The Daily Shot: 16-Mar-22

• China

• Japan

• Europe

• The United Kingdom

• The United States

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

China

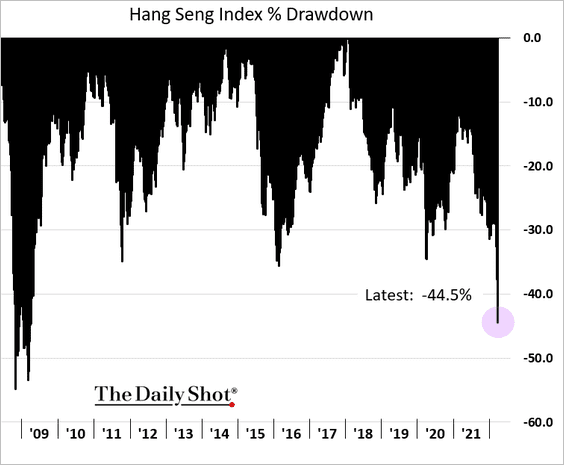

1. After the worst stock market slump since 2008 (amid a surge in COVID cases), …

… Beijing has had enough. The authorities announced a number of measures to support the markets.

Source: @SofiaHCBBG

Source: @SofiaHCBBG

Source: Bloomberg Read full article

Source: Bloomberg Read full article

China’s government does not like to see rising volatility.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

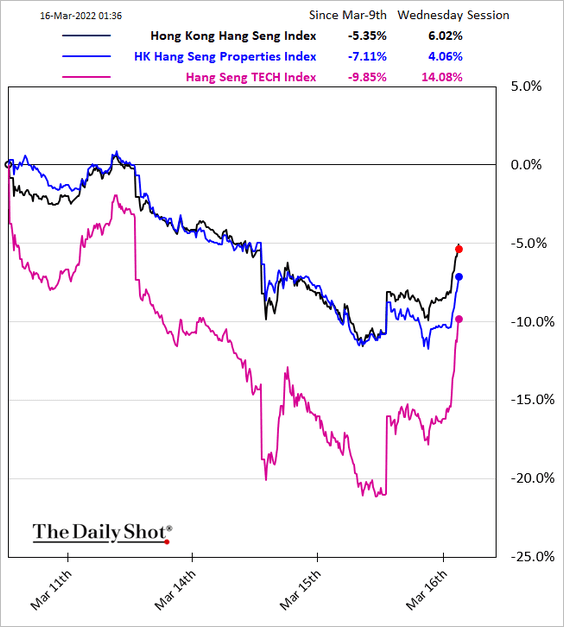

Hong Kong and mainland shares jumped in response to the announcement, …

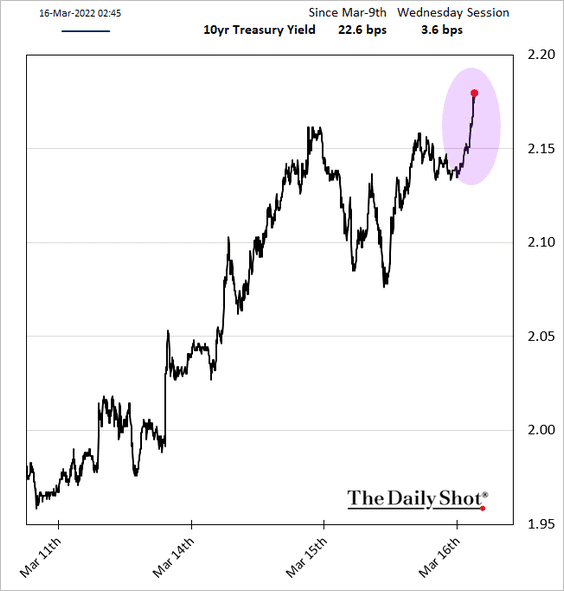

… boosting global markets and sending Treasury yields higher. It’s risk-on.

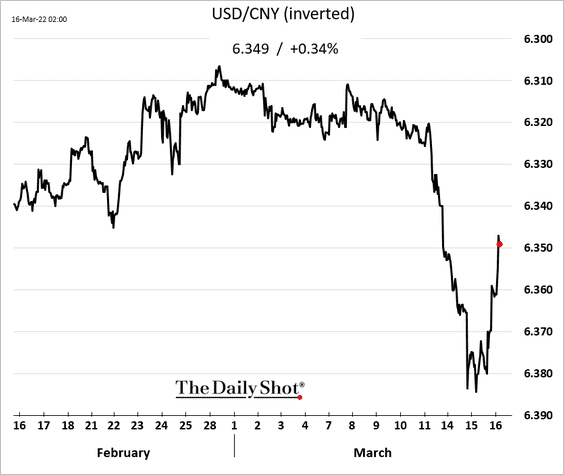

The renminbi rebounded.

——————–

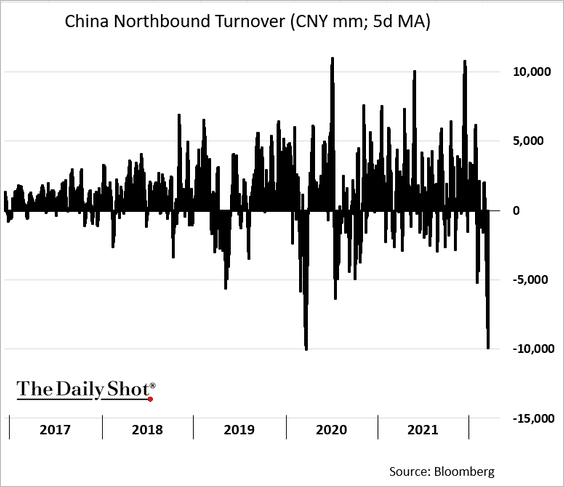

2. Will we see foreign capital return to mainland stocks?

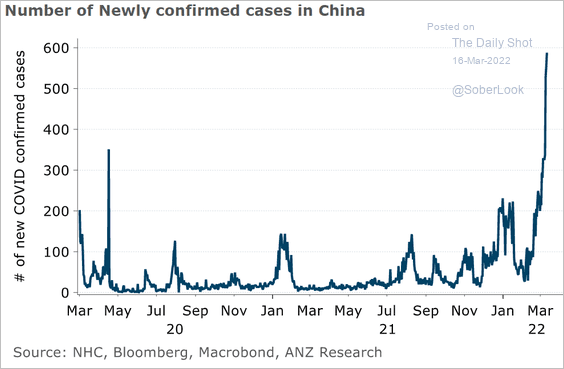

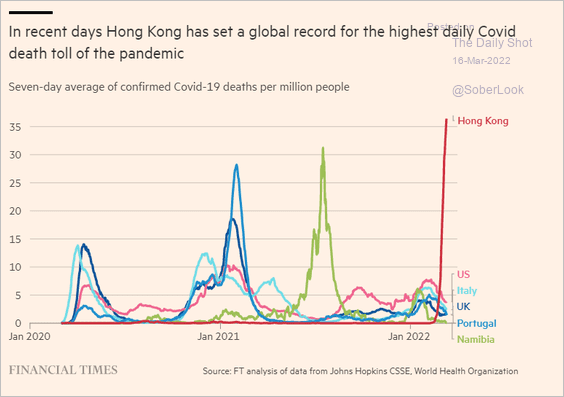

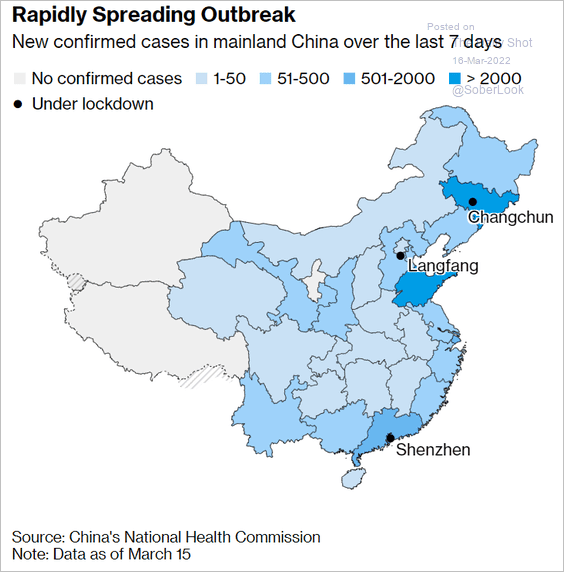

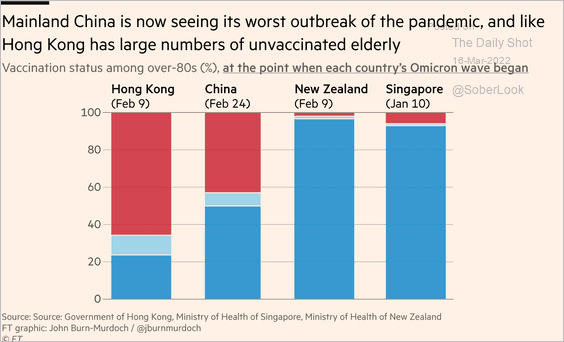

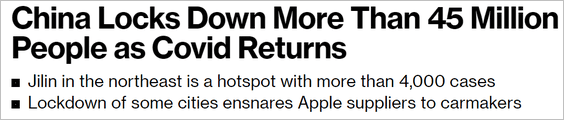

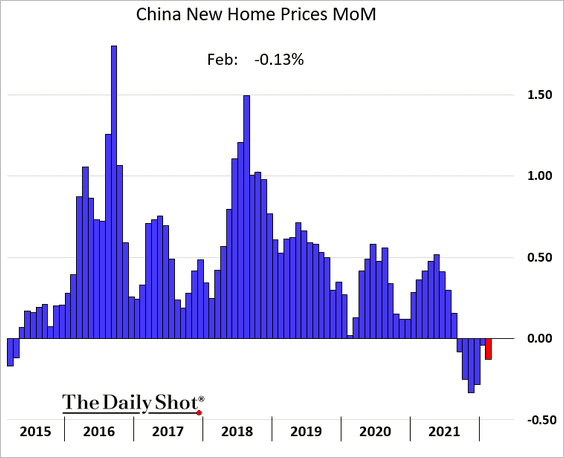

3. China’s COVID situation has deteriorated, …

Source: ANZ Research

Source: ANZ Research

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

… threatening under-vaccinated elderly population.

Source: @jburnmurdoch, @FinancialTimes

Source: @jburnmurdoch, @FinancialTimes

After a robust start of the year, the economy could see a pullback due to lockdowns.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Gavekal Research

Source: Gavekal Research

——————–

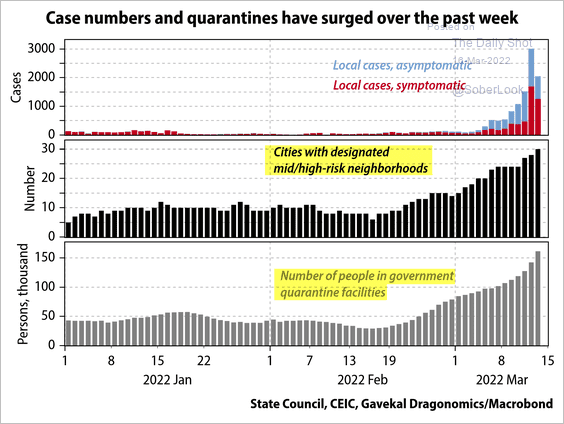

4. New home prices declined again last month.

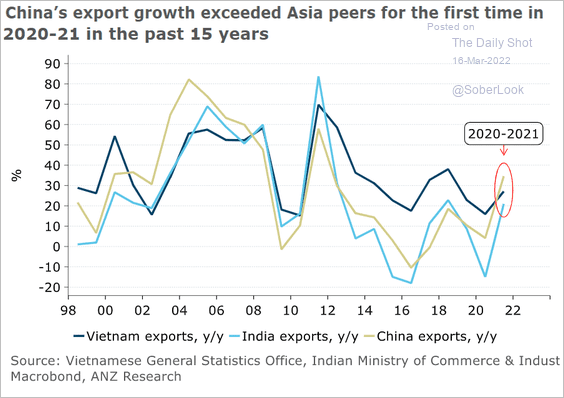

5. China’s export growth has been outpacing Asian peers.

Source: ANZ Research

Source: ANZ Research

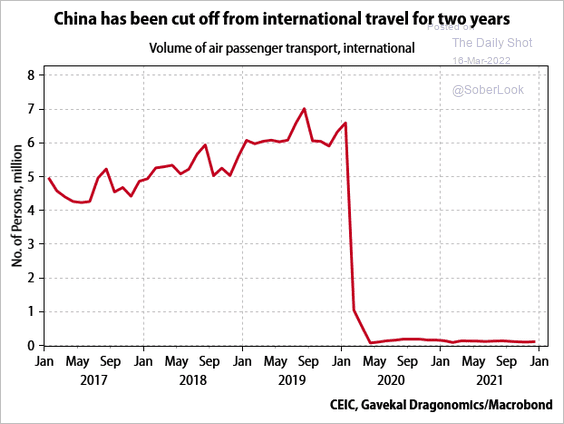

6. The nation has been cut off from international travel since the start of the pandemic.

Source: Gavekal Research

Source: Gavekal Research

Back to Index

Japan

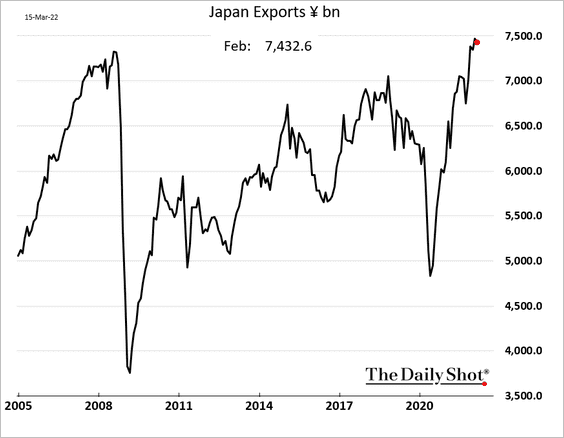

1. Exports remain near record highs.

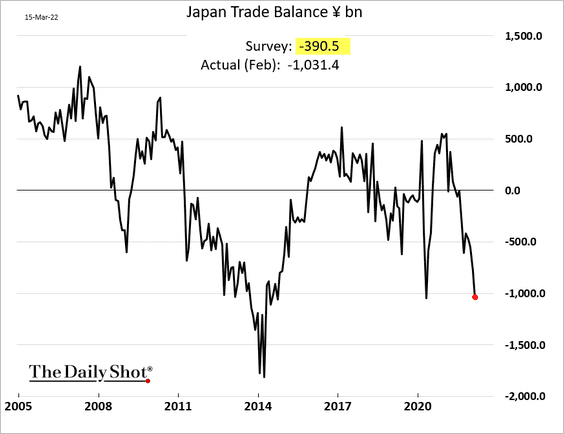

But the trade deficit worsened due to increasingly costly energy imports.

——————–

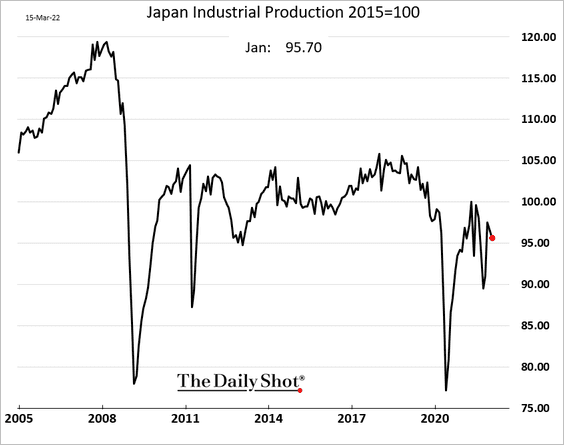

2. Industrial production eased in January, holding below pre-COVID levels.

Back to Index

Europe

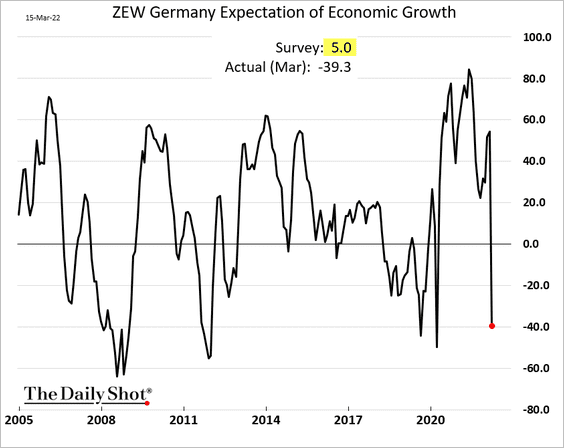

1. Germany’s growth expectations tumbled this month (in response to the war).

Source: RTT News Read full article

Source: RTT News Read full article

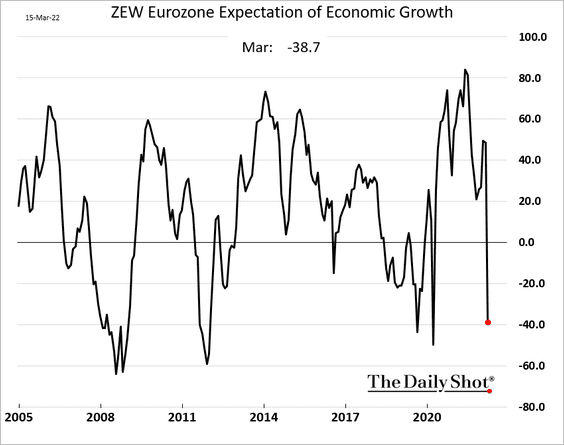

Here is the same index at the Eurozone level.

——————–

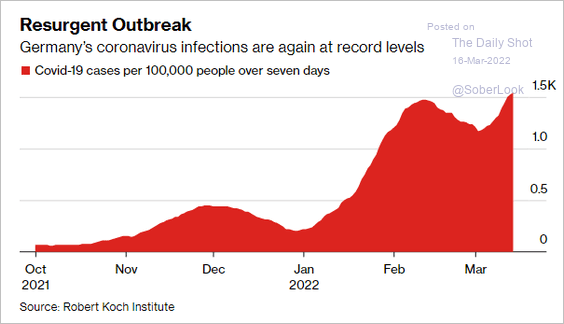

2. German COVID cases have been rising.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

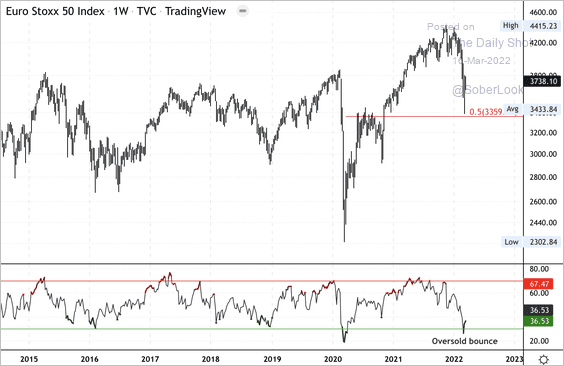

3. The Euro Stoxx 50 Index is holding support.

Source: Dantes Outlook

Source: Dantes Outlook

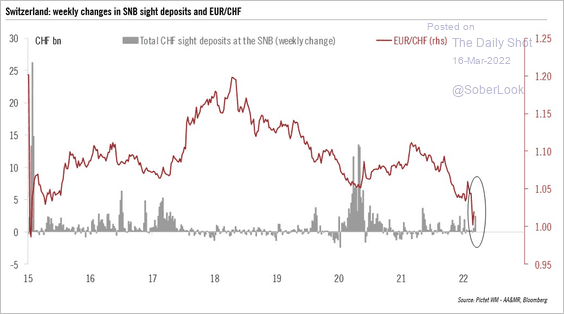

4. There has been an uptick in SNB sight deposits recently, possibly defending EUR/CHF parity.

Source: @fwred

Source: @fwred

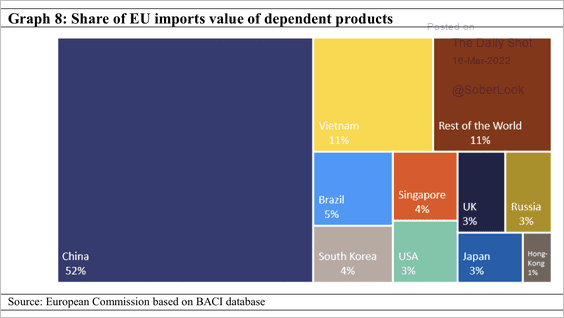

5. This graph shows sources of EU imports.

Source: European Commission

Source: European Commission

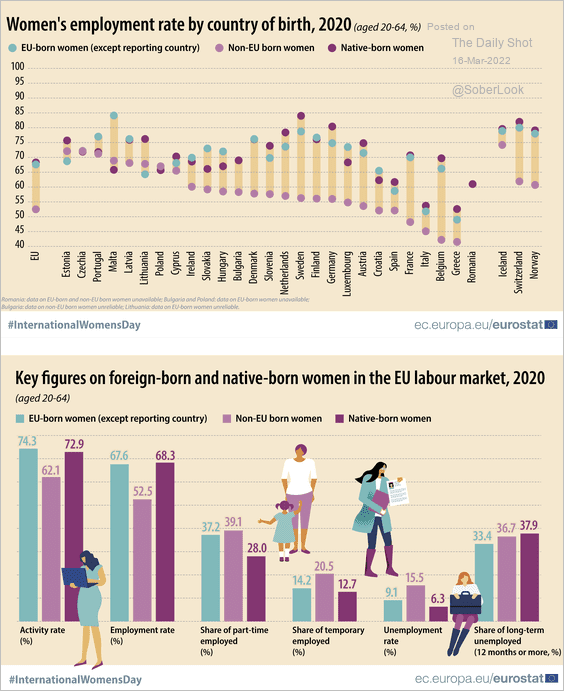

6. Next, we have women’s employment rates across the EU.

Source: Eurostat Read full article

Source: Eurostat Read full article

Back to Index

The United Kingdom

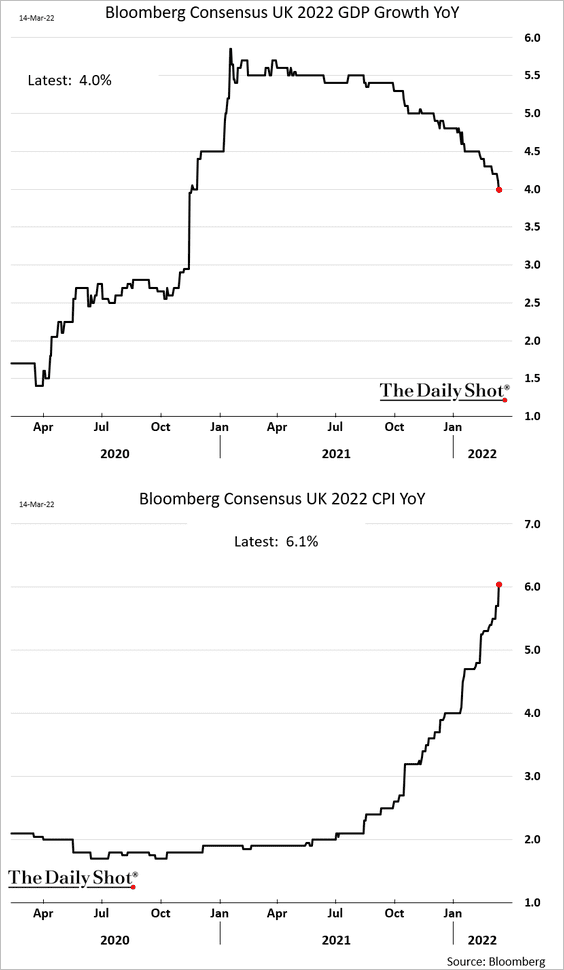

1. Economists are downgrading UK growth forecasts while boosting their CPI projections.

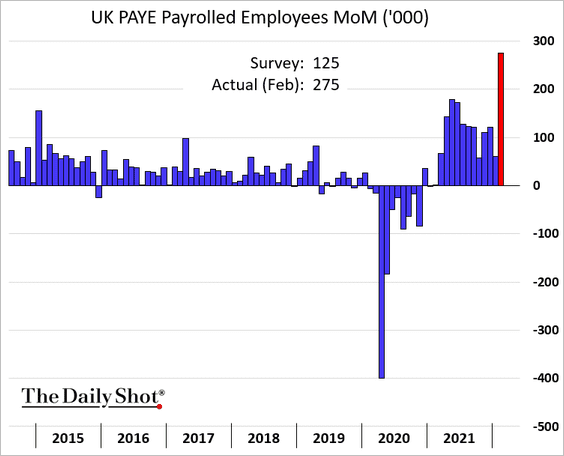

2. Payrolls jumped sharply last month. These initial figures have been revised downward recently, but this increase is impressive nonetheless.

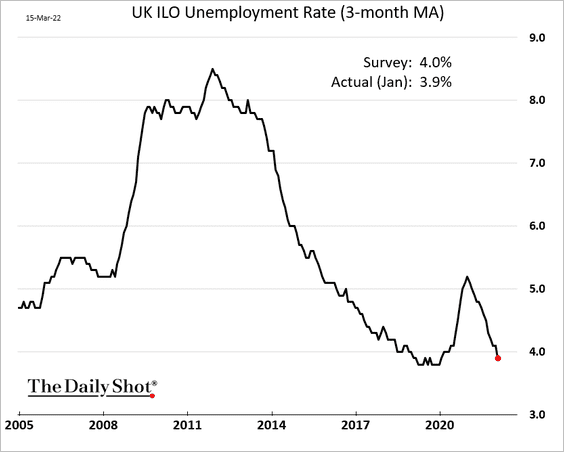

The unemployment rate dipped below 4%.

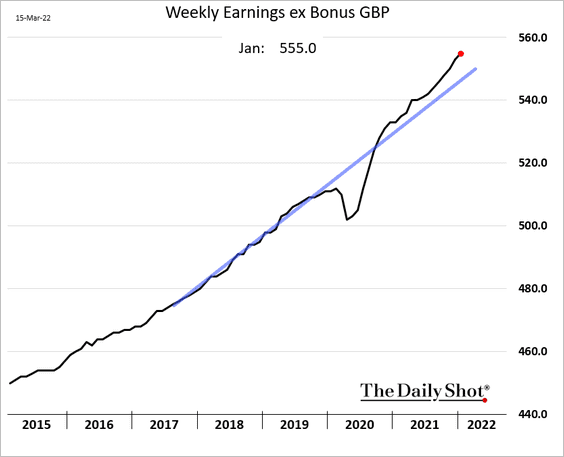

January wage growth exceeded forecasts.

Back to Index

The United States

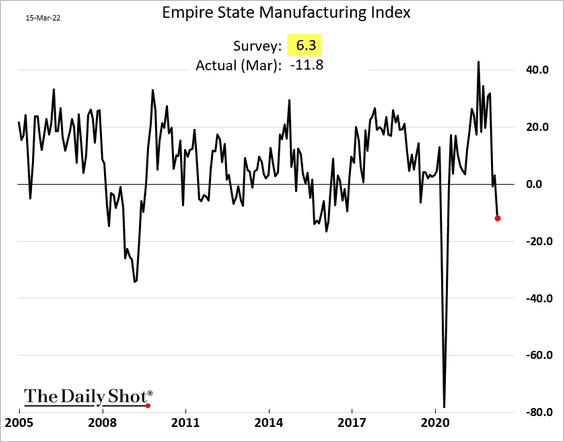

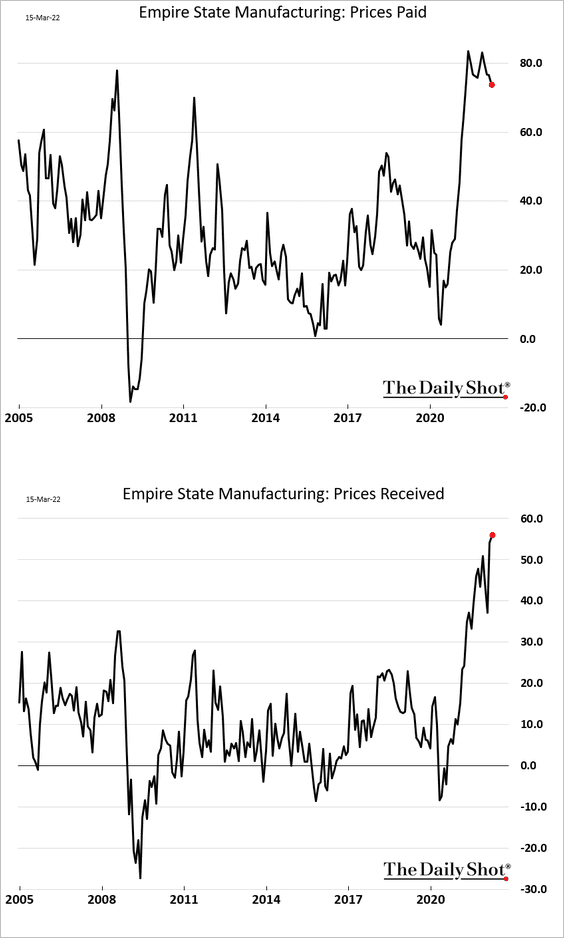

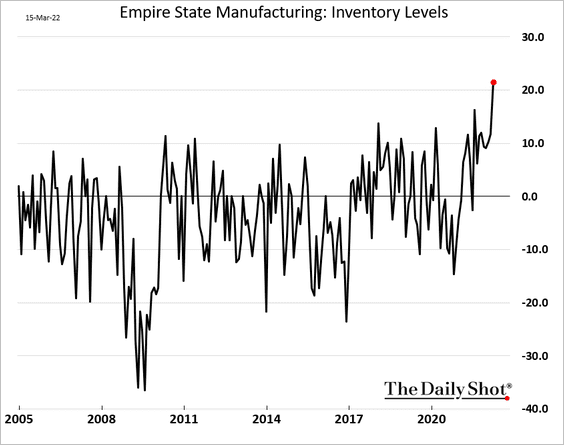

1. The NY Fed’s manufacturing index tumbled in March. It’s the first regional factory activity signal of the month.

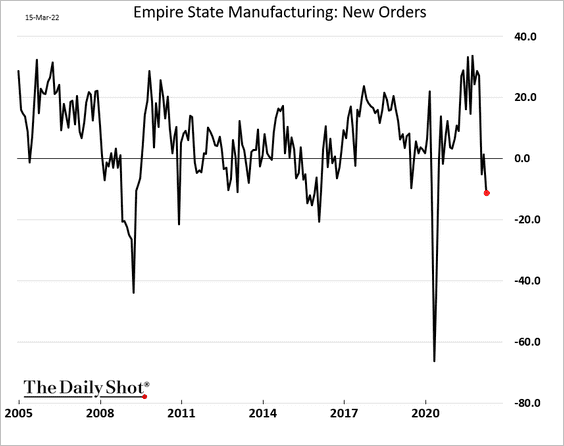

• Demand deteriorated.

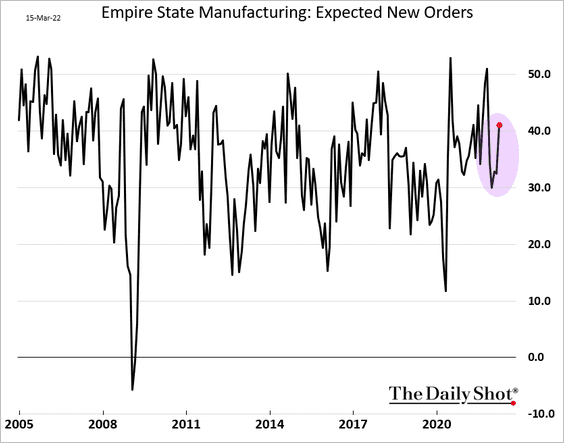

However, demand expectations for the next few months improved.

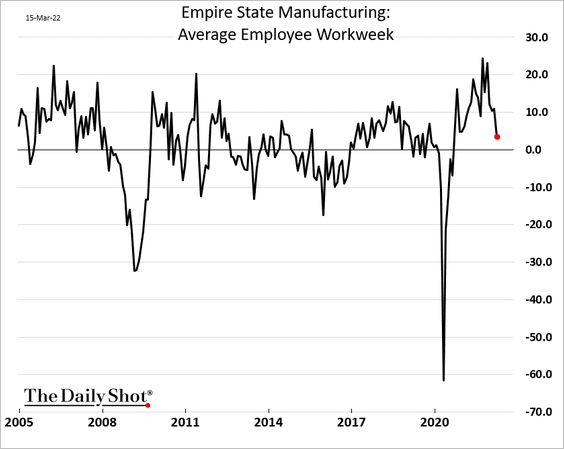

• Employee hours are down sharply.

• Price pressures persist, with factories quickly boosting output prices.

• Manufacturers are rapidly building inventories.

——————–

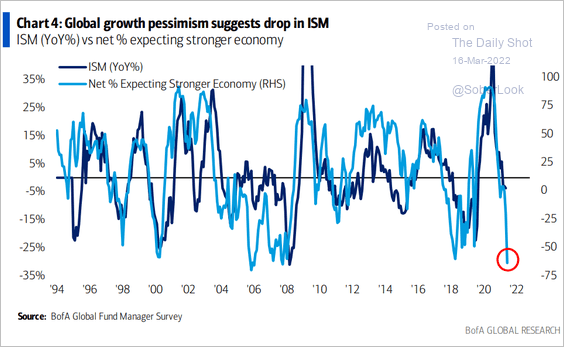

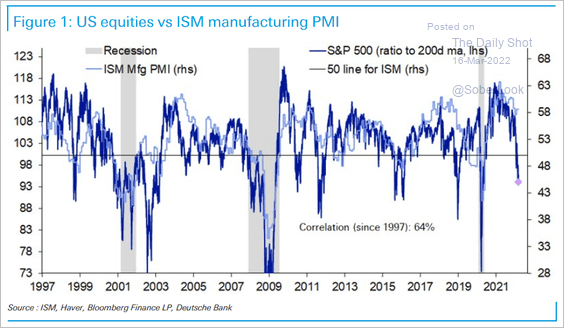

2. Investor gloom points to downside risks for US manufacturing activity (2 charts).

Source: BofA Global Research

Source: BofA Global Research

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

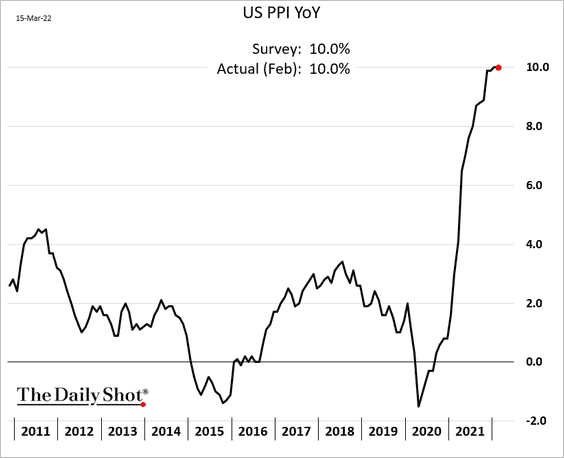

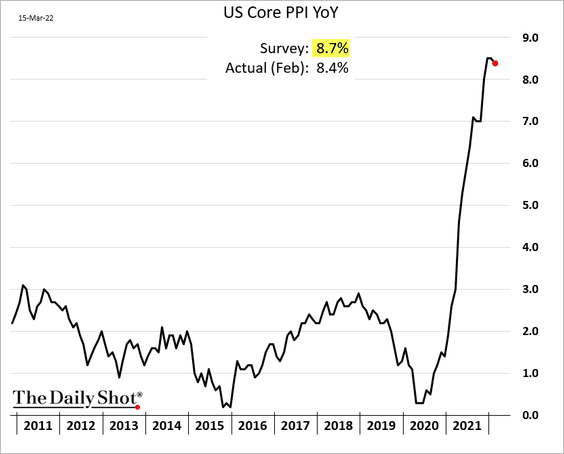

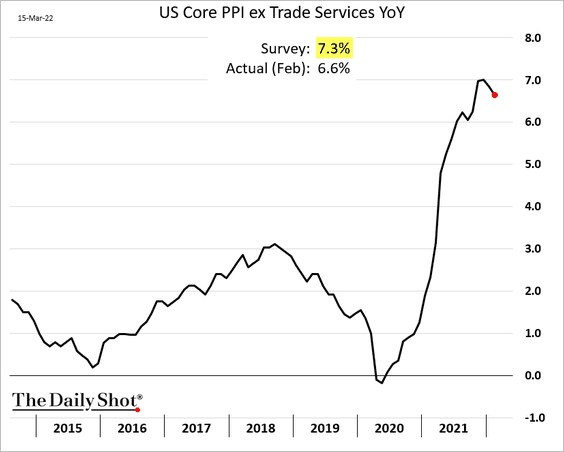

3. Gains in producer prices hit 10%, which was in line with expectations.

But core inflation was starting to moderate before Russia’s invasion of Ukraine.

——————–

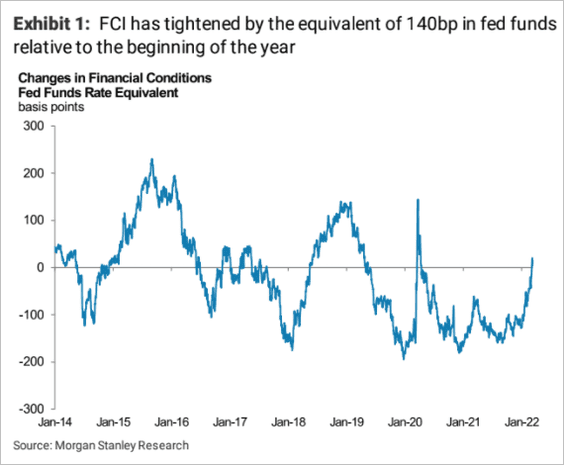

4. Financial conditions have tightened sharply this year. According to Morgan Stanley, that’s equivalent to 140 basis points of Fed rate hikes.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

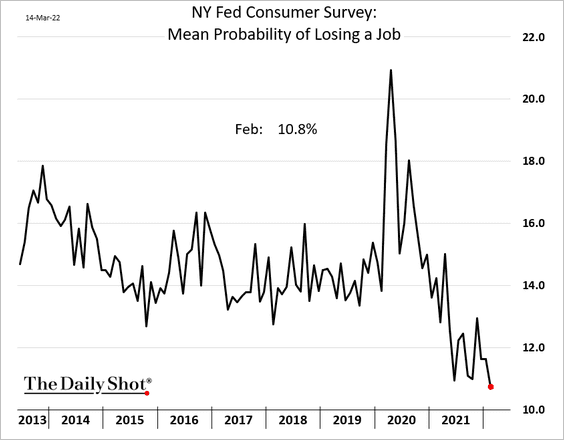

5. The NY Fed’s consumer survey points to easing concerns about job losses.

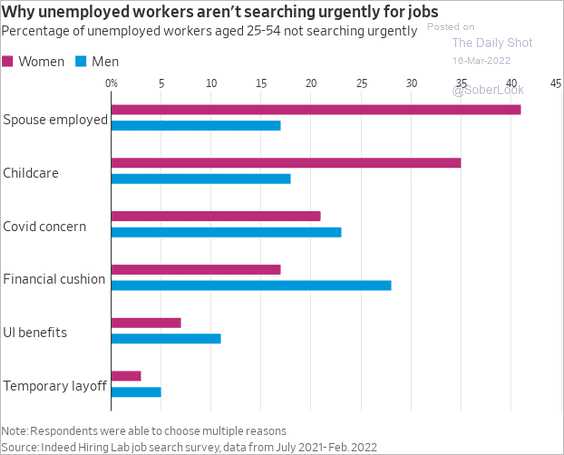

Why are many unemployed workers not urgently searching for a job?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

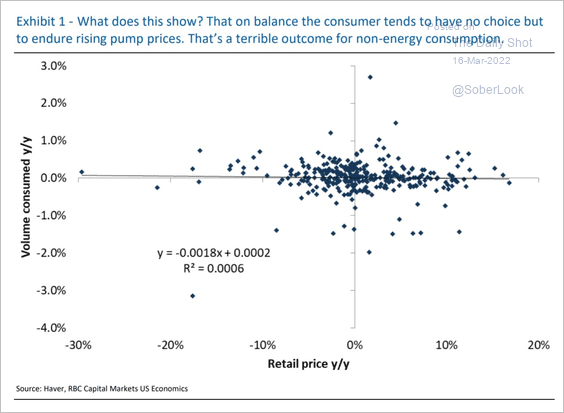

6. Demand for gasoline appears to be inelastic, which could be negative for discretionary spending.

Source: RBC Capital Markets; @Scutty

Source: RBC Capital Markets; @Scutty

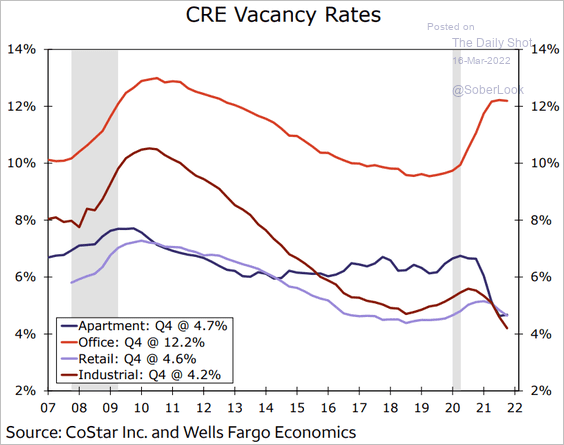

7. Finally, this chart shows the evolution of commercial real estate vacancy rates.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

Emerging Markets

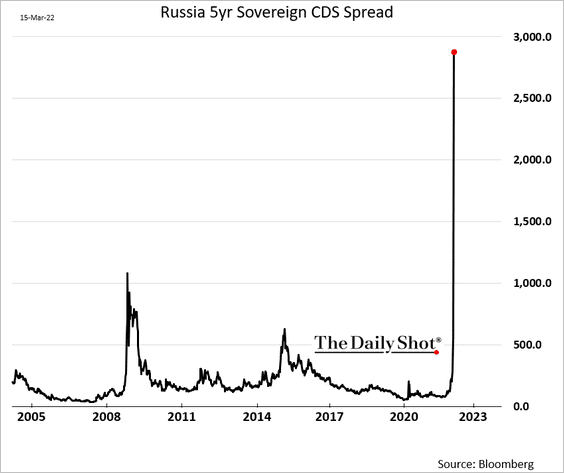

1. Markets expect Russia to default on sovereign debt.

It may be years before Russia (government and companies) re-enter global capital markets.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

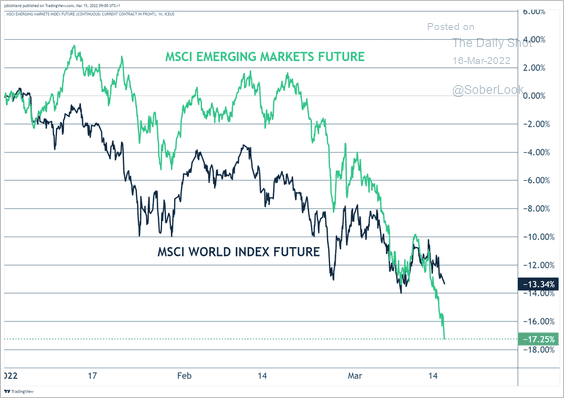

2. EM equities have been underperforming.

Source: @true_insights_

Source: @true_insights_

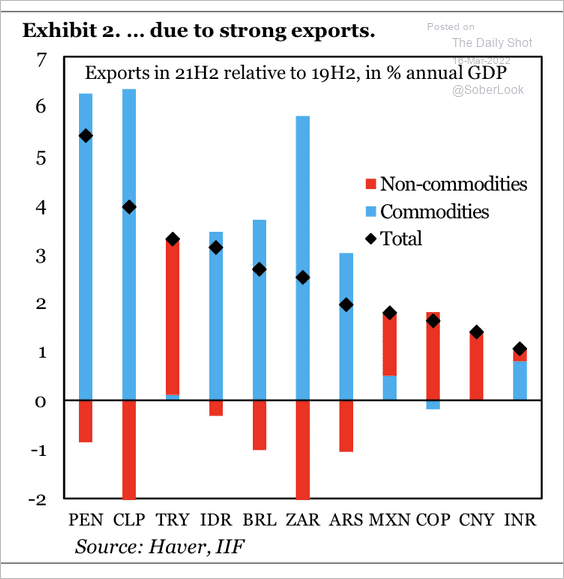

3. The commodities rally contributed to stronger trade balances.

Source: IIF

Source: IIF

Back to Index

Cryptocurrency

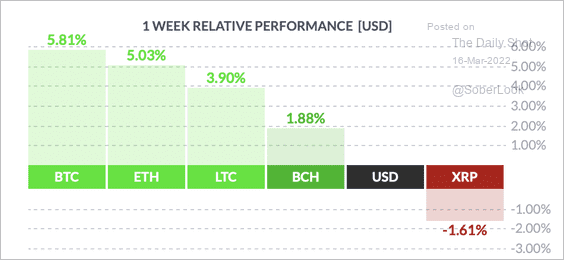

1. So far, bitcoin has outperformed other large cryptos over the past week.

Source: FinViz

Source: FinViz

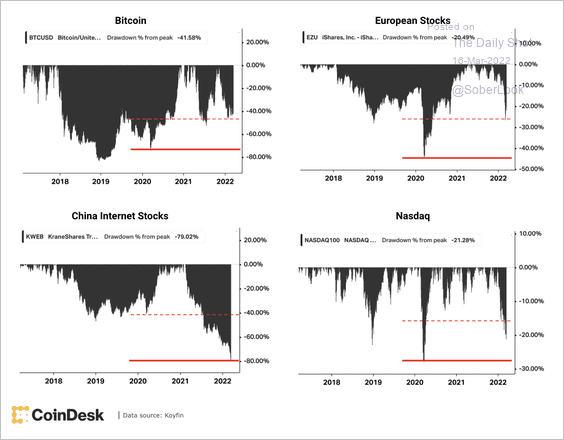

2. Here is a look at bitcoin’s drawdown compared with global stocks.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

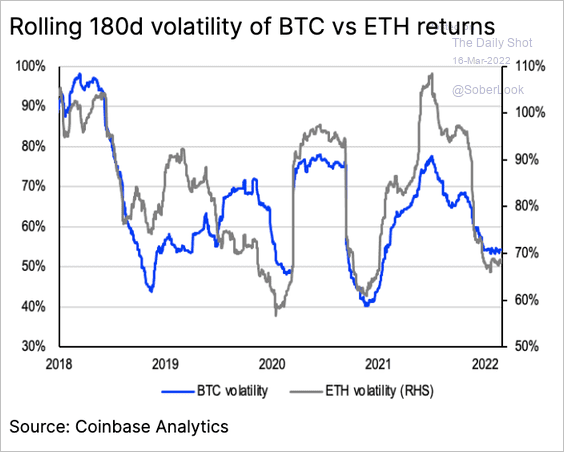

3. BTC and ETH spot volatility has been falling over the past six months.

Source: @CoinbaseInsto

Source: @CoinbaseInsto

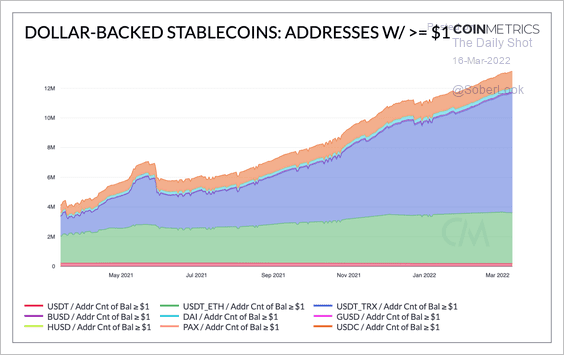

4. Adoption of dollar-backed stablecoins has accelerated, indicating a flight to safety among crypto investors.

Source: @coinmetrics

Source: @coinmetrics

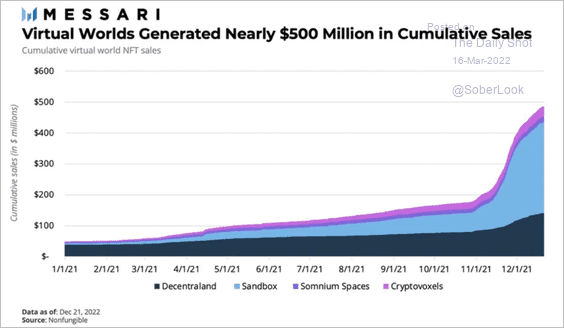

5. Sales of “virtual worlds” have seen impressive growth over the past year.

Source: @MessariCrypto

Source: @MessariCrypto

Back to Index

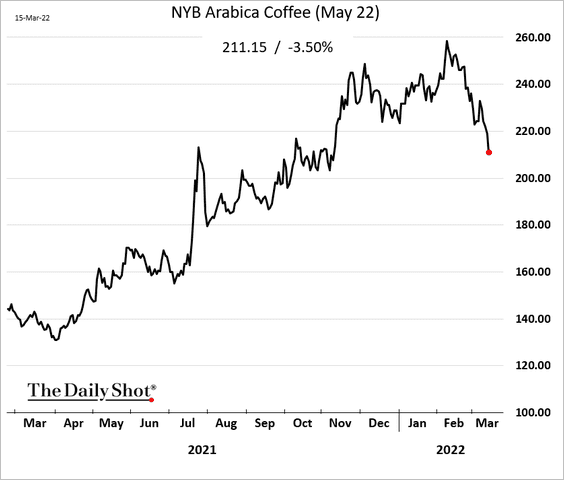

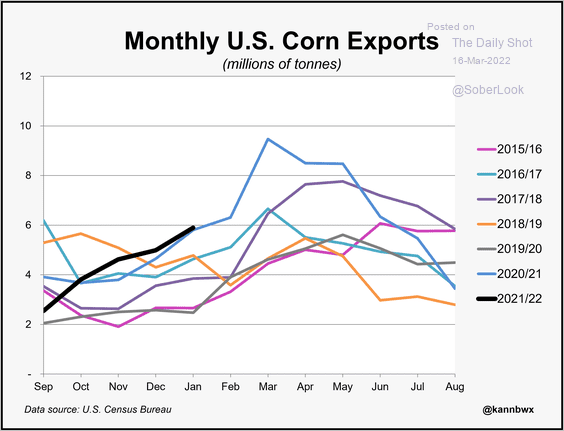

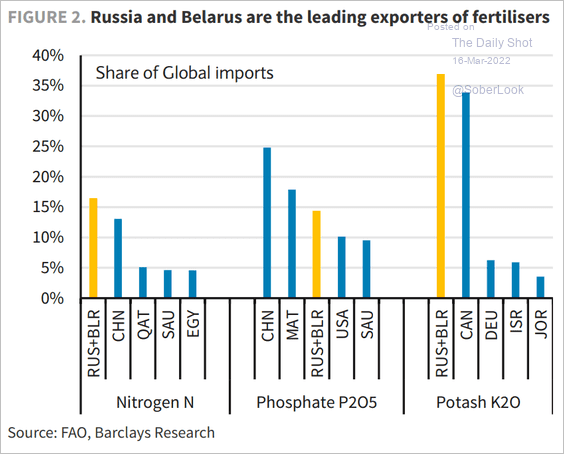

Commodities

1. Coffee futures are under pressure.

2. US corn exports have been strong.

Source: @kannbwx

Source: @kannbwx

3. Who are the largest fertilizer exporters?

Source: Barclays Research

Source: Barclays Research

Back to Index

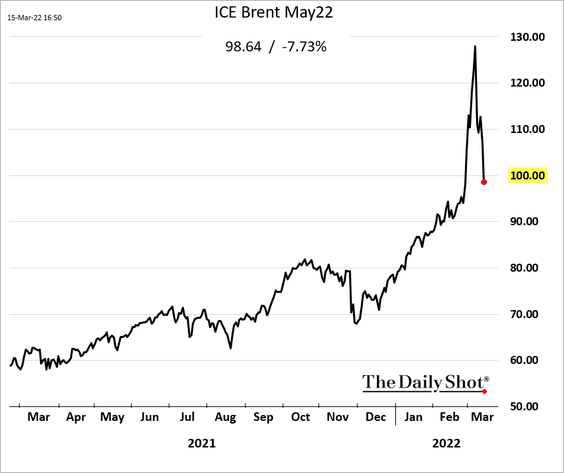

Energy

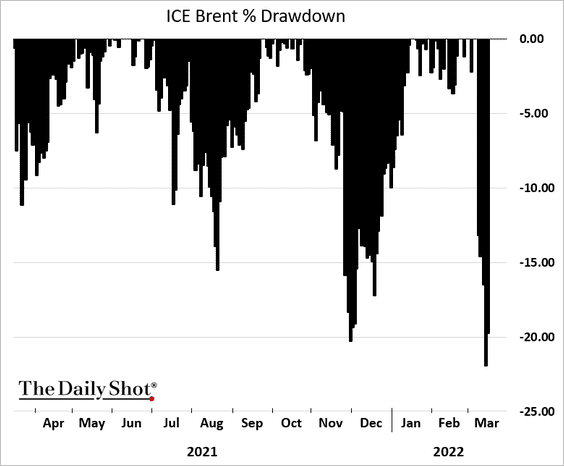

1. Brent crude dipped below $100/bbl, …

.. entering bear market territory.

——————–

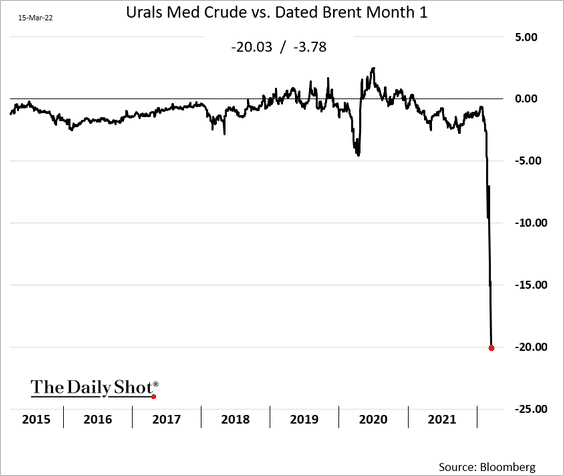

2. Russian crude oil discount continues to widen, with sales becoming limited to buyers in China and India.

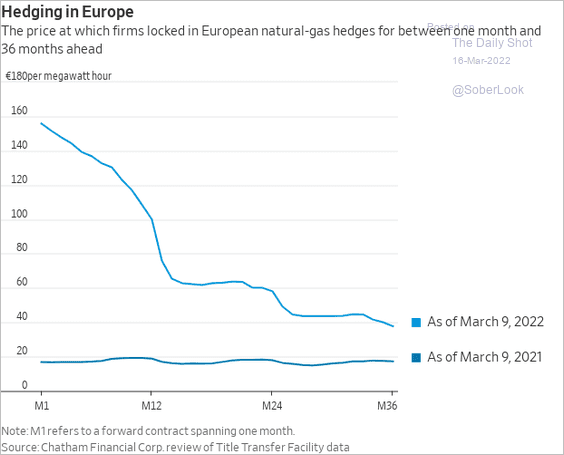

3. European companies that hedged their natural gas purchases a year ago will have a temporary reprieve from the price spike.

Source: @WSJ Read full article

Source: @WSJ Read full article

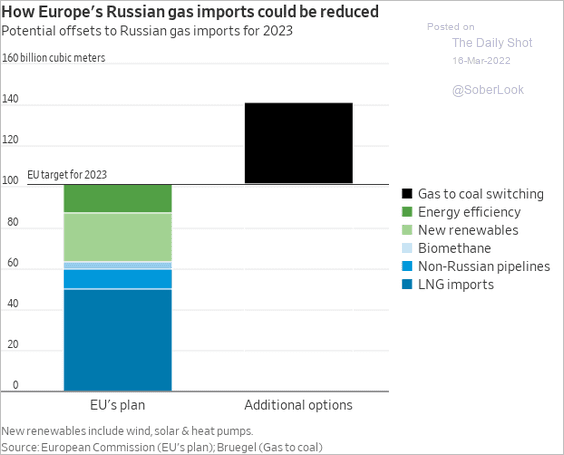

What would it take to shift away from Russian gas?

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

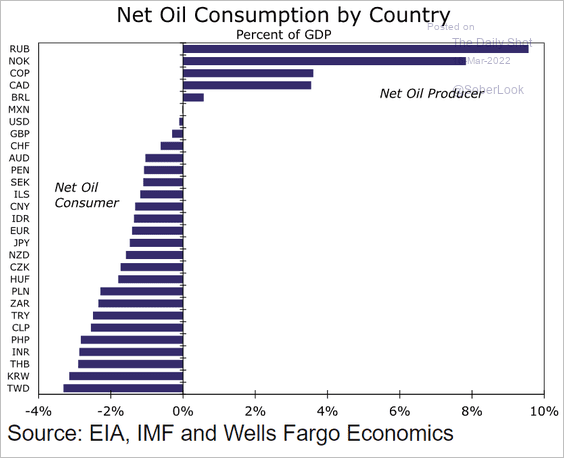

4. This chart shows net oil exports by country as a share of GDP.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

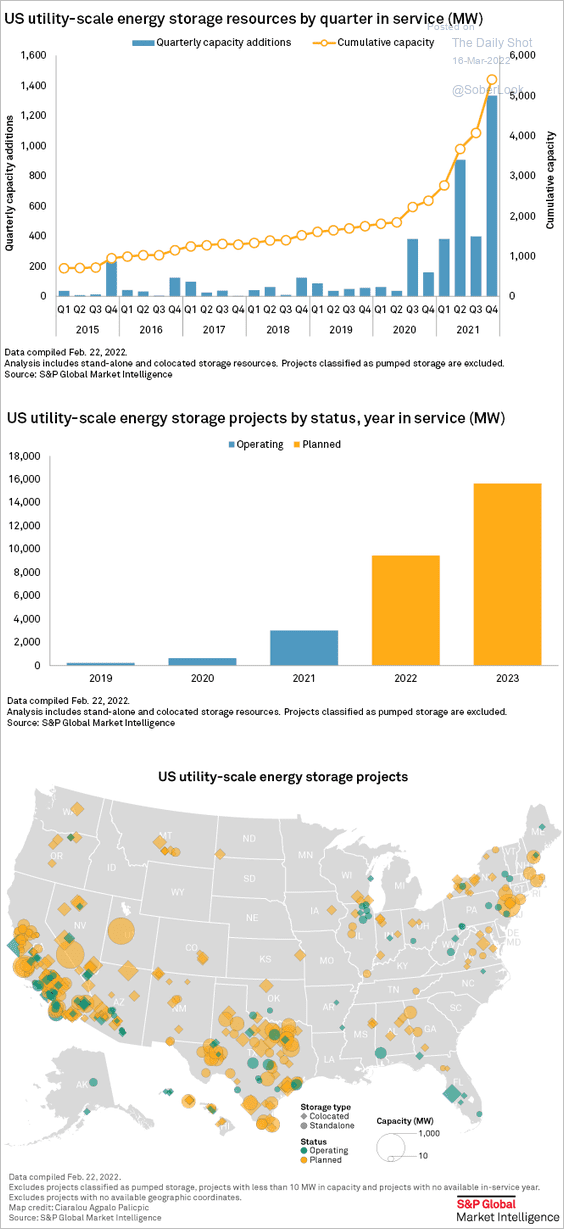

5. US commercial energy storage capacity is rising quickly.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Equities

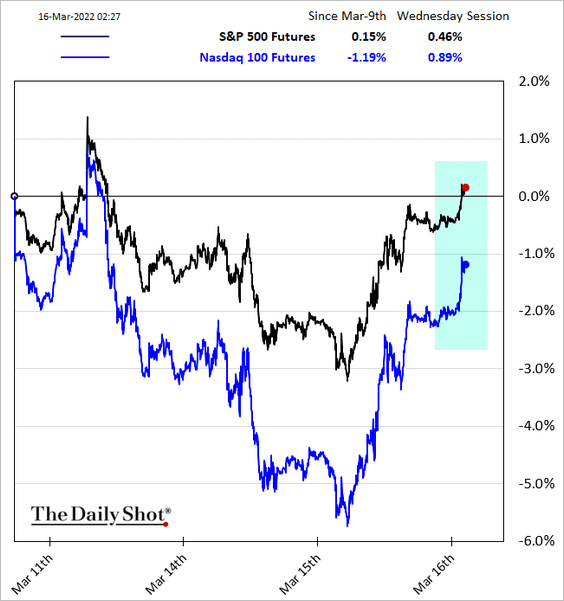

1. Stock futures are higher in response to Beijing’s announcement.

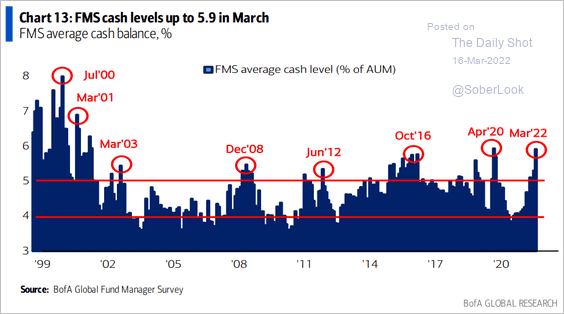

2. Fund managers’ cash levels are elevated, which tends to be a tailwind for stocks.

Source: BofA Global Research

Source: BofA Global Research

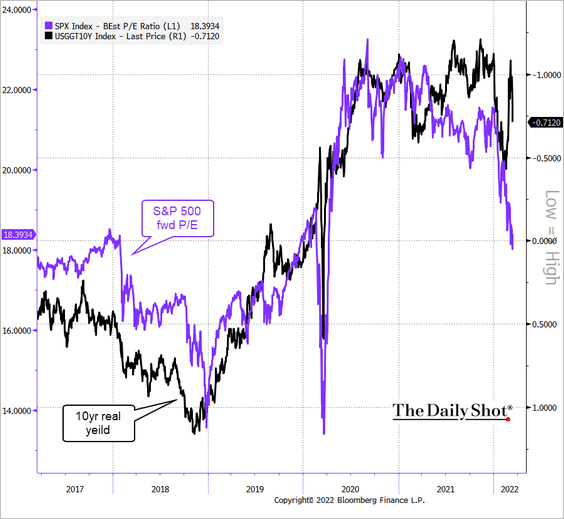

3. Real yields point to a rebound in stock valuations.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

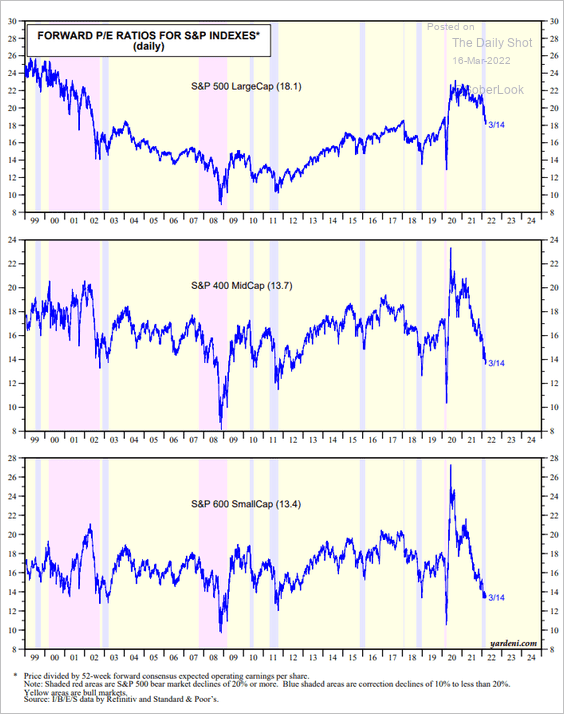

4. Mid- and small-cap valuations look attractive.

Source: Yardeni Research

Source: Yardeni Research

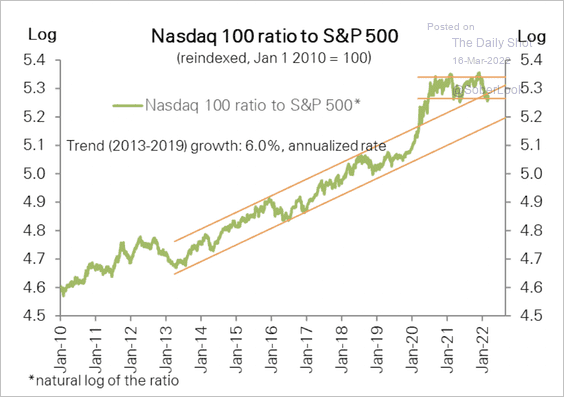

5. The Nasdaq 100 is still above long-term support relative to the S&P 500.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

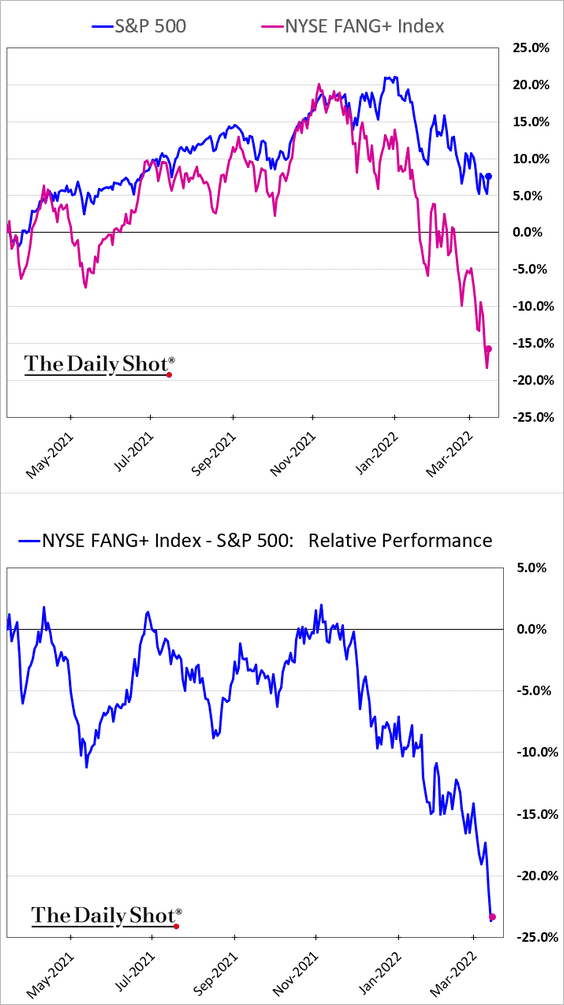

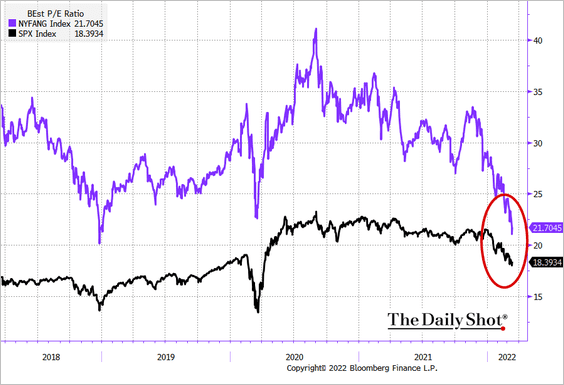

6. Mega-caps’ underperformance has been massive in recent months.

Mega-cap valuation premiums to the S&P 500 haven’t been this low in years.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

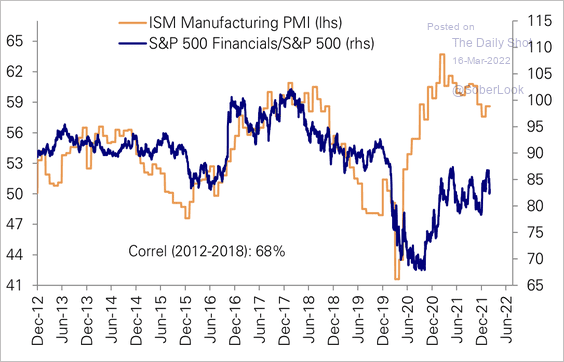

7. On a relative basis, financials have been disconnected from economic growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

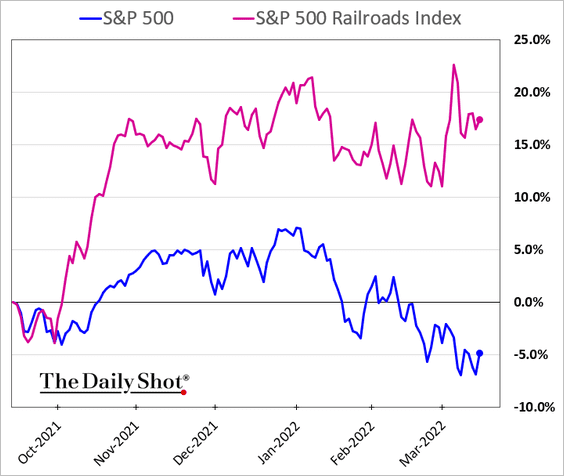

8. Railroad stocks have outperformed massively over the past six months as freight rates surged.

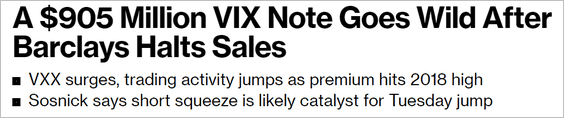

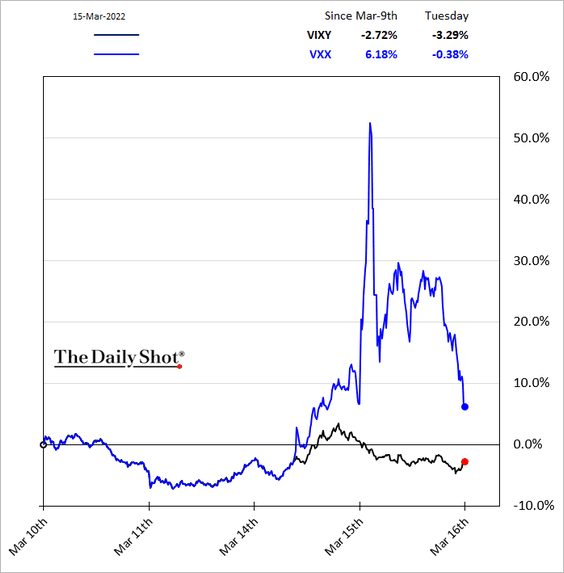

9. VXX ETN (long VIX product) got caught in a short squeeze as Barclays halted sales.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

These two ETNs are basically the same product.

Back to Index

Credit

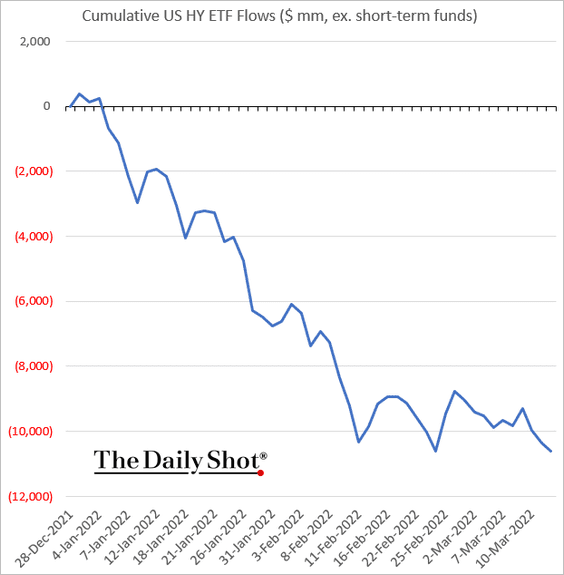

1. High-yield fund flows have been ugly this year.

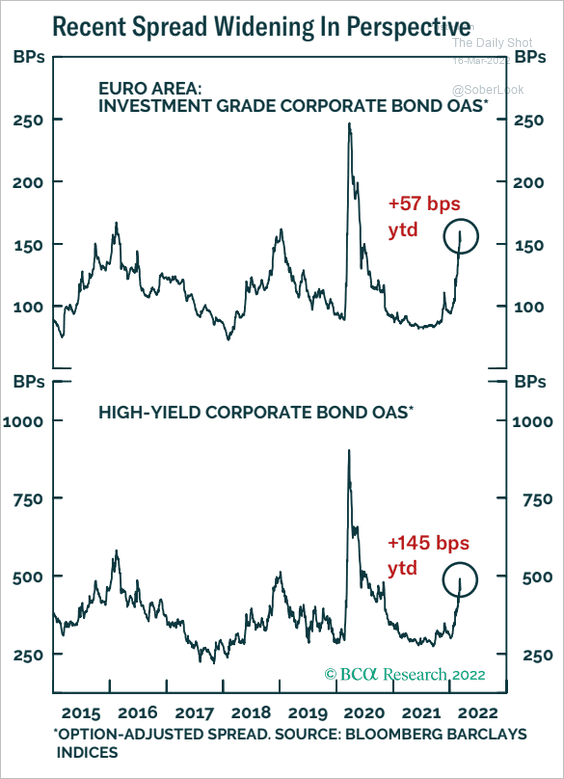

2. Spreads have risen substantially year-to-date.

Source: BCA Research

Source: BCA Research

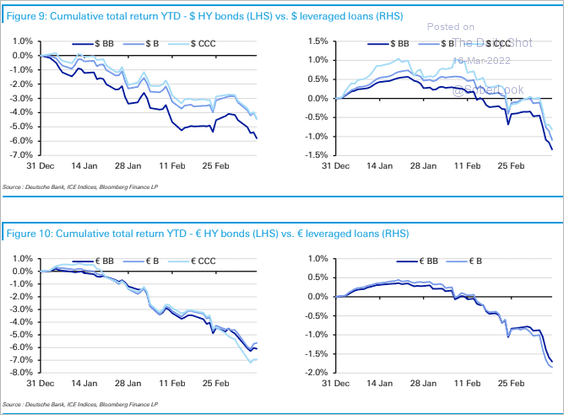

3. US lower-rated credits outperformed year-to-date due to high exposure to energy names.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

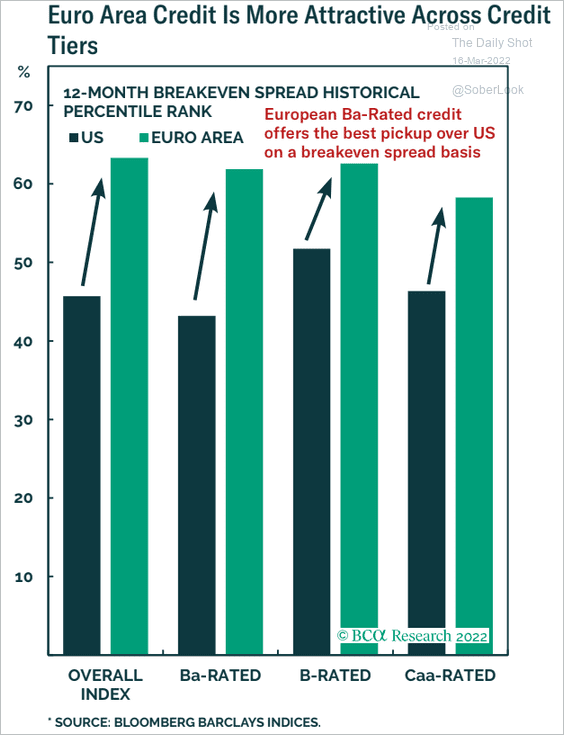

4. European credit looks attractive relative to the US.

Source: BCA Research

Source: BCA Research

Back to Index

Rates

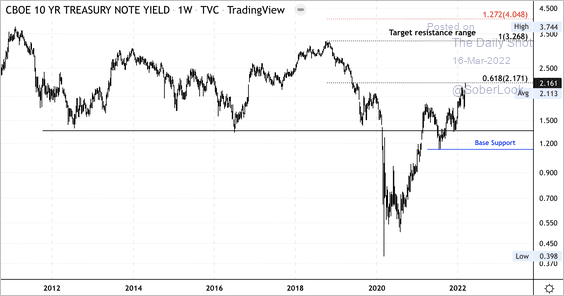

1. The 10-year Treasury yield faces long-term resistance near 3%.

Source: Dantes Outlook

Source: Dantes Outlook

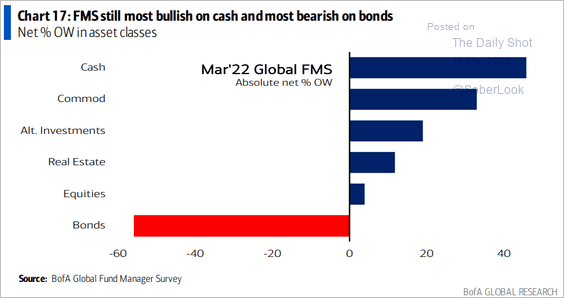

2. Fund managers have been very bearish on bonds.

Source: BofA Global Research

Source: BofA Global Research

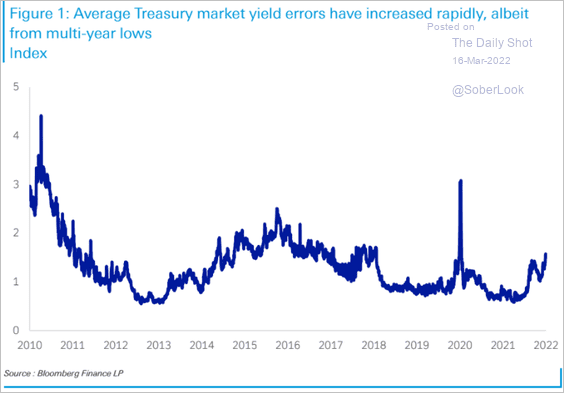

3. Treasury market liquidity has worsened in recent months.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Global Developments

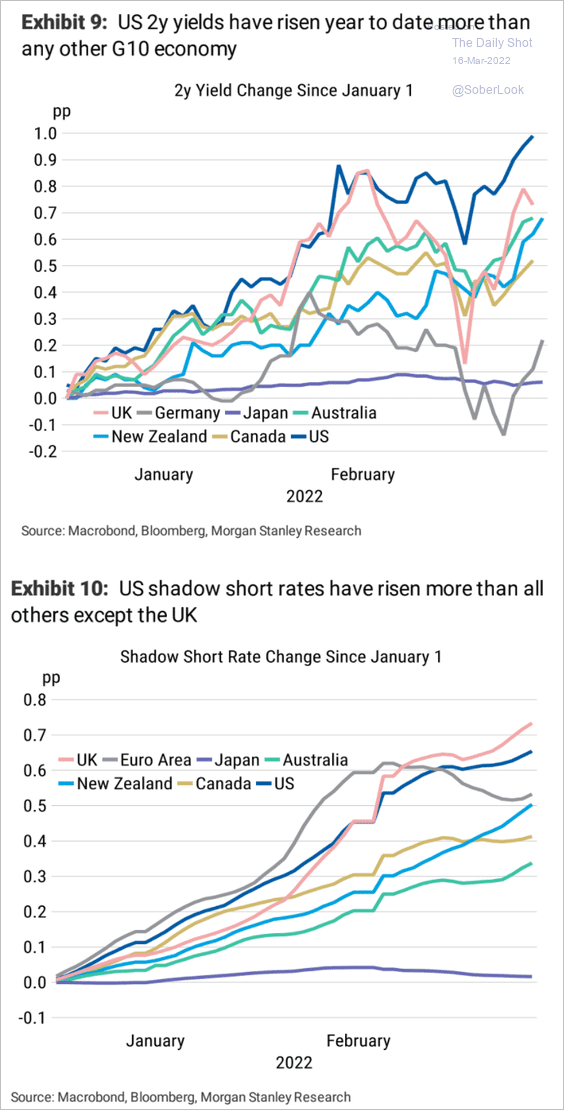

1. Let’s start with the evolution of short-term rates in advanced economies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

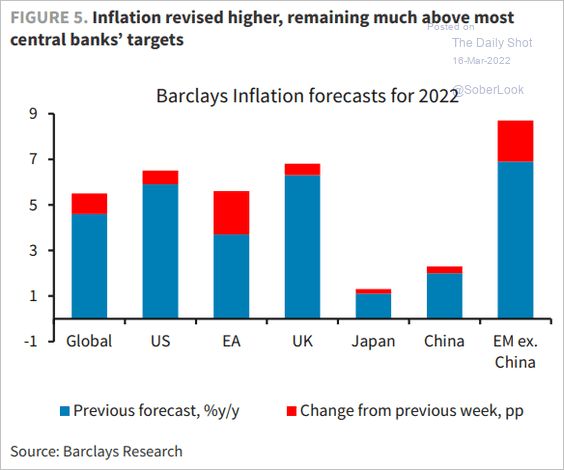

2. Economists keep boosting their inflation forecasts.

Source: Barclays Research

Source: Barclays Research

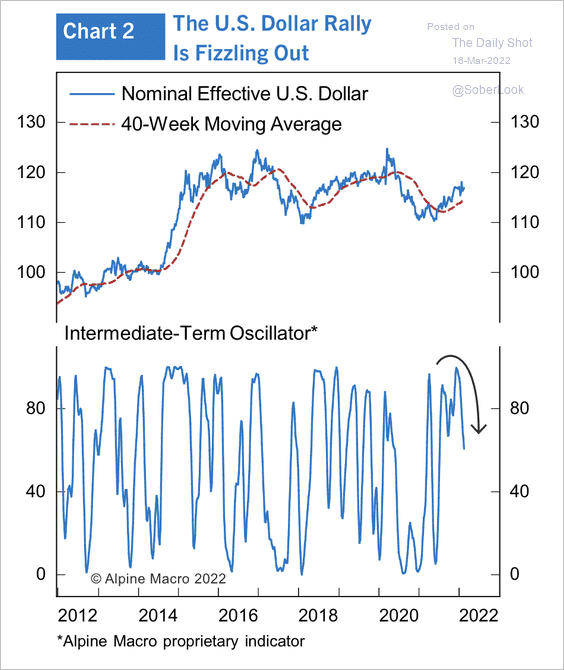

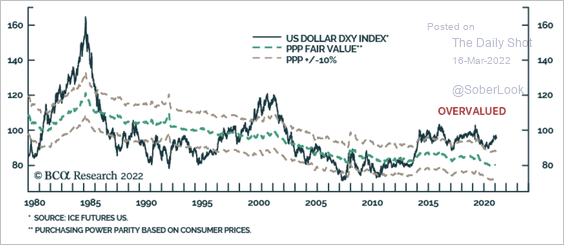

3. The dollar appears overbought/overvalued over the short term (2 charts).

Source: Alpine Macro

Source: Alpine Macro

Source: BCA Research

Source: BCA Research

——————–

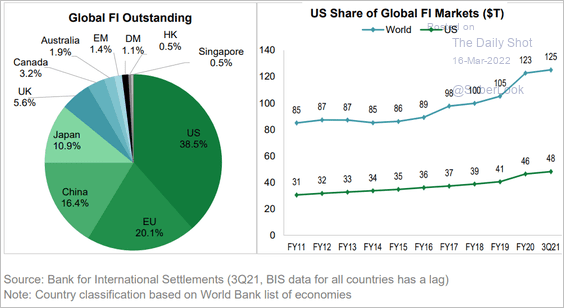

4. Here is an overview of the global fixed-income market.

Source: SIFMA

Source: SIFMA

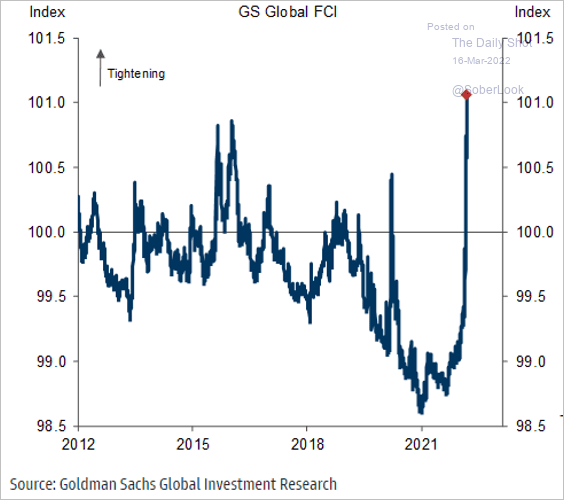

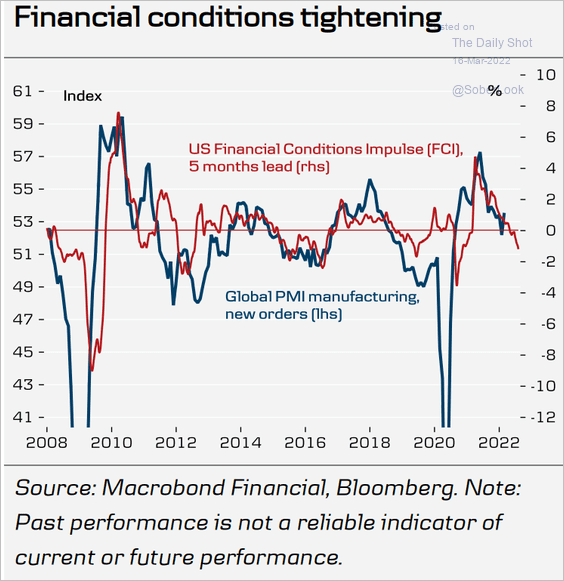

5. Financial conditions have tightened sharply.

Source: Goldman Sachs

Source: Goldman Sachs

That indicates slower economic activity ahead.

Source: Danske Bank

Source: Danske Bank

——————–

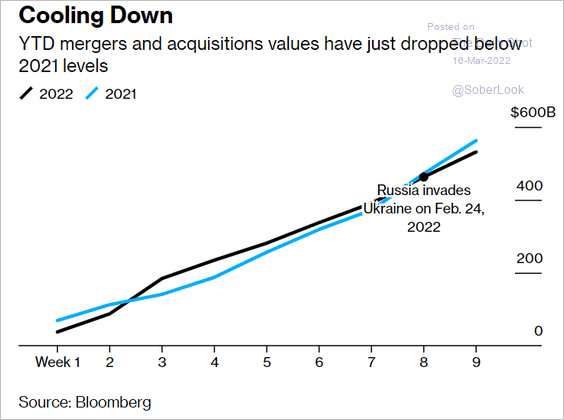

6. M&A activity is slowing.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

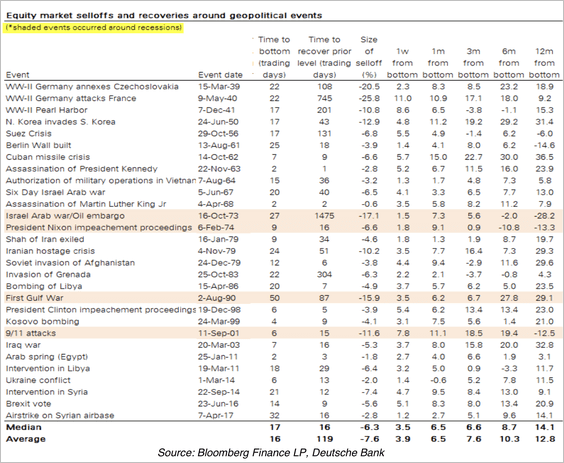

7. Historically, the market response to geopolitical events has been sharp but short-lived.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

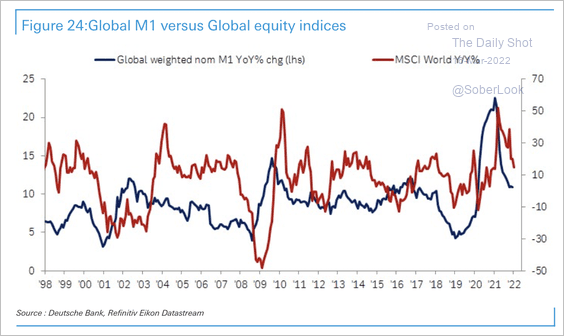

8. The sell-off in global equities occurred alongside a decline in the money supply.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

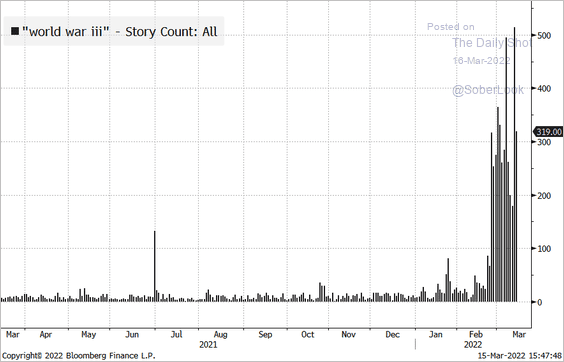

1. Daily news stories mentioning World War III:

Source: @M_McDonough

Source: @M_McDonough

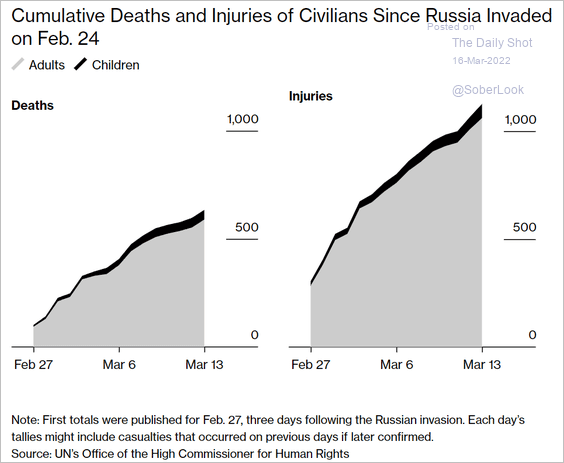

2. Civilian deaths and injuries in Ukraine:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

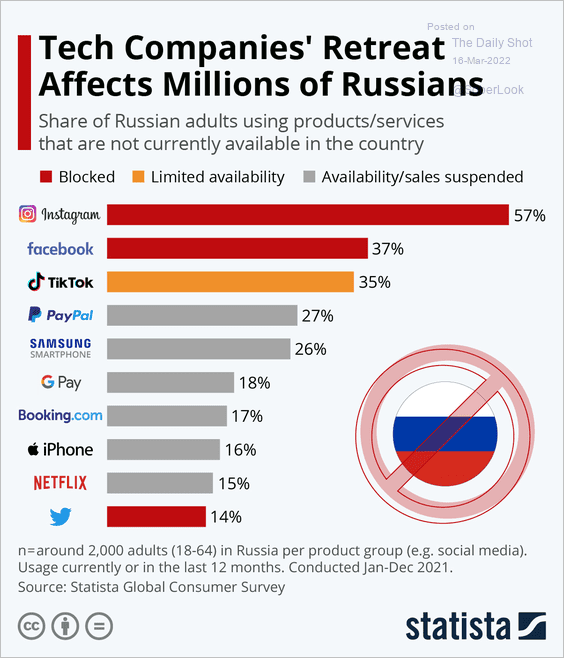

3. The loss of access to tech platforms in Russia:

Source: Statista

Source: Statista

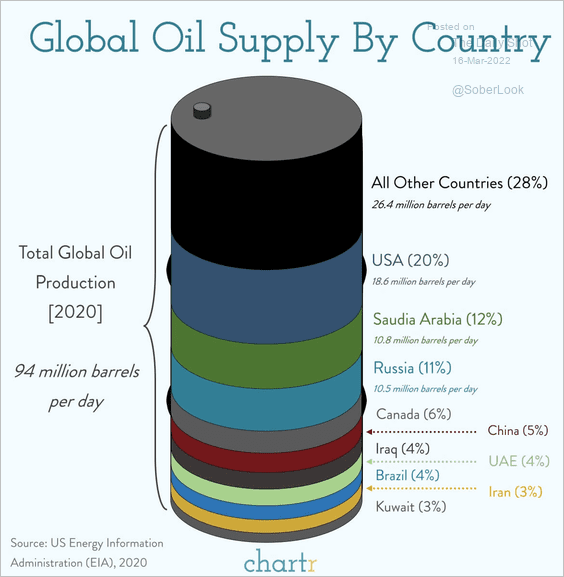

4. Global oil production:

Source: @chartrdaily

Source: @chartrdaily

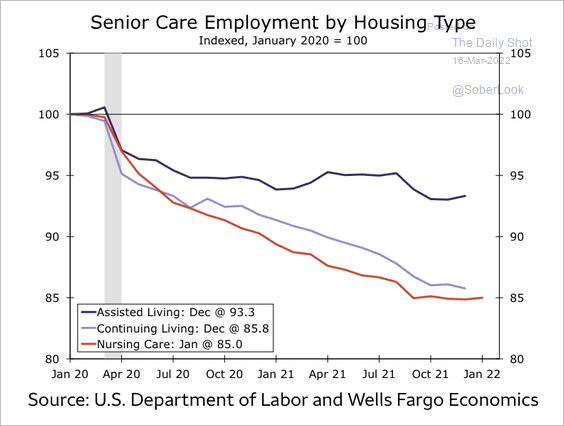

5. US assisted living employment:

Source: Wells Fargo Securities

Source: Wells Fargo Securities

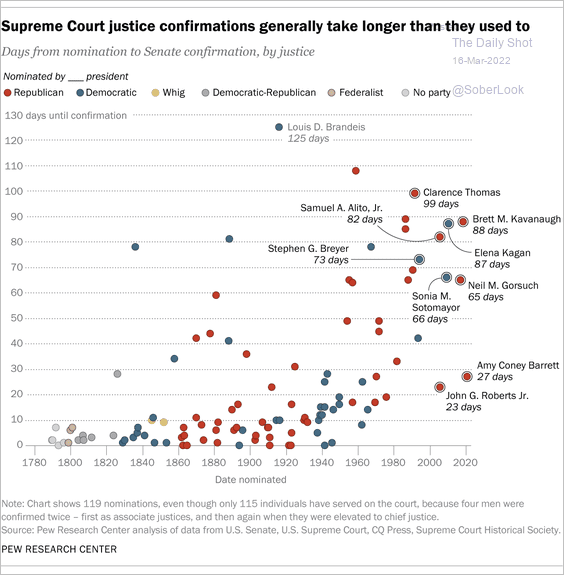

6. US Supreme Court justices’ confirmation process taking longer:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

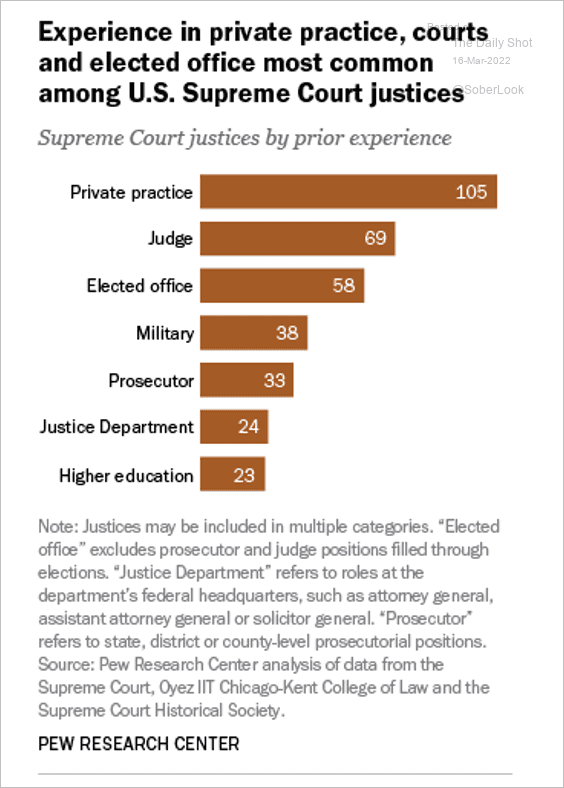

• US Supreme Court justices’ prior experience:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

——————–

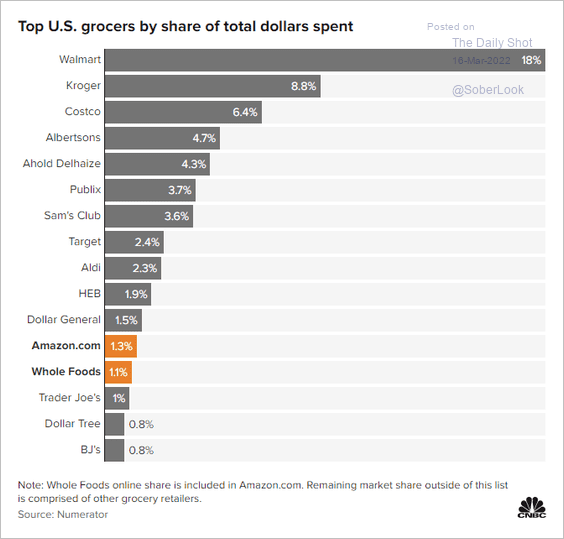

7. Top US grocers:

Source: @scottlincicome; CNBC Read full article

Source: @scottlincicome; CNBC Read full article

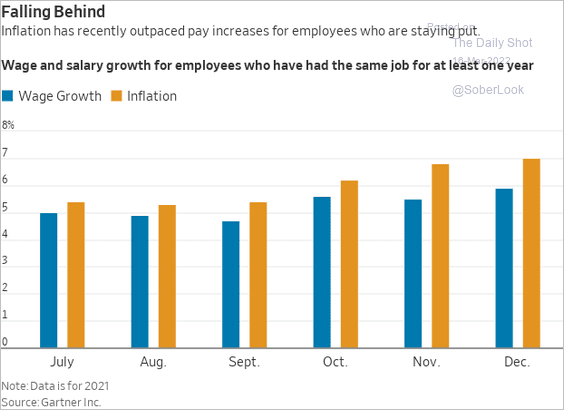

8. Wage growth vs. inflation:

Source: @WSJ Read full article

Source: @WSJ Read full article

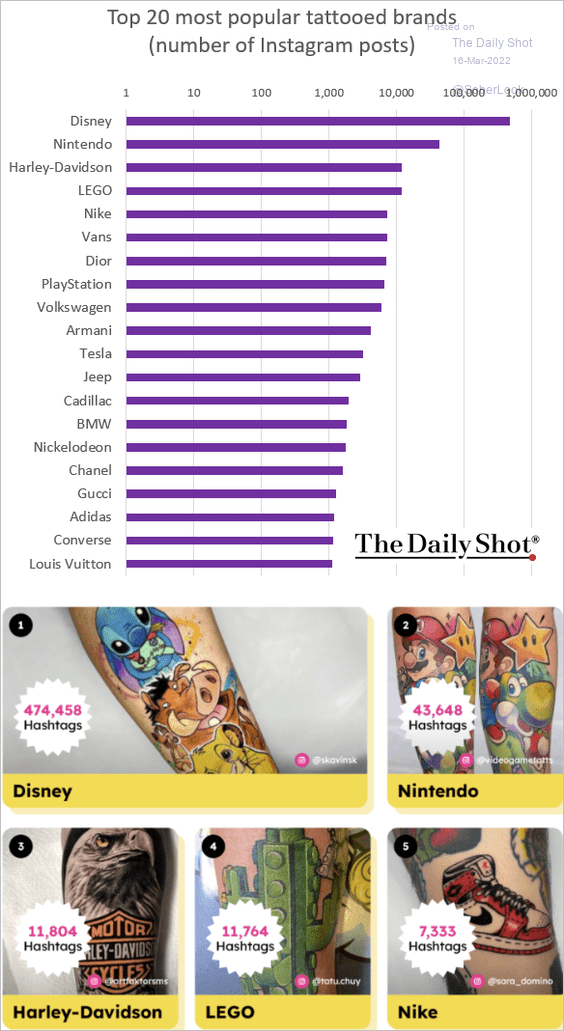

9. Most popular tattooed brands:

Source: DealA Read full article

Source: DealA Read full article

——————–

Back to Index