The Daily Shot: 08-Apr-20

• The United States

• The Eurozone

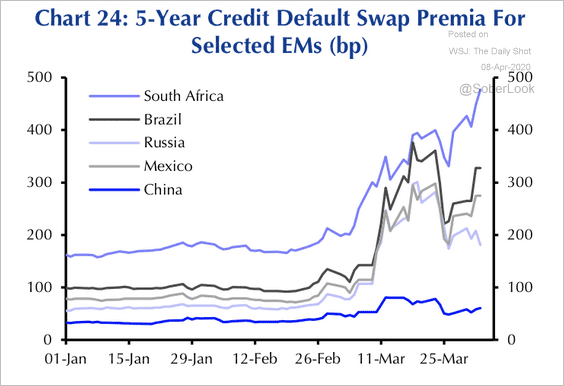

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

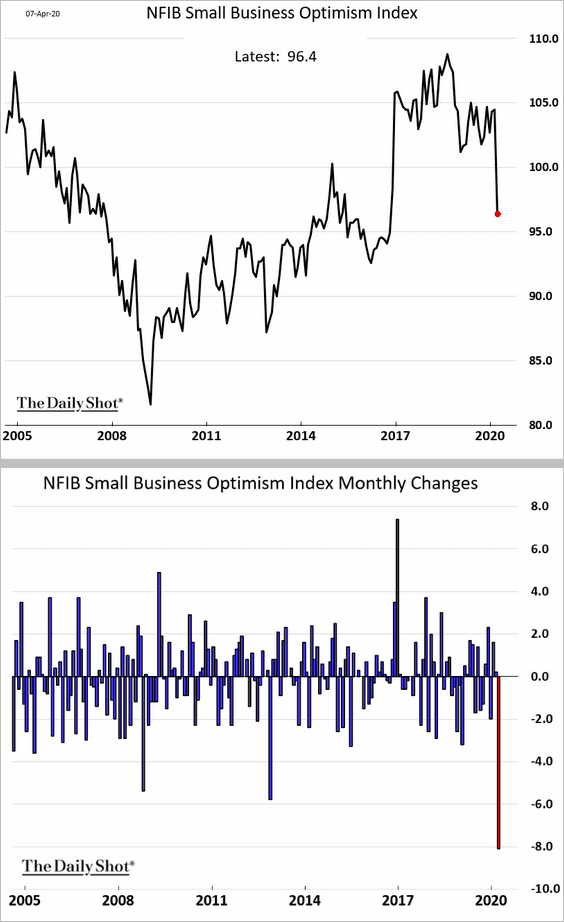

1. Last month’s NFIB Small Business Optimism Index registered the sharpest decline in decades. Business sentiment is likely to deteriorate further in April.

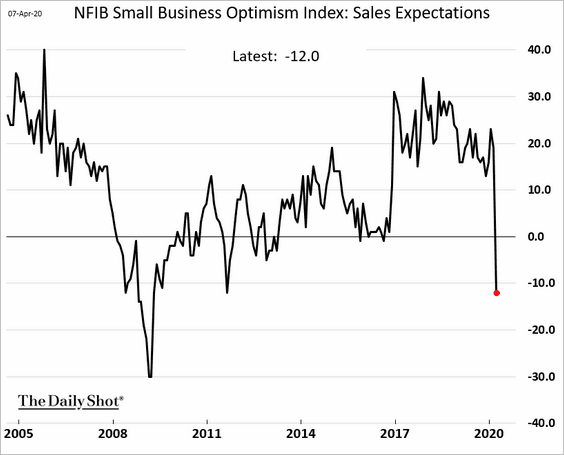

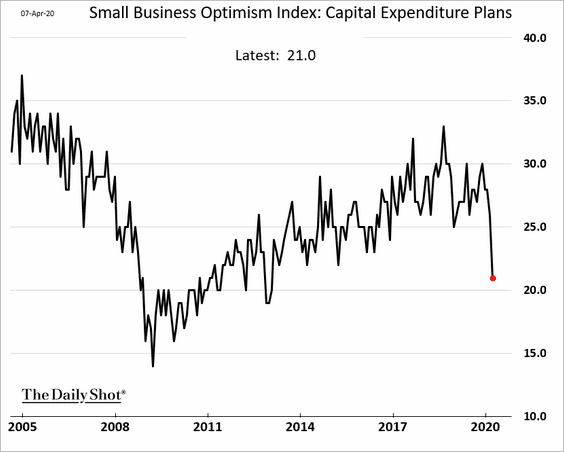

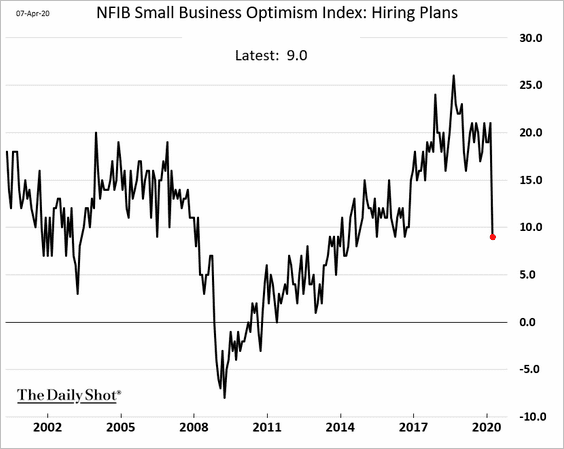

Here are some of the forward-looking components of the NFIB index.

• Sales expectations:

• CapEx expectations:

• Hiring plans:

——————–

2. Next, we have some updates on the labor market.

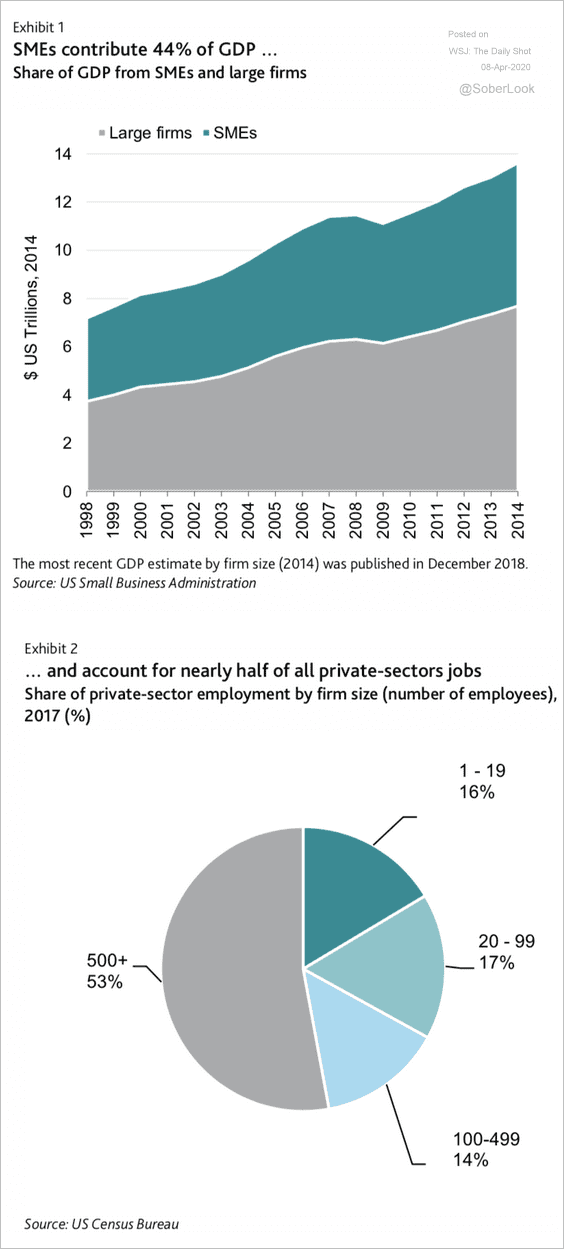

• US small and medium-size businesses contribute 44% of the US GDP and are responsible for almost half of private-sector employment.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

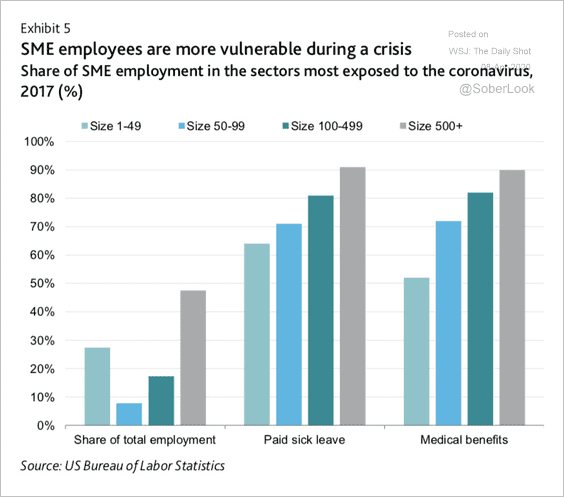

Small-business employees are more vulnerable than those working for large firms.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

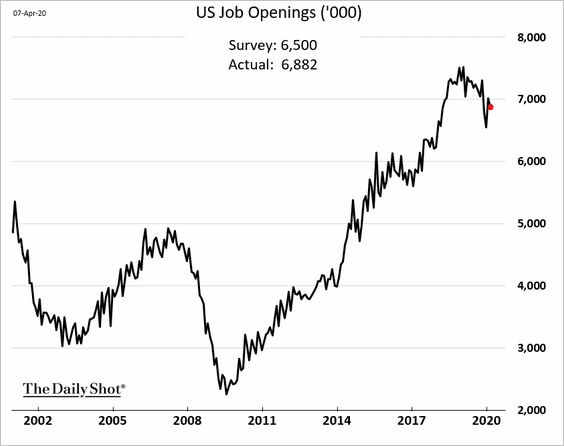

• Job openings held steady in February before the job market started unraveling.

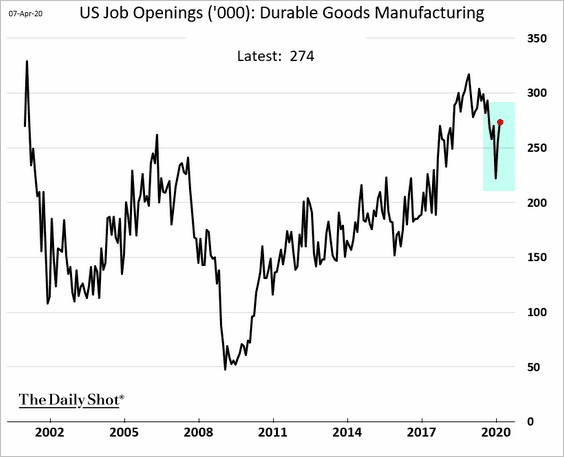

Vacancies in durable goods manufacturing jumped.

——————–

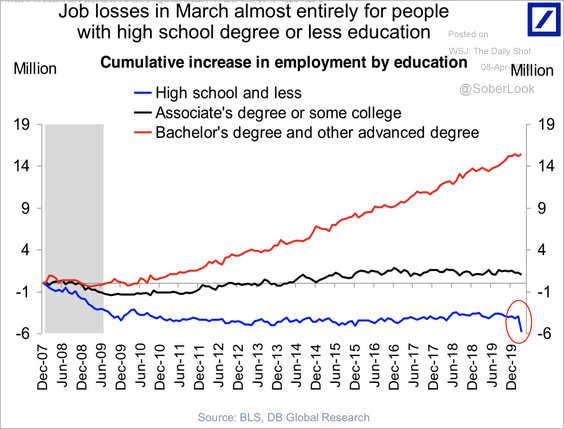

• Job losses in the March payrolls report were mostly among Americans with a high school degree or less.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

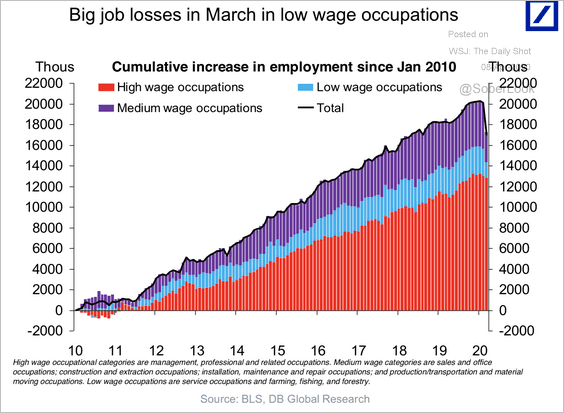

Low-wage occupations saw the biggest declines in payrolls.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

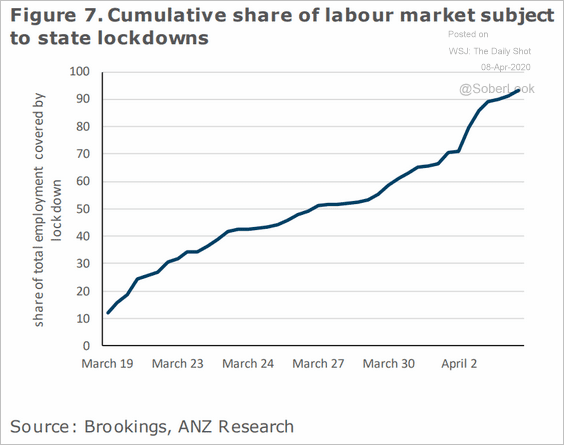

• This chart shows the share of the labor market that is subject to state lockdowns.

Source: ANZ Research

Source: ANZ Research

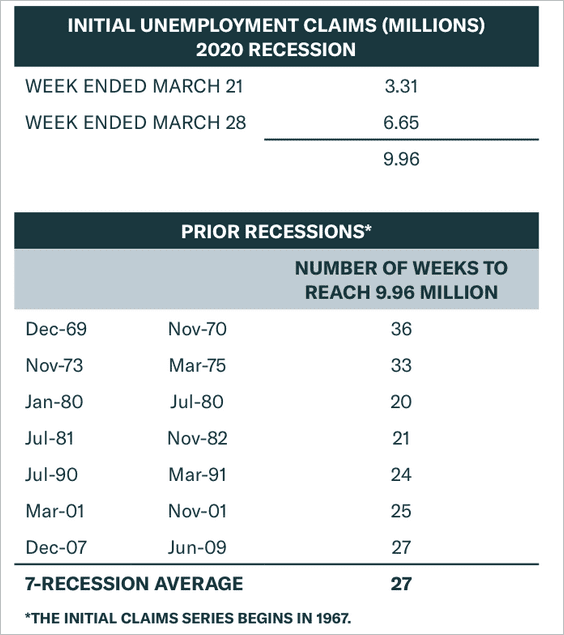

• In the 2007-2009 recession, it took 27 weeks to reach 10 million initial unemployment claims. We got there in two weeks in the current recession.

Source: BCA Research

Source: BCA Research

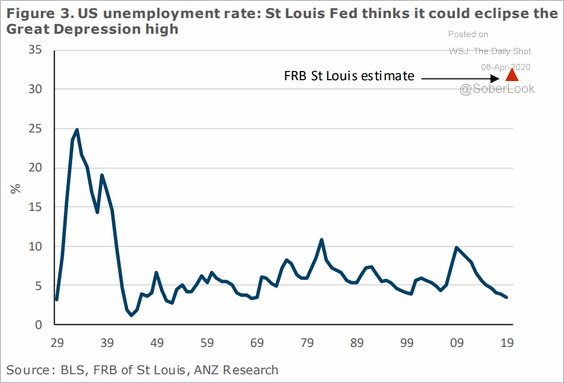

• Estimates from the St Louis Fed suggest that the unemployment rate could exceed the peak of the Great Depression.

Source: ANZ Research

Source: ANZ Research

——————–

3. Let’s take a look at some consumer metrics.

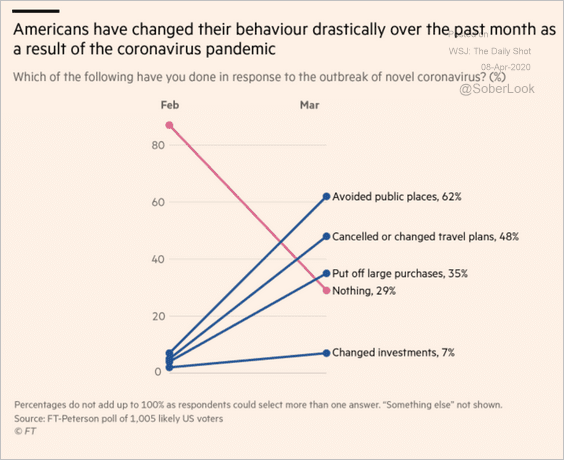

• How have Americans changed their behavior?

Source: @financialtimes Read full article

Source: @financialtimes Read full article

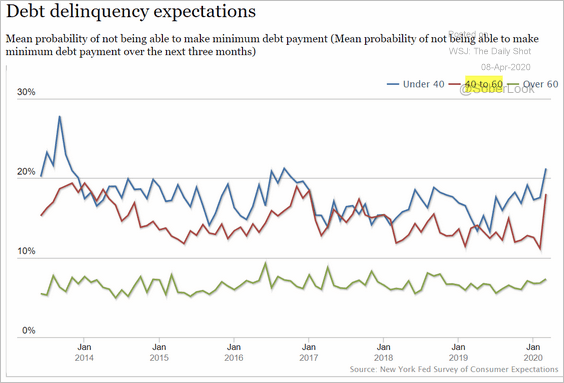

• The percentage of consumers who expect to be delinquent on their debt rose in March. The increase was especially sharp among Americans between the ages of 40 and 60.

Source: New York Fed

Source: New York Fed

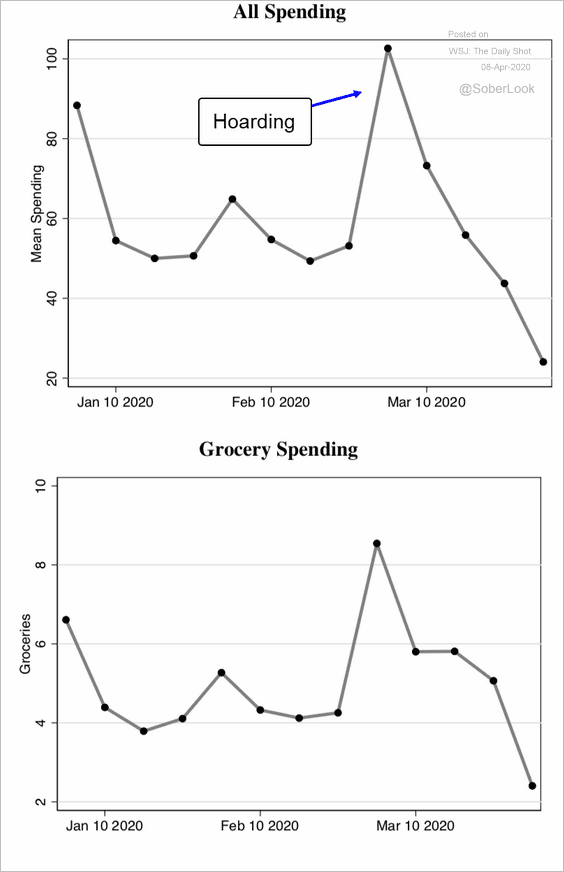

• Early estimates point to consumer spending declining by approximately 50%.

Source: NBER Working Paper Read full article

Source: NBER Working Paper Read full article

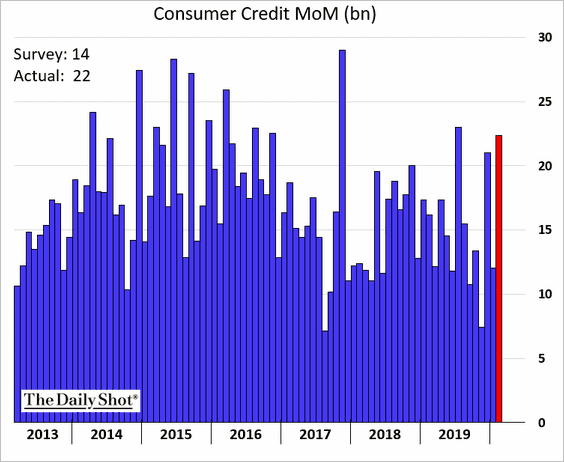

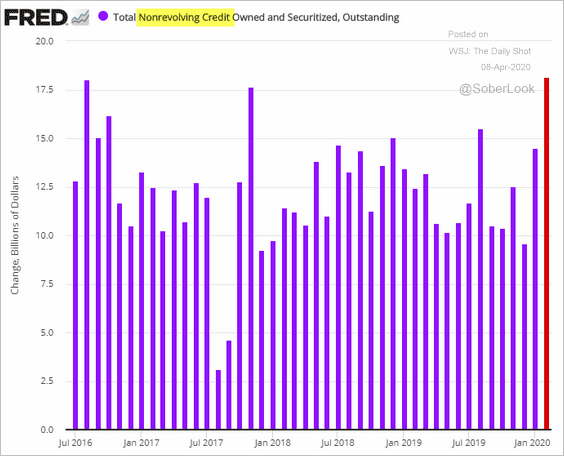

• Consumer credit rose more than expected in February, driven primarily by non-revolving debt (which is mostly auto and student loans).

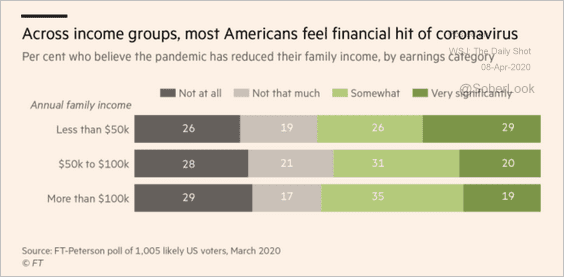

• The crisis is pressuring household incomes.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

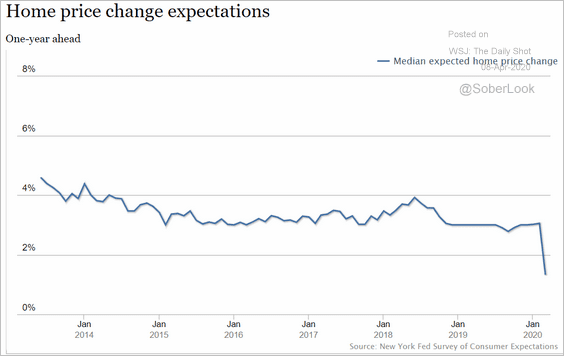

• Consumers expect slower home price appreciation.

Source: New York Fed

Source: New York Fed

——————–

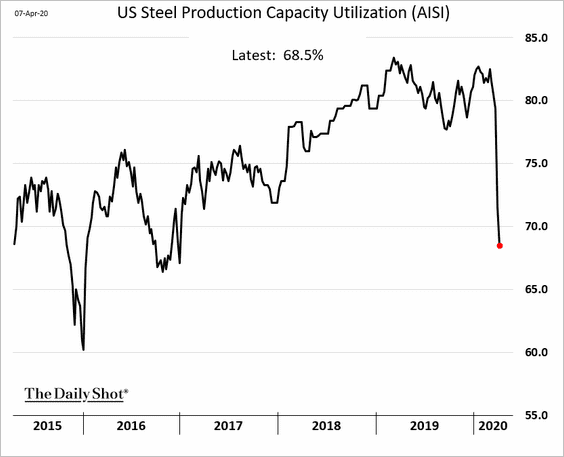

4. US steel output has deteriorated.

h/t Joe Deaux, @TheTerminal

h/t Joe Deaux, @TheTerminal

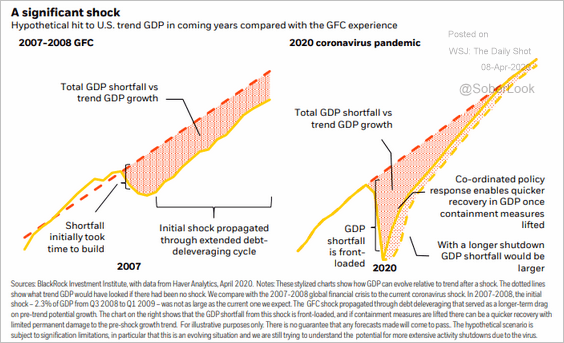

5. Here is a comparison of the potential GDP trajectory vs. the previous recession.

Source: BlackRock, @ericbeebo Read full article

Source: BlackRock, @ericbeebo Read full article

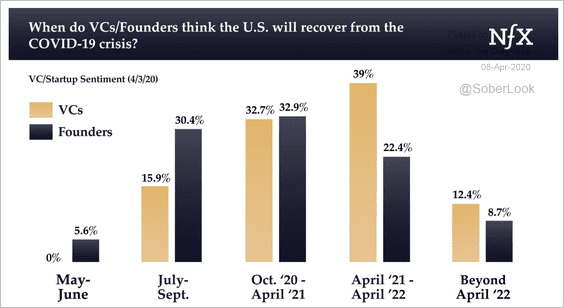

6. When do start-up founders and VCs think the US will recover from the current crisis?

Source: NFX Read full article

Source: NFX Read full article

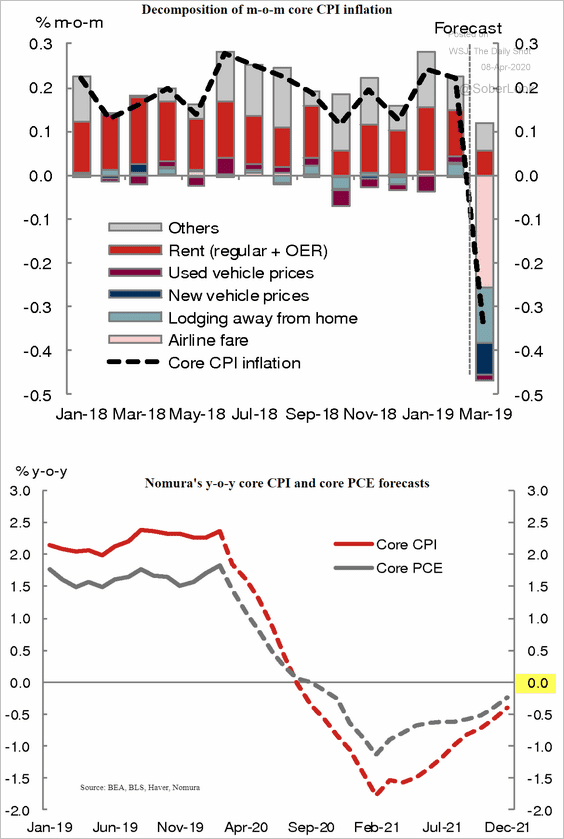

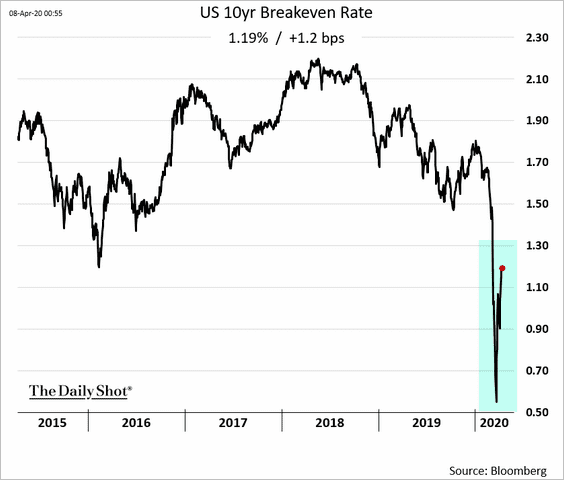

7. Nomura expects a sharp decline in the core CPI in March, with the economy entering deflation in the months ahead.

Source: Nomura Securities

Source: Nomura Securities

Long-term market-based inflation expectations have rebounded from extreme lows.

——————–

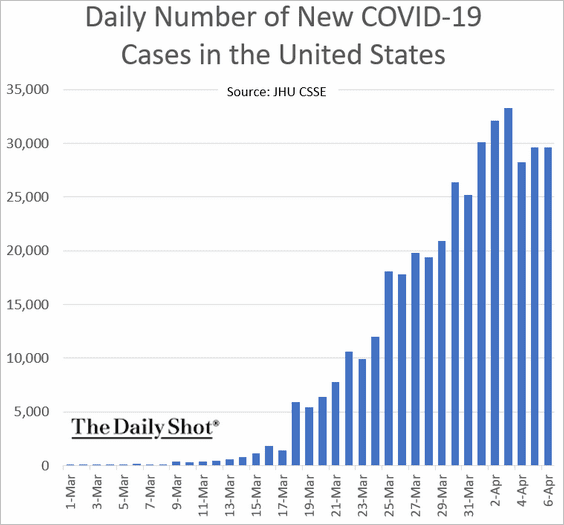

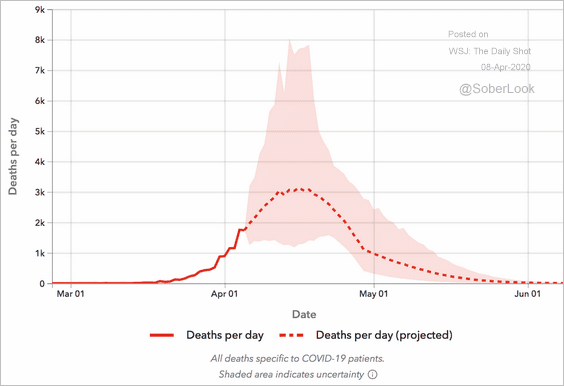

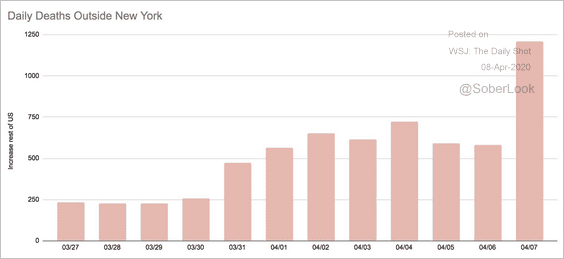

8. Finally, here are some updates on the epidemic.

• Daily new cases in the US:

• Fatalities:

Source: IHME

Source: IHME

• Deaths outside of New York:

Source: @COVID19Tracking

Source: @COVID19Tracking

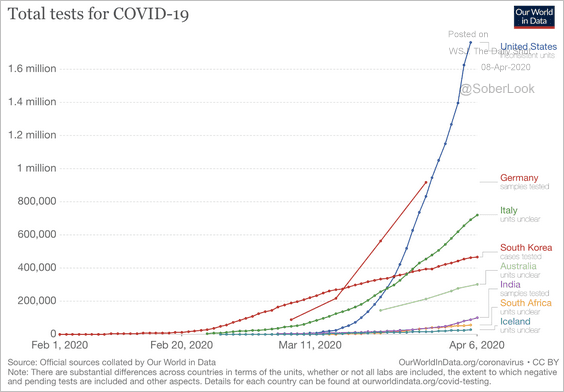

• Testing trends:

Source: Our World In Data

Source: Our World In Data

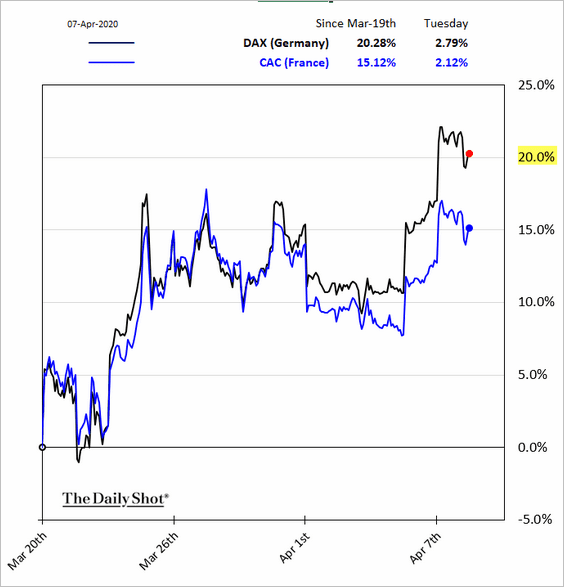

The Eurozone

1. Germany’s DAX is out of bear market (up over 20% from the lows).

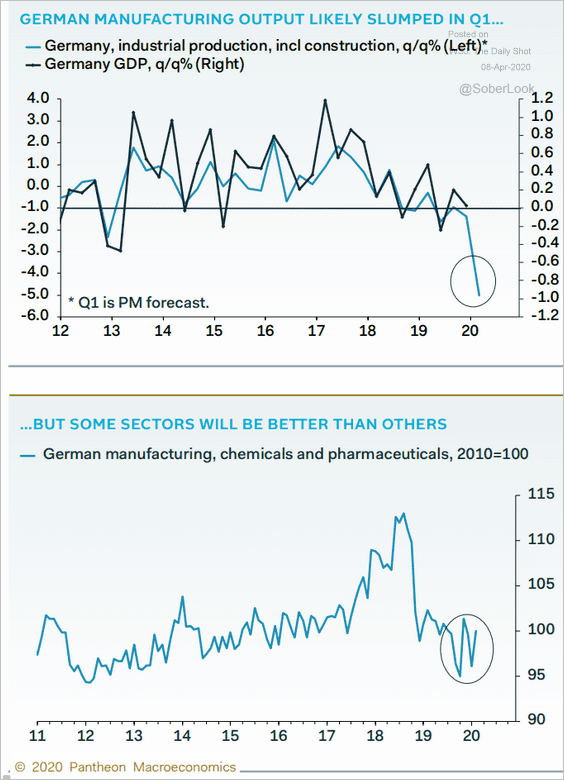

2. German industrial production is expected to deteriorate, but not all sectors will be severely impacted.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

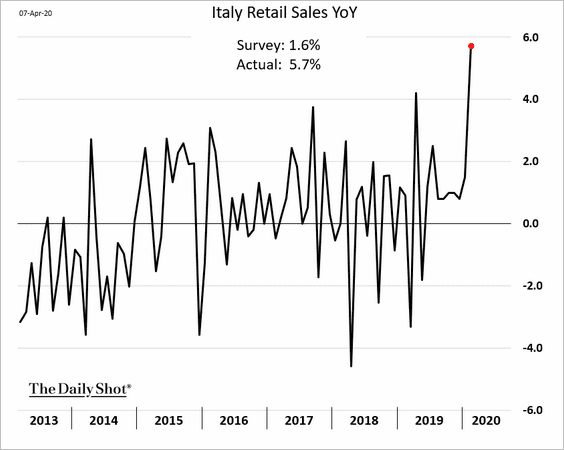

3. Italy’s retail sales rose sharply in February.

4. Italian TARGET2 imbalances are nearing record levels again (see story).

Source: @Schuldensuehner, @TheTerminal

Source: @Schuldensuehner, @TheTerminal

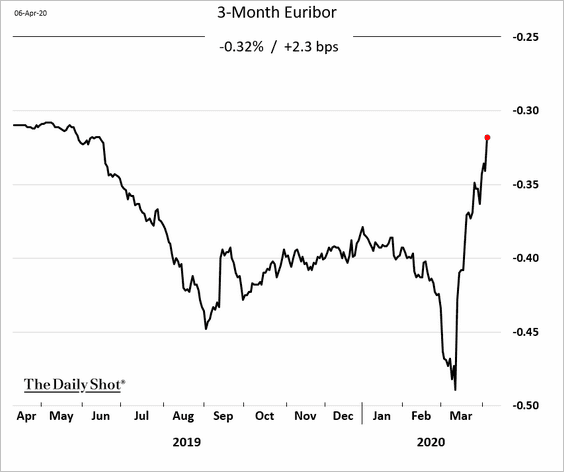

5. Euribor has been climbing amid some unease with the health of several European banks.

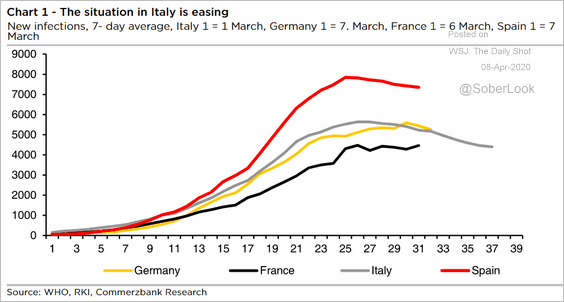

6. The number of new infections is peaking.

Source: Commerzbank Research

Source: Commerzbank Research

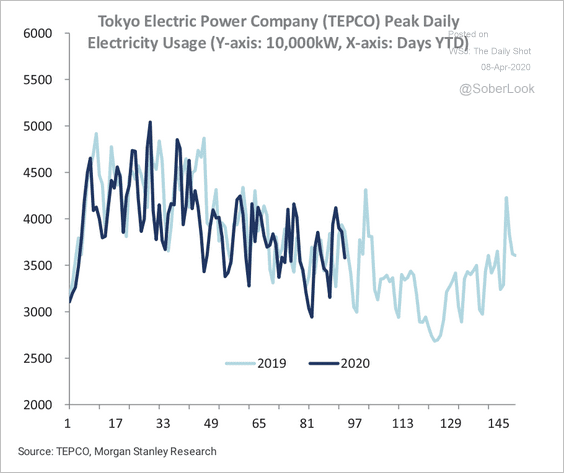

Asia – Pacific

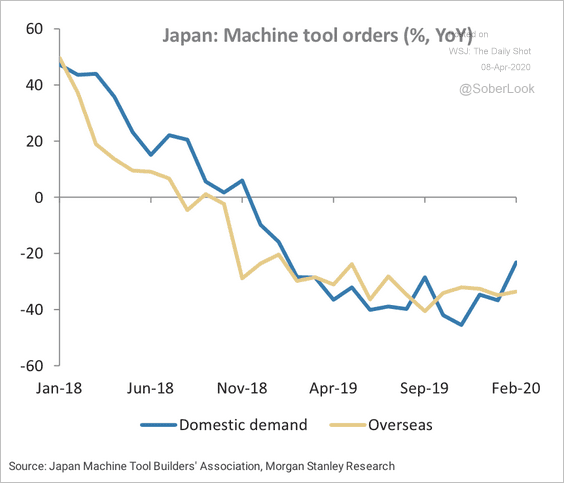

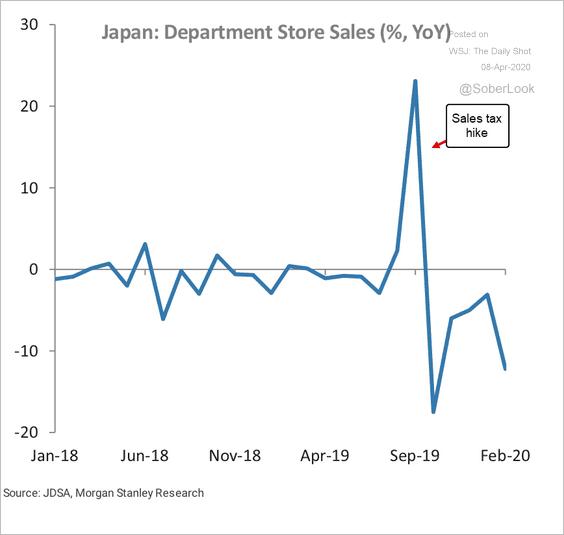

1. Let’s begin with some updates on Japan (from Morgan Stanley).

• Machine tool orders:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Department store sales:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

• Electricity usage:

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

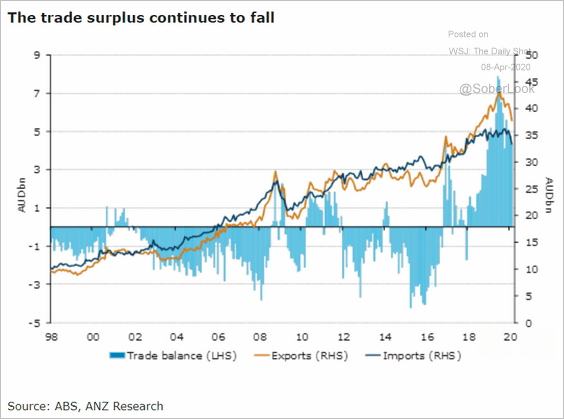

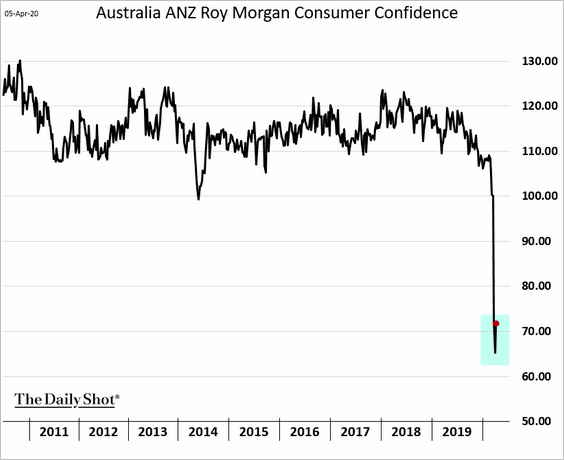

2. Here are a couple of updates on Australia.

• The nation’s trade surplus appears to have peaked.

Source: ANZ Research

Source: ANZ Research

• Consumer confidence bounced from record lows.

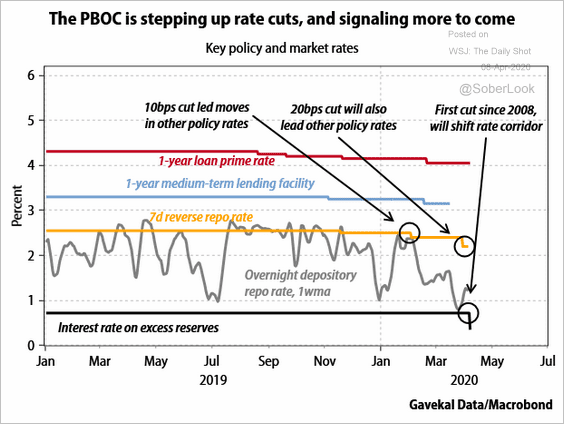

China

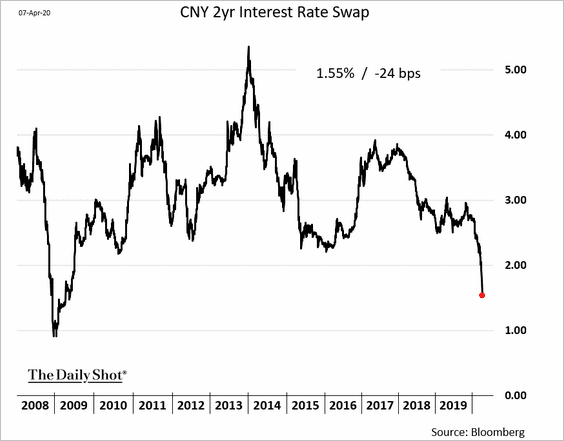

1. The PBoC has been lowering policy rates.

Source: Gavekal

Source: Gavekal

And the market expects further cuts. Here is the 2-year swap rate.

——————–

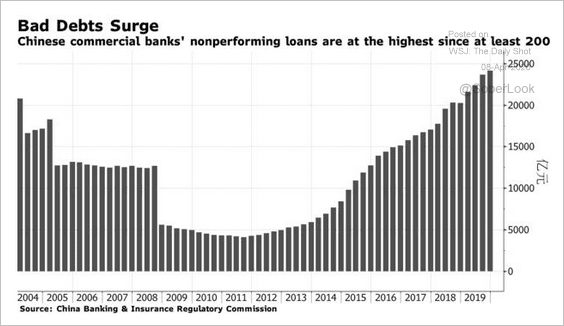

2. Nonperforming loan balances have been climbing, a trend that is likely to accelerate this year.

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

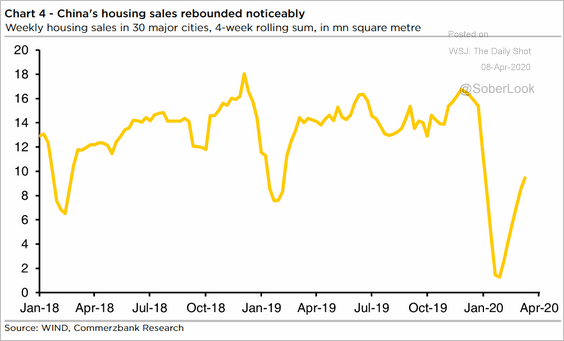

3. Housing sales are rebounding.

Source: Commerzbank Research

Source: Commerzbank Research

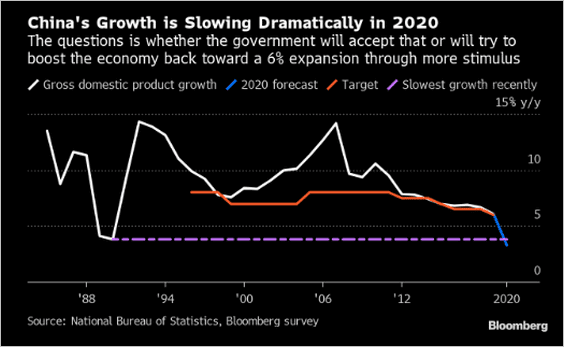

4. How severe will the growth slowdown be?

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

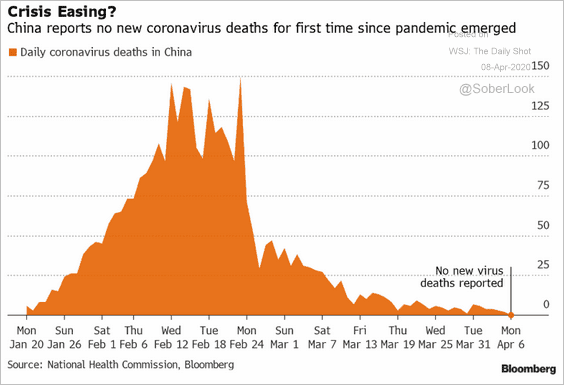

5. China reported no new COVID-19 deaths.

Source: Bloomberg Markets: Asia

Source: Bloomberg Markets: Asia

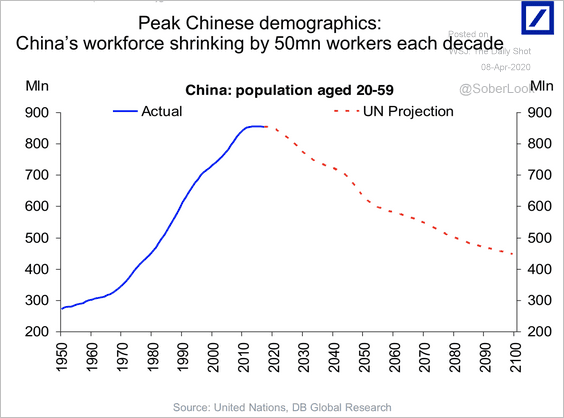

6. The nation’s working-age population has peaked.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Emerging Markets

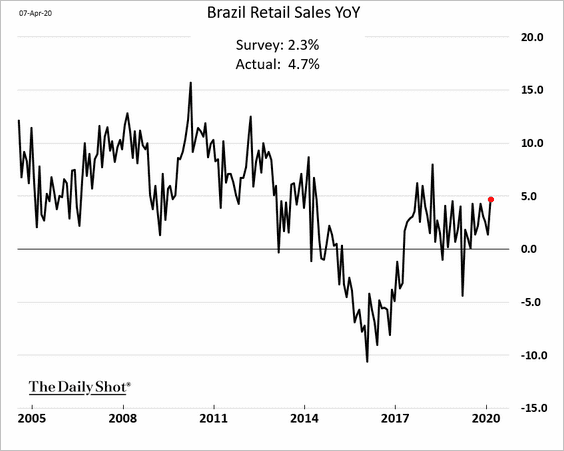

1. Brazil’s retail sales were in good shape in February.

Source:

Source:

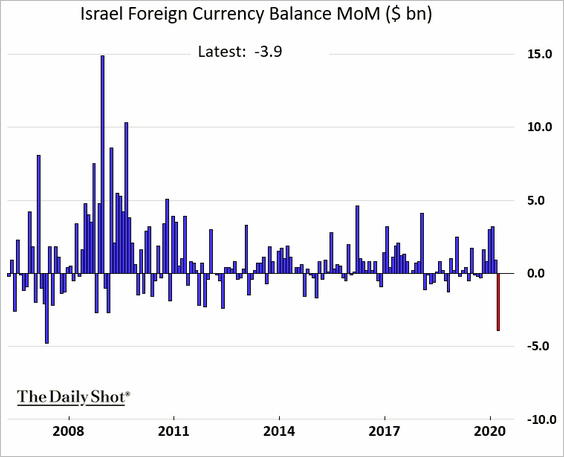

2. Israel’s F/X reserves declined sharply last month.

3. Credit default swap spreads have fallen back a bit. One exception, according to Capital Economics, is South Africa, which lost its last investment-grade rating due to increasingly strained public finances.

Source: Capital Economics

Source: Capital Economics

Commodities

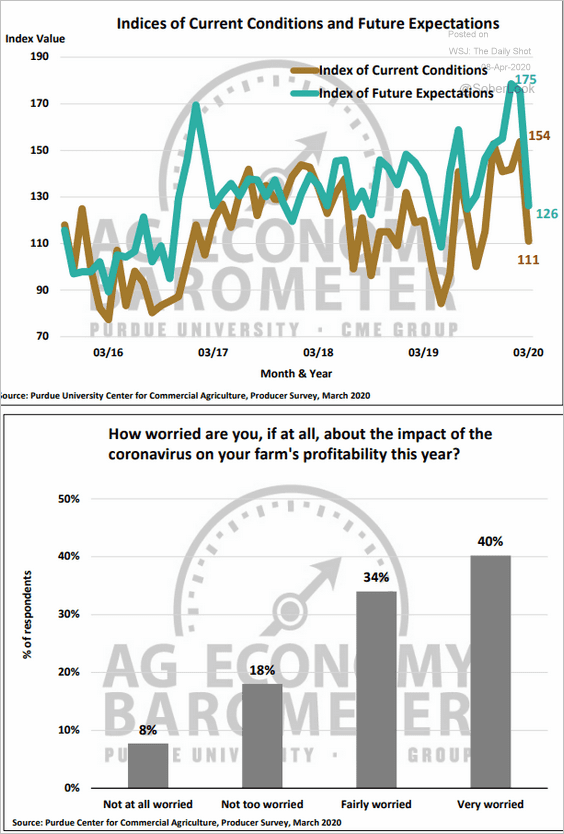

1. US farms are worried about the impact of the epidemic on their business.

Source: Purdue University/CME Group Ag Economy Barometer

Source: Purdue University/CME Group Ag Economy Barometer

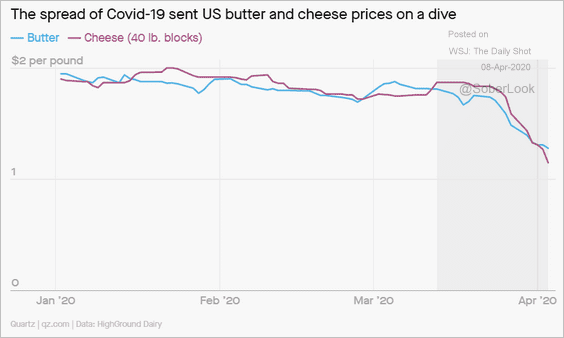

2. Butter and cheese prices have declined sharply over the past couple of weeks.

Source: Quartz Read full article

Source: Quartz Read full article

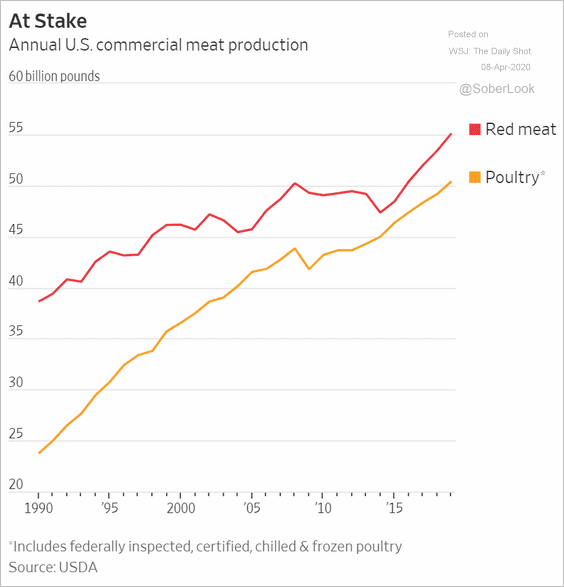

3. This chart shows US meat production since 1990.

Source: @WSJ Read full article

Source: @WSJ Read full article

Equities

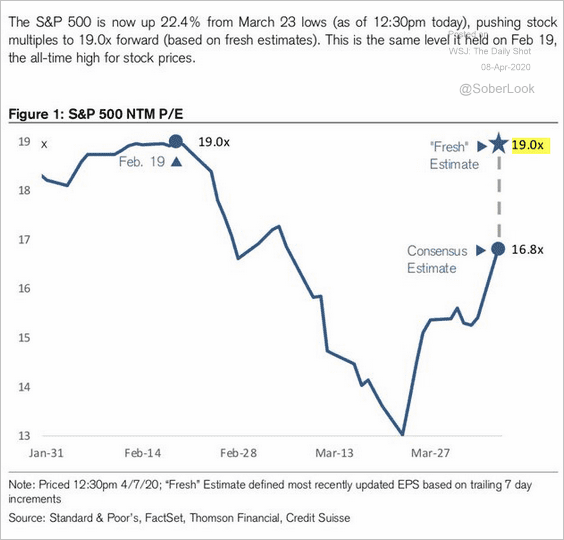

1. Credit Suisse estimates that the S&P 500 forward P/E ratio is back at 19.0x. That’s the multiple reached when the index was at record highs.

Source: Credit Suisse, @FerroTV

Source: Credit Suisse, @FerroTV

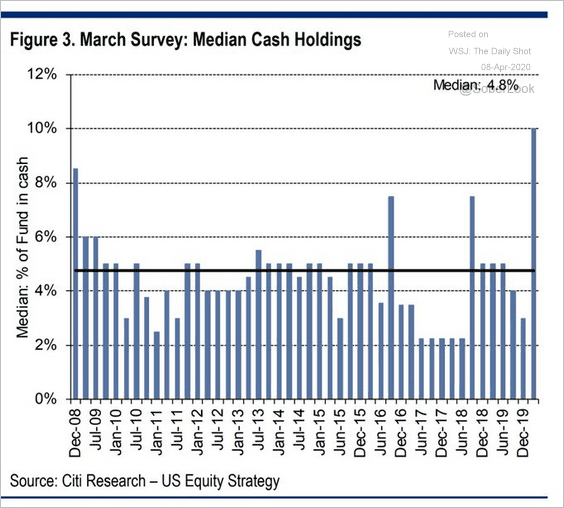

2. Fund managers have been holding record amounts of cash, which contributed to the recent bounce in stock prices (despite grim economic projections). Here is a quote from Citi Research.

We suspect that some fund managers are chasing the tape, especially given their large cash positions.

Source: @Scutty

Source: @Scutty

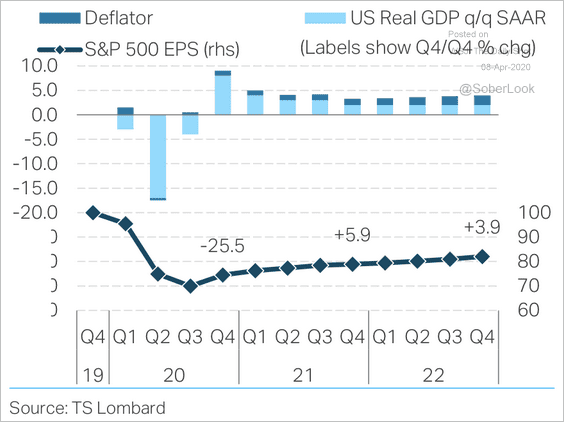

3. TS Lombard expects a lackluster earnings recovery.

Source: TS Lombard

Source: TS Lombard

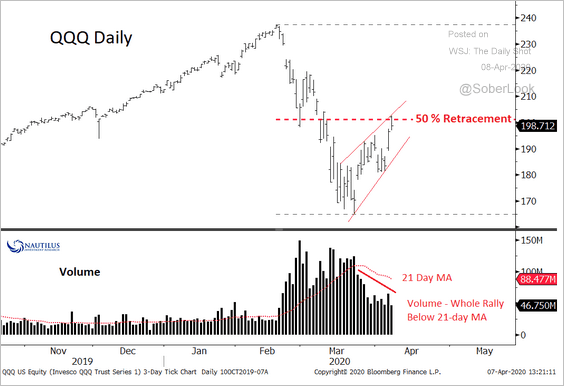

4. The Invesco QQQ ETF, which tracks the Nasdaq 100 index, has rallied with slowing volume. Will the upside begin to stall?

Source: @NautilusCap

Source: @NautilusCap

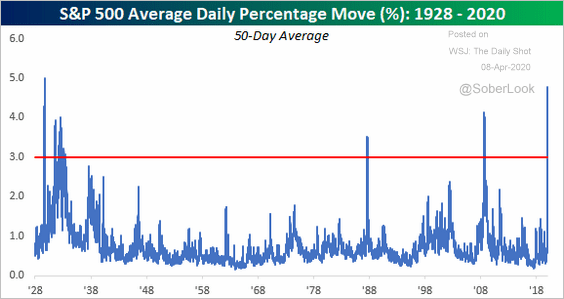

5. The S&P 500 realized volatility reached the highest level since the crash of 1929.

Source: @bespokeinvest, {ht} Armand Read full article

Source: @bespokeinvest, {ht} Armand Read full article

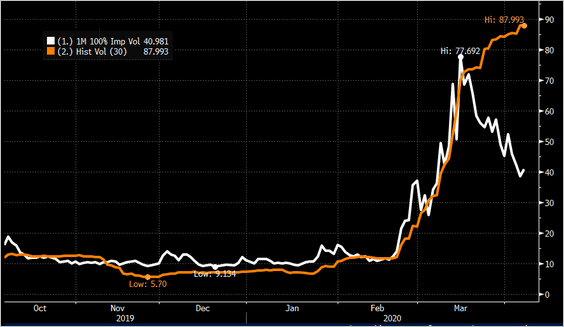

However, the S&P 500 implied volatility has been declining. This chart shows the widening divergence between the one-month at-the-money implied volatility and historical volatility.

Source: @TheTerminal, {ht} Armand

Source: @TheTerminal, {ht} Armand

Credit

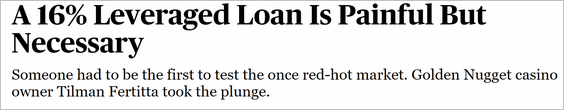

1. Desperate for liquidity, some firms are paying up to obtain financing.

Source: @bopinion Read full article

Source: @bopinion Read full article

Source: @WSJ Read full article

Source: @WSJ Read full article

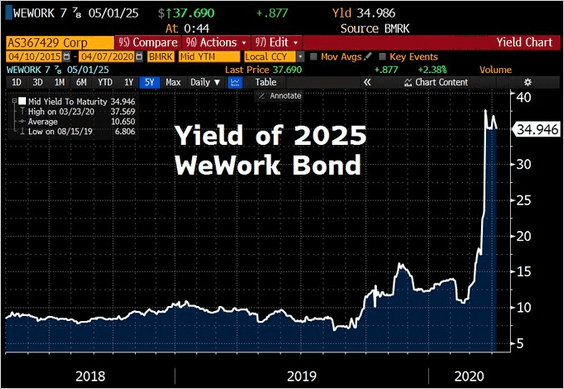

WeWork bonds are yielding 35%.

Source: @Schuldensuehner, @TheTerminal

Source: @Schuldensuehner, @TheTerminal

——————–

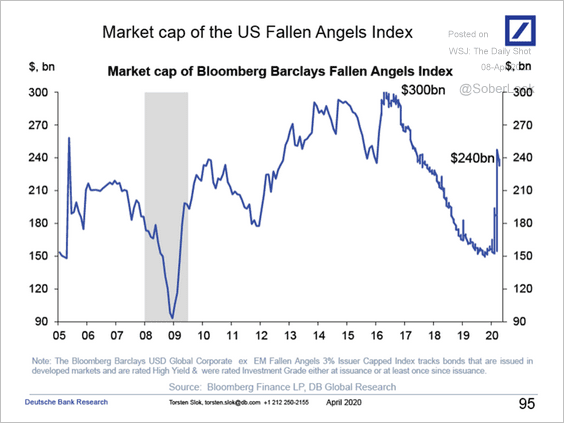

2. Here is the market cap of the US Fallen Angels Index.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

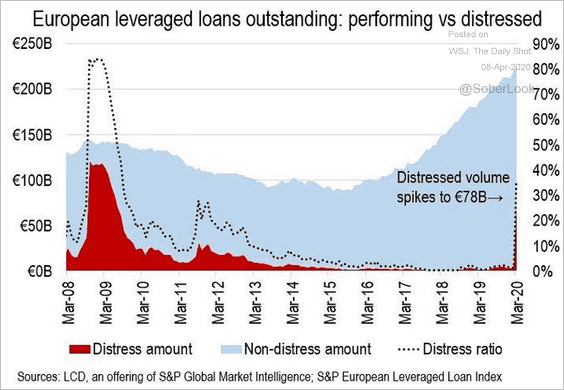

3. The volume of distressed European loans is at the highest level since 2009.

Source: @lcdnews, @IsabellWitt1 Read full article

Source: @lcdnews, @IsabellWitt1 Read full article

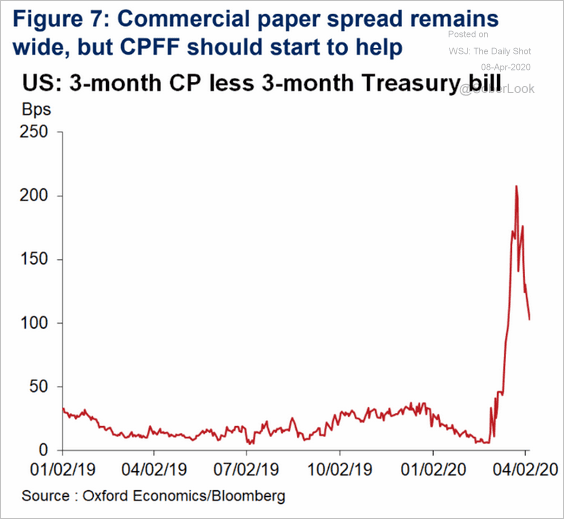

4. The Fed’s commercial paper program should ease the stress in the funding market.

Source: Oxford Economics

Source: Oxford Economics

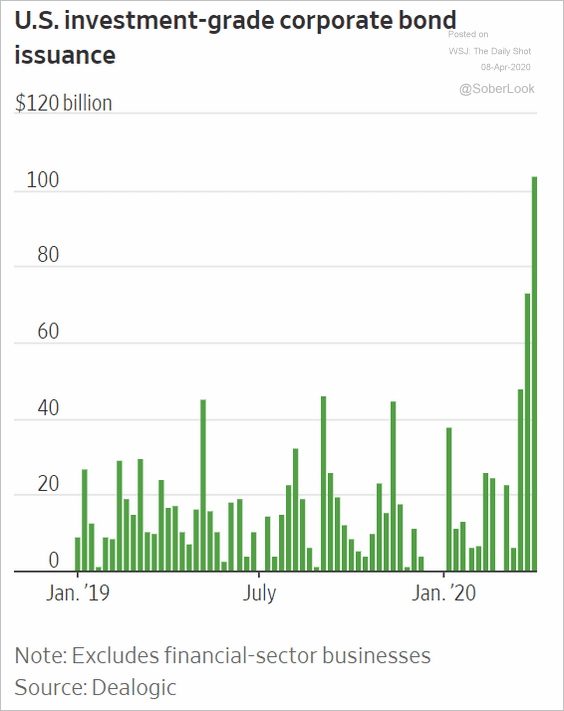

5. Corporate bond issuance has accelerated.

Source: @WSJ Read full article

Source: @WSJ Read full article

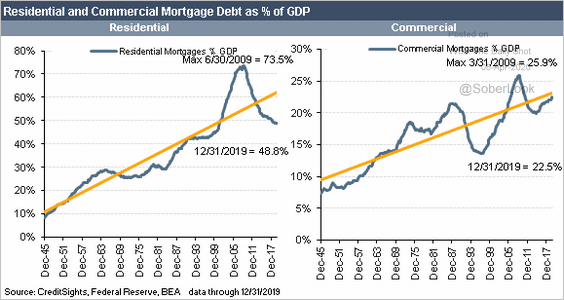

6. These charts show the debt-to-GDP ratios for residential and commercial mortgages.

Source: CreditSights

Source: CreditSights

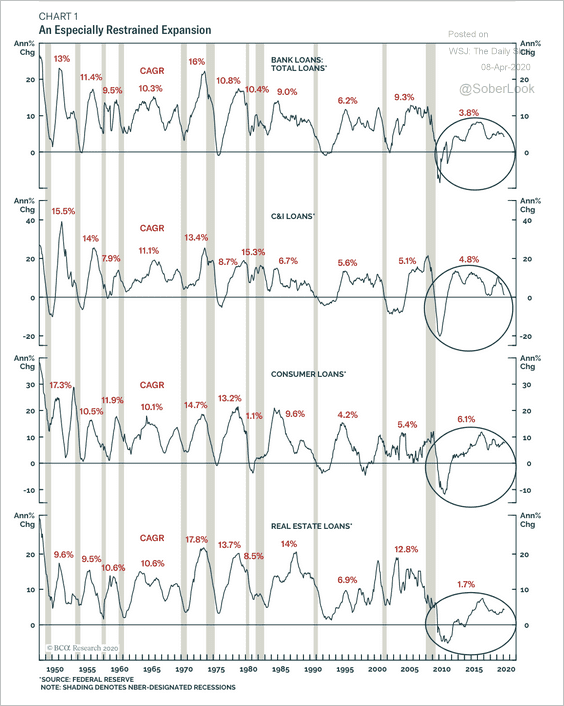

7. US loan growth has been relatively modest over the past decade.

Source: BCA Research

Source: BCA Research

Global Developments

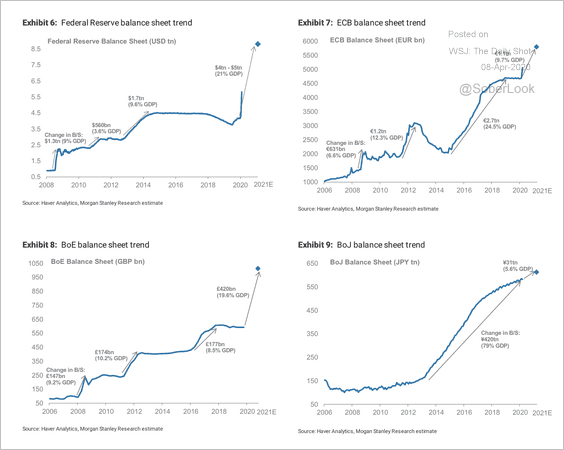

1. Central bank balance sheets are expanding at a rapid pace.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

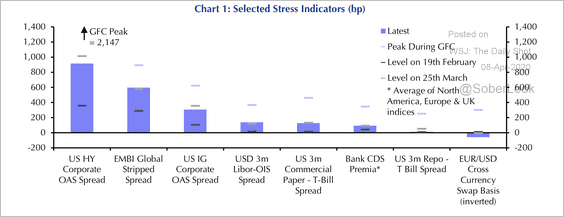

2. Capital Economics’ stress indicators are starting to stabilize.

Source: Capital Economics

Source: Capital Economics

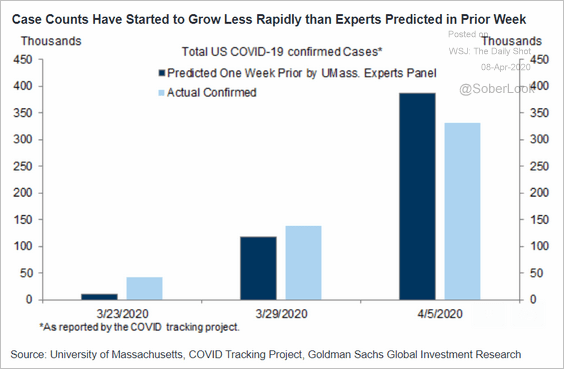

3. The recent growth in new COVID-19 cases has been slower than experts predicted a week earlier.

Source: Goldman Sachs

Source: Goldman Sachs

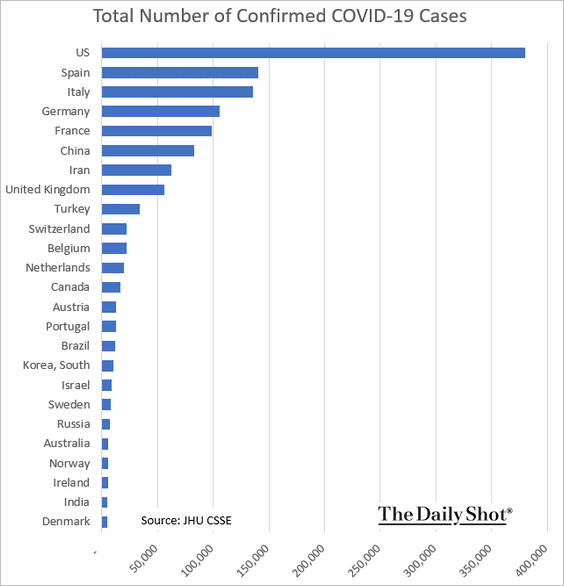

Below is the total number of cases by country.

——————–

Food for Thought

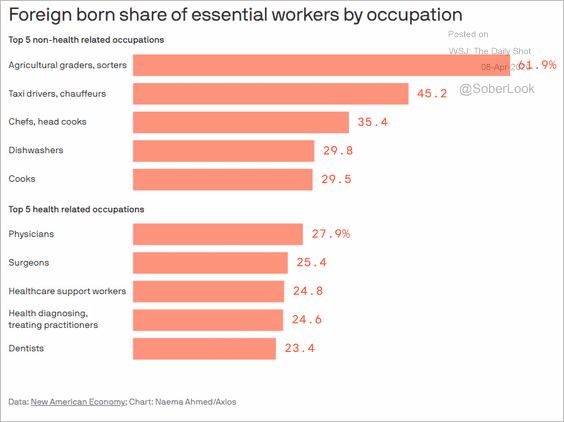

1. The foreign-born share of US essential workers:

Source: @axios Read full article

Source: @axios Read full article

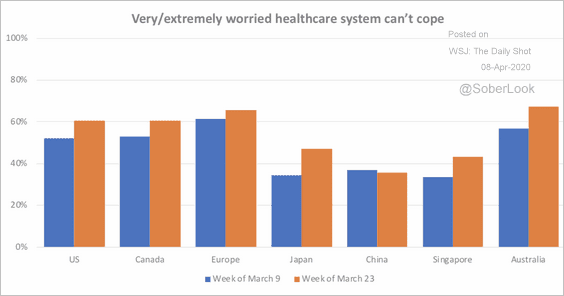

2. Concerns about the healthcare system:

Source: Dynata

Source: Dynata

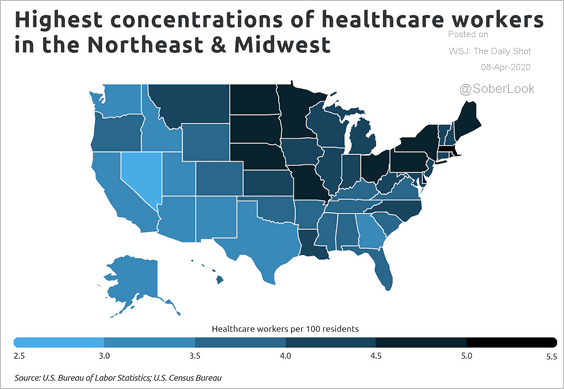

3. Concentrations of healthcare workers by state:

Source: Self Read full article

Source: Self Read full article

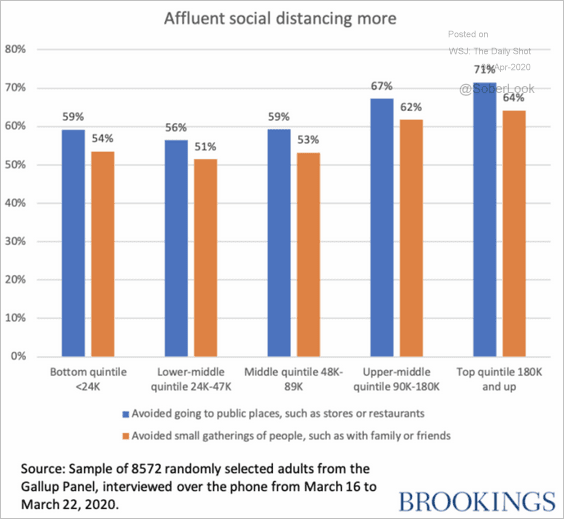

4. Social distancing by income category:

Source: The Brookings Institution Read full article

Source: The Brookings Institution Read full article

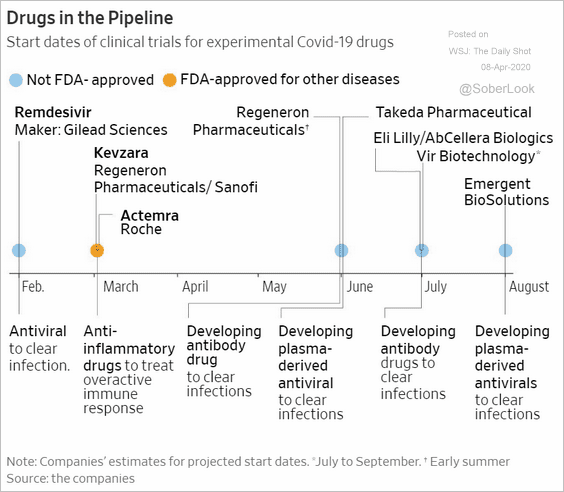

5. Clinical trials for experimental COVID-19 drugs:

Source: @WSJ Read full article

Source: @WSJ Read full article

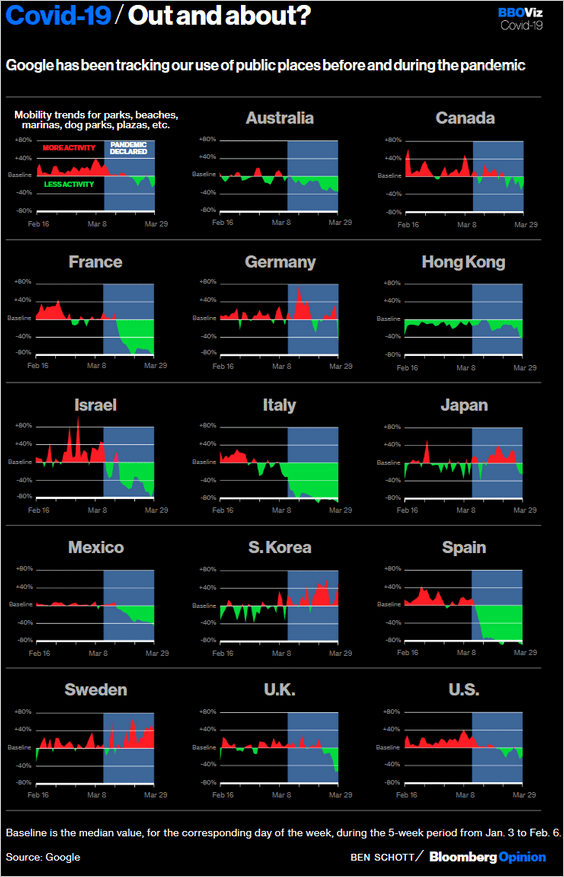

6. Use of public spaces around the world:

Source: @bopinion Read full article

Source: @bopinion Read full article

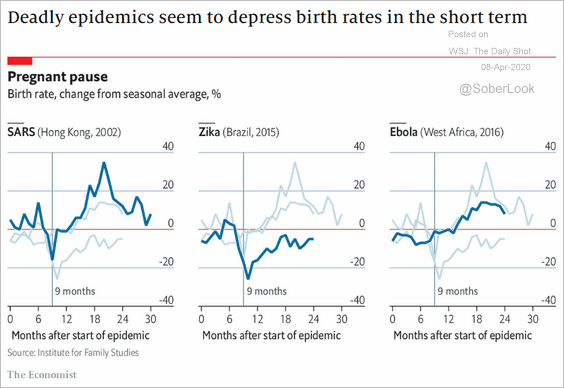

7. Epidemics and birth rates:

Source: The Economist Read full article

Source: The Economist Read full article

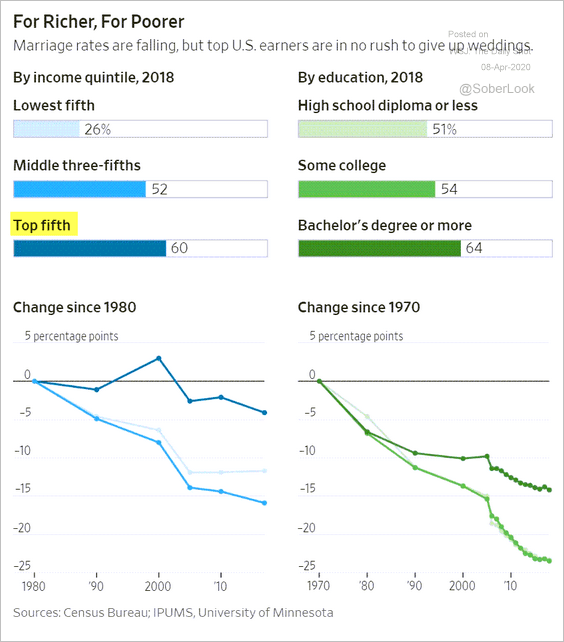

8. US marriage rates by income and education:

Source: @WSJ Read full article

Source: @WSJ Read full article

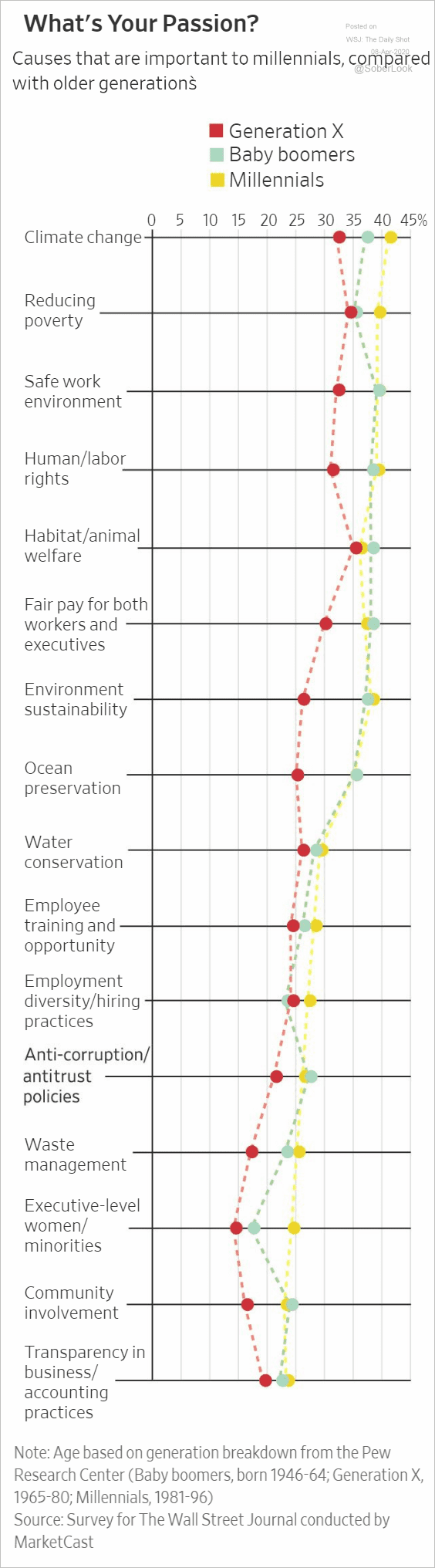

9. Support for various causes, by generation:

Source: @WSJ Read full article

Source: @WSJ Read full article

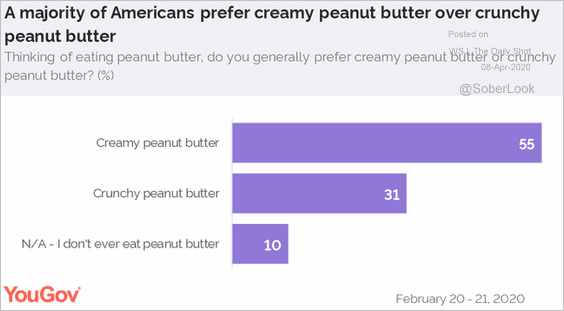

10. Peanut butter preferences:

Source: @YouGovUS Read full article

Source: @YouGovUS Read full article

——————–