The Daily Shot: 20-Jul-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Food for Thought

The United States

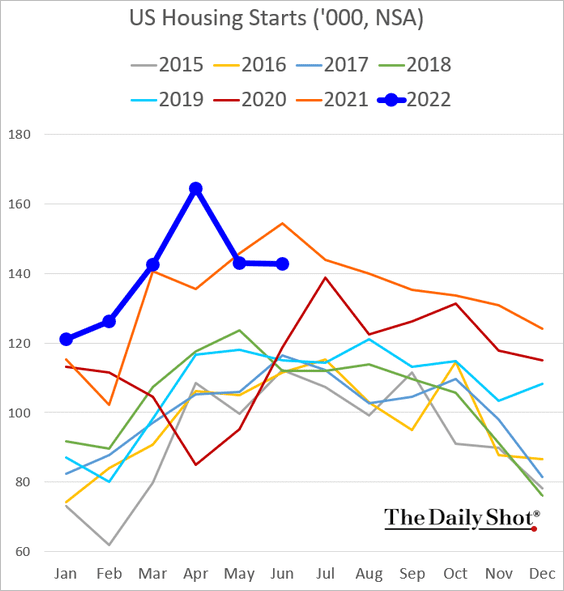

1. Once again, let’s start with the housing market.

• June housing starts were a bit below forecasts.

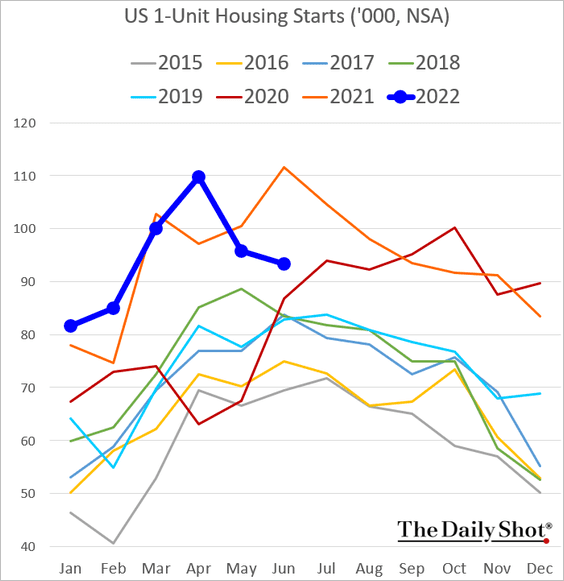

The weakness was in single-family construction.

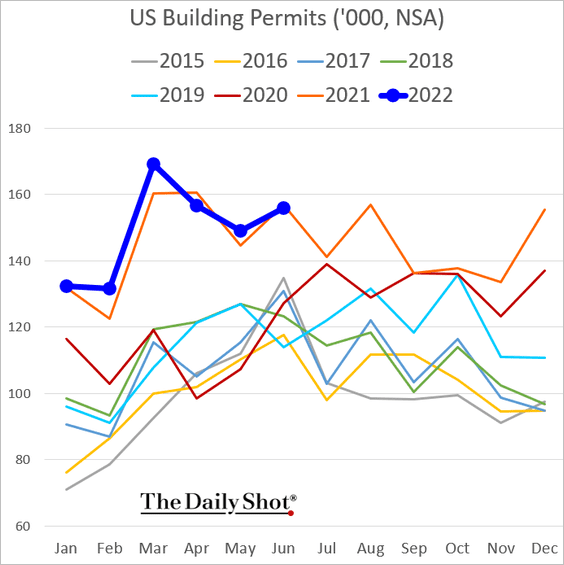

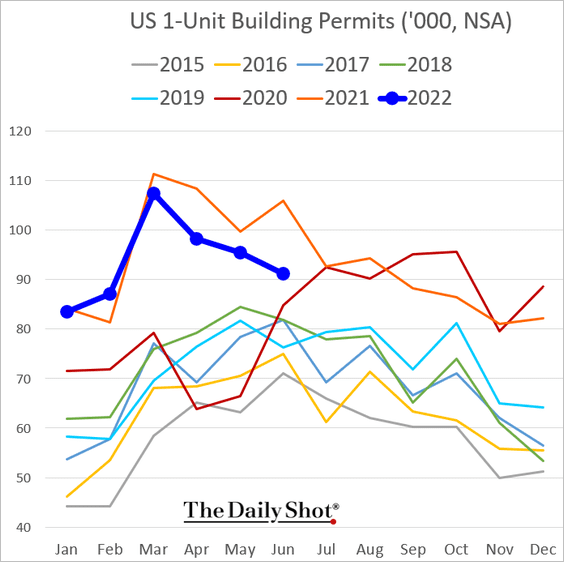

Building permits held up well last month, …

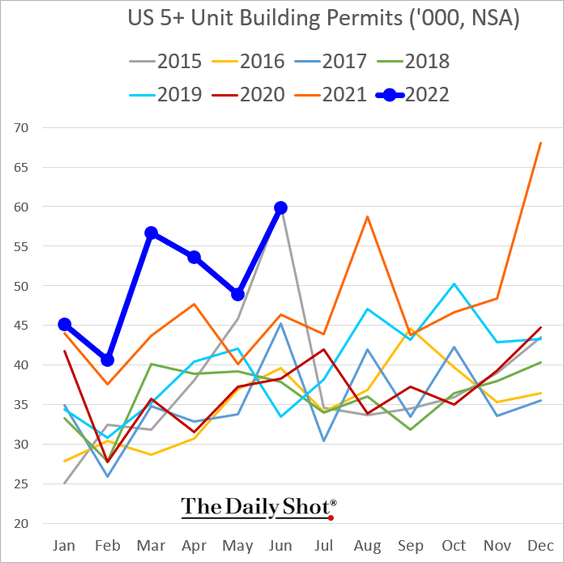

… boosted by multifamily demand.

Below is the permits chart for single-family homes.

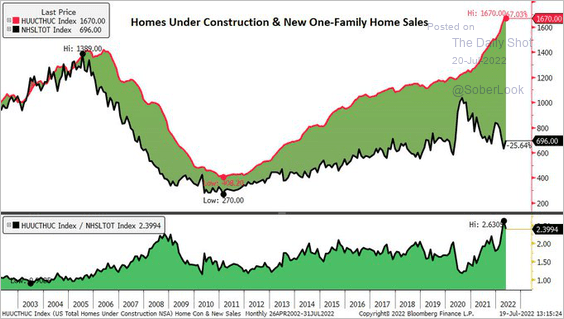

• There are a lot of homes under construction.

Source: @PPGMacro

Source: @PPGMacro

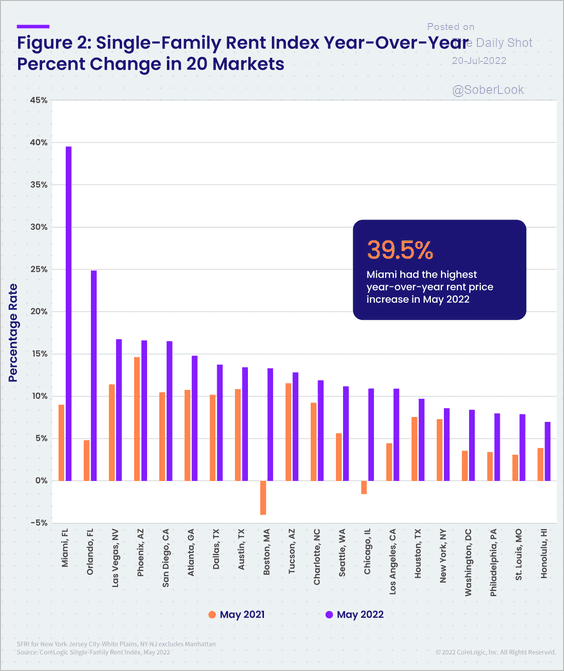

• Single-family housing rents have been surging.

Source: CoreLogic

Source: CoreLogic

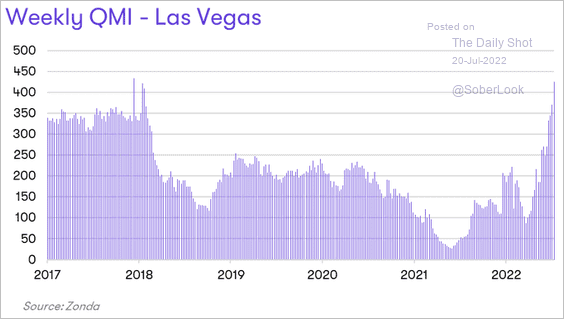

• New housing inventory is piling up in Las Vegas.

Source: @AliWolfEcon

Source: @AliWolfEcon

——————–

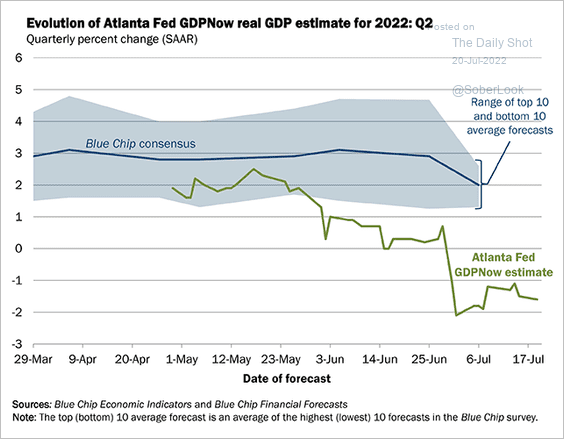

2. Next, we have some data on economic growth.

• The GDPNow model from the Atlanta Fed continues to show a contraction in Q2.

Source: @AtlantaFed Read full article

Source: @AtlantaFed Read full article

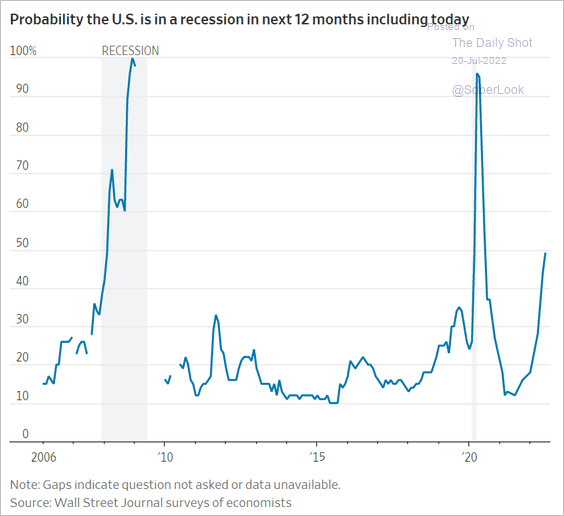

• About half of the economists surveyed by The Wall Street Journal expect a recession in the next 12 months.

Source: @WSJ Read full article

Source: @WSJ Read full article

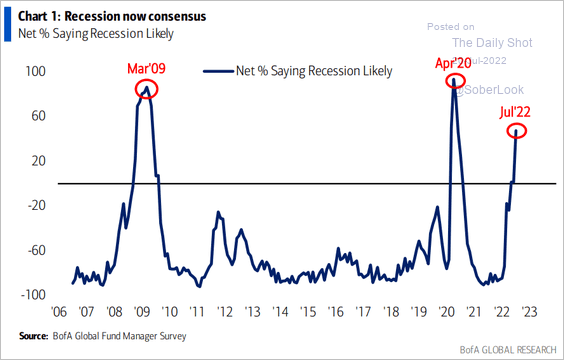

For fund managers, it’s a done deal.

Source: BofA Global Research

Source: BofA Global Research

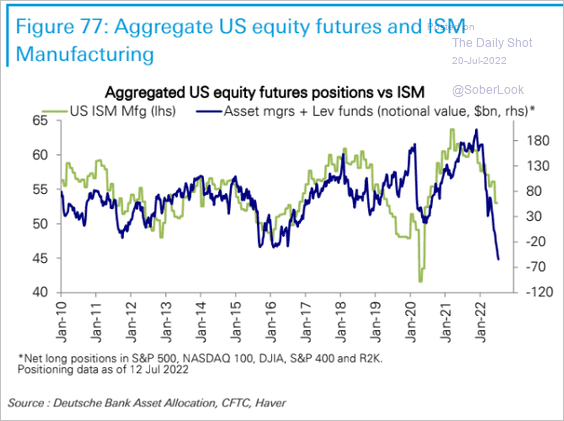

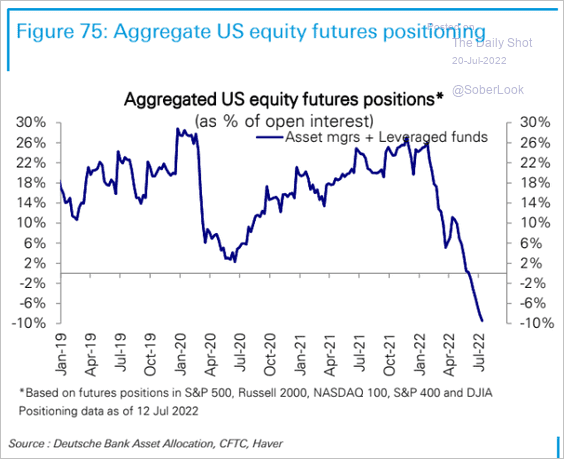

Traders have been positioning for it. Are recession fears overdone?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

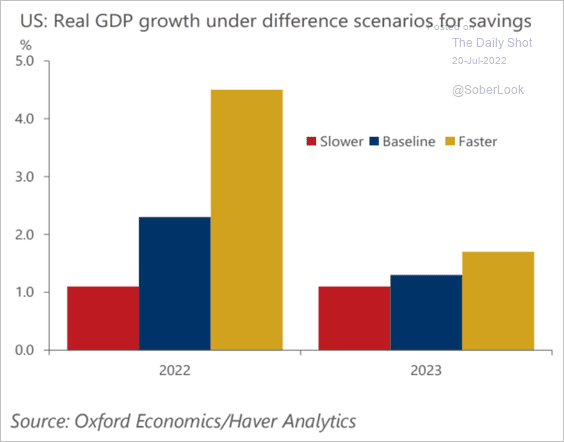

• The pace of excess savings drawdown within the next year could substantially impact GDP growth.

Source: Oxford Economics

Source: Oxford Economics

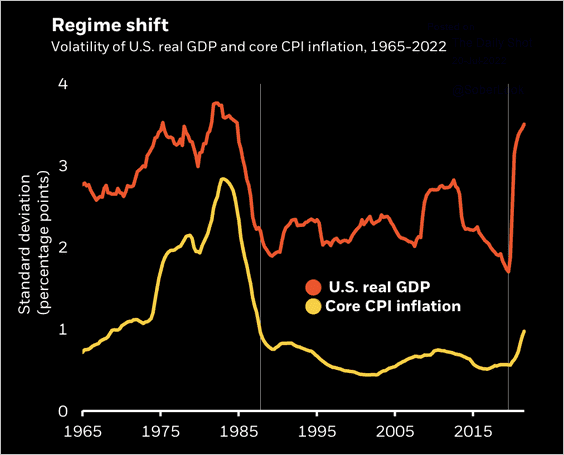

• The pandemic upended a long period of mild volatility in output and inflation.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

——————–

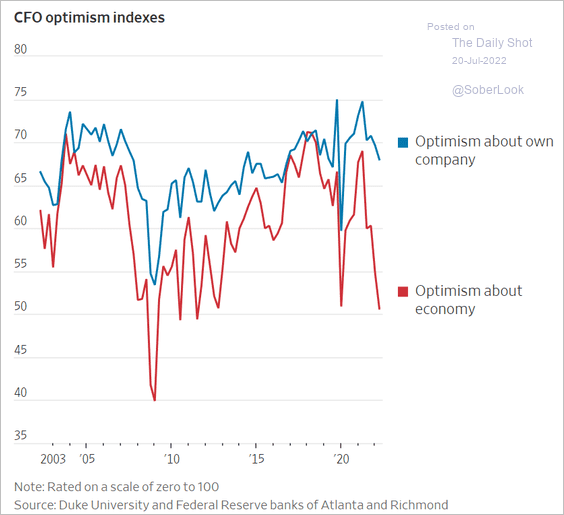

3. CFOs have soured on the economy but remain remarkably upbeat about their company’s business.

Source: @jessefelder, @WSJ Read full article

Source: @jessefelder, @WSJ Read full article

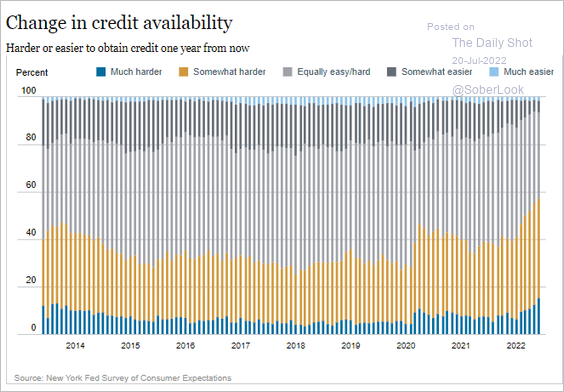

4. Consumers increasingly see a deterioration in credit availability ahead.

Source: NY Fed

Source: NY Fed

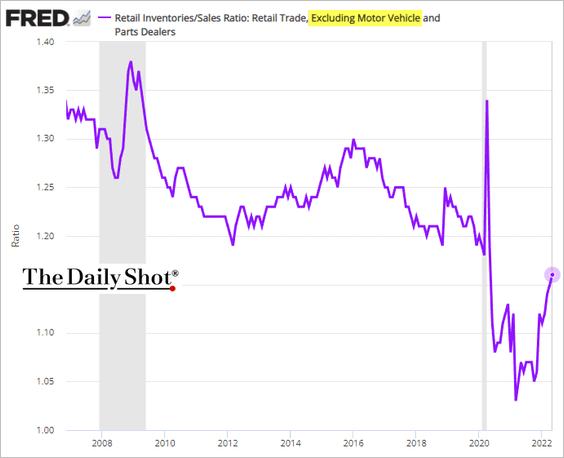

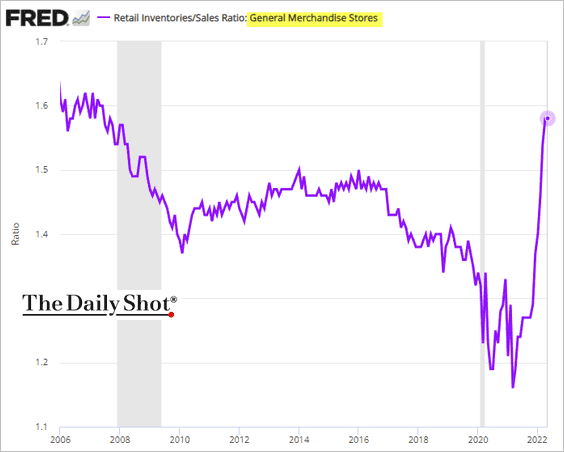

5. Excluding vehicles, the retail inventories-to-sales ratio is rebounding.

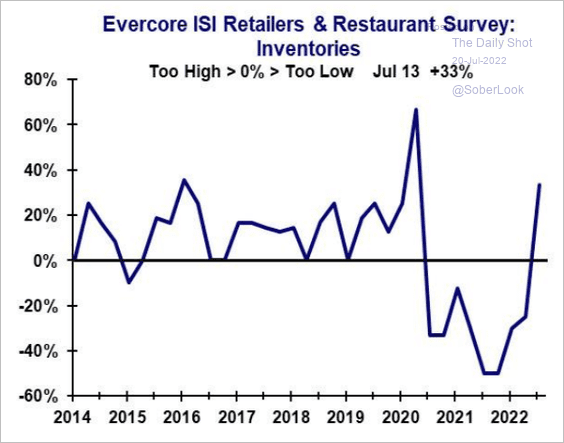

General merchandise stores are now sitting on bloated inventories.

Restaurants are no longer facing shortages.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

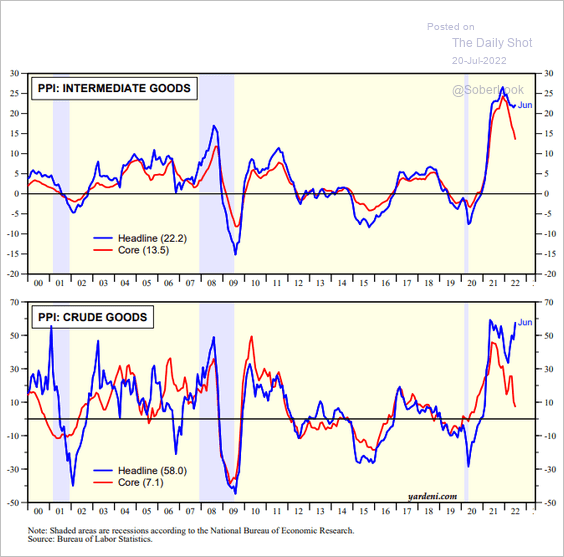

6. Gains in upstream core producer prices are slowing.

Source: Yardeni Research

Source: Yardeni Research

Back to Index

Canada

1. The iShares Canadian long-term bond ETF is attempting to break above its six-month downtrend.

Source: Aazan Habib; Paradigm Capital

Source: Aazan Habib; Paradigm Capital

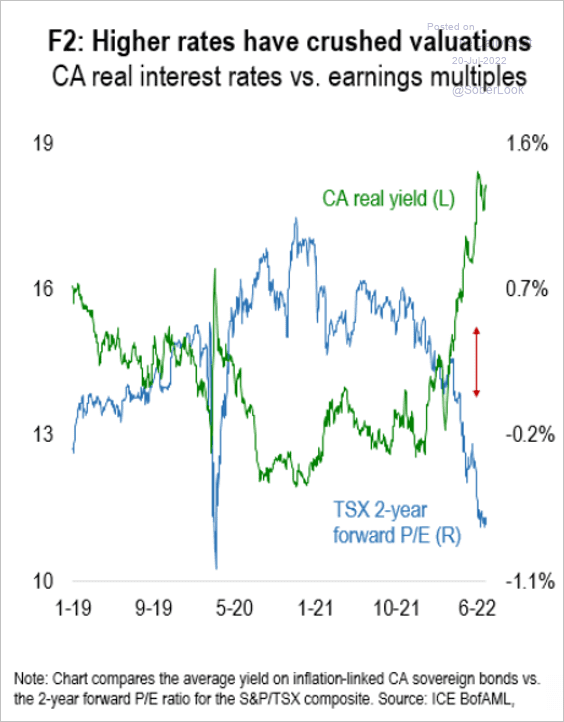

2. Real yields have been pressuring equity valuations.

Source: Numera Analytics

Source: Numera Analytics

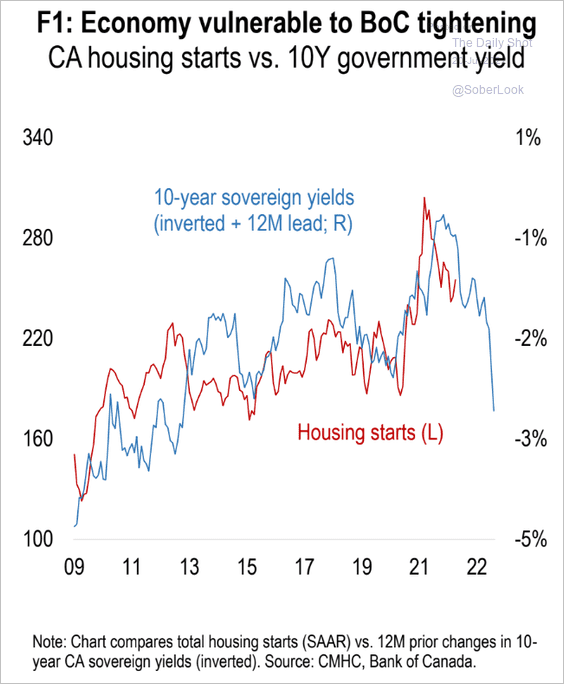

3. Housing starts will slow in the months ahead.

Source: Numera Analytics

Source: Numera Analytics

Back to Index

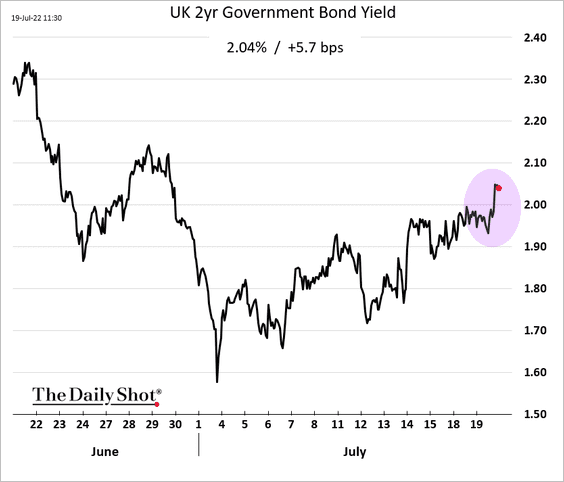

The United Kingdom

1. The message from the BoE is a 50 bps rate hike at the next meeting and quantitative tightening ahead.

Source: FXStreet Read full article

Source: FXStreet Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Gilt yields are higher.

——————–

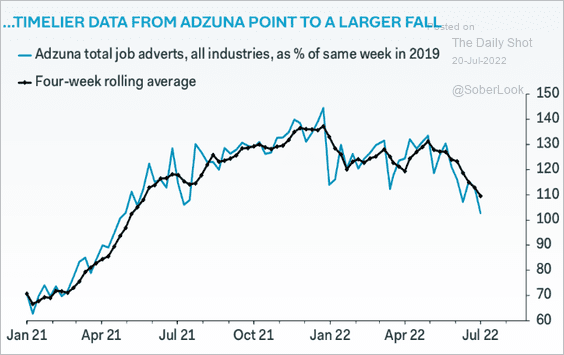

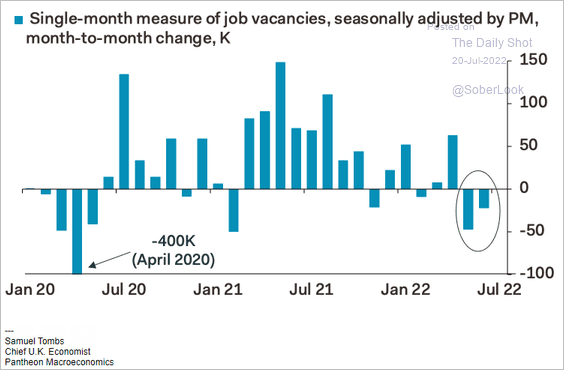

2. Demand for labor appears to be slowing (2 charts).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

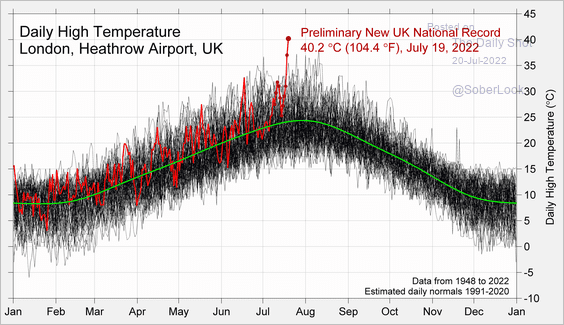

3. Ouch …

Source: @RARohde

Source: @RARohde

Back to Index

The Eurozone

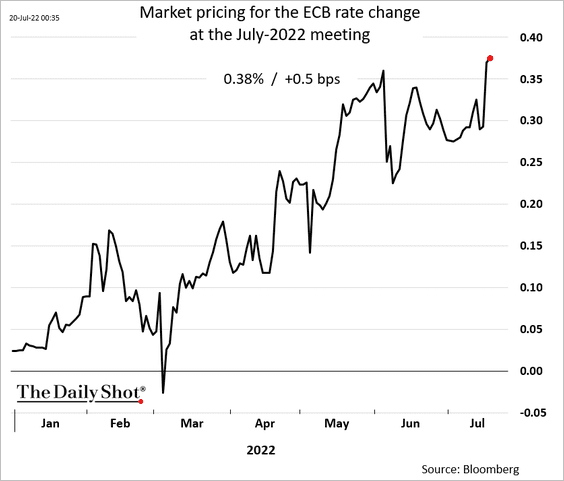

1. The market is now pricing a 50% chance of a 50 bps ECB rate hike this week.

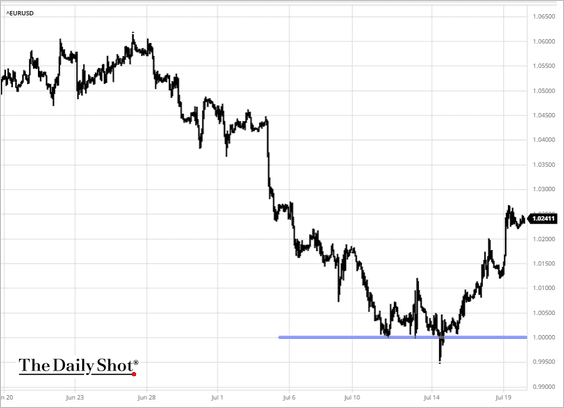

2. The euro held support at parity …

Source: barchart.com

Source: barchart.com

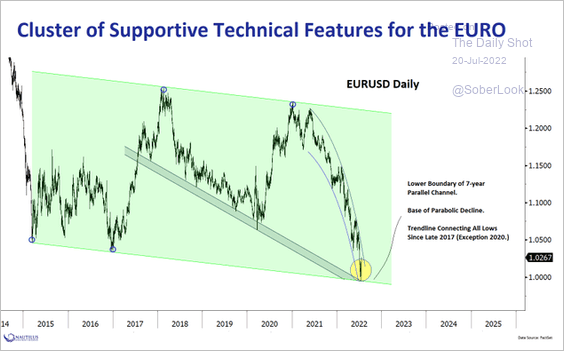

… as well as its long-term downtrend support.

Source: @NautilusCap

Source: @NautilusCap

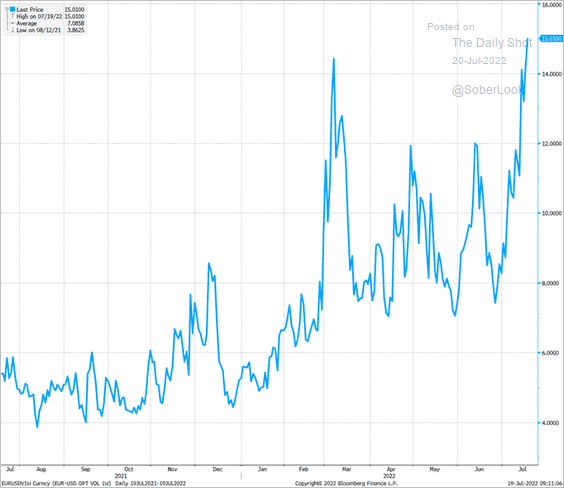

The euro implied vol surged ahead of the ECB decision.

Source: @donnelly_brent

Source: @donnelly_brent

——————–

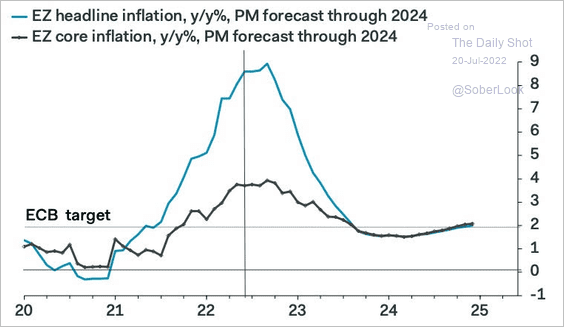

3. Inflation is yet to peak.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

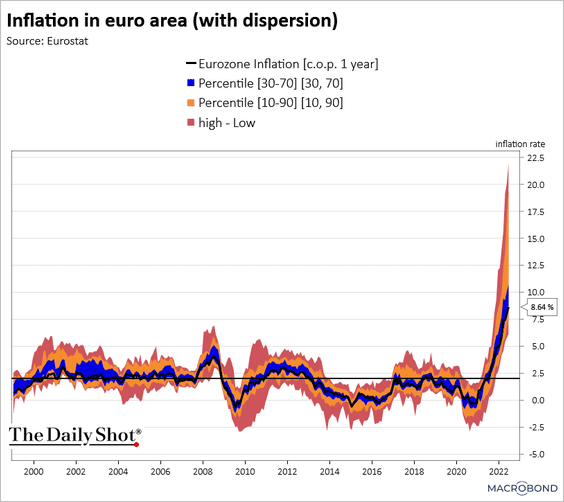

Here is the CPI dispersion.

Source: Chart and data provided by Macrobond

Source: Chart and data provided by Macrobond

——————–

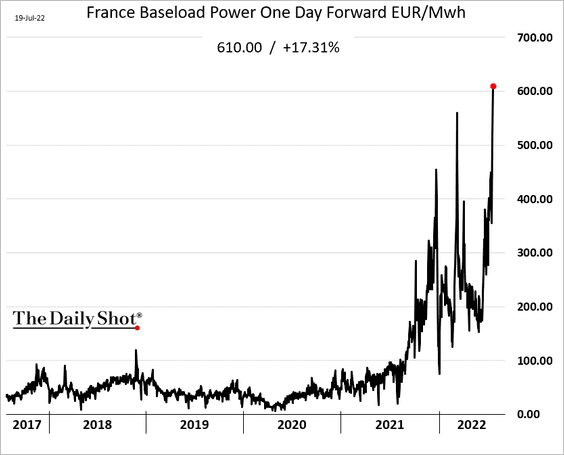

4. French wholesale electricity costs continue to surge.

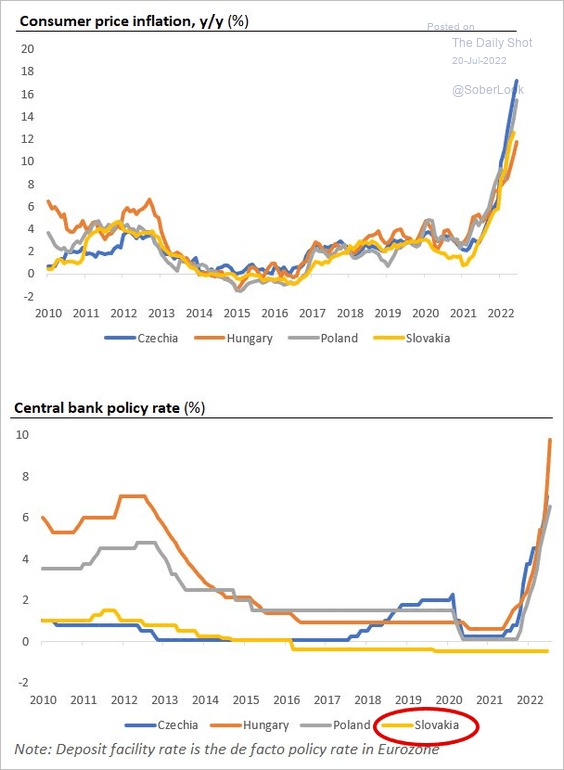

5. The joys of being part of the Eurozone:

Source: ING, @DanielKral1

Source: ING, @DanielKral1

Back to Index

Europe

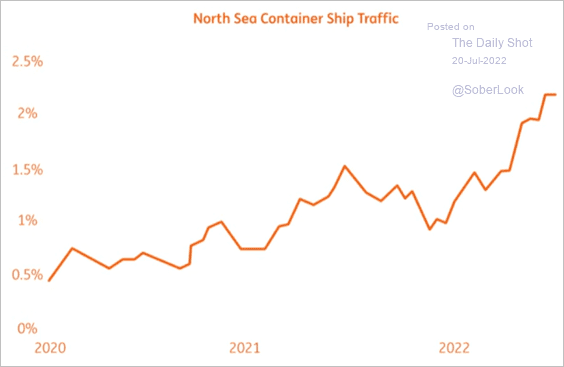

1. Supply stress remains elevated.

Source: ING

Source: ING

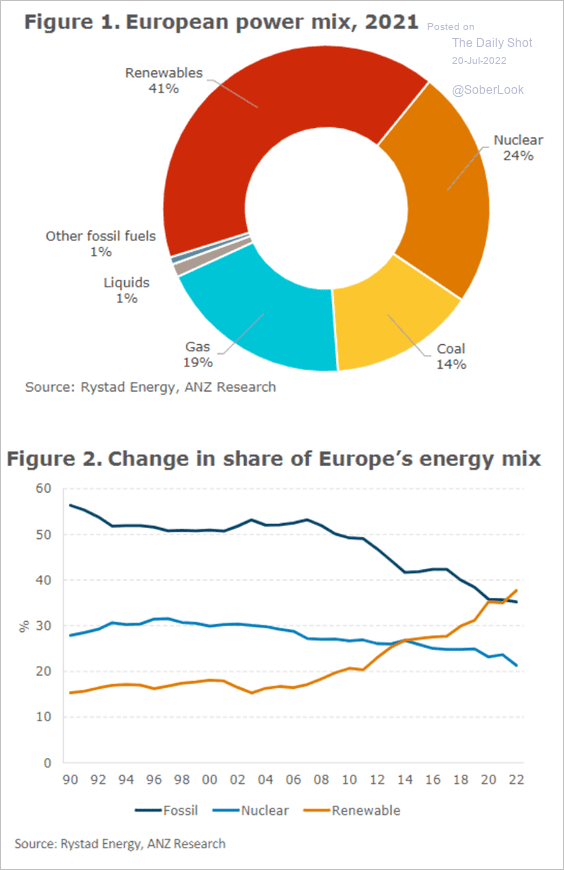

2. Here is Europe’s power/energy mix.

Source: @ANZ_Research

Source: @ANZ_Research

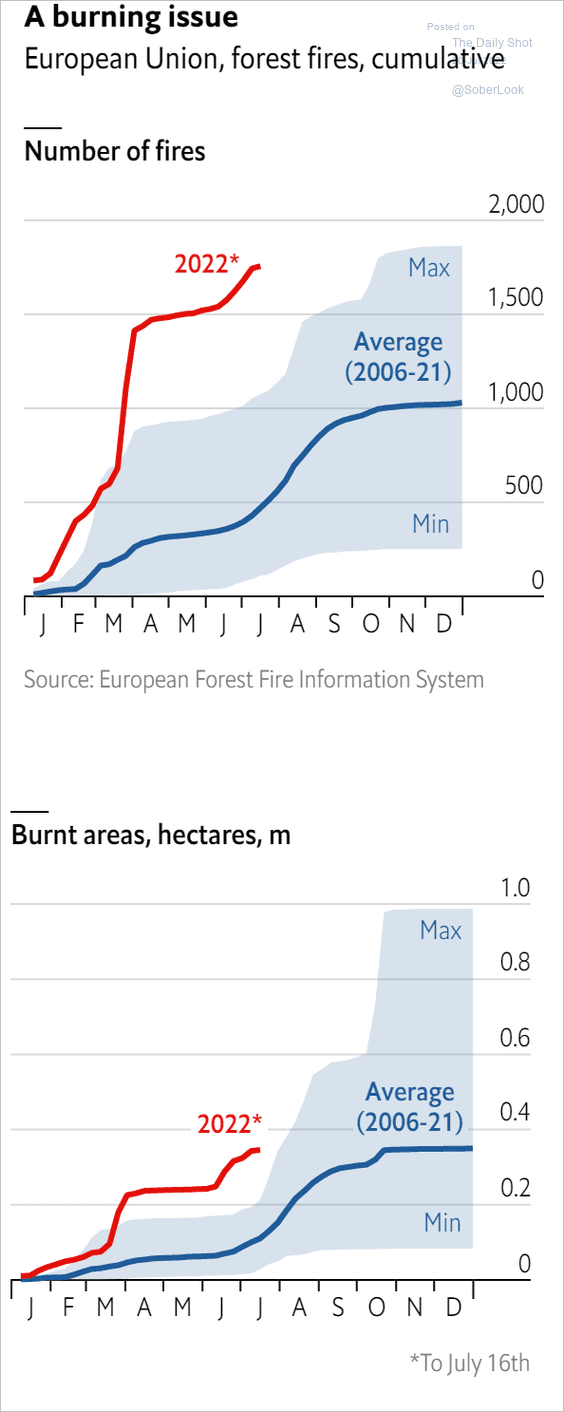

3. Wildfires have been extreme this year.

Source: The Economist Read full article

Source: The Economist Read full article

Back to Index

Asia – Pacific

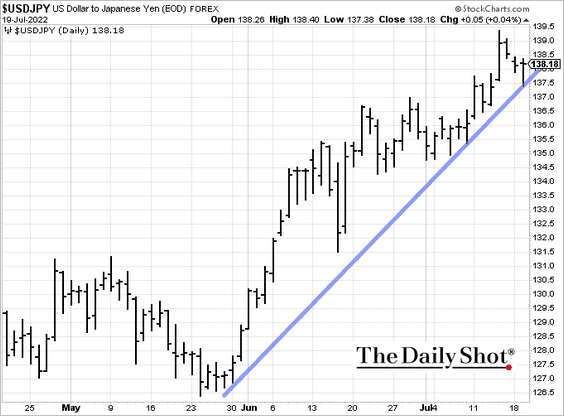

1. Dollar-yen is holding the uptrend support.

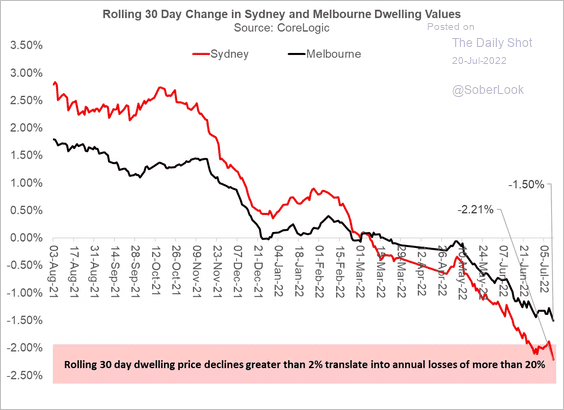

2. Home prices in Sydney and Melbourne are falling.

Source: Coolabah Capita Read full article

Source: Coolabah Capita Read full article

Back to Index

China

1. Beijing continues to struggle in its attempts to contain the property crisis.

Source: The Guardian Read full article

Source: The Guardian Read full article

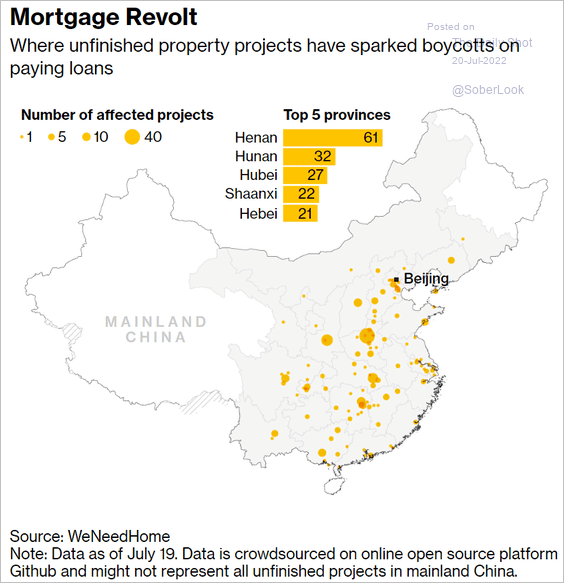

• Homebuyers refusing to make loan payments on unfinished housing:

Source: @RChoongWilkins, @bpolitics Read full article

Source: @RChoongWilkins, @bpolitics Read full article

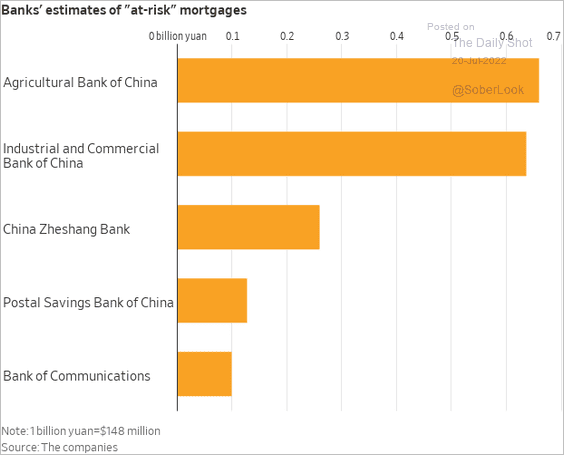

• At-risk mortgages:

Source: @WSJ Read full article

Source: @WSJ Read full article

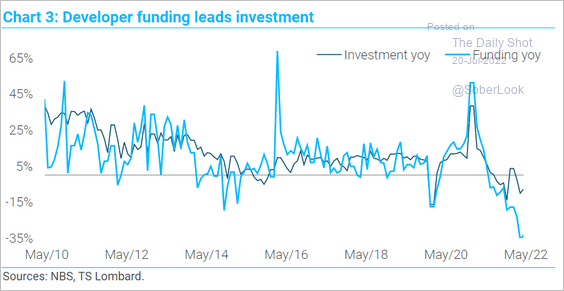

• Developers’ funding and investment:

Source: TS Lombard

Source: TS Lombard

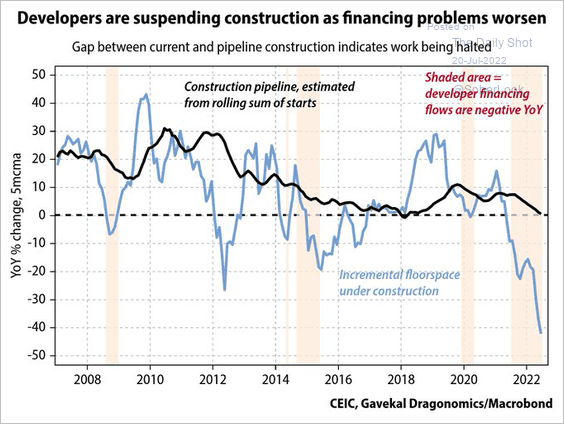

• Construction:

Source: @andrewbatson, @Gavekal

Source: @andrewbatson, @Gavekal

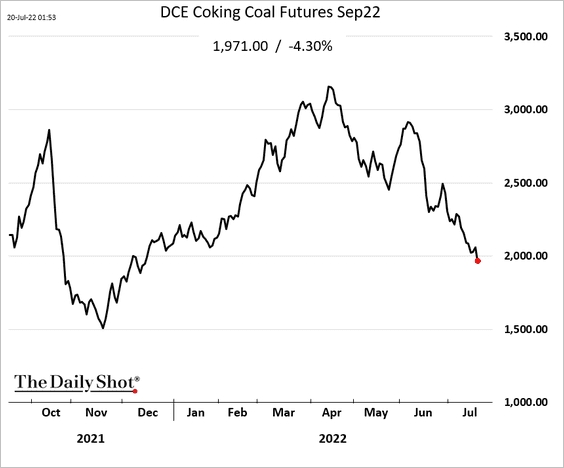

• Metallurgical coal prices (showing weaker demand for steel):

——————–

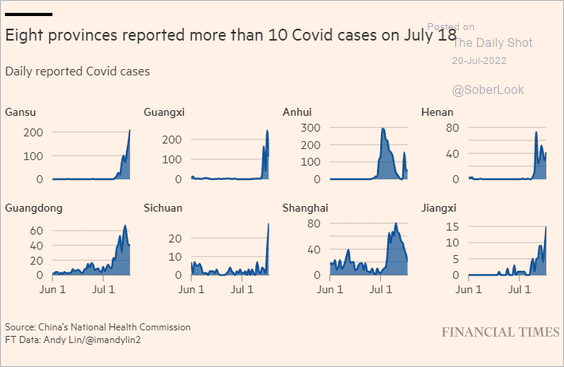

2. COVID risks are not going away any time soon.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

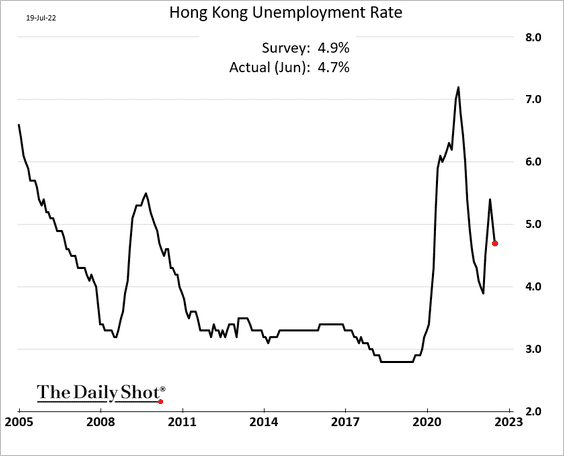

3. Unemployment eased in Hong Kong last month.

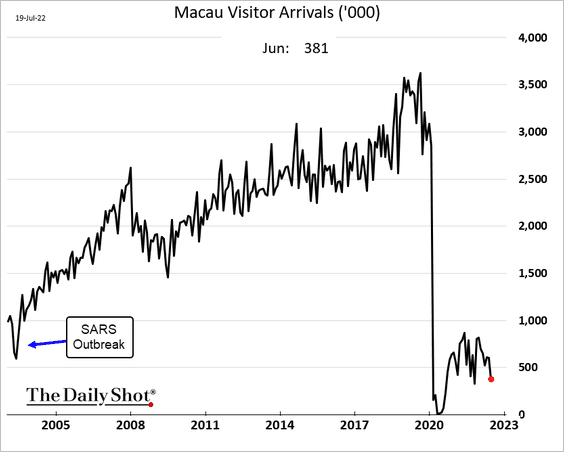

4. There is no rebound in Macau visitors.

Back to Index

Emerging Markets

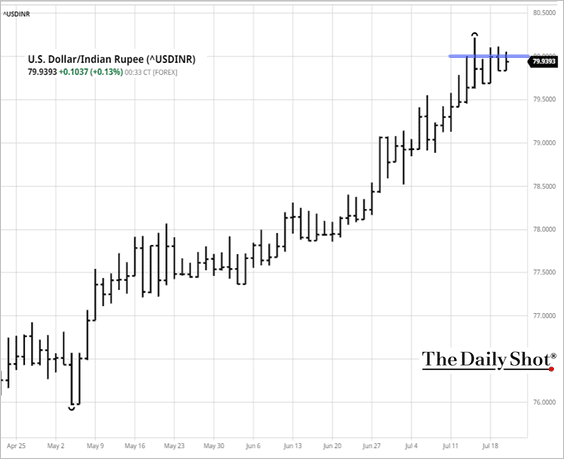

1. The Indian rupee remains under pressure as USD/INR tests resistance at 80.

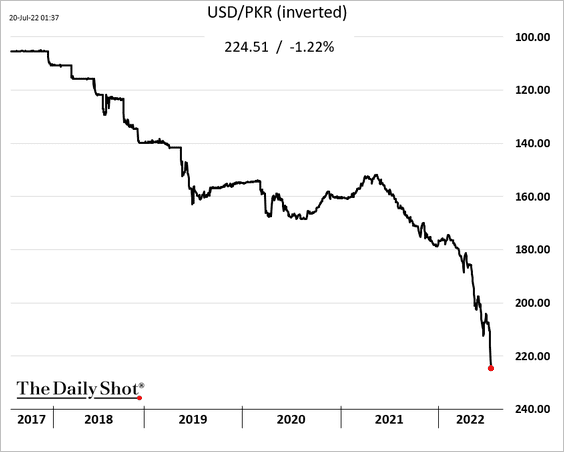

2. The Pakistani rupee continues to sink.

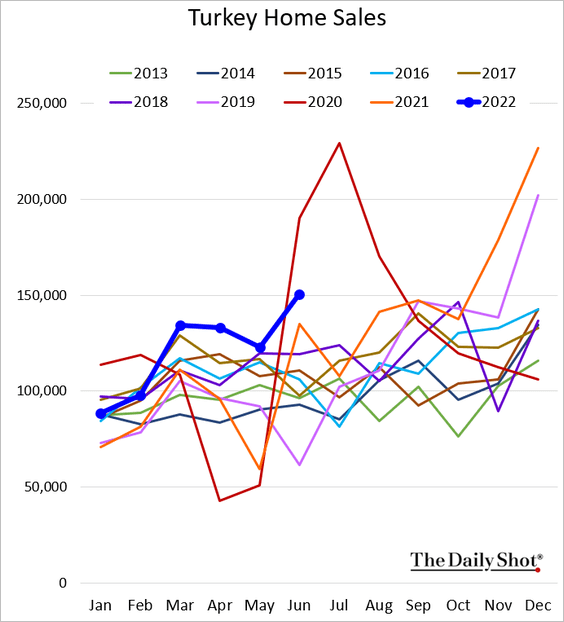

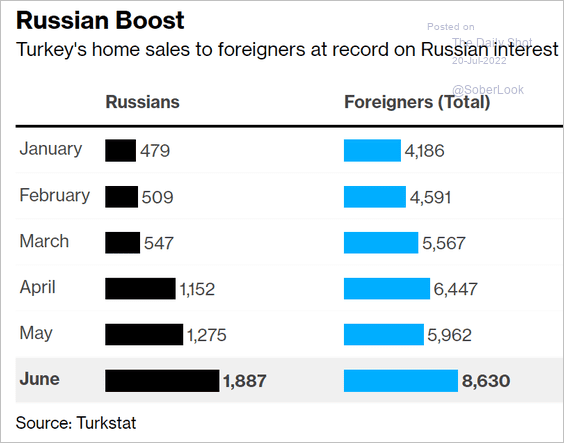

3. Turkey’s home sales jumped last month, …

… boosted by buyers from Russia.

Source: @uguruzyilmaz, Bloomberg Read full article

Source: @uguruzyilmaz, Bloomberg Read full article

——————–

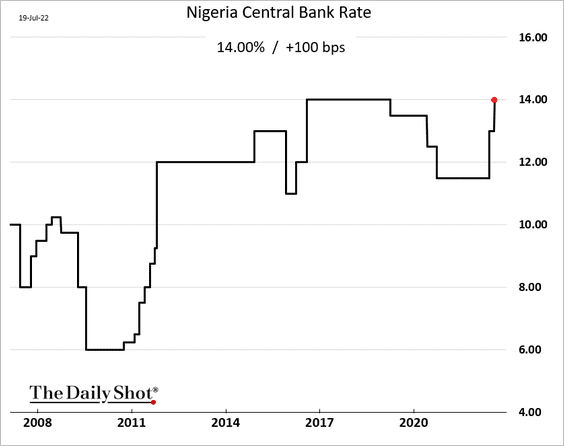

4. Nigeria’s central bank unexpectedly hiked rates by 100 bps.

Back to Index

Cryptocurrency

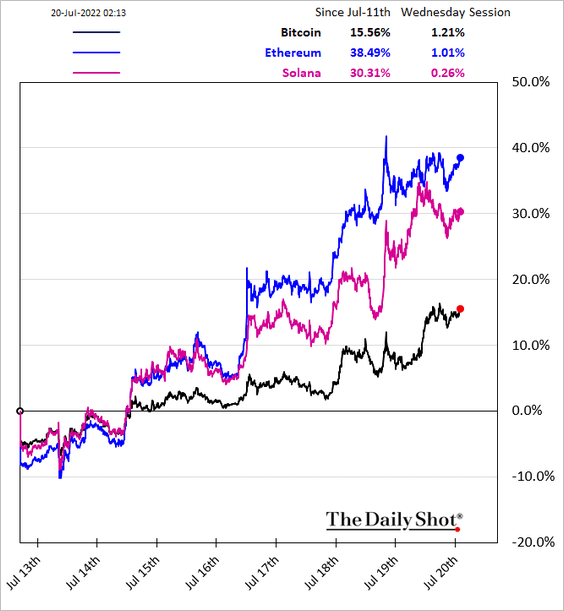

1. Cryptos continue to rebound with stocks.

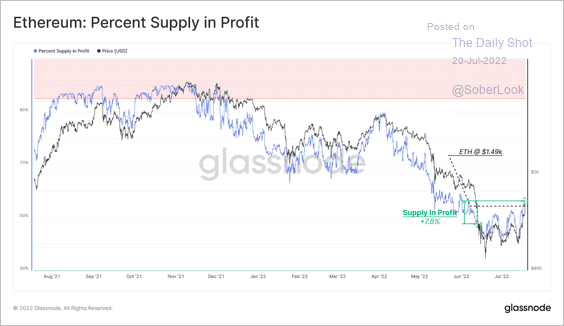

2. The total ETH supply in profit (based on the average cost basis among holders) has risen above 50% given the latest price jump.

Source: @glassnode

Source: @glassnode

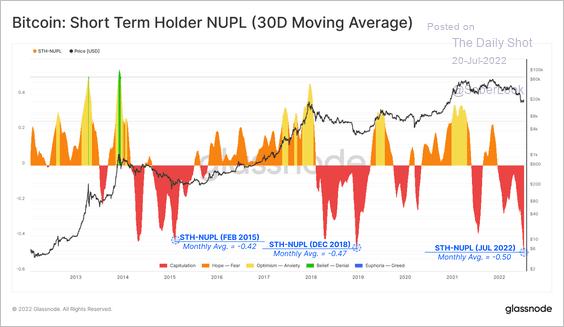

3. However, 50% of all value held by short-term bitcoin holders is still at an unrealized loss.

Source: @glassnode

Source: @glassnode

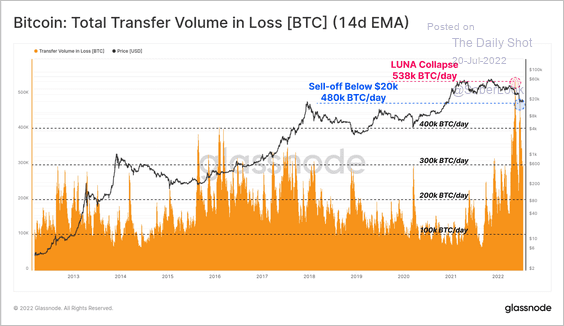

4. There was a spike in total BTC transfer volume at a loss during the LUNA stablecoin collapse.

Source: @glassnode

Source: @glassnode

Back to Index

Commodities

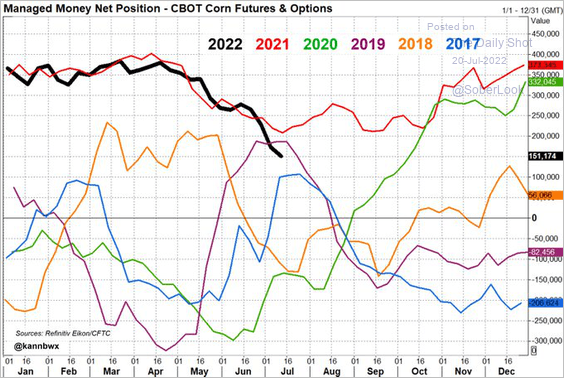

1. Money managers are trimming their bets on corn futures.

Source: @kannbwx

Source: @kannbwx

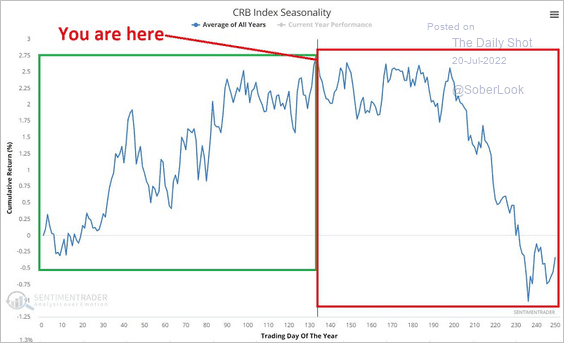

2. Commodities tend to perform worse in the second half of the year.

Source: @jaykaeppel

Source: @jaykaeppel

Back to Index

Energy

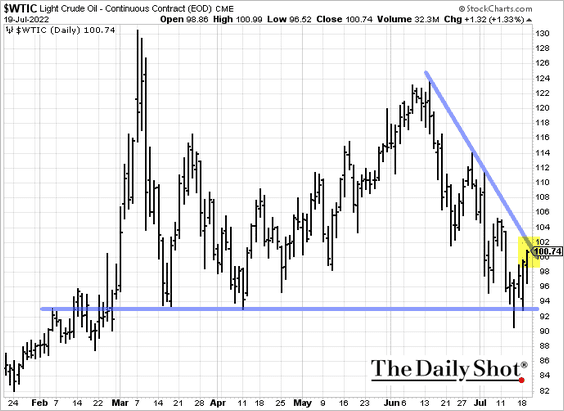

1. WTI futures are testing resistance.

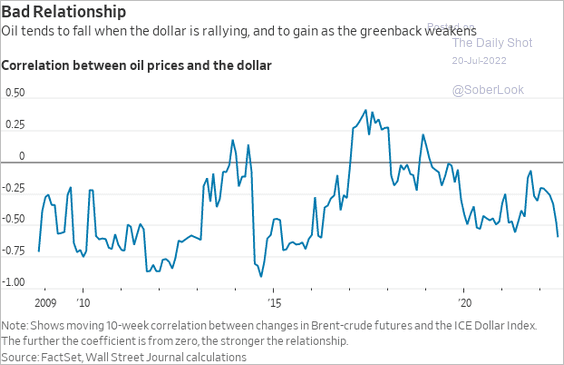

2. Crude oil is becoming more sensitive to the US dollar.

Source: @WSJ Read full article

Source: @WSJ Read full article

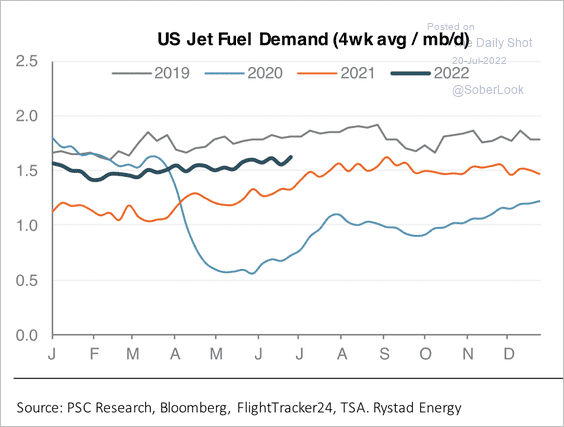

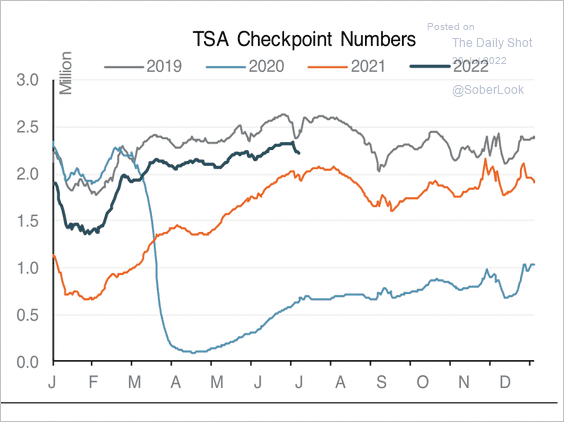

3. US jet fuel demand remains below pre-pandemic levels, tracking the recovery in air travel (2 charts).

Source: Piper Sandler

Source: Piper Sandler

Source: Piper Sandler

Source: Piper Sandler

——————–

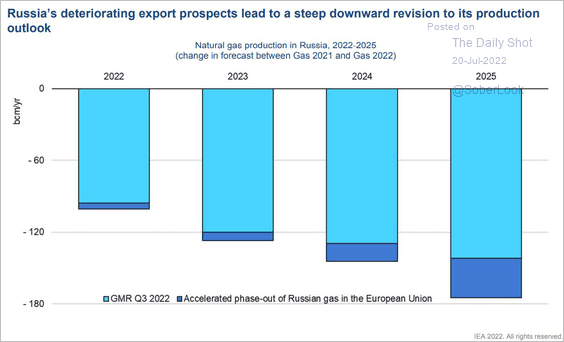

4. Russia’s natural gas production is expected to deteriorate.

Source: IEA; @Insider_FX

Source: IEA; @Insider_FX

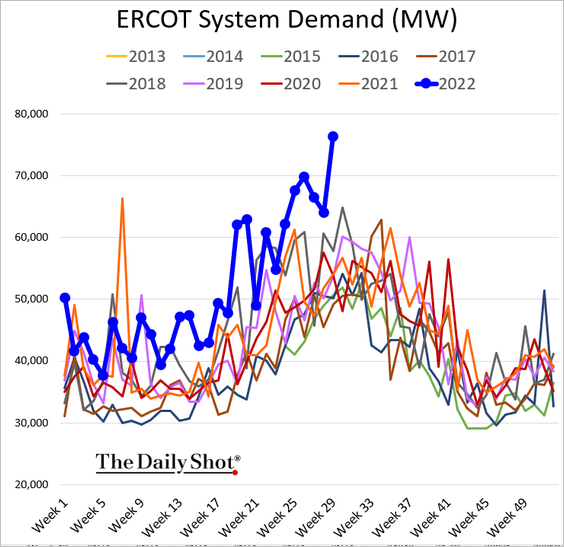

5. Concerns are growing over Texas power grid’s ability to handle the surging demand.

Source: NBC News Read full article

Source: NBC News Read full article

Back to Index

Equities

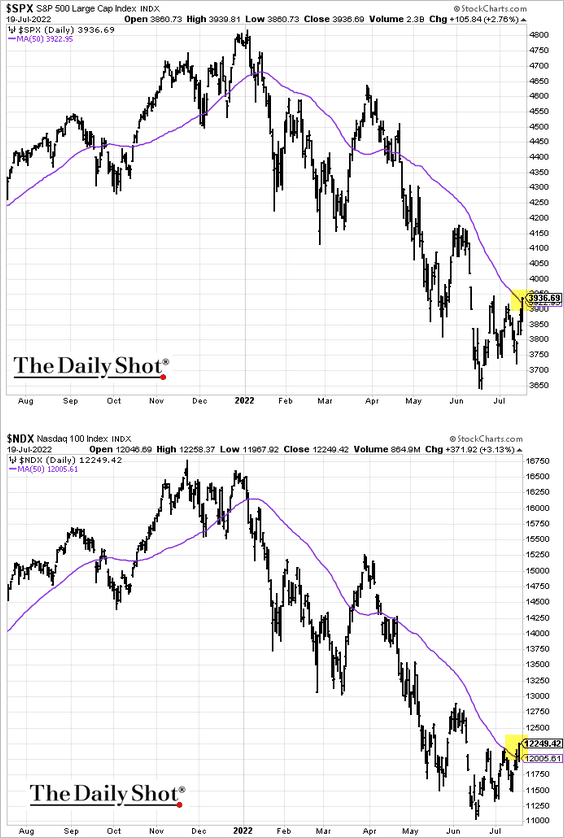

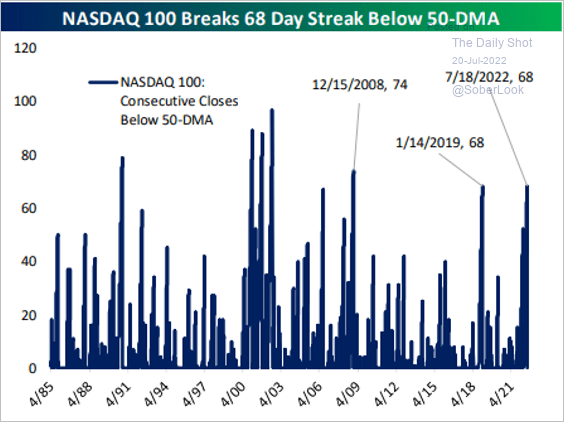

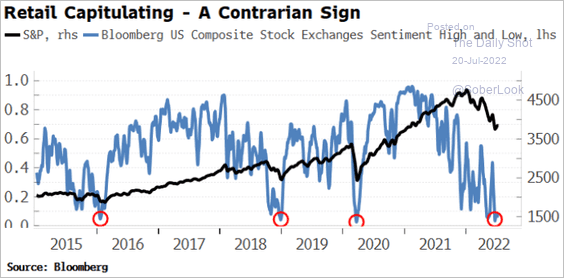

1. The S&P 500 and the Nasdaq 100 rallied above the 50-day moving average …

Source: @bespokeinvest Read full article

Source: @bespokeinvest Read full article

… amid extreme market pessimism (2 charts).

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

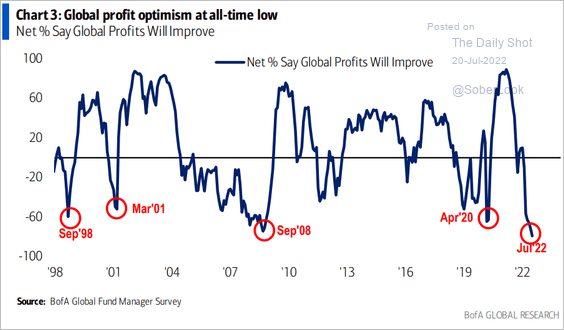

2. Fund managers’ profit sentiment hasn’t been this bad in a long time.

Source: BofA Global Research

Source: BofA Global Research

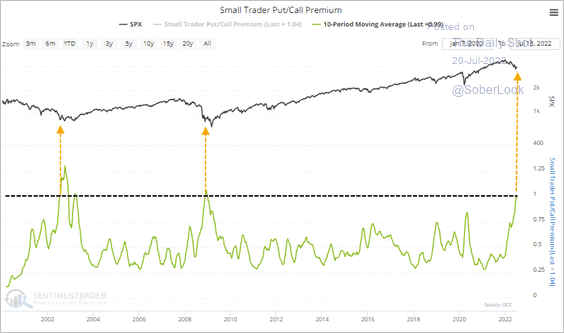

3. The put/call premium among small options traders has been stretched (very bearish).

Source: SentimenTrader

Source: SentimenTrader

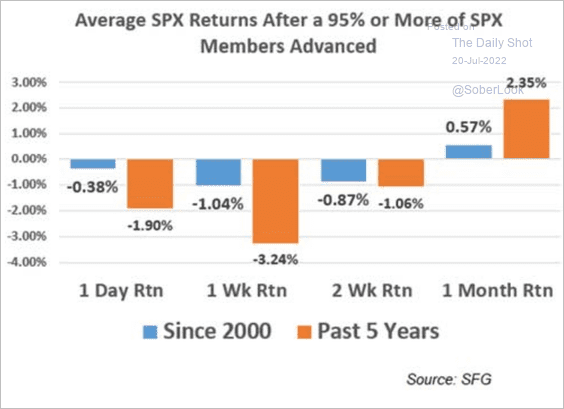

4. The broad market bounce we just had is not a positive sign for near-term performance.

Source: Chris Murphy, Susquehanna International Group

Source: Chris Murphy, Susquehanna International Group

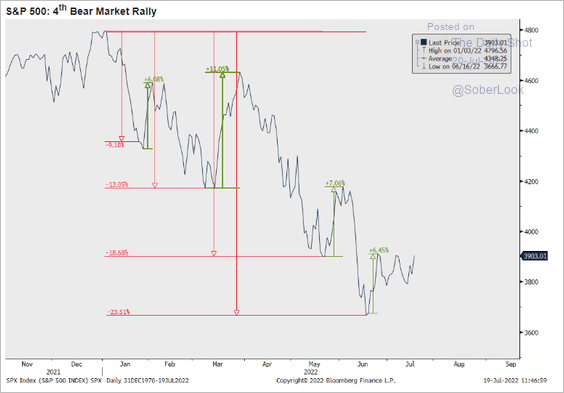

5. Another bear-market rally?

Source: Michael Kantrowitz, Piper Sandler

Source: Michael Kantrowitz, Piper Sandler

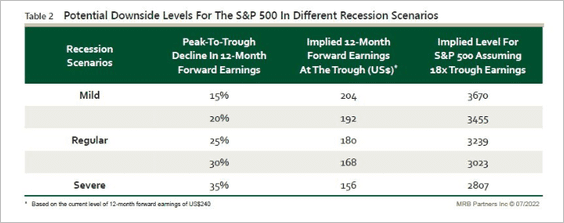

6. Here are some potential downside scenarios for the S&P 500, according to MRB Partners.

Source: MRB Partners

Source: MRB Partners

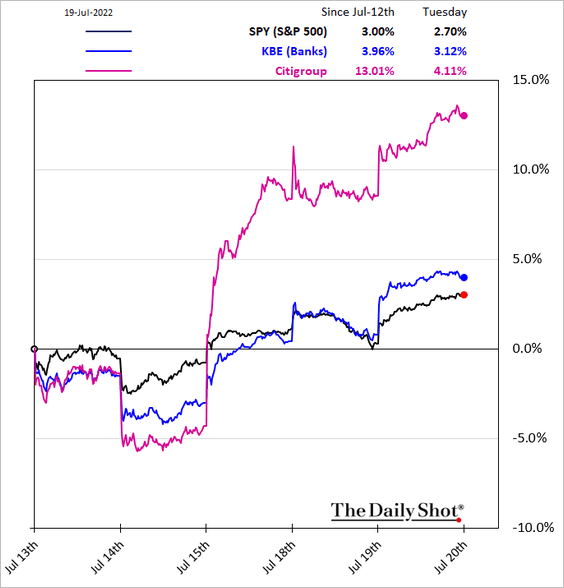

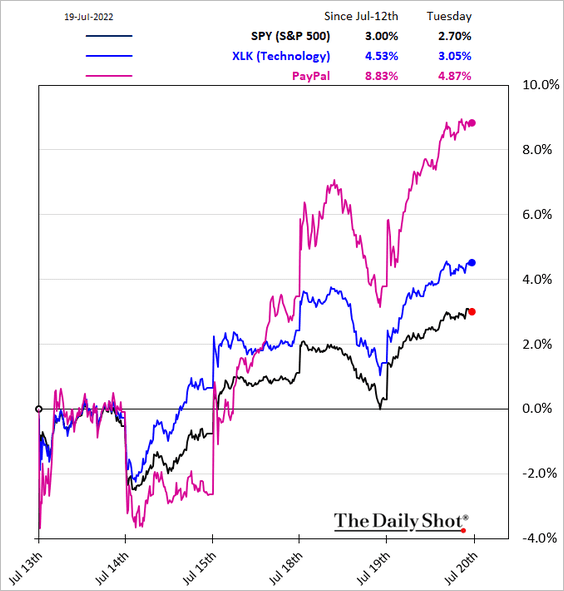

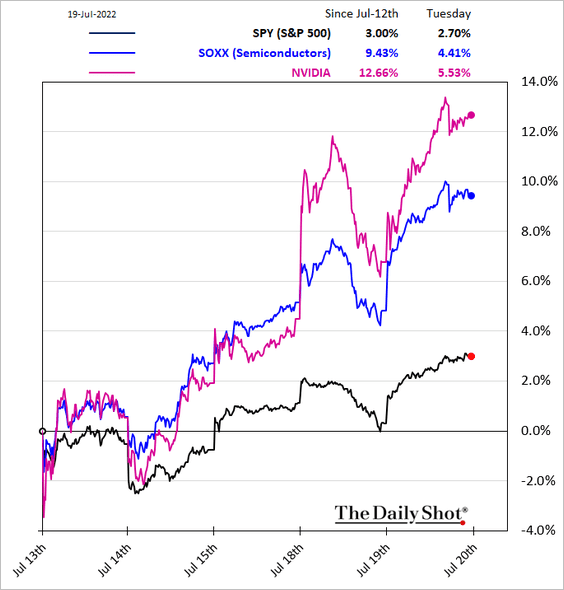

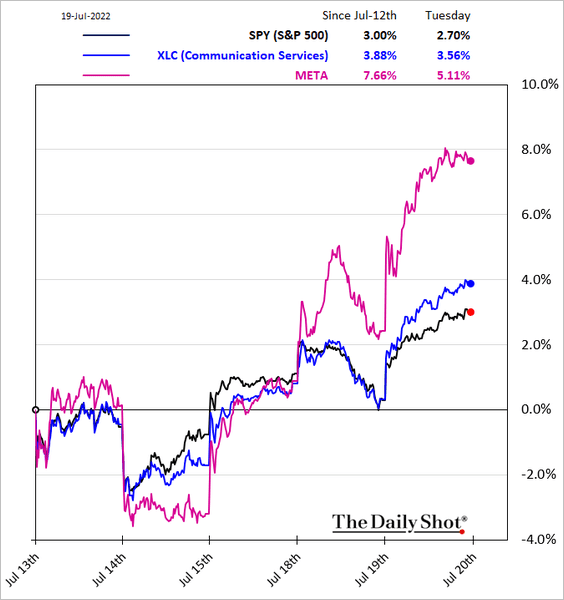

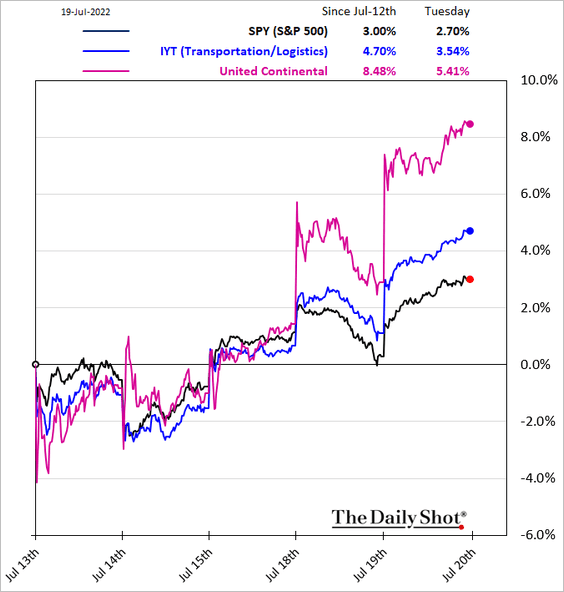

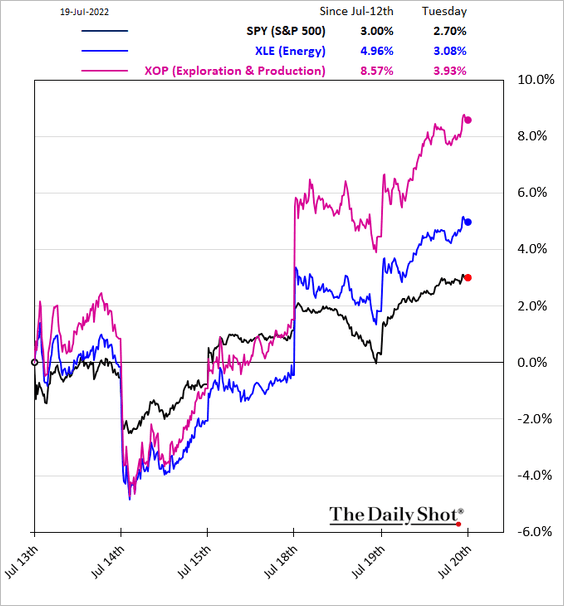

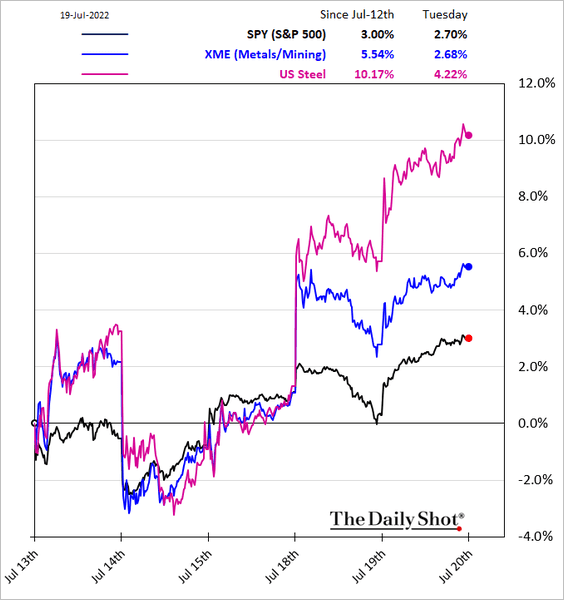

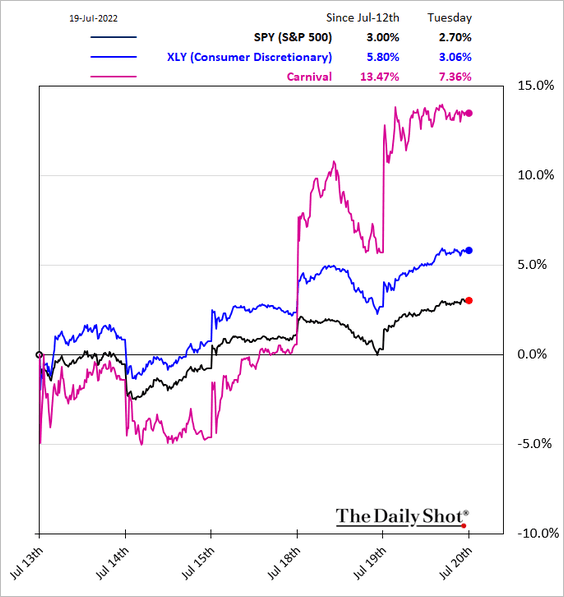

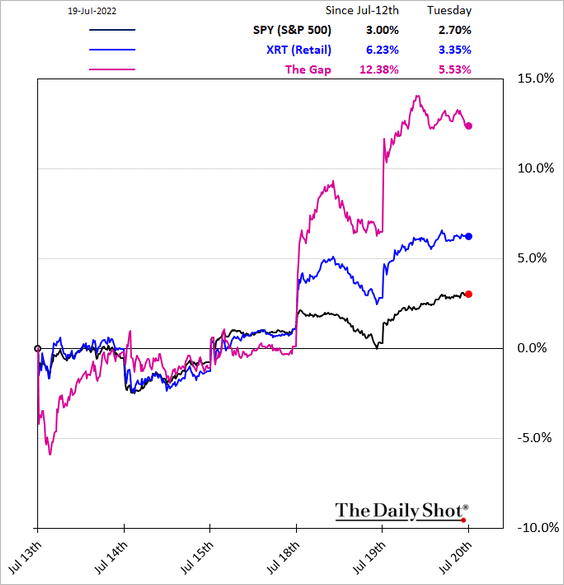

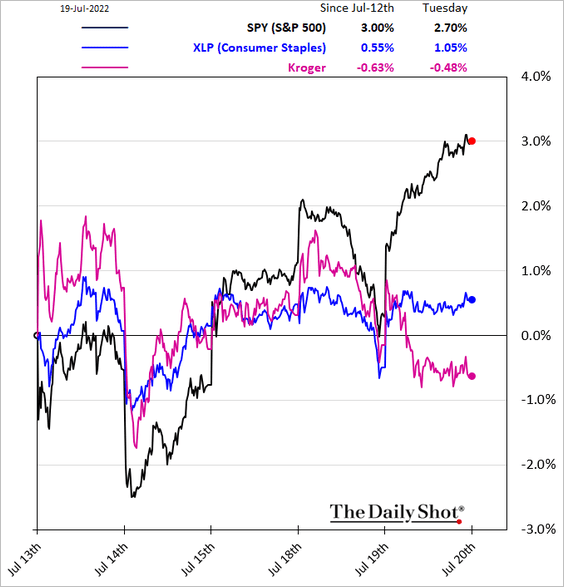

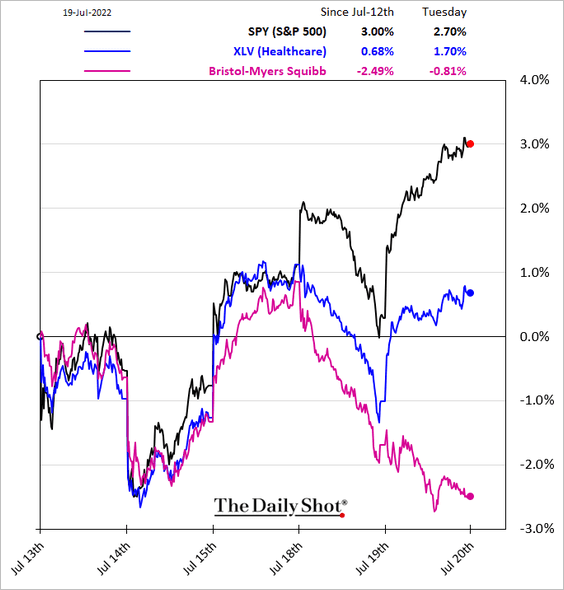

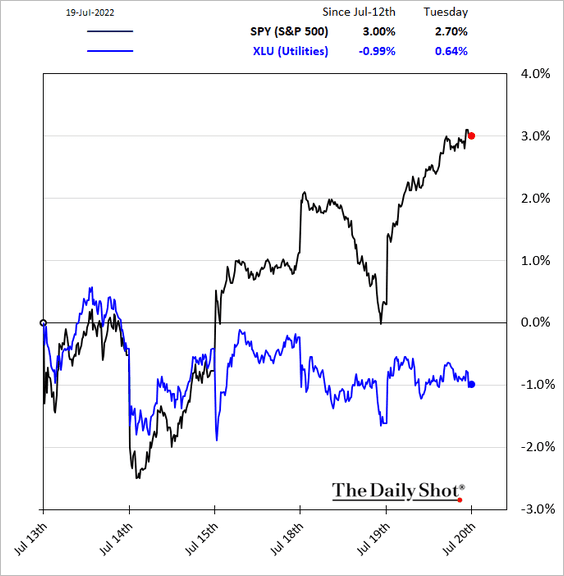

7. Next, we have some sector performance trends.

• Banks:

• Tech and semiconductors:

• Communication Services:

• Transportation:

• Energy:

• Metals & Mining:

• Consumer Discretionary:

• Retail:

• Consumer Staples:

• Healthcare:

• Utilities:

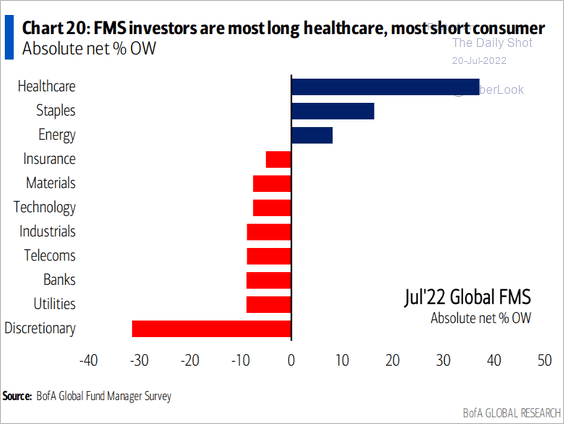

Here is fund managers’ positioning going into this rally.

Source: BofA Global Research

Source: BofA Global Research

——————–

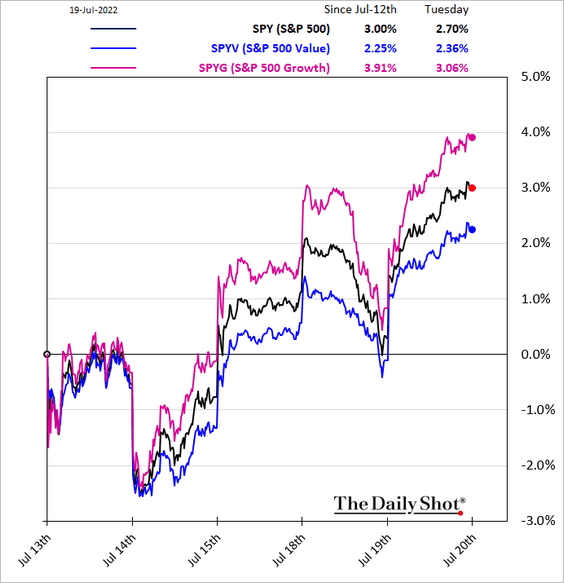

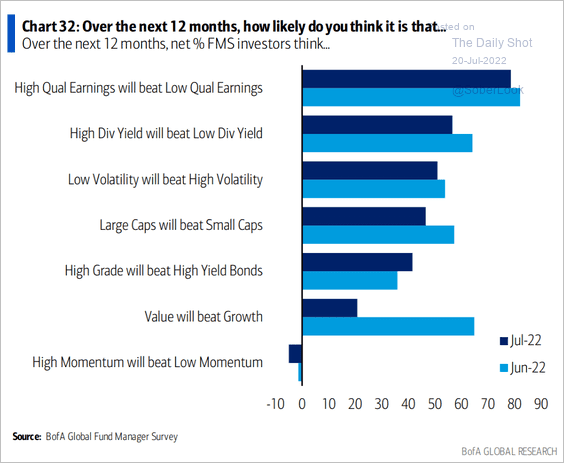

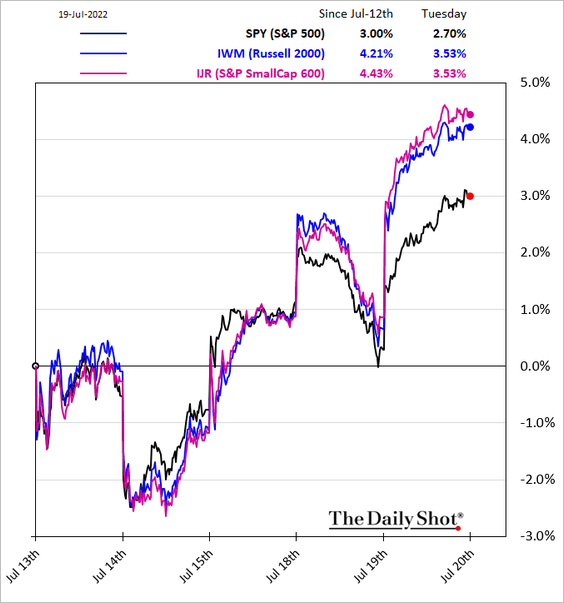

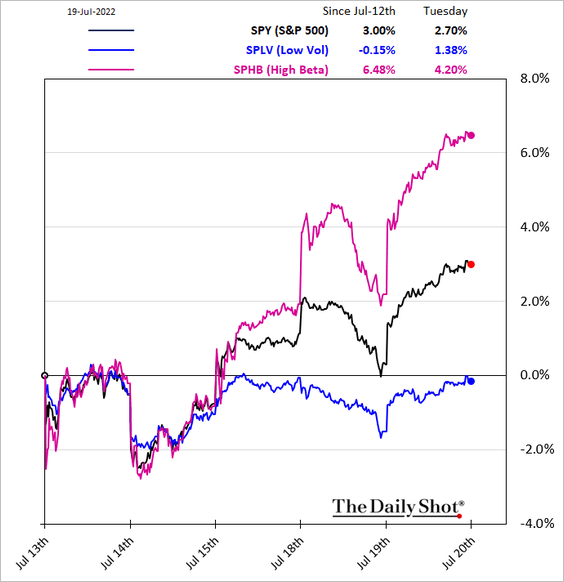

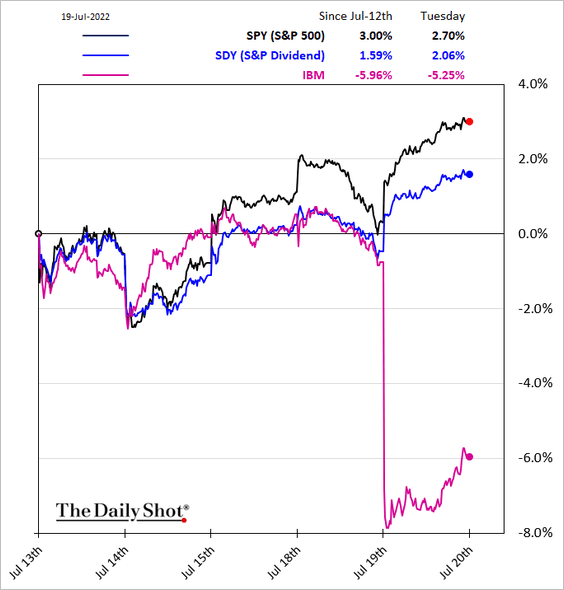

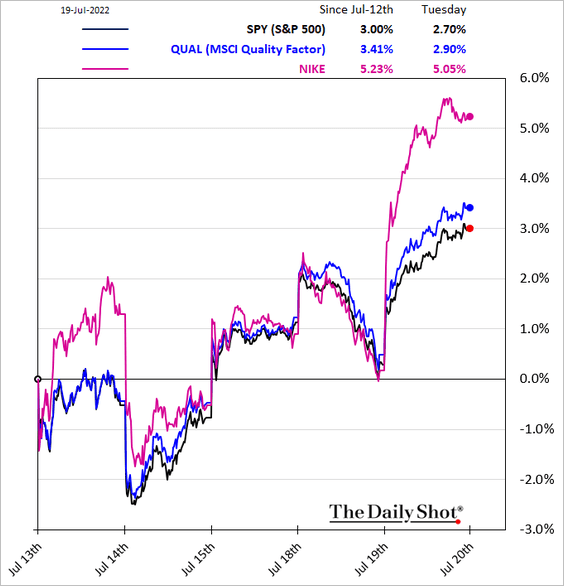

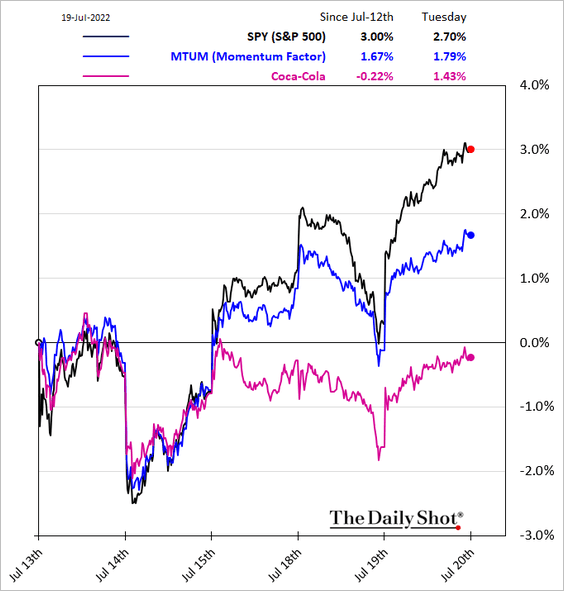

8. Next, let’s take a look at some equity factor trends.

• Value vs. growth:

By the way, fund managers are less sure that value will beat growth.

Source: BofA Global Research

Source: BofA Global Research

• Small caps:

• High-beta and low-vol:

• High-dividend:

• Quality:

• Momentum (yes, there are more value names in the momentum ETF):

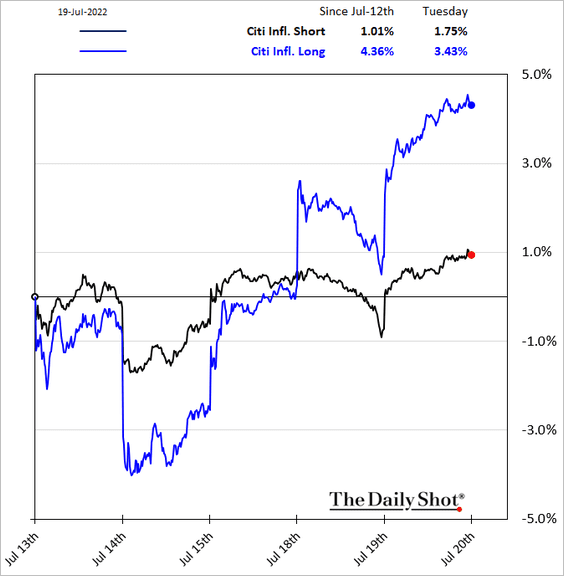

• Inflation-sensitive:

Back to Index

Rates

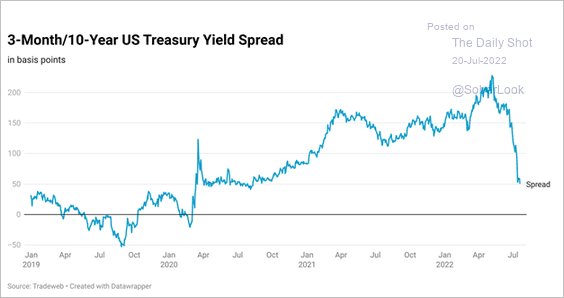

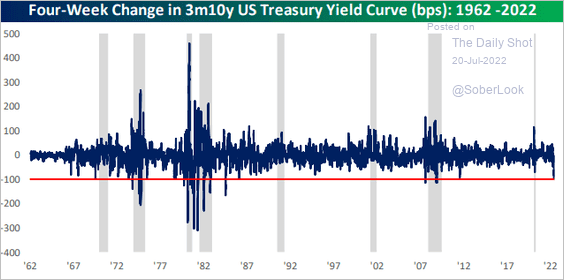

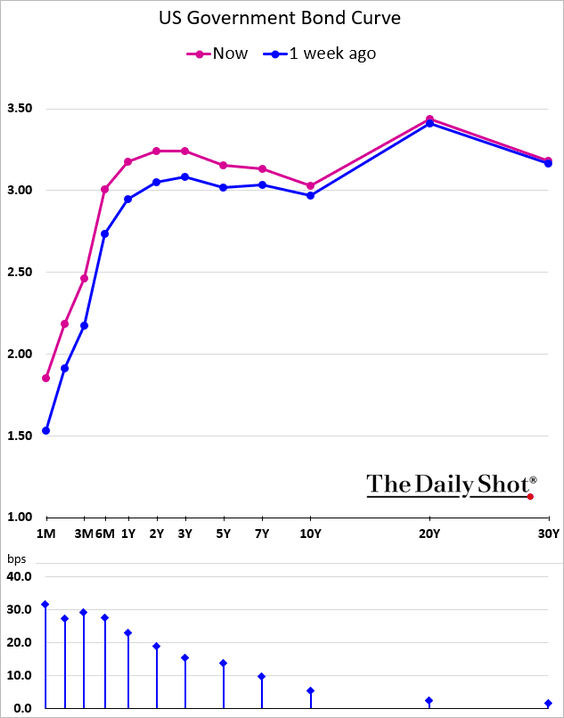

1. The 10-year – 3-month portion of the Treasury curve is flattening rapidly.

Source: Tradeweb

Source: Tradeweb

Source: @GunjanJS, @bespokeinvest

Source: @GunjanJS, @bespokeinvest

Here is the yield curve.

——————–

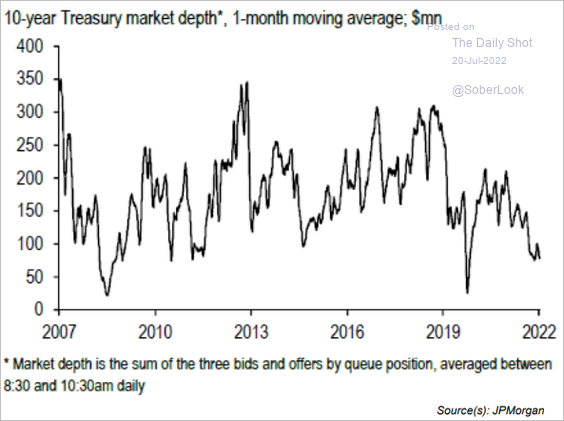

2. Treasury market liquidity has been deteriorating in recent years.

Source: JP Morgan Research, h/t III Capital Management

Source: JP Morgan Research, h/t III Capital Management

——————–

Food for Thought

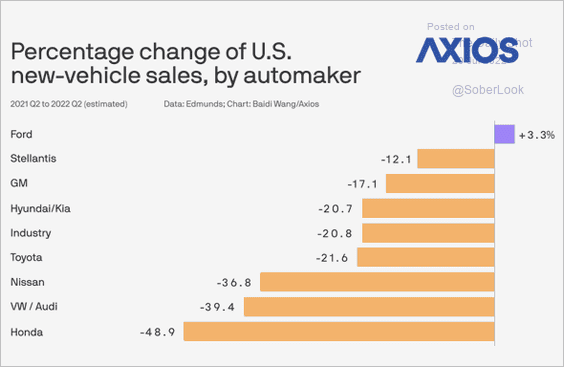

1. Change in new vehicle sales over the past 12 months:

Source: @axios Read full article

Source: @axios Read full article

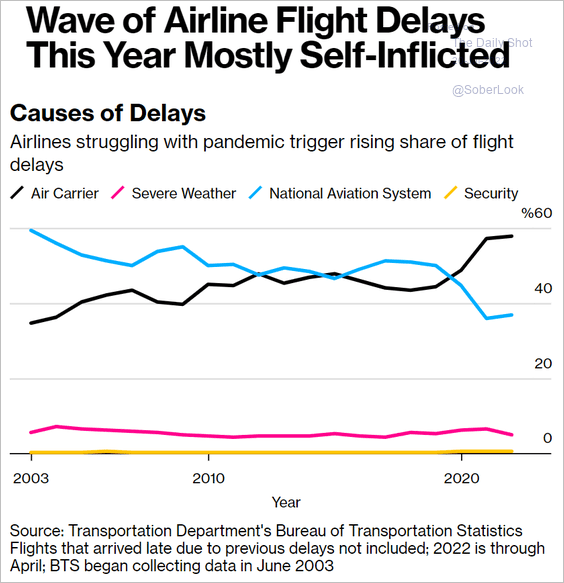

2. Who is responsible for flight delays:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

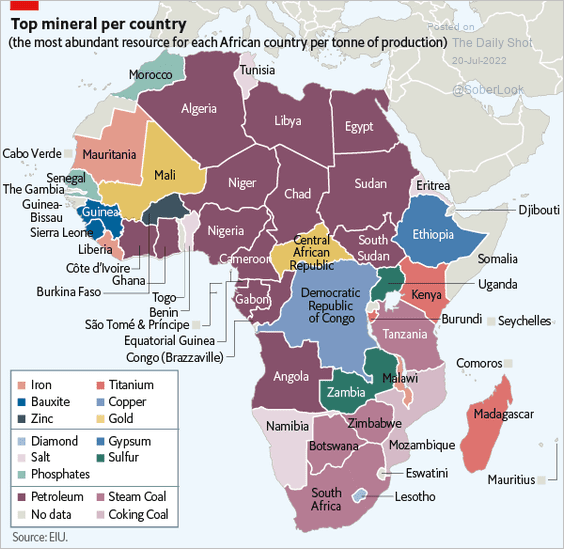

3. The most abundant mineral resource in each African country:

Source: The Economist

Source: The Economist

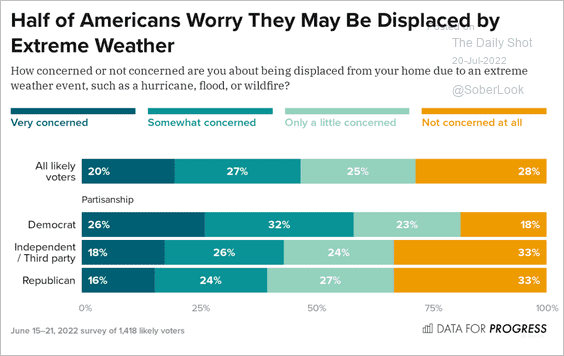

4. Concerns about extreme weather:

Source: Data for Progress Read full article

Source: Data for Progress Read full article

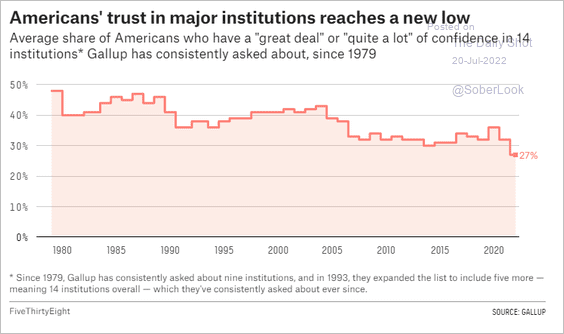

5. Americans’ trust in major institutions:

Source: FiveThirtyEight Read full article

Source: FiveThirtyEight Read full article

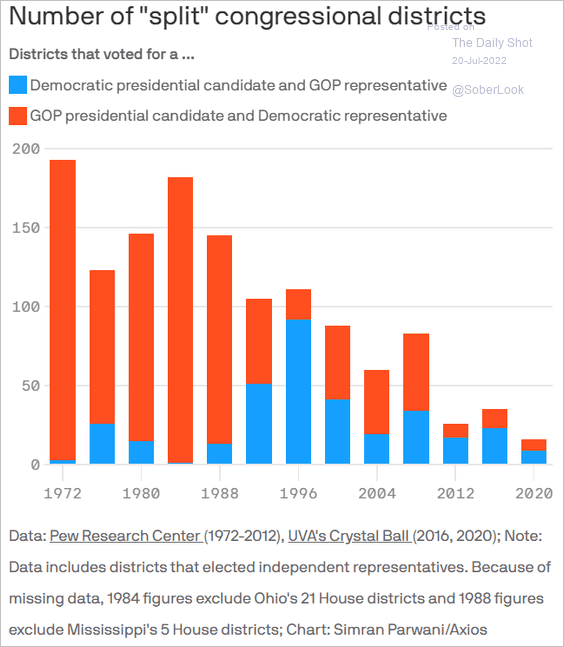

6. Split congressional districts:

Source: @axios Read full article

Source: @axios Read full article

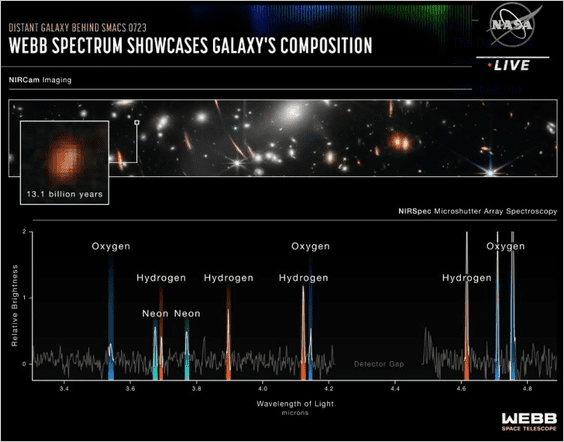

7. Peering back in time to detect oxygen in a 13.1 billion-year-old galaxy:

Source: @DrEOChapman Further reading

Source: @DrEOChapman Further reading

——————–

Back to Index