The Daily Shot: 22-Dec-21

• Energy

• Equities

• Alternatives

• Credit

• Emerging Markets

• China

• The Eurozone

• Europe

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Energy

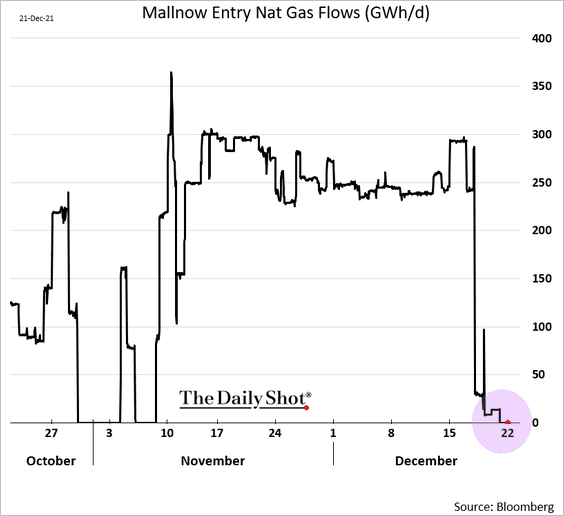

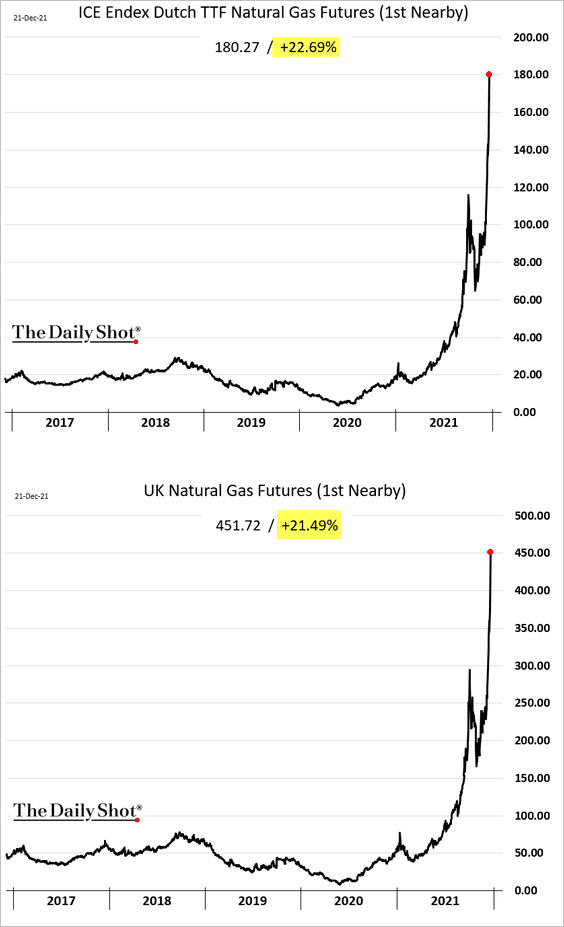

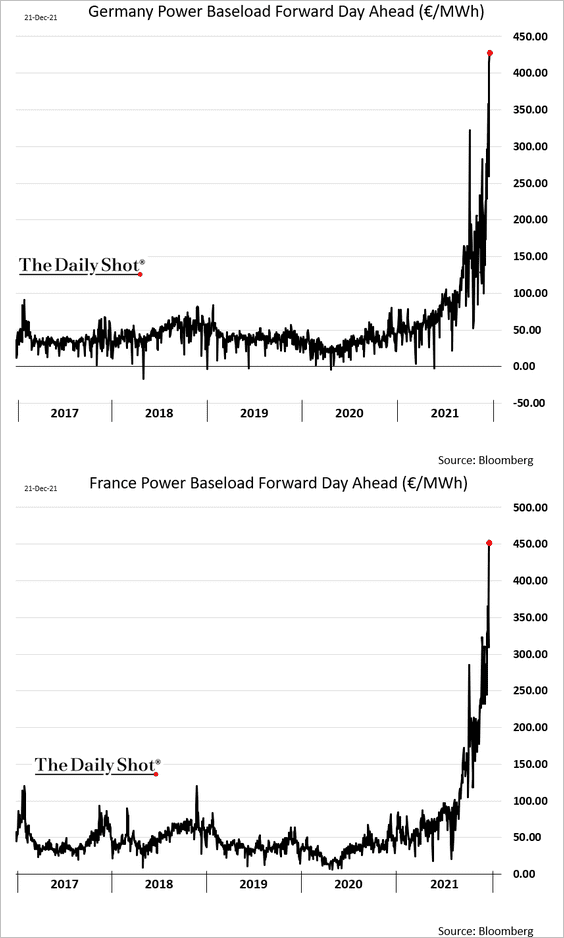

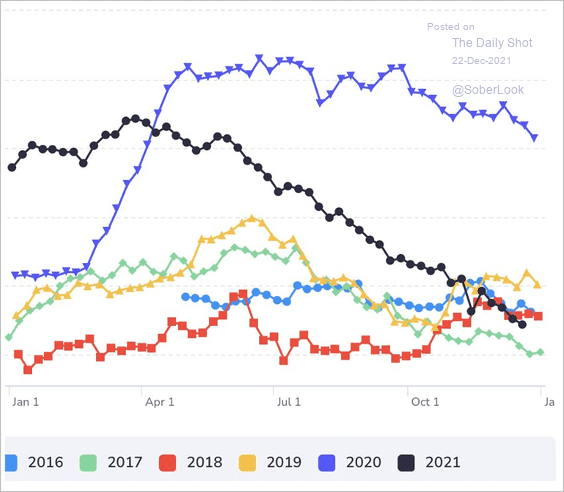

1. The European energy crisis continues to worsen as temperatures fall and Russia shuts off flows of natural gas.

• Natural gas prices have gone vertical, jumping by over 20% in one day.

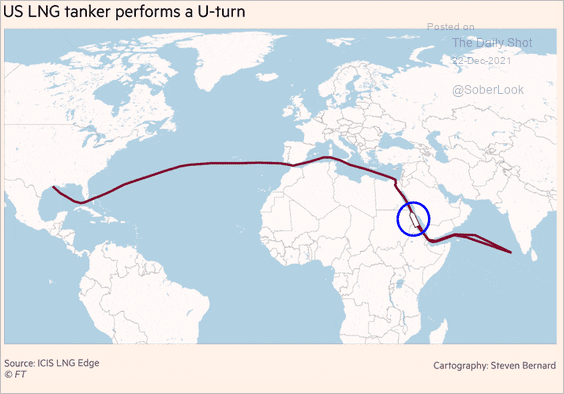

• Europe competes with Asia for LNG, and it recently became more profitable for exporters to sell into Europe.

Source: World Oil Read full article

Source: World Oil Read full article

Here is an Asia-bound US LNG tanker turning around and heading for Europe.

Source: @financialtimes, h/t Walter Read full article

Source: @financialtimes, h/t Walter Read full article

• European electricity prices have been soaring, which will show up in higher business costs and ultimately in consumer inflation.

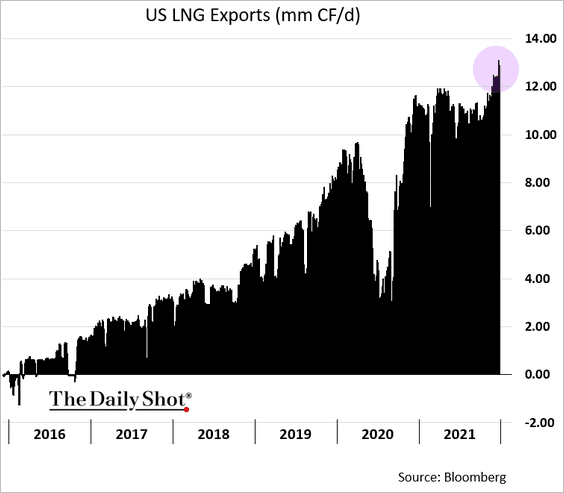

• US LNG exports are hitting record highs, but for now, the increase is not sufficient to meet the global demand for natural gas.

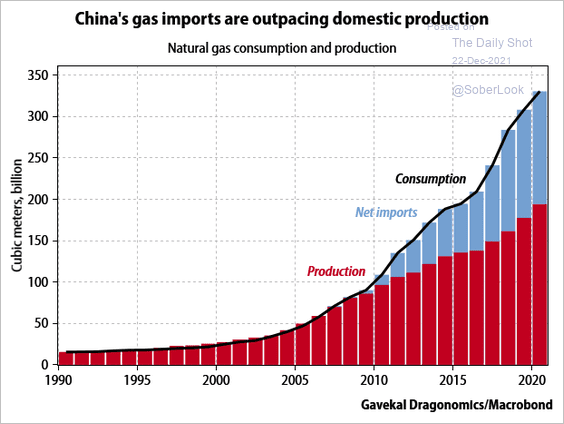

• China’s gas demand is rapidly outpacing domestic production.

Source: Gavekal Research

Source: Gavekal Research

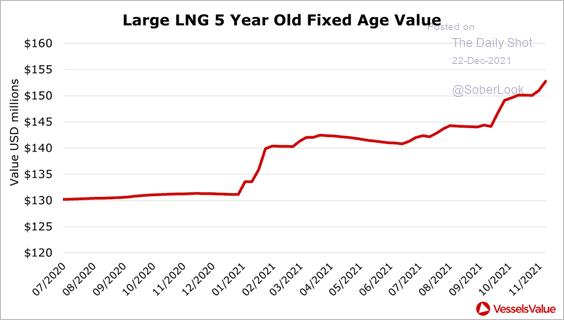

• Prices of “used” LNG vessels keep climbing.

Source: VesselsValue Read full article

Source: VesselsValue Read full article

——————–

2. Global crude oil inventories continue to fall.

Source: @antoine_halff, @Kayrros

Source: @antoine_halff, @Kayrros

——————–

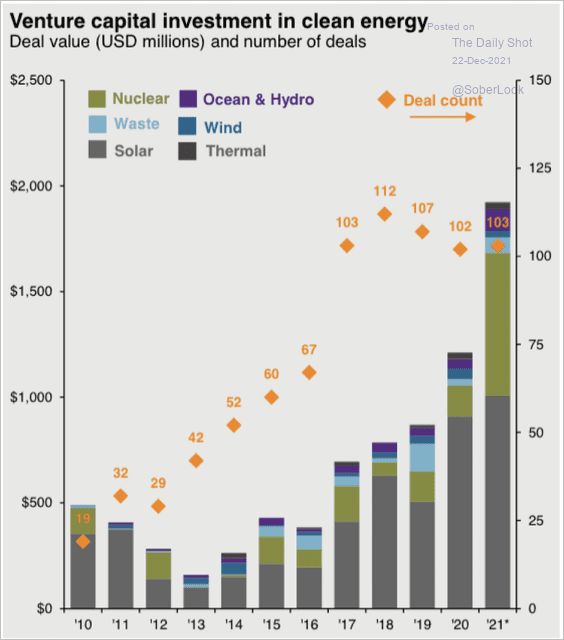

3. VCs have been investing heavily in clean energy companies over the past few years.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

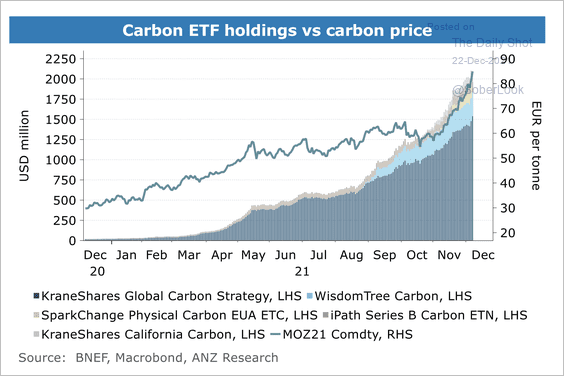

4. Carbon ETF assets under management are expanding rapidly.

Source: ANZ Research

Source: ANZ Research

Back to Index

Equities

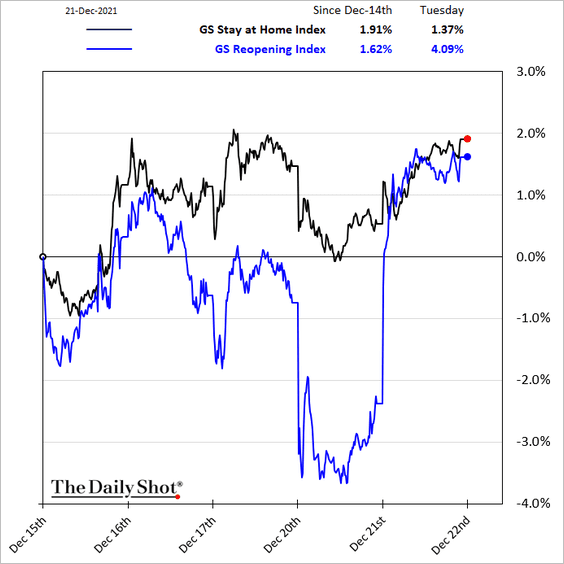

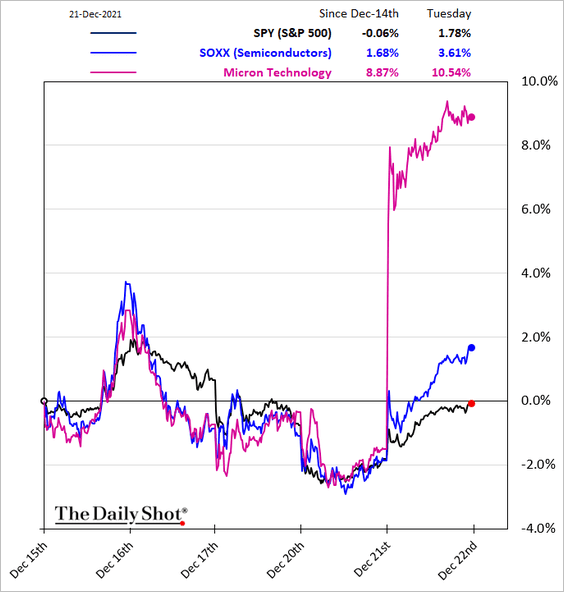

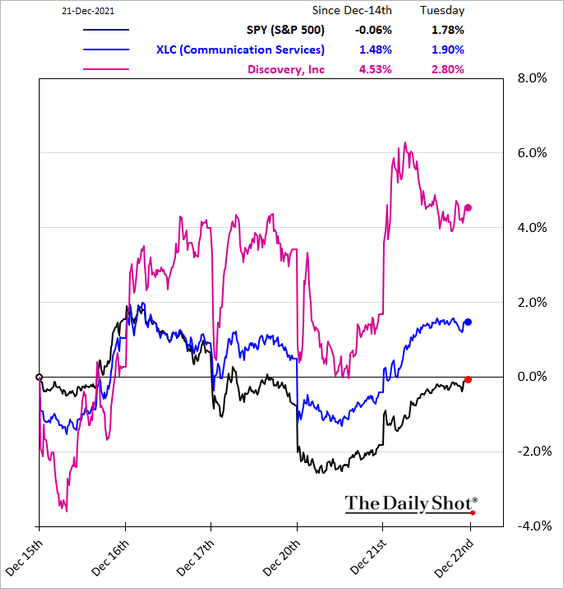

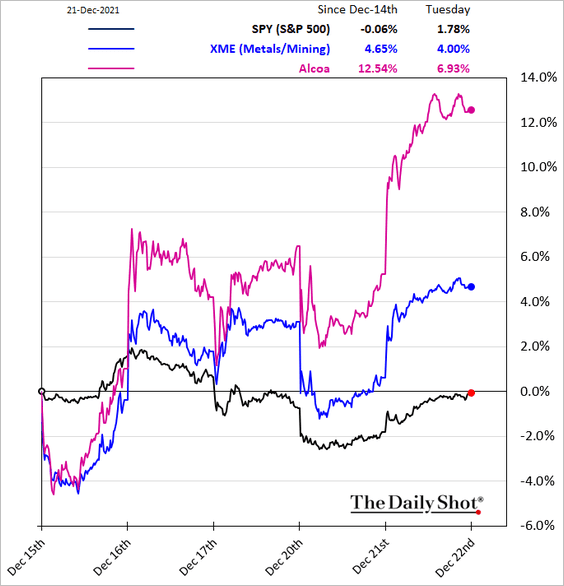

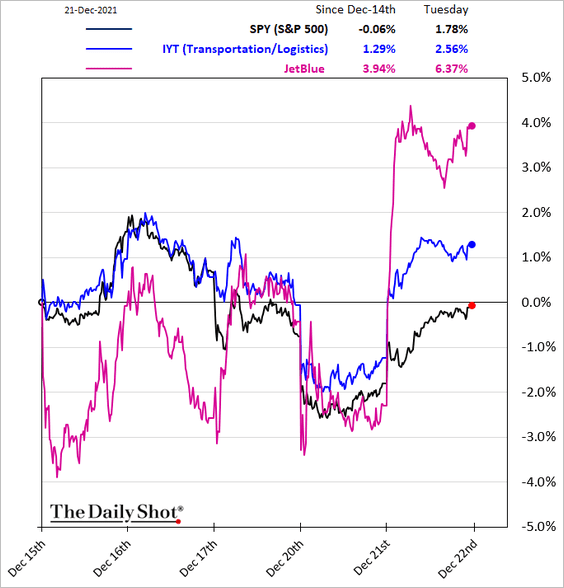

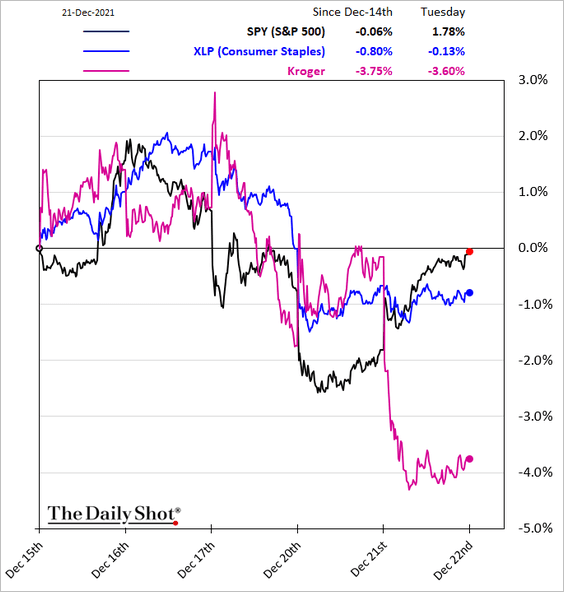

1. Stocks rallied sharply on Tuesday, as US “reopening” shares rebounded.

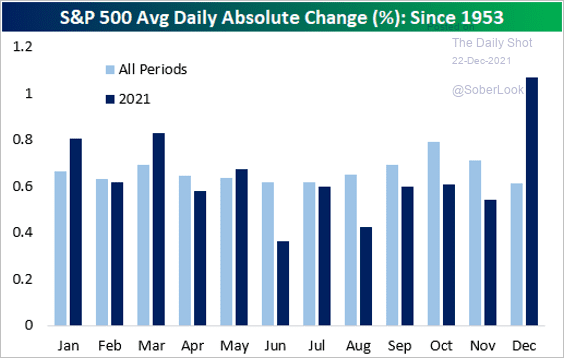

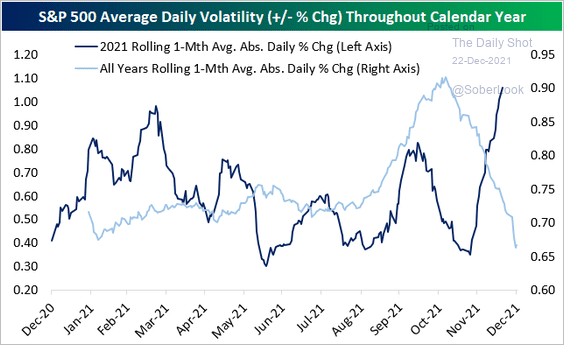

2. Volatility surged this month, bucking the year-end historical trend (2 charts).

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

3. The Russell 2000 is at resistance again.

Source: @hmeisler

Source: @hmeisler

4. Next, we have some sector updates.

• Semiconductors:

Source: Barron’s Read full article

Source: Barron’s Read full article

• Communication Services:

• Metals & Mining:

• Transportation:

• Consumer staples:

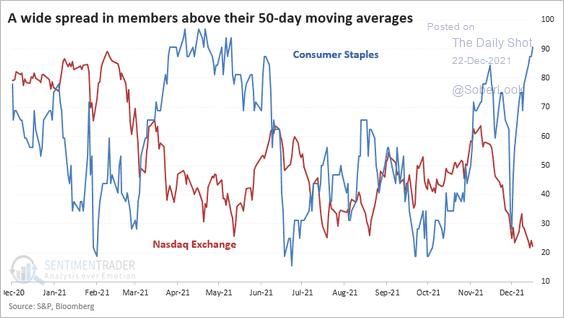

By the way, the percentage of consumer staples stocks trading above their 50-day moving averages reached 90% last week, while fewer than 25% of Nasdaq stocks managed to hold their medium-term trends.

Source: SentimenTrader

Source: SentimenTrader

——————–

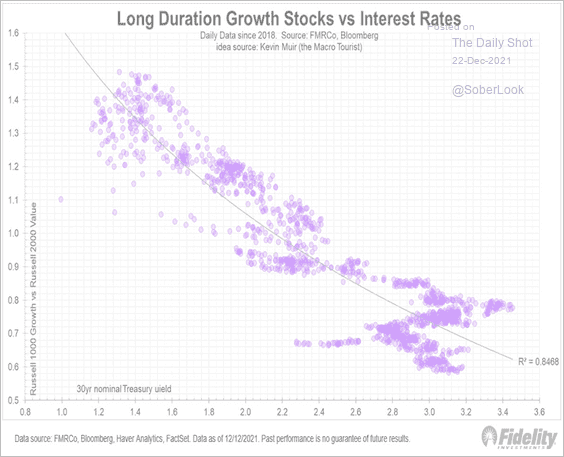

5. Long-duration (growth) stocks’ relative performance is highly sensitive to rates.

Source: @TimmerFidelity, @Fidelity

Source: @TimmerFidelity, @Fidelity

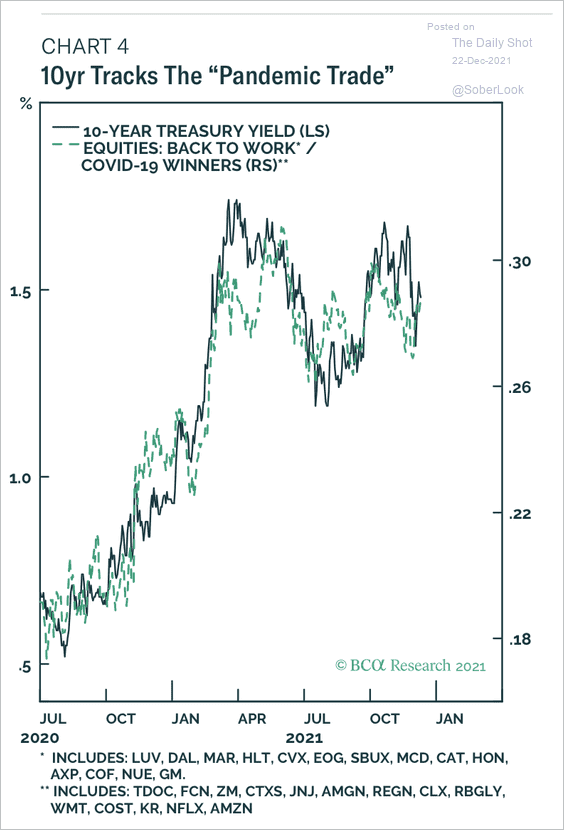

On the other hand, “reopening” stocks have moved in tandem with the 10-year Treasury yield over the past year (relative to COVID “winners”).

Source: BCA Research

Source: BCA Research

——————–

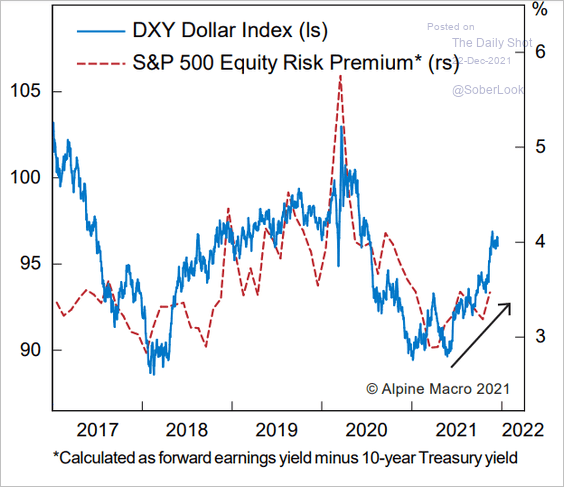

6. Equity risk premium could rise if the US dollar rally continues.

Source: Alpine Macro

Source: Alpine Macro

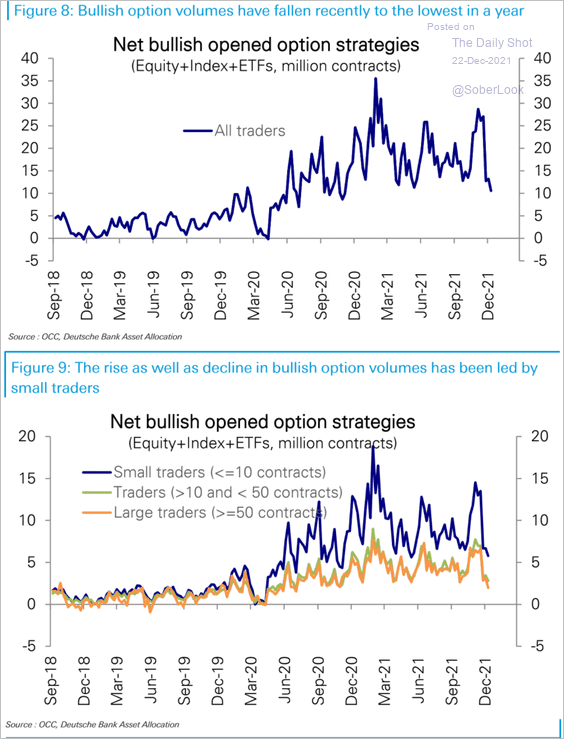

7. There has been a pullback in bullish options strategies recently.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Alternatives

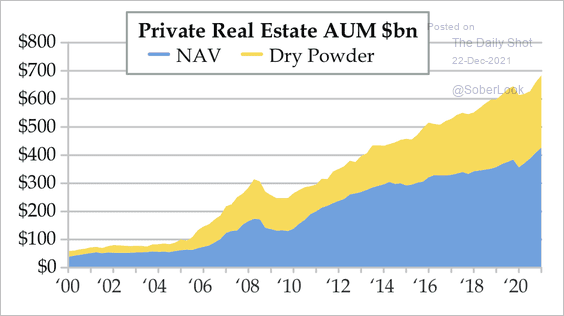

1. There is a growing amount of dry powder (committed but uncalled capital) in private real estate.

Source: Quill Intelligence

Source: Quill Intelligence

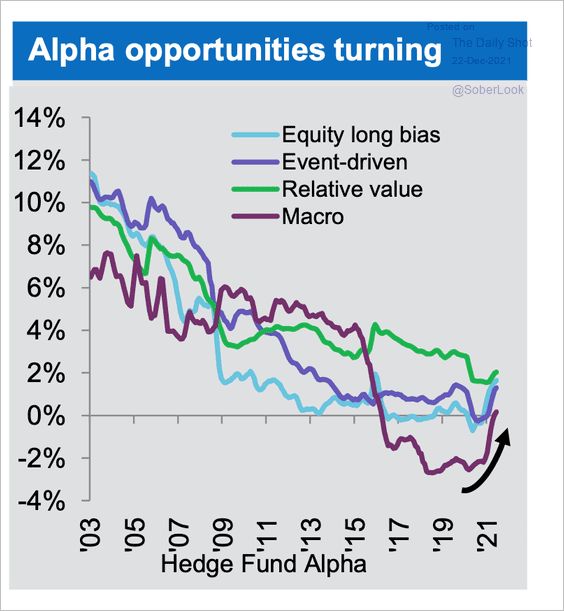

2. Hedge funds’ alpha is starting to turn around.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Credit

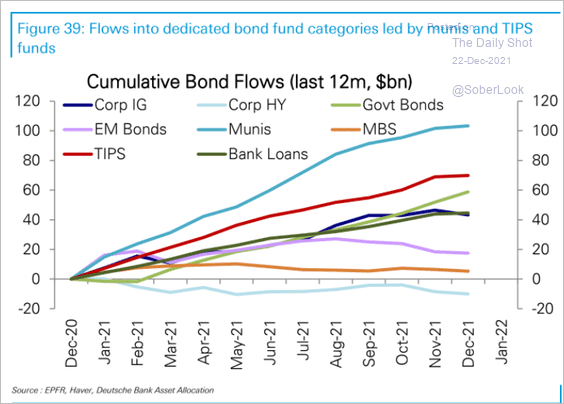

1. Flows into muni funds have been impressive.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

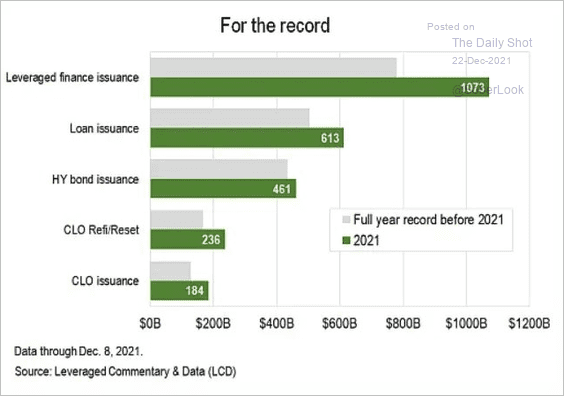

2. Multiple records have been broken in leverage finance issuance this year, …

Source: @lcdnews Read full article

Source: @lcdnews Read full article

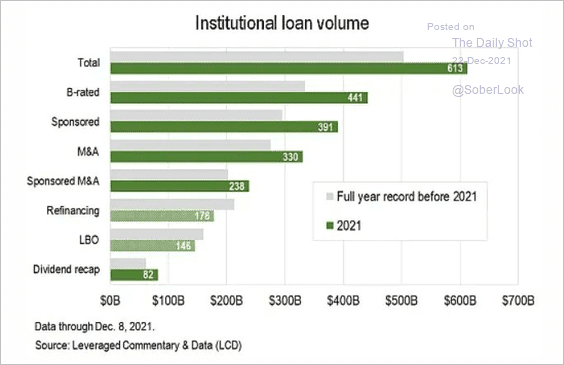

… particularly in leveraged loans.

Source: @lcdnews Read full article

Source: @lcdnews Read full article

——————–

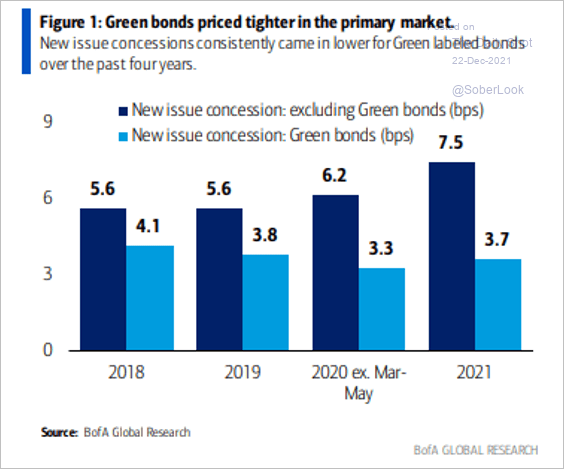

3. New-issue green bonds have been priced tighter than the overall market amid rising demand.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

Back to Index

Emerging Markets

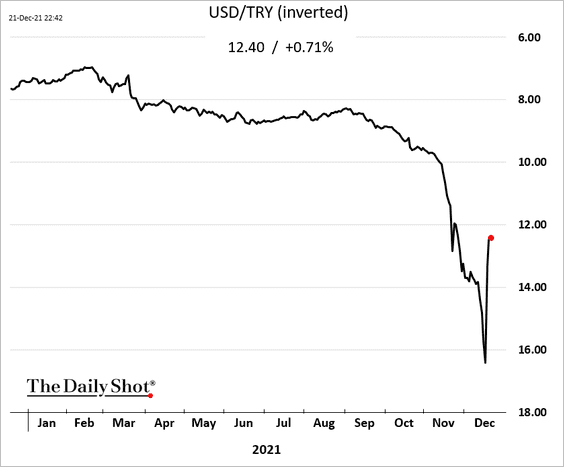

1. The Turkish lira’s massive rebound is holding.

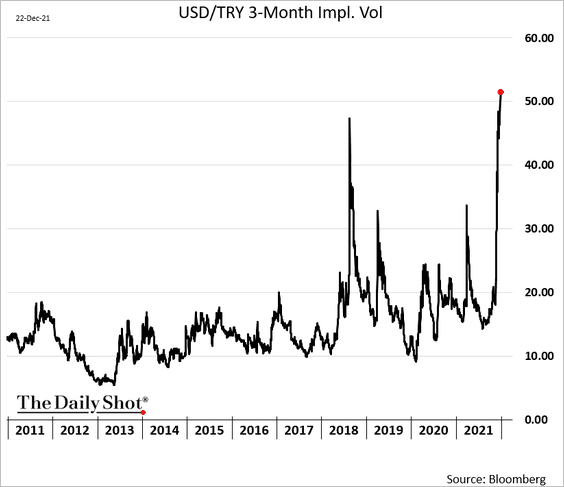

• The lira implied volatility hit a record high.

h/t @BurhanYuksekkas Read full article

h/t @BurhanYuksekkas Read full article

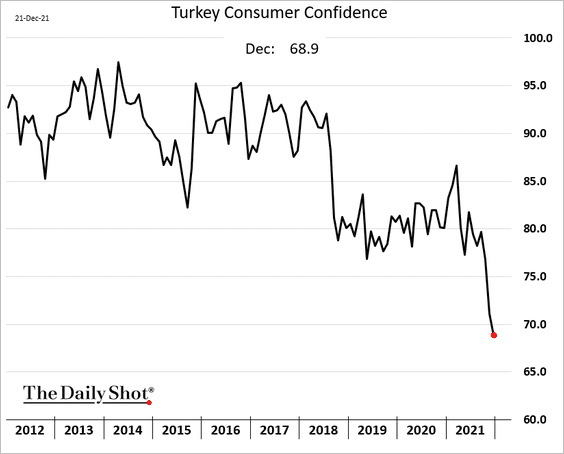

• Consumer confidence deteriorated in Turkey as the lira declined.

——————–

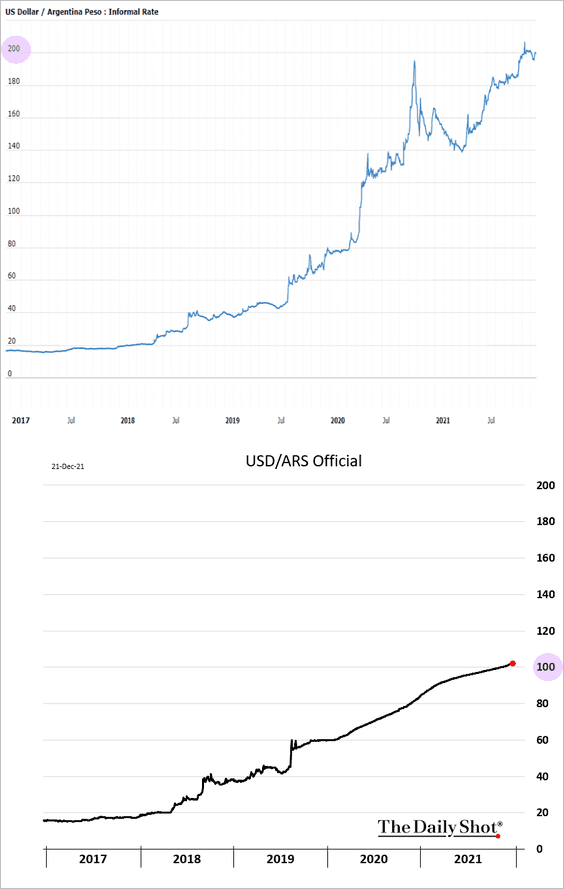

2. Argentina’s black market peso is now half the value of the official exchange rate.

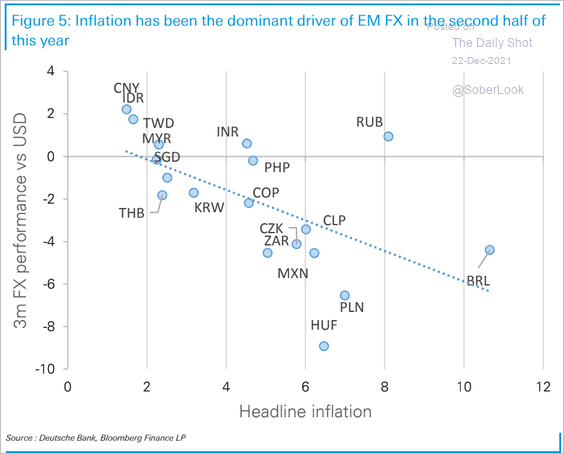

3. Inflation has been a key driver of EM currencies in recent months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

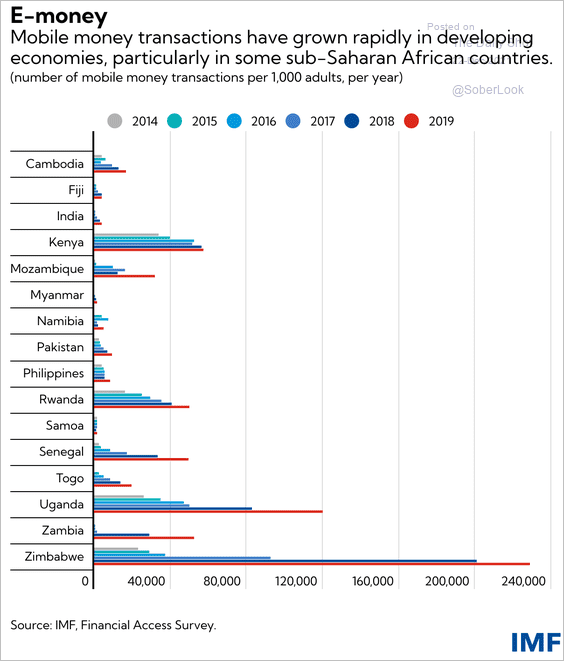

4. Mobile money transactions have grown rapidly in many underbanked economies.

Source: IMF Read full article

Source: IMF Read full article

Back to Index

China

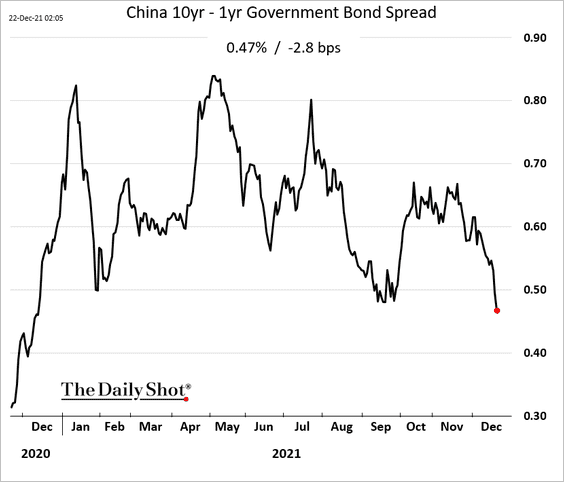

1. The yield curve has been flattening, suggesting that the PBoC has room to ease further.

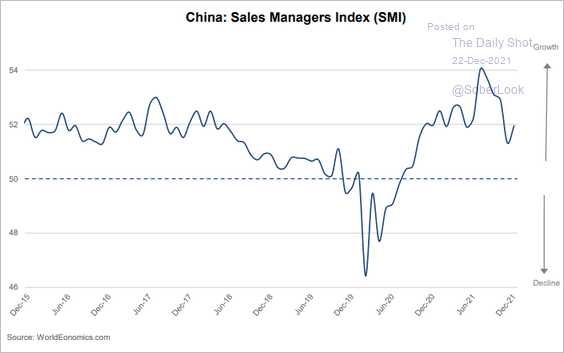

2. The World Economics SMI indicator points to improved growth in business activity this month.

Source: World Economics

Source: World Economics

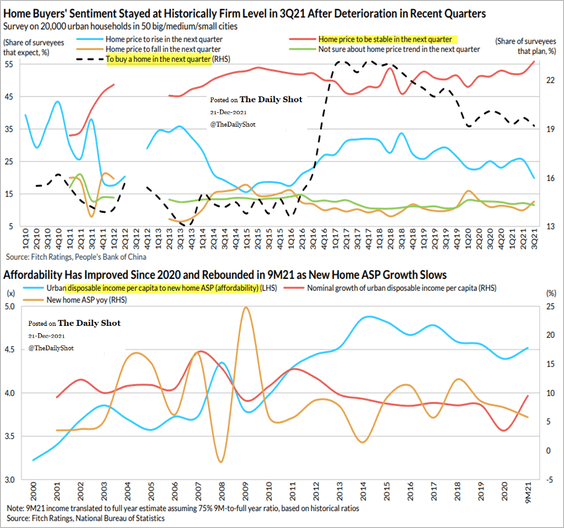

3. Next, we have some updates on the property market.

• Enthusiasm for home purchases has eased in recent years but remains elevated. Housing affordability has been stable.

Source: Fitch Ratings

Source: Fitch Ratings

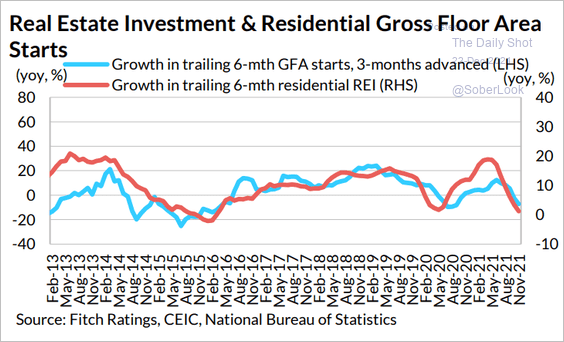

• Residential investment and housing starts have deteriorated.

Source: Fitch Ratings

Source: Fitch Ratings

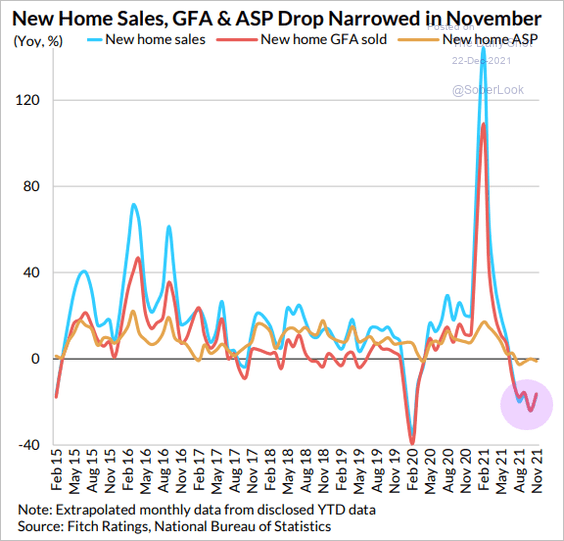

• Home sales appear to have bottomed.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

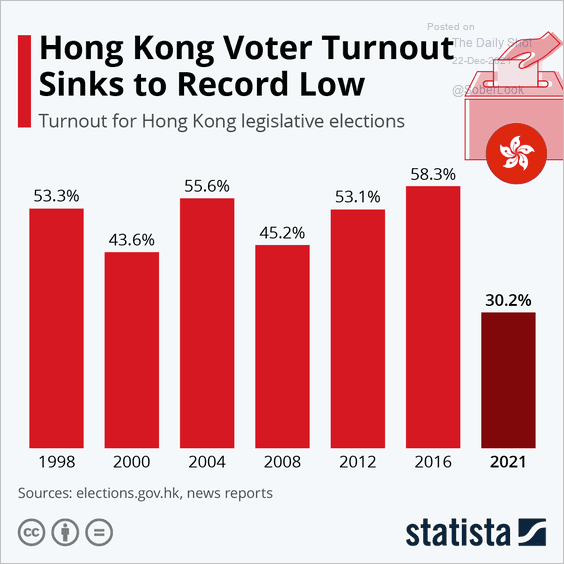

4. Hong Kong voter turnout tanked this year.

Source: Statista

Source: Statista

Back to Index

The Eurozone

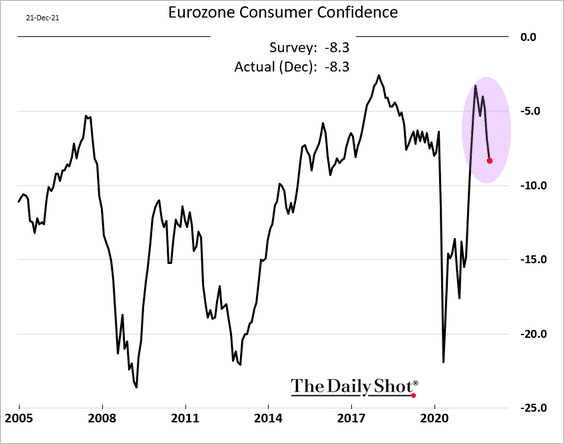

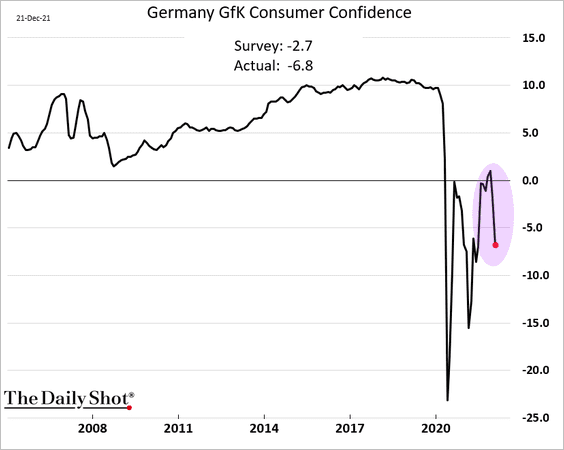

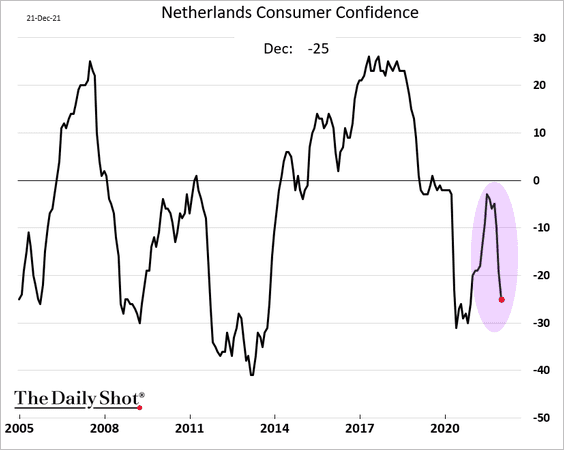

1. Consumer confidence worsened this month amid omicron concerns.

• The Eurozone:

• Germany:

• The Netherlands:

——————–

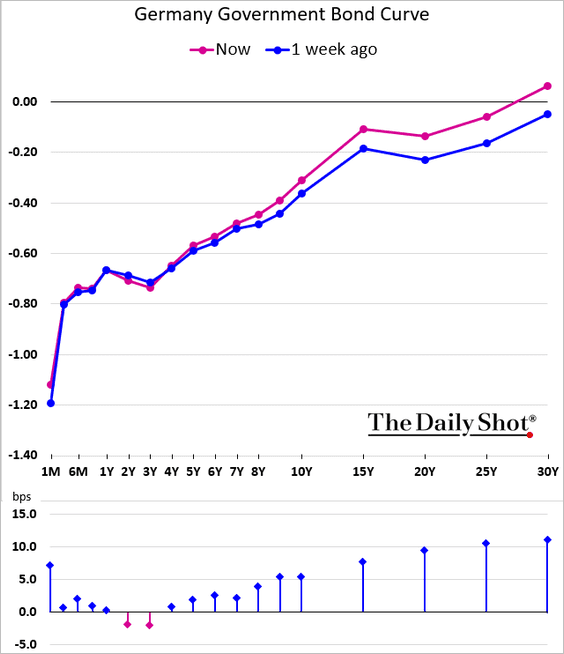

2. The Bund curve has been steepening, with the 30yr yield back in positive territory.

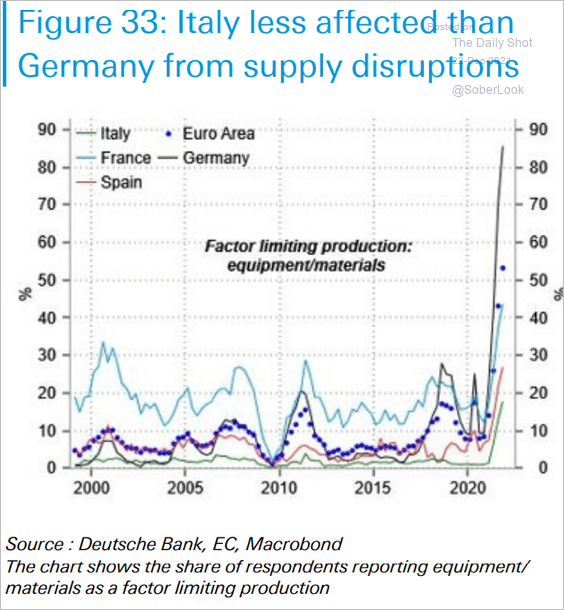

3. Italy has been less affected than Germany by supply disruptions.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

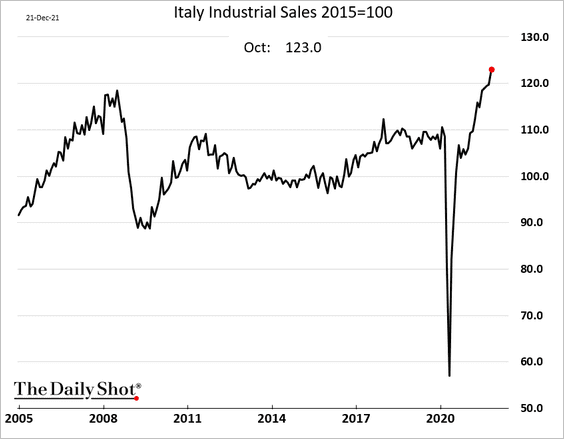

Italian industrial sales hit another record high in October.

——————–

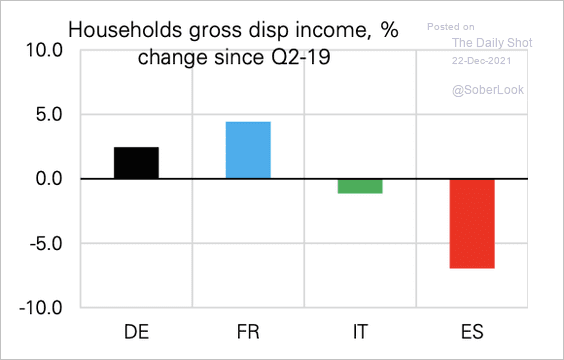

4. Spain experienced a large drop in household income relative to its peers.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Europe

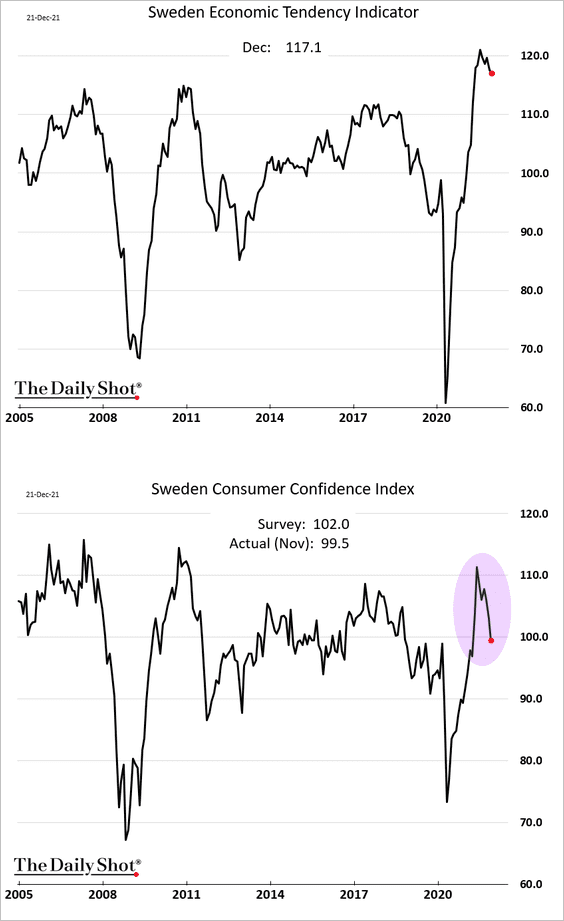

1. Sweden’s overall sentiment indicator is off the highs, pulled lower by consumer confidence.

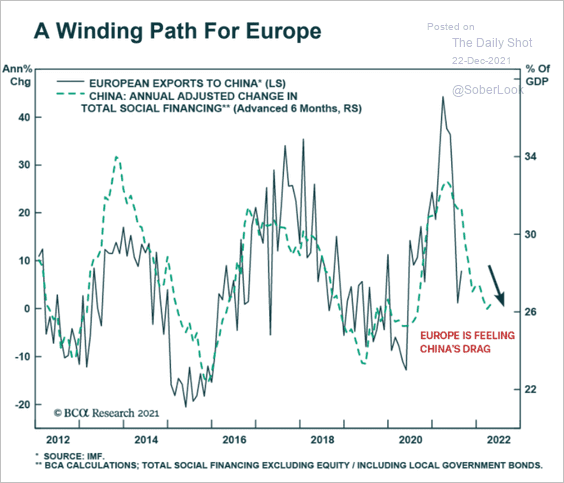

2. European exports to China have deteriorated.

Source: BCA Research

Source: BCA Research

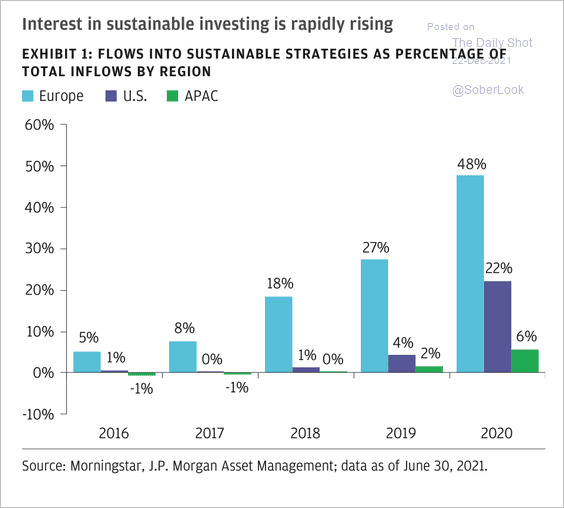

3. Europe is outperforming the US and Asia in terms of share of flows into sustainable strategies.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

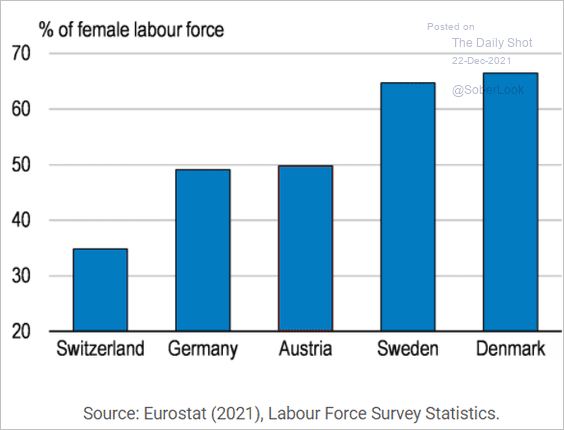

4. Finally, we have female labor force participation in select countries.

Source: OECD Read full article

Source: OECD Read full article

Back to Index

The United Kingdom

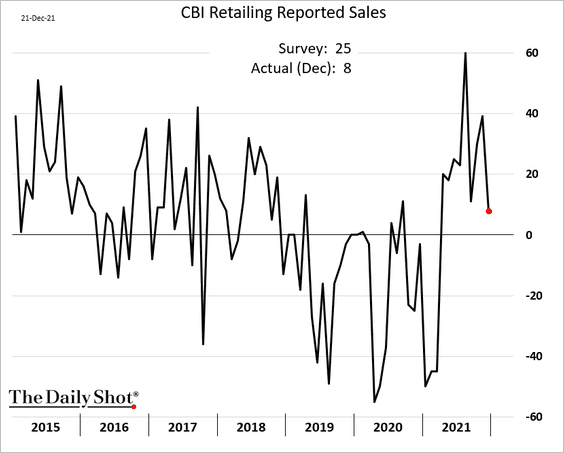

1. The CBI report showed much slower growth in retail sales this month due to early holiday shopping and omicron concerns.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

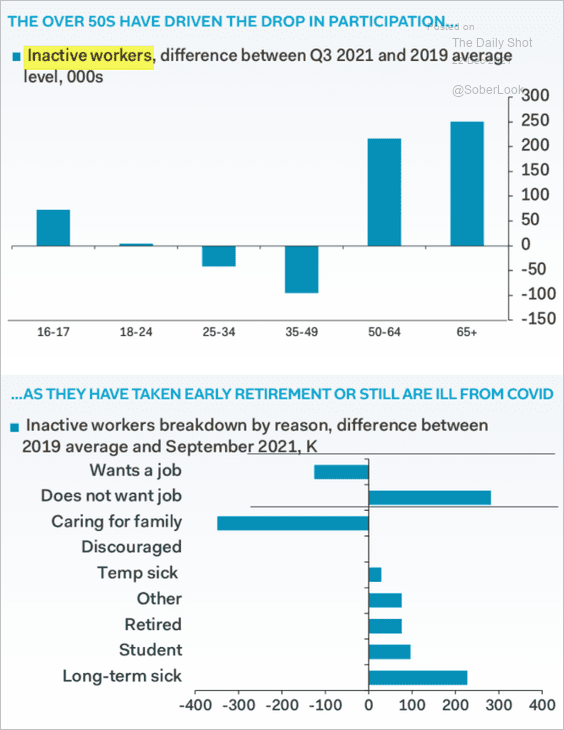

2. What are the drivers of lower labor force participation rates in the UK?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Canada

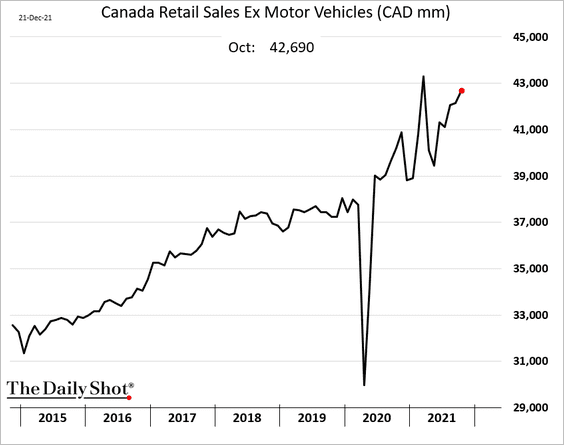

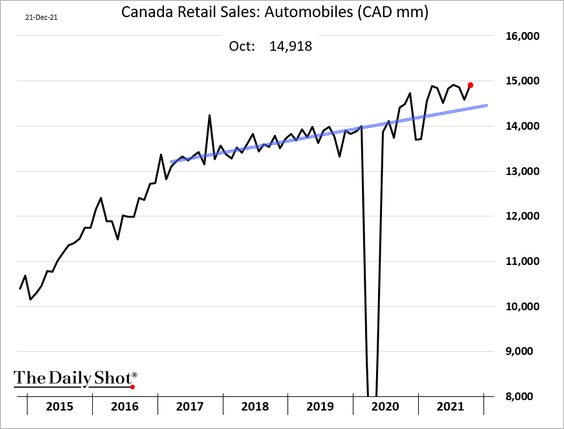

1. Retail sales continued to climb in October.

Automobile sales remain above the pre-COVID trend (partially due to higher prices generating larger sales proceeds).

——————–

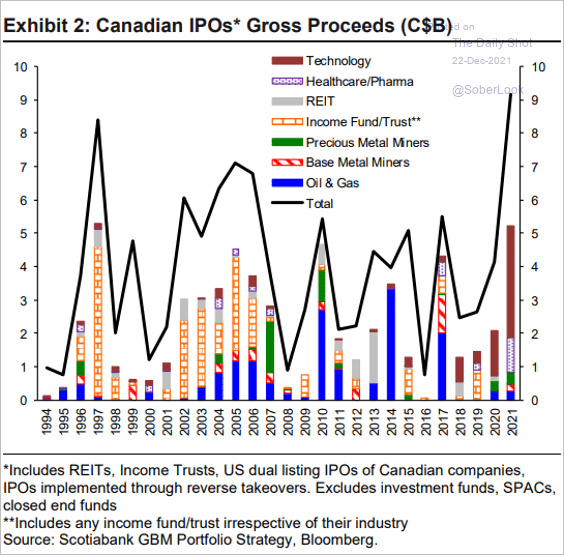

2. It’s been a good year for tech IPOs in Canada.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

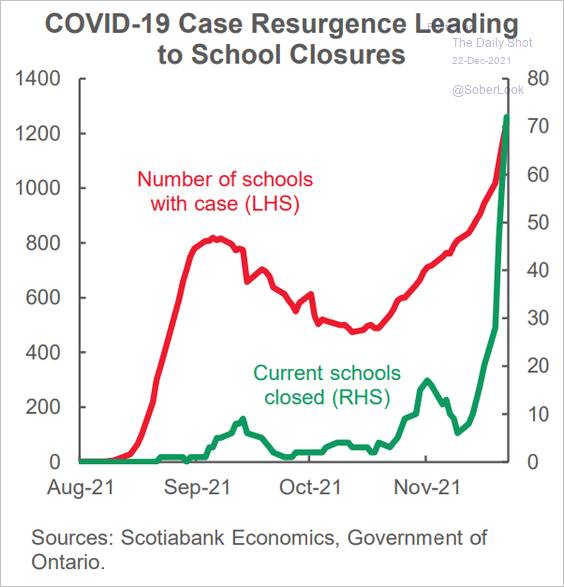

3. Omicron is forcing school closures.

Source: Scotiabank Economics

Source: Scotiabank Economics

Back to Index

The United States

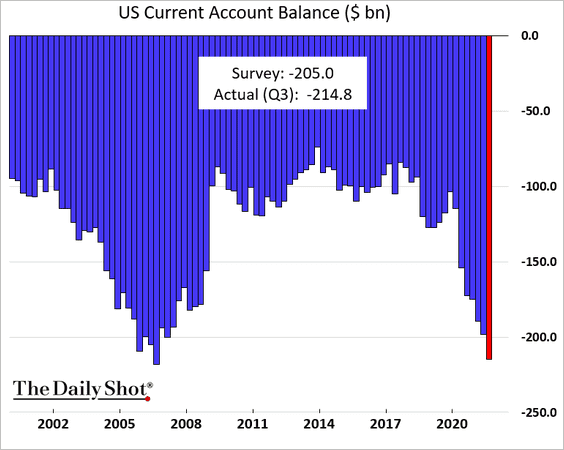

1. The current account deficit hit a 15-year high last quarter.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

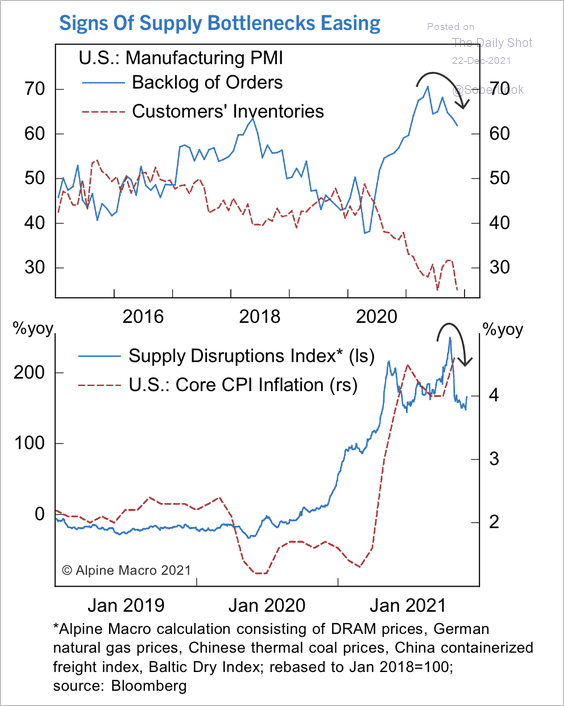

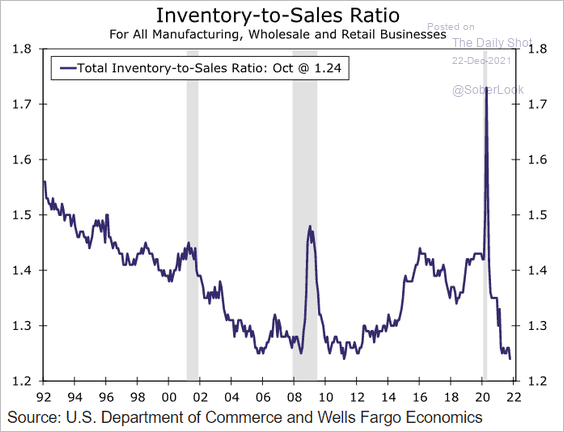

2. Supply bottlenecks are starting to ease, which could reduce inflationary pressures.

Source: Alpine Macro

Source: Alpine Macro

Will we finally see a rebound in the inventories-to-sales ratio?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

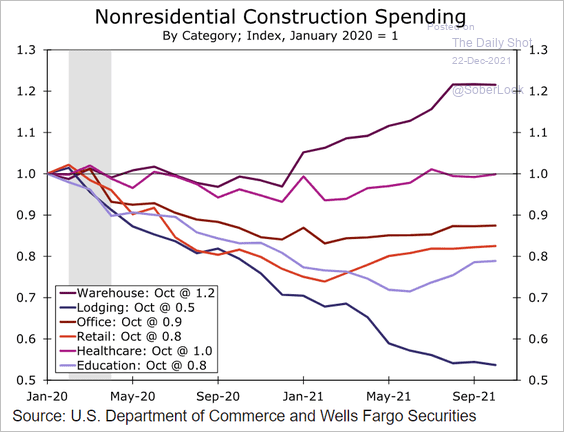

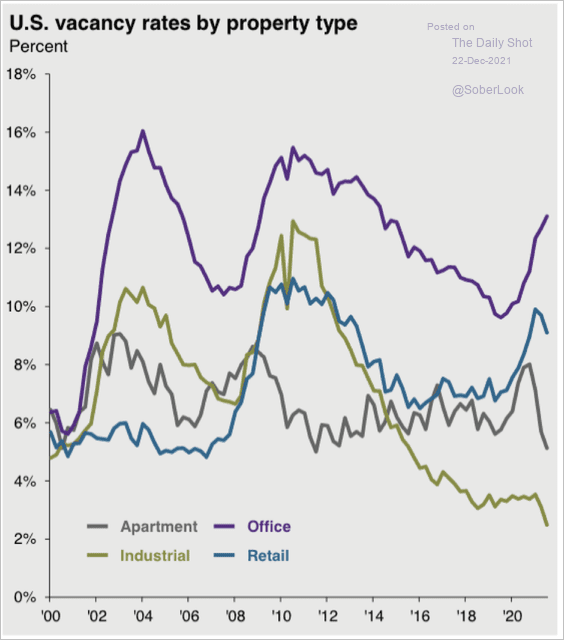

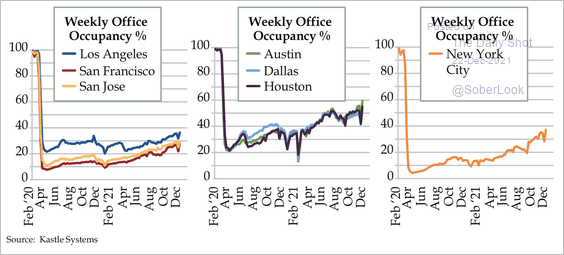

3. Next, we have some updates on nonresidential real estate.

• Construction spending by sector:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Vacancy rates:

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

• A breakdown of office occupancy rates in select cities:

Source: Quill Intelligence

Source: Quill Intelligence

——————–

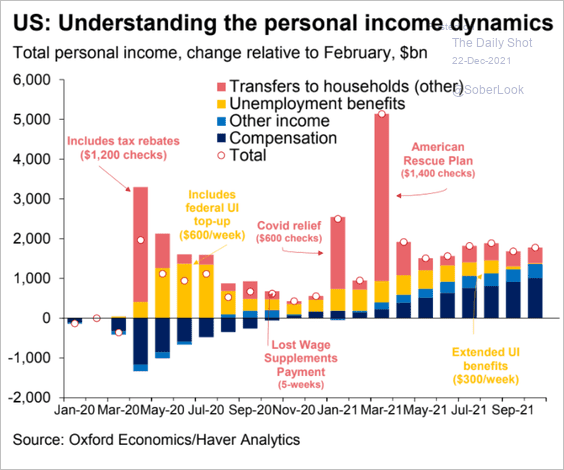

4. This chart shows the contributions to personal income in the COVID-era.

Source: Oxford Economics

Source: Oxford Economics

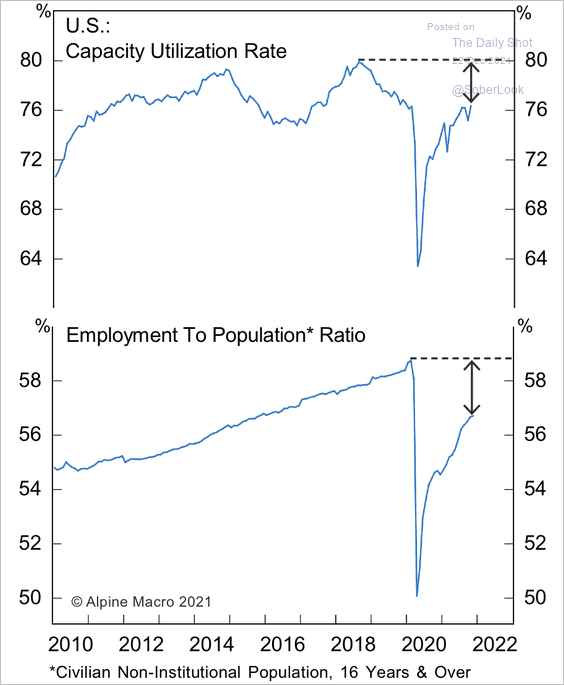

5. Key indicators show that the economy still has some slack. However industrial capacity output is limited by labor and supply shortages. And the employment-to-population ratio weakness is not due to a lack of jobs.

Source: Alpine Macro

Source: Alpine Macro

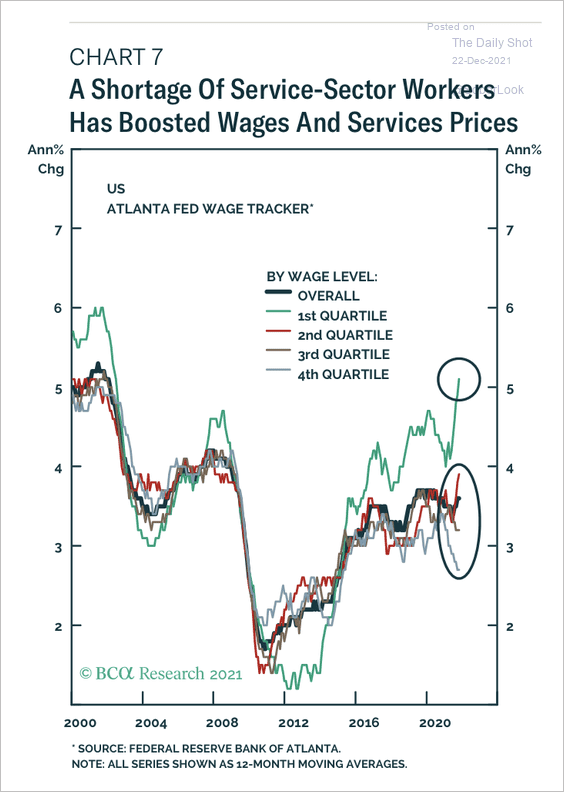

6. There is a shortage of workers, especially in the lowest-paid (first quartile) of earners, which has boosted wages and service prices.

Source: BCA Research

Source: BCA Research

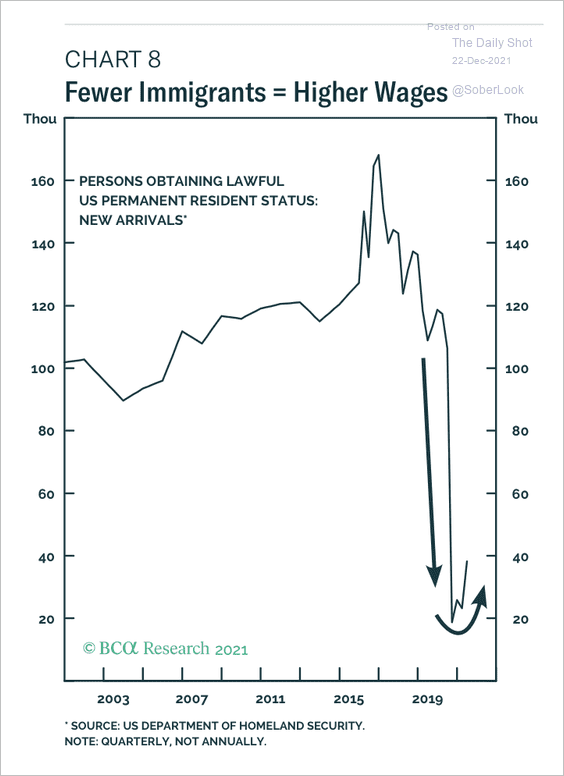

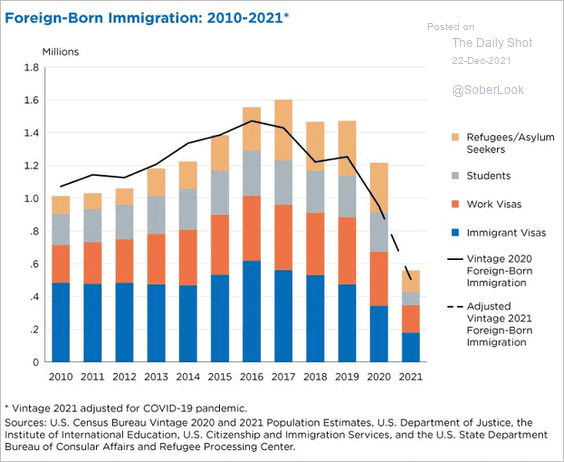

Legal immigration has collapsed following a restriction in worker visas last year, which exacerbated labor shortages (2 charts).

Source: BCA Research

Source: BCA Research

Source: @crampell Read full article

Source: @crampell Read full article

Back to Index

Global Developments

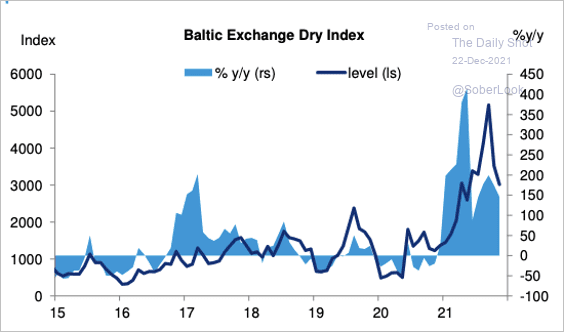

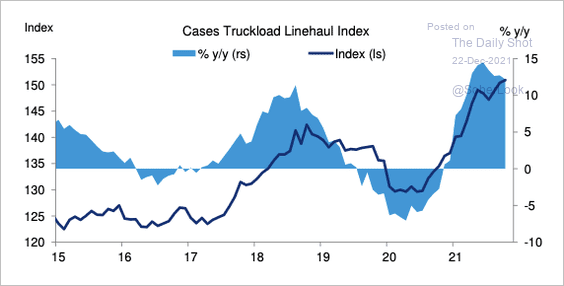

1. Ocean shipping costs have fallen, while truck shipping costs remain elevated.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

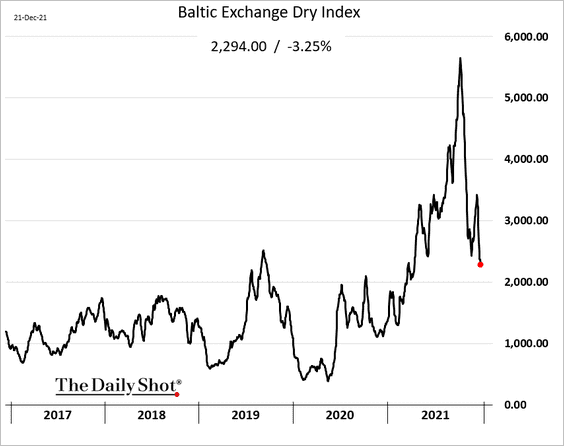

Here is Baltic Dry (dry bulk shipping price index).

——————–

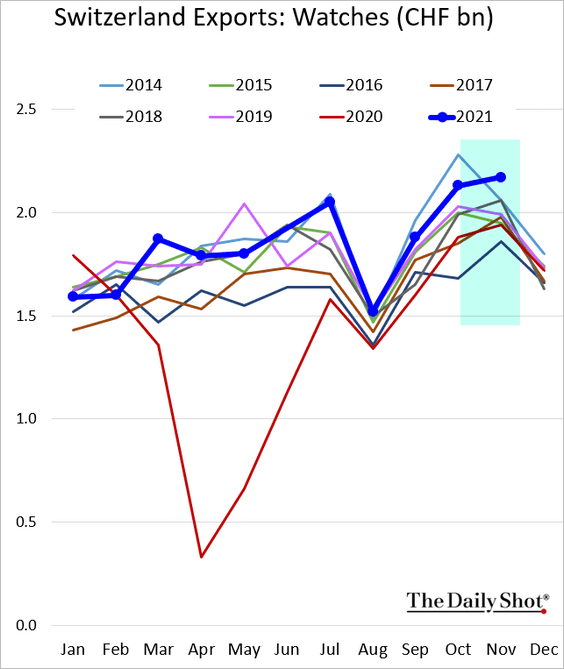

2. Swiss watch exports hit a multi-year high for this time of the year, an indication of improved demand for luxury goods.

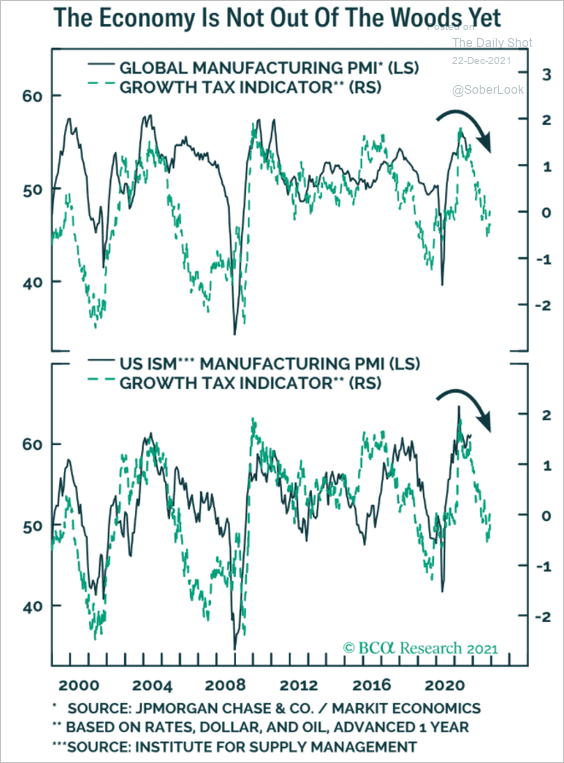

3. Leading indicators point to downside risks for manufacturing.

Source: BCA Research

Source: BCA Research

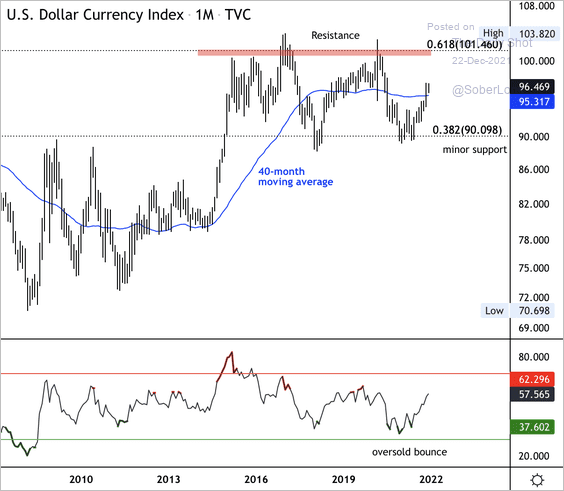

4. Despite the recent rebound, the dollar remains stuck in a five-year range and is not yet overbought on the monthly price chart.

Source: Dantes Outlook

Source: Dantes Outlook

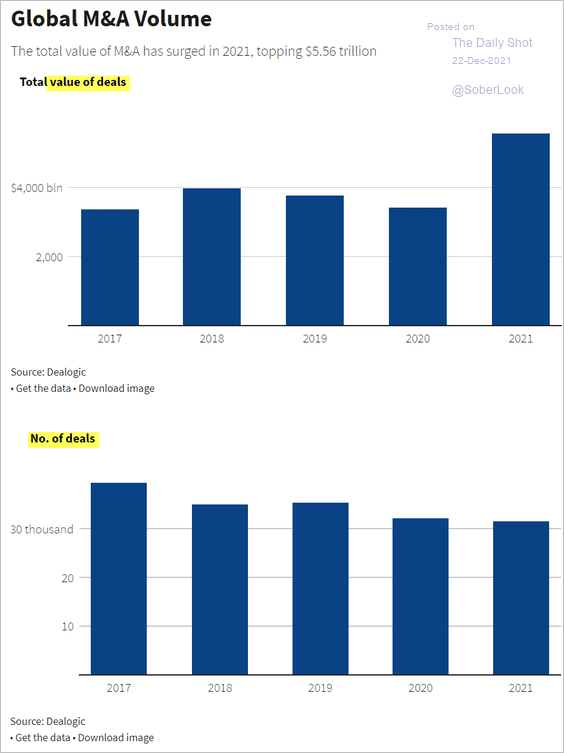

5. This chart shows global M&A activity (value and the number of deals).

Source: Reuters Read full article

Source: Reuters Read full article

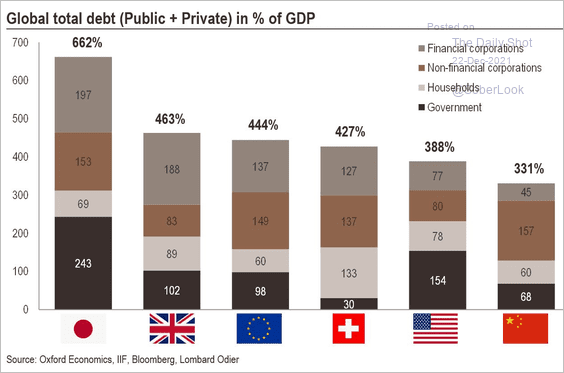

6. Next, we have the composition of total debt-to-GDP ratios for select economies.

Source: Stéphane Monier

Source: Stéphane Monier

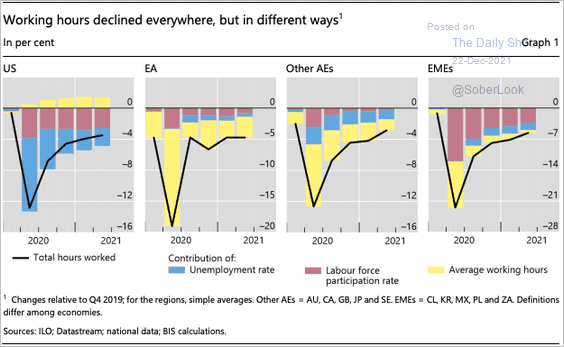

7. Finally, here is the breakdown of pandemic-driven declines in working hours.

Source: BIS; @jasonfurman

Source: BIS; @jasonfurman

——————–

Food for Thought

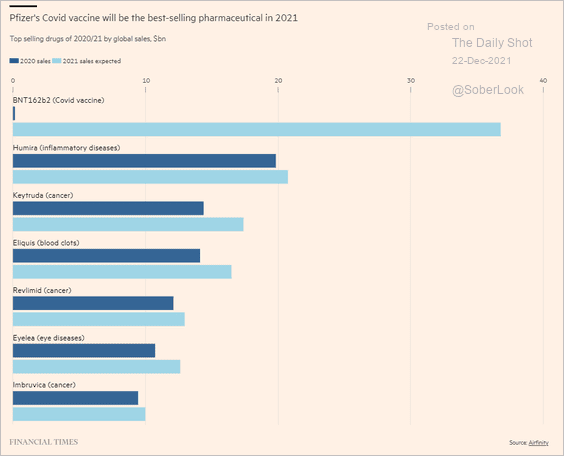

1. Top selling drugs in 2020 and 2021:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

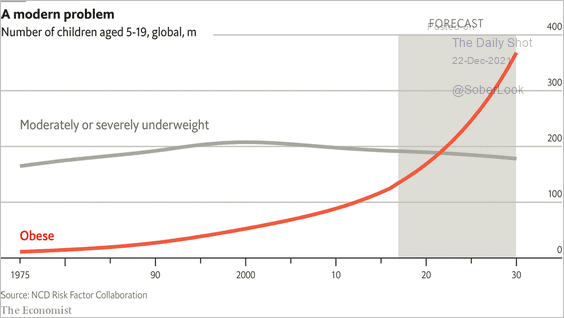

2. Obese children (globally):

Source: The Economist Read full article

Source: The Economist Read full article

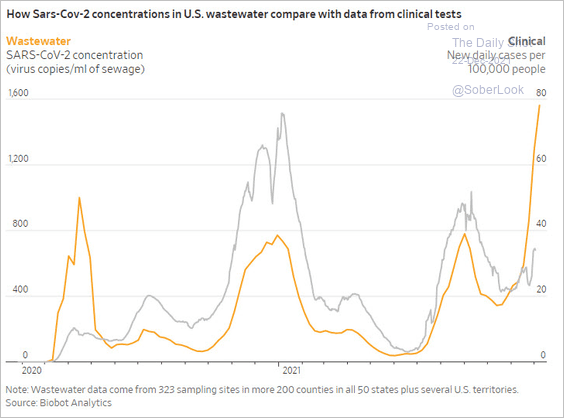

3. COVID levels in US wastewater vs. daily new cases:

Source: @WSJ Read full article

Source: @WSJ Read full article

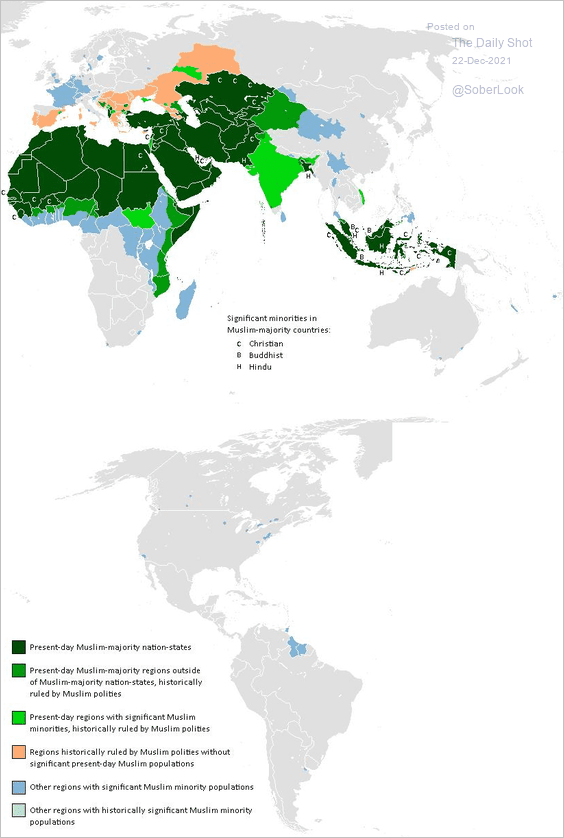

4. The Islamic world:

Source: @TheBigDataStats

Source: @TheBigDataStats

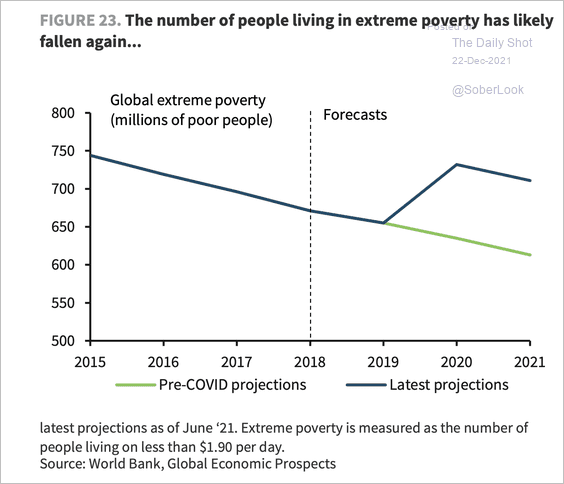

5. Extreme poverty:

Source: Barclays Research

Source: Barclays Research

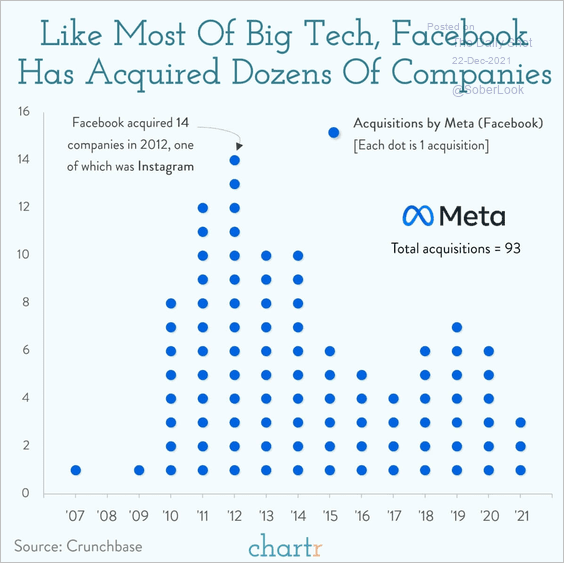

6. Facebook’s acquisitions:

Source: @chartrdaily

Source: @chartrdaily

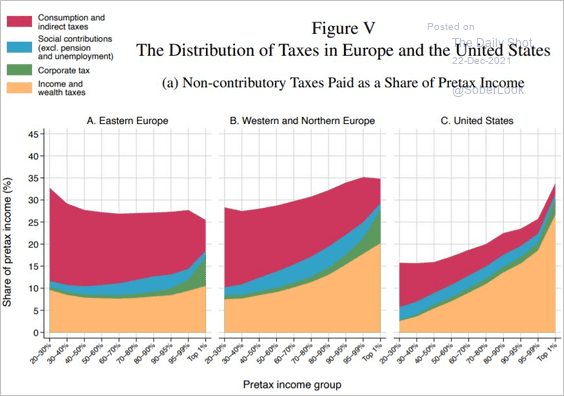

7. The distribution of taxes in Europe and the US:

Source: @amorygethin, @thomas_blncht, @lucas_chancel

Source: @amorygethin, @thomas_blncht, @lucas_chancel

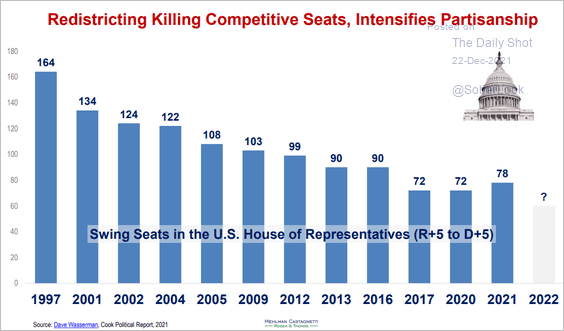

8. Disappearing swing seats in the House of Representatives:

Source: Mehlman Castagnetti Rosen & Thomas Read full article

Source: Mehlman Castagnetti Rosen & Thomas Read full article

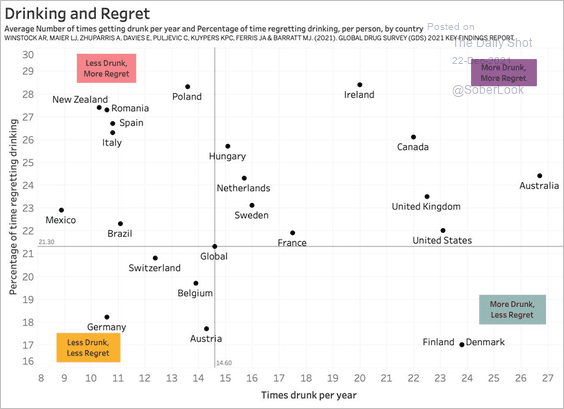

9. Getting drunk and regretting it:

Source: r/dataisbeautiful Further reading

Source: r/dataisbeautiful Further reading

——————–

Back to Index