The Daily Shot: 10-Sep-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

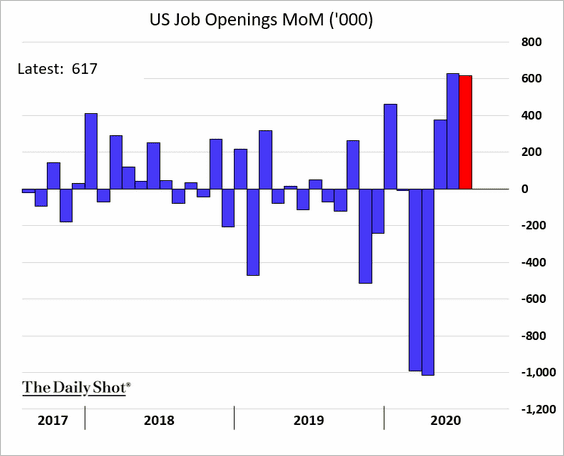

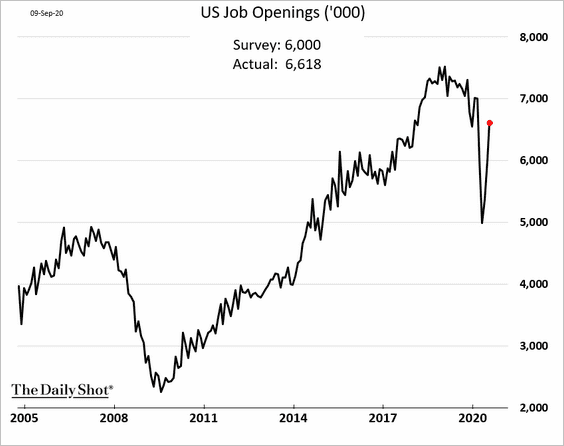

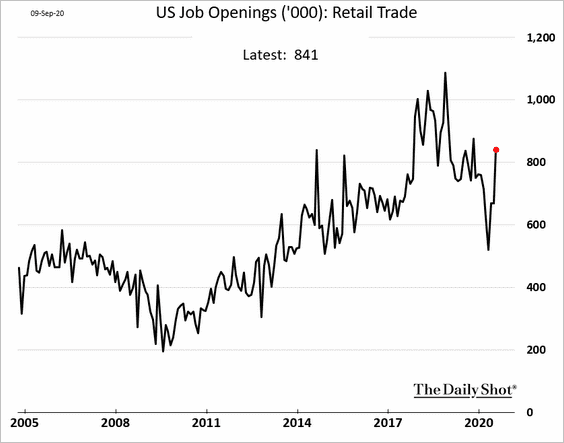

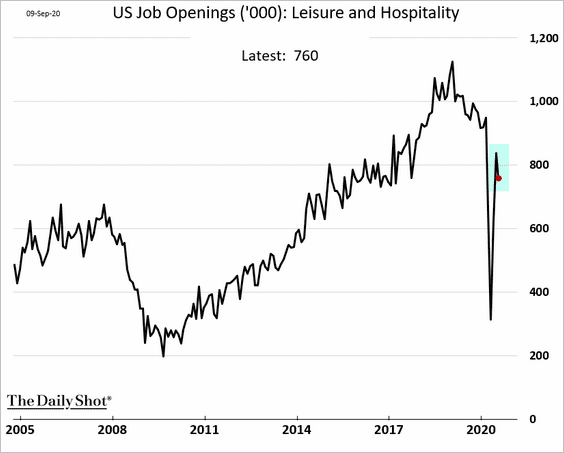

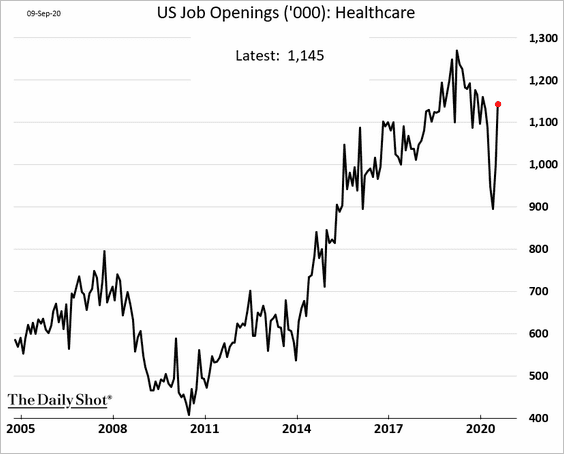

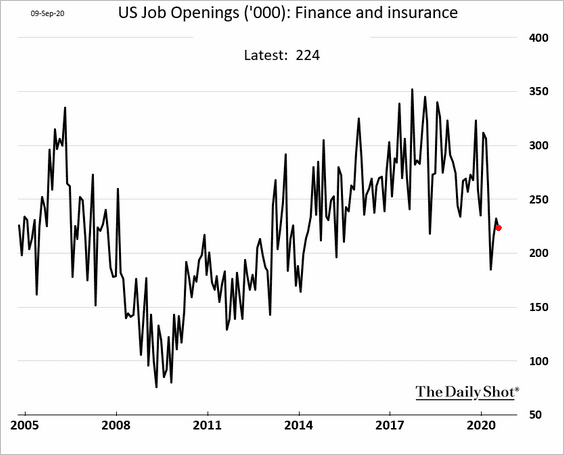

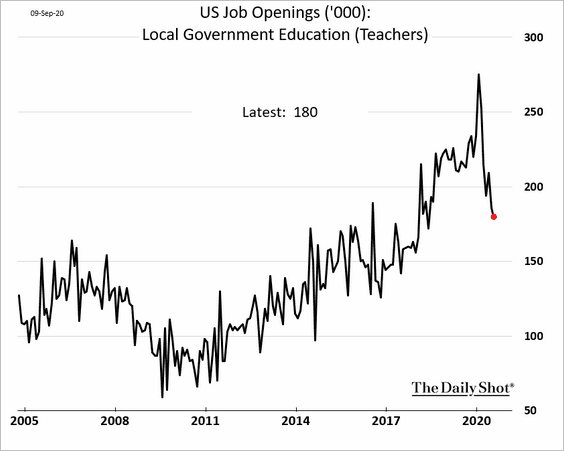

1. Job openings rose again in July, with the latest increase exceeding economists’ expectations.

Here are some of the sector trends.

• Retail:

• Leisure and Hospitality:

• Healthcare:

• Finance and Insurance:

• Public schools:

——————–

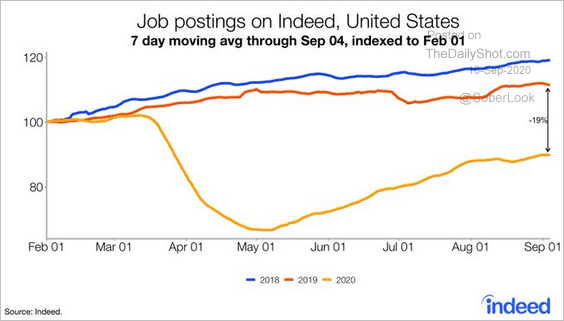

2. Next, we have some additional updates on the labor market.

• The Indeed job postings indicator is still 19% below last year’s level.

Source: @JedKolko, @indeed Read full article

Source: @JedKolko, @indeed Read full article

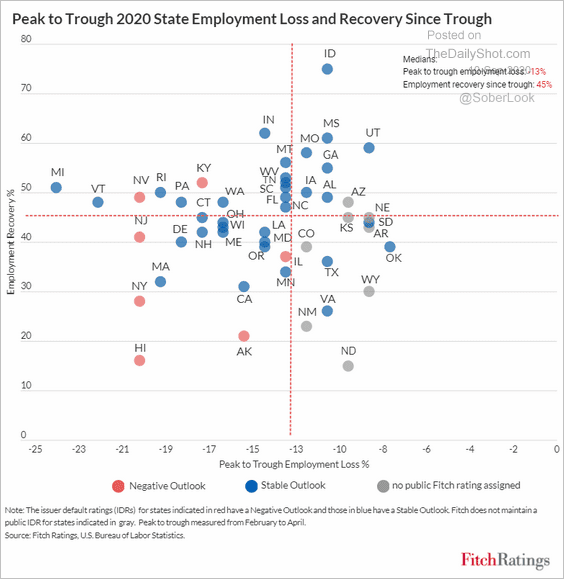

• This scatterplot shows employment recovery vs. peak-to-trough employment loss by state.

Source: Fitch Ratings

Source: Fitch Ratings

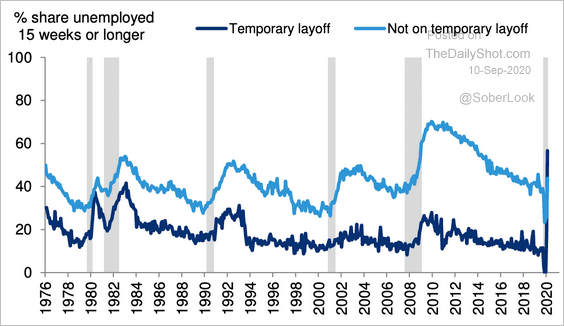

• According to Deutsche Bank, more than half of those on temporary layoff have been unemployed for 15 weeks or longer. Many of these temporary layoffs will be “converted” into permanent ones (see chart).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

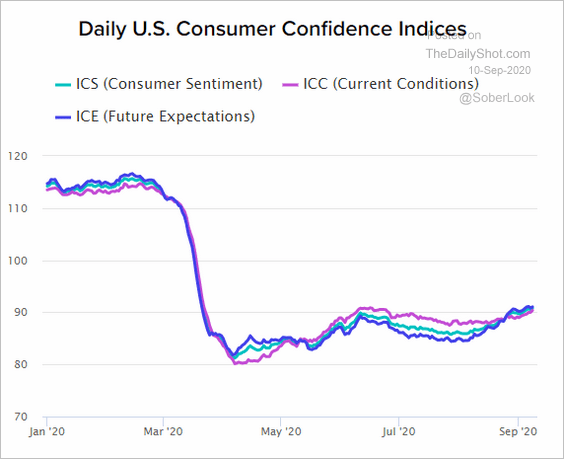

3. Consumer confidence is grinding higher again.

Source: Morning Consult Read full article

Source: Morning Consult Read full article

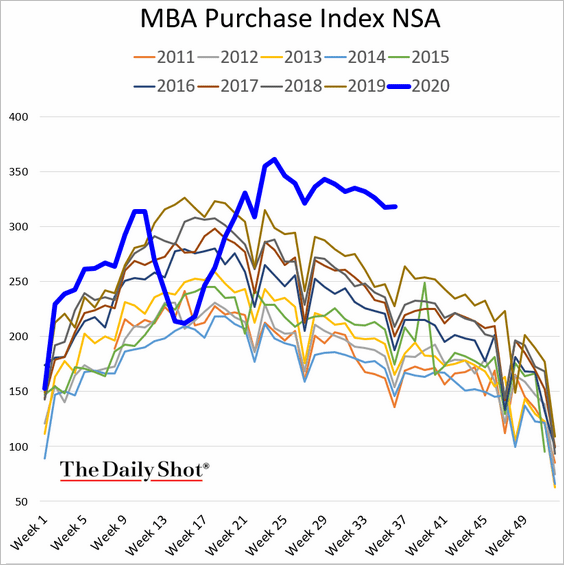

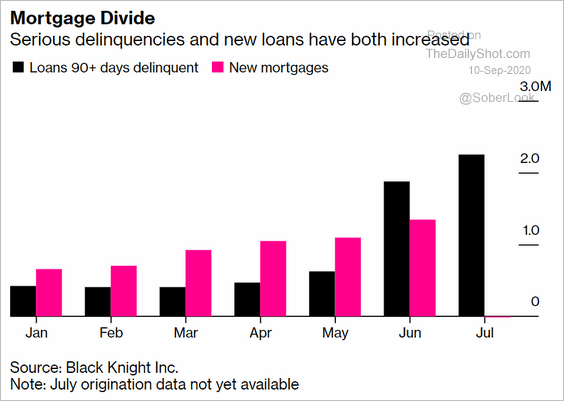

4. Below are some updates on housing finance.

• Mortgage applications for house purchase remain elevated.

• But delinquencies are rising as well.

Source: @markets Read full article

Source: @markets Read full article

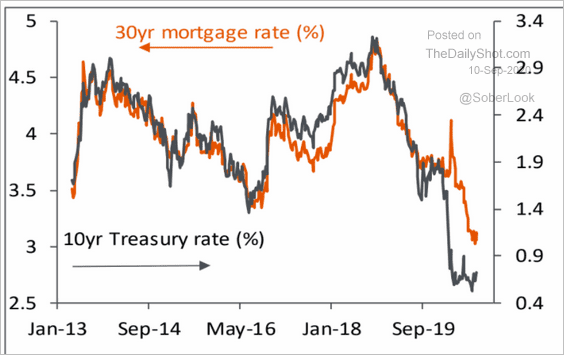

• The gap between mortgage rates and Treasury yields has been tightening.

Source: Piper Sandler

Source: Piper Sandler

——————–

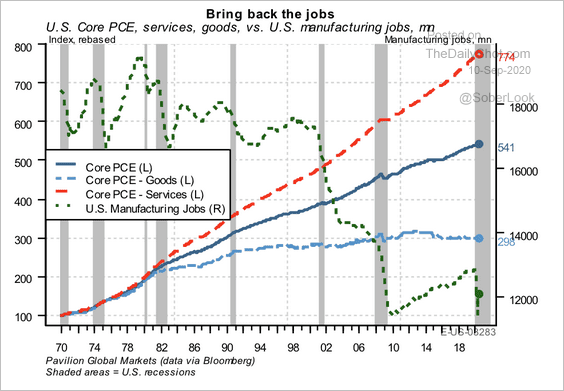

5. Next, we have a couple of inflation trends.

• Price increases have been driven by services, specifically, shelter and medical costs, according to Pavilion Global Markets.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

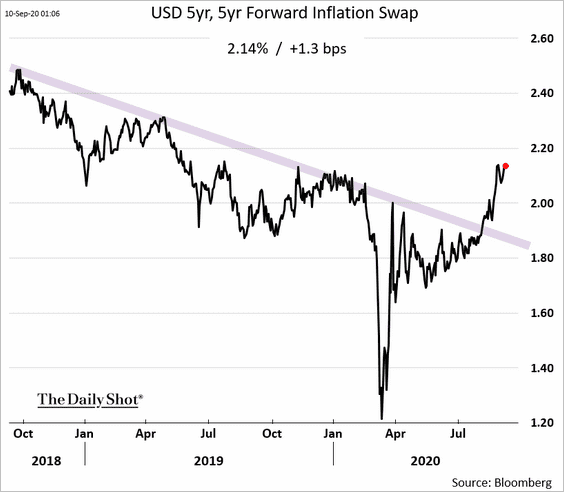

• Long-term market-based inflation expectations are back at pre-crisis levels. The downtrend has been broken.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

——————–

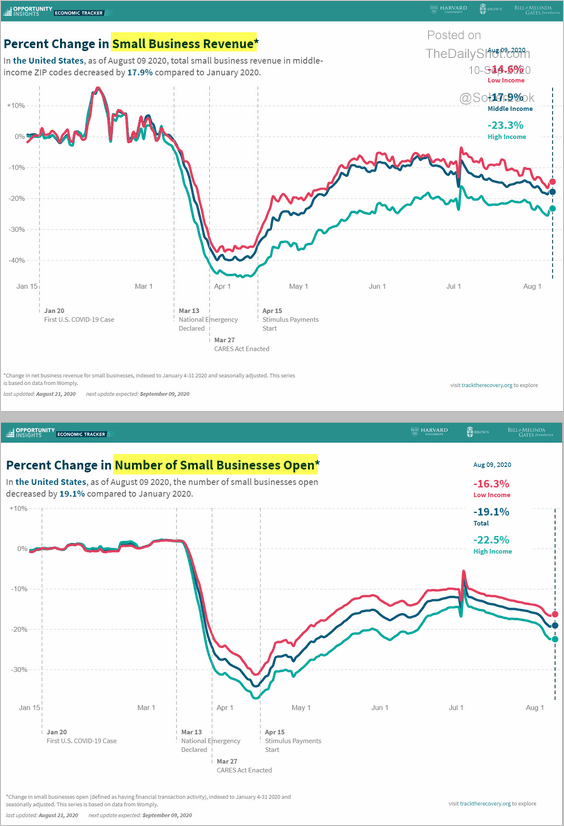

6. Finally, here are some updates on small business activity.

• Revenues have been trending lower, and the number of small firms that are open has declined as well.

Source: @OppInsights, @Harvard

Source: @OppInsights, @Harvard

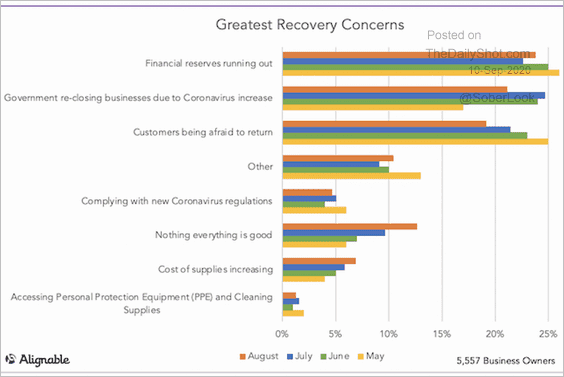

• What are their concerns?

Source: Alignable

Source: Alignable

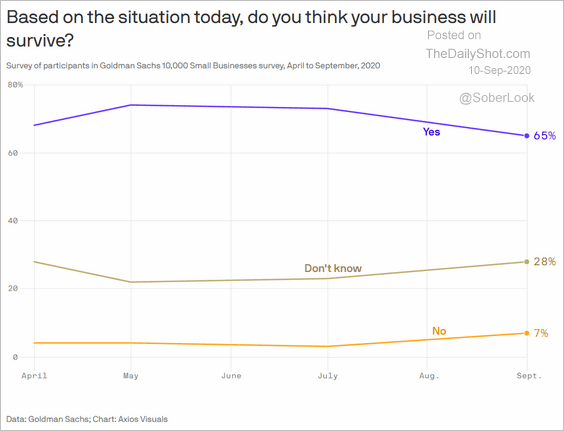

• Fewer businesses think that they will survive.

Source: @axios Read full article

Source: @axios Read full article

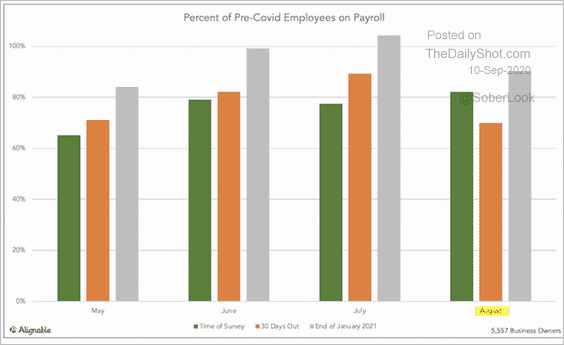

• Hiring expectations deteriorated in August. For the first time since May, small business owners are anticipating layoffs over the next 30 days.

Source: Alignable

Source: Alignable

Canada

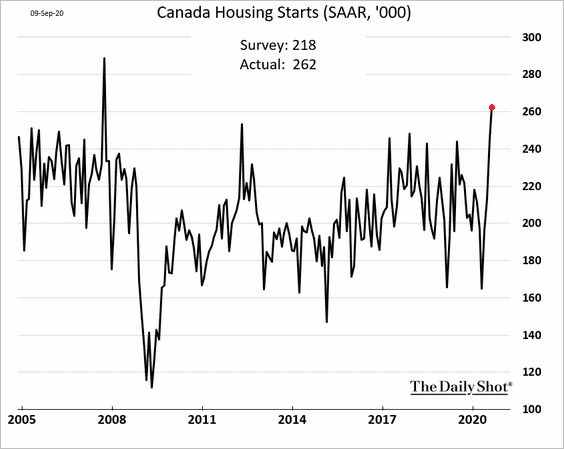

1. Housing starts rose to the highest level since 2007 last month.

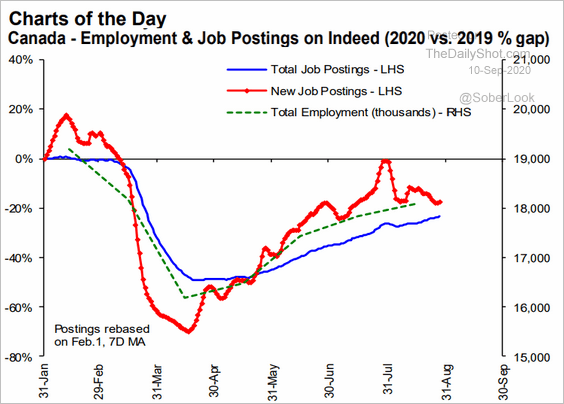

2. New job postings have slowed.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

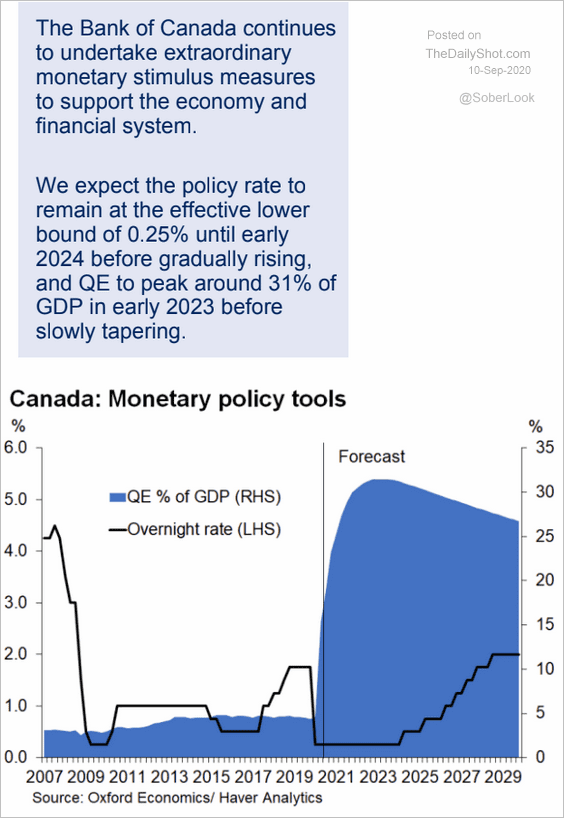

3. Here is a forecast for the BoC’s balance sheet from Oxford Economics.

Source: Oxford Economics

Source: Oxford Economics

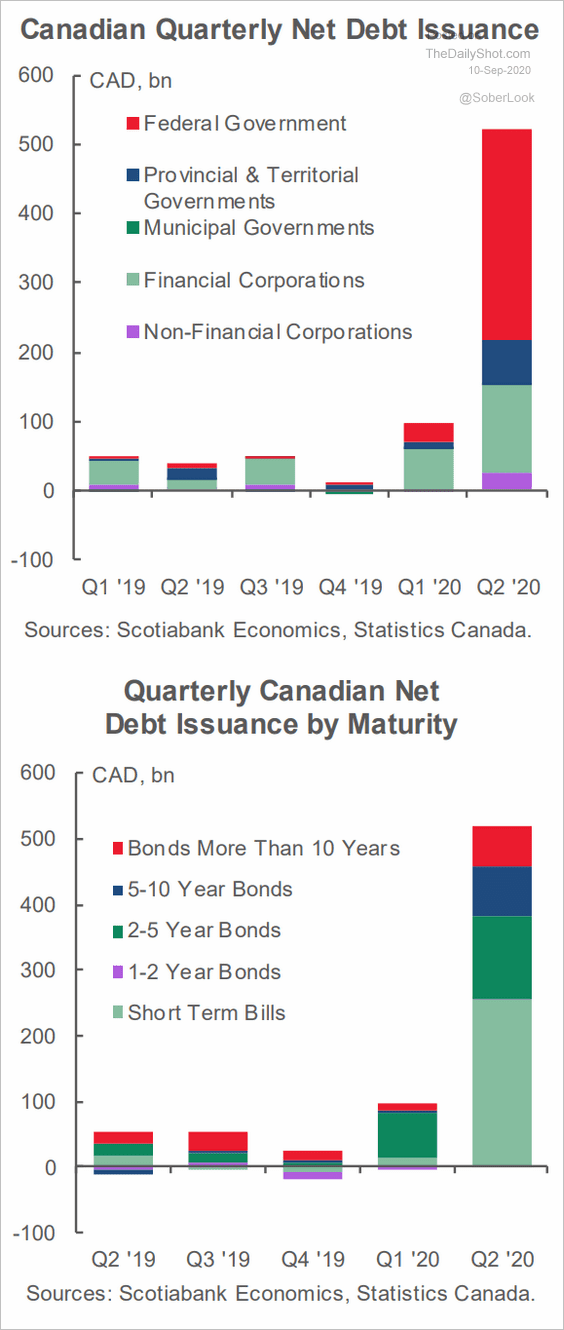

4. Canada’s debt issuance hit a record last quarter.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

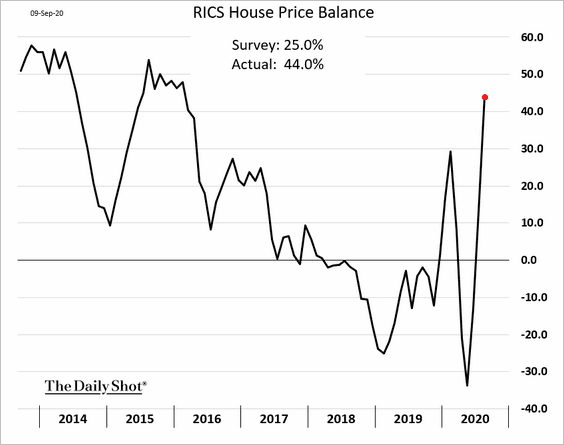

1. Home prices are surging.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

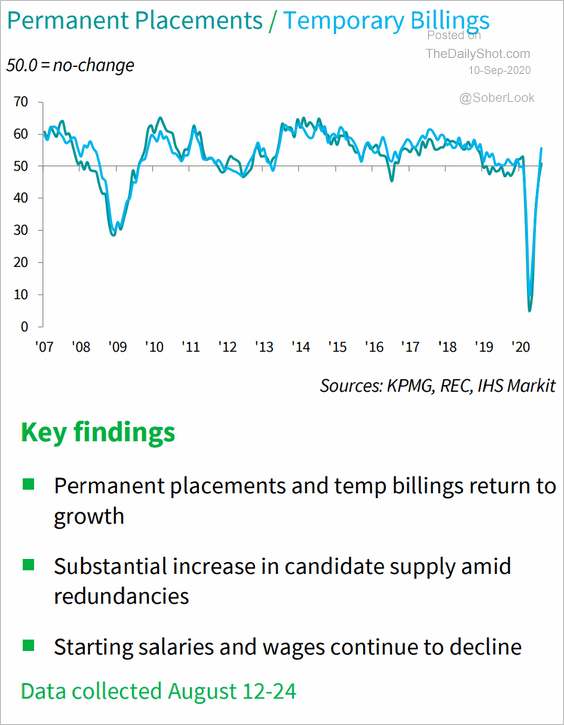

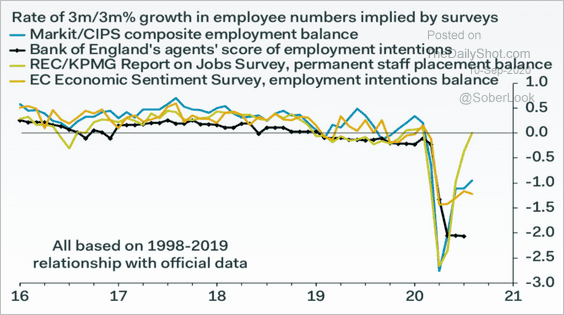

2. The KPMG/REC indicator shows job placements back in growth mode.

Source: IHS Markit

Source: IHS Markit

However, the above index is inconsistent with other indicators.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

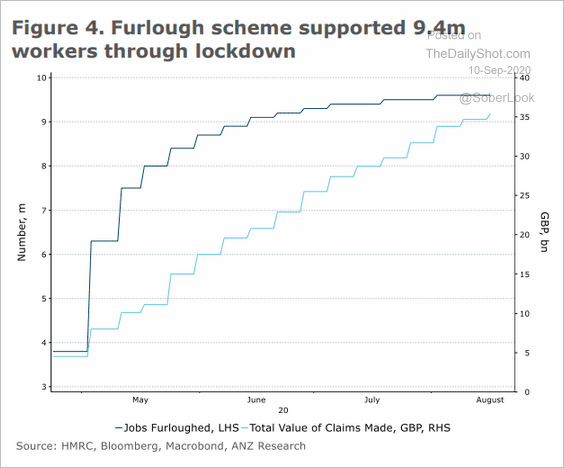

3. The furlough scheme has been costly, supporting 9.4 million workers.

Source: ANZ Research

Source: ANZ Research

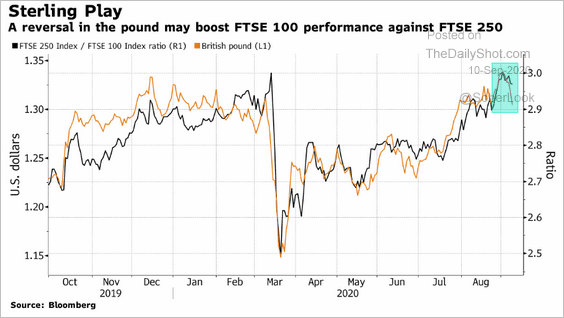

4. The pound’s weakness could put the smaller firms’ (FTSE 250) recent outperformance at risk.

Source: @mikamsika,@TheTerminal, Bloomberg Finance L.P.

Source: @mikamsika,@TheTerminal, Bloomberg Finance L.P.

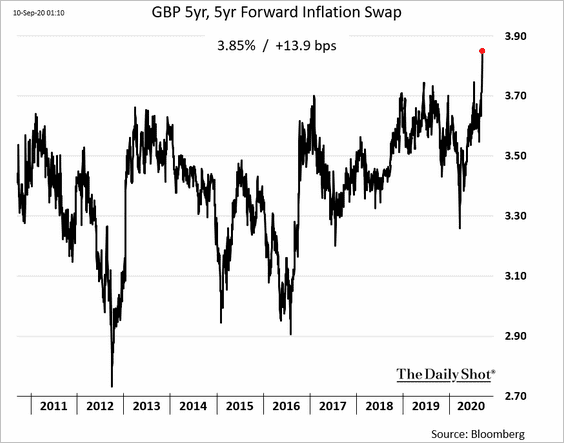

5. Long-term market-based inflation expectations have risen sharply amid hard-Brexit concerns and a weaker pound.

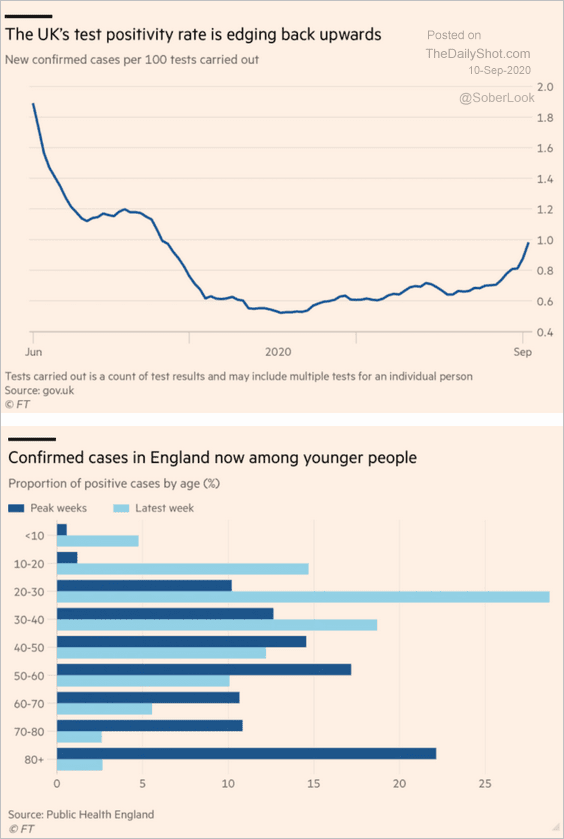

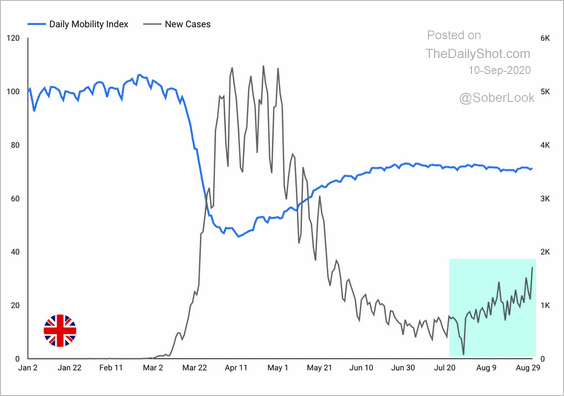

6. Infections are on the rise again (2 charts).

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: Huq Read full article

Source: Huq Read full article

——————–

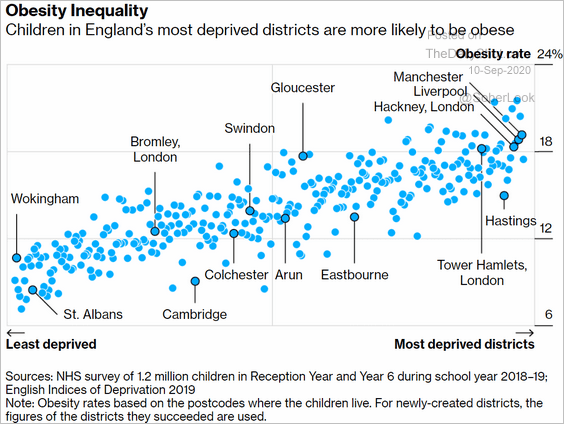

7. England’s child obesity rates are inversely correlated with the wealth of the community (not too different from the US).

Source: @business Read full article

Source: @business Read full article

The Eurozone

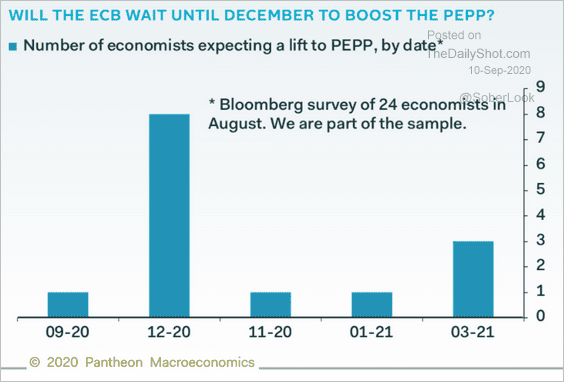

1. Most economists expect the ECB to increase its emergency securities purchases (PEPP) by the end of the year.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

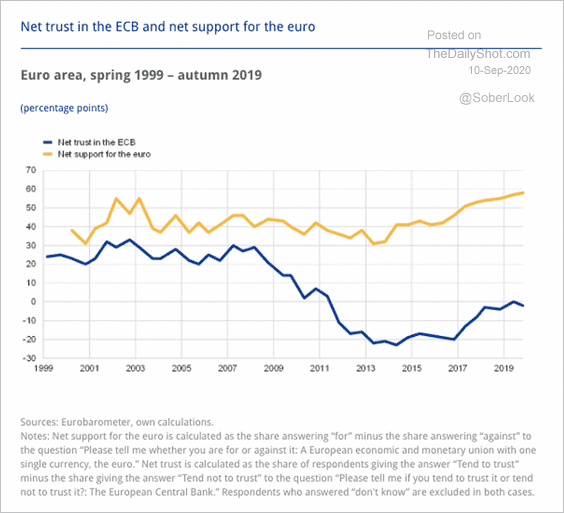

2. Trust in the ECB has waned over the past decade, but support for the Euro has remained strong.

Source: ECB

Source: ECB

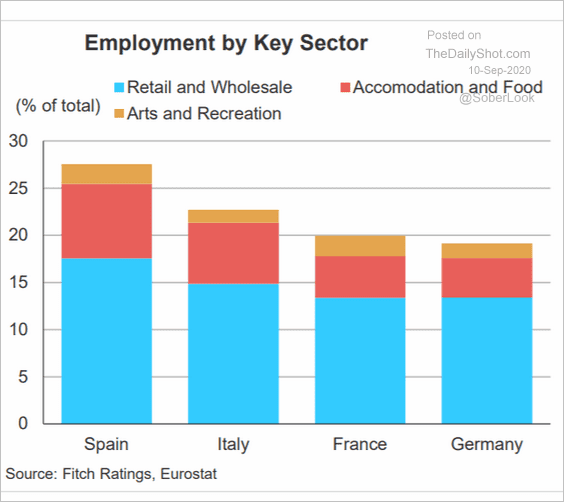

3. Spain has a higher percentage of workers in vulnerable sectors.

Source: Fitch Ratings

Source: Fitch Ratings

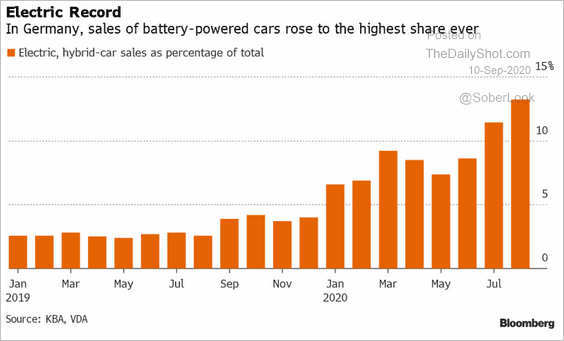

4. Germany’s battery-powered car sales have accelerated.

Source: Bloomberg Finance L.P., @sachgau

Source: Bloomberg Finance L.P., @sachgau

Japan

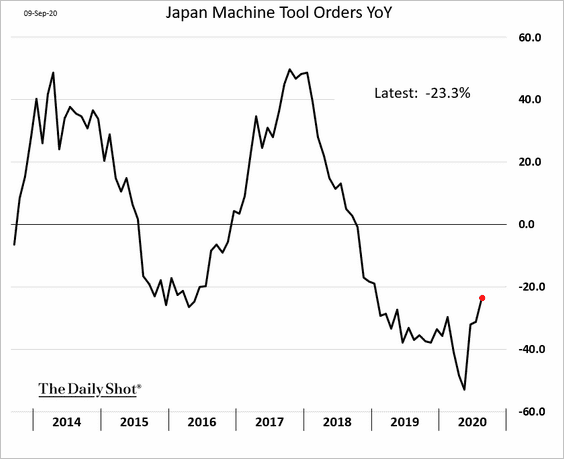

1. Machine tool orders continued to recover in August.

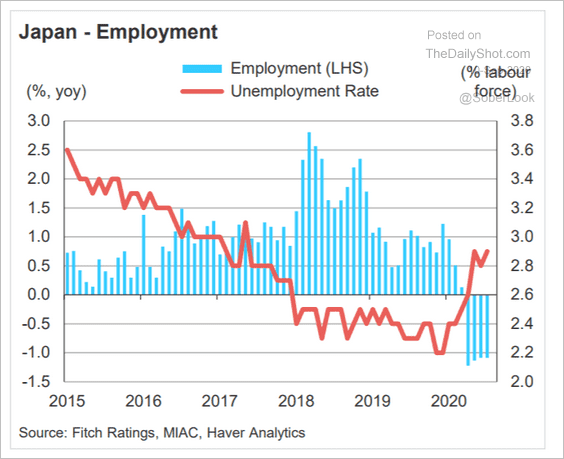

2. The labor market remains soft.

Source: Fitch Ratings

Source: Fitch Ratings

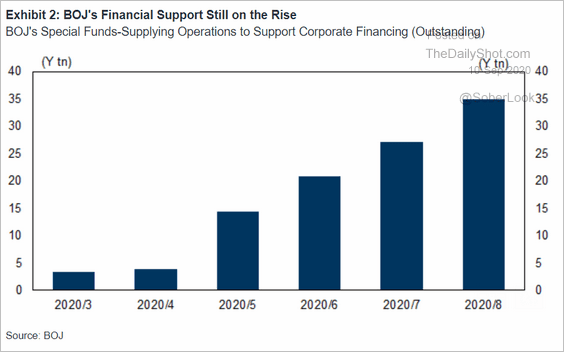

3. The BoJ has been supporting corporate lending.

Source: Goldman Sachs

Source: Goldman Sachs

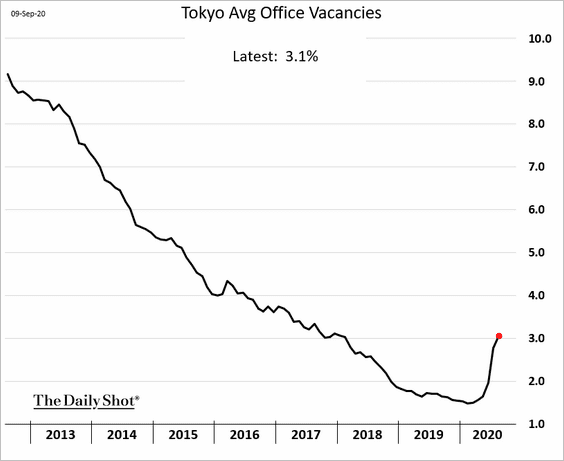

4. Tokyo office vacancies continue to climb.

Asia – Pacific

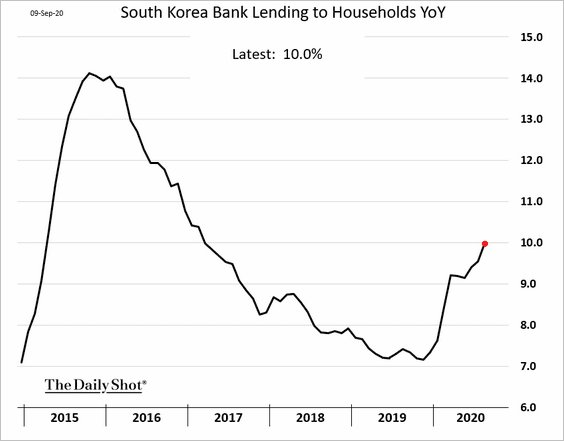

1. South Korea’s household lending has accelerated.

Source: The New York Times Read full article

Source: The New York Times Read full article

——————–

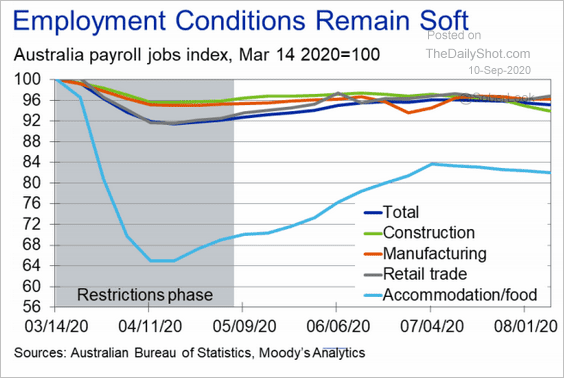

2. Australia’s employment conditions remain soft.

Source: Moody’s Analytics

Source: Moody’s Analytics

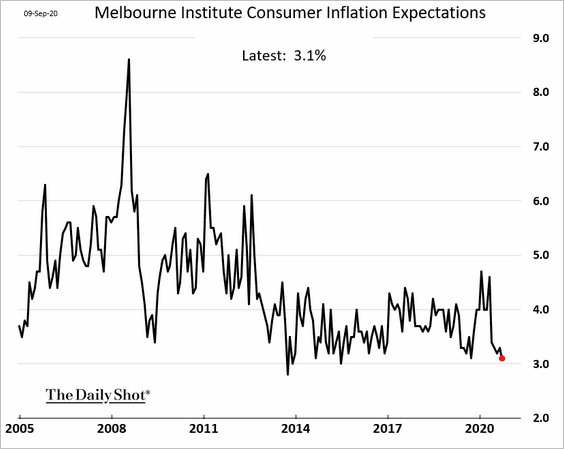

Separately, Australian inflation expectations are near multi-year lows.

——————–

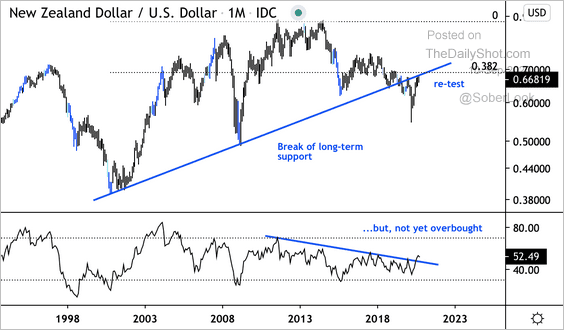

3. Next, we have some updates on New Zealand.

• NZD/USD is at long-term resistance.

Source: @DantesOutlook

Source: @DantesOutlook

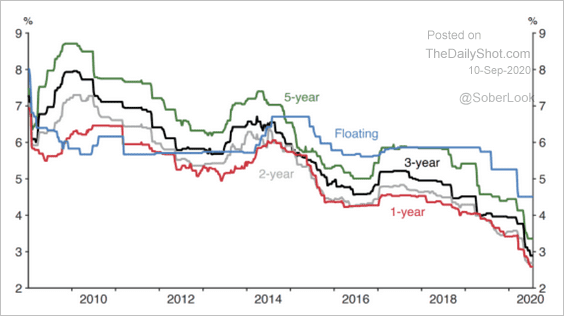

• Recent RBNZ rate cuts have had a significantly higher pass-through to mortgage rates than usual. Will this prevent the central bank from implementing a negative cash rate (see #5 here)?

Source: RBNZ Read full article

Source: RBNZ Read full article

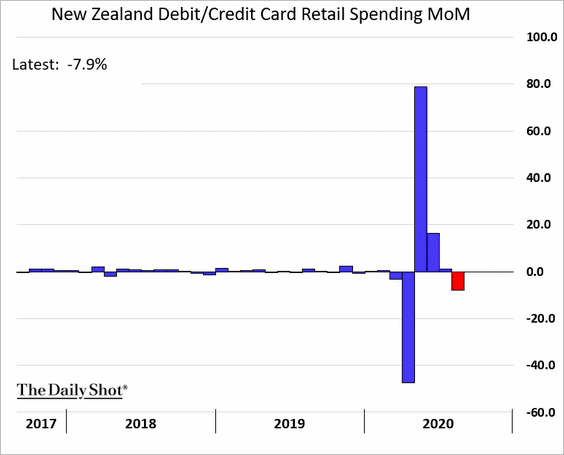

• Debit/credit card spending declined last month.

China

1. China’s Hong Kong-listed banks have widened their underperformance this year.

Source: @markets Read full article

Source: @markets Read full article

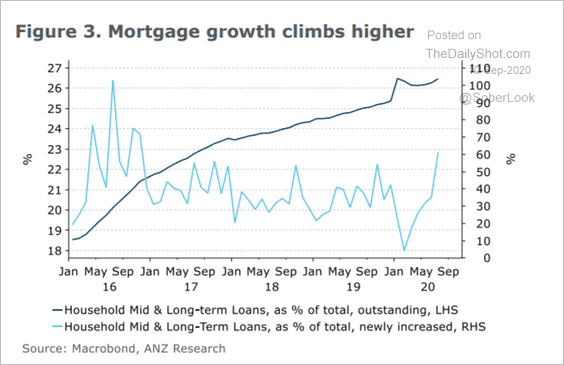

2. Mortgage growth has strengthened.

Source: ANZ Research

Source: ANZ Research

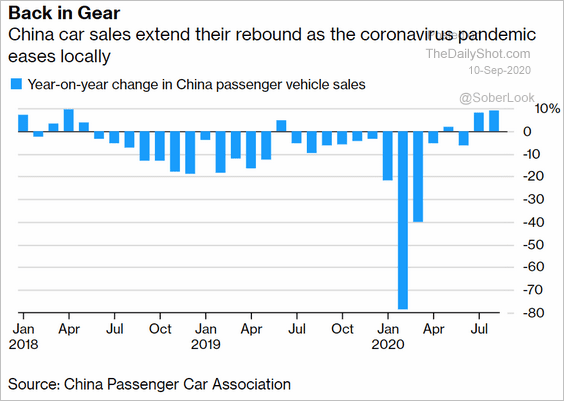

3. Car sales have recovered.

Source: @business Read full article

Source: @business Read full article

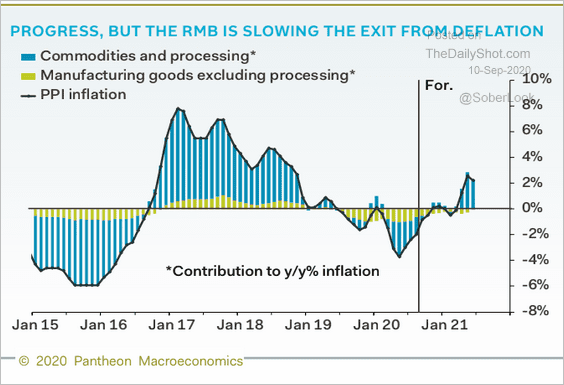

4. Pantheon Macroeconomics expects China’s PPI to rebound.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Emerging Markets

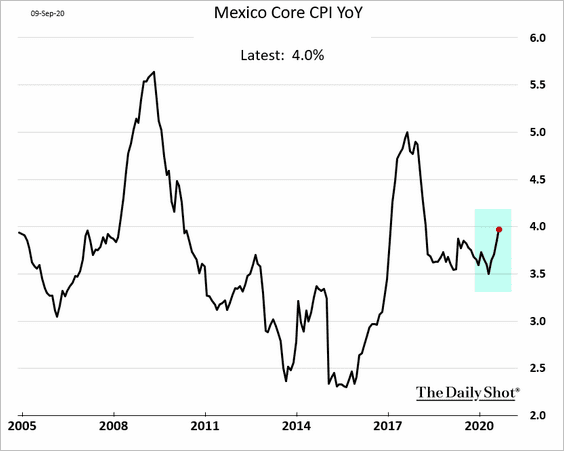

1. Mexico’s inflation is picking up.

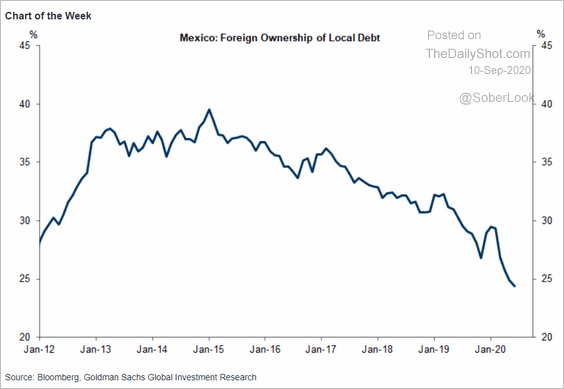

Separately, foreign ownership of Mexico’s peso-denominated debt has been declining rapidly.

Source: Goldman Sachs

Source: Goldman Sachs

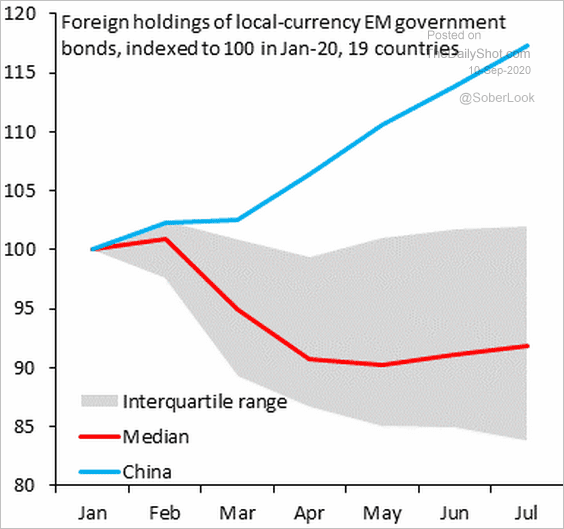

2. Here is the overall trend in foreign holdings of local-currency EM government debt.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

——————–

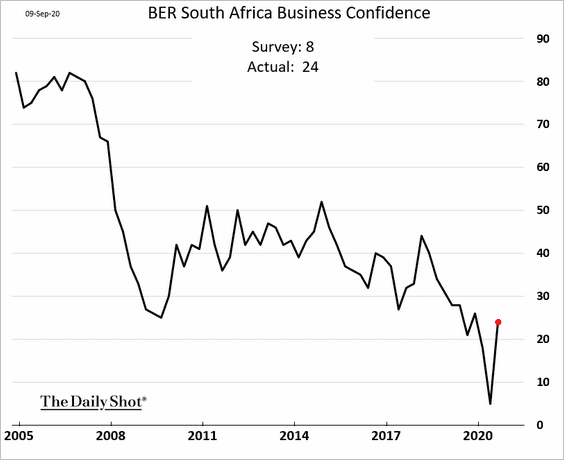

3. South Africa’s business confidence bounced from the lows.

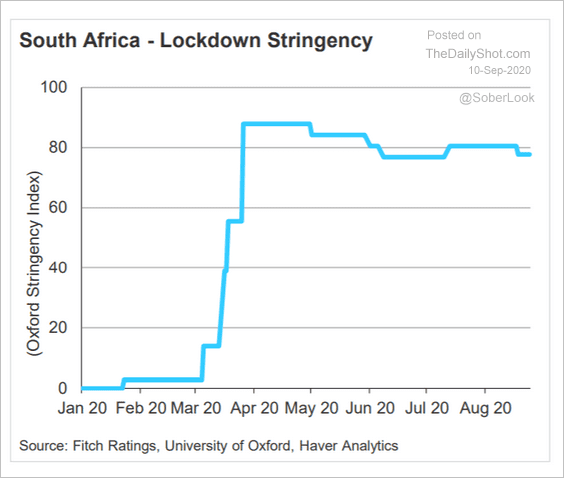

But lockdowns persist.

Source: Fitch Ratings

Source: Fitch Ratings

——————–

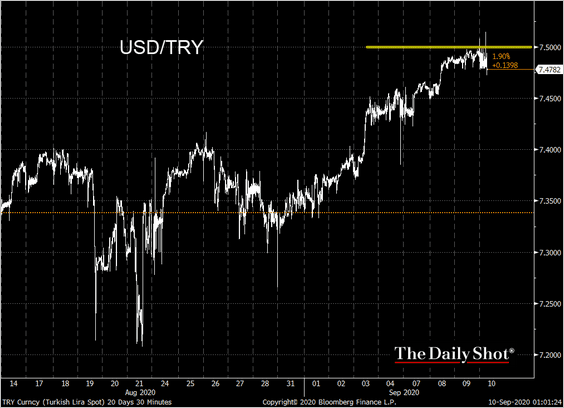

4. With the Turkish lira near all-time lows, USD/TRY is testing resistance at 7.5.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

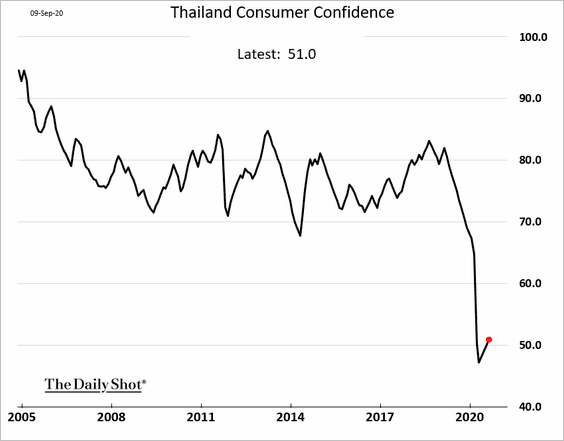

5. Thailand’s consumer confidence remains depressed.

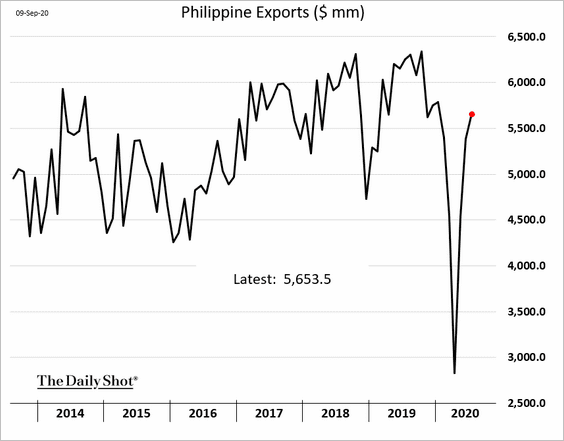

6. Philippine exports are back at pre-crisis levels.

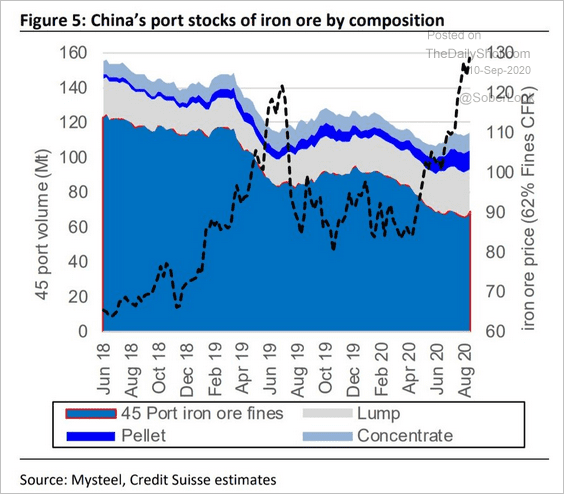

Commodities

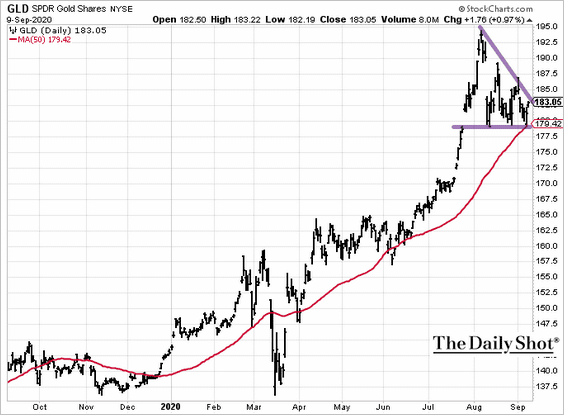

1. Gold held support at the 50-day moving average.

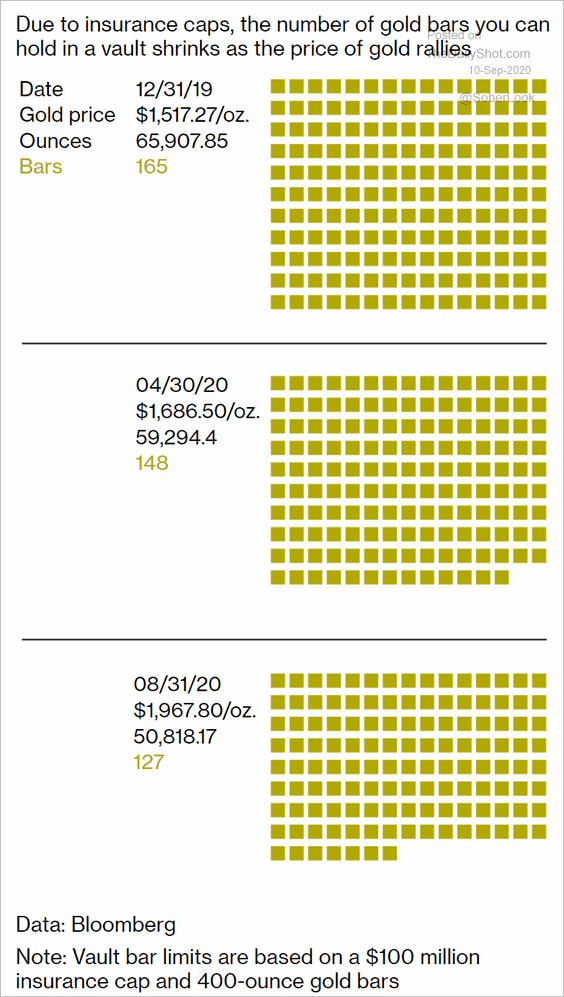

Separately, gold vaults now hold fewer bars.

Source: @BW Read full article

Source: @BW Read full article

——————–

2. US lumber futures continue to tumble.

Source: Credit Suisse, @Scutty

Source: Credit Suisse, @Scutty

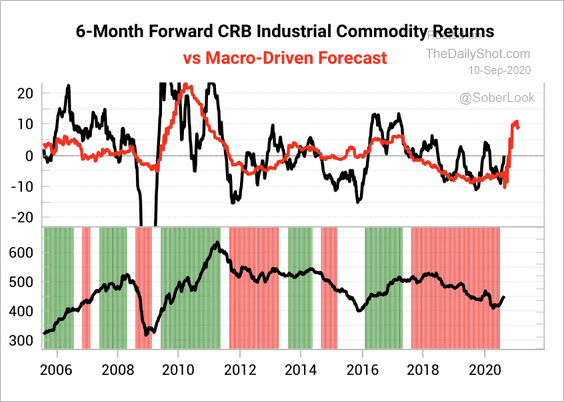

3. Variant Perception is forecasting rising industrial commodity prices.

Source: Variant Perception

Source: Variant Perception

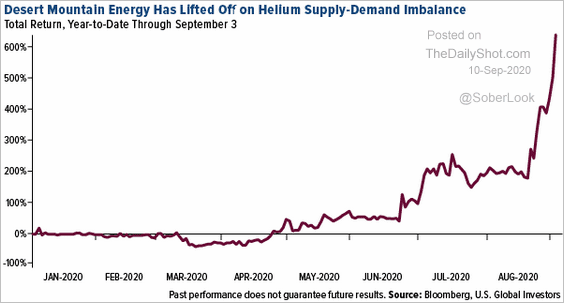

4. Helium demand has been outstripping supplies, sending DME shares sharply higher.

Source: Advisor Perspectives, h/t @Callum_Thomas Read full article

Source: Advisor Perspectives, h/t @Callum_Thomas Read full article

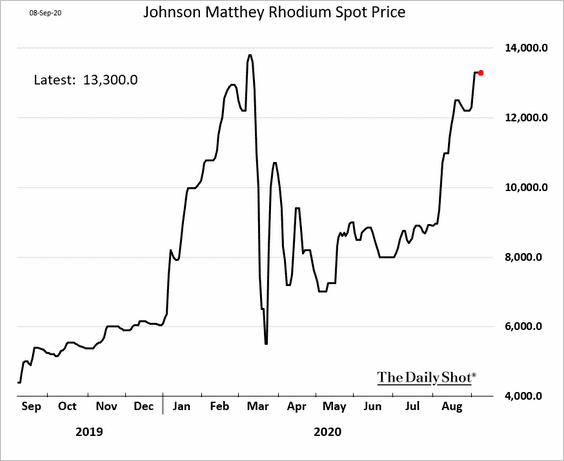

5. Rhodium prices have been climbing (see story).

Source: @TheTerminal, Bloomberg Finance L.P., h/t Elena Mazneva

Source: @TheTerminal, Bloomberg Finance L.P., h/t Elena Mazneva

Equities

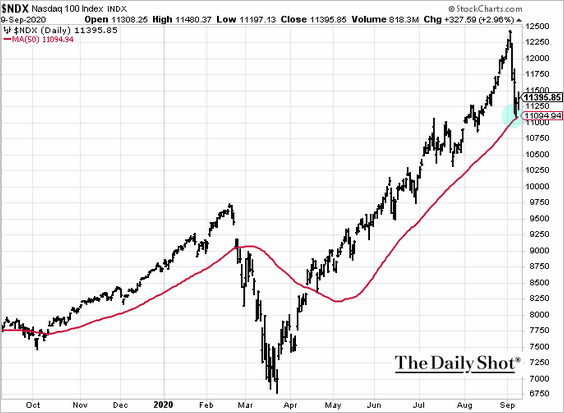

1. The Nasdaq 100 index held support at the 50-day moving average.

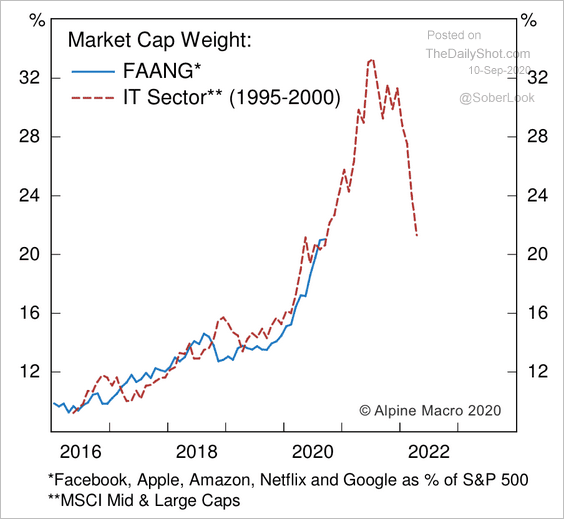

2. Market concentration is following a similar path to the dot-com bubble.

Source: Alpine Macro

Source: Alpine Macro

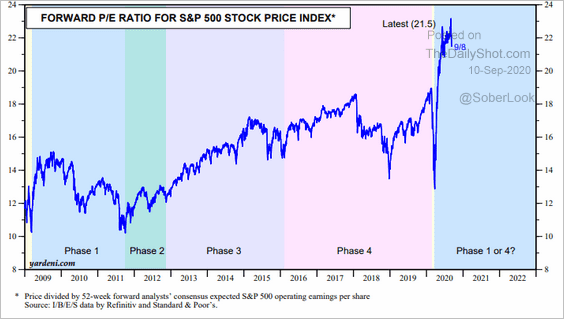

3. Valuations remain lofty.

Source: Yardeni Research

Source: Yardeni Research

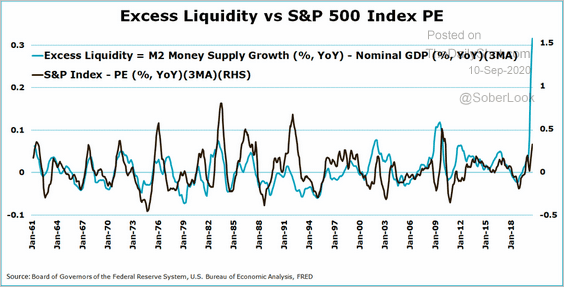

But will record US liquidity keep pushing share prices higher?

Source: @jsblokland

Source: @jsblokland

——————–

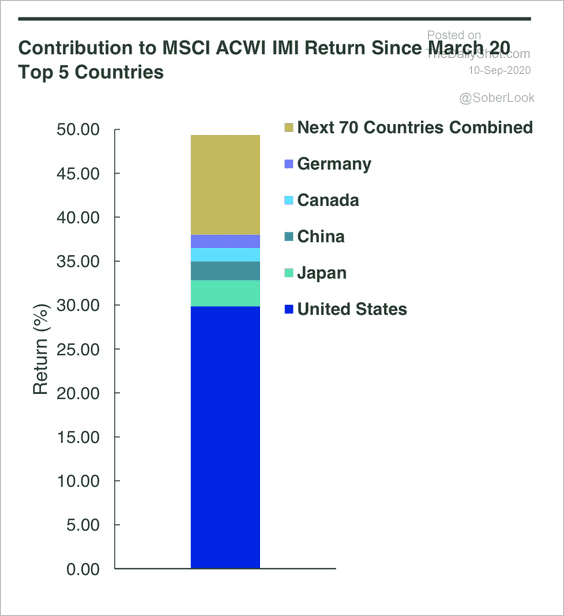

3. The US has accounted for 60% of global equity returns since the March bottom, according to State Street.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

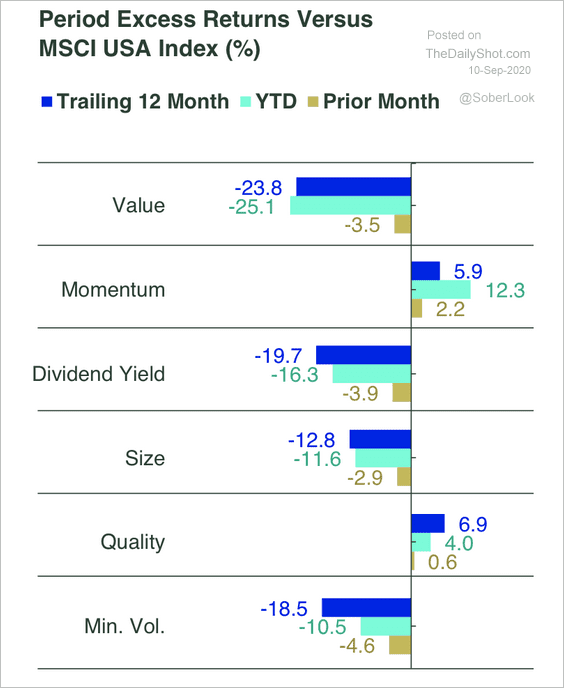

4. Here is the recent performance of US equity factors.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

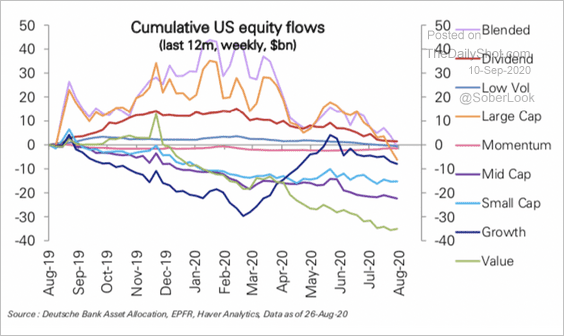

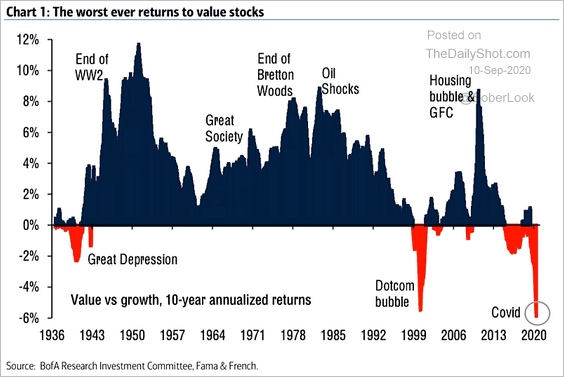

5. Next, let’s take a look at value stocks.

• Value fund outflows outpaced other factors.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

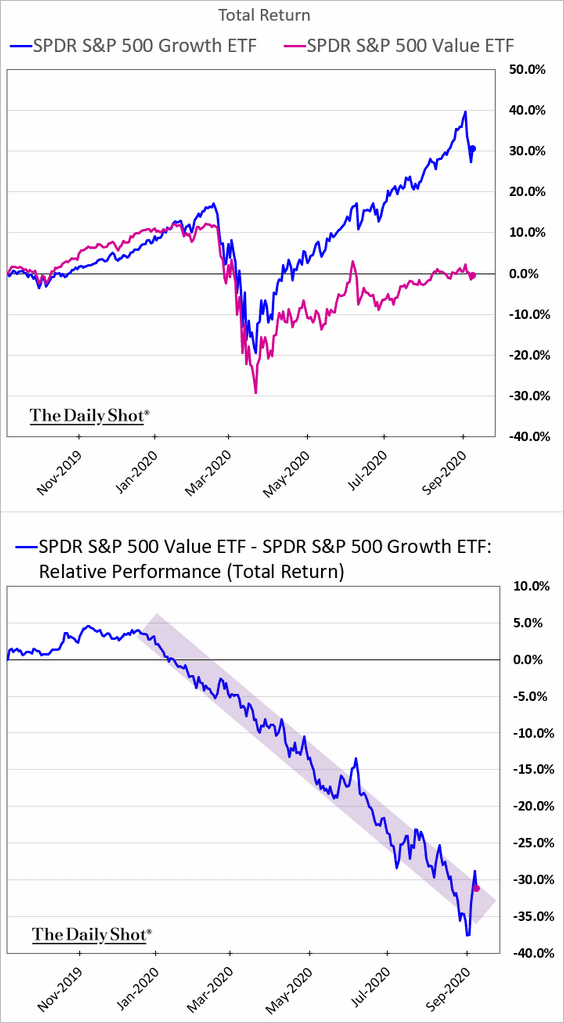

• The underperformance has been extreme (3 charts).

Source: Longview Economics

Source: Longview Economics

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

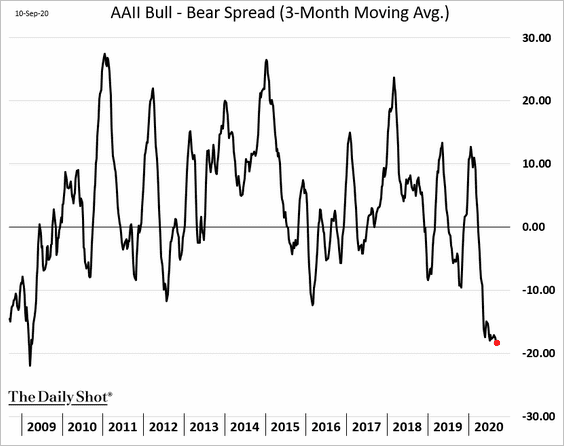

6. The AAII indicator 3-month running average suggests that individual investors have been nearly as bearish as they were in 2009. The survey tends to focus on older investors.

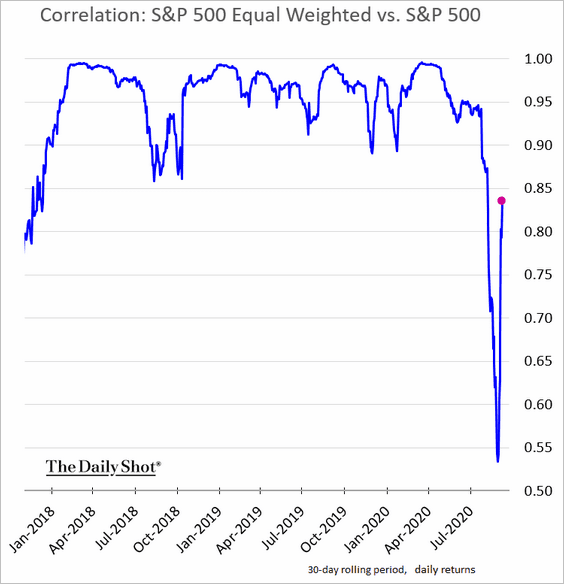

7. The correlation between the S&P 500 and the equal-weighted index is rebounding.

Credit

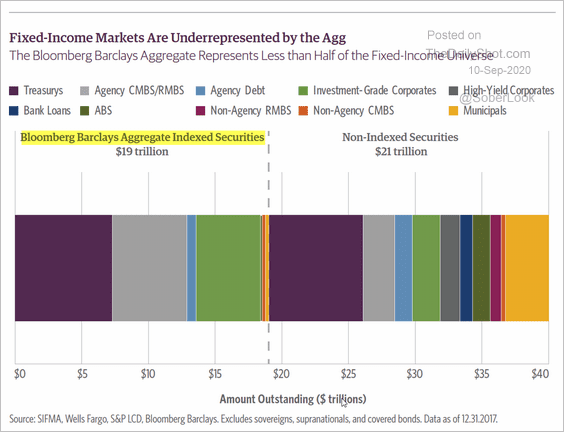

1. The Barclays Aggregate Index covers less than half of the US fixed-income market.

Source: @alphaarchitect Read full article

Source: @alphaarchitect Read full article

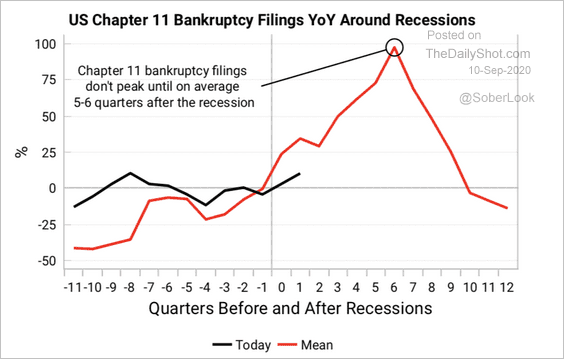

2. More Chapter-11 bankruptcy filings ahead?

Source: Variant Perception

Source: Variant Perception

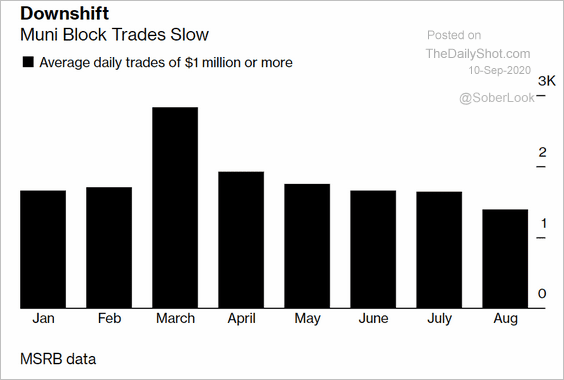

3. Here are a couple of updates on the muni markets.

• Daily institutional trading volumes have been trending lower.

Source: @markets Read full article

Source: @markets Read full article

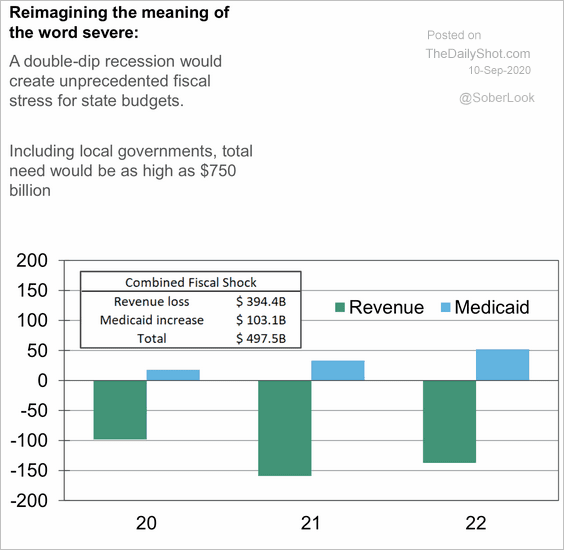

• This chart shows the aggregate fiscal shock across all states, with commentary from Moody’s.

Source: Moody’s Analytics

Source: Moody’s Analytics

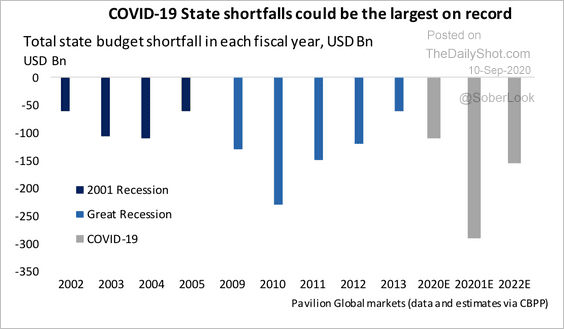

State revenue shortfalls could be the largest on record, according to Pavilion Global Markets.

Source: Pavilion Global Markets

Source: Pavilion Global Markets

Global Developments

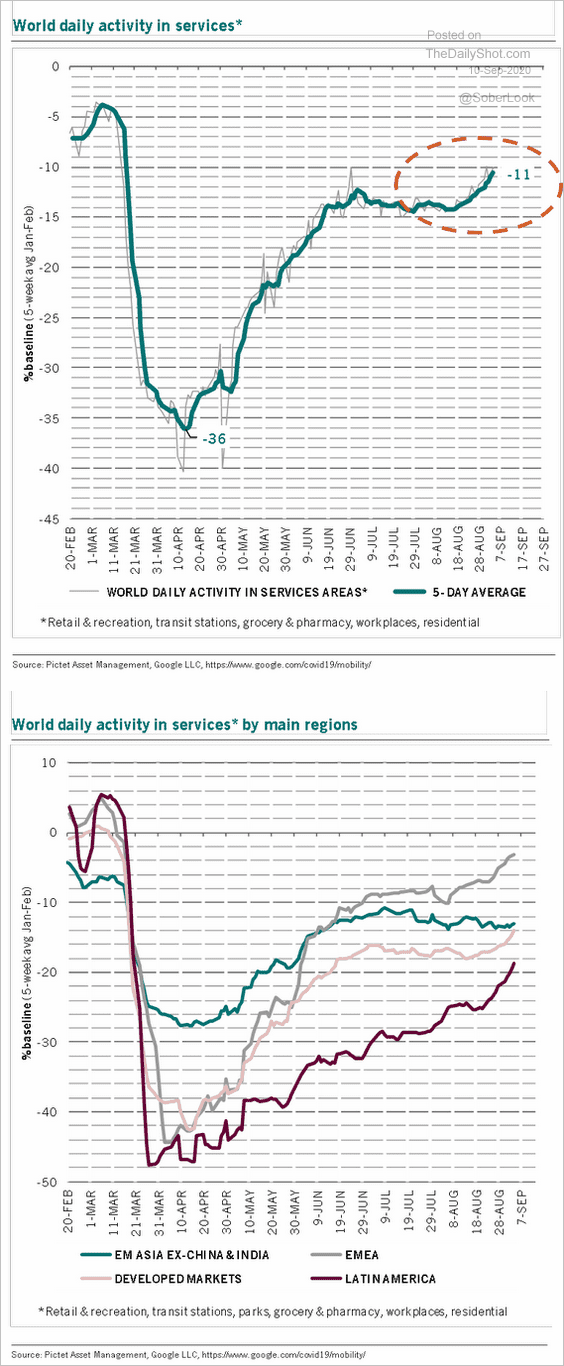

1. Services activity has been improving.

Source: @PkZweifel

Source: @PkZweifel

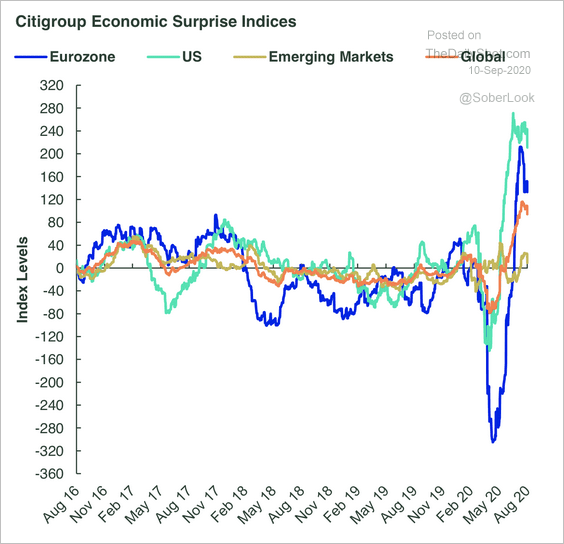

2. This chart shows the Citi Economic Surprise Index.

Source: SPDR Americas Research, @mattbartolini

Source: SPDR Americas Research, @mattbartolini

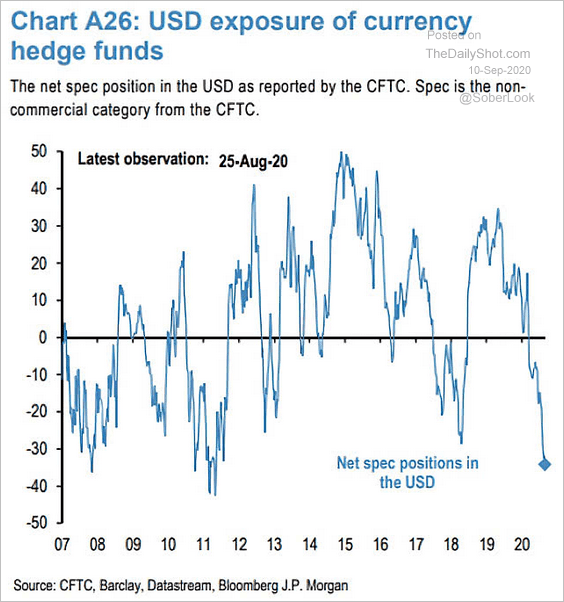

3. Currency hedge funds continue to bet against the dollar. This trade could work out well if the US Congress passes another massive stimulus bill (see #6 here)

Source: @ISABELNET_SA, @jpmorgan

Source: @ISABELNET_SA, @jpmorgan

——————–

Food for Thought

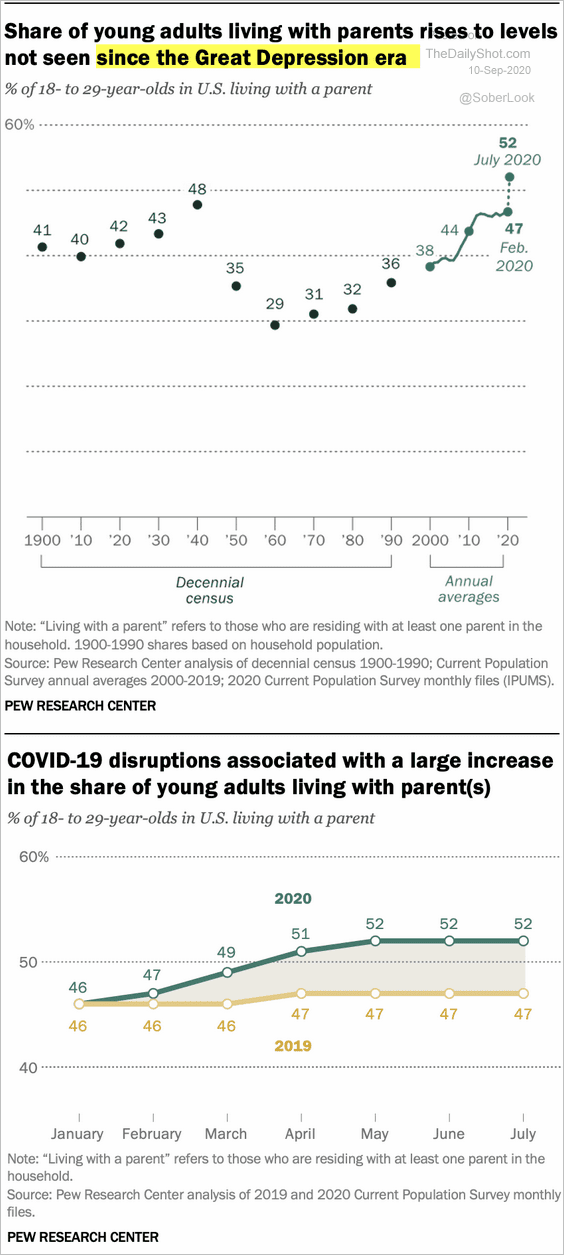

1. Young adults living with parents:

Source: Pew Research Center

Source: Pew Research Center

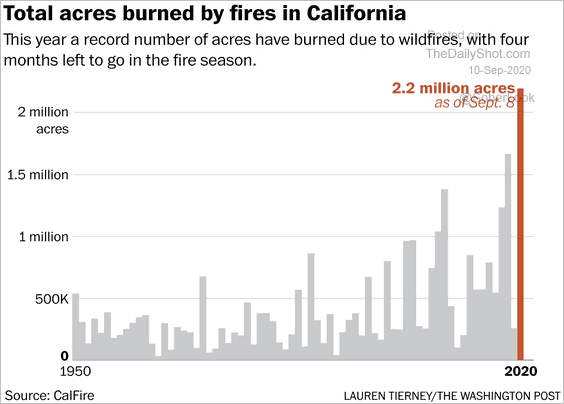

2. Acres burned in California:

Source: @PostGraphics Read full article

Source: @PostGraphics Read full article

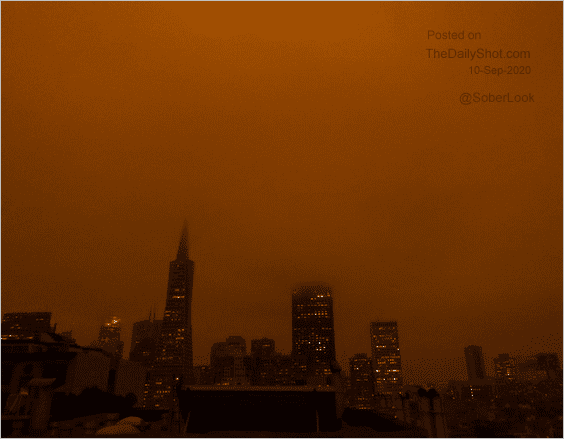

San Francisco at 10 AM:

Source: @sarahfrier

Source: @sarahfrier

——————–

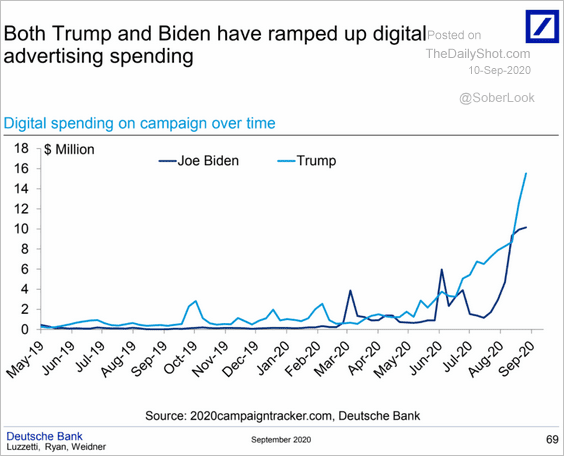

3. Digital spending on presidential campaigns:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

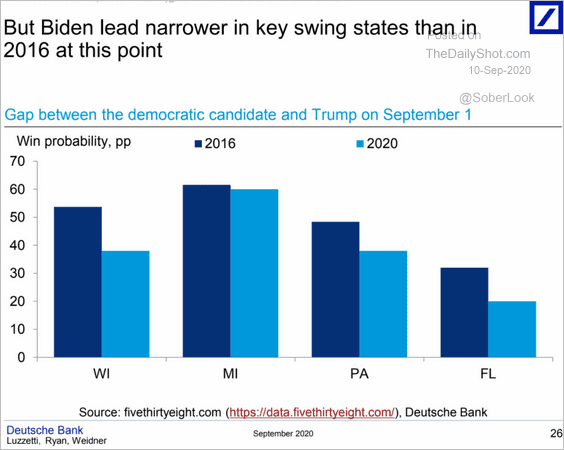

4. September poll gaps in swing states in 2016 and 2020:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

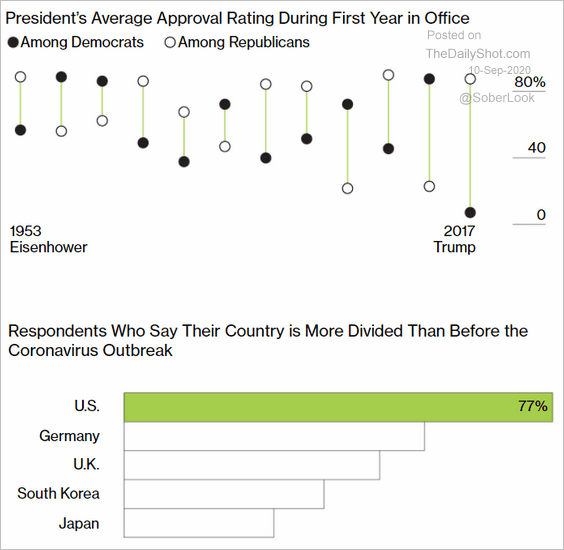

5. US political polarization:

Source: @BW Read full article

Source: @BW Read full article

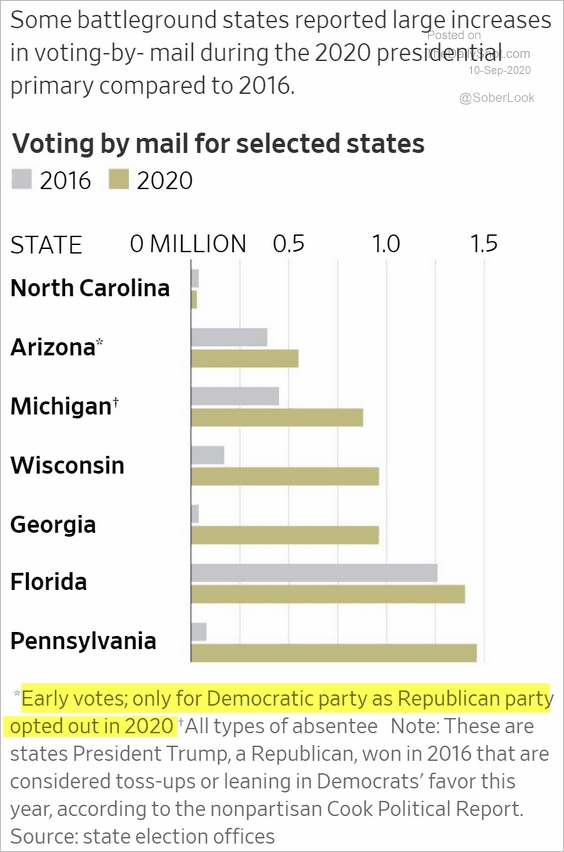

6. Voting by mail in select states:

Source: @WSJ Read full article

Source: @WSJ Read full article

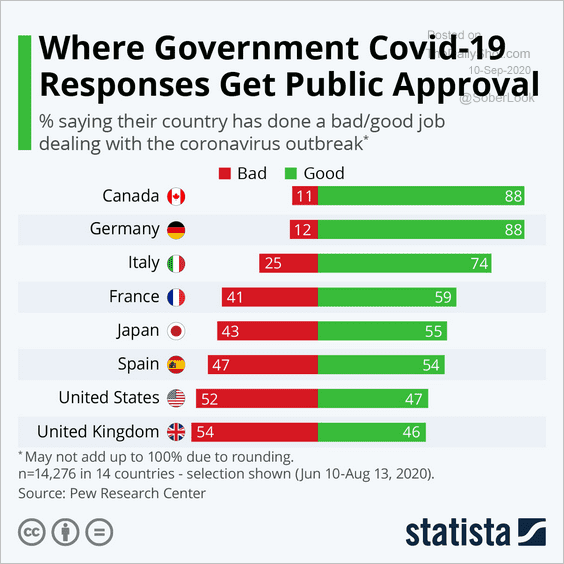

7. Approval rates of governments’ pandemic responses:

Source: Statista

Source: Statista

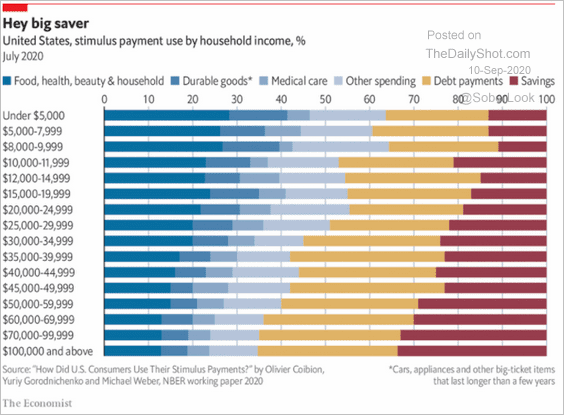

8. Spending stimulus checks in the US:

Source: @kat_devlin, @economist Read full article

Source: @kat_devlin, @economist Read full article

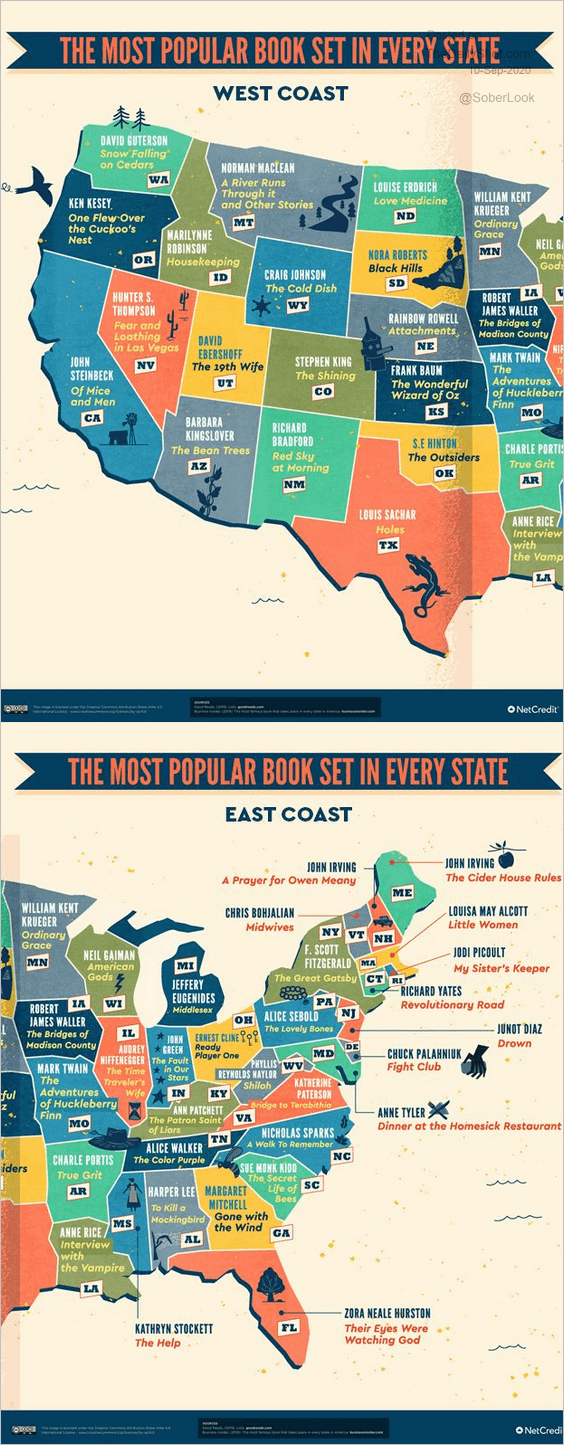

9. The most popular book set, by state:

Source: @HuffPostEnt Read full article

Source: @HuffPostEnt Read full article

——————–