The Daily Shot: 14-Aug-20

• The United States

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

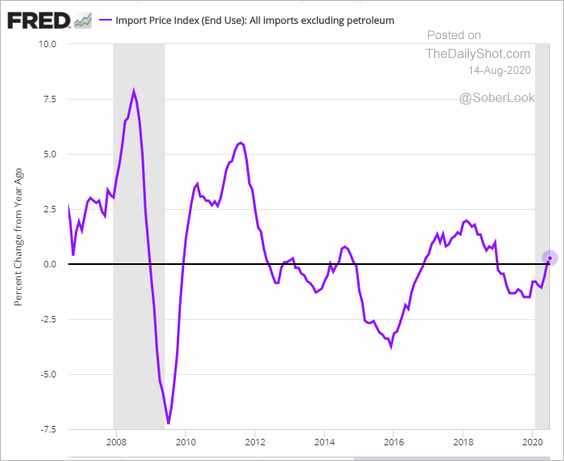

1. Import prices are rebounding. Excluding petroleum products, import prices are now up on a year-over-year basis.

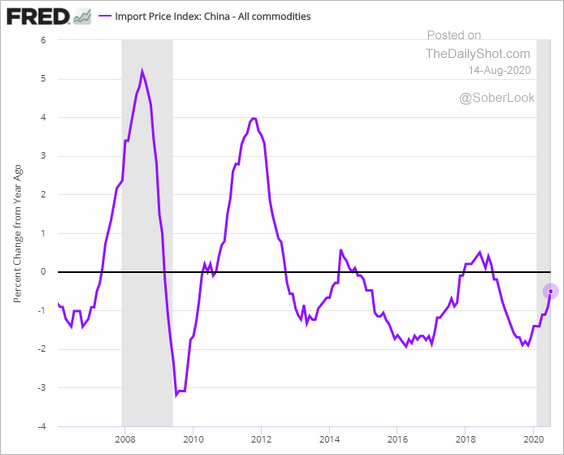

This chart shows the changes in import prices from China.

——————–

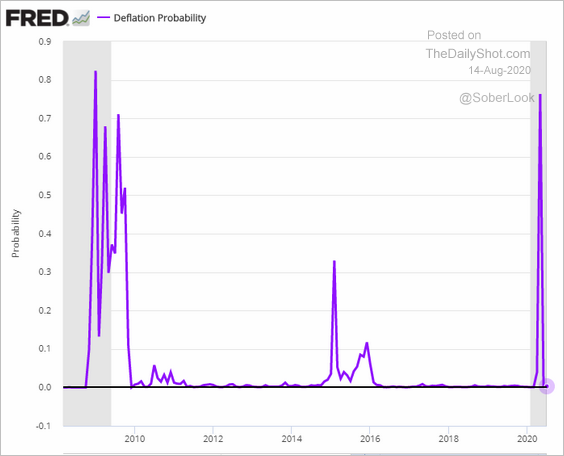

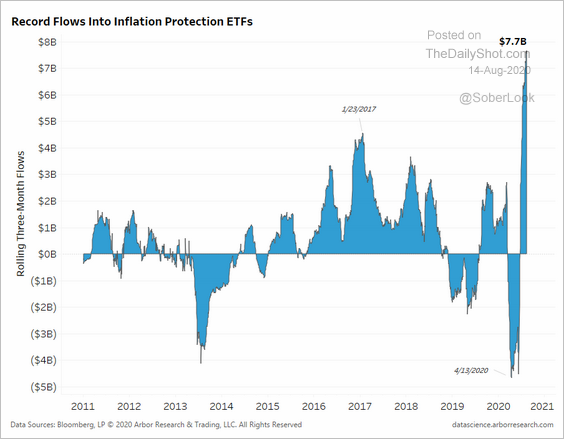

2. Next, we have a couple of other inflation-related trends.

• In May, the St. Louis Fed estimated a 75% likelihood of deflation, but that probability receded in June.

• Capital flows into inflation protection ETFs (which invest in TIPS) are hitting new records as investors prepare for faster growth in prices.

Source: @benbreitholtz

Source: @benbreitholtz

——————–

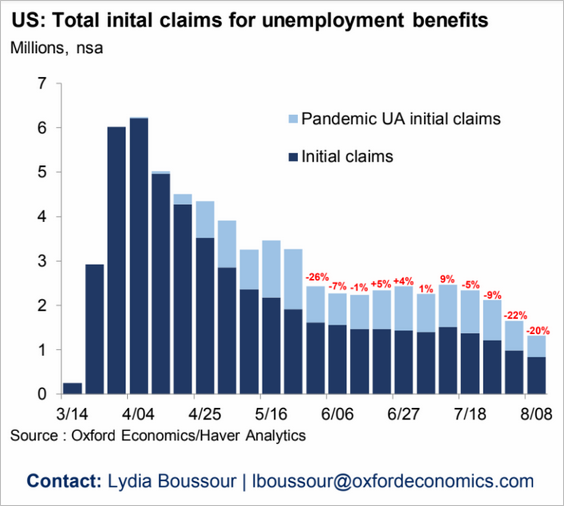

3. Here are some updates on the labor market.

• US initial jobless claims continue to moderate.

Source: Oxford Economics

Source: Oxford Economics

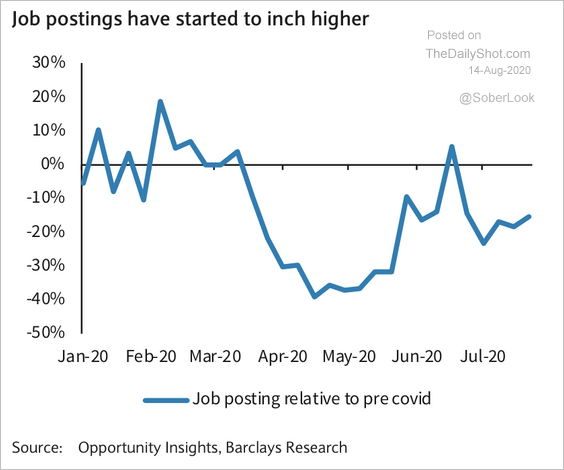

• Job postings are showing modest improvements.

Source: Barclays Research

Source: Barclays Research

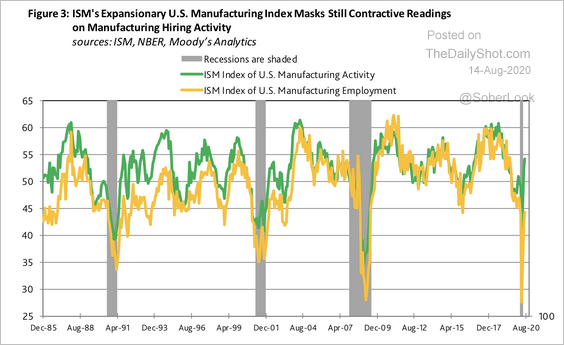

• Manufacturing employment hasn’t kept pace with the recovery in manufacturing activity.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

4. The Oxford Economics recovery tracker has stalled at about three-quarters of the pre-crisis levels.

![]() Source: Oxford Economics

Source: Oxford Economics

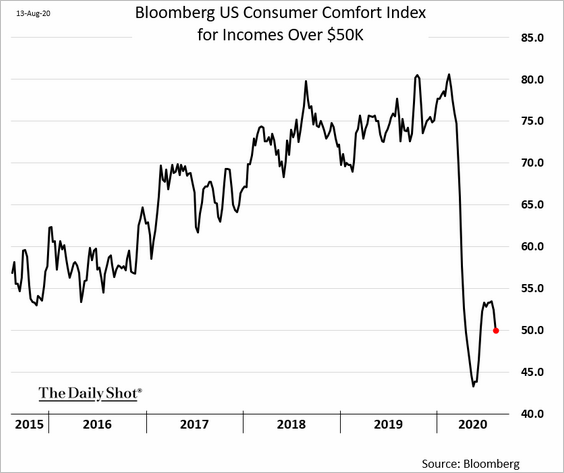

5. Bloomberg’s consumer sentiment index is rolling over.

Americans making over $50k/year are losing confidence in the recovery.

——————–

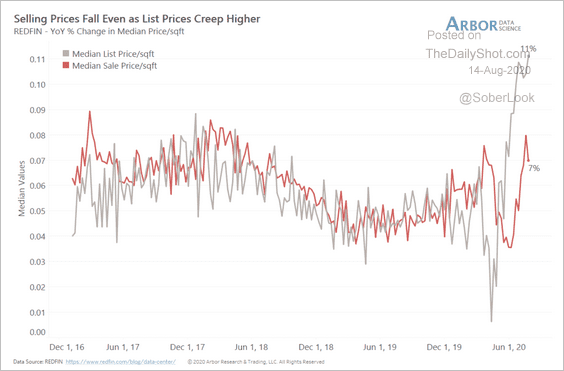

6. Selling prices of homes have failed to keep pace with list prices.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

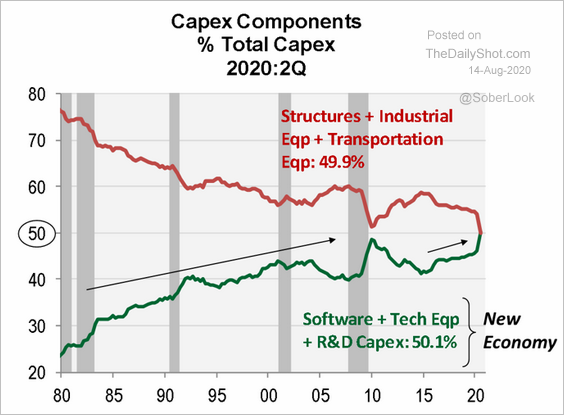

7. “New economy” business investment is now half of the total CapEx.

Source: @NancyRLazar1

Source: @NancyRLazar1

The Eurozone

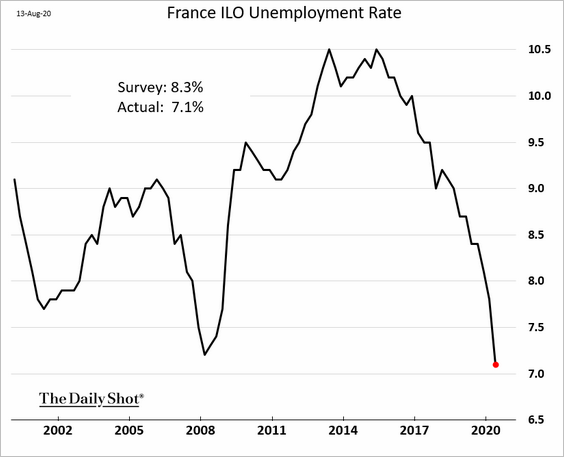

1. The French unemployment rate hit a multi-decade low, but the lockdown had distorted the figures.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

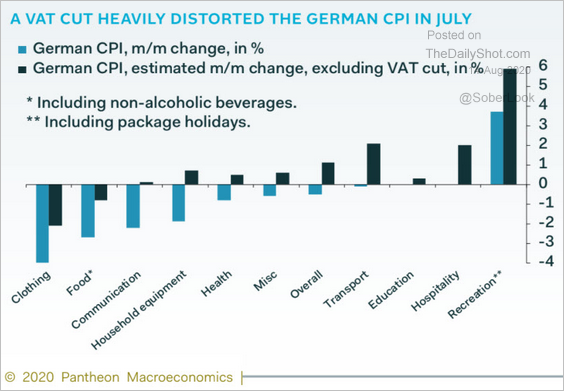

2. As we saw earlier, Germany’s consumer inflation touched zero last month.

However, the CPI figures were distorted by the recent cut in sales tax (VAT).

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

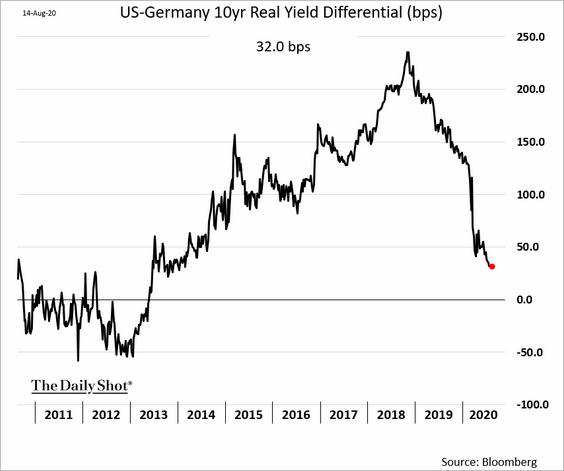

3. The spread between the US and German real yields has declined sharply this year, which provided support for the euro.

h/t Anil Varma

h/t Anil Varma

Europe

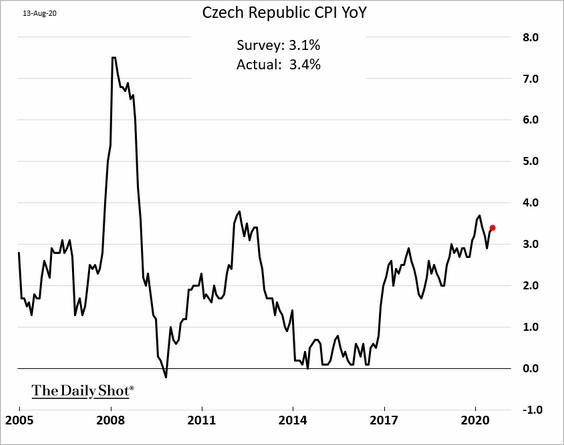

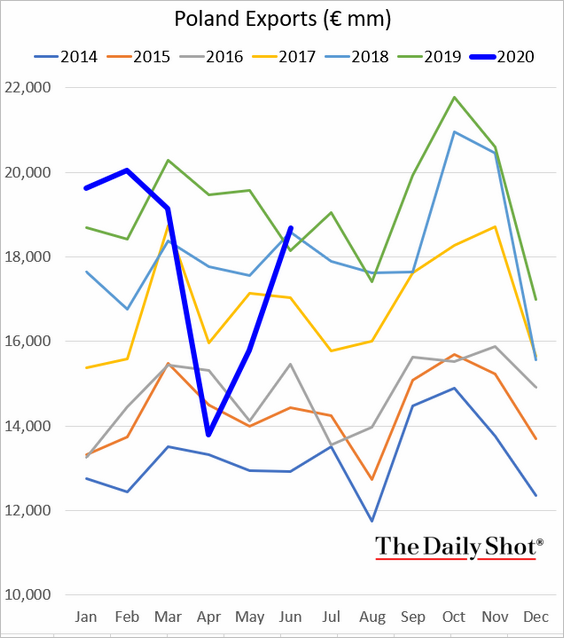

1. Here are a couple of updates on central Europe.

• The Czech CPI continues to trend higher.

• Poland’s exports are rebounding.

——————–

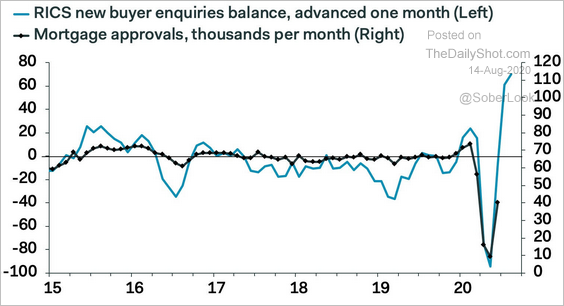

2. In the UK, new homebuyer inquiries point to a sharp rebound in mortgage approvals.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Asia – Pacific

1. Asia-Pacific shares have fully recovered from the pandemic selloff.

2. Australia’s stock market is testing resistance.

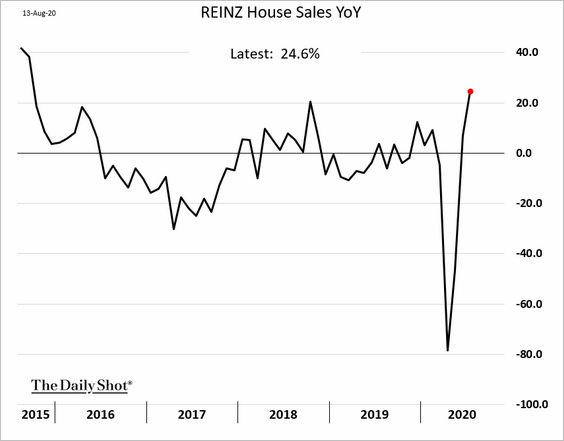

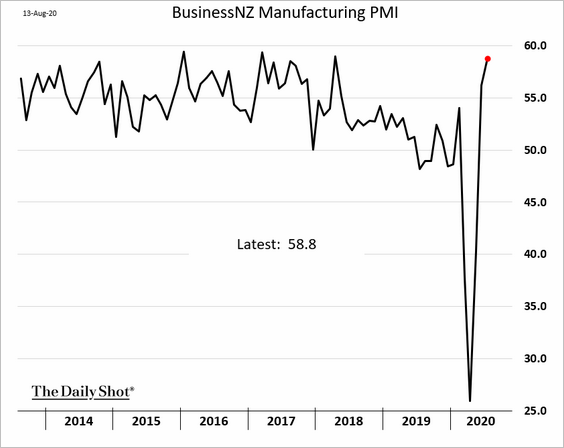

3. Next, we have a couple of updates on New Zealand.

• House sales:

• Manufacturing activity (PMI > 50 means growth):

China

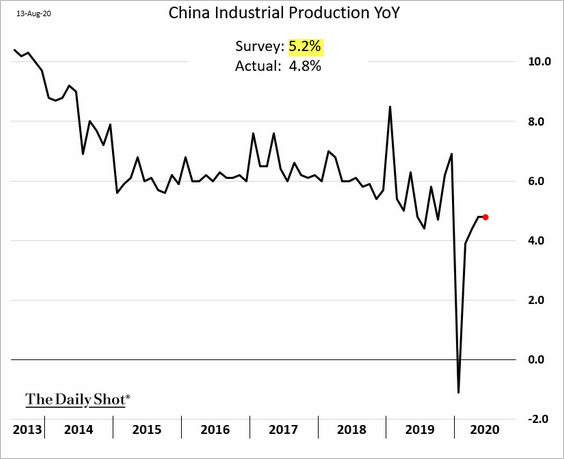

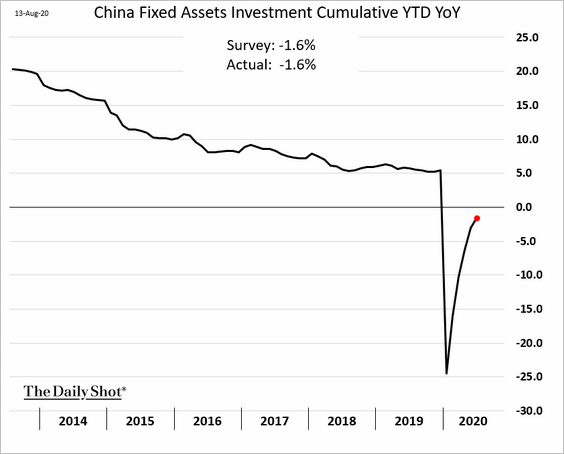

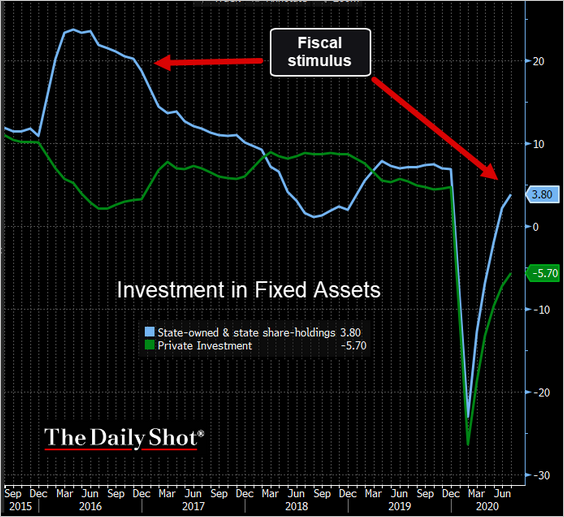

1. The July economic data was a bit disappointing, suggesting that the rebound momentum is slowing.

• Industrial production:

• Retail sales:

• Fixed asset investment:

Here is the breakdown between state and private investment.

Source: @TheTerminal

Source: @TheTerminal

——————–

2. Is the money supply growth peaking?

Source: @TaviCosta

Source: @TaviCosta

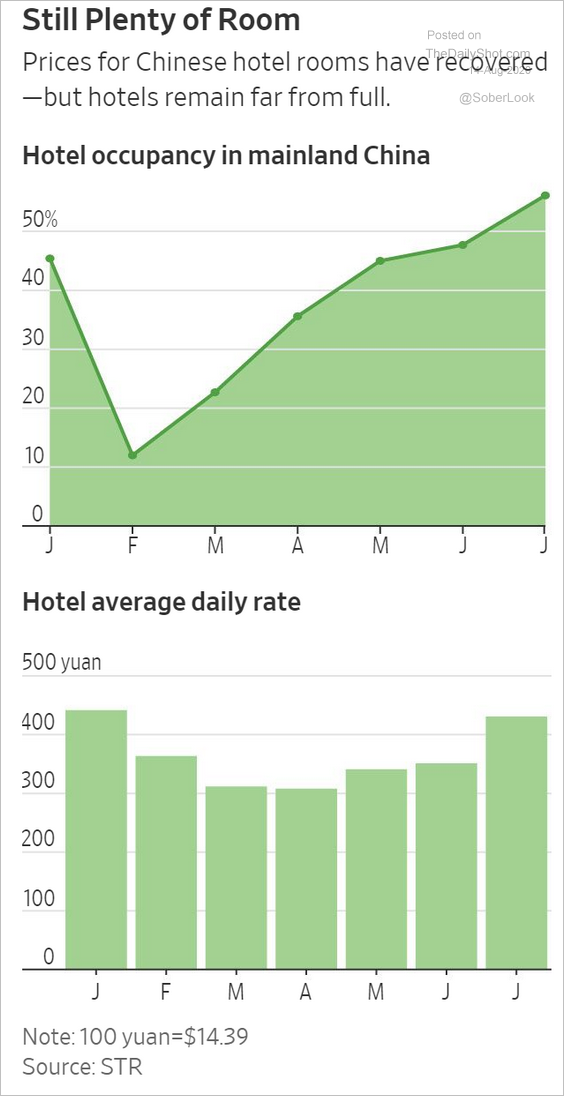

3. Domestic travel has recovered.

Source: @WSJ Read full article

Source: @WSJ Read full article

Emerging Markets

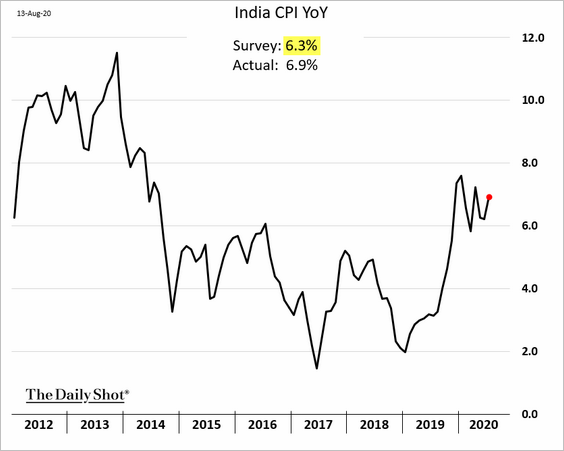

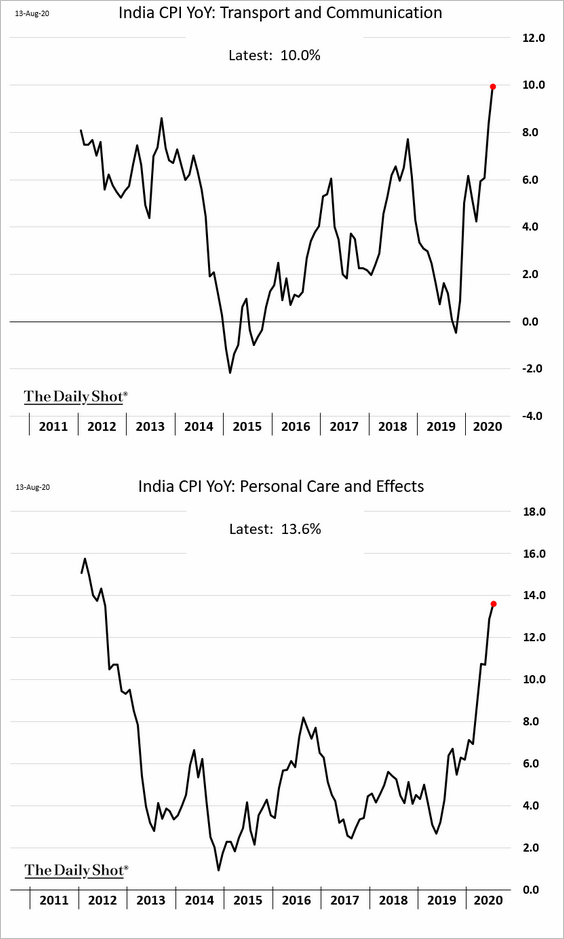

1. Let’s begin with India.

• Inflation remains stubbornly high.

And it’s not just food prices.

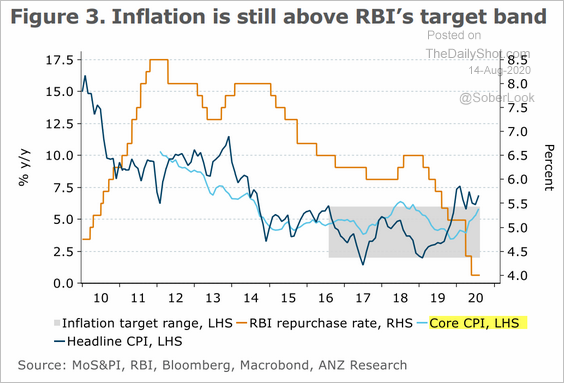

The CPI is above the RBI’s target range, and the core CPI is moving there as well.

Source: ANZ Research

Source: ANZ Research

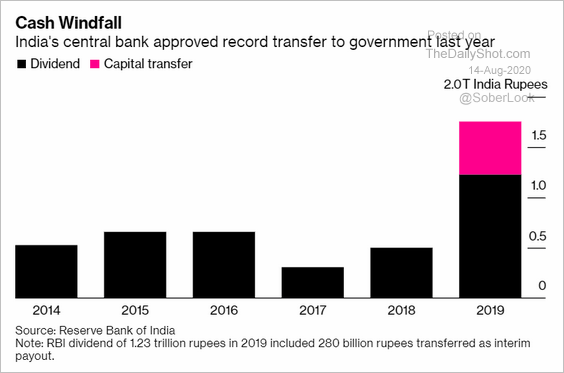

• The government has been tapping the central bank for extra funds.

Source: @markets Read full article

Source: @markets Read full article

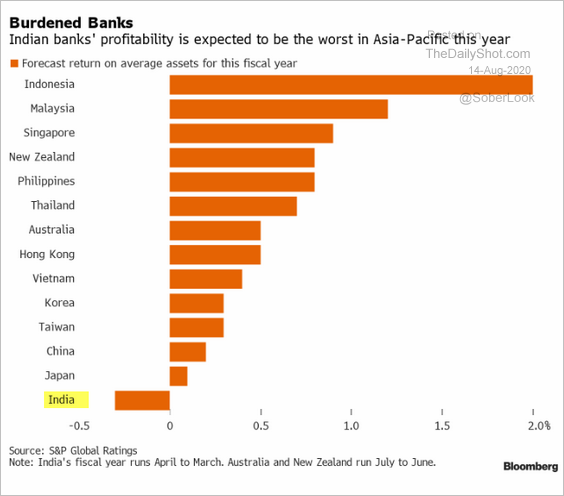

• Indian banks’ profitability is expected to be the worst in Asia.

Source: @myrahulsatija, @TheTerminal

Source: @myrahulsatija, @TheTerminal

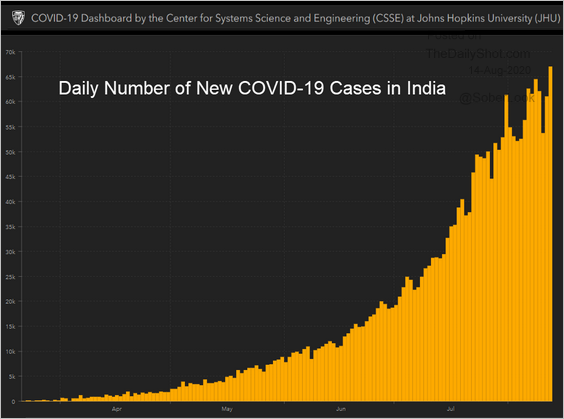

• The daily new coronavirus cases are hitting record highs.

Source: JHU CSSE

Source: JHU CSSE

——————–

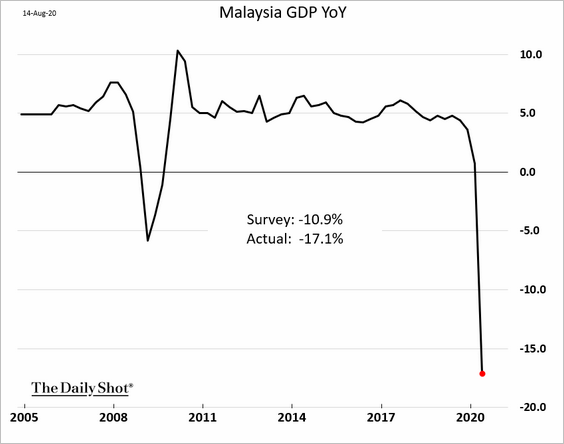

2. Malaysia’s GDP collapsed in Q2.

3. Boosted by higher gold prices, Russia’s F/X and gold reserves exceeded $600 billion for the first time.

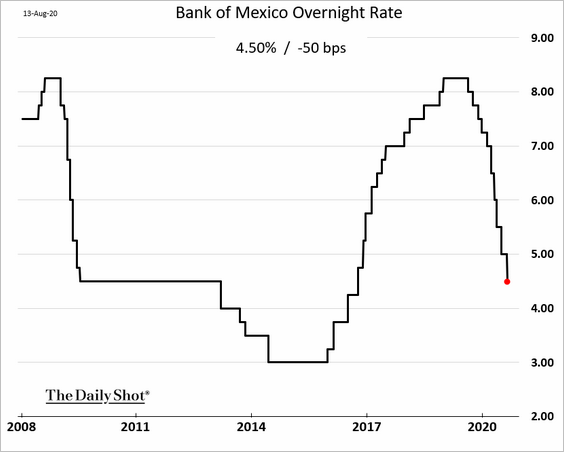

4. Banxico cut rates again.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

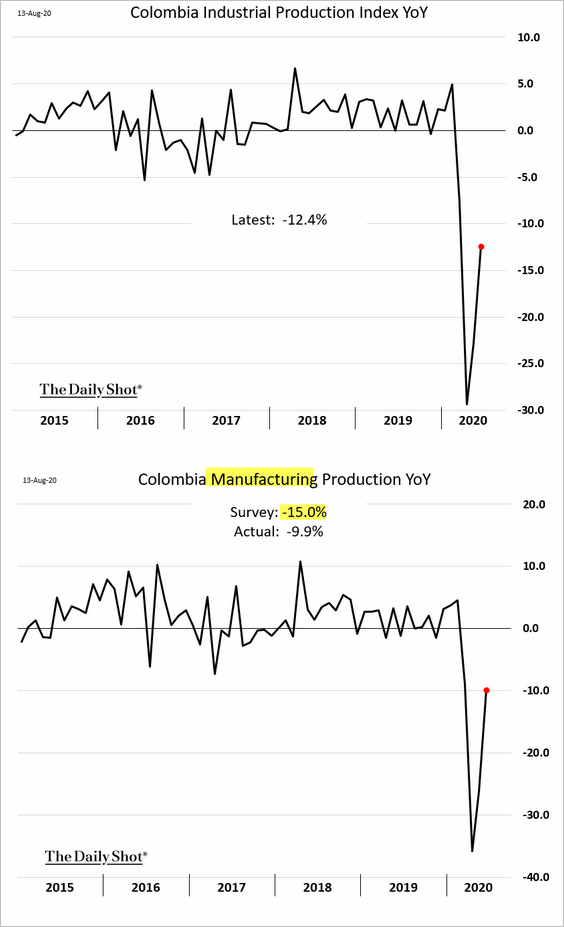

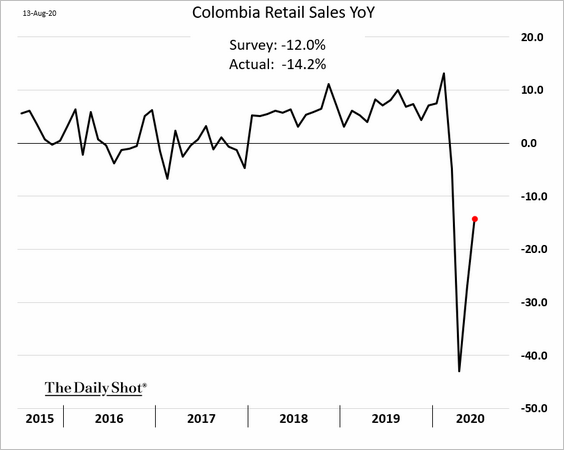

5. Colombia’s manufacturing output strengthened further in June, exceeding forecasts.

But retail sales were disappointing.

——————–

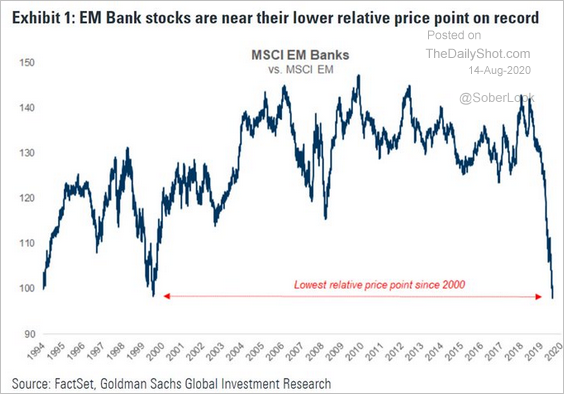

6. EM bank stocks hit the lowest point in two decades relative to the broad EM market.

Source: Goldman Sachs, @jsblokland

Source: Goldman Sachs, @jsblokland

Commodities

1. Let’s begin with precious metals.

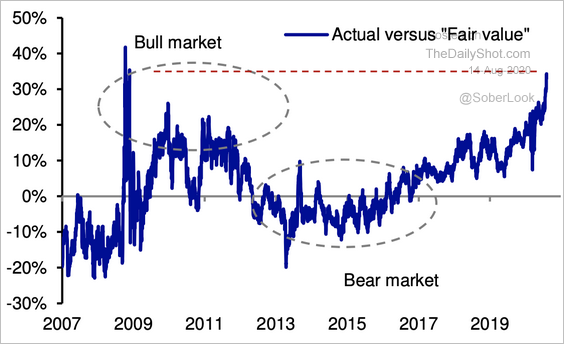

• Gold’s premium to fair value is comparable to its peak in 2008, according to Deutsche Bank.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

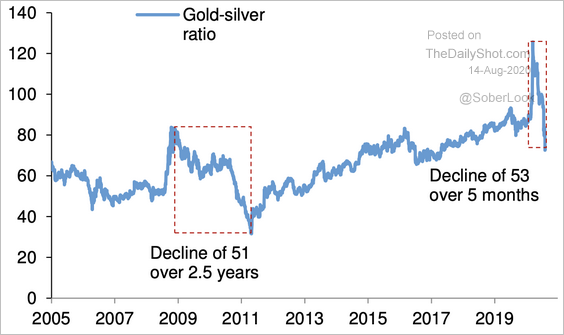

• The decline in the gold/silver ratio has been extremely rapid compared to history.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

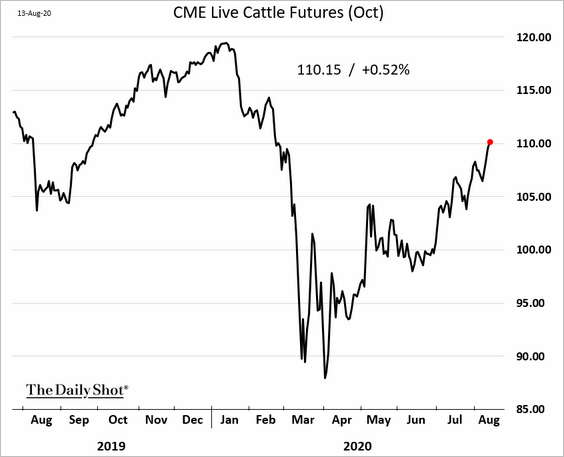

2. US cattle futures continue to recover.

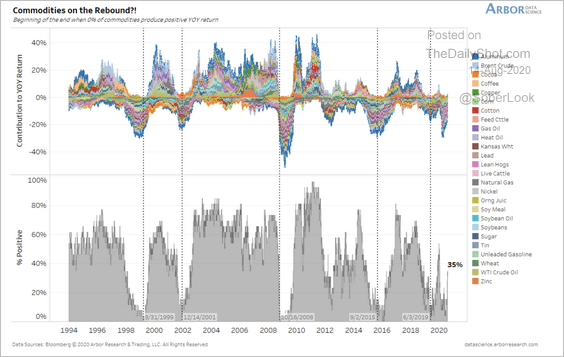

3. Only 35% of commodities are producing year-over-year gains at the moment.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Equities

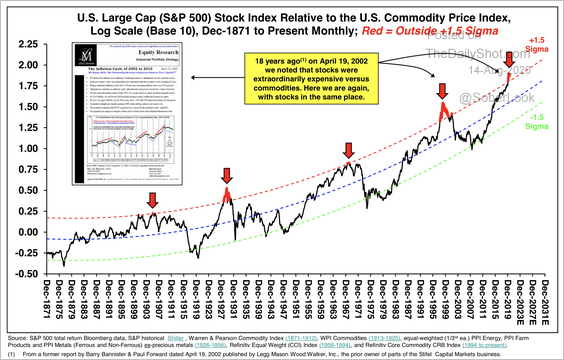

1. The S&P 500 appears expensive versus commodities. Will we see a reversal?

Source: Stifel

Source: Stifel

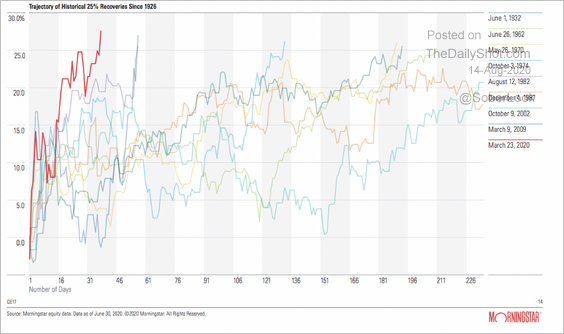

2. This recovery has been the fastest on record, with the S&P 500 rising 25% in just 37 days. The 2009 recovery took three times longer.

Source: Morningstar

Source: Morningstar

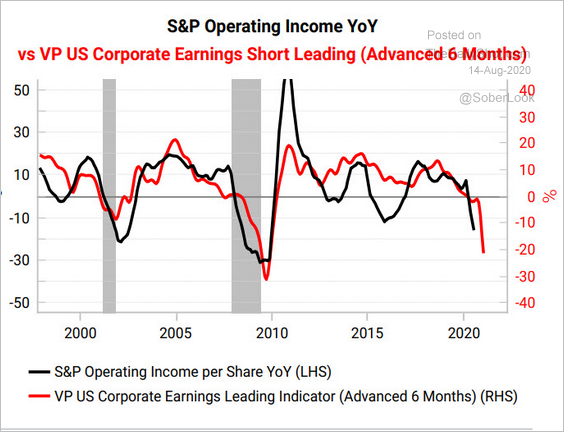

3. The Variant Perception’s leading index points to weakness in operating income for S&P 500 companies.

Source: Variant Perception

Source: Variant Perception

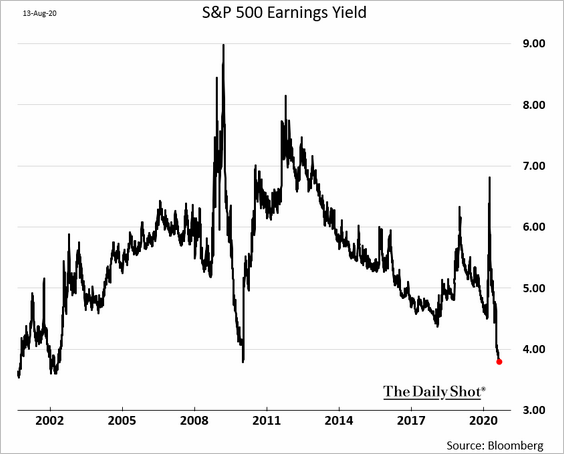

4. Here is the S&P 500 earnings yield (Bloomberg’s calculation).

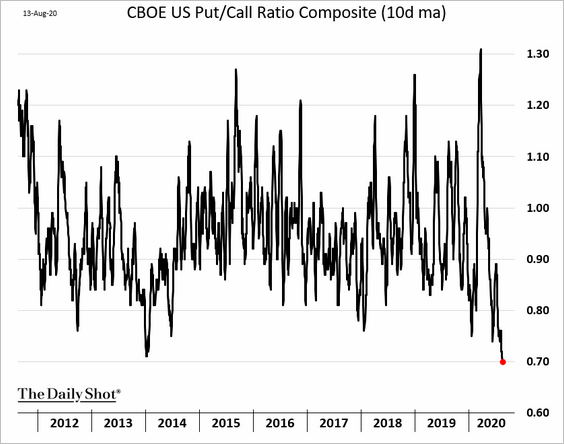

5. The 10-day moving average of the CBOE’s put/call ratio is at multi-year lows, as complacency persists.

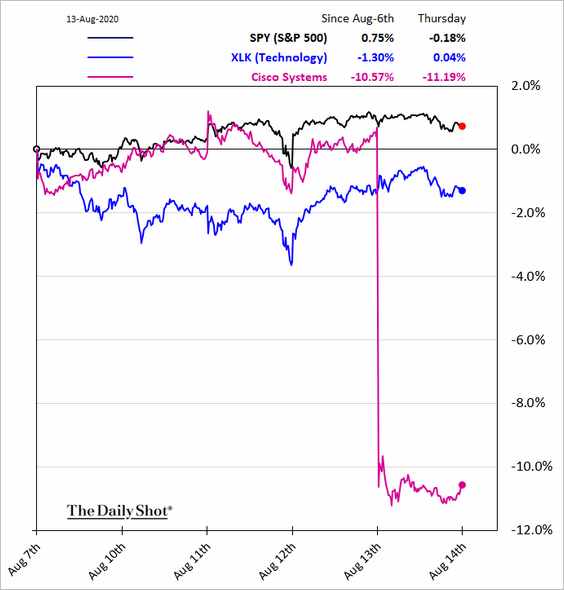

6. Next, we have a couple of charts on tech.

• Cisco (see story):

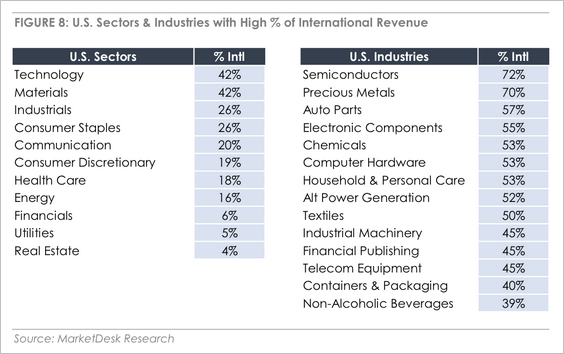

• The tech sector generates the highest percentage of international sales, while financials, utilities, and real estate are more domestically focused.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

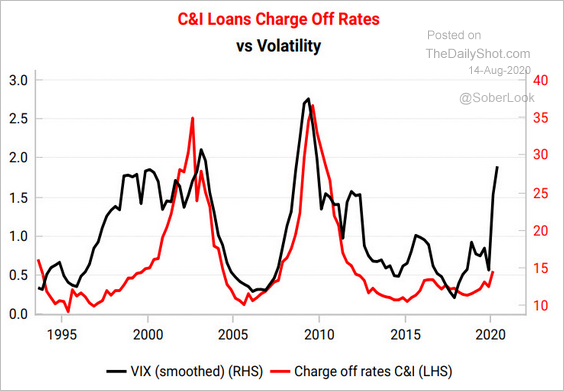

7. Banks’ loan provisions point to higher stock market volatility ahead.

Source: Variant Perception

Source: Variant Perception

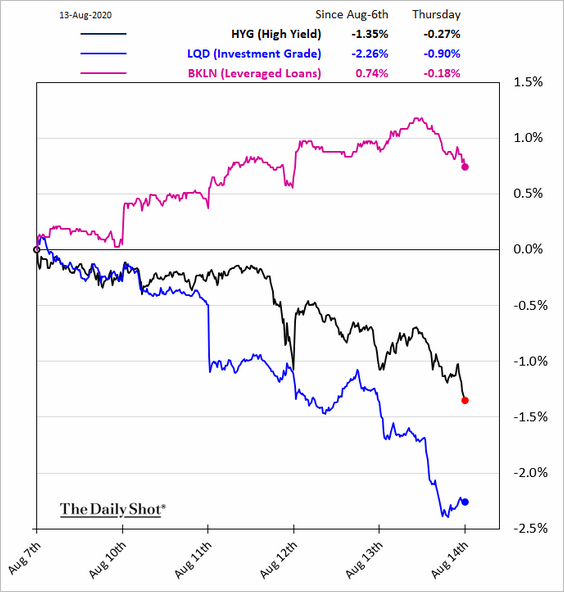

Credit

1. Leveraged loans have been outperforming as yields rise.

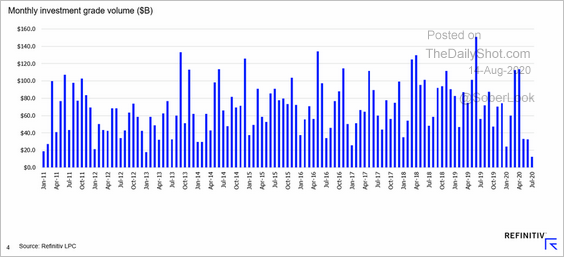

2. Investment-grade loan volume hit the lowest level in a decade.

Source: @LPCLoans

Source: @LPCLoans

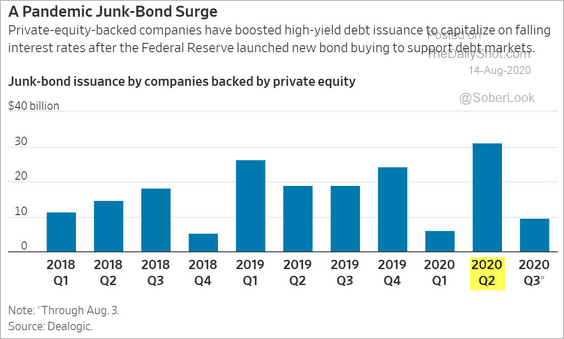

3. Private-equity-backed high-yield bond issuance has been robust.

Source: @WSJ Read full article

Source: @WSJ Read full article

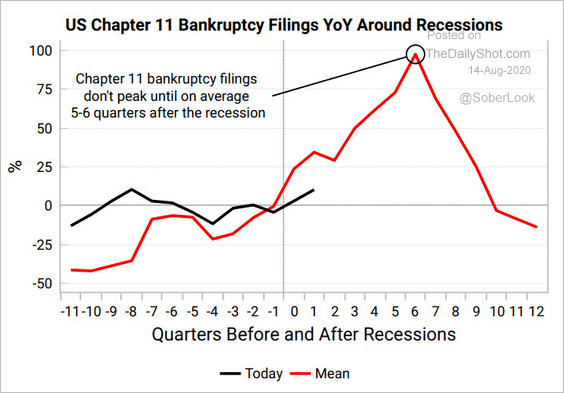

4. More Chapter 11 filings ahead?

Source: Variant Perception

Source: Variant Perception

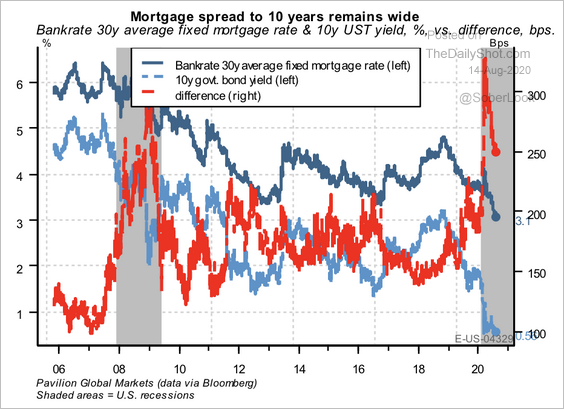

5. Despite a modest rally, MBS spreads remain stubbornly wide.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

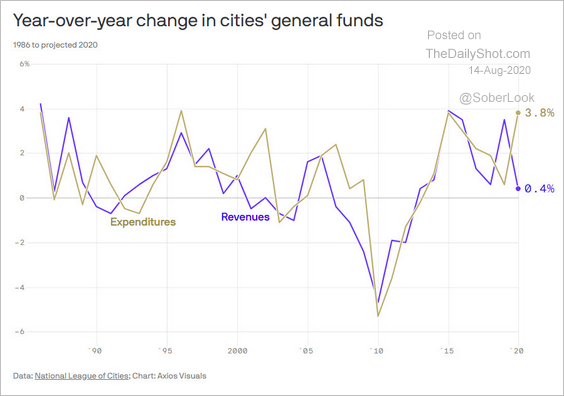

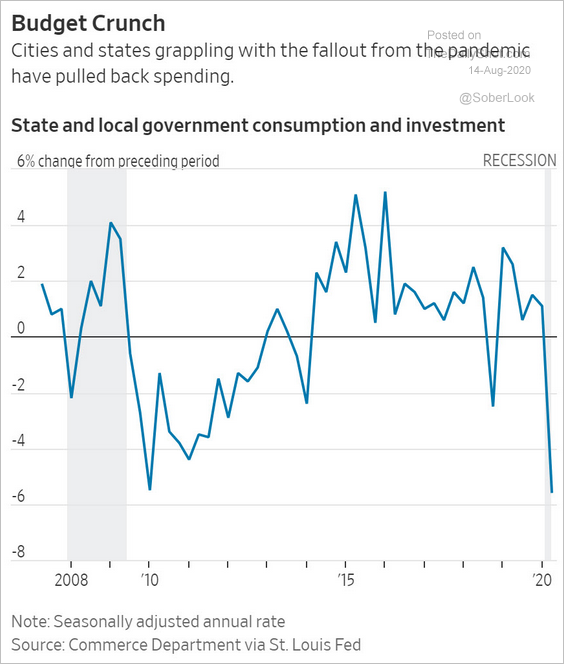

6. Next, we have a couple of updates on state/municipal budgets.

• Cities’ revenues vs. expenditures:

Source: @axios Read full article

Source: @axios Read full article

• State & local government spending:

Source: @WSJ Read full article

Source: @WSJ Read full article

Rates

1. The $26 billion long-bond auction was a bit “sloppy,” pushing the 30yr yield higher.

Source: @lisaabramowicz1

Source: @lisaabramowicz1

2. Here are a couple of technical charts.

• The 10yr Treasury yield:

Source: @RMKOutFront

Source: @RMKOutFront

• The iShares 20+ Yr Treasury ETF (TLT):

——————–

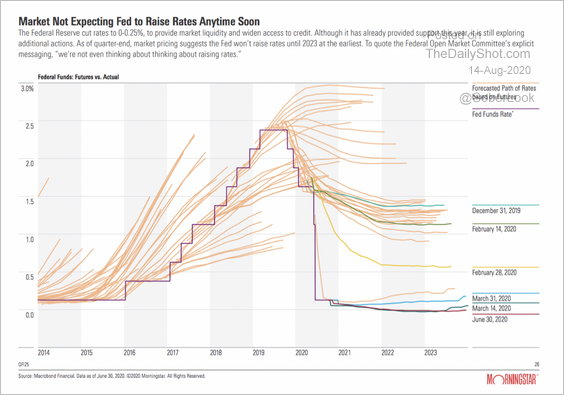

3. The market expects rates to remain at or below zero for the next few years.

Source: Morningstar

Source: Morningstar

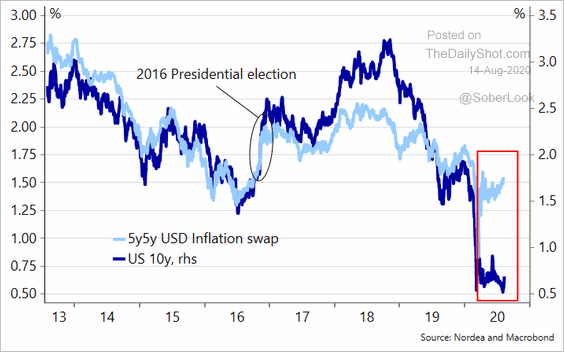

4. This chart shows the divergence between Treasury yields and inflation expectations. The widening gap has pushed real yields deep into negative territory.

Source: @meremortenlund

Source: @meremortenlund

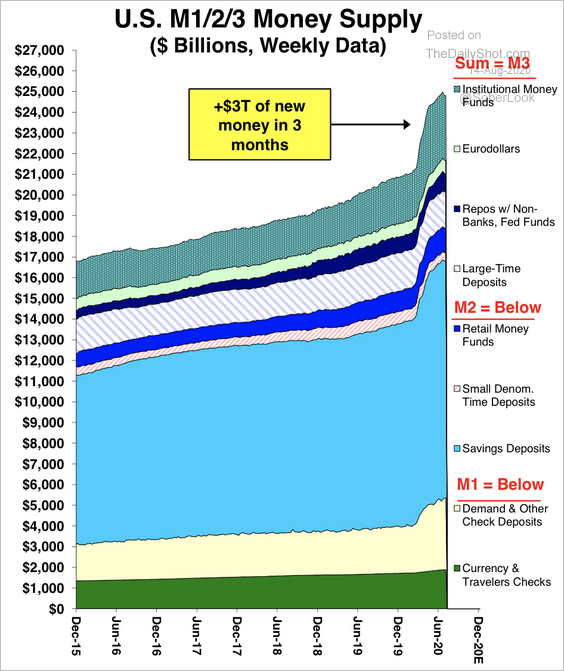

5. Below is a breakdown of the US broad money supply.

Source: Stifel

Source: Stifel

Global Developments

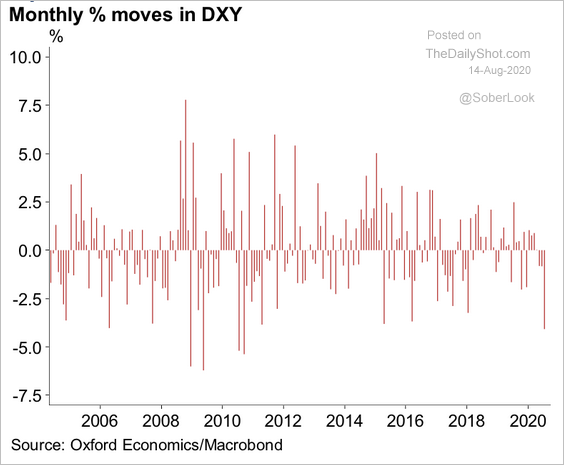

1. The July drop in the dollar was hardly unprecedented.

Source: Oxford Economics

Source: Oxford Economics

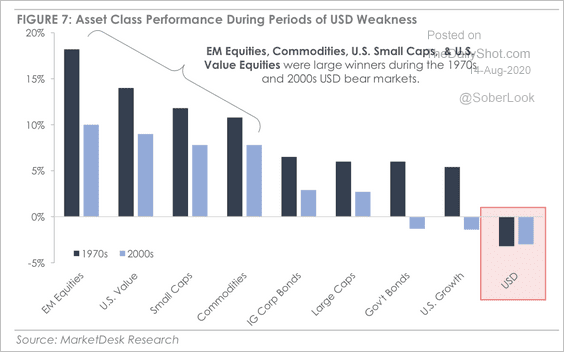

2. This chart shows the performance of various asset classes and investment factors during prior periods of dollar weakness.

Source: MarketDesk Research

Source: MarketDesk Research

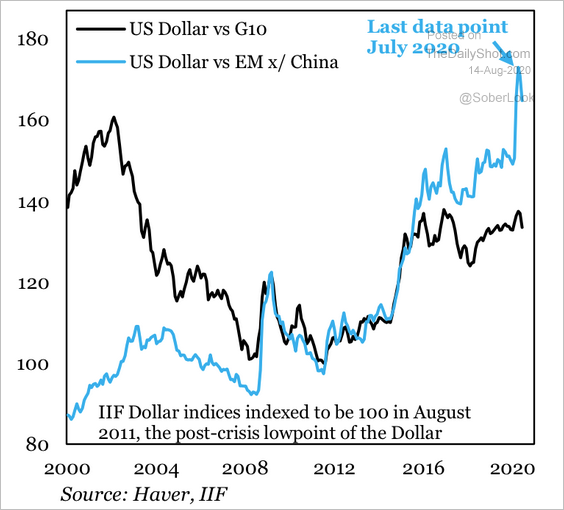

3. The dollar is elevated versus EM currencies.

Source: IIF

Source: IIF

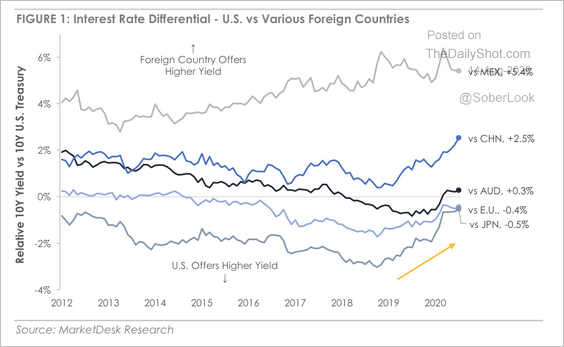

4. The interest rate differential between the US and international yields is shrinking.

Source: MarketDesk Research

Source: MarketDesk Research

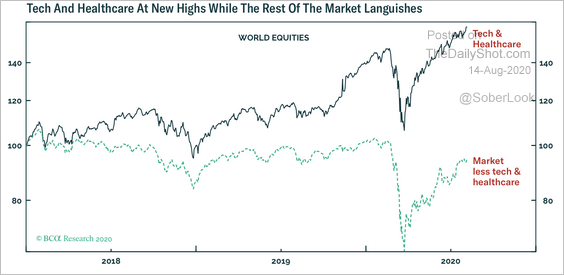

5. Global tech and healthcare stocks have diverged from the rest of the market.

Source: BCA Research

Source: BCA Research

——————–

Food for Thought

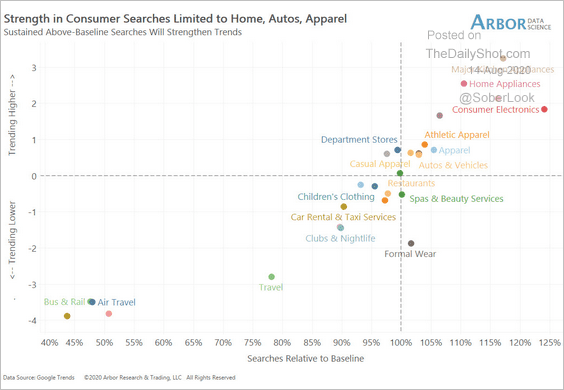

1. Online consumer search activity by sector:

Source: Arbor Research & Trading

Source: Arbor Research & Trading

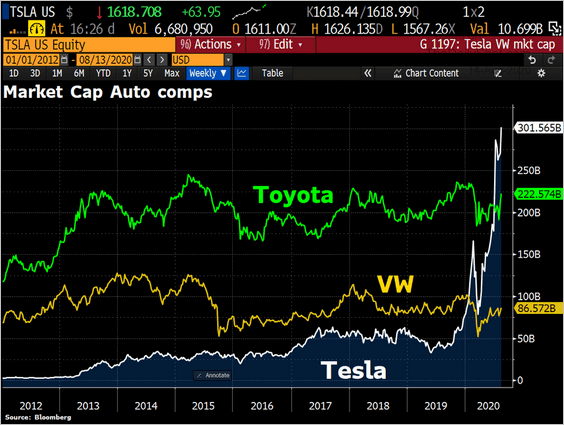

2. Tesla’s market value:

Source: @Schuldensuehner

Source: @Schuldensuehner

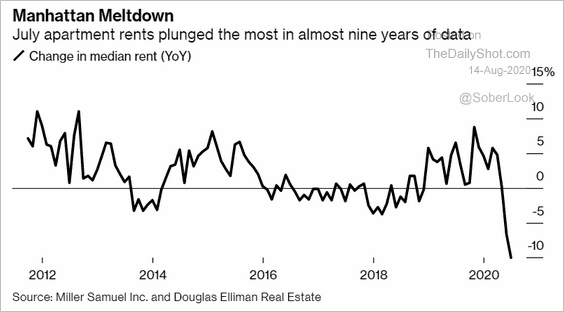

3. Manhattan apartment rents:

Source: @markets Read full article

Source: @markets Read full article

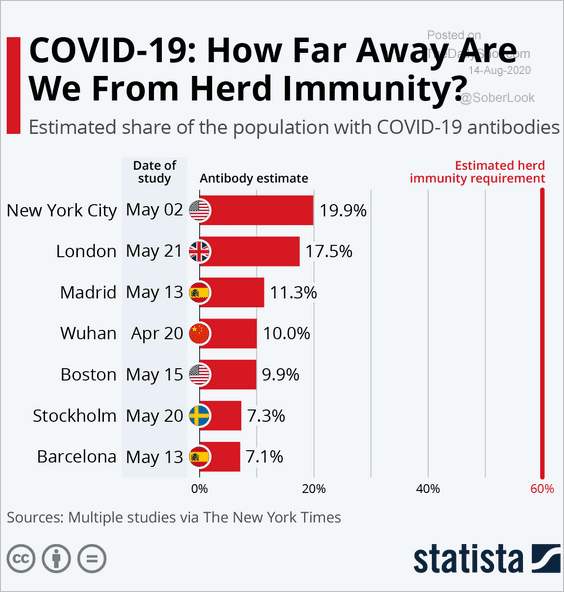

4. Herd immunity:

Source: Statista

Source: Statista

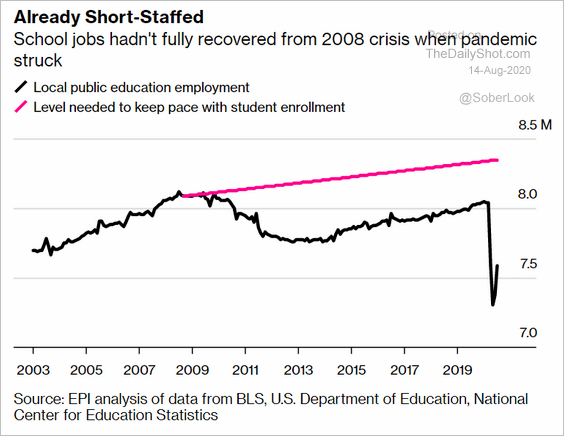

5. US public school employment:

Source: @bpolitics Read full article

Source: @bpolitics Read full article

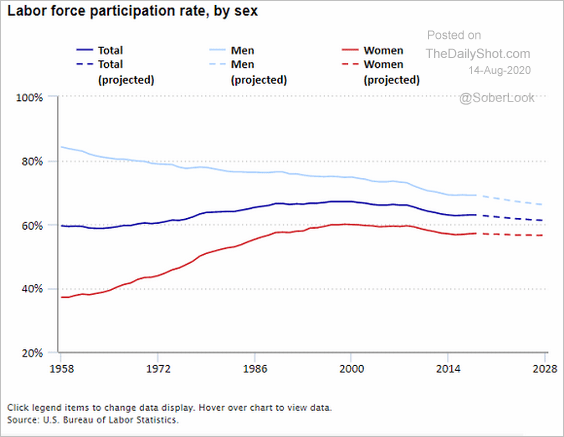

6. US labor force participation:

Source: @BLS_gov Read full article

Source: @BLS_gov Read full article

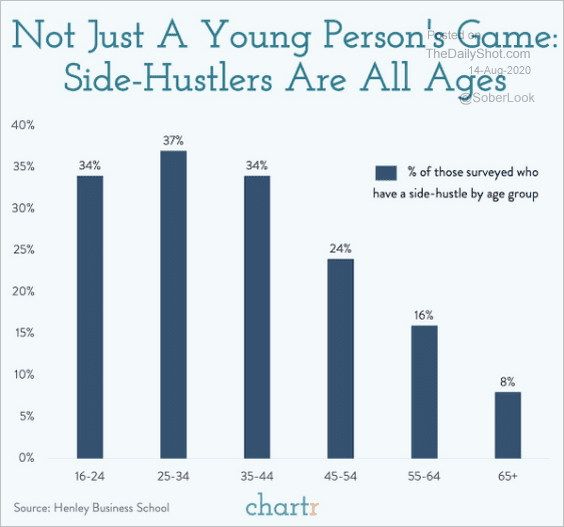

7. The percentage of Americans with a side-hustle, by age:

Source: @chartrdaily

Source: @chartrdaily

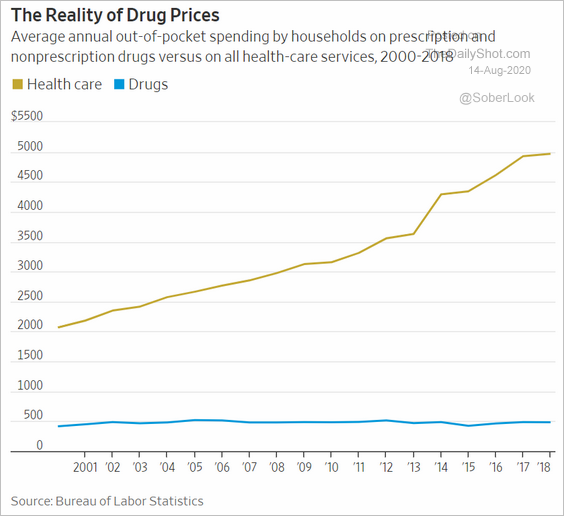

8. The overall cost of healthcare vs. prescription and nonprescription drugs:

Source: @WSJ Read full article

Source: @WSJ Read full article

9. Most popular baby names:

Source: Nameberry

Source: Nameberry

——————–

Have a great weekend!