The Daily Shot: 09-Dec-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Japan

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Equities

• Credit

• Rates

• Food for Thought

The United States

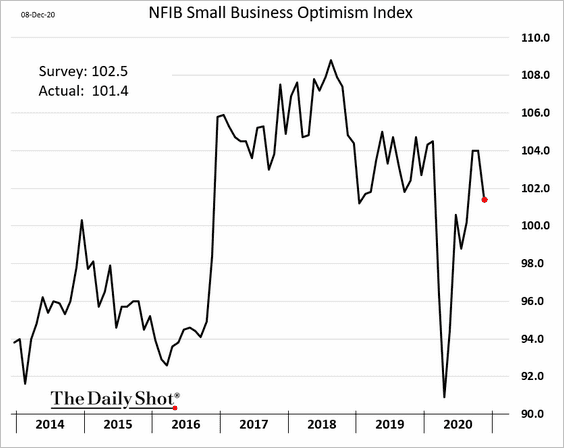

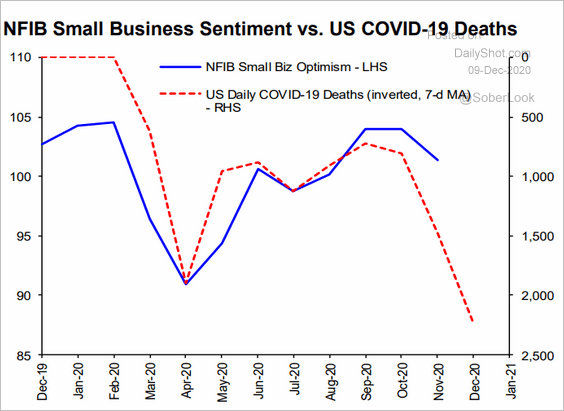

1. The NFIB small business sentiment index declined last month.

• The pandemic spike put pressure on small firms, and more pain is coming this winter.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

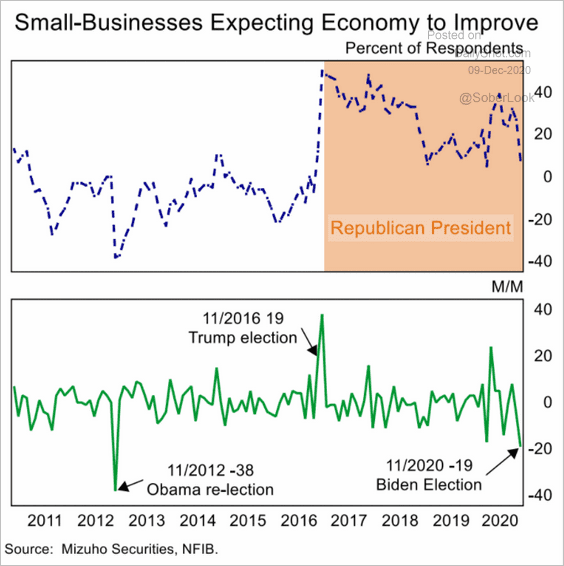

But COVID was not the full story. The NFIB index has a substantial political bias.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

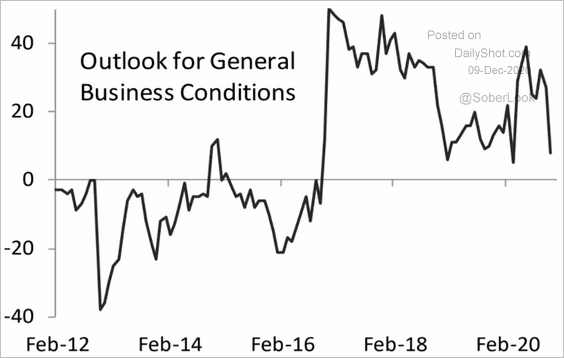

• Small companies’ outlook for general business conditions soured.

Source: Piper Sandler

Source: Piper Sandler

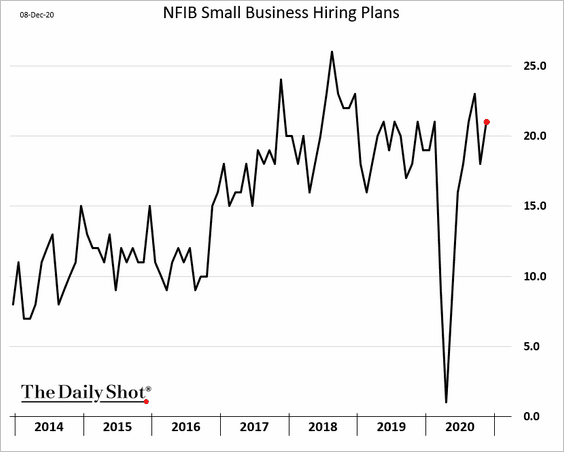

• But hiring plans remain robust.

• Businesses are increasingly saying that inventories are too low.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

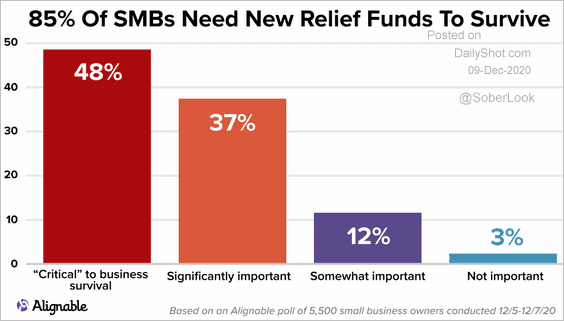

• A separate survey suggests that a large percentage of small firms view additional government funds as critical for their survival.

Source: Alignable

Source: Alignable

——————–

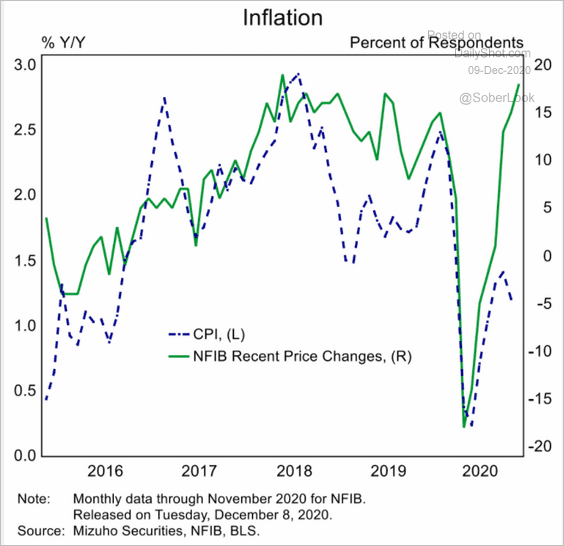

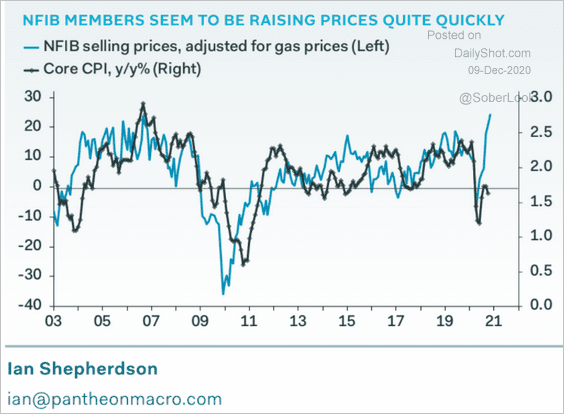

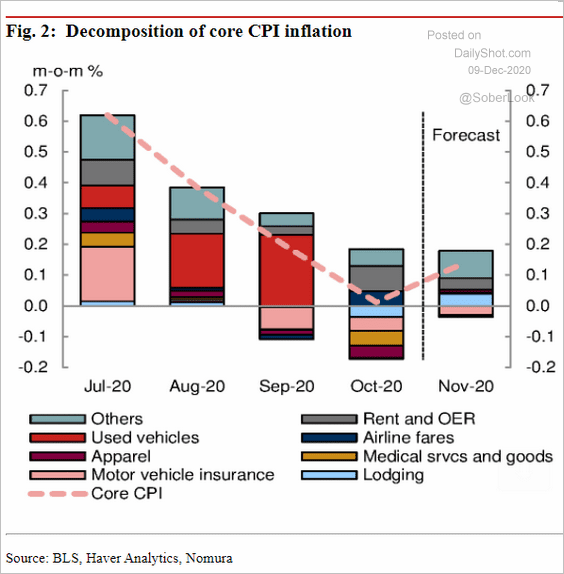

2. Next, we have some updates on inflation.

• Small businesses have been boosting prices, which is signaling higher inflation ahead.

– CPI:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

– Core CPI:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• Nomura is estimating an uptick in the core CPI in November.

Source: Nomura Securities

Source: Nomura Securities

——————–

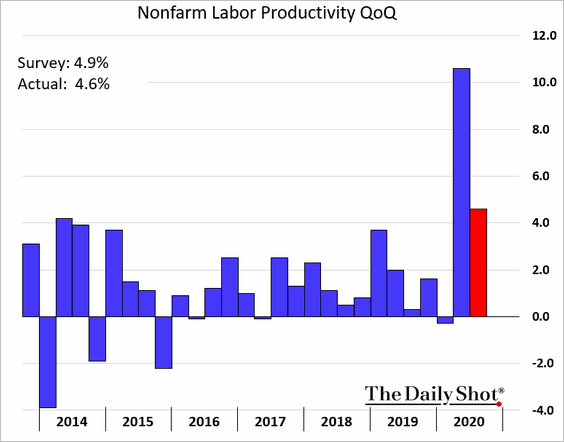

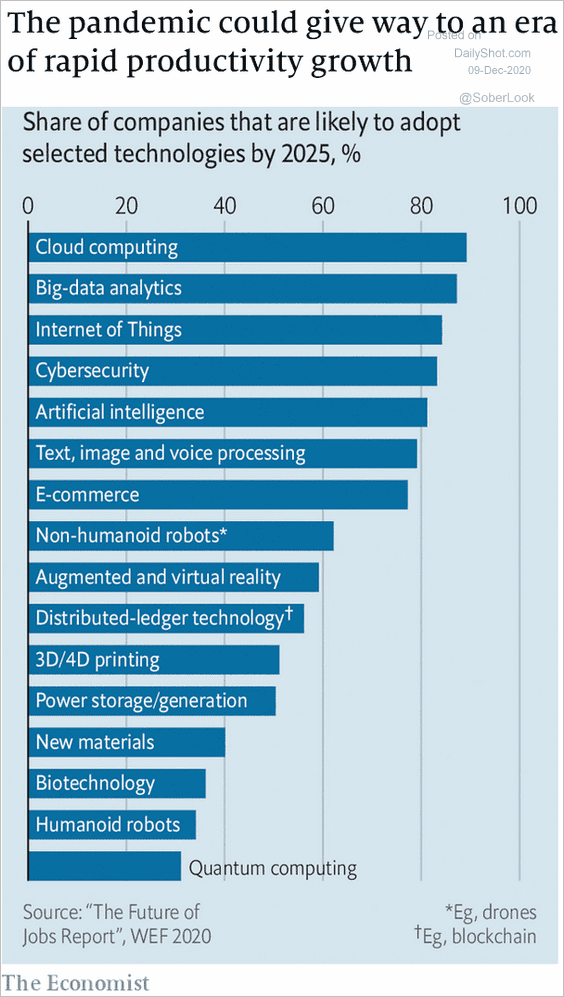

3. The third-quarter increase in productivity was adjusted down.

Will the pandemic-induced investment in technology boost productivity going forward?

Source: The Economist Read full article

Source: The Economist Read full article

——————–

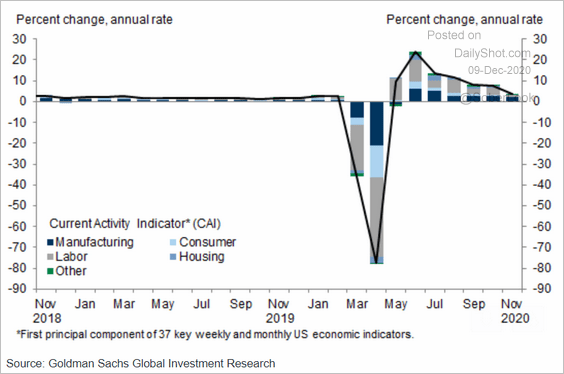

4. Given the slowing recovery (especially in the labor market) …

Source: Goldman Sachs

Source: Goldman Sachs

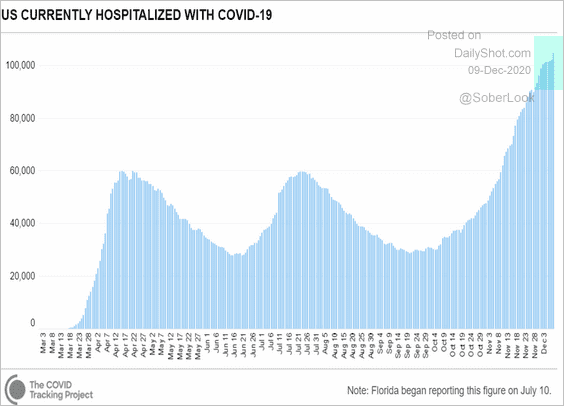

… and COVID-related hospitalizations hitting another record high, …

Source: CovidTracking.com

Source: CovidTracking.com

…. another round of stimulus looks increasingly likely. And more could be on the way next year.

Source: CNBC Read full article

Source: CNBC Read full article

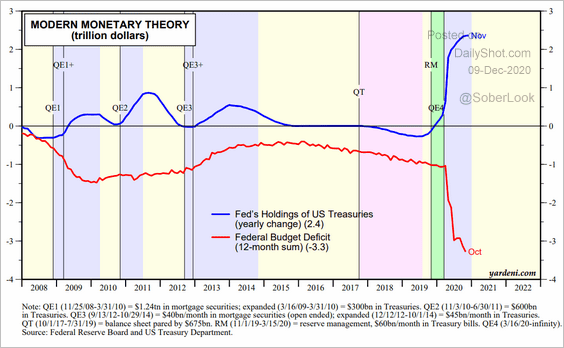

Will the Fed continue to support these stimulus measures with more bond purchases?

Source: Yardeni Research

Source: Yardeni Research

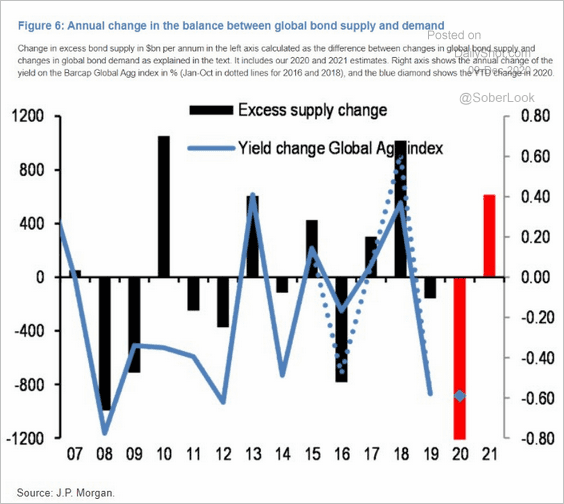

Without the Fed, the excess supply of bonds will climb, boosting yields, which will quickly dampen economic growth.

Source: JP Morgan, @jsblokland

Source: JP Morgan, @jsblokland

——————–

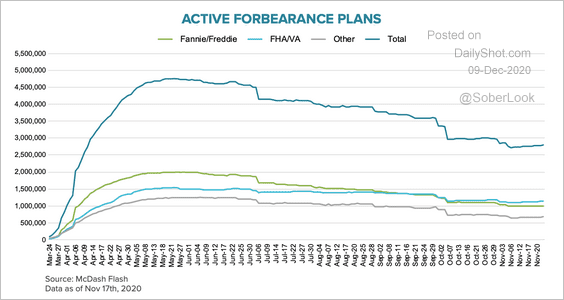

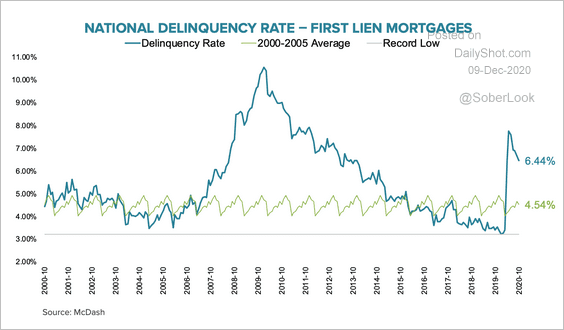

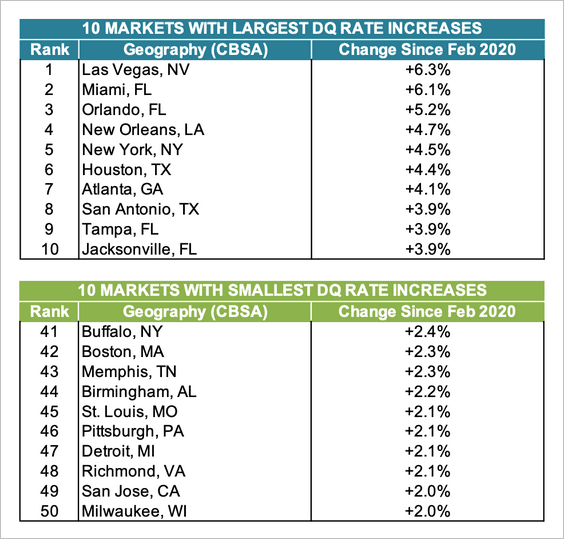

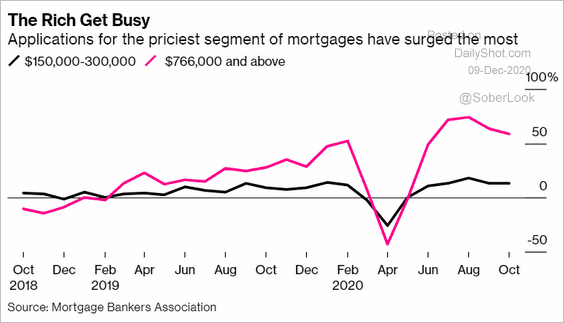

5. Here are some updates on housing finance.

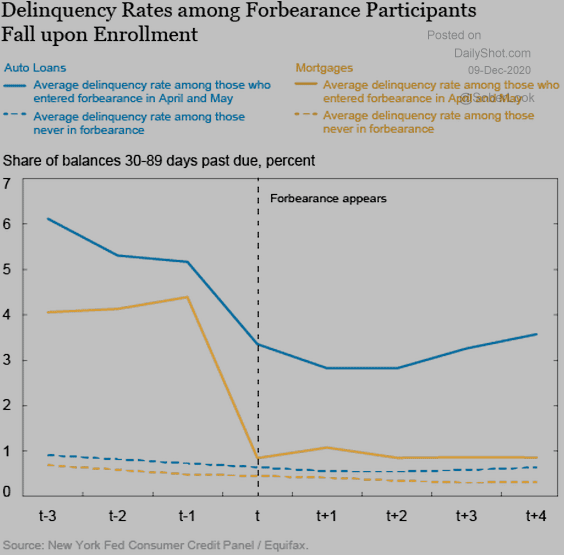

• Once borrowers enter forbearance, their odds of delinquency decrease drastically.

Source: Liberty Street Economics Read full article

Source: Liberty Street Economics Read full article

– Forbearance volumes fell over the first two weeks of November.

Source: Black Knight

Source: Black Knight

– The national delinquency rate has fallen to its lowest level since March but remains elevated.

Source: Black Knight

Source: Black Knight

– Below is a list of the top ten markets with the highest and lowest delinquency rate increases since February.

Source: Black Knight

Source: Black Knight

• Jumbo mortgage financing applications spiked this year. Wealthier households are swapping apartments in large cities for houses in less densely populated areas.

Source: @business Read full article

Source: @business Read full article

——————–

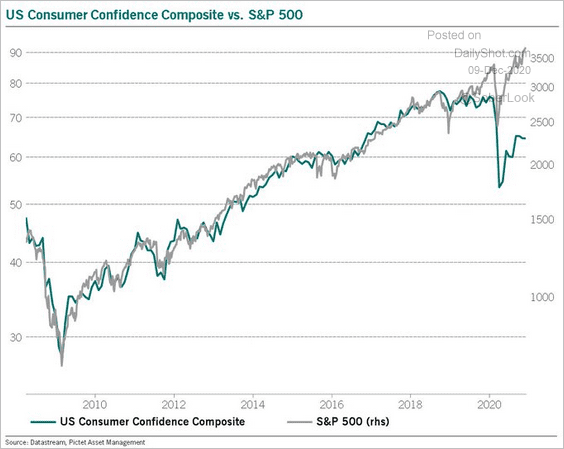

6. Either consumer confidence recovers over the next few months, or the stock market goes lower.

Source: @BittelJulien

Source: @BittelJulien

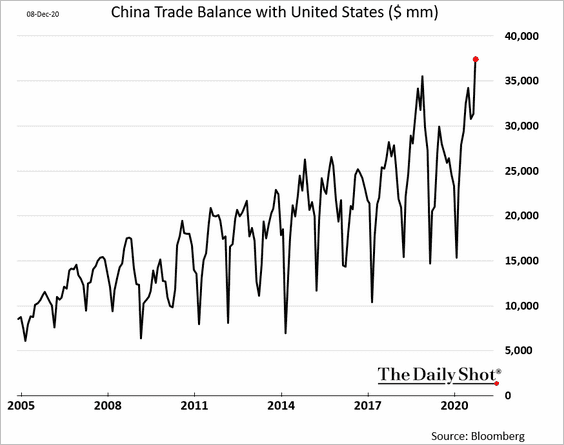

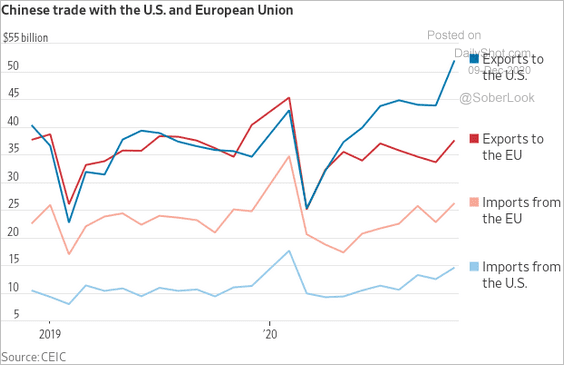

7. China’s trade surplus with the US hit a record high, …

Source: @WSJ Read full article

Source: @WSJ Read full article

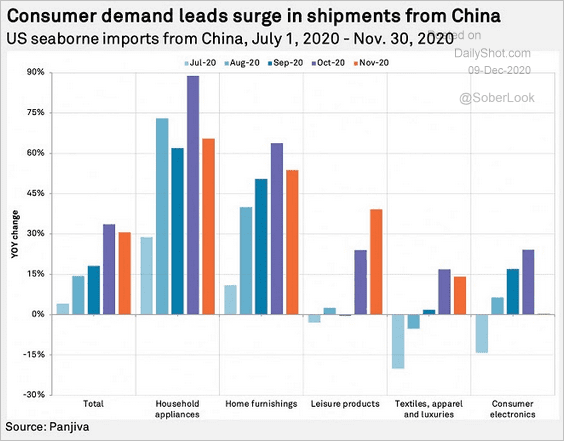

… driven by America’s consumer demand.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Canada

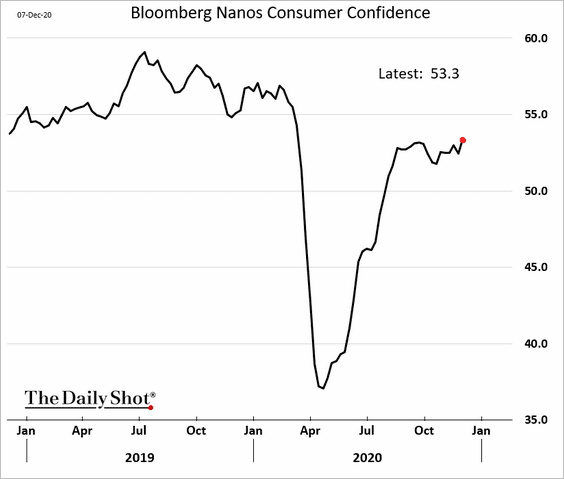

1. Consumer confidence seems to be improving gradually.

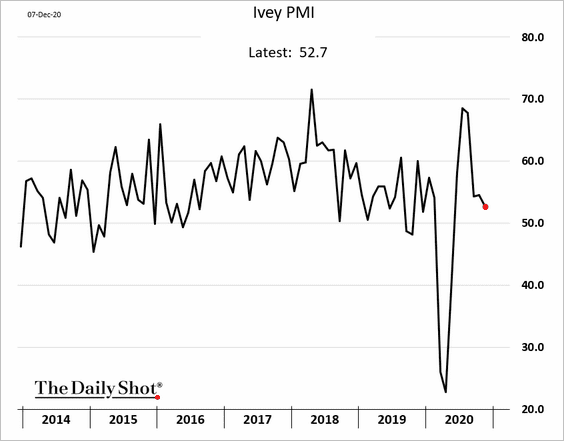

2. The Ivey PMI index shows slower growth in business activity.

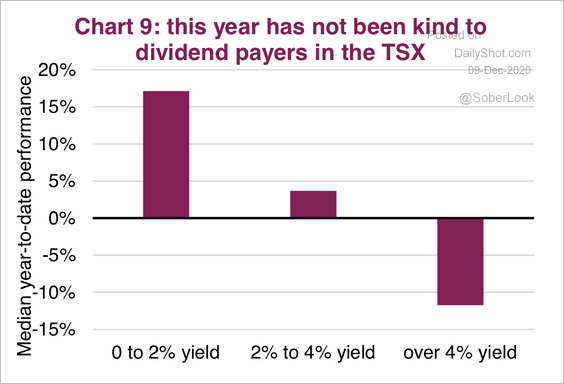

3. High dividend-paying stocks have underperformed this year.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

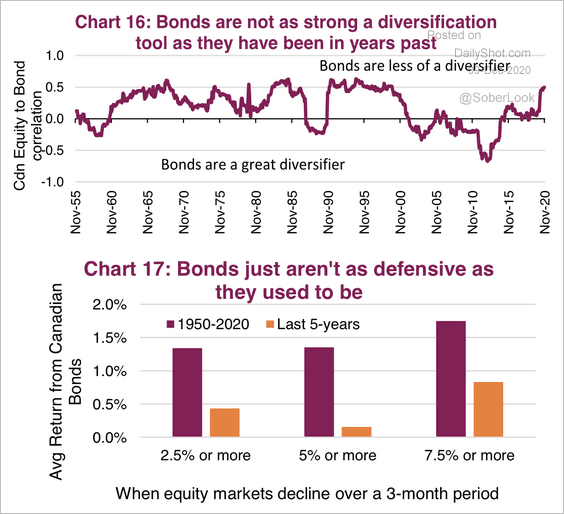

Government bonds have been less of a diversifier over the past five years.

Source: Market Ethos, Richardson GMP

Source: Market Ethos, Richardson GMP

——————–

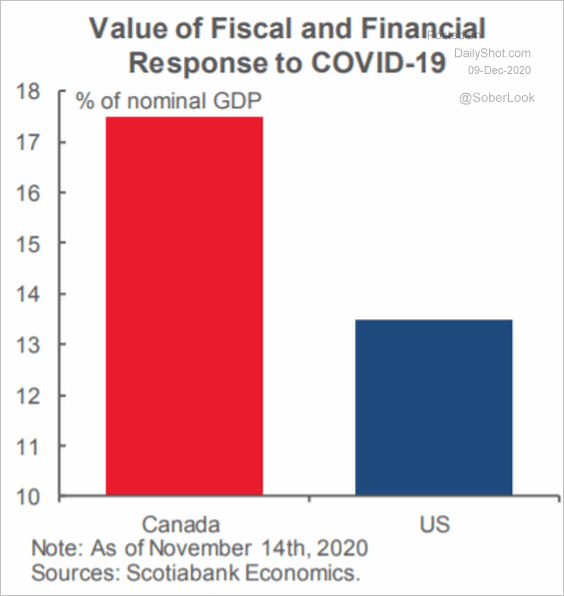

4. Canada’s fiscal response has been more extensive than in the US or other advanced economies.

Source: Scotiabank Economics

Source: Scotiabank Economics

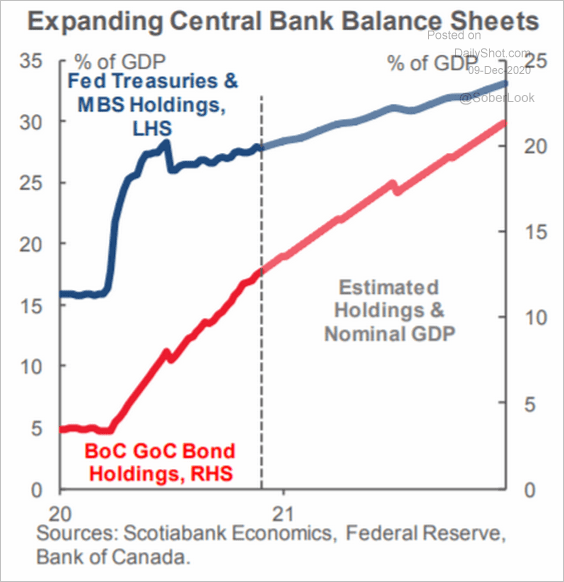

The BoC’s response has also been impressive.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

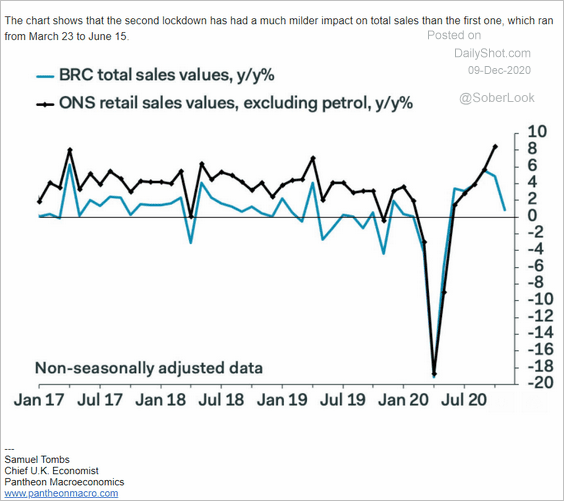

1. The pandemic’s second-wave impact on retail sales has been much less severe.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

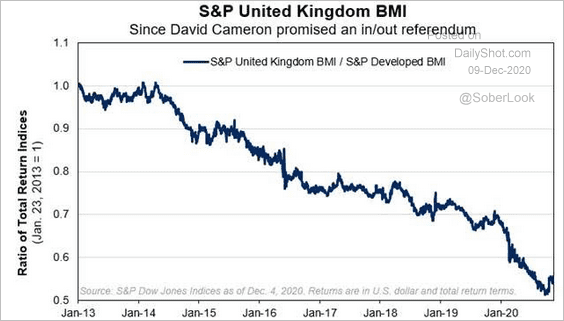

2. This chart shows the relative performance of UK equities going back to when David Cameron first promised a referendum on EU membership (January 2013).

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

3. Most expect a deal with the EU, but uncertainty remains.

Source: Reuters Read full article

Source: Reuters Read full article

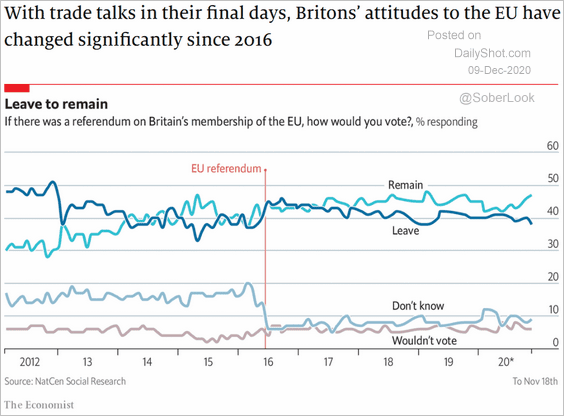

4. Attitudes toward Brexit have changed significantly.

Source: The Economist Read full article

Source: The Economist Read full article

The Eurozone

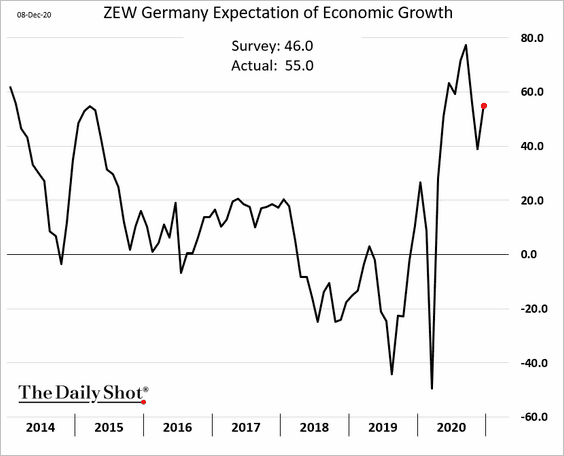

1. Germany’s ZEW sentiment index surprised to the upside.

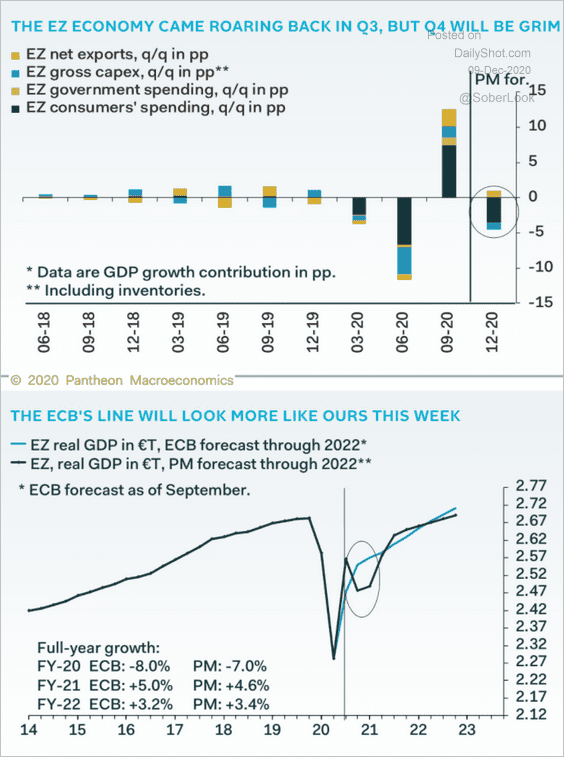

2. Here is what the W-shaped recovery will look like, according to Pantheon Macroeconomics.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

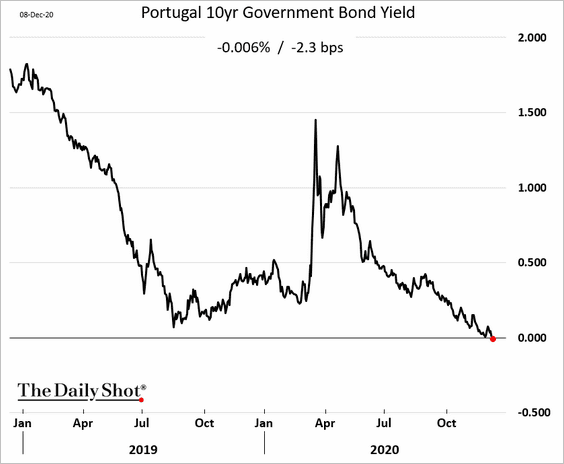

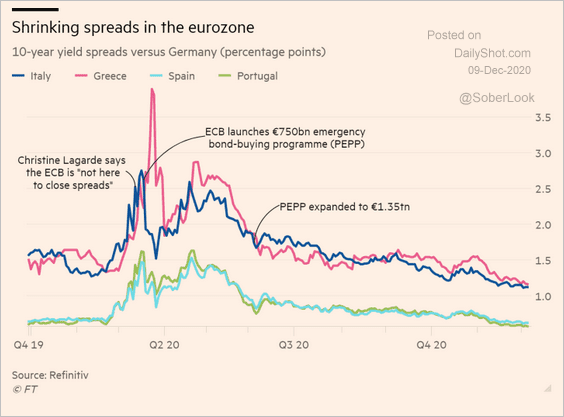

3. Portugal’s 10-year yield dipped into negative territory for the first time.

Spreads have been tightening across the Eurozone “periphery.”

Source: @acemaxx, @FT Read full article

Source: @acemaxx, @FT Read full article

——————–

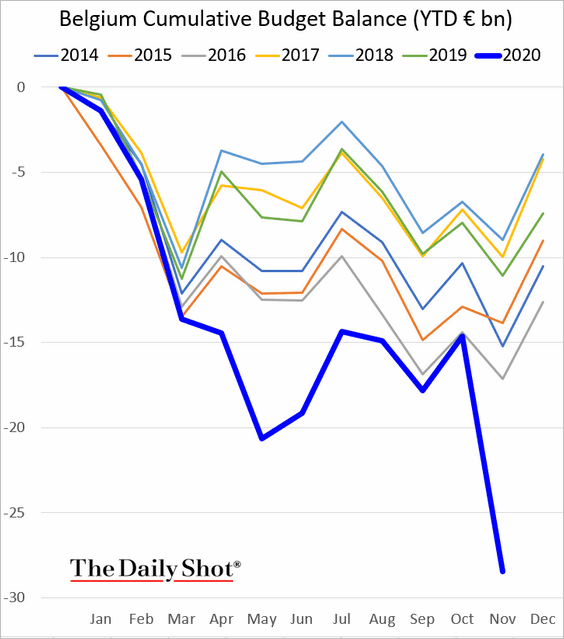

4. The Belgian budget deficit has blown out.

Source: Politico Read full article

Source: Politico Read full article

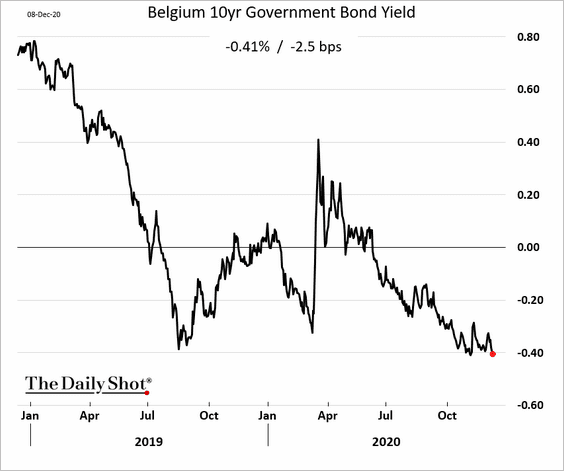

But bond yields are near record lows (deep in negative territory).

Japan

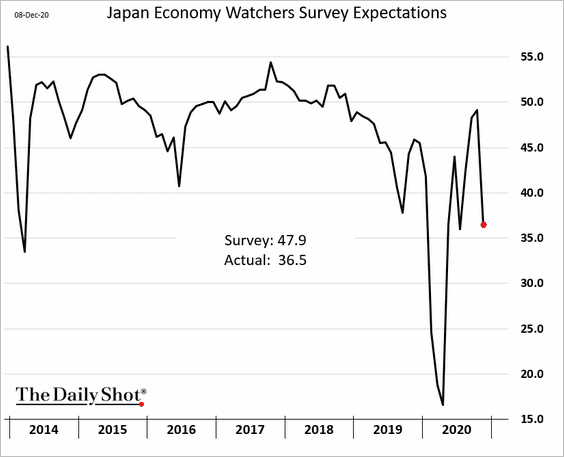

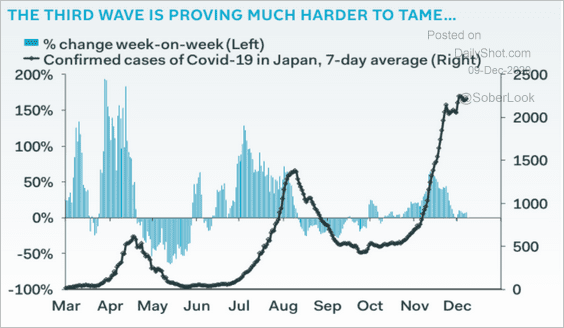

1. The Economy Watchers Expectations index tumbled as the third wave hit.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

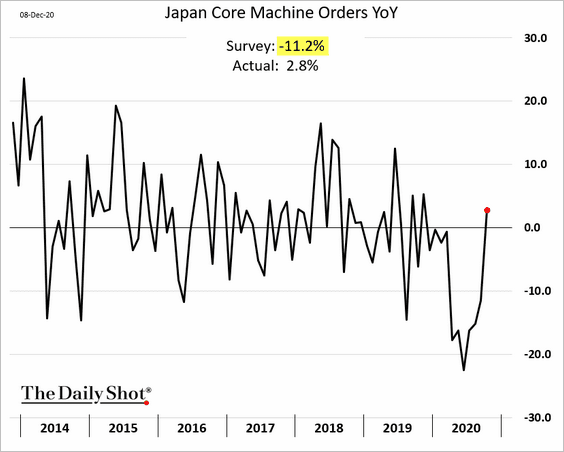

2. Machine orders rebounded, exceeding expectations.

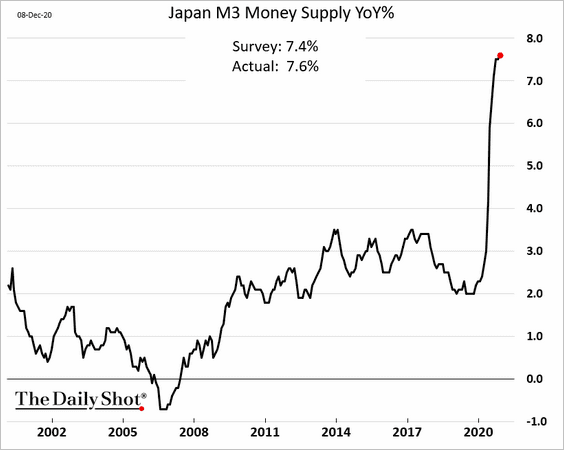

3. The growth in Japan’s broad money supply hit a record high.

4. There is more stimulus on the way.

Source: JapanToday Read full article

Source: JapanToday Read full article

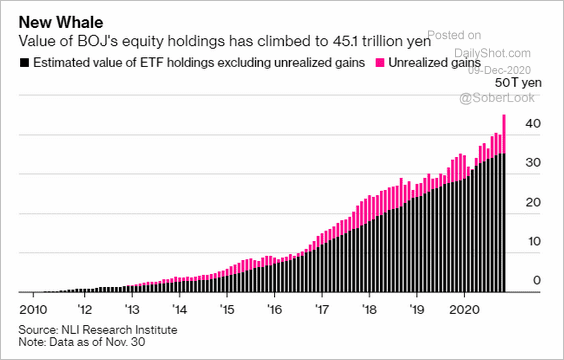

5. Here are the BoJ’s ETF holdings.

Source: @tracyalloway Read full article

Source: @tracyalloway Read full article

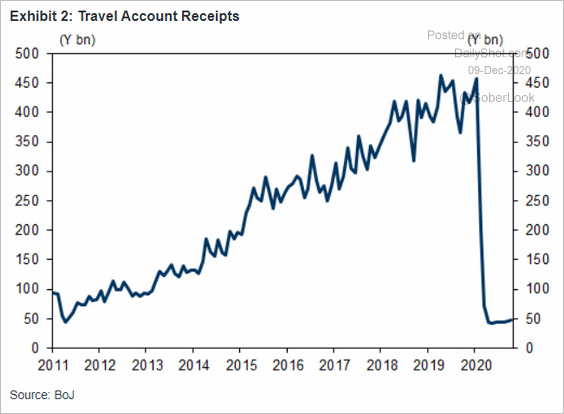

6. Tourists are staying away from Japan (travel receipts = foreign visitors’ spending).

Source: Goldman Sachs

Source: Goldman Sachs

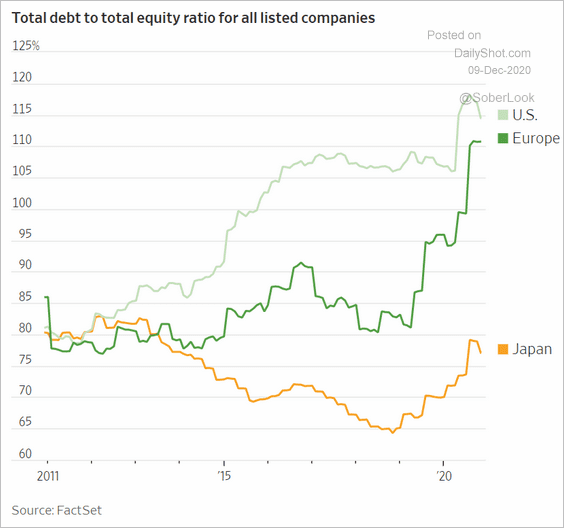

7. Low corporate leverage makes Japanese shares attractive.

Source: @WSJ Read full article

Source: @WSJ Read full article

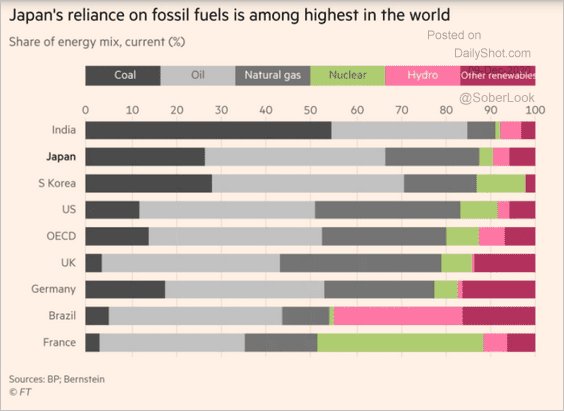

8. Japan’s reliance on fossil fuels is one of the highest globally.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Asia – Pacific

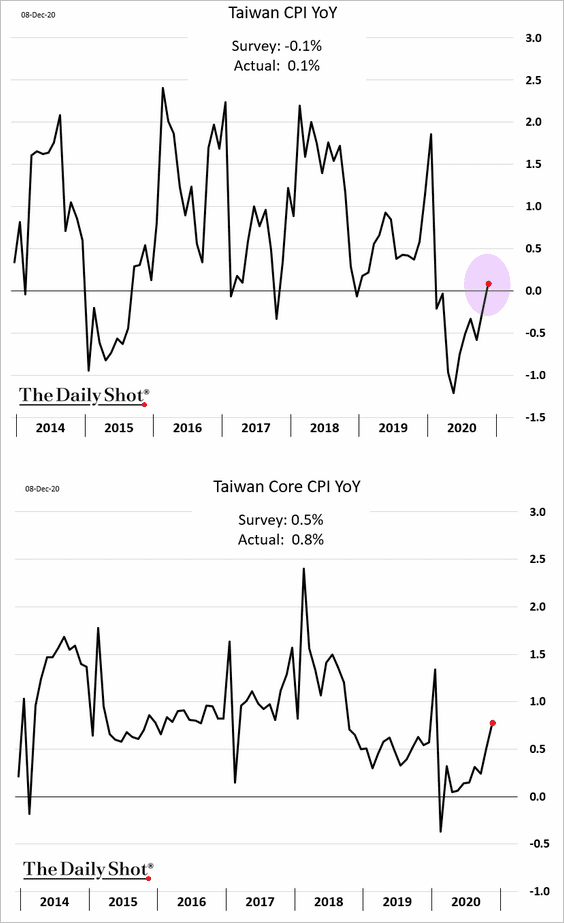

1. Taiwan’s CPI is back in positive territory.

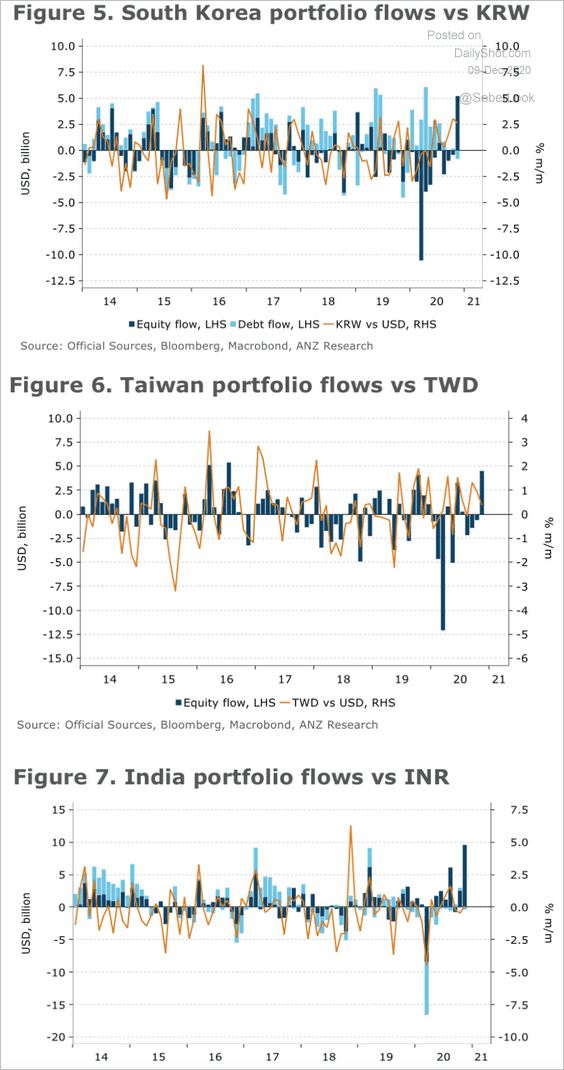

2. Equity markets in South Korea, Taiwan, and India experienced the largest capital inflows in years.

Source: ANZ Research

Source: ANZ Research

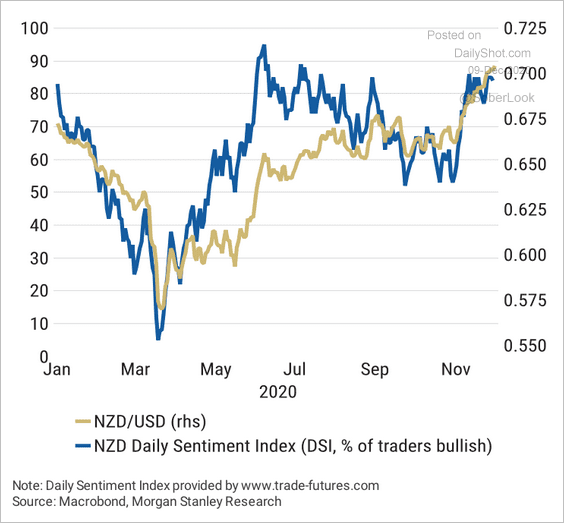

3. New Zealand dollar bullish sentiment is approaching extreme levels.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

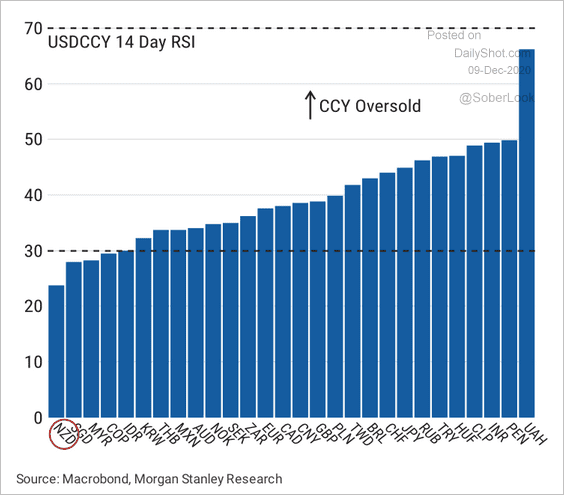

USD/NZD is the most oversold currency pair as measured by the RSI (NZD most overbought).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

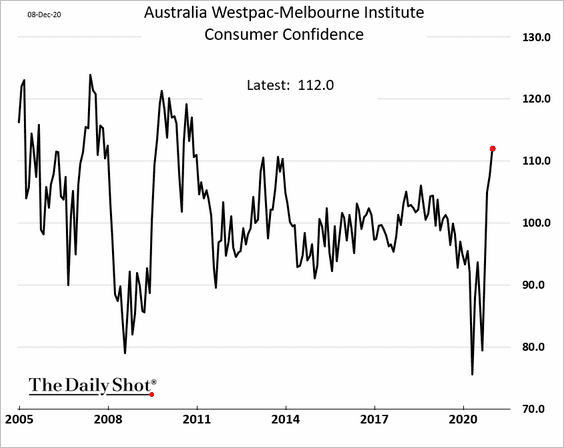

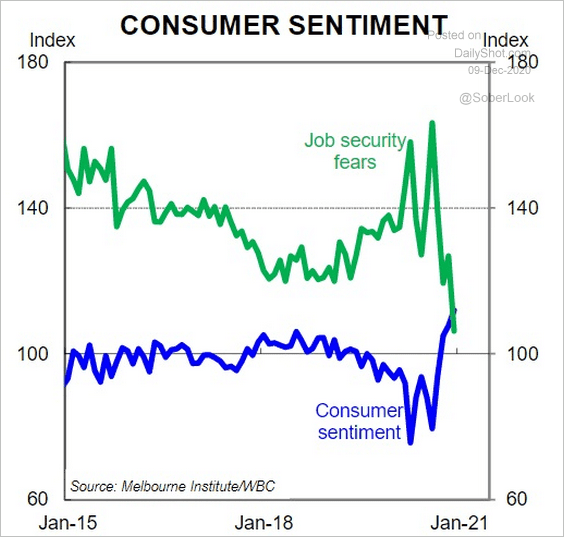

4. Australia’s consumer sentiment is at a multi-year high, according to the Westpac index.

Confidence has surged along with a collapse in job security fears.

Source: CBA, @Scutty

Source: CBA, @Scutty

——————–

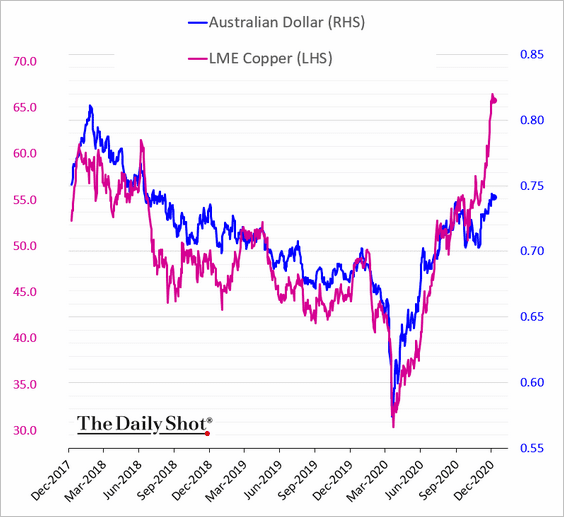

5. Copper points to further upside for the Aussie dollar.

China

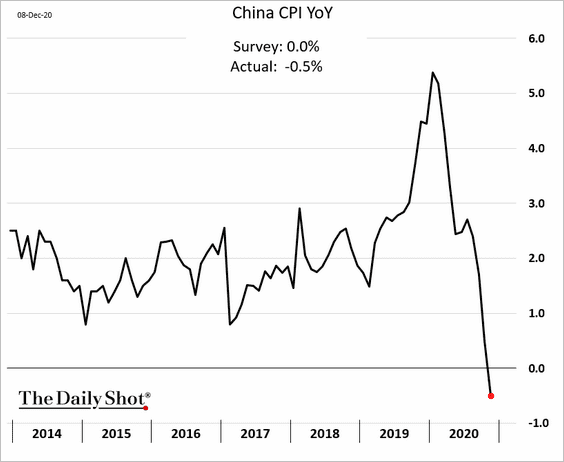

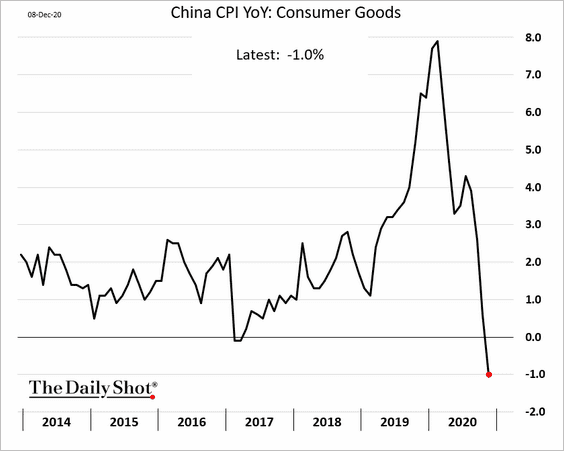

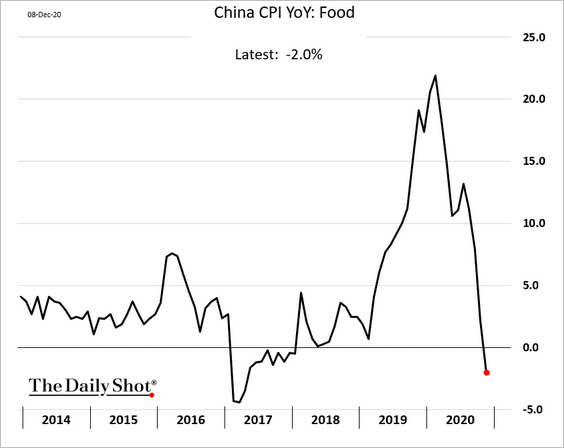

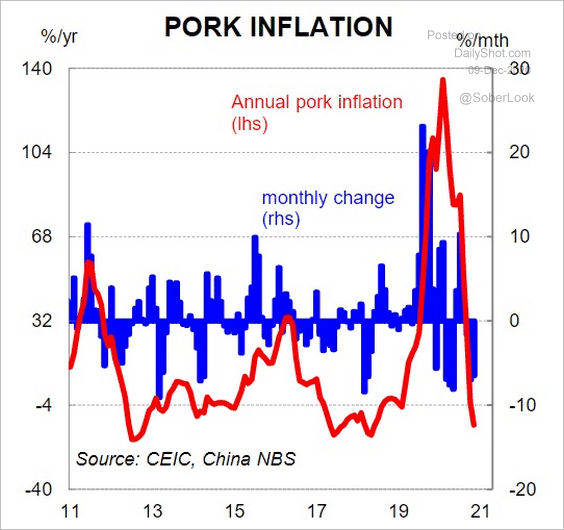

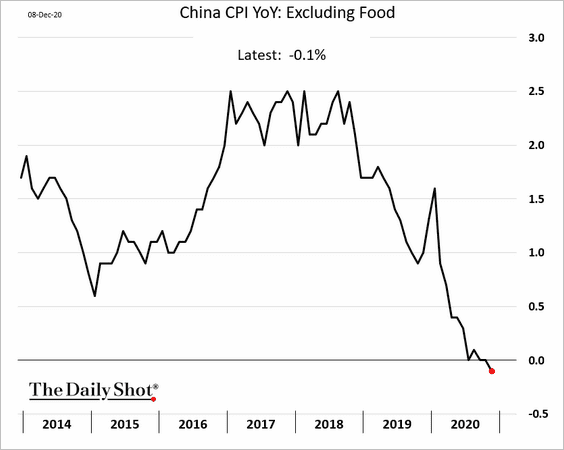

1. The CPI unexpectedly dipped into negative territory.

Consumer goods prices have been particularly soft.

While food prices contributed to the CPI decline, …

Source: @Scutty

Source: @Scutty

… it wasn’t the full story.

——————–

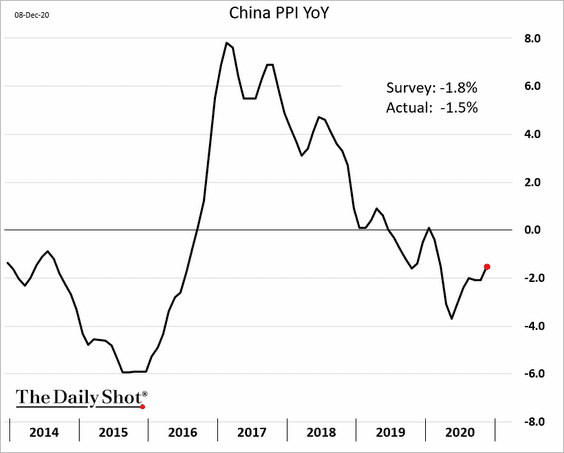

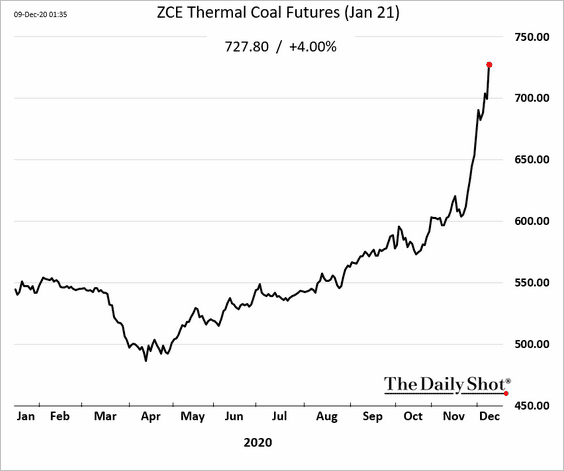

2. On the other hand, the PPI is recovering.

3. Coal prices are soaring.

Source: ABC News Read full article

Source: ABC News Read full article

Source: Argus Media Read full article

Source: Argus Media Read full article

• Thermal coal:

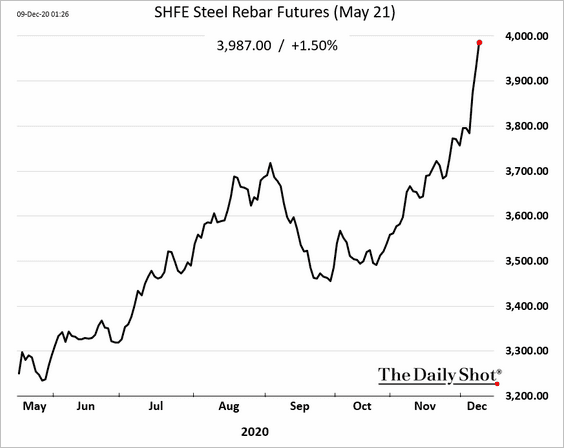

• Coking (metallurgical) coal:

Source: @YuanTalks Read full article

Source: @YuanTalks Read full article

The coking coal rally means higher steel prices.

——————–

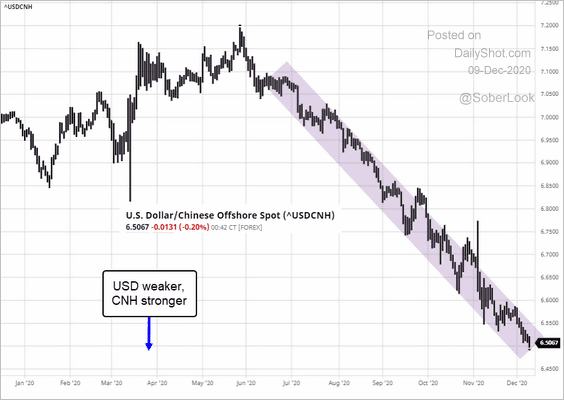

4. The renminbi rally remains intact.

Source: barchart.com

Source: barchart.com

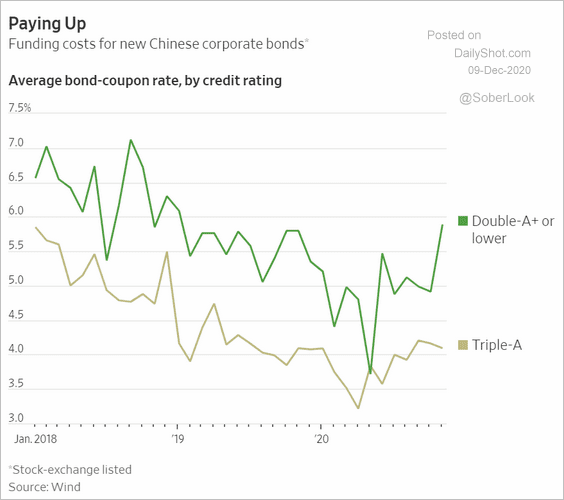

5. Bond funding costs for weaker credits have risen lately.

Source: @WSJ Read full article

Source: @WSJ Read full article

Emerging Markets

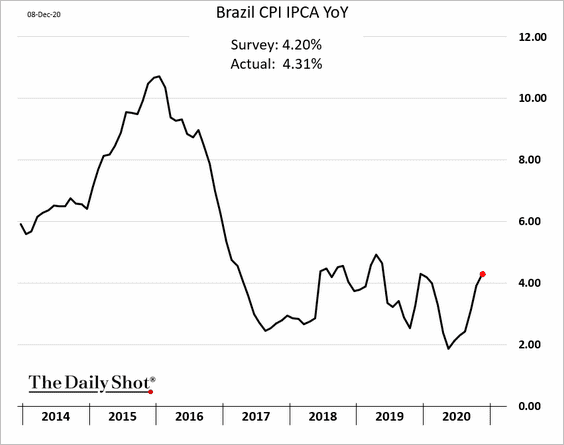

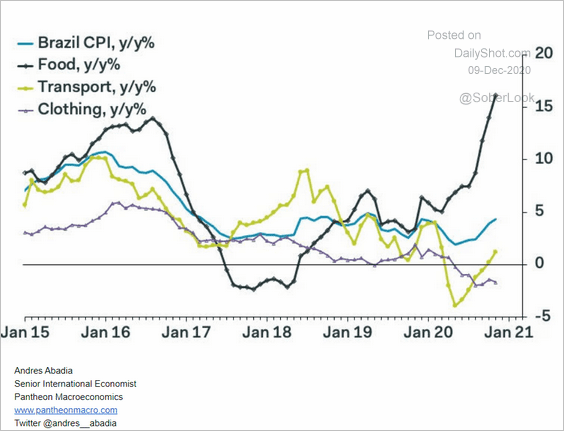

1. Brazil’s inflation is grinding higher, driven by food prices.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

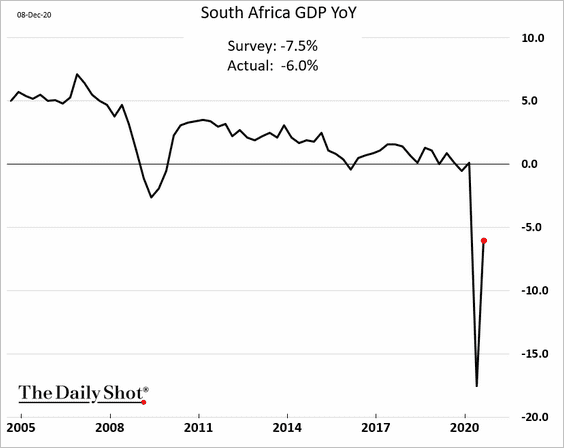

2. South Africa’s Q3 rebound was firmer than expected.

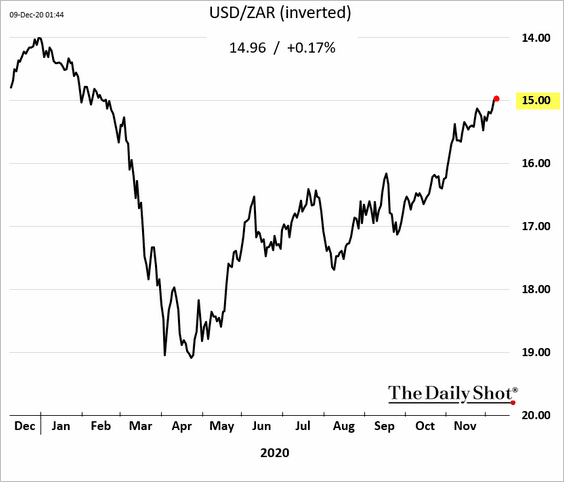

The rand continues to climb.

——————–

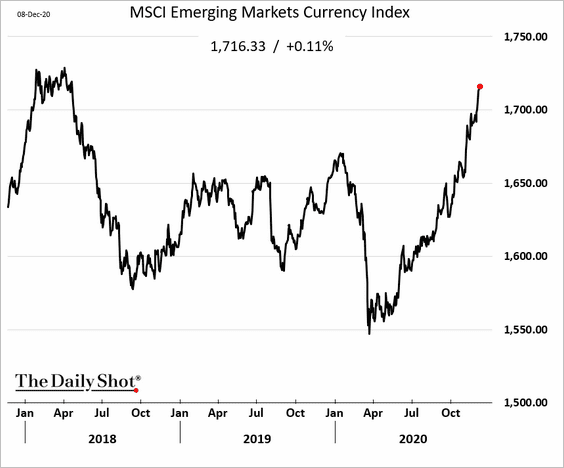

3. Here is the MSCI EM Currency Index.

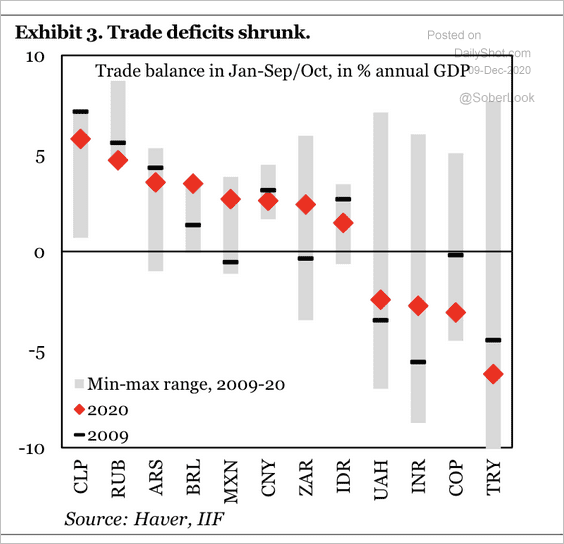

4. Trade deficits have declined significantly from 2009 levels.

Source: IIF

Source: IIF

Commodities

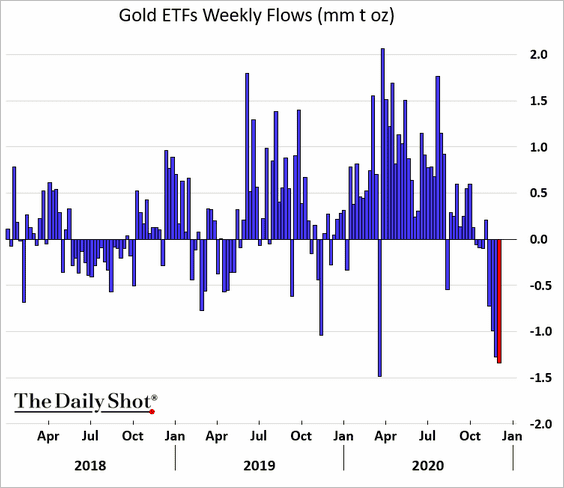

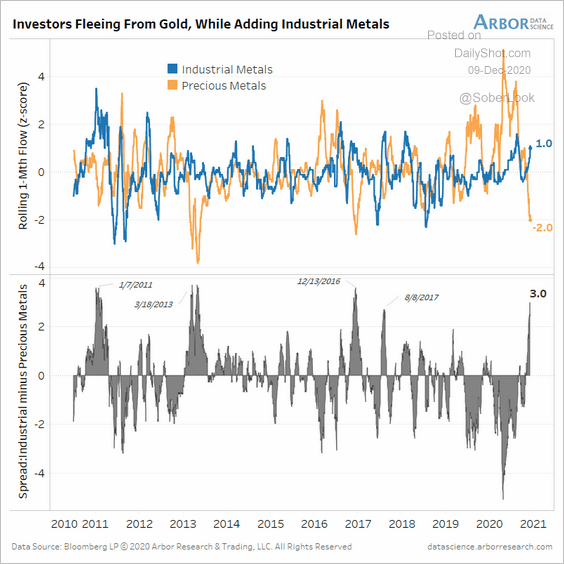

1. Gold fund outflows continue.

This chart illustrates the rotation from gold into industrial metals.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

——————–

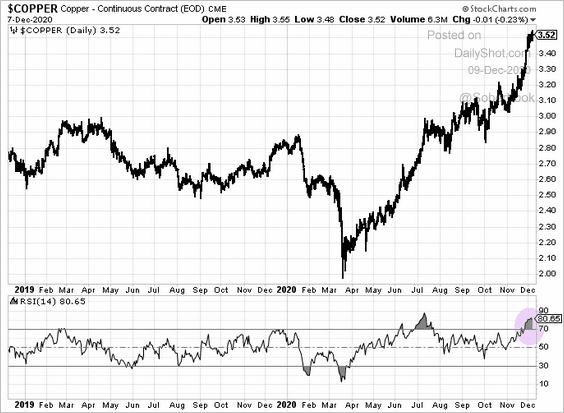

2. The copper rally looks stretched.

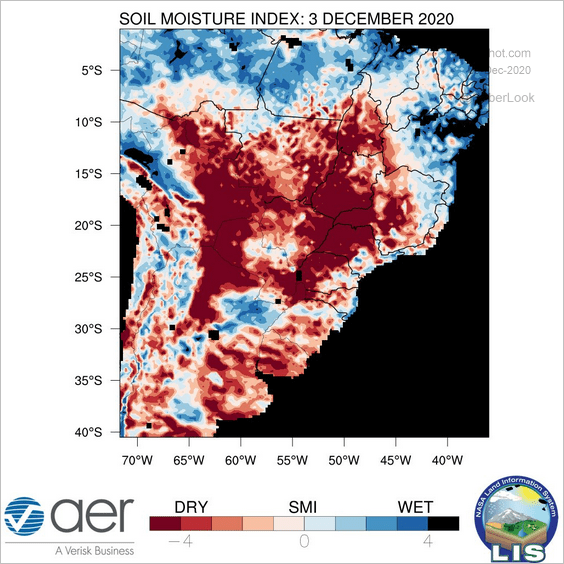

3. La Niña is causing a drought throughout South America. This complicates growing conditions for agriculture, such as corn and soybeans. Coffee crops were also impacted.

Source: @DroughtLIS

Source: @DroughtLIS

Equities

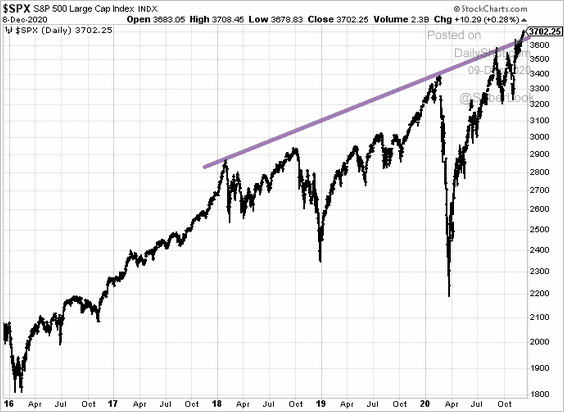

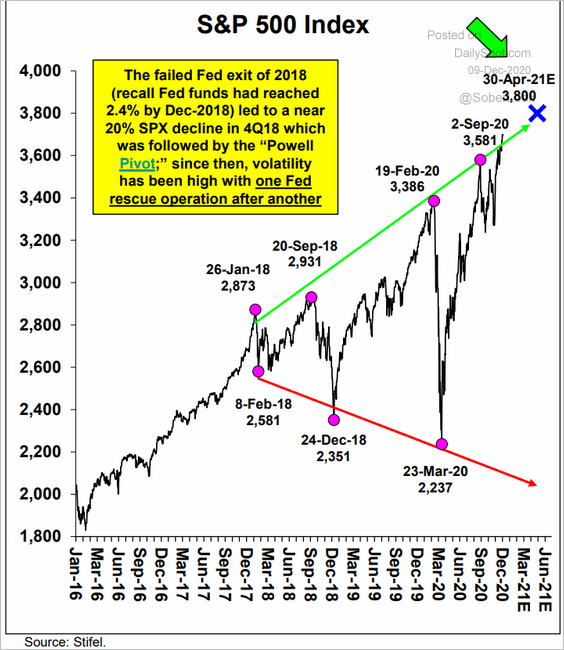

1. The S&P 500 broke resistance.

Stifel sees more upside for the S&P 500, but the path is Fed-dependent. Will we see another “taper tantrum” next year, or will it come in 2021?

Source: Stifel

Source: Stifel

——————–

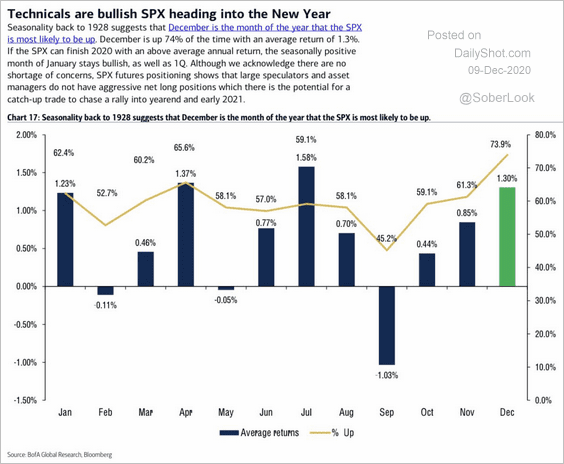

2. December tends to be a good month for stocks.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

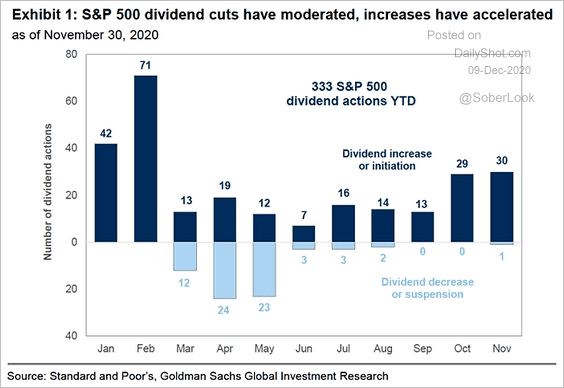

3. More firms are boosting dividends (fewer are cutting them).

Source: @ISABELNET_SA, @GoldmanSachs

Source: @ISABELNET_SA, @GoldmanSachs

4. The Russell 2,000 Index is at long-term support relative to the Nasdaq 100 Index.

Source: @TechCharts

Source: @TechCharts

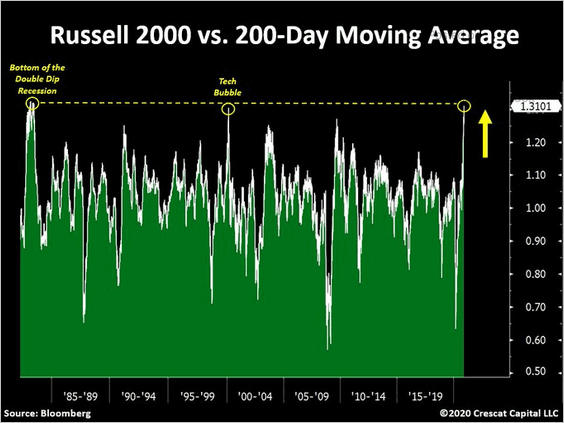

The Russell 2000 index is also at an extreme relative to its 200-day moving average.

Source: @TaviCosta

Source: @TaviCosta

——————–

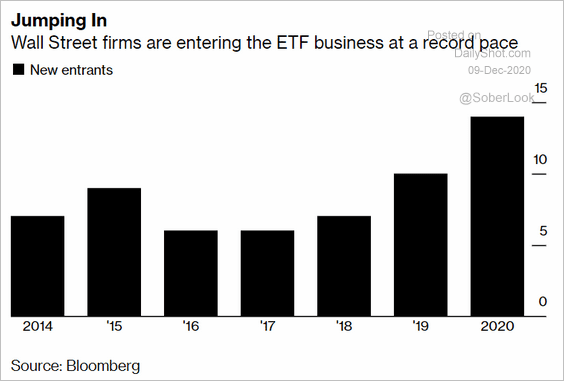

5. Many financial firms are entering the ETF business.

Source: @markets Read full article

Source: @markets Read full article

Credit

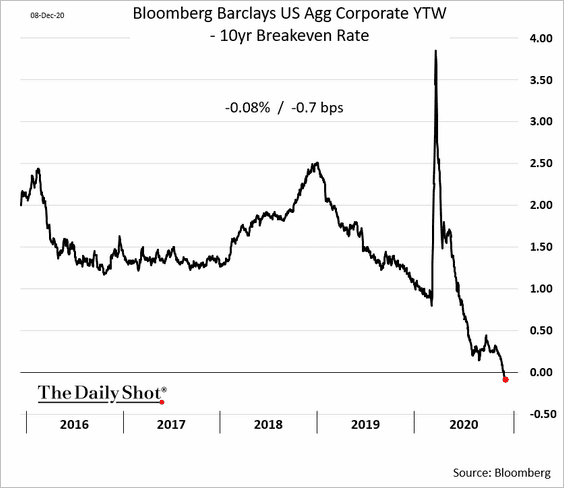

Inflation-adjusted investment-grade bond yields are moving deeper into negative territory.

Rates

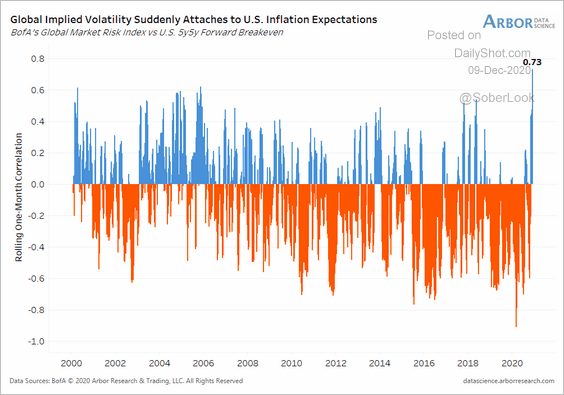

1. US inflation expectations are now correlated to global implied volatility (across multiple markets).

Source: Arbor Research & Trading

Source: Arbor Research & Trading

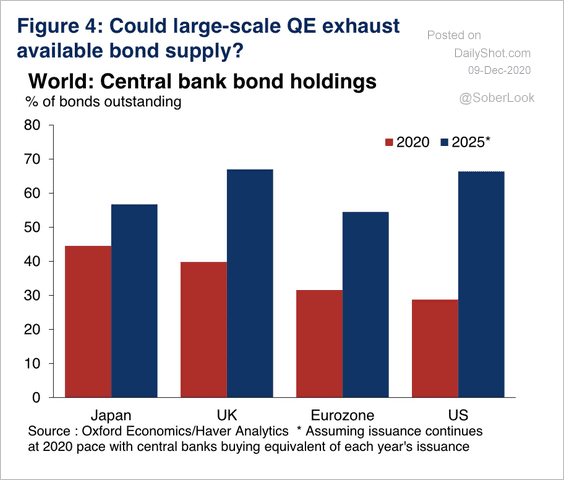

2. Central banks hold a significant amount of outstanding bonds.

Source: Oxford Economics

Source: Oxford Economics

——————–

Food for Thought

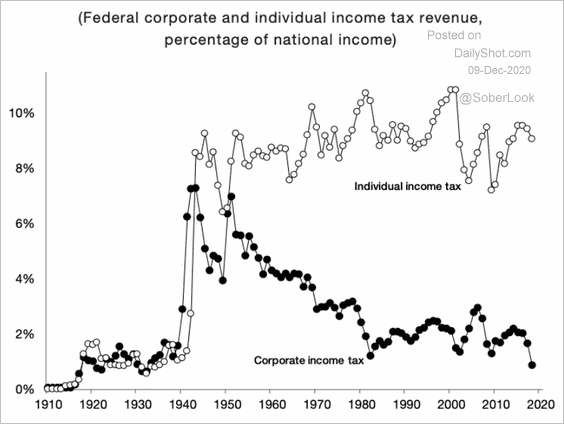

1. US corporate vs. individual income tax rates:

Source: @gabriel_zucman

Source: @gabriel_zucman

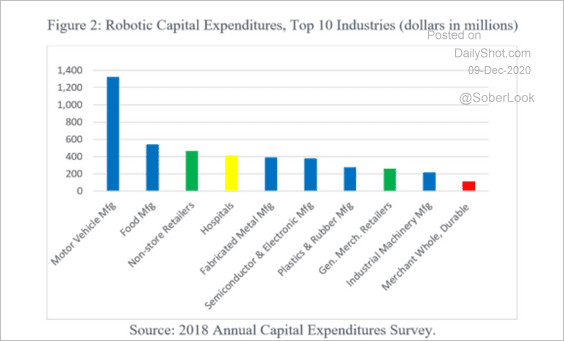

2. Investment in robots by industry:

Source: US Census Read full article

Source: US Census Read full article

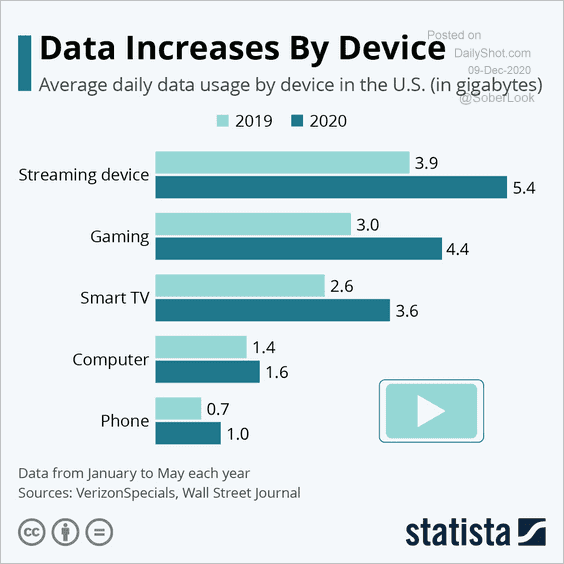

3. Data usage (2020 vs. 2019):

Source: Statista

Source: Statista

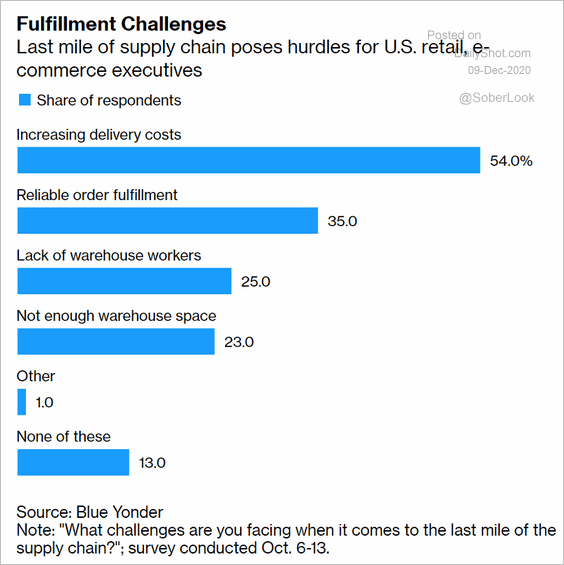

4. Fulfillment challenges:

Source: @business Read full article

Source: @business Read full article

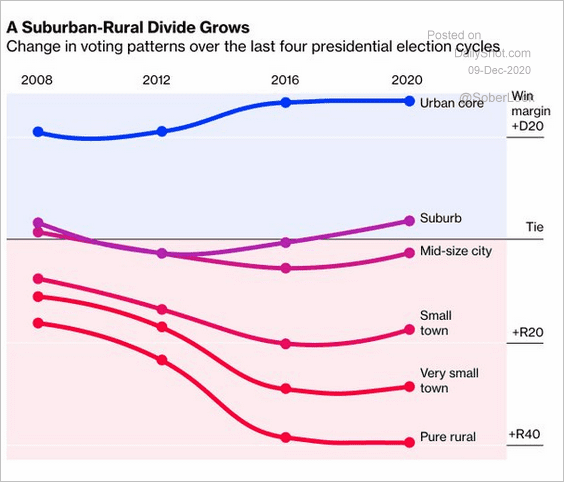

5. The US suburban/rural political divide:

Source: @BBGVisualData, @CityLab Read full article

Source: @BBGVisualData, @CityLab Read full article

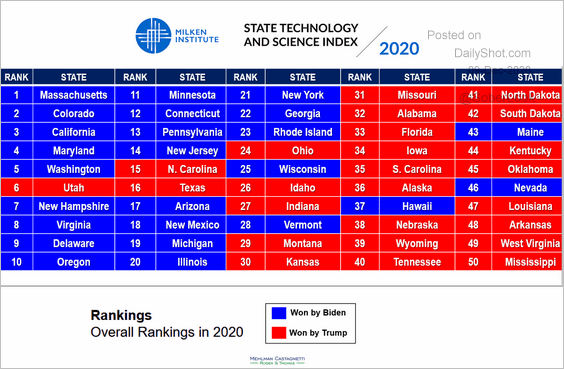

6. Technology & Science Index by state:

Source: @bpmehlman, @MilkenInstitute

Source: @bpmehlman, @MilkenInstitute

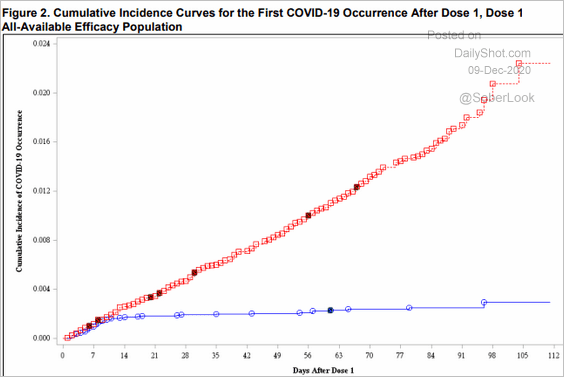

7. Pfizer’s vaccine effectiveness after the first dose (red is placebo):

Source: FDA, @DecoherenceWave

Source: FDA, @DecoherenceWave

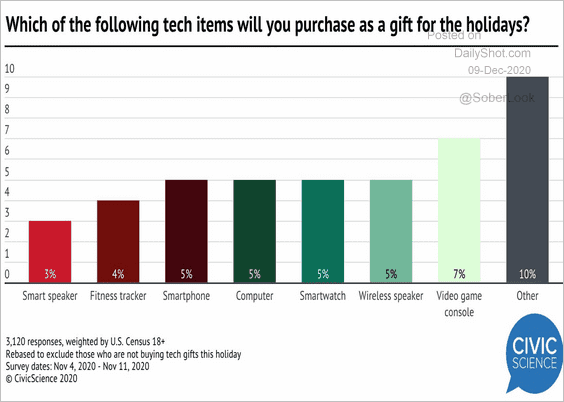

8. Which electronic item will you purchase as a gift?

Source: @CivicScience Read full article

Source: @CivicScience Read full article

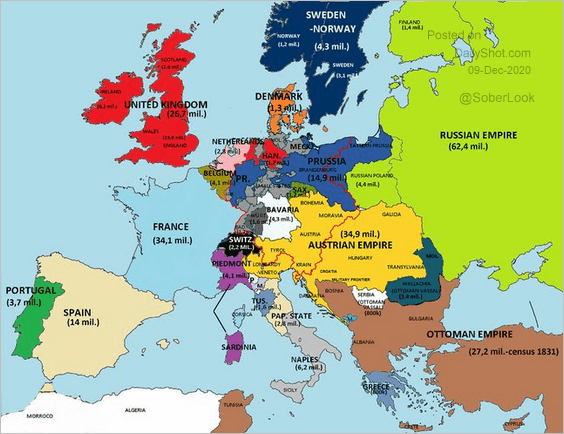

9. Europe in 1840:

Source: @simongerman600

Source: @simongerman600

——————–