The Daily Shot: 26-Jan-21

• Equities

• Credit

• Rates

• Commodities

• Cryptocurrency

• China

• Asia – Pacific

• The Eurozone

• Europe

• The United States

• Global Developments

• Food for Thought

Equities

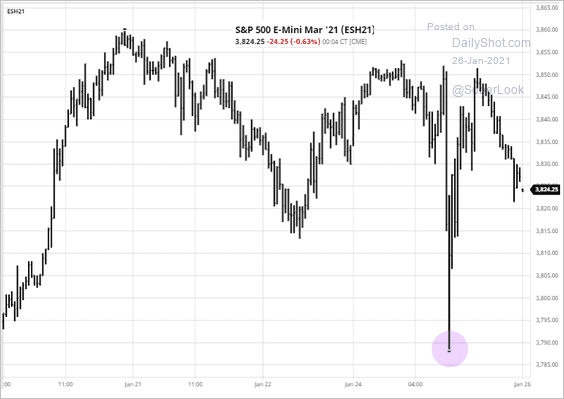

1. While US indices hit new records on Monday, there is some nervousness about the timing of Biden’s stimulus package. For now, traders are buying the dips.

Source: barchart.com

Source: barchart.com

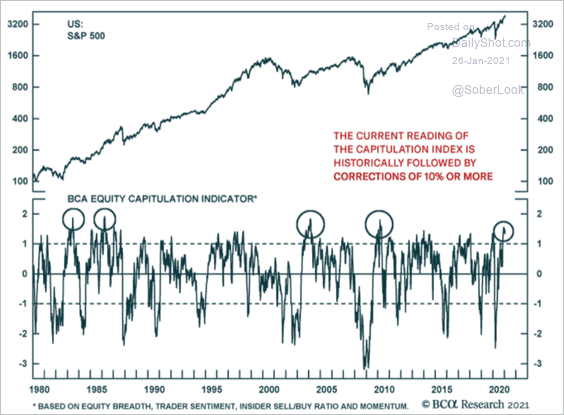

2. The BCA Capitulation Indicator points to a correction ahead.

Source: BCA Research

Source: BCA Research

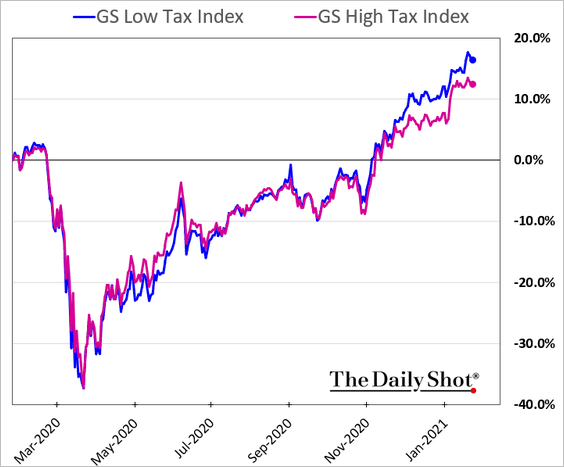

3. The market is starting to price in an increase in corporate taxes. Companies that typically pay higher taxes have underperformed since the elections.

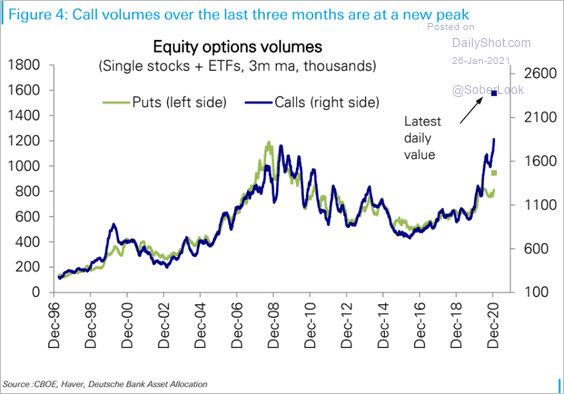

4. Call option trading hit extreme levels over the past year (driven by retail investors).

Source: Deutsche Bank Research

Source: Deutsche Bank Research

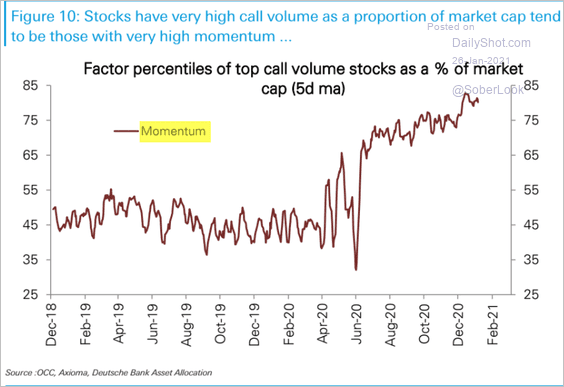

Which equity factors saw the greatest increases in call option activity?

• Momentum:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

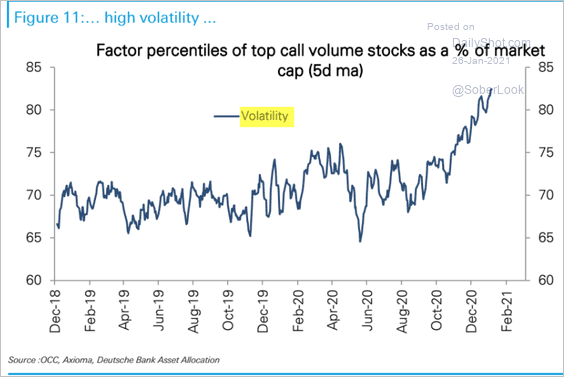

• High-vol:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

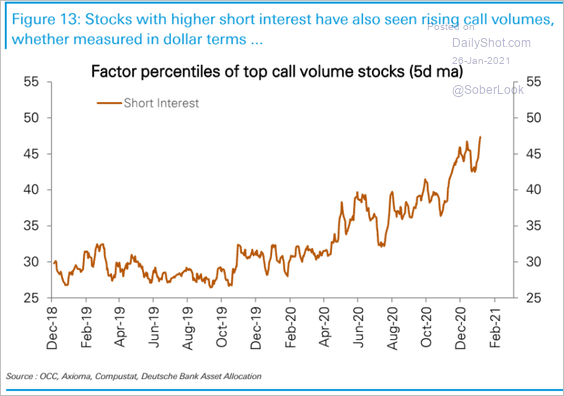

• Shares with the highest short interest:

Source: Deutsche Bank Research

Source: Deutsche Bank Research

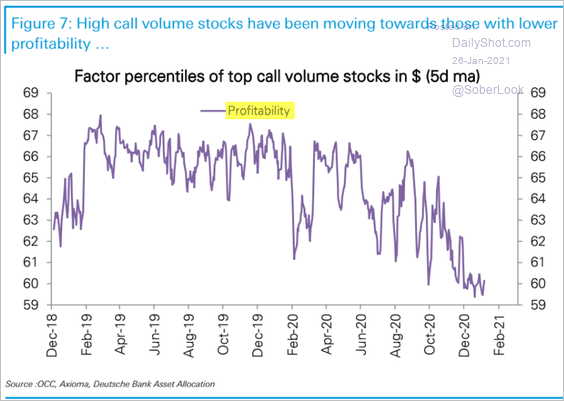

On the other hand, the factor that selects stocks based on profitability saw a decline in call option volume.

Source: Deutsche Bank Research

Source: Deutsche Bank Research

——————–

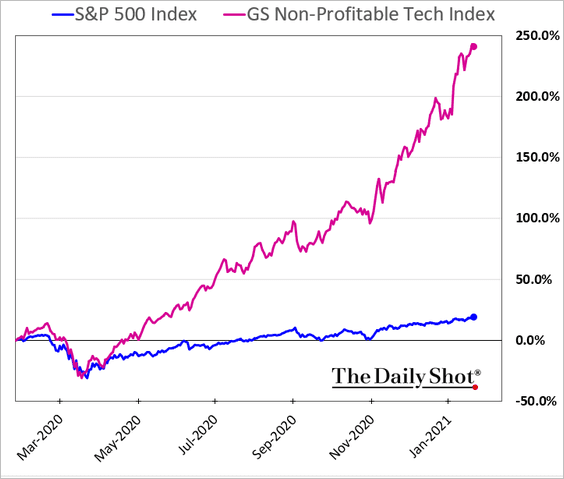

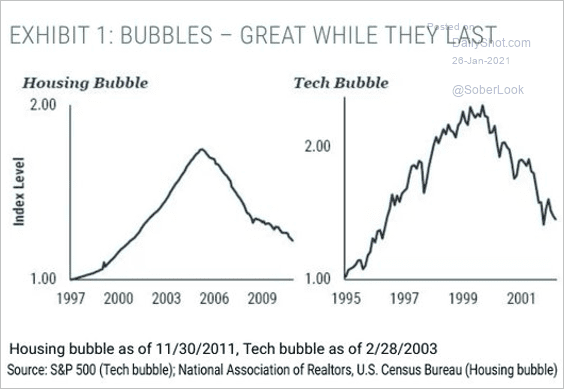

5. Related to the trend above, tech firms that are not profitable saw spectacular gains over the past year. There was a similar tech rally after the 1998 (Russia default) selloff, which didn’t end well.

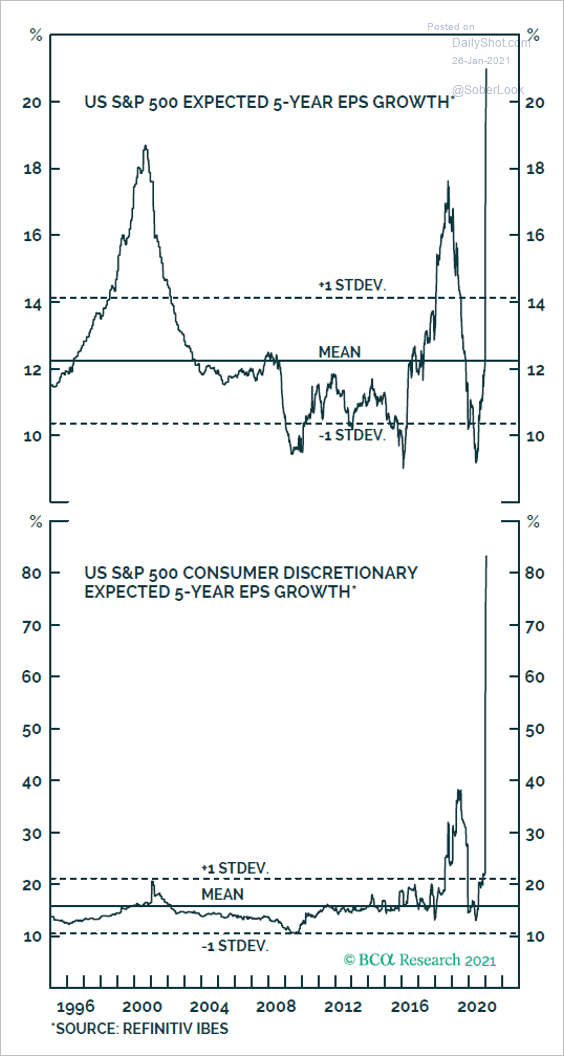

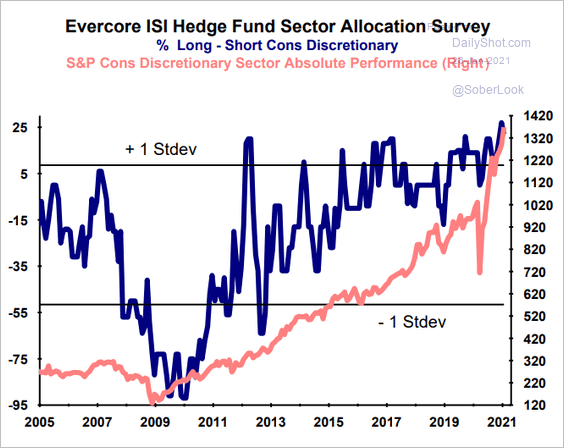

6. Tesla’s inclusion in the S&P 500 boosted the expected 5-year earnings growth, especially in the Consumer Discretionary sector.

Source: Anastasios Avgeriou, BCA Research Further reading

Source: Anastasios Avgeriou, BCA Research Further reading

According to Evercore ISI, funds’ exposure to this sector is now near the highs.

Source: Evercore ISI

Source: Evercore ISI

——————–

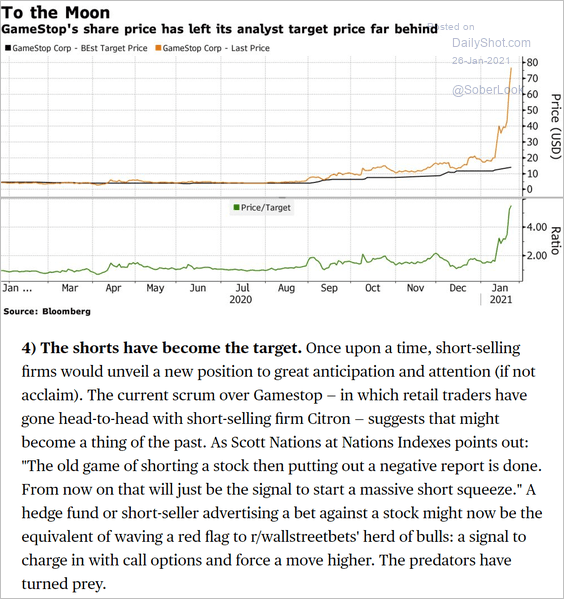

7. Encouraged by the Reddit group r/wallstreetbets (and other online discussion boards), retail traders caused a massive short-squeeze in GameStop shares. The practice of targeted short-selling appears to have been permanently altered.

Source: @tracyalloway, @business Read full article

Source: @tracyalloway, @business Read full article

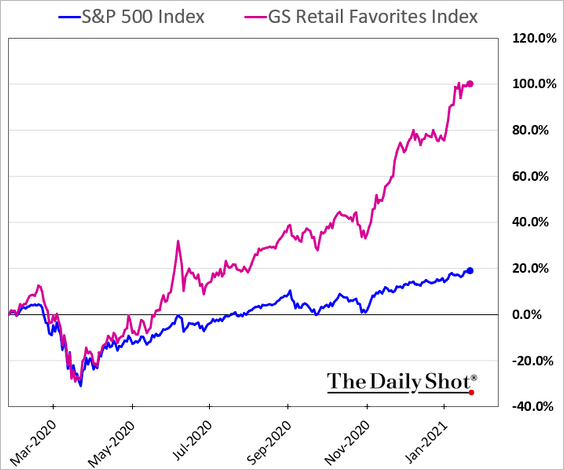

8. Goldman’s index that tracks stocks favored by retail investors is up more than 100% over the past year.

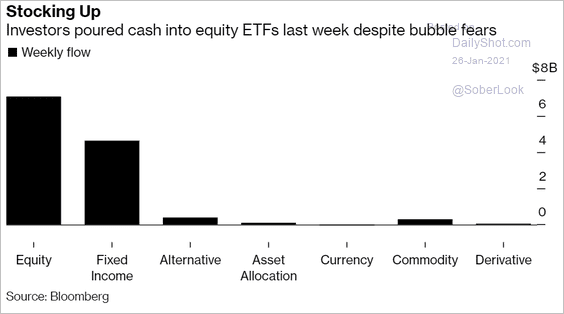

9. Flows into equity ETFs accelerated last week.

Source: @markets Read full article

Source: @markets Read full article

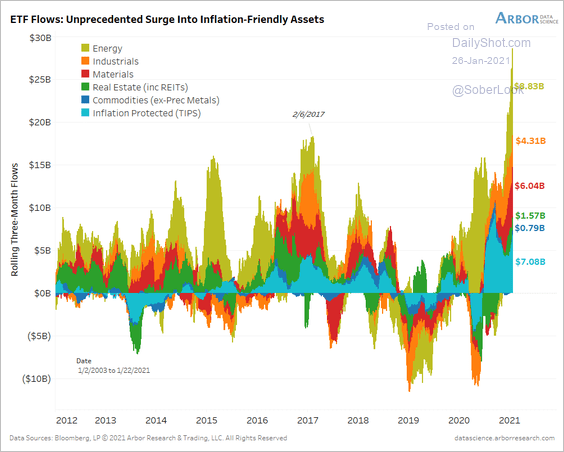

Inflation-friendly sectors have been experiencing unprecedented inflows.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

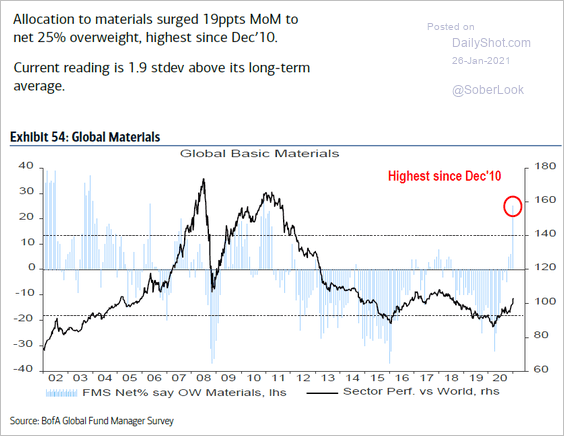

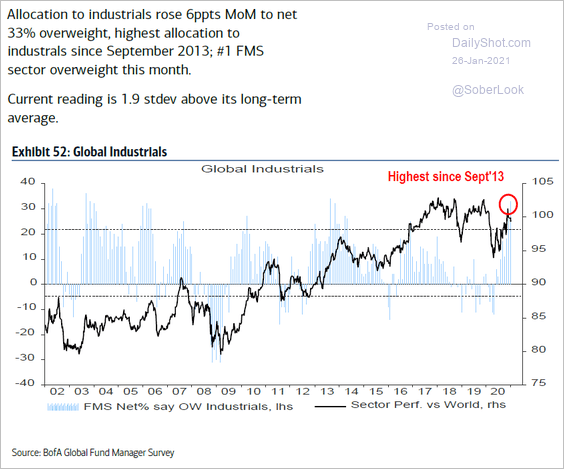

We can see the same trends in fund managers’ allocations.

• Materials:

Source: BofA Global Research

Source: BofA Global Research

• Industrials:

Source: BofA Global Research

Source: BofA Global Research

——————–

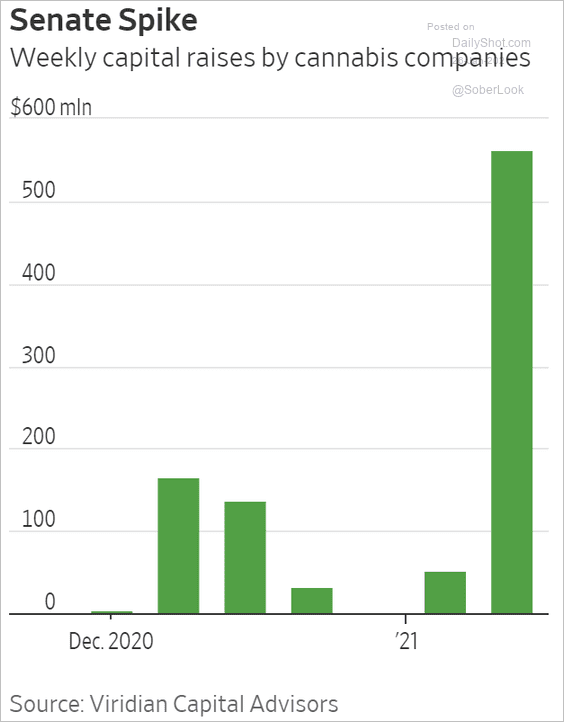

10. Finally, the cannabis market is “Up in Smoke” …

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: Paramount Pictures

Source: Paramount Pictures

Back to Index

Credit

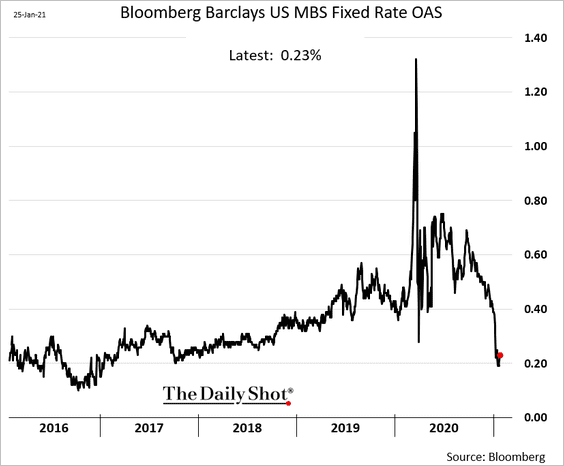

1. Supported by the Fed’s purchases, agency MBS debt continues to rally.

Source: @markets Read full article

Source: @markets Read full article

MBS spreads have tumbled going into the year-end, pushing mortgage rates lower.

——————–

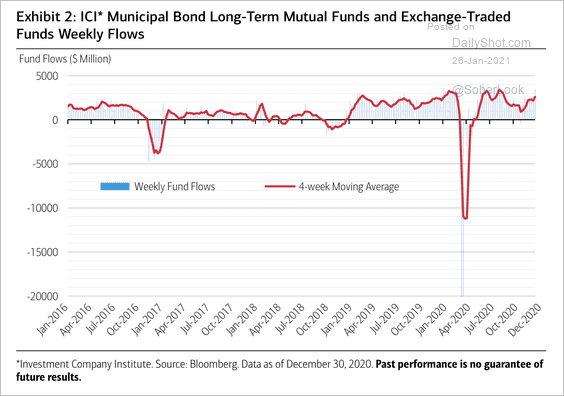

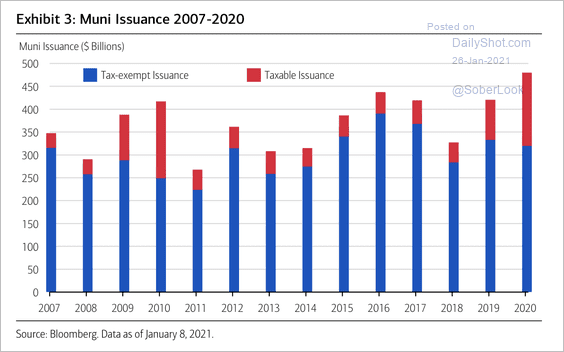

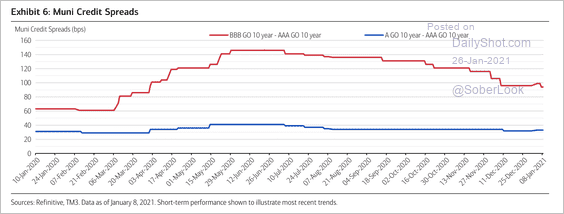

2. Here is an update on the US municipal bond market (from BofA).

• Demand for municipal bonds has been solid (except for severe outflows during March-April).

Source: BofA Global Research

Source: BofA Global Research

• Issuance increased last year, driven by a new supply of taxable munis.

Source: BofA Global Research

Source: BofA Global Research

• BBB-rated and A-rated muni credit spreads are approaching pre-pandemic levels.

Source: BofA Global Research

Source: BofA Global Research

——————–

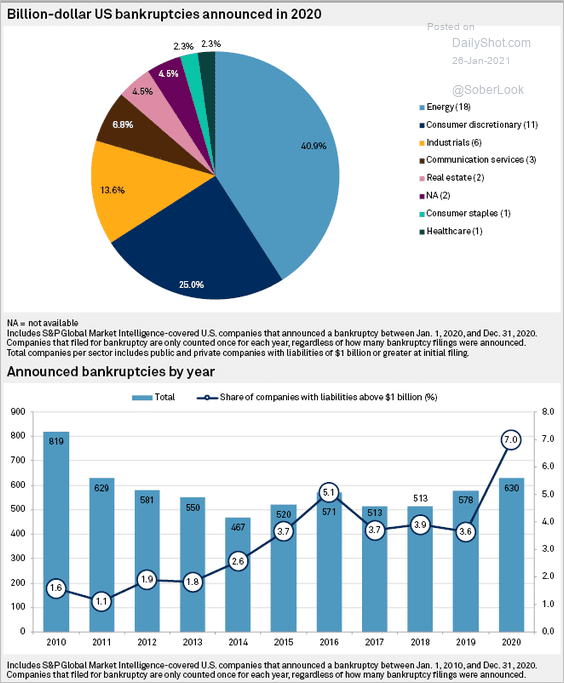

3. Below are some data on US large-company bankruptcies in 2020.

Source: S&P Global Market Intelligence

Source: S&P Global Market Intelligence

Back to Index

Rates

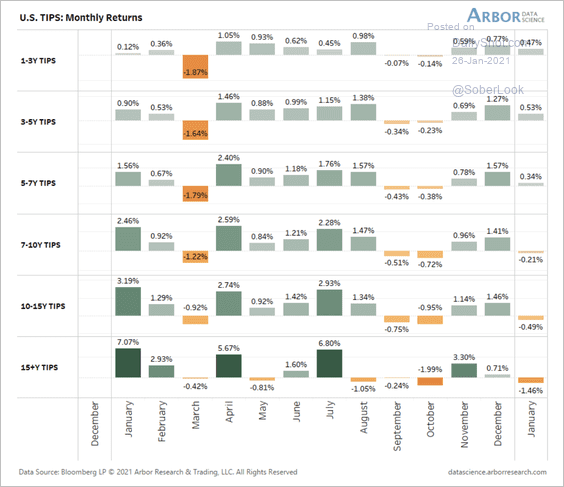

1. Long-end TIPS have been underperforming recently.

Source: Arbor Research & Trading Read full article

Source: Arbor Research & Trading Read full article

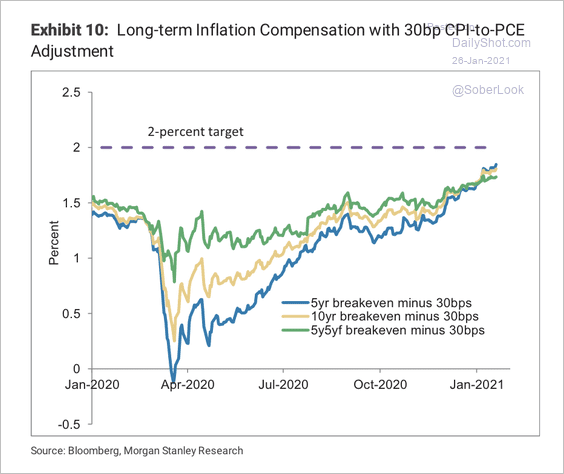

2. This chart shows long-term inflation expectations adjusted for the spread between CPI and PCE. (see Bullard’s use of this metric).

Source: Morgan Stanley Research

Source: Morgan Stanley Research

Back to Index

Commodities

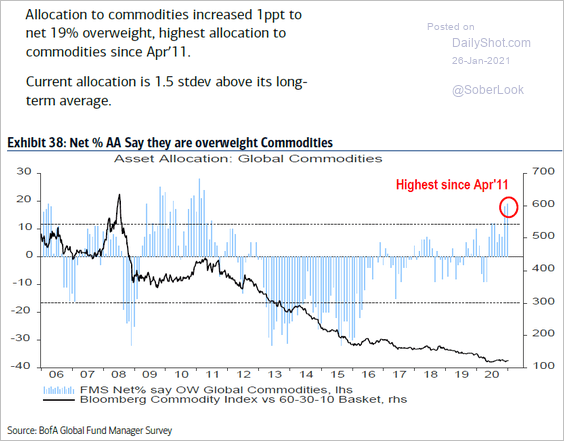

1. Fund managers have been boosting allocations to commodities.

Source: BofA Global Research

Source: BofA Global Research

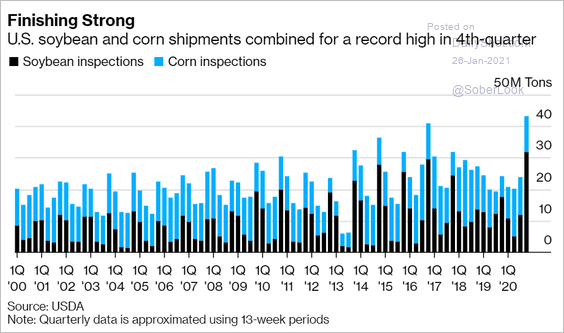

2. US soybean and corn shipments spiked last quarter.

Source: @markets Read full article

Source: @markets Read full article

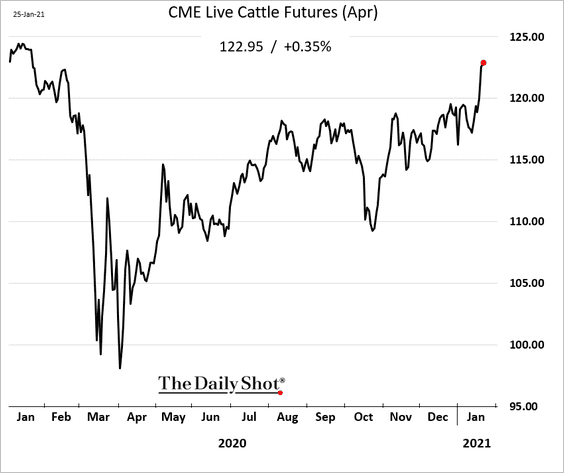

3. US cattle futures have been rallying.

Source: Successful Farming Read full article

Source: Successful Farming Read full article

Back to Index

Cryptocurrency

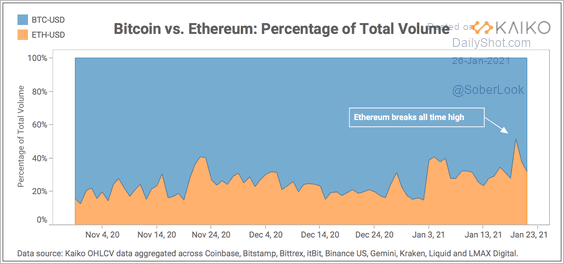

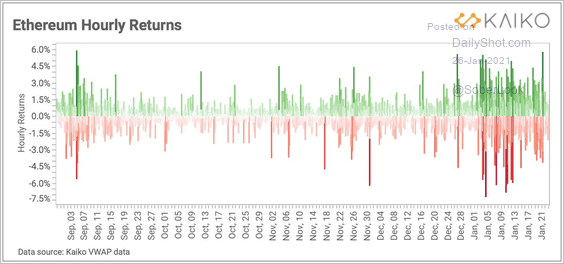

1. Ethereum’s (ETH) trading volume was briefly higher than Bitcoin over the past week.

Source: @KaikoData

Source: @KaikoData

ETH reached record highs last week while BTC was heading down.

Source: @KaikoData

Source: @KaikoData

——————–

2. There are over 120,000 Bitcoin option contracts (collectively worth $4 billion) set to expire on Friday. This could lead to significant volatility as January draws to a close.

Source: CoinDesk

Source: CoinDesk

Back to Index

China

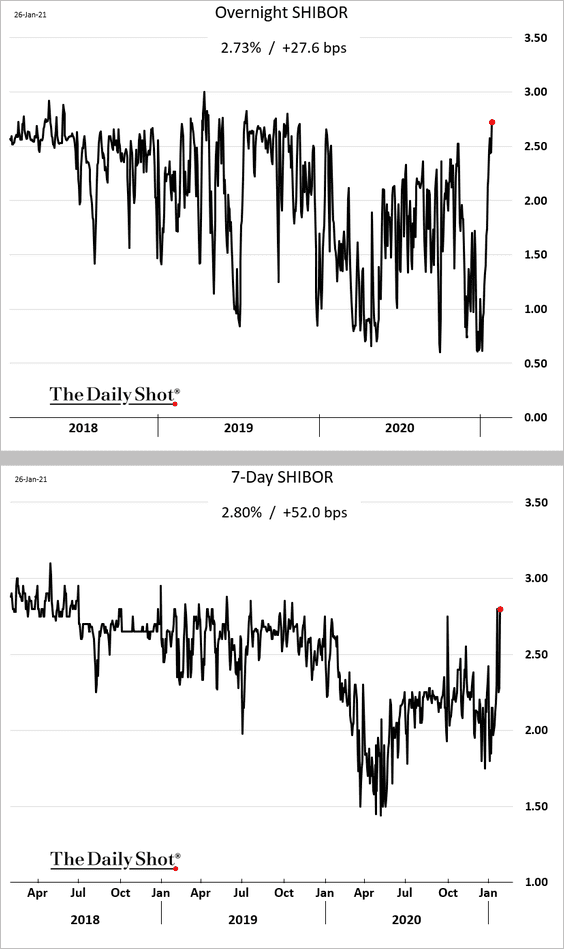

1. China’s short-term rates spiked as liquidity tightened.

Source: Reuters Read full article

Source: Reuters Read full article

——————–

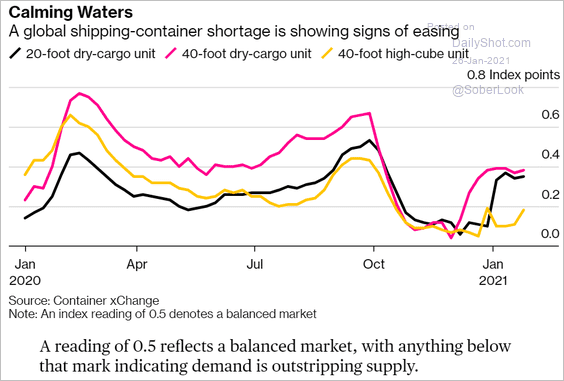

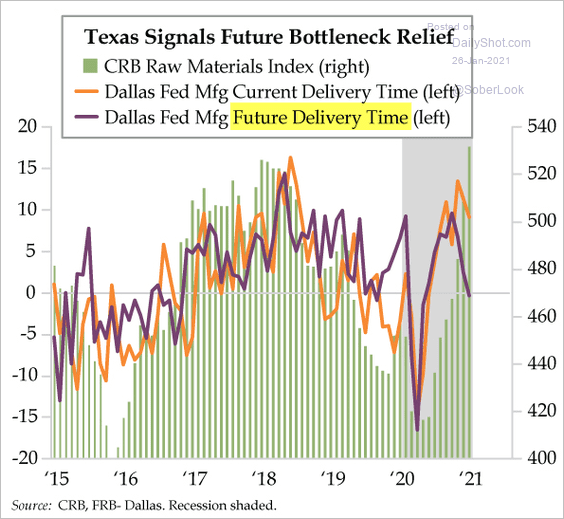

2. Shipping bottlenecks appear to be easing.

Source: @markets Read full article

Source: @markets Read full article

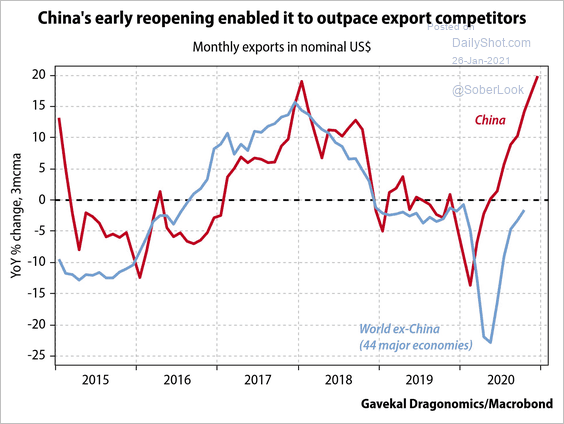

3. China’s economy benefitted from early reopening.

Source: Gavekal Research

Source: Gavekal Research

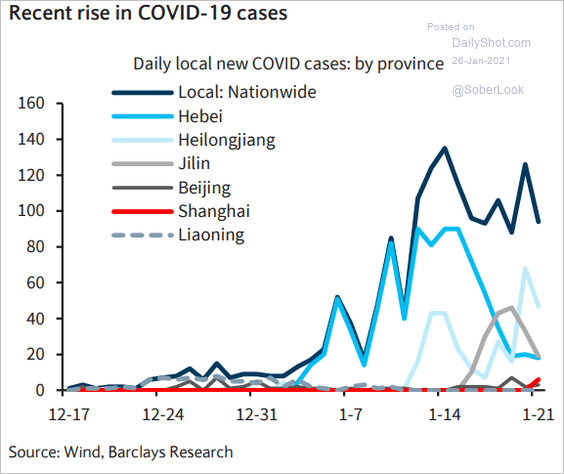

However, more COVID cases have been popping up in recent days.

Source: Barclays Research

Source: Barclays Research

——————–

4. Hong Kongers have been moving their deposits into other currencies.

Source: @business Read full article

Source: @business Read full article

Back to Index

Asia – Pacific

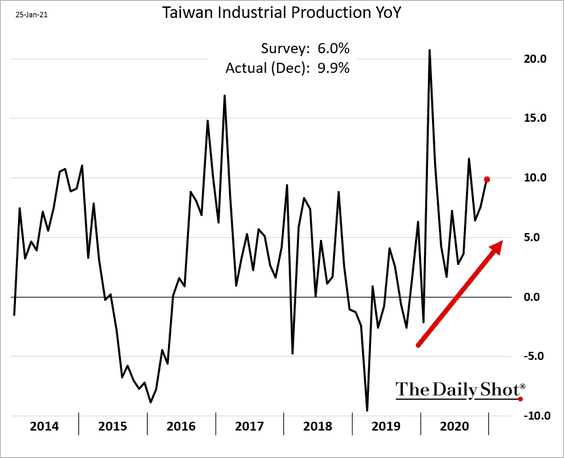

1. Taiwan’s industrial production is up 10% from a year ago.

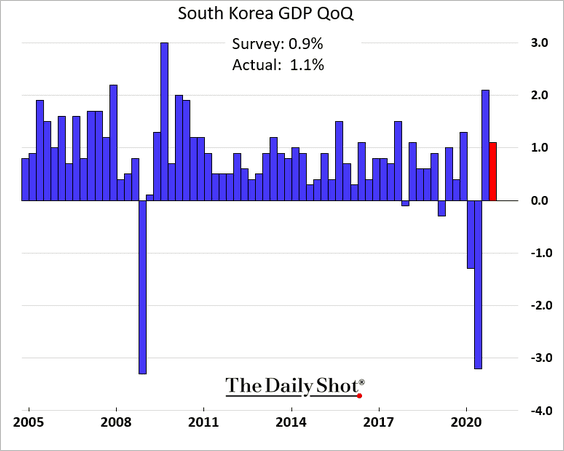

2. South Korea’s Q4 GDP growth was a bit firmer than expected.

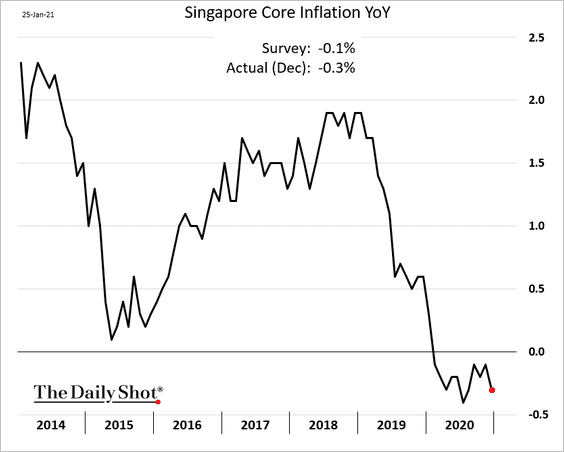

3. Singapore remains in deflation.

Back to Index

The Eurozone

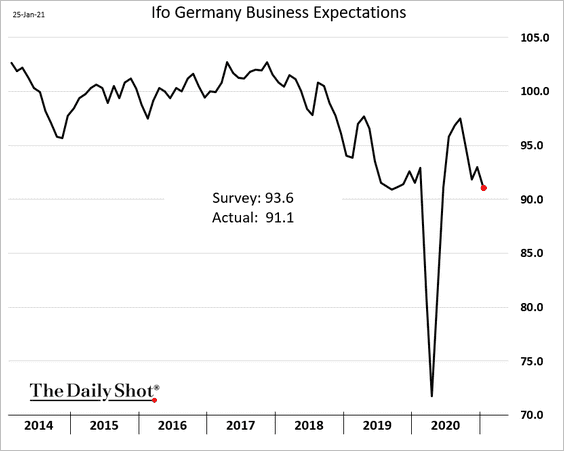

1. Germany’s Ifo business expectations indicator deteriorated further this month.

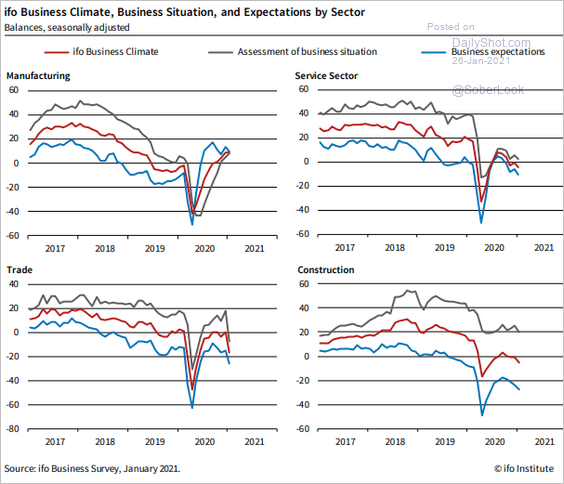

Here are the Ifo trends by sector.

Source: ifo Institute

Source: ifo Institute

——————–

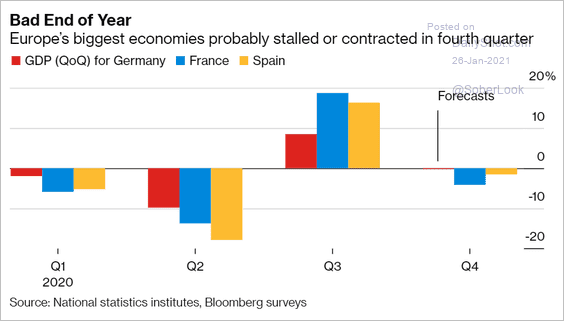

2. The Eurozone is looking at a double-dip recession.

Source: @markets Read full article

Source: @markets Read full article

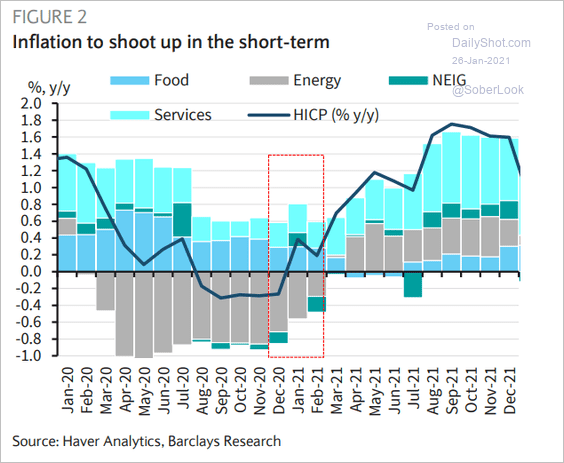

3. Here is the CPI forecast for this year from Barclays Research.

Source: Barclays Research

Source: Barclays Research

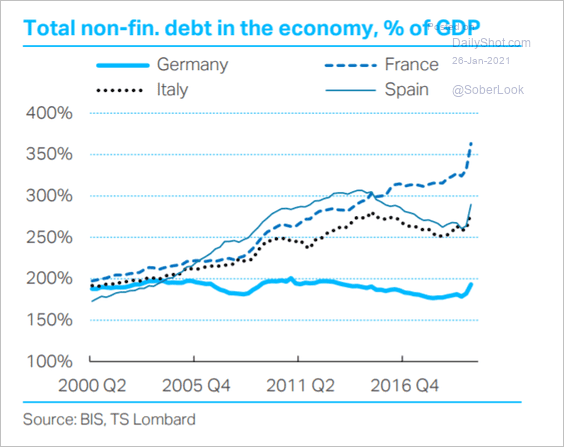

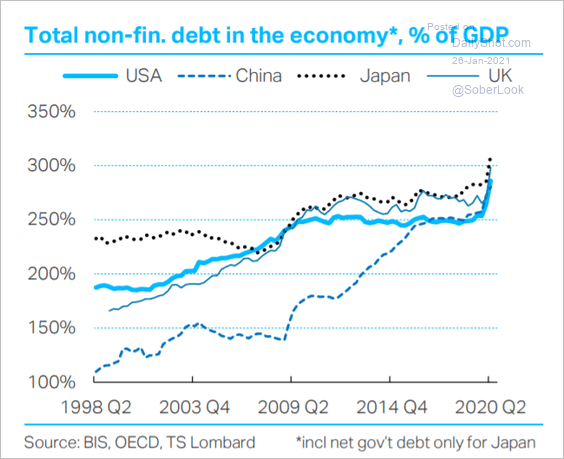

4. Nonfinancial debt spiked last year.

Source: TS Lombard

Source: TS Lombard

Back to Index

Europe

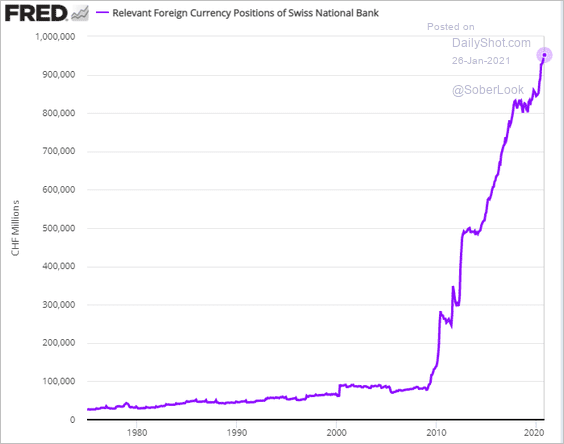

1. The rise in Swiss F/X reserves over the past decade has been unprecedented. The SNB continues to buy foreign currency (mostly euros) to keep the Swiss franc from appreciating too much.

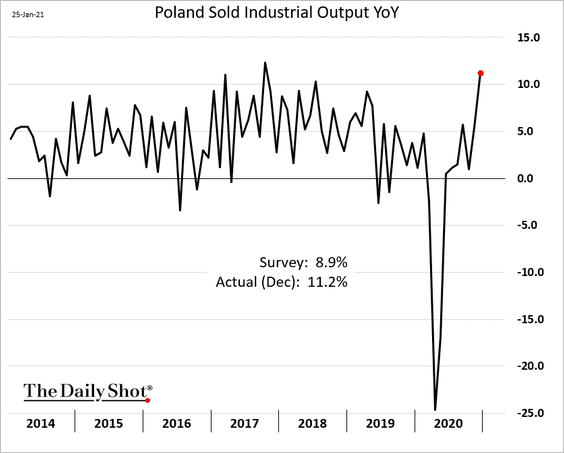

2. Poland’s industrial output accelerated last month.

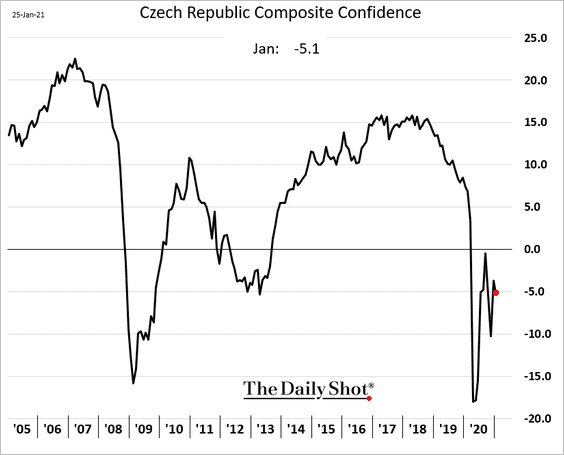

3. Sentiment in the Czech Republic remains depressed, with weakness driven by households.

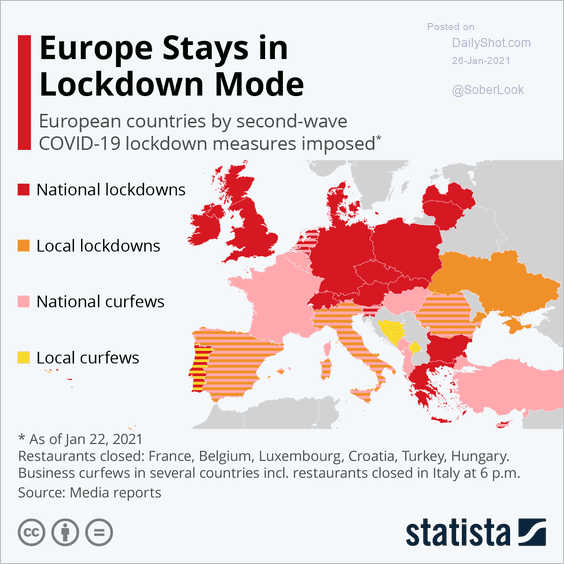

4. Much of Europe is still in lockdown mode.

Source: Statista

Source: Statista

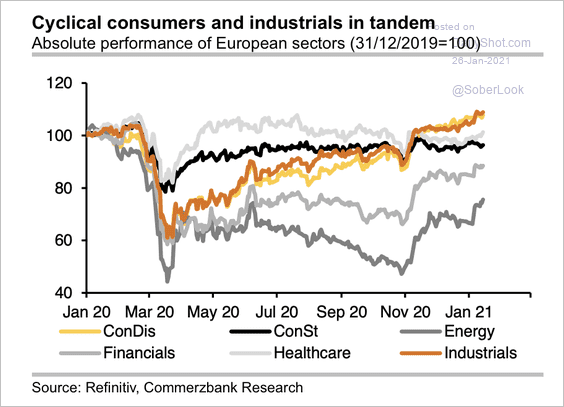

5. European consumer discretionary and industrial stocks have outperformed over the past few months.

Source: Commerzbank Research

Source: Commerzbank Research

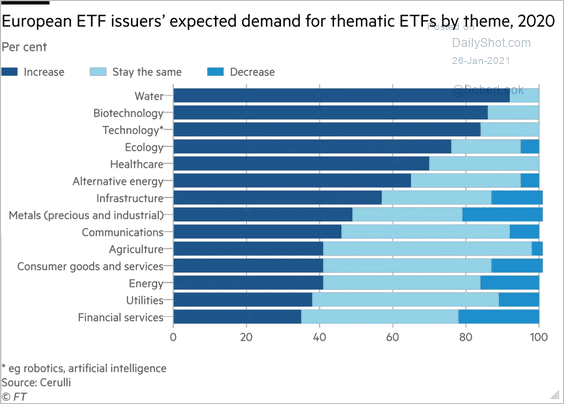

6. Water is expected to see the highest demand among thematic ETF sectors.

Source: @financialtimes Read full article

Source: @financialtimes Read full article

——————–

Back to Index

The United States

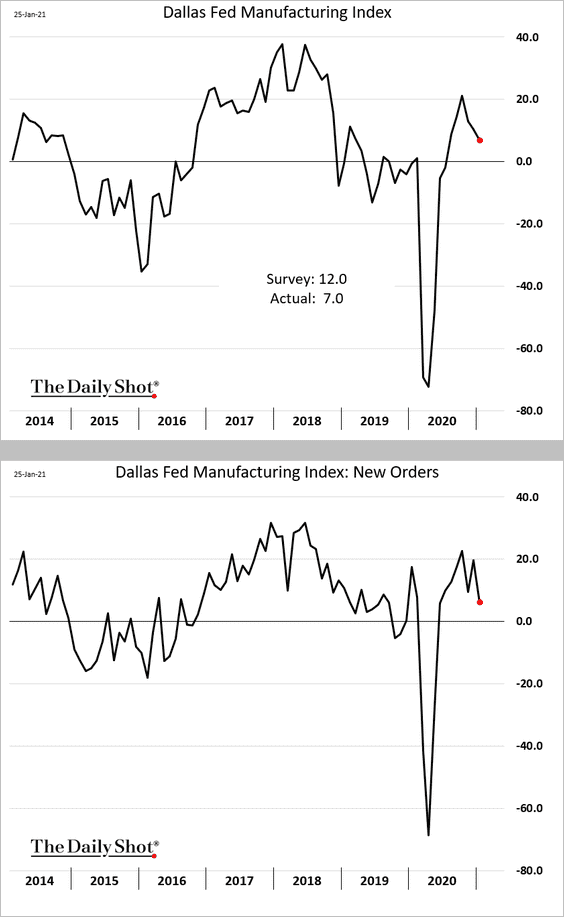

1. The regional manufacturing report from the Dallas Fed showed some loss in factory momentum this month.

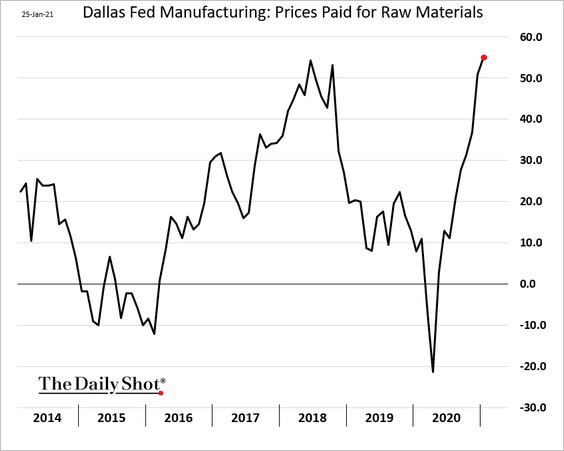

Input price increases have accelerated.

However, logistics bottlenecks appear to be easing (see a similar trend in China).

Source: The Daily Feather

Source: The Daily Feather

——————–

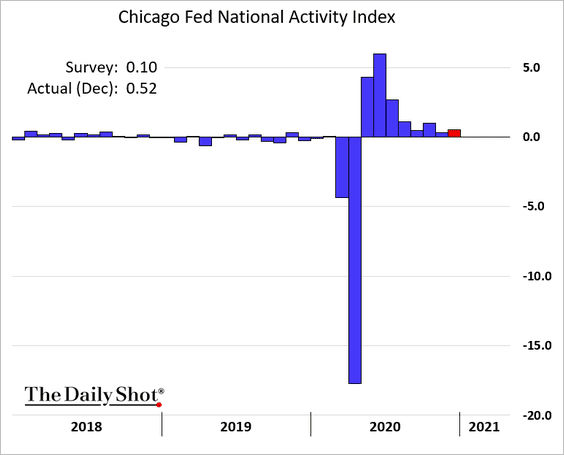

2. The Chicago Fed’s December national activity index was firmer than expected.

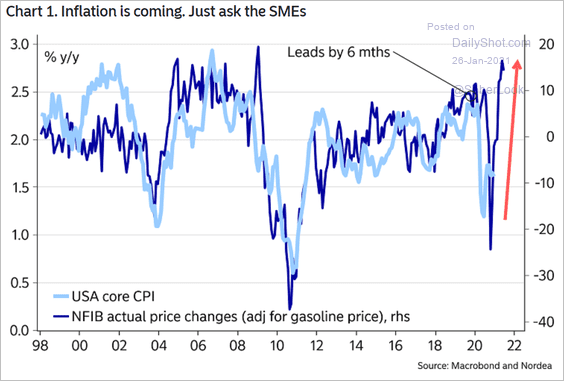

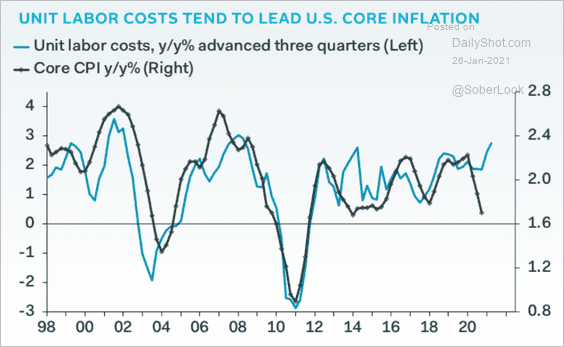

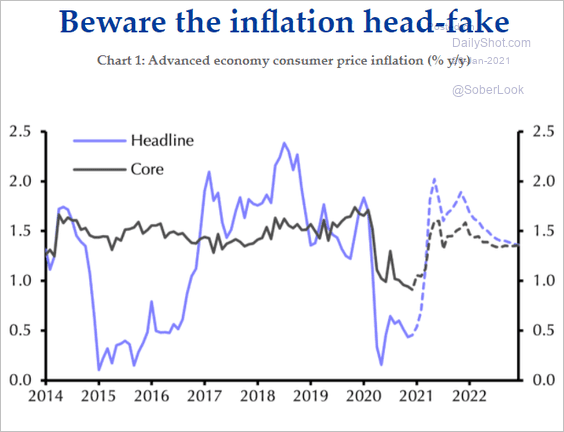

3. Inflation will rise in the near-term.

• The core CPI vs. small business price changes:

Source: Nordea Markets

Source: Nordea Markets

• The core CPI vs. unit labor costs:

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

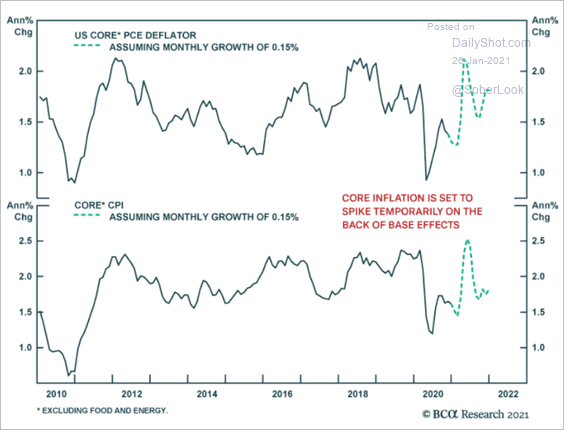

But many economists don’t expect higher inflation to persist (2 charts).

Source: BCA Research

Source: BCA Research

Source: Capital Economics

Source: Capital Economics

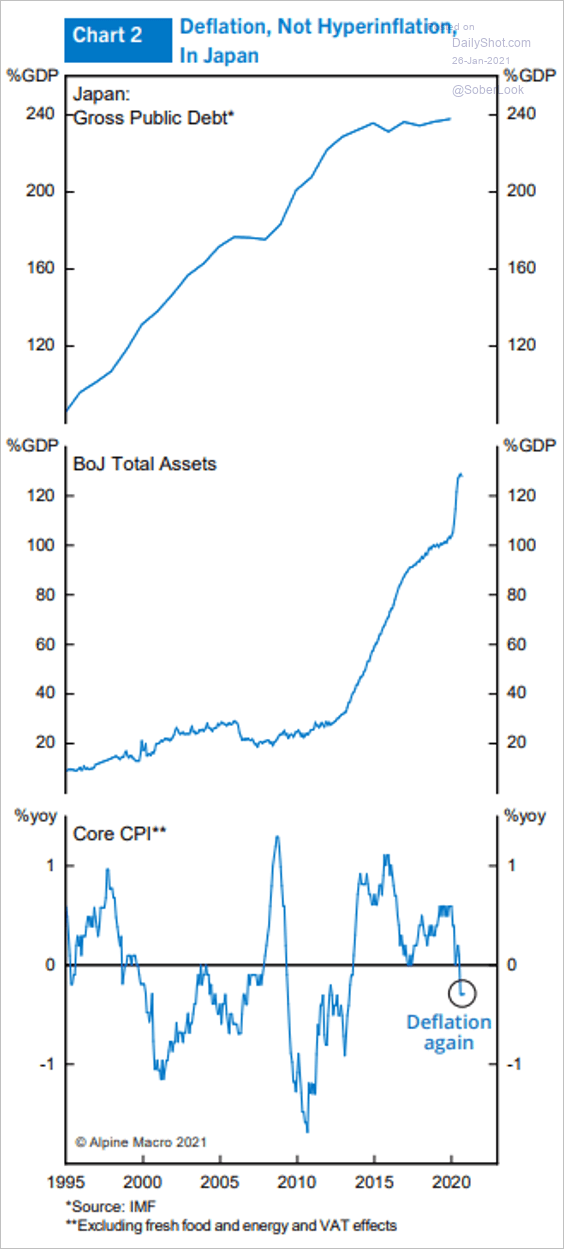

As the Japan experience shows, sharp increases in central banks’ securities purchases and fiscal stimulus don’t necessarily translate into higher inflation.

Source: Alpine Macro

Source: Alpine Macro

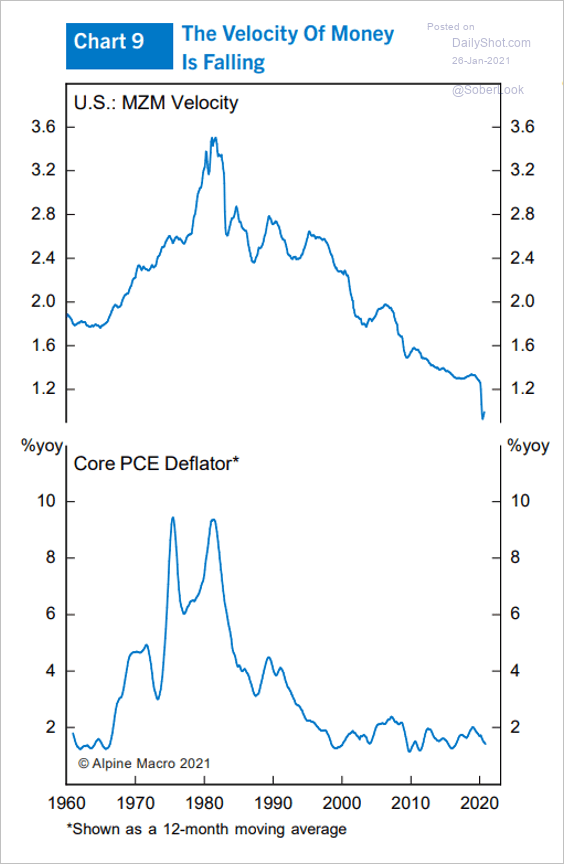

Moreover, the US velocity of money has been soft, which tends to indicate weaker inflation.

Source: Alpine Macro

Source: Alpine Macro

——————–

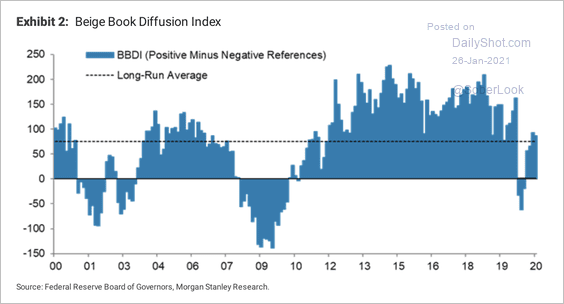

4. The spread between positive and negative references in the Fed’s Beige Book returned to its long-run average.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

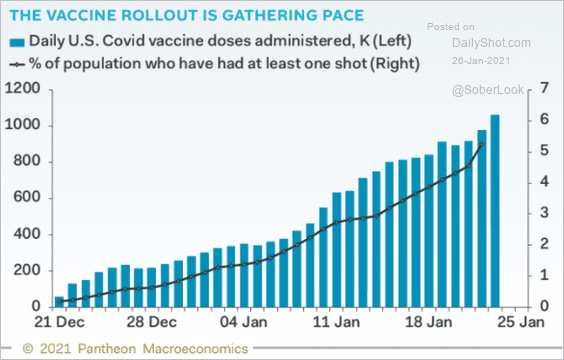

5. The pace of vaccinations continues to climb.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

Back to Index

Global Developments

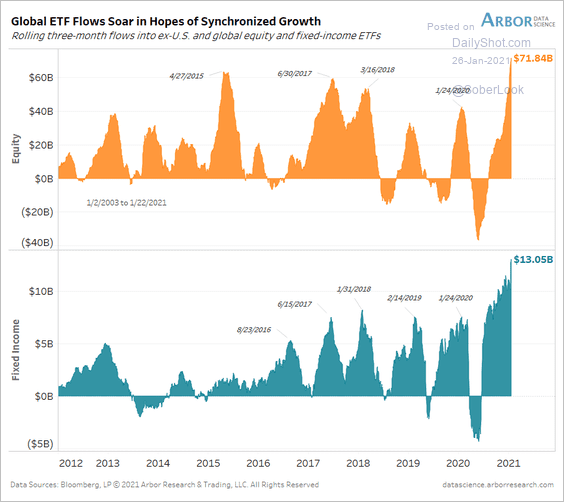

1. Outside of the US, flows into stock and bond ETFs have accelerated.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

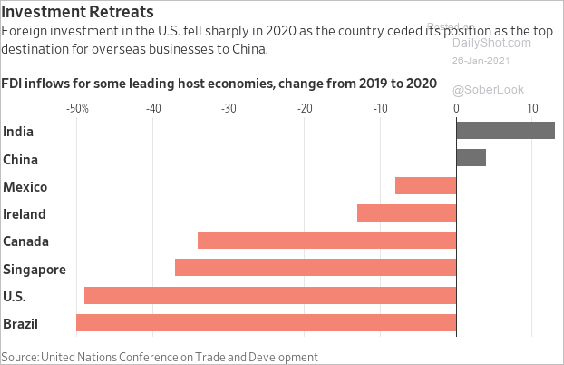

2. This chart shows last year’s foreign direct investment changes by country.

Source: @WSJ Read full article

Source: @WSJ Read full article

3. Nonfinancial debt (% of GDP) hit record highs in 2020.

Source: TS Lombard

Source: TS Lombard

——————–

Food for Thought

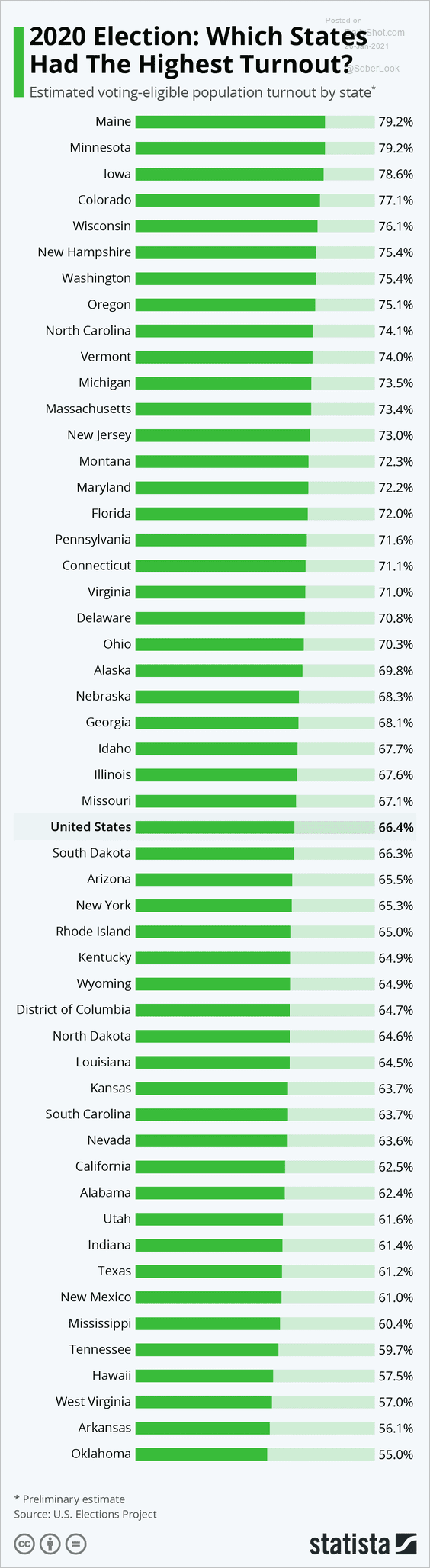

1. US voter turnout by state:

Source: Statista

Source: Statista

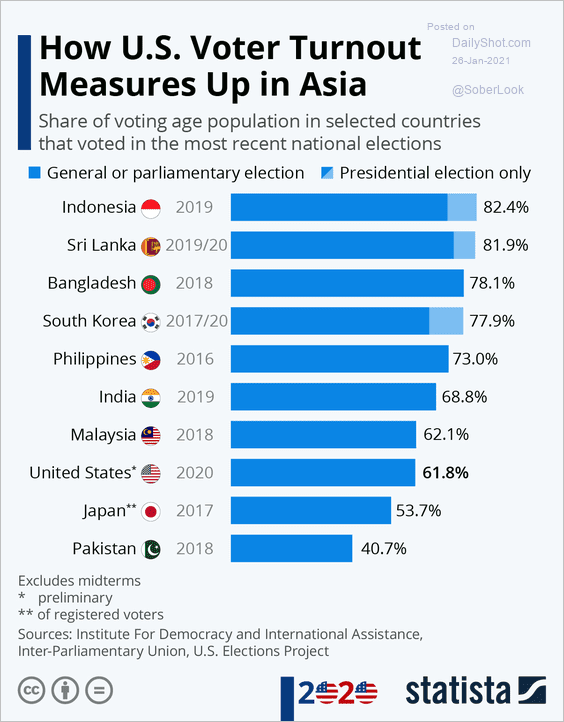

2. Voter turnout in Asia:

Source: Statista

Source: Statista

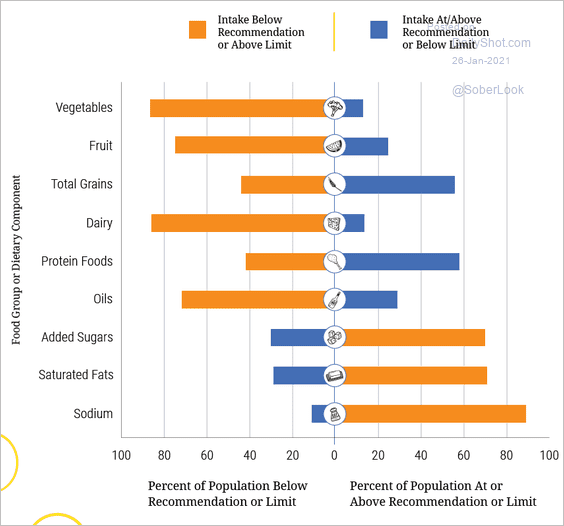

3. US dietary intakes compared to recommendations:

Source: Office of Disease Prevention and Health Promotion

Source: Office of Disease Prevention and Health Promotion

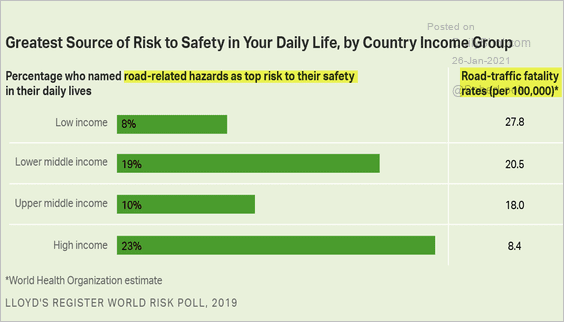

4. Road-related hazards:

Source: Gallup Read full article

Source: Gallup Read full article

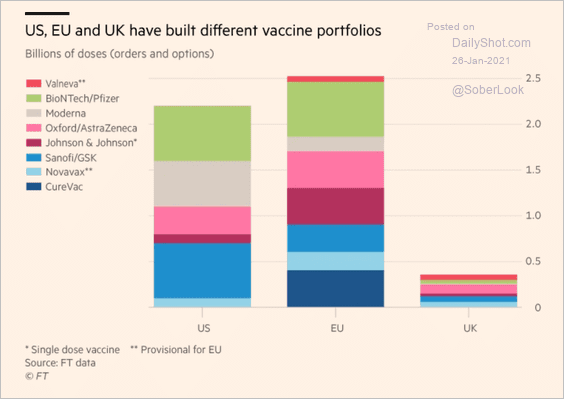

5. Vaccine portfolios:

Source: @financialtimes Read full article

Source: @financialtimes Read full article

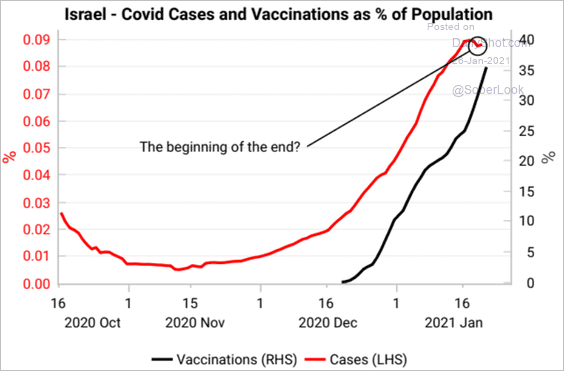

6. Israel’s COVID cases and vaccinations:

Source: Variant Perception

Source: Variant Perception

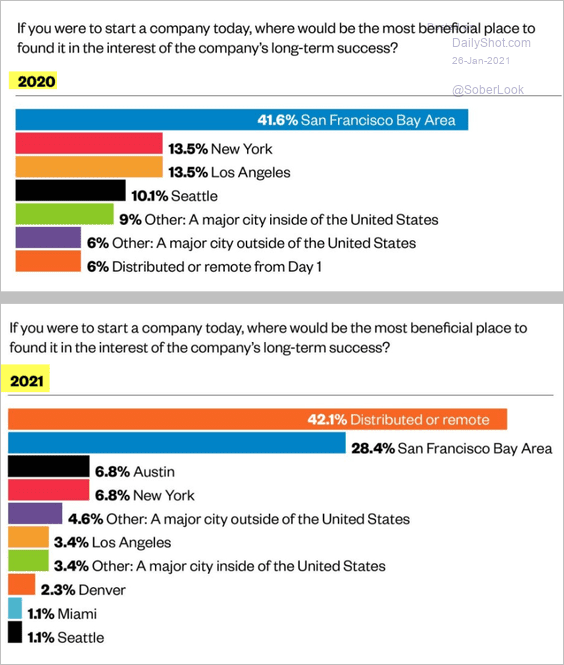

7. The most beneficial place to start a company:

Source: @Initialized Read full article

Source: @Initialized Read full article

8. Asset bubbles:

Source: @jessefelder Read full article

Source: @jessefelder Read full article

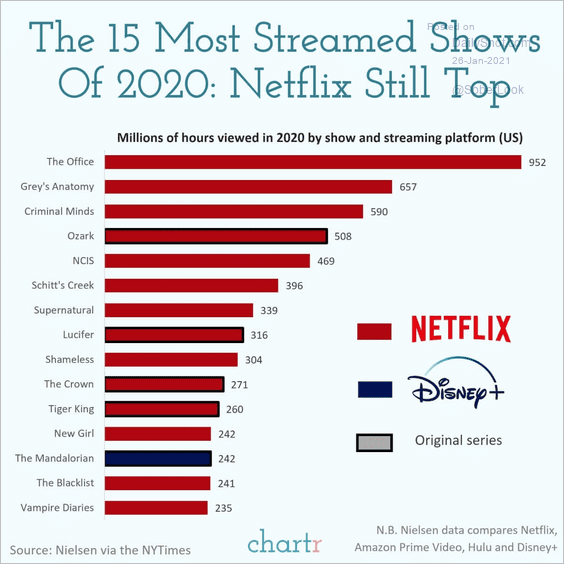

9. The most-streamed TV shows:

Source: @chartrdaily

Source: @chartrdaily

——————–

Back to Index