The Daily Shot: 11-Jan-22

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

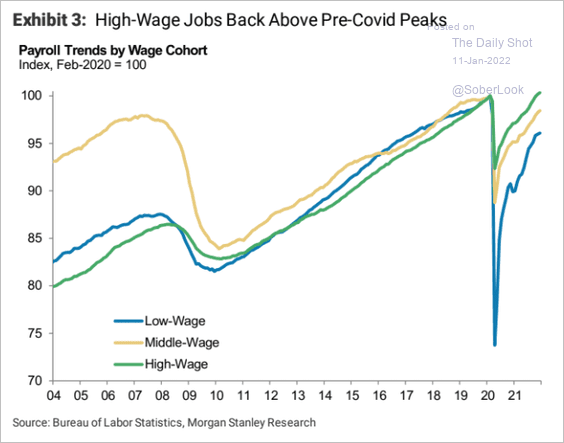

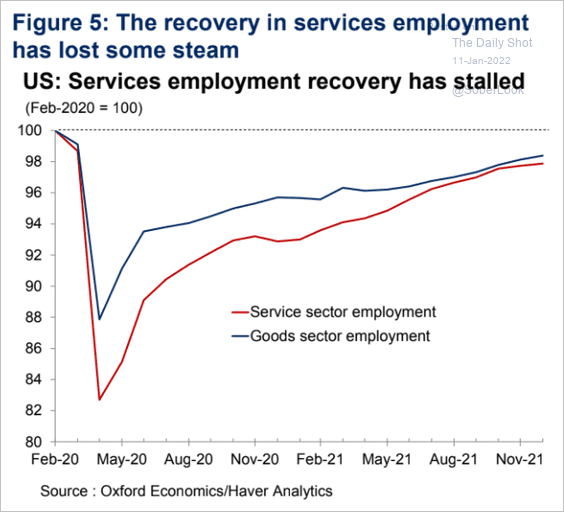

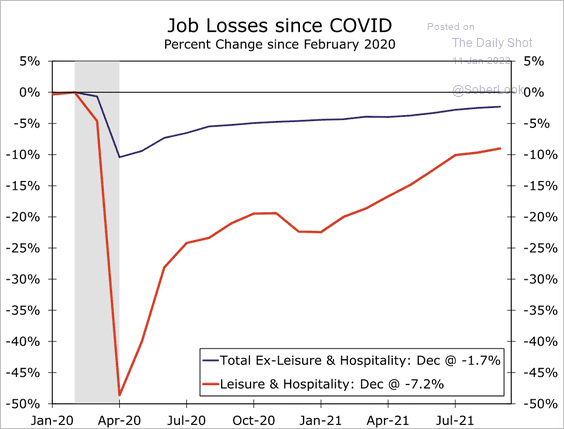

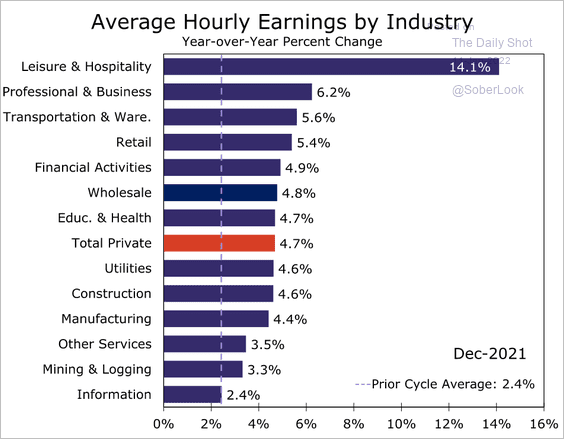

1. Let’s begin with some additional data on the December payrolls report.

• Jobs recovery by wage tier (high-paying jobs have fully recovered):

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Services vs. goods sector employment recovery:

Source: Oxford Economics

Source: Oxford Economics

• The impact of Leisure & Hospitality:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

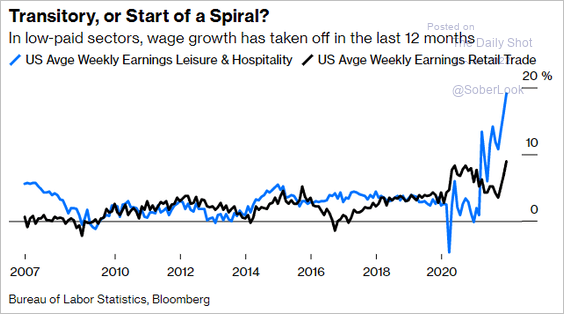

• Wage growth by industry (2 charts):

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Source: @johnauthers, @bopinion Read full article

Source: @johnauthers, @bopinion Read full article

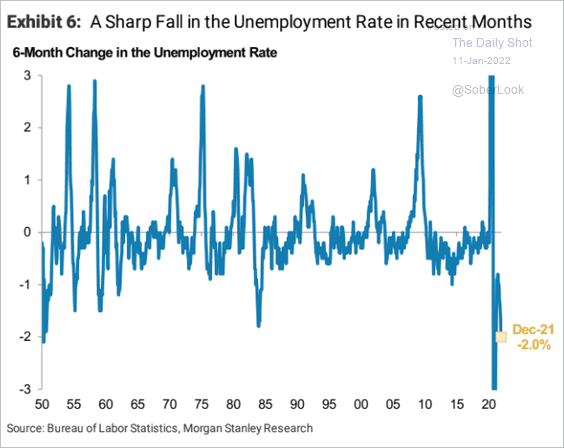

• The rapid decline in the unemployment rate:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

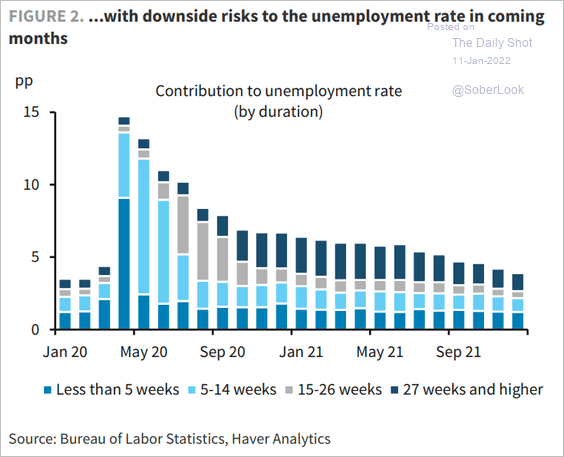

• The unemployment rate attribution by duration:

Source: Barclays Research

Source: Barclays Research

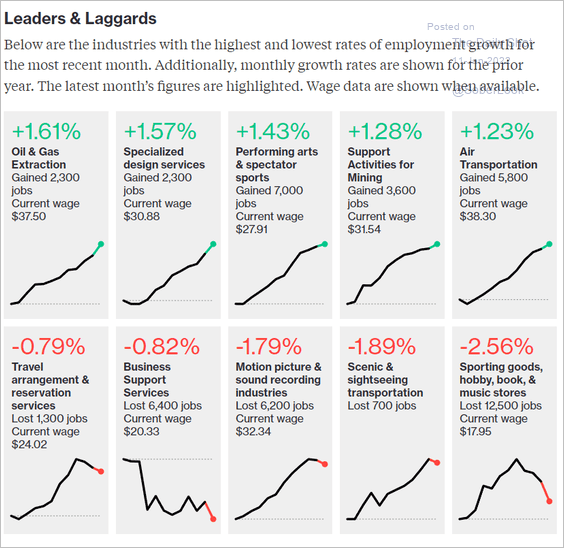

• December winners and losers:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

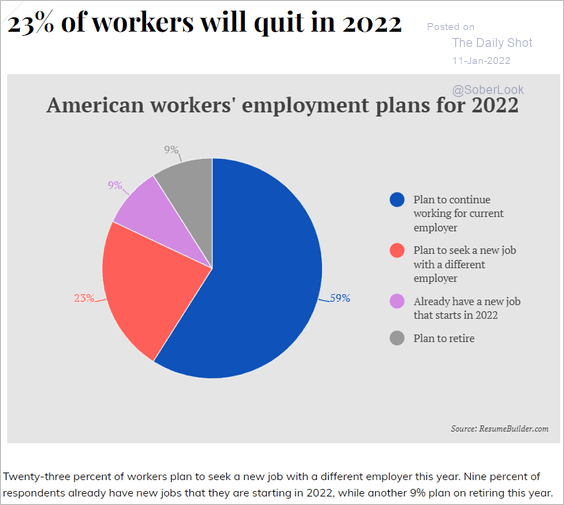

2. Many Americans expect to quit their jobs this year.

Source: ResumeBuilder.com Read full article

Source: ResumeBuilder.com Read full article

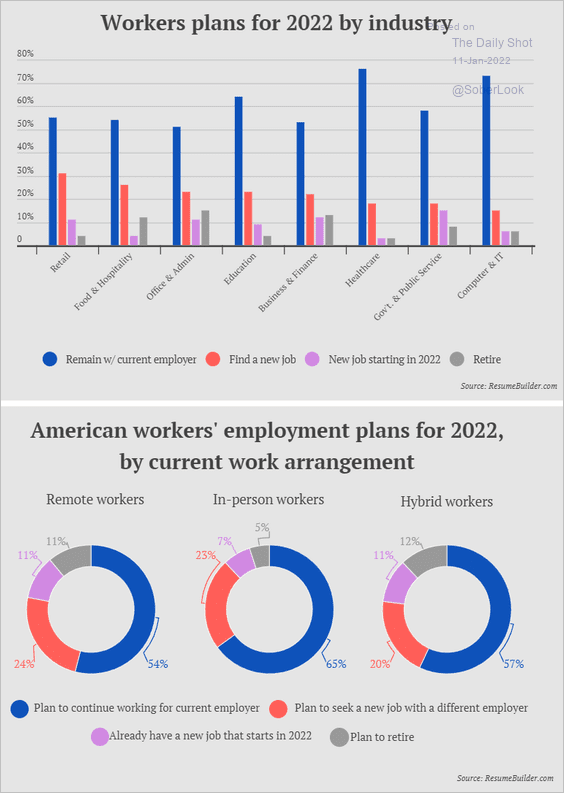

• Who is quitting?

Source: ResumeBuilder.com Read full article

Source: ResumeBuilder.com Read full article

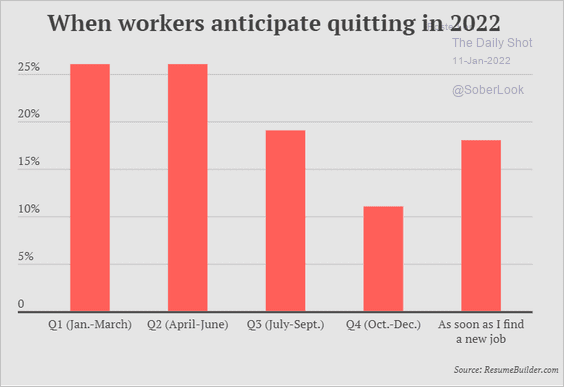

• When?

Source: ResumeBuilder.com Read full article

Source: ResumeBuilder.com Read full article

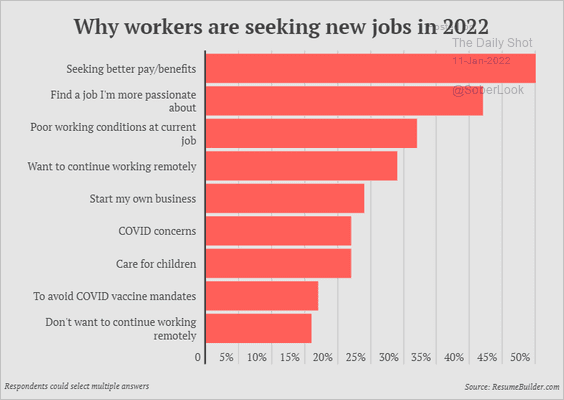

• Why?

Source: ResumeBuilder.com Read full article

Source: ResumeBuilder.com Read full article

——————–

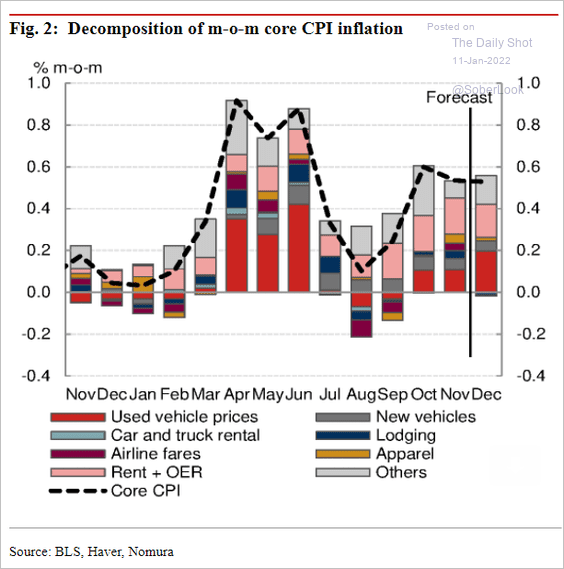

3. Next, we have some updates on inflation.

• Nomura estimates another month of strong price gains in December.

Source: Nomura Securities

Source: Nomura Securities

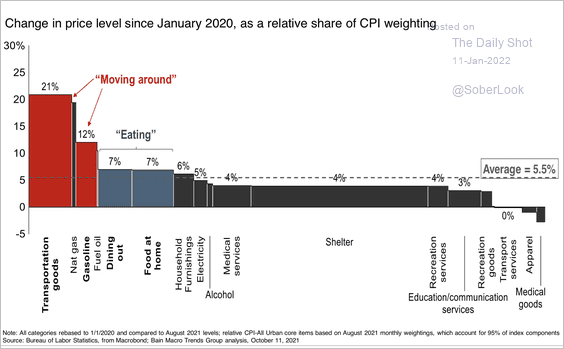

• This chart shows the relative share of CPI weighting by category.

Source: Bain & Company

Source: Bain & Company

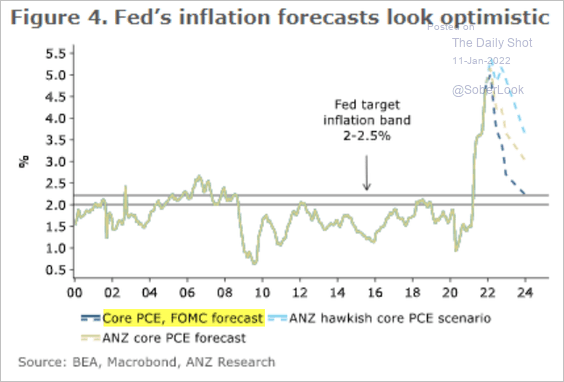

• Is the Fed too optimistic about inflation moderating over the next couple of years?

Source: ANZ Research

Source: ANZ Research

——————–

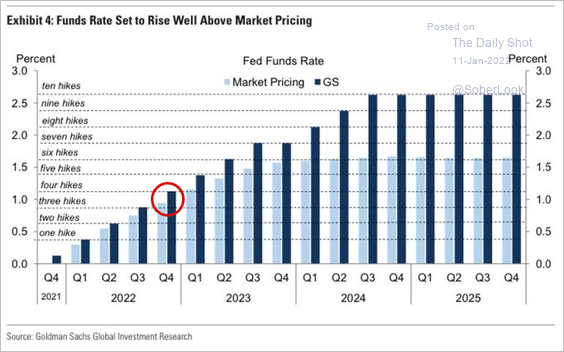

3. Goldman expects the Fed to hike rates four times this year, which is consistent with the market (the futures-based probability is now above 90%). But beyond this year, Goldman sees a more aggressive rate hike trajectory than the market.

Source: Goldman Sachs Further reading

Source: Goldman Sachs Further reading

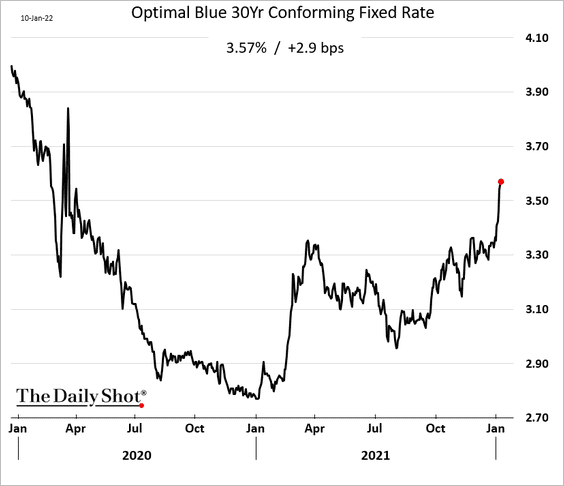

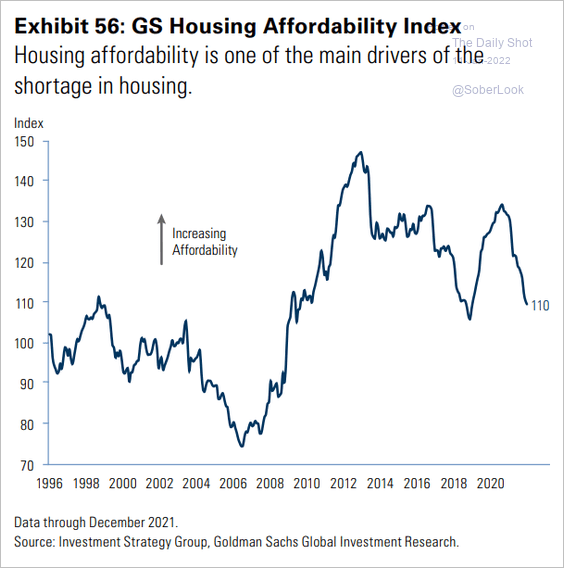

4. Next, we have some updates on housing.

• Mortgage rates continue to climb.

While rates are still historically low, the sharp increase may cool the pandemic-era enthusiasm for housing in the short term. Given the lofty price levels, affordability will deteriorate further.

Source: Goldman Sachs

Source: Goldman Sachs

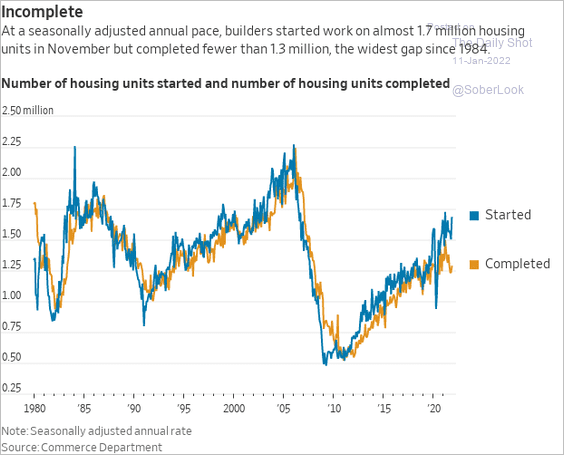

• The recent supply chain bottlenecks have been delaying residential construction projects.

Source: @WSJ Read full article

Source: @WSJ Read full article

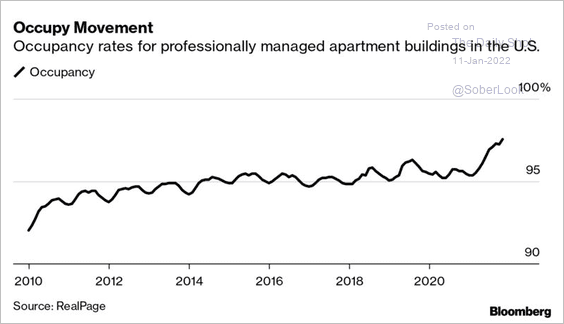

• Apartment occupancy rates have been surging.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

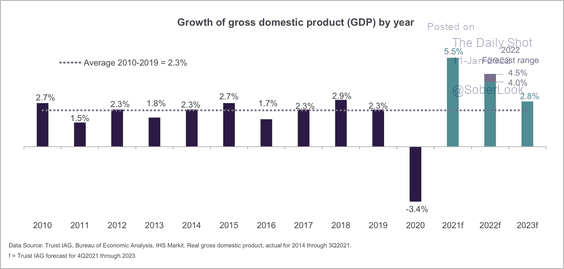

5. GDP growth is expected to remain well above pre-pandemic levels through at least 2023.

Source: Truist Advisory Services

Source: Truist Advisory Services

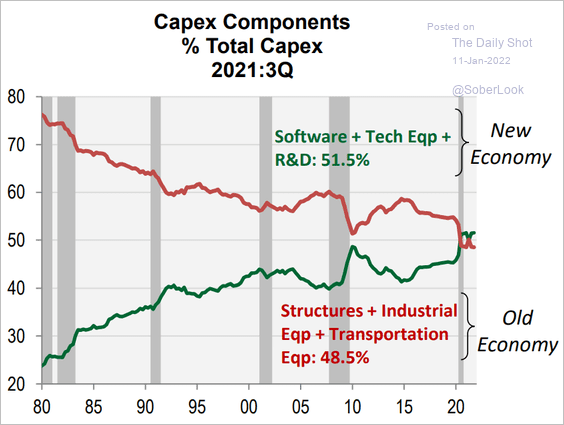

6. CapEx has been increasingly directed at “new economy” investments.

Source: Cornerstone Macro

Source: Cornerstone Macro

Back to Index

The Eurozone

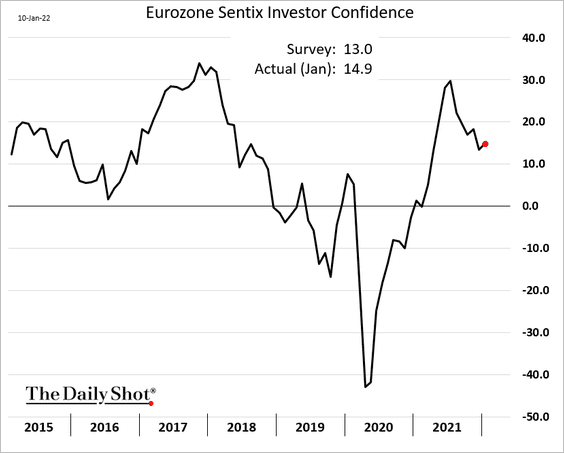

1. The Sentix confidence index ticked higher this month.

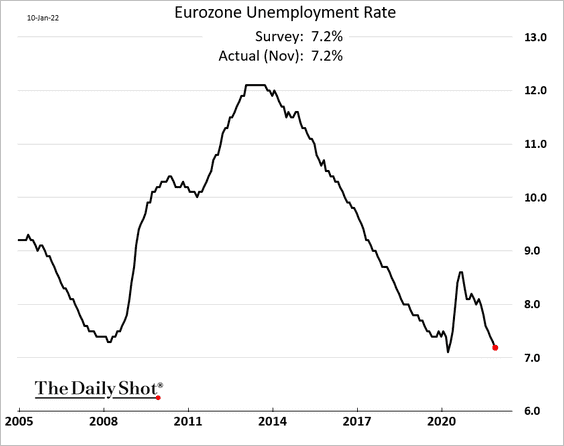

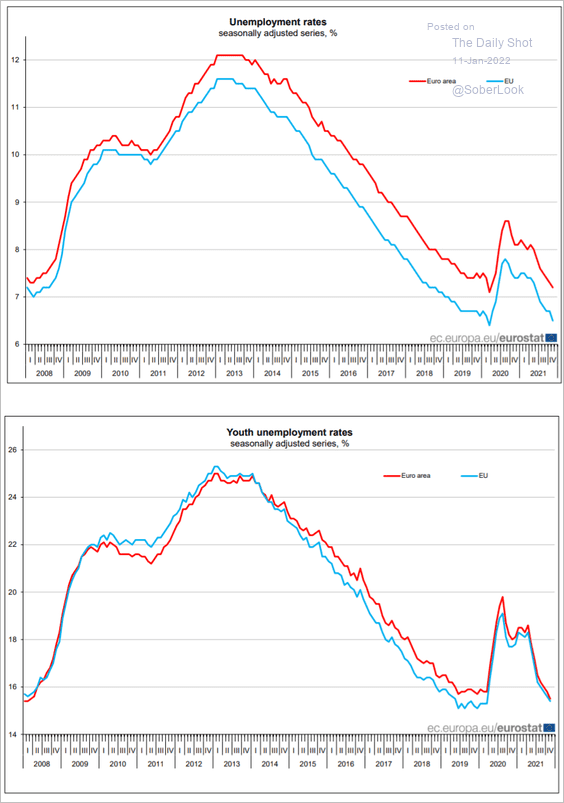

2. The unemployment rate is back at pre-COVID levels.

Source: Eurostat Read full article

Source: Eurostat Read full article

——————–

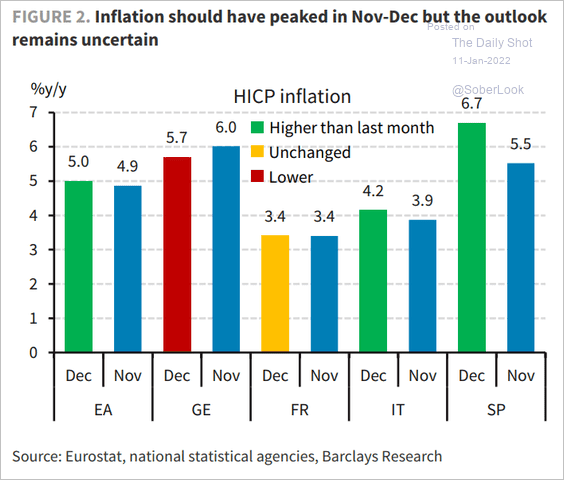

3. Here are the changes in inflation by country.

Source: Barclays Research

Source: Barclays Research

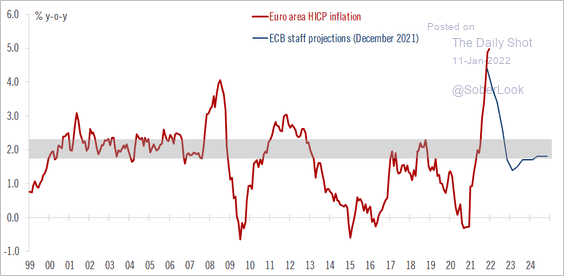

The ECB was surprised by the persistent surge in prices.

Source: @fwred

Source: @fwred

——————–

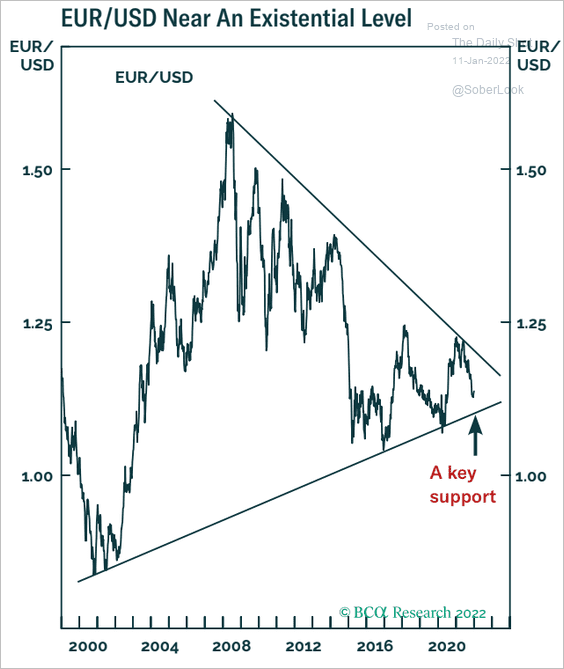

4. Will the euro test the long-term support?

Source: BCA Research

Source: BCA Research

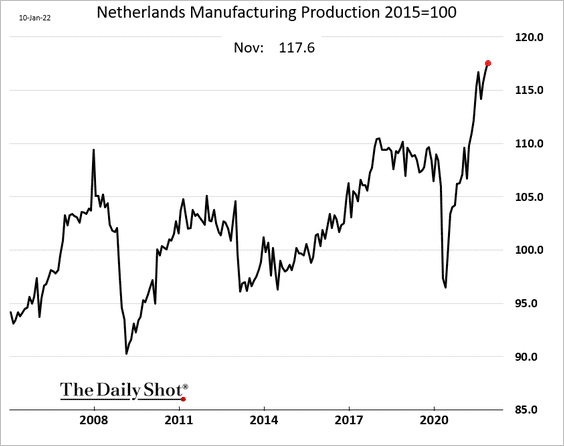

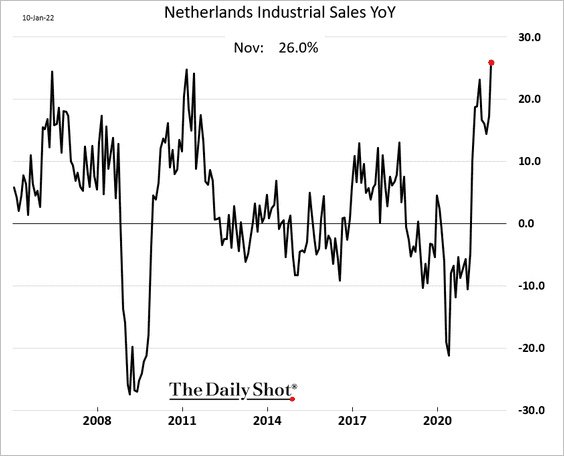

5. Dutch manufacturing output keeps hitting record highs.

Below is the growth in industrial sales.

Back to Index

Europe

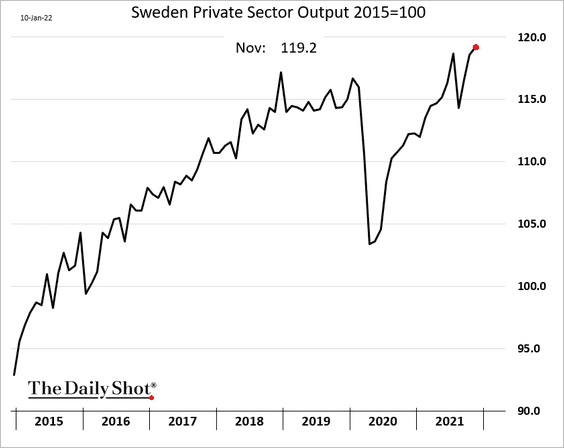

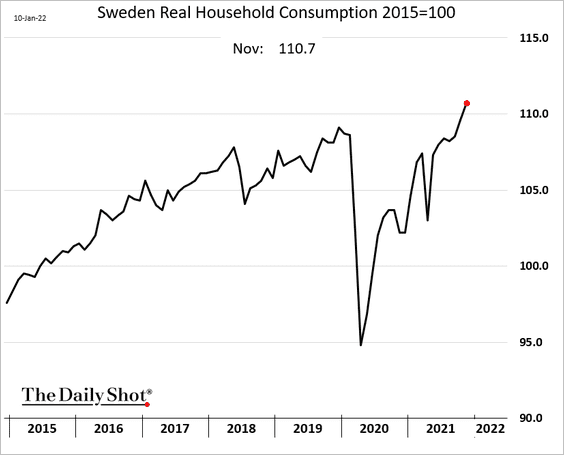

1. Sweden’s private-sector output and consumer spending continue to climb, pointing to robust economic expansion.

——————–

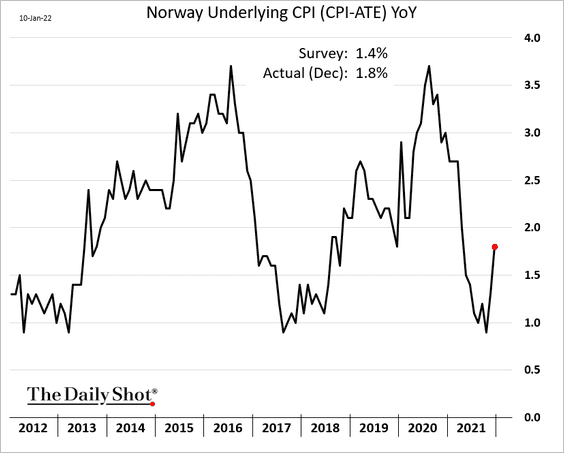

2. Norway’s CPI surprised to the upside, although the underlying index remains below 2%.

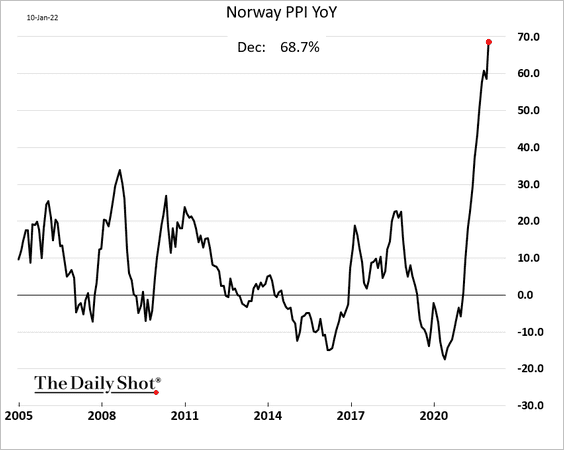

The PPI is nearing 70% year-over-year (driven by energy prices).

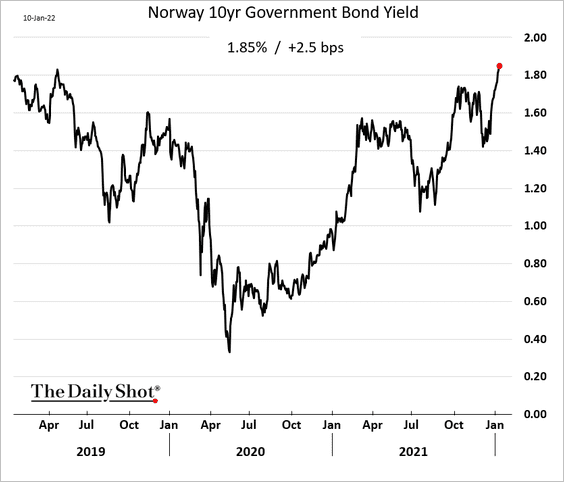

Norway’s bond yields keep climbing.

——————–

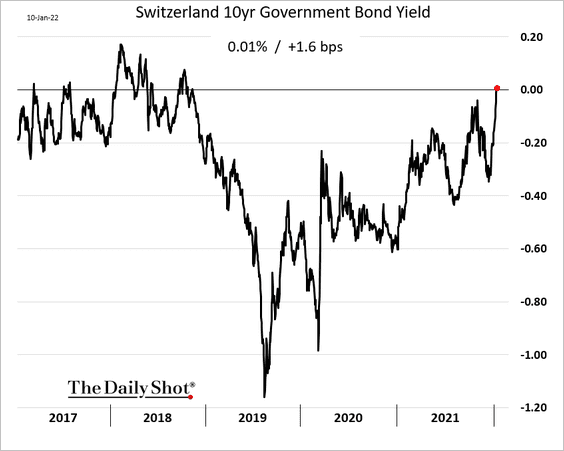

3. The Swiss 10-year bond yield is above zero for the first time since 2018.

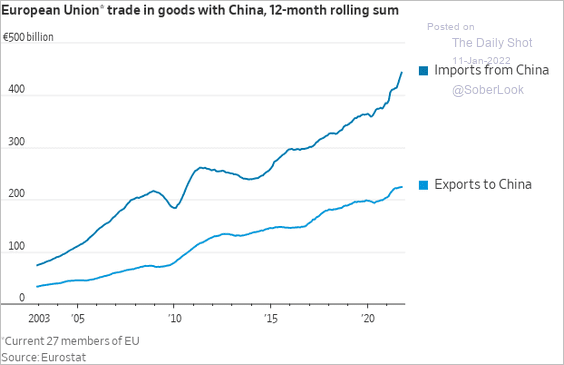

4. The EU’s trade gap with China keeps widening.

Source: @WSJ Read full article

Source: @WSJ Read full article

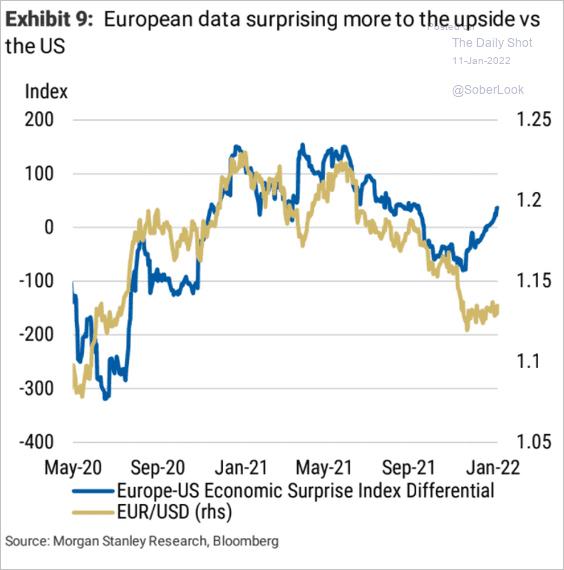

5. European economic surprises have been outperforming the US.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

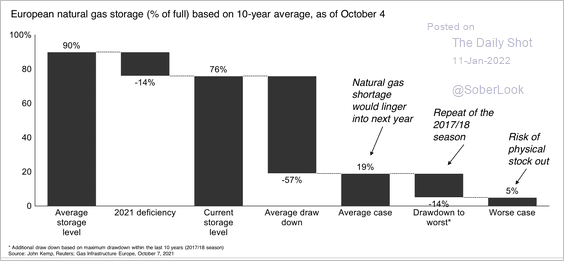

6. European natural gas storage is entering the winter season at its lowest level in 10 years.

Source: Bain & Company

Source: Bain & Company

Back to Index

Asia – Pacific

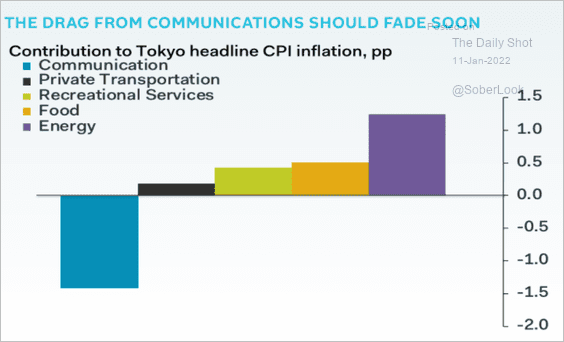

1. Telecommunications prices have been keeping the Tokyo core CPI in negative territory. But that’s likely to end soon.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

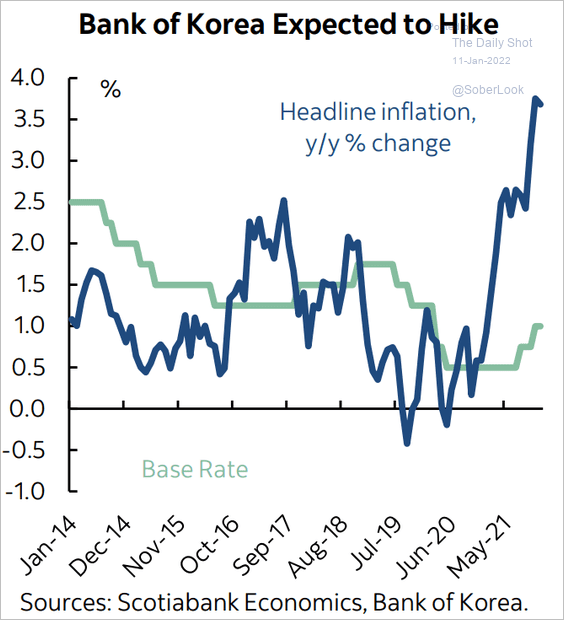

2. Bank of Korea is expected to hike rates.

Source: Scotiabank Economics

Source: Scotiabank Economics

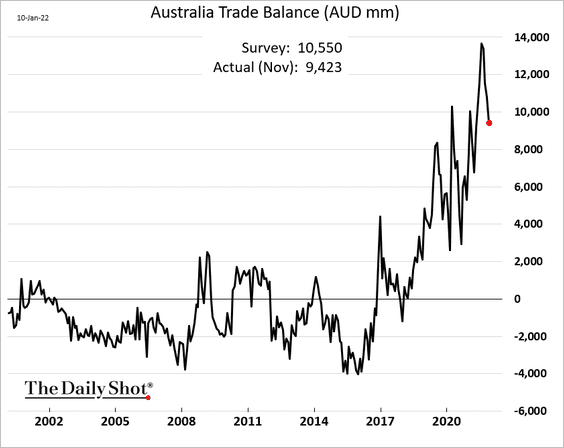

3. Next, we have some updates on Australia.

• The trade surplus is off the highs.

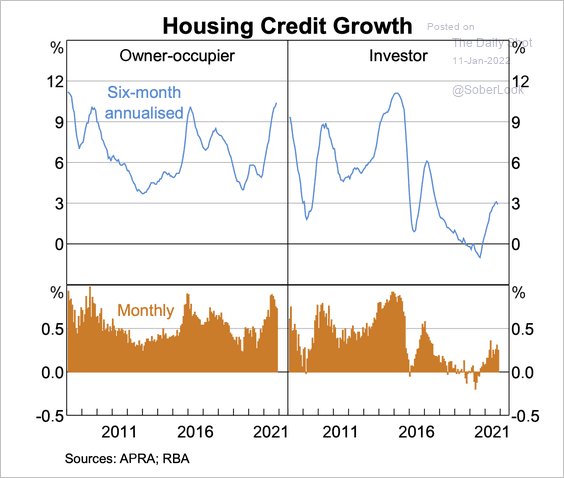

• The latest leg up in Australian housing appears to be due to both continued owner-occupier credit growth as well as a return of investors.

Source: Reserve Bank of Australia

Source: Reserve Bank of Australia

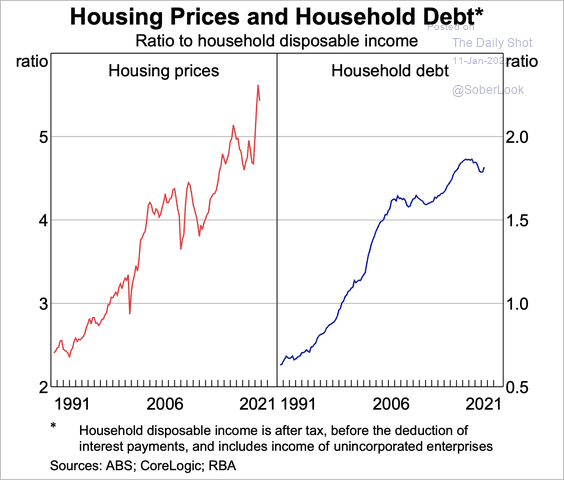

• This chart shows Australian house prices and household debt relative to disposable income.

Source: Reserve Bank of Australia

Source: Reserve Bank of Australia

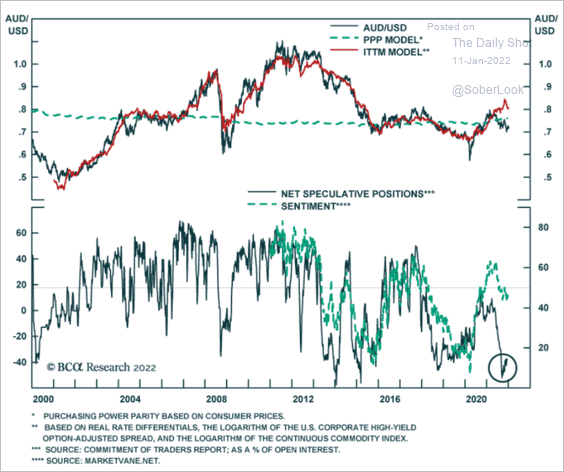

• Valuations and sentiment point to some upside for the Aussie dollar.

Source: BCA Research

Source: BCA Research

Back to Index

China

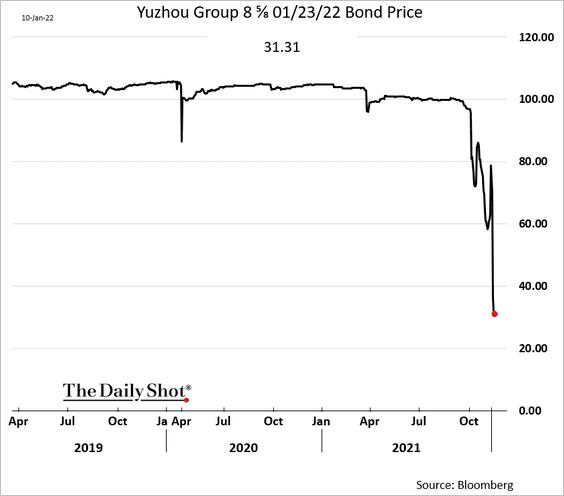

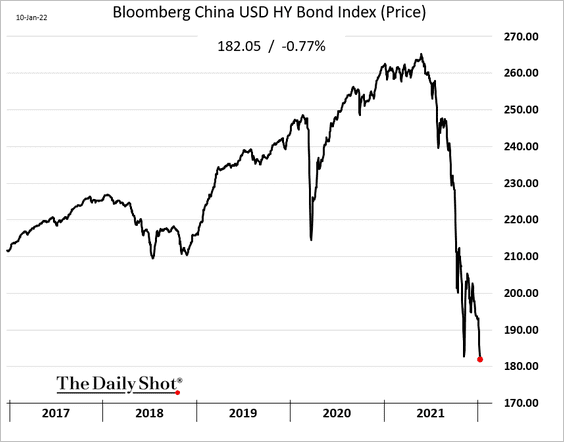

1. Here we go again. Investors remain concerned about developers’ mountain of maturing debt.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

China’s HY index hit a multi-year low.

——————–

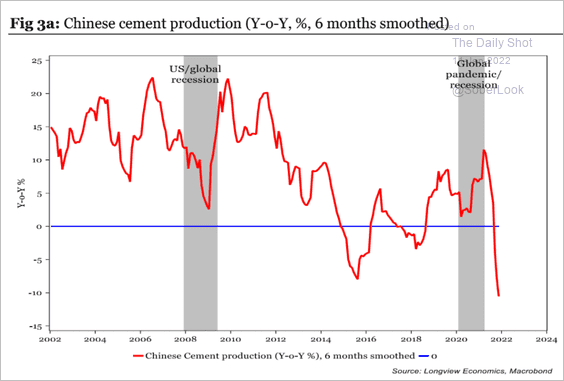

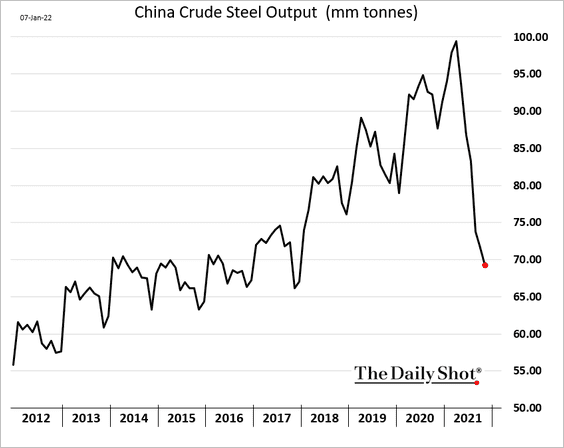

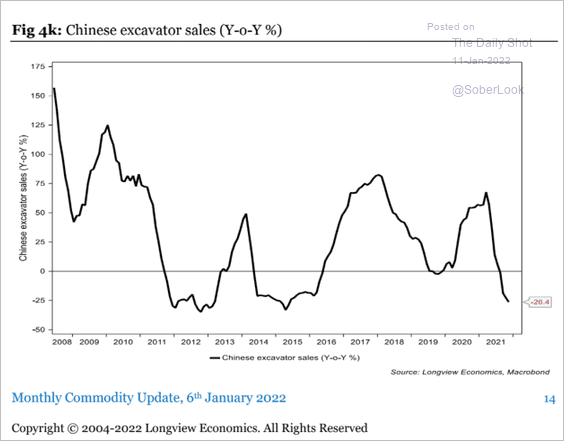

2. China’s construction sector continues to weaken.

• Cement production:

Source: Longview Economics

Source: Longview Economics

• Steel output:

• Excavator sales:

Source: Longview Economics

Source: Longview Economics

——————–

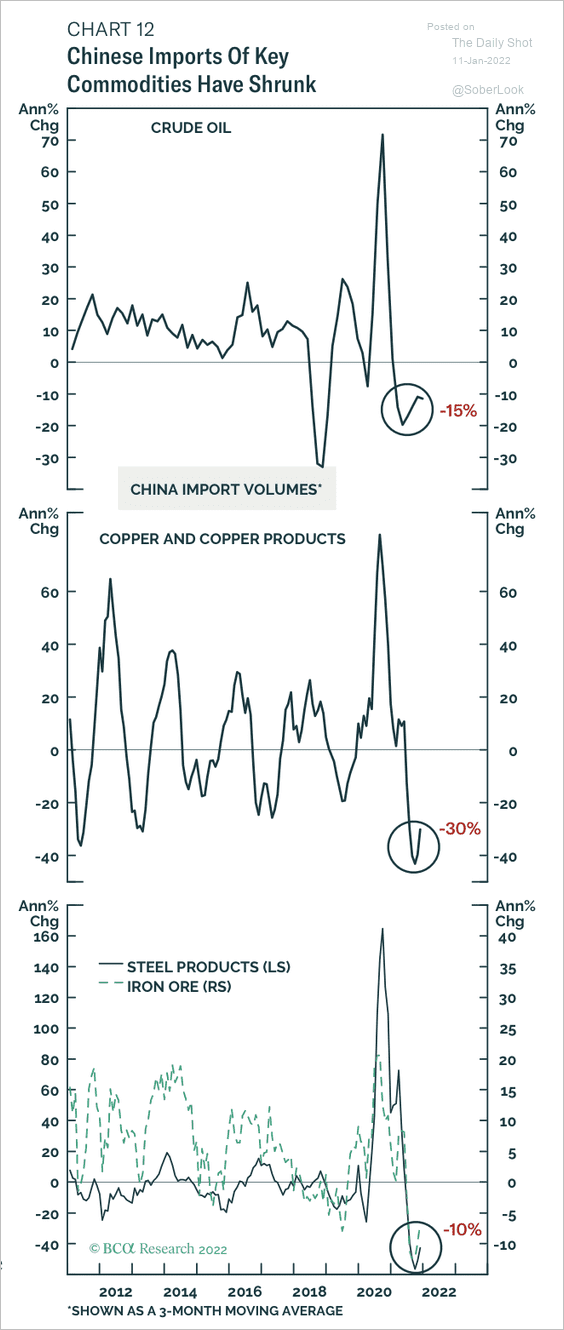

3. Imports of key commodities declined significantly during the second half of 2021.

Source: BCA Research

Source: BCA Research

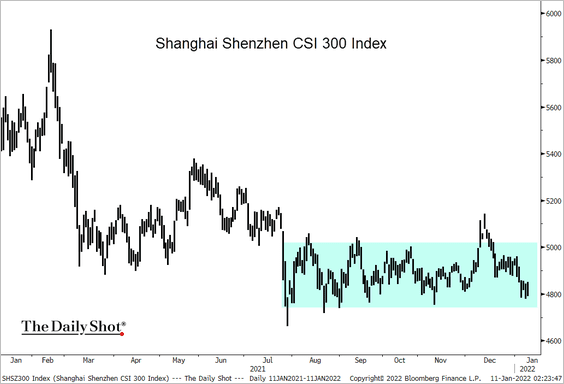

4. The mainland stock market is holding in the lower end of the trading range.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

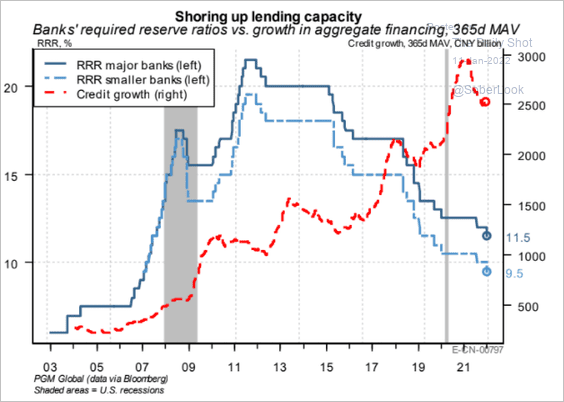

5. The PBoC will be supporting credit growth.

Source: PGM Global

Source: PGM Global

Back to Index

Emerging Markets

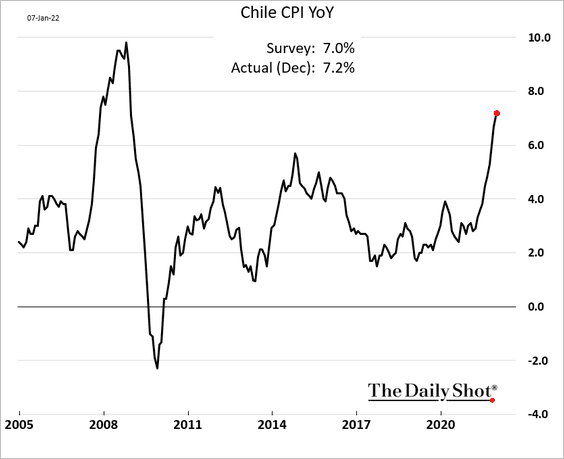

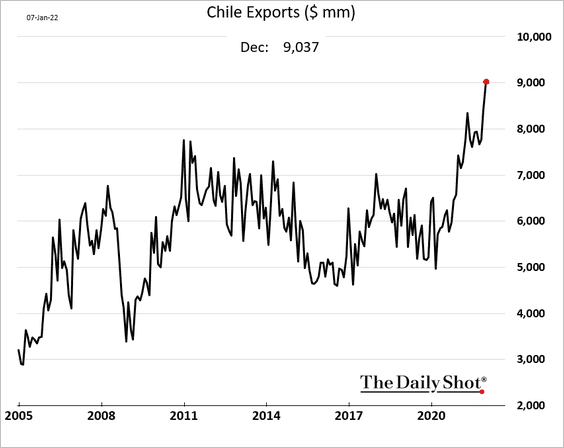

1. Chile’s inflation continues to climb.

Separately, the nation’s exports hit a record high.

——————–

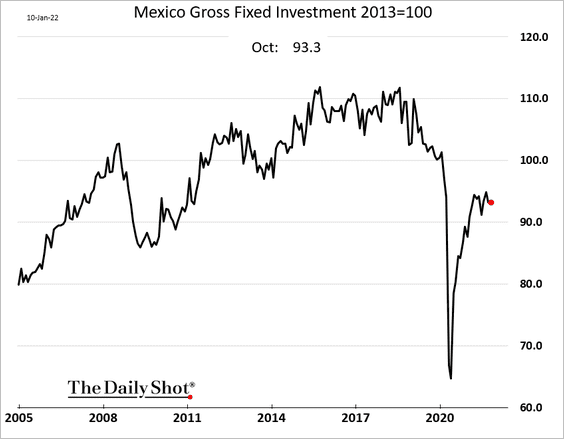

2. Mexico’s business investment remained depressed in October.

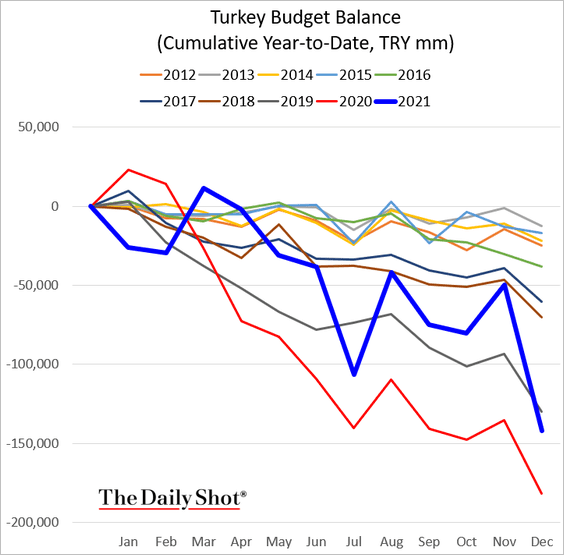

3. Turkey’s budget deteriorated sharply going into the year-end.

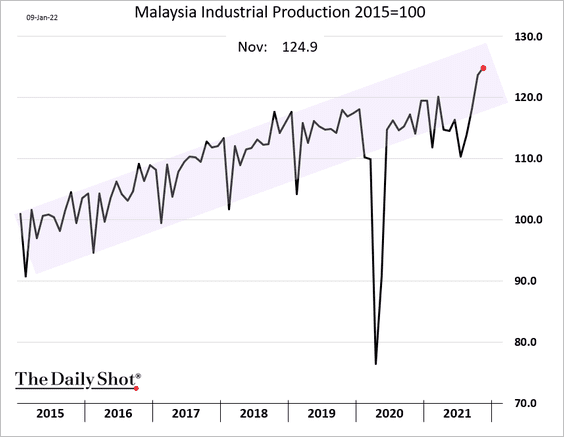

4. Malaysia’s industrial production continues to climb.

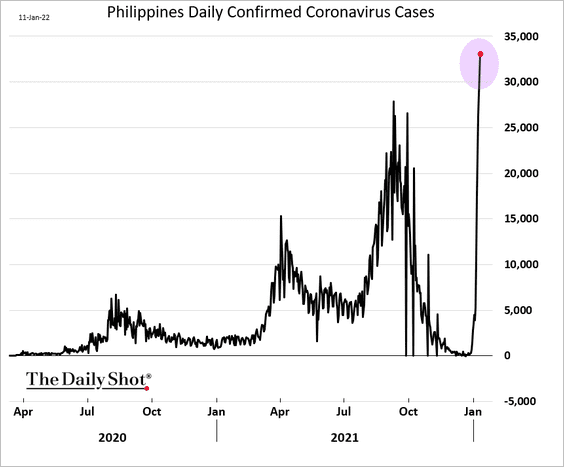

5. COVID cases hit a record high in the Philippines.

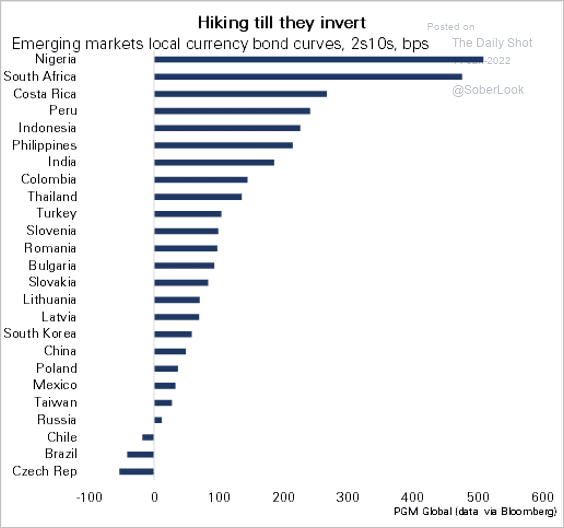

6. Rate hikes will invert yield curves in some economies.

Source: PGM Global

Source: PGM Global

Back to Index

Cryptocurrency

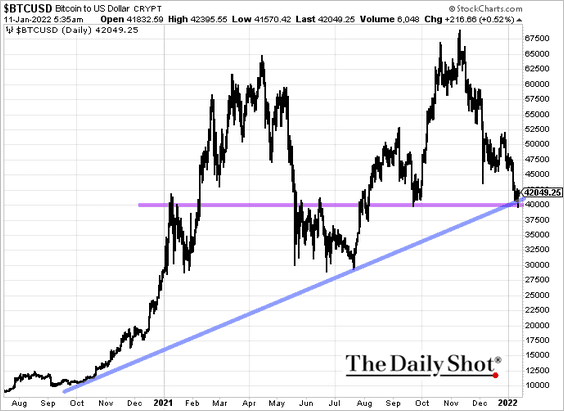

1. Bitcoin held support at $40k.

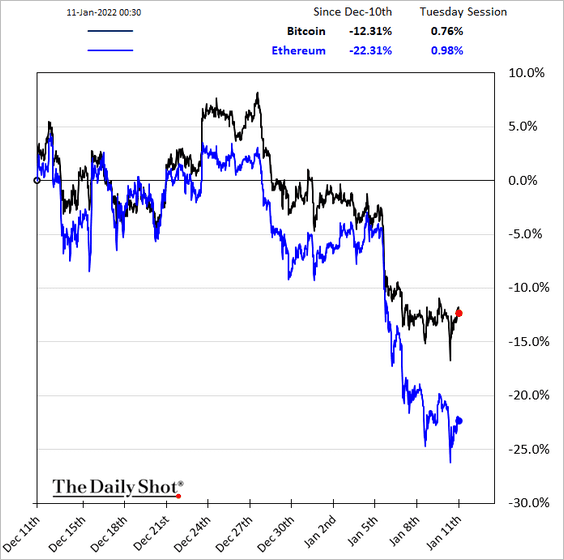

2. Ether continues to underperform.

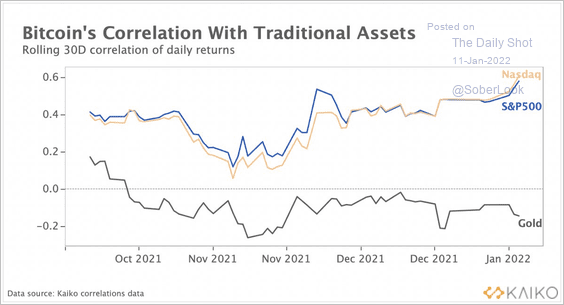

3. Bitcoin’s correlation with stocks has risen over the past few months, while its relationship to gold remains very low.

Source: @KaikoData

Source: @KaikoData

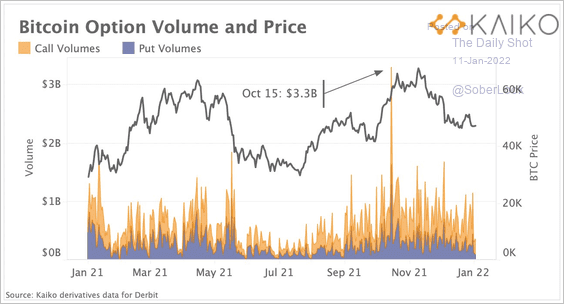

4. Bitcoin’s option volumes have been muted after hitting a yearly high in October.

Source: @KaikoData

Source: @KaikoData

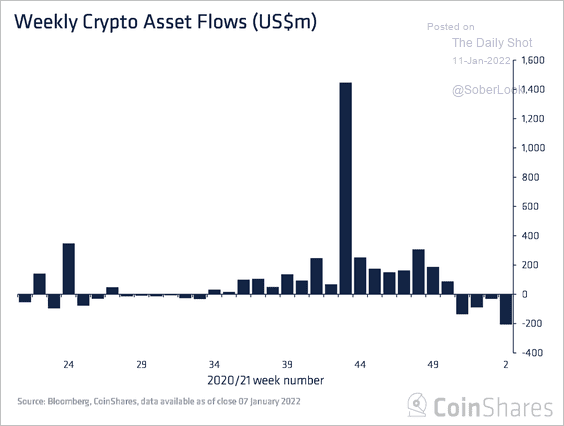

5. Digital asset investment products saw record outflows last week as crypto prices slid.

Source: CoinShares Read full article

Source: CoinShares Read full article

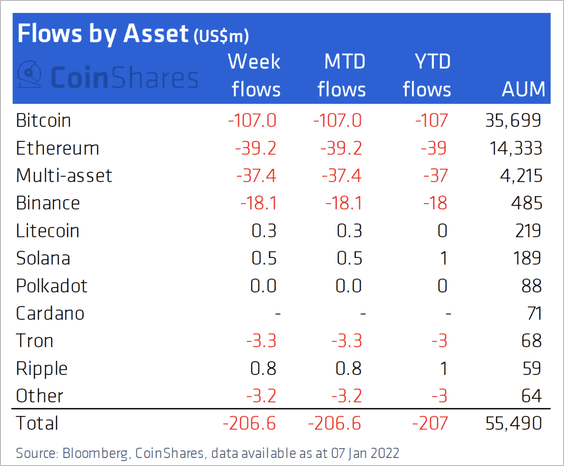

6. Bitcoin-focused investment products accounted for most of the outflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Back to Index

Commodities

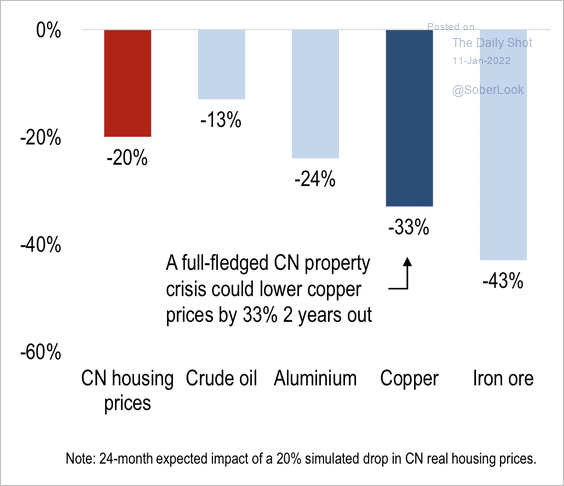

1. A Canadian housing correction could cause steep declines in the price of copper.

Source: Numera Analytics

Source: Numera Analytics

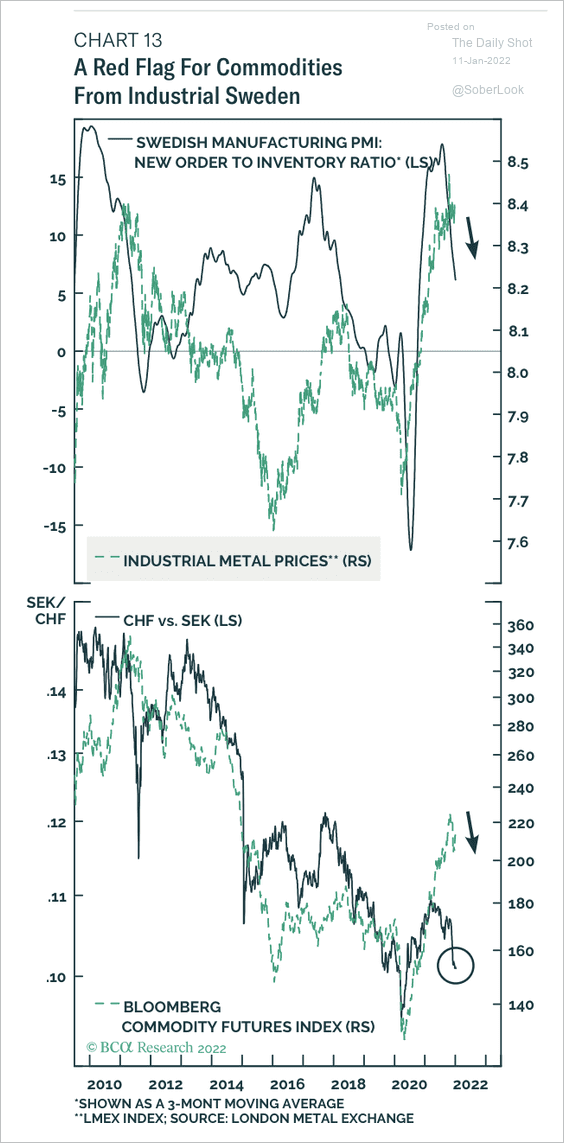

2. Declines in Sweden’s manufacturing conditions, along with a lower Swedish krona/Swiss franc cross rate, points to downside risk in raw material prices.

Source: BCA Research

Source: BCA Research

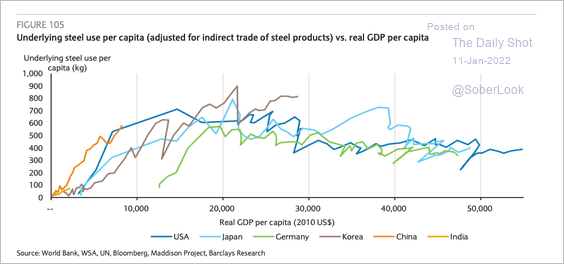

3. Steel use per capita peaks once a certain level of GDP per capita is reached. Developed countries saw this happen in the 1970s and 80s, linked directly to the peak of manufacturing as a share of their economies.

Source: Barclays Research

Source: Barclays Research

Back to Index

Energy

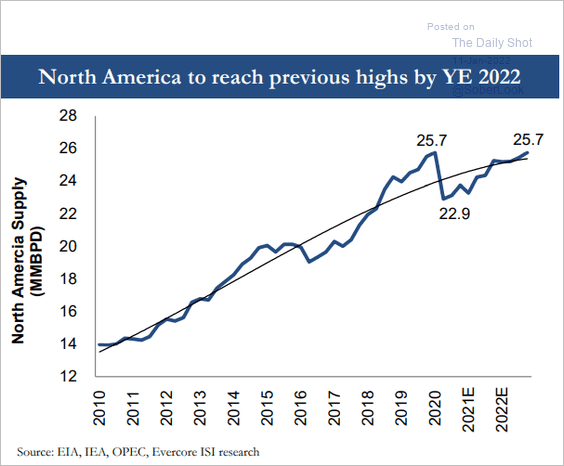

1. US oil output is expected to return to peak levels by the end of the year.

Source: Evercore ISI Research

Source: Evercore ISI Research

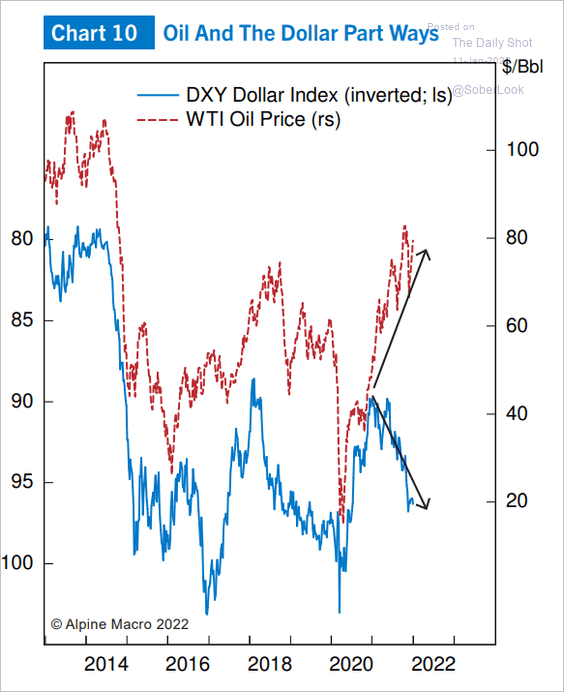

2. Oil has been rallying despite a stronger US dollar.

Source: Alpine Macro

Source: Alpine Macro

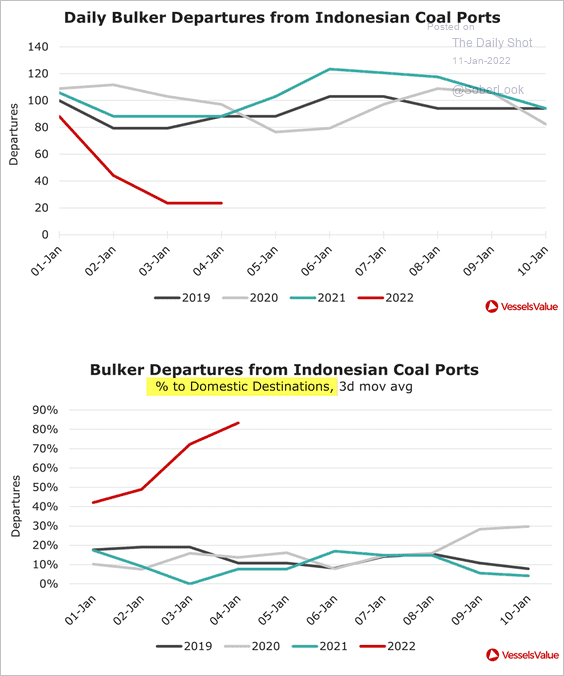

3. Indonesia’s coal hoarding is creating a headache for some economies.

Source: VesselsValue

Source: VesselsValue

But the nation appears to be easing its export ban.

Source: Reuters Read full article

Source: Reuters Read full article

Back to Index

Equities

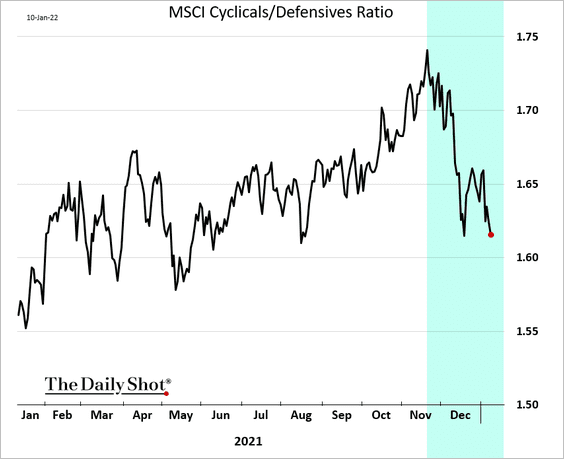

1. The rotation out of cyclicals, which started in November, has resumed.

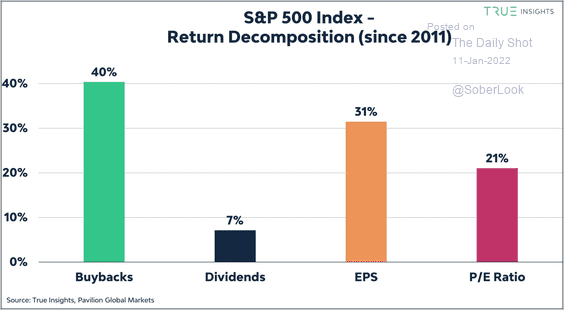

2. Buybacks accounted for 40% of the S&P 500’s total return since 2011.

Source: True Insights

Source: True Insights

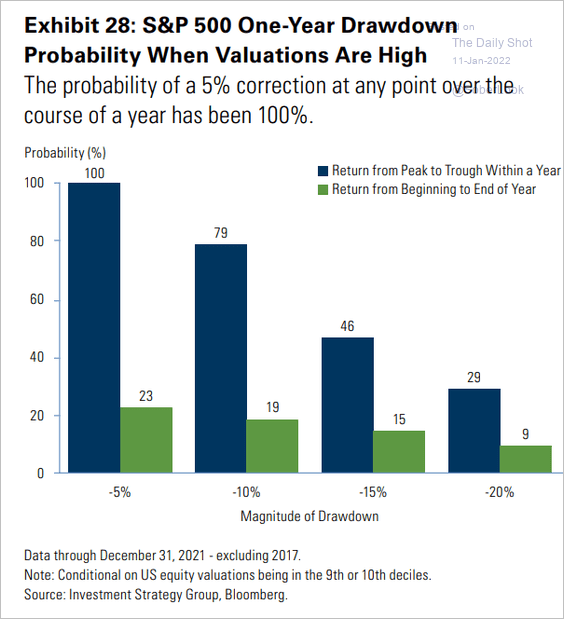

3. What size drawdowns should we expect this year?

Source: Goldman Sachs

Source: Goldman Sachs

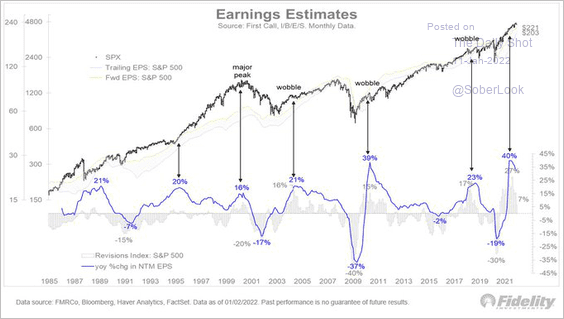

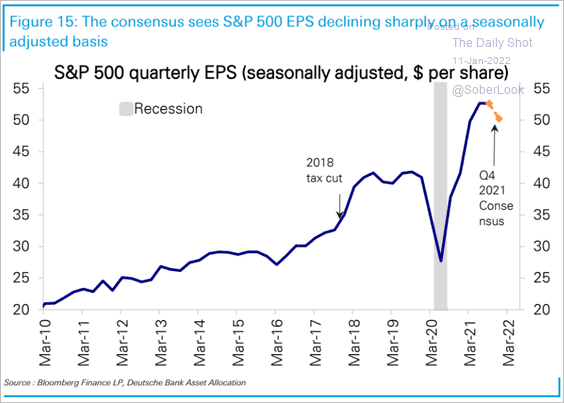

4. Prices often see a wobble when earnings growth peaks.

Source: @TimmerFidelity

Source: @TimmerFidelity

And earnings expectations have been moving lower.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

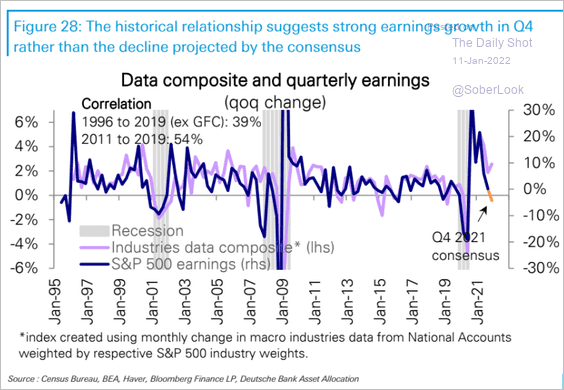

But given the robust economic activity, will we see substantial upward earnings surprises?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

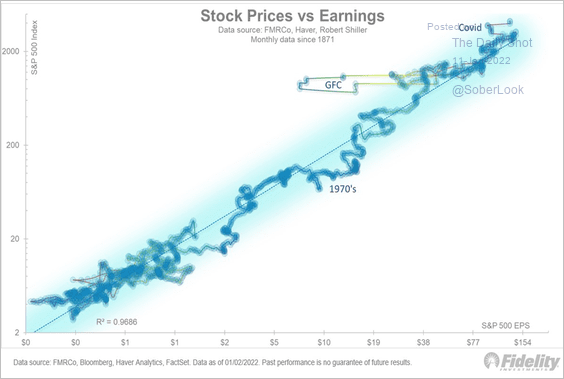

5. Over the long-run, stock prices follow earnings.

Source: @TimmerFidelity

Source: @TimmerFidelity

6. The Invesco S&P 500 Equal Weight ETF has been outperforming.

Source: Cannon Advisors

Source: Cannon Advisors

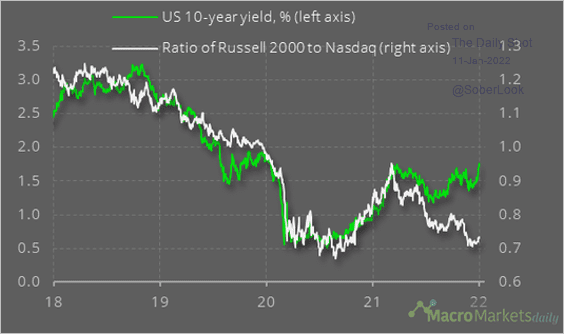

7. More upside for small caps relative to the Nasdaq composite?

Source: @macro_daily

Source: @macro_daily

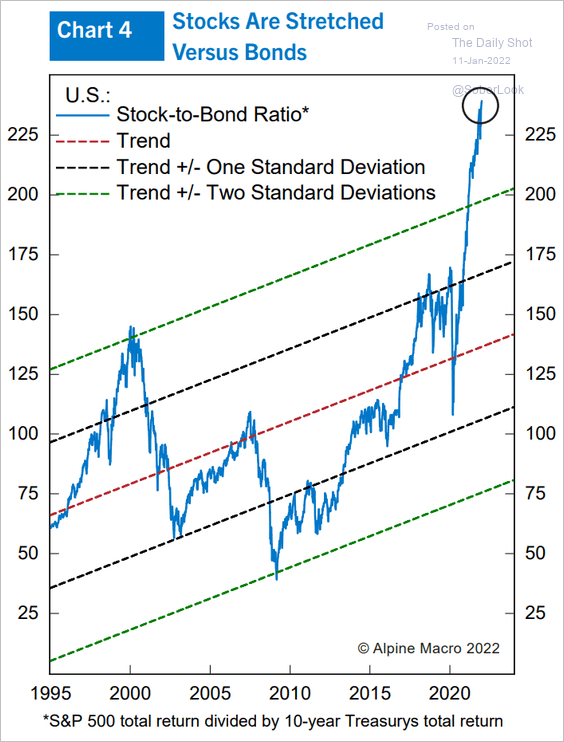

8. Stock prices remain stretched relative to bonds.

Source: Alpine Macro

Source: Alpine Macro

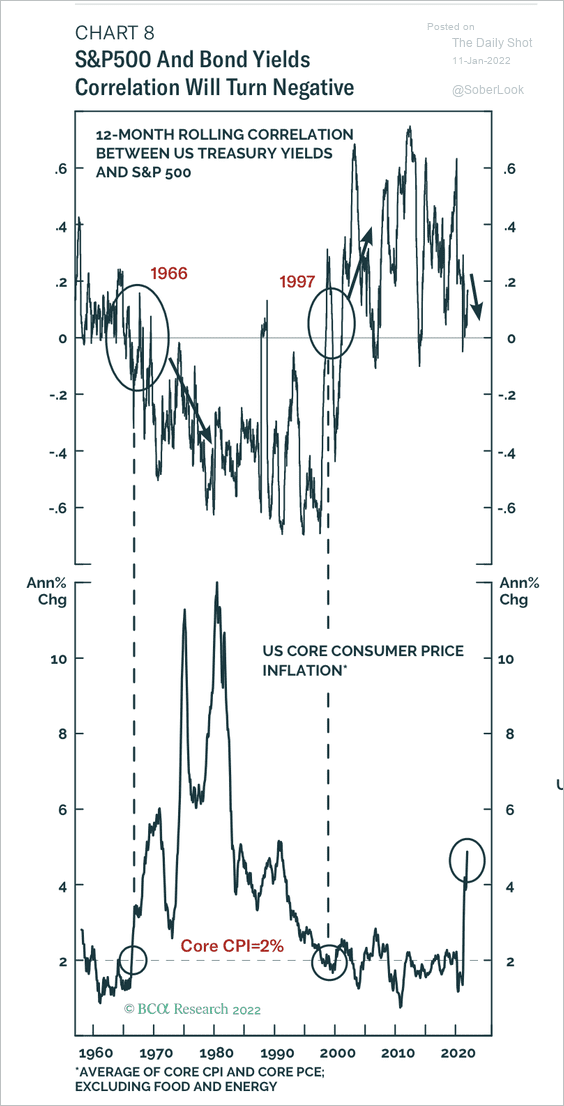

9. Rising inflation typically results in a higher stock/bond price correlation.

Source: BCA Research

Source: BCA Research

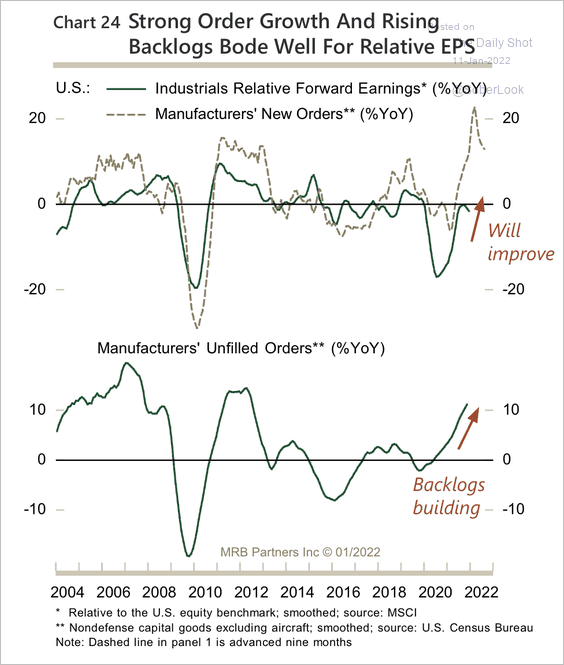

10. Industrial stocks could benefit from an inventory rebuild and rising capital spending.

Source: MRB Partners

Source: MRB Partners

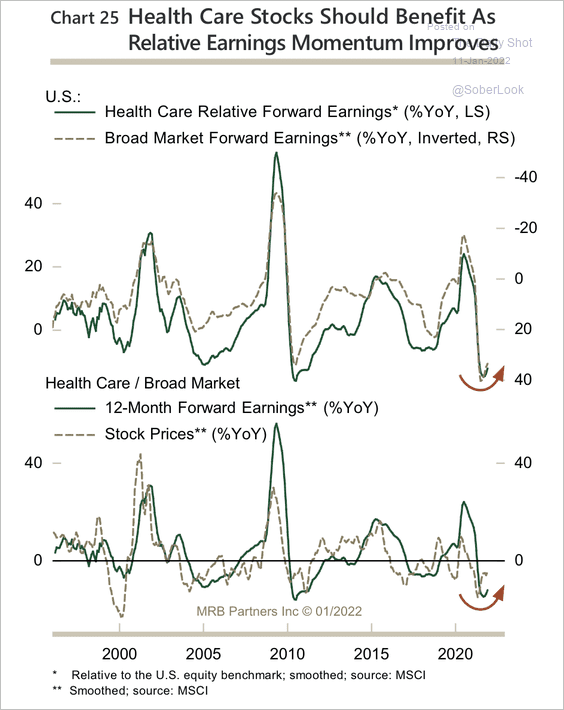

11. Relative earnings of healthcare stocks are starting to improve.

Source: MRB Partners

Source: MRB Partners

Back to Index

Rates

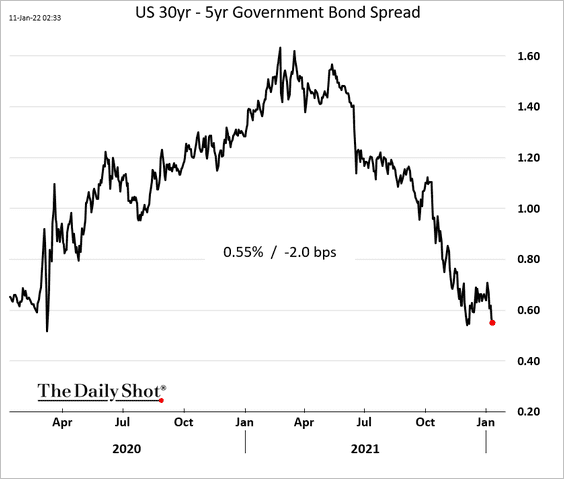

1. The Treasury curve is flattening again at the long end.

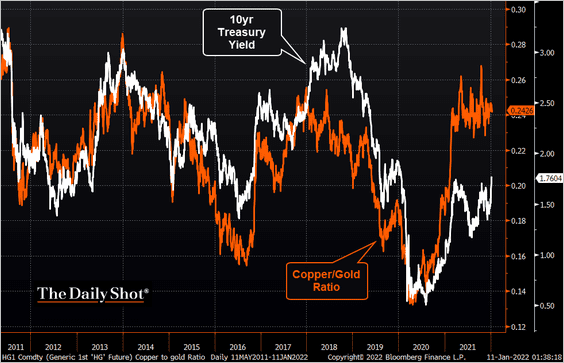

2. More upside for longer-dated Treasury yields?

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

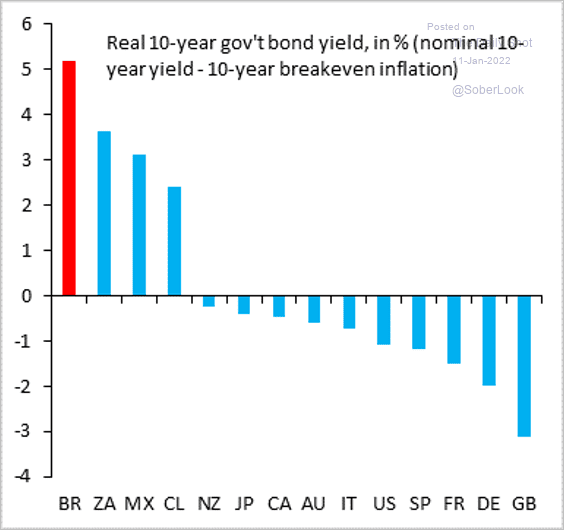

3. This chart shows real 10yr yields in select economies (based on inflation expectations).

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

Back to Index

Global Developments

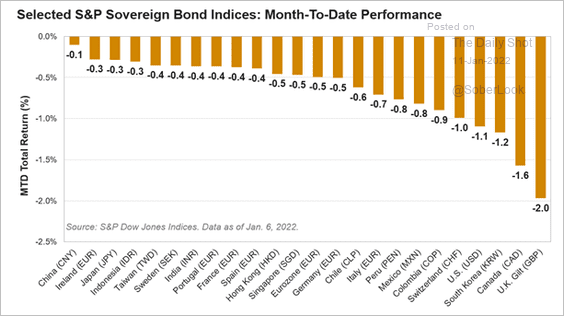

1. Let’s start with sovereign debt month-to-date performance.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

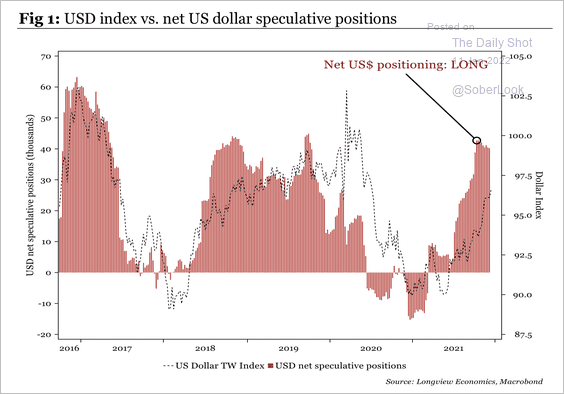

2. Speculative net-long dollar positioning is near prior extremes.

Source: Longview Economics

Source: Longview Economics

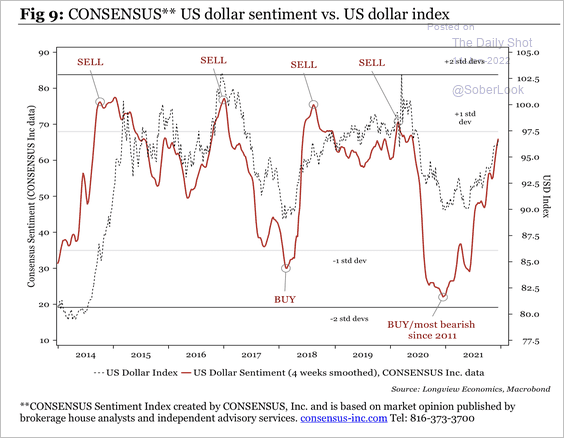

However, consensus sentiment on the dollar is not extremely bullish.

Source: Longview Economics

Source: Longview Economics

——————–

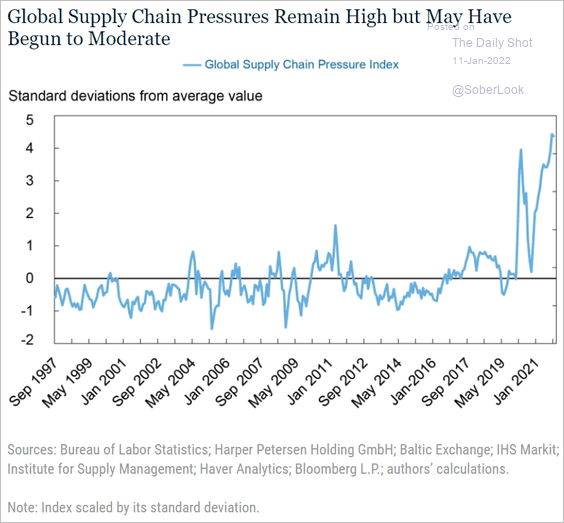

3. Supply chain bottlenecks may have peaked.

Source: @LibertyStEcon Read full article

Source: @LibertyStEcon Read full article

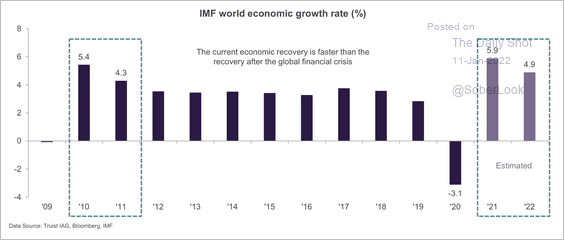

4. The global economy is projected to grow faster than the recovery years following the financial crisis.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

Food for Thought

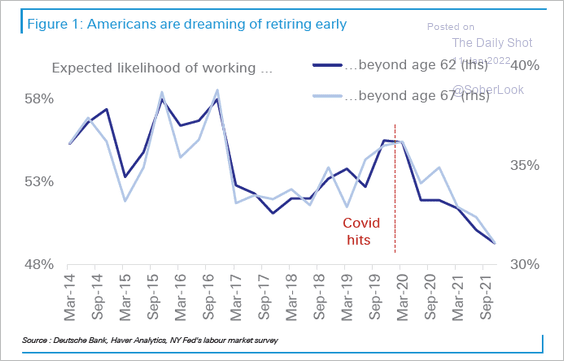

1. Retiring early:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

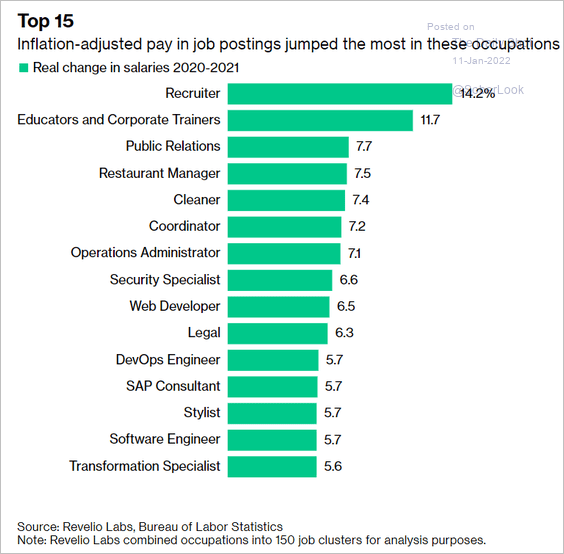

2. Highest increases in inflation-adjusted pay:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

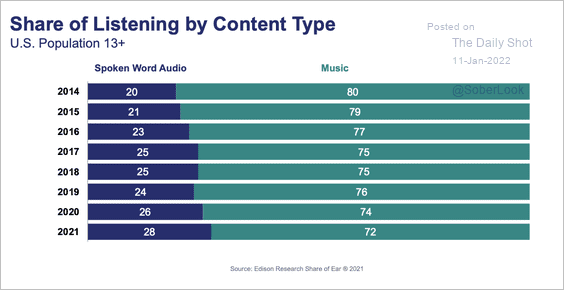

3. Spoken-word audio vs. music:

Source: NPR/Edison Research Read full article

Source: NPR/Edison Research Read full article

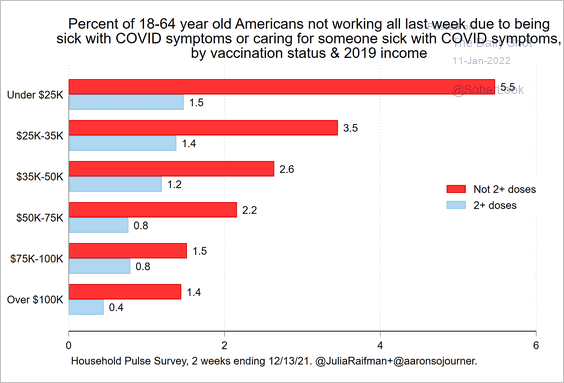

4. Not working due to COVID:

Source: @GregDaco, @JuliaRaifman, @aaronsojourner

Source: @GregDaco, @JuliaRaifman, @aaronsojourner

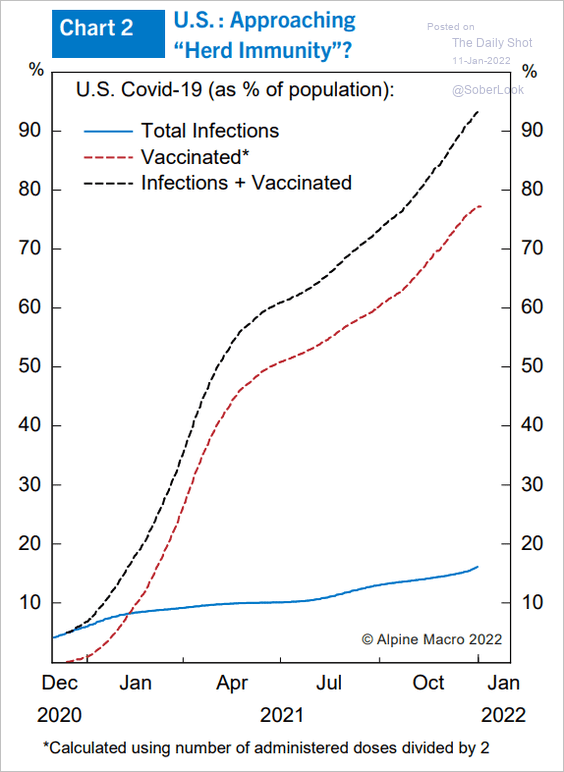

5. Herd immunity?

Source: Alpine Macro

Source: Alpine Macro

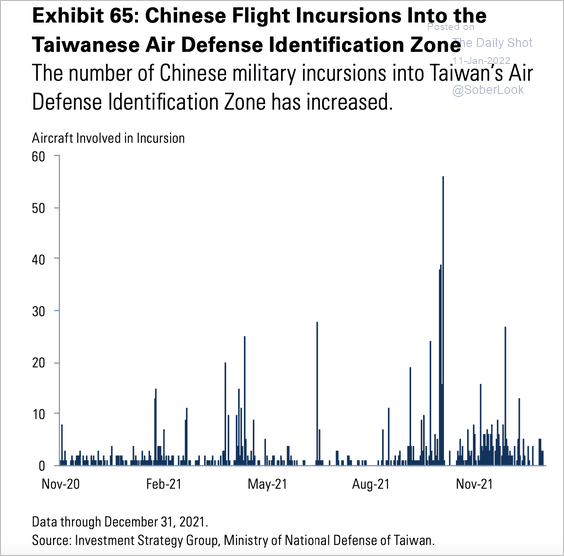

6. Flight incursions by Chinese aircraft into Taiwan:

Source: Goldman Sachs

Source: Goldman Sachs

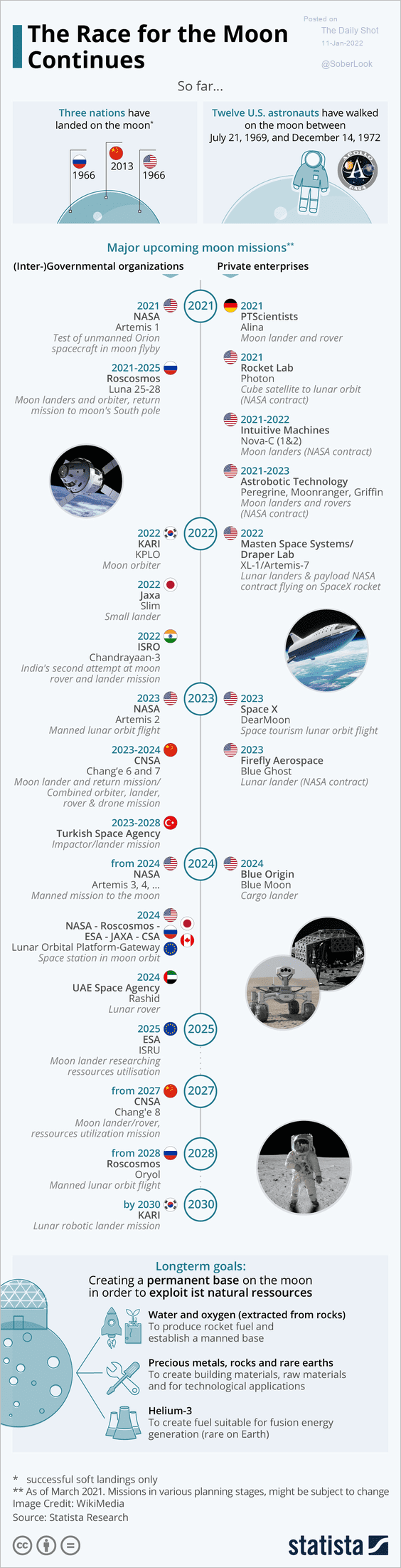

7. The race to the moon:

Source: Statista

Source: Statista

——————–

Back to Index