The Daily Shot: 18-Jan-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Rates

• Food for Thought

The United States

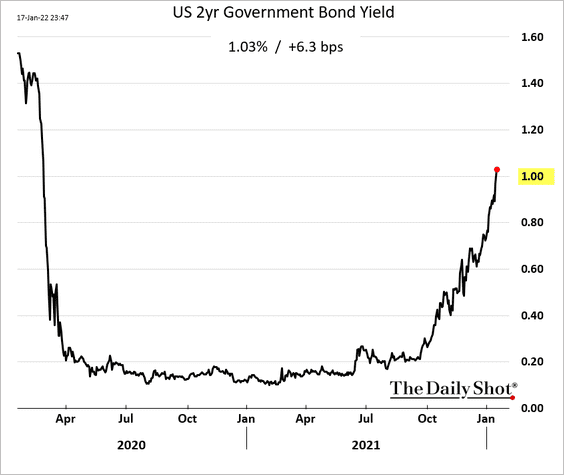

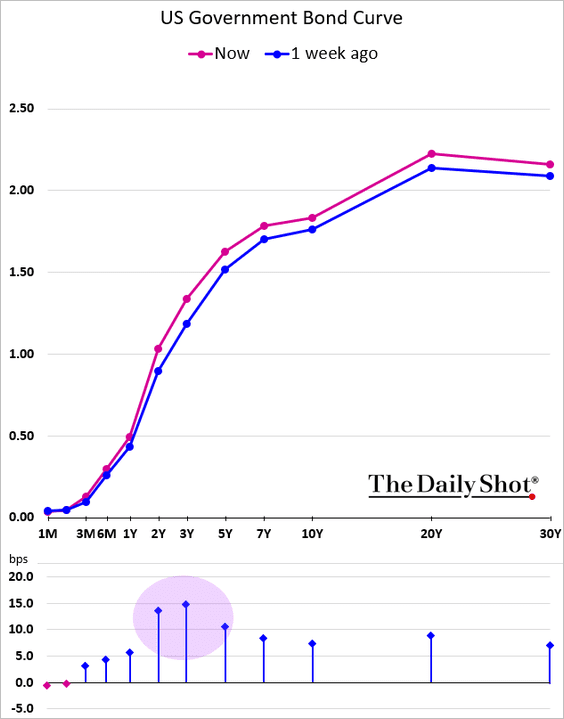

1. The 2-year Treasury yield broke above 1% as the market prices in faster rate hikes ahead.

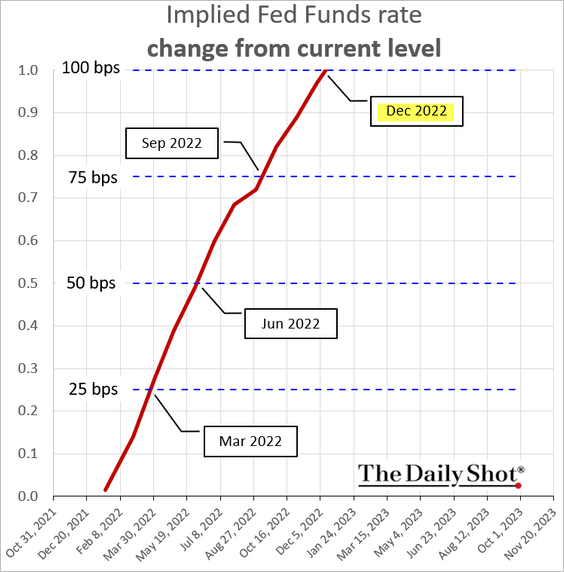

• A 1% increase this year is now fully priced in.

• And the market is starting to price in the possibility of more than four rate increases (or one 50 bps and three 25 bps hikes).

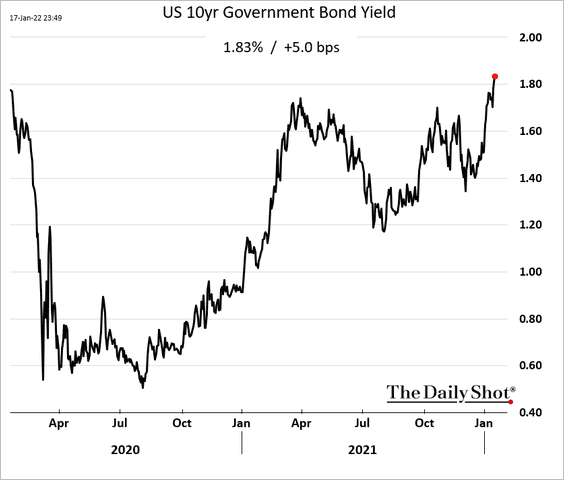

• Longer-dated Treasury yields are rising as well.

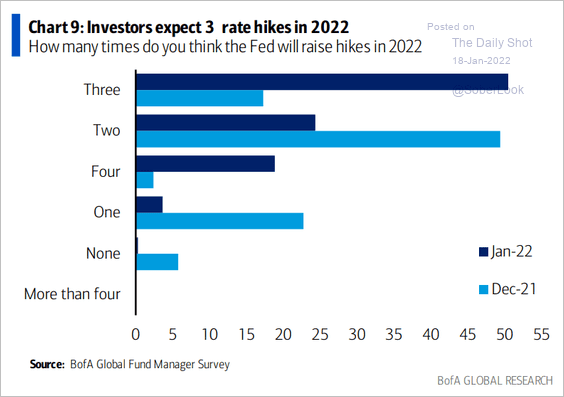

• Most fund managers expect three rate increases this year, according to a survey from BofA.

Source: BofA Global Research

Source: BofA Global Research

——————–

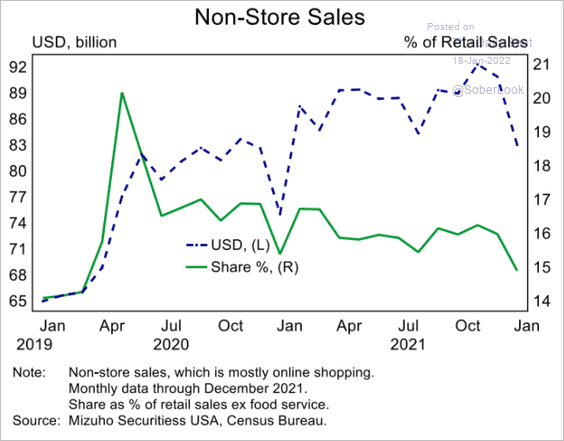

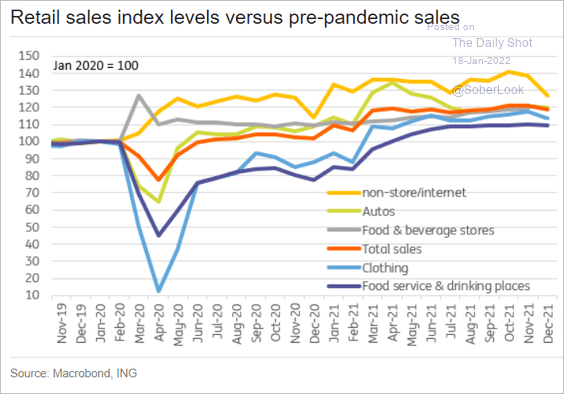

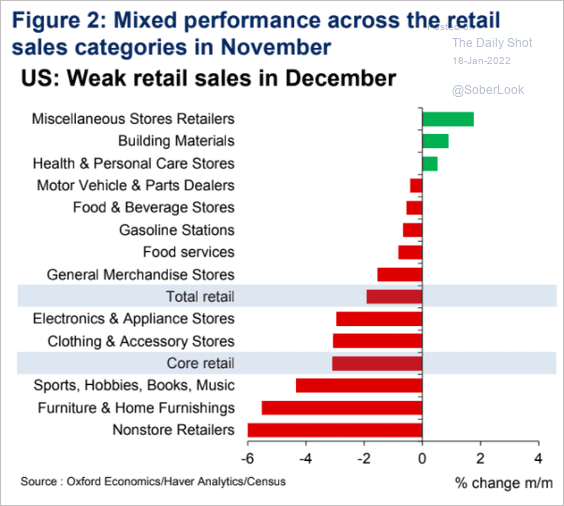

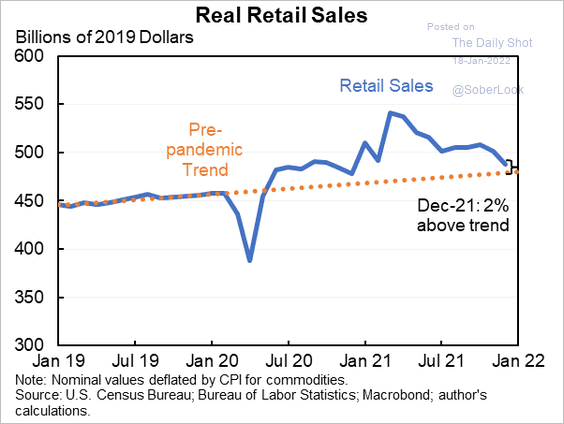

2. Next, we have some more data on the December retail sales report.

• Internet sales dropped sharply as holiday shopping got shifted to earlier months to avoid shipping delays.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• Here is the breakdown by sector (2 charts):

Source: ING

Source: ING

Source: Oxford Economics

Source: Oxford Economics

• Real retail sales are back to their pre-pandemic trend.

Source: @jasonfurman

Source: @jasonfurman

——————–

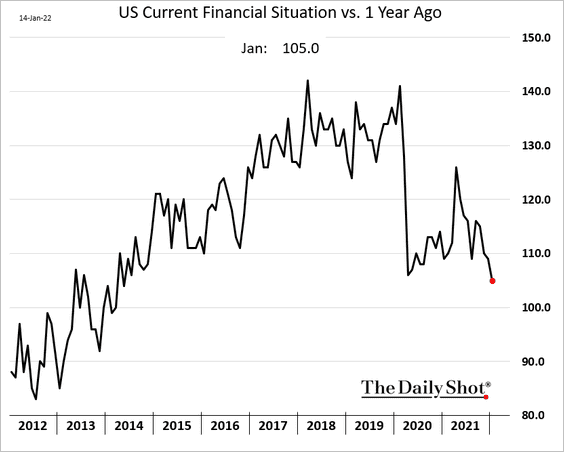

3. The U. Michigan current financial situation index dropped to the lowest point since 2014 due to inflation concerns.

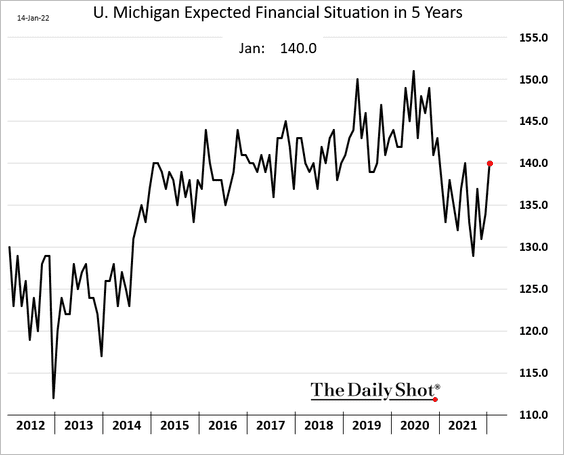

But longer-term expectations improved this month.

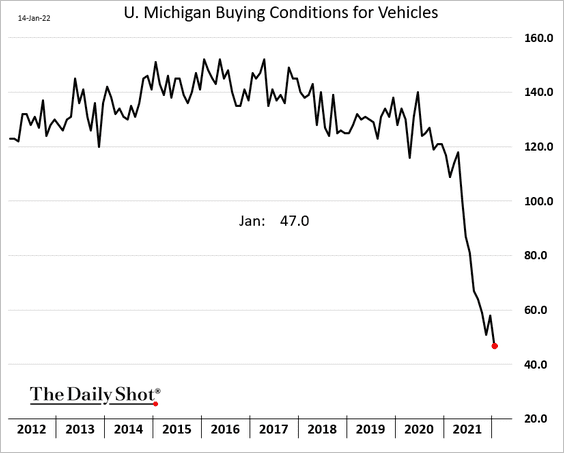

• Buying conditions for vehicles hit a multi-year low.

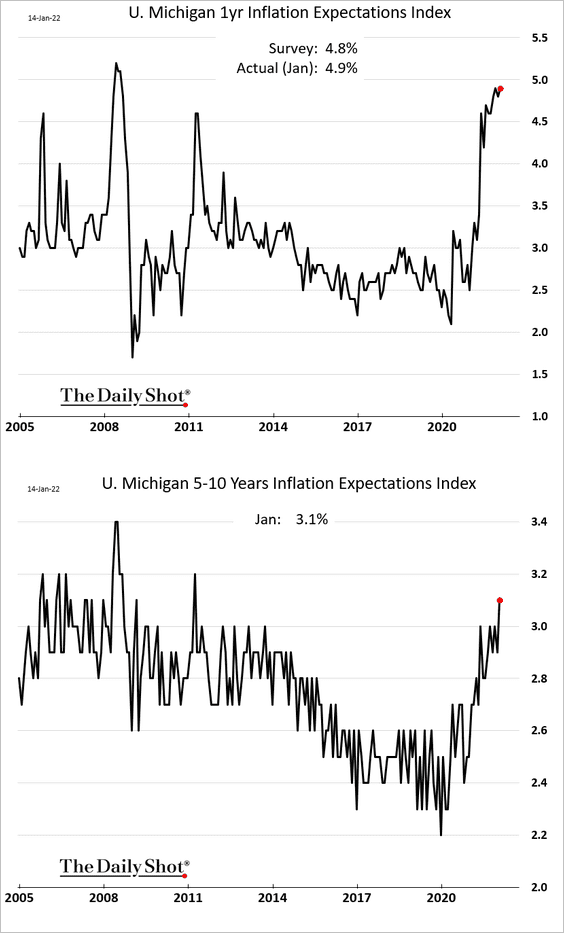

• Inflation expectations rose.

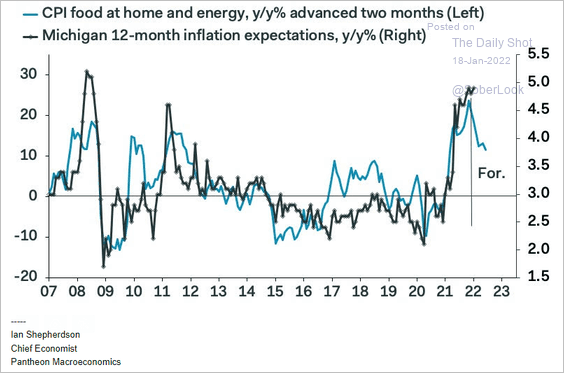

Will moderation in energy and “food at home” CPI ease inflation expectations?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

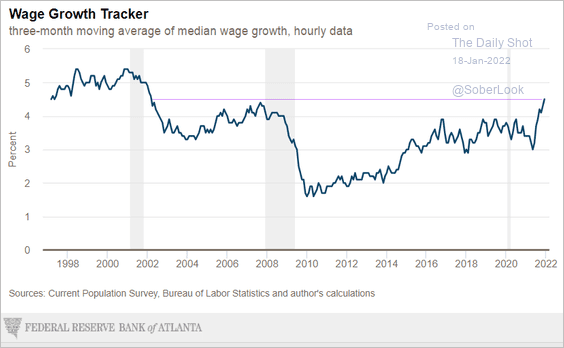

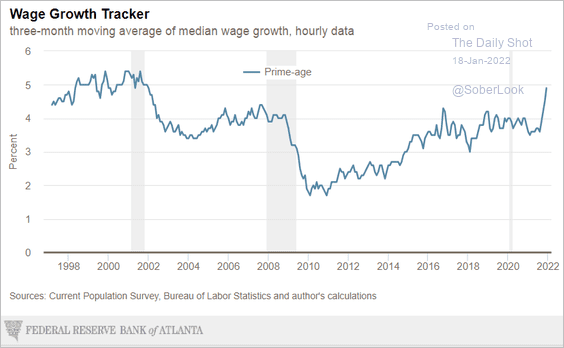

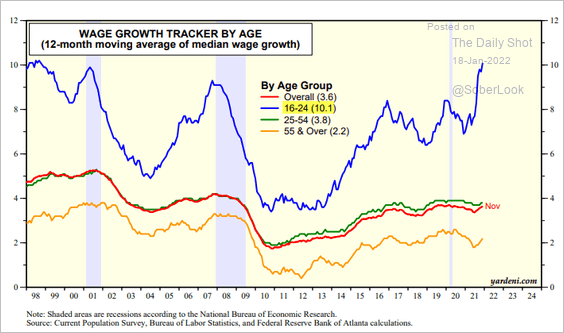

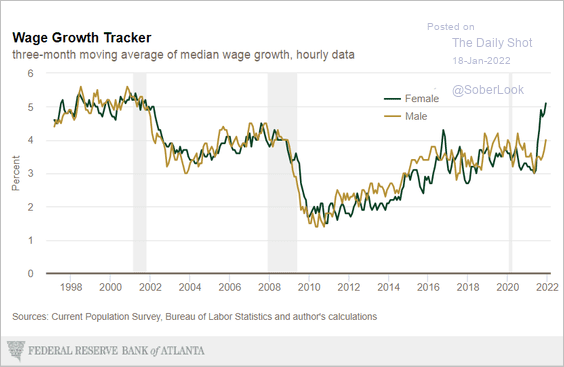

4. The Atlanta Fed’s wage growth tracker hit the highest level in two decades.

Here are some of the sub-indices.

• Prime-age workers:

• Wage growth by age:

Source: Yardeni Research

Source: Yardeni Research

• Wage growth for women and men:

——————–

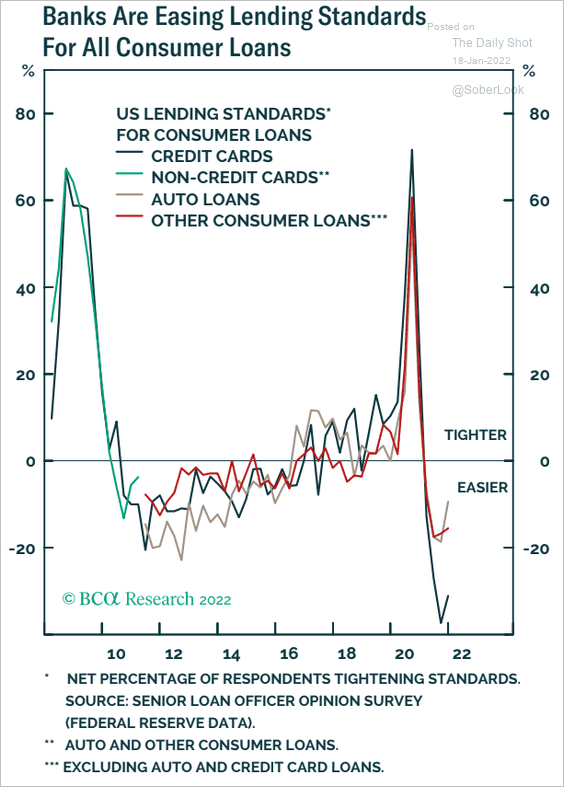

5. Now let’s take a look at some trends in consumer credit.

• Banks have been easing lending standards:

Source: BCA Research

Source: BCA Research

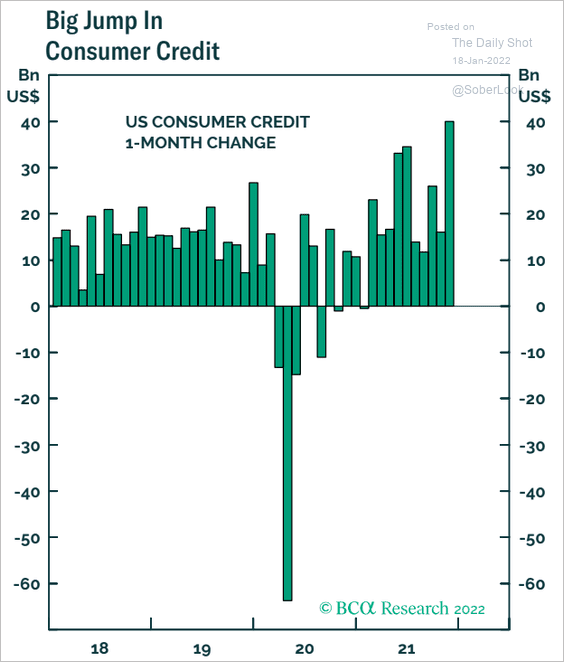

• Consumer credit is growing as card usage picks up.

Source: BCA Research

Source: BCA Research

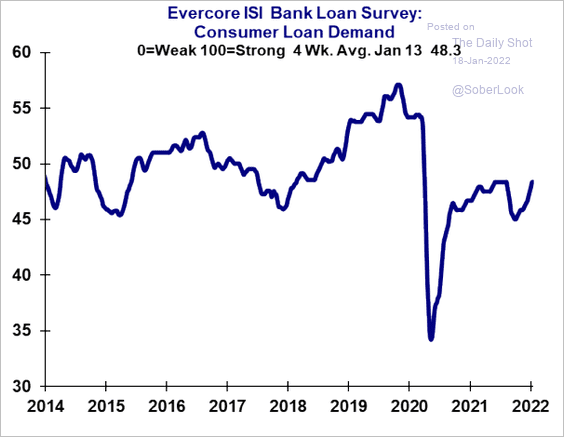

• But consumer loan demand remains well below pre-COVID levels.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

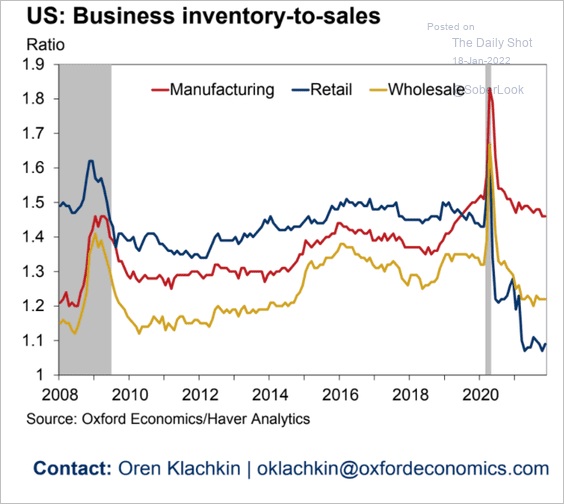

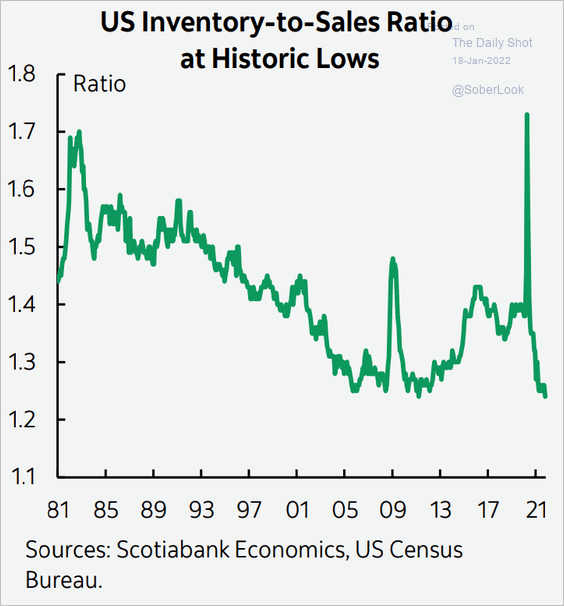

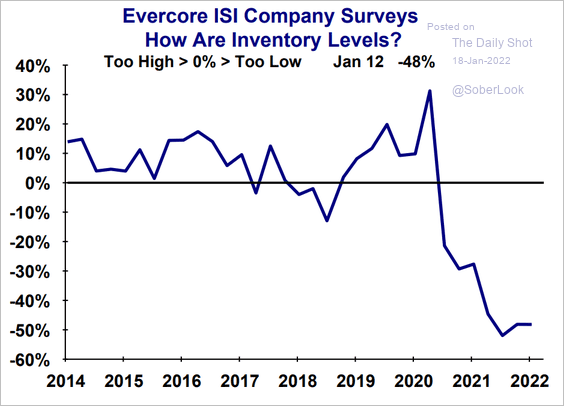

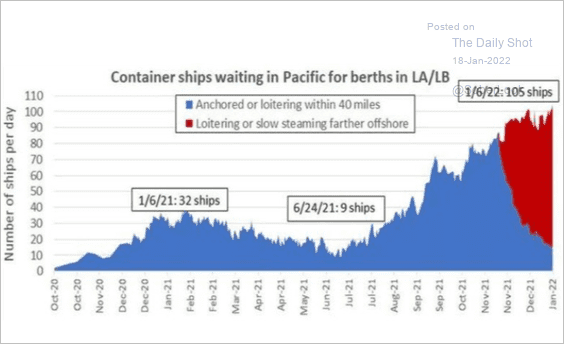

6. Finally, here are some updates on supply bottlenecks.

• Inventories-to-sales ratios remained depressed in November (2 charts).

Source: Oxford Economics

Source: Oxford Economics

Source: Scotiabank Economics

Source: Scotiabank Economics

• And according to a survey from Evercore ISI Research, there hasn’t been much improvement in many industries since then.

Source: Evercore ISI Research

Source: Evercore ISI Research

• The West Coast ports remained clogged up.

Source: HSBC, Syz Group

Source: HSBC, Syz Group

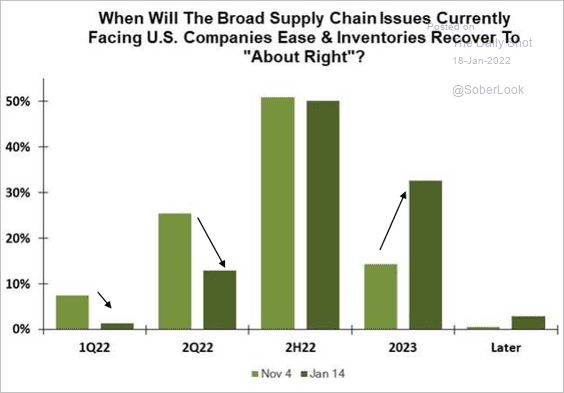

• When will supply chain issues ease?

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Canada

1. Will we see a BoC hike next week? The market is pricing in a 70%+ probability of such an outcome.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

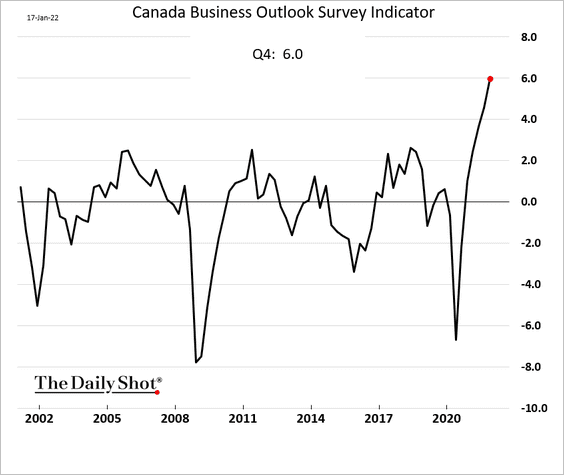

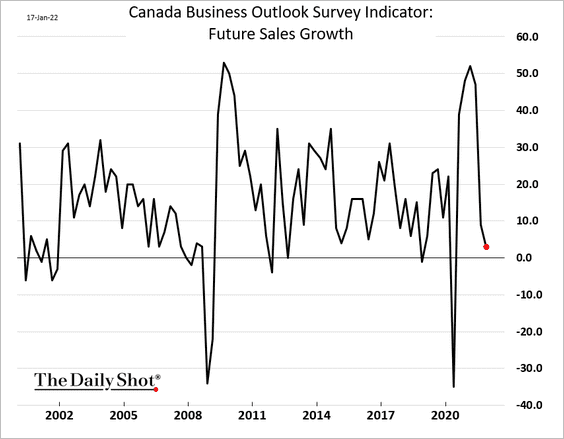

2. The BoC business outlook indicator hit a new high last quarter.

But sales growth expectations have been moderating.

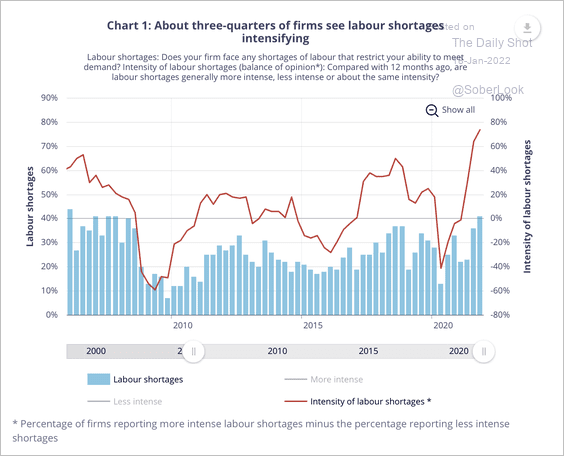

• More businesses are reporting intense labor shortages over the past year, which is placing upward pressure on wages.

Source: Bank of Canada Read full article

Source: Bank of Canada Read full article

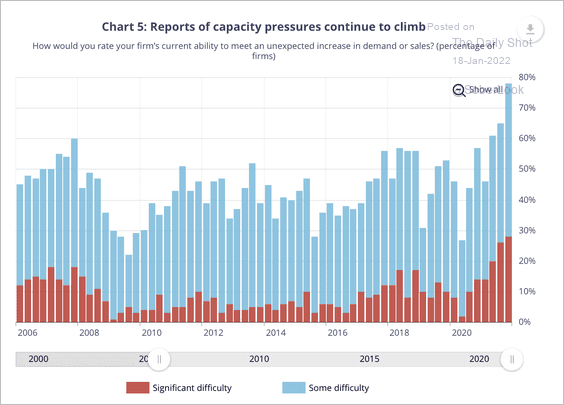

• More than three-quarters of firms said they would have difficulty meeting an unexpected increase in demand.

Source: Bank of Canada Read full article

Source: Bank of Canada Read full article

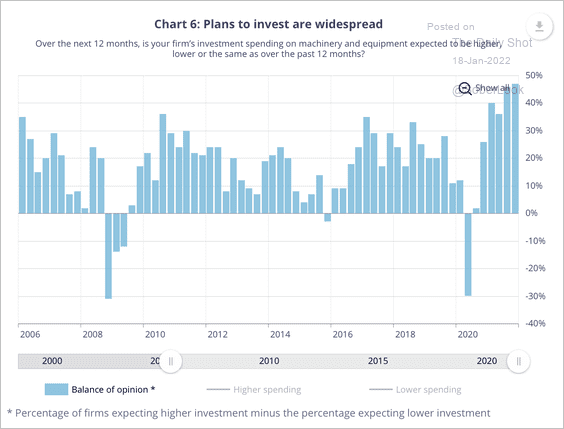

• Strong demand and capacity pressures support solid investment intentions.

Source: Bank of Canada Read full article

Source: Bank of Canada Read full article

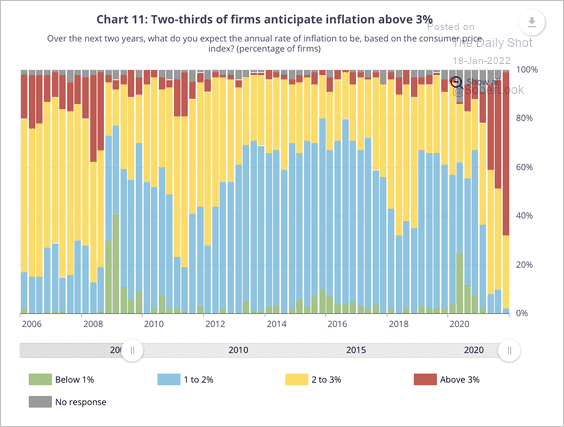

• Inflation expectations are elevated – no longer seen as transitory.

Source: Bank of Canada Read full article

Source: Bank of Canada Read full article

——————–

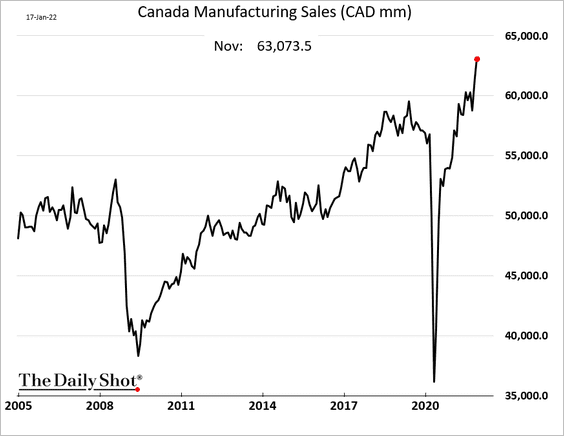

3. Manufacturing sales hit a record high in November.

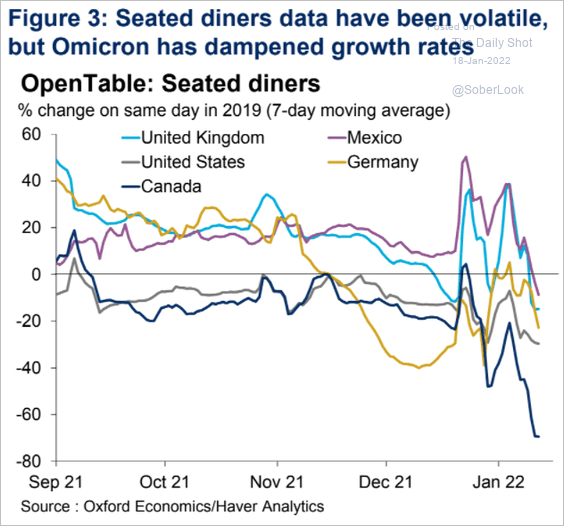

4. Canada’s omicron-driven drop in mobility has been more severe than in other economies.

Source: Oxford Economics

Source: Oxford Economics

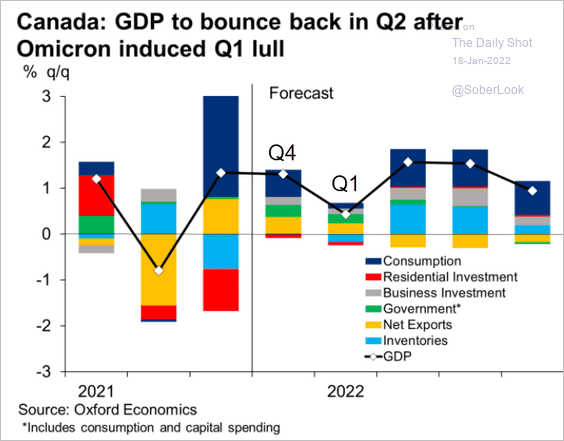

As a result, the nation’s GDP growth will slow this quarter. But according to Oxford Economics, the economy will rebound in Q2.

Source: Oxford Economics

Source: Oxford Economics

——————–

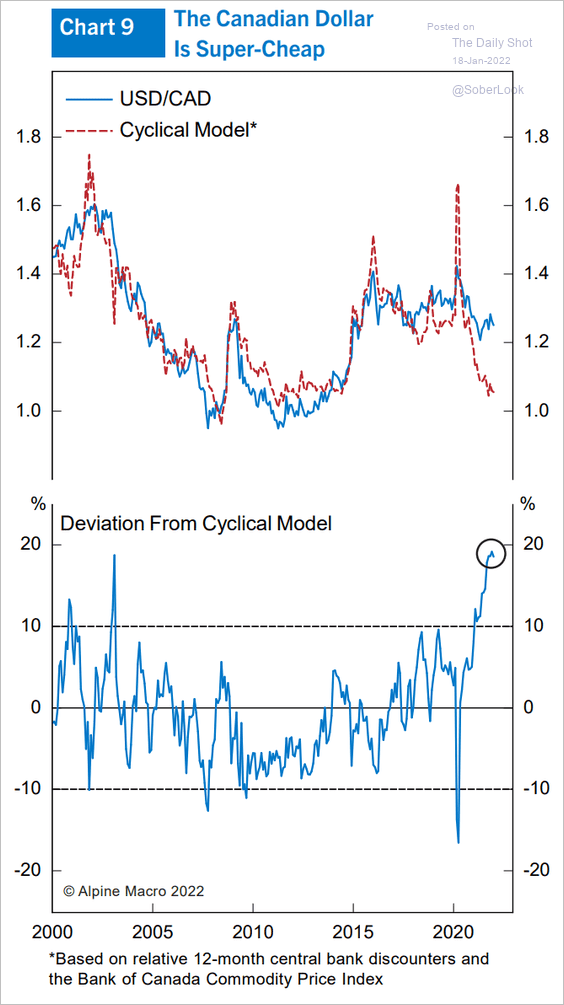

5. The Canadian dollar is cheap, according to Alpine Macro (chart shows USD as expensive relative to CAD).

Source: Alpine Macro

Source: Alpine Macro

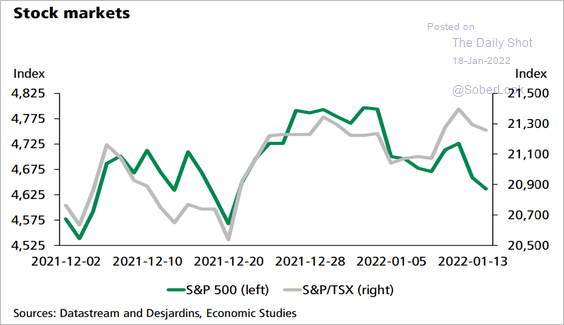

6. Canadian stocks have been outperforming the US recently as growth sectors slump and energy prices climb.

Source: Desjardins

Source: Desjardins

Back to Index

The United Kingdom

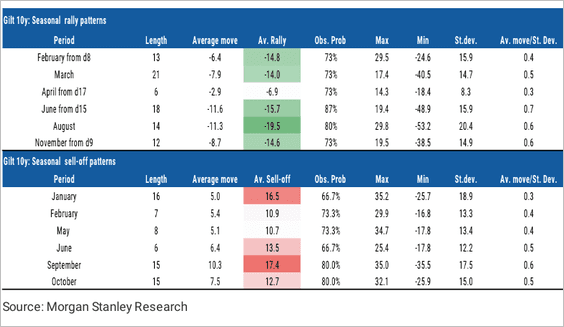

1. Higher 10-year gilt yields are supported by January seasonality.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

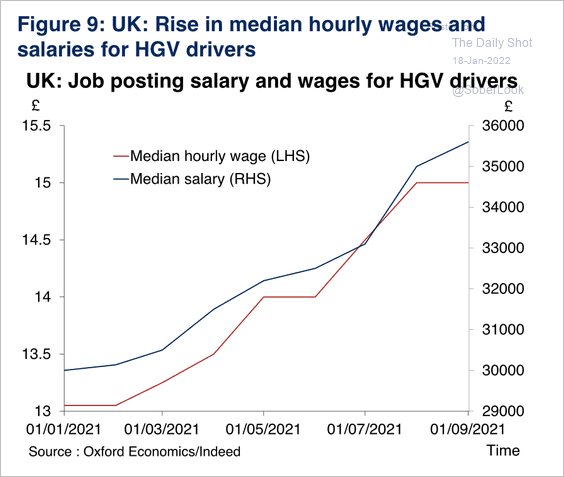

2. Haulage companies have raised pay to attract more applicants.

Source: Oxford Economics

Source: Oxford Economics

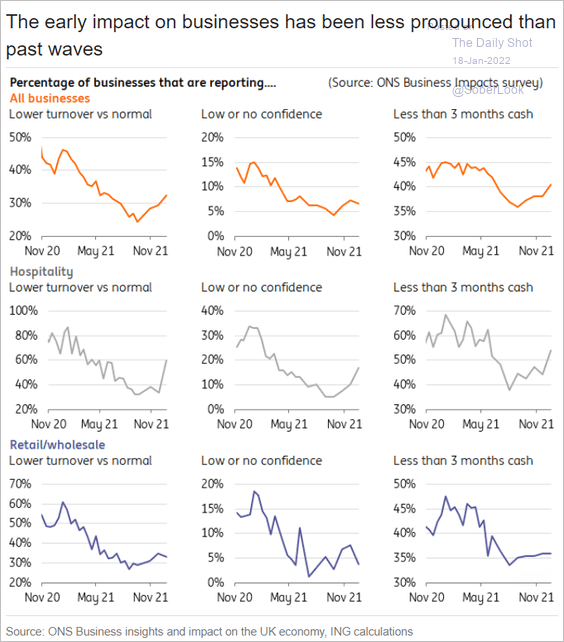

3. Omicron’s impact on businesses has been less severe than during previous COVID waves.

Source: ING

Source: ING

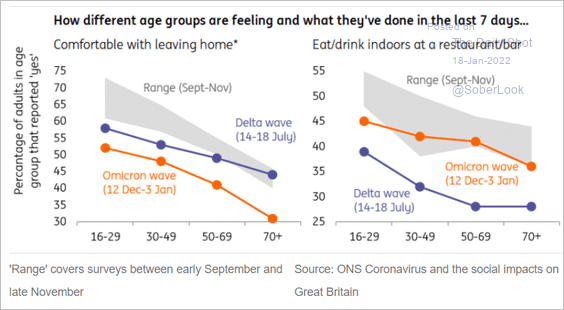

Here are some mobility indicators by age.

Source: ING

Source: ING

Back to Index

The Eurozone

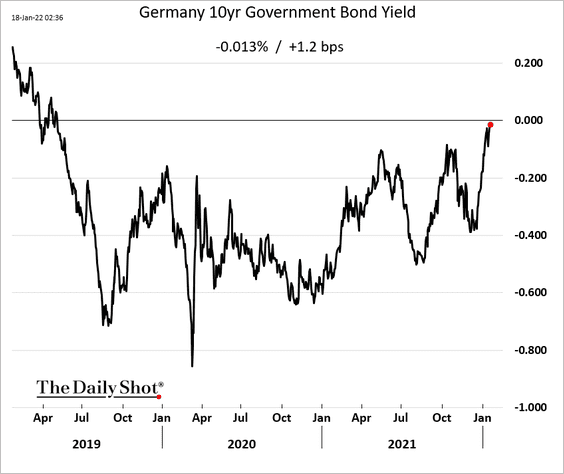

1. The 10yr Bund yield is about to move into positive territory.

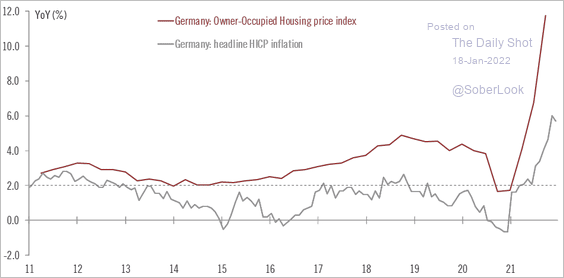

2. German home price appreciation accelerated last year.

Source: @fwred

Source: @fwred

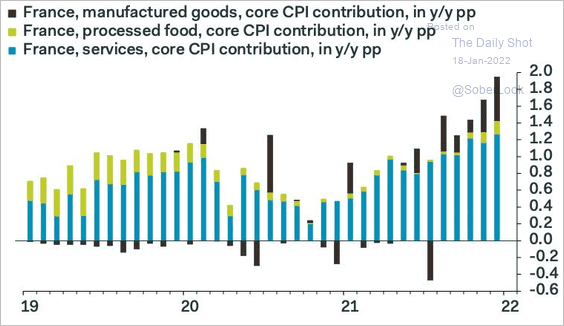

3. This chart shows the key contributions to French consumer inflation.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

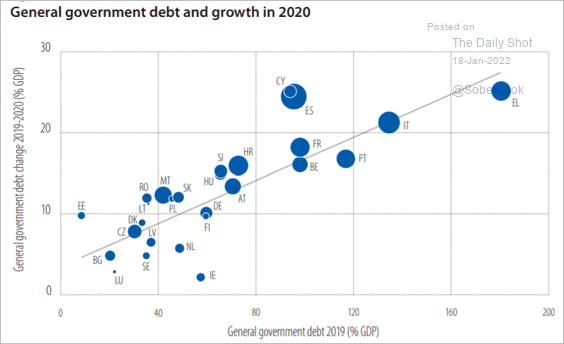

4. Next, we have the pandemic-era government debt growth vs. debt levels (as a share of GDP).

Source: EIB Read full article

Source: EIB Read full article

Back to Index

Europe

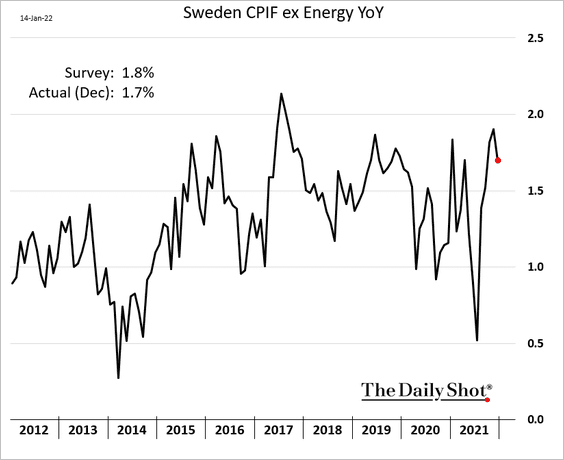

1. Sweden’s CPI is holding below 2%.

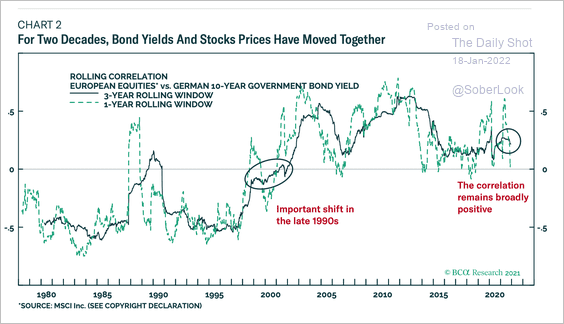

2. Since the 1990s, European shares have moved positively with bond yields.

Source: BCA Research

Source: BCA Research

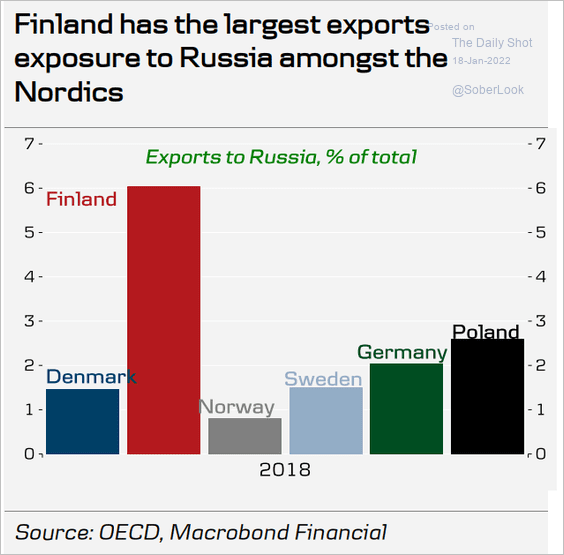

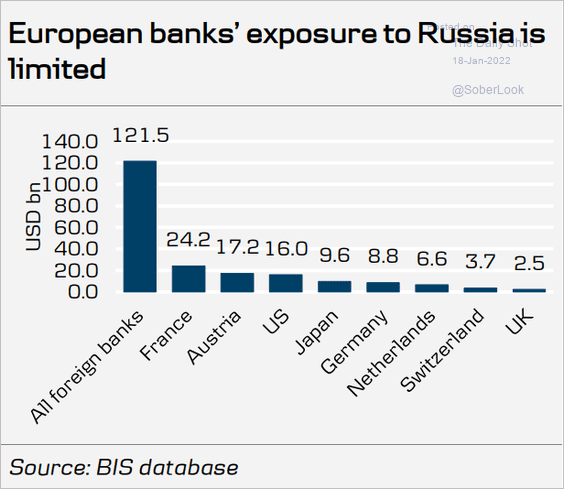

3. What is Western Europe’s exposure to Russia?

• Exports:

Source: Danske Bank

Source: Danske Bank

• Bank credit:

Source: Danske Bank

Source: Danske Bank

Back to Index

Asia – Pacific

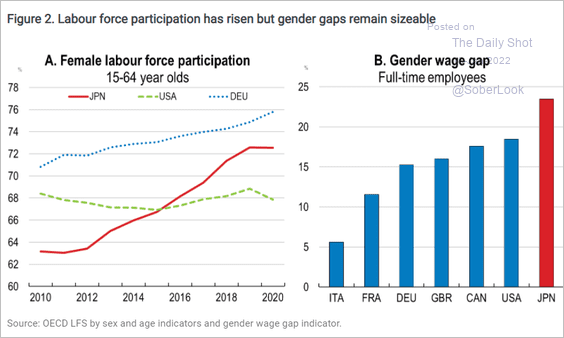

1. Here is Japan’s female labor force participation and the wage gap.

Source: OECD Read full article

Source: OECD Read full article

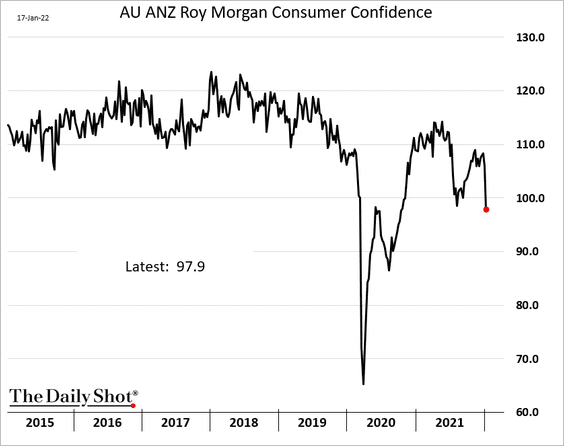

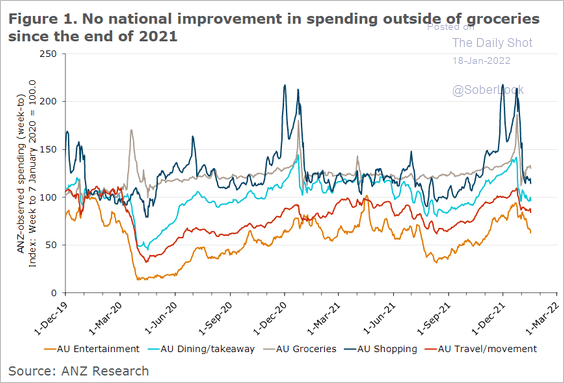

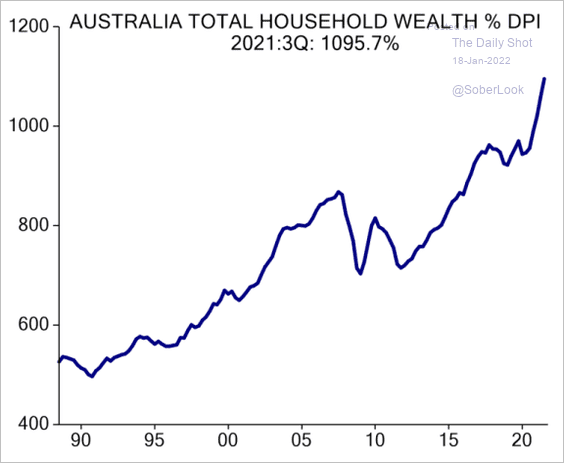

2. Next, we have some updates on Australia.

• Consumer confidence (sharp deterioration as omicron surged):

• Retail spending:

Source: ANZ Research

Source: ANZ Research

• Household wealth as a share of disposable income:

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

China

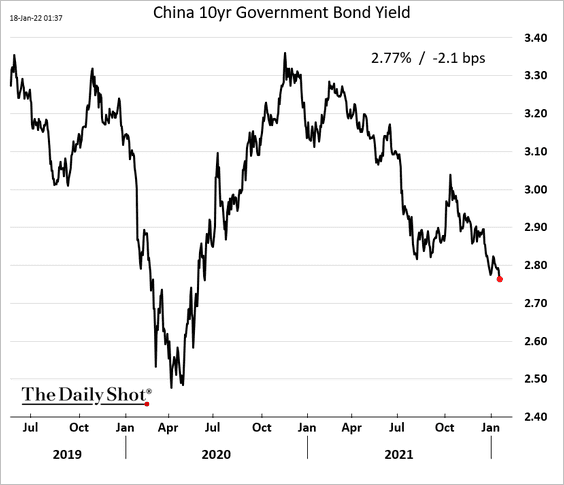

1. China’s bond yields continue to fall, …

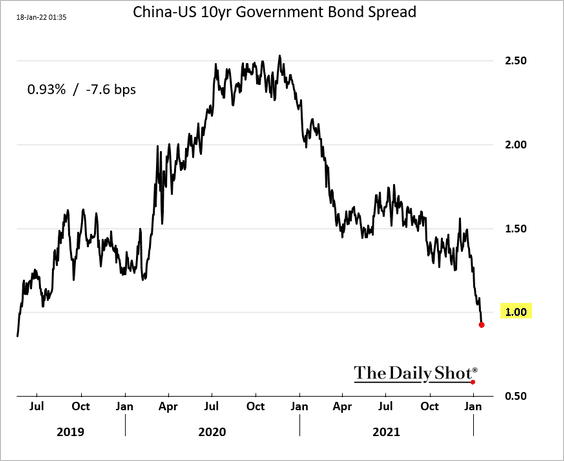

… with the China-US 10-year spread dipping below 1% for the first time since 2019, as monetary policies diverge.

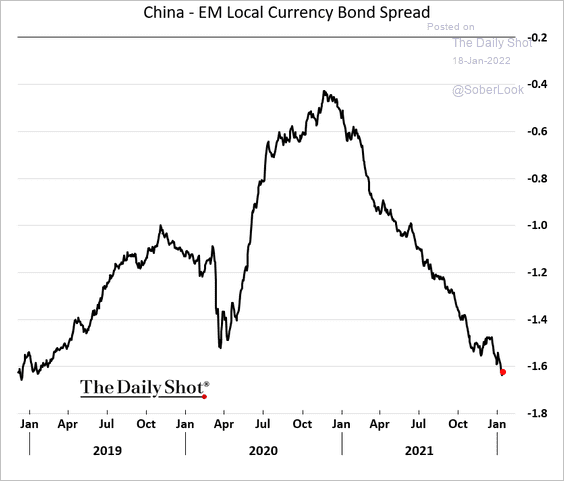

Here is the China-EM local currency bond spread.

h/t @karllesteryap

h/t @karllesteryap

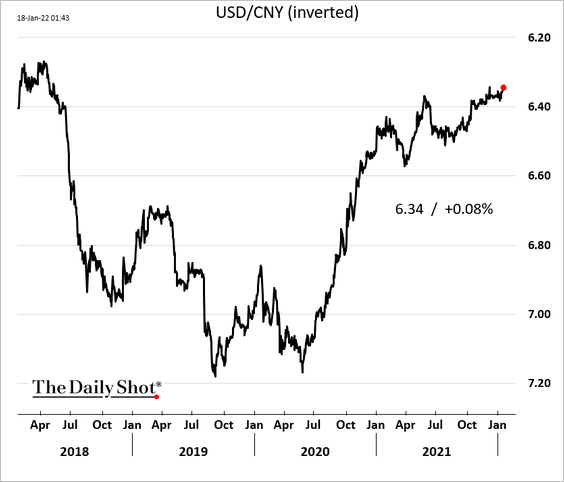

And yet, the renminbi is near the highest level vs. USD since 2018.

——————–

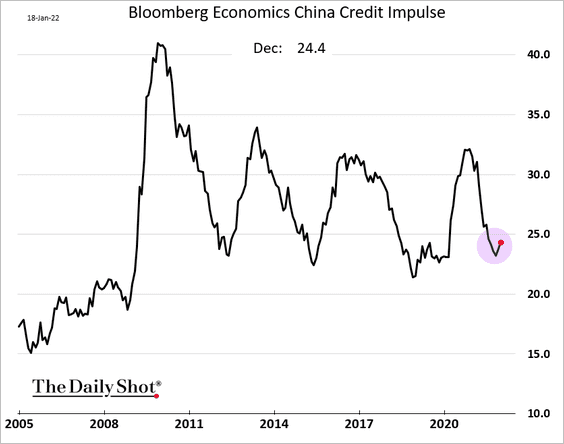

2. China’s credit impulse has bottomed.

Source: Bloomberg

Source: Bloomberg

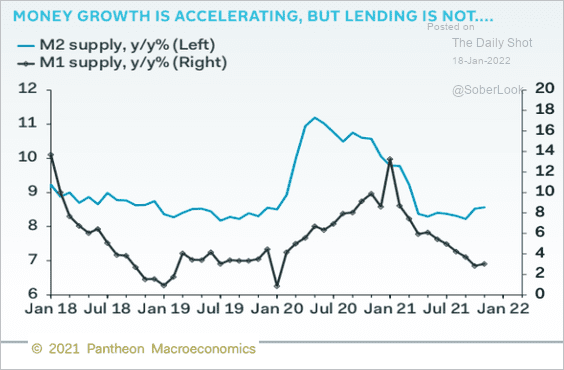

Government debt issuance has been propping up credit expansion.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

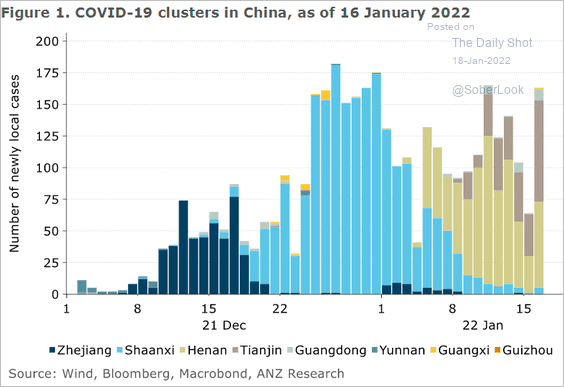

3. COVID clusters continue to pop up, …

Source: ANZ Research

Source: ANZ Research

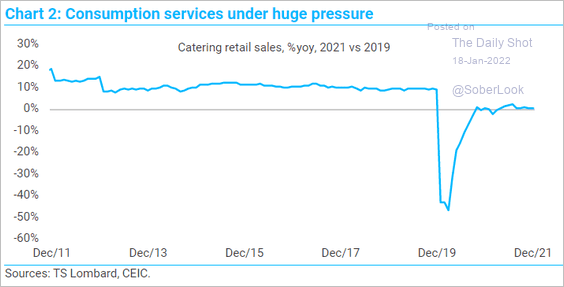

… which is a drag on consumer-facing businesses.

Source: TS Lombard

Source: TS Lombard

——————–

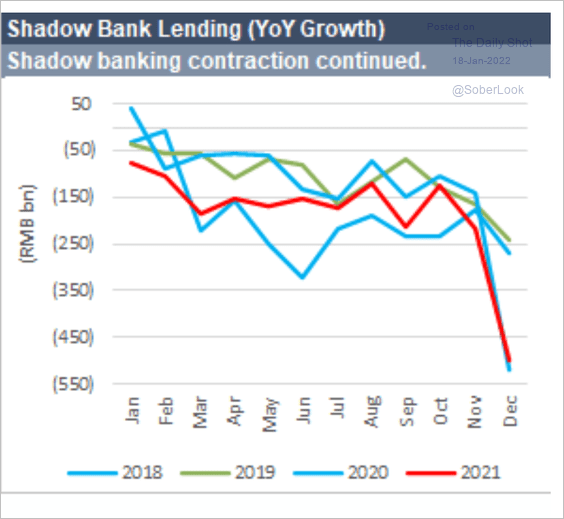

4. Chinese shadow bank lending continues to contract.

Source: CreditSights

Source: CreditSights

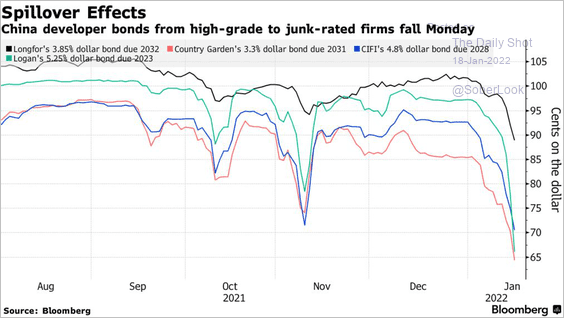

5. Developers’ bonds remain under pressure.

Source: @markets Read full article

Source: @markets Read full article

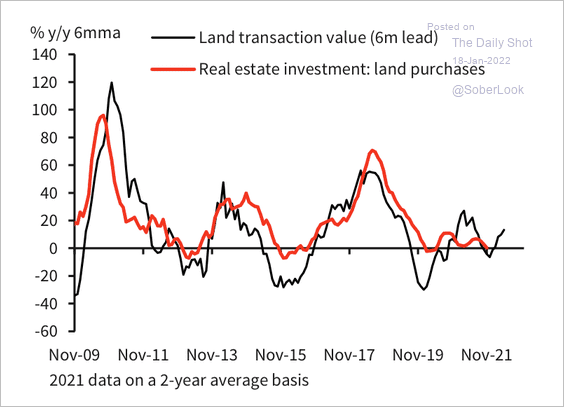

But land transactions are starting to improve.

Source: Barclays Research

Source: Barclays Research

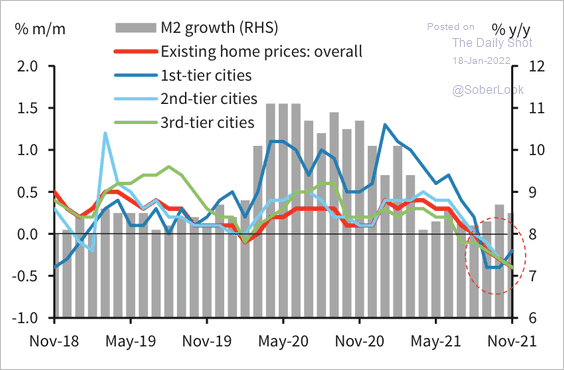

The decline in home prices has narrowed in tier-1 cities.

Source: Barclays Research

Source: Barclays Research

——————–

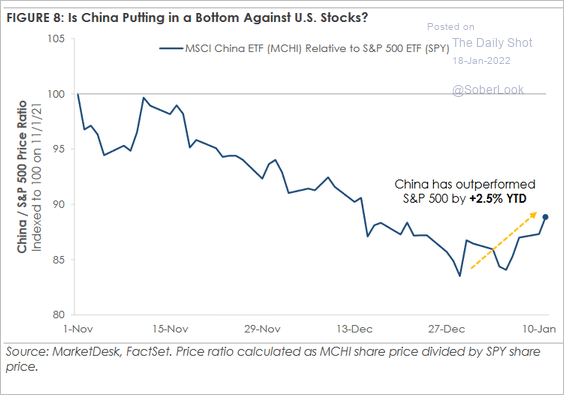

6. Has China’s stock market bottomed relative to the US?

Source: MarketDesk Research

Source: MarketDesk Research

Back to Index

Emerging Markets

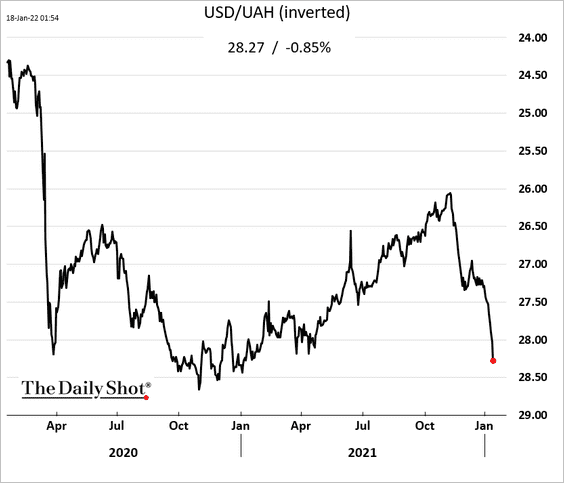

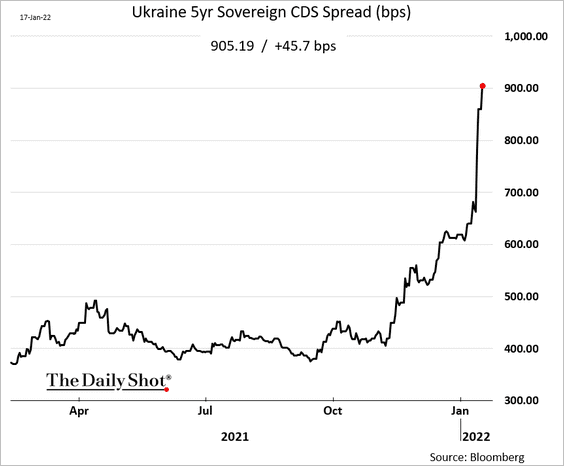

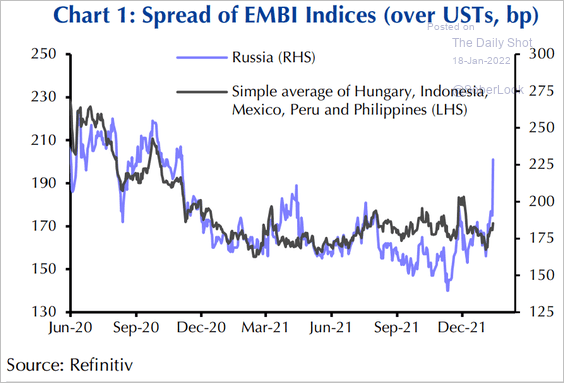

1. The market is pricing in a higher risk of a Russia-Ukraine military conflict.

• Ukraine’s currency (the hryvnia):

• Ukraine’s sovereign CDS spread:

• Russian bond spread relative to other EM debt:

Source: Capital Economics

Source: Capital Economics

——————–

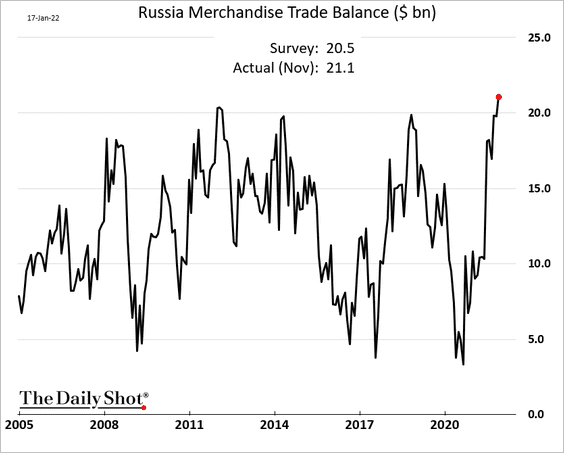

2. Russia’s trade surplus hit a record high as energy prices surge.

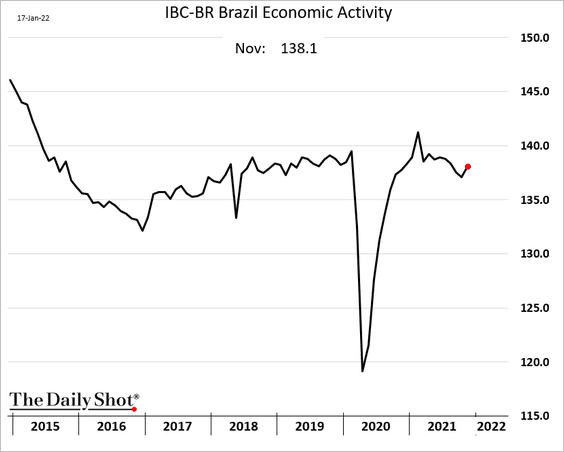

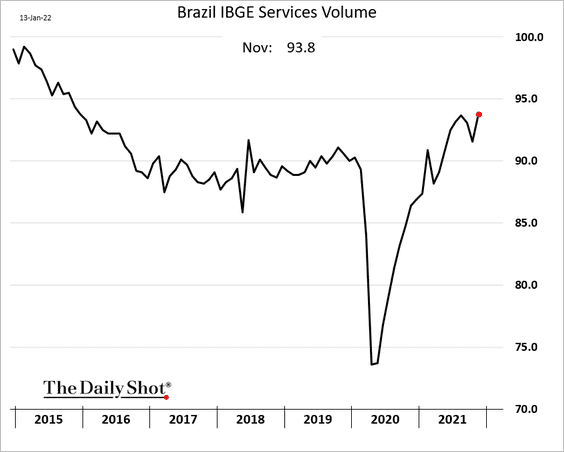

3. Brazil’s economic activity improved in November.

Service output hit a multi-year high.

——————–

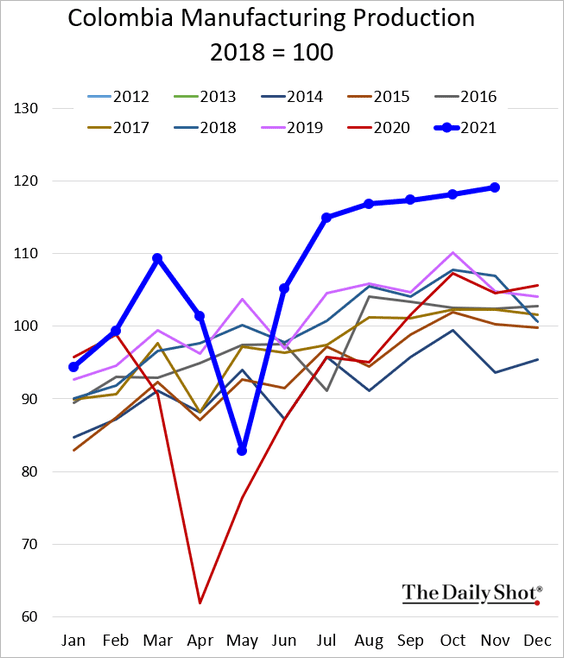

4. Colombia’s manufacturing production continues to hit record highs.

Back to Index

Cryptocurrency

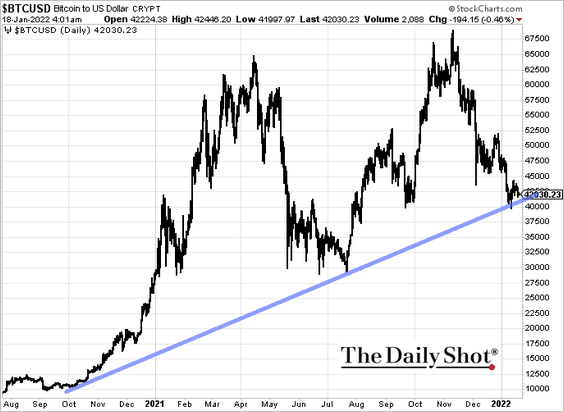

1. Bitcoin continues to hold support.

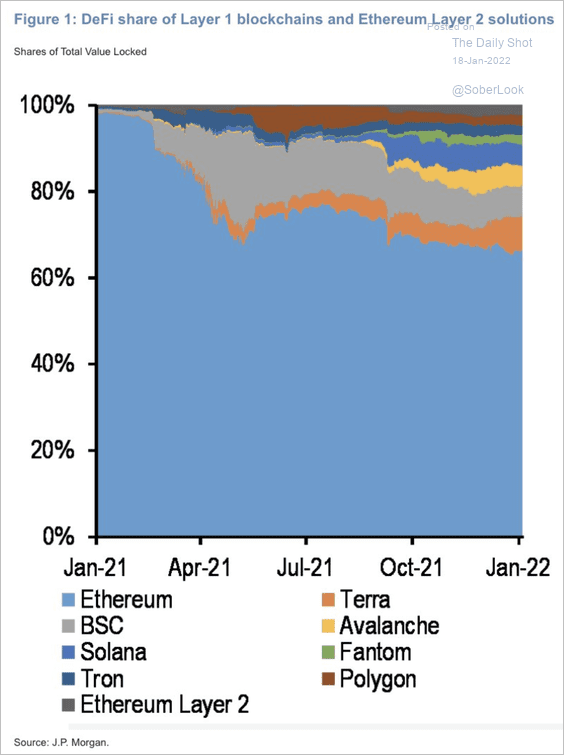

2. Growing demand for decentralized finance (DeFi) services on the Ethereum blockchain has fueled a series of upgrades and new solutions.

Source: JP Morgan Research

Source: JP Morgan Research

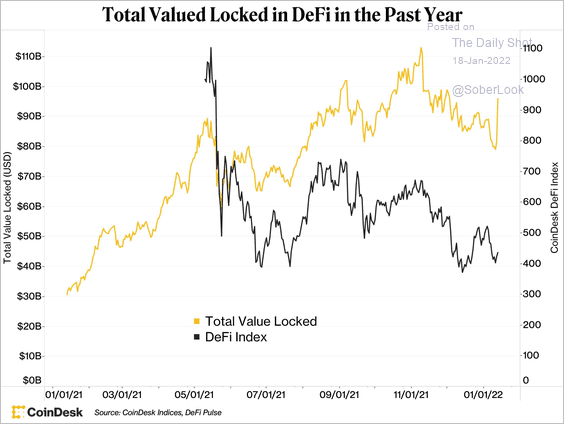

3. Total value locked in DeFi is rising despite the retreat in related crypto prices.

Source: CoinDesk

Source: CoinDesk

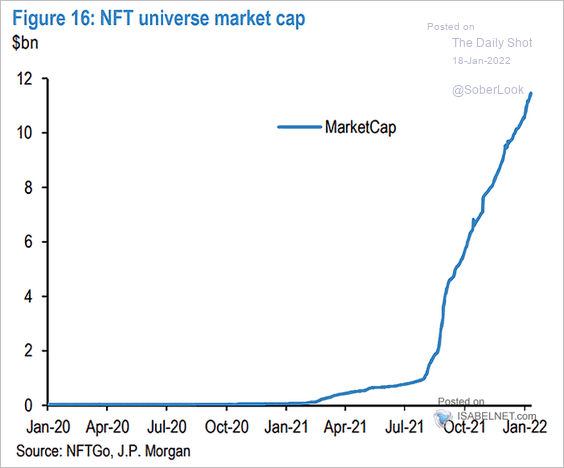

4. This chart shows the total NFT market cap.

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

Back to Index

Energy

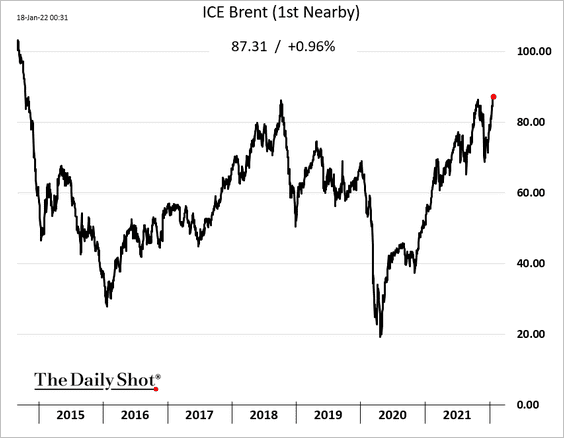

1. Brent futures are near the highest level since 2014.

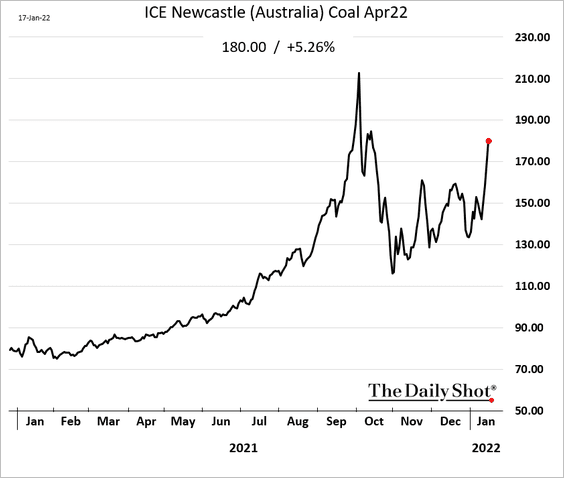

2. Coal prices have been surging.

h/t Walter

h/t Walter

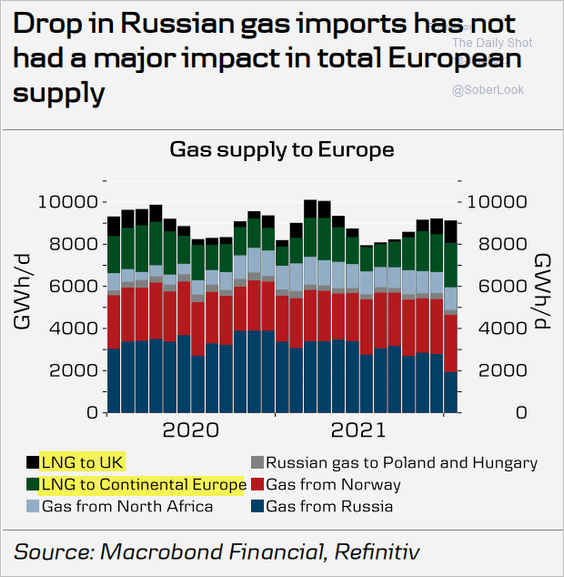

3. Europe has been able to replace lost natural gas imports from Russia with LNG.

Source: Danske Bank

Source: Danske Bank

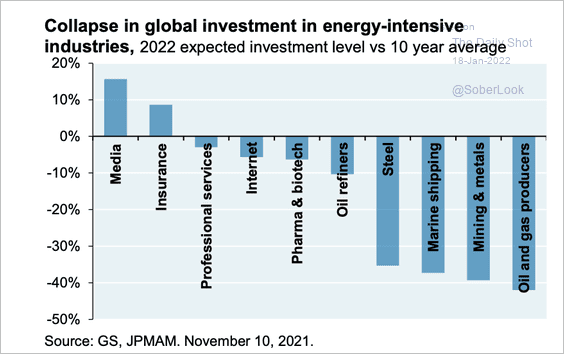

4. Energy-intensive industries have seen the biggest drop in investment.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Equities

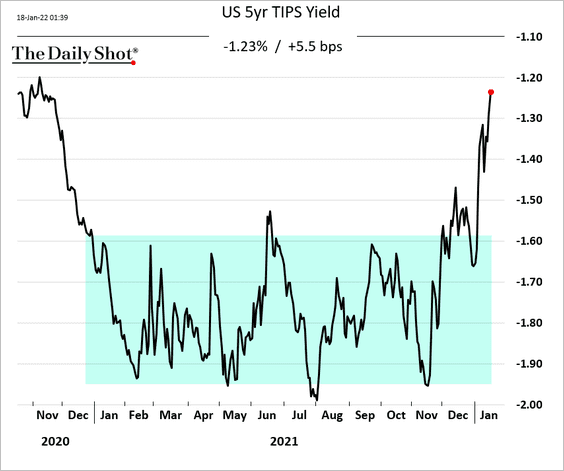

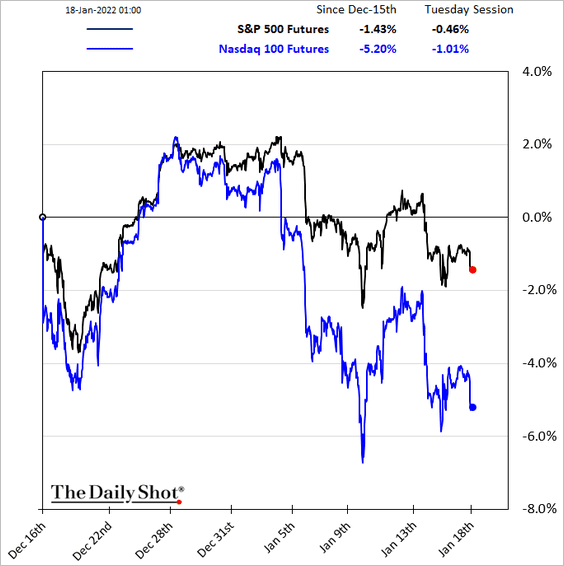

1. US real yields are surging …

… and putting pressure on stocks this morning.

——————–

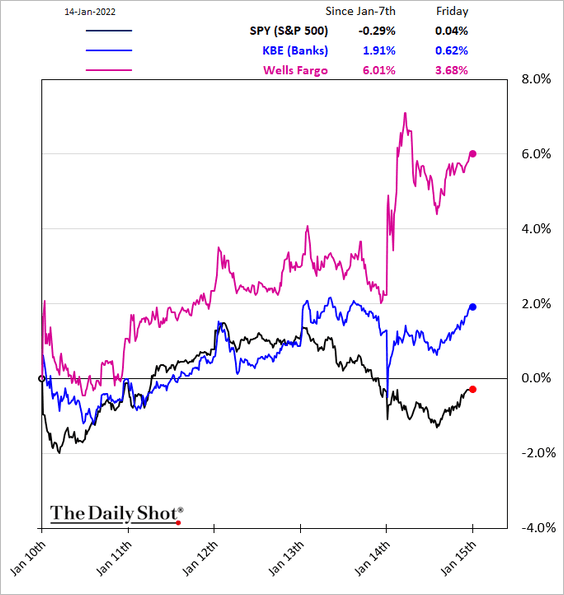

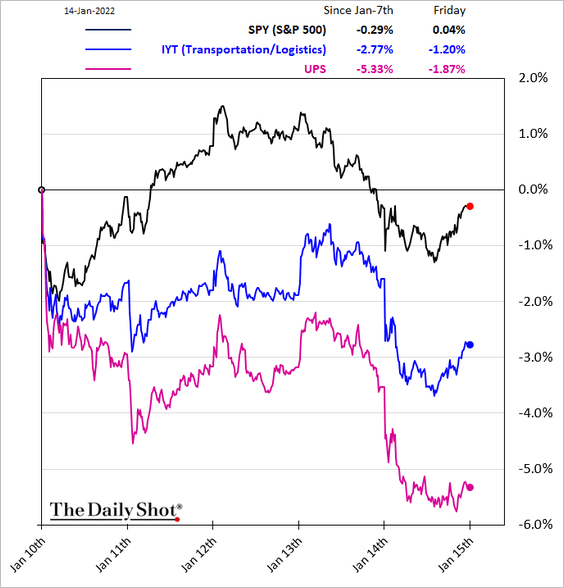

2. Next, let’s take a look at some sector trends.

• Banks:

• Transportation/logisitcs:

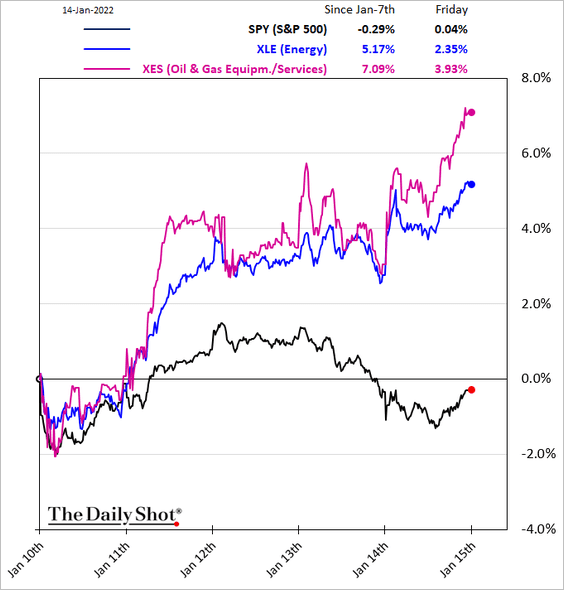

• Energy:

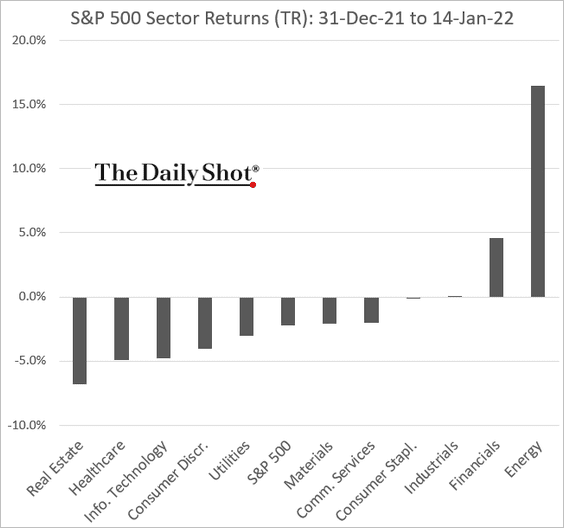

• Month-to-date performance by sector:

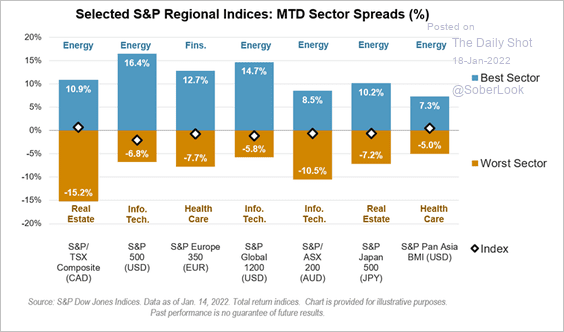

• Which sectors are month-to-date winners and losers globally?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

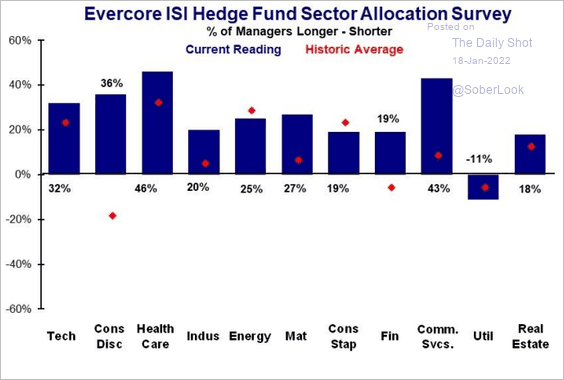

• Hedge funds’ sector allocations relative to historical averages:

Source: Evercore ISI Research

Source: Evercore ISI Research

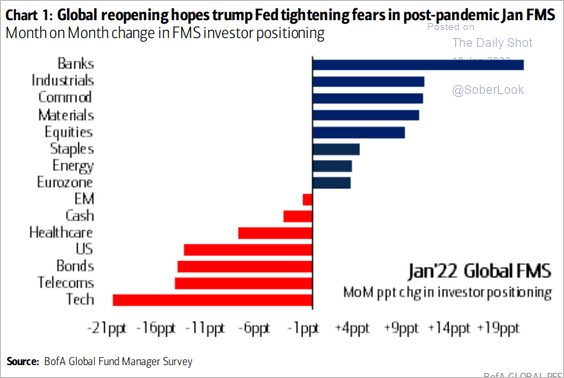

• Fund managers’ positioning changes (risk-on!):

Source: BofA Global Research

Source: BofA Global Research

——————–

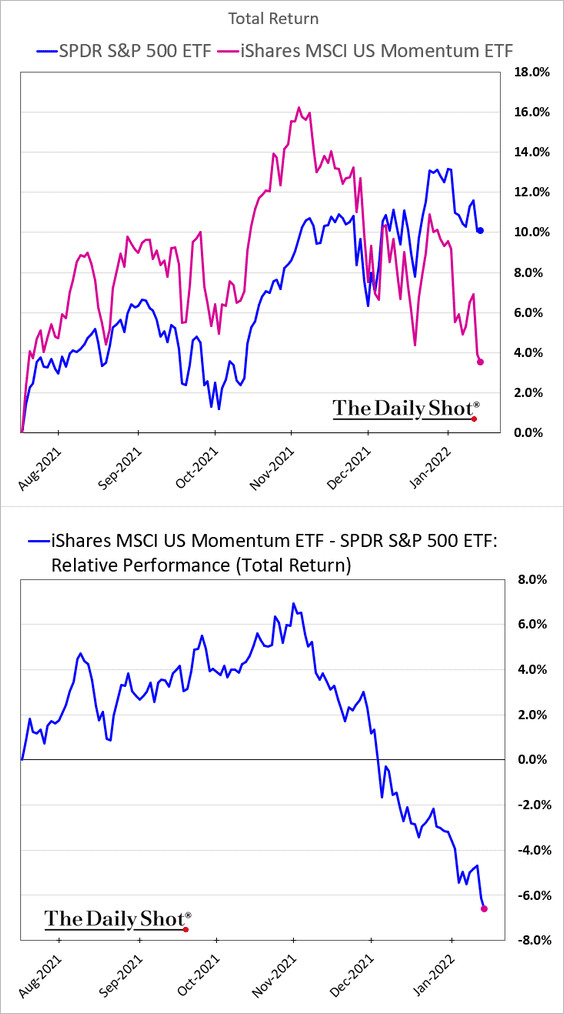

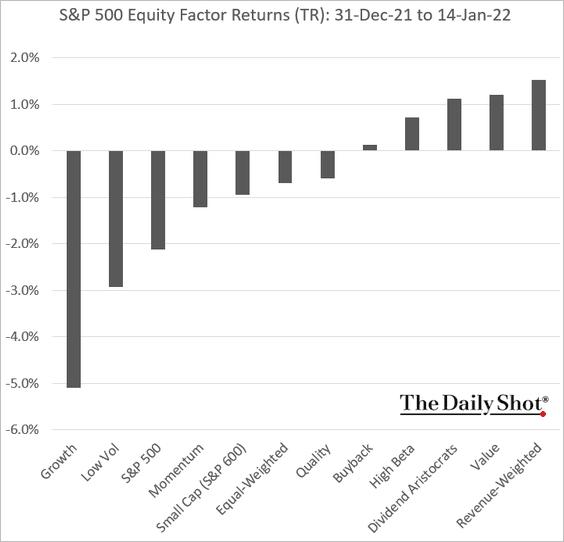

3. The momentum factor underperformance, which started in November, continues to widen.

Here is the month-to-date performance by equity factor:

——————–

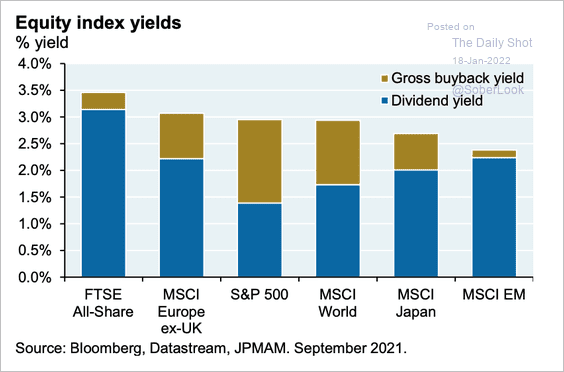

4. This chart compares equity yields (both dividend and gross buyback) of the major global equity markets.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

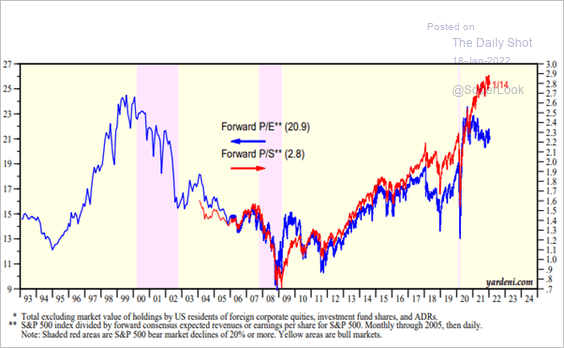

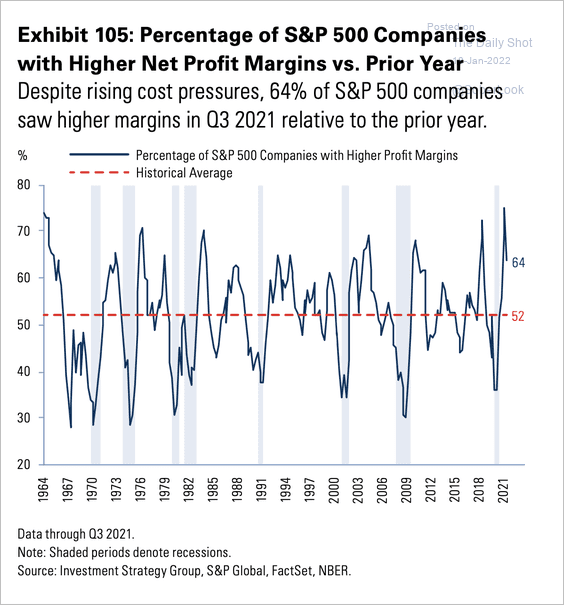

5. The S&P 500 forward price-to-earnings and price-to-sales ratios have diverged as corporate margins surged.

Source: Yardeni Research

Source: Yardeni Research

Underappreciated operating leverage from strong sales growth has meant that the majority of firms are able to offset rising cost pressures and see expanding margins.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

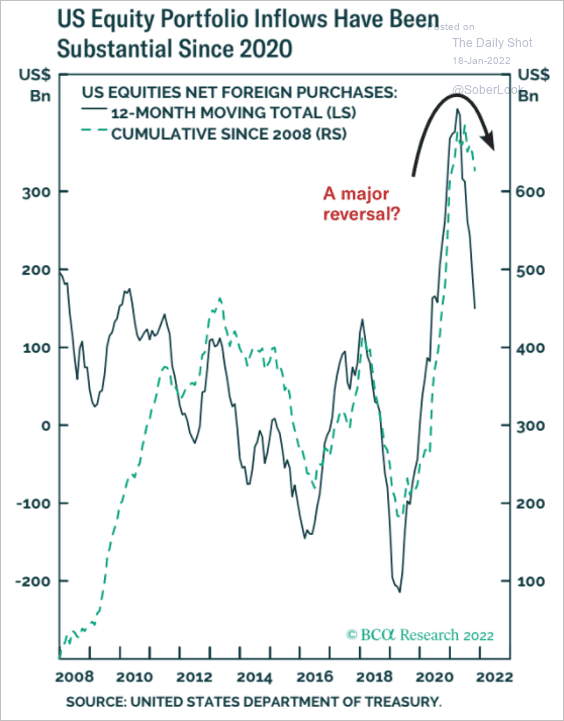

6. Foreign inflows into US equity markets appear to have peaked.

Source: BCA Research

Source: BCA Research

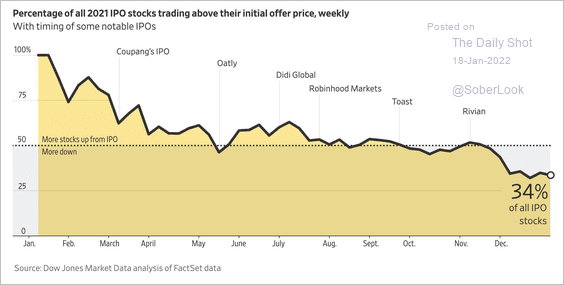

7. What percentage of 2021 IPOs trade above the initial offer price?

Source: @WSJGraphics Read full article

Source: @WSJGraphics Read full article

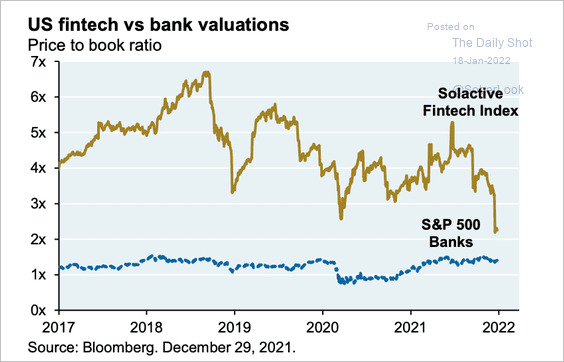

8. Are fintech valuations converging with bank valuations?

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

Back to Index

Rates

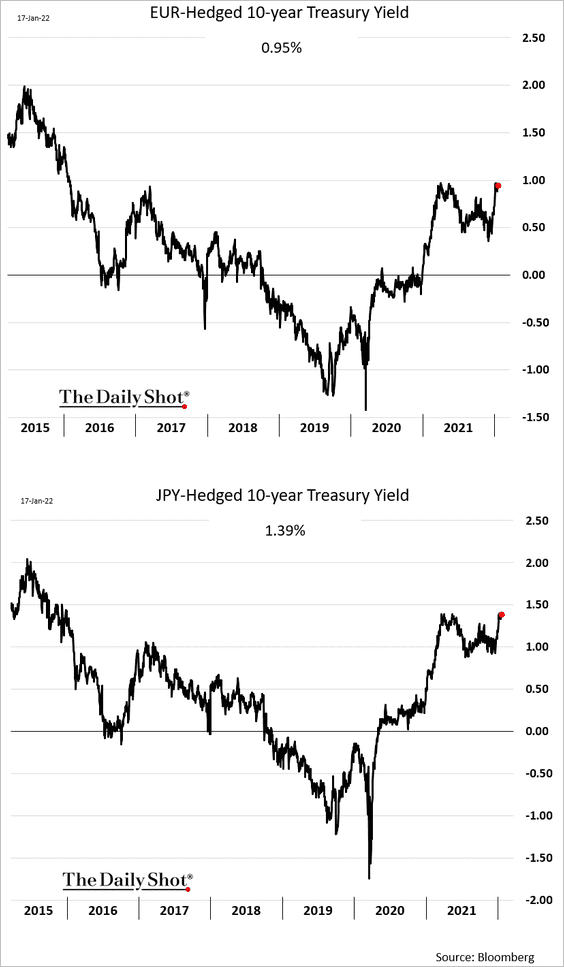

1. Non-US buyers of Treasuries get a relatively attractive yield even on a currency-hedged basis. With the Bund still below zero, getting paid 1% on Treasuries should be appealing.

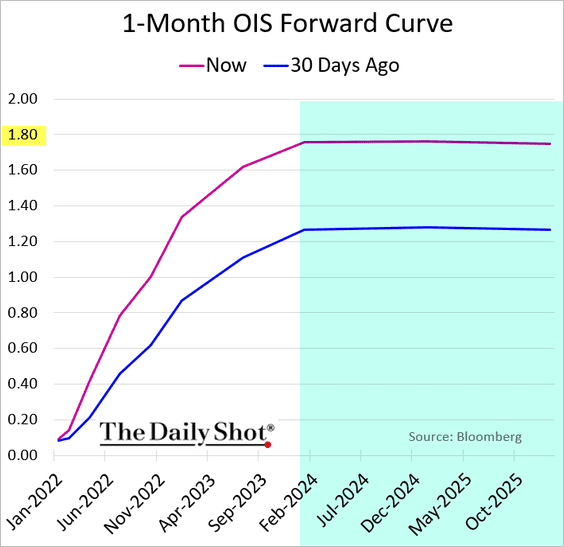

2. The market expects the Fed to be done hiking rates by the end of next year. Many economists disagree.

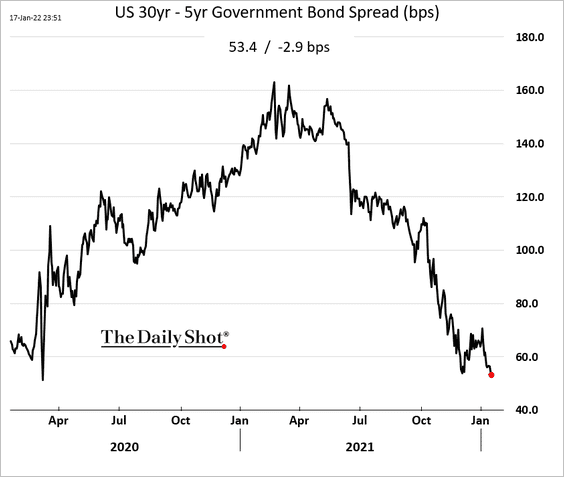

3. The Treasury curve continues to flatten at the longer end.

——————–

Food for Thought

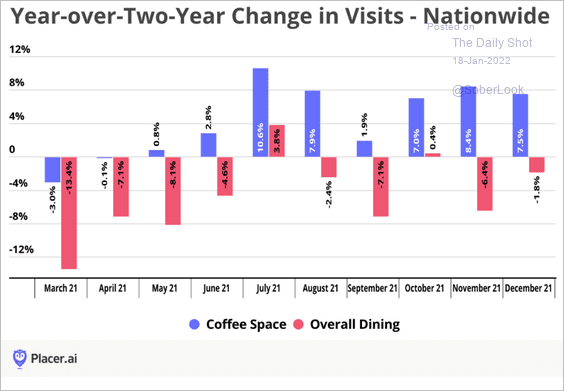

1. Coffee shops outperforming the overall dining sector:

Source: Placer.ai

Source: Placer.ai

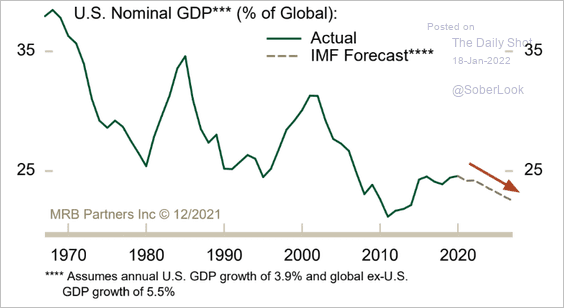

2. The US economy as a share of global GDP:

Source: MRB Partners

Source: MRB Partners

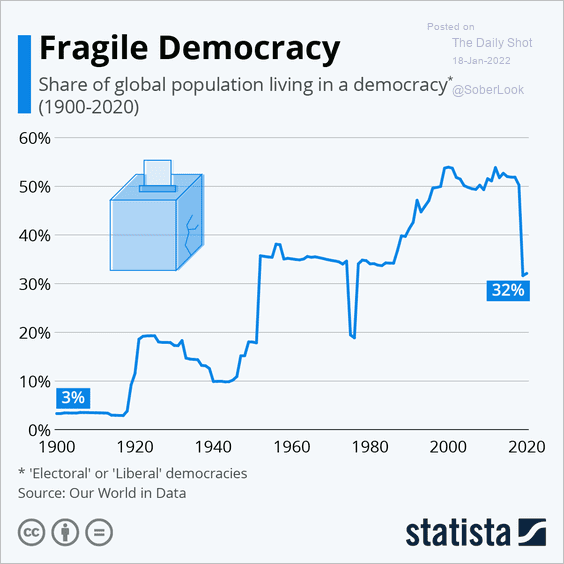

3. Share of the global population living in a democracy:

Source: Statista

Source: Statista

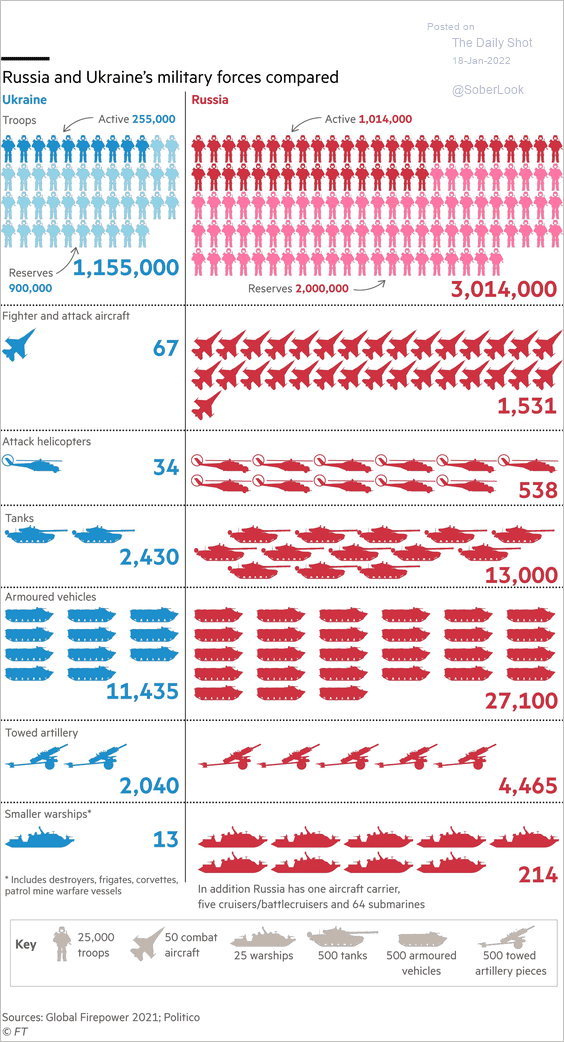

4. Russia’s vs. Ukraine’s military forces:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

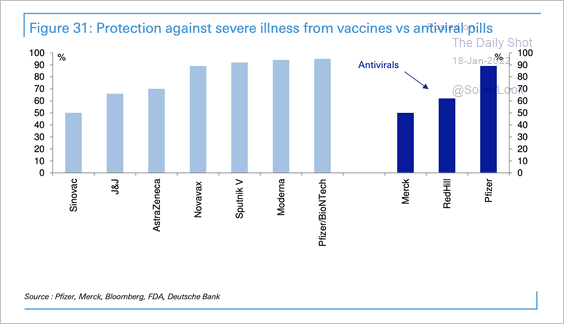

5. The current arsenal against COVID:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

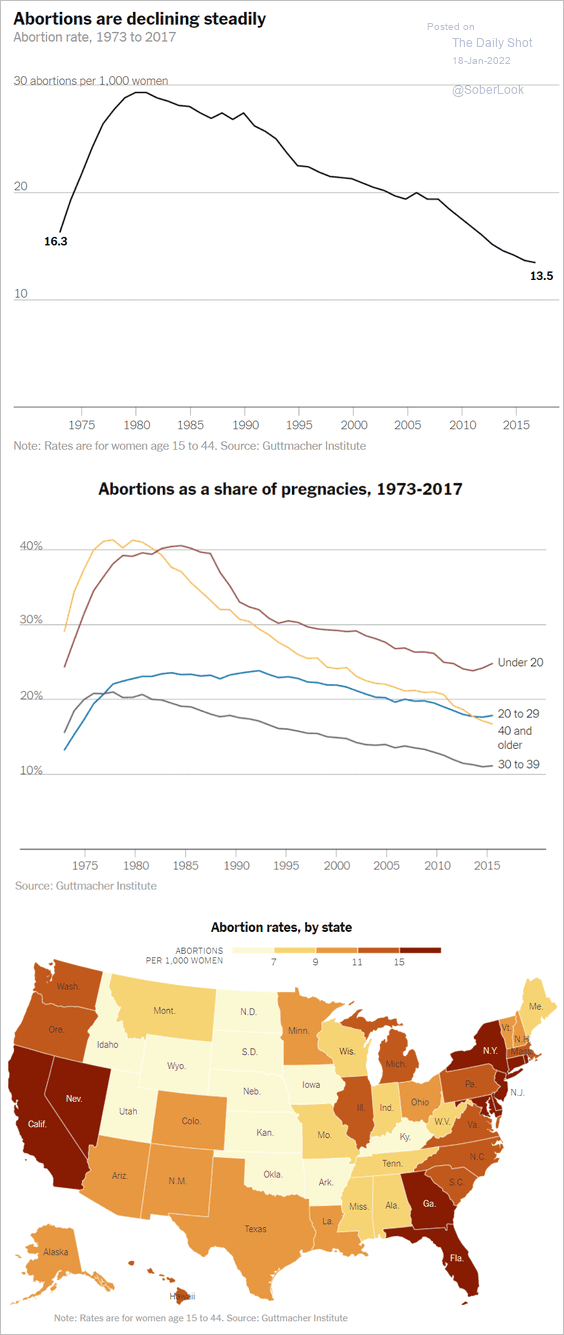

6. Abortion trends in the US:

Source: The New York Times Read full article

Source: The New York Times Read full article

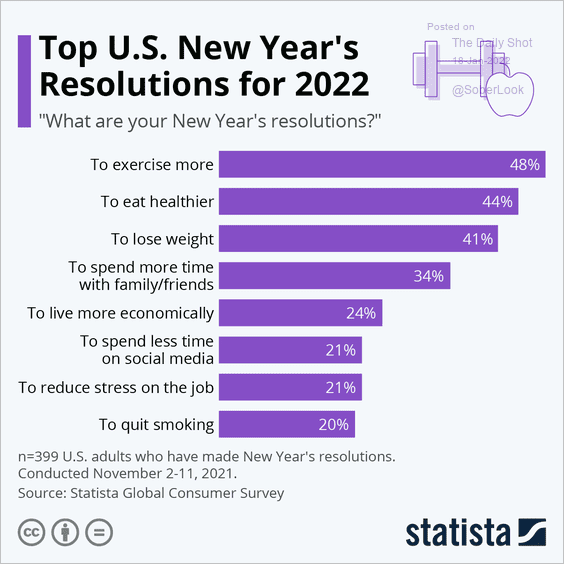

7. The 2022 New Year’s resolutions:

Source: Statista

Source: Statista

——————–

Back to Index