The Daily Shot: 21-Jul-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

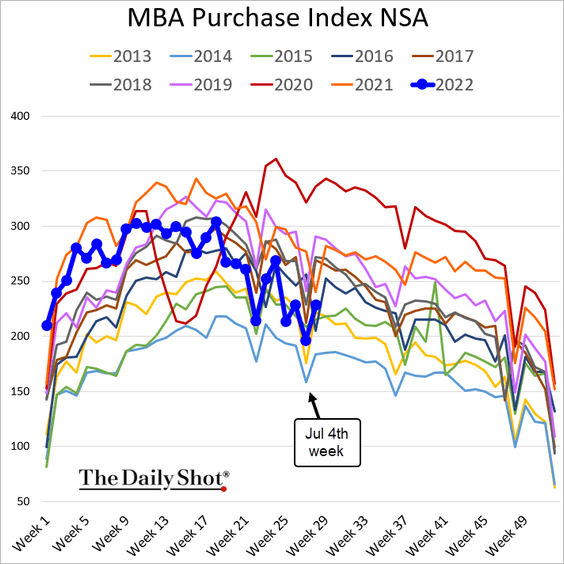

1. Let’s begin with the housing market.

• Mortgage applications continue to trend lower.

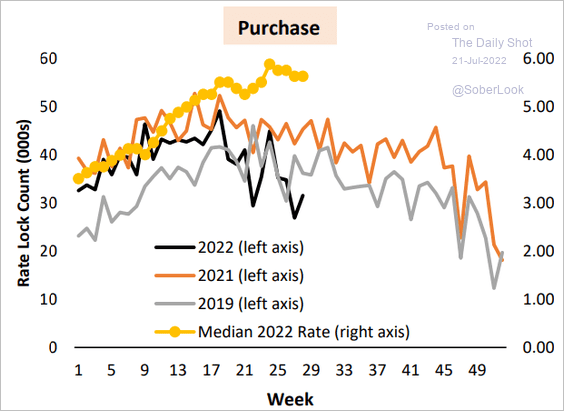

Here is the rate lock count.

Source: AEI Center on Housing Markets and Finance

Source: AEI Center on Housing Markets and Finance

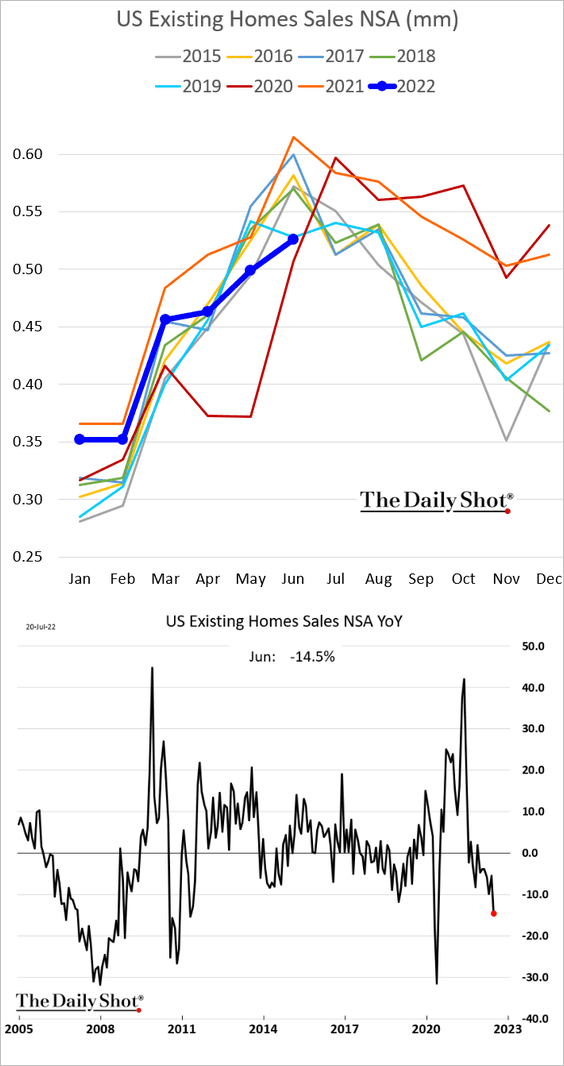

• Existing home sales are at 2019 levels, well below last year’s peak.

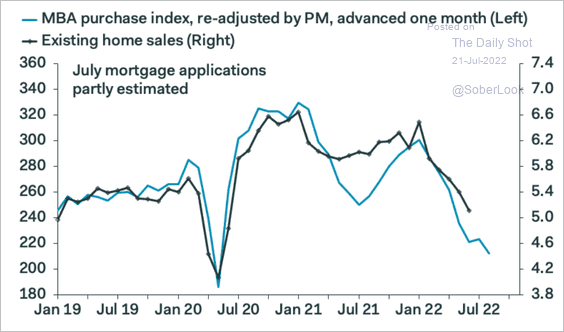

Mortgage applications point to further weakness ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

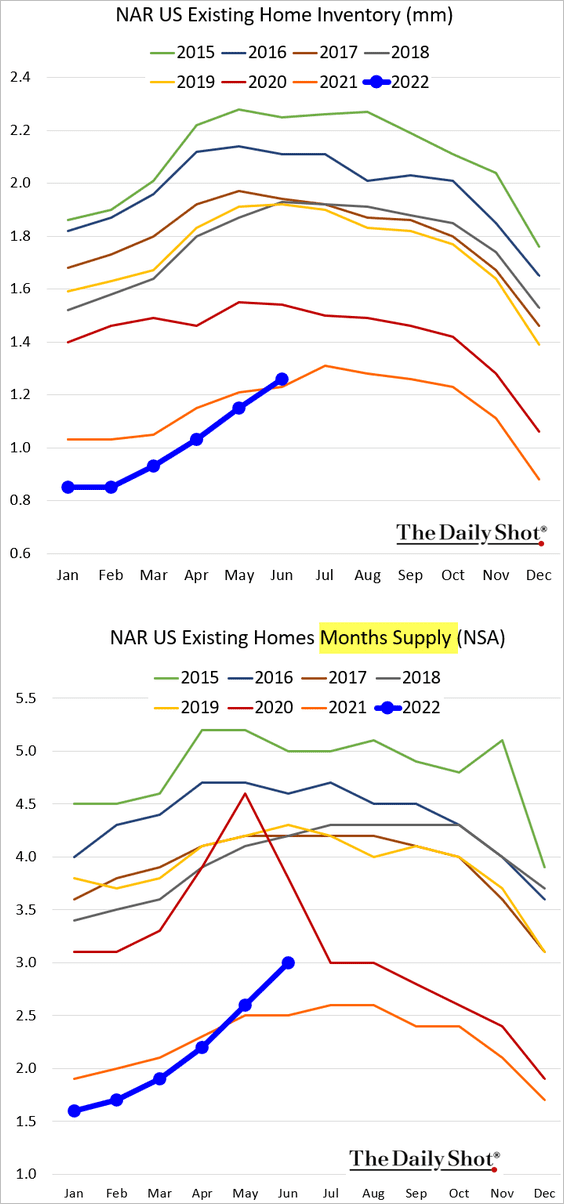

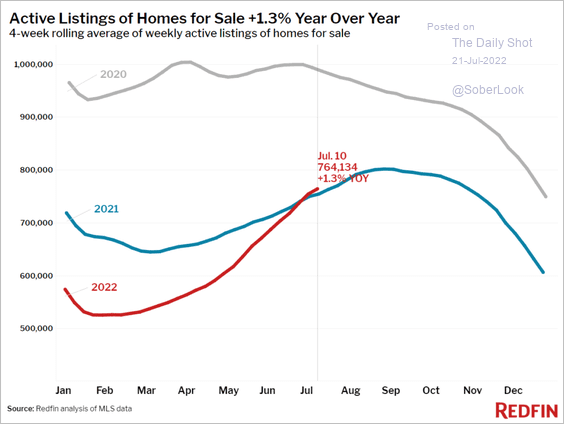

• Housing inventories are still low but climbing quickly.

Source: Redfin

Source: Redfin

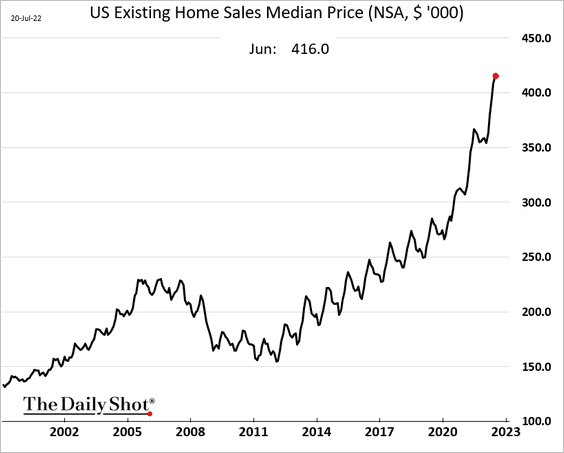

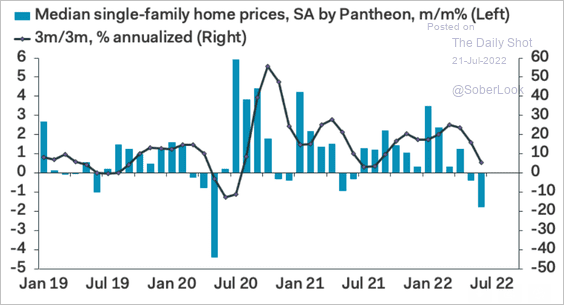

• The median price hit a record high.

However, prices are generally higher in the summer. Pantheon Macroeconomics says that the median price declined last month on a seasonally-adjusted basis.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

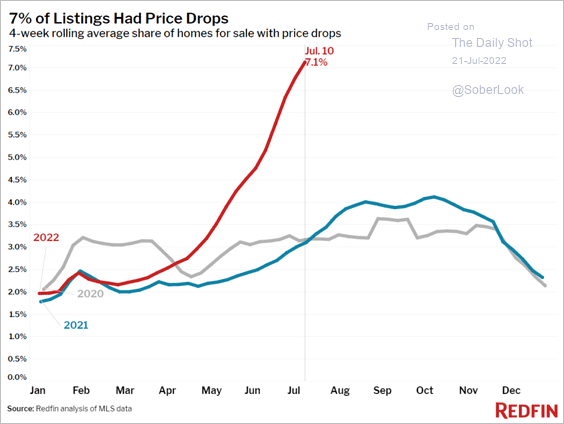

• More sellers are cutting their listing prices.

Source: Redfin

Source: Redfin

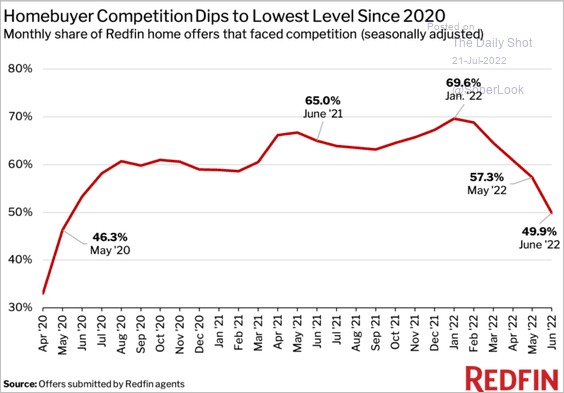

• A smaller share of buy offers resulted in a sale last month.

Source: Redfin

Source: Redfin

——————–

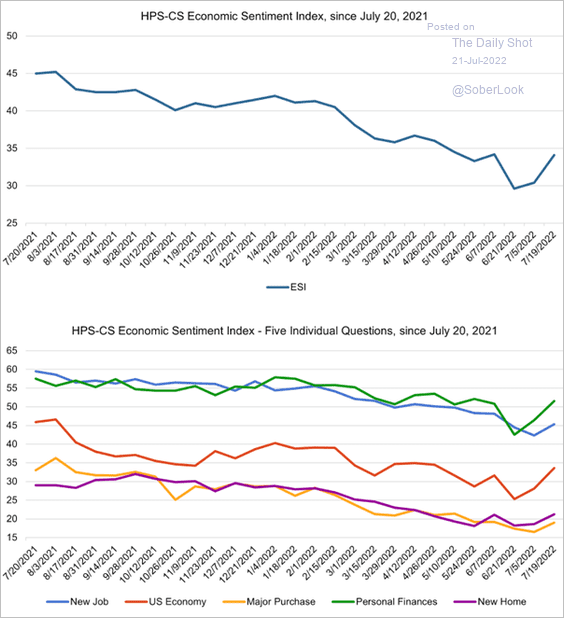

2. Consumer sentiment ticked higher over the past couple of weeks, …

Source: @HPS_CS, @HPSInsight, @CivicScience

Source: @HPS_CS, @HPSInsight, @CivicScience

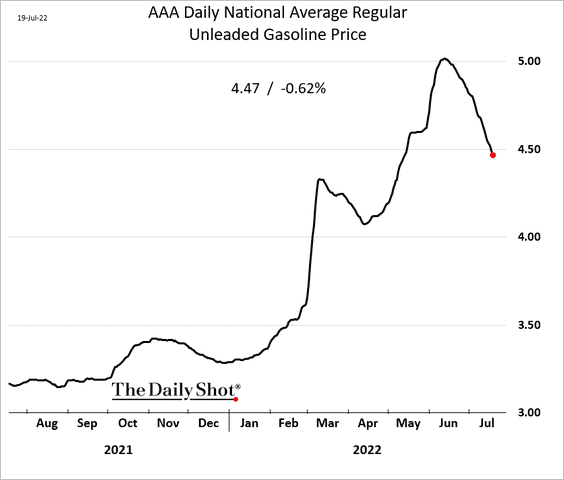

… as gasoline prices fell.

——————–

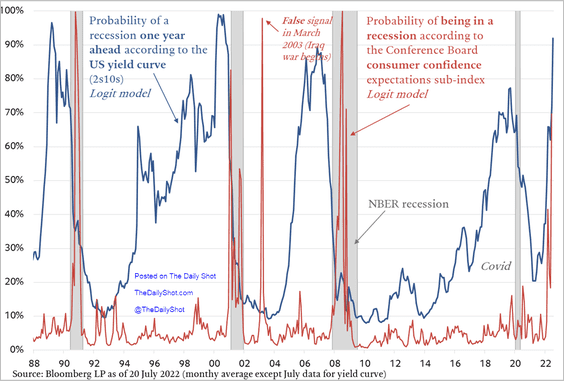

3. Various models continue to show elevated recession probabilities.

Source: @TCosterg

Source: @TCosterg

4. Next, we have some updates on the labor market.

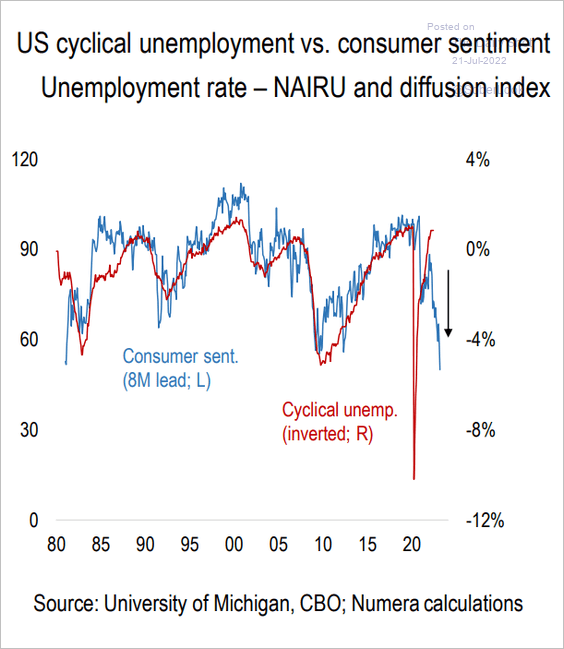

• Consumer sentiment is signaling much higher unemployment ahead.

Source: @NumeraAnalytics

Source: @NumeraAnalytics

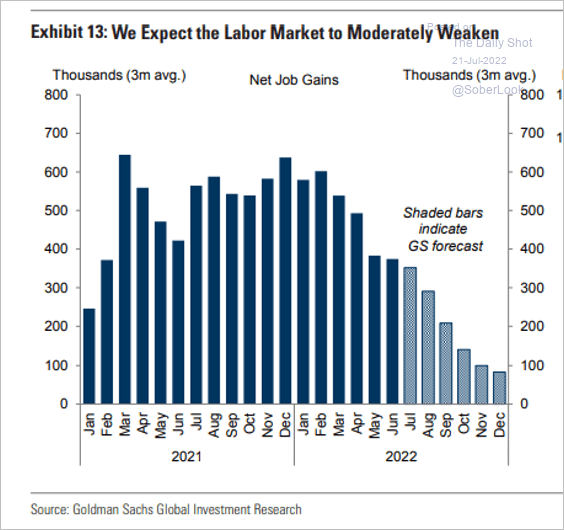

• Goldman sees slowing payroll gains going forward.

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

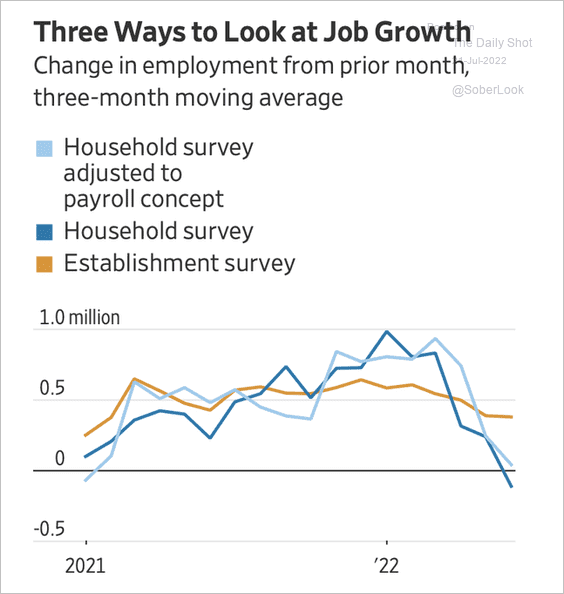

• As we mentioned previously, the household survey, which includes non-payrolled employment (for example, self-employment) has been much weaker than the establishment survey (more info on the two surveys here).

Source: @jessefelder, @WSJ Read full article

Source: @jessefelder, @WSJ Read full article

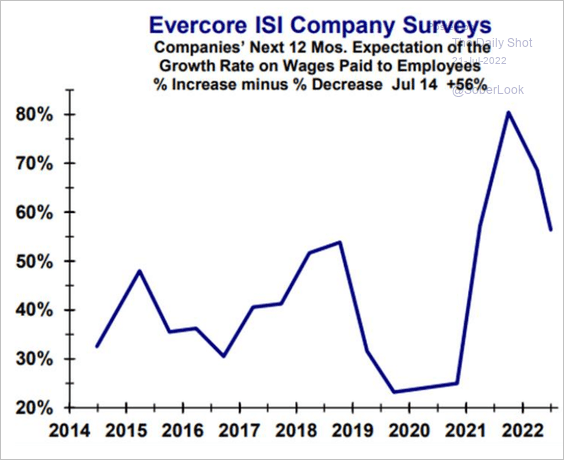

• Fewer companies plan to boost wages, according to a survey from Evercore ISI.

Source: Evercore ISI Research

Source: Evercore ISI Research

——————–

5. Below is a prescient WSJ headline from 2006.

Source: @WSJ Read full article

Source: @WSJ Read full article

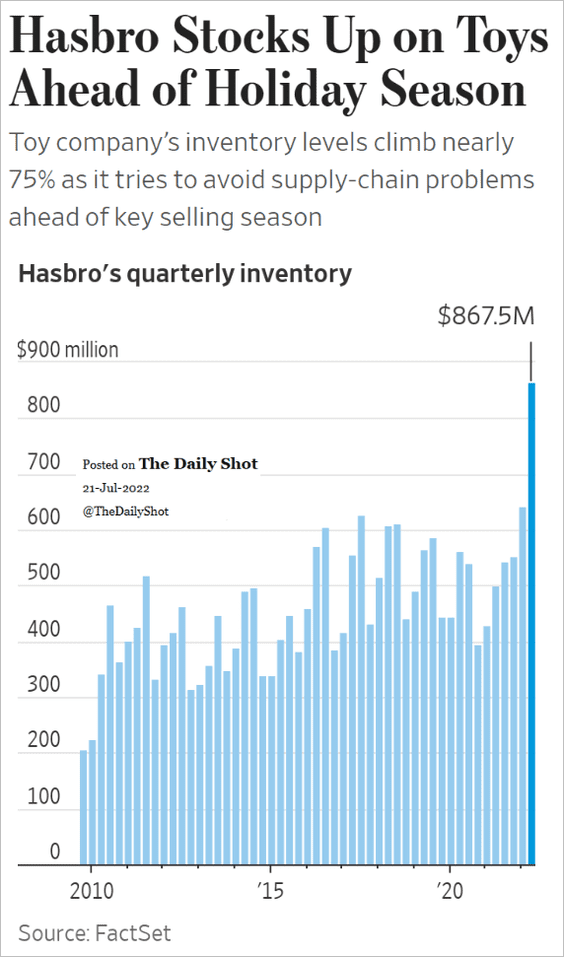

And here is one from this week. Inventory is managed differently now.

Source: @WSJ Read full article

Source: @WSJ Read full article

Back to Index

Canada

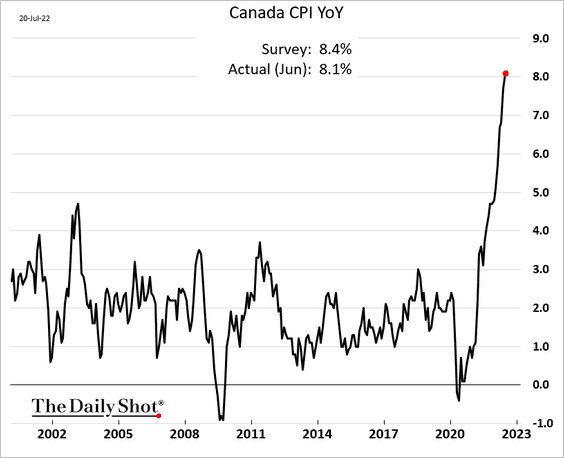

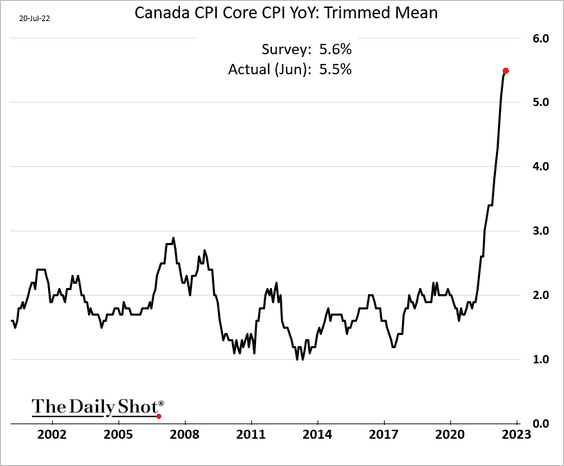

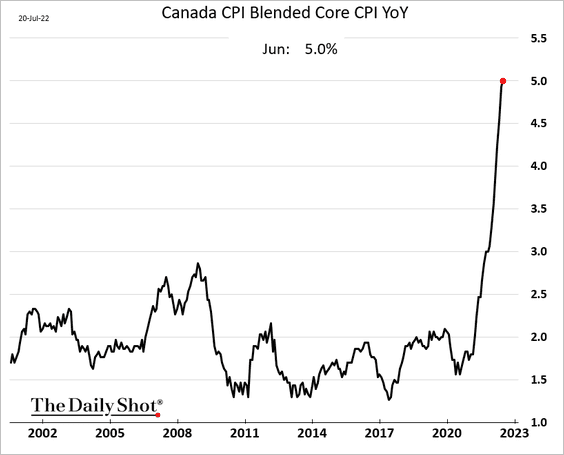

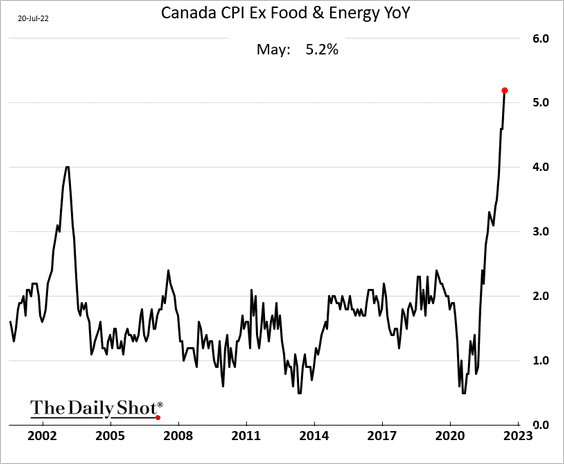

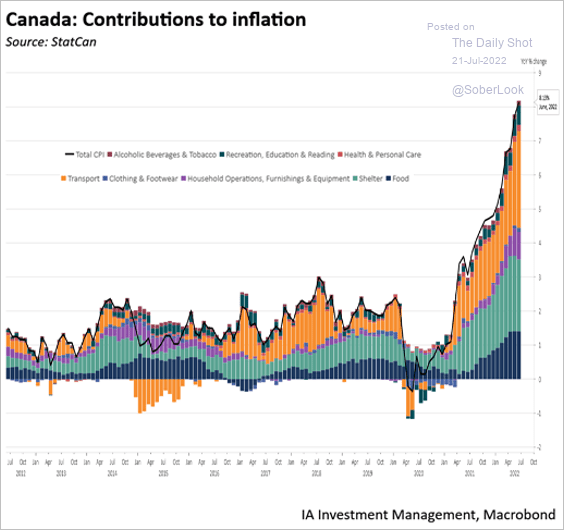

1. The headline CPI topped 8%, but the print was softer than expected.

• Core inflation measures continue to climb (3 charts).

• Transportation costs (orange) have been soaring.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

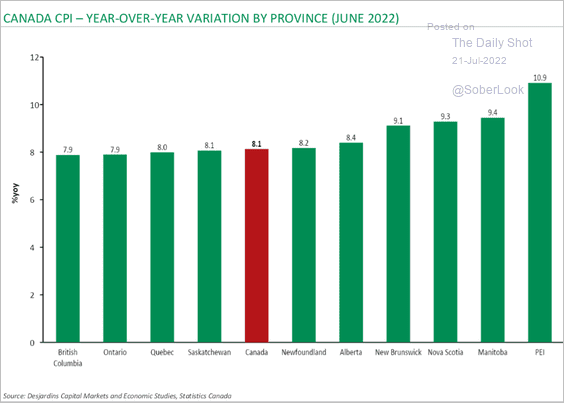

• Here is the CPI by province.

Source: Desjardins

Source: Desjardins

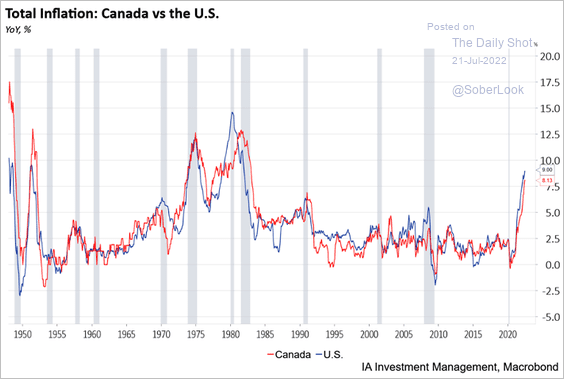

• Here is a comparison to the US.

Source: Industrial Alliance Investment Management

Source: Industrial Alliance Investment Management

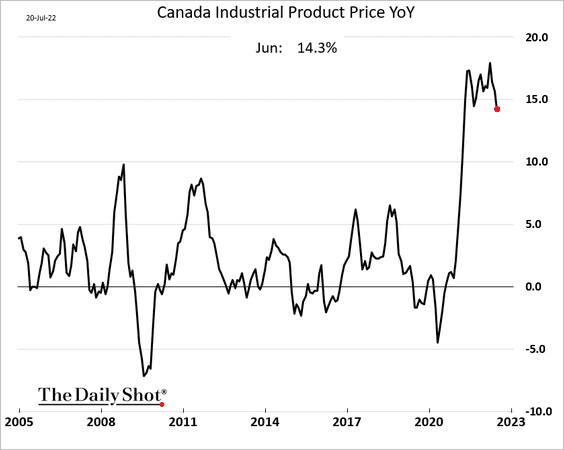

2. Industrial product inflation is off the highs but still 14% above last year’s levels.

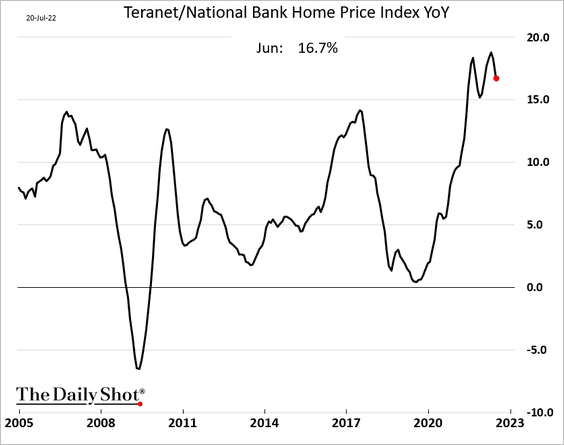

3. Home price appreciation appears to have peaked.

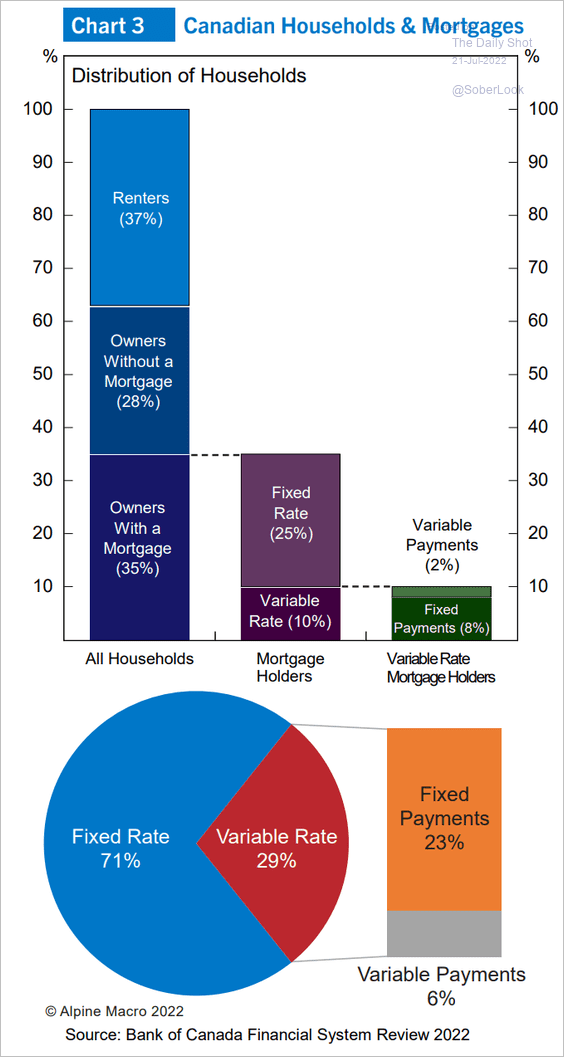

Here is a summary of Canada’s households and mortgages.

Source: Alpine Macro

Source: Alpine Macro

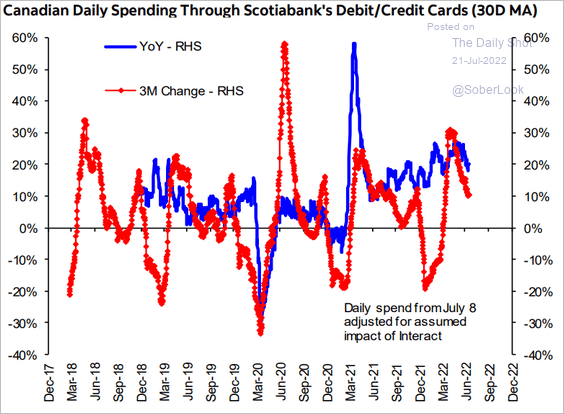

——————–

4. According to credit/debit card data, consumer spending remains robust.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Back to Index

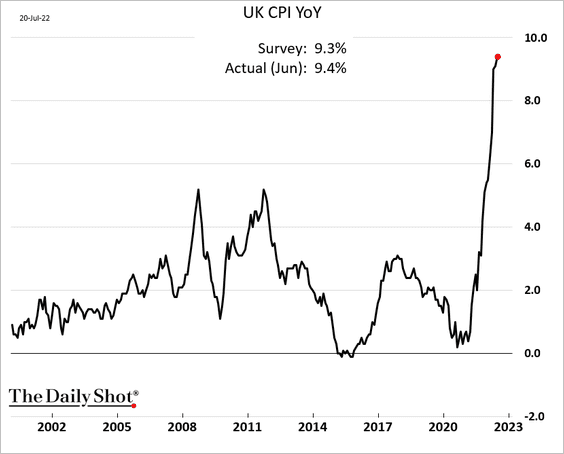

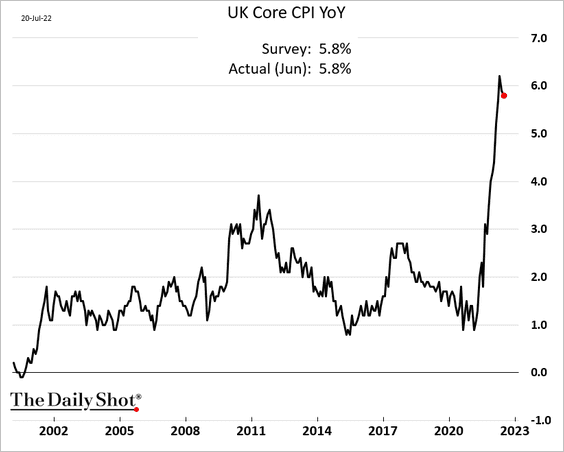

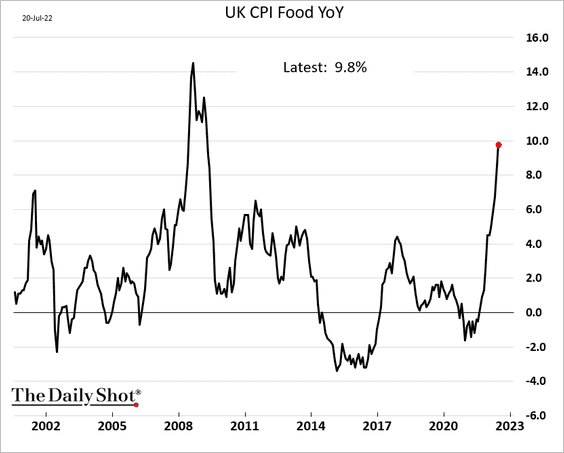

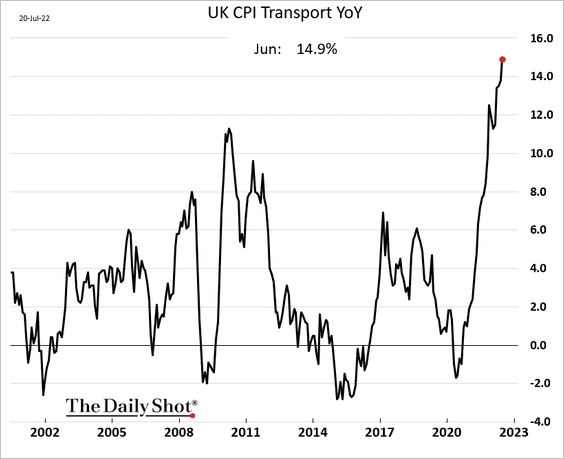

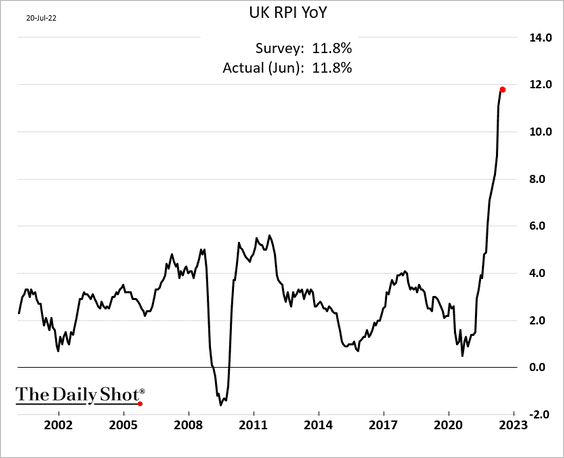

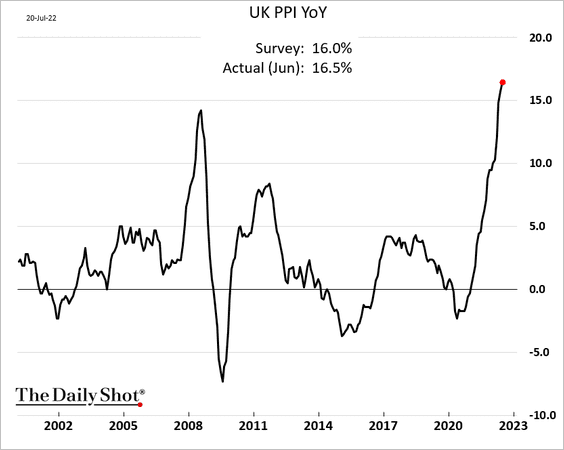

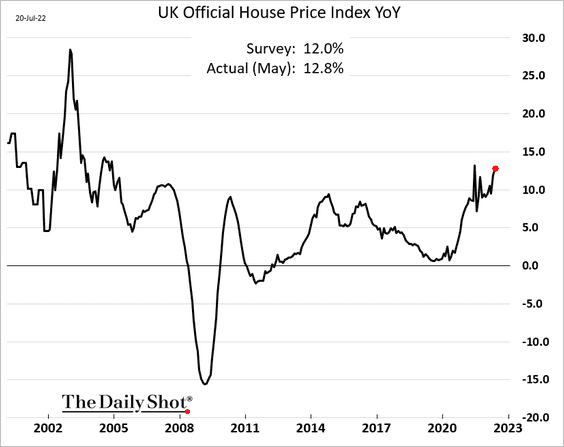

The United Kingdom

1. The headline inflation print was slightly above forecasts as prices continue to surge.

Below, we have some additional data from the CPI report.

• Core inflation:

• Food:

• Transportation:

• Retail prices:

2. Producer prices are 16.5% above last year’s level.

3. Home price appreciation held up well in May.

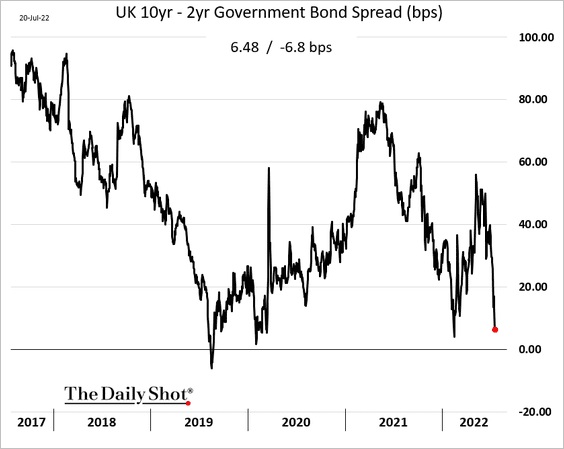

4. The yield curve is approaching inversion.

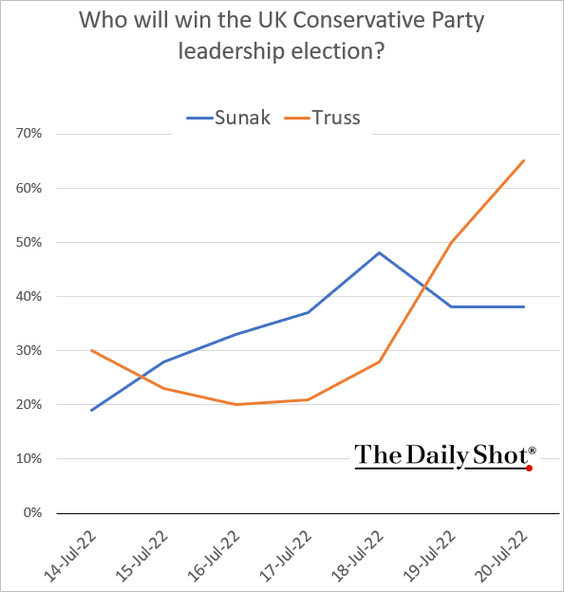

5. Liz Truss pulls ahead in the betting markets.

Source: @PredictIt

Source: @PredictIt

Back to Index

The Eurozone

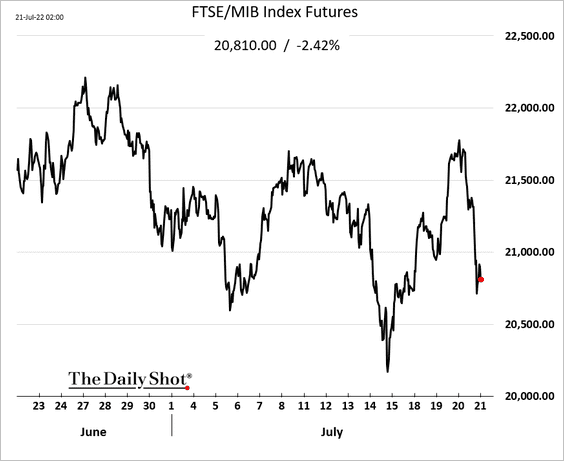

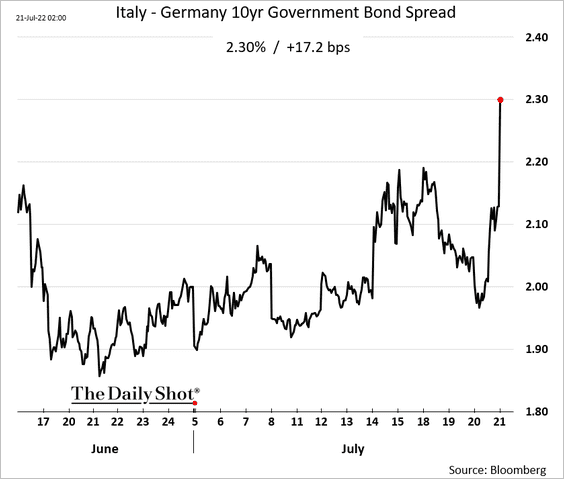

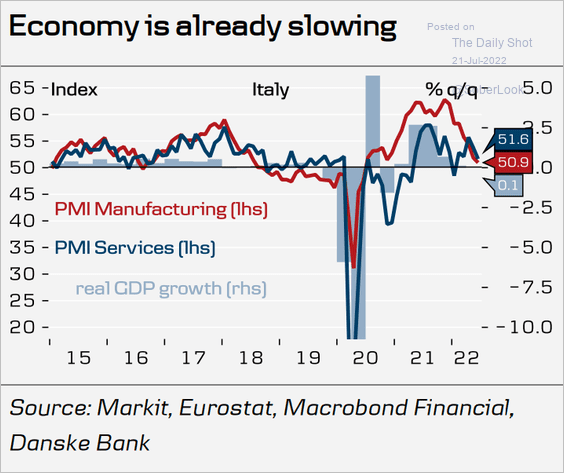

1. This is not a good outcome for Italy.

Source: CNBC Read full article

Source: CNBC Read full article

The election will take place in the first week of October. Italian stocks and bonds took a hit.

The economy was already slowing, and this renewed political uncertainty will exacerbate the decline.

Source: Danske Bank

Source: Danske Bank

——————–

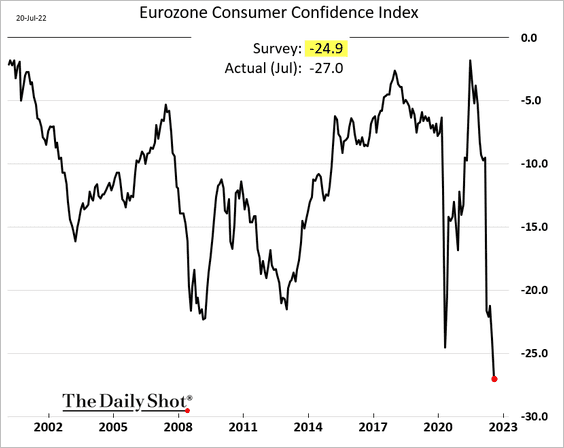

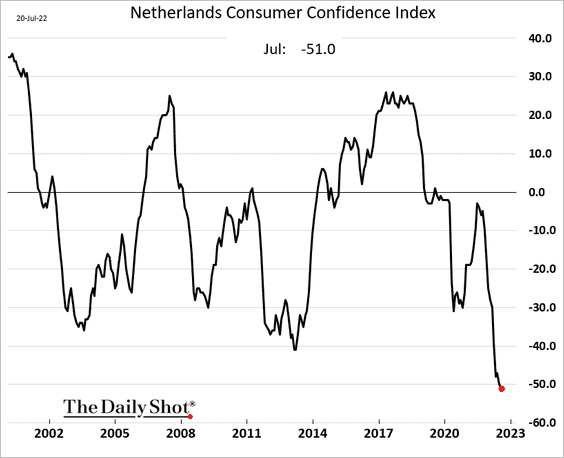

2. The Eurozone’s consumer confidence index hit a record low.

Here is the Netherlands.

——————–

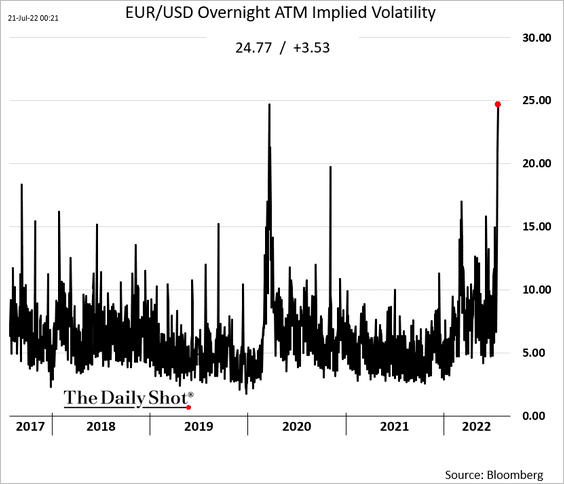

3. EUR/USD implied vol is at extreme levels ahead of the ECB.

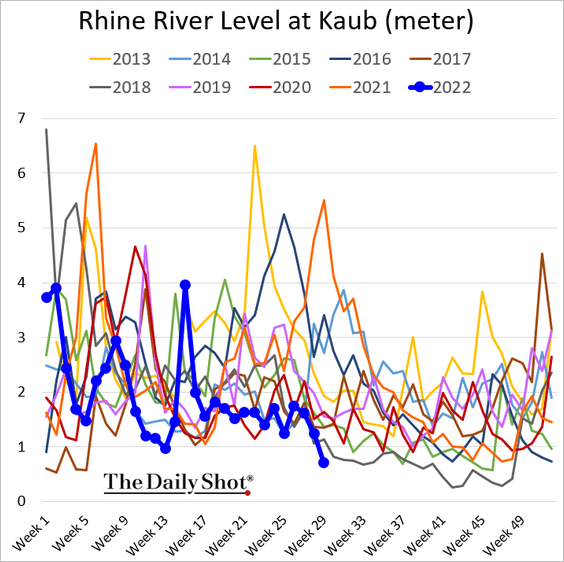

4. Germany’s logistics, particularly energy transport, is under further threat from falling water levels in the River Rhine.

Source: CNBC Read full article

Source: CNBC Read full article

Back to Index

Asia – Pacific

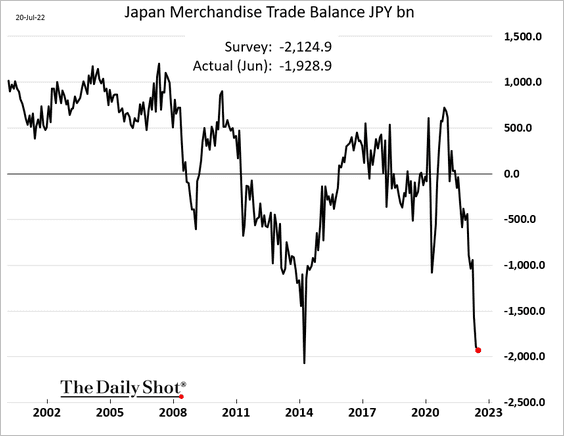

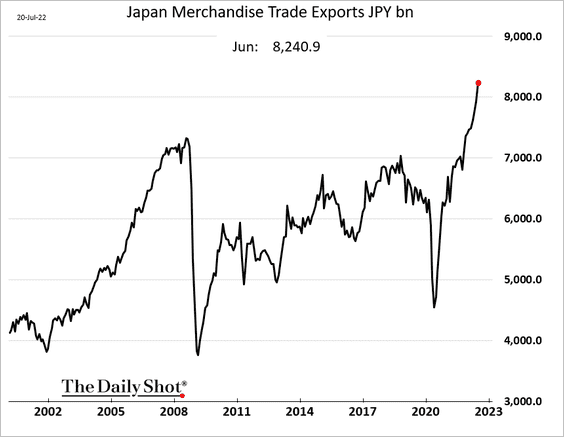

1. Japan’s June trade deficit was not as wide as expected …

… on strong exports.

——————–

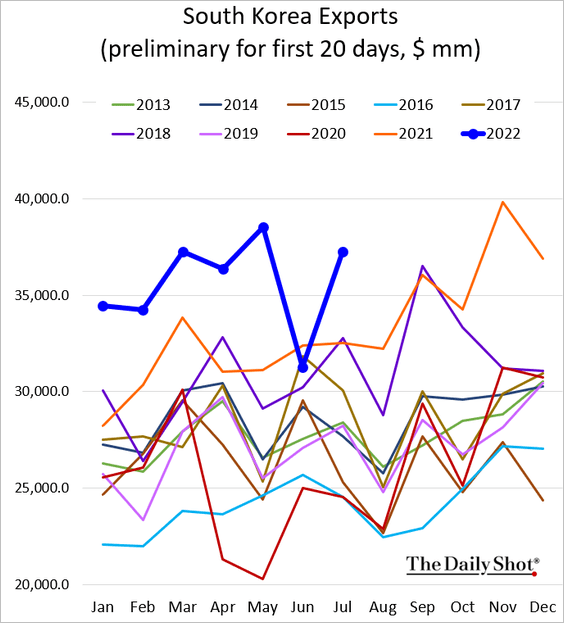

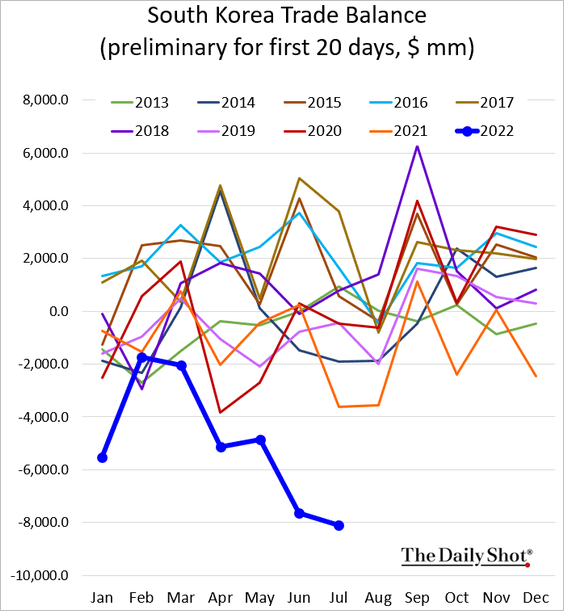

2. South Korea’s exports rebounded this month.

But the trade deficit hit a new record due to surging energy prices.

——————–

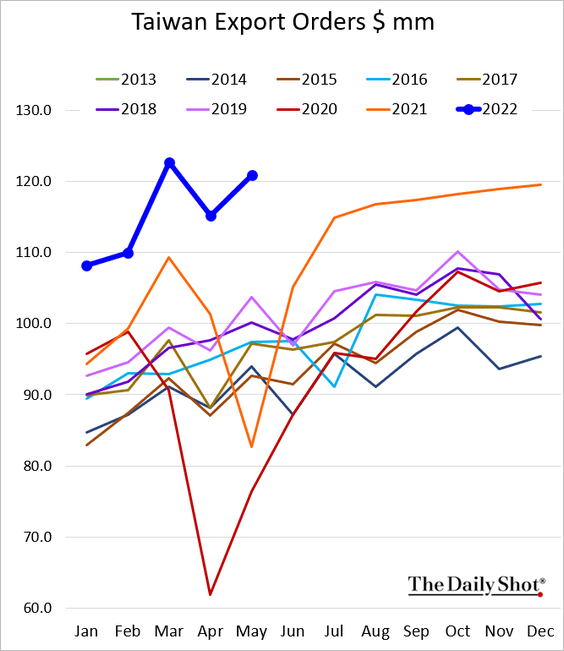

3. Taiwan’s export orders remain strong.

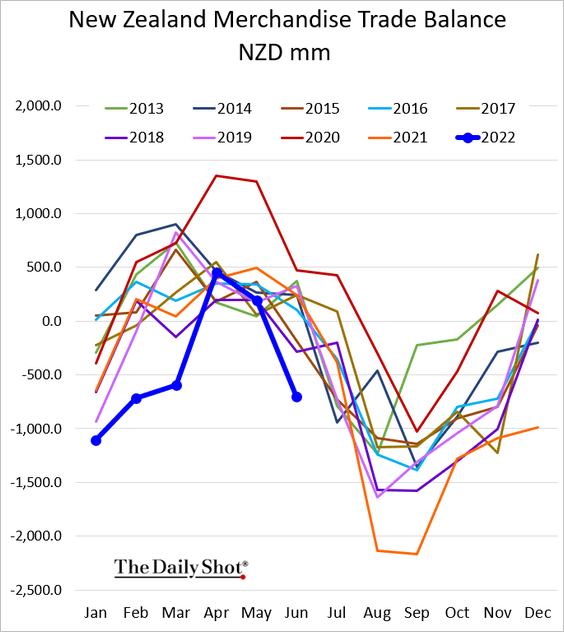

4. New Zealand’s trade deficit widened much more than usual for this time of the year due to energy prices.

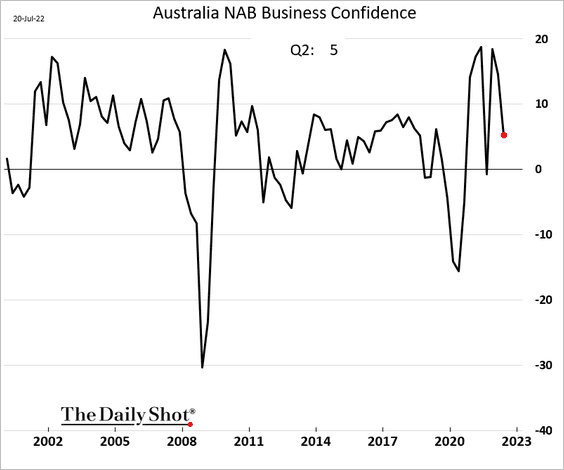

5. Australia’s business confidence declined last quarter.

Back to Index

China

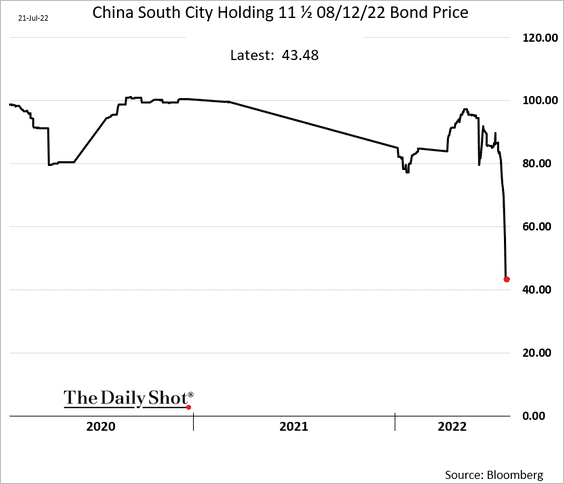

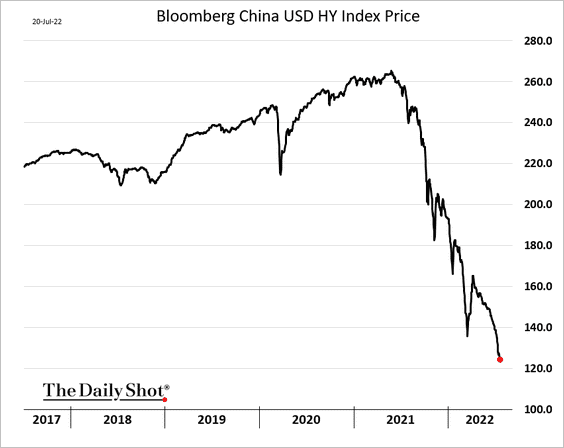

1. Developer credit crisis continues to worsen.

Source: @markets Read full article

Source: @markets Read full article

Here is the USD-denominated high-yield index.

——————–

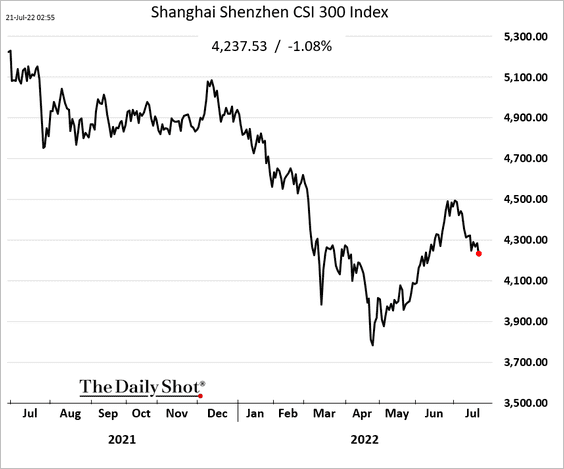

2. The stock market rebound has stalled.

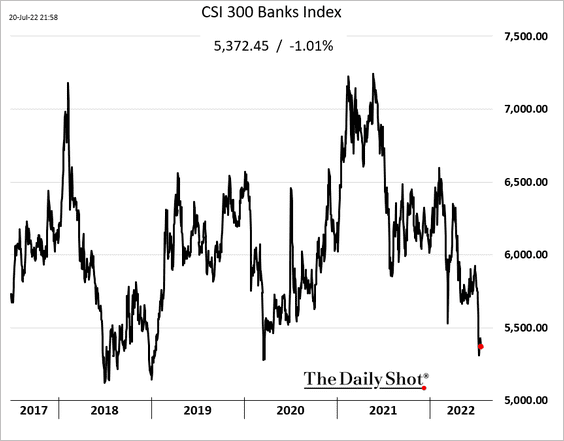

Bank shares remain under pressure.

——————–

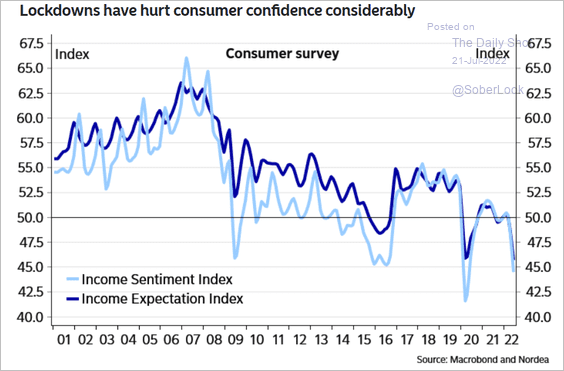

3. Consumer confidence has been soft.

Source: Nordea Markets

Source: Nordea Markets

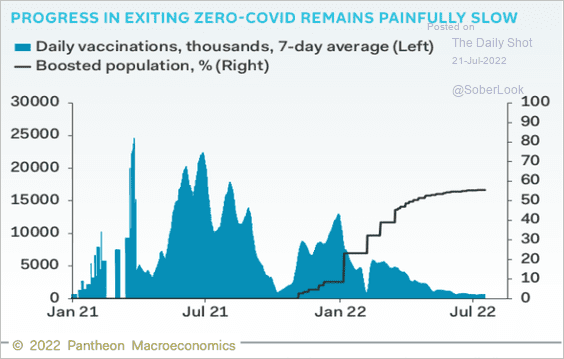

4. China’s vaccination progress has slowed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

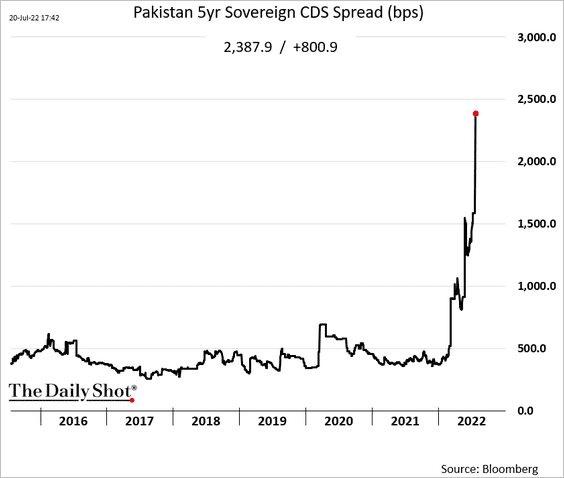

Emerging Markets

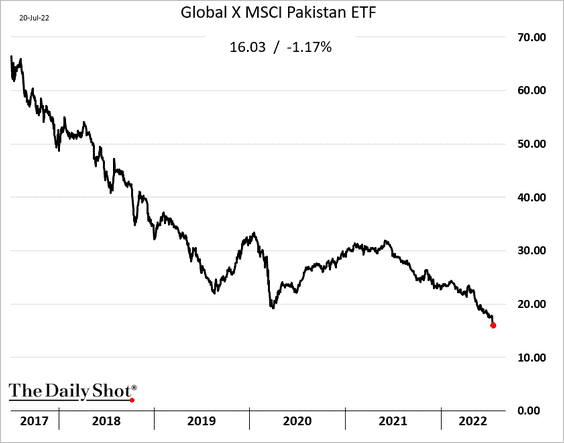

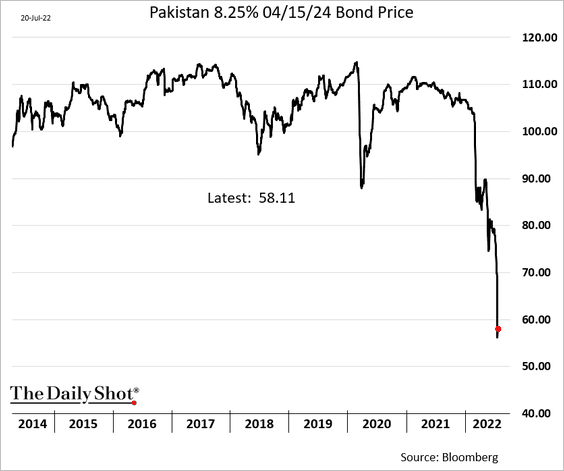

1. Investors continue to exit Pakistan’s assets.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Here is the sovereign credit default swap spread.

——————–

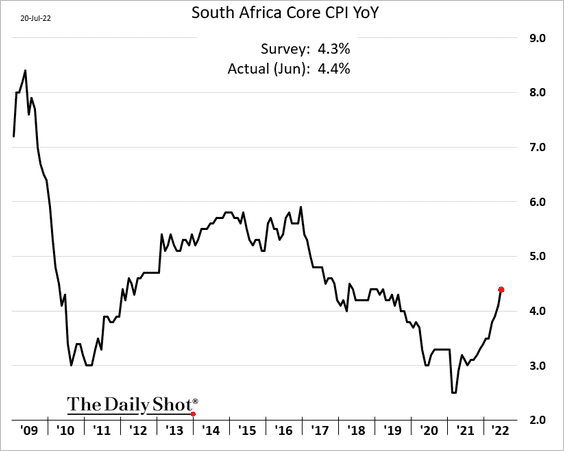

2. South Africa’s inflation is grinding higher.

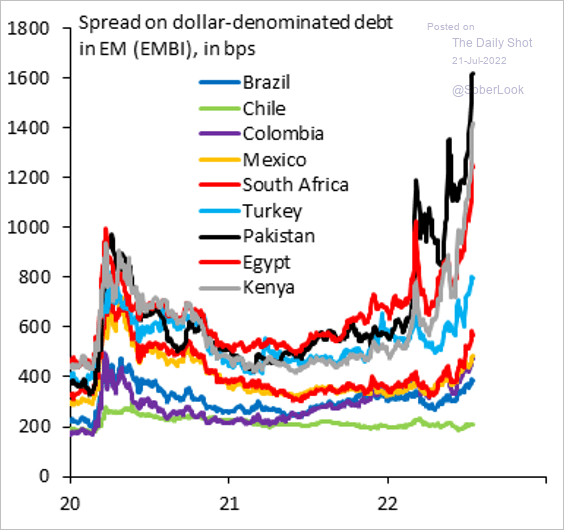

3. Dollar-denominated bond spreads have widened significantly.

Source: @RobinBrooksIIF

Source: @RobinBrooksIIF

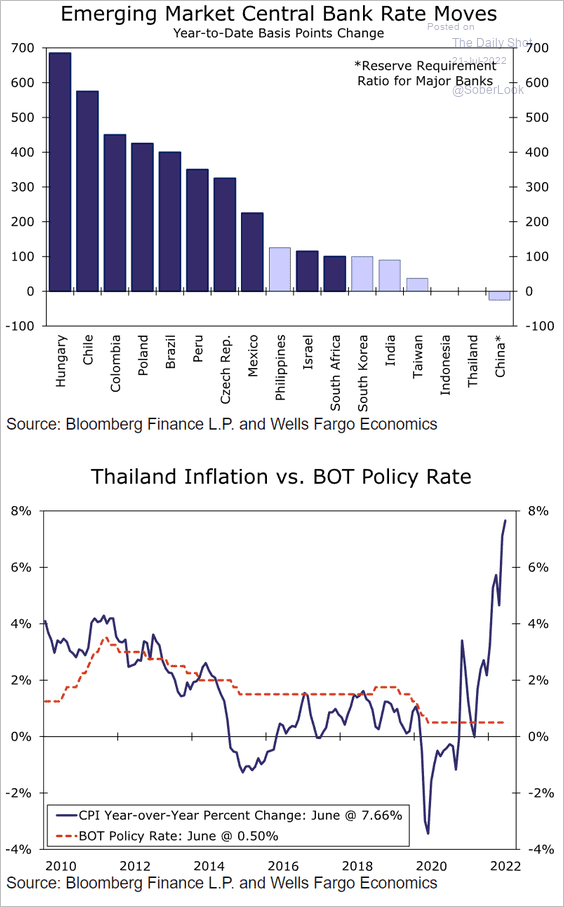

4. Are Asian central banks behind the curve?

Source: Wells Fargo Securities

Source: Wells Fargo Securities

Back to Index

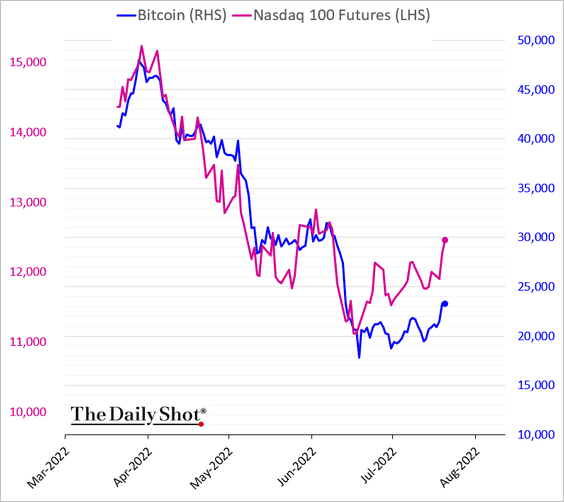

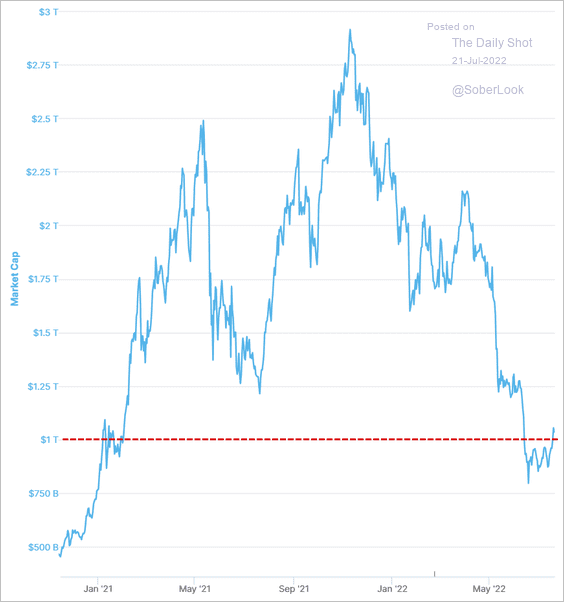

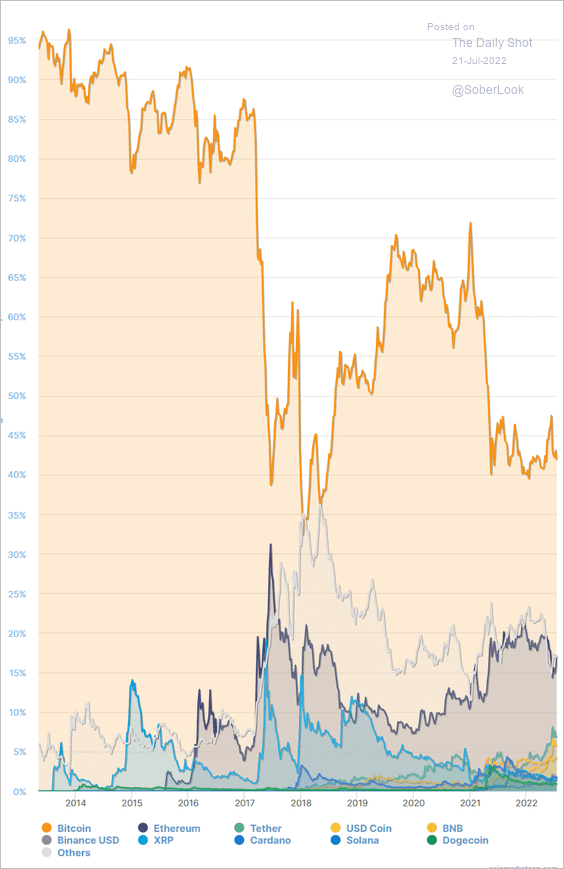

Cryptocurrency

1. Bitcoin has been lagging the bounce in tech stocks.

2. Crypto market cap is back above $1 trillion.

Source: CoinMarketCap

Source: CoinMarketCap

3. This chart shows major cryptoassets by the percentage of total market capitalization.

Source: CoinMarketCap

Source: CoinMarketCap

Back to Index

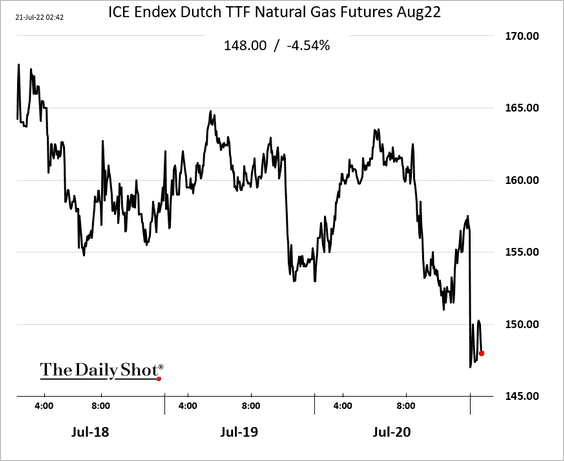

Energy

1. Russia resumed Nord Stream gas flows.

Source: @WSJ Read full article

Source: @WSJ Read full article

European natural gas prices are lower.

——————–

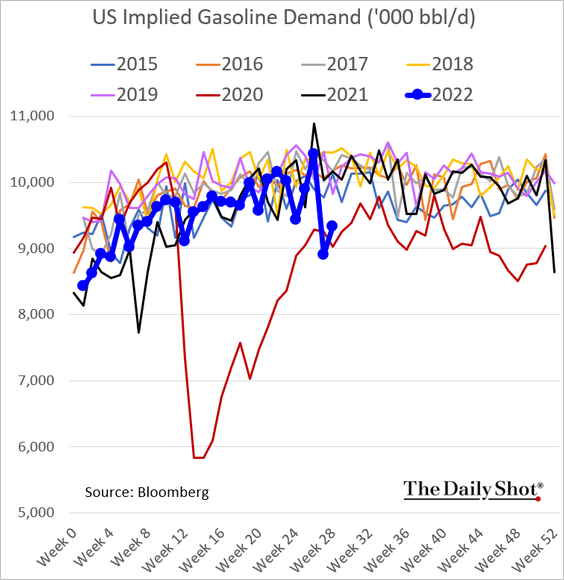

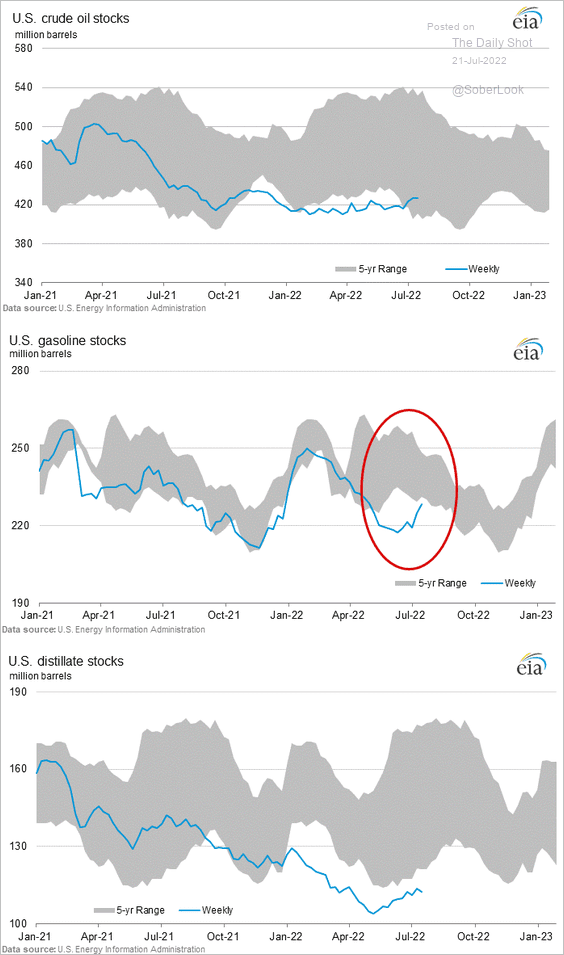

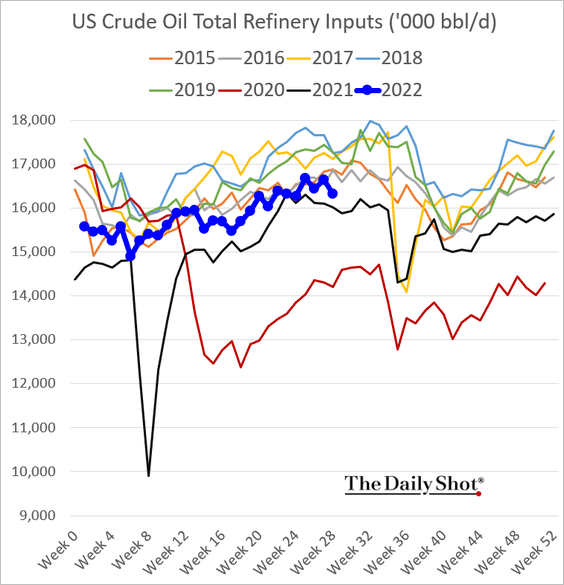

2. Us gasoline demand remains depressed (barely above 2020 levels) as drivers balk at high prices.

A recessionary signal?

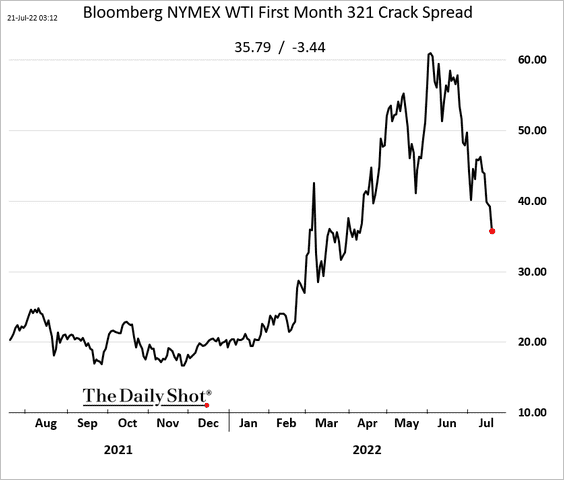

• Crack spreads are falling due to weak demand.

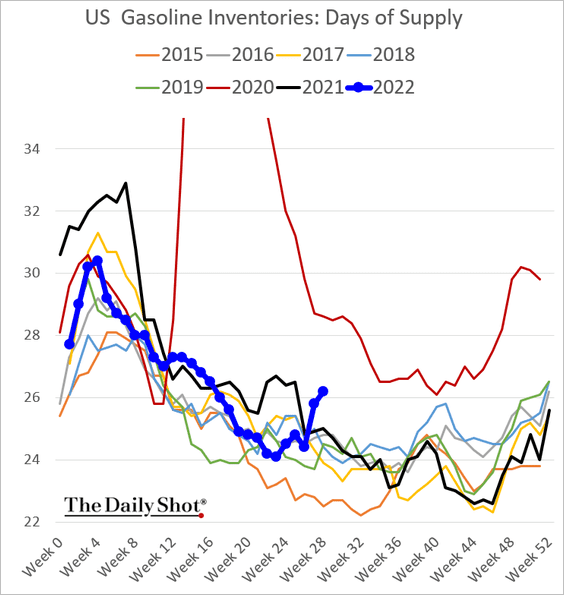

• Gasoline inventories are climbing.

• US refinery runs softened last week.

——————–

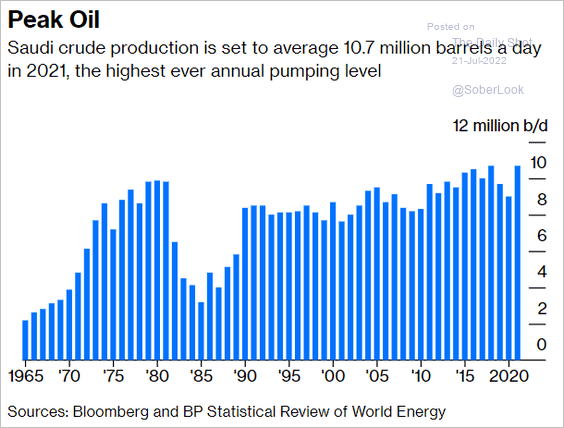

3 Saudi oil production is near maximum levels.

Source: @JavierBlas, @opinion Read full article

Source: @JavierBlas, @opinion Read full article

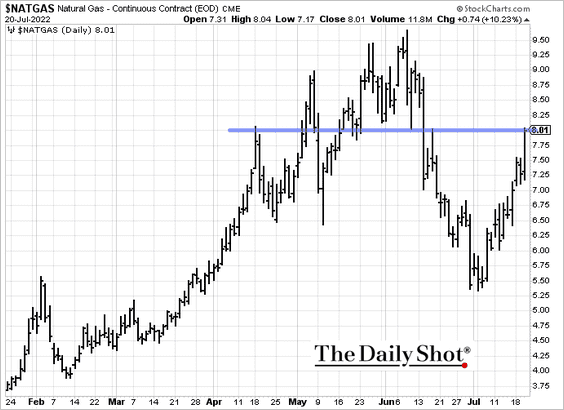

4. US natural gas is testing resistance at $8/mmbtu amid a sweltering heat wave.

Back to Index

Equities

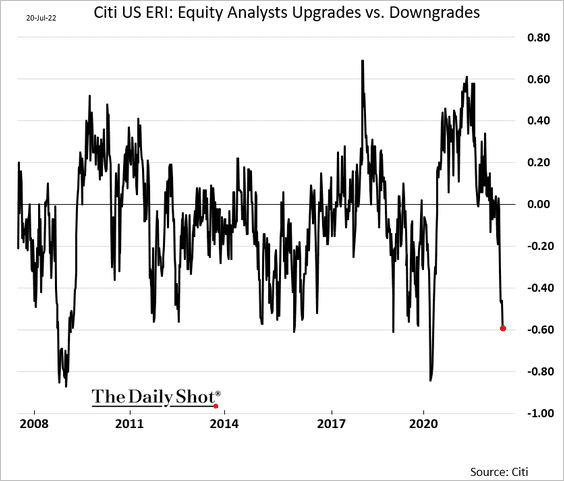

1. US corporate earnings downgrades have accelerated.

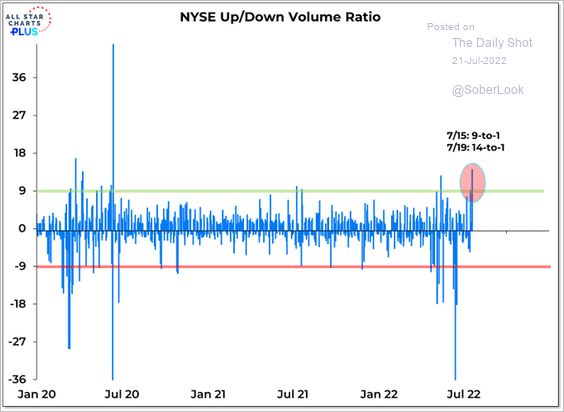

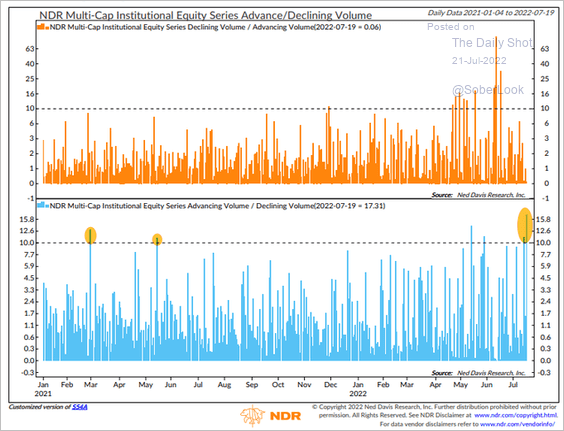

2. The rebound over the past couple of days has been very broad (2 charts).

Source: @WillieDelwiche

Source: @WillieDelwiche

Source: @edclissold, @ndr_research

Source: @edclissold, @ndr_research

——————–

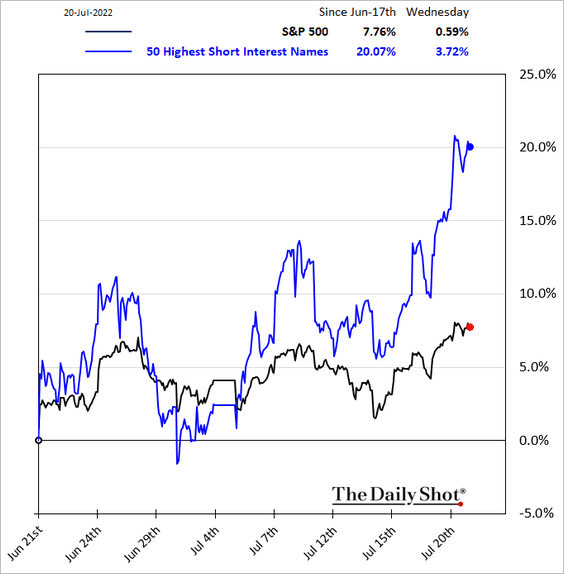

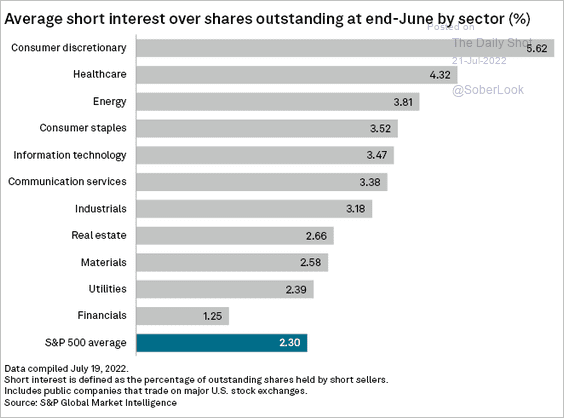

3. There is a great deal of short-covering taking place.

Here is equity short interest by sector.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

——————–

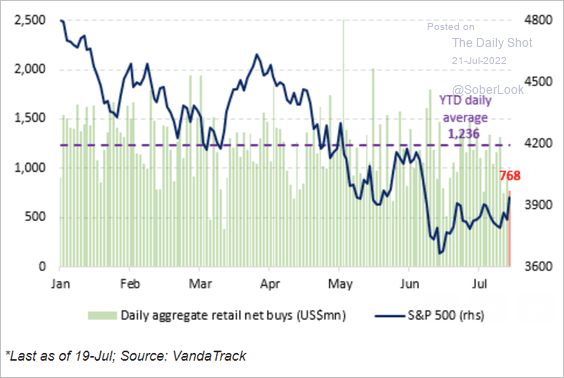

4. Retail buying has been tepid.

Source: Vanda Research

Source: Vanda Research

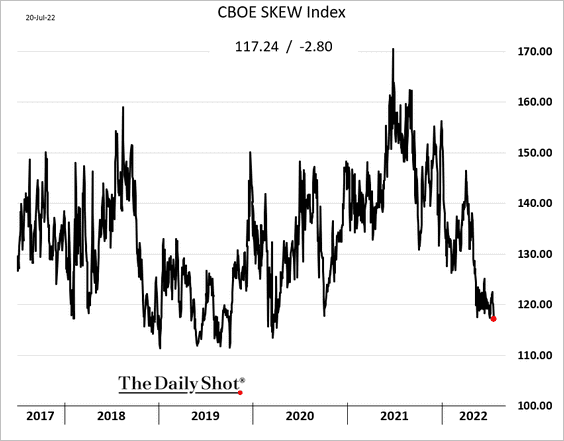

5. Demand for out-of-the-money put options (downside protection) keeps trending lower.

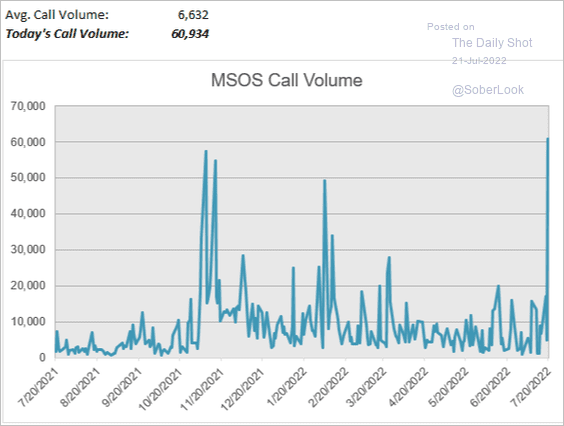

6. Bets on AdvisorShares Pure US Cannabis ETF surged as investors bet on federal legalization.

Source: @danny_kirsch

Source: @danny_kirsch

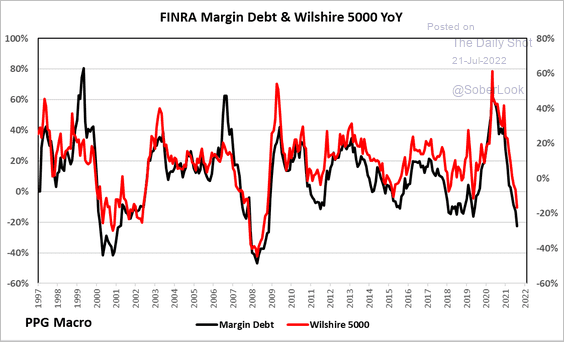

7. Margin debt is highly correlated with the broad stock market performance.

Source: @ppgmacro

Source: @ppgmacro

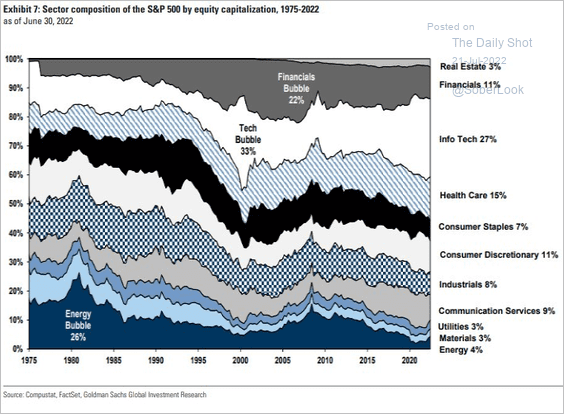

8. Finally, we have S&P 500 sector composition over time.

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

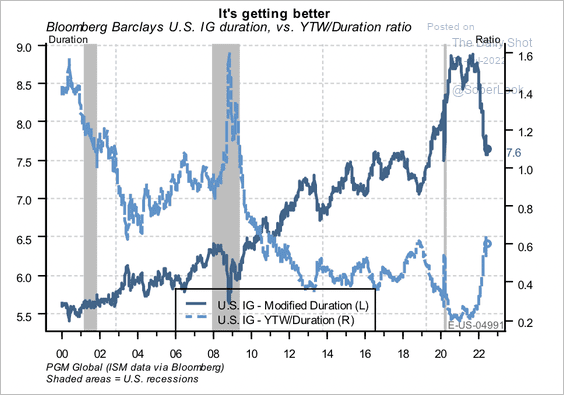

Credit

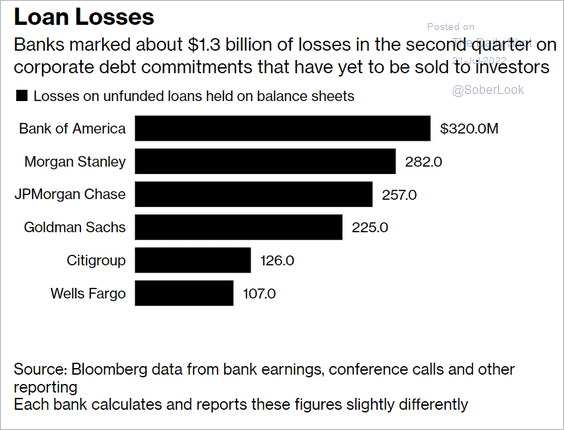

1. Bank losses on hung debt mount.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

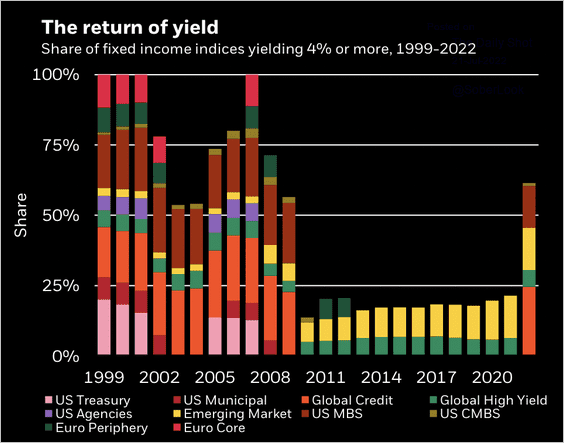

2. A majority of fixed income assets now yield 4% or more for the first time in a decade.

Source: BlackRock Investment Institute

Source: BlackRock Investment Institute

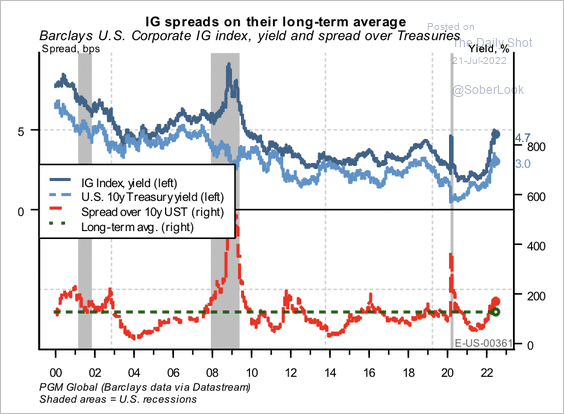

3. The spread on the aggregate US investment-grade index has risen above its long-term average.

Source: PGM Global

Source: PGM Global

Investors now see more yield per unit of duration risk than before the pandemic.

Source: PGM Global

Source: PGM Global

Back to Index

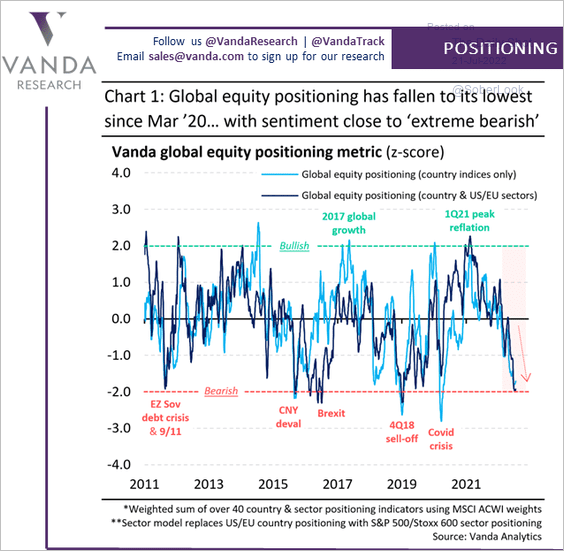

Global Developments

1. Equity positioning is near extreme bearish levels.

Source: @vandaresearch

Source: @vandaresearch

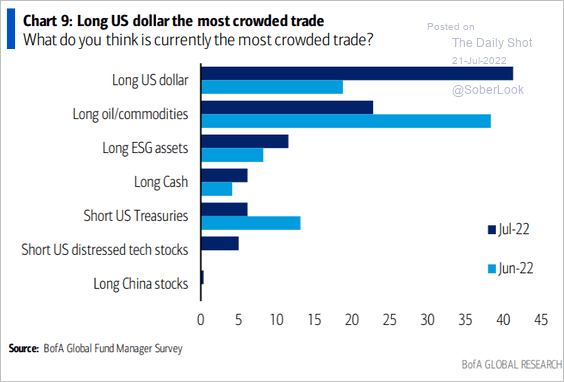

2. Fund managers see long US dollar positions as the most crowded trade.

Source: BofA Global Research

Source: BofA Global Research

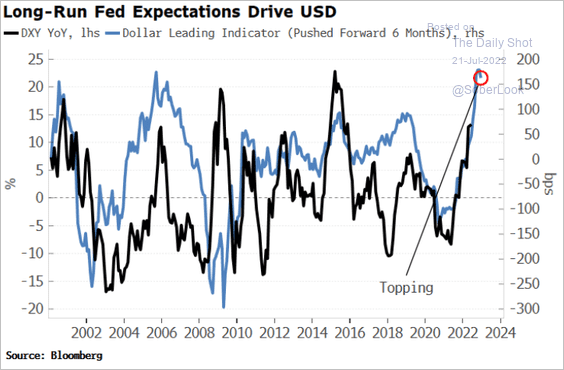

3. Long-run Fed rate trajectory expectations tend to lead the US dollar.

Source: Simon White, Bloomberg Markets Live Blog

Source: Simon White, Bloomberg Markets Live Blog

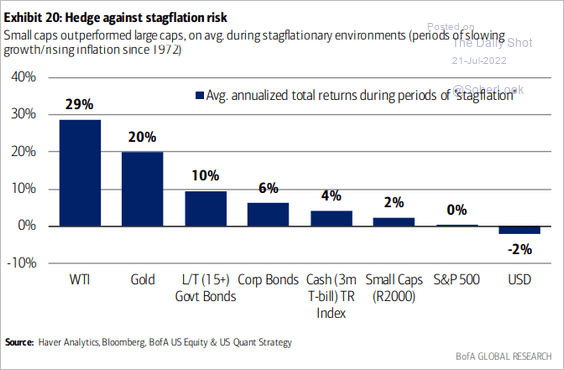

4. How do different asset classes perform during periods of stagflation?

Source: BofA Global Research

Source: BofA Global Research

——————–

Food for Thought

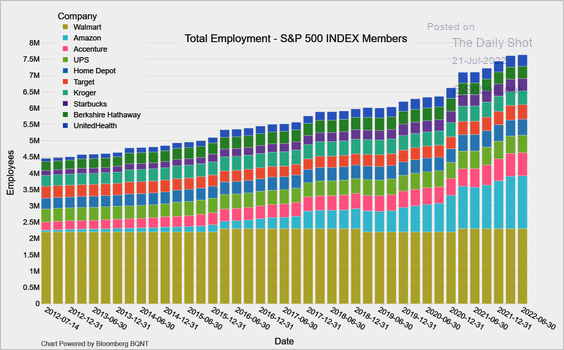

1. Ten largest employers in the S&P 500:

Source: @M_McDonough

Source: @M_McDonough

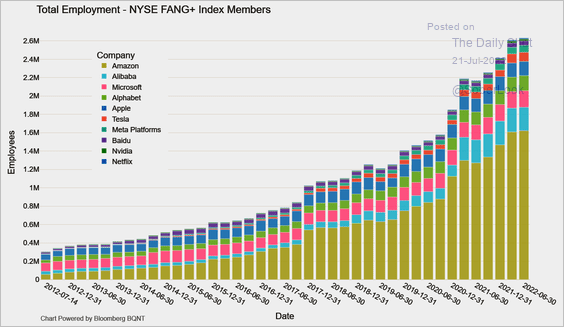

• Tech mega-cap employment trends:

Source: @M_McDonough

Source: @M_McDonough

——————–

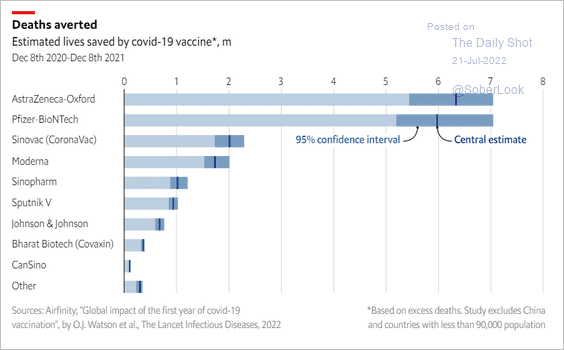

2. Lives saved with COVID vaccines:

Source: The Economist Read full article

Source: The Economist Read full article

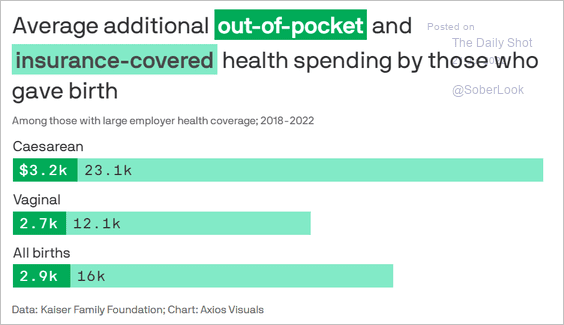

3. The costs of having a baby:

Source: @axios Read full article

Source: @axios Read full article

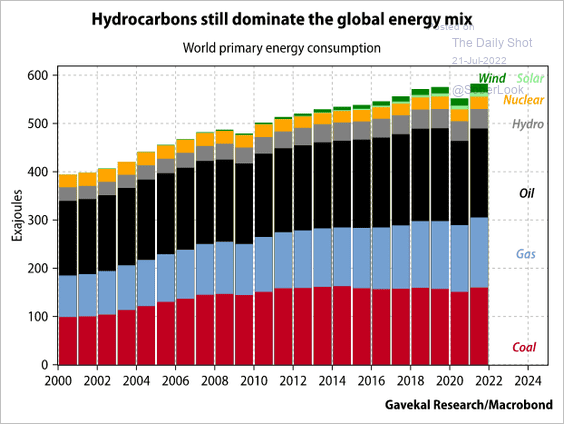

4. The global energy mix:

Source: Gavekal Research

Source: Gavekal Research

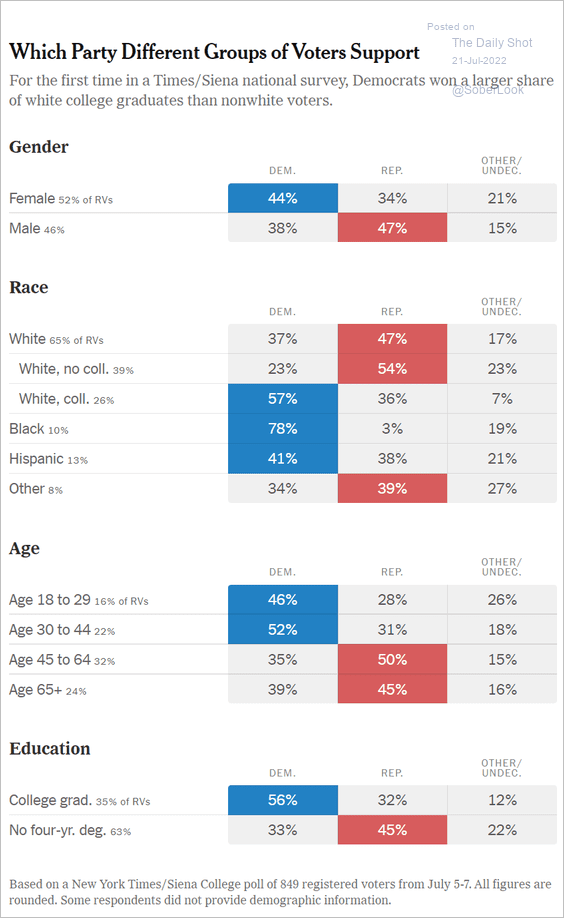

5. Party support across demographic groups in the US:

Source: The New York Times Read full article

Source: The New York Times Read full article

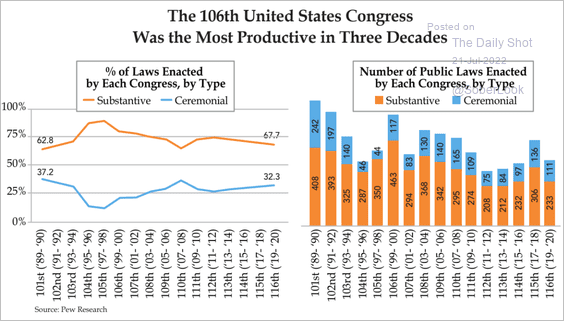

6. Productivity of the United States Congress:

Source: Quill Intelligence

Source: Quill Intelligence

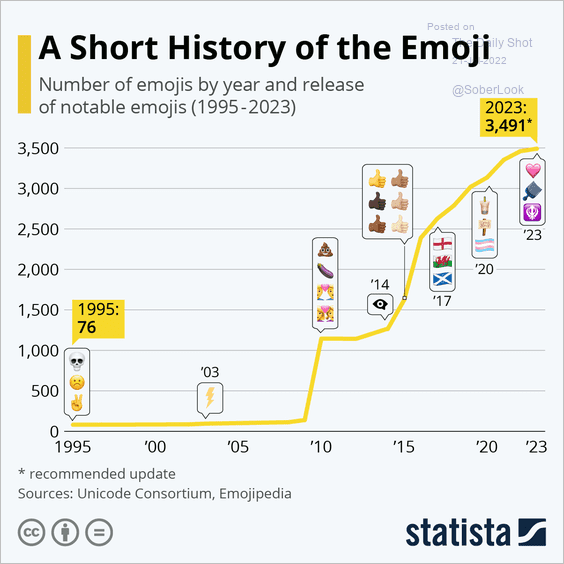

7. Number of emojis over time:

Source: Statista

Source: Statista

——————–

Back to Index