The Daily Shot: 05-Oct-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Rates

• Global Developments

• Food for Thought

The United States

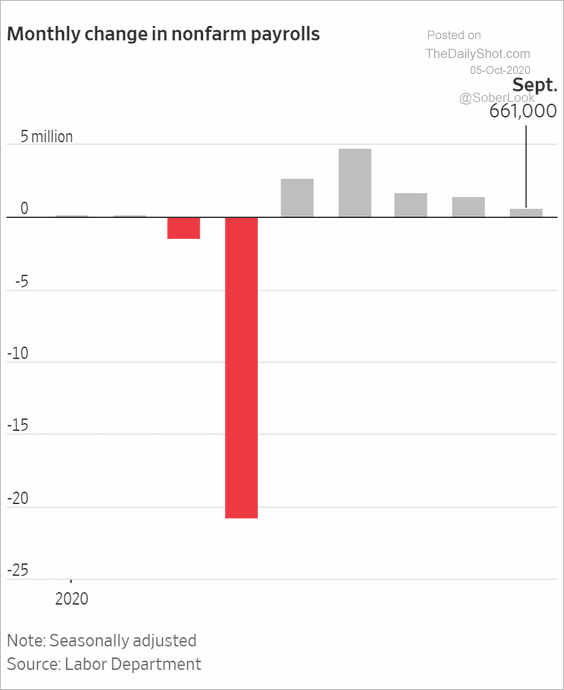

1. Let’s begin with the September payrolls report. The labor market recovery continued last month, but there were patches of weakness in the data. The headline payrolls figure was below consensus ,…

Source: @WSJ Read full article

Source: @WSJ Read full article

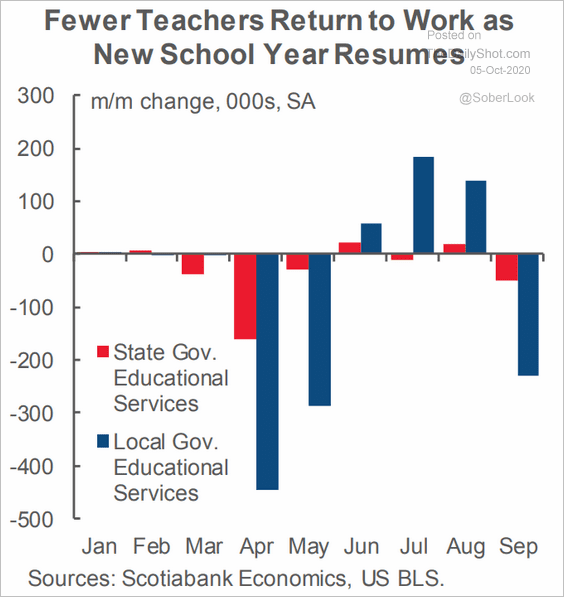

• … driven by weak government employment.

– Remote or limited-attendance classes resulted in fewer hires in the education sector.

Source: Scotiabank Economics

Source: Scotiabank Economics

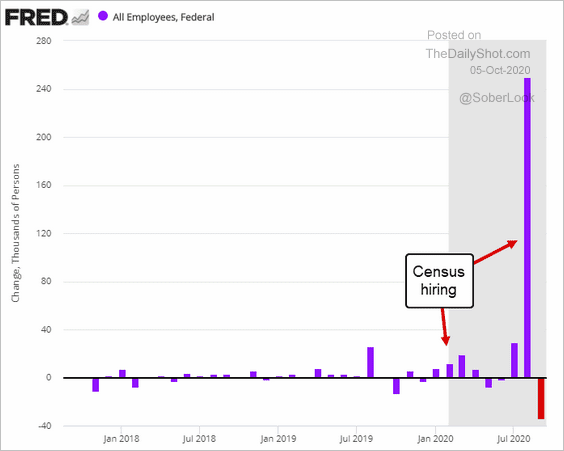

– There was also a reduction in census workers, which impacted federal employment.

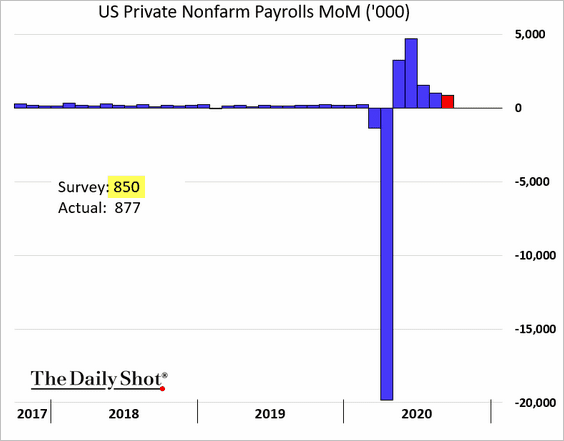

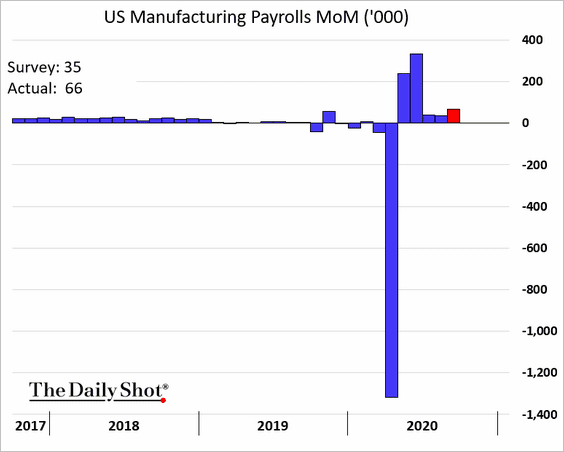

• But private payrolls exceeded expectations.

Here is manufacturing, for example.

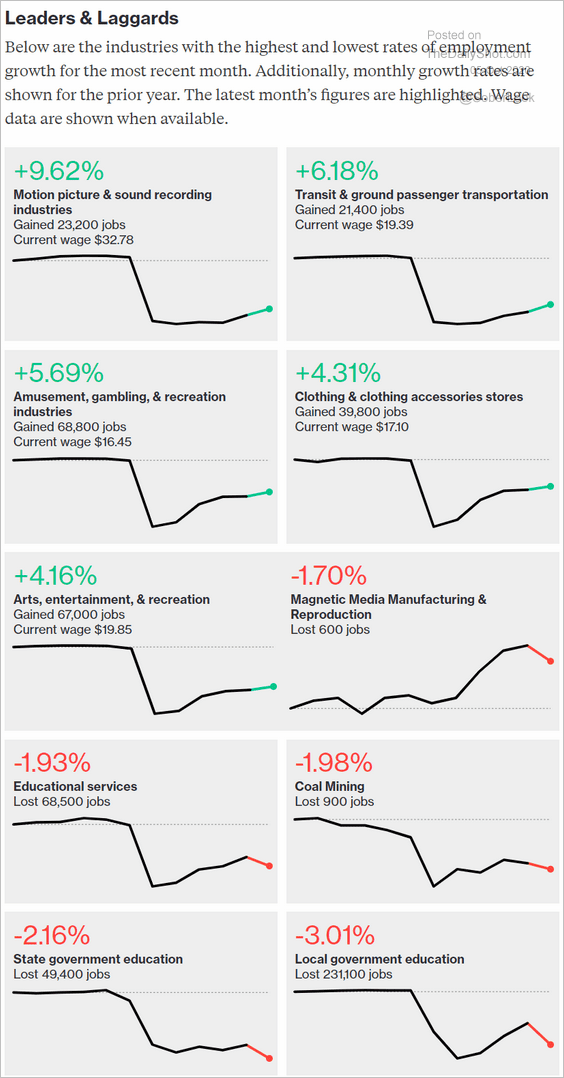

• Below are the best- and worst-performing sectors.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

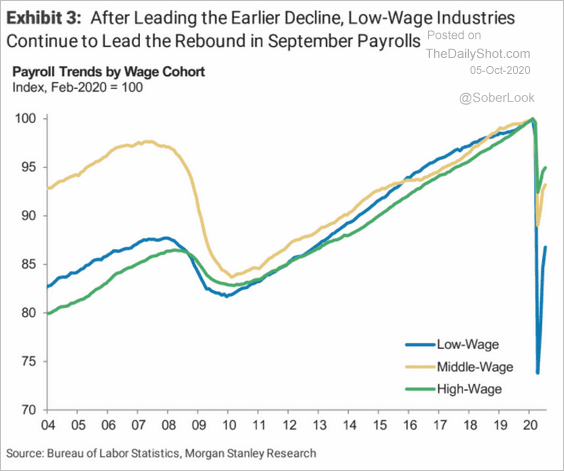

• Low-wage jobs were hit the hardest and are rebounding the fastest.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

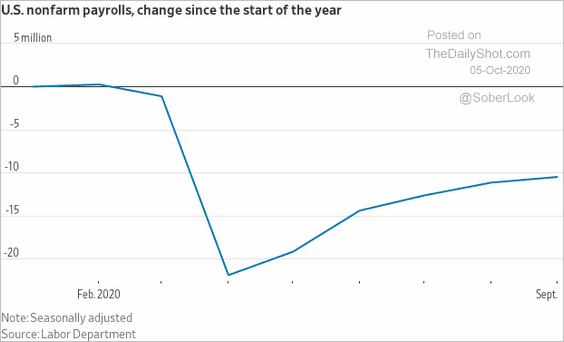

• Half of the jobs lost at the start of the crisis have been recovered.

Source: @WSJ Read full article

Source: @WSJ Read full article

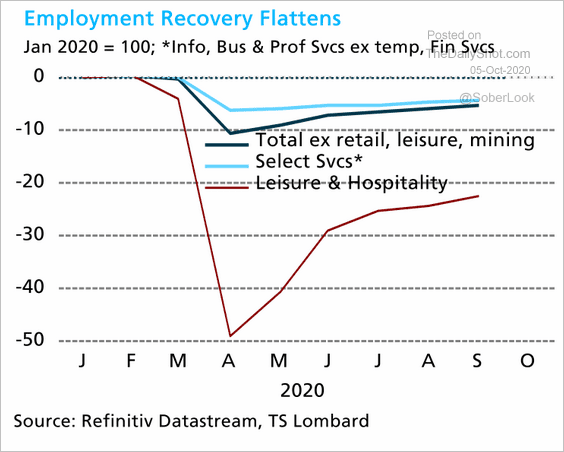

But the recovery momentum is slowing.

Source: TS Lombard

Source: TS Lombard

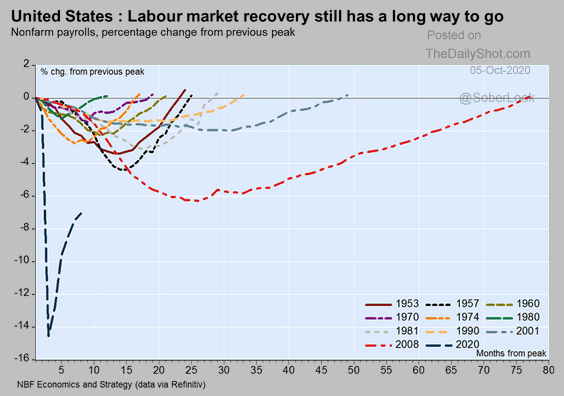

Here is a comparison to previous recessions.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

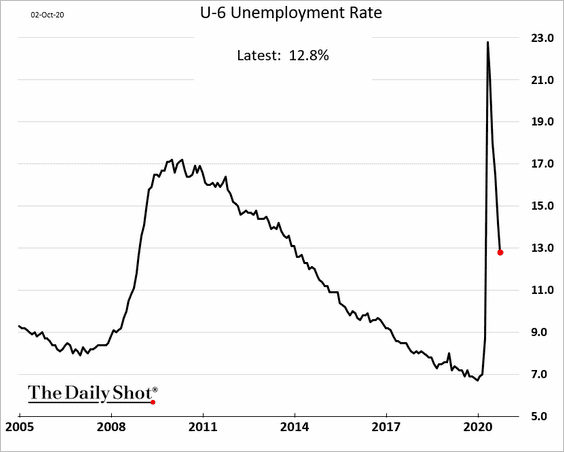

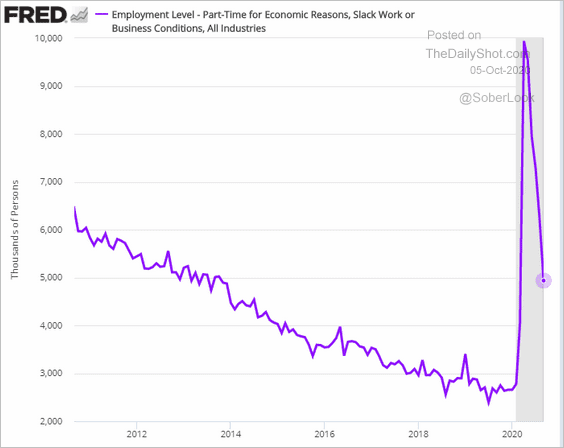

• Underemployment continues to improve.

– The U-6 unemployment rate:

– Part-time employment for “economic” reasons:

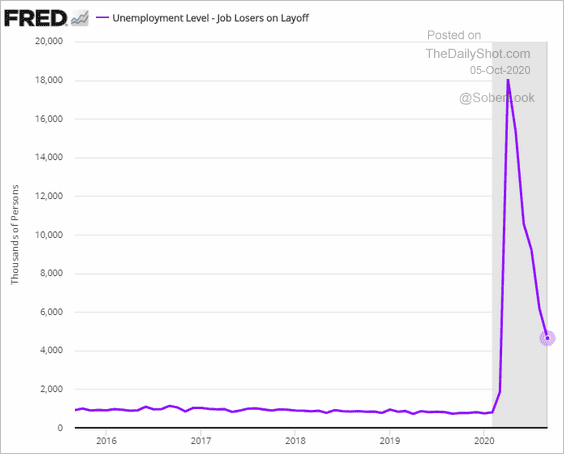

• The number of Americans on temporary layoffs is shrinking.

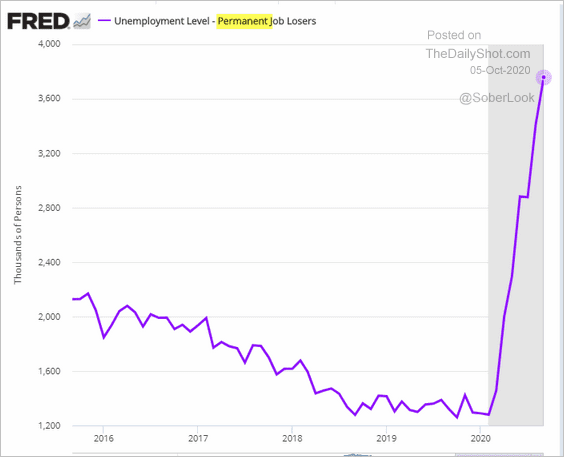

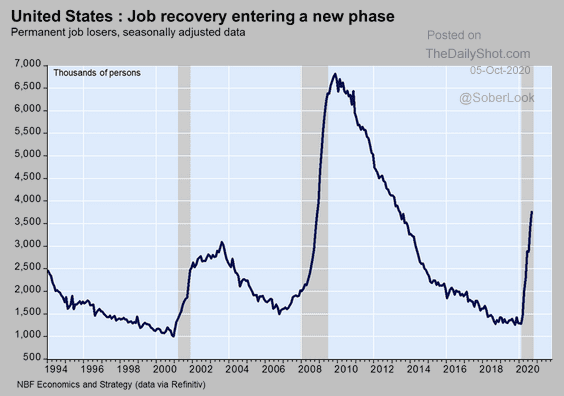

However, permanent layoffs have been on the rise (2 charts). This trend worries many economists.

Source: Economics and Strategy Group, National Bank of Canada

Source: Economics and Strategy Group, National Bank of Canada

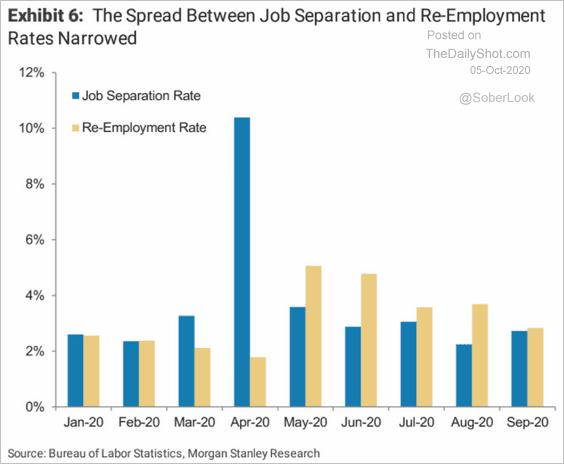

While re-employment rates continue to trend lower, separations remain elevated.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

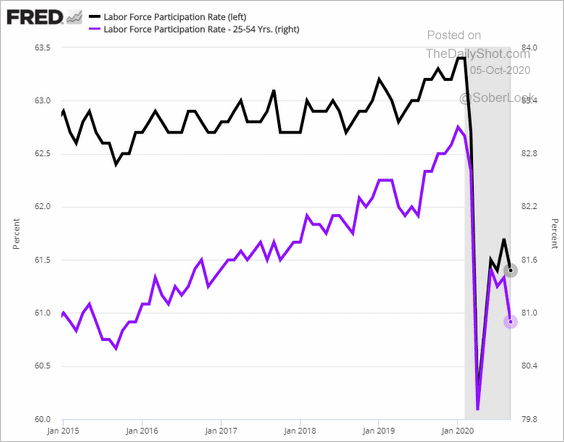

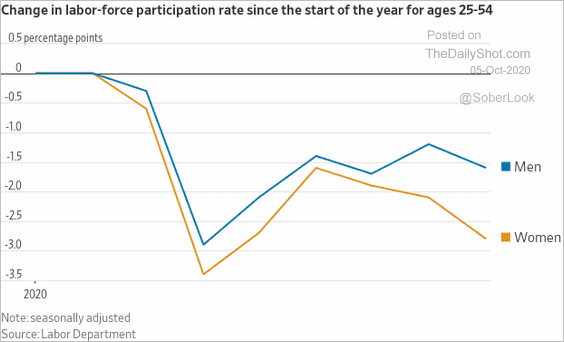

• Another concerning development is the weakness in prime-age labor force participation, especially among women (2nd chart).

Source: Jeffrey Sparshott, @WSJ Read full article

Source: Jeffrey Sparshott, @WSJ Read full article

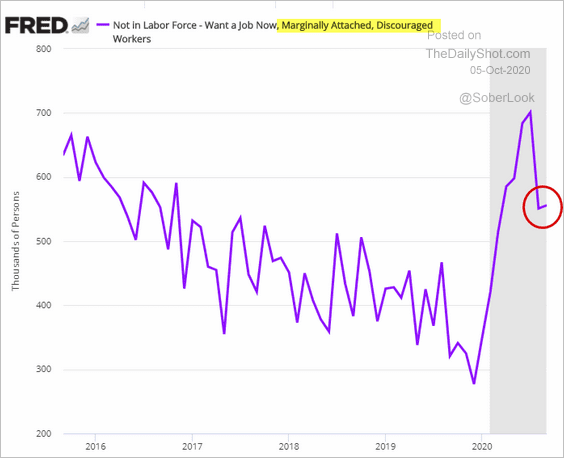

The number of discouraged workers ticked higher in September.

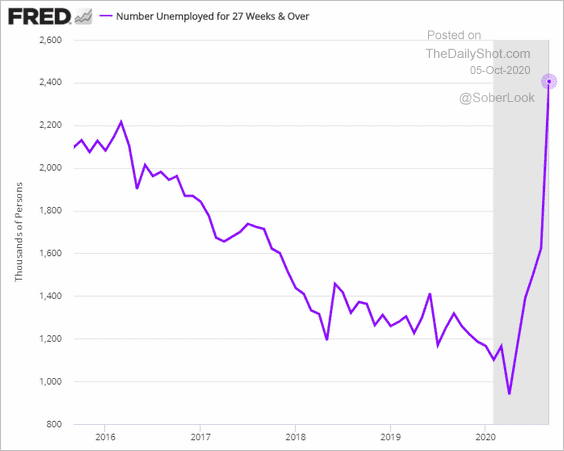

• Long-term unemployment keeps rising.

——————–

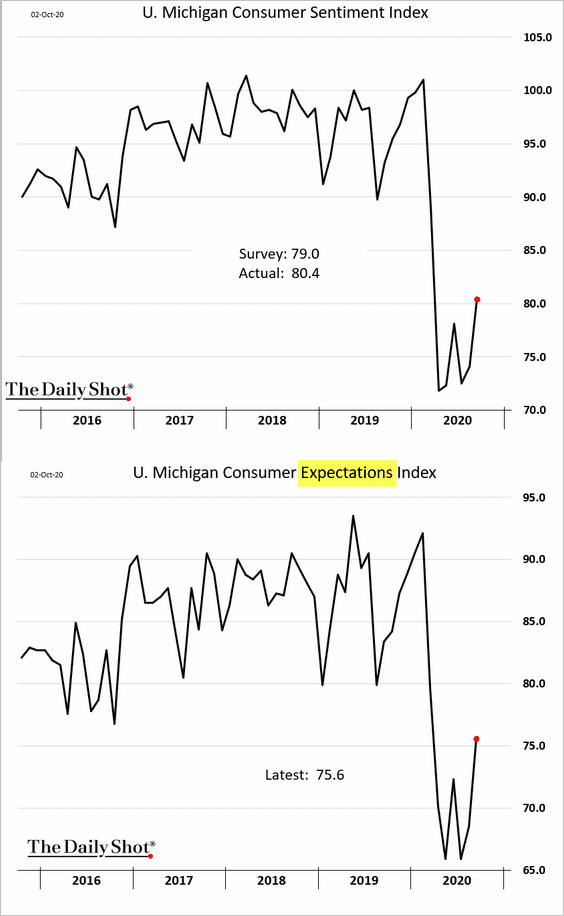

2. Just as we saw in the Conference Board’s index, the updated September U. Michigan consumer sentiment report showed substantial improvements.

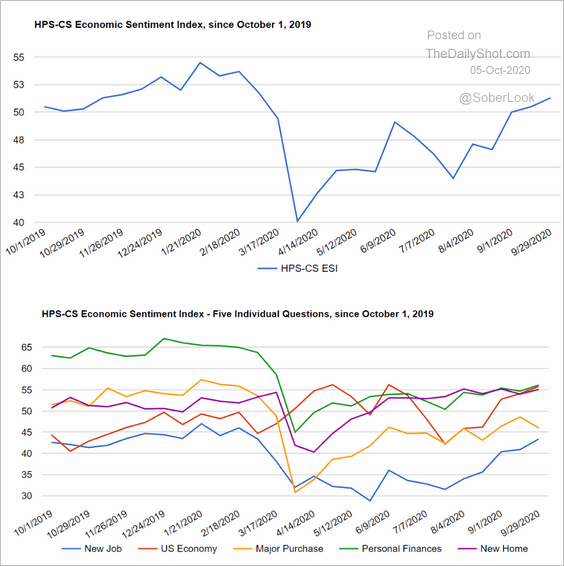

The HPS-CS sentiment data confirmed the rebound.

Source: @HPSInsight, @CivicScience

Source: @HPSInsight, @CivicScience

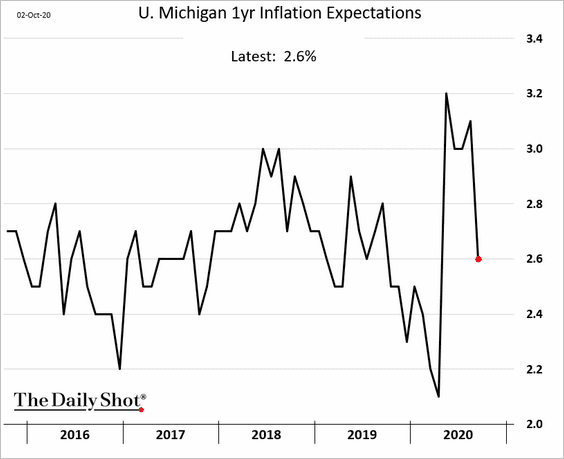

Inflation expectations have eased.

——————–

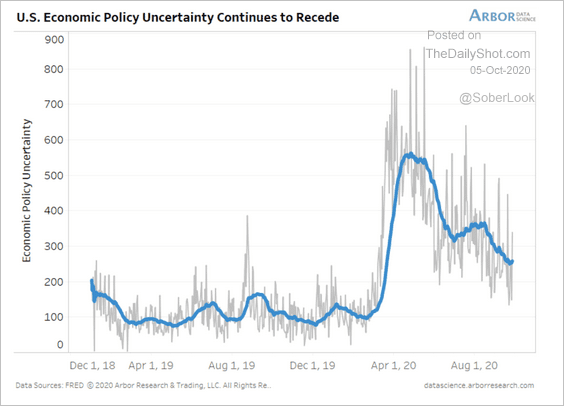

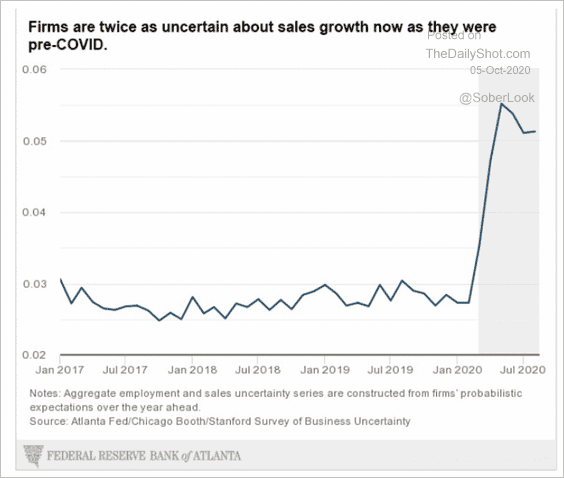

3. Economic policy uncertainty has been moderating.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

But business uncertainty remains elevated.

Source: Atlanta Fed

Source: Atlanta Fed

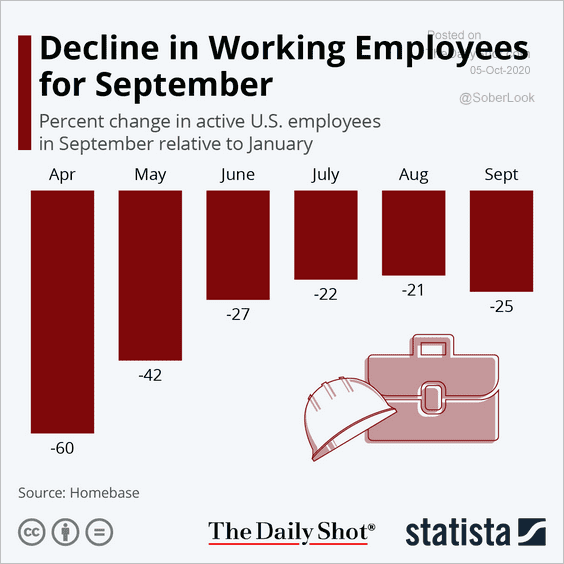

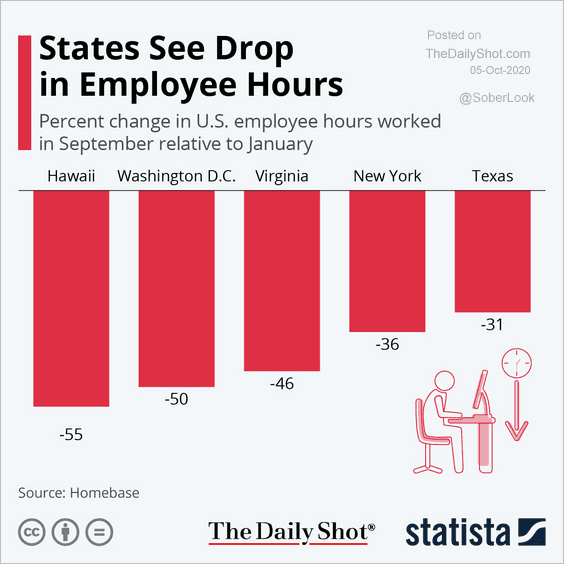

Small businesses are particularly vulnerable (2 charts).

Source: Statista

Source: Statista

Source: Statista

Source: Statista

——————–

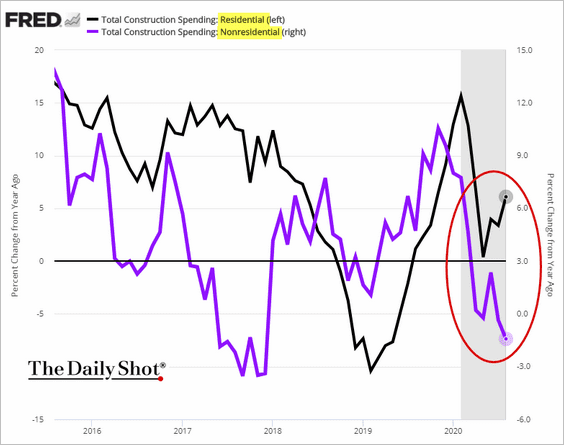

4. August construction spending data showed a sharp divergence between residential and nonresidential expenditures.

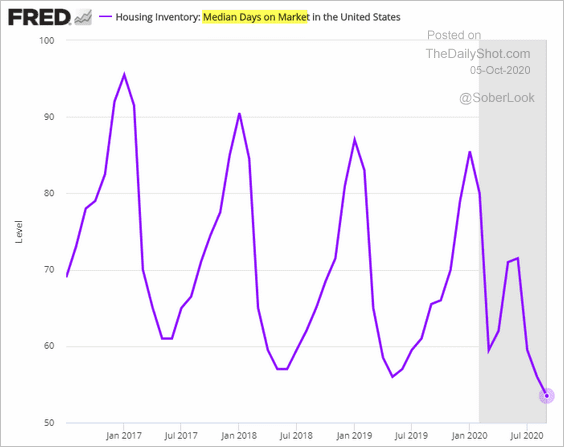

5. Housing inventories remain depressed, …

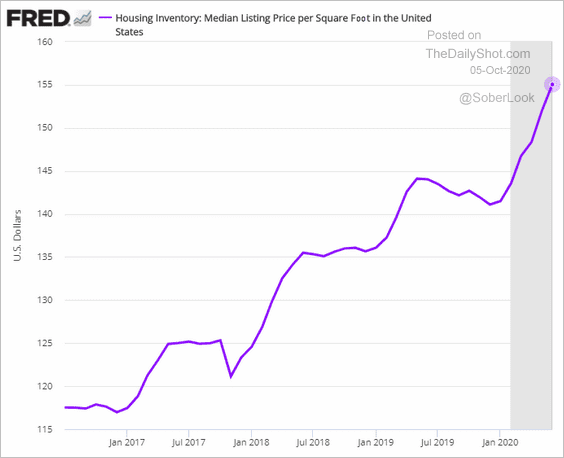

… pushing prices higher.

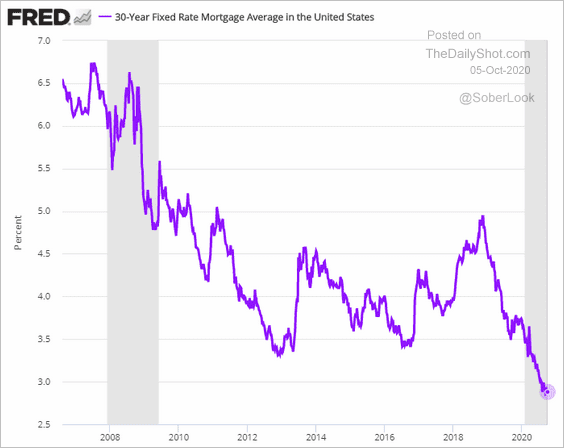

Record-low mortgage rates have been boosting demand.

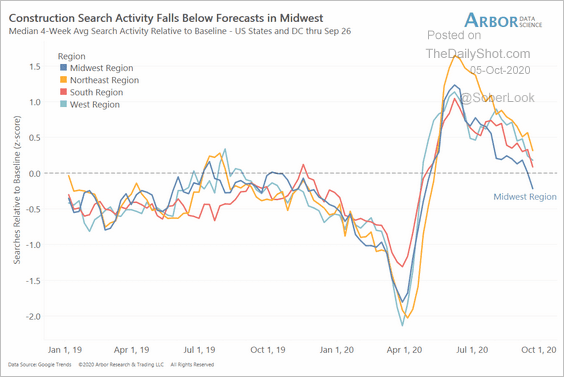

But online search activity for construction-related items has been slowing.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

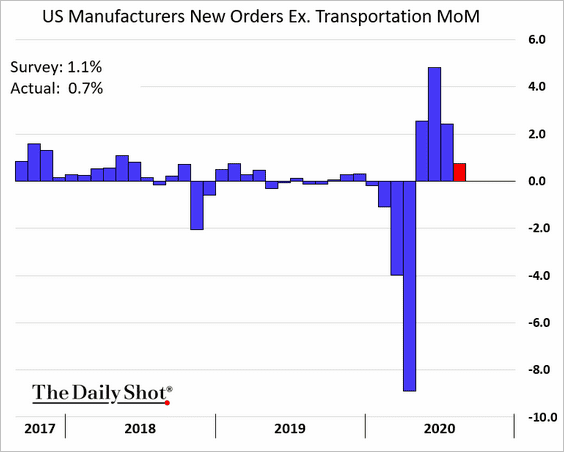

6. August factory orders showed some loss of momentum.

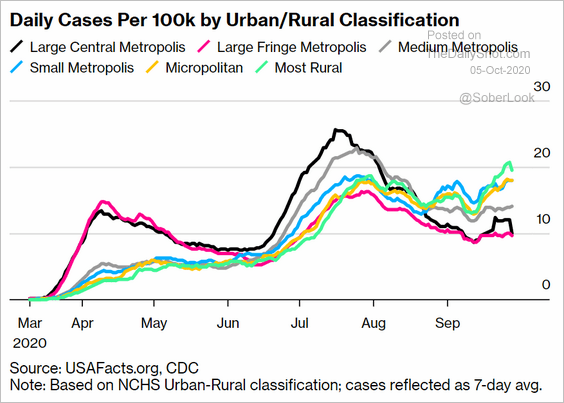

7. Rural America has been experiencing a substantial increase in COVID cases.

Source: @business Read full article

Source: @business Read full article

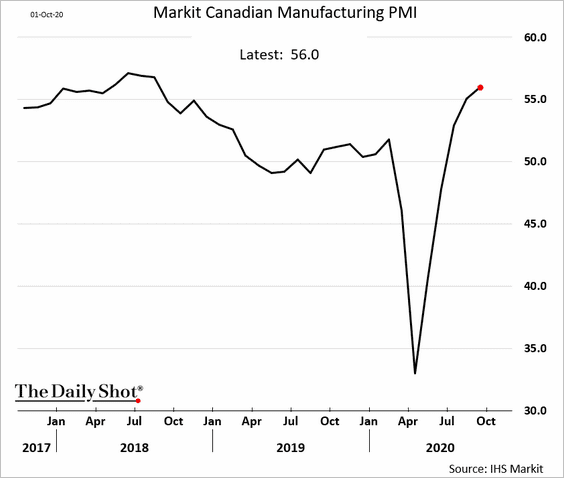

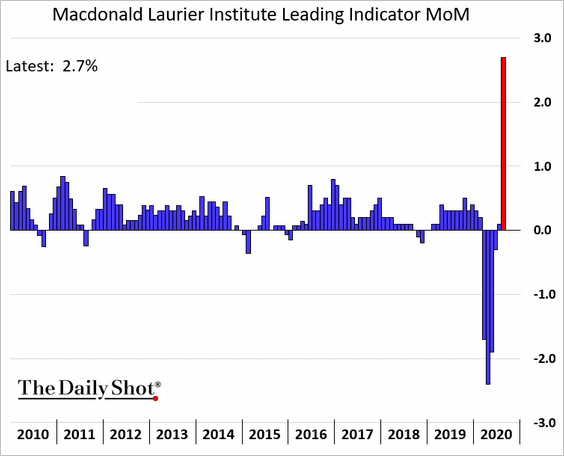

Canada

1. Factory activity accelerated last month.

2. Canada’s leading indicator soared in August.

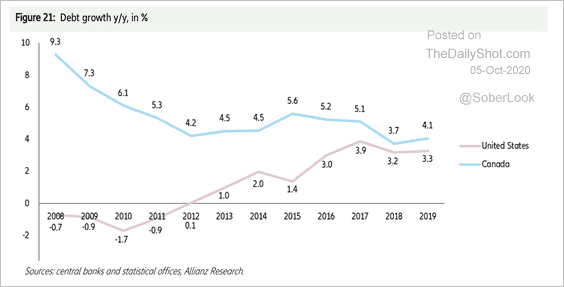

3. Here are the trends in Canadian vs. US household debt-to-GDP ratios.

Source: Allianz Research

Source: Allianz Research

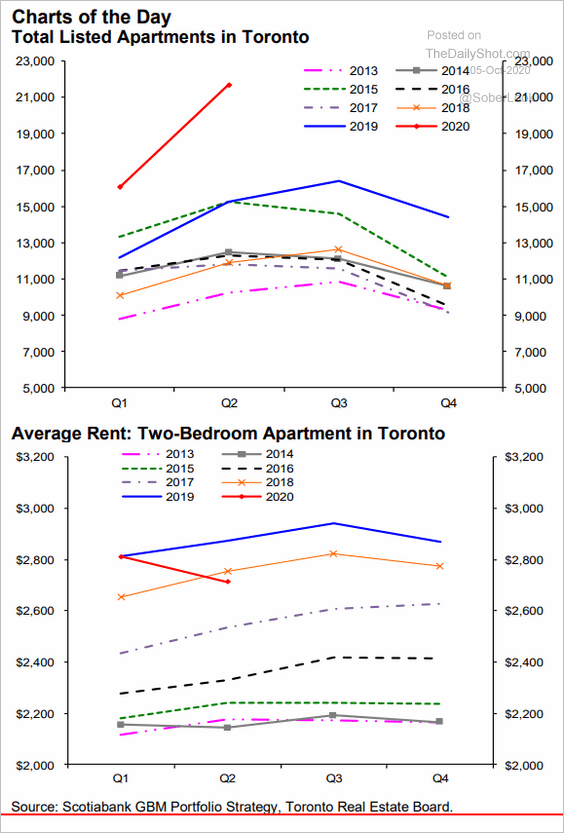

4. City living has lost its appeal this year.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

The United Kingdom

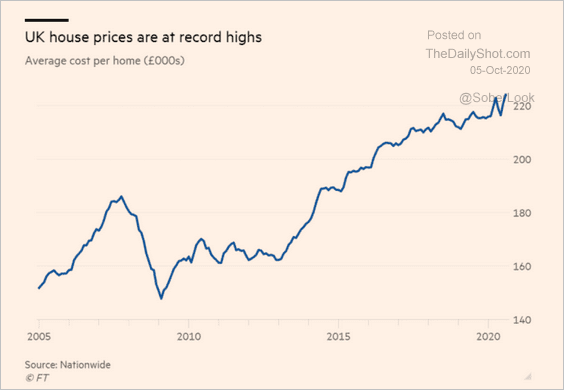

1. Home prices are hitting record highs.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

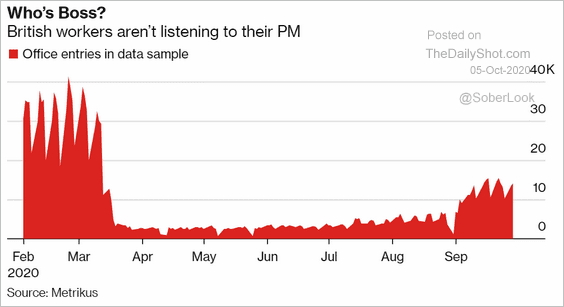

2. Many British workers are back in the office.

Source: @business Read full article

Source: @business Read full article

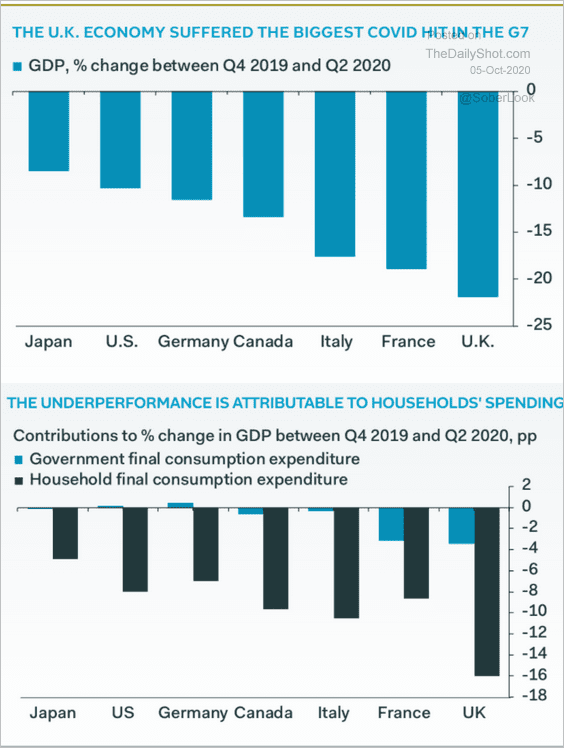

3. The UK’s economy has underperformed due to weak household spending.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

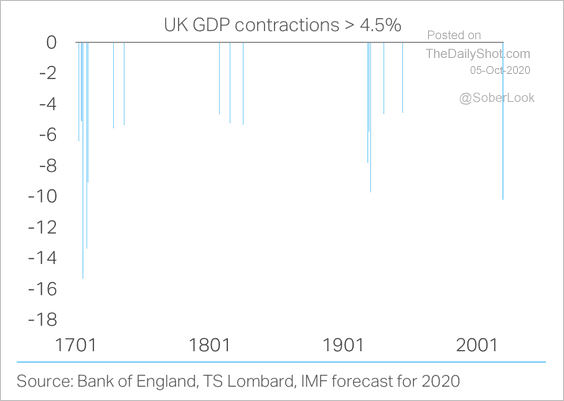

There hasn’t been a contraction of this magnitude in some 300 years.

Source: TS Lombard

Source: TS Lombard

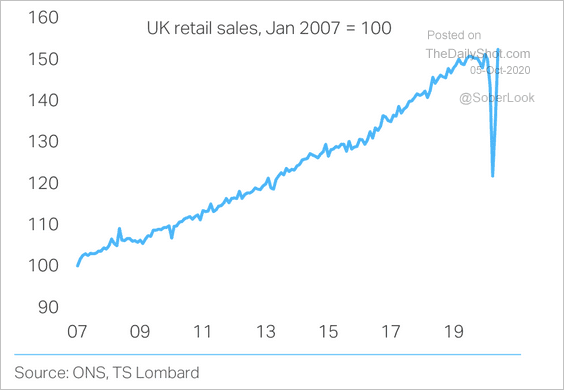

But retail sales have now fully recovered from the pandemic-induced slump, pointing to a rebound in economic growth.

Source: TS Lombard

Source: TS Lombard

——————–

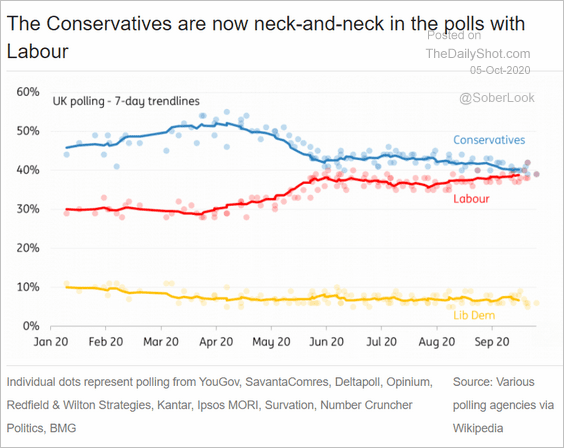

4. Here are the latest political polls.

Source: ING

Source: ING

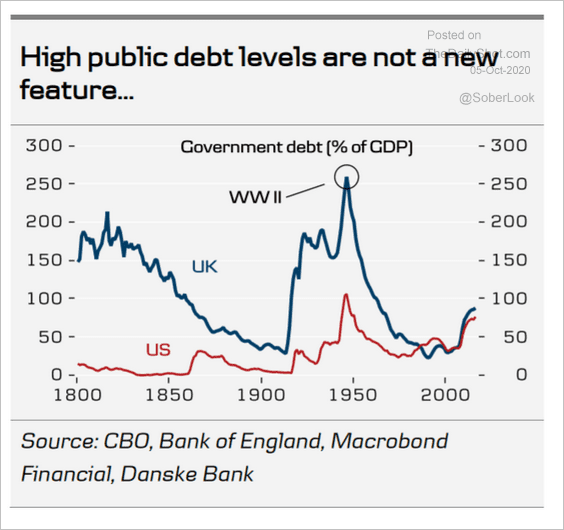

5. The current debt-to-GDP ratio is small relative to the post-WW2 highs.

Source: Danske Bank

Source: Danske Bank

The Eurozone

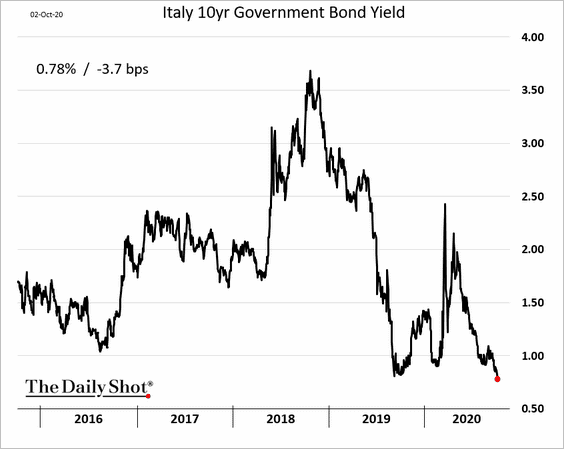

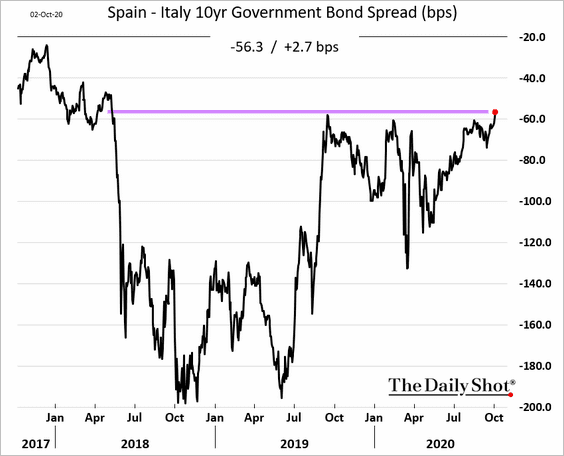

1. The 10yr Italian bond yield hit a record low.

Spain is now becoming the “problem child” of the euro-area.

Source: @bpolitics Read full article

Source: @bpolitics Read full article

Here is the Spain-Italy 10yr spread.

——————–

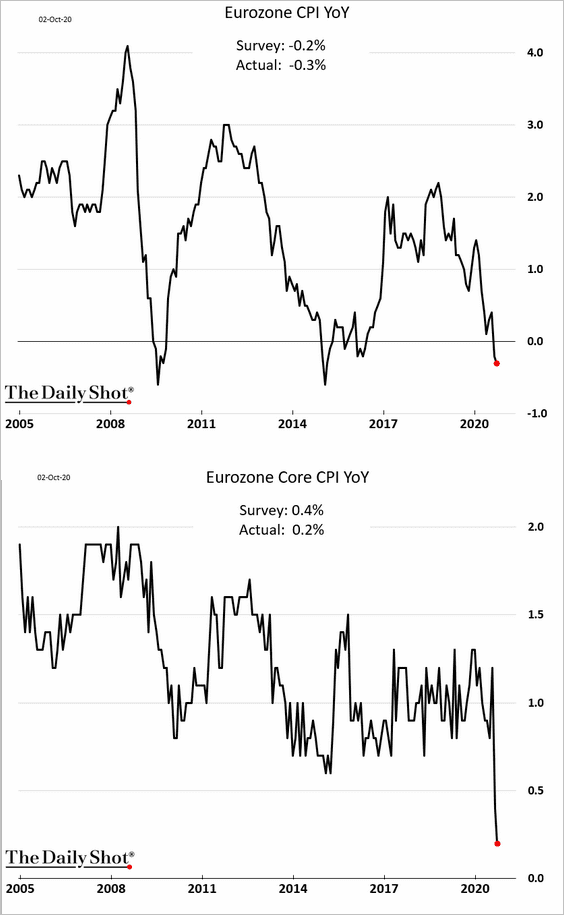

2. The Eurozone is in deflation again, as the core CPI plummets. It’s an issue for the ECB.

Source: @markets Read full article

Source: @markets Read full article

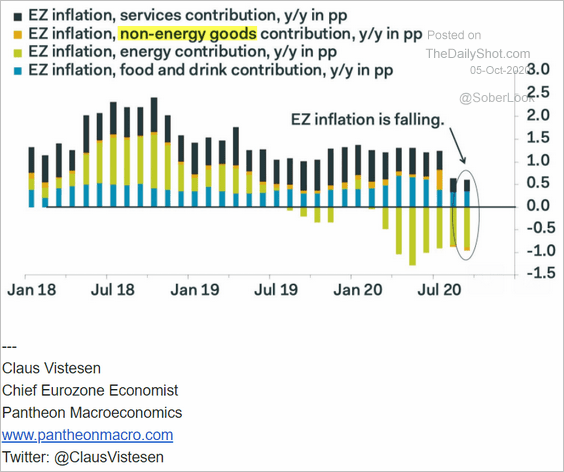

Here is the attribution from Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

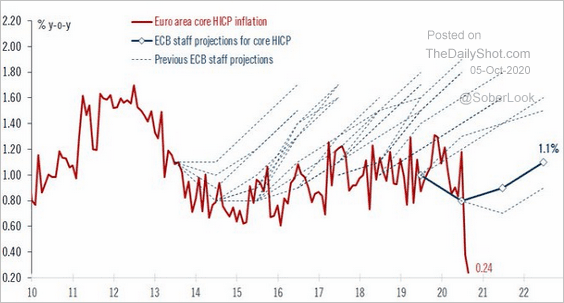

The ECB has consistently overshot on its CPI forecasts (similar to other central banks).

Source: @fwred

Source: @fwred

——————–

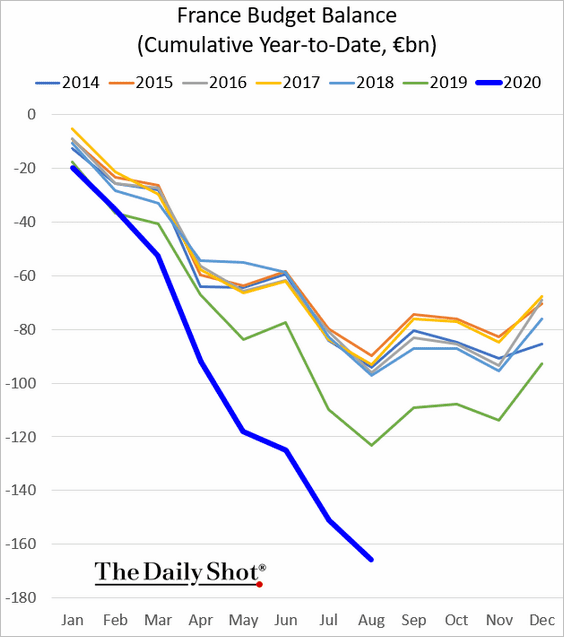

3. The French budget gap continues to widen.

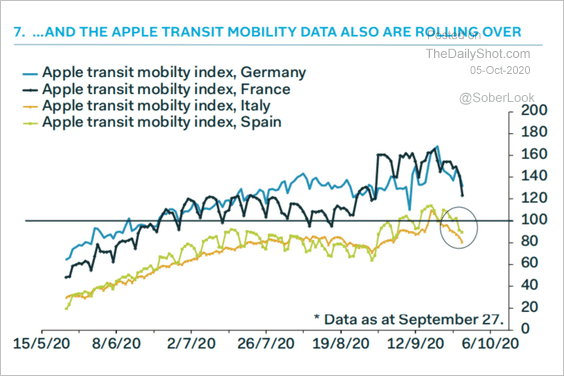

4. The Eurozone’s second wave of COVID infections is taking a toll on mobility.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

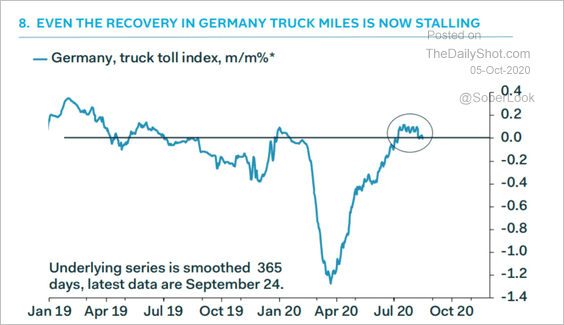

Germany’s truck miles appear to have peaked.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

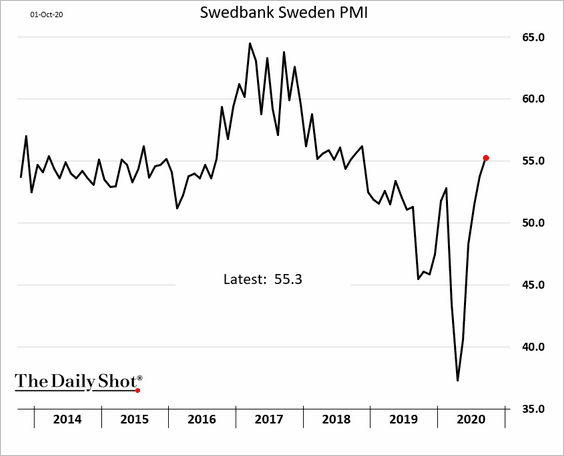

Europe

1. Sweden’s business activity is accelerating.

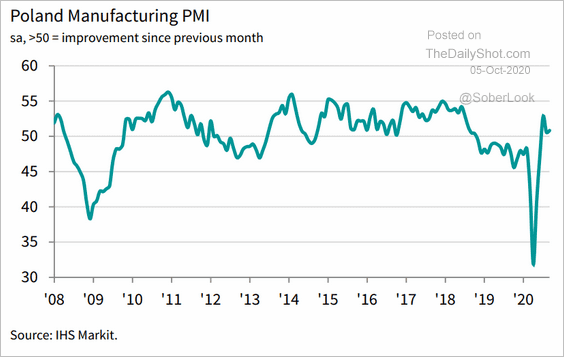

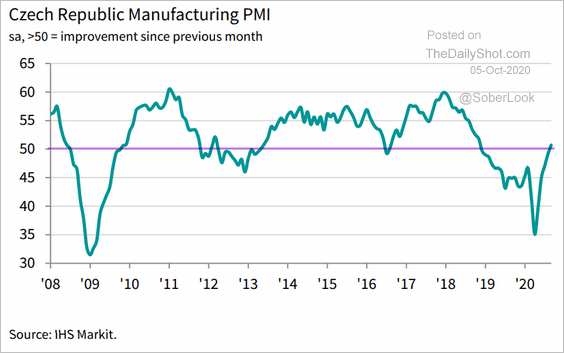

2. Factory activity in central Europe has stabilized (PMI near 50).

• Poland:

Source: IHS Markit Read full article

Source: IHS Markit Read full article

• The Czech Republic:

Source: IHS Markit Read full article

Source: IHS Markit Read full article

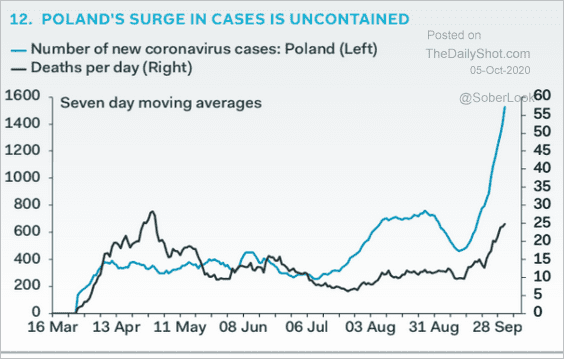

But the pandemic could derail the recovery.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

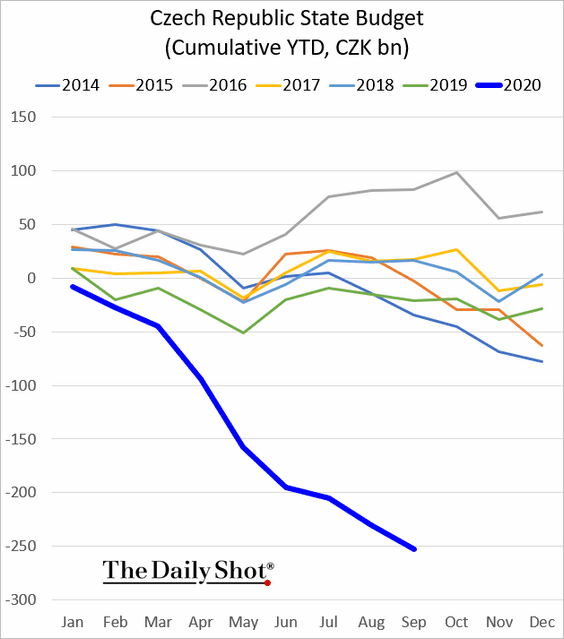

3. Here is the Czech Republic’s government budget (year-to-date).

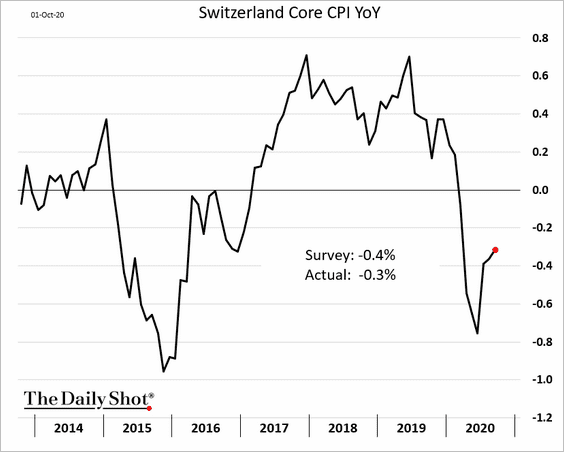

4. Swiss inflation appears to be recovering.

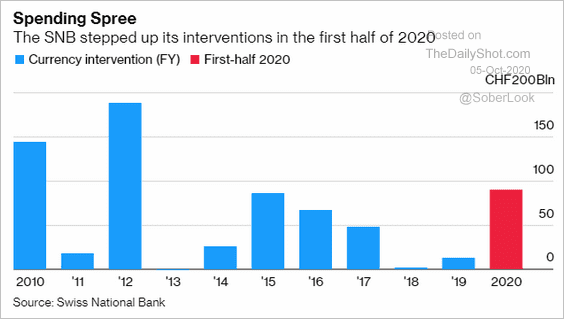

This chart shows the Swiss central bank’s interventions in the currency markets (and there is more on the way).

Source: @markets Read full article

Source: @markets Read full article

——————–

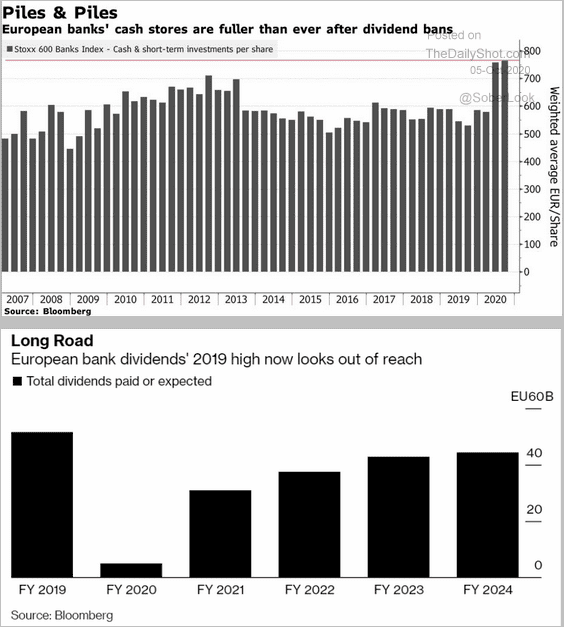

5. European banks are sitting on a pile of cash since the ECB shut off dividends.

Source: @business Read full article

Source: @business Read full article

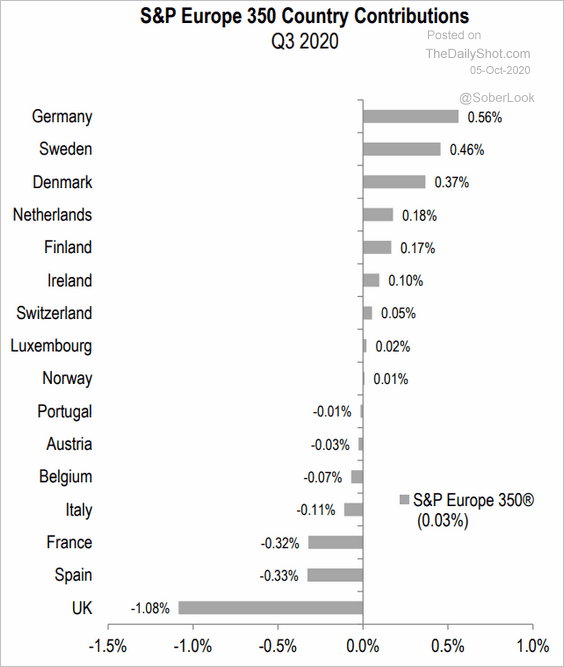

6. How did Western European equity markets perform in September?

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

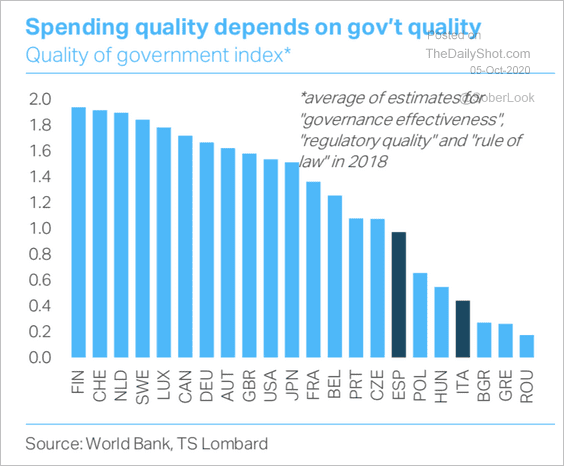

7. Finally, this chart shows the “quality of government” index for Europe.

Source: TS Lombard

Source: TS Lombard

Japan

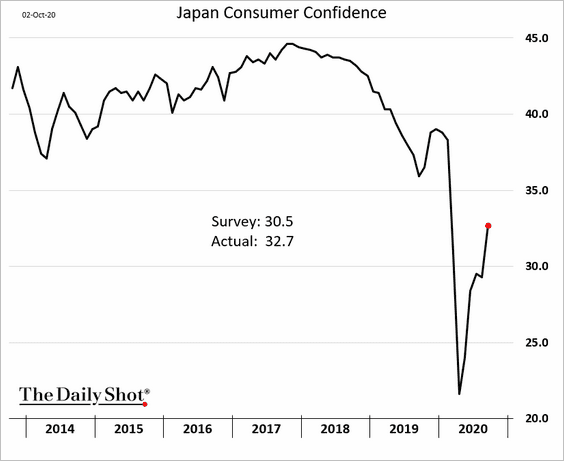

1. Consumer confidence is rebounding.

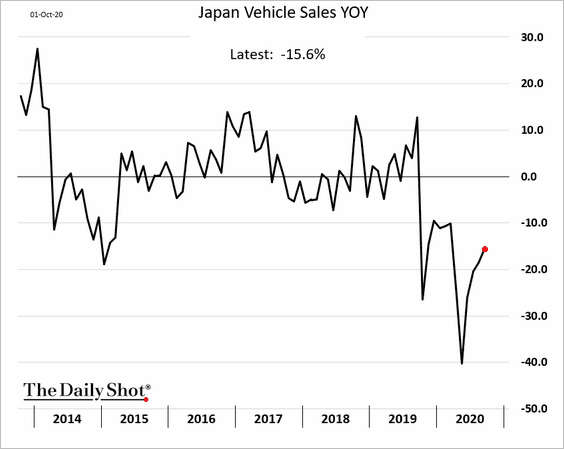

2. Vehicle sales recovery has a long way to go.

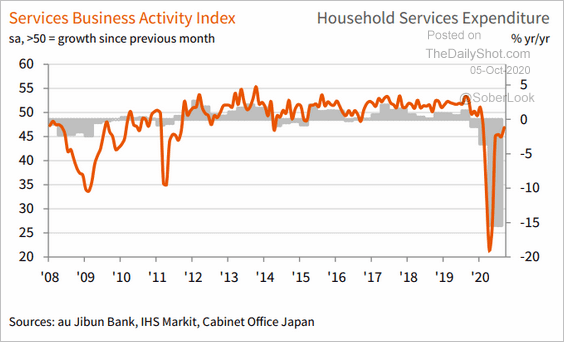

3. Service-sector activity is nearing stabilization.

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

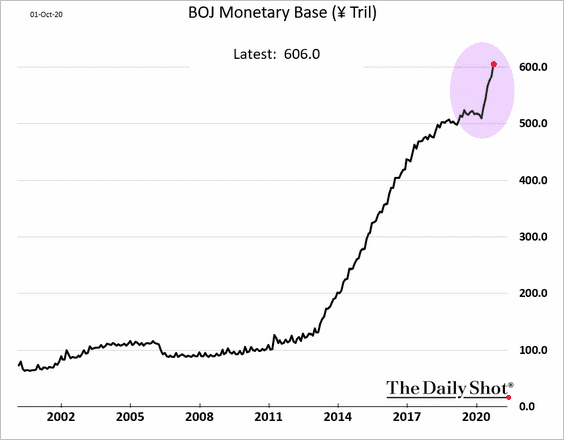

4. The monetary base expansion accelerated this year as the BoJ boosted stimulus.

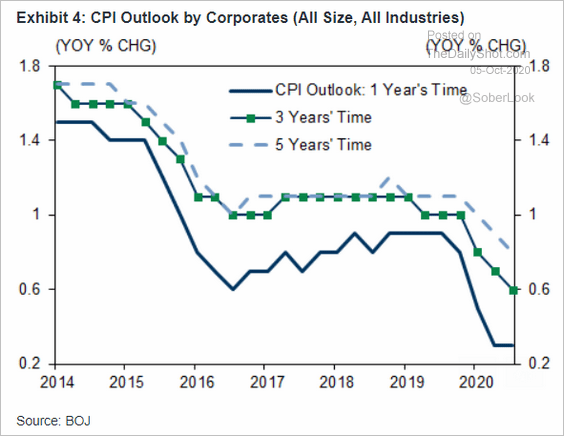

5. Companies are forecasting lower inflation.

Source: Goldman Sachs

Source: Goldman Sachs

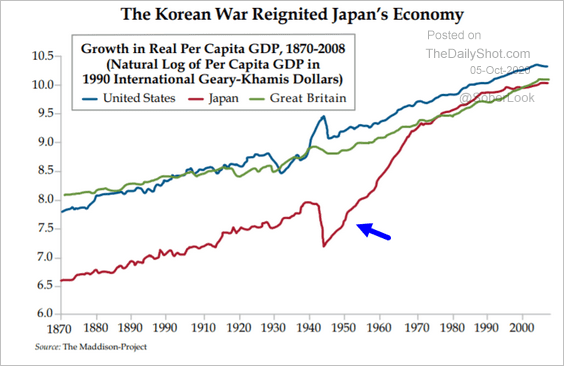

6. This long-term GDP-per-capita chart shows how the Korean War accelerated Japan’s post-WWII recovery (with Japan supporting US operations).

Source: The Daily Feather

Source: The Daily Feather

Asia – Pacific

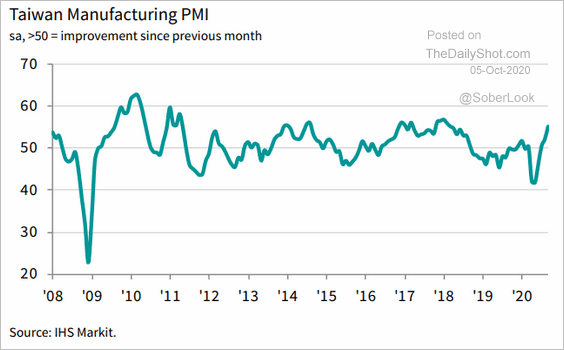

1. Taiwan’s business activity continues to strengthen.

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

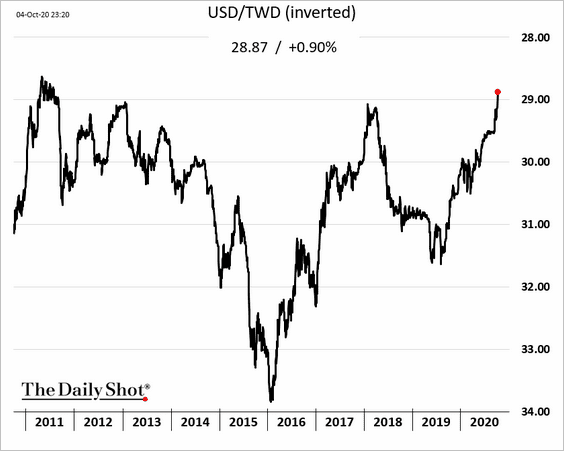

The Taiwan dollar hit the highest level vs. USD since 2011.

——————–

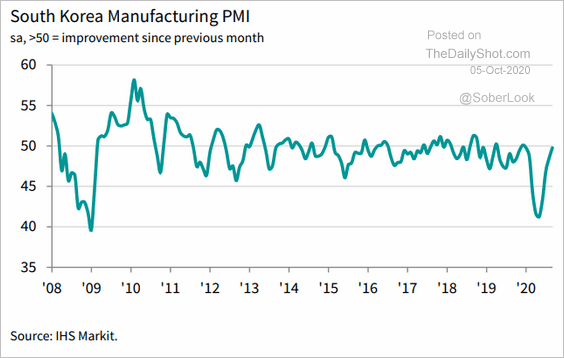

2. South Korea’s manufacturing has stabilized (PMI = 50).

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

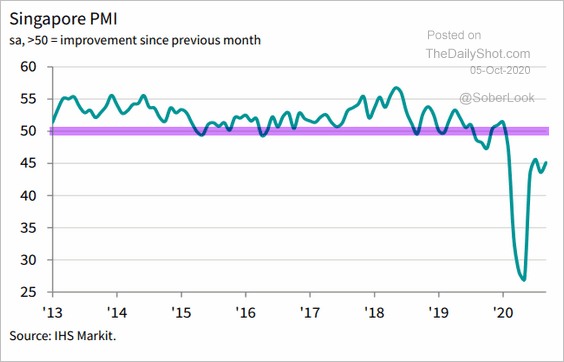

3. Singapore’s economy continues to struggle (PMI < 50).

Source: @IHSMarkitPMI Read full article

Source: @IHSMarkitPMI Read full article

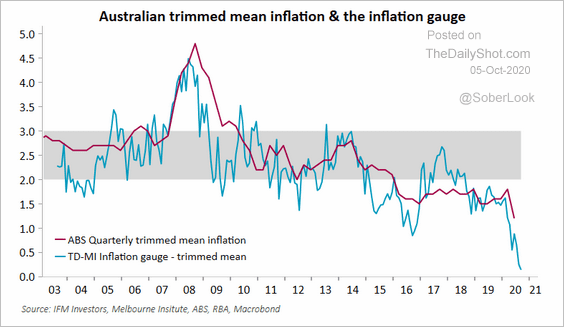

4. IFM’s inflation gauge points to a collapse in Australia’s inflation, which could pressure the RBA to take further action.

Source: @IFM_Economist

Source: @IFM_Economist

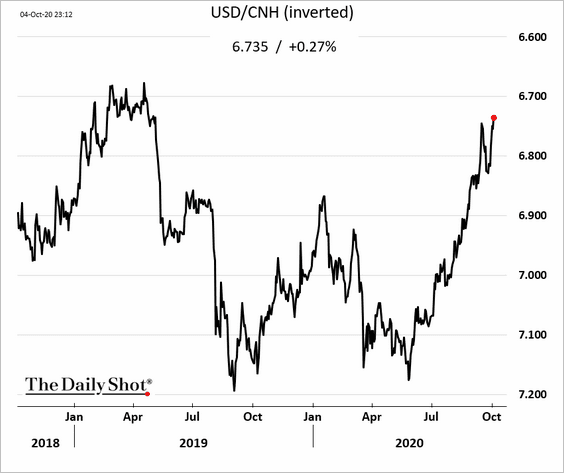

China

1. The renminbi continues to strengthen, boosted by capital inflows and the rate differential with the US.

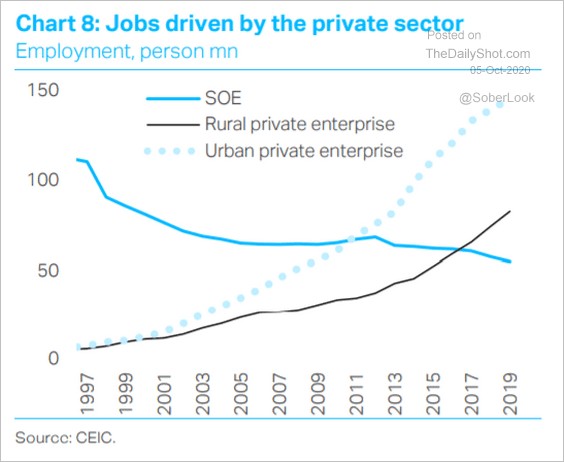

2. China’s job growth has been driven by the private sector.

Source: TS Lombard

Source: TS Lombard

3. China is expected to massively increase its share of global semiconductor production.

![]() Source: BCA Research

Source: BCA Research

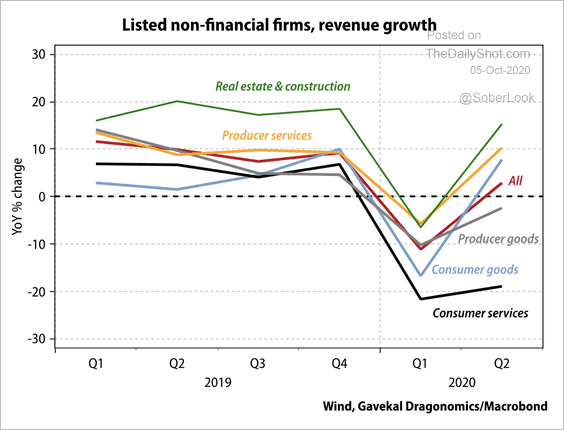

4. Q2 revenue growth was most pronounced in real estate and construction.

Source: Gavekal

Source: Gavekal

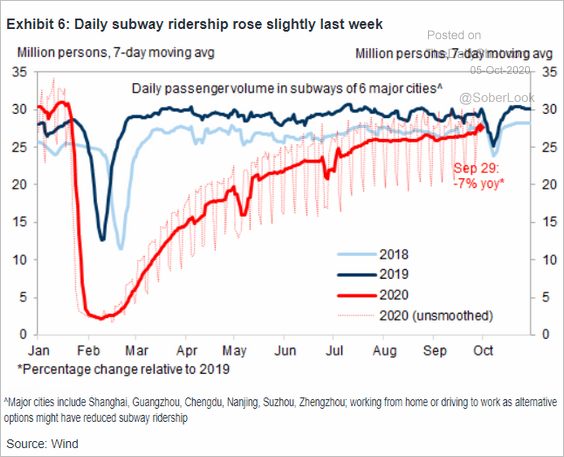

5. Subway ridership has almost recovered.

Source: Goldman Sachs

Source: Goldman Sachs

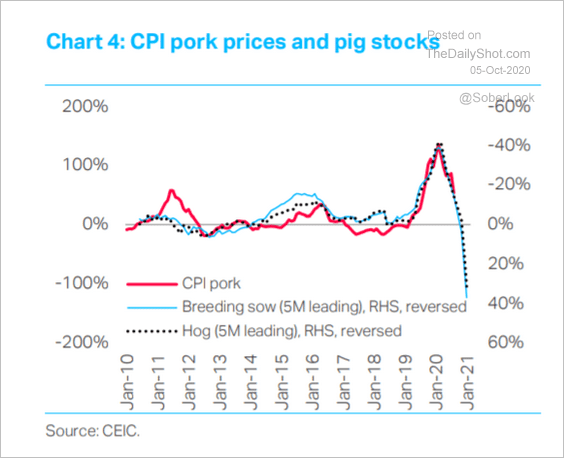

6. China is rapidly addressing its pig shortages, which should push pork inflation sharply lower.

Source: TS Lombard

Source: TS Lombard

Emerging Markets

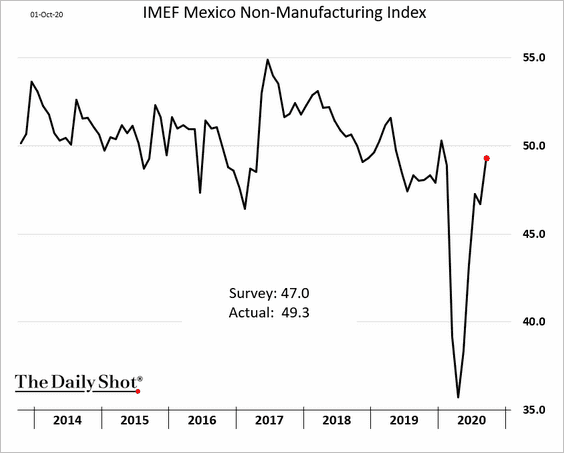

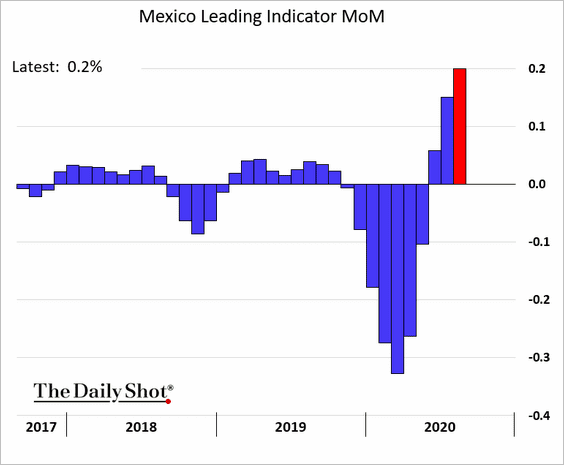

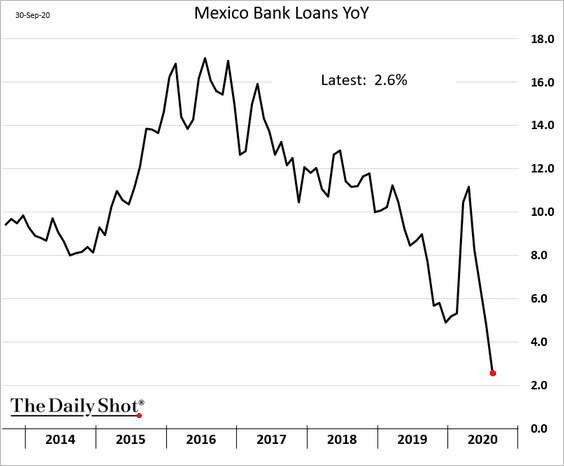

1. Let’s begin with Mexico.

• Service sector activity is stabilizing.

• The leading index continued to show improvement in August.

• Loan growth has been slowing.

——————–

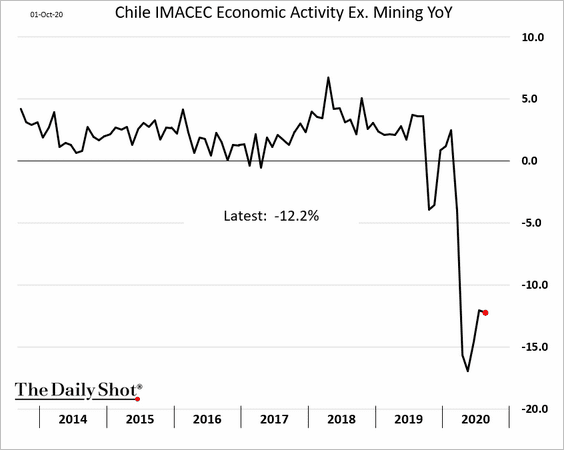

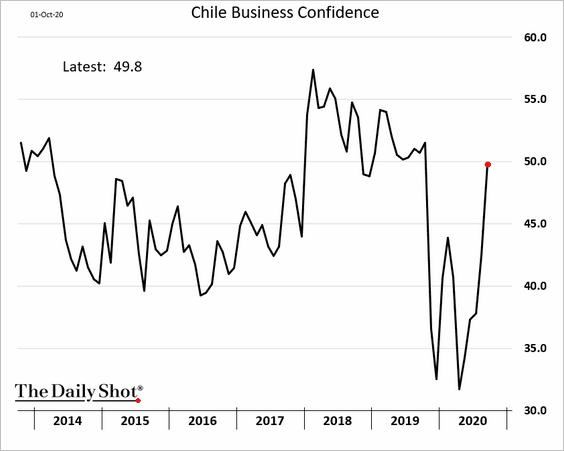

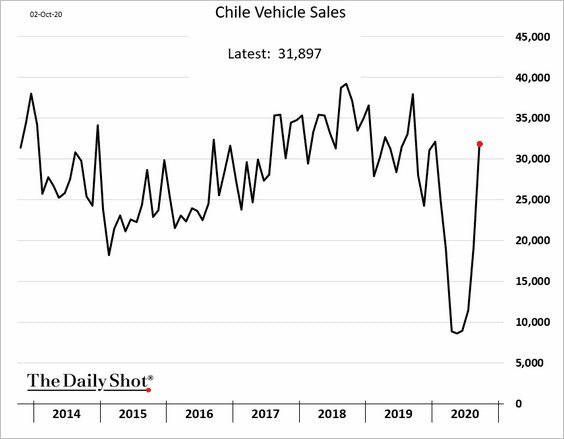

2. Next, let’s take a look at Chile.

• Economic activity was still depressed in August.

• But business confidence is recovering.

• Vehicle sales were up sharply in September.

——————–

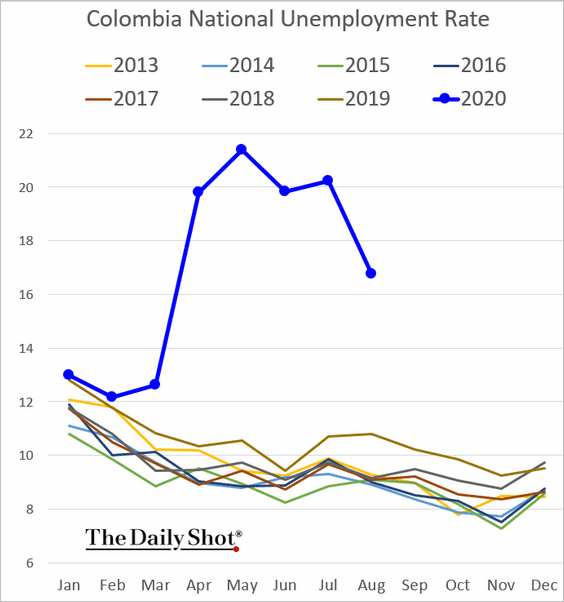

3. Colombia’s unemployment rate has been trending lower.

4. Here are some updates on Argentina.

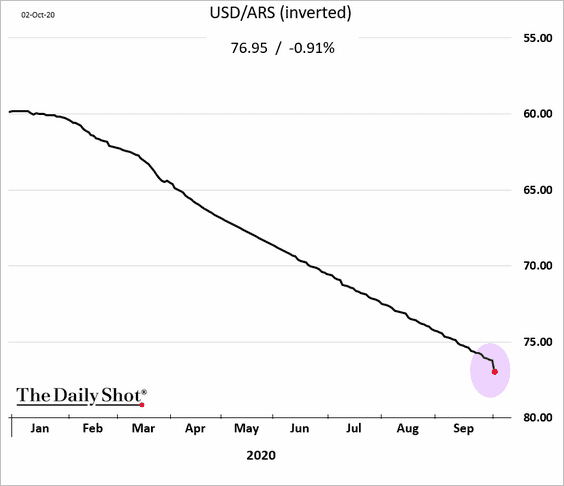

• The central bank is letting the peso depreciate faster, …

Source: Reuters Read full article

Source: Reuters Read full article

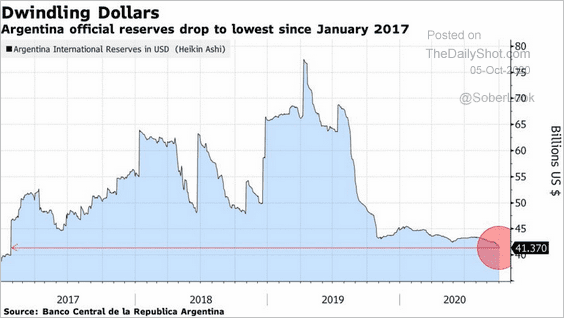

… because it can’t afford to lose more foreign reserves (defending the currency).

Source: @markets Read full article

Source: @markets Read full article

And here we are.

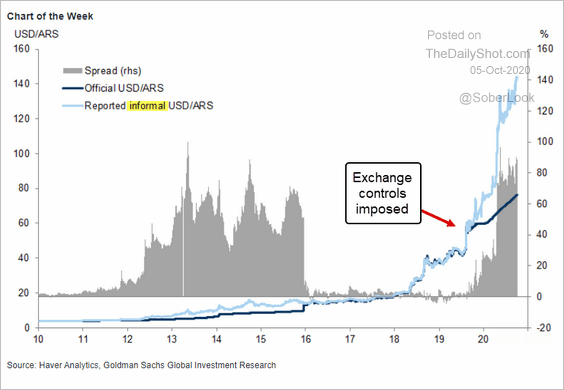

But given how weak the black-market peso is, there is a long way to go for the official exchange rate to catch up with the market.

Source: Goldman Sachs

Source: Goldman Sachs

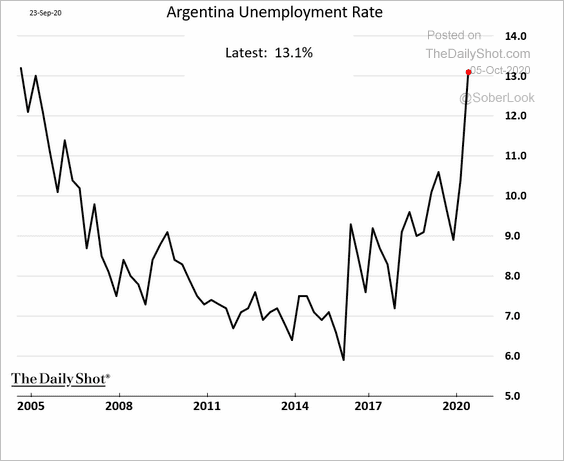

• The unemployment rate is above 13% for the first time since 2004.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

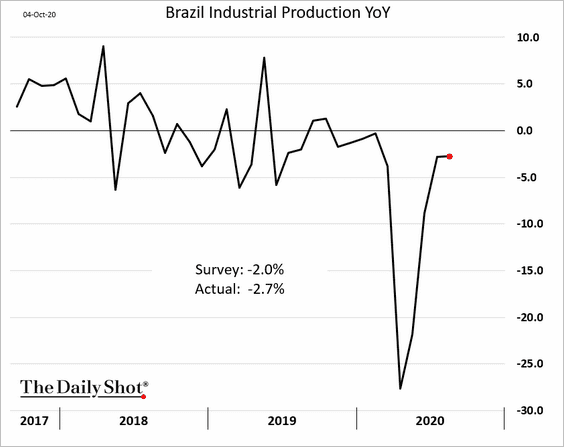

5. Brazil’s industrial production rebound has lost momentum.

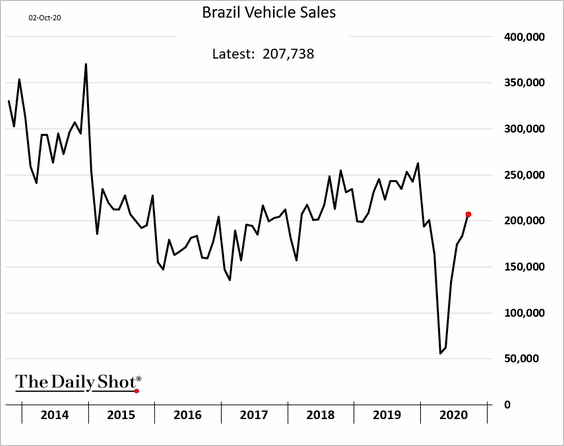

Vehicle sales continue to recover.

——————–

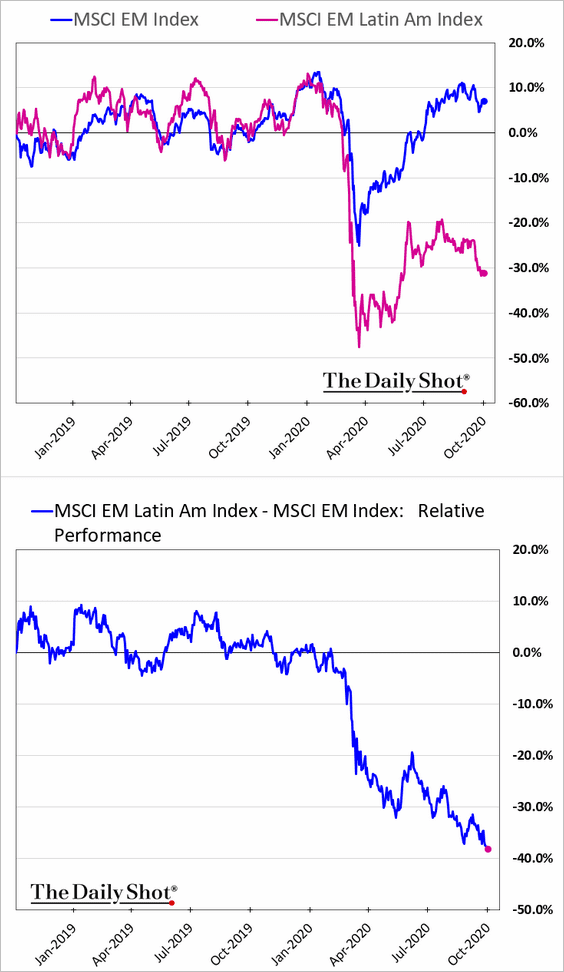

6. LatAm stocks keep underperforming.

——————–

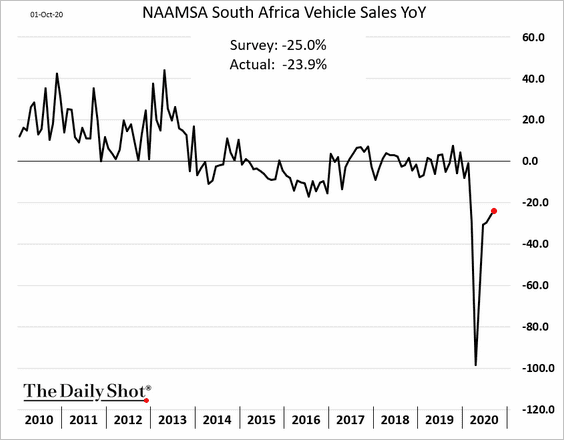

7. South Africa’s vehicle sales are gradually recovering.

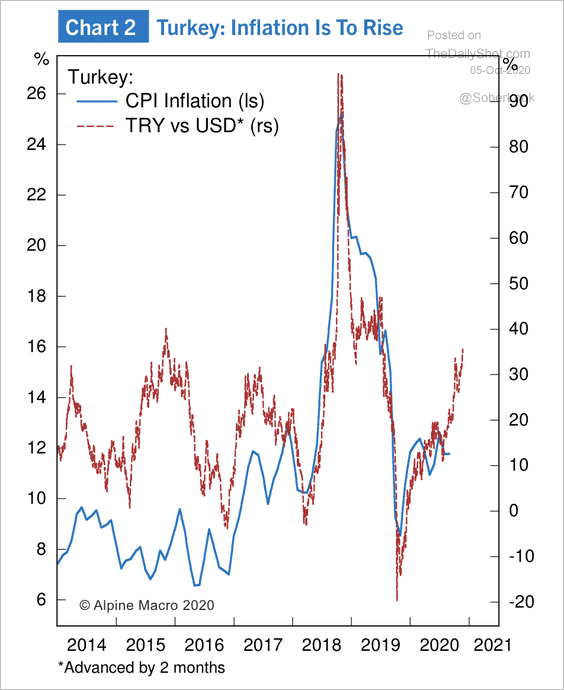

8. Turkey’s inflation is set to accelerate following the lira’s recent weakness.

Source: Alpine Macro

Source: Alpine Macro

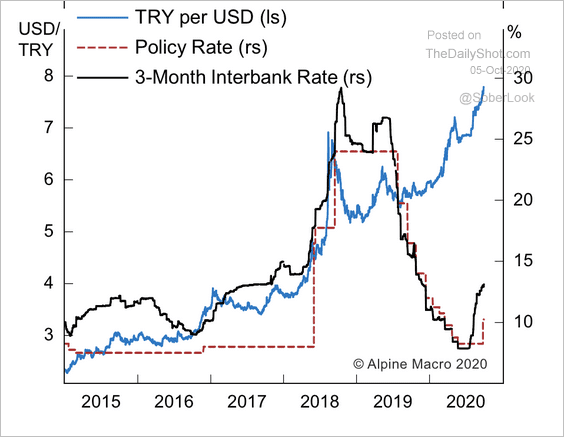

Turkey’s interbank liquidity has tightened considerably in the past two months.

Source: Alpine Macro

Source: Alpine Macro

——————–

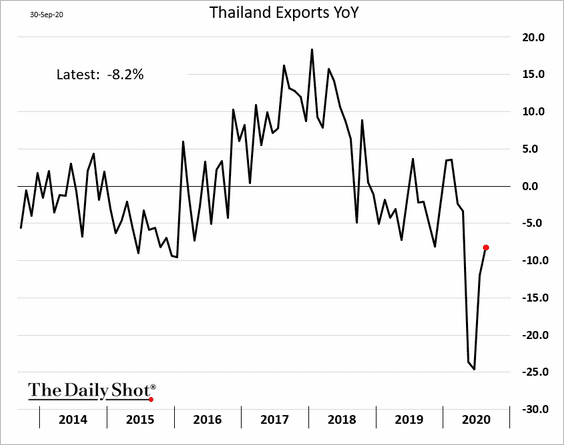

9. Thailand’s exports remain depressed.

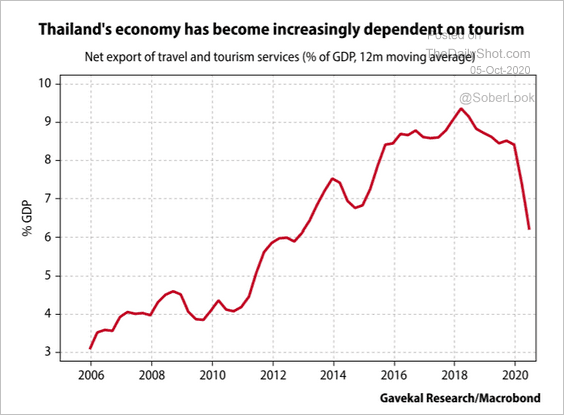

The nation’s dependence on tourism has been problematic.

Source: Gavekal

Source: Gavekal

Commodities

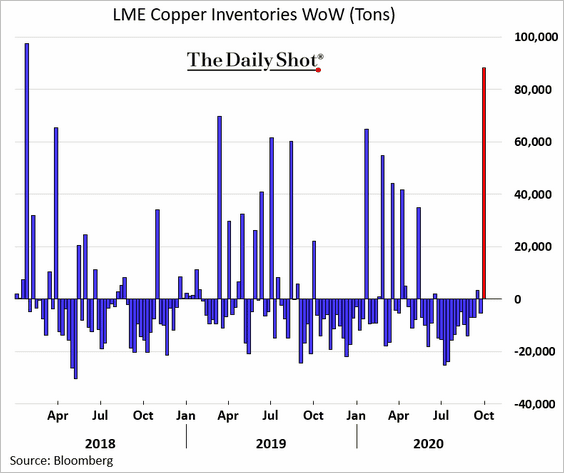

1. LME copper inventories spiked.

h/t Nicholas Larkin

h/t Nicholas Larkin

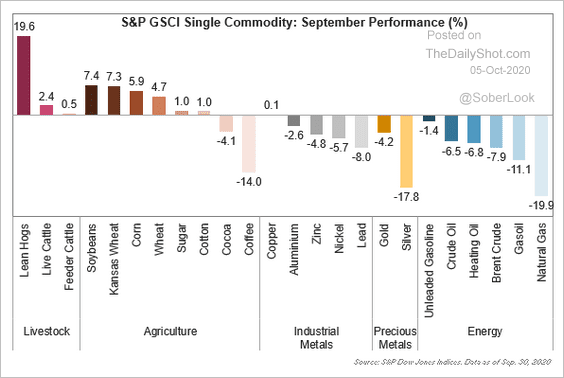

2. This chart shows how different commodities performed in September.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

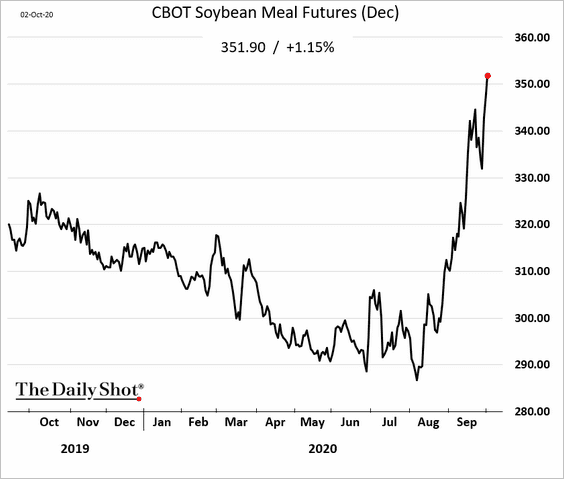

3. US soy meal futures soared last week after the USDA announced a large export order (from an unknown buyer).

Energy

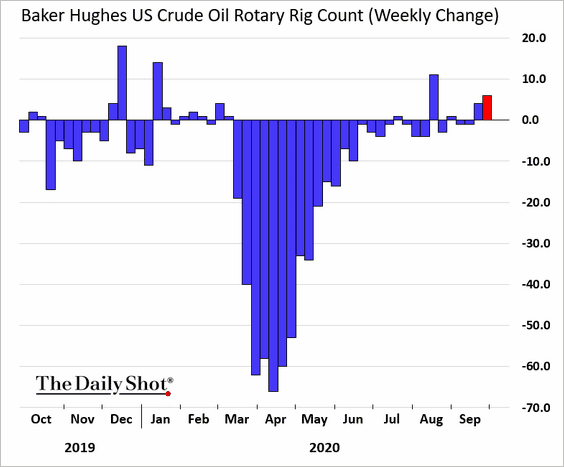

1. The US rig count increased for the second week in a row.

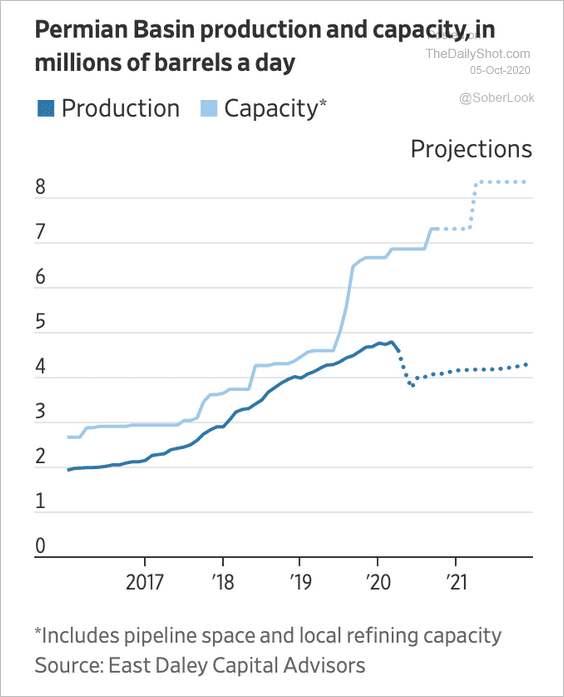

2. Excess pipeline capacity in the US Permian Basin could lead to significant consolidation in the midstream space.

Source: @WSJ Read full article

Source: @WSJ Read full article

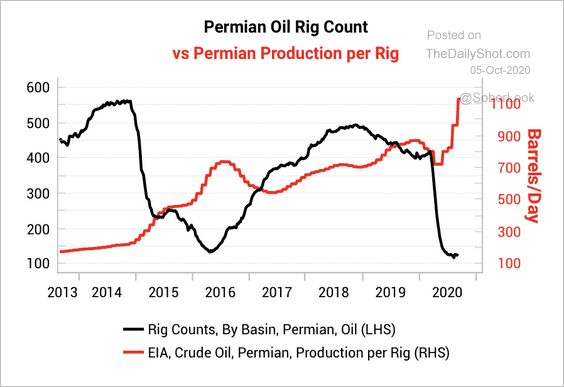

3. Will productivity improvements in the Permian Basin be sustained?

Source: Variant Perception

Source: Variant Perception

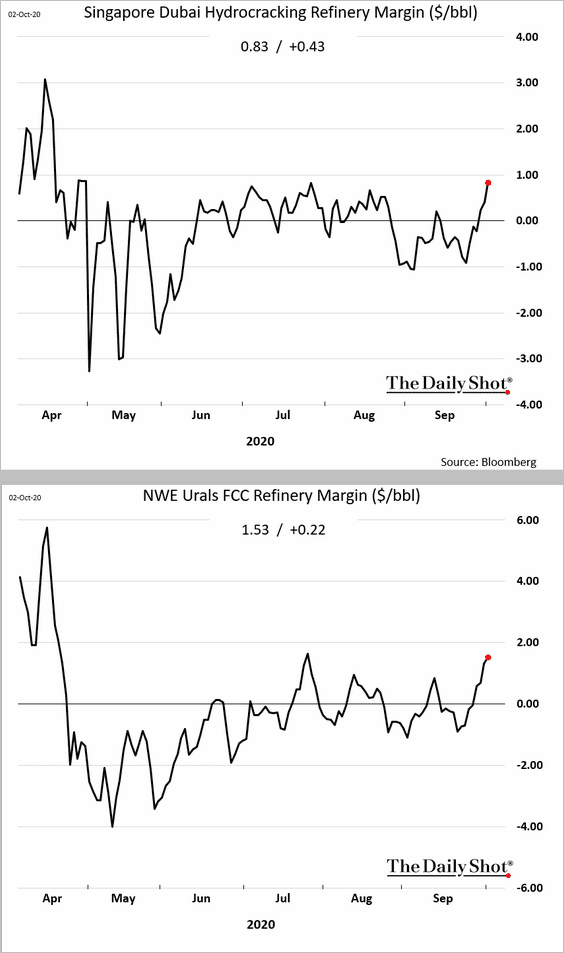

4. Global refinery margins appear to be stabilizing.

5. Will “peak oil demand” take place during the current decade?

Source: Argus Media Read full article

Source: Argus Media Read full article

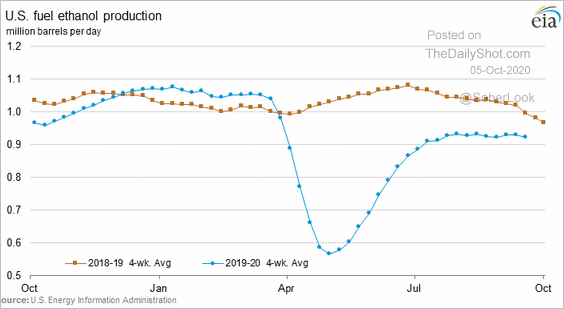

6. US fuel ethanol production is approaching last year’s levels.

7. Renewables’ shares have been outperforming.

Source: @adam_tooze, @meyer_g6 Read full article

Source: @adam_tooze, @meyer_g6 Read full article

Equities

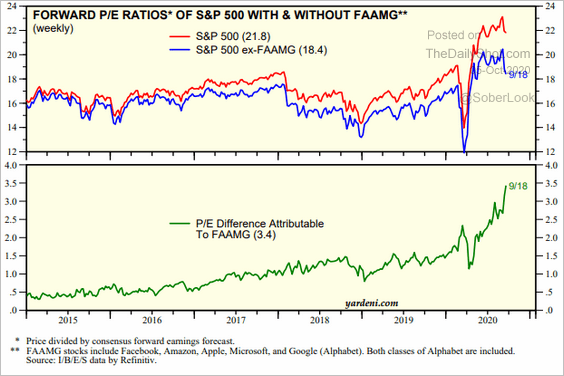

1. How much of the S&P 500 forward P/E ratio is attributable to the tech mega-caps?

Source: Yardeni Research

Source: Yardeni Research

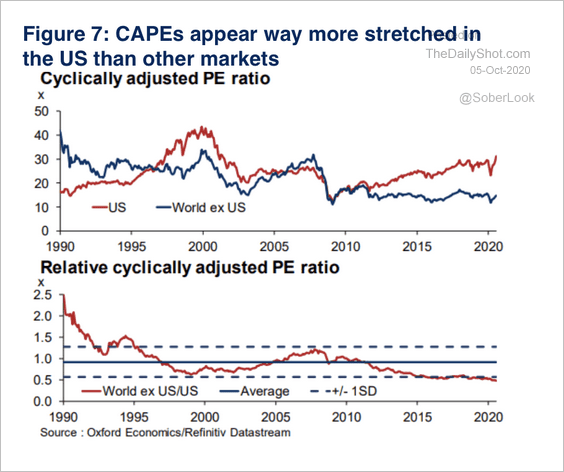

2. Based on CAPEs, US shares are extremely overvalued vs. the rest of the world.

Source: Oxford Economics

Source: Oxford Economics

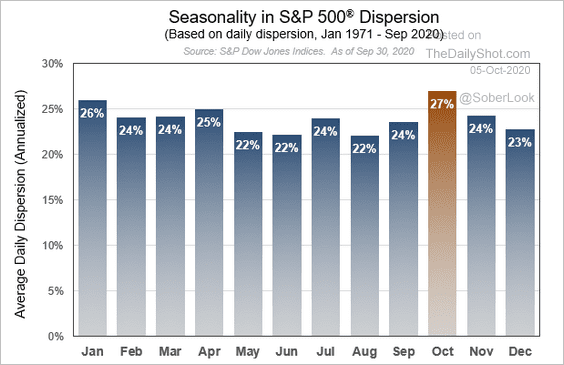

3. Returns dispersion tends to be the highest in October.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

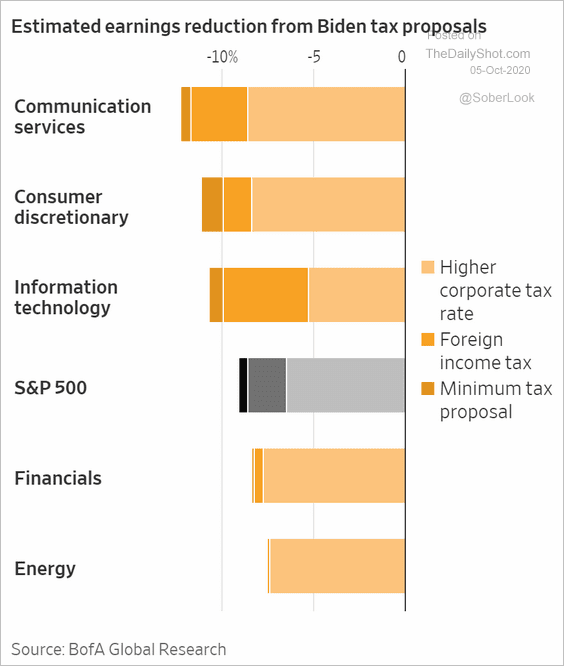

4. Which sectors are most sensitive to tax increases?

Source: @WSJ Read full article

Source: @WSJ Read full article

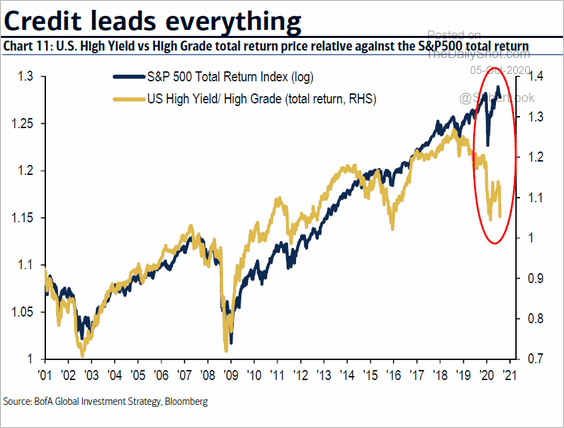

5. The credit markets are pointing to downside risks for stocks.

Source: BofA Global Research

Source: BofA Global Research

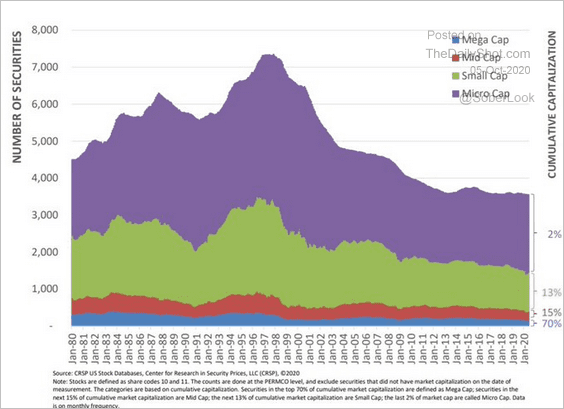

6. The total number of US equity securities has been declining over the past couple of decades.

Source: CRSP, @jsblokland

Source: CRSP, @jsblokland

Credit

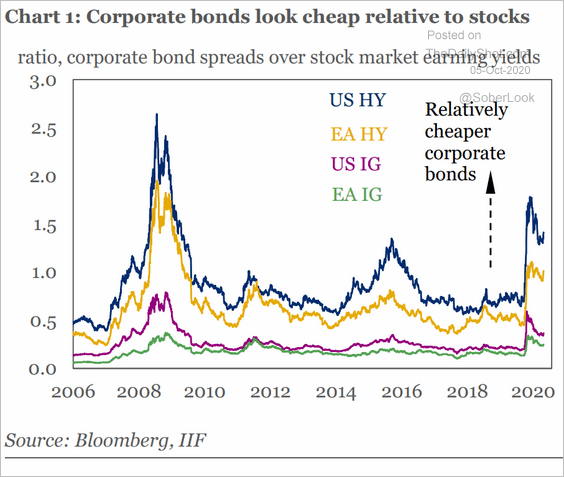

1. Corporate bonds look cheap relative to stocks.

Source: IIF

Source: IIF

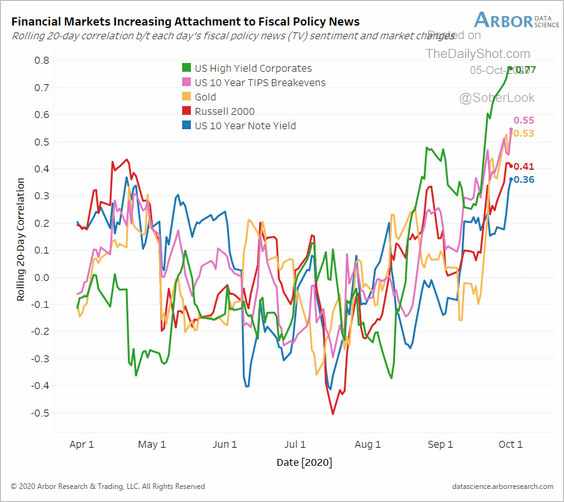

2. US high-yield bonds are highly correlated to fiscal policy news.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

3. Muni funds finally saw some outflows.

Source: @romyvarghese, Bloomberg Finance L.P.

Source: @romyvarghese, Bloomberg Finance L.P.

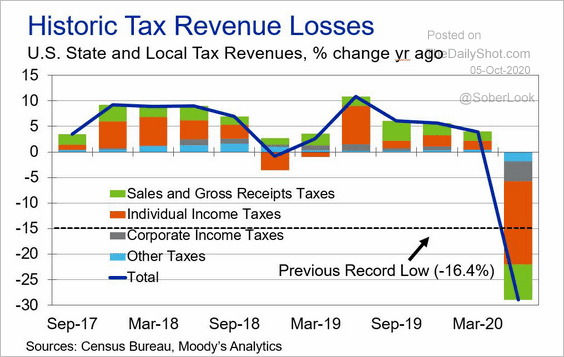

By the way, state and local governments’ tax revenue losses have been massive.

Source: Moody’s Analytics

Source: Moody’s Analytics

Rates

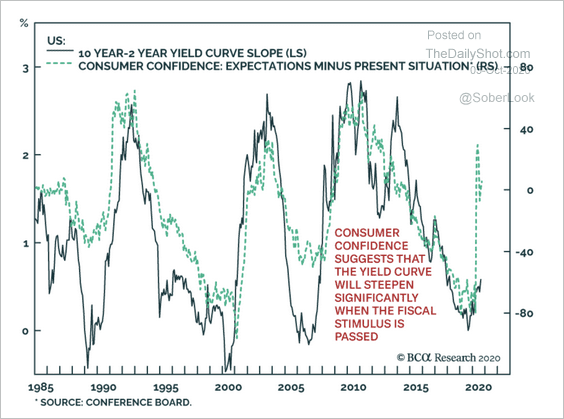

1. Improving US consumer confidence could signal a steeper yield curve.

Source: BCA Research

Source: BCA Research

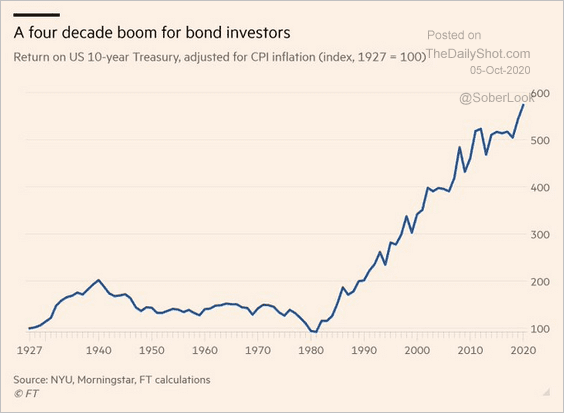

2. This chart shows the 10yr Treasury return adjusted for inflation. The direction change took place when Paul Volcker started his battle against inflation.

Source: @jessefelder Read full article

Source: @jessefelder Read full article

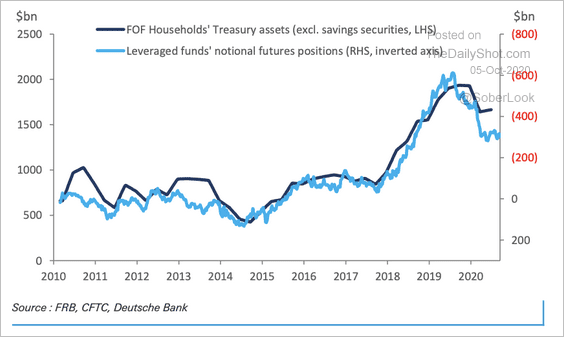

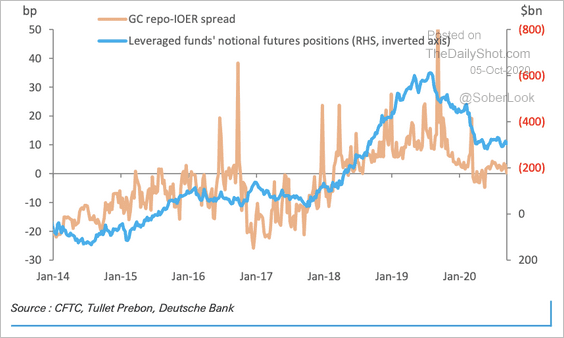

3. Leveraged Treasury positions have been declining, …

Source: Deutsche Bank Research

Source: Deutsche Bank Research

… which lessens repo (funding) pressure over year-end.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

Global Developments

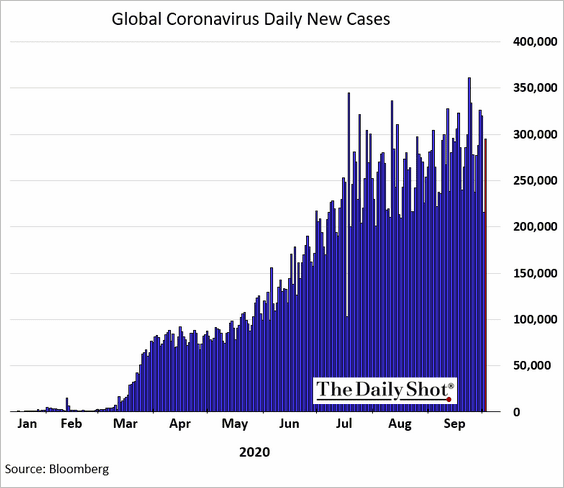

1. Are global coronavirus cases finally peaking? The world is still recording over a quarter of a million new cases per day.

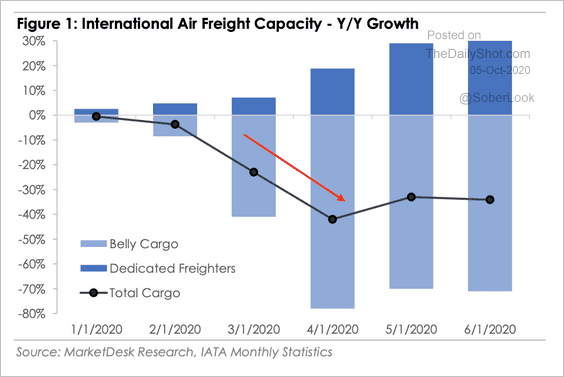

2. The recovery in international air cargo capacity has stalled as airlines cancel commercial flights.

Source: MarketDesk Research

Source: MarketDesk Research

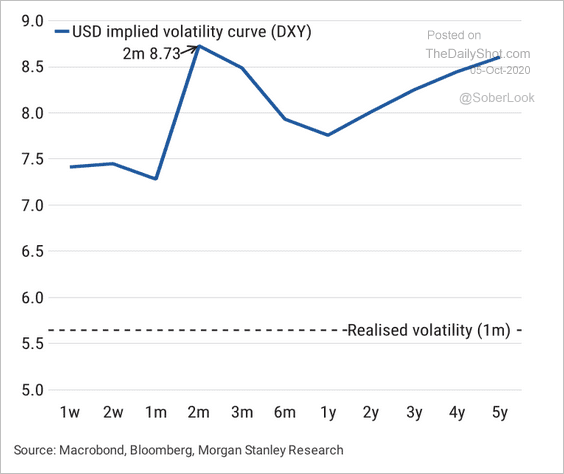

3. The dollar volatility curve is pricing in the US election risk.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

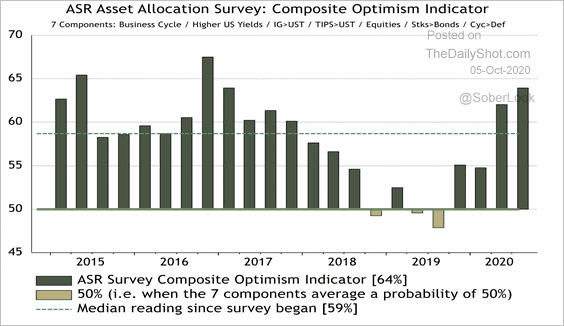

4. Investors are the most optimistic since 2016, according to Absolute Strategy’s survey of investment professionals.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

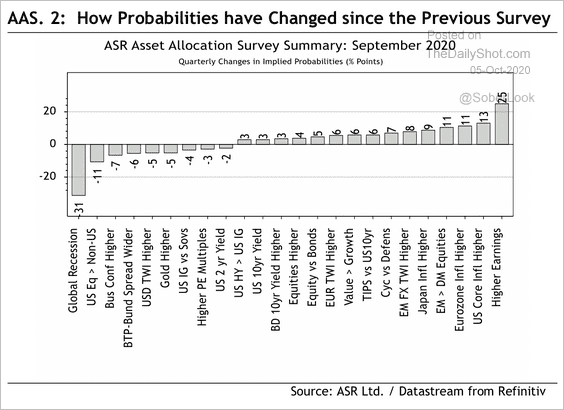

Over the past quarter, investors have become less concerned about recession and more confident about inflation.

Source: Absolute Strategy Research

Source: Absolute Strategy Research

——————–

Food for Thought

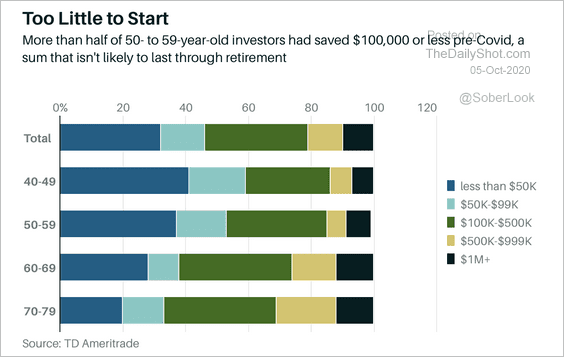

1. Retirement savings:

Source: Barron’s Read full article

Source: Barron’s Read full article

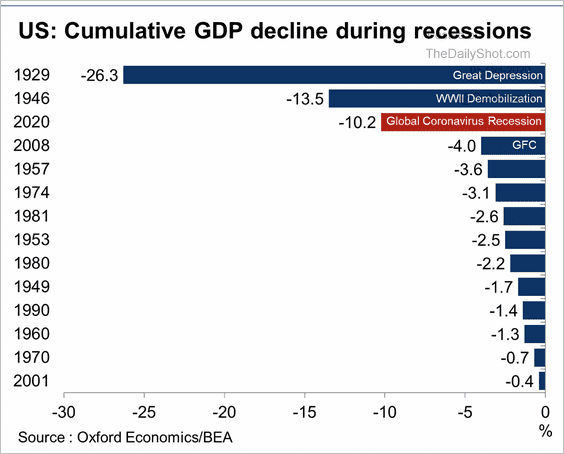

2. US GDP contractions during past recessions:

Source: Oxford Economics

Source: Oxford Economics

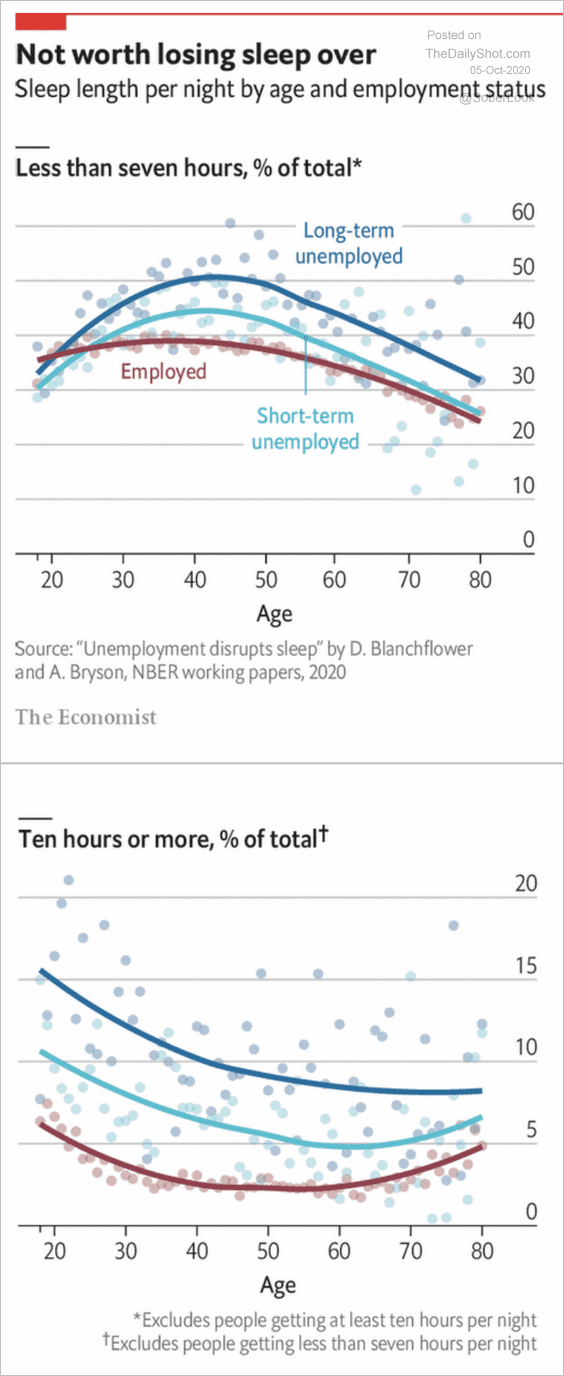

3. Unemployment and sleep:

Source: The Economist Read full article

Source: The Economist Read full article

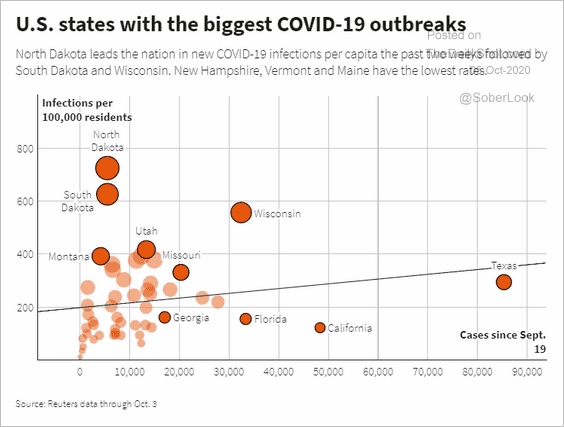

4. States with the highest infection rates:

Source: Reuters Read full article

Source: Reuters Read full article

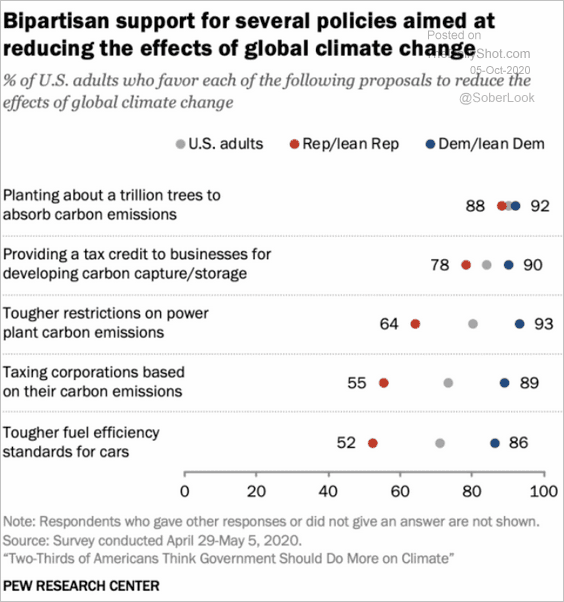

5. Support for various environmental policy proposals in the US:

Source: Pew Research Center Read full article

Source: Pew Research Center Read full article

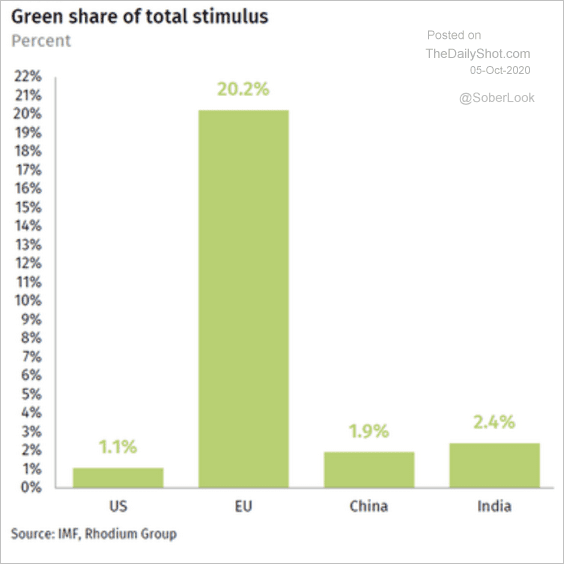

6. The share of COVID stimulus focused on the environment:

Source: World Economic Forum Read full article

Source: World Economic Forum Read full article

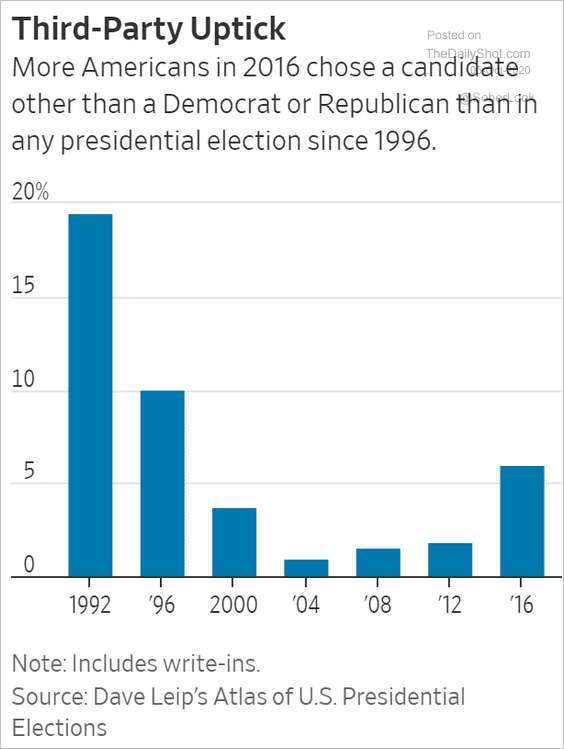

7. US third-party vote:

Source: @WSJ Read full article

Source: @WSJ Read full article

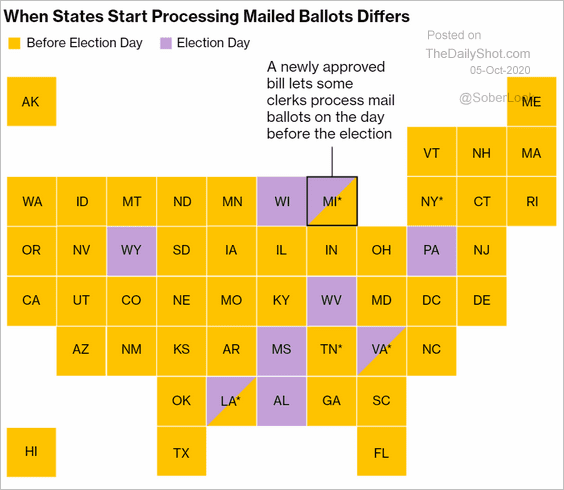

8. Processing mailed ballots:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

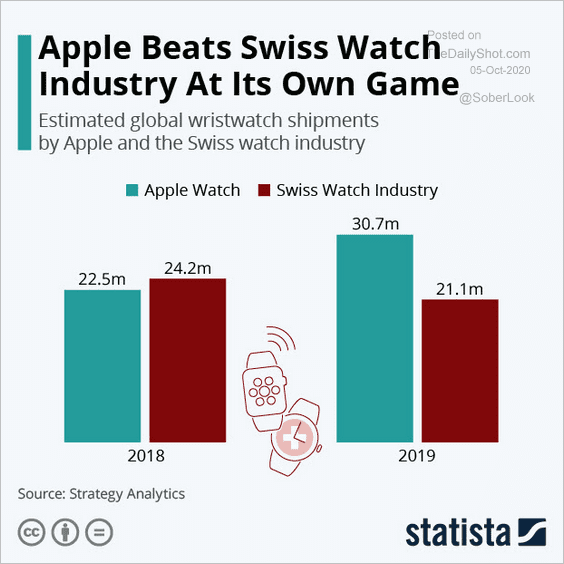

9. Apple beating the Swiss watch industry:

Source: Statista

Source: Statista

——————–