The Daily Shot: 25-Jan-22

• Equities

• Credit

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

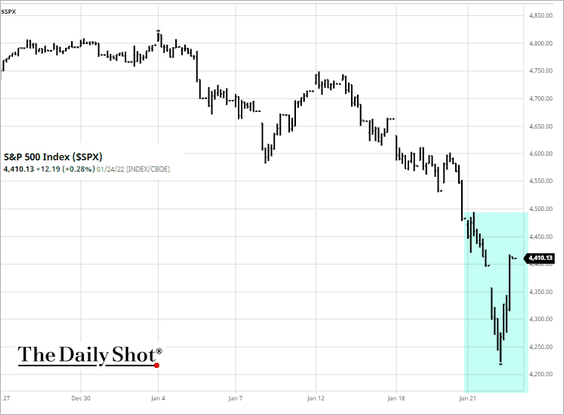

1. After entering correction territory, the S&P 500 rebounded on Monday to finish up on the day.

Source: barchart.com

Source: barchart.com

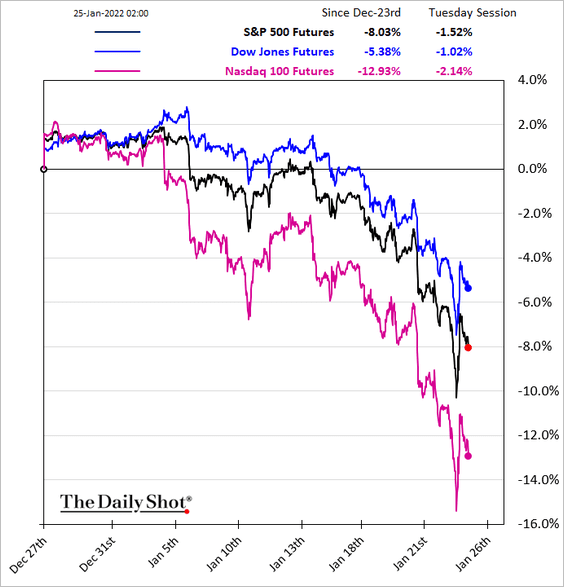

But futures are again heavy this morning. The risk of conflict in Eastern Europe continues to weigh on the market (see the Emerging Markets section).

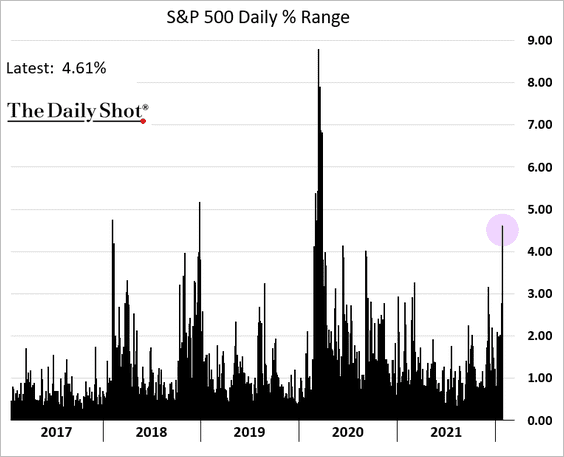

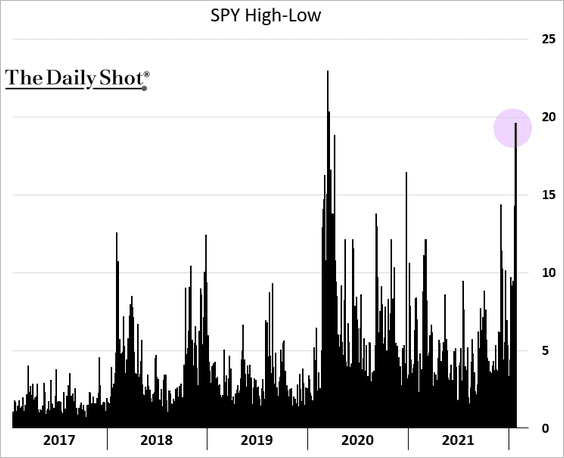

The intraday swing was one of the highest in recent years (2 charts). Volatility is back.

——————–

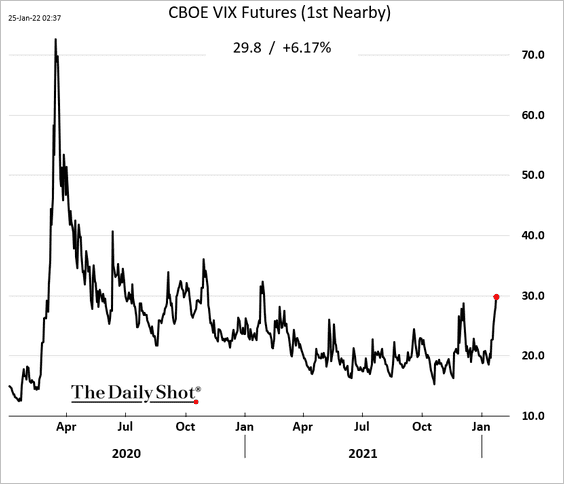

2. VIX futures are elevated but not at extreme levels yet.

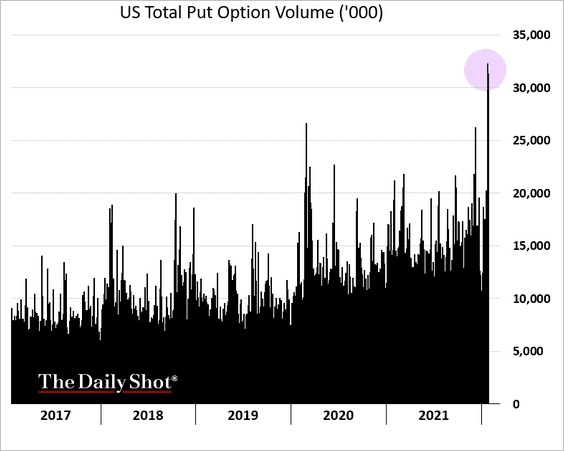

3. Demand for put options exploded, …

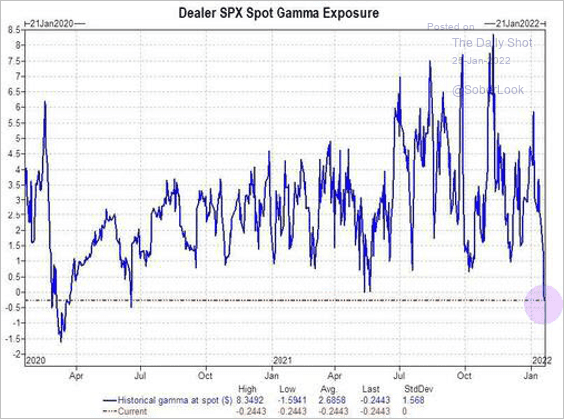

… leaving dealers short gamma (which could exacerbate swings in either direction).

Source: @MichaelGoodwell

Source: @MichaelGoodwell

——————–

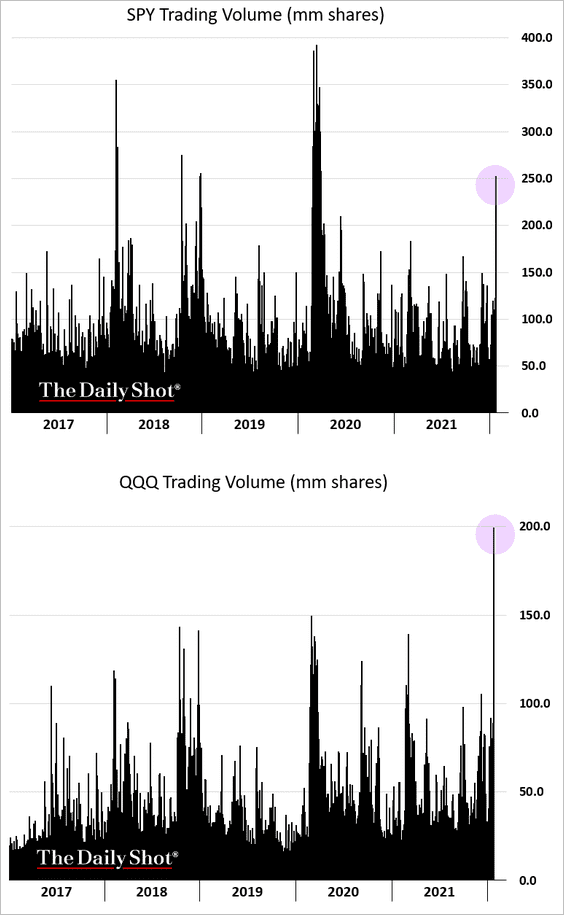

4. Key index ETF trading volumes surged.

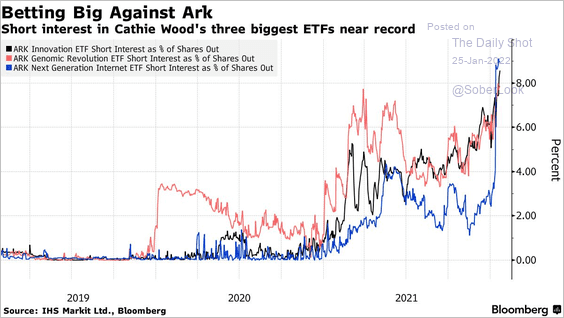

5. Traders have been building short positions in some speculative assets such as the ARK funds.

Source: @kgreifeld, @markets Read full article

Source: @kgreifeld, @markets Read full article

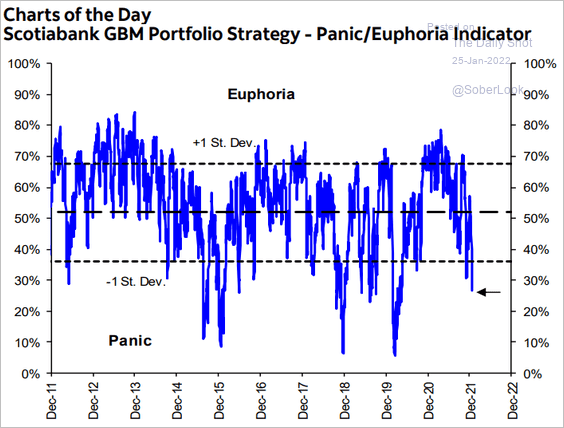

6. Scotiabank’s sentiment indicator is in panic mode (lowest since the 2020 COVID-driven selloff).

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

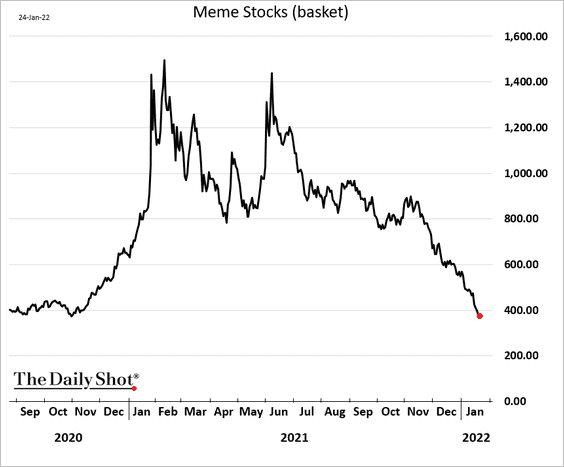

• The decline in meme stocks has been relentless.

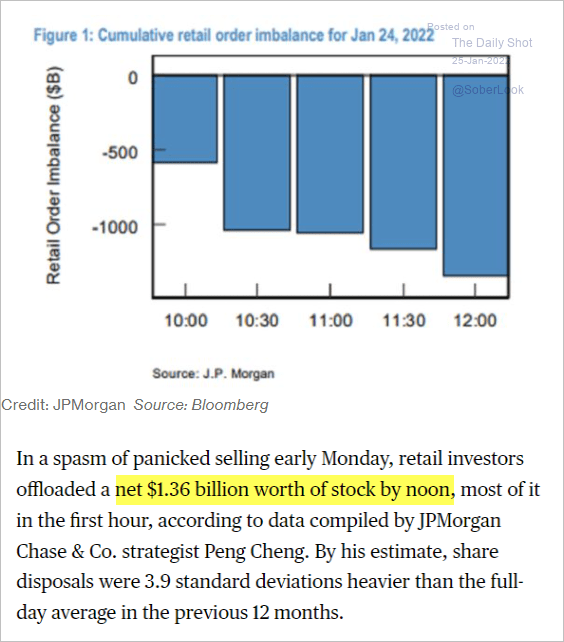

• Retail investors offloaded $1.36 billion worth of stocks on Monday in a sign of capitulation.

Source: @TheStalwart; JP Morgan Research Read full article

Source: @TheStalwart; JP Morgan Research Read full article

——————–

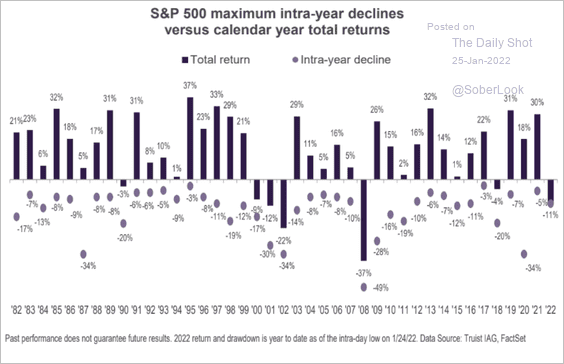

7. This chart shows intra-year maximum drawdowns vs. calendar year total returns.

Source: Truist Advisory Services

Source: Truist Advisory Services

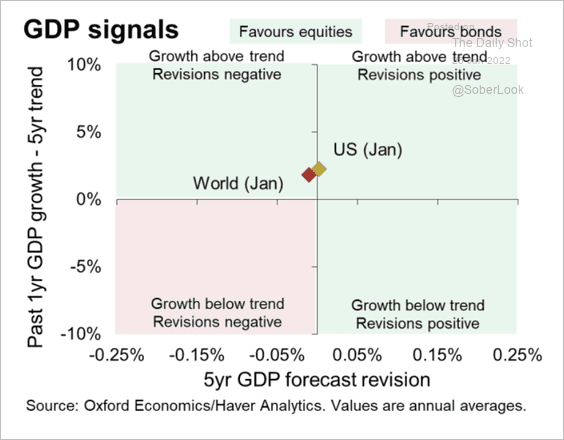

8. Oxford Economics expects that equities will continue to outperform bonds so long as global GDP growth is above trend.

Source: Oxford Economics

Source: Oxford Economics

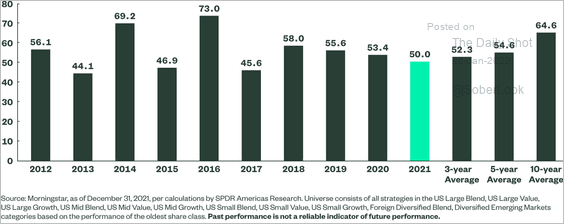

9. Last year, the lowest number of active equity managers underperformed their benchmark since 2017. Typically, when the underperformance rate falls below 50%, the next year’s performance figure is worse.

Source: SPDR Americas Research, @mattbartolini Read full article

Source: SPDR Americas Research, @mattbartolini Read full article

10. It’s not a loss until you sell it?

Source: @ParikPatelCFA

Source: @ParikPatelCFA

Back to Index

Credit

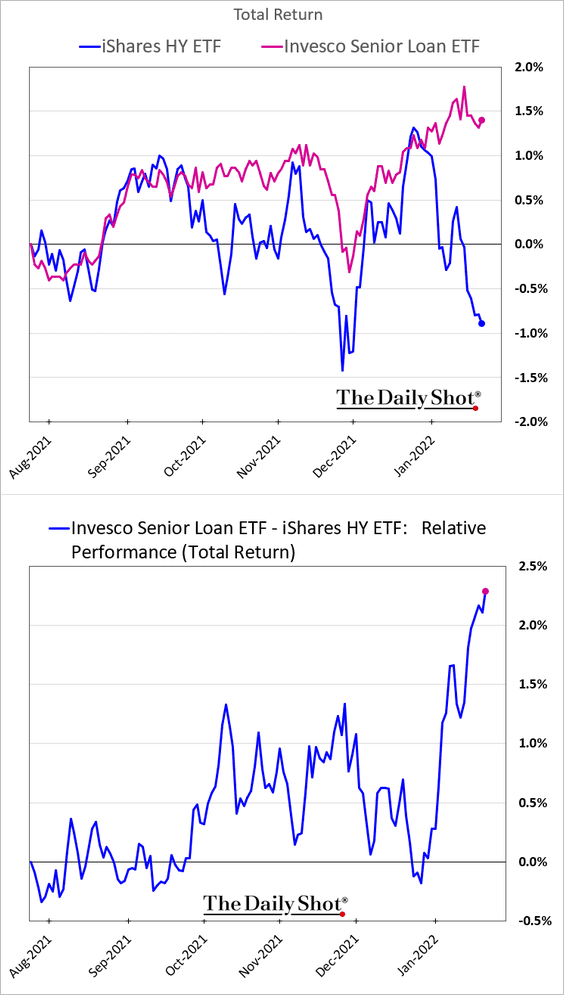

1. Leveraged loans continue to widen their outperformance vs. HY bonds.

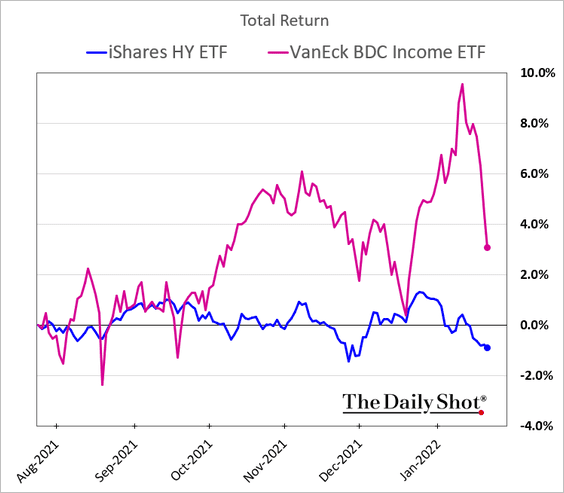

2. BDCs are rapidly giving up their recent outperformance.

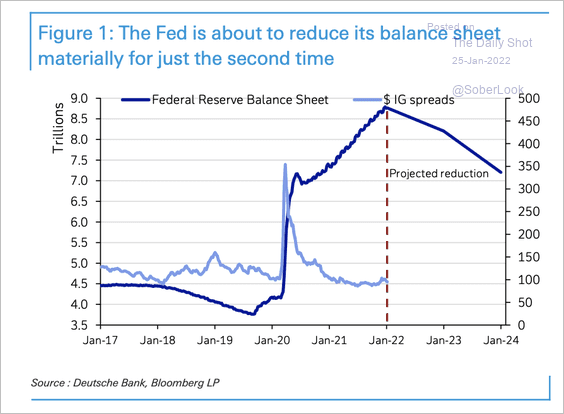

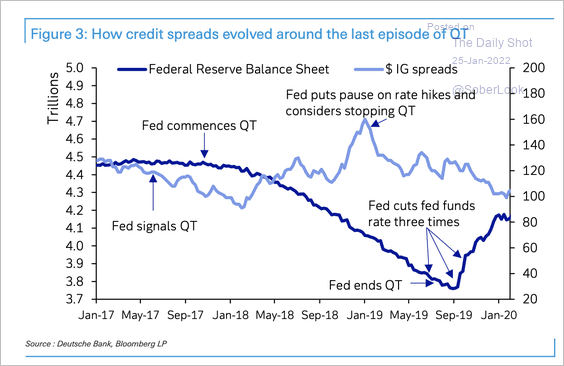

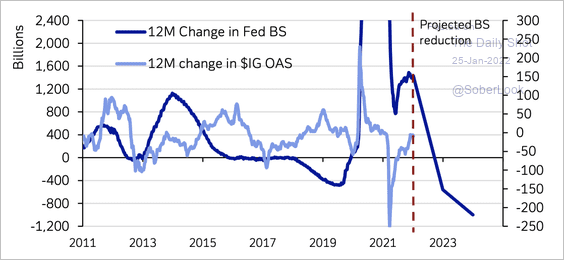

3. A reduction in the Fed’s balance sheet could precede higher US investment-grade credit spreads (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Credit spreads widened about 50 basis points during the last period of quantitative tightening.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

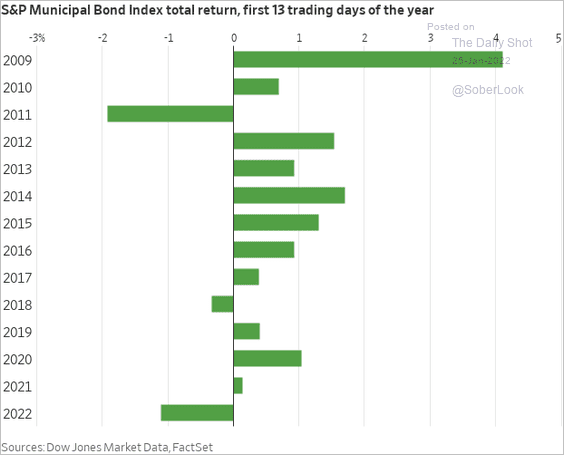

4. It’s been a tough start of the year for munis.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

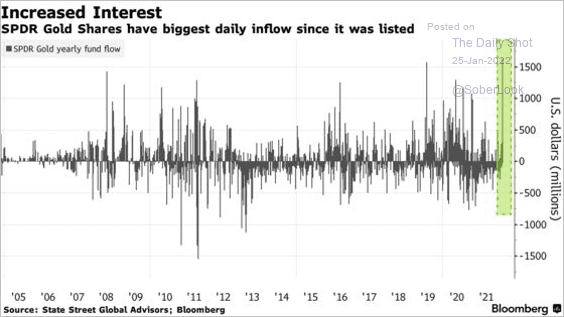

Commodities

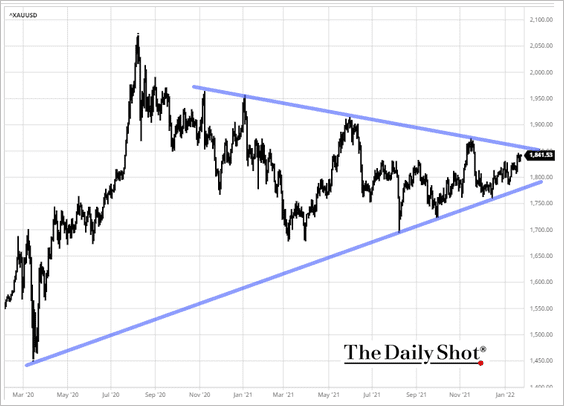

Gold has been consolidating, …

Source: barchart.com

Source: barchart.com

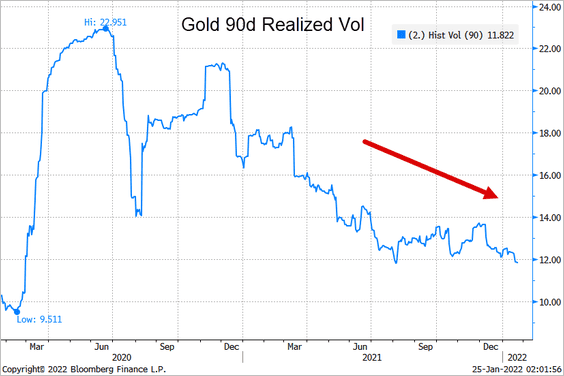

… with volatility continuing to trend lower.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The largest gold ETF (GLD) saw substantial inflows recently.

Source: @jessefelder, @markets Read full article

Source: @jessefelder, @markets Read full article

Back to Index

Energy

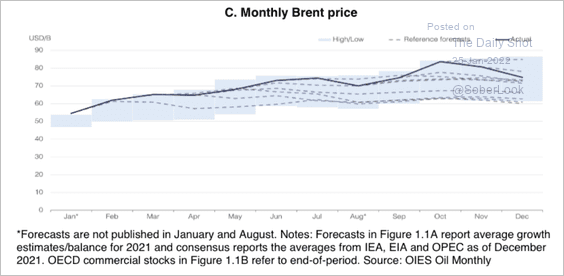

1. Brent oil prices have mostly exceeded forecasts over the past year.

Source: Oxford Economics

Source: Oxford Economics

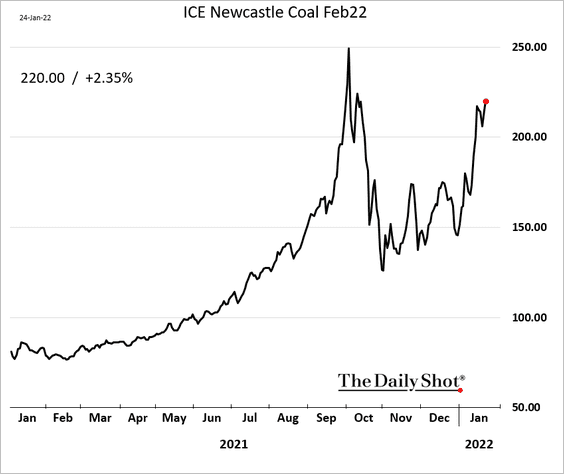

2. Demand for coal has been surging amid concerns about further disruptions of natural gas flows from Russia.

Back to Index

Cryptocurrency

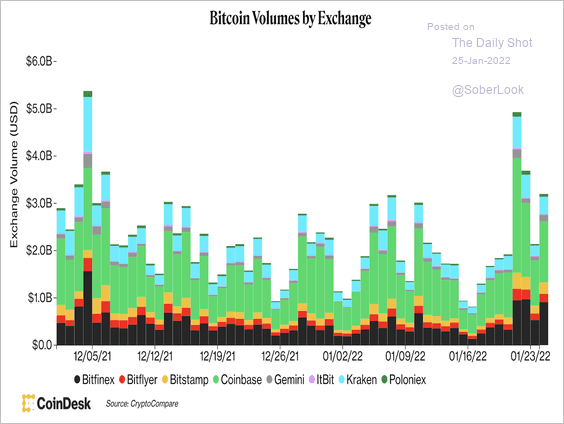

1. Bitcoin’s spot trading volume is starting to rise again, albeit still low relative to prior months.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

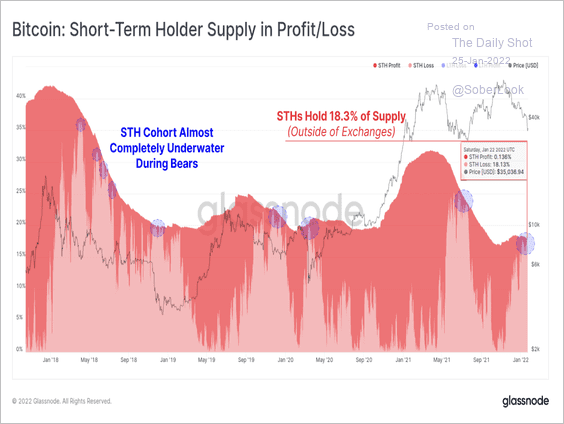

2. Losses are adding up for short-term bitcoin holders, according to blockchain data. A similar scenario occurred during the 2018 bear market and subsequent price corrections.

Source: Glassnode Read full article

Source: Glassnode Read full article

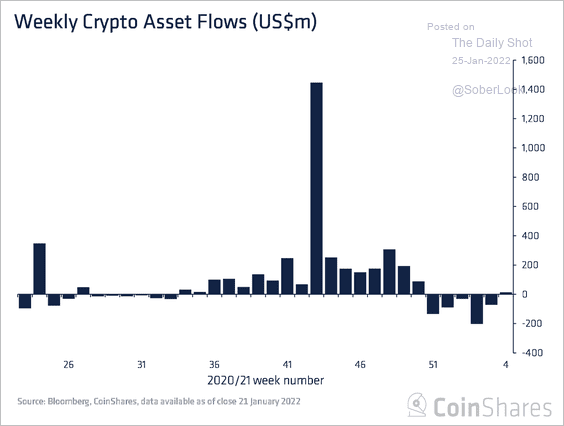

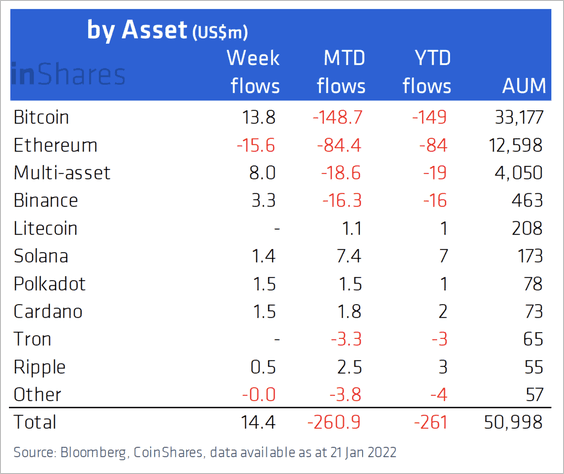

3. Crypto investment saw minor inflows last week.

Source: CoinShares Read full article

Source: CoinShares Read full article

Bitcoin-focused funds attracted the most capital last week, while Ethereum-focused funds saw outflows

Source: CoinShares Read full article

Source: CoinShares Read full article

——————–

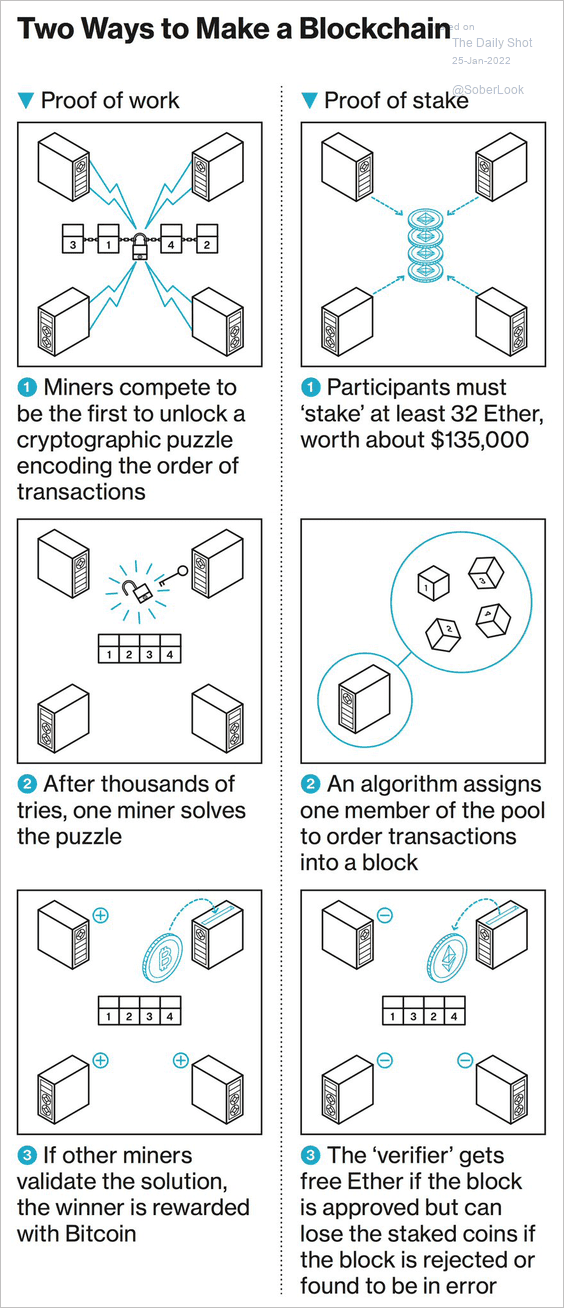

4. The Ethereum blockchain changes will be much more energy-efficient.

Source: @business Read full article

Source: @business Read full article

Back to Index

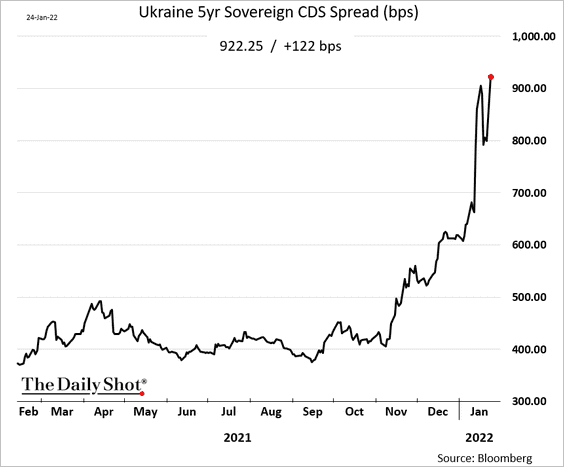

Emerging Markets

1. The possibility of a Russia-Ukraine conflict continues to spook global investors. The headlines have been particularly ominous in recent days.

Source: The Guardian Read full article

Source: The Guardian Read full article

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: NBC News Read full article

Source: NBC News Read full article

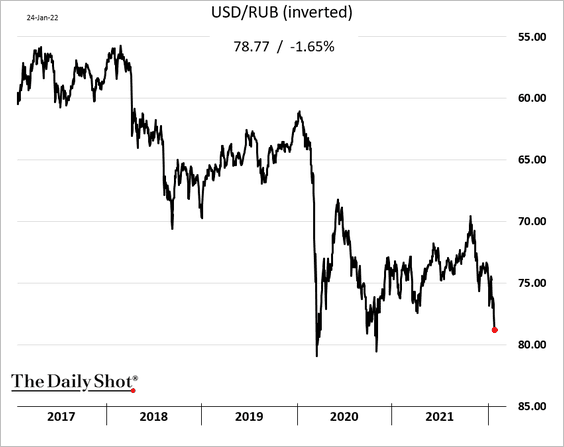

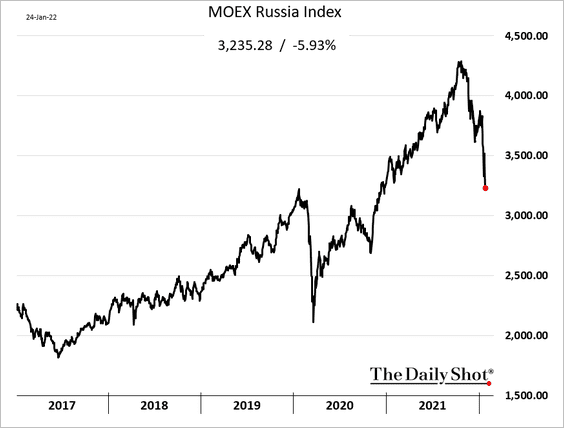

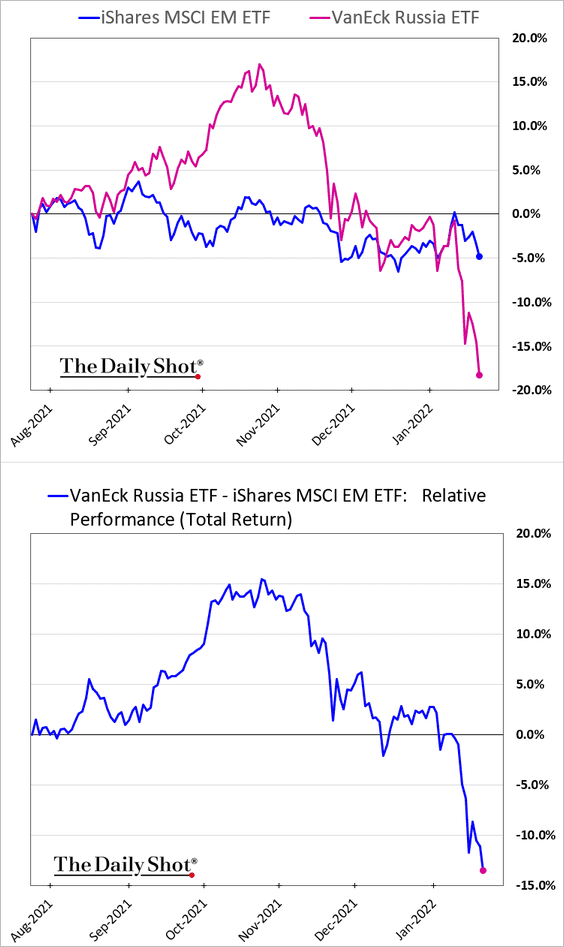

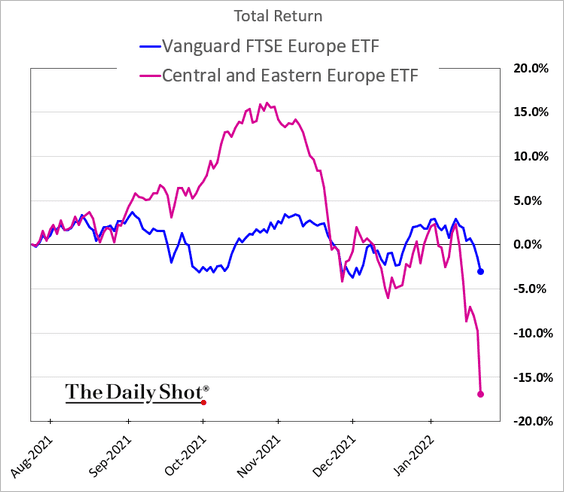

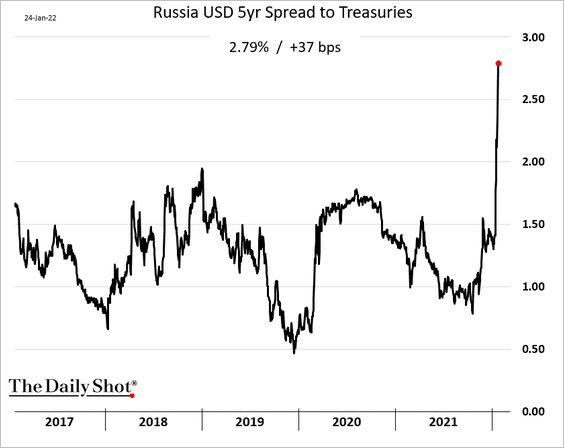

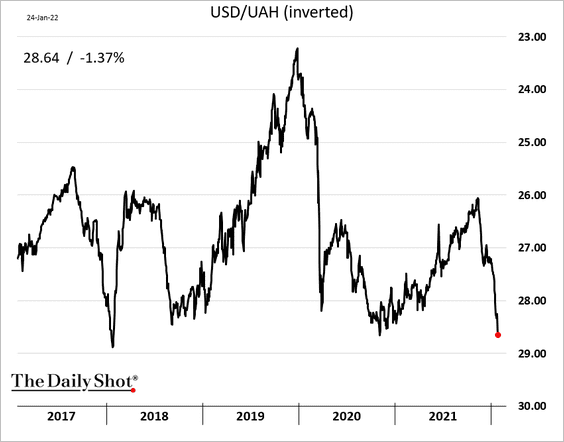

Russian, Ukrainian, and some other Eastern European assets have been under pressure.

• The ruble:

• Russian and Eastern European stocks (3 charts):

• Russian USD-denominated bond spread:

• The Ukrainian hryvnia and the sovereign CDS spread:

——————–

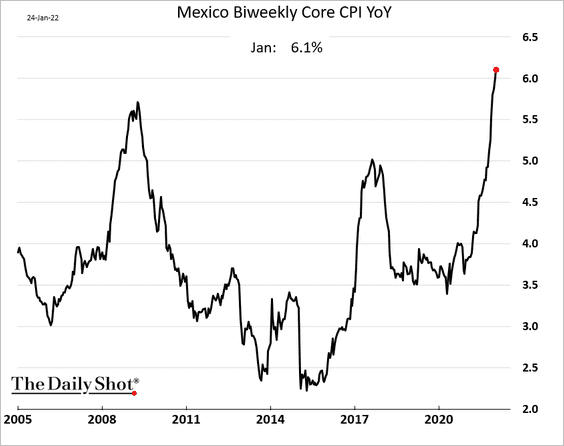

2. Mexican core CPI climbed above 6% for the first time in years.

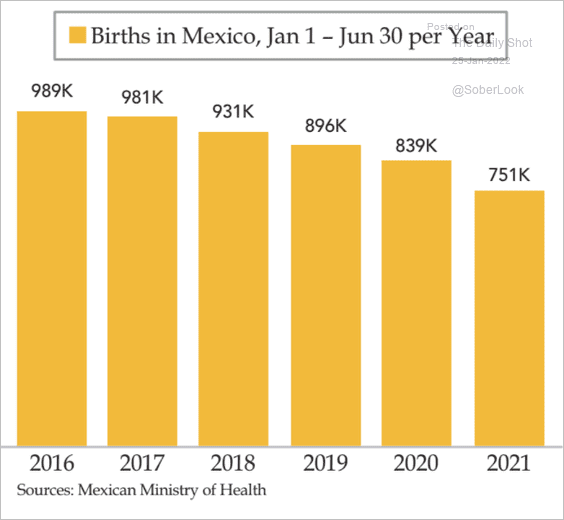

Separately, this chart shows the number of births in Mexico over time.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

China

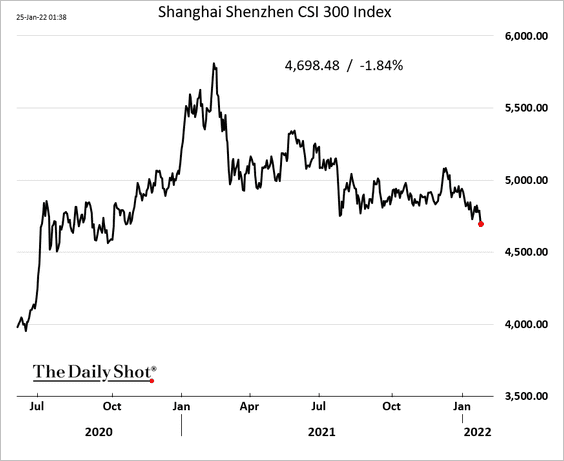

1. Mainland share prices hit the lowest level since Q4 of 2020.

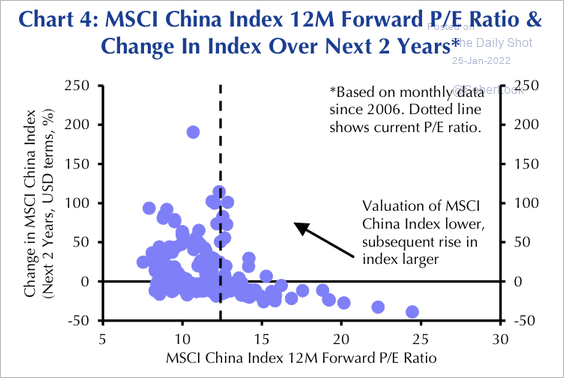

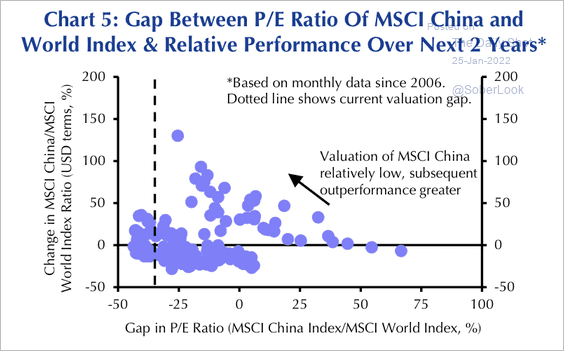

• Low equity market valuations have not been a reliable indicator of strong performance over a two-year horizon. (2 charts)

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

——————–

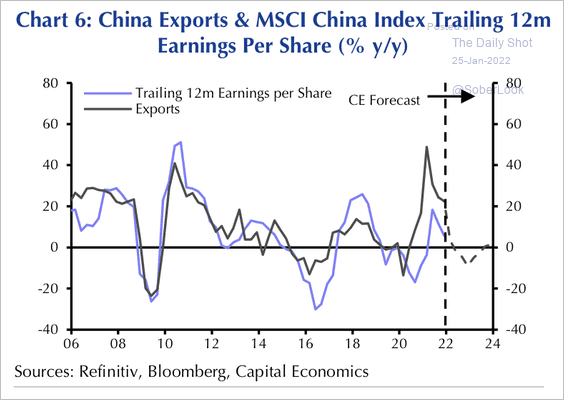

2. Capital Economics does not expect the recent strength in exports to be sustained, which could lead to slower earnings growth.

Source: Capital Economics

Source: Capital Economics

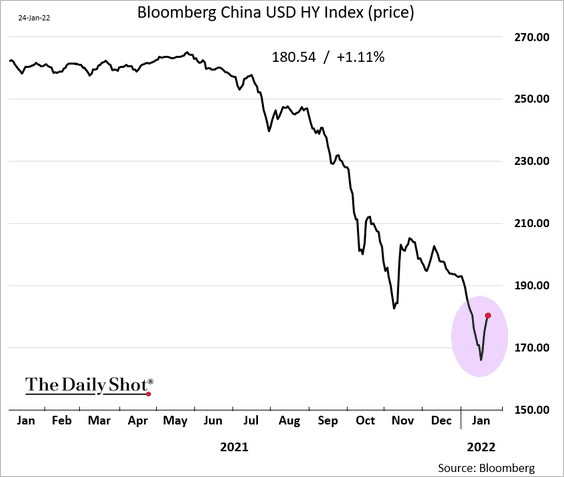

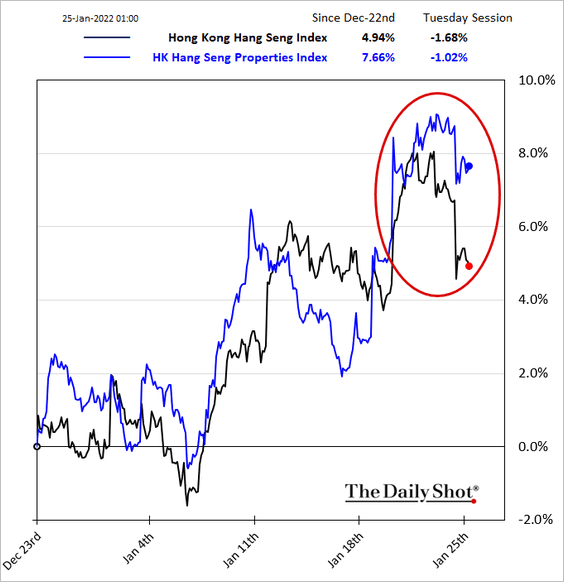

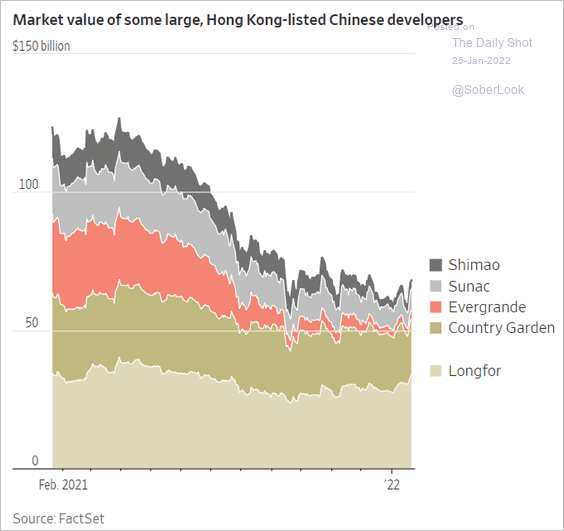

3. As Beijing steps in to support housing developers, markets stabilize.

Source: Reuters Read full article

Source: Reuters Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: Reuters Read full article

Source: Reuters Read full article

• Developers’ USD bonds are rebounding, boosting the overall high-yield index.

• Stocks are outperforming in Hong Kong (2 charts).

Source: @WSJ Read full article

Source: @WSJ Read full article

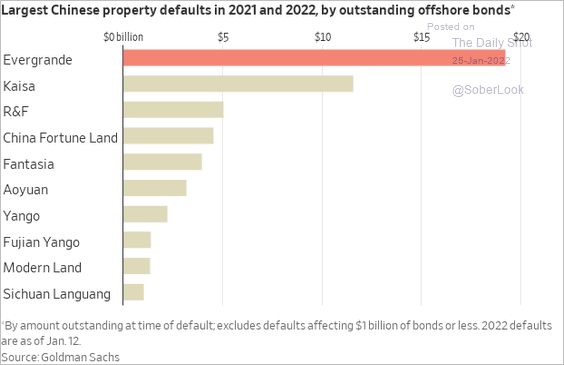

• This chart shows the recent defaults in the sector.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

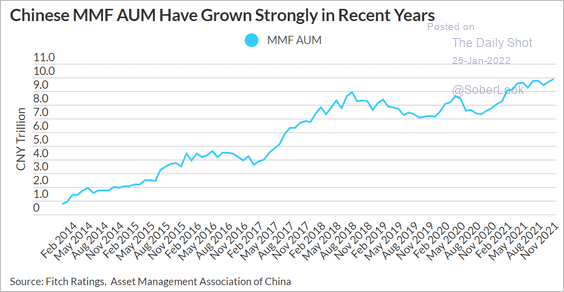

4. China’s money market fund assets continue to grow.

Back to Index

Asia – Pacific

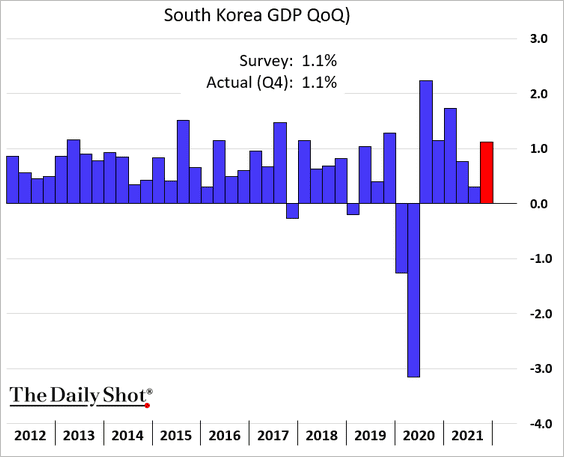

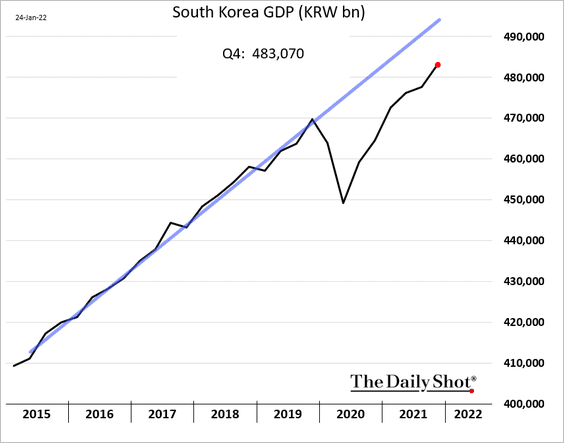

1. South Korea’s Q4 GDP report was roughly in line with expectations as the economic expansion continues.

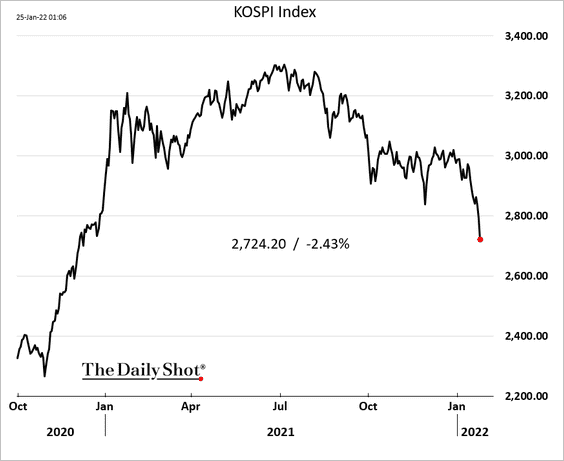

South Korea’s stocks are under pressure.

——————–

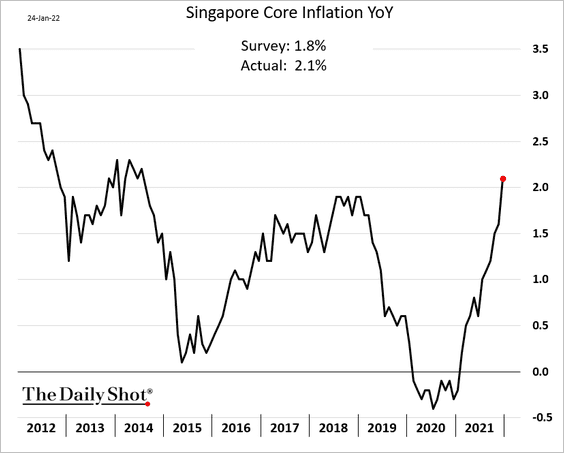

2. Singapore’s inflation surprised to the upside, prompting the central bank to tighten.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

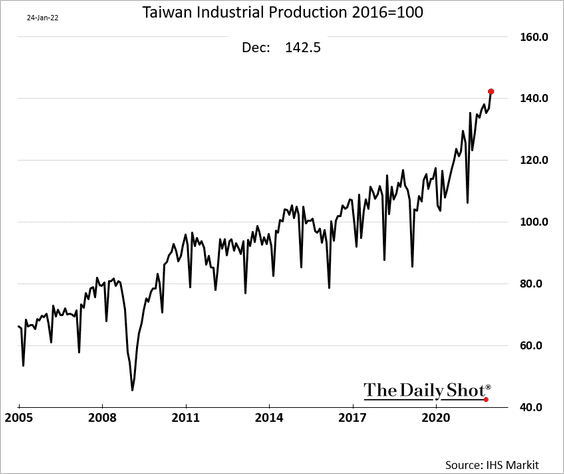

3. Taiwan’s industrial production hit a record high last month.

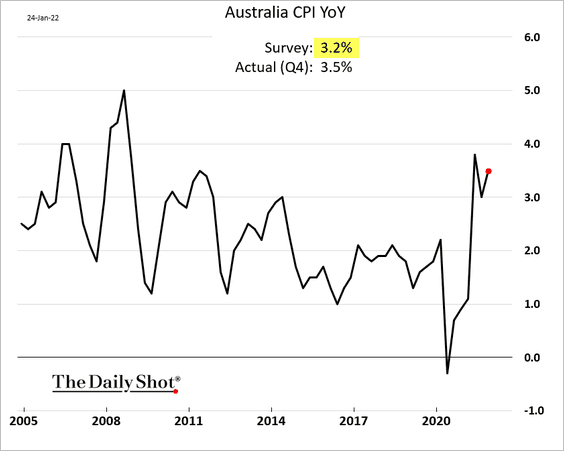

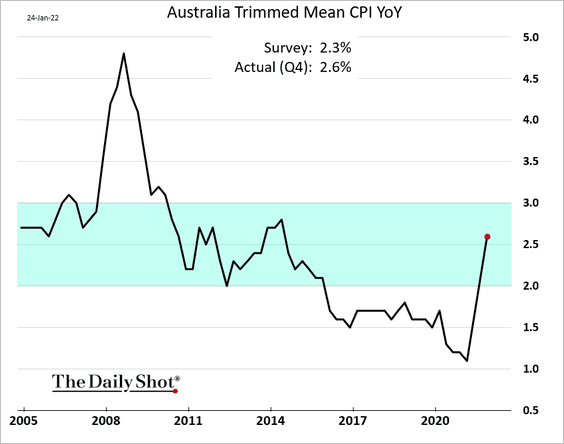

4. Next, we have some updates on Australia.

• The Q4 inflation report was stronger than expected, …

… with the core CPI moving inside the RBA’s target range.

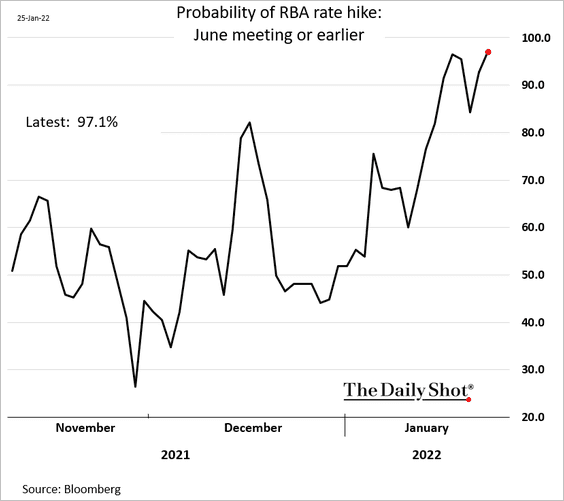

• The probability of a June (or earlier) rate hike is nearing 100%.

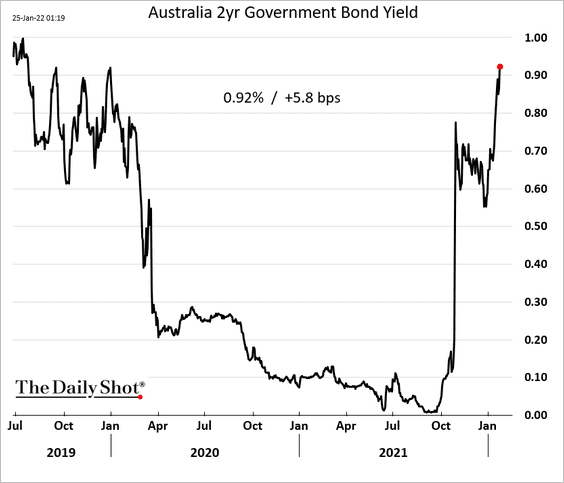

Here is the 2-year bond yield.

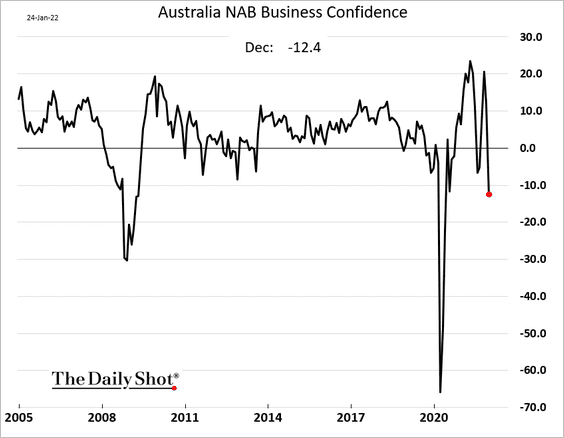

• Business confidence took a hit last month as omicron surged.

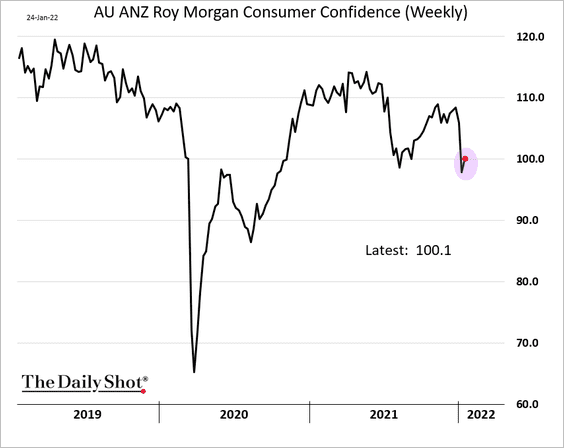

• Consumer confidence appears to have stabilized.

Back to Index

The Eurozone

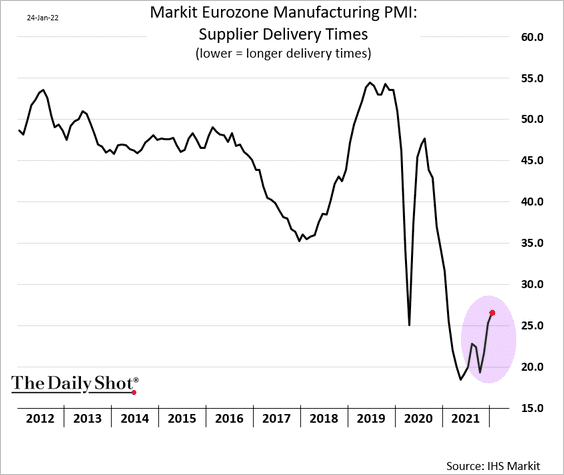

1. The January PMI report showed early signs of stabilization in supply bottlenecks. But there is a long way to go to get to more typical levels.

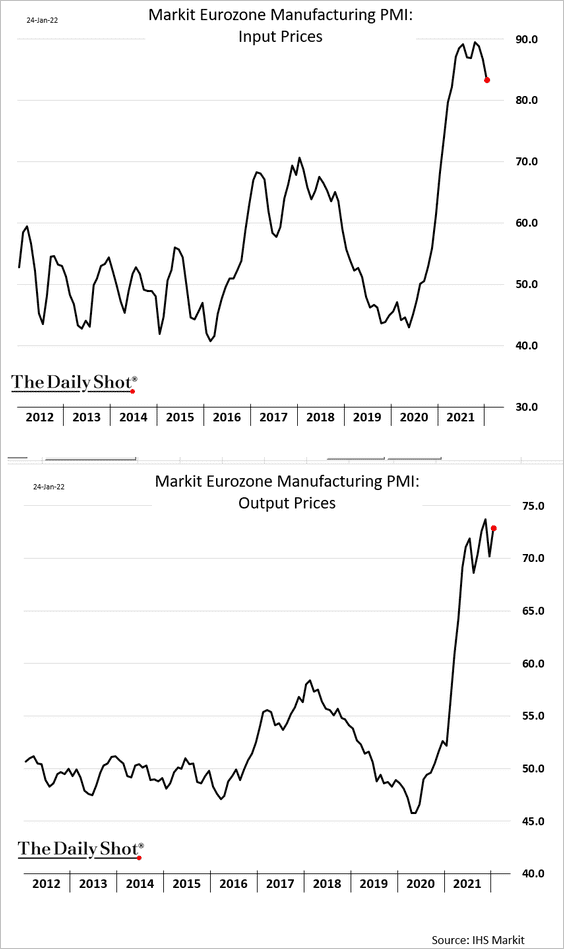

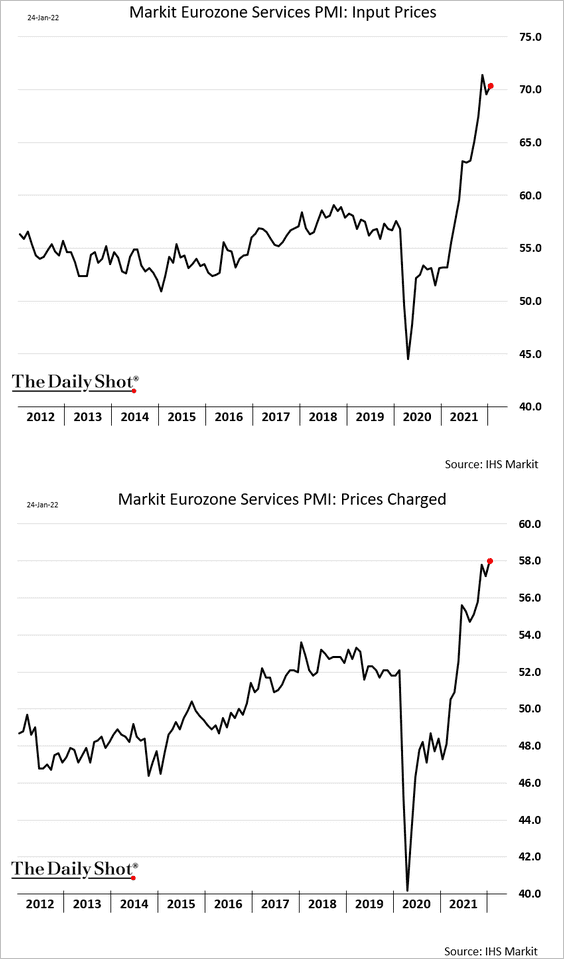

• Prices pressures remain near extreme levels.

– Manufacturing.

– Services:

——————–

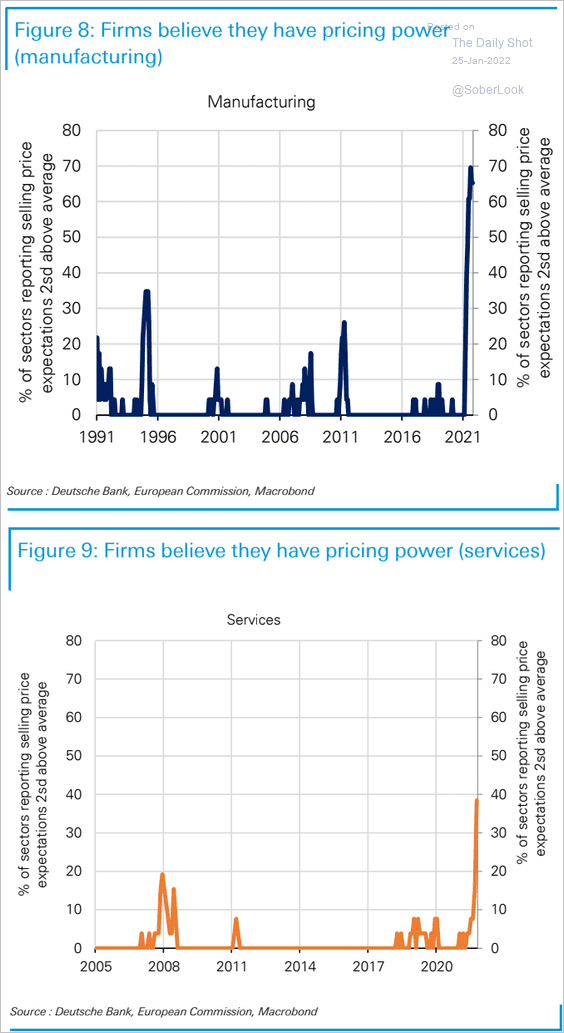

2. Businesses believe they have pricing power.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

The United Kingdom

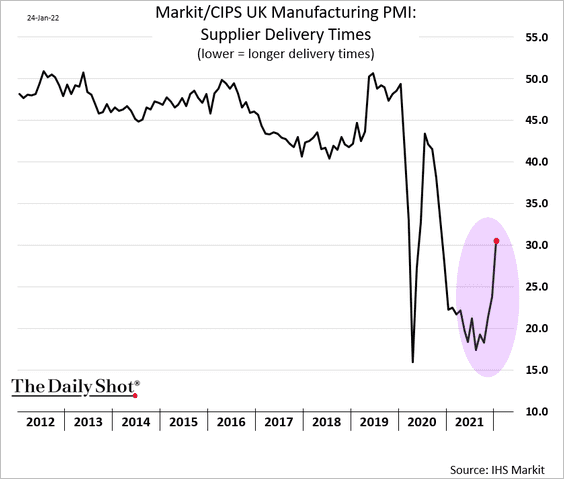

1. Supply bottlenecks appear to be easing.

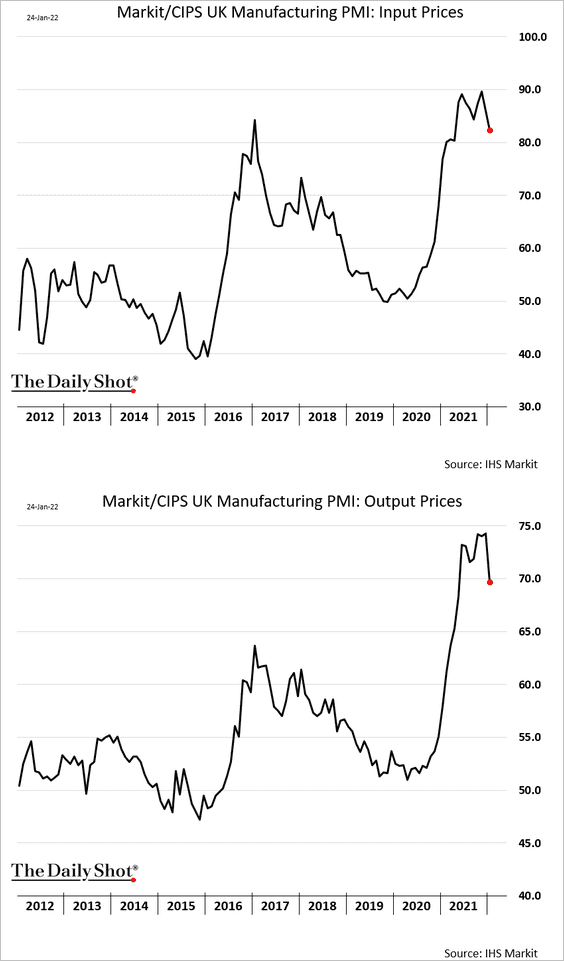

• Growth in factory prices, while still extreme, seems to be peaking.

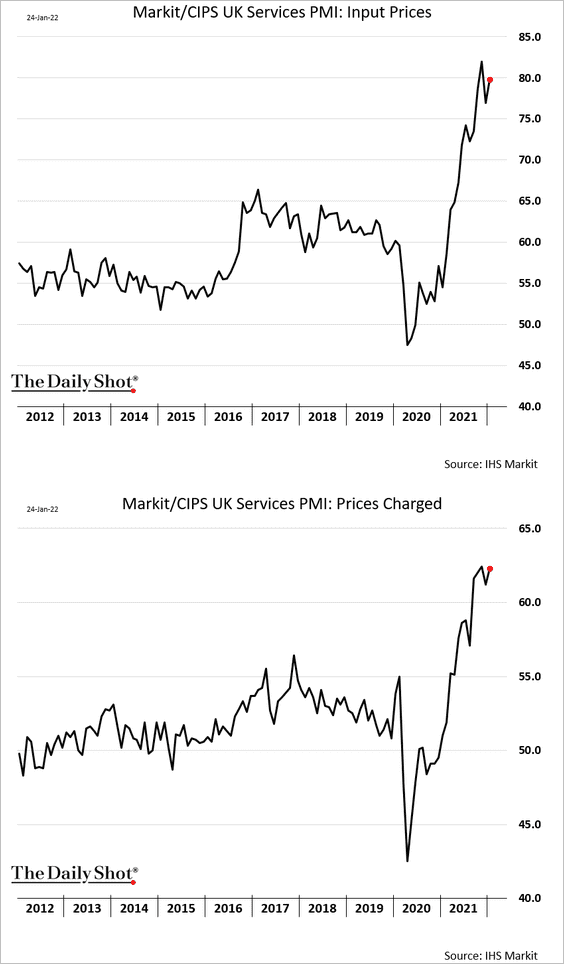

• Service-sector PMI price indices are yet to peak.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

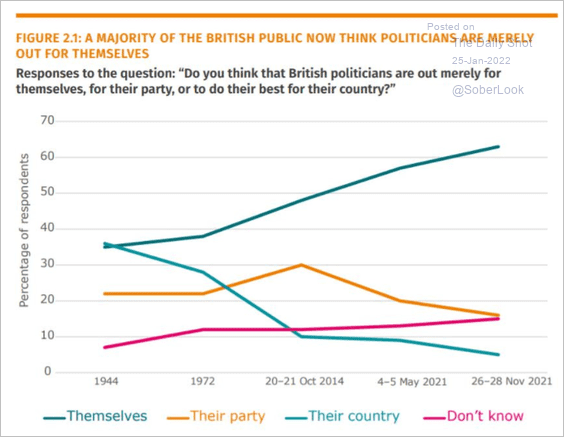

2. How do Britons view their politicians?

Source: IPPR Read full article

Source: IPPR Read full article

Back to Index

Canada

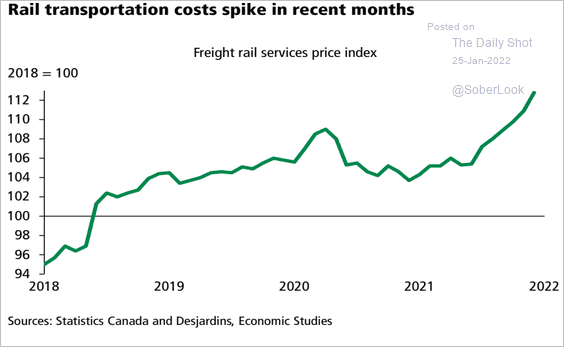

1. Rail freight costs have been surging.

Source: Desjardins

Source: Desjardins

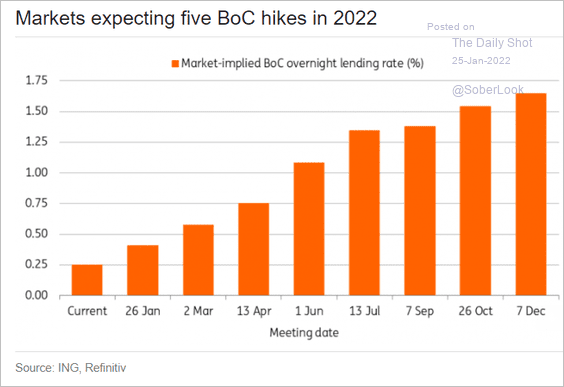

2. Expectations for BoC rate hikes this year continue to climb.

Source: ING

Source: ING

Back to Index

The United States

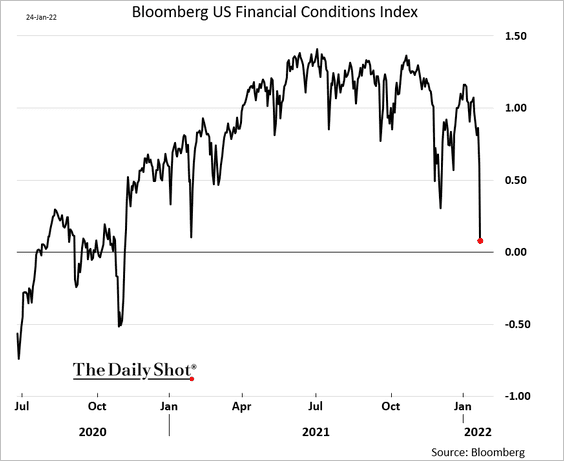

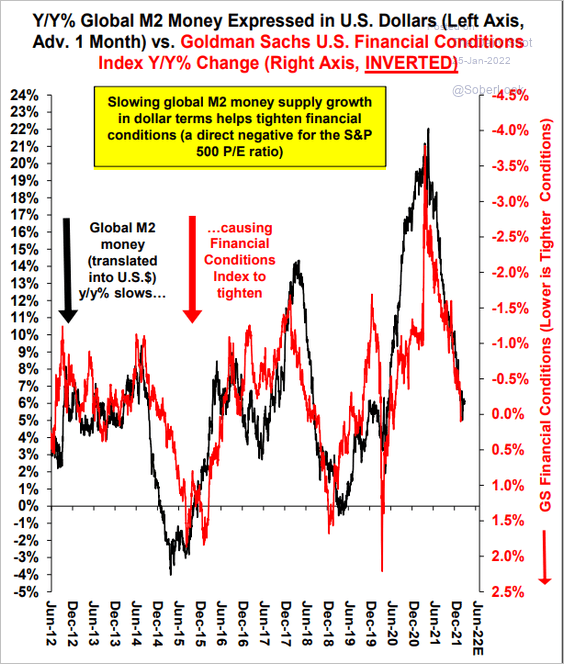

1. US financial conditions have tightened substantially in response to the Fed’s policy guidance.

According to Stifel, slower growth in the broad money supply also contributed to tighter financial conditions.

Source: Stifel

Source: Stifel

——————–

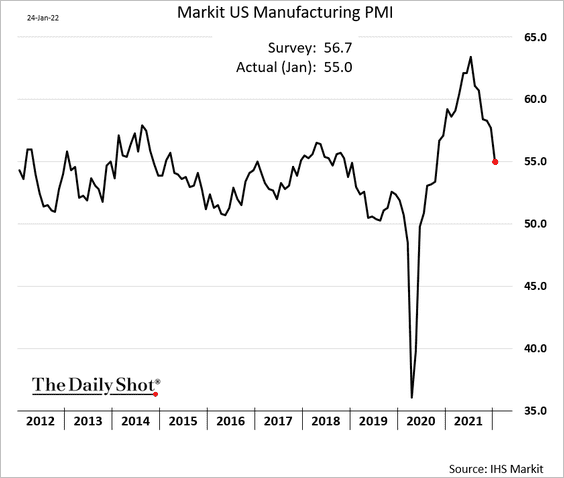

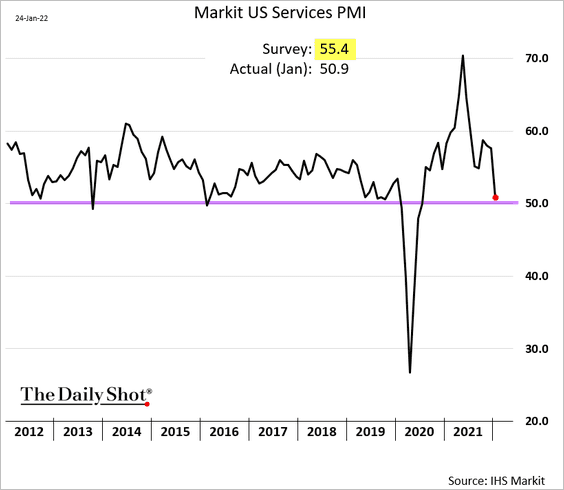

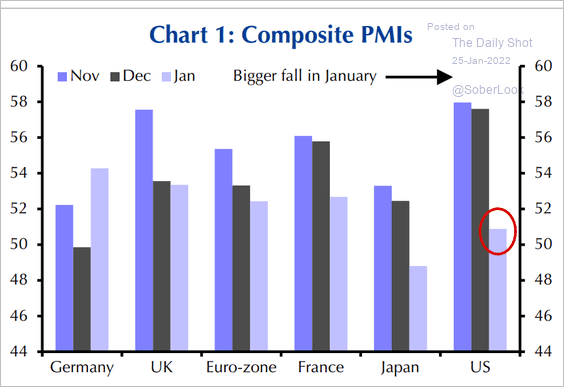

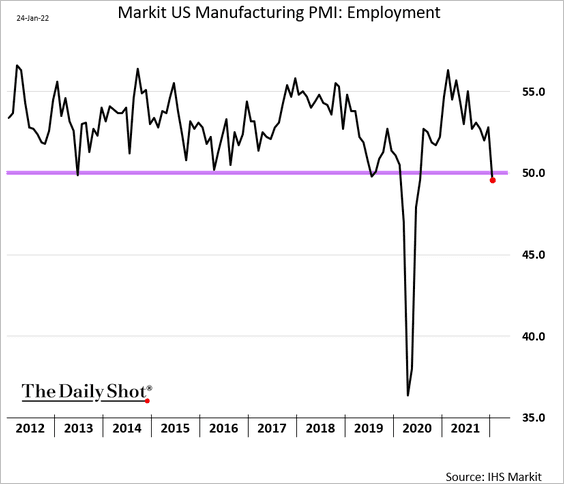

2. The latest Markit PMI report indicates that growth in business activity slowed this month, especially in services, as omicron takes a toll (PMI = 50 means growth has stalled).

• The US composite PMI decline (services + manufacturing) was sharper than in other advanced economies.

Source: Capital Economics

Source: Capital Economics

• Factory hiring deteriorated.

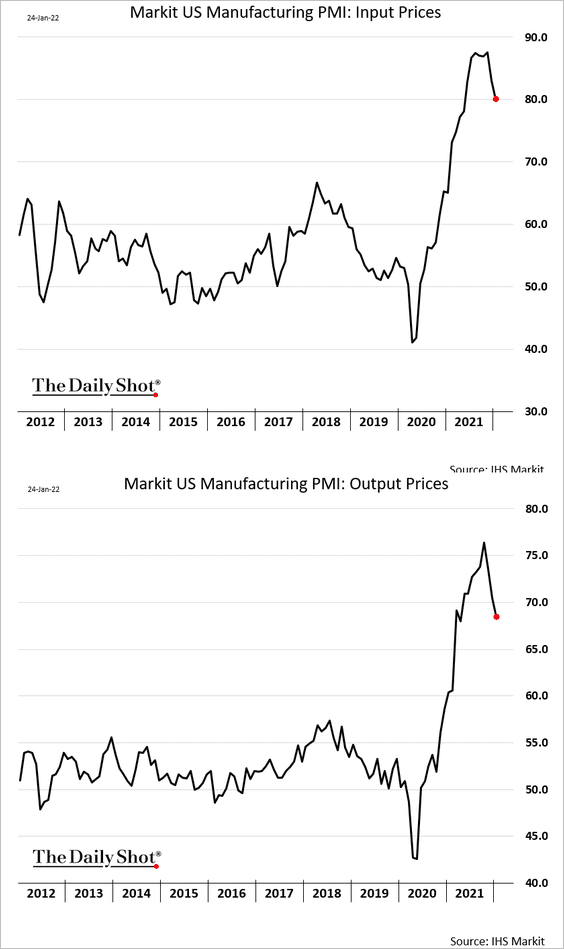

• Price gains in manufacturing are still near extremes but appear to be easing.

But service companies are boosting prices at an accelerating pace.

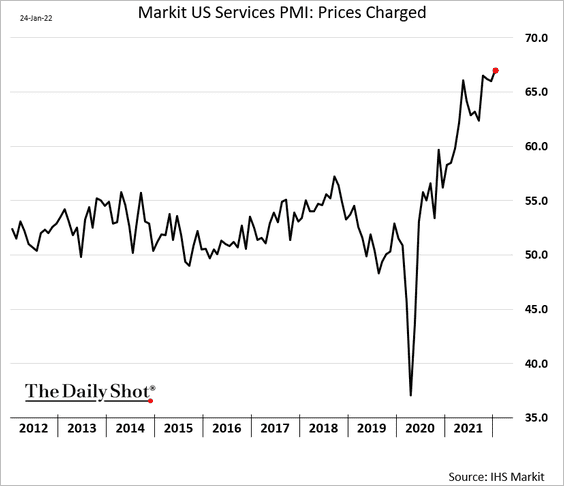

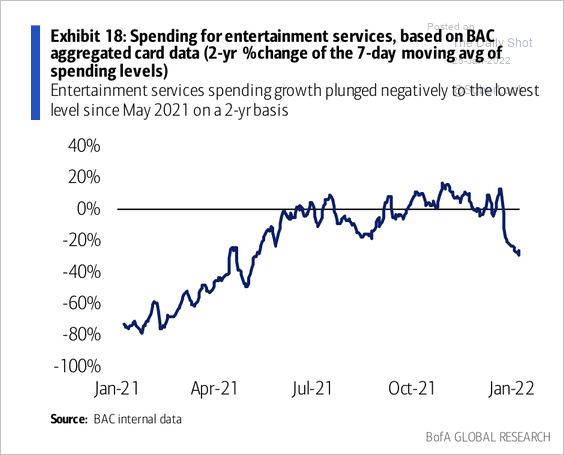

3. A report from Morgan Stanley also showed softer business conditions this month.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

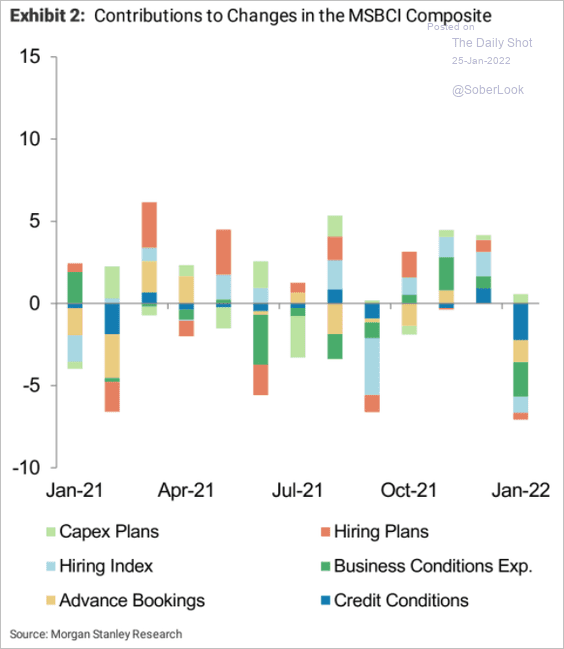

4. Consumer spending on entertainment services declined to the lowest level since May 2021, according to Bank of America credit card data.

Source: BofA Global Research

Source: BofA Global Research

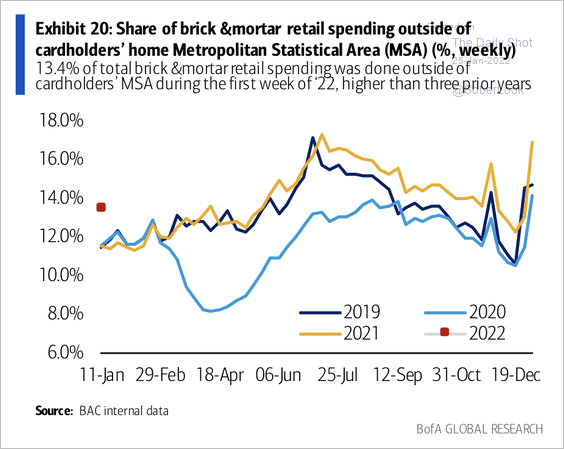

Consumer spending on brick and mortar retail outside of their local area is higher than in previous years.

Source: BofA Global Research

Source: BofA Global Research

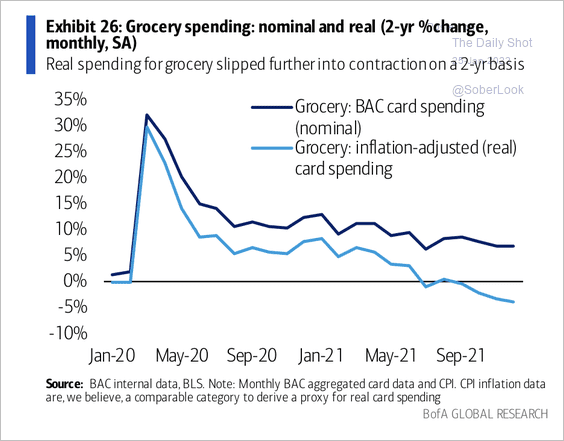

In real terms, grocery spending slipped further into contraction over the past few months.

Source: BofA Global Research

Source: BofA Global Research

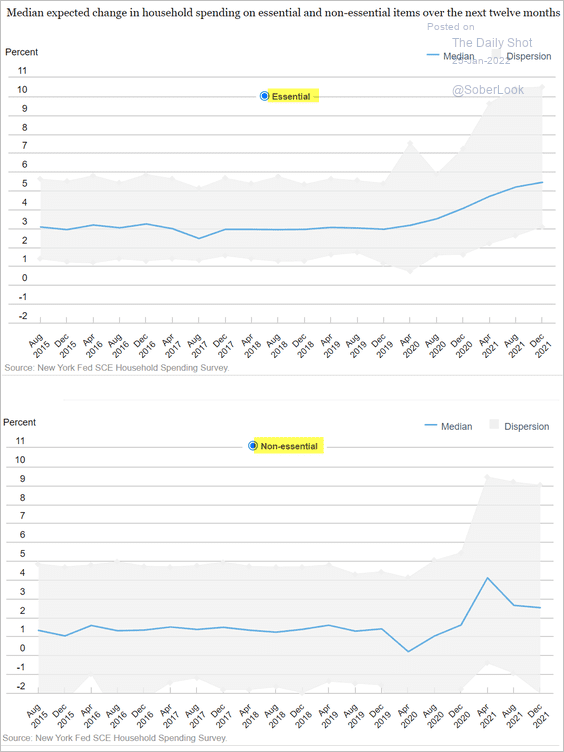

5. A survey from the NY Fed shows consumers are expecting to spend more on essential items while scaling down spending expectations for non-essential items.

Source: NY Fed

Source: NY Fed

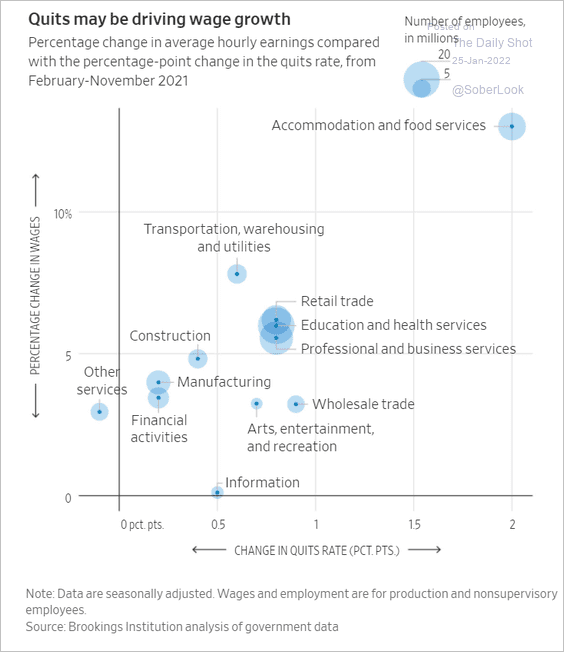

6. This scatterplot shows changes in wages vs. changes in the quits rate, by sector.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Global Developments

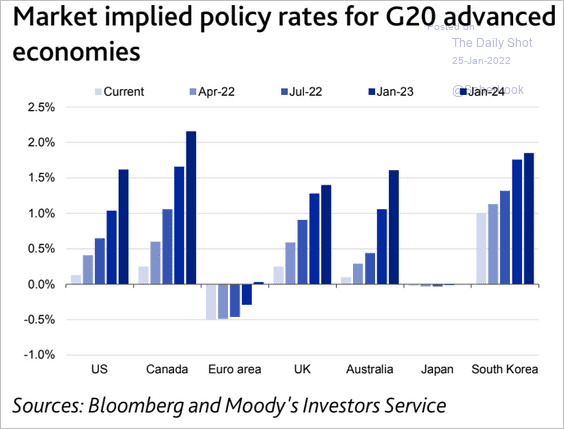

1. Market-implied policy rates in advanced economies continue to climb.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

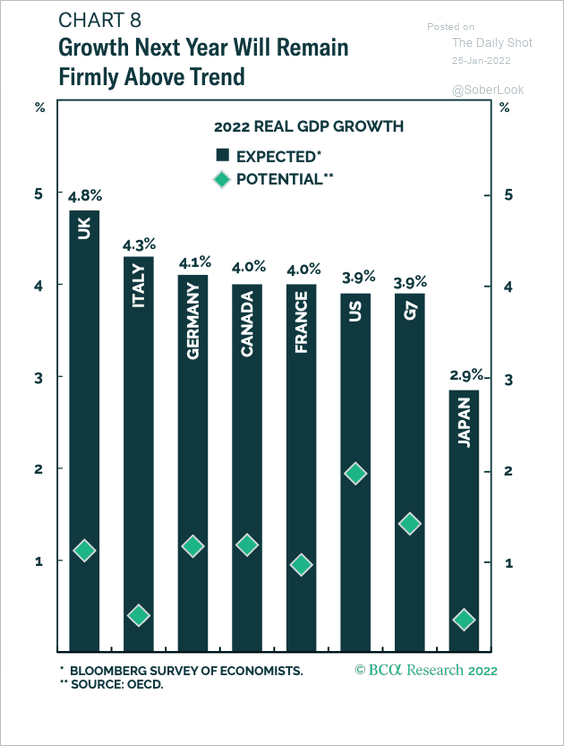

2. Growth is forecast to be above trend around the world.

Source: BCA Research

Source: BCA Research

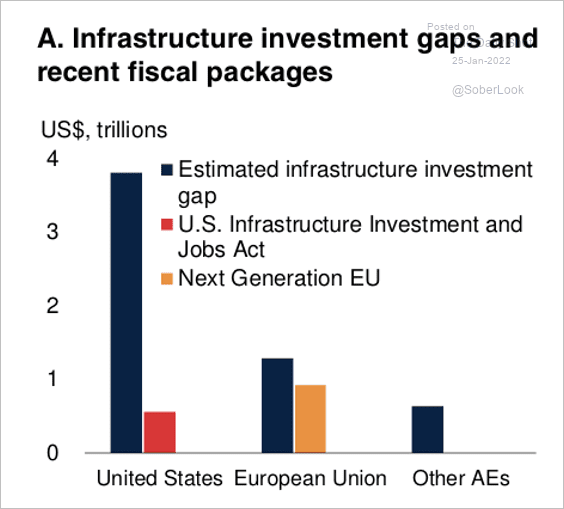

3. Recent policy actions are not enough to close the infrastructure gap in advanced economies.

Source: World Bank

Source: World Bank

——————–

Food for Thought

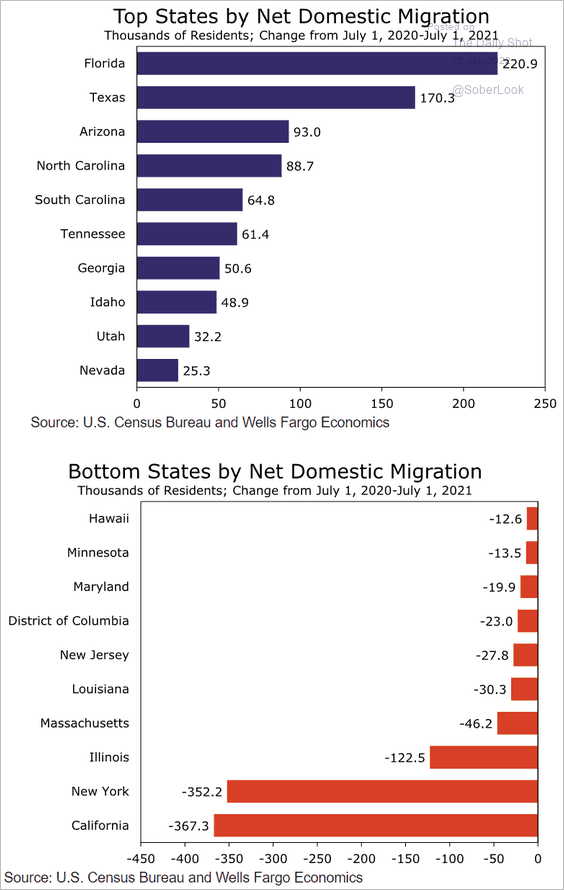

1. US domestic migration:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

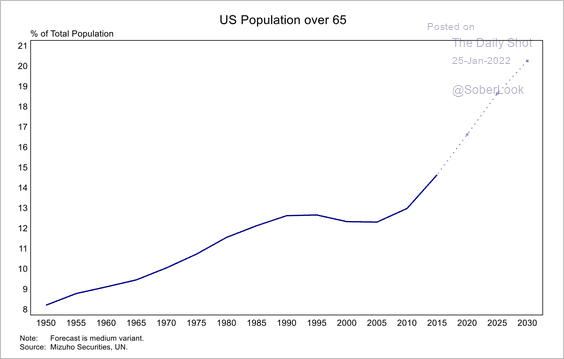

2. US population over 65:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

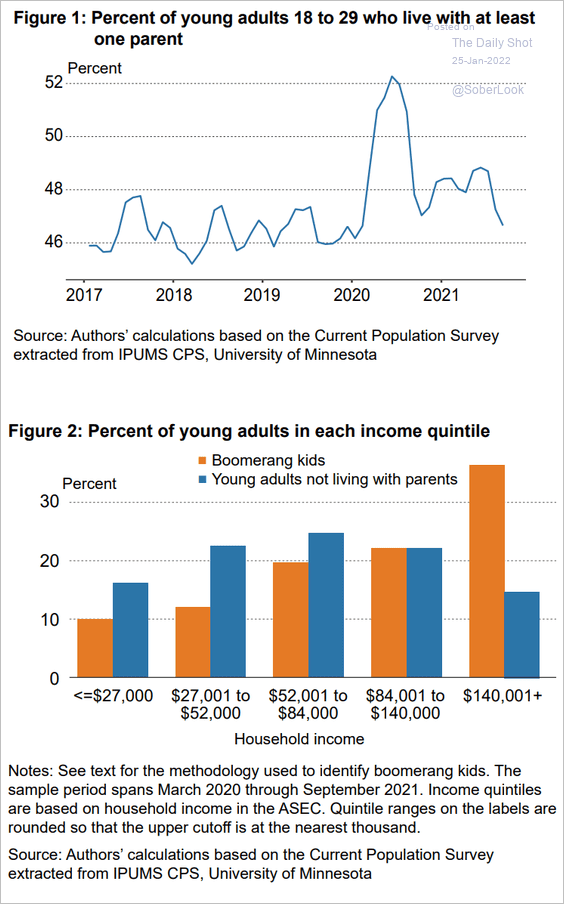

3. Young adults living with parents:

Source: FEDERAL RESERVE BANK OF CLEVELAND Read full article

Source: FEDERAL RESERVE BANK OF CLEVELAND Read full article

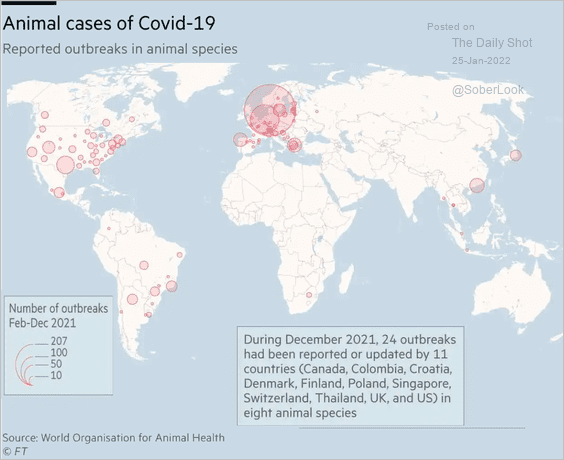

4. Animal cases of COVID-19:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

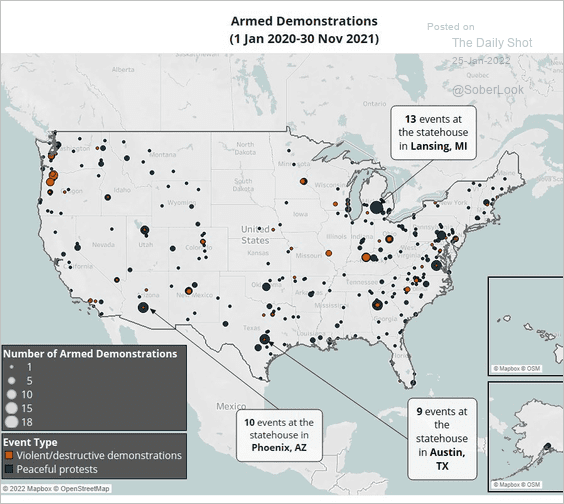

5. Armed demonstrations:

Source: @ACLEDINFO

Source: @ACLEDINFO

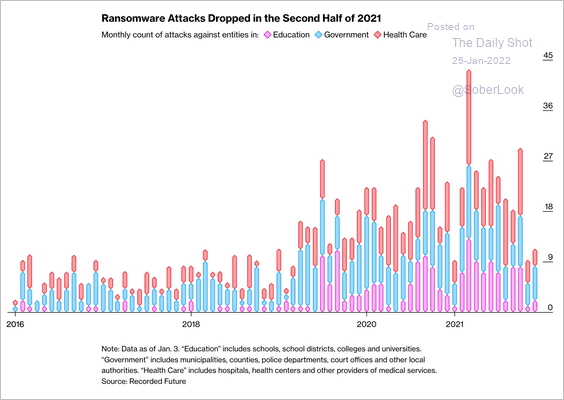

6. Ransomware attacks:

Source: @BBGVisualData Read full article

Source: @BBGVisualData Read full article

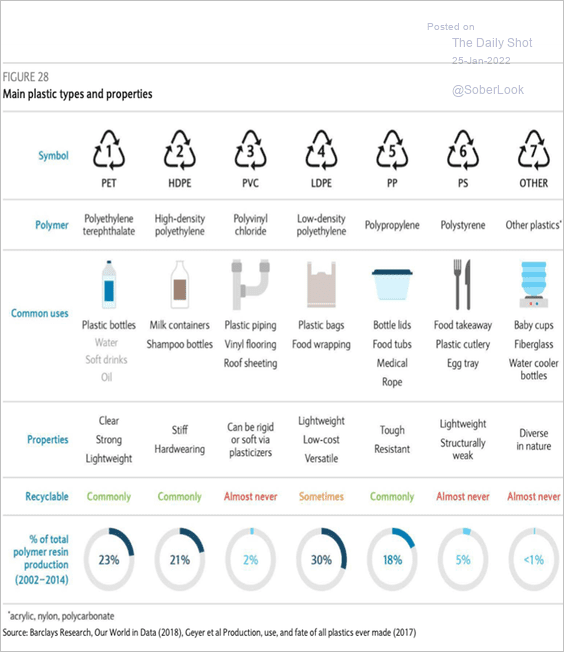

7. Types of plastics and their properties:

Source: Barclays Research

Source: Barclays Research

——————–

Back to Index