The Daily Shot: 14-Dec-20

• The United States

• Canada

• The United Kingdom

• The Eurozone

• Europe

• Asia – Pacific

• China

• Emerging Markets

• Commodities

• Energy

• Equities

• Credit

• Global Developments

• Food for Thought

The United States

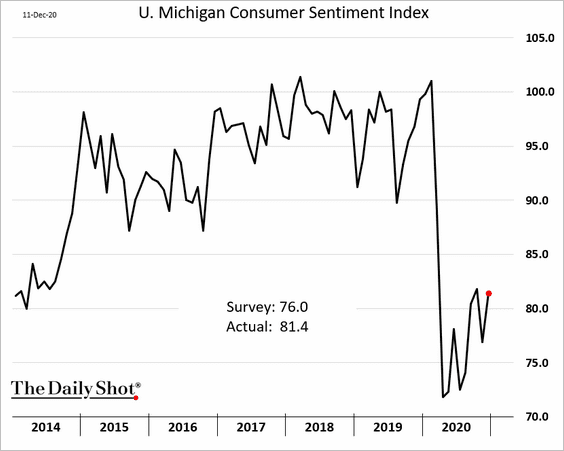

1. The U. Michigan consumer sentiment index surprised to the upside despite the worsening pandemic. Economists attributed the improvement to the vaccine news and higher stock prices.

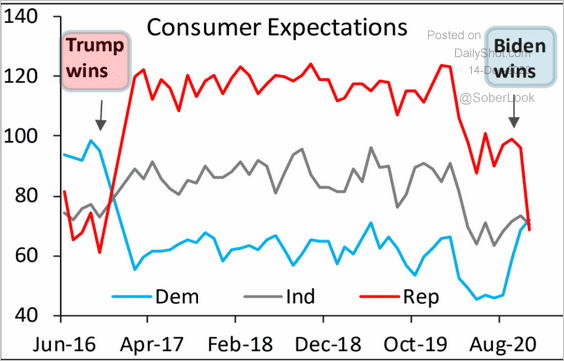

The expectations index continues to show partisan divergence.

Source: Piper Sandler

Source: Piper Sandler

——————–

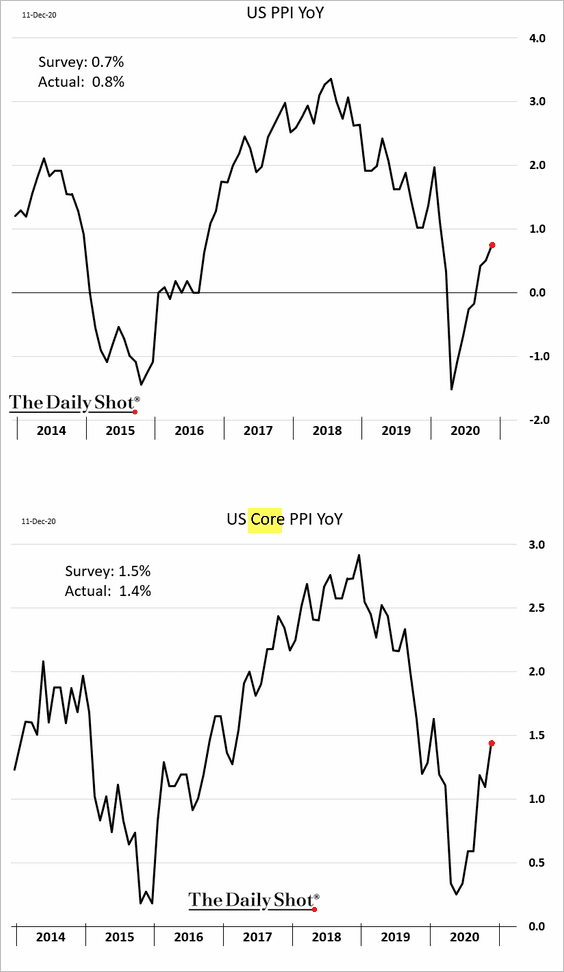

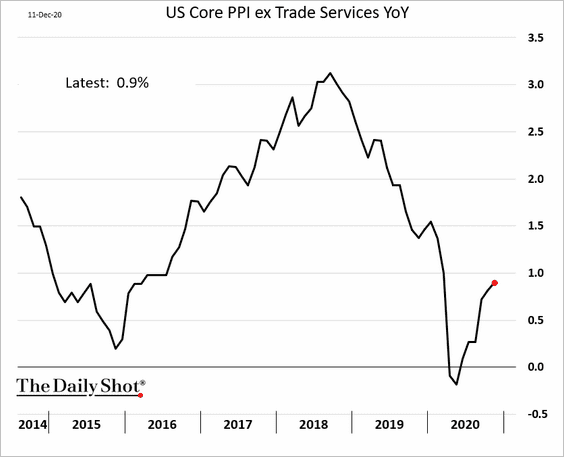

2. Next, we have some updates on inflation.

• The PPI showed a modest increase on a year-over-year basis.

Here is the core PPI excluding trade services (business markups).

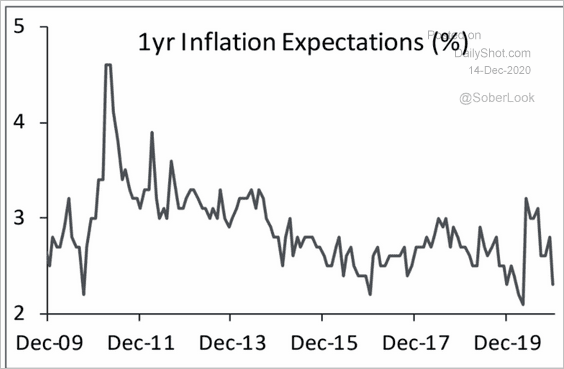

• The U. Michigan consumer inflation expectations continue to moderate.

Source: Piper Sandler

Source: Piper Sandler

• Below are some additional updates on Friday’s CPI report.

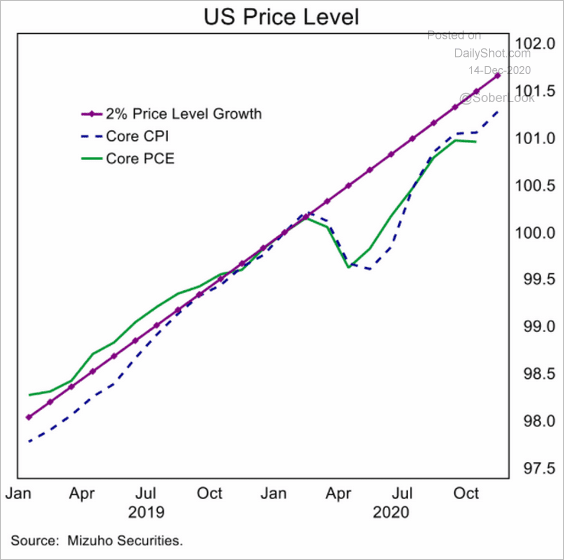

– The CPI and the PCE inflation (price levels) relative to the 2% target:

Source: Mizuho Securities USA

Source: Mizuho Securities USA

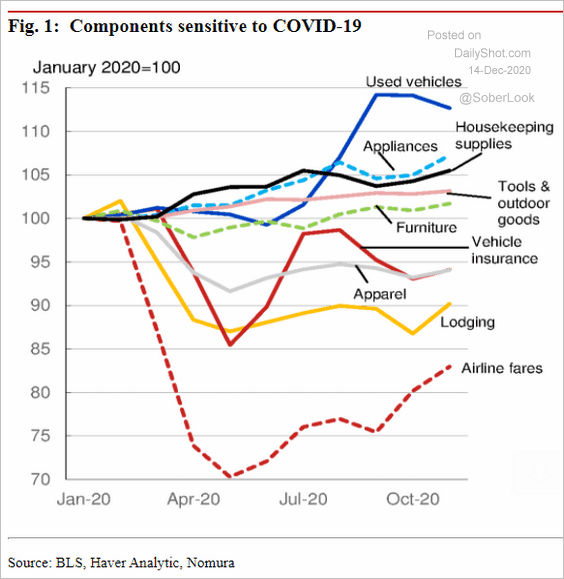

– CPI components that are sensitive to the pandemic:

Source: Nomura Securities

Source: Nomura Securities

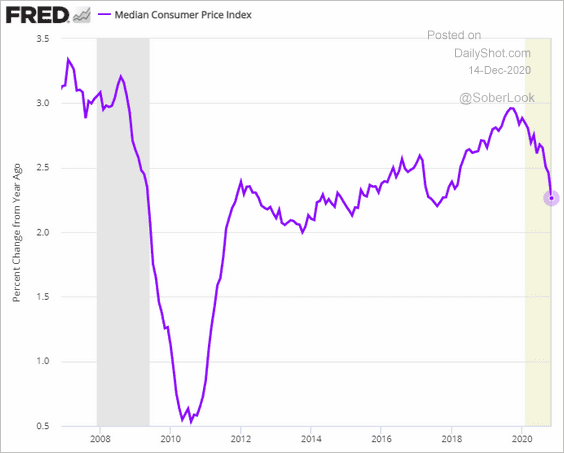

– The median CPI index:

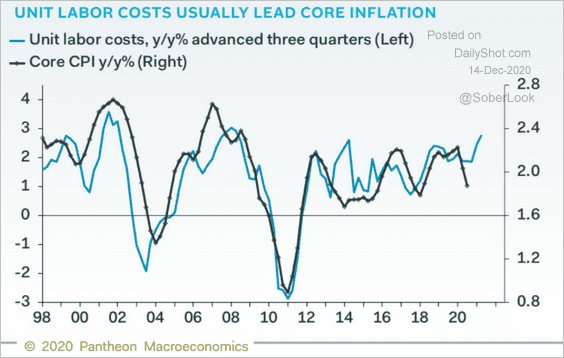

– The core CPI vs. unit labor costs (pointing to further upside for inflation):

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

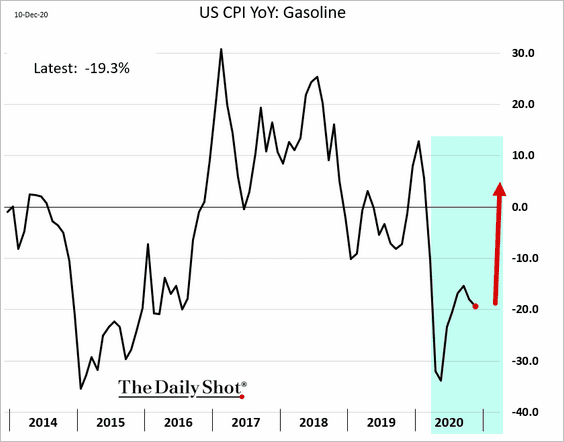

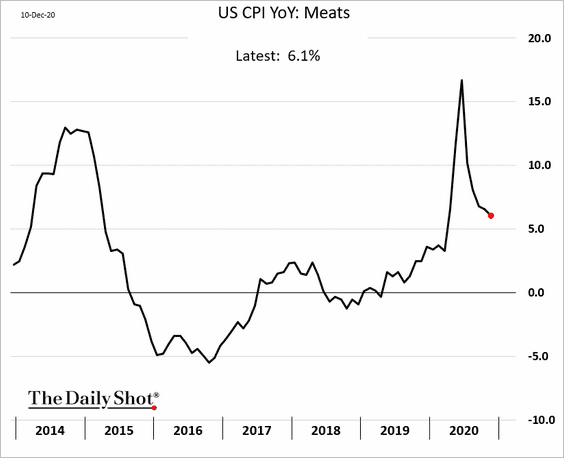

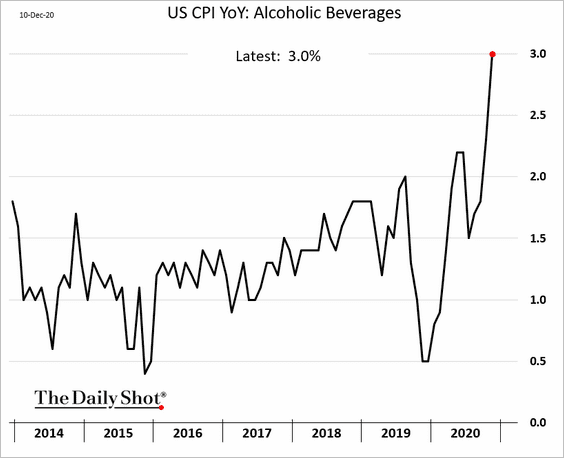

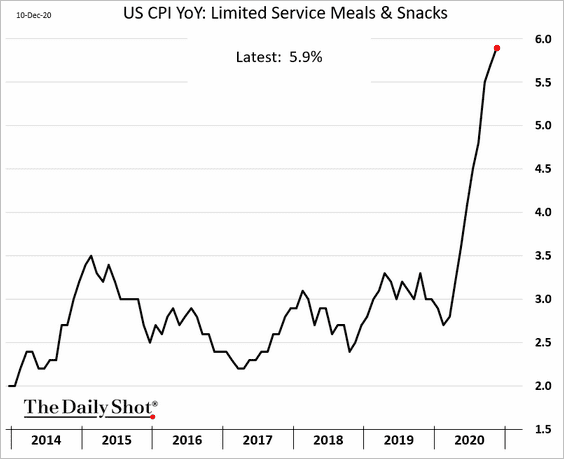

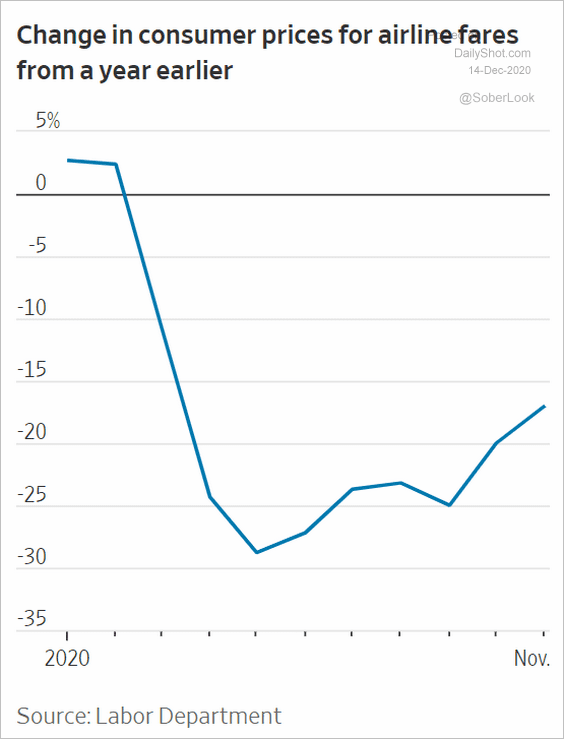

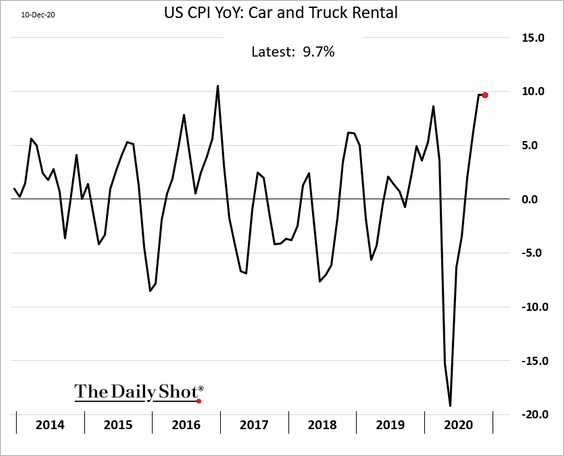

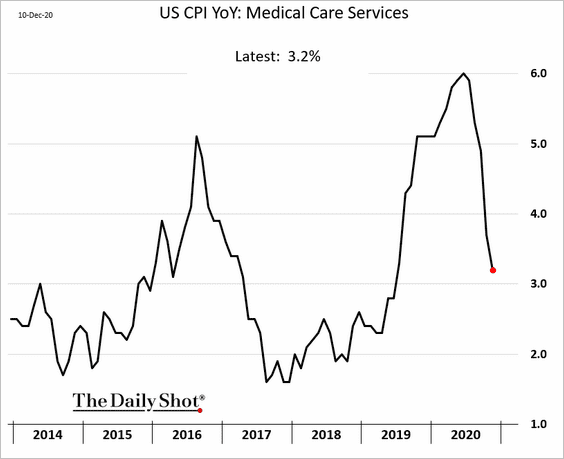

• Finally, we have a select set of CPI components.

– Gasoline (even if gasoline prices stay stable, the base effects should boost its contribution to the CPI early next year):

– Meats:

– Alcohol:

– Fast food restaurants:

– Airline fares:

Source: @WSJ Read full article

Source: @WSJ Read full article

– Car rentals:

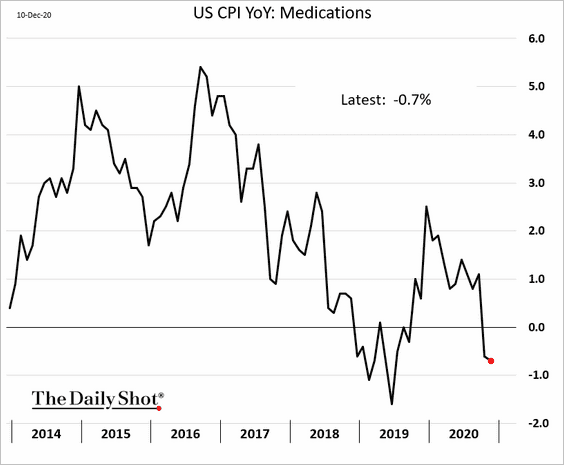

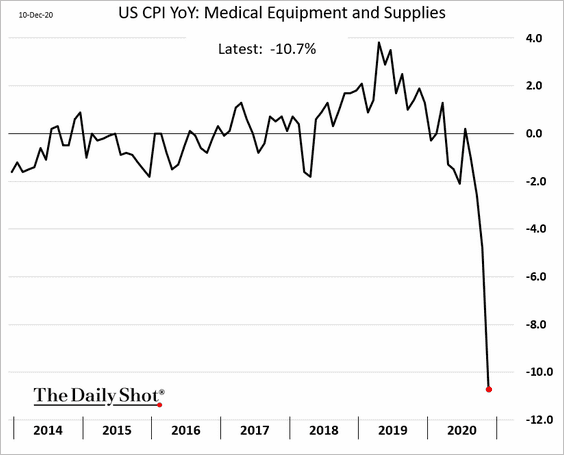

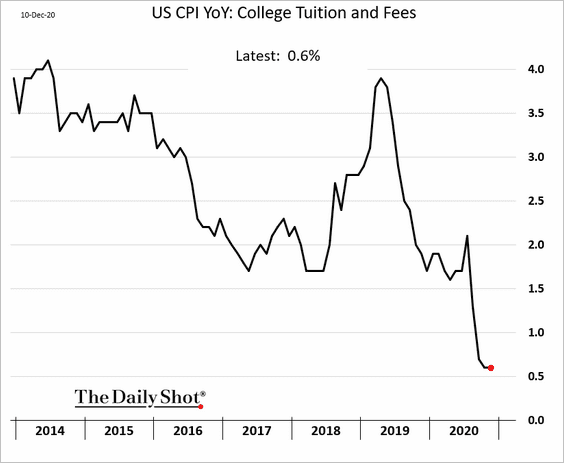

– Medical care and medications (3 charts):

– College tuition:

——————–

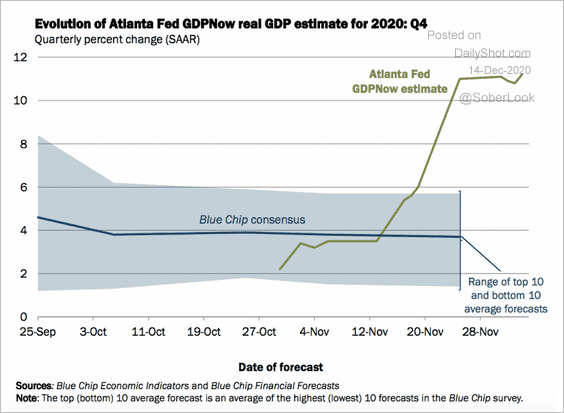

3. The Atlanta Fed’s GDP model forecast for Q4 has increased over the past few weeks and now sits at 11.2% (annualized).

Source: Atlanta Fed

Source: Atlanta Fed

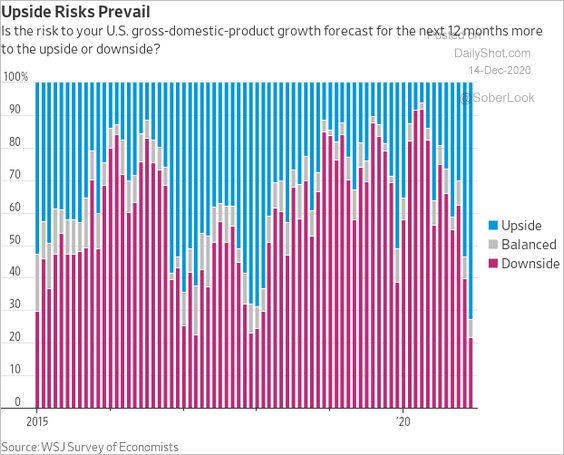

• Economists increasingly see upside risks to GDP forecasts for the next twelve months.

Source: @WSJ Read full article

Source: @WSJ Read full article

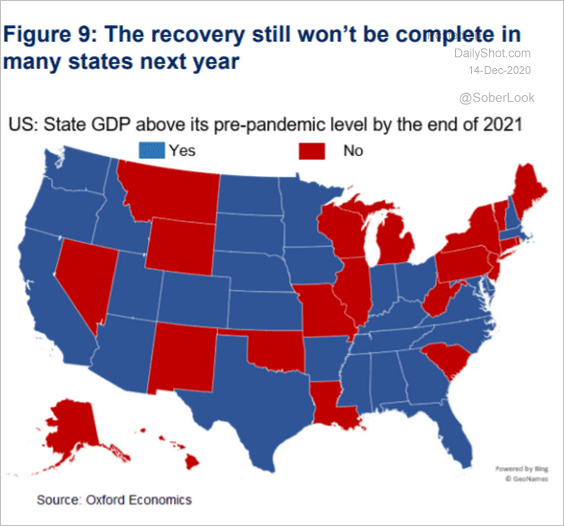

But the recovery is expected to be uneven.

Source: Oxford Economics

Source: Oxford Economics

——————–

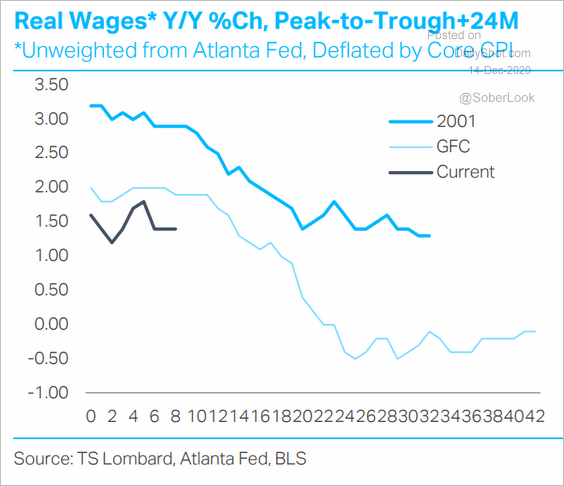

4. This chart shows the growth in real wages relative to previous economic downturns.

Source: TS Lombard

Source: TS Lombard

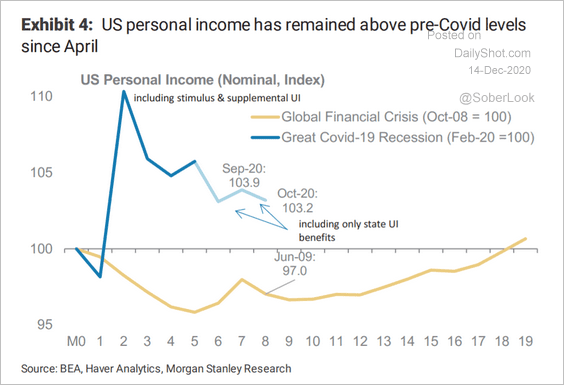

And here is personal income (which got a boost from government benefits).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

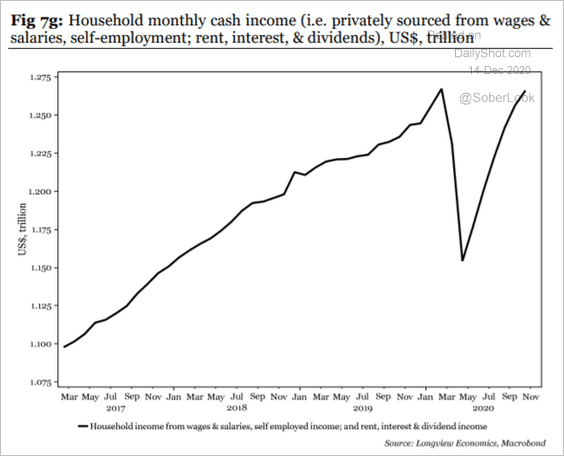

Excluding government support, household incomes have now fully recovered.

Source: Longview Economics

Source: Longview Economics

——————–

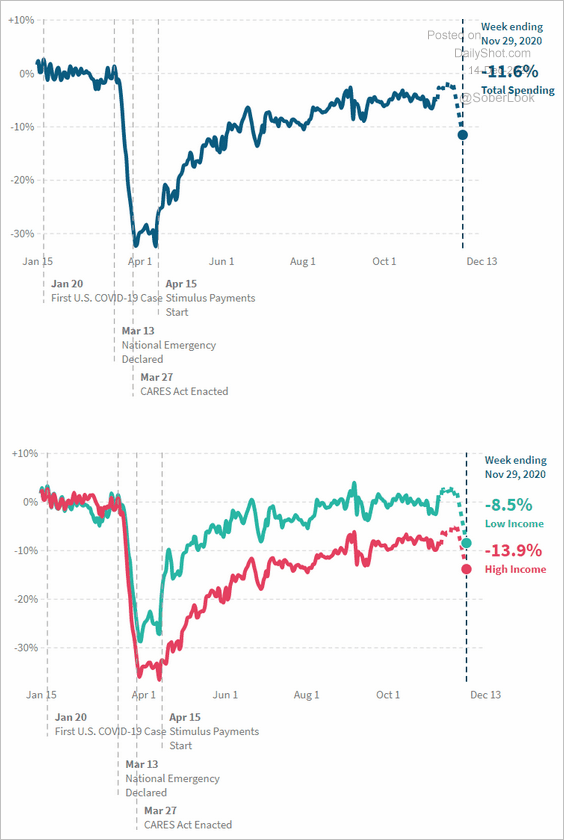

5. Consumer spending weakened in recent days.

Source: @OppInsights

Source: @OppInsights

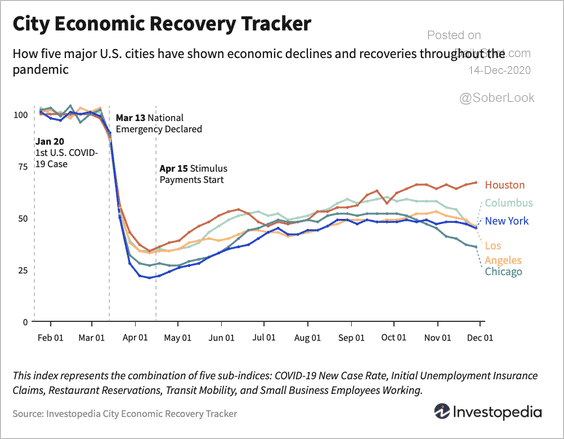

Here is a breakdown of the pandemic recovery by city (economic activity). Houston is taking the lead.

Source: Investopedia Read full article

Source: Investopedia Read full article

——————–

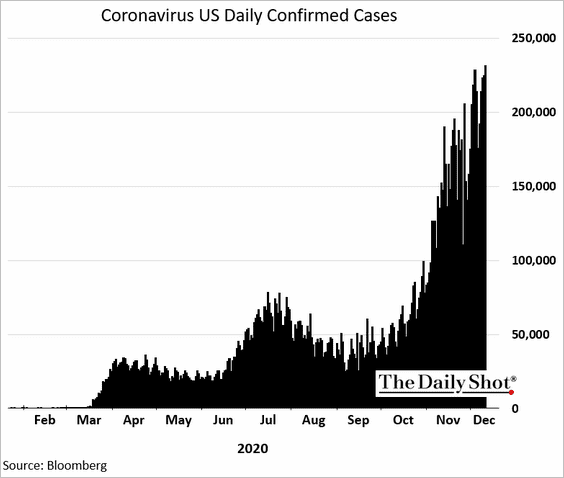

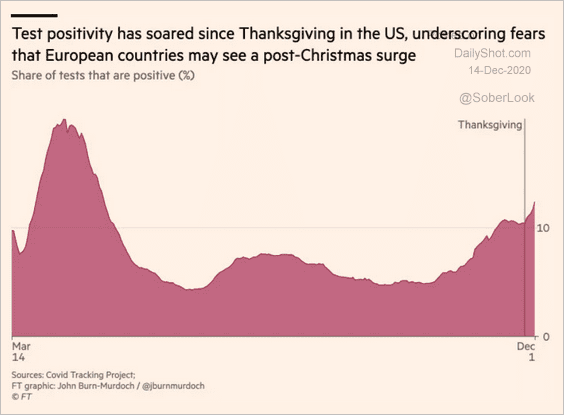

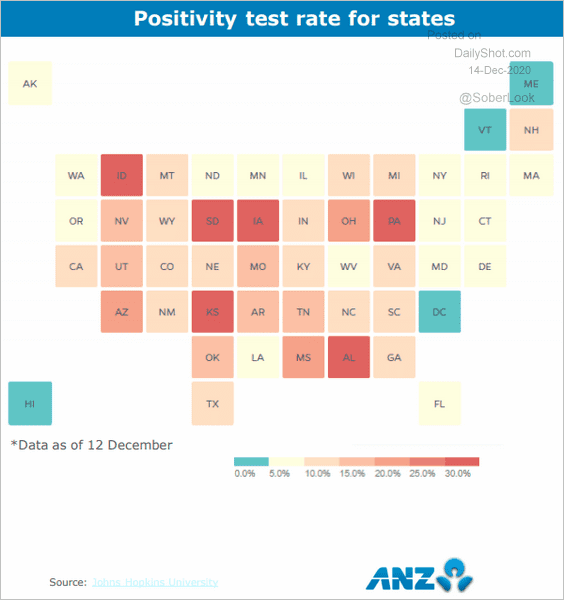

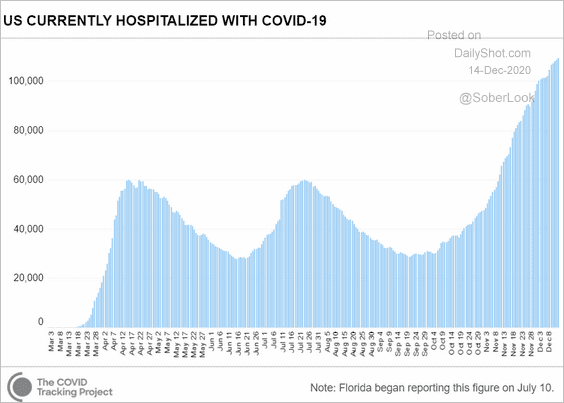

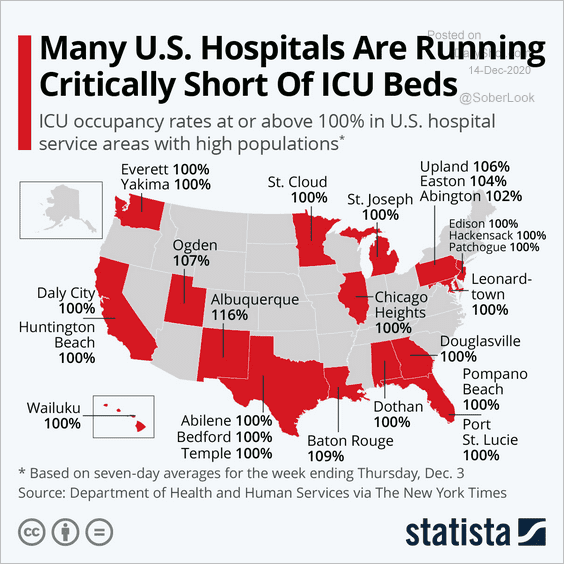

6. Finally, we have some updates on the worsening COVID situation. The vaccines couldn’t come soon enough.

• Daily new cases:

• Test positivity:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

Source: ANZ Research

Source: ANZ Research

• Hospitalizations:

Source: CovidTracking.com

Source: CovidTracking.com

• ICU beds:

Source: Statista

Source: Statista

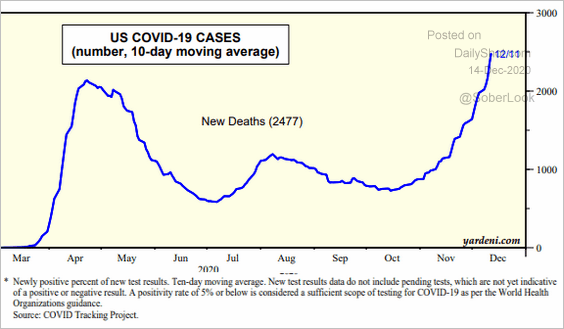

• Deaths:

Source: Yardeni Research

Source: Yardeni Research

Canada

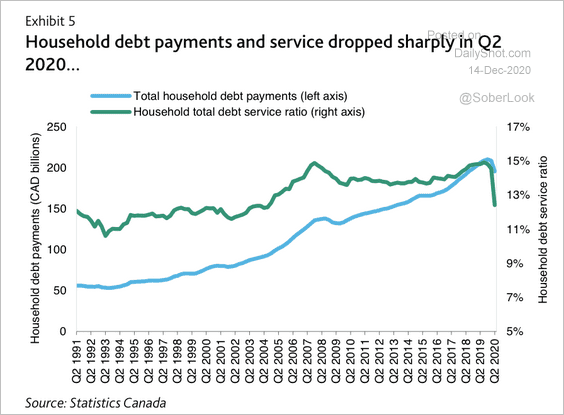

1. Widespread deferral programs led to a 6% drop in total household debt payments in Q2.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

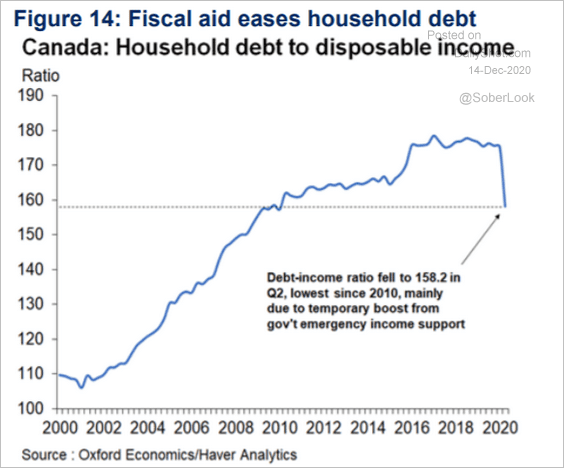

Fiscal support sharply decreased the debt-to-income ratio.

Source: Oxford Economics

Source: Oxford Economics

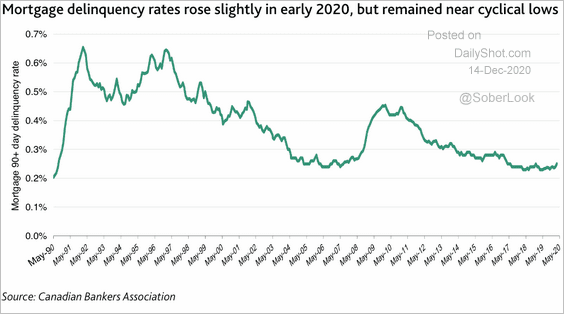

The residential mortgage 90+ day delinquency rate is near a 30 year low.

Source: Moody’s Investors Service

Source: Moody’s Investors Service

——————–

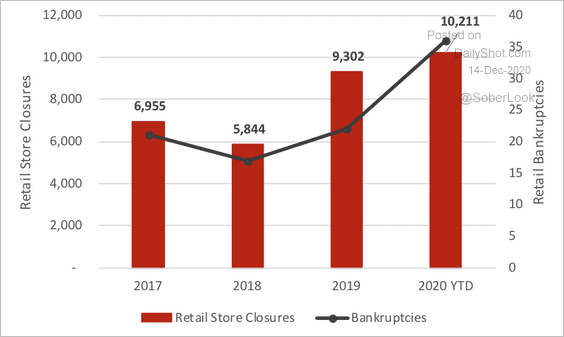

2. Retail bankruptcies and store closures accelerated this year.

Source: Scotiabank Economics

Source: Scotiabank Economics

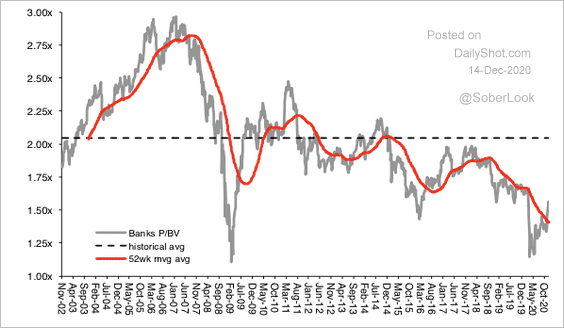

3. Bank valuations still have room to normalize.

Source: Scotiabank Economics

Source: Scotiabank Economics

The United Kingdom

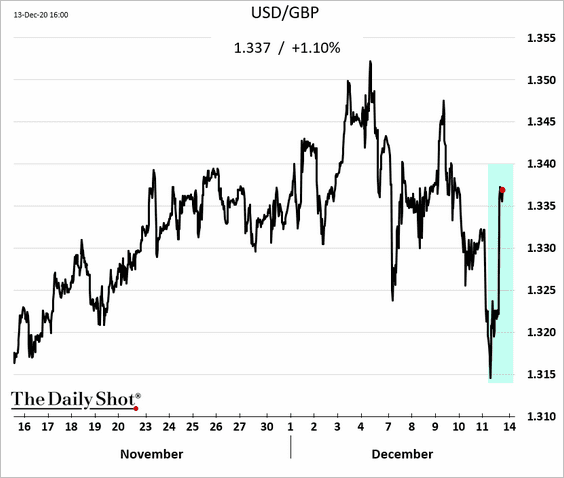

1. The pound jumped on renewed hopes for a deal.

Source: NBC News Read full article

Source: NBC News Read full article

——————–

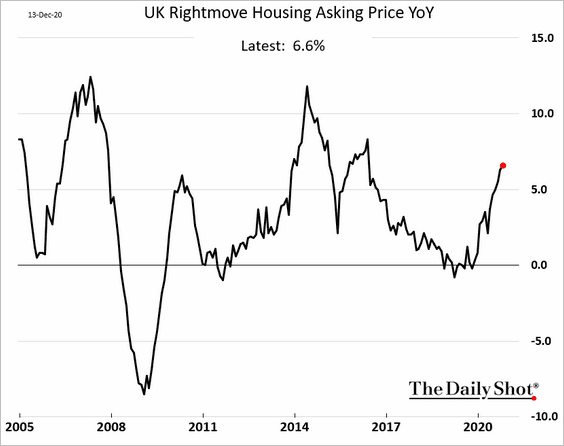

2. Asking prices point to further gains in the housing market.

The Eurozone

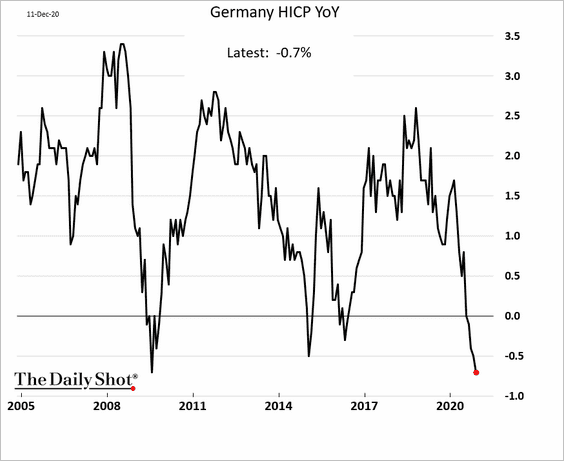

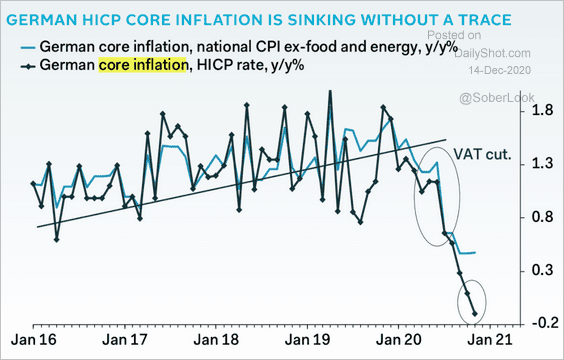

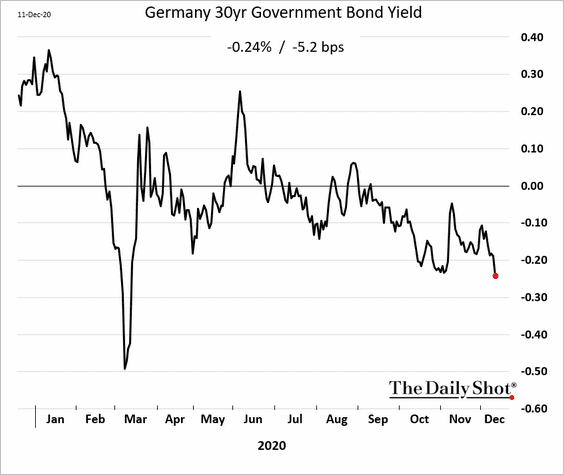

1. Let’s begin with Germany.

• Consumer inflation:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

• The 30yr Bund yield:

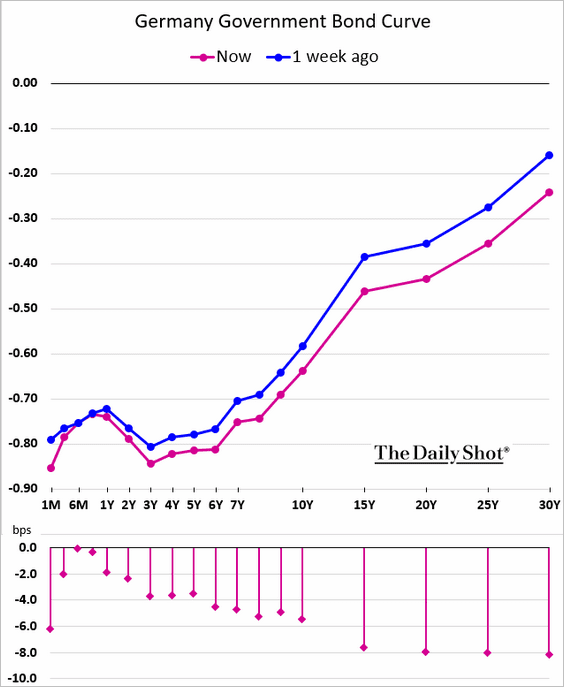

• The flattening yield curve:

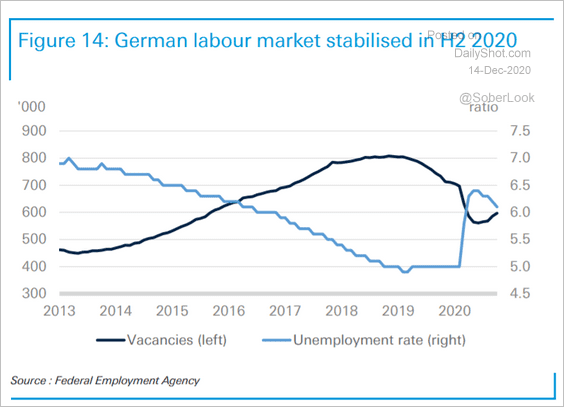

• Labor market recovery:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

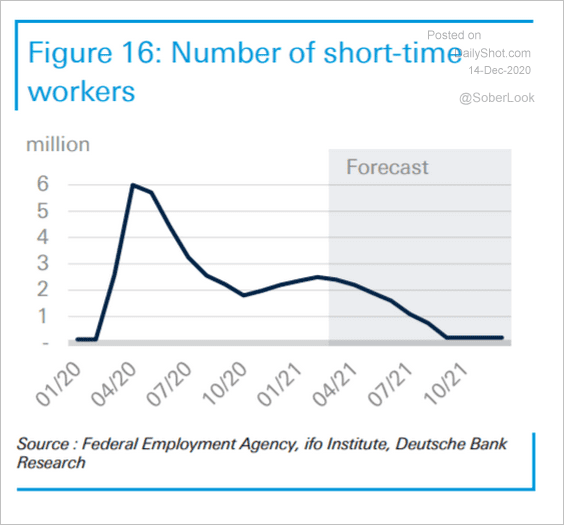

• Deutsche Bank’s forecast for short-time workers:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

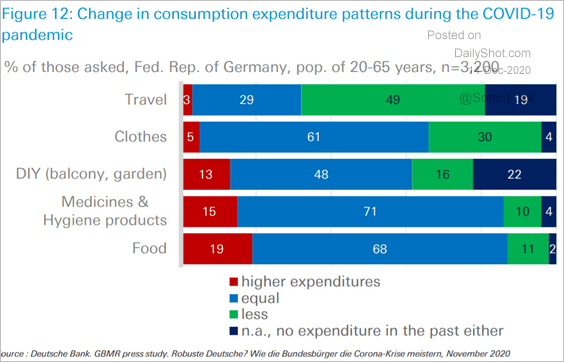

• Consumption changes by sector:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

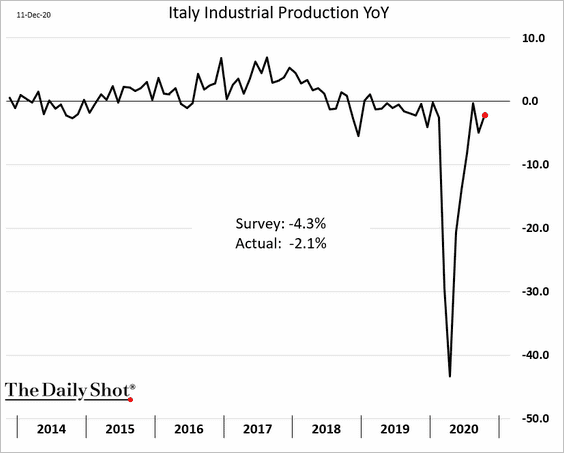

2. Italy’s industrial production has stabilized.

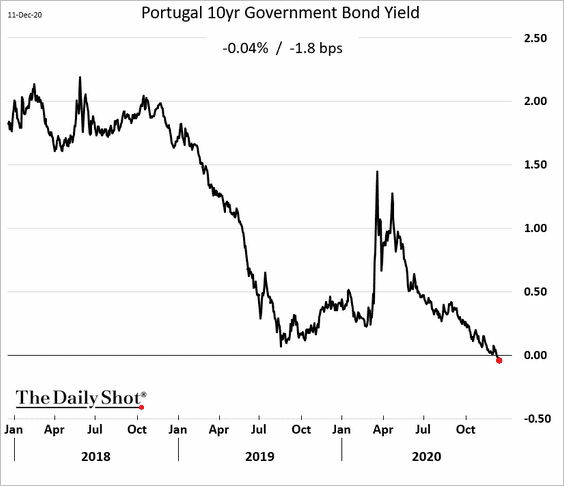

3. This is Portugal’s 10-year government bond yield.

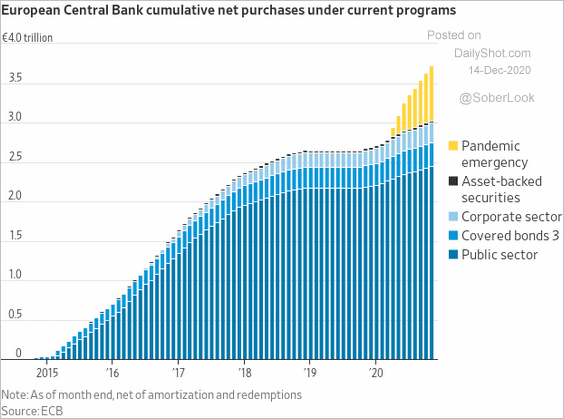

4. Here is the breakdown of the ECB’s balance sheet.

Source: @WSJ Read full article

Source: @WSJ Read full article

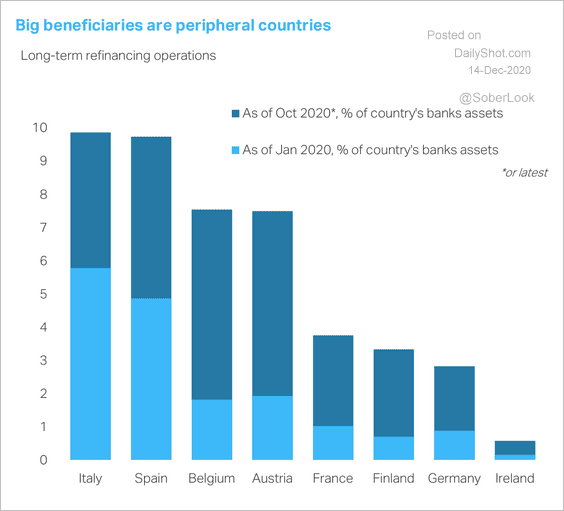

5. “Periphery” countries have been large beneficiaries of the ECB’s TLTRO program.

Source: TS Lombard

Source: TS Lombard

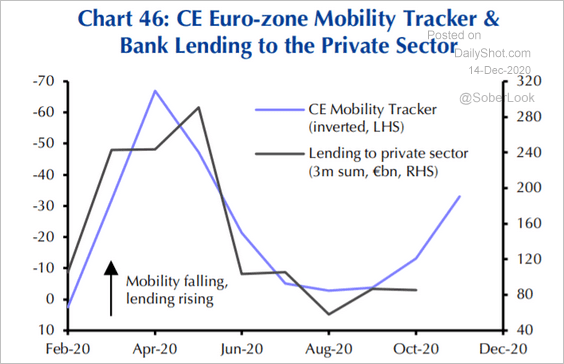

6. Will we see a tightening in the euro-area credit conditions due to lockdowns?

Source: Capital Economics

Source: Capital Economics

Europe

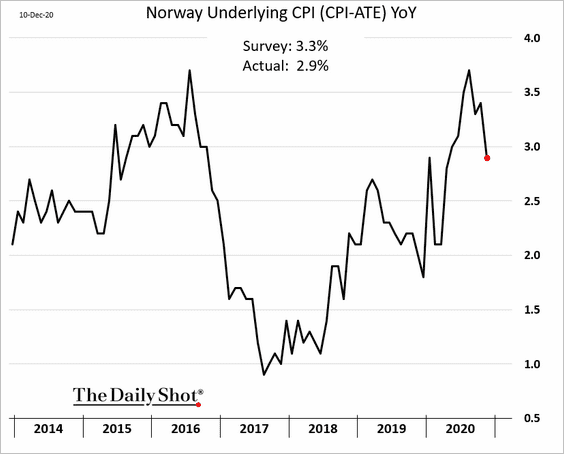

1. Norway’s CPI is moderating.

2. Iceland’s unemployment rate has exploded due to the collapse in tourism.

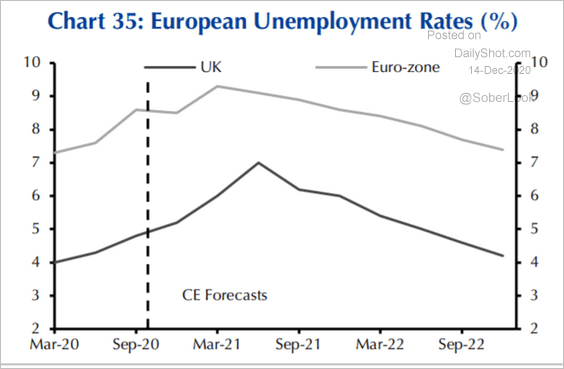

3. Unemployment rates across Western Europe are expected to climb further.

Source: Capital Economics

Source: Capital Economics

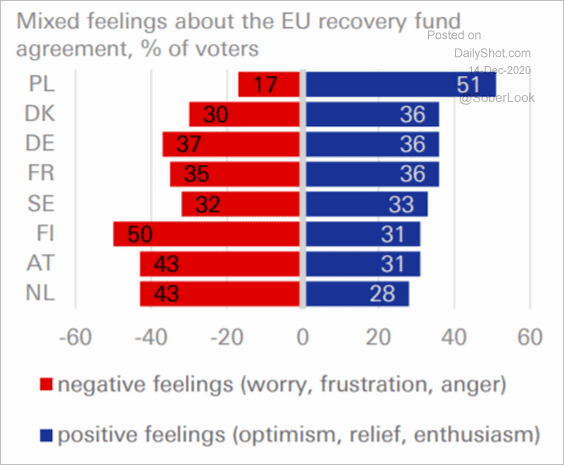

4. How do voters view the EU recovery fund?

Source: Deutsche Bank Research

Source: Deutsche Bank Research

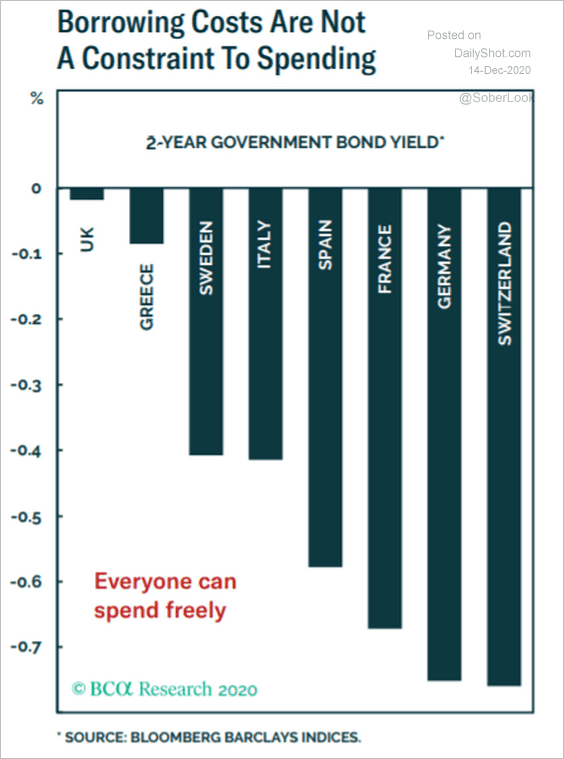

5. Borrowing costs have not been a constraint to spending.

Source: BCA Research

Source: BCA Research

Asia – Pacific

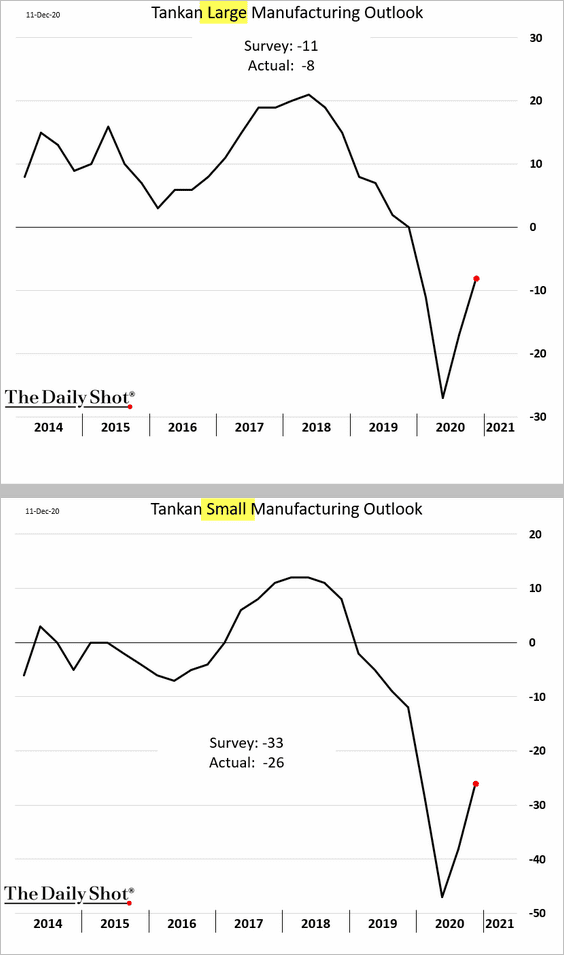

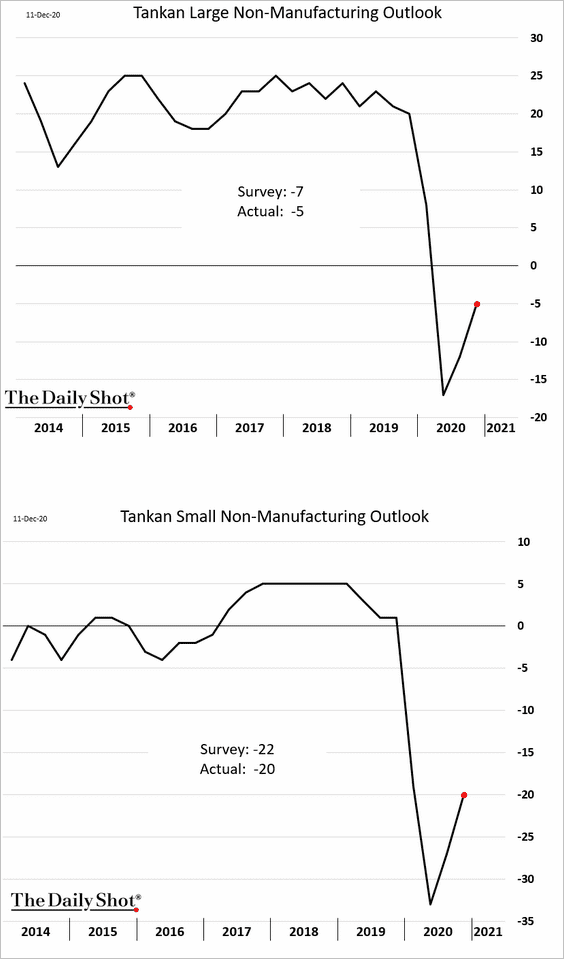

1. Japan’s Tankan survey topped economists’ forecasts.

• Manufacturing:

• Nonmanufacturing:

——————–

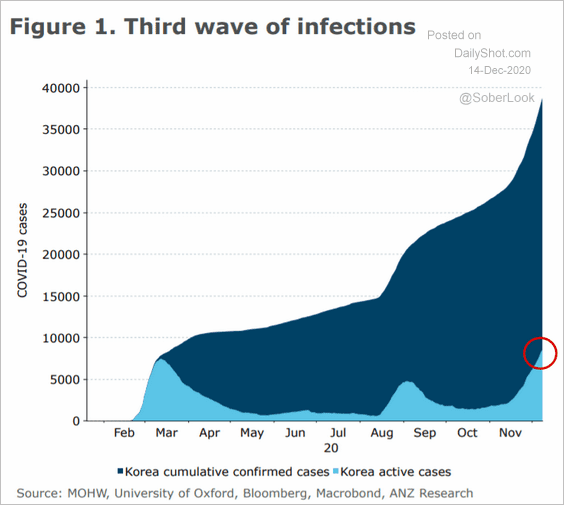

2. Here is South Korea’s third wave:

Source: ANZ Research

Source: ANZ Research

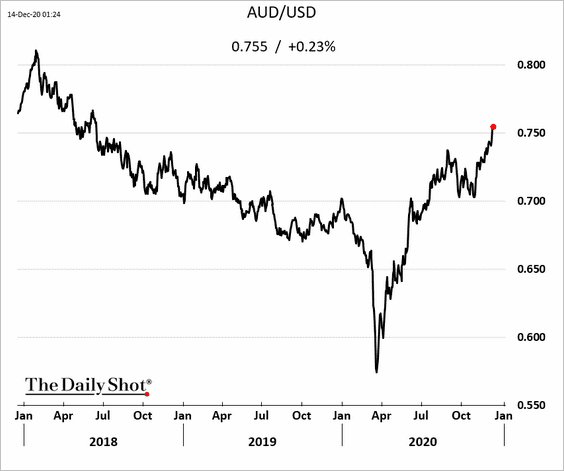

4. The Aussie dollar continues to climb.

China

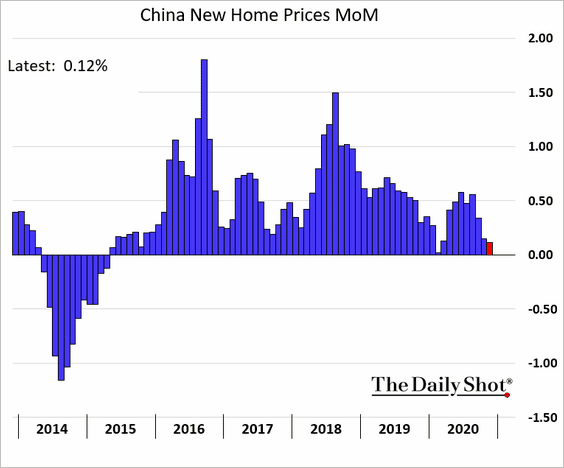

1. Home price appreciation has slowed.

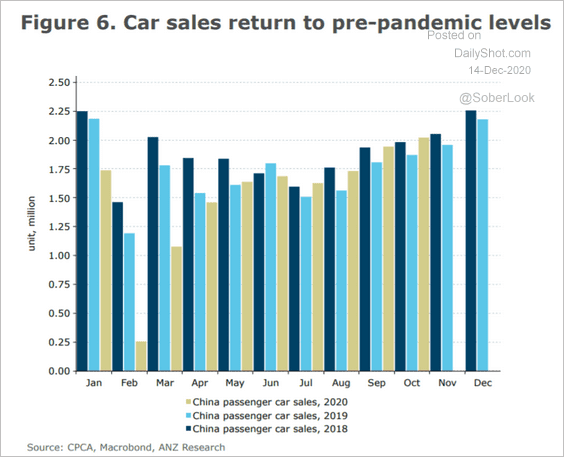

2. Car sales have recovered.

Source: ANZ Research

Source: ANZ Research

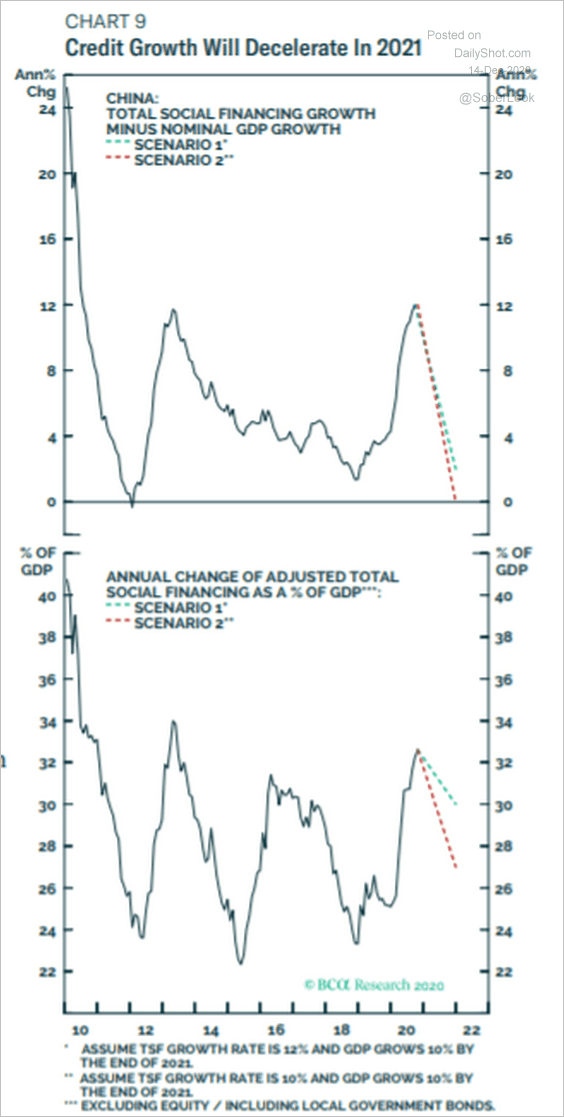

3. Credit growth is expected to slow next year.

Source: BCA Research

Source: BCA Research

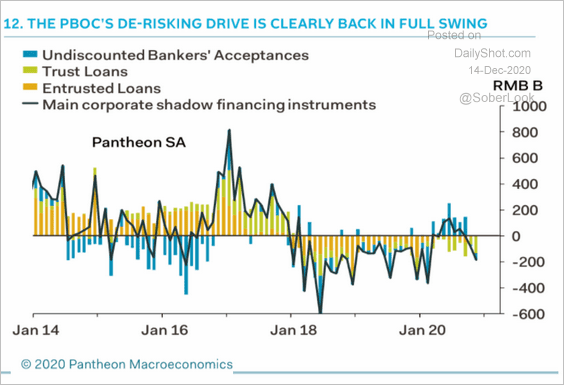

The PBoC is de-risking some of the “shadow” credit activities.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

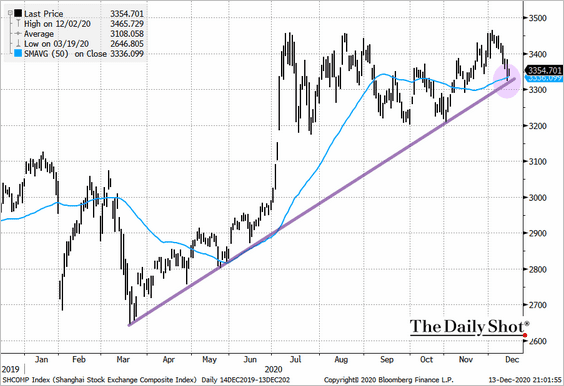

4. The Shanghai Stock Exchange Composite held support.

Source: @TheTerminal, Bloomberg Finance L.P.

Source: @TheTerminal, Bloomberg Finance L.P.

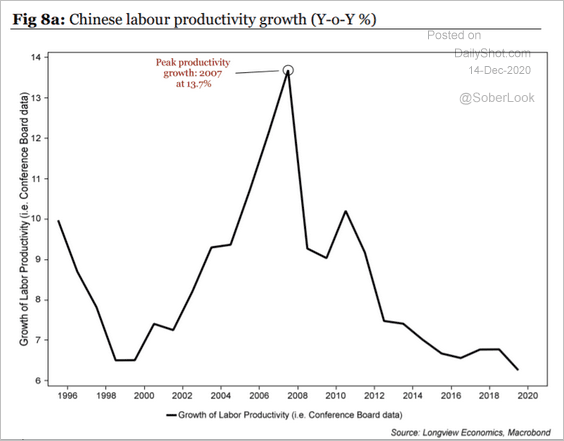

5. Growth in China’s labor productivity has been slowing.

Source: Longview Economics

Source: Longview Economics

Emerging Markets

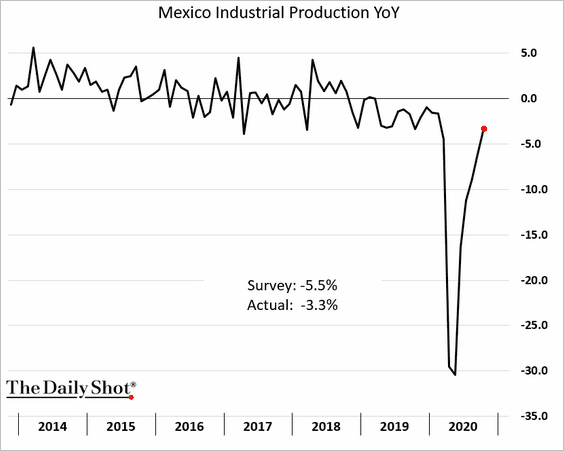

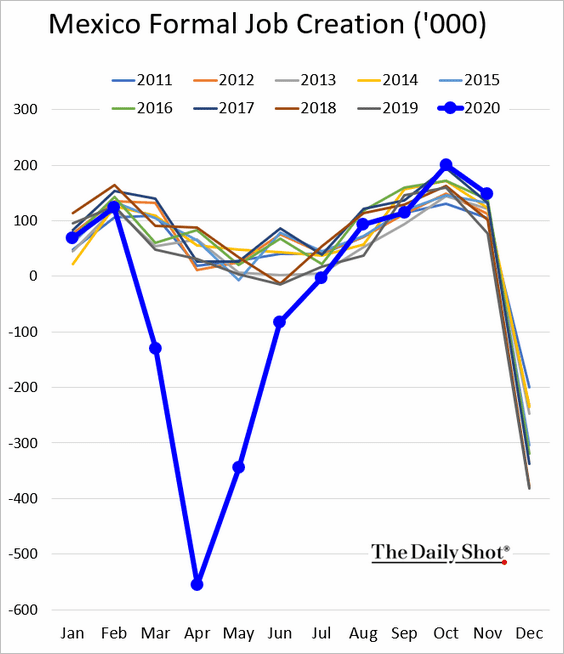

1. Mexico’s industrial production surprised to the upside.

Formal job creation is holding above last year’s levels.

——————–

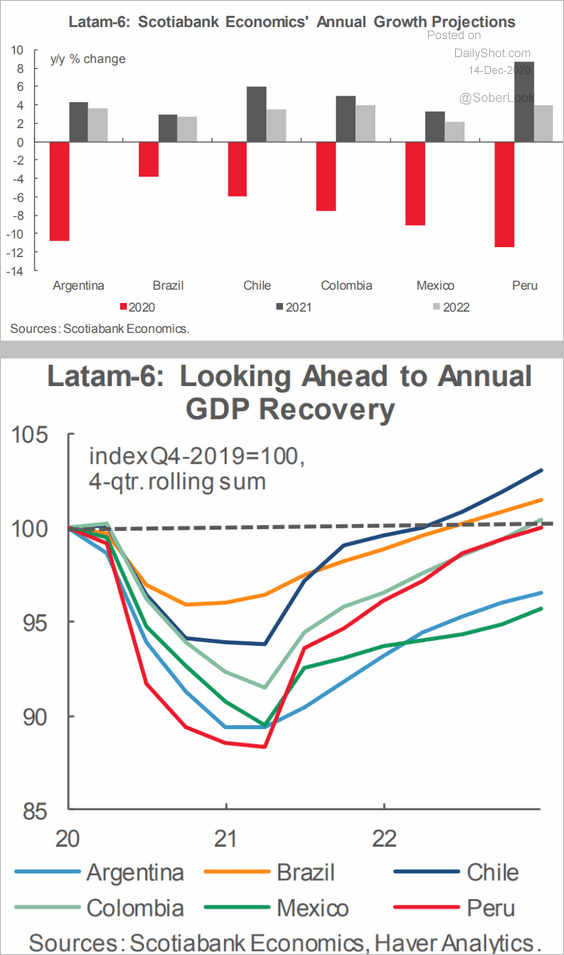

2. Here are some trends in Latin America.

• Scotiabank’s policy rate forecast:

Source: ANZ Research

Source: ANZ Research

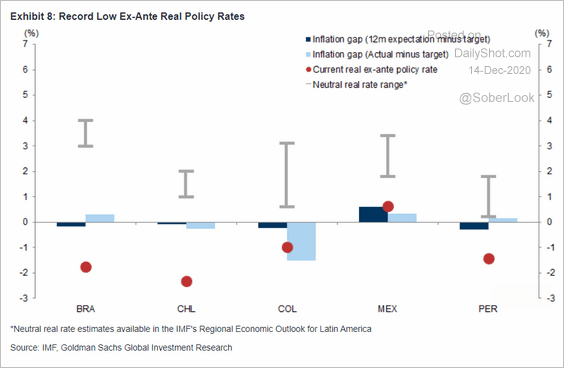

• Current real rates:

Source: Goldman Sachs

Source: Goldman Sachs

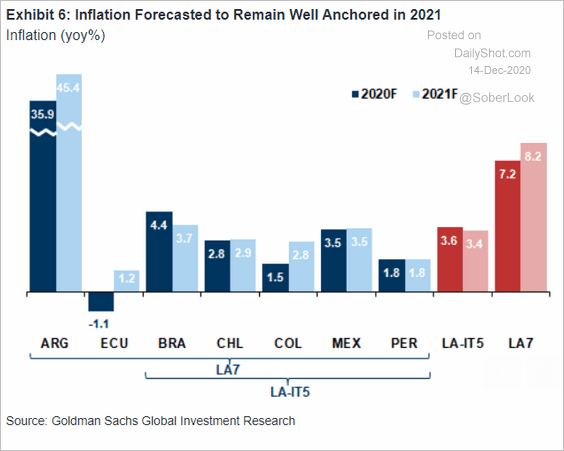

• Goldman’s inflation forecasts:

Source: Goldman Sachs

Source: Goldman Sachs

• Scotiabank’s GDP growth forecasts:

Source: Scotiabank Economics

Source: Scotiabank Economics

——————–

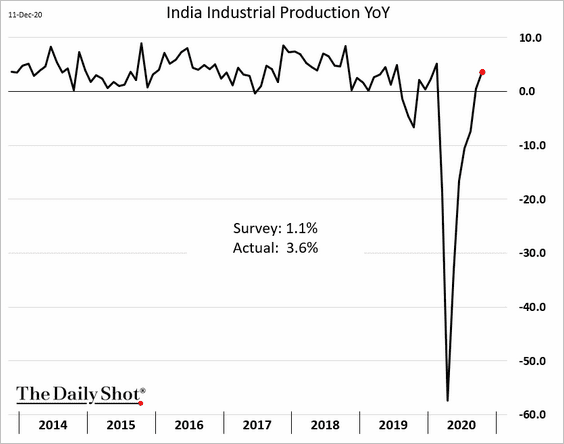

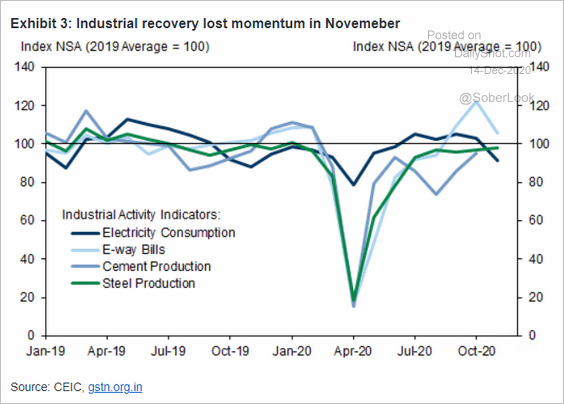

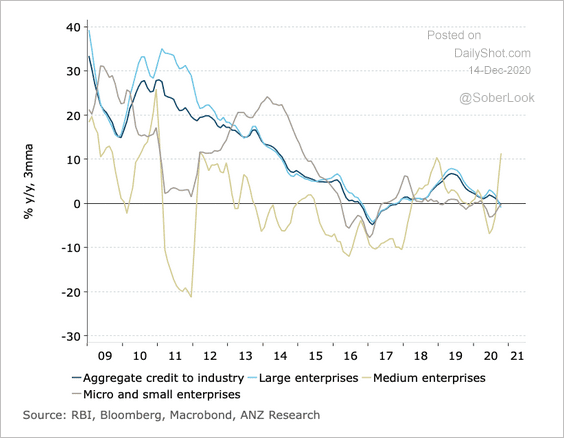

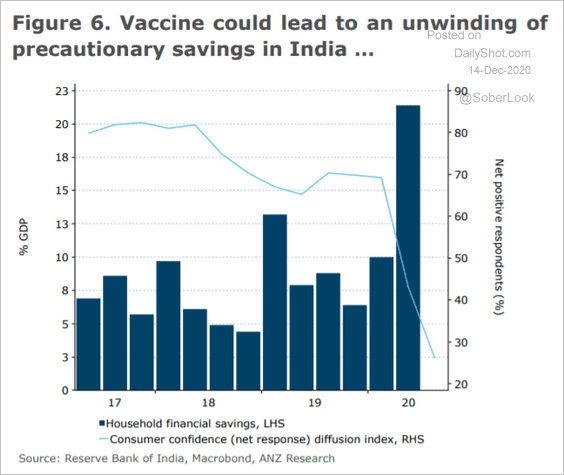

3. Next, we have some updates on India.

• Industrial production through October (better than expected):

• Industrial trends through November:

Source: Goldman Sachs

Source: Goldman Sachs

• Credit growth by business size:

Source: ANZ Research

Source: ANZ Research

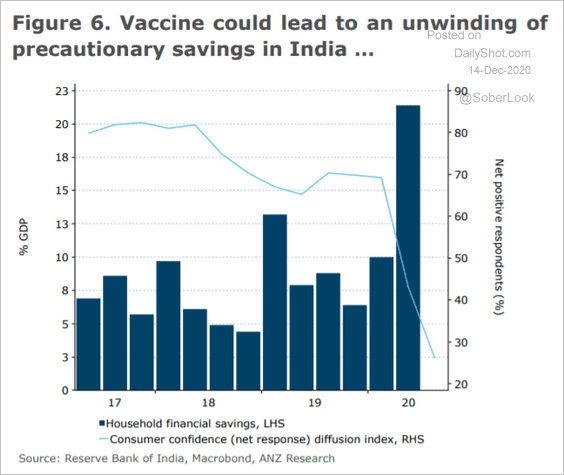

• Consumer confidence in India has collapsed, contributing to a surge in precautionary savings.

Source: ANZ Research

Source: ANZ Research

——————–

4. Russia’s exports remain depressed (in part due to weaker energy prices).

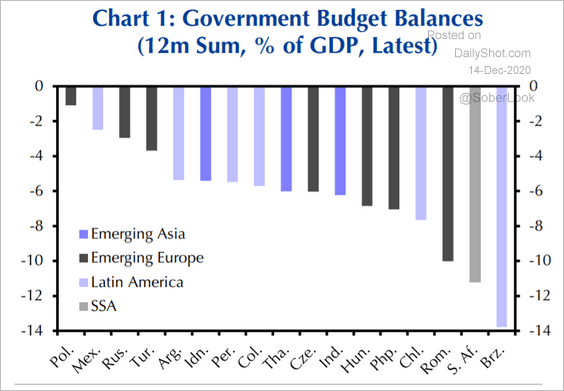

5. How have budget balances changed over the past 12 months?

Source: Capital Economics

Source: Capital Economics

Commodities

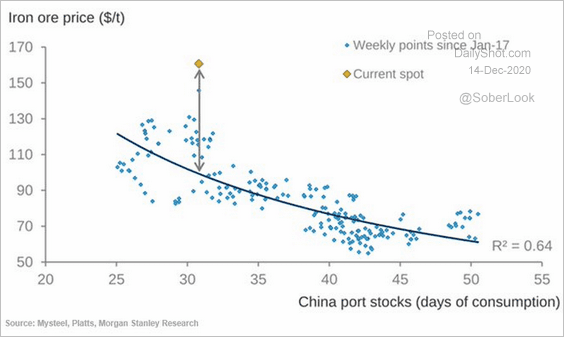

1. Iron ore prices seem to be too high relative to inventories at China’s ports.

Source: Morgan Stanley Research, @Scutty

Source: Morgan Stanley Research, @Scutty

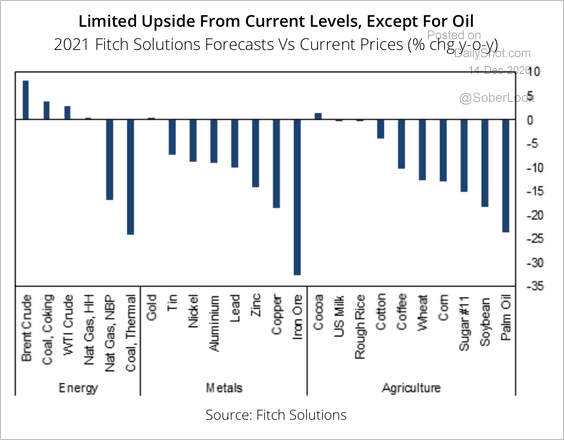

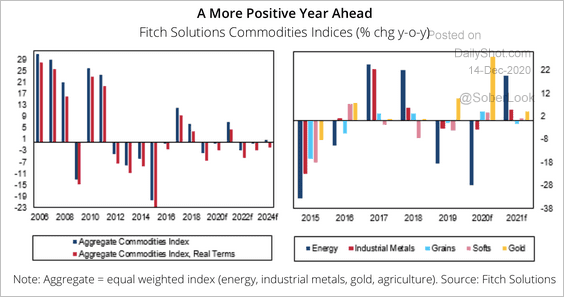

2. Fitch expects limited upside for most industrial metals (especially iron ore) and agriculture commodities.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

3. European carbon credit prices keep climbing due to the EU’s aggressive emissions plan.

Source: @SStapczynski

Source: @SStapczynski

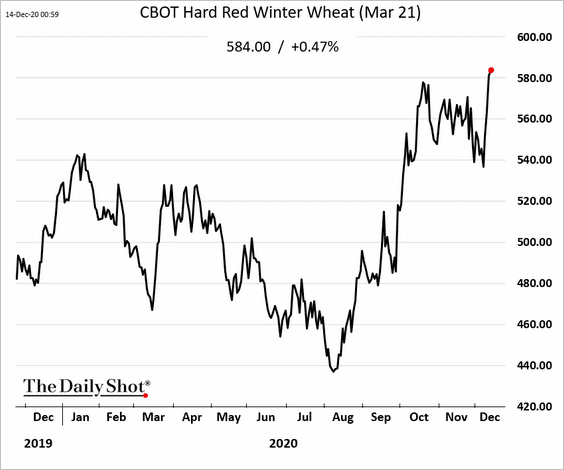

4. US wheat prices are up sharply.

Source: Enidnews.com Read full article

Source: Enidnews.com Read full article

——————–

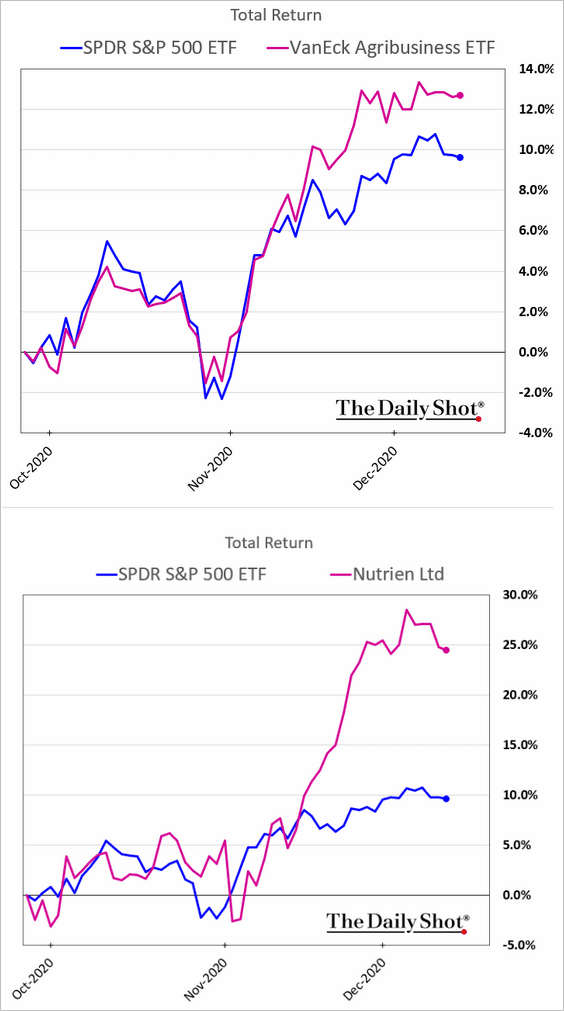

5. Fertilizer producers’ shares have been rising with agricultural commodities.

Energy

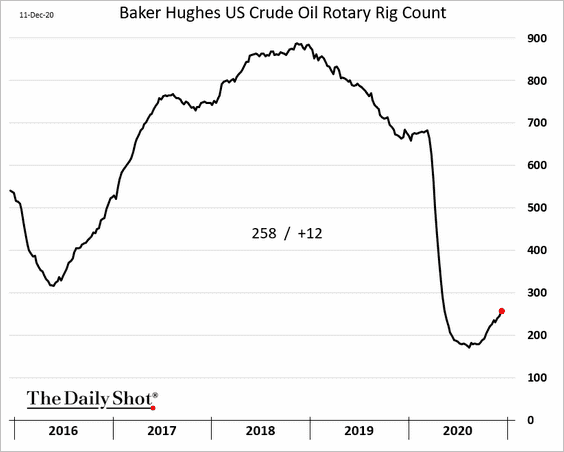

1. US rig count continues to recover.

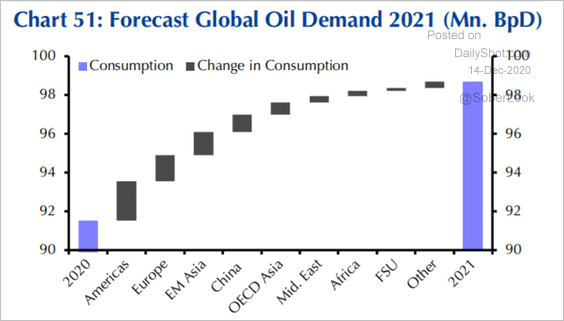

2. Oil demand is expected to increase substantially next year.

Source: Capital Economics

Source: Capital Economics

3. Fitch expects energy to outperform the commodities complex next year.

Source: Fitch Solutions Macro Research

Source: Fitch Solutions Macro Research

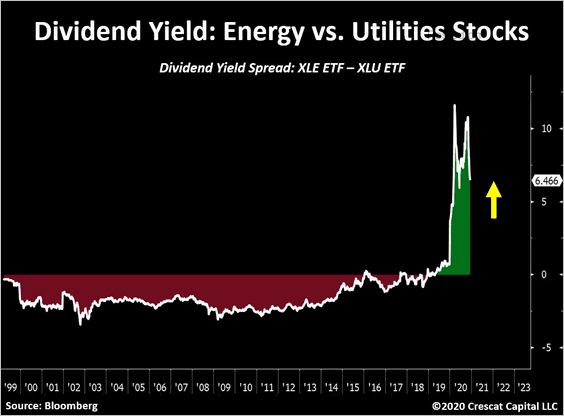

4. US energy stocks now pay higher dividends than utilities.

Source: @TaviCosta

Source: @TaviCosta

5. Asian LNG prices are up sharply.

Source: @SStapczynski

Source: @SStapczynski

Here is the LNG spread to US natural gas.

Source: @merrillmatter, @SStapczynski

Source: @merrillmatter, @SStapczynski

——————–

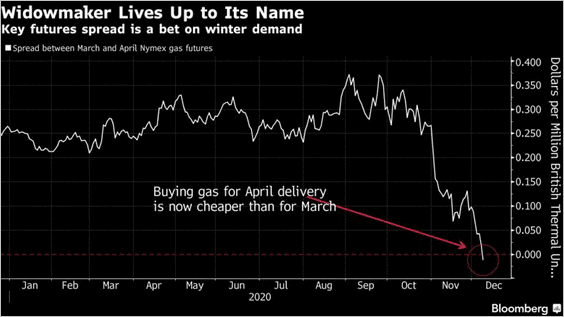

6. The March-April US natural gas futures spread has collapsed due to warmer weather expectations.

Source: @markets Read full article

Source: @markets Read full article

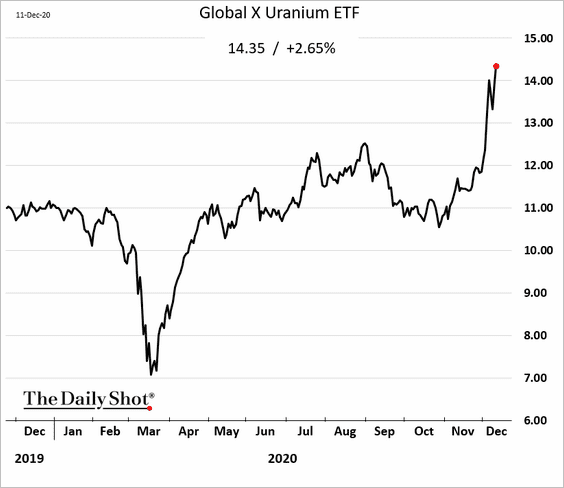

7. Uranium prices are higher this year.

h/t Walter

h/t Walter

Uranium stocks are soaring.

h/t Walter

h/t Walter

Source: Small Caps Read full article

Source: Small Caps Read full article

Equities

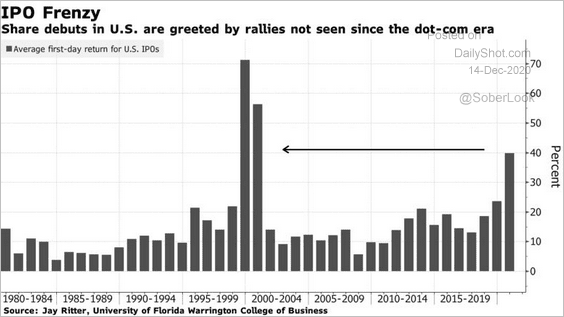

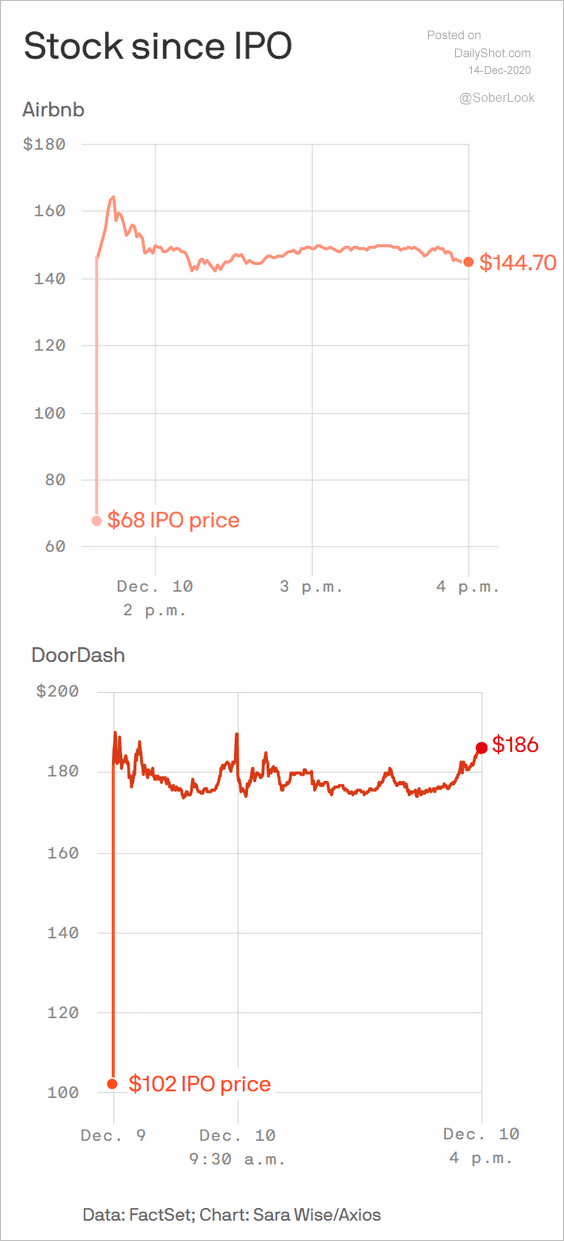

1. It’s been a good year for IPOs

Source: @markets Read full article

Source: @markets Read full article

Source: @axios Read full article

Source: @axios Read full article

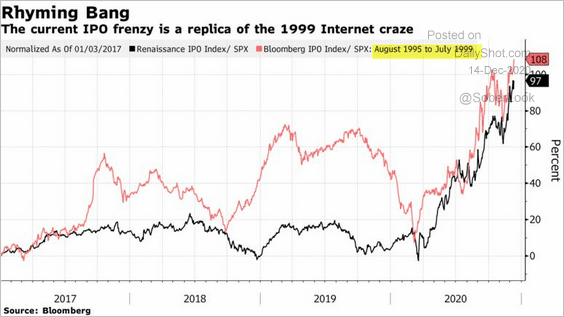

• Post-IPO stocks are following the 1995 trend.

Source: @business Read full article

Source: @business Read full article

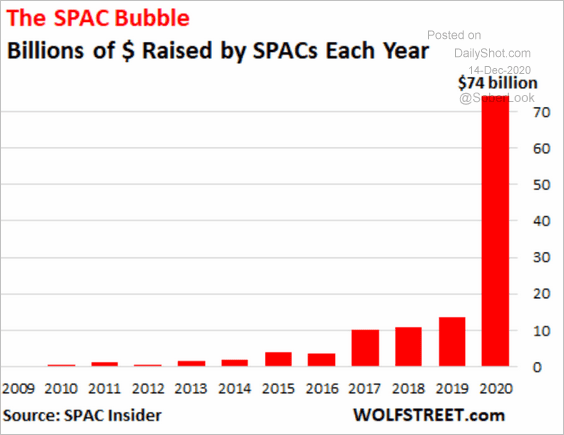

• The volume of SPAC sales has been unprecedented.

Source: Wolf Street Read full article

Source: Wolf Street Read full article

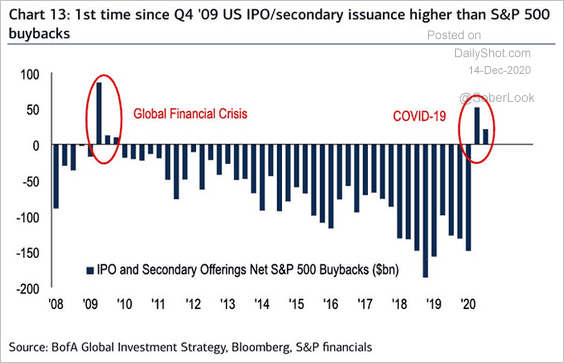

• Equity issuance has been outpacing share buybacks.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

——————–

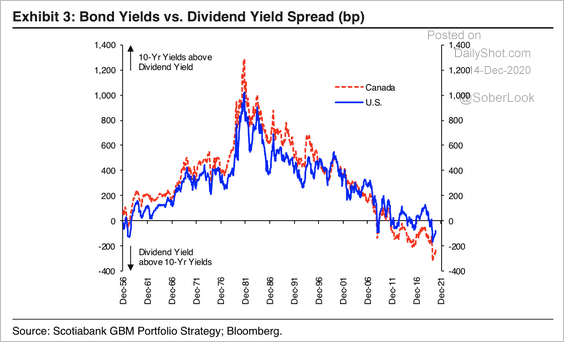

2. Dividend yields are attractive versus government bonds.

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

Source: Hugo Ste-Marie, Portfolio & Quantitative Strategy Global Equity Research, Scotia Capital

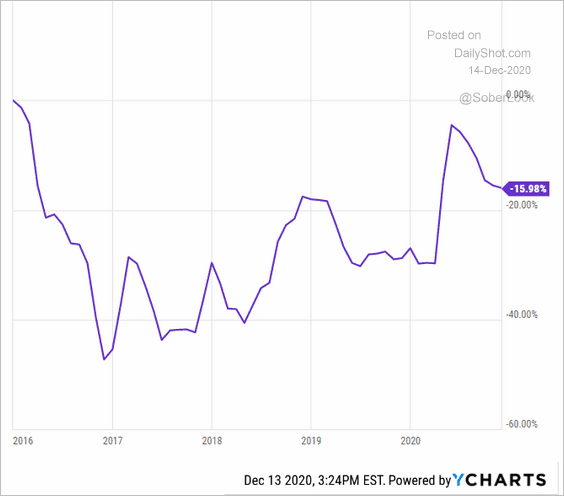

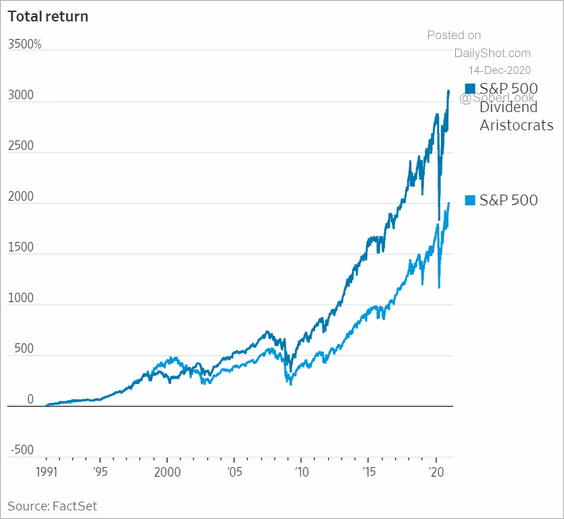

Here is the relative performance of the Dividend Aristocrats index.

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

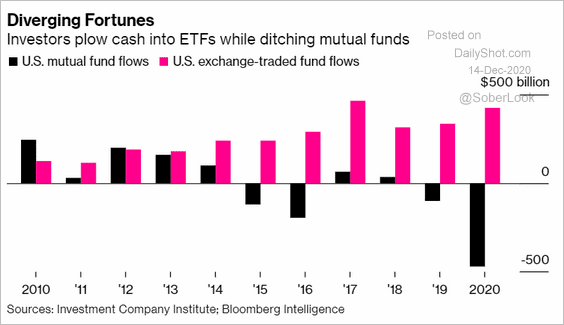

3. Mutual funds saw significant outflows this year, even as ETFs continue to attract capital.

Source: @business Read full article

Source: @business Read full article

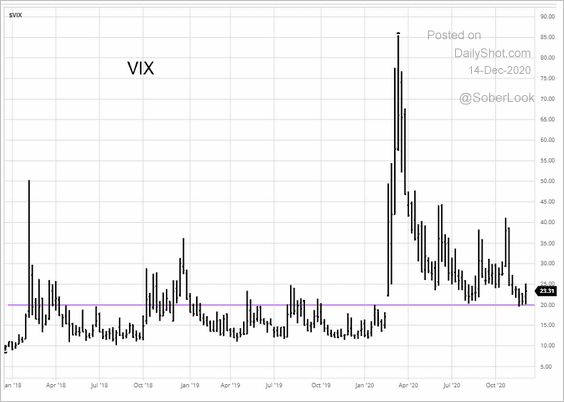

4. VIX is holding above 20 for now.

Source: barchart.com

Source: barchart.com

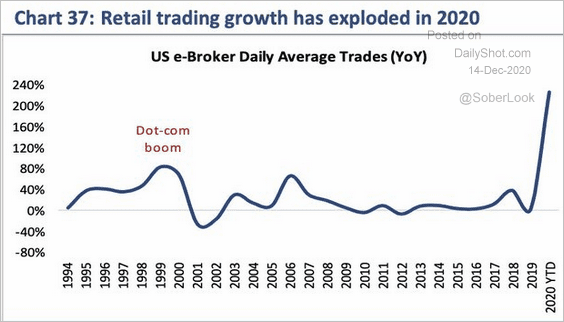

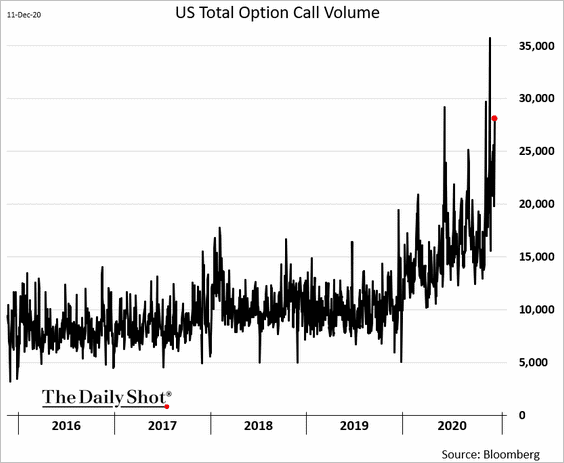

5. Retail speculative activity remains elevated.

• Electronic broker volume:

Source: @jtepper2

Source: @jtepper2

• Call option volume:

Credit

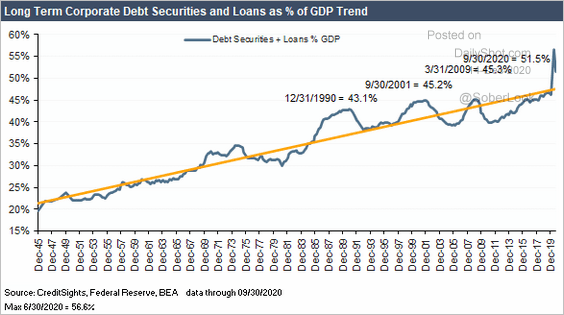

1. Corporate debt-to-GDP ratio rose sharply this year.

Source: CreditSights

Source: CreditSights

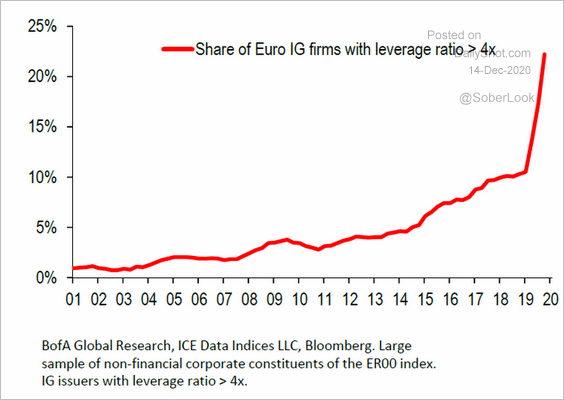

Leverage increased at many European investment-grade firms.

Source: @jsblokland

Source: @jsblokland

——————–

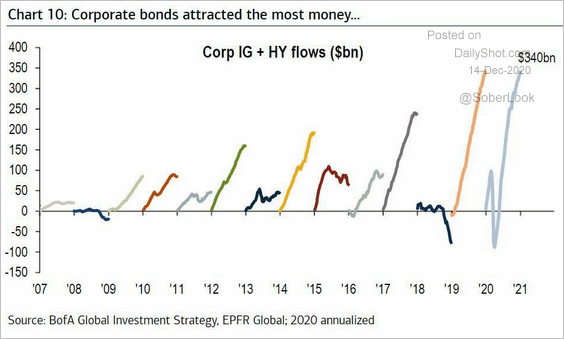

2. Corporate bond funds saw massive inflows in 2020.

Source: BofA Global Research

Source: BofA Global Research

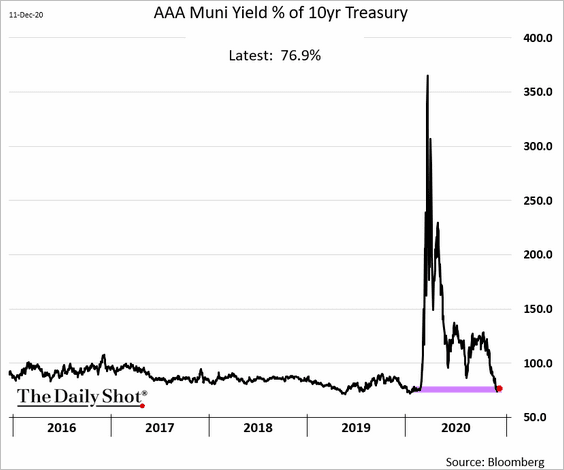

3. Despite a weakened financial situation for many states and municipalities, AAA muni yields are back at pre-crisis levels (relative to Treasuries).

Global Developments

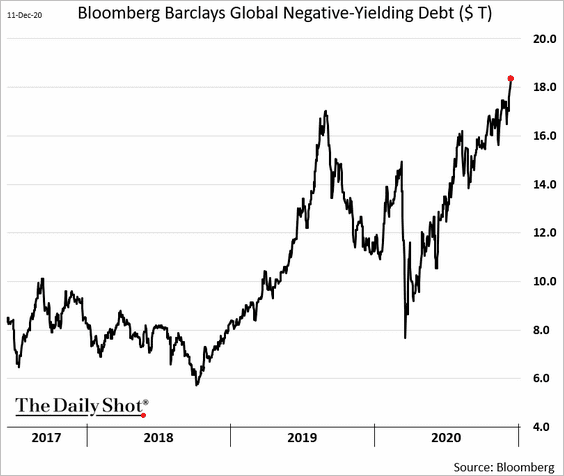

1. The amount of negative-yielding debt keeps hitting new records.

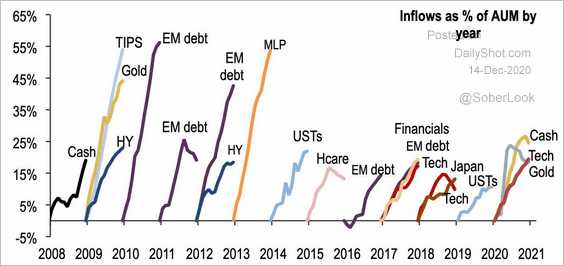

2. This chart shows asset classes with the largest fund inflows each year.

Source: BofA Global Research

Source: BofA Global Research

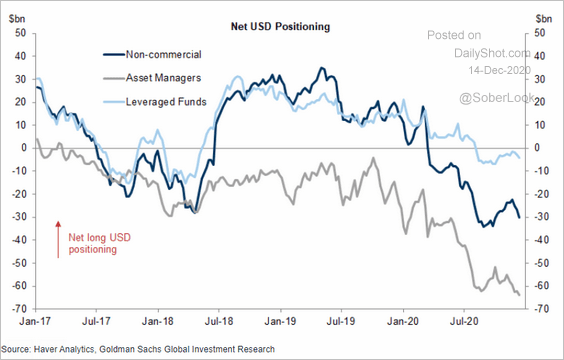

3. Asset managers continue to press their bets against the dollar.

Source: Goldman Sachs

Source: Goldman Sachs

——————–

Food for Thought

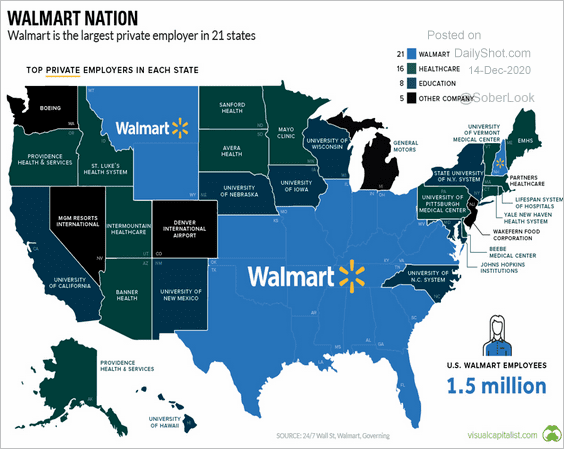

1. The biggest private employer in each state:

Source: Visual Capitalist Read full article

Source: Visual Capitalist Read full article

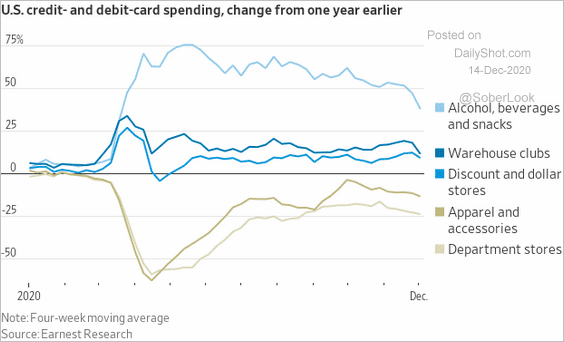

2. US credit card spending trends:

Source: @WSJ Read full article

Source: @WSJ Read full article

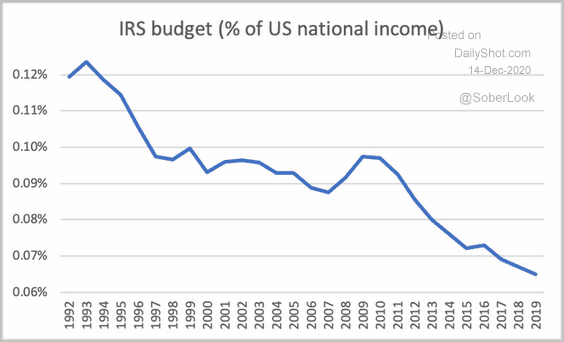

3 The IRS budget:

Source: @gabriel_zucman

Source: @gabriel_zucman

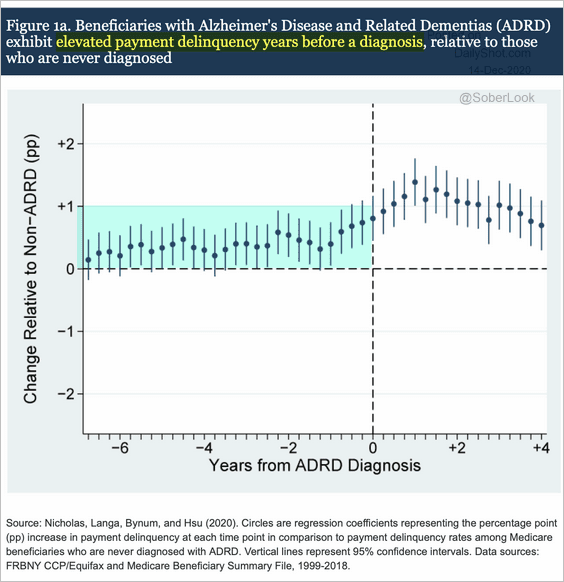

4. Elevated payment delinquencies long before borrowers’ Alzheimer’s diagnosis:

Source: Federal Reserve Read full article

Source: Federal Reserve Read full article

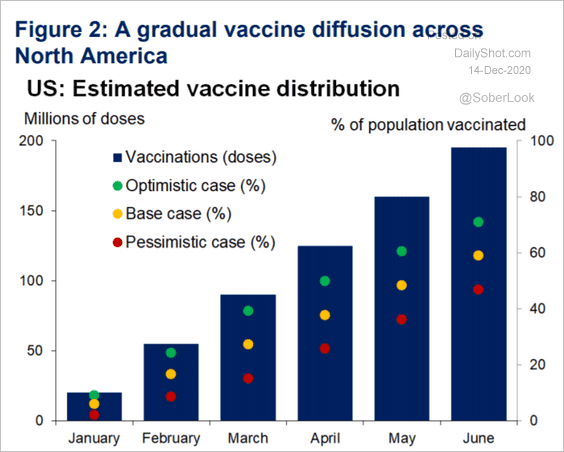

5. The vaccine distribution timeline in the US:

Source: Oxford Economics

Source: Oxford Economics

Source: @WSJ Read full article

Source: @WSJ Read full article

——————–

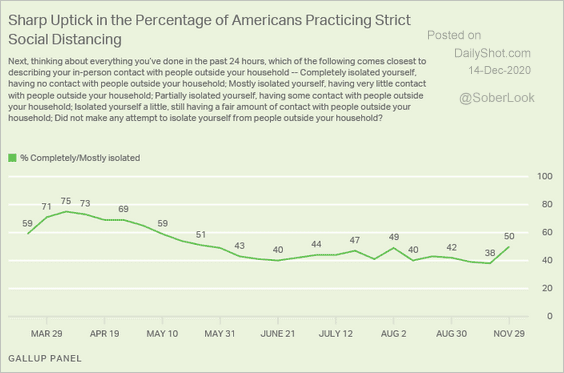

6. Social distancing:

Source: Gallup Read full article

Source: Gallup Read full article

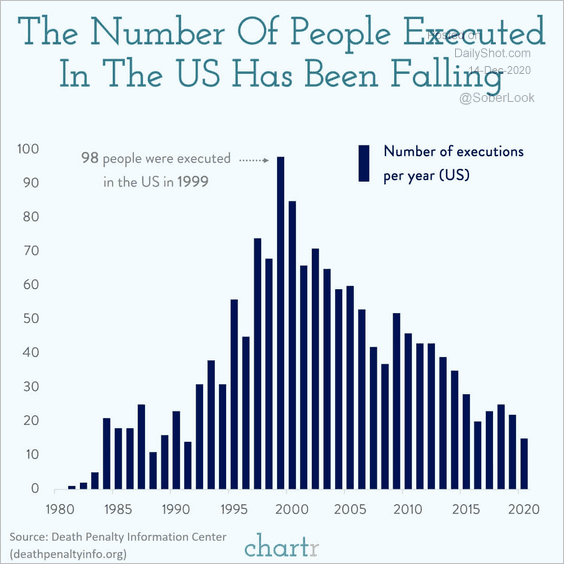

7. Total US executions:

Source: @chartrdaily

Source: @chartrdaily

——————–

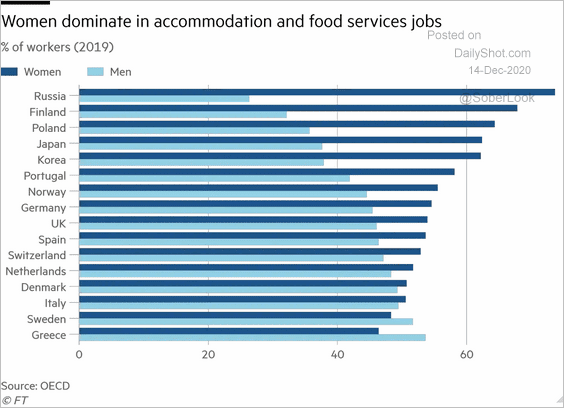

8. Hotel and restaurant jobs:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

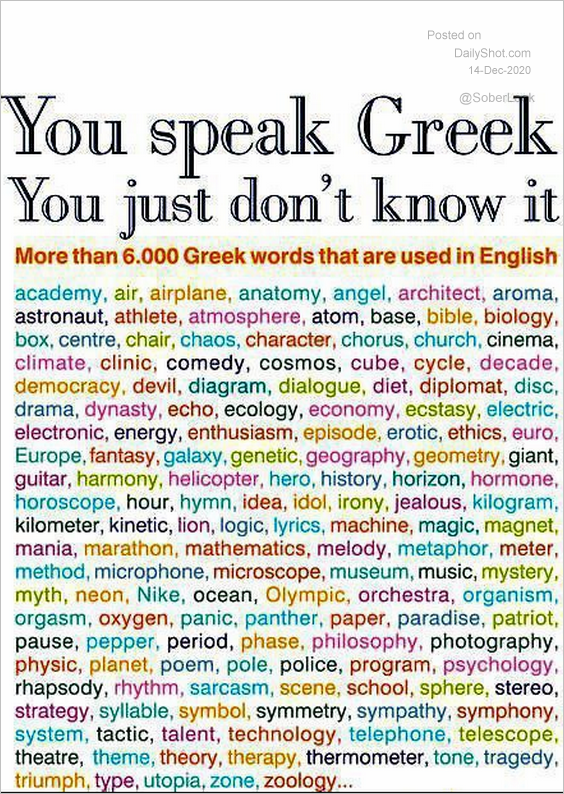

9. Greek words in the English language:

Source: Eurotalk Read full article

Source: Eurotalk Read full article

——————–