The Daily Shot: 14-Feb-22

• The United States

• The United Kingdom

• Europe

• Asia – Pacific

• China

• Emerging Markets

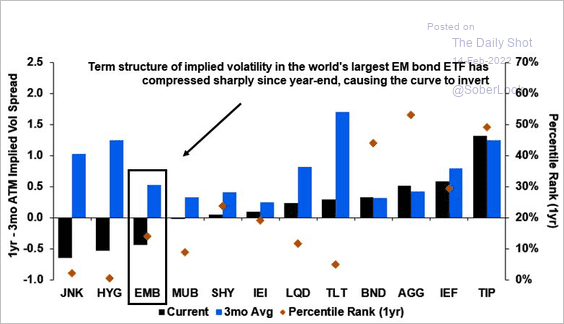

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

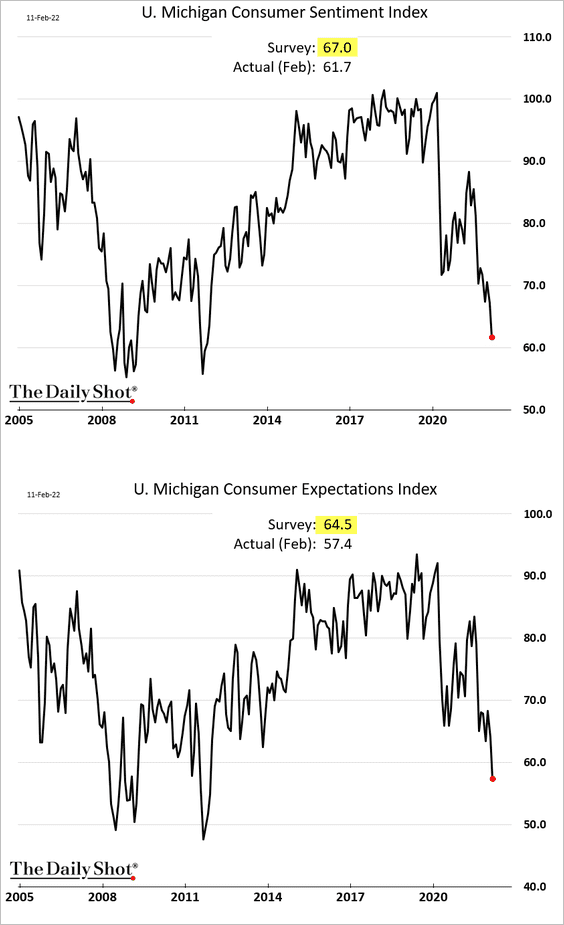

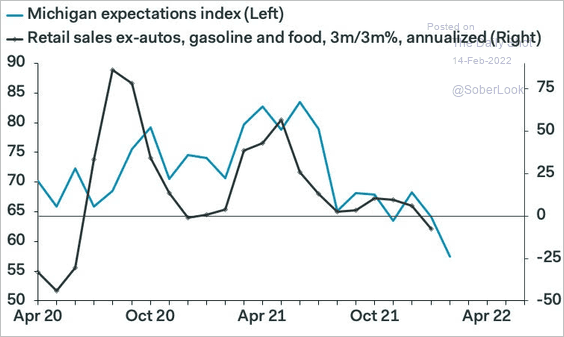

1. The U. Michigan consumer sentiment report surprised to the downside, driven by sharp declines in the expectations component.

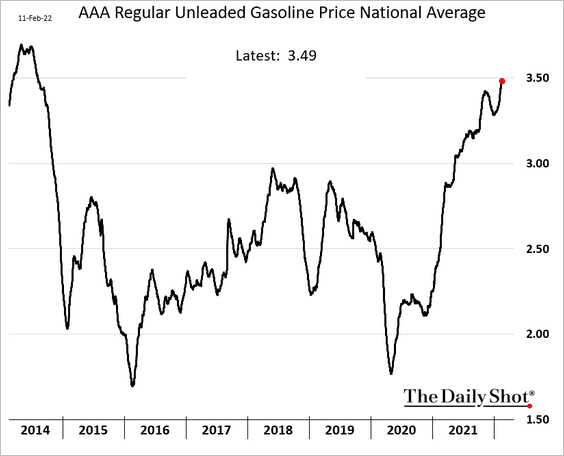

Gasoline prices, which hit the highest level since 2014, have been a drag on household confidence.

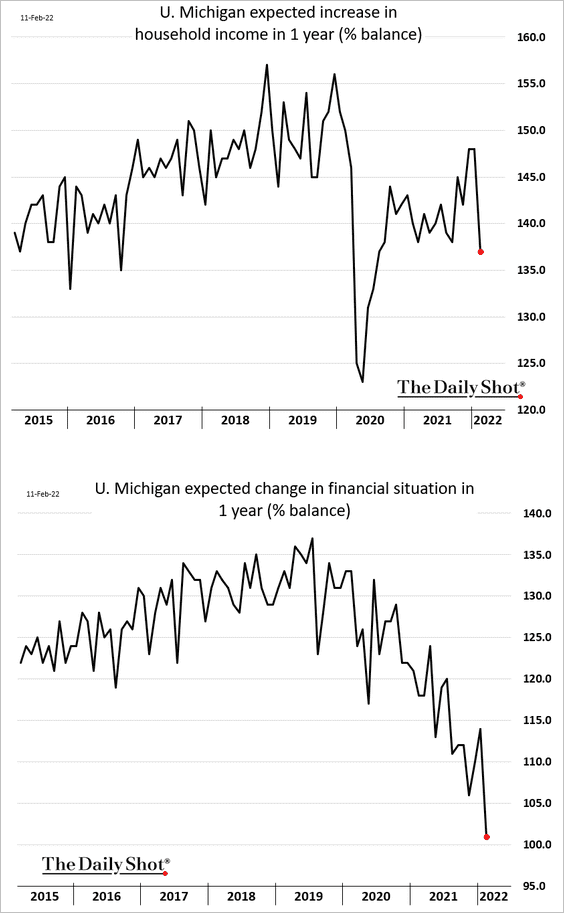

Despite the labor market’s strength, households are increasingly concerned about their finances.

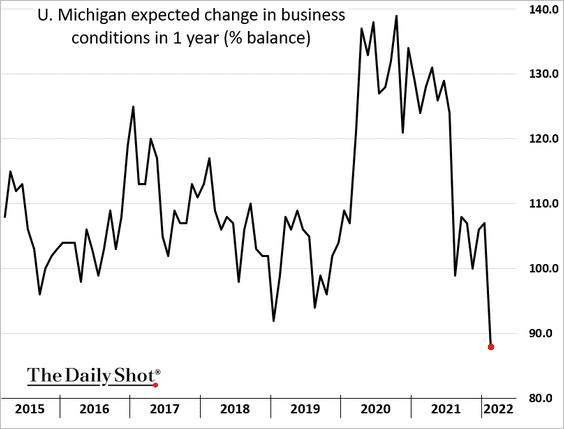

They are also uneasy about business conditions going forward.

Will retail sales take a hit as household sentiment sours?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

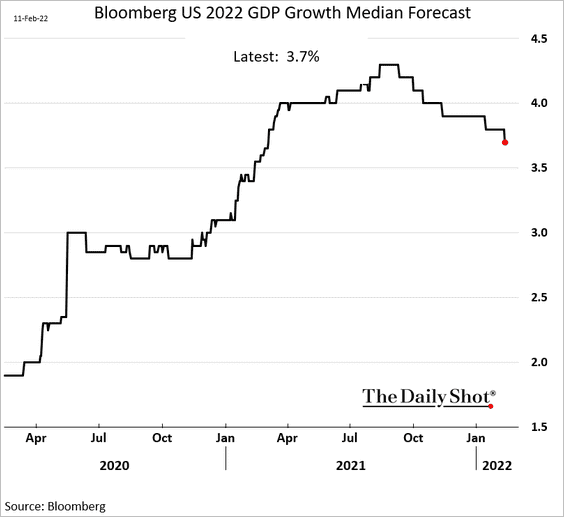

2. Economists continue to downgrade this year’s GDP growth forecasts …

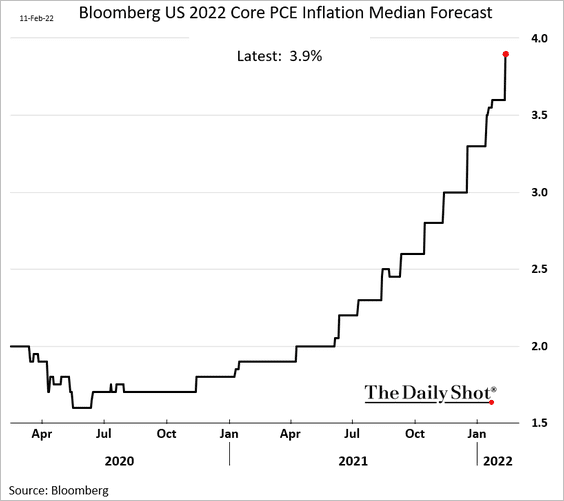

… as they push inflation projections higher.

——————–

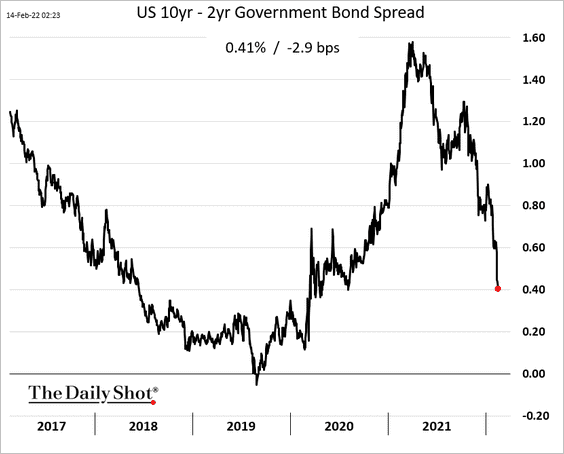

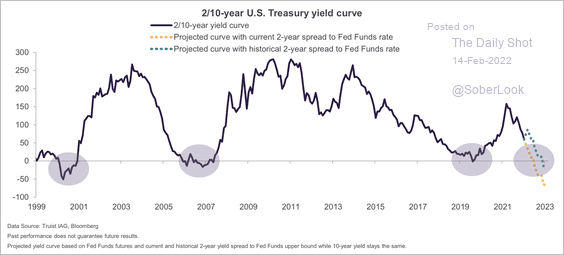

3. The Treasury curve continues to flatten as the market increasingly prices in slower growth ahead.

The yield curve is expected to invert next year, which typically signals a recession within 6-18 months.

Source: Truist Advisory Services

Source: Truist Advisory Services

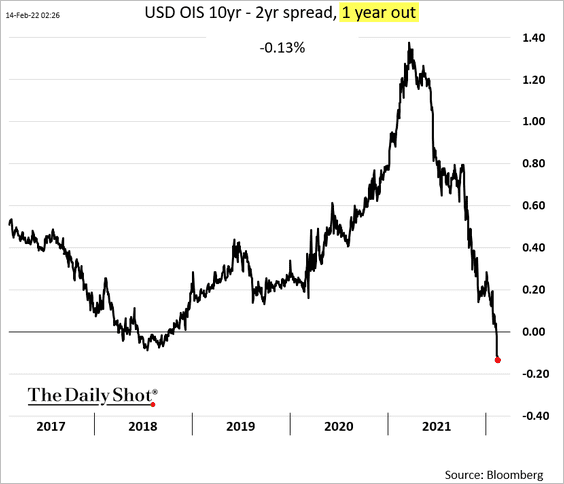

The markets agree. Here is the 10yr – 2yr (OIS) spread one year out.

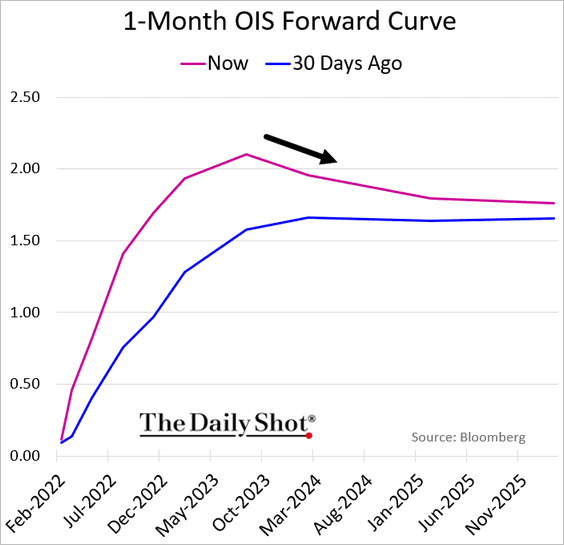

What will the Fed do in response? The market now sees rate cuts as soon as late next year, as the tightening cycle “overshoots.”

——————–

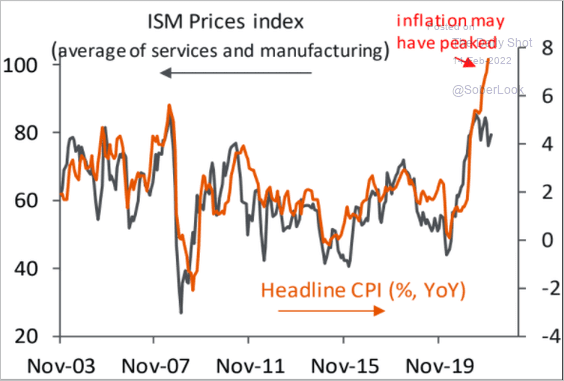

4. Next, we have some updates on inflation.

• Has the headline CPI peaked?

Source: Piper Sandler

Source: Piper Sandler

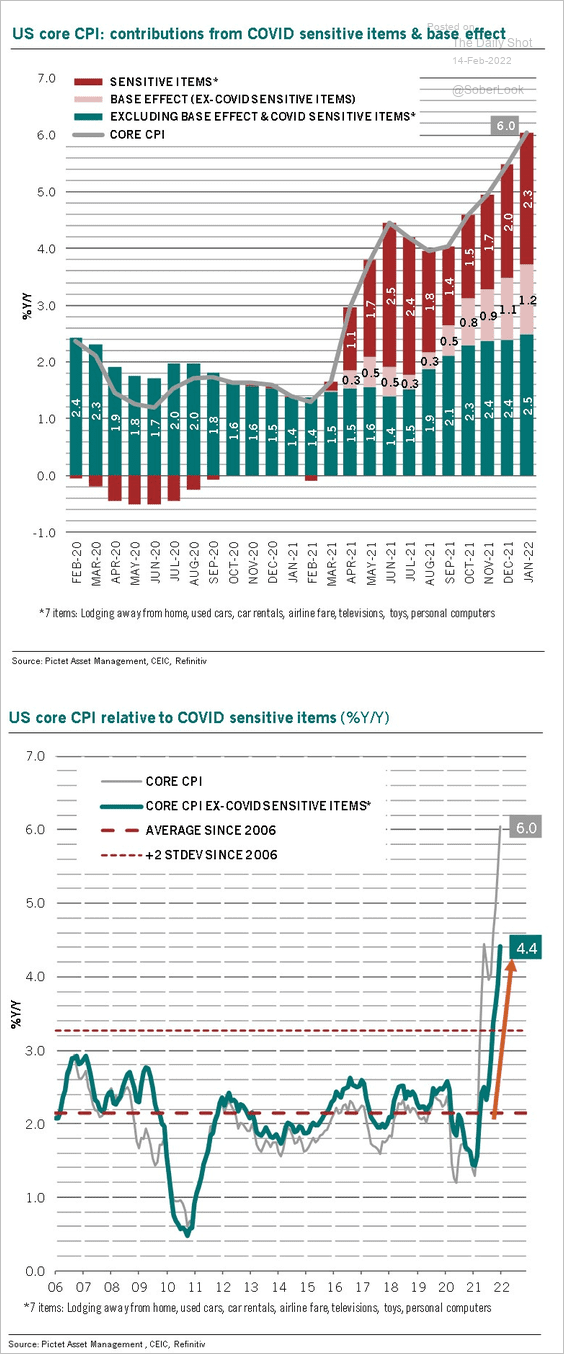

• A substantial component of the CPI surge is from “COVID-sensitive” items and base effects.

Source: @PkZweifel

Source: @PkZweifel

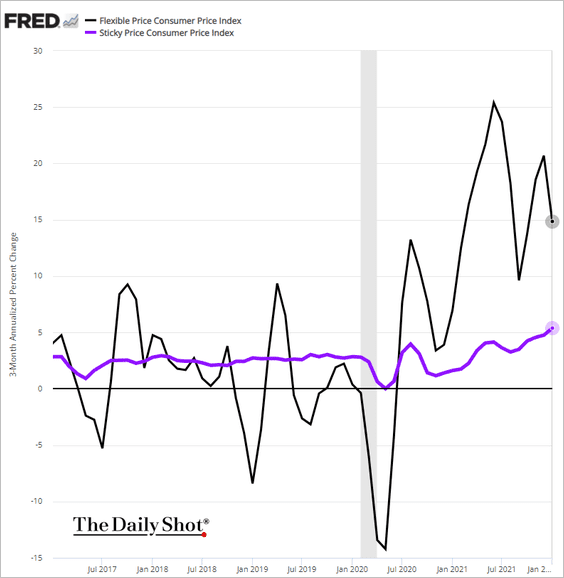

• One area of concern for the Fed is the acceleration in the sticky CPI.

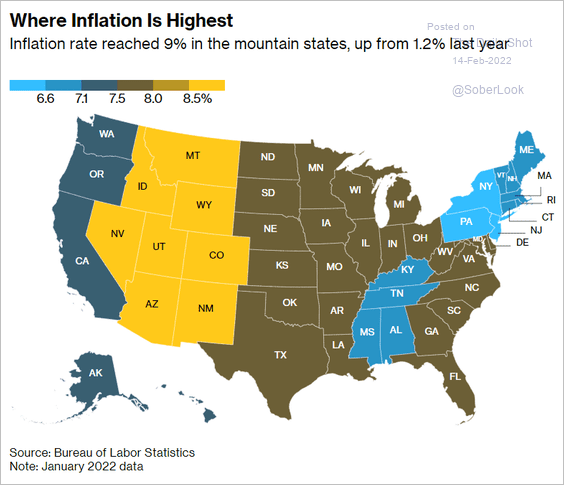

• Here are some regional inflation indicators.

– Regions:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

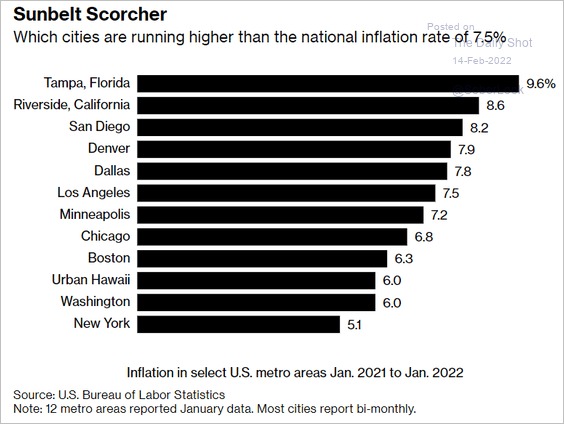

– Metro areas:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

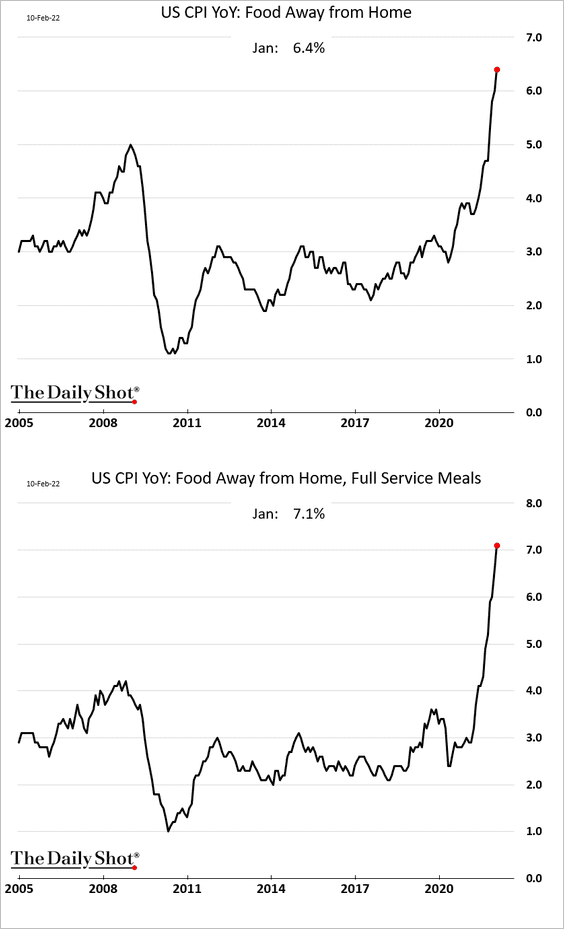

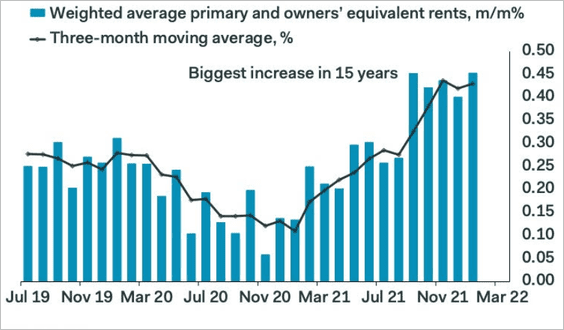

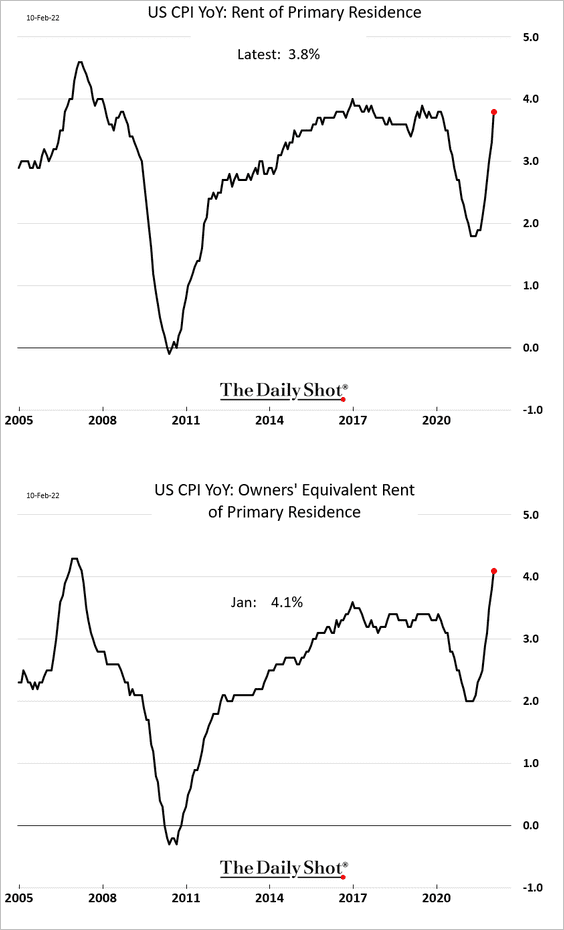

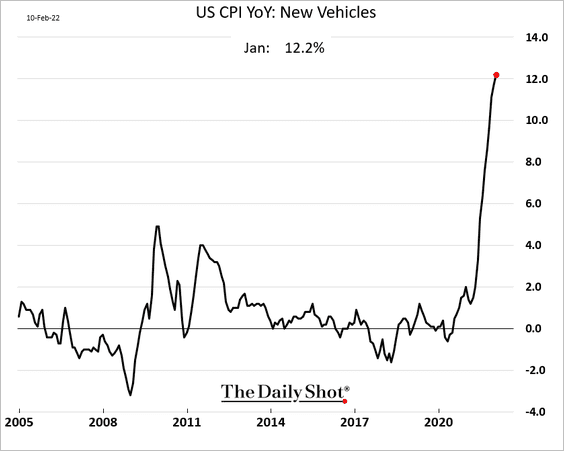

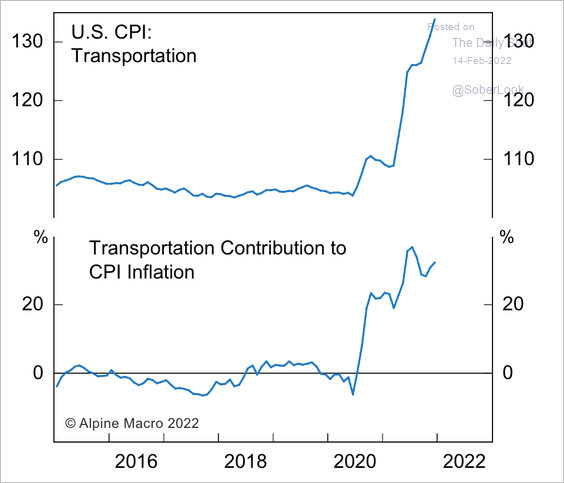

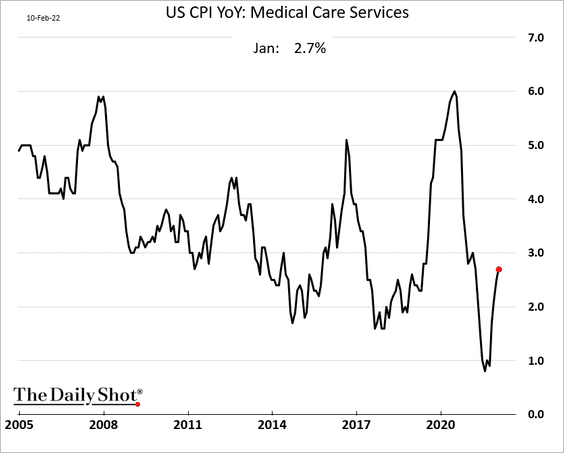

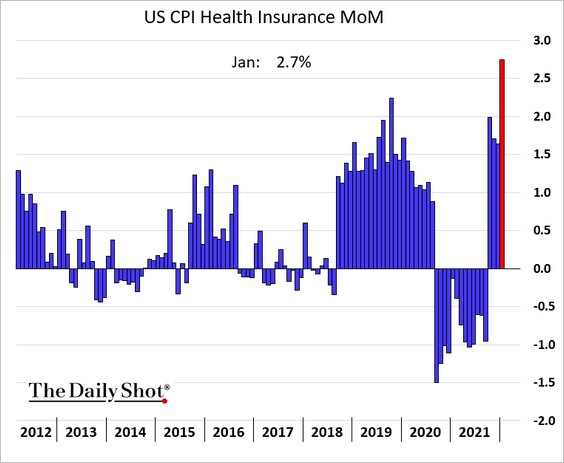

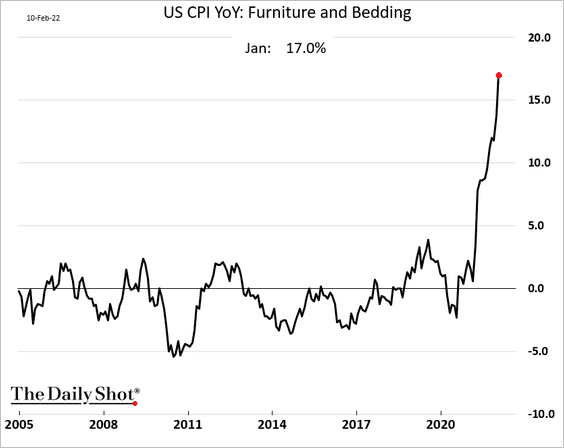

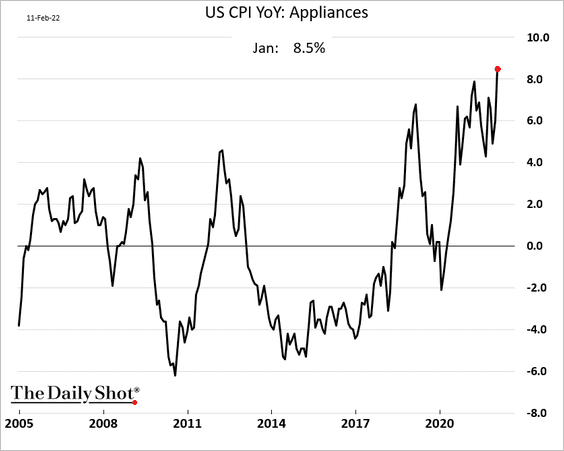

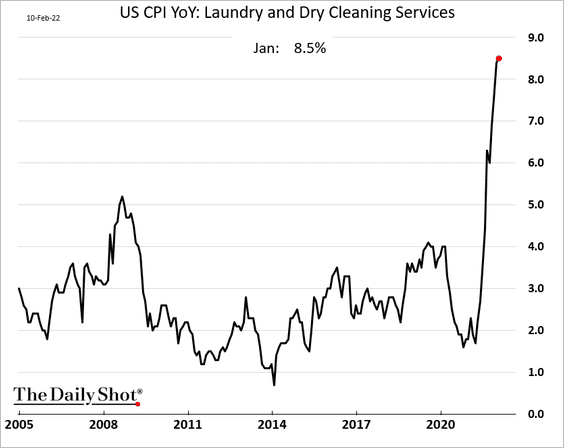

• Finally, let’s take a look at a select set of CPI components.

– Food away from home (restaurants):

– Rent and owners’ equivalent rent (blended, month-over-month):

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Year-over-year:

– New vehicles:

The transportation sector’s contribution to the CPI:

Source: Alpine Macro

Source: Alpine Macro

– Medical care services:

Health insurance (month-over-month):

– Furniture:

– Appliances:

– Dry cleaning:

——————–

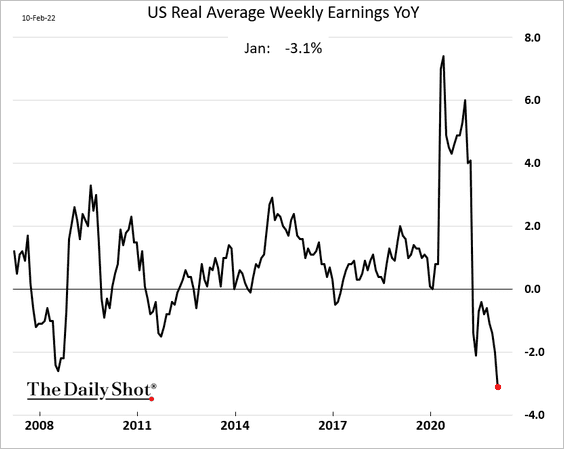

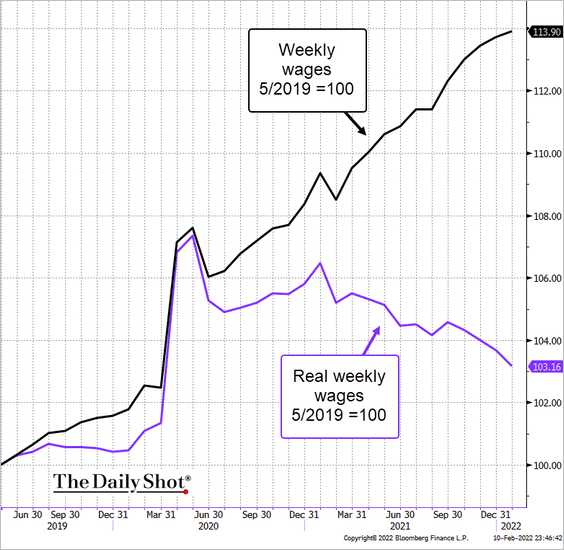

5. High inflation is rapidly eroding wages (2 charts).

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

Back to Index

The United Kingdom

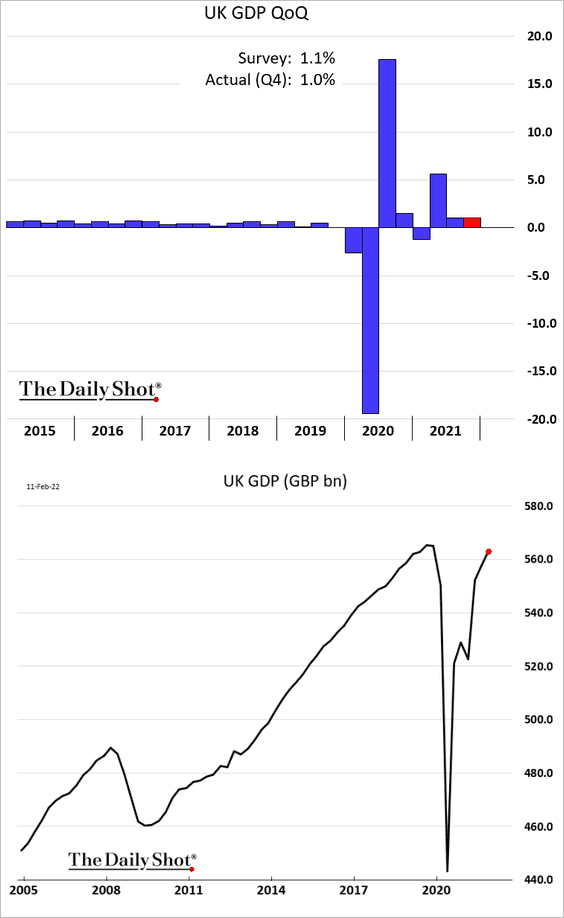

1. The UK’s GDP is just shy of the pre-COVID levels.

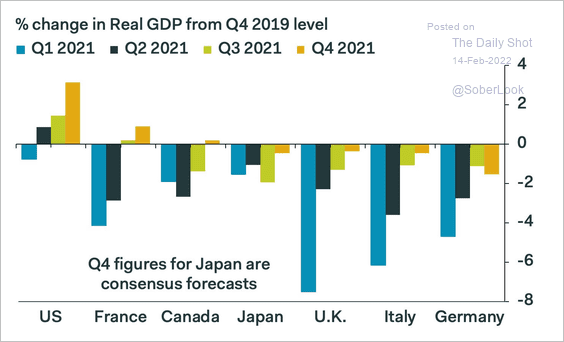

How does the UK compare to other advanced economies?

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

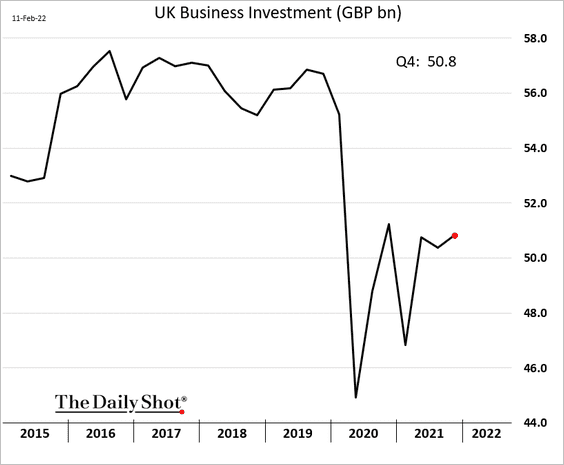

Business investment ticked higher in Q4 but remains depressed.

——————–

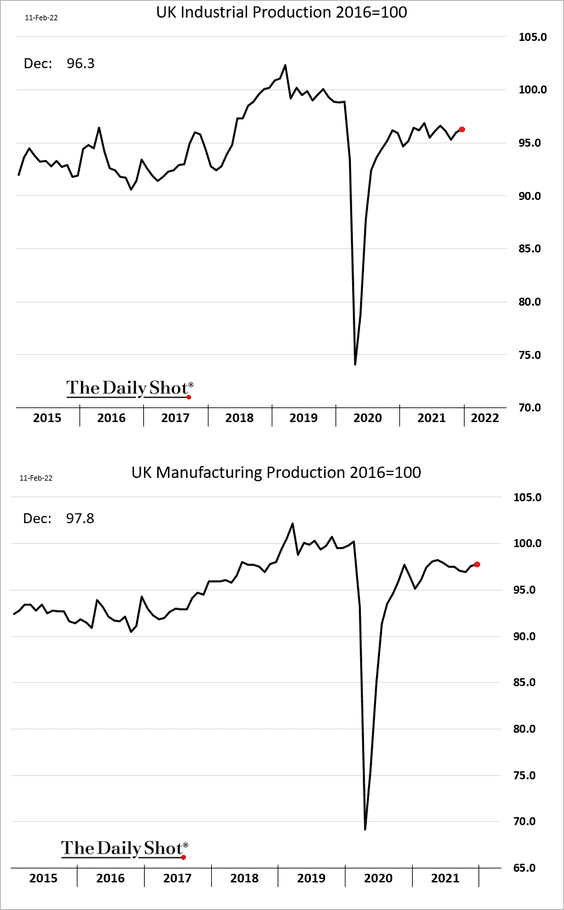

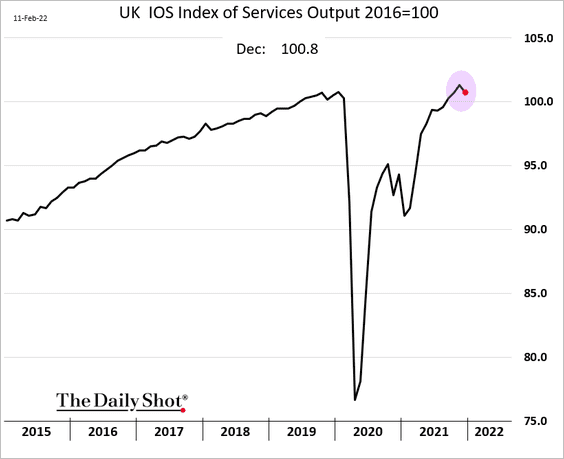

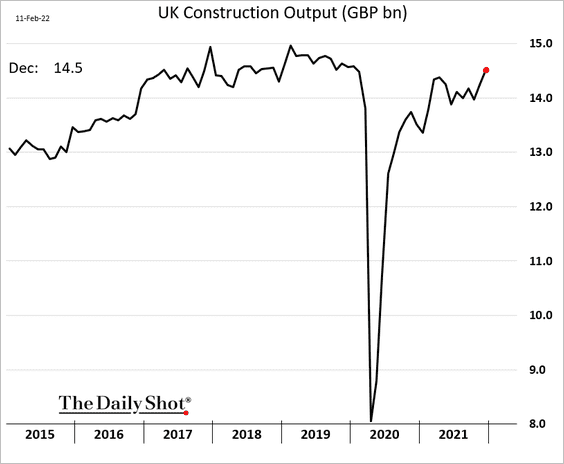

2. Next, let’s take a look a business output by sector.

• Industrial production and manufacturing output (still below pre-COVID levels):

• Services (took a hit from omicron in December):

• Construction activity (rebounding):

——————–

3. Exports to the EU are rising.

Back to Index

Europe

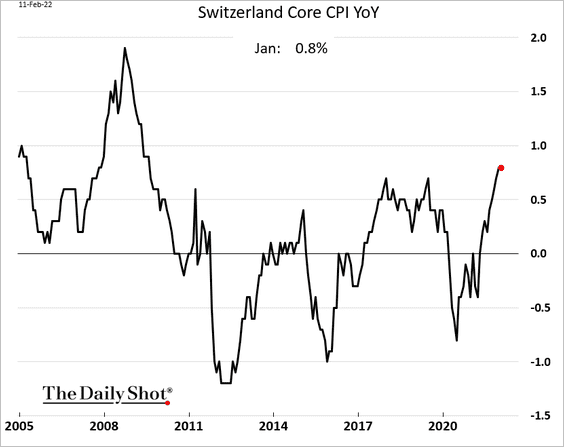

1. Swiss core inflation is holding below 1%.

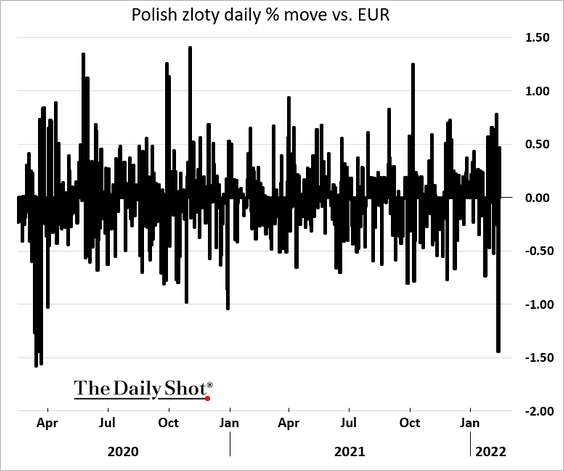

2. The Polish zloty took a hit last week due to escalating Russia/Ukraine tensions.

Back to Index

Asia – Pacific

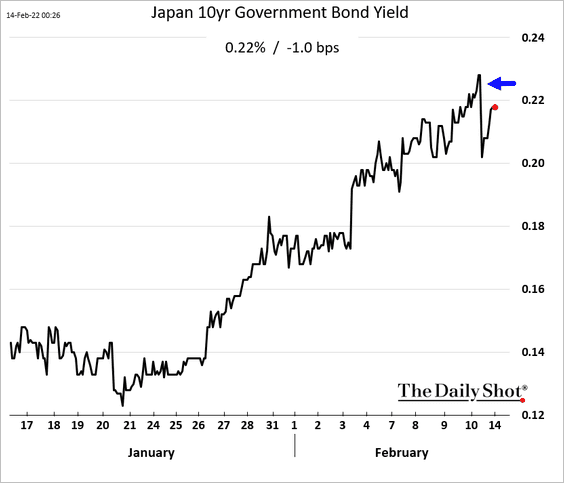

1. The BoJ sent the message last week that it will defend the 25 bps cap on the 10yr JGB yield.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

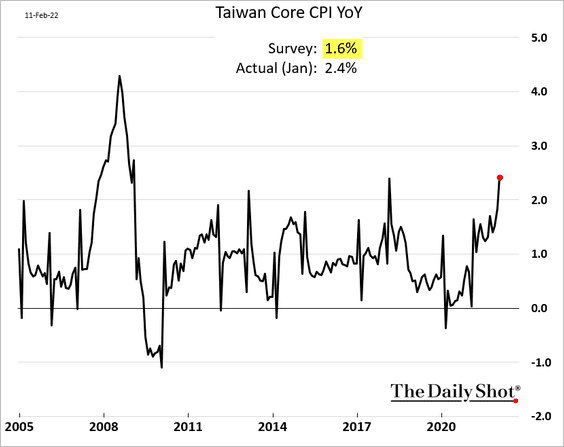

2. Taiwan’s CPI surprised to the upside.

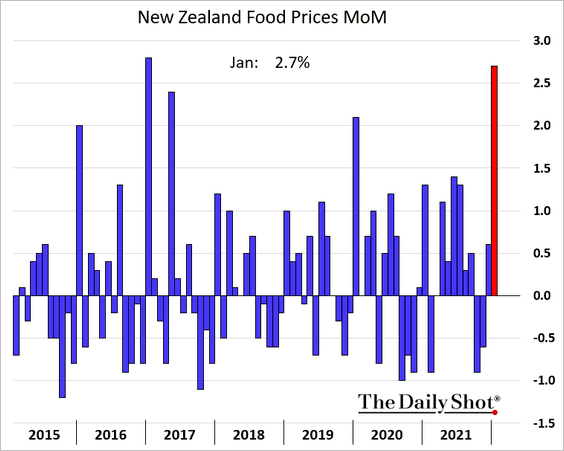

3. New Zealand’s food prices surged last month.

Back to Index

China

1. The stock market is under pressure.

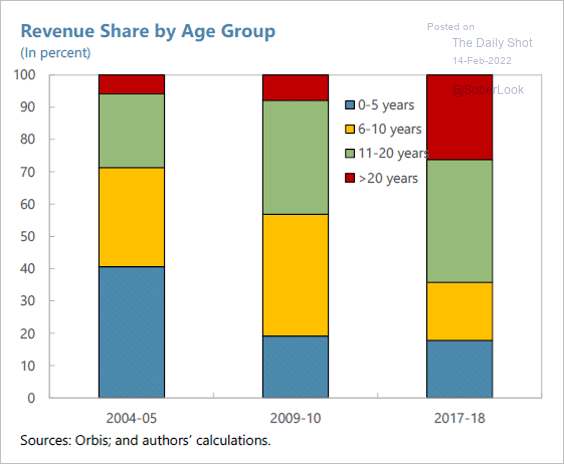

2. China’s firms are getting older.

Source: @andrewbatson

Source: @andrewbatson

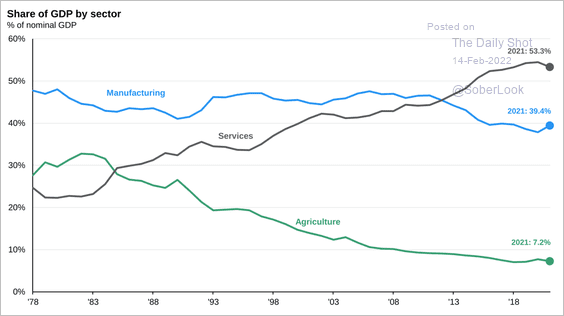

3. Services have accounted for a larger share of GDP versus manufacturing over the past decade.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

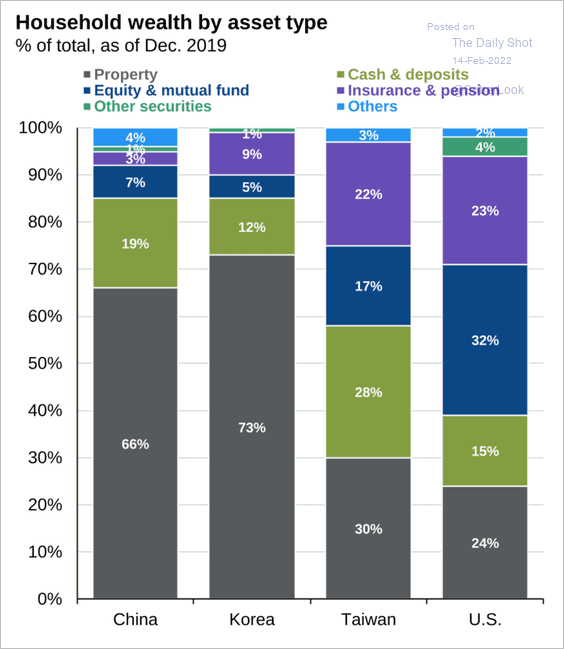

4. Property is a major component of household wealth compared with other nations.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

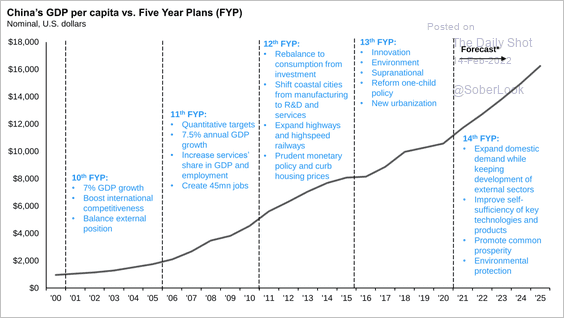

5. Here is a look at China’s five-year plans.

Source: J.P. Morgan Asset Management

Source: J.P. Morgan Asset Management

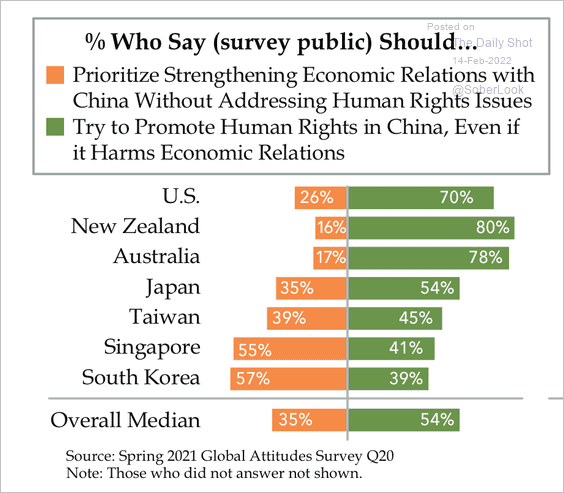

6. For most of China’s trading partners, promoting human rights transcends economic gains, according to a public survey.

Source: Quill Intelligence

Source: Quill Intelligence

Back to Index

Emerging Markets

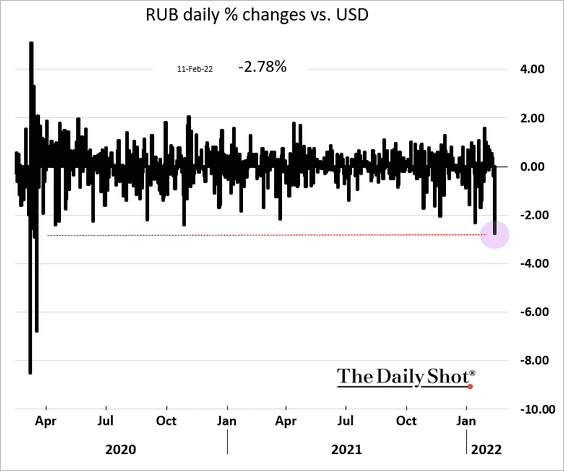

1. Russian markets took a hit as the US warned of a looming attack. The Ukraine/Russia tensions continue to weigh on global risk assets.

Source: Reuters Read full article

Source: Reuters Read full article

The ruble tumbled on Friday.

And Russian stocks are sinking again.

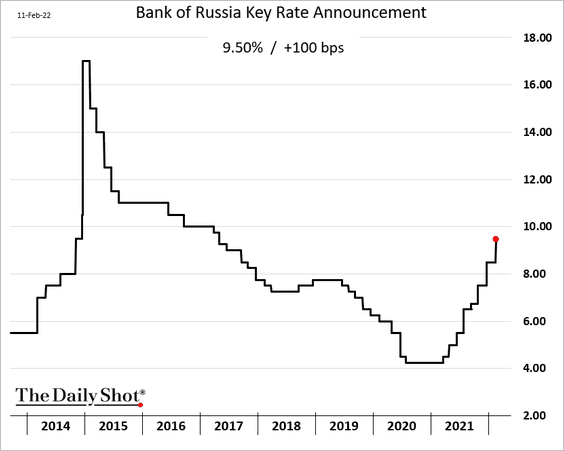

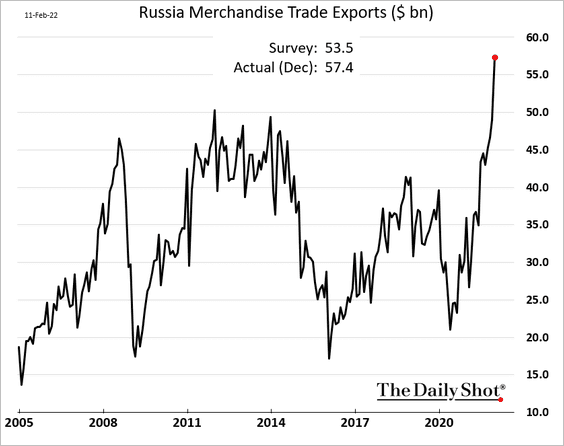

Here are a couple of additional updates on Russia.

• The central bank hiked rates by 100 bps again.

• Exports continue to surge with energy prices.

——————–

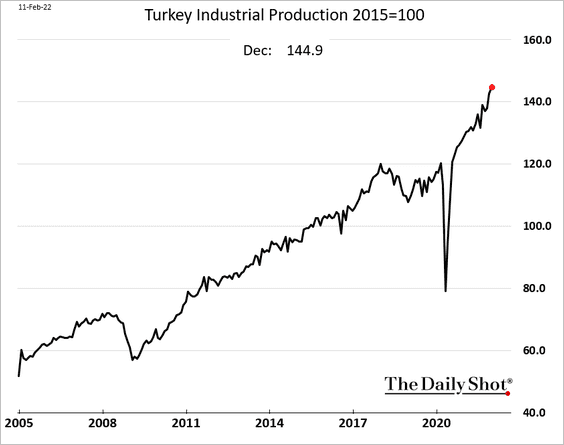

2. Turkey’s industrial production held up well in December.

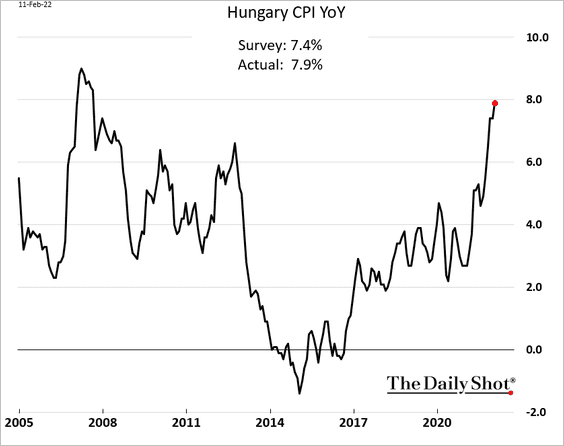

3. Hungarian January CPI topped expectations.

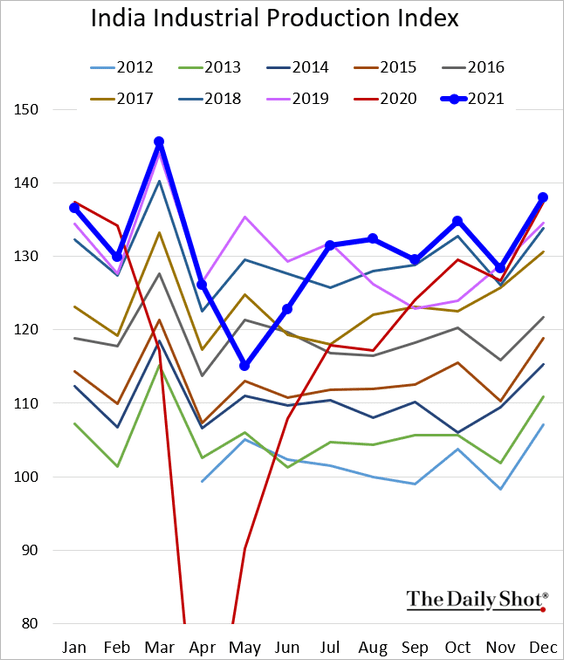

4. India’s industrial production was roughly in line with the 2020 level in December (no year-over-year growth).

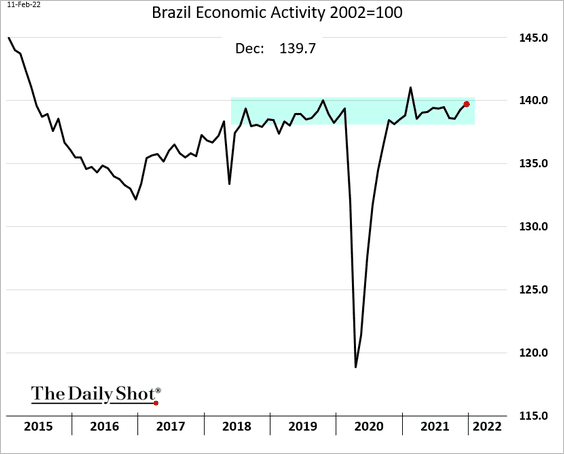

5. Brazil’s economic activity improved in December but is holding inside the recent range.

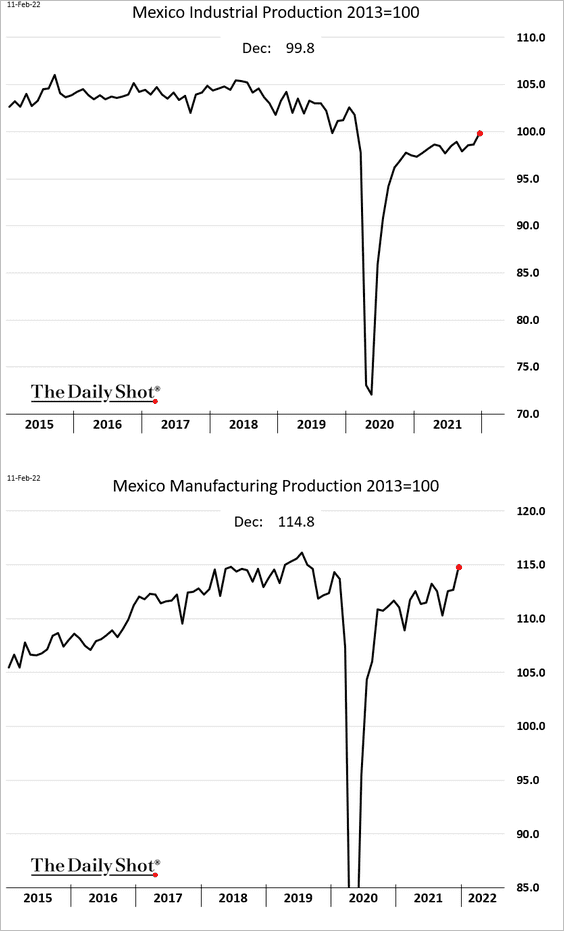

6. Mexico’s manufacturing output is above pre-COVID levels. The energy sector has been a drag on industrial production.

7. Demand for put protection has caused a spike in implied volatility, and the term structure to invert, on the iShares EM Bond ETF (EMB). Such elevated levels of uncertainty do not typically last long.

Source: @dsassower

Source: @dsassower

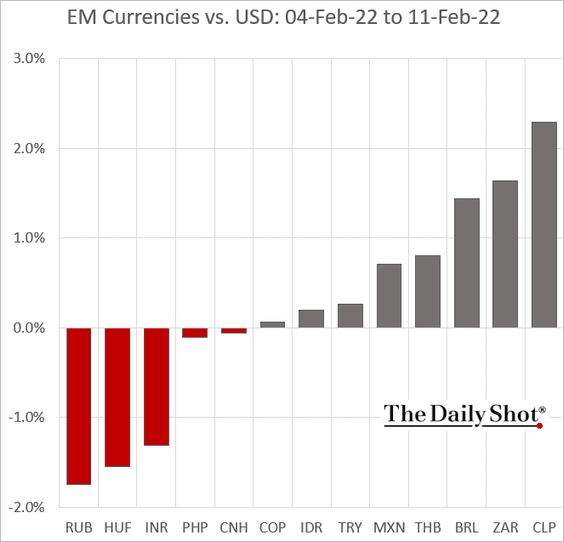

8. Finally, here are last week’s currency moves.

Back to Index

Cryptocurrency

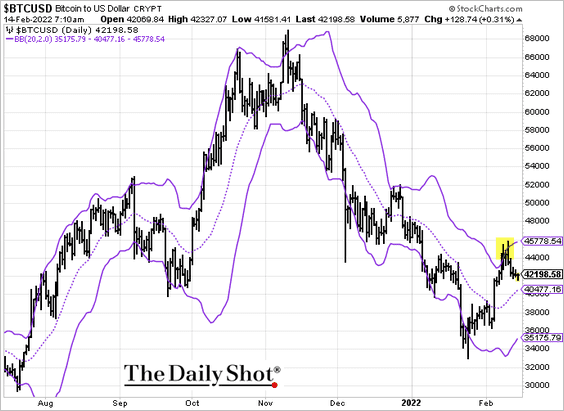

1. Bitcoin held resistance at the upper Bollinger Band.

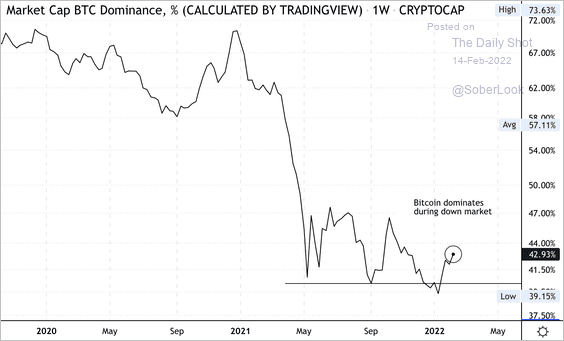

2. Bitcoin’s market cap relative to the total cryptocurrency market cap is rising, similar to the 2018 bear market. Some traders overweight BTC during market downturns due to its lower risk profile relative to altcoins.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

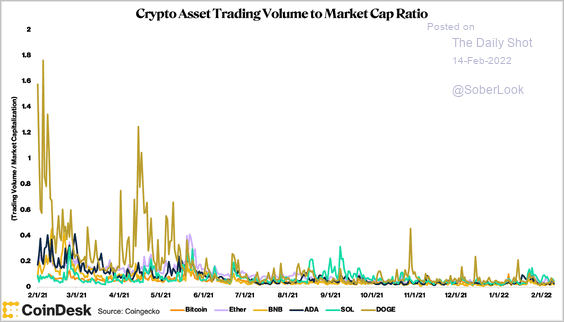

3. Trading volumes across cryptos have not kept up with skyrocketing market caps. That means it could take smaller amounts of capital to move markets.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

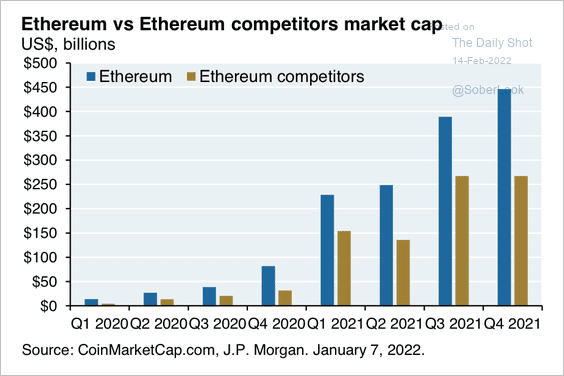

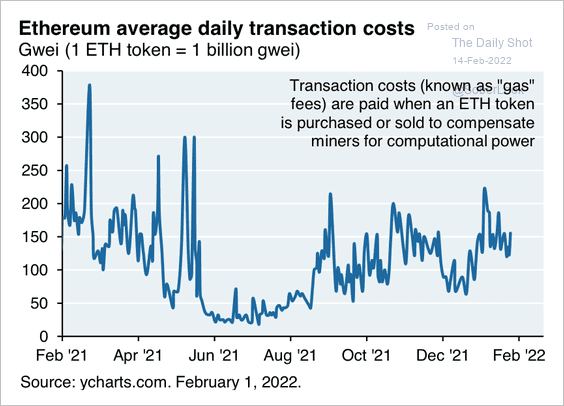

4. The Ethereum blockchain has more competitors as transaction costs rise (2 charts).

Source: Michael Cembalest, J.P. Morgan Asset Management

Source: Michael Cembalest, J.P. Morgan Asset Management

Source: Michael Cembalest, J.P. Morgan Asset Management

Source: Michael Cembalest, J.P. Morgan Asset Management

——————–

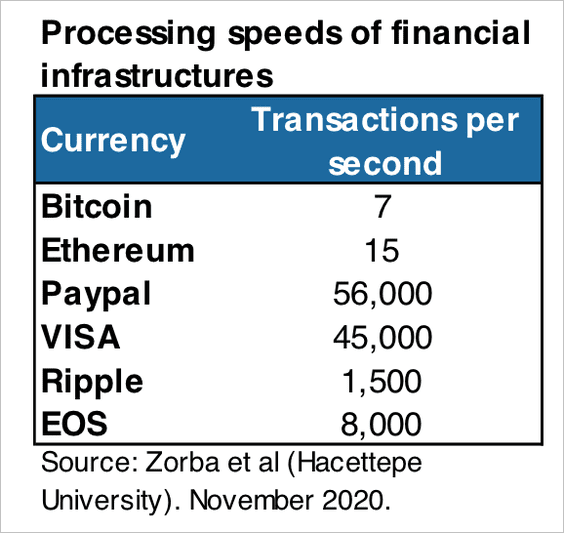

5. Here is a comparison of processing speeds across traditional and crypto payment networks.

Source: Michael Cembalest, J.P. Morgan Asset Management

Source: Michael Cembalest, J.P. Morgan Asset Management

Back to Index

Commodities

1. Aluminum prices have been surging.

Source: @markets Read full article

Source: @markets Read full article

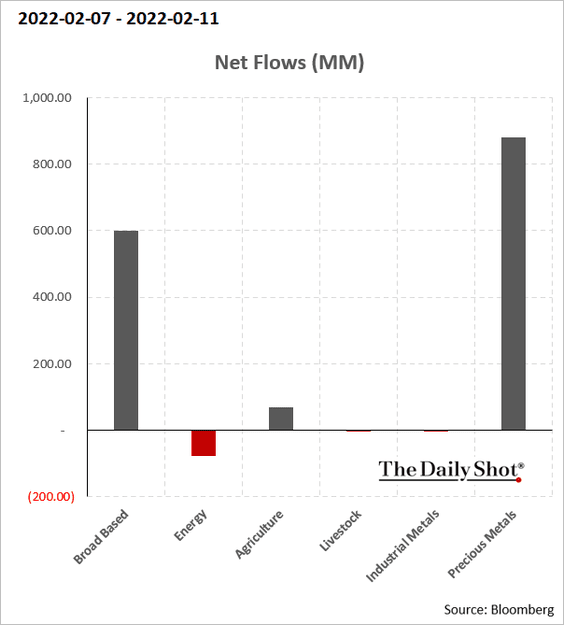

2. Precious metals saw substantial inflows last week amid Ukraine/Russia tensions.

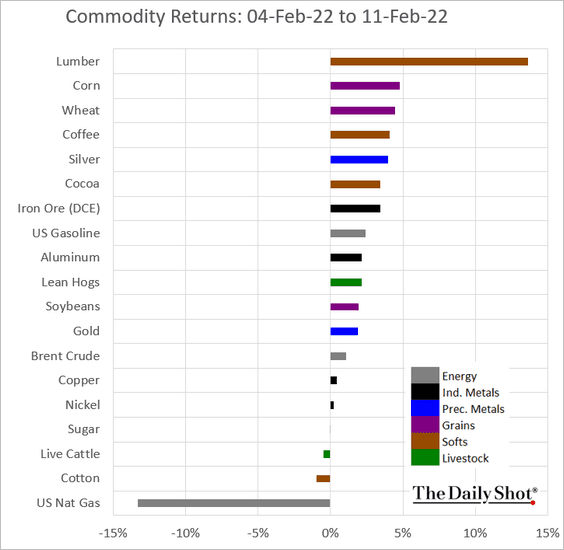

3. This chart shows last week’s returns across select commodity markets.

Back to Index

Energy

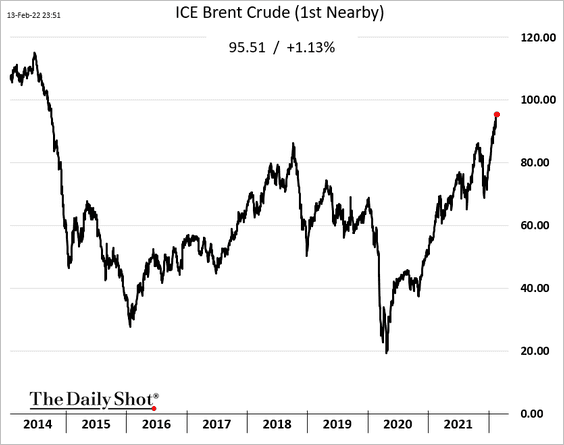

1. The Russia tensions have been a tailwind for crude oil as Brent rises above $95/bbl.

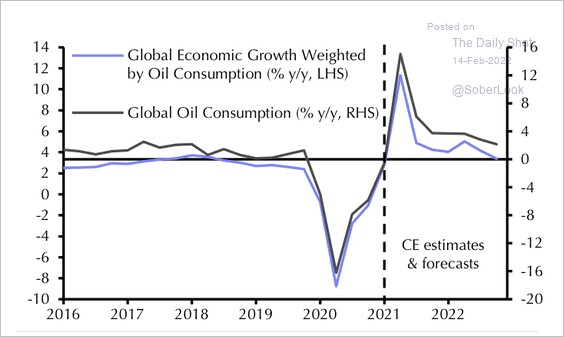

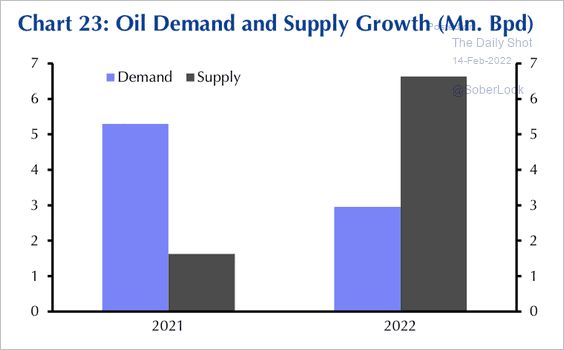

2. Capital Economics expects energy prices to broadly fall this year due to a decline in global growth and rising supply (2 charts).

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

Source: Capital Economics

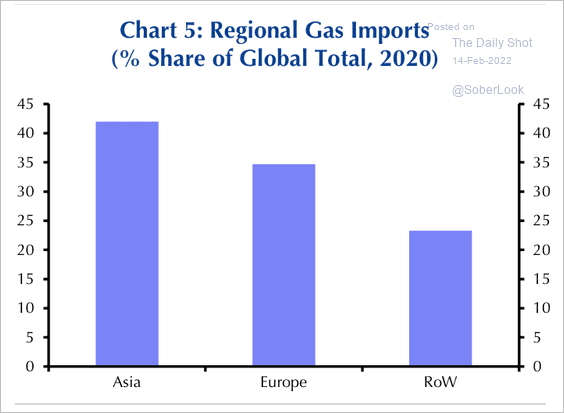

Asia and Europe account for about 75% of global gas imports.

Source: Capital Economics

Source: Capital Economics

——————–

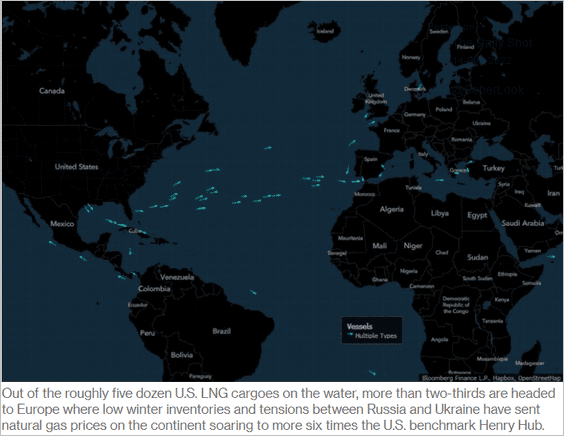

3. US LNG vessels continue to supply Europe.

Source: @markets Read full article

Source: @markets Read full article

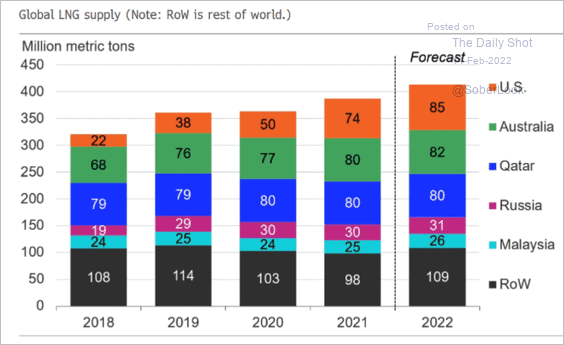

Global LNG supplies are expected to climb substantially this year.

Source: Michael Yip, @BloombergNEF Read full article

Source: Michael Yip, @BloombergNEF Read full article

Back to Index

Equities

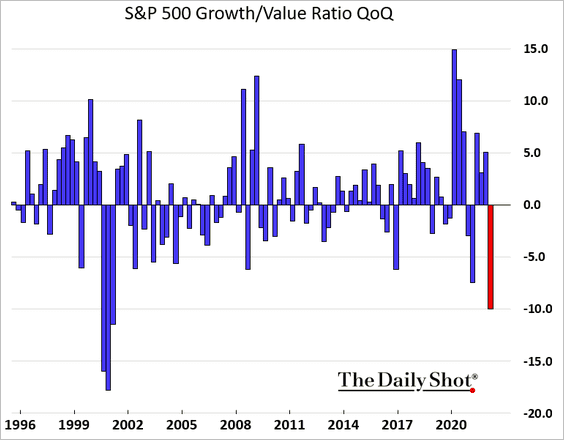

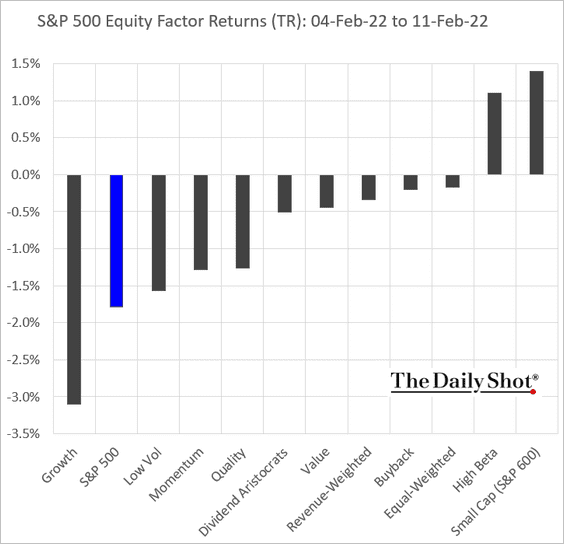

1. The growth/value underperformance this quarter has been the largest since the dot-com crash.

Here is last week’s performance by equity factor.

——————–

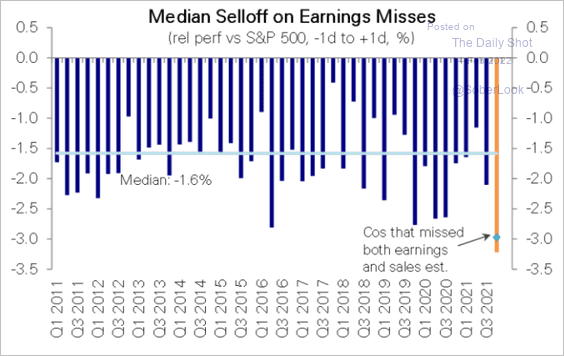

2. Companies haven’t been punished this much for missing earnings forecasts in over a decade.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

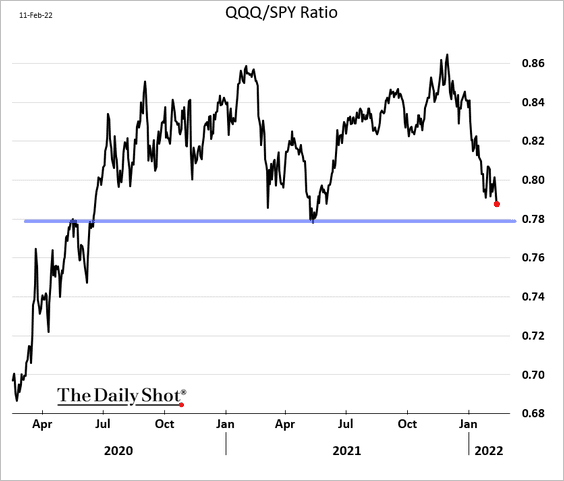

3. The Nasdaq 100/S&P 500 ratio is nearing support.

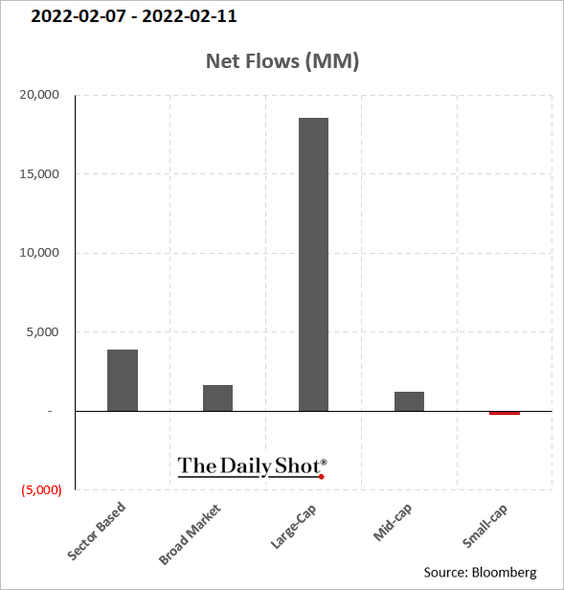

4. Large-cap stocks saw substantial inflows last week.

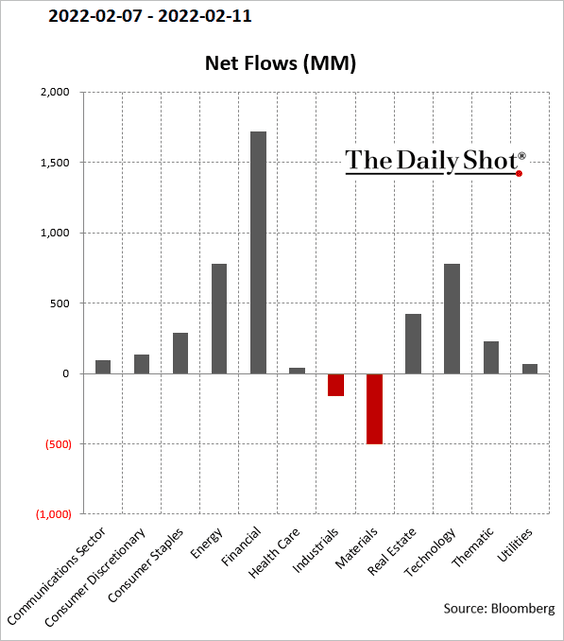

Here are last week’s etf flows by sector.

——————–

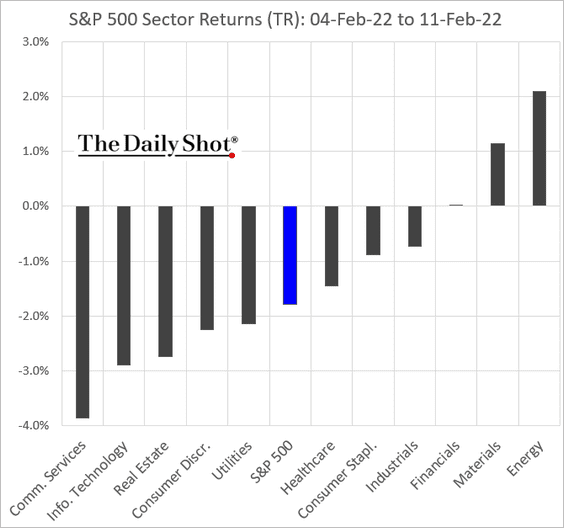

5. This chart shows last week’s sector returns.

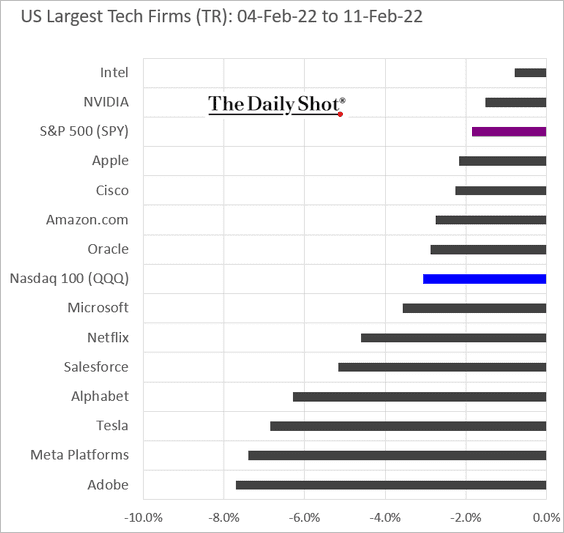

6. All large US tech firms were down last week.

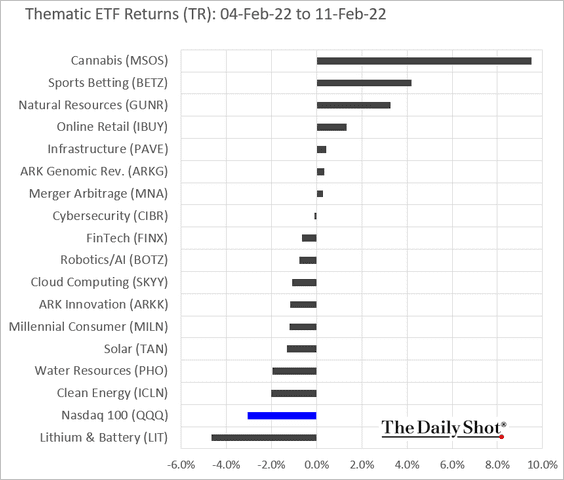

7. Cannabis shares finally caught a bid. Here are some popular thematic ETFs.

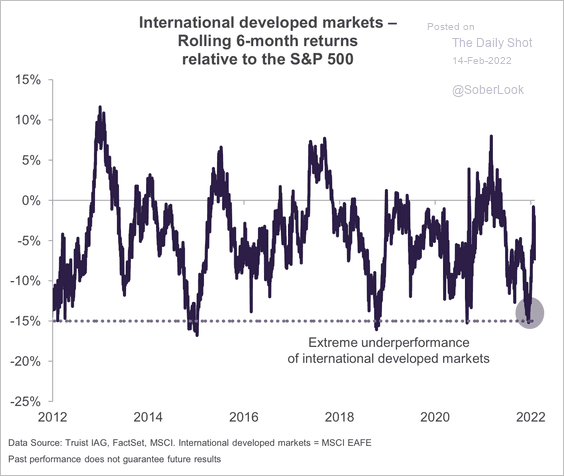

8. Ex-US developed market equities rose from oversold levels over the past few months.

Source: Truist Advisory Services

Source: Truist Advisory Services

Back to Index

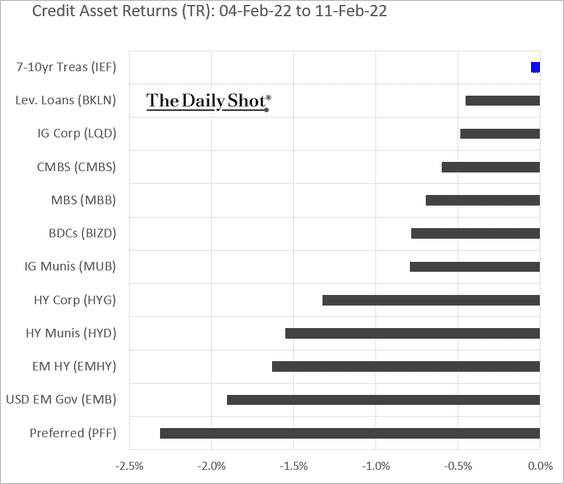

Credit

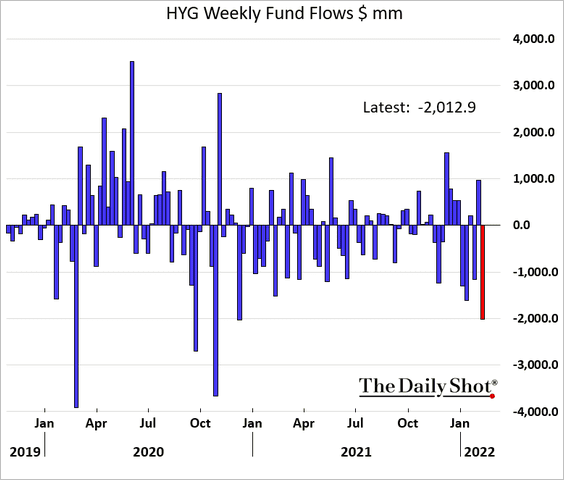

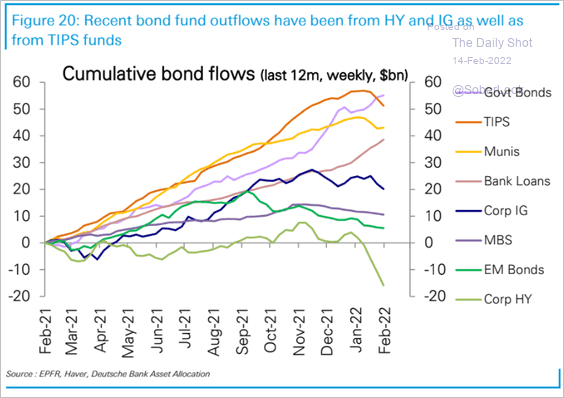

1. Credit markets were under pressure last week, …

… as fund outflows quickened (chart shows flows for the largest high-yield ETF).

This next chart shows cumulative flows over the past year.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

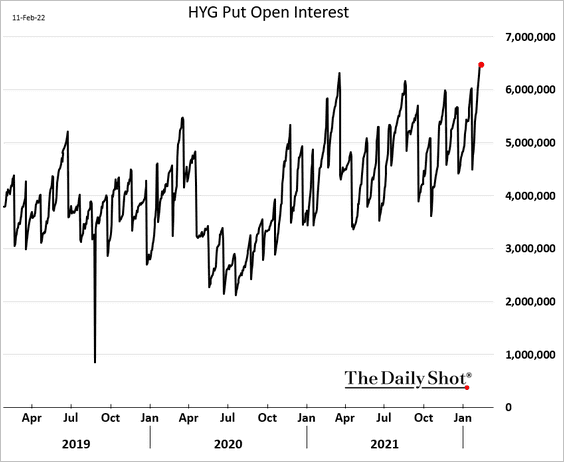

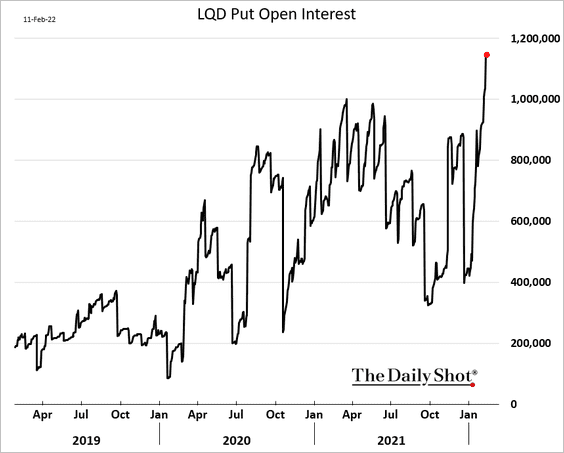

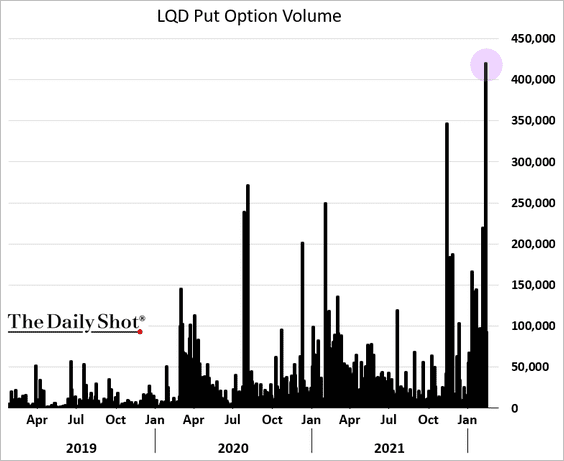

2. Demand for put options on credit ETFs has been surging.

• High-yield:

• Investment-grade:

And trading activity in put options has exploded.

——————–

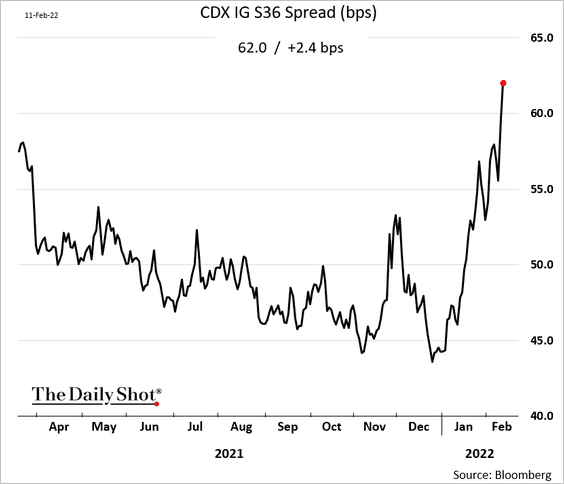

3. Investment-grade credit default swap spreads continue to widen.

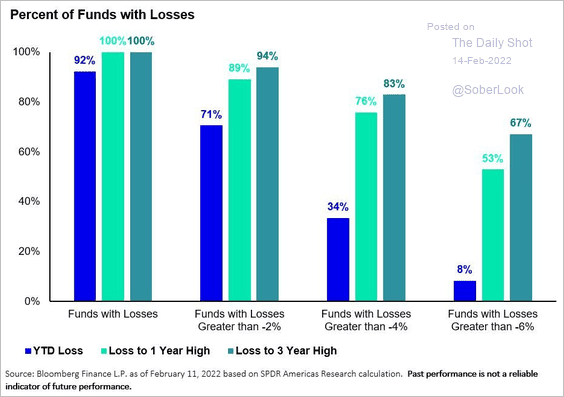

4. Most fixed-income funds are trading at a steep loss, especially after the sharp rise in rates.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Rates

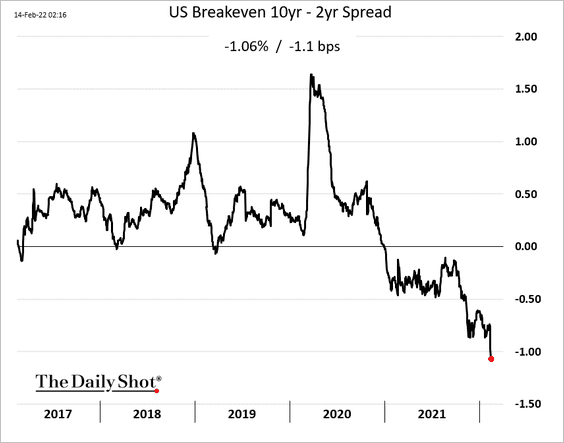

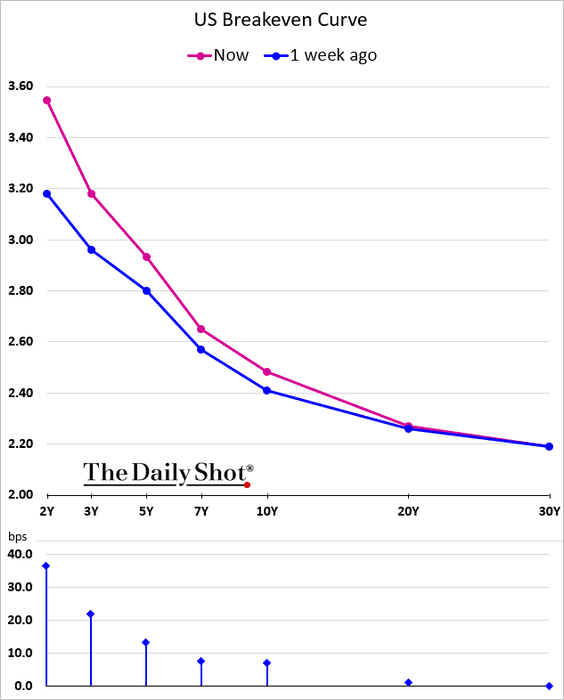

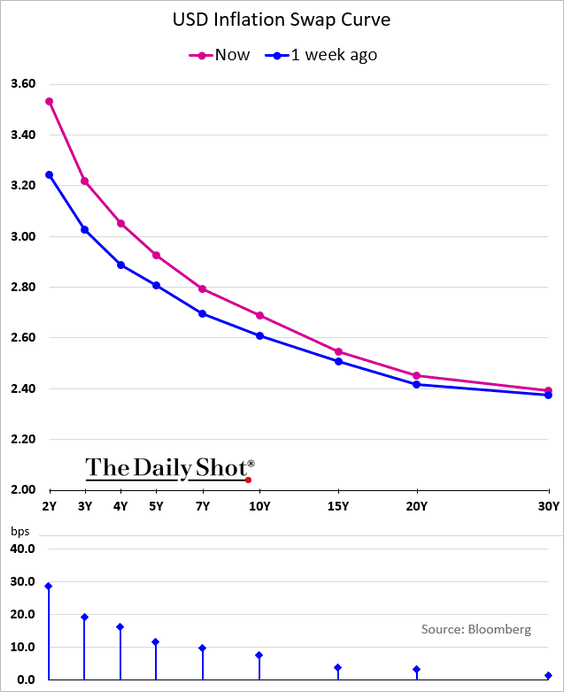

1. The US inflation curve is becoming more inverted (3 charts). Inflation is expected to be higher but “roll off” faster. Part of the reason for the steepness is the backwardation in the oil curve.

——————–

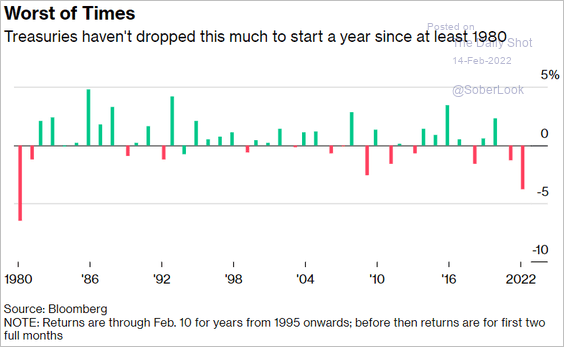

2. It’s been a rough start of the year for Treasuries.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Global Developments

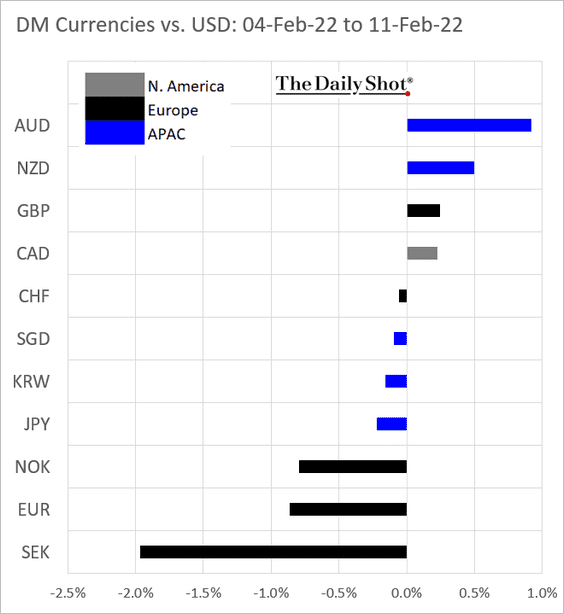

1. How have DM currencies performed last week vs. USD?

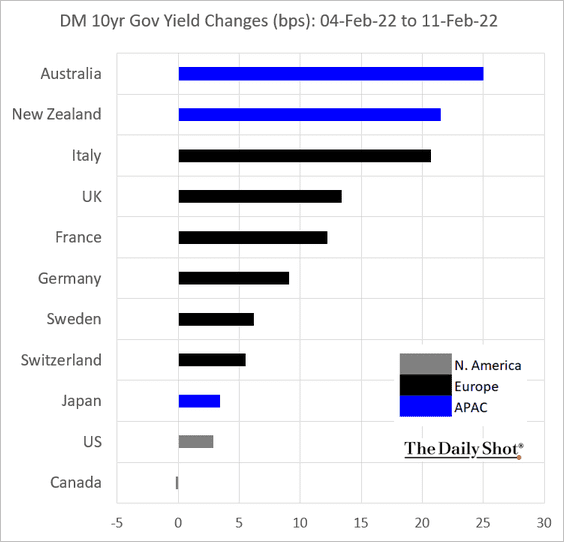

2. Most sovereign bond yields increased last week.

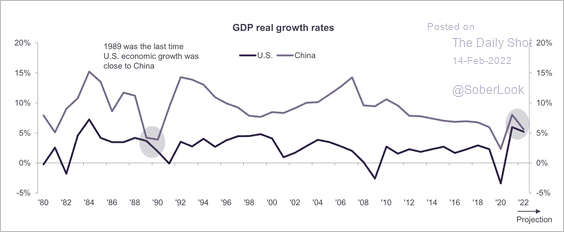

3. The US is expected to deliver economic growth on par with China for the first time since 1989.

Source: Truist Advisory Services

Source: Truist Advisory Services

——————–

Food for Thought

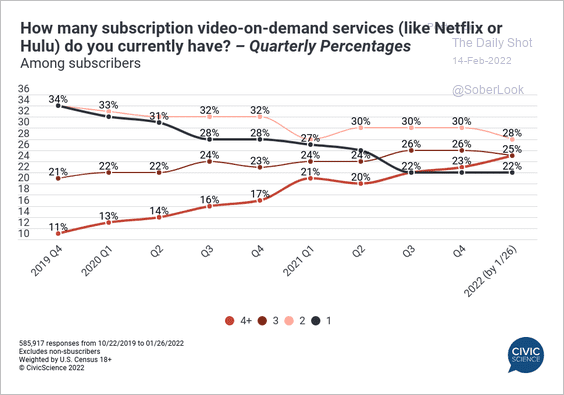

1. Video-on-demand subscription services:

Source: @CivicScience

Source: @CivicScience

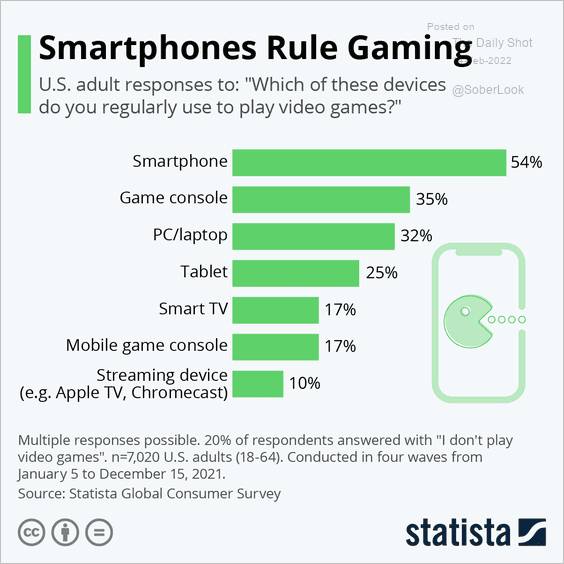

2. Preferred devices for video games:

Source: Statista

Source: Statista

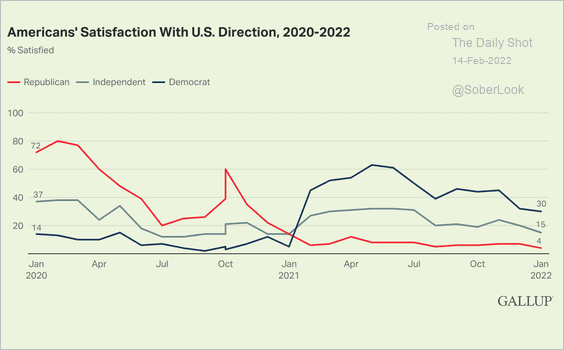

3. Satisfaction with US direction:

Source: Gallup Read full article

Source: Gallup Read full article

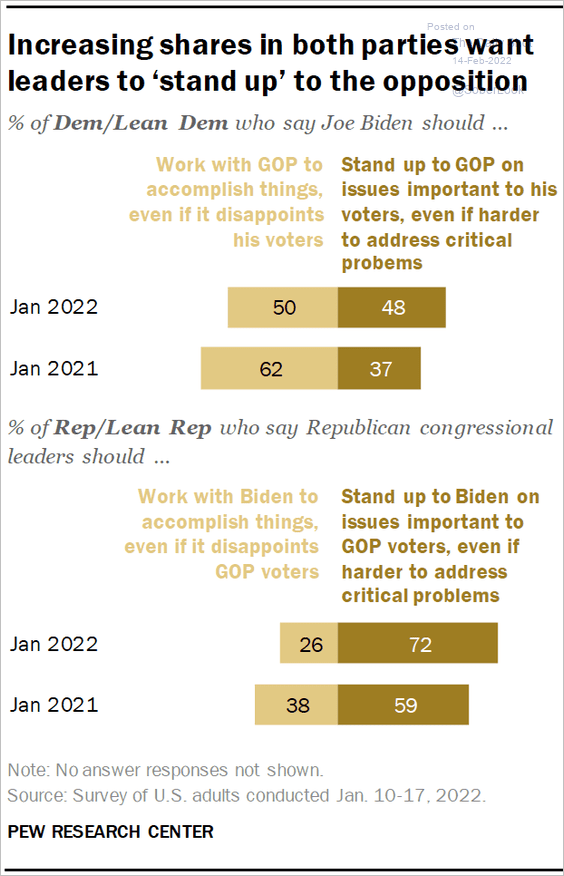

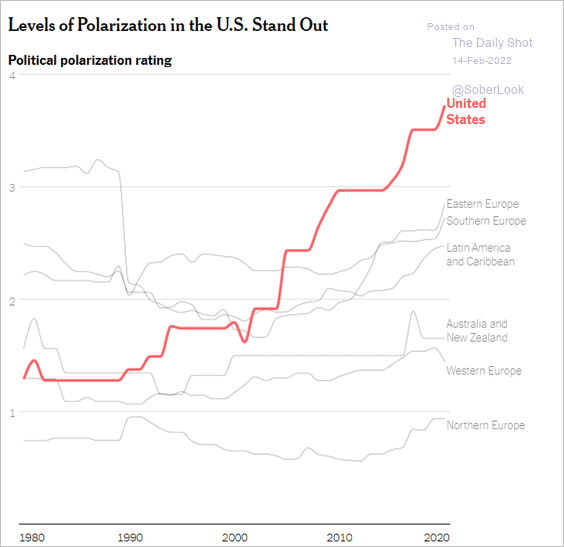

4. Increasing US polarization (2 charts):

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

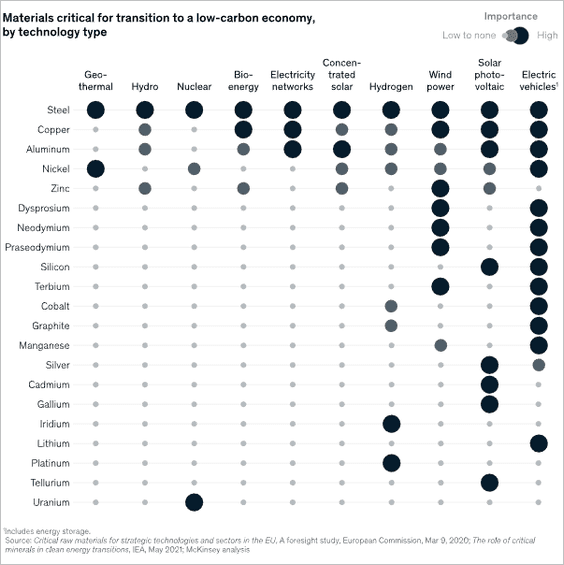

5. Metals needed for the transition to a net-zero economy:

Source: McKinsey & Company Read full article

Source: McKinsey & Company Read full article

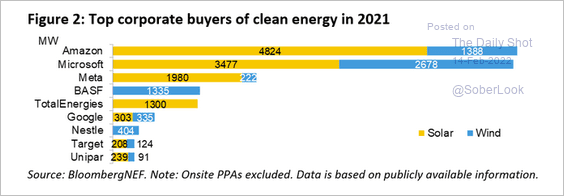

6. Corporate buyers of clean energy:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

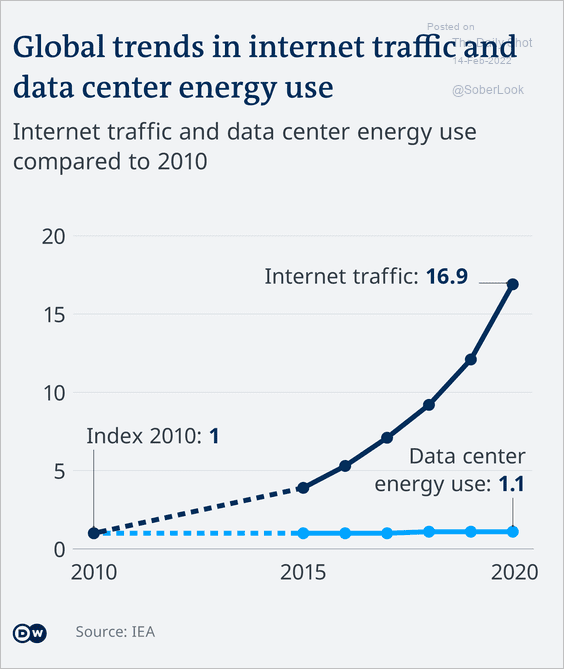

7. Data centers’ energy use vs. internet traffic:

Source: DW Read full article

Source: DW Read full article

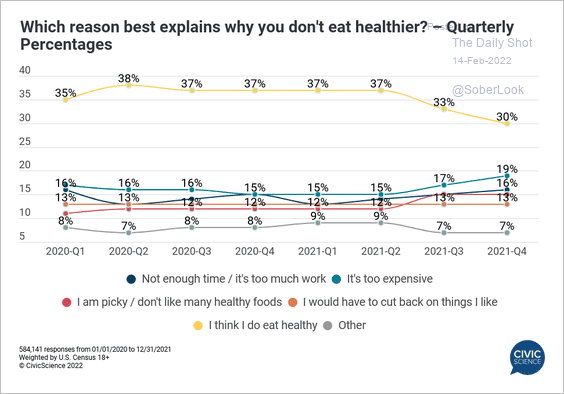

8. Reasons for not eating healthier:

Source: @CivicScience

Source: @CivicScience

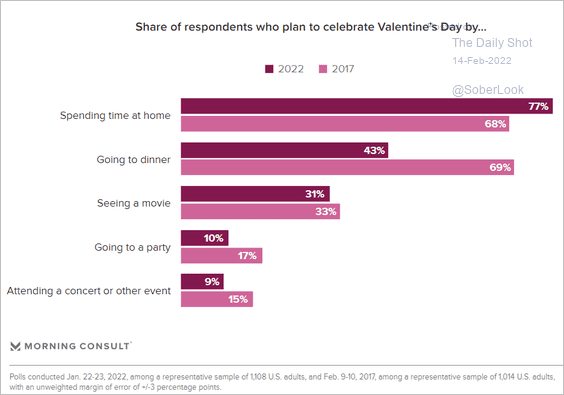

9. Celebrating Valentine’s Day:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

——————–

Back to Index