The Daily Shot: 24-Nov-20

• Equities

• Credit

• Rates

• Commodities

• Energy

• Cryptocurrency

• Emerging Markets

• China

• Asia – Pacific

• The Eurozone

• The United Kingdom

• Canada

• The United States

• Global Developments

• Food for Thought

Equities

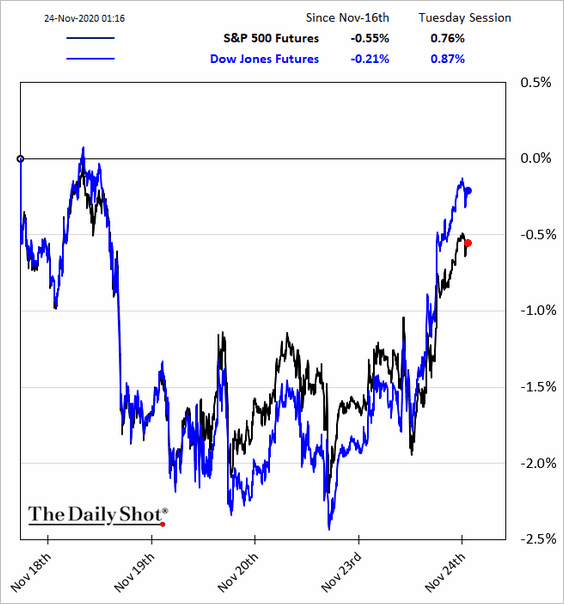

1. Stock futures are higher as Biden’s formal transition begins. Investors also breathed a sigh of relief on Yellen’s nomination for the Treasury Secretary (as opposed to Elisabeth Warren, for example).

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

Source: Reuters Read full article

——————–

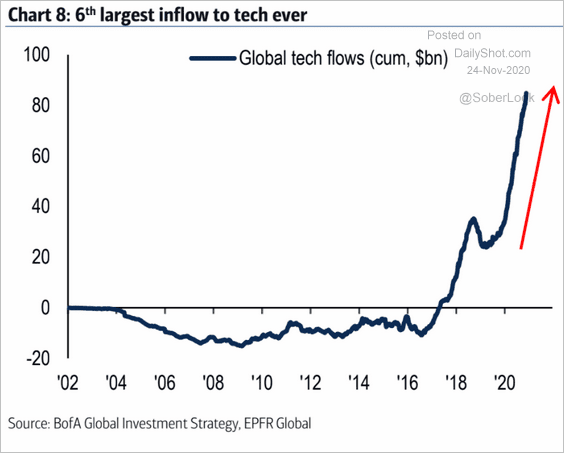

2. Tech fund inflows this year have been unprecedented.

Source: BofA Global Research

Source: BofA Global Research

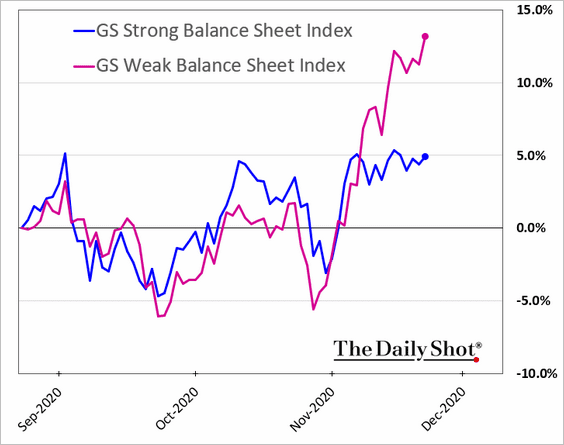

3. The vaccine-related equity rotation has been favoring more leveraged companies.

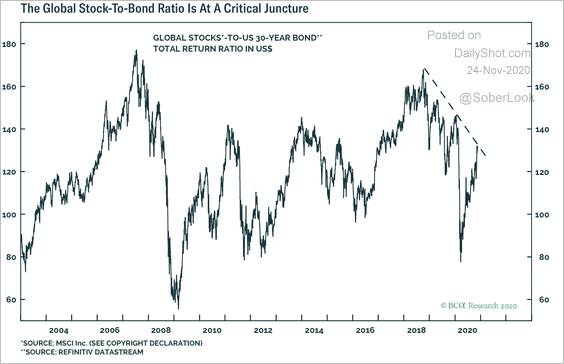

4. Will we see a breakout in the stock/bond ratio?

Source: BCA Research

Source: BCA Research

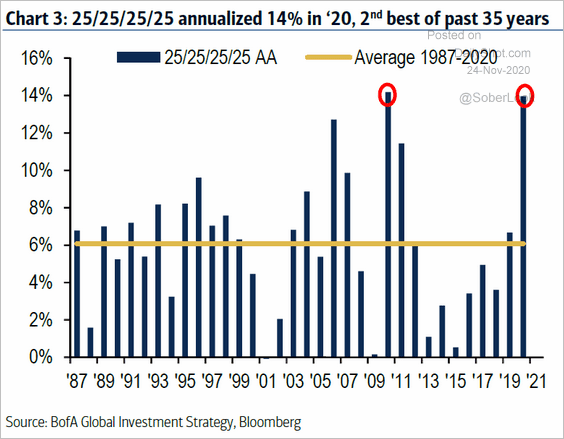

5. It’s been a good year for the 25/25/25/25 (stocks/bonds/cash/gold) portfolio.

Source: BofA Global Research

Source: BofA Global Research

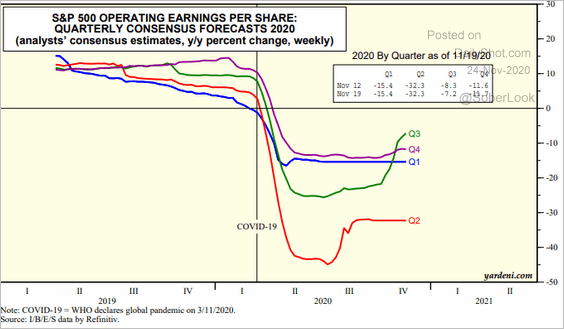

6. This chart shows the year-over-year changes in the S&P 500 EPS consensus estimates (by quarter).

Source: Yardeni Research

Source: Yardeni Research

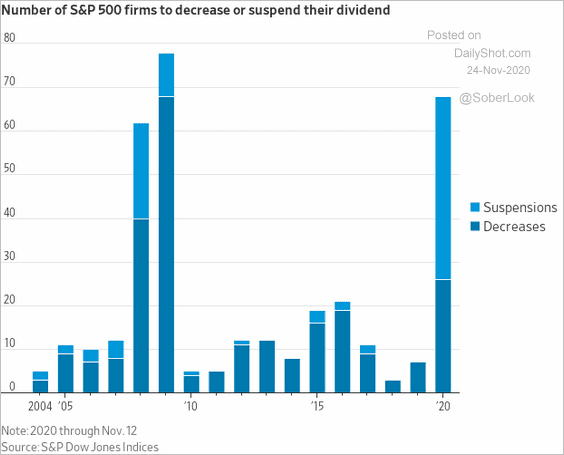

7. Dividend suspensions and decreases spiked this year.

Source: @WSJ Read full article

Source: @WSJ Read full article

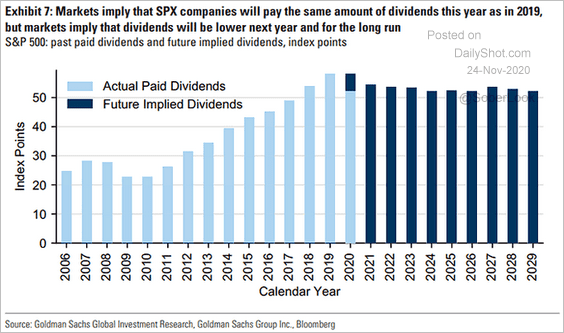

Markets expect dividends to stay below the 2018 levels for years to come.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

——————–

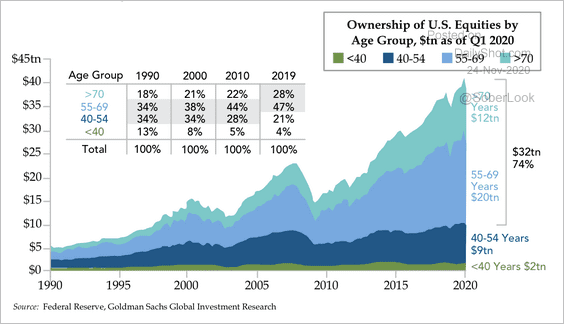

8. Retirees own an increasing share of the US stock market.

Source: Quill Intelligence

Source: Quill Intelligence

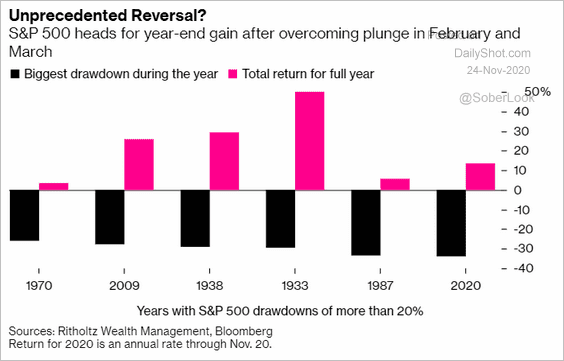

9. This chart shows the S&P 500 performance during the years with the greatest drawdowns.

Source: @markets Read full article

Source: @markets Read full article

Credit

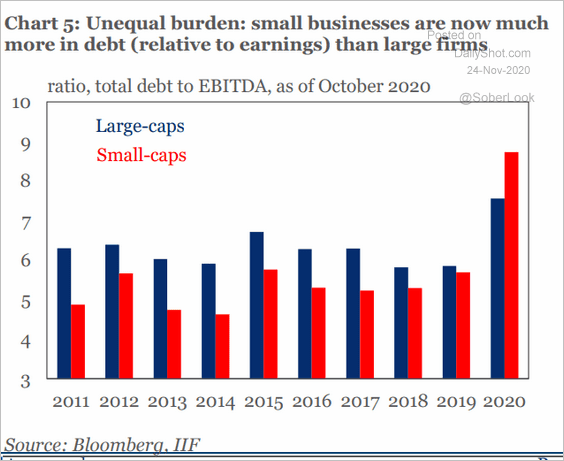

1. Leverage has increased more for small-caps vs. large-caps this year.

Source: IIF

Source: IIF

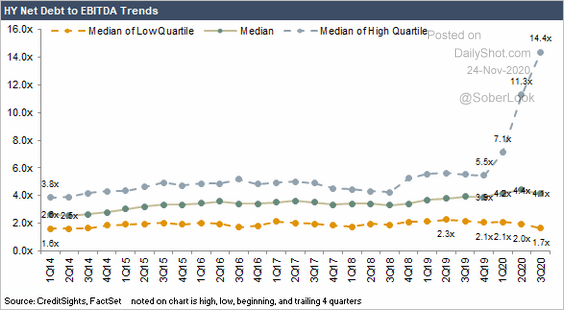

2. Leverage of some of the weaker high-yield names continues to climb.

Source: CreditSights

Source: CreditSights

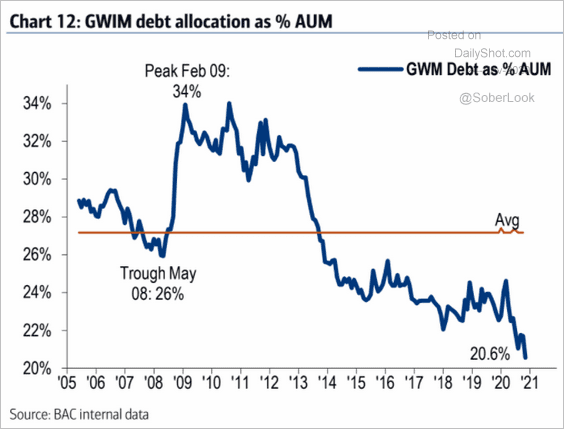

3. Merrill Lynch private clients’ allocation to debt hit a new low.

Source: BofA Global Research

Source: BofA Global Research

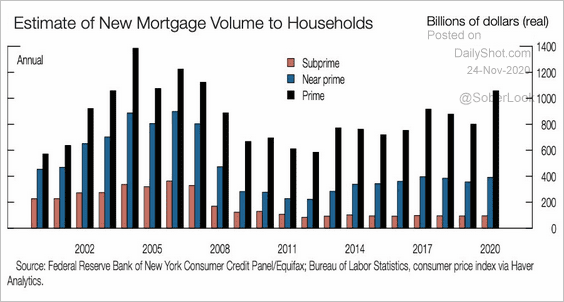

4. US subprime mortgage origination never recovered after 2008.

Source: @adam_tooze, Federal Reserve Read full article

Source: @adam_tooze, Federal Reserve Read full article

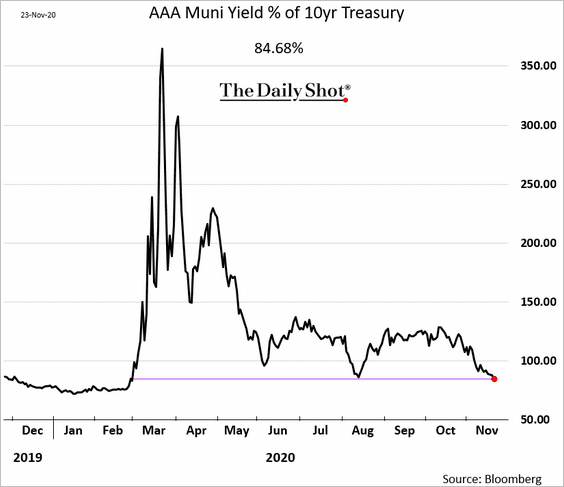

5. AAA muni yields hit the lowest level relative to Treasuries since early March.

Rates

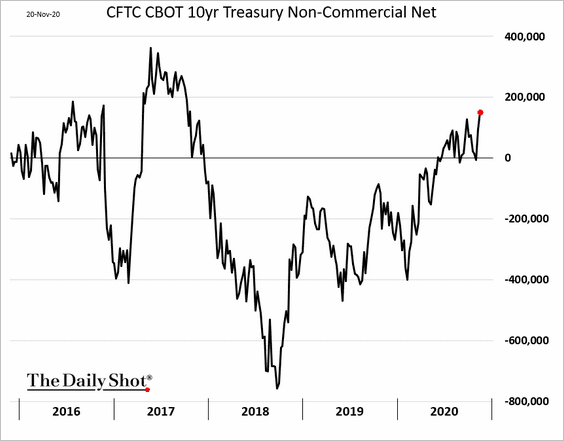

1. Speculative accounts are boosting their bets on the 10yr Treasury futures.

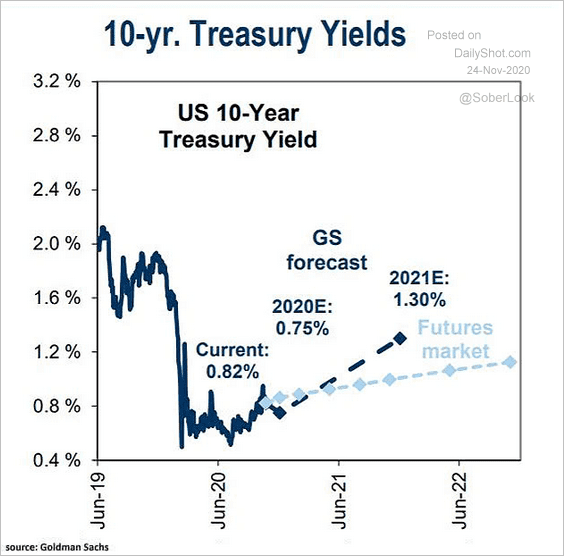

2. Goldman expects a steeper trajectory for Treasury yields than the market.

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

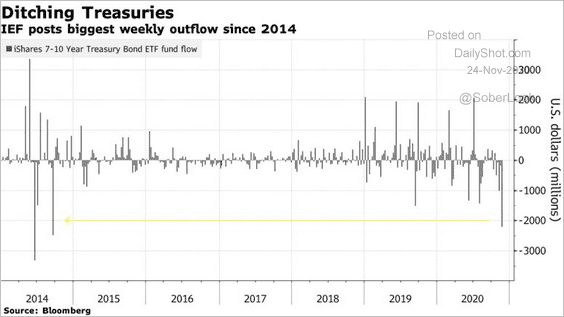

3. The largest intermediate Treasury ETF (IEF) saw substantial (and lumpy) outflows recently.

Source: @markets Read full article

Source: @markets Read full article

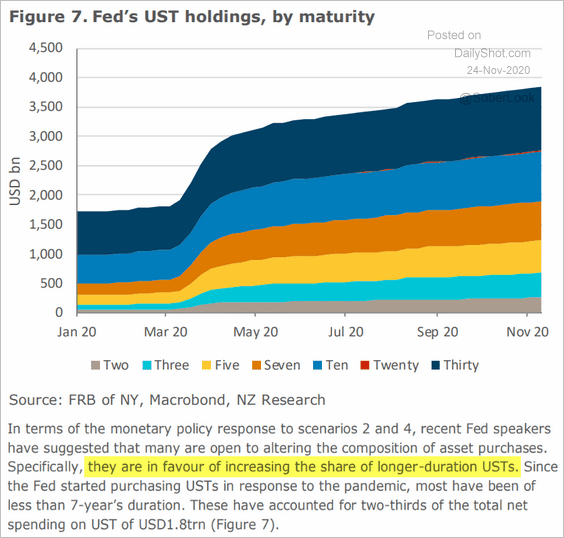

4. Fed officials seem to favor increasing the share of longer-dated Treasuries as part of QE. Will it be enough to keep the curve from steepening?

Source: ANZ Research

Source: ANZ Research

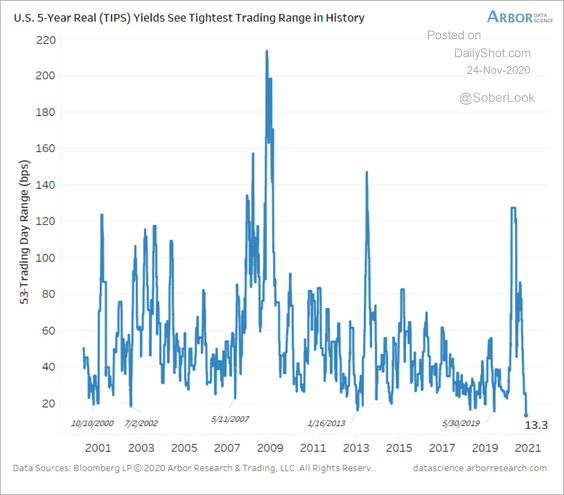

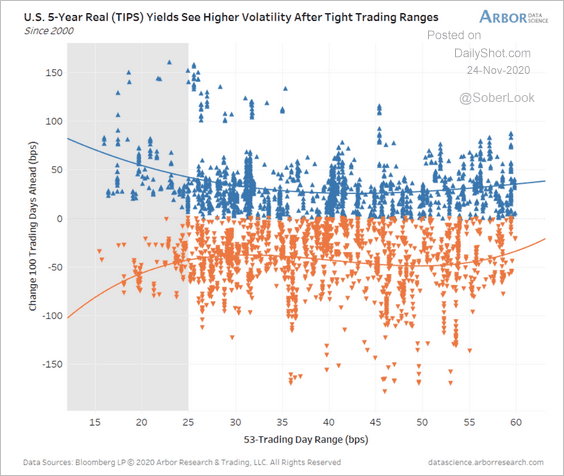

5. The US 5-year TIPS yield has seen the tightest trading range in history.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

Extremely tight trading ranges in TIPS are typically followed by sizable breakouts (shaded region).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

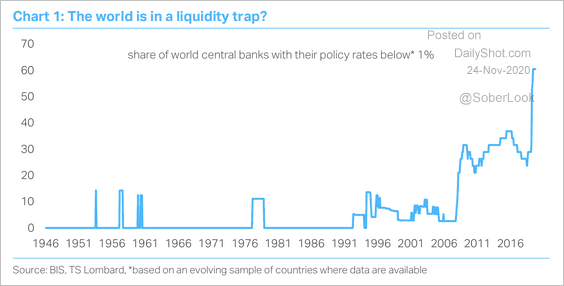

6. A majority of central banks have policy rates below 1%.

Source: TS Lombard

Source: TS Lombard

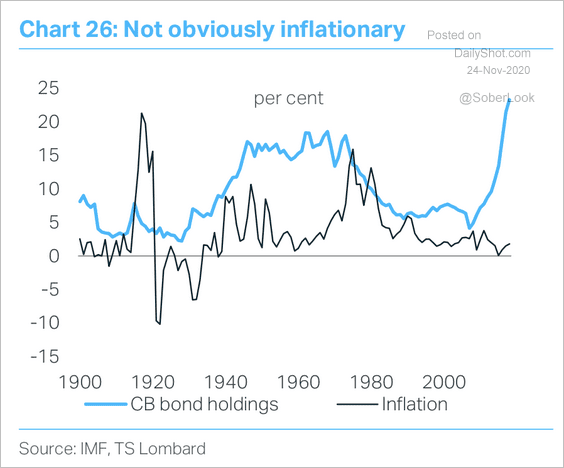

7. Will the record increase in central bank bond holdings result in higher inflation?

Source: TS Lombard

Source: TS Lombard

Commodities

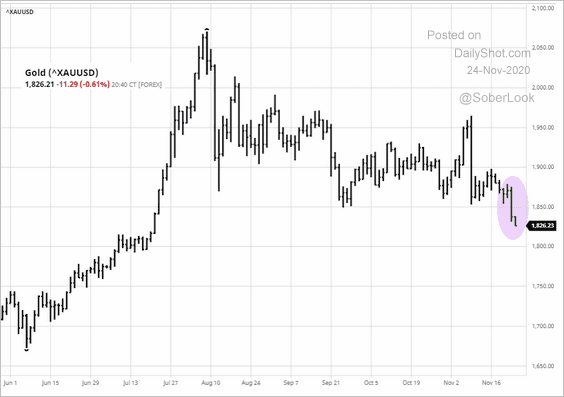

1. Let’s begin with some updates on gold.

• Gold prices weakened further on Monday.

Source: barchart.com

Source: barchart.com

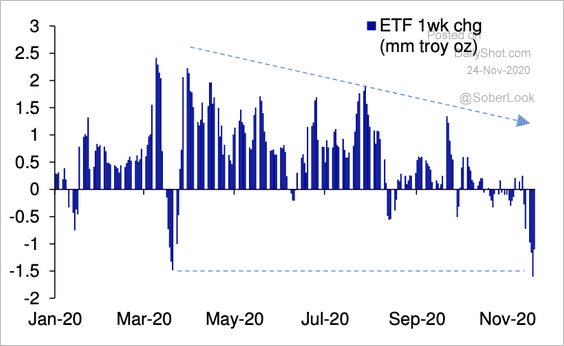

• Outflows have been severe.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

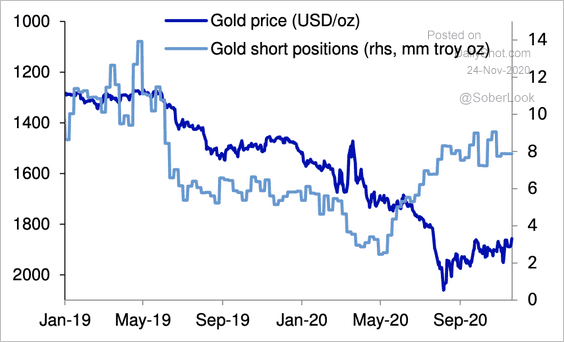

• Short positioning in gold futures is not yet extreme.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

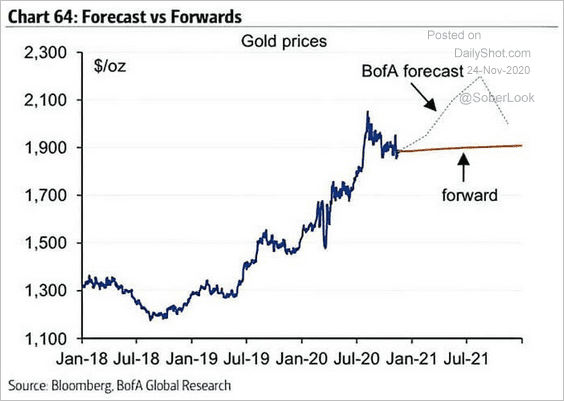

• Here is BofA’s forecast for gold prices.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

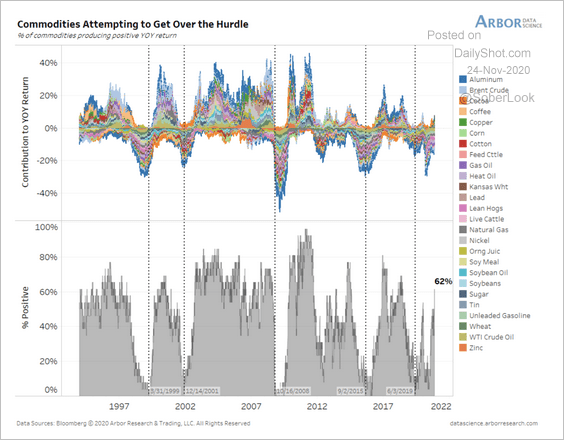

2. 62% of the world’s major commodities are producing positive year-over-year gains, according to Arbor Data Science.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

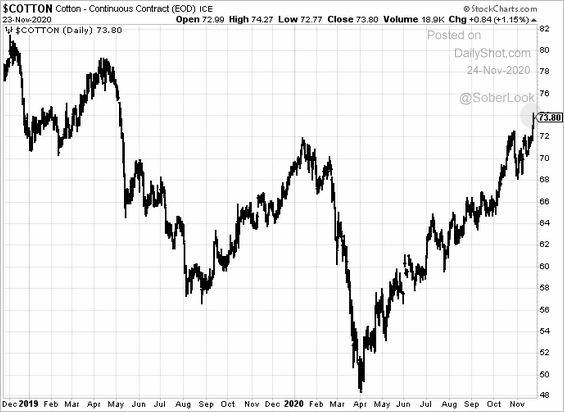

3. US cotton futures continue to rally.

Energy

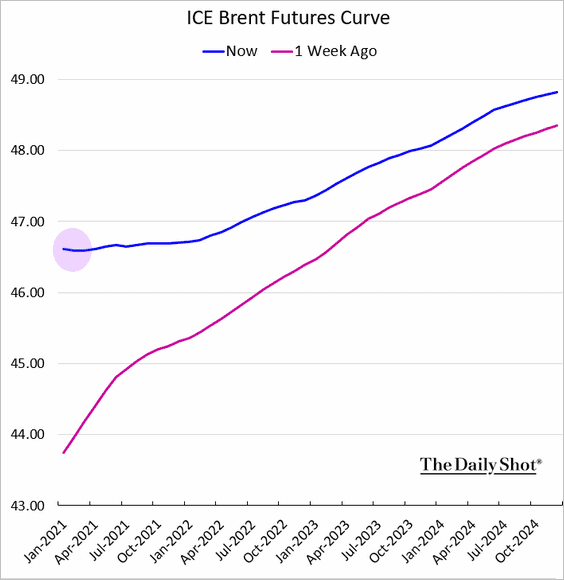

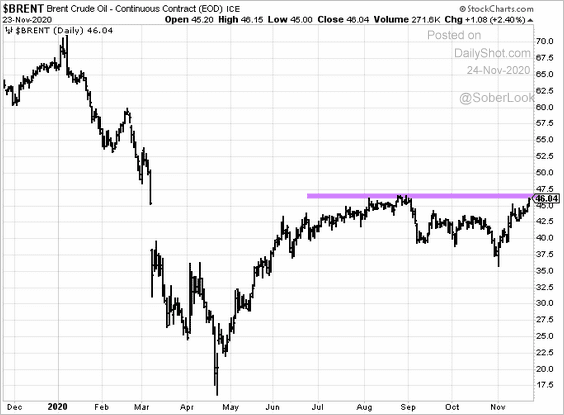

1. The front end of the Brent curve is in backwardation.

Brent futures are testing resistance at $46/bbl.

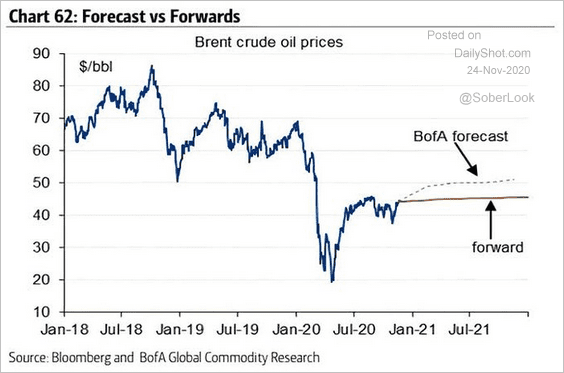

Here is BofA’s forecast.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

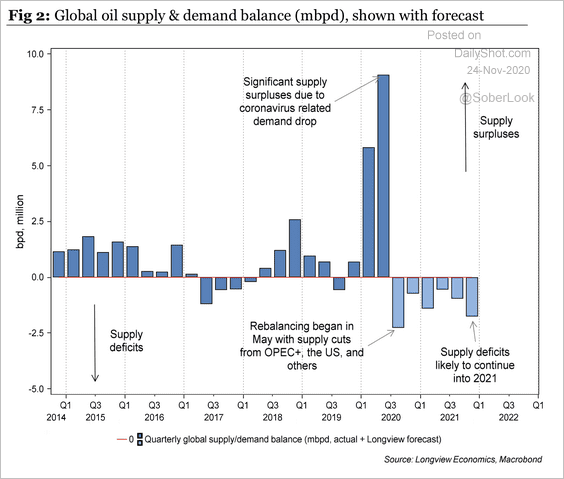

2. Longview Economics expects the global oil supply deficit to continue next year.

Source: Longview Economics

Source: Longview Economics

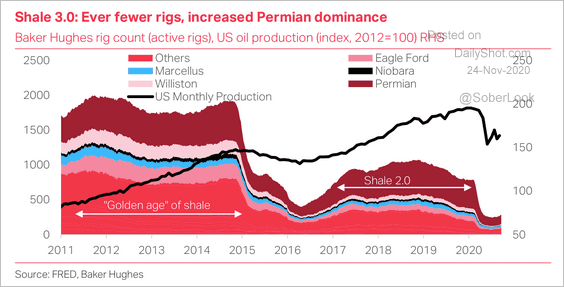

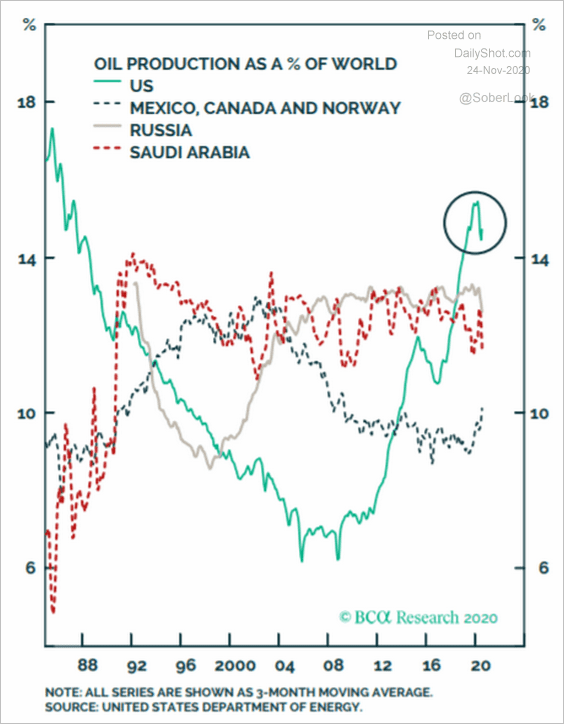

3. US oil production has remained resilient despite the significant decline in rig counts.

Source: TS Lombard

Source: TS Lombard

Source: BCA Research

Source: BCA Research

——————–

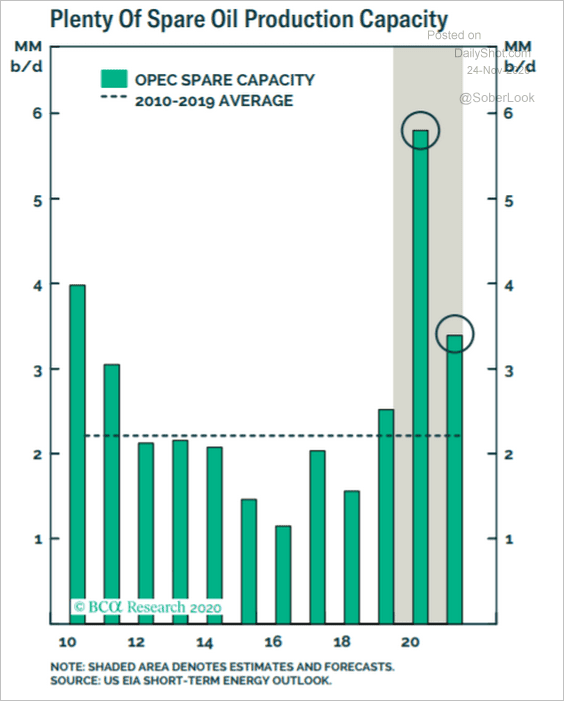

4. OPEC has plenty of spare production capacity.

Source: BCA Research

Source: BCA Research

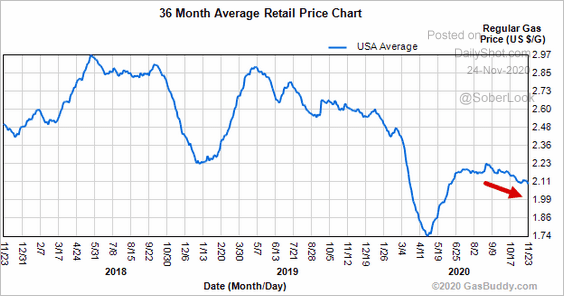

5. US retail gasoline prices have been drifting lower.

Source: GasBuddy

Source: GasBuddy

Cryptocurrency

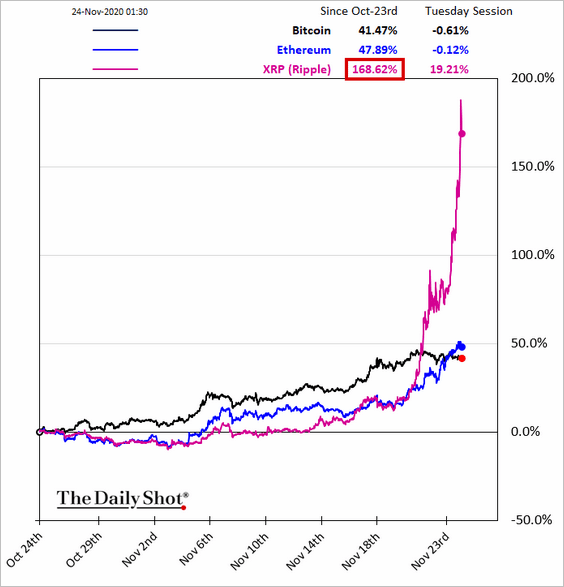

1. XRP is up some 170% over the past few days.

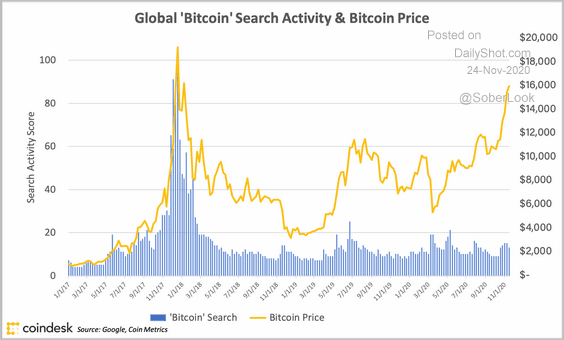

2. Search activity for Bitcoin is low compared to the extreme run-up in 2018. Does it indicate an absence of FOMO from retail traders?

Source: CoinDesk Read full article

Source: CoinDesk Read full article

Emerging Markets

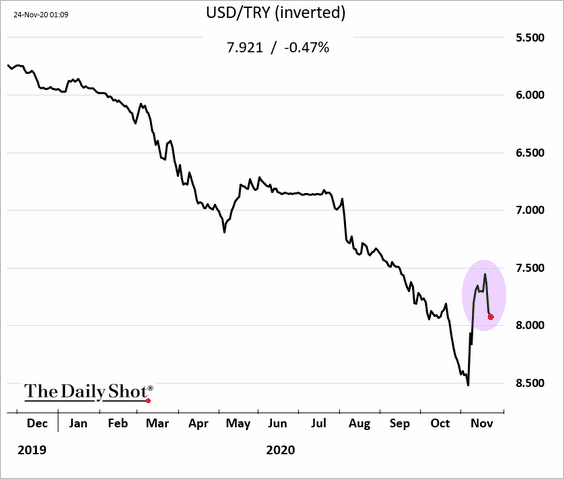

1. The Turkish lira is weakening again.

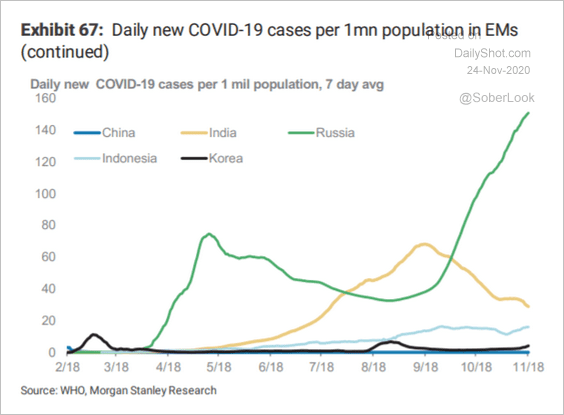

2. Russia’s COVID problem appears to be worsening.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

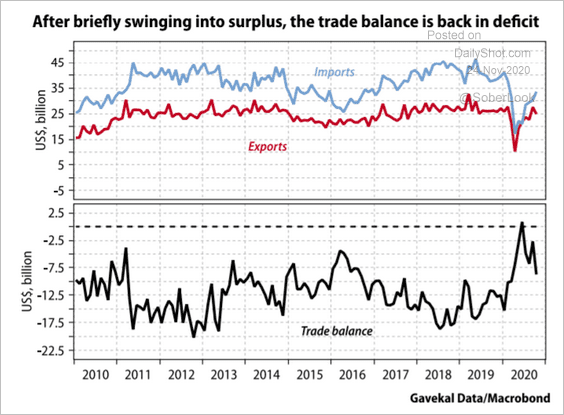

3. India’s trade balance was in surplus for one month but is now back in deficit.

Source: Gavekal

Source: Gavekal

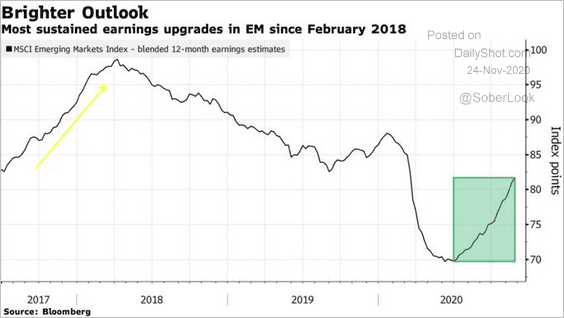

4. Analysts continue to upgrade EM corporate earnings forecasts.

Source: @markets Read full article

Source: @markets Read full article

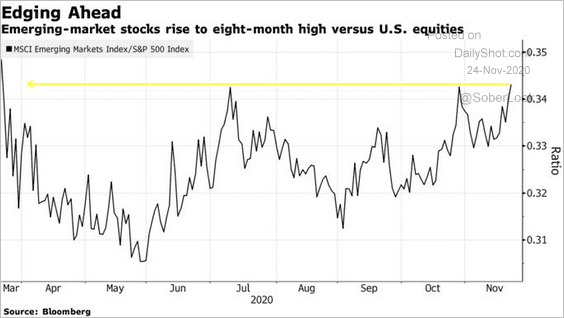

5. EM stocks have been outperforming the S&P 500 in recent days.

Source: @markets Read full article

Source: @markets Read full article

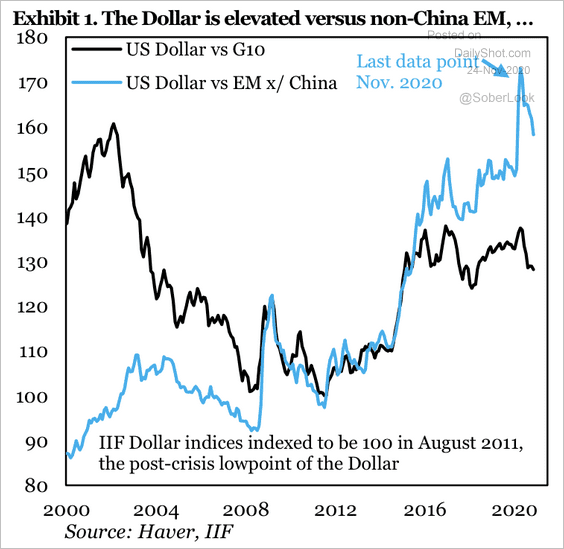

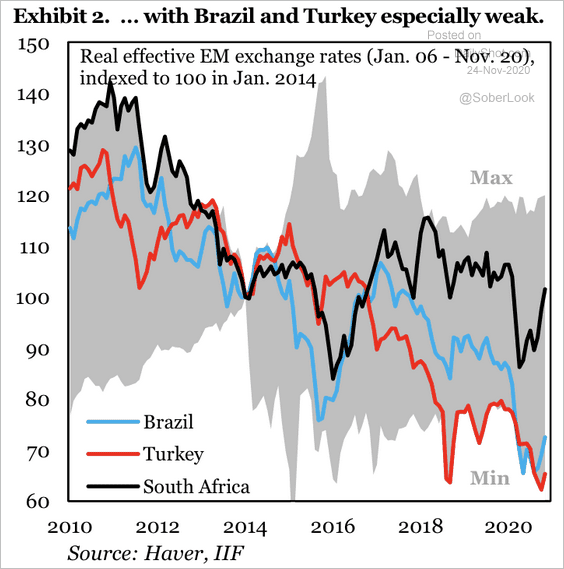

6. The dollar is substantially overvalued versus EM currencies, according to IIF (two charts).

Source: IIF

Source: IIF

Source: IIF

Source: IIF

——————–

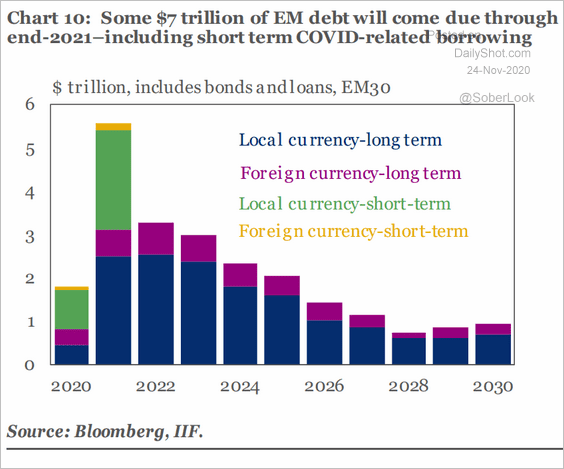

7. Here is the maturity profile of EM debt.

Source: IIF

Source: IIF

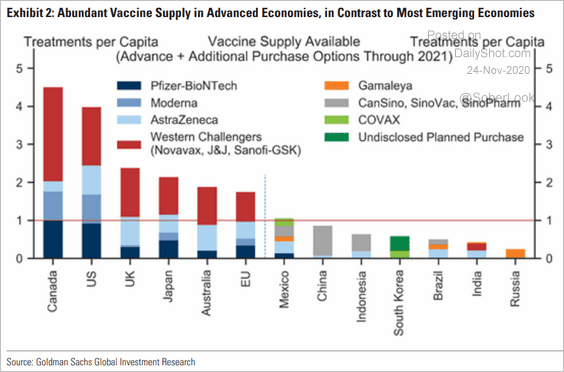

8. EM economies will have a tough time accessing enough vaccine doses.

Source: Goldman Sachs

Source: Goldman Sachs

China

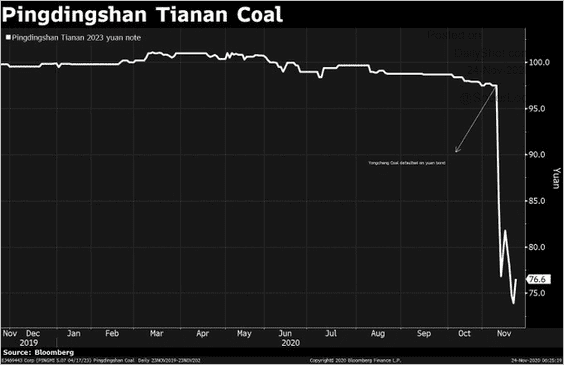

1. Some higher-rated bonds are under pressure after the recent defaults.

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

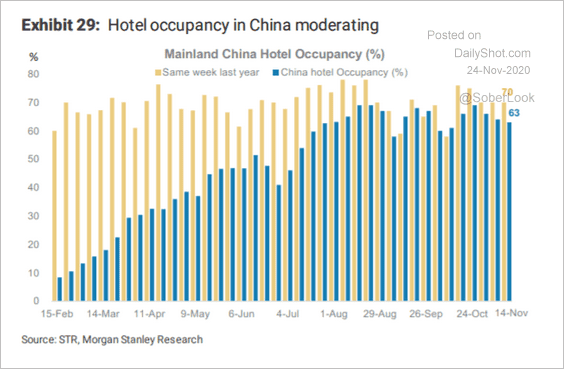

2. Hotel occupancy is moderating.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

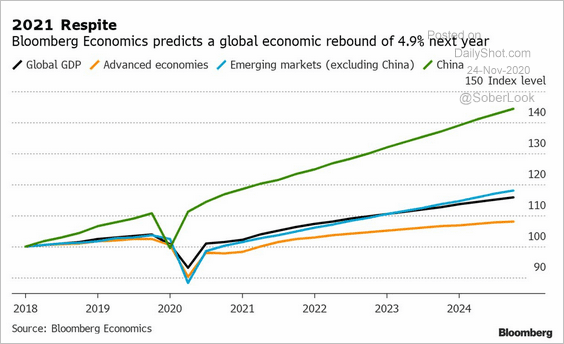

3. China’s economy will massively outperform over the next few years, according to Bloomberg Economics.

Source: @markets Read full article

Source: @markets Read full article

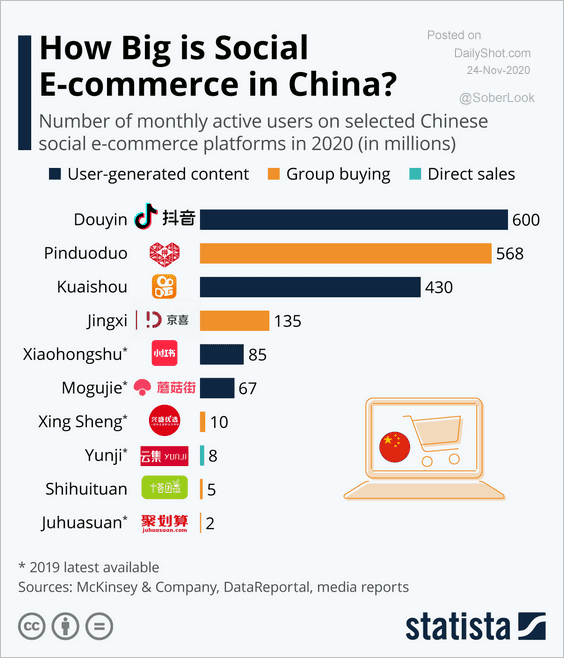

4. Here is the breakdown of social e-commerce in China.

Source: Statista

Source: Statista

Asia – Pacific

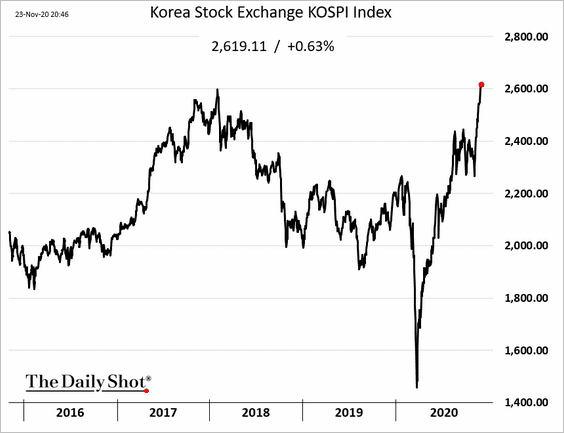

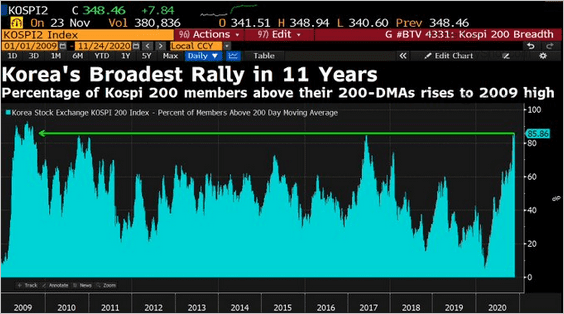

1. South Korea’s KOSPI index hit a record high in a broad rally (2nd chart).

Source: @DavidInglesTV

Source: @DavidInglesTV

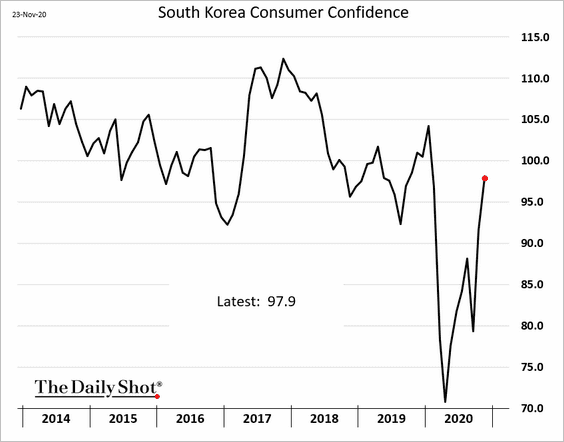

Separately, South Korea’s consumer confidence continues to rebound.

——————–

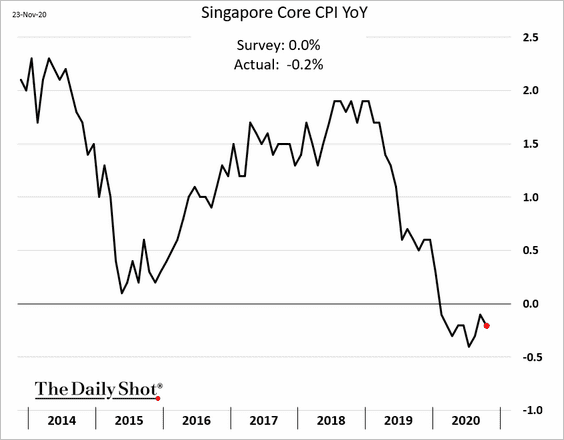

2. Singapore remains in deflation.

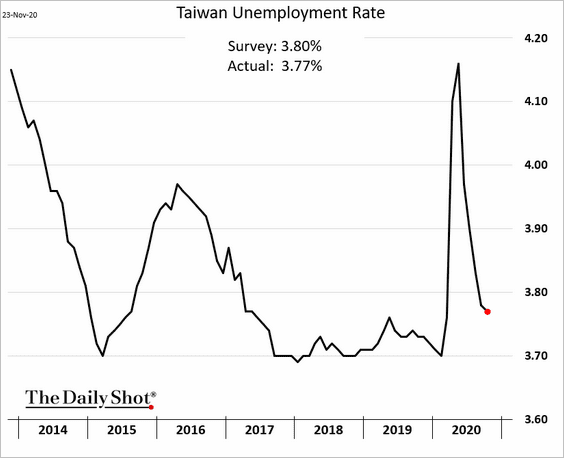

3. Taiwan’s unemployment rate is approaching pre-crisis levels.

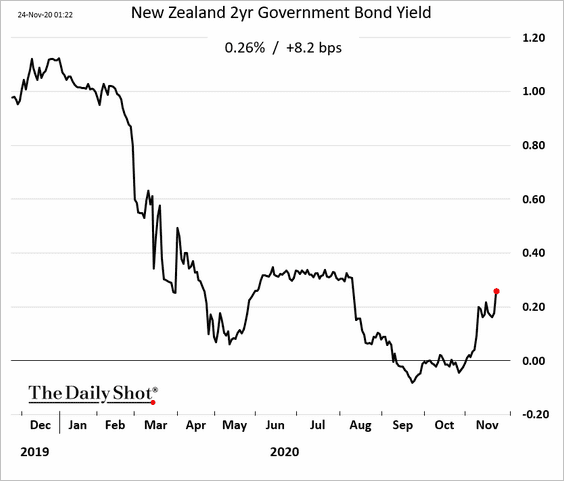

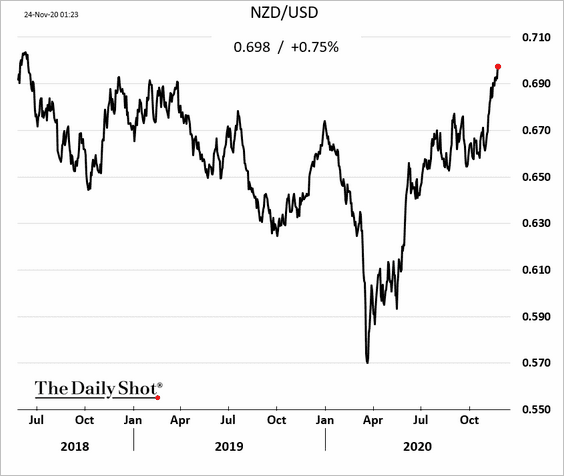

4. There has been some talk that the RBNZ may consider the nation’s hot housing market in deciding the next policy steps. The Kiwi dollar and bond yields climbed further.

——————–

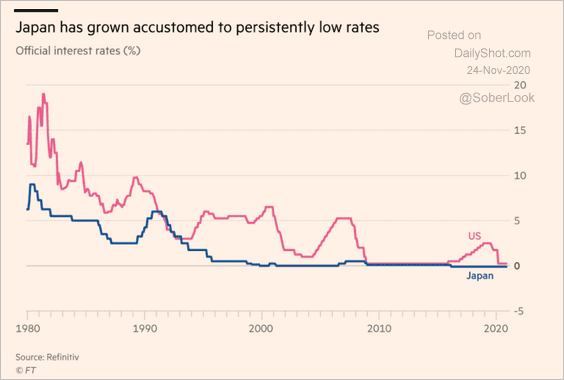

5. Japan’s policy rate has been near zero for two decades.

Source: @financialtimes

Source: @financialtimes

The Eurozone

1. Let’s begin with the November preliminary PMI report.

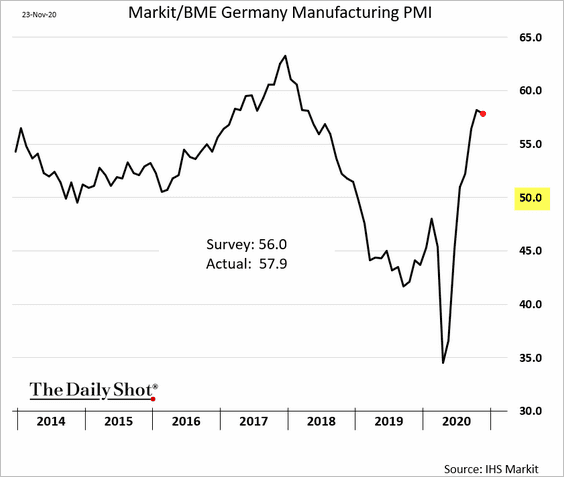

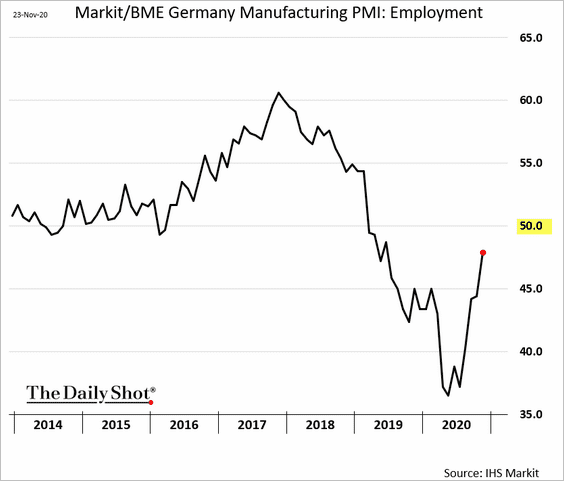

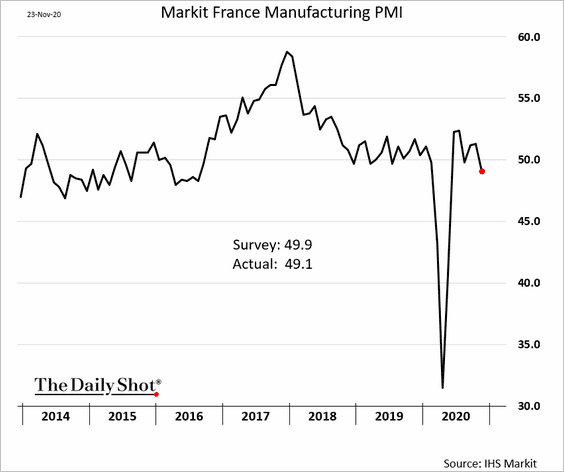

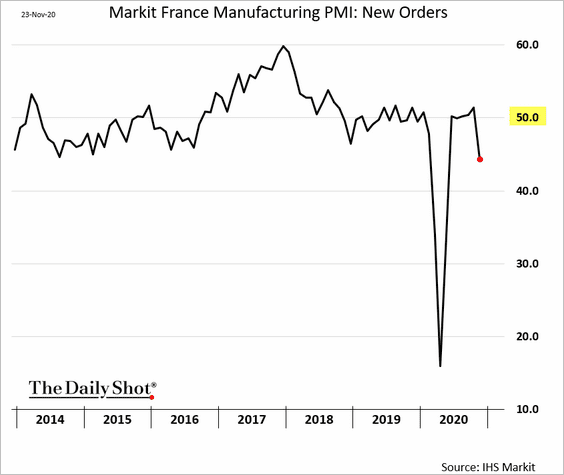

• Manufacturing:

– German manufacturing activity continued to expand, exceeding forecasts.

Factory employment has almost stabilized.

– On the other hand, the French manufacturing PMI is back in contraction territory (PMI < 50).

New orders declined.

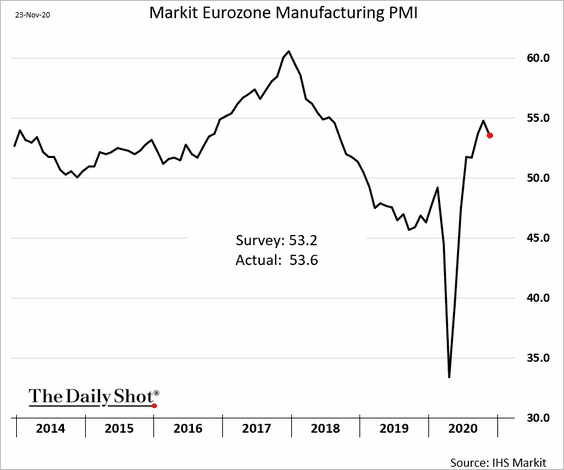

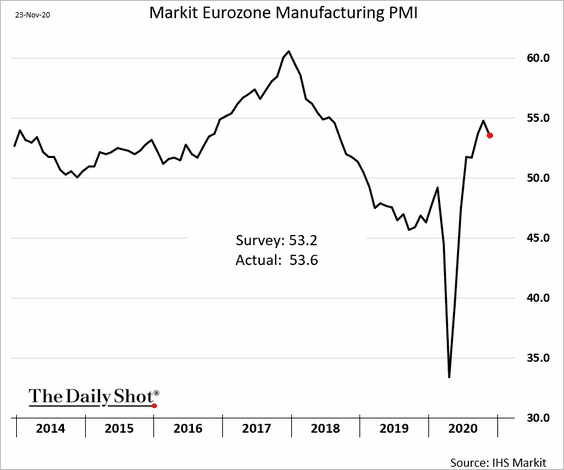

– Here is the manufacturing PMI at the Eurozone level.

• Services:

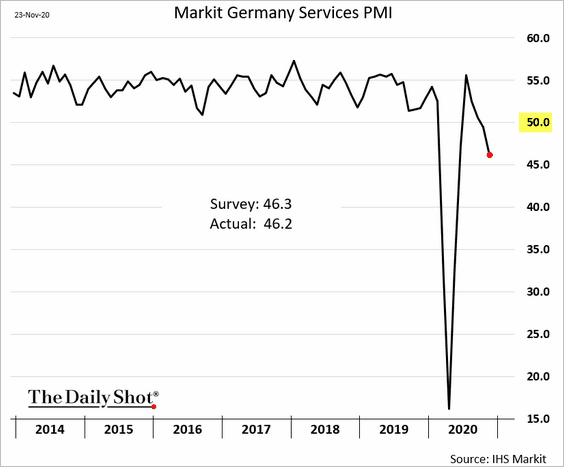

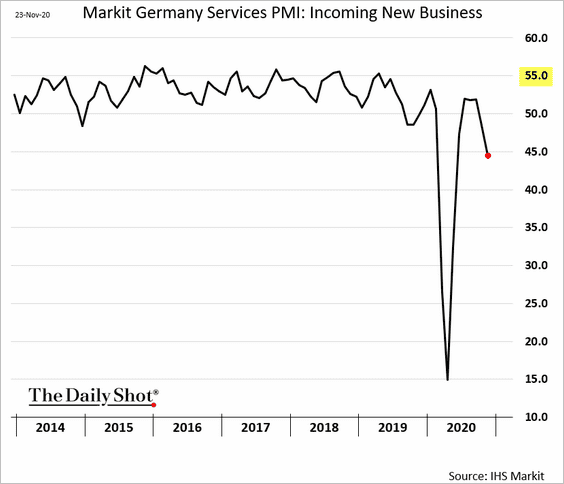

– The second wave took a toll on Germany’s service sector activity.

Demand tumbled.

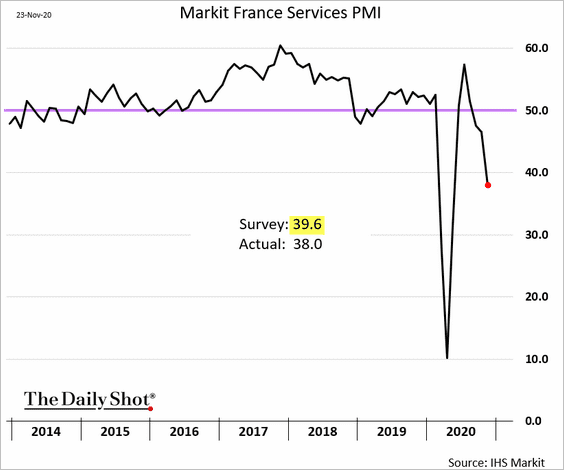

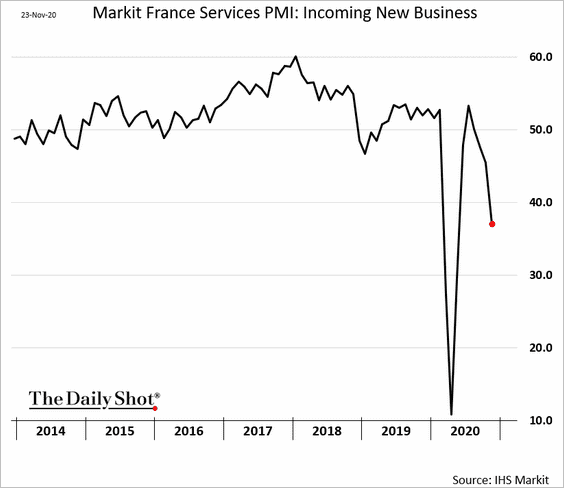

– The service-sector contraction was even worse in France.

– Here is the Eurozone services PMI.

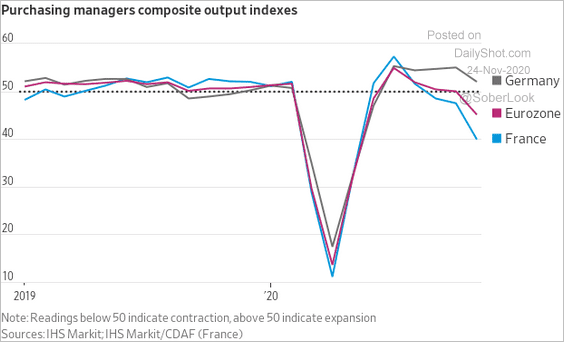

• This chart shows the composite PMI indices.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

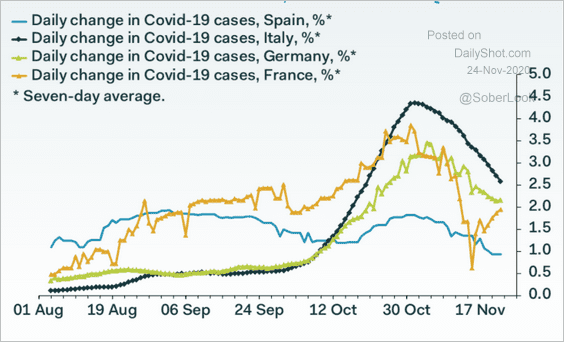

2. The good news is that COVID cases appear to have peaked.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

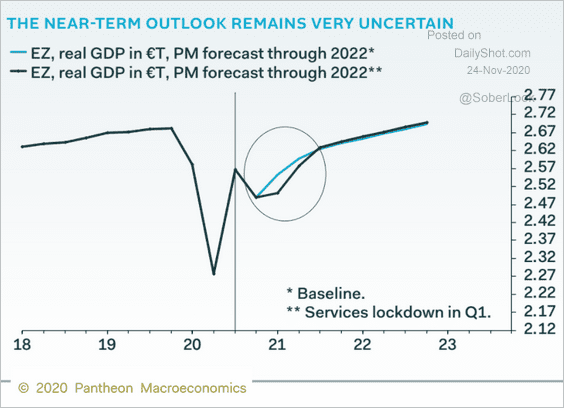

3. But there is significant uncertainty around the depth of the “double-dip” recession.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

The United Kingdom

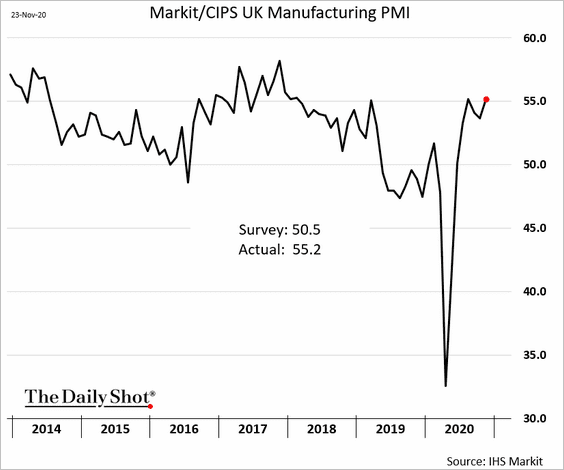

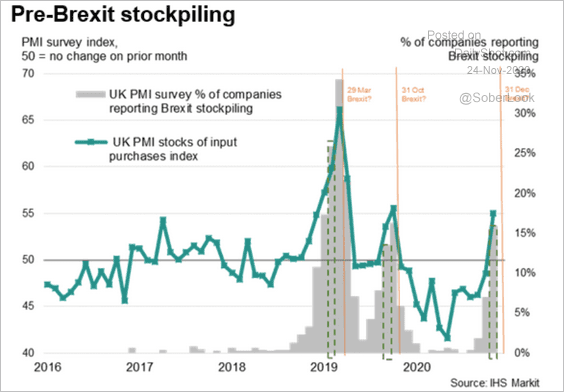

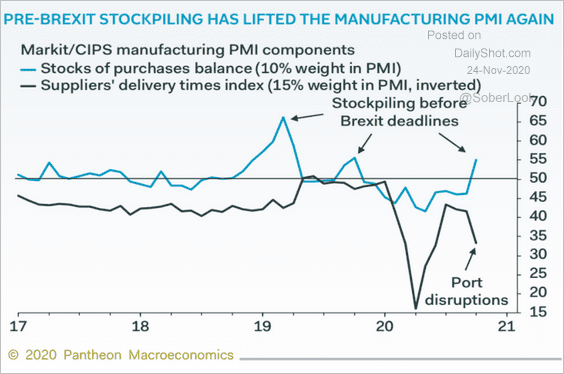

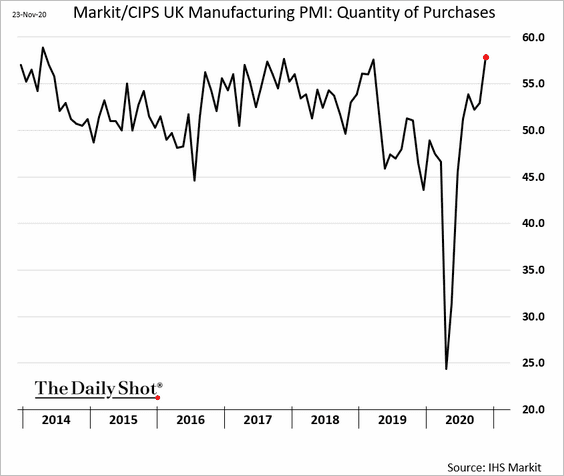

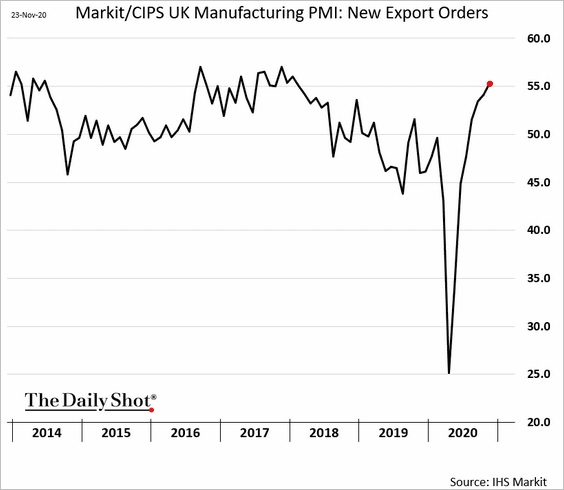

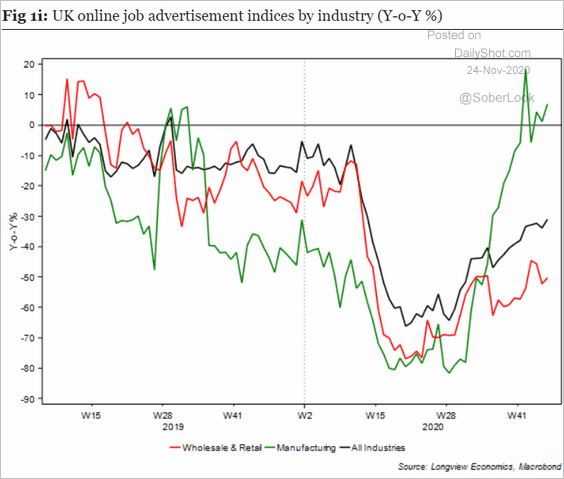

1. The November manufacturing PMI report surprised to the upside.

Companies have once again been building inventories in preparation for a no-deal Brexit.

Source: IHS Markit

Source: IHS Markit

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Quantity of purchases:

• Export orders:

• Factory job ads:

Source: Longview Economics

Source: Longview Economics

——————–

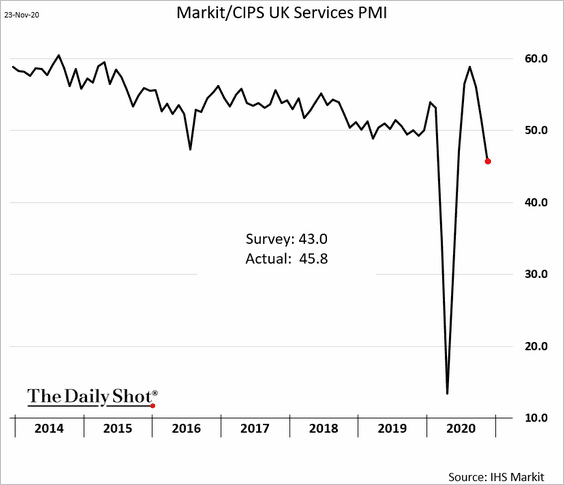

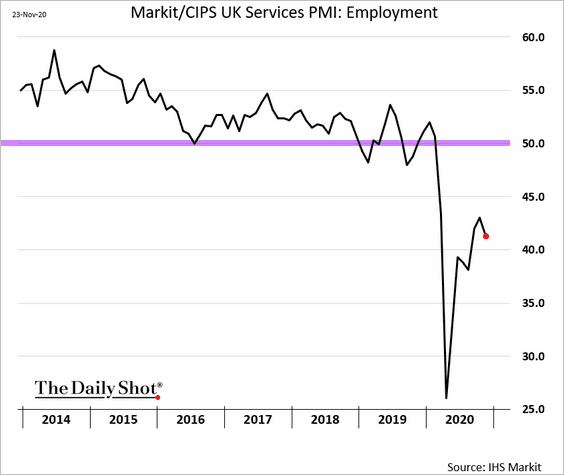

2. Service-sector activity slowed less than expected.

But service employment continues to shrink.

——————–

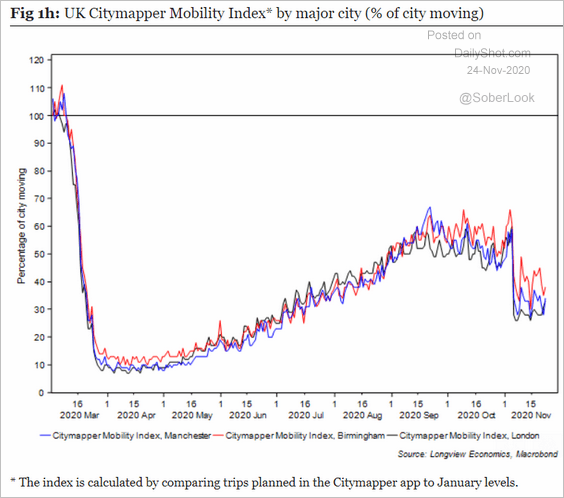

3. Here is the Citymapper Mobility Index.

Source: Longview Economics

Source: Longview Economics

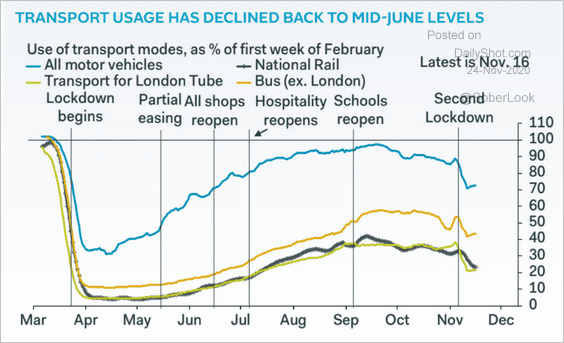

And this is the nation’s transport usage.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

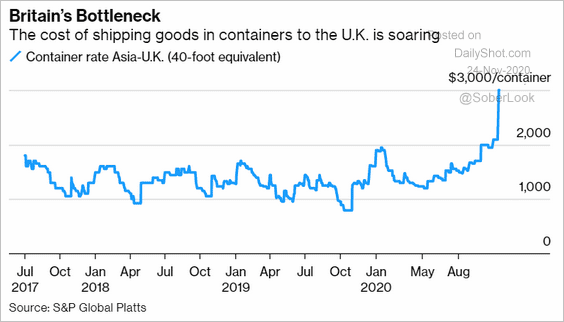

4. Container shipping costs spiked amid an increase in import demand and limited capacity.

Source: @business Read full article

Source: @business Read full article

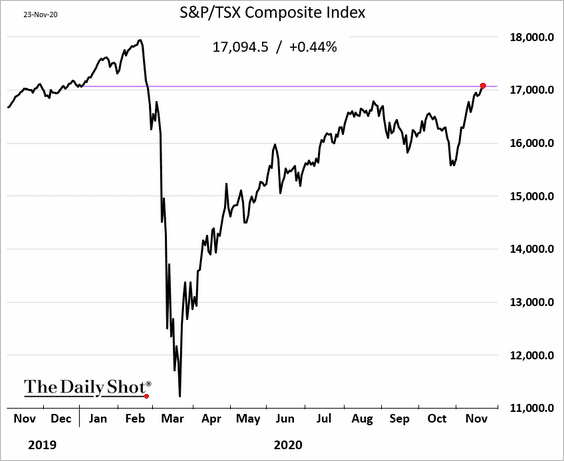

Canada

1. The S&P/TSX Composite is now up on the year.

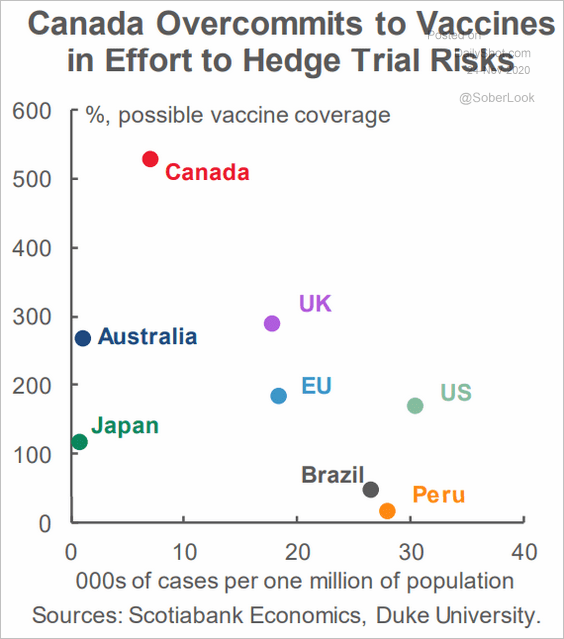

2. Canada will have a much larger vaccine supply than it can use.

Source: Scotiabank Economics

Source: Scotiabank Economics

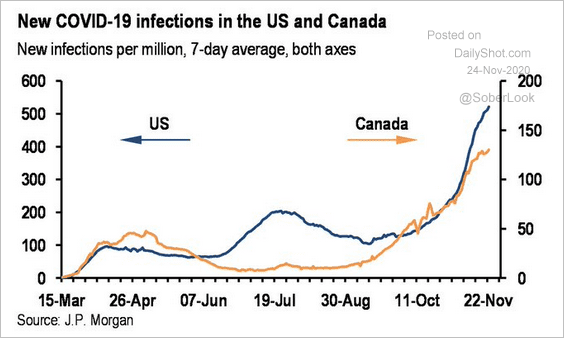

3. Canada’s infection rate is lagging the US trend.

Source: JP Morgan, @carlquintanilla

Source: JP Morgan, @carlquintanilla

The United States

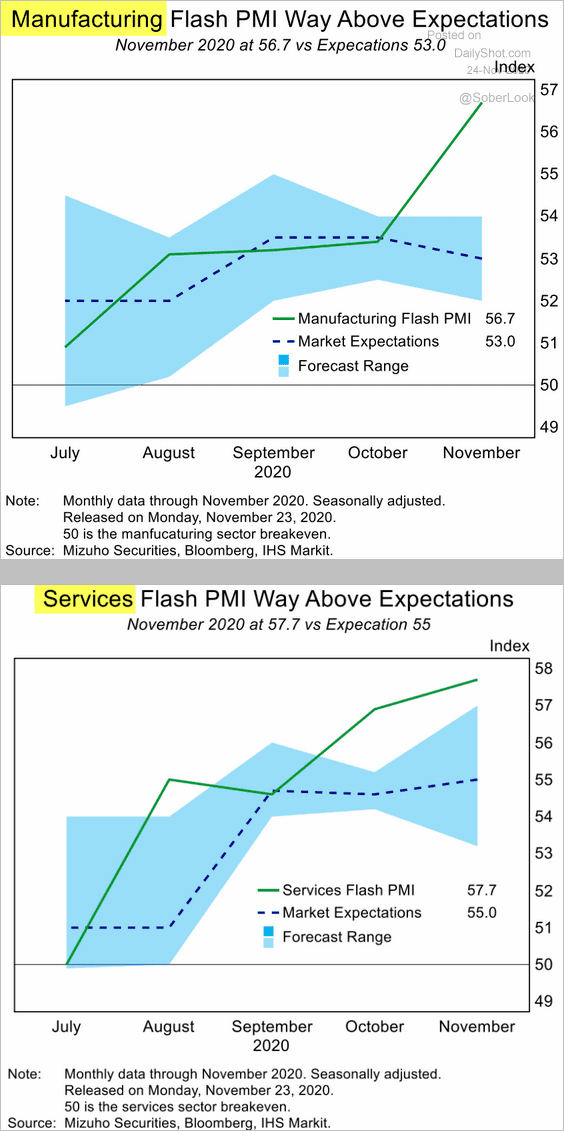

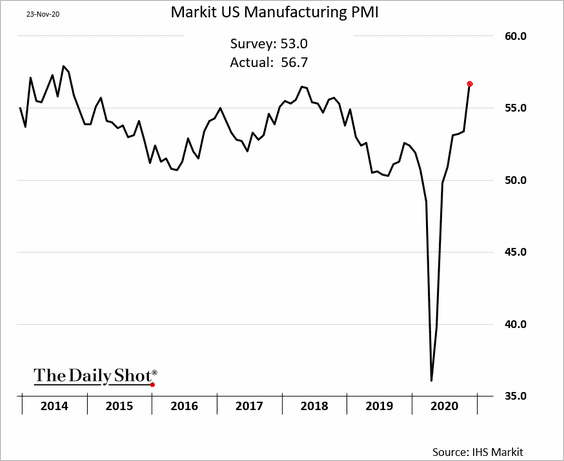

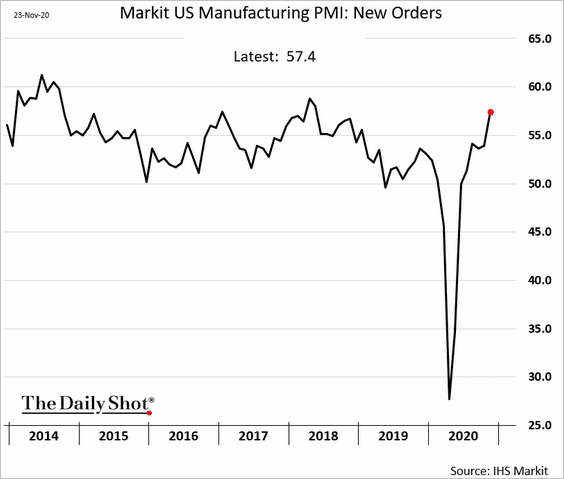

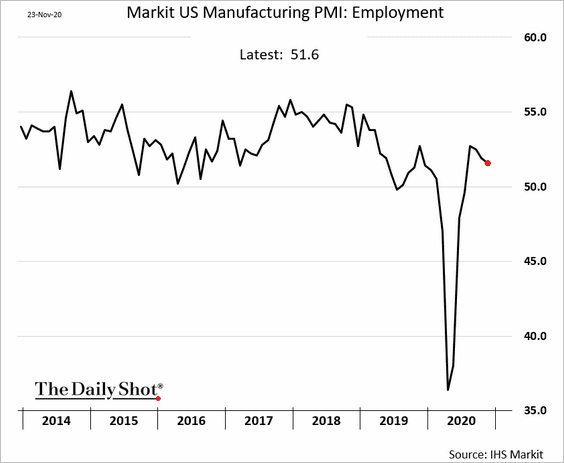

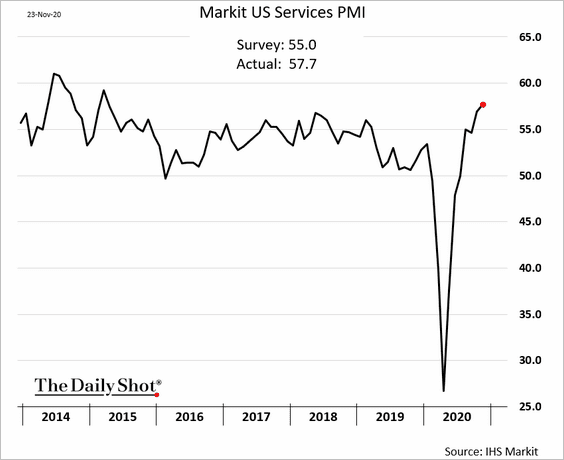

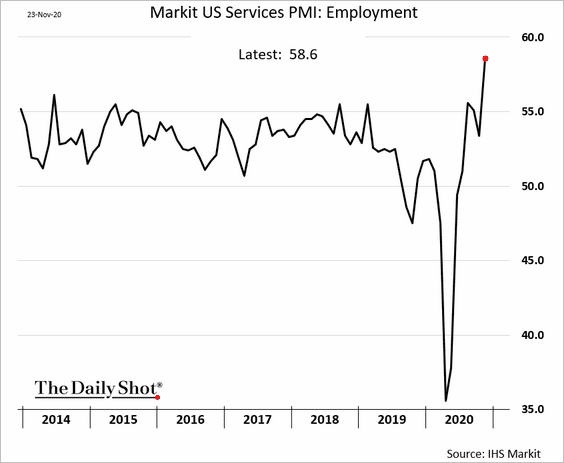

1. Let’s begin with the November preliminary PMI report from Markit, which topped economists’ forecasts.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

• US factory activity expansion accelerated.

But the pace of hiring slowed some.

• Service-sector activity strengthened further despite the spike in infections.

Hiring at service firms accelerated.

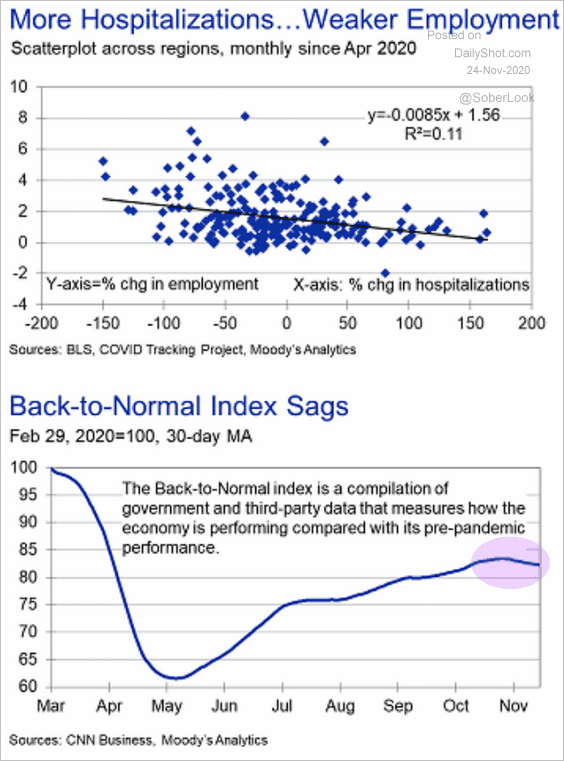

The Markit PMI report contradicts the weakness in high-frequency indicators.

Source: Moody’s Analytics

Source: Moody’s Analytics

——————–

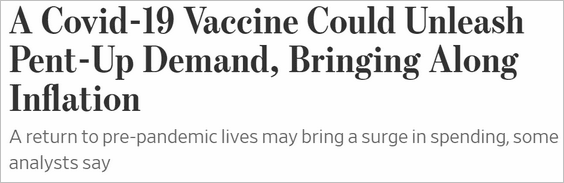

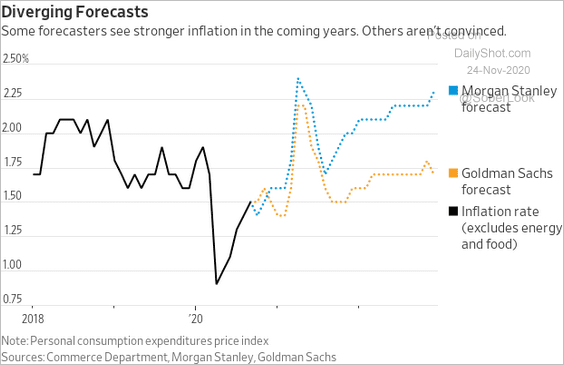

2. Will a successful vaccine program unleash pent-up demand, boosting inflation?

Source: @WSJ Read full article

Source: @WSJ Read full article

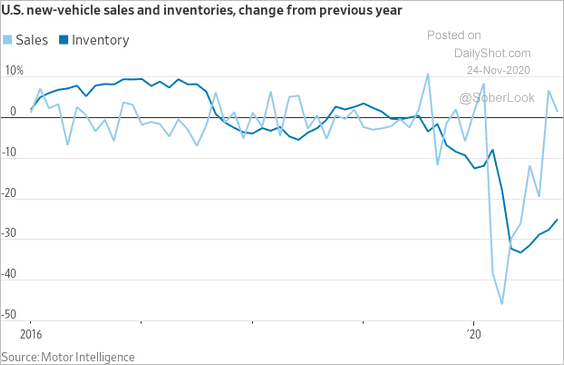

Inventories have been tight.

Source: @WSJ Read full article

Source: @WSJ Read full article

Forecasts on inflation vary.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

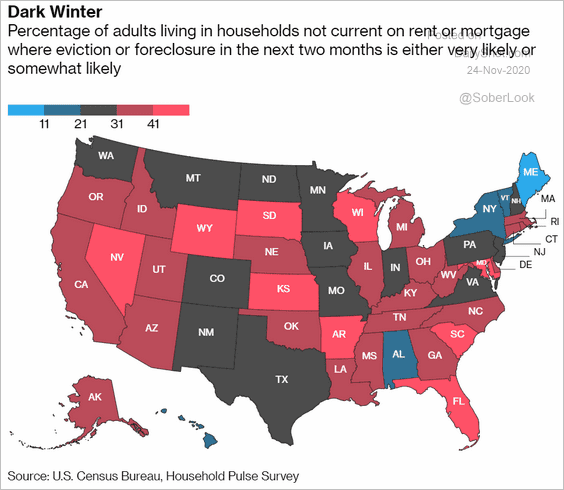

3. A spike in evictions and foreclosures is coming.

Source: @business Read full article

Source: @business Read full article

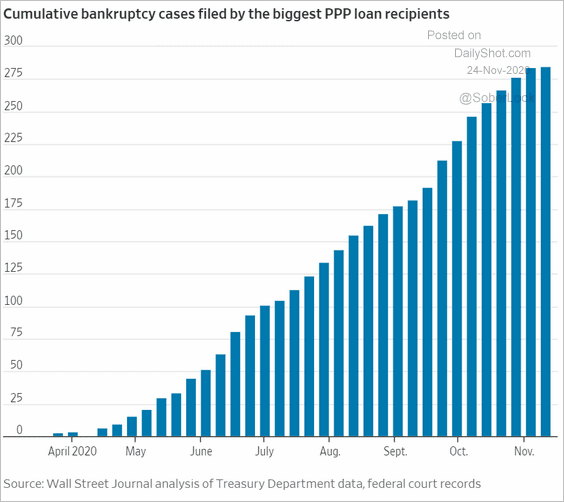

4. Many companies that received pandemic-related government loans have filed for bankruptcy.

Source: @WSJ Read full article

Source: @WSJ Read full article

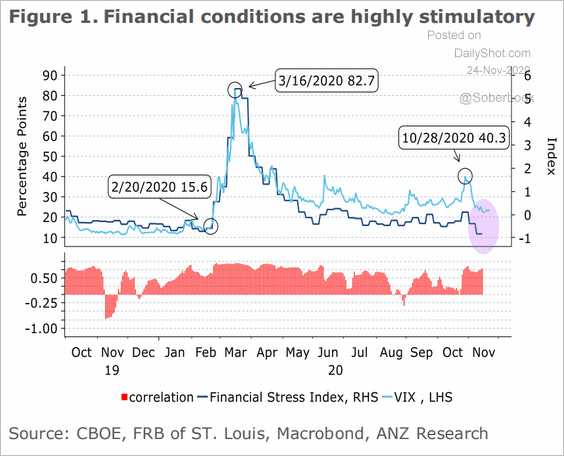

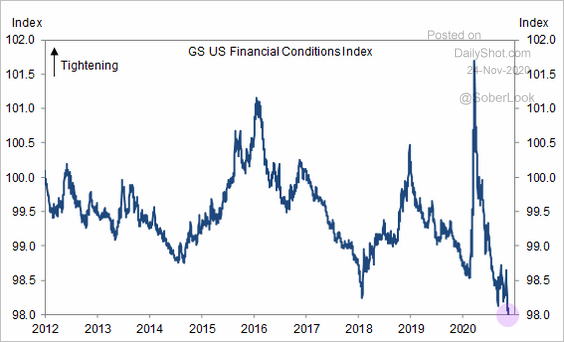

5. US financial conditions are highly stimulatory (2 charts).

Source: ANZ Research

Source: ANZ Research

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Global Developments

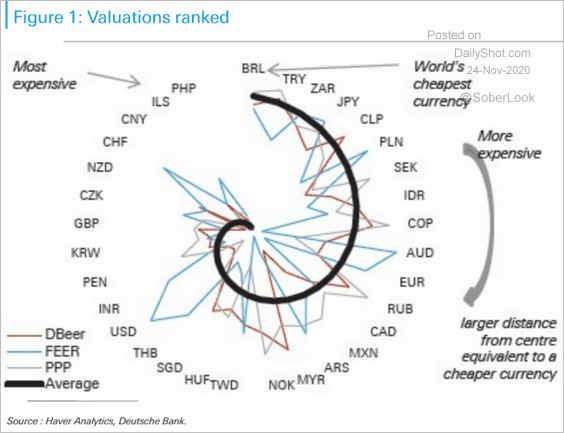

1. Which are the cheapest and the most expensive currencies?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

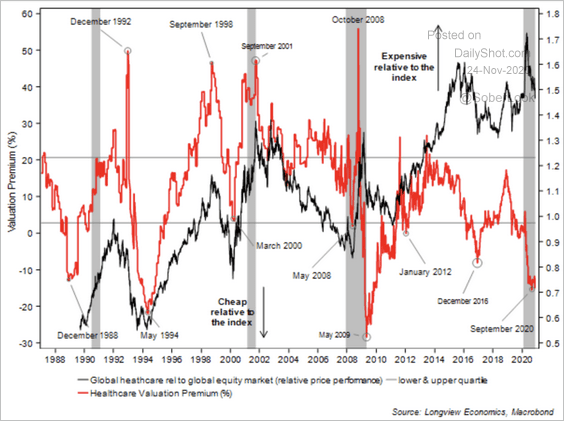

2. Global healthcare stocks are trading at a significant discount to the broader market.

Source: Longview Economics

Source: Longview Economics

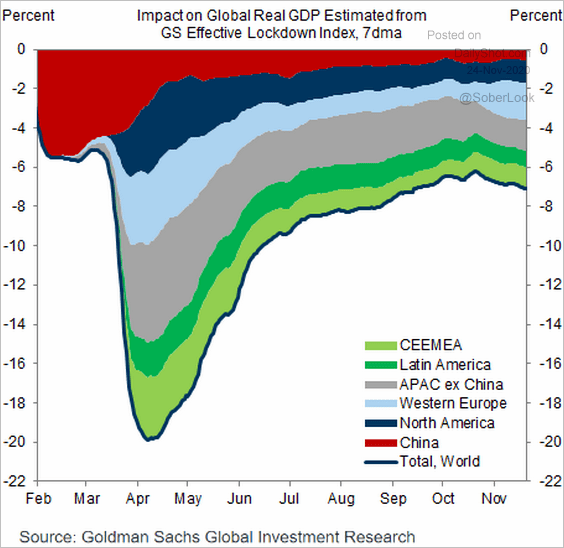

3. What is the current drag on the GDP from lockdowns around the world?

Source: Goldman Sachs

Source: Goldman Sachs

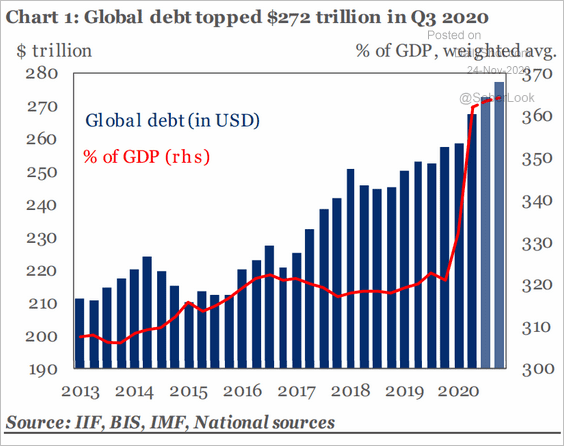

4. Here is the global debt-to-GDP ratio.

Source: IIF

Source: IIF

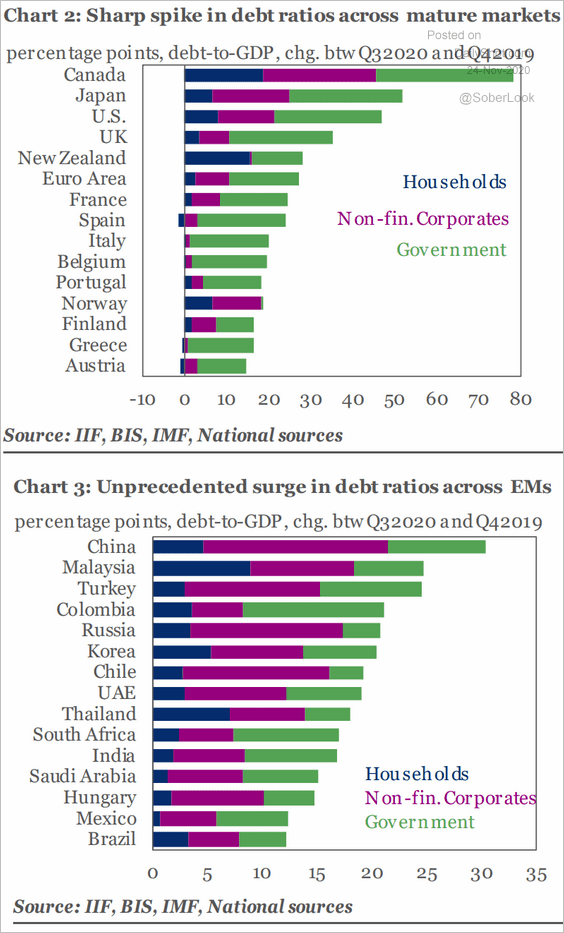

And this chart shows the debt-to-GDP ratio spike in 2020, by country.

Source: IIF

Source: IIF

——————–

Food for Thought

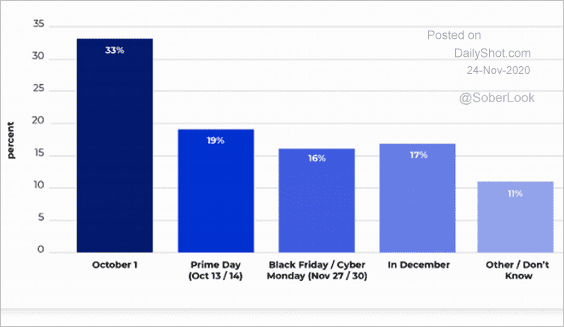

1. When does the holiday shopping season begin?

Source: JungleScout Read full article

Source: JungleScout Read full article

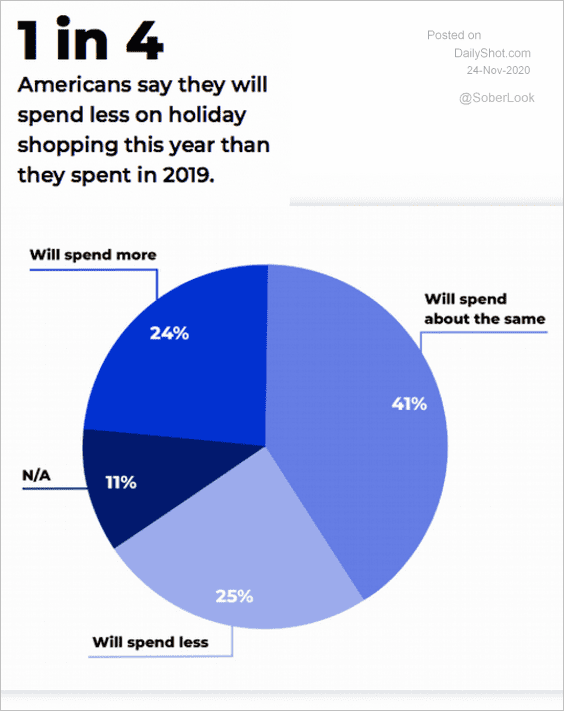

Are US consumers spending more or less this holiday season?

Source: JungleScout Read full article

Source: JungleScout Read full article

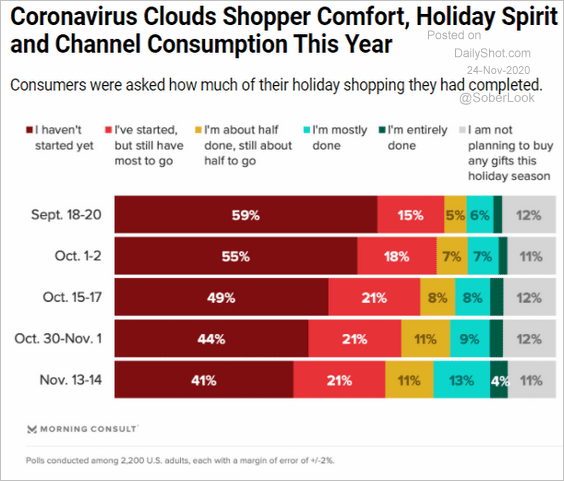

How much of the holiday shopping have US consumers completed?

Source: Morning Consult

Source: Morning Consult

——————–

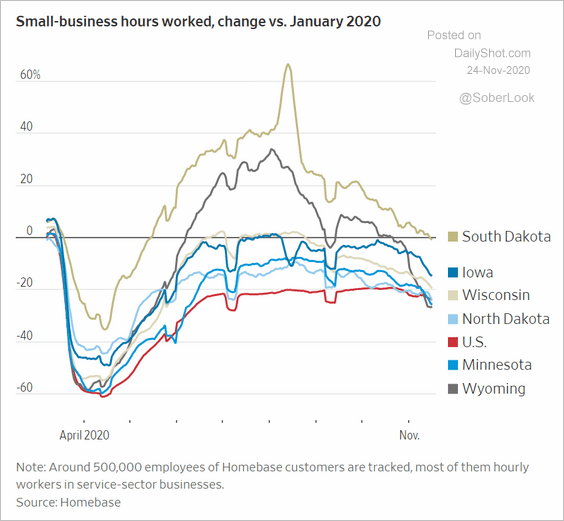

2. US small-business hours worked:

Source: @WSJ Read full article

Source: @WSJ Read full article

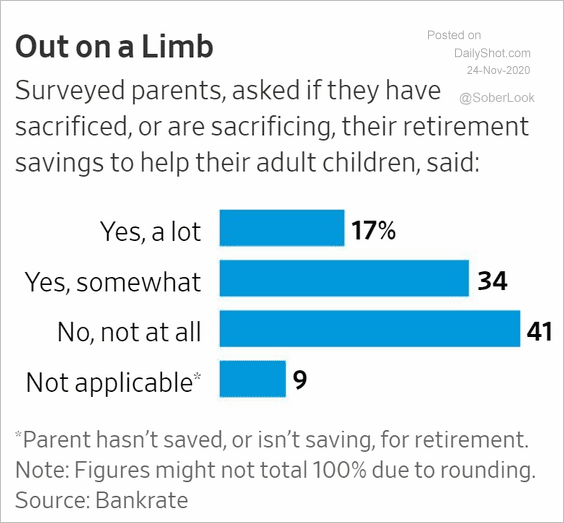

3. Sacrificing retirement to help adult children:

Source: @WSJ Read full article

Source: @WSJ Read full article

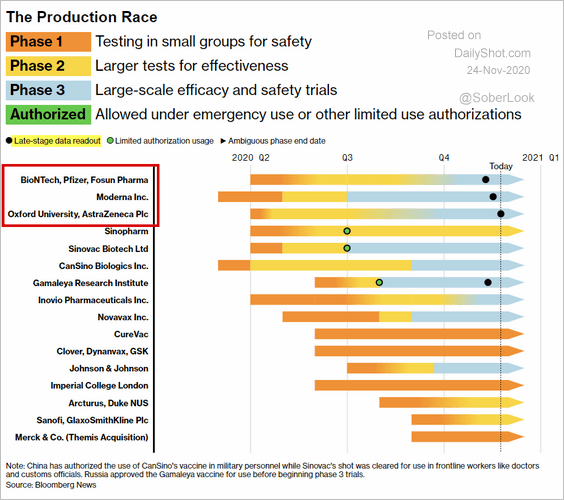

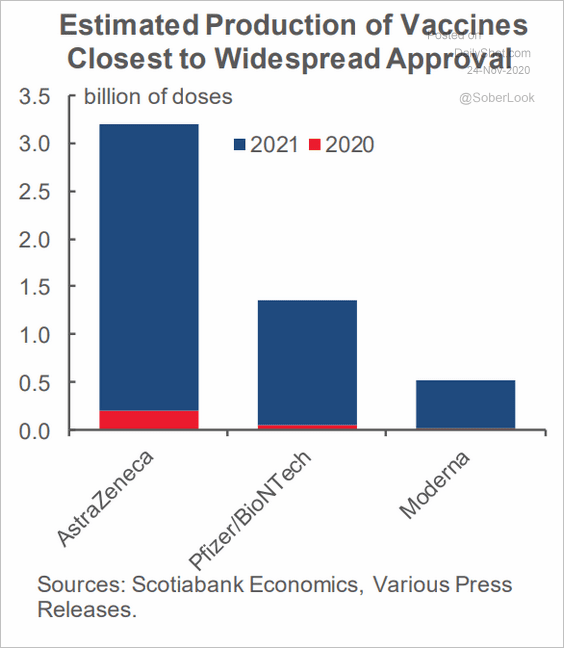

4. Vaccine development progress:

Source: @business Read full article

Source: @business Read full article

Vaccine production estimates:

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

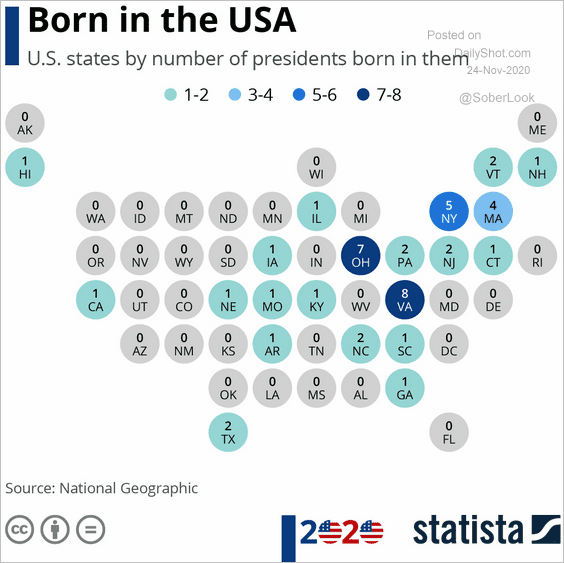

5. The number of presidents born in each state:

Source: Statista

Source: Statista

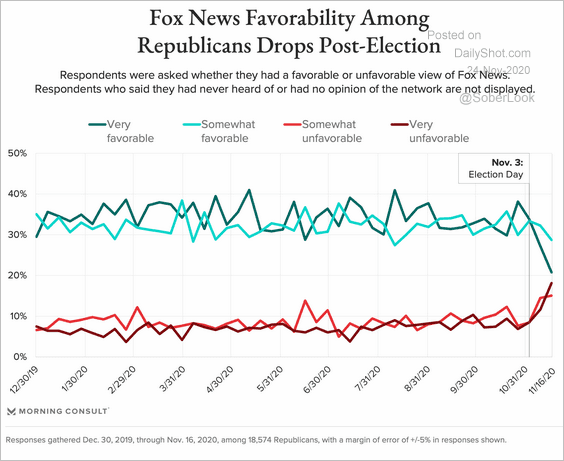

6. Fox News favorability ratings:

Source: Morning Consult Read full article

Source: Morning Consult Read full article

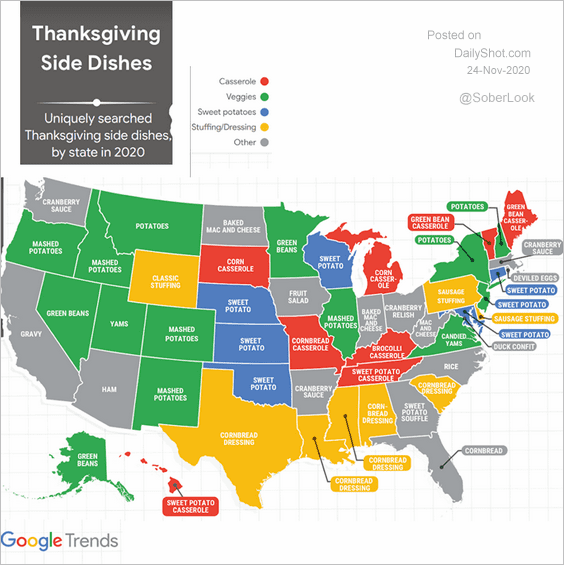

7. Thanksgiving side dishes:

Source: Google Trends

Source: Google Trends

——————–