The Daily Shot: 13-Jan-22

• The United States

• The Eurozone

• Europe

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

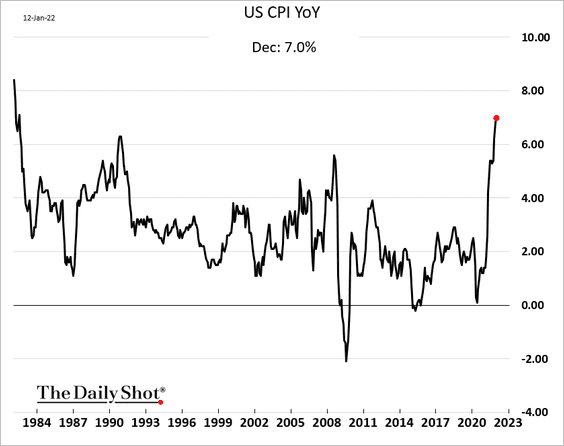

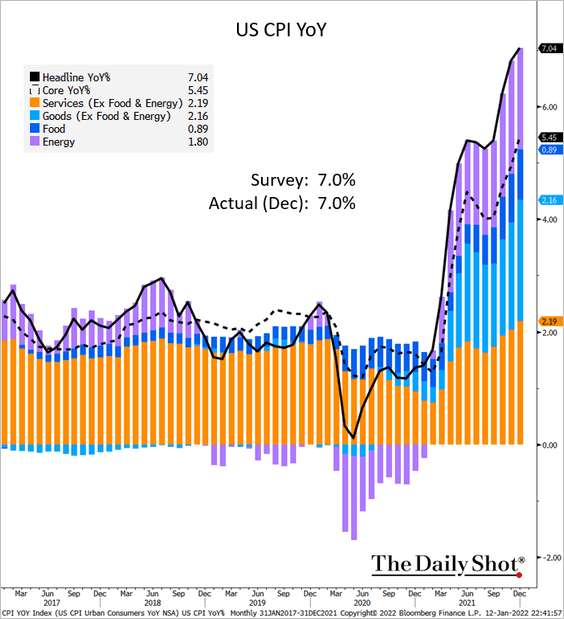

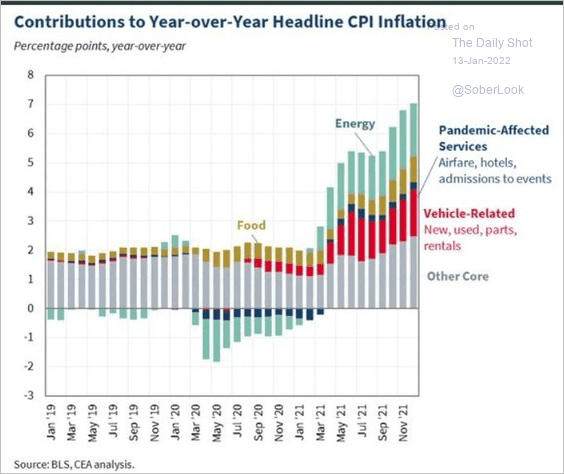

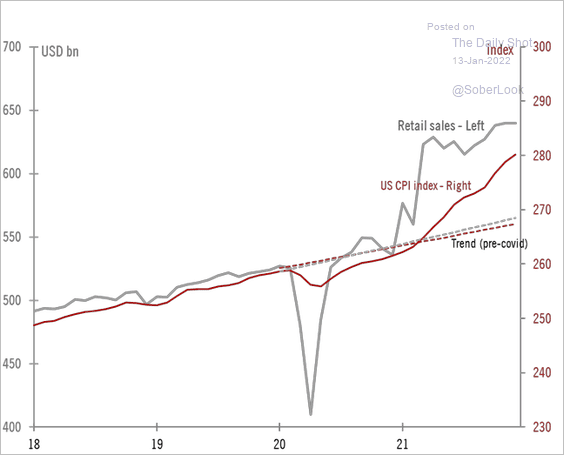

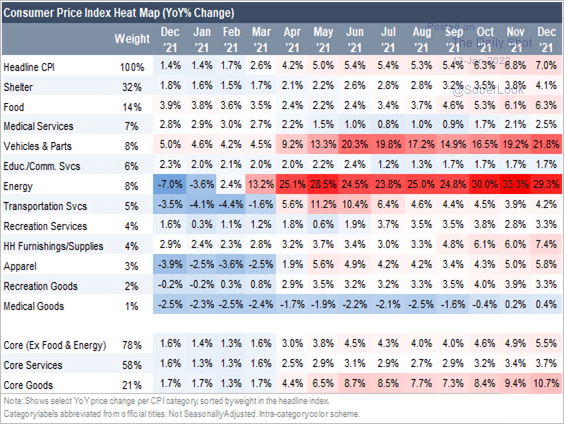

1. As expected, the CPI hit a four-decade high in December, driven by supply bottlenecks and robust consumer demand for goods.

Here are the key components.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

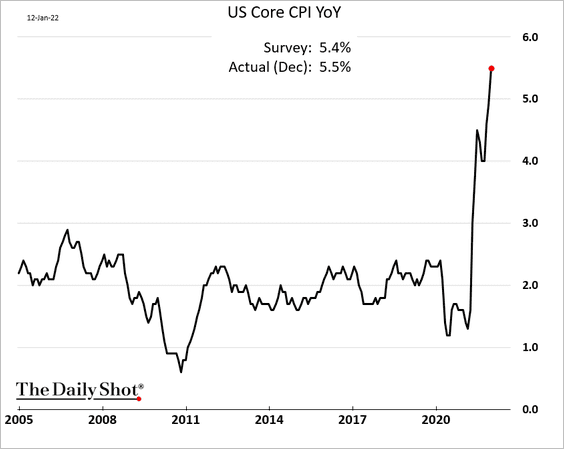

The core CPI was a bit stronger than expected.

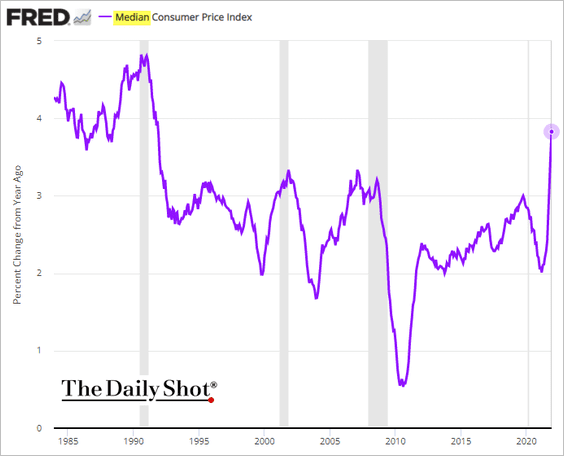

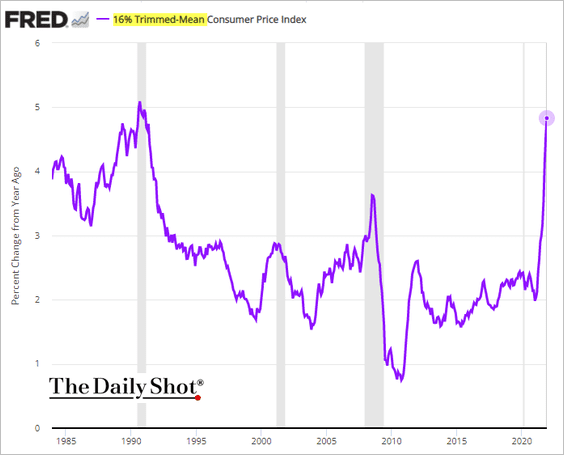

• Other measures of core inflation also surged.

– Median CPI:

– Trimmed-mean CPI:

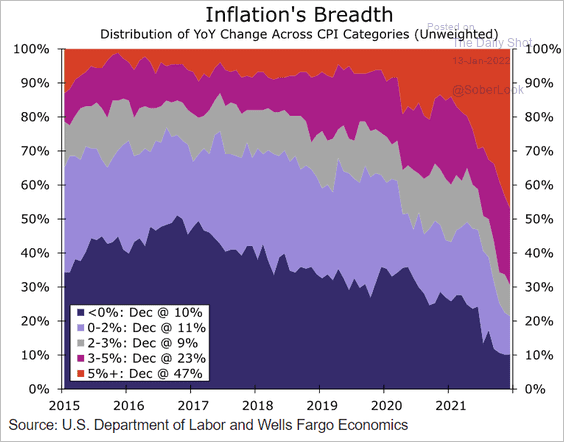

• The share of CPI components rising by more than 5% has exploded.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• However, the increase in core inflation outside of chip-related sectors (autos) and pandemic-related items is not extreme.

Source: @MarketInterest

Source: @MarketInterest

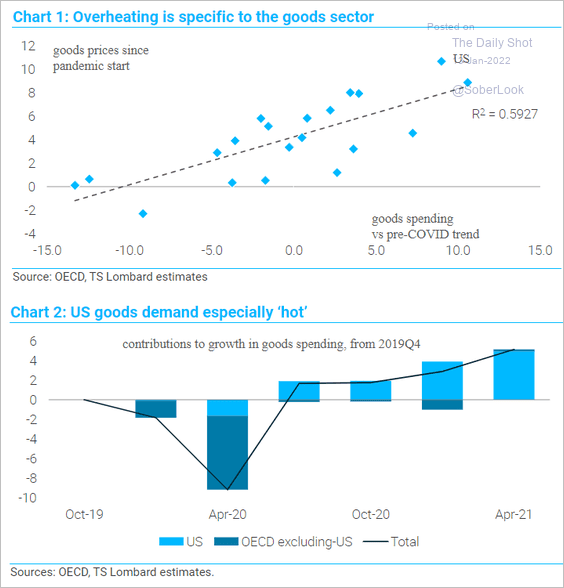

• An important driver of rapid price gains has been the massive demand for goods, …

Source: TS Lombard

Source: TS Lombard

… as Americans put their excess savings to work.

Source: @TCosterg

Source: @TCosterg

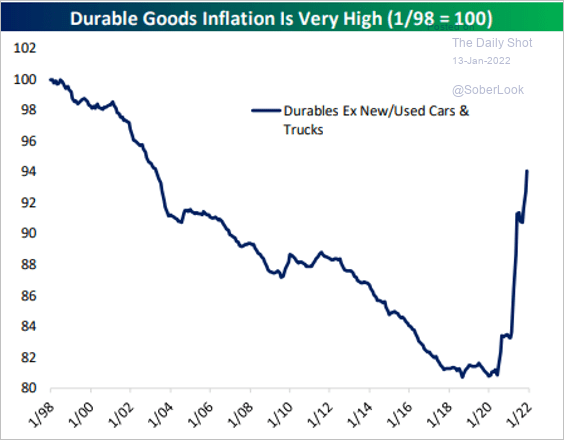

Durable goods have unwound two decades of deflation.

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

• Here is the CPI “heat map.”

Source: CreditSights

Source: CreditSights

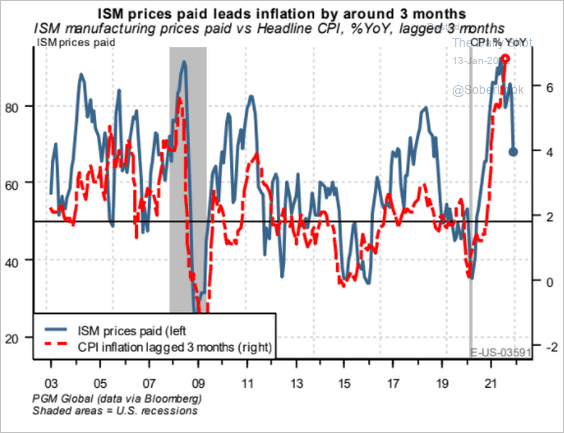

• Economists see inflation peaking within a month or two but staying elevated for some time.

Source: PGM Global

Source: PGM Global

We will have more on the CPI report tomorrow.

——————–

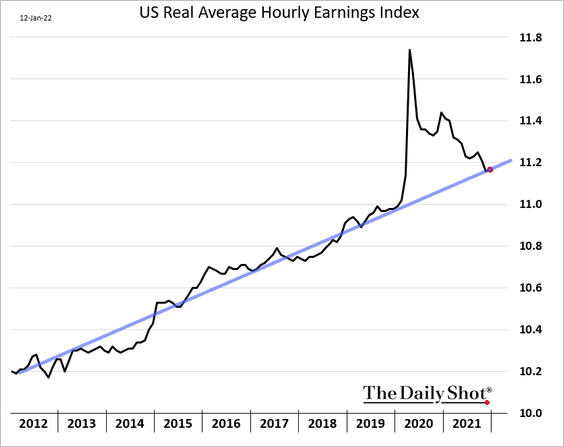

2. Real wages are back to their pre-COVID trend.

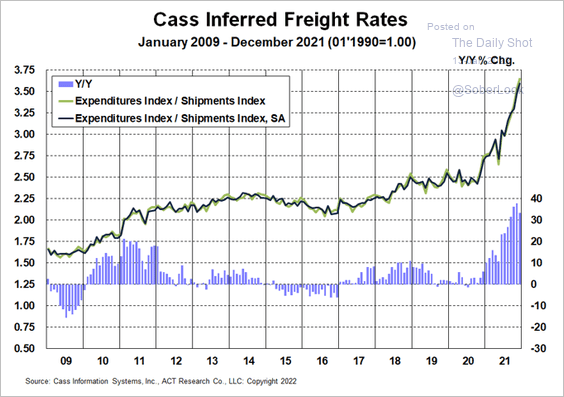

3. Freight rates continued to surge in December.

Source: Cass Information Systems

Source: Cass Information Systems

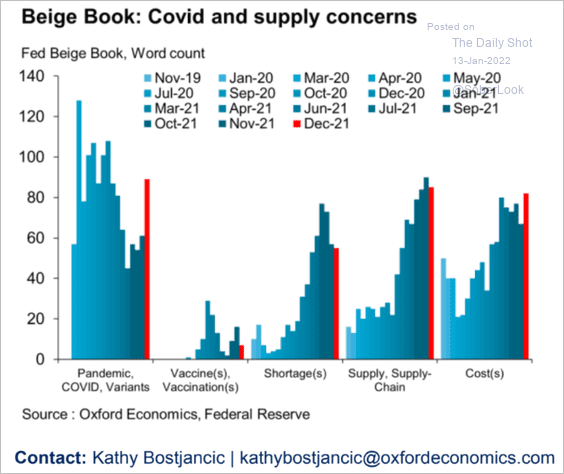

4. The Fed’s Beige Book shows companies still worried about climbing costs and supply chain issues. And the pandemic is back in focus.

Source: Oxford Economics

Source: Oxford Economics

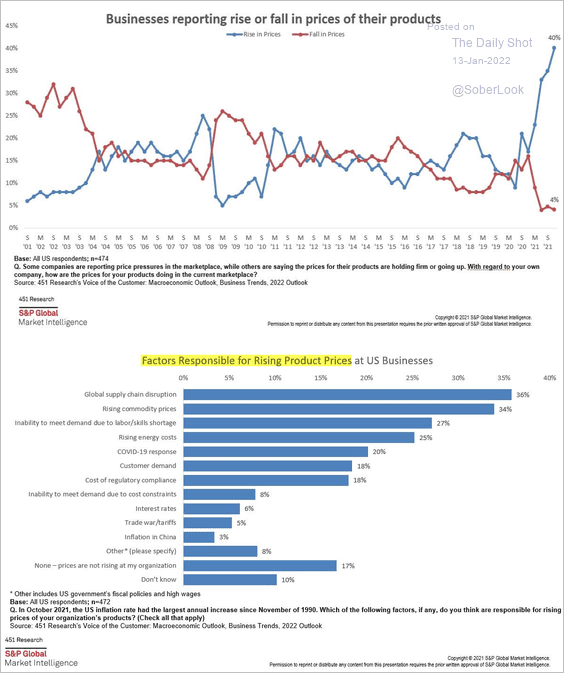

5. What factors are driving businesses to boost prices?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

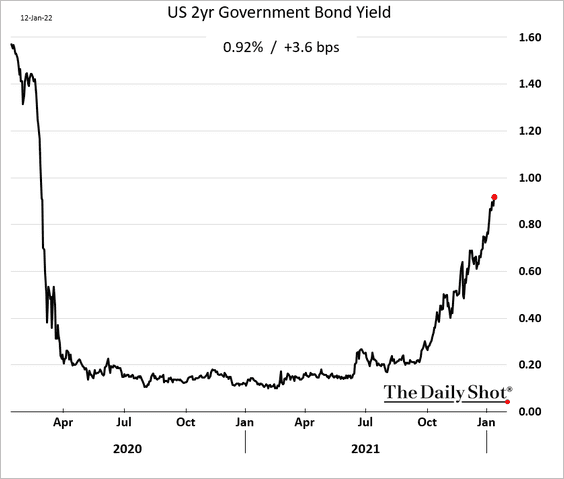

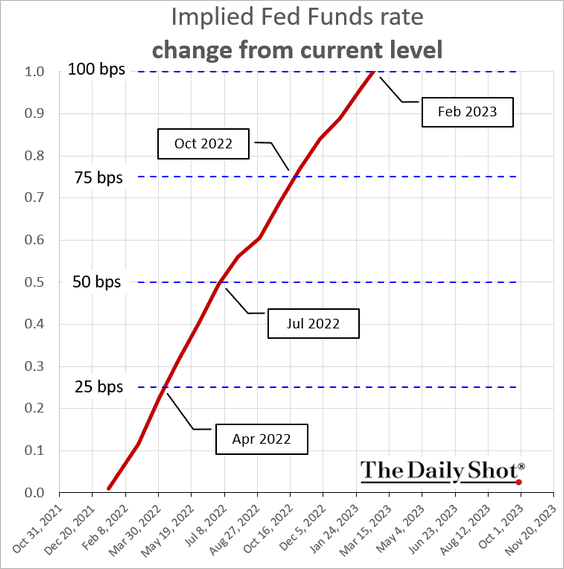

6. The 2-year Treasury yield is pushing toward 1%.

Here are the Fed rate hikes that are fully priced into the market (note that there is a high probability of these events occurring sooner).

——————–

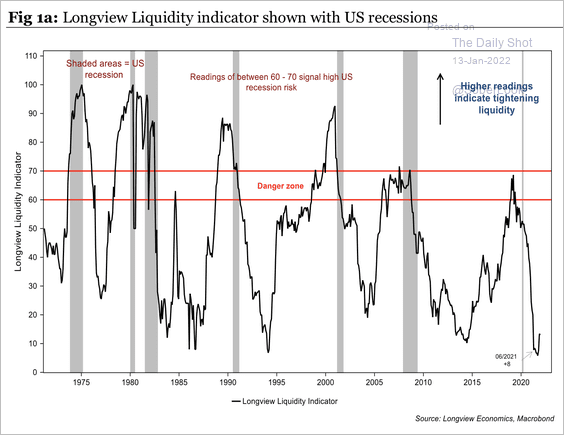

7. Liquidity conditions remain highly accommodative.

Source: Longview Economics

Source: Longview Economics

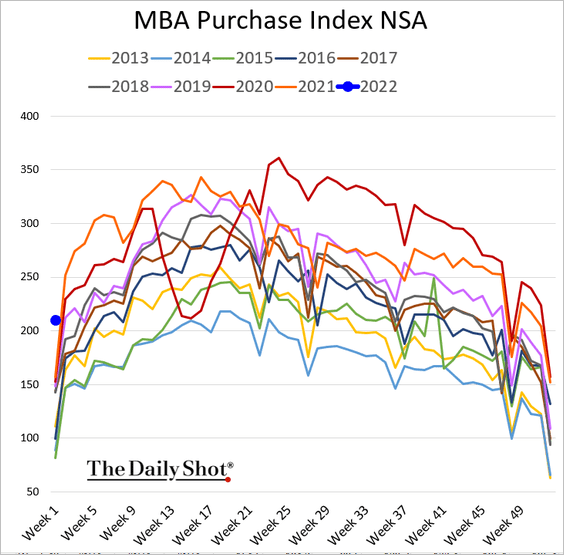

8. Mortgage applications started the year on a strong note despite higher rates.

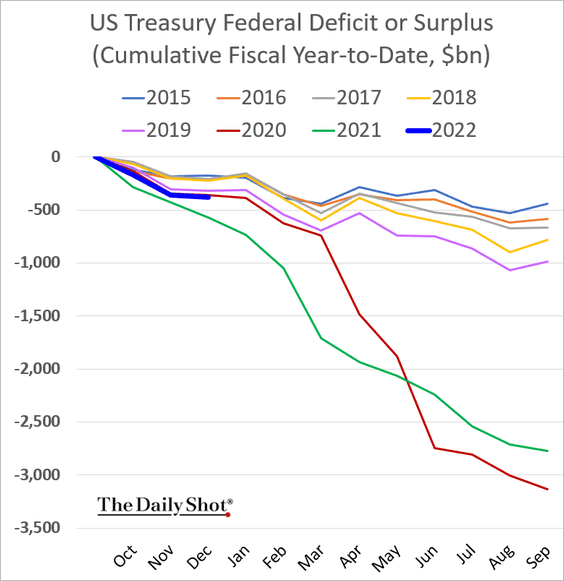

9. The federal deficit is following the 2020 trajectory for now.

Back to Index

The Eurozone

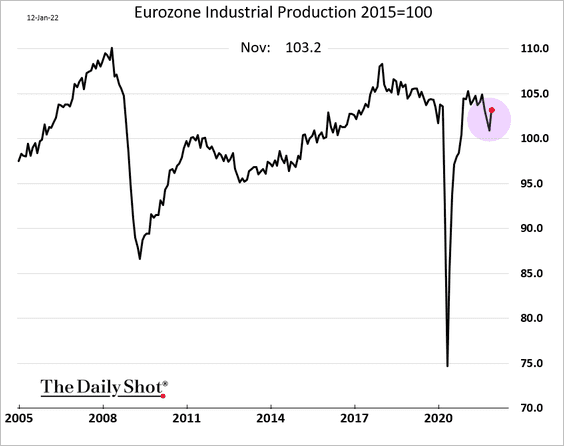

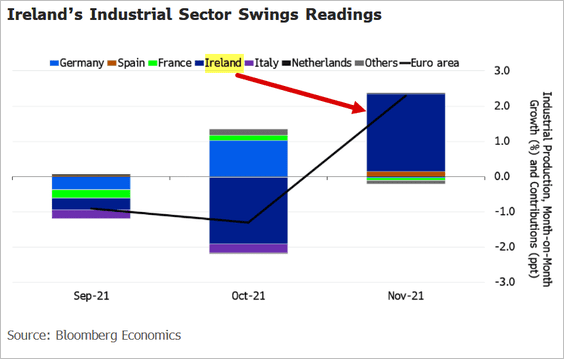

1. Industrial production rose more than expected in November.

Both the November and October figures were distorted by massive output swings in Ireland.

Source: @MaevaDebarge, @TheTerminal Read full article

Source: @MaevaDebarge, @TheTerminal Read full article

——————–

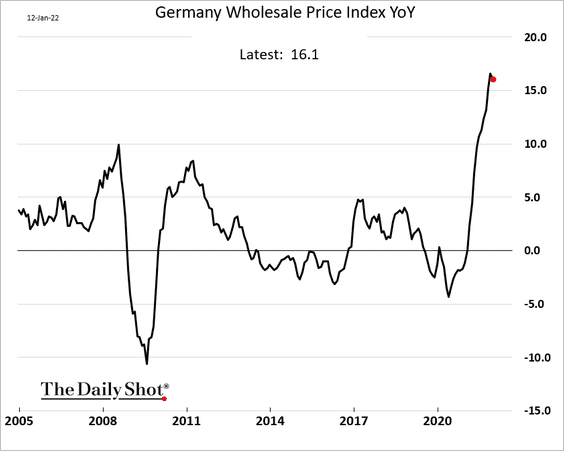

2. Germany’s wholesale inflation appears to be peaking.

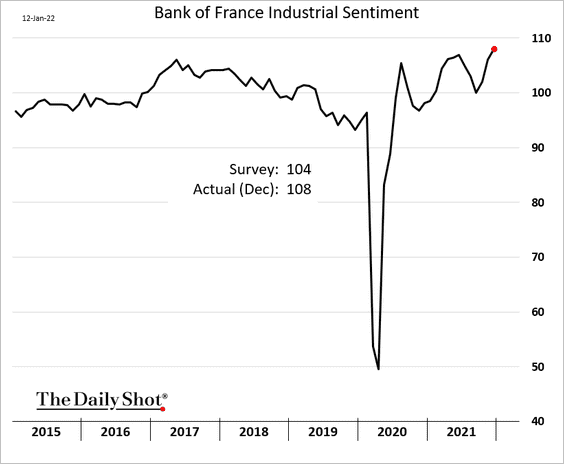

3. French industrial sentiment has been topping forecasts.

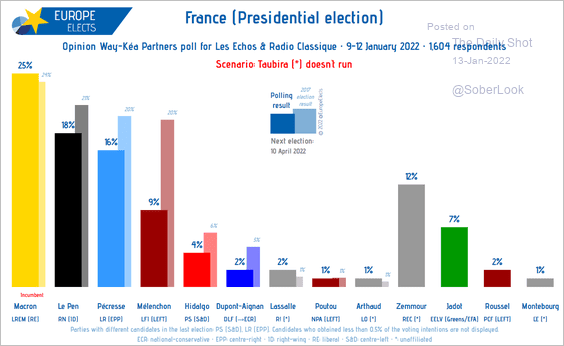

Separately, Macron continues to poll well for the upcoming election (despite his 35% approval rating).

Source: @EuropeElects Read full article

Source: @EuropeElects Read full article

Back to Index

Europe

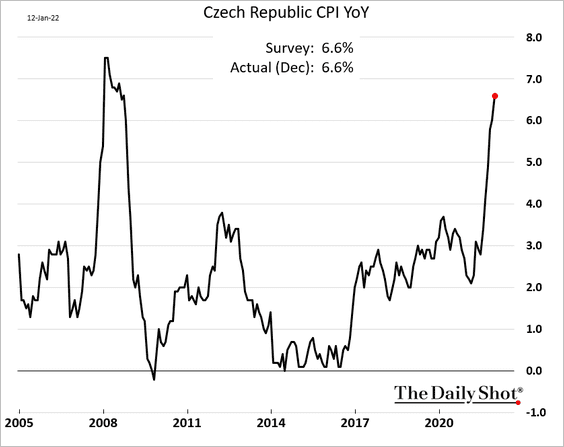

1. Czech CPI continues to surge.

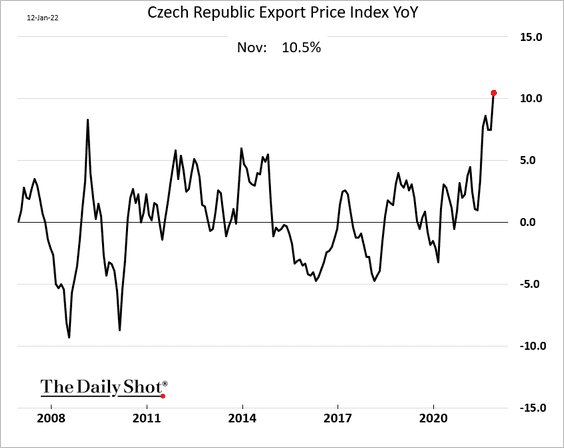

The Czech Republic is exporting inflation to the Eurozone.

——————–

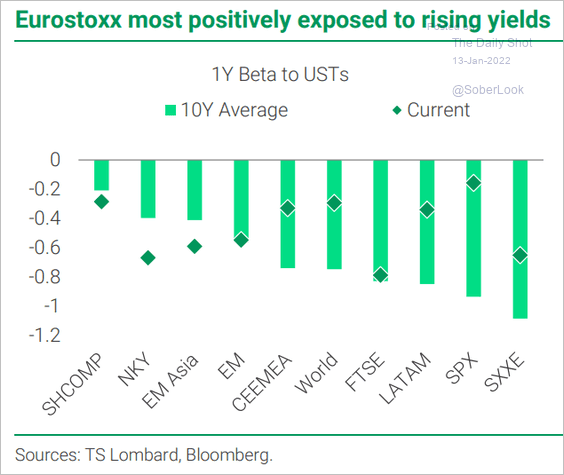

2. European equities tend to do relatively well when US yields rise (the chart shows beta to bond prices).

Source: TS Lombard

Source: TS Lombard

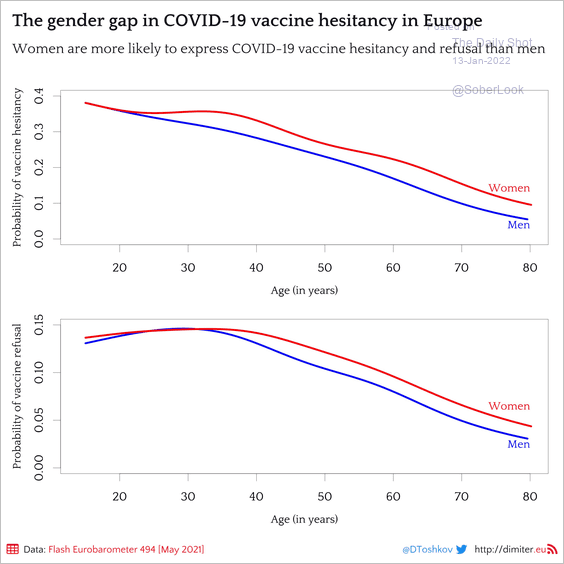

3. This chart depicts vaccine hesitancy by age.

Source: @DToshkov

Source: @DToshkov

Back to Index

China

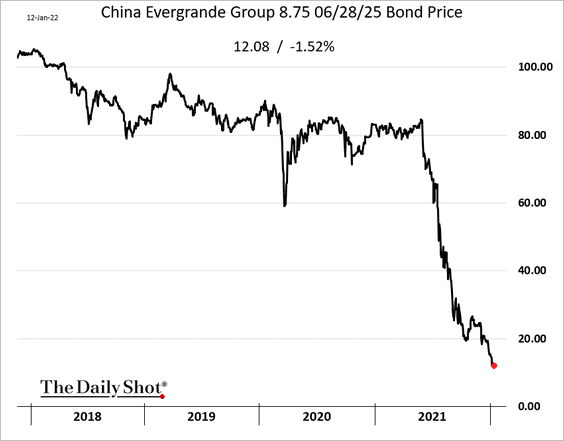

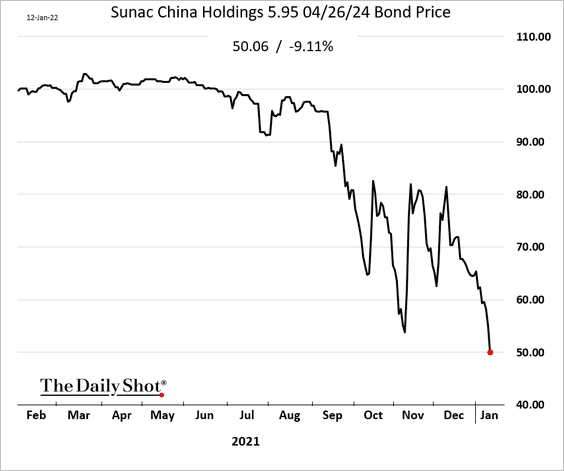

1. Developers’ bonds remain under pressure.

• Evergrande:

Source: Bloomberg

Source: Bloomberg

• Sunac:

Source: Bloomberg

Source: Bloomberg

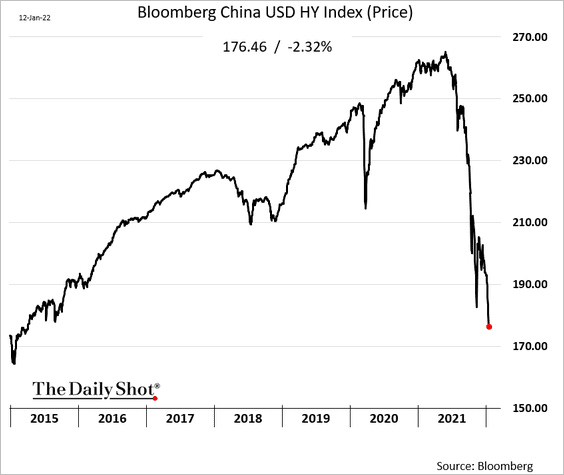

Bloomberg’s China USD high-yield index hit the lowest level since 2015.

——————–

2. Shares have been selling off in the mainland.

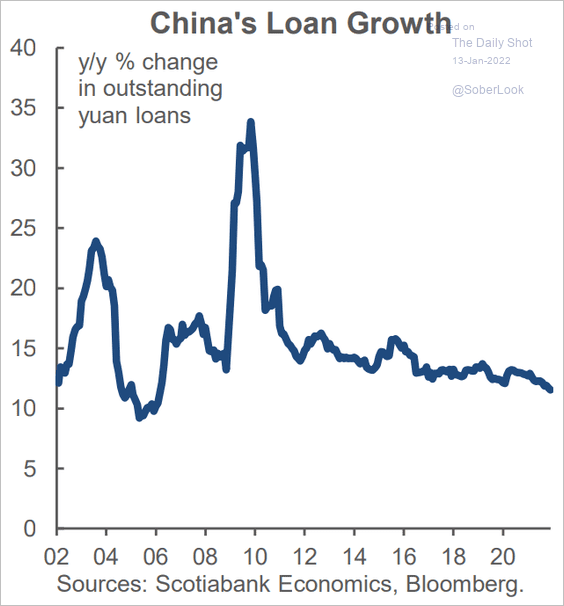

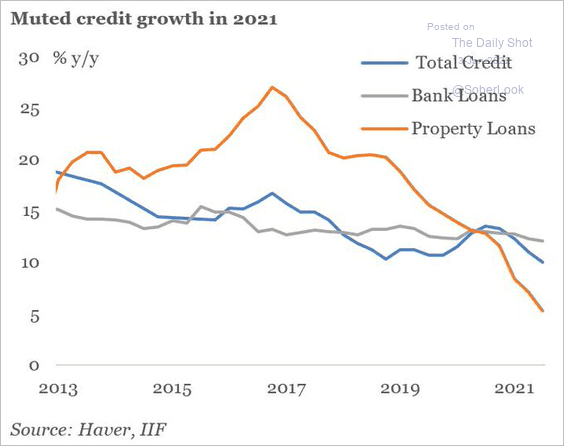

3. Loan growth has been softening (2 charts).

Source: Scotiabank Economics

Source: Scotiabank Economics

Source: @IIF, @genemaIIF, @phoebe_fengxy Read full article

Source: @IIF, @genemaIIF, @phoebe_fengxy Read full article

——————–

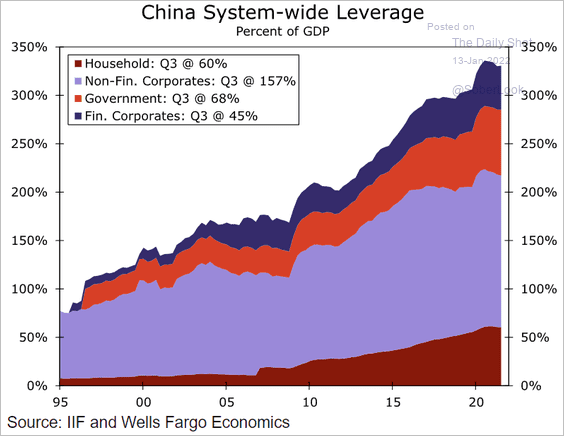

4. This chart shows China’s system-wide leverage.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

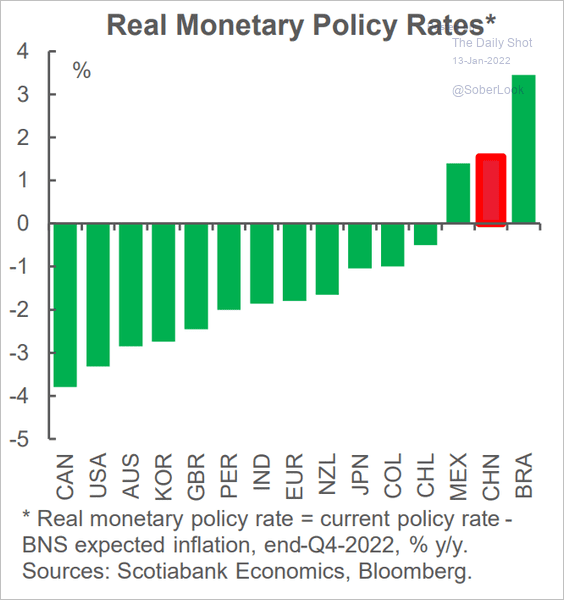

5. China’s real policy rate remains high relative to other economies.

Source: Scotiabank Economics

Source: Scotiabank Economics

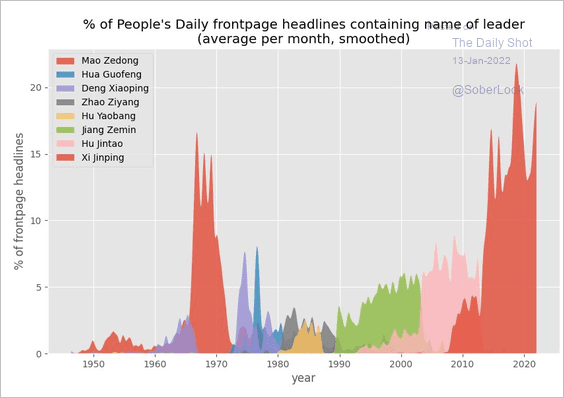

6. Finally, we have the count of headlines in People’s Daily mentioning China’s leader.

Source: @Chri5tianGoebel

Source: @Chri5tianGoebel

Back to Index

Emerging Markets

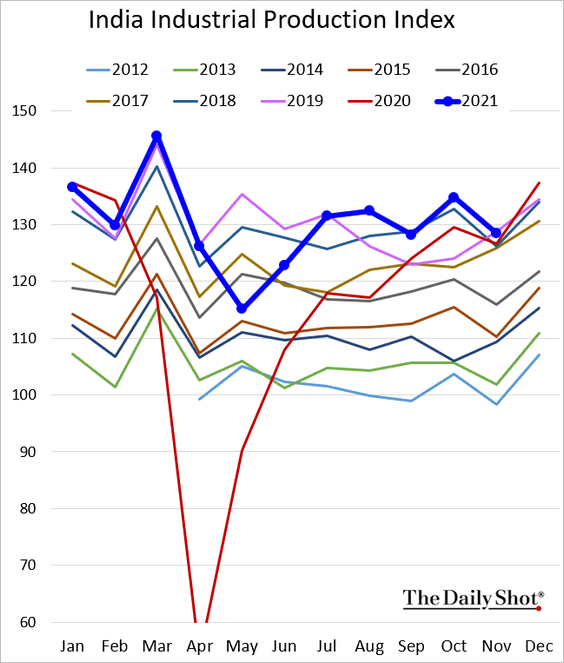

1. India’s industrial production dipped below 2019 levels in November.

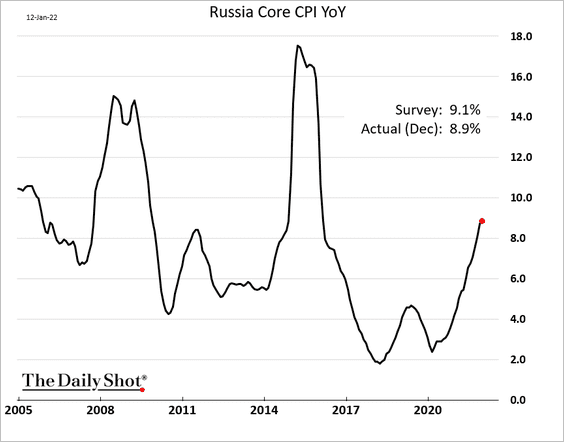

2. Russia’s core inflation was a bit lower than expected.

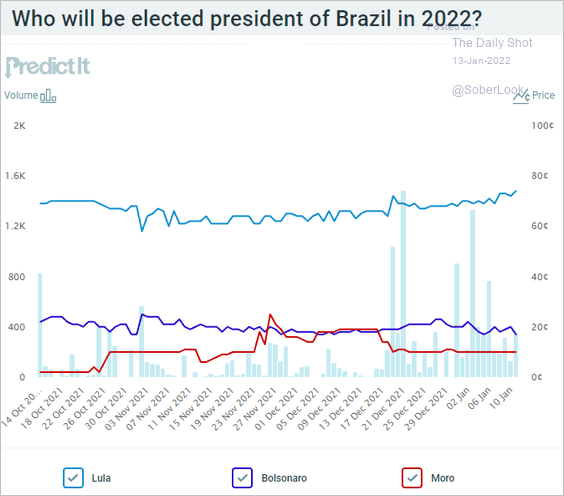

3. The betting markets see Lula winning this year’s election in Brazil.

Source: @PredictIt

Source: @PredictIt

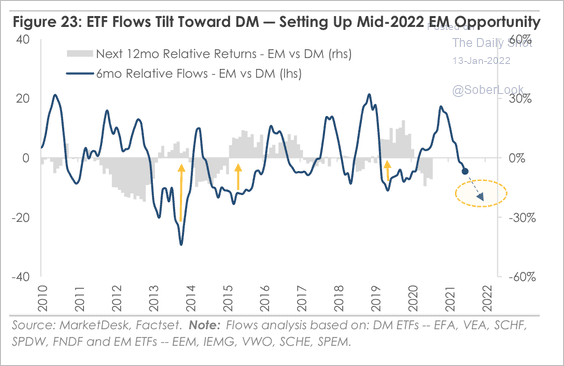

4. ETF flows have favored developed market equities over EM equities over the past six months. Could we see a reversal soon?

Source: MarketDesk Research

Source: MarketDesk Research

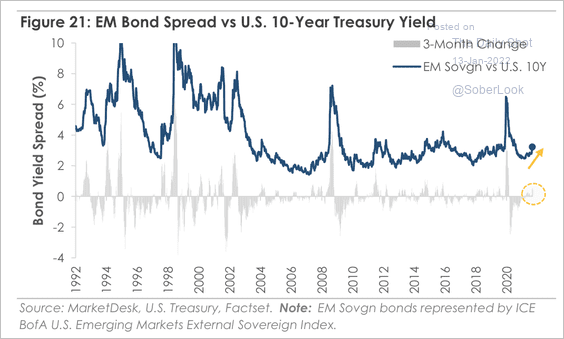

5. EM sovereign bond spreads have widened over the past few months as the market repriced credit risk higher.

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Cryptocurrency

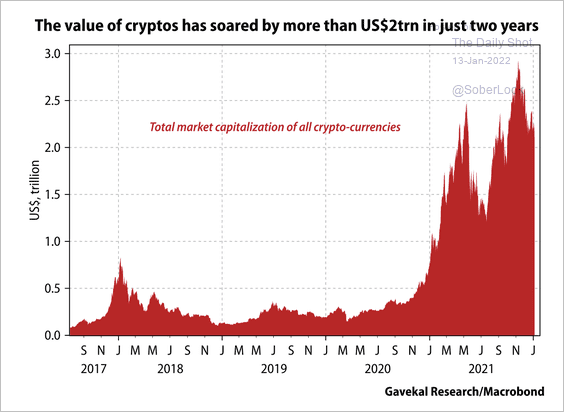

1. The total market cap of cryptocurrencies has soared over the past two years.

Source: Gavekal Research

Source: Gavekal Research

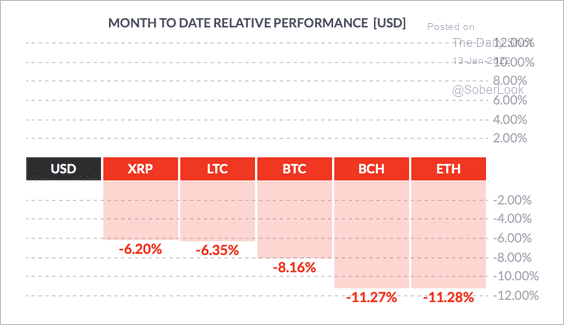

2. Cryptocurrencies had a rough start to the year so far.

Source: FinViz

Source: FinViz

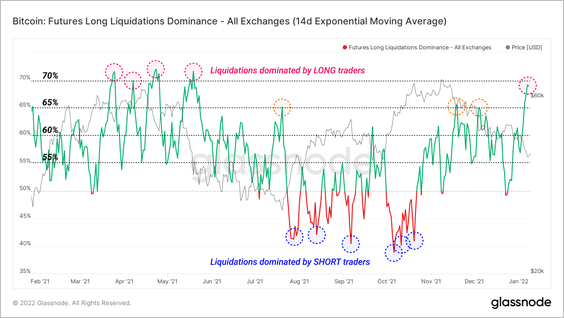

3. The chart below shows recent liquidations have been dominated by long BTC traders. If bitcoin enters a recovery phase, short traders could be vulnerable to liquidations.

Source: Glassnode Read full article

Source: Glassnode Read full article

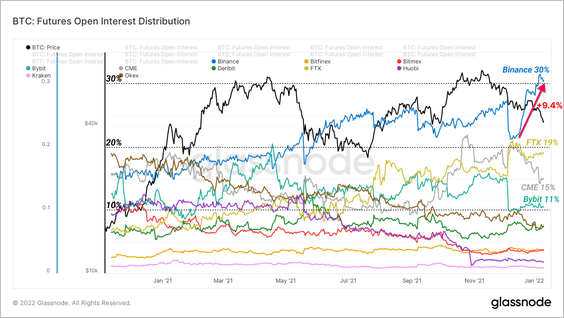

4. Binance accounts for the largest share of BTC futures open interest among all exchanges, with FTX in second place.

Source: Glassnode Read full article

Source: Glassnode Read full article

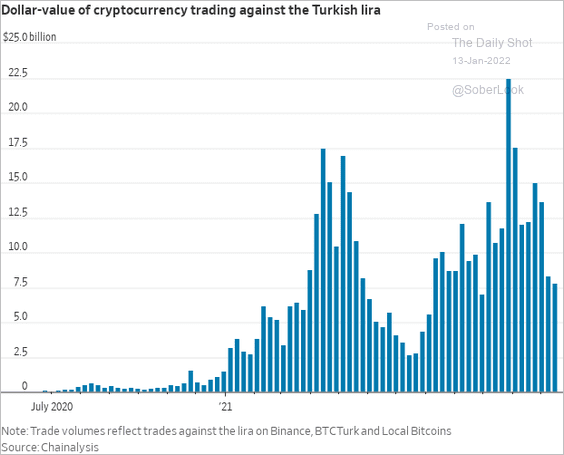

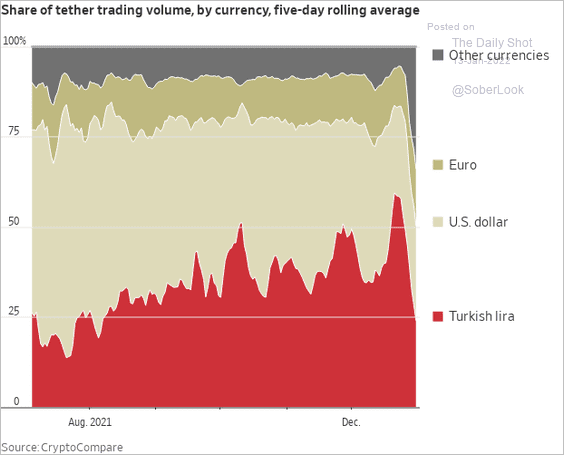

5. The lira’s massive devaluation created tremendous demand for crypto in Turkey.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

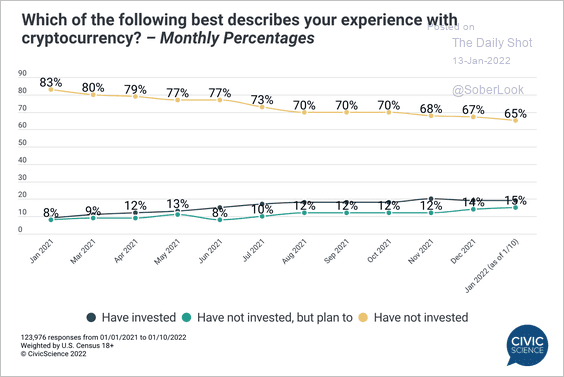

6. More people are investing or planning to invest in crypto markets.

Source: @CivicScience

Source: @CivicScience

Back to Index

Commodities

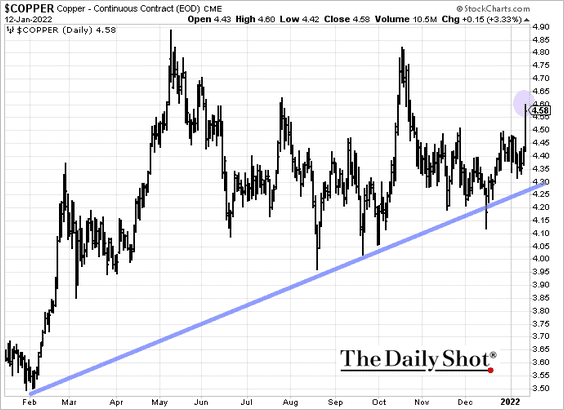

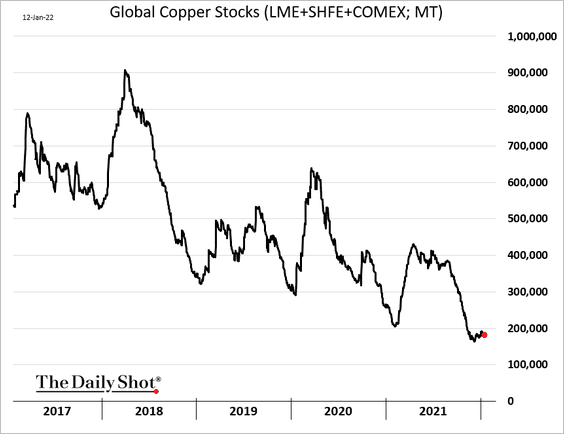

1. Copper is firmer amid tight inventories and China’s stimulus expectations.

——————–

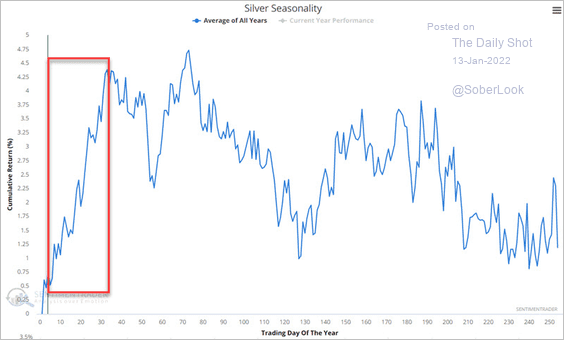

2. Silver is entering a seasonally strong period, which typically lasts through mid-February.

Source: SentimenTrader

Source: SentimenTrader

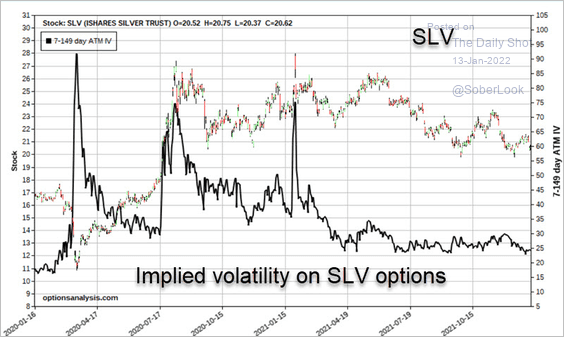

Implied volatility for options on the iShares Silver Trust ETF (SLV) is at the low end of its historical range.

Source: SentimenTrader

Source: SentimenTrader

——————–

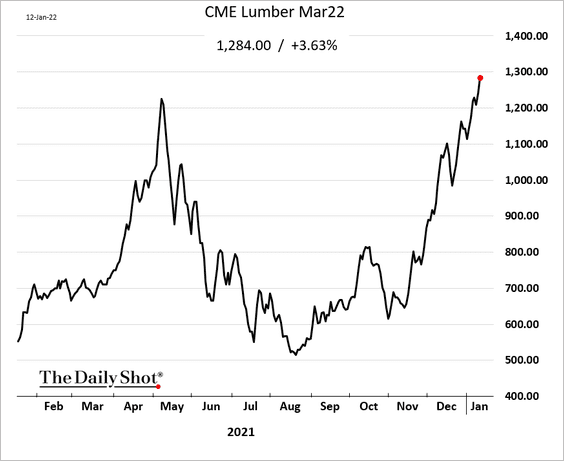

3. Lumber prices continue to climb. Here is the March contract.

Source: Mortgage News Daily Read full article

Source: Mortgage News Daily Read full article

Back to Index

Energy

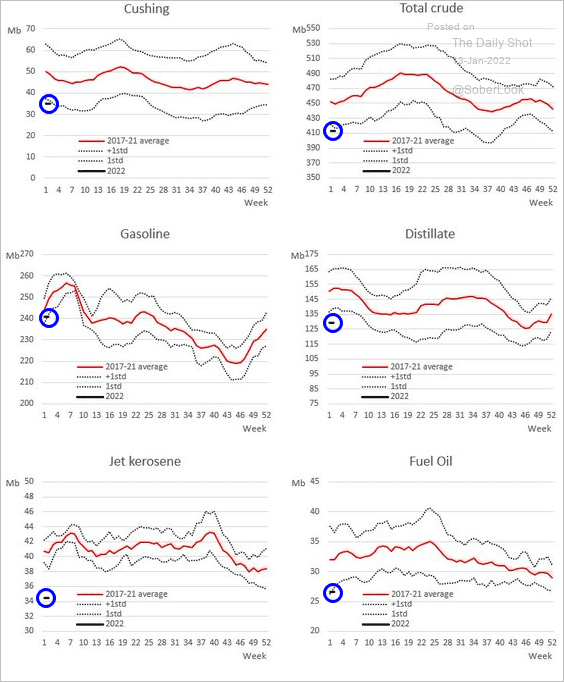

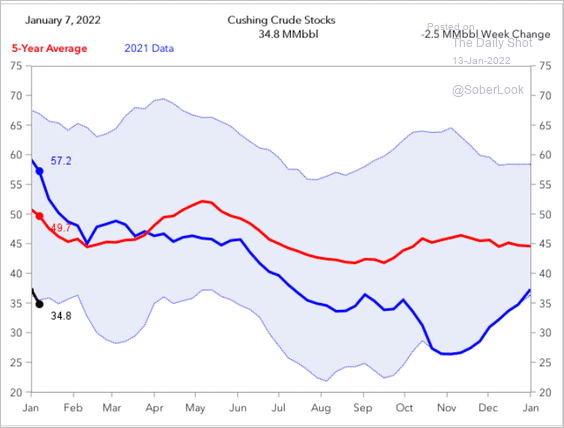

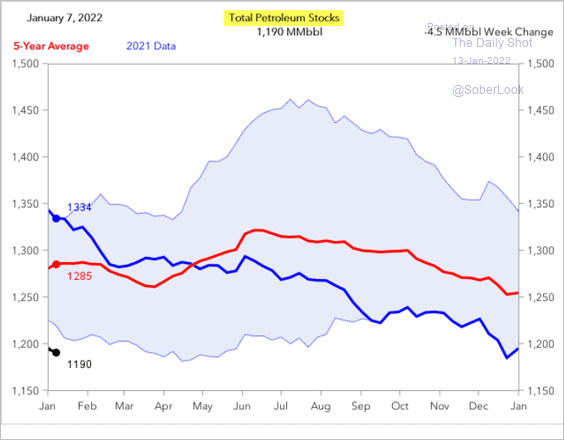

1. We are starting the year with tight crude oil and refined products inventories in the US (3 charts).

Source: @Robert__Rennie

Source: @Robert__Rennie

Source: Fundamental Analytics

Source: Fundamental Analytics

Source: Fundamental Analytics

Source: Fundamental Analytics

——————–

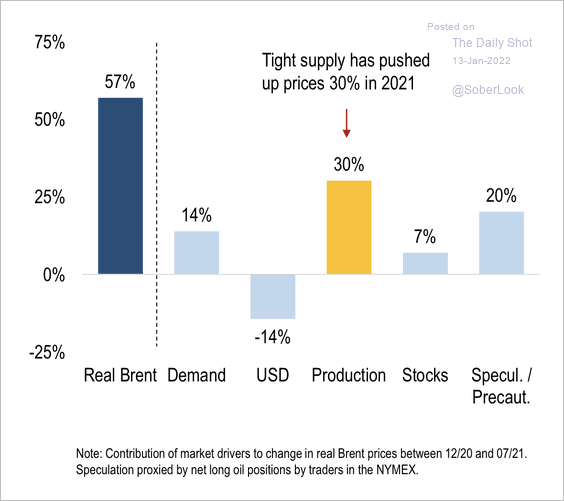

2. Tight supply was a key factor behind last year’s oil price rally …

Source: Numera Analytics

Source: Numera Analytics

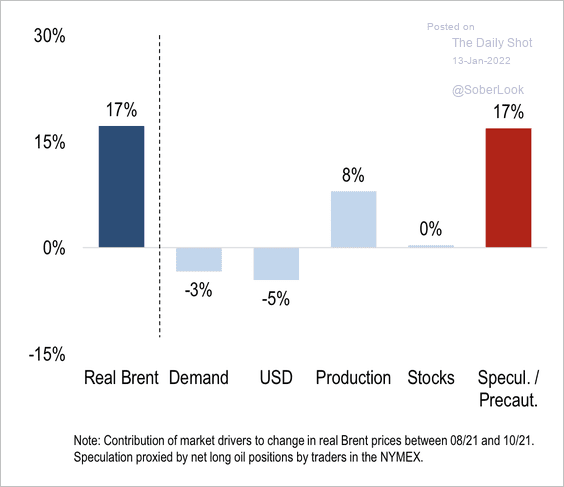

…but the Q3 bull run was mostly speculative.

Source: Numera Analytics

Source: Numera Analytics

——————–

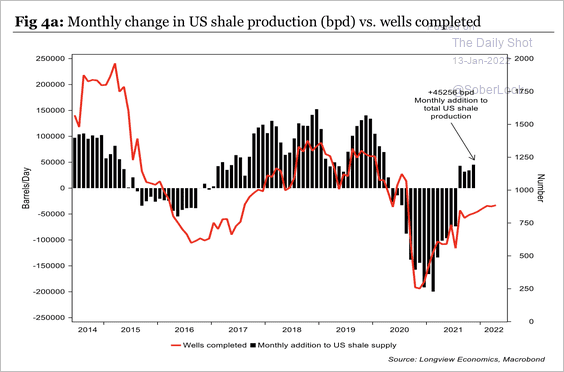

3. The recovery in shale production has been slow.

Source: Longview Economics

Source: Longview Economics

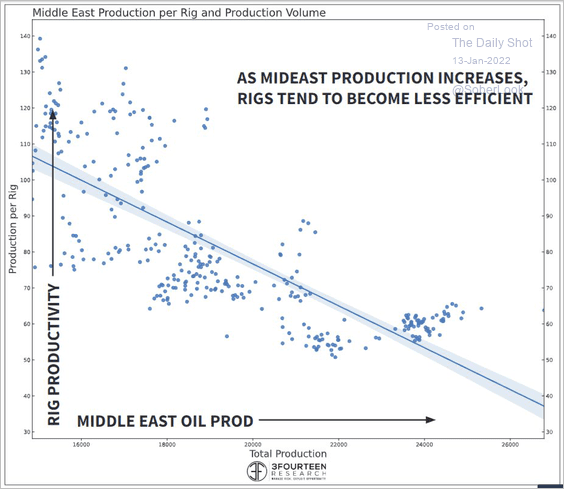

4. Analysts are watching Mideast rig efficiency. Lower output per rig could make it more challenging for OPEC to meet its quota.

Source: @WarrenPies

Source: @WarrenPies

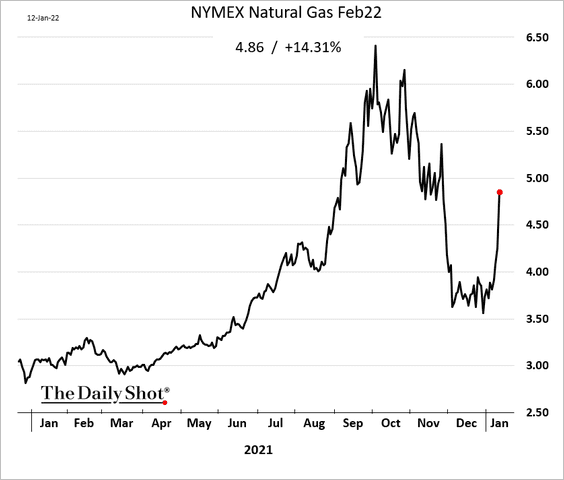

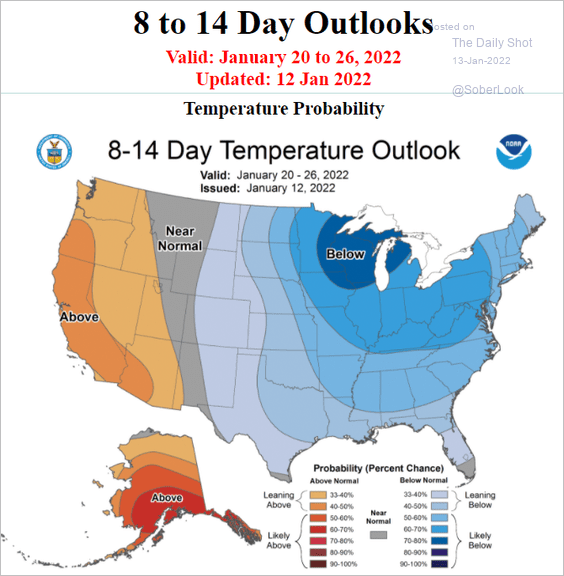

5. US natural gas surged this week.

Source: NOAA

Source: NOAA

Back to Index

Equities

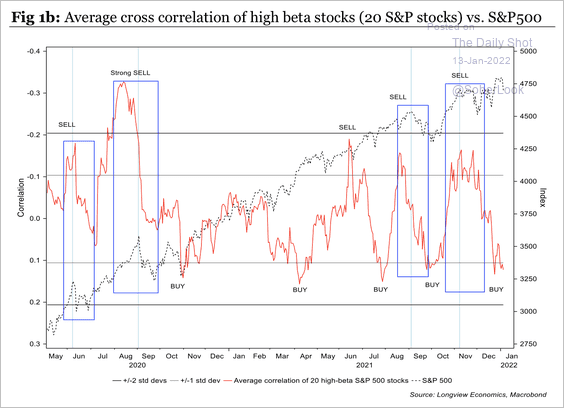

1. The average cross-correlation of high beta S&P 500 stocks has risen over the past few months, which typically precedes a market bounce.

Source: Longview Economics

Source: Longview Economics

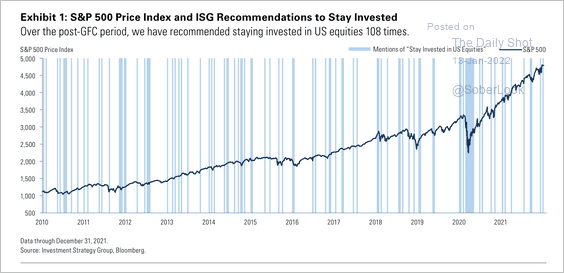

2. Here is a look at the past 106 times the Goldman Sachs Investment Strategy Group recommended clients to “stay invested.”

Source: Goldman Sachs

Source: Goldman Sachs

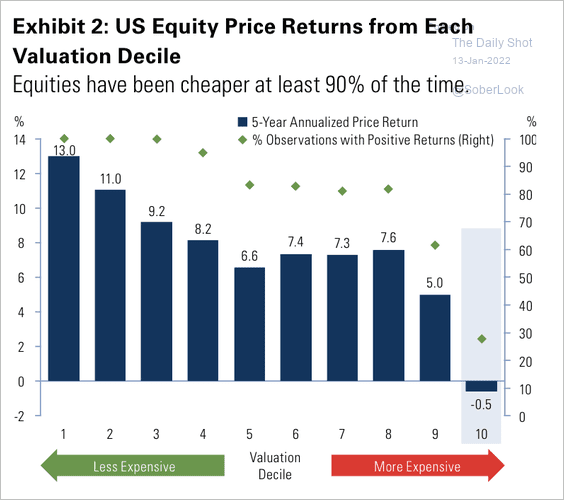

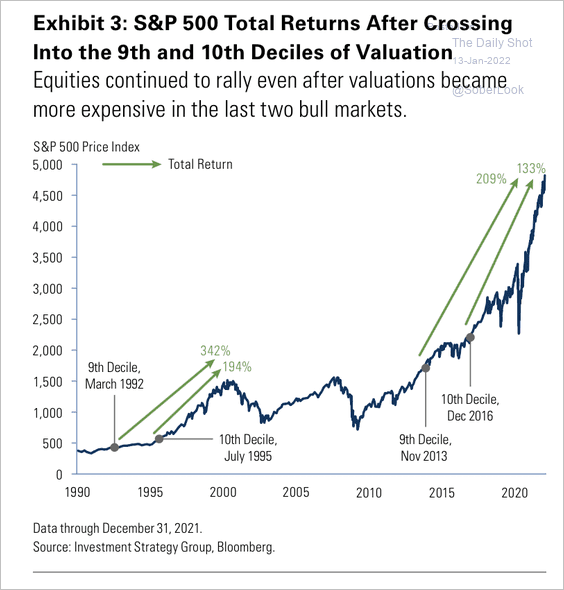

3. US equity valuations are abnormally high, which suggests lower returns going forward (2 charts).

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

Source: Goldman Sachs

——————–

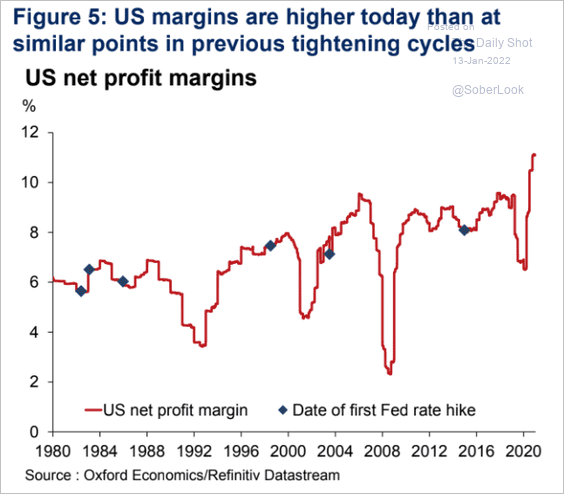

4. US corporate margins are much higher than at the start of previous tightening cycles.

Source: Oxford Economics

Source: Oxford Economics

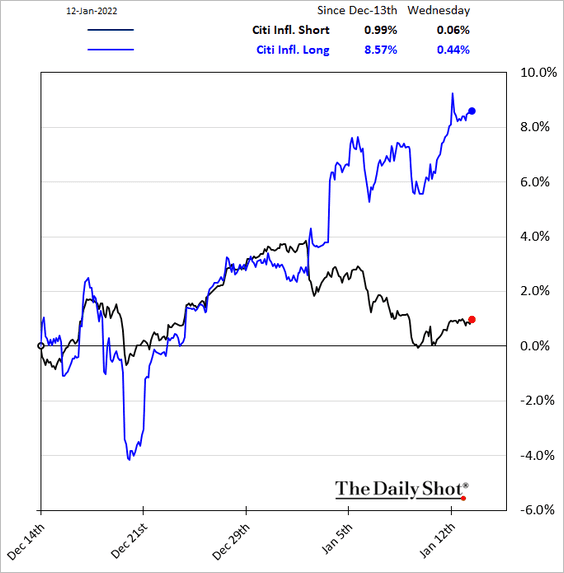

5. Companies that benefit from higher inflation have outperformed sharply this month.

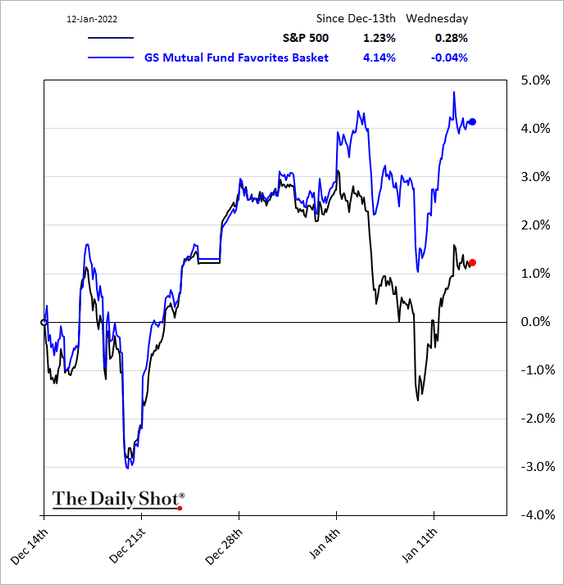

6. While stocks favored by hedge funds have been underperforming, that’s not the case for mutual funds.

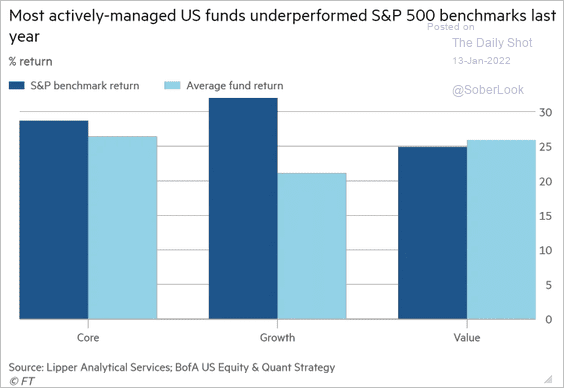

7. Most actively-managed US funds underperformed their benchmarks last year.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Back to Index

Credit

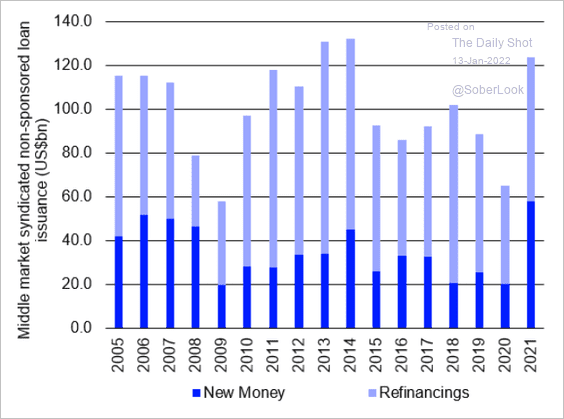

1. Middle-market lending activity surged last year.

Source: @LPCLoans Read full article

Source: @LPCLoans Read full article

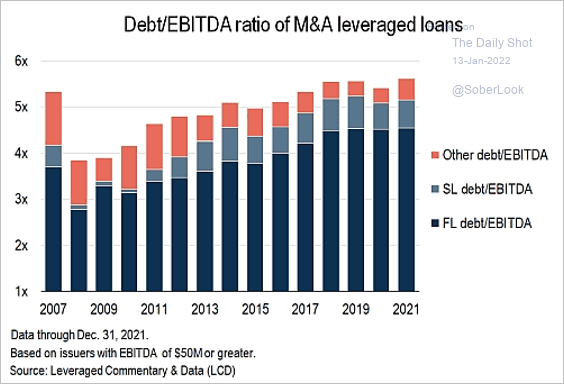

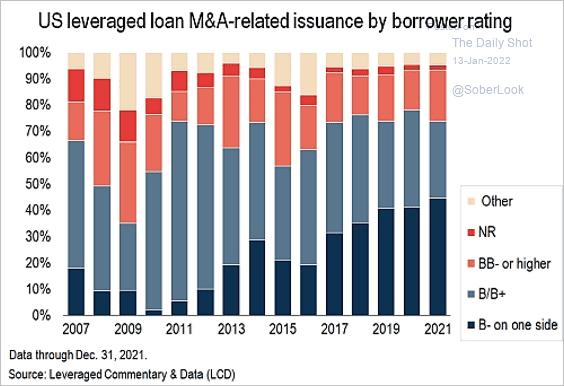

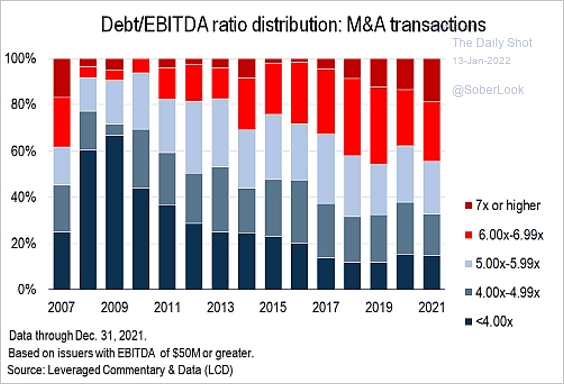

2. Next, we have some data on M&A-related financing (from S&P Global Market Intelligence).

• Leverage (higher than 2007; smaller subordinated/mezz debt):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Issuer ratings (worse than 2007, although fewer unrated deals):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

• Leverage distribution (worse than 2007):

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

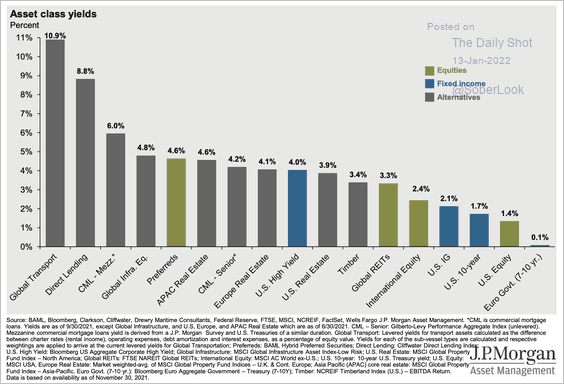

3. This chart shows yield by asset classes globally.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Rates

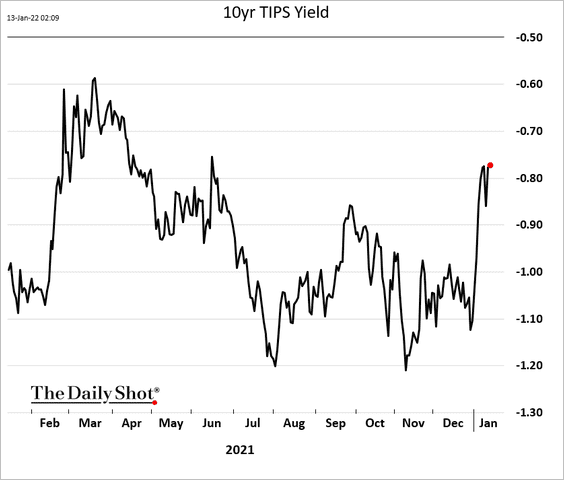

The recent increase in US real yields (TIPS yield) is holding.

Back to Index

Global Developments

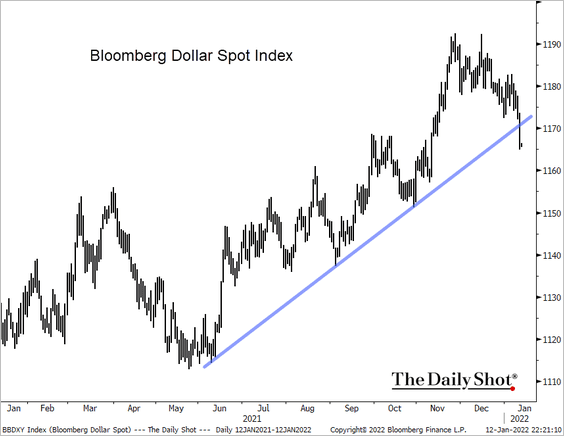

1. The US dollar broke to the downside.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

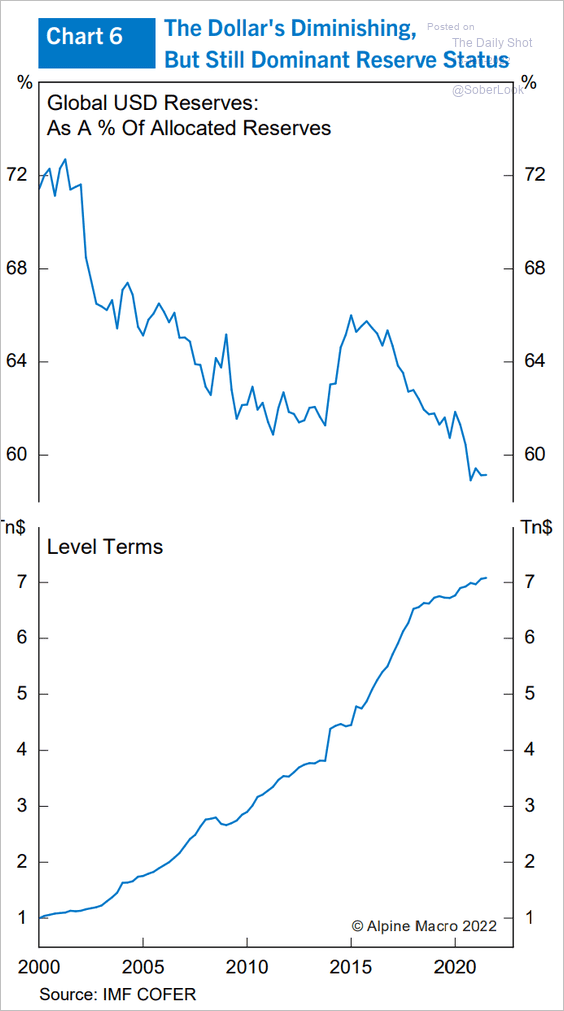

2. This chart shows the US dollar’s reserve status (nations holding dollars in their F/X reserves).

Source: Alpine Macro

Source: Alpine Macro

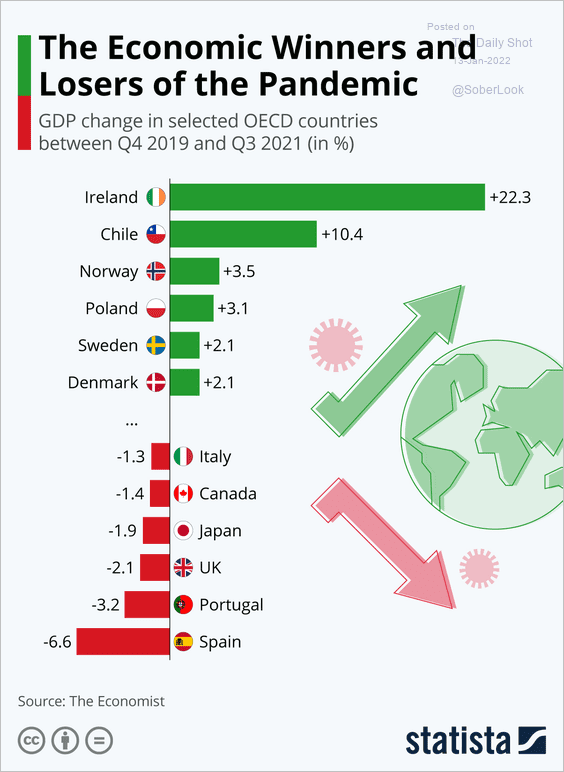

3. Who were the economic winners and losers of the pandemic?

Source: Statista

Source: Statista

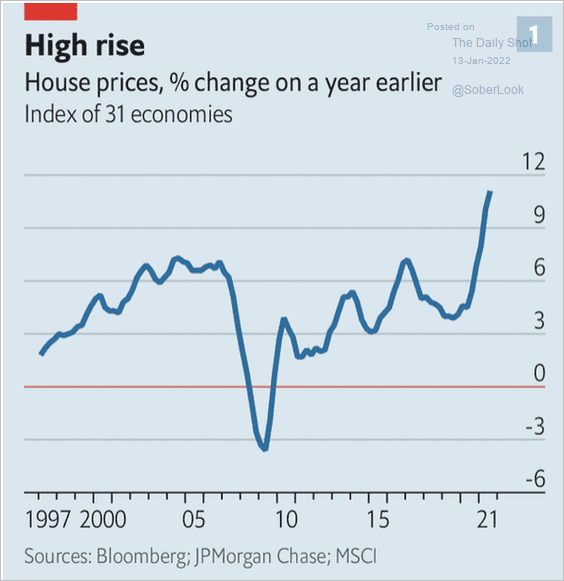

4. Home prices are surging around the world.

Source: The Economist Read full article

Source: The Economist Read full article

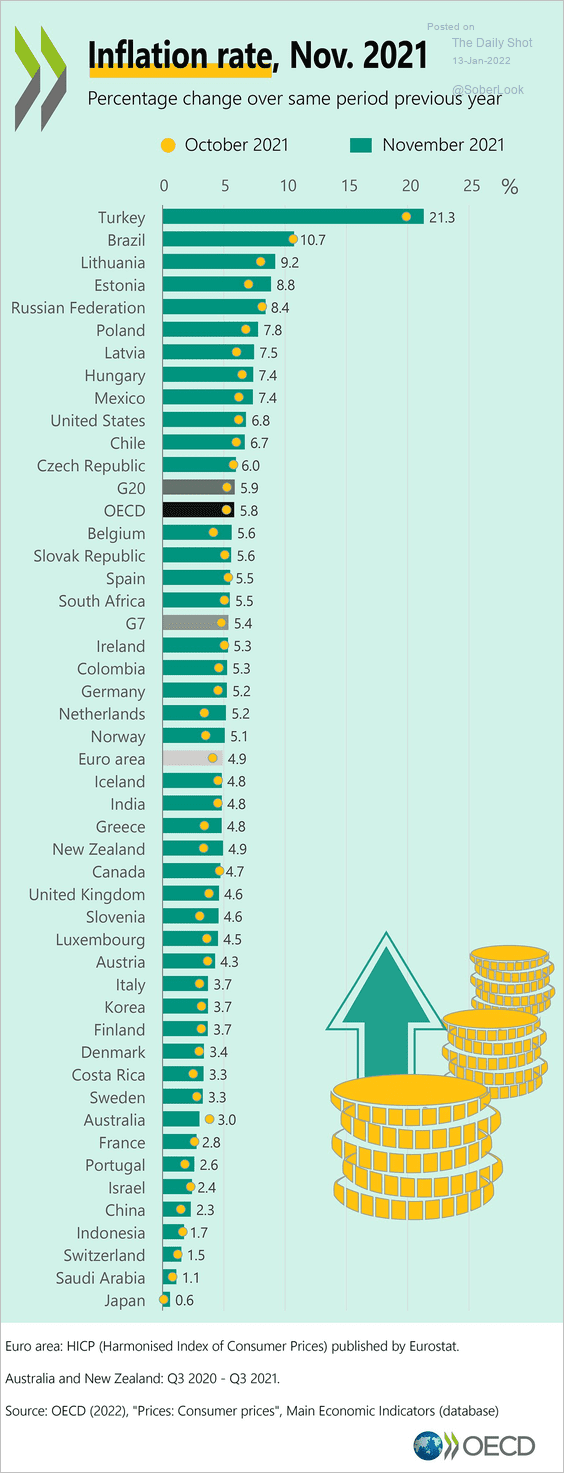

5. Finally, we have inflation rates across the OECD.

Source: @OECD_Stat Read full article

Source: @OECD_Stat Read full article

——————–

Food for Thought

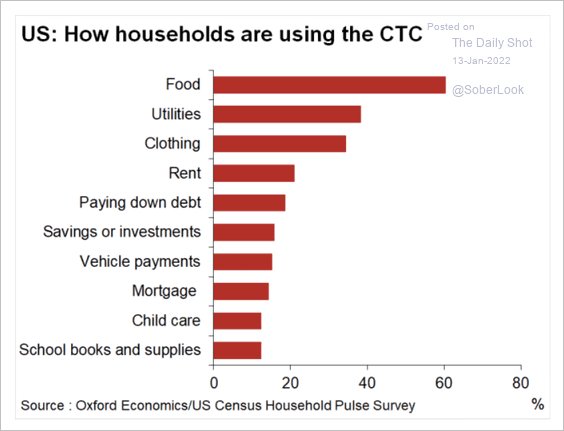

1. How US households are using their child tax credits:

Source: Oxford Economics

Source: Oxford Economics

2. Making room for home office:

Source: @WSJ Read full article

Source: @WSJ Read full article

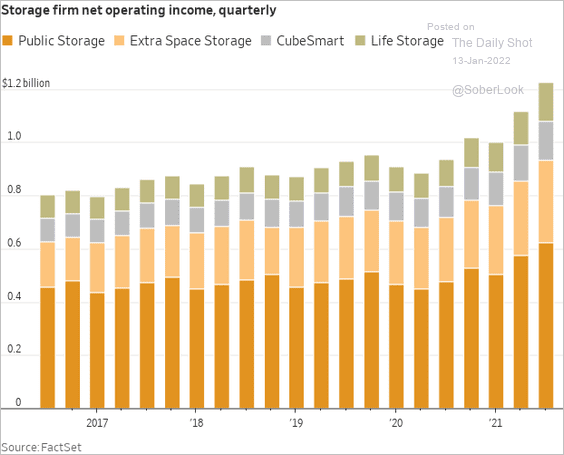

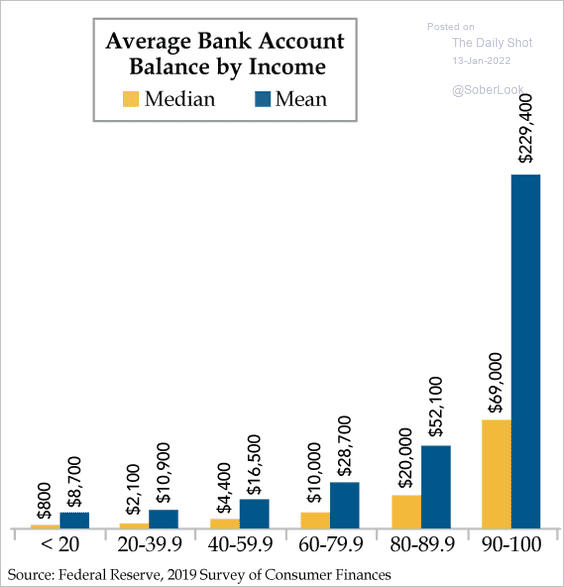

3. Online sports betting demographics:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

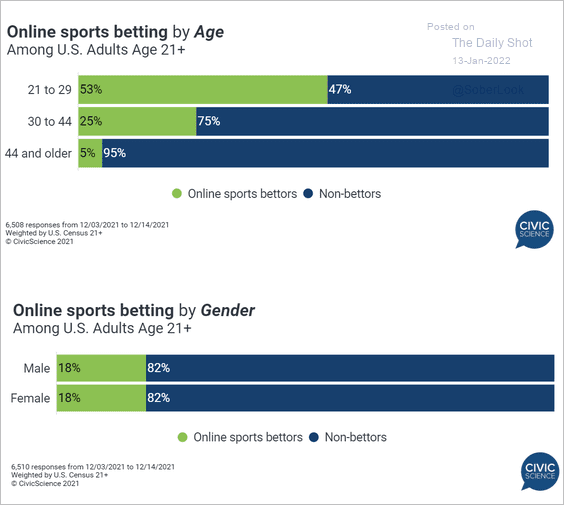

• Sports betting wager size and favorite websites:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

——————–

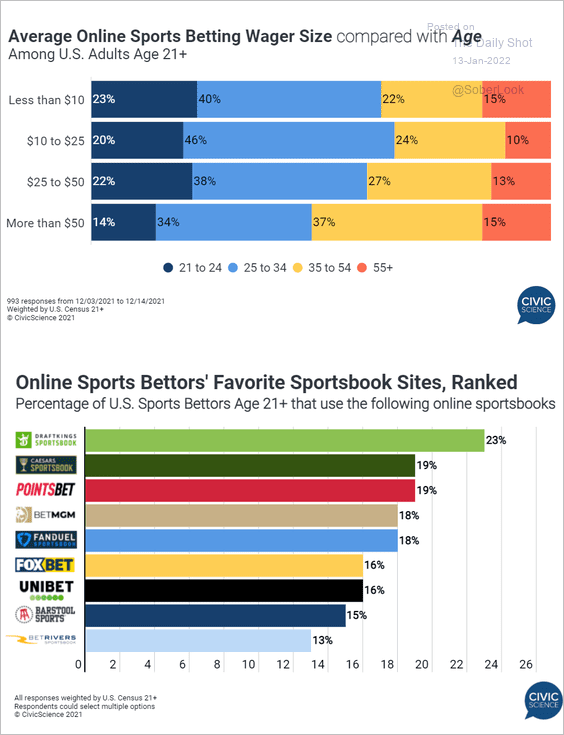

4. Mean and median bank account balance by age category:

Source: The Daily Feather

Source: The Daily Feather

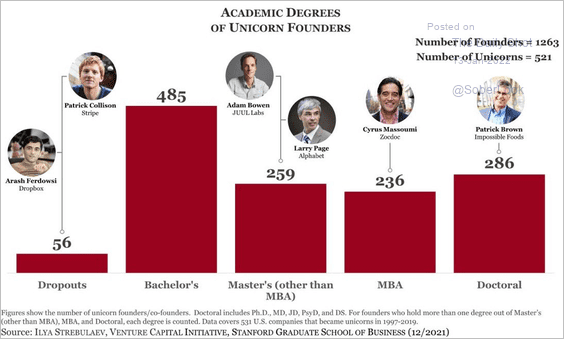

5. Academic degrees of unicorn founders:

Source: Ilya Strebulaev Read full article

Source: Ilya Strebulaev Read full article

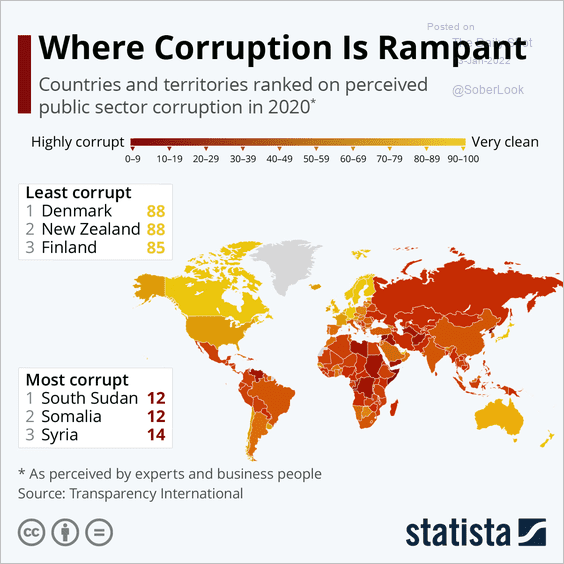

6. Public sector corruption:

Source: Statista

Source: Statista

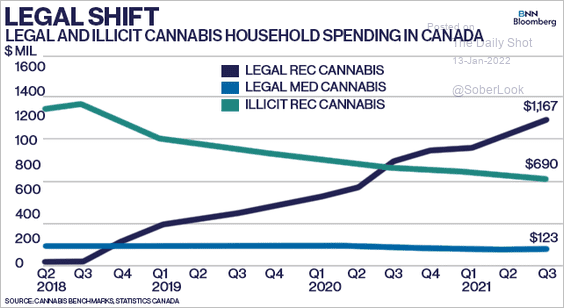

7. Shift to legal cannabis in Canada:

Source: @BNNBloomberg Read full article

Source: @BNNBloomberg Read full article

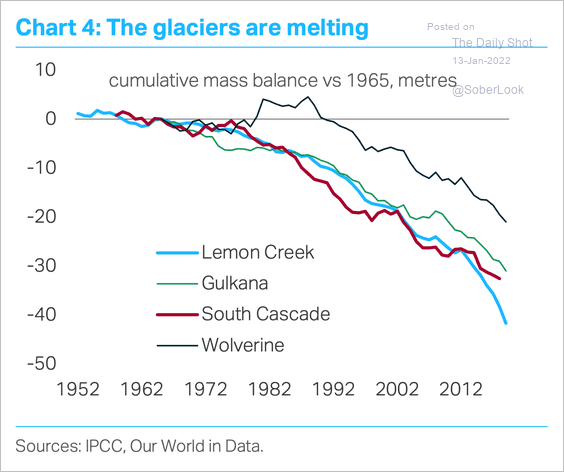

8. Accelerating glacial melt:

Source: TS Lombard

Source: TS Lombard

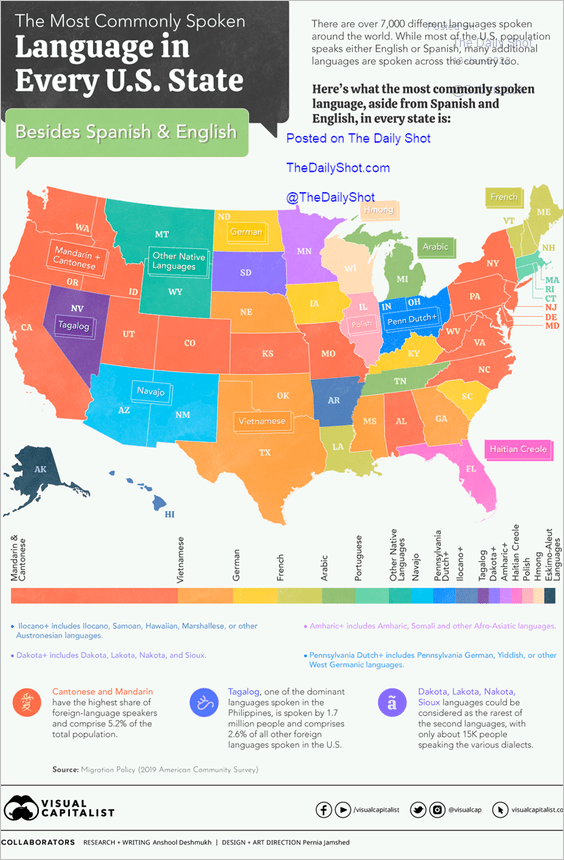

9. Most commonly spoken language aside from Spanish and English:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index