The Daily Shot: 03-Aug-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

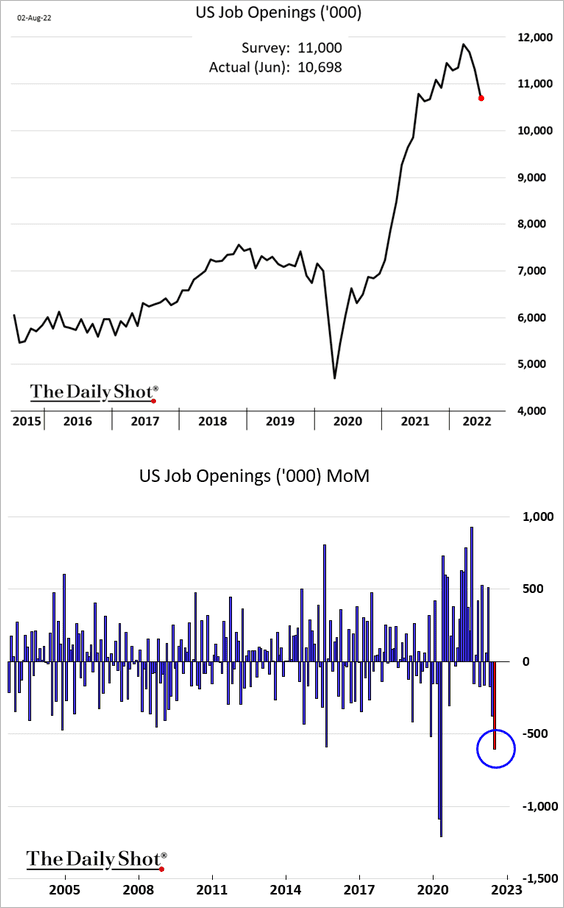

1. Job openings declined at a faster pace in June, but the labor market remains tight. The Fed would like to see this indicator come off some more.

Source: Reuters Read full article

Source: Reuters Read full article

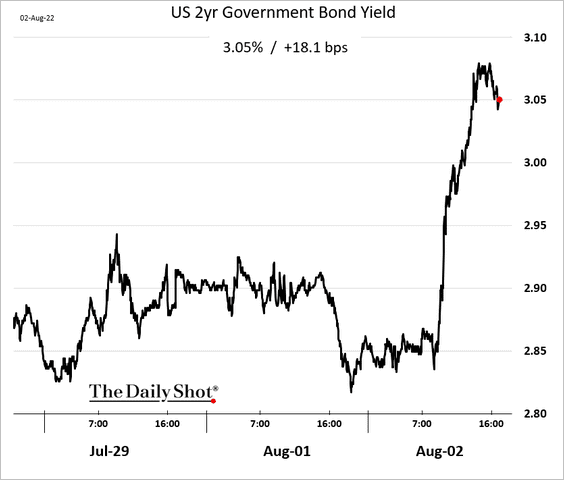

The market was reminded that the Fed has more wood to chop.

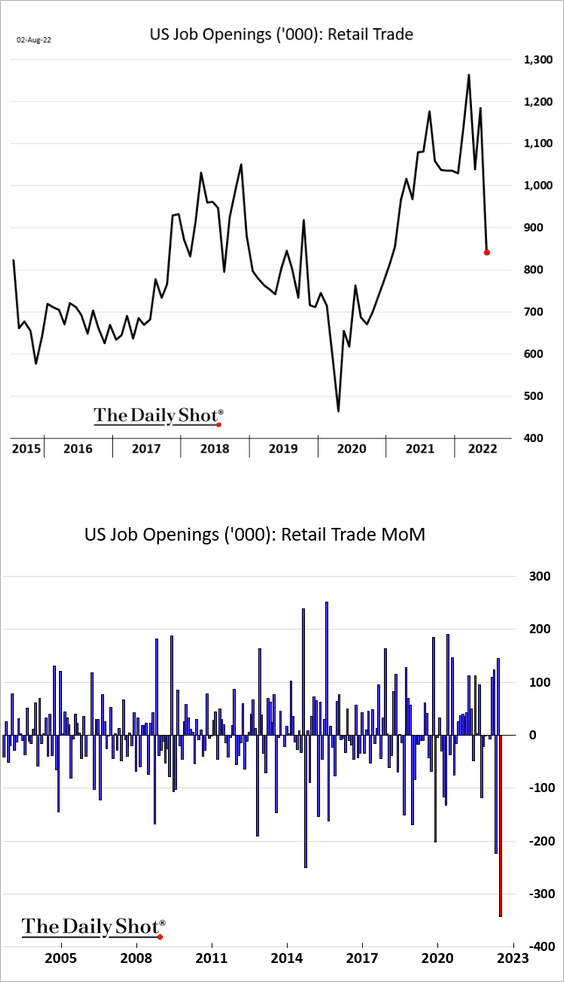

• Job vacancies in retail registered a record decline.

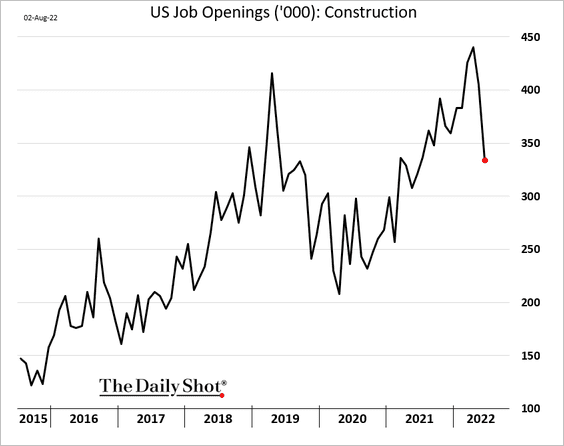

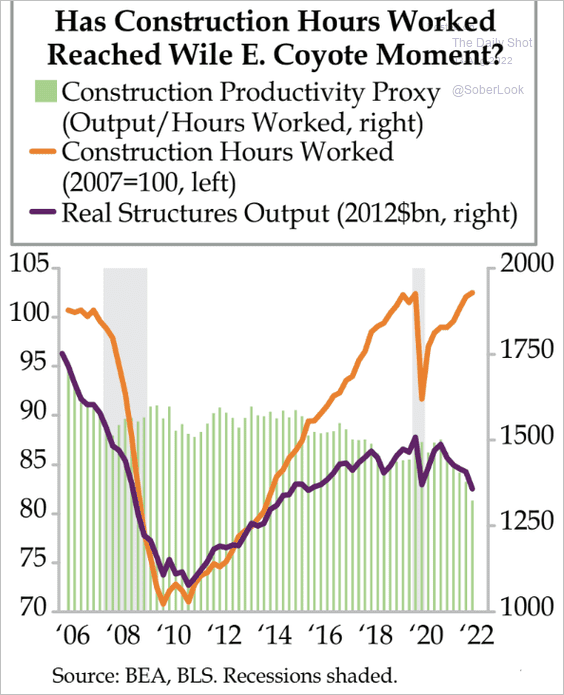

• Construction openings are down sharply as well.

Leading indicators point to further weakness in construction employment.

Source: Quill Intelligence

Source: Quill Intelligence

• Here are some additional trends.

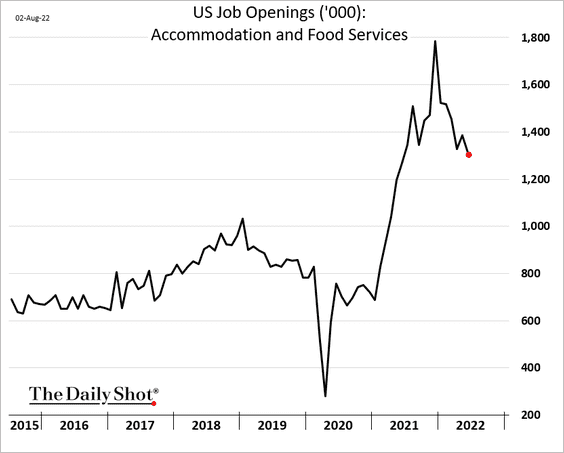

– Hotels and restaurants:

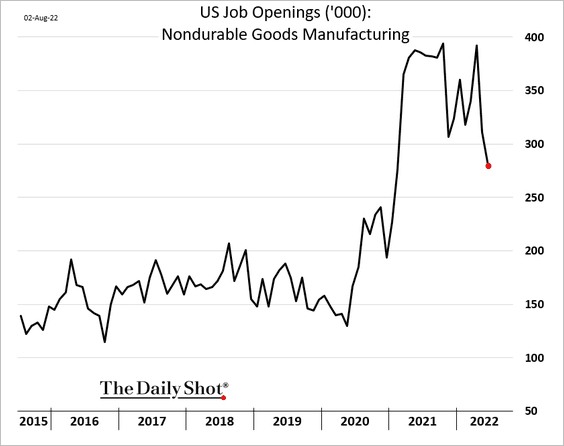

– Nondurable goods manufacturing:

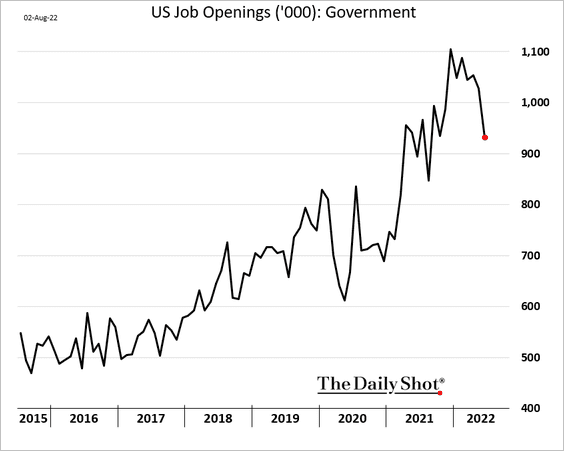

– Government (which includes public school teachers):

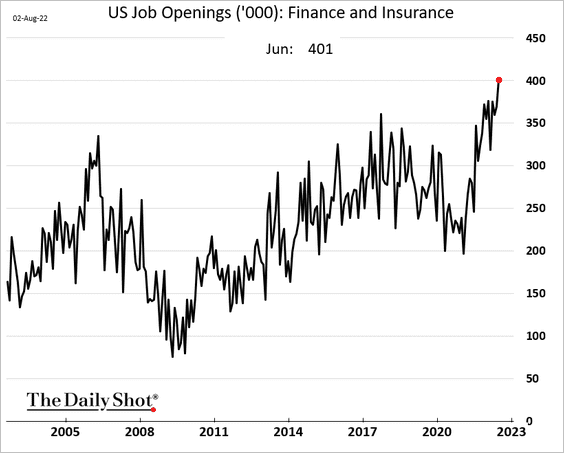

– Financial services (bucking the trend):

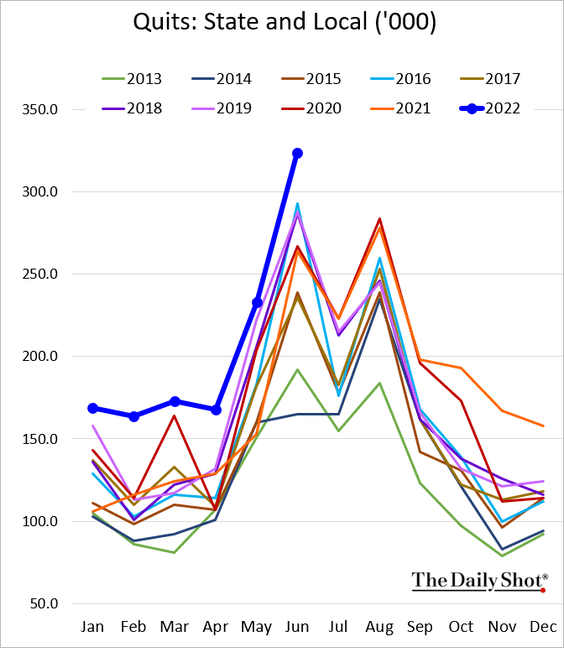

• State and local governments are seeing a lot of resignations.

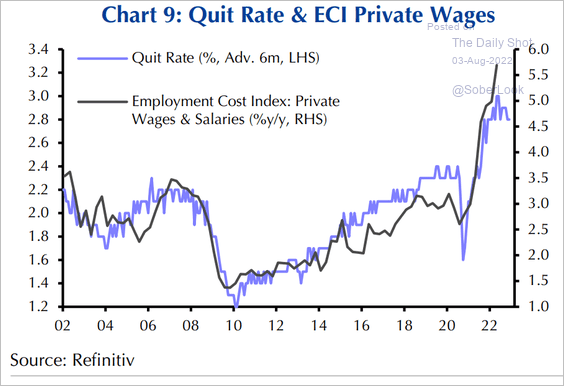

• Slower overall quit rates (voluntary resignations) point to a moderation in labor costs.

Source: Capital Economics

Source: Capital Economics

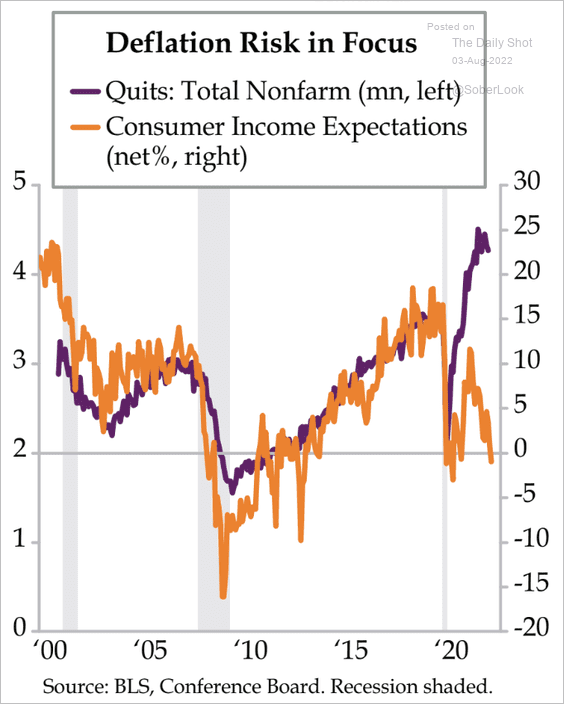

• Quit rates could move much lower as consumer income expectations slump.

Source: Quill Intelligence

Source: Quill Intelligence

——————–

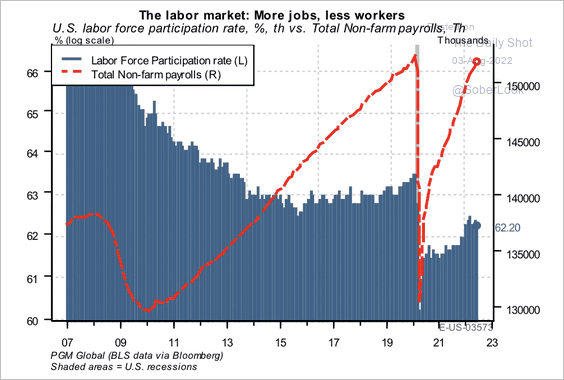

2. The labor force participation rate has not kept up with the rise in payrolls.

Source: PGM Global

Source: PGM Global

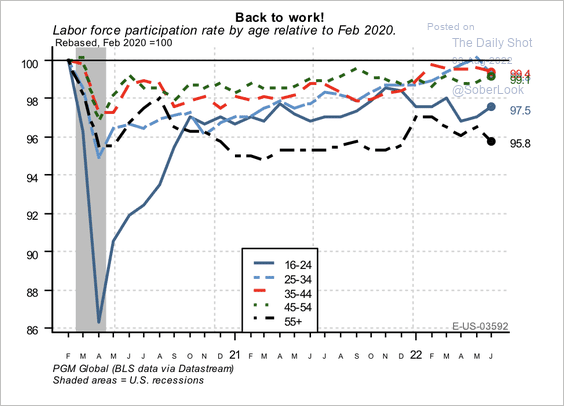

• Labor force participation (relative to pre-pandemic levels) is lowest among the youngest and oldest cohorts.

Source: PGM Global

Source: PGM Global

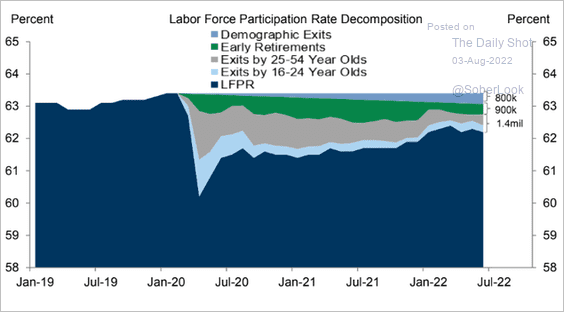

• Here are the sources of the decline in labor force participation since the start of the pandemic (demographic exits = expected retirements, given the US aging population).

Source: Goldman Sachs; @MikeZaccardi

Source: Goldman Sachs; @MikeZaccardi

——————–

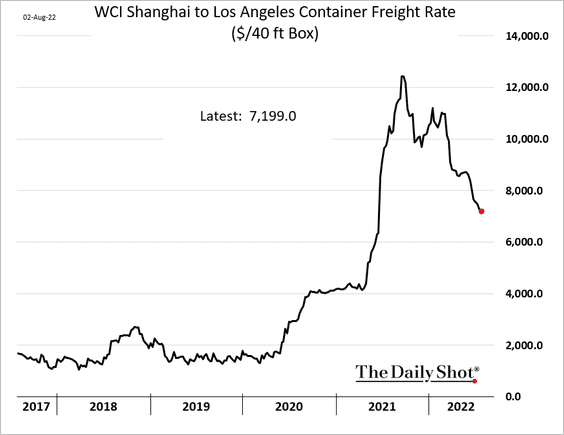

3. Freight rates continue to moderate.

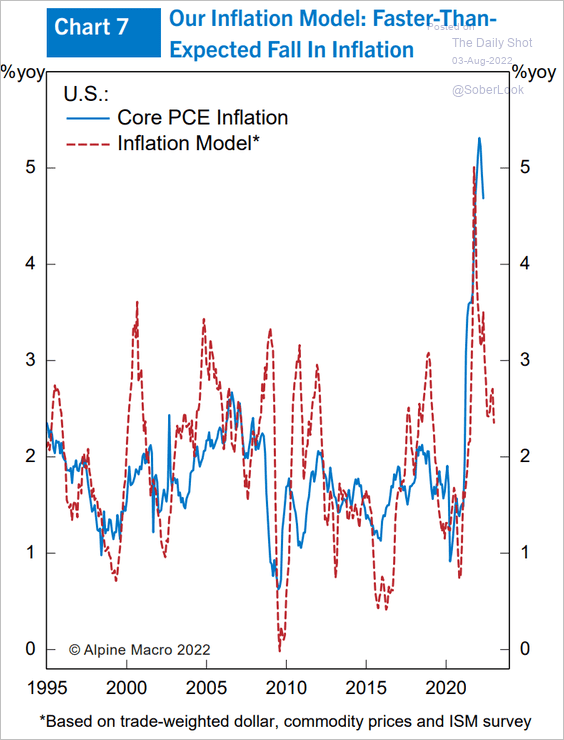

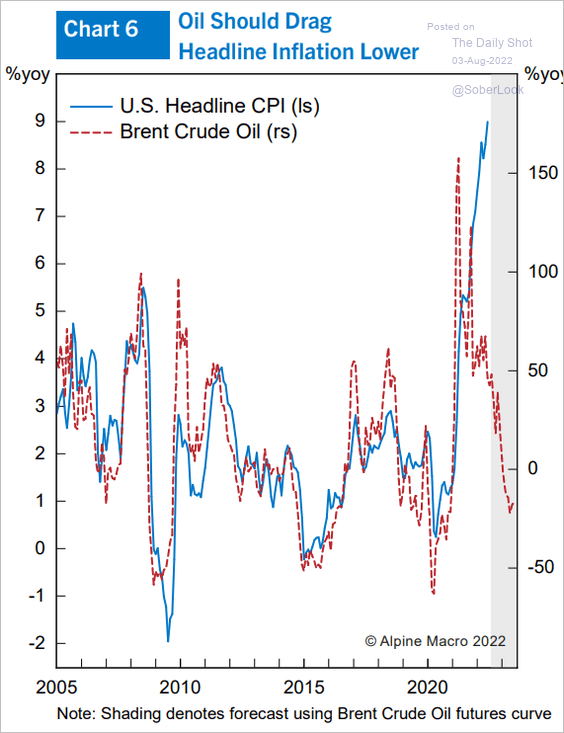

4. Could we see a faster-than-expected drop in inflation? (2 charts)

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

Source: Alpine Macro

——————–

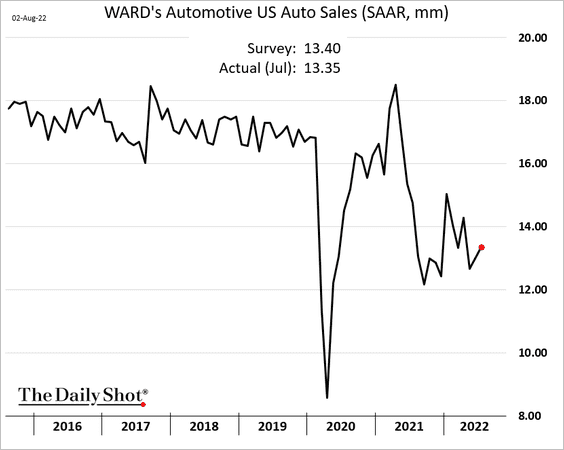

5. Vehicle sales edged higher in July.

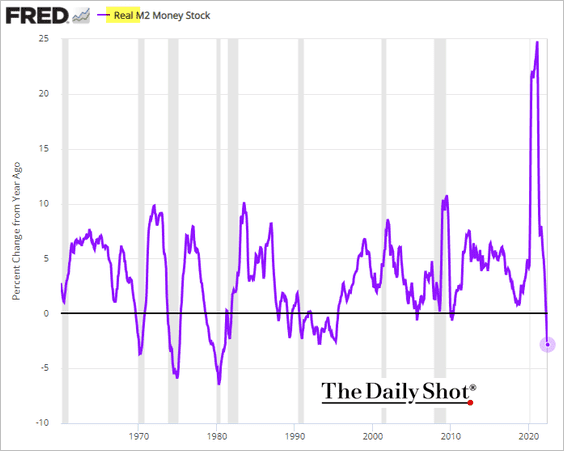

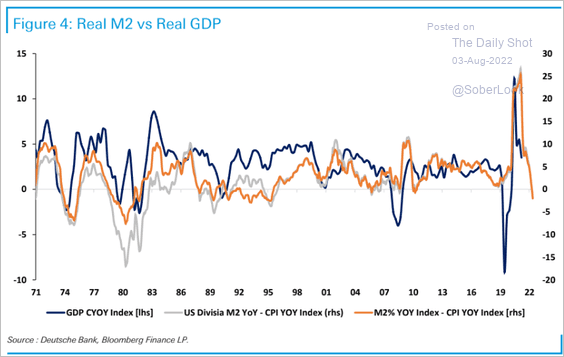

6. The real money supply (M2) is down sharply on a year-over-year basis.

This trend does not bode well for GDP growth.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Canada

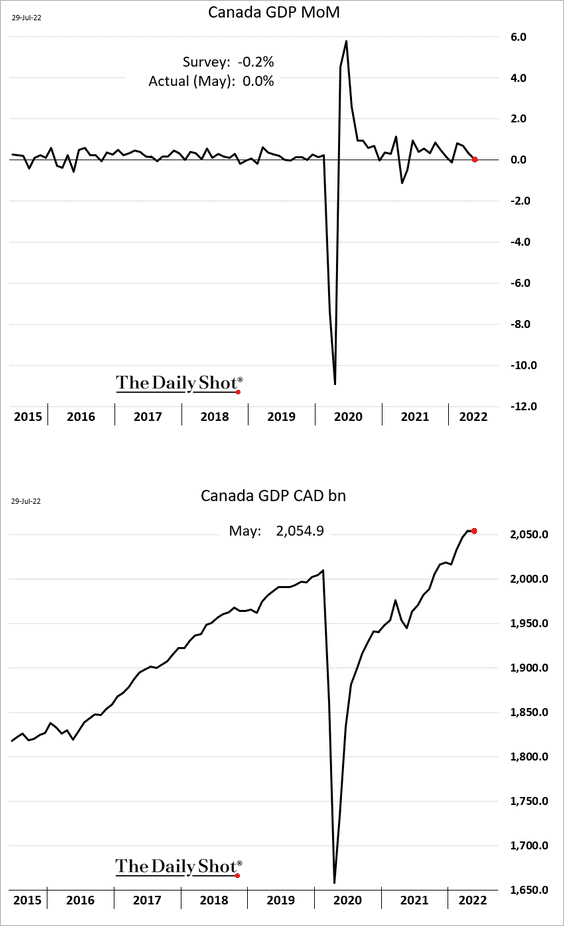

1. The GDP held up better than expected in May.

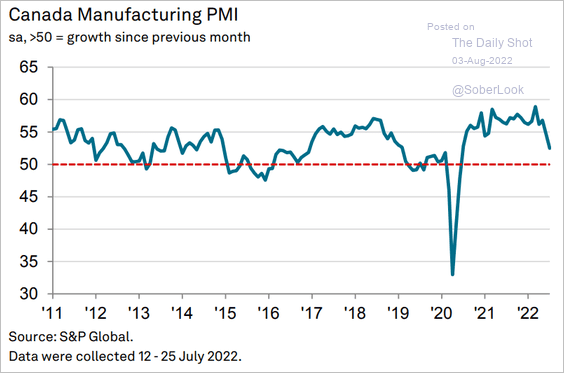

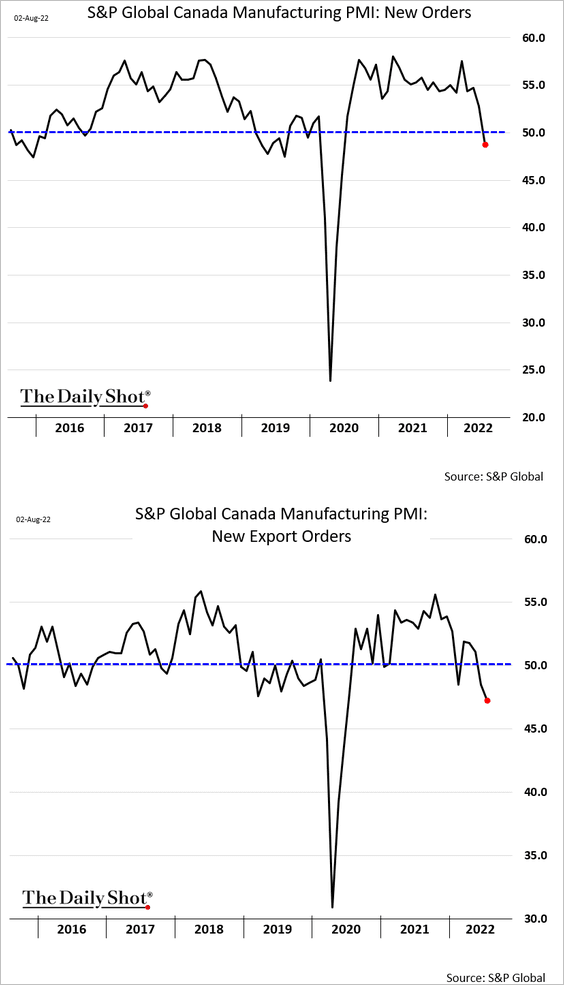

2. Manufacturing growth is slowing.

Source: S&P Global PMI

Source: S&P Global PMI

Factory orders are declining now.

Back to Index

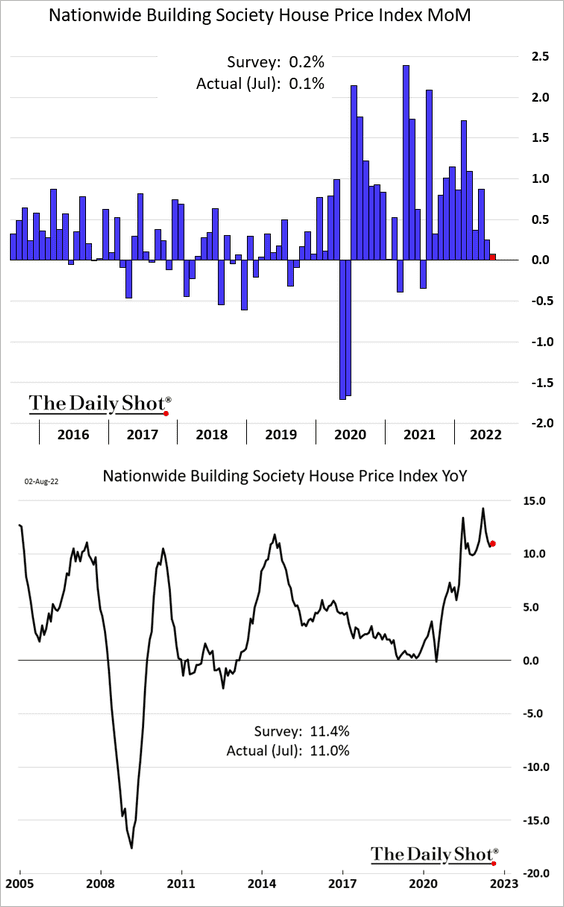

The United Kingdom

1. Home price appreciation slowed in July.

Source: Reuters Read full article

Source: Reuters Read full article

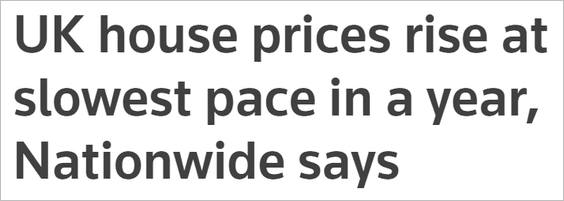

——————–

2. Job ads continue to moderate.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

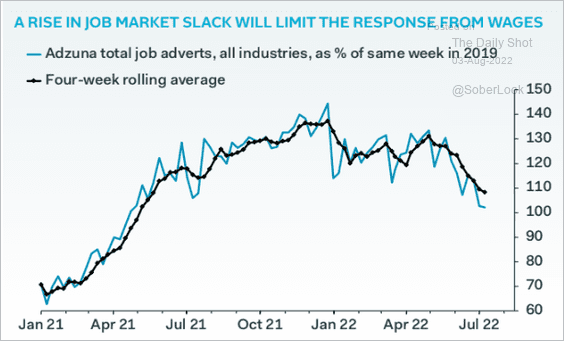

The Eurozone

1. The ECB rate trajectory expectations are resetting lower.

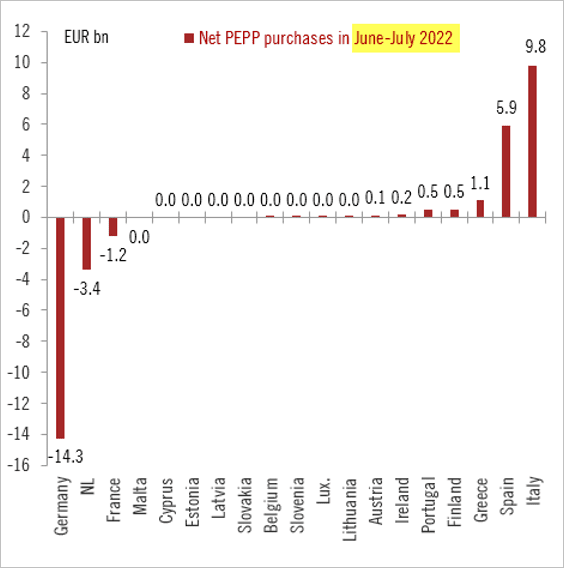

2. The ECB has been running its own version of “Operation Twist” in its fight against defragmentation risks.

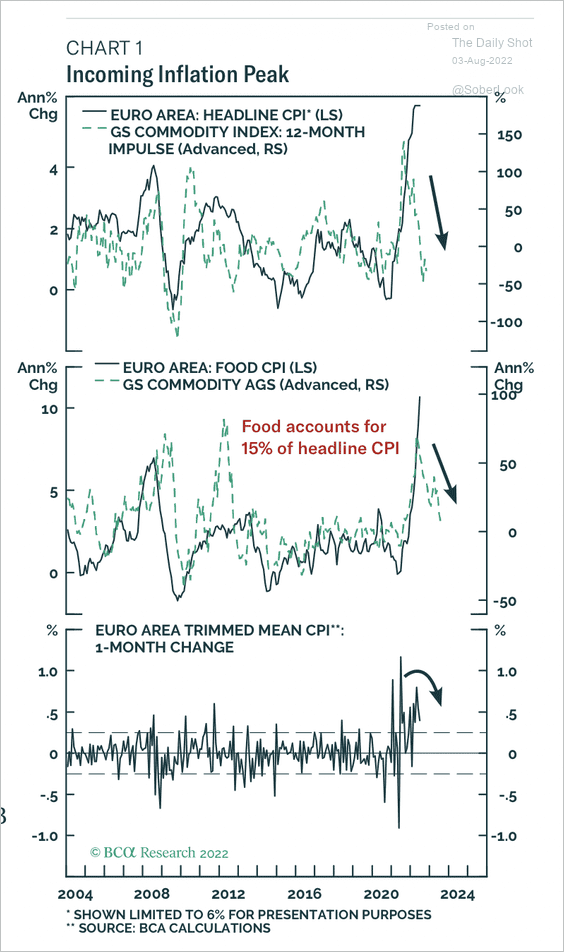

3. The euro area is nearing peak inflation.

Source: BCA Research

Source: BCA Research

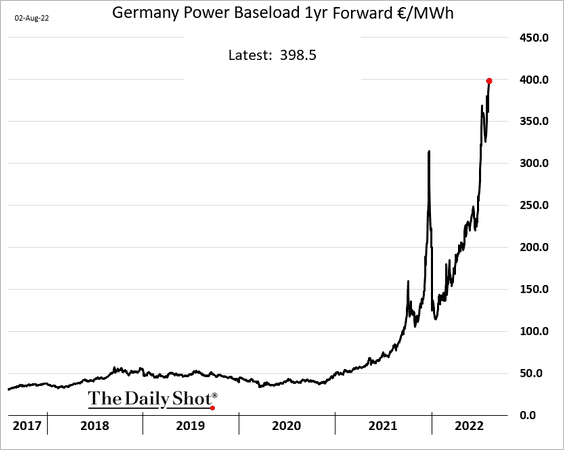

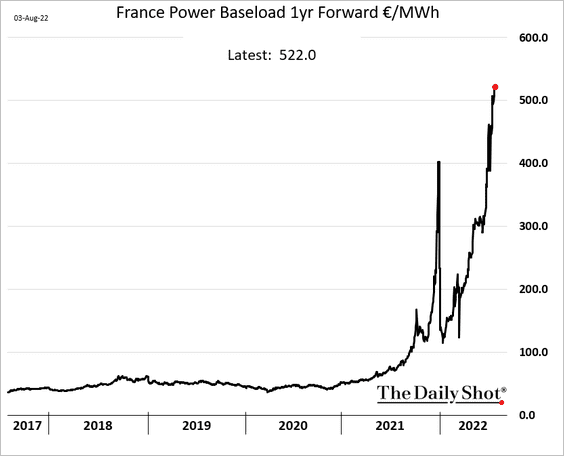

4. Electricity prices continue to hit record highs.

• Germany:

• France:

——————–

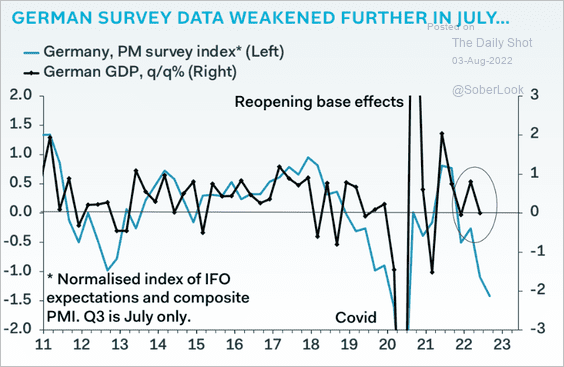

5. Germany may already be in a recession.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

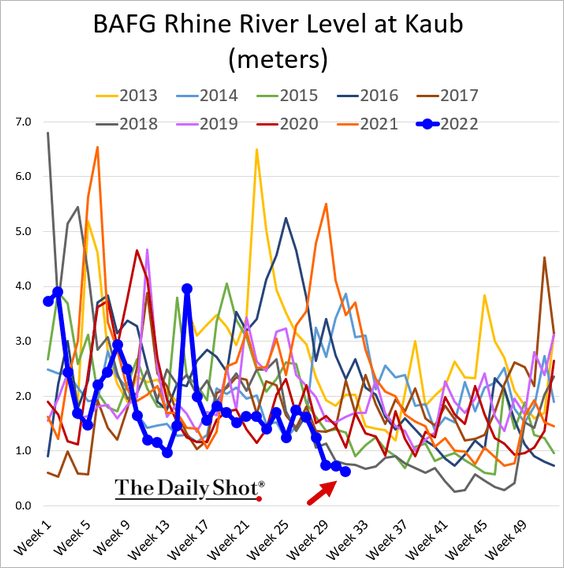

6. The Rhine River situation is a disaster.

Source: @Jwittels, @business Read full article

Source: @Jwittels, @business Read full article

The water level is at multi-year lows.

——————–

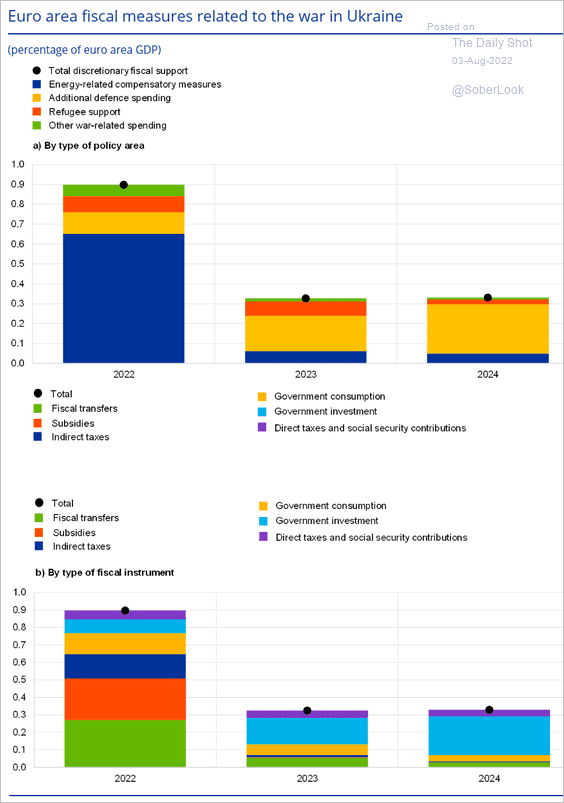

7. Here is a look at fiscal measures related to the war in Ukraine.

Source: ECB Read full article

Source: ECB Read full article

Back to Index

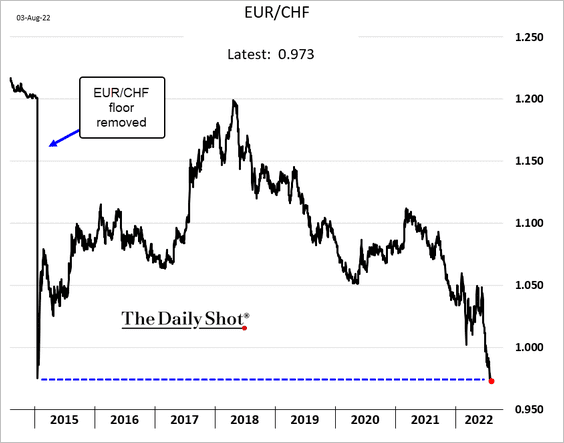

Europe

1. The Swiss franc continues to strengthen vs. the euro.

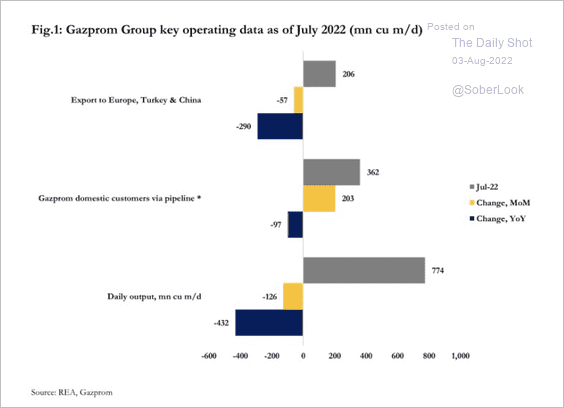

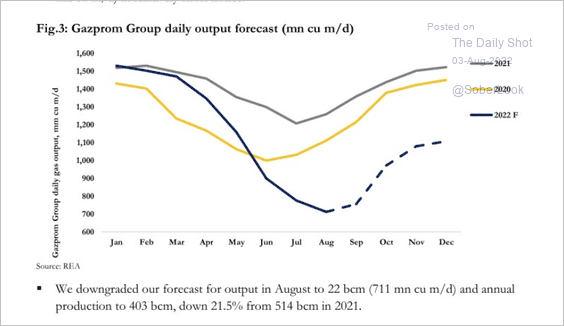

2. Russia’s Gazprom output in July declined with lower exports to Europe and Turkey and higher exports to China. Around wintertime, Germany could be forced to use some Nord Stream 2 capacity (which runs on Russian-assembled turbines) in the case of severe gas shortages, according to REA.

Source: Nadia Kazakova, REA

Source: Nadia Kazakova, REA

REA expects Gazprom output to remain lower than previous years because of lower exports to Europe and weak domestic demand (although weather effects could increase domestic flows).

Source: Nadia Kazakova, REA

Source: Nadia Kazakova, REA

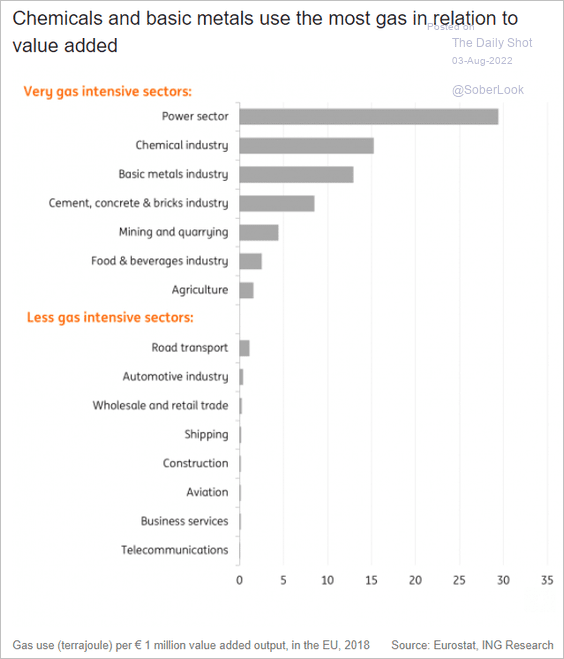

3. Which sectors are most/least sensitive to natural gas prices?

Source: ING

Source: ING

Back to Index

Asia – Pacific

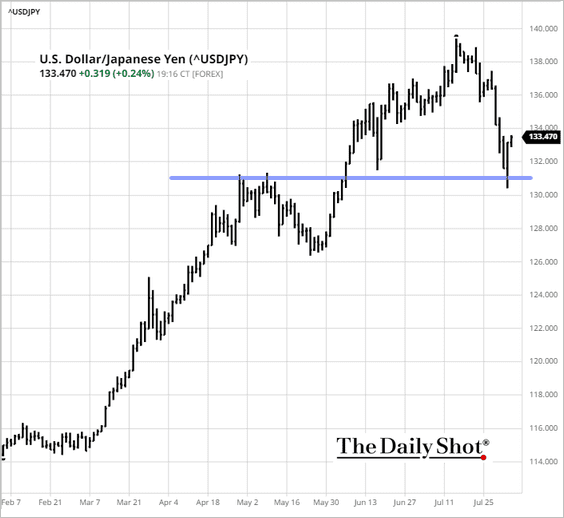

1. Dollar-yen held support near 131.

Source: barchart.com

Source: barchart.com

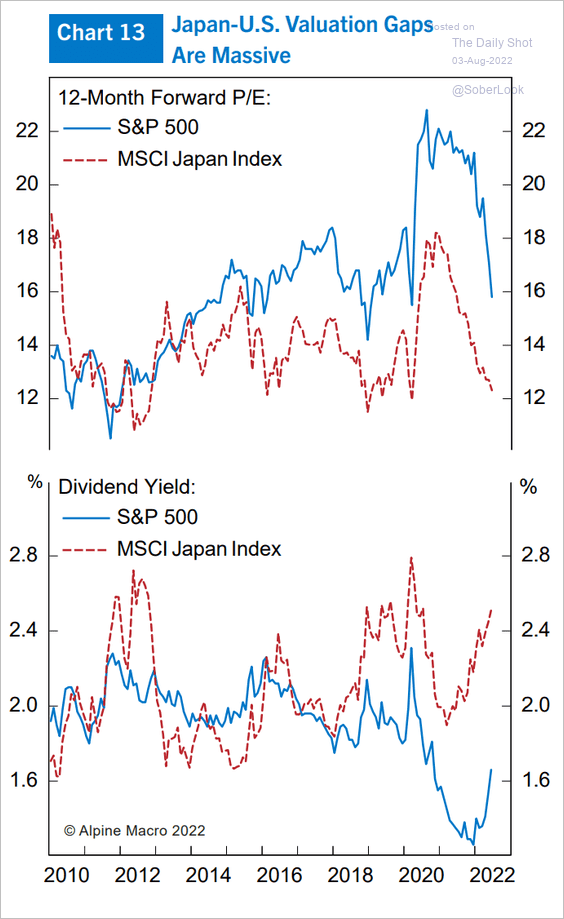

2. Japan’s shares look attractive relative to the US.

Source: Alpine Macro

Source: Alpine Macro

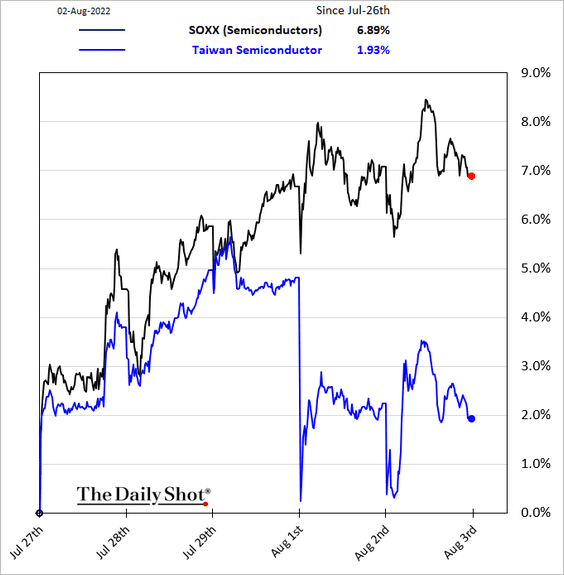

3. Taiwan Semiconductor has underperformed due to geopolitical tensions.

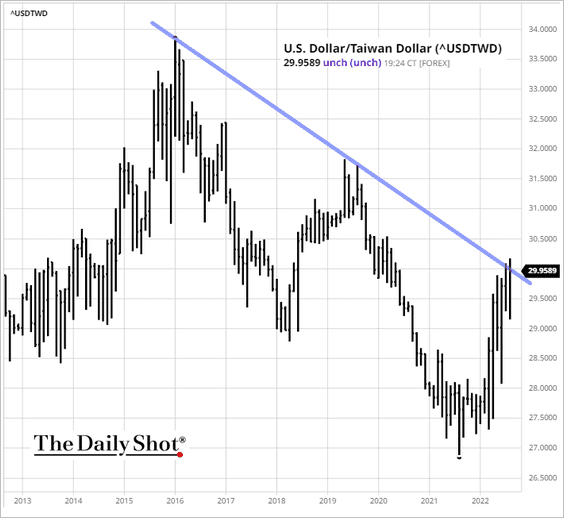

USD/TWD is at long-term resistance (the Taiwan dollar is weakening vs. USD).

Source: barchart.com

Source: barchart.com

——————–

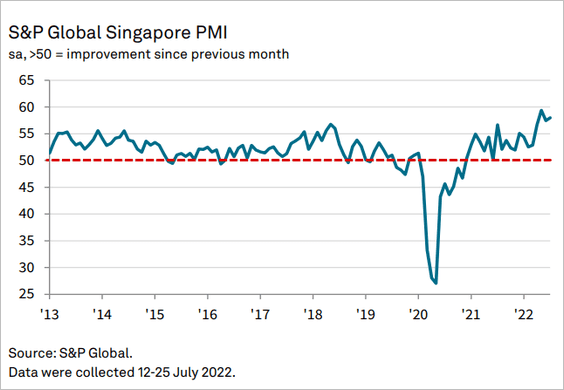

4. Singapore’s business activity remains strong.

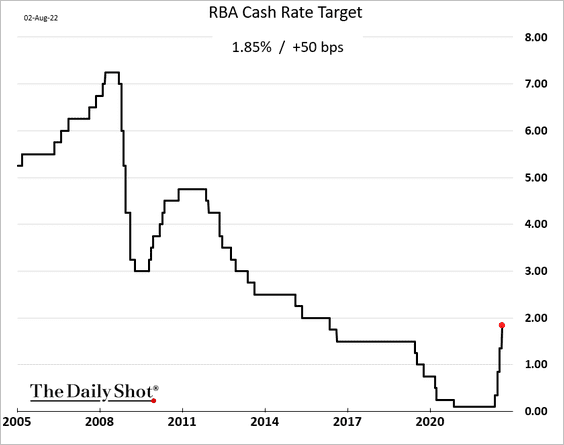

5. Australia’s central bank hiked rates again (as expected).

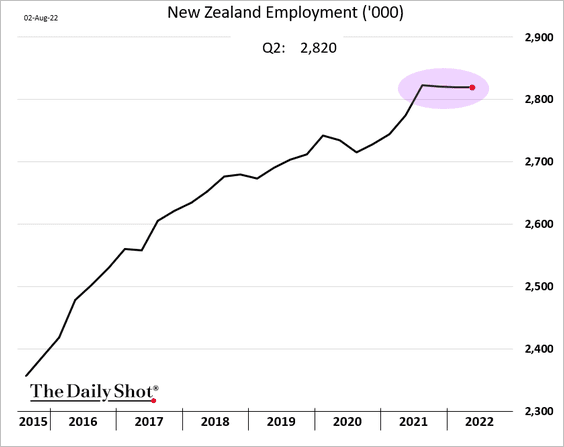

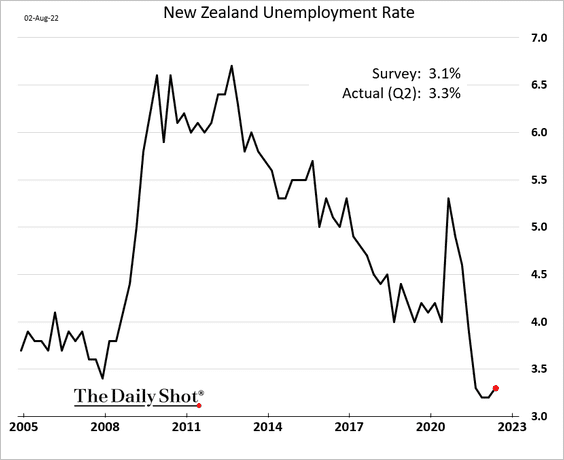

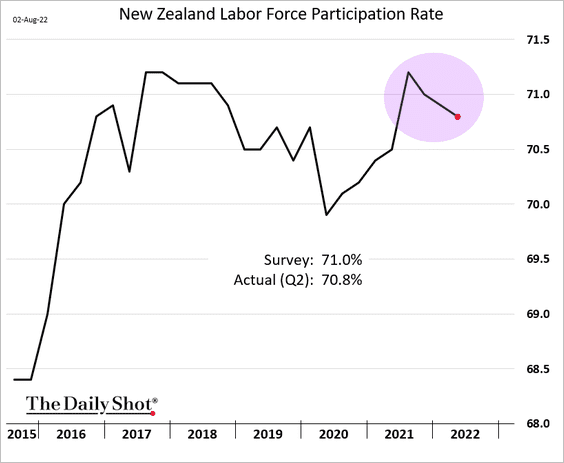

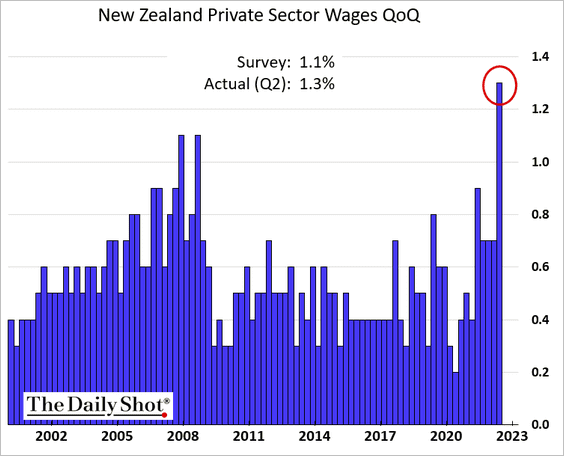

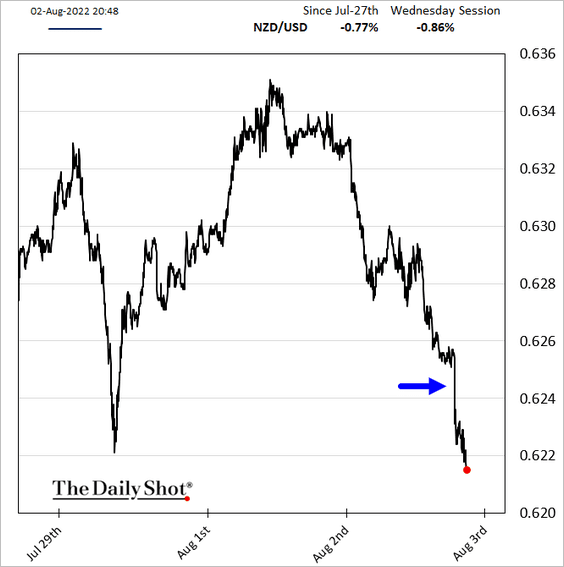

6. New Zealand’s Q2 employment report surprised to the downside.

• Employment growth has stalled.

• The unemployment rate unexpectedly edged higher.

• Participation is trending lower.

• However, wage growth surged.

• The Kiwi dollar dropped in response to the employment report.

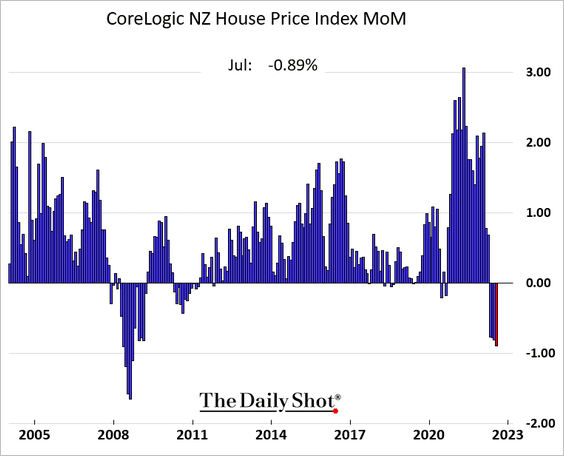

Separately, New Zealand’s home prices continue to fall.

Back to Index

China

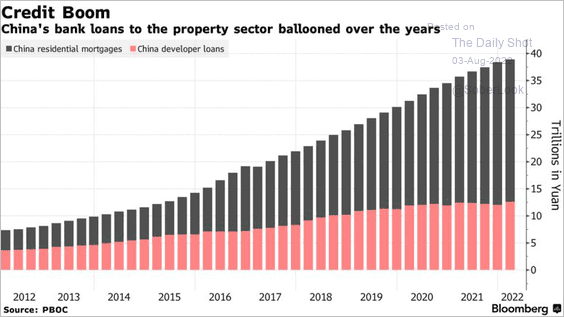

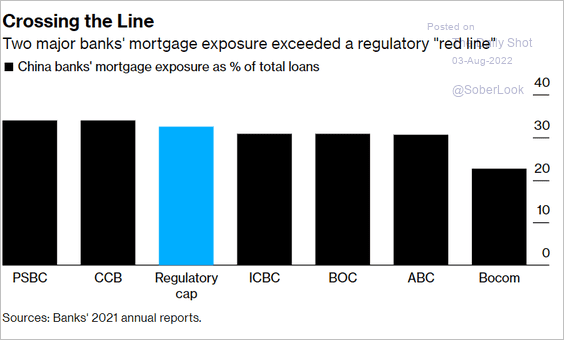

1. The banking sector is facing substantial risks related to mortgage boycotts.

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

Source: @markets Read full article

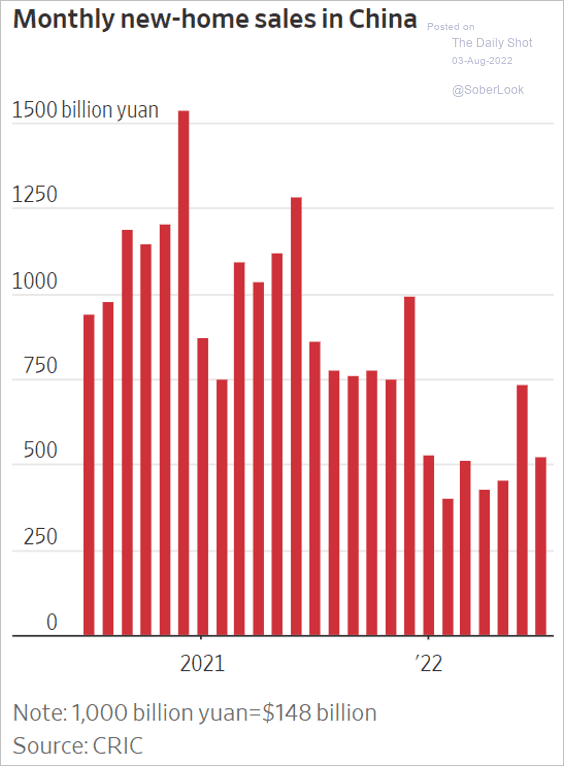

2. New home sales have been trending lower.

Source: @WSJ Read full article

Source: @WSJ Read full article

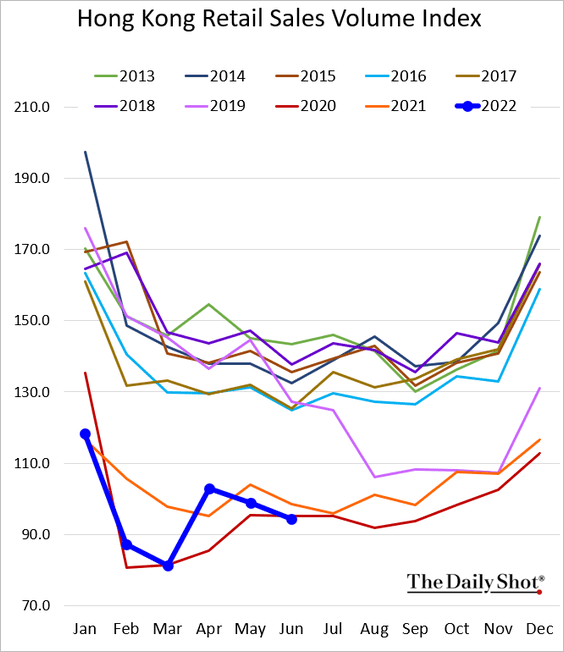

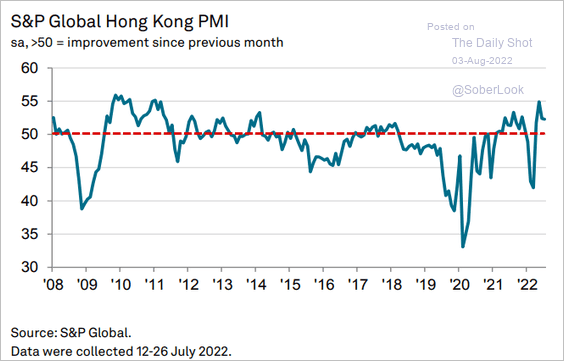

3. Hong Kong’s retail sales were very soft in June.

But business activity remains in growth mode.

Source: S&P Global PMI

Source: S&P Global PMI

Back to Index

Emerging Markets

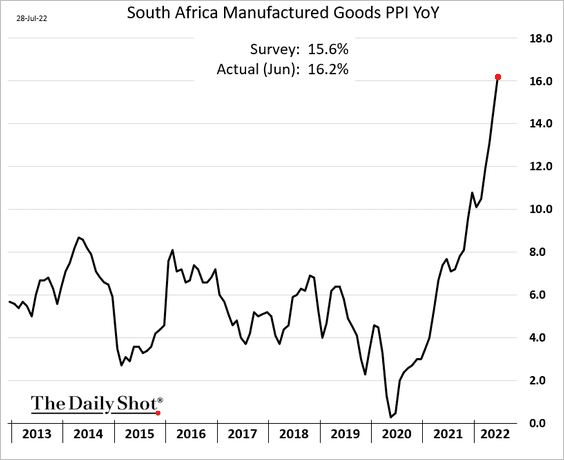

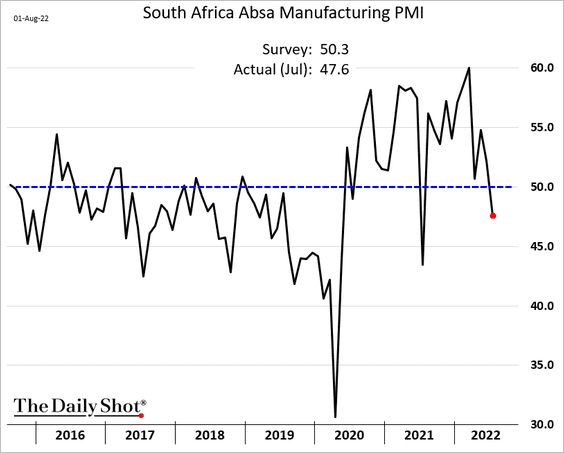

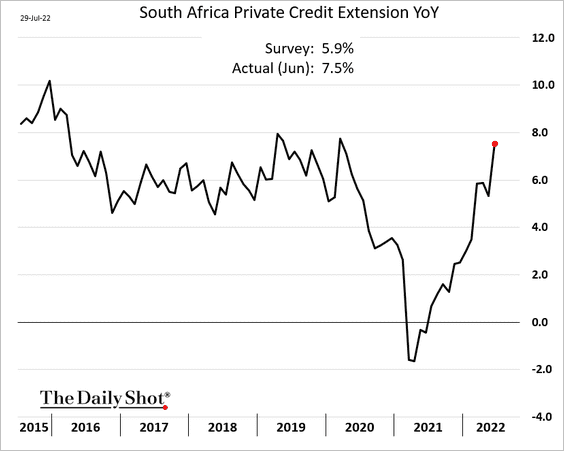

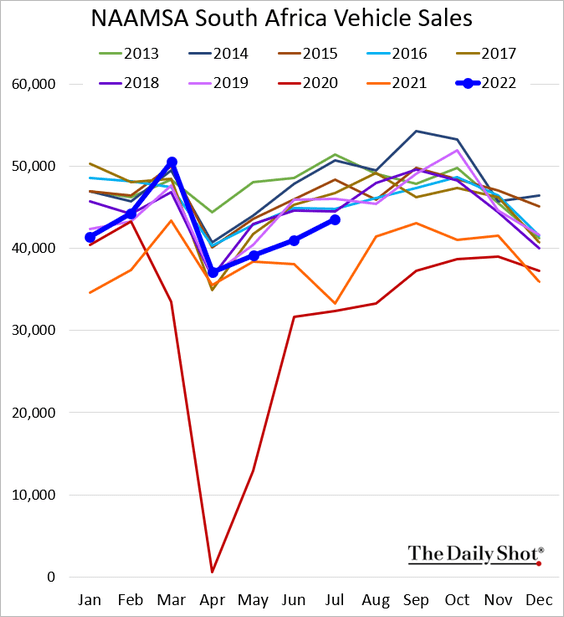

1. Let’s begin with South Africa.

• Producer prices are surging.

• Manufacturing is in contraction territory now.

• Credit growth has rebounded to pre-pandemic levels.

• Vehicle sales show some improvement.

——————–

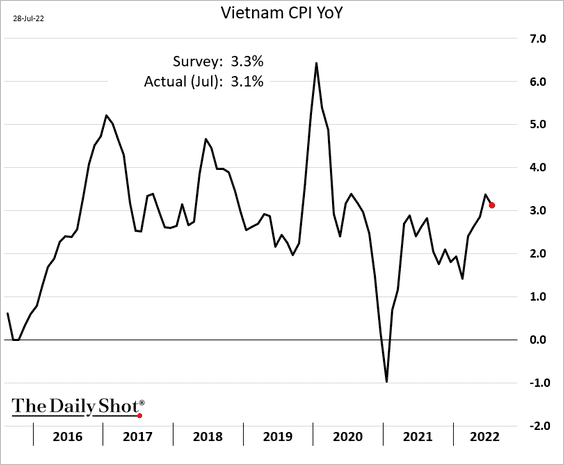

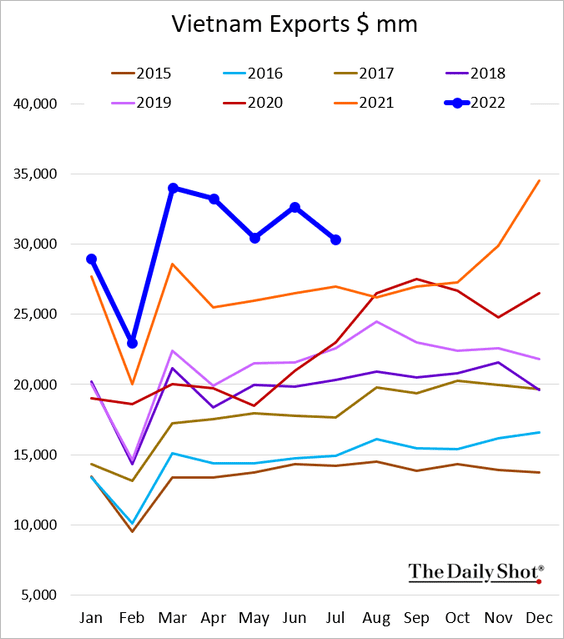

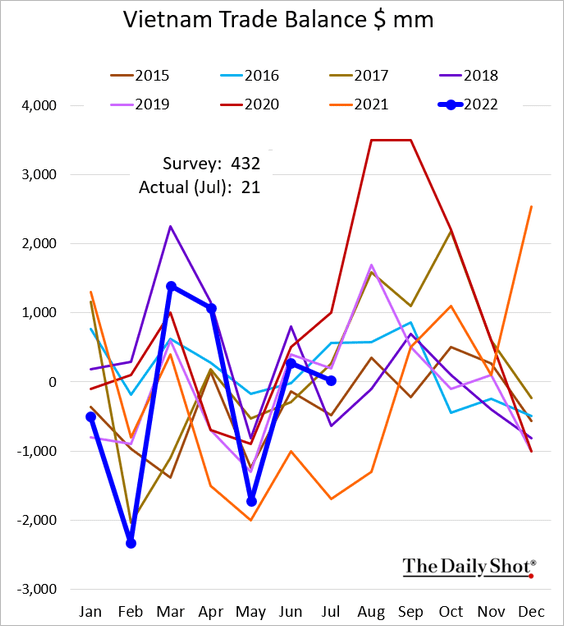

2. Next, we have some updates on Vietnam.

• The CPI (lower than expected):

• Exports (strong but losing momentum):

• Trade balance:

——————–

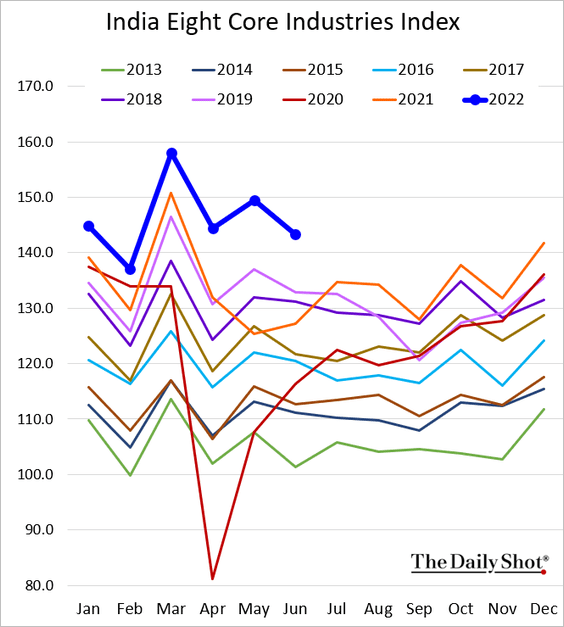

3. India’s industrial production remains robust.

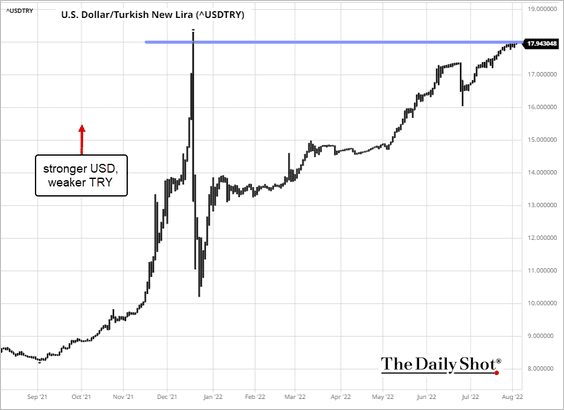

4. The Turkish lira is holding near 18 to the dollar.

Source: barchart.com

Source: barchart.com

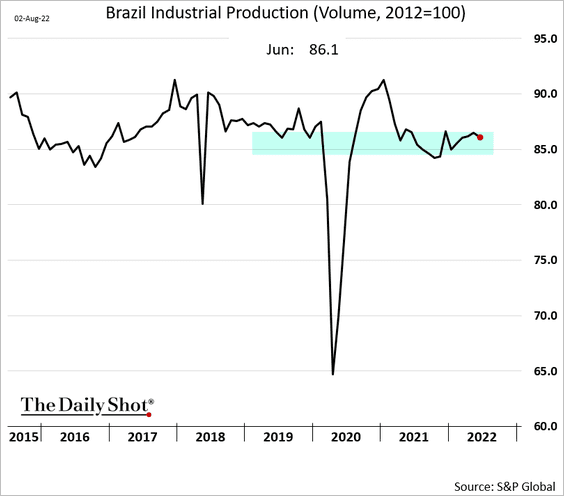

5. Brazil’s industrial production has been flat.

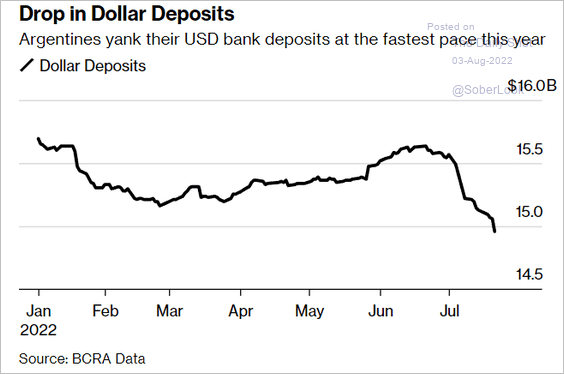

6. Argentines are pulling their USD bank deposits.

Source: @squires_esq, @markets Read full article

Source: @squires_esq, @markets Read full article

Back to Index

Cryptocurrency

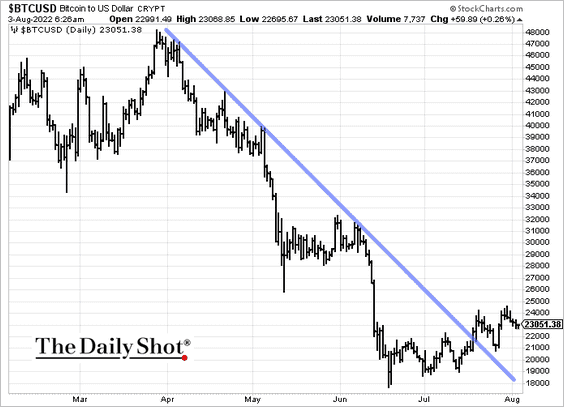

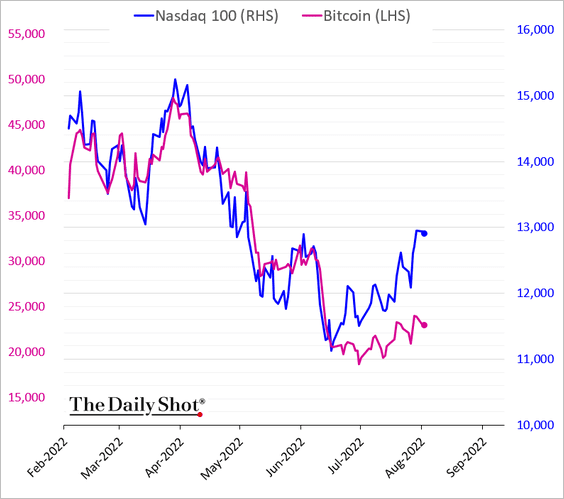

1. Bitcoin’s breakout is fading.

The cryptocurrency is not rebounding with growth stocks.

——————–

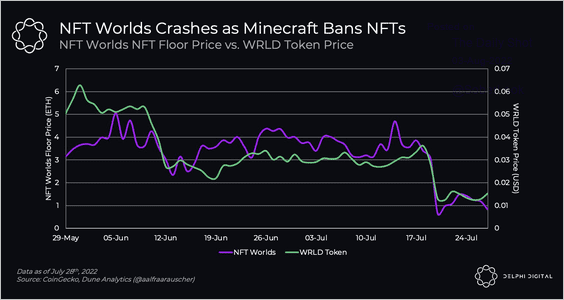

2. Minecraft’s decision to ban NFT integration triggered a plunge in related NFTs.

Source: @Delphi_Digital

Source: @Delphi_Digital

Source: Engadget Read full article

Source: Engadget Read full article

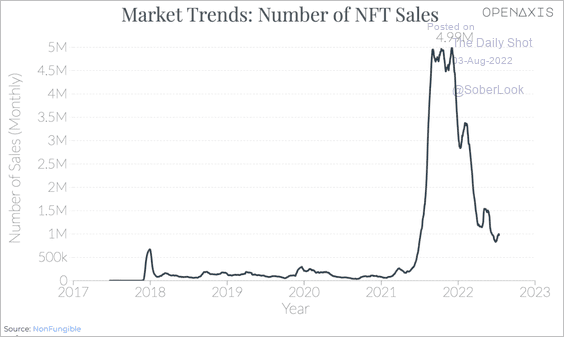

• NFT sales have been trending lower.

Source: OpenAxis

Source: OpenAxis

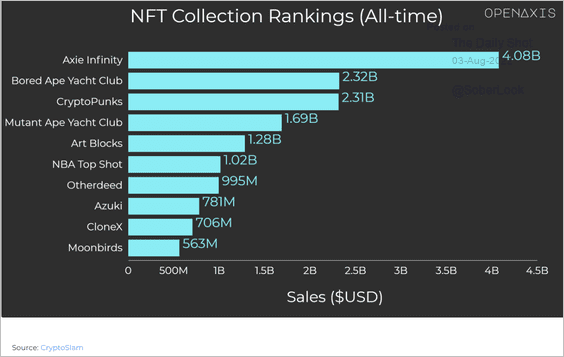

• This chart shows NFT collection rankings.

Source: OpenAxis

Source: OpenAxis

Back to Index

Commodities

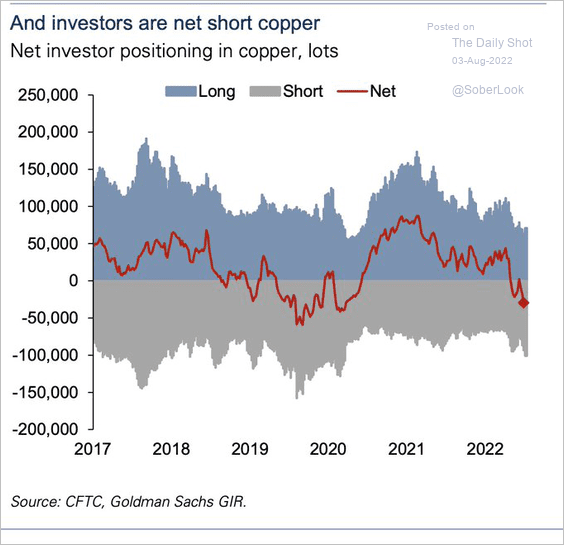

1. Copper positioning remains bearish.

Source: @acemaxx, @GoldmanSachs

Source: @acemaxx, @GoldmanSachs

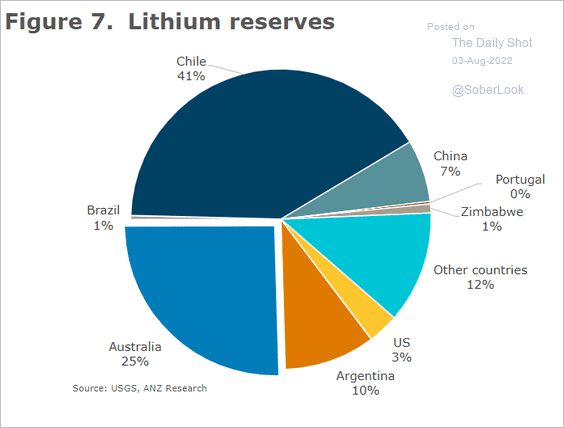

2. Here is a look at lithium reserves.

Source: @ANZ_Research

Source: @ANZ_Research

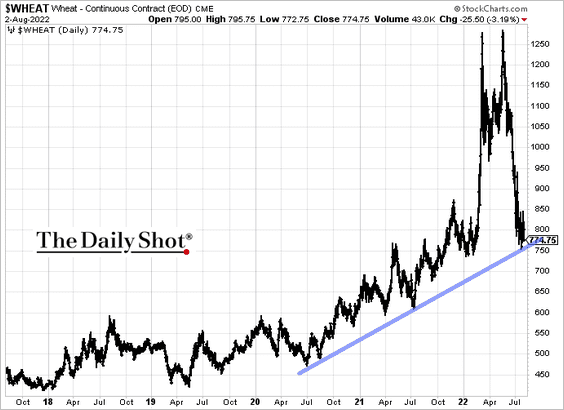

3. Wheat is at support.

4. US lumber futures are trending lower amid weakness in the housing market.

Back to Index

Energy

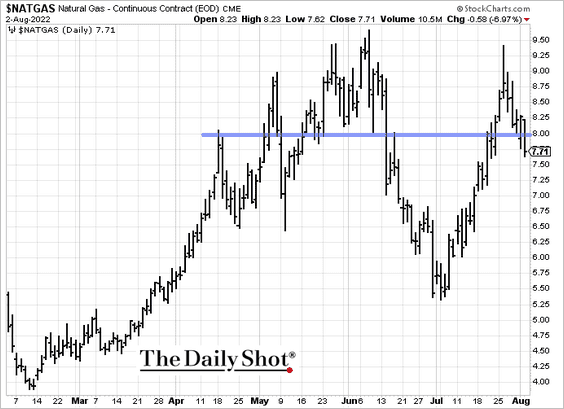

1. US natural gas is back below $8/mmbtu.

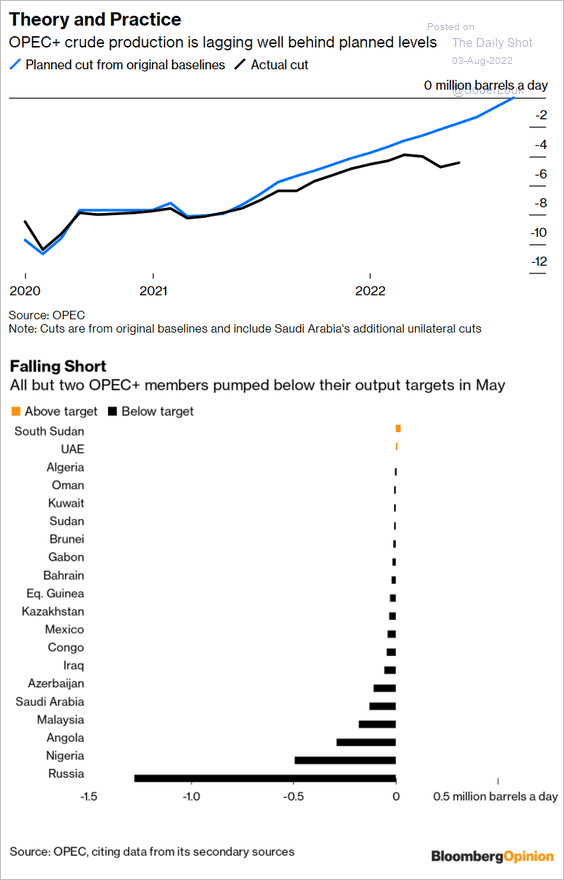

2. OPEC’s oil production continues to lag planned output.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Back to Index

Equities

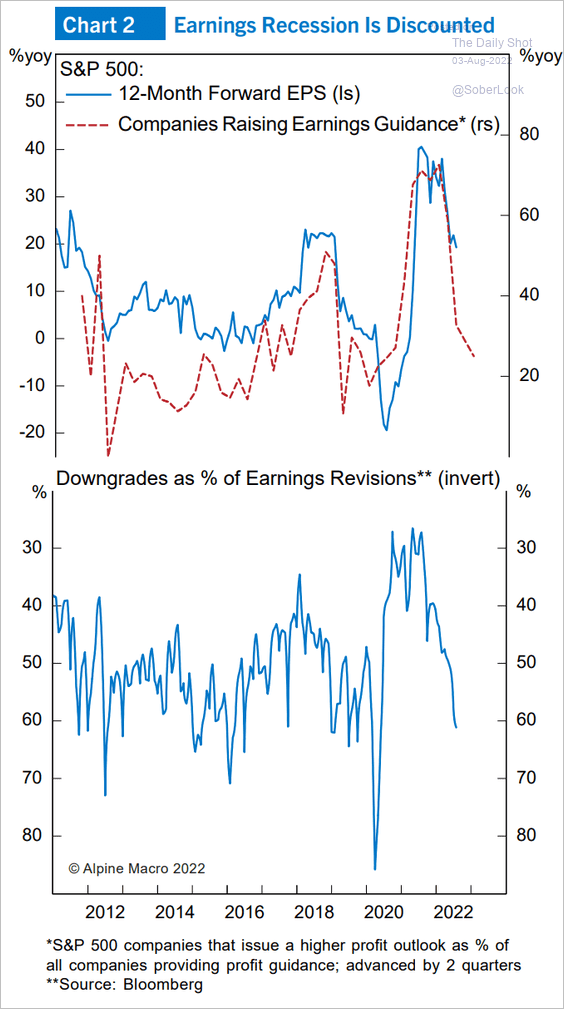

1. Companies are preparing the market for an earnings recession.

Source: Alpine Macro

Source: Alpine Macro

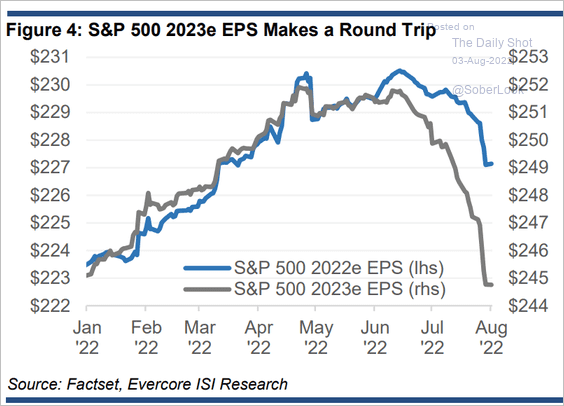

2. Downward adjustments to earnings expectations continue (EPS = earnings per share).

Source: Evercore ISI Research

Source: Evercore ISI Research

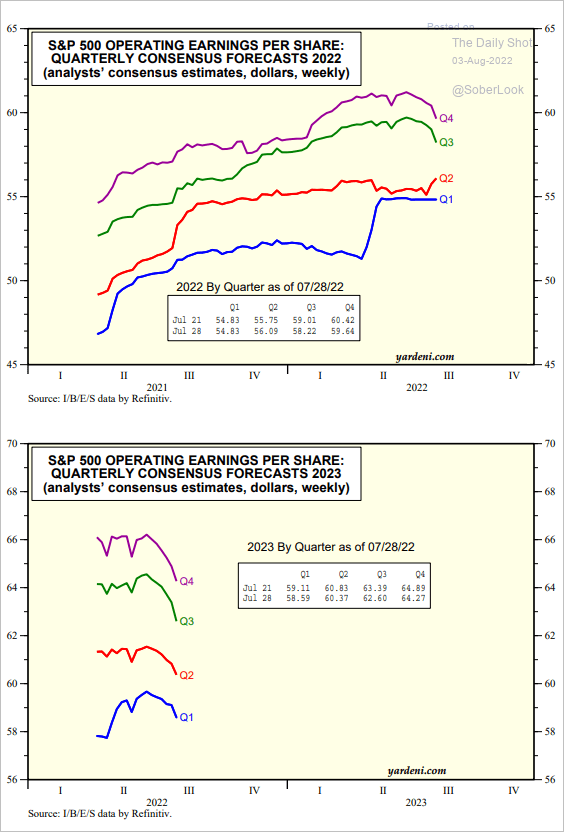

Here is the breakdown by quarter.

Source: Yardeni Research

Source: Yardeni Research

——————–

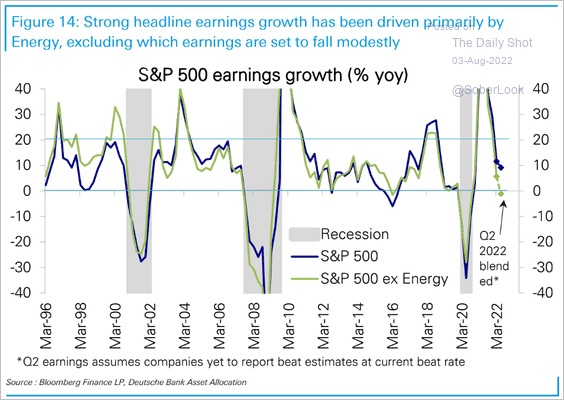

3. Recent (relatively) strong earnings growth in the S&P 500 has been driven by energy.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

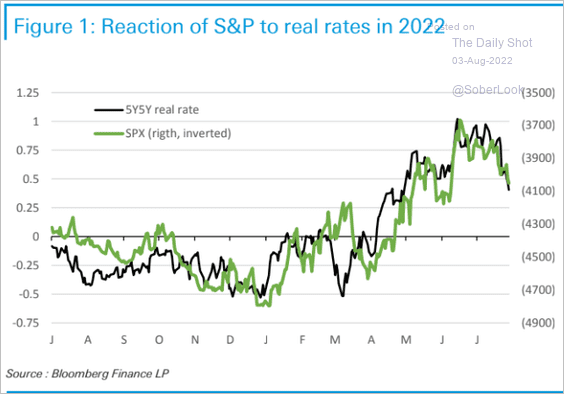

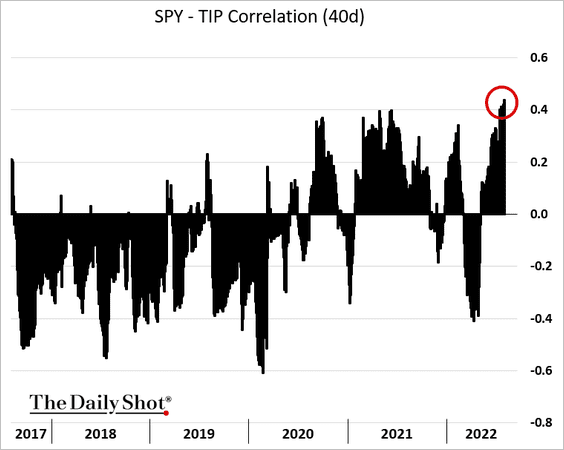

4. Stocks remain sensitive to real rates (2 charts).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

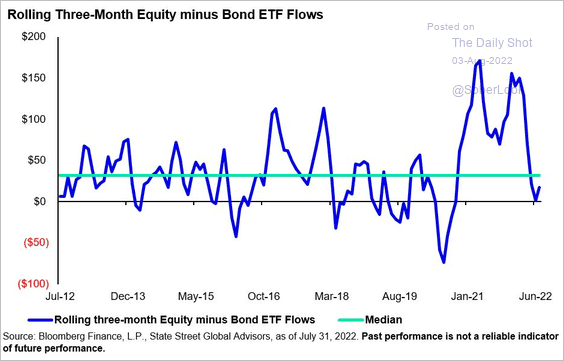

5. Equity ETF inflows were well below historical averages last month, while bond funds attracted fresh capital.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

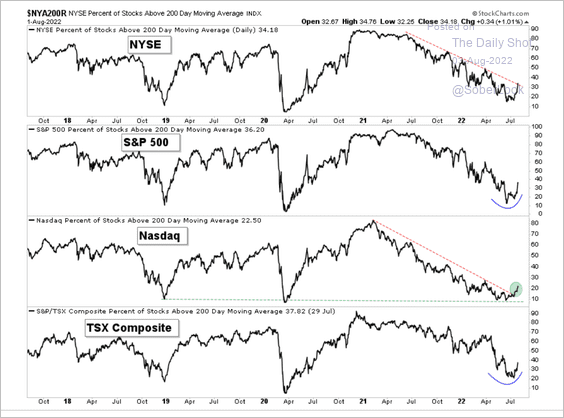

6. Breadth indicators have been improving across US and Canadian equities.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

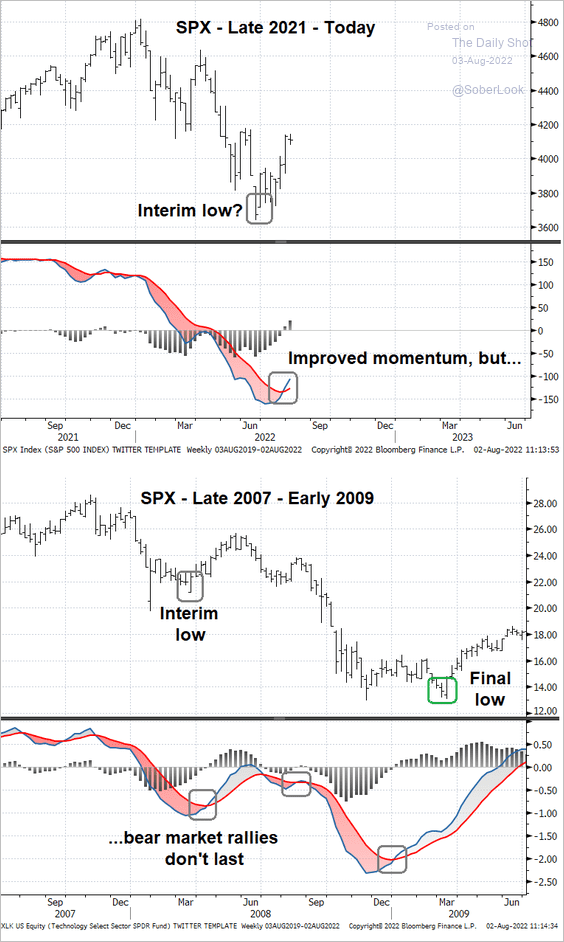

7. Bear market rallies can improve short-term momentum but typically don’t last long.

Source: @StocktonKatie

Source: @StocktonKatie

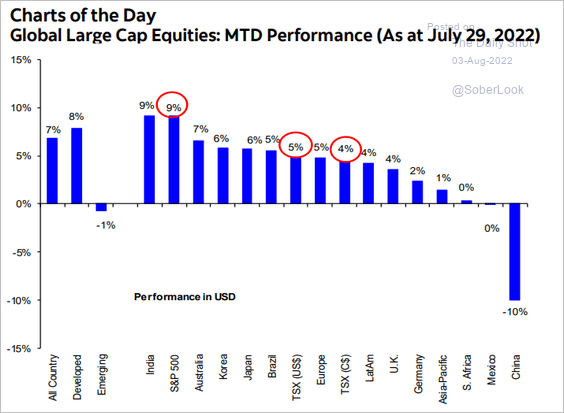

8. Below is the July large-cap performance across key global markets.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

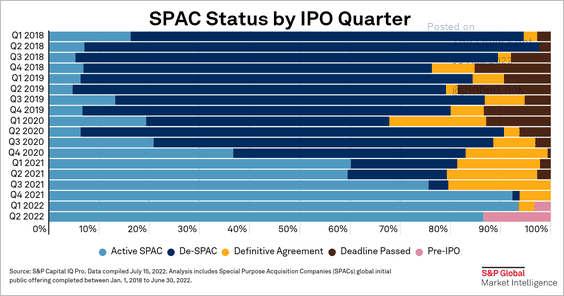

9. Here is a look at SPAC status by vintage quarter (see definition of de-SPAC).

Source: @SPGMarketIntel Read full article

Source: @SPGMarketIntel Read full article

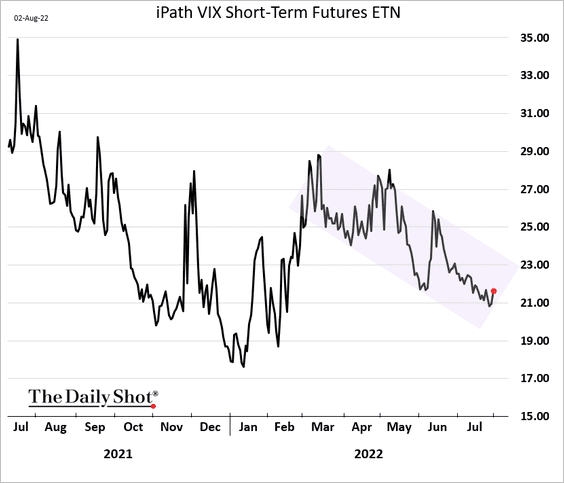

10. Long vol has been a painful trade in recent months.

Source: BNN Read full article

Source: BNN Read full article

Back to Index

Credit

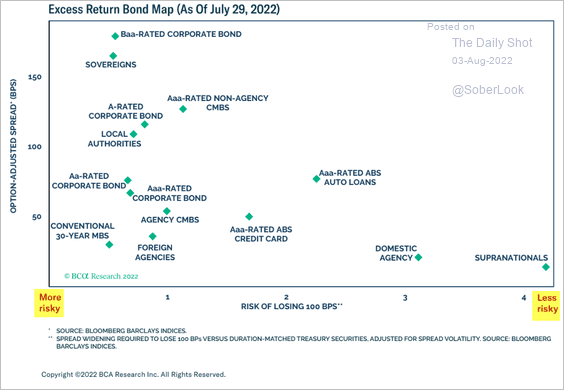

1. Here is the risk-return profile for select asset classes (y-axis = spread, x-axis = risk).

Source: BCA Research

Source: BCA Research

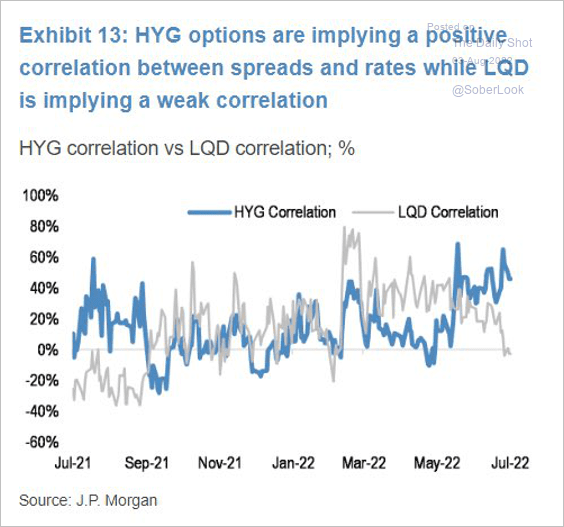

2. Implied correlations show riskier companies more vulnerable to higher rates.

Source: JP Morgan Research; @DiMartinoBooth, @tracyalloway

Source: JP Morgan Research; @DiMartinoBooth, @tracyalloway

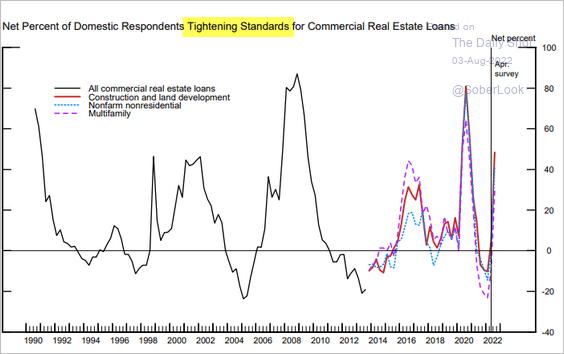

3. Banks have been tightening lending standards on commercial real estate loans.

Source: Board of Governors of The Federal Reserve System

Source: Board of Governors of The Federal Reserve System

Back to Index

Rates

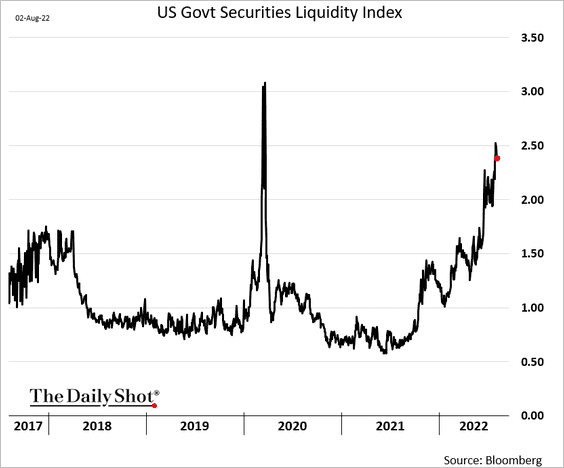

1. Off-the-run Treasury yields are increasingly deviating from the yield curve fit, pointing to worsening liquidity in the market.

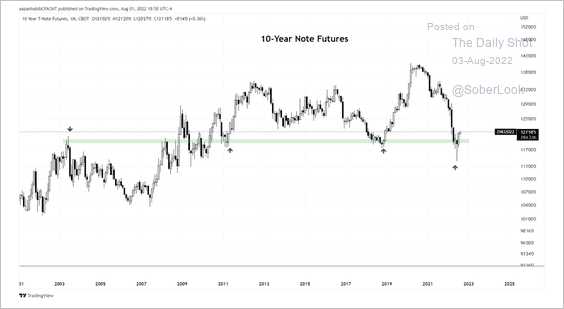

2. The 10-year note futures contract is holding support.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

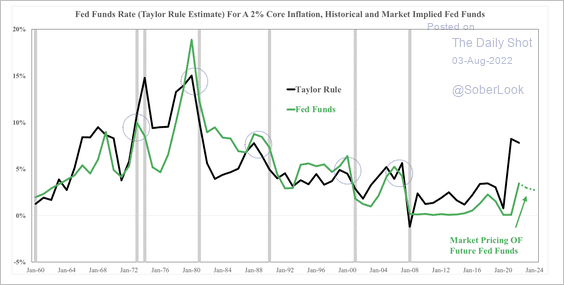

3. More rate hikes are necessary to bring inflation under control, yet the market is pricing in cuts.

Source: SOM Macro Strategies

Source: SOM Macro Strategies

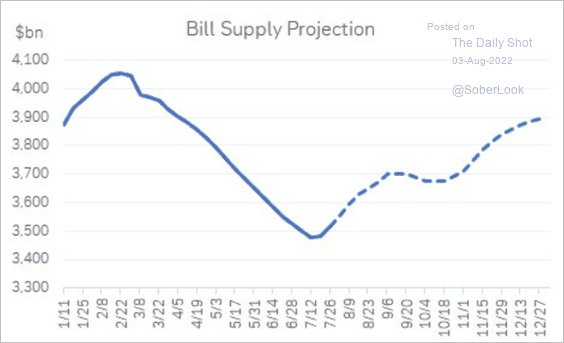

4. Treasury bill supply has bottomed.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

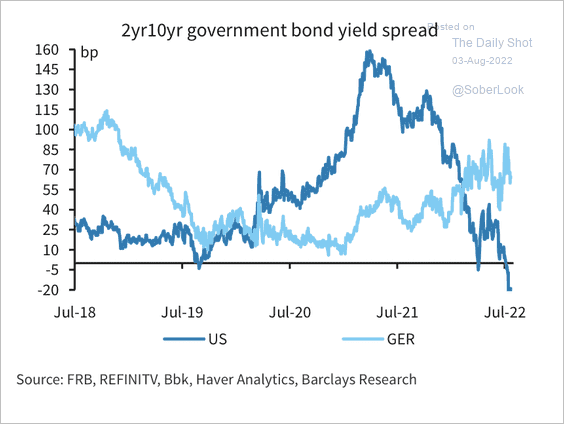

5. The 2-year/10-year Treasury yield curve is inverted, while the German Bund one is steep.

Source: Barclays Research

Source: Barclays Research

Back to Index

Global Developments

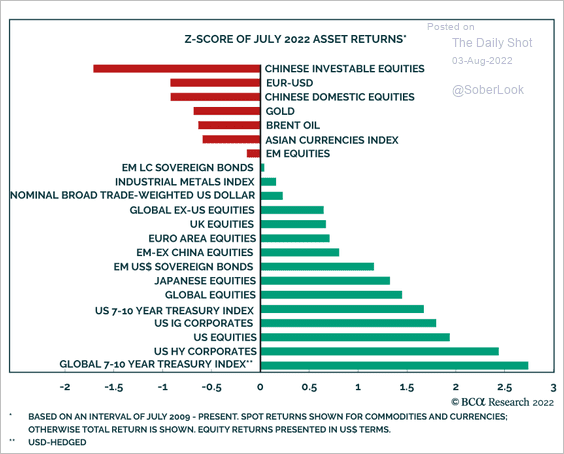

1. This chart shows the July performance by asset class.

Source: BCA Research

Source: BCA Research

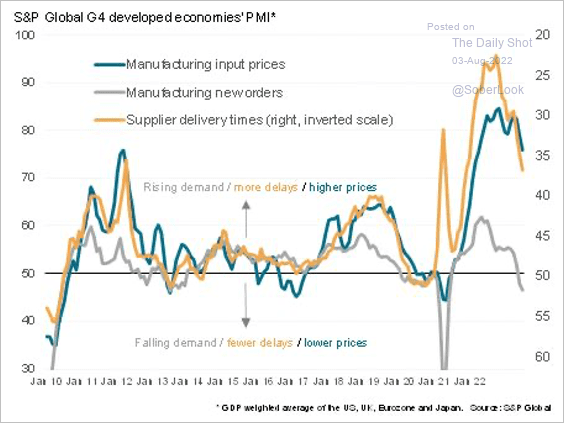

2. Industrial price pressures in developed markets are coming down sharply.

Source: @WilliamsonChris

Source: @WilliamsonChris

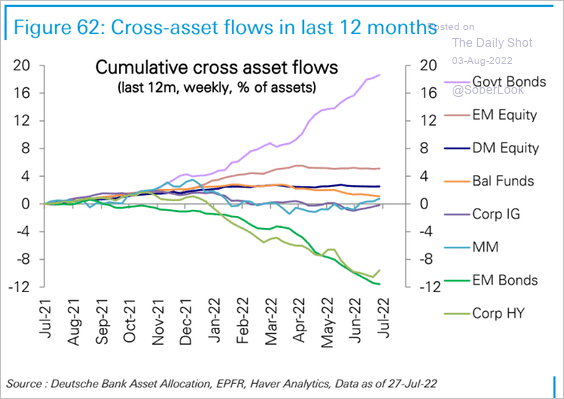

3. This chart shows fund flows by asset class.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

Food for Thought

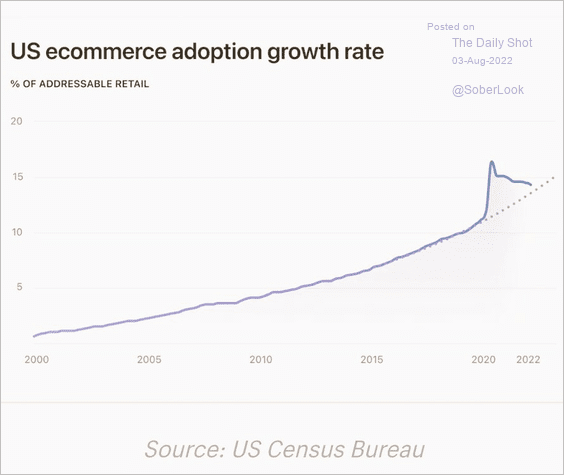

1. US e-commerce penetration:

Source: @TheTranscript_, @carlquintanilla, @knowledge_vital

Source: @TheTranscript_, @carlquintanilla, @knowledge_vital

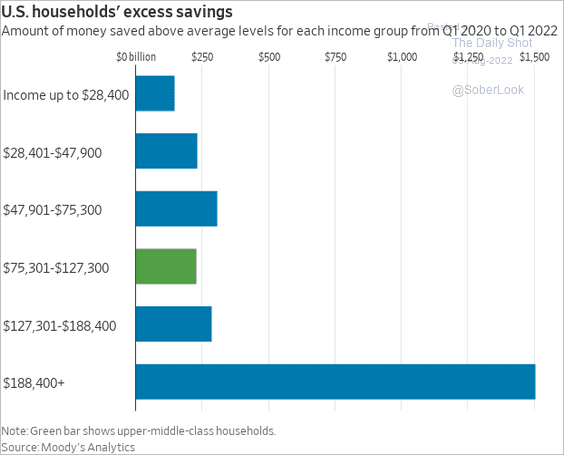

2. Households’ excess savings by income:

Source: @WSJ Read full article

Source: @WSJ Read full article

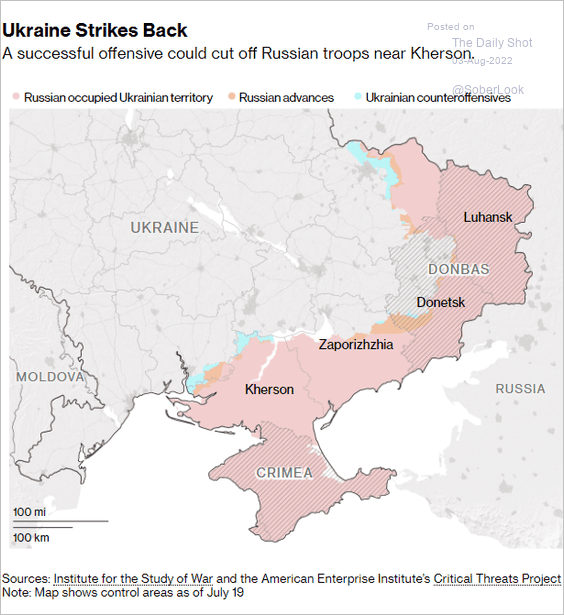

3. Ukraine’s counteroffensive:

Source: @opinion Read full article

Source: @opinion Read full article

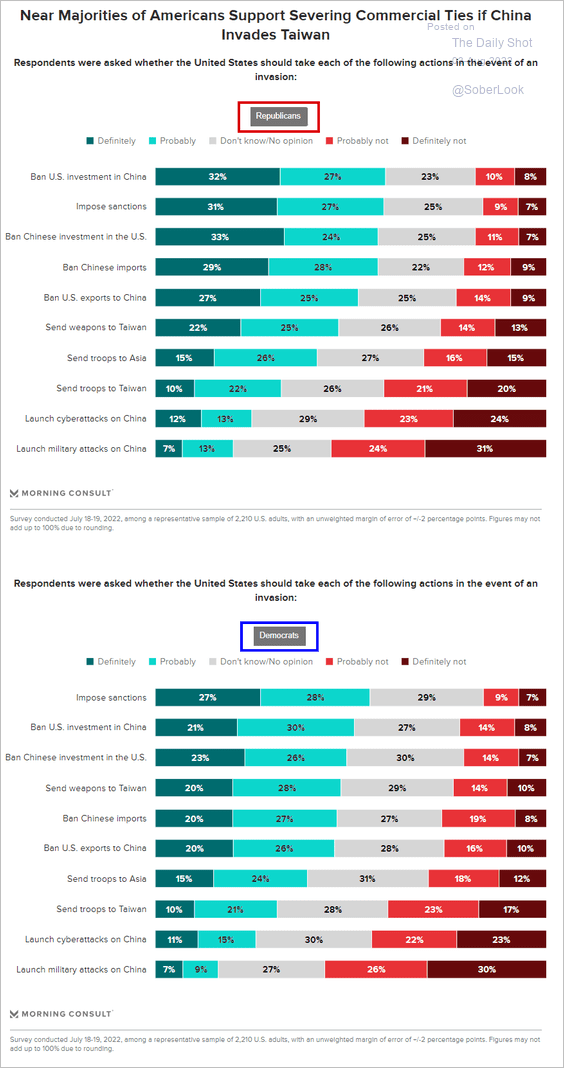

4. How should the US respond if China invades Taiwan?

Source: Morning Consult Read full article

Source: Morning Consult Read full article

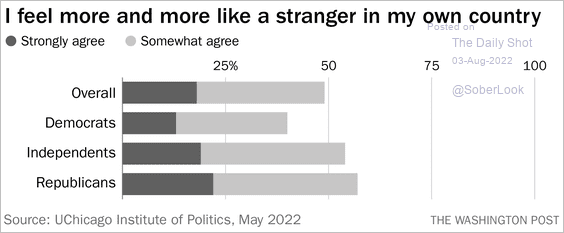

5. Americans feeling like strangers in their own country:

Source: The Washington Post Read full article

Source: The Washington Post Read full article

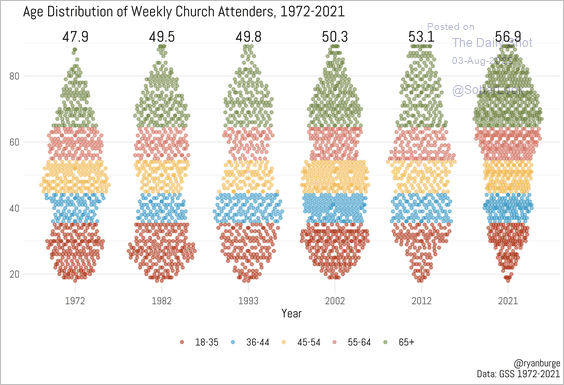

6. Aging church attendees:

Source: @ryanburge

Source: @ryanburge

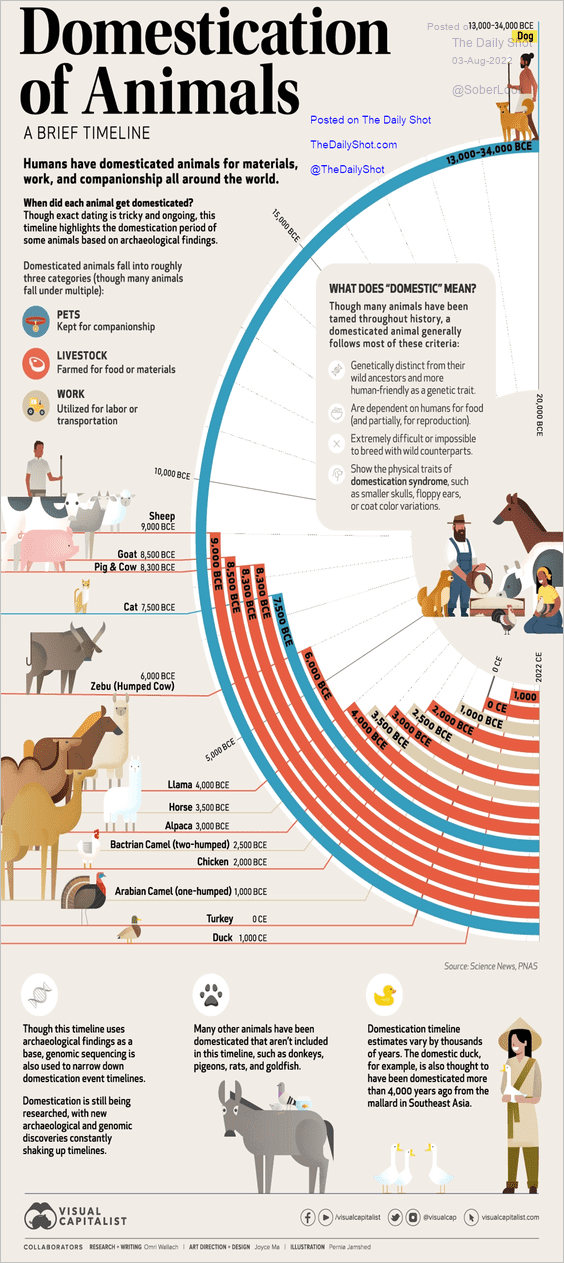

7. Domestication of animals:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

——————–

Back to Index