The Daily Shot: 07-Apr-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• China

• Emerging Markets

• Cryptocurrency

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

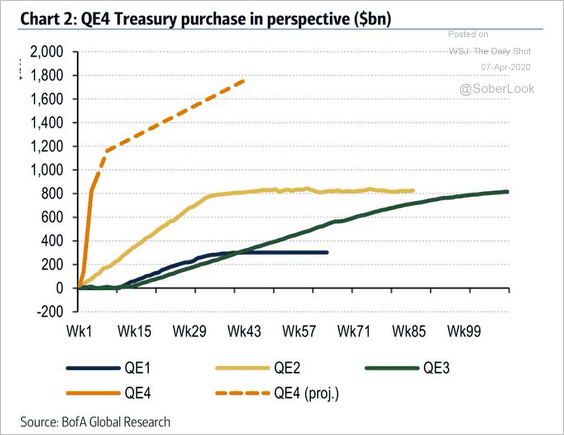

1. The speed of the Federal Reserve’s securities purchases has been unprecedented. The chart below compares the current quantitative easing (QE) trajectory to previous programs.

Source: BofA Merrill Lynch Global Research, @TayTayLLP

Source: BofA Merrill Lynch Global Research, @TayTayLLP

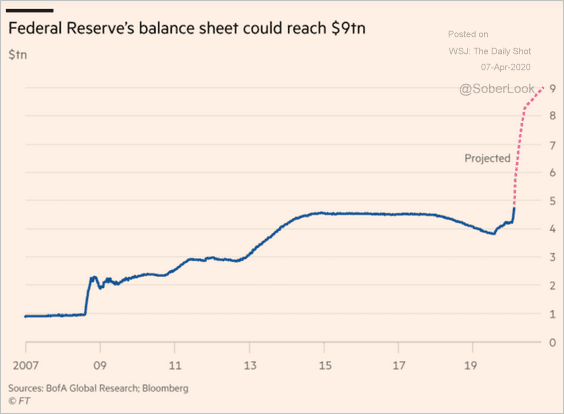

Will the Fed’s balance sheet reach $9 trillion?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

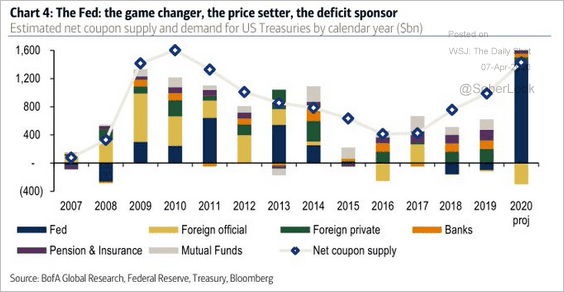

According to BofA Global Research, the Fed will fully fund the massive 2020 deficit. It’s the US version of Abenomics.

Source: BofA Merrill Lynch Global Research, @TayTayLLP

Source: BofA Merrill Lynch Global Research, @TayTayLLP

——————–

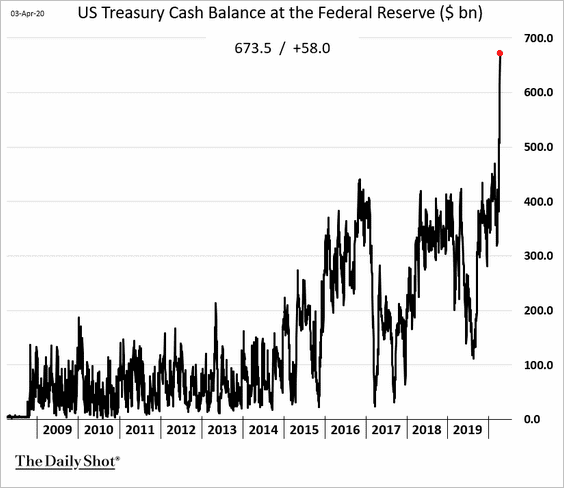

2. The US Treasury’s cash balances swell to record levels as the federal government prepares for a massive liquidity injection into the economy.

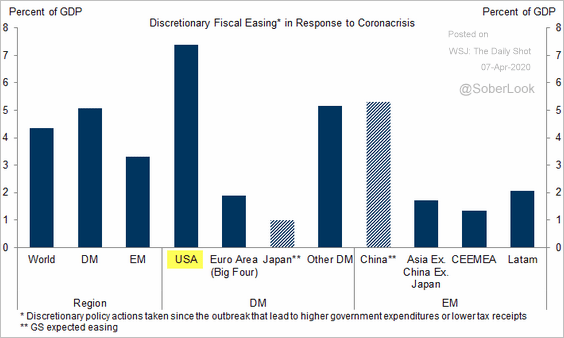

Here is how the US fiscal stimulus compares to other countries.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

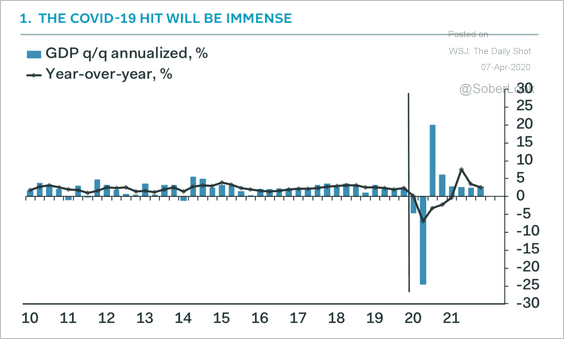

3. The current quarter’s economic contraction is expected to be unprecedented.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

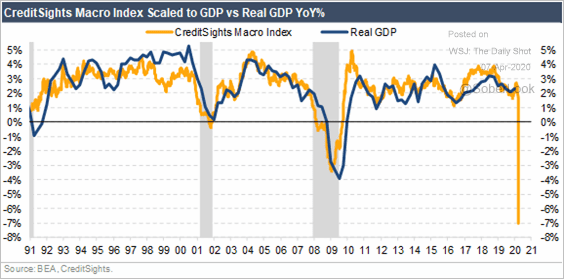

As bad as some of the macro indicators have been, they are underestimating the hit to the GDP.

Source: CreditSights

Source: CreditSights

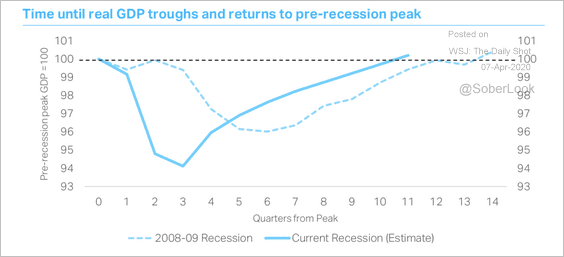

Here is the GDP path comparison to 2008 (from TS Lombard).

Source: TS Lombard

Source: TS Lombard

——————–

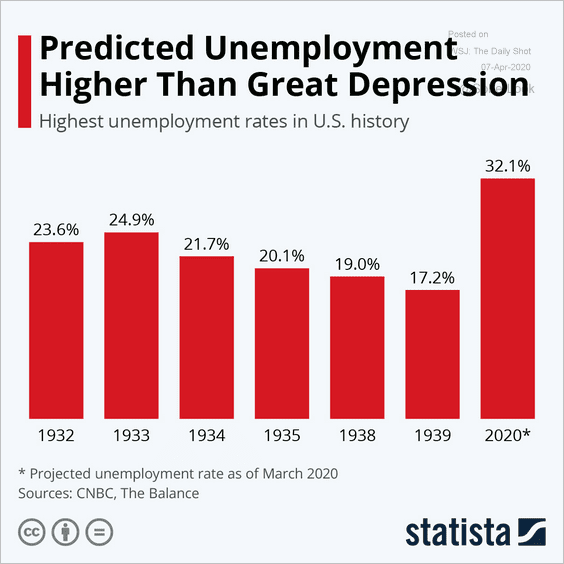

4. Will the 2020 unemployment rate exceed the highest levels of the Great Depression?

Source: Statista

Source: Statista

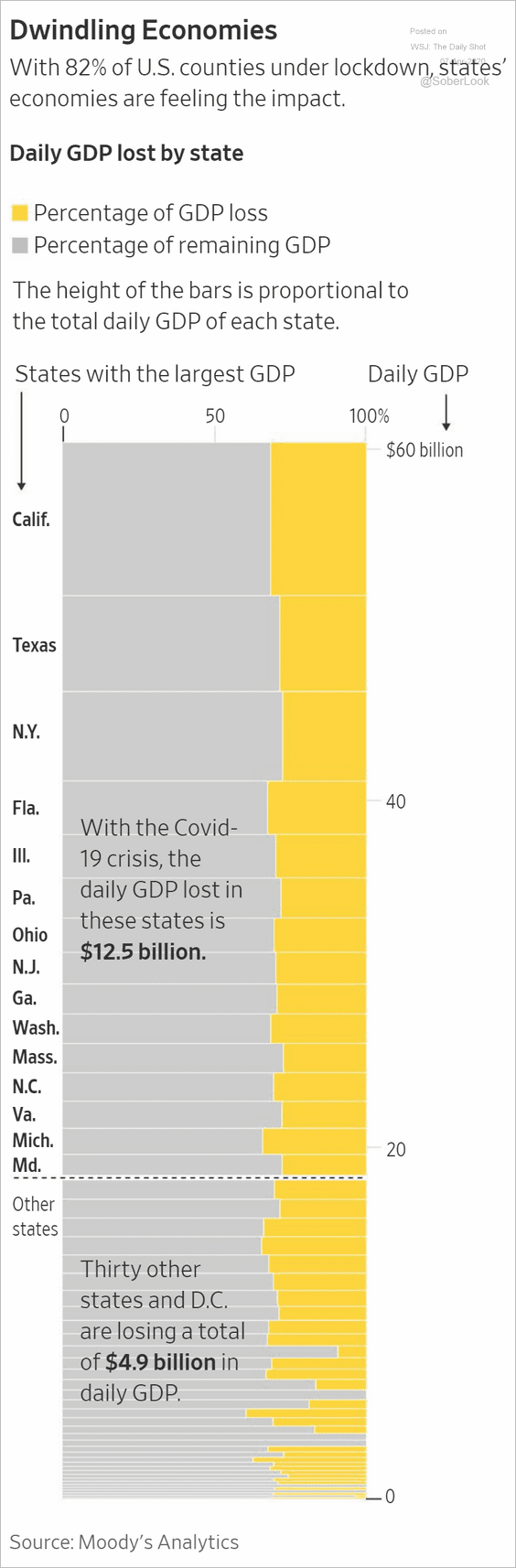

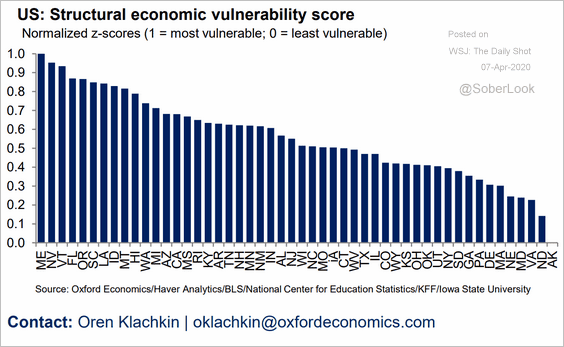

5. Which states will be impacted the most?

• GDP loss due to lockdowns:

Source: @WSJ Read full article

Source: @WSJ Read full article

• Economic vulnerability score (from Oxford Economics):

Source: Oxford Economics

Source: Oxford Economics

——————–

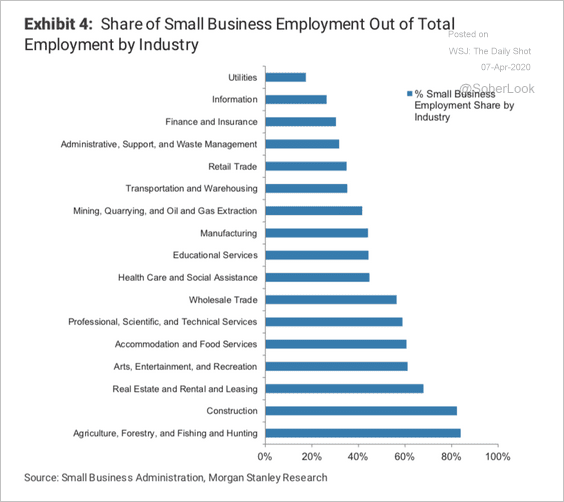

6. Which industries have the highest concentration of small business employment?

Source: Morgan Stanley Research

Source: Morgan Stanley Research

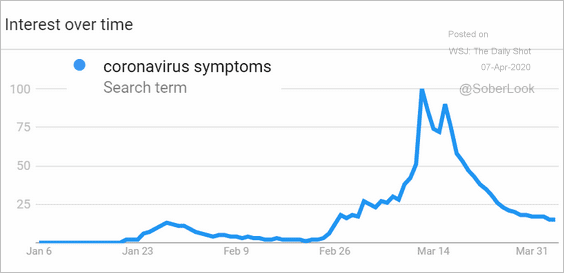

7. Online search activity for the phrase “coronavirus symptoms” has peaked.

Source: Google Trends

Source: Google Trends

Canada

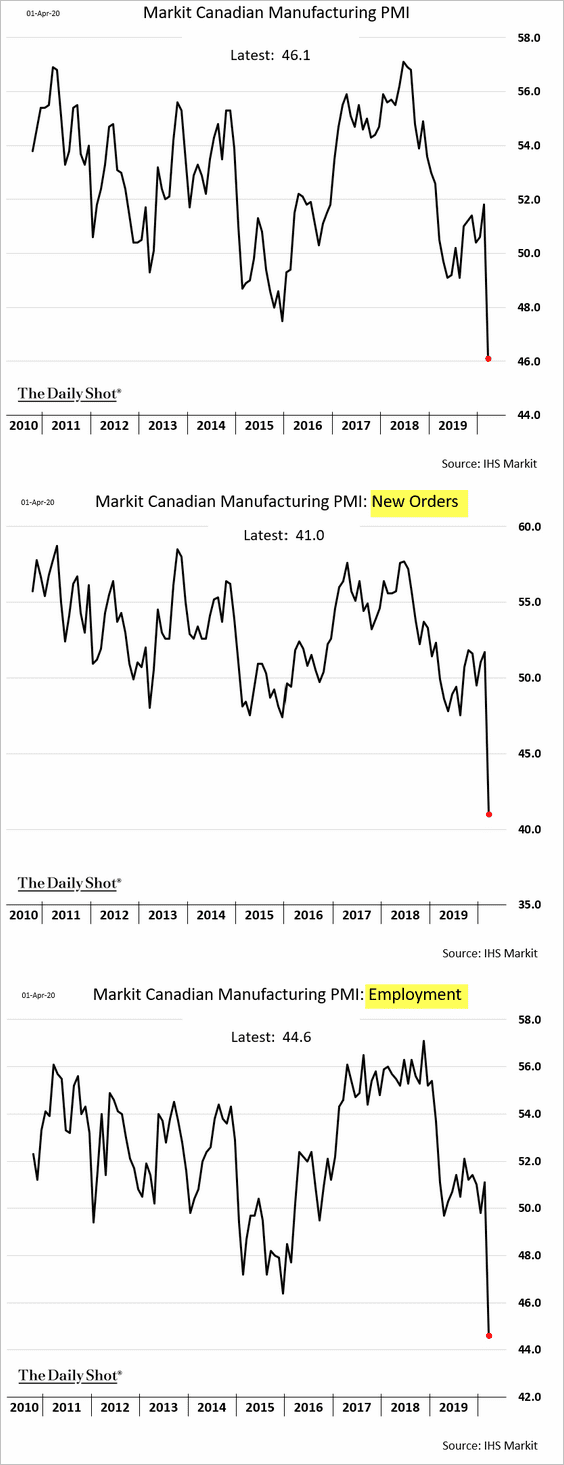

1. Factory activity is collapsing.

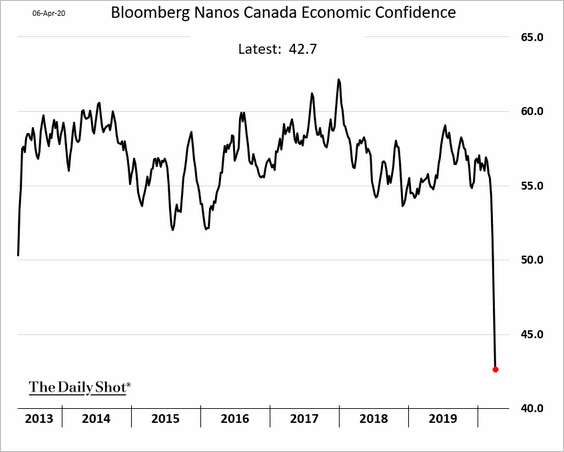

2. Consumer confidence plummeted in recent weeks.

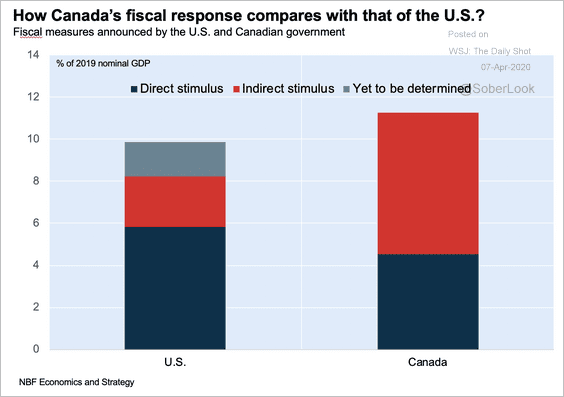

3. Here’s how Canada’s fiscal response compares with the US.

Source: Jocelyn Paquet, National Bank of Canada

Source: Jocelyn Paquet, National Bank of Canada

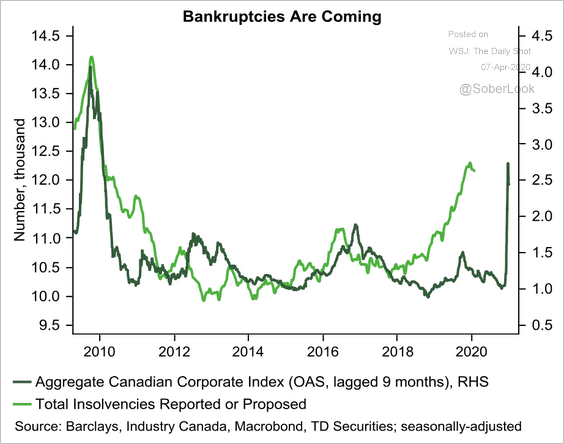

4. Weak energy prices will boost insolvencies.

Source: TD Securities

Source: TD Securities

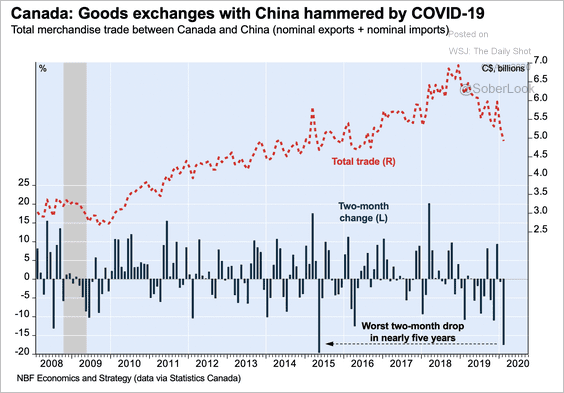

5. Merchandise trade between Canada and China has declined over the past few years.

Source: Jocelyn Paquet, National Bank of Canada

Source: Jocelyn Paquet, National Bank of Canada

The United Kingdom

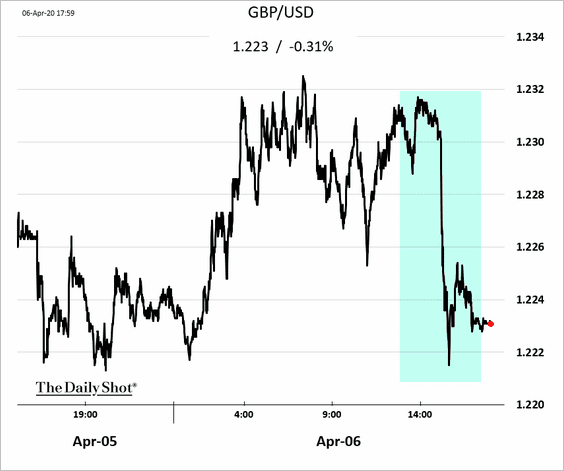

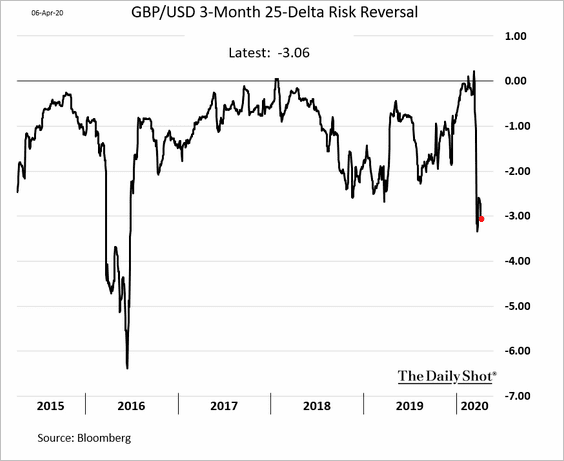

1. The Prime Minister’s health took a turn for the worse, sending the pound lower.

Source: Sky UK Read full article

Source: Sky UK Read full article

Traders remain glum on the pound’s prospects over the next few months. Here is the 3-month risk reversal.

——————–

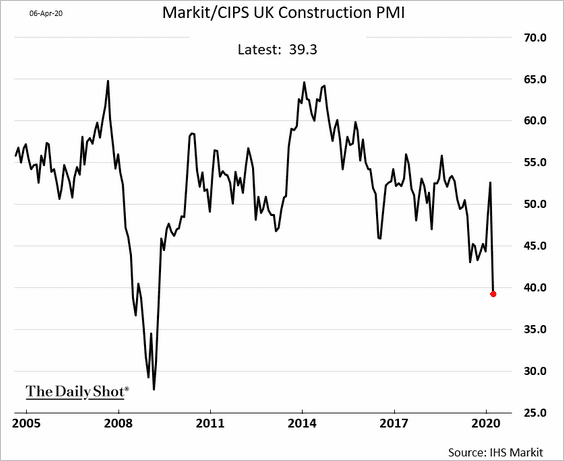

2. Construction activity shrank last month.

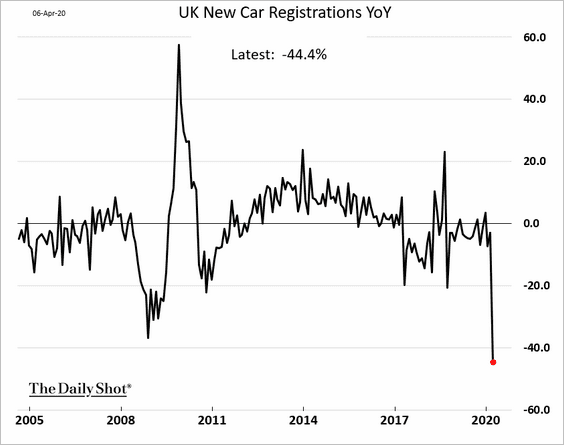

3. New car registrations are down by over 40% from the same time a year ago.

The Eurozone

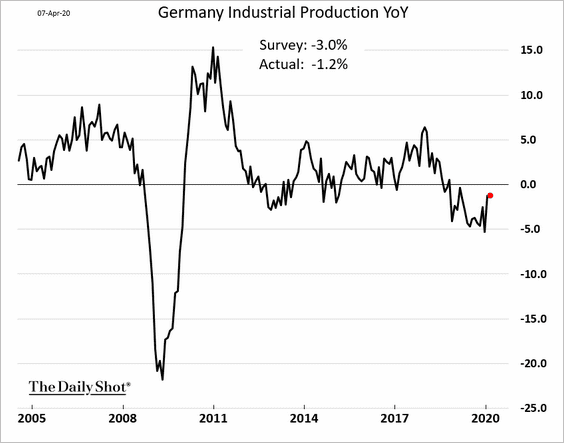

1. Germany’s factory orders and industrial production were recovering before the onset of the epidemic (the charts below are through February).

——————–

2. Next, we have some updates on Italy.

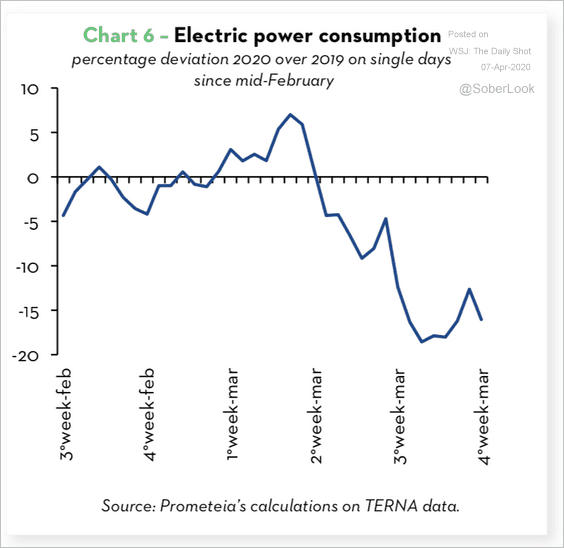

• Power consumption:

Source: Prometeia

Source: Prometeia

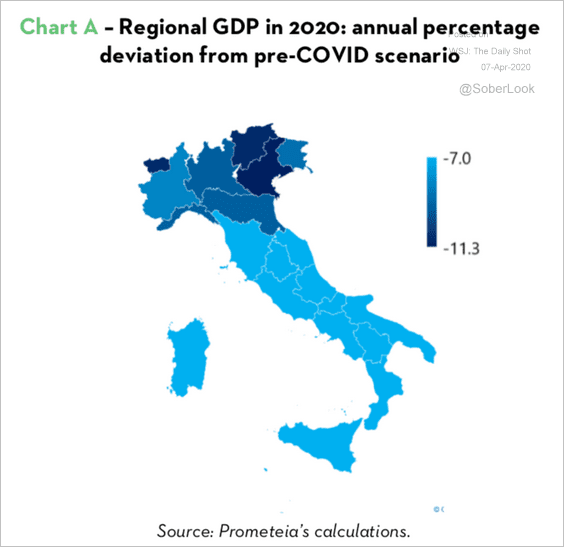

• Regional GDP declines:

Source: Prometeia

Source: Prometeia

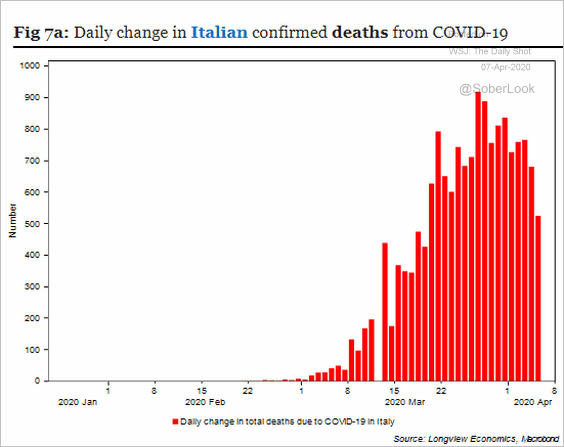

• The number of deaths from COVID-19:

Source: Longview Economics

Source: Longview Economics

——————–

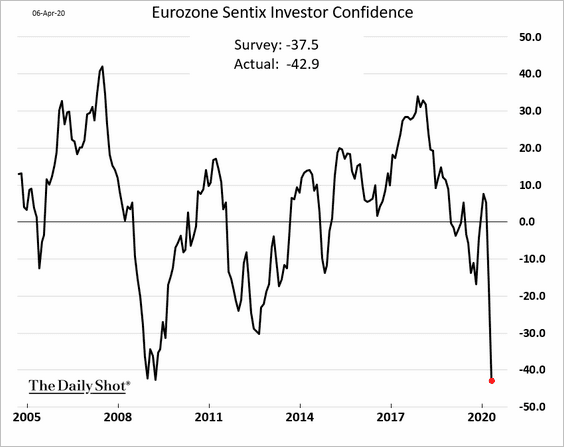

3. The Sentix sentiment index hit a record low.

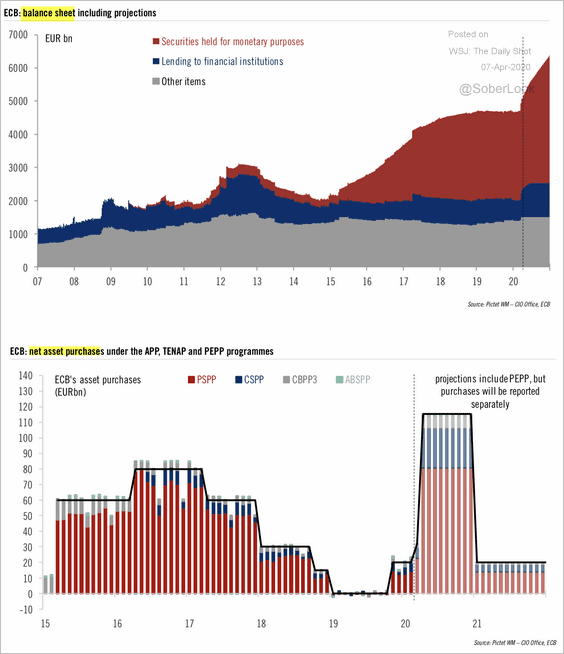

4. Here is a forecast for the ECB’s (Eurosystem) balance sheet and asset purchases (from Pictet Wealth Management).

Source: Pictet Wealth Management

Source: Pictet Wealth Management

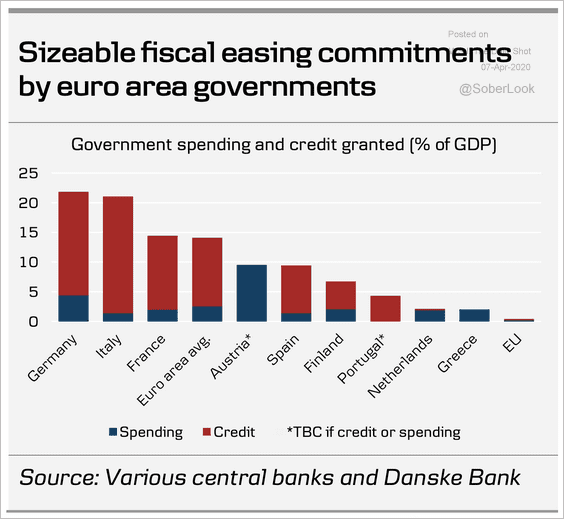

5. Below is a summary of fiscal commitments by the euro-area governments.

Source: Danske Bank

Source: Danske Bank

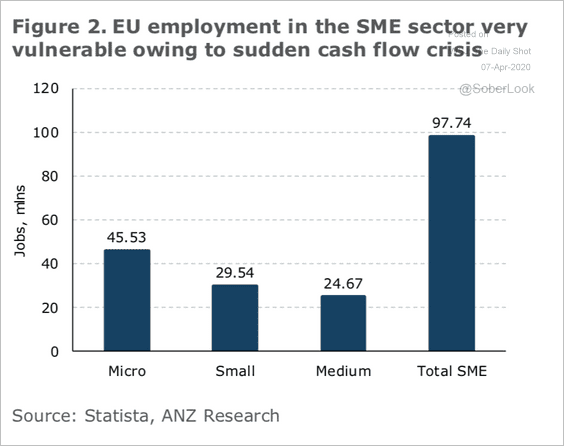

6. Small and medium-sized businesses are very vulnerable. Here is a quote from ANZ.

There were 160.7m people employed in the euro area in February, with 75% of those (120m) in the private sector. On our calculations, if the euro area economy is operating at 50% capacity and half of employees in the idled 50% of the private sector are vulnerable to redundancy or furlough, then 30m jobs are vulnerable. That is almost 20% of pre-coronavirus employment and could be an underestimate. In the EU, there are 13m jobs across tourism-related sectors. Construction, which is being idled, accounts for around 10m jobs. Over half the workforce is employed by small and medium enterprises (SMEs).

Source: ANZ Research

Source: ANZ Research

7. Eurozone banks are trading well below book value.

Source: @markets Read full article

Source: @markets Read full article

China

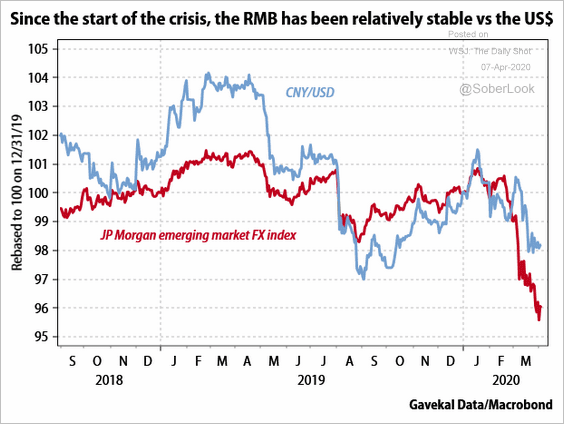

1. The renminbi has outperformed other EM currencies.

Source: Gavekal

Source: Gavekal

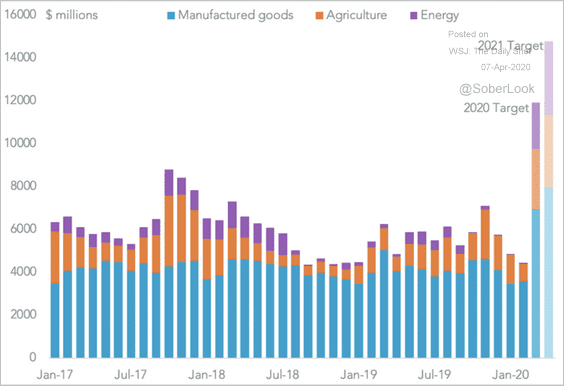

2. China has a long way to go to meet Phase-1 US trade-deal targets.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

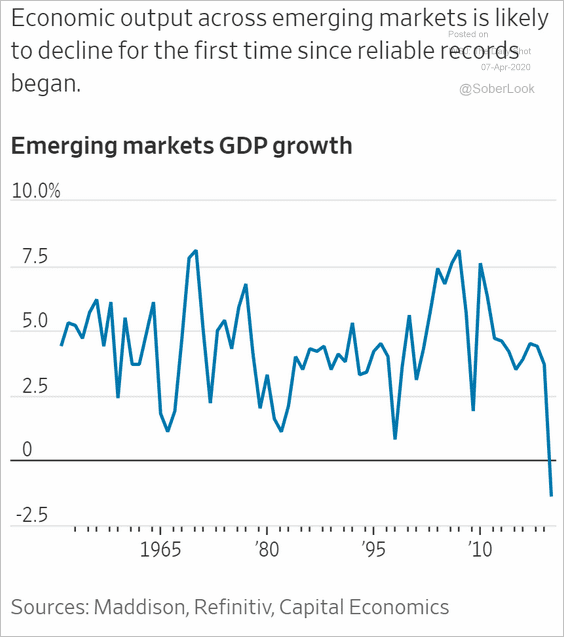

Emerging Markets

1. EM GDP is expected to contract for the first time in decades.

Source: @WSJ Read full article

Source: @WSJ Read full article

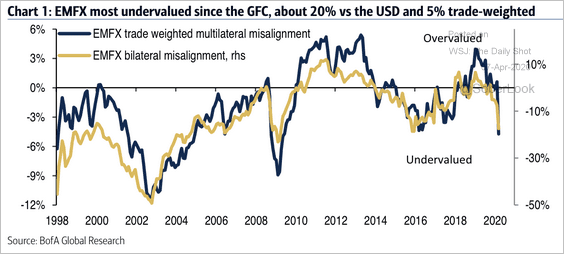

2. EM currencies are most undervalued since 2008, according to BofA.

Source: BofA Merrill Lynch Global Research

Source: BofA Merrill Lynch Global Research

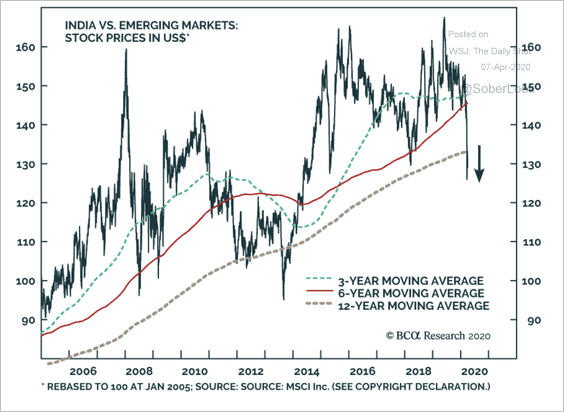

3. Indian stock prices relative to EM are breaking below long-term support (in dollar terms).

Source: BCA Research

Source: BCA Research

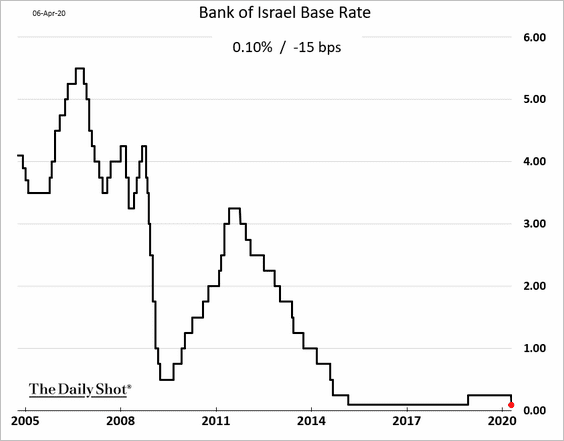

4. Israel’s central bank lowered rates back to 10 bps.

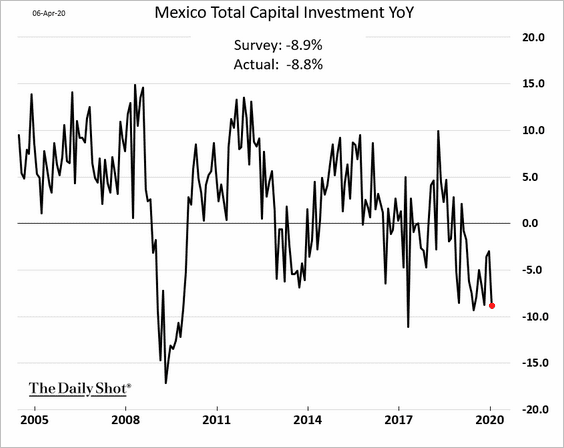

5. Mexico’s business investment was deteriorating before the start of the epidemic (this chart is through January).

Cryptocurrency

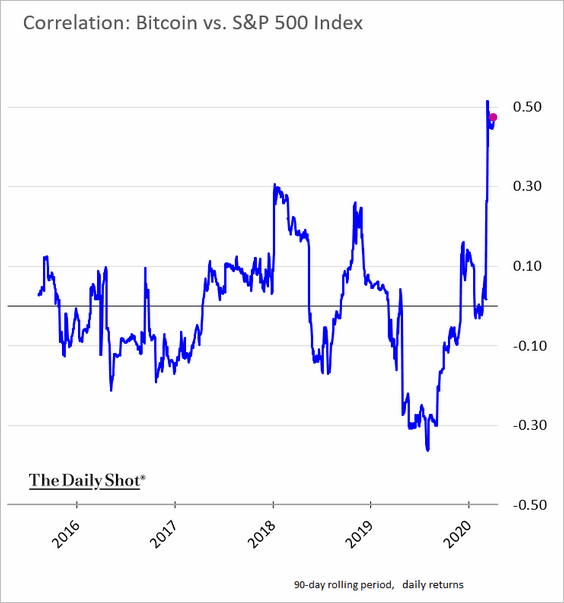

Bitcoin’s correlation with stocks has spiked this year.

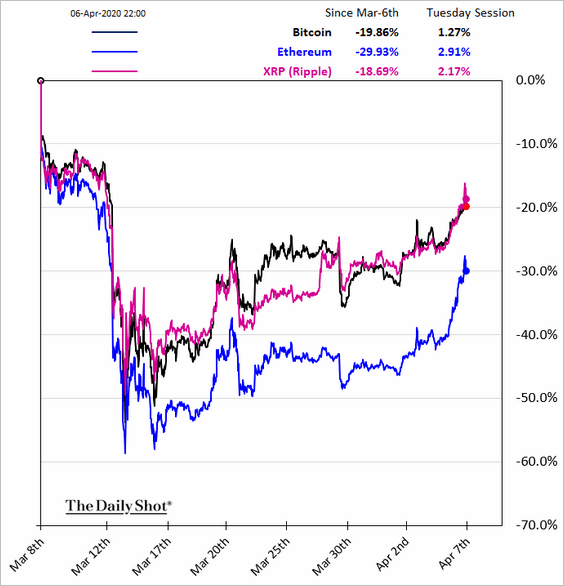

And the stock market bounce is showing up in crypto markets.

Commodities

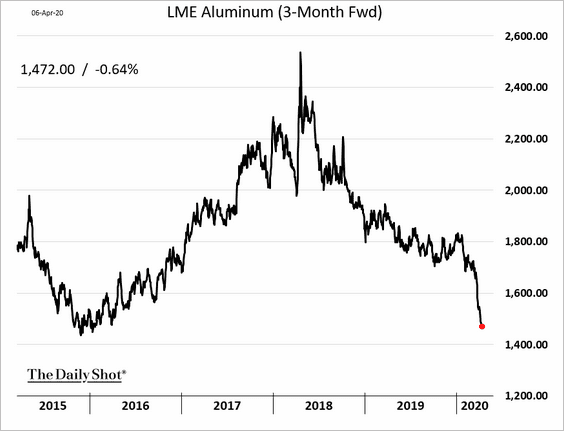

1. Aluminum prices hit a multi-year low.

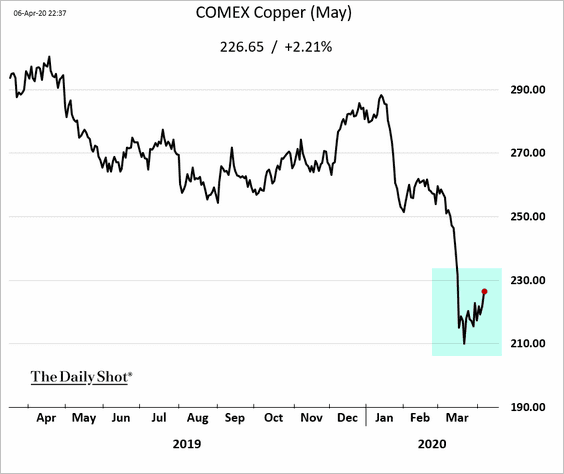

2. Copper appears to have stabilized.

Energy

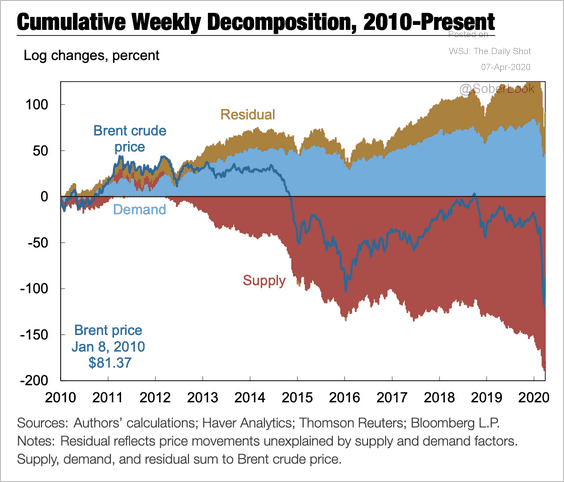

1. Excess supply became a significant driver of oil prices in mid-2012 and generally dominated price dynamics after mid-2014, according to the NY Fed.

Source: Federal Reserve Bank of New York Read full article

Source: Federal Reserve Bank of New York Read full article

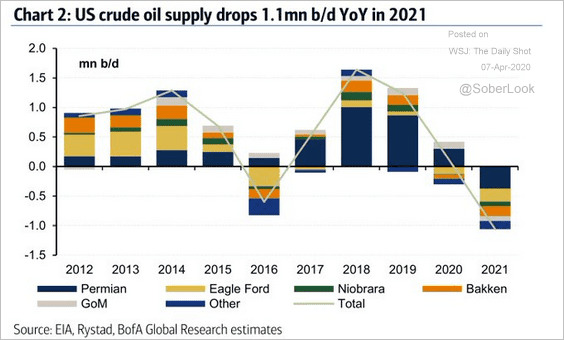

But US crude oil supply is expected to drop substantially next year (see rig count).

Source: BofA Merrill Lynch Global Research, @TayTayLLP

Source: BofA Merrill Lynch Global Research, @TayTayLLP

——————–

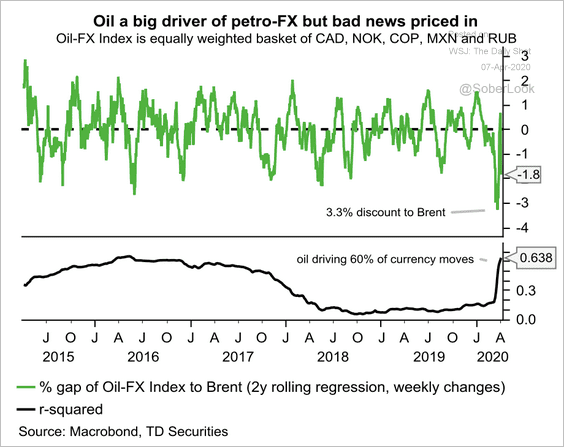

2. Price changes in Brent crude explain about 64% of the movements in energy-related currencies.

Source: TD Securities

Source: TD Securities

Equities

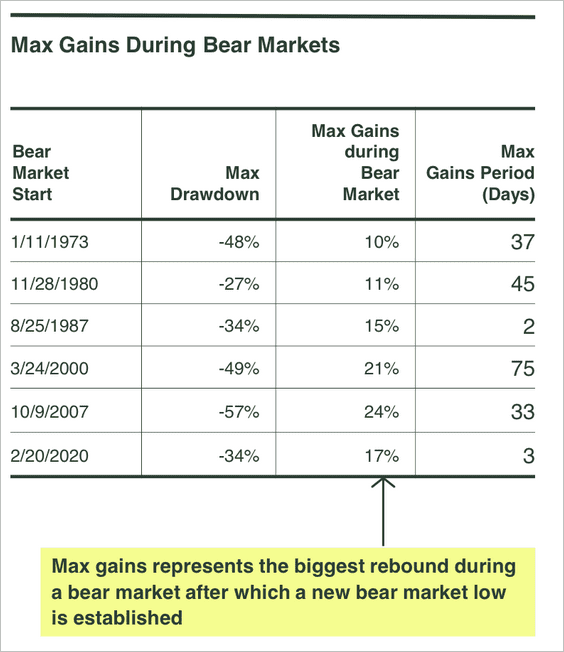

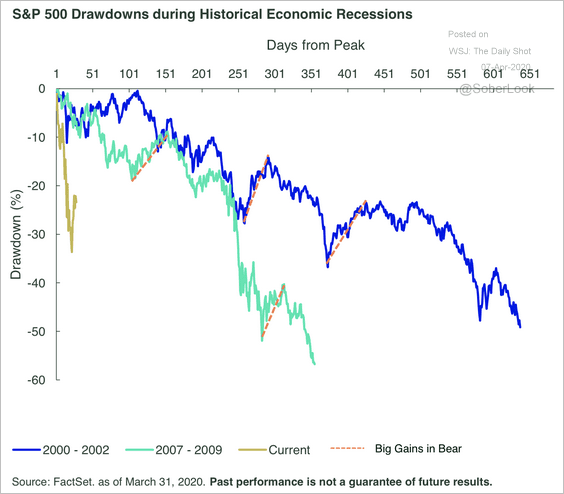

1. Monday was a good day for stocks, as the S&P 500 rose by 7%. But large gains during bear markets are not uncommon.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

——————–

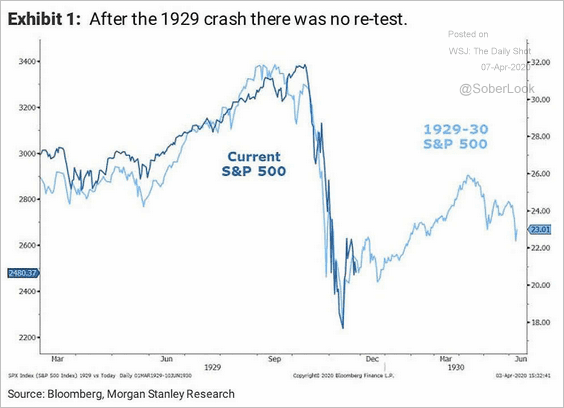

2. Here is a comparison to the 1929 crash.

Source: Morgan Stanley Research, @carlquintanilla

Source: Morgan Stanley Research, @carlquintanilla

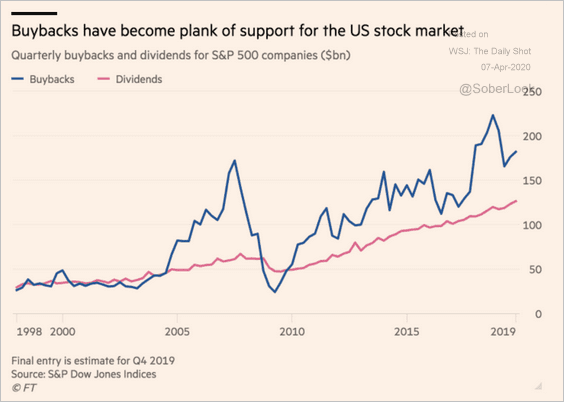

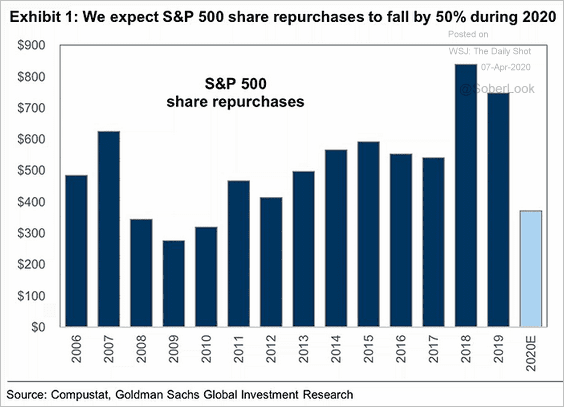

3. Share buyback activity, which was a significant driver of returns, is expected to slow sharply.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Goldman Sachs, @carlquintanilla

Source: Goldman Sachs, @carlquintanilla

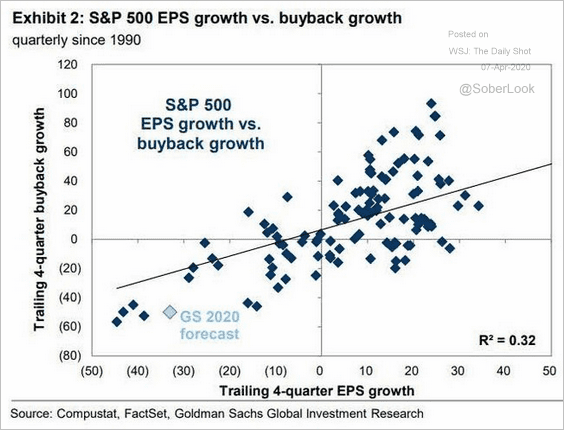

This scatterplot shows the relationship between buybacks and EPS growth.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

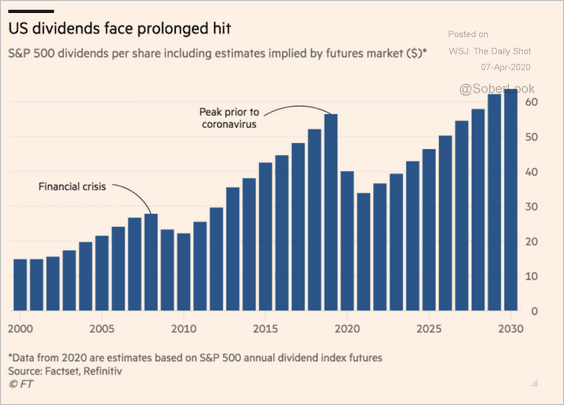

4. Analysts expect a significant deterioration in dividends per share.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

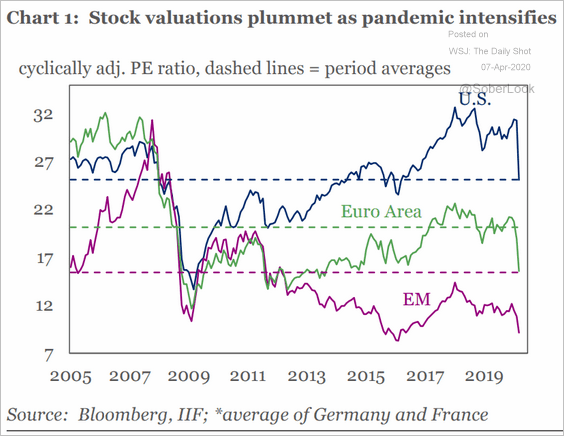

5. This chart shows the cyclically adjusted PE ratios for the US, the Eurozone, and emerging markets.

Source: IIF

Source: IIF

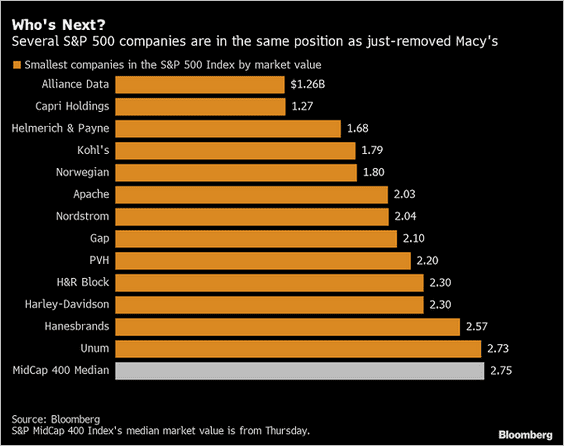

6. Will other firms follow Macy’s out of the S&P 500 index?

Source: @TheOneDave Read full article

Source: @TheOneDave Read full article

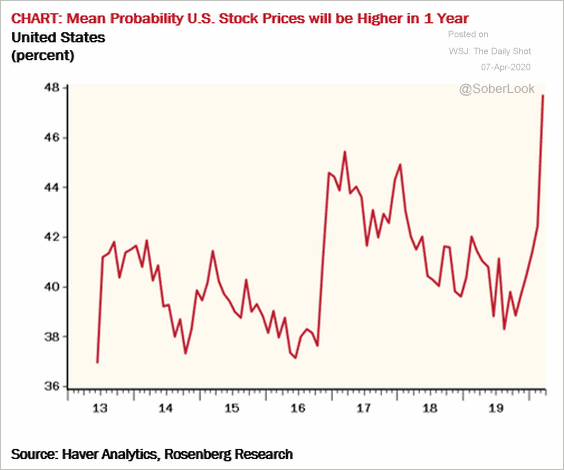

7. US consumers increasingly expect the market to rebound within a year.

Source: @EconguyRosie

Source: @EconguyRosie

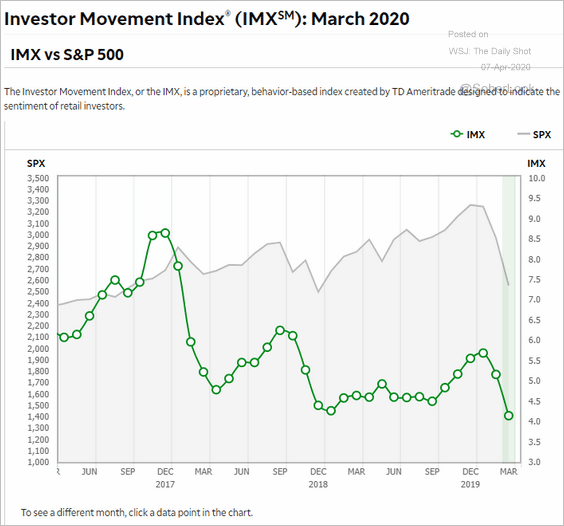

However, individual-investor positioning at Ameritrade points to caution.

Source: TD Ameritrade

Source: TD Ameritrade

——————–

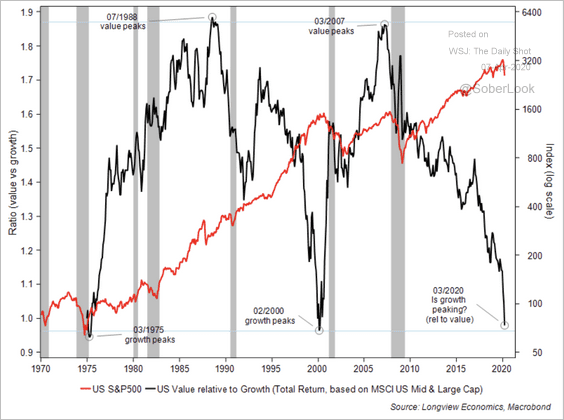

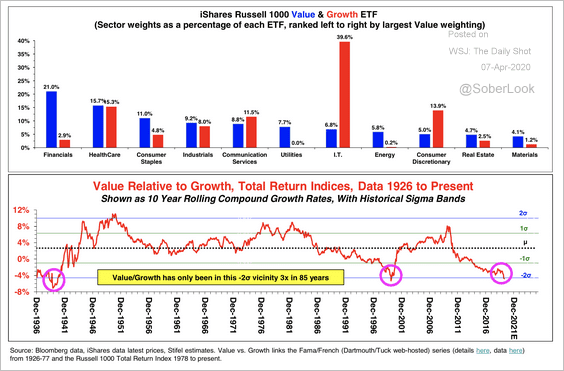

8. Have value stocks troughed relative to growth (2 charts)?

Source: Longview Economics

Source: Longview Economics

Source: Stifel

Source: Stifel

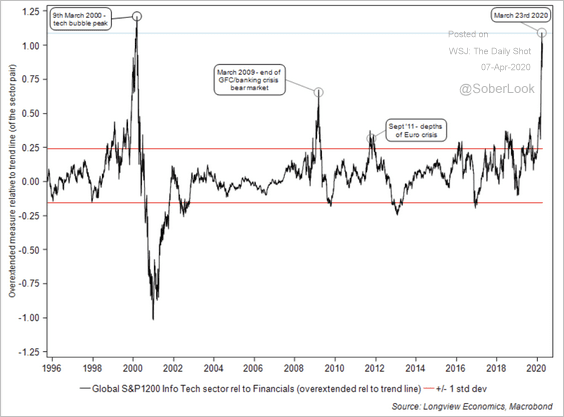

For example, the S&P 500 information technology stocks appear stretched relative to financials.

Source: Longview Economics

Source: Longview Economics

——————–

9. Bank stocks are at record lows relative to the S&P 500.

Source: @markets Read full article

Source: @markets Read full article

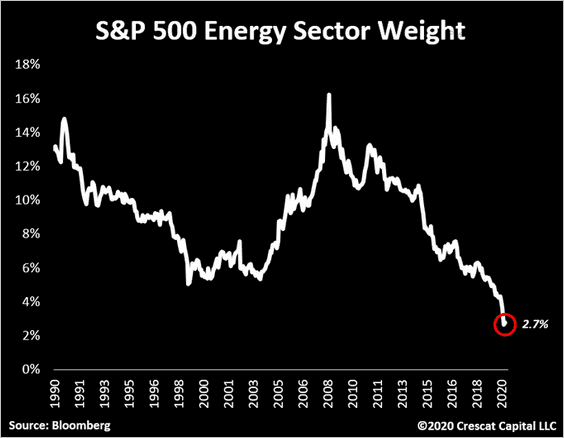

10. The energy sector weight in the S&P 500 is near record lows.

Source: @TaviCosta

Source: @TaviCosta

Credit

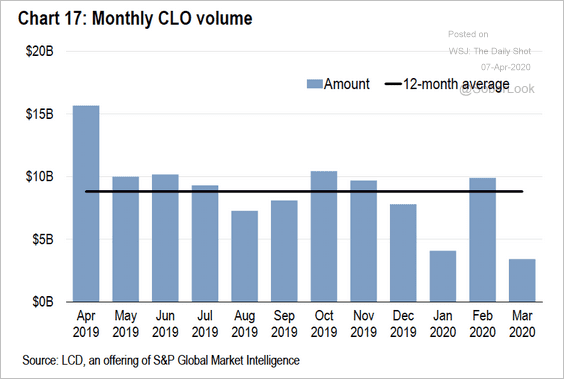

1. Primary collateralized loan obligation (CLO) markets in the US ground to a halt in mid-March with no new-issue, reset, or refi deals pricing. The first two weeks of the month hit the lowest volume reading in three years, according to S&P.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

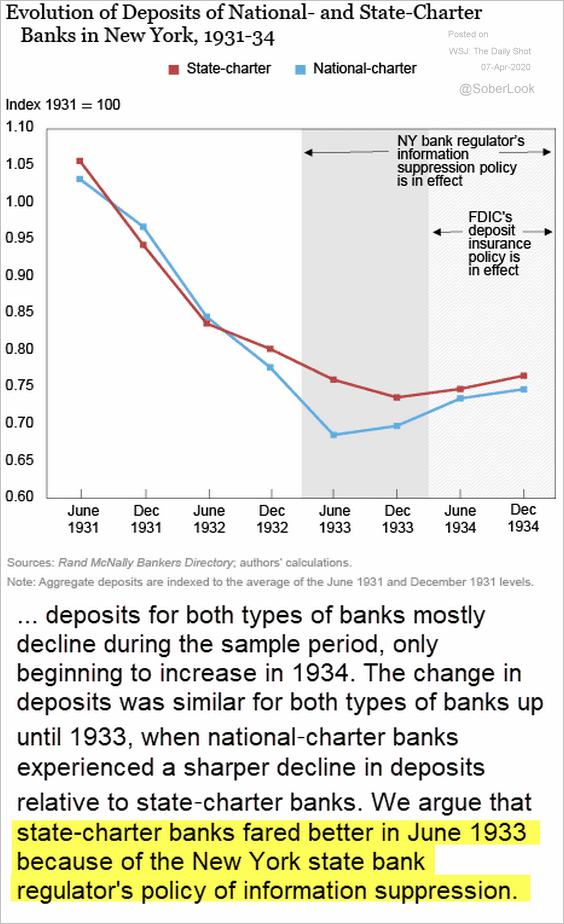

2. Did information suppression help reduce run on banks during the Great Depression?

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

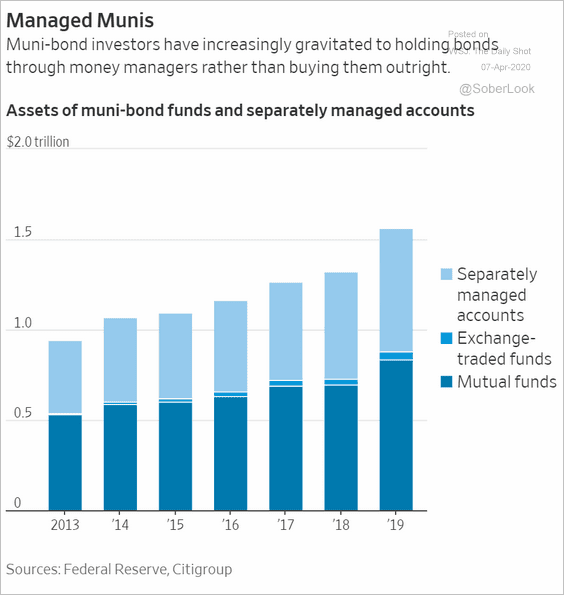

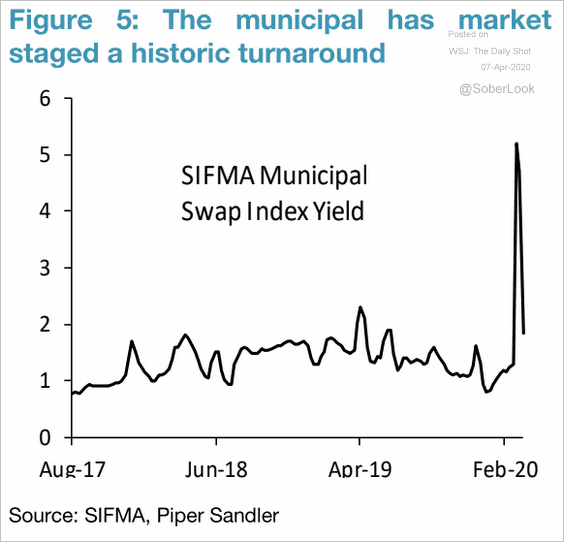

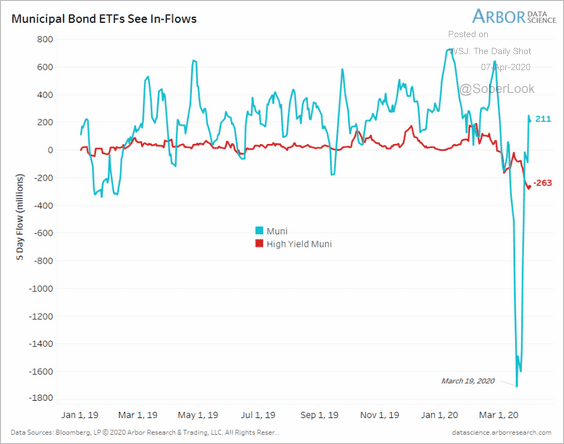

3. Next, we have some updates on the muni markets.

• Muni-bond funds and separately managed accounts AUM:

Source: @WSJ Read full article

Source: @WSJ Read full article

• The market rebound:

Source: Piper Sandler

Source: Piper Sandler

• Fund flows:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Global Developments

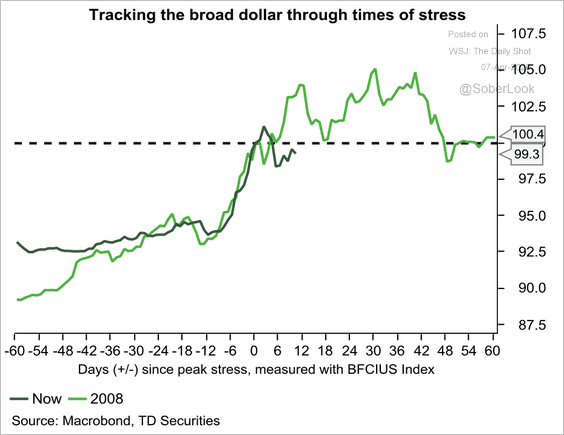

1. TD Securities expects a firmer US dollar over the next month or so, similar to what occurred in 2008.

Source: TD Securities

Source: TD Securities

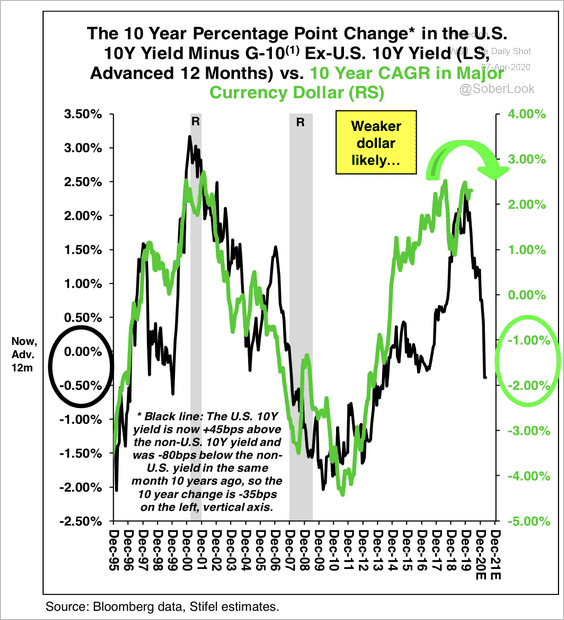

However, collapsing US – foreign yield differentials point to US dollar weakness, according to Stifel.

Source: Stifel

Source: Stifel

——————–

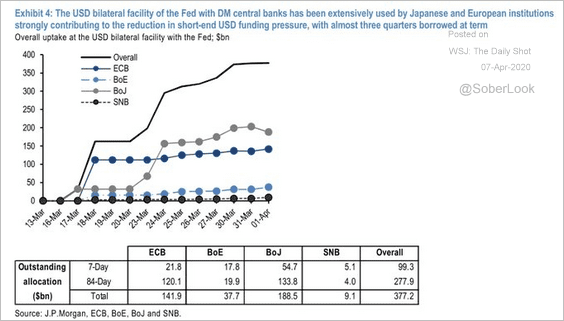

2. Below is the Fed’s dollar swap facility utilization.

Source: JP Morgan, @TayTayLLP

Source: JP Morgan, @TayTayLLP

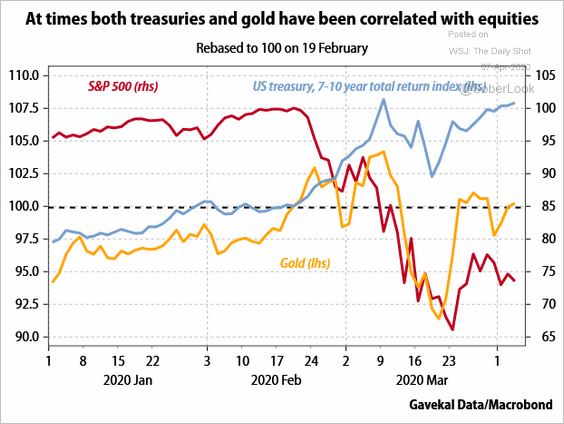

3. During the March extreme volatility, the S&P 500, Treasuries, and gold became correlated.

Source: Gavekal

Source: Gavekal

4. Finally, here is Bloomberg’s global GDP tracker.

![]() Source: @markets Read full article

Source: @markets Read full article

——————–

Food for Thought

1. The size of Western European armies:

Source: The Economist Read full article

Source: The Economist Read full article

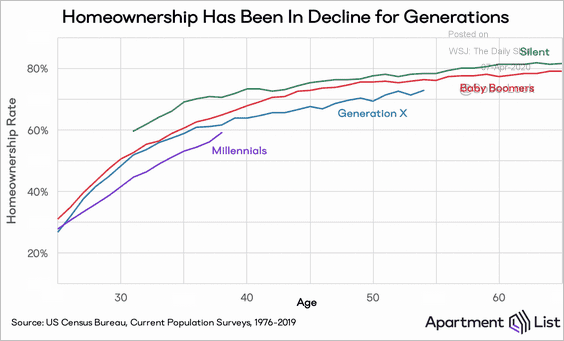

2. Homeownership by generation:

Source: Apartment List Read full article

Source: Apartment List Read full article

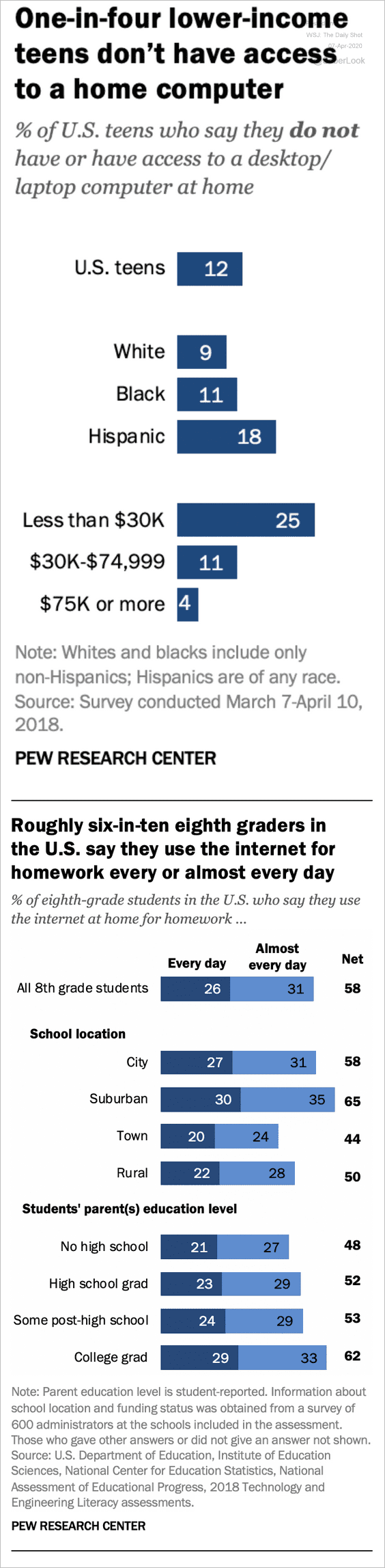

3. Access to a home computer:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

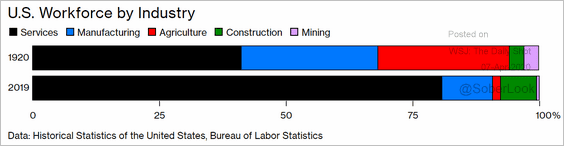

4. The US workforce in 1920 and 2019:

Source: @BW Read full article

Source: @BW Read full article

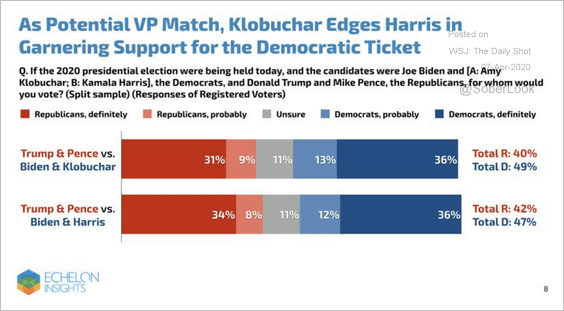

5. A poll on Democratic VP performance in the general election:

Source: Echelon Insights

Source: Echelon Insights

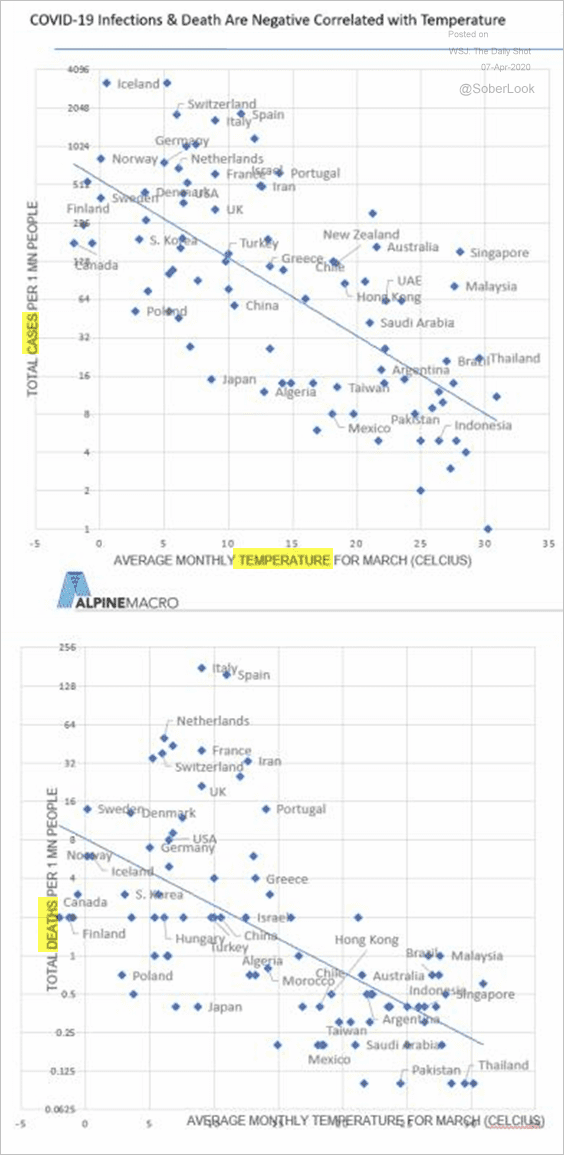

6. COVID-19 infections and deaths vs. the temperature zone (hinting at seasonality):

Source: Alpine Macro Read full article

Source: Alpine Macro Read full article

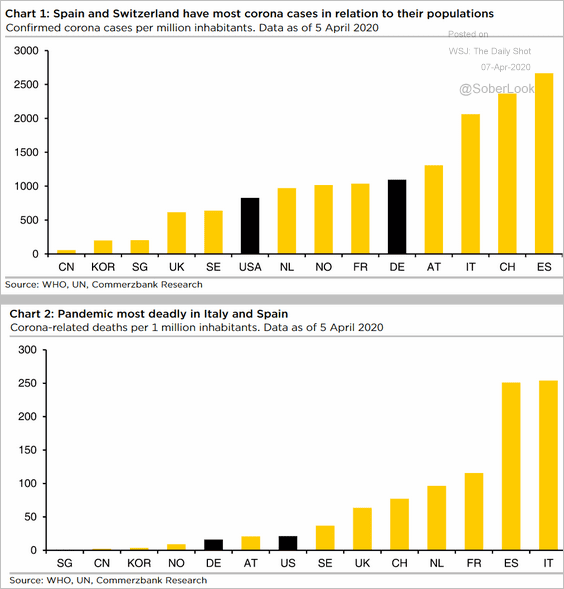

7. The number of infections and deaths relative to each country’s population:

Source: Commerzbank Research

Source: Commerzbank Research

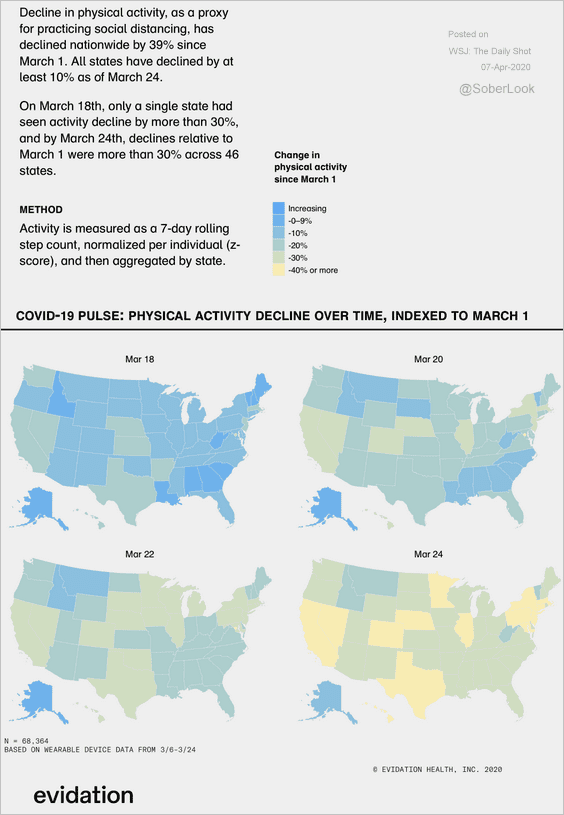

8. Physical activity in the US:

Source: CNBC Read full article

Source: CNBC Read full article

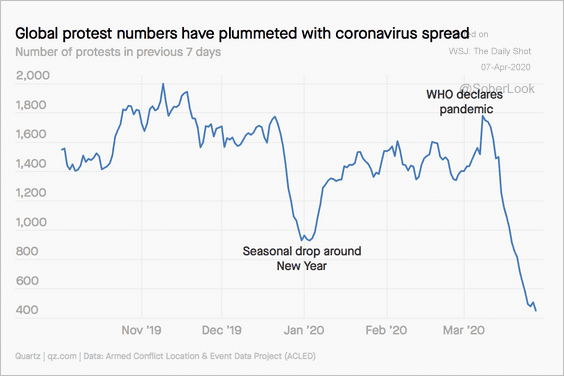

9. Protests around the world:

Source: Quartz Read full article

Source: Quartz Read full article

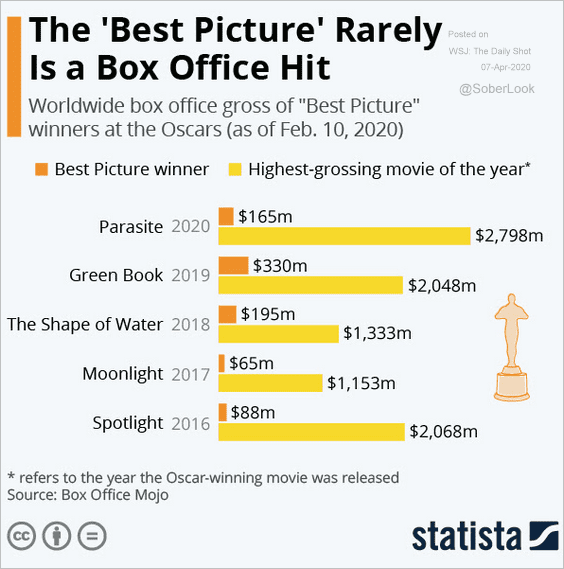

10. Best picture vs. the top-grossing movie that year:

Source: Statista

Source: Statista

——————–