The Daily Shot: 25-Oct-22

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Asia – Pacific

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Rates

• Global Developments

• Food for Thought

The United States

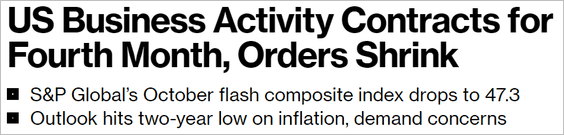

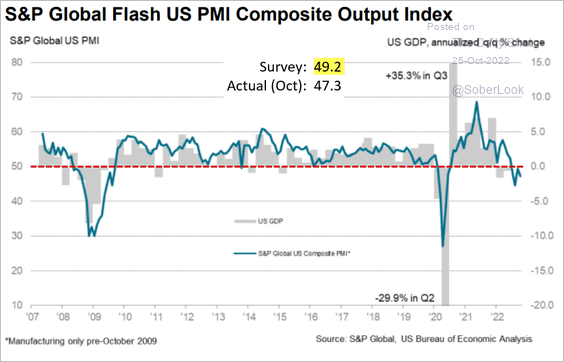

1. The S&P Global (Markit) PMI report showed US business activity holding in contraction territory this month.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

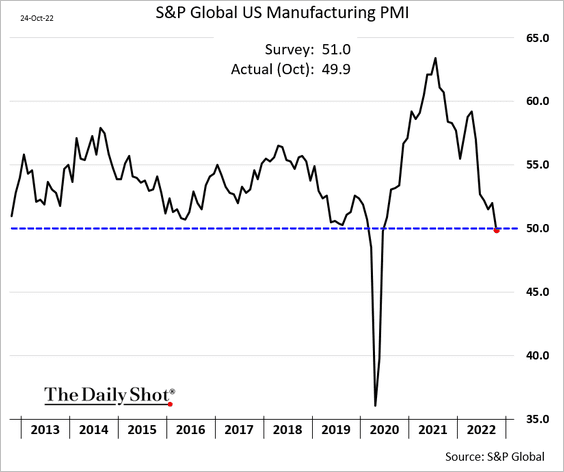

• The manufacturing PMI dipped below 50, …

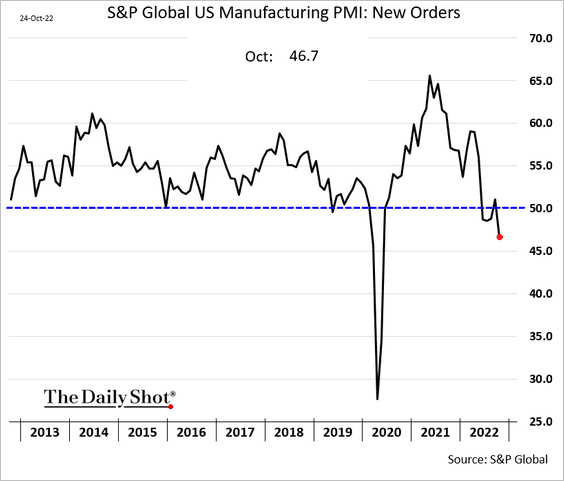

… with demand weakness worsening.

– A separate indicator, the ISM Manufacturing orders index, points to further downside risks in demand from the US dollar strength.

Source: Piper Sandler

Source: Piper Sandler

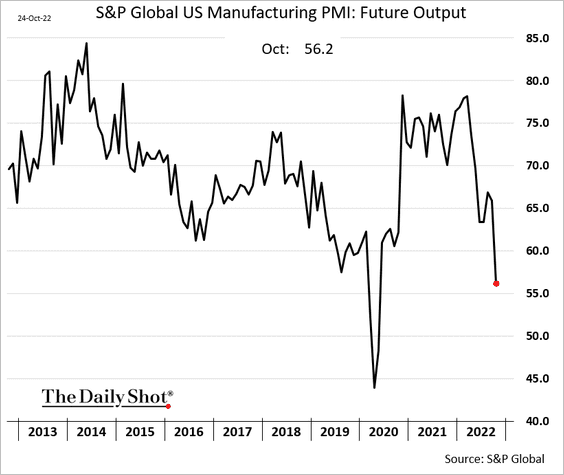

– Factories’ future output index declined sharply.

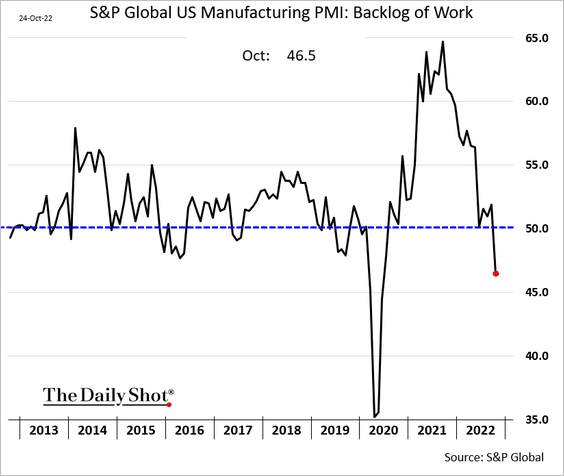

– Manufacturing backlogs are fading.

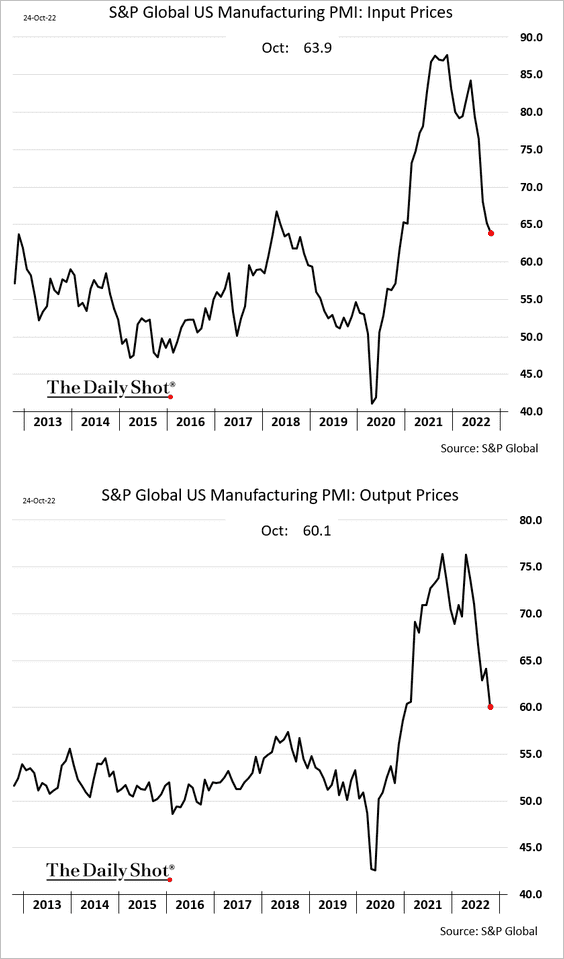

– Price gains continue to moderate.

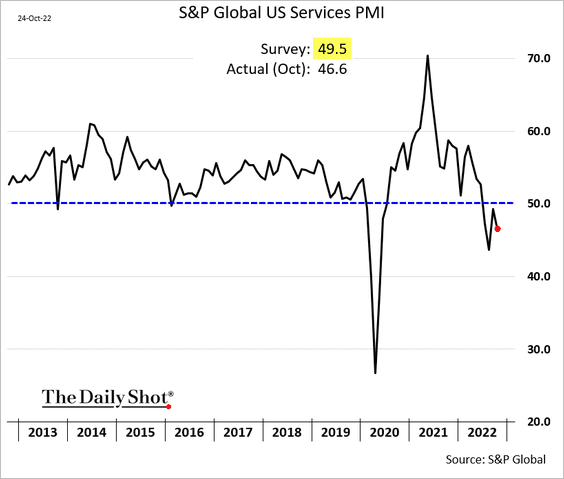

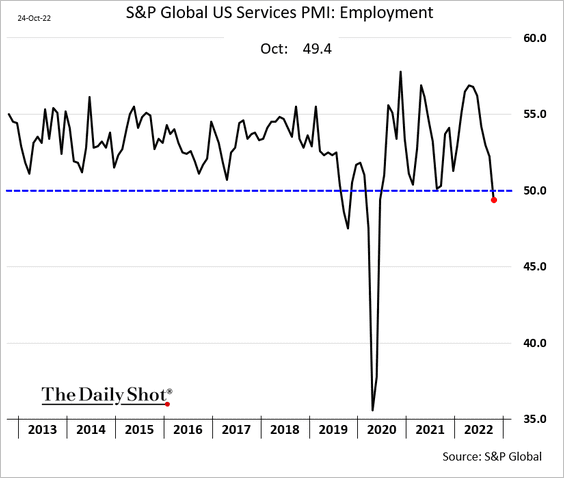

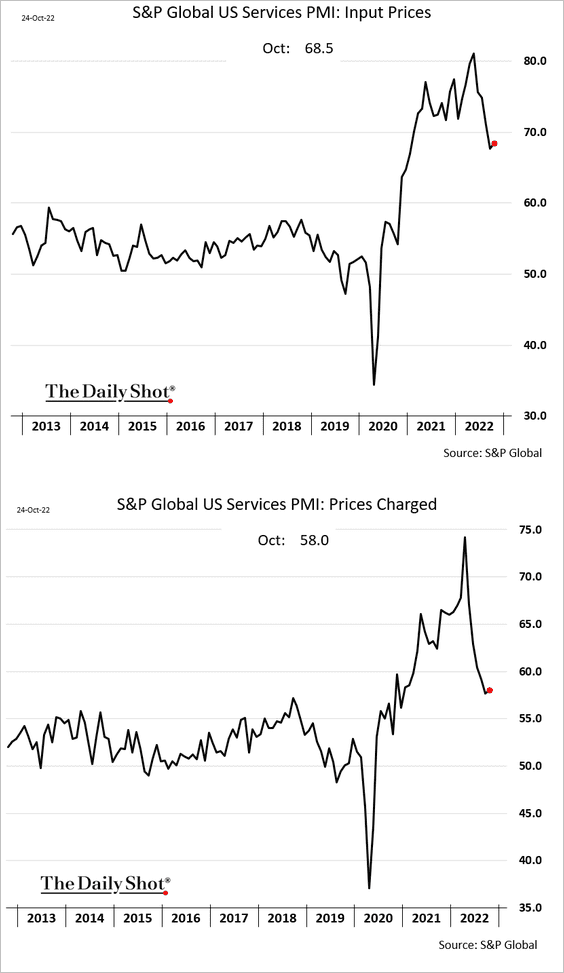

• Services activity continues to contract.

– Service-sector hiring is over.

– Service-sector price gains accelerated slightly this month.

• The composite PMI surprised to the downside.

Source: S&P Global PMI

Source: S&P Global PMI

——————–

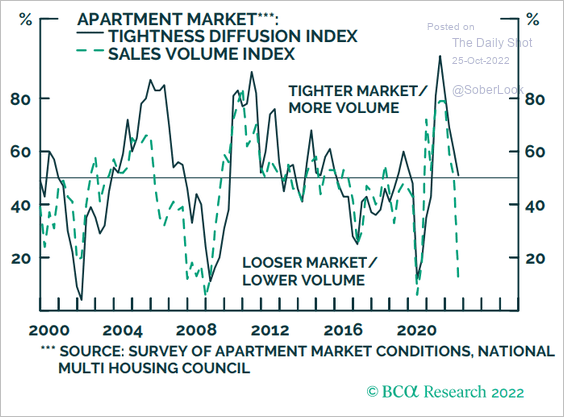

2. Next, let’s take a look at housing rental markets.

• The Apartment market tightness diffusion index vs. sales:

Source: BCA Research

Source: BCA Research

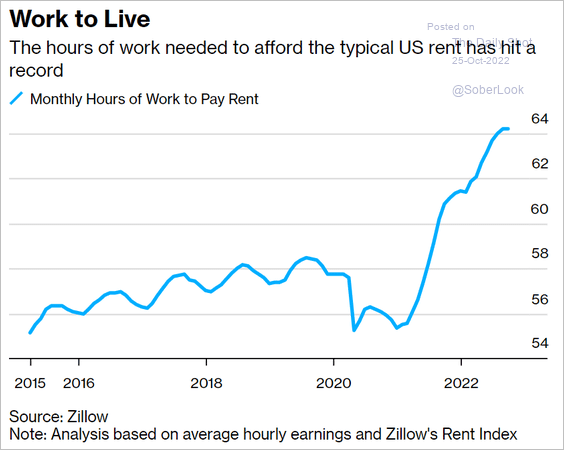

• Hours of work needed to afford rent:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

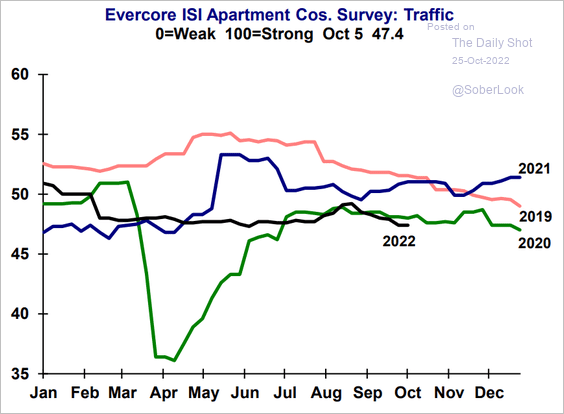

• The Evercore ISI apartment traffic (now below 2020 levels):

Source: Evercore ISI Research

Source: Evercore ISI Research

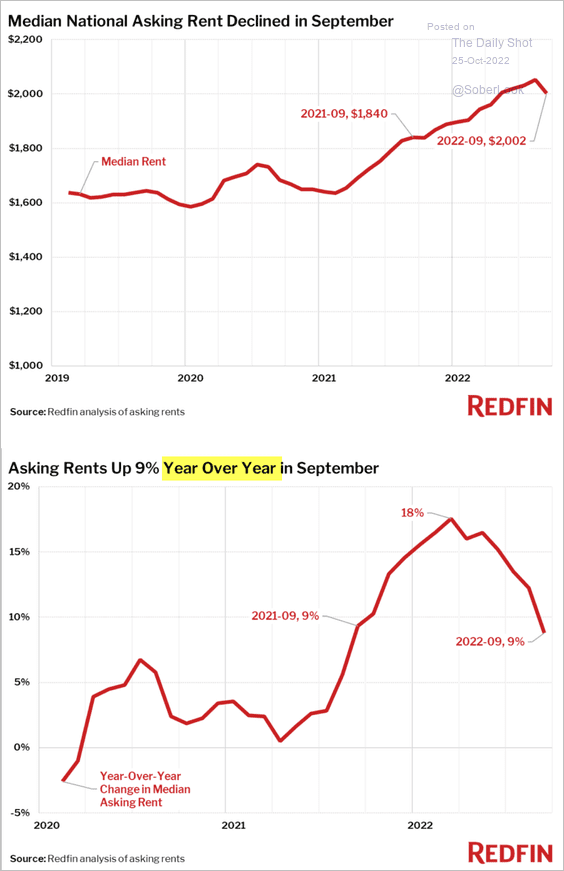

• Redfin rent inflation:

Source: Redfin

Source: Redfin

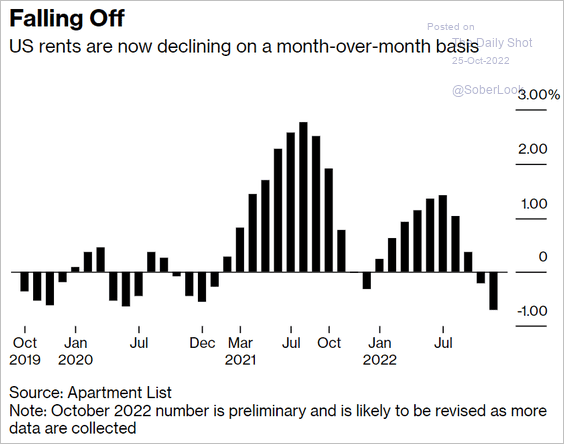

• Apartment List rent inflation (MoM):

Source: Bloomberg Read full article

Source: Bloomberg Read full article

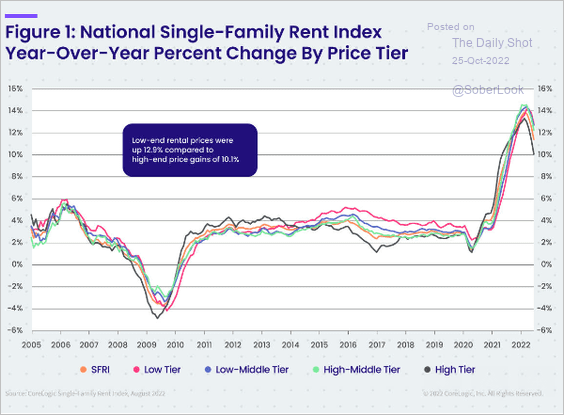

• Single-family housing rent inflation:

Source: CoreLogic

Source: CoreLogic

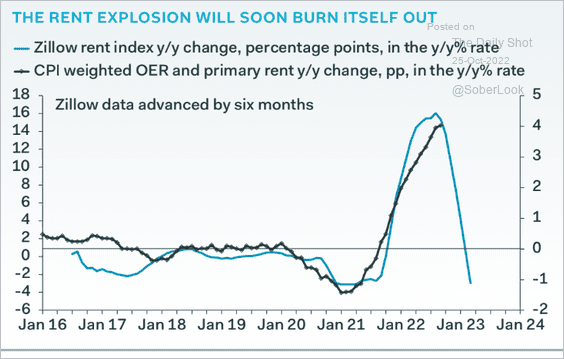

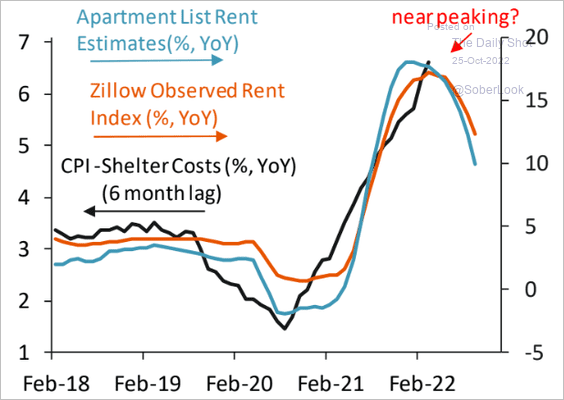

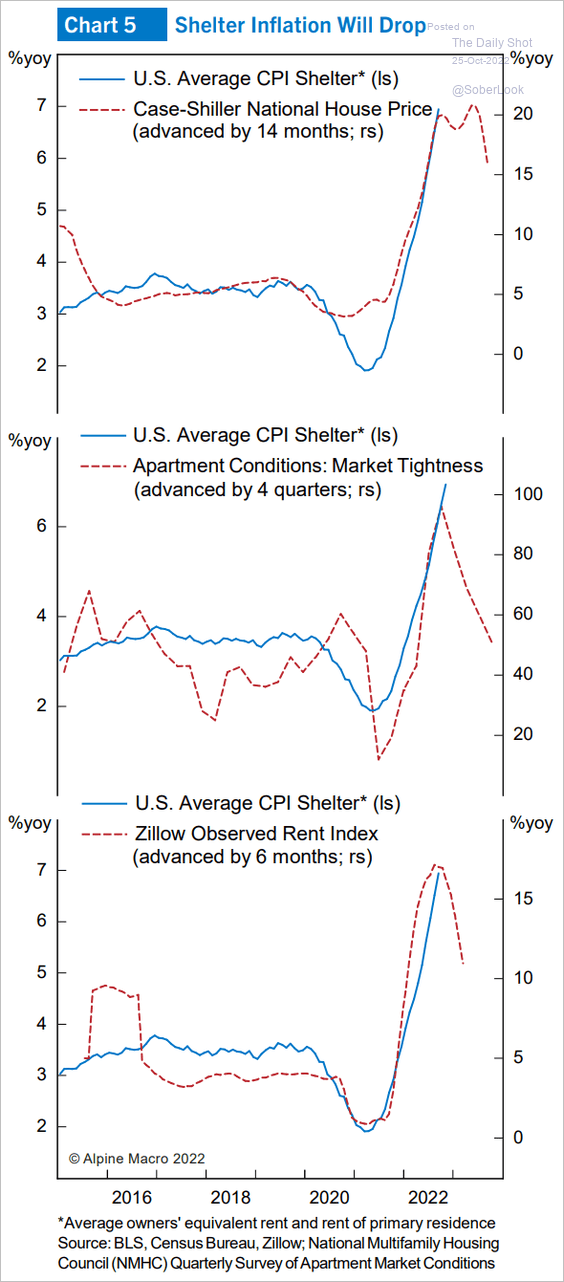

• Leading indicators of rent/shelter inflation (3 charts):

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Source: Piper Sandler

Source: Piper Sandler

Source: Alpine Macro

Source: Alpine Macro

——————–

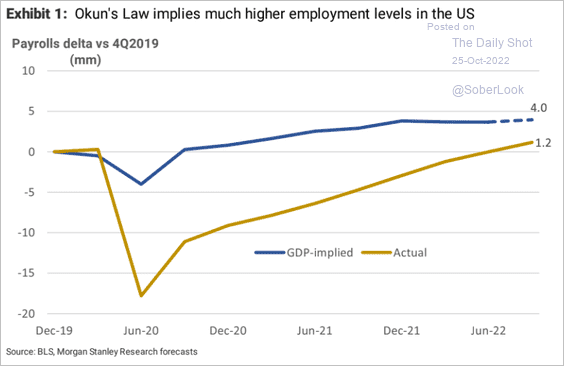

3. The number of US jobs should be higher to keep up with economic growth.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

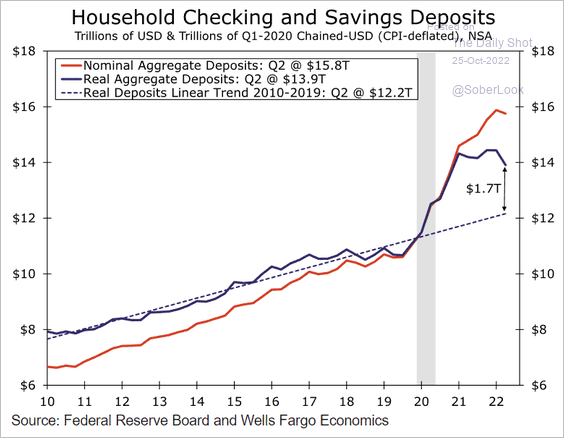

4. Households’ real excess savings remain elevated.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

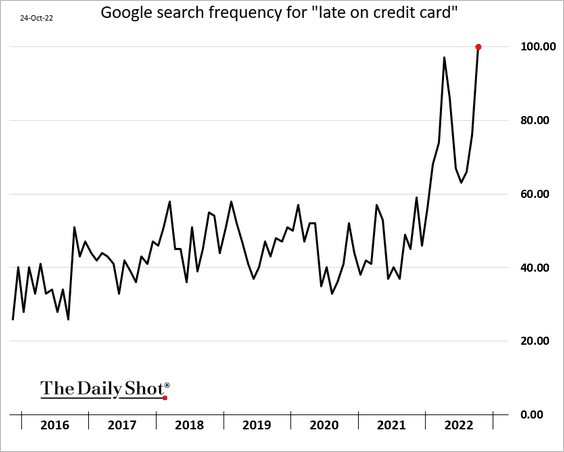

5. Online search activity for “late on credit card” has risen recently.

Back to Index

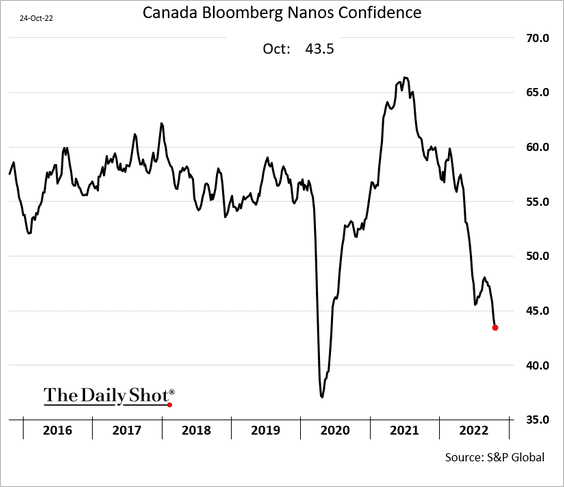

Canada

1. Consumer confidence continues to deteriorate.

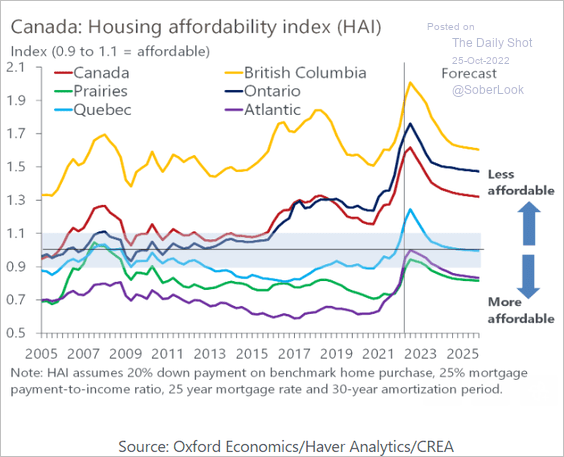

2. Housing affordability is expected to worsen next year before starting to improve.

Source: Oxford Economics

Source: Oxford Economics

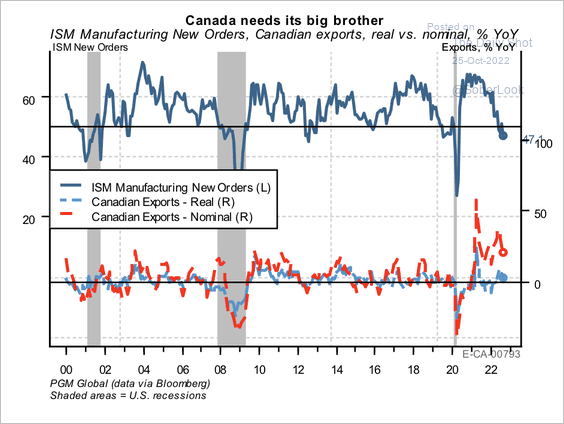

3. Export volumes have weakened as the US ISM manufacturing new orders index entered contraction territory.

Source: PGM Global

Source: PGM Global

Back to Index

The United Kingdom

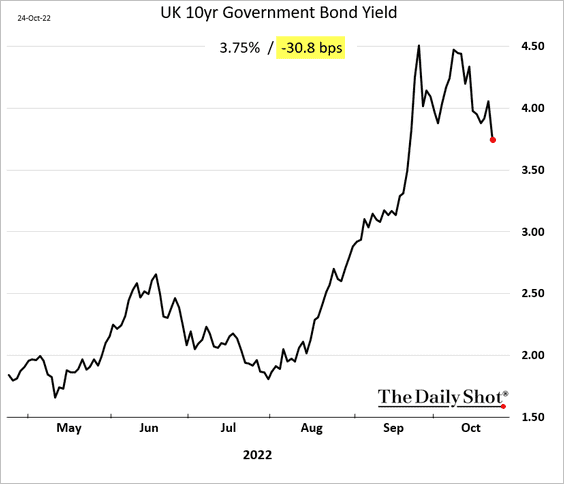

1. Gilts are firmer as Rishi Sunak becomes the next prime minister.

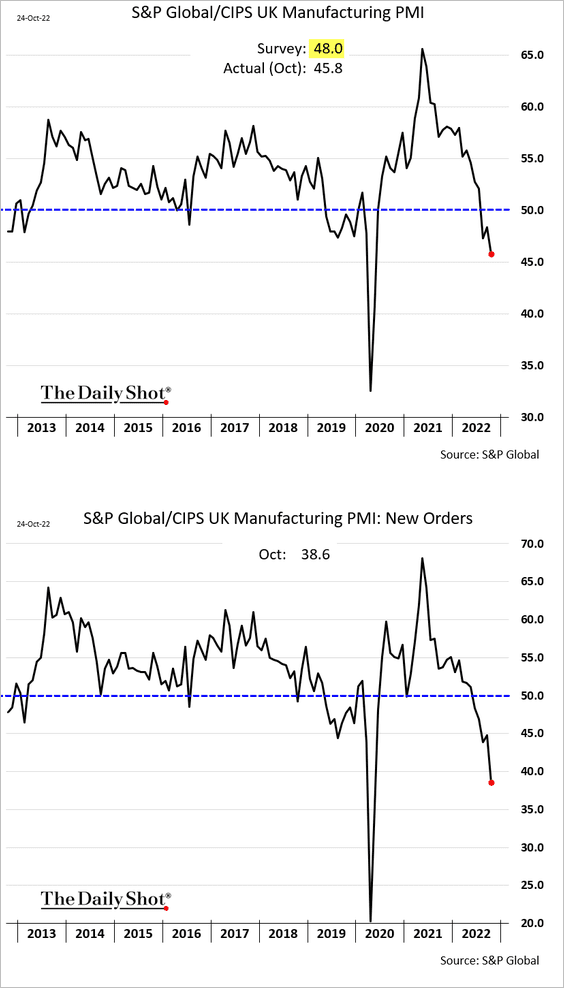

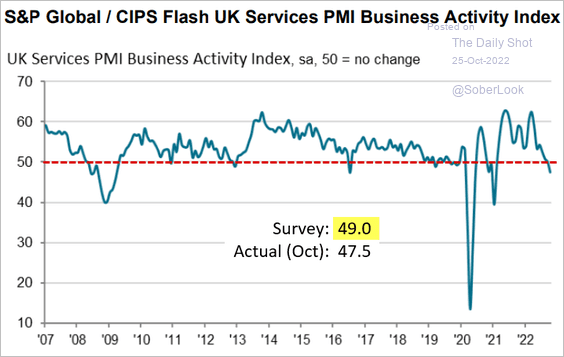

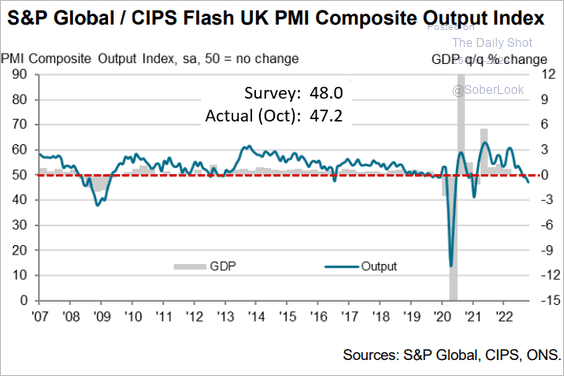

2. The PMI report suggests that the UK is in recession.

• Manufacturing PMI (well below forecasts):

• Services PMI:

Source: S&P Global PMI

Source: S&P Global PMI

• Composite PMI:

Source: S&P Global PMI

Source: S&P Global PMI

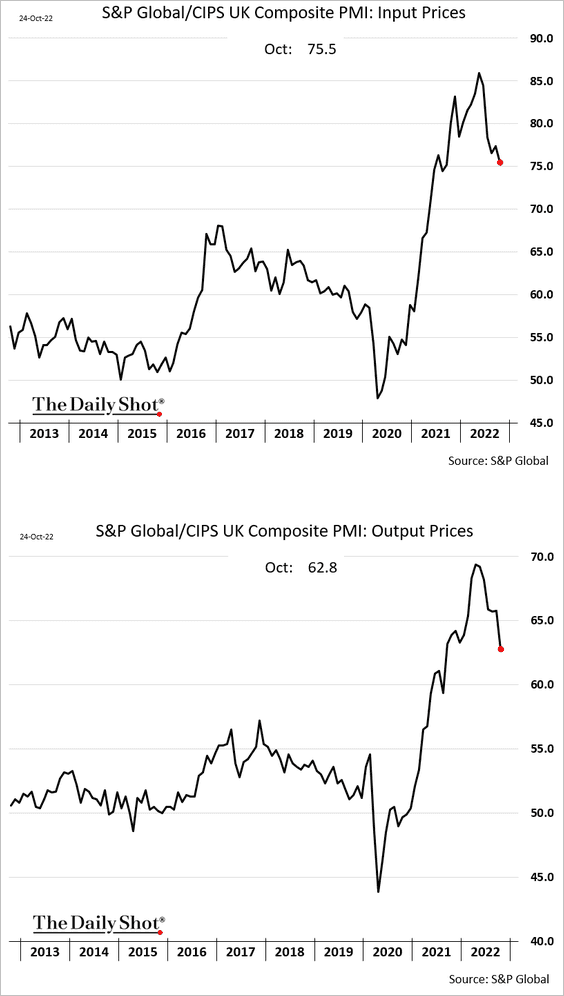

Price pressures are off the highs but remain elevated.

——————–

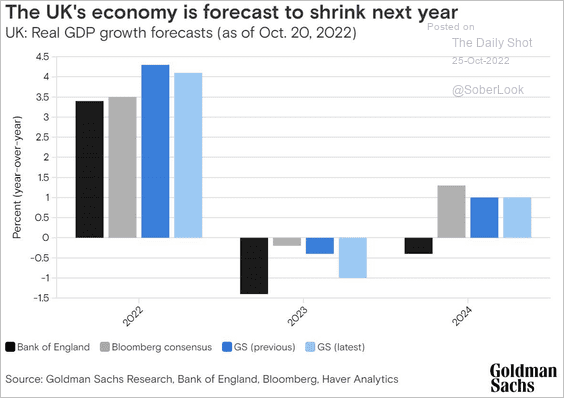

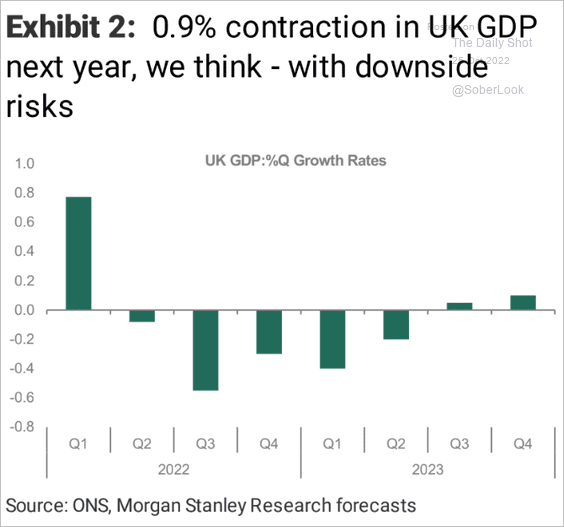

3. Goldman downgraded its 2023 GDP forecast, predicting a deeper downturn.

Source: Goldman Sachs

Source: Goldman Sachs

This chart is from Morgan Stanley.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

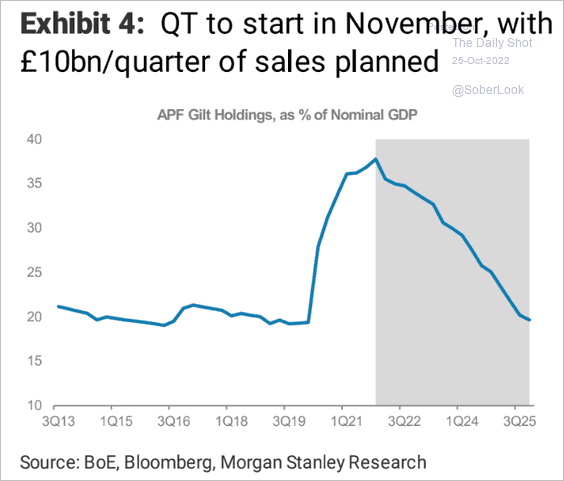

4. QT is about to start.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

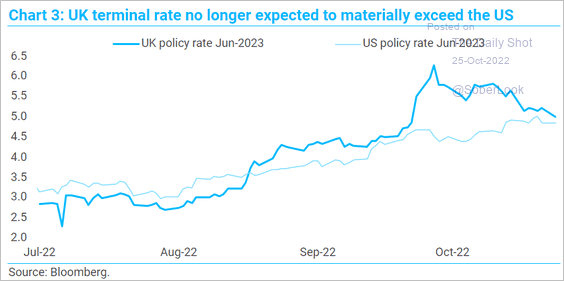

5. The UK terminal rate is converging with the US.

Source: TS Lombard

Source: TS Lombard

Back to Index

The Eurozone

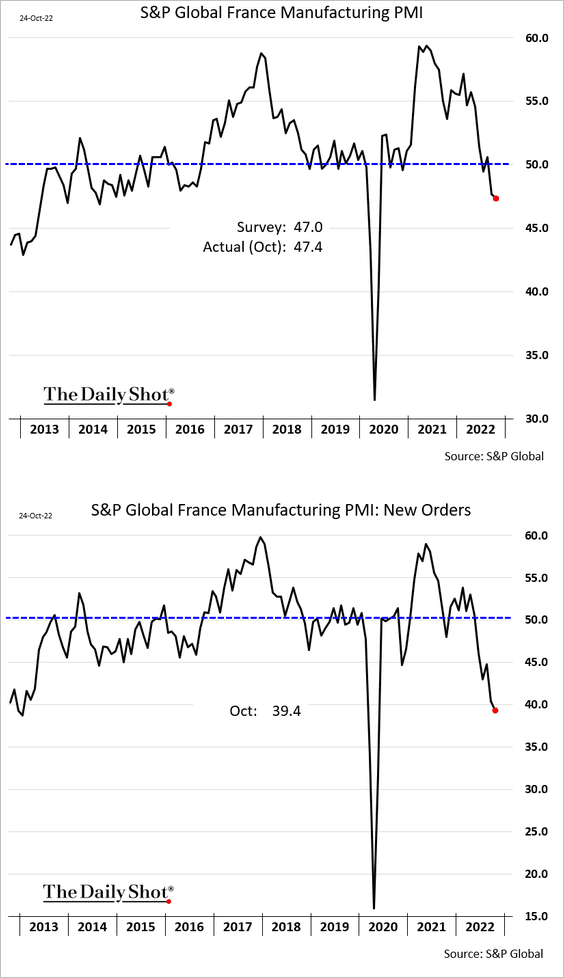

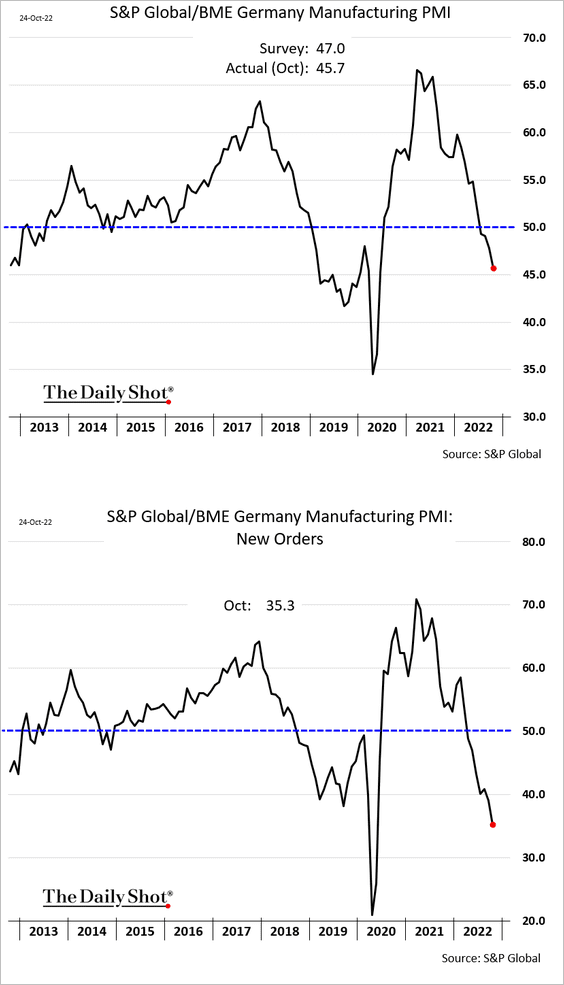

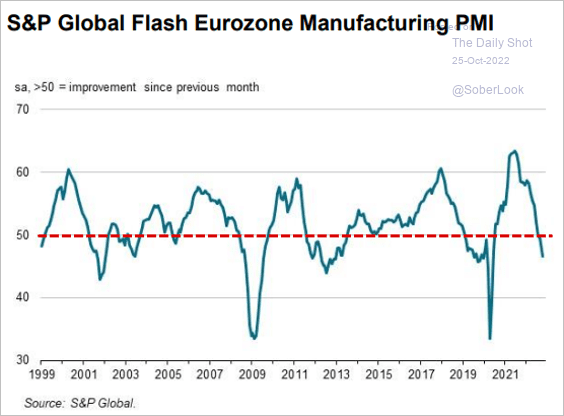

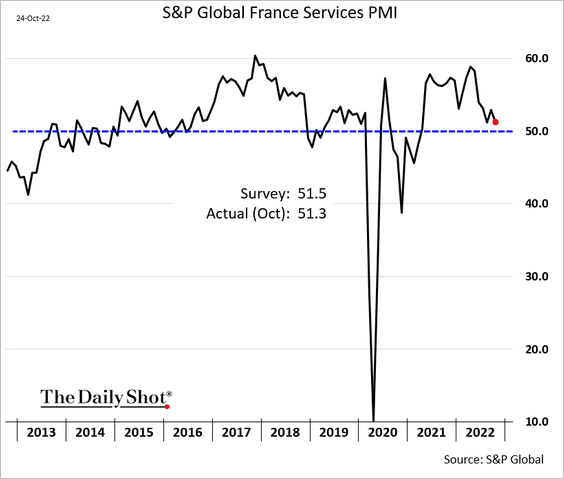

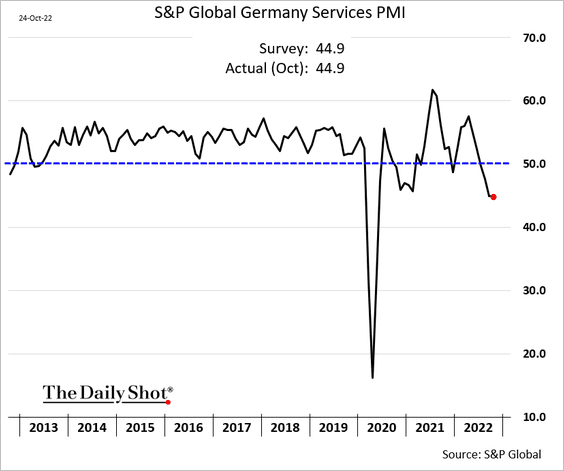

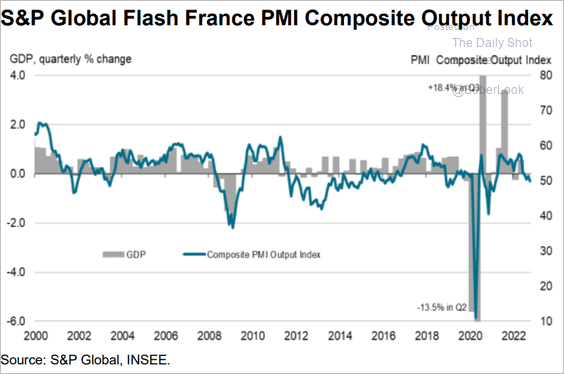

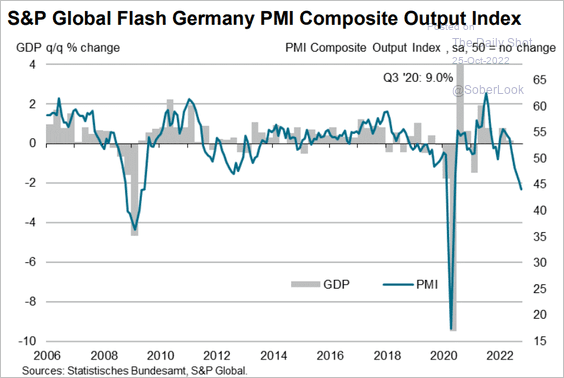

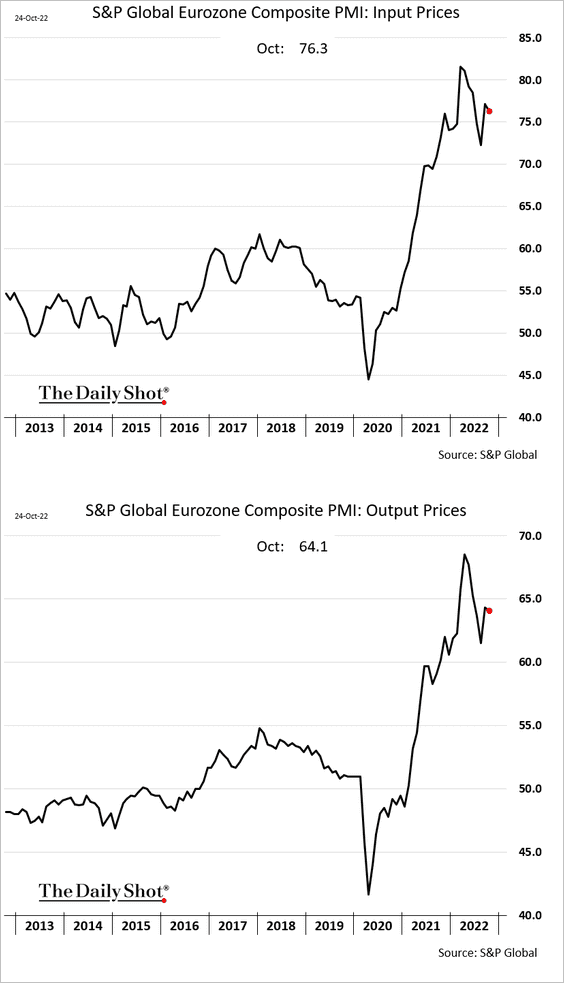

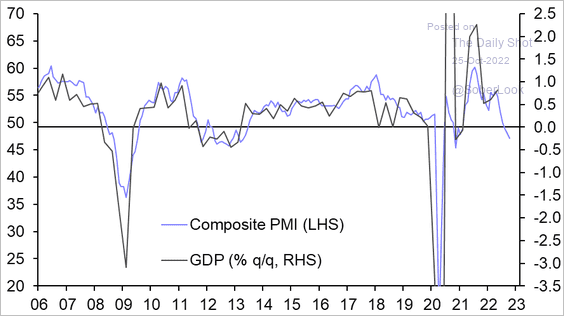

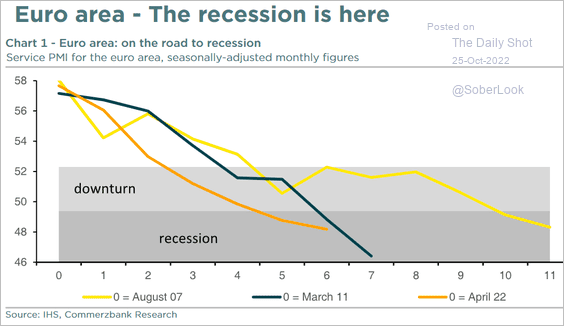

1. The euro area is probably in recession. Let’s run through the PMI report (PMI < 50 means contraction).

• Manufacturing PMI:

– France:

– Germany (orders are collapsing):

– The Eruozone:

Source: S&P Global PMI

Source: S&P Global PMI

• Services PMI:

– France (still growing):

– Germany:

• Composite PMI:

– France:

Source: S&P Global PMI

Source: S&P Global PMI

– Germany:

Source: S&P Global PMI

Source: S&P Global PMI

Prices pressures are still holding near extreme levels.

• Here is the composite PMI vs. GDP.

Source: Capital Economics

Source: Capital Economics

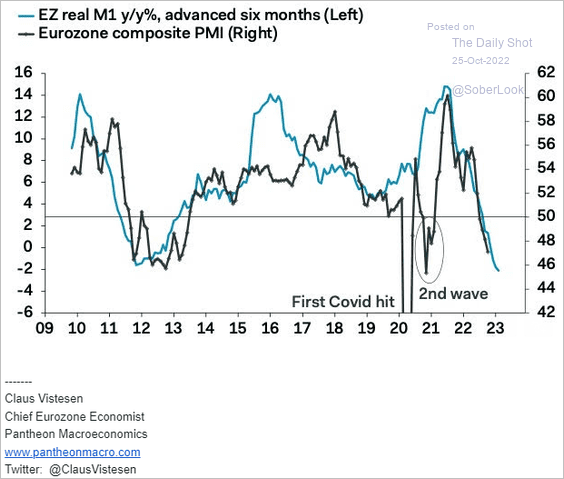

• The money supply (M1) shows further downside for business activity.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The recession is here.

Source: Commerzbank Research

Source: Commerzbank Research

——————–

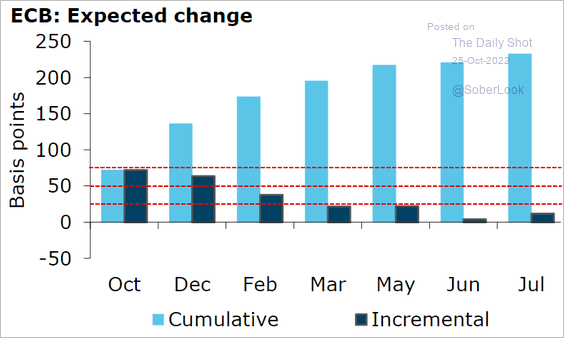

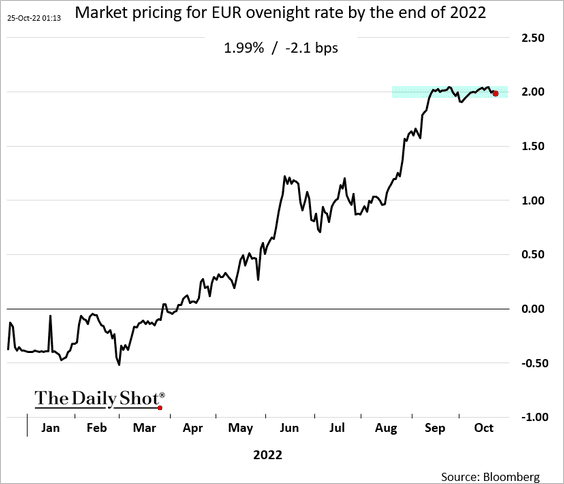

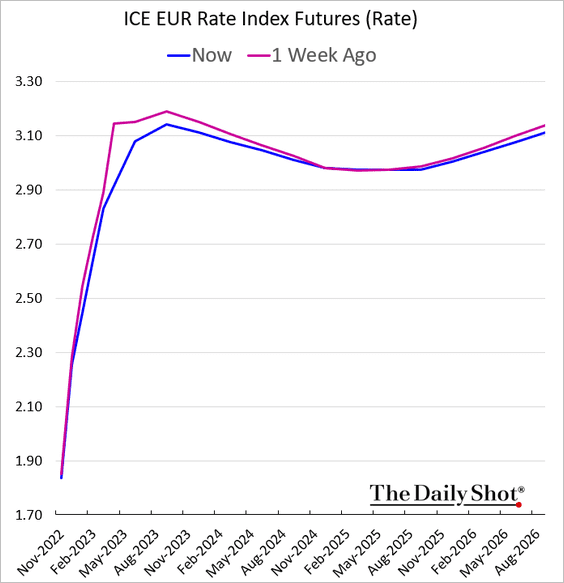

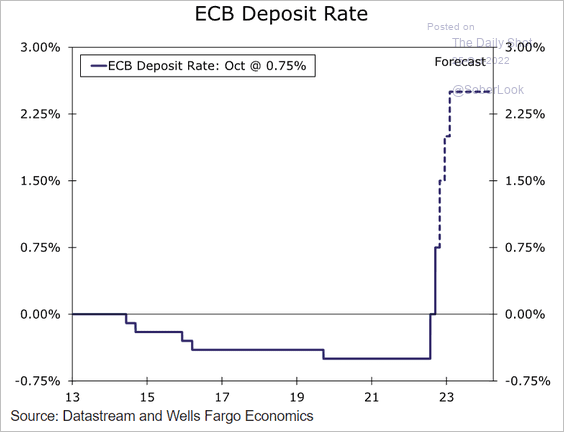

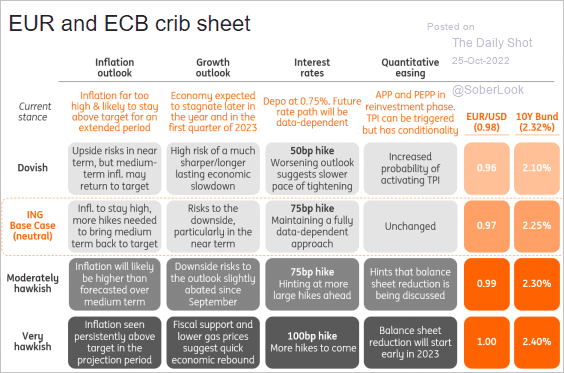

2. The market is pricing in a 75 bps rate hike this week.

Source: @ANZ_Research

Source: @ANZ_Research

• Rate expectations for the year-end have stabilized at around 2%.

• The rate trajectory (and the terminal rate) is off the highs.

• Below is a forecast from Wells Fargo.

Source: Wells Fargo Securities

Source: Wells Fargo Securities

• Here are some ECB announcement scenarios and potential market reactions from ING.

Source: ING

Source: ING

——————–

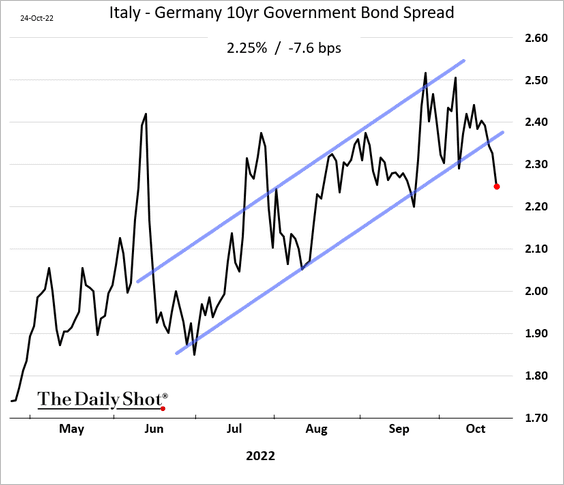

3. The Italy-Germany spread has been tightening.

Back to Index

Asia – Pacific

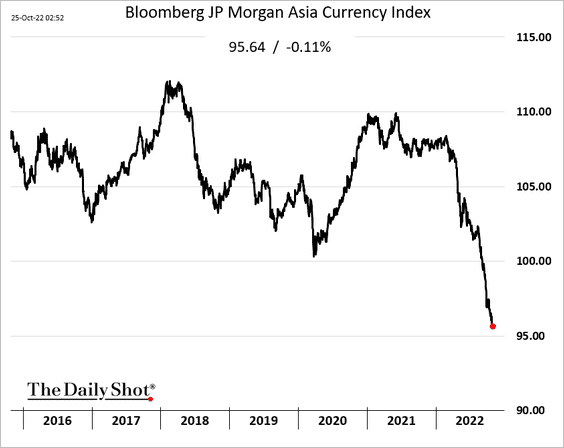

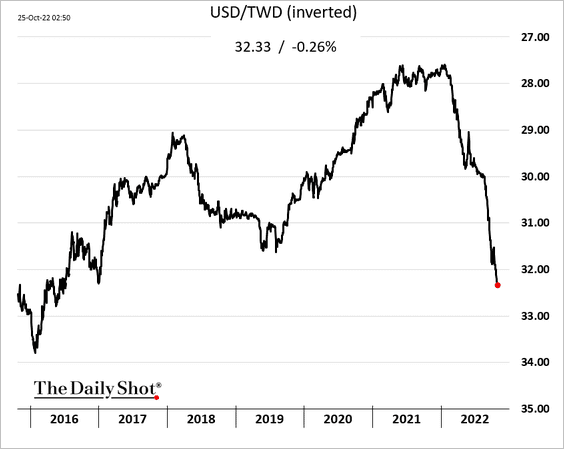

1. Asian currencies remain under pressure.

Here is the Taiwan dollar.

——————–

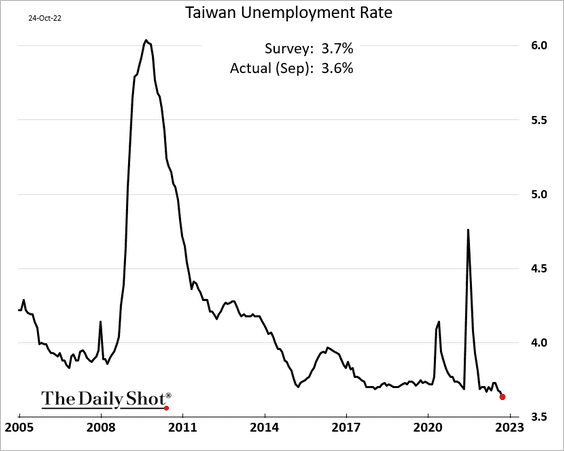

2. Taiwan’s unemployment rate (seasonally adjusted) is at multi-year lows.

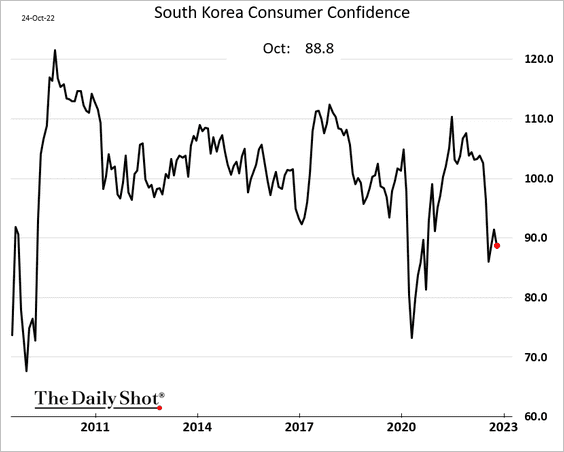

3. South Korea’s consumer confidence declined this month.

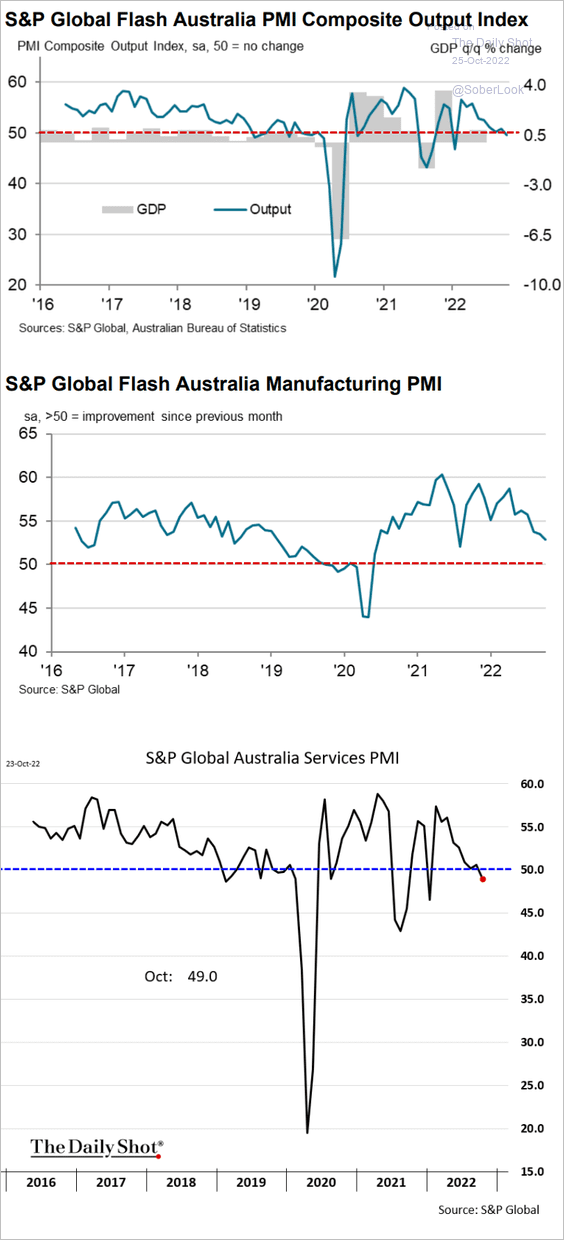

4. Australia’s composite PMI dipped below 50 this month. Manufacturing has been strong, but services activity is now contracting.

Source: S&P Global PMI

Source: S&P Global PMI

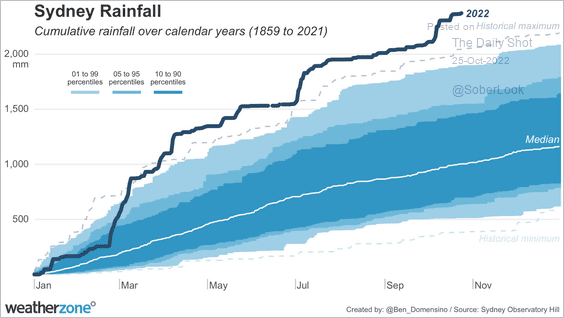

Separately, this chart shows cumulative rainfall in Sydney by year.

Source: @Ben_Domensino

Source: @Ben_Domensino

Back to Index

China

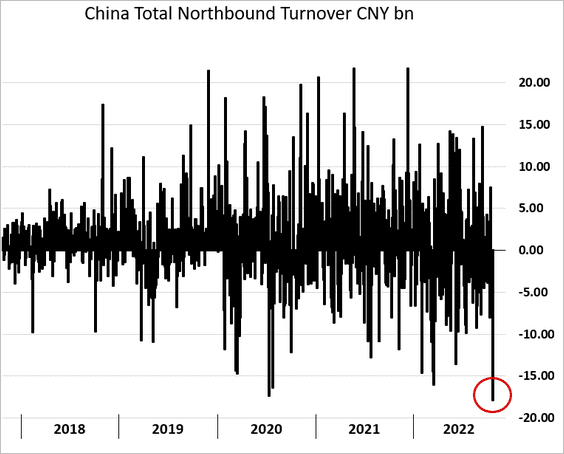

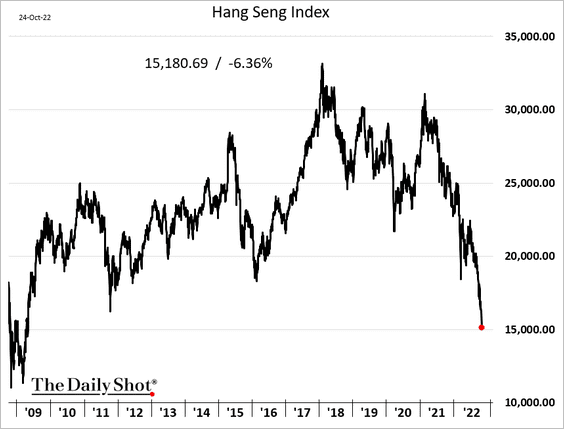

1. Foreign and Hong Kong investors dumped Mainland stocks on Monday.

Further reading

Further reading

• The Hang Seng Index hit its lowest level since the financial crisis.

• US-listed shares were down 14%.

——————–

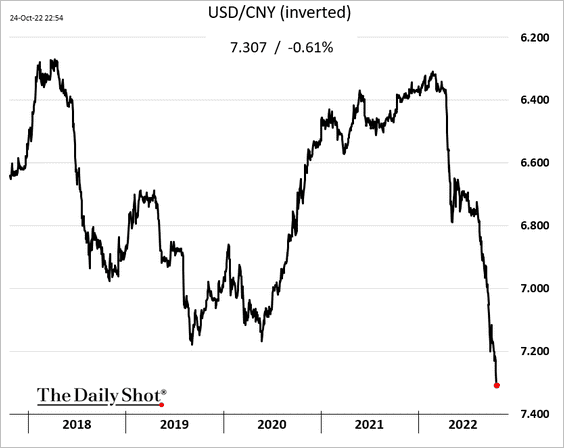

2. The renminbi continues to tumble.

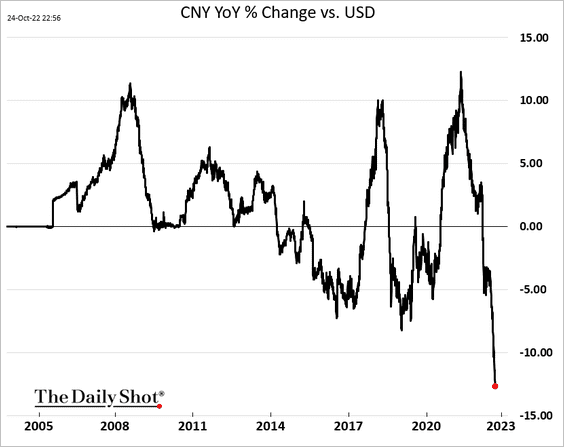

Below is the year-over-year chart.

——————–

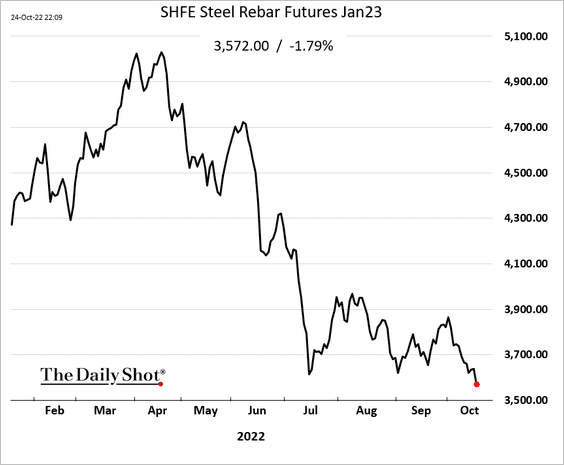

3. Steel prices keep falling …

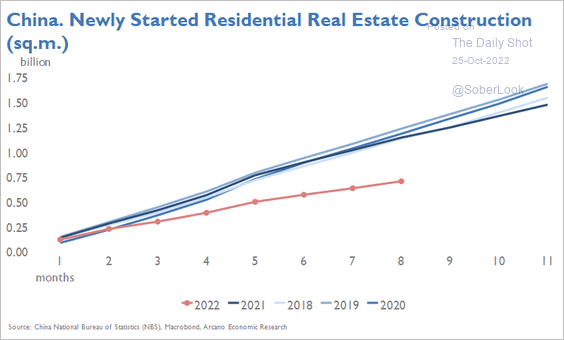

… as housing demand deteriorates.

Source: Arcano Economics

Source: Arcano Economics

——————–

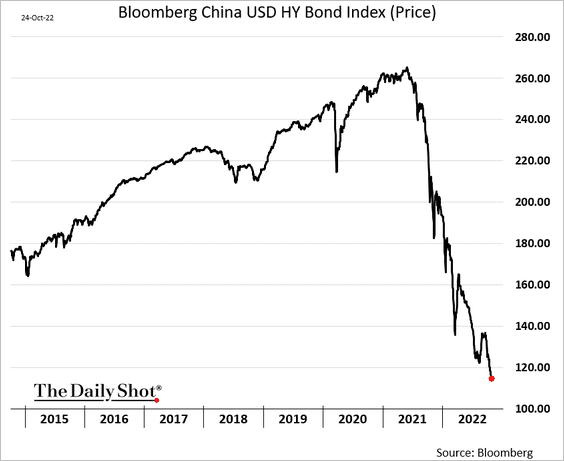

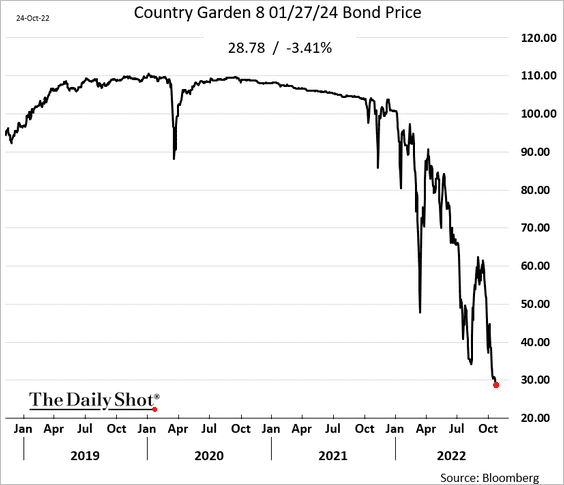

4. Developers’ offshore debt prices keep sinking as firms show little willingness to pay their foreign creditors.

• USD HY bond prices:

• Evergrande:

• Country Garden:

Back to Index

Emerging Markets

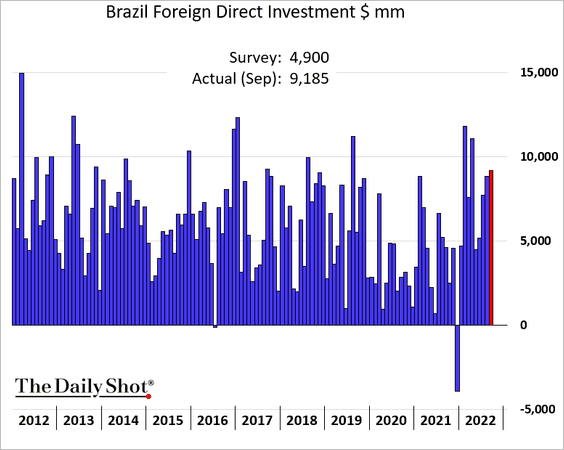

1. Brazil’s foreign direct investment surprised to the upside.

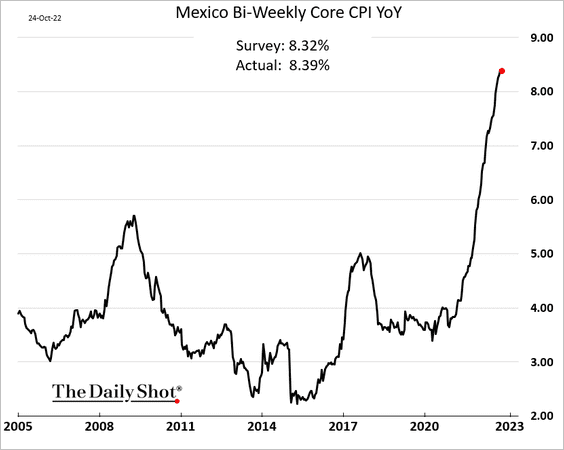

2. Mexican inflation continues to climb.

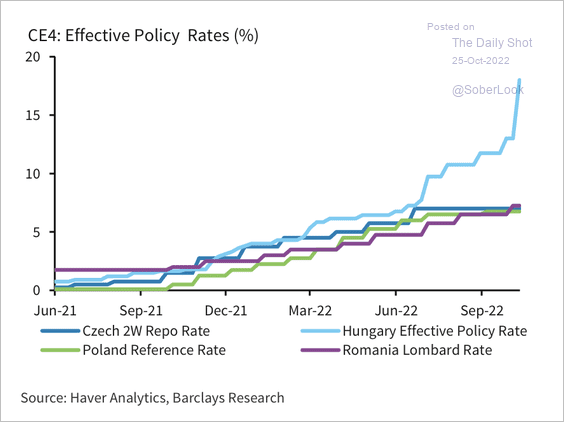

3. Hungary’s policy rate has deviated from regional peers.

Source: Barclays Research

Source: Barclays Research

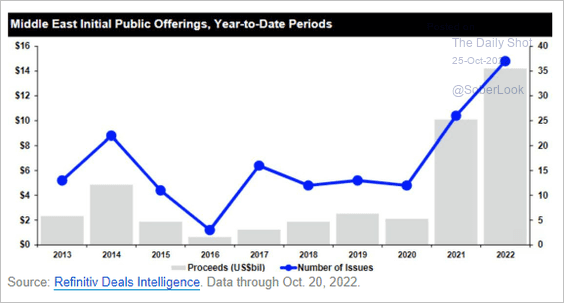

4. The Middle East saw strong IPO activity this year.

Source: @axios

Source: @axios

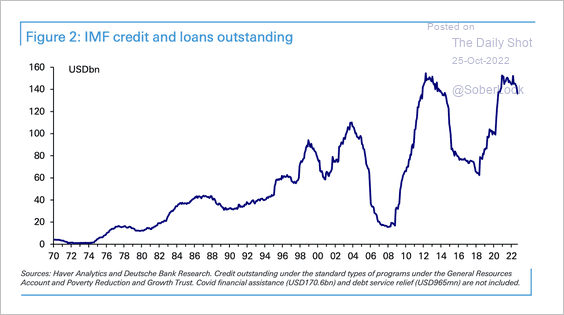

5. Total program lending by the IMF spiked during the onset of the pandemic as many countries requested financial assistance.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Back to Index

Cryptocurrency

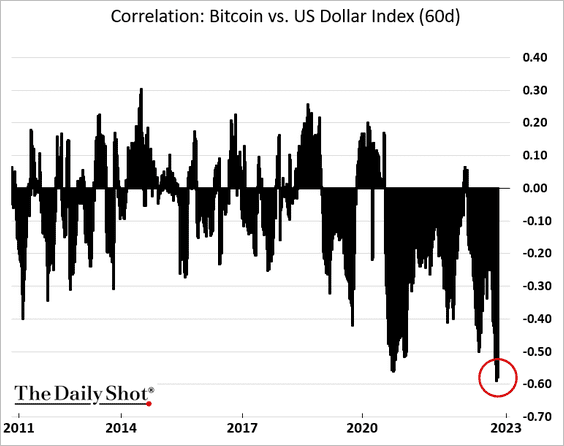

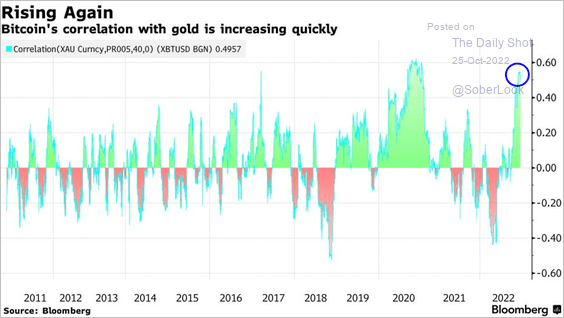

1. Bitcoin has been highly anti-correlated to the US dollar recently, …

… and therefore more correlated to gold.

Source: @business, @ossingerj Read full article

Source: @business, @ossingerj Read full article

——————–

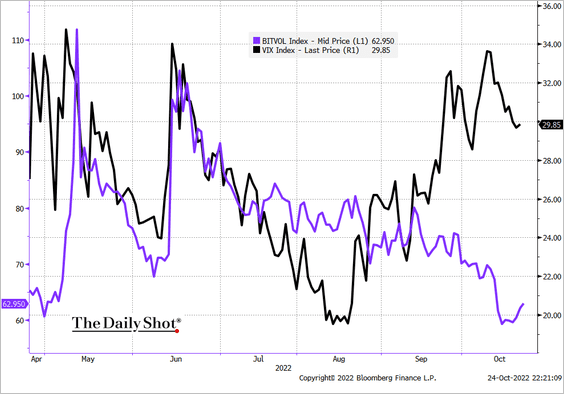

2. Bitcoin realized volatility is approaching the summer of 2020 lows.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

The implied volatility has diverged from equity vol.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

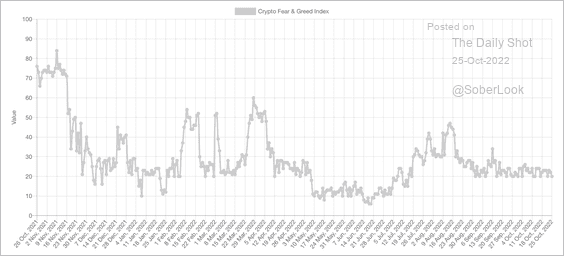

3. The Crypto Fear & Greed Index has been stuck in “extreme fear” territory over the past month.

Source: Alternative.me

Source: Alternative.me

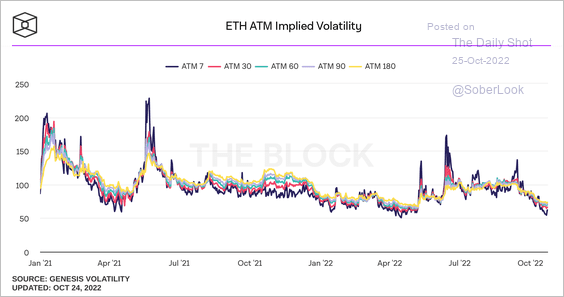

4. Ether’s implied volatility has collapsed.

Source: The Block

Source: The Block

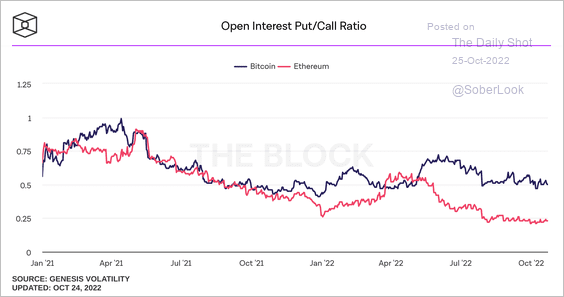

5. Bitcoin and Ether’s put/call ratios have stabilized over the past few months.

Source: The Block

Source: The Block

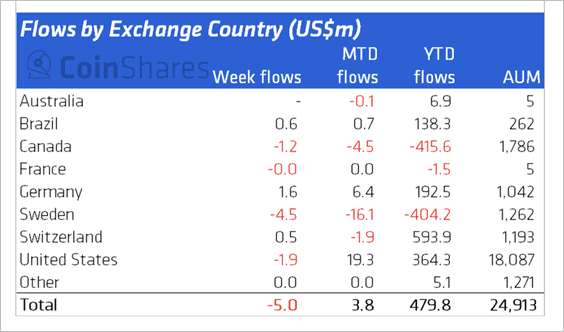

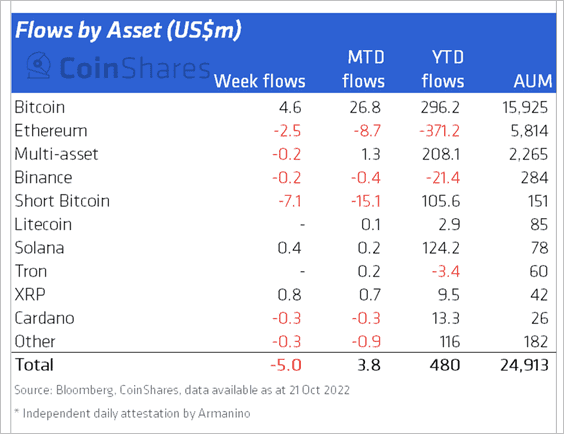

6. Crypto funds in Sweden and Canada continued to see outflows last week.

Source: James Butterfill, CoinShares Read full article

Source: James Butterfill, CoinShares Read full article

Crypto investment products saw minor outflows last week, driven by short-Bitcoin funds and long Ethereum funds.

Source: James Butterfill, CoinShares Read full article

Source: James Butterfill, CoinShares Read full article

Back to Index

Commodities

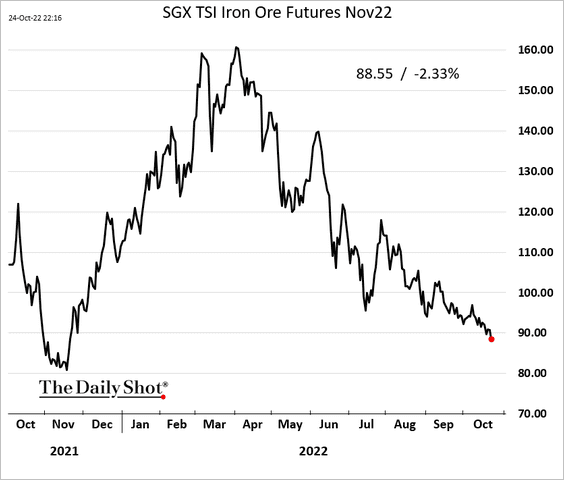

1. Iron ore prices are falling as China’s housing demand weakens.

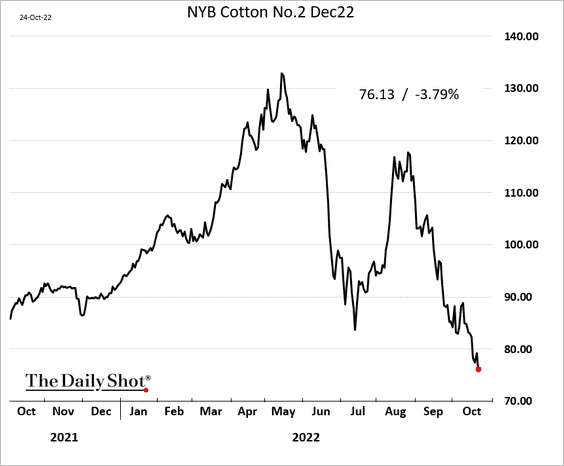

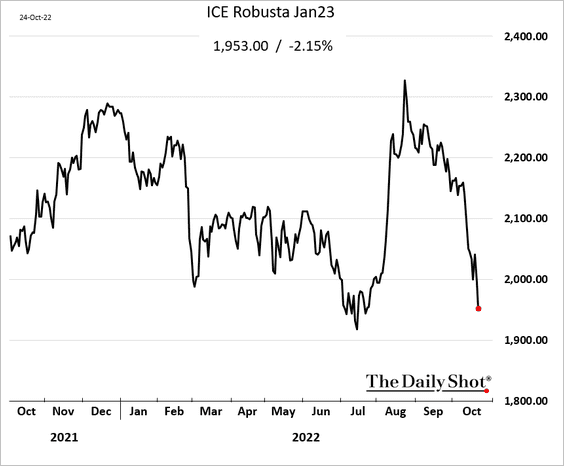

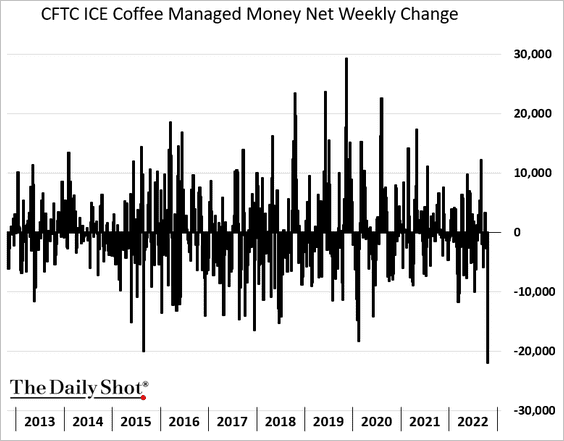

2. Softs are under pressure.

• Cotton:

• Coffee:

• Coffee speculative positions weekly changes:

h/t @dmarino4

h/t @dmarino4

Back to Index

Energy

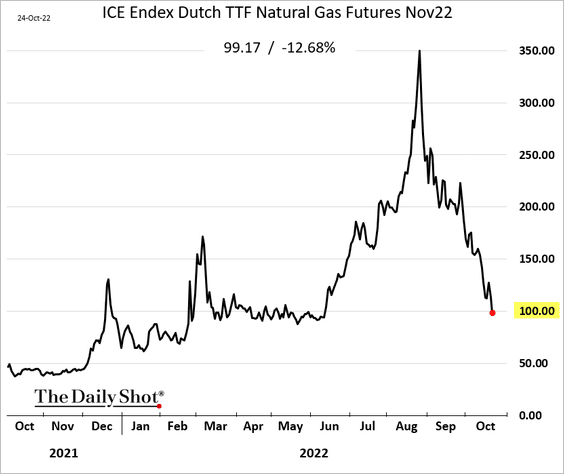

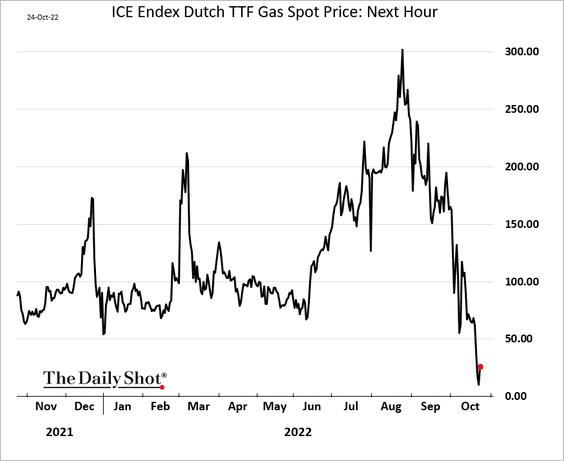

1. European natural gas prices continue to fall as demand destruction boosts inventories.

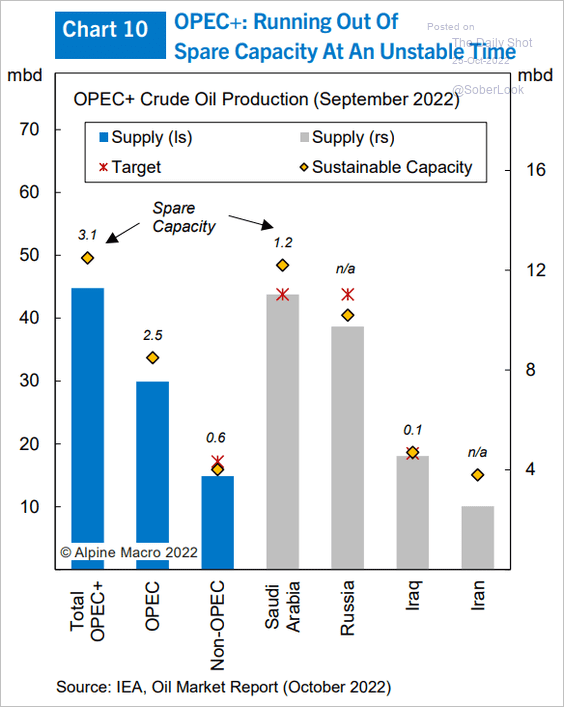

2. OPEC+ is pumping close to capacity.

Source: Alpine Macro

Source: Alpine Macro

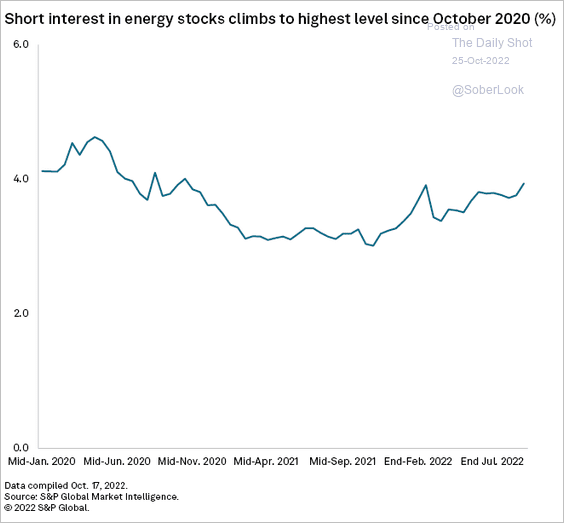

3. Short interest in energy stocks has been rising.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Equities

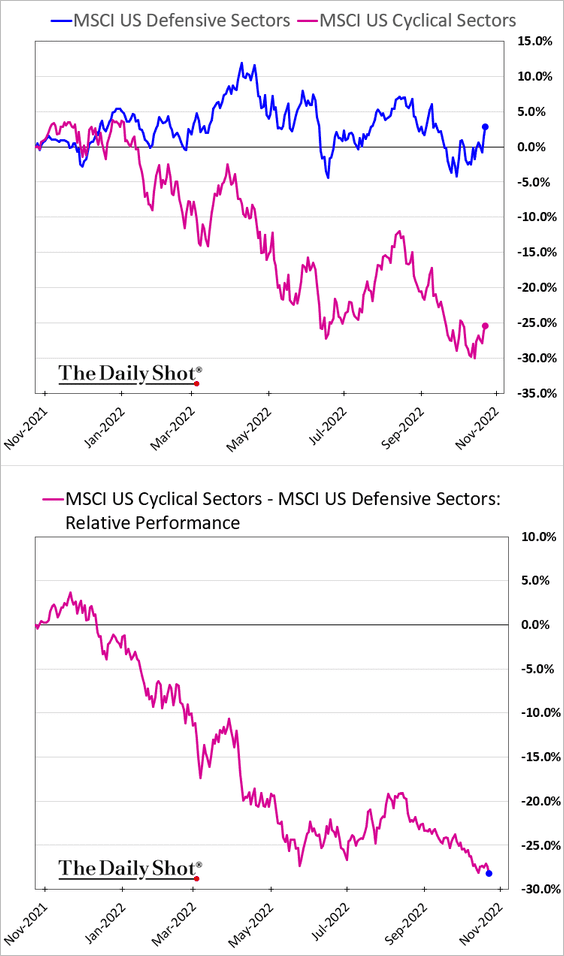

1. Cyclical sectors continue to underprerdorm.

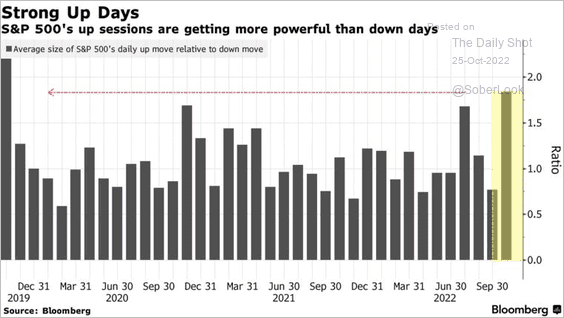

2. Stock market up sessions have been strong recently.

Source: @markets, @lena_popina Read full article

Source: @markets, @lena_popina Read full article

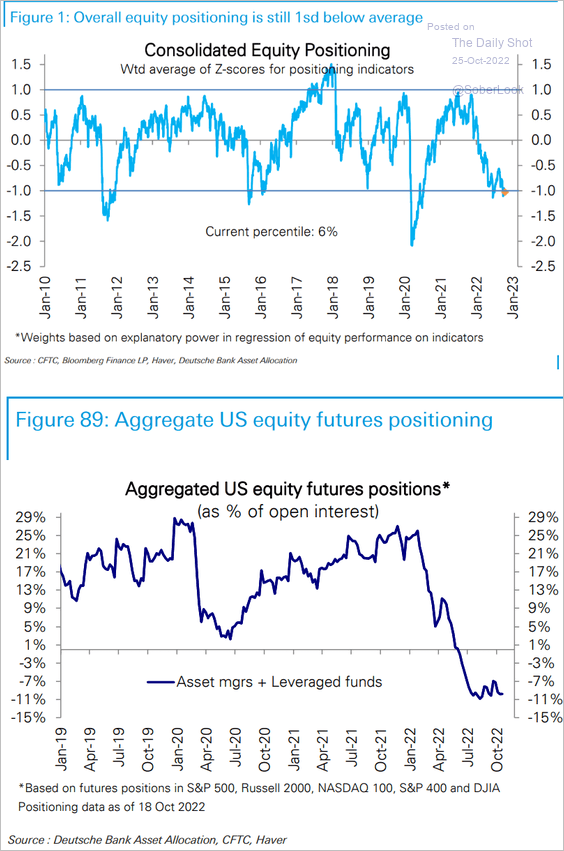

3. Investor positioning remains bearish.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

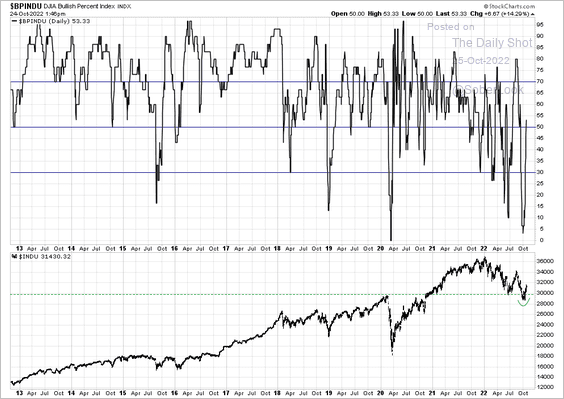

4. Market breadth is improving from oversold levels.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

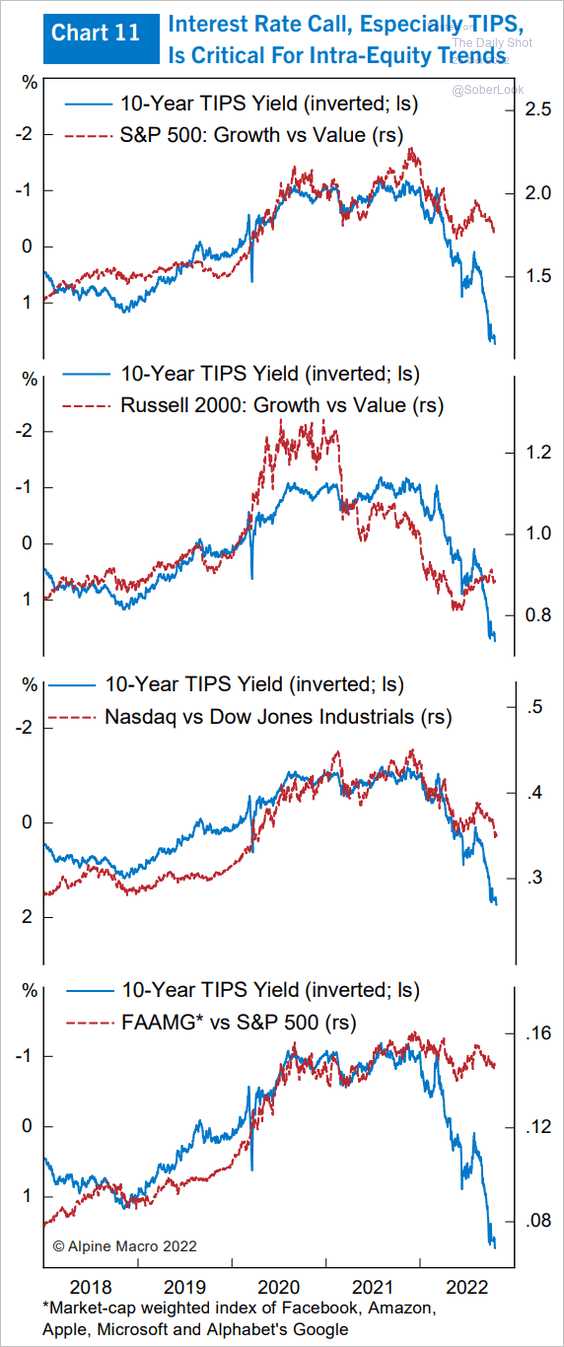

5. Real rates point to further underperformance in growth stocks.

Source: Alpine Macro

Source: Alpine Macro

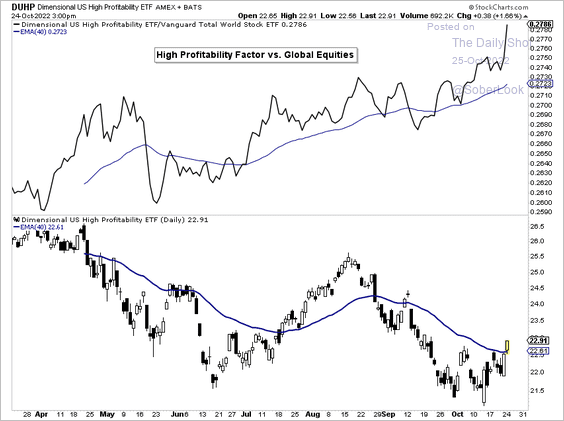

6. High profitability stocks continue to outperform.

Source: Aazan Habib, Paradigm Capital

Source: Aazan Habib, Paradigm Capital

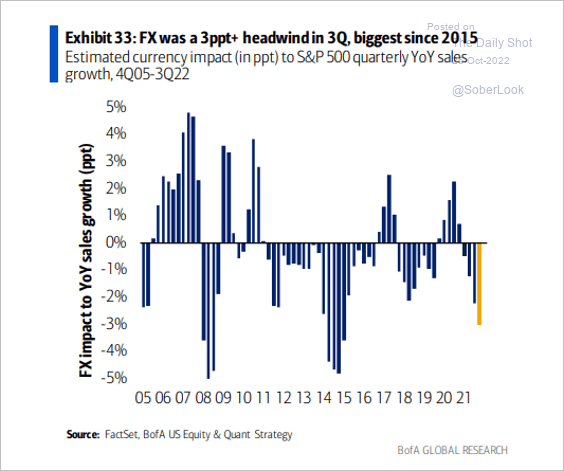

7. The US dollar strength is taking a toll on corporate sales.

Source: BofA Global Research

Source: BofA Global Research

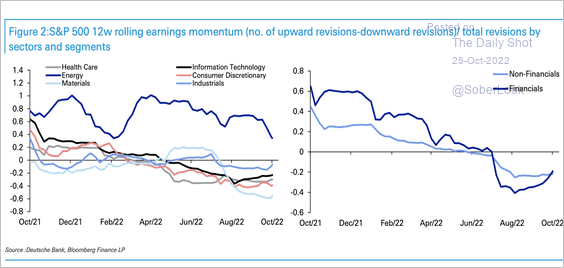

8. Earnings momentum has been negative for all S&P 500 sectors except energy. However, it appears that negative earnings revisions for financials have bottomed out.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

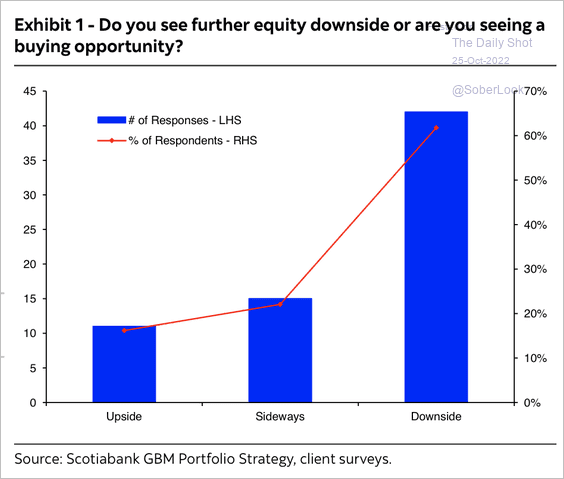

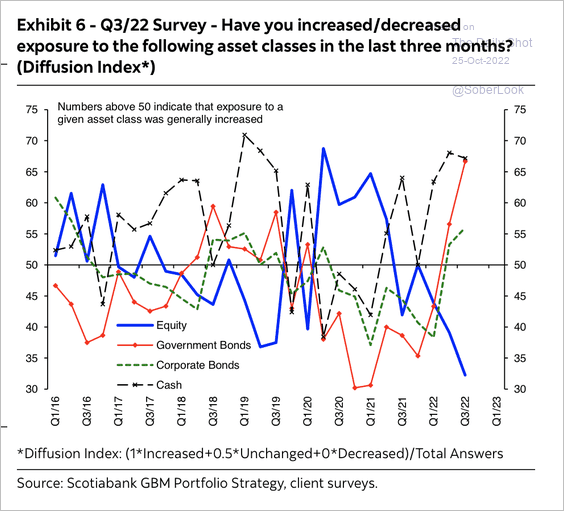

9. Institutional investors see more downside risk for equities, according to a survey by Scotiabank, …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

… prompting increased exposure to bonds versus equities …

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

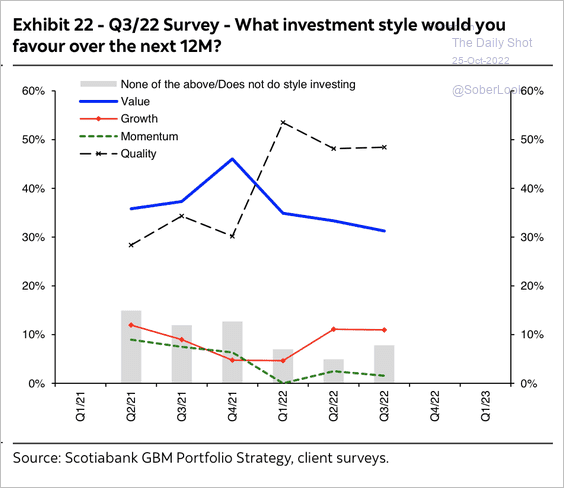

… and quality over momentum.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

——————–

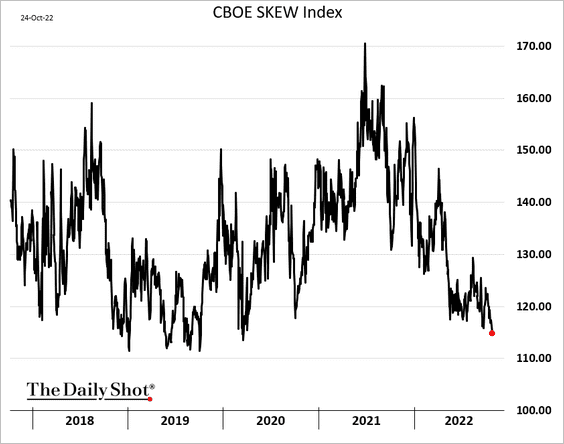

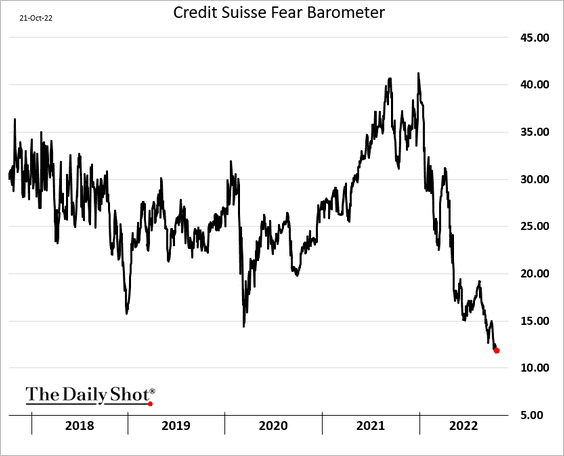

10. S&P 500 put options continue to get cheaper relative to calls.

• Skew index:

• CS Fear Barometer (the put price in a zero-cost collar):

Back to Index

Rates

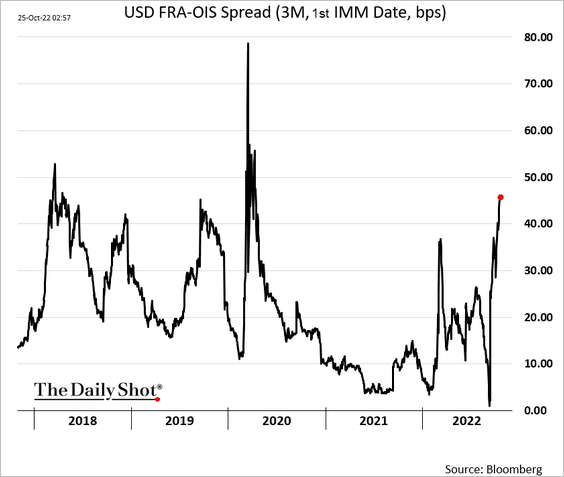

1. The FRA-OIS spread points to concerns about year-end US dollar funding availability.

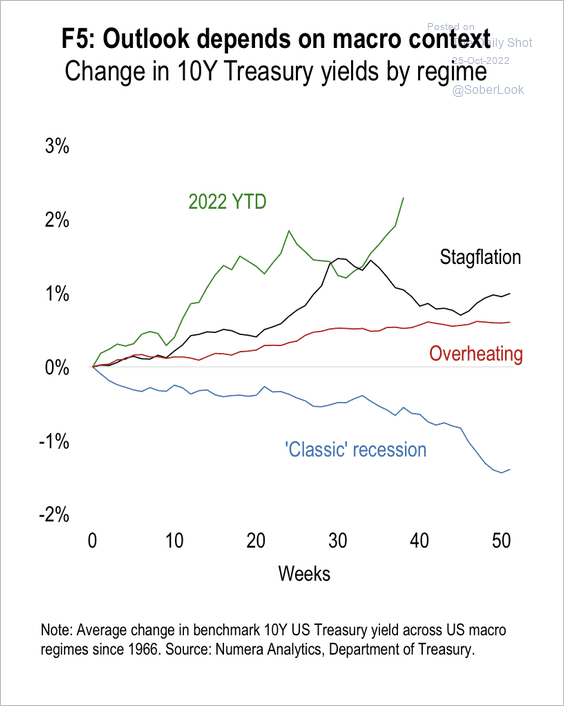

2. Treasury yields fall the most when the economy experiences a “classic” recession.

Source: Numera Analytics

Source: Numera Analytics

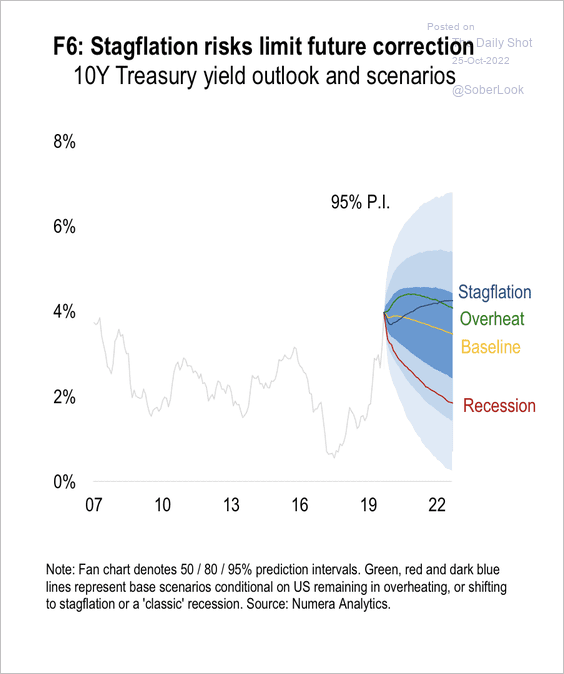

Numera Analytics expects the 10-year Treasury yield to fall modestly 12 months out as stagflation risks dominate.

Source: Numera Analytics

Source: Numera Analytics

——————–

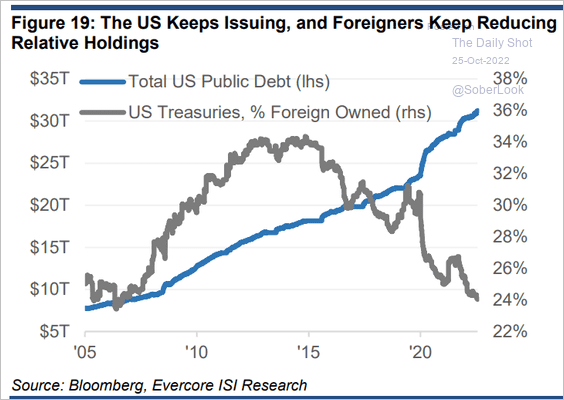

3. Foreigners’ relative holdings of Treasuries have been trending lower.

Source: Evercore ISI Research

Source: Evercore ISI Research

Back to Index

Global Developments

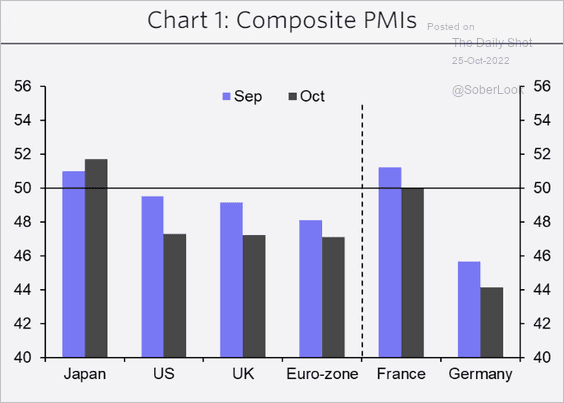

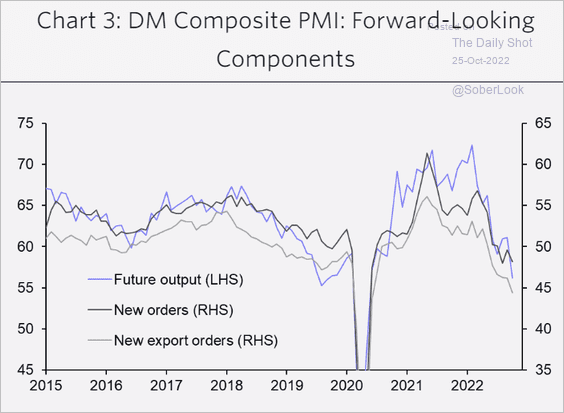

1. The October PMIs in most DM economies look recessionary (PMI below 50).

Source: Capital Economics

Source: Capital Economics

Forward-looking indicators have deteriorated sharply.

Source: Capital Economics

Source: Capital Economics

——————–

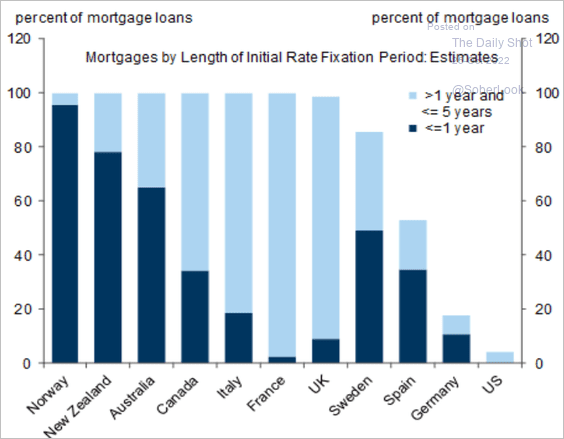

2. Resetting rates on mortgages will be painful for homeowners in many countries.

Source: Goldman Sachs; III Capital Management

Source: Goldman Sachs; III Capital Management

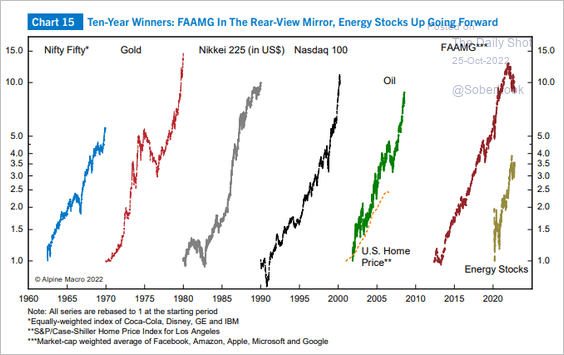

3. This chart shows some overextended rallies since the 1960s.

Source: Alpine Macro

Source: Alpine Macro

——————–

Food for Thought

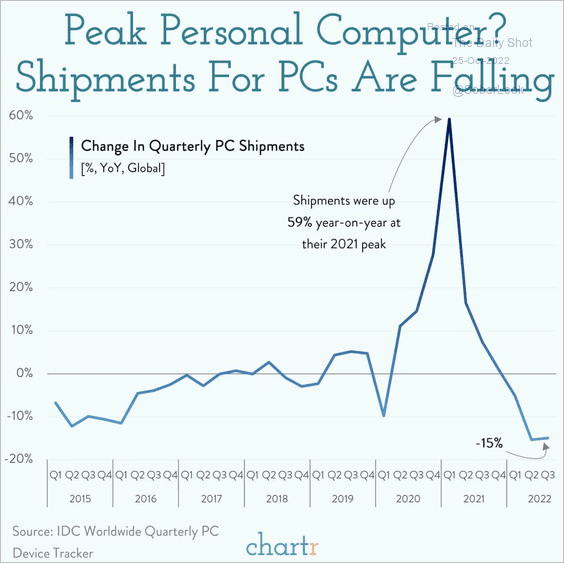

1. PC shipments (year-over-year):

Source: @chartrdaily

Source: @chartrdaily

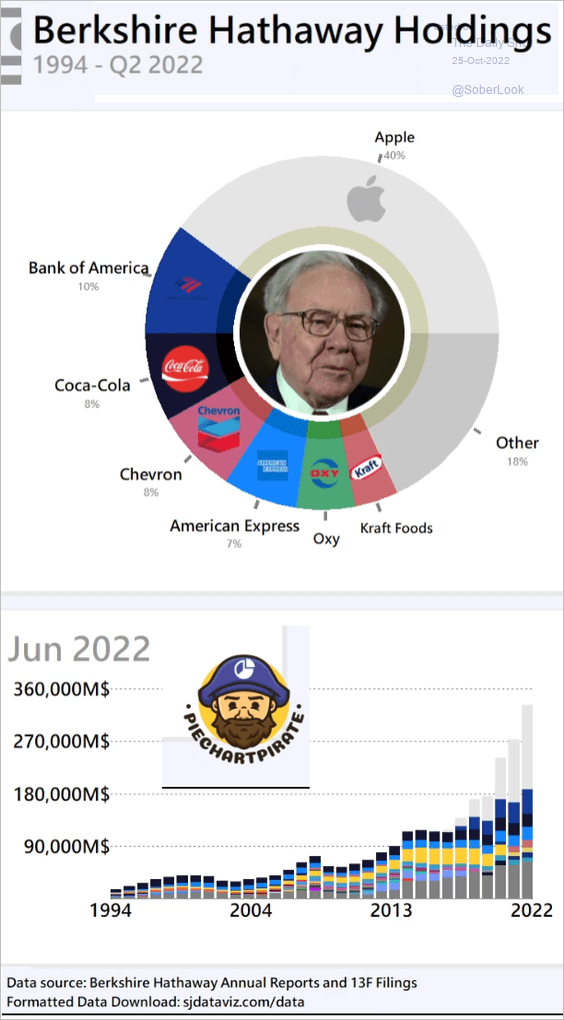

2. Berkshire Hathaway’s holdings:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

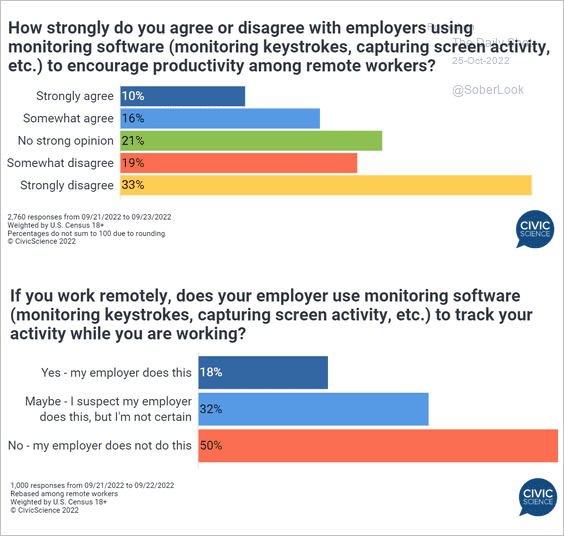

3. Views on using monitoring software to track remote workers:

Source: @CivicScience

Source: @CivicScience

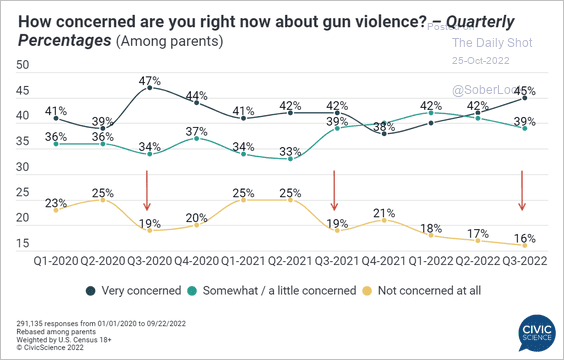

4. Concerns about gun violence at schools:

Source: @CivicScience

Source: @CivicScience

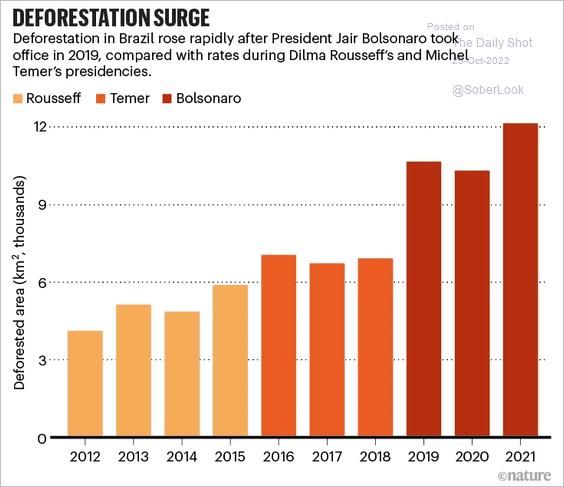

5. Deforestation in Brazil:

Source: Nature Read full article

Source: Nature Read full article

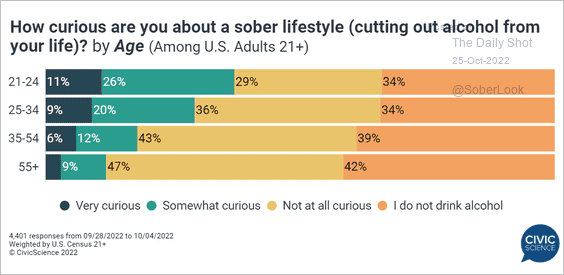

6. Interest in a sober lifestyle:

Source: @CivicScience Read full article

Source: @CivicScience Read full article

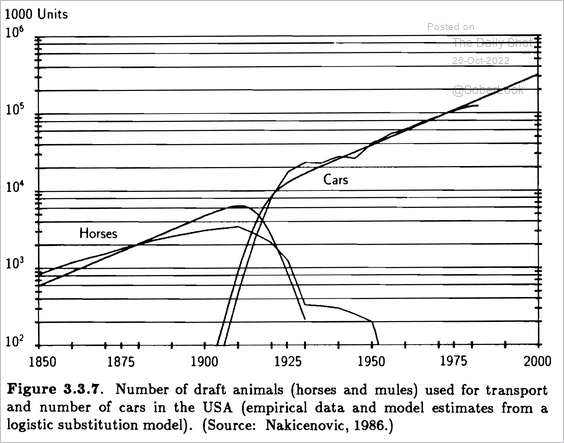

7. Horses vs cars:

——————–

Back to Index