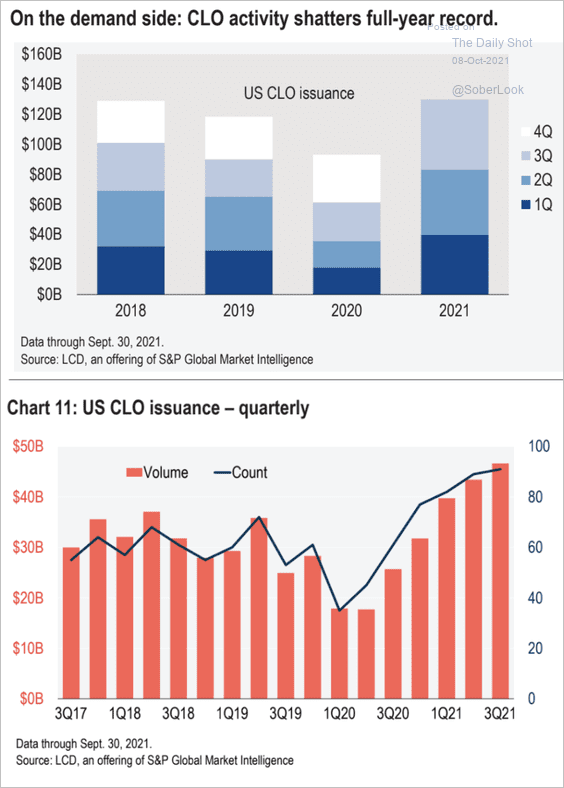

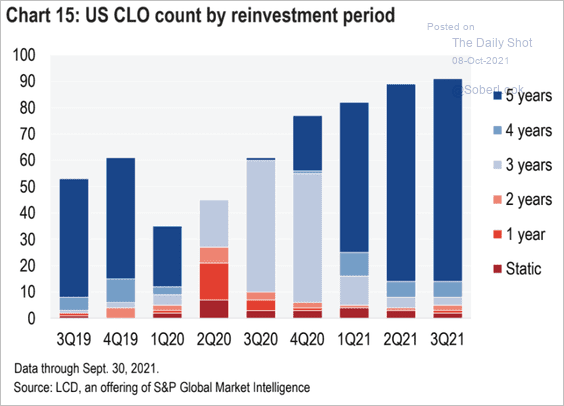

1. Let’s start with some data on CLOs.

• CLO activity:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Investment period of new deals:

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

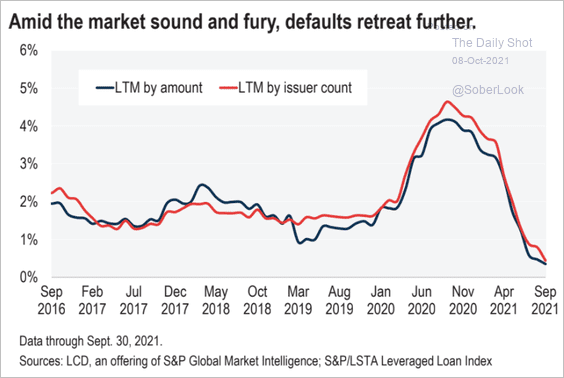

2. Loan defaults continue to decline.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

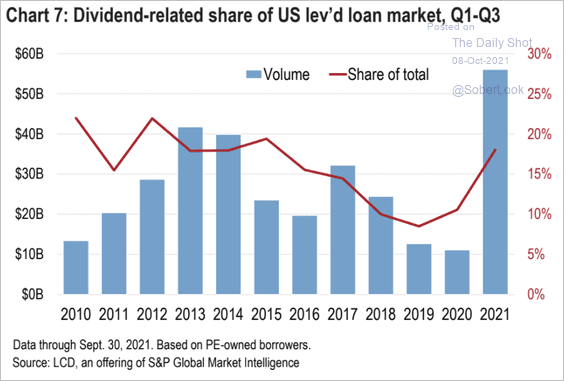

3. There has been a great deal of borrowing to fund dividend payouts.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Global Developments

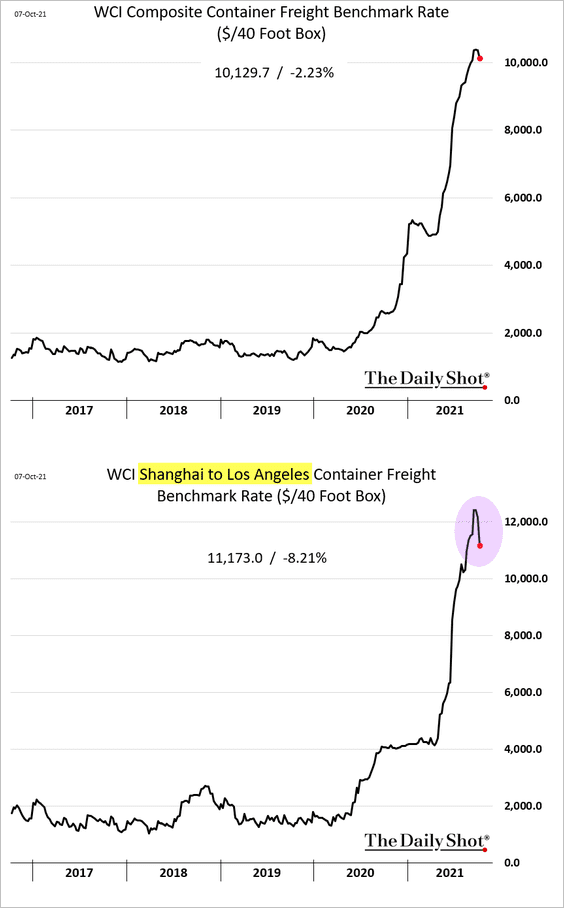

1. Container rates declined from the highs (especially China-US).

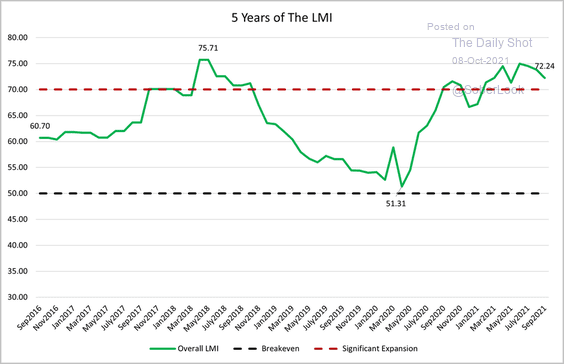

• The logistics managers’ index has recorded its longest stretch above 70, i.e. significant growth. Has the index peaked?

Source: Logistics Managers’ Index Further reading

Source: Logistics Managers’ Index Further reading

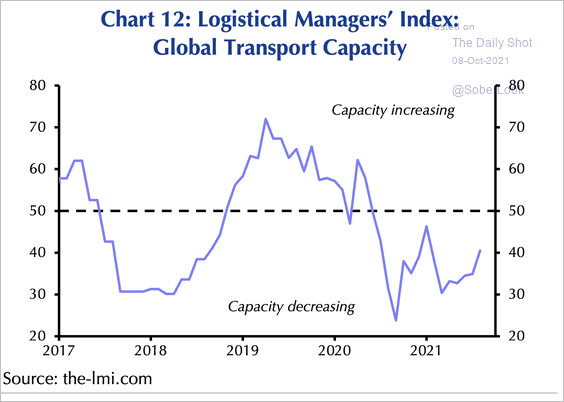

• Transportation capacity is struggling, but the declines have been moderating (a reading above 50 would indicate capacity is expanding again).

Source: Capital Economics

Source: Capital Economics

——————–

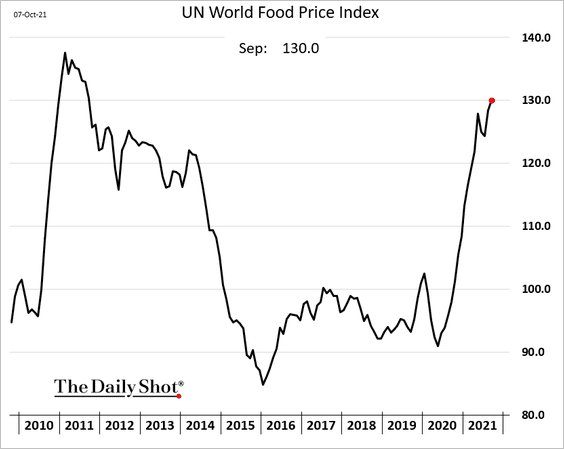

2. The global food price index continues to surge.

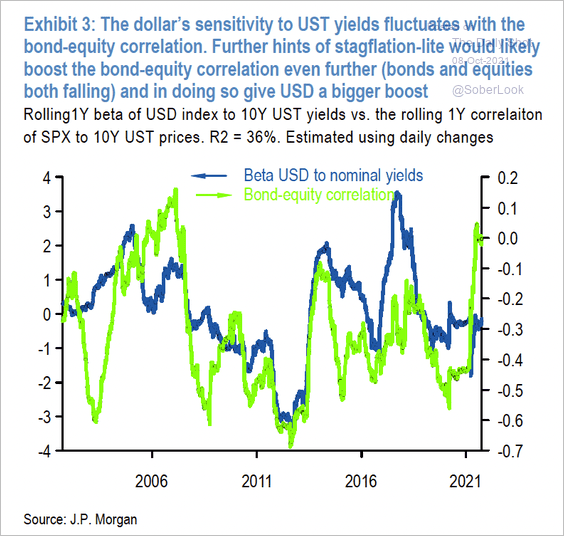

3. The rise in the stock/bond correlation points to greater sensitivity of the dollar to nominal yields.

Source: JPMorgan

Source: JPMorgan

——————–

Food for Thought

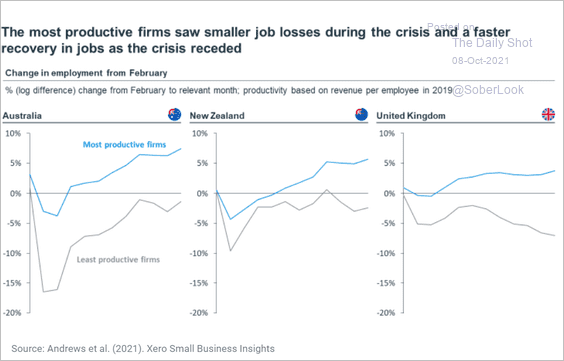

1. Job losses and gains at the most productive firms:

Source: OECD Read full article

Source: OECD Read full article

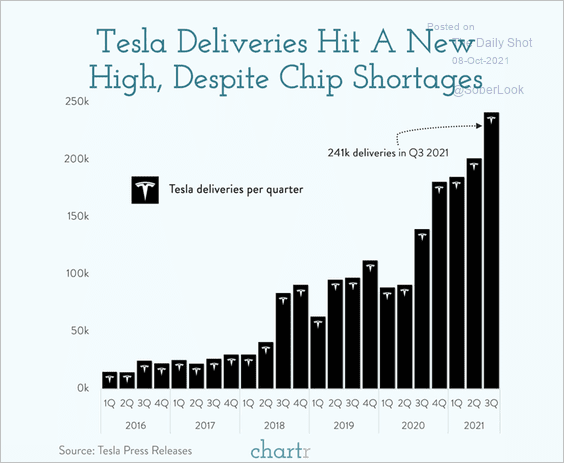

2. Tesla deliveries:

Source: @chartrdaily

Source: @chartrdaily

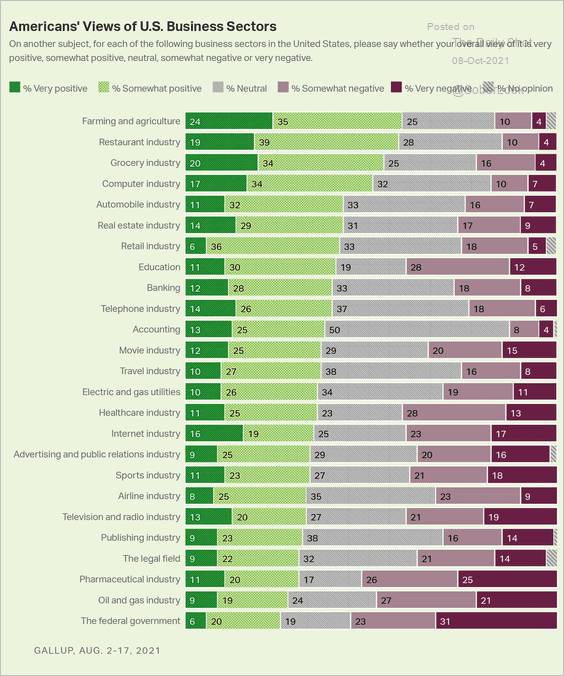

3. Americans’ views of business sectors:

Source: Gallup Read full article

Source: Gallup Read full article

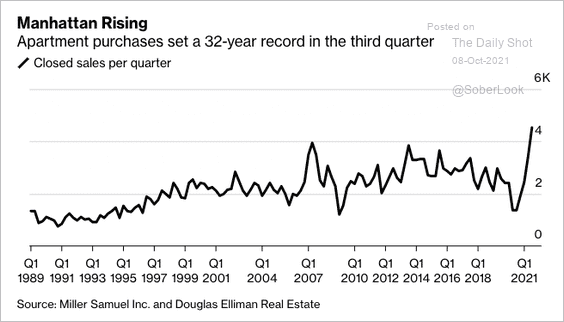

4. Manhattan apartment sales:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

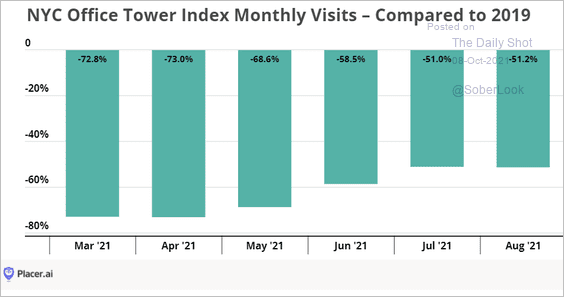

• New York City office visits (vs. 2019):

Source: Placer.ai

Source: Placer.ai

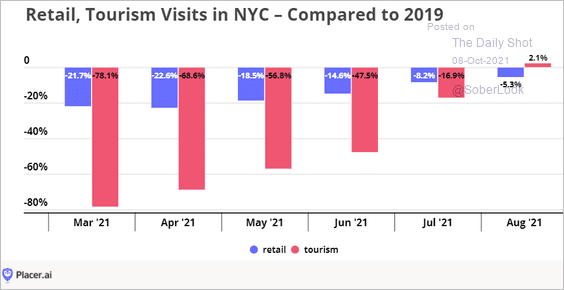

• New York City retail and tourism visits:

Source: Placer.ai

Source: Placer.ai

——————–

5. The global semiconductor sector:

![]() Source: The Economist Read full article

Source: The Economist Read full article

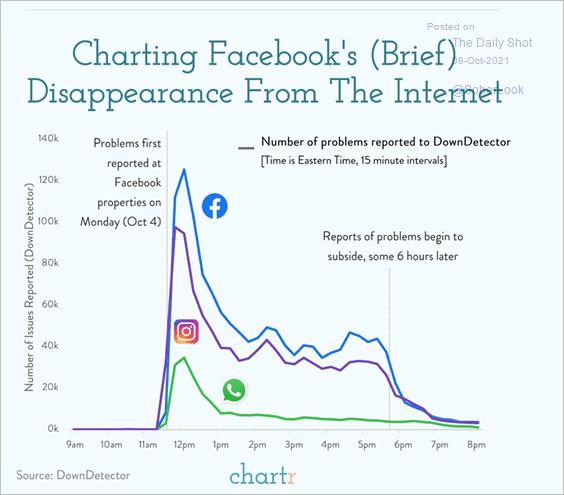

6. Facebook’s outage:

Source: @chartrdaily

Source: @chartrdaily

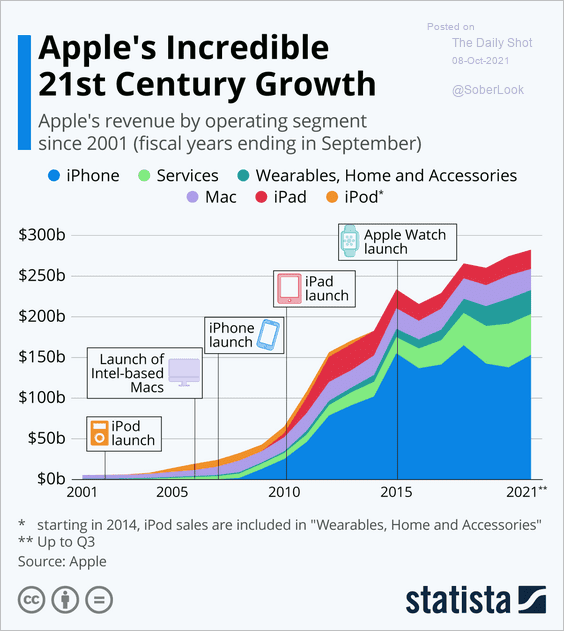

7. Apple’s growth:

Source: Statista

Source: Statista

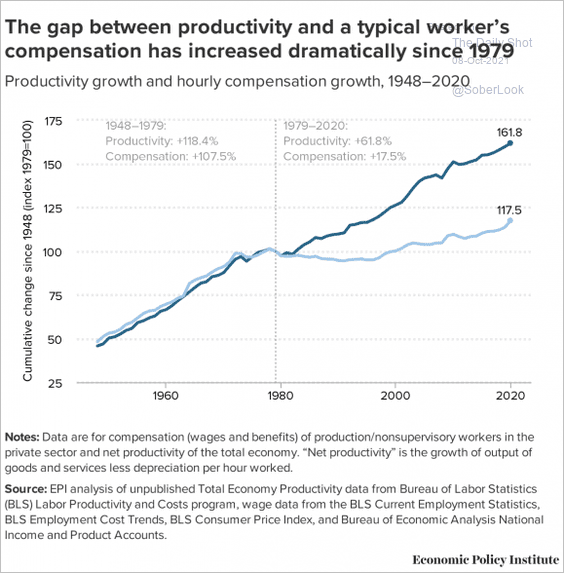

8. Productivity vs. compensation:

Source: EPI

Source: EPI

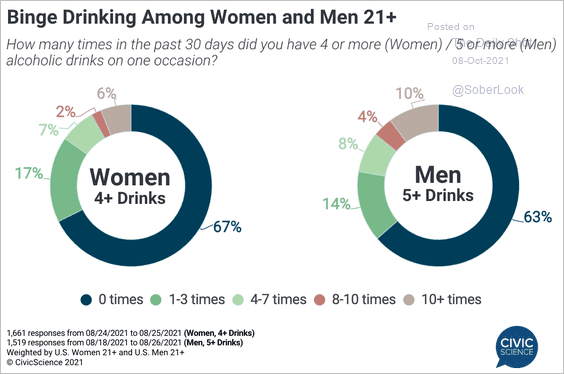

9. Binge drinking:

Source: @CivicScience

Source: @CivicScience

——————–

Have a great weekend!

Back to Index