The Daily Shot: 26-Jan-22

• Equities

• Credit

• Rates

• Commodities

• Energy

• Cryptocurrencies

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Equities

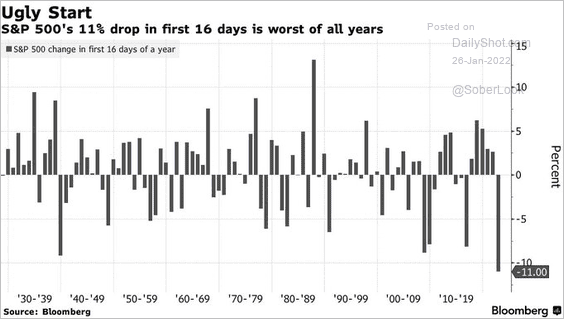

1. Stocks remained under pressure on Tuesday. It’s been a rough start to the year.

Source: @C_Barraud, Bloomberg Read full article

Source: @C_Barraud, Bloomberg Read full article

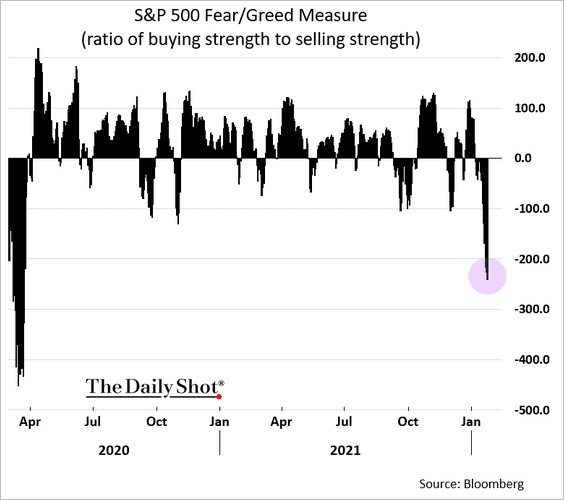

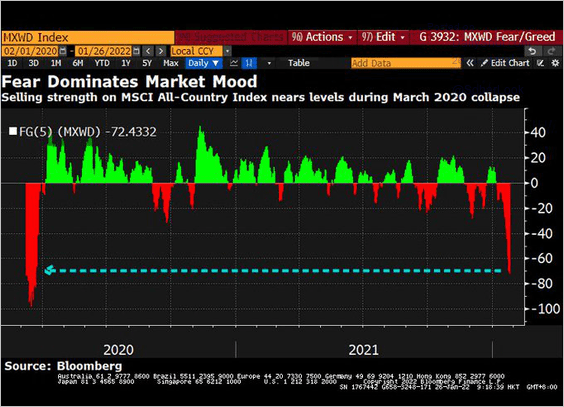

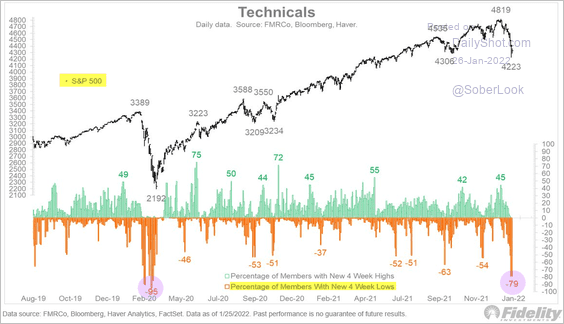

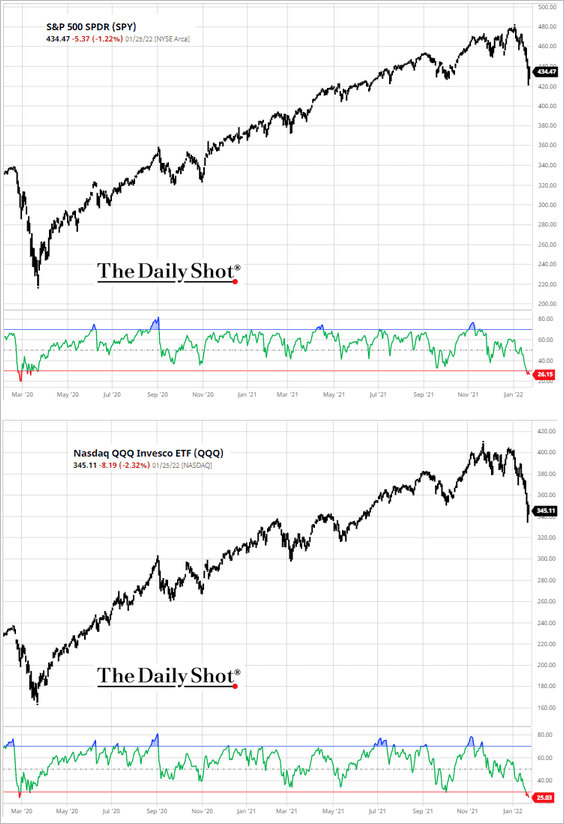

2. Technicals suggest that we are close to a rebound.

• The S&P 500 and global “fear & greed” indicators are near extremes (2 charts).

Source: @DavidInglesTV

Source: @DavidInglesTV

• Here is the share of S&P 500 members hitting 4-week lows.

Source: @TimmerFidelity

Source: @TimmerFidelity

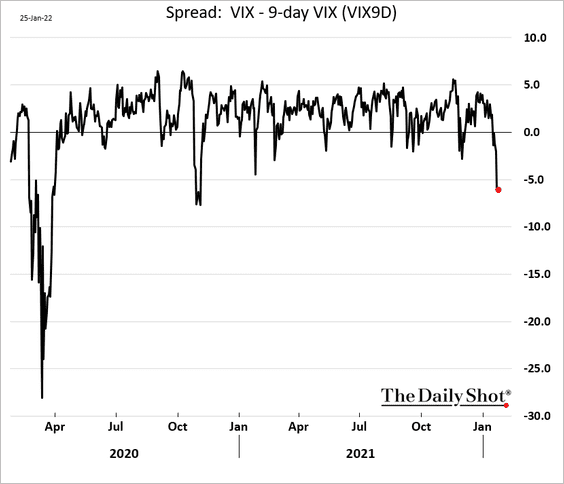

• The short end of the VIX curve (9 days vs. 1 month) has inverted substantially (which indicates risk aversion).

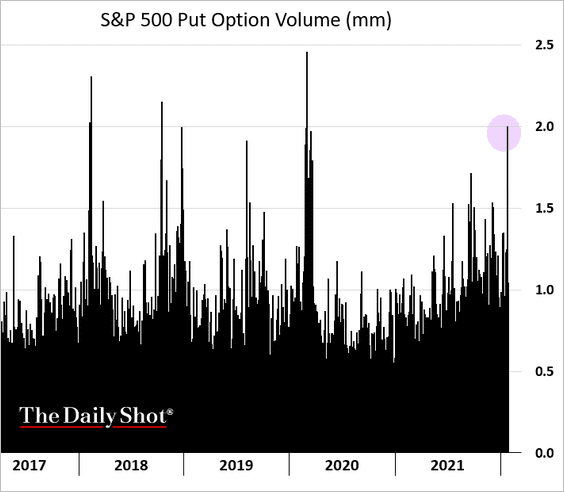

• Put option activity has been very elevated.

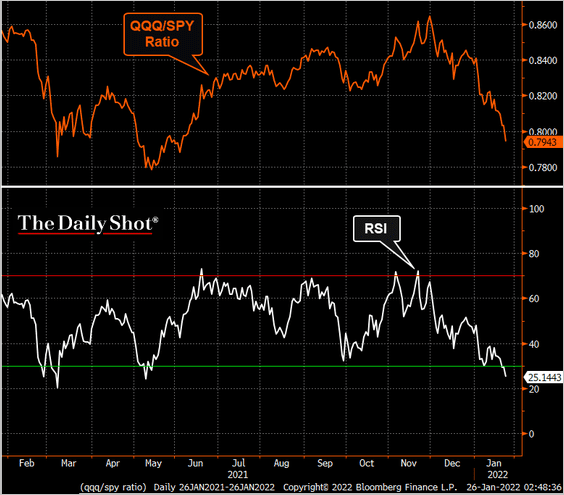

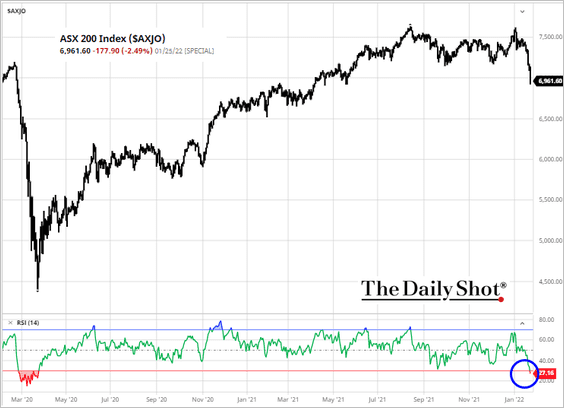

• The RSI indicators are in oversold territory.

Source: barchart.com

Source: barchart.com

Here is the RSI for the QQQ/SPY ratio.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

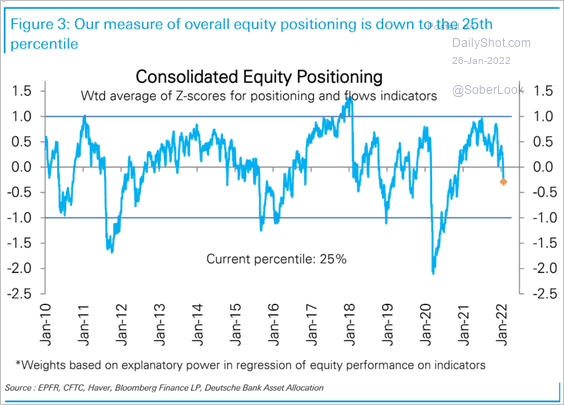

• Deutsche Bank’s positioning indicator points to investor caution.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

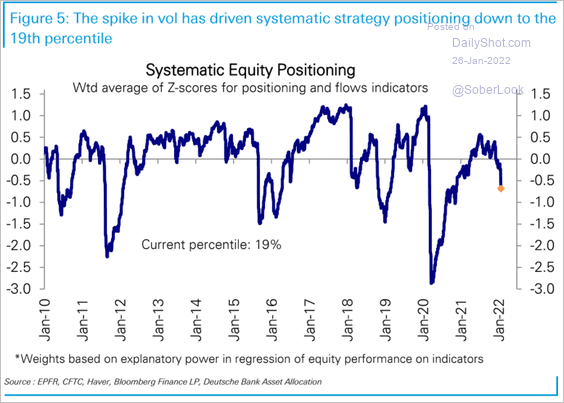

– Here is the systematic funds’ positioning.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

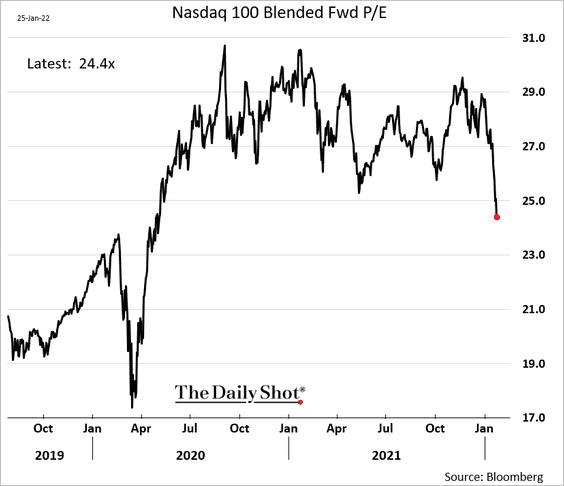

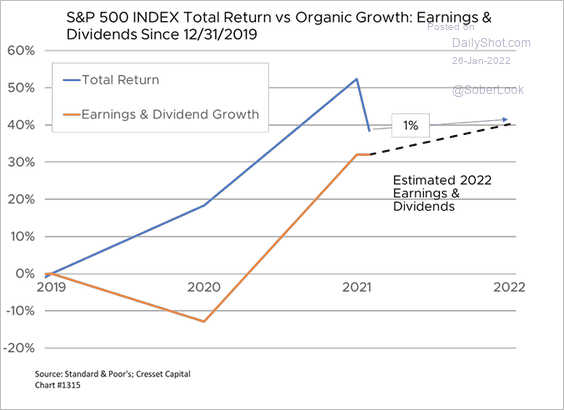

Fundamentals, however, tell us that the selloff hasn’t been particularly severe.

• The Nasdaq 100 forward P/E ratio dipped below 25x, but these stocks are still pricey.

• The S&P 500 price has outpaced earnings and dividend growth since the start of the pandemic. The latest selloff hasn’t brought us back to “fundamentals.”

Source: Jack Ablin, Cresset Wealth Advisors

Source: Jack Ablin, Cresset Wealth Advisors

——————–

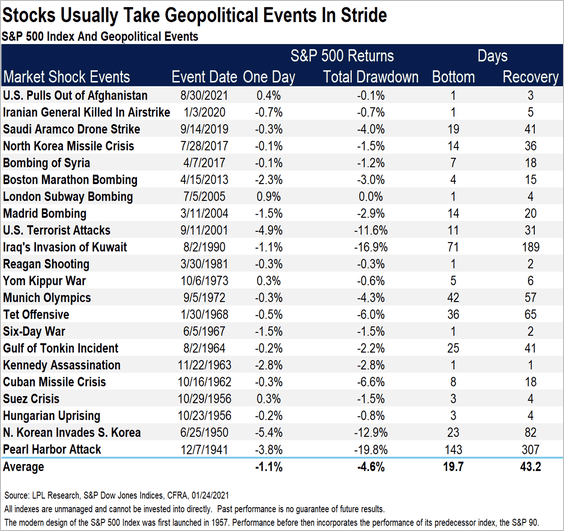

3. How should we think about the Russia/Ukraine risk? History tells us that stocks tend to be resilient when it comes to geopolitical events.

Source: LPL Research

Source: LPL Research

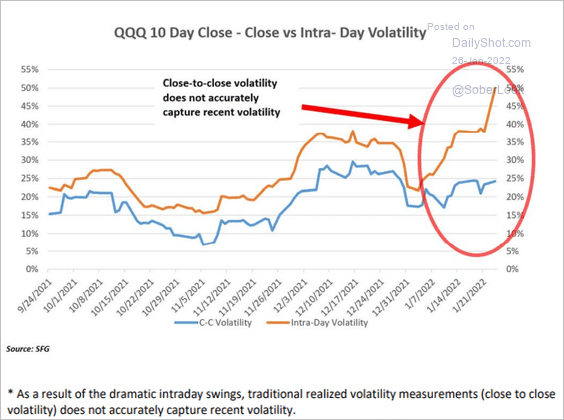

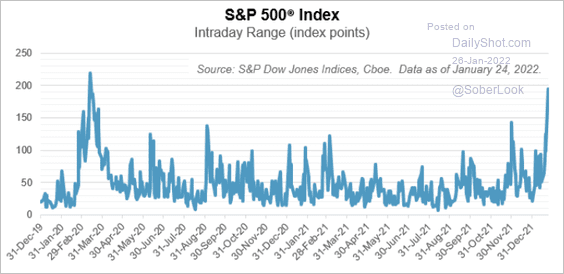

4. Intraday volatility has been much higher than close-to-close moves. As a result, standard volatility measures are understating market swings.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

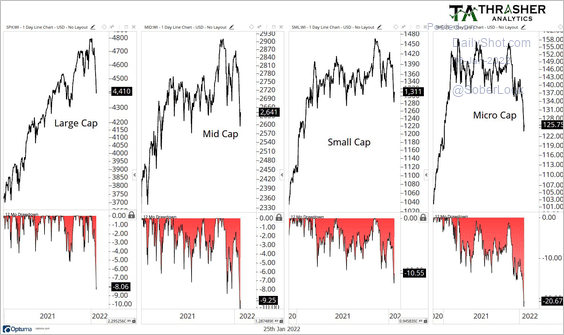

5. Microcaps (favored by the Reddit crowd) are in bear-market territory.

Source: @AndrewThrasher

Source: @AndrewThrasher

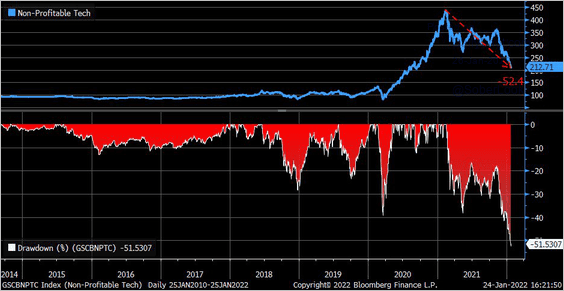

And here is the drawdown for non-profitable tech.

Source: @LizAnnSonders

Source: @LizAnnSonders

——————–

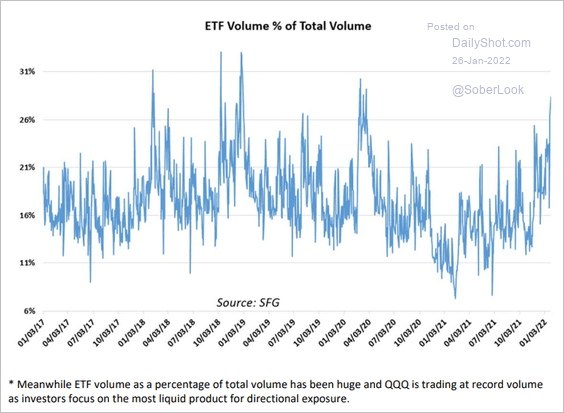

6. ETF volume surged relative to individual stocks.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

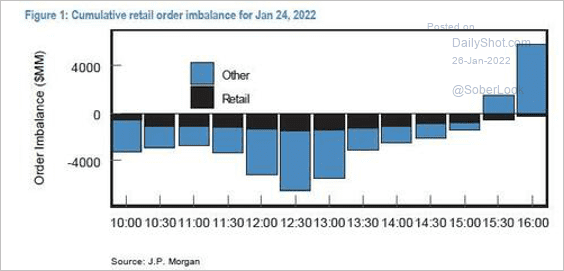

7. Retail investors are doing some dip-buying.

Source: JP Morgan Research; @MichaelGoodwell

Source: JP Morgan Research; @MichaelGoodwell

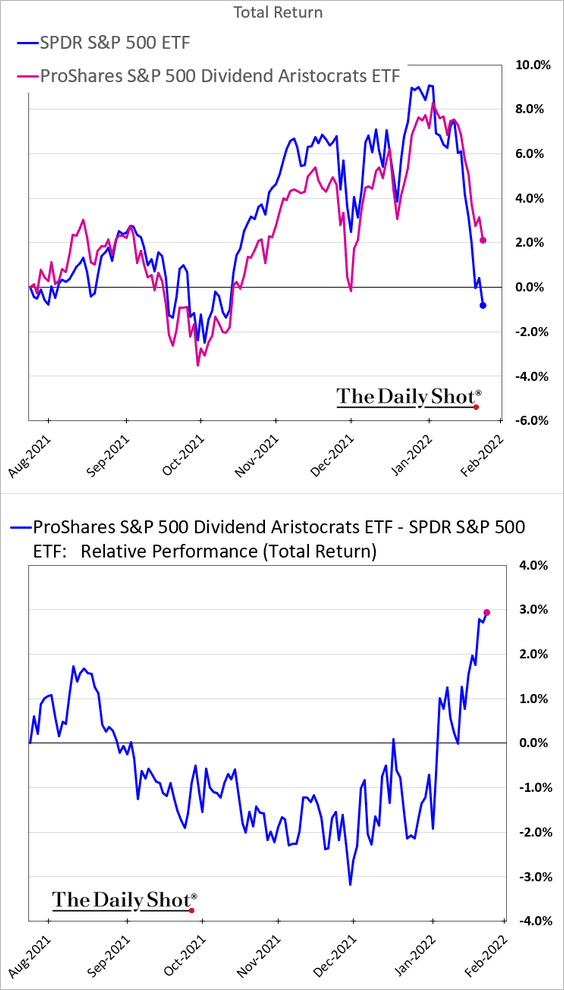

8. S&P 500 companies that have a track record of increasing dividends have been outperforming.

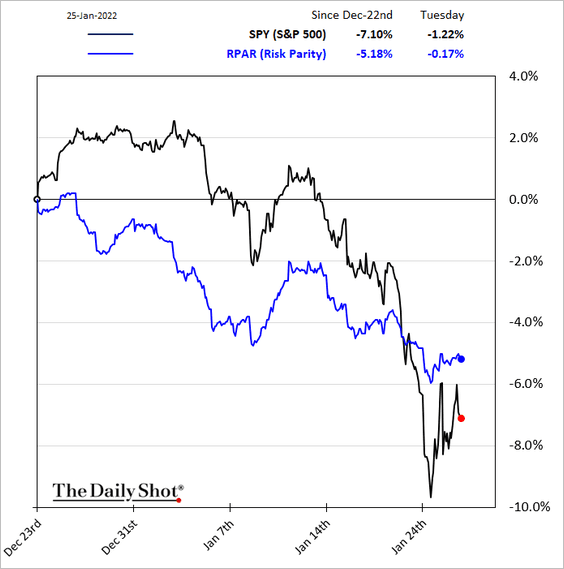

9. Risk-parity strategies have been lagging the S&P 500 for weeks. Not anymore.

Back to Index

Credit

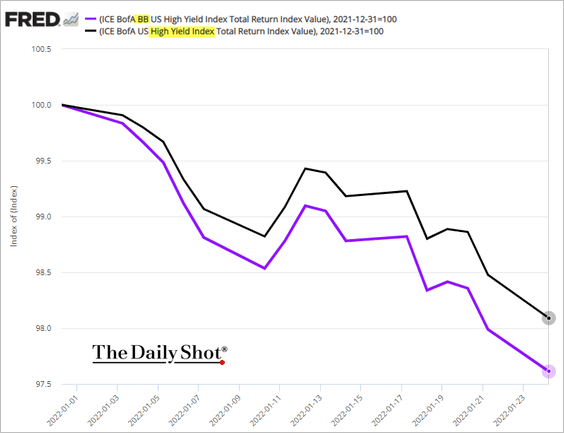

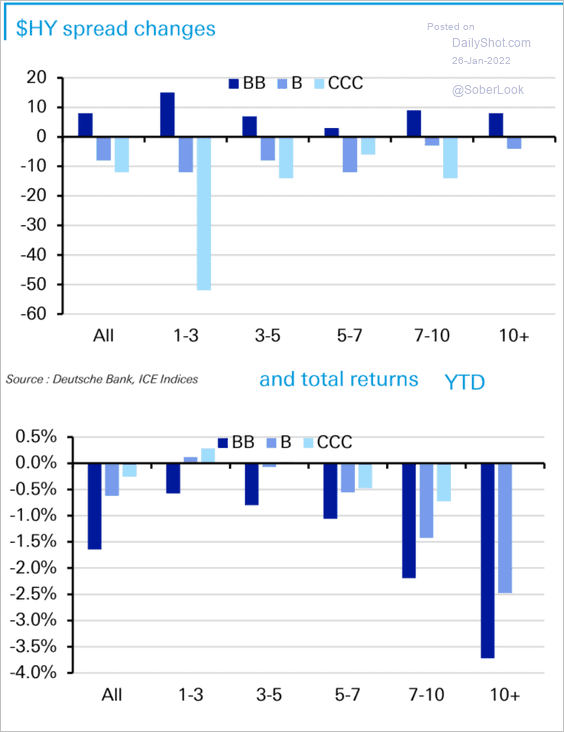

1. BB-rated corporate bonds have been underperforming (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

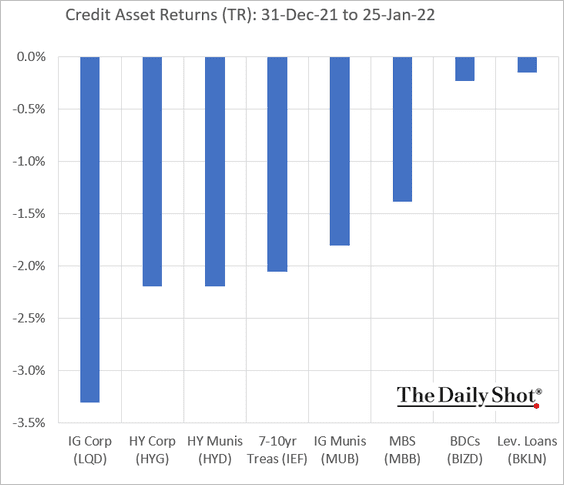

2. This chart shows where we are with credit asset performance month-to-date (total returns). Treasuries are included for comparison.

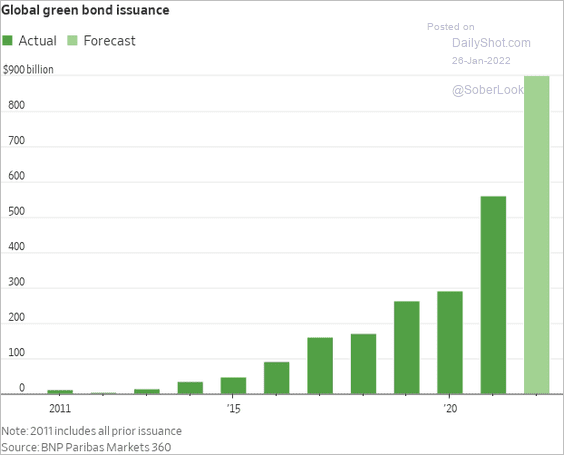

3. Green bond issuance is expected to keep surging.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Rates

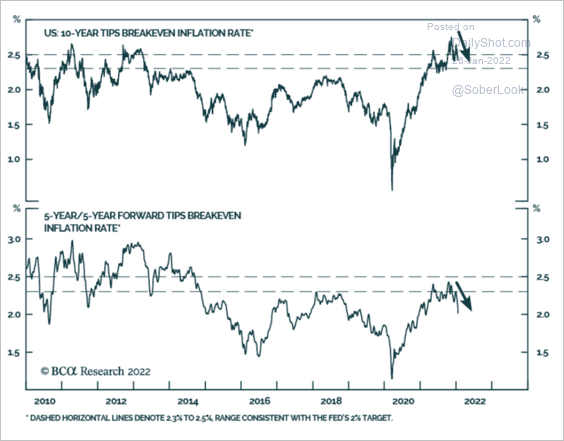

1. Have market-based inflation expectations peaked for now?

Source: BCA Research

Source: BCA Research

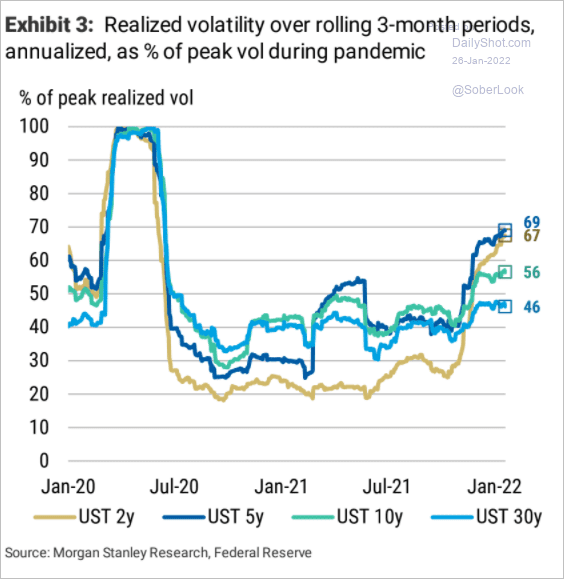

2. Treasury market realized volatility hit the highest level since the COVID peak.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

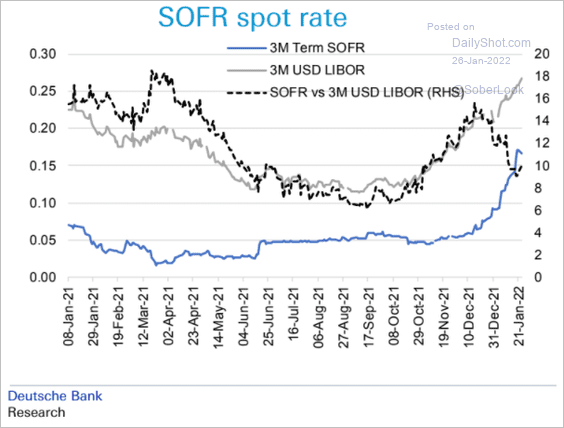

3. Here is the term SOFR rate vs. LIBOR.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

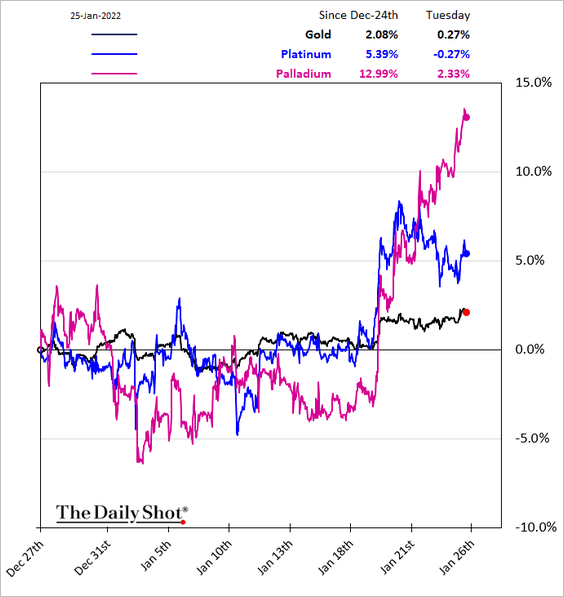

Commodities

Palladium has been outperforming.

h/t Walter

h/t Walter

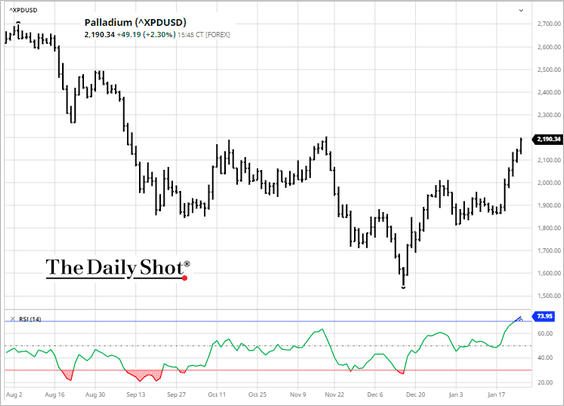

Is it overbought?

Source: barchart.com

Source: barchart.com

Back to Index

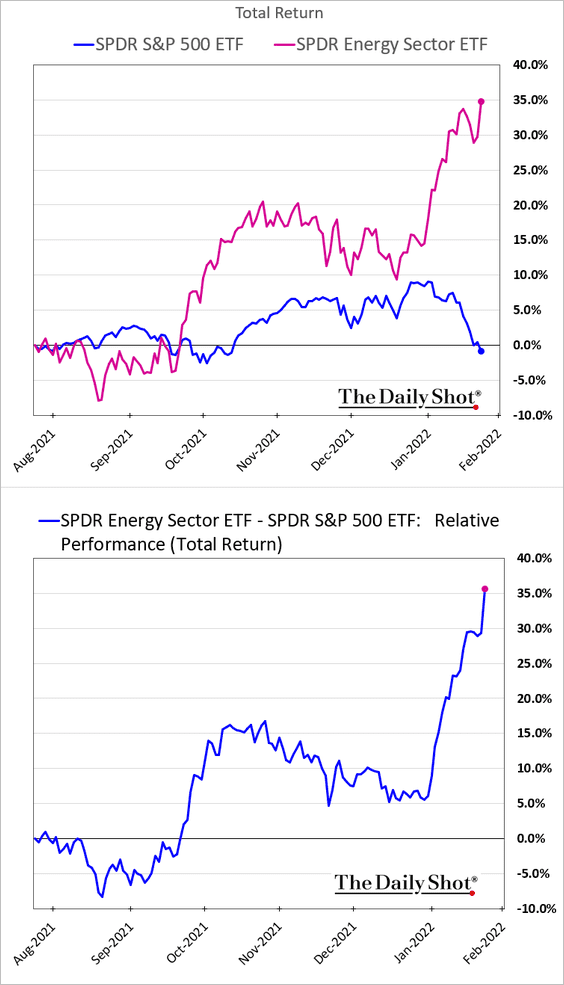

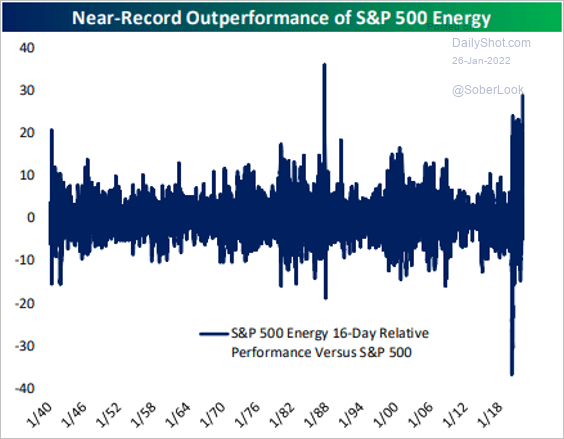

Energy

1. The outperformance of energy shares has been impressive (2 charts).

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

——————–

2. The Brent curve is moving deeper into backwardation (negative slope), which signals tight market conditions.

• April – March spread:

Source: @HFI_Research

Source: @HFI_Research

• May – April:

Source: @HFI_Research

Source: @HFI_Research

Back to Index

Cryptocurrencies

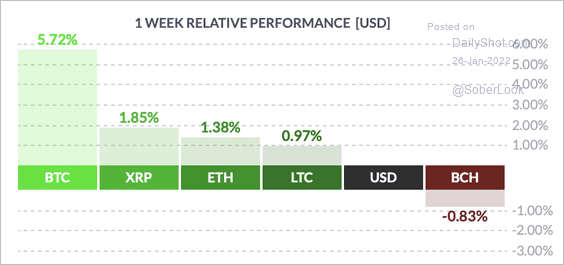

1. Cryptocurrencies are starting to stabilize after the recent sell-off.

Source: FinViz

Source: FinViz

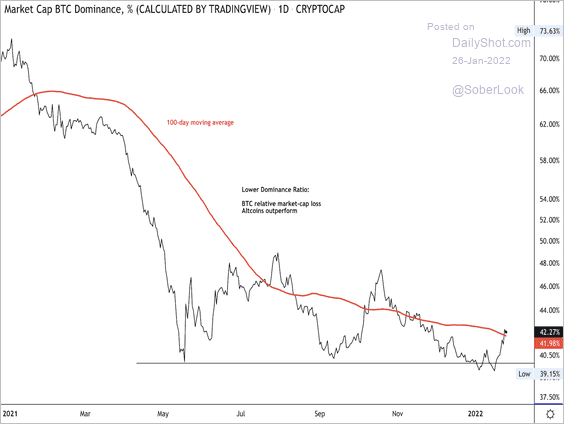

2. Bitcoin’s market cap relative to the total crypto market cap has risen so far this year, which could signal a “flight to safety” in crypto similar to 2018.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

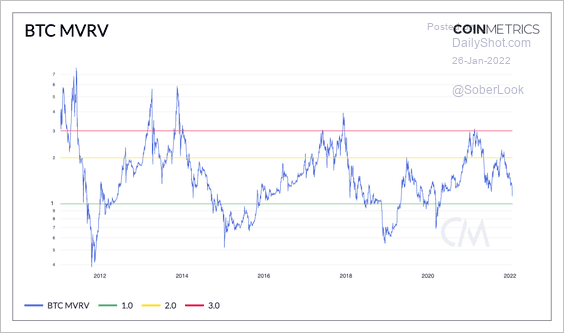

3. Bitcoin’s market value relative to its realized value (MVRV) is not yet at an extreme low, suggesting BTC is only slightly below “fair value.”

Source: @coinmetrics

Source: @coinmetrics

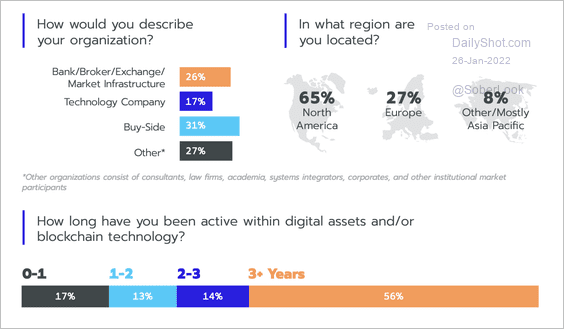

4. A majority of financial and tech firms surveyed by Arca and Coalition Greenwich have been active in digital assets/blockchain for at least three years.

Source: Arca; Coalition Greenwich Read full article

Source: Arca; Coalition Greenwich Read full article

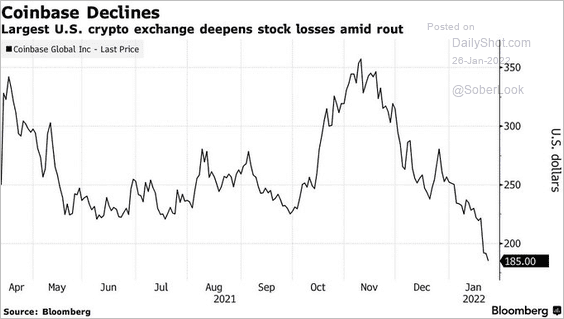

5. The Coinbase stock rout continues.

Source: @markets Read full article

Source: @markets Read full article

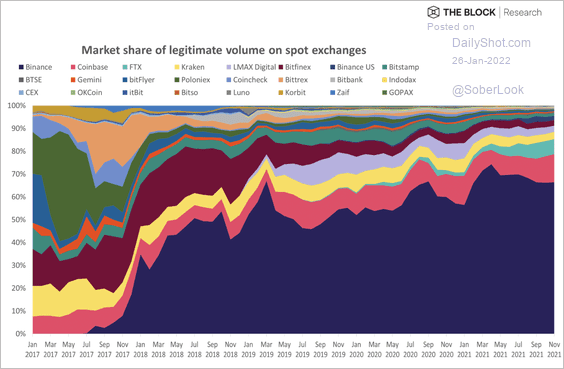

6. Binance dominates crypto spot exchange volumes.

Source: The Block

Source: The Block

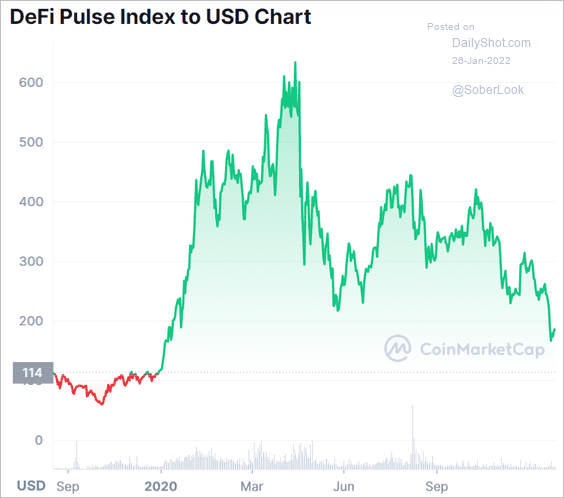

7. Market participants are concerned about a severe shakeout in the DeFi space.

Source: CoinMarketCap Further reading

Source: CoinMarketCap Further reading

Back to Index

Emerging Markets

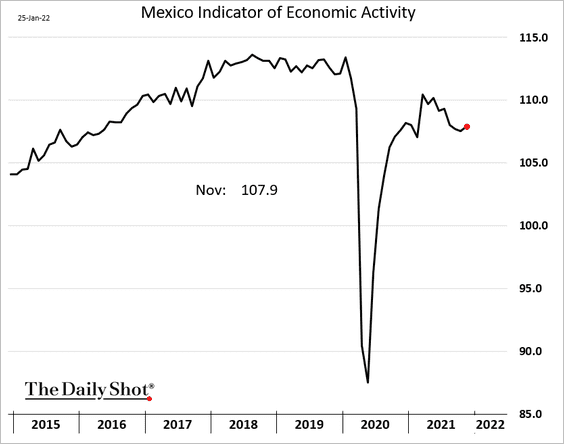

1. Mexico’s economic activity ticked higher in November but remained depressed.

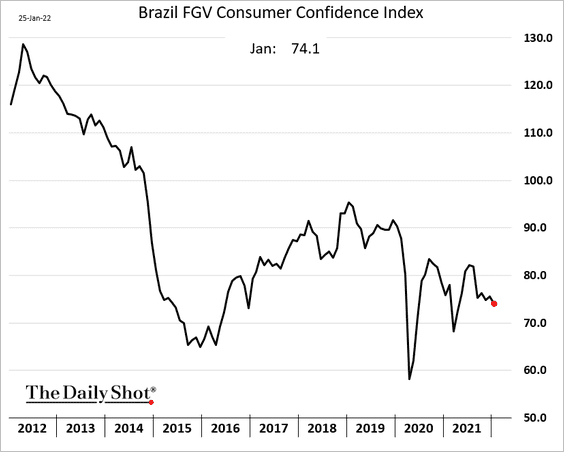

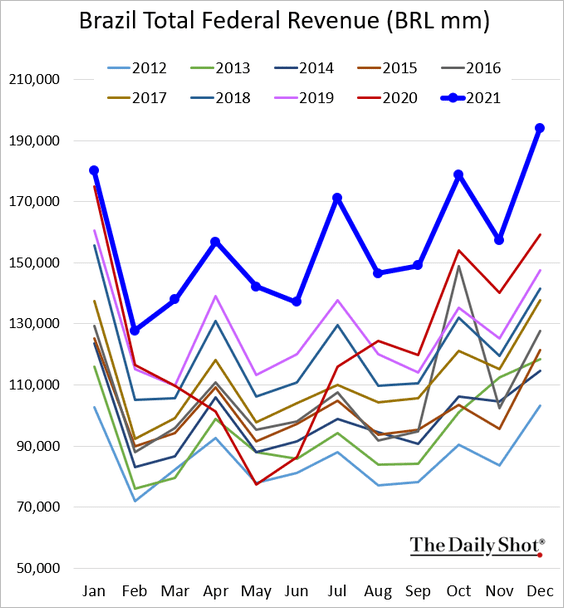

2. Brazil’s consumer confidence has been softening.

The government’s tax collections finished the year on a strong note.

——————–

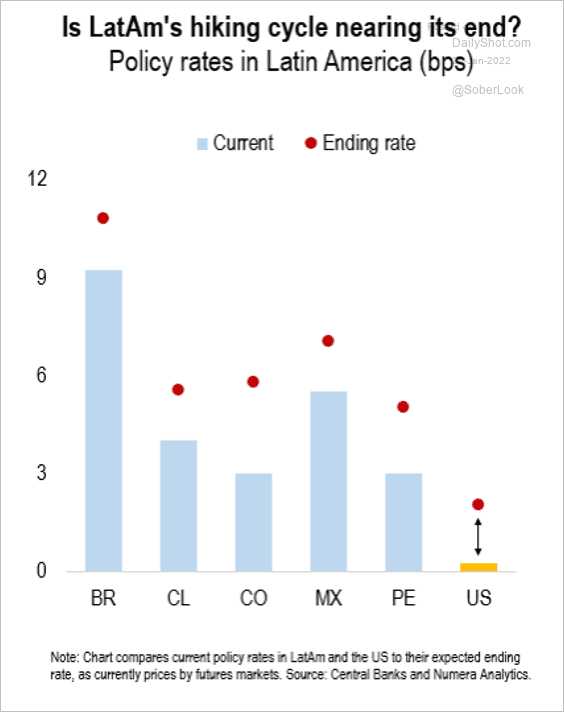

3. Are LatAm central banks nearing the end of their hiking cycle?

Source: Numera Analytics

Source: Numera Analytics

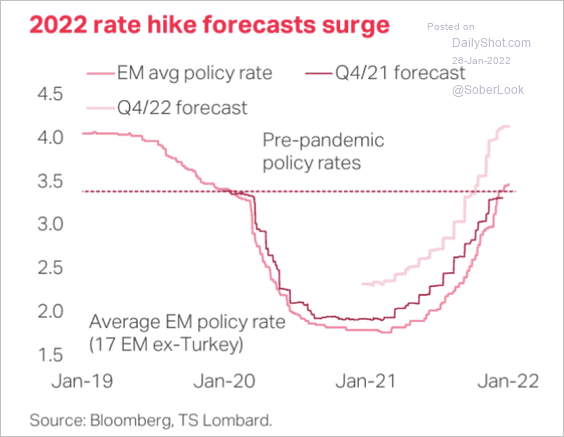

4. EM policy rates have returned near pre-pandemic levels.

Source: TS Lombard

Source: TS Lombard

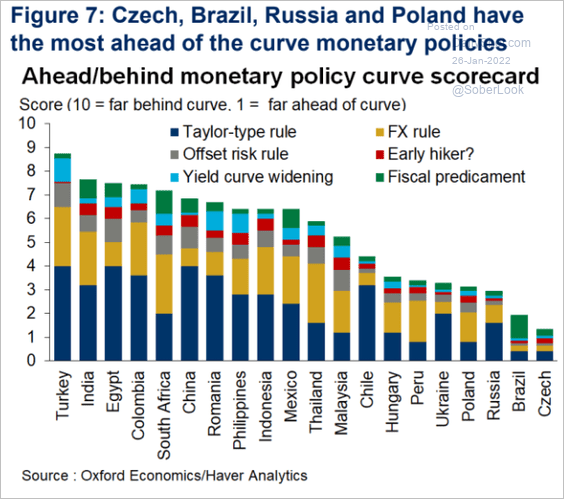

Which central banks are behind the curve?

Source: Oxford Economics

Source: Oxford Economics

——————–

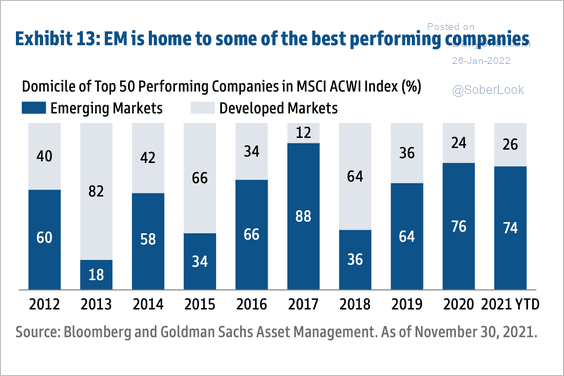

5. Emerging markets are home to a majority of the best-performing stocks over 2020 and 2021.

Source: Goldman Sachs Asset Management

Source: Goldman Sachs Asset Management

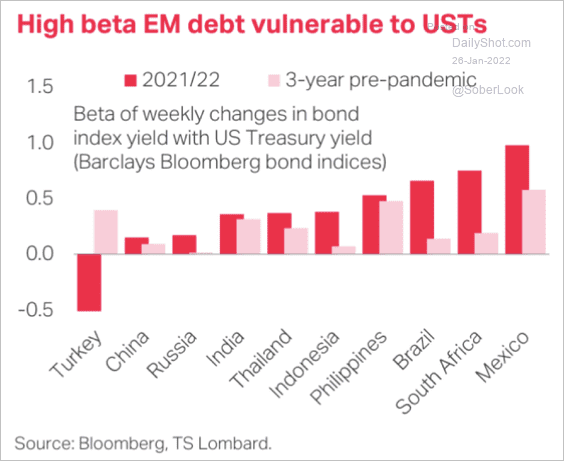

6. High-beta EM debt will be increasingly vulnerable to rising Treasury yields.

Source: TS Lombard

Source: TS Lombard

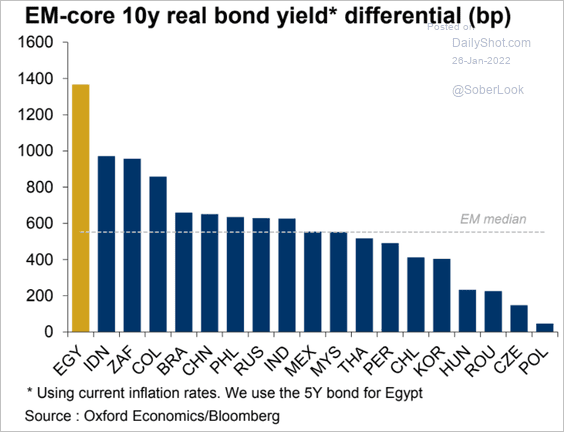

7. This chart shows real sovereign bond yields across select economies.

Source: Oxford Economics

Source: Oxford Economics

Back to Index

China

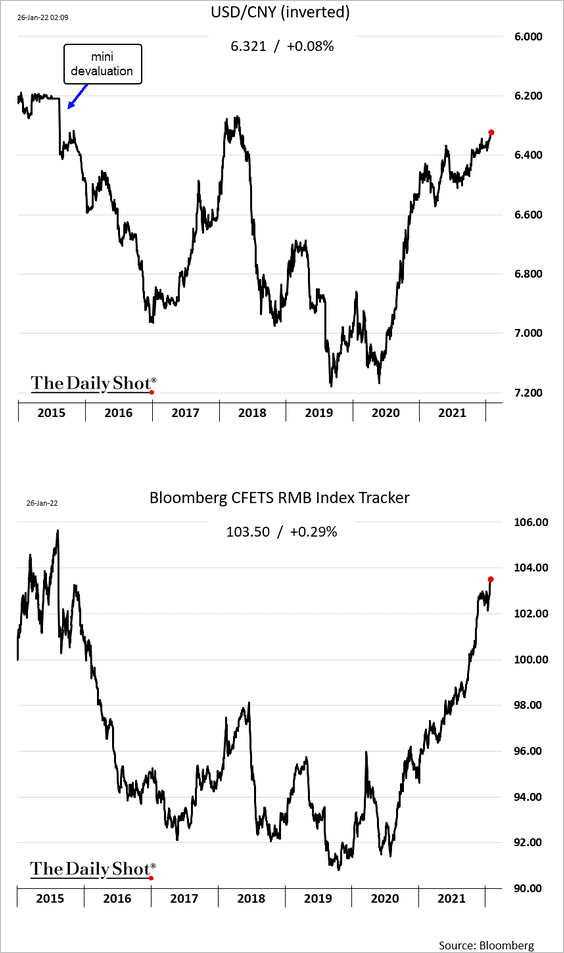

1. How long will Beijing tolerate the renminbi’s strength given its impact on financial conditions? The first panel shows CNY vs. USD and the second is CNY vs. a basket of currencies.

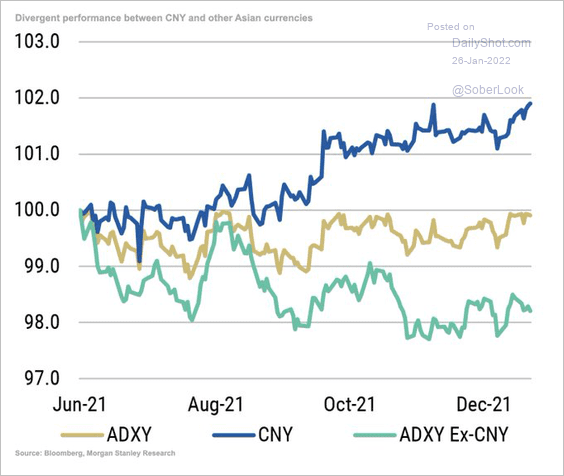

The renminbi is also outperforming other EM currencies.

Source: @acemaxx, @MorganStanley

Source: @acemaxx, @MorganStanley

——————–

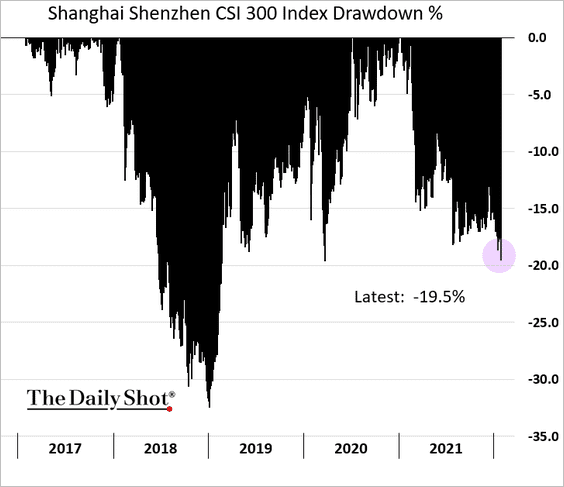

2. Stocks are near bear-market territory.

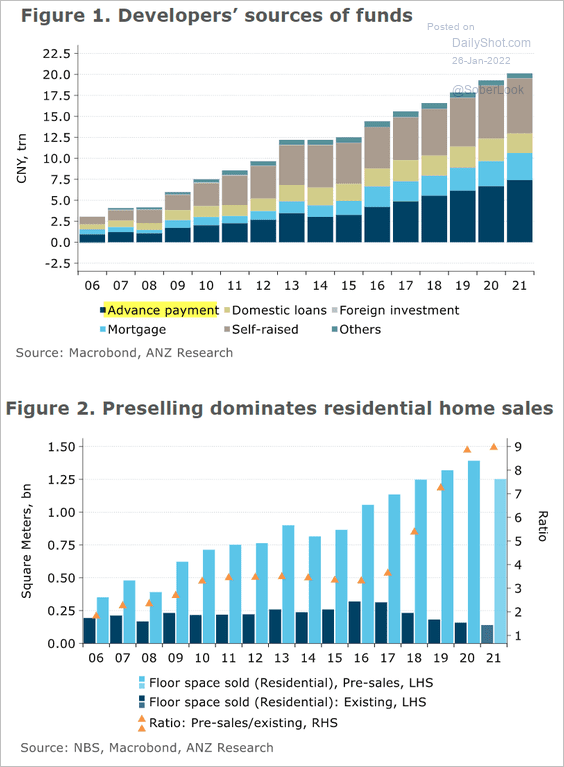

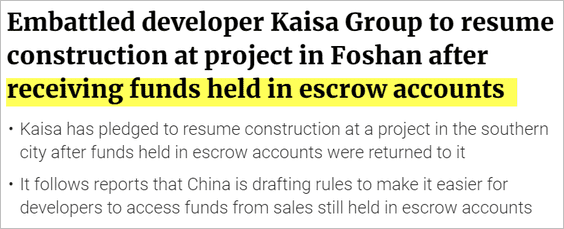

3. Beijing’s letting developers tap presale funds is giving some stressed firms a lifeline.

Source: ANZ Research

Source: ANZ Research

Source: South China Morning Post Read full article

Source: South China Morning Post Read full article

——————–

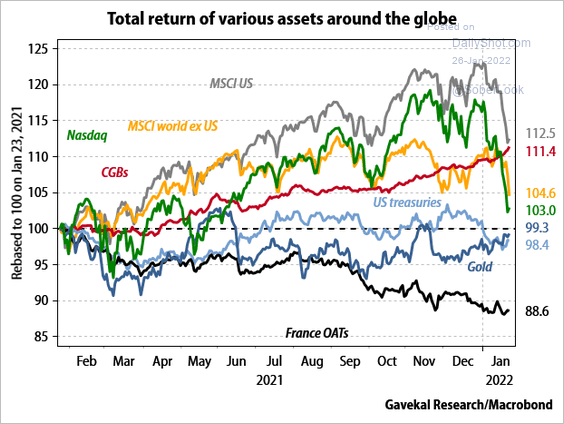

4. China’s government bonds have been outperforming other assets around the world, including stocks.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Asia – Pacific

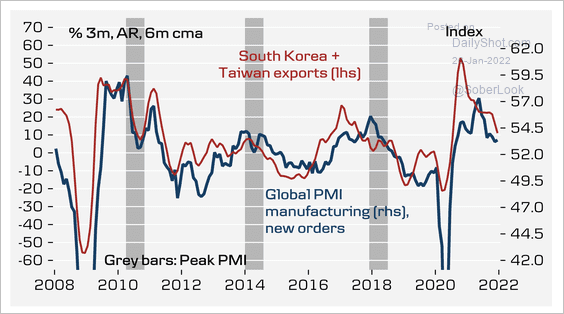

1. Growth in South Korean and Taiwanese exports has weakened amid slowing global manufacturing conditions.

Source: Danske Bank

Source: Danske Bank

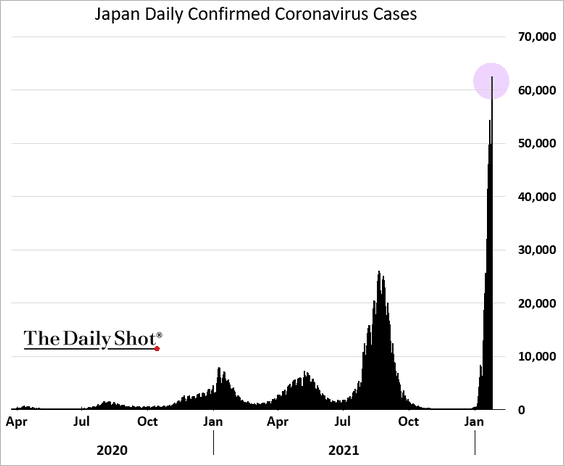

2. COVID cases are surging in Japan.

3. Australian stocks look oversold.

Back to Index

The Eurozone

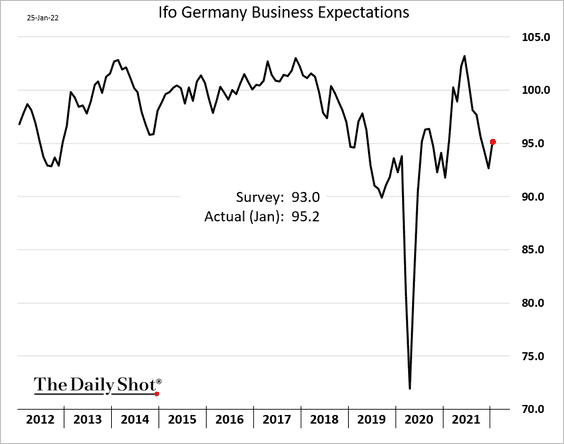

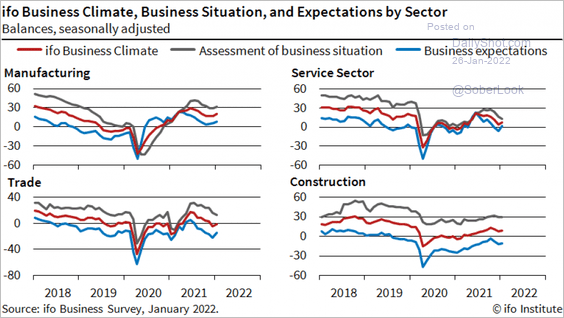

1. Just as we saw with the ZEW indicator (#2 here), the Ifo index shows improving business sentiment in Germany this month.

Source: ifo Institute

Source: ifo Institute

——————–

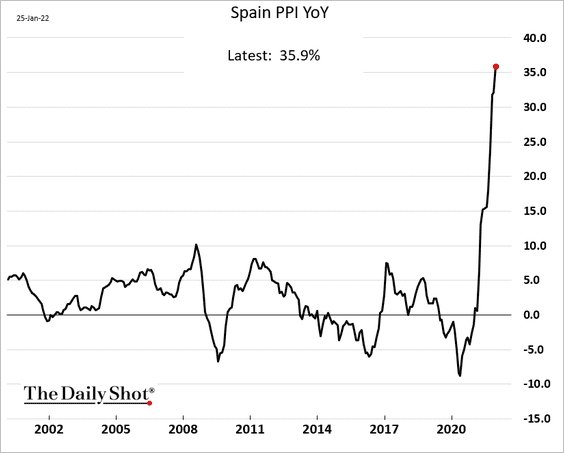

2. Spain’s PPI climbed above 35%.

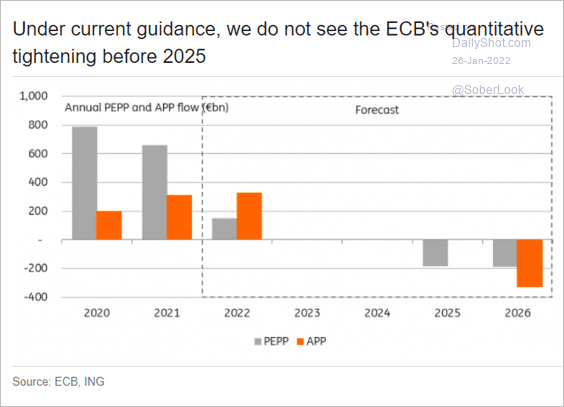

3. What will the ECB’s quantitative tightening look like?

Source: ING

Source: ING

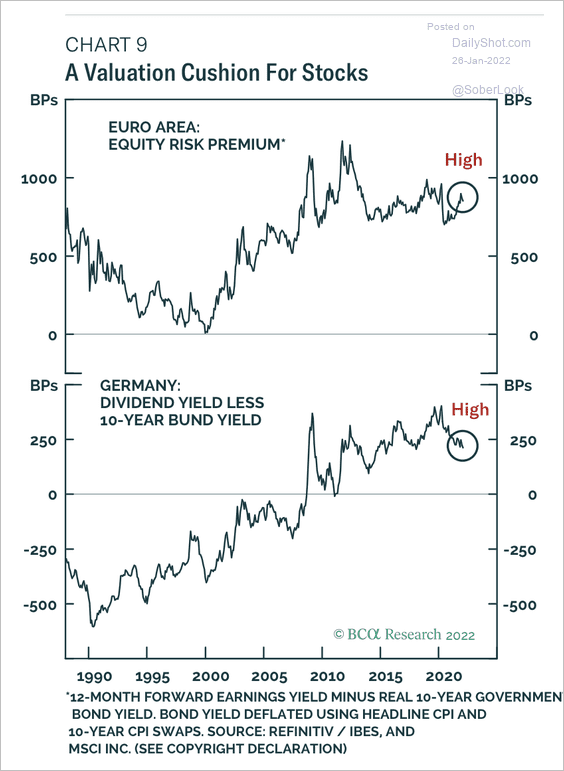

4. Equity risk premiums remain elevated.

Source: BCA Research

Source: BCA Research

Back to Index

The United Kingdom

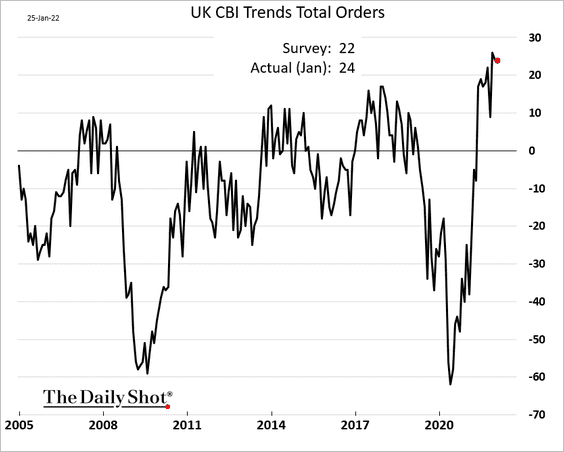

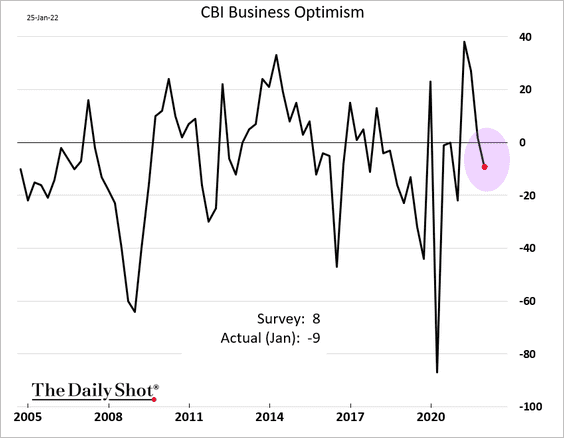

1. The CBI report showed that strong industrial orders carried over into January.

• But business sentiment deteriorated.

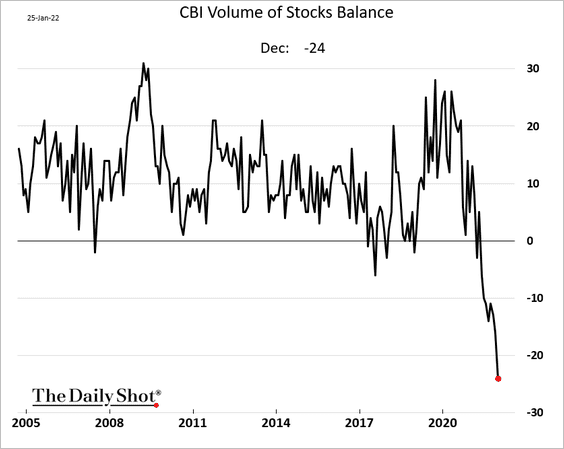

• Inventories were extraordinarily low going into the year-end.

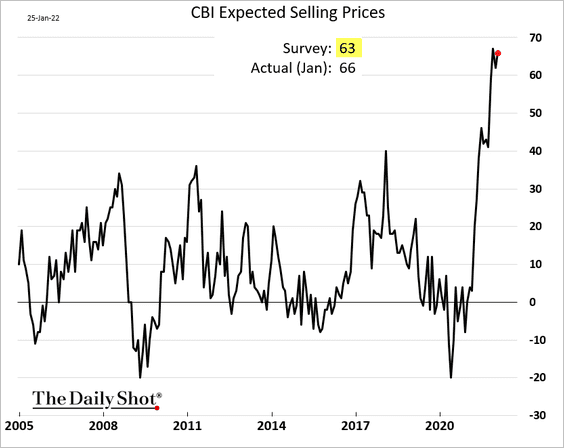

• The index of selling prices is holding near extreme levels.

Source: Reuters Read full article

Source: Reuters Read full article

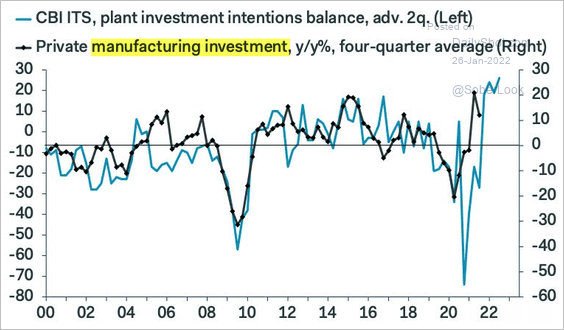

• The CBI report points to robust manufacturing investment ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

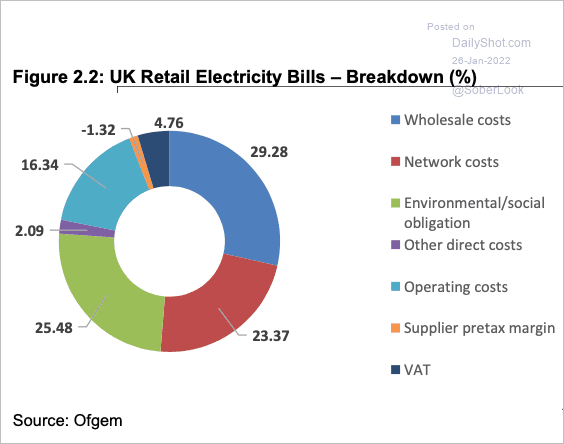

2. Levies to pay for policy initiatives represent a substantial part of UK retail electricity bills.

Source: Oxford institute for Energy Studies

Source: Oxford institute for Energy Studies

Back to Index

The United States

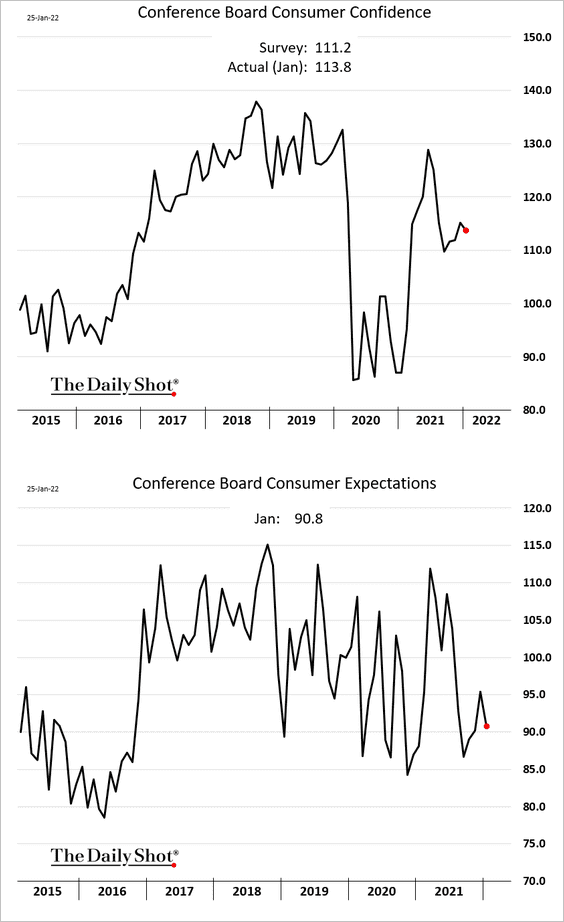

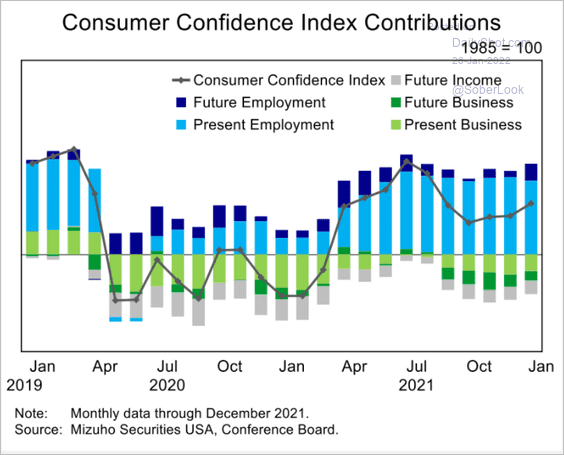

1. Consumer confidence ticked lower in January but was firmer than expected.

Sentiment was supported by robust employment trends.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

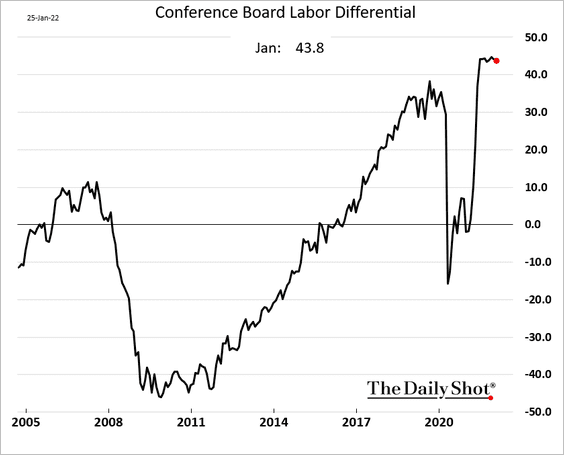

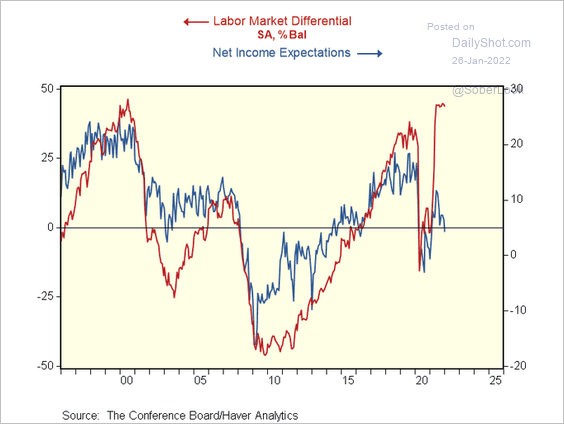

• The labor differential continues to signal strength in the jobs market.

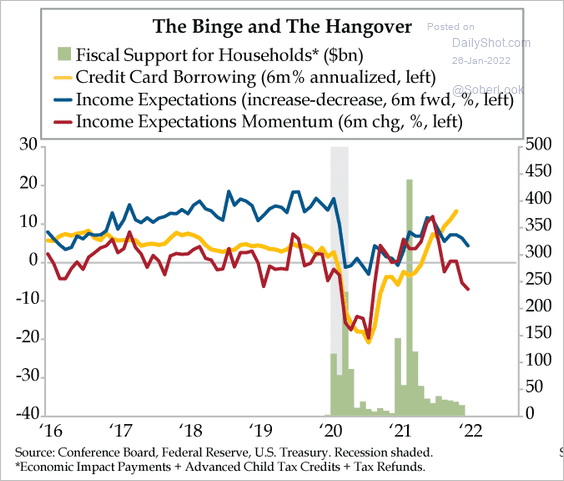

But income expectations have worsened.

Source: The Daily Feather

Source: The Daily Feather

The two indices have diverged sharply.

Source: @RenMacLLC

Source: @RenMacLLC

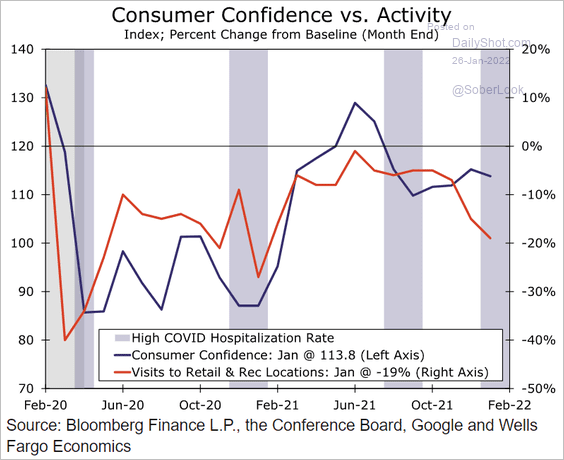

• Sentiment has been outpacing mobility/retail activity.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

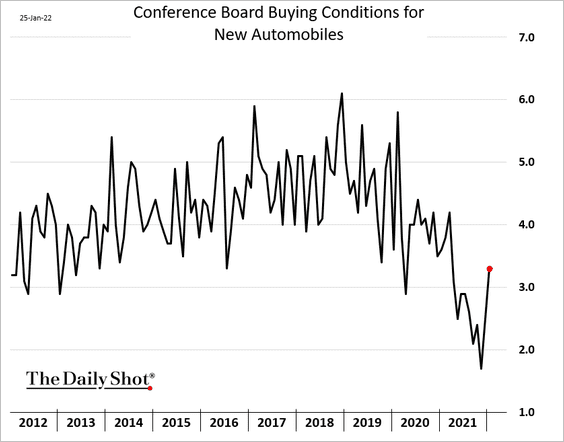

• Buying conditions for vehicles jumped in January.

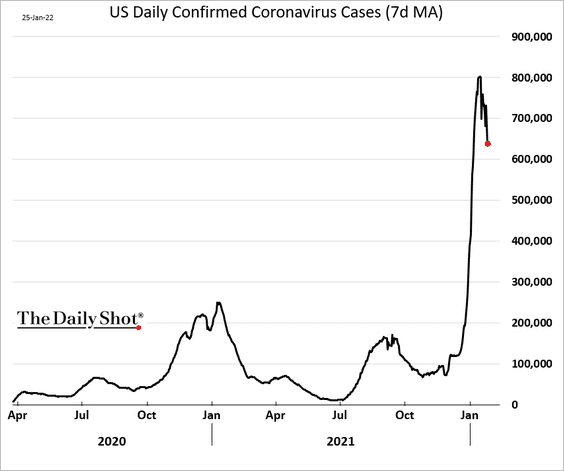

• COVID cases appear to be peaking. Will it be enough to offset the stock market rout and improve sentiment next month?

——————–

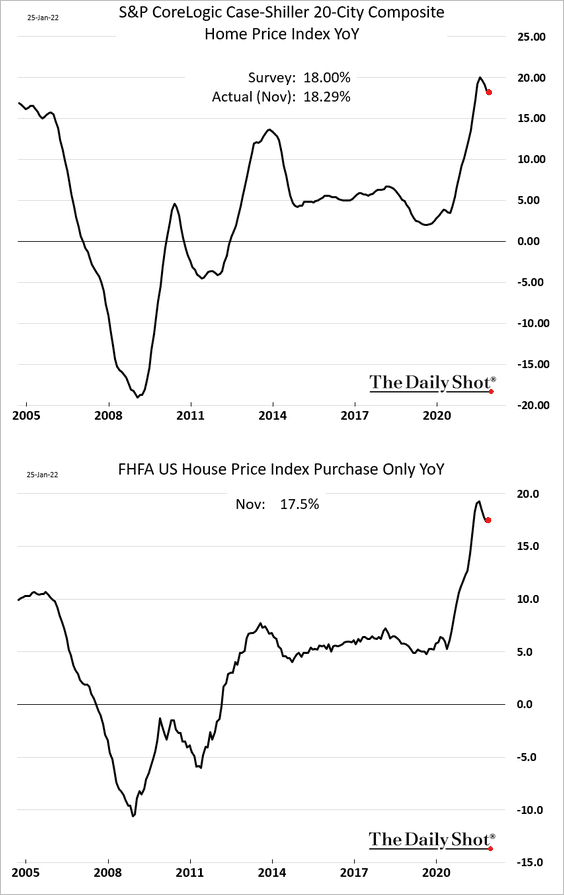

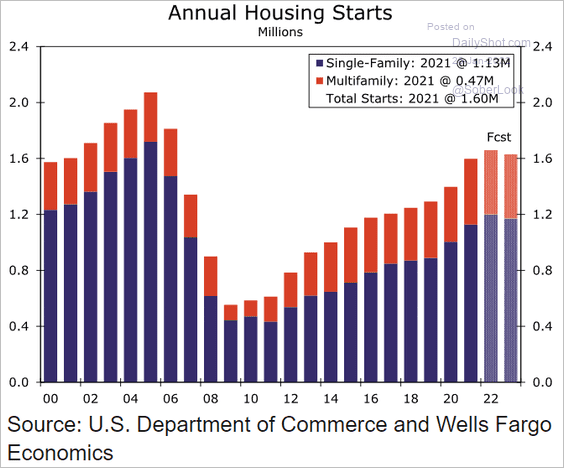

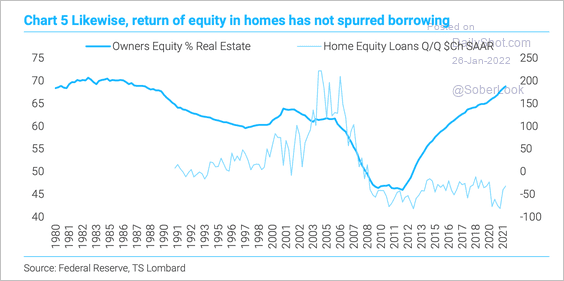

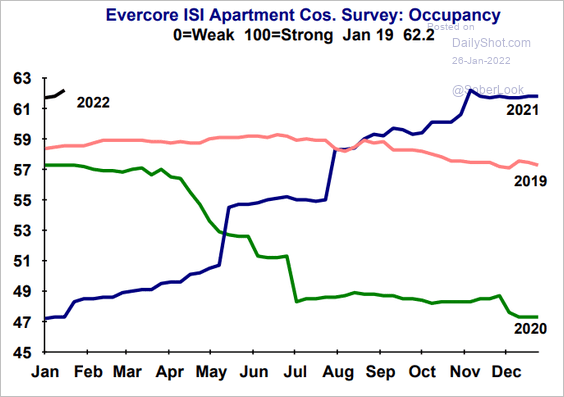

2. Next, we have some updates on the housing market.

• The pace of home price appreciation strengthened a bit in November.

• Will housing starts peak this year?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Rising equity in homes has not led to increases in home equity borrowing.

Source: TS Lombard

Source: TS Lombard

• Apartment occupancy rates started the year on a strong note.

Source: Evercore ISI Research

Source: Evercore ISI Research

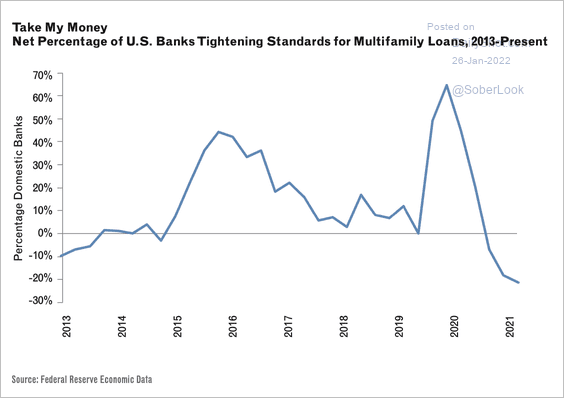

• Lending standards for multi-family properties have loosened considerably.

Source: Park Madison Partners

Source: Park Madison Partners

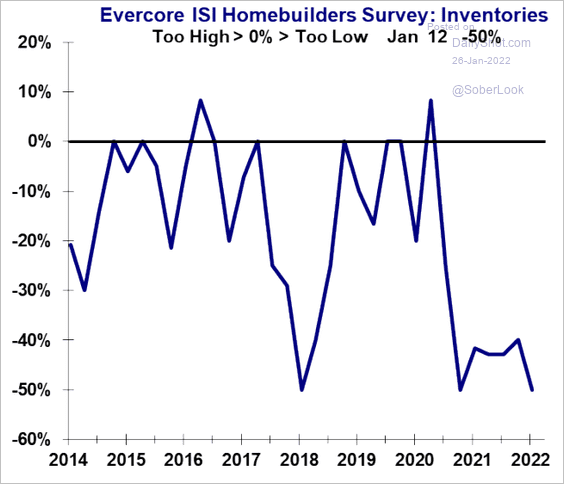

• Homebuilders view their inventories as very tight.

Source: Evercore ISI Research

Source: Evercore ISI Research

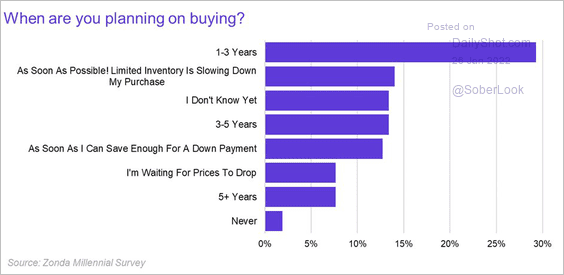

• Many Millennials are planning to buy a home soon.

Source: @AliWolfEcon

Source: @AliWolfEcon

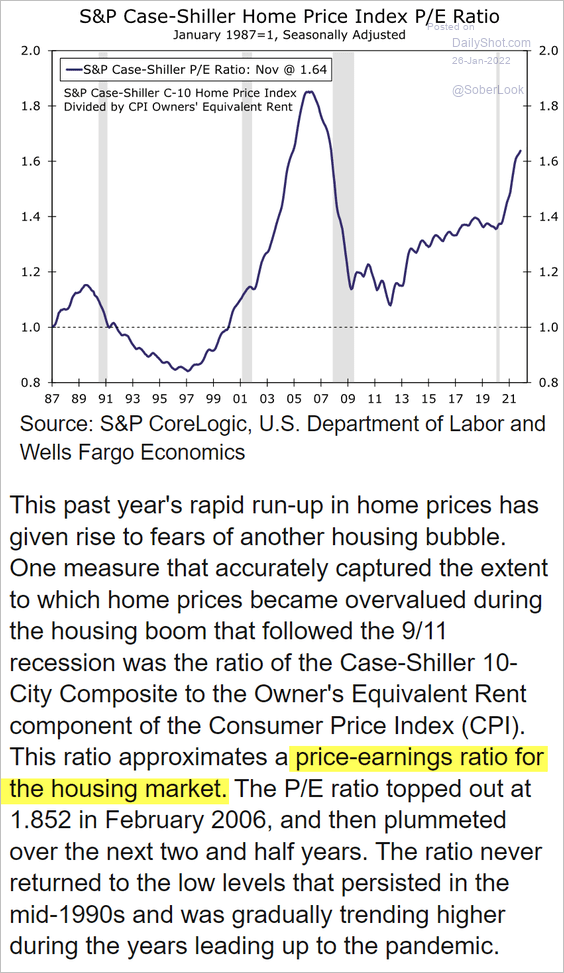

• Here is the housing “P/E” ratio (see the comment from Wells Fargo below).

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

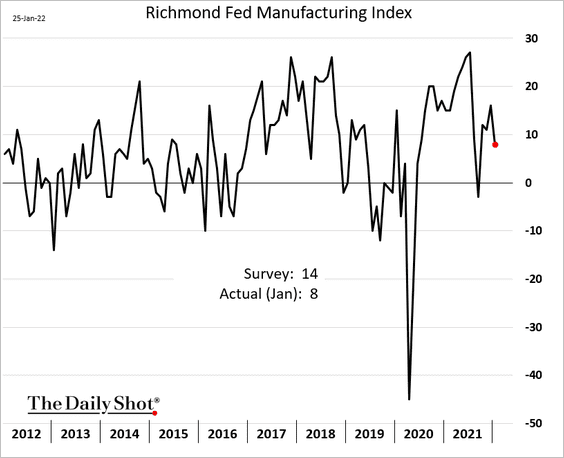

3. The Richmond Fed’s manufacturing index pulled back this month.

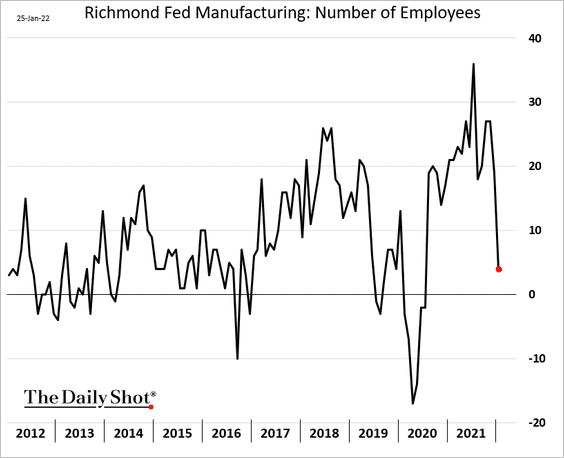

• Hiring stalled.

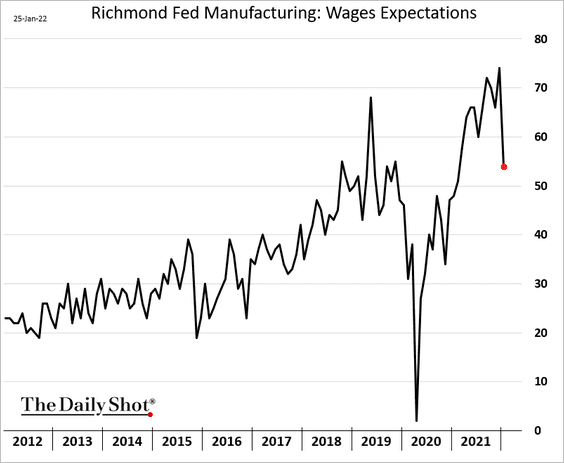

• Manufacturers’ wage expectations eased somewaht.

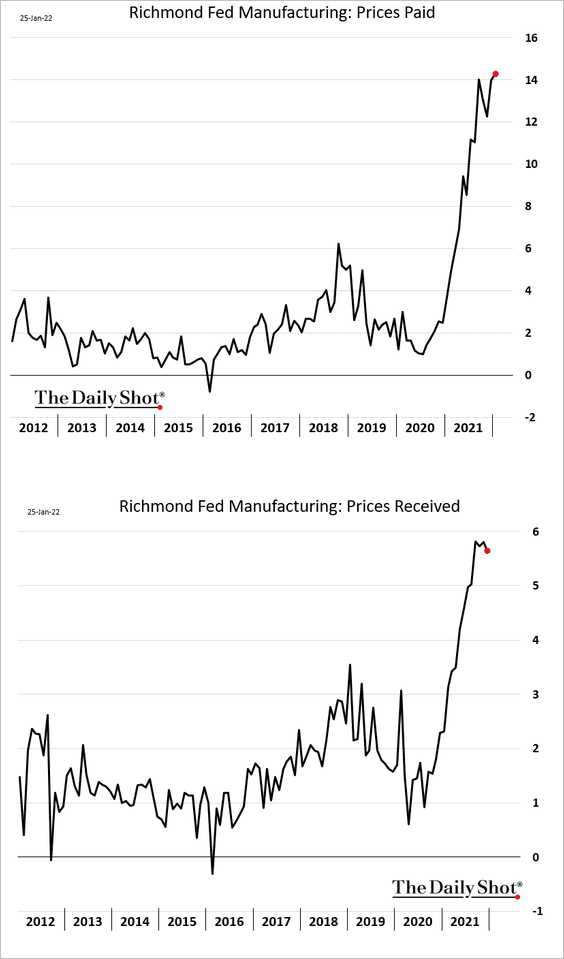

• Price gains remain at extreme levels.

——————–

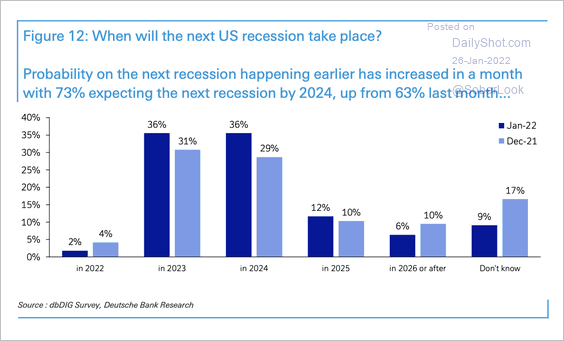

4. Most investors surveyed by Deutsche Bank expect a recession within the next 2-3 years.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

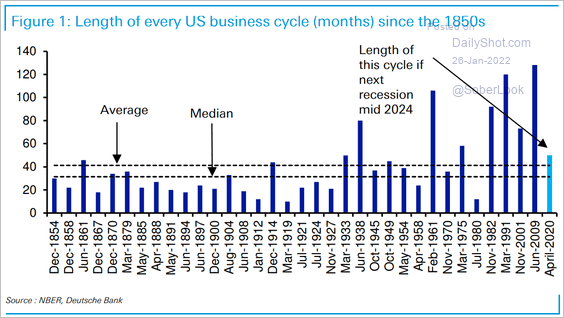

But recent business cycles have been much longer.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

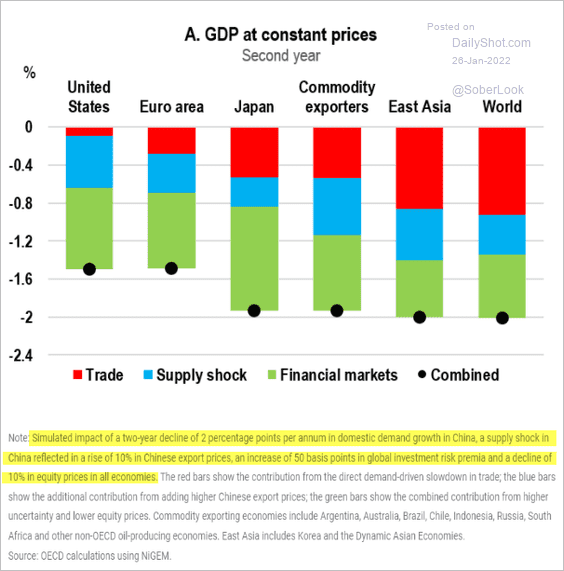

1. How would a sharp slowdown in China impact the rest of the world?

Source: OECD Read full article

Source: OECD Read full article

2. This chart shows just how cyclical the semiconductor industry is.

![]() Source: ANZ Research

Source: ANZ Research

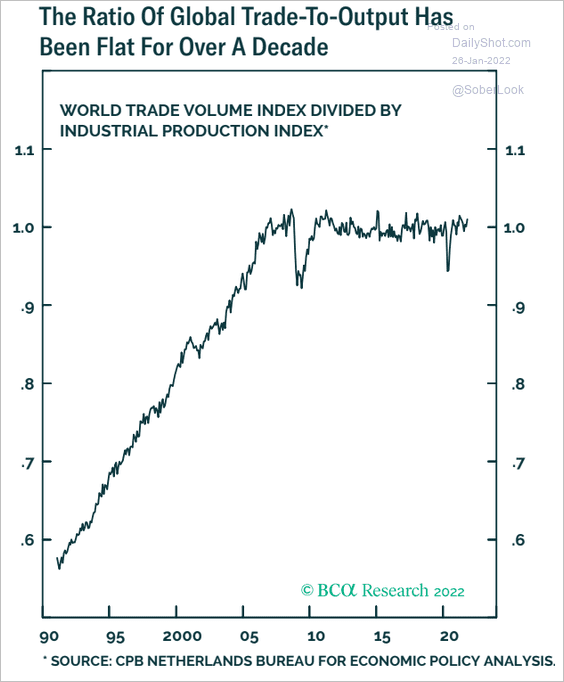

3. The global trade-to-output ratio has been remarkably flat since the financial crisis.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

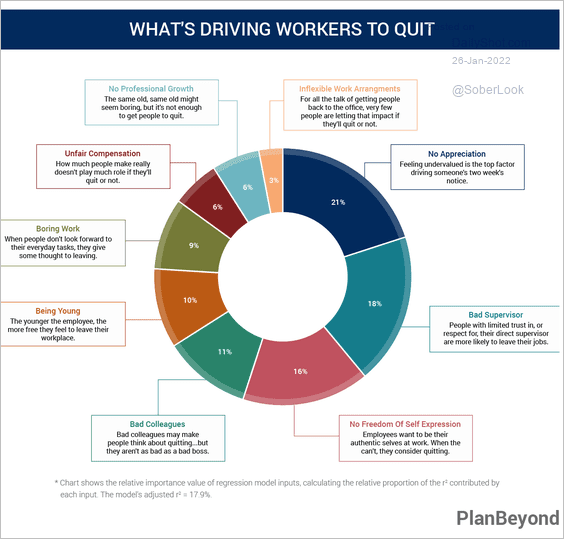

1. Why do employees want to quit?

Source: PlanBeyond Read full article

Source: PlanBeyond Read full article

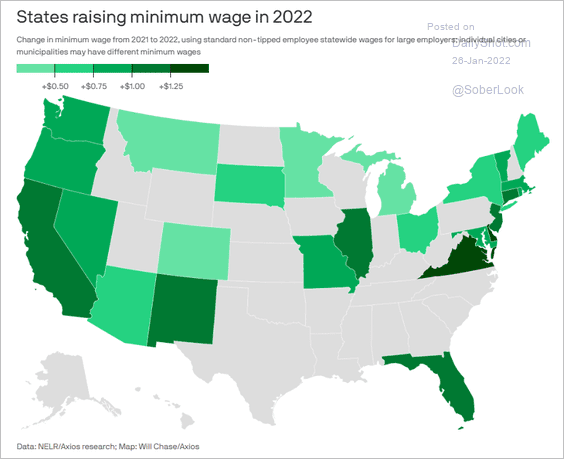

2. States raising the minimum wage in 2022:

Source: @axios Read full article

Source: @axios Read full article

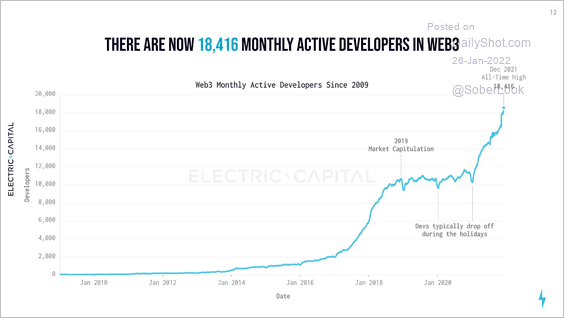

3. Active Web 3.0 developers:

Source: @JayHao8, @ElectricCapital Read full article

Source: @JayHao8, @ElectricCapital Read full article

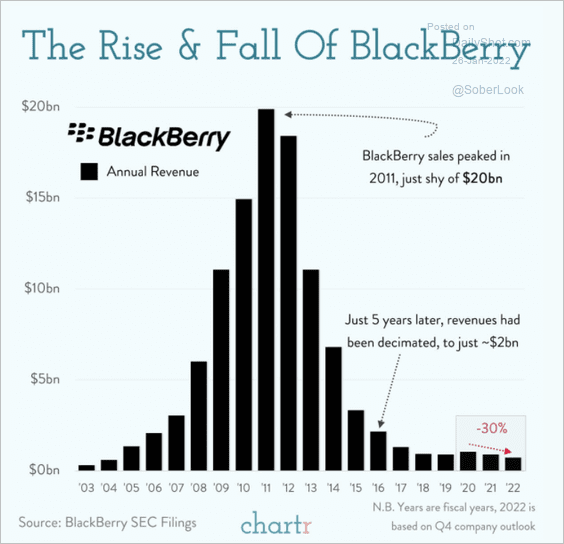

4. BlackBerry’s revenue over time:

Source: @chartrdaily

Source: @chartrdaily

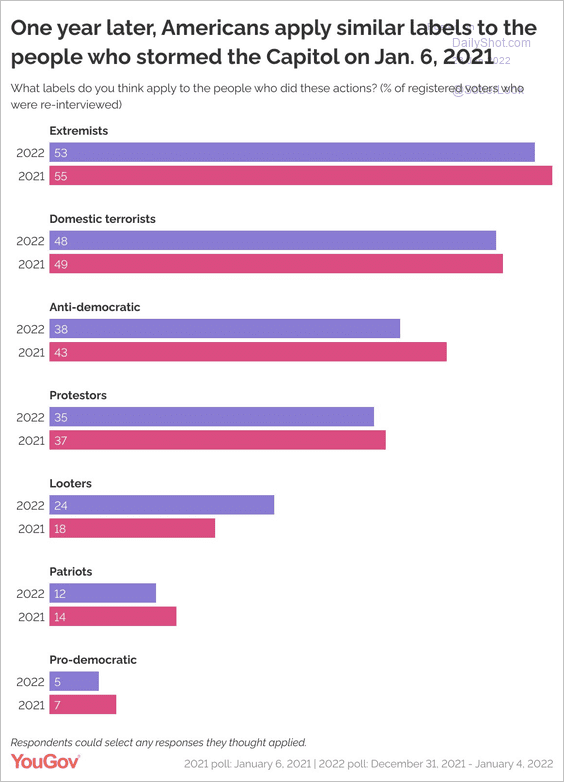

5. Labels applied to the people who stormed the US Capitol:

Source: @YouGovAmerica Read full article

Source: @YouGovAmerica Read full article

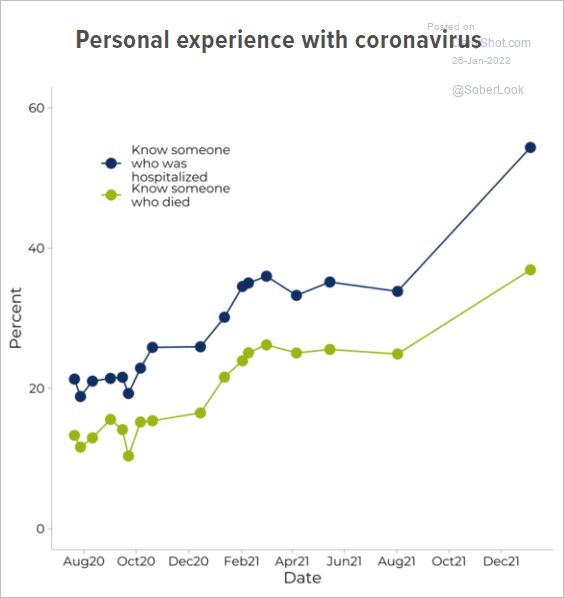

6. Personal experience with COVID:

Source: Data for Progress Read full article

Source: Data for Progress Read full article

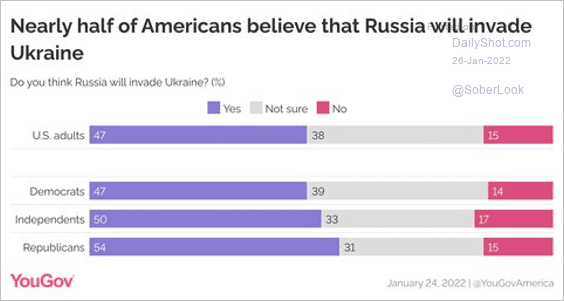

7. Will Russia invade Ukraine?

Source: YouGov

Source: YouGov

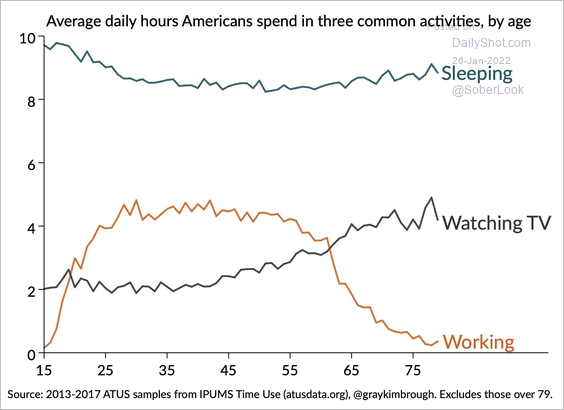

8. Three common activities, by age:

Source: @graykimbrough

Source: @graykimbrough

Back to Index