The Daily Shot: 30-Sep-20

• The United States

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Australia

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Global Developments

• Food for Thought

The United States

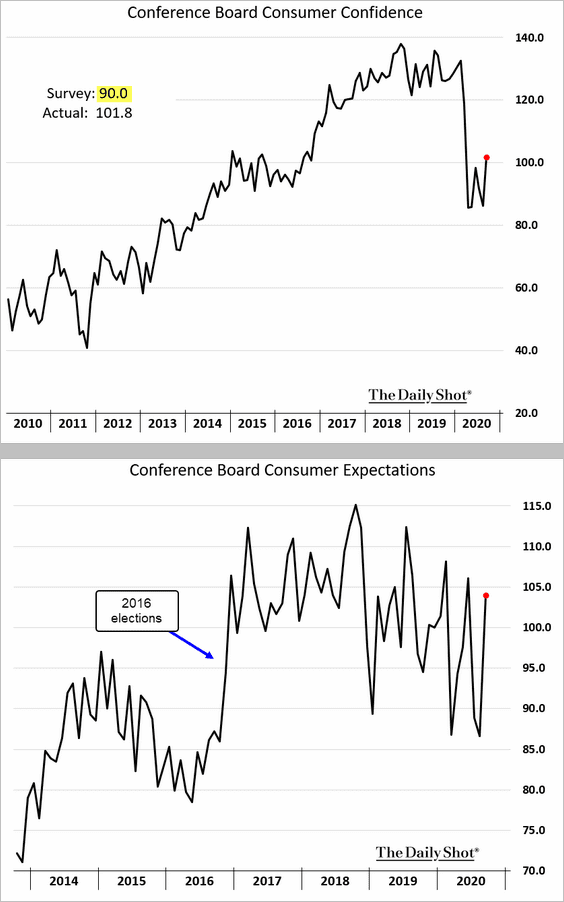

1. US consumer confidence rose sharply this month, according to the Conference Board. The improvement was well above market consensus.

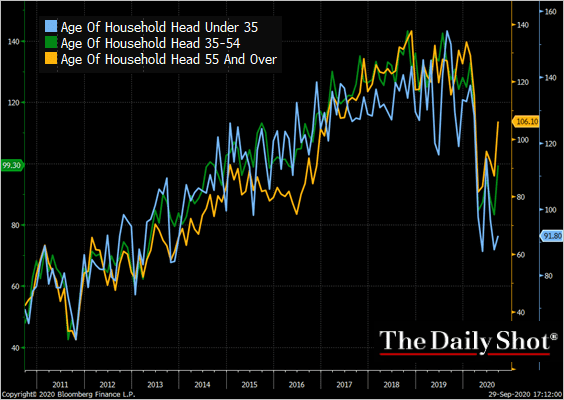

Gains in confidence were driven by older Americans, with younger households falling further behind.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

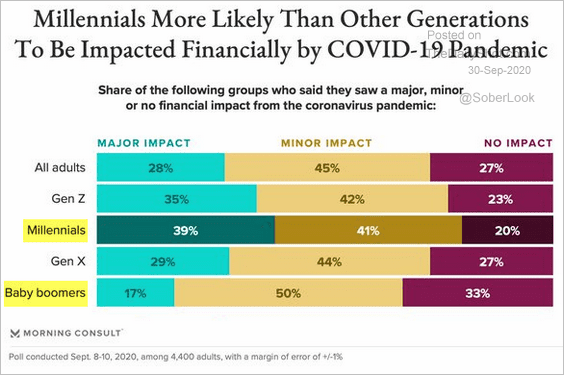

This poll from Morning Consult confirms the divergence above.

Source: @MorningConsult Read full article

Source: @MorningConsult Read full article

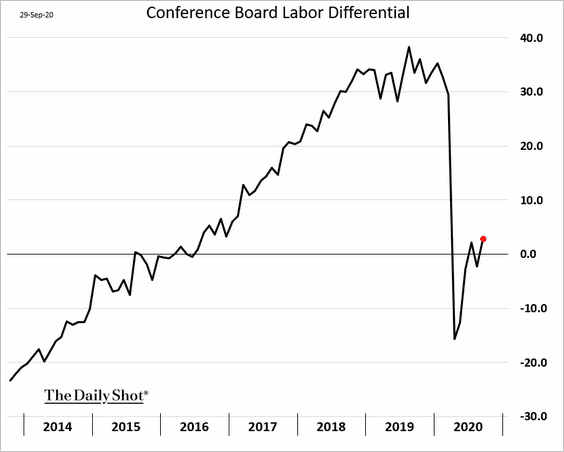

The differential between “jobs plentiful” and “jobs hard to get” is gradually recovering.

——————–

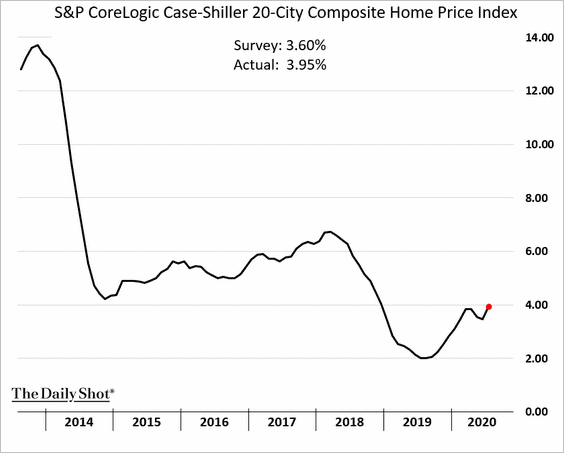

2. US home price appreciation accelerated in July. High-frequency indicators (#2 here) point to further gains in August and September.

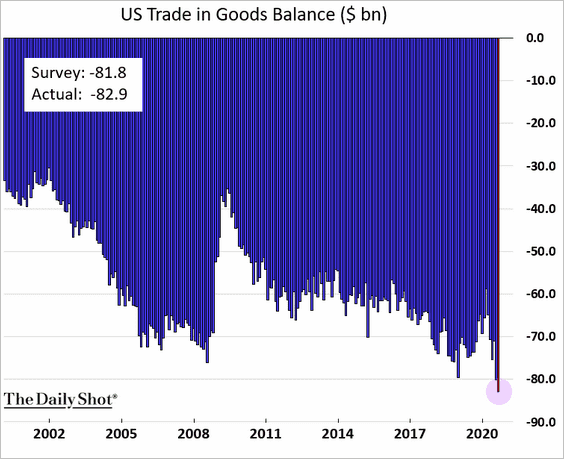

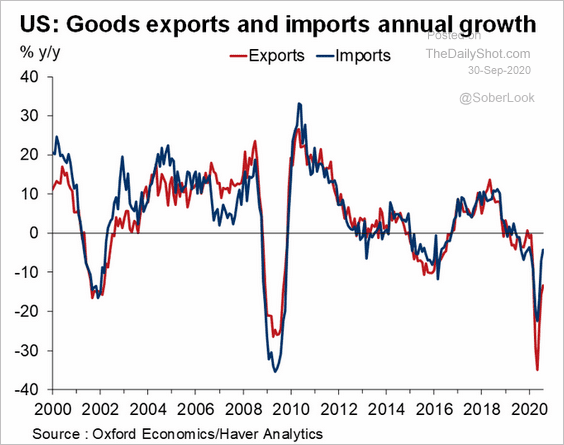

3. The nation’s trade deficit in goods hit a new record, …

… as imports recovered faster than exports.

Source: @GregDaco

Source: @GregDaco

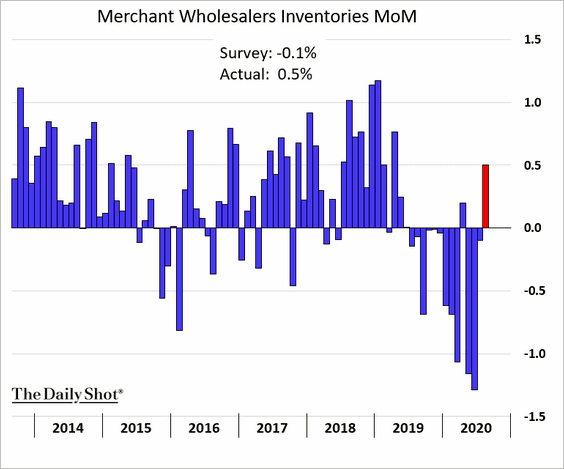

Businesses have been rebuilding inventories, driving the surge in imports.

——————–

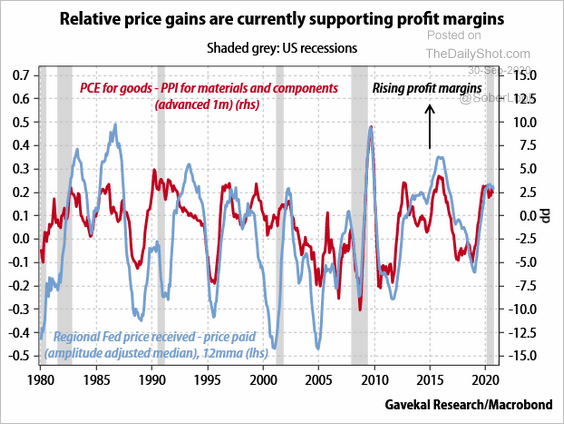

4. Next, let’s take a look at some business trends.

• Higher consumer inflation tends to be good for profit margins.

Source: Gavekal

Source: Gavekal

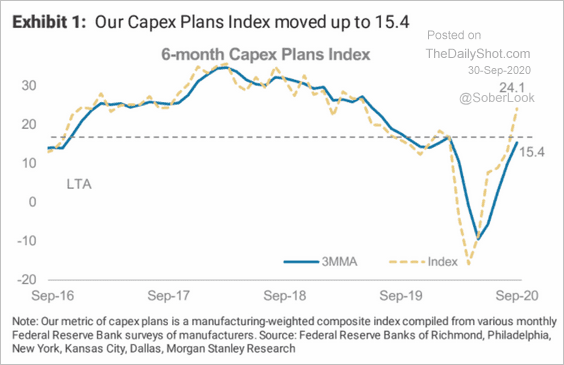

• According to Morgan Stanley, CapEx plans have recovered.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

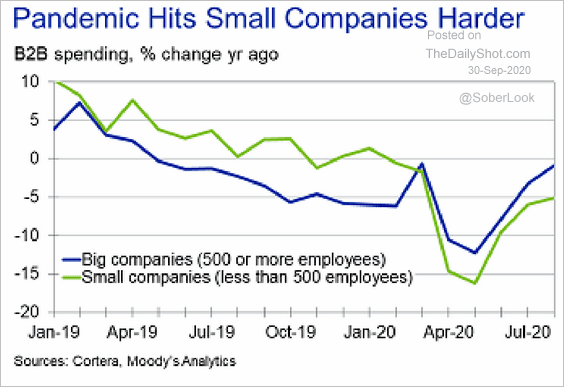

But small business spending is lagging.

Source: Moody’s Analytics

Source: Moody’s Analytics

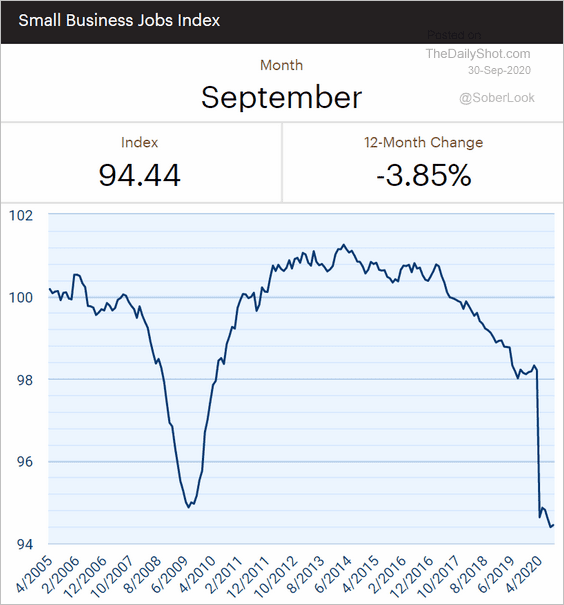

• Small business employment remains depressed.

Source: Paychex/IHS Markit Small Business Employment Watch Read full article

Source: Paychex/IHS Markit Small Business Employment Watch Read full article

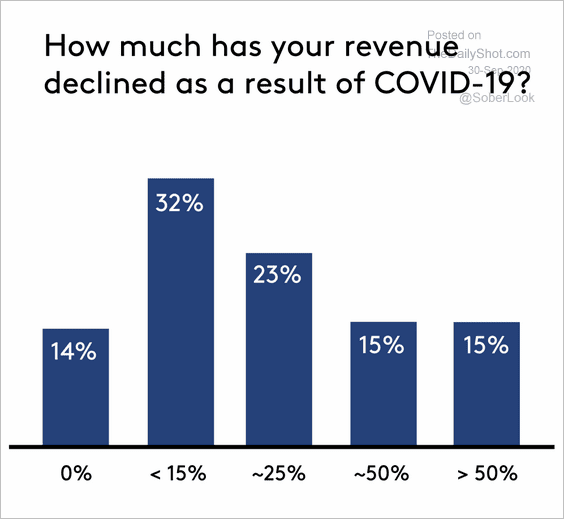

• Here are a couple of business surveys, starting with one from Comcast Business.

– Revenue impact:

Source: Comcast Business

Source: Comcast Business

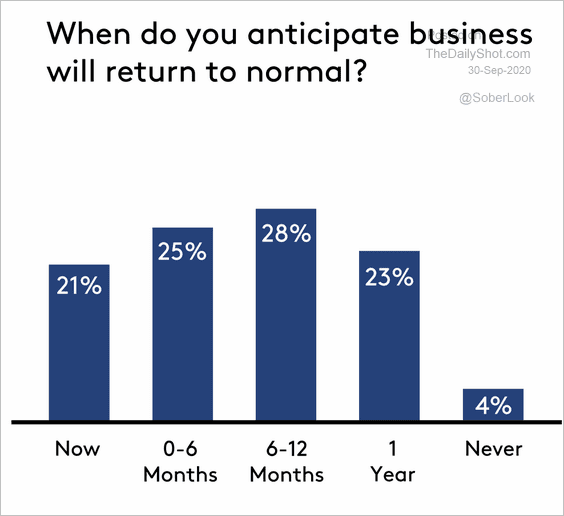

– Business returning to normal:

Source: Comcast Business

Source: Comcast Business

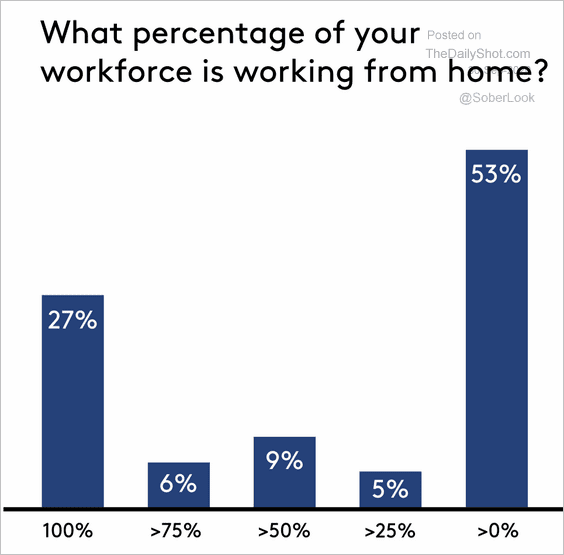

– Employees working from home:

Source: Comcast Business

Source: Comcast Business

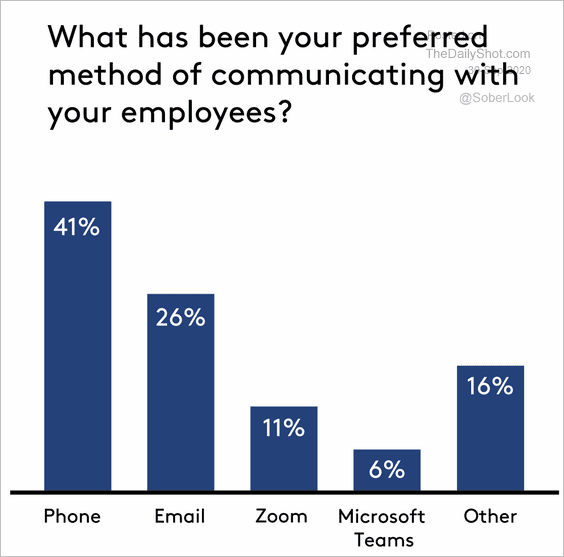

– Preferred method of communication:

Source: Comcast Business

Source: Comcast Business

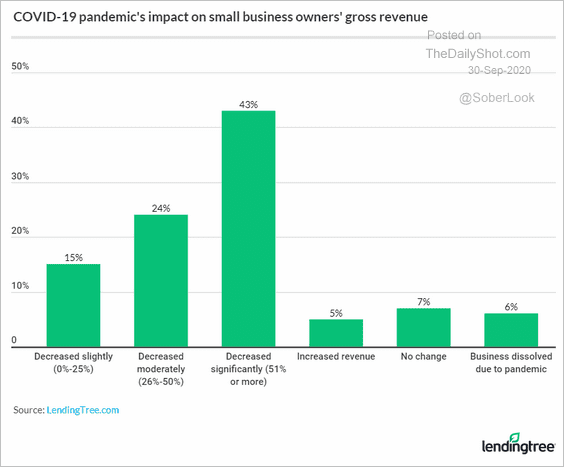

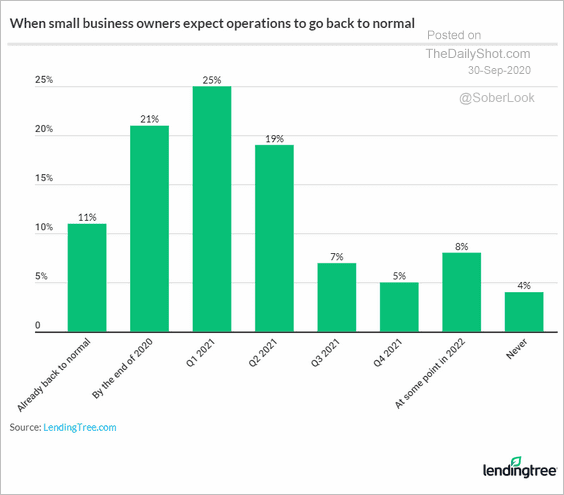

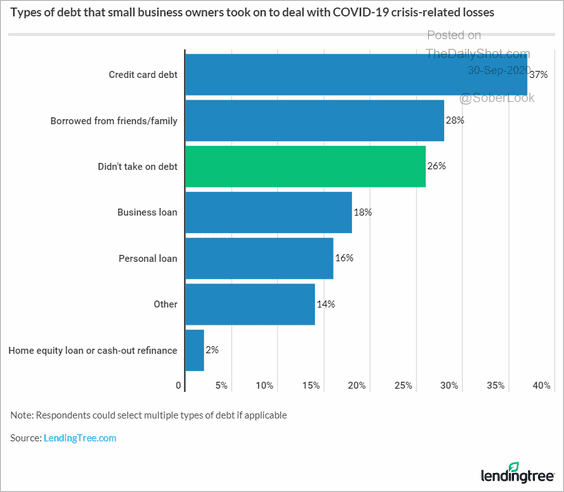

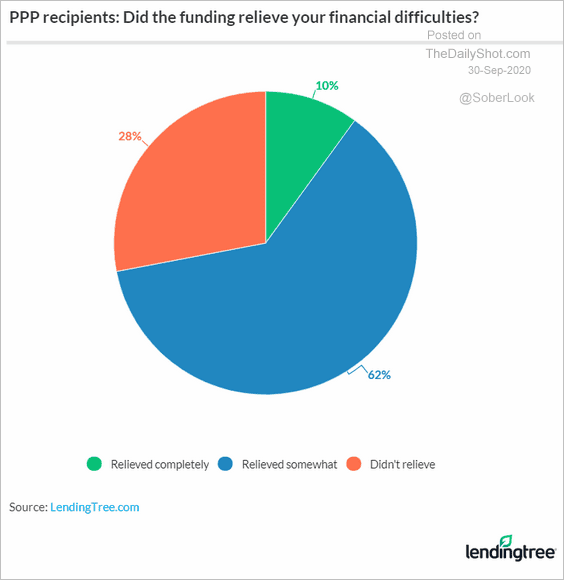

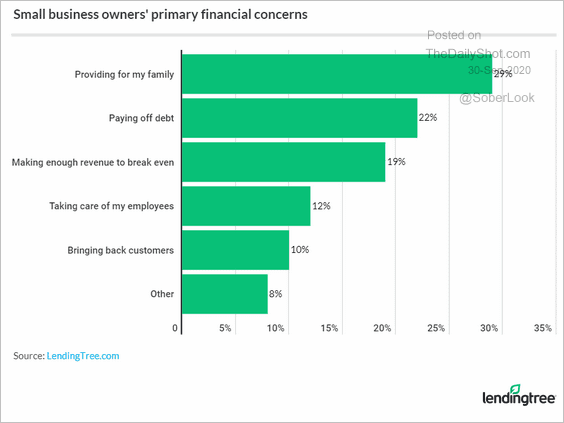

And these are the results from LendingTree’s small-business survey.

– Revenue impact:

Source: LendingTree

Source: LendingTree

– Business returning to normal:

Source: LendingTree

Source: LendingTree

– Types of new debt:

Source: LendingTree

Source: LendingTree

– How helpful was PPP?

Source: LendingTree

Source: LendingTree

– Financial concerns:

Source: LendingTree

Source: LendingTree

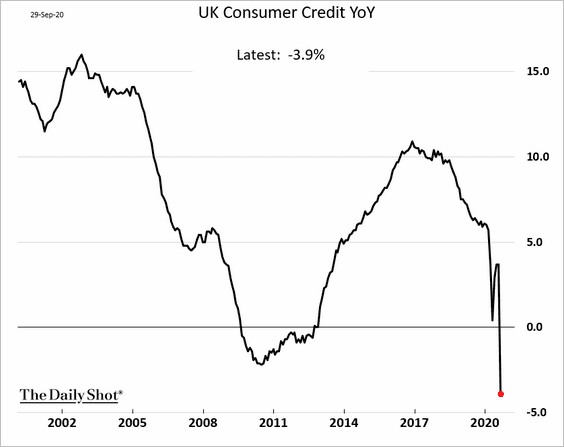

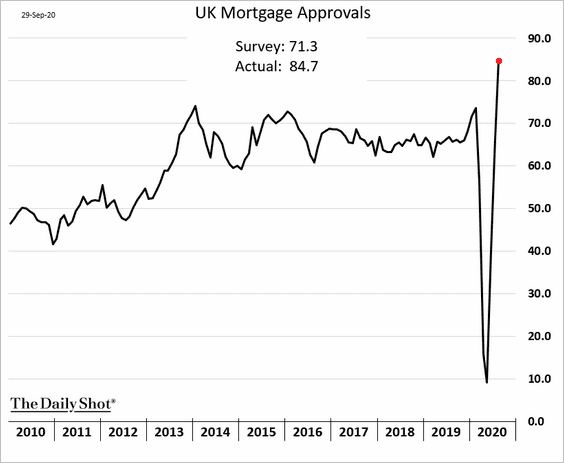

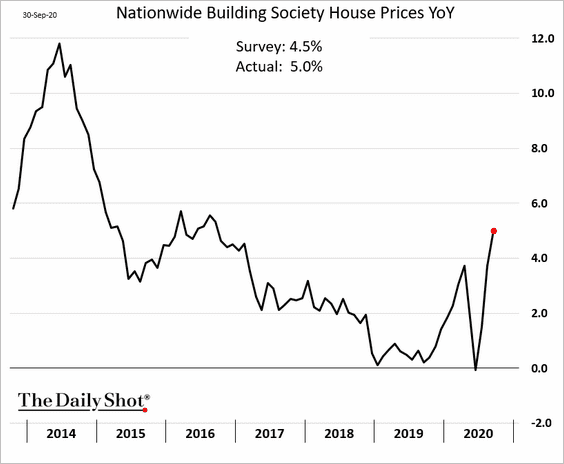

The United Kingdom

1. Consumer credit contracted last month.

However, mortgage approvals soared, topping economists’ forecasts. Tax waivers on property purchasers (part of the stimulus package) and the desire to move to the suburbs drove the increase.

With demand spiking, home price appreciation has accelerated.

However, low levels of refinancing suggest that some borrowers may be struggling to make payments.

Source: @samueltombs

Source: @samueltombs

——————–

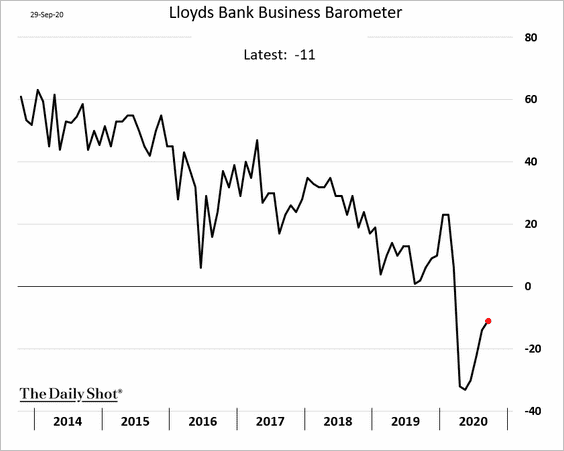

2. Business sentiment is gradually recovering.

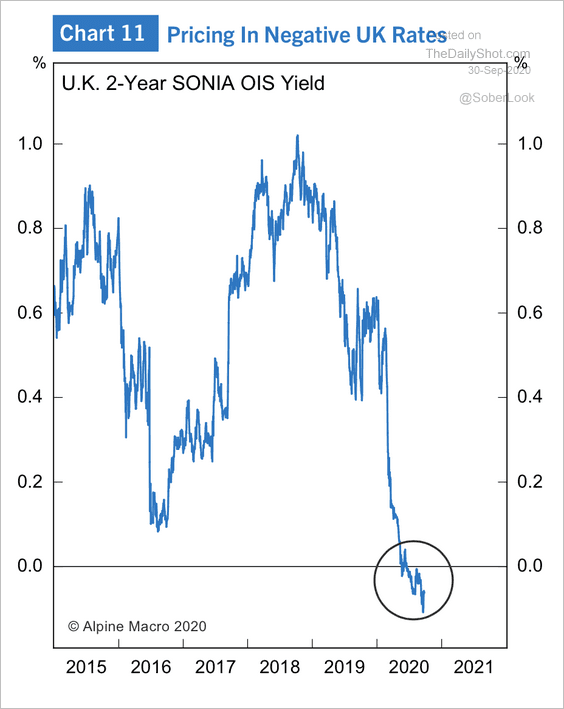

3. The market continues to price in negative rates in the UK.

Source: Alpine Macro

Source: Alpine Macro

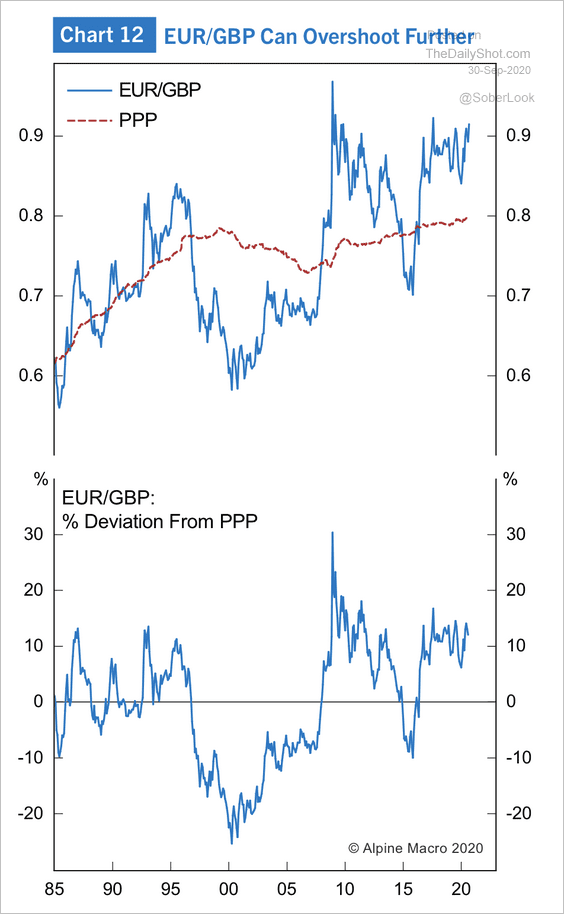

4. EUR/GBP has deviated far from purchasing power parity (PPP).

Source: Alpine Macro

Source: Alpine Macro

The Eurozone

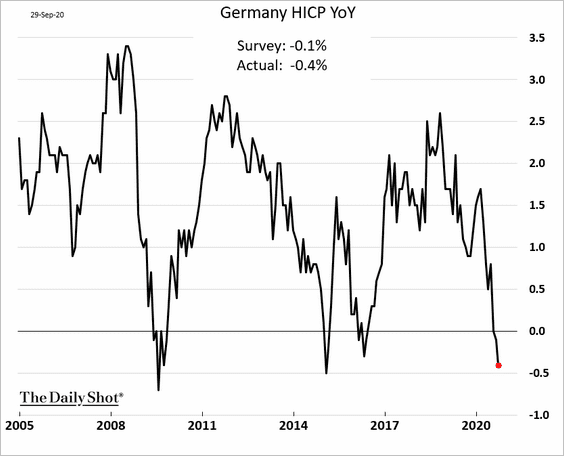

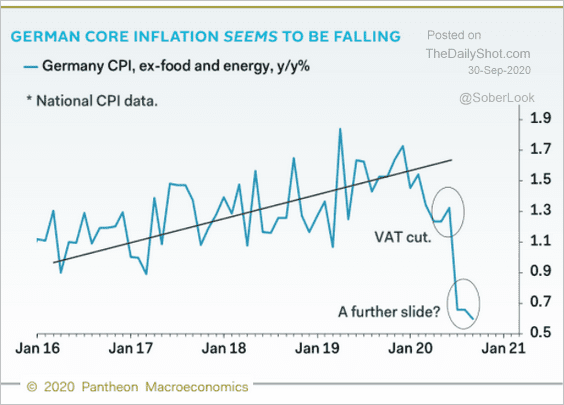

1. Germany is in deflation.

The core CPI has been slowing as well.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

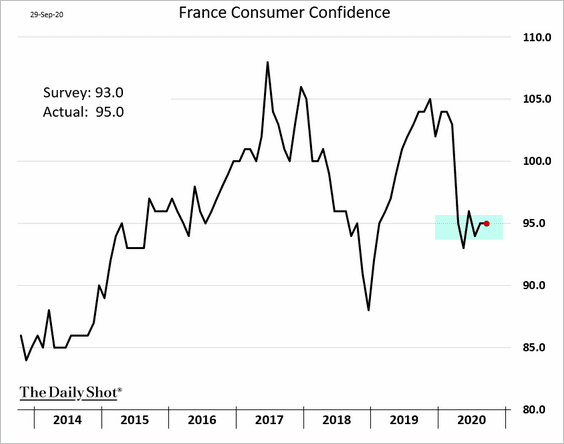

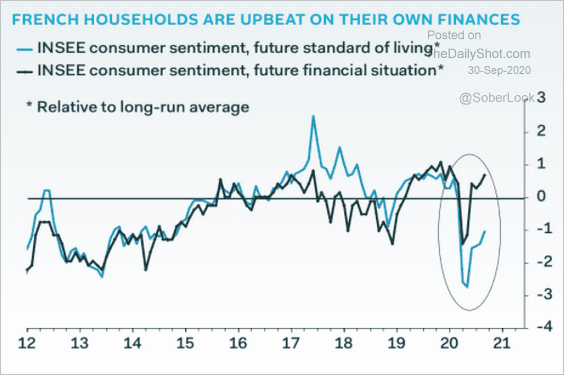

2. French consumer sentiment remains stable despite the second wave of infections.

Sentiment on households’ financial situation has recovered.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

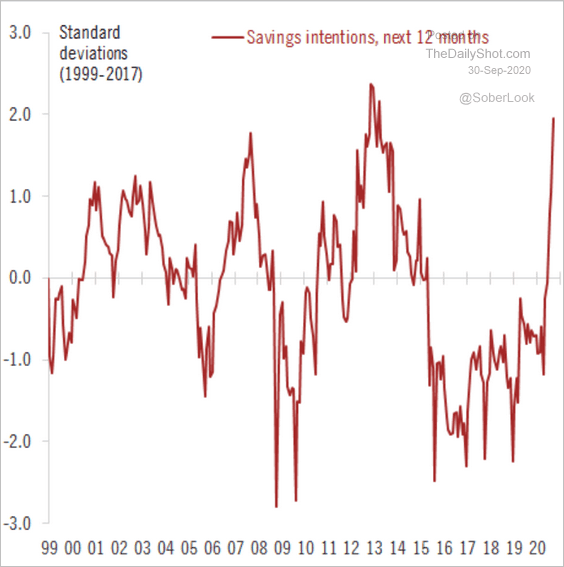

French savings intentions spiked.

Source: @fwred Read full article

Source: @fwred Read full article

——————–

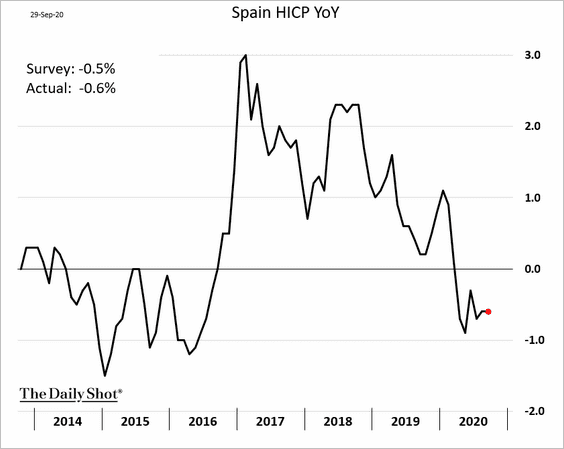

3. Spain’s CPI remains negative.

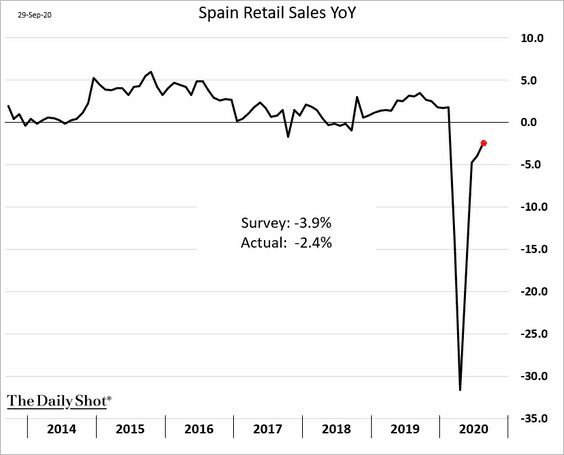

Retail sales continued to recover last month.

——————–

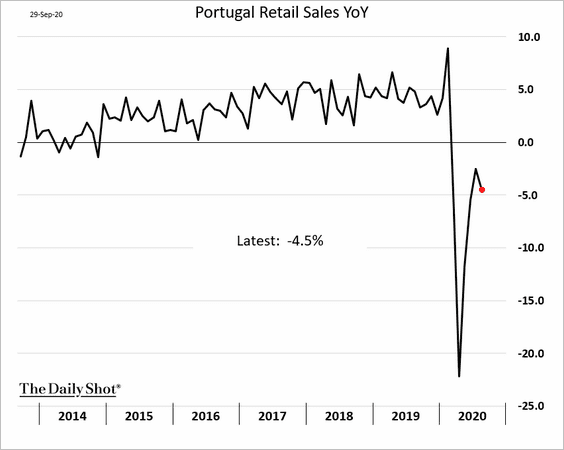

4. Portugal’s retail spending slumped in August.

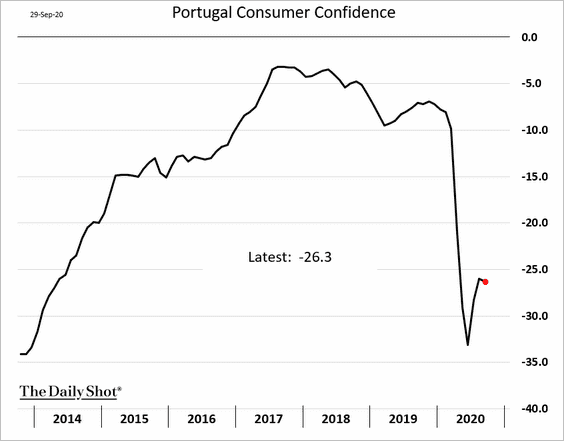

Consumer confidence remains depressed (as of September).

——————–

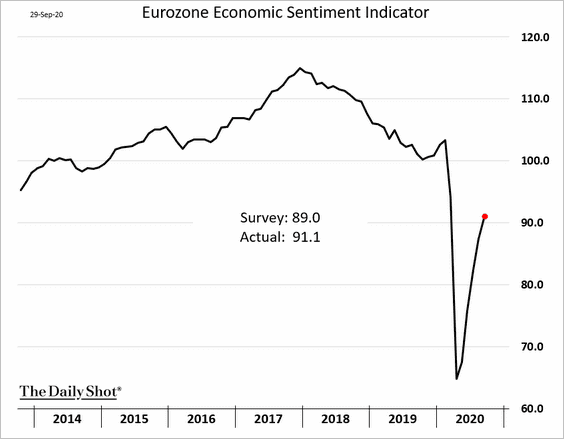

5. Sentiment continues to recover at the Eurozone level.

Europe

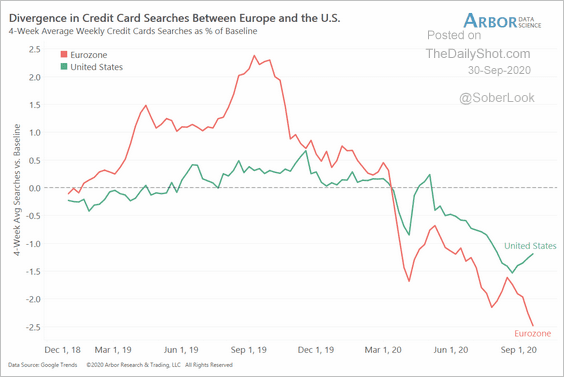

1. Online search activity for credit cards slumped in Europe, diverging from the US.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

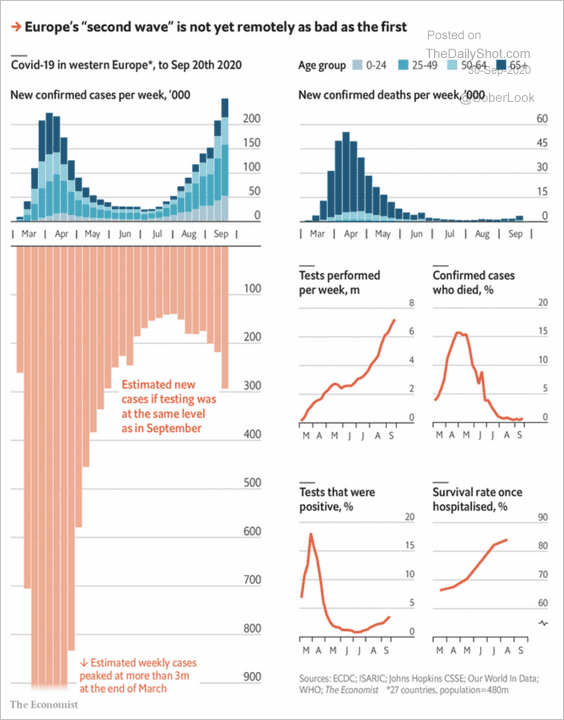

2. The health impact of the second wave hasn’t been nearly as severe as the first wave. Also, the new-case figures are inflated by a much higher testing frequency.

Source: The Economist Read full article

Source: The Economist Read full article

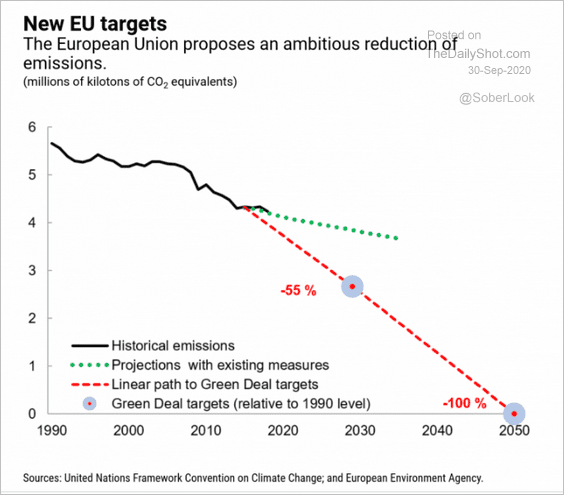

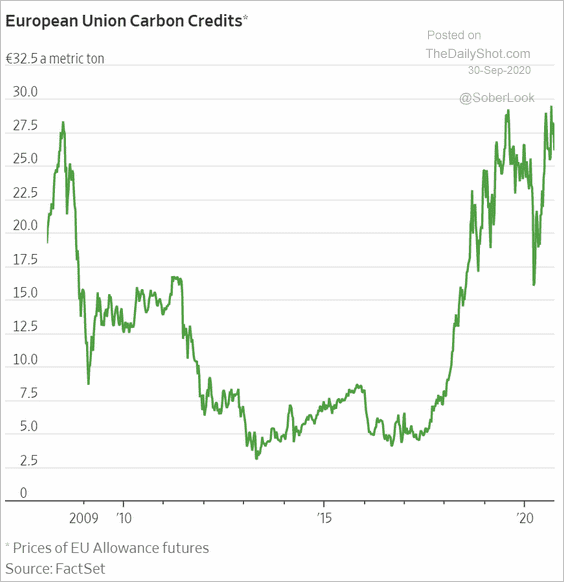

3. The EU is proposing ambitious reductions in emissions.

Source: IMF

Source: IMF

As a result, carbon credit prices may climb further.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

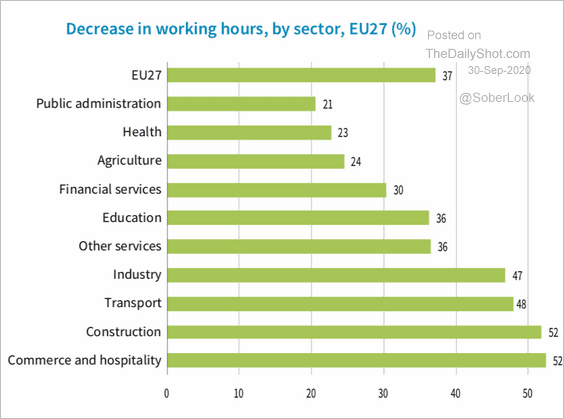

4. This chart shows the decrease in working hours by sector (EU).

Source: Eurofound

Source: Eurofound

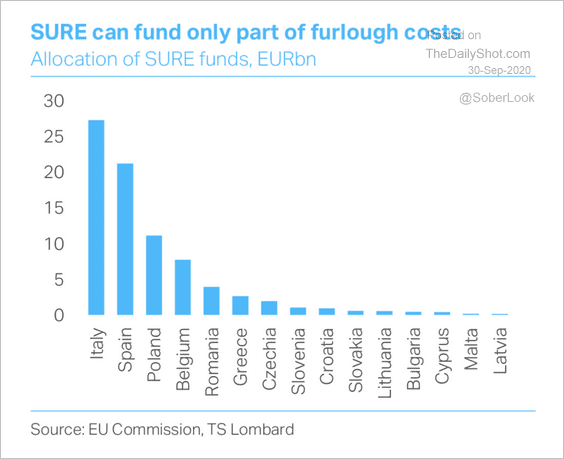

The EU stimulus program will only partially offset the cost of furloughs.

Source: TS Lombard

Source: TS Lombard

——————–

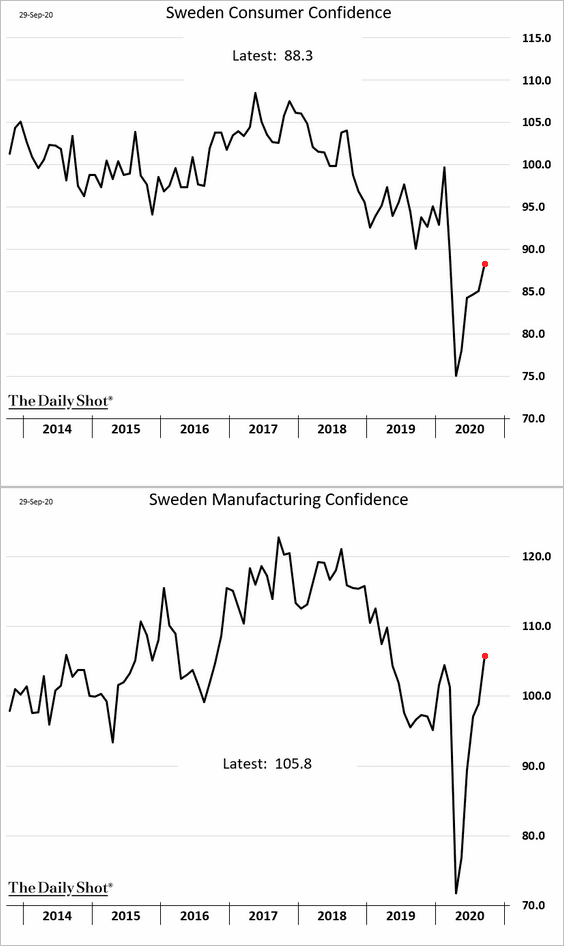

5. Sweden’s consumer and manufacturing confidence keeps improving.

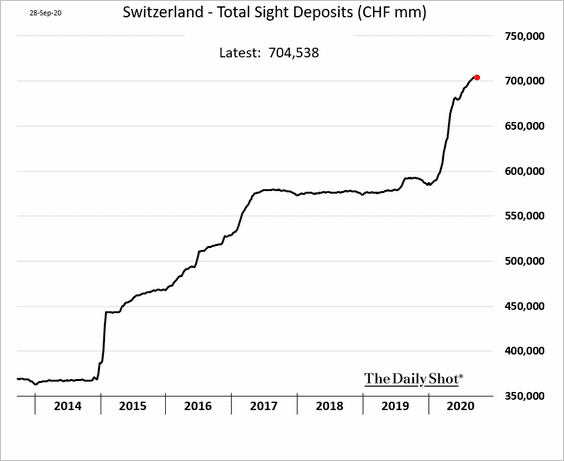

6. The Swiss central bank continues to intervene in the currency markets to keep the franc from further appreciation (mostly by buying euros).

And there is more on the way.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Japan

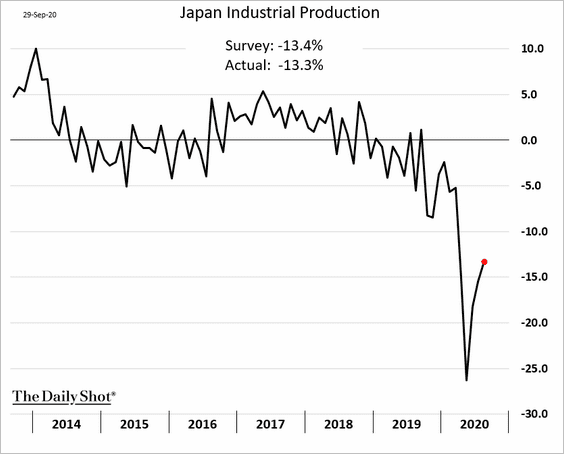

1. Industrial production recovery has a long way to go.

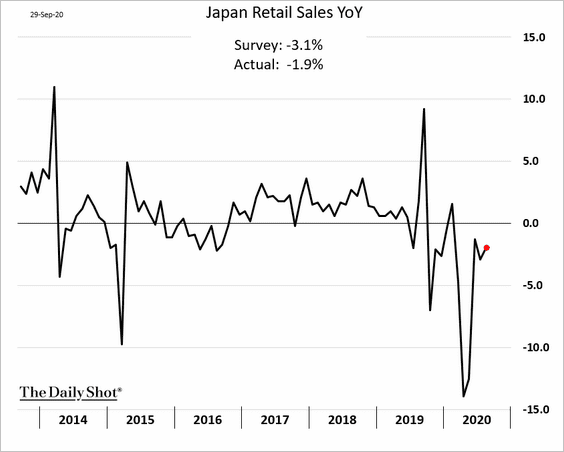

2. Retail sales surprised to the upside.

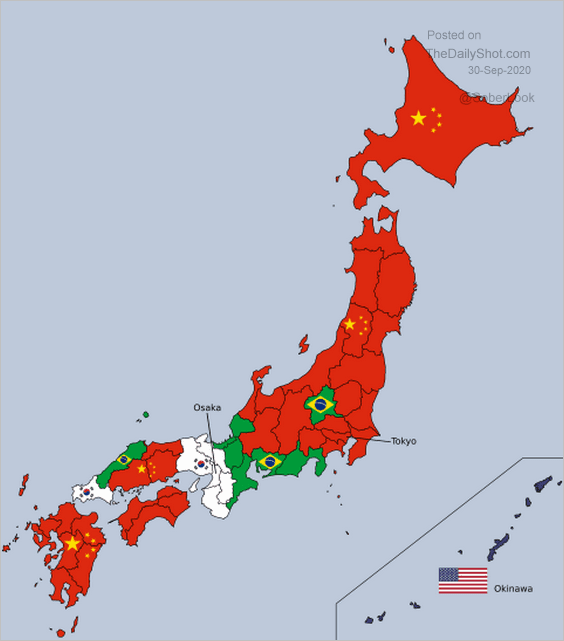

3. This map shows the most common foreign nationals in Japan by prefecture.

Source: @data_rep Read full article

Source: @data_rep Read full article

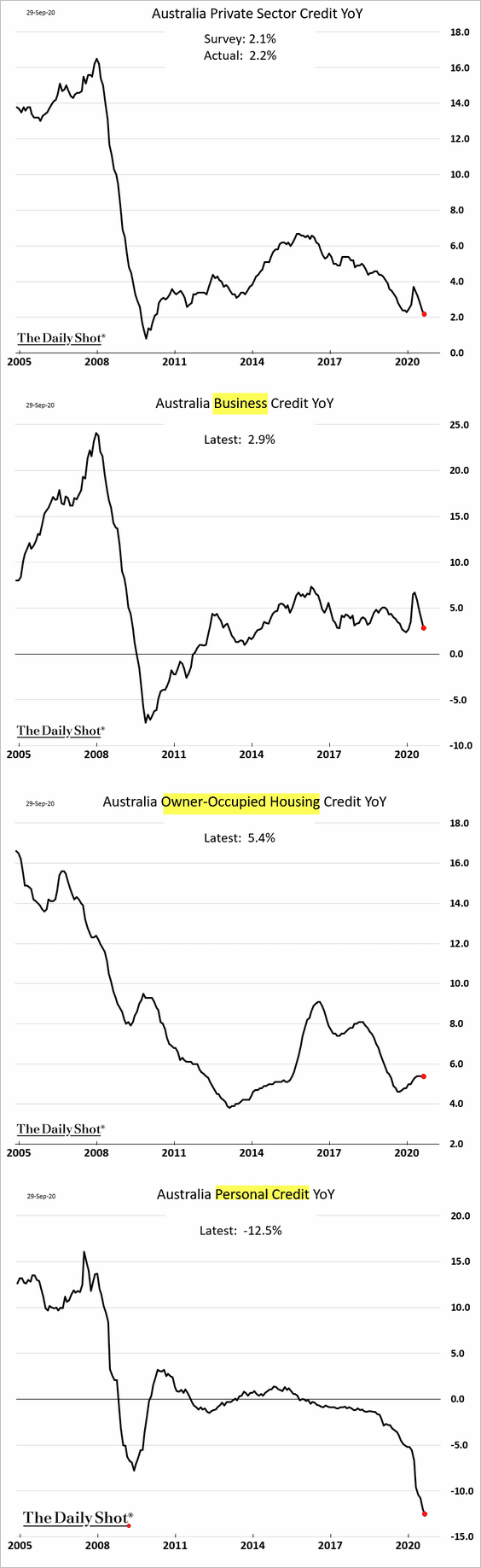

Australia

1. Private sector credit trends are not showing improvement.

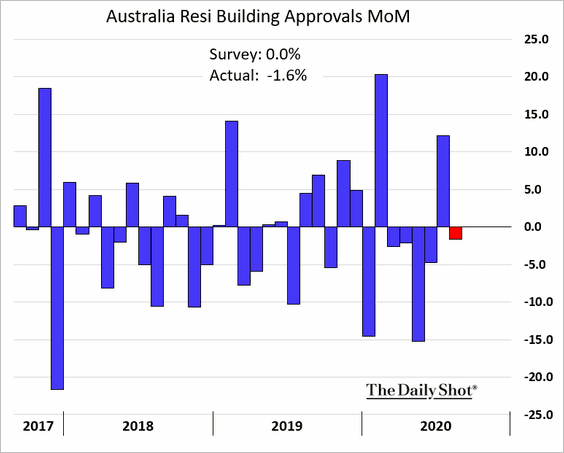

2. Building approvals eased last month.

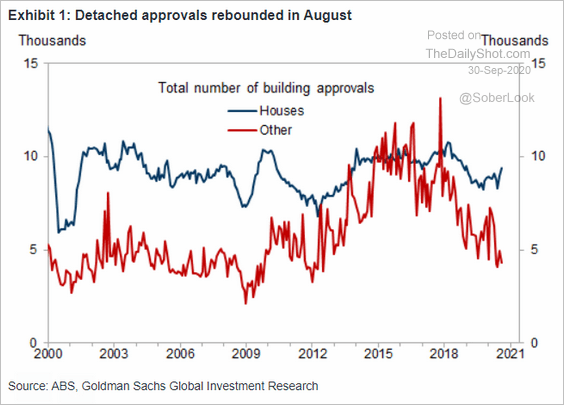

But detached units (houses) showed growth.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

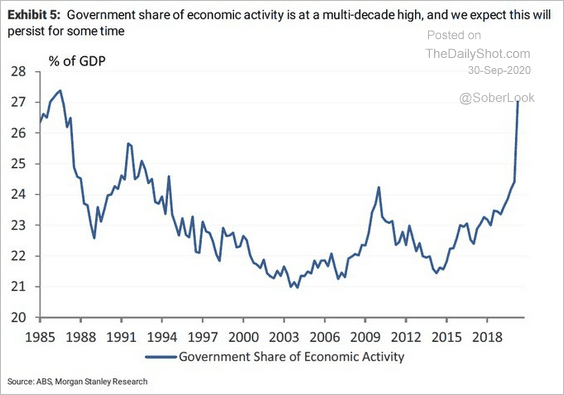

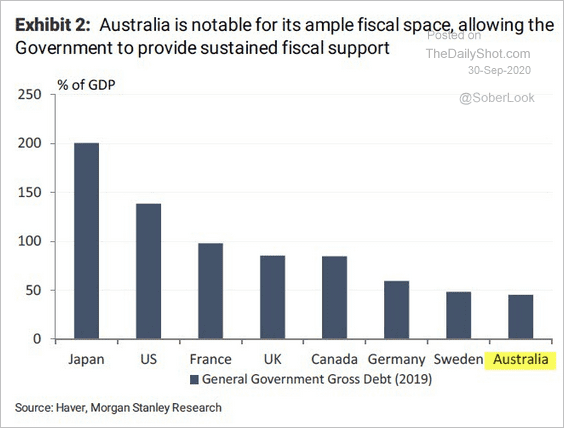

3. The government’s share of economic activity is at a multi-decade high.

Source: Morgan Stanley Research, @Scutty

Source: Morgan Stanley Research, @Scutty

And the nation has fiscal space for more stimulus.

Source: Morgan Stanley Research, @Scutty

Source: Morgan Stanley Research, @Scutty

——————–

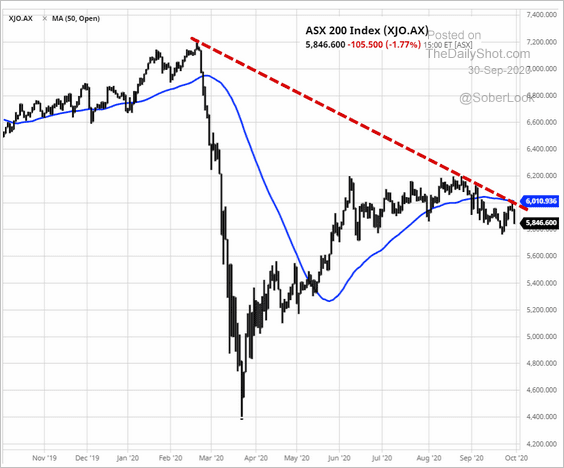

4. The S&P/ASX 200 is holding resistance.

Source: barchart.com

Source: barchart.com

China

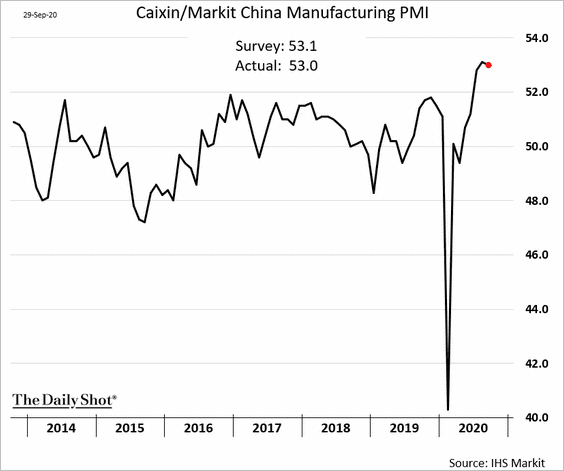

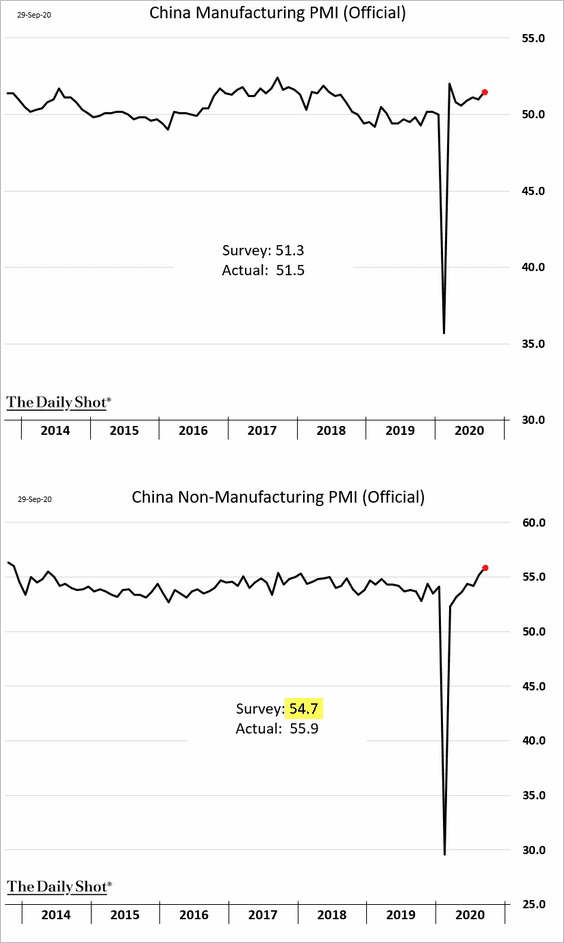

1. The September PMI reports show China’s business activity continuing to expand (PMI > 50).

• Markit PMI:

• Official PMI:

The services PMI index (above) hit the highest level since 2013.

——————–

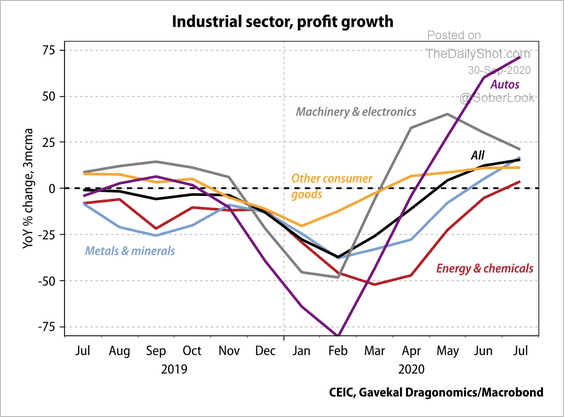

2. Profits have accelerated in the auto sector, while machinery and electronics have leveled off since April.

Source: Gavekal

Source: Gavekal

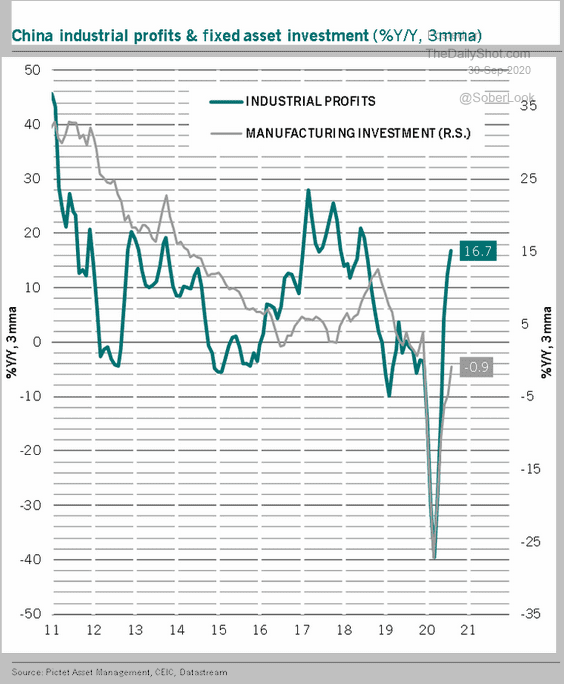

Will stronger industrial profits boost investment?

Source: @PkZweifel

Source: @PkZweifel

——————–

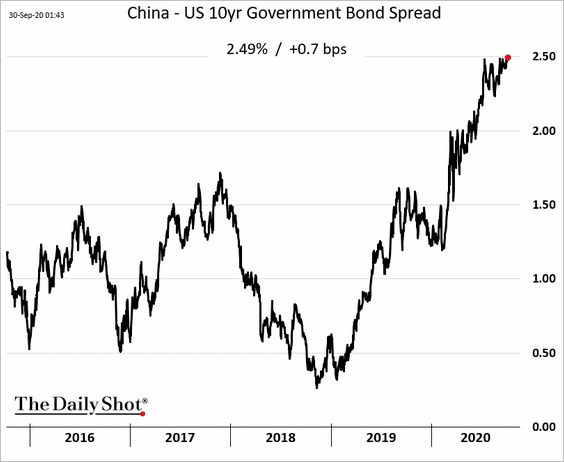

3. The China-US yield spread keeps grinding higher, which is a positive for the yuan.

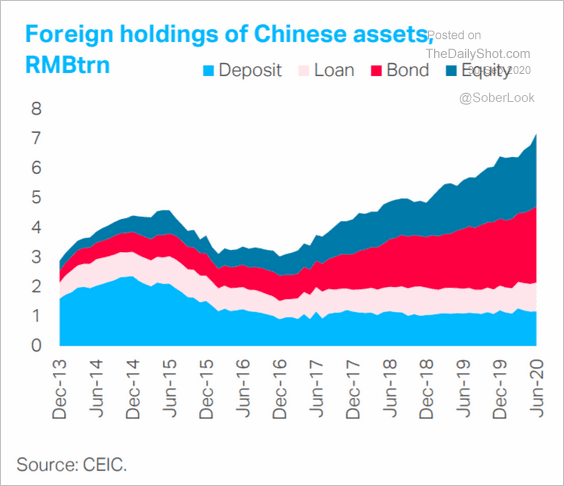

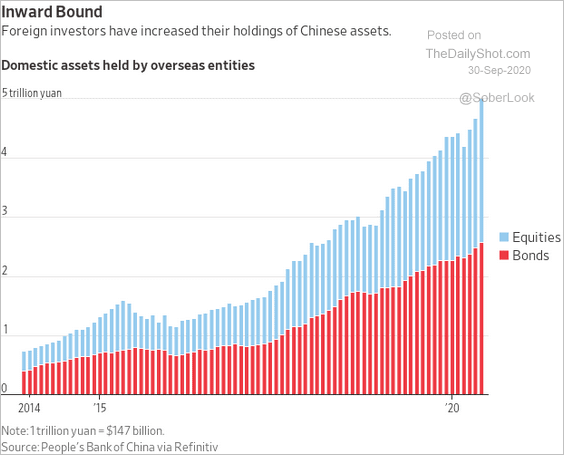

4. Foreign holdings of Chinese assets have been climbing (2 charts).

Source: TS Lombard

Source: TS Lombard

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

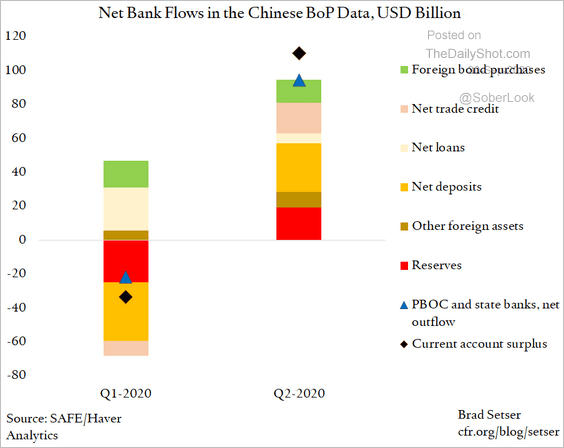

5. State banks added a substantial amount to their foreign portfolio in Q2.

Source: @Brad_Setser

Source: @Brad_Setser

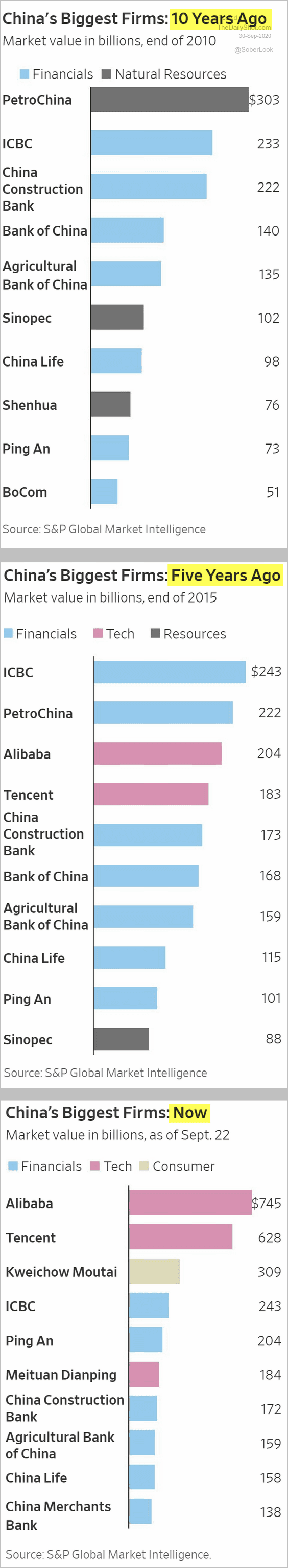

6. Here are China’s biggest firms: ten years ago, five years ago, and now.

Source: @WSJ Read full article

Source: @WSJ Read full article

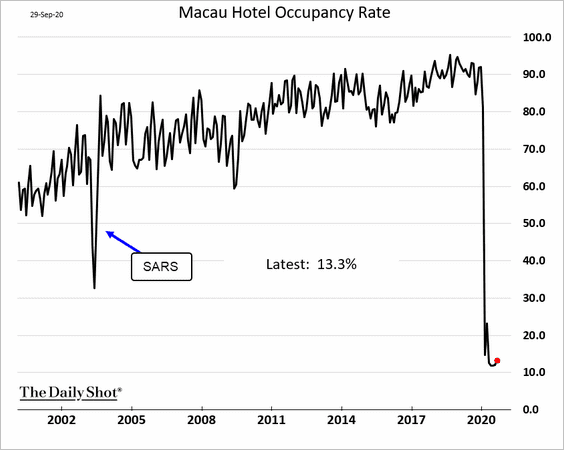

7. Gamblers are still staying away from Macau.

Emerging Markets

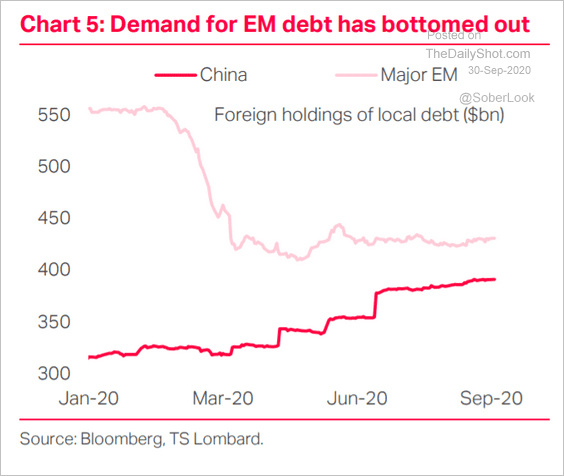

1. Foreign holdings of EM local debt have been steady.

Source: TS Lombard

Source: TS Lombard

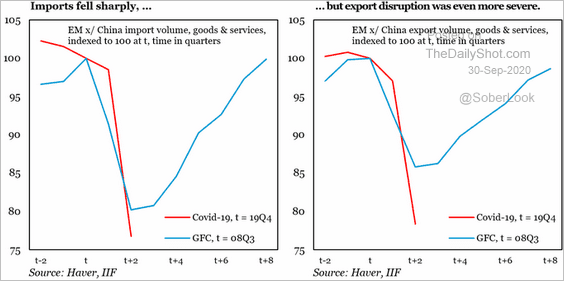

2. This chart compares the collapse in EM trade activity with the Great Financial Crisis.

Source: @IIF Read full article

Source: @IIF Read full article

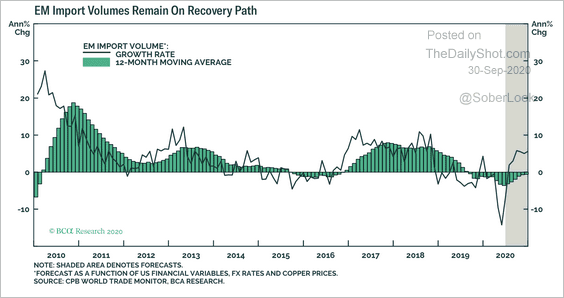

But imports have been recovering.

Source: BCA Research

Source: BCA Research

——————–

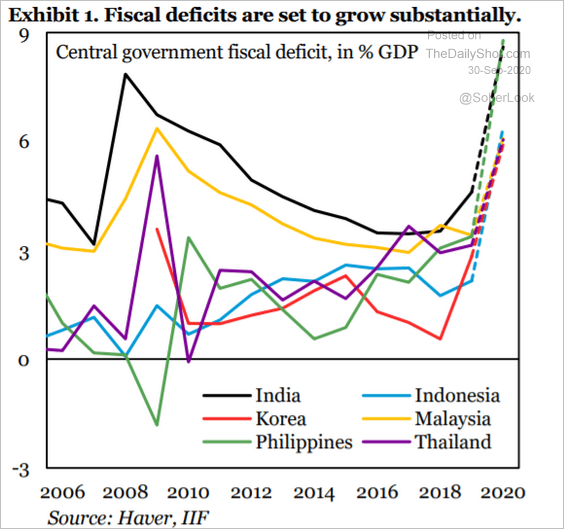

3. Fiscal deficits are expected to keep climbing.

Source: IIF

Source: IIF

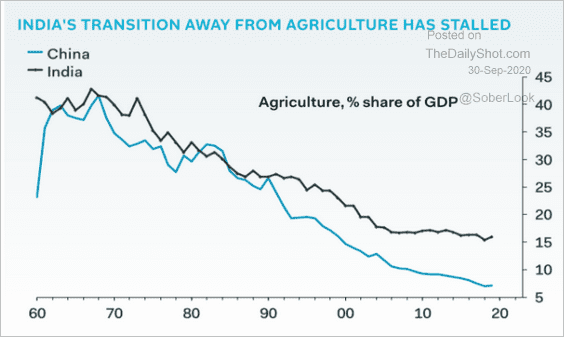

4. India’s shift away from agriculture has lagged China.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

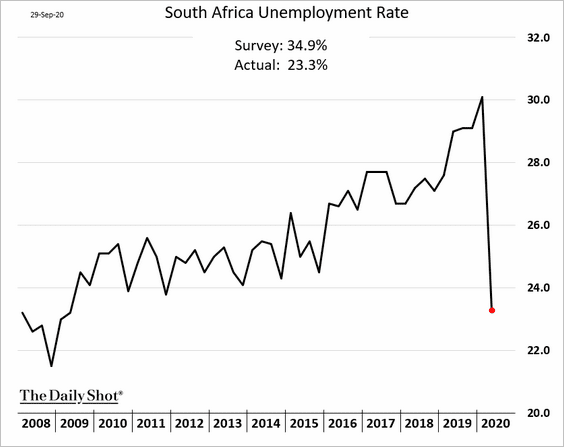

5. South Africa’s unemployment rate was artificially depressed amid lockdowns.

Source: @markets Read full article

Source: @markets Read full article

Commodities

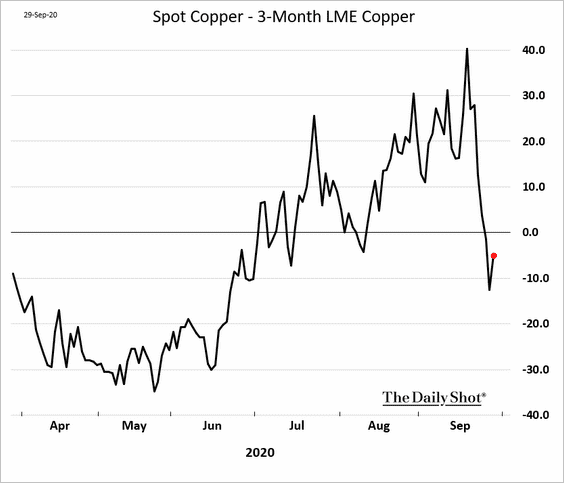

1. Copper is back in contango, suggesting that tight market conditions have receded.

h/t @MartinShanghai

h/t @MartinShanghai

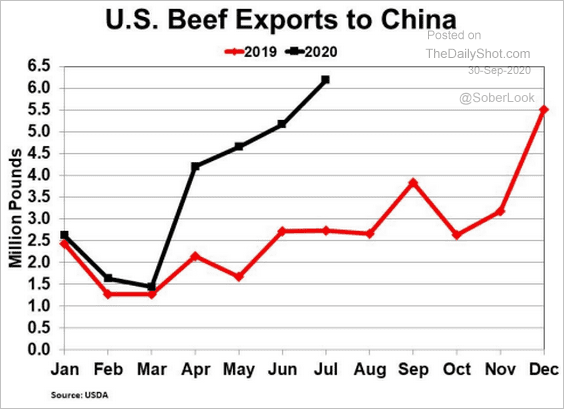

2. This chart shows US beef exports to China.

Source: @cattlefax Read full article

Source: @cattlefax Read full article

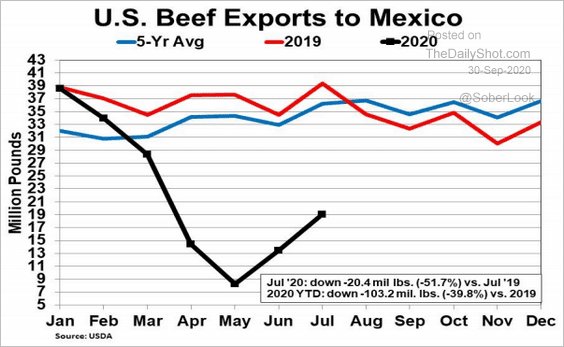

Beef exports to Mexico are recovering.

Source: @cattlefax Read full article

Source: @cattlefax Read full article

Energy

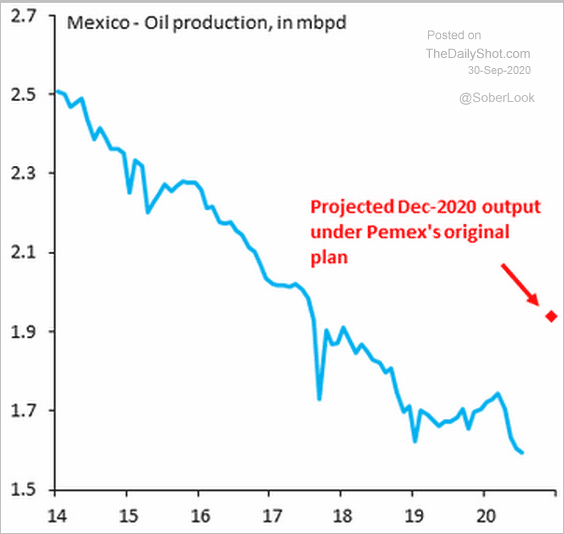

1. Mexico’s oil output has been well below target.

Source: @SergiLanauIIF

Source: @SergiLanauIIF

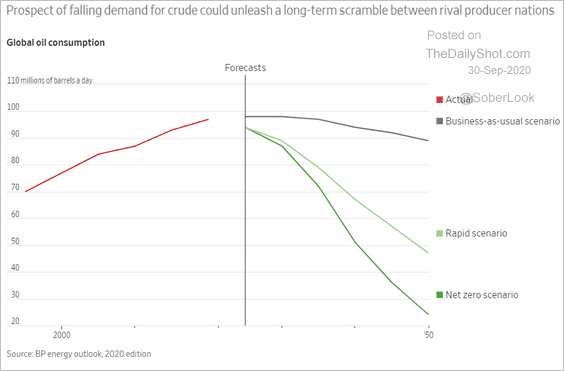

2. Peak oil demand?

Source: @WSJ Read full article

Source: @WSJ Read full article

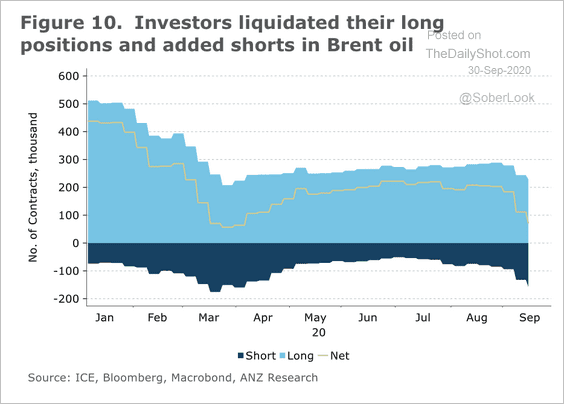

3. Speculative accounts have been trimming their bets on Brent.

Source: ANZ Research

Source: ANZ Research

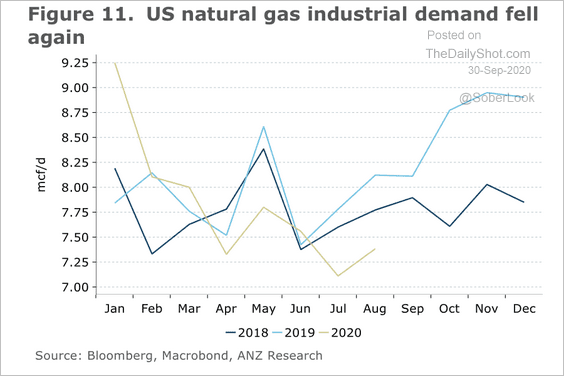

4. US natural gas demand is falling…

Source: ANZ Research

Source: ANZ Research

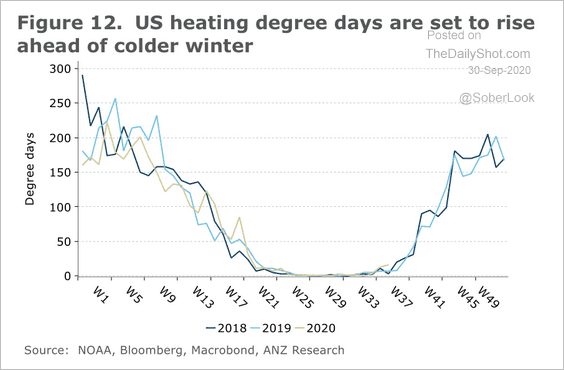

.. .but heating degree days are set to rise into the winter season.

Source: ANZ Research

Source: ANZ Research

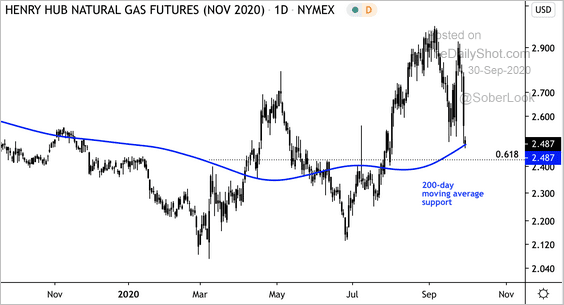

The November NYMEX natural gas futures contract is at its 200-day moving average.

Source: @DantesOutlook

Source: @DantesOutlook

Equities

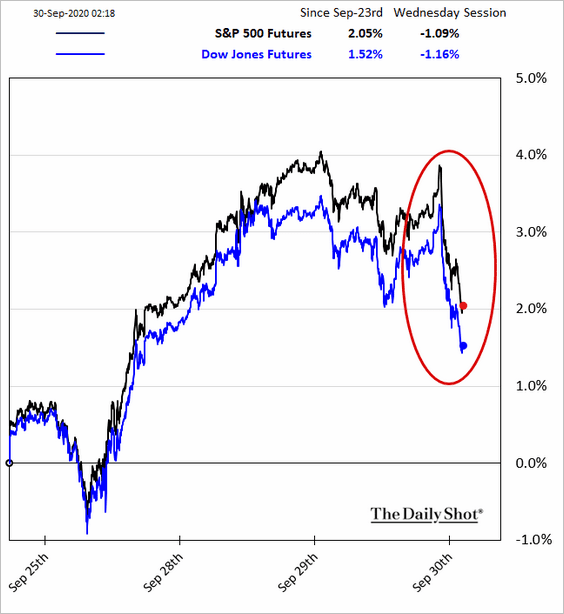

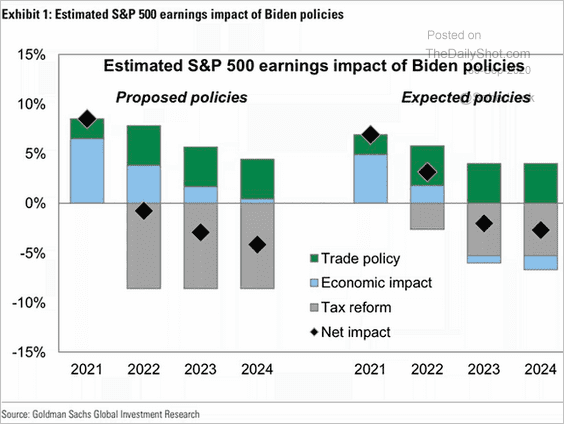

1. Stock futures softened after the presidential debate.

There is some concern about the peaceful transition of power after Election Day. Investors are also a bit uneasy about higher taxes ahead.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

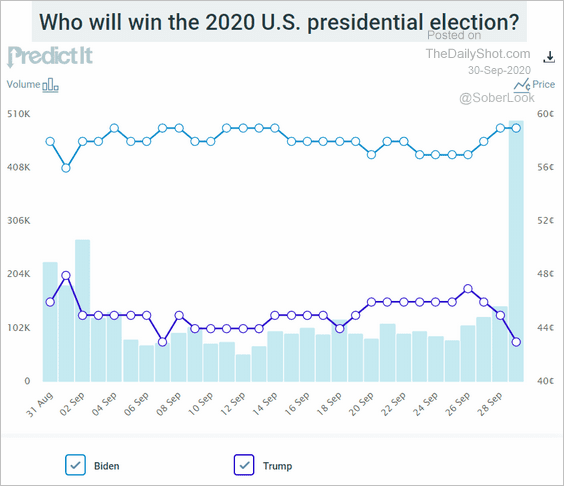

Here are the betting market odds after the debate.

Source: @PredictIt

Source: @PredictIt

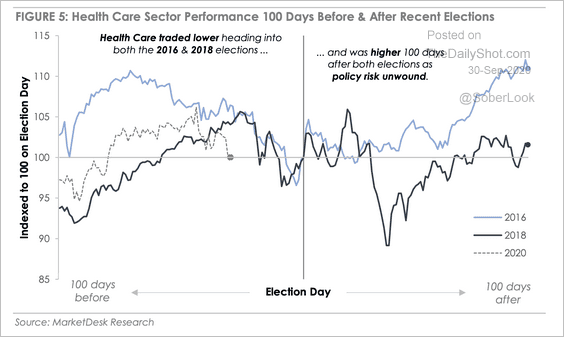

By the way, the healthcare sector traded lower heading into the 2016 and 2018 elections before rebounding about 100 days after both elections.

Source: MarketDesk Research

Source: MarketDesk Research

——————–

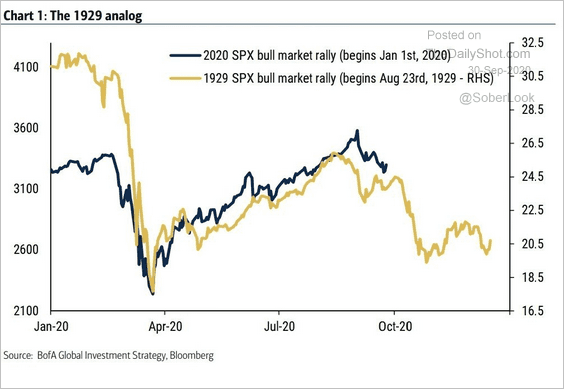

2. Is this a case of “spurious correlation”?

Source: BofA Global Research, @barnejek

Source: BofA Global Research, @barnejek

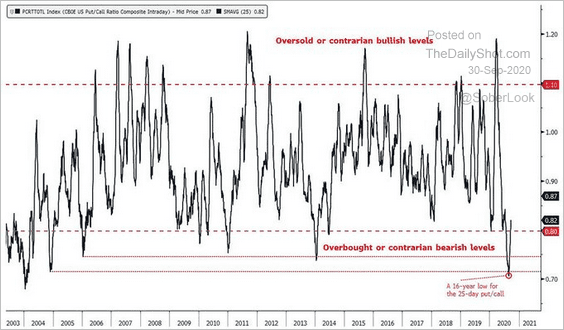

3. The put/call ratio did not show capitulation in the latest selloff.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

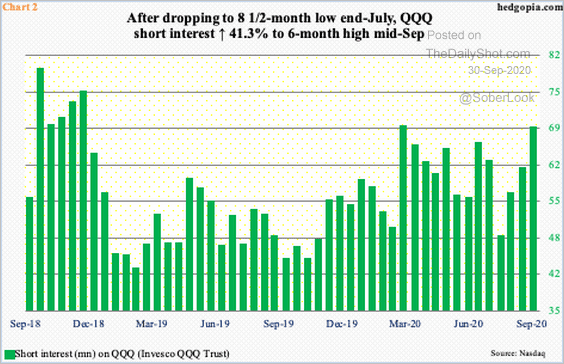

On the other hand, short interest in QQQ (Nasdaq 100 ETF) has risen.

Source: @hedgopia Read full article

Source: @hedgopia Read full article

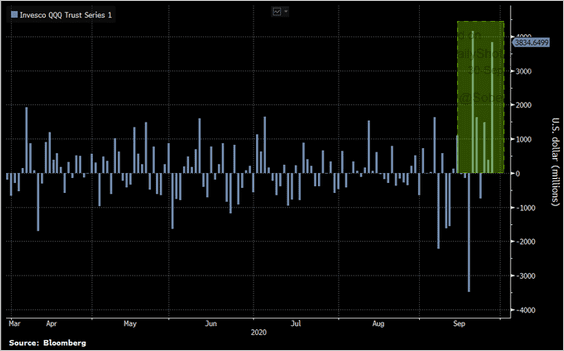

By the way, QQQ inflows remain elevated.

Source: @SarahPonczek

Source: @SarahPonczek

——————–

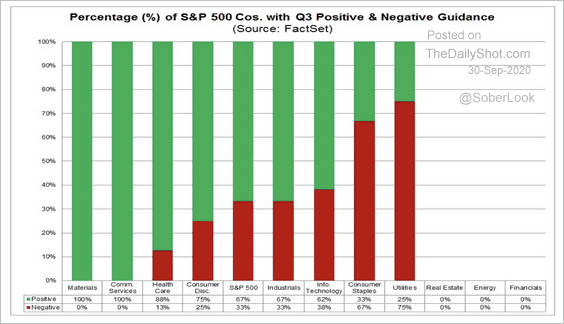

4. This chart shows Q3 positive and negative guidance by sector.

Source: @FactSet

Source: @FactSet

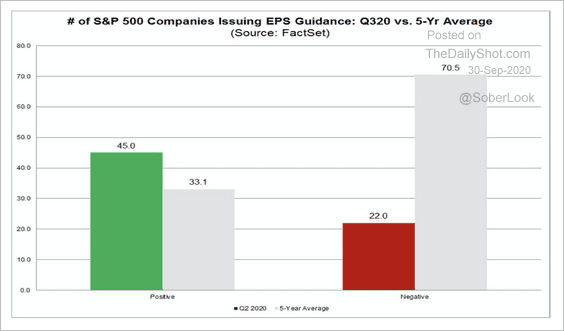

More S&P 500 companies are issuing positive EPS guidance in Q3 relative to the 5-year average.

Source: @FactSet

Source: @FactSet

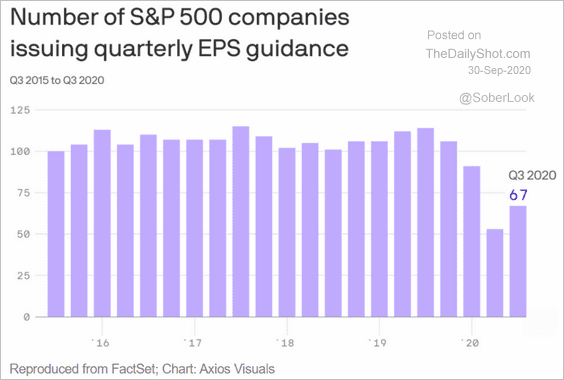

But fewer companies are issuing guidance at all.

Source: @axios Read full article

Source: @axios Read full article

——————–

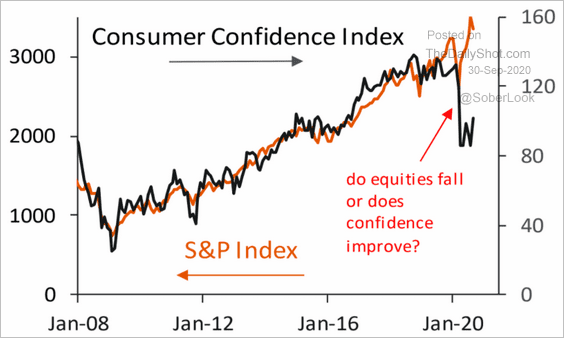

5. The gap between the stock market and consumer confidence remains wide.

Source: Piper Sandler

Source: Piper Sandler

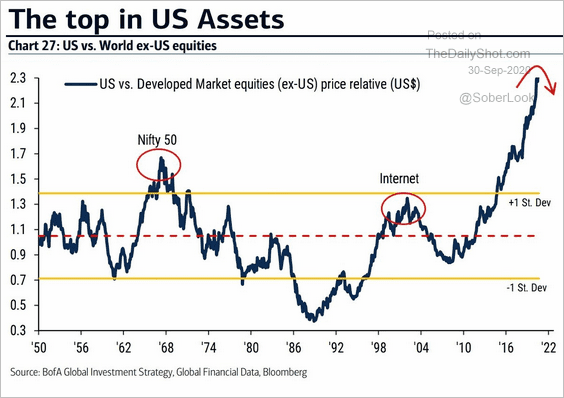

6. The US outperformance vs. other markets appears to be stretched.

Source: BofA Global Research, @barnejek

Source: BofA Global Research, @barnejek

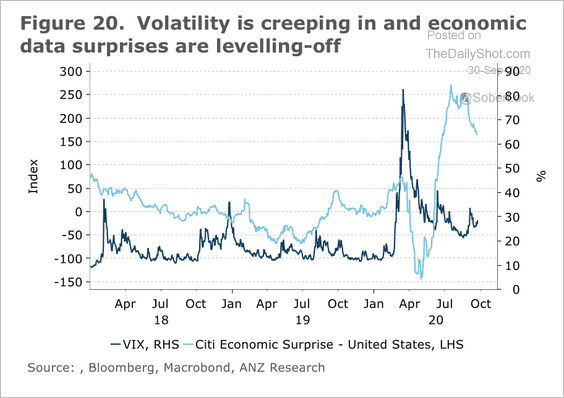

7. Volatility is picking up as the Citi Economic Surprise index moves lower.

Source: ANZ Research

Source: ANZ Research

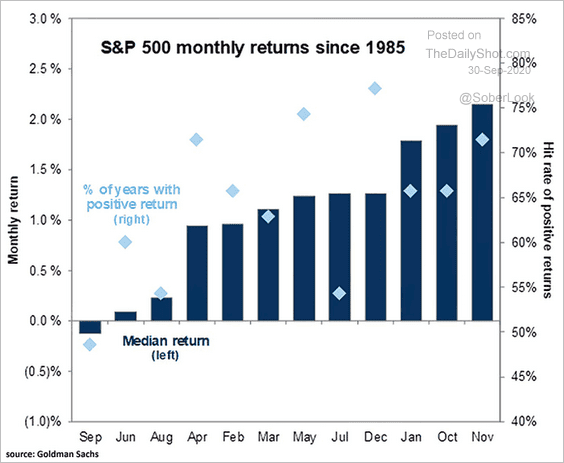

8. Historically, the S&P 500 performs well in the fourth quarter.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

Global Developments

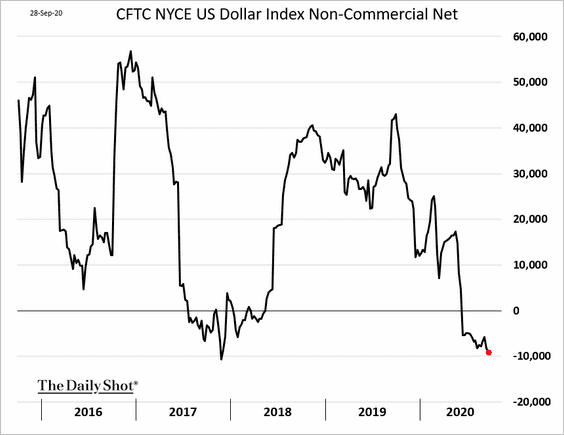

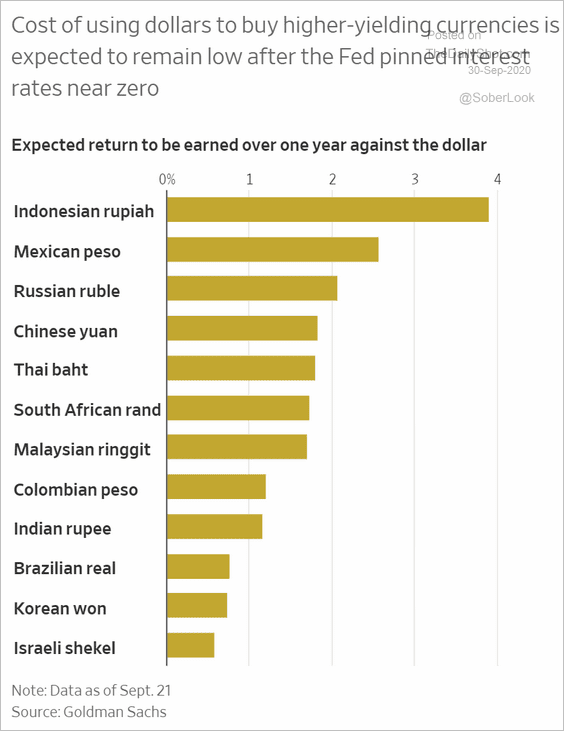

1. Let’s begin with some updates on the US dollar.

• Speculative accounts are short the dollar.

The dollar is now attractive as the short leg of carry trades.

Source: @WSJ Read full article

Source: @WSJ Read full article

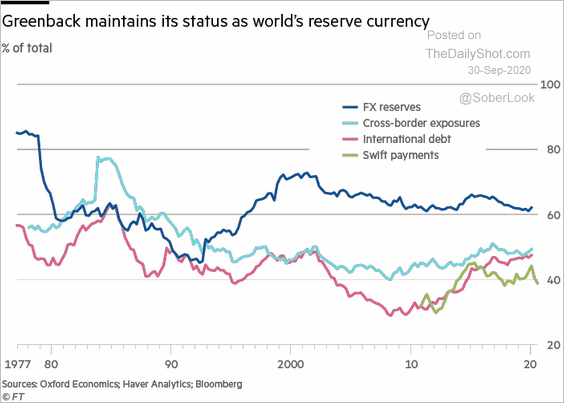

• The dollar remains the world’s reserve currency.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

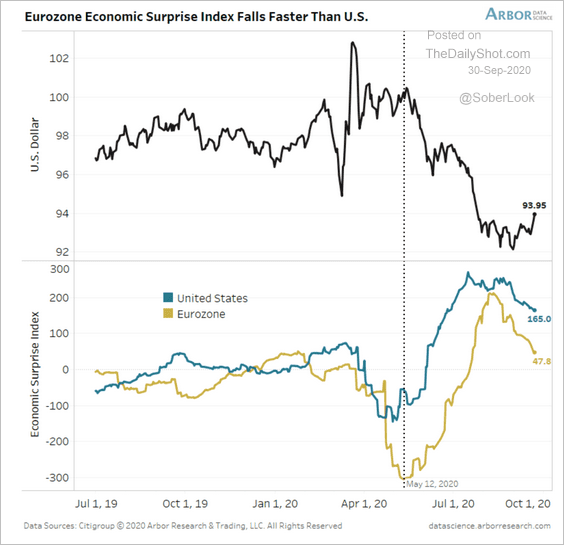

• The dollar’s short-term breakout comes after the eurozone’s economic surprise index lost pace relative to the US.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

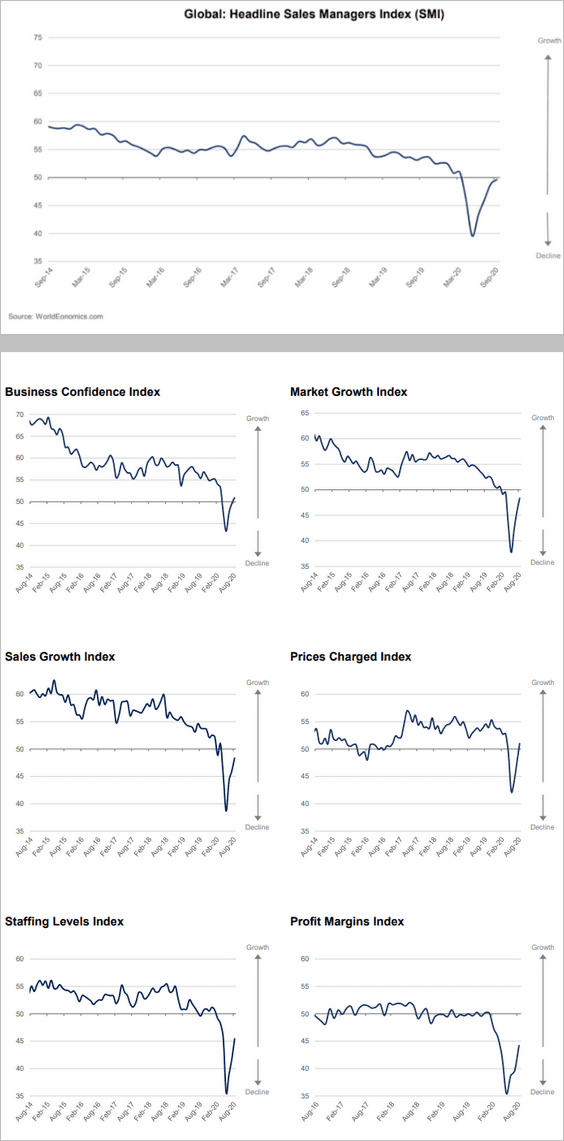

2. The World Economics global SMI report shows business activity stabilizing. However, employment (staffing levels index) remains soft (SMI < 50).

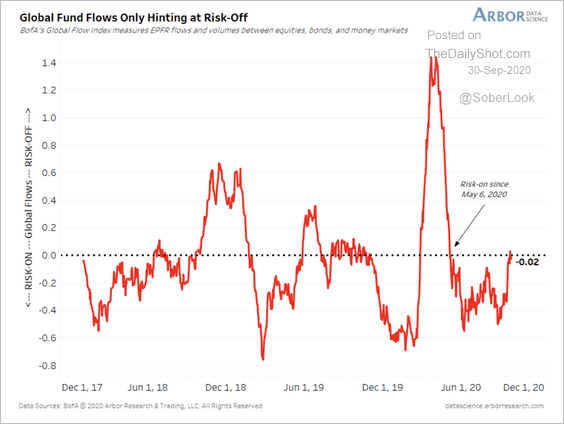

3. Fund flows have moved into risk-off mode.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

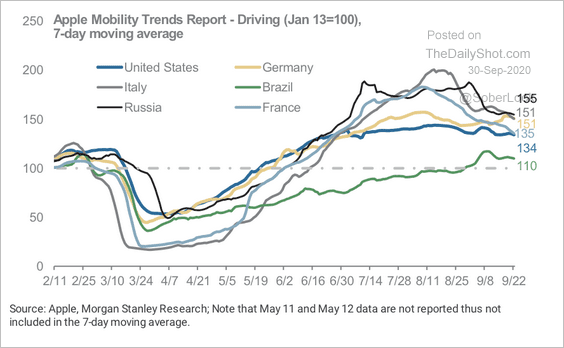

4. Driving mobility moderated in major economies.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

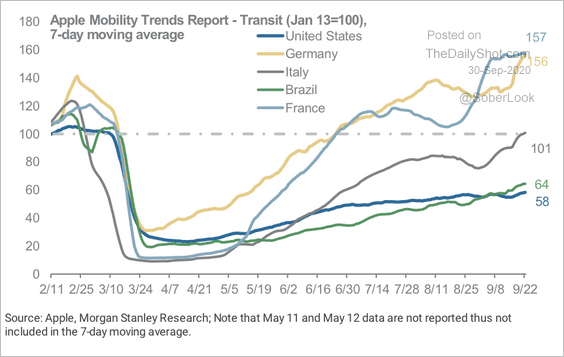

But there is a broad-based improvement in transit mobility.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

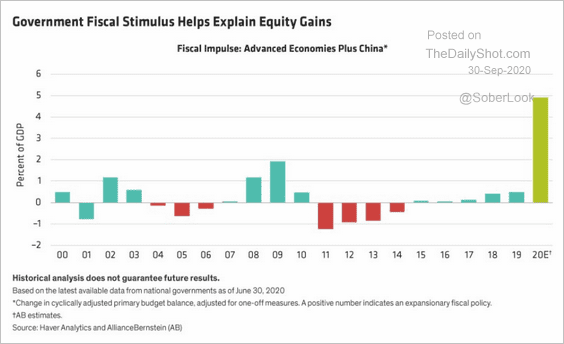

5. Massive fiscal stimulus explains the rapid gains in stocks this year.

Source: Alliance Bernstein, @tracyalloway

Source: Alliance Bernstein, @tracyalloway

——————–

Food for Thought

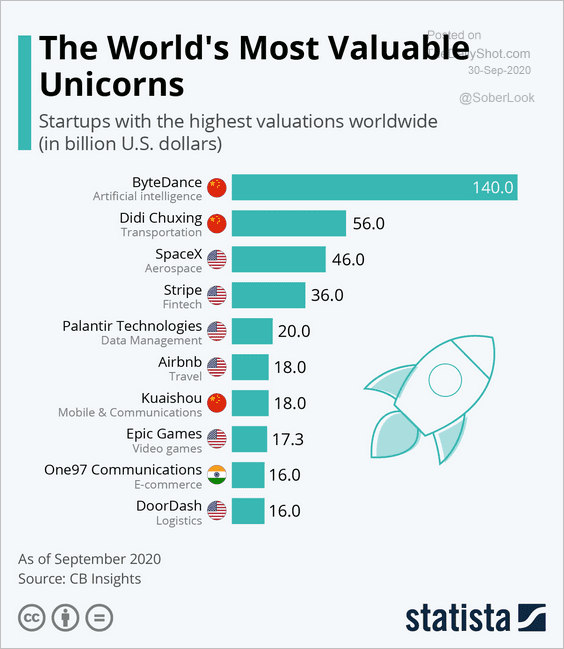

1. The world’s most valuable unicorns:

Source: Statista

Source: Statista

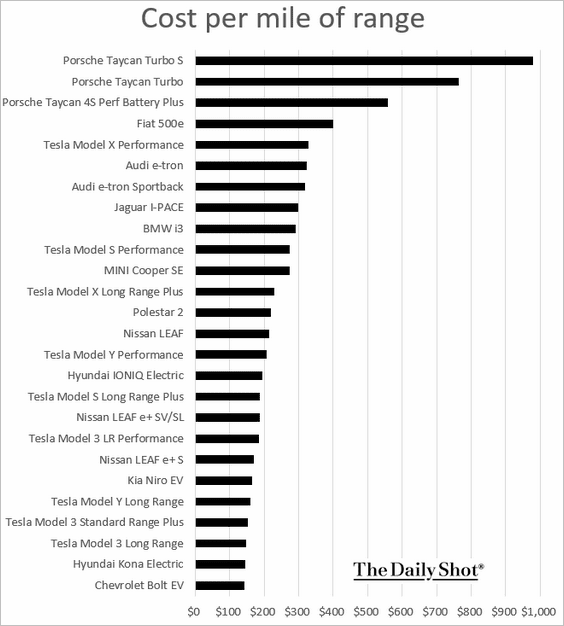

2. Cost per “mile of range” for electric vehicles:

Source: Visual Capitalist

Source: Visual Capitalist

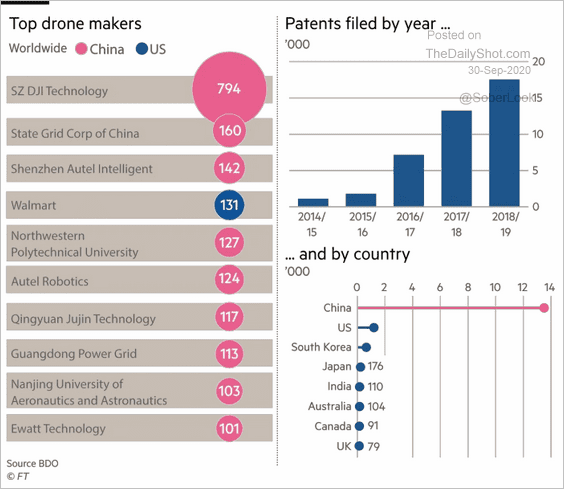

3. Drone production:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

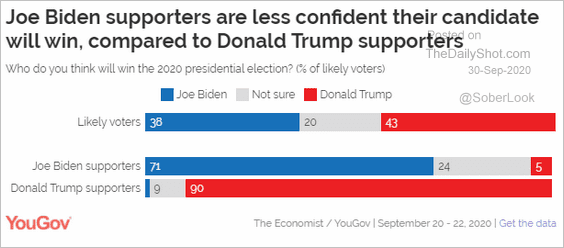

4. Who will win the 2020 presidential election?

Source: YouGov Read full article

Source: YouGov Read full article

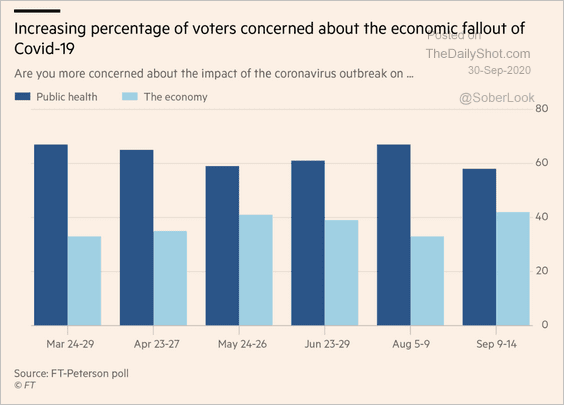

5. Concerns about the economy:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

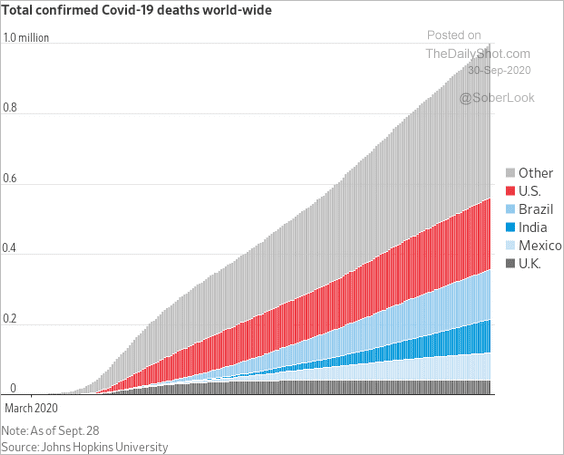

6. Confirmed COVID-19 deaths:

Source: @WSJ Read full article

Source: @WSJ Read full article

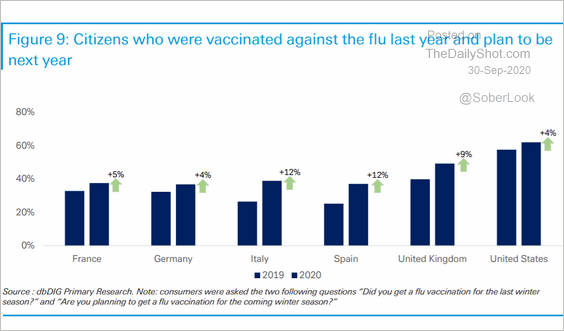

7. Vaccination against the flu:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

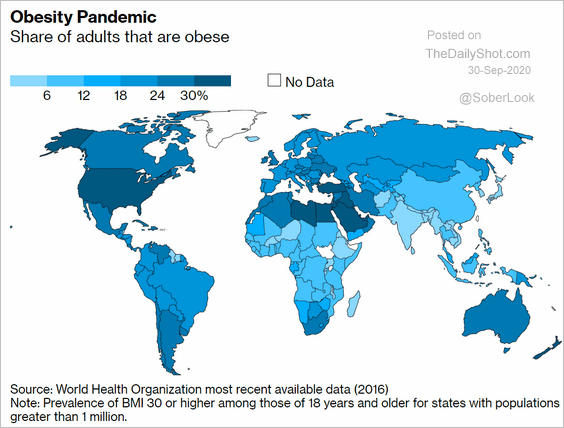

8. Obesity around the world:

Source: @business Read full article

Source: @business Read full article

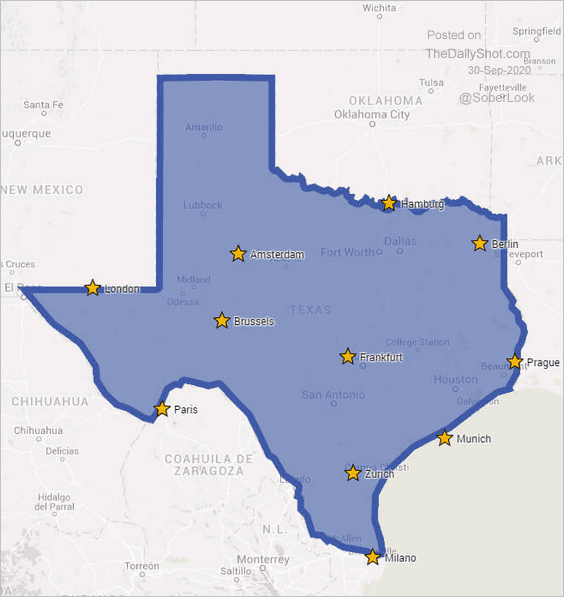

9. Texas towns named after cities in Europe:

Source: @BrilliantMaps Read full article

Source: @BrilliantMaps Read full article

——————–