The Daily Shot: 17-Mar-22

• The United States

• Canada

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

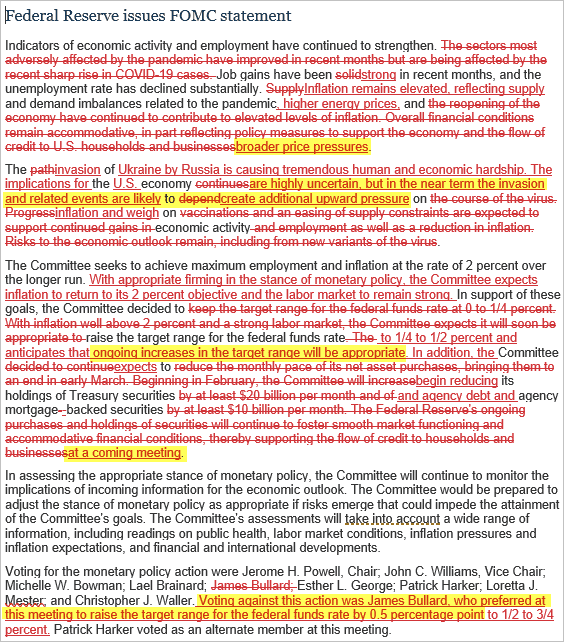

1. The Federal Reserve hiked rates by 25 basis points as expected. The statement and the rate projections were hawkish, as the central bank “plays catch-up.” Here are some takeaways.

– The Fed acknowledged “broader” price pressures.

– Russia’s invasion increases uncertainty but puts “upward pressure” on inflation.

– Rate hikes will continue.

– The balance sheet runoff could be announced in May. This time, the balance sheet reduction will likely be more aggressive than the last time (more than the $50 bn/month).

– James Bullard wanted to see a 50 bps hike (as he communicated earlier).

Here is the FOMC statement (changes vs. the previous version).

Source: @GregDaco

Source: @GregDaco

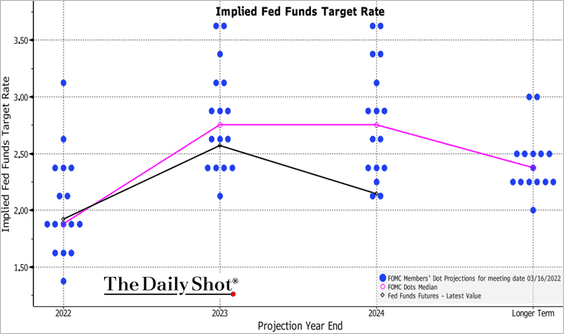

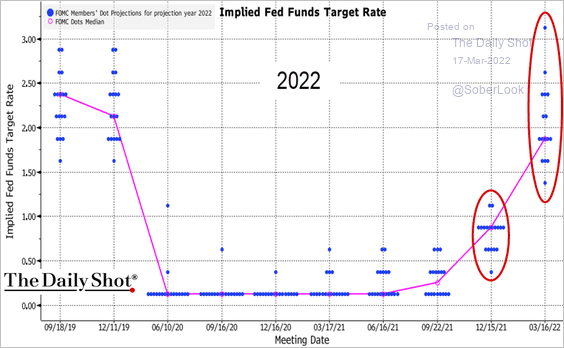

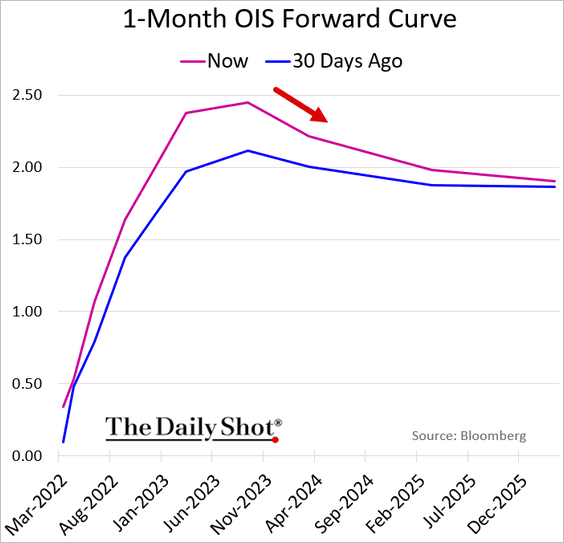

• The dot plot has six more rate hikes in 2022. The FOMC now expects to be done hiking rates by the end of next year. The market sees rate cuts in 2024.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The dispersion of rate projections for this year has exploded, highlighting increased uncertainty.

Source: LPL Research

Source: LPL Research

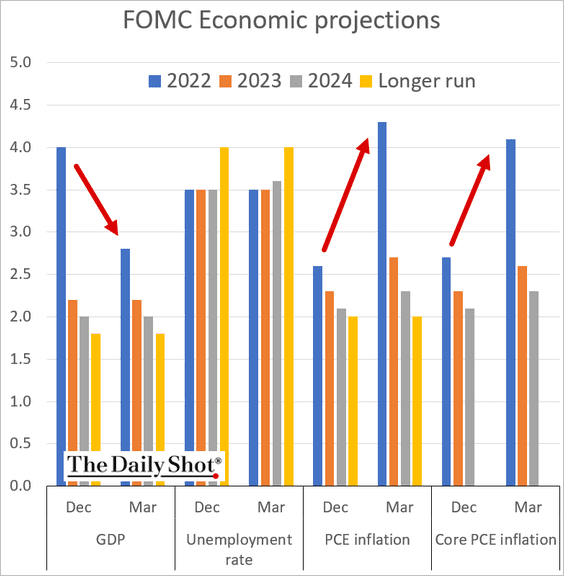

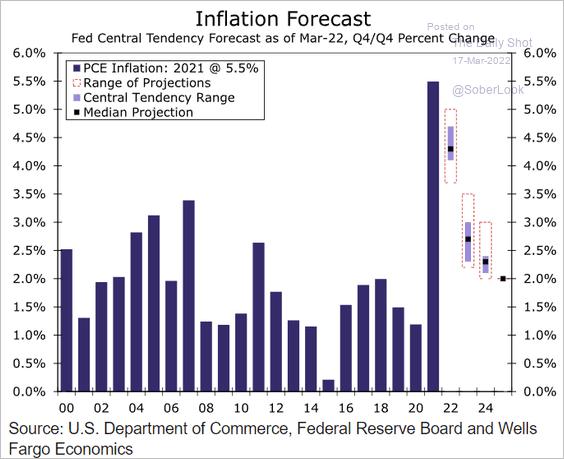

• As expected, the FOMC reduced the 2022 GDP projection and raised inflation forecasts across the board.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

——————–

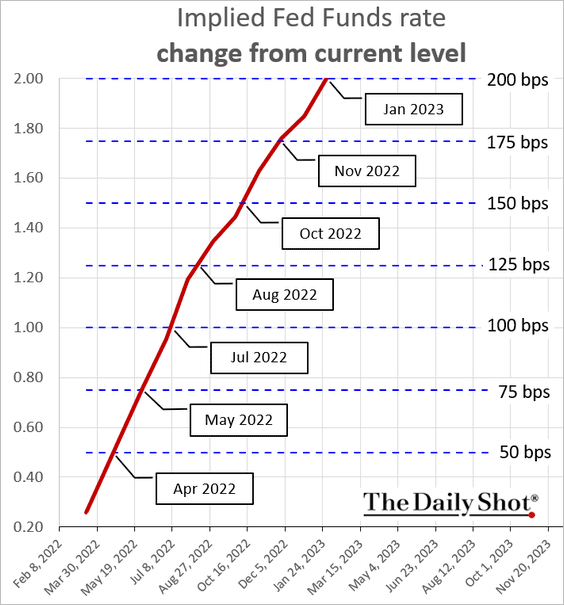

2. The market is roughly aligned with the dot-plot for 2022.

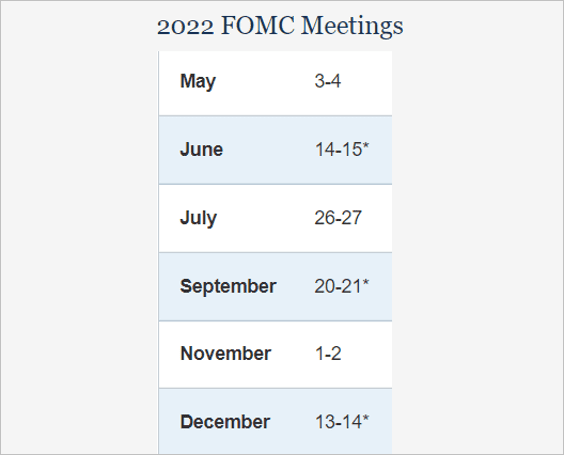

By the way, while the chart above shows the next hike priced in for April, there is no April FOMC meeting. Will we see a 50 bps hike in May?

The market expects rate cuts to begin in early 2024, diverging from the dot-plot.

——————–

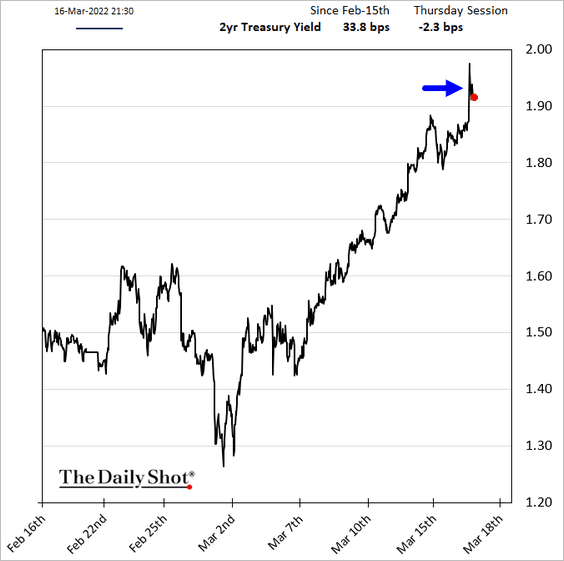

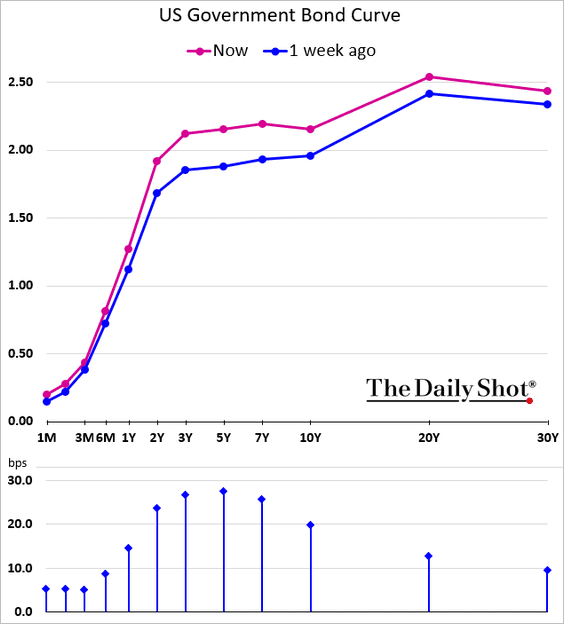

3. Short-term Treasury yields jumped.

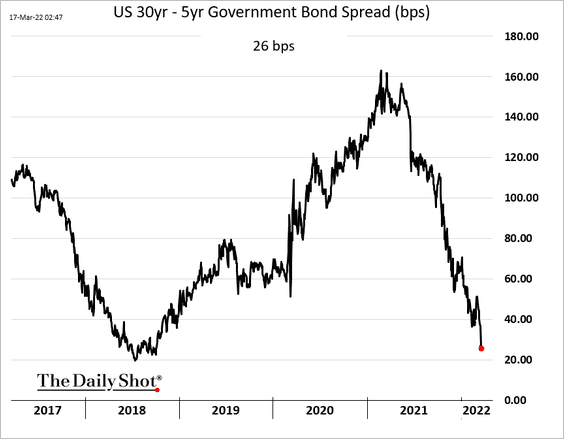

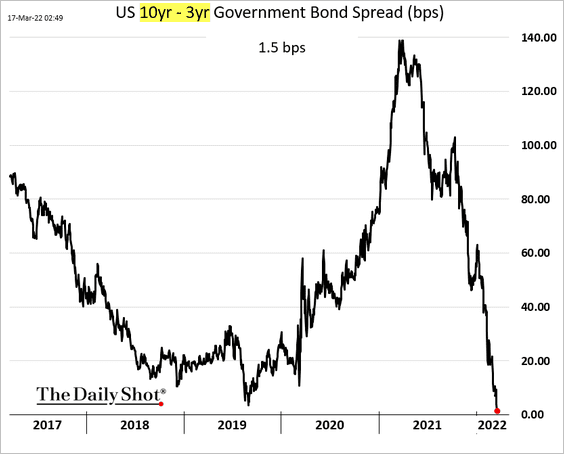

The Treasury curve flattened further.

The 3-year – 10-year portion of the yield curve is about to invert, …

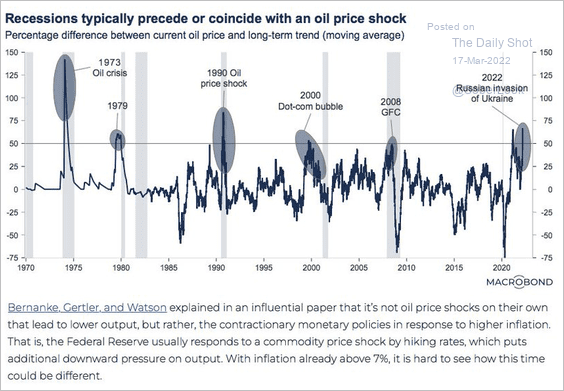

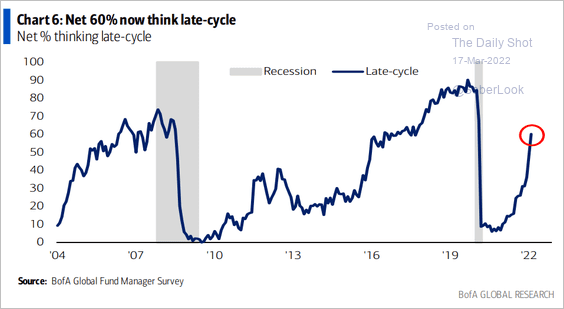

… as market participants worry about recession.

Source: @heimbergecon

Source: @heimbergecon

Source: BofA Global Research

Source: BofA Global Research

——————–

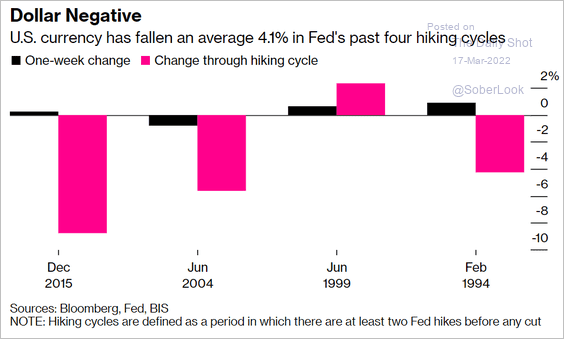

4. Fed hikes tend to be negative for the dollar over the full cycle.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

——————–

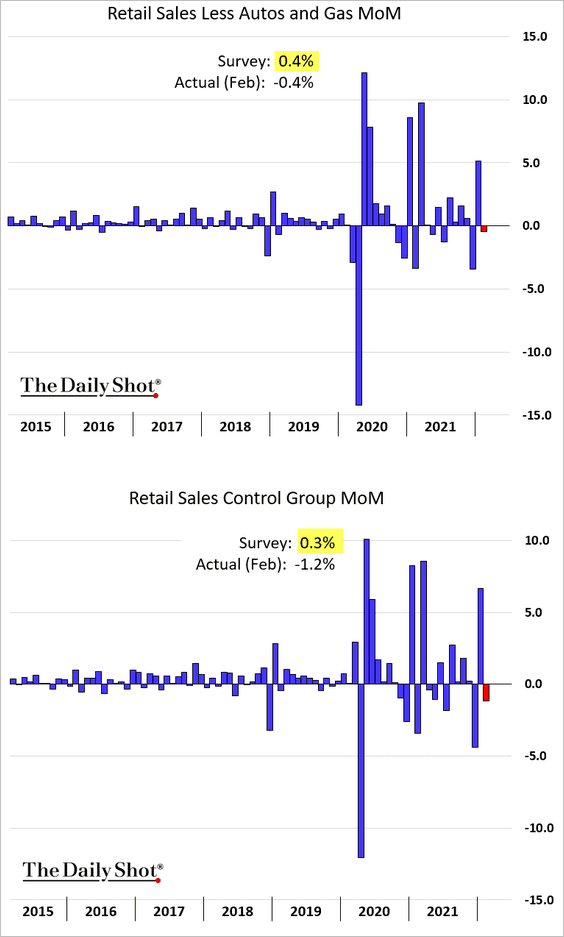

5. Retail sales were softer than expected last month as inflation takes a toll on spending. We will have more updates on this report tomorrow.

6. Homebuilders are becoming less upbeat.

Source: MarketWatch Read full article

Source: MarketWatch Read full article

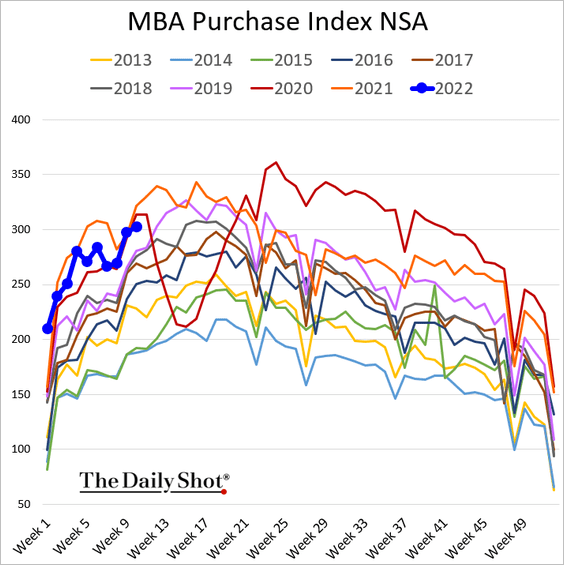

Mortgage applications were below the 2020 and 2021 levels last week.

——————–

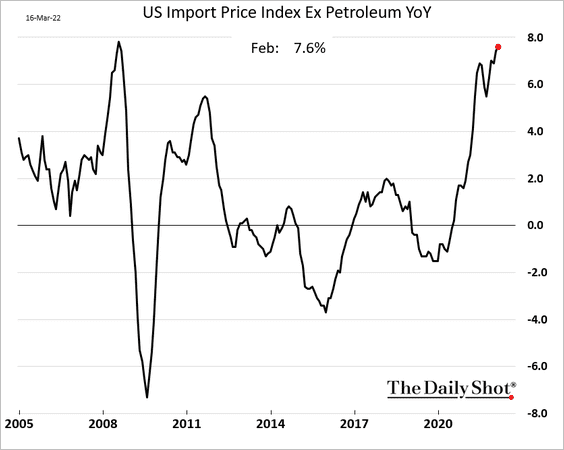

7. Import price gains continue to climb.

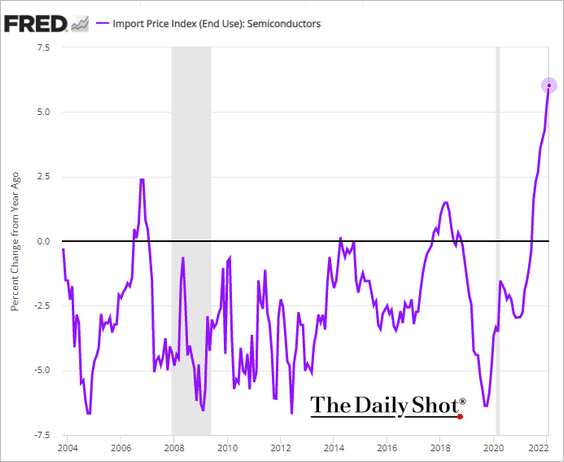

This chart shows import price inflation for semiconductors.

Back to Index

Canada

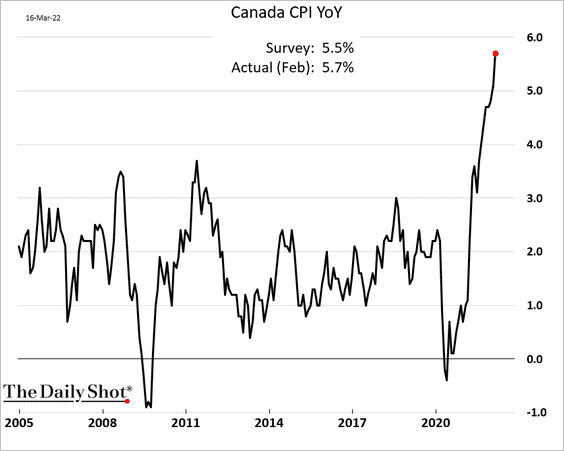

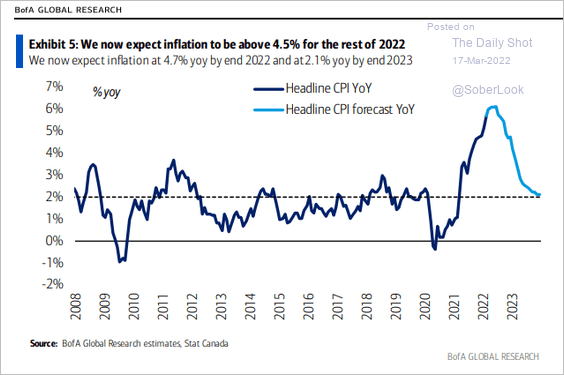

1. Inflation topped expectations, …

… and is yet to peak.

Source: BofA Global Research; @MikeZaccardi

Source: BofA Global Research; @MikeZaccardi

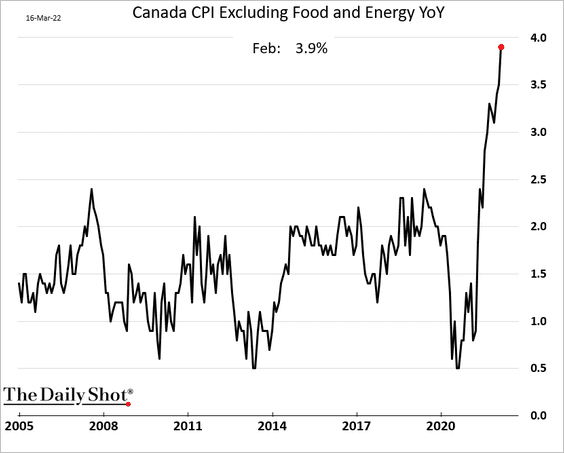

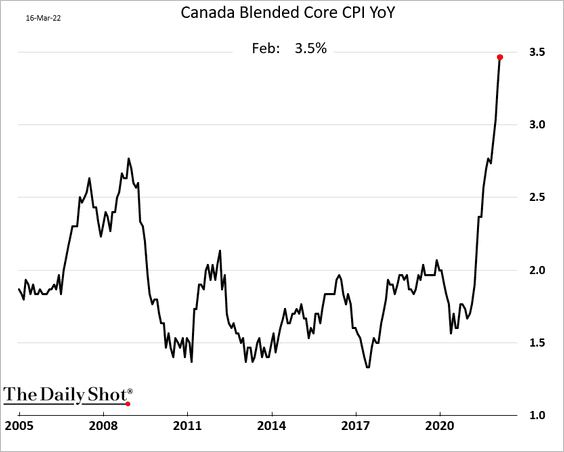

Core inflation measures are surging, …

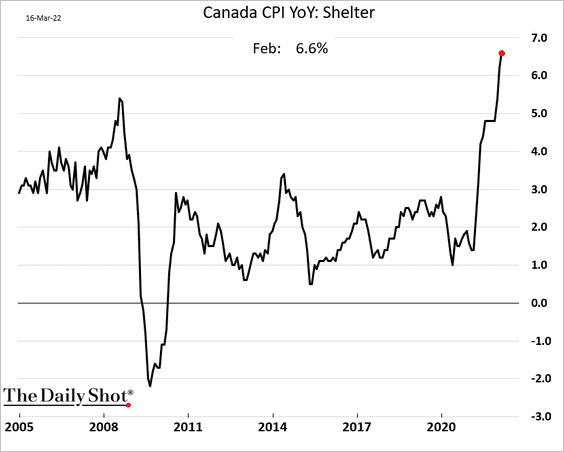

… as shelter price gains accelerate.

——————–

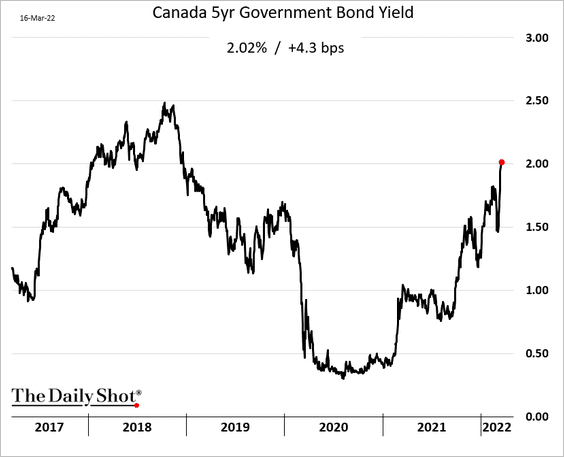

2. Short-term yields are climbing quickly.

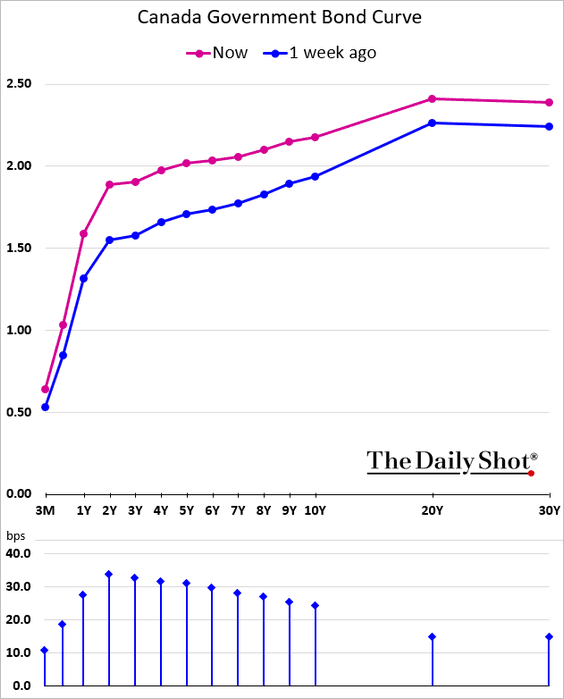

The yield curve is flattening.

——————–

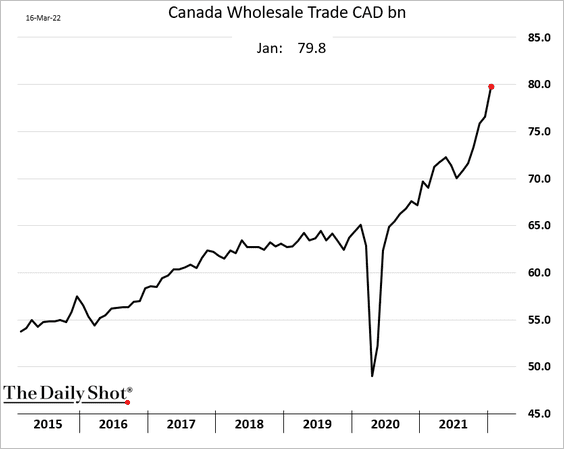

3. Wholesale trade accelerated over the past year.

Back to Index

Europe

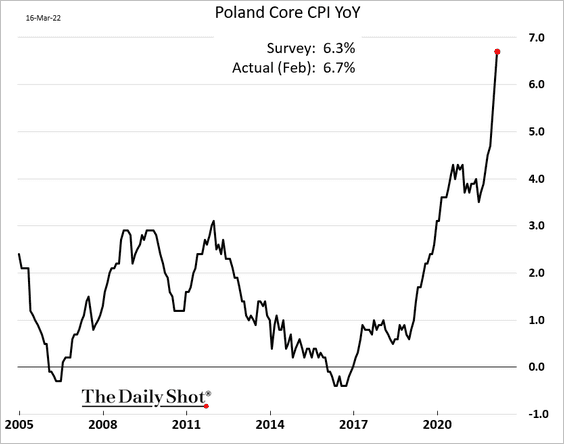

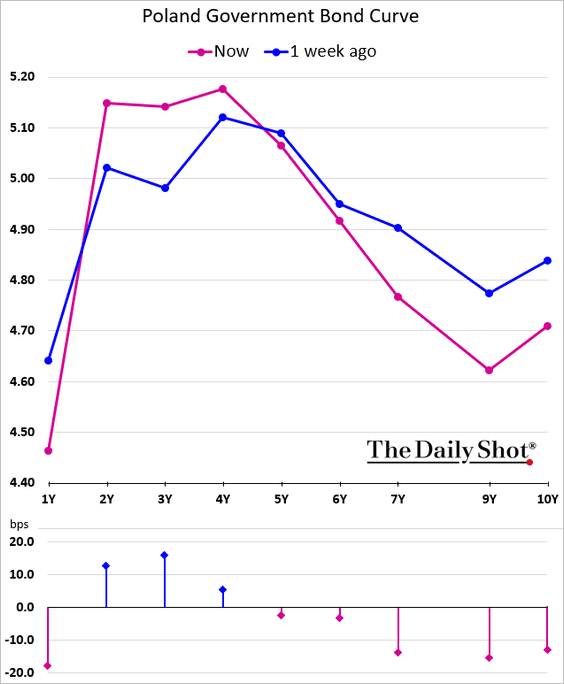

1. Poland’s inflation keeps exceeding forecasts.

The yield curve is heavily inverted at the longer end.

——————–

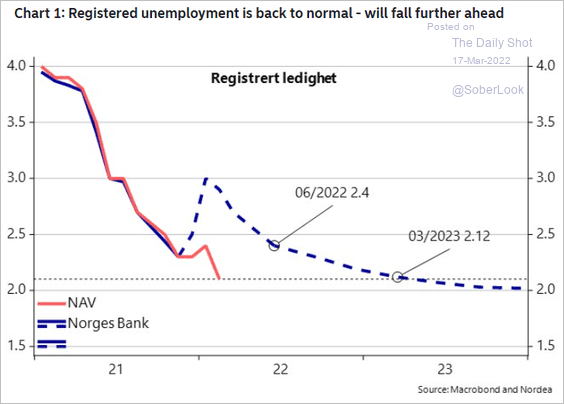

2. Norway’s labor market has recovered much faster than the central bank expected.

Source: Nordea Markets

Source: Nordea Markets

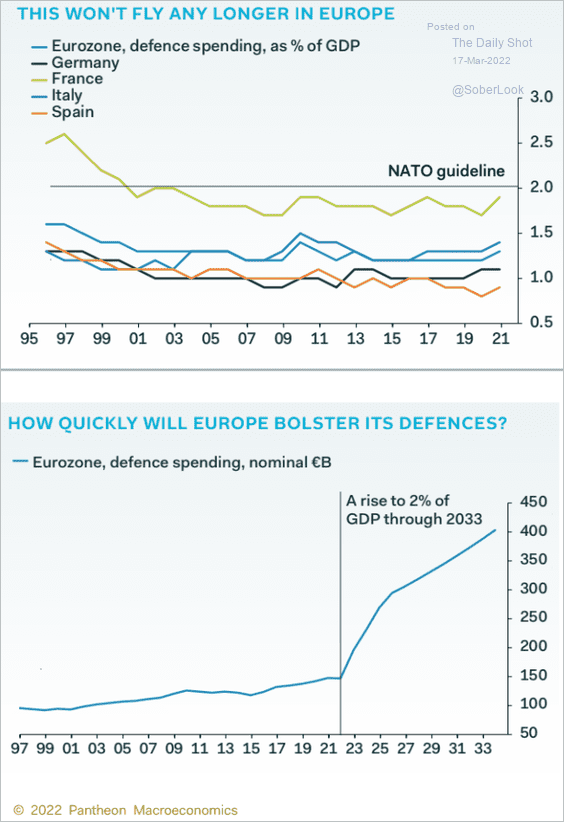

3. EU defense spending is going up substantially.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Asia – Pacific

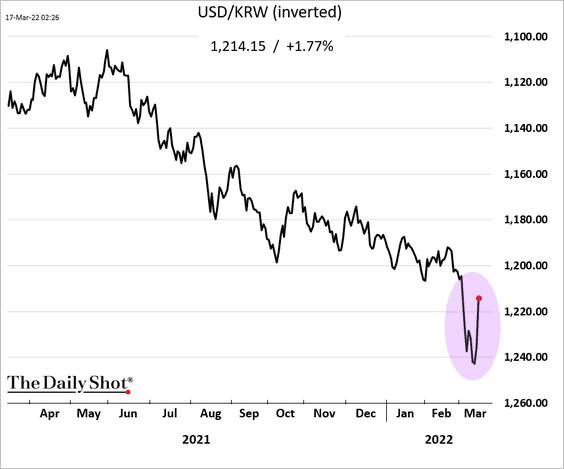

1. Asian currencies are up sharply after Beijing’s decision to prop up capital markets. Here is the South Korean won.

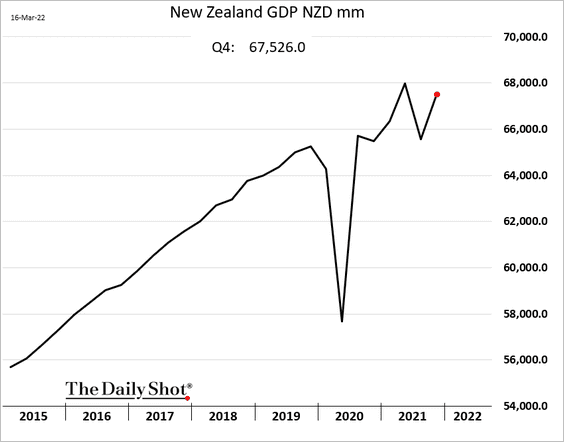

2. New Zealand’s GDP rebounded in Q4 after the lockdown-driven slump.

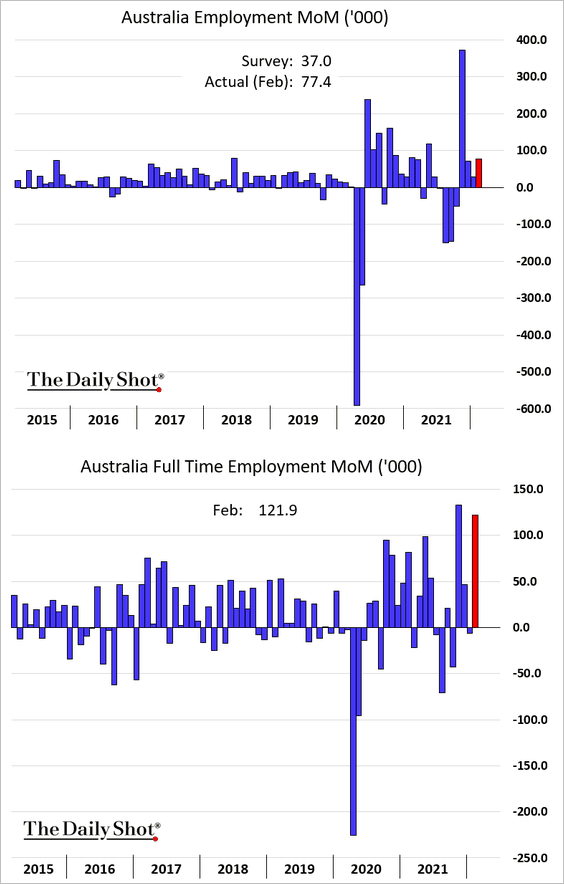

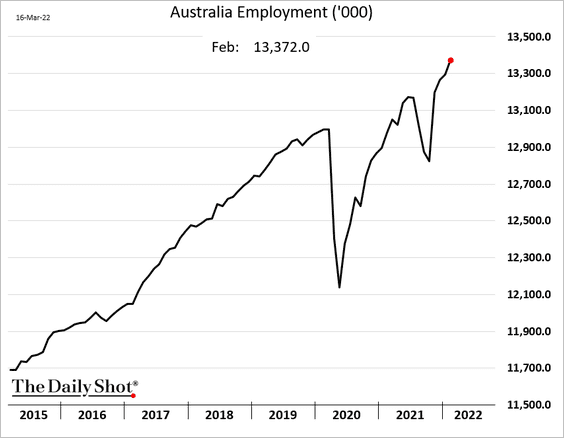

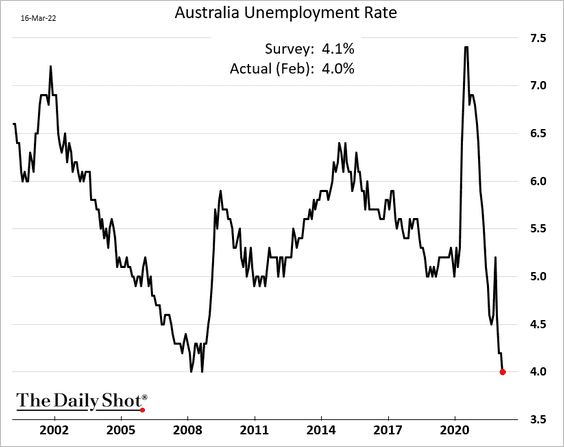

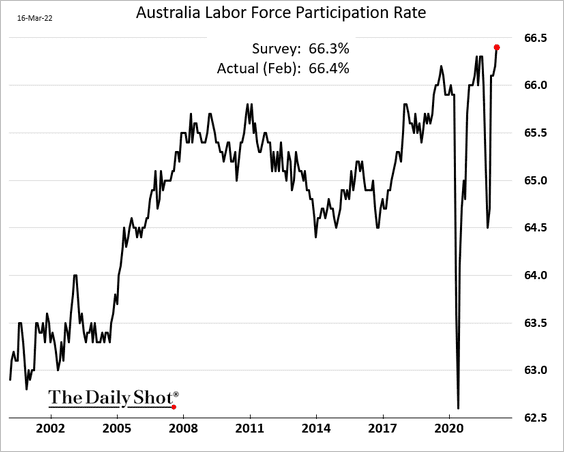

3. Next, we have some updates on Australia.

• The employment report topped forecasts, with substantial gains in full-time jobs.

The labor market is growing quickly.

The unemployment rate hit 4% for the first time since 2008.

Labor force participation has been impressive.

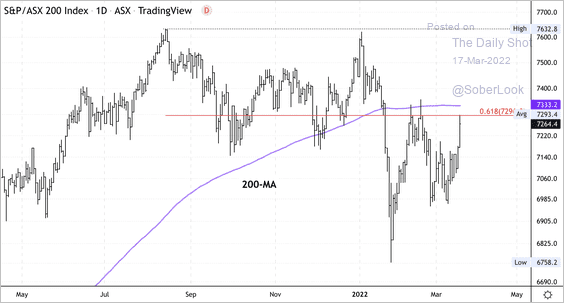

• The ASX is approaching resistance at its 200-day moving average.

Source: Dantes Outlook

Source: Dantes Outlook

Back to Index

China

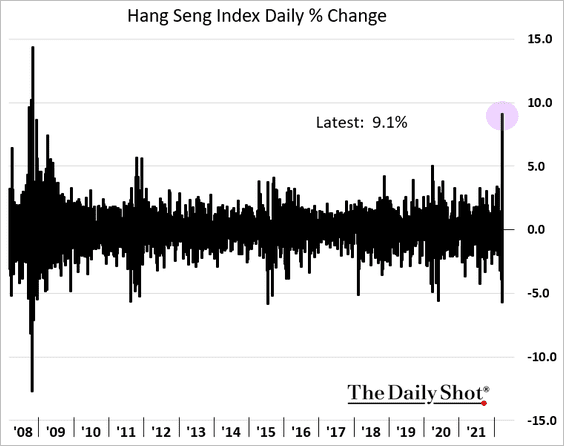

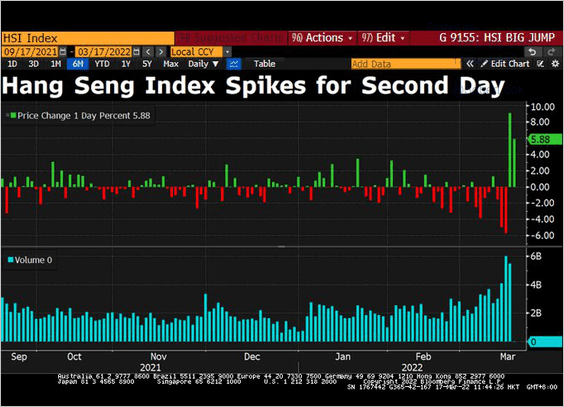

1. Hong Kong stocks saw a massive rebound yesterday after Beijing’s announcement, …

… and price gains continued today.

Source: @DavidInglesTV

Source: @DavidInglesTV

——————–

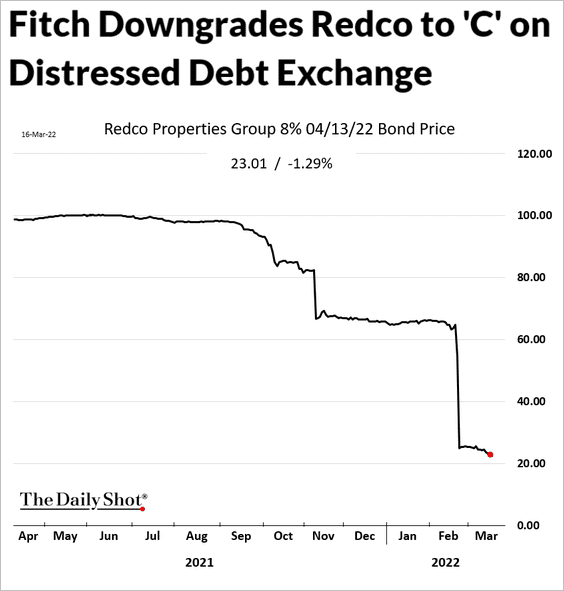

2. Developers’ credit problems are far from over.

Source: Fitch Ratings Read full article

Source: Fitch Ratings Read full article

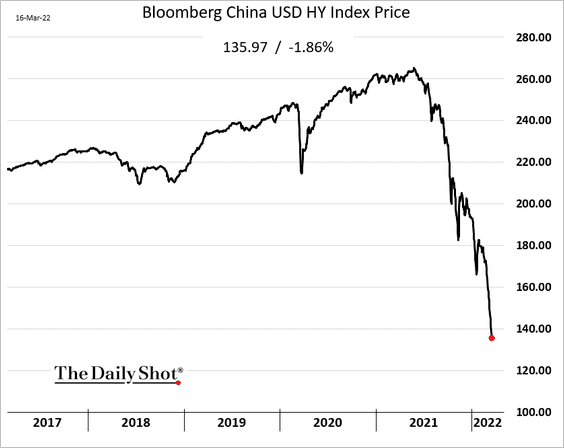

Here is the USD-denominated HY index (price)

——————–

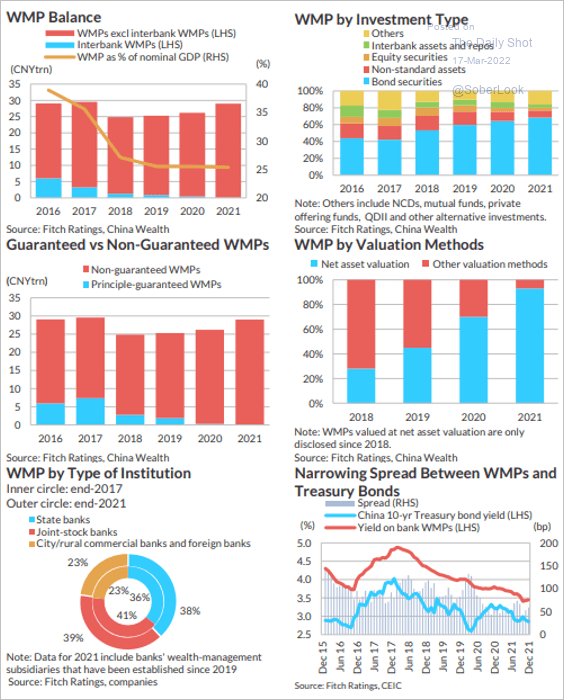

3. The wealth management product (WMP) industry risk profile has been improving.

Source: Fitch Ratings

Source: Fitch Ratings

Back to Index

Emerging Markets

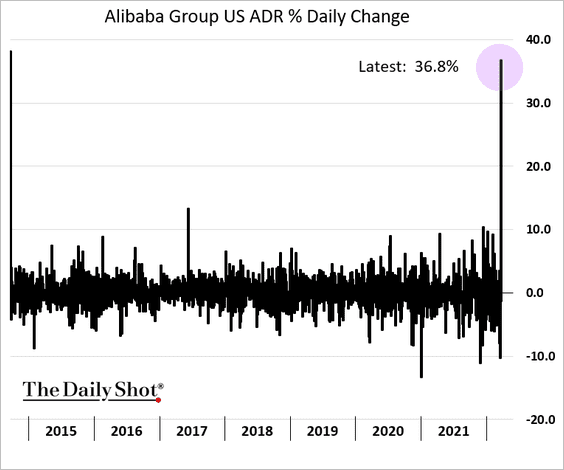

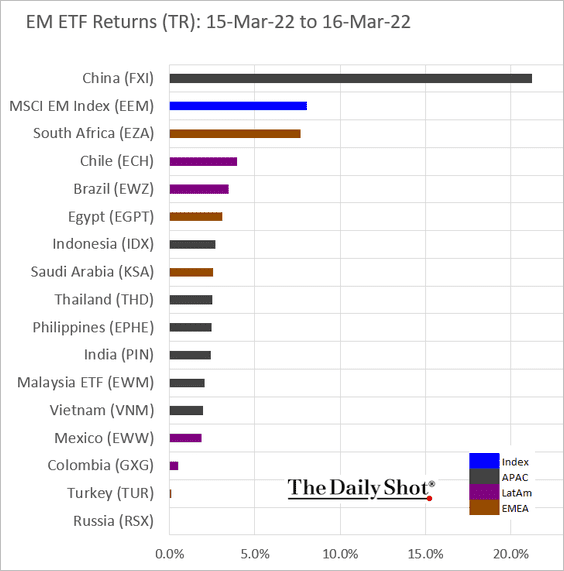

1. Beijing’s effort to stimulate the stock market boosted EM ETFs.

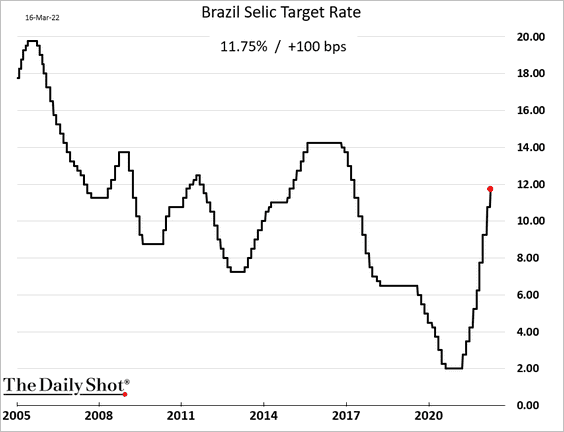

2. Brazil’s central bank hiked rates by 100 bps, lower than the previous increase. There is another one coming in May, but it’s not clear what happens after that.

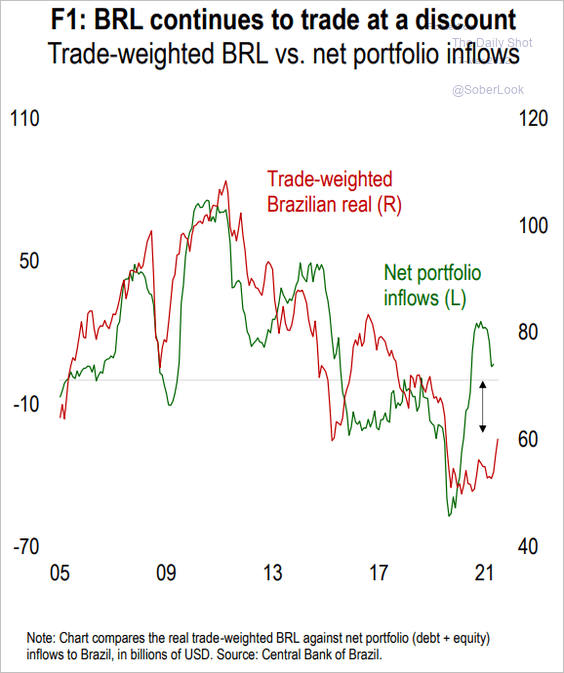

Is the real undervalued?

Source: Numera Analytics

Source: Numera Analytics

——————–

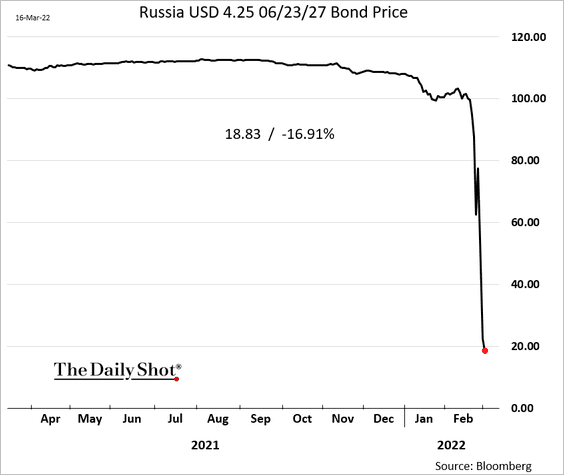

3. Will we see a rebound in Russian debt?

Source: CNN Business Read full article

Source: CNN Business Read full article

——————–

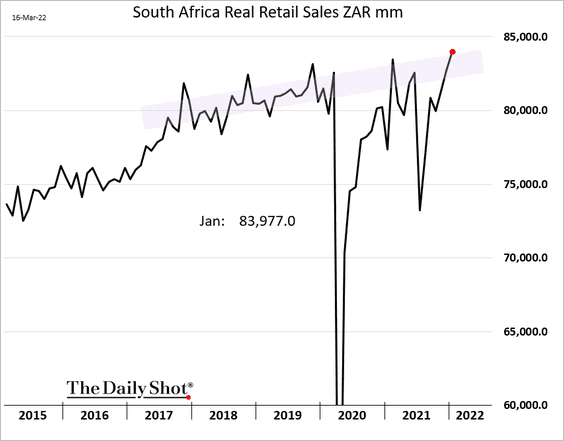

4. South African retail sales have been strong.

Back to Index

Cryptocurrency

1. Ukraine legalized crypto on Tuesday.

Source: CoinDesk Read full article

Source: CoinDesk Read full article

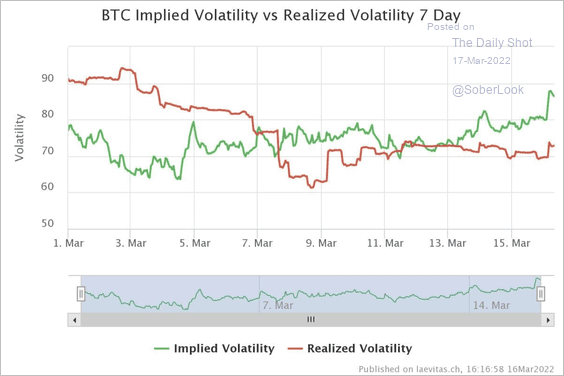

2. Bitcoin’s implied volatility is elevated versus realized volatility.

Source: @QCPCapital

Source: @QCPCapital

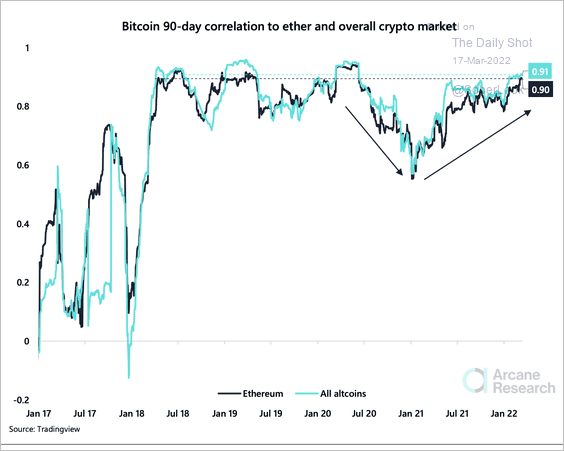

3. Bitcoin’s correlation with the overall crypto market is near all-time highs, which makes it difficult for investors who want to diversify across tokens.

Source: Arcane Research Read full article

Source: Arcane Research Read full article

Back to Index

Commodities

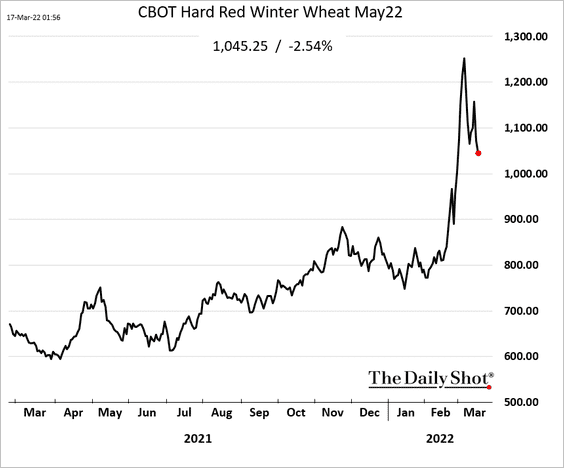

1. Grain prices are coming off the highs.

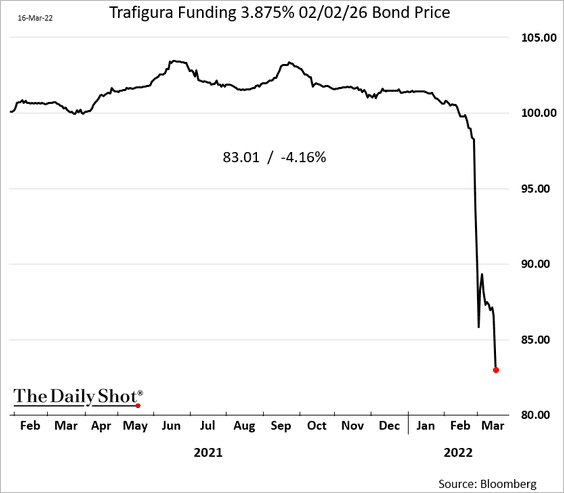

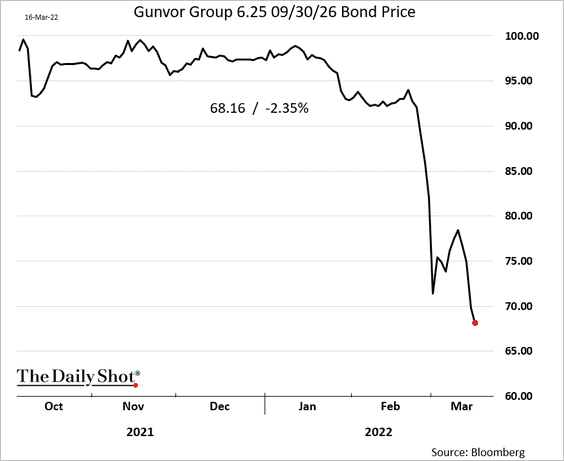

2. Commodity trading houses were hit with massive margin calls, which is putting pressure on their bonds.

Source: @business Read full article

Source: @business Read full article

Back to Index

Energy

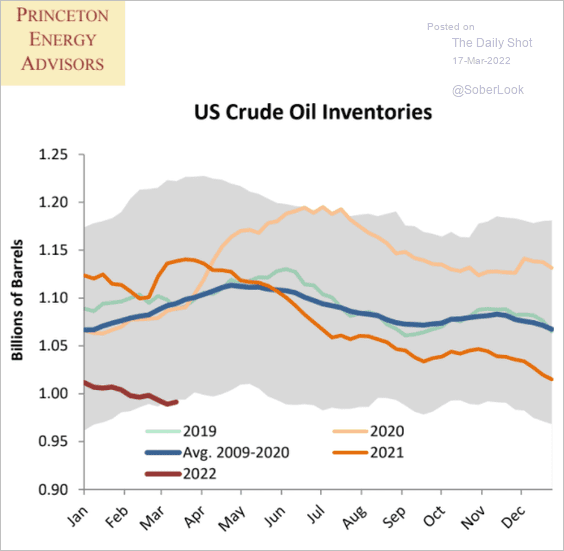

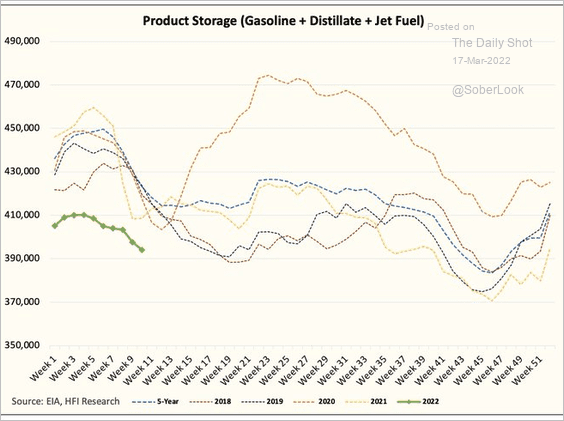

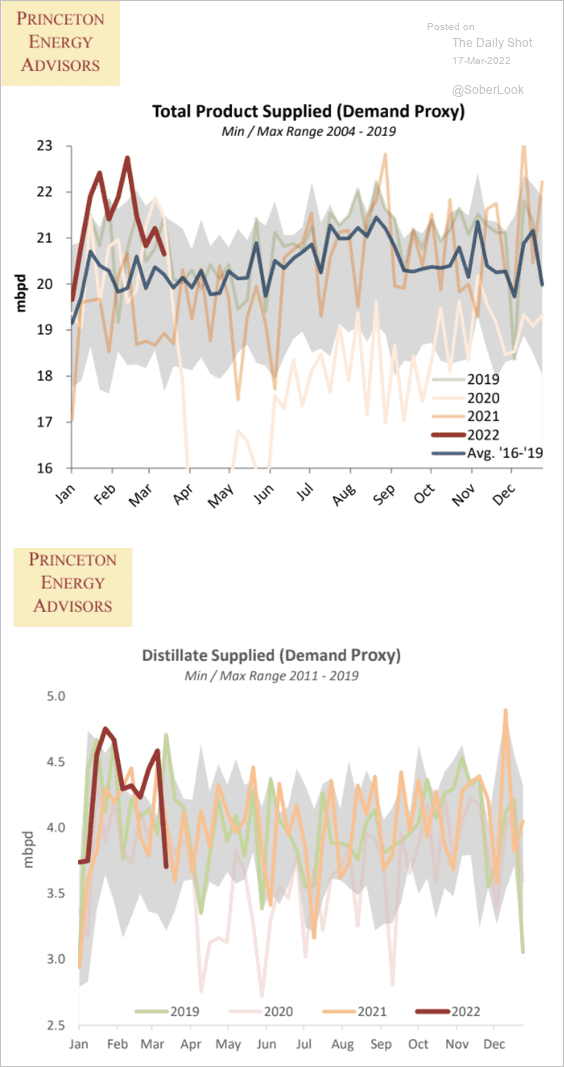

1. US crude oil and products inventories remain tight.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

Source: @HFI_Research

Source: @HFI_Research

However, demand for refined products eased last week.

Source: Princeton Energy Advisors

Source: Princeton Energy Advisors

——————–

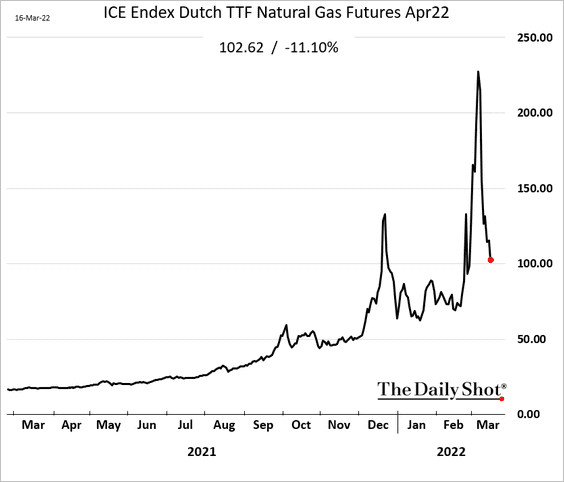

2. European natural gas futures continue to fall.

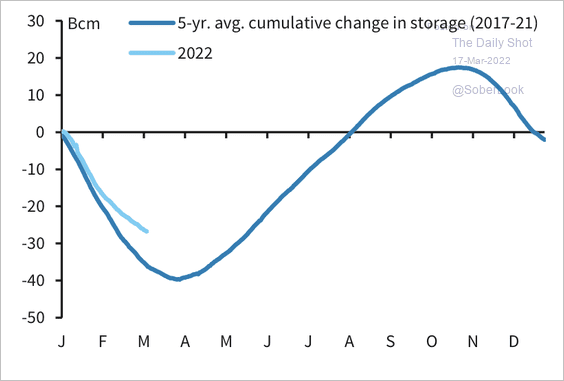

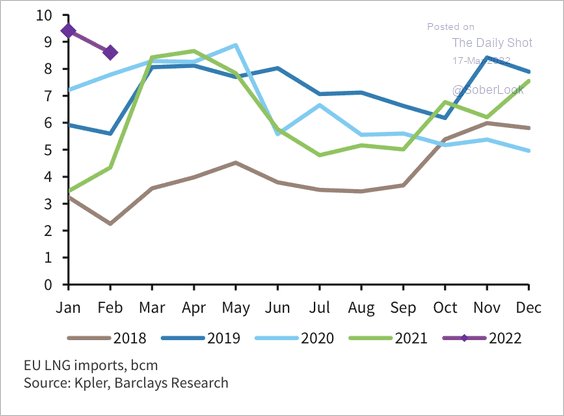

The EU’s gas storage situation has improved so far this year, due to relatively mild weather and elevated LNG imports (second chart), according to Barclays.

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

Source: Barclays Research

——————–

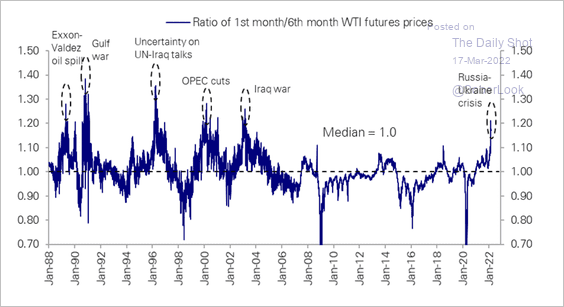

3. The level of WTI oil backwardation is roughly in line with highs seen during previous global crises.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Equities

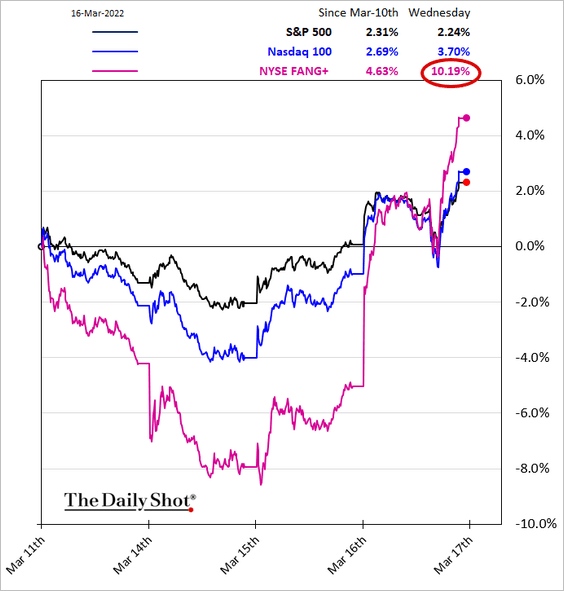

1. Mega-caps surged in response to Beijing’s announcement to support China’s markets and Powell’s comments on the economy. The Fed chair said that …

Aggregate demand is currently strong, and most forecasters expect it to remain so … All signs are that this is a strong economy.

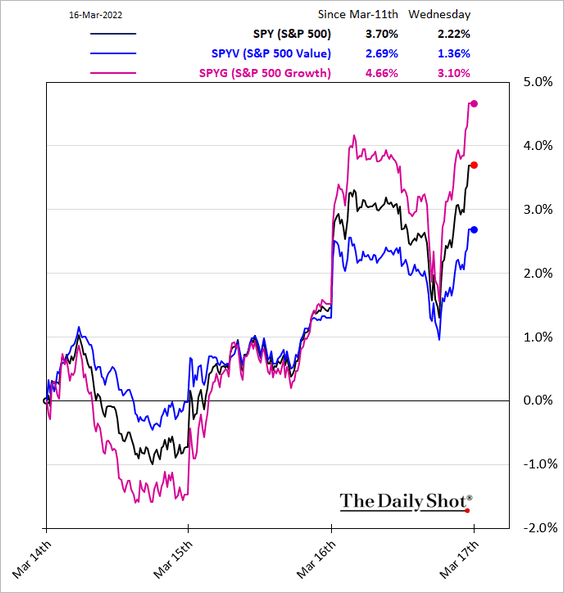

2. Growth shares outperformed.

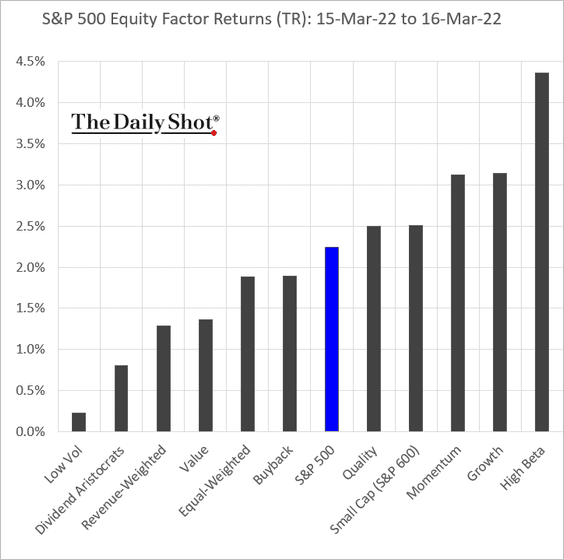

Here are Wednesday’s moves across equity factors …

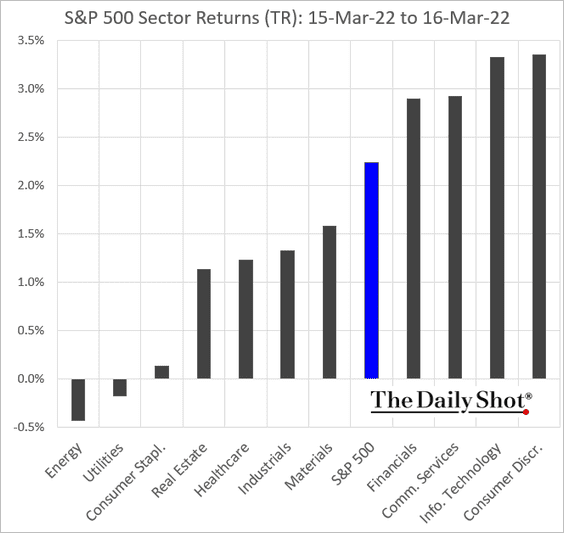

… and sectors.

——————–

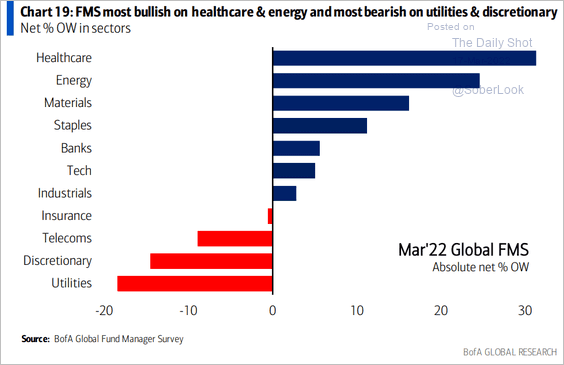

3. This chart shows fund managers’ positioning by sector, according to a survey from Bank of America.

Source: BofA Global Research

Source: BofA Global Research

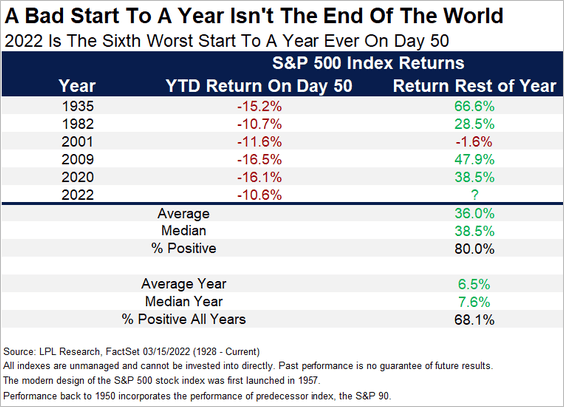

4. Big declines early in the year often translate into market gains the rest of the year.

Source: LPL Research

Source: LPL Research

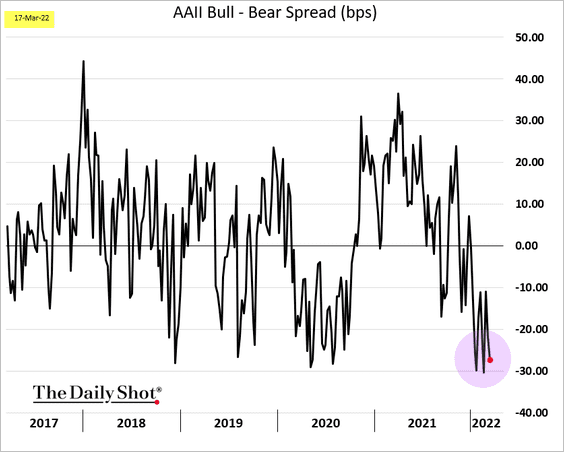

5. Investors remain very bearish.

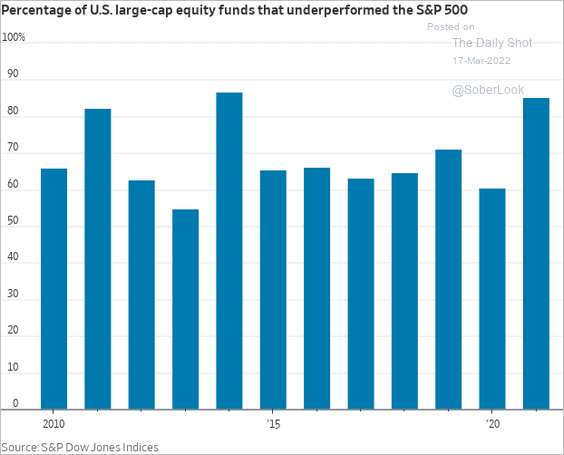

6. Most large-cap funds underperformed last year as the index surged.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Credit

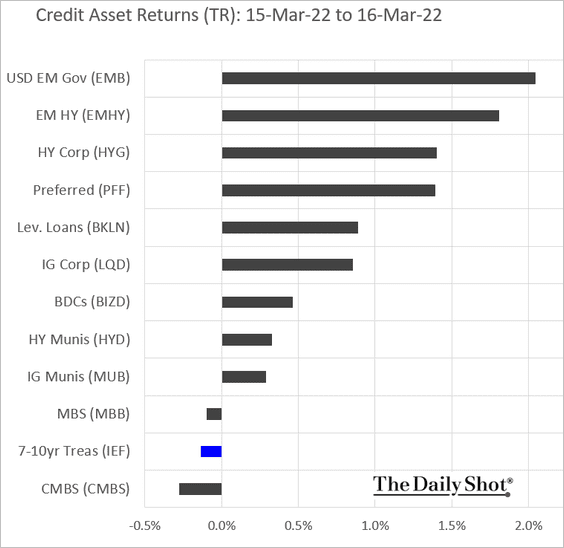

Credit rallied on Wednesday, with EM debt leading the way.

Back to Index

Rates

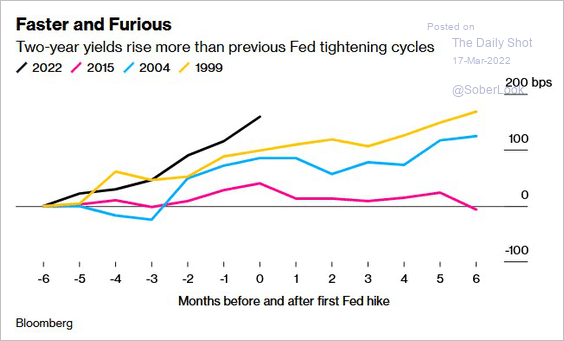

1. The increase in 2-year US yields has been much faster than in previous hiking cycles.

Source: Bloomberg; @jessefelder Read full article

Source: Bloomberg; @jessefelder Read full article

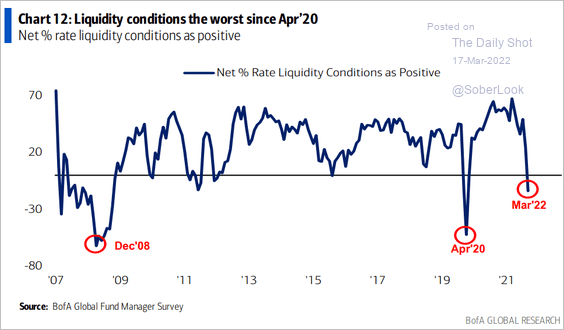

2. Fund managers see worsening liquidity conditions.

Source: BofA Global Research

Source: BofA Global Research

Back to Index

Global Developments

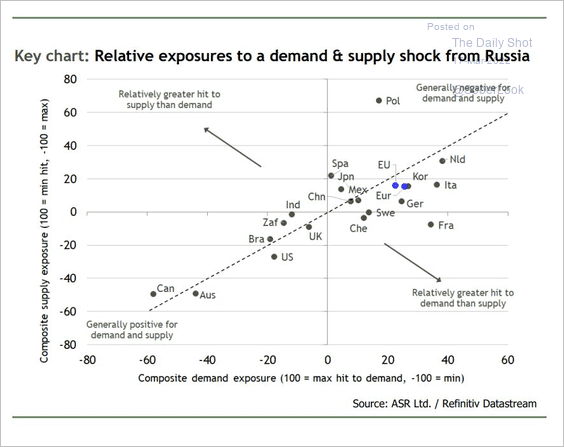

1. Which countries are most exposed to a demand/supply shock from Russia?

Source: Absolute Strategy Research

Source: Absolute Strategy Research

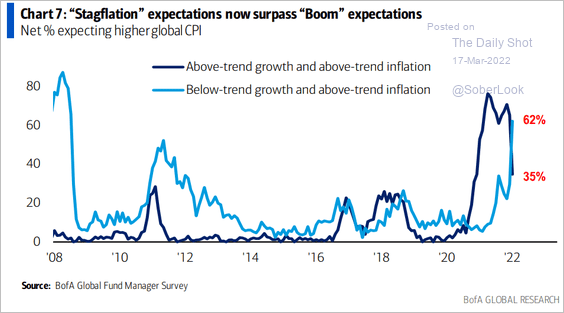

2. Investors are increasingly concerned about stagflation.

Source: BofA Global Research

Source: BofA Global Research

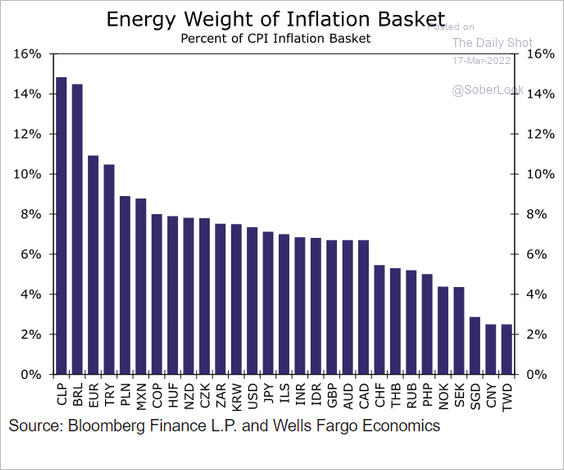

3. This chart shows the energy weight in each country’s inflation basket.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

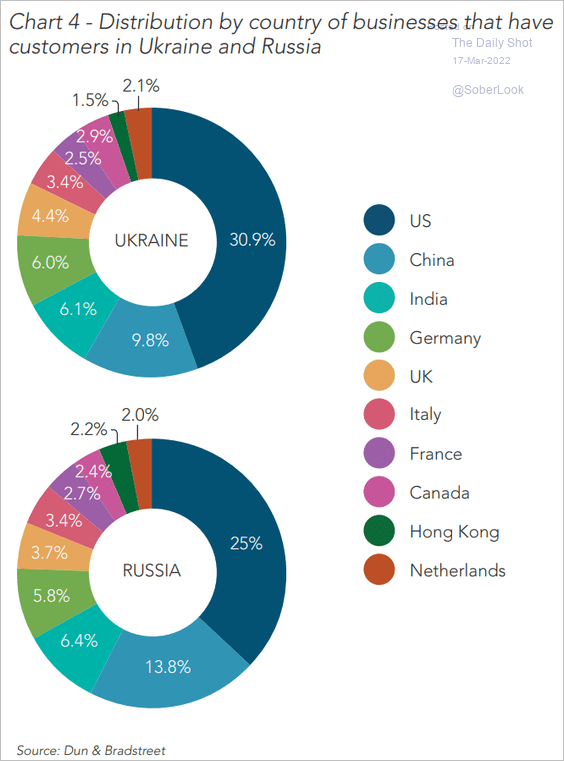

4. Here is the number of businesses that have/had customers in Ukraine and Russia.

Source: Dun & Bradstreet

Source: Dun & Bradstreet

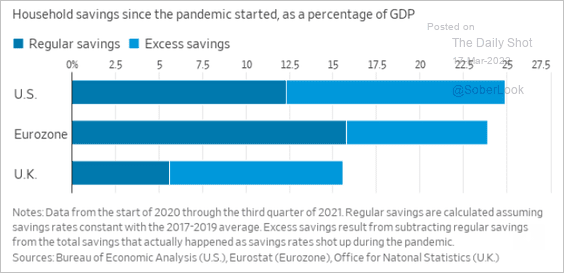

5. The increase in household savings in advanced economies since the start of the pandemic has been massive.

Source: @ceostroff

Source: @ceostroff

——————–

Food for Thought

1. Exposure to Russian debt:

Source: Statista

Source: Statista

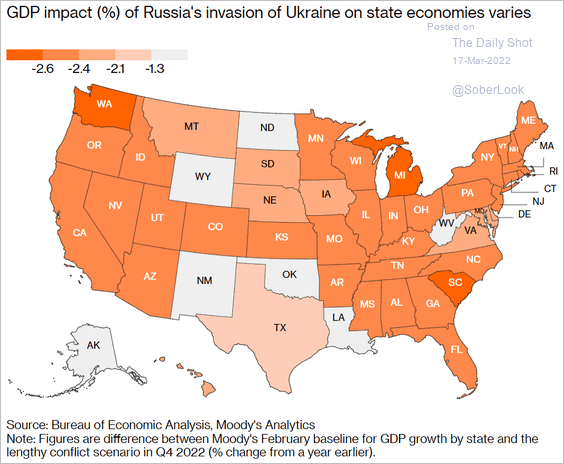

2. GDP impact of Russia’s invasion on each state:

Source: @markets Read full article

Source: @markets Read full article

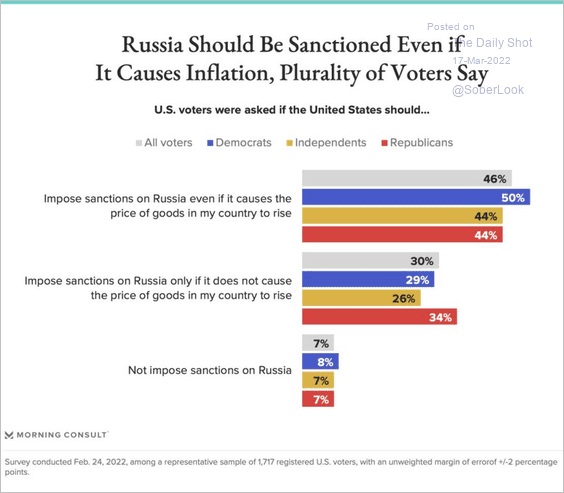

3. Views on sanctioning Russia:

Source: @MichaelRamlet, @MorningConsult Read full article

Source: @MichaelRamlet, @MorningConsult Read full article

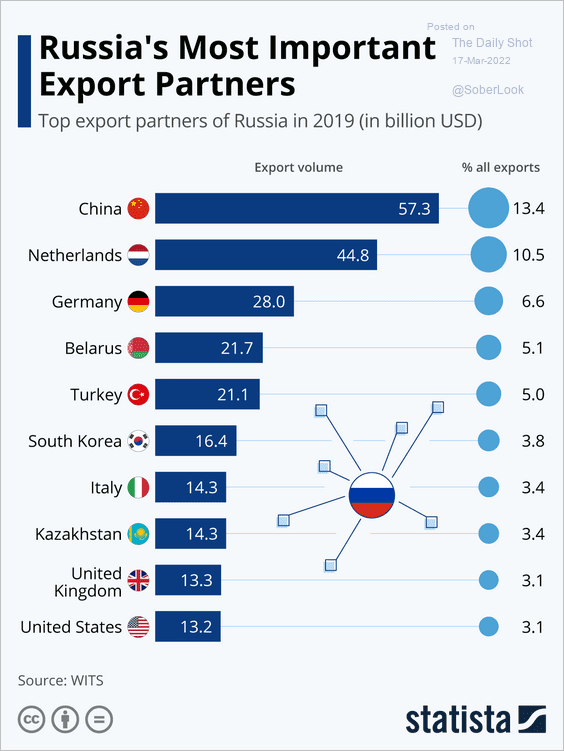

4. Russia’s key export partners:

Source: Statista

Source: Statista

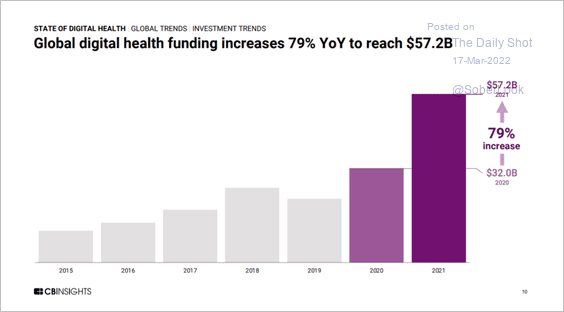

5. Digital health funding:

Source: CB Insights Read full article

Source: CB Insights Read full article

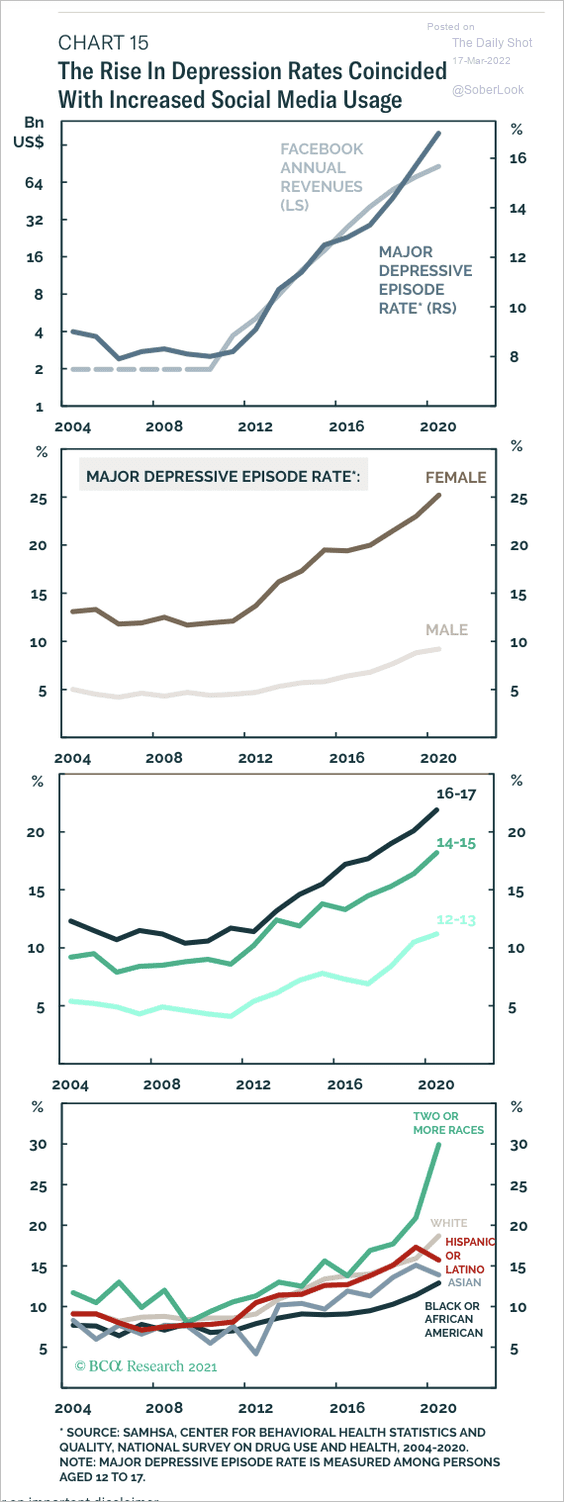

6. Social media and depression:

Source: BCA Research

Source: BCA Research

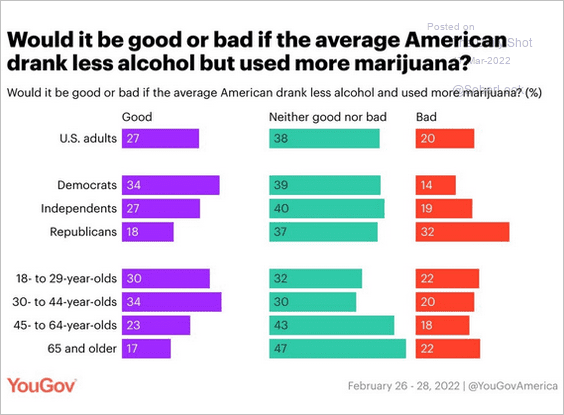

7. Less alcohol and more marijuana:

Source: @YouGovAmerica

Source: @YouGovAmerica

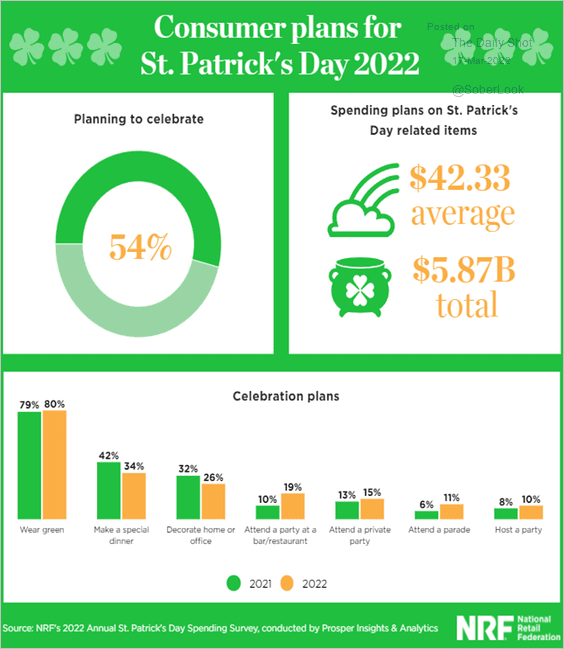

8. Saint Patrick’s Day plans:

Source: NRF

Source: NRF

• Saint Patrick’s Day by the numbers:

Source: WalletHub

Source: WalletHub

——————–

Back to Index