The Daily Shot: 05-Jan-22

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

1. Let’s begin with the labor market.

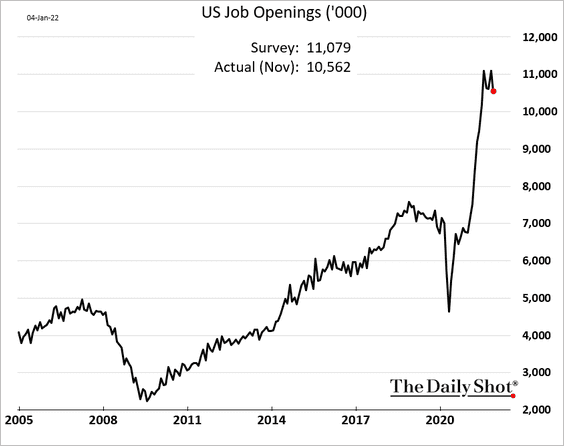

• Job openings ticked down, but demand for workers remains extraordinarily high.

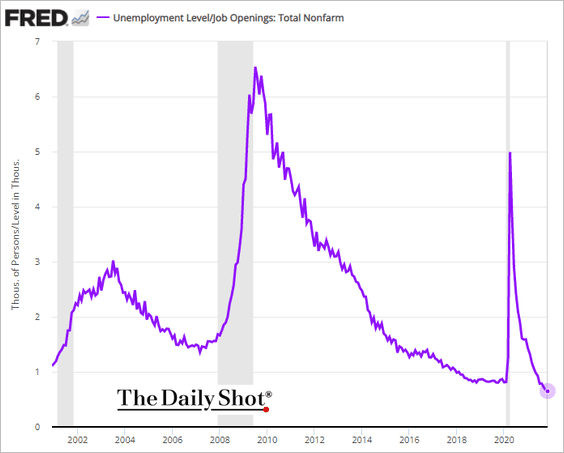

– The ratio of unemployed workers to job openings continues to hit new lows.

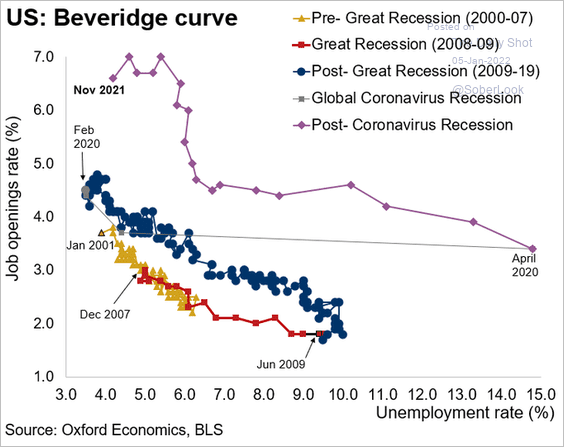

Here is the Beveridge curve.

Source: @GregDaco

Source: @GregDaco

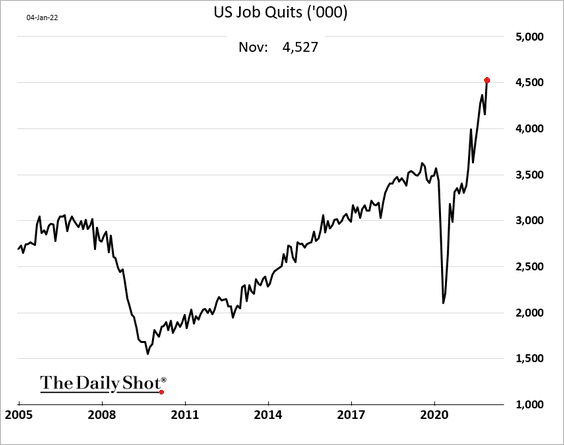

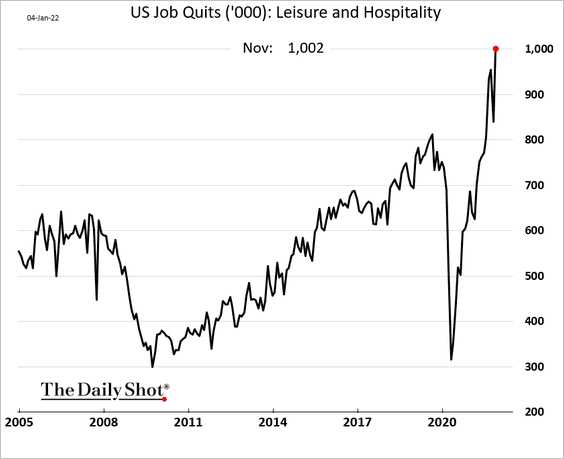

• Voluntary separations reached a new record, with 4.5 million Americans quitting their jobs in November.

A million workers resigned in Leisure and Hospitality alone.

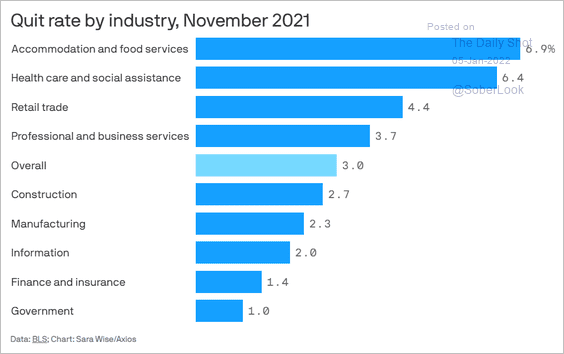

Here is the breakdown of quit rates by sector.

Source: @axios Read full article

Source: @axios Read full article

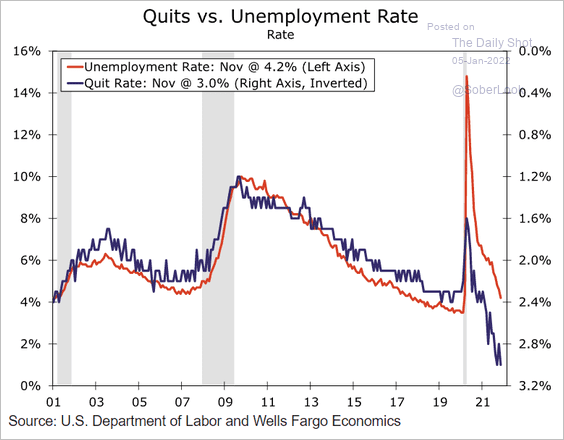

– Based on the level of resignations, the unemployment rate should be much lower.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

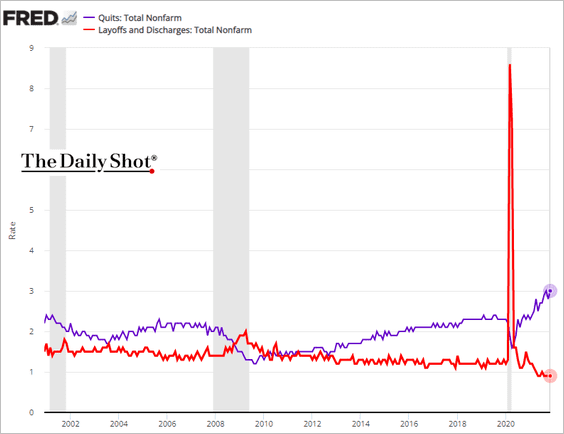

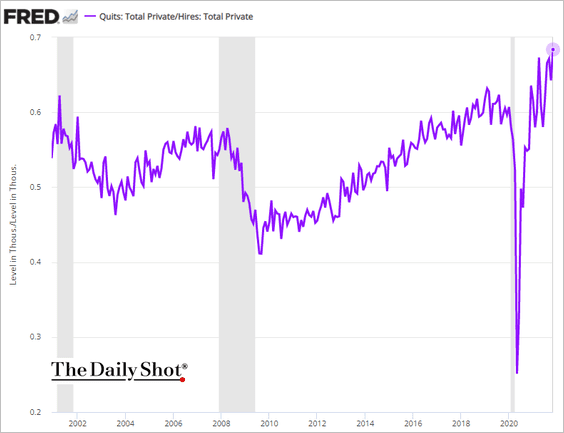

– This chart shows quits and layoffs rates over the past two decades.

– While hiring has also been strong, resignations are outpacing recruitment.

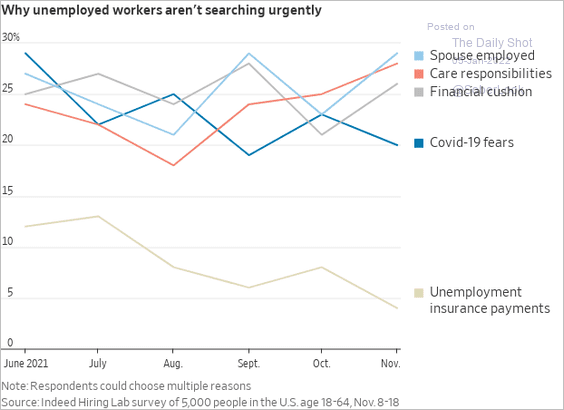

• Here is why many Americans are staying out of the labor force.

Source: @WSJ Read full article

Source: @WSJ Read full article

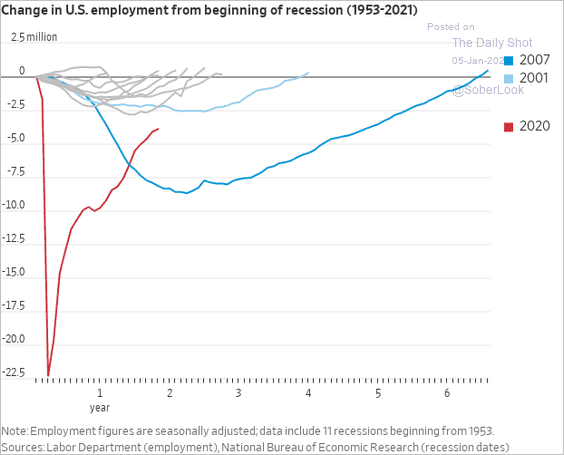

• It will take a while before US employment returns to pre-COVID levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

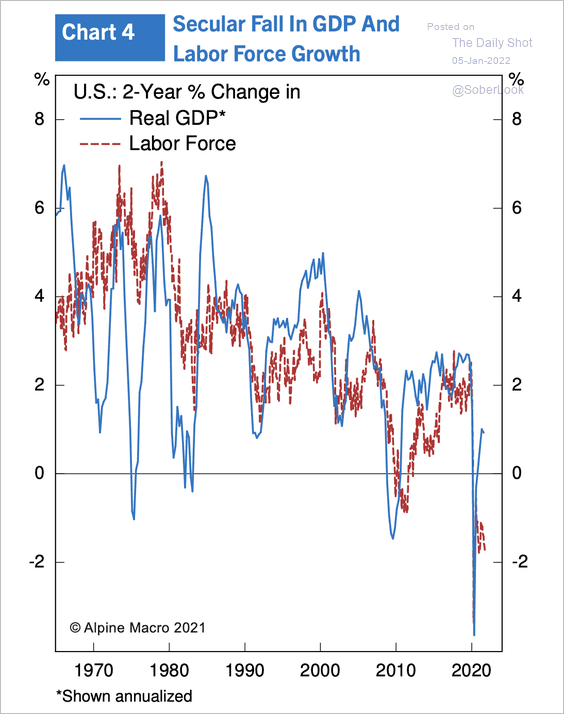

• Falling labor force growth in the US has been a long-term drag on GDP growth. With early retirements and low immigration, this trend is unlikely to reverse soon.

Source: Alpine Macro

Source: Alpine Macro

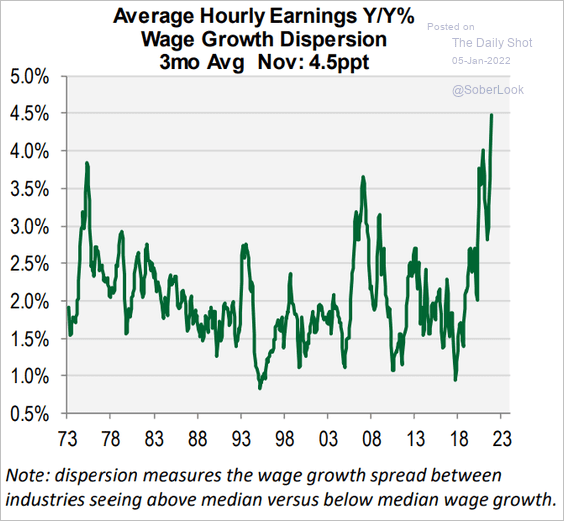

• US wage growth dispersion (see definition below) hit a new high.

Source: Cornerstone Macro

Source: Cornerstone Macro

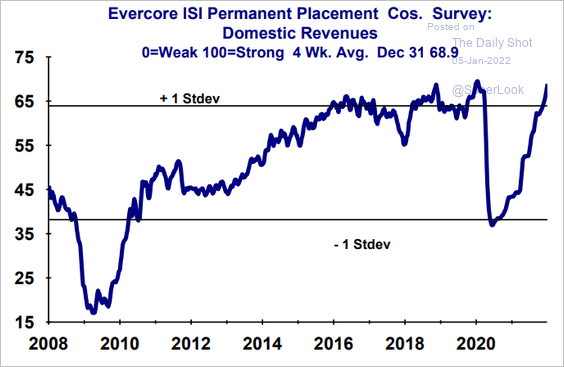

• Placement companies’ revenues have fully recovered.

Source: Evercore ISI Research

Source: Evercore ISI Research

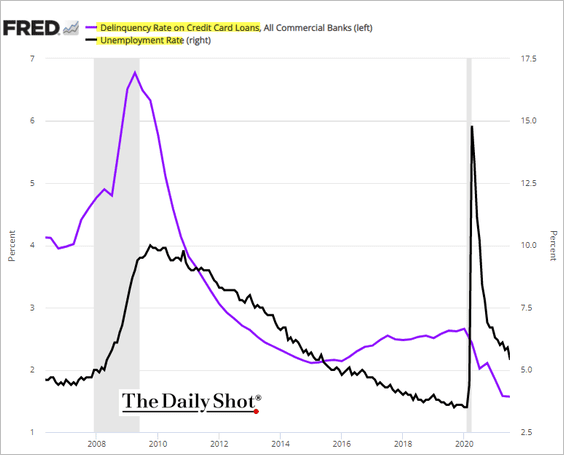

• The spike in unemployment at the start of the pandemic did not generate the consumer credit draw we saw in 2008 (partially due to generous government support).

Source: The FRED Blog Read full article

Source: The FRED Blog Read full article

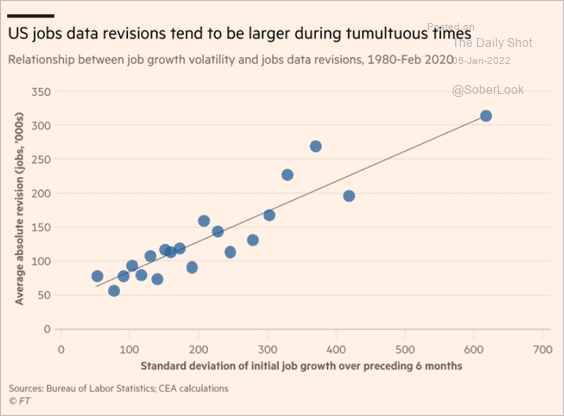

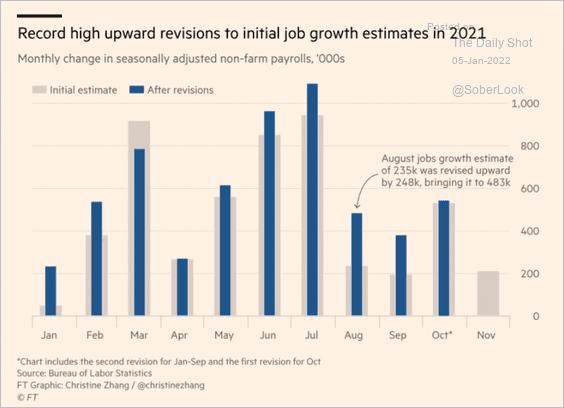

• US jobs data revisions tend to be higher during periods of job growth volatility.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

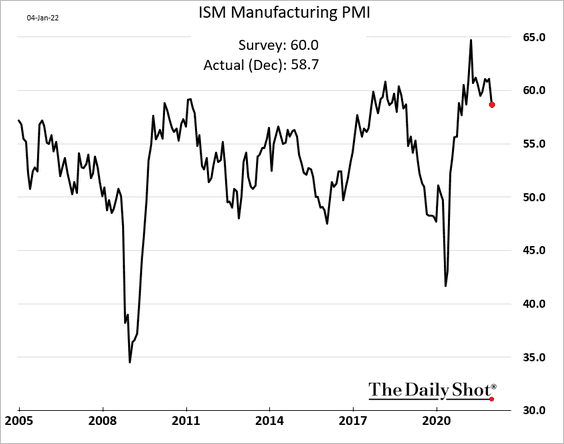

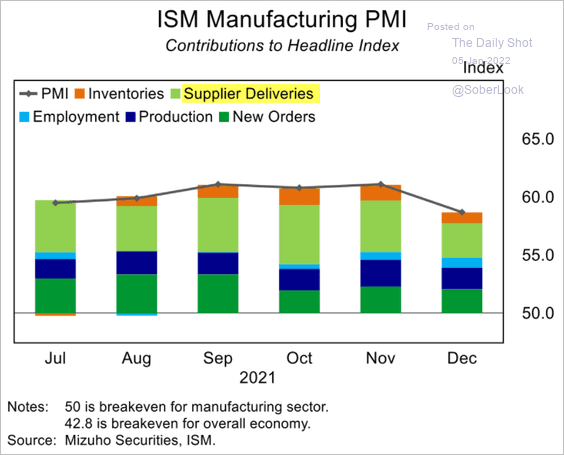

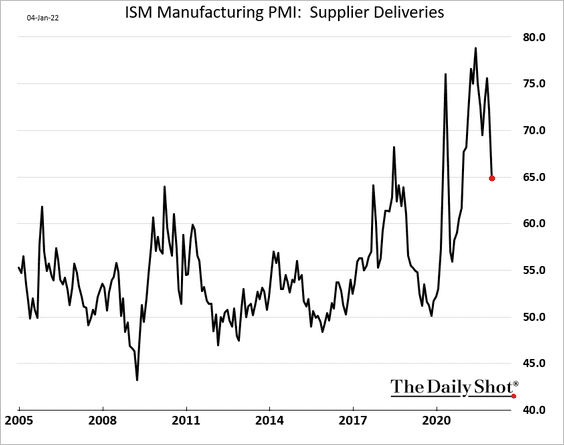

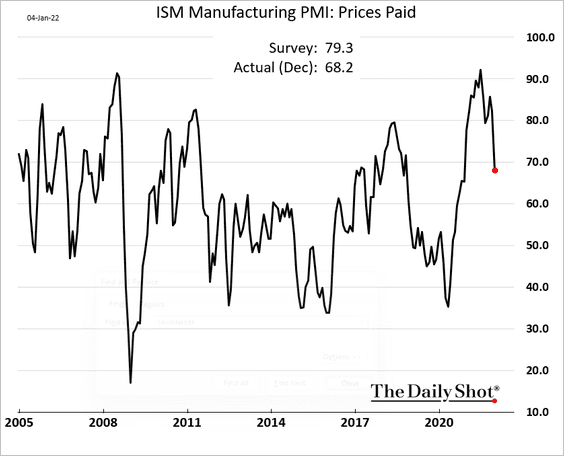

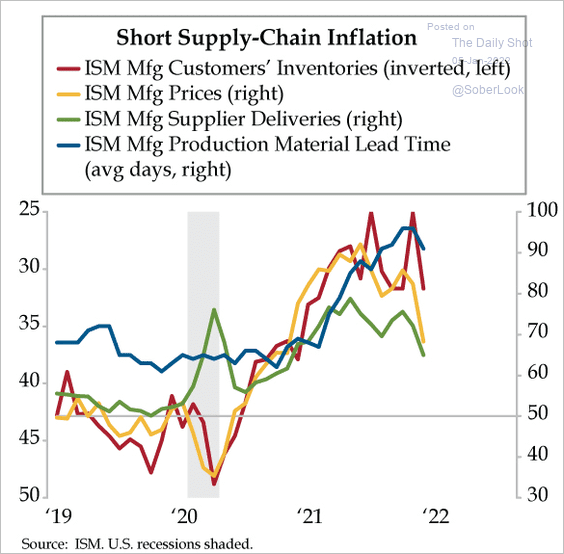

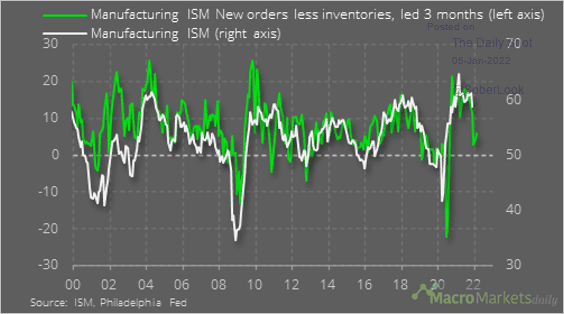

2. The ISM Manufacturing PMI declined in December.

But this drop turned out to be good news. Much of the decline was due to faster supplier deliveries rather than weaker production.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

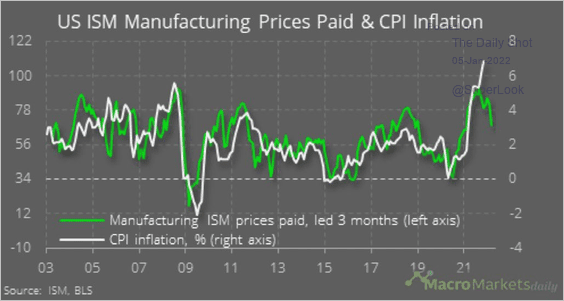

Price gains are slowing as well, …

… which points to some moderation in inflation ahead.

Source: @macro_daily

Source: @macro_daily

All supply-chain indicators have peaked.

Source: The Daily Feather

Source: The Daily Feather

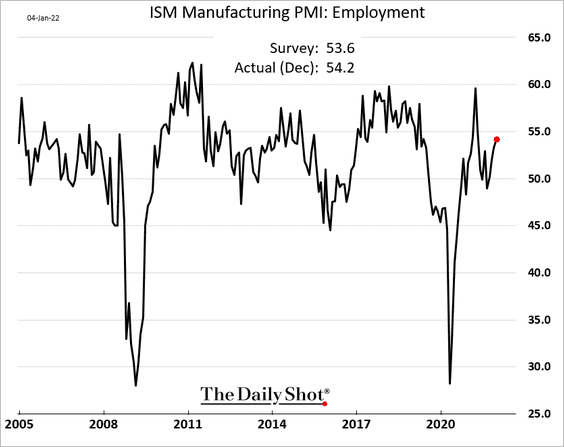

• Factory hiring improved in December.

• The spread between indices of new orders and inventory points to moderation in manufacturing growth this year.

Source: @macro_daily

Source: @macro_daily

——————–

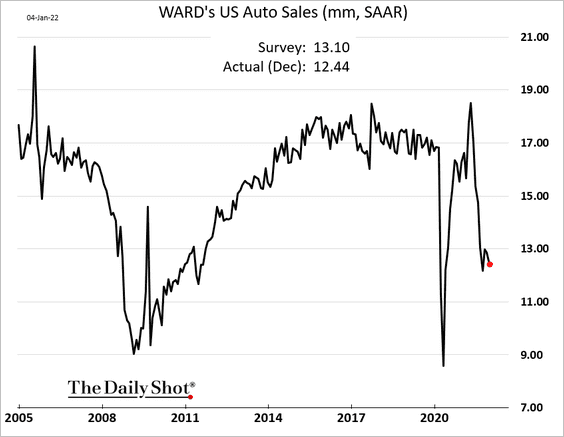

3. US automobile sales remained depressed in December …

Source: Reuters Read full article

Source: Reuters Read full article

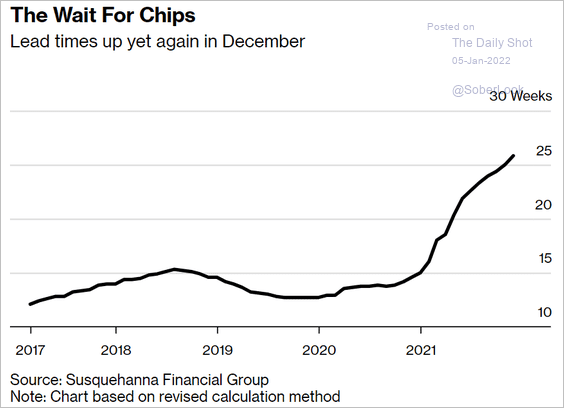

… as the semiconductor backlog continues to worsen.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

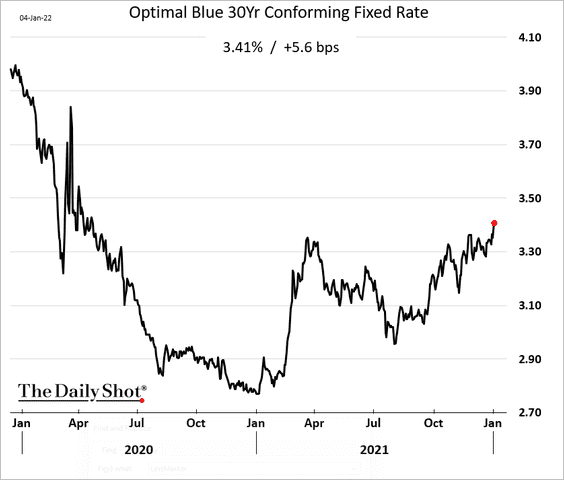

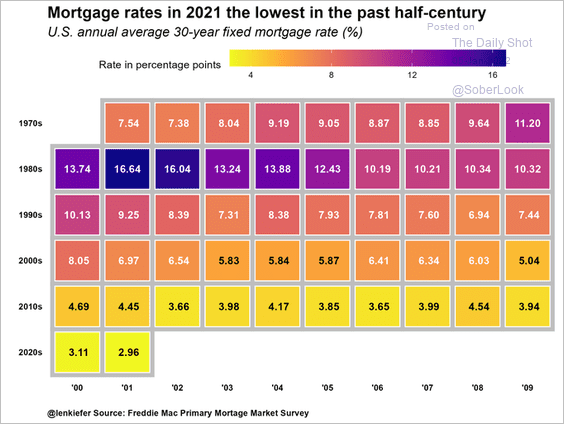

4. Mortgage rates climbed to the highest level since early 2020.

Back to Index

The United Kingdom

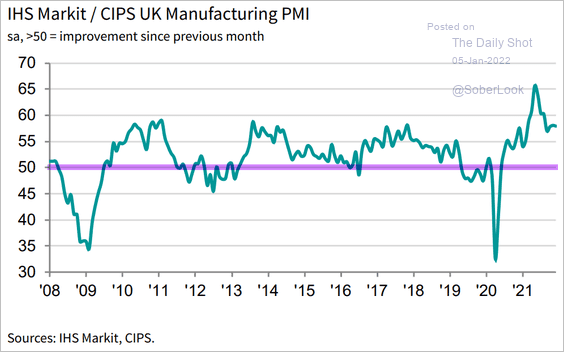

1. Manufacturing growth was stable in December.

Source: IHS Markit

Source: IHS Markit

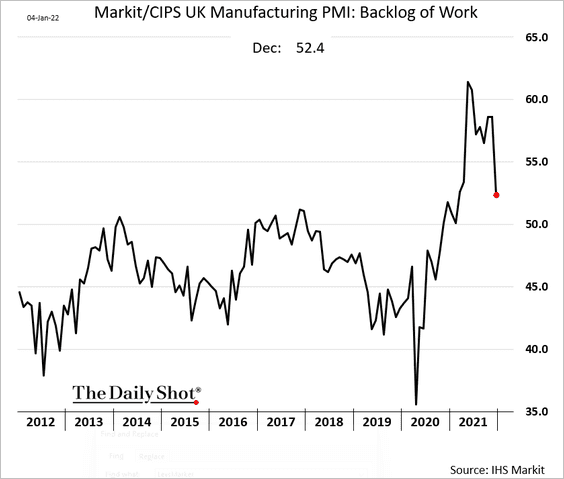

The backlog is starting to ease.

——————–

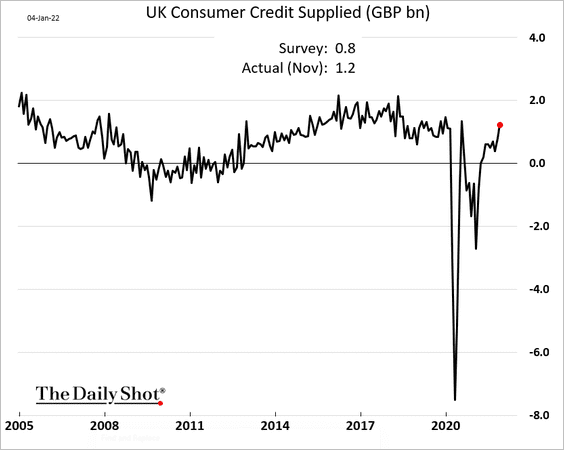

2. Consumer credit supplied is back at pre-COVID levels.

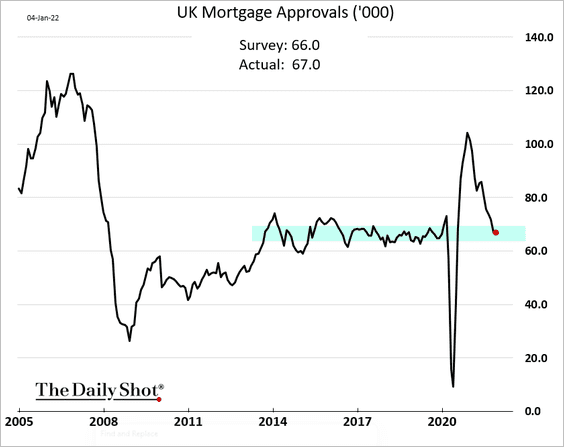

Mortgage approvals are stabilizing inside the pre-pandemic range.

——————–

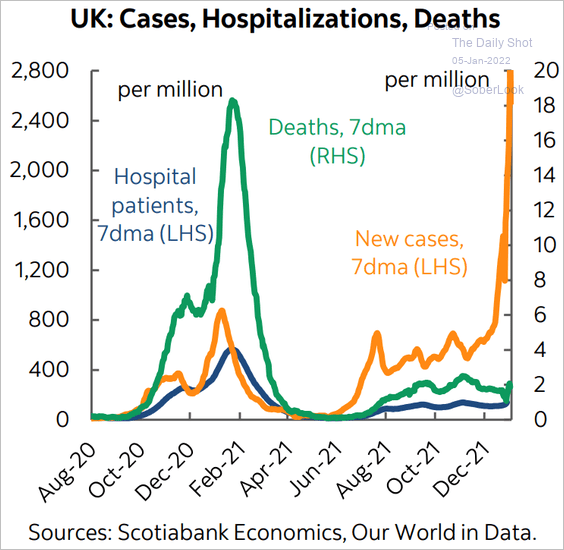

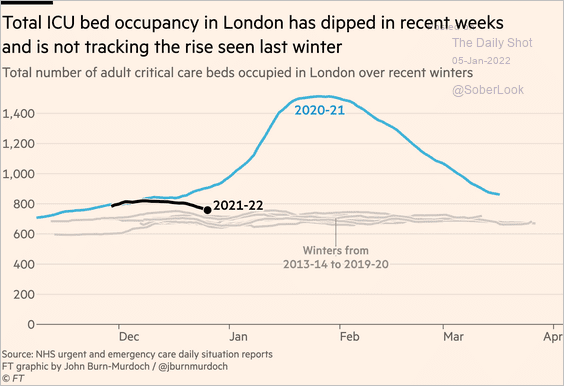

3. The surge in new cases has not translated into much higher hospitalizations and deaths (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

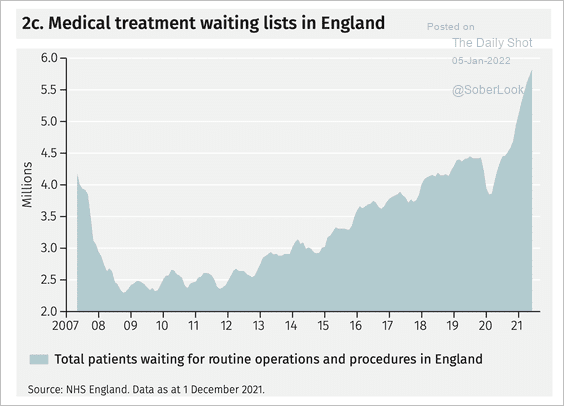

4. A record 5.9 million people in the UK are waiting for some sort of medical treatment.

Source: EFG International

Source: EFG International

Back to Index

The Eurozone

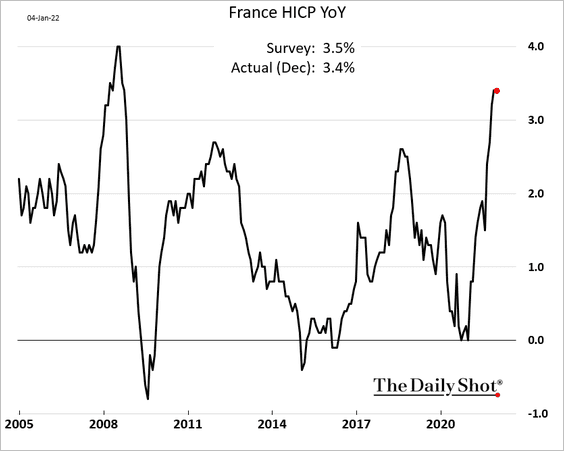

1. French inflation appears to have peaked for now.

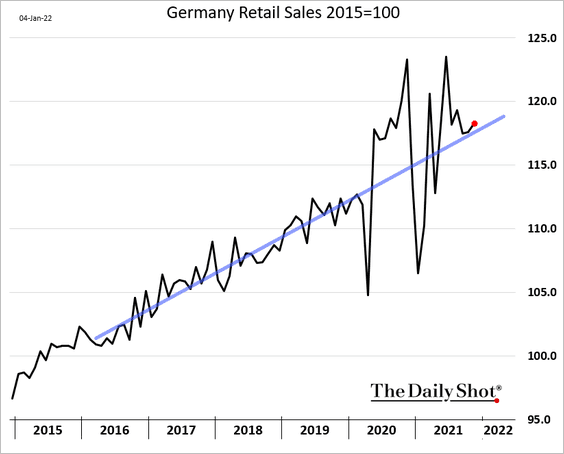

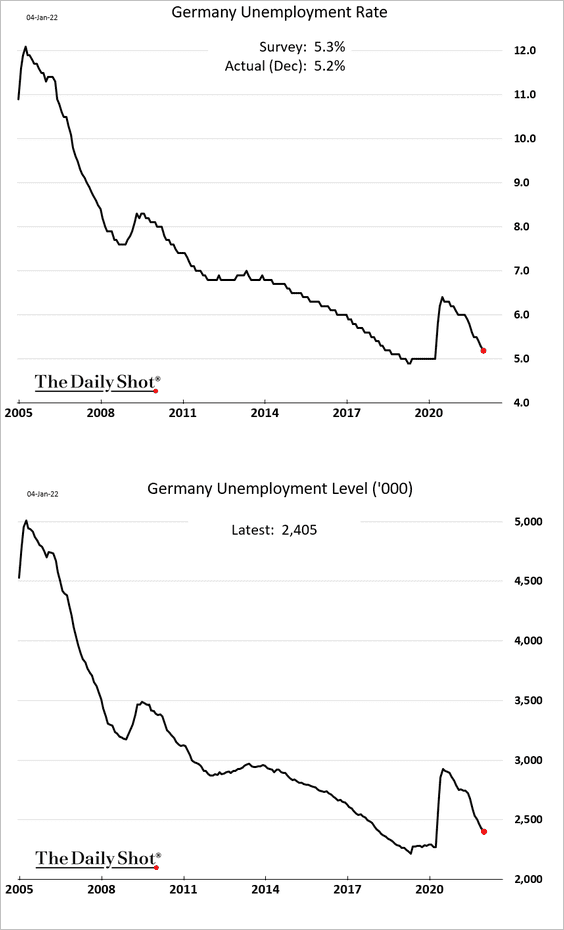

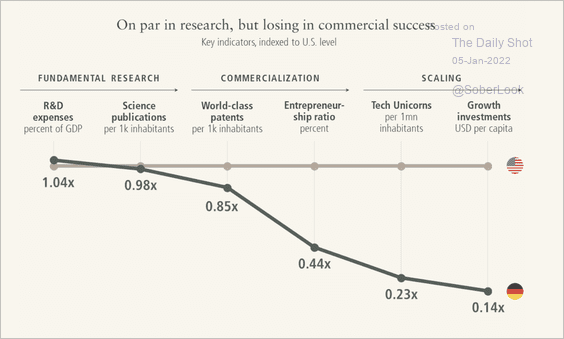

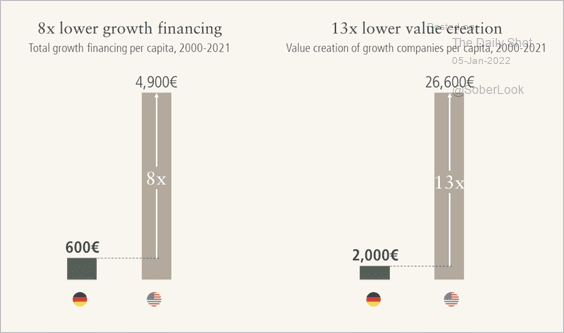

2. Next, we have some updates on Germany.

• Retail sales increased in November, running close to the pre-COVID trend.

• Unemployment is nearing pre-pandemic levels.

• Germany lags behind the US in terms of venture growth and value creation (2 charts).

Source: Lakestar Read full article

Source: Lakestar Read full article

Source: Lakestar Read full article

Source: Lakestar Read full article

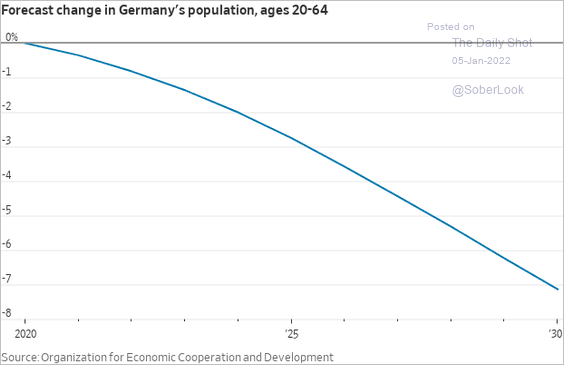

• Here is a projection for Germany’s “prime-age” population.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

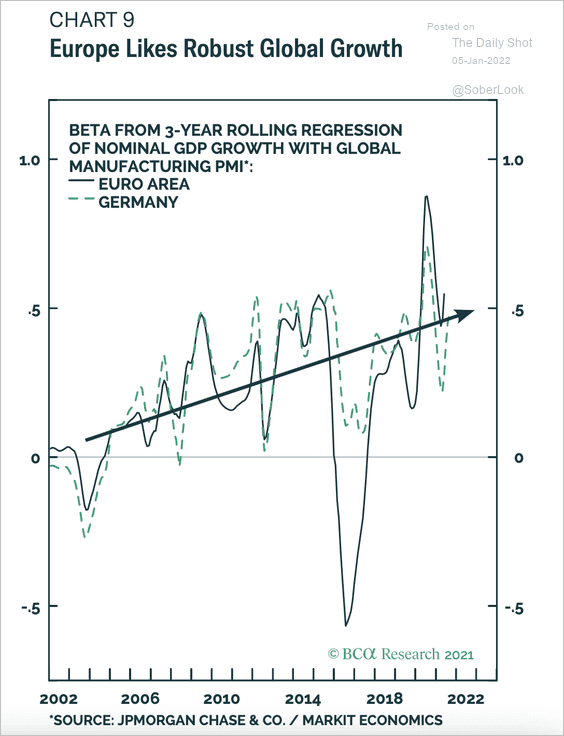

3. The euro-area economy is highly correlated to global growth.

Source: BCA Research

Source: BCA Research

Back to Index

Europe

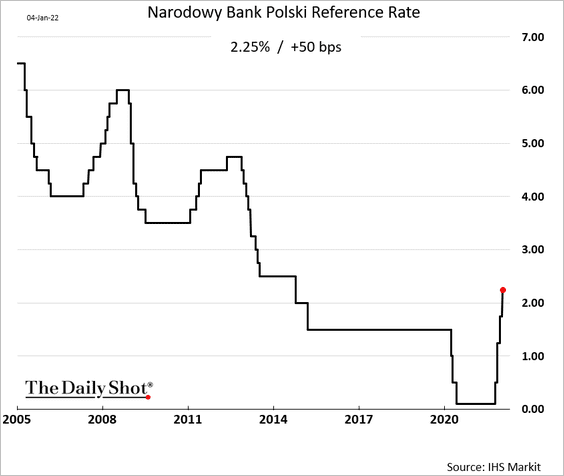

1. Poland’s central bank hiked rates again as inflation surges.

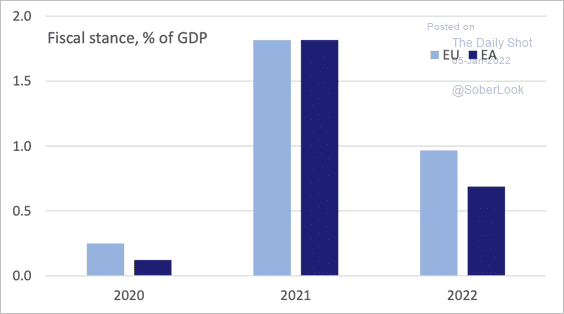

2. Deutsche Bank expects the fiscal impulse in the EU to remain positive this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

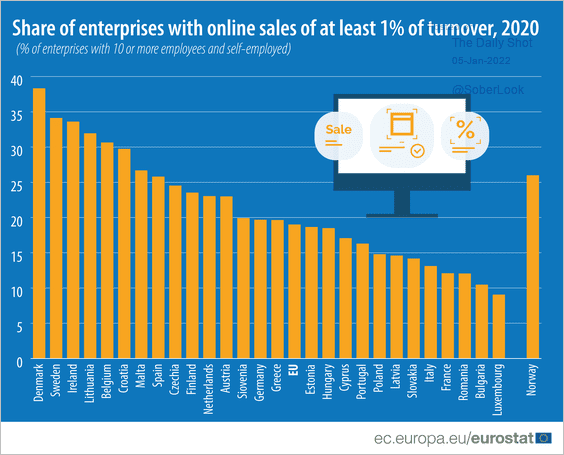

3. This chart shows the share of companies with online sales of at least 1% of the total.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

Asia – Pacific

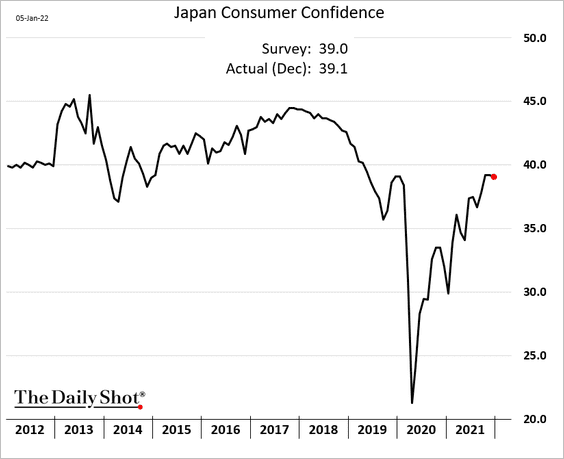

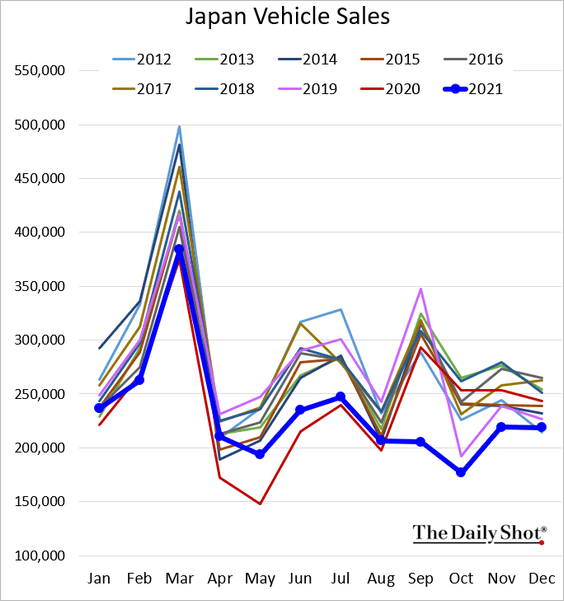

1. Japan’s consumer confidence held steady last month.

Vehicle sales remain soft.

——————–

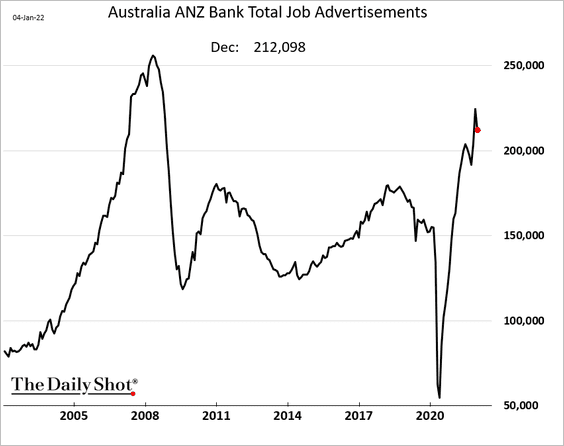

2. Australia’s job ads came off the recent highs.

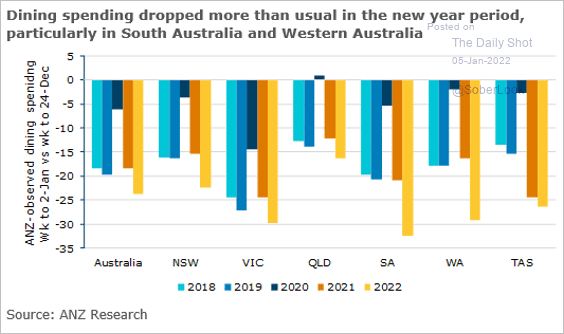

Dining spending dropped more than usual for this time of the year.

Source: ANZ Research

Source: ANZ Research

——————–

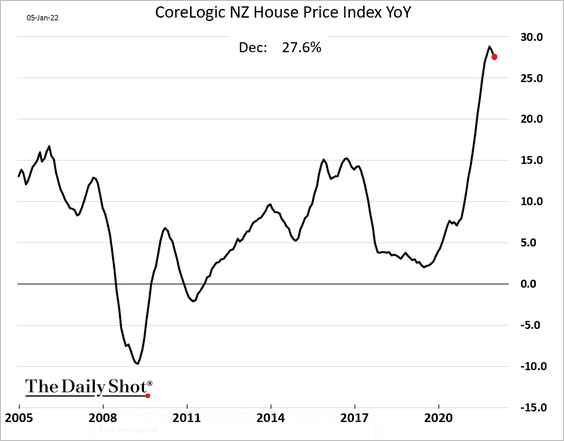

3. New Zealand’s home price appreciation has peaked.

Back to Index

China

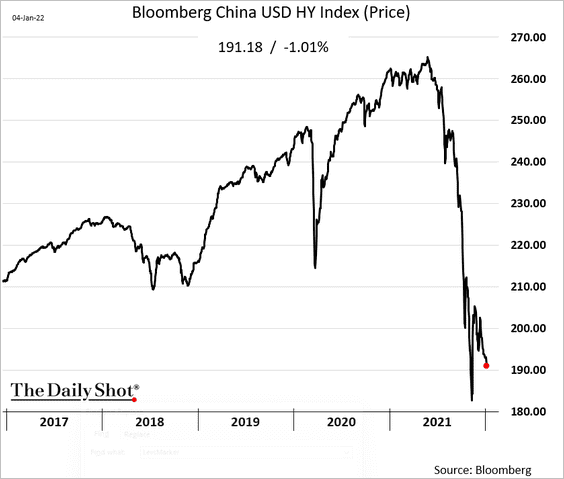

1. USD-denominated high-yield bond prices are dropping again.

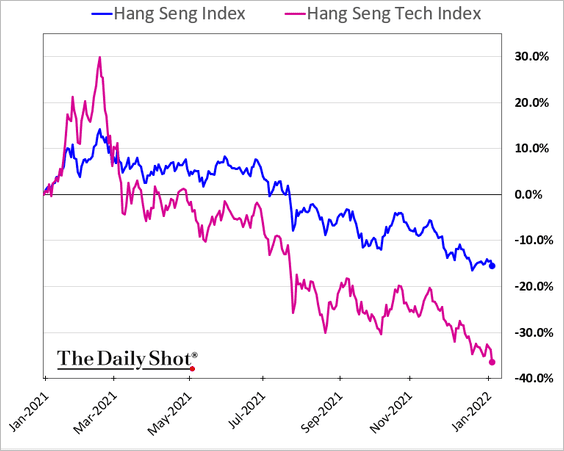

2. Tech shares continue to tumble in Hong Kong.

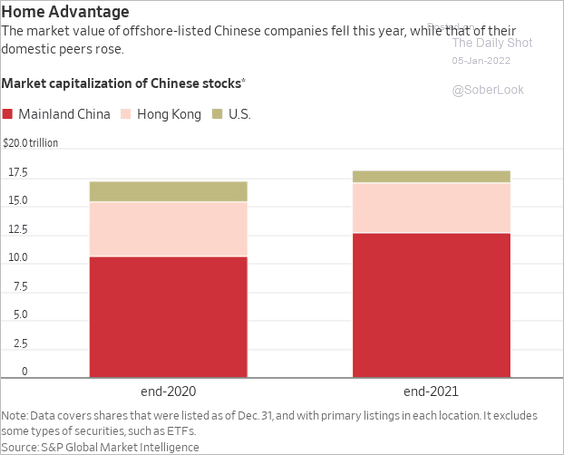

• Equity capitalization growth in 2021 has been in the mainland market.

Source: @WSJ Read full article

Source: @WSJ Read full article

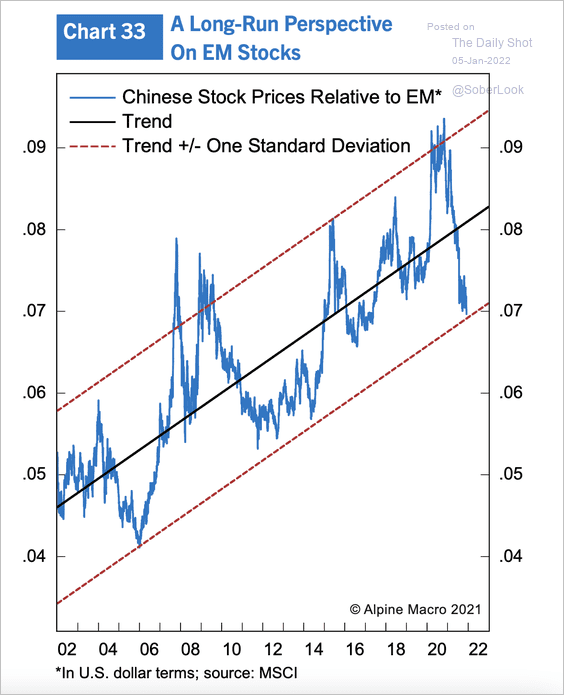

• Chinese stocks had a tough year, hitting the bottom end of the range relative to emerging markets.

Source: Alpine Macro

Source: Alpine Macro

——————–

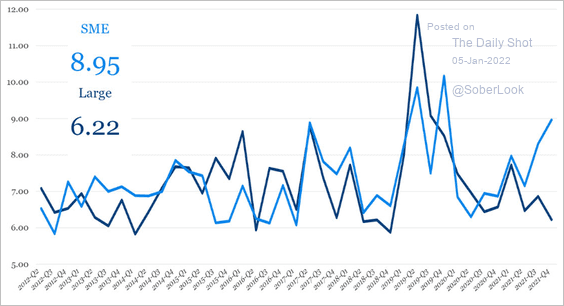

3. Interest rates on loans to small and medium-sized enterprises (SMEs) are rising relative to large firms.

Source: China Beige Book

Source: China Beige Book

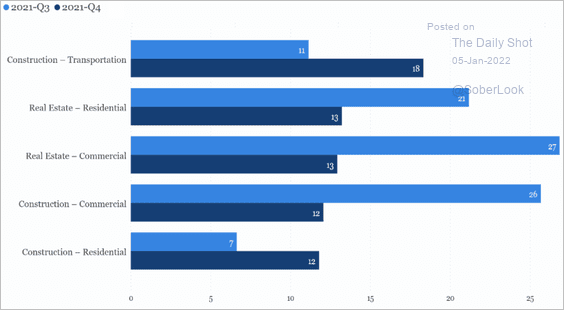

Corporate borrowing declined over the past quarter, except in the transport sector.

Source: China Beige Book

Source: China Beige Book

——————–

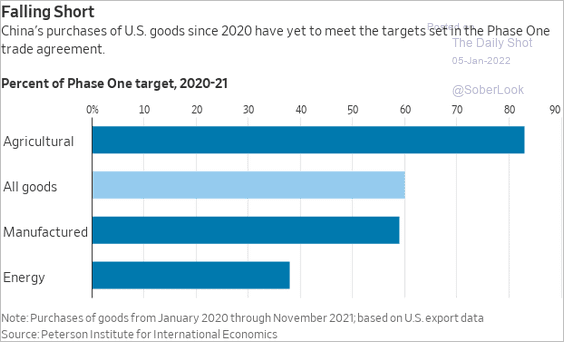

4. China’s imports from the US are well under the Phase-I agreement levels.

Source: @WSJ Read full article

Source: @WSJ Read full article

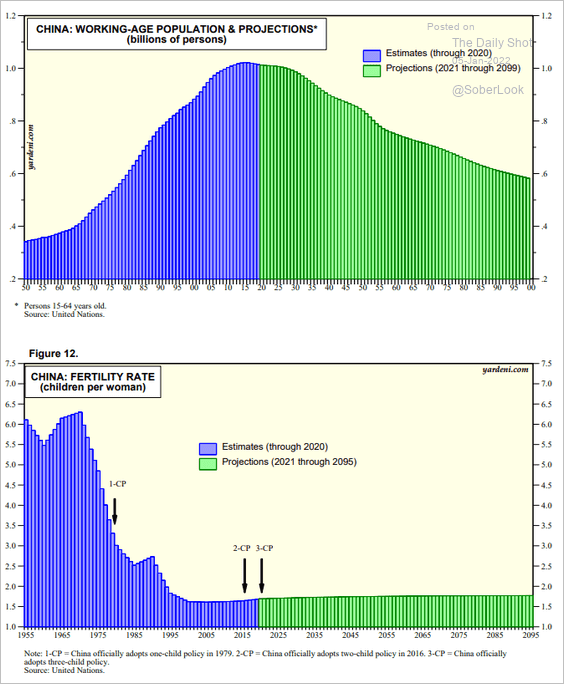

5. Here is a projection for China’s working-age population.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Emerging Markets

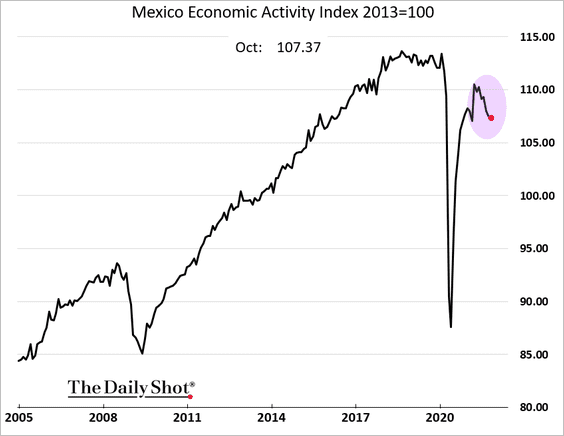

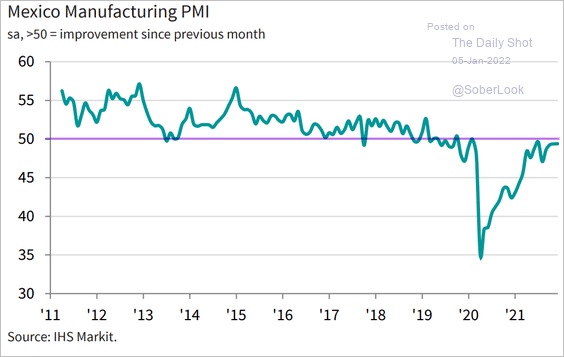

1. Let’s begin with Mexico.

• Economic activity has been weakening (through October).

• The manufacturing sector just can’t break into growth mode.

Source: IHS Markit

Source: IHS Markit

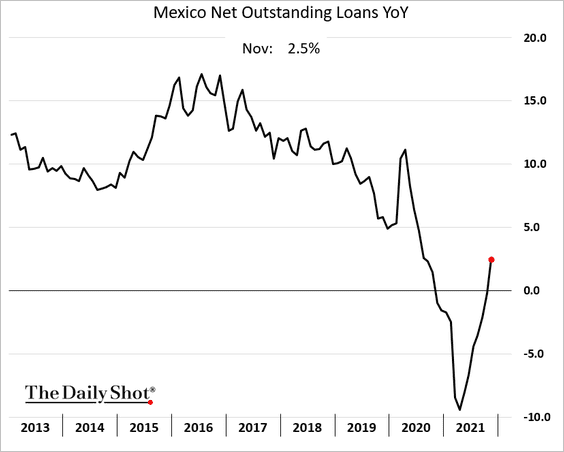

• Loan growth is rebounding.

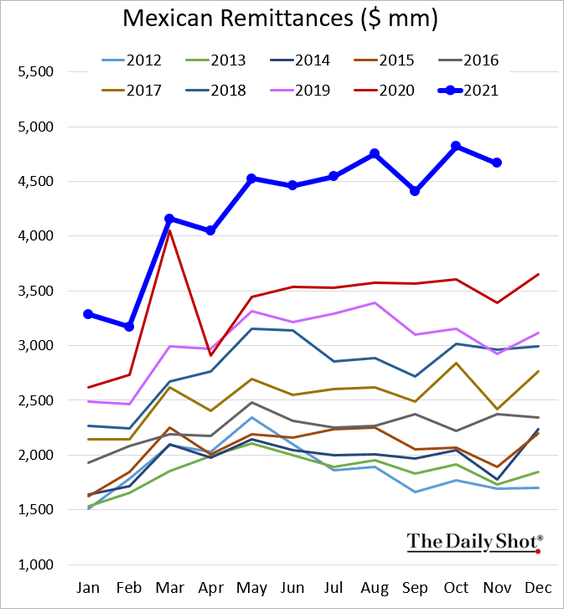

• Remittances remain at record levels for this time of the year.

——————–

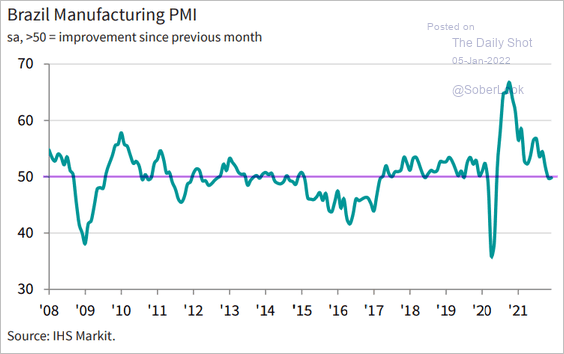

2. Next, we have some updates on Brazil.

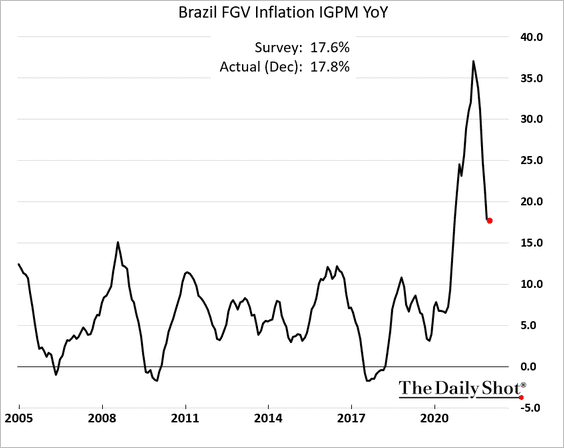

• Inflation has been moderating.

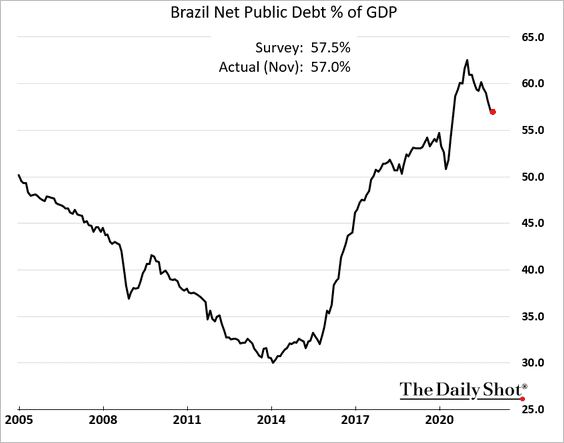

• The debt-to-GDP ratio has peaked for now but remains well above pre-COVID levels.

• Manufacturing growth has stalled.

Source: IHS Markit

Source: IHS Markit

——————–

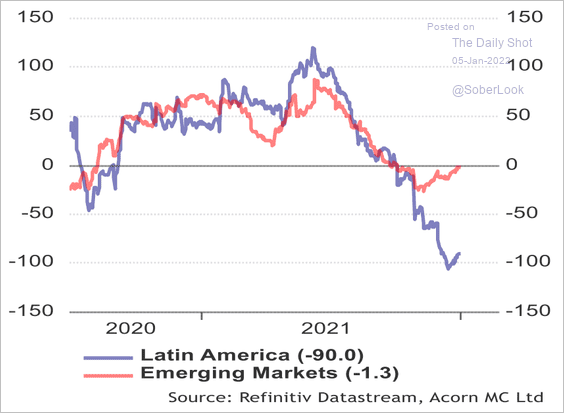

3. LatAm economic surprises have been negative recently.

Source: Acorn Macro Consulting Ltd.

Source: Acorn Macro Consulting Ltd.

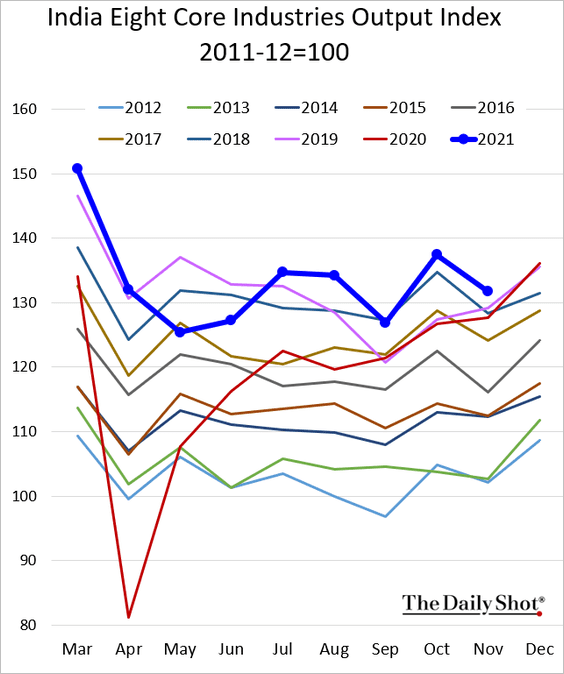

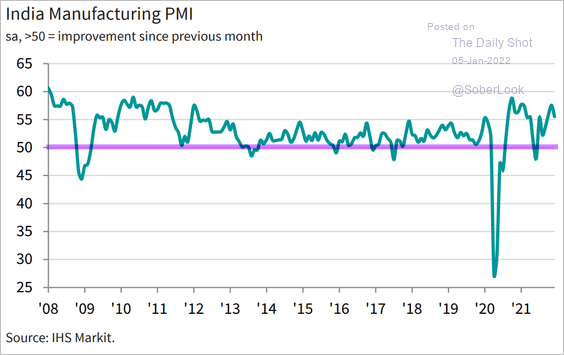

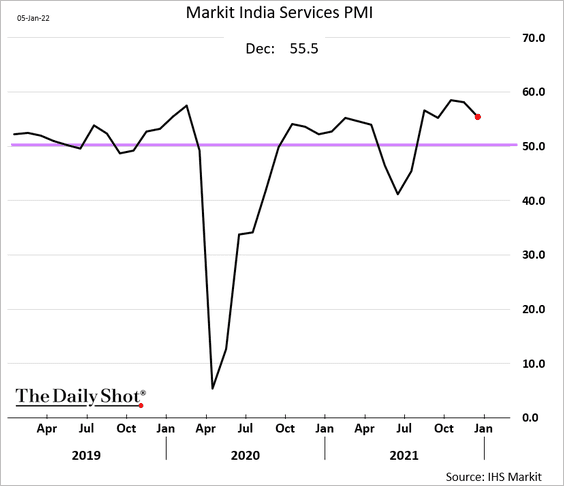

4. India’s industrial output remains robust.

PMI measures continue to show growth.

• Manufacturing:

Source: IHS Markit

Source: IHS Markit

• Services:

——————–

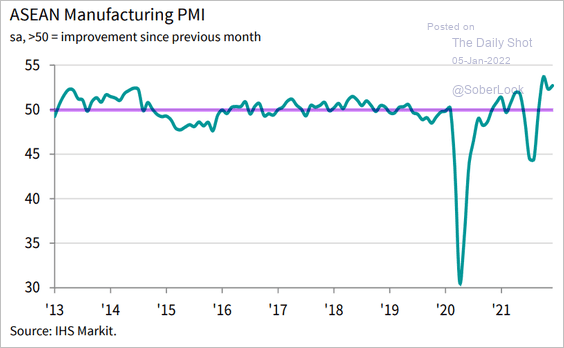

5. ASEAN manufacturing growth remains robust.

Source: IHS Markit

Source: IHS Markit

Back to Index

Cryptocurrency

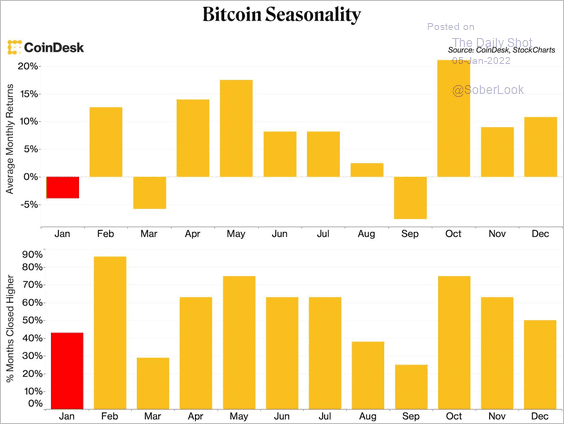

1. Historically, bitcoin tends to fall in January, although the cryptocurrency registered a positive return 50% of the time over the past nine years. The probability of a positive outcome is mixed.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

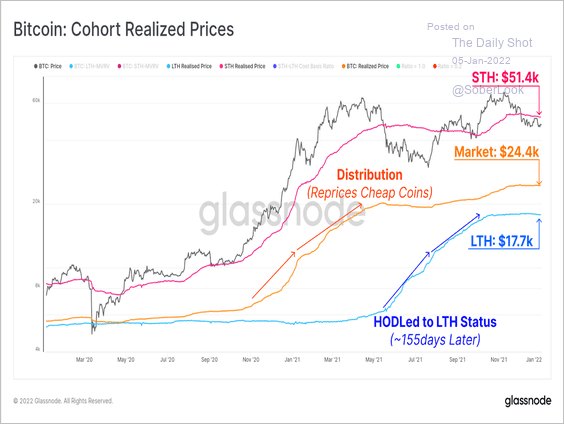

2. With bitcoin’s little movement over the past week, short-term holders are bearing the most pain, which could lead to increased selling pressure.

Source: Glassnode Read full article

Source: Glassnode Read full article

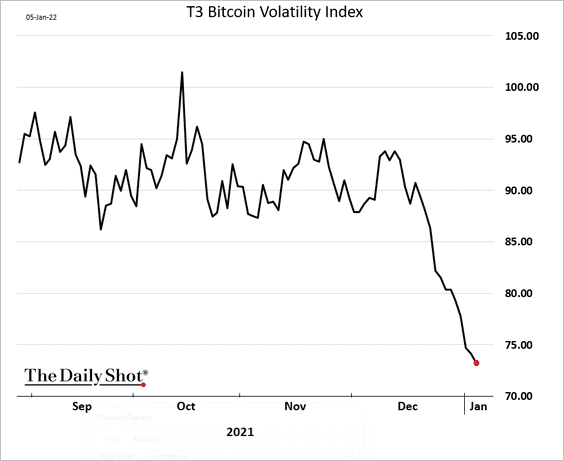

3. Bitcoin implied volatility is following realized vol lower.

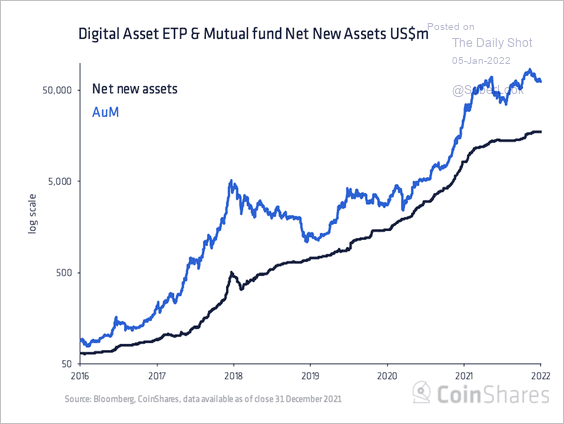

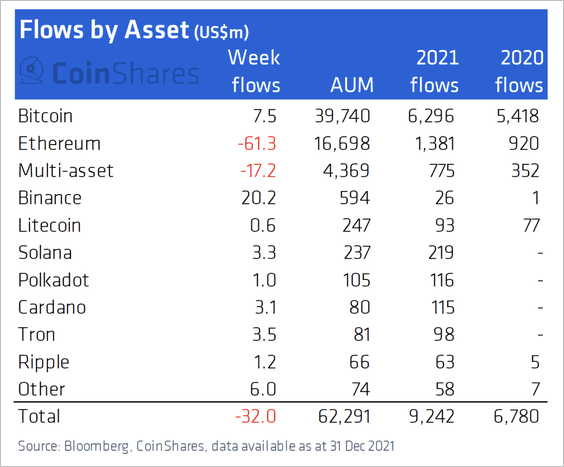

4. Digital asset funds saw a roughly 36% increase in flows over the past year. Still, over the past week, some funds saw outflows as crypto prices declined (2 charts).

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

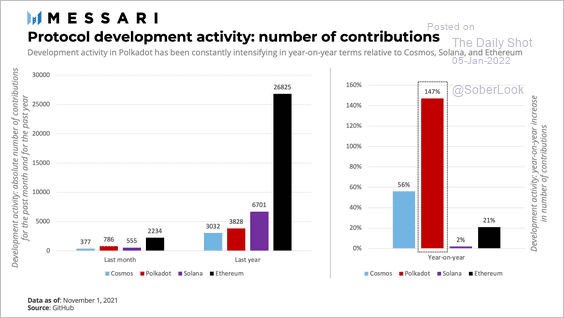

5. Development activity in Polkadot has picked up significantly over the past year.

Source: @MessariCrypto

Source: @MessariCrypto

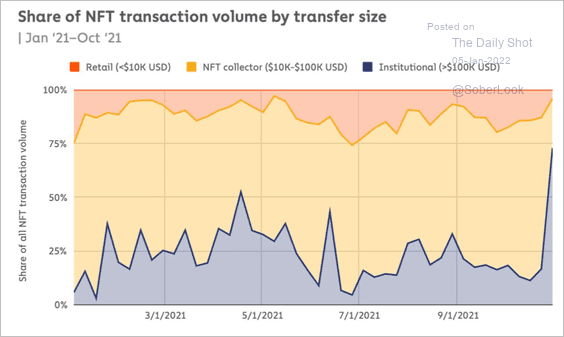

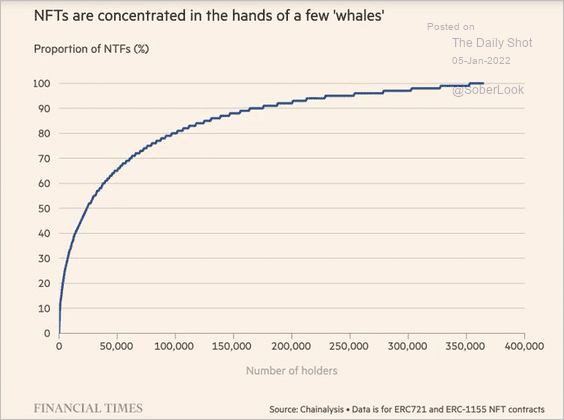

6. Recently, a majority of NFT transaction volume consists of collectors with deep pockets (2 charts).

Source: @chainalysis

Source: @chainalysis

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

Back to Index

Commodities

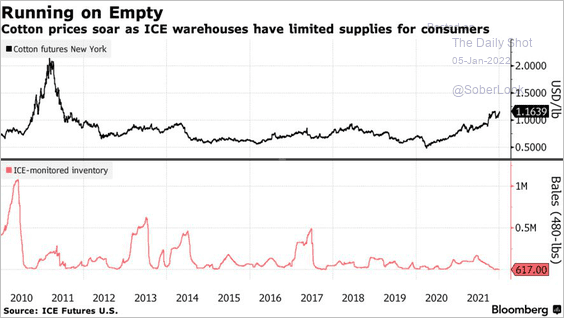

1. Cotton prices have been surging due to limited supplies.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

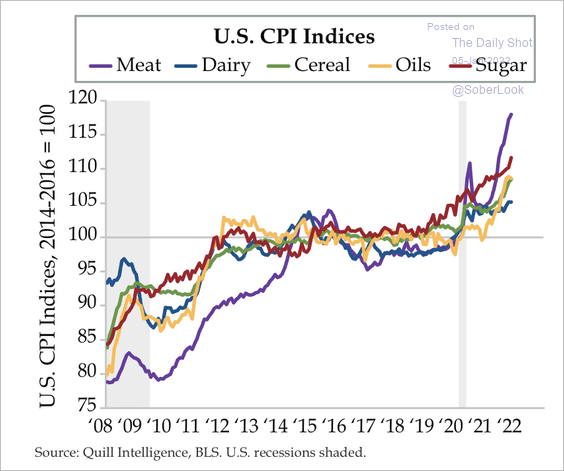

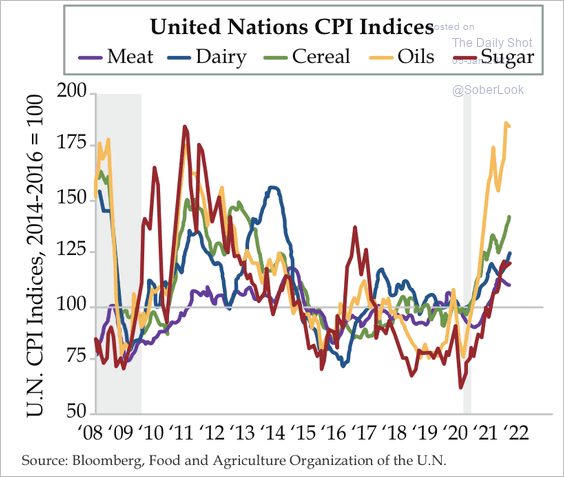

2. US meat and sugar prices rose to a higher degree relative to the world as a whole (2 charts).

Source: Quill Intelligence

Source: Quill Intelligence

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Energy

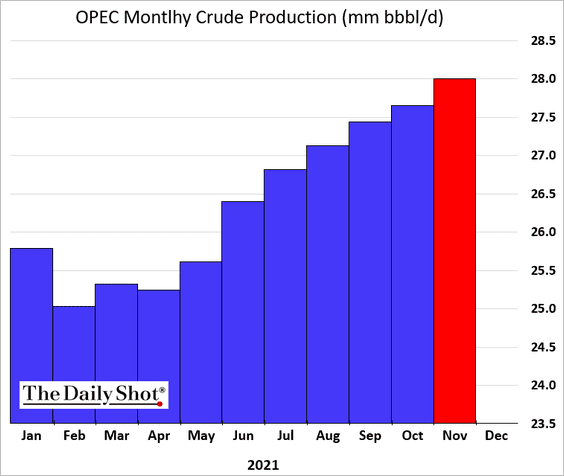

1. Comforted by estimates of tight oil supplies this year, OPEC is raising output.

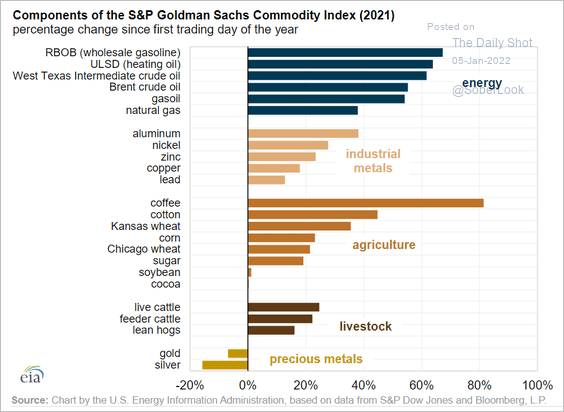

2. Energy has mostly outperformed other commodities last year.

Source: EIA Read full article

Source: EIA Read full article

3. Crude oil hedging activities are declining for US oil producers, which suggests companies expect to capitalize on higher prices. Will we see a further increase in production?

Source: Argus Media Read full article

Source: Argus Media Read full article

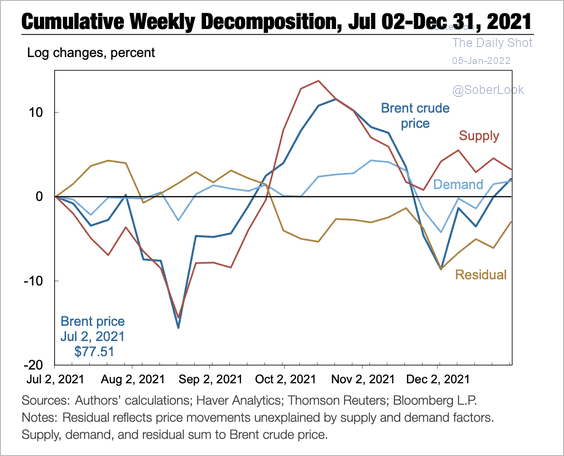

4. Over the past week, an increase in anticipated supply was offset by an increase in demand expectations, which resulted in higher oil prices.

Source: NY Fed Read full article

Source: NY Fed Read full article

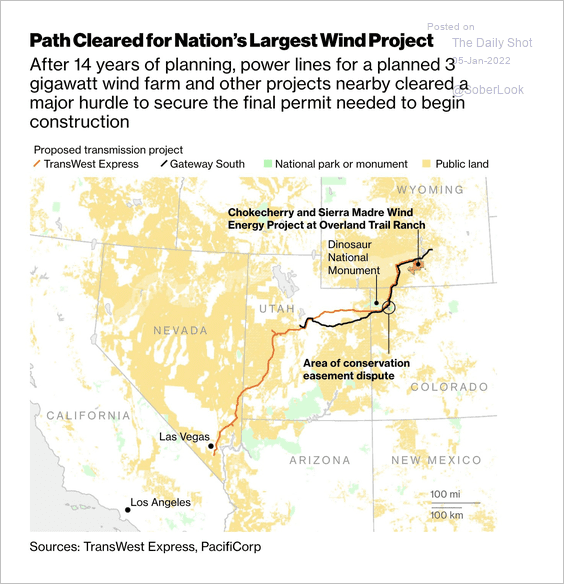

5. The largest US wind project is ready to proceed.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

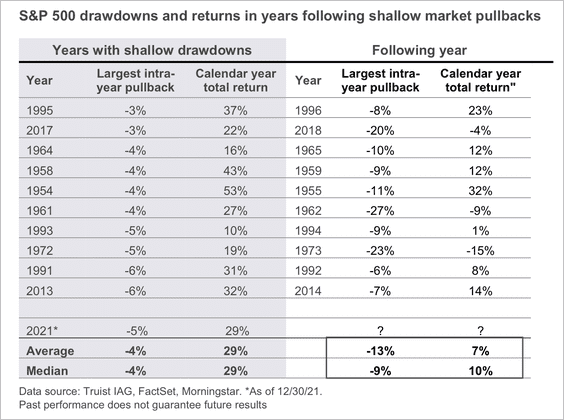

1. Following the past 10 years with the shallowest intra-year pullbacks, stocks tended to see deeper drawdowns and more modest annual gains in the next year.

Source: Truist Advisory Services

Source: Truist Advisory Services

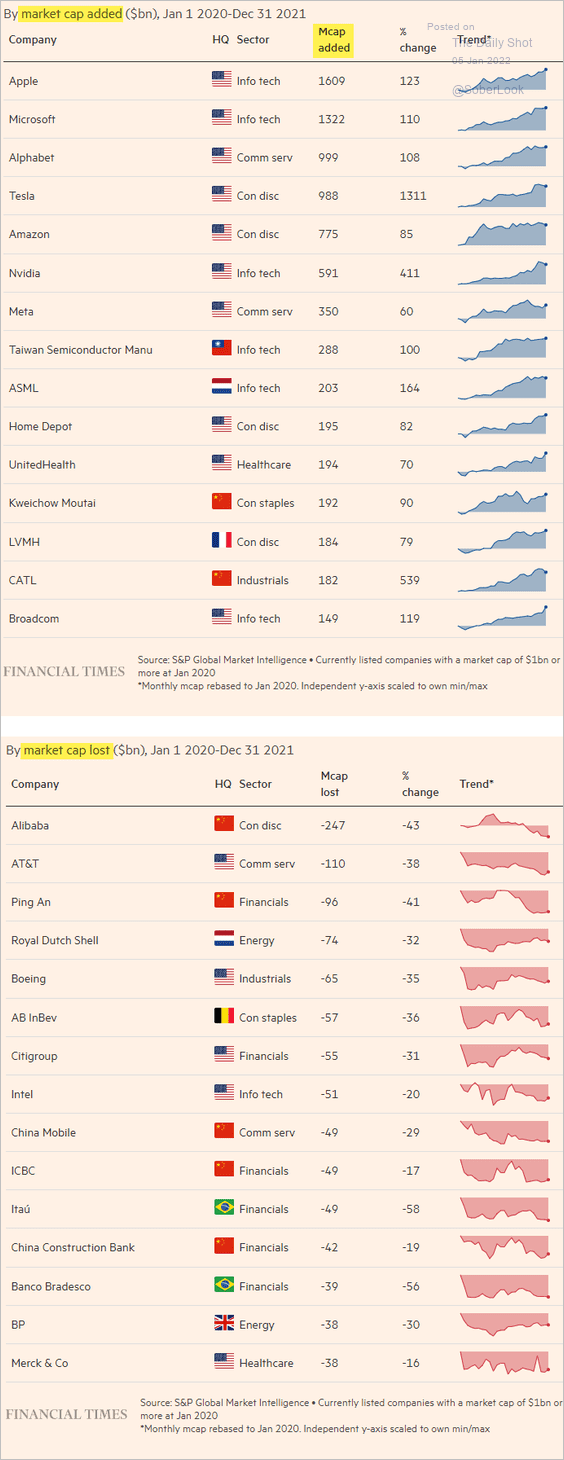

2. This chart shows the 2021 winners and losers by market cap change.

Source: @financialtimes, h/t Walter Read full article

Source: @financialtimes, h/t Walter Read full article

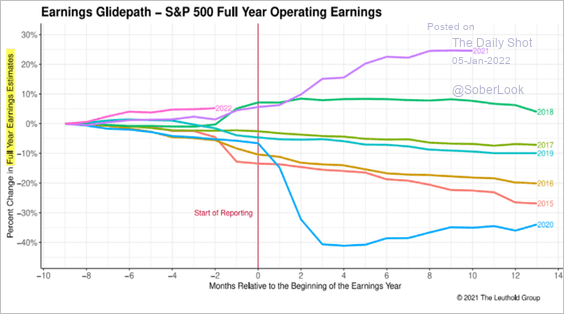

3. Next, we have the trajectories of full-year earnings estimates since 2016.

Source: Leuthold Group

Source: Leuthold Group

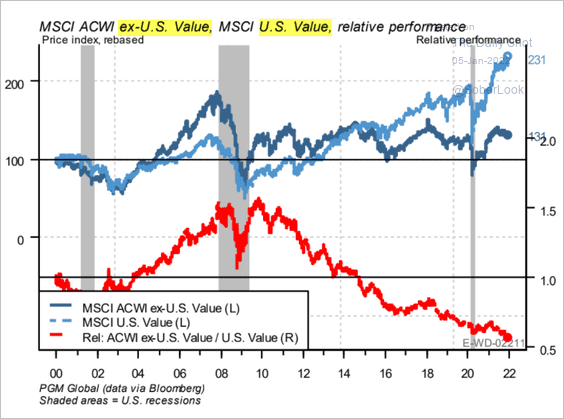

4. US outperformance vs. the rest of the world is not limited to growth stocks.

Source: PGM Global

Source: PGM Global

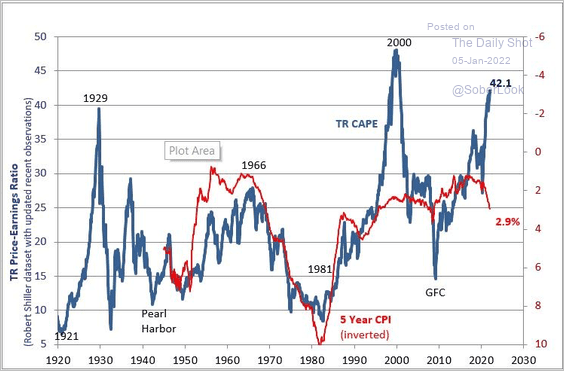

5. S&P 500 valuations tend to decline during periods of rising inflation.

Source: Norges Bank

Source: Norges Bank

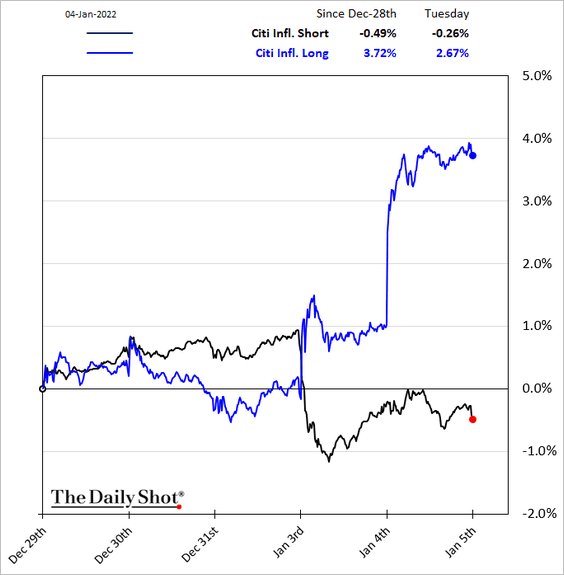

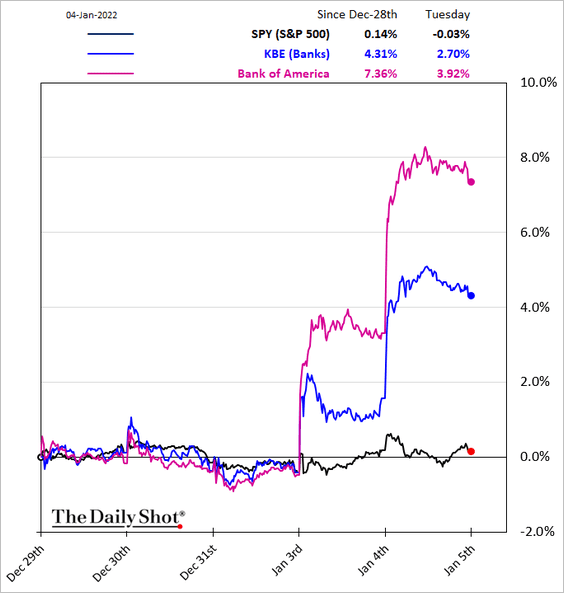

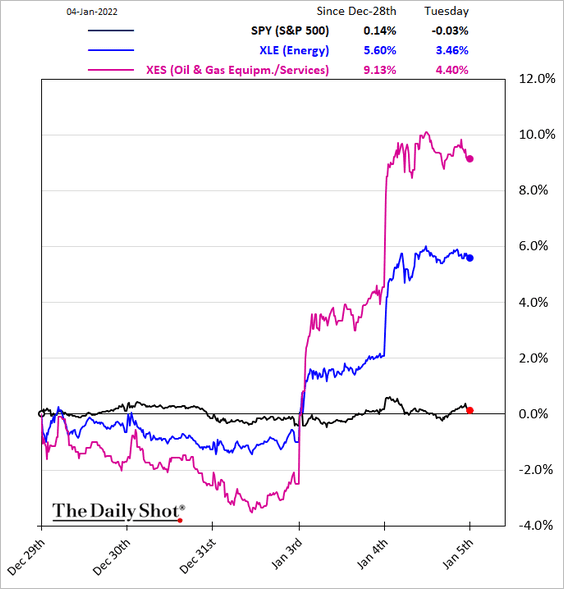

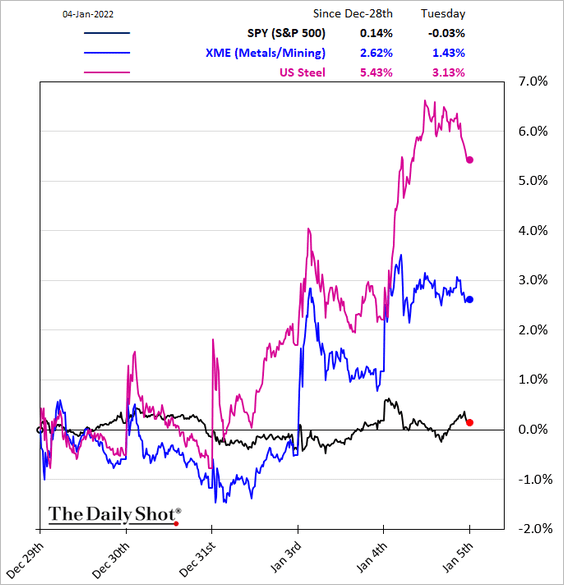

6. Inflation-sensitive stocks jumped on Tuesday.

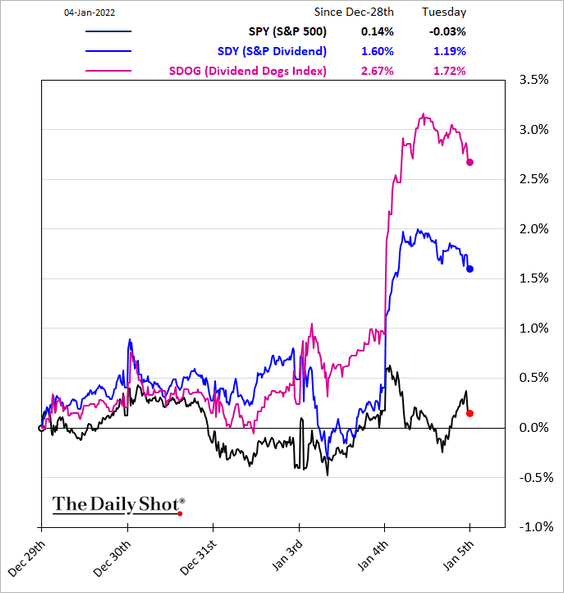

7. High-dividend sharers rallied.

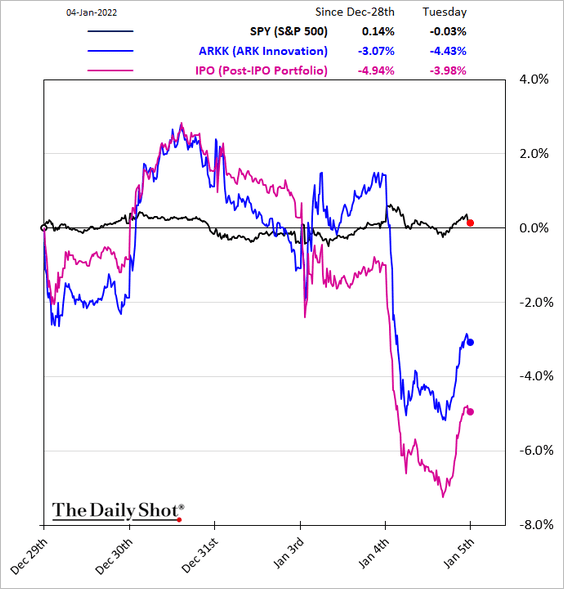

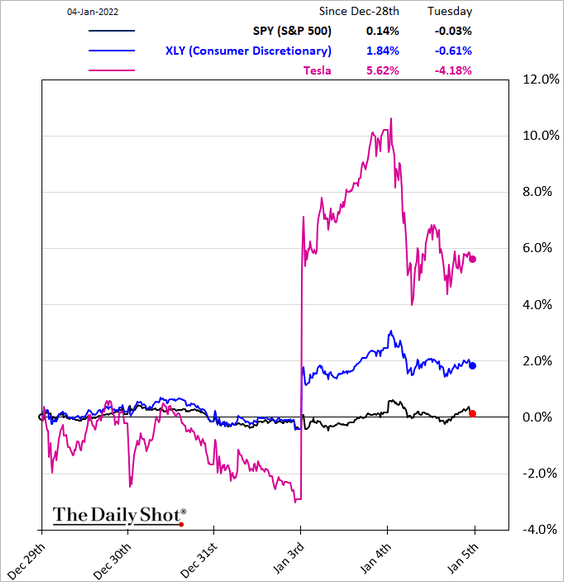

Speculative growth stocks took a hit …

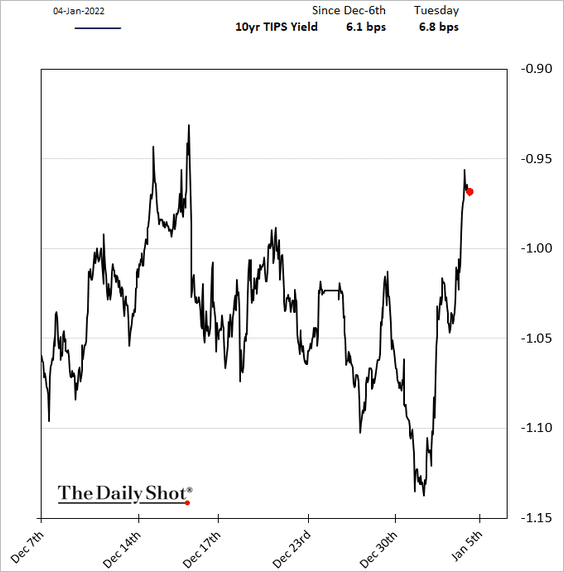

… as real rates (TIPS yields) claimed.

——————–

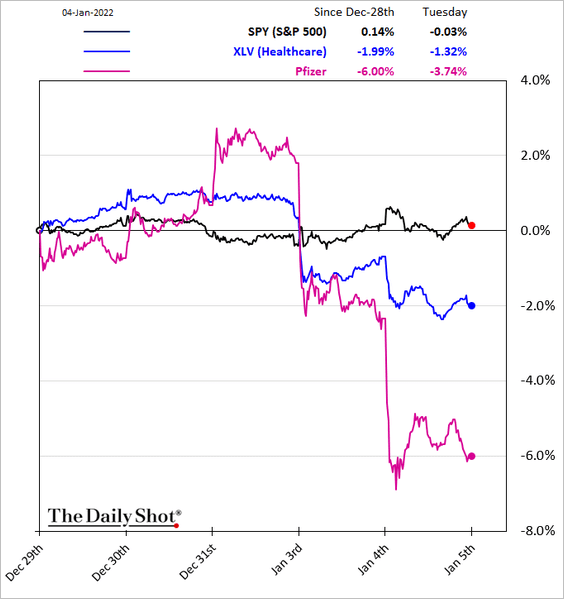

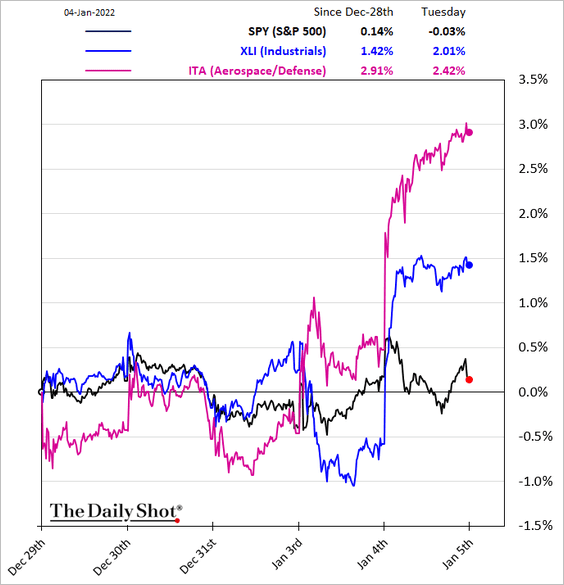

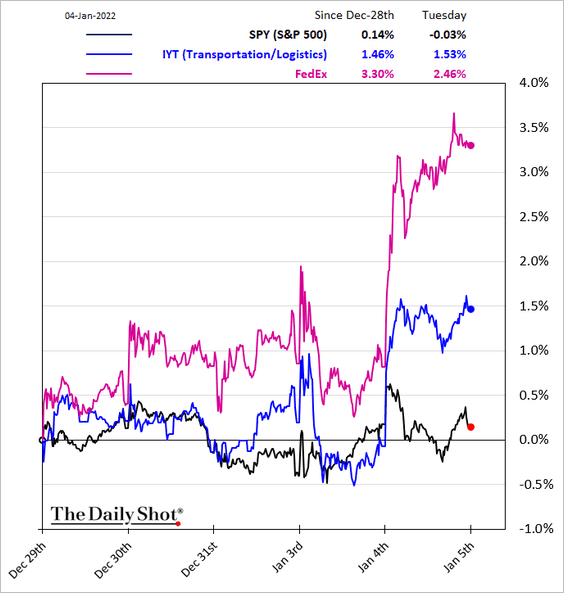

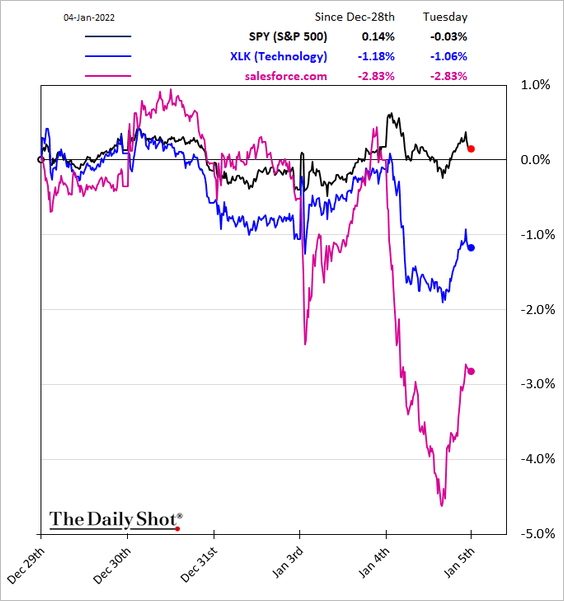

8. Here are some sector trends over the past few days.

• Banks:

• Consumer discretionary (lead by Tesla).

• Healthcare:

• Industrials:

• Transportation/logisitcs:

• Tech:

• Energy:

• Metals & Mining:

Back to Index

Credit

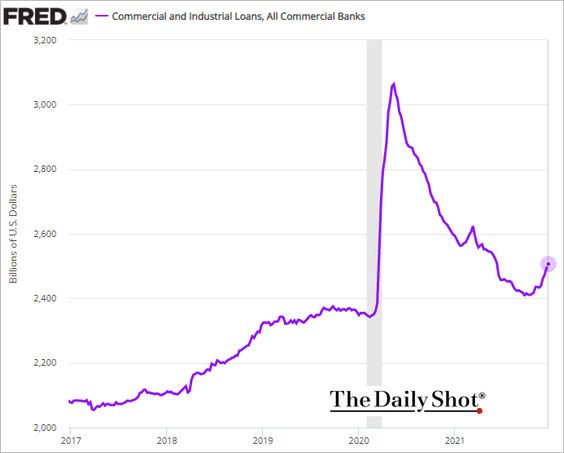

1. US business lending is rebounding.

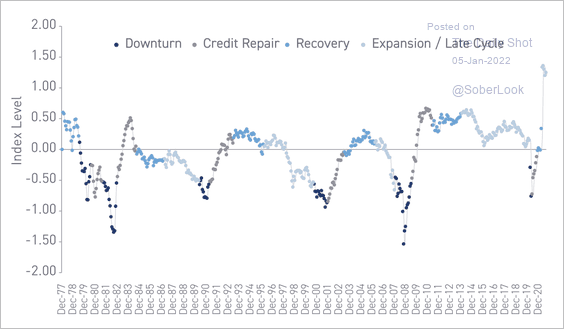

2. US corporate health appears strong relative to history, which suggests the credit cycle is in an expansion phase.

Source: Loomis Sayles Read full article

Source: Loomis Sayles Read full article

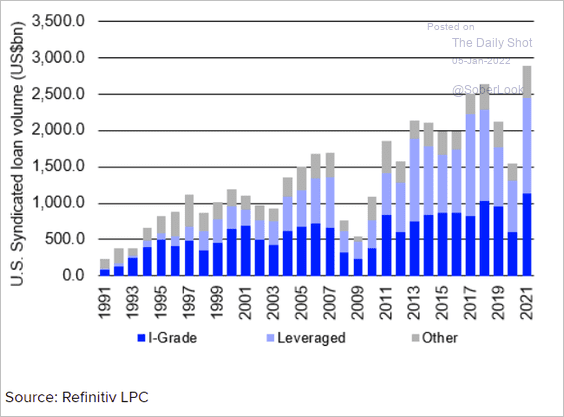

3. Loan issuance hit a record in 2021.

Source: @LPCLoans, @refinitiv Read full article

Source: @LPCLoans, @refinitiv Read full article

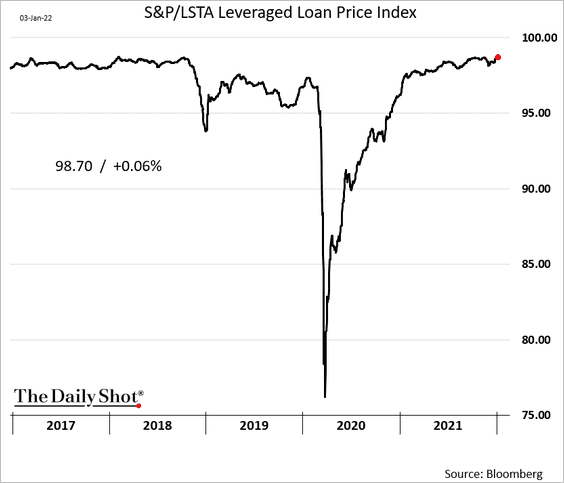

4. Loan prices are near multi-year highs.

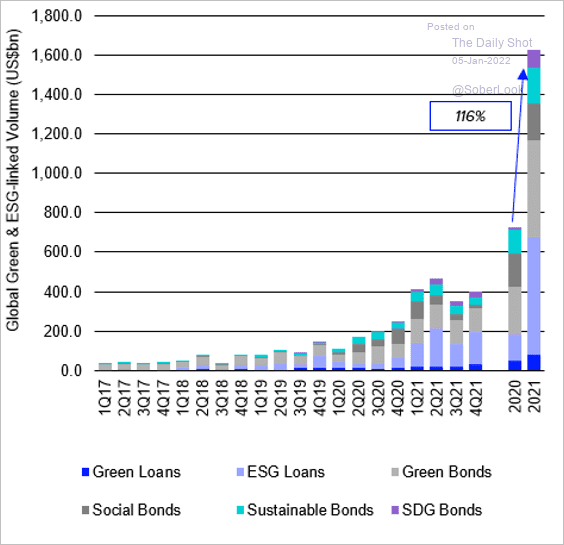

5. ESG-linked credit exploded in 2021.

Source: @LPCLoans

Source: @LPCLoans

Back to Index

Rates

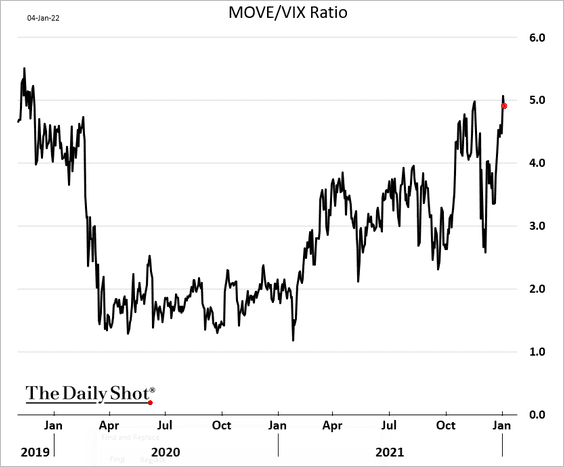

1. Treasury market implied volatility remains elevated relative to equity vol.

h/t @ossingerj

h/t @ossingerj

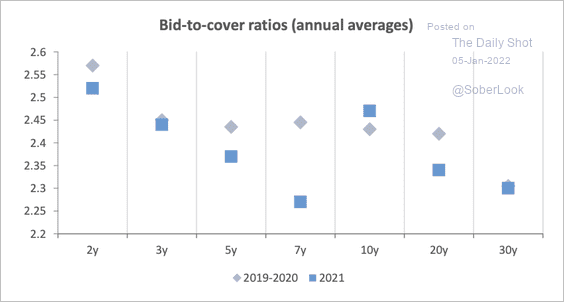

2. Demand for the 7-year and 20-year Treasury auctions have weakened last year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

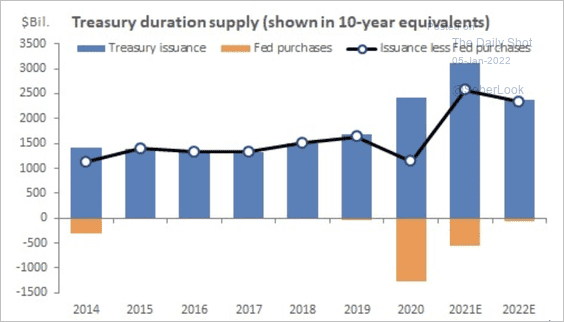

3. Treasury duration-weighted supply net of Fed purchases is projected to fall by about 10% this year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

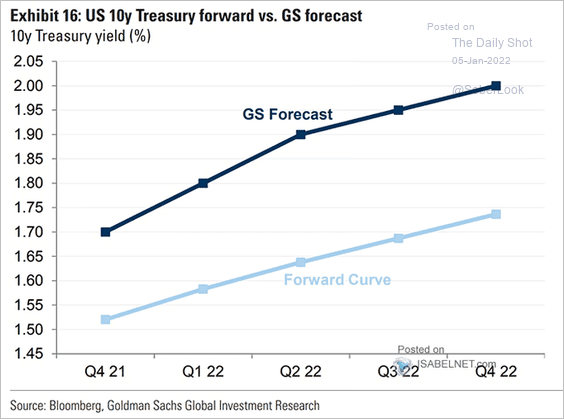

4. Here is Goldman’s forecast for the 10yr Treasury yield.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Back to Index

Global Developments

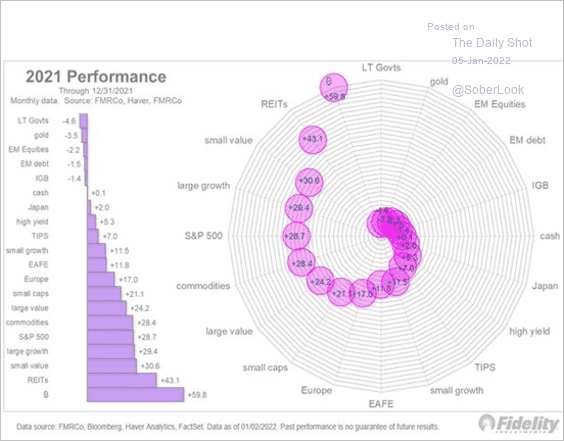

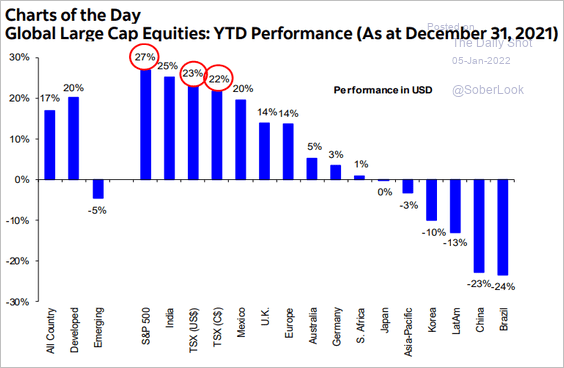

1. Let’s start with performance across asset classes in 2021.

Source: @TimmerFidelity, @Fidelity

Source: @TimmerFidelity, @Fidelity

Here is how equity markets performed.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

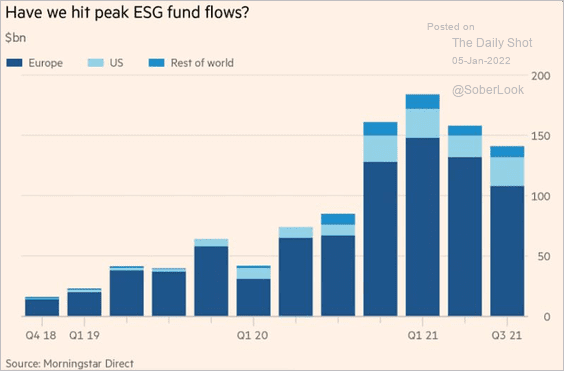

2. ESG fund flows have slowed over the past year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

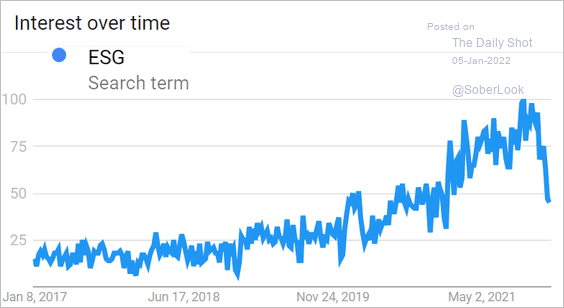

Interest in ESG appears to have peaked.

Source: Google Trends

Source: Google Trends

——————–

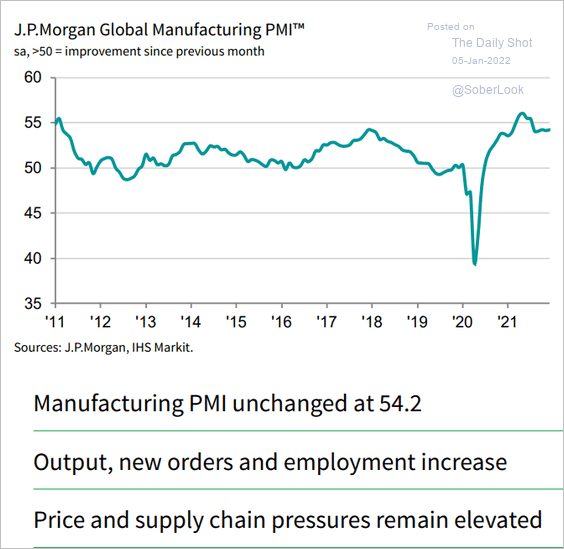

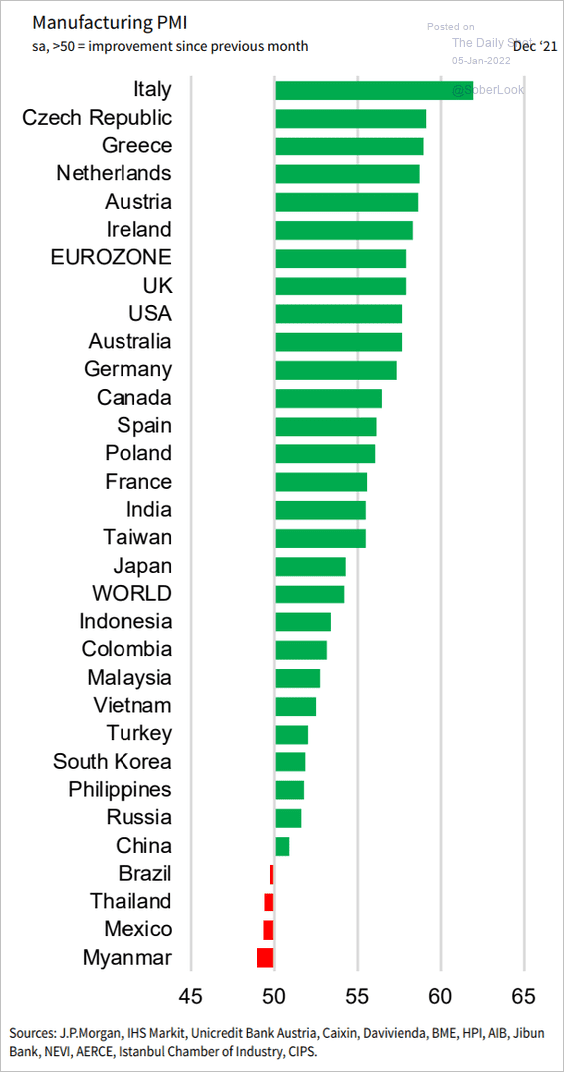

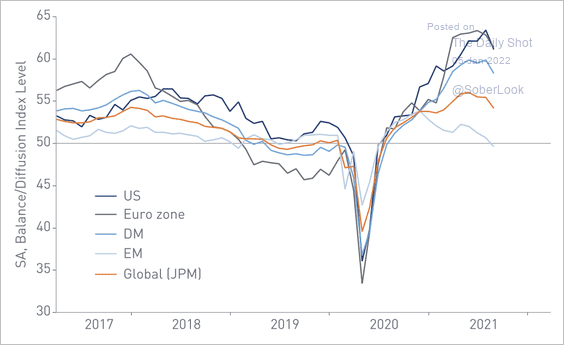

3. Manufacturing growth held steady in December.

Source: IHS Markit

Source: IHS Markit

• Italy saw the fastest growth in factory activity.

Source: IHS Markit

Source: IHS Markit

• US and Eurozone manufacturing PMIs have recovered more than emerging markets.

Source: Loomis Sayles Read full article

Source: Loomis Sayles Read full article

——————–

Food for Thought

1. US mortgage rates by year (average):

Source: @lenkiefer

Source: @lenkiefer

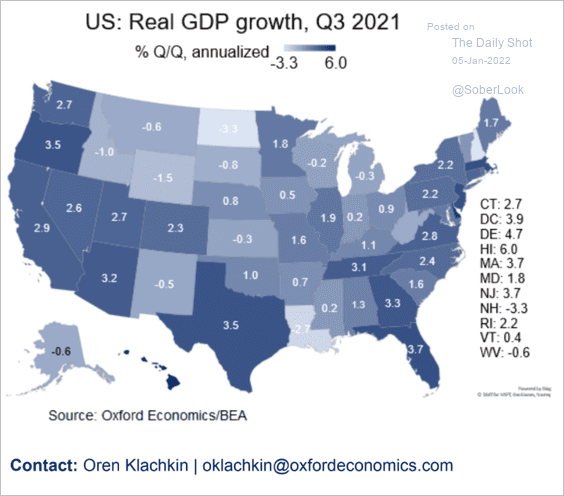

2. Third-quarter GDP growth by state:

Source: Oxford Economics

Source: Oxford Economics

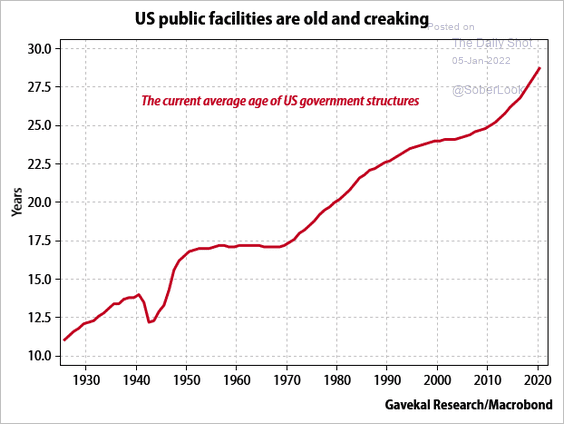

3. The average age of US government structures:

Source: Gavekal Research

Source: Gavekal Research

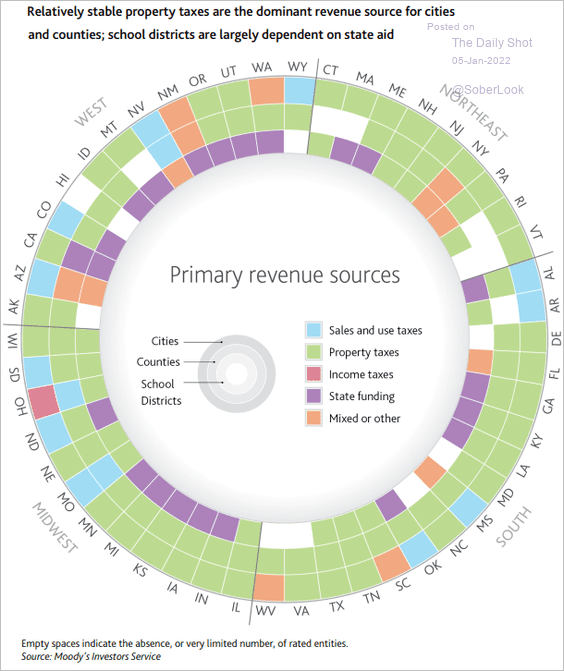

4. US local governments’ sources of revenue:

Source: Moody’s Investors Service

Source: Moody’s Investors Service

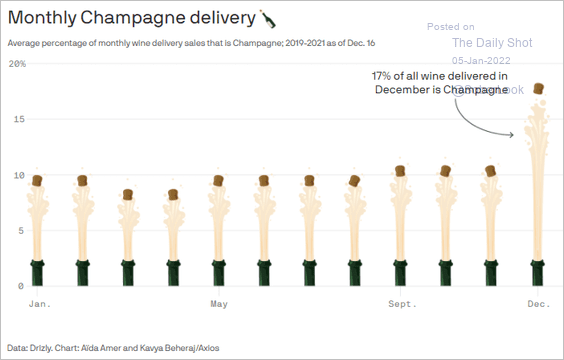

5. Champagne as a share of wine deliveries:

Source: @axios Read full article

Source: @axios Read full article

——————–

Back to Index