The Daily Shot: 12-Feb-21

• Equities

• Credit

• Rates

• Commodities

• Cryptocurrency

• Emerging Markets

• The Eurozone

• The United Kingdom

• The United States

• Global Developments

• Food for Thought

Equities

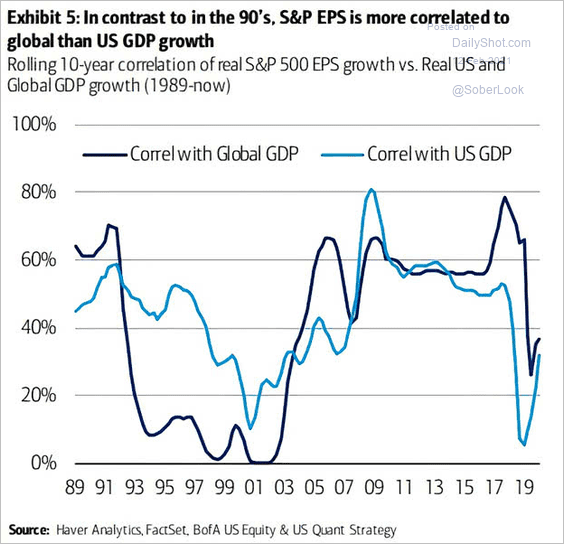

1. S&P 500 earnings have been more correlated with global rather than US GDP.

Source: @ISABELNET_SA, @BofAML

Source: @ISABELNET_SA, @BofAML

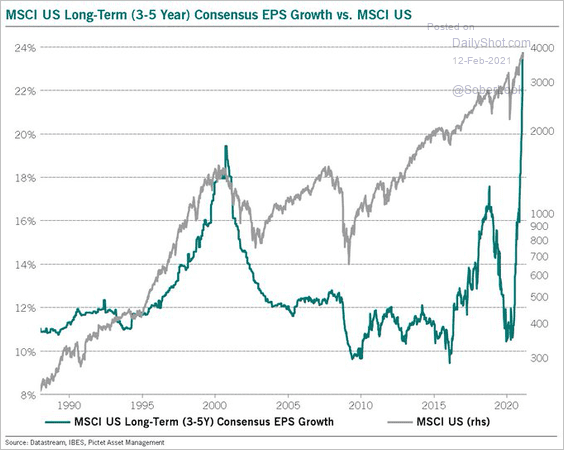

2. Longer-term estimates of US earnings per share (based on the MSCI US Index) have seen an unprecedented spike.

Source: @BittelJulien

Source: @BittelJulien

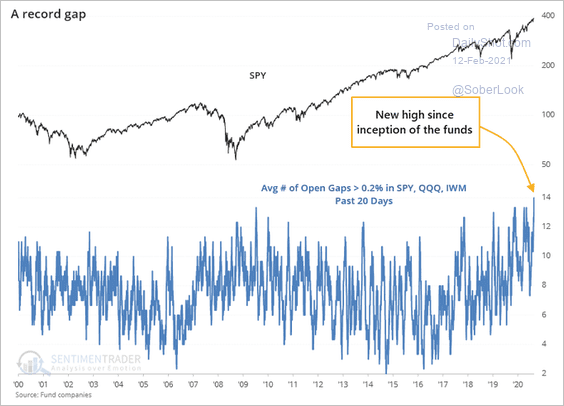

3. The most liquid US ETFs (SPY, QQQ, and IWM) have been gapping up at the open more frequently than ever before.

Source: @sentimentrader

Source: @sentimentrader

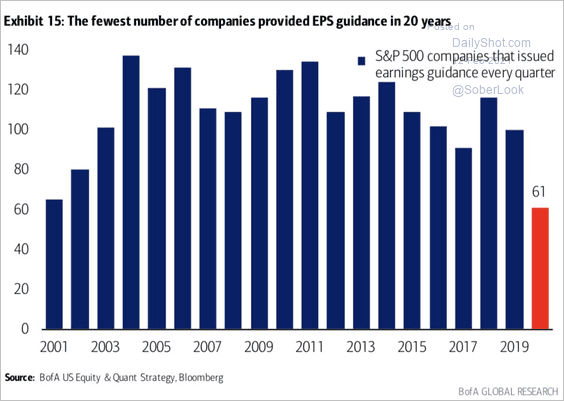

4. The number of companies providing earnings guidance has been the smallest in 20 years.

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

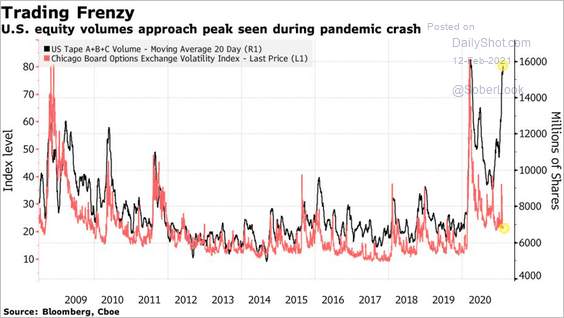

5. Boosted by the retail trading frenzy, the total US trading volume is nearing its pandemic peak.

Source: @markets Read full article

Source: @markets Read full article

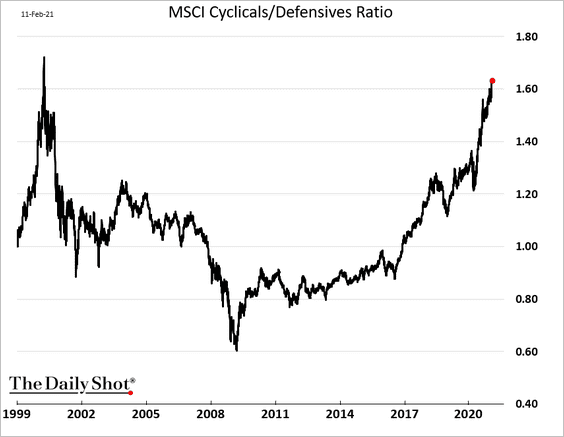

6. The cyclical/defensive sector ratio is approaching the dot-com-bubble high.

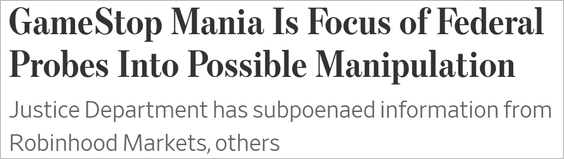

7. Regulators are now all over the Reddit “pump & dump” activity.

Source: @WSJ Read full article

Source: @WSJ Read full article

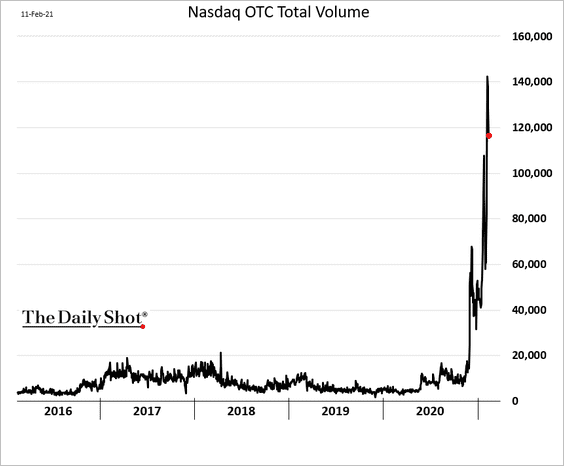

8. The Nasdaq OTC trading volume spiked in recent weeks. These are the riskiest companies because they do not meet the minimum listing standards (many have been delisted).

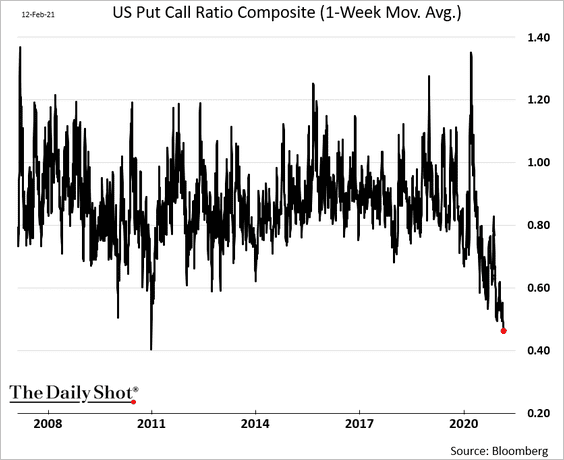

9. The put-call ratio continues to hit multi-year lows.

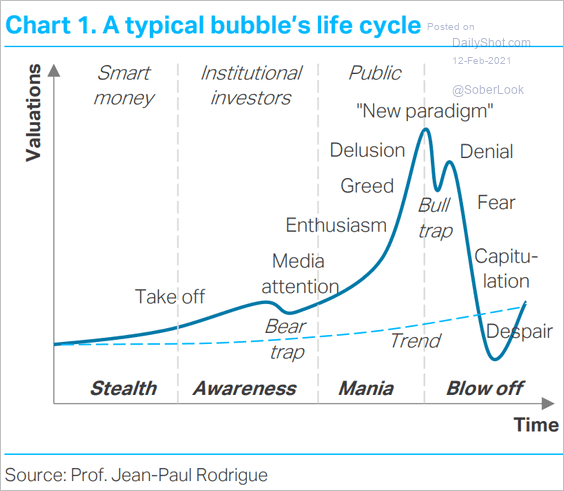

10. Here is an illustration of a market bubble’s life cycle.

Source: TS Lombard

Source: TS Lombard

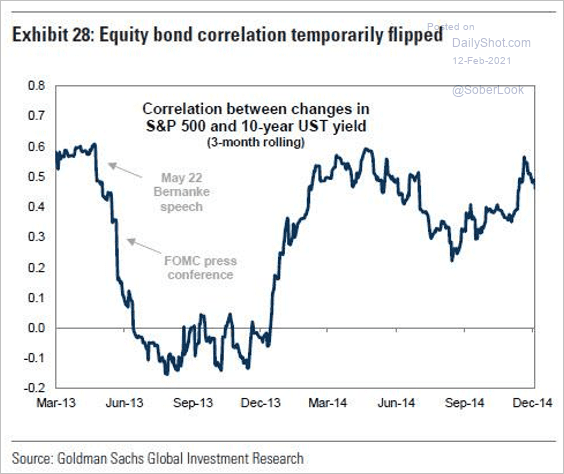

11. During the 2013 taper-tantrum, the S&P 500 – 10yr Treasury yield correlation became negative (an indicator worth monitoring).

Source: Goldman Sachs

Source: Goldman Sachs

Back to Index

Credit

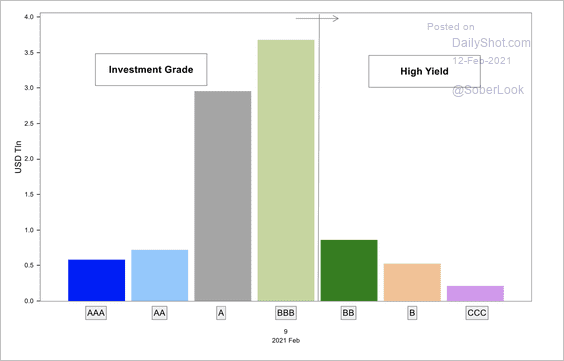

1. This chart shows the US corporate bond market cap by rating.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

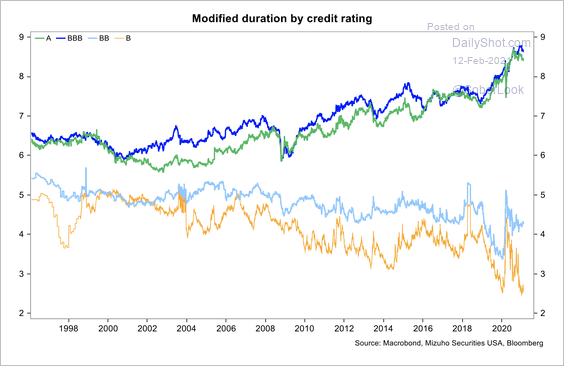

And here is the US high-yield and investment-grade duration over time.

Source: Mizuho Securities USA

Source: Mizuho Securities USA

——————–

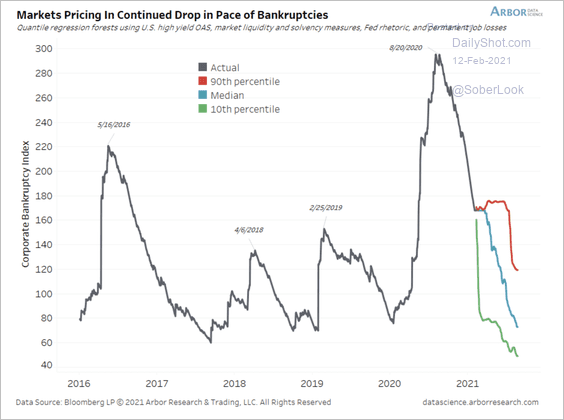

2. The market is pricing in less bankruptcy risk ahead.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

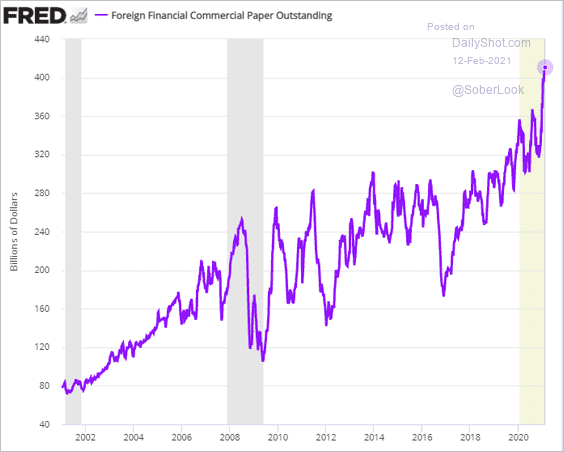

3. Foreign banks have been tapping the US commercial paper market. Unlike their US counterparts, foreign banks typically don’t have access to US dollar deposits. Given the massive spike in money-market fund AUM last year, there is plenty of demand for short-term paper.

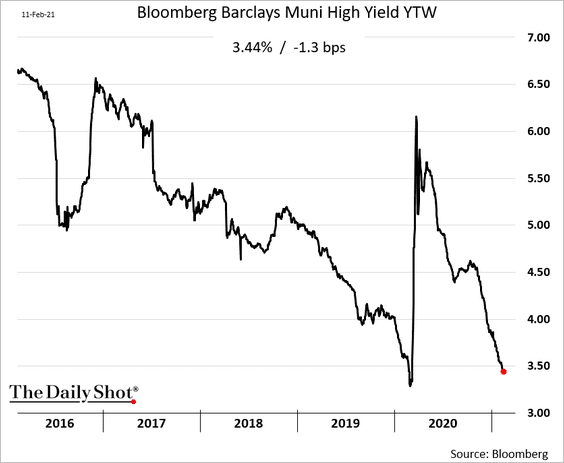

4. Yields on junk US muni bonds are nearing pre-COVID lows.

Back to Index

Rates

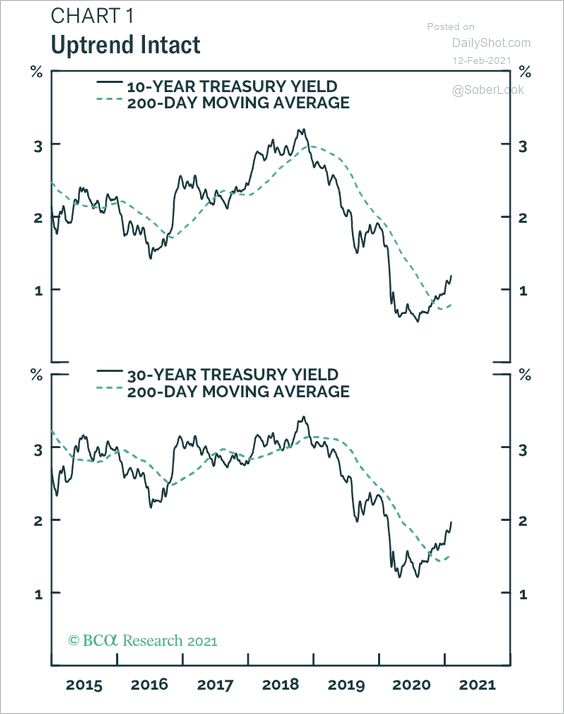

1. Both the 10-year and 30-year Treasury yields remain above their 200-day moving average.

Source: BCA Research

Source: BCA Research

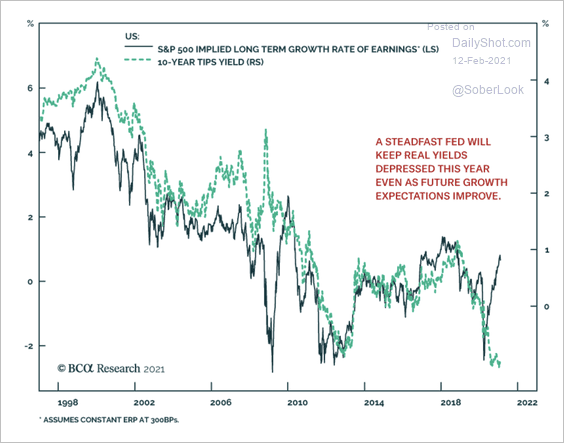

2. The 10-year TIPS yield has diverged from the implied S&P 500 long-term earnings growth rate.

Source: BCA Research

Source: BCA Research

Back to Index

Commodities

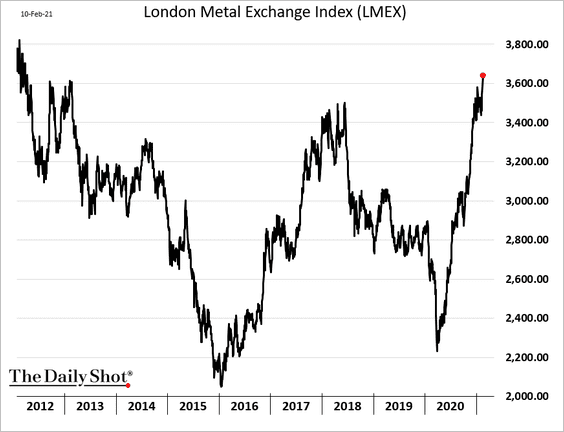

1. The LME industrial metals index is at the highest level since 2012.

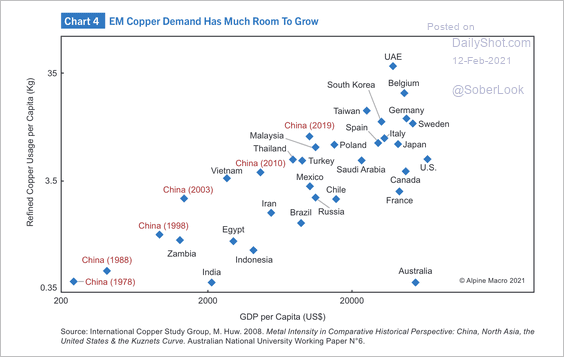

2. Copper usage in emerging markets has further room to grow.

Source: Alpine Macro

Source: Alpine Macro

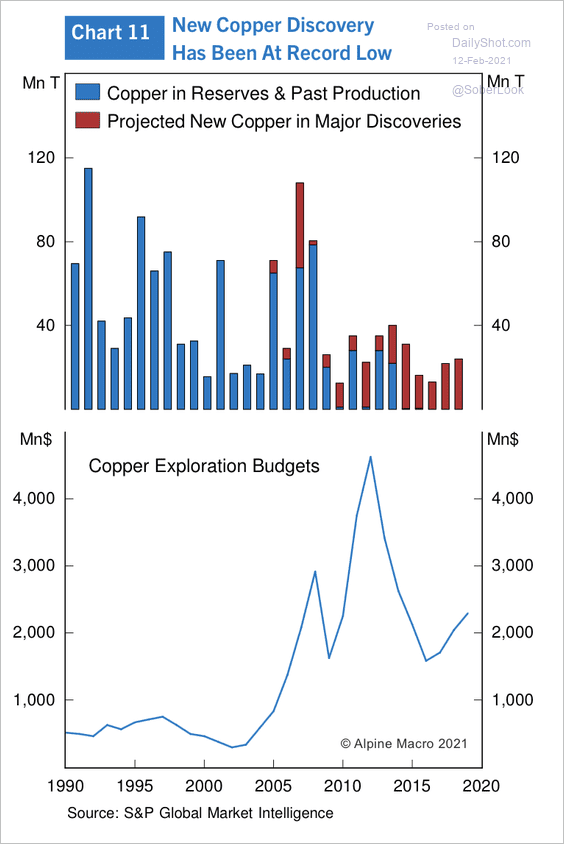

• New copper discoveries have dwindled.

Source: Alpine Macro

Source: Alpine Macro

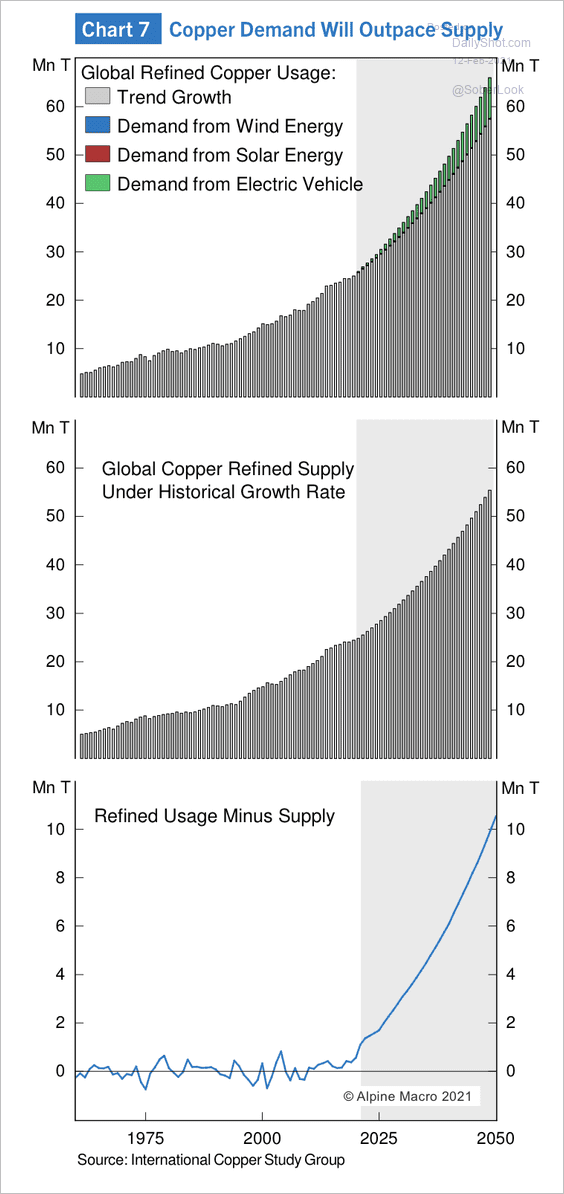

• Alpine Macro expects copper demand to triple in the next 30-years, far outpacing supply.

Source: Alpine Macro

Source: Alpine Macro

Back to Index

Cryptocurrency

1. Crypto investors continue to enjoy a streak of positive news.

Source: @WSJ Read full article

Source: @WSJ Read full article

Source: The Hill Read full article

Source: The Hill Read full article

Bitcoin is pushing toward $50k.

——————–

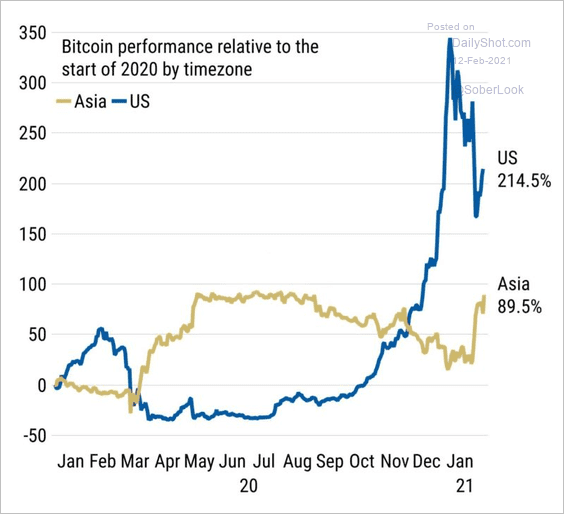

2. Much of the rally in Bitcoin has taken place during US hours. However, the Asia contribution has picked up recently.

Source: Morgan Stanley Research; Octavian Adrian Tanase

Source: Morgan Stanley Research; Octavian Adrian Tanase

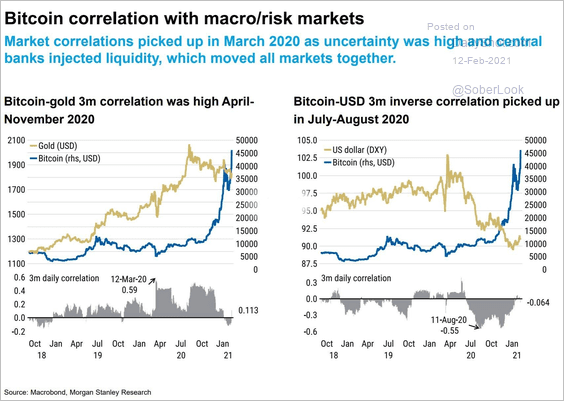

3. These charts show Bitcoin’s correlation with gold and the US dollar.

Source: Morgan Stanley Research; Octavian Adrian Tanase

Source: Morgan Stanley Research; Octavian Adrian Tanase

Back to Index

Emerging Markets

1. Let’s begin with Mexico.

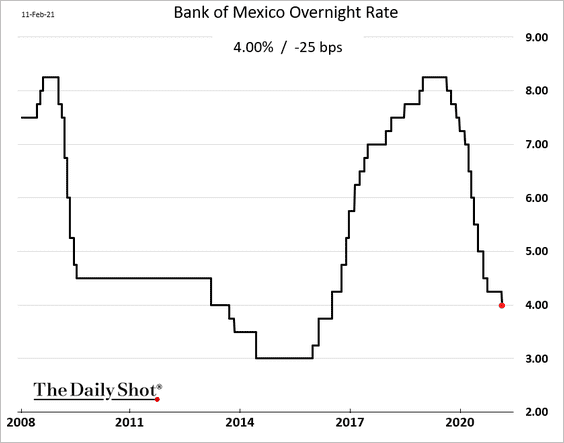

• Banxico cut rates as expected, …

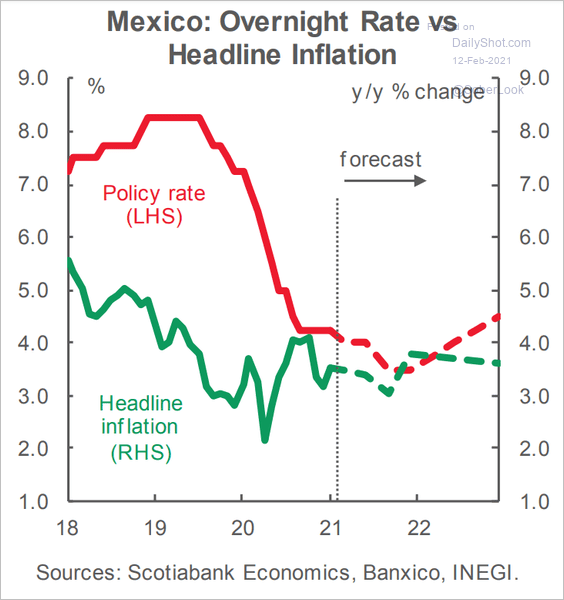

… and more easing is on the way this year (red line).

Source: Scotiabank Economics

Source: Scotiabank Economics

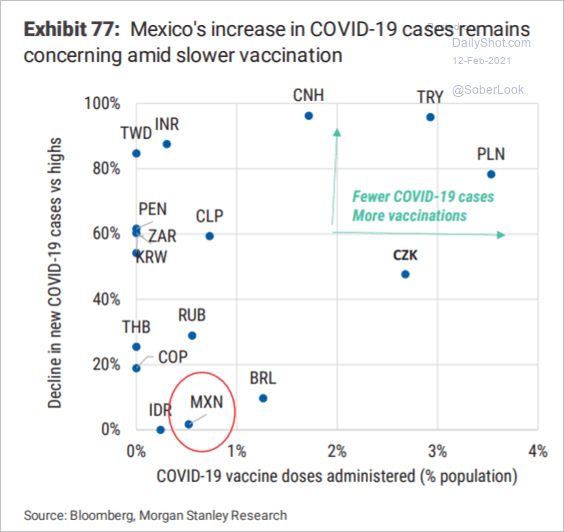

• Slow vaccination rollout and elevated new COVID cases remain a concern.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

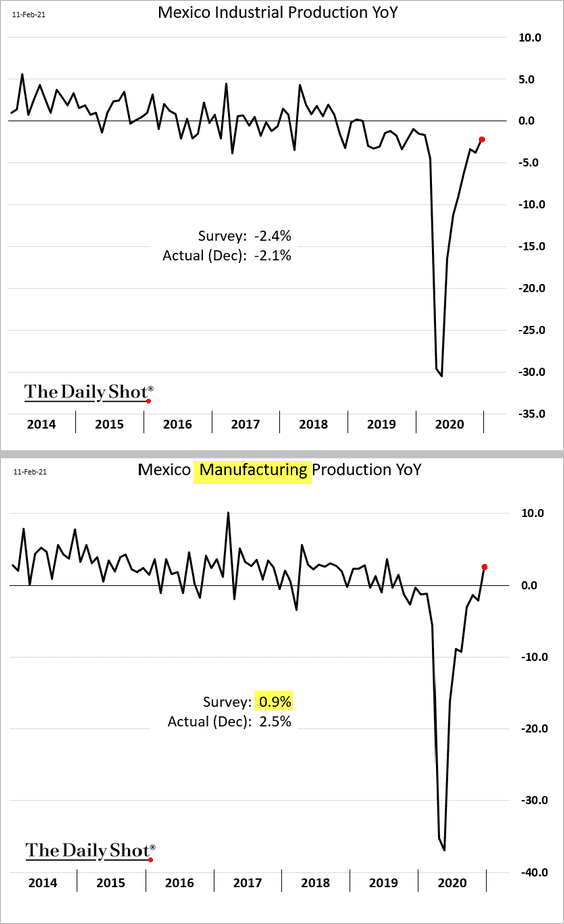

• December manufacturing output surprised to the upside.

——————–

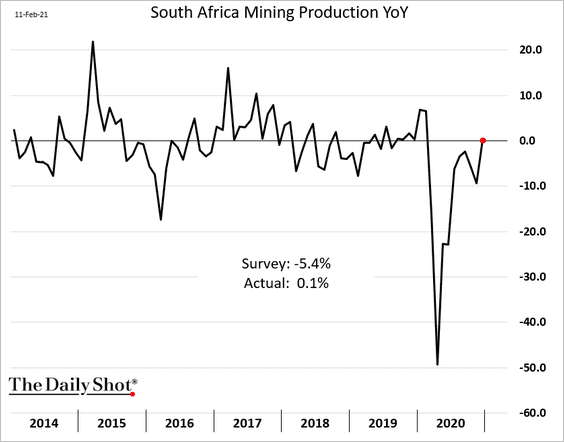

2. South Africa’s mining output has rebounded, topping forecasts.

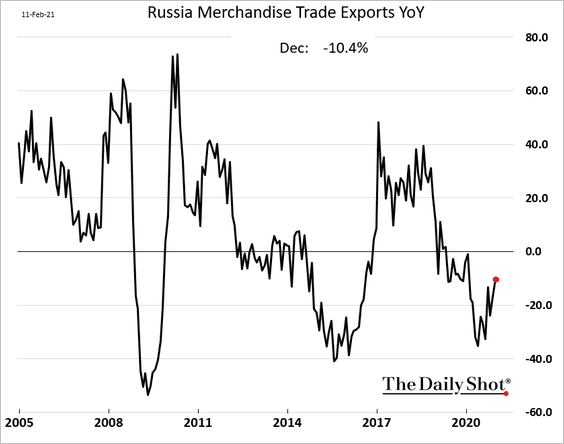

3. Russia’s exports are gradually recovering.

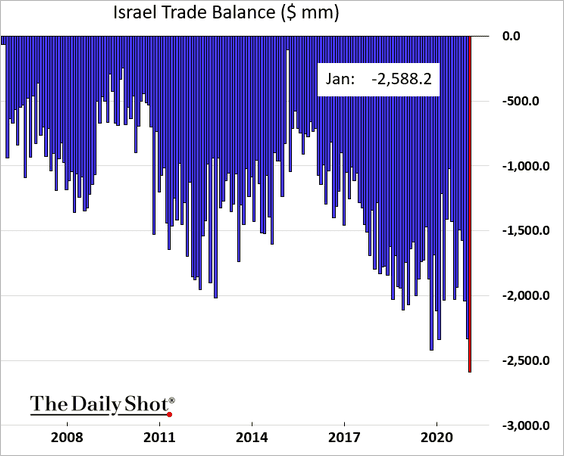

4. Israel’s trade deficit hit a new high.

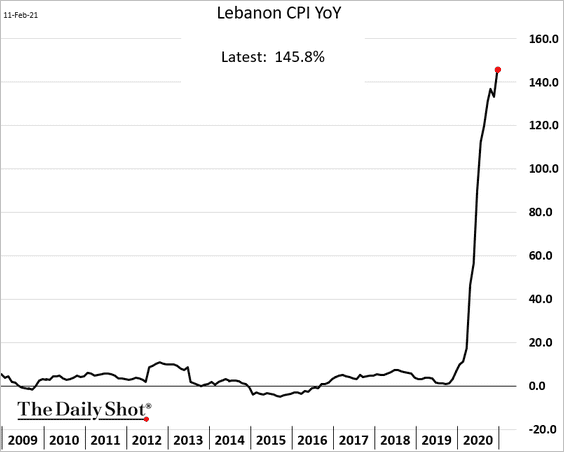

5. Lebanon’s hyperinflation continues to worsen.

Back to Index

The Eurozone

1. Things are looking up for Mario Draghi.

Source: CNBC Read full article

Source: CNBC Read full article

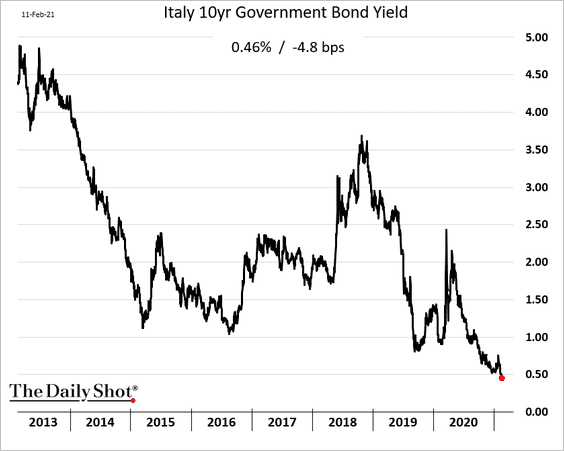

• The Italian 10yr bond yield dipped below 0.5% for the first time.

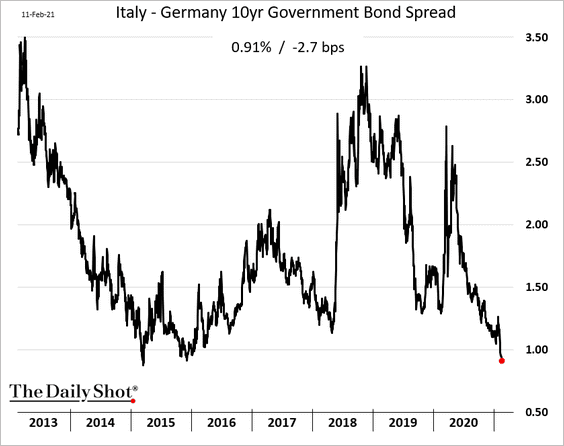

And the spread to Germany is now tightest in years.

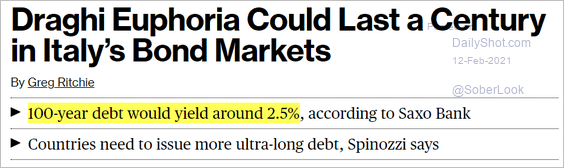

A 100-year Italian bond would yield 2.5%, according to Saxo Bank. Time for Draghi to hit that bid?

Source: @markets Read full article

Source: @markets Read full article

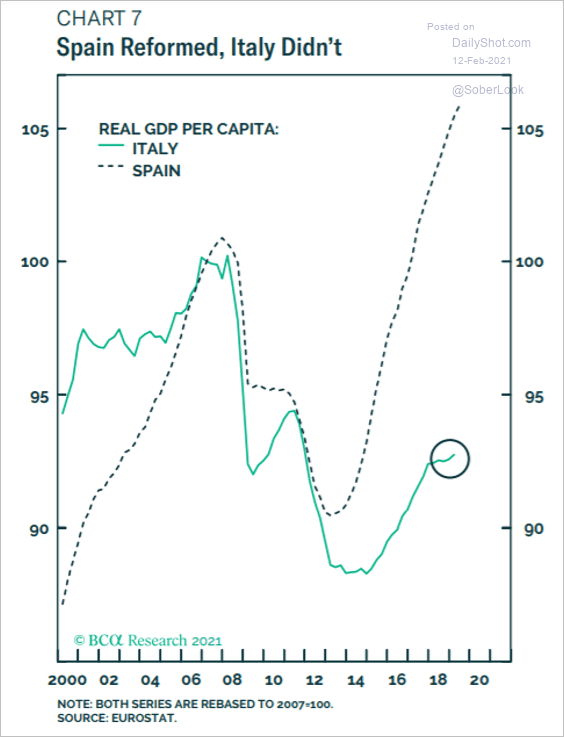

• Separately, Italian GDP per capita has been increasingly lagging that of Spain.

Source: BCA Research

Source: BCA Research

——————–

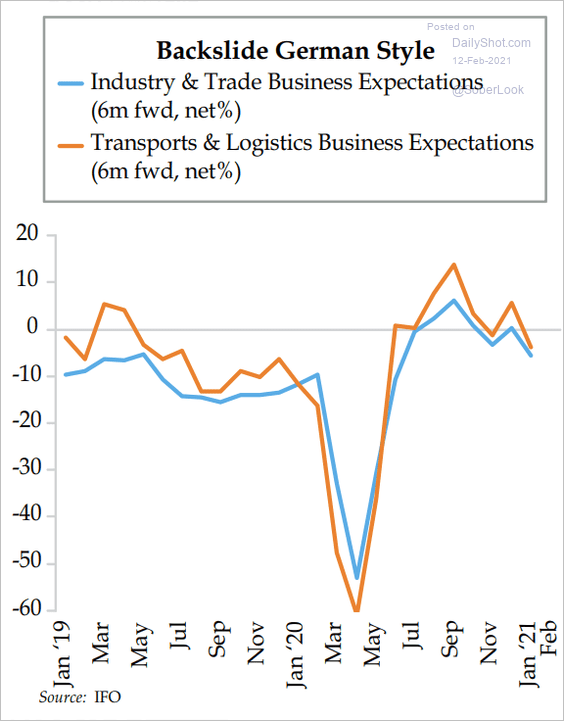

2. As we saw in the Ifo report last month, German businesses are uneasy about growth in the months ahead.

Source: The Daily Feather

Source: The Daily Feather

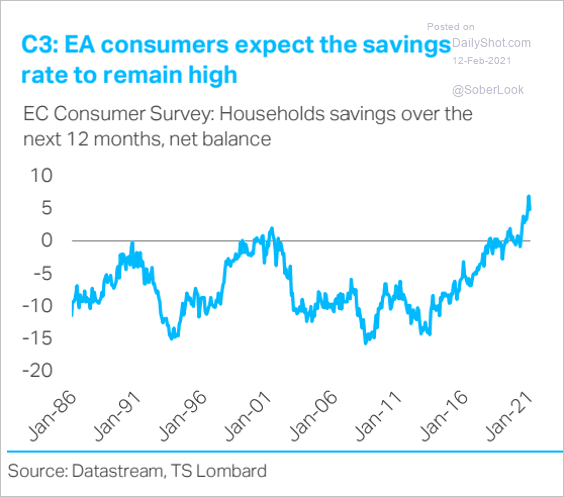

3. Eurozone consumers expect savings to remain elevated.

Source: TS Lombard

Source: TS Lombard

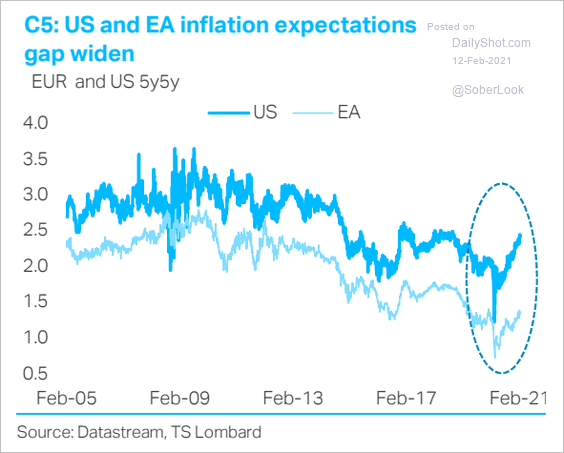

4. The gap between the US and Eurozone market-based inflation expectations has widened.

Source: TS Lombard

Source: TS Lombard

Back to Index

The United Kingdom

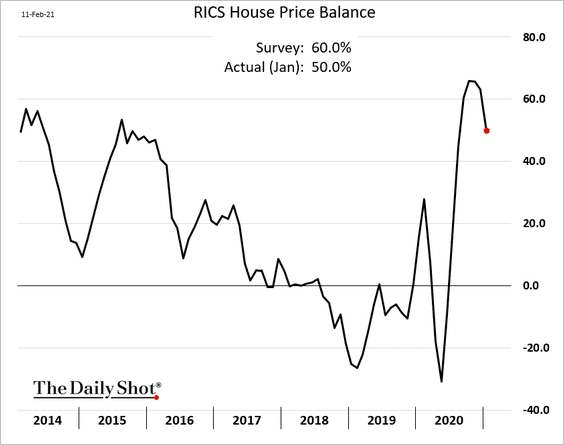

1. The housing market paused last month.

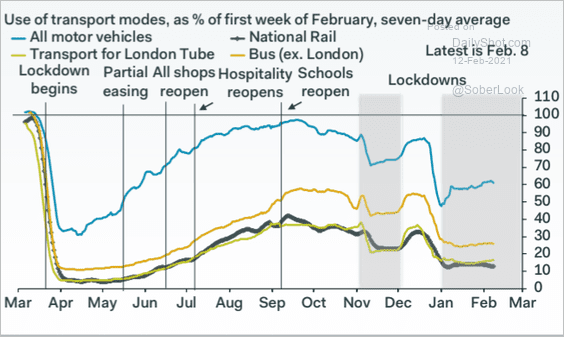

2. Transportation indicators remain depressed.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

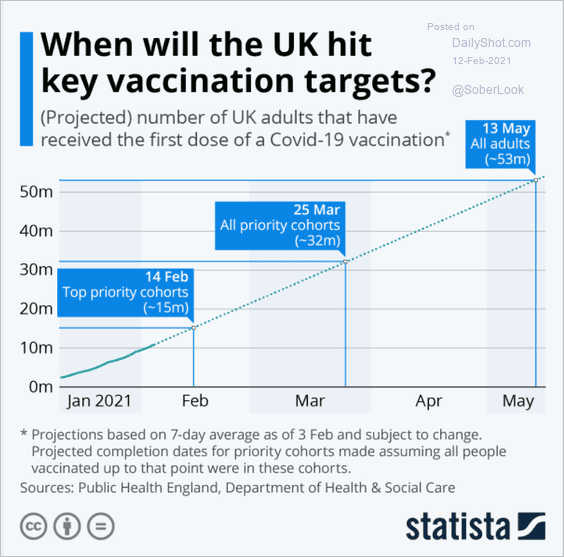

3. When will the UK hit its vaccination targets?

Source: Statista

Source: Statista

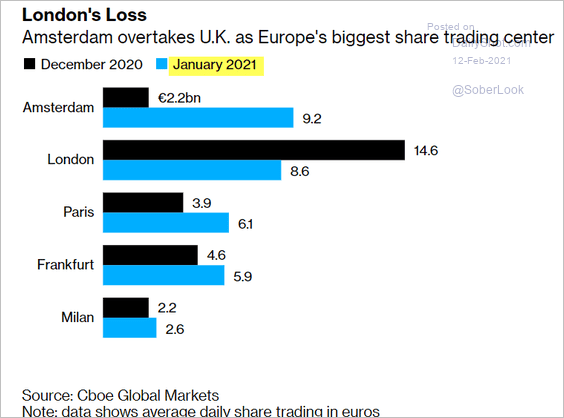

4. Amsterdam has overtaken London as Europe’s largest share trading center.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

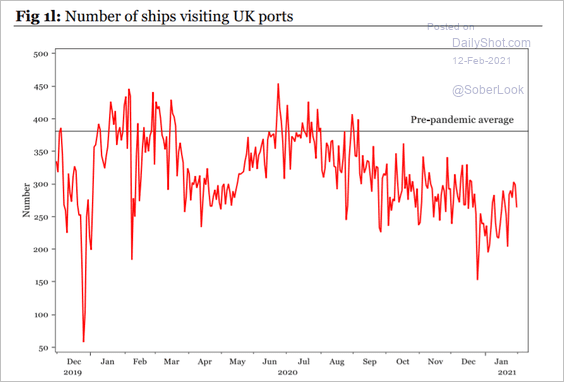

5. This chart shows the number of ships visiting UK ports.

Source: Longview Economics

Source: Longview Economics

Back to Index

The United States

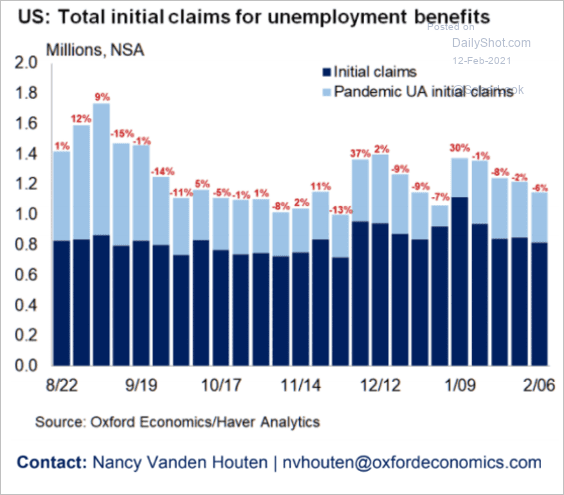

1. Initial jobless claims declined last week but are holding above one million.

Source: Oxford Economics

Source: Oxford Economics

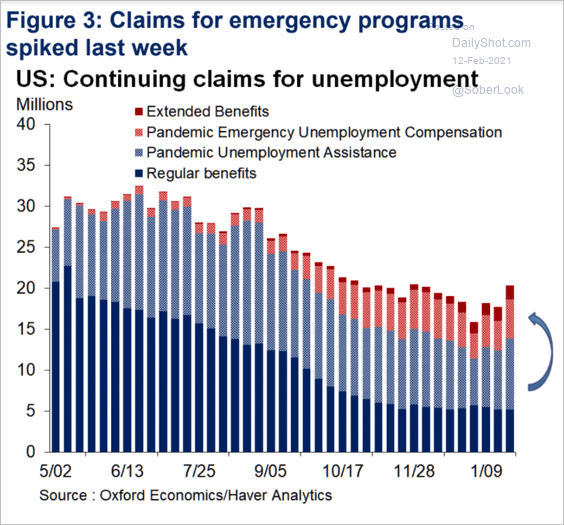

Continuing claims are increasingly dominated by federal emergency programs.

Source: Bloomberg Read full article

Source: Bloomberg Read full article

Source: Oxford Economics

Source: Oxford Economics

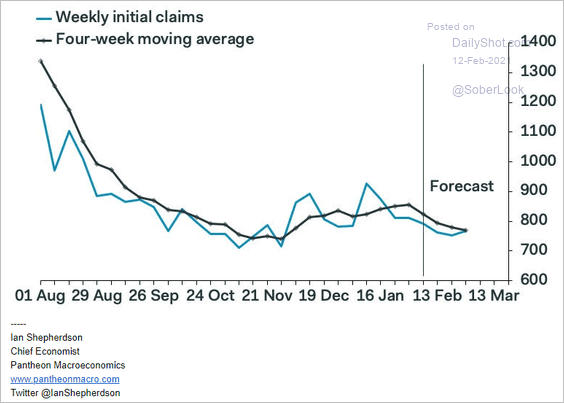

Many economists expect new claims to keep tapering in the weeks ahead.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

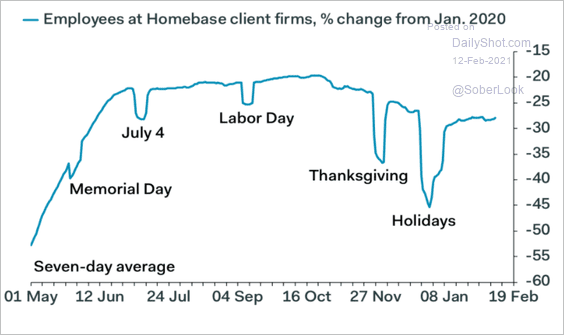

The Homebase small business employment index shows stabilization.

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

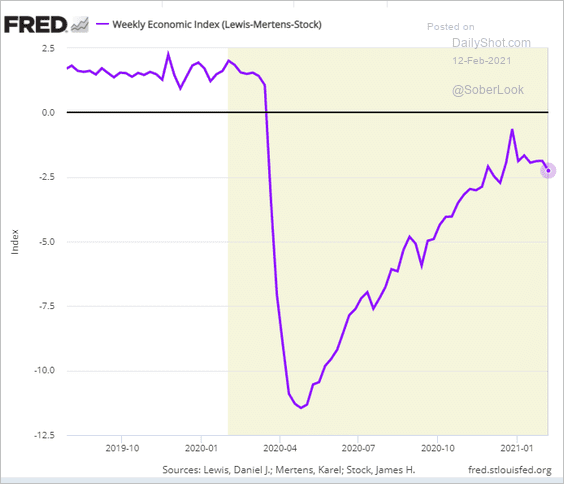

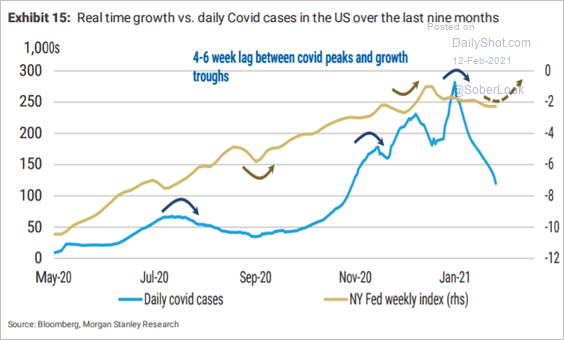

2. The NY Fed’s activity index has deteriorated in recent weeks.

But the drop in new COVID cases should reverse this trend.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

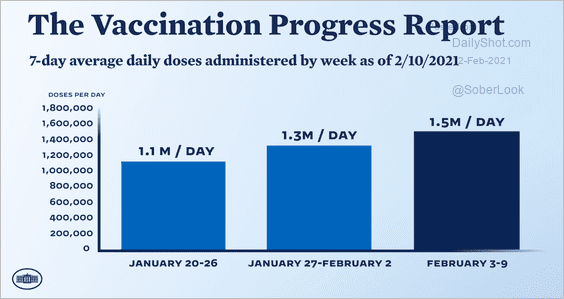

A faster pace of vaccinations should help.

Source: @WHCOVIDResponse

Source: @WHCOVIDResponse

——————–

3. Next, we have some updates on housing.

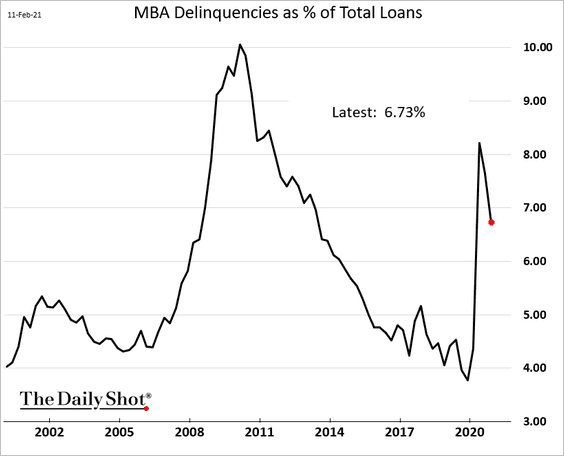

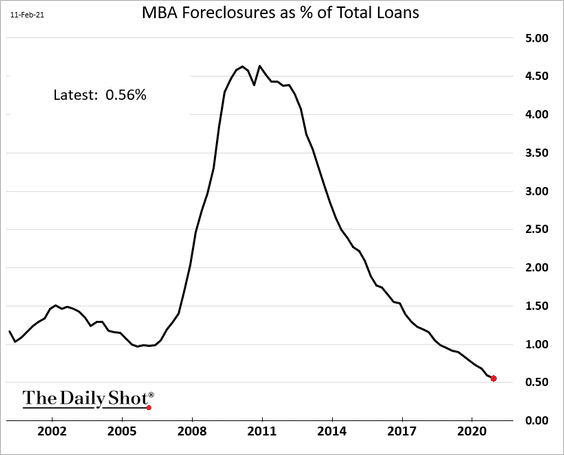

• Mortgage delinquencies slowed last quarter.

Helped by mortgage forbearance programs and housing market strength, the foreclosure rate shows no signs of last year’s massive job loss.

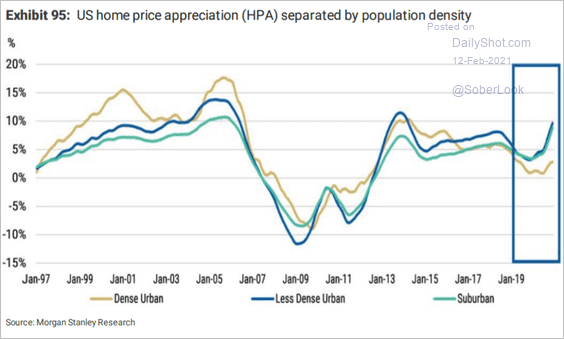

• Here is the nation’s home price appreciation by population density.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

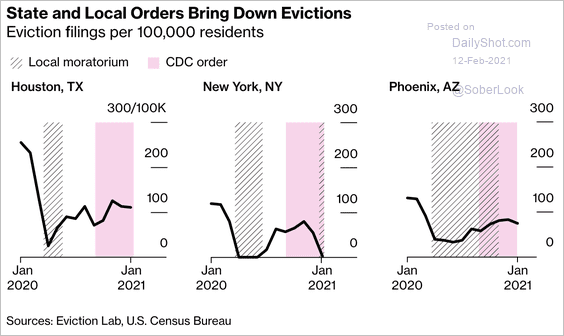

• Moratoriums have kept rental evictions from spiking.

Source: @citylab, @kristoncapps Read full article

Source: @citylab, @kristoncapps Read full article

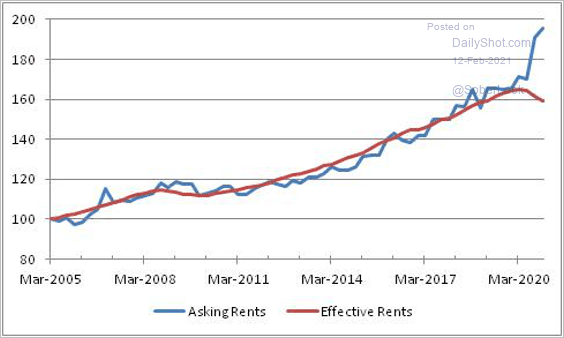

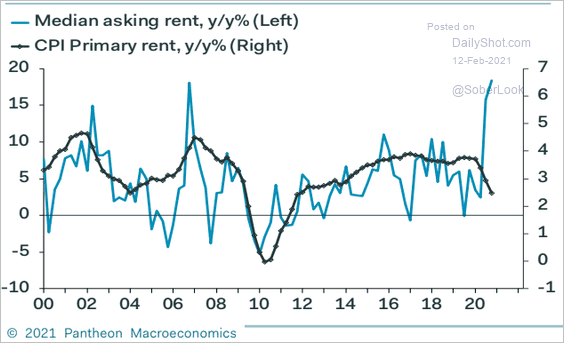

• Asking rental prices point to higher rent inflation ahead (2 charts).

Source: @inflation_guy

Source: @inflation_guy

Source: Pantheon Macroeconomics

Source: Pantheon Macroeconomics

——————–

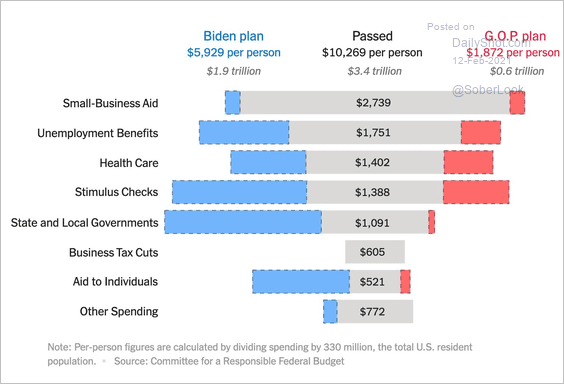

4. Finally, let’s take a look at the proposed fiscal stimulus package.

• Dollars allocated per person, by category:

Source: @BCAppelbaum; The New York Times Read full article

Source: @BCAppelbaum; The New York Times Read full article

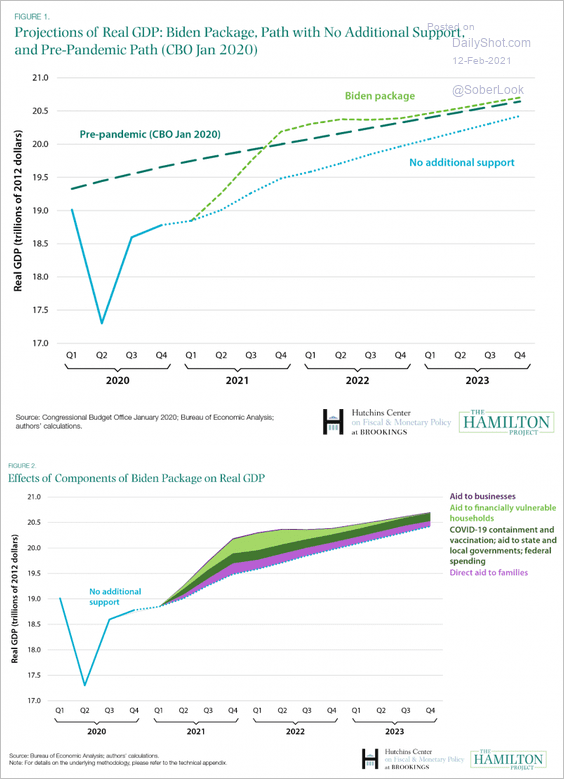

• The impact on the GDP:

Source: The Hamilton Project, h/t @jsblokland Read full article

Source: The Hamilton Project, h/t @jsblokland Read full article

Back to Index

Global Developments

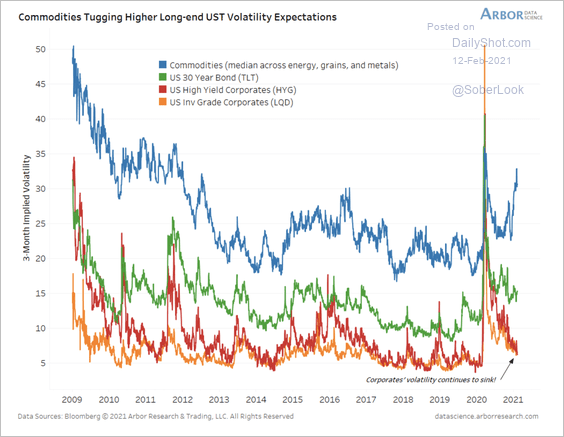

1. The average implied volatility across commodities rose over the past few months, while credit volatility continued to sink.

Source: Arbor Research & Trading

Source: Arbor Research & Trading

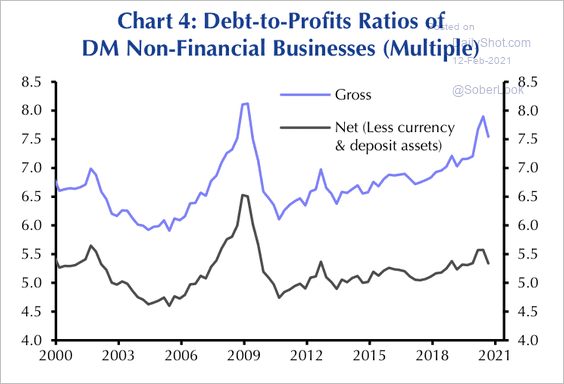

2. Corporate debt-to-profit ratios in advanced economies remain below 2008 levels.

Source: Capital Economics

Source: Capital Economics

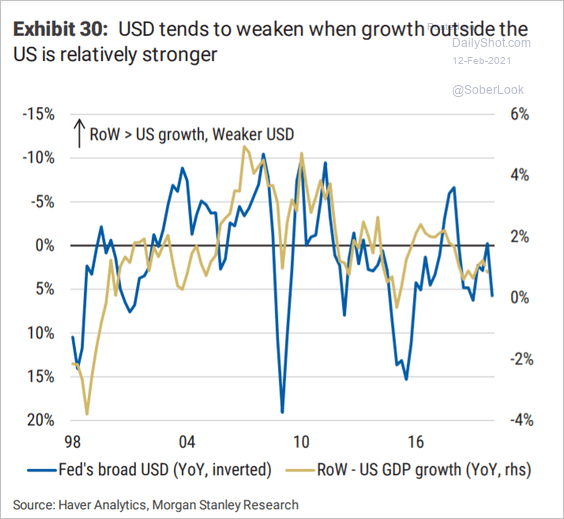

3. The US dollar tends to weaken when global GDP growth outpaces that of the US.

Source: Morgan Stanley Research

Source: Morgan Stanley Research

——————–

Food for Thought

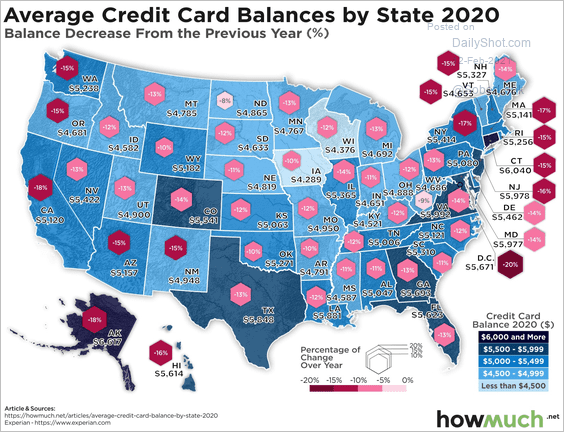

1. Declines in credit card balances by state:

Source: @howmuch_net Read full article

Source: @howmuch_net Read full article

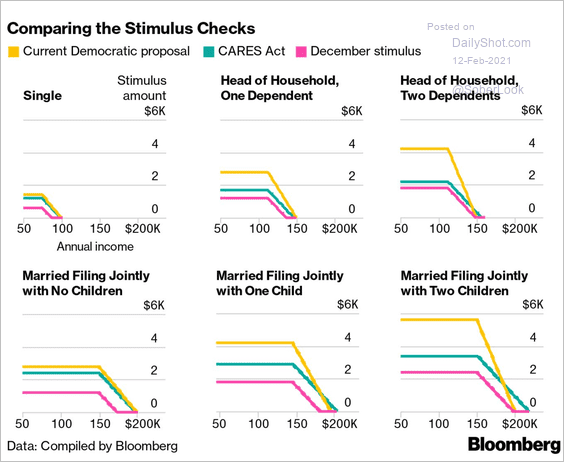

2. Comparing the stimulus checks:

Source: Bloomberg Read full article

Source: Bloomberg Read full article

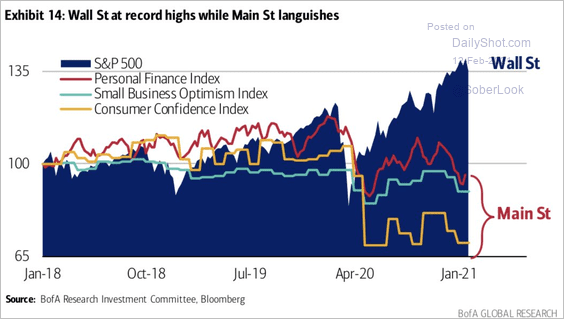

3. The Wall Street – Main Street disconnect:

Source: BofA Global Research, @WallStJesus

Source: BofA Global Research, @WallStJesus

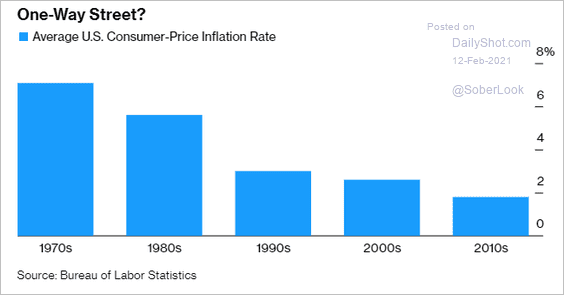

4. US CPI by decade:

Source: @markets Read full article

Source: @markets Read full article

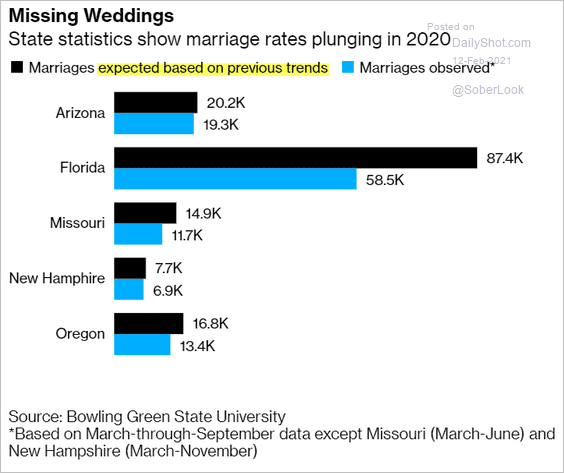

5. Marriages in 2020:

Source: @business Read full article

Source: @business Read full article

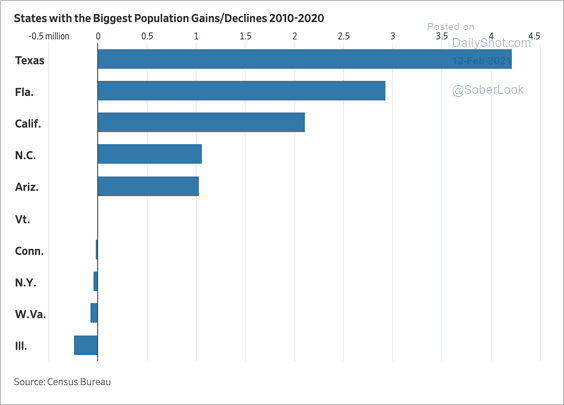

6. State population changes over the past decade:

Source: @WSJ Read full article

Source: @WSJ Read full article

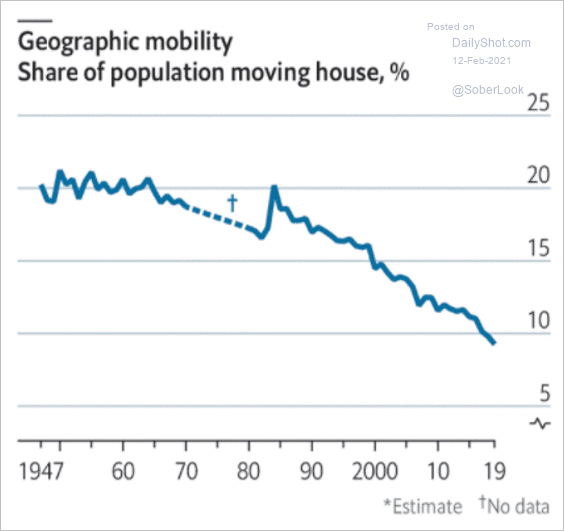

7. US geographic mobility:

Source: The Economist Read full article

Source: The Economist Read full article

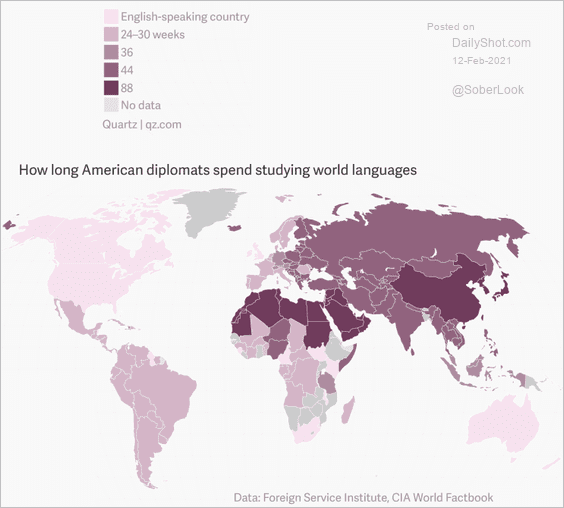

8. How long American diplomats spend studying different languages:

Source: Quartz Read full article

Source: Quartz Read full article

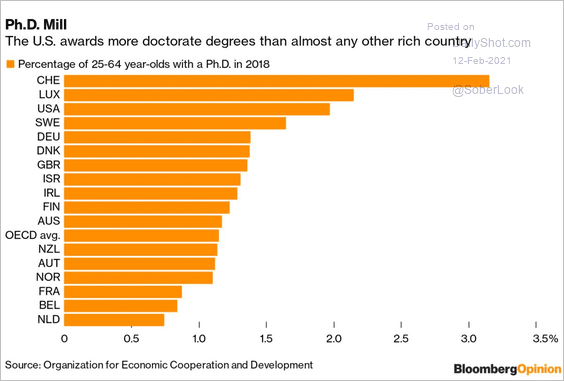

9. Ph.D. percentages by country:

Source: @BloombergQuint Read full article

Source: @BloombergQuint Read full article

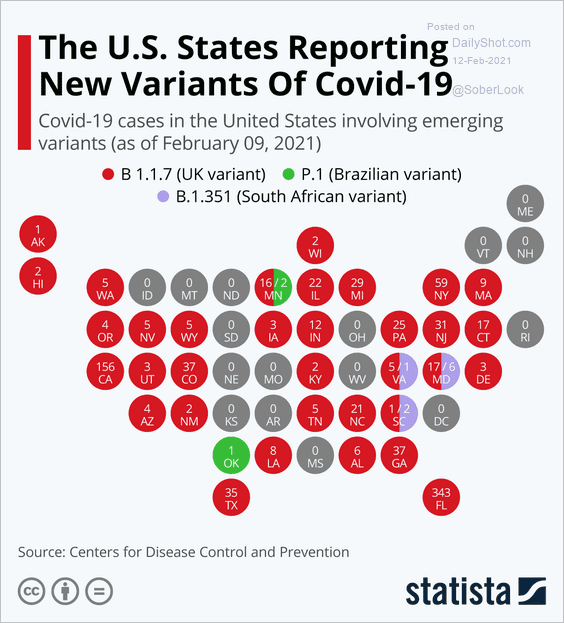

10. The new COVID variants:

Source: Statista

Source: Statista

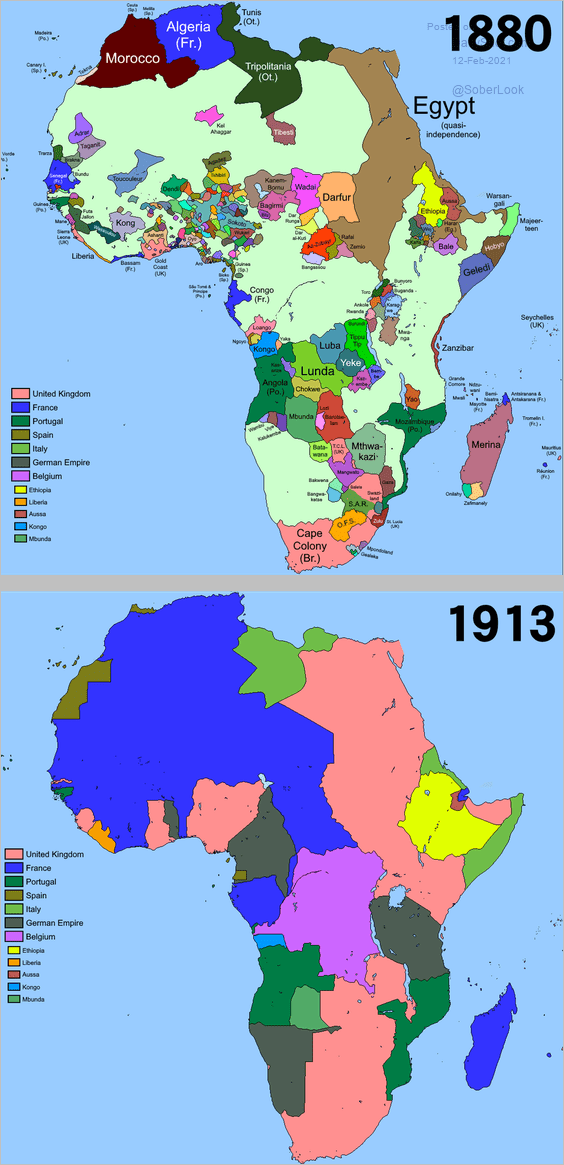

11. Control of Africa in 1880 and 1913:

Source: Wikimedia Commons

Source: Wikimedia Commons

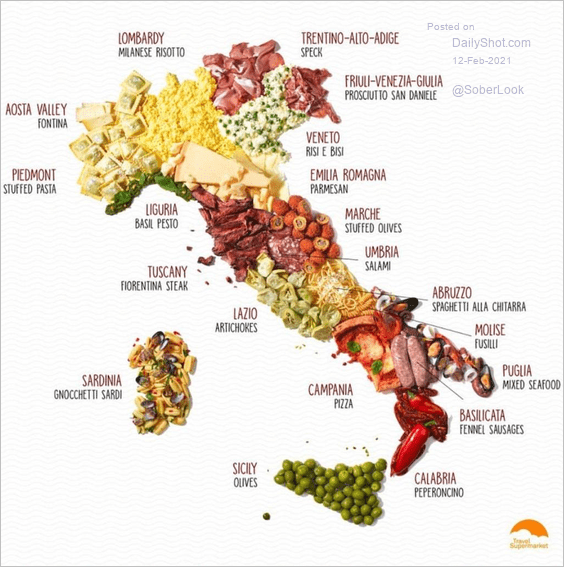

12. Food specialties of each region in Italy:

Source: Travel Supermarket

Source: Travel Supermarket

——————–

Have a great weekend!

Back to Index