The Daily Shot: 28-Oct-21

• The United States

• Canada

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

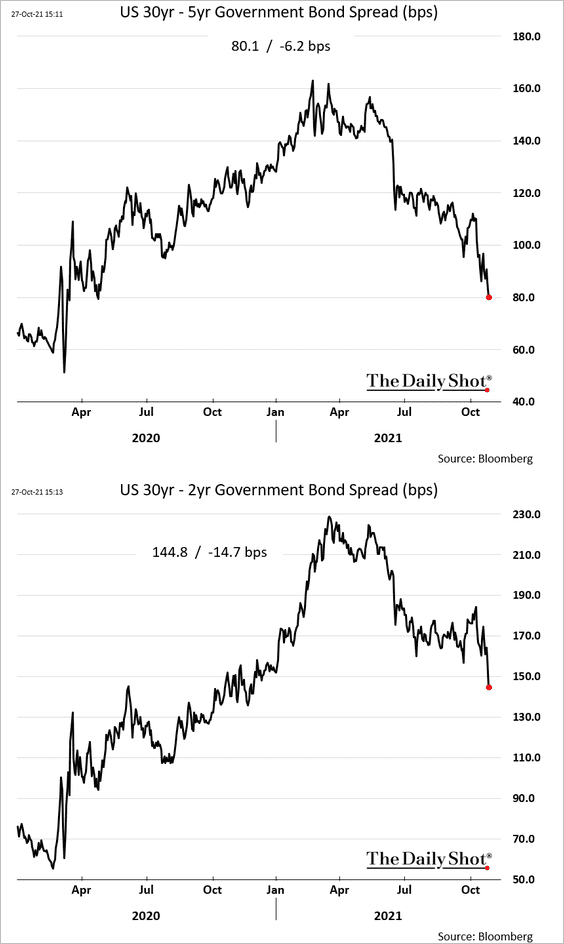

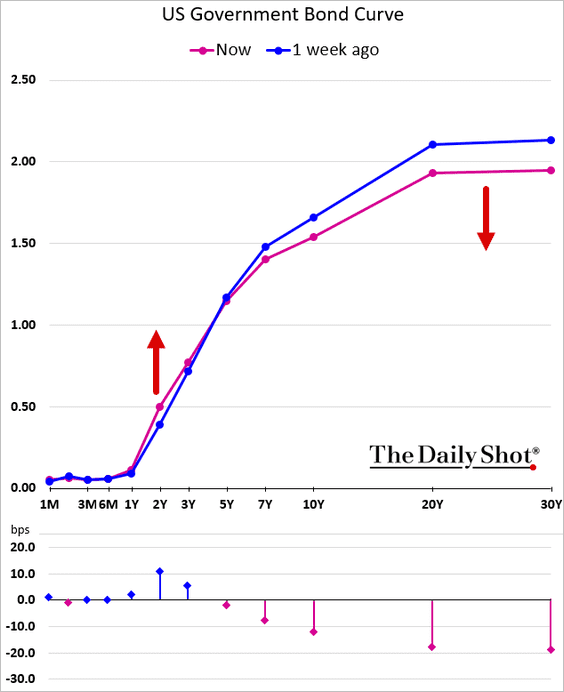

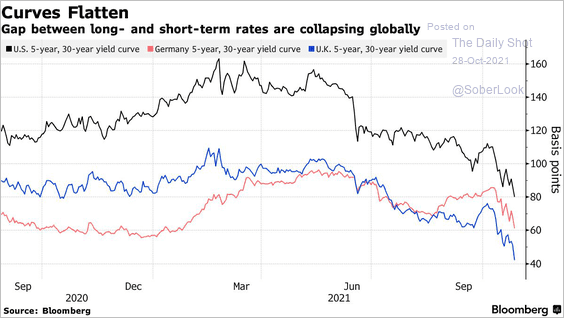

1. Concerns are mounting that global central banks are becoming increasingly hawkish in the face of stronger than expected inflation. The combination of supply chain constraints, a weaker economy in China, and tighter monetary policy will slow economic growth. The Treasury curve continues to flatten (as are yield curves around the world).

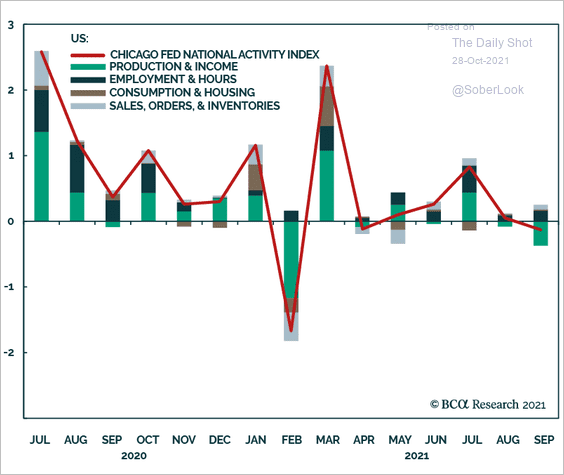

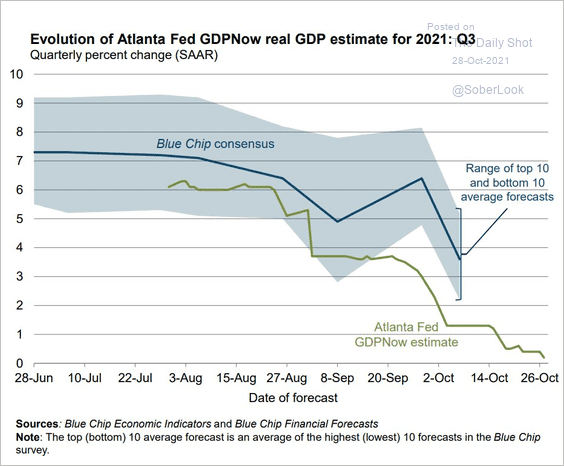

There are signs that the US GDP slowed sharply last quarter.

• The Chicago Fed National Activity Index:

Source: BCA Research

Source: BCA Research

• The Atalnta Fed’s GDPNow model:

Source: @AtlantaFed

Source: @AtlantaFed

While economists view the slowdown in the third quarter as temporary, there is now less certainty around 2022.

——————–

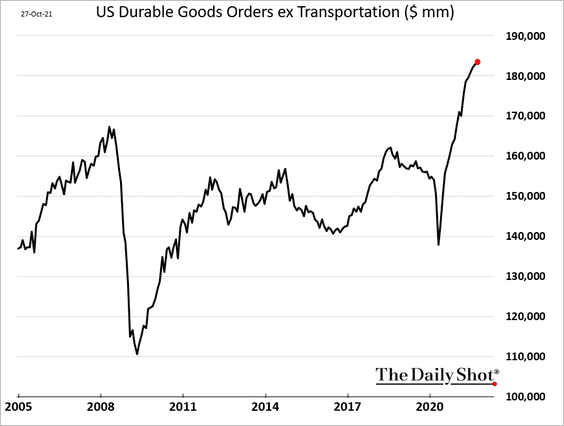

2. Durable goods orders slowed in September, driven by aircraft orders (which tend to be volatile). Outside of transportation, new orders hit a record high.

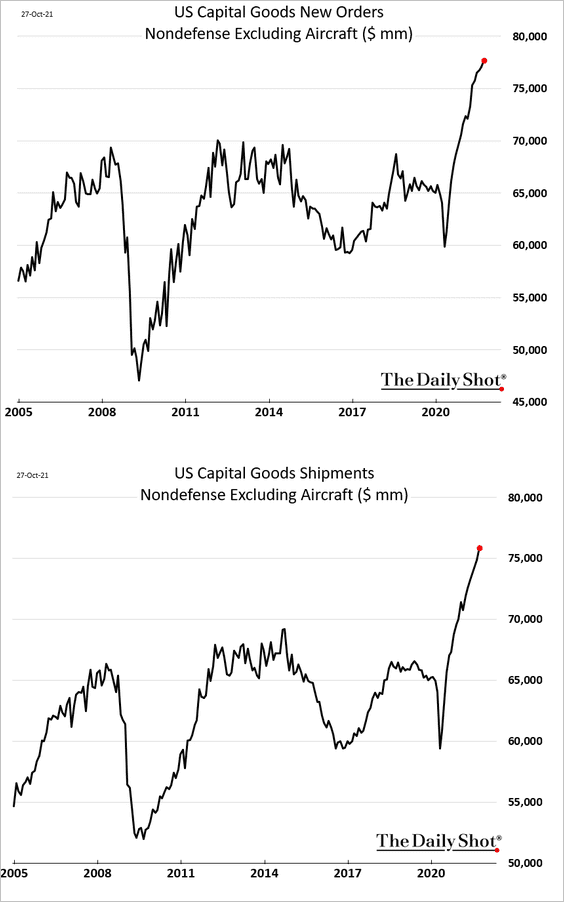

Growth in capital goods orders has been impressive, pointing to a surge in business investment.

——————–

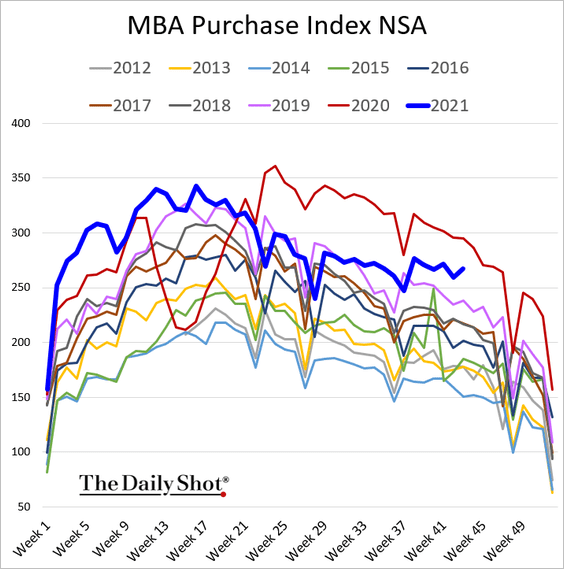

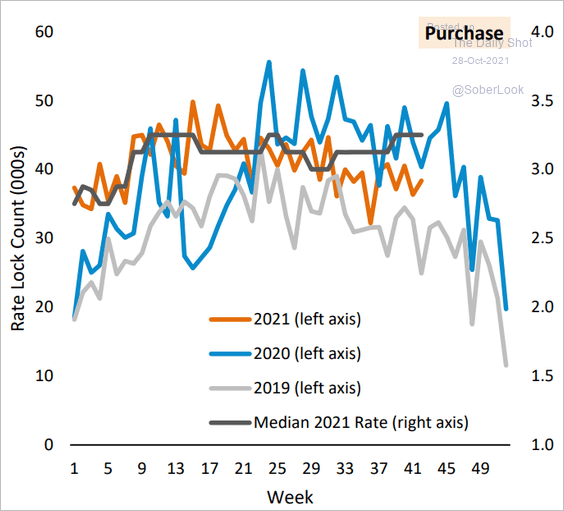

3. Mortgage applications have been exceptionally strong for this time of the year, despite an uptick in rates.

• The index tracking mortgage rate locks is also running well above 2019 levels.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

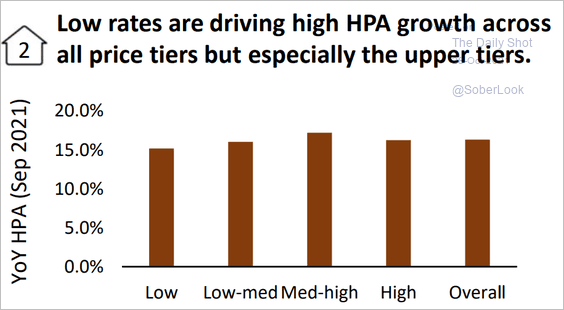

• Home price appreciation was broad over the past 12 months.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

——————–

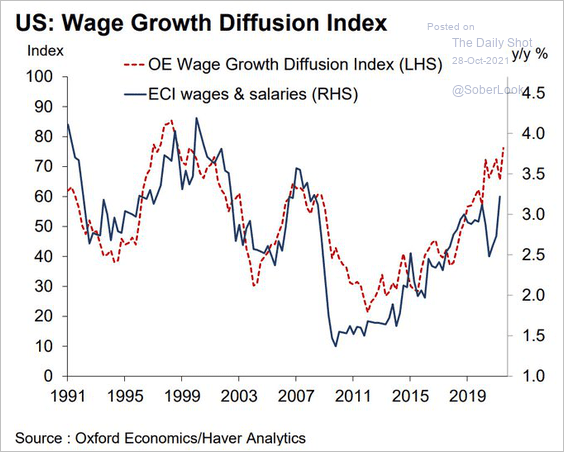

4. The Oxford Economics Wage Growth Diffusion Index points to an acceleration in wages.

Source: @GregDaco

Source: @GregDaco

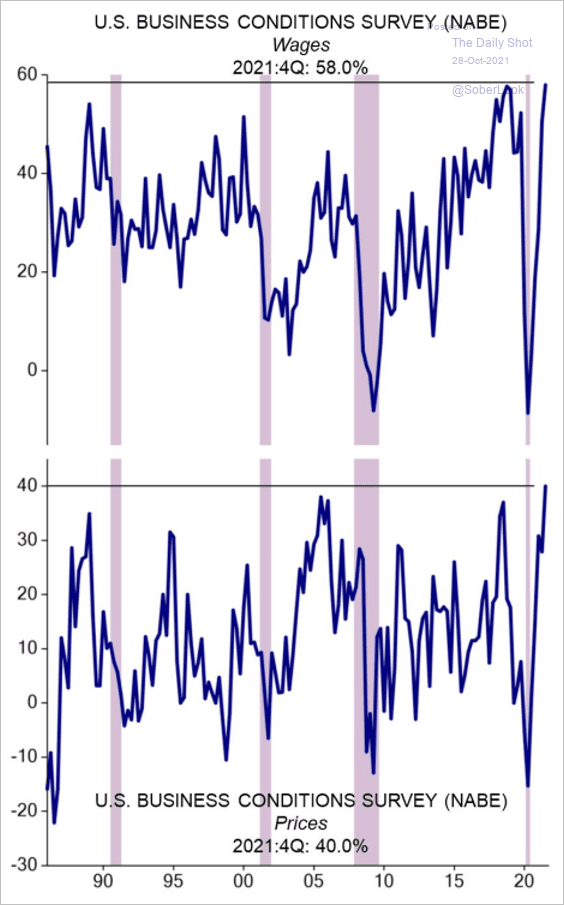

The percentage of businesses saying that wages and prices are rising at their firms is near record highs.

Source: Evercore ISI

Source: Evercore ISI

——————–

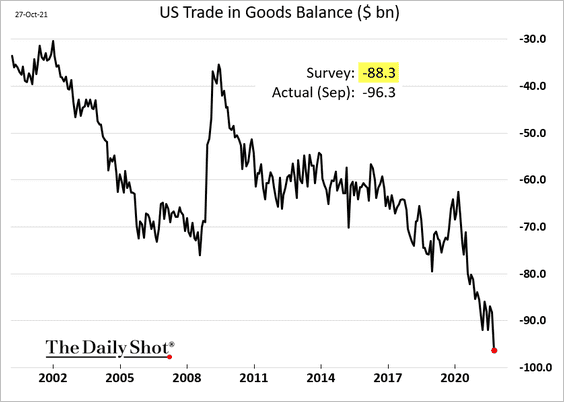

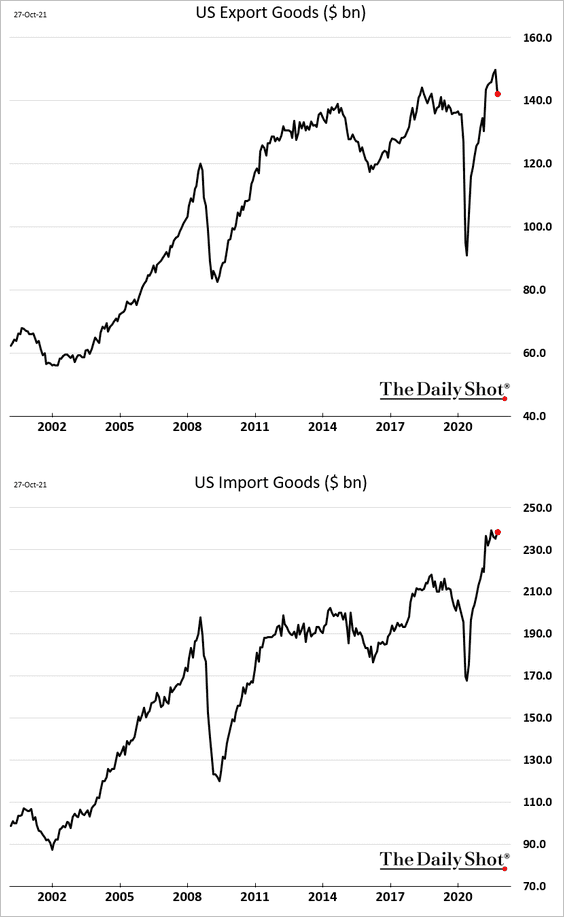

5. The US goods trade deficit hit a new record, topping expectations.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

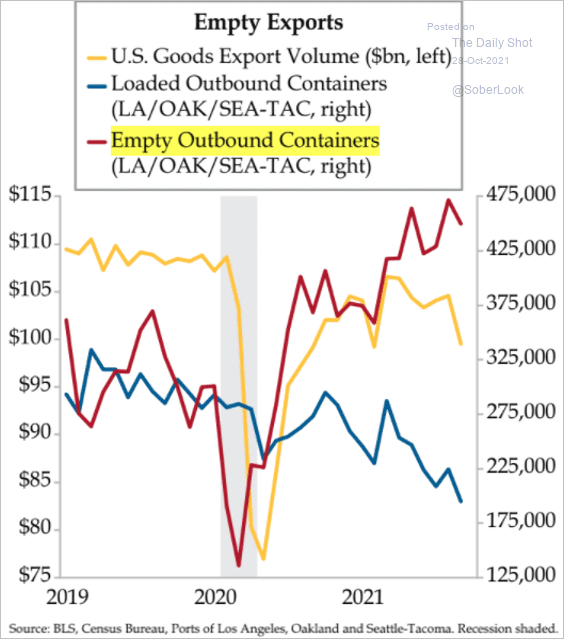

Goods exports sagged last month, while imports remain near the highs.

There are a lot of empty outbound containers leaving US ports.

Source: The Daily Feather

Source: The Daily Feather

——————–

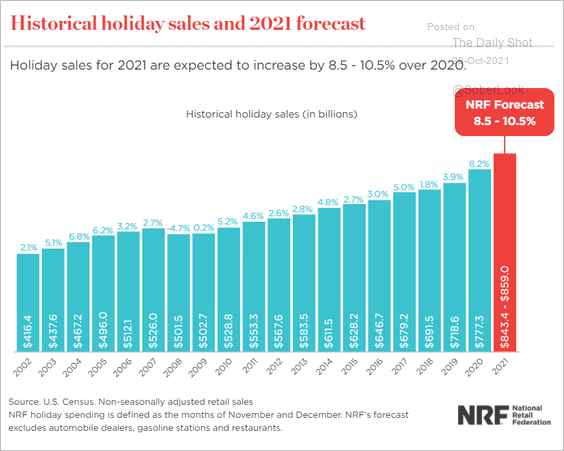

6. Holiday sales are expected to exceed $800 billion this year.

Source: Reuters Read full article

Source: Reuters Read full article

Source: NRF

Source: NRF

Back to Index

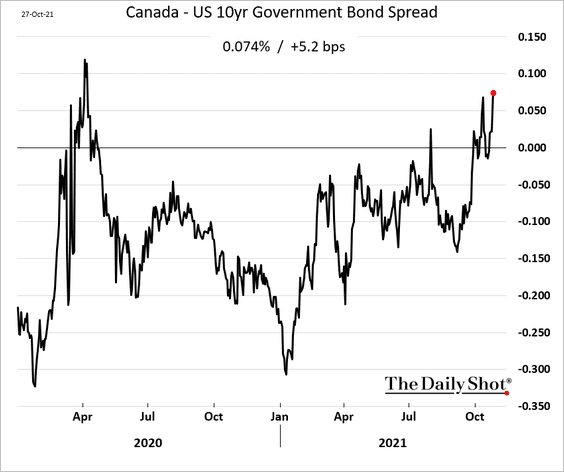

Canada

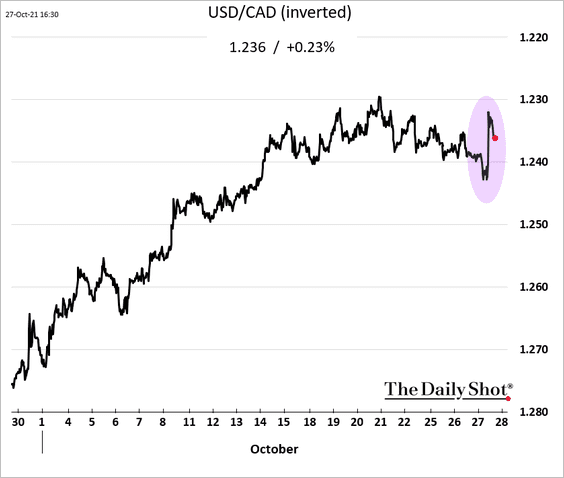

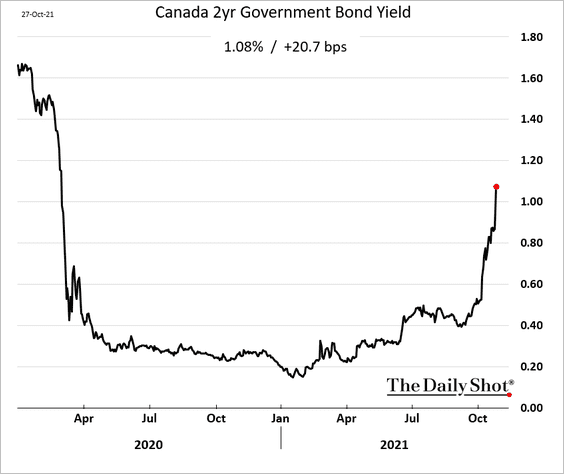

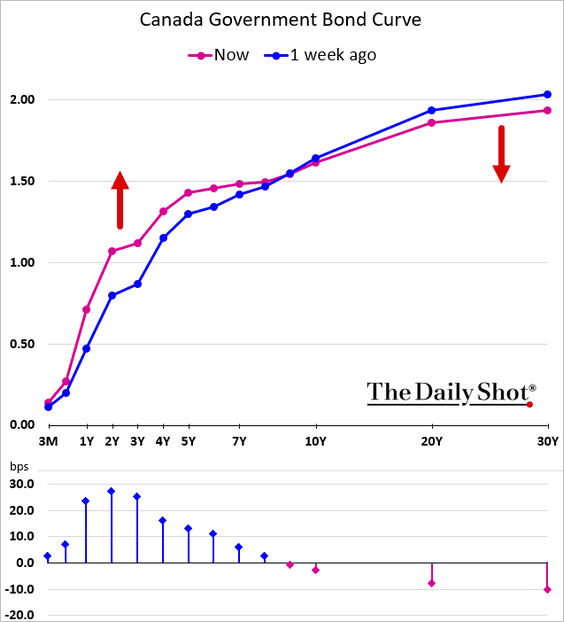

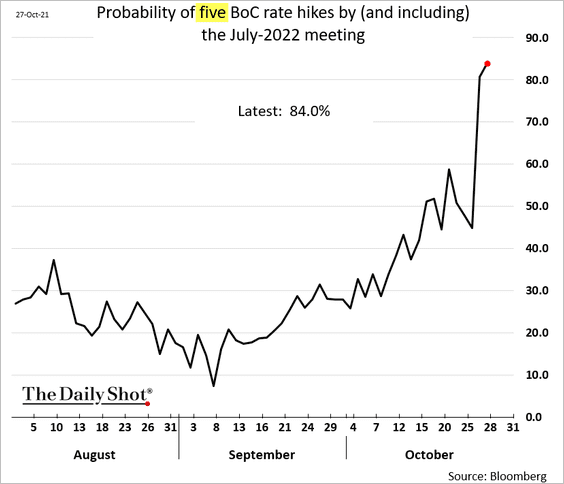

The BoC struck a hawkish tone, ending QE and pulling forward rate hikes. This is exactly the type of move that is flattening yield curves around the world.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

• The loonie moved higher.

• Short-term yields surged.

• The yield curve flattened.

• The probability of five (yes, five) rate hikes by next July jumped above 80%. The market may be overreacting here a bit.

• The 10yr Canadian bond yield is now above Treasuries.

Back to Index

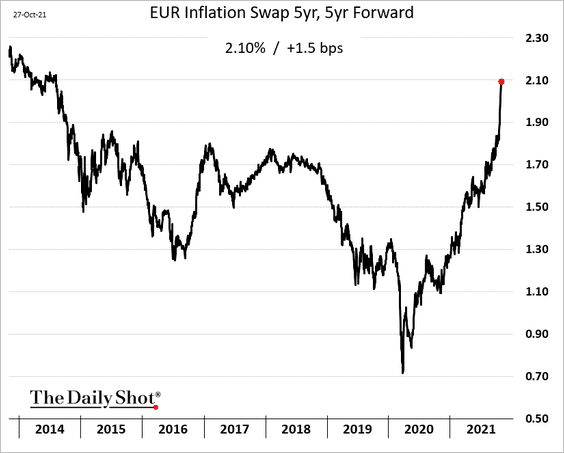

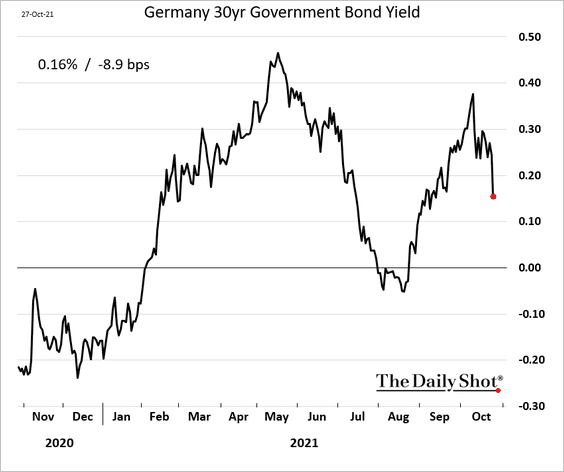

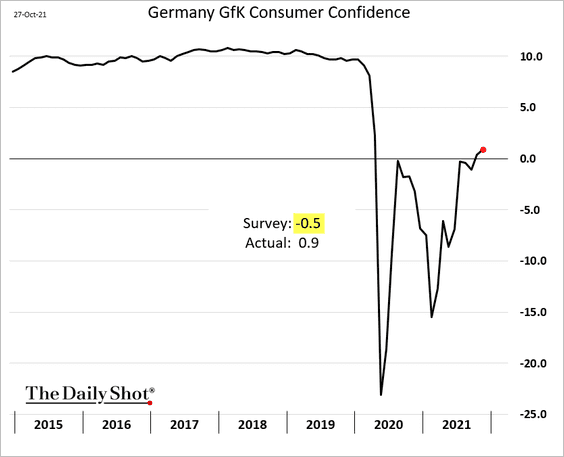

The Eurozone

1. Long-term inflation expectations keep surging.

2. Longer-dated Bund yields declined as yield curves flattened globally.

3. German consumer confidence surprised to the upside.

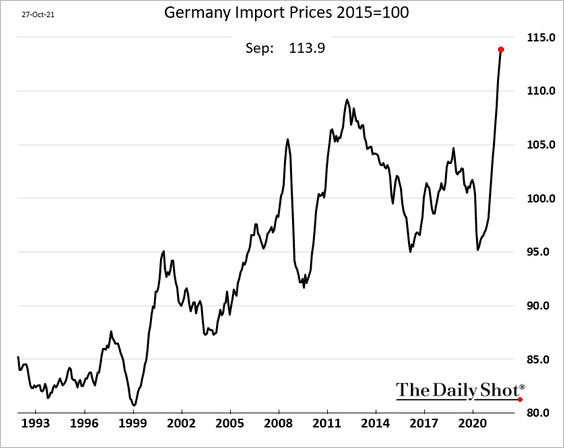

Separately, German import prices are surging.

——————–

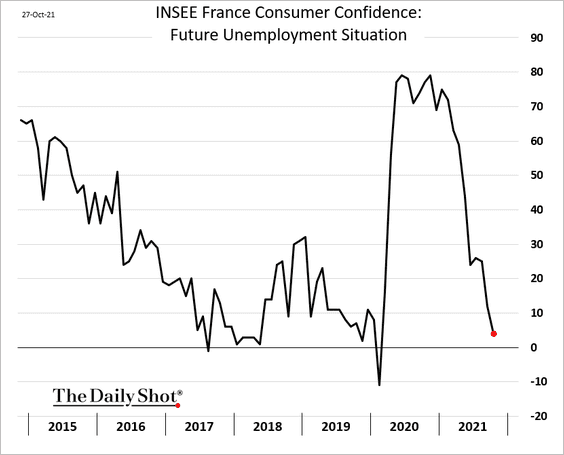

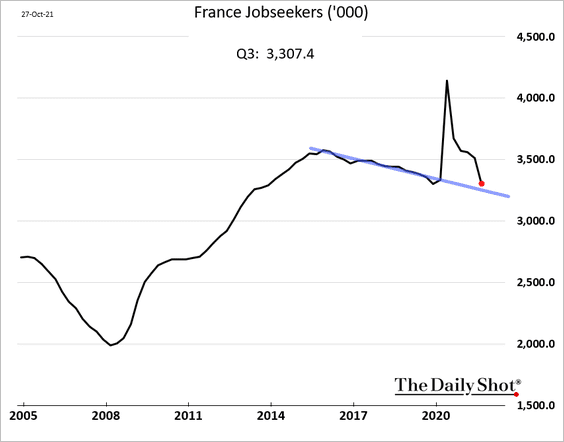

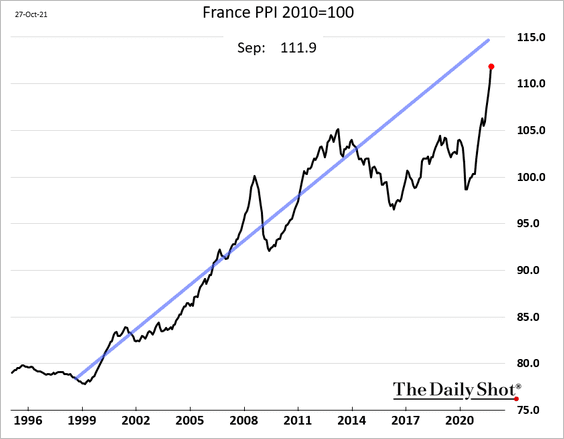

4. Next, we have some updates on France.

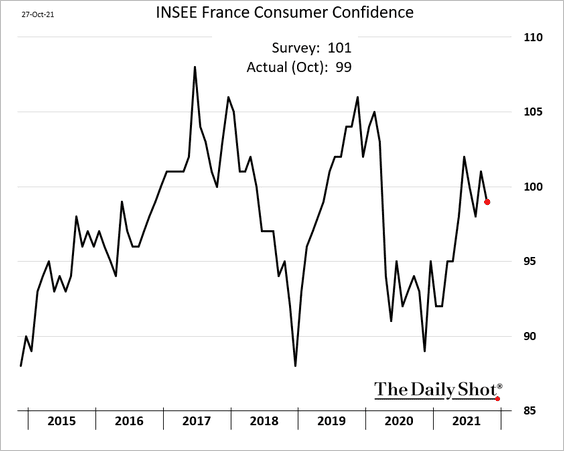

• Consumer confidence was weaker this month.

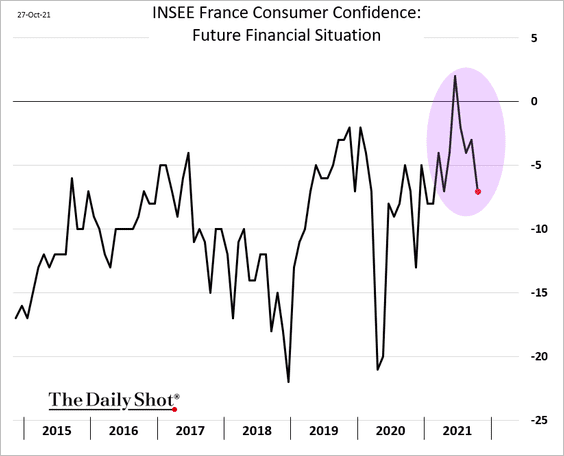

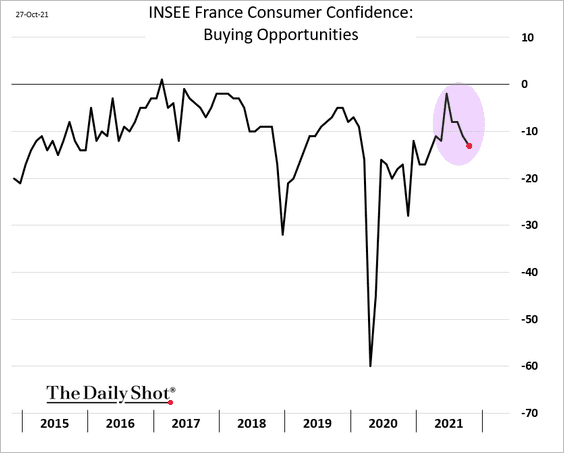

– Financial situation expectations and buying conditions have been deteriorating.

– But consumers are optimistic about the job market.

• The number of job seekers was back on its pre-COVID trend last quarter.

• Producer prices are surging but are still below the longer-term trend.

——————–

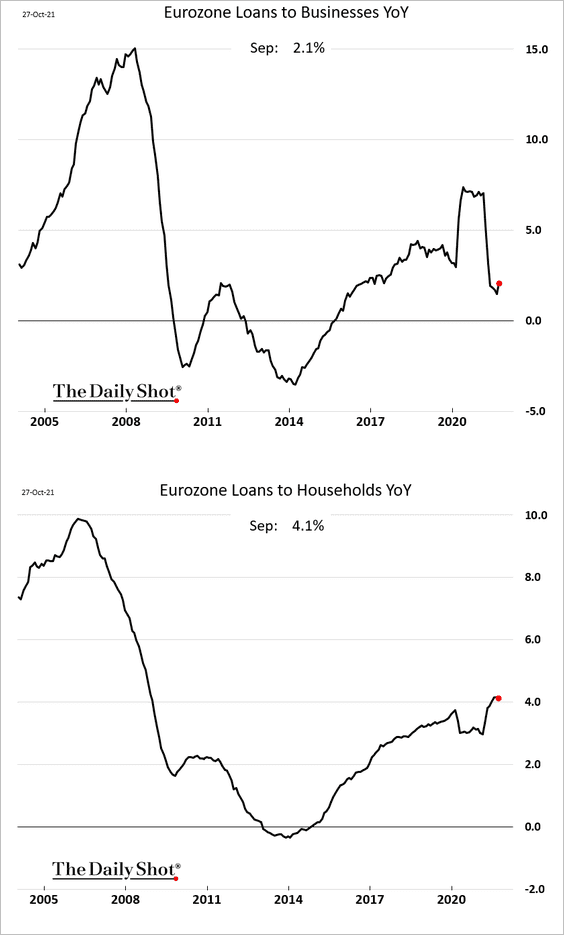

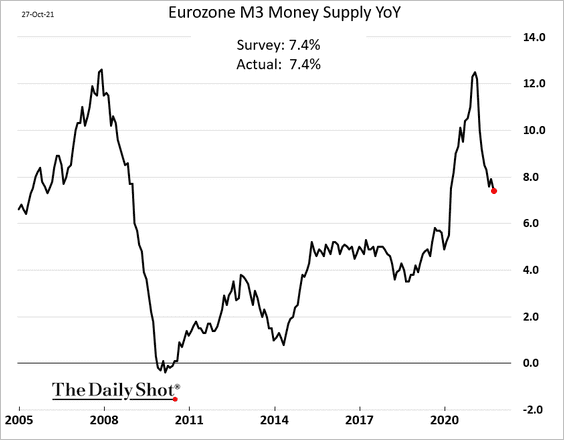

5. Growth in loans to businesses ticked higher in the Eurozone last month. Household lending was flat.

The broad money supply expansion continues to moderate after the pandemic-induced surge.

Back to Index

Asia – Pacific

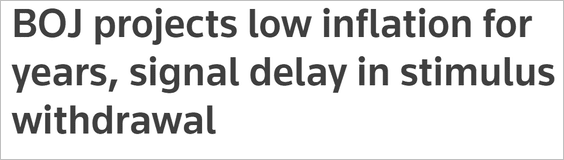

1. The BoJ remains dovish, with inflation projection (two years out) holding at 1%.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

2. Next, we have some updates on Australia.

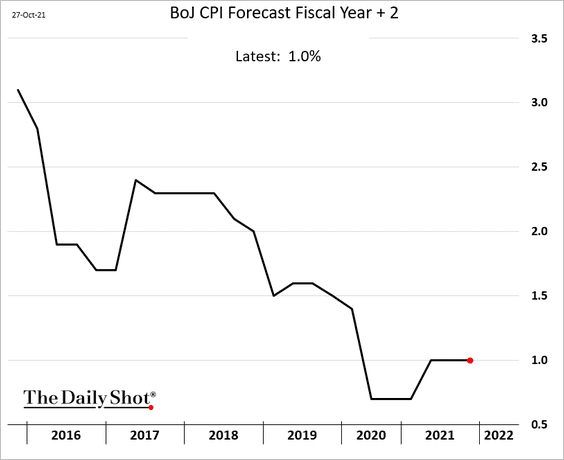

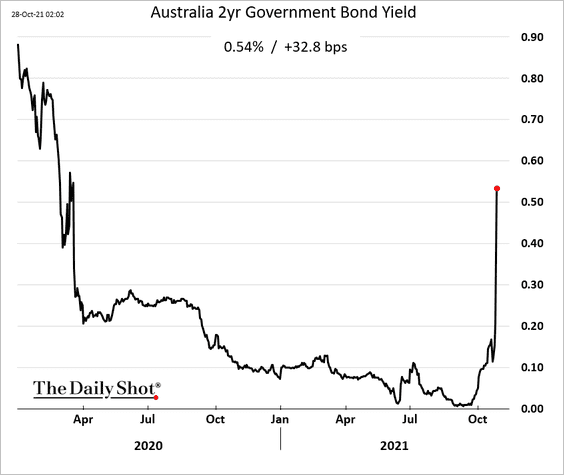

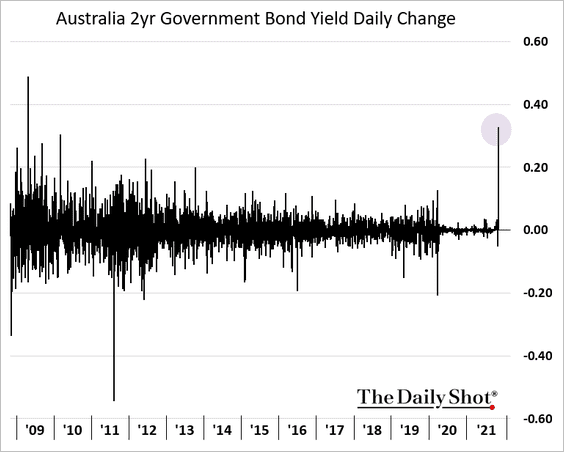

• Traders are challenging the RBA to step in with its yield control policy. The 2yr yield saw the largest one-day gain since 2009.

Source: @markets Read full article

Source: @markets Read full article

——————–

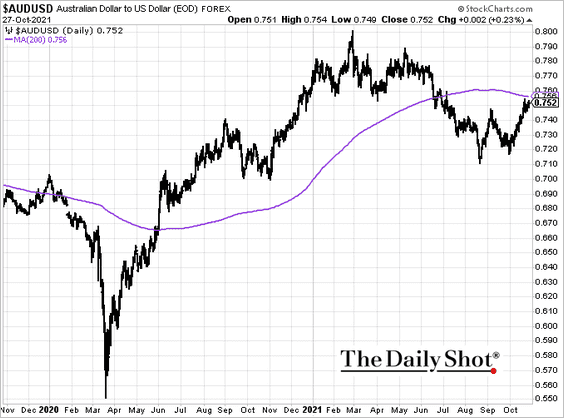

• The Aussie dollar hit resistance at the 200-day moving average.

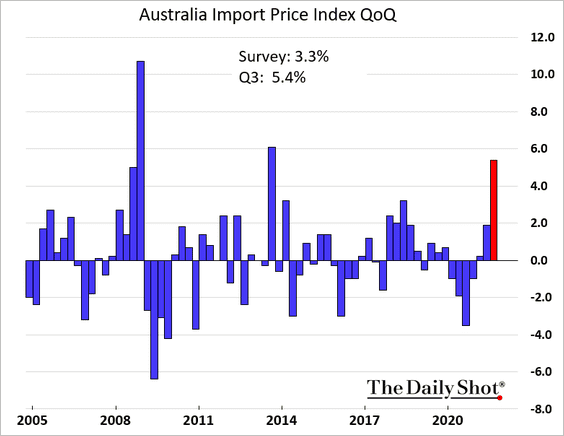

• Import price gains exceeded forecasts.

——————–

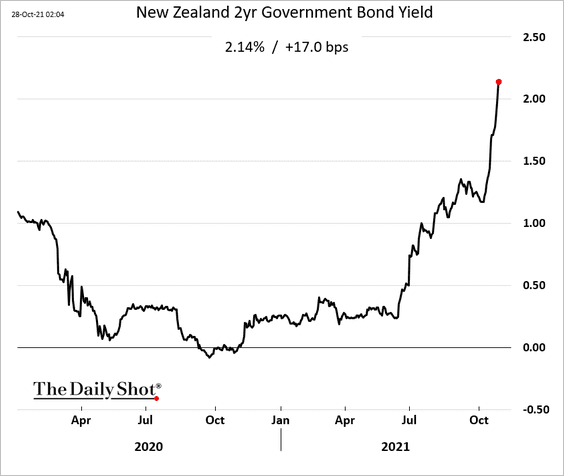

3. New Zealand’s short-term yields are surging as well.

Back to Index

China

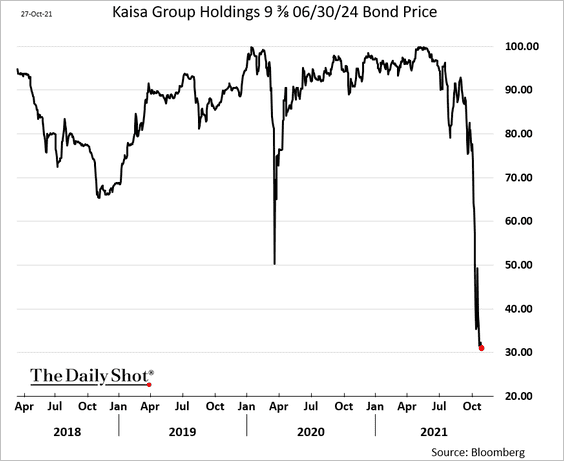

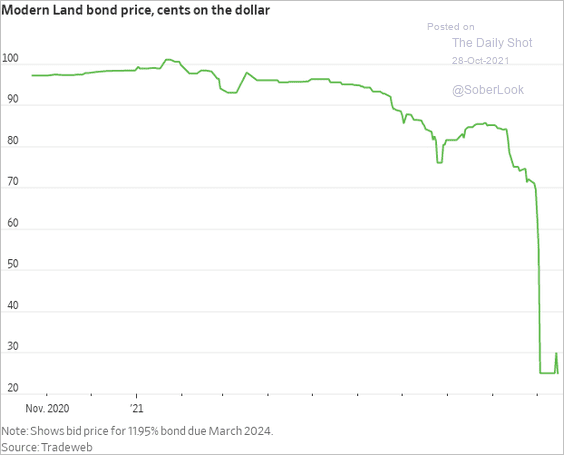

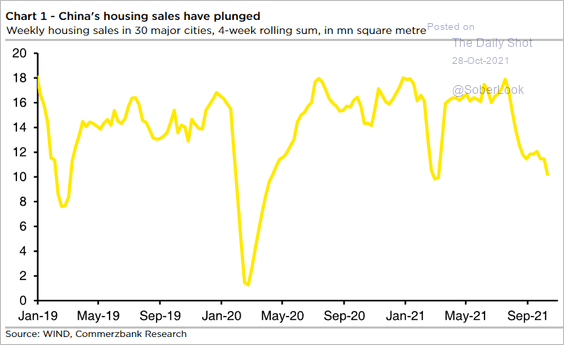

1. The property developers’ deleveraging process is going to be painful.

• Kaisa’s bonds and shares continue to sink amid rating downgrades.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

Source: @SofiaHCBBG, @markets Read full article

Source: @SofiaHCBBG, @markets Read full article

• Modern Land is officially in default.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

• Property sales remain soft.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

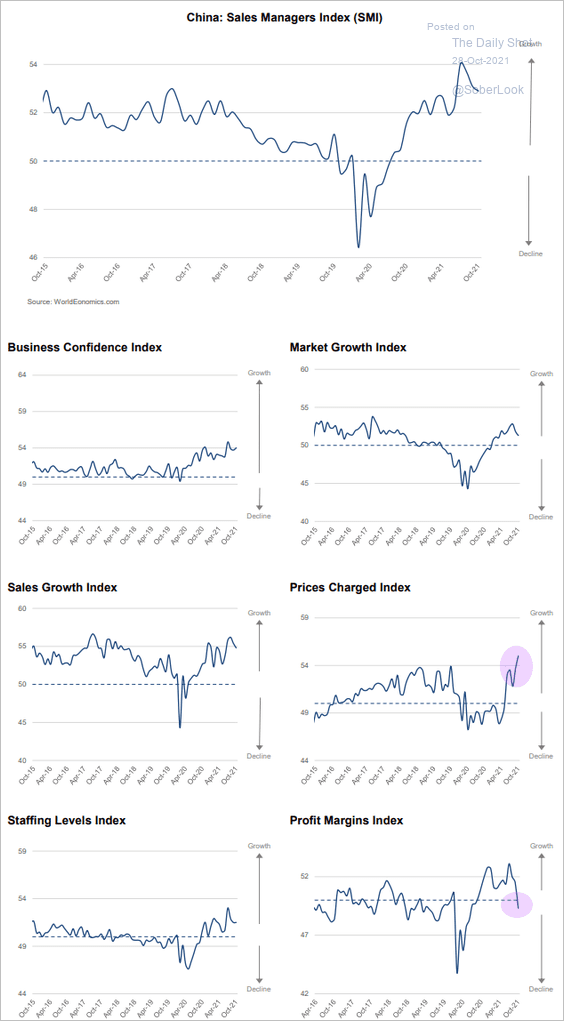

2. Business growth slowed this month but remains robust, according to the World Economics SMI report. Companies are rapidly boosting prices as margins shrink.

Source: World Economics

Source: World Economics

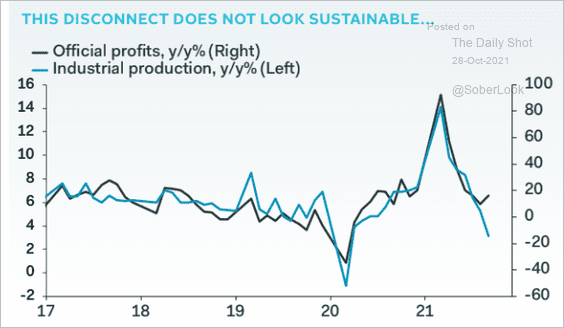

3. There is a disconnect between industrial profits (official report) and industrial production.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

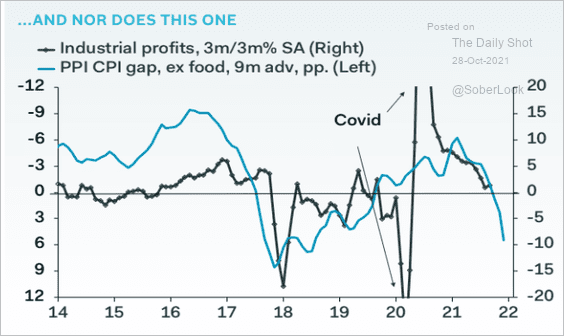

The widening gap between the PPI and the CPI points to declining margins, also suggesting that industrial profits should be lower.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Emerging Markets

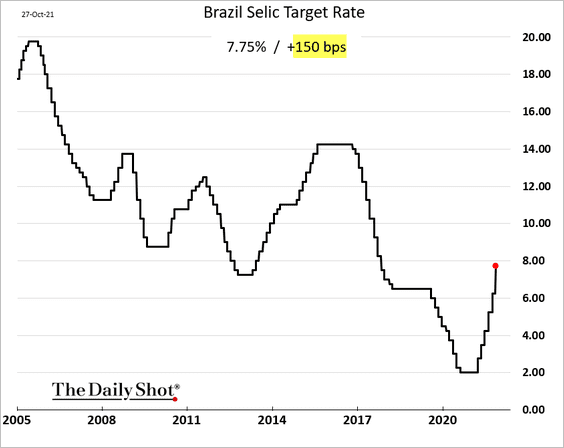

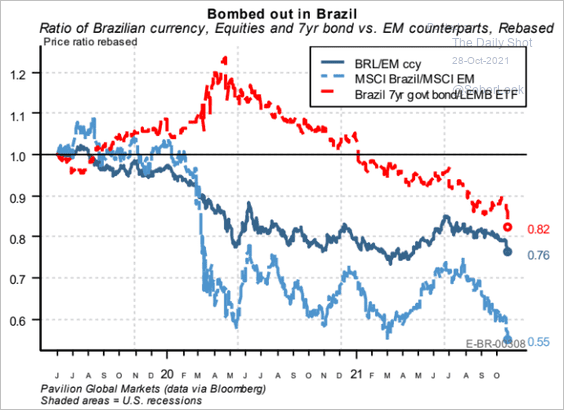

1. Brazil’s central bank hiked rates by 150 bps, the largest increase in years.

The nation’s currency, stocks, and bonds have been under pressure.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

——————–

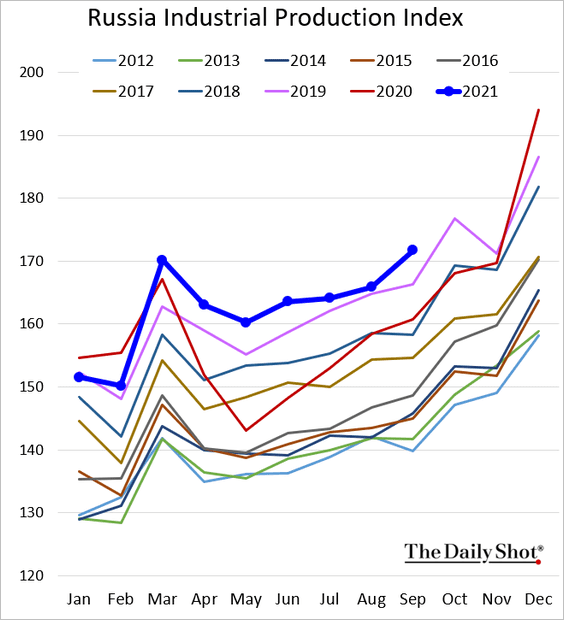

2. Russia’s industrial production remains strong.

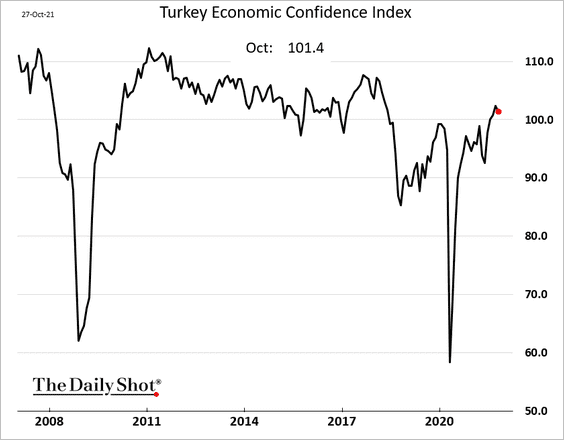

3. Turkey’s economic confidence ticked lower this month but has been resilient thus far.

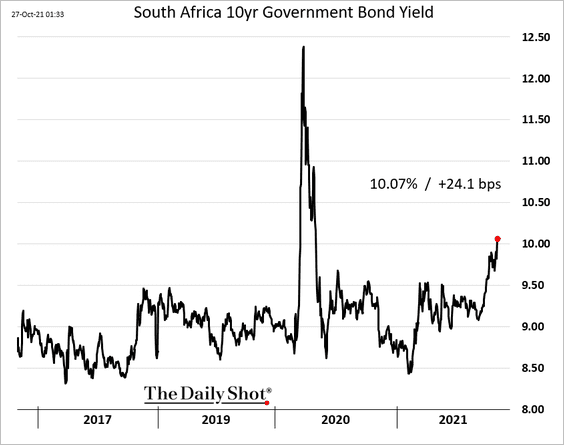

4. South Africa’s bond yields have been surging.

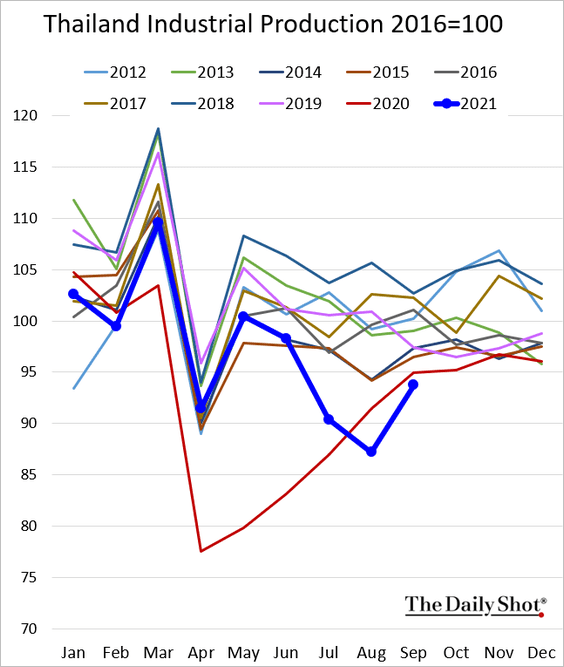

5. Thailand’s industrial production jumped after the COVID-induced slump over the summer (but remained below 2020 levels in September).

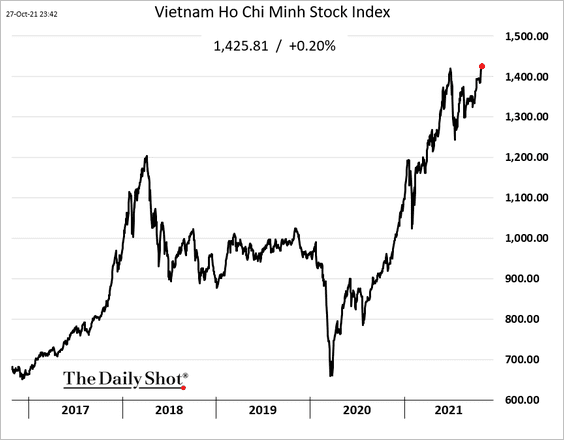

6. Vietnam’s stock market hit a record high.

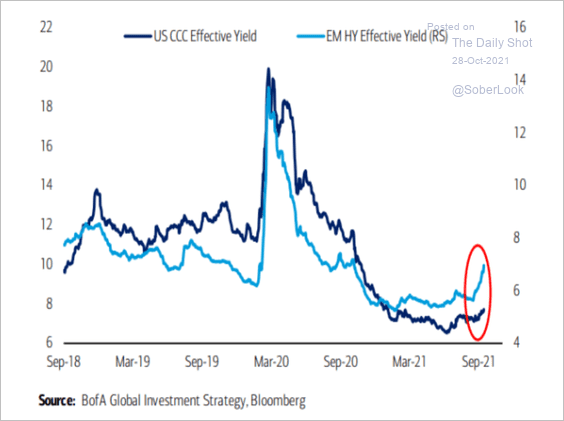

7. EM high-yield debt is showing signs of stress, especially relative to the US.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Cryptocurrency

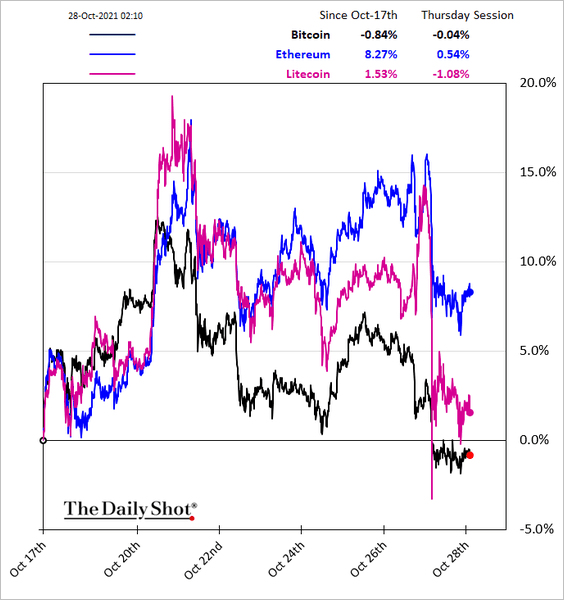

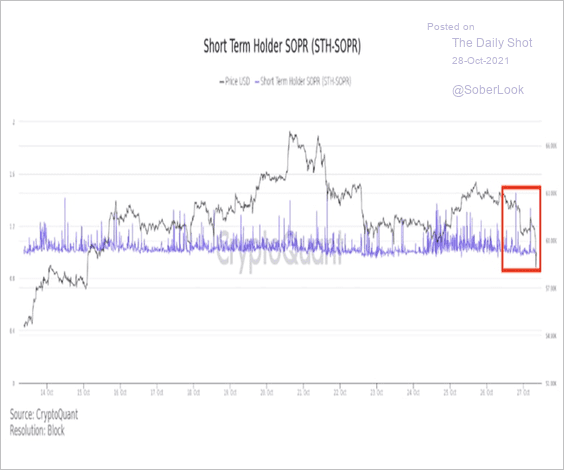

1. The market sold off on Wednesday.

Similar to long-term bitcoin holders, blockchain data also shows short-term holders are starting to take profits after the ETF-driven price rally.

Source: CryptoQuant Read full article

Source: CryptoQuant Read full article

——————–

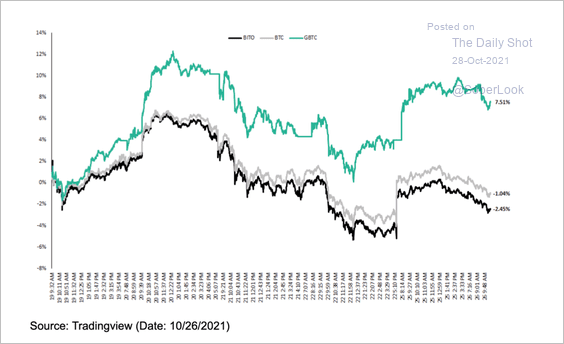

2. The ProShares Bitcoin Strategy ETF (BITO) has lagged bitcoin’s price over the past few days, while the Grayscale Bitcoin Trust (GBTC) has outperformed over the same period.

Source: Grayscale Read full article

Source: Grayscale Read full article

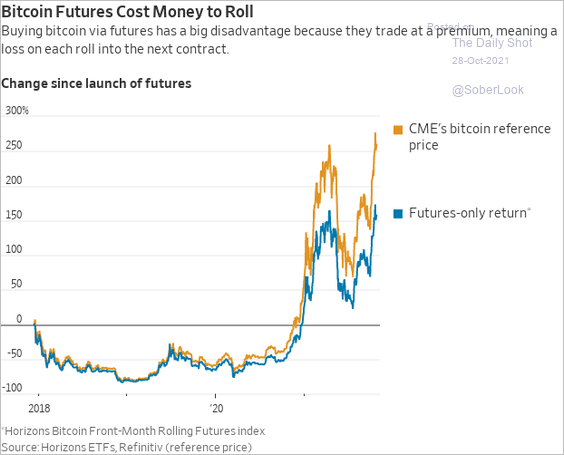

3. Crypto investors are learning about contango.

Source: @WSJ Read full article

Source: @WSJ Read full article

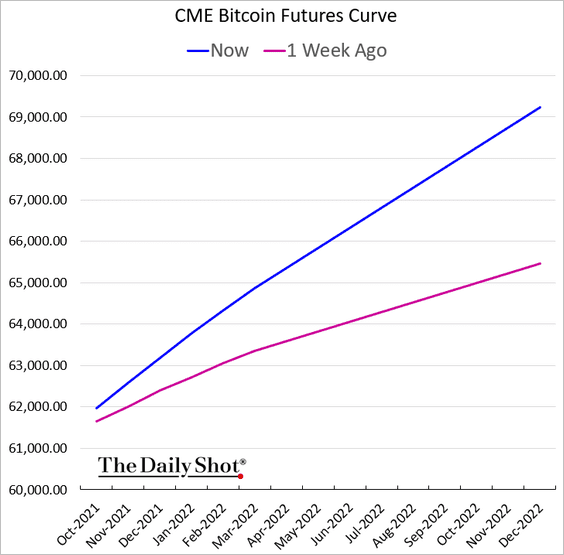

Returns in a futures-based ETF suffer as you slide down the curve. And the bitcoin futures curve has steepened since the launch of BITO.

——————–

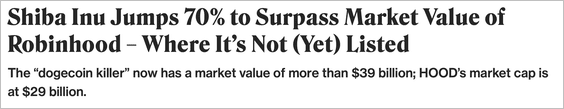

4. Shiba Inu (SHIB) token going to the moon? Why not.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Source: @newley Read full article

Source: @newley Read full article

Back to Index

Commodities

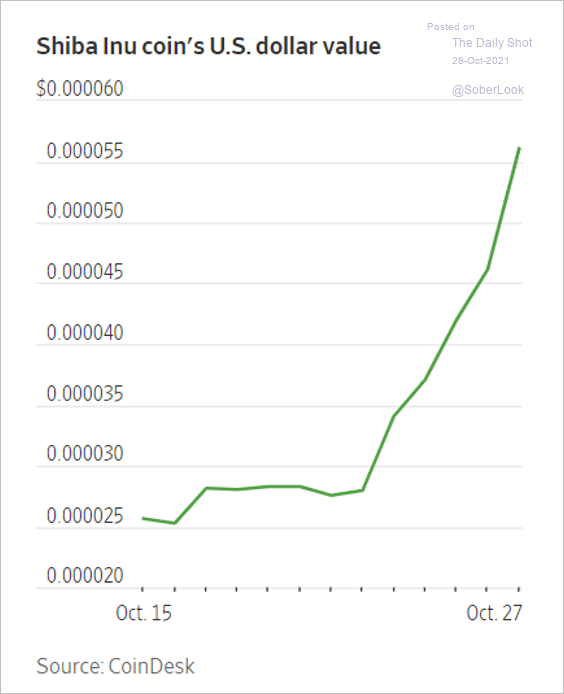

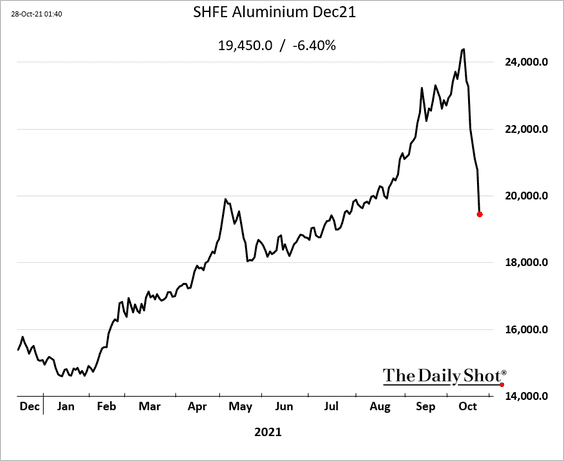

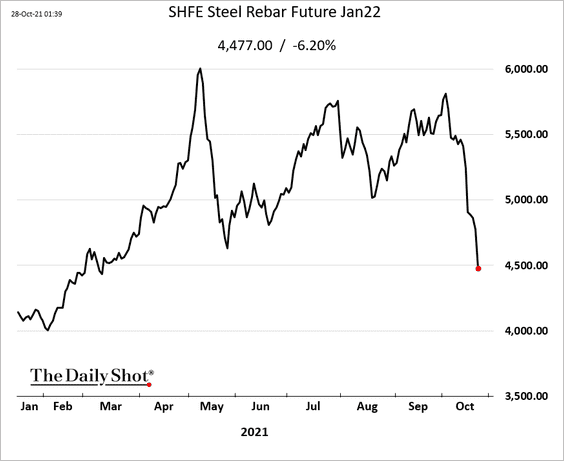

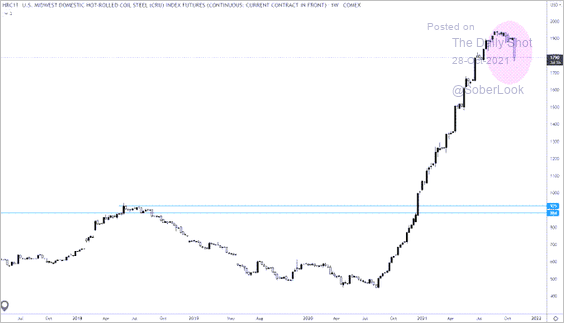

1. China’s war on coal prices is reverberating across industrial commodity markets.

• Aluminum futures in Shanghai:

• Iron ore futures in Singapore:

• Steel futures in Shanghai:

• Steel prices in the US:

Source: @MacroLukas

Source: @MacroLukas

——————–

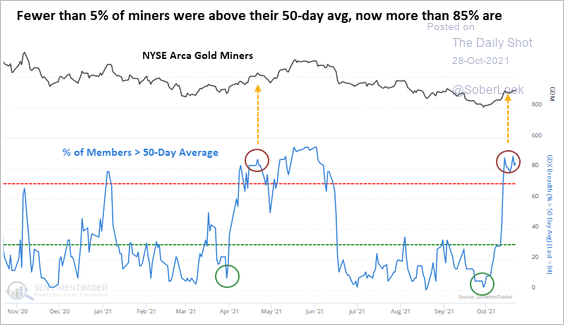

2. Roughly 85% of gold mining stocks are above their 50-day moving average – a significant improvement over the past month.

Source: SentimenTrader

Source: SentimenTrader

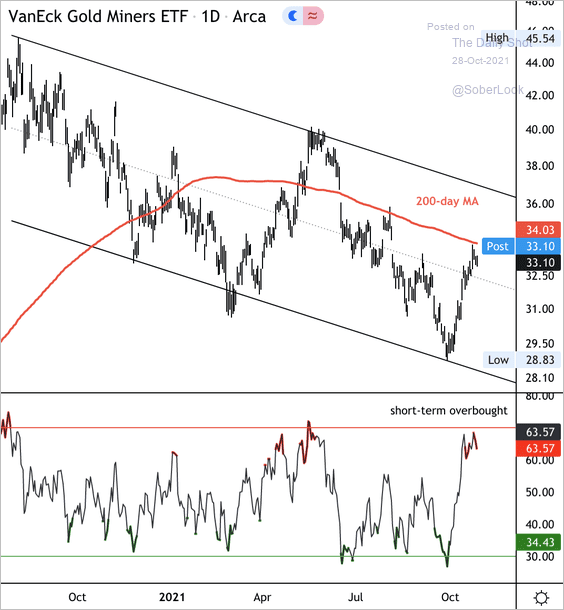

The VanEck Gold Miners ETF (GDX) is testing resistance at the 200-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

——————–

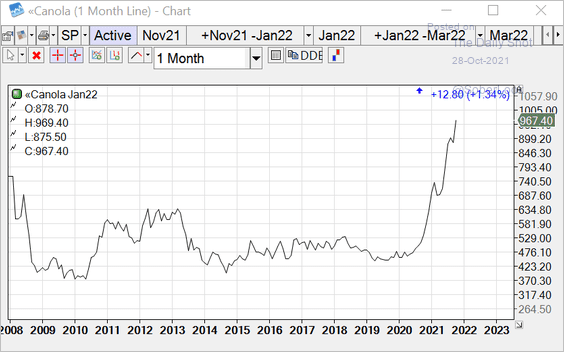

3. Canola prices are surging.

Source: Western Producer Read full article

Source: Western Producer Read full article

h/t Tom

h/t Tom

Back to Index

Energy

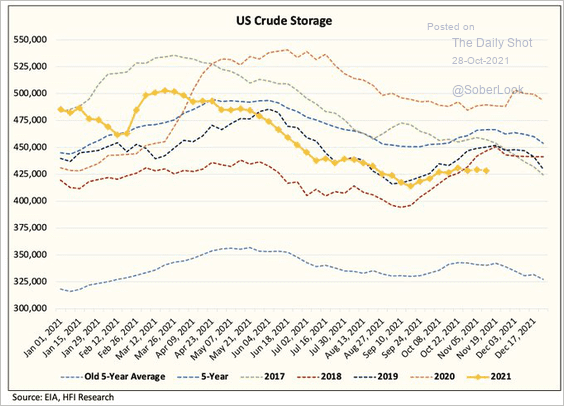

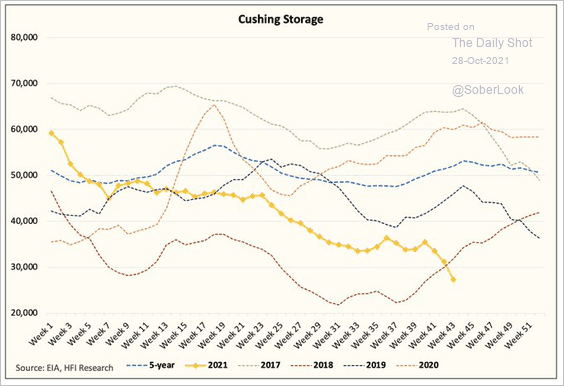

1. US crude oil inventories are low for this time of the year.

• Total:

Source: @HFI_Research

Source: @HFI_Research

• Cushing, OK:

Source: @HFI_Research

Source: @HFI_Research

Source: Reuters Read full article

Source: Reuters Read full article

——————–

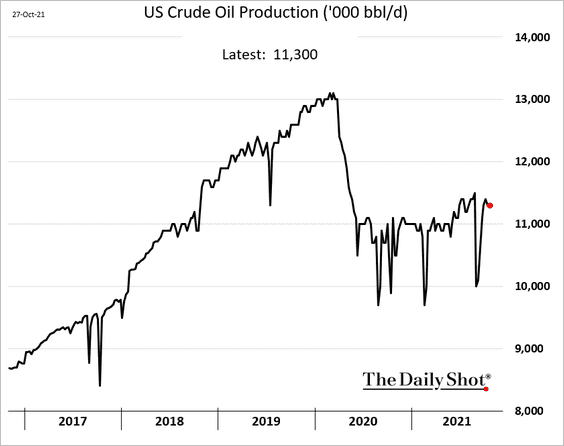

2. US oil output remains well below pre-COVID levels.

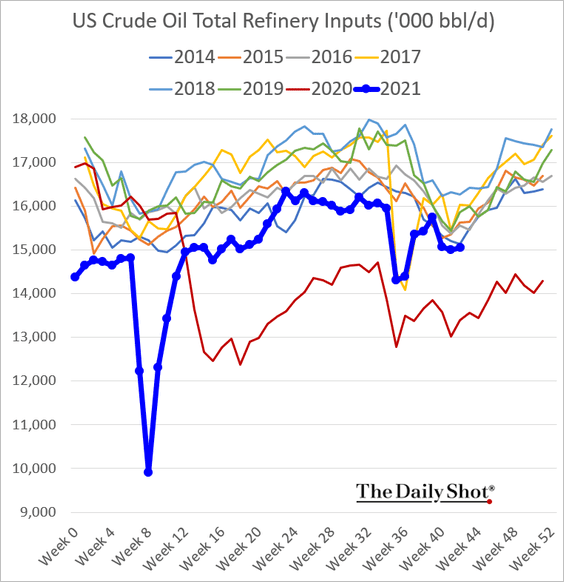

3. Refinery runs have been relatively soft.

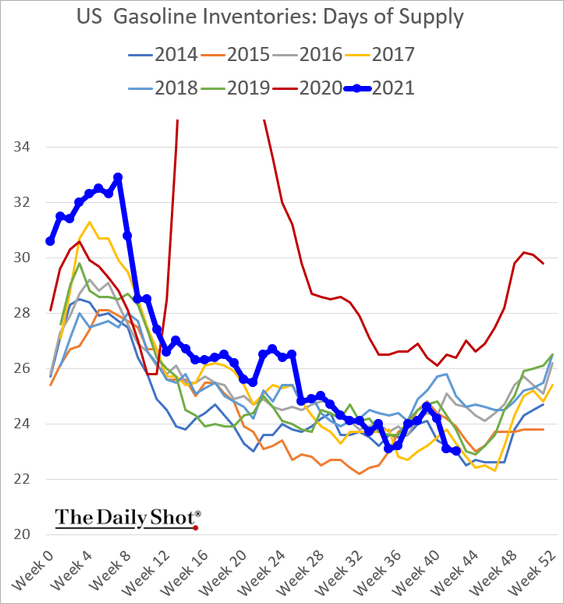

And US gasoline stockpiles remain near multi-year lows.

——————–

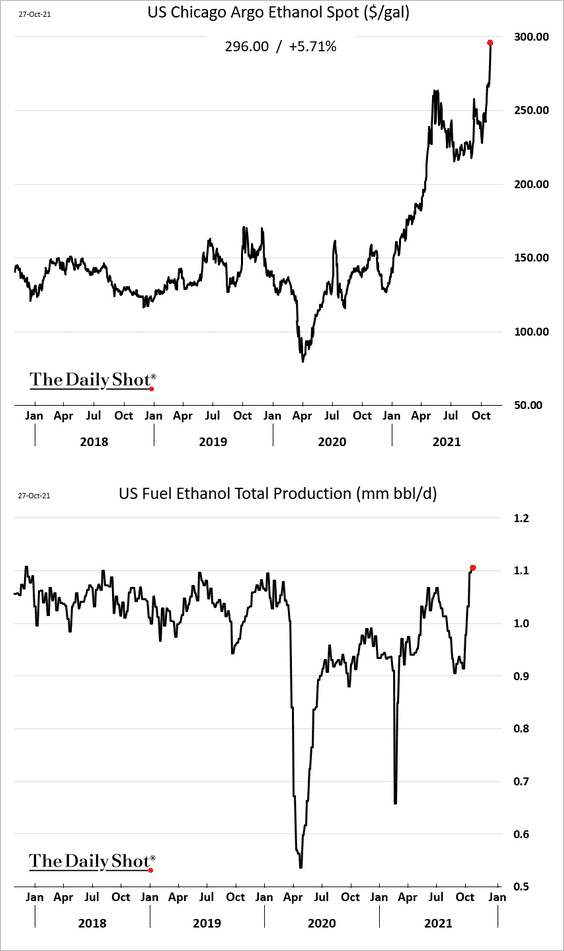

4. US ethanol production hit a multi-year high as prices surge.

h/t @KimChipman1

h/t @KimChipman1

Back to Index

Equities

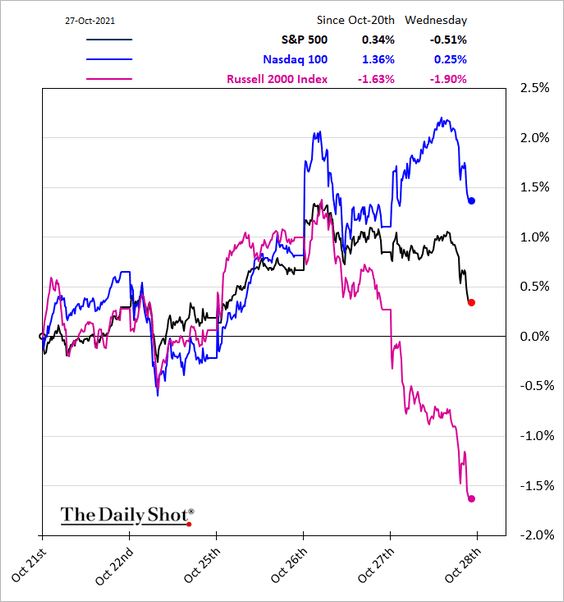

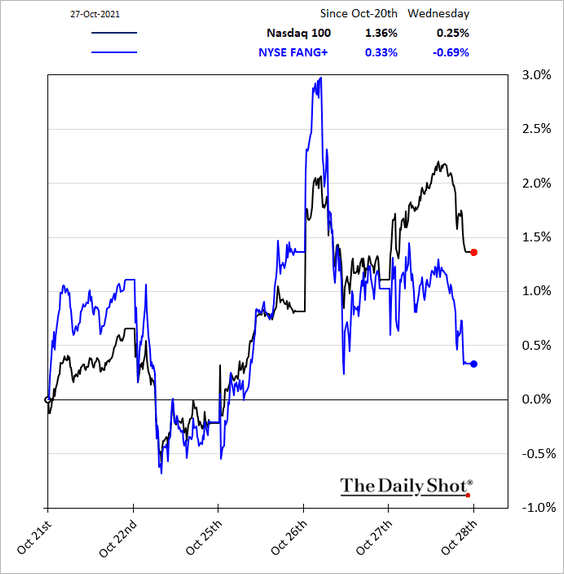

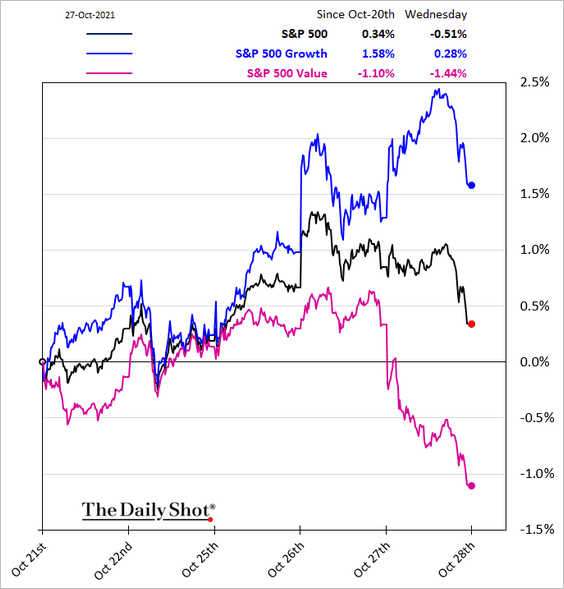

1. The Nasdaq 100 outperformed on Wednesday, while small caps sagged.

• The Nasdaq outperformance wasn’t entirely driven by tech mega-cap stocks.

• Value stocks underperformed.

——————–

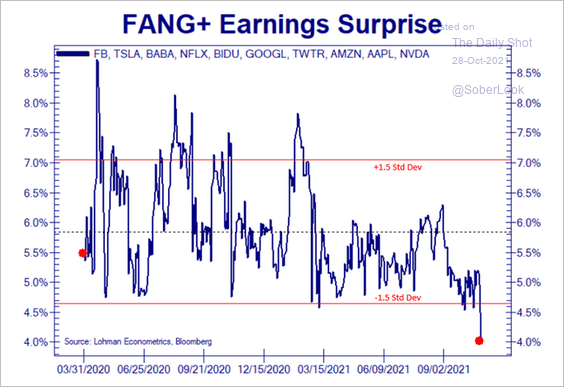

2. Tech mega-cap earnings surprises continue to moderate.

Source: @Not_Jim_Cramer

Source: @Not_Jim_Cramer

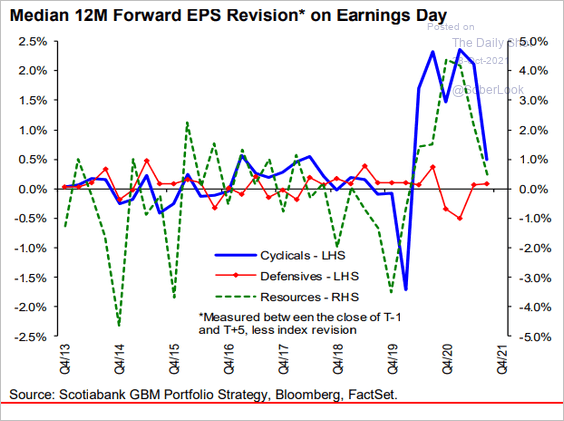

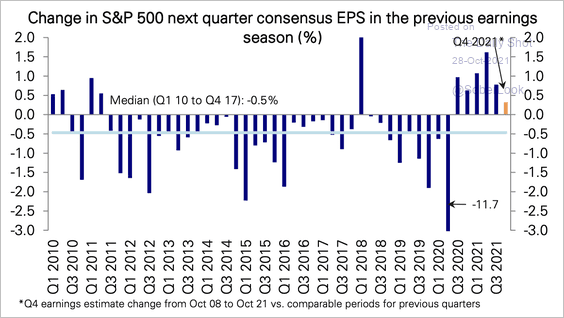

3. EPS revisions have been much more tepid in this season amid concerns about margins.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Consensus estimates for Q4 have risen slightly since earnings season began.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

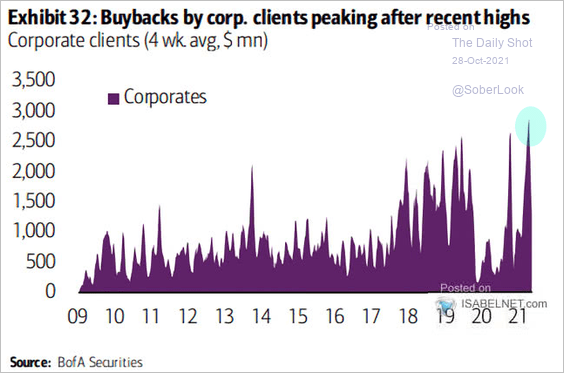

4. Share buybacks surged this year. Have they peaked?

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

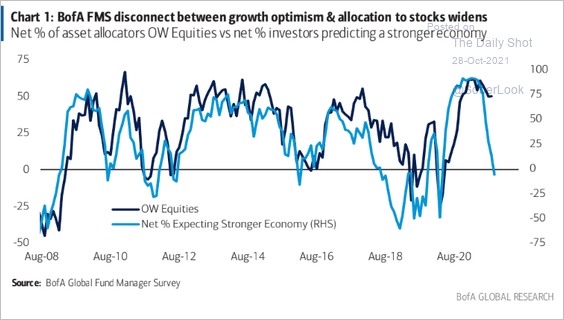

5. Fund managers are less optimistic about economic growth and yet remain heavily overweight equities.

Source: BofA Global Research

Source: BofA Global Research

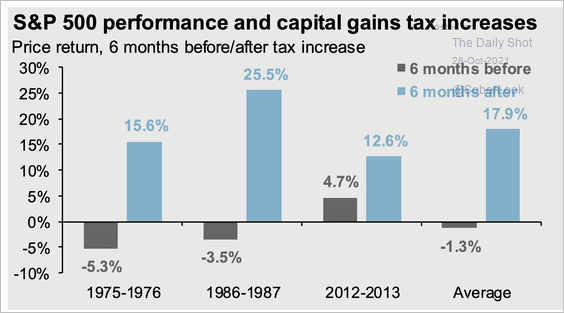

6. The S&P 500 usually anticipates capital gains tax increases and has always historically been higher six months after.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Credit

1. Munis have been struggling since June.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

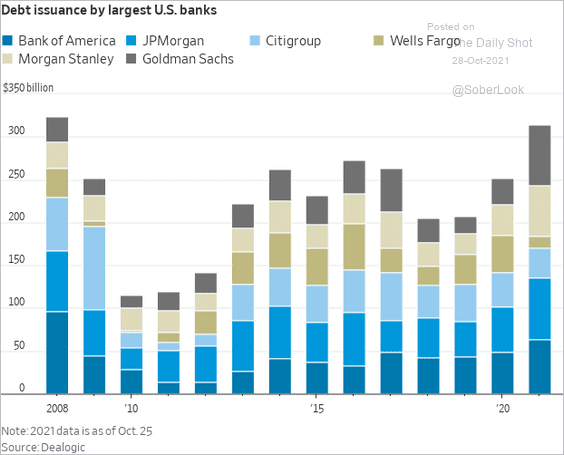

2. This chart shows debt issues by the largest US banks.

Source: @WSJ Read full article

Source: @WSJ Read full article

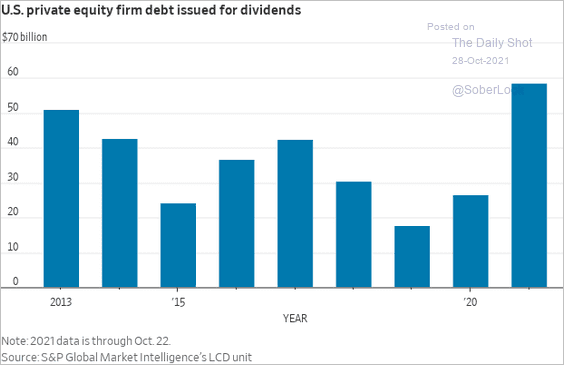

3. Dividend recaps have been popular this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

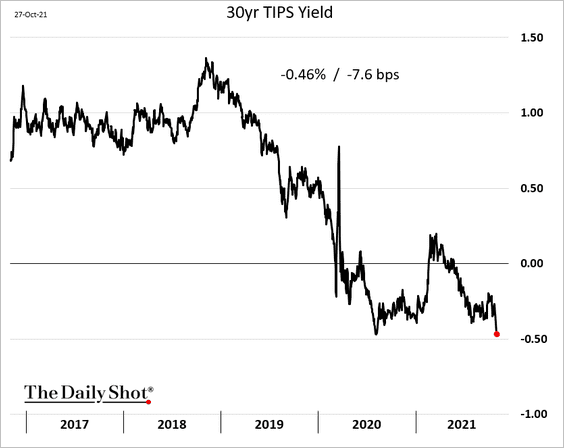

1. The 30yr TIPS yield (real rates) is nearing record lows.

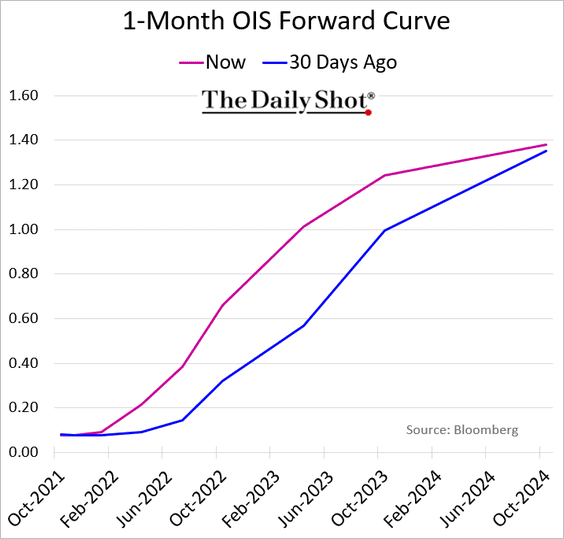

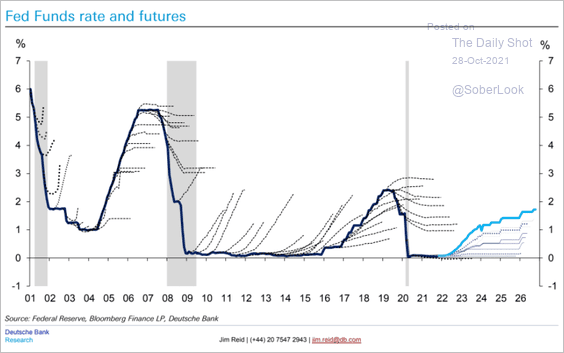

2. The market has brought forward Fed rate hike expectations.

Is the market right this time?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

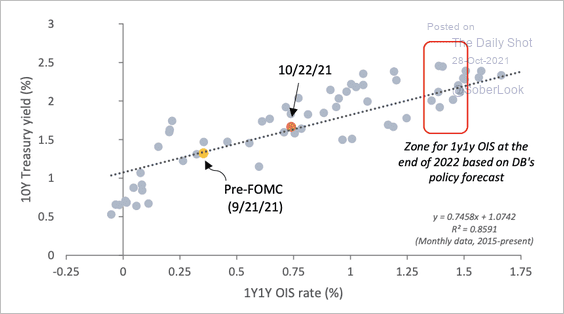

3. The close relationship between expected short-rates and long-term yields suggests more room for both to rise next year, according to Deutsche Bank Research.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

1. Yield curves around the world are flattening.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

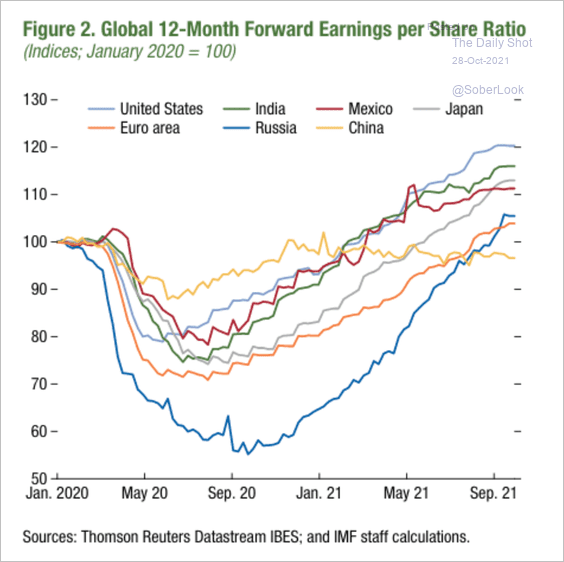

2. 12-month forward earnings per share have increased across the globe since the beginning of the pandemic, with the sole exception of China.

Source: IMF

Source: IMF

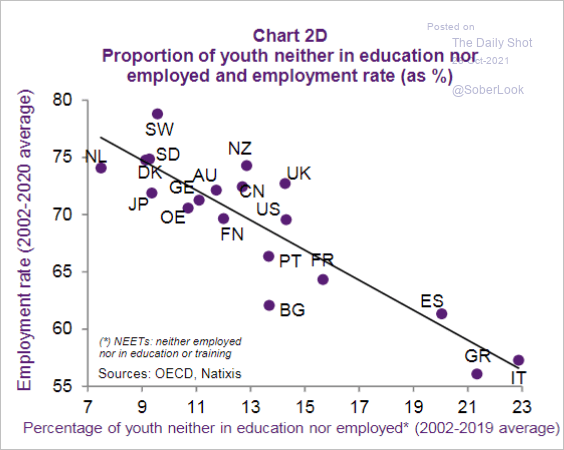

3. This scatterplot shows employment rates vs. unengaged youth percentages.

Source: Natixis

Source: Natixis

Back to Index

Food for Thought

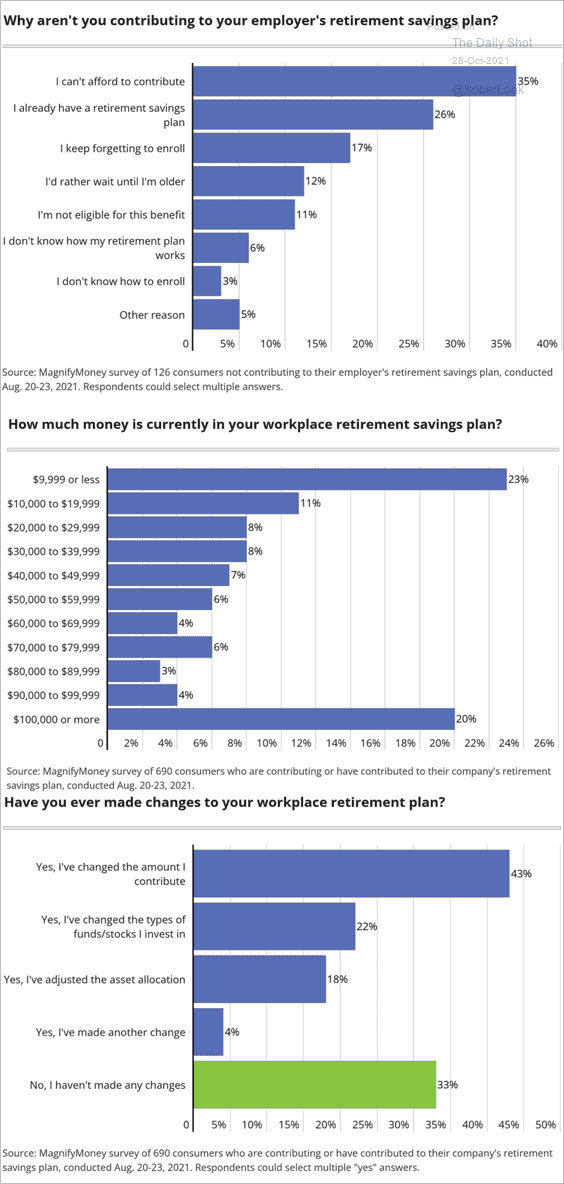

1. Data on US workplace retirement plans:

Source: MagnifyMoney Read full article

Source: MagnifyMoney Read full article

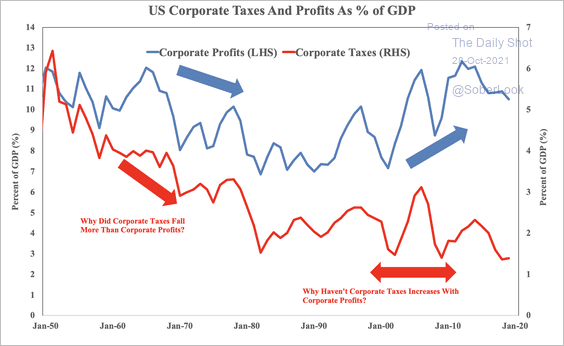

2. The divergence between corporate profits and corporate taxes (largely due to a shift toward pass-through businesses):

Source: SOM Macro Strategies

Source: SOM Macro Strategies

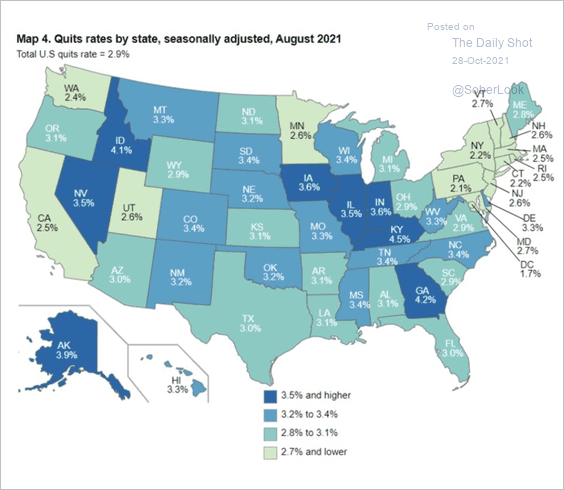

3. Quit rates (voluntary separations):

Source: @SamRo, @nick_bunker Read full article

Source: @SamRo, @nick_bunker Read full article

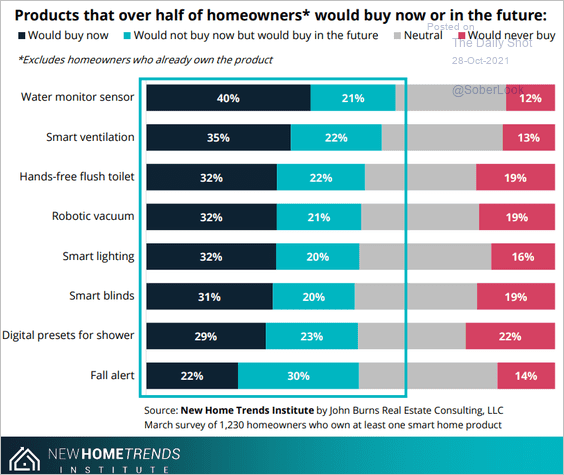

4. Smart-home tech products:

Source: New Home Trends Institute

Source: New Home Trends Institute

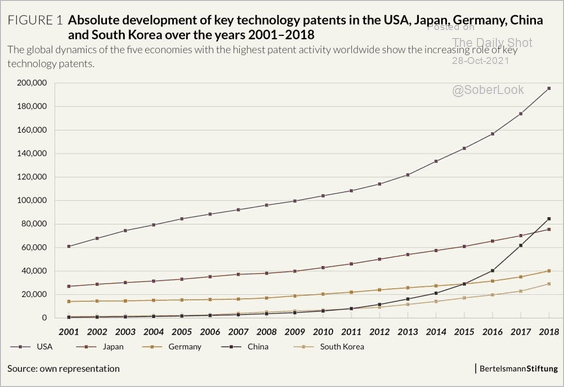

5. Key technology patents:

Source: GED, Bertelsmann Stiftung Read full article

Source: GED, Bertelsmann Stiftung Read full article

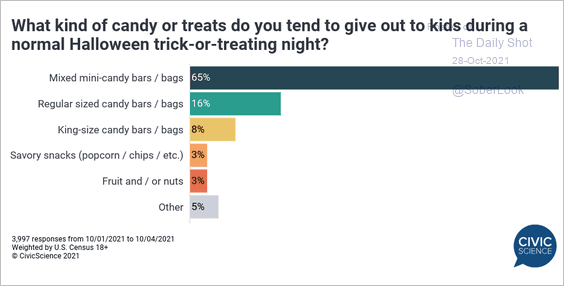

6. What kind of treats do you give out on Halloween?

Source: @CivicScience

Source: @CivicScience

——————–

Back to Index